| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Matthew J. Beck

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | February 28 | |

| | | |

| Date of reporting period: | August 31, 2018 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

HVIA EQUITY FUND

INSTITUTIONAL CLASS (HVEIX)

Managed by

Hudson Valley Investment Advisors, Inc.

SEMI-ANNUAL REPORT

August 31, 2018

(Unaudited)

HVIA EQUITY FUND

LETTER TO SHAREHOLDERS | August 31, 2018 |

The HVIA Equity Fund (“HVEIX” or the “Fund”) launched on October 3, 2016. The Fund’s focus is on using a GARP investment framework to determine suitable investments. This acronym is “Growth at a Reasonable Price,” which focuses on investing in equities that are at a discount to their expected growth rate. In my experience of using this investment philosophy, I’ve come to realize that the process does not fit neatly into months, quarters or years but is expected to outperform over the longer term.

Investment Environment

The current U.S. markets, based on continuing revenue and earnings strength, would normally have seen increased equity prices but the influence of international and domestic political headwinds have raised the overall risk to the financial markets. Since the start of 2018 the global economic environment has moved from a synchronized upswing to one where the United States economy is the strongest while developing economies are slowing.

The Trump administration has put increasing pressure on major trading partners to lower tariffs and remove trade impediments in order to avert a more difficult economic environment. These moves have dialed up pressure on overseas economies, caused threats of retaliation and strengthened the U.S. Dollar. As a result, there has been a divergence between the positive returns seen in U.S. markets and the decline attributed to the majority of many overseas markets.

Relating to the current state of the U.S. equity markets, fundamentals are clearly driving a bullish tape. Strong economic drivers in the U.S. have shielded equities from an array of geopolitical risk. The growth story has been a well-documented catalyst for the relative outperformance of domestic equity markets. Investors have also focused on a flattening yield curve, unresolved trade wars, and the potential spillover from emerging markets concerns. Based on the evidence, current risks/rewards appear balanced and we suspect the market will continue to maintain an upward bias post the midterm election. Macroeconomic indicators show no signs of a recession as many leading economic indicators point to continued solid growth and a positive bias for equities.

The Fund focuses on changes to S&P 500 revenues and earnings as they are, in our opinion, the main driver of stock prices over the longer term. The equity markets have seen acceleration in both revenues and earnings after a multiyear period in which they were relatively flat and multiple expansions were the main driver of equity prices. We anticipate that trend to continue at least for the foreseeable future. HVIA is continuing to anticipate higher earnings growth and tougher comparisons in the back half of 2018. We also realize that the market is trading at a 16.8x forward multiple, which is approximately in line with the 5 year average, making it neither cheap nor expensive. This points to the fact that equities will continue to be more reliant on earnings, and multiples will not be a positive influence in an equity market advance.

1

Current Market and Economic Conditions

In spite of increasing trade and tariff policy uncertainty, the global economy continues to expand but slower than that seen in the start of the year. Overseas conditions have slowed in emerging markets and some of the developed economies are seeing a slight spillover effect. This slowdown has not impacted the U.S. markets as domestic markets are recording increasing growth with expectations of continued strength into the first half of 2019. Underscoring this is the U.S. unemployment rate, which has declined to historically low levels, while both consumer and business confidence hit cyclical highs. Future expectation derived from Institute for Supply Management (“ISM”) readings point to a continued strengthening of the economy.

Many investors are in a tug of war between still solid fundamentals, with economic growth continuing to improve relative to non-U.S. jurisdictions. Earnings growth of 25% is expected for the second quarter while sentiment has turned somewhat negative relative to earlier in the year. The world’s second largest economy, China, has seen slowing data while a strengthening dollar could impede U.S. companies with large overseas revenue exposures.

Higher inflation is expected as economic conditions remain strong, but should remain contained relative to prior inflationary periods. Energy price appreciation has influenced rising inflation but may see a reversion in the near future as we anniversary the increased oil prices seen in the earlier part of 2018. Labor has been held in check during this expansion which should also limit inflationary pressures. The Federal Open Market Committee (FOMC) (Federal Reserve May meeting) indicates it will tolerate an undefined interim higher level of inflation, while accelerating rates of inflation would cause the FOMC to be more aggressive.

The FOMC is expected to hike the federal funds rate two more times in 2018 (September and December) as part of its announced normalization policy. At least two additional 0.25% hikes are expected in 2019. This, accompanied by the risks in the markets, has created upward pressure on the dollar. Combined with higher oil prices, this is a serious problem for many emerging market economies.

In Washington, President Trump has presided over a divisive political agenda. Going into the midterm elections an administration with a solid economic backdrop would normally see strong voter approval. The current environment may see a greater exposure to elected Democrats, which could risk some of the initiatives put in place over the first two years of Trump’s administration, such as trade negotiations, social discourse and immigration, which has maintained a higher level of market risk.

Finally, we look to the yield curve maintaining a positive slope, which points to a continued expectation of economic improvement by fixed income markets. Commodity prices have reversed lower after strengthening earlier in the year. Economic strength should continue as PMI’s, employment and confidence measures are all indicating continued strength.

Investment Philosophy and Performance

We are investing with an eye for the longer term, which means over 18 months. Our focus is on stocks that are showing improving asset utilization, margin expansion and the efficient use of capital. This can be summed up in an improving Return on Equity (which is a measure of how well a company uses investments to generate earnings), but are trading at a discount to their historical growth or that of the industry group.

2

For the six months ended August 31st, 2018, HVEIX was up 6.30% versus 7.96% for the S&P 500 Index. The following three positions had the largest positive impact on the Fund’s performance during the period.

| | a) | Eli Lilly & Co. (LLY) (+39.83%) |

| | b) | ConocoPhillips (COP) (+37.40%) |

| | c) | CSX Corp. (CSX) (+36.88%) |

Since inception, the Fund has invested in stocks that are trading at a discount to their growth rate. We have seen that these are becoming tougher to find. We continue to see economic growth which benefitted the stocks listed above. Eli Lilly & Co. (LLY) announced better than expected earnings results and a plan to spin off its stake in an animal health business which was a slight drag on the business. We expect Eli Lilly to continue to have strong revenues but are keeping a close eye to the upcoming elections, which may change the discounting of drug prices. ConocoPhillips (COP) has transformed the company by selling underperforming assets and leveraging new technologies to get greater productivity from its asset portfolio. This, combined with the higher price of oil, has continued to allow COP to put up improved earnings. This was a top performer for the Fund and we continue to see upside. CSX is going through a change in the way that it operates and has provided a strong earnings and outlook due to the continued growth in the economic environment The transformation that enhances productivity is still in its infancy and we expect continued operating improvement over the next 12 months. We expect these three names to continue to perform as the economy remains buoyant.

