| OMB APPROVAL |

OMB Number: 3235-0570

Expires: January 31, 2017

Estimated average burden hours per response: 20.6

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

Ultimus Managers Trust

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Frank L. Newbauer, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | May 31 | |

| | | |

| Date of reporting period: | November 30, 2014 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

APEXcm SMALL/MID-CAP GROWTH FUND

(APSGX)

Semi-Annual Report

November 30, 2014

(Unaudited)

APEXcm SMALL/MID-CAP GROWTH FUND

LETTER TO SHAREHOLDERS | November 30, 2014 |

Dear Fellow APEXcm Fund Shareholder,

PERFORMANCE SUMMARY

We are pleased to report that the APEXcm Small/Mid-Cap Growth Fund (the “Fund”) continues to grow and achieve its performance objectives relative to its benchmark. In spite of a challenging roller coaster environment during the six months ended November 30, 2014, the Fund’s performance was +7.50% (net of expenses), outperforming the Fund’s benchmark, the Russell 2500TM Growth Index, which rose + 7.03%.

APEX PHILOSOPHY

We believe that the best way to provide value-added returns is to identify companies that exhibit certain favorable fundamental advantages and benefit from secular growth trends, allowing us to structure the portfolio in high-conviction areas of longer-term sustainable growth. Embedded in our portfolio construction is the recognition of companies at different stages of their growth cycle, which we designate as “stable” and “emerging” growth stocks. We believe that having the spectrum of growth companies that are truly innovative and growing rapidly, combined with established growth companies, can provide relative stability while allowing the opportunity to drive outperformance versus our benchmark and peers over time. In addition, we believe the SMID style provides the opportunity to invest in higher growth companies and capture a longer period of growth as these companies mature.

INVESTMENT ENVIRONMENT

During the last six months, we have seen a market, which began almost too sanguine, become much more volatile. The volatility was initially driven by the Federal Reserve taking its foot off the gas by eliminating its bond buying program at the end of October, and then accelerated by both deflation and growth scares emerging from Brazil, Europe, Japan, and China, and heightened geopolitical concerns. As we entered the third quarter, we saw a market that had moved almost straight up for two years without any significant correction (defined as a market decline of 10%). Many smaller-cap companies were already down in excess of 20% as we entered October, with their larger-cap (S&P 500) brethren touching a correction on October 15th off of its September 18th high. This much-overdue correction set the stage for a strong rally that focused on improving valuations and a continued dissection as to whether the U.S. economy was strong enough to stand on its own two feet. At the same time, many other central banks, including the European Central Bank, the Bank of Japan, and the Peoples Bank of China, began easing credit conditions in response to slower global growth. As we moved into November, a supply shock of excess oil provided good news to the world economy in the form of falling energy prices, but left many energy stocks down in excess of 30% to 40%. Concerns over the global outlook, with associated fears of deflation and slower spending, continue to compete for investors’ attention, while declining fuel costs put more money into household coffers, which may boost spending and bolster the world’s largest economies.

DISCUSSION OF KEY POSITIONING AND

HOLDINGS VERSUS THE BENCHMARK

| • | Overall positioning added approximately 25 basis points to performance, as the overweight positioning in the cyclical sectors of Consumer Discretionary (+0.08%), and Information Technology (+0.22%) had a positive impact. Additionally, the underweights in Consumer Staples (+0.21%), Materials (+0.18%) and Industrials (0.15%) added to performance. Although we moved to an overweight in the best performing sector of Healthcare during the six months, we were underweight for most of the time period, which detracted (-0.21%) slightly from performance. The slight overweight in Energy was the most significant detractor (-0.32%). |

| • | Stock selection was positive during the six months, adding approximately 80 basis points. Solid stock selection in Consumer Discretionary, Healthcare, Industrials, and Information Technology was offset by the negative impact of Energy (-0.22%) and Materials (-0.39%). |

| • | Key secular growth areas of payments and processing, personalized medicine and genomics, and big data were offset by a significant decline in companies associated with energy independence. |

| • | The high growth areas of personalized medicine and genomics produced two outstanding performers during the six-month period. Isis Pharmaceuticals, with its strong pipeline centered on its anti-sense drug platform, was up 77%, as well as Medivation, with its pre-chemo prostate cancer drug Xtandi, up 59%. Also during the six months, we added key strategic companies in the ongoing battle with diabetes, such as continuous glucose monitoring device company DexCom, coupled with insulin pump/monitor providers Insulet and Tandem. |

| • | E-commerce continues to grow in adoption, thus one of our top holdings continues to be travel site Expedia, which was up 24% during this time period. We also believe that opportunities exist within the emerging markets to capture their growth in consumerism with e-commerce names such as Bitauto (Chinese on-line provider of new and used car listings), up 129%. Additionally, web-based platforms were added to the portfolio during this time period (which have not performed as of yet), such as Zulily, down 26%, and Yelp, down 12%. U.S. consumer spending continues to ratchet up, and a couple of our names, Signet Jewelers (+24%) and PetSmart (which is transitioning to a private company) (+38%), performed well. |

| • | The biggest challenge was our investment in companies that are leading the drive towards U.S energy independence. The plunge in oil prices from $110 per barrel in June 2014 to $60 may increase money in the pockets of U.S. consumers, but provides uncertainty for companies providing the infrastructure and exploration to extract more oil, while still maintaining profitability and servicing high debt levels. Companies like Carrizo and Whiting, who are in the trenches of the unconventional shale areas, were down -31% and -42%, respectively. Another long-term successful investment |

in horizontal flex, drill provider Heimerich & Payne (“HP”) was down -36%. Although we do believe that the U.S. will continue to accelerate its drive towards energy independence, given this traffic jam of too much supply, we decided to lighten up our exposure and sell HP subsequent to November 30th.

OUTLOOK

We expect the higher level of volatility to continue as the market wrestles with balancing multiple factors: the tailwinds of continued U.S. economic growth, a pick-up in consumer spending, consistent gains in hiring, strong corporate balance sheets, earnings acceleration, the temporary stimulus from declining energy and commodity prices, the uncertainties of declining global growth, likely U.S. interest rate increases, and a corresponding stronger U.S. dollar.

A potential silver lining exists as the stronger U.S. dollar and falling commodity prices put downward pressure on inflation. Forward inflation expectations may remain subdued, allowing the Federal Reserve to be more patient in raising interest rates, which may continue to benefit equity investors. Although it is hard to detangle all of the risks and drags from overseas with a U.S. economy that appears to be stronger and more able to cope with any external shocks, we believe that growth continues to accelerate in the U.S., and see it continuing its upward trajectory on the holy grail of earnings.

At Apex, one of the foundations of our success is focusing on the long-term sustainability of secular growth trends. During challenging times, we remain committed to the opportunities provided in such areas as consumer mobility, big data and cloud computing, the U.S. manufacturing renaissance, personalized medicine and genomics, and energy independence. As we navigate through the early stages of the self-sustaining U.S. economy, coupled with global growth concerns, our focus will continue to be on selective opportunities that could benefit in this environment. In our stable growth names, we will continue to focus on balance sheet flexibility (as depicted by accelerating cash flow) along with organic revenue and earnings growth. These companies should also be more levered to U.S. growth, with identified catalysts and capital deployment strategies. While maintaining a long-term focus, emerging growth companies in key strategic areas will be highly scrutinized in order to determine their viability in this more volatile environment.

