UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22838

The KP Funds

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855)457-3637

Date of fiscal year end: December 31, 2018

Date of reporting period: December 31, 2018

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR §270.30e-1), is attached hereto.

| | |

| The KP Funds | |  |

KP Retirement Path 2015 Fund:KPRAX

KP Retirement Path 2020 Fund:KPRBX

KP Retirement Path 2025 Fund:KPRCX

KP Retirement Path 2030 Fund:KPRDX

KP Retirement Path 2035 Fund:KPREX

KP Retirement Path 2040 Fund:KPRFX

KP Retirement Path 2045 Fund:KPRGX

KP Retirement Path 2050 Fund:KPRHX

KP Retirement Path 2055 Fund:KPRIX

KP Retirement Path 2060 Fund:KPRJX

KP Large Cap Equity Fund:KPLCX

KP Small Cap Equity Fund:KPSCX

KP International Equity Fund:KPIEX

KP Fixed Income Fund:KPFIX

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, or, if you are a direct investor, by calling1-855-457-3637.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling1-855-457-3637. Your election to receive reports in paper will apply to all funds held with your financial intermediary if you invest through a financial intermediary or all KP Funds if you invest directly with the Funds.

Annual Report

December 31, 2018

| | |

| THE KP FUNDS | | December 31, 2018 |

The Funds file their complete schedules of investments with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on FormN-Q within sixty days after period end. The Funds’ FormsN-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Funds voted proxies relating to portfolio securities during the most recent12-month period ended June 30, is available (i) without charge, upon request, by calling855-457-3637 (855-4KPFNDS); and (ii) on the Commission’s website at http://www.sec.gov.

| | |

| THE KP FUNDS | | December 31, 2018 |

Dear Shareholder,

2018 saw a resurgence of volatility in the global equity markets with all major equity markets finishing in negative territory for the year. Large Cap U.S. stocks (as measured by the Russell 1000 Index) were down 4.78% for the year.Non-U.S. equity markets (as measured by the MSCI ACWIex-US IMI Equity Index) fared even worse, posting a return of-14.76% for the year. The U.S. fixed income market was essentially flat for the year with the Bloomberg Barclays U.S. Aggregate Bond Index returning just 0.01%. U.S. listed real estate (as measured by the MSCI US REIT Index) returned-4.57% for the year, while Commodities (as measured by the Bloomberg Commodity Total Return Index) fell-11.25%.

In the face of this difficult market environment the returns for the KP Retirement Path Funds fell in a range between-2.65% for the 2015 Fund (low equity exposure) to-7.68% for the 2055 Fund (high equity exposure). The Funds generally outperformed their strategic benchmarks for the year, with the exception of the 2015 Fund (which trailed its benchmark by 0.08%). Since their inception (in January of 2014), all of the Funds have outperformed their strategic benchmarks by between 0.11% and 0.20% (annualized,net-of-fees).

In general we have been pleased with the performance of the 21 different investment management organizations that are responsible for the management of the 30 separate strategies that make up the KP Retirement Path Funds. We are also pleased with the operational infrastructure that supports the Funds which has become increasingly efficient every year. Overall, we continue to believe that the KP Retirement Path Funds are well-designed to meet the retirement savings needs of participants in Kaiser Permanente sponsored defined contribution plans.

Respectfully Submitted,

| | | | |

| |  | |  |

| | |

Gregory C. Allen Portfolio Manager CEO, President, Chief Research Officer | | Ivan S. Cliff, CFA Portfolio Manager Director of Research | | Mark Andersen Portfolio Manager Senior Vice President |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost and current performance may be lower than the performance quoted. Returns greater than one year are average annual total returns. For performance data current to the most recent month end, please call855-4-KPFNDS.

1

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Performance for the KP Retirement Path Funds for Fiscal Year 2018 was negative across the board on an absolute basis; however, relative to the Funds’ strategic benchmarks, almost all of the Funds outperformed with the exception of the KP Retirement Path 2015 Fund. In order to better understand the sources of outperformance for the year, it is helpful to review the design of the Funds.

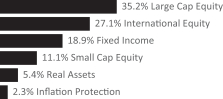

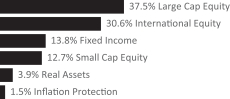

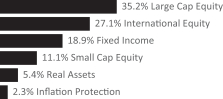

Each of the KP Retirement Path Funds is itself a“fund-of-funds”. This means that each of the Funds is composed of a collection ofsub-funds, each with a specific purpose that contributes to the overall design. At the highest level thesesub-funds can be grouped into six major categories which include: large cap US equities, small cap US equities, international equities, broad fixed income, real (or inflation sensitive) assets, and short-term fixed income. Each of the KP Retirement Path Funds varies its exposure to these asset categories over time to ensure that it is achieving the appropriate balance of capital appreciation, current income, inflation protection, and capital preservation. The 2060 Fund, for example, is primarily invested in large cap US equity, small cap US equity, and international equity. The 2015 Fund, on the other hand, has a much greater emphasis on broad fixed income, real assets, and short-term fixed income.

The performance of each Fund is compared to its own strategic benchmark. The strategic benchmarks are designed to reflect the target asset allocation for each Fund, while also assuming that each of the underlying asset classes is implemented using a passive index. While Management makes extensive use of passive strategies in the Funds’ implementation to keep costs low, we also employ a number of active strategies in our pursuit of adding value relative to the strategic benchmarks. Management does not attempt to add value by trying to time markets using tactical asset allocation. As a result, most of the relative performance of the Funds versus their strategic benchmarks can be explained by the relative performance of the strategies within each of the six underlying asset classes. Given this understanding, we can now put the relative performance of the KP Retirement Path Funds into perspective by examining the relative performance of each of the underlying asset classes.

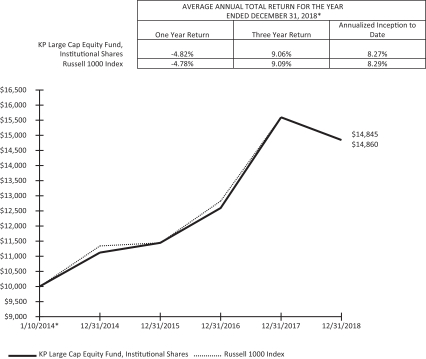

The KP Retirement Path Funds achieve their large cap US equity exposure through the use of the KP Large Cap Equity Fund. This Fund is benchmarked to the Russell 1000 Index. The Fund employs five strategies including: a passive S&P 500 Index strategy; an active large cap growth strategy; an active large cap value strategy; and two active large cap blend strategies. The Fund returned-4.82% for the year versus-4.78% for the benchmark. This slight underperformance of-0.04% at the Fund level was largely explained by the outperformance of the active large cap growth strategy offset by the underperformance of the other active strategies. The large cap growth strategy beat its benchmark for the year by 6.33% while the other active strategies trailed their benchmarks by between1.09%-3.13%. Large cap is a significant part of the asset allocation for all of the KP Retirement Path Funds, but since the Fund was very close to the benchmark over the year, its impact was relatively neutral across the entire fund family versus the benchmark.

