ANNUAL REPORT

June 30, 2019

Brown Advisory Growth Equity Fund

Brown Advisory Flexible Equity Fund

Brown Advisory Equity Income Fund

Brown Advisory Sustainable Growth Fund

Brown Advisory Mid-Cap Growth Fund

Brown Advisory Small-Cap Growth Fund

Brown Advisory Small-Cap Fundamental Value Fund

Brown Advisory Global Leaders Fund

Brown Advisory Intermediate Income Fund

Brown Advisory Total Return Fund

Brown Advisory Strategic Bond Fund

Brown Advisory Sustainable Bond Fund

Brown Advisory Maryland Bond Fund

Brown Advisory Tax-Exempt Bond Fund

Brown Advisory Mortgage Securities Fund

Brown Advisory – WMC Strategic European Equity Fund

Brown Advisory Emerging Markets Select Fund

Brown Advisory – Beutel Goodman Large-Cap Value Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.brownadvisory.com/mf/how-to-invest), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling (800) 540-6807 or by enrolling at www.brownadvisory.com/mf.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800) 540-6807 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Funds.

TABLE OF CONTENTS

Brown Advisory Growth Equity Fund | 1 |

Brown Advisory Flexible Equity Fund | 5 |

Brown Advisory Equity Income Fund | 9 |

Brown Advisory Sustainable Growth Fund | 13 |

Brown Advisory Mid-Cap Growth Fund | 17 |

Brown Advisory Small-Cap Growth Fund | 22 |

Brown Advisory Small-Cap Fundamental Value Fund | 28 |

Brown Advisory Global Leaders Fund | 33 |

Brown Advisory Intermediate Income Fund | 38 |

Brown Advisory Total Return Fund | 43 |

Brown Advisory Strategic Bond Fund | 50 |

Brown Advisory Sustainable Bond Fund | 58 |

Brown Advisory Maryland Bond Fund | 64 |

Brown Advisory Tax-Exempt Bond Fund | 69 |

Brown Advisory Mortgage Securities Fund | 76 |

Brown Advisory – WMC Strategic European Equity Fund | 86 |

Brown Advisory Emerging Markets Select Fund | 90 |

Brown Advisory – Beutel Goodman Large-Cap Value Fund | 94 |

Statements of Assets and Liabilities | 98 |

Statements of Operations | 103 |

Statements of Changes in Net Assets | 108 |

Financial Highlights | 117 |

Notes to Financial Statements | 124 |

Report of Independent Registered Public Accounting Firm | 138 |

Additional Information | 139 |

The views in the report contained herein were those of the Funds’ investment adviser, Brown Advisory LLC, or, for the sub-advised funds, of the respective sub-adviser, as of June 30, 2019 and may not reflect their views on the date this report is first published or anytime thereafter. This report may contain discussions about certain investments both held and not held in the portfolio as of June 30, 2019. All current and future holdings are subject to risk and are subject to change. While these views are intended to assist shareholders in understanding their investment in each Fund, they do not constitute investment advice, are not a guarantee of future performance and are not intended as an offer or solicitation with respect to the purchase or sale of any security. Performance figures include the reinvestment of dividend and capital gain distributions.

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC.

GLOSSARY OF TERMS

Alpha refers to the abnormal rate of return on a security or portfolio in excess of what would be predicted by an equilibrium model like the capital asset pricing model (CAPM).

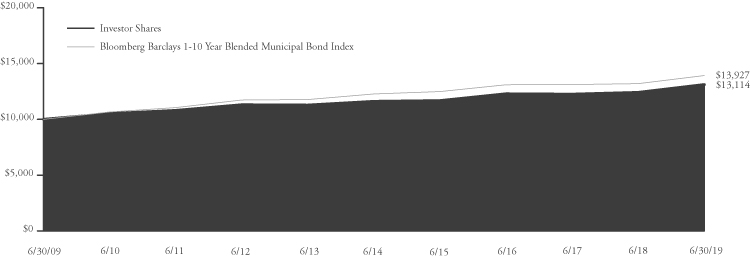

Bloomberg Barclays 1-10 Year Blended Municipal Bond Index is a market index of high quality, domestic fixed income securities with maturities of less than 10 years.

Bloomberg Barclays Intermediate US Aggregate Bond Index represents domestic taxable investment-grade bonds with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities with average maturities and durations in the intermediate range. This index represents a sector of the Bloomberg Barclays US Aggregate Bond Index.

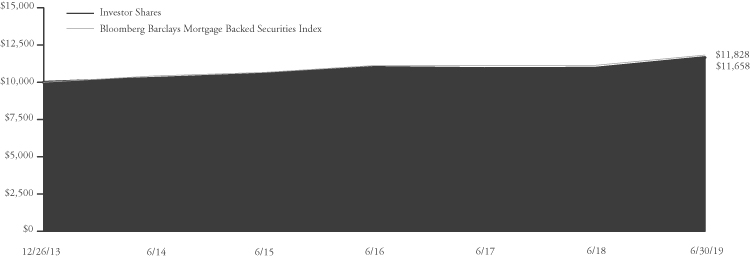

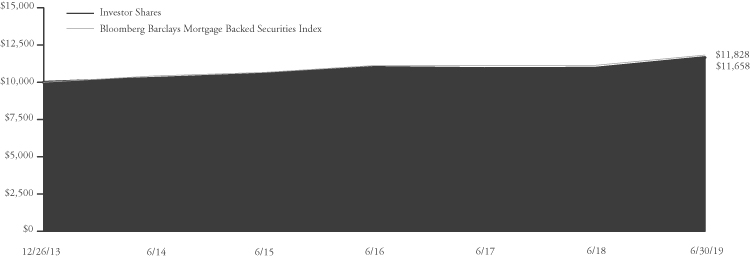

Bloomberg Barclays Mortgage Backed Securities Index is a market value-weighted index which covers the mortgage-backed securities component of the Bloomberg Barclays US Aggregate Bond Index. The index is composed of agency mortgage-backed passthrough securities of the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac) with a minimum $150 million par amount outstanding and a weighted-average maturity of at least 1 year. The index includes reinvestment of income.

Bloomberg Barclays US Aggregate Bond Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS, ABS and CMBS.

Bloomberg Barclays US Corporate High Yield Index measures the US Dollar denominated, high-yield, fixed-rate corporate bond market.

Basis point(s) (bps) is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. 1% is equal to 100 basis points.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Book value is the net asset value of a company, calculated by total assets minus intangible assets (patents, goodwill) and liabilities.

CAPEX, or capital expenditures, are funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. It is often used to undertake new projects or investments by the firm. This type of outlay is also made by companies to maintain or increase the scope of their operations.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Correlation is a statistical measurement of how two securities move in relation to each other.

Dividend Yield is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock.

Downside Capture is a statistical measure of a fund’s performance in down markets. For example, a fund with downside capture of 90% would only have declined 90% as much as the related index during the same down market period.

Duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

Earnings growth is a measure of growth in a company’s net income over a specific period, often one year. The term can apply to actual data from previous periods or estimated data for future periods.

Earnings per share (EPS) is calculated by taking the total earnings divided by the number of shares outstanding.

Earnings Yield is the earnings per share for the most recent 12-month period divided by the current market price per share. The earnings yield shows the percentage of each dollar invested in the stock that was earned by the company.

EBITDA is the Earnings Before Interest, Taxes, Depreciation and Amortization. An approximate measure of a company’s operating cash flow based on data from the company’s income statement.

Enterprise Value (EV) is a measure of a company’s value, often used as an alternative to straightforward market capitalization. Enterprise Value is calculated as market capitalization plus debt, minority interest and preferred shares, minus total cash and cash equivalents.

FTSE All-World Index is a market capitalization weighted index representing the performance of large and mid-capitalization stocks from the FTSE Global Equity Index Series.

FTSE Emerging Index is a market capitalization weighted index representing the performance of over 790 large and mid-capitalization companies in 22 emerging markets.

Forward price to earnings ratio uses forecasted earnings, rather than current earnings, to calculate the price to earnings ratio.

