UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22605

Capital Group Emerging Markets Total Opportunities Fund

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2014

Courtney R. Taylor

Capital Group Emerging Markets Total Opportunities Fund

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

Copies to:

Michael Glazer

Morgan, Lewis & Bockius LLP

355 South Grand Avenue, Suite 4400

Los Angeles, California 90071

(Counsel for the Registrant)

ITEM 1 – Reports to Stockholders

| | Capital Group Emerging Markets

Total Opportunities FundSM Annual report

for the year ended

October 31, 2014 |

Capital Group Emerging Markets Total Opportunities Fund seeks long-term growth and preservation of capital with lower volatility of returns than emerging markets equities.

Fund results shown in this report are for past periods and are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, please call (800) 266-9532.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended September 30, 2014 (the most recent calendar quarter-end):

| | | Lifetime |

| | 1 year | (since 1/27/2012) |

| | | |

| Average annual total returns | 2.78% | 2.63% |

The total annual fund operating expense ratio is 1.10% as of the most recent fiscal year-end, and as reflected in the prospectus dated January 1, 2015 (unaudited).

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

This report is for the information of shareholders of Capital Group Emerging Markets Total Opportunities Fund, but it also may be used as sales literature when preceded or accompanied by the current prospectus, which gives details about charges, expenses, investment objectives and operating policies of the fund. If used as sales material after December 31, 2014, this report must be accompanied by a statistical update for the most recently completed calendar quarter.

Investors should carefully read and consider the investment objectives, guidelines, risks, fees and expenses associated with Capital Group Emerging Markets Total Opportunities Fund (CGETOP) prior to investing. This and other important information is contained in CGETOP’s prospectus, which can be obtained from your relationship manager.

Investing in emerging markets involves risks, such as significant currency and price fluctuations, political instability, differing securities regulations and periods of illiquidity, which are detailed in the fund prospectus. Investments in emerging markets have been more volatile than investments in developed markets, reflecting the greater uncertainties of investing in less established economies. Individuals investing in emerging markets should have a long-term perspective and be able to tolerate potentially sharp declines in the value of their investments.

Contents

Fellow investors:

Capital Group Emerging Markets Total Opportunities Fund (CGETOP) invests in the full spectrum of emerging markets debt and equity securities. CGETOP does not have a benchmark but seeks to limit the volatility typically associated with investments in the developing world. The fund was started on January 27, 2012. Over its lifetime, CGETOP has risen 2.05% compared with 3.09% for the MSCI Emerging Markets (EM) Investable Market Index (IMI); fund volatility has been 8% during its lifetime through October 31, 2014, versus 13% for emerging markets equities.

The following report covers the period from November 1, 2013, through October 31, 2014. During this time, the MSCI EM IMI edged almost 1% higher as investors grappled with concerns about the end of quantitative easing in the U.S., slowing economic growth in Europe and China, and rising geopolitical tensions in the Middle East, Russia and Ukraine. Most world currencies fell against the U.S. dollar; the depreciation of emerging markets currencies undercut market gains in U.S. dollar terms, with the MSCI EM IMI rising 6% in local currency. Energy stocks posted sharp losses as oil prices slid against the backdrop of weak global demand; materials also registered double-digit declines. By contrast, the technology sector gained 12%, lifted by Asian internet firms and several large semiconductor firms.

Emerging markets U.S. dollar-denominated debt rallied as investors appeared to search for higher yields in the developing markets; the J.P. Morgan Emerging Markets Bond Index (EMBI) Global rose 7.2%. But local currency debt fell in U.S. dollar terms, weighed down by the sharp depreciation of most emerging markets currencies. The J.P. Morgan Government Bond Index Emerging Markets (GBI-EM) Global Diversified rose 7.0% in local currency, but declined 2.7% in U.S. dollar terms. In this environment, the fund fell 1.5% for the period. The realized volatility of the portfolio was 6%, compared with 10% for the MSCI EM IMI.

Market review

Most world currencies slid against the U.S. dollar during the 12-month period as investors struggled to understand the timing and extent of potentially higher interest rates in the U.S. Investors also seemed to weigh the likelihood of an improving global economy and the possible impact of geopolitical instability in several markets.

The Russian ruble fell 25% as tensions with Ukraine escalated and a rapid series of events rattled markets, including the ouster of Ukrainian Prime Minister Viktor Yanukovych in February. Russia’s subsequent annexation of Crimea triggered economic sanctions by the U.S. and Europe, further exacerbating

Results at a glance

For periods ended October 31, 2014, with distributions reinvested

| | | Cumulative | | Average annual |

| | | total returns | | total returns |

| | | 1 year | | Lifetime1 |

| | | | | |

| Capital Group Emerging Markets Total Opportunities Fund | | | -1.50 | % | | | 2.05 | % |

| MSCI Emerging Markets IMI2 | | | 0.95 | | | | 3.09 | |

| JP Morgan GBI-EM Global Diversified2 | | | -2.68 | | | | 0.24 | |

| JP Morgan EMBI Global2 | | | 7.20 | | | | 6.49 | |

| Emerging markets blended market universe3 | | | 1.61 | | | | 3.31 | |

| 1 | Since 1/27/2012. |

| 2 | The market indexes are unmanaged and, therefore, have no expenses. |

| 3 | The emerging markets blended market universe blends the MSCI EM IMI, JPM EMBI Global, and JPM GBI-EM Global Diversified indexes by weighting their cumulative total returns at 50%, 25%, and 25%, respectively. This assumes the blend is rebalanced monthly. |

Unless otherwise indicated, equity returns are based on MSCI indexes and measured in U.S. dollars with net dividends reinvested.

| Capital Group Emerging Markets Total Opportunities Fund | 1 |

| 20 largest holdings | |

| | Percent of

net assets as

of 10/31/14 |

| Mexican government bonds (MXN) | 2.5% |

| Brazilian inflation-linked bonds | 2.4 |

| Indian government bonds (INR) | 2.3 |

| Greek government bonds (EUR) | 2.1 |

| Mexican inflation-linked bonds | 2.1 |

| Taiwan Semiconductor Manufacturing | 1.9 |

| Colombian government bonds (COP) | 1.7 |

| Portuguese government bonds (EUR) | 1.5 |

| Infosys | 1.4 |

| Bharti Airtel | 1.4 |

| Indonesian government bonds (IDR) | 1.3 |

| Slovenian government bonds (USD) | 1.3 |

| South African government bonds (ZAR) | 1.3 |

| Minth Group | 1.2 |

| CEMEX | 1.1 |

| Zhuzhou CSR Times Electric | 1.1 |

| HKT Trust | 1.0 |

| China Everbright International | 1.0 |

| Lenovo Group | 1.0 |

| Standard Chartered | 1.0 |

| | 30.6% |

investor worries about the country’s financial markets and economy. The MSCI Russia IMI dropped 25%. Local bonds fell 28%, hurt by the depreciation of the ruble. By October 2014,Moody’s had cut the country’s sovereign debt rating by one notch to Baa2, its second-lowest investment-grade rating, following a downgrade by Standard & Poor’s in April; the ratings agency cited the depletion of Russia’s foreign exchange reserves and concerns about its restricted access to international markets.

Currency depreciation also weighed on Brazilian equities, with the real falling 9% against the U.S. dollar. The MSCI Brazil IMI declined 10% amid concerns about slowing economic growth and dramatic market swings in the run-up to October 2014 elections. Dilma Rousseff was narrowly re-elected, dampening investor hopes for reform. Brazilian local bonds were flat, held back by the slide of the real. Elsewhere in Latin America, Mexican stocks rose 7% as the government pressed ahead with reforms and the economy showed modest signs of recovery. Mexican U.S. dollar bonds gained 10%; local bonds rose 4%, despite the depreciation of the peso. Troubled markets in Argentina and Venezuela saw mixed results. Argentine dollar bonds gained almost 30% in aggregate despite ongoing issues related to the country’s default status and a controversial U.S. court ruling. On July 31, Standard & Poor’s declared Argentina in selective default after the sovereign could not reach an agreement with holdout creditors, despite attempting to make payments. But Venezuelan debt fell sharply as lower oil prices exacerbated concerns about a potential default.

Asian markets powered ahead. The MSCI China IMI advanced 7% as investors appeared to take in the Chinese government’s efforts to pursue reform objectives while trying to stabilize economic growth. Authorities unveiled new SOE reforms in 2014 and a series of targeted measures to support economic growth following last November’s sweeping reforms. Technology stocks posted some of the strongest gains. Telecommunications companies also rallied as investors seemed to cheer a tower-sharing venture among several large firms. But real estate stocks declined amid weakness in the property market; the government continued to ease mortgage lending restrictions during the period.

