UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number(s) 811-22845

Barings Funds Trust

(Exact Name of Registrant as Specified in Charter)

300 South Tryon Street

Suite 2500

Charlotte, NC 28202

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (704) 805-7200

Corporation Service Company (CSC)

251 Little Falls Drive

Wilmington DE 19808

United States

(Name and Address of Agent for Service)

Date of fiscal year end: June 30

Date of reporting period: June 30, 2020

Item 1. Reports to Stockholders.

The Annual Report to Shareholders is attached hereto.

BARINGS FUNDS TRUST

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website http://www.barings.com/, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-877-766-0014.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-877-766-0014 to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Annual Report

June 30, 2020

BFT Service Providers

ADVISER

Barings LLC

300 South Tryon Street

Suite 2500

Charlotte, NC 28202

SUB-ADVISER

Barings International Investments Limited

20 Old Bailey

London, UK

EC4M 7BF

COUNSEL TO THE TRUST

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02110

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP

30 Rockefeller Plaza

New York, NY

10112-0015

CUSTODIAN

State Street Bank & Trust Company

One Lincoln Street

Boston, MA 02111

TRANSFER AGENT AND REGISTRAR

ALPS Fund Services, Inc.

1290 Broadway

Suite 1100

Denver, CO 80203

FUND ADMINISTRATION / ACCOUNTING

State Street Bank & Trust Company

One Lincoln Street

Boston, MA 02111

FUND DISTRIBUTOR

ALPS Distributors, Inc.

1290 Broadway

Suite 1100

Denver, CO 80203

BLUE SKY ADMINISTRATION

DST Asset Manager Solutions, Inc.

2000 Crown Colony Drive

Quincy, MA 02169

PROXY VOTING POLICIES & PROCEDURES

The Trustees of Barings Funds Trust (the “Trust”) have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Barings LLC (“Barings”). A description of Barings’ proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-877-766-0014; (2) on the Trust’s website at http://www.Barings.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The funds in the Trust file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an attachment to Form N-PORT. The funds’ Form N-PORT are available on the SEC’s website at http://www.sec.gov. A complete schedule of portfolio holdings as of each quarter-end is available on the Trust’s website at http://www.Barings.com or upon request by calling, toll-free, 1-877-766-0014.

Daniel McGee

President

Barings Funds Trust

Barings Funds Trust

Barings Global Floating Rate Fund

Barings Global Credit Income Opportunities Fund

Barings Active Short Duration Bond Fund

Barings Diversified Income Fund

Barings Emerging Markets Debt Blended Total Return Fund

Barings Global Emerging Markets Equity Fund

Barings U.S. High Yield Fund

Dear Shareholder,

We hope that you and your families are staying healthy and safe. In this challenging environment, we remain focused on the safety and well-being of our teams, clients and communities.

The coronavirus certainly took center stage in the first half of the year, as the pandemic and related lockdown forced countries across the globe to adapt to a new reality of travel bans, school closures and working from home. Questions remain around how much damage the pandemic and lockdowns have caused to the economy – and to what extent that has been counterbalanced by the massive fiscal and monetary responses from governments around the world.

Perhaps unsurprisingly, changes in economic data have been extreme, both to the positive and the negative, making it difficult to gauge how quickly the recovery may come through. At this point, it is unclear how long it may take before we return to anything approaching normal. On the positive side, economic activity has slowly resumed in certain sectors. Markets, too, have made strong recoveries since volatility peaked in late March. Indeed, as the U.S. Federal Reserve introduced unprecedented measures to enhance liquidity, from purchasing fallen angels to buying individual corporate bonds, high yield and investment grade credit rallied. Emerging markets debt, too, took a positive turn – and could benefit from continued monetary stimulus and the potential for a sharper economic bounce-back in the second half of the year.

As the pandemic plays out and the U.S. presidential election nears, we expect additional volatility to enter the markets. But from a bottom-up, fundamental perspective, our investment teams believe there is still attractive value to be found across developed and emerging markets, including in less trafficked markets such as CLOs and asset-backed securities. We expect that opportunities will also emerge as the economy gradually improves. As active managers – and with some of the industry’s largest fixed income research teams – we believe we are well-positioned to provide access to the evolving relative value opportunities and capture the upside as the market recovers.

Above all, particularly through periods of volatility and change, we remain focused on delivering strong risk-adjusted returns for our shareholders. On behalf of the entire Barings team, we thank you for your trust and partnership and look forward to helping you achieve your investment objectives.

Sincerely,

Daniel McGee

President

The statements and opinions expressed are those of the author as of the date of this report. All information is historical and not indicative of future results and subject to change. This information is not a recommendation to buy or sell any security.

Barings Global Floating Rate Fund 2020 Annual Report

Investment Objective

Barings Global Floating Rate Fund (“Global Floating Rate Fund” or the “Fund”) seeks a high level of current income. Preservation of capital is a secondary goal.

Portfolio Management Commentary

How did the Fund perform?

| | ∎ | | The Fund reported a net total rate of return for the annual reporting period from July 1, 2019 through June 30, 2020 of -2.54%, underperforming the Credit Suisse Global Loan Benchmark (the “Benchmark”), which returned -1.72%.1, 6 |

What factors influenced performance of the Fund?

| | ∎ | | Loan market performance for the period was heavily impacted by the sharp drawdown in March 2020 that was driven by investor uncertainty related to COVID-19 and the initial recovery in the months that followed. |

| | ∎ | | During the drawdown in March and initial recovery in late March/early April 2020, investors in the loan market generally favored higher-rated (BB) loans, which outperformed lower-rated loans for the period. As the Fund had a modest overweight exposure to loans rated single-B and lower, this was one of the primary drivers of underperformance. |

| | ∎ | | Underperformance by Fund holdings in a few industry sectors (based on the Benchmark’s industry sectors) also detracted from attribution results. For example, despite being underweight the energy sector, the Fund’s holdings in that sector underperformed the broader market. Other industry sectors in which the Fund’s holdings underperformed included the service and manufacturing sectors. |

| | ∎ | | From a regional perspective, the Fund’s allocations between the North American and European markets did not have a material impact on performance. Within the regions, the Fund’s North American holdings modestly underperformed the market, which detracted from the Fund’s relative results, whereas there was not a material impact to relative performance from the Fund’s European holdings overall. |

| | ∎ | | Given the substantial drawdown in March, the Fund’s allocation to cash (for which average weight was approximately 5%) provided a positive impact to attribution results. |

| | ∎ | | Other leading positive impacts to performance comparisons against the Benchmark over the period included credit selection within single-B rated loans, an overweight position to the forest products/containers sector, and credit selection within that sector – as that sector was not as negatively impacted by recent volatility and credit selection in the metals/minerals sector. |

Describe recent portfolio activity.

| | ∎ | | In late 2019, the Fund made a modest shift of exposure from the European market to North America, as we believed there was more compelling relative value in that market at the time. In 2020 to date, there has not been a shift between the two geographic regions, as the focus has been on individual credit decision making. |

| | ∎ | | During the period, the Fund reduced its exposure to senior secured high yield bonds (by approximately 3%), in favor of first-lien senior secured loans. |

| 1. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month end performance. All returns 1-year or less are cumulative. |

| 6. | Benchmark A: The Credit Suisse Global Loan Benchmark is a market capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leveraged loan market, with loans denominated in U.S. and Western European currencies. Indices are unmanaged. It is not possible to invest directly in an index. |

2

Barings Global Floating Rate Fund 2020 Annual Report

| | ∎ | | Over the fiscal year, the Fund’s top two industry exposures, health care/education/child care and diversified/conglomerate service (based on Moody’s industries) remained the same. In 2020, the Fund increased its exposure to the leisure/amusement/entertainment sector, making it the third largest industry exposure. This increase is based on individual credit decisions in companies that are believed to be better positioned from a credit and relative value perspective. |

| | ∎ | | Changes in rating category exposure during the period were largely the result of rating agency actions during the period, along with some individual credit decisions to add exposure at discounted levels. Given the increased amount of uncertainty due to the global pandemic, rating agencies downgraded many credit facilities in the first half of 2020. |

Describe portfolio positioning at period end.

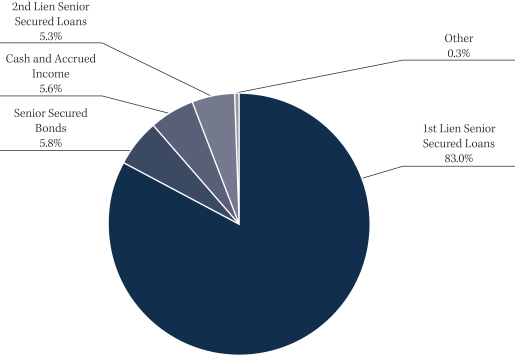

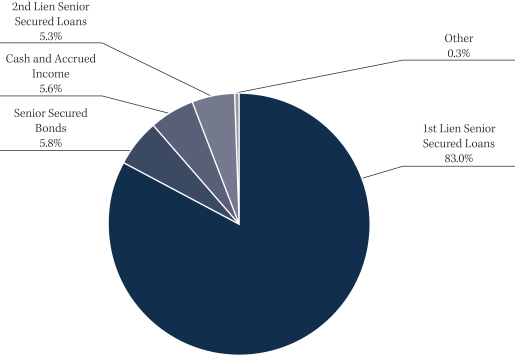

| | ∎ | | The Fund finished the twelve-month reporting period, ending June 30, 2020, with 88.3% allocated to global senior secured loans, 5.8% to global senior secured high yield bonds, and 5.6% to cash. |

| | ∎ | | From an industry perspective (based on Moody’s industries), the Fund remained well diversified across a number of sectors, with concentrations in health care/education/child care (13.2%), diversified/conglomerate services (12.2%), and leisure/amusement/entertainment (7.8%) as of June 30, 2020. |

| | ∎ | | As of June 30, 2020, the Fund had the following credit quality breakdown: 0.6% in BBB assets, 14.8% in BB assets, 65.7% in single-B assets, and 10.7% in CCC and below assets. Approximately 2.6% of the Fund’s assets are non-publicly rated. Cash and accrued income accounted for the remaining 5.6% of the portfolio assets.2 |