Free Cash Flow is the operating cash flows (net income plus amortization and depreciation) minus capital expenditures and dividends. Free cash flow is the amount of cash that a company has left over after it has paid all of its expenses, including investments.

Gross Domestic Product (GDP) is the monetary value of all the goods and services produced by an economy over a specified period. It includes consumption, government purchases, investments, and exports minus imports.

GLOSSARY OF TERMS

ICE BofAML 0-3 Month US Treasury Bill Index is a subset of the ICE BofAML US Treasury Bill Index and includes all securities with a remaining term to final maturity less than 3 months.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

MSCI Emerging Markets Small Cap Index is a free float-adjusted market capitalization index that is designed to measure small cap equity market performance in the global emerging markets.

MSCI Europe Index is an index that captures large and mid cap representation across 15 developed market countries in Europe.

Price to Book Value Ratio (P/B) is ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Price to earnings ratio (P/E) is a common tool for comparing the prices of different common stocks and is calculated by dividing the current market price of a stock by the earnings per share.

Return of Capital (ROC) is a return from an investment that is not considered income. The return of capital is when some or all of the money an investor has in an investment is paid back to him or her, thus decreasing the value of the investment.

Return on Capital Employed (ROCE) is a financial ratio that measures a company’s profitability and the efficiency with which its capital is employed. Return on Capital Employed (ROCE) is calculated as: ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed.

Return on Equity (ROE) is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Return on Invested Capital (ROIC) is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. ROIC is typically calculated by taking a company’s net income, subtracting dividends the company paid out and dividing that amount by the company’s total capital.

Russell Midcap Growth Index measures the performance of the mid-capitalization growth sector of the U.S. equity market.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the of the U.S. equity universe. It includes those Russell 1000® companies with higher price to book value ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price to book value ratios and lower expected growth values.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price to book value ratios and higher forecasted growth values.

Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price to book value ratios and lower forecasted growth values.

Russell 3000® Index measures the performance of the 3,000 largest U.S. companies representing approximately 98% of the investable U.S. equity market.

S&P 500 Index (“S&P 500”) is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks.

Tangible Book Value (“TBV”) is a valuation ratio expressing the price of a security compared to its hard, or tangible, book value as reported in the company’s balance sheet. The tangible book value number is equal to the company’s total book value less the value of any intangible assets.

Tier 1 Capital Ratio is a comparison between a banking firm’s core equity capital and total risk-weighted assets. A firm’s core equity capital is known as its Tier 1 capital and is the measure of a bank’s financial strength based on the sum of its equity capital and disclosed reserves, and sometimes non-redeemable, non-cumulative preferred stock. A firm’s risk-weighted assets include all assets that the firm holds that are systematically weighted for credit risk. Central banks typically develop the weighting scale for different asset classes, such as cash and coins, which have zero risk, versus a letter or credit, which carries more risk.

Turnover refers to a fund buying or selling securities. (The fund “turns over” its portfolio.) A fund pays transaction costs, such as commissions, when it buys and sells securities. Additionally, a higher turnover rate may result in higher taxes when the fund shares are held in a taxable account.

Yield Curve is a line that plots the yields of securities having equal credit quality but different maturity dates.

Yield Spread is the difference between yields on differing securities, calculated by deducting the yield of one security from another.

The broad based market indexes referenced in the following management commentaries are considered representative of their indicated market, the indexes are unmanaged and do not reflect the deduction of fees, such as, investment management and fund accounting fees, or taxes associated with a mutual fund. Investors cannot invest directly in an index.

Brown Advisory Growth Equity Fund

A Message to Our Shareholders

June 30, 2019

Dear Shareholders:

During the year ended June 30, 2019, the Brown Advisory Growth Equity Fund – Investor Shares (the “Fund”) increased 16.50% in value. During the same period, the Fund’s benchmark, the Russell 1000® Growth Index (the “Index”), increased 11.56%.

The Fund delivered strong results, in both absolute and relative terms over the course the fiscal year. Falling interest rates coupled with a resilient labor market has translated to robust stock market appreciation, but this by no means is considered a “Goldilocks” scenario. While the U.S. does have a relatively stronger footing than most global economies, international trade remains a wildcard and many economies have started to experience some weakness. However equity markets seem to be discounting the probability of a deep global recession.

Health care continues to be a meaningful contributor to the Fund’s performance. Yet the backdrop for the health care sector broadly remains cloudy and the sector has been an underperformer for the benchmark. Concerns over drug pricing and increasing regulation continue to weigh on biopharma stocks. The portfolio remains overweight to the sector, although this is not due to a top-down view. From a bottom-up perspective, we are quite sanguine about the underlying strength of the individual business models that we own. For example, Danaher, which has been a longtime portfolio holding, announced the acquisition of GE’s health care business, sending the stock higher. This was not necessarily considered a transformative acquisition. We believe that the company has done an extraordinary job over the last several years transforming the business by increasing both the recurring nature of its revenues and the profitability of the business, thus improving the overall quality of its multi-industry business model.

On an absolute basis, technology was a leading sector for the market and the portfolio. Fundamentals across much of the software and services segment continue to be quite robust. As companies in all areas of the economy look to invest in technology to modernize their operations and stave off disruption, “digital transformation” partners, such as Salesforce.com, Adobe, Autodesk and Microsoft are experiencing robust, secular demand. This investment cycle remains early in the large enterprise segment, with today’s investments often focusing on front-office applications before moving to back-office applications and IT infrastructure in the future. In addition to these industrywide tailwinds, the portfolio benefited from several stock-specific drivers in companies like Intuit, Autodesk and Genpact.

While our industrials stocks were additive to performance, one holding BWX Technologies, has pulled back after missing expectations due to a quality control issue in a non-core business segment. The market initially overreacted to the news, however, the core naval power-plant business which underpins our investment case remains on track, and the stock has begun to recover.

We initiated a new position in consumer staples company, Brown-Forman. Brown-Forman owns a leading portfolio of super-premium spirits brands and maintains an exceptional position in the key growth categories of American whiskey and tequila. The stock underperformed its peer group and the broader market over last year, creating an opportunity to build our position at a compelling valuation. We eliminated our position in Facebook as the company remains in the crosshairs of regulatory and consumer backlash as a result of its missteps with respect to data governance practices, and management turnover. Given these challenges, we are reallocating the capital to Microsoft which is a business we believe has greater visibility and offers a more compelling ratio of upside potential versus downside risk. Microsoft is an enterprise software company offering both cloud computing and productivity applications. The company has successfully reinvented itself over the last several years, and we have a high degree of confidence in its ability to grow revenues and expand operating margins going forward.

We are pleased that the portfolio continues to outperform, especially in light of the volatile markets we are experiencing. We believe it is impossible, nor do we even try, to predict the short-term market response or the precise quarterly cadence of companies’ results. Our focus is geared toward finding companies with unique business models that we believe have the potential to grow at above-average rates over a full cycle. We have always been confident that the market will reward these types of companies over the long term.

