UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

Copies to:

| | |

Robert Griffith, Esq. Goldman Sachs & Co. LLC 200 West Street New York, NY 10282 | | Stephen H. Bier, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders for the Goldman Sachs GQG Partners International Opportunities Fund (the “Fund”), a series of the registrant, is filed herewith.

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $127 | 1.11% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs GQG Partners International Opportunities Fund

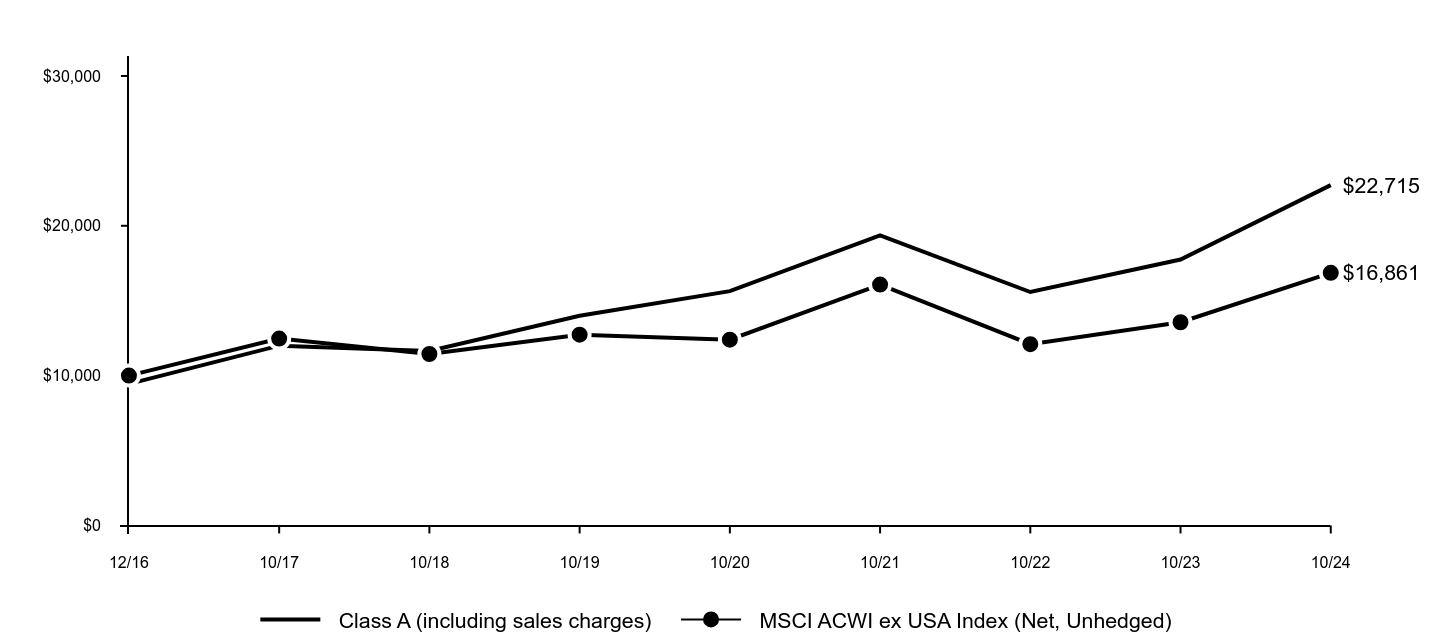

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class A (including sales charges) | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 12/16 | $9,450 | $10,000 |

| 10/17 | $11,998 | $12,469 |

| 10/18 | $11,649 | $11,442 |

| 10/19 | $14,000 | $12,731 |

| 10/20 | $15,637 | $12,399 |

| 10/21 | $19,366 | $16,076 |

| 10/22 | $15,580 | $12,101 |

| 10/23 | $17,748 | $13,561 |

| 10/24 | $22,715 | $16,861 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 12/15/16 |

|---|

| Class A excluding sales charges | 27.99% | 10.15% | 11.76% |

| Class A including sales charges | 20.95% | 8.91% | 10.97% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 6.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-526-7384.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| C | $212 | 1.86% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs GQG Partners International Opportunities Fund

