UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22696 |

|

Victory Portfolios II |

(Exact name of registrant as specified in charter) |

|

4900 Tiedeman Road, 4th Floor Brooklyn, OH | | 44144 |

(Address of principal executive offices) | | (Zip code) |

|

Christopher K. Dyer 4900 Tiedeman Road, 4th Floor Brooklyn, OH 44144 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (216) 898-2411 | |

|

Date of fiscal year end: | June 30 | |

|

Date of reporting period: | December 31, 2016 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

December 31, 2016

Semi Annual Report

VictoryShares US 500 Volatility Wtd ETF

(formerly, Victory CEMP US 500 Volatility Wtd Index ETF)

VictoryShares US Discovery Enhanced Volatility Wtd ETF

(formerly, Victory CEMP Discovery Enhanced Volatility Wtd Index ETF)

VictoryShares US 500 Enhanced Volatility Wtd ETF

(formerly, Victory CEMP US 500 Enhanced Volatility Wtd Index ETF)

VictoryShares Developed Enhanced Volatility Wtd ETF

(formerly, Victory CEMP Developed Enhanced Volatility Wtd Index ETF)

VictoryShares US EQ Income Enhanced Volatility Wtd ETF

(formerly, Victory CEMP US EQ Income Enhanced Volatility Wtd Index ETF)

VictoryShares US Small Cap Volatility Wtd ETF

(formerly, Victory CEMP US Small Cap Volatility Wtd Index ETF)

VictoryShares International Volatility Wtd ETF

(formerly, Victory CEMP International Volatility Wtd Index ETF)

VictoryShares Emerging Market Volatility Wtd ETF

(formerly, Victory CEMP Emerging Market Volatility Wtd Index ETF)

VictoryShares US Large Cap High Div Volatility Wtd ETF

(formerly, Victory CEMP US Large Cap High Div Volatility Wtd

Index ETF)

VictoryShares US Small Cap High Div Volatility Wtd ETF

(formerly, Victory CEMP US Small Cap High Div Volatility Wtd

Index ETF)

VictoryShares International High Div Volatility Wtd ETF

(formerly, Victory CEMP International High Div Volatility Wtd Index ETF)

compassempetf.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Compass EMP site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, compassempetf.com has what you seek. Visit us anytime. We're always open.

Table of Contents

Shareholder Letter | | | 5-6 | | |

Financial Statements | |

Victory Portfolios II Exchange Traded Funds | |

VictoryShares US 500 Volatility Wtd ETF | |

Schedule of Investments | | | 7-20 | | |

Statements of Assets and Liabilities | | | 113 | | |

Statements of Operations | | | 117 | | |

Statements of Changes in Net Assets | | | 121 | | |

Financial Highlights | | | 132 | | |

VictoryShares US Discovery Enhanced Volatility

Wtd ETF | |

Schedule of Investments | | | 21-34 | | |

Statements of Assets and Liabilities | | | 113 | | |

Statements of Operations | | | 117 | | |

Statements of Changes in Net Assets | | | 122 | | |

Financial Highlights | | | 133 | | |

VictoryShares US 500 Enhanced Volatility Wtd ETF | |

Schedule of Investments | | | 35-48 | | |

Statements of Assets and Liabilities | | | 113 | | |

Statements of Operations | | | 117 | | |

Statements of Changes in Net Assets | | | 123 | | |

Financial Highlights | | | 134 | | |

VictoryShares Developed Enhanced Volatility

Wtd ETF | |

Schedule of Investments | | | 49-57 | | |

Statements of Assets and Liabilities | | | 114 | | |

Statements of Operations | | | 118 | | |

Statements of Changes in Net Assets | | | 124 | | |

Financial Highlights | | | 135 | | |

VictoryShares US EQ Income Enhanced Volatility

Wtd ETF | |

Schedule of Investments | | | 58-62 | | |

Statements of Assets and Liabilities | | | 114 | | |

Statements of Operations | | | 118 | | |

Statements of Changes in Net Assets | | | 125 | | |

Financial Highlights | | | 136 | | |

VictoryShares US Small Cap Volatility Wtd ETF | |

Schedule of Investments | | | 63-76 | | |

Statements of Assets and Liabilities | | | 114 | | |

Statements of Operations | | | 118 | | |

Statements of Changes in Net Assets | | | 126 | | |

Financial Highlights | | | 137 | | |

VictoryShares International Volatility Wtd ETF | |

Schedule of Investments | | | 77-87 | | |

Statements of Assets and Liabilities | | | 115 | | |

Statements of Operations | | | 119 | | |

Statements of Changes in Net Assets | | | 127 | | |

Financial Highlights | | | 138 | | |

1

Table of Contents (continued)

VictoryShares Emerging Market Volatility Wtd ETF | |

Schedule of Investments | | | 88-99 | | |

Statements of Assets and Liabilities | | | 115 | | |

Statements of Operations | | | 119 | | |

Statements of Changes in Net Assets | | | 128 | | |

Financial Highlights | | | 139 | | |

VictoryShares US Large Cap High Div Volatility

Wtd ETF | |

Schedule of Investments | | | 100-103 | | |

Statements of Assets and Liabilities | | | 115 | | |

Statements of Operations | | | 119 | | |

Statements of Changes in Net Assets | | | 129 | | |

Financial Highlights | | | 140 | | |

VictoryShares US Small Cap High Div Volatility

Wtd ETF | |

Schedule of Investments | | | 104-108 | | |

Statements of Assets and Liabilities | | | 116 | | |

Statements of Operations | | | 120 | | |

Statements of Changes in Net Assets | | | 130 | | |

Financial Highlights | | | 141 | | |

VictoryShares International High Div Volatility

Wtd ETF | |

Schedule of Investments | | | 109-112 | | |

Statements of Assets and Liabilities | | | 116 | | |

Statements of Operations | | | 120 | | |

Statements of Changes in Net Assets | | | 131 | | |

Financial Highlights | | | 142 | | |

Notes to Financial Statements | | | 143 | | |

Supplemental Information | | | 161 | | |

Trustee and Officer Information | | | 161 | | |

Additional Federal Income Tax Information | | | 165 | | |

Proxy Voting and Form N-Q Information | | | 169 | | |

Expense Examples | | | 169 | | |

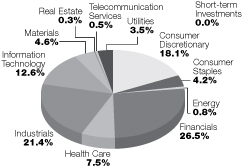

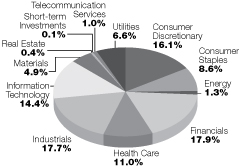

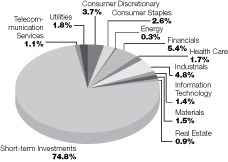

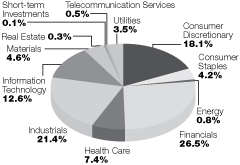

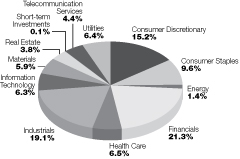

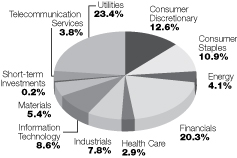

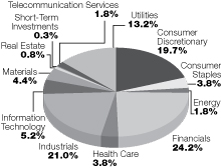

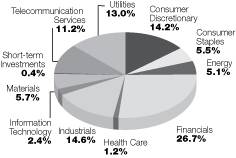

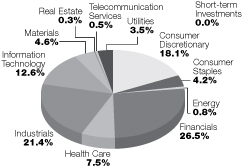

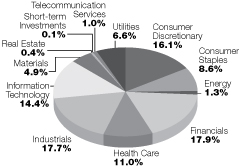

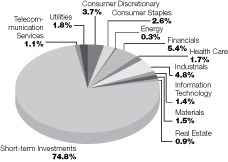

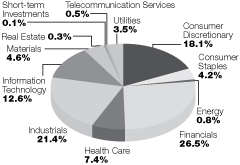

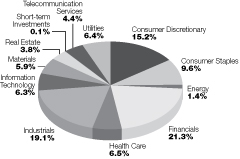

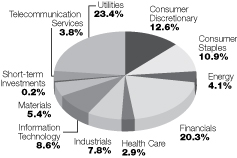

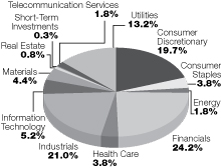

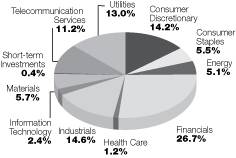

Portfolio Allocation | | | 171-173 | | |

Frequency Distribution of Premiums &

Discounts | | | 174 | | |

Advisory Contract Approval | | | 174-179 | | |

2

Table of Contents (continued)

The Victory Portfolios II ETFs are distributed by Quasar Distributors, LLC. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Portfolios II ETFs.

For additional information about any Victory Portfolios II ETF, including fees, expenses, and risks, view our prospectus online at compassempetf.com or call 866-376-7890. Read it carefully before you invest or send money.

The information in this semi-annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the ETFs, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Call Compass EMP at:

866-376-7890

Visit our website at:

www.compassempetf.com

3

This page is intentionally left blank.

4

The Victory Funds Letter to Shareholders

Dear Shareholder,

As we head full-steam into 2017, we are brimming with excitement. For starters, we launched a new brand — VictoryShares — which builds on the success of the firm's Victory CEMP volatility-weighted ETFs. The names of the existing 11 Victory CEMP ETFs have been changed to reflect the VictoryShares branding. And in conjunction with the new brand, our next generation VictoryShares ETF platform will soon include new products that will track indexes developed in partnership with Nasdaq.

The CEMP investment team provided us with an enviable doorway into the ETF world, and now our VictoryShares platform carries that forward, boasting more than $1 billion in assets under management. This is an important benchmark, and we are poised to continue helping investors bridge the gap between the active and passive elements of their portfolios with new ETFs in the years ahead.

In terms of the general investment environment, we are closely monitoring the state of the markets and the seemingly heightened level of the political and economic risk. Investors perpetually appear to be waiting for the next big surprise. Maybe that's a reflection of an aging bull market. Or maybe it's persistent worries over growth rates in emerging markets or the specter of rising U.S. interest rates that finally appears to be here.

There are plenty of other issues to ponder as well. Investors have had to grapple with the fallout from the Brexit referendum, the surprising results of the U.S. presidential election, and even negative bond yields in several major global developed markets. All this activity simply underscores that investing today is no easy task, and there are many cross-currents that need deciphering.

Yet despite all the question marks and the now-fashionable anti-globalization rhetoric, it's important to remember that equity markets in the U.S., key global developed markets, and emerging markets all moved higher during the course of 2016. In fact, as 2016 drew to a close there was a fair bit of encouraging economic news. Domestically, we are benefitting from relatively strong personal consumption, continuing job creation, and even some wage growth. Solid employment and healthier finances are underpinning household spending, and the prospect of less regulation and fiscal stimulus in the U.S. helped fuel a robust post-U.S. election rally. Equities certainly ushered in 2017 on a positive note. Nevertheless, more volatility should be expected, and catalysts could come domestically or from any corner of the globe.

