UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 | | Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders for the Goldman Sachs Multi-Strategy Alternatives Fund, Goldman Sachs Multi-Manager Non-Core Fixed Income Fund, Goldman Sachs Multi-Manager Global Equity Fund, Goldman Sachs Multi-Manager Real Assets Strategy Fund, Multi-Manager International Equity Fund, and Multi-Manager U.S. Small Cap Equity Fund is filed herewith.

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Manager Global Equity Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Manager Global Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $57 | 0.50% |

How did the Fund perform and what affected its performance?

Global equities broadly rallied as waning inflation levels led to interest rate cuts by a growing number of central banks. U.S. stocks produced the strongest gains, followed closely by non-U.S. developed markets and emerging markets equities. Growth-oriented stocks generally outperformed their value counterparts.

Top Contributors to Performance:

All 11 of the Fund’s underlying managers generated positive absolute returns, with six outperforming their respective benchmark indices.

Underlying manager WCM Investment Management, LLC performed best versus its benchmark, driven by stock selection in consumer discretionary and industrials. Health care picks detracted.

Wellington Management Company LLP outpaced its benchmark on selection in consumer discretionary and industrials. Selection in communication services detracted. All of its quantitative equity model’s factors bolstered returns.

Diamond Hill Capital Management Inc. outperformed its benchmark due to selection in consumer discretionary and materials. Selection in consumer staples detracted.

Axiom Investors LLC beat its benchmark due to selection in consumer discretionary and industrials. Selection in financials detracted.

Causeway Capital Management LLC and MFS Investment Management slightly outperformed their respective benchmarks.

Top Detractors from Performance:

Vaughan Nelson Investment Management, L.P. significantly underperformed its benchmark, with selection in energy and consumer staples detracting. Selection in materials was positive.

GW&K Investment Management, LLC trailed its benchmark largely due to selection in information technology and consumer staples. An underweight in energy added.

Boston Partners Global Investors, Inc. underperformed its benchmark due to selection in health care and communication services. Consumer discretionary selection added.

Principal Global Investors, LLC lagged its benchmark due to selection in health care and consumer discretionary. Information technology picks added.

T. Rowe Price Associates, Inc. modestly underperformed its benchmark.

The above represents the Fund’s overall global equity exposures.

Goldman Sachs Multi-Manager Global Equity Fund

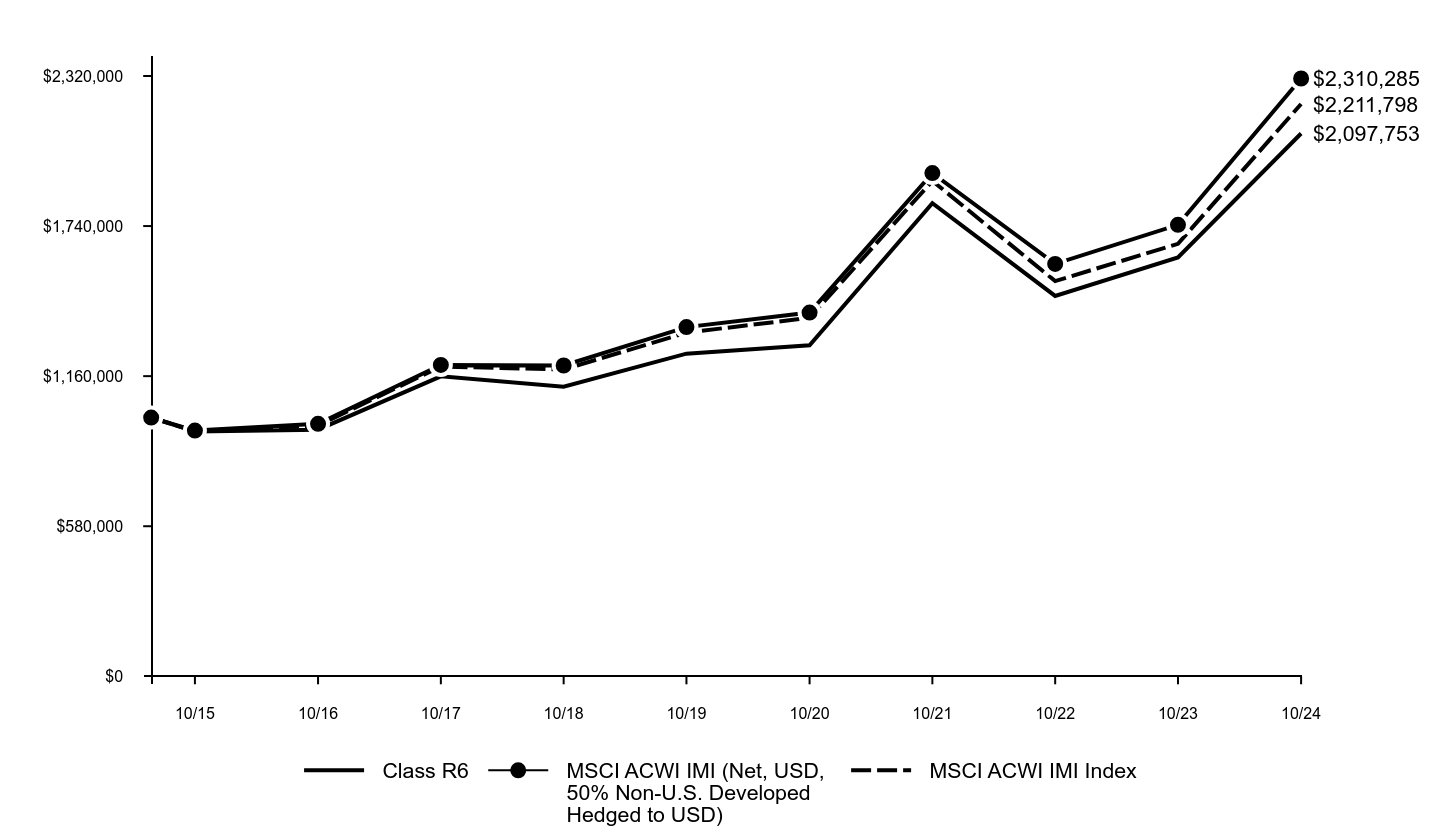

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R6 | MSCI ACWI IMI (Net, USD, 50% Non-U.S. Developed Hedged to USD) | MSCI ACWI IMI Index |

|---|

| 06/15 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/15 | $946,000 | $949,700 | $947,000 |

| 10/16 | $953,000 | $975,627 | $969,160 |

| 10/17 | $1,159,134 | $1,203,241 | $1,197,106 |

| 10/18 | $1,119,376 | $1,201,075 | $1,185,734 |

| 10/19 | $1,246,873 | $1,349,528 | $1,328,140 |

| 10/20 | $1,279,292 | $1,405,803 | $1,385,516 |

| 10/21 | $1,828,492 | $1,944,647 | $1,914,506 |

| 10/22 | $1,469,924 | $1,593,833 | $1,527,393 |

| 10/23 | $1,618,387 | $1,744,928 | $1,671,426 |

| 10/24 | $2,097,753 | $2,310,285 | $2,211,798 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 6/24/15 |

|---|

| Class R6 | 29.62% | 10.95% | 8.23% |

| MSCI ACWI IMI (Net, USD, 50% Non-U.S. Developed Hedged to USD) | 32.40% | 11.34% | 9.35% |

| MSCI ACWI IMI Index | 32.33% | 10.73% | 8.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the MSCI ACWI IMI Index.

Goldman Sachs Multi-Manager Global Equity Fund

| Total Net Assets | $1,314,598,549 |

| # of Portfolio Holdings | 905 |

| Portfolio Turnover Rate | 66% |

| Total Net Advisory Fees Paid | $4,067,282 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Information Technology | 19.9% |

| Financials | 15.9% |

| Industrials | 12.8% |

| Consumer Discretionary | 11.8% |

| Health Care | 11.6% |

| Communication Services | 5.9% |

| Consumer Staples | 4.1% |

| Materials | 3.9% |

| Energy | 3.0% |

| Other | 11.5% |

Goldman Sachs Multi-Manager Global Equity Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

The Morgan Stanley Capital International Inc. (MSCI) information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Manager Global Equity Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Strategy Alternatives Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Strategy Alternatives Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $106 | 1.07% |

How did the Fund perform and what affected its performance?

The performance of the Fund was influenced most by central bank monetary policy, especially interest rate cuts by the U.S. Federal Reserve; the depreciation of major currencies versus the U.S. dollar; and substantial price movements and dispersions across commodities.

Top Contributors to Performance:

The Fund benefited from the fixed income metal spillover factor, which views metals prices as leading indicators of economic performance. When metals prices are high, this factor signals a potential upturn in the general business environment and, therefore, less demand for bonds.

During the annual period, metals prices increased significantly as the U.S. sidestepped an economic recession. The fixed income metal spillover factor led the Fund to sell bonds in anticipation of lower interest rates, resulting in gains across almost all bond durations and global regions.

The Fund was helped by positioning in 10-year Japanese, U.K. and Australian government bonds.

Positioning in the British pound, Swedish krona and Norwegian krone added to returns.

The Fund’s positioning in zinc, soybean oil and wheat was advantageous.

Top Detractors from Performance:

The Fund was hurt by the long-term reversal factor, which aims to detect trends and reversals in commodity prices. This factor signals buying or selling when a commodity is well below or above the moving average in anticipation that fair pricing would lead that commodity to revert to its price average.