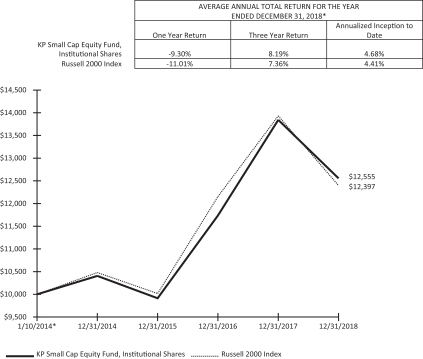

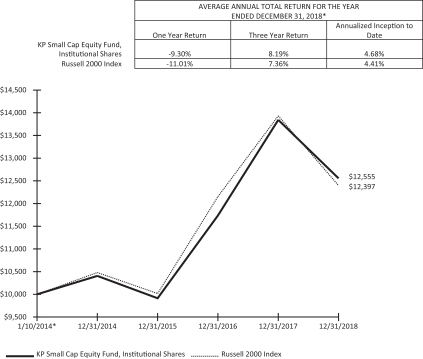

The KP Retirement Path Funds achieve their small cap US equity exposure through the use of the KP Small Cap Equity Fund. This Fund is benchmarked to the Russell 2000 Index. The Fund employs seven strategies including a passive S&P 600 Index strategy, two active small cap growth strategies, two active small cap value strategies, and two active small cap blend strategies. The Fund returned-9.30% for the year versus-11.01% for the benchmark. The outperformance of 1.71% was largely explained by the outperformance of the active growth strategies, which outweighed the underperformance of the active small cap blend strategies. The growth strategies beat their benchmarks by a range of 6.02% and 12.58% respectively, while the blend strategies underperformed by 3.51% and 7.45%. Small cap is a relatively small part of the asset allocation for the KP Retirement Path Funds, but in combination with the relatively large outperformance versus its index, this contributed to the outperformance across the fund family.

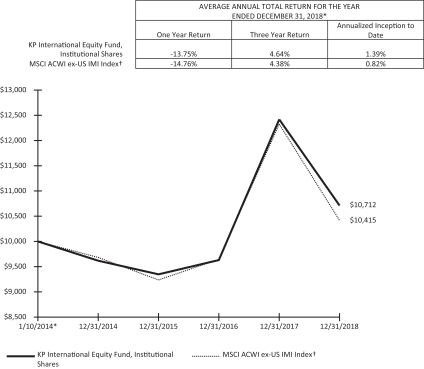

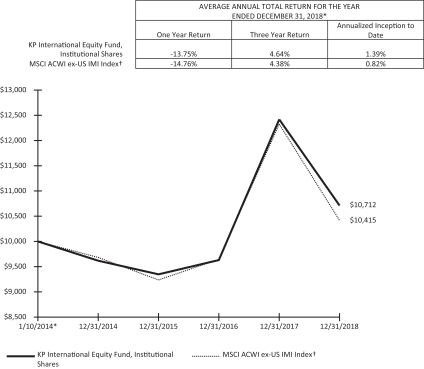

The KP Retirement Path Funds achieve their international equity exposure through the use of the KP International Equity Fund. This Fund is benchmarked to the MSCI ACWIex-US IMI Index. The Fund employs seven strategies including two passive strategies: MSCI Worldex-US and MSCI Worldex-US Small Cap Index strategies. The Fund also employs five active strategies including two active MSCI EAFE strategies, an active MSCI ACWIex-US strategy, and two active emerging markets strategies. The Fund returned-13.75% for the year versus-14.76% for the benchmark. This outperformance of 1.01% was largely attributable to an active EAFE strategy which outpaced its benchmark by 4.07% and outweighed the underperformance of the two emerging markets strategies, which underperformed their benchmarks by 1.10% on average. Because international equity is a large part of the asset allocation for the KP Retirement Path Funds, this was a noteworthy source of relative outperformance across the fund family.

2

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

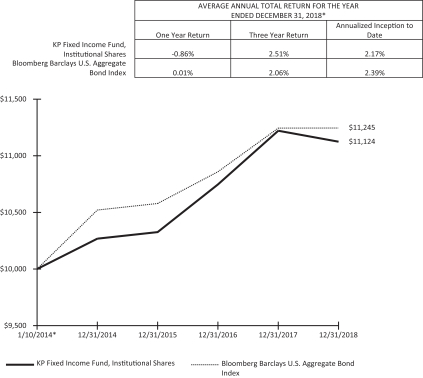

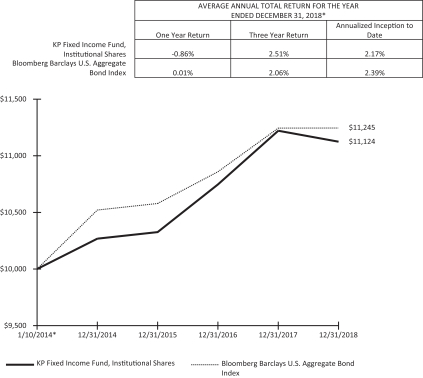

The KP Retirement Path Funds achieve their broad fixed income exposure through the use of the KP Fixed Income Fund. This Fund is benchmarked to the Bloomberg Barclays US Aggregate Bond Index. The Fund employs four strategies including a passive Bloomberg Barclays US Aggregate Bond Index strategy, an active Bloomberg Barclays Aggregate strategy, an active emerging markets debt strategy, and an active bank loan strategy. The KP Fixed Income Fund returned-0.86% for the year versus 0.01% for the benchmark. This underperformance of-0.87% was primarily due to the underperformance of the active emerging markets debt strategy, which underperformed its benchmark by-2.31% and had a lower return on an absolute basis relative to the overall Bloomberg Barclays US Aggregate Bond Index. Because fixed income is a large part of the asset allocation for the KP Retirement Path Funds, this underperformance had a negative impact on the relative performance of the KP Retirement Path Fund series.

