UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant’s telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2022

Item 1. Report to Stockholders.

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

ACR Multi-Strategy Quality Return (MQR) Fund

Class I Shares

(Ticker Symbol: MQRIX)

ACR International Quality Return (IQR) Fund

Class I Shares

(Ticker Symbol: IQRIX)

ANNUAL REPORT

November 30, 2022

ACR Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 32 |

| Schedule of Investments | 36 |

| Statements of Assets and Liabilities | 43 |

| Statements of Operations | 44 |

| Statements of Changes in Net Assets | 45 |

| Financial Highlights | 49 |

| Notes to Financial Statements | 51 |

| Report of Independent Registered Public Accounting Firm | 62 |

| Supplemental Information | 63 |

| Expense Examples | 72 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the ACR Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.acr-investfunds.com

November 30, 2022

Dear Shareholders:

The ACR Alpine Capital Research investment team is pleased to present its eighth annual investment letter for the ACR Multi-Strategy Quality Return (MQR) Fund (“MQR” or “MQR Fund,” or “the Fund”).

Our aim with this annual report is to provide a summary and discussion of the MQR Fund’s performance and positioning, plus its audited financial statements. ACR’s fund website, www.acr-investfunds.com, also provides information about the Fund and connects you to ACR’s firm website, which includes quarterly firm commentaries that explain our investment philosophy, view of market conditions, and investment strategies.

ACR understands that the trust and confidence of MQR Fund shareholders is contingent upon integrity between ACR’s words and actions and, ultimately, the MQR Fund’s investment results. The ACR investment team strives to earn and keep that trust and confidence, and we look forward to partnering with shareholders for many years of prosperity and intelligent decision-making.

Sincerely,

Tim Piechowski, CFA ®

Portfolio Manager

8000 Maryland Avenue, Suite 700 | St. Louis, MO 63105

t 314.932.7600 | f 314.932.1111 | 877.849.7733 | acr-invest.com

Management’s Discussion of Fund Performance

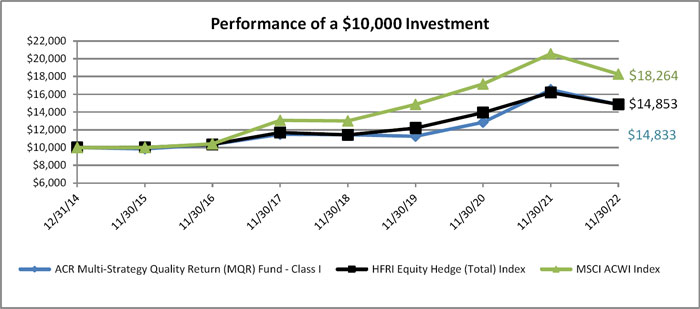

From a price perspective, MQR had a decent year as it outperformed its primary benchmark with a -10.22% net return for the fiscal year ending November 30, 2022 (“Fiscal 2022”) versus a return of -11.19% for the MSCI ACWI (Gross) Index.

However, ACR focuses on growing the fundamental value of its portfolios each year, and by this measure, the Fund’s results were less satisfactory.1 The Fund’s price-to-value ratio declined to 0.67x from 0.73x during the year, or approximately 8.22% versus the Fund’s 10.22% decline, which implies that the fundamental value of MQR’s portfolio declined by approximately 2%2.

In 2022, there were several historic events that largely explain this decline. These events included, among other items, high inflation; the need for central banks to tighten monetary policy, which led to higher interest rates and wider credit spreads; and Russia’s inexplicable invasion of Ukraine. ACR aims to incorporate significant conservativism into its appraisals of portfolio holdings so that adverse events do not drive degradation of its estimate of a holding’s fair value. However, 2022’s events were idiosyncratic enough to drive a modest decline in the portfolio’s fundamental value. The investment team believes that over time, this small decline is likely to be offset with gains in fundamental value in future years. Despite this year’s decline, ACR is confident that at its current 0.67x price-to-value level, the Fund is positioned with the potential to drive material relative outperformance and absolute returns going forward.

The Fund’s net long exposure increased from approximately 81% as of November 30, 2021 to 90% as of the November 30, 2022 fiscal year end. We stated in last year’s letter that ACR would deploy ”dry powder” if market volatility picked up in Fiscal 2022, and indeed, ACR found incremental opportunities to deploy capital into new securities during the year. The Fund’s new positions in DCC plc, FedEx, Aercap, and Nerdy generally served to lower the price to value in the portfolio while also adding some diversification.

The remainder of this letter will provide an overview of the Fund’s objectives and a discussion of the Fund’s Fiscal 2022 performance. It will also discuss the market conditions under which the Fund has operated since inception and why these past conditions, along with the Fund’s current positioning, give the team confidence that the Fund is well-positioned going forward.

MQR Objectives

The investment objectives of the MQR Fund are to preserve capital during periods of economic decline and provide above-average absolute and relative returns in the long run. “Long run” is defined as an investment performance period that includes a full economic cycle of expansion and contraction in output and equity market prices.

“Above-average absolute returns” means higher than a “fair” equity-like return (i.e., stock market returns over a full market cycle) commensurate with the risk of investing in equities in the long run. The term “absolute return” in no way implies there will be positive returns in any period other than in the “long run” as defined above. Market-value fluctuations are expected to produce significant negative returns in certain short-term periods. Annual market returns are expected to be both positive and negative.

| 1 | The MSCI (ACWI) Gross Index captures large and mid-cap representation across 23 developed markets and 23 emerging markets countries. With approximately 2,469 constituents, the index covers approximately 85% of the global investable opportunity set. |

| 2 | ACR’s price to value statistic compares the price of MQR’s holdings to ACR’s estimate of the present value of the discounted estimated future cash flows to equity of the Fund’s holdings using a weighted average discount rate (currently 10% for MQR Fund) based on ACR’s estimate of the risk of these cash flows being achieved. |

“Above-average relative returns” means returns higher than returns of an equity-market benchmark in the long run. The equity-market benchmark is the MSCI ACWI Index because it is a broad proxy for the world equity market.