The long-term reversal factor led the Fund to short copper, gold and coffee amid steep prices, but these commodities did not return to their price averages during the reporting period, resulting in losses for the Fund.

Positioning in 10-year German and South Korean government bonds detracted from the Fund’s performance.

The Fund was hampered by positioning in the Japanese yen, New Zealand dollar and Canadian dollar.

Positioning in gold, corn and cocoa had a negative impact on performance.

The above represents investment pillars.

Goldman Sachs Multi-Strategy Alternatives Fund

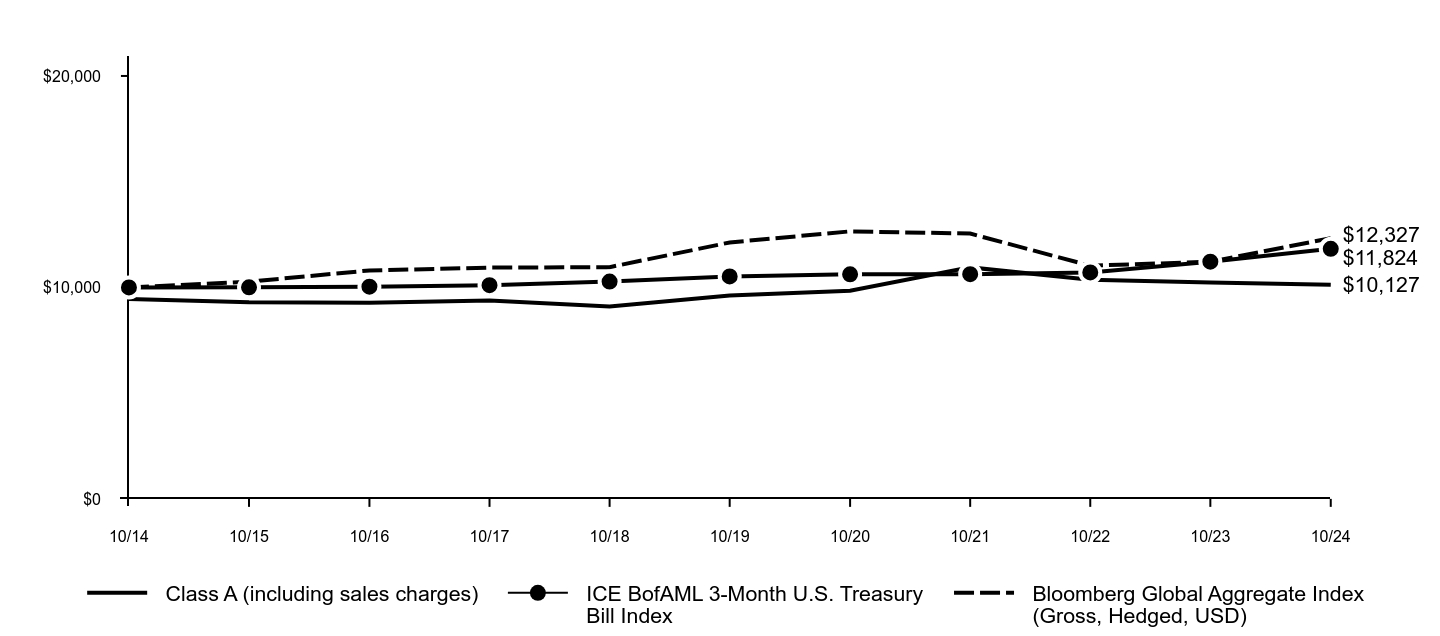

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class A (including sales charges) | ICE BofAML 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 10/14 | $9,450 | $10,000 | $10,000 |

| 10/15 | $9,298 | $10,002 | $10,272 |

| 10/16 | $9,276 | $10,033 | $10,803 |

| 10/17 | $9,377 | $10,105 | $10,936 |

| 10/18 | $9,093 | $10,275 | $10,958 |

| 10/19 | $9,615 | $10,522 | $12,127 |

| 10/20 | $9,839 | $10,618 | $12,651 |

| 10/21 | $10,947 | $10,625 | $12,546 |

| 10/22 | $10,366 | $10,708 | $11,025 |

| 10/23 | $10,231 | $11,219 | $11,215 |

| 10/24 | $10,127 | $11,824 | $12,327 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A excluding sales charges | -1.02% | 1.04% | 0.69% |

| Class A including sales charges | -6.44% | -0.10% | 0.13% |

| ICE BofAML 3-Month U.S. Treasury Bill Index | 5.39% | 2.36% | 1.69% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 2.11% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Strategy Alternatives Fund

| Total Net Assets | $64,670,541 |

| # of Portfolio Holdings | 197 |

| Portfolio Turnover Rate | 0% |

| Total Net Advisory Fees Paid | $542,250 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-526-7384.

The Fund's net expense ratio decreased during the period as a result of a lower management fee rate and lower expense limit.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

Asset Class Exposure (%)*

| Header | Gross | Long | Short | Net |

| Cash | 29.1 | 19.6 | 9.5 | 10.0 |

| Commodities | 94.7 | 49.1 | 45.5 | 3.6 |

| Developed Market Currency | 209.5 | 126.5 | 83.0 | 43.4 |

| Long-Term Fixed Income | 101.5 | 32.0 | 69.5 | -37.5 |

| Short-Term Fixed Income | 39.3 | 39.3 | - | 39.3 |

| Short-Term Investments | 91.4 | 91.4 | - | 91.4 |

*Asset class exposure includes the impact of derivatives. "Gross Exposure" represents the sum of the absolute value of long and short notional contract values in U.S. dollars of the Fund's positions (for a given asset class), divided by the Fund's net assets exposure within each asset class. "Net Exposure" represents the net exposure within the Fund to a given asset class, calculated as the difference between long and short exposures. The exposure of option contracts is delta-adjusted and offsetting forward foreign currency exchange contract positions are netted by currency pair and settlement date for both gross and net exposure calculations. Short-term Investments include investment companies and U.S. Treasury Bills.

Goldman Sachs Multi-Strategy Alternatives Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Strategy Alternatives Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Strategy Alternatives Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Strategy Alternatives Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| C | $177 | 1.79% |

How did the Fund perform and what affected its performance?

The performance of the Fund was influenced most by central bank monetary policy, especially interest rate cuts by the U.S. Federal Reserve; the depreciation of major currencies versus the U.S. dollar; and substantial price movements and dispersions across commodities.

Top Contributors to Performance:

The Fund benefited from the fixed income metal spillover factor, which views metals prices as leading indicators of economic performance. When metals prices are high, this factor signals a potential upturn in the general business environment and, therefore, less demand for bonds.

During the annual period, metals prices increased significantly as the U.S. sidestepped an economic recession. The fixed income metal spillover factor led the Fund to sell bonds in anticipation of lower interest rates, resulting in gains across almost all bond durations and global regions.

The Fund was helped by positioning in 10-year Japanese, U.K. and Australian government bonds.

Positioning in the British pound, Swedish krona and Norwegian krone added to returns.

The Fund’s positioning in zinc, soybean oil and wheat was advantageous.

Top Detractors from Performance:

The Fund was hurt by the long-term reversal factor, which aims to detect trends and reversals in commodity prices. This factor signals buying or selling when a commodity is well below or above the moving average in anticipation that fair pricing would lead that commodity to revert to its price average.

The long-term reversal factor led the Fund to short copper, gold and coffee amid steep prices, but these commodities did not return to their price averages during the reporting period, resulting in losses for the Fund.

Positioning in 10-year German and South Korean government bonds detracted from the Fund’s performance.

The Fund was hampered by positioning in the Japanese yen, New Zealand dollar and Canadian dollar.

Positioning in gold, corn and cocoa had a negative impact on performance.

The above represents investment pillars.

Goldman Sachs Multi-Strategy Alternatives Fund

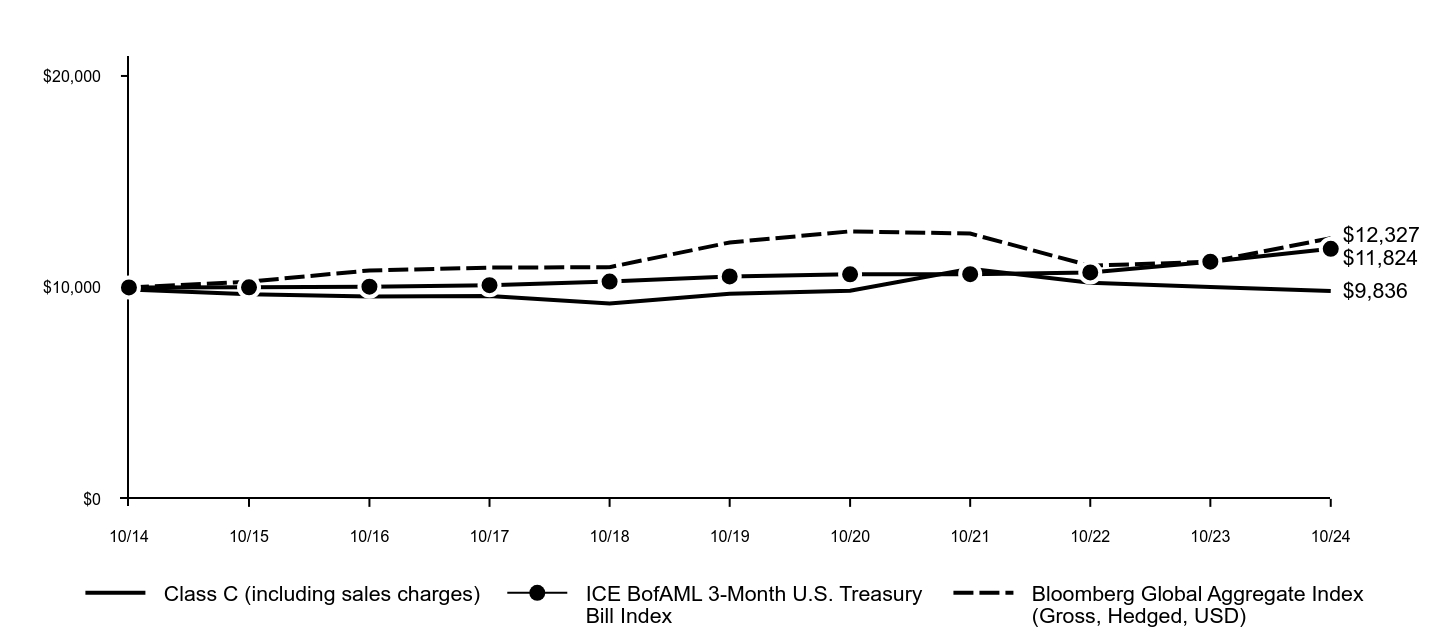

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class C (including sales charges) | ICE BofAML 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 10/14 | $9,900 | $10,000 | $10,000 |

