UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22558

BROOKFIELD INVESTMENT FUNDS

(Exact name of registrant as specified in charter)

BROOKFIELD PLACE

250 VESEY STREET, 15th Floor

NEW YORK, NEW YORK 10281-1023

(Address of principal executive offices) (Zip code)

KIM G. REDDING, PRESIDENT

BROOKFIELD INVESTMENT FUNDS

BROOKFIELD PLACE

250 VESEY STREET 15th Floor

NEW YORK, NEW YORK 10281-1023

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 777-8001

Date of fiscal year end: December 31, 2013

Date of reporting period: December 31, 2013

Item 1. Reports to Shareholders.

Brookfield Investment Management 2013 ANNUAL REPORT Brookfield Global Listed Infrastructure Fund Brookfield Global Listed Real Estate Fund Brookfield U.S. Listed Real Estate Fund

IN PROFILE Brookfield Asset Management Inc. is a global alternative asset manager with over $187 billion in assets under management as of December 31, 2013. Brookfield has over a 100-year history of owning and operating assets with a focus on property, renewable power, infrastructure and private equity. The company offers a range of public and private investment products and services, which leverage its expertise and experience and provide it with a competitive advantage in the markets where it operates. On behalf of its clients, Brookfield is also an active investor in the public securities markets, where its experience extends over 30 years. Over this time, the company has successfully developed several investment operations and built expertise in the management of institutional portfolios, retail mutual funds, and structured product investments. Brookfield’s public market activities are conducted by Brookfield Investment Management, a registered investment adviser. These activities complement Brookfield’s core competencies and include global listed real estate and infrastructure equities, corporate high yield investments, opportunistic credit strategies and a dedicated insurance asset management division. Headquartered in New York, NY, Brookfield Investment Management maintains offices and investment teams in Toronto, Chicago, Boston and London and has over $10 billion of assets under management as of December 31, 2013.

TABLE OF CONTENTS

This report is for shareholder information. This is not a prospectus intended for the use in the purchase or sale of Fund shares.

| | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NOT BANK GUARANTEED |

© Copyright 2013. Brookfield Investment Management Inc.

[THIS PAGE IS INTENTIONALLY LEFT BLANK]

LETTER TO SHAREHOLDERS

Dear Shareholders,

I am pleased to provide the Annual Report for Brookfield Global Listed Infrastructure Fund (the “Infrastructure Fund”), Brookfield Global Listed Real Estate Fund (the “Global Real Estate Fund”) for the year ended December 31, 2013 and the Brookfield U.S. Listed Real Estate Fund (the “U.S. Real Estate Fund”) (each a “Fund” and, collectively, the “Funds”) for the period from December 11, 2013 (commencement of operations) to December 31, 2013.

Overall capital market performance was mixed during the year, as the positive catalyst of an improving economic environment was offset by concerns over rising interest rates. Accordingly, equity markets generally produced attractive results while fixed income markets were more challenged. The U.S. economy gained further strength over the course of the year, driven largely by an improving labor market, an expansion in household net worth and continued recovery of both the residential and commercial property markets. This positive momentum led the U.S. Federal Reserve to begin tapering its asset purchase program in a move that had been widely discussed and debated in the marketplace for months. Importantly, the Federal Reserve also reiterated its commitment to maintaining a low interest rate environment for the foreseeable future and to providing sufficient support as needed. As a result, market volatility following the announcement was minimal and we believe implementation will serve to reduce uncertainty moving forward. We also note that despite the recent increase in interest rates, yields remain near historic lows and supportive of economic growth.

Within this environment, demand for global real estate and infrastructure securities was shaped by broader capital market volatility, as sentiment turned more cautious following the back-up in interest rates. However, fundamentals of these asset classes generally continued to improve, reflecting the ongoing recovery of many developed market economies. Accordingly, companies operating in higher growth sectors and geographies tended to generate the most attractive performance during the year.

Moving forward, we anticipate a period of normalizing interest rates and economic growth in the medium term. We expect accommodative monetary policy to continue in the U.S. and across many developed markets, providing further support for the global economic recovery. We maintain our positive outlook for real estate and infrastructure equities, as we believe these securities are well-positioned to benefit from an improving economy while providing an opportunity for attractive income. Additionally, we believe recent performance has resulted in compelling valuation levels for select opportunities, which may lead to meaningful return potential. Against this backdrop, we believe our fundamental, bottom-up approach to investing and active management style are well-suited to identify and potentially capitalize on attractive investment opportunities.

In addition to performance information, this report provides the Funds’ audited financial statements as of December 31, 2013.

We welcome your questions and comments, and encourage you to contact our Investor Relations team at (855) 777-8001 or visit us at www.brookfieldim.com for more information. Thank you for your support.

|

| Sincerely, |

|

|

|

| Kim G. Redding |

| President |

2013 Annual Report 1

LETTER TO SHAREHOLDERS (continued)

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2013 and subject to change based on subsequent developments.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in infrastructure entities involve greater exposure to the potential adverse economic, regulatory, political and other changes affecting such entities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Investing is small and mid-cap companies involve additional risks such as limited liquidity and greater volatility. Investments in MLPs could involve certain risks related to investing in the underlying assets of the MLPs and risks associated with pooled investment vehicles. Using derivatives exposes the Funds to additional risks, may increase the volatility of the Fund’s net asset value and may not provide the result intended.

Past performance does not guarantee future results.

Quasar Distributors, LLC is the distributor of Brookfield Investment Funds.

2 Brookfield Investment Management Inc.

ABOUT YOUR FUND’S EXPENSES

As a shareholder of a fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends or other distributions, redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses, which is not the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and the other funds. To do so, compare this 5% hypothetical example with hypothetical examples that appear in shareholders’ reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs overall would have been higher.

| | | | | | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account

Value

(07/01/13) | | | Ending

Account Value

(12/31/13) | | | Expenses

Paid During

Period

(07/01/13–

12/31/13) (1) | |

INFRASTRUCTURE FUND | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.35 | % | | $ | 1,000.00 | | | $ | 1,133.20 | | | $ | 7.26 | |

Class C Shares | | | 2.10 | % | | | 1,000.00 | | | | 1,129.00 | | | | 11.27 | |

Class Y Shares | | | 1.10 | % | | | 1,000.00 | | | | 1,134.50 | | | | 5.92 | |

Class I Shares | | | 1.10 | % | | | 1,000.00 | | | | 1,134.40 | | | | 5.92 | |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.35 | % | | | 1,000.00 | | | | 1,018.40 | | | | 6.87 | |

Class C Shares | | | 2.10 | % | | | 1,000.00 | | | | 1,014.62 | | | | 10.66 | |

Class Y Shares | | | 1.10 | % | | | 1,000.00 | | | | 1,019.66 | | | | 5.60 | |

Class I Shares | | | 1.10 | % | | | 1,000.00 | | | | 1,019.66 | | | | 5.60 | |

2013 Annual Report 3

ABOUT YOUR FUND’S EXPENSES

| | | | | | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account

Value

(07/01/13) | | | Ending

Account Value

(12/31/13) | | | Expenses

Paid During

Period

(07/01/13–

12/31/13) (1) | |

GLOBAL REAL ESTATE FUND | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.20 | % | | $ | 1,000.00 | | | $ | 1,032.40 | | | $ | 6.15 | |

Class C Shares | | | 1.95 | % | | | 1,000.00 | | | | 1,029.00 | | | | 9.97 | |

Class Y Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,033.50 | | | | 4.87 | |

Class I Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,033.50 | | | | 4.87 | |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.20 | % | | | 1,000.00 | | | | 1,019.16 | | | | 6.11 | |

Class C Shares | | | 1.95 | % | | | 1,000.00 | | | | 1,015.38 | | | | 9.91 | |

Class Y Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,020.42 | | | | 4.84 | |

Class I Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,020.42 | | | | 4.84 | |

| | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account

Value

(12/11/13) | | | Ending

Account Value

(12/31/13) | | | Expenses

Paid During

Period

(12/11/13–

12/31/13)(2) | |

U.S. REAL ESTATE FUND | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.20 | % | | $ | 1,000.00 | | | $ | 1,016.20 | | | $ | 0.66 | |

Class C Shares | | | 1.95 | % | | | 1,000.00 | | | | 1,015.80 | | | | 1.08 | |

Class Y Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,016.40 | | | | 0.52 | |

Class I Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,016.40 | | | | 0.52 | |

| | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account

Value

(07/01/13) | | | Ending

Account Value

(12/31/13) | | | Expenses

Paid During

Period

(07/01/13–

12/31/13)(1) | |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.20 | % | | | 1,000.00 | | | | 1,019.16 | | | | 6.11 | |

Class C Shares | | | 1.95 | % | | | 1,000.00 | | | | 1,015.38 | | | | 9.91 | |

Class Y Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,020.42 | | | | 4.84 | |

Class I Shares | | | 0.95 | % | | | 1,000.00 | | | | 1,020.42 | | | | 4.84 | |

| (1) | Expenses are equal to the Funds’ annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect a six-month period). |

| (2) | Expenses are equal to the Funds’ annualized expense ratio multiplied by the average account value over the period, multiplied by 20/365 (to reflect a 20 day period). The Fund commenced operations on December 11, 2013. |

4 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

Individual contributors to performance included Access Midstream Partners, LP, EQT Midstream Partners LP and ONEOK, Inc.