ACR achieves each of these objectives by seeking securities that (a) have reliable cash flows and (b) are priced at a discount to a conservative estimate of the present value of these cash flows. The investment team refrains from putting capital to work in a security unless the investment, at fundamental value, is expected by the investment team to generate a return that is materially in excess of inflation.3 We believe the discipline to purchase the security at a discount to our estimate of fundamental value should allow us to earn an excess return over this minimum hurdle. More importantly, the discount to fundamental value has the potential to help protect capital against permanent impairment, thereby increasing the likelihood that the Fund meets its return hurdles.

Overview of Fiscal 2022 Performance

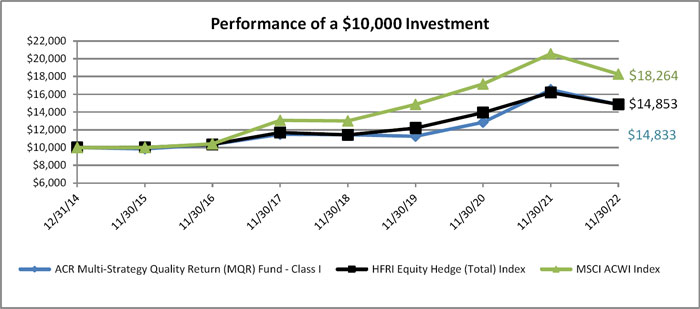

MQR Fund shares generated a -10.22% net return in Fiscal 2022 versus a return of -11.19% for the MSCI ACWI (Gross) Index and -8.26% for the HFRI Equity Hedge (Total) Index4.

MQR’s price performance was driven by its U.S.-domiciled holdings, which made up approximately 34% of the Fund’s exposure during the year. U.S.-domiciled holdings were approximately flat over the period, adding approximately 3 basis points to aggregate returns, versus a decline of 9.21% for the S&P 500 Index5,6. There was significant bifurcation in the price returns of the underlying holdings making up this return stream. Holdings in commodity businesses like Chevron Inc., Comstock Resources and Resolute Forest Products (each up between 69% and 123%) were aided by the real and perceived effects of high inflation and Russia’s invasion of Ukraine. Offsetting gains from commodity businesses were those that were or were perceived to be harmed by higher interest rates and higher inflation, including Lumen, General Motors, and Five Point Holdings (each down between 30% and 62%).

MQR’s ex-U.S. holdings made up approximately 54% of the Fund’s exposure during the year. On an aggregate basis, these holdings detracted from price performance during the year, declining on a price basis by a weighted average of 21.91% versus an 11.87% decline for the MSCI All Country World Index ex-USA (“ACWX”)7. Investment returns here were negatively impacted by the Fund’s exposure to homebuilding and building products-related businesses in the U.K., exposure to auto parts manufacturers, a lack of investments in oil and gas companies, and an investment in wine producer and distributor Naked Wines.

The three largest detractors and contributors to Fund returns during the fiscal year are discussed in greater length in the following section. However, it should be noted here that ACR focuses on growth in the fundamental value of the overall Fund, and the fluctuations in price in a given year of a few holdings are unlikely to drive the longer-term performance of the Fund. Rather, longer-term performance will be most correlated and causally tied to ACR’s investment team correctly forecasting the discounted cash flows to equity to be received by holders of its investee companies’ shares and purchasing them at a price below fundamental value.

| 3 | Cash flow refers to cash that is available to reinvest in a business, make acquisitions, pay down debt or distribute to shareholders. |

| 4 | The HFRI Equity Hedge Index consists of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. |

| 5 | A basis point is one one-hundredth of a percent. |

| 6 | The S&P 500 Index® is made up of large capitalization U.S. Equities, with the index making up approximately 500 of the largest companies in the United States that make up some 80% of the country’s available market capitalization. |

| 7 | The MSCI ACWI ex USA index captures large and mid-cap representation across 22 of 23 developed market (excluding the U.S.) and 24 emerging market countries. With 1,866 constituents, the index covers approximately 85% of the global equity opportunity outside the United States. |

ACR’s fundamental investment approach employs deep research at both the industry and company level. The goal of this approach is to achieve an understanding of a business’s cash flow profile, its ability to redeploy its cash flow, as well as to gain an understanding of the terminal economics of each business it analyzes. ACR’s primary goal in this approach is to have a high probability of only deploying capital at a discount to the present value of a security’s long-term cash flows.

Despite a modest 2% reduction in the portfolio’s fundamental value in 2022, the investment team continues to believe that its current holdings are materially undervalued. One measure for this is the Fund’s price-to-value (p/v) statistic, currently 0.67x, which measures the discount at which the Fund’s holdings (ex-cash) trade to fundamental value. Its reciprocal, 1/0.67x or 49%, is the amount by which the Fund’s holdings would appreciate in total if they were to each reach fundamental value immediately.

Importantly, ACR would highlight that the p/v statistic of 0.67x is based upon ACR discounting the future cash flows to equity of the Fund’s holdings at a weighted average of 10%. Thus, theoretically, if ACR’s investment team were 100% accurate in its analysis (which it will not be) and were buying the portfolio at a 1 price to value, Fund investors would expect to generate a 10% annualized return on the Fund’s equity holdings. Given that ACR believes it is buying companies well below a 1 price to value, our analysis suggests returns for the Fund will be better than this if our assumptions prove to be approximately correct.