Sincerely,

Kenneth M. Stuzin, CFA

Portfolio Manager

www.brownadvisory.com/mf

Brown Advisory Growth Equity FundA Message to Our Shareholders

June 30, 2019

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in medium capitalization companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. The value of the Fund’s investments in REITs may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. Investments in foreign securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. These risks are greater for investments in emerging markets. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisory.com/mf

Brown Advisory Growth Equity FundPerformance Information & Portfolio Holdings Summary

June 30, 2019

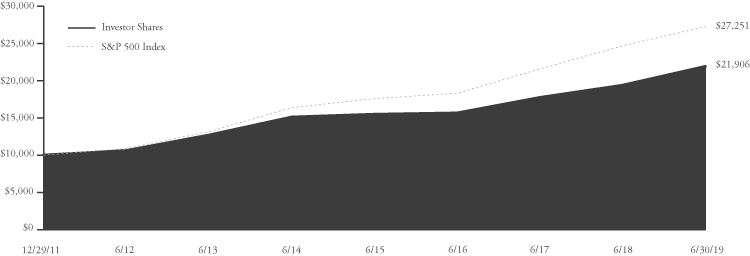

GROWTH OF A $10,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Fund as measured against broad-based securities market indices. The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price to book ratios and higher forecasted growth values. The S&P 500 Index is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks. The indexes are unmanaged and do not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

| PORTFOLIO HOLDINGS | % of Net Assets |

Information Technology | | | 33.6 | % | |

Health Care | | | 20.3 | % | |

Industrials | | | 11.6 | % | |

Consumer Discretionary | | | 11.4 | % | |

Consumer Staples | | | 7.4 | % | |

Communication Services | | | 5.9 | % | |

Real Estate Investment Trusts | | | 3.9 | % | |

Materials | | | 3.1 | % | |

Money Market Funds | | | 2.8 | % | |

Other Assets and Liabilities | | | 0.0 | % | |

| | | | 100.0 | % | |

Average Annual Total Return | One Year | Five Year | Ten Year |

Institutional Shares1 | 16.69% | 13.57% | 16.31% |

| Investor Shares | 16.50% | 13.39% | 16.14% |

| Advisor Shares | 16.22% | 13.11% | 15.82% |

Russell 1000® Growth Index | 11.56% | 13.39% | 16.28% |

| S&P 500 Index | 10.42% | 10.71% | 14.70% |

| | Institutional Shares | Investor Shares | Advisor Shares |

Gross Expense Ratio2 | 0.71% | 0.86% | 1.11% |

Net Expense Ratio2 | 0.71% | 0.86% | 1.11% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisory.com/mf/growth-equity-fund. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects periods during which fee waivers were in effect. In the absence of such waivers, total return would have been reduced. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower. Returns shown are calculated using the net asset values (“NAV”) that were used for shareholder transactions as of the respective period ends. These NAV, and the returns calculated from them, may differ from the NAV and returns shown elsewhere in this report.

1 | Performance information for the Institutional Shares, prior to commencement of operations on October 19, 2012, is based on the performance of Investor Shares, and adjusted for the lower expenses applicable to Institutional Shares. |

2 | Per the Fund’s prospectus dated October 31, 2018. Refer to the financial highlights for the gross and net expense ratios for the year ended as of the date of this report. Please note that the expense ratios per the prospectus include acquired fund fees and expenses (as applicable) and the expense ratios in the financial highlights do not. |

www.brownadvisory.com/mf

Brown Advisory Growth Equity FundSchedule of Investments

June 30, 2019

| Shares | | Security Description | | Value $ | |

| Common Stocks — 93.3% | | | |

| | | | |

| Communication Services — 5.9% | | | |

| | 64,945 | | Alphabet, Inc. — Class C* | | | 70,199,700 | |

| | 673,995 | | Electronic Arts, Inc.* | | | 68,248,734 | |

| | | | | | | 138,448,434 | |

| Consumer Discretionary — 11.4% | | | | |

| | 272,690 | | Alibaba Group Holding, Ltd. ADR* | | | 46,207,320 | |

| | 54,825 | | Amazon.com, Inc.* | | | 103,818,265 | |

| | 32,114 | | Booking Holdings, Inc.* | | | 60,204,437 | |

| | 1,099,685 | | TJX Companies, Inc. | | | 58,151,343 | |

| | | | | | | 268,381,365 | |

| Consumer Staples — 7.4% | | | | |

| | 979,915 | | Brown-Forman Corp. | | | 54,316,688 | |

| | 189,018 | | Costco Wholesale Corp. | | | 49,949,897 | |

| | 386,962 | | Estee Lauder Companies, Inc. | | | 70,856,612 | |

| | | | | | | 175,123,197 | |

| Health Care — 20.3% | | | | |

| | 573,908 | | Danaher Corp. | | | 82,022,931 | |

| | 449,197 | | DexCom, Inc.* | | | 67,307,679 | |

| | 305,202 | | Edwards Lifesciences Corp.* | | | 56,383,017 | |

| | 154,434 | | Intuitive Surgical, Inc.* | | | 81,008,355 | |

| | 307,991 | | Thermo Fisher Scientific, Inc. | | | 90,450,797 | |

| | 893,135 | | Zoetis, Inc. | | | 101,361,891 | |

| | | | | | | 478,534,670 | |

| Industrials — 11.6% | | | | |

| | 800,300 | | BWX Technologies, Inc. | | | 41,695,630 | |

| | 304,645 | | Cintas Corp. | | | 72,289,212 | |

| | 863,492 | | Fortive Corp. | | | 70,391,868 | |

| | 247,668 | | Roper Technologies, Inc. | | | 90,710,881 | |

| | | | | | | 275,087,591 | |

| Information Technology — 33.6% | | | | |

| | 200,095 | | Adobe, Inc.* | | | 58,957,992 | |

| | 646,105 | | Amphenol Corp. | | | 61,987,314 | |

| | 443,699 | | Autodesk, Inc.* | | | 72,278,567 | |

| | 126,464 | | FleetCor Technologies, Inc.* | | | 35,517,414 | |

| | 1,651,121 | | Genpact, Ltd. | | | 62,891,199 | |

| | 307,991 | | Intuit, Inc. | | | 80,487,288 | |

| | 792,490 | | Microsoft Corp. | | | 106,161,960 | |

| | 478,841 | | NXP Semiconductors NV | | | 46,739,670 | |

| | 830,581 | | PayPal Holdings, Inc.* | | | 95,068,301 | |

| | 446,249 | | salesforce.com, Inc.* | | | 67,709,361 | |

| | 600,285 | | Visa, Inc. | | | 104,179,462 | |

| | | | | | | 791,978,528 | |

| Materials — 3.1% | | | | |

| | 158,259 | | Sherwin-Williams Co. | | | 72,528,517 | |

Total Common Stocks (Cost $1,181,225,033) | | | 2,200,082,302 | |

| | | | | |

| Real Estate Investment Trusts — 3.9% | | | | |

| | 409,513 | | SBA Communications Corp.* | | | 92,074,903 | |

Total Real Estate Investment Trusts (Cost $41,070,486) | | | 92,074,903 | |

| | | | | | | | |

| Short-Term Investments — 2.8% | | | | |

| | | | | |

| Money Market Funds — 2.8% | | | | |

| | 65,816,903 | | First American Government | | | | |

| | | | Obligations Fund — Class Z, 2.26%# | | | 65,816,903 | |

Total Short-Term Investments (Cost $65,816,903) | | | 65,816,903 | |

Total Investments — 100.0% (Cost $1,288,112,422) | | | 2,357,974,108 | |

Other Assets in Excess of Liabilities — 0.0% | | | 729,657 | |

| NET ASSETS — 100.0% | | $ | 2,358,703,765 | |

ADR — American Depositary Receipt

* | Non-Income Producing |

# | Annualized seven-day yield as of June 30, 2019. |

| | |

The accompanying notes are an integral part of these financial statements.

www.brownadvisory.com/mf

Brown Advisory Flexible Equity FundA Message to Our Shareholders

June 30, 2019

Dear Shareholders:

During the year ended June 30, 2019, the Brown Advisory Flexible Equity Fund – Investor Shares (the “Fund”) increased 8.77% in value. During the same period, the Fund’s benchmark, the S&P 500® Index (the “Index”), increased 10.42%.

The U.S. stock market and the Fund rose sharply in the first half of 2019, recovering from the fourth quarter’s sharp decline. The catalyst for the equity market reversing the dour mood of late 2018 was a signal from the Federal Reserve that it was no longer as set on increasing interest rates. This caused bonds to rally, and equities followed. The gains in the equity market were against a backdrop of an escalation in the U.S. trade dispute with China and heightened concerns related to a slowing global economy. Fears related to a potential economic slowdown were reflected by a surge in demand for Treasuries and the associated meaningful decline in the bond yields. The ten year yield fell to 2%, a level which was last seen in 2016.

