UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22564

GMO Series Trust

(Exact name of the registrant as specified in charter)

| 40 Rowes Wharf, Boston, MA | 02110 | |||

| (Address of principal executive offices) | (Zip Code) |

Sheppard N. Burnett, Chief Executive Officer, 40 Rowes Wharf, Boston, MA 02110

(Name and address of agent for services)

Registrant’s telephone number, including area code: 617-346-7646

Date of fiscal year end: 02/28/15*

Date of reporting period: 02/28/15

* On September 18, 2014, the registrant’s Board of Trustees approved the change of the fiscal year-end of the Registrant from April 30 to February 28/29.

Item 1. Reports to Stockholders.

The annual reports for each series of the registrant for the period ended February 28, 2015 are filed herewith.

GMO Series Trust

Annual Report

February 28, 2015

Benchmark-Free Allocation Series Fund

Emerging Countries Series Fund

Global Asset Allocation Series Fund

Global Equity Allocation Series Fund

International Developed Equity Allocation Series Fund

International Equity Allocation Series Fund

For a free copy of the Funds’ proxy voting guidelines, shareholders may call 1-617-346-7646 (collect) or visit the Securities and Exchange Commission’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on GMO’s website www.dc.gmo.com, or on the Securities and Exchange Commission’s website at www.sec.gov.

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-Q, which is available on the Commission’s website at www.sec.gov. The Funds’ Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus for GMO Series Trust, which contains a complete discussion of the risks associated with an investment in these Funds and other important information. The GMO Series Trust prospectus can be obtained at www.dc.gmo.com.

An investment in the Funds is subject to risk, including the possible loss of the principal amount invested. There can be no assurance that the Funds will achieve the stated investment objectives. Please see the Funds’ prospectus regarding specific risks for each Fund. General risks may include: market risk, management and operational risk, non-U.S. investment risk, smaller company risk and derivatives risk.

The Funds are distributed by Funds Distributor LLC. Funds Distributor LLC is not affiliated with GMO.

| 2 | |||||

| 2 | |||||

| 3 | |||||

| 4 | |||||

| 5 | |||||

| 5 | |||||

| 6 | |||||

| 7 | |||||

| 8 | |||||

| 8 | |||||

| 9 | |||||

| 10 | |||||

| 11 | |||||

| 11 | |||||

| 12 | |||||

| 13 | |||||

| 14 | |||||

| 14 | |||||

| 15 | |||||

| 16 | |||||

| 17 | |||||

| 17 | |||||

| 18 | |||||

| 19 | |||||

| 20 | |||||

| 21 | |||||

| 23 | |||||

| 26 | |||||

| 32 | |||||

| 59 | |||||

| 60 | |||||

| 61 | |||||

| 62 | |||||

| 63 |

GMO Benchmark-Free Allocation Series Fund

(A Series of GMO Series Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Asset Allocation Team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

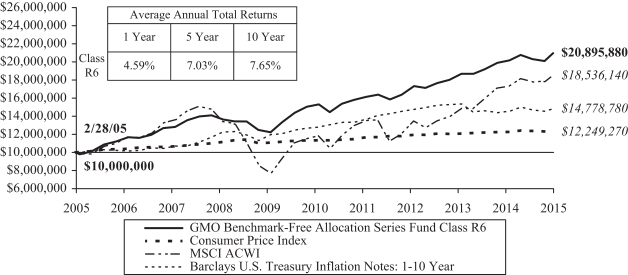

Although GMO does not manage the Fund to, or control the Fund’s risk relative to, any securities index or securities benchmark, a discussion of the Fund’s performance relative to the CPI is included for comparative purposes.

Class R6 shares of GMO Benchmark-Free Allocation Series Fund returned +4.59% for the fiscal year ended February 28, 2015, as compared with +0.01% for the CPI.

The Fund’s exposures to U.S. quality equities, developed rates positions (driven primarily by euro and Japanese yen positions), and select fundamentally researched U.S. equity holdings were the biggest drivers of the positive relative performance. The Fund’s exposure to European value equities and the investment in GMO Alpha Only Fund detracted from relative performance.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

Comparison of Change in Value of a $10,000,000 Investment in

GMO Benchmark-Free Allocation Series Fund Class R6 Shares and the

Consumer Price Index

As of February 28, 2015

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance data shown above for GMO Benchmark-Free Allocation Series Fund (the “Fund”) reflects the performance data of GMO Benchmark-Free Allocation Fund (the “Institutional Fund”) through January 24, 2013 (the commencement date of the Fund), restated to reflect the additional fees and expenses of the Fund. The year ends shown above have been restated to align with the change from an April 30 to a February 28/29 year end. For the period May 1, 2014 through February 28, 2015, the Fund returned +2.47%. Performance data shown above for the Fund is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited.

The Fund invests substantially all of its assets in shares of the Institutional Fund. Prior to January 1, 2012, the Institutional Fund served as a principal component of a broader GMO real return strategy. Beginning on January 1, 2012, the Institutional Fund has been managed as a standalone investment vehicle.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

2

GMO Benchmark-Free Allocation Series Fund

(A Series of GMO Series Trust)

Investment Concentration Summary

February 28, 2015 (Unaudited)

| Asset Class Summary* | % of Total Net Assets | |||

Common Stocks | 49.1 | % | ||

Short-Term Investments | 26.1 | |||

Debt Obligations | 20.3 | |||

Futures Contracts | 6.4 | |||

Options Purchased | 2.5 | |||

Preferred Stocks | 1.7 | |||

Swap Contracts | 0.3 | |||

Forward Currency Contracts | 0.2 | |||

Loan Participations | 0.1 | |||

Investment Funds | 0.1 | |||

Rights/Warrants | 0.1 | |||

Loan Assignments | 0.0 | ^ | ||

Written/Credit Linked Options | (0.8 | ) | ||

Securities Sold Short | (3.0 | ) | ||

Other | (3.1 | ) | ||

|

| |||

| 100.0 | % | |||

|

| |||

| Country/Region Summary** | % of Investments | |||

Emerging*** | 42.1 | % | ||

United States | 40.7 | |||

Australia | 10.2 | |||

Denmark | 6.8 | |||

New Zealand | 5.2 | |||

France | 4.3 | |||

Germany | 3.0 | |||

Hong Kong | 1.8 | |||

Spain | 1.2 | |||

Italy | 1.2 | |||

Netherlands | 1.2 | |||

Norway | 0.5 | |||

United Kingdom | 0.5 | |||

Canada | 0.4 | |||

Israel | 0.3 | |||

Sweden | 0.3 | |||

Belgium | 0.2 | |||

Ireland | 0.1 | |||

Finland | 0.1 | |||

Singapore | 0.1 | |||

Portugal | 0.1 | |||

Austria | 0.1 | |||

Switzerland | (2.0 | ) | ||

Japan | (18.4 | ) | ||

|

| |||

| 100.0 | % | |||

|

| |||

| * | The table above incorporates aggregate indirect asset class exposure resulting from investments in shares of a series of GMO Trust (the “Institutional Fund”) and the series of GMO Trust in which the Institutional Fund invests (collectively referred to as the “Underlying Funds”), if any, except for GMO Alpha Only Fund. Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ** | The table above incorporates aggregate indirect country exposure associated with investments in the Institutional Fund and Underlying Funds, if any. The table excludes short-term investments, if any. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options, if any. The table is based on duration adjusted net exposures (both investments and derivatives), taking into account the market value of securities and the notional amounts of swaps and other derivative financial instruments. For example, U.S. asset-backed securities may represent a relatively small percentage due to their short duration, even though they represent a large percentage of market value (direct and indirect). Duration is based on GMO’s models. The greater the duration of a bond, the greater its contribution to the concentration percentage. Credit default swap exposures are factored into the duration adjusted exposure using the reference security and applying the same methodology to that security. |

| *** | The “Emerging” exposure is primarily comprised of: Angola, Argentina, Azerbaijan, Brazil, Chile, China, Colombia, Congo, Costa Rica, Croatia, Dominican Republic, Ecuador, Greece, Hungary, Indonesia, Iraq, Korea, Malaysia, Mexico, Morocco, Pakistan, Panama, Peru, Philippines, Russia, Serbia, South Africa, Sri Lanka, Tunisia, Turkey, Ukraine, Uruguay, Venezuela, and Vietnam. |

| ^ | Rounds to 0.0%. |

3

GMO Benchmark-Free Allocation Series Fund

(A Series of GMO Series Trust)