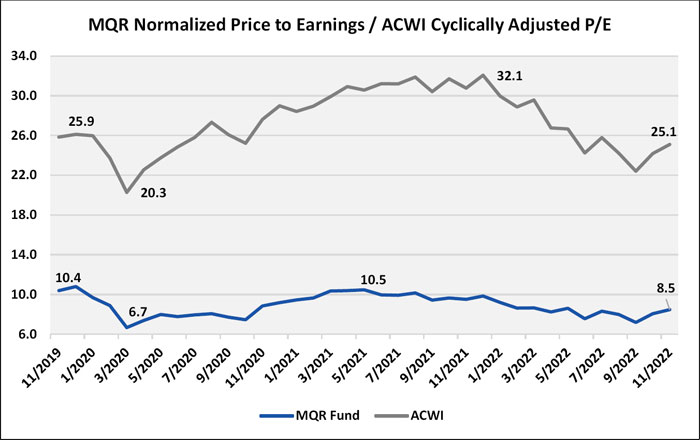

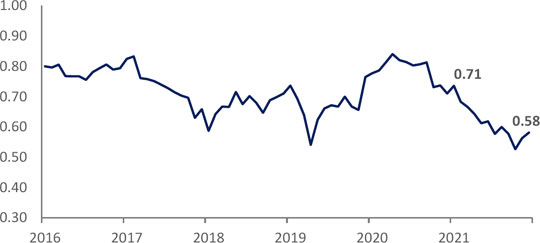

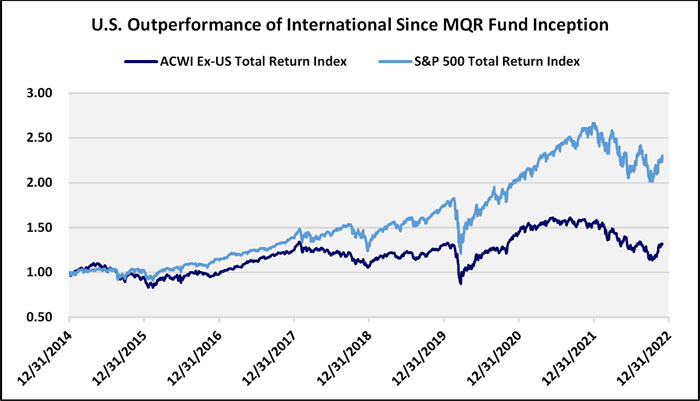

In the above chart, one can see that in the past few years, price to value has not converged closer to 1 in the MQR portfolio. Though we do not know when, our belief is that there will be periods when this will occur in the future. One potential catalyst for closing the price-to-value discount in the portfolio is if value stocks gain favor over growth stocks in the period ahead. The “value” versus “growth” phenomenon is discussed more in the section below titled “The Market Conditions Under Which the Fund has Operated Since Inception.”

Detractors and Contributors Fiscal 2022

The three largest detractors for the Fund in FY 2022 were Naked Wines, Plastic Omnium, and Eurocell.

Naked Wines (“WINE,” 379 basis points negative contribution, 88% decline)

Naked Wines was the Fund’s largest detractor in the period. WINE is based in the U.K. but is considered the largest winery in the U.S., selling wine online only, direct to consumer (DTC). WINE’s business received a significant tailwind from the Covid pandemic as wine consumers had to find alternative sources for their wine purchases outside normal retail channels. During the Covid year of 2020, WINE’s customer count increased 53%, revenue 67% and profit 86%. ACR’s investment team internally debated alternative possible outcomes but thought the most likely outcome was that the added business scale and higher level of consumer awareness would start a virtuous circle for the businesses. More awareness should increase customers, which should incentivize more talented wine makers to join, which should improve product assortment, which should lead to more sales, which should allow for more supply-chain efficiency, which in turn should allow WINE to improve its customer proposition (either higher quality or lower prices). The company’s management appeared to align with ACR’s thinking, and in 2021 made large upfront wine purchase commitments to satisfy the expected demand growth over the subsequent years. ACR, and management, were wrong. It became apparent in 2022 that the customers acquired during the Covid years had a lower propensity to remain customers and, hence, were less profitable than historical customer acquisitions. In 2022, we also saw the reopening of society post Covid lockdowns; wine purchases shifted back to retail and restaurant locations, and DTC wine volume shipments dropped by approximately 9%. The company quickly went from a well-capitalized company with an improving business to one overcommitted on inventory that needed a credit facility to pay for wine production in progress and the committed inventory that was sitting idle in its warehouses. Further, Apple made changes to its privacy policies for iOS devices, and this made digital advertising much less effective and, hence, more expensive. Lastly, inflation increased Naked Wines’ distribution costs, and the company had to raise prices while industry volumes were declining. The confluence of these events led to the company’s 85% share-price decline. While ACR continues to believe that Naked Wine’s business is differentiated versus peers, that the company’s unit economics work and that its product provides a value to customers, the fact remains that 2022 was an unexpected step backwards for the company. ACR’s investment team was wrong in its assessment of continued corporate performance progress, and this, combined with the lower level of certainty around the company’s eventual customer count and other opportunities to invest the Fund’s capital, caused ACR to exit the Fund’s position in WINE.

Plastic Omnium (“POM,” 224 basis point negative contribution, 39% decline)

Plastic Omnium was the second-largest detractor in the period. POM is a French auto parts manufacturer, and it is, to a large extent, dependent on global auto production. The company has now faced three consecutive years of well-below normal levels of global auto production. Global auto production was approximately 86 million in 2019, and this dropped to approximately 72 million during the Covid year of 2020. The production rebound that many expected in 2021 did not occur, as global semiconductor shortages kept global auto production to approximately 74 million units. In 2022, we did not see the rebound previously expected as Russia’s invasion of Ukraine further deteriorated the global automotive supply chain. ACR’s investment process makes allowances for uncertainty by incorporating our estimates of industry up and down cycles into our expectations, but we did not envision three consecutive years of well-below normal levels of global auto production. It appears the market was similarly caught off guard and reacted myopically to the near-term deterioration in the company’s corporate performance by reducing the company’s share price significantly. ACR’s investment process revolves around investing in businesses it believes are durable and adaptable (quality) and investing in these companies at a significant discount to ACR’s estimate of fundamental value, with fundamental value determined by the cash the company can distribute to shareholders over its business life. ACR’s estimate of fundamental value for POM has come down slightly as the past two years have been worse than originally expected, but ACR’s overall thesis continues to hold up. POM is a global leader in its markets with number 1 global share in intelligent exterior systems (15% market share), clean energy systems (22% market share) and plastic modules (18% market share). The company continues to gain market share and is well-managed. The investment team continues to believe a more normal level of global auto production is closer to the high 80s to low 90s million per year and expect the company’s share price to be materially higher once these more normal levels of production are reached.

