UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Karen Jacoppo-Wood

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | October 31 | |

| | | |

| Date of reporting period: | April 30, 2024 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a).

| Westwood Quality Value Fund |

| Westwood Quality MidCap Fund |

| Westwood Quality SMidCap Fund |

| Westwood Quality SmallCap Fund |

| Westwood Quality AllCap Fund |

| Westwood Capital Appreciation and Income Fund |

| Westwood Income Opportunity Fund |

| Westwood Multi-Asset Income Fund |

| Westwood Alternative Income Fund |

| Westwood Global Real Estate Fund |

| Westwood Real Estate Income Fund |

| Westwood Broadmark Tactical Growth Fund |

| Westwood Broadmark Tactical Plus Fund |

| Semi-Annual Report | April 30, 2024 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Investment Adviser: |

| | Westwood Management Corp. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| WESTWOOD FUNDS |

| |

| TABLE OF CONTENTS |

| Shareholder Letter | 1 |

| Schedules of Investments | |

| Westwood Quality Value Fund | 14 |

| Westwood Quality MidCap Fund | 16 |

| Westwood Quality SMidCap Fund | 18 |

| Westwood Quality SmallCap Fund | 20 |

| Westwood Quality AllCap Fund | 22 |

| Westwood Capital Appreciation and Income Fund | 24 |

| Westwood Income Opportunity Fund | 29 |

| Westwood Multi-Asset Income Fund | 35 |

| Westwood Alternative Income Fund | 41 |

| Westwood Global Real Estate Fund | 47 |

| Westwood Real Estate Income Fund | 49 |

| Westwood Broadmark Tactical Growth Fund | 51 |

| Westwood Broadmark Tactical Plus Fund | 52 |

| Statements of Assets and Liabilities | 53 |

| Statements of Operations | 58 |

| Statements of Changes in Net Assets | 62 |

| Financial Highlights | 78 |

| Notes to Financial Statements | 102 |

| About Your Funds’ Expenses | 131 |

| Other Information | 138 |

| Liquidity Risk Management Program | 139 |

| Customer Privacy Notice | 140 |

| WESTWOOD FUNDS (Unaudited) |

November 1, 2023 – April 30, 2024

Dear Shareholders,

Soft-Landing Theory Gains Traction

The most significant economic development in the final months of 2023 was the shift in policy outlook by the Federal Reserve. Coming into its final meetings of the year, markets were still pricing in the possibility of additional rate hikes. But in a surprising twist, the Federal Open Market Committee (FOMC) shifted to a decidedly more dovish tone and outlook, fueling a boost in risk assets and fixed income alike — the latter would later lose luster. In fact, by year-end, none of the FOMC members surveyed believed that rates would be increased, and the consensus forecasted 0.75% worth of cuts in 2024.

Despite starting the quarter weak, this dovish Fed pivot sent U.S. stocks surging, with the S&P 500 up 11.7% in Q4 alone. The S&P logged a 26.3% return for 2023 with roughly 70% of the total market returns driven by the so-called “Magnificent 7” stocks. The resilience of this mega-cap tech block continues to call into question the notion of a broadening market after what was an especially narrow 2023.

Financial conditions eased significantly over the last two months of the year as bonds rallied and Treasury yields fell. Bonds turned a decidedly bullish corner after a string of negative returns. A dovish pivot took place in November, which led to a huge turnaround and a quarterly return from the Bloomberg Aggregate of +6.8%. This brought the YTD return up from negative territory to a gain of +5.5%. The November return alone of +4.5% was the largest monthly gain since May 1985. Before the FOMC pivot, the 10-year Treasury peaked at 4.99% in mid-October.

Early in the period, multiple readings of price levels revealed the lowest rates of price growth since 2021, suggesting that inflation may finally be slowing. Economic data also appeared to be stable late last year, making the idea of a soft landing in 2024 an even more realistic outcome. By the end of December, the market became overly exuberant to the point of pricing in six rate cuts for the upcoming year — those expectations would quickly be tempered as additional data sets and Fed commentary rolled in during the first few months of the year.

As we ushered in the new year, the U.S. economy remained resilient despite short-term interest rates still near 20-year highs. Continued robustness in the labor market, healthy corporate earnings growth, and a now more aggressive rate-lowering regime anticipated by investors early in the year helped send equities soaring. The S&P 500 Index continued to reach new highs throughout the period, up until early April, when the S&P experienced an 11% correction before resuming its climb. Enthusiasm around artificial intelligence (AI) continued to boost technology stocks, in particular, semiconductor companies. However, unlike last year, the rally broadened out to the more cyclical areas of the market. Although retail sales pulled back, the trend toward a broadening market rally remains positive.

The strongest sectors included Communication Services, Industrials, Materials, Energy and Financials. The broadening, driven by strong economic data, resilient corporate earnings and expectations for rate cuts propelled the S&P 500 to new record highs 22 times during the first quarter of 2024.

And though consumers’ financial health and spending habits are certainly in question, while housing costs remain sky-high, investors are not ready to sound any alarms just yet. Large- cap U.S. stocks (S&P 500 Index) outperformed small-cap U.S. stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value). Bond returns were more mixed during the period, but rates trended mostly higher in the new year with the benchmark 10-year Treasury yield peaking at 4.7% in late April as investors rethought the pace and cadence of coming interest rate cuts.

The behavior of both the market and economy over the last six months has certainly surprised investors. A widely anticipated U.S. recession has yet to materialize, with labor markets remaining fairly robust, while inflation has cooled. It is important to note that we continue to see cracks forming in labor market dynamics and increasing cutbacks and

| WESTWOOD FUNDS (Unaudited) |

layoffs. At this point, the elusive “soft landing” could be in sight for the economy, with inflation returning to the Fed’s target zone and a strong jobs market continuing to provide disposable income to workers.

Buried in the fine print beneath the mostly positive headlines and surprises remain contrasting signals, and as we have noted in previous comments, economic data still suggests a divergence in growth trends. Soaring housing costs, including insurance and utilities, along with persistently high food prices, all have the potential to derail this panacea. There are also theories that a drop in rates could actually trigger a downward move in home prices as Americans look to downsize and/or take advantage of the increased activity to sell. The added inventory could drive prices lower.

The Road Ahead

The U.S. economy continues to prove resilient despite the Fed maintaining a higher level of interest rates for longer than most expected. A main driver of this better-than-expected economic growth has been the continued strength of the U.S. consumer. The combination of robust job gains and steady real income growth has allowed consumers to continue spending despite higher rates. Inflation (Consumer Price Index (CPI)) has declined meaningfully over the past year but exceeded expectations in the early months of the year to its current level of 3.3%. In March, headline CPI inflation climbed 0.3% to 3.5% year over year (y/y), the fastest rate since September 2023, while core inflation held steady at 3.8% y/y, the lowest level since April 2021. We believe that the “last mile” of inflation reduction will be far more difficult than expected.

By year-end, we expect headline and core CPI inflation to be at 2.7% y/y and 2.9% y/y, respectively, with the Fed likely only cutting rates by 25 basis points later in the year. We see the economy continuing to gently cool as labor demand slows, wage growth decelerates, all while stubborn inflation and tight credit conditions constrain private sector activity. Consumers are still “spending,” but we believe it is more out of necessity than frivolousness and that the average consumer has not fully adjusted to all the rising costs of living. The aforementioned pressures of inflation, slowing wage growth, and higher-for-longer interest rates will likely cause consumers to exercise more caution with their personal expenditures.

Risks to our thesis include elevated tensions in the Middle East, which could escalate, triggering general headline risk, or a true energy price shock that could trigger a combination of even higher inflation and lower growth. Conflict also brings the specter of supply-chain breakdowns back into focus.

Domestically, a more hawkish Fed and a continuation of a restrictive interest rate environment could lead to a substantial tightening of U.S. and global financial conditions, triggering a downturn in private sector activity, which is already skittish. In summary, we remain cautiously optimistic about markets and the economy, as we have for the last two years. We believe there are still catalysts for earnings and economic growth, but our vigilance is now heightened as 2024 rolls on. The presidential election is yet another wild card that must be taken into consideration as the election draws near.

The current market environment continues to produce dislocations concerning valuation and increased levels of fundamental skepticism that play to our strength. Now, more than ever, we believe highly tactical and surgical investment techniques, with properly hedged and balanced allocations, will be needed to reduce volatility and produce alpha.

Thank you for your trust.