While markets will continue to provide tactical challenges for investors, we believe that maintaining a long-term view and maintaining a portfolio that is diversified across strategies and asset classes is still appropriate for investors seeking to weather market turbulence and achieve goals. Of this thinking, we have no doubt.

To help investors maintain their longer-term conviction, we are committed to offering an eclectic mix of investment products. In conjunction with our efforts, in July 2016 Victory Capital completed its acquisition of RS Investments (including the recently renamed Sophus Capital). The acquisition expands Victory Capital's

5

multi-boutique model to include 11 distinct investment franchises with $54.9 billion in assets under management and advisement as of December 31, 2016.

On the following pages, you will find information relating to your Victory Funds investment. If you have any questions, we encourage you to contact your financial advisor. Or, if you invest with us directly, you may call (866) 376-7890, or visit our website at www.vcm.com.

My colleagues and I sincerely appreciate the confidence you have placed in the Victory Funds and we value the opportunity to help meet your investment goals.

Christopher K. Dyer, CFA

President,

Victory Funds

Must be preceded or accompanied by a Prospectus

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Investments involve risk including possible loss of principal. ETFs have the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are limited and often commissions are charged on each trade, and ETFs may trade at a premium or discount to their net asset value. The Funds are not actively managed and do not, therefore, seek returns in excess of their respective Index. The Funds' returns may not match the returns of their respective Index for a number of reasons, including: the Fund incurs operating expenses not applicable to the Index and incurs costs in buying and selling securities; the Fund may not be fully invested at times; differences in the valuation of securities and differences between the Fund's portfolio and the Index resulting from legal restrictions, cost, or liquidity constraints. The ETFs may invest in small and medium-sized companies. The earnings and prospects of these companies are more volatile than larger companies. Small and medium-sized companies may have limited markets, product lines, or financial resources and lack management experience and may experience higher failure rates than larger companies. In general the price of a fixed income security falls when interest rates rise. ETFs focused on high dividend strategies may not be successful. Dividend paying stocks may fall out of favor relative to the overall market. ETFs may invest in securities included in, or representative of securities included in, the index, regardless of their investment merits. ETFs with a foreign focus are subject to the special risks associated with investments in foreign markets which may include less liquidity, exchange rate risk, greater volatility, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards.

One cannot invest directly in an index.

The ETFs are distributed by Quasar Distributors, LLC. Victory Capital Management Inc., the adviser to the ETFs, is not affiliated with Quasar Distributors, LLC.

6

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (99.8%) | |

Aerospace & Defense (2.9%): | |

B/E Aerospace, Inc. | | | 3,455 | | | $ | 207,956 | | |

General Dynamics Corporation | | | 1,836 | | | | 317,004 | | |

Huntington Ingalls Industries, Inc. | | | 1,581 | | | | 291,204 | | |

Lockheed Martin Corporation | | | 1,472 | | | | 367,912 | | |

Northrop Grumman Corporation | | | 1,576 | | | | 366,546 | | |

Orbital ATK, Inc. | | | 1,821 | | | | 159,756 | | |

Raytheon Company | | | 2,219 | | | | 315,098 | | |

Rockwell Collins, Inc. | | | 3,026 | | | | 280,692 | | |

Spirit AeroSystems Holdings, Inc. — Class A | | | 3,830 | | | | 223,481 | | |

Textron, Inc. | | | 4,195 | | | | 203,709 | | |

TransDigm Group, Inc. | | | 598 | | | | 148,878 | | |

United Technologies Corporation | | | 2,744 | | | | 300,797 | | |

| | | | 3,183,033 | | |

Air Freight & Logistics (0.9%): | |

CH Robinson Worldwide, Inc. | | | 3,901 | | | | 285,787 | | |

Expeditors International of Washington, Inc. | | | 5,656 | | | | 299,542 | | |

United Parcel Service, Inc. — Class B | | | 3,493 | | | | 400,438 | | |

| | | | 985,767 | | |

Airlines (1.0%): | |

Alaska Air Group, Inc. | | | 2,333 | | | | 207,007 | | |

American Airlines Group, Inc. | | | 3,360 | | | | 156,878 | | |

Delta Air Lines, Inc. | | | 3,885 | | | | 191,103 | | |

JetBlue Airways Corporation (a) | | | 8,257 | | | | 185,122 | | |

Southwest Airlines Company | | | 4,208 | | | | 209,727 | | |

United Continental Holdings, Inc. (a) | | | 2,279 | | | | 166,094 | | |

| | | | 1,115,931 | | |

Auto Components (0.7%): | |

BorgWarner, Inc. | | | 3,563 | | | | 140,525 | | |

Gentex Corporation | | | 11,216 | | | | 220,843 | | |

Johnson Controls International PLC | | | 4,705 | | | | 193,799 | | |

Lear Corporation | | | 1,364 | | | | 180,552 | | |

| | | | 735,719 | | |

Automobiles (0.7%): | |

Ford Motor Company | | | 14,364 | | | | 174,235 | | |

General Motors Company | | | 6,579 | | | | 229,213 | | |

Harley-Davidson, Inc. | | | 2,483 | | | | 144,858 | | |

Thor Industries, Inc. | | | 2,419 | | | | 242,021 | | |

| | | | 790,327 | | |

Banks (5.4%): | |

Bank of America Corporation | | | 9,499 | | | | 209,928 | | |

Bank of the Ozarks, Inc. | | | 3,729 | | | | 196,108 | | |

BB&T Corporation | | | 5,413 | | | | 254,519 | | |

BOK Financial Corporation | | | 2,206 | | | | 183,186 | | |

CIT Group, Inc. | | | 4,147 | | | | 176,994 | | |

See notes to financial statements.

7

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Banks (5.4%) cont'd | |

Citigroup, Inc. | | | 3,060 | | | $ | 181,856 | | |

Citizens Financial Group, Inc. | | | 6,092 | | | | 217,058 | | |

Comerica, Inc. | | | 3,084 | | | | 210,051 | | |

Commerce Bancshares, Inc. | | | 4,806 | | | | 277,832 | | |

Cullen/Frost Bankers, Inc. | | | 1,888 | | | | 166,578 | | |

East West Bancorp, Inc. | | | 3,978 | | | | 202,202 | | |

Fifth Third Bancorp | | | 7,670 | | | | 206,860 | | |

First Republic Bank | | | 2,378 | | | | 219,109 | | |

Huntington Bancshares, Inc. | | | 15,799 | | | | 208,863 | | |

JPMorgan Chase & Company | | | 2,852 | | | | 246,099 | | |

KeyCorp | | | 13,910 | | | | 254,136 | | |

M&T Bank Corporation | | | 1,668 | | | | 260,925 | | |

PacWest Bancorp | | | 3,498 | | | | 190,431 | | |

People's United Financial, Inc. | | | 12,947 | | | | 250,654 | | |

PNC Financial Services Group, Inc. | | | 2,467 | | | | 288,540 | | |

Regions Financial Corporation | | | 14,418 | | | | 207,042 | | |

Signature Bank (a) | | | 1,358 | | | | 203,972 | | |

SunTrust Banks, Inc. | | | 3,791 | | | | 207,936 | | |

SVB Financial Group (a) | | | 1,036 | | | | 177,840 | | |

U.S. Bancorp | | | 5,243 | | | | 269,333 | | |

Wells Fargo & Company | | | 4,532 | | | | 249,759 | | |

Zions Bancorporation | | | 4,737 | | | | 203,880 | | |

| | | | 5,921,691 | | |

Beverages (1.7%): | |

Brown-Forman Corporation — Class B | | | 5,710 | | | | 256,493 | | |

Constellation Brands, Inc. — Class A | | | 1,394 | | | | 213,714 | | |

Dr Pepper Snapple Group, Inc. | | | 3,278 | | | | 297,216 | | |

Molson Coors Brewing Company — Class B | | | 2,251 | | | | 219,045 | | |

Monster Beverage Corporation (a) | | | 3,708 | | | | 164,413 | | |

PepsiCo, Inc. | | | 3,719 | | | | 389,119 | | |

The Coca-Cola Company | | | 8,354 | | | | 346,357 | | |

| | | | 1,886,357 | | |

Biotechnology (0.9%): | |

AbbVie, Inc. | | | 2,856 | | | | 178,843 | | |

Amgen, Inc. | | | 1,341 | | | | 196,068 | | |

Biogen, Inc. (a) | | | 438 | | | | 124,208 | | |

Gilead Sciences, Inc. | | | 2,222 | | | | 159,117 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 325 | | | | 119,304 | | |

United Therapeutics Corporation (a) | | | 1,120 | | | | 160,642 | | |

| | | | 938,182 | | |

Building Products (0.9%): | |

AO Smith Corporation | | | 4,200 | | | | 198,870 | | |

Fortune Brands Home & Security, Inc. | | | 3,679 | | | | 196,679 | | |

Lennox International, Inc. | | | 1,674 | | | | 256,407 | | |

Masco Corporation | | | 5,603 | | | | 177,167 | | |

Owens Corning | | | 3,899 | | | | 201,032 | | |

| | | | 1,030,155 | | |

See notes to financial statements.