Eurocell (“ECEL,” 156 basis points negative contribution, 43% decline)

Eurocell was the third-largest detractor in the period. ECEL is a U.K.-based manufacturer and retailer of PVC (plastic) window frames and other products for the repair, maintenance, and improvement (RMI) market. ECEL is expected to be negatively impacted by inflationary cost increases at a time of deteriorating consumer confidence related to rising inflation and higher interest rates. The company’s share price dropped to reflect the deteriorating near-term corporate performance outlook. ACR also expects a more difficult near-term operating environment but believes the market’s focus on near-term first-order effects (higher interest rates means lower RMI spend) has caused a large overreaction in the company’s share-price decline. Zooming out from the near term, the opportunity for ECEL is as attractive as it was at the beginning of the year, perhaps even more so. ECEL is differentiated versus competitors due to its large number of retail locations (makes it easier for contractors to find products) and its ownership and usage of its recycling facility (lower cost production and more environmentally friendly). ECEL has invested significantly in its supply chain, recycling capability, retail store count, and warehousing capacity, and this has allowed the company to increase market share over the past years. ACR expects a deteriorating industry environment to impact competitors more negatively than ECEL, and the investment team expects the company to come out of this industry downturn better positioned versus peers than it went in. Further, ACR does not expect long-term demand for its products to be negatively impacted by the current environment, perhaps the opposite. This inflationary crisis is partially driven by high energy prices, and one of the easiest and most affordable ways to improve a home’s energy efficiency is by replacing old drafty windows. ECEL is the U.K.’s market-leading manufacturer of energy-efficient window frames to cater to this demand. We expect the market to revalue ECEL’s shares materially higher once it realizes the quality of the business and the favorable longer-term industry dynamics.

The three largest contributors to the Fund in FY 2022 were Comstock Resources, Chevron, and Fairfax Financial.

Comstock Resources (“CRK,” 313 basis point contribution, 123% return)

Comstock was the largest contributor to the fund in the period. CRK is an energy exploration and production company, primarily operating in the unconventional Haynesville basin in northwest Louisiana and east Texas. The Haynesville basin is a premier natural gas basin with direct access to the high-value Gulf Coast markets and liquefied natural gas (LNG) exporting corridor. Exports of natural gas have grown fourfold since the fund initially made this investment more than four years ago. At the time of investment, natural gas was selling for less than $3 per one thousand cubic feet (mcf) versus the $6.50 it averaged in 2022. ACR’s original purchase price translated to less than four times Comstock’s depressed cash flow at 2018 trough natural gas prices or, put another way, ACR felt like it was buying a dollar for around 60 cents. ACR’s research also indicated that those depressed prices were not high enough to stimulate new production in what is a capital-intensive industry. CRK had a best-in-class cost structure, and ACR expected eventual price support for natural gas due to capital discipline, because so much money had been lost in the space in prior years. Further, ACR anticipated climate concerns would drive increased power generation demand from coal-to-natural gas switching (e.g., natural gas is about 66% less carbon-intensive than coal). ACR’s views turned out to be correct. Storage levels of natural gas remain below the five-year average despite high prices as capital drilling still remains scarce. According to the U.S. Energy Information Administration, five years ago, coal and natural gas were each about 25% of power production in the U.S. Today, natural gas is near 40% and coal is less than 20% and in decline. Nuclear has remained steady at 20%. Renewables have doubled to nearly 20% of production in the last five years, but their intermittent availability makes them unreliable for base load power, unlike natural gas. And for now, the cost of several days of storage for renewable power remains prohibitively expensive, leaving natural gas as the dominant base load power source. The high price realizations in 2022 have produced a doubling of free cash flow growth at CRK, which has allowed the company to de-lever materially, reinstate a dividend, and do tuck-in acquisitions at low multiples. Today, the company is well-positioned to keep meeting global demand growth for LNG as countries grapple with both energy security and climate concerns. ACR first reduced and then entirely exited the Fund’s position in CRK as its share price moved up throughout the year.

Chevron (“CVX,” 196 basis point contribution, 69% return)

Chevron was the second-largest contributor to the Fund in the period. Unlike Comstock, which is a smaller, somewhat niche operator in the energy exploration and production space, CVX is a global, fully integrated energy producer with operations in the U.S. and abroad. It produces about 3% of all the oil equivalents consumed globally in a day. At the time of ACR’s investment back in early 2020, Covid was wreaking havoc on the energy markets. Front month West Texas Intermediate crude oil for May 2020 settlement actually traded at a negative value ($45 per barrel), as those that were long the contract had to pay for storage because there was no immediate demand for it. Global oil consumption had been about 100 million barrels of oil per day, and during Covid it dropped to about 90 million barrels of oil a day. While just a 10% demand drop seems incongruous with what were plummeting oil prices at the time ($70 to $20), ACR’s experience in the sector told us that this was very much possible in an extreme scenario given that prices are set by the marginal purchaser in oil markets. ACR’s expectation was that at some point, economic activity would normalize, and we would see oil demand rebound. The key was owning a company that would be able to survive the lull in economic activity and the decline in oil and gas prices for long enough to see an eventual rebound. CVX had, and still has, the best balance sheet in the industry, an AA credit rating, and was best positioned to weather the Covid-induced storm. At the time of its investment, ACR’s research indicated that CVX could generate $8 to $12 of normalized cash earnings in a $60 oil price environment, which ACR believes is the price that is needed globally to stimulate incremental production in this capital-intensive industry. Similar to our Comstock thesis, ACR anticipated that the losses incurred in the sector during the years prior to and including the early days of the Covid-19 pandemic would make capital scarce. Thus, those that had capital like CVX would be well-positioned once the market recovered. This thesis came to fruition this year as the price of oil shot north of $100 and demand once again neared 100 million barrels of oil per day, in excess of supply for most of 2022. Chevron was the beneficiary of that, as cash earnings per share have been over $17 over the last 12 months. The company never cut its dividend during the downturn and has reinstated stock buybacks with the substantial free cash flow it is generating. ACR believes CVX remains the premier globally integrated energy producer.