The KP Retirement Path Funds achieve their real assets exposure through the use of a diversified collection ofnon-affiliatedsub-funds each specializing in a different inflation-sensitive strategy. Collectively these strategies returned-4.80% over the measurement period versus-5.37% for their composite benchmark, resulting in relative outperformance of 0.57%. The seven underlying real assets funds had a wide range of returns, from-16.10% for the global natural resources fund to 0.38% for the floating rate loan fund. Because real assets are a relatively small part of the asset allocation for the KP Retirement Path Funds, they had only a modest impact on the relative performance across the series.

The KP Retirement Path Funds achieve their short-term fixed income exposure through the use oflow-cost index strategies. Thesesub-funds performed in line with their benchmarks and did not have a material effect on the relative performance across the series.

The tables that follow detail the performance of each of the KP Retirement Path Funds over various periods ended December 31, 2018. The period labeled “Since January 31, 2014” represents the period over which the funds were available to KP participants.

To determine if one of these funds is an appropriate investment for you, carefully consider the fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information may be found in the fund’s summary and full prospectuses, which may be obtained by calling(855)4-KPFNDS or by visiting the website atwww.kp-funds.com. Please read the prospectus carefully before investing.

The KP Retirement Path Funds and the KP Core Funds are mutual funds. They are part of The KP Funds Series Trust, anopen-end management investment company that offers shares of diversified portfolios. The funds are advised by Callan LLC, a registered investment advisor. They are administered by SEI Investments Global Funds Services and distributed by SEI investments Distribution Co., which are not affiliated with Callan LLC.

Only participants in the Kaiser Permanente defined contribution plans and 403(b) plans can invest in the funds.

There can be no assurance that a Fund will achieve its stated objectives. An investor may experience losses, at any time, including near, at or after the Fund’s target year. In addition, there is no guarantee that an investor’s investment in the fund will provide any income at or through the years following the Fund’s target year in amounts adequate to meet the investor’s goals or retirement needs.

Investing involves risk including loss of principal. Bond and bond funds are subject to interest rate risk and will decline in value as interest rates rise. Mortgage-backed securities are subject topre-payment and extension risk and therefore react differently to changes in interest rates than other bonds. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities.Non-investment grade bonds involve greater risks of default and are more volatile than investment grade securities, due to the speculative nature of the investment. International investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. These risks are heightened when investing in emerging markets or in a single state.

Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Underlying Fund would be adversely affected. The use of leverage by the fund managers may accelerate the velocity of potential losses. Furthermore, the use of derivatives are often more volatile than other investments and magnify the Fund’s gains or losses. Diversification does not protect against market loss.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost and current performance may be lower than the performance quoted. Returns greater than one year are average annual total returns. For performance data current to the most recent month end, please call855-4-KPFNDS.

3

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Definition of Comparitive Indices

The Russell 1000 Index measures the performance of thelarge-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the Russell 3000 Index.

The Russell 2000 Index measures the performance of thesmall-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

The MSCI ACWIex-US Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets countries (excluding the United States) and 24 Emerging Markets countries. With 6,278 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI EAFE Index captures large, mid, small and micro cap representation across 21 Developed Markets countries (excluding Canada and the United States). With 921 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based index and measures the performance of the U.S. investment grade bond market. It invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States – including government and corporate, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year.

The S&P 500 Index is based on market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ.