| 10/15 | $9,672 | $10,002 | $10,272 |

| 10/16 | $9,573 | $10,033 | $10,803 |

| 10/17 | $9,595 | $10,105 | $10,936 |

| 10/18 | $9,240 | $10,275 | $10,958 |

| 10/19 | $9,700 | $10,522 | $12,127 |

| 10/20 | $9,843 | $10,618 | $12,651 |

| 10/21 | $10,880 | $10,625 | $12,546 |

| 10/22 | $10,218 | $10,708 | $11,025 |

| 10/23 | $10,017 | $11,219 | $11,215 |

| 10/24 | $9,836 | $11,824 | $12,327 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C excluding sales charges | -1.81% | -2.79% | -0.06% |

| Class C including sales charges | -2.79% | 0.56% | -0.06% |

| ICE BofAML 3-Month U.S. Treasury Bill Index | 5.39% | 2.36% | 1.69% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 2.11% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Strategy Alternatives Fund

| Total Net Assets | $64,670,541 |

| # of Portfolio Holdings | 197 |

| Portfolio Turnover Rate | 0% |

| Total Net Advisory Fees Paid | $542,250 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-526-7384.

The Fund's net expense ratio decreased during the period as a result of a lower management fee rate and lower expense limit.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

Asset Class Exposure (%)*

| Header | Gross | Long | Short | Net |

| Cash | 29.1 | 19.6 | 9.5 | 10.0 |

| Commodities | 94.7 | 49.1 | 45.5 | 3.6 |

| Developed Market Currency | 209.5 | 126.5 | 83.0 | 43.4 |

| Long-Term Fixed Income | 101.5 | 32.0 | 69.5 | -37.5 |

| Short-Term Fixed Income | 39.3 | 39.3 | - | 39.3 |

| Short-Term Investments | 91.4 | 91.4 | - | 91.4 |

*Asset class exposure includes the impact of derivatives. "Gross Exposure" represents the sum of the absolute value of long and short notional contract values in U.S. dollars of the Fund's positions (for a given asset class), divided by the Fund's net assets exposure within each asset class. "Net Exposure" represents the net exposure within the Fund to a given asset class, calculated as the difference between long and short exposures. The exposure of option contracts is delta-adjusted and offsetting forward foreign currency exchange contract positions are netted by currency pair and settlement date for both gross and net exposure calculations. Short-term Investments include investment companies and U.S. Treasury Bills.

Goldman Sachs Multi-Strategy Alternatives Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Strategy Alternatives Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Strategy Alternatives Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Strategy Alternatives Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $75 | 0.75% |

How did the Fund perform and what affected its performance?

The performance of the Fund was influenced most by central bank monetary policy, especially interest rate cuts by the U.S. Federal Reserve; the depreciation of major currencies versus the U.S. dollar; and substantial price movements and dispersions across commodities.

Top Contributors to Performance:

The Fund benefited from the fixed income metal spillover factor, which views metals prices as leading indicators of economic performance. When metals prices are high, this factor signals a potential upturn in the general business environment and, therefore, less demand for bonds.

During the annual period, metals prices increased significantly as the U.S. sidestepped an economic recession. The fixed income metal spillover factor led the Fund to sell bonds in anticipation of lower interest rates, resulting in gains across almost all bond durations and global regions.

The Fund was helped by positioning in 10-year Japanese, U.K. and Australian government bonds.

Positioning in the British pound, Swedish krona and Norwegian krone added to returns.

The Fund’s positioning in zinc, soybean oil and wheat was advantageous.

Top Detractors from Performance:

The Fund was hurt by the long-term reversal factor, which aims to detect trends and reversals in commodity prices. This factor signals buying or selling when a commodity is well below or above the moving average in anticipation that fair pricing would lead that commodity to revert to its price average.

The long-term reversal factor led the Fund to short copper, gold and coffee amid steep prices, but these commodities did not return to their price averages during the reporting period, resulting in losses for the Fund.

Positioning in 10-year German and South Korean government bonds detracted from the Fund’s performance.

The Fund was hampered by positioning in the Japanese yen, New Zealand dollar and Canadian dollar.

Positioning in gold, corn and cocoa had a negative impact on performance.

The above represents investment pillars.

Goldman Sachs Multi-Strategy Alternatives Fund

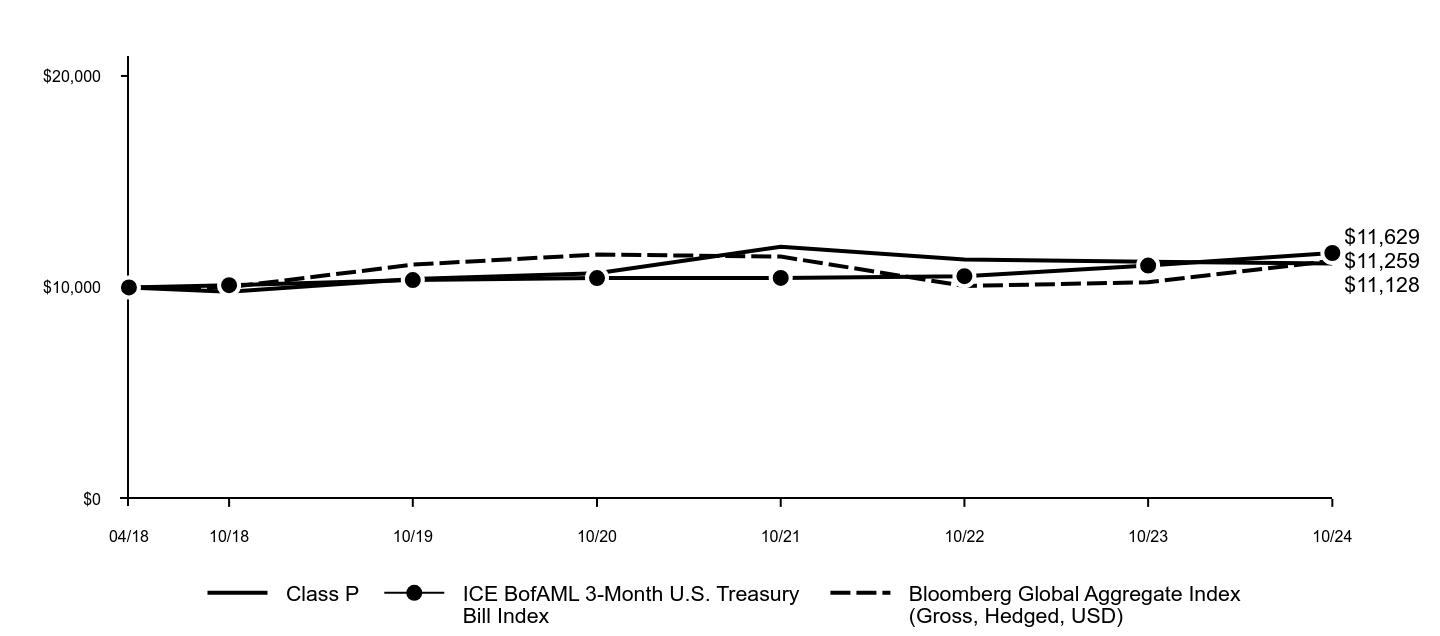

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class P | ICE BofAML 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 04/18 | $10,000 | $10,000 | $10,000 |

| 10/18 | $9,794 | $10,105 | $10,008 |

| 10/19 | $10,401 | $10,348 | $11,076 |

| 10/20 | $10,673 | $10,443 | $11,554 |

| 10/21 | $11,920 | $10,449 | $11,458 |

| 10/22 | $11,316 | $10,530 | $10,070 |

| 10/23 | $11,213 | $11,034 | $10,243 |

| 10/24 | $11,128 | $11,629 | $11,259 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 4/16/18 |

|---|

| Class P | -0.76% | 1.36% | 1.65% |

| ICE BofAML 3-Month U.S. Treasury Bill Index | 5.39% | 2.36% | 2.33% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 1.83% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Strategy Alternatives Fund

| Total Net Assets | $64,670,541 |

| # of Portfolio Holdings | 197 |

| Portfolio Turnover Rate | 0% |

| Total Net Advisory Fees Paid | $542,250 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

The Fund's net expense ratio decreased during the period as a result of a lower management fee rate and lower expense limit.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

Asset Class Exposure (%)*

| Header | Gross | Long | Short | Net |

| Cash | 29.1 | 19.6 | 9.5 | 10.0 |

| Commodities | 94.7 | 49.1 | 45.5 | 3.6 |

| Developed Market Currency | 209.5 | 126.5 | 83.0 | 43.4 |

| Long-Term Fixed Income | 101.5 | 32.0 | 69.5 | -37.5 |

| Short-Term Fixed Income | 39.3 | 39.3 | - | 39.3 |

| Short-Term Investments | 91.4 | 91.4 | - | 91.4 |

*Asset class exposure includes the impact of derivatives. "Gross Exposure" represents the sum of the absolute value of long and short notional contract values in U.S. dollars of the Fund's positions (for a given asset class), divided by the Fund's net assets exposure within each asset class. "Net Exposure" represents the net exposure within the Fund to a given asset class, calculated as the difference between long and short exposures. The exposure of option contracts is delta-adjusted and offsetting forward foreign currency exchange contract positions are netted by currency pair and settlement date for both gross and net exposure calculations. Short-term Investments include investment companies and U.S. Treasury Bills.