Sincerely,

The Investment Team

The Westwood Funds

| WESTWOOD FUNDS (Unaudited) |

The information contained herein represents the views of the manager at a specific point in time and is based on information believed to be reliable. No representation or warranty is made concerning the accuracy or completeness of any data compiled herein. Any statements non-factual in nature constitute only current opinion, which is subject to change. Any statements concerning financial market trends are based on current market conditions, which will fluctuate. Past performance is not indicative of future results. All information provided herein is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned. Investing involves risk, including possible loss of principal. A discussion of each Fund’s performance during the semiannual period ending April 30, 2024, is presented below.

Westwood Quality Value Fund

The performance of the Westwood Quality Value Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Quality Value Fund – I Shares (WHGLX) | 15.18% | 3.89% |

| Westwood Quality Value Fund – A Shares (WWLAX)* | 15.09% | 3.87% |

| Westwood Quality Value Fund – C Shares (WWLCX) | 14.67% | 3.57% |

| Westwood Quality Value Fund – Ultra Shares (WHSQX)** | 15.12% | 3.82% |

| Russell 1000 Value Index | 18.42% | 4.33% |

| ** | Ultra Share inception date 11/30/2022 |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

For the six months ending April 30, 2024, the Westwood Quality Value Fund returned 15.18% (I Shares), trailing the Russell 1000 Value Index, which returned 18.42%. For the first five months of the period, the stock market performed a steady march upwards, as the large- cap S&P 500 Index gained over 25% from October 31, 2023 through March 31, 2024. Stocks fell about 5% in the first few days of April but rebounded quickly. The turn in November began as the Federal Reserve signaled the end of their tightening campaign, noting that the next move would most likely be to cut interest rates. Low-quality stocks immediately rebounded, while quality lagged, impacting our returns versus the benchmark index. Bond prices spiked, pushing interest rates lower. The large-cap market was highly concentrated during the period, as the “Magnificent 7” stocks, large-cap technology names, provided the bulk of the index returns. Strategies that did not overweight those seven stocks generally underperformed. We have a cautiously optimistic outlook for both stocks and bonds for the coming year. We believe earnings growth should continue to accelerate into 2024, assuming lower rates into the back half of the year. But with equity valuations elevated, we believe multiple expansion from here forward is less likely and could limit the appeal of pure “beta” exposure. We believe earnings growth could become the main driver of stock returns as we look ahead.

| WESTWOOD FUNDS (Unaudited) |

Westwood Quality MidCap Fund

The performance of the Westwood Quality MidCap Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Quality MidCap Fund – I Shares (WWMCX) | 18.14% | 3.54% |

| Russell Midcap Value Index | 20.97% | 2.56% |

WWMCX Inception Date: 11/30/2021

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

For the six months ending April 30, 2024, the Westwood Quality MidCap Fund returned 18.14% (I Shares), trailing the Russell Midcap Value Index, which returned 20.97%. For the first five months of the period, the stock market performed a steady march upwards, as the S&P 500 Index gained over 25% from October 31, 2023 through March 31, 2024. Stocks fell about 5% in the first few days of April but rebounded quickly. The turn in November began as the Federal Reserve signaled the end of their tightening campaign, noting that the next move would most likely be to cut interest rates. Low-quality stocks immediately rebounded, while quality lagged, impacting our returns versus the benchmark index. Bond prices spiked, pushing interest rates lower. Mid-cap stocks fared better in the period than either large- or small-cap stocks. Showing a combination of visible earnings growth and growth opportunities often not available to smaller-cap stocks, mid-cap stocks were an attractive option. We have a cautiously optimistic outlook for both stocks and bonds for the coming year. We believe earnings growth should continue to accelerate into 2024, assuming lower rates into the back half of the year. But with equity valuations elevated, we believe multiple expansion from here forward is less likely and could limit the appeal of pure “beta” exposure. We believe earnings growth could become the main driver of stock returns as we look ahead.

Westwood Quality SMidCap Fund

The performance of the Westwood Quality SMidCap Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Quality SMidCap Fund – I Shares (WHGMX) | 17.81% | 1.45% |

| Westwood Quality SMidCap Fund – Ultra Shares (WWSMX) | 17.92% | 1.45% |

| Russell 2500 Value Index | 19.80% | -0.60% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

For the six months ending April 30, 2024, the Westwood Quality SMidCap Fund returned 17.81% (I Shares), trailing the Russell 2500 Value Index, which returned 19.80%. For the first five months of the period, the stock market performed a steady march upwards, as the S&P 500 Index gained over 25% from October 31, 2023 through March 31, 2024. Stocks fell about 5% in the first few days of April but rebounded quickly. The turn in November began as the Federal Reserve signaled the end of their tightening campaign, noting that the next move would most likely be to cut interest rates. Low-quality stocks immediately rebounded, while quality lagged, impacting our returns versus the benchmark index. Bond prices spiked, pushing interest rates lower. Small- and mid-cap stocks performed well

| WESTWOOD FUNDS (Unaudited) |

during the reporting period, as they were able to capture the upside of small-cap stocks while providing the risk profile of large-cap stocks. We particularly benefited from our exposure to Industrials stocks, as well as Financials. We were helped by our allocation to Financials stocks and to Industrials, as our holdings in those sectors performed well. In Industrials, we have made some strong choices among stocks that are tied to the electrification theme, including wire manufacturer Encore Wire Corp. (WIRE), which agreed to be purchased by a large Italian firm at a premium. We believe the U.S. economy will likely continue to slow due to the lagged impact of tighter financial conditions. We believe tighter lending standards accompanied by higher interest rates would lead to lower capital spend, higher risk of defaults and reduced spend. In our opinion, small- and mid-cap stocks are more exposed to these risks given the inherent volatility in their revenue and cash flows relative to larger cap companies.

Westwood Quality SmallCap Fund

The performance of the Westwood Quality SmallCap Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Quality SmallCap Fund – I Shares (WHGSX) | 13.89% | -3.71% |

| Westwood Quality SmallCap Fund – A Shares (WHGAX)* | 13.82% | -3.72% |

| Westwood Quality SmallCap Fund – C Shares (WHGCX) | 13.37% | -3.95% |

| Westwood Quality SmallCap Fund – Ultra Shares (WWSYX) | 14.00% | -3.61% |

| Russell 2000 Value Index | 18.09% | -3.66% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

For the six months ending April 30, 2024, the Westwood Quality SmallCap Fund returned 13.89% (I Shares), trailing the Russell 2000 Value Index, which returned 18.09%. For the first five months of the period, the stock market performed a steady march upwards, as the S&P 500 Index gained over 25% from October 31, 2023 through March 31, 2024. Stocks fell a little more than 5% in the first few days of April but rebounded quickly. The turn in November began as the Federal Reserve signaled the end of their tightening campaign, noting that the next move would most likely be to cut interest rates. Low-quality stocks immediately rebounded, while quality lagged, impacting our returns versus the benchmark index. Bond prices spiked, pushing interest rates lower. In the small-cap market, we were helped by our allocation to Financials stocks and to Industrials, as our holdings performed well. There were a number of acquisitions in the portfolio, including Masonite (DOOR), acquired by Owens Corning, and Encore Wire Corp. (WIRE), which was purchased by a large Italian firm. We continue to maintain a cautiously optimistic outlook for both stocks and bonds for the coming year. Headline consumer data still suggests optimism, but we remain concerned about housing costs, depleted savings and record high-rate credit card debt. We are most concerned about the health of the labor market and how that impacts consumer spending, particularly among lower-income households, which appear to be holding back. While easing inflation is good for consumers, it reduces pricing power and margin growth for companies. We believe earnings growth should continue to accelerate into 2024, assuming lower rates into the back half of the year.

| WESTWOOD FUNDS (Unaudited) |

Westwood Quality AllCap Fund

The performance of the Westwood Quality AllCap Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Quality AllCap Fund – I Shares (WQAIX) | 12.49% | 1.59% |

| Westwood Quality AllCap Fund – Ultra Shares (WQAUX) | 12.51% | 1.59% |

| Russell 3000 Value Index | 18.40% | 3.85% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

For the six months ending April 30, 2024, the Westwood Quality AllCap Fund returned 12.49% (I Shares), trailing the Russell 3000 Value Index, which returned 18.40%. For the first five months of the period, the stock market performed a steady march upwards, as the S&P 500 Index gained over 25% from October 31, 2023 through March 31, 2024. Stocks fell about 5% in the first few days of April but rebounded quickly. The turn in November began as the Federal Reserve signaled the end of their tightening campaign, noting that the next move would most likely be to cut interest rates. Low-quality stocks immediately rebounded, while quality lagged, impacting our returns versus the benchmark index. Bond prices spiked, pushing interest rates lower. We continue to maintain a cautiously optimistic outlook for both stocks and bonds for the coming year. Headline consumer data still suggests optimism, but we remain concerned about housing costs, depleted savings and record high-rate credit card debt. While easing inflation is good for consumers, it reduces pricing power and margin growth for companies. Consensus expectations for earnings in the first quarter are modest, and investors and analysts are looking for much larger earnings growth in the second quarter of 2024. While that expectation might give some pause, the abysmal earnings performance of Q2 2023 sets a low year-over-year bar that we believe should be fairly easy to clear. In our opinion, the biggest factor continues to be just how accommodative the Fed may be, and what impact geopolitical risks and the coming election will have on the market. The poor relative performance in small caps has traditionally been a harbinger of tough times to come, but the artificial intelligence revolution driving large and mega-cap growth names may have distorted that trend.

Westwood Capital Appreciation and Income Fund

The performance of the Westwood Capital Appreciation and Income Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Capital Appreciation and Income Fund – I Shares (WLVIX) | 12.65% | 0.49% |

| Westwood Capital Appreciation and Income Fund – A Shares (WWTAX)* | 12.55% | 0.43% |

| Westwood Capital Appreciation and Income Fund – C Shares (WTOCX) | 12.22% | 0.27% |

| 60% S&P 500 Index / 40% Bloomberg Barclays US Aggregate Bond Index | 14.40% | 2.28% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted.

| WESTWOOD FUNDS (Unaudited) |

The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

The Fund underperformed the blended benchmark, delivering a return of 12.65% (I Shares) for the period while the blended benchmark returned 14.40%. After falling by more than 10% from August through October 2023, the stock market built a sustained rally, halted only by a brief downturn in April. For the period, the S&P 500 gained 20.98%, driven by Technology (+24.9%) and Financials (+25.9%). Investors seemed to think that the Federal Reserve had pulled off the remarkable feat of the “soft landing,” managing to slow inflation without cratering the economy. In the portfolio, stock selection was the primary detractor to relative performance, centered around the significant outperformance and index concentration with the Magnificent 7 stocks (+33% equal-weighted).

Westwood Income Opportunity Fund

The performance of the Westwood Income Opportunity Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Income Opportunity Fund – I Shares (WHGIX) | 11.05% | 0.24% |

| Westwood Income Opportunity Fund – A Shares (WWIAX)* | 10.95% | 0.19% |

| Westwood Income Opportunity Fund – C Shares (WWICX) | 10.51% | -0.09% |

| Westwood Income Opportunity Fund – Ultra Shares (WHGOX)** | 11.08% | 0.34 |

| 60% Bloomberg Barclays US Aggregate Bond Index / 40% S&P 500 Index | 11.20% | 0.41% |

| Bloomberg Barclays US Aggregate Bond Index | 4.97% | -3.28% |

| S&P 500 Index | 20.98% | 6.04% |

| ** | Ultra Shares inception date 11/30/2022 |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

The Fund slightly underperformed the blended benchmark, delivering a return of 11.05% (I Shares) for the period while the blended benchmark returned 11.20%. After falling by more than 10% from August through October 2023, the stock market built a sustained rally, halted only by a brief downturn in April. For the period, the S&P 500 gained 20.98%, driven by Technology (+24.9%) and Financials (+25.9%). Investors seemed to think that the Federal Reserve had pulled off the remarkable feat of the “soft landing,” managing to slow inflation without cratering the economy. In the portfolio, stock selection was the primary detractor to relative performance, centered around the significant outperformance and index concentration with the Magnificent 7 stocks (+33% equal-weighted).

| WESTWOOD FUNDS (Unaudited) |

Westwood Multi-Asset Income Fund

The performance of the Westwood Multi-Asset Income Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Multi-Asset Income Fund – I Shares (WHGHX) | 9.41% | 0.01% |

| Westwood Multi-Asset Income Fund – A Shares (WSDAX)* | 9.36% | -0.06% |

| Westwood Multi-Asset Income Fund – C Shares (WWHCX) | 8.92% | -0.31% |

| 80% Bloomberg Barclays US Aggregate Bond Index / 20% S&P 500 Index | 8.06% | -1.44% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

The Fund outperformed the blended benchmark, delivering a return of 9.41% (I Shares) for the period while the blended benchmark returned 8.06%. After falling by more than 10% from August through October 2023, the stock market built a sustained rally, halted only by a brief downturn in April. For the period, the S&P 500 gained 20.98%, driven by Technology (+24.9%) and Financials (+25.9%). Investors seemed to think that the Federal Reserve had pulled off the remarkable feat of the “soft landing,” managing to slow inflation without cratering the economy. In the portfolio, selection within our fixed income allocation was additive to relative performance. Our notable overweight to high-yield bond holdings was additive to our relative performance as high-yield bonds outperformed corporates during the period. Our selection within equities during the period was the primary detractor to relative performance as the Magnificent 7 stocks continued to outperform other equities.

Westwood Alternative Income Fund

The performance of the Westwood Alternative Income Fund for the period ending April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Alternative Income Fund – I Shares (WMNIX) | 4.55% | 0.70% |

| Westwood Alternative Income Fund – A Shares (WMNAX)* | 4.52% | 0.69% |

| Westwood Alternative Income Fund – C Shares (WWACX) | 4.09% | 0.48% |

| Westwood Alternative Income Fund – Ultra Shares (WMNUX) | 4.61% | 0.72% |

| FTSE 1-Month Treasury Bill | 2.74% | 1.81% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until March 1, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

The Fund outperformed the benchmark, delivering a return of 4.55% (I Shares) for the period while the benchmark returned 2.74%. The Fund’s overweight to convertible bonds was a main contributor to relative performance as the asset class rallied over the measurement period (10.2%). Convertible issuance increased during the period

| WESTWOOD FUNDS (Unaudited) |

as companies found the hybrid structure an attractive option to finance equity repurchases, refinance existing traditional debt or to refinance short-dated convertibles.

Westwood Global Real Estate Fund

The performance of the Westwood Global Real Estate Fund for the period ended April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Global Real Estate Fund – Institutional Shares (KIRYX) | 10.33% | -6.65% |

| Westwood Global Real Estate Fund – A Shares (KIRAX)* | 10.15% | -6.69% |

| Westwood Global Real Estate Fund – C Shares (KIRCX) | 9.83% | -6.94% |

| FTSE EPRA Nareit Developed Index | 14.40% | -5.72% |

| MSCI World Index | 20.59% | 5.01% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until April 30, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

The Fund underperformed the benchmark, delivering a return of 10.33% (I Shares) for the period while the benchmark returned 14.40%. Although REITs had a strong finish to 2023 (21% return from November through December), they have had a challenging start to 2024 so far from a performance standpoint as the broader market continues its upward trajectory. While it is clear those eagerly awaited interest rate cuts have yet to materialize, the broader economy remains steadily supportive of economic growth, even if the explanatory narrative seems to change by the week. The Fed’s ongoing battle with inflation remains top of mind for most investors and the home stretch to get this figure down to the Fed’s target of 2% appears a lot more difficult than prognosticators initially anticipated. Hence the delay in interest rate cuts and the resulting tepid performance to start the 2024 year for interest rate-sensitive sectors of the capital markets like REITs. In the portfolio, our overweight to the underperforming Industrial sub -sector (2.5% return for the period) and underweight to regional malls (a strong 31.6% return for the period) were the main detractors to the Fund’s relative performance.

Westwood Real Estate Income Fund

The performance of the Westwood Real Estate Income Fund for the period ended April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Real Income Fund – Institutional Shares (KIFYX) | 10.48% | -2.82% |

| Westwood Real Income Fund – A Shares (KIFAX)* | 10.36% | -2.89% |

| Westwood Real Income Fund – C Shares (KIFCX) | 9.98% | -3.13% |

| ICE BofA Fixed Rate Preferred Securities Index | 12.20% | 1.79% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted.

| WESTWOOD FUNDS (Unaudited) |

The Adviser has contractually agreed to waive fees and reimburse expenses until April 30, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

The Fund underperformed the benchmark, delivering a return of 10.48% (I Shares) for the period while the benchmark returned 12.20%. Although REITs and REIT Preferreds had a strong finish to 2023, they have had a challenging start to 2024 so far from a performance standpoint as the broader market continues its upward trajectory. While it is clear those eagerly awaited interest rate cuts have yet to materialize, the broader economy remains steadily supportive of economic growth, even if the explanatory narrative seems to change by the week. The Fed’s ongoing battle with inflation remains top of mind for most investors and the home stretch to get this figure down to the Fed’s target of 2% appears a lot more difficult than prognosticators initially anticipated. Hence the delay in interest rate cuts and the resulting tepid performance to start the 2024 year for interest rate -sensitive sectors of the capital markets like REITs. During the period, both the high-yield and the broader financial preferred markets produced strong positive returns as credit spreads tightened meaningfully. As the Fund is focused on identifying opportunities within REIT Preferreds and REIT common equity, underperformance relative to the benchmark was mainly attributed to not holding financial preferred securities, which outperformed their REIT counterparts for the period.

Westwood Broadmark Tactical Growth Fund

The performance of the Westwood Broadmark Tactical Growth Fund for the period ended April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Broadmark Tactical Growth Fund – Institutional Shares (FTGWX) | 0.85% | -0.12% |

| Westwood Broadmark Tactical Growth Fund – A Shares (FTAGX)* | 0.73% | -0.21% |

| Westwood Broadmark Tactical Growth Fund – C Shares (FTGOX) | 0.40% | -0.41% |

| HFRX Equity Hedge Index | 7.26% | 2.58% |

| S&P 500 Index | 20.98% | 6.04% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted.

For the six months ended April 30, 2024, Westwood Broadmark Tactical Growth Fund returned 0.85% (I Shares), providing a modest positive absolute record for investors but underperforming the Fund’s primary benchmark, the HFRX Equity Hedge Index, which returned 7.26%. The Fund underperformed its secondary benchmark, the S&P 500 Index, which rose 20.98% over the same period. The U.S. stock market was on an upward trend for nearly the entire period, a challenging environment for our investment strategy. Our directional investment strategy determines when and how much exposure to have to equities and bonds, using our four-pillar investment process. The four pillars of our investment process are valuation, monetary policy and credit conditions, investor sentiment and momentum. For much of the period, as the market rallied, valuations were excessive compared to historical averages. Monetary policy and credit conditions were not accommodative, as the Fed had raised interest rates and banks were restricting credit. Investor sentiment was oddly bullish, a negative factor in our view, as the fervor over artificial intelligence buoyed the stock market. Finally, the momentum pillar showed positive momentum until April, another negative factor in our view. This combination of factors led us to reduce our long exposure, causing us to underperform the S&P 500 Index during the period. We also trailed the HFRX Hedge Fund Index, an unmanaged basket of hedge funds that have similar strategies. During April, when the S&P 500 declined by -4.08%, the Fund declined -2.66%, a good showing and proof that the strategy of reducing downside exposure works.

| WESTWOOD FUNDS (Unaudited) |

Westwood Broadmark Tactical Plus Fund

The performance of the Westwood Broadmark Tactical Plus Fund for the period ended April 30, 2024, was as follows:

| | 6 Months | 2024 Year to Date |

| Westwood Broadmark Tactical Plus Fund – Institutional Shares (SBTIX) | -1.00% | 0.27% |

| Westwood Broadmark Tactical Plus Fund – A Shares (SBTAX)* | -1.06% | 0.18% |

| Westwood Broadmark Tactical Plus Fund – C Shares (SBTCX) | -1.43% | 0.00% |

| Westwood Broadmark Tactical Plus Fund – F Shares (BTPIX) | -0.74% | 0.44% |

| HFRX Equity Hedge Index | 7.26% | 2.58% |

| S&P 500 Index | 20.98% | 6.04% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until April 30, 2025. In the absence of current fee waivers, total return and yield would have been reduced.

For the six months ended April 30, 2024, Westwood Broadmark Tactical Plus Fund returned -1.00% (I Shares), underperforming the Fund’s primary benchmark, the HFRX Equity Hedge Index, which returned 7.26%. The Fund underperformed its secondary benchmark, the S&P 500 Index, which rose 20.98% over the same period. The Broadmark Tactical Plus Fund is our more aggressive approach, which can be quicker to adapt to a changing market regime and typically has a broader range between our net long and net short positions. The U.S. stock market was on an upward trend for nearly the entire period, a challenging environment for our investment strategy. Our directional investment strategy determines when and how much exposure to have to equities and bonds, using our four-pillar investment process. The four pillars of our investment process are valuation, monetary policy and credit conditions, investor sentiment and momentum. For much of the period, as the market rallied, valuations were excessive compared to historical averages. Monetary policy and credit conditions were not accommodative, as the Fed had raised interest rates and banks were restricting credit. Investor sentiment was oddly bullish, a negative factor in our view, as the fervor over artificial intelligence buoyed the stock market. Finally, the momentum pillar showed positive momentum until April, another negative factor in our view. This combination of factors led us to maintain our position of being less than 100% net long for much of the period, causing us to underperform the S&P 500 during the period. We also trailed the HFRX Hedge Fund Index, an unmanaged basket of hedge funds that have similar strategies. During April, when the S&P 500 declined by -4.08%, the Fund declined -1.49%, a testament to our goal of reducing downside exposure.

| WESTWOOD FUNDS (Unaudited) |

Disclosures

To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and other information can be found in the Fund’s prospectus, which may be obtained by calling 1.877.386.3944. Read the prospectus carefully before investing or sending money.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-877-386-3944.

An investor should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus, visit the Funds’ website at westwoodfunds.com or call 1-877-386-3944 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time, and may no longer be held by the Funds. For a complete list of securities held by the Funds as of April 30, 2024, please see the Schedules of Investments section of this Report. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

Alerian Midstream Energy Select Index (AMEIX) is a composite of North American midstream energy infrastructure companies that are engaged in activities involving energy commodities. The capped, float-adjusted, capitalization-weighted index is disseminated in real time on a price-return basis.

Alpha is the measure of risk-adjusted performance.

Compound Annual Growth Rate is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits are reinvested at the end of each year of the investment’s lifespan.

FTSE EPRA Nareit Developed Index is designed to track the performance of listed real estate companies and REITs worldwide.

HFRX Equity Hedge Index comprises private funds with strategies that maintain both long and short positions primarily in equity securities and equity derivatives.

ICE BofA Fixed Rate Preferred Securities Index consists of investment-grade, fixed and fixed-to-floating rate U.S. dollar-denominated preferred securities.

| WESTWOOD FUNDS (Unaudited) |

MSCI World Index is a free float-adjusted market capitalization index designed to measure equity market performance in the global developed markets.

Russell 2500 Value measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratio and lower forecasted growth values.

S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic stock market through changes in the aggregate market value of 500 stocks representing all major industries.

| WESTWOOD QUALITY VALUE FUND |

| APRIL 30, 2024 (Unaudited) |

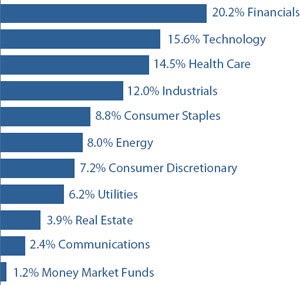

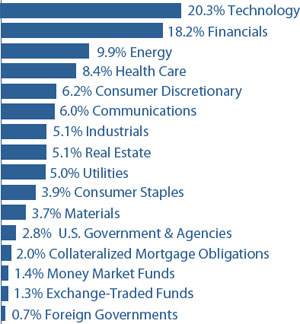

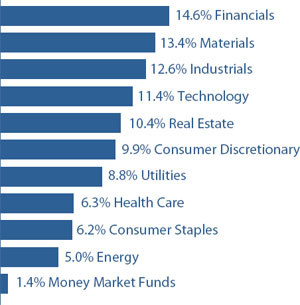

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 99.6% |

| | | Shares | | | Value | |

| Communications — 2.4% | | | | | | | | |

| Internet Media & Services — 2.4% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 30,289 | | | $ | 4,930,443 | |

| | | | | | | | | |

| Consumer Discretionary — 7.3% | | | | | | | | |

| Leisure Facilities & Services — 4.3% | | | | | | | | |

| Darden Restaurants, Inc. | | | 25,889 | | | | 3,971,632 | |

| Domino’s Pizza, Inc. | | | 9,153 | | | | 4,844,408 | |

| | | | | | | | 8,816,040 | |

| Retail - Discretionary — 3.0% | | | | | | | | |

| Home Depot, Inc. (The) | | | 6,153 | | | | 2,056,456 | |

| O’Reilly Automotive, Inc. (a) | | | 3,956 | | | | 4,008,456 | |

| | | | | | | | 6,064,912 | |

| Consumer Staples — 8.9% | | | | | | | | |

| Beverages — 2.0% | | | | | | | | |

| PepsiCo, Inc. | | | 23,778 | | | | 4,182,788 | |

| | | | | | | | | |

| Food — 2.1% | | | | | | | | |

| Hershey Company (The) | | | 21,628 | | | | 4,194,102 | |

| | | | | | | | | |

| Household Products — 1.1% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 21,329 | | | | 2,301,186 | |

