UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | | 45246 |

| (Address of principal executive offices) | | (Zip code) |

Karen Jacoppo-Wood

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | November 30 | |

| | | |

| Date of reporting period: | May 31, 2024 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Q3 All-Season Active Rotation ETF (QVOY) Cboe BZX Exchange, Inc Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Q3 All-Season Active Rotation ETF for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.q3allseasonfunds.com/etf/. You can also request this information by contacting us at (888) 348-1255.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Q3 All-Season Active Rotation ETF | | $47 | | 0.94% |

How did the Fund perform during the reporting period?

Over the last six months, the Q3 All-Season Active Rotation Fund has held diversified equity positions across all market capitalizations and the growth/value spectrum. As large caps – particularly growth - have dominated, the performance of the Fund has lagged traditional equity indexes while maintaining increased diversification.

Because the Fund invests across several asset classes including equities, bonds, and alternatives, it may trail popular equity indexes, such as the S&P 500, which are focused on just one segment of the market. This is by design, and it is what makes the Fund appropriate for investors seeking true, active asset allocation.

In addition to its diversified core equity holdings, the Fund also invests in “active” equity funds. These consist of sectors, subsectors and internationals. Returns from this portion of the Fund’s holdings tend to have an outsized impact on the portfolio as a whole. Over the last six months, these positions were varied, though value was generally favored over growth which hampered performance. A shift to more growth-oriented sectors occurred later in the period as the NASDAQ 100 made new highs at the end of May.

Fixed income holdings in the Fund shifted from being conservative in nature for the first few months of 2024, to more aggressive positions including High Yields and Emerging Markets. This portion of the portfolio was a bright spot as QVOY’s bond holdings outperformed the fixed income market as a whole. However, bonds only make up a small portion of the Fund so the overall impact was muted. Alternative ETFs struggled for the period, as investments in Gold and Blockchain ETFs rallied, then gave back much of their gains resulting in a small net loss from this sleeve of the portfolio.

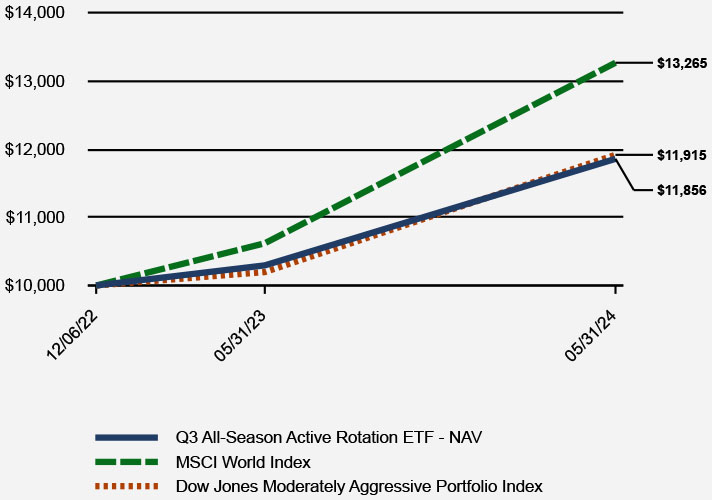

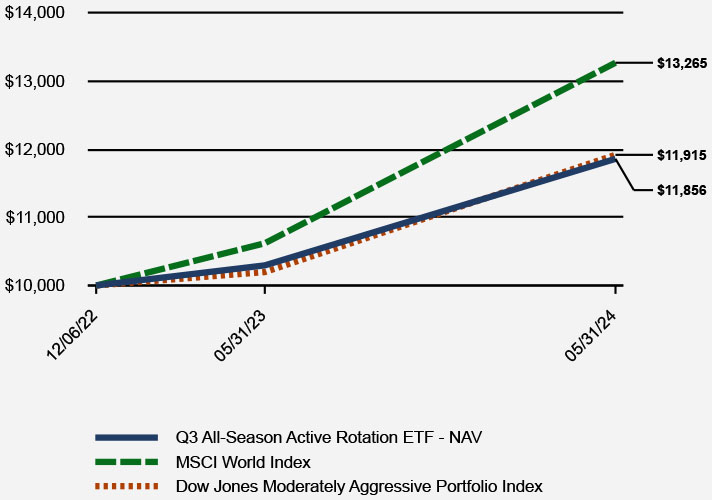

| How has the Fund performed since inception? |

| Total Return Based on $10,000 Investment |

|

| Years | Years | MSCI World Index | Dow Jones Moderately Aggressive Portfolio Index |

| 12/06/22 | 12/06/22 | 10,000 | 10,000 |

| May-2023 | May-2023 | 10,619 | 10,197 |

| May-2024 | May-2024 | 13,265 | 11,915 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(12/6/2022) |

| Q3 All-Season Active Rotation ETF - NAV | | 15.16% | | 12.17% |

| Q3 All-Season Active Rotation ETF - Market Price | | 15.30% | | 12.15% |

| MSCI World Index | | 24.92% | | 21.00% |

| Dow Jones Moderately Aggressive Portfolio Index | | 16.84% | | 12.55% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $84,630,168 |

| Number of Portfolio Holdings | | 13 |

| Advisory Fee | | $258,540 |

| Portfolio Turnover | | 339% |

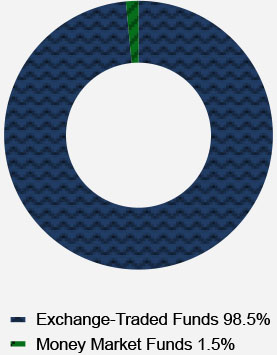

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Equity | 67.7% |

| Commodity | 28.1% |

| Fixed Income | 4.0% |

| Other Assets in Excess of Liabilities | 0.2% |

Exchange-Traded Funds | 100.0% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Assets |

| VanEck Gold Miners ETF | | 14.4% |

| iShares Core S&P 500 ETF | | 14.1% |

| Fidelity MSCI Utilities Index ETF | | 13.8% |

| Vanguard Mid-Cap Value ETF | | 13.6% |

| Vanguard FTSE Emerging Markets ETF | | 13.2% |

| iShares MSCI USA Momentum Factor ETF | | 13.0% |

| abrdn Physical Platinum Shares ETF | | 4.7% |

| Global X Uranium ETF | | 4.7% |

| SPDR Gold MiniShares Trust ETF | | 4.3% |

| iShares J.P. Morgan USD Emerging Markets Bond ETF | | 1.4% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

| | | |

| |

Q3 All-Season Active Rotation ETF (QVOY) Semi-Annual Shareholder Report - May 31, 2024 Where can I find additional information about the Fund? Additional information is available on the Fund’s website (www.q3allseasonfunds.com/etf/), including its: | |

| | | ● | Prospectus | |

| | | ● | Financial information | |

| | | ● | Holdings | |

| | | ● | Proxy voting information | |

| | | | | |

| | | | TSR-SAR 053124-QVOY | |

Q3 All-Season Tactical Fund C Class (QACTX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Q3 All-Season Tactical Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.q3allseasonfunds.com/funds/. You can also request this information by contacting us at (855) 784-2399.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| C Class | | $147 | | 2.94% |

How did the Fund perform during the reporting period?

Performance for the Q3 All-Season Tactical Fund for the period was largely due to positions in NASDAQ 100 as the Fund was able to identify a positive trend in that index. Continued strength in the technology sector bolstered the index to new highs during the year, and as such the Fund’s quantitative trading rules signaled buying opportunities.

Defensive positions were taken in long-term Treasuries when the Fund determined the volatility of the NASDAQ was heightened. Such positions amounted to about 20% of the overall market exposure for the period. Small gains were realized in the Treasury positions – long and inverse - as that market trended down the first several months of the year, before it began an upward move in May. The majority of the profitable trades in Treasuries were on the short side, though, as yields began to rise earlier in the year on fears of continued elevated inflation readings.

The Tactical Fund was able to participate in the upside movement of the equity markets during the period, as it kept a close watch on signs of exuberance by monitoring technical signals on a daily basis. Such indicators are designed to identify short-term tops in the market, so the Fund is able to pivot away from equities and into areas of the market deemed less prone to significant downside moves.

| How has the Fund performed since inception? |

| Total Return Based on $10,000 Investment |

|

| Years | Years | Bloomberg U.S. Aggregate Bond Index | Dow Jones Moderate Portfolio Index |

| 03/18/21 | 03/18/21 | 10,000 | 10,000 |

| May-2021 | May-2021 | 10,142 | 10,367 |

| May-2022 | May-2022 | 9,308 | 9,508 |

| May-2023 | May-2023 | 9,108 | 9,344 |

| May-2024 | May-2024 | 9,227 | 10,499 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(3/18/2021) |

| Q3 All-Season Tactical Fund - C Class | | 17.09% | | -1.85% |

| Bloomberg U.S. Aggregate Bond Index | | 1.31% | | -2.48% |

| Dow Jones Moderate Portfolio Index | | 12.35% | | 1.53% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $48,472,978 |