Thank you for your continued confidence in the APEXcm Small/Mid-Cap Growth Fund.

Sincerely,

Nitin N. Kumbhani

President and Chief Investment Officer

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-575-4800.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at www.apexcmfund.com or call 1-888-575-4800 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The APEXcm Small/Mid-Cap Growth Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. The opinions of the Adviser with respect to those securities may change at any time.

APEXcm SMALL/MID-CAP GROWTH FUND

PORTFOLIO INFORMATION

November 30, 2014 (Unaudited)

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

| Security Description | | % of

Net Assets |

| Signet Jewelers Ltd. | | 2.8% |

| Expedia, Inc. | | 2.7% |

| United Rentals, Inc. | | 2.6% |

| Robert Half International, Inc. | | 2.5% |

| PetSmart, Inc. | | 2.2% |

| Universal Health Services, Inc. - Class B | | 2.2% |

| Wabtec Corp. | | 2.2% |

| Old Dominion Freight Line, Inc. | | 2.2% |

| Polaris Industries, Inc. | | 2.1% |

| IAC/InterActiveCorp | | 2.1% |

APEXcm SMALL/MID-CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

November 30, 2014 (Unaudited) | |

| COMMON STOCKS — 98.5% | | Shares | | | Value | |

| Consumer Discretionary — 22.0% | | | | | | |

| Auto Components — 4.6% | | | | | | |

Autoliv, Inc. | | | 26,330 | | | $ | 2,605,617 | |

Gentex Corp. | | | 40,841 | | | | 1,452,306 | |

Visteon Corp. * | | | 24,134 | | | | 2,365,132 | |

| | | | | | | | 6,423,055 | |

| Hotels, Restaurants & Leisure — 1.5% | | | | | | | | |

Wyndham Worldwide Corp. | | | 24,808 | | | | 2,067,995 | |

| | | | | | | | | |

| Internet & Catalog Retail — 3.3% | | | | | | | | |

Expedia, Inc. | | | 42,858 | | | | 3,733,360 | |

zulily, inc. - Class A * | | | 26,879 | | | | 772,234 | |

| | | | | | | | 4,505,594 | |

| Leisure Products — 2.1% | | | | | | | | |

Polaris Industries, Inc. | | | 18,642 | | | | 2,921,388 | |

| | | | | | | | | |

| Multi-line Retail — 1.0% | | | | | | | | |

Dillard's, Inc. - Class A | | | 11,660 | | | | 1,374,481 | |

| | | | | | | | | |

| Specialty Retail — 8.3% | | | | | | | | |

Foot Locker, Inc. | | | 35,152 | | | | 2,013,858 | |

PetSmart, Inc. | | | 39,574 | | | | 3,116,848 | |

Signet Jewelers Ltd. | | | 29,959 | | | | 3,923,431 | |

Williams-Sonoma, Inc. | | | 32,329 | | | | 2,410,450 | |

| | | | | | | | 11,464,587 | |

| Textiles, Apparel & Luxury Goods — 1.2% | | | | | | | | |

Deckers Outdoor Corp. * | | | 17,766 | | | | 1,718,327 | |

| | | | | | | | | |

| Energy — 3.7% | | | | | | | | |

| Energy Equipment & Services — 1.7% | | | | | | | | |

Core Laboratories N.V. | | | 8,155 | | | | 1,050,609 | |

Helmerich & Payne, Inc. | | | 20,124 | | | | 1,399,624 | |

| | | | | | | | 2,450,233 | |

| Oil, Gas & Consumable Fuels — 2.0% | | | | | | | | |

Carrizo Oil & Gas, Inc. * | | | 37,492 | | | | 1,479,434 | |

Whiting Petroleum Corp. * | | | 30,321 | | | | 1,266,508 | |

| | | | | | | | 2,745,942 | |

| Financials — 8.4% | | | | | | | | |

| Banks — 2.6% | | | | | | | | |

Cullen/Frost Bankers, Inc. | | | 20,512 | | | | 1,531,426 | |

APEXcm SMALL/MID-CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| COMMON STOCKS — 98.5% (Continued) | | Shares | | | Value | |

| Financials — 8.4% (Continued) | | | | | | |

| Banks — 2.6% (Continued) | | | | | | |

First Republic Bank/CA | | | 40,472 | | | $ | 2,085,522 | |

| | | | | | | | 3,616,948 | |

| Capital Markets — 1.4% | | | | | | | | |

Affiliated Managers Group, Inc. * | | | 9,537 | | | | 1,941,638 | |

| | | | | | | | | |

| Diversified Financial Services — 0.9% | | | | | | | | |

Interactive Brokers Group, Inc. - Class A | | | 24,806 | | | | 677,700 | |

MarketAxess Holdings, Inc. | | | 8,844 | | | | 579,901 | |

| | | | | | | | 1,257,601 | |

| Insurance — 1.5% | | | | | | | | |

XL Group plc | | | 58,730 | | | | 2,086,090 | |

| | | | | | | | | |

| Real Estate Management & Development — 2.0% | | | | | | | | |

CBRE Group, Inc. - Class A * | | | 83,422 | | | | 2,814,658 | |

| | | | | | | | | |

| Health Care — 19.5% | | | | | | | | |

| Biotechnology — 4.9% | | | | | | | | |

Isis Pharmaceuticals, Inc. * | | | 38,923 | | | | 2,015,822 | |

Keryx Biopharmaceuticals, Inc. * | | | 65,812 | | | | 1,046,411 | |

Medivation, Inc. * | | | 19,957 | | | | 2,312,817 | |

Momenta Pharmaceuticals, Inc. * | | | 34,194 | | | | 401,096 | |

United Therapeutics Corp. * | | | 7,458 | | | | 988,707 | |

| | | | | | | | 6,764,853 | |

| Health Care Equipment & Supplies — 2.6% | | | | | | | | |

Align Technology, Inc. * | | | 25,264 | | | | 1,437,522 | |

DexCom, Inc. * | | | 23,645 | | | | 1,216,772 | |

Insulet Corp. * | | | 13,252 | | | | 617,411 | |

Tandem Diabetes Care, Inc. * | | | 24,473 | | | | 345,803 | |

| | | | | | | | 3,617,508 | |

| Health Care Providers & Services — 4.4% | | | | | | | | |

Centene Corp. * | | | 17,309 | | | | 1,709,610 | |

Tenet Healthcare Corp. * | | | 28,311 | | | | 1,360,343 | |

Universal Health Services, Inc. - Class B | | | 29,657 | | | | 3,102,715 | |

| | | | | | | | 6,172,668 | |

| Life Sciences Tools & Services — 3.1% | | | | | | | | |

ICON plc * | | | 26,995 | | | | 1,499,302 | |

PAREXEL International Corp. * | | | 22,607 | | | | 1,322,736 | |

| WuXi PharmaTech (Cayman), Inc. - ADR * | | | 41,319 | | | | 1,417,655 | |

| | | | | | | | 4,239,693 | |

APEXcm SMALL/MID-CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| COMMON STOCKS — 98.5% (Continued) | | Shares | | | Value | |