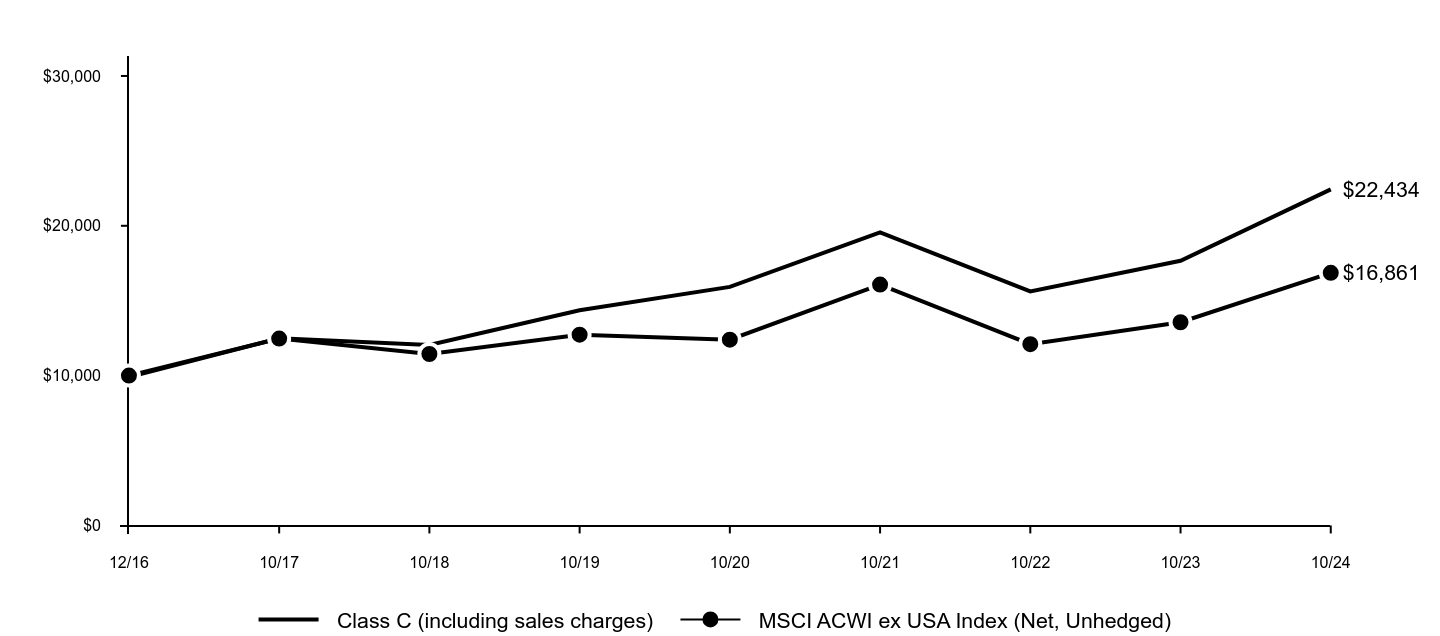

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class C (including sales charges) | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 12/16 | $9,900 | $10,000 |

| 10/17 | $12,487 | $12,469 |

| 10/18 | $12,041 | $11,442 |

| 10/19 | $14,358 | $12,731 |

| 10/20 | $15,923 | $12,399 |

| 10/21 | $19,557 | $16,076 |

| 10/22 | $15,622 | $12,101 |

| 10/23 | $17,663 | $13,561 |

| 10/24 | $22,434 | $16,861 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 12/15/16 |

|---|

| Class C excluding sales charges | 27.01% | 9.32% | 10.93% |

| Class C including sales charges | 25.99% | 9.32% | 10.93% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 6.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-526-7384.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| P | $84 | 0.73% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs GQG Partners International Opportunities Fund

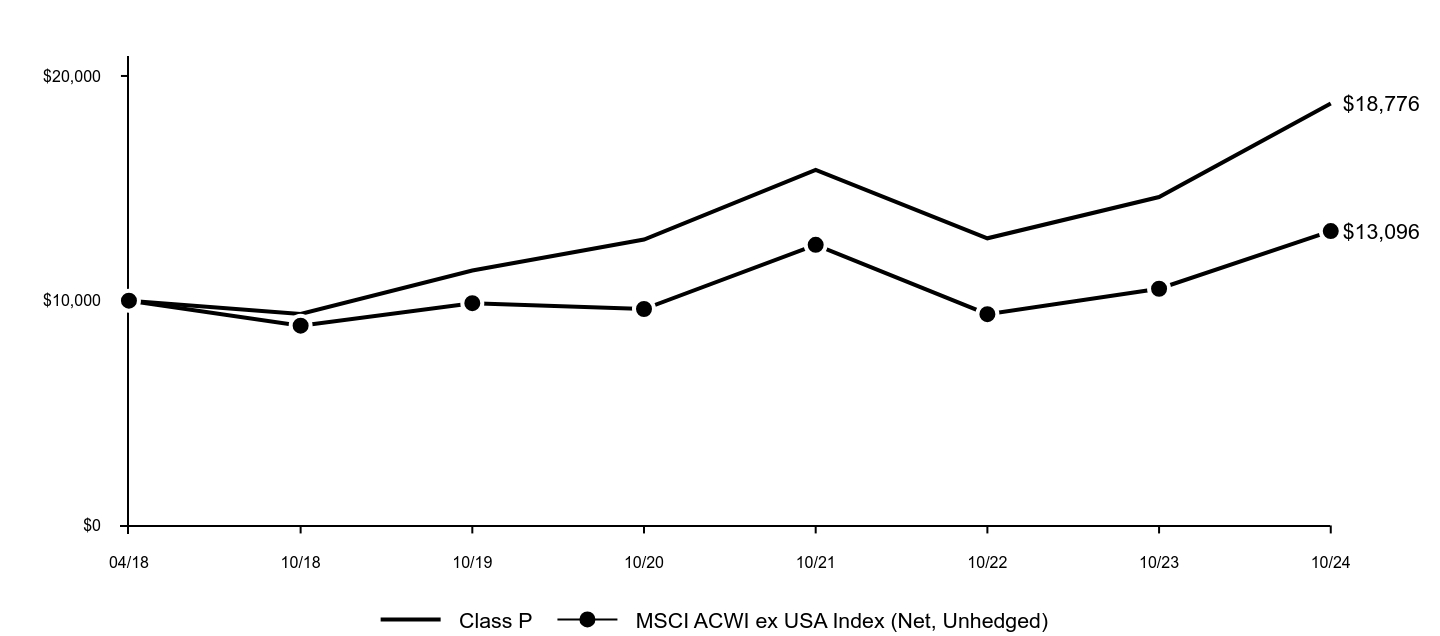

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class P | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 04/18 | $10,000 | $10,000 |

| 10/18 | $9,408 | $8,887 |

| 10/19 | $11,346 | $9,889 |

| 10/20 | $12,721 | $9,630 |

| 10/21 | $15,818 | $12,487 |

| 10/22 | $12,777 | $9,399 |

| 10/23 | $14,614 | $10,533 |

| 10/24 | $18,776 | $13,096 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 4/16/18 |

|---|

| Class P | 28.48% | 10.59% | 10.09% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 4.20% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R | $156 | 1.36% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