8

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Capital Markets (4.8%): | |

Affiliated Managers Group, Inc. (a) | | | 911 | | | $ | 132,368 | | |

Ameriprise Financial, Inc. | | | 1,575 | | | | 174,731 | | |

BlackRock, Inc. | | | 500 | | | | 190,270 | | |

CBOE Holdings, Inc. | | | 4,142 | | | | 306,052 | | |

Charles Schwab Corporation | | | 4,384 | | | | 173,037 | | |

CME Group, Inc. | | | 2,414 | | | | 278,455 | | |

Eaton Vance Corporation | | | 4,537 | | | | 190,010 | | |

FactSet Research Systems, Inc. | | | 1,301 | | | | 212,623 | | |

Franklin Resources, Inc. | | | 4,629 | | | | 183,216 | | |

Interactive Brokers Group, Inc. | | | 4,632 | | | | 169,114 | | |

Intercontinental Exchange, Inc. | | | 3,850 | | | | 217,217 | | |

Invesco Ltd. | | | 4,414 | | | | 133,921 | | |

MarketAxess Holdings, Inc. | | | 1,183 | | | | 173,806 | | |

Moody's Corporation | | | 1,688 | | | | 159,128 | | |

Morgan Stanley | | | 4,536 | | | | 191,646 | | |

MSCI, Inc. | | | 2,978 | | | | 234,607 | | |

Nasdaq, Inc. | | | 3,551 | | | | 238,343 | | |

Northern Trust Corporation | | | 2,537 | | | | 225,920 | | |

Raymond James Financial, Inc. | | | 2,630 | | | | 182,180 | | |

S&P Global, Inc. | | | 1,560 | | | | 167,762 | | |

SEI Investments Company | | | 3,065 | | | | 151,288 | | |

State Street Corporation | | | 2,150 | | | | 167,098 | | |

T. Rowe Price Group, Inc. | | | 3,185 | | | | 239,703 | | |

TD Ameritrade Holding Corporation | | | 4,800 | | | | 209,280 | | |

The Bank of New York Mellon Corporation | | | 4,540 | | | | 215,105 | | |

The Goldman Sachs Group, Inc. | | | 1,087 | | | | 260,282 | | |

| | | | 5,177,162 | | |

Chemicals (2.4%): | |

Axalta Coating Systems Ltd. (a) | | | 6,137 | | | | 166,926 | | |

CF Industries Holdings, Inc. | | | 3,731 | | | | 117,452 | | |

Eastman Chemical Company | | | 2,844 | | | | 213,897 | | |

Ecolab, Inc. | | | 1,847 | | | | 216,505 | | |

Huntsman Corporation | | | 5,612 | | | | 107,077 | | |

International Flavors & Fragrances, Inc. | | | 1,407 | | | | 165,787 | | |

LyondellBasell Industries NV — Class A | | | 2,003 | | | | 171,817 | | |

NewMarket Corporation | | | 494 | | | | 209,377 | | |

PPG Industries, Inc. | | | 2,092 | | | | 198,238 | | |

Praxair, Inc. | | | 2,168 | | | | 254,068 | | |

RPM International, Inc. | | | 4,427 | | | | 238,306 | | |

The Dow Chemical Company | | | 4,200 | | | | 240,324 | | |

The Sherwin-Williams Company | | | 799 | | | | 214,723 | | |

Westlake Chemical Corporation | | | 2,429 | | | | 136,000 | | |

| | | | 2,650,497 | | |

Commercial Services & Supplies (1.8%): | |

Cintas Corporation | | | 2,112 | | | | 244,063 | | |

Copart, Inc. (a) | | | 4,419 | | | | 244,857 | | |

KAR Auction Services, Inc. | | | 5,283 | | | | 225,161 | | |

Republic Services, Inc. | | | 6,845 | | | | 390,507 | | |

See notes to financial statements.

9

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Commercial Services & Supplies (1.8%) cont'd | |

Rollins, Inc. | | | 7,882 | | | $ | 266,254 | | |

Stericycle, Inc. (a) | | | 1,549 | | | | 119,335 | | |

Waste Management, Inc. | | | 5,932 | | | | 420,638 | | |

| | | | 1,910,815 | | |

Communications Equipment (1.2%): | |

Arista Networks, Inc. (a) | | | 1,451 | | | | 140,413 | | |

Brocade Communications Systems, Inc. | | | 13,045 | | | | 162,932 | | |

Cisco Systems, Inc. | | | 6,799 | | | | 205,466 | | |

F5 Networks, Inc. (a) | | | 1,500 | | | | 217,080 | | |

Juniper Networks, Inc. | | | 6,385 | | | | 180,440 | | |

Motorola Solutions, Inc. | | | 3,083 | | | | 255,550 | | |

Ubiquiti Networks, Inc. (a) | | | 2,906 | | | | 167,967 | | |

| | | | 1,329,848 | | |

Construction & Engineering (0.2%): | |

Jacobs Engineering Group, Inc. (a) | | | 3,823 | | | | 217,911 | | |

Construction Materials (0.4%): | |

Martin Marietta Materials, Inc. | | | 975 | | | | 215,992 | | |

Vulcan Materials Company | | | 1,789 | | | | 223,893 | | |

| | | | 439,885 | | |

Consumer Finance (1.0%): | |

American Express Company | | | 3,027 | | | | 224,240 | | |

Capital One Financial Corporation | | | 2,385 | | | | 208,067 | | |

Discover Financial Services | | | 3,399 | | | | 245,034 | | |

Navient Corporation | | | 8,211 | | | | 134,907 | | |

Santander Consumer USA Holdings, Inc. (a) | | | 7,221 | | | | 97,484 | | |

Synchrony Financial | | | 5,771 | | | | 209,314 | | |

| | | | 1,119,046 | | |

Containers & Packaging (1.9%): | |

AptarGroup, Inc. | | | 3,511 | | | | 257,883 | | |

Avery Dennison Corporation | | | 2,898 | | | | 203,497 | | |

Bemis Company, Inc. | | | 4,812 | | | | 230,110 | | |

Berry Plastics Group, Inc. (a) | | | 3,679 | | | | 179,278 | | |

Crown Holdings, Inc. (a) | | | 3,999 | | | | 210,227 | | |

Graphic Packaging Holding Company | | | 12,672 | | | | 158,147 | | |

International Paper Company | | | 3,716 | | | | 197,171 | | |

Packaging Corporation of America | | | 1,993 | | | | 169,046 | | |

Sealed Air Corporation | | | 3,676 | | | | 166,670 | | |

Sonoco Products Company | | | 4,869 | | | | 256,596 | | |

| | | | 2,028,625 | | |

Distributors (0.6%): | |

Genuine Parts Company | | | 2,756 | | | | 263,308 | | |

LKQ Corporation (a) | | | 5,116 | | | | 156,806 | | |

Pool Corporation | | | 2,710 | | | | 282,761 | | |

| | | | 702,875 | | |

See notes to financial statements.

10

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Diversified Consumer Services (0.4%): | |

Service Corporation International | | | 8,637 | | | $ | 245,291 | | |

ServiceMaster Global Holdings, Inc. (a) | | | 4,707 | | | | 177,312 | | |

| | | | 422,603 | | |

Diversified Financial Services (0.4%): | |

Berkshire Hathaway, Inc. — Class B (a) | | | 2,386 | | | | 388,870 | | |

Diversified Telecommunication Services (0.8%): | |

AT&T, Inc. | | | 9,674 | | | | 411,435 | | |

CenturyLink, Inc. | | | 5,953 | | | | 141,562 | | |

Verizon Communications, Inc. | | | 6,104 | | | | 325,832 | | |

| | | | 878,829 | | |

Electric Utilities (3.3%): | |

Alliant Energy Corporation | | | 7,770 | | | | 294,405 | | |

American Electric Power Company, Inc. | | | 4,646 | | | | 292,512 | | |

Duke Energy Corporation | | | 3,892 | | | | 302,097 | | |

Eversource Energy | | | 5,791 | | | | 319,837 | | |

Exelon Corporation | | | 7,348 | | | | 260,781 | | |

NextEra Energy, Inc. | | | 2,655 | | | | 317,166 | | |

OGE Energy Corporation | | | 7,235 | | | | 242,011 | | |

PG&E Corporation | | | 5,132 | | | | 311,872 | | |

Pinnacle West Capital Corporation | | | 4,046 | | | | 315,709 | | |

PPL Corporation | | | 8,248 | | | | 280,844 | | |

Southern Company | | | 6,704 | | | | 329,770 | | |

Xcel Energy, Inc. | | | 7,714 | | | | 313,960 | | |

| | | | 3,580,964 | | |

Electrical Equipment (1.4%): | |

Acuity Brands, Inc. | | | 584 | | | | 134,822 | | |

AMETEK, Inc. | | | 4,913 | | | | 238,772 | | |

Eaton Corporation PLC | | | 3,085 | | | | 206,973 | | |

Emerson Electric Company | | | 4,116 | | | | 229,467 | | |

Hubbell, Inc. | | | 2,423 | | | | 282,764 | | |

Rockwell Automation, Inc. | | | 1,893 | | | | 254,419 | | |

Sensata Technologies Holding NV (a) | | | 3,768 | | | | 146,764 | | |

| | | | 1,493,981 | | |

Electronic Equipment, Instruments & Components (2.3%): | |

Amphenol Corporation — Class A | | | 4,602 | | | | 309,254 | | |

Arrow Electronics, Inc. (a) | | | 2,766 | | | | 197,216 | | |

Avnet, Inc. | | | 5,071 | | | | 241,430 | | |

CDW Corporation | | | 4,686 | | | | 244,094 | | |

Cognex Corporation | | | 2,864 | | | | 182,208 | | |

Dolby Laboratories, Inc. | | | 3,671 | | | | 165,892 | | |

Flex Ltd. (a) | | | 14,046 | | | | 201,841 | | |

FLIR Systems, Inc. | | | 6,629 | | | | 239,904 | | |

IPG Photonics Corporation (a) | | | 1,775 | | | | 175,210 | | |

Keysight Technologies, Inc. (a) | | | 5,502 | | | | 201,208 | | |

See notes to financial statements.

11

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Electronic Equipment, Instruments & Components (2.3%) cont'd | |

SYNNEX Corporation | | | 1,680 | | | $ | 203,314 | | |

Trimble Navigation Ltd. (a) | | | 5,986 | | | | 180,478 | | |

| | | | 2,542,049 | | |

Energy Equipment & Services (0.2%): | |

FMC Technologies, Inc. (a) | | | 4,628 | | | | 164,433 | | |

Food & Staples Retailing (1.8%): | |

Casey's General Stores, Inc. | | | 1,515 | | | | 180,103 | | |

Costco Wholesale Corporation | | | 1,845 | | | | 295,403 | | |

CVS Health Corporation | | | 3,145 | | | | 248,172 | | |

Sysco Corporation | | | 5,574 | | | | 308,632 | | |

The Kroger Company | | | 6,487 | | | | 223,866 | | |

Walgreens Boots Alliance, Inc. | | | 2,862 | | | | 236,859 | | |

Wal-Mart Stores, Inc. | | | 3,547 | | | | 245,169 | | |

Whole Foods Market, Inc. | | | 6,198 | | | | 190,651 | | |

| | | | 1,928,855 | | |

Food Products (2.6%): | |

Archer-Daniels-Midland Company | | | 3,901 | | | | 178,081 | | |

Blue Buffalo Pet Products, Inc. (a) | | | 4,803 | | | | 115,464 | | |

Bunge Ltd. | | | 2,175 | | | | 157,122 | | |

Campbell Soup Company | | | 4,492 | | | | 271,631 | | |

General Mills, Inc. | | | 4,800 | | | | 296,496 | | |

Hormel Foods Corporation | | | 5,440 | | | | 189,366 | | |

Ingredion, Inc. | | | 1,635 | | | | 204,310 | | |

McCormick & Company, Inc. | | | 3,073 | | | | 286,803 | | |

Mead Johnson Nutrition Company | | | 2,424 | | | | 171,522 | | |

Pilgrim's Pride Corporation | | | 6,947 | | | | 131,924 | | |

Pinnacle Foods, Inc. | | | 4,898 | | | | 261,798 | | |

The Hershey Company | | | 1,827 | | | | 188,967 | | |

The J.M. Smucker Company | | | 1,772 | | | | 226,922 | | |

Tyson Foods, Inc. — Class A | | | 2,907 | | | | 179,304 | | |

| | | | 2,859,710 | | |

Gas Utilities (0.3%): | |

Atmos Energy Corporation | | | 4,111 | | | | 304,831 | | |

Health Care Equipment & Supplies (3.3%): | |

Abbott Laboratories | | | 4,812 | | | | 184,829 | | |

ABIOMED, Inc. (a) | | | 1,125 | | | | 126,765 | | |

Align Technology, Inc. (a) | | | 1,743 | | | | 167,555 | | |

Becton, Dickinson and Company | | | 1,661 | | | | 274,979 | | |

Danaher Corporation | | | 4,474 | | | | 348,256 | | |

DENTSPLY SIRONA, Inc. | | | 4,009 | | | | 231,440 | | |

Edwards Lifesciences Corporation (a) | | | 1,340 | | | | 125,558 | | |

Hologic, Inc. (a) | | | 4,682 | | | | 187,842 | | |

IDEXX Laboratories, Inc. (a) | | | 1,713 | | | | 200,883 | | |

Intuitive Surgical, Inc. (a) | | | 372 | | | | 235,911 | | |

ResMed, Inc. | | | 3,277 | | | | 203,338 | | |

Stryker Corporation | | | 2,750 | | | | 329,477 | | |

Teleflex, Inc. | | | 1,399 | | | | 225,449 | | |

See notes to financial statements.