The following positions had the greatest negative impact on the Fund’s performance over the six months ended August 31, 2018.

| | a) | The Goodyear Tire & Rubber Co. (GT) (-18.59%) |

| | b) | eBay, Inc. (EBAY) (-18.12%) |

| | c) | The J.M. Smucker Co. (SJM) (-17.36%) |

The investment in Goodyear Tire & Rubber Co. (GT) has been hurt by the increase in costs and the loss of a distribution point for its tire products. The company is a turnaround that is looking to benefit from the higher pricing and increased distribution into commercial markets. GT’s progress has not been as robust as first assumed. eBay was hurt when it announced earnings, as it trimmed its annual revenue forecast. The company was hurt by Amazon while brick and mortar retailing has seen a rebound in demand taking market share in the short term. J.M. Smucker Co. (SJM) has been impacted like most consumer staples companies on declines in retail shelf space and increased pricing pressure. SJM is also suffering from the revaluing of the staples space as the largest seller of coffee, and its expansion into pet food area has been met by a slowdown in both categories. The company is still well positioned but has been shunned like most stocks in the sector. We believe the company is still well positioned and will need to wait until operations are integrated and prices stabilize.

Sincerely,

Gustave J. Scacco

Portfolio Manager

3

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-209-8710.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.hviafunds.com or call 1-888-209-8710 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of August 31, 2018, please see the Schedule of Investments section of the semi-annual report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

4

HVIA EQUITY FUND

PORTFOLIO INFORMATION

August 31, 2018 (Unaudited)

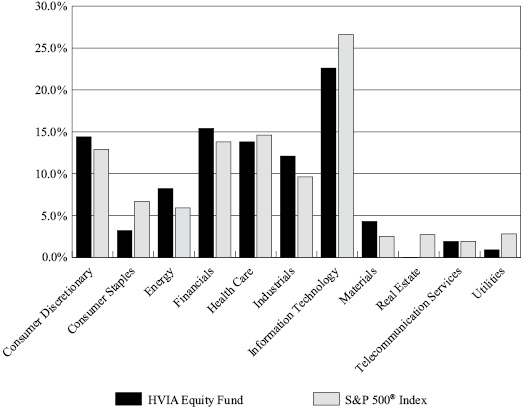

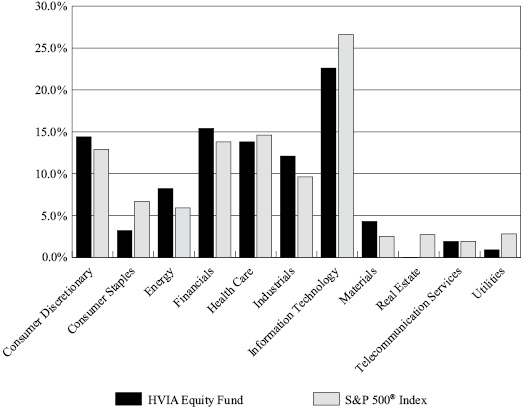

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

Security Description | % of

Net Assets |

Adobe Systems, Inc. | 3.9% |

Apple, Inc. | 3.9% |

CSX Coporation | 3.4% |

Alphabet, Inc. - Class C | 3.0% |

Red Hat, Inc. | 2.9% |

JPMorgan Chase & Company | 2.9% |

ConocoPhillips | 2.9% |

Microsoft Corporation | 2.8% |

Facebook, Inc. - Class A | 2.8% |

Bank of America Corporation | 2.8% |

5

HVIA EQUITY FUND

SCHEDULE OF INVESTMENTS

August 31, 2018 (Unaudited) |

COMMON STOCKS — 96.8% | | Shares | | | Value | |

Consumer Discretionary — 14.4% | | | | | | | | |

Auto Components — 0.6% | | | | | | | | |

Goodyear Tire & Rubber Company (The) | | | 4,950 | | | $ | 112,316 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 3.0% | | | | | | | | |

Royal Caribbean Cruises Ltd. | | | 2,335 | | | | 286,224 | |

Starbucks Corporation | | | 4,500 | | | | 240,525 | |

| | | | | | | | 526,749 | |

Household Durables — 1.3% | | | | | | | | |

Lennar Corporation - Class A | | | 4,400 | | | | 227,348 | |

| | | | | | | | | |

Media — 0.9% | | | | | | | | |

Walt Disney Company (The) | | | 1,400 | | | | 156,828 | |

| | | | | | | | | |

Multi-Line Retail — 1.7% | | | | | | | | |

Dollar General Corporation | | | 2,725 | | | | 293,564 | |

| | | | | | | | | |

Specialty Retail — 4.8% | | | | | | | | |

AutoZone, Inc. (a) | | | 445 | | | | 341,261 | |

CarMax, Inc. (a) | | | 3,175 | | | | 247,809 | |

Home Depot, Inc. (The) | | | 1,275 | | | | 255,982 | |

| | | | | | | | 845,052 | |

Textiles, Apparel & Luxury Goods — 2.1% | | | | | | | | |

NIKE, Inc. - Class B | | | 4,500 | | | | 369,900 | |

| | | | | | | | | |

Consumer Staples — 3.2% | | | | | | | | |

Beverages — 0.9% | | | | | | | | |

Molson Coors Brewing Company - Class B | | | 1,000 | | | | 66,740 | |

PepsiCo, Inc. | | | 850 | | | | 95,208 | |

| | | | | | | | 161,948 | |

Food Products — 1.3% | | | | | | | | |

J.M. Smucker Company (The) | | | 1,500 | | | | 155,070 | |

Kraft Heinz Company (The) | | | 1,200 | | | | 69,924 | |

| | | | | | | | 224,994 | |

Personal Products — 1.0% | | | | | | | | |

Estée Lauder Companies, Inc. (The) - Class A | | | 1,300 | | | | 182,156 | |

| | | | | | | | | |

Energy — 8.2% | | | | | | | | |

Oil, Gas & Consumable Fuels — 8.2% | | | | | | | | |

ConocoPhillips | | | 6,900 | | | | 506,667 | |

6

HVIA EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 96.8% (Continued) | | Shares | | | Value | |

Energy — 8.2% (Continued) | | | | | | | | |

Oil, Gas & Consumable Fuels — 8.2% (Continued) | | | | | | | | |

Enbridge, Inc. | | | 6,306 | | | $ | 215,476 | |

Exxon Mobil Corporation | | | 4,350 | | | | 348,740 | |

Williams Companies, Inc. (The) | | | 12,600 | | | | 372,834 | |

| | | | | | | | 1,443,717 | |

Financials — 15.5% | | | | | | | | |

Banks — 8.8% | | | | | | | | |

Bank of America Corporation | | | 15,800 | | | | 488,694 | |

BB&T Corporation | | | 4,300 | | | | 222,138 | |

JPMorgan Chase & Company | | | 4,450 | | | | 509,881 | |

SunTrust Banks, Inc. | | | 4,550 | | | | 334,698 | |

| | | | | | | | 1,555,411 | |

Capital Markets — 4.8% | | | | | | | | |

Bank of New York Mellon Corporation (The) | | | 4,400 | | | | 229,460 | |

Goldman Sachs Group, Inc. (The) | | | 1,200 | | | | 285,372 | |

Morgan Stanley | | | 7,000 | | | | 341,810 | |

| | | | | | | | 856,642 | |

Insurance — 1.9% | | | | | | | | |

Marsh & McLennan Companies, Inc. | | | 3,900 | | | | 330,057 | |

| | | | | | | | | |

Health Care — 13.8% | | | | | | | | |

Biotechnology — 1.8% | | | | | | | | |

Celgene Corporation (a) | | | 3,300 | | | | 311,685 | |

| | | | | | | | | |

Health Care Equipment & Supplies — 3.3% | | | | | | | | |

Danaher Corporation | | | 3,400 | | | | 352,036 | |

Medtronic plc | | | 2,400 | | | | 231,384 | |

| | | | | | | | 583,420 | |

Health Care Providers & Services — 2.0% | | | | | | | | |

UnitedHealth Group, Inc. | | | 1,350 | | | | 362,421 | |

| | | | | | | | | |

Life Sciences Tools & Services — 3.4% | | | | | | | | |

PerkinElmer, Inc. | | | 3,350 | | | | 309,641 | |

Thermo Fisher Scientific, Inc. | | | 1,200 | | | | 286,920 | |

| | | | | | | | 596,561 | |

Pharmaceuticals — 3.3% | | | | | | | | |

Eli Lilly & Company | | | 2,300 | | | | 242,995 | |

Pfizer, Inc. | | | 8,000 | | | | 332,160 | |

| | | | | | | | 575,155 | |

7

HVIA EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 96.8% (Continued) | | Shares | | | Value | |

Industrials — 12.1% | | | | | | | | |

Aerospace & Defense — 2.1% | | | | | | | | |

Harris Corporation | | | 2,250 | | | $ | 365,648 | |

| | | | | | | | | |

Air Freight & Logistics — 2.5% | | | | | | | | �� |

FedEx Corporation | | | 1,800 | | | | 439,110 | |

| | | | | | | | | |

Building Products — 1.0% | | | | | | | | |

Masco Corporation | | | 4,750 | | | | 180,357 | |

| | | | | | | | | |

Machinery — 3.1% | | | | | | | | |

Lincoln Electric Holdings, Inc. | | | 3,850 | | | | 362,516 | |

Oshkosh Corporation | | | 2,750 | | | | 193,215 | |

| | | | | | | | 555,731 | |

Road & Rail — 3.4% | | | | | | | | |

CSX Corporation | | | 8,100 | | | | 600,696 | |

| | | | | | | | | |

Information Technology — 22.6% | | | | | | | | |

Internet Software & Services — 7.1% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 435 | | | | 529,912 | |

eBay, Inc. (a) | | | 6,600 | | | | 228,426 | |

Facebook, Inc. - Class A (a) | | | 2,800 | | | | 492,044 | |

| | | | | | | | 1,250,382 | |

IT Services — 2.0% | | | | | | | | |

Visa, Inc. - Class A | | | 2,400 | | | | 352,536 | |

| | | | | | | | | |

Software — 9.6% | | | | | | | | |

Adobe Systems, Inc. (a) | | | 2,600 | | | | 685,126 | |

Microsoft Corporation | | | 4,400 | | | | 494,252 | |

Red Hat, Inc. (a) | | | 3,475 | | | | 513,362 | |

| | | | | | | | 1,692,740 | |

Technology Hardware, Storage & Peripherals — 3.9% | | | | | | | | |

Apple, Inc. | | | 3,000 | | | | 682,890 | |

| | | | | | | | | |

Materials — 4.2% | | | | | | | | |

Chemicals — 4.2% | | | | | | | | |

DowDuPont, Inc. | | | 2,850 | | | | 199,871 | |

LyondellBasell Industries N.V. - Class A | | | 2,475 | | | | 279,130 | |

Sherwin-Williams Company (The) | | | 595 | | | | 271,070 | |

| | | | | | | | 750,071 | |

8

HVIA EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 96.8% (Continued) | | Shares | | | Value | |

Telecommunication Services — 1.9% | | | | | | | | |

Diversified Telecommunication Services — 1.9% | | | | | | | | |

Verizon Communications, Inc. | | | 6,200 | | | $ | 337,094 | |

| | | | | | | | | |

Utilities — 0.9% | | | | | | | | |

Electric Utilities — 0.6% | | | | | | | | |

Duke Energy Corporation | | | 1,200 | | | | 97,488 | |

| | | | | | | | | |

Independent Power and Renewable Electricity Producers — 0.3% | | | | | | | | |

AES Corporation | | | 4,000 | | | | 53,840 | |

| | | | | | | | | |

Total Investments at Value — 96.8% (Cost $12,932,519) | | | | | | $ | 17,074,507 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 3.2% | | | | | | | 564,106 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 17,638,613 | |

(a) | Non-income producing security. |

See accompanying notes to financial statements. |

9

HVIA EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2018 (Unaudited) |

ASSETS | | | | |

Investments in securities: | | | | |

At cost | | $ | 12,932,519 | |

At value (Note 2) | | $ | 17,074,507 | |

Cash (Note 2) | | | 444,921 | |

Receivable for capital shares sold | | | 100,000 | |

Receivable from Adviser (Note 4) | | | 346 | |

Dividends and interest receivable | | | 30,160 | |

Other assets | | | 15,952 | |

TOTAL ASSETS | | | 17,665,886 | |

| | | | | |

LIABILITIES | | | | |

Payable for capital shares redeemed | | | 11,794 | |

Payable to administrator (Note 4) | | | 7,150 | |

Other accrued expenses | | | 8,329 | |

TOTAL LIABILITIES | | | 27,273 | |

| | | | | |

NET ASSETS | | $ | 17,638,613 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 13,368,726 | |

Accumulated net investment income | | | 60,366 | |

Accumulated net realized gains from investment transactions | | | 67,524 | |

Net unrealized appreciation (depreciation) on: | | | | |

Investments | | | 4,141,988 | |

Translation of assets and liabilities in foreign currencies | | | 9 | |

NET ASSETS | | $ | 17,638,613 | |

| | | | | |

PRICING OF INSTITUTIONAL SHARES (Note 1) | | | | |

Net assets applicable to Institutional Shares | | $ | 17,638,613 | |

Shares of Institutional Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,259,899 | |

| | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 14.00 | |

See accompanying notes to financial statements. |

10

HVIA EQUITY FUND

STATEMENT OF OPERATIONS

For the Six Months Ended August 31, 2018 (Unaudited) |

INVESTMENT INCOME | | | | |

Dividends | | $ | 130,726 | |

Interest | | | 2,791 | |

Foreign withholding taxes on dividends | | | (817 | ) |

TOTAL INVESTMENT INCOME | | | 132,700 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 4) | | | 60,744 | |

Professional fees | | | 22,777 | |

Fund accounting fees (Note 4) | | | 14,329 | |

Administration fees (Note 4) | | | 13,500 | |

Transfer agent fees (Note 4) | | | 9,000 | |

Registration and filing fees | | | 7,402 | |

Compliance fees (Note 4) | | | 6,000 | |

Custody and bank service fees | | | 5,110 | |

Trustees’ fees and expenses (Note 4) | | | 5,089 | |

Printing of shareholder reports | | | 2,783 | |

Postage and supplies | | | 1,943 | |

Insurance fees | | | 1,391 | |

Pricing fees | | | 742 | |

Other expenses | | | 3,481 | |

TOTAL EXPENSES | | | 154,291 | |

Less fee reductions and expense reimbursements by the Adviser (Note 4) | | | (73,025 | ) |

NET EXPENSES | | | 81,266 | |

| | | | | |

NET INVESTMENT INCOME | | | 51,434 | |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES (Note 2) | | | | |

Net realized gains (losses) from: | | | | |

Investments | | | 32,228 | |

Foreign currency transactions | | | (514 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 967,693 | |

Foreign currency translation | | | 48 | |

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND FOREIGN CURRENCIES | | | 999,455 | |

| | | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 1,050,889 | |

See accompanying notes to financial statements. |

11

HVIA EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months

Ended

August 31,

2018

(Unaudited) | | | Year

Ended

February 28,

2018 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 51,434 | | | $ | 69,222 | |

Net realized gains (losses) from: | | | | | | | | |

Investments | | | 32,228 | | | | 57,478 | |

Foreign currency transactions | | | (514 | ) | | | (195 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | 967,693 | | | | 1,844,138 | |

Foreign currency translation | | | 48 | | | | (39 | ) |

Net increase in net assets resulting from operations | | | 1,050,889 | | | | 1,970,604 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

From net investment income, Institutional Shares | | | — | | | | (66,697 | ) |

From net realized gains on investments, Institutional Shares | | | — | | | | (35,109 | ) |

Decrease in net assets from distributions to shareholders | | | — | | | | (101,806 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Institutional Shares | | | | | | | | |

Proceeds from shares sold | | | 2,007,211 | | | | 2,701,090 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 54 | |

Payments for shares redeemed | | | (478,029 | ) | | | (891,941 | ) |

Net increase in Institutional Shares net assets from capital share transactions | | | 1,529,182 | | | | 1,809,203 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 2,580,071 | | | | 3,678,001 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 15,058,542 | | | | 11,380,541 | |

End of period | | $ | 17,638,613 | | | $ | 15,058,542 | |

| | | | | | | | | |

ACCUMULATED NET INVESTMENT INCOME | | $ | 60,366 | | | $ | 9,446 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Institutional Shares | | | | | | | | |

Shares sold | | | 151,773 | | | | 215,889 | |

Shares reinvested | | | — | | | | 4 | |

Shares redeemed | | | (35,645 | ) | | | (71,246 | ) |

Net increase in shares outstanding | | | 116,128 | | | | 144,647 | |

Shares outstanding at beginning of period | | | 1,143,771 | | | | 999,124 | |

Shares outstanding at end of period | | | 1,259,899 | | | | 1,143,771 | |

12

HVIA EQUITY FUND

INSTITUTIONAL SHARES

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period |

| | Six Months

Ended

August 31,

2018

(Unaudited) | | | Year

Ended

February 28,

2018 | | | Period

Ended

February 28,

2017(a) | |

Net asset value at beginning of period | | $ | 13.17 | | | $ | 11.39 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | |

Net investment income | | | 0.04 | | | | 0.06 | | | | 0.02 | |

Net realized and unrealized gains on investments and foreign currencies | | | 0.79 | | | | 1.81 | | | | 1.39 | |

Total from investment operations | | | 0.83 | | | | 1.87 | | | | 1.41 | |

| | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.06 | ) | | | (0.02 | ) |

From net realized gains | | | — | | | | (0.03 | ) | | | — | |

Total distributions | | | — | | | | (0.09 | ) | | | (0.02 | ) |

| | | | | | | | | | | | | |

Net asset value at end of period | | $ | 14.00 | | | $ | 13.17 | | | $ | 11.39 | |

| | | | | | | | | | | | | |

Total return (b) | | | 6.30 | %(c) | | | 16.45 | % | | | 14.06 | %(c) |

| | | | | | | | | | | | | |

Net assets at end of period (000's) | | $ | 17,639 | | | $ | 15,059 | | | $ | 11,381 | |

| | | | | | | | | | | | | |

Ratios/supplementary data: | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.88 | %(d) | | | 2.11 | % | | | 2.36 | %(d) |

| | | | | | | | | | | | | |

Ratio of net expenses to average net assets (e) | | | 0.99 | %(d) | | | 0.99 | % | | | 0.99 | %(d) |

| | | | | | | | | | | | | |

Ratio of net investment income to average net assets (e) | | | 0.63 | %(d) | | | 0.53 | % | | | 0.56 | %(d) |

| | | | | | | | | | | | | |

Portfolio turnover rate | | | 3 | %(c) | | | 4 | % | | | 2 | %(c) |

(a) | Represents the period from the commencement of operations (October 3, 2016) through February 28, 2017. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and reimbursed expenses. |

(c) | Not annualized. |

(d) | Annualized. |

(e) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

13

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

August 31, 2018 (Unaudited)

1. Organization

HVIA Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is to seek growth at a reasonable price.

The Fund currently offers one class of shares: Institutional Class shares (sold without any sales loads or distribution fees and subject to a $25,000 initial investment requirement). As of August 31, 2018, the Investor Class shares (to be sold without any sales load, but subject to a distribution fee of up to 0.25% of the class’ average daily net assets and subject to a $2,500 initial investment requirement) are not currently offered. When both classes are offered, each share class will represent an ownership interest in the same investment portfolio.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its common stocks on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. The Fund values securities traded in the over-the-counter market at the last sale price, if available, otherwise at the most recently quoted mean price. When using a quoted price and when the market is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities

14

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of August 31, 2018:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 17,074,507 | | | $ | — | | | $ | — | | | $ | 17,074,507 | |

Refer to the Fund’s Schedule of Investments for a listing of common stocks by industry type. As of August 31, 2018, the Fund did not have any transfers between Levels. In addition, the Fund did not have any derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of August 31, 2018. It is the Fund’s policy to recognize transfers between Levels at the end of the reporting period.

Foreign currency translation – Securities and other assets and liabilities denominated in or expected to settle in foreign currencies, if any, are translated into U.S. dollars based on exchange rates on the following basis:

| | A. | The fair values of investment securities and other assets and liabilities are translated as of the close of the NYSE each day. |

| | B. | Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing as of 4:00 p.m. Eastern Time on the respective date of such transactions. |

15

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

| | C. | The Fund does not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments. |

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies, 2) currency gains or losses realized between the trade and settlement dates on securities transactions, and 3) the difference between the amounts of dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities that result from changes in exchange rates.

Cash account – The Fund’s cash is held in a bank account with balances which may exceed the amount covered by federal deposit insurance. As of August 31, 2018, the cash balance reflected on the Statement of Assets and Liabilities represents the amount held in a deposit sweep account.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of its assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – The Fund will distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid by the Fund to shareholders during the year ended February 28, 2018 was ordinary income. There were no distributions paid by the Fund to shareholders during the six months ended August 31, 2018.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions which affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

16

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of August 31, 2018:

Tax cost of portfolio investments and foreign currencies | | $ | 12,932,528 | |

Gross unrealized appreciation | | $ | 4,464,047 | |

Gross unrealized depreciation | | | (322,050 | ) |

Net unrealized appreciation | | | 4,141,997 | |

Undistributed ordinary income | | | 9,446 | |

Undistributed long-term capital gains | | | 35,296 | |

Other gains | | | 83,148 | |

Accumulated earnings | | $ | 4,269,887 | |

For the six months ended August 31, 2018, the Fund reclassified $514 of net realized losses on foreign currency transactions against accumulated net investment income on the Statement of Assets and Liabilities. This reclassification is the result of permanent differences between the financial statement and income tax reporting requirements. It had no effect on the Fund’s net assets or its NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for the current and all open tax periods (period ended February 28, 2017 and year ended February 28, 2018) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal.

3. Investment Transactions

During the six months ended August 31, 2018, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $2,690,446 and $482,821, respectively.

17

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Hudson Valley Investment Advisors, Inc. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 0.74% of its average daily net assets.

Pursuant to an Expense Limitation Agreement (“ELA”), the Adviser has contractually agreed, until July 1, 2020, to reduce investment advisory fees and reimburse other expenses to the extent necessary to limit total annual operating expenses (exclusive of brokerage costs, taxes, interest, costs to organize the Fund, acquired fund fees and expenses, extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 0.99% of average daily net assets. Accordingly, the Adviser did not collect any of its investment advisory fees and, in addition, reimbursed other operating expenses totaling $12,281 during the six months ended August 31, 2018.

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided the repayments do not cause total annual operating expenses to exceed: (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of August 31, 2018, the Adviser may seek repayment of investment advisory fee reductions and expense reimbursements in the amount of $272,396 no later than the dates listed below:

February 29, 2020 | | $ | 53,835 | |

February 28, 2021 | | $ | 145,536 | |

August 31, 2021 | | $ | 73,025 | |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and costs of pricing the Fund’s portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as the principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor.

18

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

TRUSTEE COMPENSATION

Effective August 1, 2018, each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses. Prior to August 1, 2018, each Independent Trustee received a $1,000 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who received a $1,200 annual retainer from the Fund, paid quarterly. Each Independent Trustee also received from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

PRINCIPAL HOLDER OF FUND SHARES

As of August 31, 2018, the following shareholder owned of record more than 5% of the outstanding shares of the Fund:

NAME OF RECORD OWNER | % Ownership |

Pershing, LLC (for the benefit of its customers) | 99.7% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

19

HVIA EQUITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (March 1, 2018) and held until the end of the period (August 31, 2018).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

20

HVIA EQUITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

Institutional Class | Beginning

Account Value

March 1,

2018 | Ending

Account Value

August 31,

2018 | Net Expense

Ratio (a) | Expenses

Paid During

Period (b) |

Based on Actual Fund Return | $ 1,000.00 | $ 1,063.00 | 0.99% | $ 5.15 |

Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,020.21 | 0.99% | $ 5.04 |

(a) | Annualized, based on the Fund’s most recent one-half year expenses. |

(b) | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied 184/365 (to reflect the one-half year period). |

21

HVIA EQUITY FUND

OTHER INFORMATION (Unaudited) |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-209-8710, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-888-209-8710, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-888-209-8710. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

22

HVIA EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) |

The Board of Trustees (the “Board”), including the Independent Trustees voting separately, has reviewed and approved the Fund’s Investment Advisory Agreement with Hudson Valley Investment Advisors, Inc. (the “Adviser”) for an additional one-year term (the “Agreement”). The Board approved the Agreement at an in-person meeting held on July 23-24, 2018, at which all of the Trustees were present.

Legal counsel advised the Board during its deliberations. Additionally, the Board received and reviewed a substantial amount of information provided by the Adviser in response to requests of the Board and counsel. In considering whether to approve the Agreement and in reaching its conclusions with respect thereto, the Board reviewed and analyzed various factors that it determined were relevant to the Agreement, including the following factors.

The nature, extent, and quality of the services provided by the Adviser. In this regard, the Board reviewed the services being provided by the Adviser to the Fund including, without limitation, its investment advisory services since the Fund’s inception, the Adviser’s compliance policies and procedures, its efforts to promote the Fund and assist in its distribution, and its compliance program. After reviewing the foregoing information and further information in the Adviser Memorandum (e.g., descriptions of its business and Form ADV), the Board concluded that the quality, extent, and nature of the services provided by the Adviser were satisfactory and adequate for the Fund.

The investment performance of the Fund. In this regard, the Board compared the performance of the Fund with the performance of its benchmark index, custom peer group and related Morningstar category. The Board noted that the Fund had underperformed its custom peer group’s average and median performance for the one year period and overperformed its custom peer group’s average and median performance since the Fund’s inception; while it underperformed its Morningstar category’s (Large Cap Growth Category Under $25 million, True No-Load) median and average performance for the one year period, and overperformed the median and average performance since the Fund’s inception. The Board also considered the consistency of the Adviser’s management with the Fund’s investment objective and policies. The Board indicated that the Adviser had satisfactorily explained its performance results for the Fund. Following discussion of the investment performance of the Fund and its performance relative to its Morningstar category, the Adviser’s experience in managing a mutual fund and separate accounts, its historical investment performance, and other factors, the Board concluded that the investment performance of the Fund has been satisfactory.

The costs of the services provided and profits realized by the Adviser and its affiliates from its relationship with the Fund. In this regard, the Board considered the Adviser’s staffing, personnel, and methods of operations; the education and experience of its personnel; compliance program, policies, and procedures; financial condition and the level of commitment to the Fund, and, generally, the Adviser’s advisory business; the asset level of the Fund; and the overall expenses of the Fund, including the advisory fee. The Board considered the Adviser’s expense limitation agreement, and considered the Adviser’s current

23

HVIA EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

and past fee reductions and expense reimbursements for the Fund. The Board further took into account the Adviser’s commitment to continue the Adviser’s expense limitation agreement until at least January 1, 2020.

The Board also considered potential benefits for the Adviser in managing the Fund, including promotion of the Adviser’s name and the potential for it to receive research, statistical, or other services from the Fund’s trades. The Board compared the Fund’s advisory fee and overall expense ratio to the average advisory fees and average expense ratios for its custom peer group and Morningstar category. The Board noted that the 0.74% advisory fee for the Fund was above the average and the median for the Fund’s custom peer group, and above the average and median of funds of similar size and structure in the Fund’s Morningstar category (Large Cap Growth Category Under $25 million, True No-Load), but less than the highest advisor fee in its Morningstar category. The Board further noted that the overall annual expense ratio of 0.99% for the Fund is above the average and median for the Fund’s custom peer group, and above the median but below the average for its Morningstar category. The Board also considered the fee charged by the Adviser to its other accounts that have a substantially similar strategy as the Fund and considered the similarities and differences of services received by such other accounts as compared to the services received by the Fund. The Board noted that the fee structures applicable to the Adviser’s other clients were not indicative of any unreasonableness with respect to the advisory fees payable to the Fund. The Board further considered the investment strategy and style used by the Adviser in managing the portfolio of the Fund. Following these comparisons and upon further consideration and discussion of the foregoing, the Board concluded that the advisory fee paid to the Adviser by the Fund is fair and reasonable.

The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered that the Fund’s fee arrangements with the Adviser involve both the advisory fee and the Adviser’s expense limitation agreement. The Board determined that while the advisory fee remained the same as asset levels increased, the shareholders of the Fund have experienced benefits from the Adviser’s expense limitation agreement and will continue to experience benefits from the Adviser’s expense limitation agreement until the Fund assets grow to a level where its expenses otherwise fall below the expense limit. Following further discussion of the Fund’s asset level, expectations for growth, and level of fees, the Board determined that the Fund’s fee arrangements with the Adviser would continue to provide benefits. The Board also determined that the fee arrangements were fair and reasonable in relation to the nature and quality of services being provided by the Adviser, given the Fund’s projected asset levels for the next year.

Brokerage and portfolio transactions. In this regard, the Board considered the Adviser’s trading policies, procedures, and performance in seeking best execution for its clients, including the Fund. The Board also considered the historical portfolio turnover rate

24

HVIA EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

for the Fund; the process by which evaluations are made of the overall reasonableness of commissions paid; the process by which the Adviser evaluates best execution; the method and basis for selecting and evaluating the broker-dealers used; and any anticipated allocation of portfolio business to persons affiliated with the Adviser. After further review and discussion, the Board determined that the Adviser’s practices regarding brokerage and portfolio transactions were satisfactory.

Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as the experience and abilities of the advisory personnel assigned to the Fund, the Adviser’s process for allocating trades among its different clients, and the substance and administration of the Adviser’s Code of Ethics. Following further consideration and discussion, the Board found that the Adviser’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory.

After full consideration of the above factors as well as other factors, the Board unanimously concluded that approval of the Agreement was in the best interests of the Fund and its shareholders.

25

CUSTOMER PRIVACY NOTICE

FACTS | WHAT DOES THE HVIA EQUITY FUND (the “Fund”) DO WITH YOUR PERSONAL INFORMATION? |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you are no longer our customer, we continue to share your information as described in this notice. |

How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

Reasons we can share your personal information | Does the

Fund share? | Can you limit this sharing? |

For our everyday business purposes –

Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes –

to offer our products and services to you | No | We don’t share |

For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We don’t share |

For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call 1-888-209-8710 |

26

Who we are |

Who is providing this notice? | HVIA Equity Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

What we do |

How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tell us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ Sharing for affiliates’ everyday business purposes – information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Hudson Valley Investment Advisor, Inc., the investment adviser to the Fund, could be deemed to be an affiliate. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ■ The Fund does not share with nonaffiliates so they can market to you. |

Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ The Fund does not jointly market. |

27

This page intentionally left blank.

