| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 | Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Matthew J. Beck

| Ultimus Fund Solutions, LLC | 225 Pictoria Drive, Suite 450 | Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | October 31 | |

| | | |

| Date of reporting period: | April 30, 2019 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-866-822-9555 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-866-822-9555. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

STRALEM EQUITY FUND

LETTER TO SHAREHOLDERS

June 2019

Dear Shareholder,

During the first six months of its fiscal year, November 1, 2018 through April 30, 2019, Stralem Equity Fund’s (the “Fund’s”) performance was as follows:

Time Period | STEFX* | S&P 500** |

Nov 1, 2018 – April 30, 2019 | 12.17% | 9.76% |

PERFORMANCE NOTES: Stralem Equity Fund is advised by Stralem & Company Incorporated (“Stralem”), an independent, SEC registered investment adviser established in 1966.The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end or to receive a prospectus, please call (866) 822-9555 toll free or visit the Fund’s website at www.stralemequityfund.com. Performance results for the Fund are stated after investment advisory fees and expenses (net) but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund can suffer losses as well as gains. Performance results are calculated on a total return basis, which includes all income from dividends and interest and realized and unrealized gains or losses. Assuming dividends are reinvested, the growth in dollars of an investment in a period can be computed using these rates of return. The S&P 500 Index is widely used as a barometer of U.S. stock market performance. The S&P 500 Index is the Standard & Poor’s Composite Index of 500 Stocks, a widely recognized, unmanaged index of common stock prices. It is shown with dividends included and reflects no deduction for fees, expenses or taxes.

* | Net, after fees. |

** | Does not reflect deduction for fees, expenses or taxes |

Stralem Equity Fund outperformed the benchmark index over the first six months of the fiscal year by 2.41%, returning 12.17% vs. 9.76% for the S&P 500 Index (the “Index”). This was largely the result of our Participation with Protection portfolio structure working exactly as designed, by protecting capital when the market falls and participating when it goes back up, thus producing outperformance over the cycle.

The Fund’s six-month period return was certainly strong but belies the truly historic volatility that occurred in December and January.

While the Index return from November through the year end was -7.18%, the month of December was down 9.03%, representing the worst December since the Great Depression! However, in 2019 headwinds quickly turned to tailwinds and the market responded favorably, rebounding 18.25% through the end of April, and returning a solid 9.76% over the six-month period. As historic as December was on the downside, January’s return of 8.01% was the fifth best January since the Great Depression, and it helped drive the best Q1 return for the S&P 500 in over 20 years.

1

This historically volatile period serves as an ideal case study of the power of our portfolio structure even during a period that produced very strong returns. When the market fell precipitously during November and December (-7.18%), Stralem Equity Fund went down far less, dropping only 4.02%, or 57% of the downside capture. When the S&P 500 roared back 18.25% in 2019, the Fund captured 95% of this upside by returning 16.87%, but because we protected capital on the downside, the Fund was able to produce a 2.41% premium to the Index across the entire six-month period. The incredible market volatility is something we’ve not seen in quite some time and is likely indicative of the risk-on/risk-off intellectual struggle investors face trying to balance positive economic factors such as low interest rates, moderate inflation, and record unemployment against continuing trade wars, slowing economic growth and geopolitical instability.

We believe that the strength in the stock market leading up to November (the Index reached a record high on September 21st) was based on record corporate earnings and margins resulting from the Trump tax cuts enacted in early 2018. These tax cuts were a catalyst for the U.S. economy that posted a Q2 GDP of 4.2% and reached the lowest unemployment rate in over 50 years.

However, by calendar Q4 investors turned cautious largely due to three issues, the Federal government shutdown, the Federal Reserve’s fourth rate increase of 2018 and the ninth overall, and the lack of progress on a trade deal with China. All of which seemed to recede in early 2019 as the President and Congress were able to work out a deal to re-open the government; the Fed reacted to the market sell-off and the sub-par Q4 GDP (2.2%) by reversing course and suspending all rate hikes; and despite any concrete progress, the Trump Administration provided repeated optimism that a resolution to the China trade stalemate was imminent and it would be “great”.

While investors were quick to recover their optimism for equities in 2019, we remained disciplined and slightly more cautious about the global macro environment. We acknowledge that unemployment is at record low levels, Fed tightening is on hold, and inflation remains at bay; however, we must balance this against the political gridlock in Washington, the moderating GDP growth in the U.S., Europe, and some emerging markets, and the unending trade war with China, all within the context of a decade long bull market that appears to be tiring.

From a portfolio perspective, during the steep decline in November and December, it was the more defensive sectors of Utilities, Healthcare and REITs that performed the best and the growthier, economically sensitive sectors of Technology, Financials, Energy, and Industrials that performed the worst. The Fund’s 2.41% outperformance during this period was largely attributable to very strong stock selection in Healthcare, Information Technology, and Financials offset by some weakness in Industrials and Consumer Discretionary.

However, during the strong rally of 2019, the sectors that lagged in the downturn, rebounded to lead the market higher, namely, Technology, Consumer Discretionary and Industrials. Likewise, the poorest performers in 2019 were the leaders at the end of 2018, Healthcare and Utilities. While the Fund did

2

slightly underperform the Index during the strong rally (+16.87% to +18.25%) by 1.38%, it was powered by strong stock selection in Healthcare, Consumer Discretionary and Communication Services offset by poor selection in Financials, an overweight to Utilities, and small underweight to Technology.

From a stock perspective, Fedex (FDX) was a victim of trade war with China as tariffs led to less import/export and the stock was down 13.5% during the period. UnitedHealth Group (UNH) lost 10.5% in the period as 2020 Presidential candidates espoused their support for “Medicare-for-All”, which is seen as an afront to private insurance plans. EOG Resources, one of the largest U.S. shale oil producers, lost 7.8% in the period as oil was down slightly based on concerns about US GDP and global growth. Collectively, these three companies hurt the Fund’s relative performance by just about 1.00%.

The Fund achieved excellent stock performance led by Broadcom (AVGO), a diversified semiconductor company with high margins and robust cash flow. The company completed its acquisition of Computer Associates, began generating the free-cash-flow it promised and investors better understood the strategic fit. The stock was up a whopping 45.1% in the period. Danaher (DHR) was up 33.3% because it was a beneficiary of the financial difficulties at General Electric, which gave Danaher the opportunity to purchase GE’s highly regarded BioPharma business for over $21 billion. This was a large deal by Danaher standards, but the business is a perfect complement to Danaher’s Life Science business and integrating acquisitions is a core competence. Lastly, early in 2019 it was announced that Celgene (CELG), a biotechnology pioneer and a long-term Fund holding, would be acquired by Bristol-Myers for a heathy premium of cash and stock. Celgene was up 32% over the period, and we exited the position. Collectively, these three holdings added 2.08% of alpha to the Fund for the period.