Goldman Sachs GQG Partners International Opportunities Fund

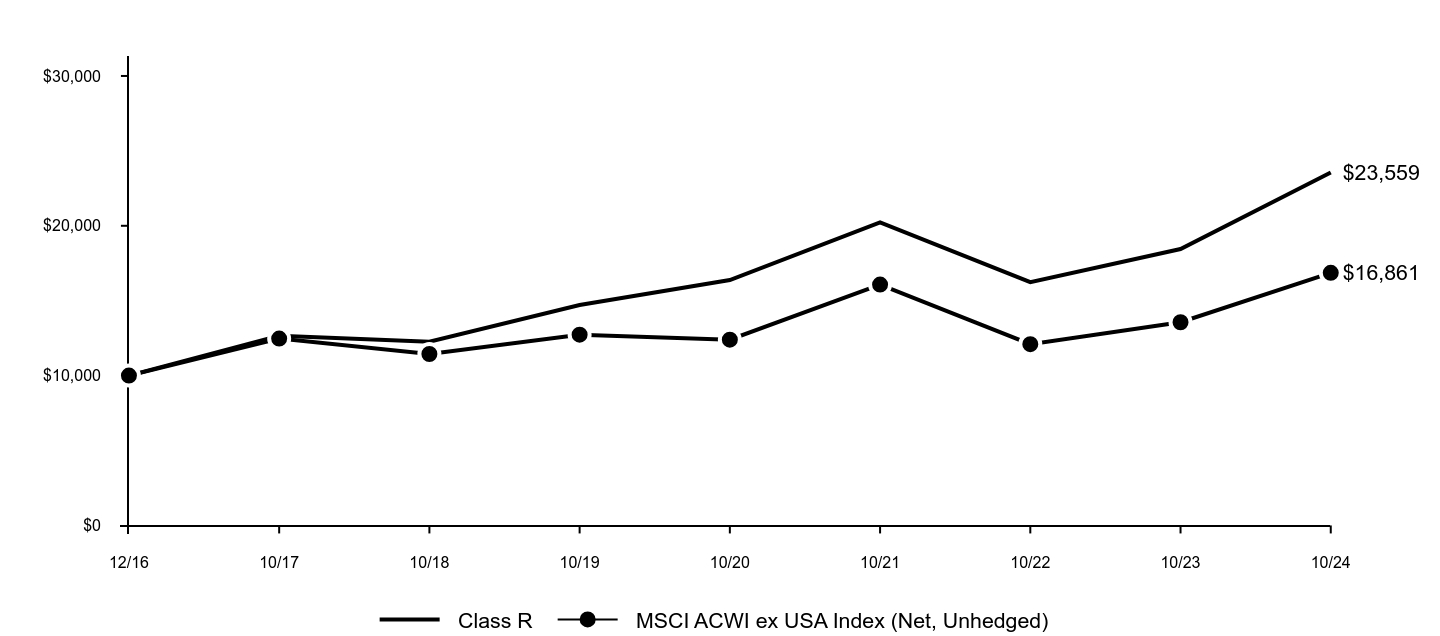

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 12/16 | $10,000 | $10,000 |

| 10/17 | $12,665 | $12,469 |

| 10/18 | $12,265 | $11,442 |

| 10/19 | $14,708 | $12,731 |

| 10/20 | $16,378 | $12,399 |

| 10/21 | $20,231 | $16,076 |

| 10/22 | $16,239 | $12,101 |

| 10/23 | $18,452 | $13,561 |

| 10/24 | $23,559 | $16,861 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 12/15/16 |

|---|

| Class R | 27.68% | 9.87% | 11.48% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 6.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $84 | 0.73% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