This page intentionally left blank.

LADDER SELECT BOND FUND

INSTITUTIONAL CLASS (LSBIX)

Managed by

Ladder Capital Asset Management LLC

SEMI-ANNUAL REPORT

August 31, 2018

(Unaudited)

LADDER SELECT BOND FUND

LETTER TO SHAREHOLDERS | October 2018 |

Dear Ladder Select Bond Fund Shareholders,

For the six month period ended August 31, 2018, the Ladder Select Bond Fund (the “Fund”) returned 1.35%. For the same period, the Fund’s benchmark, the Bloomberg Barclays Intermediate Government/Credit Bond Index (the “Benchmark”), returned 0.99%, outperforming its Benchmark by 0.36%. For the quarter ended August 31, 2018, the Fund returned 0.68% compared to the Benchmark return of 0.55%, outperforming its benchmark by 0.13%.

The Fund seeks to capitalize on the sector-specific knowledge of commercial real estate (“CRE”) and commercial mortgage-backed securities (“CMBS”) of its adviser, Ladder Capital Asset Management (“LCAM”), to select investments that satisfy the Fund’s investment objective of a combination of current income and capital preservation.

Consistent with LCAM’s philosophy of seeking outperformance through deep sector expertise, the performance of the Fund was driven by two of the Funds larger holdings:

| | ■ | JPMCC 2016-WPT D – This investment is secured by a highly diverse portfolio of 108 office properties with 417 tenant leases. A significant proportion of the tenants are rated investment grade. The floating-rate investment grade security owned by the Fund is rated BBB by S&P and has a coupon of one-month dollar LIBOR +3.75%. This position was paid off at par during the previous quarter and refinanced as JPMCC 2018-WPT. The Fund reinvested a portion of the received proceeds in class DFL of the new JPMCC 2018-WPT securitization. |

| | ■ | COMM 2015-CR23 CMB and CMD – These investments are secured by a geographically diverse portfolio of 65 Courtyard by Marriott hotels located across 29 states. The sponsors are a joint venture between Clarion Partners, LLC and the State of Michigan Retirement Systems. Spreads on both positions have tightened year-to-date as the April 2020 maturity date approaches increasing the price of each position. In August 2017, 13 of the 65 properties were sold and the resulting proceeds were used to de-lever and partially defease the securitizations current loan. |

The Fund’s weighting in shorter duration and floating-rate investments along with open short positions in futures contributed to the Fund’s outperformance vs. the Benchmark. The Fund’s exposure to fixed-rate investments with durations longer than four years such as HILT 2016-SFP A and COMM 2031-LC13 AM partially offset the Fund’s overall positive performance.

To minimize exposure to potential interest rate moves, the Fund portfolio’s general composition remained unchanged. Given market uncertainties and higher short-term interest rates, the Fund’s defensive portfolio posture continued to focus on investments with shorter durations and/or floating-rate coupons, with the prior six month period seeing an increase in short-term, fixed-rate investments as a number of floating-rate positions paid off due to assets being refinanced. The Fund ended the period with a portfolio comprised of 44% floating-rate securities indexed off 1-Month USD LIBOR, 52.7% fixed-rate securities, and 3.3% cash diversified amongst its 30 securities. To further mitigate the portfolio’s exposure

1

to interest rate movements, the Fund incorporates hedging strategies using Treasury futures. The Fund also continues to be conservatively positioned with respect to credit exposure with a current weighted-average rating of ‘AA/AA-‘. In addition, the Fund’s returns during the period benefited from assets indexed to LIBOR, with 1-Month USD LIBOR increasing from 188 basis points on March 31, 2018 to 211 basis points on August 31, 2018. Since the Fund’s inception on October 16, 2016, 1-Month USD LIBOR has increased by 158 basis points.

Market Environment:

The Treasury curve continued its flattening trend, with the 30-year Treasury virtually unchanged and the front-end of the curve responding to the Federal Reserve’s ongoing tightening of monetary policy. The relative moves across the Treasury curve during the period were the following: the 3-month Treasury bill yield was 39 basis points higher closing at 2.10%; the 2-year Treasury yield was 36 basis points higher closing at 2.63%; the 5-year Treasury yield increased by 18 basis points closing at 2.74%; the 10-year Treasury yield increased by 12 basis points higher closing at 2.86%; and the 30-year Treasury yield increased by 5 basis points closing at 3.02%. The Treasury curve continues to be influenced on the front-end by historically strong economic growth and the corresponding Federal Reserve’s tightening of monetary policy. The long end of the Treasury curve, in our opinion, has been well bid due to the significant spread difference between other developed market debt (i.e., German 10-year Bunds at 34 basis points on 8/31/18) along with a stronger U.S. dollar. The U.S. economy continues to be robust even with global uncertainty such as developing trade wars, Emerging Market/China growth, and potential market liquidity events. The most recent Q3 U.S. GDP estimate released by the Atlanta Federal Reserve Bank is 4.43% following a Q2 U.S. GDP of 4.2% which was the fastest rate of quarterly U.S. economic growth since Q3 of 2014.

The lack of CMBS issuance and a generally quiet summer on Wall Street allowed for spreads to tighten. Spreads on CMBS ‘on-the-run’ last cash flow AAA bonds were tighter by 12 basis points and spreads on CMBS ‘on-the-run’ BBB- bonds were tighter by 102 basis points over the previous twelve months. Spreads on 2013 last cash flow AAA bonds, which LCAM looks at as an example of intermediate-duration performance, ended the period at 45bps over Treasuries achieving their tightest spread to Treasuries on a one year look back. Supply in new-issue U.S. CMBS volume year-to-date for 2018 is unchanged from the prior year at 53.8mm. (Commercial Mortgage Alert – 9.7.18)

Outlook:

The following themes defined the period and we expect will also define the near term investment landscape: a flatter Treasury curve driven by Federal Open Market Committee rate increases and expectations of further increases through 2020, a significant spread difference between U.S. yields and other developing market debt, historically strong U.S. GDP during Q2 2018, continuing expectations for stronger than historical GDP for Q3 2018, lower than expected inflation, a flatter CMBS credit curve as BBBs continued to tighten along with the chase for incremental yield. While the Fund continues to be well-positioned for all of these market dynamics, during the period, the Fund took a slightly more defensive duration and credit stance by reinvesting proceeds in seasoned fixed-rate and AAA rated floating-rate positions. The Fund continues to be focused on absolute Treasury rates,

2

managing interest rate and spread duration, finding relative value along the credit curve and purchasing investments with potential value-add propositions similar to the COMM 2015-CR23 and the recently defeased AVMT 2013-AVM investments. Going into year-end and the 2019 new year, the Fund will be intensely focused on increasing tail risk (‘fatter’) and the slope of the credit curve (“flatter”) when analyzing new investments and surveilling the current portfolio.