Several other Asian markets rebounded amid signs of political change and hopes for reform. Indian stocks jumped 33%, fueled by optimism surrounding Prime Minister Narendra Modi’s historic May election and better-than-expected economic growth. The country’s stock market bounced back from a mid-2013 rout spurred by concerns about slowing economic growth, rising inflation and a falling rupee. Indonesian equities advanced 7% over the 12-month period, with Joko Widodo winning Indonesia’s presidential election in late July. Thai stocks climbed 7% despite the December dissolution of the Thai parliament and a military-led coup in May; political uncertainty appeared to subside in the months following the coup.

Portfolio review*

The portfolio lost value in a broadly challenging environment for emerging markets assets. Investments in equities weighed on returns, particularly the

| * | Percentage of net assets for securities mentioned in the portfolio review are listed in the 20 largest holdings, except for Alrosa and Hyundai Motor, which each make up 0.9% of net assets, and First Quantum Minerals, which comprises 0.8% of net assets. |

| 2 | Capital Group Emerging Markets Total Opportunities Fund |

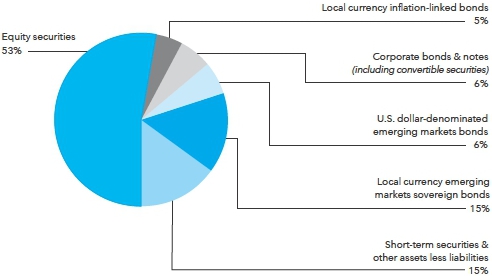

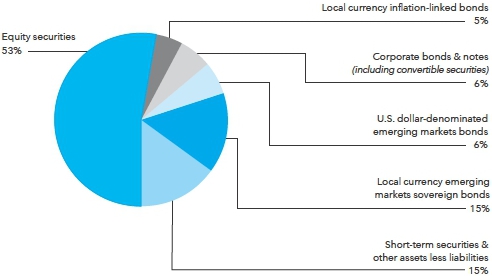

| Asset mix (percent of net assets) | as of October 31, 2014 |

| | |

|

| Top 5 equity sectors | | percent of net assets |

| Industrials | | | 8.7 | % |

| Information technology | | | 7.7 | |

| Financials | | | 7.2 | |

| Consumer discretionary | | | 7.0 | |

| Materials | | | 6.1 | |

| 15 largest country positions | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Percent of net assets

as of 10/31/14 |

| | | Equity | | Bonds & notes | | Total |

| China (including Hong Kong) | | | 13.8 | % | | | 1.0 | % | | | 14.8 | % |

| Mexico | | | 2.2 | | | | 6.0 | | | | 8.2 | |

| India | | | 4.9 | | | | 2.3 | | | | 7.2 | |

| Taiwan | | | 5.1 | | | | — | | | | 5.1 | |

| Brazil | | | 1.6 | | | | 3.3 | | | | 4.9 | |

| Greece | | | 1.0 | | | | 2.1 | | | | 3.1 | |

| South Korea | | | 2.9 | | | | 0.1 | | | | 3.0 | |

| United Kingdom* | | | 2.8 | | | | 0.1 | | | | 2.9 | |

| United States of America* | | | 1.5 | | | | 0.5 | | | | 2.0 | |

| Malaysia | | | 2.0 | | | | — | | | | 2.0 | |

| Russia | | | 1.9 | | | | 0.1 | | | | 2.0 | |

| Colombia | | | — | | | | 1.8 | | | | 1.8 | |

| Indonesia | | | — | | | | 1.6 | | | | 1.6 | |

| Portugal | | | — | | | | 1.5 | | | | 1.5 | |

| Chile | | | 0.7 | | | | 0.6 | | | | 1.3 | |

| | | | 40.4 | % | | | 21.0 | % | | | 61.4 | % |

| * | Includes investments in companies listed in developed markets that have significant operations in emerging markets. |

| Capital Group Emerging Markets Total Opportunities Fund | 3 |

fund’s exposure to commodity-related firms and consumer discretionary stocks. Fixed-income investments rose in aggregate.

Investments in several oil services providers and energy exploration and production firms fell sharply amid lower oil prices, reduced capital expenditures and company-specific problems. Managers have tended to avoid the larger integrated oil companies, instead favoring a few smaller exploration and production companies with unique assets. They trimmed investments in several oil services stocks during the period but continue to invest in exploration and production firms that they believe are well-positioned in the industry. Investments in the materials sector also weighed on fund results, including metals conglomerate First Quantum Minerals and Russian diamond miner Alrosa, which lost ground along with the rest of the Russian market; investors also worried about a management shift at Alrosa after the firm’s CEO stepped down for health reasons. Investments in Russia detracted from returns overall. Managers reduced investments in several Russian securities during the period as economic and geopolitical conditions continued to deteriorate.

Stock selection in the consumer discretionary sector had a negative impact on portfolio results. Several automakers declined. Shares of Hyundai Motor dropped as investors reacted to the firm’s pricey acquisition of land for a new headquarters in Seoul’s Gangnam district. Hyundai also reported disappointing profits, hurt by a stronger won relative to the yen.

Investments in technology were a bright spot. Several investments in the sector rose sharply across a wide range of industries, from Chinese PC maker Lenovo Group to Indian software and outsourcing firm Infosys; both firms recorded robust earnings. Taiwan Semiconductor Manufacturing shares advanced, with the firm posting healthy sales of its 28-nanometer chips used in smartphones.

The fund’s fixed-income investments also supported results on the whole. Several peripheral European bond markets rallied, fueled by hopes for improvement following difficult periods and reduced risk of economic crisis. Investments in hard-currency bonds in Greece and Portugal posted strong gains. Managers took some profits in Greek bonds during the period. Currency hedging supported results overall as most currencies depreciated.

Outlook

Managers are concerned about the prospect of higher U.S. interest rates now that the Fed’s quantitative easing has officially ended, though rates may not climb as quickly as some investors have feared. Emerging markets currencies may experience increased volatility in the coming months given the likelihood of a stronger U.S. dollar. At the same time, central banks in other developed markets appear to be leaning toward more accommodative policies and China’s government seems to be focused on providing targeted stimulus and interest rate cuts to help stabilize economic growth. Several other Asian countries are also pressing ahead with reforms, such as India, where economic growth has improved in recent quarters. Portfolio managers continue to balance these macroeconomic factors with company-specific opportunities and the likelihood of an improving global economy over time.

About half of total portfolio assets are invested in equities. The portfolio emphasizes economically sensitive stocks, particularly industrials, financials and the commodity-related sectors. Managers are interested in a diversified range of financial companies, including select local banks as well as larger regional institutions in Asia that are likely to be supported by a combination of strong management and solid earnings growth. They are also attracted to companies that they believe should be supported by specific reforms in areas such as cleaner energy in China as well as firms that make niche industrial products. Furthermore, the fund invests in a number of firms that are likely to benefit from an increasingly sophisticated Asian consumer, with more than 10% of the portfolio’s assets invested in the consumer sectors. An additional 14% of assets are invested in technology and telecommunication services stocks.

The emerging markets debt universe also continues to offer diverse opportunities, with the fixed-income portion of the portfolio remaining dynamic. Managers have reduced investments in areas that are likely to be affected by increased uncertainty, such as Brazilian inflation-linked bonds and local Russian debt. Instead, they prefer markets like Mexico, which they expect to benefit from longer term improvements, as well as higher yielding opportunities in Africa or India that are likely to provide compensation for the risks involved. The fund’s managers are remaining nimble about currency hedging as some emerging markets currencies may experience increased volatility. The portfolio’s significant cash position should help provide some cushion against economically sensitive equity exposure and more aggressive bond investments.

We believe that the emerging markets universe offers a wide range of compelling investment opportunities and we look forward to reporting to you again in another six months.