| Number of Portfolio Holdings | | 2 |

| Advisory Fee | | $236,866 |

| Portfolio Turnover | | 369% |

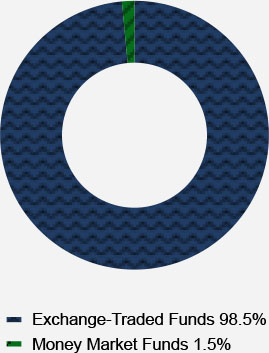

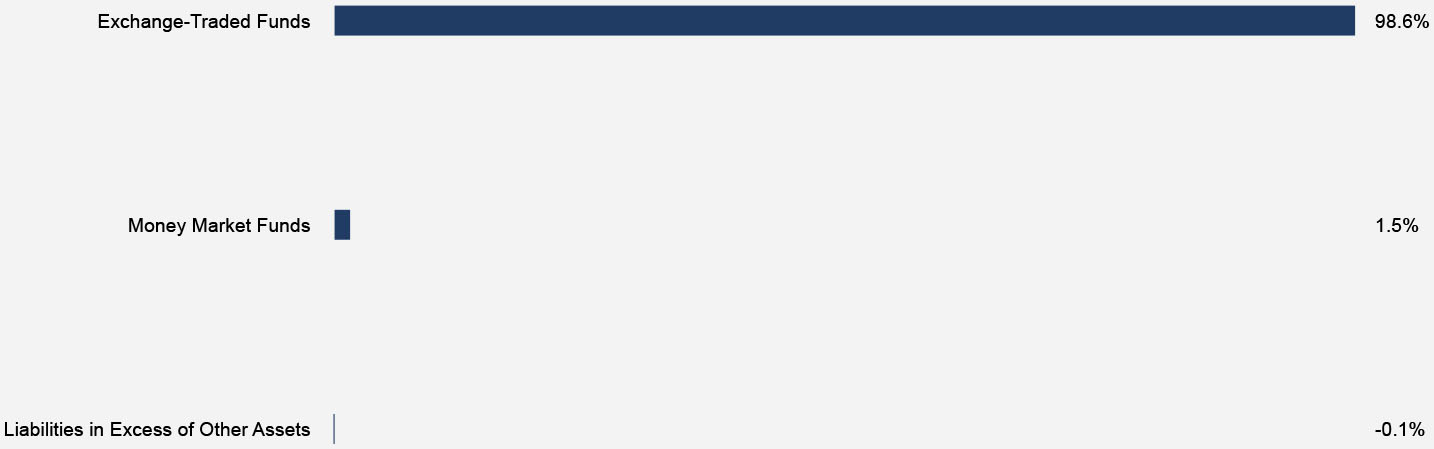

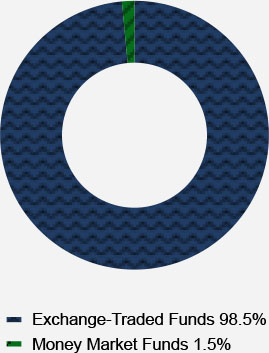

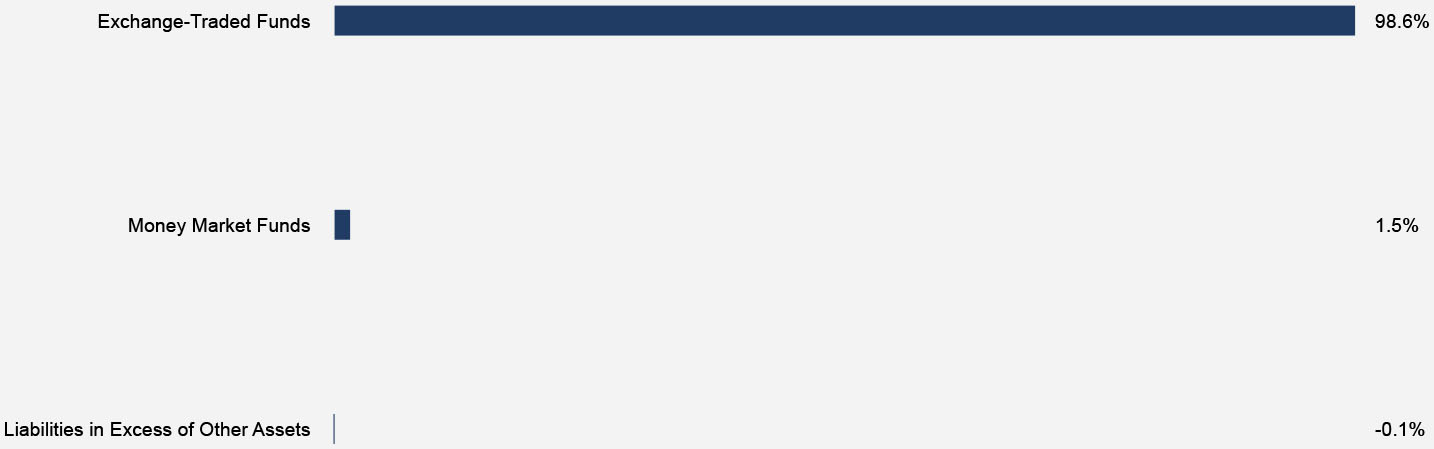

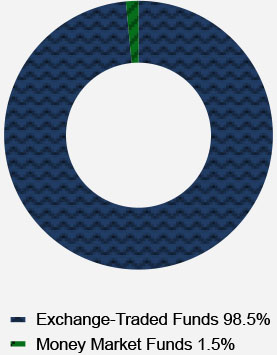

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Exchange-Traded Funds | 98.6% |

Money Market Funds | 1.5% |

Liabilities in Excess of Other Assets | -0.1% |

| Exchange-Traded Funds | 98.5% |

| Money Market Funds | 1.5% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

| | | |

| |

Q3 All-Season Tactical Fund - C Class (QACTX) Semi-Annual Shareholder Report - May 31, 2024 Where can I find additional information about the Fund? Additional information is available on the Fund's website (https://www.q3allseasonfunds.com/funds/), including its: | |

| | | ● | Prospectus | |

| | | ● | Financial information | |

| | | ● | Holdings | |

| | | ● | Proxy voting information | |

| | | | | |

Lyrical International Value Equity Fund Investor Class (LYRNX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical International Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Investor Class | | $62 | | 1.24% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period. Our Fund was up over 200 basis points compared to the MSCI EAFE during the 6-month period. Our performance was driven by a combination of both multiple expansion and earnings growth.

For the reporting period, the three positions that most positively impacted performance were: Aercap (AER-US) up 36%, Rexel (RXL-FR) up 31%, and Spie (SPIE-FR) up 43%. On the other side, the three positions that most negatively impacted performance were: OpenText (OTEX-CA) down 28%, Teleperformance (TEP-FR) down 16%, and Entain (ENT-LON) down 14%.

Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 9.3x times the next twelve months consensus earnings. The MSCI EAFE had a valuation of 14.2 times earnings on this same basis, a premium of 53% to the Fund.

In addition to an attractive valuation, our Fund also has had superior earnings growth. Since 2012, the companies in our portfolio have grown their EPS at a 6.8% annualized rate, compared to the MSCI EAFE at 5.7%.

| How has the Fund performed since inception? |

| Total Return Based on $100,000 Investment |

|

| Years | Years | MSCI EAFE Index |

| 03/02/20 | 03/02/20 | 100,000 |

| May-2020 | May-2020 | 95,200 |

| May-2021 | May-2021 | 131,770 |

| May-2022 | May-2022 | 118,093 |

| May-2023 | May-2023 | 121,708 |

| May-2024 | May-2024 | 144,256 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(3/2/2020) |

| Lyrical International Value Equity Fund - Investor Class | | 15.96% | | 7.99% |

| MSCI EAFE Index | | 18.53% | | 9.01% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

| Sector Weighting (% of net assets) |

|

| Fund Statistics |

| Net Assets | | $13,252,836 |

| Number of Portfolio Holdings | | 31 |

| Advisory Fee (net of waivers) | | $0 |

| Portfolio Turnover | | 16% |

| Asset Weighting (% of total investments) |

|

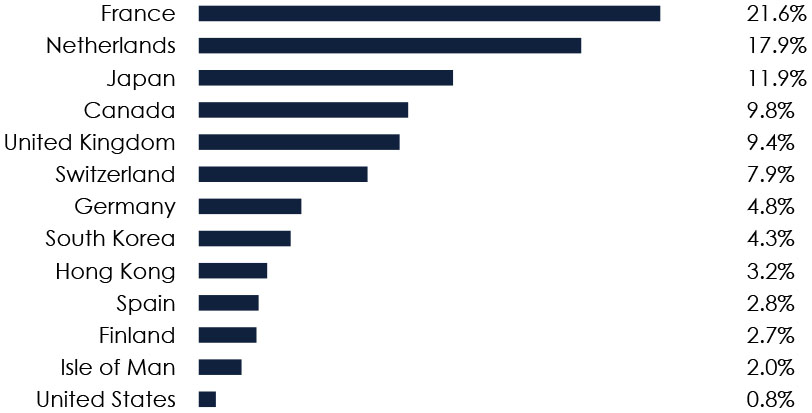

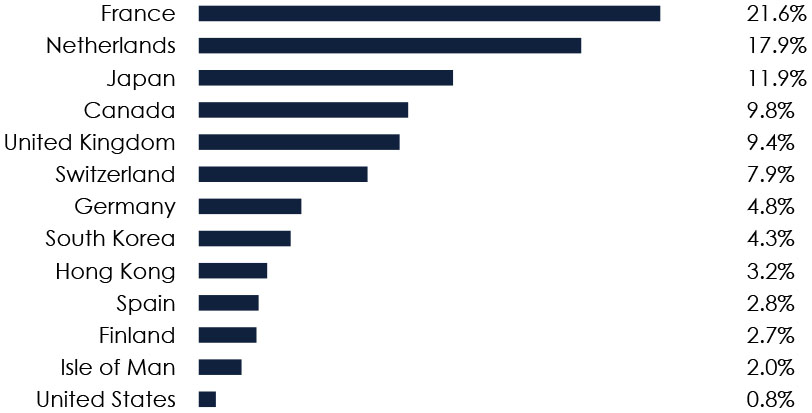

| Country Weighting (% of net assets) |

|

| France | 21.6% |

| Netherlands | 17.9% |

| Japan | 11.9% |

| Canada | 9.8% |

| United Kingdom | 9.4% |

| Switzerland | 7.9% |

| Germany | 4.8% |

| South Korea | 4.3% |

| Hong Kong | 3.2% |

| Spain | 2.8% |

| Finland | 2.7% |

| Isle of Man | 2.0% |

| United States | 0.8% |

| Common Stocks | 95.4% |

| Money Market Funds | 0.8% |

| Preferred Stocks | 3.8% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Assets |

| AerCap Holdings N.V. | | 5.2% |

| Suncor Energy, Inc. | | 5.1% |

| Exor N.V. | | 4.9% |

| Euronext N.V. | | 4.9% |

| Rexel S.A. | | 4.9% |

| Bollore SE | | 4.7% |

| Ashtead Group plc | | 4.6% |

| Samsung Electronics Company Ltd. | | 4.3% |

| Nintendo Company Ltd. - ADR | | 4.3% |

| Johnson Controls International plc | | 4.0% |

| Material Fund Changes |

| No material changes occured during the period ended May 31, 2024. |

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund - Investor Class (LYRNX)

| Semi-Annual Shareholder Report - May 31, 2024 |

Lyrical U.S. Value Equity Fund Institutional Class (LYRIX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical U.S. Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | | $50 | | 0.99% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period with above average absolute returns. Our returns also exceeded those of the S&P 500, which was no easy task given how much of the index returns were driven by one mega cap growth stock, NVIDIA. That one stock drove 20% of the S&P 500 return in the period, contributing 3.3 percentage points of the 16.4% index return.

For the reporting period, the three positions that most positively impacted performance were: United Rentals (URI) up 41%, Flex (FLEX) up 75%, and NRG Energy (NRG) up 72%. On the other side, the three positions that most negatively impacted performance were: Expedia (EXPE) down 17%, Concentrix (CNXC) down 34%, and Global Payments (GPN) down 12%. Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 11.4 times the next twelve months consensus earnings. The S&P 500 had a valuation of 20.7 times earnings on this same basis, a premium of 81% to the Fund.

What is uncommon about our portfolio is not just how cheap it is but also its attractive growth. Throughout our history our portfolios have had a discounted P/E to the S&P 500 with comparable growth. Currently, our growth profile is much better than that, with not just comparable growth, but superior growth. In fact, this continues to be one of the best growth profiles in our firm’s history.