12

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Health Care Equipment & Supplies (3.3%) cont'd | |

The Cooper Companies, Inc. | | | 1,290 | | | $ | 225,660 | | |

Varian Medical Systems, Inc. (a) | | | 2,644 | | | | 237,378 | | |

West Pharmaceutical Services, Inc. | | | 2,899 | | | | 245,922 | | |

| | | | 3,551,242 | | |

Health Care Providers & Services (3.6%): | |

Acadia Healthcare Company, Inc. (a) | | | 2,382 | | | | 78,844 | | |

Aetna, Inc. | | | 1,737 | | | | 215,405 | | |

AmerisourceBergen Corporation | | | 2,592 | | | | 202,669 | | |

Anthem, Inc. | | | 1,577 | | | | 226,725 | | |

Cardinal Health, Inc. | | | 2,581 | | | | 185,755 | | |

Cigna Corporation | | | 1,470 | | | | 196,083 | | |

Express Scripts Holdings Company (a) | | | 3,078 | | | | 211,736 | | |

HCA Holdings, Inc. (a) | | | 2,848 | | | | 210,809 | | |

Henry Schein, Inc. (a) | | | 1,417 | | | | 214,973 | | |

Humana, Inc. | | | 981 | | | | 200,153 | | |

Laboratory Corporation of America Holdings (a) | | | 1,931 | | | | 247,902 | | |

McKesson Corporation | | | 963 | | | | 135,253 | | |

MEDNAX, Inc. (a) | | | 3,093 | | | | 206,179 | | |

Patterson Companies, Inc. | | | 4,816 | | | | 197,600 | | |

Quest Diagnostics, Inc. | | | 3,399 | | | | 312,368 | | |

UnitedHealth Group, Inc. | | | 2,199 | | | | 351,928 | | |

Universal Health Services, Inc. — Class B | | | 1,613 | | | | 171,591 | | |

VCA, Inc. — Class A (a) | | | 2,650 | | | | 181,923 | | |

WellCare Health Plans, Inc. (a) | | | 1,457 | | | | 199,726 | | |

| | | | 3,947,622 | | |

Health Care Technology (0.3%): | |

Cerner Corporation (a) | | | 3,008 | | | | 142,489 | | |

Veeva Systems, Inc. (a) | | | 3,711 | | | | 151,038 | | |

| | | | 293,527 | | |

Hotels, Restaurants & Leisure (3.0%): | |

Aramark | | | 6,584 | | | | 235,181 | | |

Carnival Corporation | | | 3,882 | | | | 202,097 | | |

Darden Restaurants, Inc. | | | 3,880 | | | | 282,154 | | |

Domino's Pizza, Inc. | | | 1,226 | | | | 195,228 | | |

Hilton Worldwide Holdings, Inc. | | | 7,186 | | | | 195,459 | | |

Hyatt Hotels Corporation — Class A (a) | | | 3,069 | | | | 169,593 | | |

Las Vegas Sands Corporation | | | 2,580 | | | | 137,798 | | |

Marriott International, Inc. — Class A | | | 2,697 | | | | 222,988 | | |

McDonald's Corporation | | | 2,715 | | | | 330,470 | | |

Norwegian Cruise Line Holdings Ltd. (a) | | | 3,399 | | | | 144,559 | | |

Panera Bread Company — Class A (a) | | | 1,026 | | | | 210,422 | | |

Royal Caribbean Cruises Ltd. | | | 1,768 | | | | 145,047 | | |

Starbucks Corporation | | | 4,163 | | | | 231,130 | | |

Wyndham Worldwide Corporation | | | 2,543 | | | | 194,209 | | |

Wynn Resorts Ltd. | | | 1,067 | | | | 92,306 | | |

Yum! Brands, Inc. | | | 3,683 | | | | 233,244 | | |

| | | | 3,221,885 | | |

See notes to financial statements.

13

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Household Durables (1.8%): | |

CalAtlantic Group, Inc. | | | 4,151 | | | $ | 141,175 | | |

D.R. Horton, Inc. | | | 5,611 | | | | 153,349 | | |

Harman International Industries, Inc. | | | 1,310 | | | | 145,620 | | |

Leggett & Platt, Inc. | | | 4,861 | | | | 237,606 | | |

Lennar Corporation — Class A | | | 4,152 | | | | 178,245 | | |

Mohawk Industries, Inc. (a) | | | 976 | | | | 194,888 | | |

Newell Rubbermaid, Inc. | | | 3,330 | | | | 148,684 | | |

NVR, Inc. (a) | | | 159 | | | | 265,371 | | |

PulteGroup, Inc. | | | 8,473 | | | | 155,734 | | |

Toll Brothers, Inc. (a) | | | 5,127 | | | | 158,937 | | |

Whirlpool Corporation | | | 1,041 | | | | 189,222 | | |

| | | | 1,968,831 | | |

Household Products (1.3%): | |

Church & Dwight Company, Inc. | | | 5,982 | | | | 264,344 | | |

Kimberly-Clark Corporation | | | 2,530 | | | | 288,724 | | |

Procter & Gamble Company | | | 4,385 | | | | 368,691 | | |

Spectrum Brands Holdings, Inc. | | | 1,684 | | | | 206,004 | | |

The Clorox Company | | | 2,497 | | | | 299,690 | | |

| | | | 1,427,453 | | |

Industrial Conglomerates (1.1%): | |

| 3M Company | | | 1,889 | | | | 337,319 | | |

Carlisle Companies, Inc. | | | 2,379 | | | | 262,380 | | |

Honeywell International, Inc. | | | 2,640 | | | | 305,844 | | |

Roper Technologies, Inc. | | | 1,292 | | | | 236,539 | | |

| | | | 1,142,082 | | |

Insurance (6.1%): | |

Aflac, Inc. | | | 4,158 | | | | 289,397 | | |

Alleghany Corporation (a) | | | 532 | | | | 323,520 | | |

American Financial Group, Inc. | | | 4,089 | | | | 360,323 | | |

AmTrust Financial Services, Inc. | | | 6,838 | | | | 187,224 | | |

Arthur J Gallagher & Company | | | 5,706 | | | | 296,484 | | |

Brown & Brown, Inc. | | | 7,669 | | | | 344,031 | | |

Cincinnati Financial Corporation | | | 4,008 | | | | 303,606 | | |

Erie Indemnity Company — Class A | | | 2,550 | | | | 286,748 | | |

First American Financial Corporation | | | 5,196 | | | | 190,329 | | |

Hartford Financial Services Group, Inc. | | | 4,791 | | | | 228,291 | | |

Lincoln National Corporation | | | 2,593 | | | | 171,838 | | |

Markel Corporation (a) | | | 309 | | | | 279,491 | | |

Marsh & McLennan Companies, Inc. | | | 4,978 | | | | 336,463 | | |

MetLife, Inc. | | | 3,280 | | | | 176,759 | | |

Old Republic International Corporation | | | 16,310 | | | | 309,890 | | |

Principal Financial Group, Inc. | | | 3,234 | | | | 187,119 | | |

Progressive Corporation | | | 9,457 | | | | 335,724 | | |

Prudential Financial, Inc. | | | 1,999 | | | | 208,016 | | |

Reinsurance Group of America, Inc. | | | 2,363 | | | | 297,336 | | |

The Allstate Corporation | | | 4,911 | | | | 364,003 | | |

The Travelers Companies, Inc. | | | 2,552 | | | | 312,416 | | |

See notes to financial statements.

14

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Insurance (6.1%) cont'd | |

Torchmark Corporation | | | 3,888 | | | $ | 286,779 | | |

Unum Group | | | 4,640 | | | | 203,835 | | |

W.R. Berkley Corporation | | | 5,030 | | | | 334,545 | | |

| | | | 6,614,167 | | |

Internet & Catalog Retail (0.4%): | |

Netflix, Inc. (a) | | | 1,134 | | | | 140,389 | | |

The Priceline Group, Inc. (a) | | | 107 | | | | 156,869 | | |

TripAdvisor, Inc. (a) | | | 2,090 | | | | 96,913 | | |

| | | | 394,171 | | |

Internet & Direct Marketing Retail (0.1%): | |

Amazon.com, Inc. (a) | | | 209 | | | | 156,723 | | |

Internet Software & Services (0.8%): | |

Akamai Technologies, Inc. (a) | | | 2,201 | | | | 146,763 | | |

Alphabet, Inc. — Class A (a) | | | 286 | | | | 226,641 | | |

eBay, Inc. (a) | | | 4,964 | | | | 147,381 | | |

Facebook, Inc. — Class A (a) | | | 1,299 | | | | 149,450 | | |

VeriSign, Inc. (a) | | | 2,703 | | | | 205,617 | | |

| | | | 875,852 | | |

IT Services (5.0%): | |

Alliance Data Systems Corporation | | | 594 | | | | 135,729 | | |

Amdocs Ltd. | | | 4,743 | | | | 276,280 | | |

Automatic Data Processing, Inc. | | | 3,228 | | | | 331,774 | | |

Black Knight Financial Services, Inc. (a) | | | 4,324 | | | | 163,447 | | |

Booz Allen Hamilton Holding Corporation | | | 7,841 | | | | 282,825 | | |

Broadridge Financial Solutions, Inc. | | | 4,001 | | | | 265,266 | | |

Cognizant Technology Solutions Corporation — Class A (a) | | | 3,200 | | | | 179,296 | | |

Fidelity National Information Services, Inc. | | | 2,915 | | | | 220,491 | | |

Fiserv, Inc. (a) | | | 2,691 | | | | 285,999 | | |

FleetCor Technologies, Inc. (a) | | | 1,033 | | | | 146,190 | | |

Gartner, Inc. (a) | | | 2,602 | | | | 262,984 | | |

Genpact Ltd. (a) | | | 10,427 | | | | 253,793 | | |

Global Payments, Inc. | | | 2,112 | | | | 146,594 | | |

International Business Machines Corporation | | | 1,497 | | | | 248,487 | | |

Jack Henry & Associates, Inc. | | | 3,388 | | | | 300,787 | | |

Leidos Holdings, Inc. | | | 2,602 | | | | 133,066 | | |

MasterCard, Inc. — Class A | | | 2,336 | | | | 241,192 | | |

Paychex, Inc. | | | 4,417 | | | | 268,907 | | |

PayPal Holdings, Inc. (a) | | | 4,588 | | | | 181,088 | | |

Sabre Corporation | | | 6,547 | | | | 163,348 | | |

The Western Union Company | | | 10,101 | | | | 219,394 | | |

Total System Services, Inc. | | | 3,178 | | | | 155,817 | | |

Vantiv, Inc. — Class A (a) | | | 3,732 | | | | 222,502 | | |

Visa, Inc. — Class A | | | 2,703 | | | | 210,888 | | |

WEX, Inc. (a) | | | 1,343 | | | | 149,879 | | |

| | | | 5,446,023 | | |

See notes to financial statements.