During the period, two portfolio positions were sold, Chubb (CB) and Celgene (CELG), and two positions were purchased, Cisco Systems (CSCO) and Progressive (PGR). In addition, during the period DowDupont (DWDP) spun-off its material science division, Dow (DOW), to existing shareholders, and this currently represents the 34th holding in the portfolio.

Given that the market achieved an all-time high in September of 2018 followed by an historic bout of volatility in December and January, we believe investors are struggling with a panoply of economic factors that are difficult to interpret. The Federal Reserve’s policy of monetary tightening suddenly put on hold while unemployment reaches record lows, inflation remains muted and the trade war with China remains unresolved. These cross-currents impact GDP growth and confidence in the U.S and abroad and can make it difficult for companies to effectively navigate the uncertainty. For these reasons, we believe it continues to be prudent to maintain around 35% of the portfolio in what we view as defensive positions with downside protection while allocating around 65% to the Up Market Sector of higher growth stocks that participate with the market. We remain convinced that over ten years into a market rally with very few significant pullbacks, and new political and geopolitical risks, additional uncertainty, volatility and caution have been reintroduced to the market. It is our contention that a

3

disciplined portfolio structure based on diligent research and stock selection driven by strong fundamentals will be increasingly rewarded. In our view, the portfolio is well-positioned to participate in continued upside momentum as well as to protect capital on the downside if necessary. We believe it is more imperative than ever to balance “participation with protection” in order to create, build and protect long term wealth.

Sincerely,

Stralem & Company Incorporated

4

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-866-822-9555.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at www.stralemequityfund.com or call 1-866-822-9555 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. Stralem Equity Fund is distributed by Ultimus Fund Distributors, LLC.

This Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. For a complete list of securities held by the Fund as of April 30, 2019, please see the Schedule of Investments section of the semi-annual report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest

5

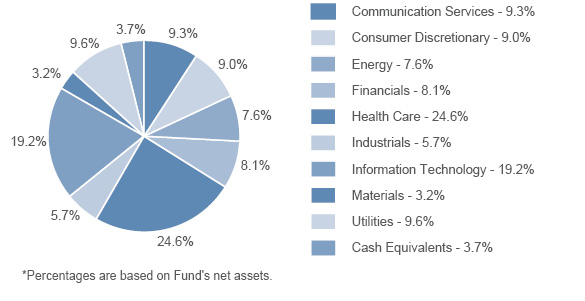

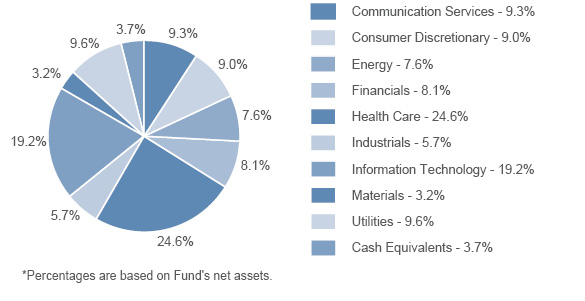

STRALEM EQUITY FUND

PORTFOLIO INFORMATION

April 30, 2019 (Unaudited)

| | | | As of October 31, 2018 | | | As of April 30, 2019 | |

| | | Value | | | % of Total

Investments | | | Value | | | % of Total

Investments | |

UP MARKET | NEW PRODUCTS | | $ | 12,103,796 | | | | 12.5 | % | | $ | 9,230,290 | | | | 10.1 | % |

| | NEW INDUSTRIES | | | 17,883,847 | | | | 18.5 | % | | | 20,398,573 | | | | 22.2 | % |

| | DOMINANT COMPANIES | | | 32,447,888 | | | | 33.5 | % | | | 27,569,586 | | | | 30.1 | % |

| | | | | | | | | | | | | | | | | | |

DOWN MARKET | LOW PRICE TO CASH FLOW | | | 10,810,753 | | | | 11.2 | % | | | 11,555,160 | | | | 12.6 | % |

| | HIGH YIELD | | | 20,108,204 | | | | 20.8 | % | | | 19,661,684 | | | | 21.4 | % |

| | | | | | | | | | | | | | | | | | |

MONEY MARKET | | | | 3,345,210 | | | | 3.5 | % | | | 3,311,207 | | | | 3.6 | % |

| | | | $ | 96,699,698 | | | | 100.0 | % | | $ | 91,726,500 | | | | 100.0 | % |

6

STRALEM EQUITY FUND

SCHEDULE OF INVESTMENTS

April 30, 2019 (Unaudited)

COMMON STOCKS — 96.3% | | Shares | | | Value | |

Communication Services — 9.3% | | | | | | | | |

Diversified Telecommunication Services — 3.2% | | | | | | | | |

AT&T, Inc. | | | 95,000 | | | $ | 2,941,200 | |

| | | | | | | | | |

Interactive Media & Services — 6.1% | | | | | | | | |

Alphabet, Inc. - Class A (a) | | | 2,240 | | | | 2,685,671 | |

Facebook, Inc. - Class A (a) | | | 15,300 | | | | 2,959,020 | |

| | | | | | | | 5,644,691 | |

Consumer Discretionary — 9.0% | | | | | | | | |

Auto Components — 3.1% | | | | | | | | |

Aptiv plc | | | 32,850 | | | | 2,815,245 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 2.8% | | | | | | | | |

Carnival Corporation | | | 47,250 | | | | 2,592,135 | |

| | | | | | | | | |

Household Durables — 3.1% | | | | | | | | |

D.R. Horton, Inc. | | | 63,900 | | | | 2,831,409 | |

| | | | | | | | | |

Energy — 7.6% | | | | | | | | |

Oil, Gas & Consumable Fuels — 7.6% | | | | | | | | |

Chevron Corporation | | | 19,000 | | | | 2,281,140 | |

EOG Resources, Inc. | | | 24,200 | | | | 2,324,410 | |

Kinder Morgan, Inc. | | | 118,700 | | | | 2,358,569 | |

| | | | | | | | 6,964,119 | |

Financials — 8.1% | | | | | | | | |

Capital Markets — 5.5% | | | | | | | | |

Bank of New York Mellon Corporation (The) | | | 43,350 | | | | 2,152,761 | |

Intercontinental Exchange, Inc. | | | 35,400 | | | | 2,879,790 | |

| | | | | | | | 5,032,551 | |

Insurance — 2.6% | | | | | | | | |

Progressive Corporation (The) | | | 31,200 | | | | 2,438,280 | |

| | | | | | | | | |

Health Care — 24.6% | | | | | | | | |

Biotechnology — 5.0% | | | | | | | | |

AbbVie, Inc. | | | 28,700 | | | | 2,278,493 | |

Alexion Pharmaceuticals, Inc. (a) | | | 16,800 | | | | 2,286,984 | |

| | | | | | | | 4,565,477 | |

Health Care Equipment & Supplies — 5.6% | | | | | | | | |

Abbott Laboratories | | | 29,300 | | | | 2,331,108 | |

Danaher Corporation | | | 21,500 | | | | 2,847,460 | |

| | | | | | | | 5,178,568 | |

See notes to financial statements. |

7

STRALEM EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued)