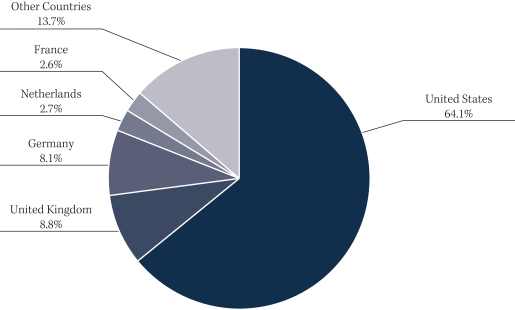

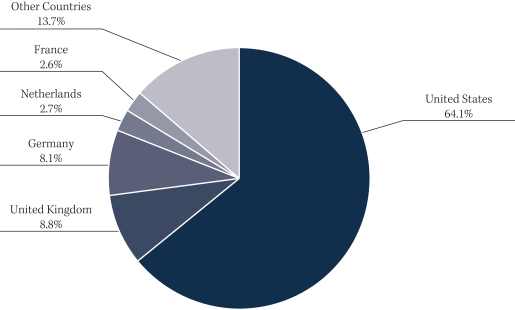

| | ∎ | | The top five countries in the portfolio at the end of the reporting period were the U.S. (64.1%), the U.K. (8.8%), Germany (8.1%), the Netherlands (2.7%) and France (2.6%). Overall, the Fund had exposure to 16 different countries, and we continue to focus on building a well-diversified portfolio of global floating rate securities. |

Describe market and portfolio outlook.

| | ∎ | | The global credit markets staged a strong rebound throughout the second quarter 2020, bolstered by swift action by governments, central banks and private investors, to support global economies as the world comes to terms with life during a pandemic. While default activity has increased across below investment grade credit, in our view some of these elements have helped some companies navigate the current environment. |

| | ∎ | | Despite the recovery thus far, below investment grade credit markets have not yet fully recovered to pre-pandemic levels. Therefore, we continue to believe there are opportunities for below investment grade credit to be additive to total return performance as the recovery continues. |

| | ∎ | | However, until there is a greater resolve in the global pandemic, there will remain an element of uncertainty across credit markets. For this reason, we believe that prudent asset selection and actively managed portfolios are crucial for navigating the current environment. Also, while the pace of recovery may vary at times across geographies and markets, opportunities will emerge, and therefore we believe that taking a global approach to the asset class provides the ability to capture additional relative value opportunities. |

| 2. | Ratings shown are the highest rating given by one of the following national rating agencies: S&P, Moody’s or Fitch. Additional information about ratings can be found, respectively, at www.standardandpoors.com, www.moodys.com and www.fitchratings.com. Credit ratings are subject to change. AAA, AA, single-A, and BBB are investment grade ratings categories used by S&P and Fitch; BB, single-B, CCC/CC/C and single-D are below investment grade ratings categories used by S&P and Fitch. Aaa, Aa, single-A and Baa are investment grade ratings categories used by Moody’s; Ba, B, Caa/Ca and single-C are below investment grade ratings categories used by Moody’s. Ratings categories may include gradations within each category. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

3

Barings Global Floating Rate Fund 2020 Annual Report

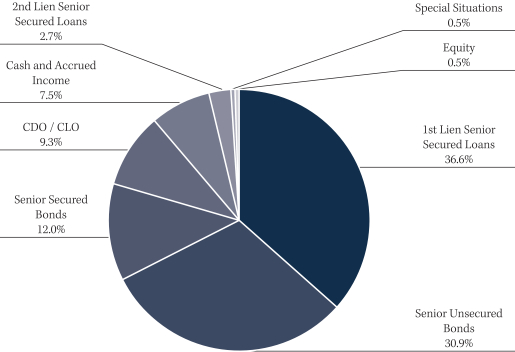

PORTFOLIO COMPOSITION (% OF ASSETS*)

COUNTRY COMPOSITION (% OF ASSETS**)

| ** | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. As of June 30, 2020. |

4

Barings Global Floating Rate Fund 2020 Annual Report

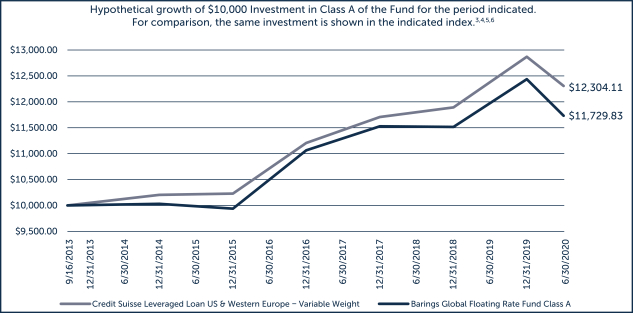

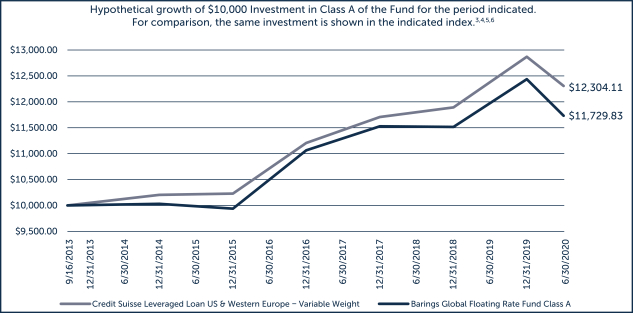

| | | | | | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 5,7,8 | | INCEPTION DATE | | | ONE YEAR | | | THREE YEARS | | | INCEPTION TO DATE | |

Class A With Load | | | 09/16/2013 | | | | -5.71 | % | | | 0.26 | % | | | 2.16 | % |

Class A No Load | | | 09/16/2013 | | | | -2.79 | % | | | 1.29 | % | | | 2.62 | % |

Class C With Load | | | 09/16/2013 | | | | -4.44 | % | | | 0.53 | % | | | 1.86 | % |

Class C No Load | | | 09/16/2013 | | | | -3.52 | % | | | 0.53 | % | | | 1.86 | % |

Class I With Load | | | 09/16/2013 | | | | -2.47 | % | | | 1.57 | % | | | 2.92 | % |

Class I No Load | | | 09/16/2013 | | | | -2.47 | % | | | 1.57 | % | | | 2.92 | % |

Class Y With Load | | | 09/16/2013 | | | | -2.54 | % | | | 1.54 | % | | | 2.89 | % |

Class Y No Load | | | 09/16/2013 | | | | -2.54 | % | | | 1.54 | % | | | 2.89 | % |

| 3. | Duration is a measure of the sensitivity of the price – the value of principal – of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond prices are said to have an inverse relationship with interest rates. Therefore, rising interest rates indicate bond prices are likely to fall, while declining interest rates indicate bond prices are likely to rise. |

| 4. | Inception date: September 16, 2013. |

| 5. | Class A performance with the sales charges includes the maximum 3.00% sales charge. |

| 6. | Benchmark A: The Credit Suisse Global Loan Benchmark is a market capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investable universe of the Western European leveraged loan market, with loans denominated in U.S. and Western European currencies. Indices are unmanaged. It is not possible to invest directly in an index. |

| 7. | Line graph and table do not reflect the deduction of taxes that a shareholder would pay. |

| 8. | Class C performance with the sales charges includes the 1.00% contingent deferred sales charge (CDSC) for returns of one year or less. |

5

Barings Global Credit Income Opportunities Fund 2020 Annual Report

Investment Objective

Barings Global Credit Income Opportunities Fund (“Global Credit Income Opportunities Fund” or the “Fund”) seeks an absolute return, primarily through current income and secondarily through capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

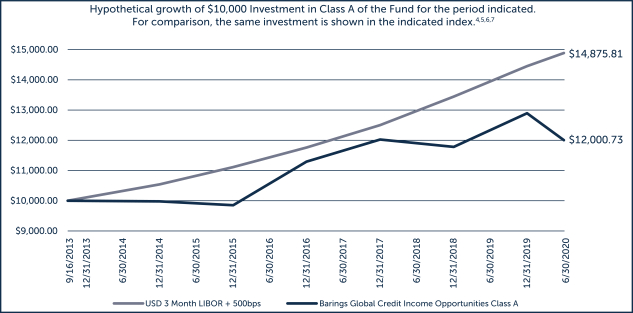

| | ∎ | | The Fund reported a net total rate of return for the annual reporting period from July 1, 2019 through June 30, 2020 of -3.44%, and underperformed the 3 Month USD LIBOR +500 basis points (bps)1 benchmark, which returned 6.71%.2, 6 |

What factors influenced performance of the Fund?

| | ∎ | | The significant decline in mark-to-market trading levels across many credit markets in March 2020, and the varied pace of recovery across markets in the months that followed had a material impact on the Fund’s return for the period. Please note that a large portion of the benchmark is static and therefore will not be influenced to mark-to-market changes, which is the main driver of the Fund’s underperformance relative to the benchmark over the period. |

| | ∎ | | For the core asset classes, high yield bonds underperformed senior secured loans over the full period, and were the biggest detractor from the Fund’s total return. Senior secured loans had a modestly positive impact on the Fund’s total return for the period, and the Fund’s European holdings outperformed the North American holdings. |

| | ∎ | | From a ratings category perspective, the Fund’s higher-rated credits in the high yield bond and senior secured loan markets outperformed lower rated credits during the fiscal year period, as those credits did not see as significant of a drawdown in March 2020, and saw their trading levels recover quicker than lower-rated credits. |

| | ∎ | | For the opportunistic asset classes, allocations to collateralized loan obligations (CLOs) and special situation credits both detracted from the Fund’s total return. |

Describe recent portfolio activity.

| | ∎ | | In the first half of the reporting period, which was in 2019, shifts in the Fund’s core asset classes (high yield bonds and senior secured loans) were focused on modestly shifting exposure from the European markets to North America in both high yield bonds and loans, as relative value was more compelling in the North American market at that time. In 2020, there have been minimal shifts between regions for core asset classes, as the focus has been on individual credit relative value decisions. |

| | ∎ | | In general, as these portfolios build over time, the Fund intends to deploy cash into asset classes which we believe offer the best relative value at that time, and will shift exposure between asset classes as relative value opportunities change. |

| | ∎ | | In regard to the opportunistic asset classes, early in the period the Fund added a modest exposure to emerging markets corporate debt (within high yield bonds). Also, the Fund’s exposure to CLOs modestly decreased over the period. |

| 1. | A unit that is equal to 1/100th of 1% or 0.01%. |

| 2. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month end performance. All returns 1-year or less are cumulative. |

| 6. | Benchmark: 3-Month USD LIBOR plus 500 bps. The 3-Month USD LIBOR (London Interbank Offered Rate) is an average interest rate, determined by the Intercontinental Exchange, that banks charge one another for the use of short-term money (three months) in England’s Euro dollar market. The return shown includes 3-Month USD LIBOR plus 500 bps, or 5% per annum. LIBOR is unmanaged. It is not possible to invest directly in LIBOR. No assurance can be given that the Fund’s performance will exceed that of LIBOR by any given increment, or at all. |

6

Barings Global Credit Income Opportunities Fund 2020 Annual Report

| | ∎ | | Given the recent market events (volatility and rating agency downgrades), changes in exposure by ratings category during the period were impacted by individual credit decisions and downgrades, rather than strategic portfolio shifts. |

| | ∎ | | From an industry sector perspective, during the period there were no material changes to the Fund’s top industry exposures. |

Describe portfolio positioning at period end.

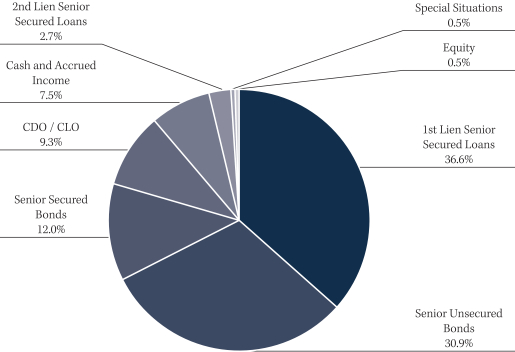

| | ∎ | | The Fund finished the annual reporting period, ended June 30, 2020, with an allocation of 42.9%, 39.3% and 9.3% to global high yield bonds, global senior secured loans and CLOs, respectively. The remainder of the portfolio was invested in equities at 0.5%, special situations at 0.5%, and cash/other at 7.5%. A significant portion of the portfolio (approximately 60.6%) was senior secured in nature (including CLOs backed by secured loans), which can potentially mitigate principal loss in default situations. |

| | ∎ | | From an industry perspective, the Fund was well diversified across a number of sectors, with concentrations in health care, education and childcare (9.0%), diversified/conglomerate services (6.7%), and broadcasting and entertainment (5.4%) as of June 30, 2020. |

| | ∎ | | As of June 30, 2020, the Fund had the following credit quality breakdown: 3.7% in BBB assets, 26.8% in BB assets, 42.1% in single-B assets, and 15.4% in CCC and below assets. Approximately 4.3% of the Fund’s assets are not publicly rated. Cash and accrued income accounted for the remaining 7.5% of the portfolio assets.3 |

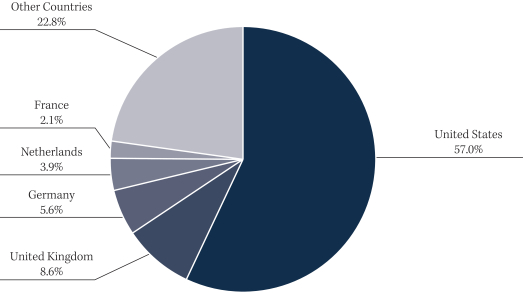

| | ∎ | | The top five countries in the portfolio at the end of the reporting period were the U.S. (57.0%), the U.K. (8.6%), Germany (5.6%), the Netherlands (3.9%) and France (2.1%). The Cayman Islands exposure related to the Fund’s CLO holdings was included in the U.S. Overall, the Fund had exposure to 29 different countries, and we continue to focus on building a well-diversified portfolio of global high yield securities. |

Describe market and portfolio outlook.

| | ∎ | | The global credit markets staged a strong rebound throughout the second quarter of 2020,bolstered by swift action by governments, central banks and private investors, to support global economies as the world comes to terms with life during a pandemic. While default activity has increased across below investment grade credit, in our view some of these elements have helped some companies navigate the current environment. |

| | ∎ | | Despite the recovery thus far, below investment grade credit markets have not yet fully recovered to pre-pandemic levels. Therefore, we continue to believe there are opportunities in below investment grade credit to be additive to total return performance as the recovery continues. |

| | ∎ | | However, until there is a clear path past the global pandemic, there will remain an element of uncertainty across credit markets. For this reason, we believe that prudent asset selection and actively managed portfolios are crucial for navigating the current environment. Also, while the pace of recovery may vary at times across geographies and markets, opportunities will emerge, and therefore we believe that taking a global, multi-credit approach to below investment grade credit provides the ability to capture additional relative value opportunities. |

| 3. | Ratings shown are the highest rating given by one of the following national rating agencies: S&P, Moody’s or Fitch. Additional information about ratings can be found, respectively, at www.standardandpoors.com, www.moodys.com and www.fitchratings.com. Credit ratings are subject to change. AAA, AA, single-A, and BBB are investment grade ratings categories used by S&P and Fitch; BB, single-B, CCC/CC/C and single-D are below investment grade ratings categories used by S&P and Fitch. Aaa, Aa, single-A and Baa are investment grade ratings categories used by Moody’s; Ba, single-B, Caa/Ca and single-C are below investment grade ratings categories used by Moody’s. Ratings categories may include gradations within each category. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated “Not Publicly Rated” are not rated by these national rating agencies. |

7

Barings Global Credit Income Opportunities Fund 2020 Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

COUNTRY COMPOSITION (% OF ASSETS**)

| **Percentage | of assets are expressed by market value excluding cash and accrued income, and may vary over time. As of June 30, 2020. |

8

Barings Global Credit Income Opportunities Fund 2020 Annual Report

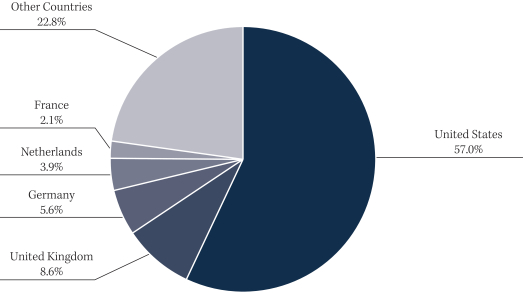

| | | | | | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 5,7,8 | | INCEPTION DATE | | | ONE YEAR | | | THREE YEARS | | | INCEPTION TO DATE | |

Class A With Load | | | 09/16/2013 | | | | -7.54 | % | | | -0.76 | % | | | 2.64 | % |

Class A No Load | | | 09/16/2013 | | | | -3.69 | % | | | 0.60 | % | | | 3.22 | % |

Class C With Load | | | 09/16/2013 | | | | -5.32 | % | | | -0.15 | % | | | 2.45 | % |

Class C No Load | | | 09/16/2013 | | | | -4.41 | % | | | -0.15 | % | | | 2.45 | % |

Class I With Load | | | 09/16/2013 | | | | -3.45 | % | | | 0.85 | % | | | 3.47 | % |

Class I No Load | | | 09/16/2013 | | | | -3.45 | % | | | 0.85 | % | | | 3.47 | % |

Class Y With Load | | | 09/16/2013 | | | | -3.44 | % | | | 0.85 | % | | | 3.47 | % |

Class Y No Load | | | 09/16/2013 | | | | -3.44 | % | | | 0.85 | % | | | 3.47 | % |

| 4. | Inception date: September 16, 2013. |

| 5. | Class A performance with the sales charges includes the maximum 3.00% sales charge. |

| 6. | Benchmark: 3-Month USD LIBOR plus 500 bps. The 3-Month USD LIBOR (London Interbank Offered Rate) is an average interest rate, determined by the Intercontinental Exchange, that banks charge one another for the use of short-term money (three months) in England’s Euro dollar market. The return shown includes 3-Month USD LIBOR plus 500 bps, or 5% per annum. LIBOR is unmanaged. It is not possible to invest directly in LIBOR. No assurance can be given that the Fund’s performance will exceed that of LIBOR by any given increment, or at all. |

| 7. | Line graph and table do not reflect the deduction of taxes that a shareholder would pay. |

| 8. | Class C performance with the sales charges includes the 1.00% contingent deferred sales charge (CDSC) for returns of one year or less. |

9

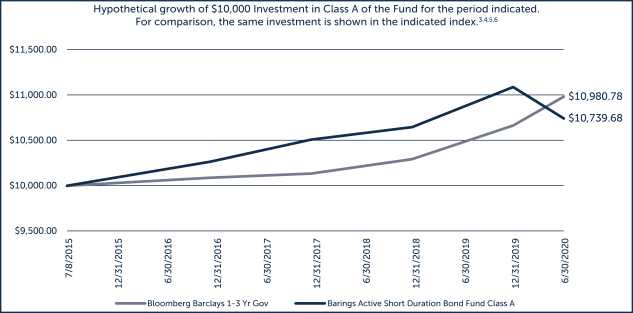

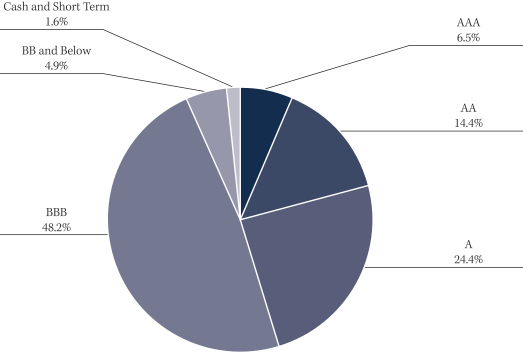

Barings Active Short Duration Bond Fund 2020 Annual Report

Investment Objective

Barings Active Short Duration Bond Fund (“Active Short Duration Bond Fund” or the “Fund”) seeks to achieve a high total rate of return, primarily from current income while minimizing fluctuations in capital values by investing primarily in a diversified portfolio of short-term investment grade fixed income securities.

Portfolio Management Commentary

How did the Fund perform?

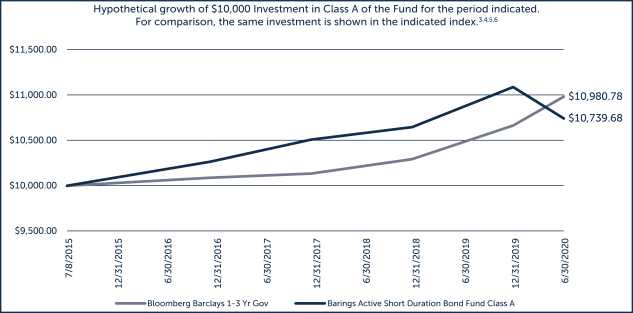

| | ∎ | | The Fund reported a net total rate of return for the period from July 1, 2019 through June 30, 2020 of -1.45%, underperforming the Bloomberg Barclays U.S. 1-3 Year Government Bond Index (the “Benchmark”), which returned 4.12%.1,5 |

What factors influenced performance of the Fund?