We continue to view equities as more attractive than bonds. With interest on U.S. Treasuries capitalized at 2% and stocks capitalized at 5.6% with price-to-earnings ratios (P/E) of 17.7x on forward-year earnings, the advantage of stocks is strong, in our view. With this spread in favor of stocks, one would have to either be very negative on the future of sustainable earnings of stocks or, given stocks’ greater sensitivity to increases in interest rates, very negative on the outlook for inflation and thus interest rates. In the 12-month period, information technology was our best performing sector compared to the S&P 500 Index and the financial sector was the laggard. The Fund’s information technology holdings had a larger weighting and a higher return than the Index sector. Our financials’ sector holdings declined very slightly relative to the sector’s increase in the Index.

The biggest contributors, all long-term holdings, to returns in the twelve-month period were global payments networks MasterCard and Visa. Microsoft, a software and services provider, Edwards Lifesciences, a manufacturer and marketer of medical devices to treat late-stage cardiovascular disease, and PayPal Holdings, a digital payments company, were also strong contributors. These companies achieved strong business results and we continue to like their long-term prospects.

The largest detractors to returns were Charles Schwab Corp, a financial services provider, Conagra Brands, a packaged food business, Cimarex Energy Co., an oil and gas exploration and production company, Suncor Energy Inc, a Canadian integrated energy company and Wells Fargo & Co., a banking and diversified financial services company. Energy and financial stocks were generally lower for the period. Energy stocks fell with the decline in the price of oil while financials were impacted by lower interest rates. Conagra Brands disappointed investors with its results which included its recent acquisition of Pinnacle Foods. Despite the setback, we continue to hold the shares.

We added one new investment and eliminated three since our December 31, 2018 Semi-Annual Report to shareholders. New holdings include Stericycle, Inc., a medical waste removal and document destruction business, as well as spin-offs Corteva, Inc. (agricultural products) and Dow, Inc. (materials science) from our original investment in DowDuPont. We believe that value will be realized from these and future business portfolio changes within the various DowDuPont companies.

We view Stericycle’s business as a tollbooth on medical and business activity with a highly recurring revenue base. The business had faced challenges due to poor management. A new management team is in place to revive the business prospects.

We purchased Stericycle with the proceeds from the sale of T. Rowe Price. T. Rowe Price is a good business but the asset management industry is facing challenges such as fee compression as low fee passive investing continues to gain share.

We sold Altaba and invested the proceeds in existing holding Alibaba Group Holding due to a narrowing spread in valuation between the two. Since Altaba’s value was largely tied to its investment in Alibaba, our exposure to the underlying business did not change. We now own Alibaba directly rather than through an intermediary. Alibaba is the largest e-commerce company in China. We believe that Alibaba will continue to achieve above-average growth in China and other regions in Asia.

We eliminated eBay due to its lagging overall e-commerce growth rates. We made our investment in eBay in 2014 and saw an opportunity for improvement in its namesake business and potential for its PayPal business. PayPal was spun out of eBay in 2016 and is currently held in the Fund. eBay was moderately successful as an investment and PayPal, to date, has been very successful, making the combination quite attractive overall in our view.

We search for investment bargains among long-term attractive businesses with shareholder-oriented managers. These businesses should have or develop competitive advantages that result in good business economics, managers who allocate capital well, capacity to adjust to changes in the world and the ability to grow business value over time. Bargains in these types of stocks can arise for various reasons, but are often due to short-term investor perceptions, temporary business challenges that will improve,

www.brownadvisory.com/mf

Brown Advisory Flexible Equity FundA Message to Our Shareholders

June 30, 2019

company or industry changes for the better or as-yet-unrecognized potential for long-term growth and development. Despite the occasional investment that will go awry, we are optimistic about the long-term outlook for equities of good businesses purchased at reasonable prices and our ability to find them. To that end, our equity research team is experienced, enterprising, and motivated in this search.

Sincerely,

Maneesh Bajaj, CFA

Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in securities of foreign issuers. Investments in such securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. These risks are greater for investments in emerging markets. The value of the Fund’s investments in REITs may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Investments in smaller and medium-sized companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisory.com/mf

Brown Advisory Flexible Equity FundPerformance Information & Portfolio Holdings Summary

June 30, 2019

GROWTH OF A $10,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Fund as measured against the broad-based securities market index. The S&P 500 Index (“Index”) is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks. The Index is unmanaged and does not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

| PORTFOLIO HOLDINGS | % of Net Assets |

Information Technology | | | 26.0 | % | |

Financials | | | 19.9 | % | |

Consumer Discretionary | | | 14.9 | % | |

Communication Services | | | 10.0 | % | |

Health Care | | | 8.9 | % | |

Industrials | | | 7.4 | % | |

Energy | | | 4.4 | % | |

Consumer Staples | | | 3.2 | % | |

Real Estate Investment Trusts | | | 2.6 | % | |

Money Market Funds | | | 1.4 | % | |

Materials | | | 1.2 | % | |

Other Assets and Liabilities | | | 0.1 | % | |

| | | | 100.0 | % | |

Average Annual Total Return | One Year | Five Year | Ten Year |

Institutional Shares1 | 8.94% | 10.58% | 14.98% |

| Investor Shares | 8.77% | 10.42% | 14.81% |

| Advisor Shares | 8.52% | 10.15% | 14.54% |

| S&P 500 Index | 10.42% | 10.71% | 14.70% |

| | Institutional Shares | Investor Shares | Advisor Shares |

Gross Expense Ratio2 | 0.58% | 0.73% | 0.98% |

Net Expense Ratio2 | 0.58% | 0.73% | 0.98% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisory.com/mf/flexible-equity-fund. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects periods during which fee waivers were in effect. In the absence of such waivers, total return would have been reduced. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower. Returns shown are calculated using the net asset values (“NAV”) that were used for shareholder transactions as of the respective period ends. These NAV, and the returns calculated from them, may differ from the NAV and returns shown elsewhere in this report.

1 | Performance information for the Institutional Shares, prior to commencement of operations on October 19, 2012, is based on the performance of Investor Shares, and adjusted for the lower expenses applicable to Institutional Shares. |

2 | Per the Fund’s prospectus dated October 31, 2018. Refer to the financial highlights for the gross and net expense ratios for the year ended as of the date of this report. Please note that the expense ratios per the prospectus include acquired fund fees and expenses (as applicable) and the expense ratios in the financial highlights do not. |