Fairfax Financial (“FFH,” 142 basis points contribution, 31% return)

Fairfax Financial Holdings is a Toronto-based global multi-line property and casualty insurance company with approximately $89 billion in assets. FFH’s shares appreciated in 2022 because of two items. First, FFH entered the year with its fixed-income portfolio very conservatively positioned with just a 1.2-year duration. In comparison, many of FFH’s competitors were operating with durations of approximately 4 to 5 years. For each 100-basis-point increase in interest rates at a 1.2-year duration, FFH would expect to have unrealized losses of approximately 1.2% of the value of its investment book. In contrast, peers would have expected a 4% to 5% loss per 100-basis-point change in rates. Given that rates on one-year U.S. Treasuries moved up approximately 450 basis points during the year and rates on 5-year U.S. Treasuries moved up 268 basis points during the year, there were significant unrealized fixed-income losses across the insurance landscape. For Fairfax, these figures were small given the low duration of its investment book. This will benefit FFH as it will rapidly accrete gains on its investment book as its low-duration bonds mature, and then, monies can be redeployed into bonds with much higher rates, which will boost interest income in future periods. In contrast, it will take longer for its peers to recoup unrealized losses in their fixed-income books, and longer to increase their cash flow with higher interest income. Secondarily, the insurance market continued a “hard market” or period of high pricing per unit of risk insured. For FFH this hard market is very likely to prove beneficial as the company is currently writing more insurance policies than in prior periods when pricing was softer, and likely doing so at much higher underwriting profits. ACR’s research indicates that FFH continues to be materially undervalued based on the level of interest income FFH is likely to generate in the future, and the potential for the company to generate large underwriting profits from the current hard market.

The Market Conditions Under Which the Fund has Operated Since Inception

In past MQR Fund annual letters, ACR has written about a phenomenon we have called the Value Depression. In 2022, we began to see the reversal of this phenomenon and believe that over time there is a likelihood that this reversal will continue and provide both relative- and absolute-return benefits to MQR shareholders.

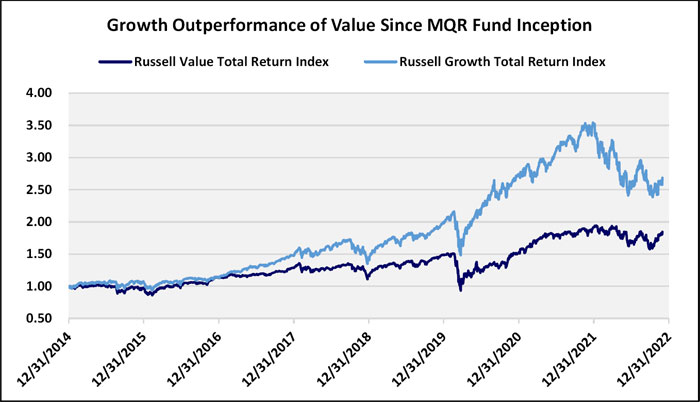

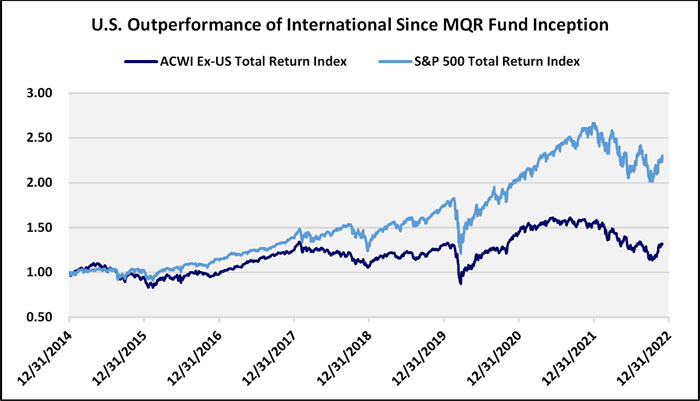

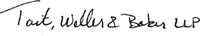

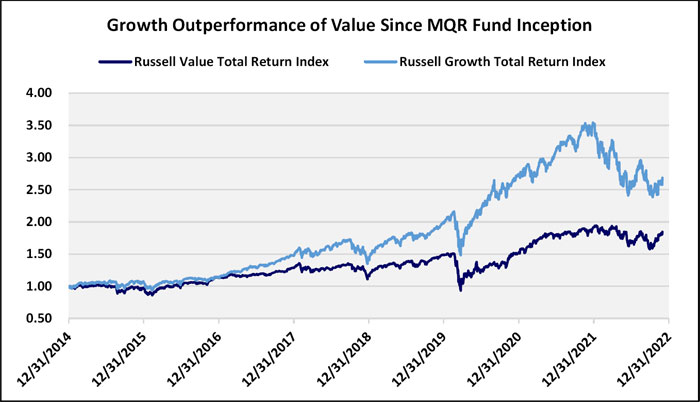

There are two related phenomena that make up the Value Depression. First, “growth” stocks have significantly outperformed “value” stocks since inception of the Fund. Second, U.S. stocks have materially outperformed ex-U.S. stocks. There is some correlation to these items, as ex-U.S. indices are materially underweight technology stocks, which generally are in the “growth” camp.

One can see in the chart below that value stocks, or those companies that generally have established business models, are likely to grow at rates at or slightly below GDP, and those that generally have lower multiples have underperformed, while those in nascent industries have seen their share prices rise more substantially. One example of this is in the United States, where the Russell 1000 Growth Index8 is up 168% since the inception of the Fund on December 31, 2014, while the Russell 1000 Value index is up just 85%.9

| 8 | The Russell 1000 Growth Index® measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index® companies with higher price-to-book ratios and higher forecasted growth values. |

| 9 | Please reference the appendix for the full MQR Fund performance disclosures. The Russell 1000 Value Index® measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. |

Secondarily, the S&P 500 is up 130% since inception of the Fund versus a 32% return for the MSCI ACWI ex USA (“ACWX”).

Each of these factors has held back the Fund’s performance, as ACR’s analysis generally has a “value” tilt to it, and value stocks have been exceptionally out of favor.