Goldman Sachs Multi-Strategy Alternatives Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Strategy Alternatives Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Strategy Alternatives Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Strategy Alternatives Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $75 | 0.75% |

How did the Fund perform and what affected its performance?

The performance of the Fund was influenced most by central bank monetary policy, especially interest rate cuts by the U.S. Federal Reserve; the depreciation of major currencies versus the U.S. dollar; and substantial price movements and dispersions across commodities.

Top Contributors to Performance:

The Fund benefited from the fixed income metal spillover factor, which views metals prices as leading indicators of economic performance. When metals prices are high, this factor signals a potential upturn in the general business environment and, therefore, less demand for bonds.

During the annual period, metals prices increased significantly as the U.S. sidestepped an economic recession. The fixed income metal spillover factor led the Fund to sell bonds in anticipation of lower interest rates, resulting in gains across almost all bond durations and global regions.

The Fund was helped by positioning in 10-year Japanese, U.K. and Australian government bonds.

Positioning in the British pound, Swedish krona and Norwegian krone added to returns.

The Fund’s positioning in zinc, soybean oil and wheat was advantageous.

Top Detractors from Performance:

The Fund was hurt by the long-term reversal factor, which aims to detect trends and reversals in commodity prices. This factor signals buying or selling when a commodity is well below or above the moving average in anticipation that fair pricing would lead that commodity to revert to its price average.

The long-term reversal factor led the Fund to short copper, gold and coffee amid steep prices, but these commodities did not return to their price averages during the reporting period, resulting in losses for the Fund.

Positioning in 10-year German and South Korean government bonds detracted from the Fund’s performance.

The Fund was hampered by positioning in the Japanese yen, New Zealand dollar and Canadian dollar.

Positioning in gold, corn and cocoa had a negative impact on performance.

The above represents investment pillars.

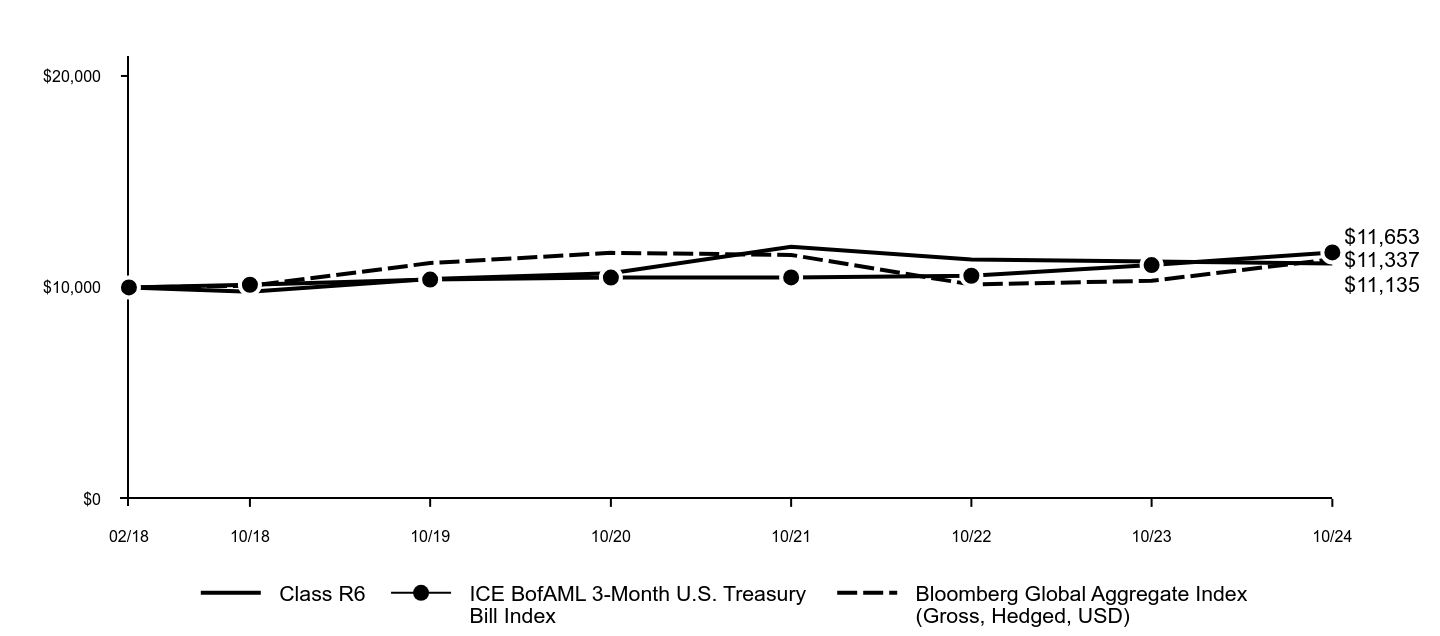

Goldman Sachs Multi-Strategy Alternatives Fund

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R6 | ICE BofAML 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 02/18 | $10,000 | $10,000 | $10,000 |

| 10/18 | $9,795 | $10,126 | $10,077 |

| 10/19 | $10,401 | $10,369 | $11,152 |

| 10/20 | $10,673 | $10,464 | $11,634 |

| 10/21 | $11,919 | $10,471 | $11,537 |

| 10/22 | $11,316 | $10,552 | $10,139 |

| 10/23 | $11,225 | $11,057 | $10,313 |

| 10/24 | $11,135 | $11,653 | $11,337 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 2/28/18 |

|---|

| Class R6 | -0.80% | 1.37% | 1.62% |

| ICE BofAML 3-Month U.S. Treasury Bill Index | 5.39% | 2.36% | 2.31% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 1.90% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Strategy Alternatives Fund

| Total Net Assets | $64,670,541 |

| # of Portfolio Holdings | 197 |

| Portfolio Turnover Rate | 0% |

| Total Net Advisory Fees Paid | $542,250 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

The Fund's net expense ratio decreased during the period as a result of a lower management fee rate and lower expense limit.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

Asset Class Exposure (%)*

| Header | Gross | Long | Short | Net |

| Cash | 29.1 | 19.6 | 9.5 | 10.0 |

| Commodities | 94.7 | 49.1 | 45.5 | 3.6 |

| Developed Market Currency | 209.5 | 126.5 | 83.0 | 43.4 |

| Long-Term Fixed Income | 101.5 | 32.0 | 69.5 | -37.5 |

| Short-Term Fixed Income | 39.3 | 39.3 | - | 39.3 |

| Short-Term Investments | 91.4 | 91.4 | - | 91.4 |

*Asset class exposure includes the impact of derivatives. "Gross Exposure" represents the sum of the absolute value of long and short notional contract values in U.S. dollars of the Fund's positions (for a given asset class), divided by the Fund's net assets exposure within each asset class. "Net Exposure" represents the net exposure within the Fund to a given asset class, calculated as the difference between long and short exposures. The exposure of option contracts is delta-adjusted and offsetting forward foreign currency exchange contract positions are netted by currency pair and settlement date for both gross and net exposure calculations. Short-term Investments include investment companies and U.S. Treasury Bills.

Goldman Sachs Multi-Strategy Alternatives Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Strategy Alternatives Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Strategy Alternatives Fund

GSMMX: Institutional Class

This annual shareholder report contains important information about Goldman Sachs Multi-Strategy Alternatives Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $76 | 0.76% |

How did the Fund perform and what affected its performance?

The performance of the Fund was influenced most by central bank monetary policy, especially interest rate cuts by the U.S. Federal Reserve; the depreciation of major currencies versus the U.S. dollar; and substantial price movements and dispersions across commodities.

Top Contributors to Performance:

The Fund benefited from the fixed income metal spillover factor, which views metals prices as leading indicators of economic performance. When metals prices are high, this factor signals a potential upturn in the general business environment and, therefore, less demand for bonds.

During the annual period, metals prices increased significantly as the U.S. sidestepped an economic recession. The fixed income metal spillover factor led the Fund to sell bonds in anticipation of lower interest rates, resulting in gains across almost all bond durations and global regions.

The Fund was helped by positioning in 10-year Japanese, U.K. and Australian government bonds.

Positioning in the British pound, Swedish krona and Norwegian krone added to returns.