www.brownadvisory.com/mf

Brown Advisory Flexible Equity FundSchedule of Investments

June 30, 2019

| Shares | | Security Description | | Value $ | |

| Common Stocks — 95.9% | | | |

| | | | |

| Communication Services — 10.0% | | | |

| | 5,631 | | Alphabet, Inc. — Class A* | | | 6,097,247 | |

| | 13,724 | | Alphabet, Inc. — Class C* | | | 14,834,409 | |

| | 100,082 | | Facebook, Inc.* | | | 19,315,826 | |

| | 57,561 | | Walt Disney Co. | | | 8,037,818 | |

| | | | | | | 48,285,300 | |

| Consumer Discretionary — 14.9% | | | | |

| | 72,972 | | Alibaba Group Holding, Ltd. ADR* | | | 12,365,105 | |

| | 2,831 | | Amazon.com, Inc.* | | | 5,360,866 | |

| | 7,958 | | Booking Holdings, Inc.* | | | 14,918,942 | |

| | 214,901 | | CarMax, Inc.* | | | 18,659,854 | |

| | 164,470 | | Lowe’s Companies, Inc. | | | 16,596,668 | |

| | 80,351 | | TJX Companies, Inc. | | | 4,248,961 | |

| | | | | | | 72,150,396 | |

| Consumer Staples — 3.2% | | | | |

| | 230,720 | | Conagra Brands, Inc. | | | 6,118,695 | |

| | 437,740 | | Nomad Foods, Ltd.* | | | 9,350,126 | |

| | | | | | | 15,468,821 | |

| Energy — 4.4% | | | | |

| | 79,859 | | Cimarex Energy Co. | | | 4,738,035 | |

| | 467,633 | | Kinder Morgan, Inc. | | | 9,764,177 | |

| | 221,345 | | Suncor Energy, Inc. | | | 6,897,110 | |

| | | | | | | 21,399,322 | |

| Financials — 19.9% | | | | |

| | 78,002 | | Ameriprise Financial, Inc. | | | 11,322,770 | |

| | 474,204 | | Bank of America Corp. | | | 13,751,916 | |

| | 97,712 | | Berkshire Hathaway, Inc.* | | | 20,829,267 | |

| | 287,594 | | Charles Schwab Corp. | | | 11,558,403 | |

| | 137,660 | | JPMorgan Chase & Co. | | | 15,390,388 | |

| | 272,692 | | KKR & Co., Inc. | | | 6,890,927 | |

| | 328,682 | | Regions Financial Corp. | | | 4,910,509 | |

| | 247,514 | | Wells Fargo & Co. | | | 11,712,362 | |

| | | | | | | 96,366,542 | |

| Health Care — 8.9% | | | | |

| | 31,906 | | Anthem, Inc. | | | 9,004,192 | |

| | 86,474 | | Edwards Lifesciences Corp.* | | | 15,975,207 | |

| | 50,819 | | Merck & Co., Inc. | | | 4,261,173 | |

| | 55,207 | | UnitedHealth Group, Inc. | | | 13,471,060 | |

| | | | | | | 42,711,632 | |

| Industrials — 7.4% | | | | |

| | 67,898 | | Canadian National Railway Co. | | | 6,279,207 | |

| | 121,999 | | Delta Air Lines, Inc. | | | 6,923,443 | |

| | 28,599 | | General Dynamics Corp. | | | 5,199,870 | |

| | 119,175 | | Stericycle, Inc.* | | | 5,690,606 | |

| | 38,504 | | United Rentals, Inc.* | | | 5,106,786 | |

| | 51,157 | | United Technologies Corp. | | | 6,660,642 | |

| | | | | | | 35,860,554 | |

| Information Technology — 26.0% | | | | |

| | 56,547 | | Accenture PLC | | | 10,448,189 | |

| | 66,203 | | Apple, Inc. | | | 13,102,898 | |

| | 27,014 | | Broadcom, Inc. | | | 7,776,250 | |

| | 98,637 | | MasterCard, Inc. | | | 26,092,446 | |

| | 158,249 | | Microsoft Corp. | | | 21,199,036 | |

| | 98,171 | | PayPal Holdings, Inc.* | | | 11,236,653 | |

| | 116,078 | | Taiwan Semiconductor | | | | |

| | | | Manufacturing Co., Ltd. ADR | | | 4,546,775 | |

| | 179,808 | | Visa, Inc. | | | 31,205,678 | |

| | | | | | | 125,607,925 | |

| Materials — 1.2% | | | | |

| | 38,550 | | Corteva, Inc. | | | 1,139,923 | |

| | 38,550 | | Dow, Inc. | | | 1,900,900 | |

| | 38,550 | | DuPont de Nemours, Inc. | | | 2,893,949 | |

| | | | | | | 5,934,772 | |

Total Common Stocks (Cost $262,848,453) | | | 463,785,264 | |

| | | | | |

| Real Estate Investment Trusts — 2.6% | | | | |

| | 39,605 | | Crown Castle International Corp. | | | 5,162,512 | |

| | 34,038 | | SBA Communications Corp.* | | | 7,653,104 | |

Total Real Estate Investment Trusts (Cost $8,139,080) | | | 12,815,616 | |

| | | | | |

| Short-Term Investments — 1.4% | | | | |

| | | | | |

| Money Market Funds — 1.4% | | | | |

| | 6,831,305 | | First American Government | | | | |

| | | | Obligations Fund — Class Z, 2.26%# | | | 6,831,305 | |

Total Short-Term Investments (Cost $6,831,305) | | | 6,831,305 | |

Total Investments — 99.9% (Cost $277,818,838) | | | 483,432,185 | |

Other Assets in Excess of Liabilities — 0.1% | | | 326,452 | |

| NET ASSETS — 100.0% | | $ | 483,758,637 | |

| | | | | | | | |

ADR — American Depositary Receipt

* | Non-Income Producing |

# | Annualized seven-day yield as of June 30, 2019. |

The accompanying notes are an integral part of these financial statements.

www.brownadvisory.com/mf

Brown Advisory Equity Income FundA Message to Our Shareholders

June 30, 2019

Dear Shareholders:

During the year ended June 30, 2019, the Brown Advisory Equity Income Fund – Investor Shares (the “Fund”) increased 13.03% in value. During the same period, the Fund’s benchmark, the S&P 500® Index (the “Index”), increased 10.42%.

The past year was far from a smooth upward ride for U.S. investors. Stocks jumped during the first three months, declined sharply in October and December, and then reversed course and recouped more than all of their lost ground during the final six months of the period. Worries over the direction of interest rates and trade tensions between the U.S. and China preoccupied investors’ minds throughout the year. However, by the end of the period a sense of relief on both issues emerged and helped to push stock prices higher and the Index to a new all-time high.

The best performing sectors for the Fund during the period were financials, information technology, and health care. Most notably among financials, property and casualty insurers Erie Indemnity and Cincinnati Financial were strong performers. Recently, both companies have posted steady business growth attributable to a beneficial pricing environment and market share gains for their various insurance products. Moreover, the changing interest rate environment is not expected to greatly impact Erie and Cincinnati’s future financial results. In contrast, lower interest rates are expected to create a bit of a near-term growth headwind for the Fund’s bank stocks such as Bank of America, JPMorgan Chase, and Wells Fargo.

Information technology holdings Microsoft and Cisco Systems also rose in price during the period. Both companies continued to report strong financial results because of a persistent spending tailwind for cloud computing and systems digitalization by corporate customers around the globe. Other information technology sector holdings such as Automatic Data Processing and Broadcom have seen strong demand for their products as well. Higher margins and impressive free cash flow growth during the year propelled both of those stocks higher.

The Fund’s health care stocks performed well in the face of growing political scrutiny in the U.S. around the issue of drug prices. Pharmaceutical companies Merck, Novartis, and Johnson & Johnson all gained because of a brighter general sales outlook for their current drugs and investor enthusiasm for future drugs in their development pipelines. The Fund added fellow pharmaceutical maker Gilead Sciences during the market selloff in December. Along with a historical commitment to dividend growth, Gilead has a strong franchise in HIV drugs where it continues to innovate to maintain its leading position with patients.

Industrials and consumer staples were the worst performing sectors for the Fund during the period. In industrials, nursing home outsourced services provider Healthcare Services Group declined because of an ongoing Securities and Exchange Commission examination of its financial reporting practices. The company, which has also struggled with stagnating margins in its core business, delayed but eventually filed its annual report without any changes to its previous financial statements. Also in the sector, data measurement company Nielsen was eliminated during the period because of deteriorating cash flows that led to a reduction in its full-year financial guidance.

In consumer staples, tobacco holdings Altria and Philip Morris International dropped amid ongoing investor concerns over how the rapid adoption of new e-cigarette technologies and tighter regulatory oversight could negatively impact the sales volumes of traditional cigarettes. The declines from Altria and Philip Morris International offset solid stock performance during the period from the Fund’s other consumer staples holdings, Coca-Cola and Unilever.

The December stock market sell-off created new investment opportunities as price/earnings multiples fell across many industry sectors. Besides adding Gilead Sciences in health care, the Fund also added cable and broadband provider Comcast in communications services and luxury retailer Tiffany & Co. in consumer discretionary. Along with reasonable valuations, both Comcast and Tiffany offered above-average dividend yields, strong balance sheets and cash flows, and attractive future growth potential.

There were several corporate actions that impacted existing holdings during the final months of the period. Chemical maker Dow Inc. and agricultural products company Corteva separated from specialty products maker DuPont de Nemours, and jeans producer Kontoor Brands was spun-off from former parent VF Corp. While the Fund continues to hold these new positions, it eliminated eye care company Alcon following the company’s spin-off from Novartis. While the Alcon business has many attractive attributes, the expected dividend yield from the new company was well below the Index’s average.

www.brownadvisory.com/mf

Brown Advisory Equity Income FundA Message to Our Shareholders

June 30, 2019

Remaining patient and disciplined early in the period paid off for investors in December, as market volatility increased. This created a better environment to buy high quality companies with durable, defensible business models at attractive prices. Through ups and downs in the stock market, the Fund’s long-term strategy has remained the same. The ultimate goal is to build a portfolio of investments that should generate a reliable stream of growing income over time, while also offering capital conservation during those periods when it is needed.