This value tilt is not necessarily intentional; rather, ACR’s investment team generally is underinvested in “growthier” businesses as these tend to be companies that trade at high valuation multiples with business models that have not been tested over cycles and where ACR’s investment team has difficulty building confidence in the durability of high growth rates. This is not to say that ACR couldn’t own certain high-growth businesses in the future—and, indeed, one feature of the current portfolio is that our research shows that our companies are positioned to generally grow at the same rate or faster than the MSCI ACWI Index as a whole—but that ACR would have to be confident that it was paying a very low multiple of expected cash flow in the event that we are wrong about a company’s going-forward growth rate.

The question for ACR’s investment team (and Fund shareholders) that we asked last year bears repeating: have we missed the proverbial boat by not riding along as growth outperformed value, or, does the significant outperformance of growth reflect a cyclical willingness of the market to buy growth at speculative prices while ignoring fundamentals?

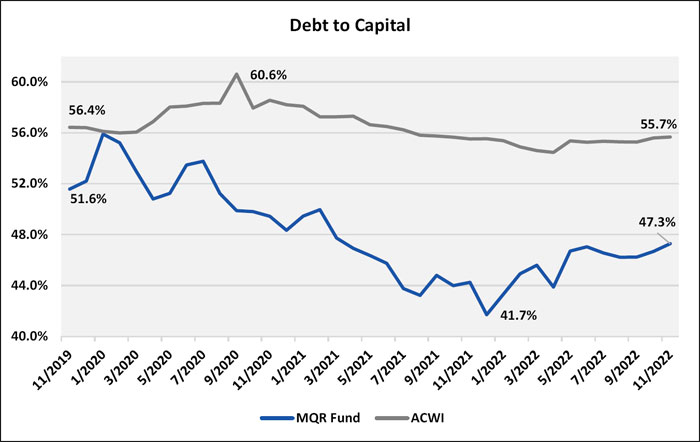

Our research continues to indicate that the markets of the least several years have largely ignored fundamentals and provided ACR with the opportunity to build a portfolio that is demonstrably cheaper than the market with better debt-to-capital statistics and similar growth rates. We look forward to a continuation of a reset where companies with discernable cash flows rerate higher and those with more speculative cash flow profiles rerate lower.

Current Positioning of the MQR Fund

ACR’s investment team believes that the Value Depression has allowed it to create a portfolio that is concentrated in a select number of opportunities with characteristics that are substantially different than that of the market.

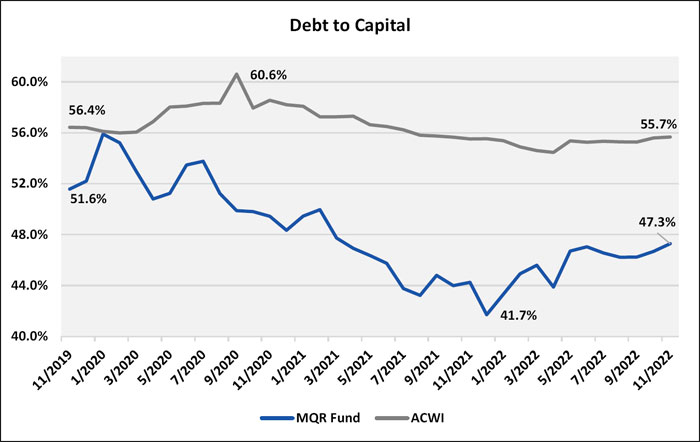

Today, as is shown graphically in the charts below, MQR is structured with a portfolio that has a weighted average price/earnings (P/E)10 ratio that is well below that of the ACWI, with returns on equity11 that are above and price-to-book (P/B) values12 that are well below those of the index. Too, the Fund’s companies maintain debt-to-capital ratios13 that are below that of the average company in the index, suggesting that the Fund’s holdings have better balance sheets and greater financial flexibility than the average index constituent.

| 10 | Price to Earnings compares the market capitalization of a company to the net income available to common equity. |

| 11 | Return on Equity compares the net income available to common equity to common equity. |

| 12 | Price to Book compares the market capitalization of a company to its common shareholders’ equity. |

| 13 | Debt to Capital compares the debt of a company to the total of its debt plus its shareholders’ equity. |

As of November 30, 2022, Source: ACR Analysis, Barclays, DataStream

As of November 30, 2022 Source: ACR Analysis, Bloomberg, S&P Capital IQ

As of November 30, 2022, Source: ACR Analysis, Bloomberg, S&P Capital IQ

As of November 30, 2022, Source: ACR Analysis, Bloomberg, S&P Capital IQ

As ever, ACR does not know when the market will appreciate the characteristics of the Fund’s portfolio companies. However, we continue to believe that high-conviction, fundamentally researched portfolios with advantaged characteristics such as those demonstrated in the charts above have the potential to provide the best opportunity for material relative outperformance and absolute returns over the long run.

Conclusion

MQR’s Fiscal Year 2022 performance was acceptable from a relative market-price perspective, but from a fundamental value standpoint, ACR’s research indicates that the Fund’s holdings saw a 2% reduction in fundamental value. ACR’s research indicates that this reduction in fundamental value was likely one time and that increases to estimates of fundamental value in future years will likely cause this year’s decline to become a rounding error over the longer term. MQR’s holdings continue to have low P/Es, low P/Bs, higher returns on equity, and low debt-to-capital statistics in both absolute terms and relative to that of its benchmark. Given this and the investment team’s deep fundamental research on each holding in the portfolio, ACR’s investment team is confident that the MQR Fund is well-positioned to potentially generate attractive returns in future periods.

Thank you for your continued trust,

Tim Piechowski, CFA ®

Portfolio Manager

Appendix: MQR Fund’s Performance Disclosures

Total Fund Market Return | Fiscal Year

Ended

11/30/2022 | 5 Years

Ended

11/30/2022 | Inception

To Date

Return1 |

| MQRIX at NAV | -10.22% | 5.23% | 5.11% |

| MSCI ACWI (Gross) Index | -11.19% | 6.94% | 7.91% |

| HFRI Equity Hedge (Total) Index | -8.26% | 4.92% | 5.13% |

| 1 | Reflects 95 months of performance, annualized, as fund was launched 12/13/2014. |

The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses as determined in accordance with SEC Form N-1A), professional fees related to services for the collection of foreign tax reclaims, expenses incurred in connection with any merger or reorganization, and extraordinary expenses (such as litigation expenses) do not exceed 1.25% of the average daily net assets of Class I shares of the Fund. This agreement is in effect until March 31, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees.

The performance data quoted here represents past performance, which is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (855) 955-9552.

Appendix: ACR’s Investment Principles

Investment Principles

Fundamental value and risk are our focus when evaluating investments

Fundamental (or intrinsic) value is the cash generated by an enterprise or asset over its useful life. Fundamental value is earned in the future as dividends, interest, and principal are paid or as retained earnings are successfully reinvested.

Risk is the likelihood and potential magnitude of a permanent decline in the earning power or asset value of an enterprise, or the payment of a market price at purchase, which is higher than fundamental value. Our objective is to mitigate risk through integrity with our investment principles and investment process excellence.

When buying, we never confuse fundamental value with market price. Market price is what we pay. Fundamental value is what we get. Market price may be found quoted daily from news services or ascertained from past transaction records. Fundamental value is determined by enterprise cash flows.

Market price, it follows, is not a barometer we would use to evaluate corporate performance. Our evaluation of corporate performance is based on items such as income, assets, and return on capital. We view the price of a security simply as a record of what others—well informed or not—were willing to pay for it at various times in the past.

Fundamental value is such a critical concept because it is the only reference point for what an investment is actually worth, and therefore, whether or not the market price is fair, high, or low. Two facts support this view. First, the theoretical point that an investment is worth the present value of its future cash flows is self-evident and undisputed. Second, new-era theories that have driven market prices to speculative levels in the short run have always succumbed to fundamental value in the long run.

We insist on quality with a “margin of safety”

The quality of a security is defined by the reliability of the cash flows or assets that comprise its fundamental value. The quality of an investment is defined by the price paid for the fundamental value received.

A quantifiable “margin of safety” is the hallmark of a quality investment. For higher-rated fixed-income investments, an issuer’s available resources must be significantly greater than the interest and principal due the investor. For lower-rated fixed-income investments selling below their principal value, the assets backing an issue must be significantly greater than its price. For equity investments, the fundamental value of a company must be significantly greater than its price. For other types of investments and as a general rule, the probability of achieving a return commensurate with the risk taken must be very high.

We only invest in what we understand

True understanding is built upon high probability statements about security values. It requires a dogged determination to get to the bottom of things and an equally dogged honesty about whether or not we did.

Understanding is also relative. Achieving better-than-average returns requires understanding security values better-than-average. The problem is most investment managers believe they are better-than-average.

Competence and honesty are the keys to assuring that we are not fooling ourselves. Competence means that we are capable of estimating security values and returns for both our portfolios and the markets in which we participate. Honesty means that we are candid about our relative-return advantage or lack thereof, and only commit capital when we have an advantage.

Diversification and concentration are balanced with knowledge

Proper diversification is paramount to quality at the portfolio level. Proper diversification is achieved when the overall portfolio return is protected from unexpected adverse results in individual holdings, industries, countries, or other risk factors.

Proper concentration can be risk-reducing as well as value-enhancing. Concentration refers to making greater commitments to more attractive investments. The greater the difference between fundamental value and market price, the more robust our knowledge of an investment’s value, and the lower the risk of the investment, the more capital we are willing to concentrate in that investment.

Successfully executed, concentration has three benefits: (a) returns are enhanced by selecting investments with the highest probability of success, (b) risk is reduced by avoiding mediocre and poor commitments, and (c) knowledge is improved by concentrating the analytical effort.

A concentrated portfolio with fewer holdings is desirable when value-to-price, understanding, and quality are high. A low-cost, more widely diversified approach to a market is appropriate when there are no clear advantages in understanding, and therefore, in our ability to evaluate quality or estimate value-to-price.

Communication is essential for intelligent investor decision-making

One of the greatest risks investors face is selling low in a panic. Education and communication can greatly reduce this risk. We explain to investors the difference between fundamental and market value and openly share the rationale behind our investment decision-making. We believe this significantly reduces the risk of investors selling at market bottoms or buying at market tops.

Communication is also important for evaluating an investment manager’s abilities. Luck, risk, and a bull market can make an incompetent manager look brilliant. Conversely, every brilliant manager will underperform at some time, and usually this is the best time to invest with them. Investors must look beyond performance to evaluate manager competence. To aid current and prospective investors in this endeavor, we regularly discuss the strategy and holdings behind our performance, and candidly address both our successes and mistakes.

The views in this letter were as of November 30th 2022, and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the Fund’s investment methodology and do not constitute investment advice.

The Fund is non-diversified and may invest a greater percentage of its assets in a particular issue and may own fewer securities than other mutual funds. All investments involve risk, and principal loss is possible. The securities of small-capitalization and mid-capitalization companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger, more-established companies or market averages in general. The prices of fixed- income securities respond to economic developments, particularly interest-rate changes, as well as to changes in an issuer’s credit rating or market perceptions about the creditworthiness of an issuer.

Investments in foreign securities may involve risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation.

Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets. Derivatives may be more sensitive to changes in market conditions and may amplify risks. Short sales by a Fund theoretically involve unlimited loss potential since the market price of securities sold short may continuously increase.

Fund holdings are subject to change. Please see full holdings in the Schedule of Investments in this report.

November 30, 2022

Dear Shareholders:

The ACR Alpine Capital Research investment team is pleased to present our sixth annual investment report for the ACR International Quality Return Fund (“IQR” or “IQR Fund” or “the Fund”) covering the period November 30, 2021 through November 30, 2022.

Our aim with this annual report is to provide you with the information you need to understand the Fund’s investment principles, its recent performance, its current positioning, and its potential longer-term prospects. We believe that once shareholders understand the investments they own and why they own them, they can make decisions based on knowledge, not short-term noise/emotion. We believe that making long-term decisions based on knowledge is the most reliable way to investment success in a world that is becoming increasingly short-term-oriented.

We understand that your trust and confidence in ACR and the IQR Fund is contingent upon the integrity between ACR’s words and actions, and ultimately the IQR Fund’s investment results. The ACR investment team will strive to earn and keep that trust and confidence, and we look forward to partnering with shareholders for many years of prosperity and intelligent decision- making.