| Health Care — 19.5% (Continued) | | | | | | |

| Pharmaceuticals — 4.5% | | | | | | |

Akorn, Inc. * | | | 57,941 | | | $ | 2,321,696 | |

Jazz Pharmaceuticals plc * | | | 11,671 | | | | 2,066,817 | |

Salix Pharmaceuticals Ltd. * | | | 17,921 | | | | 1,840,307 | |

| | | | | | | | 6,228,820 | |

| Industrials — 15.0% | | | | | | | | |

| Aerospace & Defense — 1.1% | | | | | | | | |

B/E Aerospace, Inc. * | | | 20,647 | | | | 1,607,782 | |

| | | | | | | | | |

| Machinery — 5.0% | | | | | | | | |

Nordson Corp. | | | 22,593 | | | | 1,765,643 | |

Proto Labs, Inc. * | | | 9,682 | | | | 628,362 | |

Valmont Industries, Inc. | | | 10,897 | | | | 1,473,492 | |

Wabtec Corp. | | | 34,938 | | | | 3,091,664 | |

| | | | | | | | 6,959,161 | |

| Professional Services — 4.1% | | | | | | | | |

Robert Half International, Inc. | | | 60,751 | | | | 3,450,049 | |

Towers Watson & Co. - Class A | | | 19,197 | | | | 2,168,493 | |

| | | | | | | | 5,618,542 | |

| Road & Rail — 2.2% | | | | | | | | |

Old Dominion Freight Line, Inc. * | | | 37,173 | | | | 3,012,500 | |

| | | | | | | | | |

| Trading Companies & Distributors — 2.6% | | | | | | | | |

United Rentals, Inc. * | | | 31,331 | | | | 3,550,116 | |

| | | | | | | | | |

| Information Technology — 26.2% | | | | | | | | |

| Communications Equipment — 2.7% | | | | | | | | |

Ciena Corp. * | | | 68,205 | | | | 1,127,429 | |

F5 Networks, Inc. * | | | 20,254 | | | | 2,616,614 | |

| | | | | | | | 3,744,043 | |

Electronic Equipment, Instruments &

Components — 2.1% | | | | | | | | |

Dolby Laboratories, Inc. - Class A | | | 32,546 | | | | 1,444,392 | |

FEI Co. | | | 17,449 | | | | 1,494,332 | |

| | | | | | | | 2,938,724 | |

| Internet Software & Services — 5.4% | | | | | | | | |

Bitauto Holdings Ltd. - ADR * | | | 23,982 | | | | 2,210,181 | |

IAC/InterActiveCorp | | | 44,229 | | | | 2,887,269 | |

Yelp, Inc. * | | | 20,309 | | | | 1,159,441 | |

YY, Inc. - ADR * | | | 16,492 | | | | 1,260,813 | |

| | | | | | | | 7,517,704 | |

APEXcm SMALL/MID-CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| COMMON STOCKS — 98.5% (Continued) | | Shares | | | Value | |

| Information Technology — 26.2% (Continued) | | | | | | |

| IT Services — 7.7% | | | | | | |

Gartner, Inc. * | | | 32,119 | | | $ | 2,745,532 | |

Global Payments, Inc. | | | 27,410 | | | | 2,367,128 | |

Heartland Payment Systems, Inc. | | | 35,736 | | | | 1,948,327 | |

NeuStar, Inc. - Class A * | | | 38,141 | | | | 1,039,342 | |

Total System Services, Inc. | | | 77,243 | | | | 2,548,247 | |

| | | | | | | | 10,648,576 | |

| Semiconductors & Semiconductor Equipment — 1.9% | | | | | | | | |

Entegris, Inc. * | | | 101,796 | | | | 1,371,192 | |

Power Integrations, Inc. | | | 25,240 | | | | 1,266,038 | |

| | | | | | | | 2,637,230 | |

| Software — 6.4% | | | | | | | | |

Advent Software, Inc. | | | 40,950 | | | | 1,291,154 | |

Informatica Corp. * | | | 29,306 | | | | 1,066,152 | |

Manhattan Associates, Inc. * | | | 21,350 | | | | 844,606 | |

NetScout Systems, Inc. * | | | 30,244 | | | | 1,153,809 | |

Rovi Corp. * | | | 46,486 | | | | 1,035,708 | |

Splunk, Inc.* | | | 22,380 | | | | 1,501,698 | |

Tableau Software, Inc. - Class A * | | | 22,999 | | | | 1,929,156 | |

| | | | | | | | 8,822,283 | |

| Materials — 3.7% | | | | | | | | |

| Chemicals — 0.8% | | | | | | | | |

Albemarle Corp. | | | 19,325 | | | | 1,140,948 | |

| | | | | | | | | |

| Containers & Packaging — 1.2% | | | | | | | | |

Silgan Holdings, Inc. | | | 33,100 | | | | 1,670,226 | |

| | | | | | | | | |

| Metals & Mining — 0.3% | | | | | | | | |

Constellium N.V. - Class A * | | | 26,691 | | | | 420,383 | |

| | | | | | | | | |

| Paper & Forest Products — 1.4% | | | | | | | | |

KapStone Paper and Packaging Corp. * | | | 62,171 | | | | 1,857,048 | |

| | | | | | | | | |

Total Common Stocks (Cost $119,269,616) | | | | | | $ | 136,557,345 | |

APEXcm SMALL/MID-CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| MONEY MARKET FUNDS — 2.9% | | Shares | | | Value | |

Fidelity Institutional Money Market Portfolio - Class I, 0.05% (a) (Cost $4,090,258) | | | 4,090,258 | | | $ | 4,090,258 | |

| | | | | | | | | |

Total Investments at Value — 101.4% (Cost $123,359,874) | | | | | | $ | 140,647,603 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (1.4%) | | | | | | | (1,960,040 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 138,687,563 | |

ADR - American Depositary Receipt. |

| * | Non-income producing security. |

(a) | The rate shown is the 7-day effective yield as of November 30, 2014. |

| See accompanying notes to financial statements. |

APEXcm SMALL/MID-CAP GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES

November 30, 2014 (Unaudited) | |

| ASSETS | | | |

| Investments in securities: | | | |

At acquisition cost | | $ | 123,359,874 | |

At value (Note 2) | | $ | 140,647,603 | |

Dividends receivable | | | 103,790 | |

Receivable for capital shares sold | | | 35,768 | |

Other assets | | | 21,892 | |

Total assets | | | 140,809,053 | |

| | | | | |

| LIABILITIES | | | | |

Payable for investment securities purchased | | | 1,991,516 | |

Payable for capital shares redeemed | | | 14,146 | |

Payable to Adviser (Note 4) | | | 83,311 | |

Payable to administrator (Note 4) | | | 17,248 | |

Other accrued expenses | | | 15,269 | |

Total liabilities | | | 2,121,490 | |

| | | | | |

NET ASSETS | | $ | 138,687,563 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 121,409,547 | |