Sincerely,

Brian Graney, CFA

Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and nonrated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in smaller and medium capitalization companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. The value of the Fund’s investments in REITs and Real Estate may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Investments in foreign securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. Investing in Master Limited Partnerships (“MLPs”) entails risk related to fluctuations in energy prices, decreases in supply of or demand for energy commodities, unique tax consequences due to the partnership structure and various other risks. Private Placement issued securities are restricted securities that are not publicly traded. Delay or difficulty in selling such securities may result in a loss to the Fund.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisory.com/mf

Brown Advisory Equity Income FundPerformance Information & Portfolio Holdings Summary

June 30, 2019

GROWTH OF A $10,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Fund as measured against a broad-based securities market index. The S&P 500 Index (“Index”) is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks. The Index is unmanaged and does not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

| PORTFOLIO HOLDINGS | % of Net Assets |

Information Technology | | | 23.4 | % | |

Financials | | | 15.6 | % | |

Health Care | | | 14.2 | % | |

Consumer Discretionary | | | 11.8 | % | |

Consumer Staples | | | 7.7 | % | |

Real Estate Investment Trusts | | | 7.3 | % | |

Energy | | | 5.5 | % | |

Industrials | | | 5.1 | % | |

Materials | | | 4.2 | % | |

Money Market Funds | | | 3.2 | % | |

Communication Services | | | 2.1 | % | |

Other Assets and Liabilities | | | (0.1 | )% | |

| | | | 100.0 | % | |

| | | | Since Inception |

Average Annual Total Return | One Year | Five Year | (12/29/11) |

Institutional Shares1 | 13.12% | 7.86% | 11.18% |

| Investor Shares | 13.03% | 7.71% | 11.02% |

| Advisor Shares | 12.67% | 7.44% | 10.74% |

| S&P 500 Index | 10.42% | 10.71% | 14.29% |

| | Institutional Shares | Investor Shares | Advisor Shares |

Gross Expense Ratio2 | 0.77% | 0.92% | 1.17% |

Net Expense Ratio2 | 0.77% | 0.92% | 1.17% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisory.com/mf/equity-income-fund. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower. Returns shown are calculated using the net asset values (“NAV”) that were used for shareholder transactions as of the respective period ends. These NAV, and the returns calculated from them, may differ from the NAV and returns shown elsewhere in this report.

1 | Performance information for the Institutional Shares, prior to commencement of operations on October 19, 2012, is based on the performance of Investor Shares, and adjusted for the lower expenses applicable to Institutional Shares. |

2 | Per the Fund’s prospectus dated October 31, 2018. Refer to the financial highlights for the gross and net expense ratios for the year ended as of the date of this report. Please note that the expense ratios per the prospectus include acquired fund fees and expenses (as applicable) and the expense ratios in the financial highlights do not. |

www.brownadvisory.com/mf

Brown Advisory Equity Income FundSchedule of Investments

June 30, 2019

| Shares | | Security Description | | Value $ | |

| Common Stocks — 89.6% | | | |

| | | | |

| Communication Services — 2.1% | | | |

| | 44,662 | | Comcast Corp. | | | 1,888,309 | |

| | | | | |

| Consumer Discretionary — 11.8% | | | | |

| | 19,172 | | Best Buy Co., Inc. | | | 1,336,863 | |

| | 16,863 | | Hasbro, Inc. | | | 1,782,082 | |

| | 6,708 | | Home Depot, Inc. | | | 1,395,063 | |

| | 1,686 | | Kontoor Brands, Inc. | | | 47,242 | |

| | 12,950 | | Lowe’s Companies, Inc. | | | 1,306,784 | |

| | 13,263 | | McDonald’s Corp. | | | 2,754,195 | |

| | 10,053 | | Tiffany & Co. | | | 941,363 | |

| | 11,802 | | V.F. Corp. | | | 1,030,905 | |

| | | | | | | 10,594,497 | |

| Consumer Staples — 7.7% | | | | |

| | 23,299 | | Altria Group, Inc. | | | 1,103,208 | |

| | 45,630 | | Coca-Cola Co. | | | 2,323,480 | |

| | 16,761 | | Philip Morris International, Inc. | | | 1,316,241 | |

| | 36,239 | | Unilever NV ADR | | | 2,200,432 | |

| | | | | | | 6,943,361 | |

| Energy — 5.5% | | | | |

| | 106,373 | | Kinder Morgan, Inc. | | | 2,221,068 | |

| | 15,316 | | Occidental Petroleum Corp. | | | 770,088 | |

| | 62,329 | | Suncor Energy, Inc. | | | 1,942,172 | |

| | | | | | | 4,933,328 | |

| Financials — 15.6% | | | | |

| | 14,333 | | Ameriprise Financial, Inc. | | | 2,080,578 | |

| | 72,748 | | Bank of America Corp. | | | 2,109,692 | |

| | 22,857 | | Cincinnati Financial Corp. | | | 2,369,585 | |

| | 10,948 | | Erie Indemnity Co. | | | 2,783,857 | |

| | 25,337 | | JPMorgan Chase & Co. | | | 2,832,677 | |

| | 37,903 | | Wells Fargo & Co. | | | 1,793,570 | |

| | | | | | | 13,969,959 | |

| Health Care — 14.2% | | | | |

| | 13,025 | | AbbVie, Inc. | | | 947,178 | |

| | 12,159 | | Gilead Sciences, Inc. | | | 821,462 | |

| | 17,763 | | Johnson & Johnson | | | 2,474,031 | |

| | 21,822 | | Medtronic PLC | | | 2,125,245 | |

| | 44,102 | | Merck & Co., Inc. | | | 3,697,953 | |

| | 29,192 | | Novartis AG ADR | | | 2,665,521 | |

| | | | | | | 12,731,390 | |

| Industrials — 5.1% | | | | |

| | 7,472 | | General Dynamics Corp. | | | 1,358,559 | |

| | 29,047 | | Healthcare Services Group, Inc. | | | 880,705 | |

| | 18,272 | | United Technologies Corp. | | | 2,379,014 | |

| | | | | | | 4,618,278 | |

| Information Technology — 23.4% | | | | |

| | 13,246 | | Accenture PLC | | | 2,447,463 | |

| | 18,816 | | Apple, Inc. | | | 3,724,063 | |

| | 19,138 | | Automatic Data Processing, Inc. | | | 3,164,085 | |

| | 6,623 | | Broadcom, Inc. | | | 1,906,497 | |

| | 74,601 | | Cisco Systems, Inc. | | | 4,082,913 | |

| | 42,556 | | Microsoft Corp. | | | 5,700,802 | |

| | | | | | | 21,025,823 | |

| Materials — 4.2% | | | | |

| | 9,492 | | Corteva, Inc. | | | 280,679 | |

| | 14,276 | | Dow, Inc. | | | 703,950 | |

| | 9,492 | | DuPont de Nemours, Inc. | | | 712,564 | |

| | 10,308 | | Linde PLC | | | 2,069,846 | |

| | | | | | | 3,767,039 | |

Total Common Stocks (Cost $45,392,630) | | | 80,471,984 | |

| | | | | |

| Real Estate Investment Trusts — 7.3% | | | | |

| | 10,834 | | American Tower Corp. | | | 2,215,011 | |

| | 32,554 | | W.P. Carey, Inc. | | | 2,642,734 | |

| | 64,072 | | Weyerhaeuser Co. | | | 1,687,657 | |

Total Real Estate Investment Trusts (Cost $4,610,933) | | | 6,545,402 | |

| | | | | |

| Short-Term Investments — 3.2% | | | | |

| | | | | |

| Money Market Funds — 3.2% | | | | |

| | 2,873,953 | | First American Government | | | | |

| | | | Obligations Fund — Class Z, 2.26%# | | | 2,873,953 | |

Total Short-Term Investments (Cost $2,873,953) | | | 2,873,953 | |

Total Investments — 100.1% (Cost $52,877,516) | | | 89,891,339 | |

Liabilities in Excess of Other Assets — (0.1)% | | | (115,615 | ) |

| NET ASSETS — 100.0% | | $ | 89,775,724 | |

ADR — American Depositary Receipt

| # | Annualized seven-day yield as of June 30, 2019. |

The accompanying notes are an integral part of these financial statements.

www.brownadvisory.com/mf

Brown Advisory Sustainable Growth FundA Message to Our Shareholders

June 30, 2019

Dear Shareholders:

During the year ended June 30, 2019, the Brown Advisory Sustainable Growth Fund – Institutional Shares (the “Fund”) increased 18.89% in value. During the same period, the Fund’s benchmark, the Russell 1000® Growth Index (the “Index”), increased 11.56%.