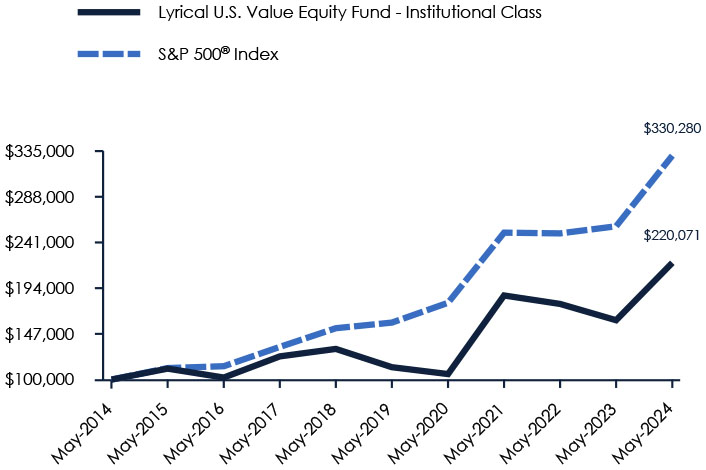

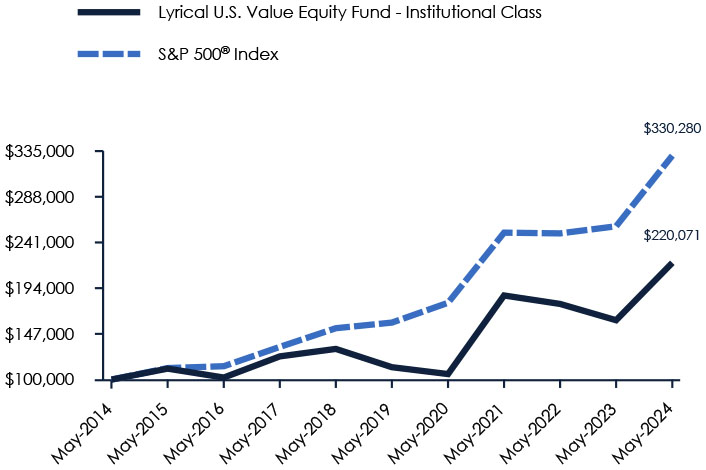

| How has the Fund performed over the last 10 years? |

| Total Return Based on $100,000 Investment |

|

| Years | Years | S&P 500 Index |

| May-2014 | May-2014 | 100,000 |

| May-2015 | May-2015 | 111,806 |

| May-2016 | May-2016 | 113,725 |

| May-2017 | May-2017 | 133,591 |

| May-2018 | May-2018 | 152,806 |

| May-2019 | May-2019 | 158,587 |

| May-2020 | May-2020 | 178,945 |

| May-2021 | May-2021 | 251,093 |

| May-2022 | May-2022 | 250,341 |

| May-2023 | May-2023 | 257,656 |

| May-2024 | May-2024 | 330,280 |

| Average Annual Total Returns |

| | | 1 Year | | 5 Years | | 10 Years |

| Lyrical U.S. Value Equity Fund - Institutional Class | | 36.66% | | 14.32% | | 8.21% |

| S&P 500® Index | | 28.19% | | 15.80% | | 12.69% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $719,078,349 |

| Number of Portfolio Holdings | | 32 |

| Advisory Fee (net of waivers) | | $2,744,559 |

| Portfolio Turnover | | 13% |

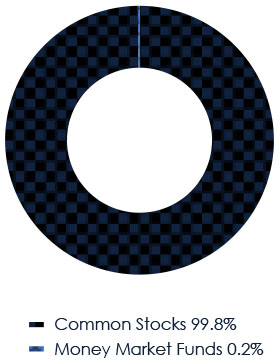

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Technology | 26.0% |

| Financials | 16.7% |

| Industrials | 14.3% |

| Health Care | 11.5% |

| Communications | 8.0% |

| Consumer Discretionary | 7.9% |

| Materials | 5.7% |

| Energy | 5.0% |

| Utilities | 4.7% |

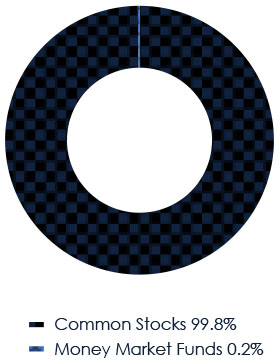

| Money Market Funds | 0.2% |

| Common Stocks | 99.8% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Asset |

| United Rentals, Inc. | | 7.6% |

| Fidelity National Information Services, Inc. | | 6.0% |

| Ameriprise Financial, Inc. | | 5.2% |

| Suncor Energy, Inc. | | 5.0% |

| NRG Energy, Inc. | | 4.7% |

| Johnson Controls International plc | | 4.6% |

| Uber Technologies, Inc. | | 4.6% |

| Cigna Group (The) | | 4.3% |

| Flex Ltd. | | 4.1% |

| HCA Healthcare, Inc. | | 4.0% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

Lyrical U.S. Value Equity Fund - Institutional

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical U.S. Value Equity Fund A Class (LYRAX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical U.S. Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| A Class | | $62 | | 1.24% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period with above average absolute returns. Our returns also exceeded those of the S&P 500, which was no easy task given how much of the index returns were driven by one mega cap growth stock, NVIDIA. That one stock drove 20% of the S&P 500 return in the period, contributing 3.3 percentage points of the 16.4% index return.

For the reporting period, the three positions that most positively impacted performance were: United Rentals (URI) up 41%, Flex (FLEX) up 75%, and NRG Energy (NRG) up 72%. On the other side, the three positions that most negatively impacted performance were: Expedia (EXPE) down 17%, Concentrix (CNXC) down 34%, and Global Payments (GPN) down 12%. Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 11.4 times the next twelve months consensus earnings. The S&P 500 had a valuation of 20.7 times earnings on this same basis, a premium of 81% to the Fund.

What is uncommon about our portfolio is not just how cheap it is but also its attractive growth. Throughout our history our portfolios have had a discounted P/E to the S&P 500 with comparable growth. Currently, our growth profile is much better than that, with not just comparable growth, but superior growth. In fact, this continues to be one of the best growth profiles in our firm’s history.

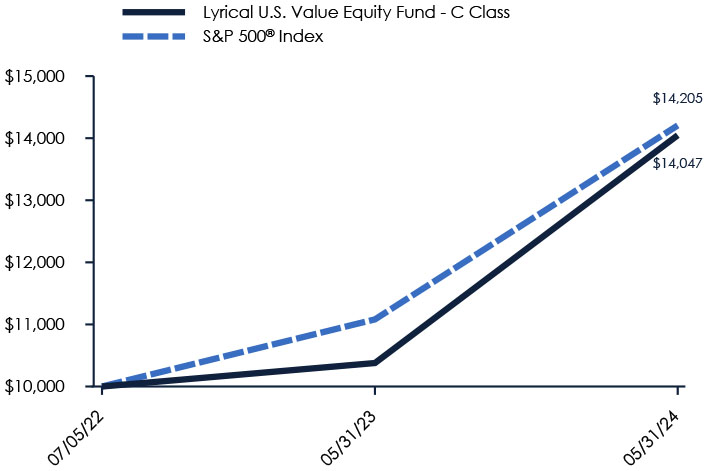

| How has the Fund performed since inception? |

| Total Return Based on $10,000 Investment* |

|

| Years | Years | S&P 500 Index |

| 07/05/22 | 07/05/22 | 10,000 |

| May-2023 | May-2023 | 11,081 |

| May-2024 | May-2024 | 14,205 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(7/5/2022) |

| Lyrical U.S. Value Equity Fund - A Class | | | | |

| Without Load | | 36.31% | | 20.42% |

| With Load | | 28.50% | | 16.74% |

| S&P 500® Index | | 28.19% | | 20.24% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| * | Reflects the maximum sales charge applicable to A Class. |

| Fund Statistics |

| Net Assets | | $719,078,349 |

| Number of Portfolio Holdings | | 32 |

| Advisory Fee (net of waivers) | | $2,744,559 |

| Portfolio Turnover | | 13% |

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Technology | 26.0% |

| Financials | 16.7% |

| Industrials | 14.3% |

| Health Care | 11.5% |

| Communications | 8.0% |

| Consumer Discretionary | 7.9% |

| Materials | 5.7% |

| Energy | 5.0% |

| Utilities | 4.7% |

| Money Market | 0.2% |

| Common Stocks | 99.8% |

| Money Market Funds | 0.2% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Asset |

| United Rentals, Inc. | | 7.6% |

| Fidelity National Information Services, Inc. | | 6.0% |

| Ameriprise Financial, Inc. | | 5.2% |

| Suncor Energy, Inc. | | 5.0% |

| NRG Energy, Inc. | | 4.7% |

| Johnson Controls International plc | | 4.6% |

| Uber Technologies, Inc. | | 4.6% |

| Cigna Group (The) | | 4.3% |

| Flex Ltd. | | 4.1% |

| HCA Healthcare, Inc. | | 4.0% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

Lyrical U.S. Value Equity Fund - A Class (LYRAX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund Institutional Class (LYRWX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical International Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | | $50 | | 0.99% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period. Our Fund was up over 200 basis points compared to the MSCI EAFE during the 6-month period. Our performance was driven by a combination of both multiple expansion and earnings growth.

For the reporting period, the three positions that most positively impacted performance were: Aercap (AER-US) up 36%, Rexel (RXL-FR) up 31%, and Spie (SPIE-FR) up 43%. On the other side, the three positions that most negatively impacted performance were: OpenText (OTEX-CA) down 28%, Teleperformance (TEP-FR) down 16%, and Entain (ENT-LON) down 14%.

Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 9.3x times the next twelve months consensus earnings. The MSCI EAFE had a valuation of 14.2 times earnings on this same basis, a premium of 53% to the Fund.

In addition to an attractive valuation, our Fund also has had superior earnings growth. Since 2012, the companies in our portfolio have grown their EPS at a 6.8% annualized rate, compared to the MSCI EAFE at 5.7%.

| How has the Fund performed since inception? |

| Total Return Based on $100,000 Investment |

|

| Years | Years | MSCI EAFE Index |

| 03/02/20 | 03/02/20 | 100,000 |

| May-2020 | May-2020 | 95,200 |

| May-2021 | May-2021 | 131,770 |

| May-2022 | May-2022 | 118,093 |

| May-2023 | May-2023 | 121,708 |

| May-2024 | May-2024 | 144,256 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(3/2/2020) |

| Lyrical International Value Equity Fund - Institutional Class | | 16.29% | | 8.26% |

| MSCI EAFE Index | | 18.53% | | 9.01% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

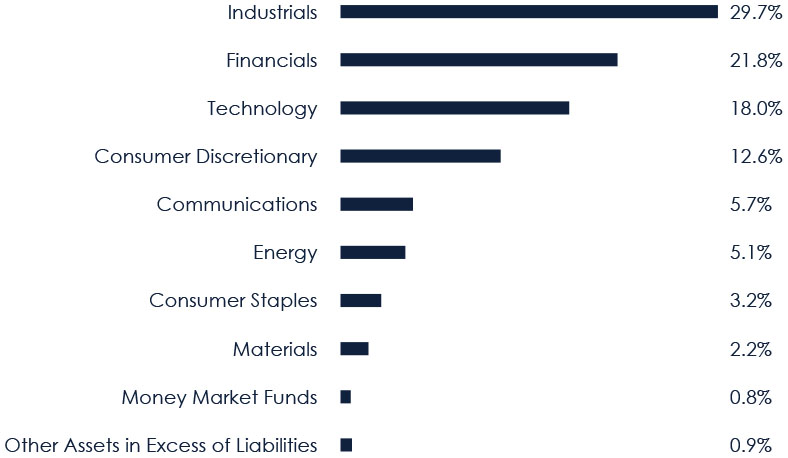

| Sector Weighting (% of net assets) |

|

| Industrials | 29.7% |

| Financials | 21.8% |

| Technology | 18.0% |

| Consumer Discretionary | 12.6% |

| Communications | 5.7% |

| Energy | 5.1% |

| Consumer Staples | 3.2% |

| Materials | 2.2% |

| Money Market Funds | 0.8% |

| Other Assets in Excess of Liabilities | 0.9% |

| Fund Statistics |

| Net Assets | | $13,252,836 |

| Number of Portfolio Holdings | | 31 |

| Advisory Fee (net of waivers) | | $0 |

| Portfolio Turnover | | 16% |

| Asset Weighting (% of total investments) |

|

| Country Weighting (% of net assets) |

|

| France | 21.6% |

| Netherlands | 17.9% |

| Japan | 11.9% |

| Canada | 9.8% |

| United Kingdom | 9.4% |

| Switzerland | 7.9% |

| Germany | 4.8% |

| South Korea | 4.3% |

| Hong Kong | 3.2% |

| Spain | 2.8% |

| Finland | 2.7% |

| Isle of Man | 2.0% |

| United States | 0.8% |

| Common Stocks | 95.4% |

| Money Market Funds | 0.8% |

| Preferred Stocks | 3.8% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Assets |

| AerCap Holdings N.V. | | 5.2% |

| Suncor Energy, Inc. | | 5.1% |

| Exor N.V. | | 4.9% |

| Euronext N.V. | | 4.9% |

| Rexel S.A. | | 4.9% |

| Bollore SE | | 4.7% |

| Ashtead Group plc | | 4.6% |

| Samsung Electronics Company Ltd. | | 4.3% |

| Nintendo Company Ltd. - ADR | | 4.3% |

| Johnson Controls International plc | | 4.0% |

| Material Fund Changes |

| No material changes occured during the period ended May 31, 2024. |

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund - Institutional

| Semi-Annual Shareholder Report - May 31, 2024 |

Lyrical U.S. Value Equity Fund C Class (LYRCX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical U.S. Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| C Class | | $100 | | 1.99% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period with above average absolute returns. Our returns also exceeded those of the S&P 500, which was no easy task given how much of the index returns were driven by one mega cap growth stock, NVIDIA. That one stock drove 20% of the S&P 500 return in the period, contributing 3.3 percentage points of the 16.4% index return.

For the reporting period, the three positions that most positively impacted performance were: United Rentals (URI) up 41%, Flex (FLEX) up 75%, and NRG Energy (NRG) up 72%. On the other side, the three positions that most negatively impacted performance were: Expedia (EXPE) down 17%, Concentrix (CNXC) down 34%, and Global Payments (GPN) down 12%. Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 11.4 times the next twelve months consensus earnings. The S&P 500 had a valuation of 20.7 times earnings on this same basis, a premium of 81% to the Fund.

What is uncommon about our portfolio is not just how cheap it is but also its attractive growth. Throughout our history our portfolios have had a discounted P/E to the S&P 500 with comparable growth. Currently, our growth profile is much better than that, with not just comparable growth, but superior growth. In fact, this continues to be one of the best growth profiles in our firm’s history.

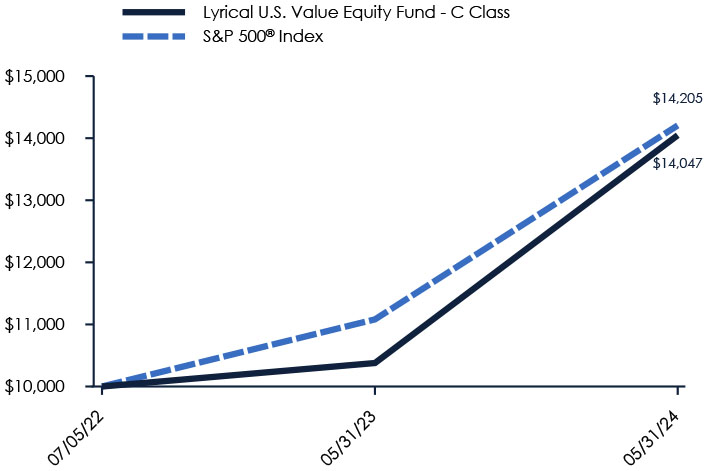

| How has the Fund performed since inception? |

| Total Return Based on $10,000 Investment |

|

| Years | Years | S&P 500 Index |

| 07/05/22 | 07/05/22 | 10,000 |

| May-2023 | May-2023 | 11,081 |

| May-2024 | May-2024 | 14,205 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(7/5/2022) |

| Lyrical U.S. Value Equity Fund - C Class | | | | |

| Without CDSC | | 35.34% | | 19.54% |

| With CDSC | | 34.34% | | 19.54% |

| S&P 500® Index | | 28.19% | | 20.24% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $719,078,349 |

| Number of Portfolio Holdings | | 32 |

| Advisory Fee (net of waivers) | | $2,744,559 |

| Portfolio Turnover | | 13% |

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Technology | 26.0% |

| Financials | 16.7% |

| Industrials | 14.3% |

| Health Care | 11.5% |

| Communications | 8.0% |

| Consumer Discretionary | 7.9% |

| Materials | 5.7% |

| Energy | 5.0% |

| Utilities | 4.7% |

| Money Market | 0.2% |

| Common stocks | 99.8% |

| Money Market Funds | 0.2% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Asset |

| United Rentals, Inc. | | 7.6% |

| Fidelity National Information Services, Inc. | | 6.0% |

| Ameriprise Financial, Inc. | | 5.2% |

| Suncor Energy, Inc. | | 5.0% |

| NRG Energy, Inc. | | 4.7% |

| Johnson Controls International plc | | 4.6% |

| Uber Technologies, Inc. | | 4.6% |

| Cigna Group (The) | | 4.3% |

| Flex Ltd. | | 4.1% |

| HCA Healthcare, Inc. | | 4.0% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

Lyrical U.S. Value Equity Fund - C Class (LYRCX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund A Class (LYRVX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical International Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| A Class | | $62 | | 1.24% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period. Our Fund was up over 200 basis points compared to the MSCI EAFE during the 6-month period. Our performance was driven by a combination of both multiple expansion and earnings growth.

For the reporting period, the three positions that most positively impacted performance were: Aercap (AER-US) up 36%, Rexel (RXL-FR) up 31%, and Spie (SPIE-FR) up 43%. On the other side, the three positions that most negatively impacted performance were: OpenText (OTEX-CA) down 28%, Teleperformance (TEP-FR) down 16%, and Entain (ENT-LON) down 14%.

Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 9.3x times the next twelve months consensus earnings. The MSCI EAFE had a valuation of 14.2 times earnings on this same basis, a premium of 53% to the Fund.

In addition to an attractive valuation, our Fund also has had superior earnings growth. Since 2012, the companies in our portfolio have grown their EPS at a 6.8% annualized rate, compared to the MSCI EAFE at 5.7%.

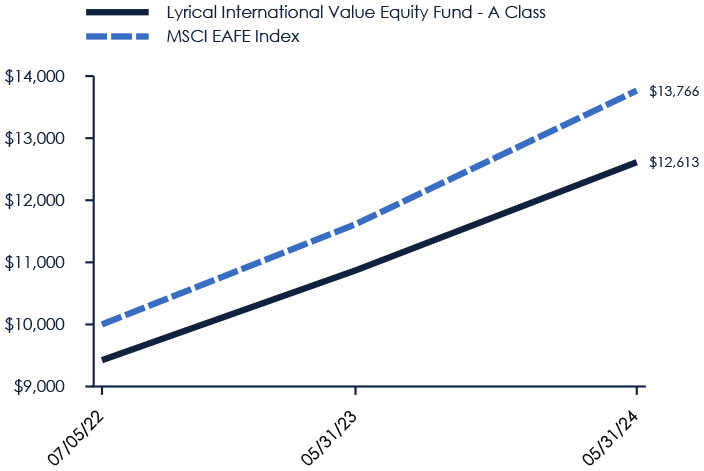

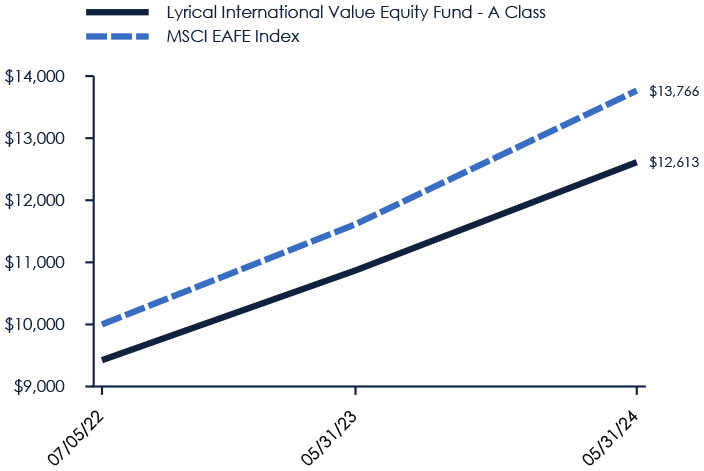

| How has the Fund performed since inception? |

| Total Return Based on $10,000 Investment* |

|

| Years | Years | MSCI EAFE Index |

| 07/05/22 | 07/05/22 | 10,000 |

| May-2023 | May-2023 | 11,614 |

| May-2024 | May-2024 | 13,766 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(7/5/2022) |

| Lyrical International Value Equity Fund - A Class | | | | |

| Without Load | | 16.03% | | 16.54% |

| With Load | | 9.36% | | 12.96% |

| MSCI EAFE Index | | 18.53% | | 18.28% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| * | Reflects the maximum sales charge applicable to A Class. |

What did the Fund invest in?