15

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Leisure Products (0.3%): | |

Hasbro, Inc. | | | 2,694 | | | $ | 209,566 | | |

Polaris Industries, Inc. | | | 1,713 | | | | 141,134 | | |

| | | | 350,700 | | |

Life Sciences Tools & Services (1.5%): | |

Agilent Technologies, Inc. | | | 4,594 | | | | 209,303 | | |

Bio-Rad Laboratories, Inc. (a) | | | 1,669 | | | | 304,225 | | |

Illumina, Inc. (a) | | | 606 | | | | 77,592 | | |

Mettler-Toledo International, Inc. (a) | | | 582 | | | | 243,602 | | |

PerkinElmer, Inc. | | | 3,617 | | | | 188,627 | | |

Quintiles Transnational Holdings, Inc. (a) | | | 2,866 | | | | 217,959 | | |

Thermo Fisher Scientific, Inc. | | | 1,618 | | | | 228,300 | | |

Waters Corporation (a) | | | 1,603 | | | | 215,427 | | |

| | | | 1,685,035 | | |

Machinery (3.6%): | |

Allison Transmission Holdings, Inc. | | | 7,506 | | | | 252,877 | | |

Cummins, Inc. | | | 1,604 | | | | 219,219 | | |

Deere & Company | | | 2,175 | | | | 224,112 | | |

Donaldson Company, Inc. | | | 5,511 | | | | 231,903 | | |

Dover Corporation | | | 2,745 | | | | 205,683 | | |

Flowserve Corporation | | | 3,290 | | | | 158,085 | | |

IDEX Corporation | | | 2,871 | | | | 258,562 | | |

Illinois Tool Works, Inc. | | | 2,468 | | | | 302,231 | | |

Ingersoll-Rand PLC | | | 3,116 | | | | 233,825 | | |

Middleby Corporation (a) | | | 1,393 | | | | 179,432 | | |

Nordson Corporation | | | 1,604 | | | | 179,728 | | |

Parker-Hannifin Corporation | | | 1,729 | | | | 242,060 | | |

Snap-on, Inc. | | | 1,509 | | | | 258,446 | | |

Stanley Black & Decker, Inc. | | | 1,985 | | | | 227,660 | | |

The Toro Company | | | 5,076 | | | | 284,002 | | |

Wabtec Corporation | | | 2,324 | | | | 192,938 | | |

Xylem, Inc. | | | 5,440 | | | | 269,389 | | |

| | | | 3,920,152 | | |

Media (2.7%): | |

CBS Corporation — Class B | | | 3,715 | | | | 236,348 | | |

Cinemark Holdings, Inc. | | | 5,170 | | | | 198,321 | | |

Comcast Corporation — Class A | | | 4,426 | | | | 305,615 | | |

Discovery Communications, Inc. (a) | | | 6,299 | | | | 172,656 | | |

Omnicom Group, Inc. | | | 3,076 | | | | 261,798 | | |

Scripps Networks Interactive, Inc. — Class A | | | 2,967 | | | | 211,755 | | |

Sirius XM Holdings, Inc. | | | 61,529 | | | | 273,804 | | |

TEGNA, Inc. | | | 7,979 | | | | 170,671 | | |

The Interpublic Group of Companies. Inc. | | | 10,147 | | | | 237,541 | | |

The Walt Disney Company | | | 2,926 | | | | 304,948 | | |

Time Warner, Inc. | | | 2,815 | | | | 271,732 | | |

Twenty-First Century Fox, Inc. — Class A | | | 8,810 | | | | 247,033 | | |

Viacom, Inc. | | | 2,539 | | | | 89,119 | | |

| | | | 2,981,341 | | |

See notes to financial statements.

16

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Metals & Mining (0.2%): | |

Reliance Steel & Aluminum Company | | | 2,537 | | | $ | 201,793 | | |

Multiline Retail (0.8%): | |

Dollar General Corporation | | | 2,149 | | | | 159,176 | | |

Dollar Tree, Inc. (a) | | | 2,105 | | | | 162,464 | | |

Kohl's Corporation | | | 2,538 | | | | 125,327 | | |

Macy's, Inc. | | | 3,449 | | | | 123,509 | | |

Nordstrom, Inc. | | | 2,543 | | | | 121,886 | | |

Target Corporation | | | 3,071 | | | | 221,818 | | |

| | | | 914,180 | | |

Multi-Utilities (2.6%): | |

Ameren Corporation | | | 6,204 | | | | 325,462 | | |

CMS Energy Corporation | | | 7,510 | | | | 312,566 | | |

Consolidated Edison, Inc. | | | 4,006 | | | | 295,162 | | |

Dominion Resources, Inc. | | | 4,321 | | | | 330,945 | | |

DTE Energy Company | | | 3,352 | | | | 330,206 | | |

Public Service Enterprise Group, Inc. | | | 7,029 | | | | 308,433 | | |

SCANA Corporation | | | 4,378 | | | | 320,820 | | |

Sempra Energy | | | 2,646 | | | | 266,293 | | |

WEC Energy Group, Inc. | | | 5,033 | | | | 295,185 | | |

| | | | 2,785,072 | | |

Oil, Gas & Consumable Fuels (1.1%): | |

Cheniere Energy Partners LP Holdings LLC | | | 6,759 | | | | 151,199 | | |

Exxon Mobil Corporation | | | 2,856 | | | | 257,783 | | |

Marathon Petroleum Corporation | | | 2,538 | | | | 127,788 | | |

ONEOK, Inc. | | | 2,000 | | | | 114,820 | | |

Phillips 66 | | | 2,428 | | | | 209,803 | | |

Plains GP Holdings LP | | | 2,124 | | | | 73,660 | | |

Tesoro Corporation | | | 1,510 | | | | 132,050 | | |

Valero Energy Corporation | | | 2,549 | | | | 174,148 | | |

| | | | 1,241,251 | | |

Personal Products (0.2%): | |

Estee Lauder Companies, Inc. | | | 3,030 | | | | 231,765 | | |

Pharmaceuticals (1.4%): | |

Eli Lilly and Company | | | 3,030 | | | | 222,856 | | |

Johnson & Johnson | | | 3,246 | | | | 373,972 | | |

Mallinckrodt PLC (a) | | | 1,292 | | | | 64,367 | | |

Merck & Company, Inc. | | | 3,999 | | | | 235,421 | | |

Mylan NV (a) | | | 2,959 | | | | 112,886 | | |

Pfizer, Inc. | | | 8,477 | | | | 275,333 | | |

Zoetis, Inc. | | | 4,430 | | | | 237,138 | | |

| | | | 1,521,973 | | |

Professional Services (1.1%): | |

Dun & Bradstreet Corporation | | | 1,447 | | | | 175,550 | | |

Equifax, Inc. | | | 1,797 | | | | 212,459 | | |

ManpowerGroup, Inc. | | | 2,060 | | | | 183,072 | | |

Nielsen Holdings PLC | | | 5,301 | | | | 222,377 | | |

See notes to financial statements.

17

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Professional Services (1.1%) cont'd | |

Robert Half International, Inc. | | | 3,816 | | | $ | 186,145 | | |

Verisk Analytics, Inc. (a) | | | 3,174 | | | | 257,634 | | |

| | | | 1,237,237 | | |

Real Estate Management & Development (0.4%): | |

CBRE Group, Inc. — Class A (a) | | | 4,575 | | | | 144,067 | | |

Jones Lang LaSalle, Inc. | | | 1,016 | | | | 102,656 | | |

The Howard Hughes Corporation (a) | | | 1,339 | | | | 152,780 | | |

| | | | 399,503 | | |

Road & Rail (1.4%): | |

AMERCO | | | 536 | | | | 198,100 | | |

CSX Corporation | | | 6,570 | | | | 236,060 | | |

JB Hunt Transport Services, Inc. | | | 2,956 | | | | 286,939 | | |

Kansas City Southern | | | 1,953 | | | | 165,712 | | |

Norfolk Southern Corporation | | | 1,903 | | | | 205,657 | | |

Old Dominion Freight Line, Inc. (a) | | | 2,592 | | | | 222,368 | | |

Union Pacific Corporation | | | 2,163 | | | | 224,260 | | |

| | | | 1,539,096 | | |

Semiconductors & Semiconductor Equipment (1.9%): | |

Analog Devices, Inc. | | | 3,556 | | | | 258,237 | | |

Applied Materials, Inc. | | | 5,284 | | | | 170,515 | | |

Intel Corporation | | | 5,977 | | | | 216,786 | | |

Lam Research Corporation | | | 1,950 | | | | 206,173 | | |

NVIDIA Corporation | | | 2,386 | | | | 254,682 | | |

ON Semiconductor Corporation (a) | | | 12,097 | | | | 154,358 | | |

QUALCOMM, Inc. | | | 2,818 | | | | 183,733 | | |

Skyworks Solutions, Inc. | | | 1,718 | | | | 128,266 | | |

Texas Instruments, Inc. | | | 3,291 | | | | 240,144 | | |

Xilinx, Inc. | | | 3,730 | | | | 225,180 | | |

| | | | 2,038,074 | | |

Software (2.8%): | |

Activision Blizzard, Inc. | | | 3,513 | | | | 126,854 | | |

Adobe Systems, Inc. (a) | | | 1,905 | | | | 196,120 | | |

ANSYS, Inc. (a) | | | 2,370 | | | | 219,201 | | |

CA, Inc. | | | 7,342 | | | | 233,255 | | |

Cadence Design Systems, Inc. (a) | | | 8,790 | | | | 221,684 | | |

CDK Global, Inc. | | | 3,724 | | | | 222,286 | | |

Citrix Systems, Inc. (a) | | | 2,012 | | | | 179,692 | | |

Manhattan Associates, Inc. (a) | | | 2,165 | | | | 114,810 | | |

Microsoft Corporation | | | 3,621 | | | | 225,009 | | |

Oracle Corporation | | | 6,353 | | | | 244,273 | | |

Red Hat, Inc. (a) | | | 2,535 | | | | 176,690 | | |

Symantec Corporation | | | 5,818 | | | | 138,992 | | |

Synopsys, Inc. (a) | | | 4,841 | | | | 284,941 | | |

Tyler Technologies, Inc. (a) | | | 864 | | | | 123,353 | | |

Ultimate Software Group, Inc. (a) | | | 764 | | | | 139,315 | | |

VMware, Inc. — Class A (a) | | | 2,148 | | | | 169,112 | | |

| | | | 3,015,587 | | |

See notes to financial statements.

18

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Specialty Retail (3.8%): | |

Advance Auto Parts, Inc. | | | 1,363 | | | $ | 230,511 | | |

AutoNation, Inc. (a) | | | 2,977 | | | | 144,831 | | |

AutoZone, Inc. (a) | | | 376 | | | | 296,961 | | |

Bed Bath & Beyond, Inc. | | | 4,260 | | | | 173,126 | | |

Best Buy Company, Inc. | | | 3,404 | | | | 145,249 | | |

Burlington Stores, Inc. (a) | | | 1,829 | | | | 155,008 | | |

CarMax, Inc. (a) | | | 2,334 | | | | 150,286 | | |

Dick's Sporting Goods, Inc. | | | 2,685 | | | | 142,573 | | |

Foot Locker, Inc. | | | 2,685 | | | | 190,340 | | |

L Brands, Inc. | | | 2,205 | | | | 145,177 | | |

Lowe's Companies, Inc. | | | 3,115 | | | | 221,539 | | |

Michaels Companies, Inc. (a) | | | 6,312 | | | | 129,080 | | |

O'Reilly Automotive, Inc. (a) | | | 851 | | | | 236,927 | | |

Ross Stores, Inc. | | | 3,613 | | | | 237,013 | | |

Signet Jewelers Ltd. | | | 1,514 | | | | 142,710 | | |

The Gap, Inc. | | | 4,904 | | | | 110,046 | | |

The Home Depot, Inc. | | | 2,053 | | | | 275,266 | | |

The TJX Companies, Inc. | | | 3,277 | | | | 246,201 | | |

Tiffany & Company | | | 2,655 | | | | 205,577 | | |

Tractor Supply Company | | | 2,688 | | | | 203,777 | | |

Ulta Salon, Cosmetics & Fragrances, Inc. (a) | | | 643 | | | | 163,926 | | |

Urban Outfitters, Inc. (a) | | | 3,397 | | | | 96,747 | | |

Williams-Sonoma, Inc. | | | 2,803 | | | | 135,637 | | |

| | | | 4,178,508 | | |

Technology Hardware, Storage & Peripherals (0.3%): | |

Apple, Inc. | | | 1,883 | | | | 218,089 | | |

HP, Inc. | | | 10,618 | | | | 157,571 | | |

| | | | 375,660 | | |

Textiles, Apparel & Luxury Goods (0.8%): | |

Carter's, Inc. | | | 1,836 | | | | 158,612 | | |

Coach, Inc. | | | 4,415 | | | | 154,613 | | |

Hanesbrands, Inc. | | | 5,449 | | | | 117,535 | | |

NIKE, Inc. — Class B | | | 3,737 | | | | 189,952 | | |

PVH Corporation | | | 1,338 | | | | 120,741 | | |

VF Corporation | | | 3,193 | | | | 170,347 | | |

| | | | 911,800 | | |

Thrifts & Mortgage Finance (0.3%): | |

TFS Financial Corporation | | | 15,278 | | | | 290,893 | | |

Tobacco (0.9%): | |

Altria Group, Inc. | | | 5,439 | | | | 367,785 | | |

Philip Morris International, Inc. | | | 3,387 | | | | 309,876 | | |

Reynolds American, Inc. | | | 5,568 | | | | 312,031 | | |

| | | | 989,692 | | |

Trading Companies & Distributors (1.1%): | |

Fastenal Company | | | 5,009 | | | | 235,323 | | |

MSC Industrial Direct Company, Inc. | | | 3,358 | | | | 310,246 | | |

See notes to financial statements.

19

Victory Portfolios II

VictoryShares US 500 Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Trading Companies & Distributors (1.1%) cont'd | |

United Rentals, Inc. (a) | | | 1,235 | | | $ | 130,391 | | |

W.W. Grainger, Inc. | | | 1,077 | | | | 250,133 | | |

Watsco, Inc. | | | 1,714 | | | | 253,878 | | |

| | | | 1,179,971 | | |

Transportation Infrastructure (0.2%): | |

Macquarie Infrastructure Company LLC | | | 2,096 | | | | 171,243 | | |

Water Utilities (0.5%): | |

American Water Works Company, Inc. | | | 3,496 | | | | 252,971 | | |

Aqua America, Inc. | | | 9,379 | | | | 281,745 | | |

| | | | 534,716 | | |

Wireless Telecommunication Services (0.2%): | |

T-Mobile US, Inc. (a) | | | 4,004 | | | | 230,270 | | |

Total Common Stocks (Cost $103,172,149) | | | 108,694,041 | | |

Short-Term Investments (0.1%) | |

Money Market Funds (0.1%): | |

Short-Term Investments Trust Government & Agency Portfolio —

Institutional Class, 0.43% (b) | | | 130,818 | | | | 130,818 | | |

Total Short-Term Investments (Cost $130,818) | | | 130,818 | | |

Total Investments — 99.9% (Cost $103,302,967) | | | 108,824,859 | | |

Other assets in excess of liabilities — 0.1% | | | 102,872 | | |

NET ASSETS — 100.0% | | $ | 108,927,731 | | |

(a) Non-income producing security.

(b) Annualized seven-day yield as of December 31, 2016.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor's Financial Services LLC ("S&P"). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund's Administrator, U.S. Bancorp Fund Services, LLC.

Schedule of Open Futures Contracts

Number of

Contracts

Purchased | | Description | | Notional Value | | Unrealized

Appreciation | |

| | 1 | | | S&P 500 E-Mini Future, March 2017 | | $ | 111,810 | | | $ | 233 | | |

| | | $ | 233 | | |

See notes to financial statements.

20

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (100.0%) | |

Aerospace & Defense (1.3%): | |

AAR Corporation | | | 2,068 | | | $ | 68,347 | | |

Astronics Corporation (a) | | | 137 | | | | 4,617 | | |

Astronics Corporation (a) | | | 980 | | | | 33,163 | | |

DigitalGlobe, Inc. (a) | | | 1,787 | | | | 51,198 | | |

Mercury Systems, Inc. (a) | | | 2,702 | | | | 81,654 | | |

Moog, Inc. — Class A (a) | | | 978 | | | | 64,235 | | |

National Presto Industries, Inc. | | | 930 | | | | 98,952 | | |

TASER International, Inc. (a) | | | 2,173 | | | | 52,674 | | |

| | | | 454,840 | | |

Air Freight & Logistics (0.5%): | |

Air Transport Services Group, Inc. (a) | | | 3,855 | | | | 61,526 | | |

Echo Global Logistics, Inc. (a) | | | 2,397 | | | | 60,045 | | |

Hub Group, Inc. — Class A (a) | | | 1,669 | | | | 73,018 | | |

| | | | 194,589 | | |

Airlines (0.7%): | |

Allegiant Travel Company | | | 429 | | | | 71,386 | | |

Hawaiian Holdings, Inc. (a) | | | 1,070 | | | | 60,990 | | |

SkyWest, Inc. | | | 1,697 | | | | 61,856 | | |

Spirit Airlines, Inc. (a) | | | 1,183 | | | | 68,448 | | |

| | | | 262,680 | | |

Auto Components (2.1%): | |

American Axle & Manufacturing Holdings, Inc. (a) | | | 2,277 | | | | 43,946 | | |

Cooper Standard Holding, Inc. (a) | | | 720 | | | | 74,434 | | |

Cooper Tire & Rubber Company | | | 1,843 | | | | 71,601 | | |

Dorman Products, Inc. (a) | | | 1,157 | | | | 84,530 | | |

Drew Industries, Inc. | | | 764 | | | | 82,321 | | |

Fox Factory Holdings Corporation (a) | | | 2,972 | | | | 82,473 | | |

Gentherm, Inc. (a) | | | 1,412 | | | | 47,796 | | |

Metaldyne Performance Group, Inc. | | | 2,953 | | | | 67,771 | | |

Standard Motor Products, Inc. | | | 1,245 | | | | 66,259 | | |

Stoneridge, Inc. (a) | | | 2,965 | | | | 52,451 | | |

Superior Industries International, Inc. | | | 2,272 | | | | 59,867 | | |

Visteon Corporation | | | 430 | | | | 34,546 | | |

| | | | 767,995 | | |

Automobiles (0.2%): | |

Winnebago Industries, Inc. | | | 2,748 | | | | 86,974 | | |

Banks (16.3%): | |

1st Source Corporation | | | 2,654 | | | | 118,528 | | |

Ameris Bancorp | | | 2,282 | | | | 99,495 | | |

Associated Banc-Corp | | | 3,722 | | | | 91,933 | | |

Banc of California, Inc. | | | 2,815 | | | | 48,840 | | |

BancFirst Corporation | | | 1,191 | | | | 110,823 | | |

BancorpSouth, Inc. | | | 2,808 | | | | 87,188 | | |

Banner Corporation | | | 1,763 | | | | 98,393 | | |

BNC Bancorp | | | 3,282 | | | | 104,696 | | |

See notes to financial statements.