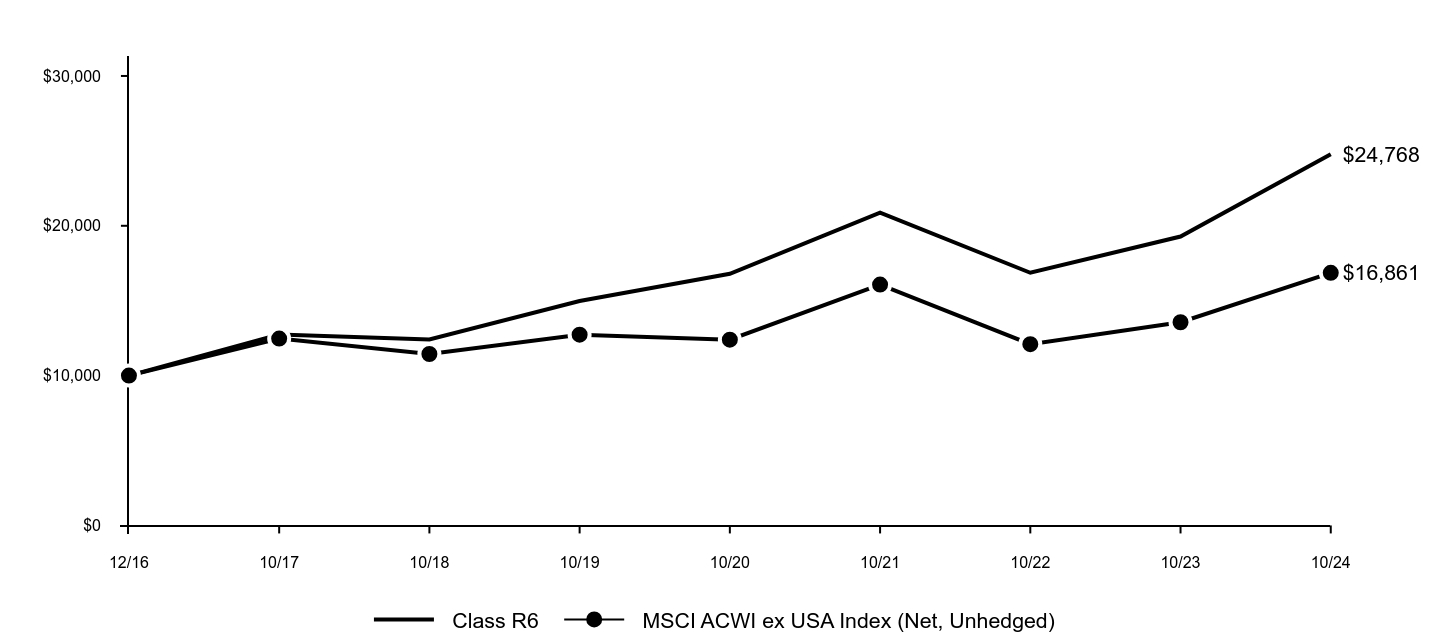

Goldman Sachs GQG Partners International Opportunities Fund

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Class R6 | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 12/16 | $10,000 | $10,000 |

| 10/17 | $12,739 | $12,469 |

| 10/18 | $12,418 | $11,442 |

| 10/19 | $14,983 | $12,731 |

| 10/20 | $16,796 | $12,399 |

| 10/21 | $20,879 | $16,076 |

| 10/22 | $16,865 | $12,101 |

| 10/23 | $19,284 | $13,561 |

| 10/24 | $24,768 | $16,861 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 12/15/16 |

|---|

| Class R6 | 28.48% | 10.58% | 12.20% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 6.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

GSIMX: Institutional Class

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $86 | 0.75% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

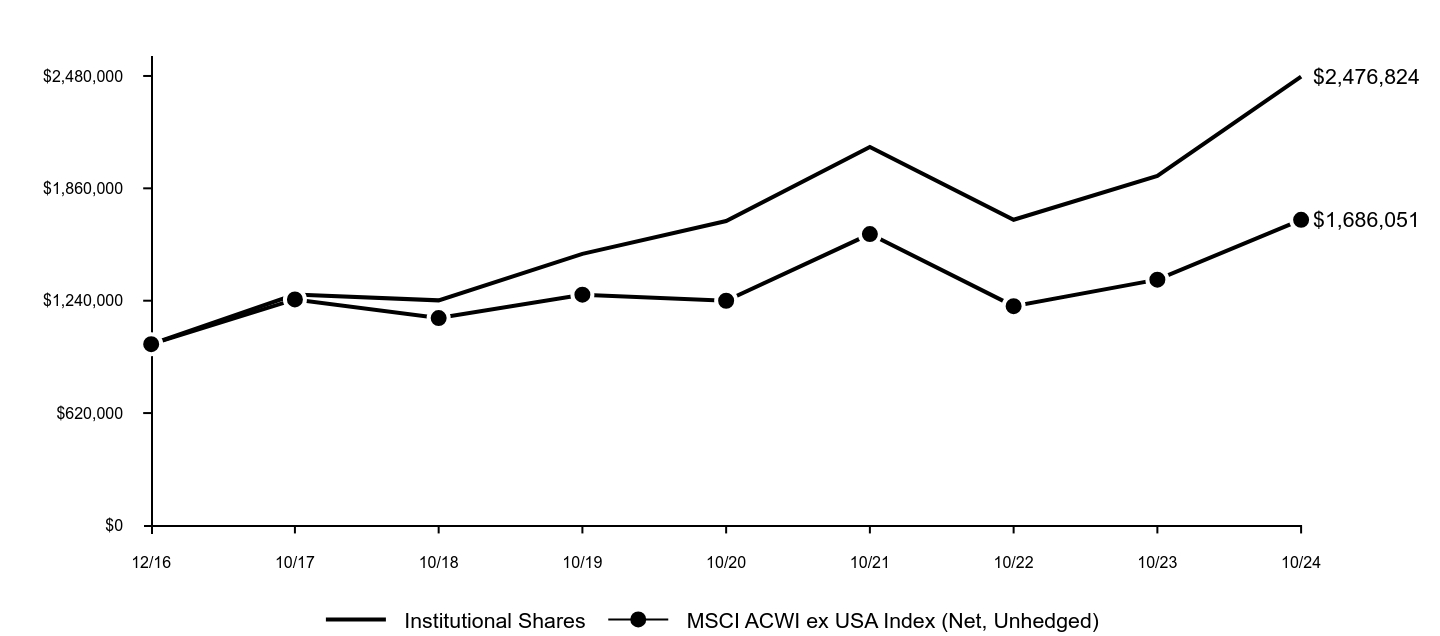

Goldman Sachs GQG Partners International Opportunities Fund

The following graph assumes an initial $1,000,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Institutional Shares | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 12/16 | $1,000,000 | $1,000,000 |

| 10/17 | $1,273,901 | $1,246,900 |

| 10/18 | $1,241,846 | $1,144,155 |

| 10/19 | $1,498,335 | $1,273,102 |

| 10/20 | $1,679,598 | $1,239,874 |

| 10/21 | $2,087,935 | $1,607,620 |

| 10/22 | $1,686,471 | $1,210,056 |

| 10/23 | $1,928,389 | $1,356,110 |

| 10/24 | $2,476,824 | $1,686,051 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 12/15/16 |

|---|

| Institutional Shares | 28.44% | 10.56% | 12.19% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 6.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

Annual Shareholder Report

October 31, 2024

GS GQG Partners International Opportunities Fund

This annual shareholder report contains important information about Goldman Sachs GQG Partners International Opportunities Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at am.gs.com or dfinview.com/GoldmanSachs. You can also request this information by contacting us at 1-800-621-2550.