Accumulated net investment loss | | | (336,529 | ) |

| Accumulated net realized gains from security transactions | | | 326,816 | |

Net unrealized appreciation on investments | | | 17,287,729 | |

NET ASSETS | | $ | 138,687,563 | |

| | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 8,485,954 | |

| | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 16.34 | |

| See accompanying notes to financial statements. |

APEXcm SMALL/MID-CAP GROWTH FUND

STATEMENT OF OPERATIONS

For the Six Months Ended November 30, 2014 (Unaudited) | |

| INVESTMENT INCOME | | | |

Dividend income (net of foreign expense of $984) | | $ | 350,307 | |

| | | | | |

| EXPENSES | | | | |

Investment advisory fees (Note 4) | | | 553,764 | |

Administration fees (Note 4) | | | 55,452 | |

Custody and bank service fees | | | 23,264 | |

Registration and filing fees | | | 21,415 | |

Fund accounting fees (Note 4) | | | 20,301 | |

Professional fees | | | 17,727 | |

Transfer agent fees (Note 4) | | | 9,008 | |

Compliance fees (Note 4) | | | 6,597 | |

Postage and supplies | | | 4,590 | |

Trustees' fees and expenses (Note 4) | | | 3,369 | |

Insurance expense | | | 1,717 | |

Other expenses | | | 9,625 | |

Total expenses | | | 726,829 | |

Less fee reductions by the Adviser (Note 4) | | | (145,381 | ) |

Net expenses | | | 581,448 | |

| | | | | |

NET INVESTMENT LOSS | | | (231,141 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | |

Net realized gains from security transactions | | | 784,141 | |

Net change in unrealized appreciation/depreciation on investments | | | 7,520,167 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 8,304,308 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 8,073,167 | |

| See accompanying notes to financial statements. |

APEXcm SMALL/MID-CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS | |

| | | Six Months Ended November 30, 2014 (Unaudited) | | | Year Ended May 31, 2014 | |

| FROM OPERATIONS | | | | | | |

Net investment loss | | $ | (231,141 | ) | | $ | (192,714 | ) |

| Net realized gains (losses) from security transactions | | | 784,141 | | | | (197,613 | ) |

Net change in unrealized appreciation/ depreciation on investments | | | 7,520,167 | | | | 8,704,592 | |

Net increase in net assets resulting from operations | | | 8,073,167 | | | | 8,314,265 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net realized gains on investments | | | — | | | | (226,268 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 50,446,250 | | | | 74,662,709 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 162,061 | |

Payments for shares redeemed | | | (8,308,554 | ) | | | (7,589,046 | ) |

Net increase in net assets from capital share transactions | | | 42,137,696 | | | | 67,235,724 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 50,210,863 | | | | 75,323,721 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

Beginning of period | | | 88,476,700 | | | | 13,152,979 | |

End of period | | $ | 138,687,563 | | | $ | 88,476,700 | |

| | | | | | | | | |

ACCUMULATED NET INVESTMENT LOSS | | $ | (336,529 | ) | | $ | (105,388 | ) |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 3,181,661 | | | | 5,289,946 | |

Shares reinvested | | | ��� | | | | 10,768 | |

Shares redeemed | | | (517,929 | ) | | | (515,199 | ) |

Net increase in shares outstanding | | | 2,663,732 | | | | 4,785,515 | |

Shares outstanding at beginning of period | | | 5,822,222 | | | | 1,036,707 | |

Shares outstanding at end of period | | | 8,485,954 | | | | 5,822,222 | |

| See accompanying notes to financial statements. |

APEXcm SMALL/MID-CAP GROWTH FUND

FINANCIAL HIGHLIGHTS | |

| Per Share Data for a Share Outstanding Throughout each Period | |

| | | Six Months Ended November 30, 2014 (Unaudited) | | | Year

Ended

May 31,

2014 | | | Period

Ended

May 31,

2013(a) | |

Net asset value at beginning of period | | $ | 15.20 | | | $ | 12.69 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | |

Net investment income (loss) | | | (0.02 | ) | | | (0.03 | ) | | | 0.04 | (b) |

Net realized and unrealized gains on investments | | | 1.16 | | | | 2.60 | | | | 2.72 | |

Total from investment operations | | | 1.14 | | | | 2.57 | | | | 2.76 | |

| | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (0.07 | ) |

From net realized gains on investments | | | — | | | | (0.06 | ) | | | — | |

Total distributions | | | — | | | | (0.06 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | |

Net asset value at end of period | | $ | 16.34 | | | $ | 15.20 | | | $ | 12.69 | |

| | | | | | | | | | | | | |

Total return (c) | | | 7.50 | %(d) | | | 20.26 | % | | | 27.65 | %(d) |

| | | | | | | | | | | | | |

Net assets at end of period (000's) | | $ | 138,688 | | | $ | 88,477 | | | $ | 13,153 | |

| | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.31 | %(e) | | | 1.49 | % | | | 4.87 | %(e) |

| | | | | | | | | | | | | |

Ratio of net expenses to average net assets (f) | | | 1.05 | %(e) | | | 1.05 | % | | | 1.05 | %(e) |

| | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets (f) | | | (0.42% | )(e) | | | (0.38 | %) | | | 0.26 | %(e) |

| | | | | | | | | | | | | |

Portfolio turnover rate | | | 28 | %(d) | | | 47 | % | | | 18 | %(d) |

(a) | Represents the period from the commencement of operations (June 29, 2012) through May 31, 2013. |

(b) | Calculated using weighted average shares outstanding during the period. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses. |

(d) | Not annualized. |

(e) | Annualized. |

(f) | Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

| See accompanying notes to financial statements. |

APEXcm SMALL/MID-CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

November 30, 2014 (Unaudited)

1. Organization

APEXcm Small/Mid-Cap Growth Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. The Fund commenced operations on June 29, 2012.

The investment objective of the Fund is long-term capital growth.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Fund follows accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The pricing and valuation of portfolio securities is determined in good faith in accordance with procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. The Fund values its listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted bid price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value pursuant to the procedures adopted by the Board. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

APEXcm SMALL/MID-CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2014:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 136,557,345 | | | $ | — | | | $ | — | | | $ | 136,557,345 | |

| Money Market Funds | | | 4,090,258 | | | | — | | | | — | | | | 4,090,258 | |

Total | | $ | 140,647,603 | | | $ | — | | | $ | — | | | $ | 140,647,603 | |

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by industry type. As of November 30, 2014, the Fund did not have any transfers in and out of any Level. In addition, the Fund did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of November 30, 2014. It is the Fund’s policy to recognize transfers into and out of any Level at the end of the reporting period.

Share valuation – The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to the net asset value per share.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned.

Security transactions – Security transactions are accounted for on the trade date. Gains and losses on securities sold are determined on a specific identification basis.

APEXcm SMALL/MID-CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – The Fund will distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions are recorded on the ex-dividend date. There were no distributions paid during the six months ended November 30, 2014. The tax character of the Fund’s distributions paid during the year ended May 31, 2014 was as follows:

| Year Ended | | Ordinary Income | | | Long-Term Capital Gains | | | Total Distributions | |

| May 31, 2014 | | $ | 212,871 | | | $ | 13,397 | | | $ | 226,268 | |

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986 (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code. Accordingly, no provision for income tax has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

APEXcm SMALL/MID-CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

The following information is computed on a tax basis for each item as of November 30, 2014:

| Tax cost of portfolio investments | | $ | 123,387,413 | |

| Gross unrealized appreciation | | $ | 20,942,870 | |

| Gross unrealized depreciation | | | (3,682,680 | ) |

| Net unrealized appreciation | | | 17,260,190 | |

| Accumulated net investment loss | | | (336,529 | ) |

| Other gains | | | 354,355 | |

| Accumulated earnings | | $ | 17,278,016 | |

The difference between the federal income tax cost of portfolio investments and the financial statement cost is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for the current and all open tax periods (periods ended May 31, 2013 and May 31, 2014) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

3. Investment Transactions

During the six months ended November 30, 2014, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $75,386,237 and $30,735,150, respectively.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Apex Capital Management, Inc. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an advisory fee, computed and accrued daily and paid monthly, at the annual rate of 1.00% of its average daily net assets.

APEXcm SMALL/MID-CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Pursuant to an expense limitation agreement (the “Expense Limitation Agreement”), the Adviser has contractually agreed, until October 1, 2017, to reduce investment advisory fees and reimburse other expenses to the extent necessary to limit total annual fund operating expenses (exclusive of brokerage costs, taxes, interest, acquired fund fees and expenses, extraordinary expenses, and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 1.05% of the Fund’s average daily net assets. Accordingly, during the six months ended November 30, 2014, the Adviser reduced its advisory fees in the amount of $145,381.

Under the terms of the Expense Limitation Agreement, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided the repayments do not cause total annual fund operating expenses to exceed the foregoing expense limitations. As of November 30, 2014, the Adviser may seek repayment of investment advisory fee reductions and expense reimbursements no later than the dates as stated below:

| May 31, 2016 | | May 31, 2017 | | November 30, 2017 |

| $144,876 | | $223,293 | | $145,381 |

Certain officers of the Fund are also officers of the Adviser.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides fund administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including but not limited to postage, supplies and costs of pricing the Fund’s portfolio securities.

DISTRIBUTION AGREEMENT

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers of the Trust are also officers of Ultimus and/or the Distributor.

TRUSTEE COMPENSATION

Each Independent Trustee receives from each Fund of the Trust a fee of $500 for each Board meeting attended plus reimbursement of travel and other meeting-related expenses. Trustees affiliated with the Adviser or Ultimus are not compensated by the Fund for their services.

APEXcm SMALL/MID-CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

5. Sector Risk

If a Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s net asset value per share. Occasionally, market conditions, regulatory changes or other developments may negatively impact this sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of November 30, 2014, the Fund had 26.2% of the value of its net assets invested in stocks within the Information Technology sector.

6. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

7. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

APEXcm SMALL/MID-CAP GROWTH FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (June 1, 2014) and held until the end of the period (November 30, 2014).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

APEXcm SMALL/MID-CAP GROWTH FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | Beginning

Account Value

June 1, 2014 | Ending

Account Value

November 30,

2014 | Expenses

Paid During

Period* |

| Based on Actual Fund Return | $1,000.00 | $1,075.00 | $5.46 |

| Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.80 | $5.32 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.05% for the period, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

OTHER INFORMATION (Unaudited)

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-575-4800, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-888-575-4800, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-888-575-4800. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

BARROW ALL-CAP CORE FUND

INSTITUTIONAL CLASS (BALIX)

INVESTOR CLASS (BALAX)

BARROW ALL-CAP LONG/SHORT FUND

INSTITUTIONAL CLASS (BFSLX)

INVESTOR CLASS (BFLSX)

Semi-Annual Report

November 30, 2014

(Unaudited)

BARROW ALL-CAP CORE FUND

LETTER TO SHAREHOLDERS | January 15, 2015 |

Dear Shareholder,

For the six-month period ended November 30, 2014, the Barrow All-Cap Core Fund’s (the “Fund”) Institutional Class posted a total return net of fees and expenses of +3.64%, which lagged the total return of +8.58% for the S&P 500 Index (“S&P 500”). Calendar year-to-date, the Fund’s Institutional Class generated a total return of +5.60% compared to +13.98% for the S&P 500. Since 12/31/08, the Fund has generated a total return of +179.45% compared to +160.08% for the S&P 500*.

The Fund’s performance for the six months ended November 30, 2014 was negatively impacted by two main factors:

| 1. | Large-cap companies significantly outperformed mid-caps and small-caps, which compose roughly 80% of the Fund’s portfolio. The large-cap S&P 500 generated a total return of +8.58% compared to +5.47% and +4.09% for the S&P 400 Midcap and Russell 2000 Indices, which measure the performance of mid-cap and small-cap equities, respectively. |

| 2. | The performance of the six sectors in which the Fund currently invests (Consumer Discretionary, Consumer Staples, Energy, Health Care, Industrials, and Materials) lagged that of the four non-included sectors (Financials, Information Technology, Telecommunications, and Utilities). For the six months ended November 30, 2014, the Fund’s six sectors in the S&P 500 Index generated a weighted average total return of +6.28% compared to +12.01% for the four non-included sectors. This differential was primarily caused by the Energy sector, which generated a total return of -14.48%. The S&P 400 Midcap and Russell 2000 Indices revealed a similar story with Energy sector total returns of -24.70% and -40.12%, respectively. |

The Fund continued to implement its strategy of investing in companies that we believe are at the intersection of quality and value. We seek to employ a disciplined and dispassionate approach to investing in high quality companies at prices that are well below our estimate of their intrinsic value. During the period, we invested in new companies comprising multiple industry sectors and market capitalizations with what we consider to be strong balance sheets that are growing, generating ample free cash flow, and re-investing that cash at high internal rates of return.

Drawing on our investment team’s 18 years of private and public equity investment experience and research, we made these investments based on our belief that the market price of a well-constructed portfolio of high-quality stocks purchased at, in our opinion, bargain levels will trend toward our estimate of its intrinsic value over time. The Fund’s portfolio is highly diversified by market cap segment, industry, and position size.

The Fund’s investments are sourced by taking account of the opportunity set of all companies in our broad investment universe each time we commit capital to a new position. We think this approach allows us to uncover investment opportunities that arise from temporary market inefficiencies and to gather up the most compelling investments across a wide array of industries and market capitalizations without the behavioral biases inherent in concentrated-stock and sector-specialized investing.

With regard to hold period, we typically give the market at least one year to re-appraise each of the Fund’s holdings. The idea here is that it takes time from the date of our investment in any given company for the market to realize (or not) that a security’s market value is low compared to our estimate of intrinsic value and has high quality business metrics. We are more interested in the aggregate performance of the Fund’s diversified portfolio as opposed to any one position.

The three best-performing positions for the six months ended November 30, 2014 were USANA Health Sciences, Inc., United Therapeutics Corp., and Pilgrim’s Pride Corp., which generated total returns of +48.06%, +32.07% and +26.90%, respectively. The three worst-performing positions were Smith and Wesson Holding Corp., Future Fuel Corp., and Geospace Technologies Corp., which generated total returns of -35.36%, -29.43% and -42.45%, respectively.

Four of the Fund’s holdings were announced as take-over targets during the six-month period. On average, the Fund has experienced more than two take-overs per quarter, for a total of 64 since 12/31/08*, or roughly 4 times the market average.1 The control premium we have captured by virtue of holding stocks that end up being merger targets has made meaningful contributions to the Fund’s total returns, and we expect to continue to benefit from this effect going forward. We remove companies from the Fund’s portfolio soon after they are announced as take-over targets and re-invest that capital.

For the six-month period, the portfolio generated a total return before fees and expenses of +4.29%, including +3.62% for large-caps, +6.94% for mid-caps and +2.45% for small-caps. This compares to +8.58% for the S&P 500 Index, +5.47% for the S&P 400 Midcap Index, and +4.09% for the Russell 2000 Index. Our sectors with the best absolute performance were Health Care and Consumer Staples, which generated total returns of +14.99% and +10.31%, respectively. Our sectors that did least well were Energy and Materials, which returned -14.34% and -4.36%, respectively.

Going forward, we believe the Fund is well positioned for near-term and long-term success given the quality and value attributes of its portfolio. Our goal remains unchanged, we expect the Fund to outperform its benchmarks over time.

The Fund’s portfolio had a position-weighted EBIT (Earnings Before Interest and Taxes) yield of 9.42% on November 30, 2014, which compares favorably with the 6.68% EBIT yield for the S&P 500. As of November 30, 2014, the Fund’s trailing twelve-month dividend yield was 1.92%, and the Fund’s 30 day SEC yield was 1.26%. We consider these healthy vital signs as being consistent with the use of our private equity framework, which, among other things, focuses on cash flow over GAAP earnings, in selecting securities for investment.

In addition to what we consider to be an attractive valuation level for our portfolio, we expect to benefit from the absolute and relative level of quality fundamentals in our holdings. As of November 30, 2014, our portfolio had the following position-weighted quality characteristics relative to the S&P 500 (SPX): return on equity (25.9% vs. 15.2% SPX); return on assets (11.1% vs. 3.3% SPX), operating margin (18.3% vs. 14.0% SPX) and debt-to-enterprise value (17.6% vs. 34.0% SPX).

Sincerely,

| Nicholas Chermayeff | Robert F. Greenhill, Jr. | David R. Bechtel |

| Principal | Principal | Principal |

1 | Barrow calculates the frequency of merger and acquisition ("M&A") activity in the Fund's portfolio on a quarterly basis by dividing the cumulative number of portfolio holdings that have been announced as merger or acquisition targets by the cumulative number of unique holdings the Fund has held in the Fund's portfolio. Barrow calculates the frequency of M&A activity in the market on a quarterly basis by dividing the cumulative number of publicly-traded U.S. common stocks that have been announced as acquisition targets per Bloomberg by the total universe of publicly-traded U.S. common stocks as identified by Bloomberg (approximately 10,000). |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-877-767-6633.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at www.barrowfunds.com or call 1-877-767-6633 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. The opinions of the Fund’s Adviser with respect to those securities may change at any time.

| * | The investment related and performance information discussed above for periods prior to Barrow All-Cap Core Fund’s inception date (August 30, 2013) are based on the activities of the Fund’s predecessor, the Barrow Street Fund LP, an unregistered limited partnership managed by the portfolio managers of Barrow All-Cap Core Fund (the “Predecessor Private Fund”). The Predecessor Private Fund was reorganized into the Institutional Class shares on August 30, 2013, the date that Barrow All- Cap Core Fund commenced operations. Barrow All-Cap Core Fund has been managed in the same style and by the same portfolio managers since the Predecessor Private Fund’s inception on December 31, 2008. The performance information shows the Predecessor Private Fund’s returns calculated using the actual fees and expenses that were charged by the Predecessor Private Fund. This prior performance is net of management fees and other expenses but does not include the effect of the Predecessor Private Fund’s performance fee which was in place until October 7, 2012. From the Predecessor Private Fund’s inception on December 31, 2008 through the date of this prospectus, the Predecessor Private Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended (the “1940 Act”) or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected Barrow All-Cap Core Fund’s performance. |

BARROW ALL-CAP CORE FUND

PERFORMANCE INFORMATION

November 30, 2014 (Unaudited)

Comparison of the Change in Value of a $250,000 Investment in

Barrow All-Cap Core Fund - Institutional Class(a)

versus the S&P 500® Index

Average Annual Total Returns(a)(b) For the periods ended November 30, 2014(a) | |

| | 1 Year | 5 Years | Since

Inception(c) | |

| Barrow All-Cap Core Fund - Institutional Class | 6.62% | 17.93% | 18.97% | |

| Barrow All-Cap Core Fund - Investor Class | 6.35% | n/a | 15.32% | |

S&P 500® Index | 16.86% | 15.96% | 17.54% | |

BARROW ALL-CAP CORE FUND

PERFORMANCE INFORMATION

November 30, 2014 (Unaudited) (Continued)

Comparison of Total Rates of Return with the S&P 500® Index | |

| | Barrow All-Cap Core Fund - Institutional Class(a) | S&P 500® Index | Difference | |

Annual Total Rates of Return

for the Calendar Years: | | | | |

| 2009 | 30.10% | 26.46% | 3.64% | |

| 2010 | 18.75% | 15.06% | 3.69% | |

| 2011 | 5.50% | 2.12% | 3.38% | |

| 2012 | 18.77% | 16.00% | 2.77% | |

| 2013 | 36.69% | 32.38% | 4.31% | |

| 2014 (through 11/30/14) | 5.60% | 13.98% | (8.38%) | |

| | | | | |

Total Return Since Inception

(not annualized, as of 11/30/14) | 179.45% | 160.08% | 19.37% | |

(a) | The Barrow All-Cap Core Fund - Institutional Class (the "Fund") performance includes the performance of the Barrow Street Fund LP (the "Predecessor Private Fund"), the Fund's predecessor, for the periods before the Fund's registration statement became effective. The Predecessor Private Fund was reorganized into the Institutional Class shares of the Fund at the close of business on August 30, 2013, the date the Fund commenced operations. The Fund has been managed in the same style and by the same portfolio managers since the Predecessor Private Fund’s inception on December 31, 2008. The Fund’s investment goals, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Private Fund. The performance of the Predecessor Private Fund is net of management fees of 1.50% of assets but does not include the effect of a 20% performance fee which was in place until October 7, 2012. The prior performance of the Predecessor Private Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended, or Subchapter M of the Internal Revenue Code of 1986, as amended. If such restrictions had been applicable, they might have adversely affected the Predecessor Private Fund’s performance. |

(b) | The Fund’s total return does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

(c) | Represents the period from December 31,2008(a) and August 30,2013 for the Institutional and Investor Classes, respectively, through November 30, 2014. |

BARROW ALL-CAP LONG/SHORT FUND

LETTER TO SHAREHOLDERS | January 15, 2015 |

Dear Shareholder,

For the six-month period ended November 30, 2014, the Barrow All-Cap Long/Short Fund’s (the “Fund”) Institutional Class posted a total return net of fees and expenses of +0.00%, which compares to +8.58% for the S&P 500 Index (“S&P 500”).

The Fund’s performance for the past six months was negatively impacted by two main factors:

| 1. | Large cap companies significantly outperformed mid caps and small caps, which compose roughly 80% of the Fund’s long and short portfolios. The S&P 500 generated a total return of +8.58% compared to +5.47% and +4.09% for the S&P 400 Midcap and Russell 2000 Indices, which measure the performance of mid-cap and small-cap equities, respectively. |

| 2. | The performance of the six sectors (Consumer Discretionary, Consumer Staples, Energy, Health Care, Industrials, and Materials) in which the Fund currently invests lagged that of the four non-included sectors (Financials, Information Technology, Telecommunications, and Utilities). For the six months ended November 30, 2014, the Fund’s six sectors in the S&P 500 Index generated a weighted average total return of +6.28% compared to +12.01% for the four non-included sectors. This differential was primarily caused by the Energy sector, which generated a total return of -14.48%. The S&P 400 Midcap and Russell 2000 Indices revealed a similar story with Energy sector total returns of -24.70% and -40.12%, respectively. |

The Fund continued to implement its strategy of investing in companies that we believe are at the intersection of quality and value. We seek to employ a disciplined and dispassionate approach to investing in companies at prices that are well below (longs) or well above (shorts) our appraisal of their intrinsic value. During the period, we invested in new companies comprising multiple industry sectors and market capitalizations. We purchased long many businesses that we believe are high-quality with strong balance sheets that are growing, generating ample free cash flow, and re-investing that cash at high internal rates of return. In tandem, we sold short four times as many companies that we consider to be overpriced with poor quality characteristics. Our short positions are tailored to our long positions by market capitalization and sector.