COMMON STOCKS — 96.3% (Continued) | | Shares | | | Value | |

Health Care — 24.6% (Continued) | | | | | | | | |

Health Care Providers & Services — 2.8% | | | | | | | | |

UnitedHealth Group, Inc. | | | 11,250 | | | $ | 2,622,037 | |

| | | | | | | | | |

Life Sciences Tools & Services — 2.5% | | | | | | | | |

Thermo Fisher Scientific, Inc. | | | 8,150 | | | | 2,261,218 | |

| | | | | | | | | |

Pharmaceuticals — 8.7% | | | | | | | | |

Johnson & Johnson | | | 16,650 | | | | 2,350,980 | |

Merck & Company, Inc. | | | 36,400 | | | | 2,865,044 | |

Pfizer, Inc. | | | 68,200 | | | | 2,769,602 | |

| | | | | | | | 7,985,626 | |

Industrials — 5.7% | | | | | | | | |

Aerospace & Defense — 2.6% | | | | | | | | |

Boeing Company (The) | | | 6,200 | | | | 2,341,678 | |

| | | | | | | | | |

Air Freight & Logistics — 3.1% | | | | | | | | |

FedEx Corporation | | | 15,100 | | | | 2,860,846 | |

| | | | | | | | | |

Information Technology — 19.2% | | | | | | | | |

Communications Equipment — 3.2% | | | | | | | | |

Cisco Systems, Inc. | | | 52,700 | | | | 2,948,565 | |

| | | | | | | | | |

IT Services — 3.1% | | | | | | | | |

Visa, Inc. - Class A | | | 17,250 | | | | 2,836,418 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment — 3.2% | | | | | | | | |

Broadcom, Inc. | | | 9,180 | | | | 2,922,912 | |

| | | | | | | | | |

Software — 9.7% | | | | | | | | |

Adobe, Inc. (a) | | | 10,400 | | | | 3,008,200 | |

Microsoft Corporation | | | 22,800 | | | | 2,977,680 | |

Oracle Corporation | | | 52,350 | | | | 2,896,525 | |

| | | | | | | | 8,882,405 | |

Materials — 3.2% | | | | | | | | |

Chemicals — 3.2% | | | | | | | | |

Dow, Inc. (a) | | | 17,100 | | | | 970,083 | |

DowDuPont, Inc. | | | 51,300 | | | | 1,972,485 | |

| | | | | | | | 2,942,568 | |

See notes to financial statements. |

8

STRALEM EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued)

COMMON STOCKS — 96.3% (Continued) | | Shares | | | Value | |

Utilities — 9.6% | | | | | | | | |

Electric Utilities — 6.4% | | | | | | | | |

American Electric Power Company, Inc. | | | 34,050 | | | $ | 2,912,977 | |

Duke Energy Corporation | | | 32,000 | | | | 2,915,840 | |

| | | | | | | | 5,828,817 | |

Multi-Utilities — 3.2% | | | | | | | | |

Dominion Energy, Inc. | | | 38,250 | | | | 2,978,528 | |

| | | | | | | | | |

Total Common Stocks (Cost $60,058,138) | | | | | | $ | 88,415,293 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 3.6% | | Shares | | | Value | |

Dreyfus Treasury Securities Cash Management Fund - Investor Shares, 2.02% (b) (Cost $3,311,207) | | | 3,311,207 | | | $ | 3,311,207 | |

| | | | | | | | | |

Investments at Value — 99.9% (Cost $63,369,345) | | | | | | $ | 91,726,500 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 73,416 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 91,799,916 | |

(a) | Non-income producing security. |

(b) | The rate shown is the 7-day effective yield as of April 30, 2019. |

See accompanying notes to financial statements. |

9

STRALEM EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2019 (Unaudited)

ASSETS | | | | |

Investments in securities: | | | | |

At cost | | $ | 63,369,345 | |

At value (Note 2) | | $ | 91,726,500 | |

Cash | | | 5,324 | |

Dividends receivable | | | 130,530 | |

Other assets | | | 8,399 | |

Total Assets | | | 91,870,753 | |

| | | | | |

LIABILITIES | | | | |

Payable to Investment Adviser (Note 4) | | | 35,110 | |

Payable to administrator (Note 4) | | | 12,967 | |

Accrued expenses | | | 22,760 | |

Total Liabilities | | | 70,837 | |

| | | | | |

NET ASSETS | | $ | 91,799,916 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 55,524,514 | |

Accumulated earnings | | | 36,275,402 | |

Net Assets | | $ | 91,799,916 | |

| | | | | |

Shares of beneficial interest outstanding | | | 10,687,315 | |

| | | | | |

Net asset value, offering price and redemption price per share (a) | | $ | 8.59 | |

(a) | Redemption price varies based on length of time held (Note 2). |

See accompanying notes to financial statements. |

10

STRALEM EQUITY FUND

STATEMENT OF OPERATIONS

For the Six Months Ended April 30, 2019 (Unaudited)

INVESTMENT INCOME | | | | |

Dividends | | $ | 996,939 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 4) | | | 505,356 | |

Administration fees (Note 4) | | | 44,270 | |

Professional fees | | | 26,118 | |

Fund accounting fees (Note 4) | | | 19,426 | |

Registration and filing fees | | | 10,378 | |

Transfer agent fees (Note 4) | | | 7,500 | |

Trustees' fees and expenses (Note 4) | | | 6,087 | |

Compliance fees (Note 4) | | | 5,887 | |

Bank service fees | | | 5,431 | |

Postage and supplies | | | 3,101 | |

Printing | | | 2,970 | |

Insurance expense | | | 1,877 | |

Other | | | 10,912 | |

Total Expenses | | | 649,313 | |

Investment advisory fee reductions (Note 4) | | | (228,263 | ) |

Net Expenses | | | 421,050 | |

| | | | | |

NET INVESTMENT INCOME | | | 575,889 | |

| | | | | |

REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | |

Net realized gains from investment transactions | | | 7,731,182 | |

Net change in unrealized appreciation (depreciation) on investments | | | 1,966,253 | |

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 9,697,435 | |

| | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 10,273,324 | |

See accompanying notes to financial statements. |

11

STRALEM EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | Six Months

Ended

April 30,

2019

(Unaudited) | | | Year

Ended

October 31,

2018 | |

OPERATIONS | | | | | | | | |

Net investment income | | $ | 575,889 | | | $ | 1,403,776 | |

Net realized gains from investment transactions | | | 7,731,182 | | | | 21,339,408 | |

Net change in unrealized appreciation (depreciation) on investments | | | 1,966,253 | | | | (20,505,741 | ) |

Net increase in net assets resulting from operations | | | 10,273,324 | | | | 2,237,443 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (22,588,139 | ) | | | (8,723,481 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 13,657,276 | | | | 5,181,862 | |

Net asset value of shares issued in reinvestment of distributions | | | 14,090,686 | | | | 6,957,351 | |

Proceeds from redemption fees (Note 2) | | | 185 | | | | 64 | |

Payments for shares redeemed | | | (21,181,483 | ) | | | (44,946,201 | ) |

Net increase (decrease) in net assets from capital share transactions | | | 6,566,664 | | | | (32,806,924 | ) |

| | | | | | | | | |

TOTAL DECREASE IN NET ASSETS | | | (5,748,151 | ) | | | (39,292,962 | ) |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 97,548,067 | | | | 136,841,029 | |

End of period | | $ | 91,799,916 | | | $ | 97,548,067 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 1,751,121 | | | | 505,521 | |

Shares reinvested | | | 1,770,656 | | | | 690,899 | |

Shares redeemed | | | (2,604,028 | ) | | | (4,426,909 | ) |

Net increase (decrease) in shares outstanding | | | 917,749 | | | | (3,230,489 | ) |

Shares outstanding, beginning of period | | | 9,769,566 | | | | 13,000,055 | |

Shares outstanding, end of period | | | 10,687,315 | | | | 9,769,566 | |

See accompanying notes to financial statements. |

12

STRALEM EQUITY FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period) |

| | | Six

Months

Ended

April 30,

2019 | | | Year Ended October 31, | |

| | (Unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Net asset value, beginning of period | | $ | 9.98 | | | $ | 10.53 | | | $ | 10.52 | | | $ | 15.53 | | | $ | 17.45 | | | $ | 16.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.04 | | | | 0.13 | | | | 0.12 | | | | 0.22 | | | | 0.23 | | | | 0.24 | |

Net realized and unrealized gains on investments | | | 0.94 | | | | 0.00 | (a) | | | 1.49 | | | | 0.24 | | | | 0.34 | | | | 1.70 | |

Total from investment operations | | | 0.98 | | | | 0.13 | | | | 1.61 | | | | 0.46 | | | | 0.57 | | | | 1.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.11 | ) | | | (0.11 | ) | | | (0.17 | ) | | | (0.25 | ) | | | (0.25 | ) | | | (0.26 | ) |

Distributions from net realized gains | | | (2.26 | ) | | | (0.57 | ) | | | (1.43 | ) | | | (5.22 | ) | | | (2.24 | ) | | | (1.00 | ) |

Total distributions | | | (2.37 | ) | | | (0.68 | ) | | | (1.60 | ) | | | (5.47 | ) | | | (2.49 | ) | | | (1.26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected (Note 2) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 8.59 | | | $ | 9.98 | | | $ | 10.53 | | | $ | 10.52 | | | $ | 15.53 | | | $ | 17.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return (b) | | | 12.17 | %(c) | | | 1.13 | % | | | 17.36 | % | | | 4.72 | % | | | 3.43 | % | | | 12.18 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000's) | | $ | 91,800 | | | $ | 97,548 | | | $ | 136,841 | | | $ | 142,965 | | | $ | 190,800 | | | $ | 318,237 | |

Ratio of total expenses to average net assets | | | 1.46 | %(d) | | | 1.30 | % | | | 1.28 | % | | | 1.42 | % | | | 1.21 | % | | | 1.12 | % |

Ratio of net expenses to average net assets (e) | | | 0.95 | %(d) | | | 0.95 | % | | | 0.95 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % |

Ratio of net investment income to average net assets (e) | | | 1.30 | %(d) | | | 1.10 | % | | | 1.03 | % | | | 1.52 | % | | | 1.17 | % | | | 1.27 | % |

Portfolio turnover rate | | | 17 | %(c) | | | 32 | % | | | 7 | % | | | 8 | % | | | 33 | % | | | 19 | % |

(a) | Amount rounds to less than $0.01 per share. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(c) | Not annualized. |

(d) | Annualized. |

(e) | Ratio was determined after fee reductions and/or expense reimbursements by the Adviser (Note 4). |

See accompanying notes to financial statements. |

13

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

April 30, 2019 (Unaudited)

Stralem Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”). The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was reorganized into the Trust on October 17, 2016. It was formerly a series of Stralem Fund.

The Fund’s investment objective is to seek long-term capital appreciation.

2. | SIGNIFICANT ACCOUNTING POLICIES |

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with principles generally accepted in the United States of America (“GAAP”).

Investment valuation:

The Fund’s portfolio securities are valued as of the close of business of the regular session of trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern time) on each day the NYSE is open. Securities which are traded on stock exchanges are valued at the closing price on the day the securities are being valued, or, if not traded on a particular day, at the closing mean price. Securities quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities traded in the over-the-counter market are valued at the last sale price, if available, otherwise, at the last quoted mean price. Investments in money market funds are valued at net asset value (“NAV”). When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s NAV may differ from quoted or published prices for the same securities.

14

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs

Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the above fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments by security type as of April 30, 2019:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 88,415,293 | | | $ | — | | | $ | — | | | $ | 88,415,293 | |

Money Market Funds | | | 3,311,207 | | | | — | | | | — | | | | 3,311,207 | |

Total | | $ | 91,726,500 | | | $ | — | | | $ | — | | | $ | 91,726,500 | |

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by sector and industry type. There were no Level 2 or Level 3 securities or derivative instruments held by the Fund as of or during the six months ended April 30, 2019.

Share valuation and redemption fees:

The NAV per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share is equal to the NAV per share, except that shares are subject to a redemption fee of 1% if shares are redeemed within 60 days of purchase. During the periods ended April 30, 2019 and October 31 2018, proceeds from redemption fees totaled $185 and $64, respectively.

Investment transactions and income:

Investment transactions are accounted for on the trade date. Realized gains and losses on sales of investments are calculated on a specific identification basis. Dividend income is recorded on the ex-dividend date, and interest income

15

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

is recognized on the accrual basis. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

Common expenses:

Common expenses of the Trust are allocated among the Fund and other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders:

Distributions arising from net investment income and net realized capital gains are declared and paid to shareholders annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. The tax character of distributions paid to shareholders during the periods ended April 30, 2019 and October 31, 2018 was as follows:

Periods Ended | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total

Distributions | |

April 30, 2019 | | $ | 1,514,867 | | | $ | 21,073,272 | | | $ | 22,588,139 | |

October 31, 2018 | | $ | 1,508,018 | | | $ | 7,215,463 | | | $ | 8,723,481 | |

Use of estimates:

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax:

The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of a federal excise tax applicable to regulated investment companies, the Fund must declare and pay as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

16

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

The following information is computed on a tax basis for each item as of April 30, 2019:

Cost of portfolio investments | | $ | 63,729,187 | |

Gross unrealized appreciation | | $ | 29,372,945 | |

Gross unrealized depreciation | | | (1,375,632 | ) |

Net unrealized appreciation | | | 27,997,313 | |

Accumulated ordinary income | | | 363,381 | |

Other gains | | | 7,914,708 | |

Accumulated earnings | | $ | 36,275,402 | |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due to the tax deferral of losses on wash sales.

3. | INVESTMENT TRANSACTIONS |

During the six months ended April 30, 2019, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $14,295,004 and $28,858,138, respectively.

4. | TRANSACTIONS WITH RELATED PARTIES |

INVESTMENT ADVISORY AGREEMENT

Pursuant to an Investment Advisory Agreement with Stralem & Company Incorporated (the “Adviser”), the Fund pays the Adviser an advisory fee, payable quarterly, based on the average weekly net assets of the Fund, equal to 1.25% per annum of the first $50 million of such net assets; 1.00% per annum of the next $50 million of such net assets; and 0.75% per annum of such net assets in excess of $100 million.

The Adviser has agreed contractually, until at least March 1, 2020, to reduce its advisory fees and reimburse other expenses to the extent necessary to limit total annual operating expenses (excluding brokerage costs; taxes; interest; borrowing costs such as interest and dividend expenses on securities sold short; costs to organize the Fund; acquired fund fees and expenses; and extraordinary expenses, such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 0.95% of the Fund’s average daily net assets. During the six months ended April 30, 2019, the Adviser reduced its advisory fees in the amount of $228,263.

17

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause total annual operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. Prior to March 1, 2020, this agreement may not be modified or terminated without the approval of the Board. This agreement will terminate automatically if the Investment Advisory Agreement is terminated. As of April 30, 2019, the amount of fee reductions and expense reimbursements available for recovery by the Adviser is $1,105,904, which must be recovered no later than the dates stated below:

October 31, 2020 | | $ | 431,852 | |

October 31, 2021 | | | 445,789 | |

April 30, 2022 | | | 228,263 | |

| | | $ | 1,105,904 | |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance, and transfer agent services for the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and costs of pricing the Fund’s portfolio securities.

Pursuant to a Distribution Agreement with Ultimus Fund Distributors, LLC (the “Distributor”), the Distributor provides distribution services and serves as principal underwriter for the Fund. The Distributor is a wholly owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor.

TRUSTEE COMPENSATION

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

18

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

PRINCIPAL HOLDER OF FUND SHARES

As of April 30, 2019, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

Name of Record Owner | % Ownership |

Pershing, LLC (for the benefit of its customers) | 80% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. | CONTINGENCIES AND COMMITMENTS |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had any prior claims or losses pursuant to these arrangements.

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

19

STRALEM EQUITY FUND

DISCLOSURE OF FUND EXPENSES (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses, which are deducted from the Fund’s gross income. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period (November 1, 2018) and held until the end of the period (April 30, 2019).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| Beginning

Account Value

November 1,

2018 | Ending

Account Value

April 30, 2019 | Expenses Paid

During Period* |

Based on Actual Fund Return | $ 1,000.00 | $ 1,121.70 | $ 5.00 |

Based on Hypothetical 5% Return | $ 1,000.00 | $ 1,020.08 | $ 4.76 |

* | Expenses are equal to the Fund’s annualized net expense ratio of 0.95% for the period, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

20

STRALEM EQUITY FUND

ADDITIONAL INFORMATION (Unaudited)

PROXY VOTING POLICIES AND PROCEDURES

A description of the Fund’s proxy voting policies and procedures is available, without charge, upon request by calling toll free (866) 822-9555, or on the U.S. Securities and Exchange Commission (the “SEC”) website at https://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available, without charge, upon request by calling toll free (866) 822-9555, or on the SEC website at https://www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Fund’s Forms N-Q containing a complete schedule of portfolio holdings as of the end of the first and third quarters of each fiscal year are available on the SEC’s website at https://www.sec.gov or are available upon request, without charge, by calling toll free at (866) 822-9555.

HOUSEHOLDING

The Fund will generally send only one copy of the summary prospectus, proxy material, annual report and semi-annual report to shareholders residing at the same “household.” This reduces Fund expenses which benefits all shareholders, minimizes the volume of mail you receive and eliminates duplicates of the same information. If you need additional copies of these documents, a copy of the prospectus or do not want your mailings to be “householded,” please send us a written request or call us toll free at (866) 822-9555.

21

STRALEM EQUITY FUND

Results of Special Meeting of Shareholders

(Unaudited)

On June 18, 2018, a Special Meeting of Shareholders of the Trust was held for the purpose of considering the election of seven trustees for the Trust. The number of shares of the Trust present and voting at the Special Meeting represented 68.40% of the total shares entitled to vote at the meeting. Each of the seven nominees was elected by the shareholders of the Trust.

The results of the voting with respect to the election of the seven Trustees were as follows:

| | | Number of Shares | |

Nominee/Trustee | | Affirmative | | | Withhold | |

Robert G. Dorsey | | | 79,822,871 | | | | 11,178 | |

John J. Discepoli | | | 79,499,054 | | | | 334,995 | |

David M. Deptula | | | 79,499,054 | | | | 334,995 | |

Janine L. Cohen | | | 79,485,191 | | | | 348,858 | |

Jacqueline A. Williams | | | 79,757,455 | | | | 76,594 | |

Clifford N. Shireson | | | 79,771,318 | | | | 62,731 | |

Robert E. Morrison, Jr. | | | 79,771,349 | | | | 62,700 | |

22

STRALEM EQUITY FUND

INVESTMENT ADVISER

Stralem & Company Incorporated

551 Madison Avenue, 10th Floor

New York, NY 10022

Telephone (212) 888-8123

Fax (212) 888-8152

This report is prepared for the information of the Fund’s shareholders. It is not authorized for distribution to prospective investors in the Fund unless it is preceded or accompanied by a current summary prospectus and/or prospectus which each describe the Fund’s objectives, risks, policies, expenses and other important information. Investors are advised to read the summary prospectus and/or prospectus carefully before investing. Past performance is not indicative of future results. Current performance may be lower or higher than the data contained herein. For performance information current through the most recent month end, please visit the Fund’s website at www.stralemequityfund.com or call toll-free (866) 822-9555. The Fund can suffer losses as well as gains.

23

| FACTS | WHAT DOES THE STRALEM EQUITY FUND (the “Fund”) DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you areno longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the

Fund share? | Can you limit

this sharing? |

For our everyday business purposes — Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes — to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes — information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes — information about your creditworthiness | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call 1-866-822-9555 |

24

| Who we are |

| Who is providing this notice? | Stralem Equity Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tell us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ Sharing for affiliates’ everyday business purposes – information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■Stralem & Company Incorporated, the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ■The Fund does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■The Fund does not jointly market. |

25

MEEHAN FOCUS FUND

SEMI-ANNUAL REPORT

April 30, 2019

(Unaudited)

This report is for the information of the shareholders of Meehan Focus Fund. Its use in connection with any offering of the Fund’s shares is authorized only in a case of concurrent or prior delivery of the Fund’s current prospectus. Investors should refer to the Fund’s prospectus for a description of risk factors associated with investments in the Fund. |

Meehan Focus Fund

A Series of Ultimus Managers Trust

7250 Woodmont Avenue, Suite 315

Bethesda, MD 20814

(866) 884-5968 | Distributor:

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(800) 933-8413 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-866-884-5968 or, if you own these shares through a financial intermediary, by contacting your financial intermediary. You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-866-884-5968. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary. |

MEEHAN FOCUS FUND

LETTER TO SHAREHOLDERS | June 6, 2019 |

Dear Fellow Shareholders1:

The total return for the Meehan Focus Fund (“the Fund”) for the first six months of its 2019 fiscal year through April 30, 2019 was 10.43%2; the Fund’s net asset value (“NAV”) per share at April 30 was $26.83.

Market and Economic Conditions

The markets have taken stock investors on a rollercoaster ride since last fall. After reaching record highs in September, the U.S. stock market plunged in the fourth quarter as a litany of concerns, including recession fears, rising interest rates, trade wars, and other geopolitical issues, combined to shake investors’ confidence. U.S. stocks, as measured by the S&P 500, fell 19.8% from their September peak to their low point on December 24, barely missing the 20% drop that would have officially put the index into bear market territory for the first time since 2009.

The sharp drop to the Christmas Eve low was followed by a sharp rally that saw the S&P 500 rise more than 25% and set a new all-time high in late April. The rally came after the U.S. Federal Reserve allayed concerns that it might tighten monetary policy too aggressively, trade talks showed signs of progress, and fears that the economy would tip into recession shifted to a still concerning but less worrisome slowdown. Markets outside the United States also rallied, with emerging markets and foreign developed markets rising roughly 15% and 17%, respectively.

First quarter corporate earnings supported the rally. Earnings estimates at the end of the first quarter called for a decline of 4%, but actual reported earnings showed a much lower decline of 0.4%, and 76% of S&P 500 companies reported a positive earnings surprise.3 Overall, market sentiment shifted from decidedly negative on Christmas Eve to largely positive at the end of April.

In response to concerns about global growth, central banks in the United States, Europe, and China have taken steps to boost their economies in 2019. After raising rates four times in 2018, the U.S. Federal Reserve has paused future rate increases, while the European Central Bank and the Bank of China have announced or extended stimulus programs.

Economic indicators have been generally positive and confirm that the U.S. economy continues to expand, despite the partial government shutdown and continued trade uncertainty. First quarter U.S. gross domestic product growth of 3.2%4 exceeded expectations, and the

1 | The views expressed herein are not meant as investment advice. Although some of the described portfolio holdings were viewed favorably as of the date of this letter, there is no guarantee that the Fund will continue to hold these securities in the future. Please consider the investment objectives, risks, charges, and expenses of the Fund before investing. Contact the Fund at (866) 884-5968 for a prospectus, which contains this and other important information about the Fund. Read the prospectus carefully before investing. |

2 | Past performance does not guarantee future results. Performance data quoted above represents past performance, and the investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance information, please call (866) 884-5968. |

3 | FactSet Earnings Insight, John Butters, May 31, 2019, |

4 | U.S. Bureau of Economic Analysis Press Release, May 30, 2019. |

1

unemployment rate dropped to 3.6% in April, the lowest reading since 1969.5 Steady growth, a strong labor market, and modest inflation helped boost consumer confidence and leading economic indicators in recent months.6

While the overall picture is positive, there are some signs that the economy may be slowing. April orders for capital goods fell 0.9%7, and the Institute for Supply Management’s manufacturing index, while still showing expansion, declined in each of the past two months.8

Looking forward, we are optimistic that the pieces are in place for further gains this year, given reasonable valuations and our expectations for moderate earnings growth, but stock performance will depend not just on reported earnings but also on the outlook provided by company management. We believe the economic expansion will continue and do not expect the U.S. economy to enter a recession in 2019. Interest rates remain low, inflation is tame, and the Federal Reserve has made it clear that it will move cautiously and, if needed, may lower the Fed Funds rate to boost the economy. Finally, the third year of a presidential term has historically been the best year for stock returns as the party holding the White House seeks to boost the economy heading into the next year’s elections.

The biggest risk to the markets, in our view, remains the potential for a full-blown trade war between the United States and China, as indicated by the market’s negative reaction to the breakdown of talks between the United States and China in early May. The recent announcement that the United States would impose escalating tariffs on Mexico if it did not move to stop the flow of migrants from Central America is also cause for concern. We believe all sides have strong incentives to avoid the worst outcomes and are hopeful that ongoing negotiations will resolve the most pressing issues, but we will keep a watchful eye on progress.

Portfolio Review

The attached Schedule of Investments identifies the Fund’s investments and their market value as of April 30, 2019. The Fund’s top 10 holdings, which represented 58.6% of the Fund’s portfolio on April 30, 2019 were as follows:

Company | % of Fund |

1. | Microsoft Corporation | 10.1 |

2. | Berkshire Hathaway, Inc. – Class B | 8.2 |

3. | Lowe’s Companies, Inc. | 8.0 |

4. | Apple, Inc. | 6.4 |

5. | Alphabet Inc. – Classes A and C | 6.1 |

6. | PNC Financial Services Group, Inc. | 4.8 |

7. | United Rentals Inc. | 4.0 |

8. | Boeing Company (The) | 3.9 |

9. | General Motors Company | 3.8 |

10. | Bank of America Corporation | 3.3 |

| | | 58.6 |

5 | U.S. Bureau of Labor Statistics. |

6 | The Conference Board Consumer Confidence Survey, May 28, 2019; The Conference Board Leading Economic Index, May 17, 2019. |

7 | Reuters, Weak U.S. Manufacturing Underscores Slowing Economic Growth, Lucia Mutikani, May 24, 2019. |

8 | Institute for Supply Management, Manufacturing ISM Report on Business, April 2019, May 2019. |

2

The Fund’s 10.43% return over the past six months exceeded the 9.76% return of the S&P 500 and the 7.90% return of the Russell 1000 Value over the same time period. This solid performance was driven by strong results from long-term Fund holdings Microsoft and Lowe’s, and more recent addition Broadcom.

Microsoft’s transformation under CEO Satya Nadella from a personal computer-based model to one focused on mobile, cloud-based products has taken hold and accelerated the company’s growth in notable new areas like cloud services, artificial intelligence, and internet services. Microsoft is now the second-largest provider of public cloud services, behind Amazon, and revenue in this segment is growing rapidly. In addition, Microsoft continues to benefit from the network effect around its applications and operating systems created by its large enterprise footprint across a multitude of products and services. Its March earnings report reinforced the growth story as revenues grew 14% year-over-year and diluted earnings per share were up 20%.9

Through April, Lowe’s shares regained much of the ground lost in late 2018. Although substantial write-downs associated with its Rona Canada and Orchard Supply businesses pushed Lowe’s to a fourth quarter loss, investors were encouraged by management’s focus on improving sales execution, revamping stores, and implementing supply chain and inventory changes. While better operational performance, combined with a solid job market and rising incomes, should enable Lowe’s to post solid results in 2019, Lowe’s first quarter earnings report, released in May, disappointed investors, and the shares gave back some of their gains.