What were the Fund costs for the period?

Based on a hypothetical $10,000 investment.

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor | $99 | 0.86% |

How did the Fund perform and what affected its performance?

International and emerging markets equities generated double-digit gains, as inflation decelerated in the U.S. and Europe and developed markets central banks began cutting interest rates. Strong corporate earnings also bolstered stock prices, especially in the information technology and communication services sectors.

Top Contributors to Performance:

Stock selection added most to the Fund’s performance versus the MSCI ACWI ex USA Index (Index), with the largest relative contributors coming from the information technology, utilities and consumer staples sectors.

In information technology, the Fund was helped by investments in companies that benefited from advancements in generative artificial intelligence. Notable contributors included out-of-Index positions in U.S. semiconductor maker NVIDIA and U.K.-based computer processor developer ARM Holdings.

In utilities, the Fund owned stocks that benefited from friendly regulatory environments and, within the power industry, from an imbalance between supply and demand.

In consumer staples, an out-of-Index position in tobacco company Philip Morris International contributed positively to relative returns, as investors generally rotated out of defensive stocks in anticipation of looser central bank monetary policy.

Top Detractors from Performance:

Sector allocation decisions broadly held back the Fund’s relative performance.

An overweight position in energy detracted most, as investor sentiment weakened in response to increased crude oil supply, driven by rising production.

An underweight in financials was a drag on the Fund’s relative returns, as the sector rallied on investor optimism about central bank rate cuts, which were expected to drive an increase in loan growth.

Top individual detractors were French oil and gas producer TotalEnergies, Swiss mining company Glencore and Brazil’s state-owned oil and gas company Petroleo Brasileiro.

The above represents countries.

KEY

SS–Security Selection

OW–Overweight

UW–Underweight

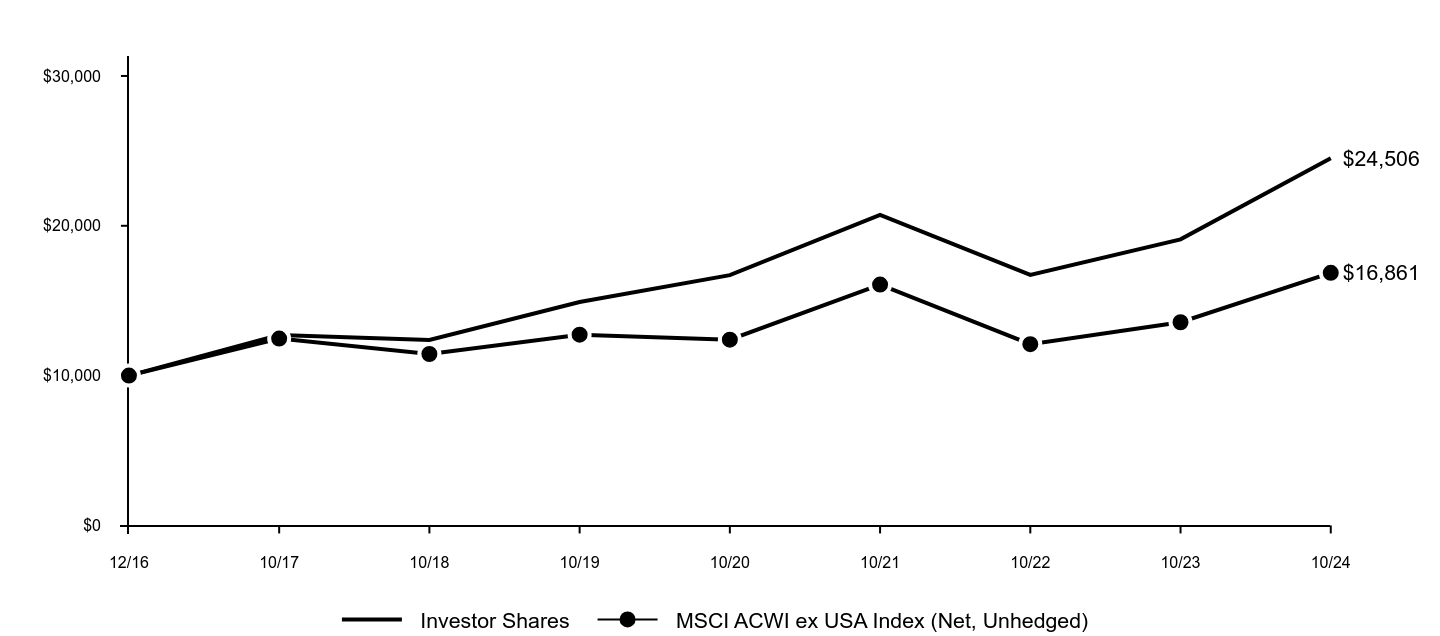

Goldman Sachs GQG Partners International Opportunities Fund

The following graph assumes an initial $10,000 investment in the Fund and compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund's share class (or less if the share class has been in operation for less than 10 years). The Fund's performance reflects applicable sales charges, if any. For comparative purposes, the performance of the Fund's benchmark and any additional performance benchmark(s) are also shown.

| Investor Shares | MSCI ACWI ex USA Index (Net, Unhedged) |

|---|

| 12/16 | $10,000 | $10,000 |

| 10/17 | $12,718 | $12,469 |

| 10/18 | $12,382 | $11,442 |

| 10/19 | $14,911 | $12,731 |

| 10/20 | $16,706 | $12,399 |

| 10/21 | $20,730 | $16,076 |

| 10/22 | $16,719 | $12,101 |

| 10/23 | $19,096 | $13,561 |

| 10/24 | $24,506 | $16,861 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 12/15/16 |

|---|

| Investor Shares | 28.33% | 10.43% | 12.04% |

| MSCI ACWI ex USA Index (Net, Unhedged) | 24.33% | 5.77% | 6.85% |

Performance data quoted above represents past performance. Past performance does not guarantee future results.