We are pleased with the outperformance generated over the period. We added value in six of the ten economic sectors and added the most value in the areas of the market in which we have the largest weights (i.e. technology and health care). The Fund’s relative outperformance was also due to strong stock selection in materials and real estate. Our underweight in communication services also contributed to the positive performance relative to the benchmark. These positive factors more than offset weak performance from some of our industrial holdings.

As of the date of this writing, uncertainty surrounding trade talks between the U.S. and China dominate short-term sentiment. Increased antitrust scrutiny of big technology companies, slowing global growth, and the hope of a dovish Federal Reserve in the back half of the year round out the major, near-term caveats to an otherwise healthy domestic market. While the macroeconomic environment remains fluid and is always uncertain, our focus remains unchanged. We seek to identify fundamentally superior companies that are using sustainability strategies to drive strong financial performance. We are in the tenth year of a bull market and are careful to avoid chasing momentum-led stories.

Taking a closer look at the last twelve months, performance was broad-based with a number of stocks from different sectors contributing positively to performance, including Ball Corporation, American Tower and Danaher. Ball Corporation posted strong revenue growth in its most recent quarter. The majority of new beverage offerings are being packaged in cans which is a dramatic shift from just a few years ago when most were packaged in plastic bottles. American Tower posted strong growth in the U.S. as carrier spending remains robust. Going forward, we expect domestic carrier spending to remain elevated given the move to 5G. During the first quarter in 2019, Danaher announced its intentions to acquire the biopharma business from General Electric for roughly $21b. The deal should expand Danaher’s presence in multiple fast-growing areas of life sciences including research, discovery, process development, and manufacturing workflows of biopharmaceuticals.

In terms of our largest detractors, Facebook, Welbilt and J.B. Hunt were our worst performers during the period. Facebook came under significant pressure after the company reduced its near-term profitability goals. Welbilt encountered lower-than-expected demand for its cooking equipment and J.B. Hunt’s intermodal business suffered reduced volume as a result of the trade war with China.

We added three new names to the portfolio during the last twelve months including Analog Devices, Illumina, Aspen Technologies.

Analog Devices is a leading, high-performance analog technology company. The company translates real-world phenomena to accurately sense, measure, connect, interpret and power various applications. Energy efficiency has increased the adoption of analog chips which has helped make numerous applications smarter, safer, more accurate and more efficient.

Illumina is a leading developer of life science tools and integrated systems for the analysis of genetic variation and function. Illumina’s sustainable business advantage is its ability to drive the efficiency and productivity of diagnostics and therapeutics within the health system.

Aspen Technology is a provider of process optimization and asset performance management software to the process industries. Its solutions help improve the competitiveness and profitability of its customers by increasing throughput, energy efficiency, and production yields and by reducing unplanned downtime.

As for deletions during the period, we eliminated A.O. Smith, Facebook, and Welbilt. We sold A.O. Smith because the Chinese market has become increasingly competitive which is extremely concerning given that part of our investment thesis had been centered on the company’s strong market position in the region. We exited the stock and swapped the position into Analog Devices with confidence that this is an upgrade to the portfolio.

We also exited our position in Facebook during the period given the elevated risks around privacy, data security, governance, and regulation. Soon after our initiation of Welbilt, the company’s CEO surprisingly resigned. This prompted us to exit the position, having lost confidence in the management team and their ability to execute in a highly competitive industry. We swapped our position into Aspen Technologies in the fourth quarter. We also sold our position in Red Hat after IBM announced its intention to acquire the company in the fourth quarter of 2018. Finally, we consolidated our ownership in Alphabet by selling our Class C shares and retaining our ownership in the Class A shares.

www.brownadvisory.com/mf

Brown Advisory Sustainable Growth FundA Message to Our Shareholders

June 30, 2019

We maintain a disciplined process of discerning what we believe to be are high-quality names poised for steady success–even in uncertain operating environments. Sustainable growth requires management teams to be resilient against many challenges, including constraints on the natural environment and resources. Our deep sustainability research helps us identify the companies that have been making the right long-term investments, for many years now, toward their own long-term sustainability and growth.

While we enter the second half of calendar year 2019 with considerable macroeconomic and political uncertainty, we will maintain focus on our disciplined, repeatable formula for stock selection which we believe will enable us to provide attractive long-term returns.

Sincerely,

David Powell and Karina Funk

Portfolio Managers

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund’s investment focus on environmental factors could cause it to make or avoid investments that could result in the Fund underperforming similar funds that do not have an environmental focus. Investments in smaller and medium-sized capitalization companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. Investments in foreign securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. These risks are greater for investments in emerging markets. The value of the Fund’s investments in REITS may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisory.com/mf

Brown Advisory Sustainable Growth FundPerformance Information & Portfolio Holdings Summary

June 30, 2019

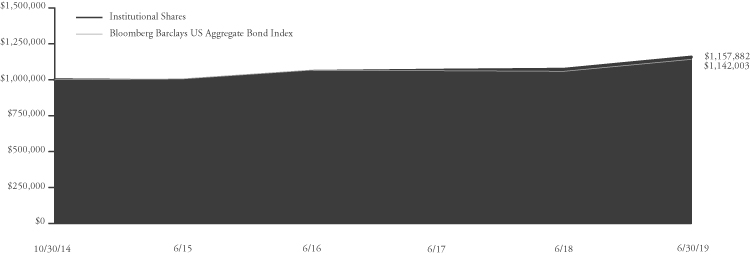

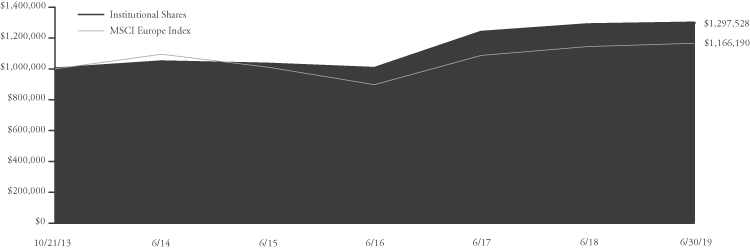

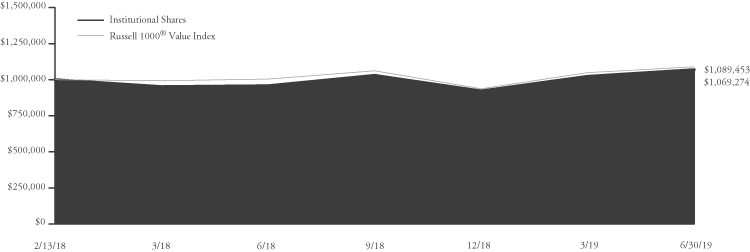

GROWTH OF A $1,000,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $1,000,000 investment, including reinvested dividends and distributions, in the Fund as measured against a broad-based securities market index. The Russell 1000® Growth Index (“Index”) measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price to book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

| PORTFOLIO HOLDINGS | % of Net Assets |

Information Technology | | | 31.8 | % | |

Health Care | | | 24.8 | % | |

Consumer Discretionary | | | 13.2 | % | |

Industrials | | | 10.3 | % | |

Materials | | | 6.4 | % | |

Real Estate Investment Trusts | | | 4.5 | % | |

Communication Services | | | 3.4 | % | |

Money Market Funds | | | 3.0 | % | |

Consumer Staples | | | 2.1 | % | |

Other Assets and Liabilities | | | 0.5 | % | |

| | | | 100.0 | % | |

| | | | Since Inception |

Average Annual Total Return | One Year | Five Year | (6/29/12) |

| Institutional Shares | 18.89% | 16.26% | 17.16% |

| Investor Shares | 18.68% | 16.08% | 16.97% |

| Advisor Shares | 18.39% | 15.78% | 16.68% |

Russell 1000® Growth Index | 11.56% | 13.39% | 15.75% |

| | Institutional Shares | Investor Shares | Advisor Shares |

Gross Expense Ratio1 | 0.73% | 0.88% | 1.13% |

Net Expense Ratio1 | 0.73% | 0.88% | 1.13% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisory.com/mf/sustainable-growth-fund. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower. Returns shown are calculated using the net asset values (“NAV”) that were used for shareholder transactions as of the respective period ends. These NAV, and the returns calculated from them, may differ from the NAV and returns shown elsewhere in this report.

1 | Per the Fund’s prospectus dated October 31, 2018. Refer to the financial highlights for the gross and net expense ratios for the year ended as of the date of this report. Please note that the expense ratios per the prospectus include acquired fund fees and expenses (as applicable) and the expense ratios in the financial highlights do not. |

www.brownadvisory.com/mf

Brown Advisory Sustainable Growth FundSchedule of Investments

June 30, 2019

| Shares | | Security Description | | Value $ | |

| Common Stocks — 92.0% | | | |

| | | | |

| Communication Services — 3.4% | | | |

| | 43,228 | | Alphabet, Inc. — Class A* | | | 46,807,278 | |

| | | | | |

| Consumer Discretionary — 13.2% | | | | |

| | 31,655 | | Amazon.com, Inc.* | | | 59,942,858 | |

| | 369,988 | | Aptiv PLC | | | 29,906,130 | |

| | 123,897 | | Home Depot, Inc. | | | 25,766,859 | |

| | 233,157 | | Marriott International, Inc. | | | 32,709,595 | |

| | 638,544 | | TJX Companies, Inc. | | | 33,766,207 | |

| | | | | | | 182,091,649 | |

| Consumer Staples — 2.1% | | | | |

| | 484,354 | | Unilever NV ADR | | | 29,409,975 | |

| | | | | |

| Health Care — 24.8% | | | | |

| | 461,889 | | Danaher Corp. | | | 66,013,176 | |

| | 175,293 | | Edwards Lifesciences Corp.* | | | 32,383,629 | |

| | 126,279 | | IDEXX Laboratories, Inc.* | | | 34,768,397 | |

| | 104,495 | | Illumina, Inc.* | | | 38,469,834 | |

| | 41,866 | | Mettler-Toledo International, Inc.* | | | 35,167,440 | |

| | 186,526 | | Thermo Fisher Scientific, Inc. | | | 54,778,956 | |

| | 210,011 | | UnitedHealth Group, Inc. | | | 51,244,784 | |

| | 219,882 | | West Pharmaceutical Services, Inc. | | | 27,518,232 | |

| | | | | | | 340,344,448 | |

| Industrials — 10.3% | | | | |

| | 432,617 | | Fortive Corp. | | | 35,266,938 | |

| | 293,744 | | J.B. Hunt Transport Services, Inc. | | | 26,851,139 | |

| | 218,521 | | Nordson Corp. | | | 30,879,202 | |

| | 329,824 | | Verisk Analytics, Inc. | | | 48,306,023 | |

| | | | | | | 141,303,302 | |

| Information Technology — 31.8% | | | | |

| | 135,129 | | Adobe, Inc.* | | | 39,815,760 | |

| | 175,705 | | Analog Devices, Inc. | | | 19,831,823 | |

| | 272,640 | | Aspen Technology, Inc.* | | | 33,883,699 | |

| | 234,518 | | Autodesk, Inc.* | | | 38,202,982 | |

| | 216,138 | | Intuit, Inc. | | | 56,483,344 | |

| | 1,148,426 | | Marvell Technology Group, Ltd. | | | 27,412,929 | |

| | 512,605 | | Microsoft Corp. | | | 68,668,566 | |

| | 232,817 | | Monolithic Power Systems, Inc. | | | 31,611,892 | |

| | 207,969 | | salesforce.com, Inc.* | | | 31,555,136 | |

| | 136,831 | | Tyler Technologies, Inc.* | | | 29,558,233 | |

| | 347,863 | | Visa, Inc. | | | 60,371,624 | |

| | | | | | | 437,395,988 | |

| Materials — 6.4% | | | | |

| | 577,276 | | Ball Corp. | | | 40,403,547 | |

| | 244,049 | | Ecolab, Inc. | | | 48,185,035 | |

| | | | | | | 88,588,582 | |

Total Common Stocks (Cost $912,548,668) | | | 1,265,941,222 | |

| | | | | |

| Real Estate Investment Trusts — 4.5% | | | | |

| | 300,551 | | American Tower Corp. | | | 61,447,652 | |

Total Real Esate Investment Trusts (Cost $40,176,397) | | | 61,447,652 | |

| | | | | | | | |

| Short-Term Investments — 3.0% | | | | |

| | | | | |

| Money Market Funds — 3.0% | | | | |

| | 41,319,174 | | First American Government | | | | |

| | | | Obligations Fund — Class Z, 2.26%# | | | 41,319,174 | |

Total Short-Term Investments (Cost $41,319,174) | | | 41,319,174 | |

Total Investments — 99.5% (Cost $994,044,239) | | | 1,368,708,048 | |

Other Assets in Excess of Liabilities — 0.5% | | | 6,880,026 | |

| NET ASSETS — 100.0% | | $ | 1,375,588,074 | |

ADR — American Depositary Receipt

* | Non-Income Producing |

# | Annualized seven-day yield as of June 30, 2019. |

The accompanying notes are an integral part of these financial statements.

www.brownadvisory.com/mf

Brown Advisory Mid-Cap Growth FundA Message to Our Shareholders

June 30, 2019

Dear Shareholders:

During the year ended June 30, 2019, the Brown Advisory Mid-Cap Growth Fund – Investor Shares (the “Fund”) increased 16.80% in value. During the same period, the Fund’s benchmark, the Russell Midcap Growth Index (the “Index”), increased 13.94%.

Solid returns since last June might seem benevolent, but that masks a jarring December-quarter drawdown and ebullient 2019 recovery. Specifically, the Fund’s benchmark retrenched 22.46% between September 14th and Christmas Eve of 2018, then surged 35.18% into the end of June. Given our quality-bent, our Fund benefited from that volatility in terms of relative results. Also, many fourth-quarter “losers” turned into recent “winners,” helping the Fund outpace its benchmark in the first half of 2019. As detailed below, we took advantage of several pops and drops. We added to numerous existing positions such as Catalent (CTLT), SiteOne (SITE), National Vision (EYE), and GoDaddy (GDDY) and built new ones in companies that we think will compound at above-average rates for many years to come.

While we welcome volatility, the Fund’s subtle small-cap bias likely counteracted any tailwind it may have provided. Aside from the frenetic swing captioned above, small-caps’ lag may be the most notable market dynamic in the last 12 months. Measured by the Russell Midcap Growth Index and the Russell 2000® Growth Index, mid-caps have outpaced small-caps by a staggering 14% over the last twelve months. Why? We suspect a number of reasons play a role. Tech has outperformed, and the mid- and large-cap growth benchmarks boast heavier weights in that sector. Specifically, the Russell Midcap Growth Information Technology sector was the best performing vertical June to June, rising more than 23%, beating the Index average by more than 9%. Outside of what we have dubbed “the tech phenomenon,” small-cap valuations seemed mildly stretched to us twelve months ago. So, the starting point of this analysis matters. Finally, Wall Street analysts now expect mid- and large-caps to post faster growth rates this year.