4

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

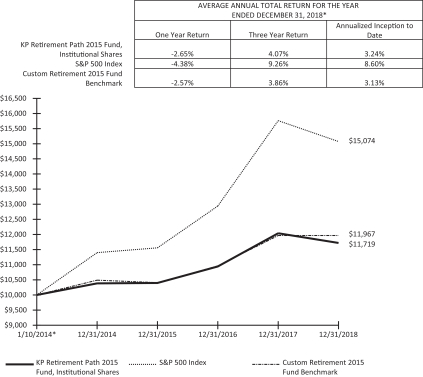

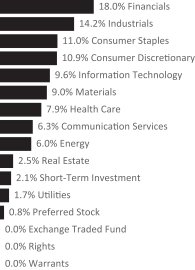

| KP Retirement Path 2015 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

5

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

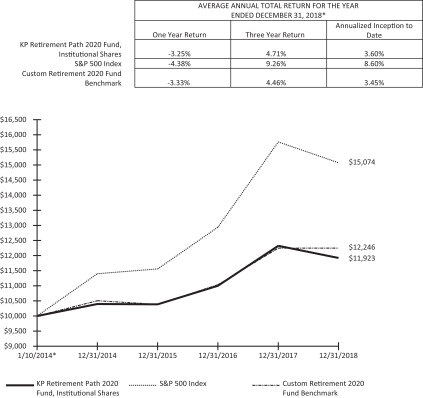

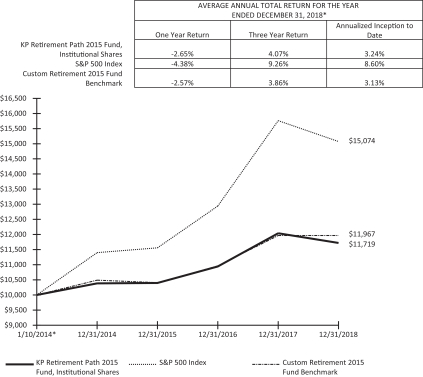

| KP Retirement Path 2020 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

6

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

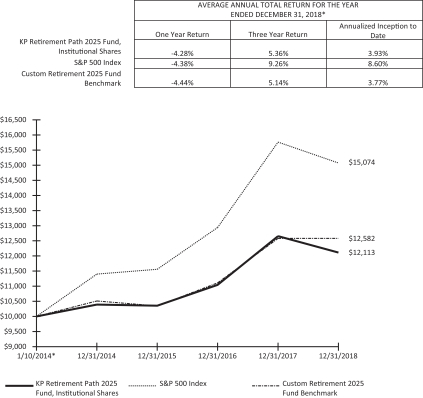

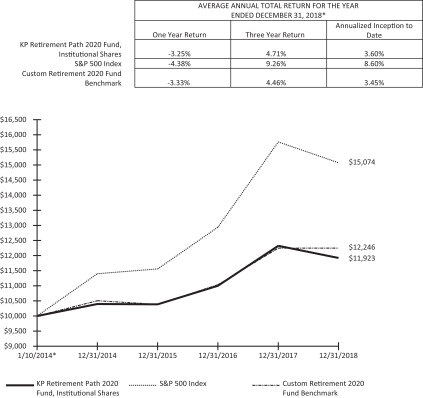

| KP Retirement Path 2025 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

7

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

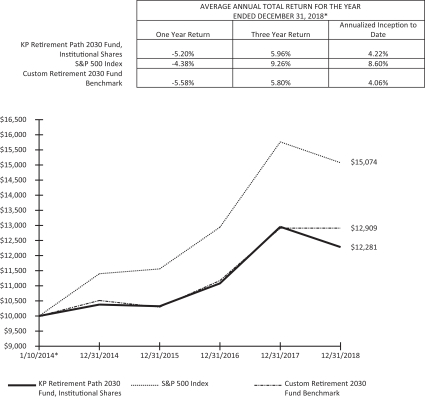

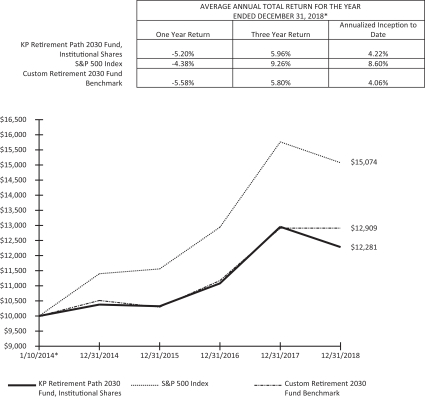

| KP Retirement Path 2030 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

8

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

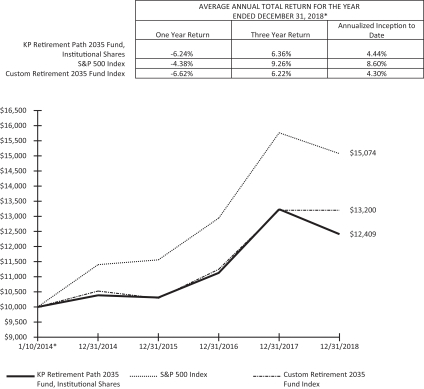

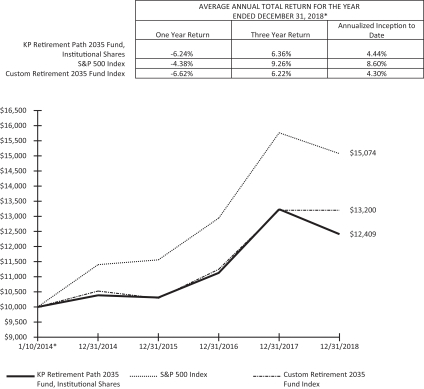

| KP Retirement Path 2035 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

9

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

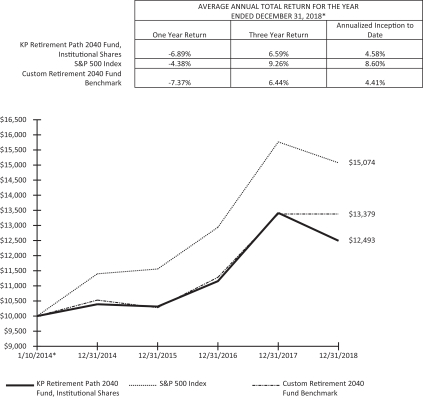

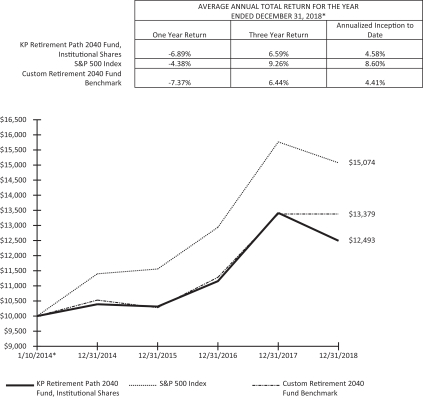

| KP Retirement Path 2040 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

10

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

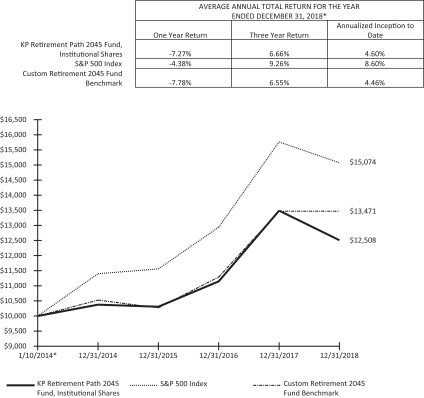

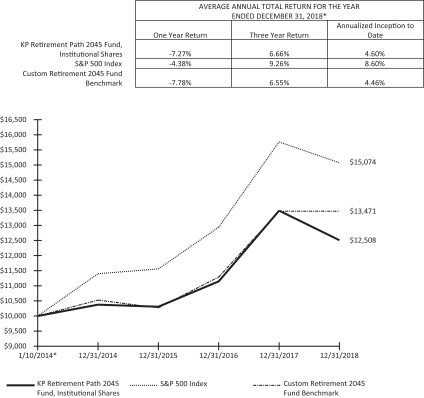

| KP Retirement Path 2045 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

11

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

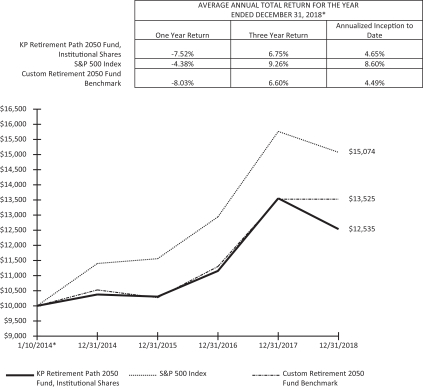

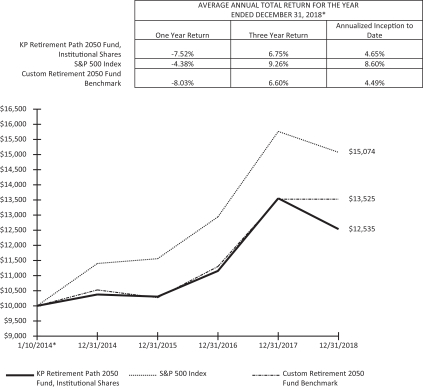

| KP Retirement Path 2050 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

12

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

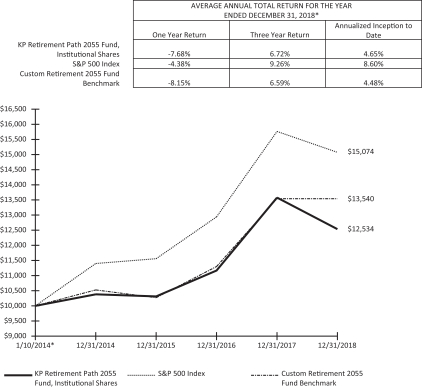

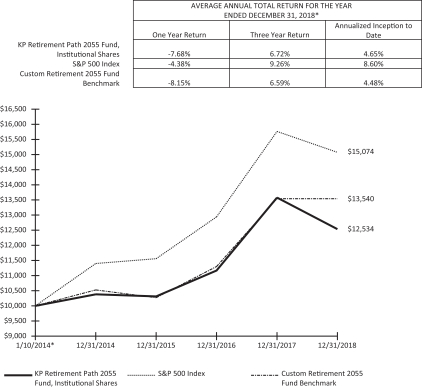

| KP Retirement Path 2055 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

13

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

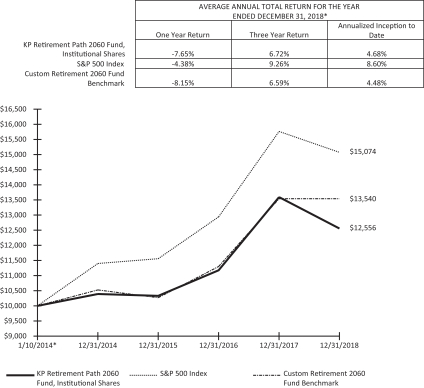

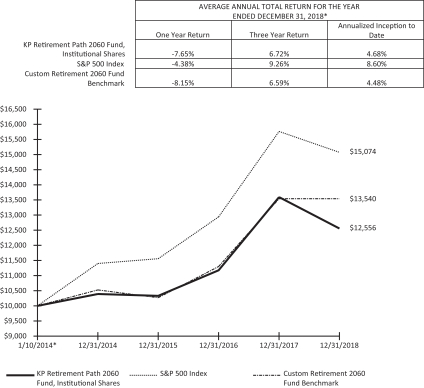

| KP Retirement Path 2060 Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

14

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

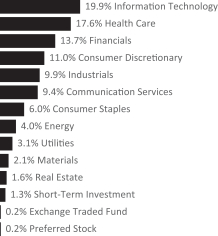

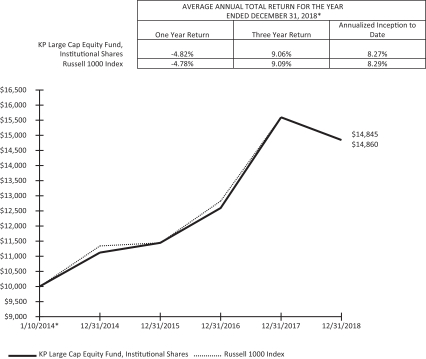

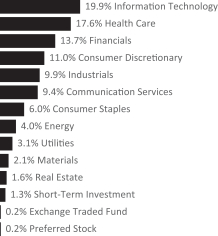

| KP Large Cap Equity Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

15

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

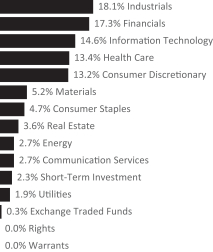

| KP Small Cap Equity Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

16

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP International Equity Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

| † | The Fund changed it’s benchmark index to the MSCI ACWI ex-US IMI Index as of April 1, 2017. The Fund utilized the MSCI ACWI ex-US Index as it’s benchmark index through March 31, 2017. The performance data above are reflective of this change. |

