UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Karen Jacoppo-Wood

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | November 30 | |

| | | |

| Date of reporting period: | May 31, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Explanatory Note: The Registrant is filing this amendment to its Form N-CSR for the fiscal period ended May 31, 2023, originally filed with the Securities and Exchange Commission on July 31, 2023 (Accession Number 0001580642-23-003871). The sole purpose of this amendment is to an exhibit from the Funds' former independent registered public accounting firm as required pursuant to Item 304(a) of Regulation S-K, as amended, as an exhibit to the Form N-CSR filing. Except as set forth above, this amendment does not amend, update or change any other items or disclosures found in the original Form N-CSR filing.

| Item 1. | Reports to Stockholders. |

(a).

LYRICAL U.S. VALUE EQUITY FUND

Institutional Class (LYRIX)

Investor Class (LYRBX)

A Class (LYRAX)

C Class (LYRCX)

LYRICAL INTERNATIONAL VALUE EQUITY FUND

Institutional Class (LYRWX)

Investor Class (LYRNX)

A Class (LYRVX)

C Class (LYRZX)

Semi-Annual Report

May 31, 2023

(Unaudited)

| LYRICAL FUNDS | May 31, 2023 |

| LETTER TO SHAREHOLDERS | (Unaudited) |

Dear Fellow Shareholders,

Enclosed is the Semi-Annual Report to shareholders of the Lyrical U.S. Value Equity Fund (the “U.S. Fund”) and Lyrical International Value Equity Fund (the “International Fund”) (collectively, the “Funds”). On behalf of the Funds and their investment adviser, Lyrical Asset Management LP, I would like to thank you for your investment.

Lyrical U.S. Value Equity

In the last six months, our value approach is down 5.0%, driven by concerns around the recent banking crisis, which negatively impacted cheaper priced stocks. Fundamentally, our portfolio companies are doing well. Nearly every stock is tracking in line with our expectations, at odds with the unusual volatility of stock prices. It seems clear to us that fundamentals are not driving the market. Rather, it seems the banking crisis has sent bond yields tumbling, driving a reinflation of growth stock valuations, especially the mega-caps. It also drove a decline in most other stocks, but especially value stocks.

Our price-to-earnings (P/E) spread versus the S&P 500® Index (S&P 500) is over 100% and our P/E of 9.4, reflecting the extreme negativity discounted in our stock valuations. What is uncommon about Lyrical’s portfolios is not just how cheap our portfolios are but also their attractive growth. Throughout our history our portfolios have had a discounted P/E to the S&P 500 with comparable growth. Currently, our growth profile is much better than that, with not just comparable growth, but superior growth. In fact, this continues to be the best growth profile in our firm’s history.

Since its launch on February 4, 2013 through May 31, 2023, the U.S. Fund’s Institutional Class has produced a cumulative total return of +153.09%, compared to the +240.95% cumulative total return for the S&P 500. For the six months ended May 31, 2023, the U.S. Fund’s Institutional Class has produced a total return of -4.98%, compared to the +3.33% total return for the S&P 500.

For the six months ended May 31, 2023, the three positions that most positively impacted performance were Broadcom Inc. (AVGO), Uber Technologies, Inc. (UBER), and Flex Ltd. (FLEX) with contributions of 245 basis points (bps) (up 49%), 117 bps (up 30%) and 58 bps (up 16%), respectively; conversely, the three positions that most negatively impacted performance were Centene Corporation (CNC), Cigna Group (CI), and Gen Digital Inc. (GEN) which detracted 131 bps (down 29%), 125 bps (down 24%) and 80 bps (down 23%), respectively. Please see the following for commentary on these stocks for the period:

Broadcom Inc. (AVGO) up 49%: Broadcom continues to deliver strong earnings growth despite macroeconomic weakness seen across the IT supply chain, driven by its portfolio diversification combined with its exposure to large customers and strategic IT infrastructure spending. In addition, Broadcom established itself as the 2nd largest AI semiconductor supplier behind NVIDIA, and, in our opinion, only a few companies are ready to power this wave of AI. Also, Apple announced a multibillion-

dollar component supply agreement with Broadcom. The partnership provides significant predictability for Broadcom and provides Apple with supply assurance from their most strategic semiconductor partner. The multi-year supply agreement is, in our opinion, reflective of Broadcom’s technology leadership and its track record of stellar execution supporting a large customer like Apple.

Uber Technologies, Inc. (UBER) up 30%: Uber is demonstrating the benefits of scale and management’s focus on cost efficiency is driving significant operating leverage. The street is starting to notice, and estimates continue to be revised higher. Investments required to build a dominant rides and delivery platform are a drag on profitability in the near term, but at target margins, the stock is trading for 11x 2023 P/E.

Flex Ltd. (FLEX) up 16%: Flex continues to deliver strong earnings growth given its exposure to secularly growing markets, share gains, and solid execution on margin improvement plans. Additionally, in February, Flex completed the IPO of its solar business, Nextracker, at $24 per share. Flex retains a 61% stake in Nextracker and now investors can easily value Flex’s legacy electronic manufacturing services business separately. Excluding Nextracker, Flex is trading at 7.5x P/E.

Centene Corporation. (CNC) down 29%: Centene is down on concerns over member enrollment. Emergency measures enacted in response to the COVID-19 pandemic to expand government sponsored healthcare will be removed in 2023. As the leading provider of Managed Medicaid in the U.S., Centene benefitted from an increase in members that were previously ineligible for Medicaid. Beginning in 2Q23, states began redetermining the threshold for Medicaid eligibility. This means that some of the members picked up during the pandemic would no longer be eligible. This is a minor headwind to earnings per share (EPS) growth, and Centene is still expected to grow EPS 12% in 2023 and 4% in 2024.

Cigna Group (CI) down 24%: Cigna is down due to increasing scrutiny towards Pharmacy Benefit Managers’ (PBM) business practices by lawmakers as prescription drug affordability continues to be an issue within the U.S. healthcare system. We believe Cigna’s PBM business is not as exposed to proposed legislation as it once was given changes to pricing methodologies implemented in recent years. While we agree that prescription drug affordability is a critical issue, we think the role of PBMs is broadly misunderstood and that they do play a meaningful role in lowering healthcare costs, increasing the prevalence of generics, and improving health outcomes. The PBM concerns led to significant multiple compression year-to-date as next 12-month EPS estimates have increased 6% throughout the year, while the P/E dropped to under 10x, from 13x as of year-end 2022. It is also worth mentioning that Cigna outperformed the S&P 500 by 66% in 2022, which is likely a factor contributing to Cigna’s performance in 2023.

Gen Digital Inc. (GEN) down 23%: The balance sheet is an overhang from the transformational Avast deal, completed last year. We believe the debt levels are manageable and, on the positive side, the benefits of the merger are showing up in results. Gen Digital is a leading global consumer cyber safety provider, with a subscription software business that is highly attractive. The company has 50%+

operating margins and little capital employed, resulting in extraordinary returns on invested capital and abundant free cash flow. The merger with Avast significantly increased the company’s addressable market. Gen Digital trades at less than 9x NTM EPS. By 2027, we believe the company should generate about $2.50 of EPS, adjusting for higher interest rates on variable rate loans and on debt as it matures.

In analyzing the U.S. Fund portfolio’s performance attribution, we find it helpful to examine both the investment success rate and any skew in the distribution of returns. Over the life of the U.S. Fund, 73% of the U.S. Fund’s investments posted gains, and 52% outperformed the S&P 500. Skew has been a positive factor, as the U.S. Fund’s outperformers have outperformed by 198%, while our underperformers have underperformed by 90% over the life of the U.S. Fund. For the six-month period ended May 31, 2023, 26% of the U.S. Fund’s investments posted gains, and 23% outperformed the S&P 500. For the six-month period, skew has been a negative factor as the U.S. Fund’s outperformers have outperformed by 16%, while its underperformers have underperformed by 18%.

During the life of the U.S. Fund, we have sold fifty-two positions, as ten companies announced they were being acquired, twenty-six approached our estimates of fair value, for five we lost conviction in our investment thesis, for one the company announced or completed acquisitions which increased the complexity and decreased analyzability and for ten the risk/reward became less compelling than other investment opportunities. For each sale we added a new position from our pipeline of investment opportunities.

As of May 31, 2023, the valuation of our portfolio is 9.4 times the next twelve months consensus earnings. The S&P 500 has a valuation of 18.3 times earnings on this same basis, a premium of 94.7% over the U.S. Fund.

Lyrical International Value Equity

In March 2020, we launched the Lyrical International Value Equity Fund to apply our value strategy to the international space. Our portfolio is constructed to be balanced and diversified across approximately 25-40 positions, giving us exposure to as many different types of companies and situations as possible without sacrificing our strict investment standards.