The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at: am.gs.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Goldman Sachs GQG Partners International Opportunities Fund

| Total Net Assets | $48,180,575,966 |

| # of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 88% |

| Total Net Advisory Fees Paid | $294,734,596 |

What did the Fund invest in?

The table below shows the investment makeup of the Fund, representing the percentage of total net assets of the Fund. Figures in the table below may not sum to 100% due to the exclusion of other assets and liabilities and may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any. These allocations may not be representative of the Fund’s future investments.

| Consumer Staples | 16.7% |

| Health Care | 16.6% |

| Financials | 14.8% |

| Energy | 12.6% |

| Information Technology | 11.2% |

| Industrials | 8.9% |

| Utilities | 8.6% |

| Communication Services | 4.2% |

| Materials | 2.5% |

| Other | 3.9% |

Goldman Sachs GQG Partners International Opportunities Fund

If you wish to view additional information about the Fund, including the documents and other information listed below, please visit dfinview.com/GoldmanSachs or call 1-800-621-2550.

prospectus

financial information

fund holdings

proxy voting information

Goldman Sachs & Co. LLC is the distributor of the GS GQG Partners International Opportunities Fund. Goldman Sachs Asset Management, LP is the investment adviser to the Fund. GQG Partners is the sub-adviser to the Fund.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential, lost profits) or any other damages. (www.msci.com).

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of Morgan Stanley Capital International Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P) and is licensed for use by Goldman Sachs. Neither MSCI, S&P nor any other party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

© 2024 Goldman Sachs. All rights reserved.

No Bank Guarantee

May Lose Value

Not FDIC Insured

Goldman Sachs GQG Partners International Opportunities Fund

| | (a) | As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party (the “Code of Ethics”). |

| | (c) | During the period covered by this report, no amendments were made to the provisions of the Code of Ethics. |

| | (d) | During the period covered by this report, the registrant did not grant any waivers, including an implicit waiver, from any provision of the Code of Ethics. |

| | (f) | A copy of the Code of Ethics is available as provided in Item 19(a)(1) of this report. |

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

The registrant’s board of trustees has determined that the registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its audit committee. Kathryn A. Cassidy and Michael Latham are each an “audit committee financial expert” and “independent” (as each term is defined in Item 3 of Form N-CSR).

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Table 1 — Items 4(a) - 4(d). The accountant fees below reflect the aggregate fees billed by all of the Funds of the Goldman Sachs Trust II and includes the Goldman Sachs Funds to which this certified shareholder report relates.

| | | | | | | | | | | | |

| | | 2024 | | 2023 | | Description of Services Rendered |

| | | |

| | | | | | | | | | | | |

| | | |

Audit Fees: | | | | | | | | | | | | |

| | | |

• PricewaterhouseCoopers LLP

(“PwC”) | | | $ | 414,639 | | | | $ | 490,622 | | | Financial Statement audits. |

| | | |

Audit-Related Fees: | | | | | | | | | | | | |

| | | |

• PwC | | | $ | 44,100 | | | | $ | 100,800 | | | Other attest services. |

| | | |

Tax Fees: | | | | | | | | | | | | |

| | | |

• PwC | | | $ | 0 | | | | $ | 0 | | | |

Table 2 — Items 4(b)(c) & (d). Non-Audit Services to the Goldman Sachs Trust II’s service affiliates* that were pre-approved by the Audit Committee of the Goldman Sachs Trust II pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X.

| | | | | | | | | | | | |

| | | 2024 | | 2023 | | Description of Services Rendered |

| | | |

| | | | | | | | | | | | |

| | | |

Audit-Related Fees: | | | | | | | | | | | | |

| | | |

• PwC | | | $ | 2,122,312 | | | | $ | 2,075,449 | | | Internal control review performed in accordance with Statement on Standards for Attestation Engagements No. 16 and semi-annual updates related to withholding tax accrual for non-US jurisdictions. These fees are borne by the Funds’ Adviser. |

| * | These include the advisor (excluding sub-advisors) and any entity controlling, controlled by or under common control with the advisor that provides ongoing services to the registrant (hereinafter referred to as “service affiliates”). |

Item 4(e)(1) — Audit Committee Pre-Approval Policies and Procedures

Pre-Approval of Audit and Non-Audit Services Provided to the Funds of the Goldman Sachs Trust II. The Audit and Non-Audit Services Pre-Approval Policy (the “Policy”) adopted by the Audit Committee of Goldman Sachs Trust II (“GST II”) sets forth the procedures and the conditions pursuant to which services performed by an independent auditor for GST II may be pre-approved. Services may be pre-approved specifically by the Audit Committee as a whole or, in certain circumstances, by the Audit Committee Chairman or the person designated as the Audit Committee Financial Expert. In addition, subject to specified cost limitations, certain services may be pre-approved under the provisions of the Policy. The Policy provides that the Audit Committee will consider whether the services provided by an independent auditor are consistent with the Securities and Exchange Commission’s rules on auditor independence. The Policy provides for periodic review and pre-approval by the Audit Committee of the services that may be provided by the independent auditor.

De Minimis Waiver. The pre-approval requirements of the Policy may be waived with respect to the provision of non-audit services that are permissible for an independent auditor to perform, provided (1) the aggregate amount of all such services provided constitutes no more than five percent of the total amount of revenues subject to pre-approval that was paid to the independent auditors during the fiscal year in which the services are provided; (2) such services were not recognized by GST II at the time of the engagement to be non-audit services; and (3) such services are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Audit Committee or by one or more members of the Audit Committee to whom authority to grant such approvals has been delegated by the Audit Committee, pursuant to the pre-approval provisions of the Policy.

Pre-Approval of Non-Audit Services Provided to GST II’s Investment Advisers. The Policy provides that, in addition to requiring pre-approval of audit and non-audit services provided to GST II, the Audit Committee will pre-approve those non-audit services provided to GST II’s investment advisers (and entities controlling, controlled by or under common control with the investment advisers that provide ongoing services to GST II) where the engagement relates directly to the operations or financial reporting of GST II.

Item 4(e)(2) – 0% of the audit-related fees, tax fees and other fees listed in Table 1 were approved by GST II’s Audit Committee pursuant to the “de minimis” exception of Rule 2-01(c)(7)(i)(C) of Regulation S-X. In addition, 0% of the non-audit services to the GST II’s service affiliates listed in Table 2 were approved by GST II’s Audit Committee pursuant to the “de minimis” exception of Rule 2-01 (c)(7)(i)(C) of Regulation S-X.

Item 4(f) – Not applicable.

Item 4(g) Aggregate Non-Audit Fees Disclosure

The aggregate non-audit fees billed to GST II by PwC for the twelve months ended October 31, 2024 and October 31, 2023 were approximately $44,100 and $100,800, respectively. The aggregate non-audit fees billed to GST II’s adviser and service affiliates by PwC for non-audit services for the twelve months ended December 31, 2023 and December 31, 2022 were approximately $18.0 million and $17.1 million, respectively. With regard to the aggregate non-audit fees billed to GST II’s adviser and service affiliates, the 2023 and 2022 amounts include fees for non-audit services required to be pre-approved [see Table 2] and fees for non-audit services that did not require pre-approval since they did not directly relate to GST II’s operations or financial reporting.

Item 4(h) — GST II’s Audit Committee has considered whether the provision of non-audit services to GST II’s investment adviser and service affiliates that did not require pre-approval pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the auditors’ independence.

Item 4(i) – Not applicable.

Item 4(j) – Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

Schedule of Investments is included in Item 7 of this report.

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Goldman Sachs Funds Annual Financial Statements October 31, 2024 Goldman Sachs GQG Partners International Opportunities Fund

Goldman Sachs GQG Partners International Opportunities Fund

GOLDMAN SACHS GQG PARTNERS INTERNATIONAL OPPORTUNITIES FUND

|

Schedule of Investments October 31, 2024 |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks – 93.4% | |

| |

| | Australia* – 2.5% | |

| | 226,343,241 | | Glencore PLC (Metals & Mining) | | $ | 1,187,088,468 | |

| |

| | | |

| |

| | Belgium – 1.3% | |

| | 10,477,984 | | Anheuser-Busch InBev SA (Beverages) | | | 621,253,971 | |

| |

| | | |

| |

| | Brazil – 1.9% | |

| | 68,239,535 | | Petroleo Brasileiro SA ADR (Oil, Gas & Consumable Fuels) | | | 917,821,746 | |

| |

| | | |

| |

| | Canada – 6.1% | |

| | 150,570 | | Constellation Software, Inc. (Software) | | | 454,088,019 | |

| | 36,348,660 | | Enbridge, Inc. (Oil, Gas & Consumable Fuels) | | | 1,468,200,264 | |

| | 1,320,414 | | Imperial Oil Ltd. (Oil, Gas & Consumable Fuels) | | | 98,531,989 | |

| | 1,277,378 | | Intact Financial Corp. (Insurance) | | | 243,943,556 | |

| | 1,113,476 | | Loblaw Cos. Ltd. (Consumer | | | | |

| | | | Staples Distribution & Retail) | | | 140,780,921 | |

| | 4,374,511 | | Royal Bank of Canada (Banks) | | | 529,050,818 | |

| | | |

| | | | | | | | |

| | | | | | | 2,934,595,567 | |

| |

| | | |

| |

| | China – 0.3% | |

| | 203,311,000 | | Industrial & Commercial Bank of China Ltd. Class H (Banks) | | | 121,957,336 | |

| |

| | | |

| |

| | Denmark – 7.4% | |

| | 3,458,328 | | Novo Nordisk AS ADR (Pharmaceuticals) | | | 387,159,819 | |

| | 28,446,716 | | Novo Nordisk AS Class B (Pharmaceuticals) | | | 3,190,725,607 | |

| | | |

| | | | | | | | |

| | | | | | | 3,577,885,426 | |

| |

| | | |

| |

| | France – 7.3% | |

| | 4,417,266 | | BNP Paribas SA (Banks) | | | 301,672,684 | |

| | 2,919,546 | | Pernod Ricard SA (Beverages) | | | 364,267,514 | |

| | 7,207,453 | | Sanofi SA (Pharmaceuticals) | | | 761,681,965 | |

| | 1,961,995 | | Thales SA (Aerospace & Defense) | | | 316,270,628 | |

| | 28,430,183 | | TotalEnergies SE (Oil, Gas & Consumable Fuels) | | | 1,784,154,460 | |

| | | |

| | | | | | | | |

| | | | | | | 3,528,047,251 | |

| |

| | | |

| |

| | Germany – 7.5% | |

| | 1,868,382 | | Commerzbank AG (Banks) | | | 33,136,910 | |

| | 2,141,256 | | Deutsche Boerse AG (Capital Markets) | | | 497,367,245 | |

| | 19,954,581 | | Deutsche Telekom AG (Diversified Telecommunication Services) | | | 603,297,056 | |

| | 10,435,725 | | SAP SE (Software) | | | 2,436,584,042 | |

| | 190,755 | | SAP SE ADR (Software) | | | 44,567,998 | |

| | | |

| | | | | | | | |

| | | | | | | 3,614,953,251 | |

| |

| | | |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | India – 14.9% | |

| | 33,741,816 | | Adani Energy Solutions Ltd.* (Electric Utilities) | | $ | 390,073,586 | |

| | 24,300,861 | | Adani Enterprises Ltd. (Trading Companies & Distributors) | | | 849,933,619 | |

| | 40,886,936 | | Adani Green Energy Ltd.* (Independent Power and Renewable Electricity Producers) | | | 774,384,819 | |

| | 55,744,582 | | Adani Ports & Special Economic Zone Ltd. (Transportation Infrastructure) | | | 909,509,599 | |

| | 128,274,197 | | Adani Power Ltd.* (Independent Power and Renewable Electricity Producers) | | | 900,632,941 | |

| | 23,146,245 | | Bharti Airtel Ltd. (Wireless Telecommunication Services) | | | 443,030,076 | |

| | 214,539,668 | | GMR Airports Infrastructure Ltd.* (Transportation Infrastructure) | | | 201,418,248 | |

| | 35,001,485 | | ICICI Bank Ltd. ADR (Banks) | | | 1,064,395,159 | |

| | 146,676,651 | | ITC Ltd. (Tobacco) | | | 851,001,597 | |

| | 28,181,280 | | JSW Energy Ltd. (Independent Power and Renewable Electricity Producers) | | | 227,177,360 | |

| | 58,221,841 | | State Bank of India (Banks) | | | 566,571,863 | |

| | | |

| | | | | | | | |

| | | | | | | 7,178,128,867 | |

| |

| | | |

| |

| | Indonesia – 0.8% | |

| | 608,808,898 | | Bank Central Asia Tbk. PT (Banks) | | | 397,597,401 | |

| |

| | | |

| |

| | Italy – 2.7% | |

| | 102,179,373 | | Enel SpA (Electric Utilities) | | | 774,935,796 | |

| | 74,751,961 | | Intesa Sanpaolo SpA (Banks) | | | 319,939,034 | |

| | 5,195,487 | | UniCredit SpA (Banks) | | | 229,844,067 | |

| | | |

| | | | | | | | |

| | | | | | | 1,324,718,897 | |

| |

| | | |

| |

| | Netherlands – 1.7% | |

| | 4,305,757 | | Airbus SE (Aerospace & Defense) | | | 656,805,326 | |

| | 271,322 | | ASML Holding NV (Semiconductors & Semiconductor Equipment) | | | 182,635,258 | |

| | | |

| | | | | | | | |

| | | | | | | 839,440,584 | |

| |

| | | |

| |

| | Russia(a) – 0.0% | |

| | 48,039,056 | | Gazprom PJSC (Oil, Gas & Consumable Fuels) | | | — | |

| | 3,681,622 | | LUKOIL PJSC (Oil, Gas & Consumable Fuels) | | | — | |

| | 34,154,161 | | Rosneft Oil Co. PJSC (Oil, Gas & Consumable Fuels) | | | — | |

| | | |

| | | | | | | | |

| | | | | | | — | |

| |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 1 |

GOLDMAN SACHS GQG PARTNERS INTERNATIONAL OPPORTUNITIES FUND

|

Schedule of Investments (continued) October 31, 2024 |

| | | | | | | | |

| | | Shares | | Description | | Value | |

| |

| | Common Stocks (continued) | |

| |

| | Spain – 2.4% | |

| | 107,117,554 | | CaixaBank SA(b) (Banks) | | $ | 652,748,516 | |

| | 32,393,350 | | Iberdrola SA (Electric Utilities) | | | 481,188,052 | |

| | | |

| | | | | | | | |

| | | | | | | 1,133,936,568 | |

| |

| | | |

| |

| | Switzerland – 3.1% | |

| | 13,546,127 | | Novartis AG (Pharmaceuticals) | | | 1,469,839,440 | |

| |

| | | |

| |

| | Taiwan – 3.0% | |

| | 46,176,951 | | Taiwan Semiconductor Manufacturing Co. Ltd. (Semiconductors & Semiconductor Equipment) | | | 1,448,085,245 | |

| |

| | | |

| |

| | United Arab Emirates* – 1.1% | |

| | 4,648,706 | | International Holding Co. PJSC | | | | |

| | | | (Industrial Conglomerates) | | | 512,451,793 | |

| |

| | | |

| |

| | United Kingdom – 13.4% | |

| | 15,898,919 | | AstraZeneca PLC (Pharmaceuticals) | | | 2,262,314,198 | |

| | 22,274,782 | | British American Tobacco PLC (Tobacco) | | | 778,929,185 | |

| | 6,339,560 | | British American Tobacco PLC ADR (Tobacco) | | | 221,757,809 | |

| | 12,885,241 | | BT Group PLC (Diversified Telecommunication Services) | | | 23,007,743 | |

| | 78,264,732 | | HSBC Holdings PLC (Banks) | | | 718,315,298 | |

| | 50,971,631 | | National Grid PLC (Multi-Utilities) | | | 640,007,400 | |

| | 124,117,740 | | Rolls-Royce Holdings PLC* (Aerospace & Defense) | | | 856,461,763 | |

| | 22,160,182 | | Shell PLC (Oil, Gas & Consumable Fuels) | | | 745,841,747 | |

| | 3,822,122 | | Unilever PLC ADR (Personal Products) | | | 232,805,451 | |

| | | |

| | | | | | | | |

| | | | | | | 6,479,440,594 | |

| |

| | | |

| |

| | United States – 16.0% | |

| | 2,742,887 | | Chubb Ltd. (Insurance) | | | 774,701,004 | |