17

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Fixed Income Fund | | |

| MANAGEMENT DISCUSSION AND FUND PERFORMANCE (Unaudited): | | |

Growth of a $10,000 Investment

| * | The Fund commenced operations on January 10, 2014. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 4.

18

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

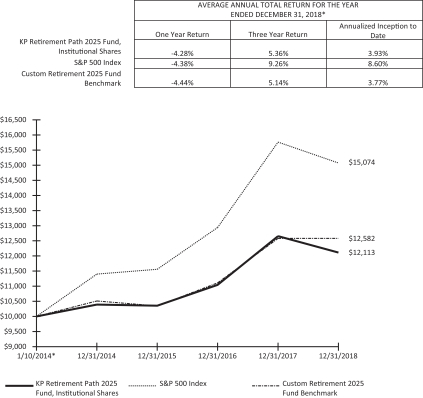

| KP Retirement Path 2015 Fund | | |

|

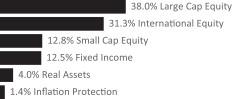

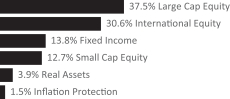

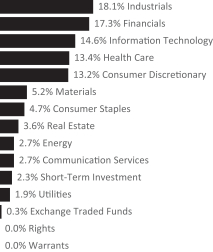

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 71.4% | |

| | |

KP Fixed Income Fund | | | 20,688,238 | | | $ | 200,468 | |

| | |

KP International Equity Fund | | | 3,640,507 | | | | 32,947 | |

| | |

KP Large Cap Equity Fund | | | 6,955,540 | | | | 78,597 | |

| | |

KP Small Cap Equity Fund | | | 1,393,506 | | | | 12,946 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $338,736) (000) | | | | 324,958 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 28.6% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 816,124 | | | | 4,252 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 970,203 | | | | 4,434 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 270,446 | | | | 8,840 | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 324,635 | | | | 4,386 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 465,903 | | | $ | 4,459 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 122,543 | | | | 3,686 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 1,532,687 | | | | 15,281 | |

| | |

Vanguard Short-Term Bond Index Fund, Cl Institutional | | | 4,642,425 | | | | 47,863 | |

| | |

Vanguard Short-Term Inflation-Protected Securities Index Fund, Cl Institutional | | | 1,548,104 | | | | 37,202 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $134,290) (000) | | | | 130,403 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $473,026) (000) | | | $ | 455,361 | |

| | | | | | | | |

Percentages are based on Net Assets of $455,335 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the year. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 179,057 | | | $ | 71,207 | | | $ | (42,800 | ) | | $ | (6,767 | ) | | $ | (229 | ) | | $ | 200,468 | | | $ | 5,509 | | | $ | — | |

| KP International Equity Fund | | | 36,623 | | | | 11,466 | | | | (8,009 | ) | | | (8,063 | ) | | | 930 | | | | 32,947 | | | | 672 | | | | 1,418 | |

| KP Large Cap Equity Fund | | | 89,342 | | | | 22,656 | | | | (22,382 | ) | | | (17,135 | ) | | | 6,116 | | | | 78,597 | | | | 1,321 | | | | 5,386 | |

| KP Small Cap Equity Fund | | | 16,167 | | | | 4,724 | | | | (4,665 | ) | | | (4,321 | ) | | | 1,041 | | | | 12,946 | | | | 90 | | | | 1,852 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 321,189 | | | $ | 110,053 | | | $ | (77,856 | ) | | $ | (36,286 | ) | | $ | 7,858 | | | $ | 324,958 | | | $ | 7,592 | | | $ | 8,656 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