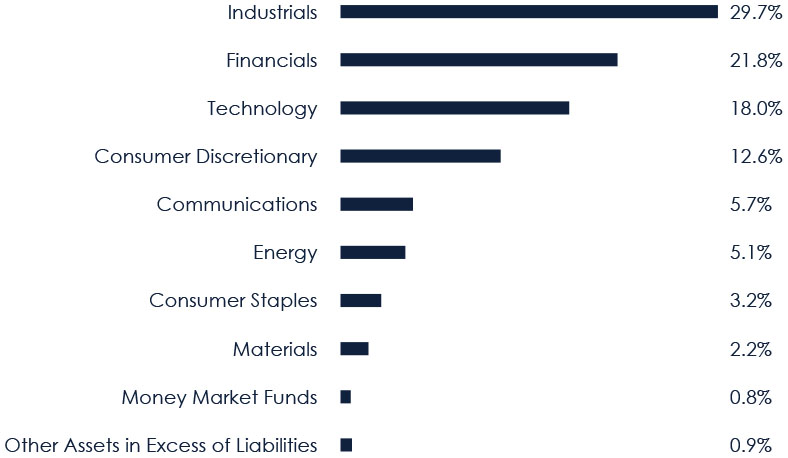

| Sector Weighting (% of net assets) |

|

| Industrials | 29.7% |

| Financials | 21.8% |

| Technology | 18.0% |

| Consumer Discretionary | 12.6% |

| Communications | 5.7% |

| Energy | 5.1% |

| Consumer Staples | 3.2% |

| Materials | 2.2% |

| Money Market Funds | 0.8% |

| Other Assets in Excess of Liabilities | 0.9% |

| Fund Statistics |

| Net Assets | | $13,252,836 |

| Number of Portfolio Holdings | | 31 |

| Advisory Fee (net of waivers) | | $0 |

| Portfolio Turnover | | 16% |

| Asset Weighting (% of total investments) |

|

| Country Weighting (% of net assets) |

|

| Common Stocks | 95.4% |

| Money Market Funds | 0.8% |

| Preferred Stocks | 3.8% |

| France | 21.6% |

| Netherlands | 17.9% |

| Japan | 11.9% |

| Canada | 9.8% |

| United Kingdom | 9.4% |

| Switzerland | 7.9% |

| Germany | 4.8% |

| South Korea | 4.3% |

| Hong Kong | 3.2% |

| Spain | 2.8% |

| Finland | 2.7% |

| Isle of Man | 2.0% |

| United States | 0.8% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Assets |

| AerCap Holdings N.V. | | 5.2% |

| Suncor Energy, Inc. | | 5.1% |

| Exor N.V. | | 4.9% |

| Euronext N.V. | | 4.9% |

| Rexel S.A. | | 4.9% |

| Bollore SE | | 4.7% |

| Ashtead Group plc | | 4.6% |

| Samsung Electronics Company Ltd. | | 4.3% |

| Nintendo Company Ltd. - ADR | | 4.3% |

| Johnson Controls International plc | | 4.0% |

| Material Fund Changes |

| No material changes occured during the period ended May 31, 2024. |

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund - A Class (LYRVX)

| Semi-Annual Shareholder Report - May 31, 2024 |

Q3 All-Season Systematic Opportunities Fund Institutional Class (QASOX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Q3 All-Season Systematic Opportunities Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.q3allseasonfunds.com/funds/. You can also request this information by contacting us at (855) 784-2399.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | | $66 | | 1.32% |

How did the Fund perform during the reporting period?

The Q3 All-Season Systematic Opportunities Fund continues to perform as designed – producing positive returns over any market environment. For the most recent period, the Fund again registered profits as the markets looked to maintain their positive trends. The Fund, however, is largely indifferent as to the overall direction of the markets, since its trading rules are short-term in nature and not dependent on trends.

Over the last six months, the Fund was only exposed to equities approximately 60% of the time, and still notched gains, with considerably less market risk. While the last several months have been decidedly bullish, the Fund has had fewer trades than historically expected. QASOX only enters the market during pullbacks and tends to stay invested in trades for just a few days.

With very few meaningful pullbacks in equities over the last several months, the Fund has maintained larger than normal defensive positions (money market funds) while it waited for opportunities to enter the equity market. Currently, these defensive positions are generating just over 5% a year, so the Fund has the opportunity to make meaningful gains when it is waiting for potential equity trades.

| How has the Fund performed since inception? |

| Total Return Based on $100,000 Investment |

|

| Years | Years | Bloomberg U.S. Aggregate Bond Index | Dow Jones Moderate Portfolio Index |

| 12/30/19 | 12/30/19 | 100,000 | 100,000 |

| May-2020 | May-2020 | 105,385 | 94,569 |

| May-2021 | May-2021 | 104,959 | 119,739 |

| May-2022 | May-2022 | 96,329 | 109,822 |

| May-2023 | May-2023 | 94,265 | 107,927 |

| May-2024 | May-2024 | 95,495 | 121,258 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(12/30/2019) |

| Q3 All-Season Systematic Opportunities Fund - Institutional Class | | 11.27% | | 2.86% |

| Bloomberg U.S. Aggregate Bond Index | | 1.31% | | -1.04% |

| Dow Jones Moderate Portfolio Index | | 12.35% | | 4.46% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $192,428,373 |

| Number of Portfolio Holdings | | 1 |

| Advisory Fee (net of recoupments) | | $938,594 |

| Portfolio Turnover | | 5641% |

What did the Fund invest in?

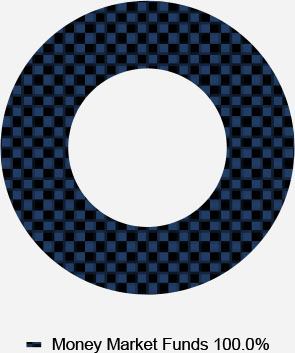

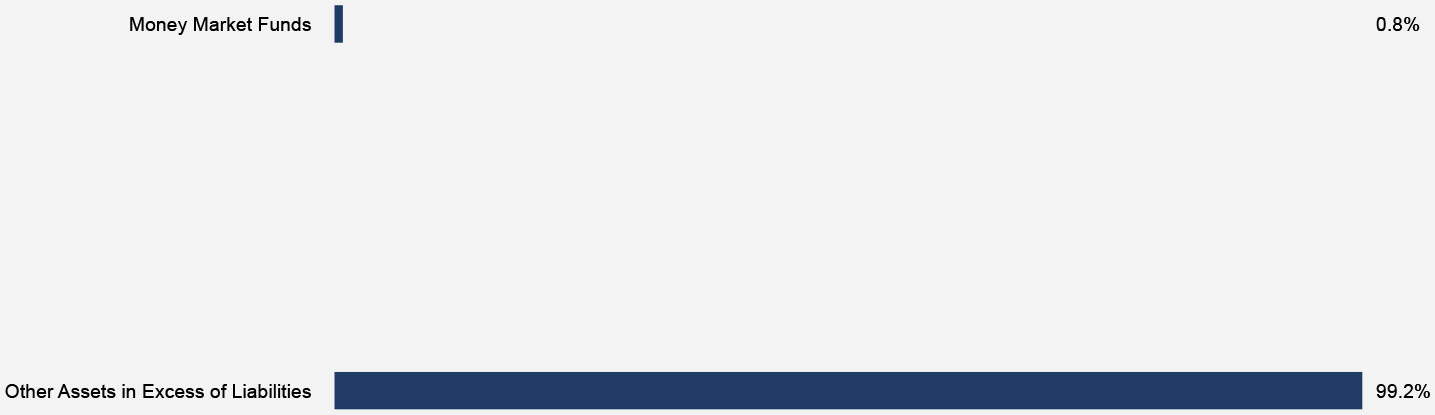

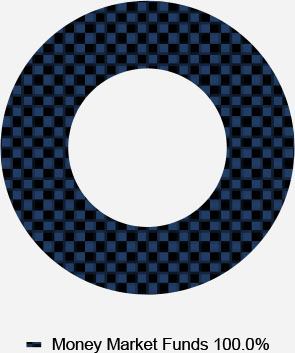

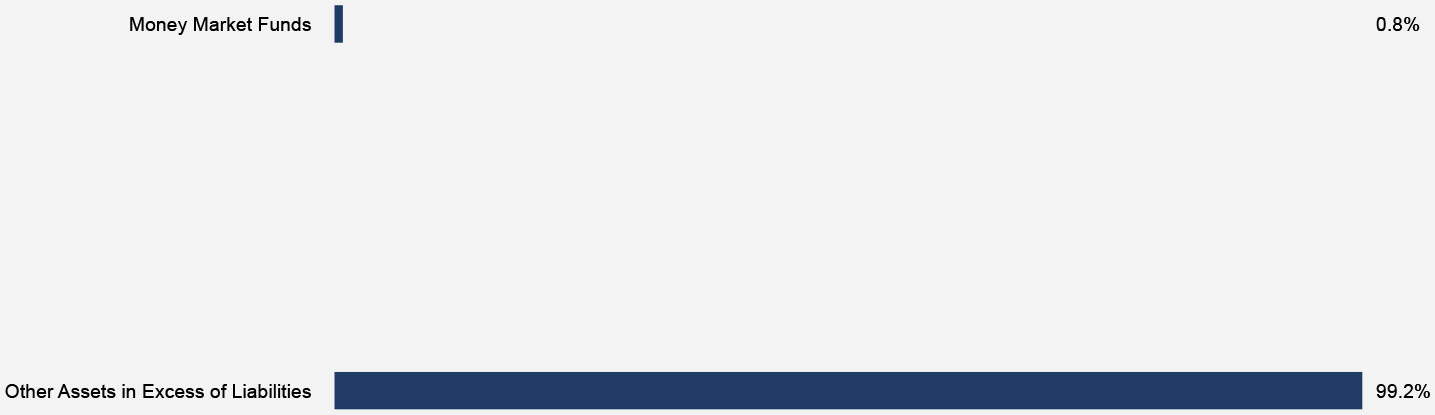

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Money Market Funds | 100.0% |

| Other Assets in Excess of Liabilities | 99.2% |

| Money Market Funds | 0.8% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

| | | |

| |

Q3 All-Season Systematic Opportunities Fund - Institutional Class (QASOX) Semi-Annual Shareholder Report - May 31, 2024 Where can I find additional information about the Fund? Additional information is available on the Fund's website (https://www.q3allseasonfunds.com/funds/), including its: | |

| | | ● | Prospectus | |

| | | ● | Financial information | |

| | | ● | Holdings | |

| | | ● | Proxy voting information | |

| | | | | |

| | | | TSR-SAR 053124-QASOX | |

Lyrical U.S. Value Equity Fund Investor Class (LYRBX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical U.S. Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Investor Class | | $62 | | 1.24% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period with above average absolute returns. Our returns also exceeded those of the S&P 500, which was no easy task given how much of the index returns were driven by one mega cap growth stock, NVIDIA. That one stock drove 20% of the S&P 500 return in the period, contributing 3.3 percentage points of the 16.4% index return.