| | | | | | | | | |

| Retail - Consumer Staples — 3.7% | | | | | | | | |

| Dollar General Corporation | | | 23,642 | | | | 3,290,730 | |

| Walmart, Inc. | | | 70,246 | | | | 4,169,100 | |

| | | | | | | | 7,459,830 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Energy — 8.1% | | | | | | | | |

| Oil & Gas Producers — 8.1% | | | | | | | | |

| Chevron Corporation | | | 27,605 | | | $ | 4,451,858 | |

| ConocoPhillips | | | 16,019 | | | | 2,012,307 | |

| EOG Resources, Inc. | | | 30,680 | | | | 4,053,748 | |

| Exxon Mobil Corporation | | | 34,238 | | | | 4,049,328 | |

| Valero Energy Corporation | | | 12,412 | | | | 1,984,307 | |

| | | | | | | | 16,551,548 | |

| Financials — 20.3% | | | | | | | | |

| Asset Management — 2.0% | | | | | | | | |

| Charles Schwab Corporation (The) | | | 54,784 | | | | 4,051,277 | |

| | | | | | | | | |

| Banking — 7.9% | | | | | | | | |

| Bank of America Corporation | | | 161,734 | | | | 5,985,775 | |

| JPMorgan Chase & Company | | | 32,328 | | | | 6,198,571 | |

| Wells Fargo & Company | | | 68,093 | | | | 4,039,277 | |

| | | | | | | | 16,223,623 | |

| Institutional Financial Services — 2.5% | | | | | | | | |

| Goldman Sachs Group, Inc. (The) | | | 12,230 | | | | 5,218,663 | |

| | | | | | | | | |

| Insurance — 7.9% | | | | | | | | |

| American International Group, Inc. | | | 70,186 | | | | 5,285,707 | |

| Arthur J. Gallagher & Company | | | 17,980 | | | | 4,219,726 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 10,127 | | | | 4,017,685 | |

| Progressive Corporation (The) | | | 12,227 | | | | 2,546,273 | |

| | | | | | | | 16,069,391 | |

| Health Care — 14.6% | | | | | | | | |

| Biotech & Pharma — 3.2% | | | | | | | | |

| Johnson & Johnson | | | 45,375 | | | | 6,560,771 | |

| | | | | | | | | |

| Health Care Facilities & Services — 4.3% | | | | | | | | |

| CVS Health Corporation | | | 54,222 | | | | 3,671,372 | |

| UnitedHealth Group, Inc. | | | 10,663 | | | | 5,157,693 | |

| | | | | | | | 8,829,065 | |

| Medical Equipment & Devices — 7.1% | | | | | | | | |

| Abbott Laboratories | | | 54,286 | | | | 5,752,687 | |

| Becton, Dickinson & Company | | | 20,311 | | | | 4,764,961 | |

| Danaher Corporation | | | 16,075 | | | | 3,964,417 | |

| | | | | | | | 14,482,065 | |

| Industrials — 12.1% | | | | | | | | |

| Aerospace & Defense — 2.0% | | | | | | | | |

| General Dynamics Corporation | | | 14,293 | | | | 4,103,377 | |

| | | | | | | | | |

| Commercial Support Services — 1.0% | | | | | | | | |

| Waste Management, Inc. | | | 10,012 | | | | 2,082,696 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY VALUE FUND |

| APRIL 30, 2024 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Industrials — continued | | | | | | | | |

| Diversified Industrials — 2.0% | | | | | | | | |

| Honeywell International, Inc. | | | 21,348 | | | $ | 4,114,400 | |

| | | | | | | | | |

| Electrical Equipment — 3.0% | | | | | | | | |

| Hubbell, Inc. | | | 10,994 | | | | 4,073,497 | |

| Littelfuse, Inc. | | | 8,700 | | | | 2,006,568 | |

| | | | | | | | 6,080,065 | |

| Transportation & Logistics — 4.1% | | | | | | | | |

| FedEx Corporation | | | 16,130 | | | | 4,222,512 | |

| Union Pacific Corporation | | | 17,033 | | | | 4,039,546 | |

| | | | | | | | 8,262,058 | |

| Real Estate — 4.0% | | | | | | | | |

| REITs — 4.0% | | | | | | | | |

| Federal Realty Investment Trust | | | 9,589 | | | | 998,886 | |

| Prologis, Inc. | | | 39,831 | | | | 4,064,754 | |

| VICI Properties, Inc. | | | 107,544 | | | | 3,070,381 | |

| | | | | | | | 8,134,021 | |

| Technology — 15.7% | | | | | | | | |

| Semiconductors — 2.0% | | | | | | | | |

| Microchip Technology, Inc. | | | 44,486 | | | | 4,091,822 | |

| | | | | | | | | |

| Software — 5.0% | | | | | | | | |

| Microsoft Corporation | | | 16,550 | | | | 6,443,411 | |

| Salesforce, Inc. | | | 14,222 | | | | 3,824,865 | |

| | | | | | | | 10,268,276 | |

| Technology Hardware — 2.6% | | | | | | | | |

| Apple, Inc. | | | 31,337 | | | | 5,337,631 | |

| | | | | | | | | |

| Technology Services — 6.1% | | | | | | | | |

| Accenture plc - Class A | | | 12,582 | | | | 3,786,050 | |

| CACI International, Inc. - Class A (a) | | | 10,990 | | | | 4,420,508 | |

| Visa, Inc. - Class A | | | 15,740 | | | | 4,227,921 | |

| | | | | | | | 12,434,479 | |

| Utilities — 6.2% | | | | | | | | |

| Electric Utilities — 6.2% | | | | | | | | |

| DTE Energy Company | | | 38,902 | | | | 4,291,669 | |

| NextEra Energy, Inc. | | | 66,329 | | | | 4,442,053 | |

| WEC Energy Group, Inc. | | | 48,411 | | | | 4,000,685 | |

| | | | | | | | 12,734,407 | |

| Total Common Stocks | | | | | | | | |

| (Cost $149,305,095) | | | | | | $ | 203,578,936 | |

| MONEY MARKET FUNDS — 1.2% |

| | | Shares | | | Value | |

| First American Government Obligations Fund - Class U, 5.25% (b) (Cost $2,372,696) | | | 2,372,696 | | | $ | 2,372,696 | |

| | | | | | | | | |

| Investments at Value — 100.8% | | | | | | | | |

| (Cost $151,677,791) | | | | | | $ | 205,951,632 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.8%) | | | | | | | (1,705,945 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 204,245,687 | |

plc - Public Limited Company

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of April 30, 2024. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY MIDCAP FUND |

| APRIL 30, 2024 (Unaudited) |

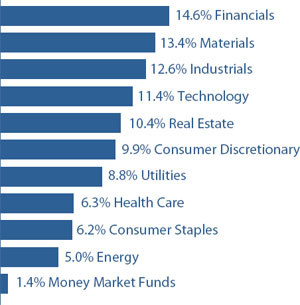

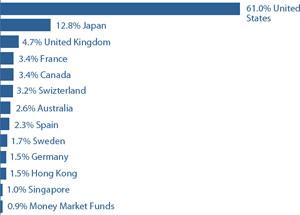

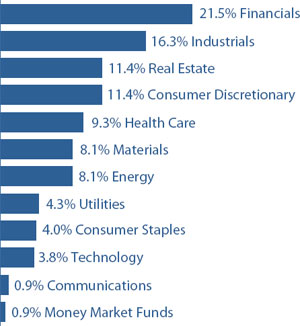

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 99.0% |

| | | Shares | | | Value | |

| Consumer Discretionary — 10.0% | | | | | | | | |

| Apparel & Textile Products — 1.5% | | | | | | | | |

| Tapestry, Inc. | | | 692 | | | $ | 27,625 | |

| | | | | | | | | |

| Home Construction — 1.6% | | | | | | | | |

| PulteGroup, Inc. | | | 251 | | | | 27,966 | |

| | | | | | | | | |

| Leisure Facilities & Services — 1.7% | | | | | | | | |

| Texas Roadhouse, Inc. | | | 195 | | | | 31,352 | |

| | | | | | | | | |

| Retail - Discretionary — 5.2% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 261 | | | | 15,216 | |

| Bath & Body Works, Inc. | | | 434 | | | | 19,712 | |

| O’Reilly Automotive, Inc. (a) | | | 26 | | | | 26,345 | |

| Ulta Beauty, Inc. (a) | | | 83 | | | | 33,602 | |

| | | | | | | | 94,875 | |

| Consumer Staples — 6.2% | | | | | | | | |

| Food — 2.1% | | | | | | | | |

| McCormick & Company, Inc. | | | 497 | | | | 37,802 | |

| | | | | | | | | |

| Household Products — 2.1% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 347 | | | | 37,438 | |