19

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2020 Fund | | |

|

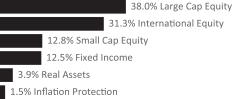

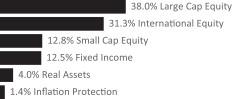

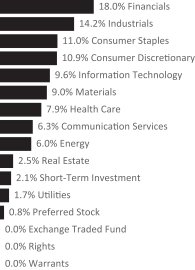

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 74.3% | |

| | |

KP Fixed Income Fund | | | 39,634,147 | | | $ | 384,055 | |

| | |

KP International Equity Fund | | | 10,754,173 | | | | 97,325 | |

| | |

KP Large Cap Equity Fund | | | 18,113,658 | | | | 204,684 | |

| | |

KP Small Cap Equity Fund | | | 4,277,631 | | | | 39,739 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $758,566) (000) | | | | 725,803 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 25.7% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 1,793,209 | | | | 9,343 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 2,136,341 | | | | 9,763 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 596,606 | | | | 19,502 | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 716,924 | | | | 9,686 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 1,028,946 | | | $ | 9,847 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 271,205 | | | | 8,158 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 3,221,985 | | | | 32,123 | |

| | |

Vanguard Short-Term Bond Index Fund, Cl Institutional | | | 8,505,409 | | | | 87,691 | |

| | |

Vanguard Short-Term Inflation-Protected Securities Index Fund, Cl Institutional | | | 2,708,931 | | | | 65,096 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $259,776) (000) | | | | 251,209 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $1,018,342) (000) | | | $ | 977,012 | |

| | | | | | | | |

Percentages are based on Net Assets of $976,953 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the year. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 309,890 | | | $ | 140,438 | | | $ | (53,405 | ) | | $ | (12,599 | ) | | $ | (269 | ) | | $ | 384,055 | | | $ | 10,531 | | | $ | — | |

| KP International Equity Fund | | | 101,298 | | | | 34,237 | | | | (17,221 | ) | | | (23,242 | ) | | | 2,253 | | | | 97,325 | | | | 1,982 | | | | 4,185 | |

| KP Large Cap Equity Fund | | | 215,339 | | | | 62,425 | | | | (44,016 | ) | | | (41,544 | ) | | | 12,480 | | | | 204,684 | | | | 3,433 | | | | 14,010 | |

| KP Small Cap Equity Fund | | | 46,447 | | | | 14,985 | | | | (11,591 | ) | | | (12,764 | ) | | | 2,662 | | | | 39,739 | | | | 275 | | | | 5,679 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 672,974 | | | $ | 252,085 | | | $ | (126,233 | ) | | $ | (90,149 | ) | | $ | 17,126 | | | $ | 725,803 | | | $ | 16,221 | | | $ | 23,874 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

20

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2025 Fund | | |

|

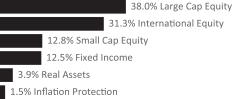

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 78.9% | |

| | |

KP Fixed Income Fund | | | 40,853,711 | | | $ | 395,872 | |

| | |

KP International Equity Fund | | | 18,446,113 | | | | 166,937 | |

| | |

KP Large Cap Equity Fund | | | 27,466,865 | | | | 310,376 | |

| | |

KP Small Cap Equity Fund | | | 7,549,421 | | | | 70,134 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $987,382) (000) | | | | 943,319 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 21.1% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 2,228,222 | | | | 11,609 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 2,682,437 | | | | 12,259 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 758,223 | | | | 24,786 | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 911,286 | | | | 12,311 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 1,307,539 | | | $ | 12,513 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 345,603 | | | | 10,396 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 3,861,715 | | | | 38,501 | |

| | |

Vanguard Short-Term Bond Index Fund, Cl Institutional | | | 7,332,057 | | | | 75,594 | |

| | |

Vanguard Short-Term Inflation-Protected Securities Index Fund, Cl Institutional | | | 2,236,513 | | | | 53,744 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $261,906) (000) | | | | 251,713 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0% (Cost $1,249,288) (000) | | | $ | 1,195,032 | |

| | | | | | | | |

Percentages are based on Net Assets of $1,194,960 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the year. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 307,654 | | | $ | 132,318 | | | $ | (31,063 | ) | | $ | (12,876 | ) | | $ | (161 | ) | | $ | 395,872 | | | $ | 10,855 | | | $ | — | |

| KP International Equity Fund | | | 164,867 | | | | 56,650 | | | | (18,709 | ) | | | (38,393 | ) | | | 2,522 | | | | 166,937 | | | | 3,400 | | | | 7,166 | |

| KP Large Cap Equity Fund | | | 313,441 | | | | 86,717 | | | | (46,156 | ) | | | (56,790 | ) | | | 13,164 | | | | 310,376 | | | | 5,206 | | | | 21,205 | |

| KP Small Cap Equity Fund | | | 77,485 | | | | 25,126 | | | | (14,694 | ) | | | (21,232 | ) | | | 3,449 | | | | 70,134 | | | | 486 | | | | 10,004 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 863,447 | | | $ | 300,811 | | | $ | (110,622 | ) | | $ | (129,291 | ) | | $ | 18,974 | | | $ | 943,319 | | | $ | 19,947 | | | $ | 38,375 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

21

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2030 Fund | | |

|

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 84.1% | |

| | |

KP Fixed Income Fund | | | 32,764,180 | | | $ | 317,485 | |

| | |

KP International Equity Fund | | | 23,534,473 | | | | 212,987 | |

| | |

KP Large Cap Equity Fund | | | 30,967,905 | | | | 349,937 | |

| | |

KP Small Cap Equity Fund | | | 9,583,106 | | | | 89,027 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $1,019,414) (000) | | | | 969,436 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 15.9% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 2,115,741 | | | | 11,023 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 2,544,267 | | | | 11,627 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 717,817 | | | | 23,466 | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 862,980 | | | | 11,659 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 1,238,368 | | | $ | 11,851 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 327,902 | | | | 9,863 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 3,569,106 | | | | 35,584 | |

| | |

Vanguard Short-Term Bond Index Fund, Cl Institutional | | | 3,921,021 | | | | 40,426 | |

| | |

Vanguard Short-Term Inflation-Protected Securities Index Fund, Cl Institutional | | | 1,135,527 | | | | 27,287 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $191,644) (000) | | | | 182,786 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $1,211,058) (000) | | | $ | 1,152,222 | |

| | | | | | | | |

Percentages are based on Net Assets of $1,152,153 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the year. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 238,907 | | | $ | 110,945 | | | $ | (22,046 | ) | | $ | (10,198 | ) | | $ | (123 | ) | | $ | 317,485 | | | $ | 8,699 | | | $ | — | |

| KP International Equity Fund | | | 203,754 | | | | 76,221 | | | | (21,389 | ) | | | (48,365 | ) | | | 2,766 | | | | 212,987 | | | | 4,335 | | | | 9,139 | |

| KP Large Cap Equity Fund | | | 337,314 | | | | 107,091 | | | | (44,511 | ) | | | (62,519 | ) | | | 12,562 | | | | 349,937 | | | | 5,866 | | | | 23,896 | |

| KP Small Cap Equity Fund | | | 94,220 | | | | 34,282 | | | | (16,731 | ) | | | (26,646 | ) | | | 3,902 | | | | 89,027 | | | | 616 | | | | 12,692 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 874,195 | | | $ | 328,539 | | | $ | (104,677 | ) | | $ | (147,728 | ) | | $ | 19,107 | | | $ | 969,436 | | | $ | 19,516 | | | $ | 45,727 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