| | ∎ | | Financial markets were hit very hard in the first quarter of 2020 as a result of the COVID-19 pandemic, including even short maturity, high quality strategies. Given the market disruption, experienced, short U.S. Treasuries were among the highest performing sectors in the market for the period. Furthermore, an index such as the Benchmark did particularly well, as it has no credit exposure, being comprised primarily of Treasuries. |

| | ∎ | | A shorter-duration position contributed negatively to performance relative to the Benchmark as rates declined over the period. The Fund uses Treasury bonds and futures to help manage duration. The front end of the Treasury yield curve remains flat between three months and three years. The U.S. Federal Reserve (Fed) continued its accommodative monetary policy with rates held at a target of 0.00% to 0.25%. Markets are now anticipating that the next rate move will not occur before 2021. The Fund ended the period with a 0.27 year duration in accordance with our rules-based duration management process. |

| | ∎ | | We continue to favor securitized credit over corporate credit, emphasizing structure over unsecured positions. The Fund’s allocation to consumer asset-backed securities (ABS) was a negative contributor to performance. Student loans, aviation, and consumer loan collateral were among the top detractors within the ABS sector. At the onset of the crisis, the market observed prices across securitized asset classes detach from underlying fundaments, causing mark-to-market volatility that brought asset prices lower. Market concern over consumer demand impact amid the once developing COVID-19 crisis had higher beta consumer sectors – such as auto rental, timeshare and aviation – at very illiquid and wide spread levels. By the end of the reporting period, securitized risk assets had rebounded on the heels of positive technicals that allowed spreads to compress tighter and reprice collateral higher. |

| | ∎ | | The Fund’s allocation to commercial mortgage-backed securities (CMBS) and residential mortgage-backed securities (RMBS) also detracted from performance over the period. Many investors sold these securities to source liquidity with very few market participants willing to purchase them at the onset of the crisis. Prices across both CMBS and RMBS securities were negatively affected by this technical. |

| | ∎ | | The 35% allocation to investment grade corporate credit detracted from performance, but recovered much quicker than the Fund’s securitized allocations. The outbreak of the COVID-19 global pandemic resulted in a rapid repricing of corporate risk assets in the first quarter. Market spreads widened to 373 basis points (bps) on March 23, with the pace of widening much greater than the 2008-09 crisis period. Corporate spreads have recovered 223 bps since then, as a result monetary intervention and improved investor sentiment. |

| 1. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results, and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month-end performance. All returns one-year or less are cumulative. |

| 5. | Benchmark: The Bloomberg Barclays U.S. 1-3 Year Government Bond Index is comprised of the U.S. Treasury Index and U.S. Agency Index. The U.S. Government Index includes Treasuries (public obligations of the U.S. Treasury) and U.S. agency debentures (publicly issued debt of U.S. government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the U.S. government) that have remaining maturities of more than one year, and up to but not including three years. Indexes are unmanaged. It is not possible to invest directly in an index. |

10

Barings Active Short Duration Bond Fund 2020 Annual Report

| | ∎ | | The Fund’s small position in high-quality collateralized loan obligation (CLO) tranches was also a negative contributor. Spreads widened, negatively impacting security prices as a result of volatility seen in the first quarter of 2020. The Fund is invested in AAA-rated and select AA-rated tranches. We continue to like the structural subordination offered by CLOs, and favor high quality managers. |

| | ∎ | | The allocation to BB-rated high yield corporate bonds was a neutral contributor to performance. |

Describe recent portfolio activity.

| | ∎ | | The Fund ended the period with a duration positioning of 0.27 years, as the front end of the U.S. Treasury curve remained flat. |

| | ∎ | | The Fund reduced positioning in ABS and Treasuries, while increasing allocations to investment grade corporates, high yield corporates, RMBS and CMBS over the period. The Fund’s high quality CLO weight remained unchanged. |

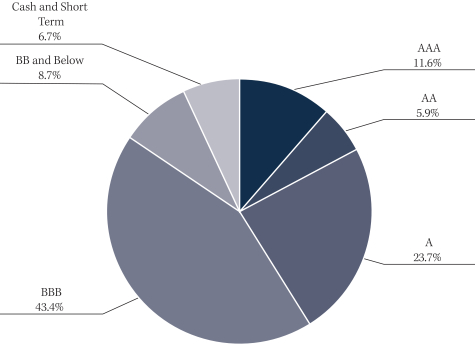

| | ∎ | | The Funds allocation to AAA-rated positions decreased, while BBB quality increased over the reporting period. |

Describe portfolio positioning at period end.

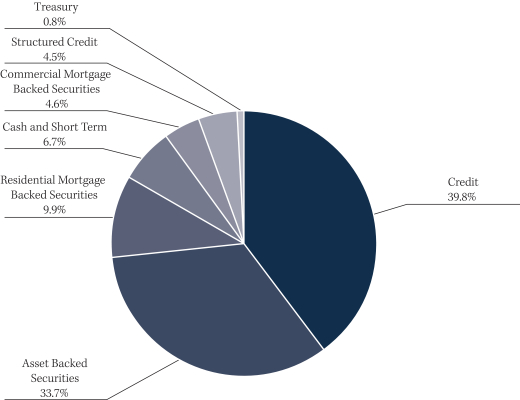

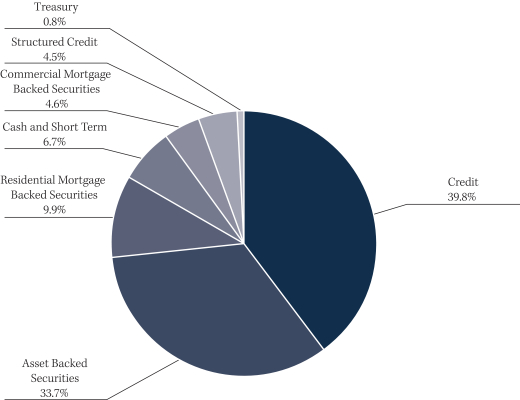

| | ∎ | | The Fund continued to be well diversified across corporate and securitized sectors. The securitized ABS allocation was 33.7% at the end of the period. Automotive loan collateral represented the largest allocation, followed by student loan collateral. Further, commercial ABS sub-sectors include timeshare, personal consumer loan, aircraft leasing and franchise receivables deals. The Fund maintained an active position in RMBS and CMBS securities, ending the period at 9.9% and 4.4%, respectively. |

| | ∎ | | At the end of the period, the Fund’s credit allocation was 39.7%. This allocation was comprised of 32.9% in investment grade corporates, 4.2% in BB-rated high yield corporates, and 0.8% in U.S. dollar-denominated emerging markets debt (EMD). Banks/brokers and independent finance represent the Fund’s largest corporate sector allocations, followed by midstream pipes and chemicals. |

| | ∎ | | High-quality AAA and AA CLO tranches represented a combined 4.5% allocation for the Fund. |

Describe market and portfolio outlook.

| | ∎ | | The market saw unprecedented events unfold over the past six months. Starting in the first quarter, financial markets were hit very hard, including even short maturity, high quality strategies. |

| | ∎ | | Starting in late April, investors experienced a case of whiplash as markets turned positive on the sentiment that the worst of the pandemic may be behind us. |

| | ∎ | | The Fed took an expedited course to stem volatility by implementing an alphabet soup of programs meant to get the market back on course, and it has largely been successful to date. Targeting the corporate credit market, it established the PMCCF and SMCCF to support credit to employers by providing liquidity to the market for outstanding corporate bonds. Targeting the securitized market, it established the TALF program to support the flow of credit to consumers and businesses. |

| | ∎ | | To date, these programs have largely accomplished their goals, as market liquidity, investor sentiment, and security prices regained much of the ground lost at the start of the crisis. |

| | ∎ | | Market trends continued to show modest signs of improvement by the end of the second quarter; however, there are still many longer-term unknowns facing investors. In our view, economic data released continues to be better than once feared at the onset of the pandemic; however, the U.S. faces a second wave of the virus as multiple states have started to relax stay-at-home orders. |

| | ∎ | | A spike in cases could open the possibility of continued consumer restrictions that run the risk of producing a second leg down for markets. While many investors are enjoying the sugar high by trading on technicals created by monetary and fiscal stimulus, we remain committed to our fundamental bottom-up process of capital preservation. |

11

Barings Active Short Duration Bond Fund 2020 Annual Report

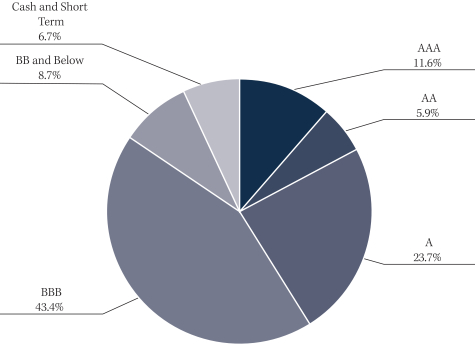

CREDIT QUALITY BREAKDOWN (% OF ASSETS*)

PORTFOLIO COMPOSITION (% OF ASSETS*)

12

Barings Active Short Duration Bond Fund 2020 Annual Report

| | | | | | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 3,4,6,7,8 | | INCEPTION DATE | | | ONE YEAR | | | THREE YEARS | | | INCEPTION TO DATE | |

Class A With Load | | | 07/08/2015 | | | | -1.68 | % | | | 0.96 | % | | | 1.24 | % |

Class A No Load | | | 07/08/2015 | | | | -1.68 | % | | | 0.96 | % | | | 1.24 | % |

Class C With Load | | | 07/08/2015 | | | | -2.44 | % | | | 0.68 | % | | | 0.97 | % |

Class C No Load | | | 07/08/2015 | | | | -1.96 | % | | | 0.68 | % | | | 0.97 | % |

Class L With Load | | | 05/01/2020 | | | | N/A | | | | N/A | | | | 3.52 | % |

Class L No Load | | | 05/01/2020 | | | | N/A | | | | N/A | | | | 3.52 | % |

Class I With Load | | | 07/08/2015 | | | | -1.45 | % | | | 1.22 | % | | | 1.49 | % |

Class I No Load | | | 07/08/2015 | | | | -1.45 | % | | | 1.22 | % | | | 1.49 | % |

Class Y With Load | | | 07/08/2015 | | | | -1.45 | % | | | 1.21 | % | | | 1.48 | % |