The Fund’s positioning in zinc, soybean oil and wheat was advantageous.

Top Detractors from Performance:

The Fund was hurt by the long-term reversal factor, which aims to detect trends and reversals in commodity prices. This factor signals buying or selling when a commodity is well below or above the moving average in anticipation that fair pricing would lead that commodity to revert to its price average.

The long-term reversal factor led the Fund to short copper, gold and coffee amid steep prices, but these commodities did not return to their price averages during the reporting period, resulting in losses for the Fund.

Positioning in 10-year German and South Korean government bonds detracted from the Fund’s performance.

The Fund was hampered by positioning in the Japanese yen, New Zealand dollar and Canadian dollar.

Positioning in gold, corn and cocoa had a negative impact on performance.

The above represents investment pillars.

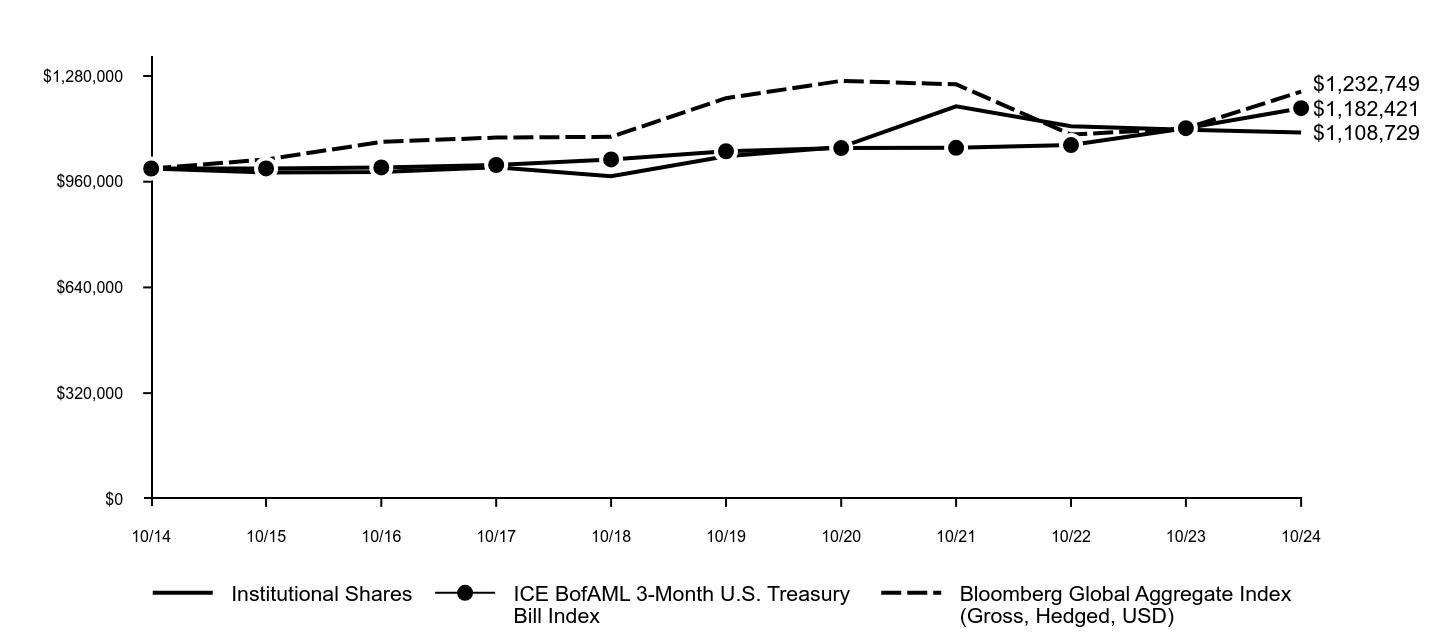

Goldman Sachs Multi-Strategy Alternatives Fund

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Institutional Shares | ICE BofAML 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 10/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/15 | $987,900 | $1,000,200 | $1,027,200 |

| 10/16 | $989,184 | $1,003,301 | $1,080,306 |

| 10/17 | $1,003,725 | $1,010,524 | $1,093,594 |

| 10/18 | $976,424 | $1,027,501 | $1,095,781 |

| 10/19 | $1,036,962 | $1,052,161 | $1,212,701 |

| 10/20 | $1,064,649 | $1,061,841 | $1,265,090 |

| 10/21 | $1,187,935 | $1,062,478 | $1,254,589 |

| 10/22 | $1,127,707 | $1,070,766 | $1,102,533 |

| 10/23 | $1,117,332 | $1,121,948 | $1,121,497 |

| 10/24 | $1,108,729 | $1,182,421 | $1,232,749 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Shares | -0.77% | 1.35% | 1.04% |

| ICE BofAML 3-Month U.S. Treasury Bill Index | 5.39% | 2.36% | 1.69% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 2.11% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Strategy Alternatives Fund

| Total Net Assets | $64,670,541 |

| # of Portfolio Holdings | 197 |

| Portfolio Turnover Rate | 0% |

| Total Net Advisory Fees Paid | $542,250 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

The Fund's net expense ratio decreased during the period as a result of a lower management fee rate and lower expense limit.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

Asset Class Exposure (%)*

| Header | Gross | Long | Short | Net |

| Cash | 29.1 | 19.6 | 9.5 | 10.0 |

| Commodities | 94.7 | 49.1 | 45.5 | 3.6 |

| Developed Market Currency | 209.5 | 126.5 | 83.0 | 43.4 |

| Long-Term Fixed Income | 101.5 | 32.0 | 69.5 | -37.5 |

| Short-Term Fixed Income | 39.3 | 39.3 | - | 39.3 |

| Short-Term Investments | 91.4 | 91.4 | - | 91.4 |

*Asset class exposure includes the impact of derivatives. "Gross Exposure" represents the sum of the absolute value of long and short notional contract values in U.S. dollars of the Fund's positions (for a given asset class), divided by the Fund's net assets exposure within each asset class. "Net Exposure" represents the net exposure within the Fund to a given asset class, calculated as the difference between long and short exposures. The exposure of option contracts is delta-adjusted and offsetting forward foreign currency exchange contract positions are netted by currency pair and settlement date for both gross and net exposure calculations. Short-term Investments include investment companies and U.S. Treasury Bills.

Goldman Sachs Multi-Strategy Alternatives Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Strategy Alternatives Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Strategy Alternatives Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Strategy Alternatives Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $82 | 0.82% |

How did the Fund perform and what affected its performance?

The performance of the Fund was influenced most by central bank monetary policy, especially interest rate cuts by the U.S. Federal Reserve; the depreciation of major currencies versus the U.S. dollar; and substantial price movements and dispersions across commodities.

Top Contributors to Performance:

The Fund benefited from the fixed income metal spillover factor, which views metals prices as leading indicators of economic performance. When metals prices are high, this factor signals a potential upturn in the general business environment and, therefore, less demand for bonds.

During the annual period, metals prices increased significantly as the U.S. sidestepped an economic recession. The fixed income metal spillover factor led the Fund to sell bonds in anticipation of lower interest rates, resulting in gains across almost all bond durations and global regions.

The Fund was helped by positioning in 10-year Japanese, U.K. and Australian government bonds.

Positioning in the British pound, Swedish krona and Norwegian krone added to returns.

The Fund’s positioning in zinc, soybean oil and wheat was advantageous.

Top Detractors from Performance:

The Fund was hurt by the long-term reversal factor, which aims to detect trends and reversals in commodity prices. This factor signals buying or selling when a commodity is well below or above the moving average in anticipation that fair pricing would lead that commodity to revert to its price average.

The long-term reversal factor led the Fund to short copper, gold and coffee amid steep prices, but these commodities did not return to their price averages during the reporting period, resulting in losses for the Fund.

Positioning in 10-year German and South Korean government bonds detracted from the Fund’s performance.

The Fund was hampered by positioning in the Japanese yen, New Zealand dollar and Canadian dollar.

Positioning in gold, corn and cocoa had a negative impact on performance.

The above represents investment pillars.

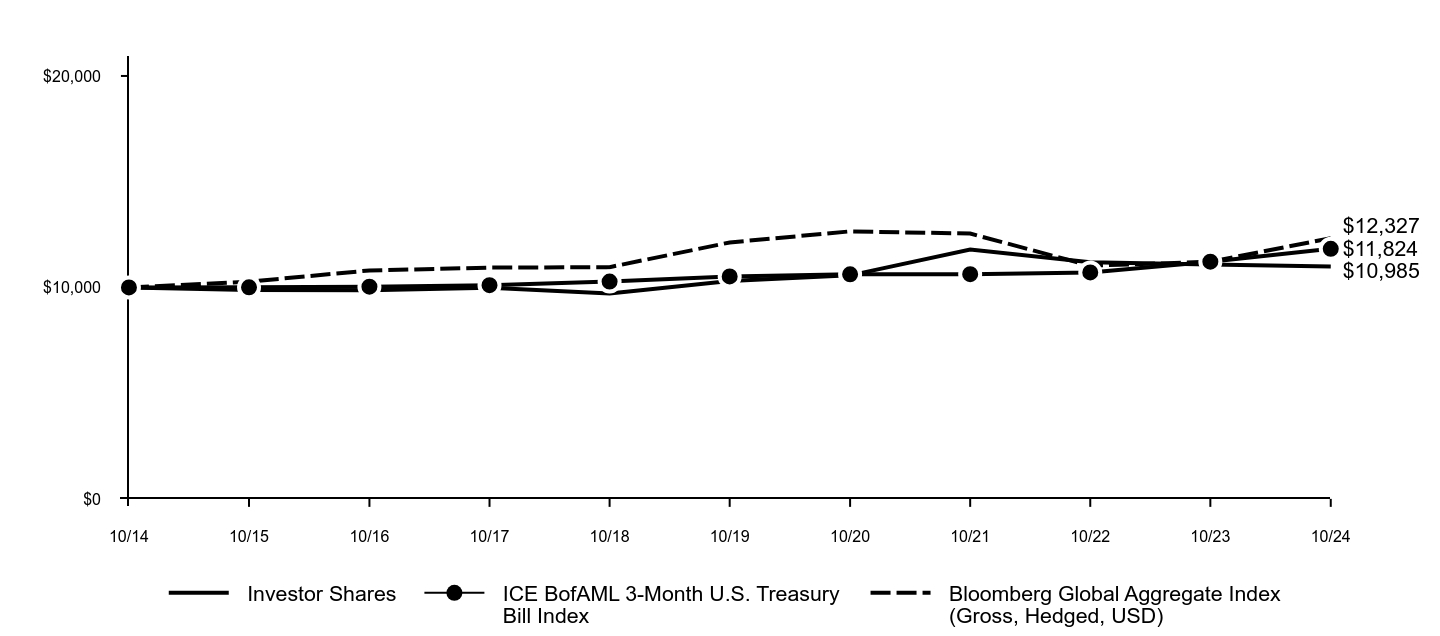

Goldman Sachs Multi-Strategy Alternatives Fund

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Investor Shares | ICE BofAML 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 10/15 | $9,874 | $10,002 | $10,272 |

| 10/16 | $9,868 | $10,033 | $10,803 |

| 10/17 | $9,989 | $10,105 | $10,936 |

| 10/18 | $9,717 | $10,275 | $10,958 |

| 10/19 | $10,302 | $10,522 | $12,127 |

| 10/20 | $10,570 | $10,618 | $12,651 |

| 10/21 | $11,791 | $10,625 | $12,546 |

| 10/22 | $11,190 | $10,708 | $11,025 |

| 10/23 | $11,078 | $11,219 | $11,215 |

| 10/24 | $10,985 | $11,824 | $12,327 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Investor Shares | -0.84% | 1.29% | 0.94% |

| ICE BofAML 3-Month U.S. Treasury Bill Index | 5.39% | 2.36% | 1.69% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 2.11% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Strategy Alternatives Fund

| Total Net Assets | $64,670,541 |

| # of Portfolio Holdings | 197 |

| Portfolio Turnover Rate | 0% |

| Total Net Advisory Fees Paid | $542,250 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

The Fund's net expense ratio decreased during the period as a result of a lower management fee rate and lower expense limit.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

Asset Class Exposure (%)*

| Header | Gross | Long | Short | Net |

| Cash | 29.1 | 19.6 | 9.5 | 10.0 |

| Commodities | 94.7 | 49.1 | 45.5 | 3.6 |

| Developed Market Currency | 209.5 | 126.5 | 83.0 | 43.4 |

| Long-Term Fixed Income | 101.5 | 32.0 | 69.5 | -37.5 |

| Short-Term Fixed Income | 39.3 | 39.3 | - | 39.3 |

| Short-Term Investments | 91.4 | 91.4 | - | 91.4 |

*Asset class exposure includes the impact of derivatives. "Gross Exposure" represents the sum of the absolute value of long and short notional contract values in U.S. dollars of the Fund's positions (for a given asset class), divided by the Fund's net assets exposure within each asset class. "Net Exposure" represents the net exposure within the Fund to a given asset class, calculated as the difference between long and short exposures. The exposure of option contracts is delta-adjusted and offsetting forward foreign currency exchange contract positions are netted by currency pair and settlement date for both gross and net exposure calculations. Short-term Investments include investment companies and U.S. Treasury Bills.

Goldman Sachs Multi-Strategy Alternatives Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES, REPRESENTATIONS, EXPRESS AND/OR IMPLIED INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND GOLDMAN SACHS, OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Strategy Alternatives Fund

Annual Shareholder Report

October 31, 2024

Goldman Sachs Multi-Manager Non-Core Fixed Income Fund

This annual shareholder report contains important information about Goldman Sachs Multi-Manager Non-Core Fixed Income Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $56 | 0.53% |

How did the Fund perform and what affected its performance?

Global fixed income was influenced most by central bank monetary policy, waning inflation and resilient economic growth. Bond yields fell, as many central banks cut interest rates. External emerging markets debt posted the largest gains, followed by high yield corporate bonds, bank loans and local emerging markets debt.

Top Contributors to Performance:

All six underlying managers that managed Fund assets for the entire annual period generated positive absolute returns. Two outperformed their respective benchmark indices.

In high yield, underlying manager RBC BlueBay Asset Management outpaced its benchmark, with positioning in banking credits adding most. Credit quality positioning and term structure effects detracted.

Marathon Asset Management, L.P. outperformed its benchmark, with selection in Mexico, Brazil, Egypt, Peru and Guatemala adding. Positioning in China and security selection in Argentina detracted.

Ares Capital Management II LLC (Ares) outpaced its benchmark between November 2023, when it began managing a bank loan portfolio, and the end of the annual period.

Top Detractors from Performance:

Ares, as a high yield underlying manager, underperformed its benchmark due to selection of electric and communications credits. Selection in energy, transportation, capital goods and basic industry added.

In high yield, Brigade Capital Management, LP trailed its benchmark, with selection in services, basic industry and utilities detracting. Selection in telecommunications, technology, health care and financials added.

In bank loans, Aristotle Pacific Capital, LLC underperformed its benchmark due to underweights in media and telecommunications. Overweights in second lien loans and insurance loans added.

In local emerging markets debt, TCW Investment Management Company LLC lagged its benchmark due to underweights in low yielding markets. Exposure to Egypt and the Turkish lira added.

High Yield Corporate Bonds

The above represents the Fund’s overall global fixed income exposures.

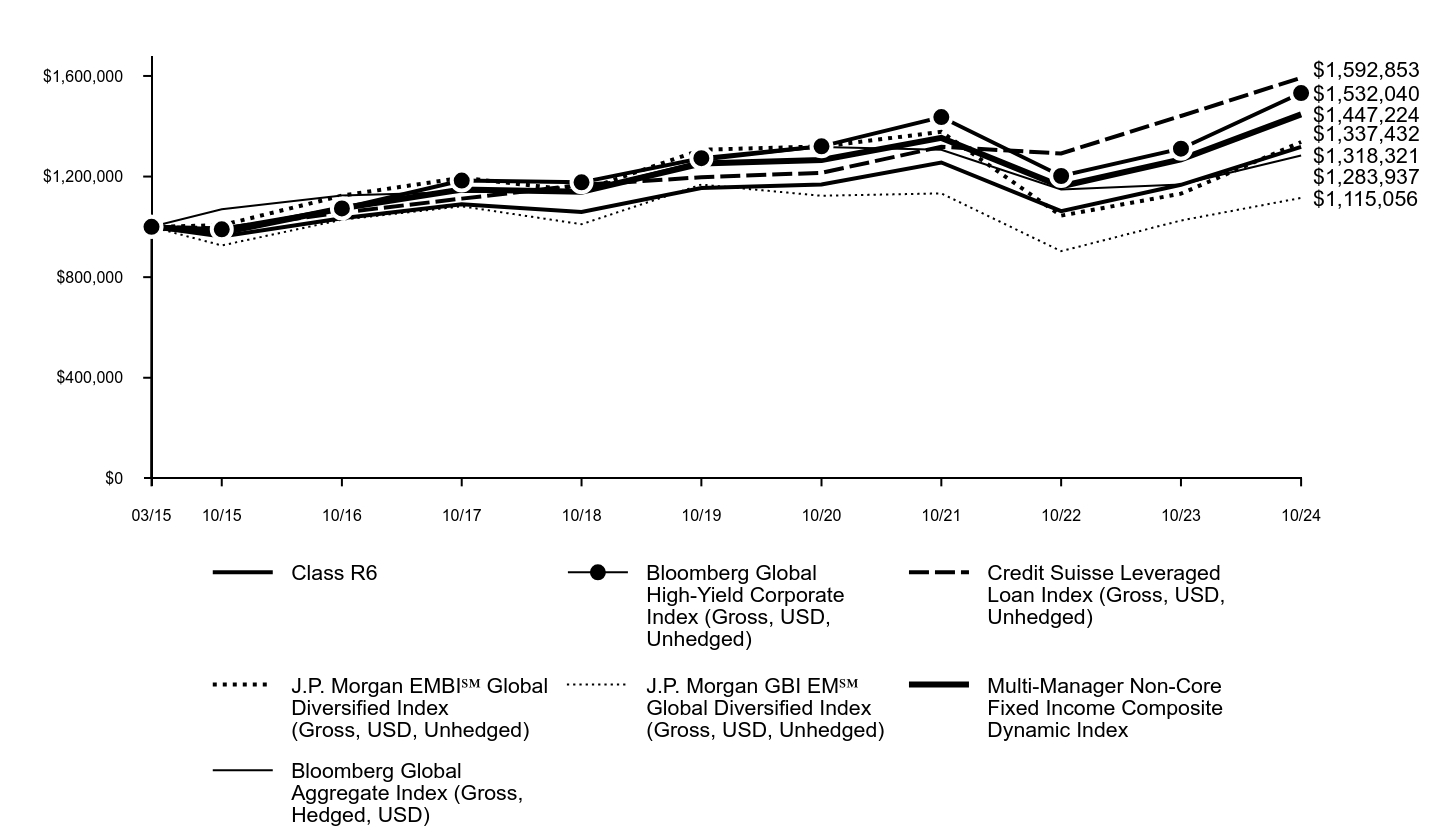

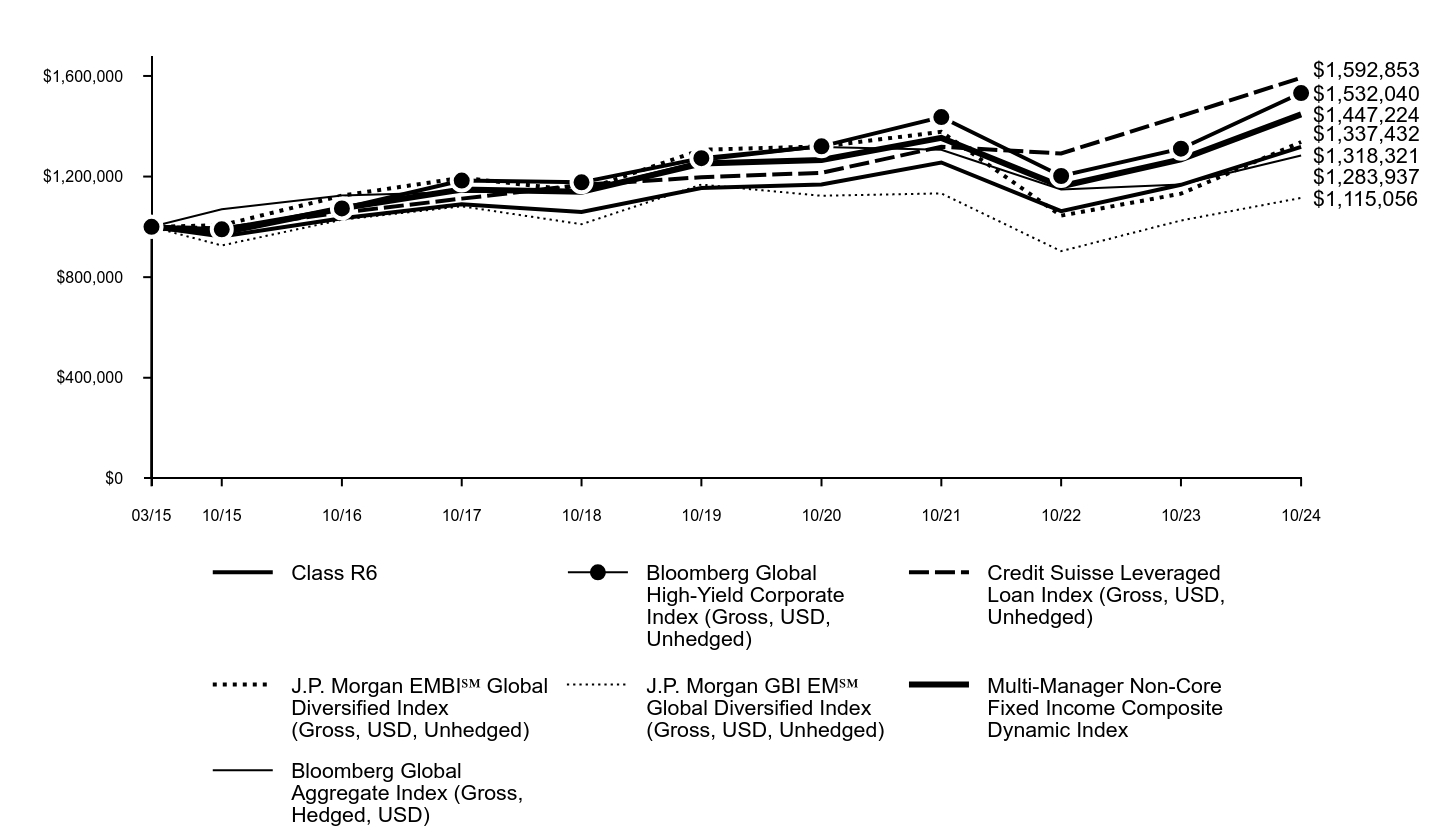

Goldman Sachs Multi-Manager Non-Core Fixed Income Fund

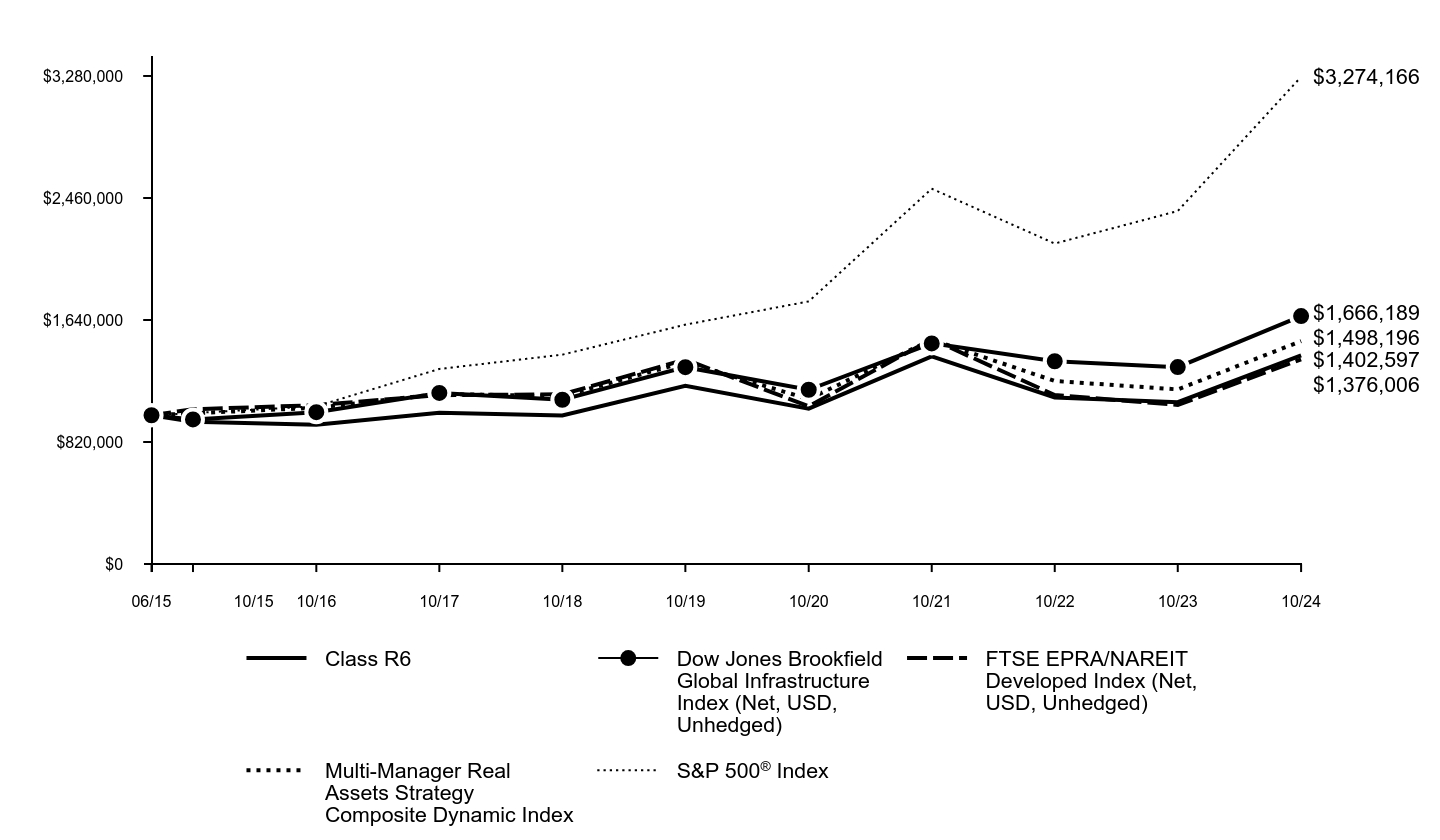

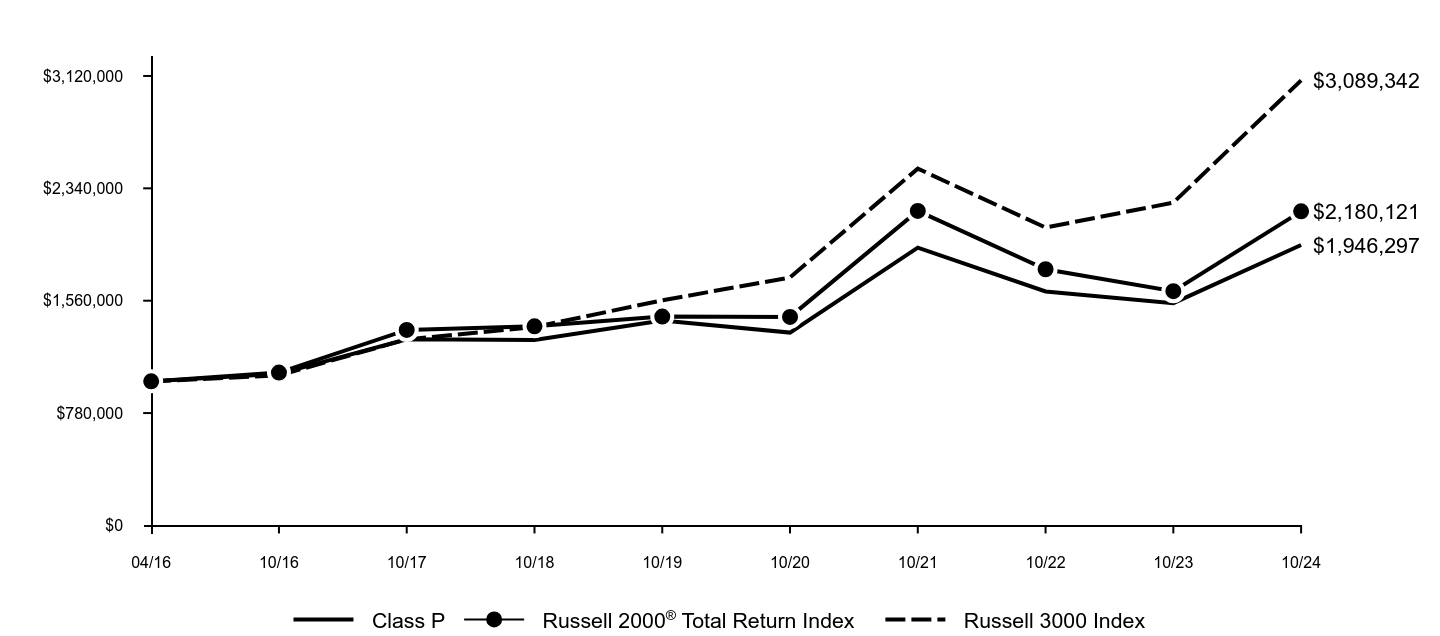

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R6 | Bloomberg Global High-Yield Corporate Index (Gross, USD, Unhedged) | Credit Suisse Leveraged Loan Index (Gross, USD, Unhedged) | J.P. Morgan EMBI℠ Global Diversified Index (Gross, USD, Unhedged) | J.P. Morgan GBI EM℠ Global Diversified Index (Gross, USD, Unhedged) | Multi-Manager Non-Core Fixed Income Composite Dynamic Index | Bloomberg Global Aggregate Index (Gross, Hedged, USD) |

|---|

| 03/15 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | - |

| 03/15 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/15 | $961,600 | $990,258 | $994,161 | $1,006,446 | $926,134 | $976,539 | $1,069,836 |

| 10/16 | $1,034,297 | $1,073,247 | $1,056,802 | $1,124,209 | $1,028,406 | $1,073,889 | $1,125,130 |

| 10/17 | $1,089,942 | $1,184,010 | $1,112,282 | $1,195,216 | $1,081,698 | $1,148,777 | $1,138,949 |

| 10/18 | $1,058,988 | $1,176,928 | $1,166,695 | $1,142,769 | $1,010,525 | $1,139,496 | $1,141,268 |

| 10/19 | $1,154,614 | $1,273,077 | $1,197,106 | $1,306,728 | $1,168,072 | $1,251,650 | $1,263,075 |

| 10/20 | $1,168,585 | $1,320,060 | $1,215,099 | $1,319,542 | $1,123,536 | $1,265,592 | $1,317,676 |

| 10/21 | $1,255,879 | $1,436,629 | $1,318,546 | $1,377,790 | $1,132,988 | $1,353,667 | $1,306,787 |

| 10/22 | $1,062,222 | $1,202,327 | $1,291,826 | $1,044,541 | $903,282 | $1,161,313 | $1,148,348 |

| 10/23 | $1,167,276 | $1,310,755 | $1,440,871 | $1,131,866 | $1,025,268 | $1,268,515 | $1,168,102 |

| 10/24 | $1,318,321 | $1,532,040 | $1,592,853 | $1,337,432 | $1,115,056 | $1,447,224 | $1,283,937 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 3/31/15 |

|---|

| Class R6 | 12.94% | 2.68% | 2.92% |

| Bloomberg Global High-Yield Corporate Index (Gross, USD, Unhedged) | 16.88% | 3.77% | 4.55% |

| Credit Suisse Leveraged Loan Index (Gross, USD, Unhedged) | 10.55% | 5.87% | 4.97% |

| J.P. Morgan EMBI℠ Global Diversified Index (Gross, USD, Unhedged) | 18.16% | 0.47% | 3.08% |

| J.P. Morgan GBI-EM℠ Global Diversified Index (Gross, USD, Unhedged) | -0.92% | 11.51% | 1.14% |

| Multi-Manager Non-Core Fixed Income Composite Dynamic Index | 14.09% | 2.94% | 3.93% |

| Bloomberg Global Aggregate Index (Gross, Hedged, USD) | 9.92% | 0.33% | 1.87% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. In accordance with changing regulatory requirements, the Fund is now required to compare its performance to a regulatory benchmark, which in this case is the Bloomberg Global Aggregate Index (Gross, Hedged, USD).

Goldman Sachs Multi-Manager Non-Core Fixed Income Fund

| Total Net Assets | $1,625,268,512 |

| # of Portfolio Holdings | 1,331 |

| Portfolio Turnover Rate | 123% |

| Total Net Advisory Fees Paid | $5,584,561 |

This is a summary of certain changes to the Fund for the period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at dfinview.com/GoldmanSachs or upon request at 1-800-621-2550.

Nuveen Asset Management LLC no longer serves as an investment subadviser for the Fund.

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Sovereign Debt Obligations | 36.5% |

| Software | 4.1% |

| Oil Field Services | 3.6% |

| Commercial Services | 3.5% |

| Media | 2.9% |

| Insurance | 2.9% |

| Packaging | 2.2% |

| Pipelines | 1.9% |

| Diversified Financial Services | 1.9% |

| Other | 39.5% |

Goldman Sachs Multi-Manager Non-Core Fixed Income Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance LP. And its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. Information has been obtained from sources believed to be reliable but J.P. Morgan and its data suppliers do not warrant its completeness or accuracy. This Index is used with permission. The Index may note be copied, used or distributed without J.P. Morgan's prior written approval. Copyright 2014, J.P. Morgan Chase & Co.. All rights reserved.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs Multi-Manager Non-Core Fixed Income Fund

Annual Shareholder Report

October 31, 2024

Multi-Manager International Equity Fund

This annual shareholder report contains important information about Multi-Manager International Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $58 | 0.52% |

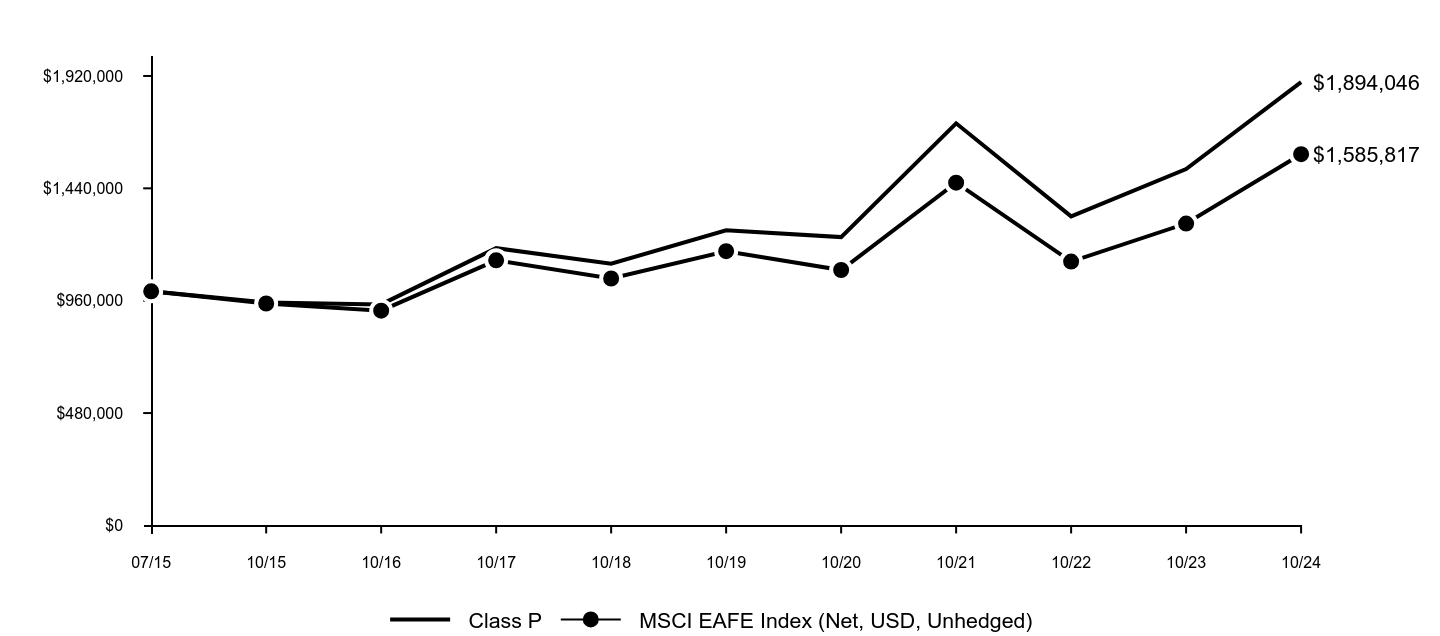

How did the Fund perform and what affected its performance?