22

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2035 Fund | | |

|

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 88.9% | |

| | |

KP Fixed Income Fund | | | 29,656,420 | | | $ | 287,371 | |

| | |

KP International Equity Fund | | | 32,477,286 | | | | 293,919 | |

| | |

KP Large Cap Equity Fund | | | 37,189,697 | | | | 420,244 | |

| | |

KP Small Cap Equity Fund | | | 13,064,915 | | | | 121,373 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $1,182,597) (000) | | | | 1,122,907 | |

| | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 11.1% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 2,095,609 | | | | 10,918 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 2,529,144 | | | | 11,558 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 717,298 | | | | 23,449 | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 862,135 | | | | 11,647 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 1,236,964 | | | $ | 11,838 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 327,571 | | | | 9,853 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 3,537,278 | | | | 35,266 | |

| | |

Vanguard Short-Term Bond Index Fund, Cl Institutional | | | 1,633,734 | | | | 16,844 | |

| | |

Vanguard Short-Term Inflation-Protected Securities Index Fund, Cl Institutional | | | 344,134 | | | | 8,270 | �� |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $147,838) (000) | | | | 139,643 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $1,330,435) (000) | | | $ | 1,262,550 | |

| | | | | | | | |

Percentages are based on Net Assets of $1,262,478 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the year. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 216,991 | | | $ | 98,453 | | | $ | (18,722 | ) | | $ | (9,255 | ) | | $ | (96 | ) | | $ | 287,371 | | | $ | 7,872 | | | $ | — | |

| KP International Equity Fund | | | 277,208 | | | | 106,483 | | | | (26,718 | ) | | | (66,402 | ) | | | 3,348 | | | | 293,919 | | | | 5,980 | | | | 12,581 | |

| KP Large Cap Equity Fund | | | 403,680 | | | | 126,093 | | | | (50,006 | ) | | | (73,705 | ) | | | 14,182 | | | | 420,244 | | | | 7,042 | | | | 28,625 | |

| KP Small Cap Equity Fund | | | 127,924 | | | | 46,039 | | | | (21,763 | ) | | | (35,973 | ) | | | 5,146 | | | | 121,373 | | | | 839 | | | | 17,256 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 1,025,803 | | | $ | 377,068 | | | $ | (117,209 | ) | | $ | (185,335 | ) | | $ | 22,580 | | | $ | 1,122,907 | | | $ | 21,733 | | | $ | 58,462 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

23

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2040 Fund | | |

|

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 92.3% | |

| | |

KP Fixed Income Fund | | | 22,362,151 | | | $ | 216,689 | |

| | |

KP International Equity Fund | | | 34,320,712 | | | | 310,602 | |

| | |

KP Large Cap Equity Fund | | | 35,672,254 | | | | 403,097 | |

| | |

KP Small Cap Equity Fund | | | 13,755,172 | | | | 127,786 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $1,116,755) (000) | | | | 1,058,174 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 7.7% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 1,610,866 | | | | 8,393 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 1,945,819 | | | | 8,892 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 552,470 | | | | 18,060 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 664,185 | | | $ | 8,973 | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 952,944 | | | | 9,120 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 252,533 | | | | 7,596 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 2,694,374 | | | | 26,863 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $93,969) (000) | | | | 87,897 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $1,210,724) (000) | | | $ | 1,146,071 | |

| | | | | | | | |

Percentages are based on Net Assets of $1,146,007 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 164,735 | | | $ | 71,279 | | | $ | (12,261 | ) | | $ | (6,998 | ) | | $ | (66 | ) | | $ | 216,689 | | | $ | 5,934 | | | $ | — | |

| KP International Equity Fund | | | 290,421 | | | | 110,973 | | | | (24,058 | ) | | | (69,629 | ) | | | 2,895 | | | | 310,602 | | | | 6,317 | | | | 13,284 | |

| KP Large Cap Equity Fund | �� | | 385,954 | | | | 116,506 | | | | (42,781 | ) | | | (68,745 | ) | | | 12,163 | | | | 403,097 | | | | 6,752 | | | | 27,434 | |

| KP Small Cap Equity Fund | | | 132,342 | | | | 47,926 | | | | (20,081 | ) | | | (37,210 | ) | | | 4,809 | | | | 127,786 | | | | 884 | | | | 18,151 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 973,452 | | | $ | 346,684 | | | $ | (99,181 | ) | | $ | (182,582 | ) | | $ | 19,801 | | | $ | 1,058,174 | | | $ | 19,887 | | | $ | 58,869 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

24

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2045 Fund | | |

|

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

AFFILIATED REGISTERED INVESTMENT COMPANIES — 94.0% | |

| | |

KP Fixed Income Fund | | | 14,475,055 | | | $ | 140,263 | |

| | |

KP International Equity Fund | | | 28,440,589 | | | | 257,387 | |

| | |

KP Large Cap Equity Fund | | | 28,099,504 | | | | 317,525 | |

| | |

KP Small Cap Equity Fund | | | 11,402,785 | | | | 105,932 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $876,464) (000) | | | | 821,107 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 6.0% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 965,866 | | | | 5,032 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 1,169,047 | | | | 5,343 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 332,622 | | | | 10,873 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 399,927 | | | $ | 5,403 | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 573,863 | | | | 5,492 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 152,324 | | | | 4,582 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 1,567,750 | | | | 15,630 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $56,001) (000) | | | | 52,355 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $932,465) (000) | | | $ | 873,462 | |

| | | | | | | | |

Percentages are based on Net Assets of $873,412 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 103,026 | | | $ | 50,160 | | | $ | (8,416 | ) | | $ | (4,458 | ) | | $ | (49 | ) | | $ | 140,263 | | | $ | 3,840 | | | $ | — | |

| KP International Equity Fund | | | 227,002 | | | | 103,758 | | | | (18,561 | ) | | | (56,922 | ) | | | 2,110 | | | | 257,387 | | | | 5,232 | | | | 10,989 | |

| KP Large Cap Equity Fund | | | 291,029 | | | | 104,440 | | | | (32,932 | ) | | | (54,357 | ) | | | 9,345 | | | | 317,525 | | | | 5,316 | | | | 21,568 | |

| KP Small Cap Equity Fund | | | 104,856 | | | | 44,307 | | | | (16,206 | ) | | | (30,885 | ) | | | 3,860 | | | | 105,932 | | | | 733 | | | | 15,015 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 725,913 | | | $ | 302,665 | | | $ | (76,115 | ) | | $ | (146,622 | ) | | $ | 15,266 | | | $ | 821,107 | | | $ | 15,121 | | | $ | 47,572 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