(showing percentage of total net assets)

February 28, 2015

| Shares | Description | Value ($) | ||||||||||

| MUTUAL FUNDS — 98.9% | ||||||||||||

| Affiliated Issuers — 98.9% | ||||||||||||

| 10,283,875 | GMO Benchmark-Free Allocation Fund, Class III | 277,973,153 | ||||||||||

|

| |||||||||||

| TOTAL MUTUAL FUNDS (COST $271,987,612) | 277,973,153 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENTS — 98.9% | 277,973,153 | |||||||||||

| Other Assets and Liabilities (net) — 1.1% | 3,136,391 | |||||||||||

|

| |||||||||||

| TOTAL NET ASSETS — 100.0% | $281,109,544 | |||||||||||

|

| |||||||||||

See accompanying notes to the financial statements.

4

GMO Emerging Countries Series Fund

(A Series of GMO Series Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Emerging Markets Team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

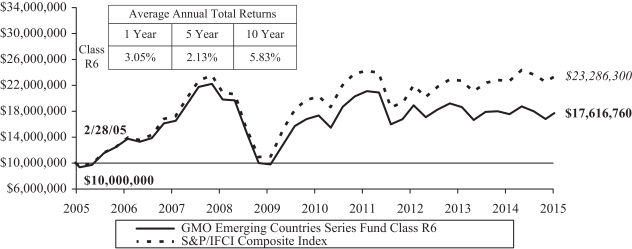

Since their inception on May 2, 2014, Class R6 shares of GMO Emerging Countries Series Fund returned -1.01% for the fiscal year ended February 28, 2015, as compared with +1.45% for the Fund’s benchmark, the S&P/IFCI Composite Index.

Country-sector allocation detracted from the Fund’s relative returns for the fiscal period. The Fund’s overweights in Korea Financials and Korea Consumer Discretionary and the overweight in Brazil Materials detracted from relative performance. The Fund’s underweight in Brazil Energy and overweight in China Telecommunications added to relative performance.

Stock selection detracted from relative returns during the fiscal period. In particular, the Fund’s stock selections in Korea Financials detracted from relative performance.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

Comparison of Change in Value of a $10,000,000 Investment in

GMO Emerging Countries Series Fund Class R6 Shares and the

S&P/IFCI Composite Index

As of February 28, 2015

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance data shown above for GMO Emerging Countries Series Fund (the “Fund”) reflects the performance data of GMO Emerging Countries Fund (the “Institutional Fund”) through May 2, 2014 (the commencement date of the Fund), restated to reflect the additional fees and expenses of the Fund. For the period May 2, 2014 through February 28, 2015, the Fund returned -1.01%. Performance data shown above for the Fund is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited.

The Fund invests substantially all of its assets in shares of the Institutional Fund.

For S&P disclaimers please visit http://www.gmo.com/America/_Disclaimers/_BenchmarkDisclaimers.htm.

5

GMO Emerging Countries Series Fund

(A Series of GMO Series Trust)

Investment Concentration Summary

February 28, 2015 (Unaudited)

| Asset Class Summary* | % of Total Net Assets | |||

Common Stocks | 85.4 | % | ||

Preferred Stocks | 10.7 | |||

Investment Funds | 2.0 | |||

Short-Term Investments | 0.3 | |||

Rights/Warrants | 0.0 | ^ | ||

Other | 1.6 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| Country/Region Summary** | % of Investments | |||

South Korea | 19.6 | % | ||

China | 15.3 | |||

Brazil | 11.9 | |||

Taiwan | 11.4 | |||

Russia | 11.2 | |||

India | 9.8 | |||

Thailand | 3.8 | |||

Egypt | 3.0 | |||

Indonesia | 2.4 | |||

Poland | 2.2 | |||

Turkey | 2.1 | |||

Czech Republic | 1.8 | |||

South Africa | 1.8 | |||

Philippines | 1.7 | |||

United States*** | 0.5 | |||

Mexico | 0.4 | |||

United Kingdom*** | 0.3 | |||

Colombia | 0.2 | |||

Peru | 0.2 | |||

Qatar | 0.2 | |||

Malaysia | 0.1 | |||

Panama | 0.1 | |||

Hungary | 0.0 | ^ | ||

|

| |||

| 100.0 | % | |||

|

| |||

| * | The table above incorporates aggregate indirect asset class exposure resulting from investments in shares of a series of GMO Trust (the “Institutional Fund”) and the series of GMO Trust in which the Institutional Fund invests (collectively referred to as the “Underlying Funds”), if any. Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ** | The table above incorporates aggregate indirect country exposure associated with investments in the Institutional Fund and Underlying Funds. The table excludes short-term investments, if any. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options, if any. |

| *** | Includes companies that derive more than 50% of their revenues or profits from emerging markets. |

| ^ | Rounds to 0.0%. |

6

GMO Emerging Countries Series Fund

(A Series of GMO Series Trust)

(showing percentage of total net assets)

February 28, 2015

| Shares | Description | Value ($) | ||||||||||

| MUTUAL FUNDS — 99.1% | ||||||||||||

| Affiliated Issuers — 99.1% | ||||||||||||

| 1,497,717 | GMO Emerging Countries Fund, Class III | 13,674,155 | ||||||||||

|

| |||||||||||

| TOTAL MUTUAL FUNDS (COST $14,302,463) | 13,674,155 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENTS — 99.1% | 13,674,155 | |||||||||||

| Other Assets and Liabilities (net) — 0.9% | 120,711 | |||||||||||

|

| |||||||||||

| TOTAL NET ASSETS — 100.0% | $13,794,866 | |||||||||||

|

| |||||||||||

See accompanying notes to the financial statements.

7

GMO Global Asset Allocation Series Fund

(A Series of GMO Series Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Asset Allocation Team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

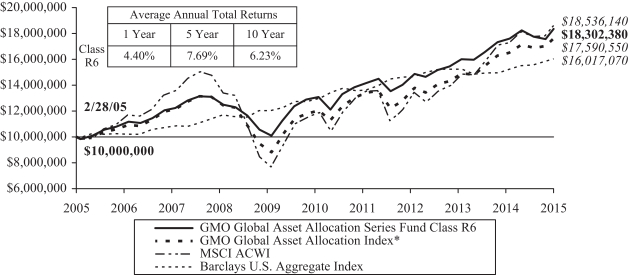

Class R6 shares of GMO Global Asset Allocation Series Fund returned +4.40% for the fiscal year ended February 28, 2015, as compared with +6.76% for the Fund’s benchmark, the GMO Global Asset Allocation Index (65% MSCI All Country World Index (“ACWI”) and 35% Barclays U.S. Aggregate Index).

The Fund’s underweight in equities, which rose, and the allocations to cash and GMO Alpha Only Fund detracted from relative performance.

Exposure to European value equities was the Fund’s largest detractor, but was partially offset by fixed income strategies, particularly developed rates exposures, and U.S. quality stocks, which contributed positively to relative performance.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

Comparison of Change in Value of a $10,000,000 Investment in

GMO Global Asset Allocation Series Fund Class R6 Shares and the

GMO Global Asset Allocation Index

As of February 28, 2015

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance data shown above for GMO Global Asset Allocation Series Fund (the “Fund”) reflects the performance data of GMO Global Asset Allocation Fund (the “Institutional Fund”) through July 31, 2012 (the commencement date of the Fund), restated to reflect the additional fees and expenses of the Fund. The year ends shown above have been restated to align with the change from an April 30 to a February 28/29 year end. For the period May 1, 2014 through February 28, 2015, the Fund returned +2.31%. Performance data shown above for the Fund is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited.

The Fund invests substantially all of its assets in shares of the Institutional Fund.

| * | The GMO Global Asset Allocation Index is comprised of 48.75% S&P 500 Index, 16.25% MSCI ACWI ex USA and 35% Barclays U.S. Aggregate Index through 3/31/2007, and 65% MSCI ACWI (All Country World Index) and 35% Barclays U.S. Aggregate Index thereafter. |

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

For S&P disclaimers please visit http://www.gmo.com/America/_Disclaimers/_BenchmarkDisclaimers.htm.

8

GMO Global Asset Allocation Series Fund

(A Series of GMO Series Trust)

Investment Concentration Summary

February 28, 2015 (Unaudited)

| Asset Class Summary* | % of Total Net Assets | |||

Common Stocks | 53.6 | % | ||

Short-Term Investments | 21.6 | |||

Debt Obligations | 20.3 | |||

Futures Contracts | 3.7 | |||

Options Purchased | 2.5 | |||

Preferred Stocks | 1.9 | |||

Investment Funds | 0.3 | |||

Swap Contracts | 0.3 | |||

Forward Currency Contracts | 0.2 | |||

Loan Participations | 0.1 | |||

Loan Assignments | 0.0 | ^ | ||

Rights/Warrants | 0.0 | ^ | ||

Written/Credit Linked Options | (0.8 | ) | ||

Other | (3.7 | ) | ||

|

| |||

| 100.0 | % | |||

|

| |||

| Country/Region Summary** | % of Investments | |||

United States | 52.4 | % | ||

Emerging*** | 25.9 | |||

Australia | 7.2 | |||

France | 4.9 | |||

Denmark | 4.7 | |||

Germany | 4.0 | |||

New Zealand | 3.5 | |||

Spain | 1.4 | |||

Italy | 1.4 | |||

Netherlands | 1.1 | |||

Hong Kong | 0.8 | |||

Sweden | 0.6 | |||

Norway | 0.5 | |||

Israel | 0.5 | |||

Canada | 0.4 | |||

Belgium | 0.3 | |||

Finland | 0.3 | |||

Ireland | 0.2 | |||

Austria | 0.1 | |||

Portugal | 0.1 | |||

Singapore | 0.1 | |||

United Kingdom | 0.0 | ^ | ||

Switzerland | (1.2 | ) | ||

Japan | (9.2 | ) | ||

|

| |||

| 100.0 | % | |||

|

| |||

| * | The table above incorporates aggregate indirect asset class exposure resulting from investments in shares of a series of GMO Trust (the “Institutional Fund”) and the series of GMO Trust in which the Institutional Fund invests (collectively referred to as the “Underlying Funds”), if any, except for GMO Alpha Only Fund. Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ** | The table above incorporates aggregate indirect country exposure associated with investments in the Institutional Fund and Underlying Funds. The table excludes short-term investments, if any. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options, if any. The table is based on duration adjusted net exposures (both investments and derivatives), taking into account the market value of securities and the notional amounts of swaps and other derivative financial instruments. For example, U.S. asset-backed securities may represent a relatively small percentage due to their short duration, even though they represent a large percentage of market value (direct and indirect). Duration is based on GMO’s models. The greater the duration of a bond, the greater its contribution to the concentration percentage. Credit default swap exposures are factored into the duration adjusted exposure using the reference security and applying the same methodology to that security. |

| *** | The “Emerging” exposure is primarily comprised of: Angola, Argentina, Azerbaijan, Brazil, Chile, China, Colombia, Congo, Costa Rica, Croatia, Czech Republic, Dominican Republic, Ecuador, Egypt, Greece, Hungary, India, Indonesia, Iraq, Korea, Malaysia, Mexico, Morocco, Pakistan, Panama, Peru, Philippines, Poland, Russia, Serbia, South Africa, Sri Lanka, Taiwan, Thailand, Turkey, Tunisia, Ukraine, Uruguay, Venezuela, and Vietnam. |

| ^ | Rounds to 0.0%. |

9

GMO Global Asset Allocation Series Fund

(A Series of GMO Series Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2015

| Shares | Description | Value ($) | ||||||||||

| MUTUAL FUNDS — 99.0% | ||||||||||||

| Affiliated Issuers — 99.0% | ||||||||||||

| 71,660,208 | GMO Global Asset Allocation Fund, Class III | 807,610,539 | ||||||||||

|

| |||||||||||

| TOTAL MUTUAL FUNDS (COST $784,466,786) | 807,610,539 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENTS — 99.0% | 807,610,539 | |||||||||||

| Other Assets and Liabilities (net) — 1.0% | 8,363,465 | |||||||||||

|

| |||||||||||

| TOTAL NET ASSETS — 100.0% | $815,974,004 | |||||||||||

|

| |||||||||||

See accompanying notes to the financial statements.

10

GMO Global Equity Allocation Series Fund

(A Series of GMO Series Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Asset Allocation Team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

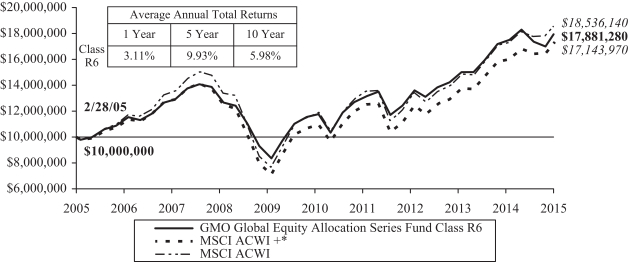

Class R6 shares of GMO Global Equity Allocation Series Fund returned +3.11% for the fiscal year ended February 28, 2015, as compared with +7.55% for the Fund’s benchmark, the MSCI All Country World Index (“ACWI”).

GMO values companies with common economic characteristics in groups, and group allocation had a negative impact on performance relative to the benchmark. The Fund’s exposure to European value stocks was the largest detractor from relative performance, more than offsetting the positive impact from owning U.S. quality stocks.

Among countries, having an underweight in the U.S. was the largest detractor from relative performance, followed by an overweight in France. Underweights in Australia and Canada had a positive impact.

Both sector allocation and stock selection had a negative impact on relative performance. An overweight position in Energy was the largest detractor to relative performance, more than offsetting the positive impact from being underweight Financials.

Top stock contributions came from overweight positions in French telecom Orange SA, U.S. health care provider Express Scripts, and U.S. technology company Cisco Systems. Detractors included French energy company Total SA, German chemical company BASF SE, and U.K. energy company BP.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

Comparison of Change in Value of a $10,000,000 Investment in

GMO Global Equity Allocation Series Fund Class R6 Shares and the MSCI ACWI +

As of February 28, 2015

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance data shown above for GMO Global Equity Allocation Series Fund (the “Fund”) reflects the performance data of GMO Global Equity Allocation Fund (the “Institutional Fund”) through September 4, 2012 (the commencement date of the Fund), restated to reflect the additional fees and expenses of the Fund. The year ends shown above have been restated to align with the change from an April 30 to a February 28/29 year end. For the period May 1, 2014 through February 28, 2015, the Fund returned +0.28%. Performance data shown above for the Fund is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited.

The Fund invests substantially all of its assets in shares of the Institutional Fund.

| * | The MSCI ACWI + represents 75% S&P 500 Index and 25% MSCI ACWI ex-USA prior to May 30, 2008 and MSCI ACWI thereafter. |

| MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. |

| For | S&P disclaimers please visit http://www.gmo.com/America/_Disclaimers/_BenchmarkDisclaimers.htm. |

11

GMO Global Equity Allocation Series Fund

(A Series of GMO Series Trust)

Investment Concentration Summary

February 28, 2015 (Unaudited)

| Asset Class Summary* | % of Total Net Assets | |||

Common Stocks | 92.6 | % | ||

Preferred Stocks | 3.0 | |||

Short-Term Investments | 1.7 | |||

Investment Funds | 0.4 | |||

Rights/Warrants | 0.0 | ^ | ||

Swap Contracts | 0.0 | ^ | ||

Other | 2.3 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| Country/Region Summary** | % of Investments | |||

United States | 34.2 | % | ||

Emerging*** | 19.2 | |||

United Kingdom | 10.3 | |||

Japan | 10.3 | |||

France | 7.4 | |||

Germany | 5.8 | |||

Italy | 2.2 | |||

Spain | 2.1 | |||

Canada | 1.0 | |||

Netherlands | 0.9 | |||

Sweden | 0.9 | |||

Switzerland | 0.9 | |||

Norway | 0.8 | |||

Israel | 0.7 | |||

Finland | 0.5 | |||

Belgium | 0.5 | |||

Australia | 0.4 | |||

Hong Kong | 0.4 | |||

Denmark | 0.4 | |||

Singapore | 0.3 | |||

Ireland | 0.3 | |||

Austria | 0.2 | |||

Portugal | 0.2 | |||

New Zealand | 0.1 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| * | The table above incorporates aggregate indirect asset class exposure resulting from investments in shares of a series of GMO Trust (the “Institutional Fund”) and the series of GMO Trust in which the Institutional Fund invests (collectively referred to as the “Underlying Funds”), if any. Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ** | The table above incorporates aggregate indirect country exposure associated with investments in the Institutional Fund and Underlying Funds. The table excludes short-term investments, if any. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options, if any. |

| *** | The “Emerging” exposure is primarily comprised of: Brazil, China, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Panama, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. |

| ^ | Rounds to 0.0%. |

12

GMO Global Equity Allocation Series Fund

(A Series of GMO Series Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2015

| Shares | Description | Value ($) | ||||||||||

| MUTUAL FUNDS — 97.8% | ||||||||||||

| Affiliated Issuers — 97.8% | ||||||||||||

| 1,879,179 | GMO Global Equity Allocation Fund, Class III | 16,424,022 | ||||||||||

|

| |||||||||||

| TOTAL MUTUAL FUNDS (COST $17,024,525) | 16,424,022 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENTS — 97.8% | 16,424,022 | |||||||||||

| Other Assets and Liabilities (net) — 2.2% | 368,380 | |||||||||||

|

| |||||||||||

| TOTAL NET ASSETS — 100.0% | $16,792,402 | |||||||||||

|

| |||||||||||

See accompanying notes to the financial statements.

13

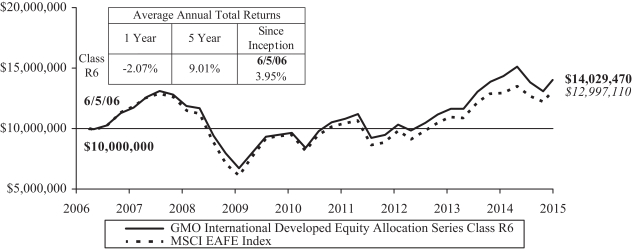

GMO International Developed Equity Allocation Series Fund

(A Series of GMO Series Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Asset Allocation Team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

Since their inception on January 12, 2015, Class R6 shares of GMO International Developed Equity Allocation Series Fund returned +10.00% for the fiscal period ended February 28, 2015, as compared with +8.97% for the MSCI EAFE Index.

GMO values companies with common economic characteristics in groups, and group allocation had a negative impact on performance relative to the benchmark. The Fund’s exposure to emerging value stocks was the largest detractor from relative performance, more than offsetting the positive impact from owning European value stocks.

Among countries, having an underweight in Switzerland and Australia contributed to relative returns, while owning emerging detracted. Stock selection in Japan was the largest positive contributor.

Sector allocation had a negative impact and stock selection had a positive impact on relative performance. An overweight position in Utilities was the largest detractor to relative performance, offsetting the positive impact from being overweight Energy.

Top stock contributions came from overweight positions in Japanese automotive company Nissan, French automotive company Renault SA, and not owning Swiss pharmaceuticals company Roche Holdings Ltd Genusssch. Detractors included U.K. pharmaceuticals company AstraZenica PLC, French telecommunication company Vivendi SA, and U.K. energy company Royal Dutch Shell.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

Comparison of Change in Value of a $10,000,000 Investment in

GMO International Developed Equity Allocation Series Fund Class R6 Shares and the

MSCI EAFE Index

As of February 28, 2015

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance data shown above for GMO International Developed Equity Allocation Series Fund (the “Fund”) reflects the performance data of GMO International Developed Equity Allocation Fund (the “Institutional Fund”) through January 12, 2015 (the commencement date of the Fund), restated to reflect the additional fees and expenses of the Fund. For the period January 12, 2015, through February 28, 2015, the Fund returned +10.00%. Performance data shown above for the Fund is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited.

The Fund invests substantially all of its assets in shares of the Institutional Fund.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

14

GMO International Developed Equity Allocation Series Fund

(A Series of GMO Series Trust)

Investment Concentration Summary

February 28, 2015 (Unaudited)

| Asset Class Summary* | % of Total Net Assets | |||

Common Stocks | 93.9 | % | ||

Preferred Stocks | 2.5 | |||

Short-Term Investments | 1.8 | |||

Investment Funds | 0.2 | |||

Rights/Warrants | 0.0 | ^ | ||

Swap Contracts | 0.0 | ^ | ||

Other | 1.6 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| Country/Region Summary** | % of Investments | |||

United Kingdom | 20.1 | % | ||

Japan | 20.1 | |||

France | 14.4 | |||

Germany | 11.3 | |||

Emerging*** | 9.8 | |||

Italy | 4.3 | |||

Spain | 4.0 | |||

Canada | 1.9 | |||

Netherlands | 1.8 | |||

Sweden | 1.8 | |||

Switzerland | 1.7 | |||

Norway | 1.5 | |||

Israel | 1.3 | |||

Finland | 0.9 | |||

Belgium | 0.9 | |||

Australia | 0.8 | |||

Hong Kong | 0.8 | |||

Denmark | 0.7 | |||

Singapore | 0.5 | |||

Ireland | 0.5 | |||

Austria | 0.3 | |||

Portugal | 0.3 | |||

New Zealand | 0.2 | |||

United States | 0.1 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| * | The table above incorporates aggregate indirect asset class exposure resulting from investments in shares of a series of GMO Trust (the “Institutional Fund”) and the series of GMO Trust in which the Institutional Fund invests (collectively referred to as the “Underlying Funds”), if any. Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ** | The table above incorporates aggregate indirect country exposure associated with investments in the Institutional Fund and Underlying Funds, if any. The table excludes short-term investments, if any. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options, if any. |

| *** | The “Emerging” exposure is primarily comprised of: Brazil, China, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Panama, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. |

| ^ | Rounds to 0.0%. |

15

GMO International Developed Equity Allocation Series Fund

(A Series of GMO Series Trust)

Schedule of Investments

(showing percentage of total net assets)

February 28, 2015

| Shares | Description | Value ($) | ||||||||||

| MUTUAL FUNDS — 98.5% | ||||||||||||

| Affiliated Issuers — 98.5% | ||||||||||||

| 619,084 | GMO International Developed Equity Allocation Fund, Class III | 10,450,137 | ||||||||||

|

| |||||||||||

| TOTAL MUTUAL FUNDS (COST $9,503,457) | 10,450,137 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENTS — 98.5% | 10,450,137 | |||||||||||

| Other Assets and Liabilities (net) — 1.5% | 160,250 | |||||||||||

|

| |||||||||||

| TOTAL NET ASSETS — 100.0% | $10,610,387 | |||||||||||

|

| |||||||||||

See accompanying notes to the financial statements.

16

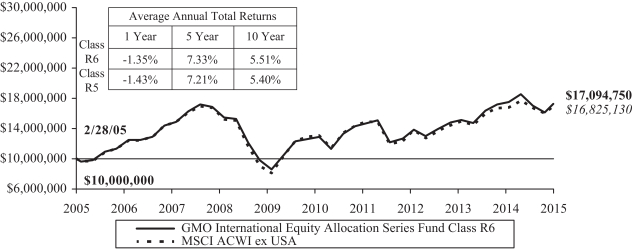

GMO International Equity Allocation Series Fund

(A Series of GMO Series Trust)

Portfolio Management

Day-to-day management of the Fund’s portfolio is the responsibility of the Asset Allocation Team at Grantham, Mayo, Van Otterloo & Co. LLC.

Management Discussion and Analysis of Fund Performance

Class R6 shares of GMO International Equity Allocation Series Fund returned -1.35% for the fiscal year ended February 28, 2015, as compared with +0.87% for the MSCI ACWI (All Country World Index) ex USA.

GMO values companies with common economic characteristics in groups, and group allocation had a negative impact on performance relative to the benchmark. The Fund’s exposure to European value stocks was the largest detractor from relative performance, more than offsetting the positive impact from owning Japanese value stocks.

Among countries, having an overweight in France was the largest detractor from relative performance that more than offset the positive impact from being underweight Canada.

Both sector allocation and stock selection had a negative impact on relative performance. An overweight position in Energy was the largest detractor to relative performance, more than offsetting the positive impact from being overweight Telecommunication Services.

Top stock contributions came from overweight positions in French telecom Orange SA, Japanese automotive company Nissan, and Israeli software company Check Point. Detractors included French energy company Total SA, Swiss pharmaceutical company Novartis, and German chemical company BASF SE.

The views expressed herein are exclusively those of Grantham, Mayo, Van Otterloo & Co. LLC as of the date of this report and are subject to change. GMO disclaims any responsibility to update such views. They are not meant as investment advice. References to specific securities are not recommendations of such securities and may not be representative of any GMO portfolio’s current or future investments.

Comparison of Change in Value of a $10,000,000 Investment in

GMO International Equity Allocation Series Fund Class R6 Shares and the

MSCI ACWI ex USA

As of February 28, 2015

Performance data quoted represents past performance and is not indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance data may be lower or higher than the performance data provided herein. To obtain performance information up to the most recent month-end, visit www.gmo.com. Performance data shown above for GMO International Equity Allocation Series Fund (the “Fund”) reflects the performance data of GMO International Equity Allocation Fund (the “Institutional Fund”) through March 30, 2012 (the commencement date of the Fund), restated to reflect the additional fees and expenses of the Fund. The year ends shown above have been restated to align with the change from an April 30 to a February 28/29 year end. For the period May 1, 2014 through February 28, 2015, Class R6 returned -4.45% and Class R5 returned -4.61%. Performance data shown above for the Fund is net of all fees after reimbursement from GMO. Returns would have been lower had certain expenses not been reimbursed during the periods shown and do not include the effect of taxes on distributions and redemptions. All information is unaudited.

The Fund invests substantially all of its assets in shares of the Institutional Fund.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

17

GMO International Equity Allocation Series Fund

(A Series of GMO Series Trust)

Investment Concentration Summary

February 28, 2015 (Unaudited)

| Asset Class Summary* | % of Total Net Assets | |||

Common Stocks | 92.2 | % | ||

Preferred Stocks | 4.4 | |||

Short-Term Investments | 1.6 | |||

Investment Funds | 0.6 | |||

Rights/Warrants | 0.0 | ^ | ||

Swap Contracts | 0.0 | ^ | ||

Other | 1.2 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| Country/Region Summary** | % of Investments | |||

Emerging*** | 28.0 | % | ||

United Kingdom | 16.0 | |||

Japan | 16.0 | |||

France | 11.4 | |||

Germany | 9.0 | |||

Italy | 3.5 | |||

Spain | 3.2 | |||

Canada | 1.5 | |||

Switzerland | 1.4 | |||

Netherlands | 1.4 | |||

Sweden | 1.4 | |||

Norway | 1.2 | |||

Israel | 1.0 | |||

Finland | 0.7 | |||

Belgium | 0.7 | |||

Australia | 0.6 | |||

Denmark | 0.6 | |||

Hong Kong | 0.6 | |||

Singapore | 0.5 | |||

Ireland | 0.4 | |||

Austria | 0.3 | |||

Portugal | 0.3 | |||

New Zealand | 0.2 | |||

United States | 0.1 | |||

|

| |||

| 100.0 | % | |||

|

| |||

| * | The table above incorporates aggregate indirect asset class exposure resulting from investments in shares of a series of GMO Trust (the “Institutional Fund”) and the series of GMO Trust in which the Institutional Fund invests (collectively referred to as the “Underlying Funds”). Derivative financial instruments, if any, are based on market values or unrealized appreciation/depreciation rather than notional amounts. |

| ** | The table above incorporates aggregate indirect country exposure associated with investments in the Institutional Fund and Underlying Funds. The table excludes short-term investments, if any. The table includes exposure through the use of certain derivative financial instruments and excludes exposure through certain currency linked derivatives such as forward currency contracts and currency options, if any. |

| *** | The “Emerging” exposure is primarily comprised of: Brazil, China, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Panama, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. |

| ^ | Rounds to 0.0%. |

18

GMO International Equity Allocation Series Fund

(A Series of GMO Series Trust)

(showing percentage of total net assets)

February 28, 2015

| Shares | Description | Value ($) | ||||||||||

| MUTUAL FUNDS — 99.1% | ||||||||||||

| Affiliated Issuers — 99.1% | ||||||||||||

| 26,069,258 | GMO International Equity Allocation Fund, Class III | 275,552,056 | ||||||||||

|

| |||||||||||

| TOTAL MUTUAL FUNDS (COST $259,496,768) | 275,552,056 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENTS — 99.1% | 275,552,056 | |||||||||||

| Other Assets and Liabilities (net) — 0.9% | 2,522,288 | |||||||||||

|

| |||||||||||

| TOTAL NET ASSETS — 100.0% | $278,074,344 | |||||||||||

|

| |||||||||||

See accompanying notes to the financial statements.

19

GMO Series Trust

Statements of Assets and Liabilities — February 28, 2015

| Benchmark- Free Allocation Series Fund | Emerging Countries Series Fund | Global Asset Allocation Series Fund | Global Equity Allocation Series Fund | International Developed Equity Allocation Series Fund | International Equity Allocation Series Fund | |||||||||||||||||||||||||

Assets: | ||||||||||||||||||||||||||||||

Investments in affiliated issuers, at value (Notes 2 and 10)(a) | $ | 277,973,153 | $ | 13,674,155 | $ | 807,610,539 | $ | 16,424,022 | $ | 10,450,137 | $ | 275,552,056 | ||||||||||||||||||

Receivable for investments sold | — | — | 20,380,422 | — | — | — | ||||||||||||||||||||||||

Cash | 3,137,758 | 126,794 | 7,747,624 | 1,314,489 | 117,853 | 2,448,740 | ||||||||||||||||||||||||

Receivable for Fund shares sold | 121,808 | — | 445,633 | 203,827 | 43,057 | 193,949 | ||||||||||||||||||||||||

Receivable for reimbursement by GMO (Note 5) | 2,362 | 112 | 2,454 | 116 | 406 | 203 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total assets | 281,235,081 | 13,801,061 | 836,186,672 | 17,942,454 | 10,611,453 | 278,194,948 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Liabilities: | ||||||||||||||||||||||||||||||

Payable for investments purchased | — | — | — | 1,148,601 | — | — | ||||||||||||||||||||||||

Payable for Fund shares repurchased | 114,927 | 4,844 | 20,179,972 | — | — | 104,946 | ||||||||||||||||||||||||

Payable to affiliate for (Note 5): | ||||||||||||||||||||||||||||||

Administration fee | 10,610 | 507 | 32,696 | 603 | 408 | 10,913 | ||||||||||||||||||||||||

Payable for 12b-1 fee — Class R5 | — | — | — | — | — | 3,261 | ||||||||||||||||||||||||

Accrued expenses | — | 844 | — | 848 | 658 | 1,484 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total liabilities | 125,537 | 6,195 | 20,212,668 | 1,150,052 | 1,066 | 120,604 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net assets | $ | 281,109,544 | $ | 13,794,866 | $ | 815,974,004 | $ | 16,792,402 | $ | 10,610,387 | $ | 278,074,344 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net assets consist of: | ||||||||||||||||||||||||||||||

Paid-in capital | $ | 272,725,165 | $ | 14,515,919 | $ | 778,697,499 | $ | 17,263,696 | $ | 9,655,331 | $ | 260,397,897 | ||||||||||||||||||

Accumulated undistributed net investment income (loss) | 98,367 | — | 312,564 | 2,845 | — | 157,650 | ||||||||||||||||||||||||

Distributions in excess of net investment income (loss) | — | (805 | ) | — | — | — | — | |||||||||||||||||||||||

Accumulated net realized gain (loss) | 2,300,471 | (91,940 | ) | 13,820,188 | 126,364 | 8,376 | 1,463,509 | |||||||||||||||||||||||

Net unrealized appreciation (depreciation) | 5,985,541 | (628,308 | ) | 23,143,753 | (600,503 | ) | 946,680 | 16,055,288 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

| $ | 281,109,544 | $ | 13,794,866 | $ | 815,974,004 | $ | 16,792,402 | $ | 10,610,387 | $ | 278,074,344 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net assets attributable to: | ||||||||||||||||||||||||||||||

Class R5 shares | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 21,099,564 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Class R6 shares | 281,109,544 | 13,794,866 | 815,974,004 | 16,792,402 | 10,610,387 | 256,974,780 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Shares outstanding: | ||||||||||||||||||||||||||||||

Class R5 | — | — | — | — | — | 2,009,013 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Class R6 | 26,504,678 | 1,450,289 | 74,870,330 | 1,520,098 | 964,785 | 24,456,119 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net asset value per share: | ||||||||||||||||||||||||||||||

Class R5 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 10.50 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Class R6 | $ | 10.61 | $ | 9.51 | $ | 10.90 | $ | 11.05 | $ | 11.00 | $ | 10.51 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

(a) Cost of investments — affiliated issuers: | $ | 271,987,612 | $ | 14,302,463 | $ | 784,466,786 | $ | 17,024,525 | $ | 9,503,457 | $ | 259,496,768 | ||||||||||||||||||

See accompanying notes to the financial statements.

20

GMO Series Trust

| Benchmark-Free Allocation Series Fund | Emerging Countries Series Fund | Global Asset Allocation Series Fund | |||||||||||||||||||||||

| Period Ended February 28, 2015* | Year Ended April 30, 2014** | Period Ended February 28, 2015*** | Period Ended February 28, 2015* | Year Ended April 30, 2014** | |||||||||||||||||||||

Investment Income: | |||||||||||||||||||||||||

Dividends from affiliated issuers (Note 10) | $ | 4,651,360 | $ | 2,377,463 | $ | 537,093 | $ | 29,768,065 | $ | 18,117,281 | |||||||||||||||

Interest | 173 | — | — | 556 | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total investment income | 4,651,533 | 2,377,463 | 537,093 | 29,768,621 | 18,117,281 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Expenses: | |||||||||||||||||||||||||

Administration fee — (Note 5) | 89,974 | 81,492 | 6,323 | 340,093 | 360,474 | ||||||||||||||||||||

Registration fees | 30,866 | 3,256 | 1,844 | 23,740 | 1,029 | ||||||||||||||||||||

Miscellaneous | 498 | — | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total expenses | 121,338 | 84,748 | 8,167 | 363,833 | 361,503 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Fees and expenses reimbursed by GMO (Note 5) | (30,866 | ) | (3,256 | ) | (1,844 | ) | (23,740 | ) | (1,029 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net expenses | 90,472 | 81,492 | 6,323 | 340,093 | 360,474 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net investment income (loss) | 4,561,061 | 2,295,971 | 530,770 | 29,428,528 | 17,756,807 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Realized and unrealized gain (loss): | |||||||||||||||||||||||||

Net realized gain (loss) on: | |||||||||||||||||||||||||

Investments in affiliated issuers | 817,672 | 587,420 | (60,367 | ) | 3,602,608 | 1,212,581 | |||||||||||||||||||

Realized gain distributions from affiliated issuers (Note 10) | 6,022,058 | 2,212,646 | — | 41,999,510 | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net realized gain (loss) | 6,839,730 | 2,800,066 | (60,367 | ) | 45,602,118 | 1,212,581 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Change in net unrealized appreciation (depreciation) on: | |||||||||||||||||||||||||

Investments in affiliated issuers | (5,257,955 | ) | 6,129,992 | (628,308 | ) | (56,500,980 | ) | 48,132,724 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net unrealized gain (loss) | (5,257,955 | ) | 6,129,992 | (628,308 | ) | (56,500,980 | ) | 48,132,724 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net realized and unrealized gain (loss) | 1,581,775 | 8,930,058 | (688,675 | ) | (10,898,862 | ) | 49,345,305 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net increase (decrease) in net assets resulting from operations | $ | 6,142,836 | $ | 11,226,029 | $ | (157,905 | ) | $ | 18,529,666 | $ | 67,102,112 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| * | For the period May 1, 2014 through February 28, 2015. |

| ** | For the year May 1, 2013 through April 30, 2014. |

| *** | For the period May 2, 2014 (commencement of operations) through February 28, 2015. |

See accompanying notes to the financial statements.

21

GMO Series Trust

Statements of Operations — (Continued)

| Global Equity Allocation Series Fund | International Developed Equity Allocation Series Fund | International Equity Allocation Series Fund | |||||||||||||||||||||||

| Period Ended February 28, 2015* | Year Ended April 30, 2014** | Period Ended February 28, 2015*** | Period Ended February 28, 2015* | Year Ended April 30, 2014** | |||||||||||||||||||||

Investment Income: | |||||||||||||||||||||||||

Dividends from affiliated issuers (Note 10) | $ | 501,454 | $ | 167,576 | $ | — | $ | 12,738,754 | $ | 9,235,354 | |||||||||||||||

Interest | 6 | — | — | 217 | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total investment income | 501,460 | 167,576 | — | 12,738,971 | 9,235,354 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Expenses: | |||||||||||||||||||||||||

Administration fee — (Note 5) | 4,479 | 2,093 | 651 | 130,451 | 155,813 | ||||||||||||||||||||

12b-1 fee — Class R5 (Note 5) | — | — | — | 18,549 | 22,398 | ||||||||||||||||||||

Registration fees | 1,622 | 1,029 | 658 | 4,992 | 2,340 | ||||||||||||||||||||

Miscellaneous | 17 | 28 | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total expenses | 6,118 | 3,150 | 1,309 | 153,992 | 180,551 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Fees and expenses reimbursed by GMO (Note 5) | (1,622 | ) | (1,029 | ) | (658 | ) | (4,992 | ) | (2,340 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net expenses | 4,496 | 2,121 | 651 | 149,000 | 178,211 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net investment income (loss) | 496,964 | 165,455 | (651 | ) | 12,589,971 | 9,057,143 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Realized and unrealized gain (loss): | |||||||||||||||||||||||||

Net realized gain (loss) on: | |||||||||||||||||||||||||

Investments in affiliated issuers | (40,031 | ) | 75,387 | 9,027 | 1,173,281 | 2,402,541 | |||||||||||||||||||

Realized gain distributions from affiliated issuers (Note 10) | 665,057 | 166,165 | — | 5,116,160 | 10,503,170 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net realized gain (loss) | 625,026 | 241,552 | 9,027 | 6,289,441 | 12,905,711 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Change in net unrealized appreciation (depreciation) on: | |||||||||||||||||||||||||

Investments in affiliated issuers | (907,828 | ) | 238,826 | 946,680 | (35,585,759 | ) | 20,102,762 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net unrealized gain (loss) | (907,828 | ) | 238,826 | 946,680 | (35,585,759 | ) | 20,102,762 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net realized and unrealized gain (loss) | (282,802 | ) | 480,378 | 955,707 | (29,296,318 | ) | 33,008,473 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net increase (decrease) in net assets resulting from operations | $ | 214,162 | $ | 645,833 | $ | 955,056 | $ | (16,706,347 | ) | $ | 42,065,616 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| * | For the period May 1, 2014 through February 28, 2015. |

| ** | For the year May 1, 2013 through April 30, 2014. |

| *** | For the period January 12, 2015 (commencement of operations) through February 28, 2015. |

See accompanying notes to the financial statements.

22

GMO Series Trust

Statements of Changes in Net Assets

| Benchmark-Free Allocation Series Fund | Emerging Countries Series Fund | |||||||||||||||||||

| Period from May 1, 2014 through February 28, 2015 | Year Ended April 30, 2014 | Period from January 24, 2013 (commencement of operations) through April 30, 2013 | Period from May 2, 2014 (commencement of operations) through February 28, 2015 | |||||||||||||||||

Increase (decrease) in net assets: | ||||||||||||||||||||

Operations: | ||||||||||||||||||||

Net investment income (loss) | $ | 4,561,061 | $ | 2,295,971 | $ | (18,918 | ) | $ | 530,770 | |||||||||||

Net realized gain (loss) | 6,839,730 | 2,800,066 | — | (60,367 | ) | |||||||||||||||

Change in net unrealized appreciation (depreciation) | (5,257,955 | ) | 6,129,992 | 5,113,504 | (628,308 | ) | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase (decrease) in net assets from operations | 6,142,836 | 11,226,029 | 5,094,586 | (157,905 | ) | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Distributions to shareholders from: | ||||||||||||||||||||

Net investment income | ||||||||||||||||||||

Class R6 | (7,047,863 | ) | (3,572,773 | ) | — | (531,065 | ) | |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net realized gains | ||||||||||||||||||||

Class R6 | (3,257,552 | ) | (219,802 | ) | — | (32,083 | ) | |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net share transactions (Note 9): | ||||||||||||||||||||

Class R6 | 120,829,659 | (3,128,548 | ) | 155,042,972 | 14,515,919 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Increase (decrease) in net assets resulting from net share transactions | 120,829,659 | (3,128,548 | ) | 155,042,972 | 14,515,919 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Total increase (decrease) in net assets | 116,667,080 | 4,304,906 | 160,137,558 | 13,794,866 | ||||||||||||||||

| Net assets: | ||||||||||||||||||||

Beginning of period | 164,442,464 | 160,137,558 | — | — | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

End of period | $ | 281,109,544 | $ | 164,442,464 | $ | 160,137,558 | $ | 13,794,866 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Accumulated undistributed net investment income | $ | 98,367 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Distributions in excess of net investment income | $ | — | $ | (26,873 | ) | $ | — | $ | (805 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||||||

See accompanying notes to the financial statements.

23

GMO Series Trust

Statements of Changes in Net Assets — (Continued)

| Global Asset Allocation Series Fund | Global Equity Allocation Series Fund | |||||||||||||||||||||||||||||

| Period from May 1, 2014 through February 28, 2015 | Year Ended April 30, 2014 | Period from July 31, 2012 (commencement of operations) through April 30, 2013 | Period from May 1, 2014 through February 28, 2015 | Year Ended April 30, 2014 | Period from September 4, 2012 (commencement of operations) through April 30, 2013 | |||||||||||||||||||||||||

Increase (decrease) in net assets: | ||||||||||||||||||||||||||||||

Operations: | ||||||||||||||||||||||||||||||

Net investment income (loss) | $ | 29,428,528 | $ | 17,756,807 | $ | 13,965,952 | $ | 496,964 | $ | 165,455 | $ | 19,421 | ||||||||||||||||||

Net realized gain (loss) | 45,602,118 | 1,212,581 | 974,291 | 625,026 | 241,552 | 30,258 | ||||||||||||||||||||||||

Change in net unrealized appreciation (depreciation) | (56,500,980 | ) | 48,132,724 | 31,512,009 | (907,828 | ) | 238,826 | 68,499 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net increase (decrease) in net assets from operations | 18,529,666 | 67,102,112 | 46,452,252 | 214,162 | 645,833 | 118,178 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Distributions to shareholders from: | ||||||||||||||||||||||||||||||

Net investment income | ||||||||||||||||||||||||||||||

Class R6 | (29,763,737 | ) | (17,792,669 | ) | (14,067,683 | ) | (492,710 | ) | (225,831 | ) | (23,005 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net realized gains | ||||||||||||||||||||||||||||||

Class R6 | (31,435,087 | ) | (1,552,750 | ) | (195,599 | ) | (646,156 | ) | (61,765 | ) | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Net share transactions (Note 9): | ||||||||||||||||||||||||||||||

Class R6 | 55,910,593 | 162,560,491 | 560,226,415 | 11,381,869 | 4,515,562 | 1,366,265 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Increase (decrease) in net assets resulting from net share transactions | 55,910,593 | 162,560,491 | 560,226,415 | 11,381,869 | 4,515,562 | 1,366,265 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total increase (decrease) in net assets | 13,241,435 | 210,317,184 | 592,415,385 | 10,457,165 | 4,873,799 | 1,461,438 | ||||||||||||||||||||||||

| Net assets: | ||||||||||||||||||||||||||||||

Beginning of period | 802,732,569 | 592,415,385 | — | 6,335,237 | 1,461,438 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

End of period | $ | 815,974,004 | $ | 802,732,569 | $ | 592,415,385 | $ | 16,792,402 | $ | 6,335,237 | $ | 1,461,438 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Accumulated undistributed net investment income | $ | 312,564 | $ | — | $ | — | $ | 2,845 | $ | — | $ | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Distributions in excess of net investment income | $ | — | $ | (128,414 | ) | $ | (93,768 | ) | $ | — | $ | (1,376 | ) | $ | (208 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

See accompanying notes to the financial statements.

24

GMO Series Trust

Statements of Changes in Net Assets — (Continued)

| International Developed Equity Allocation Series Fund | International Equity Allocation Series Fund | |||||||||||||||||||

| Period from January 12, 2015 (commencement of operations) through February 28, 2015 | Period from May 1, 2014 through February 28, 2015 | Year Ended April 30, | ||||||||||||||||||

| 2014 | 2013 | |||||||||||||||||||

Increase (decrease) in net assets: | ||||||||||||||||||||

Operations: | ||||||||||||||||||||

Net investment income (loss) | $ | (651 | ) | $ | 12,589,971 | $ | 9,057,143 | $ | 8,012,926 | |||||||||||

Net realized gain (loss) | 9,027 | 6,289,441 | 12,905,711 | 328,740 | ||||||||||||||||

Change in net unrealized appreciation (depreciation) | 946,680 | (35,585,759 | ) | 20,102,762 | 35,743,862 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net increase (decrease) in net assets from operations | 955,056 | (16,706,347 | ) | 42,065,616 | 44,085,528 | |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Distributions to shareholders from: | ||||||||||||||||||||

Net investment income | ||||||||||||||||||||

Class R5 | — | (835,499 | ) | (643,102 | ) | — | ||||||||||||||

Class R6 | — | (11,537,810 | ) | (8,611,227 | ) | (8,065,989 | ) | |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Total distributions from net investment income | — | (12,373,309 | ) | (9,254,329 | ) | (8,065,989 | ) | |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net realized gains | ||||||||||||||||||||

Class R5 | — | (1,175,323 | ) | (91,761 | ) | — | ||||||||||||||

Class R6 | — | (15,408,520 | ) | (1,193,542 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Total distributions from net realized gains | — | (16,583,843 | ) | (1,285,303 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Net share transactions (Note 9): | ||||||||||||||||||||

Class R5 | — | 854,473 | (1,927,424 | ) | 21,976,142 | * | ||||||||||||||

Class R6 | 9,655,331 | (7,936,846 | ) | (2,837,461 | ) | 62,733,574 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Increase (decrease) in net assets resulting from net share transactions | 9,655,331 | (7,082,373 | ) | (4,764,885 | ) | 84,709,716 | ||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Total increase (decrease) in net assets | 10,610,387 | (52,745,872 | ) | 26,761,099 | 120,729,255 | |||||||||||||||

| Net assets: | ||||||||||||||||||||

Beginning of period | — | 330,820,216 | 304,059,117 | 183,329,862 | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

End of period | $ | 10,610,387 | $ | 278,074,344 | $ | 330,820,216 | $ | 304,059,117 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Accumulated undistributed net investment income (loss) | $ | — | $ | 157,650 | $ | — | $ | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Distributions in excess of net investment income | $ | — | $ | — | $ | (59,012 | ) | $ | (47,031 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||||||

| * | Period from April 5, 2013 (commencement of operations) through April 30, 2013. |

See accompanying notes to the financial statements.

25

GMO Series Trust

(For a share outstanding throughout each period)

BENCHMARK-FREE ALLOCATION SERIES FUND

| Class R6 Shares | |||||||||||||||

| Period from May 1, 2014 through February 28, 2015 | Year Ended April 30, 2014 | Period from January 24, 2013 (commencement of operations) through April 30, 2013 | |||||||||||||

Net asset value, beginning of period | $ | 10.84 | $ | 10.35 | $ | 10.00 | |||||||||

|

|

|

|

|

| ||||||||||

Income (loss) from investment operations: | |||||||||||||||

Net investment income (loss)(a)† | 0.23 | 0.15 | (0.00 | )(b) | |||||||||||

Net realized and unrealized gain (loss) | 0.03 | 0.58 | 0.35 | ||||||||||||

|

|

|

|

|

| ||||||||||

Total from investment operations | 0.26 | 0.73 | 0.35 | ||||||||||||

|

|

|

|

|

| ||||||||||

Less distributions to shareholders: | |||||||||||||||

From net investment income | (0.32 | ) | (0.23 | ) | — | ||||||||||

From net realized gains | (0.17 | ) | (0.01 | ) | — | ||||||||||

|

|

|

|

|

| ||||||||||

Total distributions | (0.49 | ) | (0.24 | ) | — | ||||||||||

|

|

|

|

|

| ||||||||||

Net asset value, end of period | $ | 10.61 | $ | 10.84 | $ | 10.35 | |||||||||

|

|

|

|

|

| ||||||||||

Total Return(c) | 2.47 | %** | 7.15 | % | 3.50 | %** | |||||||||

| Ratios/Supplemental Data: | |||||||||||||||

Net assets, end of period (000’s) | $ | 281,110 | $ | 164,442 | $ | 160,138 | |||||||||

Net expenses to average daily net assets(d) | 0.05 | %* | 0.05 | % | 0.05 | %* | |||||||||

Net investment income (loss) to average daily net assets(a) | 2.53 | %* | 1.41 | % | (0.05 | )%* | |||||||||

Portfolio turnover rate | 6 | %** | 8 | % | 0 | %** | |||||||||

Fees and expenses reimbursed and/or waived by GMO to average daily net assets: | 0.02 | %* | 0.00 | %(e) | 0.01 | %* | |||||||||

| (a) | Net investment income is affected by the timing of the declaration of dividends by the Institutional Fund in which the Fund invests. |

| (b) | Rounds to less than $0.01. |

| (c) | The total returns would have been lower had certain expenses not been reimbursed during the periods shown and assumes the effect of invested distributions, if any. |

| (d) | Net expenses exclude expenses incurred indirectly through investment in the Underlying Funds (Note 5). |

| (e) | Fees and expenses reimbursed by GMO to average daily net assets were less than 0.01%. |

| † | Calculated using average shares outstanding throughout the period. |

| * | Annualized. |

| ** | Not annualized. |

See accompanying notes to the financial statements.

26

GMO Series Trust

Financial Highlights

(For a share outstanding throughout the period)

EMERGING COUNTRIES SERIES FUND

| Class R6 Shares | |||||

| Period from May 2, 2014 (commencement of operations) through February 28, 2015 | |||||

Net asset value, beginning of period | $ | 10.00 | |||

|

| ||||

Income (loss) from investment operations: | |||||

Net investment income (loss)(a)† | 0.35 | ||||

Net realized and unrealized gain (loss) | (0.47 | ) | |||

|

| ||||

Total from investment operations | (0.12 | ) | |||

|

| ||||

Less distributions to shareholders: | |||||

From net investment income | (0.35 | ) | |||

From net realized gains | (0.02 | ) | |||

|

| ||||

Total distributions | (0.37 | ) | |||

|

| ||||

Net asset value, end of period | $ | 9.51 | |||

|

| ||||

Total Return(b) | (1.01 | )%** | |||

| Ratios/Supplemental Data: | |||||

Net assets, end of period (000’s) | $ | 13,795 | |||

Net expenses to average daily net assets(c) | 0.05 | %* | |||

Net investment income (loss) to average daily net assets(a) | 4.17 | %* | |||

Portfolio turnover rate | 17 | %** | |||

Fees and expenses reimbursed and/or waived by GMO to average daily net assets: | 0.01 | %* | |||

| (a) | Net investment income is affected by the timing of the declaration of dividends by the Institutional Fund in which the Fund invests. |

| (b) | The total returns would have been lower had certain expenses not been reimbursed during the periods shown and assumes the effect of reinvested distributions, if any. |

| (c) | Net expenses exclude expenses incurred indirectly through investment in the Underlying Funds (Note 5). |

| † | Calculated using average shares outstanding throughout the period. |

| * | Annualized. |

| ** | Not annualized. |

See accompanying notes to the financial statements.

27

GMO Series Trust

Financial Highlights

(For a share outstanding throughout each period)

GLOBAL ASSET ALLOCATION SERIES FUND

| Class R6 Shares | |||||||||||||||

| Period from May 1, 2014 through February 28, 2015 | Year Ended April 30, 2014 | Period from July 31, 2012 (commencement of operations) through April 30, 2013 | |||||||||||||

Net asset value, beginning of period | $ | 11.52 | $ | 10.84 | $ | 10.00 | |||||||||

|

|

|

|

|

| ||||||||||

Income (loss) from investment operations: | |||||||||||||||

Net investment income (loss)(a)† | 0.41 | 0.27 | 0.32 | ||||||||||||

Net realized and unrealized gain (loss) | (0.17 | ) | 0.69 | 0.79 | |||||||||||

|

|

|

|

|

| ||||||||||

Total from investment operations | 0.24 | 0.96 | 1.11 | ||||||||||||

|

|

|

|

|

| ||||||||||

Less distributions to shareholders: | |||||||||||||||

From net investment income | (0.42 | ) | (0.26 | ) | (0.27 | ) | |||||||||

From net realized gains | (0.44 | ) | (0.02 | ) | (0.00 | )(b) | |||||||||

|

|

|

|

|

| ||||||||||

Total distributions | (0.86 | ) | (0.28 | ) | (0.27 | ) | |||||||||

|

|

|

|

|

| ||||||||||

Net asset value, end of period | $ | 10.90 | $ | 11.52 | $ | 10.84 | |||||||||

|

|

|

|

|

| ||||||||||

Total Return(c) | 2.31 | %** | 9.02 | % | 11.36 | %** | |||||||||

| Ratios/Supplemental Data: | |||||||||||||||

Net assets, end of period (000’s) | $ | 815,974 | $ | 802,733 | $ | 592,415 | |||||||||

Net expenses to average daily net assets(d) | 0.05 | %* | 0.05 | % | 0.05 | %* | |||||||||

Net investment income (loss) to average daily net assets(a) | 4.33 | %* | 2.46 | % | 4.07 | %* | |||||||||

Portfolio turnover rate | 6 | %** | 2 | % | 6 | %** | |||||||||