| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Matthew J. Beck

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | May 31 | |

| | | |

| Date of reporting period: | November 30, 2018 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

BARROW VALUE OPPORTUNITY FUND

(BALIX)

Semi-Annual Report

November 30, 2018

(Unaudited)

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-877-767-6633 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-877-767-6633. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

BARROW VALUE OPPORTUNITY FUND

LETTER TO SHAREHOLDERS (Unaudited) | January 7, 2019 |

Dear Shareholder,

We are pleased to report on the status and performance of the Barrow Value Opportunity Fund (“the Fund”) for the six months ended November 30, 2018.

We believe that the Fund owns a well-positioned portfolio of equity interests in excellent businesses at attractive valuations. This portfolio is highly diversified by market capitalization segments (large, middle, small), industry sectors, and issuers. In selecting investments for the Fund, we search for businesses that feature high returns on capital, wide operating margins, and low debt loads. Based on our estimates of intrinsic value, we believe our portfolio’s valuation is attractively low on an absolute basis and less expensive than the U.S. stock market, as a whole.

On August 30, 2013, the Fund was reorganized as a mutual fund from a private limited partnership, which had commenced operations on December 31, 2008. Please refer to the Performance Information on pages4 and 5 for a summary of Fund performance versus the Russell 2500 Value Index (the “Russell 2500 Value”) and the S&P 500 Index (the “S&P 500”) over various periods since the Fund’s inception.

The Fund has exceeded the total return of the Russell 2500 Value in five of the past nine calendar years1, with an annual average total return of 13.26% since inception. During the most recent six months ended November 30, 2018, the Fund returned -3.34% net of all fees and expenses, which outperformed the Russell 2500 Value by 0.48%.

Barrow Street Advisors, LLC (the “Adviser”) continues to use its proprietary private-equity approach to uncover companies that exhibit its Quality-meets-Value criteria. Based on extensive research by the Adviser, the Fund seeks to generate long-term capital appreciation by investing in companies with fundamental operating and financial attributes representative of both quality and value. To increase the Fund’s chances for success, we invest in a variety of positions that are diversified across market capitalization and industry sectors.

Over the past six-months, we added 39 new portfolio investments, composed of 20 small-caps, 12 mid-caps, and 7 large-caps, and representing eight different industry sectors. We believe all of these new additions to the Fund’s portfolio are excellent companies with strong balance sheets. These companies are generally using their ample free cash flow to: a) re-invest in growth opportunities at high rates of return on investment; b) pay dividends; c) repurchase stock at attractive valuations; and/or d) retire outstanding debt.

In keeping with our practice since the beginning of 2009, over the past six months the Fund’s investments were sourced by taking account of the opportunity set of all companies in our broad investment universe each time we committed capital to a new position. We think this approach allows us to identify excellent investment opportunities that arise from temporary market inefficiencies and to gather up the most compelling

1

investments across a wide array of industries and market capitalizations, while avoiding the destructive behavioral biases inherent in concentrated-stock and sector-specialized investing.

Eight of the Fund’s holdings were announced as take-over targets over the past six months, which was approximately 3.8x the market average. The Fund has had investments in 116 take-overs since December 31, 20081, or roughly 3.8x the market average2. The control premiums we have captured by virtue of holding stocks that end up being merger targets have made repeated and meaningful contributions to the Fund’s total returns, and we expect continued benefits from this effect going forward. We typically sell companies from the Fund’s portfolio soon after they are announced as take-over targets and re-invest that capital.

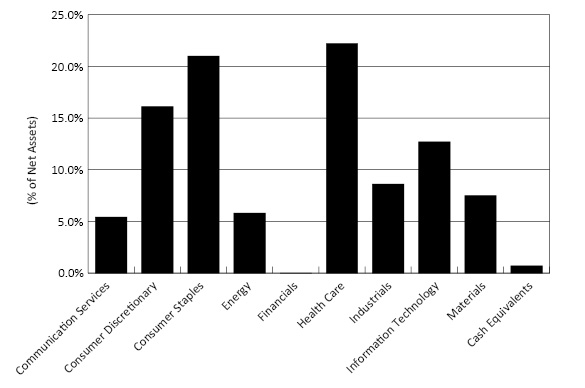

Over the past six months, the Fund’s large cap positions generated returns of +4.18%, while mid and small-cap positions generated -4.90% and -4.16%, respectively. This compares to +3.02% for the S&P 500 (for large-caps), -2.71% for the S&P 400 Midcap (for mid-caps), and -5.53% for the Russell 2000 (for small-caps) over the same period. The Fund’s sectors with the best absolute performance were Health Care and Consumer Staples, which generated total returns of +6.23% and +0.94%, respectively. The Fund’s sectors with the worst absolute performance were Materials and Communication Services, which returned -24.37% and -11.04%, respectively.

You can find additional commentary and reports about the Adviser’s management of the Fund’s portfolio on the Fund’s website (www.barrowfunds.com).

Sincerely,

Nicholas Chermayeff | Robert F. Greenhill, Jr. | David R. Bechtel |

Co-Portfolio Manager, | Co-Portfolio Manager, | Principal, |

Investment Committee | Investment Committee | Investment Committee |

1 | The investment related and performance information discussed above for periods prior to Barrow Value Opportunity Fund’s reorganization date (August 30, 2013) are based on the activities of the Fund’s predecessor, the Barrow Street Fund L.P., an unregistered limited partnership managed by the portfolio managers of Barrow Value Opportunity Fund (the “Predecessor Private Fund”). The Predecessor Private Fund was reorganized into the Institutional Class shares of the Barrow Value Opportunity Fund on August 30, 2013, the date that the Fund commenced operations (the “Reorganization”). Barrow Value Opportunity Fund has been managed in the same style and by the same portfolio managers since the Predecessor Private Fund’s inception on December 31, 2008. The performance information shows the Predecessor Private Fund’s returns calculated using the actual fees and expenses charged by the Predecessor Private Fund. This prior performance is net of management fees and other expenses, but does not include the effect of the Predecessor Private Fund’s performance fee, which was in place until October 7, 2012. Prior to the Reorganization, the Predecessor Private Fund was not subject to certain investment restrictions, diversification requirements, and other restrictions of the Investment Company Act of 1940, as amended, or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected Barrow Value Opportunity Fund’s performance. |

2 | The frequency of merger and acquisition (“M&A”) activity in the Fund’s portfolio is calculated on a quarterly basis by dividing the cumulative number of portfolio holdings that have been announced as merger or acquisition targets by the cumulative number of unique holdings held in the Fund’s portfolio. The frequency of M&A activity in the market is calculated on a quarterly basis by dividing the cumulative number of publicly-traded U.S. common stocks that have been announced as acquisition targets per Bloomberg by the total universe of publicly-traded U.S. common stocks as identified by Bloomberg (approximately 10,000). |

2

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-877-767-6633.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at www.barrowfunds.com or call 1-877-767-6633 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. For a complete list of securities held by the Fund as of November 30, 2018, please see the Schedule of Investments section of this Report. The opinions of the Fund’s Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

BARROW VALUE OPPORTUNITY FUND

PERFORMANCE INFORMATION

November 30, 2018 (Unaudited)

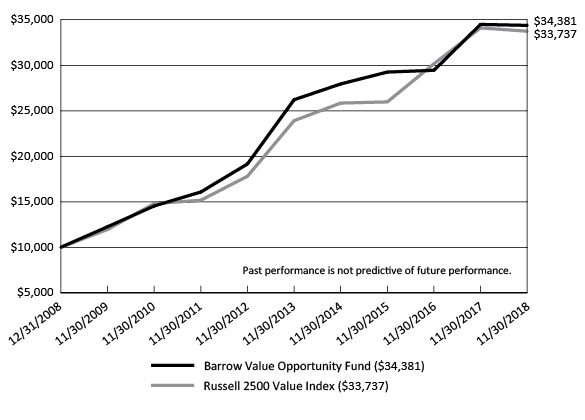

Comparison of the Change in Value of a $10,000 Investment in

Barrow Value Opportunity Fund

versus the Russell 2500 Value Index

Average Annual Total Returns

For the periods ended November 30, 2018 | |

| | 1 Year | 5 Years | Since

Inception(c) | |

Barrow Value Opportunity Fund(a)(b) | (0.31%) | 5.58% | 13.26% | |

Russell 2500 Value Index | (1.07%) | 7.13% | 13.05% | |

4

BARROW VALUE OPPORTUNITY FUND

PERFORMANCE INFORMATION

November 30, 2018 (Unaudited)

Comparison of Yearly Returns with the Russell 2500 Value Index | |

| | Barrow Value

Opportunity

Fund(a) | Russell

2500 Value

Index | Difference | |

Yearly Total Returns for

Calendar Years: | | | | |

2009 | 30.10% | 27.68% | 2.42% | |

2010 | 18.75% | 24.82% | (6.07%) | |

2011 | 5.50% | (3.36%) | 8.86% | |

2012 | 18.77% | 19.21% | (0.44%) | |

2013 | 36.69% | 33.32% | 3.37% | |

2014 | 5.13% | 7.11% | (1.98%) | |

2015 | 0.81% | (5.49%) | 6.30% | |

2016 | 7.41% | 25.20% | (17.79%) | |

2017 | 16.10% | 10.36% | 5.74% | |

2018 (through 11/30/18) | (1.70%) | (1.47%) | (0.23%) | |

| | | | | |

Total Return Since Inception (not annualized, as of 11/30/18) | 243.81% | 237.37% | 6.44% | |

(a) | The Barrow Value Opportunity Fund (the “Fund”) performance includes the performance of the Barrow Street Fund L.P. (the “Predecessor Private Fund”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Private Fund was reorganized into the Fund at the close of business on August 30, 2013 (the “Reorganization”), the date the Fund commenced operations. The Fund has been managed in the same style and by the same portfolio managers since the Predecessor Private Fund’s inception on December 31, 2008. The Fund’s investment goals, policies, guidelines and restrictions are, in all material respects, equivalent to those of the Predecessor Private Fund. The performance of the Predecessor Private Fund is net of management fees of 1.50% of assets but does not include the effect of a 20% performance fee which was in place until October 7, 2012. Prior to the Reorganization, the Predecessor Private Fund was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended, or Subchapter M of the Internal Revenue Code of 1986, as amended. If such restrictions had been applicable, they might have adversely affected the Predecessor Private Fund’s performance. |

(b) | The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

(c) | Represents the period from December 31, 2008(a) through November 30, 2018. |

5

BARROW VALUE OPPORTUNITY FUND

PORTFOLIO INFORMATION

November 30, 2018 (Unaudited)

Sector Diversification

Top 10 Equity Holdings

Security Description | % of

Net Assets |

Pilgrim's Pride Corporation | 1.5% |

Molson Coors Brewing Company - Class B | 1.5% |

Herbalife Nutrition Ltd. | 1.4% |

Ingredion, Inc. | 1.4% |

USANA Health Sciences, Inc. | 1.4% |

Nu Skin Enterprises, Inc. - Class A | 1.3% |

Simply Good Foods Company (The) | 1.3% |

Cal-Maine Foods, Inc. | 1.1% |

Hologic, Inc. | 1.1% |

ResMed, Inc. | 1.1% |

6

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS

November 30, 2018 (Unaudited) |

COMMON STOCKS — 99.3% | | Shares | | | Value | |

Communication Services — 5.4% | | | | | | | | |

Entertainment — 0.6% | | | | | | | | |

Viacom, Inc. - Class B | | | 9,481 | | | $ | 292,584 | |

| | | | | | | | | |

Interactive Media & Services — 0.3% | | | | | | | | |

Cars.com, Inc.(a)(b) | | | 3,403 | | | | 88,035 | |

Match Group, Inc.(a) | | | 1,544 | | | | 62,177 | |

| | | | | | | | 150,212 | |

Media — 4.5% | | | | | | | | |

CBS Corporation - Class B(b) | | | 7,111 | | | | 385,274 | |

Comcast Corporation - Class A(b) | | | 11,189 | | | | 436,483 | |

Emerald Expositions Events, Inc. | | | 9,487 | | | | 110,998 | |

Interpublic Group of Companies, Inc. (The)(b) | | | 12,650 | | | | 297,275 | |

MSG Networks, Inc. - Class A(a) | | | 8,309 | | | | 222,515 | |

National CineMedia, Inc. | | | 15,758 | | | | 108,888 | |

Omnicom Group, Inc.(b) | | | 5,176 | | | | 398,396 | |

Tribune Publishing Company(a) | | | 14,554 | | | | 212,343 | |

| | | | | | | | 2,172,172 | |

Consumer Discretionary — 16.1% | | | | | | | | |

Auto Components — 1.8% | | | | | | | | |

BorgWarner, Inc.(b) | | | 1,262 | | | | 49,950 | |

Gentex Corporation(b) | | | 15,198 | | | | 342,259 | |

Lear Corporation(b) | | | 2,287 | | | | 311,604 | |

Tenneco, Inc. - Class A | | | 671 | | | | 22,646 | |

Visteon Corporation(a) | | | 1,843 | | | | 136,050 | |

| | | | | | | | 862,509 | |

Diversified Consumer Services — 2.1% | | | | | | | | |

frontdoor, inc.(a) | | | 6,337 | | | | 147,589 | |

H&R Block, Inc.(b) | | | 11,995 | | | | 323,985 | |

ServiceMaster Global Holdings, Inc.(a) | | | 7,079 | | | | 313,387 | |

Weight Watchers International, Inc.(a) | | | 4,727 | | | | 236,445 | |

| | | | | | | | 1,021,406 | |

Hotels, Restaurants & Leisure — 1.5% | | | | | | | | |

Bojangles', Inc.(a) | | | 13,894 | | | | 223,554 | |

Choice Hotels International, Inc. | | | 4,236 | | | | 329,857 | |

Jack in the Box, Inc. | | | 1,827 | | | | 162,037 | |

| | | | | | | | 715,448 | |

7

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 16.1% (Continued) | | | | | | | | |

Household Durables — 1.6% | | | | | | | | |

La-Z-Boy, Inc. | | | 5,087 | | | $ | 148,693 | |

NVR, Inc.(a)(b) | | | 80 | | | | 196,000 | |

TopBuild Corporation(a) | | | 3,195 | | | | 162,785 | |

Tupperware Brands Corporation(b) | | | 6,574 | | | | 249,549 | |

| | | | | | | | 757,027 | |

Internet & Direct Marketing Retail — 2.3% | | | | | | | | |

Booking Holdings, Inc.(a) | | | 218 | | | | 412,430 | |

eBay, Inc.(a)(b) | | | 14,213 | | | | 424,258 | |

Nutrisystem, Inc. | | | 6,539 | | | | 243,185 | |

Stamps.com, Inc.(a) | | | 232 | | | | 39,779 | |

| | | | | | | | 1,119,652 | |

Leisure Products — 0.9% | | | | | | | | |

Brunswick Corporation | | | 879 | | | | 46,622 | |

Malibu Boats, Inc. - Class A(a) | | | 5,087 | | | | 246,313 | |

MasterCraft Boat Holdings, Inc.(a) | | | 6,688 | | | | 173,286 | |

| | | | | | | | 466,221 | |

Multi-Line Retail — 0.9% | | | | | | | | |

Dollar Tree, Inc.(a) | | | 4,822 | | | | 418,405 | |

| | | | | | | | | |

Specialty Retail — 2.3% | | | | | | | | |

Aaron's, Inc. | | | 1,709 | | | | 79,981 | |

Buckle, Inc. (The) | | | 10,673 | | | | 203,854 | |

Chico's FAS, Inc. | | | 19,407 | | | | 104,798 | |

GameStop Corporation - Class A | | | 14,584 | | | | 199,217 | |

Sally Beauty Holdings, Inc.(a) | | | 12,360 | | | | 260,920 | |

Winmark Corporation(b) | | | 919 | | | | 136,297 | |

Zumiez, Inc.(a) | | | 6,508 | | | | 128,338 | |

| | | | | | | | 1,113,405 | |

Textiles, Apparel & Luxury Goods — 2.7% | | | | | | | | |

Carter's, Inc. | | | 2,771 | | | | 256,317 | |

Deckers Outdoor Corporation(a) | | | 1,665 | | | | 221,845 | |

Hanesbrands, Inc.(b) | | | 16,106 | | | | 256,246 | |

Skechers U.S.A., Inc. - Class A(a) | | | 11,000 | | | | 297,000 | |

Tapestry, Inc.(b) | | | 7,335 | | | | 285,552 | |

| | | | | | | | 1,316,960 | |

Consumer Staples — 21.0% | | | | | | | | |

Beverages — 1.5% | | | | | | | | |

Molson Coors Brewing Company - Class B(b) | | | 11,235 | | | | 738,926 | |

8

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Consumer Staples — 21.0% (Continued) | | | | | | | | |

Food Products — 8.7% | | | | | | | | |

Cal-Maine Foods, Inc. | | | 11,802 | | | $ | 551,389 | |

Ingredion, Inc.(b) | | | 6,562 | | | | 685,467 | |

Kellogg Company | | | 5,665 | | | | 360,577 | |

Kraft Heinz Company (The) | | | 7,078 | | | | 361,827 | |

Pilgrim's Pride Corporation(a)(b) | | | 37,495 | | | | 743,901 | |

Sanderson Farms, Inc. | | | 4,584 | | | | 518,725 | |

Simply Good Foods Company (The)(a) | | | 29,911 | | | | 607,792 | |

Tyson Foods, Inc. - Class A | | | 6,445 | | | | 379,933 | |

| | | | | | | | 4,209,611 | |

Household Products — 2.9% | | | | | | | | |

Central Garden & Pet Company(a) | | | 14,804 | | | | 501,115 | |

Colgate-Palmolive Company(b) | | | 6,297 | | | | 399,986 | |

Energizer Holdings, Inc.(b) | | | 10,936 | | | | 490,261 | |

| | | | | | | | 1,391,362 | |

Personal Products — 5.1% | | | | | | | | |

Edgewell Personal Care Company(a)(b) | | | 12,325 | | | | 515,185 | |

Herbalife Nutrition Ltd.(a)(b) | | | 12,058 | | | | 690,320 | |

Nu Skin Enterprises, Inc. - Class A(b) | | | 9,214 | | | | 607,848 | |

USANA Health Sciences, Inc.(a)(b) | | | 5,398 | | | | 660,607 | |

| | | | | | | | 2,473,960 | |

Tobacco — 2.8% | | | | | | | | |

Altria Group, Inc.(b) | | | 6,518 | | | | 357,382 | |

Philip Morris International, Inc. | | | 4,580 | | | | 396,307 | |

Turning Point Brands, Inc. | | | 13,462 | | | | 401,168 | |

Vector Group Ltd.(b) | | | 13,118 | | | | 165,287 | |

| | | | | | | | 1,320,144 | |

Energy — 5.8% | | | | | | | | |

Oil, Gas & Consumable Fuels — 5.8% | | | | | | | | |

Alliance Resource Partners, L.P. | | | 13,173 | | | | 258,849 | |

Antero Midstream GP, L.P.(b) | | | 21,862 | | | | 323,776 | |

Arch Coal, Inc. - Class A | | | 2,732 | | | | 222,030 | |

CVR Refining, L.P. | | | 13,359 | | | | 184,889 | |

Delek Logistics Partners, L.P. | | | 8,402 | | | | 256,093 | |

EQGP Holdings, L.P. | | | 5,444 | | | | 108,989 | |

Green Plains Partners, L.P. | | | 17,063 | | | | 229,668 | |

HollyFrontier Corporation(b) | | | 6,054 | | | | 378,193 | |

Peabody Energy Corporation(b) | | | 13,416 | | | | 417,774 | |

Phillips 66 Partners, L.P. | | | 1,760 | | | | 82,544 | |

9

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Energy — 5.8% (Continued) | | | | | | | | |

Oil, Gas & Consumable Fuels — 5.8% (Continued) | | | | | | | | |

Renewable Energy Group, Inc.(a) | | | 8,927 | | | $ | 240,583 | |

Western Gas Partners, L.P. | | | 2,158 | | | | 95,901 | |

| | | | | | | | 2,799,289 | |

Health Care — 22.2% | | | | | | | | |

Health Care Equipment & Supplies — 11.2% | | | | | | | | |

Anika Therapeutics, Inc.(a) | | | 6,681 | | | | 230,160 | |

Atrion Corporation | | | 42 | | | | 32,475 | |

Danaher Corporation(b) | | | 4,906 | | | | 537,403 | |

Edwards Lifesciences Corporation(a) | | | 3,135 | | | | 507,901 | |

Globus Medical, Inc. - Class A(a) | | | 9,207 | | | | 444,606 | |

Hologic, Inc.(a)(b) | | | 12,292 | | | | 545,888 | |

Integer Holdings Corporation(a) | | | 3,516 | | | | 311,447 | |

Lantheus Holdings, Inc.(a)(b) | | | 19,686 | | | | 369,113 | |

LeMaitre Vascular, Inc.(b) | | | 1,443 | | | | 40,245 | |

Masimo Corporation(a)(b) | | | 4,303 | | | | 475,137 | |

Meridian Bioscience, Inc.(b) | | | 16,743 | | | | 317,112 | |

Quidel Corporation(a) | | | 4,103 | | | | 249,545 | |

ResMed, Inc.(b) | | | 4,862 | | | | 543,523 | |

Stryker Corporation | | | 2,862 | | | | 502,167 | |

Varex Imaging Corporation(a) | | | 10,108 | | | | 266,346 | |

Varian Medical Systems, Inc.(a) | | | 466 | | | | 57,500 | |

| | | | | | | | 5,430,568 | |

Health Care Providers & Services — 8.1% | | | | | | | | |

American Renal Associates Holdings, Inc.(a) | | | 15,282 | | | | 253,528 | |

AmerisourceBergen Corporation(b) | | | 5,335 | | | | 474,282 | |

AMN Healthcare Services, Inc.(a) | | | 5,377 | | | | 342,515 | |

Apollo Medical Holdings, Inc.(a) | | | 3,231 | | | | 57,900 | |

Cardinal Health, Inc. | | | 9,594 | | | | 526,039 | |

CVS Health Corporation | | | 6,531 | | | | 523,786 | |

MEDNAX, Inc.(a)(b) | | | 11,589 | | | | 465,878 | |

Premier, Inc. - Class A(a)(b) | | | 11,084 | | | | 439,591 | |

Quest Diagnostics, Inc.(b) | | | 4,900 | | | | 433,993 | |

Tivity Health, Inc.(a)(b) | | | 8,425 | | | | 345,088 | |

U.S. Physical Therapy, Inc. | | | 455 | | | | 54,140 | |

| | | | | | | | 3,916,740 | |

Pharmaceuticals — 2.9% | | | | | | | | |

Akorn, Inc.(a) | | | 10,867 | | | | 74,548 | |

Horizon Pharma plc(a) | | | 16,403 | | | | 327,732 | |

10

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Health Care — 22.2% (Continued) | | | | | | | | |

Pharmaceuticals — 2.9% (Continued) | | | | | | | | |

Innoviva, Inc.(a)(b) | | | 19,851 | | | $ | 362,479 | |

Pacira Pharmaceuticals, Inc.(a) | | | 1,526 | | | | 73,752 | |

Phibro Animal Health Corporation - Class A | | | 6,973 | | | | 236,385 | |

Supernus Pharmaceuticals, Inc.(a)(b) | | | 6,441 | | | | 305,432 | |

| | | | | | | | 1,380,328 | |

Industrials — 8.6% | | | | | | | | |

Aerospace & Defense — 0.8% | | | | | | | | |

Harris Corporation | | | 961 | | | | 137,375 | |

National Presto Industries, Inc.(b) | | | 412 | | | | 52,934 | |

TransDigm Group, Inc.(a) | | | 488 | | | | 176,495 | |

| | | | | | | | 366,804 | |

Air Freight & Logistics — 0.4% | | | | | | | | |

Expeditors International of Washington, Inc. | | | 2,450 | | | | 186,421 | |

| | | | | | | | | |

Building Products — 1.3% | | | | | | | | |

A.O. Smith Corporation | | | 3,605 | | | | 170,805 | |

American Woodmark Corporation(a) | | | 835 | | | | 55,853 | |

CSW Industrials, Inc.(a) | | | 1,126 | | | | 59,644 | |

Gibraltar Industries, Inc.(a) | | | 1,344 | | | | 48,599 | |

Insteel Industries, Inc. | | | 1,884 | | | | 51,885 | |

Johnson Controls International plc | | | 4,996 | | | | 173,761 | |

NCI Building Systems, Inc.(a) | | | 3,672 | | | | 41,677 | |

Patrick Industries, Inc.(a) | | | 1,059 | | | | 42,064 | |

Resideo Technologies, Inc.(a)(b) | | | 178 | | | | 3,672 | |

| | | | | | | | 647,960 | |

Commercial Services & Supplies — 0.9% | | | | | | | | |

Brady Corporation - Class A(b) | | | 1,244 | | | | 54,189 | |

Deluxe Corporation | | | 975 | | | | 49,091 | |

Ennis, Inc. | | | 2,615 | | | | 51,071 | |

Herman Miller, Inc.(b) | | | 1,523 | | | | 51,569 | |

Kimball International, Inc. - Class B | | | 3,202 | | | | 48,862 | |

Knoll, Inc.(b) | | | 2,424 | | | | 46,953 | |

McGrath RentCorp | | | 1,059 | | | | 56,582 | |

SP Plus Corporation(a)(b) | | | 1,609 | | | | 48,769 | |

| | | | | | | | 407,086 | |

Electrical Equipment — 1.2% | | | | | | | | |

Acuity Brands, Inc. | | | 1,323 | | | | 172,016 | |

AMETEK, Inc. | | | 2,322 | | | | 170,504 | |

11

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Industrials — 8.6% (Continued) | | | | | | | | |

Electrical Equipment — 1.2% (Continued) | | | | | | | | |

Atkore International Group, Inc.(a) | | | 2,287 | | | $ | 46,701 | |

Hubbell, Inc. | | | 342 | | | | 37,675 | |

Rockwell Automation, Inc. | | | 995 | | | | 173,468 | |

| | | | | | | | 600,364 | |

Industrial Conglomerates — 0.3% | | | | | | | | |

Honeywell International, Inc.(b) | | | 1,072 | | | | 157,316 | |

| | | | | | | | | |

Machinery — 0.7% | | | | | | | | |

Global Brass & Copper Holdings, Inc.(b) | | | 1,577 | | | | 51,048 | |

Greenbrier Companies, Inc. (The)(b) | | | 888 | | | | 43,432 | |

Hillenbrand, Inc. | | | 1,040 | | | | 46,082 | |

Meritor, Inc.(a) | | | 3,070 | | | | 50,655 | |

Rexnord Corporation(a) | | | 1,995 | | | | 56,479 | |

Wabash National Corporation(b) | | | 3,826 | | | | 59,456 | |

Welbilt, Inc.(a) | | | 2,683 | | | | 37,079 | |

| | | | | | | | 344,231 | |

Professional Services — 2.1% | | | | | | | | |

FTI Consulting, Inc.(a) | | | 759 | | | | 53,320 | |

Heidrick & Struggles International, Inc. | | | 1,776 | | | | 65,108 | |

Kforce, Inc. | | | 1,474 | | | | 46,711 | |

Korn/Ferry International | | | 1,124 | | | | 55,042 | |

ManpowerGroup, Inc. | | | 2,122 | | | | 172,264 | |

Navigant Consulting, Inc. | | | 2,387 | | | | 61,155 | |

Nielsen Holdings plc | | | 6,117 | | | | 166,199 | |

Resources Connection, Inc. | | | 3,070 | | | | 51,699 | |

Robert Half International, Inc.(b) | | | 2,601 | | | | 160,820 | |

TriNet Group, Inc.(a)(b) | | | 3,384 | | | | 155,359 | |

| | | | | | | | 987,677 | |

Road & Rail — 0.1% | | | | | | | | |

Landstar System, Inc. | | | 339 | | | | 36,978 | |

| | | | | | | | | |

Trading Companies & Distributors — 0.8% | | | | | | | | |

HD Supply Holdings, Inc.(a) | | | 4,354 | | | | 173,725 | |

MSC Industrial Direct Company, Inc. - Class A | | | 2,030 | | | | 179,838 | |

Systemax, Inc. | | | 1,897 | | | | 52,907 | |

| | | | | | | | 406,470 | |

12

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Information Technology — 12.7% | | | | | | | | |

Communications Equipment — 2.5% | | | | | | | | |

Cisco Systems, Inc. | | | 5,551 | | | $ | 265,727 | |

F5 Networks, Inc.(a)(b) | | | 2,000 | | | | 343,940 | |

InterDigital, Inc.(b) | | | 2,207 | | | | 166,099 | |

Juniper Networks, Inc. | | | 11,952 | | | | 343,142 | |

Ubiquiti Networks, Inc. | | | 1,084 | | | | 118,134 | |

| | | | | | | | 1,237,042 | |

Electronic Equipment, Instruments & Components — 3.1% | | | | | | | | |

Anixter International, Inc.(a) | | | 721 | | | | 46,115 | |

Arrow Electronics, Inc.(a) | | | 1,478 | | | | 113,762 | |

AVX Corporation | | | 3,042 | | | | 50,163 | |

Belden, Inc. | | | 2,610 | | | | 145,586 | |

Benchmark Electronics, Inc. | | | 4,273 | | | | 101,868 | |

CDW Corporation | | | 1,208 | | | | 111,957 | |

Electro Scientific Industries, Inc.(a) | | | 9,051 | | | | 266,099 | |

Insight Enterprises, Inc.(a) | | | 3,199 | | | | 142,611 | |

IPG Photonics Corporation(a) | | | 530 | | | | 75,340 | |

KEMET Corporation | | | 1,413 | | | | 28,938 | |

Methode Electronics, Inc.(b) | | | 5,436 | | | | 164,711 | |

PC Connection, Inc. | | | 1,500 | | | | 47,010 | |

Tech Data Corporation(a) | | | 2,220 | | | | 199,689 | |

| | | | | | | | 1,493,849 | |

IT Services — 4.5% | | | | | | | | |

Amdocs Ltd. | | | 1,279 | | | | 83,020 | |

Booz Allen Hamilton Holding Corporation(b) | | | 1,643 | | | | 84,302 | |

Broadridge Financial Solutions, Inc. | | | 684 | | | | 72,415 | |

CACI International, Inc. - Class A(a) | | | 443 | | | | 73,055 | |

Cass Information Systems, Inc. | | | 1,366 | | | | 90,170 | |

Cognizant Technology Solutions Corporation - Class A(b) | | | 1,733 | | | | 123,442 | |

CoreLogic, Inc.(a) | | | 1,775 | | | | 71,817 | |

CSG Systems International, Inc. | | | 2,391 | | | | 83,852 | |

DXC Technology Company | | | 1,470 | | | | 92,669 | |

Euronet Worldwide, Inc.(a) | | | 725 | | | | 85,267 | |

First Data Corporation - Class A(a) | | | 5,624 | | | | 107,306 | |

Hackett Group, Inc. (The) | | | 4,260 | | | | 75,189 | |

I3 Verticals, Inc. - Class A(a) | | | 922 | | | | 20,773 | |

International Business Machines Corporation | | | 989 | | | | 122,903 | |

Leidos Holdings, Inc. | | | 1,208 | | | | 76,104 | |

13

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Information Technology — 12.7% (Continued) | | | | | | | | |

IT Services — 4.5% (Continued) | | | | | | | | |

ManTech International Corporation - Class A(b) | | | 1,327 | | | $ | 74,710 | |

MAXIMUS, Inc.(b) | | | 1,234 | | | | 87,762 | |

NIC, Inc.(b) | | | 5,998 | | | | 77,974 | |

Paychex, Inc.(b) | | | 1,861 | | | | 131,684 | |

Perspecta, Inc. | | | 3,169 | | | | 66,898 | |

Presidio, Inc. | | | 5,962 | | | | 83,945 | |

Sabre Corporation | | | 3,281 | | | | 83,895 | |

Science Applications International Corporation(b) | | | 1,190 | | | | 82,729 | |

Sykes Enterprises, Inc.(a) | | | 2,808 | | | | 77,557 | |

Unisys Corporation(a) | | | 4,499 | | | | 60,826 | |

Western Union Company (The) | | | 4,476 | | | | 83,835 | |

| | | | | | | | 2,174,099 | |

Software — 1.4% | | | | | | | | |

CDK Global, Inc. | | | 1,411 | | | | 71,114 | |

Cision Ltd.(a) | | | 5,090 | | | | 63,727 | |

Citrix Systems, Inc.(a) | | | 793 | | | | 86,413 | |

Ebix, Inc.(b) | | | 1,443 | | | | 68,138 | |

j2 Global, Inc. | | | 1,087 | | | | 80,232 | |

Manhattan Associates, Inc.(a)(b) | | | 1,788 | | | | 88,560 | |

Oracle Corporation(b) | | | 2,613 | | | | 127,410 | |

Progress Software Corporation | | | 2,632 | | | | 92,541 | |

| | | | | | | | 678,135 | |

Technology Hardware, Storage & Peripherals — 1.2% | | | | | | | | |

HP, Inc.(b) | | | 10,561 | | | | 242,903 | |

Xerox Corporation | | | 12,638 | | | | 340,215 | |

| | | | | | | | 583,118 | |

Materials — 7.5% | | | | | | | | |

Chemicals — 2.5% | | | | | | | | |

Celanese Corporation | | | 1,840 | | | | 185,711 | |

Eastman Chemical Company | | | 2,245 | | | | 176,951 | |

Valvoline, Inc.(b) | | | 20,855 | | | | 439,832 | |

Westlake Chemical Corporation | | | 5,696 | | | | 412,903 | |

| | | | | | | | 1,215,397 | |

Containers & Packaging — 1.2% | | | | | | | | |

Myers Industries, Inc. | | | 21,592 | | | | 356,268 | |

Packaging Corporation of America | | | 1,899 | | | | 185,760 | |

Sealed Air Corporation | | | 1,540 | | | | 56,257 | |

| | | | | | | | 598,285 | |

14

BARROW VALUE OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.3% (Continued) | | Shares | | | Value | |

Materials — 7.5% (Continued) | | | | | | | | |

Metals & Mining — 0.9% | | | | | | | | |

Reliance Steel & Aluminum Company | | | 1,447 | | | $ | 116,411 | |

Steel Dynamics, Inc. | | | 8,723 | | | | 307,050 | |

| | | | | | | | 423,461 | |

Paper & Forest Products — 2.9% | | | | | | | | |

Domtar Corporation | | | 7,826 | | | | 341,057 | |

Louisiana-Pacific Corporation(b) | | | 21,976 | | | | 502,371 | |

Neenah, Inc. | | | 4,457 | | | | 306,998 | |

P.H. Glatfelter Company | | | 19,769 | | | | 252,055 | |

| | | | | | | | 1,402,481 | |

| | | | | | | | | |

Total Common Stocks (Cost $46,009,684) | | | | | | $ | 48,014,103 | |

|

MONEY MARKET FUNDS — 0.6% | | Shares | | | Value | |

Fidelity Institutional Money Market Government Portfolio - Class I, 2.10%(c) (Cost $286,162) | | | 286,162 | | | $ | 286,162 | |

| | | | | | | | | |

Total Investments at Value — 99.9% (Cost $46,295,846) | | | | | | $ | 48,300,265 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 35,048 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 48,335,313 | |

(a) | Non-income producing security. |

(b) | All or a portion of the shares have been pledged as collateral for trading purposes. The total value of such securities as of November 30, 2018 was $13,011,878. |

(c) | The rate shown is the 7-day effective yield as of November 30, 2018. |

See accompanying notes to financial statements. |

15

BARROW VALUE OPPORTUNITY FUND

STATEMENT OF ASSETS AND LIABILITIES

November 30, 2018 (Unaudited) |

ASSETS | | | | |

Investments in securities: | | | | |

At cost | | $ | 46,295,846 | |

At value (Note 2) | | $ | 48,300,265 | |

Receivable for capital shares sold | | | 81 | |

Dividends receivable | | | 59,245 | |

Other assets | | | 19,078 | |

TOTAL ASSETS | | | 48,378,669 | |

| | | | | |

LIABILITIES | | | | |

Payable to Adviser (Note 4) | | | 29,822 | |

Payable to administrator (Note 4) | | | 8,880 | |

Other accrued expenses and liabilities | | | 4,654 | |

TOTAL LIABILITIES | | | 43,356 | |

| | | | | |

NET ASSETS | | $ | 48,335,313 | |

| | | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 43,391,146 | |

Accumulated earnings | | | 4,944,167 | |

Net assets | | $ | 48,335,313 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 1,777,257 | |

| | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 27.20 | |

See accompanying notes to financial statements. |

16

BARROW VALUE OPPORTUNITY FUND

STATEMENT OF OPERATIONS

For the Six Months Ended November 30, 2018 (Unaudited) |

INVESTMENT INCOME | | | | |

Dividends | | $ | 452,465 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 4) | | | 250,769 | |

Administration fees (Note 4) | | | 25,355 | |

Professional fees | | | 21,167 | |

Accounting services fees (Note 4) | | | 17,540 | |

Registration and filing fees | | | 10,801 | |

Custodian and bank service fees | | | 6,463 | |

Transfer agent fees (Note 4) | | | 6,000 | |

Compliance service fees (Note 4) | | | 6,000 | |

Trustees’ fees and expenses (Note 4) | | | 5,364 | |

Printing of shareholder reports | | | 3,486 | |

Pricing fees | | | 2,419 | |

Insurance expense | | | 1,554 | |

Other expenses | | | 646 | |

TOTAL EXPENSES | | | 357,564 | |

Investment advisory fee reductions (Note 4) | | | (66,628 | ) |

NET EXPENSES | | | 290,936 | |

| | | | | |

NET INVESTMENT INCOME | | | 161,529 | |

| | | | | |

REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | | |

Net realized losses from investments | | | (256,787 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (1,828,353 | ) |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (2,085,140 | ) |

| | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (1,923,611 | ) |

See accompanying notes to financial statements. |

17

BARROW VALUE OPPORTUNITY FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months

Ended

November 30,

2018

(Unaudited) | | | Year Ended

May 31, 2018(a) | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 161,529 | | | $ | 254,889 | |

Net realized gains (losses) from investment transactions | | | (256,787 | ) | | | 6,433,813 | |

Net change in unrealized appreciation (depreciation) on investments | | | (1,828,353 | ) | | | (1,937,607 | ) |

Net increase (decrease) in net assets resulting from operations | | | (1,923,611 | ) | | | 4,751,095 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | — | | | | (4,026,325 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | �� | | | | | | | |

Proceeds from shares sold | | | 7,445,599 | | | | 7,592,521 | |

Net asset value of shares issued in reinvestment of distributions | | | — | | | | 4,023,803 | |

Payments for shares redeemed | | | (1,681,957 | ) | | | (2,218,506 | ) |

Net increase in net assets from capital share transactions | | | 5,763,642 | | | | 9,397,818 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 3,840,031 | | | | 10,122,588 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 44,495,282 | | | | 34,372,694 | |

End of period | | $ | 48,335,313 | | | $ | 44,495,282 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 258,526 | | | | 268,435 | |

Shares reinvested | | | — | | | | 146,791 | |

Shares redeemed | | | (62,550 | ) | | | (79,369 | ) |

Net increase in shares outstanding | | | 195,976 | | | | 335,857 | |

Shares outstanding, beginning of period | | | 1,581,281 | | | | 1,245,424 | |

Shares outstanding, end of period | | | 1,777,257 | | | | 1,581,281 | |

(a) | The presentation of Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018 (Note 2). For the year ended May 31, 2018, distributions to shareholders consisted of $178,341 from net investment income and $3,847,984 from net realized gains from investments. As of May 31, 2018, undistributed net investment income was $339,164. |

See accompanying notes to financial statements. |

18

BARROW VALUE OPPORTUNITY FUND

FINANCIAL HIGHLIGHTS |

Per share data for a share outstanding throughout each period: |

| | Six Months

Ended

Nov. 30,

2018

(Unaudited) | | | Year Ended

May 31,

2018 | | | Year Ended

May 31,

2017 | | | Year Ended

May 31,

2016 | | | Year Ended

May 31,

2015 | | | Period

Ended

May 31,

2014(a) | |

Net asset value at beginning of period | | $ | 28.14 | | | $ | 27.60 | | | $ | 24.78 | | | $ | 26.58 | | | $ | 26.40 | | | $ | 23.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.07 | | | | 0.12 | | | | 0.31 | | | | 0.27 | (b) | | | 0.27 | | | | 0.18 | |

Net realized and unrealized gains (losses) on investments | | | (1.01 | ) | | | 3.33 | | | | 2.69 | | | | (1.68 | ) | | | 2.25 | | | | 3.47 | |

Total from investment operations | | | (0.94 | ) | | | 3.45 | | | | 3.00 | | | | (1.41 | ) | | | 2.52 | | | | 3.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.12 | ) | | | (0.13 | ) | | | (0.19 | ) | | | (0.20 | ) | | | (0.06 | ) |

From net realized gains from investments | | | — | | | | (2.79 | ) | | | (0.05 | ) | | | (0.20 | ) | | | (2.14 | ) | | | (0.49 | ) |

Total distributions | | | — | | | | (2.91 | ) | | | (0.18 | ) | | | (0.39 | ) | | | (2.34 | ) | | | (0.55 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 27.20 | | | $ | 28.14 | | | $ | 27.60 | | | $ | 24.78 | | | $ | 26.58 | | | $ | 26.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(c) | | | (3.34 | %)(d) | | | 12.81 | % | | | 12.14 | % | | | (5.29 | %) | | | 10.10 | % | | | 15.73 | %(d) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 48,335 | | | $ | 44,495 | | | $ | 34,373 | | | $ | 34,522 | | | $ | 31,945 | | | $ | 21,380 | |

Ratio of total expenses to average net assets | | | 1.41 | %(e) | | | 1.51 | % | | | 1.57 | % | | | 1.60 | % | | | 1.79 | % | | | 1.86 | %(e) |

Ratio of net expenses to average net assets(f) | | | 1.15 | %(e) | | | 1.15 | % | | | 1.16 | %(g) | | | 1.16 | %(g) | | | 1.15 | % | | | 1.15 | %(e) |

Ratio of net investment income to average net assets(f) | | | 0.64 | %(e) | | | 0.63 | % | | | 1.06 | % | | | 1.08 | % | | | 1.29 | % | | | 1.01 | %(e) |

Portfolio turnover rate | | | 110 | %(d) | | | 276 | % | | | 88 | % | | | 84 | % | | | 112 | % | | | 45 | %(d) |

(a) | Represents the period from the commencement of operations (close of business August 30, 2013) through May 31, 2014. |

(b) | Calculated using average shares outstanding. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser had not reduced advisory fees and/or reimbursed expenses. |

(d) | Not annualized. |

(e) | Annualized. |

(f) | Ratio was determined after fee reductions and/or expense reimbursements by the Adviser (Note 4). |

(g) | Ratio includes borrowing costs of 0.01% and 0.01% for the years ended May 31, 2017 and 2016, respectively. |

See accompanying notes to financial statements. |

19

BARROW VALUE OPPORTUNITY FUND

NOTES TO FINANCIAL STATEMENTS

November 30, 2018 (Unaudited)

1. Organization

Barrow Value Opportunity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is to seek to generate long-term capital appreciation.

2. Significant Accounting Policies

In August 2018, the U.S. Securities and Exchange Commission (the “SEC”) adopted regulations that eliminated or amended disclosure requirements that were redundant or outdated in light of SEC requirements, accounting principles generally accepted in the United States of America (“GAAP”), International Financial Reporting Standards or changes in technology or the business environment. These regulations were effective November 5, 2018, and the Fund is complying with them effective with these financial statements.

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in preparation of its financial statements. These policies are in conformity with GAAP.

New Accounting Pronouncement – In August 2018, FASB issued Accounting Standards Update No. 2018-13 (“ASU 2018-13”), “Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure requirements of ASC Topic 820 (“ASC 820”), “Fair Value Measurement.” ASU 2018-13 includes new, eliminated, and modified disclosure requirements for ASC 820. In addition, ASU 2018-13 clarifies that materiality is an appropriate consideration when evaluating disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted and the Fund has adopted ASU 2018-13 with these financial statements.

Securities valuation– The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are

20

BARROW VALUE OPPORTUNITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees (the “Board”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments and other financial instruments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2018:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 48,014,103 | | | $ | — | | | $ | — | | | $ | 48,014,103 | |

Money Market Funds | | | 286,162 | | | | — | | | | — | | | | 286,162 | |

Total | | $ | 48,300,265 | | | $ | — | | | $ | — | | | $ | 48,300,265 | |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry type. As of November 30, 2018, the Fund did not have any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3).

Share valuation– The NAV per share of the Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to the NAV per share.

21

BARROW VALUE OPPORTUNITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned.

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders– The Fund distributes to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid to shareholders of the Fund was as follows:

Period Ended | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total

Distributions | |

November 30, 2018 | | $ | — | | | $ | — | | | $ | — | |

May 31, 2018 | | $ | 178,341 | | | $ | 3,847,984 | | | $ | 4,026,325 | |

On December 31, 2018, the Fund paid an ordinary income dividend in the amount of $0.2679 per share; a short-term capital gain distribution in the amount of $1.2934 per share and a long-term capital gain distribution in the amount of $0.5464 per share to shareholders of record on December 28, 2018.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify each year as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

22

BARROW VALUE OPPORTUNITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

The following information is computed on a tax basis for each item as of November 30, 2018:

Cost of portfolio investments | | $ | 46,691,559 | |

Gross unrealized appreciation | | $ | 4,006,656 | |

Gross unrealized depreciation | | | (2,397,950 | ) |

Net unrealized appreciation | | | 1,608,706 | |

Undistributed long-term capital gains | | | 867,893 | |

Accumulated ordinary income | | | 512,413 | |

Other gains | | | 1,955,155 | |

Accumulated earnings | | $ | 4,944,167 | |

The value of the federal income tax cost of portfolio investments may temporarily differ from the financial statement cost. This book/tax difference is due to the recognition of capital gains or losses under income tax regulations and GAAP, primarily the tax deferral of losses on wash sales and the tax treatment of income and capital gains on publicly-traded partnerships held by the Fund.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on Federal income tax returns for the current and all open tax years (generally three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal.

3. Investment Transactions

During the six months ended November 30, 2018, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $61,365,288 and $54,671,807, respectively, for the Fund.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by the Adviser pursuant to the terms of an Investment Advisory Agreement. The Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 0.99% of its average daily net assets.

Pursuant to an Expense Limitation Agreement (“ELA”) between the Fund and the Adviser, the Adviser has contractually agreed, until October 1, 2019, to reduce investment advisory fees and reimburse other operating expenses to limit total annual operating expenses of the Fund (exclusive of brokerage costs; taxes; interest; borrowing costs such as interest and dividend expenses on securities sold short; costs

23

BARROW VALUE OPPORTUNITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

to organize the Fund; acquired fund fees and expenses; extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business; and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940, as amended) to an amount not exceeding 1.15% of the Fund’s average daily net assets. Accordingly, during the six months ended November 30, 2018, the Adviser reduced its investment advisory fees in the amount of $66,628.

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to recoupment by the Adviser for a period of three years after such fees and expenses were incurred, provided that the recoupments do not cause total annual operating expenses of the Fund to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of November 30, 2018, the Adviser may seek recoupment of investment advisory fee reductions and/or expense reimbursements in the amount of $429,952, which must be recouped no later than the dates as stated below:

May 31, 2019 | | | $ | 76,069 | |

May 31, 2020 | | | | 143,227 | |

May 31, 2021 | | | | 144,028 | |

November 30, 2021 | | | | 66,628 | |

Total | | | $ | 429,952 | |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance, and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and costs of pricing its portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor.

TRUSTEE COMPENSATION

Effective August 1, 2018, each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and

24

BARROW VALUE OPPORTUNITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

other meeting-related expenses. Prior to August 1, 2018, each Independent Trustee received a $1,000 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who received a $1,200 annual retainer from the Fund, paid quarterly. Each Independent Trustee also received from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

PRINCIPAL HOLDERS OF FUND SHARES

As of November 30, 2018, the following shareholders owned of record 25% or more of the outstanding shares of the Fund:

Name of Record Owner | % Ownership |

Charles Schwab & Company, Inc. (for the benefit of its customers) | 46% |

Socatean Partners | 38% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events other than the payment of net investment income dividends on December 31, 2018, as discussed in Note 2.

25

BARROW VALUE OPPORTUNITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (June 1, 2018) and held until the end of the period (November 30, 2018).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

26

BARROW VALUE OPPORTUNITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| Beginning

Account Value

June 1, 2018 | Ending

Account Value

November 30, 2018 | Net

Expense

Ratio(a) | Expenses

Paid During

Period(b) |

Based on Actual Fund Return | $1,000.00 | $ 966.60 | 1.15% | $5.67 |

Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.30 | 1.15% | $5.82 |

(a) | Annualized, based on the Fund’s most recent one-half year expenses. |

(b) | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

27

BARROW VALUE OPPORTUNITY FUND

OTHER INFORMATION (Unaudited) |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-877-767-6633, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30 is also available without charge upon request by calling toll-free 1-877-767-6633, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-877-767-6633. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov.

28

FACTS | WHAT DOES BARROW VALUE OPPORTUNITY FUND (the “Fund”) DO WITH YOUR PERSONAL INFORMATION? |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you areno longer our customer, we continue to share your information as described in this notice. |

How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Funds choose to share; and whether you can limit this sharing. |

Reasons we can share your personal information | Does the Fund share? | Can you limit this sharing? |

For our everyday business purposes –

Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes –

to offer our products and services to you | No | We don’t share |

For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We don’t share |

For nonaffiliates to market to you | No | We don’t share |

Questions? | Call 1-877-767-6633 |

29

Who we are |

Who is providing this notice? | Barrow Value Opportunity Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

What we do |

How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tell us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ Sharing for affiliates’ everyday business purposes – information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■Barrow Street Advisors LLC, the investment adviser to the Fund, could be deemed to be an affiliate. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ■The Fund does not share with non-affiliates so they can market to you. |

Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■The Fund does not jointly market. |

30

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

CINCINNATI ASSET MANAGEMENT FUNDS:

BROAD MARKET STRATEGIC INCOME FUND

Semi-Annual Report

November 30, 2018

(Unaudited)

CINCINNATI ASSET MANAGEMENT FUNDS:

BROAD MARKET STRATEGIC INCOME FUND

LETTER TO SHAREHOLDERS | January 7, 2019 |

Dear Fellow Shareholders,

Our Semi-Annual report for the Cincinnati Asset Management Funds: Broad Market Strategic Income Fund (the “Fund”) presents data and performance for the six months ended November 30, 2018. All of us at Cincinnati Asset Management, Inc. want to thank you for your investment in the Fund, and we appreciate your confidence in our investment management.

The Fund is invested primarily in investment-grade and high-yield corporate bonds that we consider undervalued. We believe that our proprietary analysis enhances our ability to identify such opportunities and enables us to sell securities when more attractive opportunities present themselves. These investment decisions are made with the important discipline of maintaining portfolio diversification and with the dual objectives of achieving a high level of income while preserving capital. Our objective is to improve quality, increase yield and shorten maturity.

Our disciplined investing strategy resulted in the Fund holding 89 positions in the bonds of 78 different corporations on November 30. The Fund continues to be fully invested, as is its objective. The Fund outperformed the Bloomberg Barclays U.S. Corporate Baa Index (the “Benchmark”) for the six-month fiscal period ended November 30, with a total return of -0.37% compared to a return of -1.38% for the Benchmark. The Fund achieves its Baa credit quality by diversifying its holdings across the credit spectrum, although it does not purchase securities of companies rated below B3/B- credit quality. The lowest rated credits in the investment grade universe underperformed the investment grade index as a whole; it is important to remember that the Fund achieves its Baa average quality via a barbell strategy of higher and lower rated securities. Therefore, the Fund’s performance is not singly attributable to the return of the Baa rated credit segment. This resulted in the Fund’s outperformance for the six months. We continue to believe that a broader diversification of credit risk as well as a focus on intermediate term maturities will benefit Fund investors over reasonable time periods.

Interest rates rose during the six months. On June 1, 2018, the yield on the 10-year Treasury Bond was 2.86%; it rose gradually to 2.99 by November 30. It subsequently rose to 3.24% and is at 2.76% as of the date of this letter. The premium yield on both investment grade and high yield bonds increased from 1.15% to 1.37% and from 3.62% to 4.18%, respectively. So, yields increased during the period, resulting in price declines across both investment grade and high yield bonds.

The Federal Reserve Board (the “FED”) increased the Federal Funds Target Rate twice during the six months (June and September) and is expected to increased the rate again at the December meeting. Further, the rate is expected to be increased twice more by the end of calendar 2019, given the expected continuing sustained growth in GDP. Typically, changes in the Target Rate don’t significantly influence the 10-year Treasury rate but rather result in rate increases over the shorter portion of the yield curve; that dynamic can be observed in the “flattening” of the yield curve where the difference between yields on the 10-year and 2-year Treasuries declined from 0.43% to 0.20% over the course of the six months. As of November 30, bonds that the Fund

1

owns were yielding 4.88% to maturity, around 1.89% more than comparative U.S. Treasury yields. We believe that the Fund’s positions will continue to provide excellent value relative to other investment-grade rated fixed-income alternatives.

During the third calendar quarter of 2018, GDP increased by 3.5% (Bureau of Economic Analysis). Although several sources predict far greater growth in GDP for the second calendar quarter, the Federal Reserve Open Market Committee estimates 2018 GDP growth to be on the order of 2.9% and 2.6% growth for 2019. Unemployment has declined to its lowest levels since the 2008 financial crisis and initial jobless claims during the last six months have been steady at reduced levels. The FED’s measure of inflation is around its target of 2.0%. Although interest rates will be impacted by “headline” news and the so-called “risk-off/risk-on” trades that cause short-term volatility, we intend to focus on the relative value of investment grade and high-yield corporate bonds and will maintain our focus on the intermediate-term maturity of the portfolio. It is the underlying credit quality of the companies we purchase that influences our investment decisions, not short-term interest rate fluctuations.

Oil prices declined steadily throughout the six months and are sub-$50 as of the date of this letter. The Fund holds several positions in companies that are engaged in the energy sector, and we continue to actively monitor these credits to determine how they may perform over a full market cycle, always seeking to be rewarded for the risks we assume.

We expect increased volatility in fixed-income markets as some participants continually readjust positioning. High yield bond funds had negative flows ($14 billion) during the Fund’s last fiscal quarter, as did investment grade funds ($10 billion). In a world of low interest rates, corporate and high yield bonds continue to offer value relative to Treasury securities. As always, we will continue to search for value and adjust positions as we uncover compelling situations.

While we remain fully convicted that our Broad Market strategy will deliver superior risk-adjusted returns over a long-term investment cycle, after careful consideration, we have decided to liquidate the mutual fund. We expect the liquidation to be completed by the end of February 2019. The Broad Market strategy will continue to be available as a Separately Managed Account via many Wrap Programs and otherwise. We appreciate your trust in Cincinnati Asset Management.

Sincerely,

Cincinnati Asset Management Funds: Broad Market Strategic Income Fund

Managed by Cincinnati Asset Management, Inc.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-866-738-1128.