25

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2050 Fund | | |

|

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 94.6% | |

| | |

KP Fixed Income Fund | | | 7,315,383 | | | $ | 70,886 | |

| | |

KP International Equity Fund | | | 17,326,415 | | | | 156,804 | |

| | |

KP Large Cap Equity Fund | | | 17,000,265 | | | | 192,103 | |

| | |

KP Small Cap Equity Fund | | | 7,027,246 | | | | 65,283 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $527,430) (000) | | | | 485,076 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 5.4% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 510,458 | | | | 2,659 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 621,703 | | | | 2,841 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 178,526 | | | | 5,837 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 214,126 | | | $ | 2,893 | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 307,195 | | | | 2,940 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 81,748 | | | | 2,459 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 788,289 | | | | 7,859 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $29,525) (000) | | | | 27,488 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $556,955) (000) | | | $ | 512,564 | |

| | | | | | | | |

Percentages are based on Net Assets of $512,532 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 47,536 | | | $ | 29,617 | | | $ | (4,074 | ) | | $ | (2,094 | ) | | $ | (99 | ) | | $ | 70,886 | | | $ | 1,937 | | | $ | — | |

| KP International Equity Fund | | | 126,616 | | | | 74,007 | | | | (10,849 | ) | | | (33,840 | ) | | | 870 | | | | 156,804 | | | | 3,182 | | | | 6,670 | |

| KP Large Cap Equity Fund | | | 161,162 | | | | 77,286 | | | | (18,842 | ) | | | (32,816 | ) | | | 5,313 | | | | 192,103 | | | | 3,210 | | | | 12,999 | |

| KP Small Cap Equity Fund | | | 58,229 | | | | 32,851 | | | | (8,974 | ) | | | (18,878 | ) | | | 2,055 | | | | 65,283 | | | | 451 | | | | 9,215 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Totals | | $ | 393,543 | | | $ | 213,761 | | | $ | (42,739 | ) | | $ | (87,628 | ) | | $ | 8,139 | | | $ | 485,076 | | | $ | 8,780 | | | $ | 28,884 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

26

| | |

| THE KP FUNDS | | December 31, 2018 |

| | |

| KP Retirement Path 2055 Fund | | |

|

| SECTOR WEIGHTINGS† (unaudited) |

| † | Percentages based on total investments. |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

|

AFFILIATED REGISTERED INVESTMENT COMPANIES — 94.6% | |

| | |

KP Fixed Income Fund | | | 2,133,950 | | | $ | 20,678 | |

| | |

KP International Equity Fund | | | 5,734,272 | | | | 51,895 | |

| | |

KP Large Cap Equity Fund | | | 5,603,960 | | | | 63,325 | |

| | |

KP Small Cap Equity Fund | | | 2,284,831 | | | | 21,226 | |

| | | | | | | | |

| |

Total Affiliated Registered Investment Companies

(Cost $175,615) (000) | | | | 157,124 | |

| | | | | | | | |

|

UNAFFILIATED REGISTERED INVESTMENT

COMPANIES — 5.4% | |

| | |

DFA Commodity Strategy Portfolio, Cl Institutional | | | 170,818 | | | | 890 | |

| | |

DFA International Real Estate Securities, Cl Institutional | | | 207,809 | | | | 950 | |

| | |

DFA Real Estate Securities Portfolio, Cl Institutional | | | 59,629 | | | | 1,949 | |

| | | | | | | | |

| Description | | Shares | | | Value

(000) | |

| | |

Lazard Global Listed Infrastructure Portfolio, Cl Institutional | | | 71,453 | | | $ | 965 | |

| | |

T. Rowe Price Institutional Floating Rate Fund, Cl Institutional | | | 102,586 | | | | 982 | |

| | |

T. Rowe Price New Era Fund, Cl Institutional | | | 27,440 | | | | 825 | |

| | |

Vanguard Inflation-Protected Securities Fund, Cl Institutional | | | 233,400 | | | | 2,327 | |

| | | | | | | | |

| |

Total Unaffiliated Registered Investment Companies

(Cost $9,605) (000) | | | | 8,888 | |

| | | | | | | | |

| |

Total Investments In Securities — 100.0%

(Cost $185,220) (000) | | | $ | 166,012 | |

| | | | | | | | |

Percentages are based on Net Assets of $166,000 (000).

Cl — Class

As of December 31, 2018, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the year ended December 31, 2018, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. During the year ended December 31, 2018, there were no Level 3 investments.

For further financial information on individual registered investment companies, available upon request at no charge, please go to the Securities Exchange Commission’s website at http://www.sec.gov or the individual registered investment company’s website.

The following is a summary of the transactions with affiliates for the year ended December 31, 2018 (000):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value

12/31/2017 | | | Purchases

at Cost | | | Proceeds

from Sales | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Realized

Gain

(Loss) | | | Value

12/31/2018 | | | Income | | | Capital Gain

Distributions | |

| KP Fixed Income Fund | | $ | 11,964 | | | $ | 10,774 | | | $ | (1,454 | ) | | $ | (583 | ) | | $ | (23 | ) | | $ | 20,678 | | | $ | 564 | | | $ | — | |

| KP International Equity Fund | | | 34,624 | | | | 32,008 | | | | (4,106 | ) | | | (11,311 | ) | | | 680 | | | | 51,895 | | | | 1,050 | | | | 2,198 | |

| KP Large Cap Equity Fund | | | 43,926 | | | | 35,364 | | | | (6,555 | ) | | | (10,579 | ) | | | 1,169 | | | | 63,325 | | | | 1,055 | | | | 4,265 | |

| KP Small Cap Equity Fund | | | 15,711 | | | | 14,154 | | | | (3,053 | ) | | | (6,366 | ) | | | 780 | | | | 21,226 | | | | 146 | | | | 2,982 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |