| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Frank L. Newbauer, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | February 29, 2016 | |

| | | |

| Date of reporting period: | August 31, 2015 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

WAYCROSS LONG/SHORT EQUITY FUND

(WAYEX)

Semi-Annual Report

August 31, 2015

(Unaudited)

WAYCROSS LONG/SHORT EQUITY FUND LETTER TO SHAREHOLDERS | August 31, 2015 |

Dear Shareholders,

We are pleased to provide this update for the Waycross Long/Short Equity Fund (the “Fund”). At Waycross Partners, we believe that through deep comprehensive analysis a portfolio can be carefully constructed using both long and short positions that meets investors’ growth objectives while reducing short-term volatility. This philosophy represents the guiding principles that shape our investment decision making process. The Fund’s investment approach is based on bottom-up company research that combines a thorough examination of a company’s fundamentals, valuation and market sentiment. The Fund is actively managed as we seek to achieve consistent, positive returns by continually researching new opportunities for profitable stock selection.

Performance Review

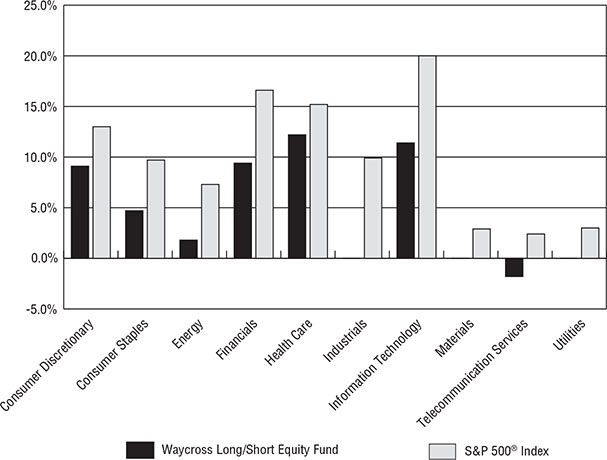

Since its launch on April 29, 2015 through the period ended August 31, 2015, the Fund has produced a cumulative total return of -4.5% compared to -5.7% for the S&P 500 Index and -4.0% for the Credit Suisse AllHedge Long/Short Index over the same period. The portfolio’s short exposure provided downside protection during the period, particularly within the Energy and Industrials sectors.

Energy stocks were impacted by declining crude oil prices during the period. Long exposure detracted from returns while gains from the Fund’s short positions helped to offset losses. Long positions within the Industrials sector were also under pressure during the period. Several industrial manufacturers posted losses as investors shied away from these positions on concerns that weakening demand from China will have a meaningful impact on earnings. As with Energy, gains from the Fund’s short exposure to Industrials helped to offset losses from long positions. The Fund benefited from its exposure to the Consumer Discretionary sector during the period as several long positions in the retail industry posted strong returns. This group has benefited from a boost in consumer spending as a result of lower fuel prices.

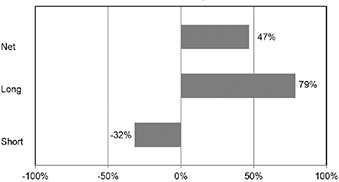

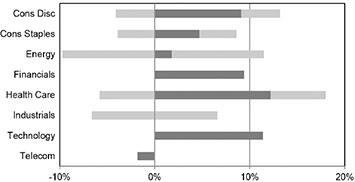

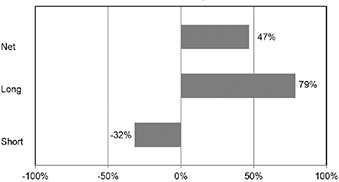

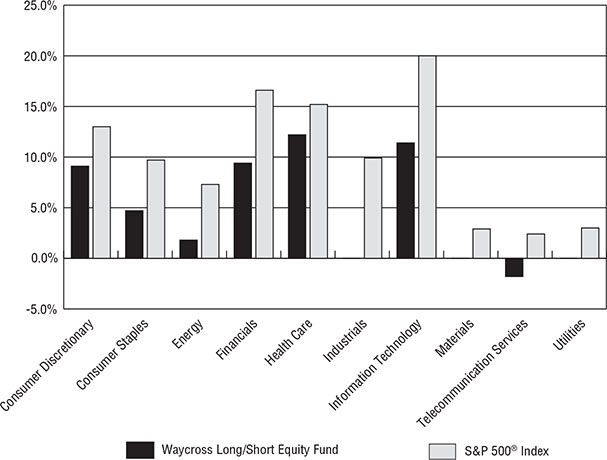

Exposures Summary

The Fund’s long exposure increased modestly during the period resulting in a higher net long exposure (longs minus shorts) of 49% at the end of August. Beta, also known as beta coefficient, is a measure of volatility. The Fund maintained a beta of 0.47 relative to the S&P 500, which represents the market as a whole with a beta of 1. The Fund maintains a long position in Financials stocks, which are well-positioned to benefit from increasing interest rates. The Fund recently moved from neutral to a net short position in the Industrials sector. Our outlook for the sector is more cautious due to declining earnings estimates, particularly for industrial manufacturers with international exposure. The Fund continues to navigate the volatile Energy sector through the use of paired trades. The decline in crude oil prices over the last year has resulted in significant earnings losses and challenged business models.

Fund Exposure and Attribution |

Total Portfolio Exposures

| Long/Short Exposure by Sector

|

Top Five Long Positions | | Top Five Short Positions |

Security Name | Sector | % of

Net Assets | | Security Name | Sector | % of

Net Assets |

Facebook Inc. | Technology | 3.7% | | Bed Bath & Beyond Inc. | Cons Disc | 2.3% |

Allergan PLC | Health Care | 3.5% | | Ensco-PLC CL A | Energy | 2.2% |

Foot Locker, Inc. | Cons Disc | 3.3% | | Apache Corp. | Energy | 2.1% |

Goldman Sachs Group | Financials | 3.1% | | Eli Lilly & Company | Health Care | 2.1% |

Kroger Company | Cons Staples | 2.9% | | 3M Company | Industrials | 2.0% |

Market Outlook

We expect above average volatility to continue as investors watch for what could be the first increase in short-term interest rates since June of 2006. Corporate earnings are another concern. At the time of this publication, third quarter earnings estimates are negative year-over-year for not just Energy, but Materials, Industrials, and Consumer Staples as well. These are the areas of the market with the most international exposure, especially to China. Even where expected earnings show positive growth, estimates have been revised downward in recent weeks. We believe investors will be watching third quarter earnings announcements closely, as these results could set the market tone for the remainder of the year.

On behalf of Waycross Partners, LLC, thank you for investing in the Fund.

Sincerely,

Benjamin H. Thomas, CFA

Managing Partner | Portfolio Manager

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-866-267-4304.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-866-267-4304 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

WAYCROSS LONG/SHORT EQUITY FUND

PORTFOLIO INFORMATION

August 31, 2015 (Unaudited)

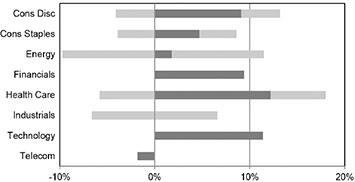

Net Sector Exposure versus S&P 500® Index*

| * | The net percentages are computed by taking the net dollar exposure, including short positions, and dividing by the net assets of the Fund. Consequently, the percentages will not total to 100%. |

Top 10 Long Equity Holdings | | Top 10 Short Equity Holdings |

Security Description | % of

Net Assets | | Security Description | % of

Net Assets |

Facebook, Inc. - Class A | 3.7% | | Bed Bath & Beyond, Inc. | 2.3% |

Allergan plc | 3.6% | | Ensco plc - Class A | 2.2% |

Foot Locker, Inc. | 3.3% | | Apache Corporation | 2.1% |

Goldman Sachs Group, Inc. (The) | 3.1% | | Eli Lilly & Company | 2.1% |

Kroger Company (The) | 2.9% | | 3M Company | 2.0% |

AbbVie, Inc. | 2.9% | | Cimarex Energy Company | 2.0% |

Morgan Stanley | 2.9% | | UnitedHealth Group, Inc. | 2.0% |

Monster Beverage Corporation | 2.9% | | Cummins, Inc. | 1.9% |

Coca-Cola Company (The) | 2.8% | | Caterpillar, Inc. | 1.9% |

Pioneer Natural Resources Company | 2.6% | | Helmerich & Payne, Inc. | 1.8% |

WAYCROSS LONG/SHORT EQUITY FUND

SCHEDULE OF INVESTMENTS

August 31, 2015 (Unaudited) | |

COMMON STOCKS — 78.7% | | Shares | | | Value | |

Consumer Discretionary — 13.2% | | | | | | |

Hotels, Restaurants & Leisure — 1.9% | | | | | | |

Buffalo Wild Wings, Inc. * | | | 285 | | | $ | 54,059 | |

| | | | | | | | | |

Media — 4.6% | | | | | | | | |

Time Warner, Inc. | | | 1,031 | | | | 73,304 | |

Walt Disney Company (The) | | | 552 | | | | 56,237 | |

| | | | | | | | 129,541 | |

Multi-Line Retail — 1.1% | | | | | | | | |

Target Corporation | | | 400 | | | | 31,084 | |

| | | | | | | | | |

Specialty Retail — 3.3% | | | | | | | | |

Foot Locker, Inc. | | | 1,334 | | | | 94,434 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 2.3% | | | | | | | | |

Under Armour, Inc. - Class A * | | | 676 | | | | 64,578 | |

| | | | | | | | | |

Consumer Staples — 8.6% | | | | | | | | |

Beverages — 5.7% | | | | | | | | |

Coca-Cola Company (The) | | | 2,031 | | | | 79,859 | |

Monster Beverage Corporation * | | | 578 | | | | 80,030 | |

| | | | | | | | 159,889 | |

Food & Staples Retailing — 2.9% | | | | | | | | |

Kroger Company (The) | | | 2,417 | | | | 83,387 | |

| | | | | | | | | |

Energy — 11.5% | | | | | | | | |

Energy Equipment & Services — 2.0% | | | | | | | | |

Patterson-UTI Energy, Inc. | | | 3,400 | | | | 55,352 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels — 9.5% | | | | | | | | |

Anadarko Petroleum Corporation | | | 725 | | | | 51,896 | |

Concho Resources, Inc. * | | | 485 | | | | 52,458 | |

Devon Energy Corporation | | | 889 | | | | 37,925 | |

Newfield Exploration Company * | | | 1,578 | | | | 52,563 | |

Pioneer Natural Resources Company | | | 600 | | | | 73,836 | |

| | | | | | | | 268,678 | |

Financials — 9.4% | | | | | | | | |

Capital Markets — 6.0% | | | | | | | | |

Goldman Sachs Group, Inc. (The) | | | 470 | | | | 88,642 | |

Morgan Stanley | | | 2,364 | | | | 81,440 | |

| | | | | | | | 170,082 | |

WAYCROSS LONG/SHORT EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) | |

COMMON STOCKS — 78.7% (Continued) | | Shares | | | Value | |

Financials — 9.4% (Continued) | | | | | | |

Diversified Financial Services — 3.4% | | | | | | |

Bank of America Corporation | | | 4,440 | | | $ | 72,550 | |

JPMorgan Chase & Company | | | 352 | | | | 22,563 | |

| | | | | | | | 95,113 | |

Health Care — 18.0% | | | | | | | | |

Biotechnology — 7.0% | | | | | | | | |

Biogen, Inc. * | | | 182 | | | | 54,109 | |

Celgene Corporation * | | | 611 | | | | 72,147 | |

Gilead Sciences, Inc. | | | 686 | | | | 72,078 | |

| | | | | | | | 198,334 | |

Health Care Providers & Services — 4.5% | | | | | | | | |

Aetna, Inc. | | | 520 | | | | 59,550 | |

Tenet Healthcare Corporation * | | | 1,400 | | | | 68,922 | |

| | | | | | | | 128,472 | |

Pharmaceuticals — 6.5% | | | | | | | | |

AbbVie, Inc. | | | 1,322 | | | | 82,506 | |

Allergan plc * | | | 328 | | | | 99,627 | |

| | | | | | | | 182,133 | |

Industrials — 6.6% | | | | | | | | |

Machinery — 4.2% | | | | | | | | |

Ingersoll-Rand plc | | | 1,172 | | | | 64,800 | |

Terex Corporation | | | 2,300 | | | | 53,659 | |

| | | | | | | | 118,459 | |

Road & Rail — 2.4% | | | | | | | | |

Canadian Pacific Railway Ltd. | | | 460 | | | | 66,791 | |

| | | | | | | | | |

Information Technology — 11.4% | | | | | | | | |

Internet Software & Services — 6.0% | | | | | | | | |

Facebook, Inc. - Class A * | | | 1,171 | | | | 104,723 | |

Google, Inc. - Class A * | | | 99 | | | | 64,134 | |

| | | | | | | | 168,857 | |

IT Services — 2.6% | | | | | | | | |

Visa, Inc. - Class A | | | 1,030 | | | | 73,439 | |

| | | | | | | | | |

Technology Hardware, Storage & Peripherals — 2.8% | | | | | | | | |

Apple, Inc. | | | 422 | | | | 47,585 | |

Hewlett-Packard Company | | | 1,089 | | | | 30,557 | |

| | | | | | | | 78,142 | |

| | | | | | | | | |

Total Common Stocks (Cost $2,326,341) | | | | | | $ | 2,220,824 | |

WAYCROSS LONG/SHORT EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 5.0% | | Shares | | | Value | |

Fidelity Institutional Money Market Government Portfolio - Class I, 0.01% (a) (Cost $141,666) | | | 141,666 | | | $ | 141,666 | |

| | | | | | | | | |

Total Investments at Value — 83.7% (Cost $2,468,007) | | | | | | $ | 2,362,490 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities (b) — 16.3% | | | | | | | 459,642 | |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 2,822,132 | |

| * | Non-income producing security. |

| (a) | The rate shown is the 7-day effective yield as of August 31, 2015. |

| (b) | Includes cash held as collateral and margin deposits for open short positions. |

See accompanying notes to financial statements.

WAYCROSS LONG/SHORT EQUITY FUND

SCHEDULE OF SECURITIES SOLD SHORT

August 31, 2015 (Unaudited) | |

COMMON STOCKS — 31.9% | | Shares | | | Value | |

Consumer Discretionary — 4.1% | | | | | | |

Specialty Retail — 3.3% | | | | | | |

Bed Bath & Beyond, Inc. | | | 1,050 | | | $ | 65,216 | |

Lowe's Companies, Inc. | | | 420 | | | | 29,051 | |

| | | | | | | | 94,267 | |

Textiles, Apparel & Luxury Goods — 0.8% | | | | | | | | |

Coach, Inc. | | | 700 | | | | 21,175 | |

| | | | | | | | | |

Consumer Staples — 3.9% | | | | | | | | |

Food & Staples Retailing — 2.2% | | | | | | | | |

Costco Wholesale Corporation | | | 245 | | | | 34,312 | |

Wal-Mart Stores, Inc. | | | 413 | | | | 26,733 | |

| | | | | | | | 61,045 | |

Personal Products — 1.7% | | | | | | | | |

Johnson & Johnson | | | 517 | | | | 48,588 | |

| | | | | | | | | |

Energy — 9.7% | | | | | | | | |

Energy Equipment & Services — 5.6% | | | | | | | | |

Ensco plc - Class A | | | 3,450 | | | | 62,480 | |

Helmerich & Payne, Inc. | | | 878 | | | | 51,811 | |

National Oilwell Varco, Inc. | | | 1,025 | | | | 43,388 | |

| | | | | | | | 157,679 | |

Oil, Gas & Consumable Fuels — 4.1% | | | | | | | | |

Apache Corporation | | | 1,326 | | | | 59,988 | |

Cimarex Energy Company | | | 512 | | | | 56,581 | |

| | | | | | | | 116,569 | |

Health Care — 5.8% | | | | | | | | |

Health Care Providers & Services — 3.7% | | | | | | | | |

DaVita HealthCare Partners, Inc. | | | 647 | | | | 48,939 | |

UnitedHealth Group, Inc. | | | 480 | | | | 55,536 | |

| | | | | | | | 104,475 | |

Pharmaceuticals — 2.1% | | | | | | | | |

Eli Lilly & Company | | | 715 | | | | 58,880 | |

| | | | | | | | | |

Industrials — 6.6% | | | | | | | | |

Industrial Conglomerates — 2.0% | | | | | | | | |

3M Company | | | 406 | | | | 57,709 | |

| | | | | | | | | |

Machinery — 3.8% | | | | | | | | |

Caterpillar, Inc. | | | 681 | | | | 52,056 | |

Cummins, Inc. | | | 448 | | | | 54,544 | |

| | | | | | | | 106,600 | |

WAYCROSS LONG/SHORT EQUITY FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 31.9% (Continued) | | Shares | | | Value | |

Industrials — 6.6% (Continued) | | | | | | |

Road & Rail — 0.8% | | | | | | |

J.B. Hunt Transport Services, Inc. | | | 315 | | | $ | 22,926 | |

| | | | | | | | | |

Telecommunication Services — 1.8% | | | | | | | | |

Diversified Telecommunication Services — 1.8% | | | | | | | | |

AT&T, Inc. | | | 1,495 | | | | 49,634 | |

| | | | | | | | | |

Total Securities Sold Short — 31.9% (Proceeds $983,264) | | | | | | $ | 899,547 | |

See accompanying notes to financial statements. |

WAYCROSS LONG/SHORT EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2015 (Unaudited) | |

ASSETS | | | |

Investments in securities: | | | |

At acquisition cost | | $ | 2,468,007 | |

At value (Note 2) | | $ | 2,362,490 | |

Cash* | | | 477,000 | |

Deposits with brokers for securities sold short (Note 2) | | | 990,152 | |

Dividends receivable | | | 1,542 | |

Receivable for investment securities sold | | | 56,953 | |

Receivable from Advisor (Note 4) | | | 5,113 | |

Other assets | | | 7,095 | |

Total assets | | | 3,900,345 | |

| | | | | |

LIABILITIES | | | | |

Securities sold short, at value (proceeds $983,264) (Note 2) | | | 899,547 | |

Payable for investment securities purchased | | | 165,515 | |

Dividends payable on securities sold short (Note 2) | | | 2,724 | |

Payable to administrator (Note 4) | | | 6,024 | |

Accrued brokerage expense on securities sold short (Note 2) | | | 27 | |

Other accrued expenses | | | 4,376 | |

Total liabilities | | | 1,078,213 | |

| | | | | |

NET ASSETS | | $ | 2,822,132 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 2,940,758 | |

Accumulated net investment loss | | | (19,003 | ) |

Accumulated net realized losses from security transactions | | | (77,823 | ) |

Net unrealized appreciation (depreciation) on: | | | | |

Investments | | | (105,517 | ) |

Short positions | | | 83,717 | |

NET ASSETS | | $ | 2,822,132 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 295,652 | |

| | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 9.55 | |

| * | Committed as collateral for open short positions (Note 2). |

See accompanying notes to financial statements.

WAYCROSS LONG/SHORT EQUITY FUND

STATEMENT OF OPERATIONS

For the Period Ended August 31, 2015(a) (Unaudited) | |

INVESTMENT INCOME | | | |

Dividend income | | $ | 5,965 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 4) | | | 15,735 | |

Fund accounting fees (Note 4) | | | 8,080 | |

Administration fees (Note 4) | | | 8,000 | |

Dividend expense on securities sold short (net of foreign tax of $13) (Note 2) | | | 6,960 | |

Trustees' fees and expenses (Note 4) | | | 5,910 | |

Professional fees | | | 5,793 | |

Transfer agent fees (Note 4) | | | 4,000 | |

Compliance fees (Note 4) | | | 4,000 | |

Custody and bank service fees | | | 3,955 | |

Registration and filing fees | | | 3,648 | |

Postage and supplies | | | 1,956 | |

Brokerage expense on securities sold short (Note 2) | | | 1,008 | |

Insurance expense | | | 751 | |

Other expenses | | | 2,474 | |

Total expenses | | | 72,270 | |

Less fee waivers and expense reimbursements by the Adviser (Note 4) | | | (47,302 | ) |

Net expenses | | | 24,968 | |

| | | | | |

ACCUMULATED NET INVESTMENT LOSS | | | (19,003 | ) |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains (losses) from: | | | | |

Investments | | | (89,929 | ) |

Securities sold short | | | 12,106 | |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (105,517 | ) |

Securities sold short | | | 83,717 | |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (99,623 | ) |

| | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (118,626 | ) |

| (a) | Represents the period from the commencement of operations (April 29, 2015) through August 31, 2015. |

See accompanying notes to financial statements.

WAYCROSS LONG/SHORT EQUITY FUND

STATEMENT OF CHANGES IN NET ASSETS | |

| | Period

Ended

August 31,

2015(a)

(Unaudited) | |

FROM OPERATIONS | | | |

Net investment loss | | $ | (19,003 | ) |

Net realized gains (losses) from: | | | | |

Investments | | | (89,929 | ) |

Securities sold short | | | 12,106 | |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (105,517 | ) |

Securities sold short | | | 83,717 | |

Net decrease in net assets resulting from operations | | | (118,626 | ) |

| | | | | |

CAPITAL SHARE TRANSACTIONS | | | | |

Proceeds from shares sold | | | 3,153,928 | |

Payments for shares redeemed | | | (213,170 | ) |

Net increase in net assets from capital share transactions | | | 2,940,758 | |

| | | | | |

TOTAL INCREASE IN NET ASSETS | | | 2,822,132 | |

| | | | | |

NET ASSETS | | | | |

Beginning of period | | | — | |

End of period | | $ | 2,822,132 | |

| | | | | |

ACCUMULATED NET INVESTMENT LOSS | | $ | (19,003 | ) |

| | | | | |

CAPITAL SHARE ACTIVITY | | | | |

Shares sold | | | 317,177 | |

Shares redeemed | | | (21,525 | ) |

Net increase in shares outstanding | | | 295,652 | |

Shares outstanding at beginning of period | | | — | |

Shares outstanding at end of period | | | 295,652 | |

| (a) | Represents the period from the commencement of operations (April 29, 2015) through August 31, 2015. |

See accompanying notes to financial statements.

WAYCROSS LONG/SHORT EQUITY FUND

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout the Period | |

| | Period

Ended

August 31,

2015(a)

(Unaudited) | |

Net asset value at beginning of period | | $ | 10.00 | |

| | | | | |

Loss from investment operations: | | | | |

Net investment loss | | | (0.06 | ) |

Net realized and unrealized losses on investments | | | (0.39 | ) |

Total from investment operations | | | (0.45 | ) |

| | | | | |

Net asset value at end of period | | $ | 9.55 | |

| | | | | |

Total return (b) | | | (4.50% | )(c) |

| | | | | |

Net assets at end of period (000's) | | $ | 2,822 | |

| | | | | |

Ratios/supplementary data: | | | | |

Ratio of total expenses to average net assets | | | 9.14 | %(d) |

| | | | | |

Ratio of net expenses to average net assets (e) | | | 3.16 | %(d) |

| | | | | |

Ratio of net expenses to average net assets excluding dividend expense (e) | | | 2.28 | %(d) |

| | | | | |

Ratio of net expenses to average net assets excluding dividend expense, borrowing costs and brokerage expense on securities sold short (e) | | | 2.15 | %(d) |

| | | | | |

Ratio of net investment loss to average net assets (e) | | | (2.40 | %)(d) |

| | | | | |

Portfolio turnover rate | | | 44 | %(c) |

| (a) | Represents the period from the commencement of operations (April 29, 2015) through August 31, 2015. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not waived advisory fees and/or reimbursed expenses (Note 4). |

| (e) | Ratio was determined after advisory fee waivers and/or expense reimbursements (Note 4). |

See accompanying notes to financial statements.

WAYCROSS LONG/SHORT EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

August 31, 2015 (Unaudited)

1. Organization

Waycross Long/Short Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. The Fund commenced operations on April 29, 2015.

The investment objective of the Fund is long-term capital appreciation with a secondary emphasis on capital preservation.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Fund follows accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – The Fund values its respective portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted bid price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

WAYCROSS LONG/SHORT EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | ● | Level 1 – quoted prices in active markets for identical securities |

| | ● | Level 2 – other significant observable inputs |

| | ● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments and other financial instruments as of August 31, 2015:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | $ | 2,220,824 | | | $ | — | | | $ | — | | | $ | 2,220,824 | |

Money Market Funds | | | 141,666 | | | | — | | | | — | | | | 141,666 | |

Total | | $ | 2,362,490 | | | $ | — | | | $ | — | | | $ | 2,362,490 | |

Other Financial Instruments | | | | | | | | | | | | | | | | |

Common Stocks - Sold Short | | $ | (899,547 | ) | | $ | — | | | $ | — | | | $ | (899,547 | ) |

Refer to the Fund’s Schedule of Investments and Schedule of Securities Sold Short for a listing of the common stocks by industry type. As of August 31, 2015, the Fund did not have any transfers into and out of any Level. In addition, the Fund did not hold derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of August 31, 2015. It is the Fund’s policy to recognize transfers into and out of any Level at the end of the reporting period.

Share valuation – The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to the net asset value per share.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned.

Security transactions – Security transactions are accounted for on the trade date. Gains and losses on securities sold are determined on a specific identification basis.

WAYCROSS LONG/SHORT EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – The Fund will distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions are recorded on the ex-dividend date. There were no distributions paid to the shareholders during the period ended August 31, 2015.

Short sales – The Fund may sell securities short. For financial statement purposes, an amount equal to the settlement amount is included in the Statement of Assets and Liabilities as an asset and an equivalent liability is then subsequently marked-to-market daily to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities sold, but not yet purchased, may require purchasing the security at prices that may differ from the market value reflected on the Statement of Assets and Liabilities. The Fund is liable for any dividends payable on securities while those securities are in a short position and will also bear other costs, such as charges for the prime brokerage accounts, in connection with the short position. These costs are reported as dividend expense and brokerage expense on securities sold short, respectively, in the Statement of Operations. As collateral for its short positions, the Fund is required under the Investment Company Act of 1940 to maintain assets consisting of cash, cash equivalents or other liquid securities equal to the market value of the securities sold short. The cash deposits with brokers for securities sold short are reported on the Statement of Assets and Liabilities. The amount of collateral is required to be adjusted daily to reflect changes in the value of the securities sold short. To the extent the Fund invests the proceeds received from selling securities short, it is engaging in a form of leverage. The use of leverage by the Fund may make any change in the Fund’s net asset value greater than it would be without the use of leverage. Short sales are speculative transactions and involve special risks, including greater reliance on the ability of Waycross Partners (the “Adviser”) to accurately anticipate the future value of a security.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, each as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund intends to qualify as a regulated investment company under the Internal Revenue Code of 1986 (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code. Accordingly, no provision for income tax has been made.

WAYCROSS LONG/SHORT EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of August 31, 2015:

Tax cost of portfolio investments | | $ | 2,472,356 | |

Gross unrealized appreciation | | $ | 51,783 | |

Gross unrealized depreciation | | | (161,649 | ) |

Net unrealized depreciation | | | (109,866 | ) |

Net unrealized appreciation on securities sold short | | | 83,312 | |

Accumulated ordinary losses | | | (92,072 | ) |

Accumulated deficit | | $ | (118,626 | ) |

As of August 31, 2015, the proceeds of securities sold short on a tax basis is $982,859.

The federal income tax cost of portfolio investments and securities sold short and the tax components of accumulated earnings and the financial statement cost of portfolio investments and components of net assets may be temporarily different (“book/tax difference”). These book/tax differences are due to the recognition of capital gains or losses under income tax regulations and GAAP, primarily due to the tax deferral of losses on wash sales.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for the current tax period and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal.

3. Investment Transactions

During the period ended August 31, 2015, cost of purchases and proceeds from sales of investment securities, other than short-term investments and short positions, were $3,304,796 and $888,527, respectively.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by the Adviser pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an advisory fee, computed and accrued daily and paid monthly, at the annual rate of 1.99% of its average daily net assets.

WAYCROSS LONG/SHORT EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Pursuant to an Expense Limitation Agreement between the Fund and the Adviser, the Adviser has contractually agreed, until July 1, 2018, to waive investment advisory fees and reimburse other expenses to limit Total Annual Fund Operating Expenses (exclusive of brokerage costs, taxes, borrowing costs such as interest and dividend expenses on securities sold short, interest, acquired fund fees and expenses, extraordinary expenses such as litigation and merger or reorganization costs, and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 2.15% of the Fund’s average daily net assets. Accordingly, during the period ended August 31, 2015, the Adviser waived all of its advisory fees and, in addition, reimbursed other operating expenses totaling $31,567.

Under the terms of the Expense Limitation Agreement, investment advisory fees waived and expense reimbursements by the Adviser are subject to recoupment by the Adviser for a period of three years after such fees and expenses were incurred, provided the recoupments do not cause Total Annual Fund Operating Expenses to exceed the foregoing expense limitations. As of August 31, 2015, the Adviser may seek recoupment of investment advisory fee waivers and expense reimbursements totaling $47,302, no later than August 31, 2018.

An officer of the Fund is also an officer of the Adviser.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides fund administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including but not limited to postage, supplies and costs of pricing the Fund’s portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus.

Certain Trustees and officers of the Trust are also officers of Ultimus and the Distributor.

TRUSTEE COMPENSATION

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement of travel and other meeting-related expenses. In addition, each Independent Trustee receives a $500 annual retainer from the Fund. Trustees affiliated with the Adviser or Ultimus are not compensated by the Trust for their services.

WAYCROSS LONG/SHORT EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

PRINCIPAL HOLDERS OF FUND SHARES

As of August 31, 2015, the following shareholders owned of record 5% or more of the outstanding shares of the Fund:

Name of Record Owner | % Ownership |

NFS, LLC (for benefit of its customers) | 51% |

Maril & Company | 38% |

Vincent D. Enright | 5% |

A beneficial owner of 25% or more of a Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholder’s meeting.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

WAYCROSS LONG/SHORT EQUITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (April 29, 2015) and held until the end of the period (August 31, 2015).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

WAYCROSS LONG/SHORT EQUITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued)

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| Beginning

Account Value

March 1, 2015(a) | Ending

Account Value

August 31, 2015 | Net Expense Ratio(b) | Expenses

Paid During

Period(c) |

Based on Actual Fund Return | $1,000.00 | $955.00 | 3.16% | $10.58 |

Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,009.28 | 3.16% | $16.00 |

| (a) | Beginning Account Value is as of April 29, 2015 (date of commencement of operations) for the Actual Fund Return Information. |

| (b) | Annualized, based on the Fund’s net expenses for the period since inception. |

| (c) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by 125/365 (to reflect the period since inception) and 184/365 (to reflect the one-half year period), for Actual Fund Return and Hypothetical 5% Return information, respectively. |

WAYCROSS LONG/SHORT EQUITY FUND

OTHER INFORMATION (Unaudited)

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-866-267-4304, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-866-267-4304, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-866-267-4304. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

WAYCROSS LONG/SHORT EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT

ADVISORY AGREEMENT (Unaudited)

The Board of Trustees (the “Board”), including the Independent Trustees voting separately, has reviewed and approved the Fund’s Investment Advisory Agreement with Waycross Partners, LLC (the “Adviser”) for an initial two-year term (the “Waycross Agreement”). The Board approved the Waycross Agreement at an in-person meeting held on April 20, 2015, at which all of the Trustees were present.

In the course of their deliberations, the Board was advised by legal counsel. The Board received and reviewed a substantial amount of information provided by the Adviser in response to requests of the Board and counsel.

In considering the Waycross Agreement and reaching their conclusions with respect thereto, the Board reviewed and analyzed various factors that they determined were relevant, including the factors described below.

The nature, extent, and quality of the services to be provided by the Adviser. In this regard, the Board considered the Adviser’s responsibilities and services under the Waycross Agreement, including, without limitation, the Adviser’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objective and limitations, proposed initial marketing and distribution efforts, and compliance procedures and practices. After reviewing the foregoing and further information regarding the Adviser’s services, the Board concluded that the quality, extent, and nature of the services to be provided by the Adviser are satisfactory and adequate for the Fund.

The investment management capabilities and experience of the Adviser. In this regard, the Board considered the investment management experience of the Adviser, including the Adviser’s experience and plans for implementing the Fund’s investment objective and strategies. In particular, the Board received information from the Adviser regarding its experience in managing substantially similar strategies. The Board also noted the Adviser’s prior experience and performance with separate accounts that had similar investment objectives and strategies as the Fund. After consideration of these factors, as well as other factors, the Board determined that the Adviser has the requisite experience to serve as investment adviser for the Fund.

The costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. In this regard, the Board considered the Adviser’s staffing, personnel, and methods of operation; the education and experience of its key personnel; its compliance program, policies, and procedures; its financial condition; the projected asset levels of the Fund; and the overall expenses of the Fund, including the advisory fee. The Board reviewed the Expense Limitation Agreement with the Adviser (the “Waycross ELA”), and noted the benefits that would result to the Fund from the Adviser’s commitment to waive its advisory fee or reimburse other operating expenses until July 1, 2018. The Board discussed the financial condition of the Adviser and its ability to satisfy its financial commitments to the Fund. The Board also considered potential benefits for the Adviser

WAYCROSS LONG/SHORT EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT

ADVISORY AGREEMENT (Unaudited) (Continued)

in managing the Fund, including promotion of the Adviser’s name. The Board compared the Fund’s proposed advisory fee and overall expense ratio to other comparable funds (in terms of the type of fund, the style of investment management, the projected size of the Fund, and the nature of the investment strategy) and the fees charged by the Adviser to its other managed accounts. The Board noted that while the Fund’s advisory fee of was above the average and median for funds in the Fund’s custom peer group, it was less than the highest advisory fee in such peer group. It further noted that the proposed overall annual expense ratio for the Fund under the Waycross ELA is higher than the average and median expense ratio of Fund’s custom peer group, but less that the highest expense ratio in the peer group. Upon further consideration and discussion of the foregoing, the Board concluded that the proposed advisory fee paid to the Adviser by the Fund is fair and reasonable.

The extent to which the Fund and its investors would benefit from economies of scale. In this regard, the Board considered the Waycross Agreement and the Waycross ELA. The Board determined that the shareholders of the Fund would benefit from the Waycross ELA until the Fund’s assets grew to a level where its expenses otherwise fell below the expense limit. The Board considered the Fund’s projected asset levels, expectations for growth, and fees, and determined that the Fund’s fee arrangements with the Adviser would provide benefits for the next two years. After further discussion, the Board concluded the Fund’s arrangements with the Adviser were fair and reasonable in relation to the nature and quality of services to be provided by it.

Brokerage and portfolio transactions. In this regard, the Board considered the Adviser’s policies and procedures as it relates to seeking best execution for its clients, including the Fund. The Board also considered the anticipated portfolio turnover rate for the Fund; the method and basis for selecting and evaluating the broker-dealers used by the Adviser; any anticipated allocation of portfolio business to persons affiliated with the Adviser; and the extent to which the Fund’s trades may be allocated to soft-dollar arrangements. After further review and discussion, the Board determined that the Adviser’s practices regarding brokerage and portfolio transactions were satisfactory.

Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as the Adviser’s process for allocating trades among its different clients, including other clients with similar investment objectives and strategies as the Fund. The Board also considered the substance and administration of the Adviser’s code of ethics. Following further consideration and discussion, the Board determined that the Adviser’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory.

After full consideration of the above factors as well as other factors, the Board unanimously concluded that approval of the Waycross Agreement was in the best interests of the Fund and its shareholders.

This page intentionally left blank.

Not required

| Item 3. | Audit Committee Financial Expert. |

Not required

| Item 4. | Principal Accountant Fees and Services. |

Not required

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable

| Item 6. | Schedule of Investments. |

| (a) | Not applicable [schedule filed with Item 1] |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable

| Item 10. | Submission of Matters to a Vote of Security Holders. |

The registrant’s Committee of Independent Trustees shall review shareholder recommendations for nominations to fill vacancies on the registrant’s board of trustees if such recommendations are submitted in writing and addressed to the Committee at the registrant’s offices. The Committee may adopt, by resolution, a policy regarding its procedures for considering candidates for the board of trustees, including any recommended by shareholders.

| Item 11. | Controls and Procedures. |

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

File the exhibits listed below as part of this Form. Letter or number the exhibits in the sequence indicated.

(a)(1) Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit: Not required

(a)(2) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto

(a)(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons: Not applicable

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)): Attached hereto

| Exhibit 99.CERT | Certifications required by Rule 30a-2(a) under the Act |

| | |

| Exhibit 99.906CERT | Certifications required by Rule 30a-2(b) under the Act |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Ultimus Managers Trust | | |

| | | | |

| By (Signature and Title)* | /s/ Frank L. Newbauer | |

| | | Frank L. Newbauer, Assistant Secretary | |

| | | | |

| Date | November 9, 2015 | | |

| | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| | | | |

| By (Signature and Title)* | /s/ Benjamin H. Thomas | |

| | | Benjamin H. Thomas, Principal Executive Officer of Waycross Long/Short Equity Fund | |

| | | | |

| Date | November 9, 2015 | | |

| | | | |

| | | | |

| By (Signature and Title)* | /s/ Jennifer L. Leamer | |

| | | Jennifer L. Leamer, Treasurer | |

| | | | |

| Date | November 9, 2015 | | |

| * | Print the name and title of each signing officer under his or her signature. |