For the reporting period, the three positions that most positively impacted performance were: United Rentals (URI) up 41%, Flex (FLEX) up 75%, and NRG Energy (NRG) up 72%. On the other side, the three positions that most negatively impacted performance were: Expedia (EXPE) down 17%, Concentrix (CNXC) down 34%, and Global Payments (GPN) down 12%. Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 11.4 times the next twelve months consensus earnings. The S&P 500 had a valuation of 20.7 times earnings on this same basis, a premium of 81% to the Fund.

What is uncommon about our portfolio is not just how cheap it is but also its attractive growth. Throughout our history our portfolios have had a discounted P/E to the S&P 500 with comparable growth. Currently, our growth profile is much better than that, with not just comparable growth, but superior growth. In fact, this continues to be one of the best growth profiles in our firm’s history.

| How has the Fund performed over the last 10 years? |

| Total Return Based on $10,000 Investment |

|

| Years | Years | S&P 500 Index |

| May-2014 | May-2014 | 10,000 |

| May-2015 | May-2015 | 11,181 |

| May-2016 | May-2016 | 11,372 |

| May-2017 | May-2017 | 13,359 |

| May-2018 | May-2018 | 15,281 |

| May-2019 | May-2019 | 15,859 |

| May-2020 | May-2020 | 17,895 |

| May-2021 | May-2021 | 25,109 |

| May-2022 | May-2022 | 25,034 |

| May-2023 | May-2023 | 25,766 |

| May-2024 | May-2024 | 33,028 |

| Average Annual Total Returns |

| | | 1 Year | | 5 Years | | 10 Years |

| Lyrical U.S. Value Equity Fund - Investor Class | | 36.38% | | 14.04% | | 7.90% |

| S&P 500® Index | | 28.19% | | 15.80% | | 12.69% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $719,078,349 |

| Number of Portfolio Holdings | | 32 |

| Advisory Fee (net of waivers) | | $2,744,559 |

| Portfolio Turnover | | 13% |

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Common Stocks | 99.8% |

| Money Market Funds | 0.2% |

| Technology | 26.0% |

| Financials | 16.7% |

| Industrials | 14.3% |

| Health Care | 11.5% |

| Communications | 8.0% |

| Consumer Discretionary | 7.9% |

| Materials | 5.7% |

| Energy | 5.0% |

| Utilities | 4.7% |

| Money Market | 0.2% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Asset |

| United Rentals, Inc. | | 7.6% |

| Fidelity National Information Services, Inc. | | 6.0% |

| Ameriprise Financial, Inc. | | 5.2% |

| Suncor Energy, Inc. | | 5.0% |

| NRG Energy, Inc. | | 4.7% |

| Johnson Controls International plc | | 4.6% |

| Uber Technologies, Inc. | | 4.6% |

| Cigna Group (The) | | 4.3% |

| Flex Ltd. | | 4.1% |

| HCA Healthcare, Inc. | | 4.0% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

Lyrical U.S. Value Equity Fund - Investor Class (LYRBX)

Semi-Annual Shareholder Report - May 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund C Class (LYRZX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Lyrical International Value Equity Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at www.lyricalvaluefunds.com. You can also request this information by contacting us at (888) 884-8099.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| C Class | | $100 | | 1.99% |

How did the Fund perform during the reporting period?

The Fund performed well during the reporting period. Our Fund was up over 200 basis points compared to the MSCI EAFE during the 6-month period. Our performance was driven by a combination of both multiple expansion and earnings growth.

For the reporting period, the three positions that most positively impacted performance were: Aercap (AER-US) up 36%, Rexel (RXL-FR) up 31%, and Spie (SPIE-FR) up 43%. On the other side, the three positions that most negatively impacted performance were: OpenText (OTEX-CA) down 28%, Teleperformance (TEP-FR) down 16%, and Entain (ENT-LON) down 14%.

Even after strong returns in the periods, the portfolio remains attractively valued. The price-to-earnings (P/E) ratio ended the period at 9.3x times the next twelve months consensus earnings. The MSCI EAFE had a valuation of 14.2 times earnings on this same basis, a premium of 53% to the Fund.

In addition to an attractive valuation, our Fund also has had superior earnings growth. Since 2012, the companies in our portfolio have grown their EPS at a 6.8% annualized rate, compared to the MSCI EAFE at 5.7%.

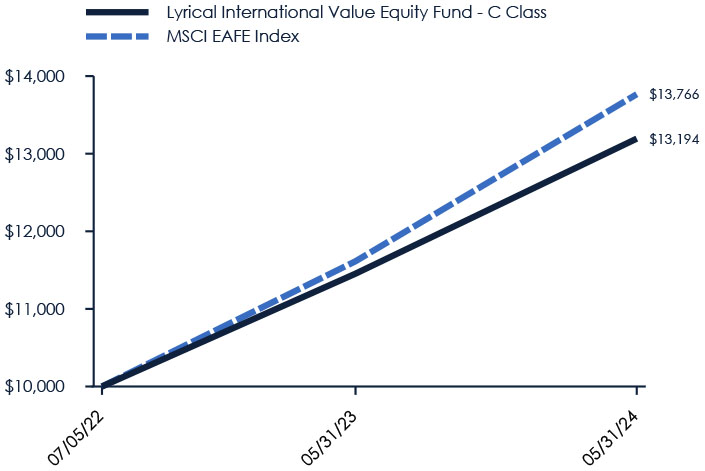

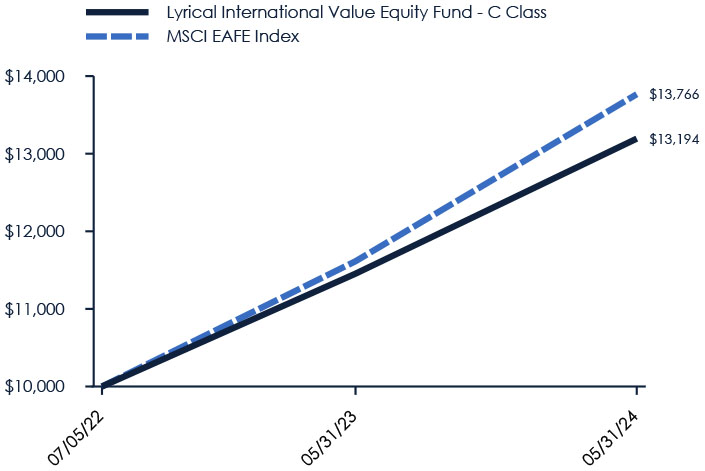

| How has the Fund performed since inception? |

| Total Return Based on $10,000 Investment |

|

| Years | Years | MSCI EAFE Index |

| 07/05/22 | 07/05/22 | 10,000 |

| May-2023 | May-2023 | 11,614 |

| May-2024 | May-2024 | 13,766 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(7/5/2022) |

| Lyrical International Value Equity Fund - C Class | | | | |

| Without CDSC | | 15.18% | | 15.67% |

| With CDSC | | 14.18% | | 15.67% |

| MSCI EAFE Index | | 18.53% | | 18.28% |

Past performance is not necessarily indicative of future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

| Sector Weighting (% of net assets) |

|

| Industrials | 29.7% |

| Financials | 21.8% |

| Technology | 18.0% |

| Consumer Discretionary | 12.6% |

| Communications | 5.7% |

| Energy | 5.1% |

| Consumer Staples | 3.2% |

| Materials | 2.2% |

| Money Market Funds | 0.8% |

| Other Assets in Excess of Liabilities | 0.9% |

| Fund Statistics |

| Net Assets | | $13,252,836 |

| Number of Portfolio Holdings | | 31 |

| Advisory Fee (net of waivers) | | $0 |

| Portfolio Turnover | | 16% |

| Asset Weighting (% of total investments) |

|

| Country Weighting (% of net assets) |

|

| Common Stocks | 95.4% |

| Money Market Funds | 0.8% |

| Preferred Stocks | 3.8% |

| France | 21.6% |

| Netherlands | 17.9% |

| Japan | 11.9% |

| Canada | 9.8% |

| United Kingdom | 9.4% |

| Switzerland | 7.9% |

| Germany | 4.8% |

| South Korea | 4.3% |

| Hong Kong | 3.2% |

| Spain | 2.8% |

| Finland | 2.7% |

| Isle of Man | 2.0% |

| United States | 0.8% |

| Top 10 Holdings (% of net assets) |

| Holding Name | | % of Net

Assets |

| AerCap Holdings N.V. | | 5.2% |

| Suncor Energy, Inc. | | 5.1% |

| Exor N.V. | | 4.9% |

| Euronext N.V. | | 4.9% |

| Rexel S.A. | | 4.9% |

| Bollore SE | | 4.7% |

| Ashtead Group plc | | 4.6% |

| Samsung Electronics Company Ltd. | | 4.3% |

| Nintendo Company Ltd. - ADR | | 4.3% |

| Johnson Controls International plc | | 4.0% |

| Material Fund Changes |

| No material changes occured during the period ended May 31, 2024. |

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (www.lyricalvaluefunds.com), including its:

| ● | Prospectus |

| ● | Financial information |

| ● | Holdings |

| ● | Proxy voting information |

Lyrical International Value Equity Fund - C Class (LYRZX)

| Semi-Annual Shareholder Report - May 31, 2024 |

Q3 All-Season Tactical Fund Institutional Class (QAITX) Semi-Annual Shareholder Report - May 31, 2024 | |  |

Fund Overview

This semi-annual shareholder report contains important information about Q3 All-Season Tactical Fund for the period of December 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.q3allseasonfunds.com/funds/. You can also request this information by contacting us at (855) 784-2399.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | | $79 | | 1.58% |

How did the Fund perform during the reporting period?

Performance for the Q3 All-Season Tactical Fund for the period was largely due to positions in NASDAQ 100 as the Fund was able to identify a positive trend in that index. Continued strength in the technology sector bolstered the index to new highs during the year, and as such the Fund’s quantitative trading rules signaled buying opportunities.

Defensive positions were taken in long-term Treasuries when the Fund determined the volatility of the NASDAQ was heightened. Such positions amounted to about 20% of the overall market exposure for the period. Small gains were realized in the Treasury positions – long and inverse - as that market trended down the first several months of the year, before it began an upward move in May. The majority of the profitable trades in Treasuries were on the short side, though, as yields began to rise earlier in the year on fears of continued elevated inflation readings.