21

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Banks (16.3%) cont'd | |

Boston Private Financial Holdings, Inc. | | | 5,805 | | | $ | 96,073 | | |

Capital Bank Financial Corporation | | | 2,912 | | | | 114,296 | | |

Cathay General Bancorp | | | 2,410 | | | | 91,652 | | |

Chemical Financial Corporation | | | 2,020 | | | | 109,423 | | |

Columbia Banking System, Inc. | | | 2,262 | | | | 101,066 | | |

Community Bank Systems, Inc. | | | 1,915 | | | | 118,328 | | |

CVB Financial Corporation | | | 4,358 | | | | 99,929 | | |

Eagle Bancorp, Inc. (a) | | | 1,427 | | | | 86,976 | | |

FCB Financial Holdings, Inc. (a) | | | 1,957 | | | | 93,349 | | |

First Busey Corporation | | | 4,327 | | | | 133,185 | | |

First Commonwealth Financial Corporation | | | 7,640 | | | | 108,335 | | |

First Financial Bancorp | | | 3,954 | | | | 112,491 | | |

First Financial Bankshares, Inc. | | | 1,837 | | | | 83,032 | | |

First Interstate BancSystem, Inc. — Class A | | | 3,002 | | | | 127,735 | | |

First Merchants Corporation | | | 3,182 | | | | 119,802 | | |

First Midwest Bancorp, Inc. | | | 3,890 | | | | 98,145 | | |

FNB Corporation | | | 5,936 | | | | 95,154 | | |

Fulton Financial Corporation | | | 5,705 | | | | 107,254 | | |

Glacier Bancorp, Inc. | | | 2,597 | | | | 94,089 | | |

Great Western Bancorp, Inc. | | | 2,160 | | | | 94,154 | | |

Hancock Holding Company | | | 1,812 | | | | 78,097 | | |

Heartland Financial USA, Inc. | | | 1,764 | | | | 84,672 | | |

Hilltop Holdings, Inc. | | | 2,808 | | | | 83,678 | | |

Hope Bancorp, Inc. | | | 4,215 | | | | 92,266 | | |

IBERIABANK Corporation | | | 934 | | | | 78,223 | | |

Independent Bank Corporation | | | 1,481 | | | | 104,337 | | |

International Bancshares Corporation | | | 2,275 | | | | 92,820 | | |

Lakeland Financial Corporation | | | 2,796 | | | | 132,419 | | |

LegacyTexas Financial Group, Inc. | | | 1,732 | | | | 74,580 | | |

MB Financial, Inc. | | | 1,946 | | | | 91,910 | | |

NBT Bancorp, Inc. | | | 2,811 | | | | 117,725 | | |

Old National Bancorp | | | 5,701 | | | | 103,473 | | |

Opus Bank | | | 1,741 | | | | 52,317 | | |

Park National Corporation | | | 790 | | | | 94,531 | | |

Pinnacle Financial Partners, Inc. | | | 1,250 | | | | 86,625 | | |

Renasant Corporation | | | 2,301 | | | | 97,148 | | |

S&T Bancorp, Inc. | | | 2,525 | | | | 98,576 | | |

ServisFirst Bancshares, Inc. | | | 2,660 | | | | 99,590 | | |

Simmons First National Corporation — Class A | | | 1,445 | | | | 89,807 | | |

South State Corporation | | | 1,092 | | | | 95,441 | | |

Sterling Bancorp | | | 4,481 | | | | 104,855 | | |

TCF Financial Corporation | | | 4,399 | | | | 86,176 | | |

Texas Capital Bancshares, Inc. (a) | | | 861 | | | | 67,502 | | |

Tompkins Financial Corporation | | | 1,064 | | | | 100,591 | | |

Towne Bank | | | 3,802 | �� | | | 126,417 | | |

Trustmark Corporation | | | 3,165 | | | | 112,832 | | |

Union Bankshares Corporation | | | 3,151 | | | | 112,617 | | |

United Community Banks, Inc. | | | 3,722 | | | | 110,246 | | |

Valley National Bancorp | | | 8,343 | | | | 97,113 | | |

WesBanco, Inc. | | | 3,080 | | | | 132,625 | | |

See notes to financial statements.

22

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Banks (16.3%) cont'd | |

Westamerica Bancorporation | | | 1,658 | | | $ | 104,338 | | |

Wintrust Financial Corporation | | | 1,310 | | | | 95,067 | | |

| | | | 5,942,978 | | |

Beverages (0.4%): | |

MGP Ingredients, Inc. | | | 960 | | | | 47,981 | | |

National Beverage Corporation | | | 1,059 | | | | 54,093 | | |

The Boston Beer Company, Inc. — Class A (a) | | | 294 | | | | 49,936 | | |

| | | | 152,010 | | |

Biotechnology (0.4%): | |

Insys Therapeutics, Inc. (a) | | | 1,793 | | | | 16,495 | | |

MiMedx Group, Inc. (a) | | | 6,437 | | | | 57,032 | | |

Myriad Genetics, Inc. (a) | | | 1,764 | | | | 29,406 | | |

Repligen Corporation (a) | | | 1,273 | | | | 39,234 | | |

| | | | 142,167 | | |

Building Products (2.6%): | |

AAON, Inc. | | | 2,359 | | | | 77,965 | | |

American Woodmark Corporation (a) | | | 580 | | | | 43,645 | | |

Apogee Enterprises, Inc. | | | 1,369 | | | | 73,324 | | |

Continental Building Products, Inc. (a) | | | 2,654 | | | | 61,307 | | |

CSW Industrials, Inc. (a) | | | 2,620 | | | | 96,547 | | |

Gibraltar Industries, Inc. (a) | | | 1,166 | | | | 48,564 | | |

Griffon Corporation | | | 4,873 | | | | 127,673 | | |

Insteel Industries, Inc. | | | 1,564 | | | | 55,741 | | |

NCI Building Systems, Inc. (a) | | | 3,565 | | | | 55,792 | | |

Patrick Industries, Inc. (a) | | | 727 | | | | 55,470 | | |

PGT, Inc. (a) | | | 3,857 | | | | 44,163 | | |

Simpson Manufacturing Company, Inc. | | | 2,250 | | | | 98,437 | | |

Trex Company, Inc. (a) | | | 856 | | | | 55,126 | | |

Universal Forest Products, Inc. | | | 564 | | | | 57,630 | | |

| | | | 951,384 | | |

Capital Markets (2.4%): | |

Artisan Partners Asset Management, Inc. — Class A | | | 2,099 | | | | 62,445 | | |

BGC Partners, Inc. — Class A | | | 10,278 | | | | 105,144 | | |

Cohen & Steers, Inc. | | | 1,750 | | | | 58,800 | | |

Evercore Partners, Inc. — Class A | | | 1,066 | | | | 73,234 | | |

Financial Engines, Inc. | | | 1,527 | | | | 56,117 | | |

Houlihan Lokey, Inc. | | | 2,784 | | | | 86,638 | | |

Janus Capital Group, Inc. | | | 4,126 | | | | 54,752 | | |

LPL Financial Holdings, Inc. | | | 976 | | | | 34,365 | | |

Moelis & Company — Class A | | | 2,436 | | | | 82,580 | | |

NorthStar Asset Management Group, Inc. | | | 3,807 | | | | 56,800 | | |

Stifel Financial Corporation (a) | | | 1,231 | | | | 61,489 | | |

Virtu Financial, Inc. | | | 4,401 | | | | 70,196 | | |

Waddell & Reed Financial, Inc. — Class A | | | 2,321 | | | | 45,283 | | |

WisdomTree Investments, Inc. | | | 3,520 | | | | 39,213 | | |

| | | | 887,056 | | |

See notes to financial statements.

23

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Chemicals (2.3%): | |

American Vanguard Corporation | | | 2,212 | | | $ | 42,360 | | |

Balchem Corporation | | | 907 | | | | 76,116 | | |

Calgon Carbon Corporation | | | 3,842 | | | | 65,314 | | |

FutureFuel Corporation | | | 4,470 | | | | 62,133 | | |

HB Fuller Company | | | 1,752 | | | | 84,639 | | |

Innospec, Inc. | | | 1,294 | | | | 88,639 | | |

Minerals Technologies, Inc. | | | 817 | | | | 63,113 | | |

PolyOne Corporation | | | 1,909 | | | | 61,164 | | |

Quaker Chemical Corporation | | | 823 | | | | 105,295 | | |

Rayonier Advanced Materials, Inc. | | | 2,459 | | | | 38,016 | | |

Stepan Company | | | 984 | | | | 80,176 | | |

Trinseo SA | | | 992 | | | | 58,826 | | |

| | | | 825,791 | | |

Commercial Services & Supplies (3.6%): | |

ABM Industries, Inc. | | | 2,791 | | | | 113,984 | | |

ACCO Brands Corporation (a) | | | 4,960 | | | | 64,728 | | |

Healthcare Services Group, Inc. | | | 2,624 | | | | 102,782 | | |

Herman Miller, Inc. | | | 1,977 | | | | 67,613 | | |

HNI Corporation | | | 1,170 | | | | 65,426 | | |

Interface, Inc. | | | 3,189 | | | | 59,156 | | |

Knoll, Inc. | | | 2,835 | | | | 79,182 | | |

Matthews International Corporation — Class A | | | 1,529 | | | | 117,504 | | |

McGrath RentCorp | | | 2,355 | | | | 92,292 | | |

Mobile Mini, Inc. | | | 1,971 | | | | 59,623 | | |

MSA Safety, Inc. | | | 1,320 | | | | 91,516 | | |

Multi-Color Corporation | | | 756 | | | | 58,666 | | |

Steelcase, Inc. — Class A | | | 5,035 | | | | 90,126 | | |

UniFirst Corporation | | | 717 | | | | 102,997 | | |

US Ecology, Inc. | | | 1,347 | | | | 66,205 | | |

West Corporation | | | 2,617 | | | | 64,797 | | |

| | | | 1,296,597 | | |

Communications Equipment (1.1%): | |

ADTRAN, Inc. | | | 3,806 | | | | 85,064 | | |

Finisar Corporation (a) | | | 2,136 | | | | 64,657 | | |

Infinera Corporation (a) | | | 3,274 | | | | 27,796 | | |

InterDigital, Inc. | | | 1,097 | | | | 100,211 | | |

NETGEAR, Inc. (a) | | | 1,261 | | | | 68,535 | | |

Plantronics, Inc. | | | 846 | | | | 46,327 | | |

| | | | 392,590 | | |

Construction & Engineering (1.0%): | |

Argan, Inc. | | | 1,248 | | | | 88,046 | | |

Comfort Systems USA, Inc. | | | 2,236 | | | | 74,459 | | |

Dycom Industries, Inc. (a) | | | 534 | | | | 42,875 | | |

KBR, Inc. | | | 3,544 | | | | 59,149 | | |

Primoris Services Corporation | | | 3,024 | | | | 68,887 | | |

Tutor Perini Corporation (a) | | | 1,541 | | | | 43,148 | | |

| | | | 376,564 | | |

See notes to financial statements.