Consistent with its capital preservation objective, the Fund will continue its strategy of investing in CRE debt exhibiting strong fundamental credit metrics while focusing on relative value within each respective transaction’s capital structure. The Fund will also continue to be cautious in these later stages of the current expansion in regards to the increasing risks of ‘fatter’ credit tails and a ‘flatter’ credit spread curve.

On behalf of everyone at Ladder Capital Asset Management, we thank you for investing with us. We look forward to the Fund’s continued success as we approach 2019.

Sincerely,

|  |

| Brian Harris | Craig Sedmak |

| Principal Executive Officer and Portfolio Manager | Portfolio Manager |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-859-5867.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.ladderfunds.com or call 1-888-859-5867 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

3

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of August 31, 2018, please see the Schedule of Investments section of the semi-annual report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

4

LADDER SELECT BOND FUND

PORTFOLIO INFORMATION

August 31, 2018 (Unaudited)

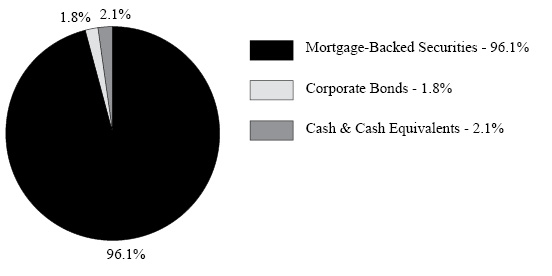

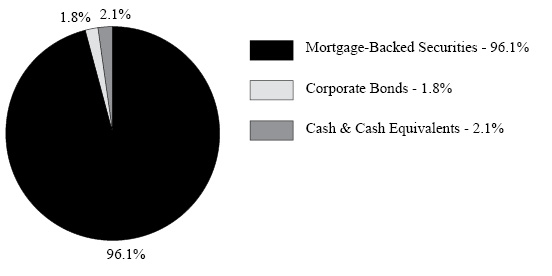

Portfolio Allocation (% of Net Assets)

Top 10 Long-Term Holdings

| Security Description | % of

Net Assets |

Commercial Mortgage Trust, Series 2015-CR23,

Class CMD, 144A, 3.684%(a), due 05/10/2048 | 11.4% |

Hudsons Bay Simon JV Trust, Series 2015-HBFL,

Class AFL, 144A, 3.910% (a), due 08/05/2034 | 9.3% |

Commercial Mortgage Trust, Series 2015-CR23,

Class CMB, 144A, 3.684% (a), due 05/10/2048 | 7.8% |

Commercial Mortgage Trust, Series 2014-TWC,

Class B, 144A, 3.697% (a), due 02/13/2032 | 7.5% |

JPMorgan Chase Commercial Mortgage Securities, Series 2018-WPT,

Class DFL, 144A, 4.630% (a), due 07/05/2023 | 6.3% |

Commercial Mortgage Trust, Series 2012-LC4,

Class AM, 4.063%, due 12/10/2044 | 4.2% |

Progressive Residential Trust, Series 2016-SFR1,

Class A, 144A, 3.573% (a), due 09/17/2033 | 4.0% |

Wells Fargo Commercial Mortgage Trust, Series 2012-LC5,

Class B, 4.142%, due 10/15/2045 | 3.8% |

VNO Mortgage Trust, Series 2013-PENN,

Class B, 144A, 3.947% (a), due 12/13/2029 | 3.8% |

Ashford Hospitality Trust, Series 2018-KEYS,

Class A, 144A, 3.050% (a), due 05/15/2035 | 3.7% |

| (a) | Variable rate security. The rate shown is the effective interest rate as of August 31, 2018. |

5

LADDER SELECT BOND FUND

SCHEDULE OF INVESTMENTS

August 31, 2018 (Unaudited) |

MORTGAGE-BACKED

SECURITIES — 96.1% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Commercial — 96.1% | | | | | | | | | | | | | | | | |

| Ashford Hospitality Trust, Series 2018-KEYS, Class A, 144A (1MO LIBOR + 100) (a) | | | 3.050 | % | | | 05/15/35 | | | $ | 500,000 | | | $ | 500,781 | |

| Aventura Mall Trust, Series 2013-AVM, Class B, 144A (a) | | | 3.743 | % | | | 12/05/32 | | | | 250,000 | | | | 254,070 | |

| Aventura Mall Trust, Series 2013-AVM, Class E, 144A (a) | | | 3.743 | % | | | 12/05/32 | | | | 100,000 | | | | 101,628 | |

| Citigroup Commercial Mortgage Trust, Series 2016-SMPL, Class A, 144A | | | 2.228 | % | | | 09/10/31 | | | | 51,000 | | | | 50,964 | |

| Commercial Mortgage Asset Trust, IO, Series 1999-C2, Class X (a) | | | 2.036 | % | | | 11/17/32 | | | | 287,279 | | | | 183 | |

| Commercial Mortgage Trust, Series 2014-TWC, Class B, 144A (1MO LIBOR + 160) (a) | | | 3.697 | % | | | 02/13/32 | | | | 1,000,000 | | | | 1,001,255 | |

| Commercial Mortgage Trust, Series 2012-LC4, Class AM | | | 4.063 | % | | | 12/10/44 | | | | 550,000 | | | | 559,457 | |

| Commercial Mortgage Trust, Series 2013-LC6, Class AM | | | 3.282 | % | | | 01/10/46 | | | | 212,000 | | | | 209,186 | |