UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22865

Forethought Variable Insurance Trust

(Exact name of registrant as specified in charter)

10 West Market Street, Suite 2300

Indianapolis, Indiana 46204

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-355-1820

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

Annual Report

December 31, 2022

Global Atlantic Portfolios

Global Atlantic American Funds® Managed Risk Portfolio

Global Atlantic Balanced Managed Risk Portfolio

Global Atlantic BlackRock Selects Managed Risk Portfolio

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Global Atlantic Growth Managed Risk Portfolio

Global Atlantic Moderate Growth Managed Risk Portfolio

Global Atlantic Select Advisor Managed Risk Portfolio

Global Atlantic Wellington Research Managed Risk Portfolio

Class II shares

Each a separate series of the Forethought Variable Insurance Trust

Distributed by Global Atlantic Distributors, LLC

Member FINRA

Dear Shareholders/Contract Owners:

Since the COVID-19 Pandemic (the "Pandemic") began nearly three years ago, the financial markets have experienced a prolonged period of heightened volatility driven by the global economic uncertainties posed under the circumstances and central banks' responses to rapidly changing conditions. In 2020 and 2021, the additional Pandemic-related easing of monetary policy from an already accommodative position helped fuel a two-year broad-based equity rally. In 2022, however, the decade-long accommodative policies from global central banks that fueled the bull market led to a rise in inflation. When combined with already challenging supply chains made worse by China's zero COVID policy and Russia's invasion of Ukraine, which drove food and energy prices higher (Ukraine a large wheat supplier, Russia a large energy supplier), inflation rose to levels not seen in decades. As a consequence, central banks quickly pivoted to an aggressive tightening schedule in an attempt to curb inflation, which led to concerns over slowing growth and the possibility of a recession.

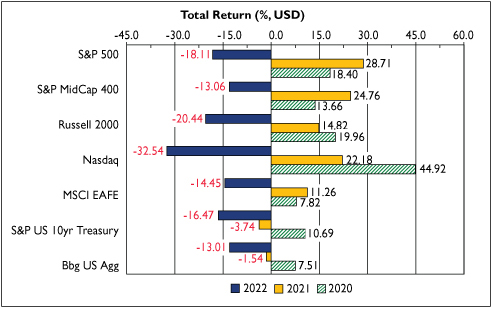

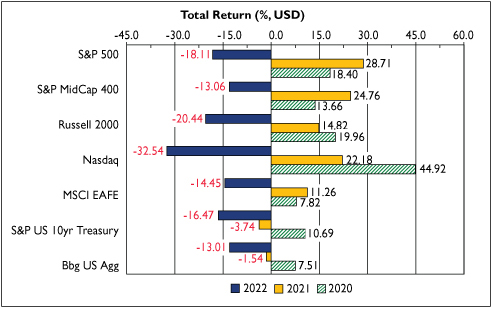

The result was meaningfully negative returns in both equity and fixed income markets in 2022, as shown in the chart below. International equity indices generally fared better than U.S. indices, particularly the U.S. technology-focused Nasdaq and U.S. small cap-oriented Russell 2000, both of which finished the year in a bear market (defined as down 20% or more). Within fixed income, the Federal Reserve increased interest rates on seven occasions in 2022 by a total of 425 basis points which resulted in fixed income volatility levels not seen since the 2008 Global Financial Crisis. To illustrate the impact, the U.S. 10-year Treasury peaked in October 2022 at 4.33% and finished the year at 3.88%, compared to ending 2021 and 2020 at 1.51% and 0.92%, respectively. This rapid rise in rates, which has not been experienced since the early 1980s, led to some of the weakest returns in history across much of fixed income, with the S&P U.S. 10-year Treasury Index ("S&P US 10yr Treasury") down -16.47% and the Bbg US Agg down -13.01% in 2022. Unlike many historical periods when fixed income returns helped partially offset negative equity returns in diversified portfolios, this did not happen in 2022.

We expect inflation, interest rates, and the Ukraine/Russia conflict to be the key concerns surrounding economic growth in 2023, particularly given the lag effect that interest rate changes typically have on the economy, and therefore, economic data. In addition, while the Pandemic has eased somewhat with the greater adoption of vaccines globally, COVID-19 has not been eliminated and may continue to pose a risk if new variants and/or regional outbreaks emerge.

Given the hardships endured in recent years, we hope this shareholder letter finds you healthy and wish you all the best for 2023 and beyond.

Thank you for investing in the Global Atlantic Portfolios.

Sincerely, | |

| |

| |

Eric D. Todd, CFA | | Cameron Jeffreys, CFA | |

President | | Senior Vice President | |

Global Atlantic Investment Advisors, LLC | | Global Atlantic Investment Advisors, LLC | |

1

Portfolio | | Benchmark | |

Global Atlantic American Funds® Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Conservative | |

Global Atlantic Balanced Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Conservative | |

Global Atlantic BlackRock Selects Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Conservative | |

Global Atlantic Franklin Dividend and Income Managed

Risk Portfolio | | S&P 500 Managed Risk Index – Moderate | |

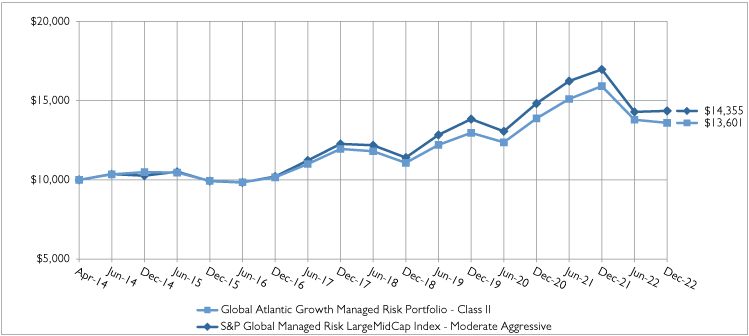

Global Atlantic Growth Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Aggressive | |

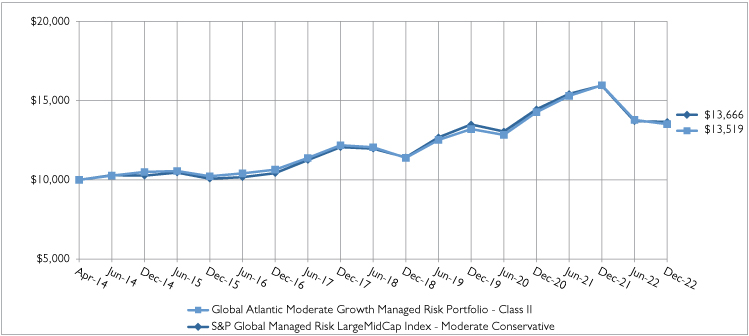

Global Atlantic Moderate Growth Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Conservative | |

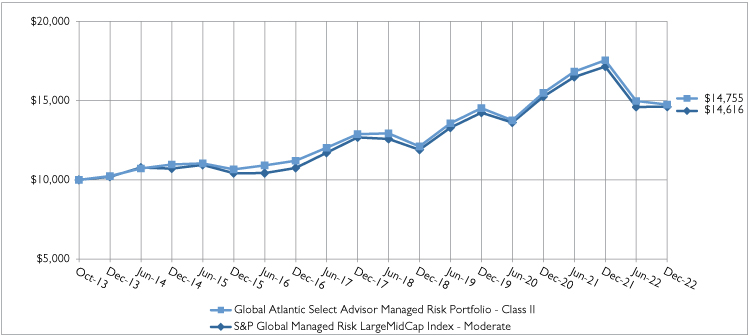

Global Atlantic Select Advisor Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate | |

Global Atlantic Wellington Research Managed Risk Portfolio | | S&P 500 Managed Risk Index – Moderate Conservative | |

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest directly in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

This report contains the current opinions of Global Atlantic Investment Advisors, LLC and/or sub-advisers at the time of its publication and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, a Portfolio's portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Index Definitions:

Bloomberg Global Aggregate Index. A broad global market capitalization weighted equity index that represents large and mid-cap companies across all 23 developed market countries, capturing approximately 85% of each countries' market capitalization.

Bloomberg U.S. Aggregate Bond Index ("Bbg US Agg"). An index weighted according to market capitalization and includes, among other categories, Treasury securities, mortgage-backed securities, government agency bonds and corporate bonds. To be included in the index, bonds must be rated investment grade by Moody's and S&P Global Ratings.

MSCI EAFE Total Return Index ("MSCI EAFE"). An index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major developed international equity markets as represented by 21 major MSCI indexes from Europe, Australasia and the Far East.

MSCI World Index. A broad global market capitalization weighted equity index that represents large and mid-cap companies across all 23 developed market countries, capturing approximately 85% of each countries' market capitalization.

Nasdaq Composite ("Nasdaq"). A broad-based market capitalization-weighted index of over 3,700 stocks listed on the Nasdaq Stock Exchange. As a broad index that is heavily weighted toward the technology sector, the Nasdaq serves as a benchmark for technology stocks in the United States.

Russell 2000® Index ("Russell 2000"). An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

S&P 500 Index ("S&P 500"). A market capitalization weighted price index composed of 500 widely held U.S. common stocks. Frequently used as a measure of U.S. stock market performance.

