| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Frank L. Newbauer, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | August 31 | |

| | | |

| Date of reporting period: | February 29, 2016 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ALAMBIC SMALL CAP VALUE PLUS FUND

ALAMBIC SMALL CAP GROWTH PLUS FUND

Semi-Annual Report

February 29, 2016

(Unaudited)

ALAMBIC FUNDS

LETTER TO SHAREHOLDERS | March 18, 2016 |

Dear Fellow Shareholders:

Despite the recent rebound in U.S. equities, small cap stock performance over the past 6 months continues to be hampered by higher volatility, widening credit spreads, and generally weak earnings growth, although recent performance has lifted small caps out of bear market territory relative to their June 2015 highs. Small caps tend to be negatively correlated with credit spreads and volatility and, with high-yield spreads widening and the CBOE Volatility Index above 20, performance continues to suffer. Although the Russell 2000® Index was flat for the month of February 2015 and is down only 8.97% through February this year, we expect this cycle of low liquidity and tighter credit spreads to persist this year, which will continue to weigh on the performance of small cap stocks.

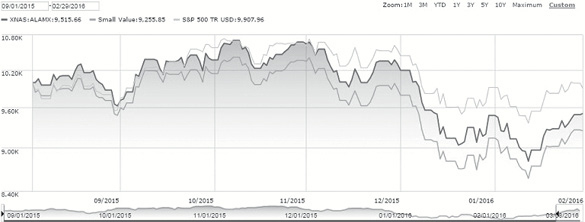

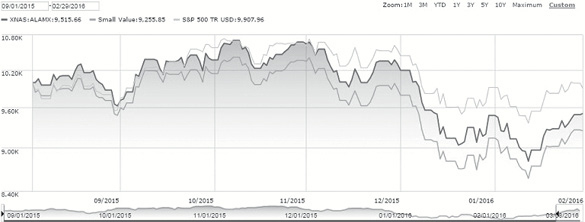

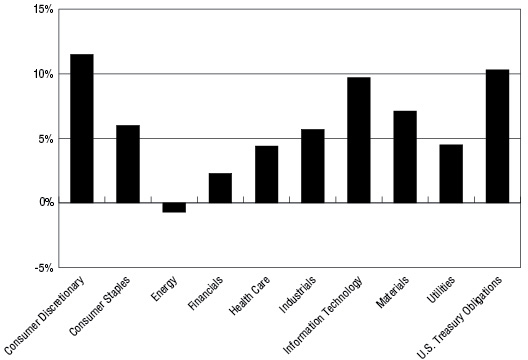

Within that macro market backdrop, since inception (September 1, 2015) through February 29, 2016, the Alambic Small Cap Value Plus Fund (“ALAMX” or the “Value Fund”) has delivered a total return of -4.84% versus the Value Fund’s benchmark, the Russell 2000 Value Index, at -4.03% for the same period. Year to date, ALAMX is down -6.69% versus the Russell 2000 Value Index at -6.08%. Although month-to-month comparisons vary significantly, our tracking error to our benchmark averaged 4.38% during this same period, which is well within our expectations.

The following chart summarizes ALAMX’s cumulative performance over the past 6 months versus the Morningstar Small Cap Value category, which summarizes the average performance of small cap value managers reported in the Morningstar database.

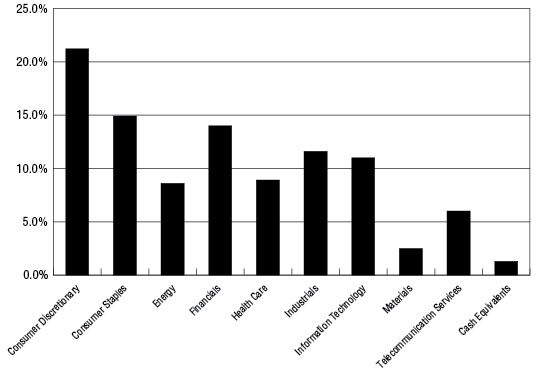

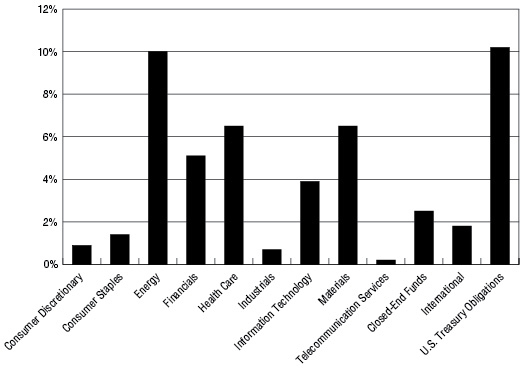

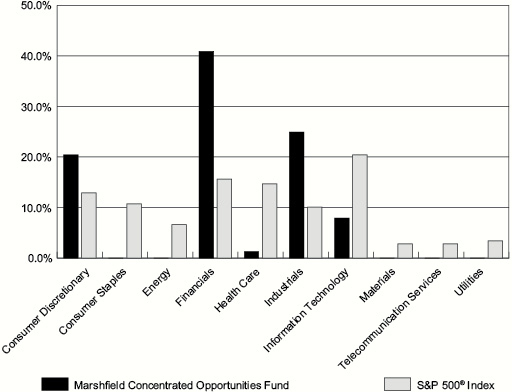

While our stated objective is to provide returns that exceed the benchmark and the Value Fund’s peer group averages over time, we are pleased with ALAMX’s recent performance relative to its peers and we are now focused on improving performance relative to the Russell 2000 Value Index. To that end, as we look to identify the underlying factors, other than macro market trends, that have impacted the Fund’s first 6 months of performance, we note that ALAMX’s sector weights often (and most often intentionally) vary significantly from those of the benchmark. During the past 6 months, ALAMX tended to be significantly underweight in the interest rate sensitive sectors, particularly financial services and utilities. Since these sectors improved as rates declined going into the first quarter, ALAMX’s performance relative to the benchmark was negatively impacted.

1

Investment style weights can also contribute to performance. Although the largest style component of ALAMX’s portfolio is value, significant parts of the portfolio could be classified as small cap blend or small cap growth and can cause a variance in performance relative to the benchmark. We do not believe investment style weights had a material impact on the Fund’s performance relative to the benchmark in the past 6 months.

On December 29, 2015, we launched our second registered mutual fund, the Alambic Small Cap Growth Plus Fund (“ALGSX” or the “Growth Fund”). As with ALAMX, our stock selection process for the Growth Fund is also based on the systematic application of fundamental equity research principals, but for ALGSX the benchmark is the Russell 2000 Growth Index. Since inception through February 29, 2016, ALGSX has delivered a return of -7.30% versus the benchmark’s return of -13.32%. We attribute ALGSX’s strong relative performance during this period to a combination of stock selection and to an intentional investment style shift during the period that resulted in a higher value-weight than that of the Growth Fund’s benchmark.

Although macro market conditions for small caps have been challenging the past few months, we have used this period to continuously optimize our portfolio management processes. As a result, our two funds have performed well relative to their benchmarks and category peers. This validates our stated objective of consistently outperforming the benchmark indices over time.

Thank you for your ongoing trust and commitment.

Sincerely

Albert Richards | Brian Thompson | Rob Slaymaker |

CEO | CRO | Partner |

2

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-890-8988.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus please visit our website at https://alambicfunds.com or call 1-888-890-8988 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Alambic Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Funds, may be sold at any time and may no longer be held by the Funds. For a complete listing of securities held in the Funds as of February 29, 2016, please see the Schedule of Investments section of the Semi-Annual Report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

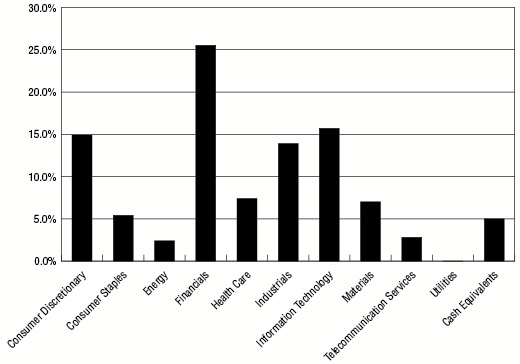

ALAMBIC SMALL CAP VALUE PLUS FUND

PORTFOLIO INFORMATION

February 29, 2016 (Unaudited)

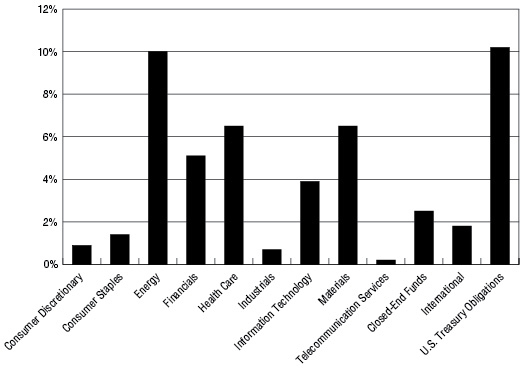

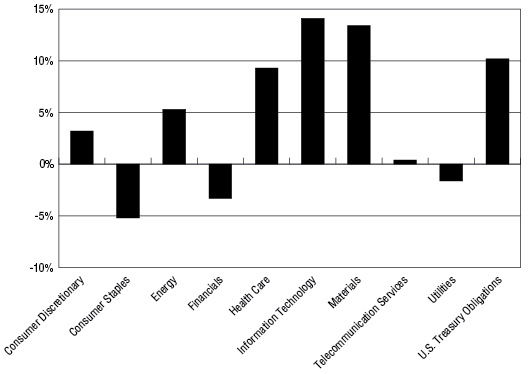

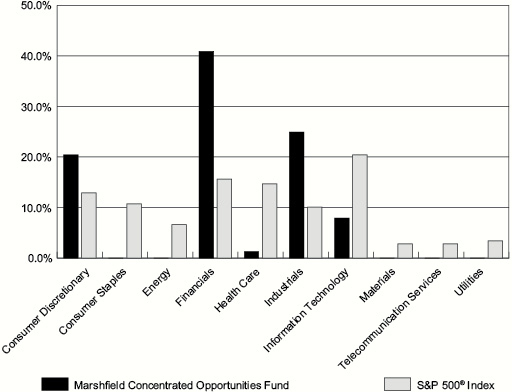

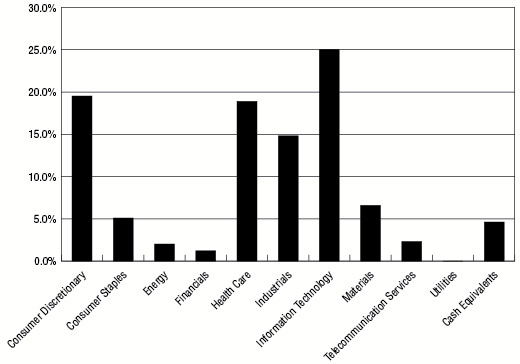

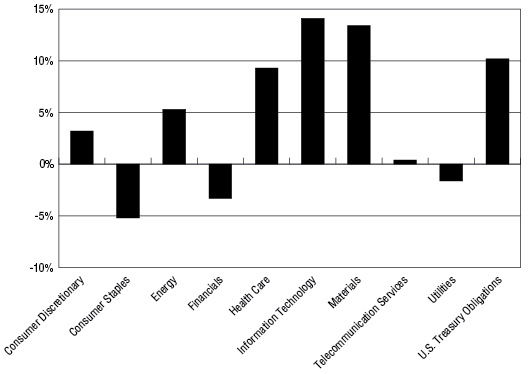

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

Security Description | % of Net Assets |

Prestige Brands Holdings, Inc. | 1.5% |

Haverty Furniture Companies, Inc. | 1.4% |

FairPoint Communications, Inc. | 1.4% |

Alpha & Omega Semiconductor Ltd. | 1.3% |

DHI Group, Inc. | 1.3% |

Dean Foods Company | 1.2% |

Chase Corporation | 1.2% |

Bridgepoint Education, Inc. | 1.1% |

ManTech International Corporation - Class A | 1.1% |

Greif, Inc. - Class A | 1.0% |

4

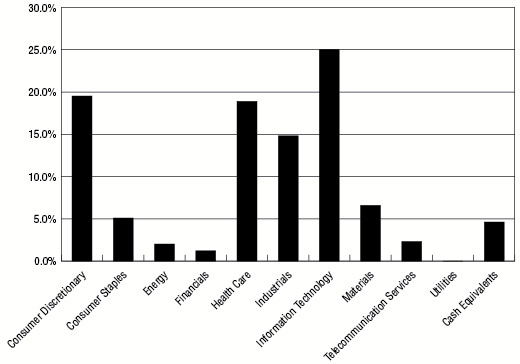

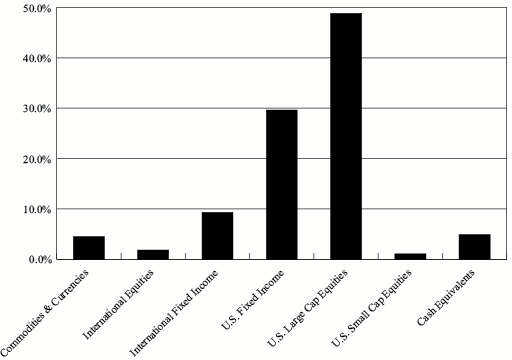

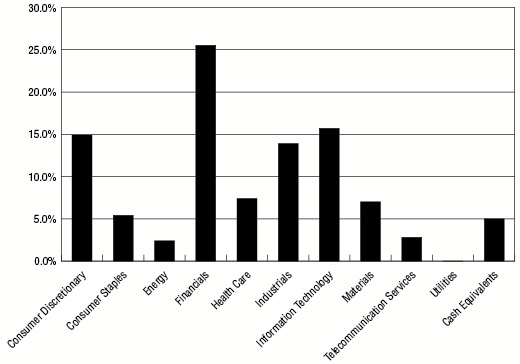

ALAMBIC SMALL CAP GROWTH PLUS FUND

PORTFOLIO INFORMATION

February 29, 2016 (Unaudited)

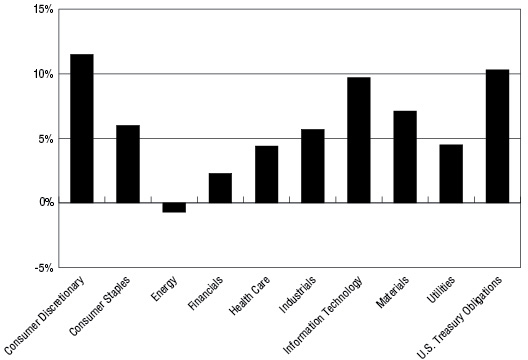

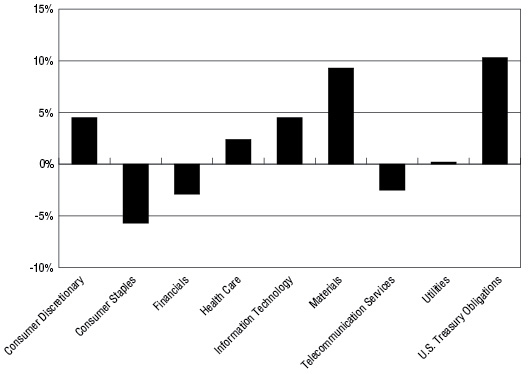

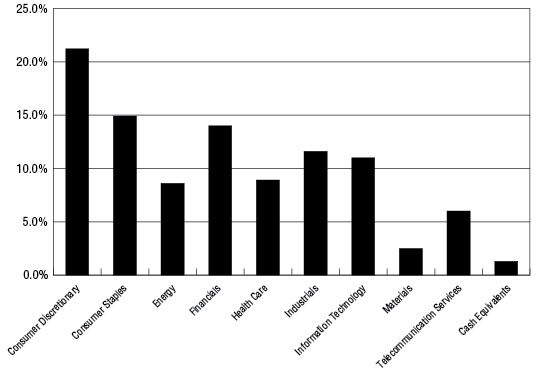

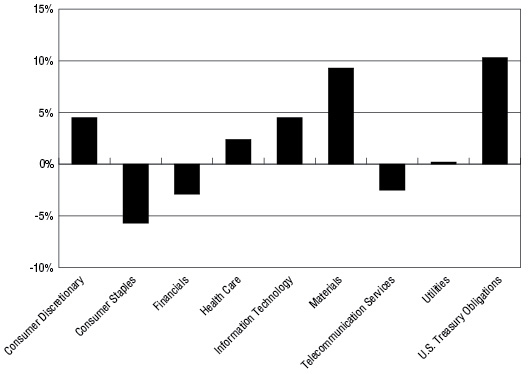

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

Security Description | % of Net Assets |

Greif, Inc. - Class A | 1.2% |

Del Taco Restaurants, Inc. | 1.2% |

Dean Foods Company | 1.1% |

EVERTEC, Inc. | 1.0% |

Vitamin Shoppe, Inc. | 0.9% |

Prestige Brands Holdings, Inc. | 0.9% |

Knowles Corporation | 0.9% |

Syntel, Inc. | 0.9% |

Axiall Corporation | 0.9% |

Carlisle Companies, Inc. | 0.8% |

5

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS

February 29, 2016 (Unaudited) |

COMMON STOCKS — 95.0% | | Shares | | | Value | |

Consumer Discretionary — 14.9% | | | | | | |

Distributors — 0.3% | | | | | | |

Weyco Group, Inc. | | | 200 | | | $ | 5,444 | |

| | | | | | | | | |

Diversified Consumer Services — 1.3% | | | | | | | | |

Bridgepoint Education, Inc. (a) | | | 3,400 | | | | 21,522 | |

K12, Inc. (a) | | | 300 | | | | 2,937 | |

| | | | | | | | 24,459 | |

Hotels, Restaurants & Leisure — 4.4% | | | | | | | | |

Caesars Acquisition Company - Class A (a) | | | 1,500 | | | | 9,090 | |

Carrols Restaurant Group, Inc. (a) | | | 1,000 | | | | 13,270 | |

Century Casinos, Inc. (a) | | | 2,600 | | | | 17,498 | |

Del Taco Restaurants, Inc. (a) | | | 900 | | | | 9,747 | |

J. Alexander's Holdings, Inc. (a) | | | 300 | | | | 3,114 | |

Monarch Casino & Resort, Inc. (a) | | | 200 | | | | 4,024 | |

Potbelly Corporation (a) | | | 1,100 | | | | 13,805 | |

Ruby Tuesday, Inc. (a) | | | 100 | | | | 529 | |

Speedway Motorsports, Inc. | | | 700 | | | | 12,754 | |

| | | | | | | | 83,831 | |

Household Durables — 1.0% | | | | | | | | |

CSS Industries, Inc. | | | 200 | | | | 5,414 | |

Ethan Allen Interiors, Inc. | | | 150 | | | | 4,280 | |

iRobot Corporation (a) | | | 200 | | | | 6,268 | |

Lifetime Brands, Inc. | | | 300 | | | | 3,588 | |

Skullcandy, Inc. (a) | | | 100 | | | | 354 | |

| | | | | | | | 19,904 | |

Internet & Catalog Retail — 1.0% | | | | | | | | |

1-800-FLOWERS.COM, Inc. - Class A (a) | | | 400 | | | | 3,124 | |

Gaiam, Inc. - Class A (a) | | | 500 | | | | 2,835 | |

PetMed Express, Inc. | | | 300 | | | | 4,950 | |

Shutterfly, Inc. (a) | | | 200 | | | | 8,888 | |

| | | | | | | | 19,797 | |

Leisure Products — 0.1% | | | | | | | | |

JAKKS Pacific, Inc. (a) | | | 300 | | | | 2,172 | |

| | | | | | | | | |

Media — 1.2% | | | | | | | | |

A.H. Belo Corporation - Class A | | | 535 | | | | 3,199 | |

Crown Media Holdings, Inc. - Class A (a) | | | 700 | | | | 3,073 | |

Discovery Communications, Inc. - Series A (a) | | | 100 | | | | 2,500 | |

Lee Enterprises, Inc. (a) | | | 3,400 | | | | 4,522 | |

Starz - Series A (a) | | | 200 | | | | 5,038 | |

Time, Inc. | | | 300 | | | | 4,230 | |

| | | | | | | | 22,562 | |

6

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 14.9% (Continued) | | | | | | |

Multiline Retail — 0.9% | | | | | | |

Tuesday Morning Corporation (a) | | | 2,400 | | | $ | 16,152 | |

| | | | | | | | | |

Specialty Retail — 4.2% | | | | | | | | |

Barnes & Noble Education, Inc. (a) | | | 1,200 | | | | 12,816 | |

Christopher & Banks Corporation (a) | | | 2,500 | | | | 3,525 | |

Haverty Furniture Companies, Inc. | | | 1,400 | | | | 27,216 | |

Office Depot, Inc. (a) | | | 800 | | | | 4,064 | |

Outerwall, Inc. | | | 150 | | | | 4,678 | |

Rent-A-Center, Inc. | | | 900 | | | | 11,493 | |

Tilly's, Inc. - Class A (a) | | | 100 | | | | 719 | |

West Marine, Inc. (a) | | | 400 | | | | 3,272 | |

Zumiez, Inc. (a) | | | 600 | | | | 12,396 | |

| | | | | | | | 80,179 | |

Textiles, Apparel & Luxury Goods — 0.5% | | | | | | | | |

Movado Group, Inc. | | | 300 | | | | 8,763 | |

| | | | | | | | | |

Consumer Staples — 5.4% | | | | | | | | |

Food & Staples Retailing — 1.6% | | | | | | | | |

SUPERVALU, Inc. (a) | | | 3,800 | | | | 19,418 | |

Village Super Market, Inc. - Class A | | | 400 | | | | 10,604 | |

| | | | | | | | 30,022 | |

Food Products — 2.6% | | | | | | | | |

Dean Foods Company | | | 1,200 | | | | 23,148 | |

Farmer Brothers Company (a) | | | 600 | | | | 15,816 | |

John B. Sanfilippo & Son, Inc. | | | 20 | | | | 1,392 | |

Seaboard Corporation (a) | | | 3 | | | | 8,775 | |

Seneca Foods Corporation - Class A (a) | | | 50 | | | | 1,663 | |

| | | | | | | | 50,794 | |

Household Products — 1.2% | | | | | | | | |

Energizer Holdings, Inc. | | | 200 | | | | 7,788 | |

Oil-Dri Corporation of America | | | 400 | | | | 14,736 | |

| | | | | | | | 22,524 | |

Energy — 2.4% | | | | | | | | |

Energy Equipment & Services — 1.2% | | | | | | | | |

Dawson Geophysical Company (a) | | | 800 | | | | 2,728 | |

Gulf Island Fabrication, Inc. | | | 400 | | | | 3,564 | |

PHI, Inc. (a) | | | 400 | | | | 7,296 | |

RigNet, Inc. (a) | | | 400 | | | | 5,280 | |

Unit Corporation (a) | | | 700 | | | | 3,752 | |

| | | | | | | | 22,620 | |

7

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Energy — 2.4% (Continued) | | | | | | |

Oil, Gas & Consumable Fuels — 1.2% | | | | | | |

Adams Resources & Energy, Inc. | | | 50 | | | $ | 1,636 | |

Alon USA Energy, Inc. | | | 400 | | | | 3,944 | |

Cloud Peak Energy, Inc. (a) | | | 1,400 | | | | 2,380 | |

EP Energy Corporation - Class A (a) | | | 4,300 | | | | 7,396 | |

Marathon Petroleum Corporation | | | 150 | | | | 5,138 | |

PBF Energy, Inc. - Class A | | | 50 | | | | 1,510 | |

Whiting Petroleum Corporation (a) | | | 300 | | | | 1,203 | |

| | | | | | | | 23,207 | |

Financials — 25.5% | | | | | | | | |

Banks — 10.9% | | | | | | | | |

BancorpSouth, Inc. | | | 100 | | | | 1,992 | |

Bank of the Ozarks, Inc. | | | 150 | | | | 5,676 | |

BankUnited, Inc. | | | 200 | | | | 6,424 | |

BOK Financial Corporation | | | 100 | | | | 4,887 | |

Cathay General Bancorp | | | 200 | | | | 5,338 | |

Citigroup, Inc. | | | 150 | | | | 5,827 | |

Commerce Bancshares, Inc. | | | 262 | | | | 11,130 | |

Cullen/Frost Bankers, Inc. | | | 150 | | | | 7,189 | |

East West Bancorp, Inc. | | | 350 | | | | 10,489 | |

F.N.B. Corporation | | | 100 | | | | 1,228 | |

First Citizens BancShares, Inc. - Class A | | | 10 | | | | 2,341 | |

First Financial Bankshares, Inc. | | | 100 | | | | 2,641 | |

First Horizon National Corporation | | | 300 | | | | 3,606 | |

First Niagara Financial Group, Inc. | | | 300 | | | | 2,772 | |

FirstMerit Corporation | | | 400 | | | | 7,852 | |

Hancock Holding Company | | | 200 | | | | 4,614 | |

Hilltop Holdings, Inc. (a) | | | 100 | | | | 1,668 | |

IBERIABANK Corporation | | | 50 | | | | 2,384 | |

Investors Bancorp, Inc. | | | 300 | | | | 3,396 | |

MB Financial, Inc. | | | 300 | | | | 9,156 | |

PacWest Bancorp | | | 300 | | | | 9,654 | |

People's United Financial, Inc. | | | 200 | | | | 2,922 | |

Pinnacle Financial Partners, Inc. | | | 100 | | | | 4,637 | |

PrivateBancorp, Inc. | | | 50 | | | | 1,718 | |

Prosperity Bancshares, Inc. | | | 350 | | | | 14,158 | |

Sterling Bancorp | | | 300 | | | | 4,323 | |

SVB Financial Group (a) | | | 100 | | | | 8,885 | |

Synovus Financial Corporation | | | 350 | | | | 9,307 | |

Texas Capital Bancshares, Inc. (a) | | | 100 | | | | 3,233 | |

U.S. Bancorp | | | 100 | | | | 3,852 | |

UMB Financial Corporation | | | 50 | | | | 2,456 | |

8

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Financials — 25.5% (Continued) | | | | | | |

Banks — 10.9% (Continued) | | | | | | |

Umpqua Holdings Corporation | | | 1,100 | | | $ | 16,544 | |

United Bankshares, Inc. | | | 100 | | | | 3,504 | |

Webster Financial Corporation | | | 200 | | | | 6,722 | |

Wells Fargo & Company | | | 60 | | | | 2,815 | |

Western Alliance Bancorp (a) | | | 150 | | | | 4,458 | |

Zions Bancorporation | | | 400 | | | | 8,528 | |

| | | | | | | | 208,326 | |

Capital Markets — 0.4% | | | | | | | | |

American Capital Ltd. (a) | | | 200 | | | | 2,738 | |

Charles Schwab Corporation (The) | | | 150 | | | | 3,758 | |

| | | | | | | | 6,496 | |

Consumer Finance — 0.2% | | | | | | | | |

OneMain Holdings, Inc. (a) | | | 200 | | | | 4,514 | |

| | | | | | | | | |

Diversified Financial Services — 0.9% | | | | | | | | |

Intercontinental Exchange, Inc. | | | 30 | | | | 7,154 | |

Leucadia National Corporation | | | 400 | | | | 5,780 | |

MarketAxess Holdings, Inc. | | | 40 | | | | 4,738 | |

| | | | | | | | 17,672 | |

Insurance — 2.0% | | | | | | | | |

Assurant, Inc. | | | 20 | | | | 1,422 | |

Brown & Brown, Inc. | | | 300 | | | | 9,693 | |

CNO Financial Group, Inc. | | | 800 | | | | 13,944 | |

Marsh & McLennan Companies, Inc. | | | 120 | | | | 6,846 | |

Primerica, Inc. | | | 50 | | | | 2,109 | |

RLI Corporation | | | 50 | | | | 3,139 | |

| | | | | | | | 37,153 | |

Real Estate Investment Trusts (REITs) — 11.1% | | | | | | | | |

Acadia Realty Trust | | | 500 | | | | 16,525 | |

Alexander's, Inc. | | | 10 | | | | 3,848 | |

Altisource Residential Corporation | | | 100 | | | | 938 | |

American Campus Communities, Inc. | | | 150 | | | | 6,565 | |

American Tower Corporation | | | 70 | | | | 6,454 | |

AvalonBay Communities, Inc. | | | 30 | | | | 5,149 | |

Capstead Mortgage Corporation | | | 600 | | | | 5,826 | |

Communications Sales & Leasing, Inc. | | | 100 | | | | 1,885 | |

Crown Castle International Corporation | | | 20 | | | | 1,730 | |

CubeSmart | | | 400 | | | | 11,960 | |

CyrusOne, Inc. | | | 100 | | | | 3,964 | |

DCT Industrial Trust, Inc. | | | 150 | | | | 5,429 | |

Douglas Emmett, Inc. | | | 100 | | | | 2,684 | |

9

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Financials — 25.5% (Continued) | | | | | | |

Real Estate Investment Trusts (REITs) — 11.1% (Continued) | | | | | | |

Education Realty Trust, Inc. | | | 250 | | | $ | 9,913 | |

Equity One, Inc. | | | 200 | | | | 5,482 | |

Equity Residential | | | 60 | | | | 4,469 | |

Extra Space Storage, Inc. | | | 120 | | | | 9,858 | |

Federal Realty Investment Trust | | | 50 | | | | 7,403 | |

Forest City Realty Trust, Inc. - Class A (a) | | | 200 | | | | 3,730 | |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 650 | | | | 11,447 | |

Kilroy Realty Corporation | | | 140 | | | | 7,598 | |

Ladder Capital Corporation | | | 319 | | | | 3,298 | |

MFA Financial, Inc. | | | 700 | | | | 4,767 | |

Paramount Group, Inc. | | | 200 | | | | 3,024 | |

Physicians Realty Trust | | | 200 | | | | 3,436 | |

Prologis, Inc. | | | 350 | | | | 13,461 | |

Public Storage | | | 50 | | | | 12,475 | |

Simon Property Group, Inc. | | | 25 | | | | 4,743 | |

Sovran Self Storage, Inc. | | | 60 | | | | 6,386 | |

Starwood Property Trust, Inc. | | | 100 | | | | 1,754 | |

STORE Capital Corporation | | | 500 | | | | 12,075 | |

Taubman Centers, Inc. | | | 100 | | | | 7,082 | |

Two Harbors Investment Corporation | | | 300 | | | | 2,325 | |

Vornado Realty Trust | | | 20 | | | | 1,727 | |

Weingarten Realty Investors | | | 50 | | | | 1,762 | |

| | | | | | | | 211,172 | |

Health Care — 7.4% | | | | | | | | |

Biotechnology — 1.7% | | | | | | | | |

Acorda Therapeutics, Inc. (a) | | | 100 | | | | 3,271 | |

Aegerion Pharmaceuticals, Inc. (a) | | | 300 | | | | 1,692 | |

ArQule, Inc. (a) | | | 400 | | | | 756 | |

aTyr Pharma, Inc. (a) | | | 300 | | | | 1,341 | |

Catabasis Pharmaceuticals, Inc. (a) | | | 800 | | | | 3,360 | |

Emergent BioSolutions, Inc. (a) | | | 100 | | | | 3,383 | |

Myriad Genetics, Inc. (a) | | | 50 | | | | 1,750 | |

PDL BioPharma, Inc. | | | 2,100 | | | | 6,321 | |

Rigel Pharmaceuticals, Inc. (a) | | | 4,600 | | | | 10,442 | |

| | | | | | | | 32,316 | |

Health Care Equipment & Supplies — 1.5% | | | | | | | | |

Accuray, Inc. (a) | | | 900 | | | | 4,545 | |

CryoLife, Inc. | | | 400 | | | | 4,284 | |

Exactech, Inc. (a) | | | 700 | | | | 13,055 | |

FONAR Corporation (a) | | | 100 | | | | 1,644 | |

Halyard Health, Inc. (a) | | | 100 | | | | 2,552 | |

10

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Health Care — 7.4% (Continued) | | | | | | |

Health Care Equipment & Supplies — 1.5% (Continued) | | | | | | |

Natus Medical, Inc. (a) | | | 50 | | | $ | 1,816 | |

| | | | | | | | 27,896 | |

Health Care Providers & Services — 1.4% | | | | | | | | |

Alliance HealthCare Services, Inc. (a) | | | 500 | | | | 3,575 | |

Cross Country Healthcare, Inc. (a) | | | 100 | | | | 1,241 | |

Express Scripts Holding Company (a) | | | 60 | | | | 4,223 | |

Five Star Quality Care, Inc. (a) | | | 3,900 | | | | 9,243 | |

Healthways, Inc. (a) | | | 300 | | | | 3,159 | |

RadNet, Inc. (a) | | | 900 | | | | 5,130 | |

| | | | | | | | 26,571 | |

Health Care Technology — 0.9% | | | | | | | | |

Allscripts Healthcare Solutions, Inc. (a) | | | 800 | | | | 10,016 | |

Quality Systems, Inc. | | | 500 | | | | 7,775 | |

| | | | | | | | 17,791 | |

Pharmaceuticals — 1.9% | | | | | | | | |

AcelRx Pharmaceuticals, Inc. (a) | | | 500 | | | | 1,855 | |

Juniper Pharmaceuticals, Inc. (a) | | | 300 | | | | 2,247 | |

Phibro Animal Health Corporation - Class A | | | 100 | | | | 2,766 | |

Prestige Brands Holdings, Inc. (a) | | | 590 | | | | 28,851 | |

Sagent Pharmaceuticals, Inc. (a) | | | 100 | | | | 1,418 | |

| | | | | | | | 37,137 | |

Industrials — 13.9% | | | | | | | | |

Aerospace & Defense — 2.4% | | | | | | | | |

AAR Corporation | | | 800 | | | | 17,032 | |

Astronics Corporation (a) | | | 250 | | | | 7,952 | |

Moog, Inc. - Class A (a) | | | 100 | | | | 4,318 | |

Vectrus, Inc. (a) | | | 900 | | | | 17,325 | |

| | | | | | | | 46,627 | |

Building Products — 0.9% | | | | | | | | |

Ply Gem Holdings, Inc. (a) | | | 1,400 | | | | 14,280 | |

Quanex Building Products Corporation | | | 200 | | | | 3,444 | |

| | | | | | | | 17,724 | |

Commercial Services & Supplies — 2.2% | | | | | | | | |

ACCO Brands Corporation (a) | | | 1,900 | | | | 13,889 | |

ARC Document Solutions, Inc. (a) | | | 2,500 | | | | 8,750 | |

Brink's Company (The) | | | 100 | | | | 2,925 | |

Ennis, Inc. | | | 100 | | | | 1,974 | |

Kimball International, Inc. - Class B | | | 700 | | | | 7,371 | |

Quad/Graphics, Inc. | | | 500 | | | | 6,330 | |

| | | | | | | | 41,239 | |

11

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Industrials — 13.9% (Continued) | | | | | | |

Construction & Engineering — 0.4% | | | | | | |

Sterling Construction Company, Inc. (a) | | | 1,500 | | | $ | 8,100 | |

| | | | | | | | | |

Electrical Equipment — 1.1% | | | | | | | | |

Allied Motion Technologies, Inc. | | | 500 | | | | 9,230 | |

General Cable Corporation | | | 1,100 | | | | 9,449 | |

Preformed Line Products Company | | | 50 | | | | 1,635 | |

| | | | | | | | 20,314 | |

Machinery — 3.7% | | | | | | | | |

Alamo Group, Inc. | | | 50 | | | | 2,594 | |

Albany International Corporation - Class A | | | 500 | | | | 18,310 | |

Commercial Vehicle Group, Inc. (a) | | | 3,800 | | | | 9,538 | |

Eastern Company (The) | | | 100 | | | | 1,584 | |

FreightCar America, Inc. | | | 400 | | | | 5,948 | |

Hurco Companies, Inc. | | | 200 | | | | 5,190 | |

Kadant, Inc. | | | 300 | | | | 11,451 | |

L.B. Foster Company - Class A | | | 300 | | | | 4,122 | |

L.S. Starrett Company (The) - Class A | | | 200 | | | | 1,886 | |

Lydall, Inc. (a) | | | 100 | | | | 2,895 | |

Navistar International Corporation (a) | | | 900 | | | | 7,569 | |

| | | | | | | | 71,087 | |

Marine — 0.1% | | | | | | | | |

Matson, Inc. | | | 50 | | | | 2,005 | |

| | | | | | | | | |

Professional Services — 1.2% | | | | | | | | |

Acacia Research Corporation | | | 1,100 | | | | 3,476 | |

Kforce, Inc. | | | 600 | | | | 9,564 | |

Resources Connection, Inc. | | | 700 | | | | 9,709 | |

| | | | | | | | 22,749 | |

Road & Rail — 0.8% | | | | | | | | |

ArcBest Corporation | | | 400 | | | | 7,828 | |

Avis Budget Group, Inc. (a) | | | 100 | | | | 2,564 | |

Hertz Global Holdings, Inc. (a) | | | 300 | | | | 2,550 | |

Swift Transportation Company (a) | | | 100 | | | | 1,704 | |

| | | | | | | | 14,646 | |

Trading Companies & Distributors — 0.4% | | | | | | | | |

WESCO International, Inc. (a) | | | 150 | | | | 6,608 | |

| | | | | | | | | |

Transportation Infrastructure — 0.7% | | | | | | | | |

Wesco Aircraft Holdings, Inc. (a) | | | 1,000 | | | | 12,790 | |

12

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Information Technology — 15.7% | | | | | | |

Communications Equipment — 1.1% | | | | | | |

Arris International plc (a) | | | 300 | | | $ | 7,167 | |

Bel Fuse, Inc. - Class B | | | 100 | | | | 1,485 | |

Digi International, Inc. (a) | | | 400 | | | | 3,396 | |

Extreme Networks, Inc. (a) | | | 2,300 | | | | 6,486 | |

Polycom, Inc. (a) | | | 100 | | | | 1,041 | |

Sonus Networks, Inc. (a) | | | 300 | | | | 2,337 | |

| | | | | | | | 21,912 | |

Electronic Equipment, Instruments & Components — 0.8% | | | | | | | | |

Identiv, Inc. (a) | | | 700 | | | | 1,533 | |

KEMET Corporation (a) | | | 300 | | | | 552 | |

Knowles Corporation (a) | | | 500 | | | | 5,690 | |

QLogic Corporation (a) | | | 300 | | | | 3,867 | |

Radisys Corporation (a) | | | 1,700 | | | | 4,386 | |

| | | | | | | | 16,028 | |

Internet Software & Services — 4.0% | | | | | | | | |

Carbonite, Inc. (a) | | | 100 | | | | 757 | |

DHI Group, Inc. (a) | | | 3,100 | | | | 24,118 | |

EarthLink Holdings Corporation | | | 700 | | | | 3,948 | |

Marchex, Inc. - Class B | | | 3,200 | | | | 13,728 | |

Marin Software, Inc. (a) | | | 1,500 | | | | 4,500 | |

Match Group, Inc. (a) | | | 300 | | | | 3,267 | |

Monster Worldwide, Inc. (a) | | | 2,800 | | | | 8,344 | |

Travelzoo, Inc. (a) | | | 200 | | | | 1,570 | |

United Online, Inc. (a) | | | 800 | | | | 9,848 | |

XO Group, Inc. (a) | | | 400 | | | | 5,712 | |

| | | | | | | | 75,792 | |

IT Services — 3.1% | | | | | | | | |

Computer Task Group, Inc. | | | 2,800 | | | | 13,244 | |

CSG Systems International, Inc. | | | 300 | | | | 11,388 | |

Datalink Corporation (a) | | | 600 | | | | 4,296 | |

Everi Holdings, Inc. (a) | | | 1,200 | | | | 3,528 | |

Higher One Holdings, Inc. (a) | | | 200 | | | | 860 | |

ManTech International Corporation - Class A | | | 700 | | | | 20,391 | |

Unisys Corporation (a) | | | 500 | | | | 5,385 | |

| | | | | | | | 59,092 | |

Semiconductors & Semiconductor Equipment — 3.3% | | | | | | | | |

Advanced Energy Industries, Inc. (a) | | | 50 | | | | 1,491 | |

Alpha & Omega Semiconductor Ltd. (a) | | | 2,100 | | | | 24,843 | |

Axcelis Technologies, Inc. (a) | | | 5,600 | | | | 14,000 | |

IXYS Corporation | | | 1,000 | | | | 11,280 | |

Sigma Designs, Inc. (a) | | | 500 | | | | 3,440 | |

13

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

Information Technology — 15.7% (Continued) | | | | | | |

Semiconductors & Semiconductor Equipment — 3.3% (Continued) | | | | | | |

SunEdison Semiconductor Ltd. (a) | | | 1,200 | | | $ | 8,196 | |

| | | | | | | | 63,250 | |

Software — 2.7% | | | | | | | | |

ACI Worldwide, Inc. (a) | | | 300 | | | | 5,598 | |

American Software, Inc. - Class A | | | 1,900 | | | | 17,860 | |

BSQUARE Corporation (a) | | | 400 | | | | 2,280 | |

EnerNOC, Inc. (a) | | | 400 | | | | 2,456 | |

GlobalSCAPE, Inc. | | | 300 | | | | 1,131 | |

Glu Mobile, Inc. (a) | | | 2,200 | | | | 8,162 | |

MicroStrategy, Inc. - Class A (a) | | | 30 | | | | 4,827 | |

Progress Software Corporation (a) | | | 100 | | | | 2,522 | |

QAD, Inc. - Class A | | | 200 | | | | 3,914 | |

Rovi Corporation (a) | | | 100 | | | | 2,278 | |

| | | | | | | | 51,028 | |

Technology Hardware, Storage & Peripherals — 0.7% | | | | | | | | |

HP, Inc. | | | 1,200 | | | | 12,828 | |

| | | | | | | | | |

Materials — 7.0% | | | | | | | | |

Chemicals — 4.6% | | | | | | | | |

AgroFresh Solutions, Inc. (a) | | | 2,500 | | | | 12,225 | |

Chase Corporation | | | 490 | | | | 23,040 | |

Codexis, Inc. (a) | | | 1,100 | | | | 4,466 | |

Core Molding Technologies, Inc. (a) | | | 100 | | | | 1,138 | |

KMG Chemicals, Inc. | | | 200 | | | | 4,290 | |

OMNOVA Solutions, Inc. (a) | | | 2,630 | | | | 13,781 | |

Trecora Resources (a) | | | 300 | | | | 2,898 | |

Tredegar Corporation | | | 1,300 | | | | 17,849 | |

Trinseo S.A. (a) | | | 300 | | | | 8,943 | |

| | | | | | | | 88,630 | |

Construction Materials — 0.5% | | | | | | | | |

United States Lime & Minerals, Inc. | | | 170 | | | | 9,040 | |

| | | | | | | | | |

Containers & Packaging — 1.2% | | | | | | | | |

AEP Industries, Inc. | | | 20 | | | | 1,574 | |

Greif, Inc. - Class A | | | 750 | | | | 19,883 | |

UFP Technologies, Inc. (a) | | | 100 | | | | 2,237 | |

| | | | | | | | 23,694 | |

Metals & Mining — 0.7% | | | | | | | | |

Commercial Metals Company | | | 200 | | | | 2,938 | |

Handy & Harman Ltd. (a) | | | 100 | | | | 1,995 | |

Materion Corporation | | | 300 | | | | 7,824 | |

| | | | | | | | 12,757 | |

14

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 95.0% (Continued) | | Shares | | | Value | |

| Telecommunication Services — 2.8% | | | | | | |

| Diversified Telecommunication Services — 1.9% | | | | | | |

| CenturyLink, Inc. | | | 100 | | | $ | 3,059 | |

FairPoint Communications, Inc. (a) | | | 1,800 | | | | 27,054 | |

| Windstream Holdings, Inc. | | | 800 | | | | 6,016 | |

| | | | | | | | 36,129 | |

| Wireless Telecommunication Services — 0.9% | | | | | | | | |

Spōk Holdings, Inc. | | | 1,000 | | | | 17,720 | |

| | | | | | | | | |

Total Common Stocks — 95.0% (Cost $1,763,341) | | | | | | $ | 1,811,263 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 5.0% | | | | | | | 94,696 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,905,959 | |

(a) | Non-income producing security. |

See accompanying notes to financial statements. |

15

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS

February 29, 2016 (Unaudited) |

COMMON STOCKS — 95.4% | | Shares | | | Value | |

Consumer Discretionary — 19.5% | | | | | | |

Auto Components — 1.3% | | | | | | |

Dana Holding Corporation | | | 300 | | | $ | 3,732 | |

Goodyear Tire & Rubber Company (The) | | | 300 | | | | 9,036 | |

Tenneco, Inc. (a) | | | 60 | | | | 2,731 | |

| | | | | | | | 15,499 | |

Distributors — 0.4% | | | | | | | | |

Weyco Group, Inc. | | | 150 | | | | 4,083 | |

| | | | | | | | | |

Diversified Consumer Services — 0.3% | | | | | | | | |

Bridgepoint Education, Inc. (a) | | | 317 | | | | 2,007 | |

K12, Inc. (a) | | | 200 | | | | 1,958 | |

| | | | | | | | 3,965 | |

Hotels, Restaurants & Leisure — 3.8% | | | | | | | | |

Caesars Acquisition Company - Class A (a) | | | 500 | | | | 3,030 | |

Carrols Restaurant Group, Inc. (a) | | | 300 | | | | 3,981 | |

Del Taco Restaurants, Inc. (a) | | | 1,300 | | | | 14,079 | |

Hyatt Hotels Corporation - Class A (a) | | | 120 | | | | 5,538 | |

Isle of Capri Casinos, Inc. (a) | | | 400 | | | | 4,540 | |

J. Alexander's Holdings, Inc. (a) | | | 200 | | | | 2,076 | |

Monarch Casino & Resort, Inc. (a) | | | 50 | | | | 1,006 | |

Nathan's Famous, Inc. | | | 100 | | | | 5,051 | |

Potbelly Corporation (a) | | | 200 | | | | 2,510 | |

Scientific Games Corporation - Class A (a) | | | 300 | | | | 2,553 | |

| | | | | | | | 44,364 | |

Household Durables — 2.7% | | | | | | | | |

CSS Industries, Inc. | | | 180 | | | | 4,873 | |

Ethan Allen Interiors, Inc. | | | 50 | | | | 1,426 | |

Hovnanian Enterprises, Inc. - Class A (a) | | | 1,500 | | | | 2,265 | |

iRobot Corporation (a) | | | 150 | | | | 4,701 | |

La-Z-Boy, Inc. | | | 300 | | | | 7,305 | |

Lifetime Brands, Inc. | | | 300 | | | | 3,588 | |

Skullcandy, Inc. (a) | | | 600 | | | | 2,124 | |

Tempur Sealy International, Inc. (a) | | | 40 | | | | 2,307 | |

ZAGG, Inc. (a) | | | 300 | | | | 3,126 | |

| | | | | | | | 31,715 | |

Internet & Catalog Retail — 1.4% | | | | | | | | |

Gaiam, Inc. - Class A (a) | | | 500 | | | | 2,835 | |

NutriSystem, Inc. | | | 400 | | | | 8,140 | |

PetMed Express, Inc. | | | 300 | | | | 4,950 | |

| | | | | | | | 15,925 | |

16

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 19.5% (Continued) | | | | | | |

Leisure Products — 0.5% | | | | | | |

JAKKS Pacific, Inc. (a) | | | 400 | | | $ | 2,896 | |

Johnson Outdoors, Inc. - Class A | | | 150 | | | | 3,290 | |

| | | | | | | | 6,186 | |

Media — 3.3% | | | | | | | | |

Crown Media Holdings, Inc. - Class A (a) | | | 1,700 | | | | 7,463 | |

Discovery Communications, Inc. - Series A (a) | | | 150 | | | | 3,750 | |

Harte-Hanks, Inc. | | | 2,300 | | | | 7,107 | |

Lee Enterprises, Inc. (a) | | | 2,400 | | | | 3,192 | |

MSG Networks, Inc. - Class A (a) | | | 500 | | | | 8,210 | |

Time, Inc. | | | 600 | | | | 8,460 | |

| | | | | | | | 38,182 | |

Multiline Retail — 0.7% | | | | | | | | |

Fred's, Inc. - Class A | | | 300 | | | | 4,287 | |

Tuesday Morning Corporation (a) | | | 600 | | | | 4,038 | |

| | | | | | | | 8,325 | |

Specialty Retail — 4.5% | | | | | | | | |

American Eagle Outfitters, Inc. | | | 200 | | | | 3,052 | |

Barnes & Noble Education, Inc. (a) | | | 200 | | | | 2,136 | |

Buckle, Inc. (The) | | | 150 | | | | 4,770 | |

Christopher & Banks Corporation (a) | | | 3,500 | | | | 4,935 | |

Haverty Furniture Companies, Inc. | | | 500 | | | | 9,720 | |

Murphy USA, Inc. (a) | | | 20 | | | | 1,274 | |

Office Depot, Inc. (a) | | | 800 | | | | 4,064 | |

Rent-A-Center, Inc. | | | 100 | | | | 1,277 | |

Shoe Carnival, Inc. | | | 100 | | | | 2,357 | |

Staples, Inc. | | | 600 | | | | 5,670 | |

Tilly's, Inc. - Class A (a) | | | 300 | | | | 2,157 | |

Vitamin Shoppe, Inc. (a) | | | 400 | | | | 11,036 | |

| | | | | | | | 52,448 | |

Textiles, Apparel & Luxury Goods — 0.6% | | | | | | | | |

Fossil Group, Inc. (a) | | | 140 | | | | 6,567 | |

| | | | | | | | | |

Consumer Staples — 5.1% | | | | | | | | |

Food & Staples Retailing — 0.8% | | | | | | | | |

SpartanNash Company | | | 200 | | | | 5,490 | |

SUPERVALU, Inc. (a) | | | 300 | | | | 1,533 | |

Village Super Market, Inc. - Class A | | | 100 | | | | 2,651 | |

| | | | | | | | 9,674 | |

Food Products — 2.9% | | | | | | | | |

Bunge Ltd. | | | 140 | | | | 6,961 | |

Dean Foods Company | | | 650 | | | | 12,539 | |

17

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Consumer Staples — 5.1% (Continued) | | | | | | |

Food Products — 2.9% (Continued) | | | | | | |

Farmer Brothers Company (a) | | | 240 | | | $ | 6,326 | |

General Mills, Inc. | | | 140 | | | | 8,239 | |

| | | | | | | | 34,065 | |

Household Products — 0.6% | | | | | | | | |

Energizer Holdings, Inc. | | | 80 | | | | 3,115 | |

Oil-Dri Corporation of America | | | 100 | | | | 3,684 | |

| | | | | | | | 6,799 | |

Personal Products — 0.8% | | | | | | | | |

Natural Alternatives International, Inc. (a) | | | 700 | | | | 8,666 | |

| | | | | | | | | |

Energy — 2.0% | | | | | | | | |

Energy Equipment & Services — 0.5% | | | | | | | | |

Dawson Geophysical Company (a) | | | 400 | | | | 1,364 | |

Gulf Island Fabrication, Inc. | | | 200 | | | | 1,782 | |

RigNet, Inc. (a) | | | 200 | | | | 2,640 | |

| | | | | | | | 5,786 | |

Oil, Gas & Consumable Fuels — 1.5% | | | | | | | | |

Alon USA Energy, Inc. | | | 350 | | | | 3,451 | |

EP Energy Corporation - Class A (a) | | | 2,300 | | | | 3,956 | |

Marathon Oil Corporation | | | 400 | | | | 3,284 | |

Murphy Oil Corporation | | | 150 | | | | 2,577 | |

ONEOK, Inc. | | | 150 | | | | 3,600 | |

| | | | | | | | 16,868 | |

Financials — 1.2% | | | | | | | | |

Capital Markets — 0.2% | | | | | | | | |

Charles Schwab Corporation (The) | | | 50 | | | | 1,252 | |

E*TRADE Financial Corporation (a) | | | 50 | | | | 1,173 | |

| | | | | | | | 2,425 | |

Consumer Finance — 0.1% | | | | | | | | |

OneMain Holdings, Inc. (a) | | | 50 | | | | 1,129 | |

| | | | | | | | | |

Insurance — 0.4% | | | | | | | | |

American Equity Investment Life Holding Company | | | 150 | | | | 2,040 | |

CNO Financial Group, Inc. | | | 100 | | | | 1,743 | |

Genworth Financial, Inc. - Class A (a) | | | 500 | | | | 1,060 | |

| | | | | | | | 4,843 | |

Real Estate Investment Trusts (REITs) — 0.5% | | | | | | | | |

Ladder Capital Corporation | | | 400 | | | | 4,136 | |

MFA Financial, Inc. | | | 200 | | | | 1,362 | |

| | | | | | | | 5,498 | |

18

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Health Care — 18.9% | | | | | | |

Biotechnology — 7.0% | | | | | | |

Acceleron Pharma, Inc. (a) | | | 60 | | | $ | 1,520 | |

Aegerion Pharmaceuticals, Inc. (a) | | | 800 | | | | 4,512 | |

Alder Biopharmaceuticals, Inc. (a) | | | 50 | | | | 949 | |

Alexion Pharmaceuticals, Inc. (a) | | | 10 | | | | 1,408 | |

Anacor Pharmaceuticals, Inc. (a) | | | 100 | | | | 6,378 | |

Anavex Life Sciences Corporation (a) | | | 300 | | | | 1,341 | |

Applied Genetic Technologies Corporation (a) | | | 100 | | | | 1,327 | |

ARCA biopharma, Inc. (a) | | | 300 | | | | 1,032 | |

ArQule, Inc. (a) | | | 1,600 | | | | 3,024 | |

Array BioPharma, Inc. (a) | | | 400 | | | | 1,004 | |

aTyr Pharma, Inc. (a) | | | 400 | | | | 1,788 | |

Baxalta, Inc. | | | 40 | | | | 1,541 | |

Biogen, Inc. (a) | | | 10 | | | | 2,594 | |

Catabasis Pharmaceuticals, Inc. (a) | | | 300 | | | | 1,260 | |

Cepheid, Inc. (a) | | | 100 | | | | 2,968 | |

ContraFect Corporation (a) | | | 200 | | | | 680 | |

Cytokinetics, Inc. (a) | | | 200 | | | | 1,260 | |

Emergent BioSolutions, Inc. (a) | | | 100 | | | | 3,383 | |

Exelixis, Inc. (a) | | | 500 | | | | 1,820 | |

Geron Corporation (a) | | | 500 | | | | 1,205 | |

Gilead Sciences, Inc. | | | 20 | | | | 1,745 | |

Halozyme Therapeutics, Inc. (a) | | | 400 | | | | 3,252 | |

Incyte Corporation (a) | | | 20 | | | | 1,470 | |

Inovio Pharmaceuticals, Inc. (a) | | | 200 | | | | 1,260 | |

Intrexon Corporation (a) | | | 100 | | | | 3,095 | |

Ionis Pharmaceuticals, Inc. (a) | | | 80 | | | | 2,765 | |

Ironwood Pharmaceuticals, Inc. (a) | | | 300 | | | | 2,895 | |

MacroGenics, Inc. (a) | | | 100 | | | | 1,598 | |

Medivation, Inc. (a) | | | 50 | | | | 1,788 | |

MiMedx Group, Inc. (a) | | | 300 | | | | 2,469 | |

Novavax, Inc. (a) | | | 200 | | | | 872 | |

Osiris Therapeutics, Inc. (a) | | | 100 | | | | 714 | |

Repligen Corporation (a) | | | 50 | | | | 1,287 | |

Retrophin, Inc. (a) | | | 150 | | | | 2,135 | |

Rigel Pharmaceuticals, Inc. (a) | | | 600 | | | | 1,362 | |

Sage Therapeutics, Inc. (a) | | | 60 | | | | 1,764 | |

Seattle Genetics, Inc. (a) | | | 160 | | | | 4,830 | |

Spectrum Pharmaceuticals, Inc. (a) | | | 300 | | | | 1,356 | |

Vanda Pharmaceuticals, Inc. (a) | | | 300 | | | | 2,355 | |

Vertex Pharmaceuticals, Inc. (a) | | | 20 | | | | 1,710 | |

| | | | | | | | 81,716 | |

19

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Health Care — 18.9% (Continued) | | | | | | |

Health Care Equipment & Supplies — 3.8% | | | | | | |

AngioDynamics, Inc. (a) | | | 900 | | | $ | 9,783 | |

Baxter International, Inc. | | | 40 | | | | 1,581 | |

DENTSPLY International, Inc. | | | 140 | | | | 8,534 | |

Exactech, Inc. (a) | | | 250 | | | | 4,663 | |

HeartWare International, Inc. (a) | | | 50 | | | | 1,598 | |

Hologic, Inc. (a) | | | 100 | | | | 3,463 | |

Integra LifeSciences Holdings Corporation (a) | | | 40 | | | | 2,454 | |

InVivo Therapeutics Holdings Corporation (a) | | | 1,000 | | | | 4,690 | |

Lantheus Holdings, Inc. (a) | | | 600 | | | | 1,272 | |

SurModics, Inc. (a) | | | 300 | | | | 5,598 | |

| | | | | | | | 43,636 | |

Health Care Providers & Services — 2.7% | | | | | | | | |

Alliance HealthCare Services, Inc. (a) | | | 400 | | | | 2,860 | |

BioTelemetry, Inc. (a) | | | 400 | | | | 4,824 | |

Express Scripts Holding Company (a) | | | 60 | | | | 4,223 | |

Health Net, Inc. (a) | | | 20 | | | | 1,244 | |

Healthways, Inc. (a) | | | 100 | | | | 1,053 | |

HMS Holdings Corporation (a) | | | 300 | | | | 3,951 | |

Landauer, Inc. | | | 50 | | | | 1,454 | |

National Research Corporation - Class A | | | 285 | | | | 4,266 | |

Quest Diagnostics, Inc. | | | 80 | | | | 5,322 | |

RadNet, Inc. (a) | | | 300 | | | | 1,710 | |

VCA, Inc. (a) | | | 20 | | | | 1,021 | |

| | | | | | | | 31,928 | |

Health Care Technology — 1.1% | | | | | | | | |

IMS Health Holdings, Inc. (a) | | | 200 | | | | 5,156 | |

Omnicell, Inc. (a) | | | 50 | | | | 1,369 | |

Quality Systems, Inc. | | | 400 | | | | 6,220 | |

| | | | | | | | 12,745 | |

Life Sciences Tools & Services — 1.4% | | | | | | | | |

Bruker Corporation (a) | | | 150 | | | | 3,897 | |

Charles River Laboratories International, Inc. (a) | | | 30 | | | | 2,203 | |

PAREXEL International Corporation (a) | | | 40 | | | | 2,347 | |

PerkinElmer, Inc. | | | 160 | | | | 7,562 | |

| | | | | | | | 16,009 | |

Pharmaceuticals — 2.9% | | | | | | | | |

AbbVie, Inc. | | | 20 | | | | 1,092 | |

Bristol-Myers Squibb Company | | | 60 | | | | 3,716 | |

Cempra, Inc. (a) | | | 150 | | | | 2,524 | |

Corcept Therapeutics, Inc. (a) | | | 300 | | | | 1,146 | |

Juniper Pharmaceuticals, Inc. (a) | | | 300 | | | | 2,247 | |

20

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Health Care — 18.9% (Continued) | | | | | | |

Pharmaceuticals — 2.9% (Continued) | | | | | | |

Merck & Company, Inc. | | | 60 | | | $ | 3,013 | |

Nektar Therapeutics (a) | | | 100 | | | | 1,117 | |

Phibro Animal Health Corporation - Class A | | | 180 | | | | 4,979 | |

Prestige Brands Holdings, Inc. (a) | | | 220 | | | | 10,758 | |

Sagent Pharmaceuticals, Inc. (a) | | | 150 | | | | 2,127 | |

TherapeuticsMD, Inc. (a) | | | 200 | | | | 1,222 | |

| | | | | | | | 33,941 | |

Industrials — 14.8% | | | | | | | | |

Aerospace & Defense — 1.3% | | | | | | | | |

AAR Corporation | | | 50 | | | | 1,064 | |

Astronics Corporation (a) | | | 150 | | | | 4,772 | |

Teledyne Technologies, Inc. (a) | | | 90 | | | | 7,666 | |

Vectrus, Inc. (a) | | | 100 | | | | 1,925 | |

| | | | | | | | 15,427 | |

Building Products — 1.0% | | | | | | | | |

Insteel Industries, Inc. | | | 150 | | | | 3,927 | |

Ply Gem Holdings, Inc. (a) | | | 200 | | | | 2,040 | |

Quanex Building Products Corporation | | | 100 | | | | 1,722 | |

Simpson Manufacturing Company, Inc. | | | 100 | | | | 3,394 | |

| | | | | | | | 11,083 | |

Commercial Services & Supplies — 1.5% | | | | | | | | |

ARC Document Solutions, Inc. (a) | | | 300 | | | | 1,050 | |

Brink's Company (The) | | | 180 | | | | 5,265 | |

Deluxe Corporation | | | 60 | | | | 3,445 | |

Kimball International, Inc. - Class B | | | 351 | | | | 3,696 | |

Quad/Graphics, Inc. | | | 300 | | | | 3,798 | |

| | | | | | | | 17,254 | |

Construction & Engineering — 1.0% | | | | | | | | |

Aegion Corporation (a) | | | 100 | | | | 1,811 | |

Granite Construction, Inc. | | | 60 | | | | 2,487 | |

Jacobs Engineering Group, Inc. (a) | | | 60 | | | | 2,319 | |

Sterling Construction Company, Inc. (a) | | | 900 | | | | 4,860 | |

| | | | | | | | 11,477 | |

Electrical Equipment — 1.1% | | | | | | | | |

Allied Motion Technologies, Inc. | | | 250 | | | | 4,615 | |

Belden, Inc. | | | 100 | | | | 5,477 | |

EnerSys | | | 40 | | | | 2,054 | |

General Cable Corporation | | | 130 | | | | 1,117 | |

| | | | | | | | 13,263 | |

Industrial Conglomerates — 0.8% | | | | | | | | |

Carlisle Companies, Inc. | | | 110 | | | | 9,917 | |

21

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Industrials — 14.8% (Continued) | | | | | | |

Machinery — 3.9% | | | | | | |

AGCO Corporation | | | 80 | | | $ | 3,959 | |

Altra Industrial Motion Corporation | | | 50 | | | | 1,215 | |

CIRCOR International, Inc. | | | 80 | | | | 3,207 | |

Commercial Vehicle Group, Inc. (a) | | | 852 | | | | 2,139 | |

FreightCar America, Inc. | | | 350 | | | | 5,204 | |

Hurco Companies, Inc. | | | 50 | | | | 1,297 | |

ITT Corporation | | | 60 | | | | 2,116 | |

Joy Global, Inc. | | | 100 | | | | 1,292 | |

Kadant, Inc. | | | 80 | | | | 3,054 | |

L.B. Foster Company - Class A | | | 100 | | | | 1,374 | |

L.S. Starrett Company (The) - Class A | | | 400 | | | | 3,772 | |

Lydall, Inc. (a) | | | 150 | | | | 4,343 | |

Navistar International Corporation (a) | | | 700 | | | | 5,887 | |

Terex Corporation | | | 250 | | | | 5,595 | |

Timken Company (The) | | | 50 | | | | 1,492 | |

| | | | | | | | 45,946 | |

Professional Services — 0.8% | | | | | | | | |

CDI Corporation | | | 600 | | | | 2,928 | |

Mistras Group, Inc. (a) | | | 150 | | | | 3,219 | |

Resources Connection, Inc. | | | 200 | | | | 2,774 | |

| | | | | | | | 8,921 | |

Road & Rail — 1.8% | | | | | | | | |

Avis Budget Group, Inc. (a) | | | 310 | | | | 7,948 | |

Hertz Global Holdings, Inc. (a) | | | 850 | | | | 7,225 | |

PAM Transportation Services, Inc. (a) | | | 150 | | | | 4,286 | |

Swift Transportation Company (a) | | | 100 | | | | 1,704 | |

| | | | | | | | 21,163 | |

Trading Companies & Distributors — 0.8% | | | | | | | | |

H&E Equipment Services, Inc. | | | 100 | | | | 1,317 | |

HD Supply Holdings, Inc. (a) | | | 50 | | | | 1,390 | |

United Rentals, Inc. (a) | | | 120 | | | | 6,188 | |

| | | | | | | | 8,895 | |

Transportation Infrastructure — 0.8% | | | | | | | | |

Wesco Aircraft Holdings, Inc. (a) | | | 700 | | | | 8,953 | |

| | | | | | | | | |

Information Technology — 25.0% | | | | | | | | |

Communications Equipment — 2.0% | | | | | | | | |

Arris International plc (a) | | | 250 | | | | 5,973 | |

Bel Fuse, Inc. - Class B | | | 250 | | | | 3,712 | |

Extreme Networks, Inc. (a) | | | 1,400 | | | | 3,948 | |

Ixia (a) | | | 100 | | | | 1,141 | |

22

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Information Technology — 25.0% (Continued) | | | | | | |

Communications Equipment — 2.0% (Continued) | | | | | | |

Polycom, Inc. (a) | | | 200 | | | $ | 2,082 | |

Sonus Networks, Inc. (a) | | | 600 | | | | 4,674 | |

TESSCO Technologies, Inc. | | | 100 | | | | 1,750 | |

| | | | | | | | 23,280 | |

Electronic Equipment, Instruments & Components — 3.5% | | | | | | | | |

Identiv, Inc. (a) | | | 900 | | | | 1,971 | |

Itron, Inc. (a) | | | 40 | | | | 1,594 | |

KEMET Corporation (a) | | | 1,100 | | | | 2,024 | |

Knowles Corporation (a) | | | 900 | | | | 10,242 | |

Methode Electronics, Inc. | | | 50 | | | | 1,428 | |

Multi-Fineline Electronix, Inc. (a) | | | 300 | | | | 6,771 | |

Newport Corporation (a) | | | 200 | | | | 4,554 | |

OSI Systems, Inc. (a) | | | 100 | | | | 6,037 | |

QLogic Corporation (a) | | | 100 | | | | 1,289 | |

Radisys Corporation (a) | | | 1,700 | | | | 4,386 | |

| | | | | | | | 40,296 | |

Internet Software & Services — 2.9% | | | | | | | | |

Bankrate, Inc. (a) | | | 600 | | | | 4,596 | |

Brightcove, Inc. (a) | | | 400 | | | | 2,400 | |

comScore, Inc. (a) | | | 40 | | | | 1,646 | |

DHI Group, Inc. (a) | | | 300 | | | | 2,334 | |

GrubHub, Inc. (a) | | | 50 | | | | 1,177 | |

LivePerson, Inc. (a) | | | 400 | | | | 2,052 | |

Marchex, Inc. - Class B | | | 300 | | | | 1,287 | |

Marin Software, Inc. (a) | | | 500 | | | | 1,500 | |

MeetMe, Inc. (a) | | | 500 | | | | 1,555 | |

Monster Worldwide, Inc. (a) | | | 700 | | | | 2,086 | |

Perficient, Inc. (a) | | | 150 | | | | 2,708 | |

Travelzoo, Inc. (a) | | | 200 | | | | 1,570 | |

United Online, Inc. (a) | | | 600 | | | | 7,386 | |

Web.com Group, Inc. (a) | | | 100 | | | | 1,815 | |

| | | | | | | | 34,112 | |

IT Services — 5.1% | | | | | | | | |

CACI International, Inc. - Class A (a) | | | 50 | | | | 4,831 | |

Computer Task Group, Inc. | | | 1,100 | | | | 5,203 | |

CSRA, Inc. | | | 50 | | | | 1,297 | |

Everi Holdings, Inc. (a) | | | 500 | | | | 1,470 | |

EVERTEC, Inc. | | | 1,000 | | | | 11,900 | |

Leidos Holdings, Inc. | | | 100 | | | | 4,322 | |

NeuStar, Inc. - Class A (a) | | | 250 | | | | 6,218 | |

Syntel, Inc. (a) | | | 220 | | | | 10,058 | |

23

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Information Technology — 25.0% (Continued) | | | | | | |

IT Services — 5.1% (Continued) | | | | | | |

Teradata Corporation (a) | | | 200 | | | $ | 4,990 | |

Unisys Corporation (a) | | | 200 | | | | 2,154 | |

VeriFone Systems, Inc. (a) | | | 300 | | | | 7,167 | |

| | | | | | | | 59,610 | |

Semiconductors & Semiconductor Equipment — 3.7% | | | | | | | | |

Advanced Energy Industries, Inc. (a) | | | 50 | | | | 1,491 | |

Alpha & Omega Semiconductor Ltd. (a) | | | 600 | | | | 7,098 | |

Ambarella, Inc. (a) | | | 40 | | | | 1,856 | |

Axcelis Technologies, Inc. (a) | | | 1,400 | | | | 3,500 | |

CVD Equipment Corporation (a) | | | 100 | | | | 839 | |

Qorvo, Inc. (a) | | | 60 | | | | 2,705 | |

Rudolph Technologies, Inc. (a) | | | 500 | | | | 6,480 | |

Sigma Designs, Inc. (a) | | | 400 | | | | 2,752 | |

Synaptics, Inc. (a) | | | 60 | | | | 4,873 | |

Texas Instruments, Inc. | | | 100 | | | | 5,302 | |

Veeco Instruments, Inc. (a) | | | 300 | | | | 5,565 | |

| | | | | | | | 42,461 | |

Software — 6.2% | | | | | | | | |

ACI Worldwide, Inc. (a) | | | 150 | | | | 2,799 | |

Autodesk, Inc. (a) | | | 20 | | | | 1,035 | |

BSQUARE Corporation (a) | | | 1,100 | | | | 6,270 | |

CA, Inc. | | | 50 | | | | 1,464 | |

Cadence Design Systems, Inc. (a) | | | 50 | | | | 1,077 | |

CDK Global, Inc. | | | 140 | | | | 6,285 | |

EnerNOC, Inc. (a) | | | 1,100 | | | | 6,754 | |

EPIQ Systems, Inc. | | | 350 | | | | 4,788 | |

Glu Mobile, Inc. (a) | | | 700 | | | | 2,597 | |

Interactive Intelligence Group, Inc. (a) | | | 150 | | | | 4,489 | |

MicroStrategy, Inc. - Class A (a) | | | 10 | | | | 1,609 | |

Pegasystems, Inc. | | | 100 | | | | 2,435 | |

Progress Software Corporation (a) | | | 100 | | | | 2,522 | |

PTC, Inc. (a) | | | 160 | | | | 4,946 | |

Rovi Corporation (a) | | | 400 | | | | 9,112 | |

Solera Holdings, Inc. | | | 20 | | | | 1,114 | |

Synchronoss Technologies, Inc. (a) | | | 180 | | | | 5,042 | |

TiVo, Inc. (a) | | | 500 | | | | 4,195 | |

Zynga, Inc. - Class A (a) | | | 1,900 | | | | 4,009 | |

| | | | | | | | 72,542 | |

Technology Hardware, Storage & Peripherals — 1.6% | | | | | | | | |

Avid Technology, Inc. (a) | | | 700 | | | | 5,355 | |

CPI Card Group, Inc. (a) | | | 400 | | | | 3,164 | |

24

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Information Technology — 25.0% (Continued) | | | | | | |

Technology Hardware, Storage & Peripherals — 1.6% (Continued) | | | | | | |

Cray, Inc. (a) | | | 50 | | | $ | 2,121 | |

HP, Inc. | | | 700 | | | | 7,483 | |

| | | | | | | | 18,123 | |

Materials — 6.6% | | | | | | | | |

Chemicals — 3.8% | | | | | | | | |

AgroFresh Solutions, Inc. (a) | | | 800 | | | | 3,912 | |

Axiall Corporation | | | 500 | | | | 9,950 | |

Chase Corporation | | | 160 | | | | 7,523 | |

Codexis, Inc. (a) | | | 600 | | | | 2,436 | |

OMNOVA Solutions, Inc. (a) | | | 411 | | | | 2,154 | |

PolyOne Corporation | | | 100 | | | | 2,691 | |

Stepan Company | | | 120 | | | | 5,961 | |

Trecora Resources (a) | | | 100 | | | | 966 | |

Tredegar Corporation | | | 400 | | | | 5,492 | |

Trinseo S.A. (a) | | | 100 | | | | 2,981 | |

| | | | | | | | 44,066 | |

Construction Materials — 0.5% | | | | | | | | |

Headwaters, Inc. (a) | | | 300 | | | | 5,286 | |

| | | | | | | | | |

Containers & Packaging — 1.2% | | | | | | | | |

Greif, Inc. - Class A | | | 550 | | | | 14,581 | |

| | | | | | | | | |

Metals & Mining — 1.1% | | | | | | | | |

Commercial Metals Company | | | 100 | | | | 1,469 | |

Handy & Harman Ltd. (a) | | | 100 | | | | 1,995 | |

Materion Corporation | | | 150 | | | | 3,912 | |

Reliance Steel & Aluminum Company | | | 60 | | | | 3,653 | |

Schnitzer Steel Industries, Inc. - Class A | | | 100 | | | | 1,464 | |

| | | | | | | | 12,493 | |

Telecommunication Services — 2.3% | | | | | | | | |

Diversified Telecommunication Services — 1.5% | | | | | | | | |

CenturyLink, Inc. | | | 150 | | | | 4,588 | |

FairPoint Communications, Inc. (a) | | | 300 | | | | 4,509 | |

Verizon Communications, Inc. | | | 160 | | | | 8,117 | |

| | | | | | | | 17,214 | |

25

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

| Telecommunication Services — 2.3% (Continued) | | | | | | |

| Wireless Telecommunication Services — 0.8% | | | | | | |

Spōk Holdings, Inc. | | | 450 | | | $ | 7,974 | |

United States Cellular Corporation (a) | | | 40 | | | | 1,656 | |

| | | | | | | | 9,630 | |

| | | | | | | | | |

Total Common Stocks — 95.4% (Cost $1,124,578) | | | | | | $ | 1,108,980 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 4.6% | | | | | | | 54,226 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,163,206 | |

(a) | Non-income producing security. |

See accompanying notes to financial sttements. |

26

ALAMBIC FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

February 29, 2016 (Unaudited) |

| | Alambic Small Cap Value Plus Fund | | | Alambic Small Cap Growth Plus Fund | |

ASSETS | | | | | | |

Investments in securities: | | | | | | |

At acquisition cost | | $ | 1,763,341 | | | $ | 1,124,578 | |

At value (Note 2) | | $ | 1,811,263 | | | $ | 1,108,980 | |

Cash | | | 88,513 | | | | 79,527 | |

Dividends receivable | | | 1,182 | | | | 1,071 | |

Receivable for investment securities sold | | | 122,149 | | | | 28,971 | |

Receivable from Adviser (Note 4) | | | 18,984 | | | | 21,334 | |

Other assets | | | 918 | | | | — | |

Total assets | | | 2,043,009 | | | | 1,239,883 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for investment securities purchased | | | 127,155 | | | | 67,625 | |

Payable to administrator (Note 4) | | | 6,003 | | | | 6,001 | |

Other accrued expenses | | | 3,892 | | | | 3,051 | |

Total liabilities | | | 137,050 | | | | 76,677 | |

| | | | | | | | | |

NET ASSETS | | $ | 1,905,959 | | | $ | 1,163,206 | |

| | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid-in capital | | $ | 2,010,507 | | | $ | 1,230,000 | |

Accumulated (distributions in excess of) net investment income | | | (793 | ) | | | 49 | |

Accumulated net realized losses from security transactions | | | (151,677 | ) | | | (51,245 | ) |

Net unrealized appreciation (depreciation) on investments | | | 47,922 | | | | (15,598 | ) |

NET ASSETS | | $ | 1,905,959 | | | $ | 1,163,206 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimied number of shares authorized, no par value) | | | 200,792 | | | | 125,442 | |

| | | | | | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 9.49 | | | $ | 9.27 | |

See accompanying notes to financial statements. |

27

ALAMBIC FUNDS

STATEMENTS OF OPERATIONS

For the Periods Ended February 29, 2016 (Unaudited) |

| | Alambic Small Cap Value Plus Fund(a) | | | Alambic Small Cap Growth Plus Fund(b) | |

INVESTMENT INCOME | | | | | | |

Dividend income | | $ | 15,916 | | | $ | 1,921 | |

Foreign withholding taxes on dividends | | | (2 | ) | | | (1 | ) |

Total investment income | | | 15,914 | | | | 1,920 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Fund accounting fees (Note 4) | | | 12,082 | | | | 4,009 | |

Administration fees (Note 4) | | | 12,000 | | | | 4,000 | |

Professional fees | | | 9,781 | | | | 2,716 | |

Investment advisory fees (Note 4) | | | 8,867 | | | | 1,481 | |

Compliance fees (Note 4) | | | 6,000 | | | | 2,000 | |

Transfer agent fees (Note 4) | | | 6,000 | | | | 2,000 | |

Trustees' fees and expenses (Note 4) | | | 5,189 | | | | 2,637 | |

Custody and bank service fees | | | 4,477 | | | | 1,475 | |

Registration and filing fees | | | 2,651 | | | | 1,948 | |

Postage and supplies | | | 3,533 | | | | 1,023 | |

Printing of shareholder reports | | | 810 | | | | 840 | |

Other expenses | | | 2,922 | | | | 558 | |

Total expenses | | | 74,312 | | | | 24,687 | |

Less fee reductions and expense reimbursements by the Adviser (Note 4) | | | (63,112 | ) | | | (22,816 | ) |

Net expenses | | | 11,200 | | | | 1,871 | |

| | | | | | | | | |

NET INVESTMENT INCOME | | | 4,714 | | | | 49 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

Net realized losses from investment transactions | | | (151,677 | ) | | | (51,245 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 47,922 | | | | (15,598 | ) |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (103,755 | ) | | | (66,843 | ) |

| | | | | | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (99,041 | ) | | $ | (66,794 | ) |

(a) | Represents the period from the commencement of operations (September 1, 2015) through February 29, 2016. |

(b) | Represents the period from the commencement of operations (December 29, 2015) through February 29, 2016. |

See accompanying notes to financial statements. |

28

ALAMBIC FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

For the Periods Ended February 29, 2016 (Unaudited) |

| | Alambic Small Cap Value Plus Fund(a) | | | Alambic Small Cap Growth Plus Fund(b) | |

FROM OPERATIONS | | | | | | |

Net investment income | | $ | 4,714 | | | $ | 49 | |

Net realized losses from security transactions | | | (151,677 | ) | | | (51,245 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 47,922 | | | | (15,598 | ) |

Net decrease in net assets resulting from operations | | | (99,041 | ) | | | (66,794 | ) |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (5,507 | ) | | | — | |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 2,005,000 | | | | 1,230,000 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 5,507 | | | | — | |

Net increase from capital share transactions | | | 2,010,507 | | | | 1,230,000 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 1,905,959 | | | | 1,163,206 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | — | | | | — | |

End of period | | $ | 1,905,959 | | | $ | 1,163,206 | |

| | | | | | | | | |

ACCUMULATED (DISTRIBUTIONS IN EXCESS OF) NET INVESTMENT INCOME | | $ | (793 | ) | | $ | 49 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 200,250 | | | | 125,442 | |

Shares issued in reinvestment of distributions to shareholders | | | 542 | | | | — | |

Net increase in shares outstanding | | | 200,792 | | | | 125,442 | |

Shares outstanding at beginning of period | | | — | | | | — | |

Shares outstanding at end of period | | | 200,792 | | | | 125,442 | |

(a) | Represents the period from the commencement of operations (September 1, 2015) through February 29, 2016. |

(b) | Represents the period from the commencement of operations (December 29, 2015) through February 29, 2016. |

See accompanying notes to financial statements. |

29

ALAMBIC SMALL CAP VALUE PLUS FUND

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout the Period |

| | Period Ended February 29, 2016(a) (Unaudited) | |

Net asset value at beginning of period | | $ | 10.00 | |

| | | | | |

Income (loss) from investment operations: | | | | |

Net investment income | | | 0.02 | |

Net realized and unrealized losses on investments | | | (0.50 | ) |

Total from investment operations | | | (0.48 | ) |

| | | | | |

Less distributions: | | | | |

Dividends from net investment income | | | (0.03 | ) |

| | | | | |

Net asset value at end of period | | $ | 9.49 | |

| | | | | |

Total return (b) | | | (4.84% | )(c) |

| | | | | |

Net assets at end of period (000's) | | $ | 1,906 | |

| | | | | |

Ratios/supplementary data: | | | | |

Ratio of total expenses to average net assets | | | 7.93 | %(d) |

| | | | | |

Ratio of net expenses to average net assets (e) | | | 1.20 | %(d) |

| | | | | |

Ratio of net investment income to average net assets (e) | | | 0.50 | %(d) |

| | | | | |

Portfolio turnover rate | | | 176 | %(c) |

(a) | Represents the period from the commencement of operations (September 1, 2015) through February 29, 2016. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and reimbursed expenses (Note 4). |

(c) | Not annualized. |

(d) | Annualized. |

(e) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

30

ALAMBIC SMALL CAP GROWTH PLUS FUND

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout the Period |

| | Period Ended February 29, 2016(a)

(Unaudited) | |

Net asset value at beginning of period | | $ | 10.00 | |

| | | | | |

Income (loss) from investment operations: | | | | |

Net investment income | | | 0.00 | (b) |

Net realized and unrealized losses on investments | | | (0.73 | ) |

Total from investment operations | | | (0.73 | ) |

| | | | | |

Net asset value at end of period | | $ | 9.27 | |

| | | | | |

Total return (c) | | | (7.30% | )(d) |

| | | | | |

Net assets at end of period (000's) | | $ | 1,163 | |

| | | | | |

Ratios/supplementary data: | | | | |

Ratio of total expenses to average net assets | | | 15.83 | %(e) |

| | | | | |

Ratio of net expenses to average net assets (f) | | | 1.20 | %(e) |

| | | | | |

Ratio of net investment income to average net assets (f) | | | 0.03 | %(e) |

| | | | | |

Portfolio turnover rate | | | 124 | %(d) |

(a) | Represents the period from the commencement of operations (December 29, 2015) through February 29, 2016. |

(b) | Amount rounds to less than $0.01 per share. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and reimbursed expenses (Note 4). |

(d) | Not annualized. |

(e) | Annualized. |

(f) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

31

ALAMBIC FUNDS

NOTES TO FINANCIAL STATEMENTS

February 29, 2016 (Unaudited)

1. Organization

Alambic Small Cap Value Plus Fund and Alambic Small Cap Growth Plus Fund (individually, a “Fund” and collectively, the “Funds”) are each a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. Alambic Small Cap Value Plus Fund commenced operations on September 1, 2015. Alambic Small Cap Growth Plus Fund commenced operations on December 29, 2015.

The investment objective of each Fund is long-term capital appreciation.

2. Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Funds follow accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – Each Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Funds value their listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted bid price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. The Funds value securities traded in the over-the-counter market at the last sale price, if available, otherwise at the most recently quoted bid price. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Funds value their securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate each Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

32

ALAMBIC FUNDS

NOTES TO FINANCIAL STATEMENTS (Continued) |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Funds’ investments as of February 29, 2016:

Alambic Small Cap Value Plus Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 1,811,263 | | | $ | — | | | $ | — | | | $ | 1,811,263 | |

Alambic Small Cap Growth Plus Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 1,108,980 | | | $ | — | | | $ | — | | | $ | 1,108,980 | |

Refer to the Funds’ Schedules of Investments for a listing of common stock by industry type. As of February 29, 2016, the Funds did not have any transfers between Levels. In addition, the Funds did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of February 29, 2016. It is the Funds’ policy to recognize transfers between Levels at the end of the reporting period.

Share valuation – The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the NAV per share.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned.

Security transactions – Security transactions are accounted for on the trade date. Gains and losses on securities sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Funds and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – The Funds distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid by Alambic Small

33

ALAMBIC FUNDS

NOTES TO FINANCIAL STATEMENTS (Continued) |

Cap Value Plus Fund to shareholders during the period ended February 29, 2016 was ordinary income. There were no distributions paid by Alambic Small Cap Growth Plus Fund during the period ended February 29, 2016.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions which affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – Each Fund intends to qualify as a regulated investment company under the Internal Revenue Code of 1986 (the “Code”). Qualification generally will relieve each Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code. Accordingly, no provision for income tax has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of February 29, 2016:

| | Alambic Small Cap Value Plus Fund | | | Alambic Small Cap Growth Plus Fund | |

Tax cost of portfolio investments | | $ | 1,808,955 | | | $ | 1,126,788 | |

Gross unrealized appreciation | | $ | 95,995 | | | $ | 58,225 | |

Gross unrealized depreciation | | | (93,687 | ) | | | (76,033 | ) |

Net unrealized appreciation (depreciation) | | | 2,308 | | | | (17,808 | ) |

Accumulated ordinary income | | | — | | | | 49 | |

Other losses | | | (106,856 | ) | | | (49,035 | ) |

Accumulated deficit | | $ | (104,548 | ) | | $ | (66,794 | ) |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of each Fund is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due primarily to the tax deferral of losses on wash sales.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for the current period and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Funds indentify their major tax jurisdiction as U.S. Federal.

34

ALAMBIC FUNDS

NOTES TO FINANCIAL STATEMENTS (Continued) |

3. Investment Transactions