| | | | | | | | | |

| Retail - Consumer Staples — 2.0% | | | | | | | | |

| BJ’s Wholesale Club Holdings, Inc. (a) | | | 499 | | | | 37,265 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Energy — 5.0% | | | | | | | | |

| Oil & Gas Producers — 5.0% | | | | | | | | |

| Chord Energy Corporation | | | 199 | | | $ | 35,219 | |

| Diamondback Energy, Inc. | | | 180 | | | | 36,203 | |

| SM Energy Company | | | 410 | | | | 19,881 | |

| | | | | | | | 91,303 | |

| Financials — 14.7% | | | | | | | | |

| Banking — 3.9% | | | | | | | | |

| Atlantic Union Bankshares Corporation | | | 811 | | | | 25,766 | |

| Cullen/Frost Bankers, Inc. | | | 251 | | | | 26,189 | |

| Glacier Bancorp, Inc. | | | 507 | | | | 18,343 | |

| | | | | | | | 70,298 | |

| Institutional Financial Services — 3.4% | | | | | | | | |

| Intercontinental Exchange, Inc. | | | 192 | | | | 24,722 | |

| Piper Sandler Companies | | | 193 | | | | 37,788 | |

| | | | | | | | 62,510 | |

| Insurance — 7.4% | | | | | | | | |

| American International Group, Inc. | | | 759 | | | | 57,160 | |

| Arthur J. Gallagher & Company | | | 182 | | | | 42,714 | |

| Everest Group Ltd. | | | 96 | | | | 35,175 | |

| | | | | | | | 135,049 | |

| Health Care — 6.3% | | | | | | | | |

| Health Care Facilities & Services — 1.0% | | | | | | | | |

| McKesson Corporation | | | 35 | | | | 18,802 | |

| | | | | | | | | |

| Medical Equipment & Devices — 5.3% | | | | | | | | |

| Avantor, Inc. (a) | | | 1,084 | | | | 26,265 | |

| Cooper Companies, Inc. (The) (a) | | | 398 | | | | 35,446 | |

| Zimmer Biomet Holdings, Inc. | | | 291 | | | | 35,002 | |

| | | | | | | | 96,713 | |

| Industrials — 12.7% | | | | | | | | |

| Aerospace & Defense — 1.7% | | | | | | | | |

| Mercury Systems, Inc. (a) | | | 1,116 | | | | 31,471 | |

| | | | | | | | | |

| Electrical Equipment — 3.6% | | | | | | | | |

| Hubbell, Inc. | | | 83 | | | | 30,753 | |

| Littelfuse, Inc. | | | 152 | | | | 35,057 | |

| | | | | | | | 65,810 | |

| Engineering & Construction — 1.6% | | | | | | | | |

| Jacobs Solutions, Inc. | | | 195 | | | | 27,988 | |

| | | | | | | | | |

| Industrial Intermediate Products — 1.6% | | | | | | | | |

| Timken Company (The) | | | 321 | | | | 28,640 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY MIDCAP FUND |

| APRIL 30, 2024 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Industrials — continued | | | | | | | | |

| Machinery — 2.9% | | | | | | | | |

| AGCO Corporation | | | 236 | | | $ | 26,949 | |

| Middleby Corporation (The) (a) | | | 183 | | | | 25,431 | |

| | | | | | | | 52,380 | |

| Transportation & Logistics — 1.3% | | | | | | | | |

| XPO, Inc. (a) | | | 225 | | | | 24,179 | |

| | | | | | | | | |

| Materials — 13.4% | | | | | | | | |

| Chemicals — 3.4% | | | | | | | | |

| Axalta Coating Systems Ltd. (a) | | | 1,133 | | | | 35,621 | |

| CF Industries Holdings, Inc. | | | 340 | | | | 26,850 | |

| | | | | | | | 62,471 | |

| Construction Materials — 3.0% | | | | | | | | |

| Eagle Materials, Inc. | | | 72 | | | | 18,051 | |

| Summit Materials, Inc. - Class A (a) | | | 949 | | | | 36,916 | |

| | | | | | | | 54,967 | |

| Containers & Packaging — 2.7% | | | | | | | | |

| Crown Holdings, Inc. | | | 595 | | | | 48,832 | |

| | | | | | | | | |

| Forestry, Paper & Wood Products — 3.3% | | | | | | | | |

| Boise Cascade Company | | | 248 | | | | 32,803 | |

| Louisiana-Pacific Corporation | | | 368 | | | | 26,934 | |

| | | | | | | | 59,737 | |

| Metals & Mining — 1.0% | | | | | | | | |

| Franco-Nevada Corporation | | | 154 | | | | 18,542 | |

| | | | | | | | | |

| Real Estate — 10.4% | | | | | | | | |

| REITs — 10.4% | | | | | | | | |

| Federal Realty Investment Trust | | | 165 | | | | 17,188 | |

| Healthpeak Properties, Inc. | | | 1,489 | | | | 27,710 | |

| Realty Income Corporation | | | 688 | | | | 36,836 | |

| Ventas, Inc. | | | 846 | | | | 37,461 | |

| VICI Properties, Inc. | | | 1,257 | | | | 35,887 | |

| Weyerhaeuser Company | | | 1,139 | | | | 34,364 | |

| | | | | | | | 189,446 | |

| Technology — 11.4% | | | | | | | | |

| Semiconductors — 5.1% | | | | | | | | |

| Marvell Technology, Inc. | | | 253 | | | | 16,675 | |

| Microchip Technology, Inc. | | | 544 | | | | 50,037 | |

| Rambus, Inc. (a) | | | 470 | | | | 25,766 | |

| | | | | | | | 92,478 | |

| Software — 1.6% | | | | | | | | |

| Verra Mobility Corporation (a) | | | 1,245 | | | | 29,357 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Technology — continued | | | | | | | | |

| Technology Services — 4.7% | | | | | | | | |

| Amdocs Ltd. | | | 424 | | | $ | 35,611 | |

| CACI International, Inc. - Class A (a) | | | 126 | | | | 50,681 | |

| | | | | | | | 86,292 | |

| Utilities — 8.9% | | | | | | | | |

| Electric Utilities — 8.9% | | | | | | | | |

| Alliant Energy Corporation | | | 803 | | | | 39,989 | |

| CMS Energy Corporation | | | 717 | | | | 43,457 | |

| DTE Energy Company | | | 383 | | | | 42,253 | |

| Evergy, Inc. | | | 688 | | | | 36,086 | |

| | | | | | | | 161,785 | |

| Total Common Stocks | | | | | | | | |

| (Cost $1,631,922) | | | | | | $ | 1,803,373 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 1.4% | | | | | | | | |

| First American Treasury Obligations Fund - Class X, 5.21% (b) (Cost $24,927) | | | 24,927 | | | $ | 24,927 | |

| | | | | | | | | |

| Investments at Value — 100.4% | | | | | | | | |

| (Cost $1,656,849) | | | | | | $ | 1,828,300 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.4%) | | | | | | | (6,346 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,821,954 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of April 30, 2024. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY SMIDCAP FUND |

| APRIL 30, 2024 (Unaudited) |

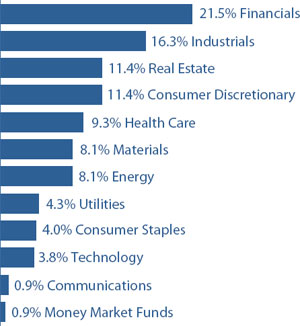

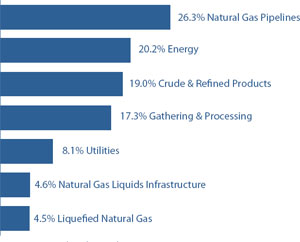

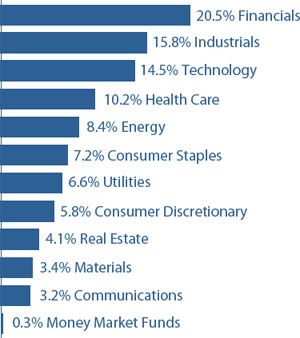

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 98.0% |

| | | Shares | | | Value | |

| Communications — 3.2% | | | | | | | | |

| Telecommunications — 3.2% | | | | | | | | |

| Cogent Communications Holdings, Inc. | | | 54,433 | | | $ | 3,493,510 | |

| DigitalBridge Group, Inc. | | | 328,274 | | | | 5,396,824 | |

| | | | | | | | 8,890,334 | |

| Consumer Discretionary — 9.0% | | | | | | | | |

| Home Construction — 1.0% | | | | | | | | |

| Century Communities, Inc. | | | 36,490 | | | | 2,894,387 | |

| | | | | | | | | |

| Leisure Facilities & Services — 3.1% | | | | | | | | |

| Domino’s Pizza, Inc. | | | 10,567 | | | | 5,592,796 | |

| Texas Roadhouse, Inc. | | | 18,929 | | | | 3,043,404 | |

| | | | | | | | 8,636,200 | |

| Retail - Discretionary — 4.9% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 97,105 | | | | 5,661,222 | |