S&P 500 Managed Risk Index – Moderate. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

2

S&P 500 Managed Risk Index – Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 50% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Moderate. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Moderate Aggressive. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 20% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

S&P MidCap 400 Total Return Index ("S&P MidCap 400"). A capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

S&P SmallCap 600 Index. A capitalization-weighted index that seeks to measure the small-cap segment of the U.S. equity market.

S&P U.S. Treasury Bond Current 10-Year Index ("S&P U.S. 10yr Treasury"). An index that holds the most recently issued 10-year U.S. Treasury Note or bond.

5434559.1

3

| | | | | Page | |

• | | Global Atlantic Portfolio Review and Portfolio of Investments | | | |

| | | Global Atlantic American Funds® Managed Risk Portfolio | | | 5 – 8 | | |

| | | Global Atlantic Balanced Managed Risk Portfolio | | | 9 – 12 | | |

| | | Global Atlantic BlackRock Selects Managed Risk Portfolio | | | 13 – 17 | | |

| | | Global Atlantic Franklin Dividend and Income Managed Risk Portfolio | | | 18 – 28 | | |

| | | Global Atlantic Growth Managed Risk Portfolio | | | 29 – 32 | | |

| | | Global Atlantic Moderate Growth Managed Risk Portfolio | | | 33 – 36 | | |

| | | Global Atlantic Select Advisor Managed Risk Portfolio | | | 37 – 40 | | |

| | | Global Atlantic Wellington Research Managed Risk Portfolio | | | 41 – 53 | | |

• | | Financial Statements: | | | |

| | | Statements of Assets and Liabilities | | | 54 – 55 | | |

| | | Statements of Operations | | | 56 – 57 | | |

| | | Statements of Changes in Net Assets | | | 58 – 61 | | |

| | | Financial Highlights | | | 62 – 69 | | |

• | | Notes to Financial Statements | | | 70 – 92 | | |

• | | Report of Independent Registered Accounting Firm | | | 93 | | |

• | | Expense Examples | | | 94 – 95 | | |

• | | Supplemental Information | | | 96 – 97 | | |

• | | Trustee and Officer Table | | | 98 – 101 | | |

• | | Privacy Notice | | | 102 – 103 | | |

• | | Proxy Voting Policy | | Back Cover | |

• | | Portfolio Holdings | | Back Cover | |

4

Global Atlantic American Funds® Managed Risk Portfolio

Portfolio Review

December 31, 2022 (Unaudited)

Investment Objective

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

Management Review

The capital appreciation and income component is sub-advised by Wilshire Advisors, LLC (formerly Wilshire Associates Incorporated) ("Wilshire"), while the managed risk component is sub-advised by Milliman Financial Risk Management LLC ("Milliman").

How did the Portfolio perform during the period?

During 2022, the Portfolio underperformed its reference benchmark, the S&P Global Managed Risk LargeMidCap Index – Moderate Conservative. The Portfolio posted a return of -15.94% compared to a benchmark return of -14.37%, a difference of -157 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio's performance?

The Portfolio was impacted by both dynamic asset allocation as well as manager selection during 2022. An overweight to U.S. large cap equities generally contributed to relative performance, as did an overweight to value equities. Other tilts within equities were towards U.S. and global, which modestly detracted to performance. The fixed income portion of the Portfolio benefited from a modest overweight to government securities, an underweight to fixed income duration early in the year, and a modest overweight to credit later in the year. From a manager selection perspective, those within equities detracted from performance while those in fixed income were additive.

The Portfolio made several allocation changes during the year. In the first quarter of 2022, the Portfolio eliminated its small allocation to the American Funds Insurance Series® Capital World Bond Fund to remove an out-of-benchmark allocation. Furthermore, the Portfolio eliminated its exposure to the American Funds Insurance Series® New World Fund and reduced its allocation to the American Funds Insurance Series® Capital World Growth & Income Fund and American Funds Insurance Series® Global Small Cap Fund, moving it to the American Funds® International Growth and Income Fund to reduce emerging markets exposure and to avoid being overweight domestic equities relative to foreign equities. During the second quarter, the Portfolio removed its underweight to duration by trimming exposure to American Funds Insurance Series® U.S. Government Securities Fund and reallocating to American Funds Insurance Series® The Bond Fund of America. Additionally, the Portfolio's allocation to American Funds Insurance Series® Growth-Income Fund and American Funds Insurance Series® Washington Mutual Investors Fund was reduced and reallocated to American Funds Insurance Series® Growth Fund to remove the overweight to domestic value equities. In the third quarter, the Portfolio reduced its allocation to American Funds Insurance Series® U.S. Government Securities Fund and reallocated to American Funds Insurance Series® The Bond Fund of America and American Funds Insurance Series® American High-Income Trust Fund in order to enact an overweight to credit relative to government fixed income.

From a volatility perspective, the Milliman Managed Risk Strategy ("MMRS") was a contributor to performance during the year, reducing both the Portfolio's volatility and maximum drawdown during a period when most asset classes, most notably equities and fixed income, posted negative returns.

How was the Portfolio positioned at period end?

Wilshire believes that the Portfolio remains well positioned to meaningfully participate in a rally in risk assets but also sufficiently diversified to potentially outperform broad market equities during a selloff. At year end, the only active equity tilt in place is a modest overweight to emerging markets equities relative to foreign developed equities due to a mixture of Wilshire's strong outlook for emerging markets GDP growth in 2023 (particularly China – as it exits COVID protocols) and a hazier outlook for Europe, which is exposed to the negative economic effects of Russia's invasion of Ukraine. Within fixed income, the Portfolio is roughly neutral overall, though with a modest overweight to credit relative to government fixed

5

Global Atlantic American Funds® Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

income. Given the weak returns generated in 2022 due to the inflationary and rising interest rate environment, Wilshire believes that fixed income enters 2023 attractively priced and expects the asset class to generate attractive returns over the coming decade. Wilshire believes that equities are somewhat more difficult to predict. While global equity markets were down substantially during 2022, Wilshire believes the negative returns can mostly be explained by the rise in interest rates (and related rise in discount rates). Wilshire believes that if corporate earnings growth is flat to modest in 2023, then year-end 2022 prices are probably fair, but if corporate earnings growth is positive and meets expectations, then equities could rally during 2023. Overall, the Portfolio is neutral for fixed income versus equities, and Wilshire believes both have a better outlook entering 2023 than they did entering 2022.

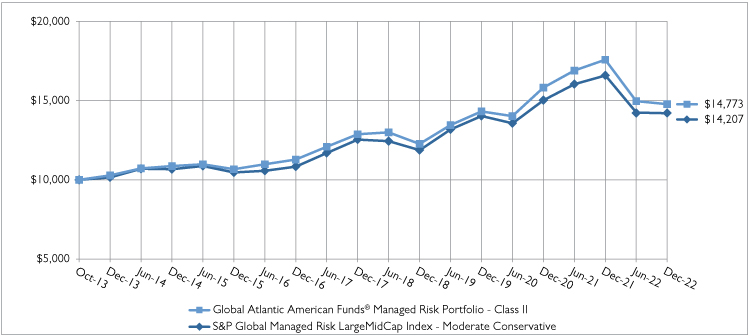

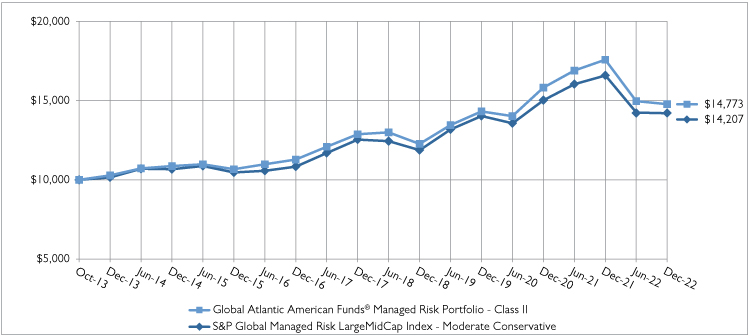

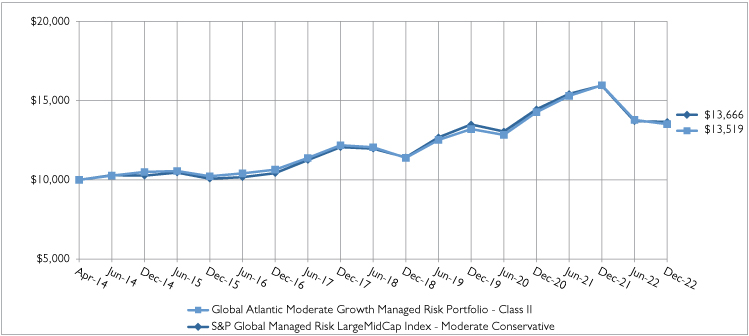

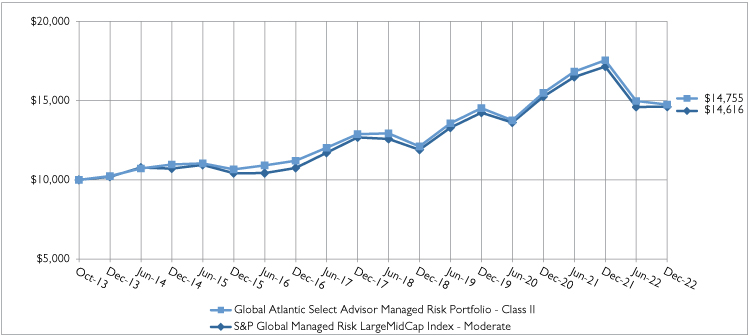

The Portfolio's performance figures for the periods ended December 31, 2022 as compared to its benchmark:

| | | | | | | Annualized | | Operating

Expense* | |

| | | Inception

Date | | One

Year | | Five

Years | | Since

Inception | | Gross

Ratio | | Net

Ratio | |

Global Atlantic American Funds® Managed Risk Portfolio | |

Class II | | October 31, 2013 | | | -15.94 | % | | | 2.79 | % | | | 4.35 | % | | | 1.63 | % | | | 1.23 | % | |

S&P Global Managed Risk LargeMidCap Index - Moderate

Conservative^ | | | | | | | -14.37 | % | | | 2.52 | % | | | 3.91 | % | | | | | | | | | |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to October 1, 2016, the Capital Appreciation and Income Component of the Portfolio was managed by the Adviser without the use of a sub-adviser. The performance prior to that date is attributable to the Adviser's asset allocation decisions.

* The estimated operating expense ratios for Class II shares, as disclosed in the most recent prospectus dated May 1, 2022. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

^ The S&P Global Managed Risk LargeMidCap Index - Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

Comparison of the Change in Value of a $10,000 Investment

6

Global Atlantic American Funds® Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

Holdings by Asset Class | | % of Net Assets | |

Variable Insurance Trusts | | | 85.9 | % | |

Mutual Funds | | | 8.6 | % | |

Short-Term Investments | | | 3.9 | % | |

Other Assets less Liabilities - Net | | | 1.6 | % | |

| | | | 100.0 | % | |

Please refer to the Portfolio of Investments in this annual report for more information regarding the Portfolio's holdings as of December 31, 2022.

Derivative exposure is included in "Other Assets less Liabilities - Net"

5435661.3

7

Global Atlantic American Funds® Managed Risk Portfolio

Portfolio of Investments

December 31, 2022

| | | Shares/

Principal | | Fair

Value | |

VARIABLE INSURANCE TRUSTS - 85.9% | |

DEBT FUNDS - 32.9% | |

American Funds Insurance Series -

American High-Income Trust, Class 1 | | | 762,233 | | | $ | 6,501,848 | | |

American Funds Insurance Series -

The Bond Fund of America, Class 1 | | | 4,839,554 | | | | 45,540,200 | | |

American Funds Insurance Series -

U.S. Government Securities Fund, Class 1 | | | 489,503 | | | | 4,890,132 | | |

TOTAL DEBT FUNDS | | | | | 56,932,180 | | |

EQUITY FUNDS - 53.0% | |

American Funds Insurance Series -

Capital World Growth and

Income Fund, Class 1 | | | 1,402,456 | | | | 16,366,664 | | |

American Funds Insurance Series -

Global Small Capitalization Fund, Class 1* | | | 201,971 | | | | 3,275,966 | | |

American Funds Insurance Series -

Washington Mutual Investors Fund, Class 1 | | | 1,937,573 | | | | 24,587,798 | | |

American Funds Insurance Series

Growth Fund, Class 1 | | | 319,003 | | | | 24,336,706 | | |

American Funds Insurance Series

Growth-Income Fund, Class 1 | | | 457,107 | | | | 22,951,341 | | |

TOTAL EQUITY FUNDS | | | | | 91,518,475 | | |

TOTAL VARIABLE INSURANCE TRUSTS

(Cost - $150,902,581) | | | | | 148,450,655 | | |

| | | Shares/

Principal | | Fair

Value | |

MUTUAL FUNDS - 8.6% | |

EQUITY FUNDS - 8.6% | |

International Growth and Income

Fund (Cost - $17,106,904) | | | 464,567 | | | $ | 14,801,108 | | |

SHORT-TERM INVESTMENTS - 3.9% | |

MONEY MARKET FUNDS - 3.9% | |

Dreyfus Government Cash

Management, 4.19% (a) | | | 6,687,191 | | | | 6,687,191 | | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 4.06% (a) | | | 15,004 | | | | 15,004 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost - $6,702,195) | | | | | | | 6,702,195 | | |

TOTAL INVESTMENTS - 98.4%

(Cost - $174,711,680) | | | | | | $ | 169,953,958 | | |

OTHER ASSETS LESS LIABILITIES - NET 1.6% | | | | | | | 2,724,422 | | |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 172,678,380 | | |

* Non-income producing security.

(a) The rate shown is the annualized seven-day yield at period end.

FUTURES CONTRACTS | |

SHORT FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

E-Mini Russell 2000 Future | | Goldman Sachs & Co. | | | 30 | | | 3/17/2023 | | $ | 2,656,350 | | | $ | 54,538 | | |

MSCI EAFE Future | | Goldman Sachs & Co. | | | 118 | | | 3/17/2023 | | | 11,501,460 | | | | 167,920 | | |

MSCI Emerging Market Index Future | | Goldman Sachs & Co. | | | 74 | | | 3/17/2023 | | | 3,549,780 | | | | 44,065 | | |

S&P 500 E-Mini Future | | Goldman Sachs & Co. | | | 119 | | | 3/17/2023 | | | 22,972,950 | | | | 532,142 | | |

S&P MID 400 E-Mini Future | | Goldman Sachs & Co. | | | 15 | | | 3/17/2023 | | | 3,663,900 | | | | 58,900 | | |

TOTAL NET UNREALIZED APPRECIATION ON FUTURES CONTRACTS | | $ | 857,565 | | |

See accompanying notes to financial statements.

8

Global Atlantic Balanced Managed Risk Portfolio

Portfolio Review

December 31, 2022 (Unaudited)

Investment Objective

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

Management Review

The capital appreciation and income component is sub-advised by BlackRock Investment Management, LLC ("BlackRock"), while the managed risk component is sub-advised by Milliman Financial Risk Management LLC ("Milliman").

How did the Portfolio perform during the period?

During 2022, the Portfolio underperformed its reference benchmark, the S&P Global Managed Risk LargeMidCap Index – Conservative. The Portfolio posted a return of -15.07% compared to a benchmark return of -13.75%, a difference of -132 basis points. The following discussion of relative performance pertains to this benchmark unless otherwise noted.

What factors and allocation decisions influenced the Portfolio's performance?

The past year was very challenging, with continued inflation pressures leading to faster than expected tightening by the U.S. Federal Reserve (the "Fed"), which in turn spurred fears of a recession. These dynamics posed headwinds for both equity and fixed income markets, with almost all asset classes delivering negative returns in 2022. From an asset allocation perspective, the Portfolio benefited from its underweight to fixed income despite being hurt by this positioning early in the year as equities rallied. Certain inflation sensitive asset classes such as commodities and energy sector equities performed well given the inflationary environment. In this vein, the Portfolio's overweight to energy equities was the biggest contributor to performance. Within equities, the Portfolio benefited from a relative overweight to U.S. equity markets and a relative overweight to value within non-U.S. developed markets. Factor exposure across value, minimum volatility, and momentum in the U.S. helped the Portfolio as well. A relative overweight to environmental, social, and governance ("ESG") equities detracted as ESG equities underperformed the broad market. Sector overweight positions were mixed during the year, with energy stocks performing well while infrastructure, global technology, and high dividend stocks detracted from performance. Within fixed income, the Portfolio was hurt by a relative overweight to longer duration fixed income as the Fed continued to raise interest rates in the U.S. and by exposure to high yield.

From a volatility perspective, the Milliman Managed Risk Strategy ("MMRS") was a significant contributor to performance during the year, reducing both the Portfolio's volatility and maximum drawdown during a period when most asset classes, most notably equities and fixed income, posted negative returns.

How was the Portfolio positioned at period end?

In BlackRock's view, outsized Fed influence, recession risk, and inflation uncertainty vastly widens the range of outcomes and thus diminishes risk-taking appetite. In this environment, BlackRock sought to de-risk the Portfolio by reducing active positions relative to the benchmark in order to create the ability to be nimble at a later date. These proactive moves have generally served the Portfolio well amidst this challenging period.

Given the continued uncertainty, the Portfolio ended the period neutral to equities and slightly underweight to fixed income. Within equities, the Portfolio is slightly overweight to the U.S. relative to non-U.S. developed markets and emerging markets. BlackRock reduced this relative overweight to the U.S. equity markets over the period. Within U.S. equities, the Portfolio maintains an overweight to ESG equities, but BlackRock reduced that overweight in the period as well. From a sector and factor perspective, the Portfolio is overweight momentum, minimum volatility, and energy stocks. Within non-U.S. developed markets, the Portfolio is overweight value, and within emerging markets, the Portfolio holds minimum volatility stocks.

Within fixed income, BlackRock's investment team believes the increase in yields has uncovered new opportunities, namely in shorter-term credit. BlackRock reduced the Portfolio's underweight to fixed income over the period and removed the allocation to treasury inflation-protected securities ("TIPS") given BlackRock's view that inflation should moderate into 2023. The Portfolio is also overweight to convertible bonds, as convertibles are generally less rate sensitive and offer exposure to technology companies.

9

Global Atlantic Balanced Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

The Portfolio's performance figures for the periods ended December 31, 2022 as compared to its benchmark:

| | | | | | | Annualized | | Operating

Expense* | |

| | | Inception

Date | | One

Year | | Five

Years | | Since

Inception | | Gross

Ratio | | Net

Ratio | |

Global Atlantic Balanced Managed Risk Portfolio | |

Class II | | October 31, 2013 | | | -15.07 | % | | | 1.67 | % | | | 3.29 | % | | | 1.00 | % | | | 1.00 | % | |

S&P Global Managed Risk LargeMidCap Index - Conservative^ | | | | | -13.75 | % | | | 2.17 | % | | | 3.57 | % | | | | | |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to October 1, 2016, the Capital Appreciation and Income Component of the Portfolio was managed by the Adviser without the use of a sub-adviser. The performance prior to that date is attributable to the Adviser's asset allocation decisions. From October 1, 2016 to May 1, 2021, BlackRock Financial Management, Inc. served as a sub-adviser to the Capital Appreciation and Income Component of the Portfolio. In addition, effective May 1, 2021 the sub-adviser to the Capital Appreciation and Income Component of the Portfolio changed from BlackRock Financial Management, Inc. to BlackRock Investment Management, LLC. No changes were made to the Portfolio's principal investment strategies or to the portfolio management team as a result of the change in sub-adviser.

* The estimated operating expense ratios for Class II shares, as disclosed in the most recent prospectus dated May 1, 2022. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

^ The S&P Global Managed Risk LargeMidCap Index - Conservative is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash, based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 50% to the underlying bond index.

Comparison of the Change in Value of a $10,000 Investment

10

Global Atlantic Balanced Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

Holdings by Asset Class | | % of Net Assets | |

Exchange-Traded Funds | | | 94.5 | % | |

Short-Term Investments | | | 4.1 | % | |

Other Assets less Liabilities - Net | | | 1.4 | % | |

| | | | 100.0 | % | |

Please refer to the Portfolio of Investments in this annual report for more information regarding the Portfolio's holdings as of December 31, 2022.

Derivative exposure is included in "Other Assets less Liabilities - Net"

5435661.3

11

Global Atlantic Balanced Managed Risk Portfolio

Portfolio of Investments

December 31, 2022

| | | Shares/

Principal | | Fair

Value | |

EXCHANGE TRADED FUNDS - 94.5% | |

DEBT FUNDS - 46.0% | |

iShares 0-5 Year High Yield Corporate

Bond ETF | | | 59,340 | | | $ | 2,426,413 | | |

iShares 10+ Year Investment Grade

Corporate Bond ETF | | | 35,936 | | | | 1,789,253 | | |

iShares 10-20 Year Treasury Bond ETF | | | 22,889 | | | | 2,476,132 | | |

iShares 1-3 Year Treasury Bond ETF | | | 46,704 | | | | 3,790,964 | | |

iShares 1-5 Year Investment Grade

Corporate Bond ETF | | | 43,346 | | | | 2,159,498 | | |

iShares 20+ Year Treasury Bond ETF | | | 10,218 | | | | 1,017,304 | | |

iShares 3-7 Year Treasury Bond ETF | | | 29,237 | | | | 3,359,039 | | |

iShares 5-10 Year Investment Grade

Corporate Bond ETF | | | 48,711 | | | | 2,411,682 | | |

iShares 7-10 Year Treasury Bond ETF | | | 6,962 | | | | 666,820 | | |

iShares Convertible Bond ETF | | | 12,199 | | | | 847,464 | | |

iShares Core Total USD Bond Market ETF | | | 269,521 | | | | 12,109,578 | | |

iShares Core U.S. Aggregate Bond ETF | | | 65,421 | | | | 6,345,183 | | |

iShares TIPS Bond ETF | | | 16,839 | | | | 1,792,343 | | |

TOTAL DEBT FUNDS | | | | | 41,191,673 | | |

EQUITY FUNDS - 48.5% | |

iShares Core MSCI EAFE ETF | | | 80,978 | | | | 4,991,484 | | |

iShares Core S&P 500 ETF | | | 56,006 | | | | 21,518,065 | | |

iShares Core S&P Mid-Cap ETF | | | 14,805 | | | | 3,581,182 | | |

iShares Core S&P Small-Cap ETF | | | 23,731 | | | | 2,245,902 | | |

iShares ESG Aware MSCI USA ETF | | | 64,760 | | | | 5,488,410 | | |

iShares MSCI EAFE Growth ETF | | | 15,536 | | | | 1,301,295 | | |

| | | Shares/

Principal | | Fair

Value | |

EQUITY FUNDS - 48.5% (Continued) | |

iShares MSCI EAFE Value ETF | | | 32,973 | | | $ | 1,512,801 | | |

iShares MSCI Emerging Markets

Min Vol Factor ETF | | | 7,720 | | | | 409,546 | | |

iShares MSCI USA Min Vol Factor ETF | | | 9,196 | | | | 663,032 | | |

iShares MSCI USA Momentum Factor ETF | | | 8,909 | | | | 1,300,090 | | |

iShares U.S. Energy ETF | | | 8,889 | | | | 413,250 | | |

TOTAL EQUITY FUNDS | | | | | 43,425,057 | | |

TOTAL EXCHANGE TRADED FUNDS

(Cost - $79,691,561) | | | | | 84,616,730 | | |

SHORT-TERM INVESTMENTS - 4.1% | |

MONEY MARKET FUNDS - 4.1% | |

Dreyfus Government Cash

Management, 4.19% (a) | | | 2,785,958 | | | | 2,785,958 | | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 4.06% (a) | | | 884,401 | | | | 884,401 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost - $3,670,359) | | | | | 3,670,359 | | |

TOTAL INVESTMENTS - 98.6%

(Cost - $83,361,920) | | | | $ | 88,287,089 | | |

OTHER ASSETS LESS LIABILITIES - NET 1.4% | | | | | 1,212,006 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 89,499,095 | | |

(a) The rate shown is the annualized seven-day yield at period end.

TIPS - Treasury Inflation Protected Security

FUTURES CONTRACTS | |

SHORT FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

E-Mini Russell 2000 Future | | Goldman Sachs & Co. | | | 16 | | | 3/17/2023 | | $ | 1,416,720 | | | $ | 31,890 | | |

MSCI EAFE Future | | Goldman Sachs & Co. | | | 37 | | | 3/17/2023 | | | 3,606,390 | | | | 55,655 | | |

MSCI Emerging Market Index Future | | Goldman Sachs & Co. | | | 4 | | | 3/17/2023 | | | 191,880 | | | | 3,990 | | |

S&P 500 E-Mini Future | | Goldman Sachs & Co. | | | 69 | | | 3/17/2023 | | | 13,320,450 | | | | 352,203 | | |

S&P MID 400 E-Mini Future | | Goldman Sachs & Co. | | | 10 | | | 3/17/2023 | | | 2,442,600 | | | | 45,480 | | |

TOTAL NET UNREALIZED APPRECIATION ON FUTURES CONTRACTS | | | | | | | | | | $ | 489,218 | | |

See accompanying notes to financial statements.

12

Global Atlantic BlackRock Selects Managed Risk Portfolio

Portfolio Review

December 31, 2022 (Unaudited)

Investment Objective

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

Management Review

The capital appreciation and income component is sub-advised by BlackRock Investment Management, LLC ("BlackRock"), while the managed risk component is sub-advised by Milliman Financial Risk Management LLC ("Milliman").

How did the Portfolio perform during the period?

During 2022, the Portfolio underperformed its reference benchmark, the S&P Global Managed Risk LargeMidCap Index – Moderate Conservative. The Portfolio posted a return of -15.48% compared to a benchmark return of -14.37%, a difference of -111 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio's performance?

The year 2022 presented a challenging market with global equity markets down 18% (as measured by the MSCI World Index), the worst calendar year for equities since the 2008 Global Financial Crisis. As difficult of an environment as it was for equities, 2022 was arguably tougher for bond investors as global bond markets were down 16% (as measured by the Bloomberg Global Aggregate Index). Market volatility was driven by multi-decade high levels of inflation that proved to be more persistent than initially expected and followed a period of supply chain bottlenecks and the Russian invasion of the Ukraine. This caused central bank policy to turn hawkish to combat higher prices. While market participants had anticipated the removal of central bank easing going into 2022, the magnitude and rapidity of the change needed was beyond what most expected. For perspective, in March 2022, the U.S. Federal Reserve (the "Fed") was still conducting quantitative easing, with the Fed Funds rate at 0%. As of the fourth quarter of 2022, the Fed Funds rate was just shy of 4.5% after a historic 4 consecutive 75-basis point interest rate hikes, followed by a 50-basis point increase to cap off the year.

Global stocks and bonds came under considerable selling pressure during the first quarter of 2022, as the combination of anticipated rate hikes from the world's major central banks, the eruption of hostilities between Russia and Ukraine, and renewed lockdown concerns in China caused investors to shun both high quality bonds and risky assets. Broad equity market weakness continued throughout the second and third quarters, as investors remained concerned that central banks would tighten monetary policy too aggressively, causing an unintended economic contraction. During prior risk-off periods, investors have been able to seek stability in high quality fixed income, but that was not the case this year. Rapidly rising interest rates and a consistently hawkish Fed put downward pressure on high quality fixed income, leaving very few places for investors to seek refuge from market volatility. Although equity markets rallied sharply at the beginning of the fourth quarter on better-than-expected corporate earnings while bonds followed suit in November following better than expected U.S. Consumer Price Index ("CPI") data, stocks and bonds resumed their declines in December as both U.S. payrolls and hourly earnings growth came in well above Wall Street consensus estimates, prompting investor concerns that the Fed would continue tightening monetary policy into 2023. In addition, the Bank of Japan's decision to alter its policy of "yield curve control" ("YCC") also weighed on global risk assets, as the economic consequences of the shift encouraged Japanese investors to sell their foreign securities holdings (including U.S. Treasuries) and repatriate capital back home, further draining liquidity from global capital markets.

From a broad asset allocation perspective, an exposure to cash and cash equivalents was the largest overall contributor for the year but was partially offset by an underweight to both equities and fixed income. Within equities, an overweight to energy positively impacted returns. Security selection within information technology was additive but was partially offset by an overweight allocation to the sector. An underweight to consumer staples detracted, as did security selection within industrials and materials. Security selection within consumer discretionary, an overweight to consumer discretionary and an underweight to financials also negatively impacted returns. Within fixed income, exposure to credit and positioning within U.S. Treasuries was additive.

13

Global Atlantic BlackRock Selects Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

From a volatility perspective, the Milliman Managed Risk Strategy ("MMRS") was a modest detractor to performance during the year.

How was the Portfolio positioned at period end?

At year end, relative to its reference benchmark, the Portfolio was underweight both equities and fixed income. Looking ahead, BlackRock continues to believe that despite the challenges faced in 2022, many underestimate how adaptive, innovative, and flexible the U.S. economy can be. As a result, the BlackRock team believes that the U.S. will likely avoid a material economic contraction in 2023 (and may avoid a recession altogether), as the strength of the U.S. labor market should provide structural support for overall consumption. Across major macro indicators, BlackRock anticipates inflation to continue to moderate, with core PCE (Personal Consumption Expenditures Price Index) declining to the 3.0-3.5% range and core CPI falling below 4% by mid-2023. BlackRock believes nominal GDP for 2022 will end between 6-7% and fall closer to 3.5% for 2023 (as compared to a nominal GDP, NGDP, of 14% in 2021). Going forward, BlackRock anticipates real GDP to be closer to 1.5-2.0%, which would give some room for U.S. Treasury Rates to come down from current levels. In terms of future central bank tightening, the BlackRock team believes the Fed is likely to maintain a tightening bias early in 2023 given the strength of the U.S. jobs market. That said, BlackRock believes the magnitude of increases will be more in line with historical moves (i.e., incremental 25-basis point hikes), which would likely have a much smaller impact on interest rate volatility and as a result allow for more stability across both fixed income and equity markets.

At the end of the period, the Portfolio was overweight the U.S., and to a lesser extent select emerging market countries, and was significantly underweight non-U.S. developed markets, most notably Japan, Canada, the United Kingdom and Australia. The Portfolio's overweight to U.S. stocks reflects the BlackRock team's view that the U.S. will likely avoid a material economic contraction in 2023 (and may avoid a recession altogether), as the strength of the U.S. labor market should provide structural support for overall consumption. The Portfolio remained underweight Japan, Canada, and Australia for a variety of reasons, notably the large exposure each of those markets have to financials (both banks and insurance). Within Europe, the team has become more constructive in recent months and narrowed the underweight given recent U.S. dollar weakness, as well as signs of a deceleration in inflation and energy prices.

From a sector perspective, the Portfolio was overweight energy and healthcare and was underweight financials, industrials, real estate, consumer discretionary, consumer staples, and communication services. Sector positioning reflects a barbell approach favoring secular growth themes alongside quality cyclicals. This reflects a desire to lean into "GARP" (growth at a reasonable price) and quality (companies that can generate strong free cash flows and have low leverage ratios.) Energy remains the Portfolio's largest overweight given the current undersupply and potential impact from the reopening of the Chinese economy. Financials remain the Portfolio's largest underweight as the BlackRock team remains cautious on banks and insurance companies, as flat and/or inverted yield curves (despite meaningfully higher interest rates) may place pressure on the net interest margins of various banking firms.

Within fixed income, the Portfolio was overweight high yield credit and, to a lesser extent, U.S. government bonds, and it was underweight securitized assets. The Portfolio was underweight duration relative to the reference benchmark (2.04 years vs. 2.53 years). While BlackRock believes the bulk of the U.S. interest rate hikes have occurred, it expects continued tightening from central banks (albeit at smaller increments). Within credit, most of the exposure is in U.S. high yield, which has historically been less sensitive to duration risk as compared to investment grade debt. While economic growth is decelerating, BlackRock does not expect a sharp contraction in economic activity in the U.S. given the strength of the U.S. labor market. As a result, the BlackRock team does not expect a significant increase in corporate credit downgrades or defaults. BlackRock also added to securitized assets over the fourth quarter as the possibility of falling interest rate volatility may help support mortgage-bond prices.

Given the current environment, BlackRock maintained exposure to cash equivalents as the team believes it to be a more efficient means to hedge equity risk compared to short- and intermediate-term U.S. Treasuries.

14

Global Atlantic BlackRock Selects Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

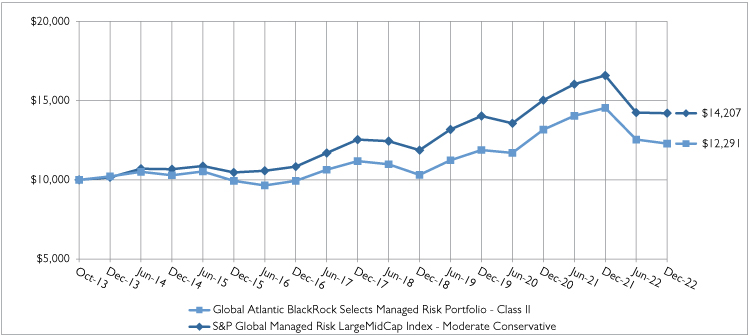

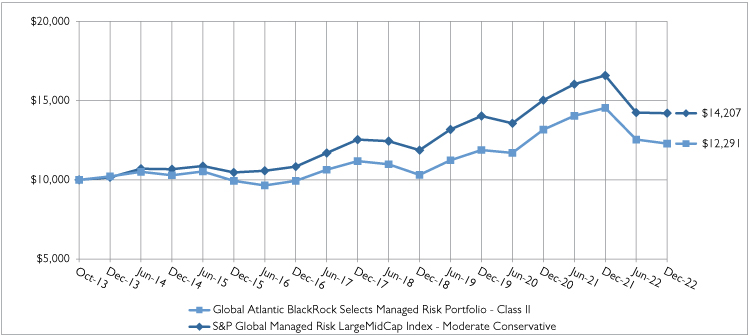

The Portfolio's performance figures for the periods ended December 31, 2022 as compared to its benchmark:

| | | | | | | Annualized | | Operating

Expense* | |

| | | Inception

Date | | One

Year | | Five

Years | | Since

Inception | | Gross

Ratio | | Net

Ratio | |

Global Atlantic BlackRock Selects Managed Risk Portfolio | |

Class II | | October 31, 2013 | | | -15.48 | % | | | 1.90 | % | | | 2.28 | % | | | 1.17 | % | | | 1.17 | % | |

S&P Global Managed Risk LargeMidCap Index - Moderate

Conservative^ | | | | | | | -14.37 | % | | | 2.52 | % | | | 3.91 | % | | | | | | | | | |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to May 1, 2019, the Capital Appreciation and Income Component of the Portfolio was managed pursuant to a different investment strategy by the Adviser without the use of a sub-adviser. The performance prior to that date is attributable to the Adviser and the prior investment strategy.

* The estimated operating expense ratios for Class II shares, as disclosed in the most recent prospectus dated May 1, 2022. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

^ The S&P Global Managed Risk LargeMidCap Index - Moderate Conservative is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash, based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

Comparison of the Change in Value of a $10,000 Investment

15

Global Atlantic BlackRock Selects Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

Holdings by Asset Class | | % of Net Assets | |

Exchange-Traded Funds | | | 71.9 | % | |

Variable Insurance Trusts | | | 22.1 | % | |

Short-Term Investments | | | 4.6 | % | |

Other Assets less Liabilities - Net | | | 1.4 | % | |

| | | | 100.0 | % | |

Please refer to the Portfolio of Investments in this annual report for more information regarding the Portfolio's holdings as of December 31, 2022.

Derivative exposure is included in "Other Assets less Liabilities - Net"

5435661.3

16

Global Atlantic BlackRock Selects Managed Risk Portfolio

Portfolio of Investments

December 31, 2022

| | | Shares/

Principal | | Fair

Value | |

EXCHANGE TRADED FUNDS - 71.9% | |

DEBT FUNDS - 29.2% | |

iShares 1-3 Year Treasury Bond ETF | | | 203,976 | | | $ | 16,556,732 | | |

iShares 20+ Year Treasury Bond ETF | | | 25,255 | | | | 2,514,388 | | |

iShares 3-7 Year Treasury Bond ETF | | | 30,120 | | | | 3,460,487 | | |

iShares 7-10 Year Treasury Bond ETF | | | 26,793 | | | | 2,566,233 | | |

iShares iBoxx $ Investment Grade

Corporate Bond ETF | | | 121,301 | | | | 12,788,764 | | |

iShares iBoxx High Yield Corporate

Bond ETF | | | 69,423 | | | | 5,111,615 | | |

iShares MBS ETF | | | 92,933 | | | | 8,619,536 | | |

TOTAL DEBT FUNDS | | | | | 51,617,755 | | |

EQUITY FUNDS - 42.7% | |

iShares Core Dividend Growth ETF | | | 183,119 | | | | 9,155,950 | | |

iShares Core MSCI EAFE ETF | | | 68,550 | | | | 4,225,422 | | |

iShares Core S&P U.S. Growth ETF | | | 354,533 | | | | 28,901,530 | | |

iShares Core S&P U.S. Value ETF | | | 141,166 | | | | 9,970,555 | | |

iShares Global Healthcare ETF | | | 29,977 | | | | 2,544,448 | | |

iShares Global Materials ETF | | | 10,380 | | | | 816,491 | | |

iShares MSCI Eurozone ETF | | | 128,110 | | | | 5,057,142 | | |

iShares MSCI Global Min Vol Factor ETF | | | 79,291 | | | | 7,534,231 | | |

iShares MSCI USA Quality Factor ETF | | | 14,363 | | | | 1,636,807 | | |

iShares U.S. Energy ETF | | | 106,053 | | | | 4,930,404 | | |

iShares U.S. Industrials ETF | | | 8,626 | | | | 832,064 | | |

TOTAL EQUITY FUNDS | | | | | 75,605,044 | | |

TOTAL EXCHANGE TRADED FUNDS

(Cost - $118,652,298) | | | | | 127,222,799 | | |

| | | Shares/

Principal | | Fair

Value | |

VARIABLE INSURANCE TRUSTS - 22.1% | |

ASSET ALLOCATION FUND - 22.1% | |

BlackRock Global Allocation VI Fund,

Class I (Cost - $39,638,730)* | | | 2,646,094 | | | $ | 39,082,810 | | |

SHORT-TERM INVESTMENTS - 4.6% | |

MONEY MARKET FUNDS - 4.6% | |

Dreyfus Government Cash

Management, 4.19% (a) | | | 5,847,101 | | | | 5,847,101 | | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 4.06% (a) | | | 2,324,980 | | | | 2,324,980 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost - $8,172,081) | | | | | 8,172,081 | | |

TOTAL INVESTMENTS - 98.6%

(Cost - $166,463,109) | | | | $ | 174,477,690 | | |

OTHER ASSETS LESS LIABILITIES - NET 1.4% | | | | | 2,501,218 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 176,978,908 | | |

* Non-income producing security.

(a) The rate shown is the annualized seven-day yield at period end.

FUTURES CONTRACTS | |

SHORT FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

E-Mini Russell 2000 Future | | Goldman Sachs & Co. | | | 19 | | | 3/17/2023 | | $ | 1,682,355 | | | $ | 35,113 | | |

MSCI EAFE Future | | Goldman Sachs & Co. | | | 92 | | | 3/17/2023 | | | 8,967,240 | | | | 125,060 | | |

MSCI Emerging Market Index Future | | Goldman Sachs & Co. | | | 40 | | | 3/17/2023 | | | 1,918,800 | | | | 23,385 | | |

S&P 500 E-Mini Future | | Goldman Sachs & Co. | | | 123 | | | 3/17/2023 | | | 23,745,150 | | | | 560,515 | | |

S&P MID 400 E-Mini Future | | Goldman Sachs & Co. | | | 18 | | | 3/17/2023 | | | 4,396,680 | | | | 63,635 | | |

TOTAL NET UNREALIZED APPRECIATION ON FUTURES CONTRACTS | | | | | | | | | | $ | 807,708 | | |

See accompanying notes to financial statements.

17

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio Review

December 31, 2022 (Unaudited)

Investment Objective

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

Management Review

The capital appreciation and income component is managed by Franklin Advisers, Inc. ("Franklin Advisers"), while the managed risk component is sub-advised by Milliman Financial Risk Management LLC ("Milliman").

How did the Portfolio perform during the period?

During 2022, the Portfolio outperformed its reference benchmark, the S&P 500 Managed Risk Index – Moderate. The Portfolio posted a return of -12.33% compared to a benchmark return of -13.13%, a difference of 80 basis points. The following discussion of relative performance pertains to this benchmark unless otherwise noted.

What factors and allocation decisions influenced the Portfolio's performance?

Franklin Advisers employs a bottom-up stock selection process for the equity sleeve of the Portfolio's capital appreciation and income component, whereby the portfolio managers invest in securities without regard to benchmark comparisons. As a result, the Portfolio frequently contains sector and security allocations that may be significantly different from those of the S&P 500® Index. With respect to the equity sleeve's performance versus the S&P 500® Index, the equity sleeve of the Portfolio's capital appreciation and income component outperformed the S&P 500® Index (net of fees), posting a return of -10.20% compared to an S&P 500® Index return of -18.11%, a difference of 791 basis points.

Relative to the Portfolio's benchmark, security selection and an underweight in the consumer discretionary and information technology sectors contributed to relative performance during the year. A lack of exposure to the communication services sector also enhanced results, as did an overweight to the industrials sector. In contrast, stock selection in the health care sector detracted from relative performance, as did an underweight in the energy and financials sectors and lack of exposure to utilities.

Among the contributors, shares of defense contractor Raytheon Technologies Corp. ("Raytheon") rallied during the 12-month reporting period, buoyed by growing U.S. Department of Defense budgets as well as additional demand for U.S.-made defense systems to assist Ukraine in its war against Russia. The Franklin Portfolio Managers believe demand for Raytheon's missile defense systems will continue, though there could be some pressure on its commercial air division if a recessionary environment were to emerge. In the information technology sector, an underweight position in consumer electronics giant Apple, Inc. ("Apple") supported relative results. Its shares lost value and significantly underperformed the benchmark index during the reporting period on concerns that rising COVID-19 cases in China would negatively impact production of its new iPhone 14. Shares of Air Products and Chemicals, Inc. ("Air Products") rallied in the materials sector after the company posted resilient fiscal fourth-quarter results. The company overcame concerns late in the reporting period on its ability to manage cost inflation in Europe and whether continued lockdowns in China would hurt results. Additionally, the growth pipeline in the United States looks excellent, in the view of the Franklin Portfolio Managers, as Air Products continues to announce large projects in areas such as carbon-free hydrogen. In the industrials sector, shares of diversified technology and manufacturing company Honeywell International, Inc. rose late in the reporting period after the company reported upbeat third-quarter earnings and full-year 2022 guidance. Year-over-year sales increases were particularly pronounced in its building technologies and performance materials lines of business.

Among detractors, shares of drug packaging and delivery company West Pharmaceutical Services, Inc. declined during the period as sales in its contract manufacturing business were softer in 2021. Its shares continued to decline through the end of the reporting period after the company reported a year-over-year decline in third-quarter net sales. The company lowered its full-year 2022 guidance during the year as management noted decreasing demand for COVID-19-related products. The Franklin Portfolio Managers remain constructive on the company, however, given its potential to drive customers to

18

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

higher-margin services and build out its international presence as emerging markets move toward more stringent pharmaceutical standards. Shares of enterprise software company Microsoft Corp. ("Microsoft") have fallen from record-high levels in late 2021, pressured by concerns of a potential recession, persistent inflation, rising interest rates and a more hawkish U.S. Federal Reserve (the "Fed") – a dynamic pressuring technology stocks in general. Supply-chain issues, exacerbated by COVID-19 lockdowns in China, a key chip supplier, also impacted investor sentiment. Microsoft reduced its guidance in June, citing the strength of the U.S. dollar, which could weigh on overseas revenues and profits. Concerns about slowing growth for personal computer shipments and growth for its Office 365 productivity software have risen. However, the Franklin Portfolio Managers continue to believe that the trends of helping business customers move to the cloud and providing workers with productivity tools should support attractive growth over the medium- to longer-term. Sportswear manufacturer Nike, Inc. ("Nike") weighed on performance, pressured by supply-chain disruptions and production shortfalls as well as softer market conditions in China. In June, Nike lowered its guidance amid margin pressures and uncertainty surrounding China. More recently, the company felt the combined impact of supply-chain issues and sharply-rising inflation as inventories surged, driving markdowns that lowered earnings. The Franklin Portfolio Managers continue to believe that Nike's strong brand and direct-to-consumer digital strategy will likely help it maintain market share and pricing advantages over an increasingly competitive field.

During 2022, the fixed income sleeve of the Portfolio's capital appreciation and income component underperformed the Bloomberg U.S. Aggregate Bond Index (net of fees), posting a return of -14.41% compared to the benchmark return of -13.01%, a difference of -140 basis points. The Portfolio's exposure to high-yield ("HY") corporate bonds, collateralized loan obligations ("CLOs") and senior secured floating-rate bank loans detracted from results, as did security selection in investment-grade ("IG") corporate bonds and mortgage-backed securities ("MBS"). Exposure to sovereign emerging market ("EM") debt hindered returns, as did allocation to non-U.S. dollar denominated developed market debt. Exposure in taxable municipal bonds and the Portfolio's non-U.S. yield curve positioning detracted from results.

Conversely, U.S. yield curve positioning was a major contributor to relative performance, mainly from the five-year portion of the curve. Foreign currency exposure also benefited results – gains from a short euro position were more than offset by the negative contribution from a long South Korean won position. An underweight allocation to agency MBS and an overweight allocation to non-agency residential mortgage-backed securities ("RMBS") were significant contributors to performance. Underweight allocation to IG corporate bonds also benefited performance. Security selection in sovereign developed market debt and allocation to non-U.S. dollar denominated EM debt contributed to results.

From a volatility perspective, the Milliman Managed Risk Strategy ("MMRS") was a modest detractor to performance during the year.

How was the Portfolio positioned at period end?

From an equity sector perspective, at the end of the period, the Portfolio's largest sector concentration was information technology, followed by industrials and health care. Over the year, positions were added in food company Mondelez International, Inc., medical technology manufacturer Danaher Corp. and consumer electronics giant Apple. There were no significant disposals over the 12-month reporting period.

At period end, the Portfolio's largest fixed income allocations were U.S. Treasuries ("UST"), IG corporate bonds and MBS. The Portfolio remained overweight CLOs and senior secured floating-rate bank loans and underweight IG corporate bonds. The Portfolio moved from an overweight to underweight allocation in HY corporate bonds. Overall, Franklin believes corporate fundamentals remain generally strong, providing most IG companies substantial flexibility to manage through a more challenging economic environment. Amid continued market uncertainty, however, the Franklin Portfolio Managers remain moderately bearish on the sector as tighter overall financial conditions will result in slower growth and deteriorating fundamentals. The Franklin Portfolio Managers decreased allocation to senior secured floating-rate loans and HY corporate bonds while maintaining CLO exposure. Despite the challenging economic environment, it is worth noting that the overall quality of HY issuers has improved as the percentage of BB rated issuers in HY indices is near the higher end of the historical range. Although spreads likely have more widening than tightening bias from current levels over the near-term, over a multi-year horizon the Franklin Portfolio Managers believe the case for HY remains compelling, given historically attractive yields and the foregoing considerations.

19

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

As rates are expected to stay higher-for-longer, the Franklin Portfolio Manager anticipates loan issuers that are more levered with cyclical and secularly challenged business models will undergo higher amounts of distress. Accordingly, the Franklin Portfolio Manager has maintained de-risking the Portfolio from lower-quality issuers in cyclical industries. The Franklin Portfolio Manager continues to focus on stringent security selection, favors higher-quality bias and maintains liquidity buffers to protect against spread widening. Within the securitized sectors, the Portfolio remained underweight MBS and overweight the RMBS sector, adding to MBS while reducing RMBS allocation over the period. The Franklin Portfolio Manager expects MBS volatility to remain high prior to Fed meetings and macroeconomic data releases. The RMBS asset class has been impacted by heavier supply and slower prepayment levels which have led to wider new issue spreads for the sector. The Franklin Portfolio Manager has reintroduced slight exposure to treasury inflation-protected securities ("TIPS"). The Portfolio was short versus the benchmark in U.S. dollar duration. In terms of currency exposure, on the long side, the Portfolio's largest currency position was the Dominican peso. The Portfolio exited Japanese yen, New Zealand dollar, South Korean won, Australian dollar, Norwegian krone, and Russian ruble allocations. The Portfolio also reduced its short euro exposure.

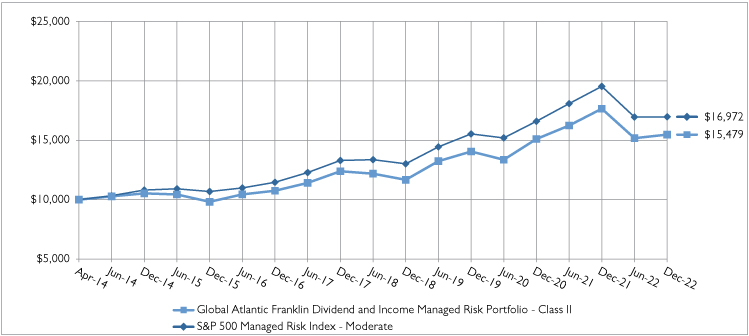

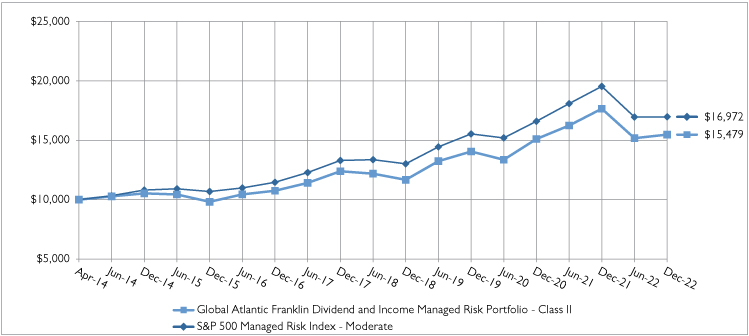

The Portfolio's performance figures for the periods ended December 31, 2022 as compared to its benchmark:

| | | | | Annualized | | Operating

Expense* | |

| | | Inception

Date | | One

Year | | Five

Years | | Since

Inception | | Gross

Ratio | | Net

Ratio | |

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio | |

Class II | | April 30, 2014 | | | -12.33 | % | | | 4.55 | % | | | 5.17 | % | | | 1.21 | % | | | 1.20 | % | |

S&P 500 Managed Risk Index - Moderate^ | | | | | -13.13 | % | | | 4.99 | % | | | 6.29 | % | | | | | |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to July 5, 2017, the fixed-income sleeve of the Capital Appreciation and Income Component of the Portfolio was managed by the Adviser without the use of a sub-adviser. The performance prior to that date is attributable to the Adviser's asset allocation decisions. The sub-adviser to the equity sleeve of the Capital Appreciation and Income Component of the Portfolio changed effective March 1, 2018 due to an organizational restructuring whereby all of the investment personnel responsible for the management of the equity sleeve transitioned from Franklin Advisory Services, LLC to Franklin Advisers.

* The estimated operating expense ratios for Class II shares, as disclosed in the most recent prospectus dated May 1, 2022. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

^ The S&P 500 Managed Risk Index - Moderate is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash, based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

20

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio Review (Continued)

December 31, 2022 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Holdings by Asset Class | | % of Net Assets | |

Common Stocks | | | 69.6 | % | |

U.S. Treasury Securities and Agency Bonds | | | 8.0 | % | |

Corporate Bonds and Notes | | | 6.4 | % | |

Short-Term Investments | | | 5.5 | % | |

Agency Mortgage Backed Securities | | | 4.8 | % | |

Asset Backed and Commercial Backed Securities | | | 3.9 | % | |

Mutual Funds | | | 0.7 | % | |

Municipal Bonds | | | 0.5 | % | |

Sovereign Debts | | | 0.3 | % | |

Preferred Stocks | | | 0.0 | %^ | |

Term Loans | | | 0.0 | %^ | |

Other Assets less Liabilities - Net | | | 0.3 | % | |

| | | | 100.0 | % | |

Please refer to the Portfolio of Investments in this annual report for more information regarding the Portfolio's holdings as of December 31, 2022.

Derivative exposure is included in "Other Assets less Liabilities - Net"

^ Represents less than 0.05%.

5435661.3

21

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments

December 31, 2022

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 69.6% | |

AEROSPACE & DEFENSE - 3.1% | |

General Dynamics Corp. | | | 9,689 | | | $ | 2,403,938 | | |

Raytheon Technologies Corp. | | | 43,522 | | | | 4,392,240 | | |

| | | | | | | | 6,796,178 | | |

AIR FREIGHT & LOGISTICS - 1.5% | |

United Parcel Service, Inc., Class B | | | 18,042 | | | | 3,136,421 | | |

BANKS - 1.0% | |

JPMorgan Chase & Co. | | | 15,751 | | | | 2,112,209 | | |

BEVERAGES - 1.4% | |

PepsiCo, Inc. | | | 17,183 | | | | 3,104,281 | | |

BIOTECHNOLOGY - 1.2% | |

AbbVie, Inc. | | | 16,133 | | | | 2,607,254 | | |

BUILDING PRODUCTS - 1.9% | |

Carlisle Cos., Inc. | | | 6,779 | | | | 1,597,471 | | |

Johnson Controls International PLC | | | 40,615 | | | | 2,599,360 | | |

| | | | | | | | 4,196,831 | | |

CAPITAL MARKETS - 1.0% | |

Nasdaq, Inc. | | | 33,601 | | | | 2,061,421 | | |

CHEMICALS - 6.9% | |

Air Products and Chemicals, Inc. | | | 14,510 | | | | 4,472,853 | | |

Albemarle Corp. | | | 10,942 | | | | 2,372,882 | | |

Ecolab, Inc. | | | 11,360 | | | | 1,653,562 | | |

Linde PLC | | | 16,725 | | | | 5,455,360 | | |

Sherwin-Williams Co. (The) | | | 4,106 | | | | 974,477 | | |

| | | | | | | | 14,929,134 | | |

COMMERCIAL SERVICES & SUPPLIES - 1.3% | |

Cintas Corp. | | | 6,325 | | | | 2,856,496 | | |

CONSUMER DISCRETIONARY SERVICES - 0.0%† | |

24 Hour Fitness Worldwide, Inc.* | | | 671 | | | | 5 | | |

ELECTRICAL EQUIPMENT - 0.5% | |

nVent Electric PLC | | | 30,260 | | | | 1,164,102 | | |

ENERGY EQUIPMENT & SERVICES - 0.0%† | |

Weatherford International PLC* | | | 1,897 | | | | 96,595 | | |

FOOD & STAPLES RETAILING - 1.0% | |

Walmart, Inc. | | | 15,942 | | | | 2,260,416 | | |

FOOD PRODUCTS - 1.7% | |

McCormick & Co., Inc. | | | 26,538 | | | | 2,199,735 | | |

Mondelez International, Inc., Class A | | | 22,380 | | | | 1,491,627 | | |

| | | | | | | | 3,691,362 | | |

HEALTH CARE EQUIPMENT & SUPPLIES - 6.6% | |

Abbott Laboratories | | | 27,874 | | | | 3,060,287 | | |

Becton Dickinson and Co. | | | 14,797 | | | | 3,762,877 | | |

| | | Shares/

Principal | | Fair

Value | |

HEALTH CARE EQUIPMENT & SUPPLIES - 6.6% (Continued) | |

Medtronic PLC | | | 31,500 | | | $ | 2,448,180 | | |

Stryker Corp. | | | 20,715 | | | | 5,064,610 | | |

| | | | | | | | 14,335,954 | | |

HEALTH CARE PROVIDERS & SERVICES - 2.4% | |

CVS Health Corp. | | | 7,828 | | | | 729,491 | | |

UnitedHealth Group, Inc. | | | 8,497 | | | | 4,504,940 | | |

| | | | | | | | 5,234,431 | | |

HOTELS, RESTAURANTS & LEISURE - 1.8% | |

McDonald's Corp. | | | 11,647 | | | | 3,069,334 | | |

Starbucks Corp. | | | 8,800 | | | | 872,960 | | |

| | | | | | | | 3,942,294 | | |

HOUSEHOLD PRODUCTS - 2.1% | |

Colgate-Palmolive Co. | | | 22,528 | | | | 1,774,981 | | |

Procter & Gamble Co. (The) | | | 18,329 | | | | 2,777,943 | | |

| | | | | | | | 4,552,924 | | |

INDUSTRIAL CONGLOMERATES - 1.8% | |

Honeywell International, Inc. | | | 18,519 | | | | 3,968,622 | | |

INSURANCE - 0.7% | |

Erie Indemnity Co., Class A | | | 5,728 | | | | 1,424,668 | | |

IT SERVICES - 3.9% | |

Accenture PLC, Class A | | | 17,421 | | | | 4,648,619 | | |

Visa, Inc., Class A | | | 17,947 | | | | 3,728,669 | | |

| | | | | | | | 8,377,288 | | |

LIFE SCIENCES TOOLS & SERVICES - 1.3% | |

Danaher Corp. | | | 2,210 | | | | 586,578 | | |

West Pharmaceutical Services, Inc. | | | 9,650 | | | | 2,271,128 | | |

| | | | | | | | 2,857,706 | | |

MACHINERY - 1.6% | |

Donaldson Co., Inc. | | | 15,179 | | | | 893,588 | | |

Dover Corp. | | | 15,567 | | | | 2,107,927 | | |

Pentair PLC | | | 12,220 | | | | 549,656 | | |

| | | | | | | | 3,551,171 | | |

MULTILINE RETAIL - 1.3% | |

Target Corp. | | | 18,941 | | | | 2,822,967 | | |

OIL, GAS & CONSUMABLE FUELS - 2.6% | |

Chevron Corp. | | | 13,427 | | | | 2,410,012 | | |

EOG Resources, Inc. | | | 13,089 | | | | 1,695,287 | | |

Exxon Mobil Corp. | | | 13,236 | | | | 1,459,931 | | |

| | | | | | | | 5,565,230 | | |

PHARMACEUTICALS - 2.2% | |

Johnson & Johnson | | | 17,660 | | | | 3,119,639 | | |

Pfizer, Inc. | | | 30,547 | | | | 1,565,228 | | |

| | | | | | | | 4,684,867 | | |

See accompanying notes to financial statements.

22

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Continued)

December 31, 2022

| | | Shares/

Principal | | Fair

Value | |

ROAD & RAIL - 1.6% | |

JB Hunt Transport Services, Inc. | | | 7,900 | | | $ | 1,377,444 | | |

Norfolk Southern Corp. | | | 8,475 | | | | 2,088,410 | | |

| | | | | | | | 3,465,854 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.9% | |

Analog Devices, Inc. | | | 26,113 | | | | 4,283,316 | | |

Texas Instruments, Inc. | | | 25,033 | | | | 4,135,952 | | |

| | | | | | | | 8,419,268 | | |

SOFTWARE - 8.1% | |

Microsoft Corp. | | | 49,537 | | | | 11,879,964 | | |

Roper Technologies, Inc. | | | 13,270 | | | | 5,733,834 | | |

| | | | | | | | 17,613,798 | | |

SPECIALTY RETAIL - 2.7% | |

Lowe's Cos., Inc. | | | 15,159 | | | | 3,020,279 | | |

Ross Stores, Inc. | | | 24,152 | | | | 2,803,323 | | |

| | | | | | | | 5,823,602 | | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 0.2% | |

Apple, Inc. | | | 2,900 | | | | 376,797 | | |

TEXTILES, APPAREL & LUXURY GOODS - 1.4% | |

NIKE, Inc., Class B | | | 25,058 | | | | 2,932,037 | | |

TRADING COMPANIES & DISTRIBUTORS - 0.9% | |

WW Grainger, Inc. | | | 3,534 | | | | 1,965,788 | | |

TOTAL COMMON STOCKS

(Cost - $69,752,269) | | | | | 150,927,971 | | |

U.S. TREASURY SECURITIES AND AGENCY BONDS - 8.0% | |

U.S. Treasury Bond | |

1.13%, 5/15/40 | | $ | 465,000 | | | | 293,259 | | |

1.13%, 8/15/40 | | | 1,175,000 | | | | 735,293 | | |

1.75%, 8/15/41 | | | 2,340,000 | | | | 1,613,229 | | |

2.50%, 5/15/46†† | | | 915,000 | | | | 688,180 | | |

2.25%, 8/15/46 | | | 795,000 | | | | 567,369 | | |

2.75%, 8/15/47 | | | 150,000 | | | | 118,020 | | |

2.75%, 11/15/47 | | | 319,000 | | | | 250,963 | | |

3.13%, 5/15/48 | | | 100,000 | | | | 84,754 | | |

3.00%, 8/15/48 | | | 330,000 | | | | 273,307 | | |

2.88%, 5/15/49 | | | 100,000 | | | | 81,176 | | |

1.25%, 5/15/50 | | | 940,000 | | | | 511,235 | | |

2.38%, 5/15/51 | | | 275,000 | | | | 199,160 | | |

1.88%, 11/15/51 | | | 960,000 | | | | 614,175 | | |

U.S. Treasury Inflation Indexed Note,

0.63%, 1/15/26 | | | 608,287 | | | | 584,383 | | |

U.S. Treasury Note | |

0.38%, 12/31/25 | | | 2,550,000 | | | | 2,281,254 | | |

1.88%, 2/28/27 | | | 1,580,000 | | | | 1,449,218 | | |

2.75%, 4/30/27 | | | 2,200,000 | | | | 2,087,938 | | |

3.25%, 6/30/27 | | | 1,880,000 | | | | 1,820,589 | | |

| | | Shares/

Principal | | Fair

Value | |

U.S. TREASURY SECURITIES AND AGENCY BONDS - 8.0% (Continued) | |

U.S. Treasury Note (continued) | |

3.13%, 8/31/27 | | $ | 710,000 | | | $ | 683,985 | | |

1.88%, 2/15/32 | | | 2,080,000 | | | | 1,770,762 | | |

2.88%, 5/15/32 | | | 715,000 | | | | 661,263 | | |

TOTAL U.S. TREASURY

SECURITIES AND AGENCY

BONDS (Cost - $19,378,967) | | | | | 17,369,512 | | |

CORPORATE BONDS AND NOTES - 6.4% | |

AEROSPACE & DEFENSE - 0.1% | |

Boeing Co. (The), 5.15%, 5/1/30 | | | 150,000 | | | | 146,746 | | |

AGRICULTURE - 0.1% | |

Altria Group, Inc., 3.40%, 5/6/30 | | | 100,000 | | | | 85,720 | | |

Imperial Brands Finance PLC,

4.25%, 7/21/25 (a) | | | 200,000 | | | | 191,208 | | |

| | | | | | | | 276,928 | | |

AIRLINES - 0.2% | |

Delta Air Lines, Inc. / SkyMiles IP Ltd.,

4.50%, 10/20/25 (a) | | | 300,000 | | | | 292,808 | | |

United Airlines 2020-1 Class B

Pass-Through Trust, 4.88%, 1/15/26 | | | 38,100 | | | | 35,909 | | |

| | | | | | | | 328,717 | | |

BANKS - 2.3% | |

Banco de Chile, 2.99%, 12/9/31 (a) | | | 200,000 | | | | 170,115 | | |

Banco Santander SA, 2.75%, 12/3/30 | | | 200,000 | | | | 154,587 | | |

Bank of America Corp. | |

3.86%, (3 Month US Libor + 0.94%),

7/23/24 (b) | | | 200,000 | | | | 198,189 | | |

3.50%, 4/19/26 | | | 500,000 | | | | 476,897 | | |