Drawing on our investment team’s 18 years of private and public equity investment experience and research, we made these investments based on the belief that the market price of a well-constructed portfolio of high (or low) quality stocks purchased at, in our opinion, bargain (or lofty) levels will trend toward our estimate of its intrinsic value over time. The Fund’s long and short portfolios are highly diversified by market cap segment, industry, and position size.

The Fund’s investments are sourced by taking account of the opportunity set of all companies in our broad investment universe each time we commit capital to a new position. We think this approach allows us to uncover investment opportunities that arise from temporary market inefficiencies and to gather up the most compelling investments across a wide array of industries and market capitalizations without the behavioral biases inherent in concentrated-stock and sector-specialized investing.

With regard to hold period, we typically give the market at least one year to re-appraise each of the Fund’s positions. The idea here is that it takes time from the date of our investment in any given company for the market to realize (or not) that a security’s market value is low (or high) compared to our estimate of intrinsic value, especially when re-considered in light of the high or low quality of their business characteristics. We are more interested in the aggregate performance of the Fund’s diversified portfolio as opposed to any one position.

The three best-performing positions for the six-months ended November 30, 2014 were USANA Health Sciences, Inc. (long), United Therapeutics Corp. (long), and Pilgrim’s Pride Corp. (long), which generated total returns of +45.93%, +31.94% and +23.27%, respectively. The three worst-performing positions were Puma Biotechnology, Inc. (short), Smith and Wesson Holding Corp. (long) and Future Fuel Corp. (long), which generated total returns of +256.15%, -35.34% and -29.74%, respectively.

Four of the Fund’s long holdings were announced as take-over targets during the six-month period. The control premium we have captured by virtue of holding stocks that end up being merger targets has made meaningful contributions to the Fund’s total returns, and we expect to continue to benefit from this effect going forward. We remove companies from the Fund’s portfolio soon after they are announced as take-over targets and re-invest that capital.

During the period, the long portfolio generated a total return before fees and expenses of +3.72%, including +3.07% for large-caps, +6.40% for mid–caps, and +1.88% for small-caps. This compares to +8.58% for the S&P 500 Index, +5.47% for the S&P 400 Midcap Index, and +4.09% for the Russell 2000 Index. Our sectors with the best performance were Health Care and Consumer Staples, which generated price returns of +14.46% and +9.12%, respectively. The two sectors that did least well were Energy and Materials, which returned -15.04% and -5.02%, respectively.

The short portfolio generated a total return before fees and expenses of +4.04%, including +7.73% for large-caps, +4.95% for mid–caps, and +1.73% for small-caps which had a negative impact on the Fund as increasing prices of shorted securities reduce the portfolio’s value. The sectors with the best performance were Energy and Material, which generated total returns of -21.14% and -2.60%, respectively. The sectors that did least well were Health Care and Consumer Staples, which returned +18.63% and +8.12%, respectively.

Going forward, we believe the Fund is well positioned for near-term and long-term success given the fundamental quality and value attributes of its positions and its hedged portfolio, designed to reduce price volatility. Our goal remains the same; we expect the Fund’s long and short portfolios to outperform its benchmarks over time.

The Fund’s long portfolio had a position-weighted EBIT (Earnings Before Interest and Taxes) yield of 9.42% on November 30, 2014, which compares favorably with the 6.68% EBIT yield for the S&P 500. The short portfolio’s position-weighted EBIT yield of 3.60% is substantially lower than the S&P 500, indicating to us that these securities are significantly overpriced relative to market values. The Fund’s returns would benefit if the prices of these stocks were to drop. Furthermore, our long portfolio had an attractive dividend yield of 1.9%, which was nearly twice that of the short portfolio at 1.1%. The Fund’s 30-day SEC yield was -0.38%. We consider these healthy vital signs as being consistent with our strategy, which, among other things, focuses on cash flow over GAAP earnings, in selecting securities for investment.

Finally, we expect to benefit from the absolute and relative level of quality fundamentals in our holdings. As of November 30, 2014, our long and short portfolios had the following position-weighted quality characteristics relative to the S&P 500 (SPX): return on equity (25.9%/10.5% L/S vs. 15.2% SPX); return on assets (11.1%/4.1% L/S vs. 3.3% SPX), operating margin (18.3%/7.9% L/S vs. 14.0% SPX) and debt-to-enterprise value (17.6%/20.5% L/S vs. 34.0% SPX).

Sincerely,

| Nicholas Chermayeff | Robert F. Greenhill, Jr. | David R. Bechtel |

| Principal | Principal | Principal |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-877-767-6633.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at www.barrowfunds.com or call 1-877-767-6633 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. The opinions of the Fund’s Adviser with respect to those securities may change at any time.

BARROW ALL-CAP LONG/SHORT FUND

PERFORMANCE INFORMATION

November 30, 2014 (Unaudited)

Comparison of the Change in Value of a $250,000 Investment in

Barrow All-Cap Long/Short Fund - Institutional Class

versus the S&P 500® Index

Average Annual Total Returns(a)

For Periods Ended November 30, 2014 | |

| | 1 Year | Since

Inception(b) | |

| Barrow All-Cap Long/Short Fund - Institutional Class | (0.29%) | 3.26% | |

| Barrow All-Cap Long/Short Fund - Investor Class | (0.48%) | 3.02% | |

S&P 500® Index | 16.86% | 23.24% | |

(a) | The Fund's total return does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

(b) | The Fund commenced operations on August 30, 2013. |

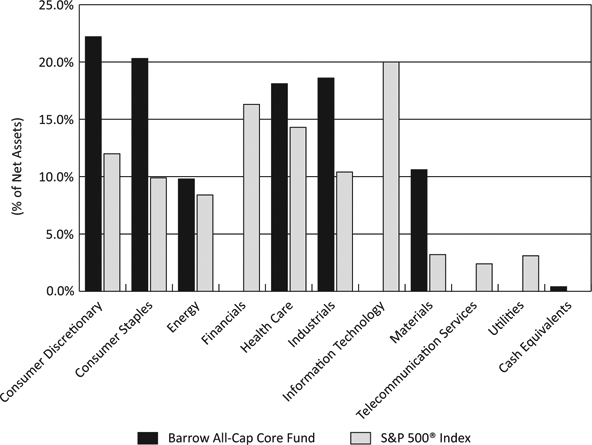

BARROW ALL-CAP CORE FUND

PORTFOLIO INFORMATION

November 30, 2014 (Unaudited)