24

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Construction Materials (0.2%): | |

Headwaters, Inc. (a) | | | 3,318 | | | $ | 78,039 | | |

Consumer Finance (0.5%): | |

FirstCash, Inc. | | | 956 | | | | 44,932 | | |

Nelnet, Inc. — Class A | | | 1,711 | | | | 86,833 | | |

PRA Group, Inc. (a) | | | 1,122 | | | | 43,870 | | |

| | | | 175,635 | | |

Containers & Packaging (0.3%): | |

Silgan Holdings, Inc. | | | 1,995 | | | | 102,104 | | |

Distributors (0.2%): | |

Core-Mark Holding Company, Inc. | | | 1,526 | | | | 65,725 | | |

Diversified Consumer Services (0.8%): | |

Capella Education Company | | | 1,218 | | | | 106,940 | | |

Grand Canyon Education, Inc. (a) | | | 1,745 | | | | 101,995 | | |

Strayer Education, Inc. (a) | | | 1,096 | | | | 88,371 | | |

| | | | 297,306 | | |

Diversified Telecommunication Services (0.5%): | |

Cincinnati Bell, Inc. (a) | | | 2,596 | | | | 58,020 | | |

Cogent Communications Holdings, Inc. | | | 1,779 | | | | 73,562 | | |

Inteliquent, Inc. | | | 2,900 | | | | 66,468 | | |

| | | | 198,050 | | |

Electric Utilities (1.0%): | |

ALLETE, Inc. | | | 1,851 | | | | 118,816 | | |

MGE Energy, Inc. | | | 1,821 | | | | 118,911 | | |

Otter Tail Corporation | | | 2,802 | | | | 114,322 | | |

| | | | 352,049 | | |

Electrical Equipment (0.7%): | |

AZZ, Inc. | | | 1,231 | | | | 78,661 | | |

Encore Wire Corporation | | | 1,513 | | | | 65,588 | | |

Generac Holdings, Inc. (a) | | | 1,424 | | | | 58,014 | | |

Thermon Group Holdings, Inc. (a) | | | 3,354 | | | | 64,028 | | |

| | | | 266,291 | | |

Electronic Equipment, Instruments & Components (3.7%): | |

Anixter International, Inc. (a) | | | 833 | | | | 67,515 | | |

AVX Corporation | | | 6,690 | | | | 104,565 | | |

Badger Meter, Inc. | | | 2,221 | | | | 82,066 | | |

Benchmark Electronics, Inc. (a) | | | 2,831 | | | | 86,345 | | |

Coherent, Inc. (a) | | | 526 | | | | 72,265 | | |

ePlus, Inc. (a) | | | 602 | | | | 69,350 | | |

II-VI, Inc. (a) | | | 2,762 | | | | 81,893 | | |

Insight Enterprises, Inc. (a) | | | 1,793 | | | | 72,509 | | |

Littelfuse, Inc. | | | 644 | | | | 97,740 | | |

Methode Electronics, Inc. | | | 1,831 | | | | 75,712 | | |

MTS Systems Corporation | | | 994 | | | | 56,360 | | |

OSI Systems, Inc. (a) | | | 518 | | | | 39,430 | | |

Plexus Corporation (a) | | | 1,559 | | | | 84,248 | | |

See notes to financial statements.

25

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Electronic Equipment, Instruments & Components (3.7%) cont'd | |

Rogers Corporation (a) | | | 870 | | | $ | 66,825 | | |

Sanmina Corporation (a) | | | 2,087 | | | | 76,489 | | |

ScanSource, Inc. (a) | | | 1,547 | | | | 62,421 | | |

Tech Data Corporation (a) | | | 872 | | | | 73,841 | | |

Universal Display Corporation (a) | | | 726 | | | | 40,874 | | |

VeriFone Systems, Inc. (a) | | | 2,648 | | | | 46,949 | | |

| | | | 1,357,397 | | |

Energy Equipment & Services (0.4%): | |

Atwood Oceanics, Inc. | | | 2,785 | | | | 36,567 | | |

Dril-Quip, Inc. (a) | | | 1,114 | | | | 66,895 | | |

Oceaneering International, Inc. | | | 1,770 | | | | 49,932 | | |

| | | | 153,394 | | |

Food & Staples Retailing (1.2%): | |

Ingles Markets, Inc. — Class A | | | 1,381 | | | | 66,426 | | |

Performance Food Group Company (a) | | | 2,648 | | | | 63,552 | | |

PriceSmart, Inc. | | | 892 | | | | 74,482 | | |

SpartanNash Company | | | 1,692 | | | | 66,902 | | |

SUPERVALU, Inc. (a) | | | 6,443 | | | | 30,089 | | |

United Natural Foods, Inc. (a) | | | 974 | | | | 46,479 | | |

Weis Markets, Inc. | | | 1,541 | | | | 103,000 | | |

| | | | 450,930 | | |

Food Products (1.5%): | |

Calavo Growers, Inc. | | | 888 | | | | 54,523 | | |

Dean Foods Company | | | 4,198 | | | | 91,432 | | |

J&J Snack Foods Corporation | | | 1,036 | | | | 138,233 | | |

John B Sanfilippo & Son, Inc. | | | 881 | | | | 62,014 | | |

Omega Protein Corporation (a) | | | 1,578 | | | | 39,529 | | |

Sanderson Farms, Inc. | | | 698 | | | | 65,780 | | |

Tootsie Roll Industries, Inc. | | | 2,714 | | | | 107,882 | | |

| | | | 559,393 | | |

Gas Utilities (0.2%): | |

Chesapeake Utilities Corporation | | | 1,096 | | | | 73,377 | | |

Health Care Equipment & Supplies (2.6%): | |

Abaxis, Inc. | | | 1,100 | | | | 58,047 | | |

Anika Therapeutics, Inc. (a) | | | 1,356 | | | | 66,390 | | |

Atrion Corporation | | | 218 | | | | 110,569 | | |

CryoLife, Inc. (a) | | | 3,449 | | | | 66,048 | | |

Cynosure, Inc. (a) | | | 1,052 | | | | 47,971 | | |

Globus Medical, Inc. (a) | | | 2,487 | | | | 61,702 | | |

ICU Medical, Inc. (a) | | | 577 | | | | 85,021 | | |

Inogen, Inc. (a) | | | 840 | | | | 56,423 | | |

Masimo Corporation (a) | | | 1,244 | | | | 83,846 | | |

Meridian Bioscience, Inc. | | | 4,194 | | | | 74,234 | | |

Merit Medical Systems, Inc. (a) | | | 2,806 | | | | 74,359 | | |

Natus Medical, Inc. (a) | | | 1,085 | | | | 37,758 | | |

Neogen Corporation (a) | | | 1,099 | | | | 72,534 | | |

Penumbra, Inc. (a) | | | 737 | | | | 47,021 | | |

| | | | 941,923 | | |

See notes to financial statements.

26

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Health Care Providers & Services (3.2%): | |

Aceto Corporation | | | 2,198 | | | $ | 48,290 | | |

Adeptus Health, Inc. (a) | | | 906 | | | | 6,922 | | |

Air Methods Corporation (a) | | | 1,579 | | | | 50,291 | | |

Amedisys, Inc. (a) | | | 1,076 | | | | 45,870 | | |

AMN Healthcare Services, Inc. (a) | | | 1,335 | | | | 51,331 | | |

BioTelemetry, Inc. (a) | | | 2,378 | | | �� | 53,148 | | |

Chemed Corporation | | | 650 | | | | 104,267 | | |

CorVel Corporation (a) | | | 1,663 | | | | 60,866 | | |

Diplomat Pharmacy, Inc. (a) | | | 1,198 | | | | 15,095 | | |

HealthEquity, Inc. (a) | | | 1,375 | | | | 55,715 | | |

LHC Group, Inc. (a) | | | 1,823 | | | | 83,311 | | |

Lifepoint Health, Inc. (a) | | | 1,093 | | | | 62,082 | | |

National HealthCare Corporation | | | 1,740 | | | | 131,875 | | |

Owens & Minor, Inc. | | | 2,522 | | | | 89,001 | | |

PharMerica Corporation (a) | | | 1,369 | | | | 34,430 | | |

Select Medical Holdings Corporation (a) | | | 3,485 | | | | 46,176 | | |

Surgical Care Affiliates, Inc. (a) | | | 1,481 | | | | 68,526 | | |

The Ensign Group, Inc. | | | 2,940 | | | | 65,298 | | |

US Physical Therapy, Inc. | | | 1,132 | | | | 79,466 | | |

| | | | 1,151,960 | | |

Health Care Technology (0.3%): | |

HealthStream, Inc. (a) | | | 2,035 | | | | 50,977 | | |

HMS Holdings Corporation (a) | | | 2,199 | | | | 39,934 | | |

Inovalon Holdings, Inc. — Class A (a) | | | 2,210 | | | | 22,763 | | |

| | | | 113,674 | | |

Hotels, Restaurants & Leisure (5.3%): | |

BJ's Restaurants, Inc. (a) | | | 1,786 | | | | 70,190 | | |

Bob Evans Farms, Inc. | | | 2,005 | | | | 106,686 | | |

Bojangles', Inc. (a) | | | 2,975 | | | | 55,484 | | |

Brinker International, Inc. | | | 1,329 | | | | 65,825 | | |

Buffalo Wild Wings, Inc. (a) | | | 359 | | | | 55,429 | | |

Choice Hotels International, Inc. | | | 1,678 | | | | 94,052 | | |

Churchill Downs, Inc. | | | 541 | | | | 81,393 | | |

Chuy's Holdings, Inc. (a) | | | 1,937 | | | | 62,856 | | |

Dave & Buster's Entertainment, Inc. (a) | | | 1,330 | | | | 74,879 | | |

DineEquity, Inc. | | | 1,101 | | | | 84,777 | | |

El Pollo Loco Holdings, Inc. (a) | | | 3,236 | | | | 39,803 | | |

Eldorado Resorts, Inc. (a) | | | 4,943 | | | | 83,784 | | |

Fiesta Restaurant Group, Inc. (a) | | | 1,789 | | | | 53,402 | | |

ILG, Inc | | | 3,599 | | | | 65,394 | | |

Isle of Capri Casinos, Inc. (a) | | | 3,349 | | | | 82,687 | | |

Marriott Vacations Worldwide Corporation | | | 706 | | | | 59,904 | | |

Papa John's International, Inc. | | | 934 | | | | 79,932 | | |

Popeyes Louisiana Kitchen, Inc. (a) | | | 1,537 | | | | 92,958 | | |

Red Robin Gourmet Burgers, Inc. (a) | | | 1,019 | | | | 57,471 | | |

Ruth's Hospitality Group, Inc. | | | 4,952 | | | | 90,622 | | |

Shake Shack, Inc. (a) | | | 1,172 | | | | 41,946 | | |

Sonic Corporation | | | 2,229 | | | | 59,091 | | |

See notes to financial statements.

27

Victory Portfolios II

VictoryShares US Discovery Enhanced Volatility Wtd ETF | | Schedule of Investments — continued

December 31, 2016 | |

(Unaudited)

Security Description | | Shares | | Value | |

Hotels, Restaurants & Leisure (5.3%) cont'd | |

The Cheesecake Factory, Inc. | | | 1,824 | | | $ | 109,221 | | |

The Marcus Corporation | | | 3,241 | | | | 102,091 | | |

Wendy's Company | | | 6,960 | | | | 94,099 | | |

Wingstop, Inc. | | | 1,766 | | | | 52,256 | | |

| | | | 1,916,232 | | |

Household Durables (2.9%): | |

Cavco Industries, Inc. (a) | | | 634 | | | | 63,305 | | |

Ethan Allen Interiors, Inc. | | | 1,994 | | | | 73,479 | | |

Helen of Troy Ltd. (a) | | | 936 | | | | 79,045 | | |

Installed Building Products, Inc. (a) | | | 1,453 | | | | 60,009 | | |

iRobot Corporation (a) | | | 1,583 | | | | 92,526 | | |

KB Home | | | 3,325 | | | | 52,568 | | |

La-Z-Boy, Inc. | | | 2,014 | | | | 62,535 | | |

LGI Homes, Inc. (a) | | | 1,103 | | | | 31,689 | | |

M/I Homes, Inc. (a) | | | 2,829 | | | | 71,234 | | |

MDC Holdings, Inc. | | | 2,803 | | | | 71,928 | | |