Global semiconductor company Broadcom was added to the Fund’s portfolio in 2018. Broadcom’s strong competitive position in radio frequency filters for smartphones, networking switches, Wi-Fi chips, and enterprise storage chips enabled it to generate net revenue growth of 18% in 2018 and to expand gross margins and free cash flow. First quarter 2019 earnings exceeded estimates on solid sales growth and further gross margin improvements. The company also has a savvy management team and has successfully grown through acquisitions. Its November 2018 acquisition of Computer Associates should help diversify its revenue stream and will add to earnings in 2019. While increasing trade tensions are a threat, we believe Broadcom has the strength to withstand them.

Partially offsetting these positive results were weaker performances from Apple, and two stocks that are no longer Fund holdings, Capital One Financial Group and the SPDR S&P Regional Banking ETF.

Apple shares dropped sharply in November after the company announced its fourth quarter earnings as management’s revenue guidance fell short of expectations. While December quarter estimates disappointed the market, March quarter earnings came in at the high end of company guidance as the iPhone business stabilized and the services segment, which includes the App Store, Apple Music, and cloud services, posted record results. Apple, with operating margins in the mid 20s, remains a very profitable company with outstanding brand strength.

We sold the Fund’s Capital One position at a loss in late 2018 in favor of the more diversified Bank of America. Capital One had underperformed in 2018, pushed down by concerns over its large exposure to credit card (42% of total loans) and consumer lending (31% of total

9 | Microsoft Corporation, Earnings Release FY19 Q3, April 24, 2019. |

3

loans) and heavy promotional spending. We believe Bank of America offers better long-term return potential due to its size, which enables it to benefit from economies of scale; the scope of its offerings, which encompass retail banking, investment banking, credit cards, and the Merrill Lynch franchise; and its strong competitive position across its businesses.

The SPDR S&P Regional Banking ETF was sold at a loss after we concluded that regional banks were unlikely to be able to boost earnings through loan growth and expanding net interest margins as we had anticipated. We decided that the funds would be better deployed in other stocks with stronger growth potential.

In addition to those discussed above, changes to the Fund’s portfolio over the past six months included the repurchase of three positions sold to realize losses and reduce the Fund’s 2018 capital gain distribution: semi-conductor manufacturing equipment supplier Applied Materials, home builder Lennar, and the iShares Core MSCI Emerging Markets ETF. Other additions included pharmaceutical company Bristol-Myers Squibb, the iShares Core MSCI Pacific ETF, the iShares EAFE Small Cap ETF, midstream energy company Enbridge, and air carrier Delta Air Lines.

The Fund’s new purchases were funded in part by the sale of long-term Fund holdings United Parcel Service, Johnson & Johnson, First Data, and Southwest Airlines, all at substantial gains. Additional funds came from the sale of the shares of AT&T and Cigna the Fund received as a result of their respective acquisitions of Fund holdings Time Warner and Express Scripts.

Conclusion

We appreciate your confidence in our management of the Fund and look forward to continued success. You can check the Fund’s NAV online at any time by typing in the Fund’s ticker symbol (MEFOX) into most stock quotation services. Best wishes for a relaxing and restful summer -- and please do not hesitate to contact us if you have any questions regarding your investment in the Fund.

Sincerely,

|

|

Thomas P. Meehan | Paul P. Meehan |

| |

R. Jordan Smyth, Jr. | |

Portfolio Managers, Meehan Focus Fund | |

4

Past performance is not predictive of future performance.Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-866-884-5968.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus visit the Fund’s website atwww.meehanmutualfunds.com or call 1-866-884-5968 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Meehan Focus Fund is distributed by Ultimus Fund Distributors, LLC.

This Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. For a complete list of securities held by the Fund as of April 30, 2019, please see the Schedule of Investments section of the semi-annual report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates.

5

MEEHAN FOCUS FUND

PERFORMANCE INFORMATION

April 30, 2019 (Unaudited)

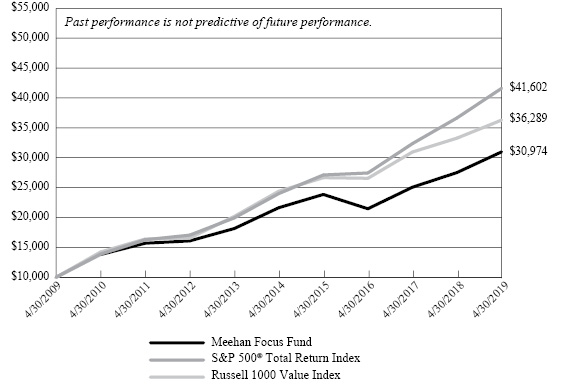

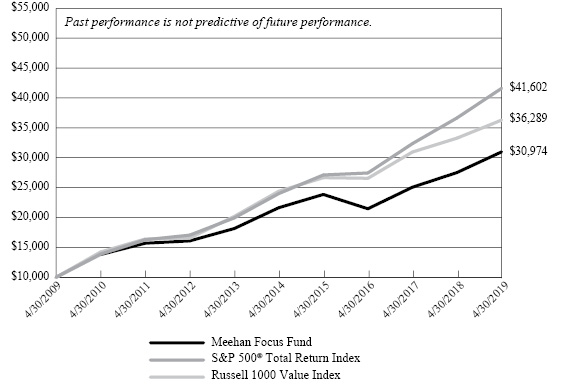

Comparison of Change in Value of a $10,000 Investment in the

Meehan Focus Fund vs. the Standard & Poor’s 500® Total Return Index

and Russell 1000 Value Index*

Average Annual Total Returns

(For Periods Ended April 30, 2019) | |

| | 1 Year | 5 Years | 10 Years | |

Meehan Focus Fund(a) | 12.54% | 7.44% | 11.97% | |

S&P 500® Total Return Index | 13.49% | 11.63% | 15.32% | |

Russell 1000 Value Index | 9.06% | 8.27% | 13.76% | |

* | The above graph depicts the performance of the Fund versus the S&P 500® Total Return Index and the Russell 1000 Value Index. It is important to note that the Fund is a professionally managed mutual fund; the S&P 500® Total Return Index by Standard & Poor’s Corp. is a capitalization weighted index comprised of 500 issues listed on various exchanges, representing the performance of the stock market generally; and the Russell 1000 Value Index measures the constituents that exhibit value characteristics within the largest 1,000 U.S. stocks by market cap of the U.S. equity investable universe. An index is not an investment product available for purchase. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends but, unlike the Fund’s returns, do not reflect any fees or expenses. |