Class Y No Load | | | 07/08/2015 | | | | -1.45 | % | | | 1.21 | % | | | 1.48 | % |

| 2. | Ratings shown are the highest ratings given by one of the following national rating agencies: S&P, Moody’s or Fitch. Additional information about ratings can be found, respectively, at www.standardandpoors.com, www.moodys.com and www.fitchratings.com. Credit ratings are subject to change. AAA, AA, single-A and BBB are investment grade ratings categories used by S&P and Fitch. BB, single-B, CCC/CC/C and single-D are below investment grade ratings categories used by S&P and Fitch. Aaa, Aa, single-A and Baa are investment grade ratings categories used by Moody’s. Ba, single-B, Caa/Ca and single-C are below investment grade ratings categories used by Moody’s. Ratings categories may include gradations within each category. Bonds backed by U.S. government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

| 3. | Inception date: July 8, 2015. |

| 4. | Class A performance with the sales charges includes the maximum 3.00% sales charge. |

| 5. | Benchmark: The Bloomberg Barclays U.S. 1-3 Year Government Bond Index is comprised of the U.S. Treasury Index and U.S. Agency Index. The U.S. Government Index includes Treasuries (public obligations of the U.S. Treasury) and U.S. agency debentures (publicly issued debt of U.S. government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the U.S. government) that have remaining maturities of more than one year, and up to but not including three years. Indexes are unmanaged. It is not possible to invest directly in an index. |

| 6. | Line graph and table do not reflect the deduction of taxes that a shareholder would pay. |

| 7. | Class C performance with the sales charges includes the 1.00% contingent deferred sales charge (CDSC) for returns of one year or less. |

| 8. | Class L share class launched effective 05/01/2020. |

13

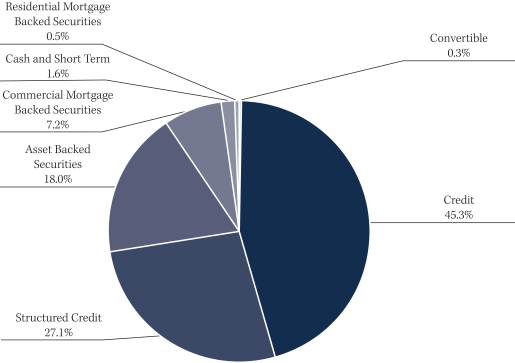

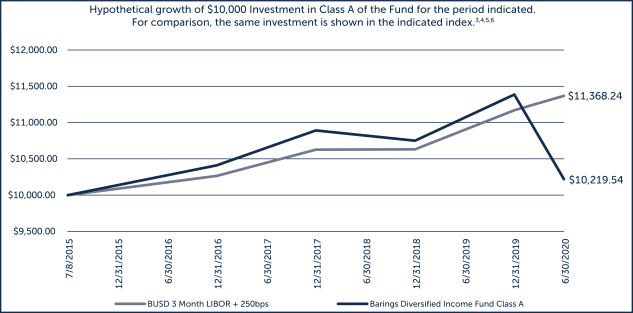

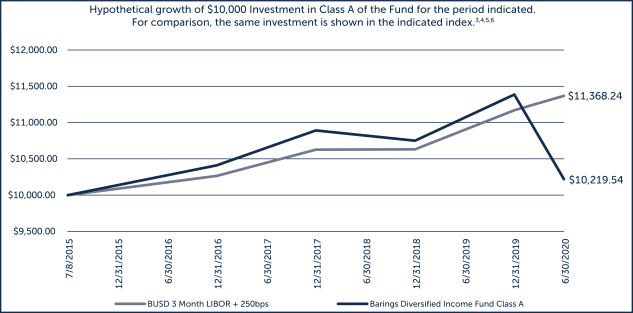

Barings Diversified Income Fund 2020 Annual Report

Investment Objective

The Barings Diversified Income Fund (“Diversified Income Fund” or the “Fund”) seeks to provide a total return comprised of current income and capital appreciation by investing primarily in an actively managed diversified portfolio of global investment grade rated fixed and floating rate instruments.

Portfolio Management Commentary

How did the Fund perform?

| | ∎ | | The Fund reported a total net rate of return for the period from July 1, 2019 through June 30, 2020 of -7.88%, underperforming the 3 Month LIBOR +250 basis points (bps) benchmark, which returned 4.16%.1,5 |

What factors influenced performance of the Fund?

| | ∎ | | High-quality collateralized loan obligation (CLO) positioning in AA to BBB-rated tranches detracted from performance over the period. The allocation has a high average of single-A quality. High quality CLO tranches were priced lower over the period, resulting in a mark-to-market performance impact, and speculation of the performance of underlying collateral during the COVID-19 pandemic. CLO prices saw a modest recovery starting in the second quarter; however, spreads remain at wide levels. |

| | ∎ | | The Fund’s allocations to securitized credit and consumer asset-backed securities (ABS) were both detractors from performance. Within the ABS sector, aviation, student loan, and franchise receivable collateral were among the top detractors. At the onset of the crisis, the market observed prices across securitized asset classes detach from underlying fundaments, causing mark-to-market volatility that brought asset prices lower. Market concern over consumer demand impact amid the once developing COVID-19 crisis had higher beta consumer sectors at very illiquid and wide levels. By the end of the reporting period, securitized risk assets had rebounded on the heels of positive technicals that allowed spreads to compress tighter and reprice collateral higher. |

| | ∎ | | The Fund’s allocation to commercial mortgage backed securities (CMBS) and residential mortgage backed securities (RMBS) also detracted from performance over the period. Many investors sold these securities to source liquidity with very few market participants willing to purchase them. Prices across both CMBS and RMBS were negatively affected by this technical. |

| | ∎ | | Investment grade corporate credit across both developed and emerging market geographies detracted from performance, but has recovered quicker than the Fund’s securitized allocation. The outbreak of the COVID-19 global pandemic resulted in a rapid repricing of U.S. corporate risk assets in the first quarter. U.S. corporate spreads widened to 373 bps on March 23, with the pace of widening much greater than the 2008-09 crisis period. Corporate spreads have recovered 223 bps since then, largely due to monetary intervention and improved investor sentiment. Both emerging and developed corporate markets continued to tighten leading up to the end of the reporting period; however, emerging markets debt (EMD) has largely lagged the recovery seen in the U.S. as a result of the lack of a centralized monetary authority guiding a cohesive market intervention. |

| | ∎ | | The Fund began to allocate to BB-rated high yield corporates over the period. This allocation was a neutral contributor to performance. |

| 1. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results, and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month-end performance. All returns one-year or less are cumulative. |

| 5. | Benchmark: 3-Month USD LIBOR plus 250 bps. The 3-Month USD LIBOR (London Interbank Offered Rate) is an average interest rate, determined by the Intercontinental Exchange, that banks charge one another for the use of short-term money (three months) in England’s Euro dollar market. The return shown includes 3-Month USD LIBOR plus 250 bps, or 2.5% per annum. LIBOR is unmanaged. It is not possible to invest directly in LIBOR. No assurance can be given that the Fund’s performance will exceed that of LIBOR by any given increment, or at all. |

14

Barings Diversified Income Fund 2020 Annual Report

| | ∎ | | Duration positioning was a positive contributor to performance, as rates declined over the period. The Fund uses futures to help manage duration. The front end of the Treasury yield curve remains flat between three months and three years. The U.S. Federal Reserve (Fed) continued its accommodative monetary policy with rates held at a target 0.00% to 0.25%. Markets are now anticipating that the next rate move will not occur before the end of 2020. |

Describe recent portfolio activity.

| | ∎ | | The Fund ended the period with a duration positioning of 0.53 years, as the front end of the U.S. Treasury curve remains flat. |

| | ∎ | | The Fund reduced positioning in ABS and CLO allocations, while increasing allocations to investment grade corporates, high yield corporates, RMBS, and CMBS over the period. The Fund’s hard currency EMD weight remained unchanged. |

| | ∎ | | The Funds allocation to AAA, BBB and BB-rated positions increased, while single-A and AA quality decreased over the reporting period. |

Describe portfolio positioning at period end.

| | ∎ | | High quality CLO tranches represented the Fund’s largest allocation, at 27.9%. We continued to favor the total return potential and structural subordination of CLOs, and favor AA to BBB quality tranches. |

| | ∎ | | The securitized ABS allocation was 25.3% at the end of the period. Student loan and aviation collateral were the highest sector allocations, followed by medical and property assessed clean energy (PACE) collateral. The Fund maintained an active position in CMBS and RMBS securities, ending the period at 6.8% and 2.1%, respectively. |

| | ∎ | | Investment grade corporates represent a 20.0% allocation. The Fund has favored BBB-rated positions in less cyclical industries such as banking, diversified industrials and insurance. |

| | ∎ | | EMD hard currency positioning was 18.1% at the end of the period. The hard currency EMD allocation in the Fund remained well-diversified across sectors and regions. At the end of the period, the largest sector within the EM sleeve was the financials sector, and the largest region represented in the portfolio was Latin America. |

Describe market and portfolio outlook.

| | ∎ | | The market saw unprecedented events unfold over the past six months. Starting in the first quarter, financial markets were hit very hard, including even short maturity, high quality strategies. |

| | ∎ | | Starting in late April, investors experienced a case of whiplash as markets turned positive on the sentiment that the worst of the pandemic may be behind us. |

| | ∎ | | The Fed took an expedited course to stem volatility by implementing an alphabet soup of programs meant to get the market back on course, and up to this point, it has largely been successful. Targeting the corporate credit market, it established PMCCF and SMCCF to support credit to employers by providing liquidity to the market for outstanding corporate bonds. Targeting the securitized market, it established the TALF program to support the flow of credit to consumers and businesses. |

| | ∎ | | To date, these programs have largely accomplished their goals, as market liquidity, investor sentiment, and security prices regained much of the ground lost at the start of the crisis. |

| | ∎ | | Market trends continued to show modest signs of improvement by the end of the second quarter; however, there are still many longer-term unknowns facing investors. Economic data released continues to be better than once feared at the onset of the pandemic; however, the U.S. faces a second wave of the virus as multiple states have started to relax stay-at-home orders. |

| | ∎ | | A spike in cases could open the possibility of continued consumer restrictions that run the risk of producing a significant dislocation for markets. While many investors have enjoyed the sugar high by trading on technicals created by monetary and fiscal stimulus, we remain diligent to our fundamental bottom-up process of capital preservation. |

15

Barings Diversified Income Fund 2020 Annual Report

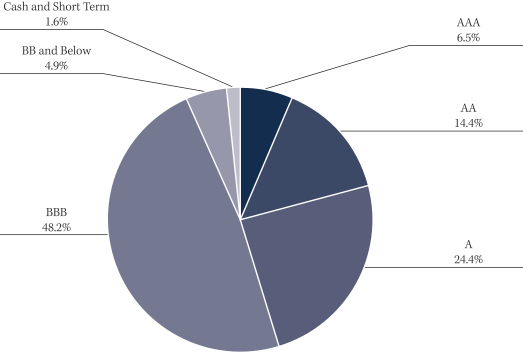

CREDIT QUALITY BREAKDOWN (% OF ASSETS*)

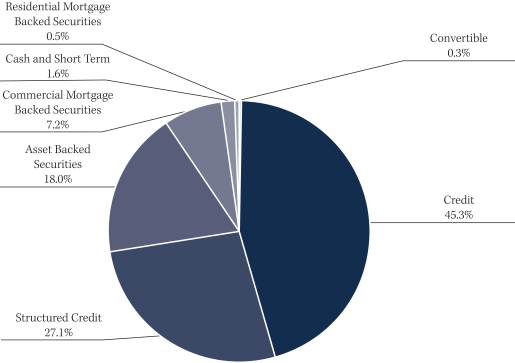

PORTFOLIO COMPOSITION (% OF ASSETS*)

16

Barings Diversified Income Fund 2020 Annual Report

| | | | | | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 3,4,6,7 | | INCEPTION DATE | | | ONE YEAR | | | THREE YEARS | | | INCEPTION TO DATE | |