The Fund’s overweight to Access Midstream Partners, LP, a Master Limited Partnership (“MLP”) was the strongest performer by security on a relative basis. The company maintains operations in most of the major shale gas basins in the U.S., and its contracts are generally fixed fee and therefore not exposed to commodity price volatility. The company had positive momentum in 2013 after management stated in 2012 that they feel the firm can grow their distributions by more than 15% per year for the foreseeable future. In addition, the MLP sector had a strong year and outperformed the Dow Jones Brookfield Global Infrastructure Composite Index.

Overweight exposure to EQT Midstream Partners LP was a positive contributor to relative Fund returns. We believe the company benefitted from an attractive growth profile and competitive positioning within the Marcellus and Utica shale formations, two of the fastest growing basins.

Overweight exposure to ONEOK, Inc. also drove positive relative performance gains in 2013. The company announced its intention to spin off its utility business in order to become a pure play General Partner, which tend to trade at strong valuations due to cash flows collected from underlying MLPs. The stock price was re-rated according to its new intended structure and gained ground in 2013 as a result.

Detractors to performance included Cheniere Energy, Inc., Cia de Saneamento Basico do Estado de Sao Paulo and Groupe Eurotunnel SA. Zero exposure to midstream pipeline company Cheniere Energy, Inc. was the largest detractor from Fund performance. The company has had a strong year due to investor optimism regarding its potential to receive approval from the Department of Energy for exports of liquefied natural gas to non-FTA countries.

Overweight exposure to Brazilian water and sewage treatment company, Cia de Saneamento Basico do Estado de Sao Paulo (“Sabesp”) detracted from Fund performance. Brazilian stocks and currencies suffered in 2013 as investors moved capital to the U.S. We believe Sabesp, in particular, was weak as fears of inflation sparked public demonstrations, and investors feared that the Brazilian government would not permit increases in rates for water due to turmoil. Subsequently, the Brazilian government has shown openness to discuss pricing with Sabesp, a situation we continue to monitor.

Overweight exposure to Groupe Eurotunnel SA was negative as potential regulatory changes were announced pertaining to the company’s allowable tolls, and we sold the Fund’s position to protect against potential losses. Thereafter, the company rebounded.

INFRASTRUCTURE MARKET OVERVIEW AND OUTLOOK

Infrastructure closes 2013 in positive territory

Market sentiment throughout 2013 was driven by interest rates – first by euphoria over low rates and later by fear over their imminent rise. Governments across the globe helped drive yields on fixed income investments to all-time lows. Not least was the Japanese government’s unprecedented monthly debt purchase announcement equaling 7.5 trillion yen, or approximately US$76 billion. Following several months of yield focused equity investing spurred by all-time low fixed income yields, markets reversed course in May when U.S. Federal Reserve Chairman Ben Bernanke foreshadowed a reduction in government bond purchases. Thereafter, interest rates rose substantially with the yield on the 10-year U.S. Treasury Note increasing 118 basis points, from 1.86% on January 2 to 3.04% on December 31.

Global equity market movements were generally positive, and the MSCI World Index rose 27.4%1 for the 12-month period ended December 31, 2013. U.S. markets outpaced global markets for the year, but ongoing political and monetary policy turmoil drove volatility in U.S. markets. International outliers included Japan, where optimism over the new Abe government’s policies led the market to outperform, and Europe, which rebounded in the year on

2013 Annual Report 5

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

signs of stabilization. Boosting markets into year-end was the Fed’s tapering announcement on December 18. The Committee’s decision to reduce purchases of agency mortgage-backed securities and longer-term Treasury securities by a total of US$10 billion per month was generally perceived as dovish. The announcement also included a provision that the targeted federal funds rate would remain “exceptionally low” until unemployment in the U.S. falls below 6.5%, further boosting sentiment.

Global infrastructure securities as measured by the Dow Jones Brookfield Global Infrastructure Composite Index2 returned 18.8% for the 12-month period ended December 31, 2013. As was the case more broadly, Europe was a bright spot among infrastructure stocks as the region rebounded off its lows. European infrastructure securities returned a strong 22.5% in 2013, followed by the Americas and Asia Pacific, up 13.6% and 11.3% respectively. Higher growth sectors levered to an economic recovery were also strong, led by airports (+26.6%) and toll roads (+25.0%). Communications (+7.7%) and water (+9.4%) lagged. Water suffered from its low growth profile while communications companies may have been impacted by relatively higher leverage levels3.

We believe underperformance of the infrastructure asset class in 2013 creates investment opportunities for the year ahead. While a steep increase in interest rates would present a downside risk for infrastructure securities, we expect a modest rise in long-term interest rates at a moderate pace. A number of positive trends, particularly investor demand for infrastructure securities as well as rapid growth in the asset class, support our positive outlook for the space in 2014.

Master Limited Partnerships remain strong in 2013

Master Limited Partnerships had a banner year, and the Alerian MLP Total Return Index4 returned 27.6% for the 12-month period ended December 31, 2013. MLPs have been among the highest yielding infrastructure securities and have offered strong earnings growth driven by new pipelines which should become operational in the coming years. Demand for MLPs did not slow in 2013. Indicatively, dedicated MLP funds have been highly successful. Five closed end and six open end funds totaling more than US$4.2 billion (including leverage)5 were raised this year, indicating ongoing retail investor demand for MLPs. We remain constructive on the MLP sector due to expectations that strong earnings growth will offset the impact of rising interest rates.

Infrastructure securities asset class grows

Estimates indicate a $25 trillion gap in government infrastructure spending over the next 25 years, creating a significant opportunity for investment by publicly traded infrastructure companies6. Listed infrastructure companies have taken action in 2013, and we have seen notable expansion of the infrastructure securities investment universe.

Privatizations

Cash strapped governments have increasingly turned to private companies to recapitalize their balance sheets. In 2013, the first ever privatization of a U.S. airport occurred. Rights to operate the San Juan airport in Puerto Rico were sold to Grupo Aeroportuario del Sureste (ASUR), a Mexican airport company that operates the Cancun airport among others, together with partner Highstar Capital. In the first quarter of 2013, the consortium received the final approvals required by the Federal Aviation Administration (FAA) to operate the airport. The transaction may pave the way for others. In fact, under the Airport Privatization Pilot Program, the FAA has already agreed to permit up to 10 public airport sponsors to sell or lease an airport in the U.S.

Emerging markets also offer significant privatization opportunities as many of these governments are capital constrained. We view Brazil especially positively in light of attractive valuations, even though the macro climate is characterized by inflation, low savings rates and low growth forecasts. President Dilma Rousseff’s administration has made significant attempts to stimulate economic growth by promoting private ownership of infrastructure assets. In 2012, President Rousseff unveiled an infrastructure privatization initiative to privatize 7,500 kilometers of toll roads requiring US$20 billion of capital investment and 10,000 kilometers of railroads requiring US$45 billion of investment. During 2013, the success of Brazilian infrastructure privatizations varied, but the two

6 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

most recent airport auctions were a boon to the Rousseff administration. The most publicized sale was the Galeao Airport in Rio. The winning bid came from a Brazilian private construction group Odebrecht SA together with a unit of Changi Airport Group, which bid 19 billion reais for the asset. This significantly outpaced the required minimum bid of 4.8 billion reais. Odebrecht SA was also awarded another Brazilian auction, BR-163 highway, an 851 kilometer toll road.

IPOs

New investment opportunities also arose through a number of successful IPOs. For instance, Mexican infrastructure company Infraestructura Energetica Nova SAB de CV (IENOVA) completed an IPO in March priced at the top end of the range at 34.00 Mexican pesos per share, or approximately US$2.75. IENOVA is a subsidiary of portfolio holding Sempra Energy (SRE), a U.S. long-haul pipeline company, and owns and operates natural gas pipelines and distribution facilities in Mexico as well as the Costa Azul liquefied natural gas (or LNG) facility near Ensenada, Mexico. Separately, NRGY Yield (NYLD) listed in July and issued 22,511,250 common shares at US$22 per share in a well-received offering. NYLD was spun out of NRG Energy, Inc. and is a diversified infrastructure company with a history of stable cash flows driven by long term contracts.

Exploring new territory

Beyond IPOs and privatizations, growth opportunities for infrastructure securities come in the form of new development and expansions. For instance, new mining operations in Canada’s oil sands continue to be announced, creating opportunities for pipeline companies to meet the growing transportation need. For example, Suncor Energy recently announced that its Fort Hills Project, located in Alberta’s Athabasca region, will be in production as early as late 2017. Enbridge Inc., an oil and gas pipeline company, was selected by Suncor and its partners to develop a new US$1.6 billion pipeline (Wood Buffalo Extension) to transport crude oil from the Fort Hills Project to Hardisty, Alberta, an important hub for oil sands production. Other companies in the infrastructure universe may benefit as additional mining operations are approved.

Separately, new LNG exports are being approved by the U.S. Department of Energy (DOE), providing international growth avenues for listed companies in our investment universe. The DOE has taken a number of steps toward relaxing its policy regarding the export of LNG to international countries without Free Trade Agreements (FTAs) with the U.S. Last December, the DOE issued a report that was supportive of natural gas drilling, and therefore positive for the energy infrastructure sector. The study was intended to protect public interest by examining the impact on domestic natural gas pricing as additional LNG export facilities become operational. Current laws require natural gas companies to obtain a license when exporting natural gas to non-FTA countries. The report concluded that additional LNG export facilities in the U.S. for exports of up to 10 billion cubic feet (“bcf”) per day would likely have a minimal impact on natural gas pricing, and that benefits would likely outweigh any costs.

Subsequent to this decision the DOE has approved five projects. We believe ongoing approvals mark an important shift for the global infrastructure securities asset class. North American energy infrastructure companies may benefit as their pipelines connect to these export facilities and are anticipated to see additional volume as exports grow. Additionally, as the 10 bcf per day amount addressed in the DOE study draws nearer, there will be winners and losers. We believe that reaching 10 bcf per day may trigger an additional study, which would create approval delays and could effectively cap non-FTA exports in the medium term. We are monitoring the situation closely.

OUTLOOK

As we look ahead to the New Year, we do not plan to make dramatic changes to portfolio exposures. We continue to favor high growth sectors in the U.S., including pipelines and rail companies. Crude by rail shipments out of the Bakken shale region in the U.S. have grown dramatically, and we expect growth to continue into 2014. We also anticipate crude by rail growth out of Canada, where rail loading facilities are being constructed. Within Europe, we remain cautious on regulated businesses like UK water companies in light of regulatory uncertainty. We favor transportation infrastructure in Spain and Italy, where signs of improving traffic driven by GDP growth should benefit transportation operators in the region.

2013 Annual Report 7

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

We also expect continued opportunities to arise within emerging markets. In Brazil, we anticipate short term volatility until the October 2014 elections, but have identified ongoing value opportunities among high quality companies in the country. We continue to favor gas utilities in China, and December’s Third Plenum boosted optimism for economic reform in the region. Finally, energy reform in Mexico may necessitate infrastructure build-out, spurring new opportunities for U.S. energy infrastructure companies.

We aim to capitalize on growth opportunities in the coming year. We believe infrastructure securities are generally well positioned to benefit from an improving macro economy while providing an opportunity for attractive income and capital preservation against ongoing market volatility into 2014.

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| As of December 31, 2013 | | 1 Year | | | Since Inception* | |

Class A Shares (excluding sales charge) | | | 22.86 | % | | | 19.89 | % |

Class A Shares (including sales charge) | | | 17.01 | % | | | 16.99 | % |

Class C Shares (excluding sales charge) | | | 21.85 | % | | | 17.33 | % |

Class C Shares (including sales charge) | | | 20.85 | % | | | 17.33 | % |

Class Y Shares | | | 23.11 | % | | | 20.06 | % |

Class I Shares | | | 23.09 | % | | | 20.10 | % |

Dow Jones Brookfield Global Infrastructure Composite Index | | | 18.77 | % | | | 17.19 | % |

| * | Class A was incepted on December 29, 2011, Class C was incepted on May 1, 2012 and Classes Y and I were incepted on December 1, 2011. The Dow Jones Brookfield Global Infrastructure Composite Index references Class I’s inception date. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days. Performance data does not reflect the imposition of the redemption fee and if it had, performance would have been lower. Performance shown including sales charge reflects the Class A maximum sales charge of 4.75% and the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance data excluding sales charge does not reflect the deduction of the sales charge or CDSC and if reflected, the sales charge or fee would reduce the performance quoted.

As per the prospectus dated April 30, 2013, the Fund’s gross expense ratio for Class A, Class C, Class Y and Class I is 2.16%, 2.63%, 1.67% and 1.78%, respectively. And the Fund’s net expense ratio for Class A, Class C, Class Y and Class I is 1.35%, 2.10%, 1.10% and 1.10%, respectively for the year ended December 31, 2012.

The Adviser has contractually agreed to reimburse the Fund’s expenses through May 1, 2015. There is no guarantee that such reimbursement will be continued after that date.

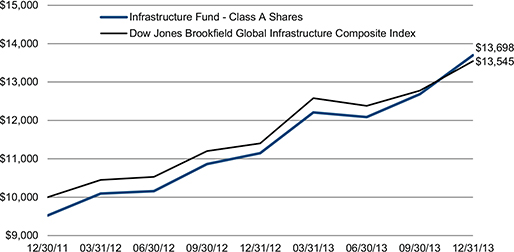

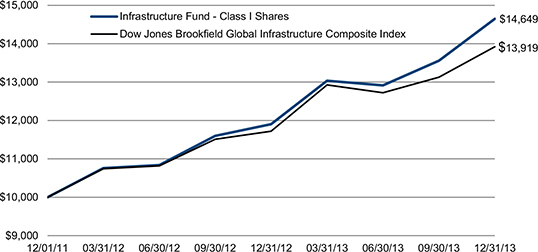

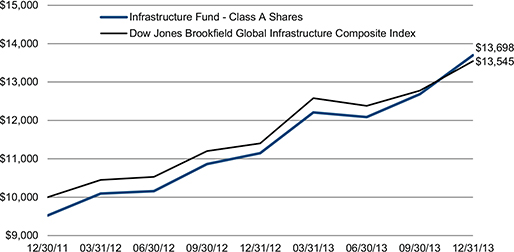

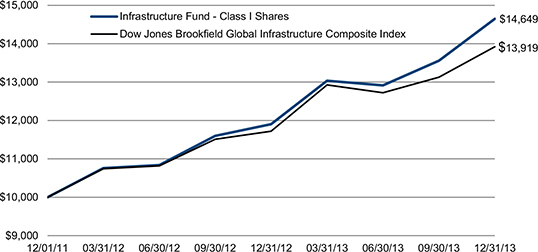

The graphs below illustrate a hypothetical investment of $10,000 in the Infrastructure Fund—Class A Shares from the commencement of investment operations on December 29, 2011 to December 31, 2013 compared to the Dow Jones Brookfield Global Infrastructure Composite Index and Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2013 compared to the Dow Jones Brookfield Global Infrastructure Composite Index.

8 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Class A Shares

Class I Shares

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Brookfield Global Listed Infrastructure Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

2013 Annual Report 9

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Mutual fund investing involves risk. Principal loss is possible.

A basis point (bps) is a unit that is equal to 1/100th of 1%.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2013 and subject to change based on subsequent developments.

| 1 | The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. You cannot invest directly in an index. |

| 2 | The Dow Jones Brookfield Global Infrastructure Composite Index is calculated and maintained by S&P Dow Jones Indices and comprises infrastructure companies with at least 70% of its annual cash flows derived from owning and operating infrastructure assets, including Master Limited Partnerships. You cannot invest directly in an index. |

| 3 | Sector and regional performance is measured by The Dow Jones Brookfield Infrastructure Indices, which aim to measure the stock performance of companies worldwide that are owners and operators of infrastructure assets. To be included in the indices, a company must have more than 70% of estimated cash flows (based on publicly available information) derived from the following infrastructure sectors: airports, toll roads, ports, communications, electricity transmission & distribution, oil & gas storage & transportation, water or diversified (multiple sectors). |

| 4 | The Alerian MLP Total Return Index is a composite of the 50 most prominent energy Master Limited Partnerships (MLPs) and is calculated using a float-adjusted, capitalization-weighted methodology. You cannot invest directly in an index. |

| 5 | As of December 31, 2013. Source: Morningstar. |

| 6 | Source: Estimates by Brookfield Investment Management, based on Organization of Economic Cooperation and Development data in August 2003 indicated a $25 trillion gap. |

10 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio Characteristics (Unaudited)

December 31, 2013

| | | | |

ASSET ALLOCATION BY GEOGRAPHY | | Percent of Net Assets | |

United States | | | 48.4 | % |

Canada | | | 14.1 | % |

United Kingdom | | | 7.5 | % |

China | | | 6.6 | % |

Italy | | | 5.0 | % |

Spain | | | 4.2 | % |

Brazil | | | 4.0 | % |

France | | | 3.2 | % |

Switzerland | | | 1.9 | % |

Hong Kong | | | 1.7 | % |

Australia | | | 1.0 | % |

Mexico | | | 0.4 | % |

Other Assets in Excess of Liabilities | | | 2.0 | % |

Total | | | 100.0 | % |

| |

ASSET ALLOCATION BY SECTOR | | | | |

Pipelines | | | 34.4 | % |

Communications | | | 13.6 | % |

Midstream | | | 11.2 | % |

Toll Roads | | | 9.6 | % |

Electricity Transmission & Distribution | | | 8.2 | % |

Rail | | | 5.6 | % |

Other | | | 4.7 | % |

Water | | | 3.9 | % |

Gas Utilities | | | 3.4 | % |

Airports | | | 1.9 | % |

Ports | | | 1.1 | % |

Diversified | | | 0.4 | % |

Other Assets in Excess of Liabilities | | | 2.0 | % |

Total | | | 100.0 | % |

| |

TOP TEN HOLDINGS | | | | |

American Tower Corp. | | | 6.0 | % |

Enbridge, Inc. | | | 4.8 | % |

National Grid PLC | | | 4.7 | % |

Spectra Energy Corp. | | | 4.4 | % |

TransCanada Corp. | | | 3.9 | % |

Crown Castle International Corp. | | | 3.7 | % |

Sempra Energy | | | 3.2 | % |

Snam SpA | | | 3.2 | % |

Union Pacific Corp. | | | 3.1 | % |

The Williams Companies, Inc. | | | 3.0 | % |

2013 Annual Report 11

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

December 31, 2013

| | | | | | | | |

| | | | | | Value | |

| | | Shares | | | (Note 2) | |

| |

COMMON STOCKS – 98.0% | | | | | | | | |

AUSTRALIA – 1.0% | | | | | | | | |

Diversified – 0.4% | | | | | | | | |

DUET Group | | | 851,400 | | | $ | 1,521,117 | |

| | | | | | | | |

Electricity Transmission & Distribution – 0.6% | | | | | | | | |

Spark Infrastructure Group | | | 1,508,800 | | | | 2,192,410 | |

| |

Total AUSTRALIA | | | | | | | 3,713,527 | |

| |

BRAZIL – 4.0% | | | | | | | | |

Toll Roads – 2.9% | | | | | | | | |

CCR SA | | | 1,457,500 | | | | 11,007,736 | |

| | | | | | | | |

Water – 1.1% | | | | | | | | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | 381,400 | | | | 4,325,076 | |

| |

Total BRAZIL | | | | | | | 15,332,812 | |

| |

CANADA – 14.1% | | | | | | | | |

Midstream – 0.9% | | | | | | | | |

Keyera Corp. | | | 59,600 | | | | 3,586,941 | |

| | | | | | | | |

Pipelines – 11.1% | | | | | | | | |

Enbridge, Inc. | | | 415,200 | | | | 18,140,204 | |

Pembina Pipeline Corp. | | | 155,500 | | | | 5,477,816 | |

TransCanada Corp. | | | 325,900 | | | | 14,892,150 | |

Veresen, Inc. | | | 274,100 | | | | 3,682,190 | |

| | | | | | | | |

Total Pipelines | | | | | | | 42,192,360 | |

| | | | | | | | |

Rail – 2.1% | | | | | | | | |

Canadian National Railway Co. | | | 141,200 | | | | 8,049,962 | |

| |

Total CANADA | | | | | | | 53,829,263 | |

| |

CHINA – 6.6% | | | | | | | | |

Gas Utilities – 1.6% | | | | | | | | |

ENN Energy Holdings Ltd. | | | 802,700 | | | | 5,949,116 | |

| | | | | | | | |

Pipelines – 4.3% | | | | | | | | |

Beijing Enterprises Holdings Ltd. | | | 911,100 | | | | 9,050,211 | |

Kunlun Energy Company Ltd. | | | 4,197,000 | | | | 7,418,829 | |

| | | | | | | | |

Total Pipelines | | | | | | | 16,469,040 | |

| | | | | | | | |

Toll Roads – 0.7% | | | | | | | | |

Anhui Expressway Co. | | | 1,235,300 | | | | 685,785 | |

Sichuan Expressway Company Ltd. | | | 2,079,900 | | | | 615,124 | |

Zhejiang Expressway Company Ltd. | | | 1,511,100 | | | | 1,430,659 | |

| | | | | | | | |

Total Toll Roads | | | | | | | 2,731,568 | |

| |

Total CHINA | | | | | | | 25,149,724 | |

| |

FRANCE – 3.2% | | | | | | | | |

Communications – 1.7% | | | | | | | | |

Eutelsat Communications SA | | | 212,500 | | | | 6,630,532 | |

| | | | | | | | |

Toll Roads – 1.5% | | | | | | | | |

Vinci SA | | | 85,600 | | | | 5,626,618 | |

| |

Total FRANCE | | | | | | | 12,257,150 | |

| |

See Notes to Financial Statements.

12 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments (continued)

December 31, 2013

| | | | | | | | |

| | | | | | Value | |

| | | Shares | | | (Note 2) | |

| |

COMMON STOCKS (continued) | | | | | | | | |

HONG KONG – 1.7% | | | | | | | | |

Gas Utilities – 0.2% | | | | | | | | |

Hong Kong & China Gas Company Ltd. | | | 282,730 | | | $ | 649,144 | |

| | | | | | | | |

Ports – 1.1% | | | | | | | | |

COSCO Pacific Ltd. | | | 3,034,800 | | | | 4,177,081 | |

| | | | | | | | |

Rail – 0.4% | | | | | | | | |

Guangshen Railway Company Ltd. | | | 3,327,400 | | | | 1,544,593 | |

| |

Total HONG KONG | | | | | | | 6,370,818 | |

| |

ITALY – 5.0% | | | | | | | | |

Pipelines – 3.2% | | | | | | | | |

Snam SpA | | | 2,165,034 | | | | 12,101,200 | |

| | | | | | | | |

Toll Roads – 1.8% | | | | | | | | |

Atlantia SpA | | | 301,400 | | | | 6,751,341 | |

| |

Total ITALY | | | | | | | 18,852,541 | |

| |

MEXICO – 0.4% | | | | | | | | |

Pipelines – 0.4% | | | | | | | | |

Infraestructura Energetica Nova SAB de CV | | | 360,100 | | | | 1,438,855 | |

| |

Total MEXICO | | | | | | | 1,438,855 | |

| |

SPAIN – 4.2% | | | | | | | | |

Electricity Transmission & Distribution – 1.5% | | | | | | | | |

Red Electrica Corp. SA | | | 87,800 | | | | 5,861,522 | |

| | | | | | | | |

Toll Roads – 2.7% | | | | | | | | |

Ferrovial SA | | | 530,100 | | | | 10,269,037 | |

| |

Total SPAIN | | | | | | | 16,130,559 | |

| |

SWITZERLAND – 1.9% | | | | | | | | |

Airports – 1.9% | | | | | | | | |

Flughafen Zuerich AG | | | 12,187 | | | | 7,126,039 | |

| |

Total SWITZERLAND | | | | | | | 7,126,039 | |

| |

UNITED KINGDOM – 7.5% | | | | | | | | |

Electricity Transmission & Distribution – 4.7% | | | | | | | | |

National Grid PLC | | | 1,361,700 | | | | 17,810,049 | |

| | | | | | | | |

Water – 2.8% | | | | | | | | |

Pennon Group PLC | | | 483,500 | | | | 5,283,231 | |

United Utilities Group PLC | | | 504,300 | | | | 5,614,677 | |

| | | | | | | | |

Total Water | | | | | | | 10,897,908 | |

| |

Total UNITED KINGDOM | | | | | | | 28,707,957 | |

| |

UNITED STATES – 48.4% | | | | | | | | |

Communications – 11.9% | | | | | | | | |

American Tower Corp. | | | 283,922 | | | | 22,662,654 | |

Crown Castle International Corp. 1 | | | 189,642 | | | | 13,925,412 | |

SBA Communications Corp. 1 | | | 98,700 | | | | 8,867,208 | |

| | | | | | | | |

Total Communications | | | | | | | 45,455,274 | |

| | | | | | | | |

See Notes to Financial Statements.

2013 Annual Report 13

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments (continued)

December 31, 2013

| | | | | | | | |

| | | | | | Value | |

| | | Shares | | | (Note 2) | |

| |

COMMON STOCKS (continued) | | | | | | | | |

Electricity Transmission & Distribution – 1.4% | | | | | | | | |

Northeast Utilities | | | 125,300 | | | $ | 5,311,467 | |

| | | | | | | | |

Gas Utilities – 1.6% | | | | | | | | |

NiSource, Inc. | | | 186,800 | | | | 6,141,984 | |

| | | | | | | | |

Midstream – 10.3% | | | | | | | | |

Access Midstream Partners LP | | | 135,900 | | | | 7,689,222 | |

Crestwood Equity Partners LP | | | 327,400 | | | | 4,527,942 | |

EQT Midstream Partners LP | | | 87,400 | | | | 5,138,246 | |

MarkWest Energy Partners LP | | | 92,300 | | | | 6,103,799 | |

Targa Resources Corp. | | | 49,200 | | | | 4,337,964 | |

The Williams Companies, Inc. | | | 299,700 | | | | 11,559,429 | |

| | | | | | | | |

Total Midstream | | | | | | | 39,356,602 | |

| | | | | | | | |

Other – 4.7% | | | | | | | | |

EV Energy Partners LP | | | 108,700 | | | | 3,688,191 | |

Teekay Corp. | | | 144,300 | | | | 6,927,843 | |

Waste Connections, Inc. | | | 164,300 | | | | 7,168,409 | |

| | | | | | | | |

Total Other | | | | | | | 17,784,443 | |

| | | | | | | | |

Pipelines – 15.4% | | | | | | | | |

Enbridge Energy Management LLC 1 | | | 1 | | | | 23 | |

Energy Transfer Equity LP | | | 97,700 | | | | 7,985,998 | |

Enterprise Products Partners LP | | | 155,300 | | | | 10,296,390 | |

MPLX LP | | | 93,600 | | | | 4,168,944 | |

SemGroup Corp. | | | 110,500 | | | | 7,207,915 | |

Sempra Energy | | | 134,900 | | | | 12,108,624 | |

Spectra Energy Corp. | | | 474,000 | | | | 16,883,880 | |

| | | | | | | | |

Total Pipelines | | | | | | | 58,651,774 | |

| | | | | | | | |

Rail – 3.1% | | | | | | | | |

Union Pacific Corp. | | | 70,000 | | | | 11,760,000 | |

| |

Total UNITED STATES | | | | | | | 184,461,544 | |

| |

Total COMMON STOCKS

(Cost $324,984,869) | | | | | | | 373,370,789 | |

| |

Total Investments – 98.0%

(Cost $324,984,869) | | | | | | | 373,370,789 | |

Other Assets in Excess of Liabilities – 2.0% | | | | | | | 7,455,467 | |

| |

TOTAL NET ASSETS – 100.0% | | | | | | $ | 380,826,256 | |

| |

| |

The following notes should be read in conjunction with the accompanying Schedule of Investments.

| 1 | — Non-income producing security. |

See Notes to Financial Statements.

14 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

Individual contributors to performance included Safestore Holdings PLC, Mitsubishi Estate Company Ltd. and AEON Mall Co., Ltd. The Fund’s overweight in Safestore Holdings PLC contributed to relative performance. Weak 2013 same store sales growth was caused by new value added taxes assessed by the government that were not fully passed through to tenants via increased rent. As this phenomenon passed, the stock performed well.

The Fund’s allocation to Mitsubishi Estate Company contributed to performance as Japanese REITs rallied strongly in early 2013. Mitsubishi Estate Company, Ltd. was a beneficiary of the rally, and the Fund’s overweight to the company contributed positively.

The Fund’s overweight position in AEON Mall Co., Ltd. benefitted Fund performance because we initiated a position after its stock price significantly underperformed its peer group following an equity offering. We were able to gain exposure on this weakness. Thereafter, the stock price traded up to its peers.

Detractors to performance included Sumitomo Realty & Development Co., Ltd, Norwegian Property ASA and Evergrande Real Estate Group Ltd. While owning Mitsubishi Estate Company Ltd. benefitted the Fund during the sharp rally in Japanese REITs, zero exposure to Sumitomo Realty & Development Co., Ltd. during the same period detracted from Fund performance.

Norwegian Property ASA screens attractively from a valuation perspective and we are positive on its fundamentals. However, it remained unloved by market participants in 2013 due to its complicated development pipeline. As such, the Fund’s overweight positioning to the company detracted from performance.

Evergrande Real Estate Group Ltd. is a pure-play homebuilder in Hong Kong and China. During the period, the company poorly executed the development and delivery of homes, causing the Fund’s overweight exposure to detract from performance. The macroeconomic environment within tier three Chinese cities where the company develops caused additional challenges for the company.

GLOBAL REAL ESTATE MARKET OVERVIEW AND OUTLOOK

Global real estate securities challenged in 2013 amid rising rates

Market sentiment throughout 2013 was driven by interest rates – first by euphoria over low rates and later by fear over their imminent rise. Governments across the globe helped drive yields on fixed income investments to all-time lows. Not least was the Japanese government’s unprecedented monthly debt purchase announcement equaling 7.5 trillion yen, or approximately US$76 billion. Following several months of yield focused equity investing spurred by all-time low fixed income yields, markets reversed course in May when U.S. Federal Reserve Chairman Ben Bernanke foreshadowed a reduction in government bond purchases. Thereafter, interest rates rose substantially with the yield on the 10-year U.S. Treasury Note increasing 118 basis points, from 1.86% on January 2 to 3.04% on December 31.

Global equity market movements were generally positive, and the MSCI World Index rose 27.4%1 for the 12-month period ended December 31, 2013. U.S. markets outpaced global markets for the year, but ongoing political and monetary policy turmoil drove volatility in U.S. markets. International outliers included Japan, where optimism over the new Abe government’s policies led the market to outperform, and Europe, which rebounded during the year on signs of stabilization. Boosting markets into year-end was the Fed’s tapering announcement on December 18. The Committee’s decision to reduce purchases of agency mortgage-backed securities and longer-term Treasury securities by a total of US$10 billion per month was generally perceived as dovish. The announcement also included a provision that the targeted federal funds rate would remain “exceptionally low” until unemployment in the U.S. falls below 6.5%, further boosting sentiment.

Concern over rising interest rates has undoubtedly weighed on global real estate securities throughout much of 2013. Global real estate securities returned 4.4% for the year ended December 31, 2013 as measured by the FTSE EPRA/NAREIT Developed Index2. Europe was the bright spot in the asset class, returning 16.2% and outperforming Asia Pacific (4.4%) and North America (1.3%) by a wide margin (as measured by the FTSE EPRA/ NAREIT Developed Index in U.S. dollars).

2013 Annual Report 15

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

While rising rates led real estate securities to underperform in 2013, our forecast for 2014 is brighter. We believe the market has priced in much of the impact of rising rates on Real Estate Investment Trusts (REITs) and, given the spread between short and long term rates is currently wide by historical standards, we believe long term rates will rise only modestly in the medium term from current levels. We see opportunity among attractively priced companies, and believe many of the sectors least vulnerable in a rising rate environment are the most attractively valued – a winning combination for active management. Furthermore, we remain positive on REIT fundamentals. Capital markets and transaction activity throughout the year illustrate positive trends among listed real estate companies.

Transaction activity

Global REIT debt and equity offerings were strong in 2013. The availability and efficiency of capital provided public real estate companies with a distinct advantage over private companies in funding external growth opportunities such as developments and Mergers and Acquisitions (M&A) activities. In some cases we saw long-term financing near record low rates providing support for higher public valuations in the sector. And in the U.S., more unsecured debt was issued than in any other year since markets reopened in 2009 following the global financial crisis, with over US$28 billion raised according to the National Association of Real Estate Investment Trusts3.

The trend was global. Australian REITs like the GPT Group (GPT) tapped U.S. debt markets to access inexpensive long-term financing. GPT raised two tranches of notes, A$150 million of 12-year notes issued at a 3.6% coupon and A$100 million of 15-year notes issued at a 3.8% coupon. Listed real estate companies throughout Europe refinanced existing debt at lower rates, shoring up balance sheets and growing portfolios. Interestingly, GAGFAH S.A. (German residential), which is one of the region’s more highly leveraged REITs, refinanced a €1.06 billion loan with a 3.90% coupon maturing in five years representing a 43 basis point reduction versus its previous loan. Simon Property Group, Inc., the largest U.S. regional mall REIT, announced the sale of €750 million of its 2.375% senior unsecured notes due October 2, 2020. Finally, U.S. REIT, Ventas, Inc., raised US$500 million in 2.7% senior notes due in 2020.

The real estate securities IPO market in 2013 was strong as well. Across the globe, key IPOs included the following:

Prologis, the largest U.S. industrial REIT, capitalized on first quarter demand for Japanese real estate securities through its 100 billion yen (US$1 billion) IPO of its Japanese REIT (J-REIT) Nippon Prologis REIT, Inc. (NPR).

Nomura Real Estate Master Fund Inc., a Japanese real estate company owning industrial and other commercial properties in Japan, raised a sizeable US$1.8 billion IPO.

Deutsche Annington Immobilien AG, Germany’s largest residential landlord, majority owned by Terra Firma Capital Partners Ltd, raised approximately €575 million (US$782 million) in an IPO in July.

Mexican Fibra, Terrafina, completed a successful 8.3 billion Mexican peso (US$665 million) IPO. Terrafina, was sponsored by Prudential Real Estate Investors and owns a large industrial portfolio in Mexico.

The U.S. IPO market was also robust. Early in the year, housing focused Tri Pointe Homes, a California focused homebuilder, and American Residential Properties, completed IPOs. In the fourth quarter, three Blackstone Group LP (Blackstone) companies completed IPOs, including Brixmor Property Group, Inc. (BRX), Extended Stay America, Inc. (STAY) and Hilton Worldwide Inc. (HLT).

16 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

M&A activity is also on the rise, and we believe the current valuation spread between public and private real estate may drive increased M&A in the space. One of the most notable transactions in the fourth quarter was the ongoing bidding war between Dexus Property Group and GPT Group, two Australian diversified REITs with large office portfolios, for Commonwealth Property Office Fund, the third primary owner of office assets in Australia. According to our estimates, bids have now exceeded net tangible assets (NTA), while many real estate securities in the country are trading below NTA.

In the U.S., direct investors have paid a premium in private markets, with several recent transactions having closed at sub-6% cap rates. However, public market valuations generally imply between a 5.5% and 7.0% cap rate. For example, a UBS AG fund acquired a 50% stake in trophy Chicago, Illinois asset Water Tower Place. The transaction values the building at US$810 million representing a 4.5% cap rate4. 2013 M&A deals include Brookfield Office Properties (BPO) acquisition of MPG Office Trust (MPG). MPG’s portfolio includes seven class A office properties totaling 8.3 million square feet for which BPO has committed a total of US$1.15 billion. In the fourth quarter Tri Pointe Homes, a homebuilder controlled by Starwood Capital, announced it will acquire the homebuilding and real estate subsidiary of Weyerhaeuser Co. for US$2.7 billion. Weyerhaeuser Co.’s core business is timber, and we believe the transaction clarifies its structure.

OUTLOOK

As we look ahead to 2014, we are increasingly constructive on the outlook for global real estate securities. We anticipate the interest rate environment will be less impactful than it was in 2013, supporting property valuations. In addition, we expect economic growth will be strong enough to drive increases in occupancy, rental rates, and cash flow but not strong enough to encourage significant new construction. We maintain most of our existing biases, but are selectively reviewing markets and sectors/sub-sectors that have exhibited weakness in recent months to identify new opportunities. We remain focused on higher growth sectors and maintain an overweight to Europe, underweight positioning in the Asia Pacific, and roughly equal weighting within North America. Within Europe we favor the Continent, where investor interest has been constrained and stocks are trading at attractive valuations, over the UK where investor interest is strong and valuations are higher.

Within the Asia Pacific region, we remain overweight Australian real estate securities, which appear attractively priced, especially given recent underperformance. We believe valuations are poised to increase as international interest in Australian property grows, particularly from neighboring Asian countries. The portfolio is underweight Japan on the basis of valuation as real estate stocks continue to trade at a premium to Net Asset Value (NAV). We believe China and Hong Kong are past the peak in their residential property cycles and that their residential markets are poised to deteriorate. Most companies in our Chinese and Hong Kong investment universe either have exposure to the residential sector or operate in sectors that are highly correlated to the housing market. Furthermore, both markets are vulnerable in a rising rate environment. In the U.S. we have high conviction in companies with pricing power such as the apartment sector, specifically Northern California apartments, as well as West Coast office markets.

2013 Annual Report 17

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| As of December 31, 2013 | | 1 Year | | | Since Inception* | |

Class A Shares (excluding sales charge) | | | 4.99 | % | | | 11.87 | % |

Class A Shares (including sales charge) | | | -0.01 | % | | | 8.65 | % |

Class C Shares (excluding sales charge) | | | 4.18 | % | | | 11.06 | % |

Class C Shares (including sales charge) | | | 3.19 | % | | | 11.06 | % |

Class Y Shares | | | 5.20 | % | | | 17.78 | % |

Class I Shares | | | 5.20 | % | | | 17.74 | % |

FTSE EPRA/NAREIT Developed Index | | | 4.39 | % | | | 15.71 | % |

| * | Classes A and C were incepted on May 1, 2012 and Classes Y and I were incepted on December 1, 2011. The FTSE/EPRA NAREIT Developed Index references Class I’s inception date. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days. Performance data does not reflect the imposition of the redemption fee and if it had, performance would have been lower. Performance shown including sales charge reflects the Class A maximum sales charge of 4.75% and the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance data excluding sales charge does not reflect the deduction of the sales charge or CDSC and if reflected, the sales charge or fee would reduce the performance quoted.

As per the prospectus dated April 30, 2013, the Fund’s gross expense ratio for Class A, Class C, Class Y and Class I is 2.54%, 3.55%, 3.24% and 2.65%, respectively. And the Fund’s net expense ratio for Class A, Class C, Class Y and Class I is 1.20%, 1.95%, 0.95% and 0.95%, respectively for the year ended December 31, 2012.

The Adviser has contractually agreed to reimburse the Fund’s expenses through May 1, 2015. There is no guarantee that such reimbursement will be continued after that date.

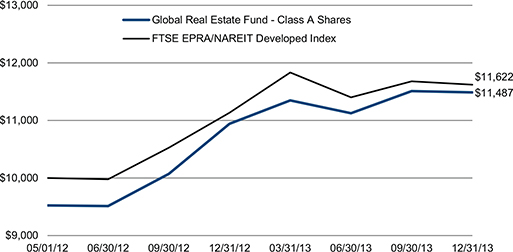

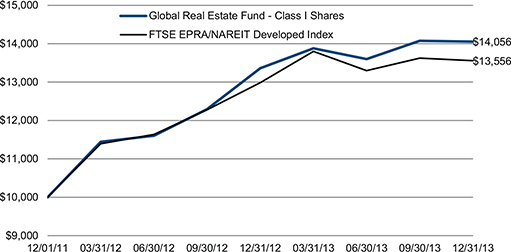

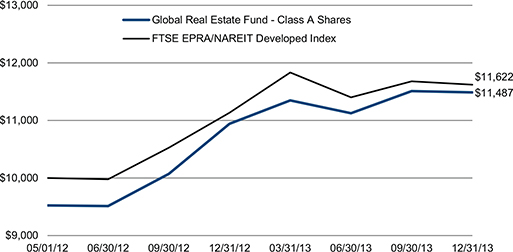

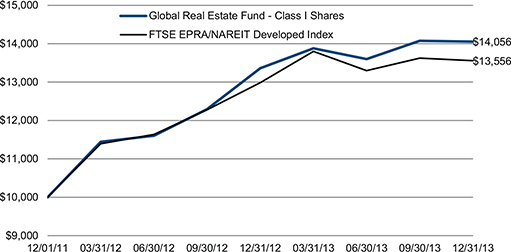

The graphs below illustrate a hypothetical investment of $10,000 in the Global Real Estate Fund—Class A Shares from the commencement of investment operations on May 1, 2012 to December 31, 2013 compared to the FTSE EPRA/NAREIT Developed Index and Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2013 compared to the FTSE EPRA/NAREIT Developed Index.

18 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Class A Shares

Class I Shares

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Brookfield Global Listed Real Estate Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

2013 Annual Report 19

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Mutual fund investing involves risk. Principal loss is possible.

A basis point (bps) is a unit that is equal to 1/100th of 1%.

A capitalization rate is a rate of return on a real estate investment property which is based on the anticipated income that the property will generate.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2013 and subject to change based on subsequent developments.

| 1 | The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. You cannot invest directly in an index. |

| 2 | The FTSE EPRA/NAREIT Developed Index is a free-float adjusted, liquidity, size and revenue screened index designed to track the performance of listed real estate companies and REITS worldwide. You cannot invest directly in an index. |

| 3 | National Association of Real Estate Investment Trusts® “Historical Offerings of Securities”; reit.com. |

| 4 | Source: Real Capital Analytics. |

20 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio Characteristics (Unaudited)

December 31, 2013

| | | | |

| | | Percent of | |

| ASSET ALLOCATION BY GEOGRAPHY | | Net Assets | |

United States | | | 44.4 | % |

Australia | | | 9.1 | % |

Japan | | | 6.2 | % |

Hong Kong | | | 5.4 | % |

Germany | | | 3.8 | % |

France | | | 3.7 | % |

Netherlands | | | 3.5 | % |

United Kingdom | | | 3.4 | % |

Russia | | | 1.8 | % |

Norway | | | 1.7 | % |

Singapore | | | 1.7 | % |

Austria | | | 1.4 | % |

Italy | | | 0.9 | % |

Brazil | | | 0.7 | % |

Other Assets in Excess of Liabilities | | | 12.3 | % |

Total | | | 100.0 | % |

| |

ASSET ALLOCATION BY SECTOR | | | | |

Office | | | 17.1 | % |

Real Estate - Diversified | | | 14.7 | % |

Residential | | | 14.2 | % |

Retail | | | 10.9 | % |

Regional Malls | | | 7.8 | % |

Healthcare | | | 5.0 | % |

Hotel | | | 3.8 | % |

Mixed | | | 3.2 | % |

Industrial | | | 3.1 | % |

Self Storage | | | 2.5 | % |

Timber | | | 1.9 | % |

Developer - Office | | | 1.7 | % |

Real Estate Operator/Developer | | | 1.0 | % |

Strip Centers | | | 0.8 | % |

Other Assets in Excess of Liabilities | | | 12.3 | % |

Total | | | 100.0 | % |

| |

TOP TEN HOLDINGS | | | | |

Simon Property Group, Inc. | | | 6.2 | % |

Equity Residential | | | 5.0 | % |

Mitsubishi Estate Company Ltd. | | | 4.0 | % |

Ventas, Inc. | | | 3.6 | % |

Sun Hung Kai Properties Ltd. | | | 3.6 | % |

Dexus Property Group | | | 3.0 | % |

Corio NV | | | 2.8 | % |

Unibail-Rodamco SE | | | 2.7 | % |

AvalonBay Communities, Inc. | | | 2.6 | % |

Highwoods Properties, Inc. | | | 2.6 | % |

2013 Annual Report 21

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

December 31, 2013

| | | | | | | | |

| | | | | | Value | |

| | | Shares | | | (Note 2) | |

COMMON STOCKS – 87.7% | | | | | | | | |

AUSTRALIA – 9.1% | | | | | | | | |

Industrial – 1.8% | | | | | | | | |

Goodman Group | | | 549,400 | | | $ | 2,327,671 | |

| | | | | | | | |

Real Estate – Diversified – 4.7% | | | | | | | | |

Dexus Property Group | | | 4,209,400 | | | | 3,785,852 | |

Mirvac Group | | | 1,476,700 | | | | 2,220,527 | |

| | | | | | | | |

Total Real Estate - Diversified | | | | | | | 6,006,379 | |

| | | | | | | | |

Retail – 2.6% | | | | | | | | |

Westfield Retail Trust | | | 1,218,600 | | | | 3,237,367 | |

| |

Total AUSTRALIA | | | | | | | 11,571,417 | |

| |

AUSTRIA – 1.4% | | | | | | | | |

Residential – 1.4% | | | | | | | | |

Conwert Immobilien Invest SE | | | 139,300 | | | | 1,786,698 | |

| |

Total AUSTRIA | | | | | | | 1,786,698 | |

| |

BRAZIL – 0.7% | | | | | | | | |

Retail – 0.7% | | | | | | | | |

Multiplan Empreendimentos Imobiliarios SA | | | 45,200 | | | | 955,326 | |

| |

Total BRAZIL | | | | | | | 955,326 | |

| |

FRANCE – 3.7% | | | | | | | | |

Hotel – 1.0% | | | | | | | | |

Accor SA | | | 25,800 | | | | 1,218,536 | |

| | | | | | | | |

Real Estate – Diversified – 2.7% | | | | | | | | |

Unibail-Rodamco SE | | | 13,500 | | | | 3,459,514 | |

| |

Total FRANCE. | | | | | | | 4,678,050 | |

| |

GERMANY – 3.8% | | | | | | | | |

Mixed – 1.0% | | | | | | | | |

DIC Asset AG | | | 141,908 | | | | 1,307,972 | |

| | | | | | | | |

Office – 1.8% | | | | | | | | |

Alstria Office REIT – AG | | | 180,900 | | | | 2,277,613 | |

| | | | | | | | |

Real Estate Operator/Developer – 1.0% | | | | | | | | |

LEG Immobilien AG | | | 20,200 | | | | 1,194,763 | |

| |

Total GERMANY | | | | | | | 4,780,348 | |

| |

HONG KONG – 5.4% | | | | | | | | |

Office – 1.8% | | | | | | | | |

Hongkong Land Holdings Ltd. | | | 400,200 | | | | 2,364,621 | |

| | | | | | | | |

Real Estate – Diversified – 3.6% | | | | | | | | |

Sun Hung Kai Properties Ltd. | | | 358,251 | | | | 4,553,142 | |

| |

Total HONG KONG | | | | | | | 6,917,763 | |

| |

ITALY – 0.9% | | | | | | | | |

Office – 0.9% | | | | | | | | |

Beni Stabili SpA | | | 1,701,900 | | | | 1,147,728 | |

| |

Total ITALY | | | | | | | 1,147,728 | |

| |

See Notes to Financial Statements.

22 Brookfield Investment Management Inc.

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments (continued)

December 31, 2013

| | | | | | | | |

| | | | | | Value | |

| | | Shares | | | (Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

JAPAN – 6.2% | | | | | | | | |

Industrial – 1.3% | | | | | | | | |

Japan Logistics Fund, Inc. | | | 163 | | | $ | 1,727,399 | |

| | | | | | | | |

Office – 4.0% | | | | | | | | |

Mitsubishi Estate Company Ltd. | | | 169,055 | | | | 5,059,147 | |

| | | | | | | | |

Real Estate – Diversified – 0.9% | | | | | | | | |

GLP J-Reit | | | 1,193 | | | | 1,165,239 | |

| |

Total JAPAN | | | | | | | 7,951,785 | |

| |

NETHERLANDS – 3.5% | | | | | | | | |

Retail – 3.5% | | | | | | | | |

Corio NV | | | 80,500 | | | | 3,612,626 | |

Vastned Retail NV | | | 17,300 | | | | 785,129 | |

| | | | | | | | |

Total Retail | | | | | | | 4,397,755 | |

| |

Total NETHERLANDS | | | | | | | 4,397,755 | |

| |

NORWAY – 1.7% | | | | | | | | |

Real Estate – Diversified – 1.7% | | | | | | | | |

Norwegian Property ASA | | | 1,773,236 | | | | 2,125,439 | |

| |

Total NORWAY | | | | | | | 2,125,439 | |

| |

RUSSIA – 1.8% | | | | | | | | |

Retail – 1.8% | | | | | | | | |

Atrium European Real Estate Ltd. | | | 391,400 | | | | 2,259,228 | |

| |

Total RUSSIA | | | | | | | 2,259,228 | |

| |

SINGAPORE – 1.7% | | | | | | | | |

Developer – Office – 1.7% | | | | | | | | |

Keppel Land Ltd. | | | 836,200 | | | | 2,219,614 | |

| |

Total SINGAPORE | | | | | | | 2,219,614 | |

| |

UNITED KINGDOM – 3.4% | | | | | | | | |

Real Estate – Diversified – 1.1% | | | | | | | | |

Safestore Holdings PLC | | | 547,000 | | | | 1,458,353 | |

| | | | | | | | |

Retail – 2.3% | | | | | | | | |

Hammerson PLC | | | 345,300 | | | | 2,874,697 | |

| |

Total UNITED KINGDOM | | | | | | | 4,333,050 | |

| |

UNITED STATES – 44.4% | | | | | | | | |

Healthcare – 5.0% | | | | | | | | |

HCP, Inc. | | | 47,300 | | | | 1,717,936 | |

Ventas, Inc. | | | 81,000 | | | | 4,639,680 | |

| | | | | | | | |

Total Healthcare | | | | | | | 6,357,616 | |

| | | | | | | | |

Hotel – 2.8% | | | | | | | | |

Host Hotels & Resorts, Inc. | | | 122,300 | | | | 2,377,512 | |

Hyatt Hotels Corp. 1 | | | 24,400 | | | | 1,206,824 | |

| | | | | | | | |

Total Hotel | | | | | | | 3,584,336 | |

| | | | | | | | |

Mixed – 2.2% | | | | | | | | |

Liberty Property Trust | | | 83,100 | | | | 2,814,597 | |

| | | | | | | | |

See Notes to Financial Statements.