Sector Diversification

Top 10 Equity Holdings

| Security Description | | % of

Net Assets |

| USANA Health Sciences, Inc. | | 1.70% |

| Vector Group Ltd. | | 1.66% |

| Lancaster Colony Corporation | | 1.54% |

| Altria Group, Inc. | | 1.43% |

| Dun & Bradstreet Corporation (The) | | 1.39% |

| Bed Bath & Beyond, Inc. | | 1.38% |

| Reynolds American, Inc. | | 1.37% |

| Northrop Grumman Corporation | | 1.35% |

| Outerwall, Inc. | | 1.32% |

| CF Industries Holdings, Inc. | | 1.31% |

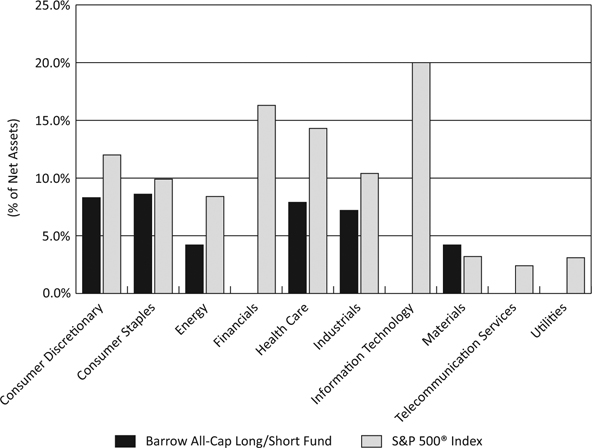

BARROW ALL-CAP LONG/SHORT FUND

PORTFOLIO INFORMATION

November 30, 2014 (Unaudited)

Net Sector Exposure Diversification*

| * | The net percentages are computed by taking the net dollar exposure, including short positions, and dividing by the net assets of the Fund. Consequently, the percentages will not total to 100%. |

| Top 10 Long Equity Holdings | | Top 10 Short Equity Holdings |

| Security Description | % of

Net Assets | | Security Description | % of

Net Assets |

| USANA Health Sciences, Inc. | 2.20% | | Boston Beer Company, Inc. - Class A | 0.64% |

| Vector Group Ltd. | 2.15% | | United Natural Foods, Inc. | 0.61% |

| Lancaster Colony Corporation | 2.00% | | TreeHouse Foods, Inc. | 0.60% |

| Altria Group, Inc. | 1.86% | | Coca-Cola Bottling Company Consolidated | 0.56% |

| Dun & Bradstreet Corporation (The) | 1.80% | | Fresh Del Monte Produce, Inc. | 0.55% |

| Bed Bath & Beyond, Inc. | 1.79% | | Hain Celestial Group, Inc. (The) | 0.53% |

| Reynolds American, Inc. | 1.78% | | Snyder's-Lance, Inc. | 0.51% |

| Northrop Grumman Corporation | 1.76% | | WhiteWave Foods Company (The) | 0.49% |

| Outerwall, Inc. | 1.71% | | Anderson's, Inc. (The) | 0.48% |

| CF Industries Holdings, Inc. | 1.71% | | DexCom, Inc. | 0.47% |

BARROW ALL-CAP CORE FUND

SCHEDULE OF INVESTMENTS

November 30, 2014 (Unaudited) | |

| COMMON STOCKS — 99.7% | | Shares | | | Value | |

| Consumer Discretionary — 22.2% | | | | | | |

| Auto Components — 0.7% | | | | | | |

Dorman Products, Inc. (a) | | | 1,286 | | | $ | 60,866 | |

Gentex Corporation | | | 314 | | | | 11,166 | |

Motorcar Parts of America, Inc. (a) | | | 2,132 | | | | 71,955 | |

| | | | | | | | 143,987 | |

| Automobiles — 0.9% | | | | | | | | |

Thor Industries, Inc. | | | 1,336 | | | | 78,504 | |

Winnebago Industries, Inc. | | | 4,807 | | | | 121,040 | |

| | | | | | | | 199,544 | |

| Diversified Consumer Services — 0.9% | | | | | | | | |

H&R Block, Inc. (b) | | | 5,933 | | | | 199,586 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure — 1.3% | | | | | | | | |

DineEquity, Inc. | | | 661 | | | | 65,657 | |

Interval Leisure Group, Inc. (b) | | | 10,432 | | | | 226,792 | |

| | | | | | | | 292,449 | |

| Household Durables — 0.7% | | | | | | | | |

NVR, Inc. (a) | | | 105 | | | | 132,160 | |

Tupperware Brands Corporation (b) | | | 466 | | | | 31,339 | |

| | | | | | | | 163,499 | |

| Leisure Products — 0.1% | | | | | | | | |

Arctic Cat, Inc. | | | 535 | | | | 17,682 | |

| | | | | | | | | |

| Media — 4.5% | | | | | | | | |

CBS Corporation - Class B | | | 1,144 | | | | 62,783 | |

| Entravision Communications Corporation - Class A | | | 15,329 | | | | 99,026 | |

Interpublic Group of Companies, Inc. (b) | | | 7,708 | | | | 156,395 | |

Omnicom Group, Inc. | | | 2,748 | | | | 212,338 | |

| Scripps Networks Interactive, Inc. - Class A | | | 1,225 | | | | 95,758 | |

Starz - Series A (a) | | | 7,744 | | | | 255,475 | |

Time Warner, Inc. | | | 802 | | | | 68,266 | |

Time, Inc. | | | 1,963 | | | | 46,994 | |

| | | | | | | | 997,035 | |

| Specialty Retail — 10.5% | | | | | | | | |

American Eagle Outfitters, Inc. (b) | | | 1,466 | | | | 20,671 | |

AutoZone, Inc. (a) | | | 76 | | | | 43,906 | |

Bed Bath & Beyond, Inc. (a) (b) | | | 4,149 | | | | 304,412 | |

Best Buy Company, Inc. | | | 713 | | | | 28,099 | |

Buckle, Inc. (The) (b) | | | 5,412 | | | | 277,040 | |

BARROW ALL-CAP CORE FUND

SCHEDULE OF INVESTMENTS (Continued) | |

| COMMON STOCKS — 99.7% (Continued) | | Shares | | | Value | |

| Consumer Discretionary — 22.2% (Continued) | | | | | | |

| Specialty Retail — 10.5% (Continued) | | | | | | |

Cato Corporation (The) - Class A (b) | | | 4,317 | | | $ | 173,198 | |

DSW, Inc. - Class A | | | 331 | | | | 11,744 | |

Express, Inc. (a) (b) | | | 13,703 | | | | 204,860 | |

Finish Line, Inc. (The) - Class A | | | 2,221 | | | | 63,387 | |

Foot Locker, Inc. (b) | | | 1,725 | | | | 98,825 | |

GameStop Corporation - Class A (b) | | | 6,225 | | | | 235,367 | |

GNC Holdings, Inc. - Class A | | | 4,058 | | | | 179,445 | |

Hibbett Sports, Inc. (a) | | | 3,198 | | | | 160,444 | |

Outerwall, Inc. (a) (b) | | | 4,136 | | | | 290,678 | |

PetSmart, Inc. | | | 157 | | | | 12,365 | |

Ross Stores, Inc. | | | 656 | | | | 60,011 | |

Sally Beauty Holdings, Inc. (a) | | | 339 | | | | 10,730 | |

Select Comfort Corporation (a) (b) | | | 5,486 | | | | 144,501 | |

| | | | | | | | 2,319,683 | |