The Tactical Fund was able to participate in the upside movement of the equity markets during the period, as it kept a close watch on signs of exuberance by monitoring technical signals on a daily basis. Such indicators are designed to identify short-term tops in the market, so the Fund is able to pivot away from equities and into areas of the market deemed less prone to significant downside moves.

| How has the Fund performed since inception? |

| Total Return Based on $100,000 Investment |

|

| Years | Years | Bloomberg U.S. Aggregate Bond Index | Dow Jones Moderate Portfolio Index |

| 12/30/19 | 12/30/19 | 100,000 | 100,000 |

| May-2020 | May-2020 | 105,385 | 94,569 |

| May-2021 | May-2021 | 104,959 | 119,739 |

| May-2022 | May-2022 | 96,329 | 109,822 |

| May-2023 | May-2023 | 94,265 | 107,927 |

| May-2024 | May-2024 | 95,495 | 121,258 |

| Average Annual Total Returns |

| | | 1 Year | | Since Inception

(12/30/2019) |

| Q3 All-Season Tactical Fund - Institutional Class | | 18.74% | | 4.59% |

| Bloomberg U.S. Aggregate Bond Index | | 1.31% | | -1.04% |

| Dow Jones Moderate Portfolio Index | | 12.35% | | 4.46% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | | $48,472,978 |

| Number of Portfolio Holdings | | 2 |

| Advisory Fee | | $236,866 |

| Portfolio Turnover | | 369% |

What did the Fund invest in?

| Asset Weighting (% of total investments) |

|

| Sector Weighting (% of net assets) |

|

| Exchange-Traded Funds | 98.5% |

| Money Market Funds | 1.5% |

| Liabilities in Excess of Other Assets | -0.1% |

| Money Market Funds | 1.5% |

| Exchange-Traded Funds | 98.6% |

Material Fund Changes

No material changes occured during the period ended May 31, 2024.

| | | |

| |

Q3 All-Season Tactical Fund - Institutional Class (QAITX) Semi-Annual Shareholder Report - May 31, 2024 Where can I find additional information about the Fund? Additional information is available on the Fund's website (https://www.q3allseasonfunds.com/funds/), including its: | |

| | | ● | Prospectus | |

| | | ● | Financial information | |

| | | ● | Holdings | |

| | | ● | Proxy voting information | |

| | | | | |

Not required

| Item 3. | Audit Committee Financial Expert. |

Not required

| Item 4. | Principal Accountant Fees and Services. |

Not required

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable

| (a) | The Registrant(s) schedule(s) of investments is included in the Financial Statements under Item 7 of this form. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

LYRICAL U.S. VALUE EQUITY FUND

Institutional Class (LYRIX)

Investor Class (LYRBX)

A Class (LYRAX)

C Class (LYRCX)

LYRICAL INTERNATIONAL VALUE EQUITY FUND

Institutional Class (LYRWX)

Investor Class (LYRNX)

A Class (LYRVX)

C Class (LYRZX)

Financial Statements

May 31, 2024

(Unaudited)

| LYRICAL U.S. VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| May 31, 2024 (Unaudited) |

| COMMON STOCKS — 99.8% | | Shares | | | Value | |

| Communications — 8.0% | | | | | | | | |

| Internet Media & Services — 8.0% | | | | | | | | |

| Expedia Group, Inc. (a) | | | 217,142 | | | $ | 24,506,646 | |

| Uber Technologies, Inc. (a) | | | 511,478 | | | | 33,021,020 | |

| | | | | | | | 57,527,666 | |

| Consumer Discretionary — 7.9% | | | | | | | | |

| Automotive — 2.4% | | | | | | | | |

| Adient plc (a) | | | 151,384 | | | | 4,275,084 | |

| Lear Corporation | | | 102,759 | | | | 12,880,841 | |

| | | | | | | | 17,155,925 | |

| E-Commerce Discretionary — 3.9% | | | | | | | | |

| eBay, Inc. | | | 516,070 | | | | 27,981,316 | |

| | | | | | | | | |

| Retail - Discretionary — 1.6% | | | | | | | | |

| Lithia Motors, Inc. | | | 46,138 | | | | 11,679,373 | |

| | | | | | | | | |

| Energy — 5.0% | | | | | | | | |

| Oil & Gas Producers — 5.0% | | | | | | | | |

| Suncor Energy, Inc. | | | 874,707 | | | | 35,705,540 | |

| | | | | | | | | |

| Financials — 16.7% | | | | | | | | |

| Asset Management — 7.0% | | | | | | | | |

| Affiliated Managers Group, Inc. | | | 79,001 | | | | 12,845,562 | |

| Ameriprise Financial, Inc. | | | 85,077 | | | | 37,145,469 | |

| | | | | | | | 49,991,031 | |

| Insurance — 4.4% | | | | | | | | |

| Assurant, Inc. | | | 102,240 | | | | 17,735,573 | |

| Primerica, Inc. | | | 62,610 | | | | 14,142,973 | |

| | | | | | | | 31,878,546 | |

| Specialty Finance — 5.3% | | | | | | | | |

| AerCap Holdings N.V. | | | 305,238 | | | | 28,298,615 | |

| Air Lease Corporation | | | 205,972 | | | | 9,812,506 | |

| | | | | | | | 38,111,121 | |

| Health Care — 11.5% | | | | | | | | |

| Health Care Facilities & Services — 11.5% | | | | | | | | |

| Centene Corporation (a) | | | 320,846 | | | | 22,969,365 | |

| Cigna Group (The) | | | 89,807 | | | | 30,949,288 | |

| HCA Healthcare, Inc. | | | 84,060 | | | | 28,559,385 | |

| | | | | | | | 82,478,038 | |

| LYRICAL U.S. VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 99.8% (Continued) | | Shares | | | Value | |

| Industrials — 14.3% | | | | | | | | |

| Electrical Equipment — 4.6% | | | | | | | | |

| Johnson Controls International plc | | | 464,060 | | | $ | 33,370,554 | |

| | | | | | | | | |

| Industrial Support Services — 9.7% | | | | | | | | |

| United Rentals, Inc. | | | 81,143 | | | | 54,317,936 | |

| WESCO International, Inc. | | | 86,647 | | | | 15,552,270 | |

| | | | | | | | 69,870,206 | |

| Materials — 5.7% | | | | | | | | |

| Chemicals — 3.7% | | | | | | | | |

| Celanese Corporation | | | 174,965 | | | | 26,601,679 | |

| | | | | | | | | |

| Containers & Packaging — 2.0% | | | | | | | | |

| Berry Global Group, Inc. | | | 238,906 | | | | 14,305,691 | |

| | | | | | | | | |

| Technology — 26.0% | | | | | | | | |

| Software — 4.0% | | | | | | | | |

| Concentrix Corporation | | | 91,684 | | | | 5,622,980 | |

| Gen Digital, Inc. | | | 943,857 | | | | 23,435,969 | |

| | | | | | | | 29,058,949 | |

| Technology Hardware — 10.9% | | | | | | | | |

| Arrow Electronics, Inc. (a) | | | 130,531 | | | | 17,140,026 | |

| F5, Inc. (a) | | | 103,733 | | | | 17,527,765 | |

| Flex Ltd. (a) | | | 880,038 | | | | 29,155,659 | |

| TD SYNNEX Corporation | | | 109,972 | | | | 14,388,736 | |

| | | | | | | | 78,212,186 | |

| Technology Services — 11.1% | | | | | | | | |

| Fidelity National Information Services, Inc. | | | 565,381 | | | | 42,901,110 | |

| Global Payments, Inc. | | | 228,222 | | | | 23,244,411 | |

| WEX, Inc. (a) | | | 72,791 | | | | 13,635,210 | |

| | | | | | | | 79,780,731 | |

| Utilities — 4.7% | | | | | | | | |

| Electric Utilities — 4.7% | | | | | | | | |

| NRG Energy, Inc. | | | 416,382 | | | | 33,726,942 | |

| | | | | | | | | |

| Total Common Stocks (Cost $496,167,193) | | | | | | $ | 717,435,494 | |

| LYRICAL U.S. VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 0.2% | | Shares | | | Value | |

| Invesco Treasury Portfolio - Institutional Class, 5.22% (b) (Cost $1,656,679) | | | 1,656,679 | | | $ | 1,656,679 | |

| | | | | | | | | |

| Investments at Value — 100.0% (Cost $497,823,872) | | | | | | $ | 719,092,173 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.0%) (c) | | | | | | | (13,824 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 719,078,349 | |

N.V. - Naamloze Vennootschap

plc - Public Limited Company

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of May 31, 2024. |

| (c) | Percentage rounds to less than 0.1%. |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| May 31, 2024 (Unaudited) |

| COMMON STOCKS — 94.5% | | Shares | | | Value | |

| Canada — 9.8% | | | | | | | | |

| Linamar Corporation | | | 4,516 | | | $ | 235,349 | |

| Open Text Corporation | | | 12,931 | | | | 378,464 | |

| Suncor Energy, Inc. | | | 16,656 | | | | 679,898 | |

| | | | | | | | 1,293,711 | |

| Finland — 2.7% | | | | | | | | |

| Konecranes OYJ | | | 6,150 | | | | 353,854 | |

| | | | | | | | | |

| France — 21.6% | | | | | | | | |

| Ayvens S.A. | | | 41,594 | | | | 312,415 | |

| Bollore SE | | | 91,699 | | | | 617,488 | |

| Elis S.A. | | | 16,374 | | | | 416,214 | |

| Rexel S.A. | | | 21,284 | | | | 646,690 | |

| SPIE S.A. | | | 12,106 | | | | 500,687 | |

| Teleperformance SE | | | 3,266 | | | | 373,530 | |

| | | | | | | | 2,867,024 | |

| Germany — 1.0% | | | | | | | | |

| Auto1 Group SE (a) | | | 17,412 | | | | 132,648 | |

| | | | | | | | | |

| Hong Kong — 3.2% | | | | | | | | |

| CK Hutchison Holdings Ltd. | | | 87,269 | | | | 426,147 | |

| | | | | | | | | |

| Isle of Man — 2.0% | | | | | | | | |

| Entain plc | | | 30,642 | | | | 267,060 | |

| | | | | | | | | |

| Japan — 11.9% | | | | | | | | |

| Air Water, Inc. | | | 17,370 | | | | 254,111 | |

| Kyudenko Corporation | | | 5,401 | | | | 219,927 | |

| Nintendo Company Ltd. – ADR | | | 42,299 | | | | 574,420 | |

| SK Kaken Company Ltd. | | | 774 | | | | 38,578 | |

| Sony Group Corporation | | | 5,934 | | | | 487,174 | |

| | | | | | | | 1,574,210 | |

| Netherlands — 17.9% | | | | | | | | |

| AerCap Holdings N.V. | | | 7,502 | | | | 695,510 | |

| CNH Industrial N.V. | | | 35,487 | | | | 374,743 | |

| Euronext N.V. | | | 6,619 | | | | 651,619 | |

| Exor N.V. | | | 5,832 | | | | 654,808 | |

| | | | | | | | 2,376,680 | |

| South Korea — 4.3% | | | | | | | | |

| Samsung Electronics Company Ltd. | | | 431 | | | | 577,109 | |

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 94.5% (Continued) | | Shares | | | Value | |

| Spain — 2.8% | | | | | | | | |

| Grupo Catalana Occidente S.A. | | | 8,935 | | | $ | 370,579 | |

| | | | | | | | | |

| Switzerland — 7.9% | | | | | | | | |

| Johnson Controls International plc | | | 7,430 | | | | 534,291 | |

| Julius Baer Group Ltd. | | | 8,472 | | | | 508,992 | |

| | | | | | | | 1,043,283 | |

| United Kingdom — 9.4% | | | | | | | | |

| Ashtead Group plc | | | 8,343 | | | | 611,165 | |

| Babcock International Group plc | | | 38,374 | | | | 277,078 | |

| Vistry Group plc (a) | | | 21,508 | | | | 356,399 | |

| | | | | | | | 1,244,642 | |

| | | | | | | | | |

| Total Common Stocks (Cost $11,356,363) | | | | | | $ | 12,526,947 | |

| PREFERRED STOCKS — 3.8% | | | | | | |

| Germany — 3.8% | | | | | | |

| Volkswagon AG (Cost $550,250) | | | 3,999 | | | $ | 502,419 | |

| MONEY MARKET FUNDS — 0.8% | | | | | | |

| Invesco Treasury Portfolio - Institutional Class, 5.22% (b) (Cost $110,257) | | | 110,257 | | | $ | 110,257 | |

| | | | | | | | | |

| Investments at Value — 99.1% (Cost $12,016,870) | | | | | | $ | 13,139,623 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.9% | | | | | | | 113,213 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 13,252,836 | |