| Boot Barn Holdings, Inc. (a) | | | 26,507 | | | | 2,822,200 | |

| Lithia Motors, Inc. | | | 20,363 | | | | 5,179,940 | |

| | | | | | | | 13,663,362 | |

| Consumer Staples — 2.5% | | | | | | | | |

| Food — 1.4% | | | | | | | | |

| J & J Snack Foods Corporation | | | 27,993 | | | | 3,843,159 | |

| | | | | | | | | |

| Retail - Consumer Staples — 1.1% | | | | | | | | |

| BJ’s Wholesale Club | | | | | | | | |

| Holdings, Inc. (a) | | | 41,273 | | | | 3,082,267 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Energy — 6.6% | | | | | | | | |

| Oil & Gas Producers — 6.6% | | | | | | | | |

| Chord Energy Corporation | | | 39,329 | | | $ | 6,960,446 | |

| Northern Oil and Gas, Inc. | | | 178,724 | | | | 7,290,152 | |

| SM Energy Company | | | 83,726 | | | | 4,059,874 | |

| | | | | | | | 18,310,472 | |

| Financials — 16.7% | | | | | | | | |

| Asset Management — 2.1% | | | | | | | | |

| Blue Owl Capital, Inc. | | | 307,680 | | | | 5,812,075 | |

| | | | | | | | | |

| Banking — 8.6% | | | | | | | | |

| Atlantic Union Bankshares Corporation | | | 176,470 | | | | 5,606,452 | |

| Cullen/Frost Bankers, Inc. | | | 51,612 | | | | 5,385,196 | |

| Glacier Bancorp, Inc. | | | 101,941 | | | | 3,688,226 | |

| Seacoast Banking Corporation of Florida | | | 166,762 | | | | 3,847,199 | |

| Wintrust Financial Corporation | | | 57,031 | | | | 5,511,476 | |

| | | | | | | | 24,038,549 | |

| Institutional Financial Services — 2.1% | | | | | | | | |

| Piper Sandler Companies | | | 29,147 | | | | 5,706,691 | |

| | | | | | | | | |

| Insurance — 3.9% | | | | | | | | |

| BRP Group, Inc. - Class A (a) | | | 117,886 | | | | 3,140,483 | |

| International General Insurance Holdings Ltd. | | | 294,497 | | | | 3,807,846 | |

| RenaissanceRe Holdings Ltd. | | | 17,638 | | | | 3,867,132 | |

| | | | | | | | 10,815,461 | |

| Health Care — 7.8% | | | | | | | | |

| Health Care Facilities & Services — 0.9% | | | | | | | | |

| Premier, Inc. - Class A | | | 122,250 | | | | 2,552,580 | |

| | | | | | | | | |

| Medical Equipment & Devices — 6.9% | | | | | | | | |

| Avantor, Inc. (a) | | | 219,498 | | | | 5,318,437 | |

| Cooper Companies, Inc. (The) (a) | | | 61,385 | | | | 5,466,948 | |

| Integer Holdings Corporation (a) | | | 49,031 | | | | 5,473,330 | |

| Teleflex, Inc. | | | 13,337 | | | | 2,784,099 | |

| | | | | | | | 19,042,814 | |

| Industrials — 20.6% | | | | | | | | |

| Aerospace & Defense — 7.3% | | | | | | | | |

| AAR Corporation (a) | | | 23,385 | | | | 1,616,839 | |

| Hexcel Corporation | | | 74,803 | | | | 4,803,101 | |

| Kratos Defense & Security Solutions, Inc. (a) | | | 227,830 | | | | 4,059,930 | |

| Mercury Systems, Inc. (a) | | | 140,005 | | | | 3,948,141 | |

| Moog, Inc. - Class A | | | 36,133 | | | | 5,747,676 | |

| | | | | | | | 20,175,687 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY SMIDCAP FUND |

| APRIL 30, 2024 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Industrials — continued | | | | | | | | |

| Electrical Equipment — 6.0% | | | | | | | | |

| Hubbell, Inc. | | | 17,167 | | | $ | 6,360,717 | |

| Littelfuse, Inc. | | | 30,633 | | | | 7,065,195 | |

| Vertiv Holdings Company - Class A | | | 33,997 | | | | 3,161,721 | |

| | | | | | | | 16,587,633 | |

| Industrial Intermediate Products — 1.6% | | | | | | | | |

| Timken Company (The) | | | 49,993 | | | | 4,460,375 | |

| | | | | | | | | |

| Machinery — 3.2% | | | | | | | | |

| AGCO Corporation | | | 45,689 | | | | 5,217,227 | |

| Middleby Corporation (The) (a) | | | 27,467 | | | | 3,817,089 | |

| | | | | | | | 9,034,316 | |

| Transportation & Logistics — 1.5% | | | | | | | | |

| XPO, Inc. (a) | | | 38,723 | | | | 4,161,174 | |

| | | | | | | | | |

| Transportation Equipment — 1.0% | | | | | | | | |

| Blue Bird Corporation (a) | | | 87,249 | | | | 2,875,291 | |

| | | | | | | | | |

| Materials — 14.5% | | | | | | | | |

| Chemicals — 3.9% | | | | | | | | |

| Axalta Coating Systems Ltd. (a) | | | 166,820 | | | | 5,244,821 | |

| Ecovyst, Inc. (a) | | | 583,780 | | | | 5,505,045 | |

| | | | | | | | 10,749,866 | |

| Construction Materials — 3.1% | | | | | | | | |

| Eagle Materials, Inc. | | | 11,078 | | | | 2,777,365 | |

| Summit Materials, Inc. - Class A (a) | | | 149,896 | | | | 5,830,955 | |

| | | | | | | | 8,608,320 | |

| Containers & Packaging — 1.6% | | | | | | | | |

| Crown Holdings, Inc. | | | 54,369 | | | | 4,462,064 | |

| | | | | | | | | |

| Forestry, Paper & Wood Products — 3.0% | | | | | | | | |

| Boise Cascade Company | | | 29,633 | | | | 3,919,557 | |

| Louisiana-Pacific Corporation | | | 60,107 | | | | 4,399,231 | |

| | | | | | | | 8,318,788 | |

| Metals & Mining — 2.9% | | | | | | | | |

| Constellium SE (a) | | | 278,150 | | | | 5,476,773 | |

| Royal Gold, Inc. | | | 22,735 | | | | 2,731,156 | |

| | | | | | | | 8,207,929 | |

| Real Estate — 7.5% | | | | | | | | |

| REITs — 7.5% | | | | | | | | |

| Americold Realty Trust, Inc. | | | 125,894 | | | | 2,765,891 | |

| COPT Defense Properties | | | 233,302 | | | | 5,592,249 | |

| PotlatchDeltic Corporation | | | 65,217 | | | | 2,609,332 | |

| Rexford Industrial Realty, Inc. | | | 130,645 | | | | 5,592,913 | |

| Urban Edge Properties | | | 265,437 | | | | 4,440,761 | |

| | | | | | | | 21,001,146 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Technology — 5.5% | | | | | | | | |

| Semiconductors — 3.4% | | | | | | | | |

| Amkor Technology, Inc. | | | 89,923 | | | $ | 2,909,009 | |

| Rambus, Inc. (a) | | | 120,917 | | | | 6,628,670 | |

| | | | | | | | 9,537,679 | |

| Software — 1.1% | | | | | | | | |

| Verra Mobility Corporation (a) | | | 132,877 | | | | 3,133,240 | |

| | | | | | | | | |

| Technology Services — 1.0% | | | | | | | | |

| Amdocs Ltd. | | | 31,282 | | | | 2,627,375 | |

| | | | | | | | | |

| Utilities — 4.1% | | | | | | | | |

| Electric Utilities — 4.1% | | | | | | | | |

| Alliant Energy Corporation | | | 113,861 | | | | 5,670,278 | |

| IDACORP, Inc. | | | 59,755 | | | | 5,663,579 | |

| | | | | | | | 11,333,857 | |

| Total Common Stocks | | | | | | | | |

| (Cost $236,271,723) | | | | | | $ | 272,563,091 | |

| | | | | | | | | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 1.9% | | | | | | | | |

| First American Government Obligations Fund - Class U, 5.25% (b) (Cost $5,421,159) | | | 5,421,159 | | | $ | 5,421,159 | |

| | | | | | | | | |

| Investments at Value — 99.9% | | | | | | | | |

| (Cost $241,692,882) | | | | | | $ | 277,984,250 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 140,623 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 278,124,873 | |