(a) | Performance presented represents historical data. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s past performance is not indicative of future performance. The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain more current performance information, please contact (866) 884-5968. As disclosed in the Fund’s February 28, 2019 prospectus, the Fund’s total annual operating expenses are 1.02%. |

6

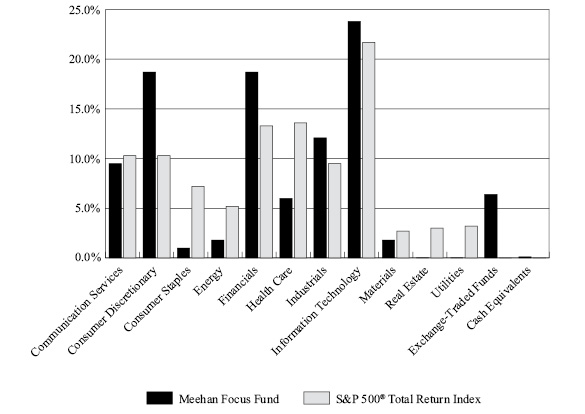

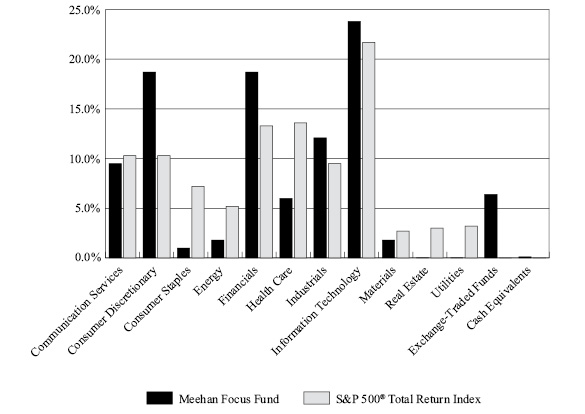

MEEHAN FOCUS FUND

PORTFOLIO INFORMATION

April 30, 2019 (Unaudited)

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

Security Description | % of

Net Assets |

Microsoft Corporation | 10.1% |

Berkshire Hathaway, Inc. - Class B | 8.2% |

Lowe's Companies, Inc. | 8.0% |

Apple, Inc. | 6.4% |

Alphabet, Inc. - Classes A and C | 6.1% |

PNC Financial Services Group, Inc. (The) | 4.8% |

United Rentals, Inc. | 4.0% |

Boeing Company (The) | 3.9% |

General Motors Company | 3.8% |

Bank of America Corporation | 3.3% |

7

MEEHAN FOCUS FUND

SCHEDULE OF INVESTMENTS

April 30, 2019 (Unaudited) |

COMMON STOCKS — 93.4% | | Shares | | | Value | |

Communication Services — 9.5% | | | | | | | | |

Entertainment — 2.5% | | | | | | | | |

Walt Disney Company (The) | | | 12,150 | | | $ | 1,664,185 | |

| | | | | | | | | |

Interactive Media & Services — 7.0% | | | | | | | | |

Alphabet, Inc. - Class A(a) | | | 1,495 | | | | 1,792,445 | |

Alphabet, Inc. - Class C(a) | | | 1,868 | | | | 2,220,081 | |

Facebook, Inc. - Class A(a) | | | 3,090 | | | | 597,606 | |

| | | | | | | | 4,610,132 | |

Consumer Discretionary — 18.7% | | | | | | | | |

Automobiles — 3.8% | | | | | | | | |

General Motors Company | | | 64,300 | | | | 2,504,485 | |

| | | | | | | | | |

Household Durables — 2.5% | | | | | | | | |

Lennar Corporation - Class A | | | 31,900 | | | | 1,659,757 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 2.9% | | | | | | | | |

Booking Holdings, Inc.(a) | | | 1,050 | | | | 1,947,739 | |

| | | | | | | | | |

Specialty Retail — 9.5% | | | | | | | | |

Lowe's Companies, Inc. | | | 46,500 | | | | 5,261,010 | |

Williams-Sonoma, Inc. | | | 17,730 | | | | 1,013,624 | |

| | | | | | | | 6,274,634 | |

Consumer Staples — 1.0% | | | | | | | | |

Food Products — 1.0% | | | | | | | | |

Nestlé S.A. - ADR | | | 6,970 | | | | 672,814 | |

| | | | | | | | | |

Energy — 1.8% | | | | | | | | |

Oil, Gas & Consumable Fuels — 1.8% | | | | | | | | |

Enbridge, Inc. | | | 32,600 | | | | 1,204,244 | |

| | | | | | | | | |

Financials — 18.7% | | | | | | | | |

Banks — 8.1% | | | | | | | | |

Bank of America Corporation | | | 70,000 | | | | 2,140,600 | |

PNC Financial Services Group, Inc. (The) | | | 23,310 | | | | 3,191,838 | |

| | | | | | | | 5,332,438 | |

Capital Markets — 2.4% | | | | | | | | |

BlackRock, Inc. | | | 3,240 | | | | 1,572,178 | |

8

MEEHAN FOCUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 93.4% (Continued) | | Shares | | | Value | |

Financials — 18.7% (Continued) | | | | | | | | |

Diversified Financial Services — 8.2% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | | 25,100 | | | $ | 5,439,421 | |

| | | | | | | | | |

Health Care — 6.0% | | | | | | | | |

Health Care Equipment & Supplies — 2.2% | | | | | | | | |

Alcon, Inc.(a) | | | 4,084 | | | | 237,689 | |

Medtronic plc | | | 14,050 | | | | 1,247,780 | |

| | | | | | | | 1,485,469 | |

Pharmaceuticals — 3.8% | | | | | | | | |

Bristol-Myers Squibb Company | | | 17,430 | | | | 809,275 | |

Novartis AG - ADR | | | 20,420 | | | | 1,679,137 | |

| | | | | | | | 2,488,412 | |

Industrials — 12.1% | | | | | | | | |

Aerospace & Defense — 3.9% | | | | | | | | |

Boeing Company (The) | | | 6,825 | | | | 2,577,734 | |

| | | | | | | | | |

Airlines — 2.1% | | | | | | | | |

Delta Air Lines, Inc. | | | 23,500 | | | | 1,369,815 | |

| | | | | | | | | |

Industrial Conglomerates — 2.1% | | | | | | | | |

3M Company | | | 7,470 | | | | 1,415,640 | |

| | | | | | | | | |

Trading Companies & Distributors — 4.0% | | | | | | | | |

United Rentals, Inc.(a) | | | 18,625 | | | | 2,624,635 | |

| | | | | | | | | |

Information Technology — 23.8% | | | | | | | | |

IT Services — 3.0% | | | | | | | | |

Visa, Inc. - Class A | | | 12,150 | | | | 1,997,825 | |

| | | | | | | | | |