Class A With Load | | | 07/08/2015 | | | | -11.79 | % | | | -2.95 | % | | | -0.56 | % |

Class A No Load | | | 07/08/2015 | | | | -8.11 | % | | | -1.62 | % | | | 0.26 | % |

Class C With Load | | | 07/08/2015 | | | | -9.69 | % | | | -2.35 | % | | | -0.49 | % |

Class C No Load | | | 07/08/2015 | | | | -8.80 | % | | | -2.35 | % | | | -0.49 | % |

Class I With Load | | | 07/08/2015 | | | | -7.88 | % | | | -1.37 | % | | | 0.50 | % |

Class I No Load | | | 07/08/2015 | | | | -7.88 | % | | | -1.37 | % | | | 0.50 | % |

Class Y With Load | | | 07/08/2015 | | | | -7.88 | % | | | -1.37 | % | | | 0.50 | % |

Class Y No Load | | | 07/08/2015 | | | | -7.88 | % | | | -1.37 | % | | | 0.50 | % |

| 2. | Ratings shown are the highest ratings given by one of the following national rating agencies: S&P, Moody’s or Fitch. Additional information about ratings can be found, respectively, at www.standardandpoors.com, www.moodys.com and www.fitchratings.com. Credit ratings are subject to change. AAA, AA, single-A and BBB are investment grade ratings categories used by S&P and Fitch. BB, single-B, CCC/CC/C and single-D are below investment grade ratings categories used by S&P and Fitch. Aaa, Aa, single-A and Baa are investment grade ratings categories used by Moody’s. Ba, single-B, Caa/Ca and single-C are below investment grade ratings categories used by Moody’s. Ratings categories may include gradations within each category. Bonds backed by U.S. government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

| 3. | Inception date: July 8, 2015. Diversified Income strategy change effective March 1, 2019. |

| 4. | Class A performance with the sales charges includes the maximum 4.00% sales charge. |

| 5. | Benchmark: 3-Month USD LIBOR plus 250 bps. The 3-Month USD LIBOR (London Interbank Offered Rate) is an average interest rate, determined by the Intercontinental Exchange, that banks charge one another for the use of short-term money (three months) in England’s Euro dollar market. The return shown includes 3-Month USD LIBOR plus 250 bps, or 2.5% per annum. LIBOR is unmanaged. It is not possible to invest directly in LIBOR. No assurance can be given that the Fund’s performance will exceed that of LIBOR by any given increment, or at all. |

| 6. | Line graph and table do not reflect the deduction of taxes that a shareholder would pay. |

| 7. | Class C performance with the sales charges includes the 1.00% contingent deferred sales charge (CDSC) for returns of one year or less. |

17

Barings Emerging Markets Debt Blended Total Return Fund 2020 Annual Report

Investment Objective

Barings Emerging Markets Debt Blended Total Return Fund (“EMD Blended Total Return Fund” or the “Fund”) seeks to achieve maximum total return, consistent with preservation of capital and prudent investment management, through high current income generation and, where appropriate, capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

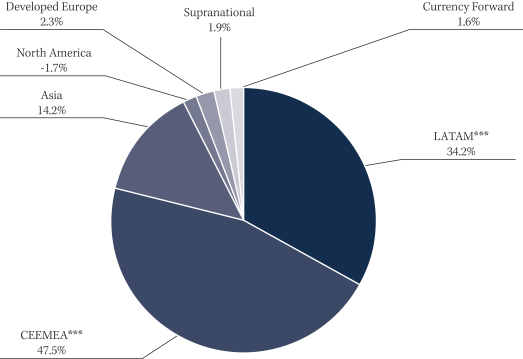

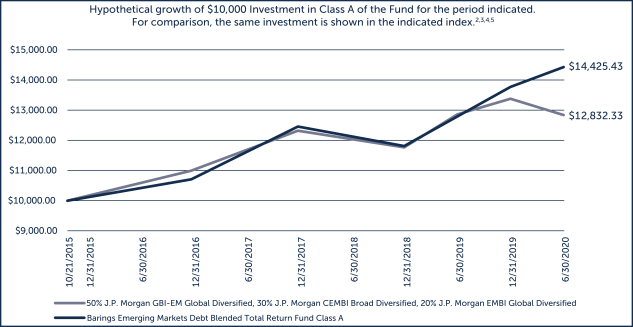

| | ∎ | | The Fund reported a net total rate of return for the period from July 1, 2019 through June 30, 2020 of 10.33%.1 The net total rate of return for the Fund’s performance benchmark – a blend of 50% JPMorgan Government Bond Index – Emerging Markets Global Diversified (GBI-EMGD), 30% JPMorgan EMBI Global Diversified and 20% JPMorgan CEMBI Broad Diversified – was -0.17%. The Fund is not managed relative to the benchmark; however, the comparison is provided to show how the Fund’s returns compare with those of a broad measure of market performance. |

| | ∎ | | All three of the Fund’s sub-strategies – emerging market (EM) corporates, EM sovereign and EM local – generated positive performance over the period. This occurred as U.S. Treasury rates rallied 136 basis points (bps) over the past 12 months, alongside a dovish U.S. Federal Reserve (Fed) and European Central Bank (ECB). Local rates in EM countries fell, while EM currencies depreciated over the period. |

What factors influenced performance of the Fund?

| | ∎ | | The Fund’s positioning, and active allocations across countries and credits, were additive to performance. EM local rallied, as we saw monetary stimulus and rate cuts across EM countries in reaction to COVID-19’s economic toll. EM debt flows were strong in the second half of 2019, with $22 billion of positive flows mostly from hard currency, which was followed by six months accounting for -$25.1 billion in net outflows for the first half of 2020. |

| | ∎ | | For the 12-month reporting period ending June 30, 2020, the Fund’s positioning in Russia, Brazil, Mexico, Hungary and South Africa contributed positively to Fund performance. However, the Fund’s positions in Argentina, India, El Salvador, Angola and Ghana detracted from performance. |

Describe recent portfolio activity.

| | ∎ | | Following the sharp sell-off experienced in March 2020, the Fund increased its exposure to EM currencies, to capture potential currency appreciation as a result of stronger balance-of-payments outlook, along with higher commodity prices. The Fund also increased exposure to EM sovereign hard currency assets, as spreads were overcompensating for defaults, and opportunities have become available following the sharp sell-off in the first half of the year. The Fund has maintained most positions, as we believe fiscal stimuli will allow for moderate growth, low inflation and lower rates in select EM local markets. Positioning in select corporate names remains similar to earlier in 2020, backed by healthy balance sheets and bonds, offering strong yields compared to some sovereign credits. |

Describe portfolio positioning at period end.

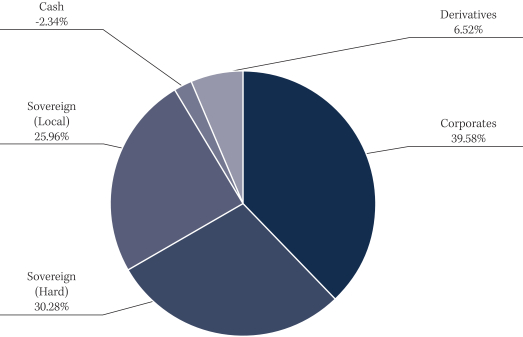

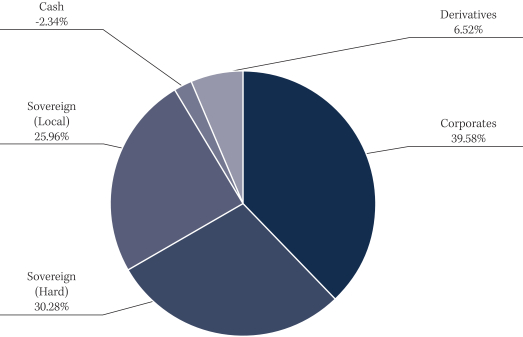

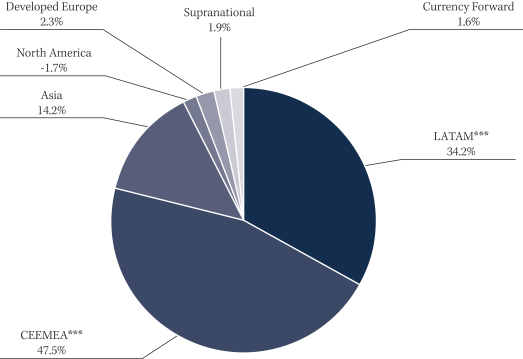

| | ∎ | | The Fund finished the reporting period, ending June 30, 2020, with a 49% exposure to sovereign hard currencies (inclusive of credit default swaps), 41% to corporate debt, 31% to sovereign local currencies, and a 0.5% settled cash position. |

| | ∎ | | The top five countries in the portfolio at the end of the reporting period were Mexico (14.8%), Brazil (14.4%), Ukraine (8.7%), Indonesia (7.2%) and South Africa (5.8%). The top five corporate issuers were Tullow Oil (2.5%), Petrobras (2.3%), PEMEX (1.9%), National Bank of Greece (1.7%) and Sovcom Bank (1.7%). Overall, the Fund had exposure to 42 countries, 36 corporates and 21 different currencies. |

| 1. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results, and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month-end performance. All returns one-year or less are cumulative. |

18

Barings Emerging Markets Debt Blended Total Return Fund 2020 Annual Report

Describe market and portfolio outlook.

| | ∎ | | We believe that the asset class is likely to benefit from continued monetary stimulus and the potential for a sharp economic rebound in the second half of the year. We expect that countries will continue down the recent path of becoming increasingly insular and relying more on domestic production of goods and services, a trend that COVID-19 is accelerating, and that may prove to be a long-term structural headwind for EMs. Technicals continue to drive the market, as the ample liquidity pumped into the system by governments and central banks continues to support asset prices. It’s difficult to say if, or when, this will take a turn in the near term. We’ve seen recent signs that fear may be creeping back into the market, as negative headlines on COVID-19 in the U.S., Brazil and other hotspots are digested. There remain risks to both the upside and downside cases for global recovery. But on balance, we think the continued monetary stimulus, along with the potential for a sharper economic bounce-back in the second half of the year, could provide a tailwind to many EMs. |

19

Barings Emerging Markets Debt Blended Total Return Fund 2020 Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

REGIONAL COMPOSITION (% OF ASSETS**)

| ** | The percentages shown above are expressed by market value, excluding cash and accrued income, and may vary over time. As of June 30, 2020. |

| *** | CEEMEA: Central Europe, Eastern Europe, Middle East and Africa. |

| | LATAM: Latin America (includes countries in Central and South America). |

20

Barings Emerging Markets Debt Blended Total Return Fund 2020 Annual Report

| | | | | | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 2,3,5,6 | | INCEPTION DATE | | | ONE YEAR | | | THREE YEARS | | | INCEPTION TO DATE | |

Class A With Load | | | 10/21/2015 | | | | 5.71 | % | | | 5.19 | % | | | 6.38 | % |

Class A No Load | | | 10/21/2015 | | | | 10.11 | % | | | 6.63 | % | | | 7.31 | % |

Class C With Load | | | 10/21/2015 | | | | 8.28 | % | | | 5.85 | % | | | 6.53 | % |

Class C No Load | | | 10/21/2015 | | | | 9.28 | % | | | 5.85 | % | | | 6.53 | % |

Class I With Load | | | 10/21/2015 | | | | 10.39 | % | | | 6.90 | % | | | 7.58 | % |

Class I No Load | | | 10/21/2015 | | | | 10.39 | % | | | 6.90 | % | | | 7.58 | % |

Class Y With Load | | | 10/21/2015 | | | | 10.33 | % | | | 6.88 | % | | | 7.57 | % |

Class Y No Load | | | 10/21/2015 | | | | 10.33 | % | | | 6.88 | % | | | 7.57 | % |

| 2. | Inception date: October 21, 2015. |

| 3. | Class A performance with the sales charges includes the maximum 4.00% sales charge. |

| 4. | Benchmark is a blend of 50% JPMorgan Government Bond Index – Emerging Markets Global Diversified (GBI-EMGD), 30% JPMorgan EMBI Global Diversified and 20% JPMorgan CEMBI Broad Diversified. |

| 5. | Line graph and table do not reflect the deduction of taxes that a shareholder would pay. |

| 6. | Class C performance with the sales charges includes the 1.00% contingent deferred sales charge (CDSC) for returns of one year or less. |

21

Barings Global Emerging Markets Equity Fund 2020 Annual Report

Investment Objective

The Barings Global Emerging Markets Equity Fund (the “Fund”) seeks to achieve long-term capital growth.

Portfolio Management Commentary

How did the Fund perform?

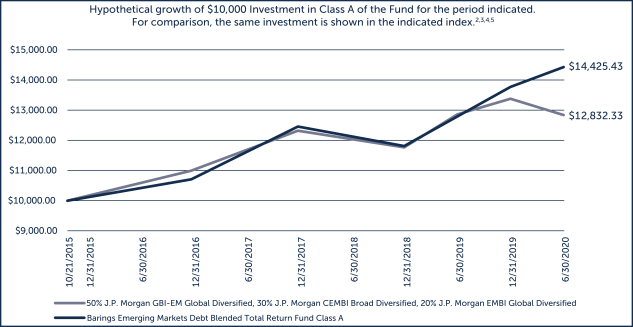

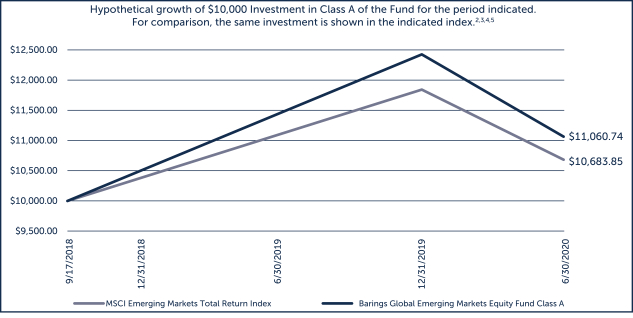

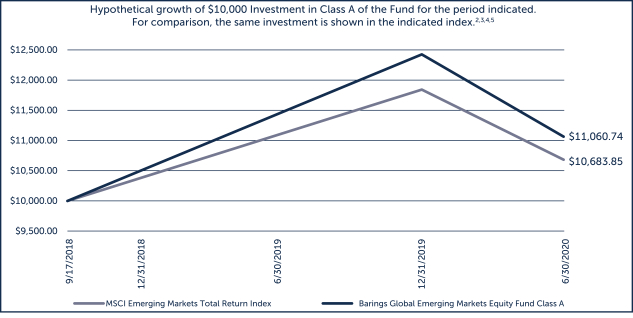

| | ∎ | | The Fund reported a net rate of return for the period from July 1, 2019, through June 30, 2020 of -3.78%, underperforming the MSCI Emerging Markets Index (the “Benchmark”), which returned -3.39%.1 |

What factors influenced performance of the Fund?

| | ∎ | | Contributors to relative Fund performance included the following: |

| | ∎ | | Tencent Holdings, a Chinese Technology group, ended the period as the Fund’s top contributor to relative returns, driven by an acceleration in online advertising revenue and a strong gaming release pipeline. |

| | ∎ | | Taiwan Semiconductor Manufacturing Co., was a strong contributor to relative returns, benefitting from earnings which beat expectations and increased optimism regarding future 5G demand. |

| | ∎ | | Reliance Industries, a large Indian conglomerate, reported strong earnings driven by capacity growth and margin expansion within its petrochemicals business, and strong subscriber acquisition within its telecommunications division. |

| | ∎ | | Detractors to relative Fund performance included the following: |

| | ∎ | | HDFC Bank, detracted on concerns that weaker economic activity in India would lead to a deterioration in asset quality. Despite this short-term weakness, the company’s most recent earnings were strong, beating expectations on growth as well as asset quality. |

| | ∎ | | PT Bank Negara Indonesia, an Indonesian bank, underperformed caused in part by a deteriorating macroeconomic environment. |

| | ∎ | | China State Construction International, detracted on lingering macroeconomic concerns, though improving orders and infrastructure investment points to a stronger profit outlook. |

Describe recent portfolio activity.

| | ∎ | | Q3 2019: Over the period, the Fund exited its position in cement manufacturer Cemex, in favor of better opportunities elsewhere. |

| | ∎ | | Q4 2019: Over the period, the Fund adjusted its exposure to the Russian energy sector, selling out of its holding in Novatek. We also initiated a position in Topsports, as we believe the company is well positioned to capitalize on the structural growth of the sportswear market in China. |

| | ∎ | | YTD 2020: While portfolio activity remained relatively low, the recent market backdrop provided a number of opportunities to start building exposure in companies with sustainable business franchises, and strong balance sheets at more attractive valuation entry points. Over the period we sold our holdings in Russian natural gas producer Gazprom, and used the proceeds to add to our position in its competitor Lukoil. Elsewhere, we exited from steel company Angang Steel, diamond producer Alrosa, and financial services group Bancolombia, and started new positions in China Resources Cement, ENN Energy, Mediatek and Powertech. |

| | ∎ | | As medium- to long-term investors, we expect the average annual turnover rate of the strategy to be 20-40%. The turnover for the Fund for the period from July 1, 2019, through June 30, 2020 was 18.8%. |

| 1. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results, and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month-end performance. All returns one-year or less are cumulative. The performance comparator is MSCI Emerging Markets Total Return Index with net dividends. |

22

Barings Global Emerging Markets Equity Fund 2020 Annual Report

Describe portfolio positioning at period end.

| | ∎ | | The Fund’s positioning at the end of the period reflects our bottom-up investment process, where we aim to identify companies with sustainable business franchises, and with future growth potential that is not fully reflected in the current share price. As a result, our active country and sector positioning relative to the Benchmark is not driven by a deliberate top-down strategy, but is a by-product of our bottom-up stock selection process. |

| | ∎ | | Relative to the Benchmark, the largest active country position was in India, and the largest active sector exposure was to financials, where in each case we continue to identify many companies that we believe have strong medium-term growth prospects and are attractively valued. |

| | ∎ | | Despite the large active position in both cases, we believe that the performance of these companies will be predominantly influenced by company-specific factors (i.e. that these companies will be largely in control of their own destiny), rather than by their respective country or sector. As bottom-up investors, we always seek these types of companies. |

| | ∎ | | As of the end of the reporting period, the top five country weightings in the Fund, on an absolute basis, were China and Hong Kong (43.4%), Taiwan (12.6%), India (11.1%), Korea (10.6%) and Russia (4.5%). |

| | ∎ | | In line with our investment process, we continue to seek out bottom-up investment opportunities where we believe the future earnings potential is not fully reflected in the current share price. |

Describe market and portfolio outlook.

| | ∎ | | In the near term, we believe that global markets are likely to remain volatile, as investors stay vigilant for any signs of an uptick in new infections which might signal a second wave. |

| | ∎ | | Clearly economic activity and corporate earnings have been, and will continue to be, significantly impacted in the short term, but we hope to begin to see some improving economic and earnings momentum from the second half of this year, as mobility restrictions are eased on a measured basis and normal consumption patterns slowly resume. |

| | ∎ | | In addition, we expect the large-scale monetary and fiscal stimulus announced globally will also help support and spur economic activity. In our view, a combination of slowly improving data, receding risk and attractive valuations should create a more positive backdrop for equity markets, as we move into the second half of this year and beyond. |

| | ∎ | | We will continue our process of building new (or adding to existing) positions in companies with strong and sustainable business franchises, where our proprietary bottom-up research has identified a significant degree of undervaluation relative to future growth potential. |

23

Barings Global Emerging Markets Equity Fund 2020 Annual Report

| | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 2,3,5,6 | | INCEPTION DATE | | | ONE YEAR | | | INCEPTION TO DATE | |

Class A With Load | | | 9/17/2018 | | | | -4.02 | % | | | 3.63 | % |

Class A No Load | | | 9/17/2018 | | | | -4.02 | % | | | 3.63 | % |

Class C With Load | | | 9/17/2018 | | | | -4.74 | % | | | 2.86 | % |

Class C No Load | | | 9/17/2018 | | | | -4.74 | % | | | 2.86 | % |

Class I With Load | | | 9/17/2018 | | | | -3.78 | % | | | 3.89 | % |

Class I No Load | | | 9/17/2018 | | | | -3.78 | % | | | 3.89 | % |

Class Y With Load | | | 9/17/2018 | | | | -3.78 | % | | | 3.89 | % |

Class Y No Load | | | 9/17/2018 | | | | -3.78 | % | | | 3.89 | % |

| 2. | Inception date: September 17, 2018. A fund’s performance for very short time periods may not be indicative of future performance |

| 3. | Class A performance with the sales charges includes the maximum 4.00% sales charge. |

| 4. | Benchmark: MSCI Emerging Markets Total Return Index with net dividends designed to measure the equity market performance of the emerging markets. Indices are unmanaged. It is not possible to invest directly in an index. |

| 5. | Line graph and table do not reflect the deduction of taxes that a shareholder would pay. |

| 6. | Class C performance with the sales charges includes the 1.00% contingent deferred sales charge (CDSC) for returns of one year or less. |

24

Barings U.S. High Yield Fund 2020 Annual Report

Investment Objective

Barings U.S. High Yield Fund (“U.S. High Yield Fund” or the “Fund”) seeks to achieve a high level of total return, with an emphasis on current income, by investing primarily in high yield debt and related securities.

Portfolio Management Commentary

How did the Fund perform?

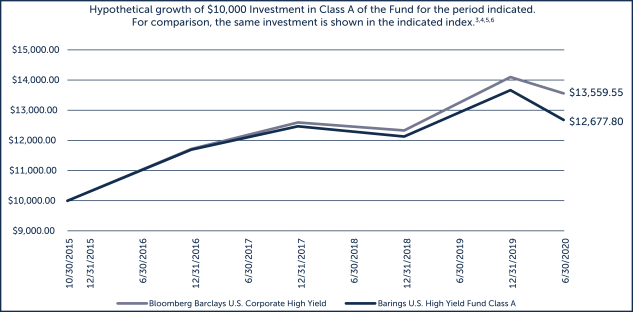

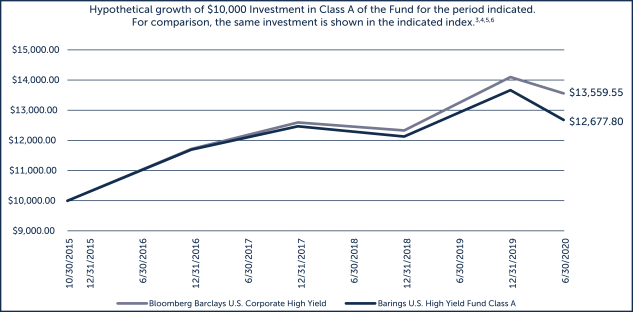

| | ∎ | | The Fund reported a net total rate of return for the reporting period from July 1, 2019 through June 30, 2020 of -3.43%, underperforming the Bloomberg Barclays U.S. Corporate High Yield Index (the “Benchmark”), which returned 0.03%.1, 5 |

What factors influenced performance of the Fund?

| | ∎ | | For much of the one-year period, the U.S. high yield bond market saw modest positive returns, driven by a stable economic outlook, accommodative central bank policies, and a strong technical backdrop. In March 2020, however, global markets experienced a historic sell-off, as a result of the COVID-19 pandemic and a freefall in crude oil prices. Following the sell-off through June month-end, crude oil prices recovered back into positive territory, and the U.S. high yield bond market rebounded on economic re-opening optimism and unprecedented actions by the U.S. Federal Reserve (Fed) – including purchasing investment grade and below investment grade bonds in the open market. However, the market remained negative for the period overall. |

| | ∎ | | Higher quality credits notably outperformed the lower end of the ratings spectrum during the one-year period, led by BBs and followed by single-Bs, while CCCs substantially lagged. As a result, the Fund’s underweight allocation to BB-rated holdings, and overweight allocation to the lower-rated categories relative to the Benchmark, were performance detractors. Security selection across single-B and CCC-rated credits was a positive contributor to Fund performance versus the Benchmark, while security selection in BB-rated holdings lagged. |

| | ∎ | | From an industry perspective, although the oil and gas sector rallied back in the second quarter of 2020 alongside the strong bounce back in crude oil prices from March lows, the sector significantly underperformed the broader market during the twelve-month period, alongside industries most directly impacted by the global economic shutdown, including the consumer cyclical and transportation sectors. The Fund’s credit selection within the telecommunications sector was the largest positive contributor to performance versus the index. The oil and gas sector was the largest detractor to relative performance as a result of credit selection and an underweight allocation on average. |

Describe recent portfolio activity.

| | ∎ | | The Fund allocation to BBs increased during the course of the one-year period, primarily through a shift from single-B rated holdings, both through relative value transactions in the secondary market and a notable portion of fallen angel purchases. Additionally, the Fund took advantage of select new issue deals, as the U.S. high yield bond market saw record new issuance activity in the second quarter of 2020. CCCs remained largely unchanged through the period. |

| | ∎ | | Across industries, the Fund’s top three sectors remained largely unchanged, led by oil & gas, telecommunications, and broadcasting & entertainment. The Fund’s position in the health care, education & child care sector was modestly reduced, while the buildings & real estate sector slightly increased during the year. |

| 1. | Total return describes the return to an investor of Class Y shares and includes the reinvestment of dividends and capital gains. Past performance is no guarantee of future results, and investment returns and the net asset value (NAV) of shares of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Call 1.855.439.5459 or visit barings.com for current month-end performance. All returns one-year or less are cumulative. |

| 5. | Benchmark: Bloomberg Barclays U.S. Corporate High Yield Index. The benchmark covers the universe of fixed-rate, non-investment grade debt focusing on corporate USD denominated and non-convertible debt. It is not possible to invest directly in an index. |

25

Barings U.S. High Yield Fund 2020 Annual Report

Describe portfolio positioning at period end.

| | ∎ | | On a traded basis, the Fund finished June 30, 2020 with a 78.1% weighting to senior unsecured bonds and a 13.4% weighting to senior secured high yield bonds. The remaining balance of the portfolio was invested in senior secured loans (5.1%), and cash, accrued and other holdings (3.4%). |

| | ∎ | | From a sector perspective, the Fund remained well-diversified across a number of Moody’s-based industries, with higher concentrations, as mentioned above, in oil & gas (12.2%), telecommunications (10.7%), and broadcasting & entertainment (10.0%) as of June 30, 2020. |

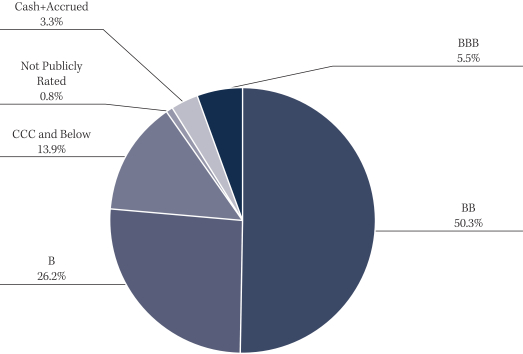

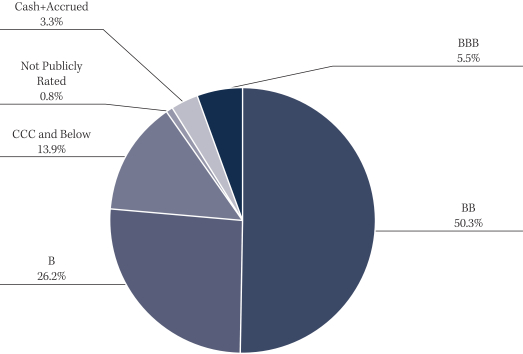

| | ∎ | | In terms of portfolio credit quality, the Fund had the following weighting breakdown: 5.5% in BBB, 50.3% in BB, 26.2% in single-B, 13.9% in CCC and below, and 3.3% in cash and accrued income. The Fund’s weighting in not-publicly rated holdings finished the period at 0.8%.2 |

Describe market and portfolio outlook.

| | ∎ | | Global credit markets staged a strong rebound throughout the second quarter of 2020, bolstered by swift action by governments, central banks and private investors to support global economies, as the world comes to terms with life during a pandemic. While default activity has increased across the U.S. high yield bond market, in our view some of these elements have softened expectations on near-term defaults from what they were at the peak of volatility in March. |

| | ∎ | | Despite the recovery thus far, the U.S. high yield bond market has not yet fully recovered to pre-pandemic levels, and we believe that the outlook for many companies will have an element of uncertainty until there is a clear path past Covid-19. The demand for high yield bonds has increased in recent months as a result of central bank actions, which we expect to continue in the near term. |

| | ∎ | | Even after a meaningful recovery, we continue to believe there are many opportunities for U.S. high yield bonds to be additive to total return performance as the recovery continues. That said, the potential for further volatility and defaults remains, which is why we continue to believe that prudent asset selection and active portfolio management will remain critical moving forward. |

| 2. | Ratings shown are the highest ratings given by one of the following national rating agencies: S&P, Moody’s or Fitch. Additional information about ratings can be found, respectively, at www.standardandpoors.com, www.moodys.com and www.fitchratings.com. Credit ratings are subject to change. AAA, AA, single-A and BBB are investment grade ratings categories used by S&P and Fitch. BB, single-B, CCC/CC/C and single-D are below investment grade ratings categories used by S&P and Fitch. Aaa, Aa, single-A and Baa are investment grade ratings categories used by Moody’s. Ba, single-B, Caa/Ca and single-C are below investment grade ratings categories used by Moody’s. Ratings categories may include gradations within each category. Bonds backed by U.S. government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

26

Barings U.S. High Yield Fund 2020 Annual Report

CREDIT QUALITY COMPOSITION (% OF ASSETS*)

COUNTRY COMPOSITION (% OF ASSETS**)

| ** | The percentages of assets are expressed by market value excluding cash and accrued income, and may vary over time. As of June 30, 2020. |

27

Barings U.S. High Yield Fund 2020 Annual Report

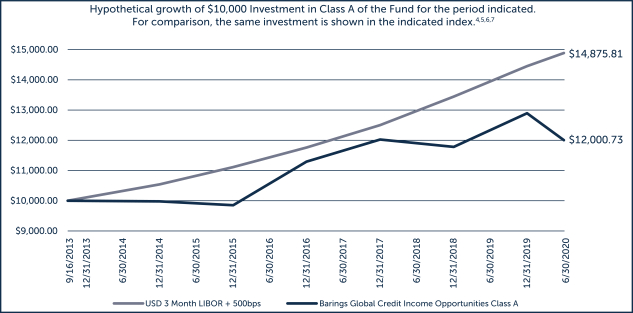

| | | | | | | | | | | | | | | | |

| % AVERAGE ANNUAL TOTAL RETURNS 4,6,7 | | INCEPTION DATE | | | ONE YEAR | | | THREE YEARS | | | INCEPTION TO DATE | |

Class A With Load | | | 10/30/2015 | | | | -7.52 | % | | | -0.28 | % | | | 3.65 | % |

Class A No Load | | | 10/30/2015 | | | | -3.67 | % | | | 1.09 | % | | | 4.56 | % |

Class C With Load | | | 10/30/2015 | | | | -5.30 | % | | | 0.34 | % | | | 3.77 | % |

Class C No Load | | | 10/30/2015 | | | | -4.39 | % | | | 0.34 | % | | | 3.77 | % |

Class I With Load | | | 10/30/2015 | | | | -3.43 | % | | | 1.34 | % | | | 4.81 | % |

Class I No Load | | | 10/30/2015 | | | | -3.43 | % | | | 1.34 | % | | | 4.81 | % |

Class Y With Load | | | 10/30/2015 | | | | -3.43 | % | | | 1.35 | % | | | 4.81 | % |

Class Y No Load | | | 10/30/2015 | | | | -3.43 | % | | | 1.35 | % | | | 4.81 | % |

| 3. | Inception date: October 30, 2015. |

| 4. | Class A performance with the sales charges includes the maximum 4.00% sales charge. |