Sincerely,

John S. Armour

President

December 17, 2014

| 4 | Capital Group Emerging Markets Total Opportunities Fund |

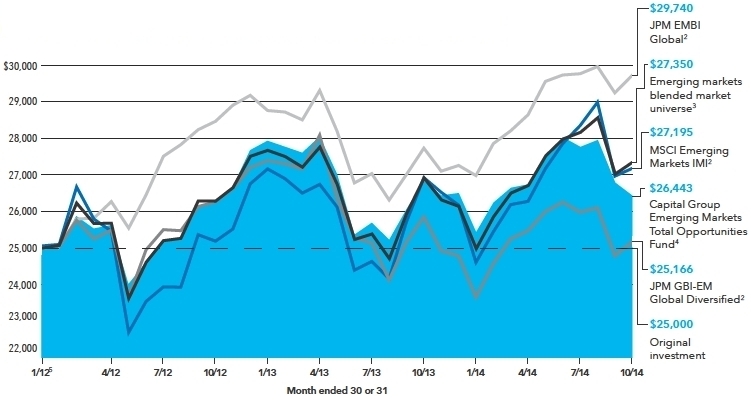

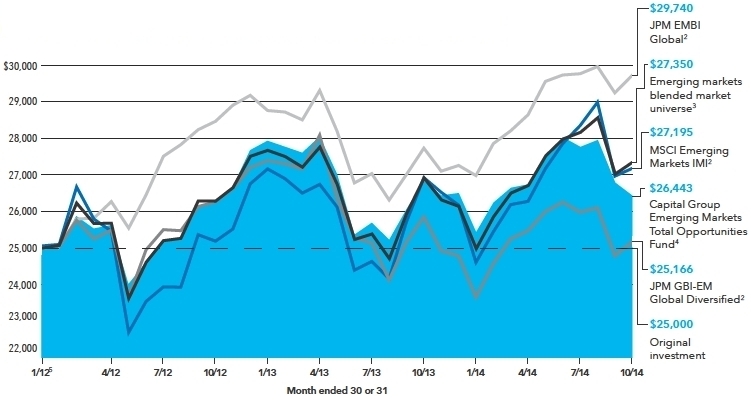

The value of a $25,000 investment

How a $25,0001 investment has grown

(for the period January 27, 2012, to October 31, 2014, with all distributions reinvested)

| | | |

| Average annual total returns based on a $1,000 investment | | Lifetime |

| (periods ended October 31, 2014) | 1 year | (since 1/27/12) |

| | | |

| | –1.50% | 2.05% |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

| 1 | The minimum initial investment for the fund is $25,000. |

| 2 | The market indexes are unmanaged and, therefore, have no expenses. |

| 3 | The emerging markets blended market universe blends the MSCI EM IMI, JPM EMBI Global, and JPM GBI-EM Global Diversified indexes by weighting their cumulative total returns at 50%, 25%, and 25%, respectively. This assumes the blend is rebalanced monthly. |

| 4 | Results are calculated with all distributions, if any, reinvested. |

| 5 | The date the fund began operations, January 27, 2012. |

Fund results shown are for past results and are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, please call (800) 266-9532.

| Capital Group Emerging Markets Total Opportunities Fund | 5 |

Investment portfolio October 31, 2014

| |

| Sector diversification | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | Equity securities | | | Bonds & notes | | Percent of net assets |

| Government | | | — | % | | | 26.3 | % | | | 26.3 | % |

| Industrials | | | 8.7 | | | | 0.5 | | | | 9.2 | |

| Financials | | | 7.2 | | | | 1.0 | | | | 8.2 | |

| Consumer discretionary | | | 7.0 | | | | 1.2 | | | | 8.2 | |

| Information technology | | | 7.7 | | | | — | | | | 7.7 | |

| Energy | | | 5.5 | | | | 1.1 | | | | 6.6 | |

| Telecommunication services | | | 5.0 | | | | 1.3 | | | | 6.3 | |

| Materials | | | 6.1 | | | | 0.1 | | | | 6.2 | |

| Consumer staples | | | 3.5 | | | | 0.1 | | | | 3.6 | |

| Utilities | | | 1.9 | | | | 0.1 | | | | 2.0 | |

| Health care | | | 0.4 | | | | — | | | | 0.4 | |

| | | | 53.0 | % | | | 31.7 | % | | | 84.7 | |

| | | | | | | | | | | | | |

| Short-term securities | | | | | | | | | | | 10.9 | |

| Other assets less liabilities (including forward currency contracts) | | | | | | | | 4.4 | |

| Net assets | | | | | | | | | | | 100.0 | % |

| | | |

| Equity securities | | | Shares | | | | Value

(000) | |

| Asia-Pacific 31.0% | | | | | | | | |

| China 10.5% | | | | | | | | |

| Anhui Conch Cement Co., Ltd. (Hong Kong) | | | 310,000 | | | $ | 1,015 | |

| Bank of China Ltd. (Hong Kong) | | | 5,702,511 | | | | 2,728 | |

| Baoxin Auto Group Ltd. (Hong Kong) | | | 3,104,500 | | | | 2,370 | |

| Beijing Enterprises Holdings Ltd. (Hong Kong) | | | 359,000 | | | | 2,930 | |

| Boer Power Holdings Ltd. (Hong Kong) | | | 1,100,000 | | | | 1,376 | |

| China Everbright International Ltd. (Hong Kong) | | | 3,110,000 | | | | 4,291 | |

| China High Speed Transmission Equipment Group Co., Ltd. (Hong Kong)1 | | | 1,682,000 | | | | 1,325 | |

| China Modern Dairy Holdings Ltd. (Hong Kong)1 | | | 1,536,000 | | | | 677 | |

| China Overseas Grand Oceans Group, Ltd. (Hong Kong) | | | 1,199,000 | | | | 632 | |

| China Pacific Insurance (Group) Co., Ltd. (Hong Kong) | | | 350,600 | | | | 1,311 | |

| China Resources Land Ltd. (Hong Kong) | | | 184,000 | | | | 438 | |

| China Unicom Ltd. (Hong Kong) | | | 1,624,000 | | | | 2,442 | |

| CSR Corp. Ltd. (Hong Kong) | | | 1,367,000 | | | | 1,530 | |

| First Tractor Co. Ltd. (Hong Kong) | | | 1,594,000 | | | | 1,020 | |

| Haitian International Holdings Ltd. (Hong Kong) | | | 1,235,000 | | | | 2,650 | |

| Honghua Group Ltd. (Hong Kong) | | | 2,820,000 | | | | 542 | |

| Industrial and Commercial Bank of China Ltd. (Hong Kong) | | | 1,057,000 | | | | 699 | |

| Lenovo Group Ltd. (Hong Kong) | | | 2,884,000 | | | | 4,247 | |

| Minth Group Ltd. (Hong Kong) | | | 2,714,000 | | | | 5,200 | |

| Nine Dragons Paper (Holdings) Ltd. (Hong Kong) | | | 1,210,000 | | | | 938 | |

| 6 | Capital Group Emerging Markets Total Opportunities Fund |

| | | Shares | | | Value

(000) | |

| Asia-Pacific (continued) | | | | | | | | |

| China (continued) | | | | | | | | |

| Shanghai Pharmaceutical (Group) Co., Ltd. (Hong Kong) | | | 245,400 | | | $ | 615 | |

| Zhongsheng Group Holdings Ltd. (Hong Kong) | | | 805,000 | | | | 827 | |

| Zhuzhou CSR Times Electric Co., Ltd. (Hong Kong) | | | 954,500 | | | | 4,515 | |

| | | | | | | | 44,318 | |

| | | | | | | | | |

| Hong Kong 3.3% | | | | | | | | |

| AIA Group Ltd. | | | 380,200 | | | | 2,120 | |

| Chow Sang Sang Holdings International Ltd. | | | 1,520,000 | | | | 3,755 | |

| Hilong Holding Ltd. | | | 4,575,000 | | | | 1,499 | |

| HKT Trust, units | | | 3,601,840 | | | | 4,389 | |

| Melco Crown Entertainment Ltd. (ADR) | | | 12,600 | | | | 342 | |

| Wynn Macau, Ltd. | | | 543,200 | | | | 1,961 | |

| | | | | | | | 14,066 | |

| | | | | | | | | |

| India 4.9% | | | | | | | | |

| Bharti Airtel Ltd. | | | 921,567 | | | | 5,987 | |

| DLF Ltd. | | | 183,000 | | | | 372 | |

| Emami Ltd. | | | 11,333 | | | | 150 | |

| Glenmark Pharmaceuticals Ltd. | | | 50,480 | | | | 590 | |

| Infosys Ltd. | | | 92,064 | | | | 6,074 | |

| Larsen & Toubro Ltd. | | | 19,000 | | | | 512 | |

| Steel Authority of India Ltd. | | | 1,354,209 | | | | 1,833 | |

| Sun Pharmaceutical Industries Ltd. | | | 34,550 | | | | 476 | |

| Tech Mahindra Ltd. | | | 54,208 | | | | 2,223 | |

| Thermax Ltd. | | | 123,837 | | | | 1,803 | |

| United Spirits Ltd.1 | | | 9,516 | | | | 428 | |

| | | | | | | | 20,448 | |

| | | | | | | | | |

| Malaysia 2.0% | | | | | | | | |

| Bumi Armada Bhd. | | | 5,231,100 | | | | 2,497 | |

| CIMB Group Holdings Bhd. | | | 570,229 | | | | 1,125 | |

| Genting Bhd | | | 679,700 | | | | 2,014 | |

| Genting Bhd, warrants, expires 12/18/181 | | | 228,825 | | | | 188 | |

| IJM Corp. Bhd. | | | 1,138,300 | | | | 2,395 | |

| | | | | | | | 8,219 | |

| | | | | | | | | |

| Philippines 0.5% | | | | | | | | |

| Ayala Land, Inc. | | | 2,437,500 | | | | 1,820 | |

| | | | | | | | | |

| Singapore 0.9% | | | | | | | | |

| KrisEnergy Ltd.1 | | | 896,000 | | | | 576 | |

| Mapletree Greater China Commercial Trust | | | 3,183,000 | | | | 2,341 | |

| Singapore Telecommunications Ltd. | | | 256,000 | | | | 753 | |

| | | | | | | | 3,670 | |

| South Korea 2.9% | | | | | | | | |

| Daum Communications Corp. | | | 2,191 | | | | 299 | |

| Hyundai Mobis Co., Ltd. | | | 9,003 | | | | 2,106 | |

| Hyundai Motor Co. | | | 23,272 | | | | 3,702 | |

| Korea Electric Power Corp. | | | 5,585 | | | | 243 | |

| OCI Co. Ltd.1 | | | 8,037 | | | | 692 | |

| Capital Group Emerging Markets Total Opportunities Fund | 7 |

| Equity securities (continued) | | Shares | | | Value

(000) | |

| Asia-Pacific (continued) | | | | | | | | |

| South Korea (continued) | | | | | | | | |

| Orion Corp. | | | 1,680 | | | $ | 1,297 | |

| Samsung Electronics Co., Ltd. | | | 2,872 | | | | 3,343 | |

| SK Telecom Co., Ltd. | | | 2,580 | | | | 644 | |

| | | | | | | | 12,326 | |

| | | | | | | | | |

| Taiwan 5.1% | | | | | | | | |

| AirTAC International Group | | | 269,290 | | | | 1,965 | |

| ASUSTeK Computer Inc. | | | 32,820 | | | | 335 | |

| CTCI Corp. | | | 819,000 | | | | 1,338 | |

| Delta Electronics, Inc. | | | 641,000 | | | | 3,836 | |

| MediaTek Inc. | | | 200,762 | | | | 2,858 | |

| Taiwan Cement Corp. | | | 1,736,000 | | | | 2,651 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | | 1,882,000 | | | | 8,075 | |

| Yungtay Engineering Co., Ltd. | | | 178,000 | | | | 395 | |

| | | | | | | | 21,453 | |

| | | | | | | | | |

| Thailand 0.9% | | | | | | | | |

| Bangkok Bank PCL, nonvoting depository receipt | | | 641,400 | | | | 3,899 | |

| | | | | | | | | |

| Latin America 4.9% | | | | | | | | |

| Argentina 0.4% | | | | | | | | |

| YPF Sociedad Anónima, Class D (ADR) | | | 53,100 | | | | 1,867 | |

| | | | | | | | | |

| Brazil 1.6% | | | | | | | | |

| Gerdau SA (ADR) | | | 234,500 | | | | 1,062 | |

| Hypermarcas SA, ordinary nominative1 | | | 182,600 | | | | 1,276 | |

| Mills Estruturas e Serviços de Engenharia SA, ordinary nominative | | | 101,800 | | | | 663 | |

| TIM Participacoes SA, ordinary nominative | | | 121,200 | | | | 659 | |

| Usinas Siderúrgicas de Minas Gerais SA – Usiminas, Class A, preferred nominative1 | | | 152,200 | | | | 350 | |

| Vale SA, Class A, preferred nominative (ADR) | | | 92,900 | | | | 814 | |

| Vale SA, ordinary nominative | | | 132,000 | | | | 1,332 | |

| Vale SA, ordinary nominative (ADR) | | | 43,600 | | | | 440 | |

| | | | | | | | 6,596 | |

| | | | | | | | | |

| Chile 0.7% | | | | | | | | |

| Enersis SA (ADR) | | | 82,600 | | | | 1,304 | |

| Inversiones La Construccion SA | | | 98,000 | | | | 1,397 | |

| Ripley Corp SA | | | 726,000 | | | | 397 | |

| | | | | | | | 3,098 | |

| | | | | | | | | |

| Mexico 2.2% |

| CEMEX, SAB de CV, ordinary participation certificates, units (ADR)1 | | | 380,551 | | | | 4,681 | |

| Fibra Uno Administracion, SA de CV | | | 210,000 | | | | 730 | |

| Grupo Comercial Chedraui, SAB de CV, Class B | | | 87,100 | | | | 306 | |

| Grupo Sanborns, SAB de CV, Series B1 | | | 551,600 | | | | 883 | |

| Impulsora del Desarrollo y el Empleo en América Latina, SA de CV, Series B11 | | | 804,300 | | | | 2,543 | |

| | | | | | | | 9,143 | |

| 8 | Capital Group Emerging Markets Total Opportunities Fund |

| | | | Shares | | | | Value

(000) | |

| Eastern Europe and Middle East 3.9% | | | | | | | | |

| Greece 1.0% | | | | | | | | |

| Eurobank Ergasias SA1 | | | 6,060,000 | | | $ | 2,103 | |

| Jumbo SA | | | 54,898 | | | | 602 | |

| Titan Cement Co. SA | | | 77,313 | | | | 1,714 | |

| | | | | | | | 4,419 | |

| | | | | | | | | |

| Oman 0.4% | | | | | | | | |

| bankmuscat SAOG | | | 936,576 | | | | 1,713 | |

| | | | | | | | | |

| Russia 1.9% | | | | | | | | |

| Globaltrans Investment PLC (GDR) | | | 37,548 | | | | 278 | |

| OJSC Alrosa | | | 4,102,121 | | | | 3,672 | |

| OJSC Moscow Exchange | | | 143,831 | | | | 194 | |

| OJSC Rosneft Oil Co. (GDR) | | | 436,700 | | | | 2,433 | |

| Sberbank of Russia1 | | | 725,091 | | | | 1,285 | |

| | | | | | | | 7,862 | |

| | | | | | | | | |

| United Arab Emirates 0.6% | | | | | | | | |

| DP World Ltd. | | | 132,452 | | | | 2,538 | |

| | | | | | | | | |

| Other markets 8.6% | | | | | | | | |

| Australia 0.7% | | | | | | | | |

| Oil Search Ltd. | | | 394,060 | | | | 2,993 | |

| | | | | | | | | |

| Austria 0.3% | | | | | | | | |

| Vienna Insurance Group AG | | | 25,079 | | | | 1,205 | |

| | | | | | | | | |

| Canada 0.9% | | | | | | | | |

| Centerra Gold Inc. | | | 132,000 | | | | 515 | |

| First Quantum Minerals Ltd. | | | 231,100 | | | | 3,486 | |

| | | | | | | | 4,001 | |

| | | | | | | | | |

| France 0.5% | | | | | | | | |

| Casino, Guichard-Perrachon SA | | | 19,463 | | | | 1,995 | |

| | | | | | | | | |

| Italy 0.4% | | | | | | | | |

| Tenaris SA (ADR) | | | 43,643 | | | | 1,730 | |

| | | | | | | | | |

| Netherlands 0.9% | | | | | | | | |

| Fugro NV, depository receipts | | | 49,199 | | | | 679 | |

| Unilever NV, depository receipts | | | 78,310 | | | | 3,037 | |

| | | | | | | | 3,716 | |

| | | | | | | | | |

| Norway 0.6% | | | | | | | | |

| BW LPG Ltd. | | | 253,626 | | | | 2,403 | |

| | | | | | | | | |

| United Kingdom 2.8% | | | | | | | | |

| Glencore PLC1 | | | 56,200 | | | | 288 | |

| Global Ports Investments PLC (GDR) | | | 111,647 | | | | 692 | |

| Imperial Tobacco Group PLC | | | 17,046 | | | | 739 | |

| Ophir Energy PLC1 | | | 403,383 | | | | 1,196 | |

| SABMiller PLC | | | 62,100 | | | | 3,502 | |

| Standard Chartered PLC | | | 271,026 | | | | 4,102 | |

| Unilever PLC | | | 28,600 | | | | 1,150 | |

| | | | | | | | 11,669 | |

| Capital Group Emerging Markets Total Opportunities Fund | 9 |

| Equity securities (continued) | | Shares | | | Value

(000) | |

| Other markets (continued) | | | | | | | | |

| United States of America 1.5% | | | | | | | | |

| Arcos Dorados Holdings, Inc., Class A | | | 273,000 | | | $ | 1,682 | |

| Cobalt International Energy, Inc.1 | | | 248,900 | | | | 2,914 | |

| Ensco PLC, Class A | | | 47,700 | | | | 1,936 | |

| | | | | | | | 6,532 | |

| | | | | | | | | |

| Miscellaneous 4.6% | | | | | | | | |

| Equity securities in initial period of acquisition | | | | | | | 19,447 | |

| | | | | | | | | |

| Total equity securities (cost: $218,854,000) | | | | | | | 223,146 | |

| | | | | | | | | |

| Bonds & notes | | Principal amount

(000) | | | | | |

| Latin America 13.1% | | | | | | | | |

| Argentina 0.7% | | | | | | | | |

| Argentina (Republic of) 7.00% April 17, 2017 | | $ | 3,400 | | | | 2,996 | |

| | | | | | | | | |

| Brazil 3.3% | | | | | | | | |

| Banco Votorantim SA, 6.25% May 16, 20162 | | BRL | 1,000 | | | | 466 | |

| Brazil (Federal Republic of) Global 4.875% January 22, 2021 | | $ | 1,200 | | | | 1,299 | |

| Brazil Notas do Tesouro Nacional: | | | | | | | | |

| Series B, 6.00% August 15, 2018 – August 15, 20502 | | BRL | 6 | | | | 9,878 | |

| Series F, 10.00% January 1, 2017 | | | — | 3 | | | 1,384 | |

| Cosan Luxembourg SA 9.50% March 14, 2018 | | | 500 | | | | 184 | |

| Odebrecht Drilling Norbe VIII/IX Ltd. 6.35% June 30, 20214 | | $ | 144 | | | | 153 | |

| Odebrecht Offshore Drilling Finance Ltd. 6.75% October 1, 20224,5 | | | 663 | | | | 696 | |

| | | | | | | | 14,060 | |

| | | | | | | | | |

| Chile 0.6% | | | | | | | | |

| Chilean Government: | | | | | | | | |

| 3.00% March 1, 2018 – March 1, 20232 | | CLP | 49,000 | | | | 2,231 | |

| Emgesa SA ESP 8.75% January 25, 2021 | | COP | 598,000 | | | | 314 | |

| | | | | | | | 2,545 | |

| | | | | | | | | |

| Colombia 1.8% | | | | | | | | |

| Colombia (Republic of): | | | | | | | | |

| Series B, 5.00% November 21, 2018 | | | 7,830,000 | | | | 3,778 | |

| Series B, 7.00% May 4, 2022 | | | 695,000 | | | | 349 | |

| Series B, 10.00% July 24, 2024 | | | 1,680,000 | | | | 1,014 | |

| Series B, 6.00% April 28, 2028 | | | 4,890,000 | | | | 2,176 | |

| Financiera de Desarrollo Territorial 7.875% August 12, 2024 | | | 318,000 | | | | 158 | |

| | | | | | | | 7,475 | |

| | | | | | | | | |

| Mexico 6.0% | | | | | | | | |

| América Móvil, SAB de CV 3.625% March 30, 2015 | | $ | 162 | | | | 164 | |

| BBVA Bancomer SA 6.50% March 10, 2021 | | | 670 | | | | 747 | |

| Petroleos Mexicanos: | | | | | | | | |

| 7.375% December 15, 2014 | | | 670 | | | | 674 | |

| 4.875% March 15, 2015 | | | 600 | | | | 609 | |

| Red de Carreteras de Occidente 9.00% June 10, 20284 | | MXN | 15,500 | | | | 1,110 | |

| 10 | Capital Group Emerging Markets Total Opportunities Fund |

| | | Principal amount

(000) | | | Value

(000) | |

| Latin America (continued) | | | | | | | | |

| Mexico(continued) | | | | | | | | |

| United Mexican States Government: | | | | | | | | |

| Series MI10, 9.50% December 18, 2014 | | MXN | 29 | | | $ | 213 | |

| Series M10, 7.75% December 14, 2017 | | | 82 | | | | 673 | |

| 4.00% June 13, 20192 | | | 130 | | | | 1,070 | |

| 2.50% December 10, 20202 | | | 108 | | | | 821 | |

| Series M, 6.50% June 10, 2021 | | | 239 | | | | 1,878 | |

| Series M20, 10.00% December 5, 2024 | | | 811 | | | | 7,892 | |

| 4.50% December 4, 20252 | | | 208 | | | | 1,828 | |

| 4.00% November 15, 20402 | | | 625 | | | | 5,096 | |

| United Mexican States Government Global: | | | | | | | | |

| Series A, 6.05% January 11, 2040 | | $ | 880 | | | | 1,069 | |

| 5.55% January 21, 2045 | | | 390 | | | | 445 | |

| Urbi Desarrollos Urbanos SA de CV: | | | | | | | | |

| 8.50% April 19, 20166 | | | 1,425 | | | | 150 | |

| 8.50% April 19, 20165,6 | | | 560 | | | | 59 | |

| 9.50% January 21, 20206 | | | 2,400 | | | | 253 | |

| 9.50% January 21, 20205,6 | | | 230 | | | | 24 | |

| 9.75% February 3, 20226 | | | 990 | | | | 105 | |

| 9.75% February 3, 20225,6 | | | 1,655 | | | | 175 | |

| | | | | | | | 25,055 | |

| | | | | | | | | |

| Panama 0.1% | | | | | | | | |

| ENA Norte Trust: | | | | | | | | |

| 4.95% April 25, 20284 | | | 327 | | | | 338 | |

| 4.95% April 25, 20284,5 | | | 227 | | | | 234 | |

| | | | | | | | 572 | |

| | | | | | | | | |

| Peru 0.5% | | | | | | | | |

| Banco de Credito del Peru 6.875% September 16, 2026 | | | 1,300 | | | | 1,472 | |

| Peru Government 5.70% August 12, 2024 | | PEN | 42 | | | | 144 | |

| Transportadora de Gas Peru 4.25% April 30, 20284 | | $ | 430 | | | | 415 | |

| | | | | | | | 2,031 | |

| | | | | | | | | |

| Uruguay 0.1% | | | | | | | | |

| Uruguay (Republic of) 4.375% December 15, 20282,4 | | UYU | 13,047 | | | | 593 | |

| | | | | | | | | |

| Eastern Europe and Middle East 6.0% | | | | | | | | |

| Croatia 0.4% | | | | | | | | |

| Croatian Government: | | | | | | | | |

| 5.50% April 4, 20235 | | $ | 575 | | | | 605 | |

| 6.00% January 26, 20245 | | | 900 | | | | 978 | |

| | | | | | | | 1,583 | |

| | | | | | | | | |

| Greece 2.1% | | | | | | | | |

| Greek Government: | | | | | | | | |

| 2.00% February 24, 2023 – February 24, 2042 | | EUR | 12,760 | | | | 9,025 | |

| | | | | | | | | |

| Hungary 1.2% | | | | | | | | |

| Hungarian Government: | | | | | | | | |

| 4.125% February 19, 2018 | | $ | 180 | | | | 187 | |

| 4.00% March 25, 2019 | | | 210 | | | | 216 | |

| 6.25% January 29, 2020 | | | 555 | | | | 627 | |

| 5.75% November 22, 2023 | | | 2,440 | | | | 2,696 | |

| Series 25B, 5.50% June 24, 2025 | | HUF | 265,000 | | | | 1,227 | |

| | | | | | | | 4,953 | |

| Capital Group Emerging Markets Total Opportunities Fund | 11 |

| Bonds & notes (continued) | | Principal amount

(000) | | | Value

(000) | |

| Eastern Europe and Middle East (continued) | | | | | | | | |

| Oman 0.0% | | | | | | | | |

| bankmuscat SAOG 4.50% convertible March 20, 2017 | | OMR | 139 | | | $ | 38 | |

| | | | | | | | | |

| Poland 0.1% | | | | | | | | |

| Poland Government, Series 1023, 4.00% October 25, 2023 | | PLN | 1,995 | | | | 665 | |

| | | | | | | | | |

| Russia 0.1% | | | | | | | | |

| Brunswick Rail Finance Ltd. 6.50% November 1, 20175 | | $ | 300 | | | | 270 | |

| | | | | | | | | |

| Slovenia 1.3% | | | | | | | | |

| Slovenia (Republic of): | | | | | | | | |

| 4.125% February 18, 2019 | | | 1,820 | | | | 1,920 | |

| 4.125% February 18, 20195 | | | 200 | | | | 211 | |

| 5.50% October 26, 2022 | | | 2,995 | | | | 3,302 | |

| | | | | | | | 5,433 | |

| | | | | | | | | |

| Turkey 0.7% | | | | | | | | |

| Turkey (Republic of) 7.10% March 8, 2023 | | TRY | 7,530 | | | | 3,108 | |

| | | | | | | | | |

| United Arab Emirates 0.1% | | | | | | | | |

| Abu Dhabi National Energy Co. PJSC (TAQA) 4.125% March 13, 2017 | | $ | 300 | | | | 319 | |

| | | | | | | | | |

| Asia-Pacific 5.6% | | | | | | | | |

| China 0.6% | | | | | | | | |

| CNOOC Finance 2013 Ltd. 3.00% May 9, 2023 | | | 2,050 | | | | 1,947 | |

| Renhe Commercial Holdings Co. Ltd.: | | | | | | | | |

| 11.75% May 18, 2015 | | | 250 | | | | 206 | |

| 13.00% March 10, 2016 | | | 550 | | | | 391 | |

| | | | | | | | 2,544 | |

| | | | | | | | | |

| Hong Kong 0.4% | | | | | | | | |

| Wynn Macau, Ltd. 5.25% October 15, 20215 | | | 1,500 | | | | 1,508 | |

| | | | | | | | | |

| India 2.3% | | | | | | | | |

| India Government Bond: | | | | | | | | |

| 7.28% June 3, 2019 | | INR | 280,000 | | | | 4,413 | |

| 8.83% November 25, 2023 | | | 120,000 | | | | 2,018 | |

| 9.15% November 14, 2024 | | | 180,000 | | | | 3,094 | |

| | | | | | | | 9,525 | |

| | | | | | | | | |

| Indonesia 1.6% | | | | | | | | |

| Indonesia (Republic of): | | | | | | | | |

| 7.25% April 20, 2015 | | $ | 270 | | | | 278 | |

| 5.875% March 13, 2020 | | | 320 | | | | 360 | |

| 3.75% April 25, 2022 | | | 500 | | | | 500 | |

| Series FR71, 9.00% March 15, 2029 | | IDR | 10,000,000 | | | | 872 | |

| Series FR68, 8.375% March 15, 2034 | | | 57,230,000 | | | | 4,725 | |

| | | | | | | | 6,735 | |

| | | | | | | | | |

| Philippines 0.6% | | | | | | | | |

| Philippines (Republic of): | | | | | | | | |

| 4.95% January 15, 2021 | | PHP | 93,000 | | | | 2,145 | |

| 6.25% January 14, 2036 | | | 20,000 | | | | 490 | |

| | | | | | | | 2,635 | |

| | | | | | | | | |

| South Korea 0.1% | | | | | | | | |

| Export-Import Bank of Korea 1.085% September 17, 20167 | | $ | 620 | | | | 623 | |

| 12 | Capital Group Emerging Markets Total Opportunities Fund |

| | | Principal amount

(000) | | | Value

(000) | |

| Africa 3.4% | | | | | | | | |

| Ghana 0.7% | | | | | | | | |

| Ghana (Republic of): | | | | | | | | |

| 7.875% August 7, 2023 | | $ | 210 | | | $ | 212 | |

| 8.125% January 18, 20264,5 | | | 2,505 | | | | 2,524 | |

| | | | | | | | 2,736 | |

| | | | | | | | | |

| Kenya 0.9% | | | | | | | | |

| Kenya (Republic of): | | | | | | | | |

| 5.875% June 24, 2019 | | | 650 | | | | 675 | |

| 6.875% June 24, 20245 | | | 2,970 | | | | 3,174 | |

| | | | | | | | 3,849 | |

| | | | | | | | | |

| Nigeria 0.1% | | | | | | | | |

| Nigeria (Republic of) 6.375% July 12, 2023 | | | 500 | | | | 533 | |

| | | | | | | | | |

| South Africa 1.3% | | | | | | | | |

| South Africa (Republic of): | | | | | | | | |

| Series R-2023, 7.75% February 28, 2023 | | ZAR | 48,280 | | | | 4,399 | |

| Series R-209, 6.25% March 31, 2036 | | | 3,917 | | | | 277 | |

| Series R-214, 6.50% February 28, 2041 | | | 9,000 | | | | 636 | |

| | | | | | | | 5,312 | |

| | | | | | | | | |

| Zambia 0.4% | | | | | | | | |

| Zambia (Republic of) 5.375% September 20, 2022 | | $ | 1,750 | | | | 1,684 | |

| | | | | | | | | |

| Other markets 3.6% | | | | | | | | |

| Canada 0.1% | | | | | | | | |

| First Quantum Minerals Ltd. 7.00% February 15, 20215 | | | 482 | | | | 475 | |

| | | | | | | | | |

| Jamaica 0.7% | | | | | | | | |

| Digicel Group Ltd.: | | | | | | | | |

| 8.25% September 30, 2020 | | | 600 | | | | 630 | |

| 8.25% September 30, 20205 | | | 1,375 | | | | 1,444 | |

| 6.00% April 15, 2021 | | | 1,000 | | | | 1,012 | |

| | | | | | | | 3,086 | |

| | | | | | | | | |

| Portugal 1.5% | | | | | | | | |

| Portuguese Government: | | | | | | | | |

| 3.85% April 15, 2021 | | EUR | 970 | | | | 1,325 | |

| 5.65% February 15, 2024 | | | 3,340 | | | | 4,997 | |

| | | | | | | | 6,322 | |

| | | | | | | | | |

| Sweden 0.3% | | | | | | | | |

| Millicom International Cellular SA: | | | | | | | | |

| 6.625% October 15, 2021 | | $ | 550 | | | | 591 | |

| 6.625% October 15, 20215 | | | 500 | | | | 538 | |

| | | | | | | | 1,129 | |

| | | | | | | | | |

| Switzerland 0.4% | | | | | | | | |

| Dufry AG 2.00% convertible 0.00% June 18, 2015 | | CHF | 1,800 | | | | 1,703 | |

| | | | | | | | | |

| United Kingdom 0.1% | | | | | | | | |

| SABMiller Holdings Inc. 1.85% January 15, 20155 | | $ | 400 | | | | 401 | |

| | | | | | | | | |

| United States of America 0.5% | | | | | | | | |

| Arcos Dorados Holdings, Inc. 10.25% July 13, 20165 | | BRL | 2,600 | | | | 986 | |

| Trilogy International Partners, LLC 10.25% August 15, 20165 | | $ | 1,000 | | | | 1,019 | |

| | | | | | | | 2,005 | |

| | | | | | | | | |

| Total bonds & notes (cost: $140,551,000) | | | | | | | 133,526 | |

| Capital Group Emerging Markets Total Opportunities Fund | 13 |

| Short-term securities | | Principal amount

(000) | | | Value

(000) | |

| Commercial paper 9.1% | | | | | | | | |

| AstraZeneca PLC 0.08% due 11/12/145 | | $ | 2,300 | | | $ | 2,300 | |

| BASF SE 0.10% due 12/15/145 | | | 6,500 | | | | 6,499 | |

| Bank of Tokyo-Mitsubishi UFJ Ltd. 0.15% due 12/1/14 | | | 8,300 | | | | 8,299 | |

| EI du Pont de Nemours & Co. 0.08% due 11/19/145 | | | 4,700 | | | | 4,700 | |

| Gotham Funding Corp. 0.15% due 11/13/145 | | | 1,500 | | | | 1,500 | |

| National Australia Funding Delaware, Inc. 0.04% due 11/3/145 | | | 10,000 | | | | 10,000 | |

| Siemens Capital Co. LLC 0.08% due 11/03/14–11/13/145 | | | 5,100 | | | | 5,100 | |

| | | | | | | | 38,398 | |

| | | | | | | | | |

| Discount Notes 1.8% | | | | | | | | |

| Federal Home Loan Bank 0.05% due 11/5/14 | | | 2,400 | | | | 2,400 | |

| Federal National Mortgage Association 0.08% due 12/10/14 | | | 5,100 | | | | 5,100 | |

| | | | | | | | 7,500 | |

| | | | | | | | | |

| Total short-term securities (cost: $45,897,000) | | | | | | | 45,898 | |

| Total investment securities (cost: $405,302,000) | | | | | | | 402,570 | |

| Other assets less liabilities (including forward currency contracts) | | | | | | | 18,440 | |

| | | | | | | | | |

| Net assets | | | | | | $ | 421,010 | |

| 1 | Security did not produce income during the last 12 months. |

| 2 | Index-linked bond whose principal amount moves with a government retail price index. |

| 3 | Amount less than one thousand. |

| 4 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 5 | Acquired in a transaction exempt from registration under Rule 144A or section 4(2) of the Securities Act of 1933 (not including purchases of securities that were publicly offered in the primary local market but were not registered under U.S. securities laws). May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $45,420,000, which represented 10.79% of the net assets of the fund. |

| 6 | Scheduled interest and/or principal payment was not received. |

| 7 | Coupon rate may change periodically. |

Key to abbreviations

| Securities: |

| ADR — American Depositary Receipts |

| GDR — Global Depositary Receipts |

| Currency: |

| BRL — Brazilian real |

| CHF — Swiss franc |

| CLP — Chilean peso |

| COP — Colombian peso |

| EUR — Euro |

| HUF — Hungarian forint |

| IDR — Indonesian rupiah |

| INR — Indian rupee |

| MXN — Mexican peso |

| OMR — Omani rial |

| PEN — Peruvian nuevo sol |

| PHP — Philippine peso |

| PLN — Polish zloty |

| TRY — Turkish lira |

| UYU — Uruguayan peso |

| ZAR — South African rand |

| 14 | Capital Group Emerging Markets Total Opportunities Fund |

Financial statements

Statement of assets and liabilities

at October 31, 2014 | (dollars in thousands, except per-share amounts) |

| Assets: | | | | | | | | |

| Investment securities, at value (cost: $405,302) | | | | | | $ | 402,570 | |

| Cash | | | | | | | 215 | |

| Cash denominated in non-U.S. currency (cost: $2,550) | | | | | | | 2,998 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 932 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 13,152 | | | | | |

| Sales of fund’s shares | | | 34 | | | | | |

| Dividends and interest | | | 2,528 | | | | | |

| Non-U.S. taxes | | | 2 | | | | 15,716 | |

| | | | | | | | 422,431 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 143 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 734 | | | | | |

| Investment advisory services | | | 386 | | | | | |

| Repurchases of fund’s shares | | | 12 | | | | | |

| Non-U.S. taxes | | | 37 | | | | | |

| Other accrued expenses | | | 109 | | | | 1,278 | |

| | | | | | | | 1,421 | |

| Net assets at October 31, 2014: | | | | | | | | |

| Equivalent to $11.13 per share on 37,819,398 shares of $0.01 par value capital stock outstanding (unlimited authorized shares) | | | | | | $ | 421,010 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of stock | | | | | | $ | 421,651 | |

| Undistributed net investment income | | | | | | | 379 | |

| Accumulated net realized gain | | | | | | | 1,027 | |

| Net unrealized depreciation | | | | | | | (2,047 | ) |

| Net assets at October 31, 2014 | | | | | | $ | 421,010 | |

See Notes to Financial Statements

| Capital Group Emerging Markets Total Opportunities Fund | 15 |

Statement of operations

for the year ended October 31, 2014 | (dollars in thousands) |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Interest (net of non-U.S. withholding tax of $95) | | $ | 11,263 | | | | | |

| Dividends (net of non-U.S. withholding tax of $449) | | | 6,857 | | | $ | 18,120 | |

| | | | | | | | | |

| Fees and expenses: | | | | | | | | |

| Investment advisory services | | | 5,012 | | | | | |

| Custodian | | | 171 | | | | | |

| Registration statement and prospectus | | | 54 | | | | | |

| Auditing and legal | | | 88 | | | | | |

| Reports to shareholders | | | 22 | | | | | |

| Trustees’ compensation | | | 38 | | | | | |

| Other | | | 111 | | | | | |

| Total fees and expenses | | | | | | | 5,496 | |

| Net investment income | | | | | | | 12,624 | |

| | | | | | | | | |

| Net realized gain and unrealized depreciation on investments, forward currency contracts and currency: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $20) | | | 982 | | | | | |

| Forward currency contracts | | | 2,248 | | | | | |

| Currency transactions | | | (342 | ) | | | 2,888 | |

| Net unrealized (depreciation) appreciation on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $33) | | | (25,650 | ) | | | | |

| Forward currency contracts | | | 11 | | | | | |

| Currency translations | | | (72 | ) | | | (25,711 | ) |

| Net realized gain and unrealized depreciation on investments, forward currency contracts and currency | | | | | | | (22,823 | ) |

| | | | | | | | | |

| Net decrease in net assets resulting from operations | | | | | | $ | (10,199 | ) |

See Notes to Financial Statements

| 16 | Capital Group Emerging Markets Total Opportunities Fund |

| Statements of changes in net assets | |

| | | (dollars in thousands) |

| | | | |

| | | Year ended October 31 | |

| | | 2014 | | | 2013 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 12,624 | | | $ | 16,023 | |

| Net realized gain (loss) on investments, forward currency contracts and currency transactions | | | 2,888 | | | | (11,787 | ) |

| Net unrealized (depreciation) appreciation on investments, forward currency contracts and currency translations | | | (25,711 | ) | | | 4,741 | |

| Net (decrease) increase in net assets resulting from operations | | | (10,199 | ) | | | 8,977 | |

| | | | | | | | | |

| Dividends paid to shareholders: | | | | | | | | |

| Dividends from net investment income | | | (9,656 | ) | | | (14,914 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares sold: 8,160,725 and 13,906,574 shares, respectively | | | 92,891 | | | | 161,635 | |

| Proceeds from shares issued in reinvestment of net investment income dividends: 781,023 and 1,183,067 shares, respectively | | | 8,669 | | | | 13,854 | |

| Cost of shares repurchased: 23,612,134 and 7,324,412 shares, respectively | | | (264,867 | ) | | | (83,143 | ) |

| Net (decrease) increase in net assets resulting from capital share transactions | | | (163,307 | ) | | | 92,346 | |

| | | | | | | | | |

| Total (decrease) increase in net assets | | | (183,162 | ) | | | 86,409 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 604,172 | | | | 517,763 | |

| End of year (including undistributed net investment income: $379 and $7,340, respectively) | | $ | 421,010 | | | $ | 604,172 | |

See Notes to Financial Statements

| Capital Group Emerging Markets Total Opportunities Fund | 17 |

Notes to financial statements

1. Organization

Capital Group Emerging Markets Total Opportunities Fund (the “fund”) is registered under the Investment Company Act of 1940, as an open-end, diversified management investment company. The fund seeks long-term growth and preservation of capital with lower volatility of returns than emerging market equities.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”).These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The fund follows the significant accounting policies described below, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments on the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Guardian Trust Company (“CGTC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive and any of the inputs may be used to value any other class of fixed-income security.

| 18 | Capital Group Emerging Markets Total Opportunities Fund |

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board of trustees and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive

| Capital Group Emerging Markets Total Opportunities Fund | 19 |

markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following tables present the fund’s valuation levels as of October 31, 2014 (dollars in thousands):

| | | Investment securities |

| | | Level 11 | | | Level 21,2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Equity securities: | | | | | | | | | | | | | | | | |

| Asia-Pacific | | $ | 124,174 | | | $ | 6,045 | | | $ | — | | | $ | 130,219 | |

| Latin America | | | 20,704 | | | | — | | | | — | | | | 20,704 | |

| Other markets | | | 52,776 | | | | — | | | | — | | | | 52,776 | |

| Miscellaneous | | | 19,447 | | | | — | | | | — | | | | 19,447 | |

| Bonds & notes: | | | | | | | | | | | | | | | | |

| Latin America | | | — | | | | 55,327 | | | | — | | | | 55,327 | |

| Eastern Europe and Middle East | | | — | | | | 25,394 | | | | — | | | | 25,394 | |

| Asia-Pacific | | | — | | | | 23,570 | | | | — | | | | 23,570 | |

| Other markets | | | — | | | | 29,235 | | | | — | | | | 29,235 | |

| Short-term securities | | | — | | | | 45,898 | | | | — | | | | 45,898 | |

| Total | | $ | 217,101 | | | $ | 185,469 | | | $ | — | | | $ | 402,570 | |

| | | Other investments3 |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Unrealized appreciation on open forward currency contracts | | $ | — | | | $ | 932 | | | $ | — | | | $ | 932 | |

| Liabilities: | | | | | | | | | | | | | | �� | | |

| Unrealized depreciation on open forward currency contracts | | | — | | | | (143 | ) | | | — | | | | (143 | ) |

| Total | | $ | — | | | $ | 789 | | | $ | — | | | $ | 789 | |

| 1 | Securities with a value of $6,045,000, which represented 1.44% of the net assets of the fund, transferred from Level 1 to Level 2 since the prior fiscal year-end, primarily due to a lack of trading volume to support observable prices. |

| 2 | Level 2 includes investment securities with an aggregate value of $6,045,000, which represented 1.44% of the net assets of the fund, that were fair valued under guidelines adopted by authority of the fund’s board of trustees. |

| 3 | Forward currency contracts are not included in the investment portfolio. |

4. Risk factors

This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments. These risks may be even greater in the case of smaller capitalization stocks.

| 20 | Capital Group Emerging Markets Total Opportunities Fund |

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available for dividend payments at, the companies in which the fund invests.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers are domiciled or operate. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the fund’s net asset value. Additionally, there may be increased settlement risks for transactions in local securities.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in junk bonds.

Thinly traded securities — There may be little trading in the secondary market for particular bonds or other debt securities, which may make them more difficult to value, acquire or sell.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

| Capital Group Emerging Markets Total Opportunities Fund | 21 |

5. Certain investment techniques

Forward currency contracts — The fund has entered into over-the-counter (“OTC”) forward currency contracts, which represent agreements to exchange currencies on specific future dates at predetermined rates. The fund’s investment adviser uses forward currency contracts to manage the fund’s exposure to changes in exchange rates. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from possible movements in exchange rates.

On a daily basis, forward currency contracts are valued and unrealized appreciation or depreciation for open forward currency contracts is recorded in the fund’s statement of assets and liabilities. Realized gains or losses are recorded at the time the forward currency contract is closed or offset by another contract with the same broker for the same settlement date and currency. Closed forward currency contracts that have not reached their settlement date are included in the respective receivables or payables for closed forward currency contracts in the fund’s statement of assets and liabilities. Net realized gains or losses from closed forward currency contracts and net unrealized appreciation or depreciation from open forward currency contracts are recorded in the fund’s statement of operations and statements of changes in net assets.

As of October 31, 2014, the fund had open OTC forward currency contracts to sell currencies, as shown in the following table. The average notional amount of open OTC forward currency contracts was $91,875,000 over the prior 12-month period.

| | | | | Notional amount

(000) | | | U.S. valuation

(000) | |

| | | Counterparty | | Non-U.S. | | U.S. | | | Amount | | | Unrealized

(depreciation)

appreciation | |

| Sales: | | | | | | | | | | | | | | | | |

| Australian dollar to U.S. dollar expiring 11/17/2014 | | Credit Suisse First Boston | | AUD574 | | $ | 500 | | | $ | 505 | | | $ | (5 | ) |

| Brazilian real to U.S. dollar expiring 11/14–12/5/2014 | | Citibank N.A. | | BRL13,653 | | | 5,579 | | | | 5,462 | | | | 117 | |

| Brazilian real to U.S. dollar expiring 11/14–12/5/2014 | | UBS AG | | BRL8,970 | | | 3,661 | | | | 3,592 | | | | 69 | |

| Brazilian real to U.S. dollar expiring 11/28/2014 | | UBS AG | | BRL10,782 | | | 4,232 | | | | 4,318 | | | | (86 | ) |

| British pound to U.S. dollar expiring 11/12/2014 | | Bank of New York Mellon | | GBP1,681 | | | 2,705 | | | | 2,689 | | | | 16 | |

| British pound to U.S. dollar expiring 11/14/2014 | | UBS AG | | GBP849 | | | 1,360 | | | | 1,358 | | | | 2 | |

| British pound to U.S. dollar expiring 11/17/2014 | | JPMorgan Chase | | GBP2,400 | | | 3,859 | | | | 3,839 | | | | 20 | |

| British pound to U.S. dollar expiring 11/17/2014 | | UBS AG | | GBP207 | | | 329 | | | | 331 | | | | (2 | ) |

| Chilean peso to U.S. dollar expiring 11/17/2014 | | UBS AG | | CLP405,064 | | | 680 | | | | 703 | | | | (23 | ) |

| Colombian peso to U.S. dollar expiring 11/14/2014 | | Citibank N.A. | | COP1,104,637 | | | 541 | | | | 537 | | | | 4 | |

| Colombian peso to U.S. dollar expiring 11/28/2014 | | JPMorgan Chase | | COP4,136,365 | | | 2,002 | | | | 2,004 | | | | (2 | ) |

| Euro to U.S. dollar expiring 11/12–11/17/2014 | | Bank of America | | EUR5,499 | | | 6,964 | | | | 6,892 | | | | 72 | |

| Euro to U.S. dollar expiring 11/14/2014 | | Citibank N.A. | | EUR4,182 | | | 5,348 | | | | 5,241 | | | | 107 | |

| Euro to U.S. dollar expiring 11/14/2014 | | Credit Suisse First Boston | | EUR4,300 | | | 5,455 | | | | 5,389 | | | | 66 | |

| Euro to U.S. dollar expiring 11/17–11/24/2014 | | UBS AG | | EUR5,772 | | | 7,366 | | | | 7,234 | | | | 132 | |

| Hungarian forint to U.S. dollar expiring 11/14/2014 | | UBS AG | | HUF27,228 | | | 112 | | | | 111 | | | | 1 | |

| Hungarian forint to U.S. dollar expiring 11/19/2014 | | Credit Suisse First Boston | | HUF43,658 | | | 181 | | | | 177 | | | | 4 | |

| Hungarian forint to U.S. dollar expiring 11/21/2014 | | JPMorgan Chase | | HUF171,609 | | | 715 | | | | 697 | | | | 18 | |

| Malaysian ringgit to U.S. dollar expiring 11/14/2014 | | Bank of America | | MYR6,865 | | | 2,112 | | | | 2,086 | | | | 26 | |

| Malaysian ringgit to U.S. dollar expiring 11/21/2014 | | JPMorgan Chase | | MYR2,891 | | | 881 | | | | 878 | | | | 3 | |

| Mexican peso to U.S. dollar expiring 11/18–12/3/2014 | | Bank of New York Mellon | | MXN84,626 | | | 6,258 | | | | 6,275 | | | | (17 | ) |

| Mexican peso to U.S. dollar expiring 11/18/2014 | | Credit Suisse First Boston | | MXN6,737 | | | 499 | | | | 500 | | | | (1 | ) |

| Mexican peso to U.S. dollar expiring 11/21/2014 | | JPMorgan Chase | | MXN18,054 | | | 1,332 | | | | 1,339 | | | | (7 | ) |

| Polish zloty to U.S. dollar expiring 12/5/2014 | | UBS AG | | PLN2,011 | | | 602 | | | | 596 | | | | 6 | |

| Russian ruble to U.S. dollar expiring 11/17–12/5/2014 | | Citibank N.A. | | RUB143,718 | | | 3,501 | | | | 3,326 | | | | 175 | |

| Singapore dollar to U.S. dollar expiring 11/14/2014 | | Bank of America | | SGD1,791 | | | 1,411 | | | | 1,394 | | | | 17 | |

| Singapore dollar to U.S. dollar expiring 11/17/2014 | | UBS AG | | SGD1,222 | | | 958 | | | | 951 | | | | 7 | |

| South Korean won to U.S. dollar expiring 11/10/2014 | | UBS AG | | KRW691,057 | | | 648 | | | | 647 | | | | 1 | |

| South Korean won to U.S. dollar expiring 11/14–11/28/2014 | | Citibank N.A. | | KRW9,046,866 | | | 8,529 | | | | 8,460 | | | | 69 | |

| | | | | | | | | | | | | | | | | |

| Forward currency contracts — net | | | | | | | | | | | | | | $ | 789 | |

| 22 | Capital Group Emerging Markets Total Opportunities Fund |

Rights of offset — The fund has entered into enforceable master netting agreements with certain counterparties for forward currency contracts, where amounts payable by each party to the other in the same currency with the same settlement date and with the same counterparty are settled net of each party’s payment obligation. For financial reporting purposes, the fund does not offset the financial assets and financial liabilities that are subject to netting arrangements in the statement of assets and liabilities.