2013 Annual Report 23

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments (continued)

December 31, 2013

| | | | | | | | |

| | | | | | Value | |

| | | Shares | | | (Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

Office – 8.6% | | | | | | | | |

Corporate Office Properties Trust | | | 26,700 | | | $ | 632,523 | |

Douglas Emmett, Inc. | | | 92,850 | | | | 2,162,476 | |

DuPont Fabros Technology, Inc. | | | 58,200 | | | | 1,438,122 | |

Highwoods Properties, Inc. | | | 90,400 | | | | 3,269,768 | |

Mack-Cali Realty Corp. | | | 81,800 | | | | 1,757,064 | |

SL Green Realty Corp. | | | 18,600 | | | | 1,718,268 | |

| | | | | | | | |

Total Office | | | | | | | 10,978,221 | |

| | | | | | | | |

Regional Malls – 7.8% | | | | | | | | |

CBL & Associates Properties, Inc. | | | 111,700 | | | | 2,006,132 | |

Simon Property Group, Inc. | | | 51,800 | | | | 7,881,888 | |

| | | | | | | | |

Total Regional Malls | | | | | | | 9,888,020 | |

| | | | | | | | |

Residential – 12.8% | | | | | | | | |

AvalonBay Communities, Inc. | | | 28,300 | | | | 3,345,909 | |

Camden Property Trust | | | 30,000 | | | | 1,706,400 | |

Equity Residential | | | 122,200 | | | | 6,338,514 | |

Essex Property Trust, Inc. | | | 15,800 | | | | 2,267,458 | |

Mid-America Apartment Communities, Inc. | | | 44,300 | | | | 2,690,782 | |

| | | | | | | | |

Total Residential | | | | | | | 16,349,063 | |

| | | | | | | | |

Self Storage – 2.5% | | | | | | | | |

Iron Mountain, Inc. | | | 103,185 | | | | 3,131,665 | |

| | | | | | | | |

Strip Centers – 0.8% | | | | | | | | |

Brixmor Property Group, Inc. | | | 51,800 | | | | 1,053,094 | |

| | | | | | | | |

Timber – 1.9% | | | | | | | | |

Weyerhaeuser Co. | | | 75,500 | | | | 2,383,535 | |

| |

Total UNITED STATES | | | | | | | 56,540,147 | |

| |

Total COMMON STOCKS

(Cost $111,105,427) | | | | | | | 111,664,348 | |

| |

Total Investments – 87.7%

(Cost $111,105,427) | | | | | | | 111,664,348 | |

Other Assets in Excess of Liabilities – 12.3% | | | | | | | 15,651,406 | |

| |

TOTAL NET ASSETS – 100.0% | | | | | | $ | 127,315,754 | |

| |

| |

The following notes should be read in conjunction with the accompanying Schedule of Investments.

1 — Non-income producing security.

See Notes to Financial Statements.

24 Brookfield Investment Management Inc.

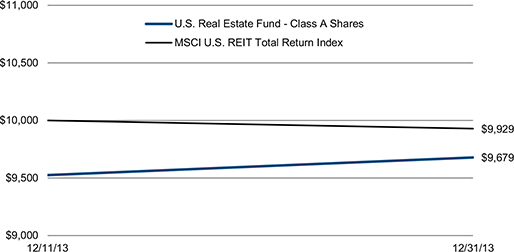

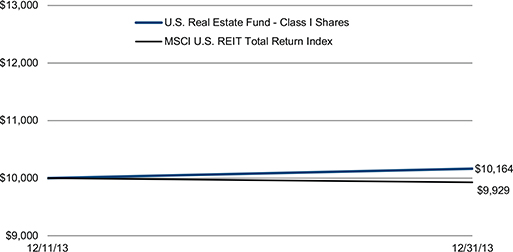

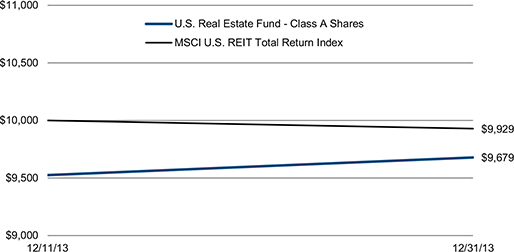

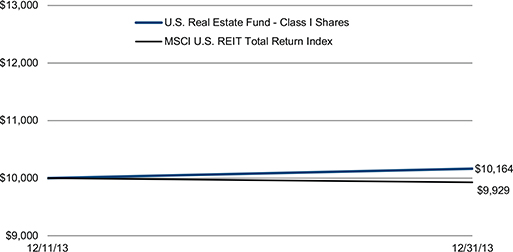

BROOKFIELD U.S. LISTED REAL ESTATE FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

Individual contributors to performance included Weyerhaeuser Co., DuPont Fabros Technology, Inc. and Iron Mountain, Inc. Non-benchmark exposure to Weyerhaeuser Co., a timber company, benefitted Fund performance. The position benefitted from the pending acquisition of its homebuilding subsidiary by Tri Pointe Homes, a homebuilder controlled by Starwood Capital, for US$2.7 billion. Market participants appear to have liked the acquisition price.

The Fund’s overweight to DuPont Fabros Technology, Inc. was a strong contributor during the period. The company trades at a higher implied capitalization rate and more attractive valuation than its data center peers and it is developing in the two strongest data center markets in the U.S., Northern Virginia and Chicago.

Non-benchmark holding Iron Mountain, Inc. (IRM) was a large contributor to Fund performance. The company is seeking conversion to REIT status and therefore, its stock price moved throughout 2013 on speculation of the potential conversion. IRM has been strong since inception of the Fund as the U.S. Internal Revenue Service announced it would resume REIT conversion decisions prior to the Fund’s inception.

Detractors to performance included Equity Residential, Essex Property Trust, Inc. and AvalonBay Communities, Inc. Overweight exposure to these three companies detracted from Fund performance driven by weakness in the residential apartment sector. We continue to favor the apartment sector despite recent weakness.

U.S. REAL ESTATE MARKET OVERVIEW AND OUTLOOK

Real estate securities challenged in 2013 amid rising rates

Market sentiment throughout 2013 was driven by interest rates – first by euphoria over low rates and later by fear over their imminent rise. Following several months of yield focused equity investing spurred by all-time low fixed income yields, markets reversed course in May when U.S. Federal Reserve Chairman Ben Bernanke foreshadowed a reduction in government bond purchases. Interest rates rose substantially, and the yield on the 10-year U.S. Treasury Note increased 118 basis points throughout the year from 1.86% on January 2 to 3.04% on December 31.

Overall, U.S. markets outpaced global markets and the S&P 500 Total Return Index1 rose 32.4% for the 12-month period ended December 31, 2013. However, ongoing political and monetary policy turmoil drove volatility in U.S. markets. Boosting markets into year-end was the Fed’s tapering announcement on December 18. The Committee’s decision to reduce purchases of agency mortgage-backed securities and longer-term Treasury securities by a total of US$10 billion per month was generally perceived as dovish. The announcement also included a provision that the targeted federal funds rate would remain “exceptionally low” until unemployment in the U.S. falls below 6.5%, further boosting sentiment.

Concern over rising interest rates undoubtedly weighed on U.S. real estate securities in 2013. U.S. real estate securities returned 2.5% for the 12-month period ended December 31, 2013, as measured by the MSCI U.S. REIT Total Return Index2. While rising rates led real estate securities to underperform in 2013, our forecast for 2014 is brighter. We believe the market has priced in much of the impact of rising rates on REITs and, given the spread between short and long term rates is currently wide by historical standards, we believe long term rates will rise only modestly in the medium term from current levels. We see opportunity among attractively priced companies, and believe many of the sectors least vulnerable in a rising rate environment are the most attractively valued – a potentially winning combination for active management. Furthermore, we remain positive on REIT fundamentals. Capital markets and transaction activity throughout the year illustrate positive trends among listed real estate companies.

Transaction activity

REIT debt and equity offerings were strong in 2013. The availability and efficiency of capital provided public real estate companies with a distinct advantage over private companies in funding external growth opportunities such

2013 Annual Report 25

BROOKFIELD U.S. LISTED REAL ESTATE FUND

as developments and Mergers and Acquisitions (M&A) activities. More unsecured debt was issued than in any other year since markets reopened in 2009 following the global financial crisis, with over US$28 billion raised according to the National Association of Real Estate Investment Trusts3. For example, Ventas, Inc. raised US$500 million in 2.7% senior notes due in 2020.

The real estate securities IPO market in 2013 was strong as well, including the following successful transactions:

American Residential Properties (ARPI), which sold 13.7 million shares raising US$288 million. ARPI is the latest single family housing REIT to list publicly in a REIT sector born in late 2012 with the REIT conversion of American Homes For Rent.

Empire State Realty Trust, which owns the Empire State building in New York City. The company listed 71,500,000 shares of common stock priced at $13.00 per share.

Three Blackstone Group LP (Blackstone) IPOs, including Brixmor Property Group (BRX), Extended Stay America, Inc. (STAY) and Hilton Worldwide Inc. (HLT).

M&A activity is also on the rise, and we believe the current valuation spread between public and private real estate may drive increased M&A in the space. In the U.S., direct investors have paid a premium in private markets, with several recent transactions having closed at sub-6% cap rates. However, public market valuations generally imply between a 5.5% and 7.0% cap rate. For example, a UBS AG fund acquired a 50% stake in trophy Chicago, Illinois asset Water Tower Place. The transaction values the building at US$810 million representing a 4.5% cap rate4. 2013 M&A deals include Brookfield Office Properties (BPO) acquisition of MPG Office Trust (MPG). MPG’s portfolio includes seven class A office properties totaling 8.3 million square feet for which BPO has committed a total of US$1.15 billion. In the fourth quarter Tri Pointe Homes, a homebuilder controlled by Starwood Capital, announced it will acquire the homebuilding and real estate subsidiary of Weyerhaeuser Co. for US$2.7 billion.