ADR - American Depositary Receipt

AG - Aktiengesellschaft

N.V. - Naamloze Vennootschap

OYJ - Julkinen Osakeyhtio

plc - Public Limited Company

S.A. - Societe Anonyme

SE - Societe Europaea

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of May 31, 2024. |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| | | % of | |

| Common Stocks & Preferred Stocks by Sector/Industry | | Net Assets | |

| Communications — 5.7% | | | | |

| Entertainment Content | | | 4.7 | % |

| Internet Media & Services | | | 1.0 | % |

| Consumer Discretionary — 12.6% | | | | |

| Automotive | | | 5.6 | % |

| Home Construction | | | 2.7 | % |

| Leisure Facilities & Services | | | 2.0 | % |

| Retail - Discretionary | | | 2.3 | % |

| Consumer Staples — 3.2% | | | | |

| Retail - Consumer Staples | | | 3.2 | % |

| Energy — 5.1% | | | | |

| Oil & Gas Producers | | | 5.1 | % |

| Financials — 21.8% | | | | |

| Asset Management | | | 8.8 | % |

| Institutional Financial Services | | | 4.9 | % |

| Insurance | | | 2.8 | % |

| Specialty Finance | | | 5.3 | % |

| Industrials — 29.7% | | | | |

| Commercial Support Services | | | 3.2 | % |

| Electrical Equipment | | | 4.0 | % |

| Engineering & Construction | | | 5.4 | % |

| Industrial Support Services | | | 9.5 | % |

| Machinery | | | 5.5 | % |

| Transportation & Logistics | | | 2.1 | % |

| Materials — 2.2% | | | | |

| Chemicals | | | 2.2 | % |

| Technology — 18.0% | | | | |

| Software | | | 2.8 | % |

| Technology Hardware | | | 12.4 | % |

| Technology Services | | | 2.8 | % |

| | | | 98.3 | % |

See accompanying notes to financial statements.

| LYRICAL FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| May 31, 2024 (Unaudited) |

| | | Lyrical

U.S. Value

Equity Fund | | | Lyrical

International Value Equity Fund | |

| Investments in securities: | | | | | | | | |

| Investments in securities: | | | | | | | | |

| At cost | | $ | 497,823,872 | | | $ | 12,016,870 | |

| At value (Note 2) | | $ | 719,092,173 | | | $ | 13,139,623 | |

| Receivable for capital shares sold | | | 394,112 | | | | — | |

| Receivable from Adviser (Note 4) | | | — | | | | 17,106 | |

| Dividends receivable | | | 417,584 | | | | 89,831 | |

| Tax reclaims receivable | | | — | | | | 11,752 | |

| Other assets | | | 46,668 | | | | 15,041 | |

| Total assets | | | 719,950,537 | | | | 13,273,353 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for capital shares redeemed | | | 234,768 | | | | — | |

| Payable to Adviser (Note 4) | | | 525,008 | | | | — | |

| Payable to administrator (Note 4) | | | 74,455 | | | | 12,990 | |

| Accrued distribution fees (Note 4) | | | 23,171 | | | | 138 | |

| Other accrued expenses | | | 14,786 | | | | 7,389 | |

| Total liabilities | | | 872,188 | | | | 20,517 | |

| CONTINGENCIES AND COMMITMENTS (NOTE 7) | | | — | | | | — | |

| NET ASSETS | | $ | 719,078,349 | | | $ | 13,252,836 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | $ | 508,187,368 | | | $ | 11,922,480 | |

| Accumulated earnings | | | 210,890,981 | | | | 1,330,356 | |

| NET ASSETS | | $ | 719,078,349 | | | $ | 13,252,836 | |

| | | | | | | | | |

| NET ASSET VALUE PER SHARE: | | | | | | | | |

| INSTITUTIONAL CLASS | | | | | | | | |

| Net assets applicable to Institutional Class | | $ | 702,390,784 | | | $ | 12,792,078 | |

| Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 28,472,965 | | | | 1,015,261 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 24.67 | | | $ | 12.60 | |

| INVESTOR CLASS | | | | | | | | |

| Net assets applicable to Investor Class | | $ | 8,823,119 | | | $ | 447,471 | |

| Investor Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 360,469 | | | | 35,590 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 24.48 | | | $ | 12.57 | |

See accompanying notes to financial statements.

| LYRICAL FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| May 31, 2024 (Unaudited) (Continued) |

|

| Lyrical

U.S. Value

Equity Fund |

|

| Lyrical

International Value

Equity Fund |

|

| NET ASSET VALUE PER SHARE: | | | | | | | | |

| A Class | | | | | | | | |

| Net assets applicable to A Class | | $ | 5,762,232 | | | $ | 6,691 | |

| A Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 234,515 | | | | 532 | |

| Net asset value and redemption price per share (Note 2) | | $ | 24.57 | | | | 12.59 | (a) |

| Maximum sales charge | | | 5.75 | % | | | 5.75 | % |

| Maximum offering price per share (Note 2) | | $ | 26.07 | | | $ | 13.36 | |

| C Class | | | | | | | | |

| Net assets applicable to C Class | | $ | 2,102,214 | | | $ | 6,596 | |

| C Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 86,437 | | | | 526 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 24.32 | | | $ | 12.54 | |

| Redemption price per share with CDSC fee (Note 2) (b) | | $ | 24.08 | | | $ | 12.41 | |

| (a) | Net Assets divided by Shares do not calculate to the stated Net Asset Value because Net Assets and Shares are shown rounded. |

| (b) | A contingent deferred sales charge (“CDSC”) of 1.00% is charged on C Class shares redeemed within one year of purchase. Redemption price per share is equal to net asset value less any redemption fee or CDSC. |

See accompanying notes to financial statements.

| LYRICAL FUNDS |

| STATEMENTS OF OPERATIONS |

| Six Months Ended May 31, 2024 (Unaudited) |

| | | Lyrical

U.S. Value

Equity Fund | | | Lyrical

International Value Equity Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Dividend income | | $ | 4,115,610 | | | $ | 264,257 | |

| Foreign witholding taxes on dividends | | | (50,330 | ) | | | (26,096 | ) |

| Total investment income | | | 4,065,280 | | | | 238,161 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Management fees (Note 4) | | | 2,832,926 | | | | 53,271 | |

| Administration fees (Note 4) | | | 262,316 | | | | 17,700 | |

| Transfer agent fees (Note 2 and 4) | | | 67,841 | | | | 25,920 | |

| Fund accounting fees (Note 4) | | | 55,712 | | | | 29,787 | |

| Compliance fees and expenses (Note 4) | | | 33,822 | | | | 6,139 | |

| Registration and filing fees (Note 2) | | | 28,933 | | | | 6,643 | |

| Custody and bank service fees | | | 25,718 | | | | 7,983 | |

| Legal fees | | | 13,209 | | | | 13,209 | |

| Distribution fees (Note 2 and 4) | | | 25,593 | | | | 514 | |

| Trustees’ fees and expenses (Note 4) | | | 10,017 | | | | 10,017 | |

| Audit and tax services fees | | | 8,450 | | | | 8,750 | |

| Postage and supplies | | | 14,456 | | | | 1,160 | |

| Networking fees | | | 13,418 | | | | 253 | |

| Printing of shareholder reports | | | 5,471 | | | | 3,585 | |

| Insurance expense | | | 3,135 | | | | 1,378 | |

| Borrowing costs (Note 5) | | | 923 | | | | — | |

| Other expenses | | | 12,335 | | | | 15,083 | |

| Total expenses | | | 3,414,275 | | | | 201,392 | |

| Less fees reduced and/or expenses reimbursed by Adviser (Note 4) | | | (88,367 | ) | | | (138,834 | ) |

| Net expenses | | | 3,325,908 | | | | 62,558 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 739,372 | | | | 175,603 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES | | | | | | | | |

| Net realized gains from investment transactions | | | 27,704,354 | | | | 183,009 | |

| Net realized gains (losses) from foreign currency transactions (Note 2) | | | 4,300 | | | | (8,138 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 71,896,350 | | | | 1,371,437 | |

| Net change in unrealized appreciation (depreciation) on foreign currency translation | | | — | | | | (204 | ) |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND FOREIGN CURRENCIES | | | 99,605,004 | | | | 1,546,104 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 100,344,376 | | | $ | 1,721,707 | |

See accompanying notes to financial statements.

| LYRICAL U.S. VALUE EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended

May 31,

2024

(Unaudited) | | | Year Ended

November 30,

2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 739,372 | | | $ | 2,955,292 | |

| Net realized gains (losses) from investment transactions | | | 27,704,354 | | | | (5,293,254 | ) |

| Net realized gains (losses) from foreign currency transactions | | | 4,300 | | | | (1,572 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 71,896,350 | | | | 57,786,075 | |

| Net increase in net assets resulting from operations | | | 100,344,376 | | | | 55,446,541 | |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

| Institutional Class | | | (2,649,010 | ) | | | (2,731,975 | ) |

| Investor Class | | | (20,258 | ) | | | (10,806 | ) |

| A Class | | | (10,591 | ) | | | (59 | ) |

| C Class | | | (1,746 | ) | | | (76 | ) |

| Decrease in net assets from distributions to shareholders | | | (2,681,605 | ) | | | (2,742,916 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 113,668,001 | | | | 133,926,339 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,728,175 | | | | 1,435,955 | |

| Payments for shares redeemed | | | (64,074,972 | ) | | | (286,969,441 | ) |

| Net increase (decrease) in Institutional Class net assets from capital share transactions | | | 51,321,204 | | | | (151,607,147 | ) |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 1,131,129 | | | | 2,419,124 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 16,260 | | | | 8,706 | |

| Payments for shares redeemed | | | (1,826,694 | ) | | | (2,767,257 | ) |