Since its launch on March 2, 2020 through May 31, 2023, the Lyrical International Value Equity Fund – Institutional Class has produced a total return of +20.45%, compared to the +21.71% total return for the MSCI EAFE. For the six months ended May 31, 2023, the International Fund’s Institutional Class produced a total return of +1.33% compared to the total return for the MSCI EAFE of +6.89%.

For the six months ended May 2023, the three positions that most positively impacted performance were Fairfax Financial Holdings Limited (FFH-CA), Bollore SE (BOL-FR), and Sony Group Corporation (6758-JP) with contributions of 125 basis points (bps) (up 28%), 89 bps (up 16%) and 61 bps (up 17%), respectively; conversely, the three positions that most negatively impacted performance were Liberty Global Plc Class C (LBTYK-US), CNH Industrial NV (CNHI-US), and Teleperformance SA (TEP-FR) which detracted 67 bps (down 18%), 57 bps (down 14%) and 45 bps (down 11%), respectively. Our commentary on these stocks for the period follows:

Fairfax Financial Holdings Limited (FFH-CA) up 28%: Fairfax is a Canadian insurance business overseen by value investor (and major shareholder) Prem Watsa. This diversified insurance business is managed as a series of decentralized business units, each incentivized to maximize underwriting profit rather than grow premiums. This focus on profit over revenues has produced a leading underwriting track record, with an average 95% combined ratio for more than three decades. With interest rates at record lows in the past ten years, Fairfax reduced exposure to long-dated bonds. Fairfax therefore benefits in a rising rate environment, such as we have seen during the past six months, since the company can increase yields on its bond investments. Furthermore, the company is rapidly expanding premium growth, as the company is finding highly profitable underwriting opportunities, given increased pricing through the industry.

Bollore SE (BOL-FR) up 16%: Bollore is a collection of high-quality assets, most notably Universal Music Group (which was spun out of Vivendi) and logistics. The company is managed by an owner-operator, Vincent Bollore, who has a long-term track record of shareholder returns. Bollore is up during the period as it announced an acquisition offer for its logistics business and instituted a share repurchase plan.

Sony Group Corporation (6758-JP) up 17%: Sony is a global leader in entertainment, with a top three position in: video games, music, and film production. This is an IP-driven content company which controls one of the widest entertainment libraries in the world, including the second largest collection of music rights and time-tested assets like Spider-Man and Jeopardy. Over the past six months, EPS estimates have increased modestly, with most of the price improvement coming from multiple expansion.

Liberty Global Plc Class C (LBTYK-US) down 18%: Liberty Global is a US-based holding company of leading European telecommunications operators. The holding company is debt-free and holds more than 75% of its market capitalization in cash and securities. Liberty’s operating subsidiaries include: Virgin Media in the UK, Telenet in Belgium, and UPC in Switzerland. Each subsidiary is a leader in European fixed line and mobile telecommunications, with the #1 or #2 market position. The stock is down during the period, despite stable fundamentals, as there are concerns about competitive pressures in European cable markets. We believe the stock is priced for those concerns and see significant upside to intrinsic value.

CNH Industrial NV (CNHI-US) down 14%: CNH Industrial operates in the agriculture and construction industries with over 90% of profits coming from its agriculture segment, where it is the #2 global player. CNH designs, manufactures, and distributes a full line of farm machinery, including tractors, combines, and harvesters. CNH is a high-quality business, with a healthy balance sheet that generates a 20% return on capital. CNH benefits from attractive secular trends in farming, producing equipment that is increasingly equipped with advanced precision-agriculture technologies. For example, a smart combine automates adjustments, previously made by a skilled operator, by using cameras and sensors to detect changes in crop conditions. These technologies have directly resulted in 1-2% annualized crop yield improvements over

the past 20 years. The stock is down over the period, despite earnings estimates up 11% as there are concerns about the impact from a weak macroeconomic environment.

Teleperformance SA (TEP-FR) down 11%: Teleperformance is the world’s largest Business Process Outsourcing (BPO) provider. The company outsources all functions of customer experience for its clients, including customer service and analytics, and helps manage business processes, back-office, and IT. Concerns around the proliferation of artificial intelligence have recently weighed on the stock, which is down more than 30% year-to-date. We believe AI fears are overblown, given that the company has consistently implemented new technology to reduce human volumes, which reduces costs for clients while improving margins. The company estimates that about 5% of volumes each year have historically been lost due to implanting new tech like chatbots, machine learning, and, more recently, artificial intelligence. Despite this volume cannibalization, Teleperformance has continued to grow more than 10% per year organically as it handles increasingly complex work, takes share from the weaker competitors that make up ~90% of the industry, and benefits from the ~70% of industry volumes that remain insourced.

In analyzing the International Fund portfolio’s performance attribution, we find it helpful to examine both the investment success rate and any skew in the distribution of returns. Over the life of the International Fund, 56% of the International Fund’s investments posted gains, and 46% outperformed the MSCI EAFE. Skew has been a positive factor, as the International Fund’s outperformers have outperformed by 50%, while our underperformers have underperformed by 31% over the life of the International Fund. For the six-month period ended May 31, 2023, 58% of the International Fund’s investments posted gains, and 50% outperformed the MSCI EAFE. For the six-month period, skew has been a negative factor as the International Fund’s outperformers have outperformed by 11%, while our underperformers have underperformed by 15%.

During the life of the International Fund, we have sold 21 positions, as two companies announced they were being acquired, seven approached our estimates of fair value, for eight we lost conviction in our thesis, and for four the risk/reward became less compelling than other investment opportunities. For each sale we added a new position from our pipeline of investment opportunities.

As of May 31, 2023, the valuation of our portfolio is 9.3x the next twelve months consensus earnings. The MSCI EAFE has a valuation of 12.7x earnings on this same basis, a premium of 37% over the International Fund.

Thank you for your continued trust and interest in Lyrical Asset Management.

Sincerely,

Andrew Wellington

Portfolio Manager

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-884-8099.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus please visit the Funds’ website at www.lyricalvaluefunds.com or call 1-888-884-8099 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time, and may no longer be held by the Funds. For a complete list of securities held by the Funds as of May 31, 2023, please see the Schedules of Investments section of this Report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward- looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

| LYRICAL U.S. VALUE EQUITY FUND |

| PORTFOLIO INFORMATION |

| May 31, 2023 (Unaudited) |

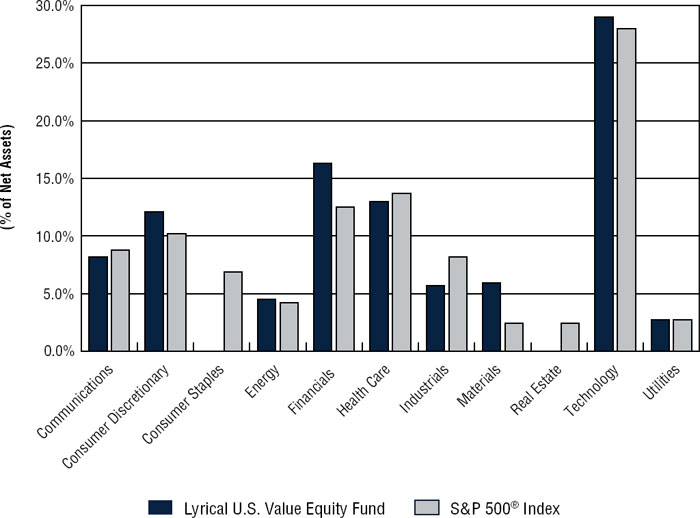

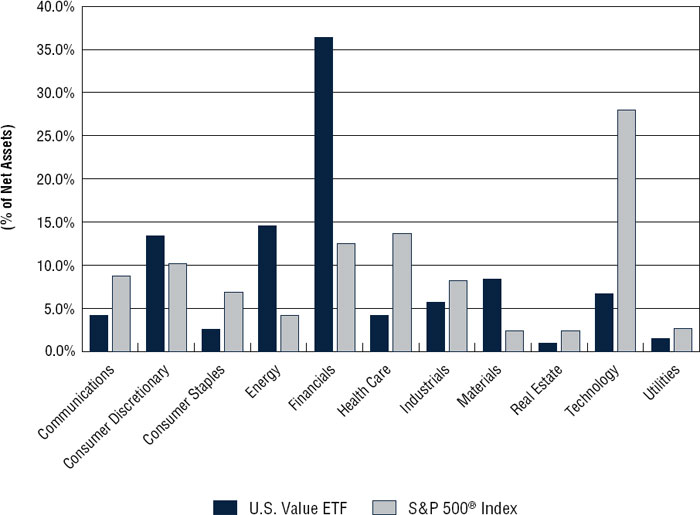

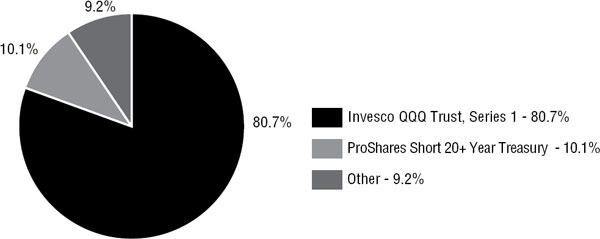

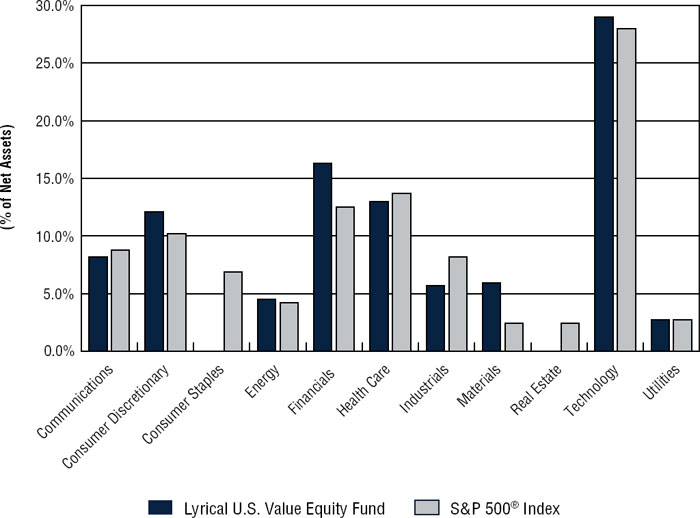

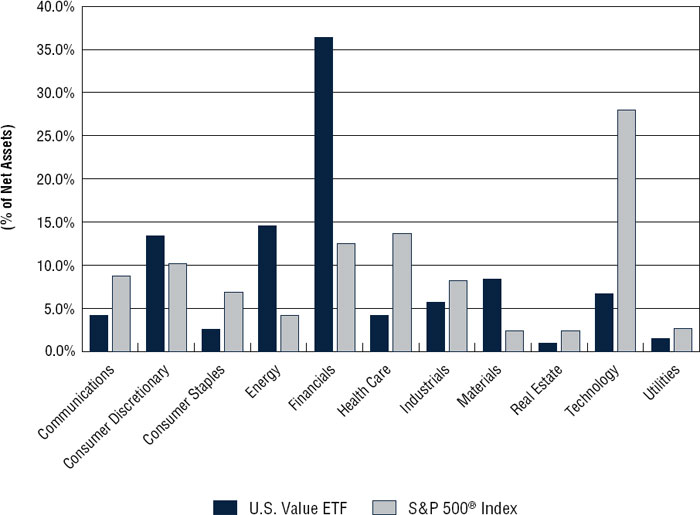

Lyrical U.S. Value Equity Fund vs. S&P 500® Index

Sector Diversification

Top Ten Equity Holdings

| | | % of |

| Security Description | | Net Assets |

| United Rentals, Inc. | | 5.7% |

| Uber Technologies, Inc. | | 5.6% |

| Broadcom, Inc. | | 5.6% |

| HCA Healthcare, Inc. | | 5.3% |

| Ameriprise Financial, Inc. | | 4.7% |

| Suncor Energy, Inc. | | 4.5% |

| Flex Ltd. | | 4.2% |

| Cigna Group (The) | | 4.1% |

| Global Payments, Inc. | | 4.0% |

| eBay, Inc. | | 3.8% |

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| PORTFOLIO INFORMATION |

| May 31, 2023 (Unaudited) |

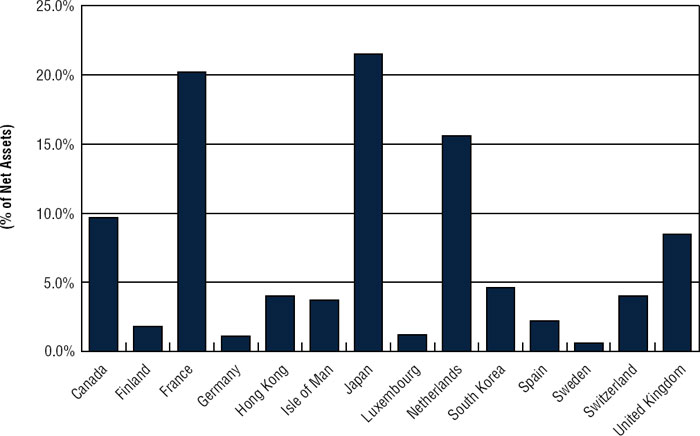

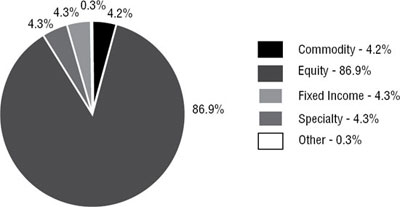

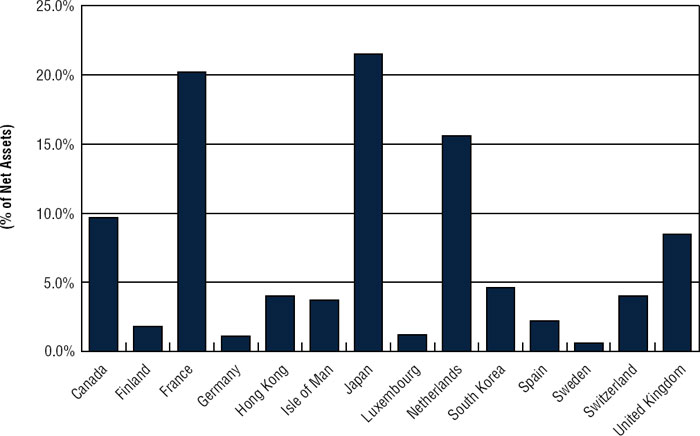

Lyrical International Value Equity Fund

Country Diversification

Top Ten Equity Holdings

| | | % of |

| Security Description | | Net Assets |

| Bollore SE | | 4.7% |

| ITOCHU Corporation | | 4.6% |

| Samsung Electronics Company Ltd. | | 4.6% |

| Exor N.V. | | 4.5% |

| Fairfax Financial Holdings Ltd. | | 4.5% |

| Nintendo Company Ltd. - ADR | | 4.3% |

| Sony Group Corporation | | 4.3% |

| Julius Baer Group Ltd. | | 4.0% |

| Ashtead Group plc | | 4.0% |

| AerCap Holdings N.V. | | 4.0% |

| LYRICAL U.S. VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| May 31, 2023 (Unaudited) |

| COMMON STOCKS — 97.4% | | Shares | | | Value | |

| Communications — 8.2% | | | | | | | | |

| Cable & Satellite — 2.6% | | | | | | | | |

| Liberty Global plc - Series C (a) | | | 787,442 | | | $ | 13,402,263 | |

| | | | | | | | | |

| Internet Media & Services — 5.6% | | | | | | | | |

| Uber Technologies, Inc. (a) | | | 745,538 | | | | 28,278,256 | |

| | | | | | | | | |

| Consumer Discretionary — 12.1% | | | | | | | | |

| Apparel & Textile Products — 0.5% | | | | | | | | |

| Hanesbrands, Inc. | | | 594,677 | | | | 2,444,123 | |

| | | | | | | | | |

| Automotive — 3.2% | | | | | | | | |

| Adient plc (a) | | | 138,714 | | | | 4,673,275 | |

| Lear Corporation | | | 96,247 | | | | 11,805,657 | |

| | | | | | | | 16,478,932 | |

| E-Commerce Discretionary — 3.8% | | | | | | | | |

| eBay, Inc. | | | 452,228 | | | | 19,237,779 | |

| | | | | | | | | |

| Home & Office Products — 2.6% | | | | | | | | |

| Whirlpool Corporation | | | 102,477 | | | | 13,249,251 | |

| | | | | | | | | |

| Retail - Discretionary — 2.0% | | | | | | | | |

| Lithia Motors, Inc. | | | 42,361 | | | | 9,881,974 | |

| | | | | | | | | |

| Energy — 4.5% | | | | | | | | |

| Oil & Gas Producers — 4.5% | | | | | | | | |

| Suncor Energy, Inc. | | | 807,375 | | | | 22,606,500 | |

| | | | | | | | | |

| Financials — 16.3% | | | | | | | | |

| Asset Management — 6.8% | | | | | | | | |

| Affiliated Managers Group, Inc. | | | 77,181 | | | | 10,735,105 | |

| Ameriprise Financial, Inc. | | | 79,849 | | | | 23,832,531 | |

| | | | | | | | 34,567,636 | |

| Insurance — 4.4% | | | | | | | | |

| Assurant, Inc. | | | 97,156 | | | | 11,657,749 | |

| Primerica, Inc. | | | 58,848 | | | | 10,711,513 | |

| | | | | | | | 22,369,262 | |

| Specialty Finance — 5.1% | | | | | | | | |

| AerCap Holdings N.V. (a) | | | 279,003 | | | | 15,925,491 | |

| Air Lease Corporation | | | 196,573 | | | | 7,473,705 | |

| Bread Financial Holdings, Inc. | | | 85,942 | | | | 2,421,846 | |

| | | | | | | | 25,821,042 | |

| LYRICAL U.S. VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 97.4% (Continued) | | Shares | | | Value | |

| Health Care — 13.0% | | | | | | | | |

| Health Care Facilities & Services — 13.0% | | | | | | | | |

| Centene Corporation (a) | | | 294,445 | | | $ | 18,376,312 | |

| Cigna Group (The) | | | 84,838 | | | | 20,989,770 | |

| HCA Healthcare, Inc. | | | 101,198 | | | | 26,735,500 | |

| | | | | | | | 66,101,582 | |

| Industrials — 5.7% | | | | | | | | |

| Industrial Support Services — 5.7% | | | | | | | | |

| United Rentals, Inc. | | | 87,452 | | | | 29,190,603 | |

| | | | | | | | | |

| Materials — 5.9% | | | | | | | | |

| Chemicals — 3.3% | | | | | | | | |

| Celanese Corporation | | | 161,435 | | | | 16,792,468 | |

| | | | | | | | | |

| Containers & Packaging — 2.6% | | | | | | | | |

| Berry Global Group, Inc. | | | 228,799 | | | | 13,089,591 | |

| | | | | | | | | |

| Technology — 29.0% | | | | | | | | |

| Semiconductors — 5.6% | | | | | | | | |

| Broadcom, Inc. | | | 34,933 | | | | 28,224,467 | |

| | | | | | | | | |

| Software — 4.3% | | | | | | | | |

| Concentrix Corporation | | | 79,917 | | | | 7,008,721 | |

| Gen Digital, Inc. | | | 858,301 | | | | 15,054,599 | |

| | | | | | | | 22,063,320 | |

| Technology Hardware — 15.1% | | | | | | | | |

| Arrow Electronics, Inc. (a) | | | 127,652 | | | | 16,165,849 | |

| CommScope Holding Company, Inc. (a) | | | 326,386 | | | | 1,357,766 | |

| F5, Inc. (a) | | | 97,123 | | | | 14,333,412 | |

| Flex Ltd. (a) | | | 834,071 | | | | 21,177,063 | |

| TD SYNNEX Corporation | | | 96,619 | | | | 8,635,806 | |

| Western Digital Corporation (a) | | | 386,065 | | | | 14,952,298 | |

| | | | | | | | 76,622,194 | |

| Technology Services — 4.0% | | | | | | | | |

| Global Payments, Inc. | | | 209,411 | | | | 20,457,360 | |

| | | | | | | | | |

| Utilities — 2.7% | | | | | | | | |

| Electric Utilities — 2.7% | | | | | | | | |

| NRG Energy, Inc. | | | 398,368 | | | | 13,460,855 | |

| | | | | | | | | |

| Total Common Stocks (Cost $420,967,766) | | | | | | $ | 494,339,458 | |

| LYRICAL U.S. VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 0.5% | | Shares | | | Value | |

| Invesco Treasury Portfolio - Institutional Class, 5.04% (b) (Cost $2,843,122) | | | 2,843,122 | | | $ | 2,843,122 | |

| | | | | | | | | |

| Investments at Value — 97.9% (Cost $423,810,888) | | | | | | $ | 497,182,580 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 2.1% | | | | | | | 10,550,281 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 507,732,861 | |

N.V. - Naamloze Vennootschap

plc - Public Limited Company

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of May 31, 2023. |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| May 31, 2023 (Unaudited) |

| COMMON STOCKS — 98.7% | | Shares | | | Value | |

| Canada — 9.7% | | | | | | | | |

| Fairfax Financial Holdings Ltd. | | | 681 | | | $ | 488,773 | |

| Linamar Corporation | | | 3,891 | | | | 172,253 | |

| Suncor Energy, Inc. | | | 14,003 | | | | 392,084 | |

| | | | | | | | 1,053,110 | |

| Finland — 1.8% | | | | | | | | |

| Konecranes OYJ | | | 5,314 | | | | 198,778 | |

| | | | | | | | | |

| France — 20.2% | | | | | | | | |

| ALD S.A. | | | 34,251 | | | | 369,579 | |

| Bollore SE | | | 79,336 | | | | 508,936 | |

| Elis S.A. | | | 13,942 | | | | 241,876 | |

| Rexel S.A. | | | 18,170 | | | | 372,944 | |

| SPIE S.A. | | | 10,410 | | | | 309,495 | |

| Teleperformance | | | 2,670 | | | | 399,454 | |

| | | | | | | | 2,202,284 | |

| Germany — 1.1% | | | | | | | | |

| Auto1 Group SE (a) | | | 14,411 | | | | 124,125 | |

| | | | | | | | | |

| Hong Kong — 4.0% | | | | | | | | |

| CK Hutchison Holdings Ltd. | | | 71,542 | | | | 431,297 | |

| | | | | | | | | |

| Isle of Man — 3.7% | | | | | | | | |

| Entain plc | | | 24,459 | | | | 403,115 | |

| | | | | | | | | |

| Japan — 21.5% | | | | | | | | |

| Air Water, Inc. | | | 14,698 | | | | 192,531 | |

| ITOCHU Corporation | | | 14,781 | | | | 498,891 | |

| Kinden Corporation | | | 12,995 | | | | 169,631 | |

| Kyudenko Corporation | | | 4,624 | | | | 122,246 | |

| Nintendo Company Ltd. - ADR | | | 44,400 | | | | 469,308 | |

| SK Kaken Company Ltd. | | | 76 | | | | 22,444 | |

| Sony Group Corporation | | | 4,961 | | | | 465,164 | |

| Suzuki Motor Corporation | | | 12,367 | | | | 407,162 | |

| | | | | | | | 2,347,377 | |

| Luxembourg — 1.2% | | | | | | | | |

| Ardagh Metal Packaging S.A. | | | 37,323 | | | | 134,736 | |

| | | | | | | | | |

| Netherlands — 15.6% | | | | | | | | |

| AerCap Holdings N.V. (a) | | | 7,653 | | | | 436,833 | |

| CNH Industrial N.V. | | | 29,400 | | | | 377,202 | |

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 98.7% (Continued) | | Shares | | | Value | |

| Netherlands — 15.6% (Continued) | | | | | | | | |

| Euronext N.V. | | | 5,874 | | | $ | 391,877 | |

| Exor N.V. (a) | | | 5,891 | | | | 489,138 | |

| | | | | | | | 1,695,050 | |

| South Korea — 4.6% | | | | | | | | |

| Samsung Electronics Company Ltd. | | | 367 | | | | 495,083 | |

| | | | | | | | | |

| Spain — 2.2% | | | | | | | | |

| Grupo Catalana Occidente S.A. | | | 7,692 | | | | 238,469 | |

| | | | | | | | | |

| Sweden — 0.6% | | | | | | | | |

| Intrum AB | | | 9,173 | | | | 65,795 | |

| | | | | | | | | |

| Switzerland — 4.0% | | | | | | | | |

| Julius Baer Group Ltd. | | | 7,132 | | | | 437,935 | |

| | | | | | | | | |

| United Kingdom — 8.5% | | | | | | | | |

| Ashtead Group plc | | | 7,167 | | | | 437,623 | |

| Babcock International Group plc (a) | | | 33,551 | | | | 128,470 | |

| Liberty Global plc - Series C (a) | | | 21,309 | | | | 362,679 | |

| | | | | | | | 928,772 | |

| | | | | | | | | |

| Total Common Stocks (Cost $10,978,801) | | | | | | $ | 10,755,926 | |

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 0.4% | | Shares | | | Value | |

| Invesco Treasury Portfolio - Institutional Class, 5.04% (b) (Cost $46,444) | | | 46,444 | | | $ | 46,444 | |

| | | | | | | | | |

| Investments at Value — 99.1% (Cost $11,025,245) | | | | | | $ | 10,802,370 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.9% | | | | | | | 97,152 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 10,899,522 | |

