| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Matthew J. Beck

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | November 30 | |

| | | |

| Date of reporting period: | May 31, 2019 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

LYRICAL U.S. VALUE EQUITY FUND

Institutional Class (LYRIX)

Investor Class (LYRBX)

Semi-Annual Report

May 31, 2019

(Unaudited)

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-888-884-8099 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-888-884-8099. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

LYRICAL U.S. VALUE EQUITY FUND

LETTER TO SHAREHOLDERS | May 31, 2019 |

Dear Fellow Shareholders,

Enclosed is the Semi-Annual Report to shareholders of the Lyrical U.S. Value Equity Fund (the “Fund”). On behalf of the Fund and its investment adviser, Lyrical Asset Management LP, I would like to thank you for your investment.

A Generational Opportunity?

It is important to put recent performance in its historical context. To do so, we analyzed data going back to 1998, the start of the internet bubble (a very poor period for value stocks). We believe the lowest P/E stocks (we use the stocks that at the start of each year have bottom quintile forward P/E multiples among our 1,000 largest U.S. stock universe) are the best proxy for value investing.

Analyzing the data1 for the 21 years from 1998 through 2018, the lowest P/E stocks were the best performing P/E quintile, outperforming the S&P 500 by nearly 400 bp per annum. Over 10 years from 2009 through 2018, the lowest P/E stocks were again the best performers, outperforming the S&P 500 by over 200 bp per annum.

2018 was the rare year where performance was inversely related to P/E cheapness, with the higher P/E quintiles outperforming the lower ones. We need to go back 19 more years to 1999 to find another year as bad for low P/E stocks. After 1999 and until 2018, low P/E stocks outperformed 72% of the years, including 8 years (44% of the years) when low P/E stocks outperformed by over 1,000 bp. The preponderance of the historical evidence is that low P/E value stocks have worked quite well.

Looking back over the last two decades, we see long stretches where low P/E outperforms significantly and then short periods where it acutely underperforms. During the internet bubble, we had two years in 1998 and 1999 when low P/E stocks underperformed the market by 57 percentage points. Then the bubble burst, and low P/E stocks went on a glorious run for the next 14 years, outperforming the S&P 500 almost every year, and by an annualized average of over 1,000 bp per annum.

Much of the bad press value stocks have received is due to the unfortunate use of the Russell 1000 Value as the value stock proxy. That index has underperformed the S&P 500 over the last year, the last five years, the last ten years, and the last fifteen years. On the other hand, low P/E stocks have delivered hundreds of percentage points of outperformance. The value investing narrative based on the Russell index misses the whole story of value investing success, as shown by our low P/E analysis.

As a result of the recent poor performance in value stocks, we see today as the best opportunity for value in a generation. The absolute P/E ratios today are well below historical norms, and lower than where P/E ratios were in the internet bubble. Furthermore, the valuation spreads we see today are unusually wide and have only been like this twice before, at the end of the financial crisis and at the end of the internet bubble. Both of those periods proved to be extraordinary entry points for value stocks.

1

Recap

Since its launch on February 4, 2013 through May 31, 2019, the Fund’s Institutional Class has produced a cumulative total return of +77.15%, compared to the +109.85% cumulative total return for the S&P 500® Index (the “S&P 500”). For the six months ended May 31, 2019, the Fund’s Institutional Class produced a total return of -10.47% compared to the total return for the S&P 500 of +0.74%. For the six months ended May 31, 2019, the three positions that most positively impacted performance were Aflac Incorporated (AFL), Willis Towers Watson Public Limited Company (WLTW), and Ameriprise Financial, Inc. (AMP) with contributions of 39 basis points (bps) (up 8%), 34 bps (up 7%) and 33 bps (up 8%), respectively; conversely, the three positions that most negatively impacted performance were Qurate Retail, Inc. Class A (QRTEA), National Oilwell Varco, Inc. (NOV), and EOG Resources, Inc. (EOG) which detracted 145 bps (down 44%), 113 bps (down 35%) and 106 bps (down 20%), respectively.

In analyzing the Fund portfolio’s performance attribution, we find it helpful to examine both the investment success rate and any skew in the distribution of returns. Over the life of the Fund, 70% of the Fund’s investments posted gains, and 47% outperformed the S&P 500. Skew has been a positive factor, as the Fund’s outperformers have outperformed by 26%, while our underperformers have underperformed by 18% over the life of the Fund. For the six month period ended May 31, 2019, 31% of the Fund’s investments posted gains, and 23% outperformed the S&P 500. For the six month period skew has been a negative factor as the Fund’s outperformers have outperformed by 5%, while our underperformers have underperformed by 17%.

During the life of the Fund we have sold thirty positions, as seven companies announced they were being acquired, eighteen approached our estimates of fair value, for two we lost conviction in our thesis, for one the company announced or completed acquisitions which increased the complexity and decreased analyzability, and for two the risk/reward became less compelling than other opportunities. For each sale we added a new position from our pipeline of opportunities.

As of May 31, 2019, the valuation of our portfolio is 8.5 times the next twelve months consensus earnings. The S&P 500 has a valuation of 15.6 times earnings on this same basis, a premium of 84% over the Fund.

Lyrical Asset Management’s Investment Philosophy and Portfolio Construction

For the new investors since our previous letter to the Fund’s shareholders, we’d like to briefly outline our investment philosophy and portfolio construction approach.

We believe our strategy and approach to investing differentiate us from other investment managers, even those that share a value approach to investing. We are deep value investors and by this we mean that we look to invest in companies trading significantly below intrinsic value. This separates us from other value managers who focus on relative value or core value approaches and whose portfolio characteristics have higher Price/Earnings, Price/Book and Price/Cash Flow multiples. We assess valuation based on current price relative to long-term normalized earnings, which contrasts us to those that rely on Price/Book or dividend yield. We only invest in what we consider to be quality businesses that we believe should earn good returns on invested capital, and avoid volatile businesses and companies with excessive leverage. Other value investors may consider owning any business regardless of quality if they believe the price is low

2

enough. Lastly, we only invest in businesses we can understand and avoid those that are excessively complex or require specialized technical knowledge, even though they may appear cheap from a high-level perspective.

We construct our portfolio purely bottom up and without regard to what is or is not contained in a benchmark. We are concerned with concentration risk and have strict limits on how much capital can be invested in any one position or any one industry. Our long portfolio is constructed to be balanced and diversified across approximately 33 positions, giving us exposure to many different types of companies and situations without sacrificing our strict investment standards.

Thank you for your continued trust and interest in Lyrical Asset Management.

Sincerely,

Andrew Wellington

Portfolio Manager

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-884-8099.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.lyricalvaluefunds.com or call 1-888-884-8099 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Funds as of November 30, 2018, please see the Schedules of Investments section of this Report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

LYRICAL U.S. VALUE EQUITY FUND

PORTFOLIO INFORMATION

May 31, 2019 (Unaudited)

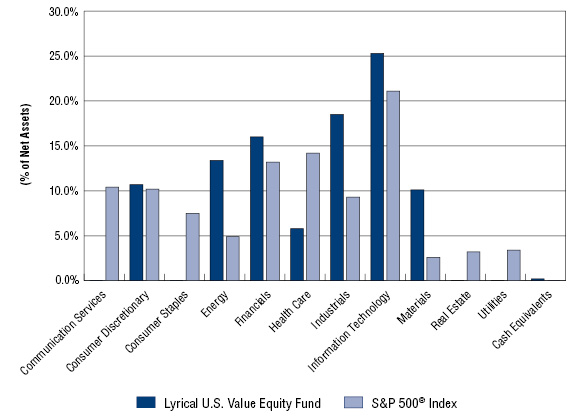

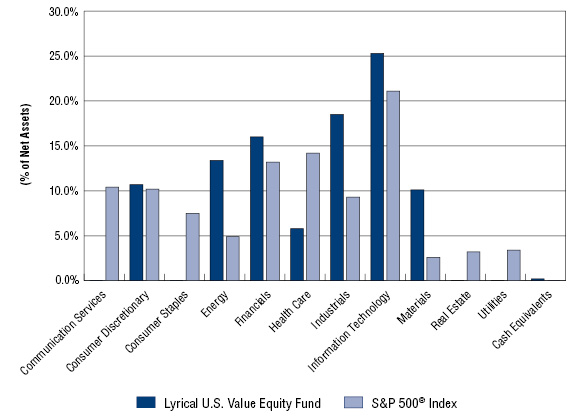

Lyrical U.S. Value Equity Fund vs S&P 500® Index

Sector Diversification

Top Ten Equity Holdings

Security Description | % of

Net Assets |

Microchip Technology, Inc. | 5.8% |

HCA Healthcare, Inc. | 5.8% |

Broadcom, Inc. | 5.7% |

Ameriprise Financial, Inc. | 5.7% |

Celanese Corporation | 5.7% |

Suncor Energy, Inc. | 5.6% |

Lincoln National Corporation | 5.4% |

EOG Resources, Inc. | 5.0% |

United Rentals, Inc. | 4.0% |

AerCap Holdings N.V. | 3.6% |

4

LYRICAL U.S. VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS

May 31, 2019 (Unaudited) |

COMMON STOCKS — 99.8% | | Shares | | | Value | |

Consumer Discretionary — 10.7% | | | | | | | | |

Auto Components — 2.3% | | | | | | | | |

Adient plc | | | 245,514 | | | $ | 4,237,572 | |

Goodyear Tire & Rubber Company (The) | | | 808,974 | | | | 10,848,341 | |

Tenneco, Inc. - Class A | | | 190,890 | | | | 1,897,447 | |

| | | | | | | | 16,983,360 | |

Household Durables — 3.4% | | | | | | | | |

Whirlpool Corporation | | | 215,336 | | | | 24,737,800 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 2.6% | | | | | | | | |

Qurate Retail, Inc.(a) | | | 1,482,115 | | | | 18,570,901 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 2.4% | | | | | | | | |

Hanesbrands, Inc. | | | 1,189,304 | | | | 17,661,164 | |

| | | | | | | | | |

Energy — 13.4% | | | | | | | | |

Energy Equipment & Services — 2.8% | | | | | | | | |

National Oilwell Varco, Inc. | | | 997,219 | | | | 20,792,016 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels — 10.6% | | | | | | | | |

EOG Resources, Inc. | | | 443,751 | | | | 36,334,332 | |

Suncor Energy, Inc. | | | 1,316,069 | | | | 40,534,925 | |

| | | | | | | | 76,869,257 | |

Financials — 16.0% | | | | | | | | |

Capital Markets — 7.7% | | | | | | | | |

Affiliated Managers Group, Inc. | | | 176,073 | | | | 14,758,439 | |

Ameriprise Financial, Inc. | | | 297,737 | | | | 41,156,186 | |

| | | | | | | | 55,914,625 | |

Insurance — 8.3% | | | | | | | | |

Assurant, Inc. | | | 205,010 | | | | 20,492,799 | |

Lincoln National Corporation | | | 663,575 | | | | 39,449,534 | |

| | | | | | | | 59,942,333 | |

Health Care — 5.8% | | | | | | | | |

Health Care Providers & Services — 5.8% | | | | | | | | |

HCA Healthcare, Inc. | | | 347,138 | | | | 41,989,812 | |

5

LYRICAL U.S. VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.8% (Continued) | | Shares | | | Value | |

Industrials — 18.5% | | | | | | | | |

Air Freight & Logistics — 2.9% | | | | | | | | |

XPO Logistics, Inc.(a) | | | 401,871 | | | $ | 20,933,461 | |

| | | | | | | | | |

Construction & Engineering — 4.3% | | | | | | | | |

AECOM(a) | | | 452,353 | | | | 14,430,061 | |

Quanta Services, Inc. | | | 480,106 | | | | 16,688,484 | |

| | | | | | | | 31,118,545 | |

Road & Rail — 1.7% | | | | | | | | |

Avis Budget Group, Inc.(a) | | | 297,227 | | | | 8,429,358 | |

Hertz Global Holdings, Inc.(a) | | | 309,999 | | | | 4,361,686 | |

| | | | | | | | 12,791,044 | |

Trading Companies & Distributors — 9.6% | | | | | | | | |

AerCap Holdings N.V.(a) | | | 587,834 | | | | 26,346,720 | |

Air Lease Corporation | | | 395,673 | | | | 14,244,228 | |

United Rentals, Inc.(a) | | | 262,873 | | | | 28,942,317 | |

| | | | | | | | 69,533,265 | |

Information Technology — 25.3% | | | | | | | | |

Communications Equipment — 1.3% | | | | | | | | |

CommScope Holding Company, Inc.(a) | | | 590,613 | | | | 9,538,400 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 6.1% | | | | | | | | |

Arrow Electronics, Inc.(a) | | | 277,080 | | | | 17,361,833 | |

Flex Ltd.(a) | | | 1,725,733 | | | | 15,428,053 | |

Tech Data Corporation(a) | | | 121,640 | | | | 11,026,666 | |

| | | | | | | | 43,816,552 | |

IT Services — 3.2% | | | | | | | | |

Alliance Data Systems Corporation | | | 169,521 | | | | 23,309,137 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment — 11.5% | | | | | | | | |

Broadcom, Inc. | | | 165,173 | | | | 41,564,134 | |

Microchip Technology, Inc. | | | 524,717 | | | | 41,993,101 | |

| | | | | | | | 83,557,235 | |

Technology Hardware, Storage & Peripherals — 3.2% | | | | | | | | |

Western Digital Corporation | | | 629,868 | | | | 23,443,687 | |

| | | | | | | | | |

Materials — 10.1% | | | | | | | | |

Chemicals — 5.7% | | | | | | | | |

Celanese Corporation | | | 432,910 | | | | 41,096,146 | |

6

LYRICAL U.S. VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 99.8% (Continued) | | Shares | | | Value | |

Materials — 10.1% (Continued) | | | | | | | | |

Containers & Packaging — 4.4% | | | | | | | | |

Crown Holdings, Inc.(a) | | | 428,546 | | | $ | 23,754,305 | |

Owens-Illinois, Inc. | | | 518,454 | | | | 8,295,264 | |

| | | | | | | | 32,049,569 | |

| | | | | | | | | |

Investments at Value — 99.8% (Cost $726,316,012) | | | | | | $ | 724,648,309 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.2% | | | | | | | 1,404,143 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 726,052,452 | |

(a) | Non-income producing security. |

See accompanying notes to financial statements. |

7

LYRICAL U.S. VALUE EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2019 (Unaudited) |

ASSETS | | | | |

Investments in securities: | | | | |

At cost | | $ | 726,316,012 | |

At value (Note 2) | | $ | 724,648,309 | |

Receivable for capital shares sold | | | 538,962 | |

Receivable for investment securities sold | | | 11,374,453 | |

Dividends receivable | | | 1,189,980 | |

Other assets | | | 52,970 | |

Total assets | | | 737,804,674 | |

| | | | | |

LIABILITIES | | | | |

Cash overdraft | | | 1,550,189 | |

Payable for capital shares redeemed | | | 9,246,580 | |

Payable to Adviser (Note 4) | | | 864,230 | |

Payable to administrator (Note 4) | | | 75,057 | |

Accrued distribution fees (Note 4) | | | 153 | |

Other accrued expenses | | | 16,013 | |

Total liabilities | | | 11,752,222 | |

| | | | | |

NET ASSETS | | $ | 726,052,452 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 738,109,678 | |

Accumulated deficit | | | (12,057,226 | ) |

NET ASSETS | | $ | 726,052,452 | |

| | | | | |

NET ASSET VALUE PER SHARE: | | | | |

INSTITUTIONAL CLASS | | | | |

Net assets applicable to Institutional Class | | $ | 719,108,905 | |

Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 51,864,416 | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 13.87 | |

INVESTOR CLASS | | | | |

Net assets applicable to Investor Class | | $ | 6,943,547 | |

Investor Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 503,975 | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 13.78 | |

See accompanying notes to financial statements. |

8

LYRICAL U.S. VALUE EQUITY FUND

STATEMENT OF OPERATIONS

Six Months Ended May 31, 2019 (Unaudited) |

INVESTMENT INCOME | | | | |

Dividend income | | $ | 7,858,536 | |

Foreign witholding taxes on dividends | | | (59,400 | ) |

Total investment income | | | 7,799,136 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 4) | | | 5,235,700 | |

Administration fees (Note 4) | | | 303,079 | |

Fund accounting fees (Note 4) | | | 51,401 | |

Transfer agent fees (Note 4) | | | 46,718 | |

Compliance fees (Note 4) | | | 42,884 | |

Registration and filing fees | | | 35,226 | |

Custody and bank service fees | | | 34,573 | |

Postage and supplies | | | 34,288 | |

Professional fees | | | 23,859 | |

Networking fees | | | 15,119 | |

Distribution fees - Investor Class (Note 4) | | | 13,178 | |

Insurance expense | | | 7,123 | |

Borrowing costs (Note 5) | | | 6,500 | |

Printing of shareholder reports | | | 6,463 | |

Trustees’ fees and expenses (Note 4) | | | 5,969 | |

Other expenses | | | 17,164 | |

Total expenses | | | 5,879,244 | |

Expense reimbursements by Adviser (Note 4) | | | (12,149 | ) |

Net expenses | | | 5,867,095 | |

| | | | | |

NET INVESTMENT INCOME | | | 1,932,041 | |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES | | | | |

Net realized gains from investment transactions | | | 39,236,366 | |

Net realized losses from foreign currency transactions (Note 2) | | | (11,202 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (134,487,335 | ) |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTSAND FOREIGN CURRENCIES | | | (95,262,171 | ) |

| | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (93,330,130 | ) |

See accompanying notes to financial statements. |

9

LYRICAL U.S. VALUE EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months

Ended

May 31, 2019

(Unaudited) | | | Year

Ended

November 30,

2018 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 1,932,041 | | | $ | 1,882,890 | |

Net realized gains from investment transactions | | | 39,236,366 | | | | 50,802,676 | |

Net realized losses from foreign currency transactions | | | (11,202 | ) | | | (4,989 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (134,487,335 | ) | | | (163,561,509 | ) |

Net decrease in net assets resulting from operations | | | (93,330,130 | ) | | | (110,880,932 | ) |

| | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

Institutional Class | | | (2,632,588 | ) | | | (77,051,597 | ) |

Investor Class | | | — | | | | (1,717,444 | ) |

Decrease in net assets from distributions to shareholders | | | (2,632,588 | ) | | | (78,769,041 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 224,256,886 | | | | 456,135,603 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 2,082,876 | | | | 61,458,585 | |

Payments for shares redeemed | | | (320,152,825 | ) | | | (542,065,326 | ) |

Net decrease in Institutional Class net assets from captial share transactions | | | (93,813,063 | ) | | | (24,471,138 | ) |

| | | | | | | | | |

Investor Class | | | | | | | | |

Proceeds from shares sold | | | 1,074,727 | | | | 4,889,814 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 1,617,814 | |

Payments for shares redeemed | | | (12,423,554 | ) | | | (18,570,922 | ) |

Net decrease in Investor Class net assets from captial share transactions | | | (11,348,827 | ) | | | (12,063,294 | ) |

| | | | | | | | | |

TOTAL DECREASE IN NET ASSETS | | | (201,124,608 | ) | | | (226,184,405 | ) |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 927,177,060 | | | | 1,153,361,465 | |

End of period | | $ | 726,052,452 | | | $ | 927,177,060 | |

See accompanying notes to financial statements. |

10

LYRICAL U.S. VALUE EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | Six Months

Ended

May 31, 2019

(Unaudited) | | | Year

Ended

November 30,

2018 | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Institutional Class | | | | | | | | |

Shares sold | | | 15,305,937 | | | | 25,680,359 | |

Shares issued in reinvestment of distributions to shareholders | | | 153,266 | | | | 3,949,556 | |

Shares redeemed | | | (21,935,313 | ) | | | (31,270,758 | ) |

Net decrease in shares outstanding | | | (6,476,110 | ) | | | (1,640,843 | ) |

Shares outstanding at beginning of period | | | 58,340,526 | | | | 59,981,369 | |

Shares outstanding at end of period | | | 51,864,416 | | | | 58,340,526 | |

| | | | | | | | | |

Investor Class | | | | | | | | |

Shares sold | | | 70,607 | | | | 268,775 | |

Shares issued in reinvestment of distributions to shareholders | | | — | | | | 104,804 | |

Shares redeemed | | | (850,944 | ) | | | (1,073,442 | ) |

Net decrease in shares outstanding | | | (780,337 | ) | | | (699,863 | ) |

Shares outstanding at beginning of period | | | 1,284,312 | | | | 1,984,175 | |

Shares outstanding at end of period | | | 503,975 | | | | 1,284,312 | |

See accompanying notes to financial statements. |

11

LYRICAL U.S. VALUE EQUITY FUND

INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period: |

| | Six Months

Ended

May 31,

2019

(Unaudited) | | | Year

Ended

Nov. 30,

2018 | | | Year

Ended

Nov. 30,

2017 | | | Year

Ended

Nov. 30,

2016 | | | Year

Ended

Nov. 30,

2015 | | | Year

Ended

Nov. 30,

2014 | |

Net asset value at beginning of period | | $ | 15.55 | | | $ | 18.62 | | | $ | 16.60 | | | $ | 15.63 | | | $ | 16.29 | | | $ | 13.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.04 | (a) | | | 0.03 | (a) | | | 0.01 | (a) | | | 0.24 | | | | 0.04 | | | | (0.00 | )(b) |

Net realized and unrealized gains (losses) on investments and foreign currencies | | | (1.67 | ) | | | (1.70 | ) | | | 3.54 | | | | 1.40 | | | | (0.35 | ) | | | 2.66 | |

Total from investment operations | | | (1.63 | ) | | | (1.67 | ) | | | 3.55 | | | | 1.64 | | | | (0.31 | ) | | | 2.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.05 | ) | | | (0.01 | ) | | | (0.24 | ) | | | (0.04 | ) | | | (0.00 | )(b) | | | (0.00 | )(b) |

Distributions from net realized gains | | | — | | | | (1.39 | ) | | | (1.29 | ) | | | (0.63 | ) | | | (0.35 | ) | | | (0.15 | ) |

Total distributions | | | (0.05 | ) | | | (1.40 | ) | | | (1.53 | ) | | | (0.67 | ) | | | (0.35 | ) | | | (0.15 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 13.87 | | | $ | 15.55 | | | $ | 18.62 | | | $ | 16.60 | | | $ | 15.63 | | | $ | 16.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(c) | | | (10.47 | %)(d) | | | (9.02 | %) | | | 21.70 | % | | | 10.73 | % | | | (1.91 | %) | | | 19.41 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 719,109 | | | $ | 907,366 | | | $ | 1,116,584 | | | $ | 993,904 | | | $ | 590,582 | | | $ | 547,021 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.40 | %(e) | | | 1.37 | % | | | 1.37 | % | | | 1.38 | % | | | 1.42 | % | | | 1.45 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets | | | 1.40 | %(e) | | | 1.37 | % | | | 1.37 | % | | | 1.38 | % | | | 1.42 | % | | | 1.44 | %(f) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.46 | %(e) | | | 0.17 | % | | | 0.03 | % | | | 1.62 | % | | | 0.24 | % | | | (0.00 | %)(f)(g) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 25 | %(d) | | | 39 | % | | | 22 | % | | | 36 | % | | | 21 | % | | | 20 | % |

(a) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

(b) | Amount rounds to less than $0.01 per share. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced advisory fees and/or reimbursed expenses for the year ended November 30, 2014 (Note 4). |

(d) | Not annualized. |

(e) | Annualized. |

(f) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

(g) | Amount rounds to less than 0.01%. |

See accompanying notes to financial statements. |

12

LYRICAL U.S. VALUE EQUITY FUND

INVESTOR CLASS

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period: |

| | Six Months

Ended

May 31,

2019

(Unaudited) | | | Year

Ended

Nov. 30,

2018 | | | Year

Ended

Nov. 30,

2017 | | | Year

Ended

Nov. 30,

2016 | | | Year

Ended

Nov. 30,

2015 | | | Period

Ended

Nov. 30,

2014(a) | |

Net asset value at beginning of period | | $ | 15.43 | | | $ | 18.54 | | | $ | 16.52 | | | $ | 15.57 | | | $ | 16.27 | | | $ | 14.68 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.01 | (b) | | | (0.03 | )(b) | | | (0.05 | )(b) | | | 0.30 | | | | 0.01 | | | | (0.01 | ) |

Net realized and unrealized gains (losses) on investments and foreign currencies | | | (1.66 | ) | | | (1.69 | ) | | | 3.53 | | | | 1.28 | | | | (0.36 | ) | | | 1.60 | |

Total from investment operations | | | (1.65 | ) | | | (1.72 | ) | | | 3.48 | | | | 1.58 | | | | (0.35 | ) | | | 1.59 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.17 | ) | | | (0.00 | )(c) | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | (1.39 | ) | | | (1.29 | ) | | | (0.63 | ) | | | (0.35 | ) | | | — | |

Total distributions | | | — | | | | (1.39 | ) | | | (1.46 | ) | | | (0.63 | ) | | | (0.35 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 13.78 | | | $ | 15.43 | | | $ | 18.54 | | | $ | 16.52 | | | $ | 15.57 | | | $ | 16.27 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(d) | | | (10.69 | %)(e) | | | (9.30 | %) | | | 21.32 | % | | | 10.36 | % | | | (2.19 | %) | | | 10.83 | %(e) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 6,944 | | | $ | 19,811 | | | $ | 36,777 | | | $ | 58,213 | | | $ | 61,375 | | | $ | 9,033 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.93 | %(f) | | | 1.72 | % | | | 1.70 | % | | | 1.70 | % | | | 1.72 | % | | | 2.39 | %(f) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets | | | 1.70 | %(f)(g) | | | 1.70 | %(g) | | | 1.70 | % | | | 1.70 | % | | | 1.70 | %(g) | | | 1.70 | %(f)(g) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets | | | 0.16 | %(f)(g) | | | (0.18 | %)(g) | | | (0.32 | %) | | | 1.39 | % | | | 0.03 | %(g) | | | (0.18 | %)(f)(g) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 25 | %(e) | | | 39 | % | | | 22 | % | | | 36 | % | | | 21 | % | | | 20 | %(e)(h) |

(a) | Represents the period from the commencement of operations (February 24, 2014) through November 30, 2014. |

(b) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

(c) | Amount rounds to less than $0.01 per share. |

(d) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses for the periods ended May 31, 2019 and November 30, 2018, 2015 and 2014 (Note 4). |

(e) | Not annualized. |

(f) | Annualized. |

(g) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

(h) | Represents the year ended November 30, 2014. |

See accompanying notes to financial statements. |

13

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2019 (Unaudited)

1. Organization

Lyrical U.S. Value Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is to seek to achieve long-term capital growth.

The Fund offers two classes of shares: Institutional Class shares (sold without any sales loads and distribution and/or shareholder service fees and requiring a $100,000 initial investment) and Investor Class shares (sold without any sales loads, but subject to a distribution and/or shareholder service fee of up to 0.25% of the average daily net assets attributable to Investor Class shares, and requiring a $2,500 initial investment). Each share class represents an ownership interest in the same investment portfolio.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities valuation – The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. When using a quoted price and when the market is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with procedures established by and under the general supervision of the Board of Trustees (the “Board”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

14

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2019:

Lyrical U.S. Value Equity Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 724,648,309 | | | $ | — | | | $ | — | | | $ | 724,648,309 | |

Total | | $ | 724,648,309 | | | $ | — | | | $ | — | | | $ | 724,648,309 | |

Refer to the Fund’s Schedule of Investments for a listing of securities by sector and industry type. The Fund did not hold any derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the six months ended May 31, 2019.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of the assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

Investment income– Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

15

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Foreign currency translation – Investment securities and other assets and liabilities denominated in or expected to settle in foreign currencies, if any, are translated into U.S. dollars based on exchange rates on the following basis:

| | A. | The fair values of investment securities and other assets and liabilities are translated as of the close of the NYSE each day. |

| | B. | Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing as of 4:00 p.m. Eastern time on the respective date of such transactions. |

| | C. | The Fund does not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments. |

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies and 2) the difference between the amounts of dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses, if any, arise from changes in the value of assets and liabilities that result from changes in exchange rates.

Allocation between Classes – Investment income earned, realized capital gains and losses, and unrealized appreciation and depreciation are allocated daily to each Class of the Fund based upon its proportionate share of total net assets of the Fund. Class-specific expenses are charged directly to the Class incurring the expense. Common expenses which are not attributable to a specific Class are allocated daily to each Class of shares of the Fund based upon its proportionate share of total net assets of the Fund.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

16

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Distributions to shareholders – The Fund distributes to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid to shareholders by the Fund during the periods ended May 31, 2019 and November 30, 2018 was as follows:

| Period

Ended | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total

Distributions | |

Institutional Class | 5/31/2019 | | $ | 2,632,588 | | | $ | — | | | $ | 2,632,588 | |

| | 11/30/2018 | | $ | 372,769 | | | $ | 76,678,828 | | | $ | 77,051,597 | |

Investor Class | 5/31/2019 | | $ | — | | | $ | — | | | $ | — | |

| | 11/30/2018 | | $ | 4,379 | | | $ | 1,713,065 | | | $ | 1,717,444 | |

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of May 31, 2019:

Tax cost of portfolio investments | | $ | 785,725,297 | |

Gross unrealized appreciation | | $ | 98,566,874 | |

Gross unrealized depreciation | | | (159,643,862 | ) |

Net unrealized depreciation | | | (61,076,988 | ) |

Accumulated ordinary income | | | 1,159,552 | |

Undistributed long-term capital gains | | | 6,836,528 | |

Other gains | | | 41,023,682 | |

Accumulated deficit | | $ | (12,057,226 | ) |

17

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for the current and all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal.

3. Investment Transactions

During the six months ended May 31, 2019, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $209,364,830 and $325,936,681, respectively.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Lyrical Asset Management L.P. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. The Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 1.25% of average daily net assets.

Pursuant to an Expense Limitation Agreement (“ELA”) between the Fund and the Adviser, the Adviser has contractually agreed, until April 1, 2020, to reduce investment advisory fees and reimburse other operating expenses to limit total annual operating expenses of the Fund (exclusive of brokerage costs; taxes; interest; borrowing costs such as interest and dividend expenses on securities sold short; costs to organize the Fund; acquired fund fees and expenses; extraordinary expenses such as litigation and merger or reorganization costs; and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding the following percentages of average daily net assets attributable to each respective class:

Institutional Class | Investor Class |

1.45% | 1.70% |

Accordingly, during the six months ended May 31, 2019, the Adviser reimbursed other operating expenses of $12,149 for Investor Class shares.

18

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause total annual fund operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of May 31, 2019, the Adviser may in the future seek repayment of expense reimbursements of $18,371. The Adviser may recover these amounts no later than the dates state below:

November 30, 2021 | | $ | 6,222 | |

May 31, 2022 | | | 12,149 | |

| | | $ | 18,371 | |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and costs of pricing its portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as the principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated partially by the Adviser and partially by the Investor Class shares of the Fund for acting as principal underwriter.

A Trustee and certain officers of the Trust are also officers of Ultimus and/or the Distributor.

DISTRIBUTION PLAN

The Fund has adopted a plan of distribution (the “Plan”), pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), which permits Investor Class shares of the Fund to directly incur or reimburse the Fund’s principal underwriter for certain expenses related to the distribution of its shares. The annual limitation for payment of expenses pursuant to the Plan is 0.25% of the Fund’s average daily net assets allocable to Investor Class shares. The Fund has not adopted a plan of distribution with respect to the Institutional Class shares. During the six months ended May 31, 2019, the Investor Class shares incurred $13,178 of distribution fees under the Plan.

TRUSTEE COMPENSATION

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid in quarterly

19

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

installments. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

PRINCIPAL HOLDER OF FUND SHARES

As of May 31, 2019, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

NAME OF RECORD OWNER | % Ownership |

Lyrical U.S. Value Equity Fund - Institutional Class | |

Charles Schwab & Company, Inc. (for the benefit of its customers) | 26% |

Lyrical U.S. Value Equity Fund - Investor Class | |

Charles Schwab & Company, Inc. (for the benefit of its customers) | 28% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person of the Fund. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Borrowing Costs

From time to time, the Fund may have an overdrawn cash balance at the custodian due to redemptions or market movements. When this occurs, the Fund will incur borrowing costs charged by the custodian. Accordingly, during the six months ended May 31, 2019, the Fund incurred $6,500 of borrowing costs charged by the custodian.

6. Sector Risk

If the Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s NAV per share. For instance, economic or market factors, regulatory changes or other developments may negatively impact all companies in a particular sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of May 31, 2019, the Fund had 25.3% of the value of its net assets invested in stocks within the Information Technology sector.

20

LYRICAL U.S. VALUE EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued) |

7. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

8. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

21

LYRICAL U.S. VALUE EQUITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees, class-specific expenses (such as distribution fees) and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (December 1, 2018) and held until the end of the period (May 31, 2019).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

22

LYRICAL U.S. VALUE EQUITY FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued)

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| Beginning

Account Value

December 1, 2018 | Ending

Account Value

May 31, 2019 | Net

Expense

Ratio(a) | Expenses

Paid During

Period(b) |

Lyrical U.S. Value Equity Fund |

Institutional Class | | | | |

Based on Actual Fund Return | $ 1,000.00 | $ 895.30 | 1.40% | $ 6.62 |

Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,017.95 | 1.40% | $ 7.04 |

Investor Class | | | | |

Based on Actual Fund Return | $ 1,000.00 | $ 893.10 | 1.70% | $ 8.02 |

Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,016.45 | 1.70% | $ 8.55 |

(a) | Annualized, based on the Fund’s most recent one-half year expenses. |

(b) | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

23

LYRICAL U.S. VALUE EQUITY FUND

OTHER INFORMATION (Unaudited)

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-884-8099, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-888-884-8099, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q or as an exhibit to its reports on Form N-Q’s successor form, Form N-PORT. These filings are available upon request by calling 1-888-884-8099. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov.

RESULTS OF SPECIAL MEETING OF SHAREHOLDERS

(Unaudited)

On June 18, 2018, a Special Meeting of Shareholders of the Trust was held for the purpose of considering the election of seven trustees for the Trust. The number of shares of the Trust present and voting at the Special Meeting represented 68.40% of the total shares entitled to vote at the meeting. Each of the seven nominees was elected by the shareholders of the Trust.

The results of the voting with respect to the election of the seven Trustees were as follows:

| | | Number of Shares | |

Nominee/Trustee | | Affirmative | | | Withhold | |

Robert G. Dorsey | | | 79,822,871 | | | | 11,178 | |

John J. Discepoli | | | 79,499,054 | | | | 334,995 | |

David M. Deptula | | | 79,499,054 | | | | 334,995 | |

Janine L. Cohen | | | 79,485,191 | | | | 348,858 | |

Jacqueline A. Williams | | | 79,757,455 | | | | 76,594 | |

Clifford N. Shireson | | | 79,771,318 | | | | 62,731 | |

Robert E. Morrison, Jr. | | | 79,771,349 | | | | 62,700 | |

24

CUSTOMER PRIVACY NOTICE |

FACTS | WHAT DOES THE LYRICAL U.S. VALUE EQUITY FUND (the “Fund”) DO WITH YOUR PERSONAL INFORMATION? |

| | | | |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | | | |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactionss ■ Wire Transfer Instructions When you areno longer our customer, we continue to share your information as described in this notice. |

| | | | |

How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Fund chooses to share; and whether you can limit this sharing. |

| | | | |

Reasons we can share your personal information | Does the

Fund share? | Can you limit this sharing? |

For our everyday business purposes –

Such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes –

to offer our products and services to you | No | We don’t share |

For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We don’t share |

For nonaffiliates to market to you | No | We don’t share |

| | |

Questions? | Call 1-888-884-8099 |

25

Who we are |

Who is providing this notice? | Lyrical U.S. Value Equity Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

What we do |

How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tell us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ Sharing for affiliates’ everyday business purposes –

information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| | |

Definitions |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■Lyrical Asset Management LP, the investment adviser to the Fund, could be deemed to be an affiliate. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ■The Fund do not share with nonaffiliates so they can market to you. |

Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■The Fund do not jointly market. |

26

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

RYAN LABS CORE BOND FUND

(RLCBX)

RYAN LABS LONG CREDIT FUND

(RLLCX)

Semi-Annual Report

May 31, 2019

(Unaudited)

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-866-561-3087 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-866-561-3087. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

RYAN LABS FUNDS

LETTER TO SHAREHOLDERS | June 28, 2019 |

Dear Shareholders,

Following is the Semi-Annual Report to shareholders of Ryan Labs Core Bond Fund and Ryan Labs Long Credit Fund (collectively, the “Funds”) for the H1 2019. On behalf of the investment manager, Ryan Labs Asset Management, Inc., we would like to thank you for your continued investment.

MARKET RECAP

The past six months ending May 2019 started with December 2018’s market sell-off which was largely influenced by fears over a US-China tariff/trade war, unsettled Brexit terms, and an overly hawkish Fed hiking rates into near bear markets in equities. We viewed the credit market’s reaction between December and the end of the first calendar quarter as a pendulum. At the end of 2018, valuations seemed oversold too far and too fast from a technical perspective versus underlying fundamentals. Spreads rose to 153 bps at December end, as shown by the Bloomberg Barclays U.S. Corporate Credit Investment Grade index, from November’s 137 bps but progressed quickly down the following months, reaching 119 bps in March and finally 128 bps at May end. Although spreads expanded during December, corporate credit yields compressed given the US Treasury yield curve falling to lower levels. Regardless, over the past 6 months, corporate credit rallied with a return of +8.81%, outperforming against duration neutral Treasuries by 127 bps.

Most recently, markets continue to be influenced by the US Federal Reserve, which paused its interest rate normalization program after 9 rate hikes, along with the on-going China trade war. The Federal Open Market Committee did not move the 2.25% - 2.50% target federal funds rate range during its March 20 and May 1 meetings and pledged to be very patient on its next move. The pause eased the pressure from rising short-term rates and saw a reversal in direction: the 2-year Treasury fell to +1.95% at the end of May, from February’s 2.52% and November’s 2.80%. This rate compression happened across the curve with the 10-year yielding 2.14%, falling from February’s 2.71% and November’s 3.01%, and the 30-year falling to 2.71% from February’s 3.09% and November’s 3.30%. Given these moves, the 2s/10s yield curve flattened from November’s +21 bps March’s + 14 bps but jumped back to +19 bps at the end of May. Fed Chairman Powell had also stated that the latest policy revision was influenced by the slowing growth in U.S. consumer and business spending and the more pronounced slowdown in EU economies. The reduction of Treasury holdings would also cease by the end of September. Regardless, US economic data has come in positively, with the Q1 GDP growth of 3.2% showing a sign of resilience after the market swoon and government shutdown in January, job market showing strength with an unemployment rate of 3.6%, and U.S. consumer confidence levels rising as shown by the University of Michigan Consumer Sentiment index.

Treasury yields have also decreased as trade negotiations between the U.S. and China broke down in May which has placed an increased concern on the state of global economic growth. On May 8, the Trump administration raised the 10% tariff rate to 25% on $200B Chinese goods with a quick retaliation by China on $60B of their American imports. Other

1

influencing geopolitical events have included the ongoing Brexit debacle, where clarity on the process has become inexistent and heightened conflict between Britain and the EU, and the Trump administration threatening Mexico with a new tariff on imports if the number of immigrants into the U.S. would not come down.

RYAN LABS CORE BOND FUND (RLCBX)

INVESTMENT PHILOSOPHY

The investment objective of Ryan Labs Core Bond Fund (the “Core Bond Fund”) is to seek total return consisting of current income and capital appreciation. The benchmark for this strategy is the Bloomberg Barclays U.S. Aggregate Bond Index (the “Core Bond Benchmark”). The Core Bond Fund seeks this investment objective while providing protection against interest rate risk. We attempt to accomplish this investment objective by investing at least 80% of Core Bond Fund assets in U.S. dollar-denominated, investment-grade debt securities. The portfolio’s sensitivity to interest rate changes is intended to track the market for domestic, investment-grade fixed-income securities. The modified duration of the Core Bond Fund’s investment portfolio at the end of each calendar month will typically be within half a year of the Core Bond Benchmark. The primary strategies utilized for value-add are sector rotation, issue selection, and yield curve positioning.

PERFORMANCE SUMMARY

For the trailing six months ending May 31, 2019, the Fund returned +6.97% compared to the Benchmark return of +6.72%, outperforming the Benchmark by 25 bps. For the trailing year, the fund returned +6.45% compared to the benchmark return of +6.40%, outperforming by 5 bps. Outperformance for the past six months was primarily driven by an underweight to Treasuries and MBS Passthroughs, the overweight to ABS and CMBS allocations, slight overweight to financials, and issue selection across all corporate credit sectors, primarily in industrials. The top outperformers included CMBS positions, Cenovus Energy, Enel Finance International, Motiva Enterprises, and Celgene. Top underperformers included CVS Health Corp, Brighthouse Financial, Domtar, Kroger, and MPLX.

RYAN LABS LONG CREDIT FUND

INVESTMENT PHILOSOPHY

The investment objective of Ryan Labs Long Credit Fund (the “Long Credit Fund”) is to seek total return consisting of current income and capital appreciation. The benchmark for this strategy is the Bloomberg Barclays U.S. Long Credit Index (the “Long Credit Benchmark”). We attempt to accomplish this investment objective by investing at least 80% of Long Credit Fund’s net assets in U.S. dollar-denominated investment-grade debt securities. The portfolio’s sensitivity to interest rate changes is intended to track the market for domestic, investment-grade fixed-income securities. The modified duration of the Long Credit Fund’s investment portfolio at the end of each calendar month will typically be within half a year of the Long Credit Benchmark. The primary strategies utilized for value-add are sector rotation, issue selection, and yield curve positioning.

2

PERFORMANCE SUMMARY

For the trailing quarter ending May 31, 2019, the Fund returned +13.95% compared to the Benchmark return of +13.83%, outperforming the Benchmark by 12 bps. For the trailing year, the fund returned +9.19% compared to the benchmark return of +9.34%, underperforming by 16 bps. Outperformance for the past six months was primarily driven by issue selection within and across corporate credit. All major subsectors, industrials, utilities, and financials, outperformed. Issue selection within government related securities, particularly within agencies, also contributed positively to outperformance. Top performers included Electricite de France, Celgene, AT&T, Warner Media, and Enel Financial International. Underperformers included CVS Health Corp, Lowe’s, Brighthouse Financial, FedEx, and SC Johnson & Son.

OUTLOOK

With the change in the Fed stance, the market is pricing a rate cut in the coming months. Many of the US Corporations with international supply chains have lowered their earnings guidance or have put a pause on investment spending on concerns on the China-US tariff war along with other geo-political concerns. Despite good financial performance in the most recent earnings season and continued liquidity in the market, we see limited upside in the credit spreads. Non-financial BBB rated companies, that levered up due to M&A, have seen a slight improvement in their debt/EBITDA ratios as they paid down debt through liability management exercise and/or asset sales. Such actions are viewed favorably by rating agencies and in turn has supported performance in the BBB tier. We continue to add to corporate credit names, some of which have deleveraged their balance sheets and provide the best risk/reward profile and add through new issue concessions.

Richard Familetti

President, Ryan Labs Asset Management

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-866-561-3087.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus, please visit our website at www.ryanlabsfunds.com or call 1-866-561-3087 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. Ryan Labs Core Bond Fund and Ryan Labs Long Credit Fund are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter

3

to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ Adviser with respect to those securities may change at any time. For a complete list of securities held by the Funds as of May 31, 2019, please see the Schedules of Investments sections of the Semi-Annual Report.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

4

RYAN LABS CORE BOND FUND

PORTFOLIO INFORMATION

May 31, 2019 (Unaudited)

Asset Allocation (% of Net Assets)

Security Allocation | Percentage of

Net Assets |

Mortgage-Backed Securities | 38.6% |

Corporate Bonds | 28.5% |

U.S. Treasury Obligations | 24.2% |

Asset-Backed Securities | 16.3% |

International Bonds | 0.1% |

Cash Equivalents and Liabilities in Excess of Other Assets | (7.7%) |

Total | 100.0% |

Top 10 Bond Holdings

Security Description | % of

Net Assets |

U.S. Treasury Notes, 1.375%, due 10/31/2020 | 4.2% |

Federal National Mortgage Association, Pool #MA3305, 3.500%, due 03/01/2048 | 2.1% |

U.S. Treasury Notes, 2.875%, due 08/15/2028 | 1.9% |

Federal Home Loan Mortgage Corporation, Pool #G08737, 3.000%, due 12/01/2046 | 1.8% |

U.S. Treasury Bonds, 4.500%, due 02/15/2036 | 1.8% |

Federal Home Loan Mortgage Corporation, Pool #G08707, 4.000%, due 05/01/2046 | 1.7% |

U.S. Treasury Notes, 3.125%, due 11/15/2028 | 1.6% |

U.S. Treasury Bonds, 3.125%, due 05/15/2048 | 1.6% |

U.S. Treasury Bonds, 3.000%, due 08/15/2048 | 1.5% |

U.S. Treasury Notes, 2.250%, due 11/15/2027 | 1.4% |

5

RYAN LABS LONG CREDIT FUND

PORTFOLIO INFORMATION

May 31, 2019 (Unaudited)

Asset Allocation (% of Net Assets)

Security Allocation | Percentage of

Net Assets |

Corporate Bonds | 90.1% |

U.S. Treasury Obligations | 7.1% |

International Bonds | 1.4% |

Municipal Bonds | 1.0% |