SE - Societe Europaea

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of April 30, 2024. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY SMALLCAP FUND |

| APRIL 30, 2024 (Unaudited) |

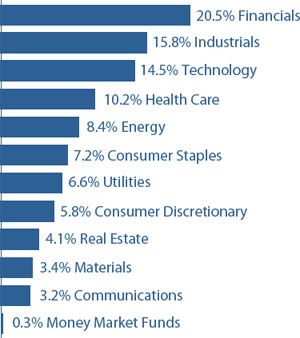

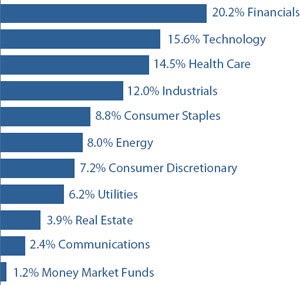

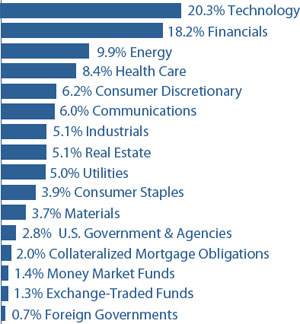

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS — 99.1% |

| | | Shares | | | Value | |

| Communications — 0.9% | | | | | | | | |

| Telecommunications — 0.9% | | | | | | | | |

| Cogent Communications Holdings, Inc. | | | 163,987 | | | $ | 10,524,686 | |

| | | | | | | | | |

| Consumer Discretionary — 11.4% | | | | | | | | |

| Home Construction — 2.1% | | | | | | | | |

| Century Communities, Inc. | | | 305,600 | | | | 24,240,192 | |

| | | | | | | | | |

| Leisure Facilities & Services — 2.9% | | | | | | | | |

| Chuy’s Holdings, Inc. (a) | | | 403,678 | | | | 11,892,354 | |

| Papa John’s International, Inc. | | | 370,440 | | | | 22,852,444 | |

| | | | | | | | 34,744,798 | |

| Retail - Discretionary — 6.4% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 410,369 | | | | 23,924,513 | |

| Boot Barn Holdings, Inc. (a) | | | 112,115 | | | | 11,936,884 | |

| GMS, Inc. (a) | | | 274,426 | | | | 25,389,893 | |

| Sonic Automotive, Inc. - Class A | | | 247,063 | | | | 14,290,124 | |

| | | | | | | | 75,541,414 | |

| Consumer Staples — 4.0% | | | | | | | | |

| Beverages — 1.0% | | | | | | | | |

| Duckhorn Portfolio, Inc. (The) (a) | | | 1,361,642 | | | | 11,533,108 | |

| | | | | | | | | |

| Food — 2.0% | | | | | | | | |

| J & J Snack Foods Corporation | | | 174,226 | | | | 23,919,487 | |

| | | | | | | | | |

| Household Products — 1.0% | | | | | | | | |

| Central Garden & Pet Company - Class A (a) | | | 331,306 | | | | 11,738,172 | |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Energy — 8.1% | | | | | | | | |

| Oil & Gas Producers — 8.1% | | | | | | | | |

| Northern Oil and Gas, Inc. | | | 582,148 | | | $ | 23,745,817 | |

| Sitio Royalties Corporation - Class A | | | 1,020,075 | | | | 23,706,543 | |

| SM Energy Company | | | 491,161 | | | | 23,816,397 | |

| Vital Energy, Inc. (a) | | | 464,146 | | | | 24,609,021 | |

| | | | | | | | 95,877,778 | |

| Financials — 21.5% | | | | | | | | |

| Banking — 14.7% | | | | | | | | |

| Atlantic Union Bankshares Corporation | | | 747,649 | | | | 23,752,809 | |

| Banner Corporation | | | 266,614 | | | | 11,632,369 | |

| City Holding Company | | | 234,287 | | | | 23,667,673 | |

| First Bancorp | | | 694,223 | | | | 21,111,321 | |

| National Bank Holdings Corporation - Class A | | | 337,605 | | | | 11,049,812 | |

| Renasant Corporation | | | 829,627 | | | | 24,108,961 | |

| Seacoast Banking Corporation of Florida | | | 985,406 | | | | 22,733,316 | |

| Simmons First National Corporation - Class A | | | 656,480 | | | | 11,219,243 | |

| Triumph Financial, Inc. (a) | | | 171,626 | | | | 12,075,605 | |

| Veritex Holdings, Inc. | | | 624,411 | | | | 12,163,526 | |

| | | | | | | | 173,514,635 | |

| Institutional Financial Services — 4.0% | | | | | | | | |

| Moelis & Company - Class A | | | 225,361 | | | | 11,060,718 | |

| Perella Weinberg Partners | | | 781,540 | | | | 11,660,577 | |

| Piper Sandler Companies | | | 125,299 | | | | 24,532,291 | |

| | | | | | | | 47,253,586 | |

| Insurance — 2.8% | | | | | | | | |

| AMERISAFE, Inc. | | | 233,434 | | | | 10,644,590 | |

| BRP Group, Inc. - Class A (a) | | | 854,159 | | | | 22,754,796 | |

| | | | | | | | 33,399,386 | |

| Health Care — 9.3% | | | | | | | | |

| Biotech & Pharma — 2.1% | | | | | | | | |

| Prestige Consumer | | | | | | | | |

| Healthcare, Inc. (a) | | | 356,745 | | | | 25,600,021 | |

| | | | | | | | | |

| Health Care Facilities & Services — 2.0% | | | | | | | | |

| Patterson Companies, Inc. | | | 917,770 | | | | 23,375,602 | |

| | | | | | | | | |

| Medical Equipment & Devices — 5.2% | | | | | | | | |

| Avanos Medical, Inc. (a) | | | 784,645 | | | | 14,186,382 | |

| CONMED Corporation | | | 318,677 | | | | 21,663,662 | |

| Merit Medical Systems, Inc. (a) | | | 349,218 | | | | 25,877,054 | |

| | | | | | | | 61,727,098 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD QUALITY SMALLCAP FUND |

| APRIL 30, 2024 (Unaudited) |

| COMMON STOCKS — continued |

| | | Shares | | | Value | |

| Industrials — 16.3% | | | | | | | | |

| Aerospace & Defense — 5.6% | | | | | | | | |

| AAR Corporation (a) | | | 229,738 | | | $ | 15,884,085 | |

| Kratos Defense & Security Solutions, Inc. (a) | | | 684,946 | | | | 12,205,738 | |

| Mercury Systems, Inc. (a) | | | 442,680 | | | | 12,483,576 | |

| Moog, Inc. - Class A | | | 160,414 | | | | 25,517,055 | |

| | | | | | | | 66,090,454 | |

| Commercial Support Services — 2.1% | | | | | | | | |

| Legalzoom.com, Inc. (a) | | | 2,105,184 | | | | 25,156,949 | |

| | | | | | | | | |

| Industrial Intermediate Products — 1.4% | | | | | | | | |

| AZZ, Inc. | | | 225,875 | | | | 16,179,426 | |

| | | | | | | | | |

| Machinery — 3.5% | | | | | | | | |

| Alamo Group, Inc. | | | 121,455 | | | | 23,608,423 | |

| Albany International Corporation - Class A | | | 68,073 | | | | 5,428,822 | |

| Thermon Group Holdings, Inc. (a) | | | 383,236 | | | | 12,236,725 | |

| | | | | | | | 41,273,970 | |

| Transportation & Logistics — 1.7% | | | | | | | | |

| ArcBest Corporation | | | 183,845 | | | | 20,390,249 | |

| | | | | | | | | |

| Transportation Equipment — 2.0% | | | | | | | | |

| Blue Bird Corporation (a) | | | 734,494 | | | | 24,205,250 | |

| | | | | | | | | |

| Materials — 8.1% | | | | | | | | |

| Chemicals — 5.1% | | | | | | | | |

| Ecovyst, Inc. (a) | | | 1,294,276 | | | | 12,205,023 | |

| Hawkins, Inc. | | | 182,720 | | | | 13,844,694 | |

| Innospec, Inc. | | | 106,041 | | | | 12,724,920 | |

| Stepan Company | | | 267,397 | | | | 22,191,277 | |

| | | | | | | | 60,965,914 | |

| Forestry, Paper & Wood Products — 1.9% | | | | | | | | |