AB - Aktiebolag

ADR - American Depositary Receipt

N.V. - Naamloze Vennootschap

OYJ - Julkinen Osakeyhtio

plc - Public Limited Company

S.A. - Societe Anonyme

SE - Societe Europaea

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of May 31, 2023. |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| | | % of | |

| Common Stocks by Sector/Industry | | Net Assets | |

| Communications — 9.1% | | | | |

| Cable & Satellite | | | 3.3 | % |

| Entertainment Content | | | 4.7 | % |

| Internet Media & Services | | | 1.1 | % |

| Consumer Discretionary — 12.4% | | | | |

| Automotive | | | 5.3 | % |

| Leisure Facilities & Services | | | 3.7 | % |

| Retail — Discretionary | | | 3.4 | % |

| Consumer Staples — 8.5% | | | | |

| Retail — Consumer Staples | | | 3.9 | % |

| Wholesale — Consumer Staples | | | 4.6 | % |

| Energy — 3.6% | | | | |

| Oil & Gas Producers | | | 3.6 | % |

| Financials — 23.4% | | | | |

| Asset Management | | | 8.5 | % |

| Institutional Financial Services | | | 3.6 | % |

| Insurance | | | 6.7 | % |

| Specialty Finance | | | 4.6 | % |

| Industrials — 21.7% | | | | |

| Commercial Support Services | | | 2.2 | % |

| Engineering & Construction | | | 5.5 | % |

| Industrial Support Services | | | 7.5 | % |

| Machinery | | | 5.3 | % |

| Transportation & Logistics | | | 1.2 | % |

| Materials — 3.2% | | | | |

| Chemicals | | | 2.0 | % |

| Containers & Packaging | | | 1.2 | % |

| Technology — 16.8% | | | | |

| Technology Hardware | | | 13.1 | % |

| Technology Services | | | 3.7 | % |

| | | | 98.7 | % |

See accompanying notes to financial statements.

| LYRICAL FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| May 31, 2023 (Unaudited) |

| | | Lyrical | | | Lyrical | |

| | | U.S. Value | | | International | |

| | | Equity Fund | | | Value Equity Fund | |

| ASSETS | | | | | | | | |

| Investments in securities: | | | | | | | | |

| At cost | | $ | 423,810,888 | | | $ | 11,025,245 | |

| At value (Note 2) | | $ | 497,182,580 | | | $ | 10,802,370 | |

| Receivable for capital shares sold | | | 711,325 | | | | — | |

| Receivable for investment securities sold | | | 10,886,024 | | | | — | |

| Receivable from Adviser (Note 4) | | | — | | | | 14,041 | |

| Dividends receivable | | | 590,044 | | | | 88,852 | |

| Tax reclaims receivable | | | — | | | | 1,218 | |

| Other assets | | | 40,976 | | | | 14,364 | |

| Total assets | | | 509,410,949 | | | | 10,920,845 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for capital shares redeemed | | | 1,250,256 | | | | — | |

| Payable to Adviser (Note 4) | | | 344,787 | | | | — | |

| Payable to administrator (Note 4) | | | 60,697 | | | | 12,101 | |

| Accrued distribution fees (Note 4) | | | 7,700 | | | | 62 | |

| Other accrued expenses | | | 14,648 | | | | 9,160 | |

| Total liabilities | | | 1,678,088 | | | | 21,323 | |

| | | | | | | | | |

| NET ASSETS | | $ | 507,732,861 | | | $ | 10,899,522 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | $ | 476,525,124 | | | $ | 11,187,888 | |

| Accumulated earnings (deficit) | | | 31,207,737 | | | | (288,366 | ) |

| NET ASSETS | | $ | 507,732,861 | | | $ | 10,899,522 | |

| | | | | | | | | |

| NET ASSET VALUE PER SHARE: | | | | | | | | |

| INSTITUTIONAL CLASS | | | | | | | | |

| Net assets applicable to Institutional Class | | $ | 500,172,690 | | | $ | 10,573,646 | |

| Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 27,595,032 | | | | 961,347 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 18.13 | | | $ | 11.00 | |

| INVESTOR CLASS | | | | | | | | |

| Net assets applicable to Investor Class | | $ | 7,131,688 | | | $ | 314,379 | |

| Investor Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 396,396 | | | | 28,685 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 17.99 | | | $ | 10.96 | |

See accompanying notes to financial statements.

| LYRICAL FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| May 31, 2023 (Unaudited)(Continued) |

| | | Lyrical | | | Lyrical | |

| | | U.S. Value | | | International | |

| | | Equity Fund | | | Value Equity Fund | |

| NET ASSET VALUE PER SHARE: | | | | | | | | |

| A Class | | | | | | | | |

| Net assets applicable to A Class | | $ | 45,532 | | | $ | 5,768 | |

| A Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 2,516 | | | | 525 | |

| Net asset value and redemption price per share (Note 2) | | $ | 18.10 | | | $ | 10.99 | |

| Maximum sales charge | | | 5.75 | % | | | 5.75 | % |

| Maximum offering price per share (Note 2) | | $ | 19.20 | | | $ | 11.66 | |

| C Class | | | | | | | | |

| Net assets applicable to C Class | | $ | 382,951 | | | $ | 5,729 | |

| C Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 21,285 | | | | 523 | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 17.99 | | | $ | 10.95 | |

| Redemption price per share with CDSC fee (Note 2)(a) | | $ | 17.81 | | | $ | 10.84 | |

| (a) | A contingent deferred sales charge (“CDSC”) of 1.00% is charged on C Class shares redeemed within one year of purchase. Redemption price per share is equal to net asset value less any redemption fee or CDSC. |

See accompanying notes to financial statements.

| LYRICAL FUNDS |

| STATEMENTS OF OPERATIONS |

| Six Months Ended May 31, 2023 (Unaudited) |

| | | Lyrical | | | Lyrical | |

| | | U.S. Value | | | International | |

| | | Equity Fund | | | Value Equity Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Dividend income | | $ | 4,939,335 | | | $ | 208,776 | |

| Foreign witholding taxes on dividends | | | (122,425 | ) | | | (22,950 | ) |

| Total investment income | | | 4,816,910 | | | | 185,826 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Management fees (Note 4) | | | 2,642,934 | | | | 34,994 | |

| Administration fees (Note 4) | | | 248,770 | | | | 15,000 | |

| Transfer agent fees (Notes 2 and 4) | | | 88,549 | | | | 24,000 | |

| Fund accounting fees (Note 4) | | | 52,534 | | | | 27,416 | |

| Registration and filing fees (Notes 2 and 4) | | | 44,284 | | | | 7,851 | |

| Custody and bank service fees | | | 31,355 | | | | 9,689 | |

| Compliance fees and expenses (Note 4) | | | 32,211 | | | | 6,141 | |

| Legal fees | | | 18,741 | | | | 18,741 | |

| Postage and supplies | | | 19,133 | | | | 3,870 | |

| Borrowing costs (Note 5) | | | 22,057 | | | | — | |

| Trustees’ fees and expenses (Note 4) | | | 9,891 | | | | 9,891 | |

| Audit and tax services fees | | | 8,200 | | | | 8,500 | |

| Networking fees | | | 13,996 | | | | 196 | |

| Distribution fees (Notes 2 and 4) | | | 10,425 | | | | 1,141 | |

| Insurance expense | | | 4,255 | | | | 1,581 | |

| Printing of shareholder reports | | | 2,675 | | | | 2,675 | |

| Other expenses | | | 11,290 | | | | 14,601 | |

| Total expenses | | | 3,261,300 | | | | 186,287 | |

| Less fees reduced and/or expenses reimbursed by Adviser (Note 4) | | | (150,576 | ) | | | (144,384 | ) |

| Net expenses | | | 3,110,724 | | | | 41,903 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 1,706,186 | | | | 143,923 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED LOSSES ON INVESTMENTS AND FOREIGN CURRENCIES | | | | | | | | |

| Net realized losses from investment transactions | | | (10,057,575 | ) | | | (96,053 | ) |

| Net realized losses from foreign currency transactions (Note 2) | | | (8,359 | ) | | | (19,182 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (18,214,184 | ) | | | (279,557 | ) |

| Net change in unrealized appreciation (depreciation) on foreign currency translation | | | — | | | | (1,137 | ) |

| NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS AND FOREIGN CURRENCIES | | | (28,280,118 | ) | | | (395,929 | ) |

| | | | | | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (26,573,932 | ) | | $ | (252,006 | ) |

See accompanying notes to financial statements.

| LYRICAL U.S. VALUE EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | Year/Period | |

| | | Ended | | | Ended | |

| | | May 31, 2023 | | | November 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 1,706,186 | | | $ | 2,436,467 | |

| Net realized gains (losses) from investment transactions | | | (10,057,575 | ) | | | 35,705,756 | |

| Net realized losses from foreign currency transactions | | | (8,359 | ) | | | (19,887 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (18,214,184 | ) | | | (89,054,197 | ) |

| Net decrease in net assets resulting from operations | | | (26,573,932 | ) | | | (50,931,861 | ) |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

| Institutional Class | | | (2,731,975 | ) | | | (32,015,143 | ) |

| Investor Class | | | (10,806 | ) | | | (365,422 | ) |

| A Class | | | (59 | ) | | | (649 | ) |

| C Class | | | (76 | ) | | | (1,456 | ) |

| Decrease in net assets from distributions to shareholders | | | (2,742,916 | ) | | | (32,382,670 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 98,273,909 | | | | 228,168,460 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,435,956 | | | | 20,933,647 | |

| Payments for shares redeemed | | | (225,925,518 | ) | | | (207,336,929 | ) |

| Net increase (decrease) in Institutional Class net assets from capital share transactions | | | (126,215,653 | ) | | | 41,765,178 | |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 1,185,965 | | | | 3,176,497 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 8,706 | | | | 294,749 | |

| Payments for shares redeemed | | | (1,413,955 | ) | | | (3,002,926 | ) |

| Net increase (decrease) in Investor Class net assets from capital share transactions | | | (219,284 | ) | | | 468,320 | |

| | | | | | | | | |

| A Class | | | | | | | | |

| Proceeds from shares sold | | | 34,983 | | | | 12,505 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 59 | | | | 649 | |

| Net increase in A Class net assets from capital share transactions | | | 35,042 | | | | 13,154 | |

| | | | | | | | | |

| C Class | | | | | | | | |

| Proceeds from shares sold | | | 369,297 | | | | 29,900 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 76 | | | | 1,168 | |

| Net increase in C Class net assets from capital share transactions | | | 369,373 | | | | 31,068 | |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (155,347,370 | ) | | | (41,036,811 | ) |

| LYRICAL U.S. VALUE EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | Six Months | | | Year/Period | |

| | | Ended | | | Ended | |

| | | May 31, 2023 | | | November 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | $ | 663,080,231 | | | $ | 704,117,042 | |

| End of period | | $ | 507,732,861 | | | $ | 663,080,231 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Institutional Class | | | | | | | | |

| Shares sold | | | 5,385,153 | | | | 11,152,241 | |

| Shares issued in reinvestment of distributions to shareholders | | | 79,467 | | | | 1,087,720 | |

| Shares redeemed | | | (12,065,937 | ) | | | (10,280,853 | ) |

| Net increase (decrease) in shares outstanding | | | (6,601,317 | ) | | | 1,959,108 | |

| Shares outstanding at beginning of period | | | 34,196,349 | | | | 32,237,241 | |

| Shares outstanding at end of period | | | 27,595,032 | | | | 34,196,349 | |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Shares sold | | | 64,177 | | | | 156,531 | |

| Shares issued in reinvestment of distributions to shareholders | | | 485 | | | | 15,521 | |

| Shares redeemed | | | (76,747 | ) | | | (149,533 | ) |

| Net increase (decrease) in shares outstanding | | | (12,085 | ) | | | 22,519 | |

| Shares outstanding at beginning of period | | | 408,481 | | | | 385,962 | |

| Shares outstanding at end of period | | | 396,396 | | | | 408,481 | |

| | | | | | | | | |

| A Class | | | | | | | | |

| Shares sold | | | 1,785 | | | | 694 | |

| Shares issued in reinvestment of distributions to shareholders | | | 3 | | | | 34 | |

| Net increase in shares outstanding | | | 1,788 | | | | 728 | |

| Shares outstanding at beginning of period | | | 728 | | | | — | |

| Shares outstanding at end of period | | | 2,516 | | | | 728 | |

| | | | | | | | | |

| C Class | | | | | | | | |

| Shares sold | | | 19,661 | | | | 1,559 | |

| Shares issued in reinvestment of distributions to shareholders | | | 4 | | | | 61 | |

| Net increase in shares outstanding | | | 19,665 | | | | 1,620 | |

| Shares outstanding at beginning of period | | | 1,620 | | | | — | |

| Shares outstanding at end of period | | | 21,285 | | | | 1,620 | |

| (a) | For A Class shares and C Class shares, represents the period from commencement of operations (July 5, 2022) through November 30, 2022. |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | Year/Period | |

| | | Ended | | | Ended | |

| | | May 31, 2023 | | | November 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 143,923 | | | $ | 19,668 | |

| Net realized losses from investment transactions | | | (96,053 | ) | | | (25,807 | ) |

| Net realized losses from foreign currency transactions | | | (19,182 | ) | | | (2,524 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (279,557 | ) | | | (150,999 | ) |

| Net change in unrealized appreciation (depreciation) on foreign currency translation | | | (1,137 | ) | | | 168 | |

| Net decrease in net assets resulting from operations | | | (252,006 | ) | | | (159,494 | ) |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

| Institutional Class | | | (37,129 | ) | | | (1,356 | ) |

| Investor Class | | | (25,670 | ) | | | (1,020 | ) |

| A Class | | | (161 | ) | | | (6 | ) |

| C Class | | | (142 | ) | | | (6 | ) |

| Decrease in net assets from distributions to shareholders | | | (63,102 | ) | | | (2,388 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 10,378,886 | | | | 238,165 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 37,129 | | | | 1,356 | |

| Payments for shares redeemed | | | (789,277 | ) | | | (243,923 | ) |

| Net increase (decrease) in Institutional Class net assets from capital share transactions | | | 9,626,738 | | | | (4,402 | ) |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 4,912 | | | | 71,533 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 25,670 | | | | 1,020 | |

| Payments for shares redeemed | | | (667,563 | ) | | | (173,241 | ) |

| Net decrease in Investor Class net assets from capital share transactions | | | (636,981 | ) | | | (100,688 | ) |

| | | | | | | | | |

| A Class | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 5,000 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 161 | | | | 6 | |

| Net increase in A Class net assets from capital share transactions | | | 161 | | | | 5,006 | |

| | | | | | | | | |

| C Class | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 5,000 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 142 | | | | 6 | |

| Net increase in C Class net assets from capital share transactions | | | 142 | | | | 5,006 | |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 8,674,952 | | | | (256,960 | ) |

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | Six Months | | | Year/Period | |

| | | Ended | | | Ended | |

| | | May 31, 2023 | | | November 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | $ | 2,224,570 | | | $ | 2,481,530 | |

| End of period | | $ | 10,899,522 | | | $ | 2,224,570 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Institutional Class | | | | | | | | |

| Shares sold | | | 914,586 | | | | 19,901 | |

| Shares issued in reinvestment of distributions to shareholders | | | 3,480 | | | | 121 | |

| Shares redeemed | | | (69,847 | ) | | | (19,456 | ) |

| Net increase in shares outstanding | | | 848,219 | | | | 566 | |

| Shares outstanding at beginning of period | | | 113,128 | | | | 112,562 | |

| Shares outstanding at end of period | | | 961,347 | | | | 113,128 | |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Shares sold | | | 442 | | | | 6,518 | |

| Shares issued in reinvestment of distributions to shareholders | | | 2,413 | | | | 92 | |

| Shares redeemed | | | (59,234 | ) | | | (15,454 | ) |

| Net decrease in shares outstanding | | | (56,379 | ) | | | (8,844 | ) |

| Shares outstanding at beginning of period | | | 85,064 | | | | 93,908 | |

| Shares outstanding at end of period | | | 28,685 | | | | 85,064 | |

| | | | | | | | | |

| A Class | | | | | | | | |

| Shares sold | | | — | | | | 509 | |

| Shares issued in reinvestment of distributions to shareholders | | | 15 | | | | 1 | |

| Net increase in shares outstanding | | | 15 | | | | 510 | |

| Shares outstanding at beginning of period | | | 510 | | | | — | |

| Shares outstanding at end of period | | | 525 | | | | 510 | |

| | | | | | | | | |

| C Class | | | | | | | | |

| Shares sold | | | — | | | | 509 | |

| Shares issued in reinvestment of distributions to shareholders | | | 13 | | | | 1 | |

| Net increase in shares outstanding | | | 13 | | | | 510 | |

| Shares outstanding at beginning of period | | | 510 | | | | — | |

| Shares outstanding at end of period | | | 523 | | | | 510 | |

| (a) | For A Class shares and C Class shares, represents the period from commencement of operations (July 5, 2022) through November 30, 2022. |

See accompanying notes to financial statements.

| LYRICAL U.S. VALUE EQUITY FUND |

| INSTITUTIONAL CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | May 31, | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | 2023 | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net asset value at beginning of period | | $ | 19.16 | | | $ | 21.59 | | | $ | 16.68 | | | $ | 15.91 | | | $ | 15.55 | | | $ | 18.62 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.05 | | | | 0.07 | | | | 0.03 | | | | 0.10 | | | | 0.05 | | | | 0.03 | |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | (1.00 | ) | | | (1.54 | ) | | | 5.02 | | | | 0.72 | (b) | | | 0.76 | | | | (1.70 | ) |

| Total from investment operations | | | (0.95 | ) | | | (1.47 | ) | | | 5.05 | | | | 0.82 | | | | 0.81 | | | | (1.67 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.08 | ) | | | (0.03 | ) | | | (0.14 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.01 | ) |

| Net realized gains | | | — | | | | (0.93 | ) | | | — | | | | — | | | | (0.40 | ) | | | (1.39 | ) |

| Total distributions | | | (0.08 | ) | | | (0.96 | ) | | | (0.14 | ) | | | (0.05 | ) | | | (0.45 | ) | | | (1.40 | ) |

| Net asset value at end of period | | $ | 18.13 | | | $ | 19.16 | | | $ | 21.59 | | | $ | 16.68 | | | $ | 15.91 | | | $ | 15.55 | |

| Total return (c) | | | (4.98 | %) (d) | | | (6.81 | %) | | | 30.44 | % | | | 5.16 | % | | | 5.03 | % | | | (9.02 | %) |

| Net assets at end of period (000’s) | | $ | 500,173 | | | $ | 655,277 | | | $ | 695,847 | | | $ | 327,121 | | | $ | 617,686 | | | $ | 907,366 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.04 | % (e) | | | 1.02 | % | | | 1.01 | % | | | 1.25 | % | | | 1.41 | % | | | 1.37 | % |

| Ratio of net expenses to average net assets | | | 1.00 | % (e)(f)(g) | | | 0.99 | % (f) | | | 0.99 | % (f) | | | 1.22 | % (f) | | | 1.41 | % | | | 1.37 | % |

| Ratio of net investment income to average net assets | | | 0.55 | % (e)(f) | | | 0.36 | % (f) | | | 0.13 | % (f) | | | 0.73 | % (f) | | | 0.36 | % | | | 0.17 | % |

| Portfolio turnover rate (h) | | | 12 | % (d) | | | 24 | % | | | 14 | % | | | 30 | % | | | 33 | % | | | 39 | % |

| (a) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (b) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same year. |

| | |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and/or reimbursed expenses (Note 4). |

| | |

| (d) | Not annualized. |

| | |

| (e) | Annualized. |

| | |

| (f) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

| | |

| (g) | Includes 0.01% of borrowing costs (Note 5). |

| | |

| (h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL U.S. VALUE EQUITY FUND |

| INVESTOR CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | May 31, | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | 2023 | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net asset value at beginning of period | | $ | 18.99 | | | $ | 21.43 | | | $ | 16.56 | | | $ | 15.78 | | | $ | 15.43 | | | $ | 18.54 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | | 0.03 | | | | 0.02 | | | | (0.02 | ) | | | 0.07 | | | | 0.02 | | | | (0.03 | ) |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | (1.00 | ) | | | (1.53 | ) | | | 4.98 | | | | 0.71 | (b) | | | 0.73 | | | | (1.69 | ) |

| Total from investment operations | | | (0.97 | ) | | | (1.51 | ) | | | 4.96 | | | | 0.78 | | | | 0.75 | | | | (1.72 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.03 | ) | | | — | | | | (0.09 | ) | | | — | | | | — | | | | — | |

| Net realized gains | | | — | | | | (0.93 | ) | | | — | | | | — | | | | (0.40 | ) | | | (1.39 | ) |

| Total distributions | | | (0.03 | ) | | | (0.93 | ) | | | (0.09 | ) | | | — | | | | (0.40 | ) | | | (1.39 | ) |

| Net asset value at end of period | | $ | 17.99 | | | $ | 18.99 | | | $ | 21.43 | | | $ | 16.56 | | | $ | 15.78 | | | $ | 15.43 | |

| Total return (c) | | | (5.12 | %) (d) | | | (7.03 | %) | | | 30.10 | % | | | 4.94 | % | | | 4.89 | % | | | (9.30 | %) |

| Net assets at end of period (000’s) | | $ | 7,132 | | | $ | 7,758 | | | $ | 8,270 | | | $ | 4,914 | | | $ | 6,682 | | | $ | 19,811 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.74 | % (e) | | | 1.74 | % | | | 1.79 | % | | | 2.02 | % | | | 2.03 | % | | | 1.72 | % |

| Ratio of net expenses to average net assets (f) | | | 1.25 | % (e)(g) | | | 1.24 | % | | | 1.24 | % | | | 1.44 | % | | | 1.70 | % | | | 1.70 | % |

| Ratio of net investment income (loss) to average net assets (f) | | | 0.30 | % (e) | | | 0.10 | % | | | (0.12 | %) | | | 0.53 | % | | | 0.10 | % | | | (0.18 | %) |

| Portfolio turnover rate (h) | | | 12 | % (d) | | | 24 | % | | | 14 | % | | | 30 | % | | | 33 | % | | | 39 | % |

| (a) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (b) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same year. |

| | |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and/or reimbursed expenses (Note 4). |

| | |

| (d) | Not annualized. |

| | |

| (e) | Annualized. |

| | |

| (f) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

| | |

| (g) | Includes 0.01% of borrowing costs (Note 5). |

| | |

| (h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL U.S. VALUE EQUITY FUND |

| A CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | |

| | | Ended | | | Period | |

| | | May 31, | | | Ended | |

| | | 2023 | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| Net asset value at beginning of period | | $ | 19.14 | | | $ | 18.23 | |

| Income (loss) from investment operations: | | | | | | | | |

| Net investment income (b) | | | 0.03 | | | | 0.03 | |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | (1.00 | ) | | | 1.81 | (c) |

| Total from investment operations | | | (0.97 | ) | | | 1.84 | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (0.07 | ) | | | — | |

| Net realized gains | | | — | | | | (0.93 | ) |

| Total distributions | | | (0.07 | ) | | | (0.93 | ) |

| Net asset value at end of period | | $ | 18.10 | | | $ | 19.14 | |

| Total return (d) | | | (5.09 | %) (e) | | | 10.12 | % (e) |

| Net assets at end of period (000’s) | | $ | 46 | | | $ | 14 | |

| Ratios/supplementary data: | | | | | | | | |

| Ratio of total expenses to average net assets | | | 45.19 | % (f) | | | 176.77 | % (f) |

| Ratio of net expenses to average net assets (g) | | | 1.25 | % (f)(h) | | | 1.24 | % (f) |

| Ratio of net investment income to average net assets (g) | | | 0.35 | % (f) | | | 0.36 | % (f) |

| Portfolio turnover rate (i) | | | 12 | % (e) | | | 24 | % |

| (a) | Represents the period from the commencement of operations (July 5, 2022) through November 30, 2022. |

| | |

| (b) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (c) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same period. |

| | |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and/or reimbursed expenses (Note 4). Calculation does not reflect sales load. |

| | |

| (e) | Not annualized. |

| | |

| (f) | Annualized. |

| | |

| (g) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

| | |

| (h) | Includes 0.01% of borrowing costs (Note 5). |

| | |

| (i) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL U.S. VALUE EQUITY FUND |

| C CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | |

| | | Ended | | | Period | |

| | | May 31, | | | Ended | |

| | | 2023 | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| Net asset value at beginning of period | | $ | 19.08 | | | $ | 18.23 | |

| Income (loss) from investment operations: | | | | | | | | |

| Net investment loss (b) | | | (0.04 | ) | | | (0.03 | ) |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | (1.00 | ) | | | 1.81 | (c) |

| Total from investment operations | | | (1.04 | ) | | | 1.78 | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (0.05 | ) | | | — | |

| Net realized gains | | | — | | | | (0.93 | ) |

| Total distributions | | | (0.05 | ) | | | (0.93 | ) |

| Net asset value at end of period | | $ | 17.99 | | | $ | 19.08 | |

| Total return (d) | | | (5.47 | %) (e) | | | 9.79 | % (e) |

| Net assets at end of period (000’s) | | $ | 383 | | | $ | 31 | |

| Ratios/supplementary data: | | | | | | | | |

| Ratio of total expenses to average net assets | | | 9.26 | % (f) | | | 196.90 | % (f) |

| Ratio of net expenses to average net assets (g) | | | 2.00 | % (f)(h) | | | 1.99 | % (f) |

| Ratio of net investment loss to average net assets (g) | | | (0.46 | %) (f) | | | (0.36 | %) (f) |

| Portfolio turnover rate (i) | | | 12 | % (e) | | | 24 | % |

| (a) | Represents the period from the commencement of operations (July 5, 2022) through November 30, 2022. |

| | |

| (b) | Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (c) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same period. |

| | |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and/or reimbursed expenses (Note 4). Calculation does not reflect CDSC. |

| | |

| (e) | Not annualized. |

| | |

| (f) | Annualized. |

| | |

| (g) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

| | |

| (h) | Includes 0.01% of borrowing costs (Note 5). |

| | |

| (i) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| INSTITUTIONAL CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Period | |

| | | May 31, | | | Ended | | | Ended | | | Ended | |

| | | 2023 | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 (a) | |

| Net asset value at beginning of period | | $ | 11.19 | | | $ | 12.03 | | | $ | 11.02 | | | $ | 10.00 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (b) | | | 0.18 | | | | 0.11 | | | | 0.05 | | | | 0.05 | |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | (0.04 | ) | | | (0.94 | ) | | | 1.69 | | | | 0.97 | |

| Total from investment operations | | | 0.14 | | | | (0.83 | ) | | | 1.74 | | | | 1.02 | |

| Less distributions from: | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.33 | ) | | | — | | | | (0.05 | ) | | | — | |

| Net realized gains | | | — | | | | (0.01 | ) | | | (0.68 | ) | | | — | |

| Total distributions | | | (0.33 | ) | | | (0.01 | ) | | | (0.73 | ) | | | — | |

| Net asset value at end of period | | $ | 11.00 | | | $ | 11.19 | | | $ | 12.03 | | | $ | 11.02 | |

| Total return (c) | | | 1.33 | % (d) | | | (6.88 | %) | | | 15.84 | % | | | 10.20 | % (d) |

| Net assets at end of period (000’s) | | $ | 10,574 | | | $ | 1,266 | | | $ | 1,355 | | | $ | 613 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 3.98 | % (e) | | | 12.32 | % | | | 11.34 | % | | | 21.16 | % (e) |

| Ratio of net expenses to average net assets (f) | | | 0.99 | % (e) | | | 0.99 | % | | | 0.99 | % | | | 1.03 | % (e) |

| Ratio of net investment income to average net assets (f) | | | 3.70 | % (e) | | | 1.00 | % | | | 0.36 | % | | | 0.72 | % (e) |

| Portfolio turnover rate (g) | | | 34 | % (d) | | | 33 | % | | | 34 | % | | | 25 | % (d) |

| (a) | Represents the period from the commencement of operations (March 2, 2020) through November 30, 2020. |

| | |

| (b) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and reimbursed expenses (Note 4). |

| | |

| (d) | Not annualized. |

| | |

| (e) | Annualized. |

| | |

| (f) | Ratio was determined after fee reductions and expense reimbursements (Note 4). |

| | |

| (g) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| INVESTOR CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Period | |

| | | May 31, | | | Ended | | | Ended | | | Ended | |

| | | 2023 | | | Nov. 30, | | | Nov. 30, | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 (a) | |

| Net asset value at beginning of period | | $ | 11.13 | | | $ | 12.00 | | | $ | 11.00 | | | $ | 10.00 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income (b) | | | 0.07 | | | | 0.08 | | | | 0.02 | | | | 0.04 | |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | 0.06 | (c) | | | (0.94 | ) | | | 1.69 | | | | 0.96 | |

| Total from investment operations | | | 0.13 | | | | (0.86 | ) | | | 1.71 | | | | 1.00 | |

| Less distributions from: | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.30 | ) | | | — | | | | (0.03 | ) | | | — | |

| Net realized gains | | | — | | | | (0.01 | ) | | | (0.68 | ) | | | — | |

| Total distributions | | | (0.30 | ) | | | (0.01 | ) | | | (0.71 | ) | | | — | |

| Net asset value at end of period | | $ | 10.96 | | | $ | 11.13 | | | $ | 12.00 | | | $ | 11.00 | |

| Total return (d) | | | 1.26 | % (e) | | | (7.15 | %) | | | 15.60 | % | | | 10.00 | % (e) |

| Net assets at end of period (000’s) | | $ | 314 | | | $ | 947 | | | $ | 1,127 | | | $ | 663 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 5.64 | % (f) | | | 12.90 | % | | | 11.70 | % | | | 21.14 | % (f) |

| Ratio of net expenses to average net assets (g) | | | 1.24 | % (f) | | | 1.24 | % | | | 1.24 | % | | | 1.27 | % (f) |

| Ratio of net investment income to average net assets (g) | | | 1.64 | % (f) | | | 0.76 | % | | | 0.16 | % | | | 0.52 | % (f) |

| Portfolio turnover rate (h) | | | 34 | % (e) | | | 33 | % | | | 34 | % | | | 25 | % (e) |

| (a) | Represents the period from the commencement of operations (July 5, 2022) through November 30, 2022. |

| | |

| (b) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (c) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same period. |

| | |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and reimbursed expenses (Note 4). |

| | |

| (e) | Not annualized. |

| | |

| (f) | Annualized. |

| | |

| (g) | Ratio was determined after fee reductions and/or expense reimbursements (Note 4). |

| | |

| (h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| A CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | |

| | | Ended | | | Period | |

| | | May 31, | | | Ended | |

| | | 2023 | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| Net asset value at beginning of period | | $ | 11.18 | | | $ | 9.82 | |

| Income from investment operations: | | | | | | | | |

| Net investment income (b) | | | 0.11 | | | | 0.01 | |

| Net realized and unrealized gains on investments and foreign currencies | | | 0.02 | (c) | | | 1.36 | (c) |

| Total from investment operations | | | 0.13 | | | | 1.37 | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (0.32 | ) | | | — | |

| Net realized gains | | | — | | | | (0.01 | ) |

| Total distributions | | | (0.32 | ) | | | (0.01 | ) |

| Net asset value at end of period | | $ | 10.99 | | | $ | 11.18 | |

| Total return (d) | | | 1.21 | % (e) | | | 13.97 | % (e) |

| Net assets at end of period | | $ | 5,768 | | | $ | 5,700 | |

| Ratios/supplementary data: | | | | | | | | |

| Ratio of total expenses to average net assets | | | 247.73 | % (f) | | | 264.21 | % (f) |

| Ratio of net expenses to average net assets (g) | | | 1.24 | % (f) | | | 1.24 | % (f) |

| Ratio of net investment income to average net assets (g) | | | 2.39 | % (f) | | | 0.14 | % (f) |

| Portfolio turnover rate (h) | | | 34 | % (e) | | | 33 | % |

| (a) | Represents the period from the commencement of operations (July 5, 2022) through November 30, 2022. |

| | |

| (b) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (c) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same period. |

| | |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would have been lower if the Adviser had not reduced fees and reimbursed expenses (Note 4). Calculation does not reflect sales load. |

| | |

| (e) | Not annualized. |

| | |

| (f) | Annualized. |

| | |

| (g) | Ratio was determined after fee reductions and expense reimbursements (Note 4). |

| | |

| (h) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | |

See accompanying notes to financial statements.

| LYRICAL INTERNATIONAL VALUE EQUITY FUND |

| C CLASS |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period:

| | | Six Months | | | | |

| | | Ended | | | Period | |

| | | May 31, | | | Ended | |

| | | 2023 | | | Nov. 30, | |

| | | (Unaudited) | | | 2022 (a) | |

| Net asset value at beginning of period | | $ | 11.15 | | | $ | 9.82 | |

| Income (loss) from investment operations: | | | | | | | | |

| Net investment income (loss) (b) | | | 0.07 | | | | (0.03 | ) |

| Net realized and unrealized gains on investments and foreign currencies | | | 0.01 | (c) | | | 1.37 | (c) |

| Total from investment operations | | | 0.08 | | | | 1.34 | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (0.28 | ) | | | — | |

| Net realized gains | | | — | | | | (0.01 | ) |

| Total distributions | | | (0.28 | ) | | | (0.01 | ) |

| Net asset value at end of period | | $ | 10.95 | | | $ | 11.15 | |

| Total return (d) | | | 0.77 | % (e) | | | 13.67 | % (e) |

| Net assets at end of period | | $ | 5,729 | | | $ | 5,682 | |

| Ratios/supplementary data: | | | | | | | | |

| Ratio of total expenses to average net assets | | | 249.69 | % (f) | | | 265.34 | % (f) |

| Ratio of net expenses to average net assets (g) | | | 1.99 | % (f) | | | 1.99 | % (f) |

| Ratio of net investment income (loss) to average net assets (g) | | | 1.65 | % (f) | | | (0.60 | %) (f) |

| Portfolio turnover rate (h) | | | 34 | % (e) | | | 33 | % |

| (a) | Represents the period from the commencement of operations (July 5, 2022) through November 30, 2022. |

| | |

| (b) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| | |

| (c) | Represents a balancing figure derived from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of the net realized and unrealized losses on the Statements of Operations for the same period. |

| | |