Sincerely,

Willem Schilpzand, CFA®

Portfolio Manager

8000 Maryland Avenue, Suite 700 | St. Louis, MO 63105

t 314.932.7600 | f 314.932.1111 | 877.849.7733 | acr-invest.com

Management’s Discussion of Fund’s Performance

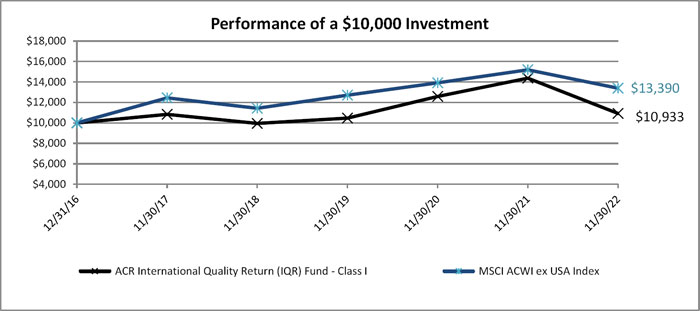

The net performance of the Fund’s I Class shares for fiscal year 2022, from November 30, 2021 to November 30, 2022, was -23.95% versus -11.87% for the Fund’s benchmark, the MSCI All Country World Index Ex-U.S. This year’s performance was disappointing, but as we will explain, the underlying performance of our companies was much better than the price performance indicates, and we have confidence that a large majority of the negative price performance will be recouped in future years. Below are the topics we will cover.

| I. | IQR Fund’s Investment Philosophy |

| II. | Fiscal Year 2022 in Review |

| IV. | IQR Fund Positioning and Potential Prospects |

| I. | IQR Fund’s Investment Philosophy |

Before discussing the Fund’s fiscal 2022 performance and its potential longer-term prospects, we first want to articulate to shareholders how we invest.

The IQR Fund deploys the simple-to-understand philosophy of valuing businesses based on the cash the company can distribute back to its owners (the shareholders for public companies) over its business life. We then attempt to invest in a select group of businesses that our research indicates are worth considerably more than the public market currently ascribes to them. This philosophy is often described as fundamental investing and stands in stark contrast to other investment strategies that have no anchor in valuing businesses. High frequency trading, momentum investing, factor investing, low price/earnings (P/E) or low price-to-book investing, macro investing, or passive/index investing are examples of strategies that do not know, or care about, what the estimated values of their investments are. We find this odd, yet strangely we appear to be in a shrinking minority.

The IQR Fund philosophy is simple to understand but not easy to implement. It requires discipline (limiting your research to companies you can actually value), more discipline (to invest only in durable and ideally adaptable businesses—in our view, quality businesses), knowledge/skill (an ability to actually render a reasonably accurate valuation), patience (to wait for the right price to buy), confidence (to have the courage to buy when the opportunity arises), humility (to keep an open mind about being wrong), more confidence (to maintain conviction when evidence supports your thesis, even when the stock price performance doesn’t), more humility (to have sufficient diversification in your portfolio to partially protect against mistakes/bad luck), and more patience (to wait for share prices to eventually converge to your estimated value over time).

Discipline, patience, confidence, and humility are each noted twice above versus just once for skill because we believe they are more important for generating satisfactory long-term investment returns. Skill is table stakes. Skill by itself would only lead to success in the hypothetical world where things happen exactly as expected (highlighted by the straight line below). In reality, where things never go exactly as expected (winding path to success below), much more is needed.

The future is uncertain, and since valuing a business is based on long-term future outcomes, investing is inherently uncertain. Most market participants attempt to circumvent this fact by coming up with investment strategies not dependent on valuing a business (examples noted above). Others ignore uncertainty and attempt to fit their investments into the straight-line future outcome model. This turns into first-order thinking, where guesstimates of the near future have a specific predictable outcome. An example of this type of thinking is: if interest rates rise, mortgages will be more expensive; hence, sell companies related to homebuilding. This looks like investing but is more guesstimating about near-term pivot points (e.g., will interest rates rise, will next quarter’s earnings beat consensus estimates) mostly unrelated to longer-term business value. From this lens, it is easy to see how near-term market movements, particularly during times of heightened uncertainty, can become detached from company fundamentals. Trade flows become dominated by actors not focused on business value or increasingly focused on near-term outcomes. For the IQR Fund, uncertainty is a feature of the investment process, not a bug. Uncertainty becomes the longer-term opportunity to take advantage of.

The remainder of this letter will describe the year’s performance and articulate why we own the investments we do. We hope this provides you the information to make a judgement on whether we are good stewards of your capital and can execute the investment philosophy (from discipline to more patience) described above. Further, we will provide our view of the potential prospects of the Fund if we can execute our philosophy appropriately. We believe the IQR Fund philosophy is sound and provides the most likely route to satisfactory long-term returns. This does not mean the path will be smooth (remember the winding path to success) or that we are immune from making mistakes. The Fund’s philosophy requires judgement under times of stress and uncertainty. We have made mistakes in the past, and we will make mistakes in the future. We will continue to execute the Fund’s investment philosophy and remain confident of meeting our long-term investment objectives of generating a satisfactory absolute and relative return over a longer time period.

| II. | Fiscal Year 2022 in Review |

The net performance of the Fund’s I Class shares for fiscal year ended November 30, 2022 was -23.95% versus -11.87% for the Fund’s benchmark. This outcome was caused by the intersection of several events. We had to recalibrate our expectations for several Fund companies due to the events that transpired in 2022, we made mistakes that cost the Fund performance, and our intra-year portfolio allocation decisions have not yet borne fruit. We should have done better, but we highlight later in this letter that the Fund’s price-to-value statistic became significantly more attractive during fiscal 2022, and therefore we are confident that most of the negative performance in fiscal 2022 is likely to prove transitory.

Recalibration of expectations:

Earlier, we explained that uncertainty is a feature in the Fund’s process. This means we must make allowances for uncertainty. We do this by limiting our investments to companies our research indicates should have durability and should be adaptable to changes in the environment (exogenous or from competition). We make further allowances for uncertainty by including the inevitable ups and downs of business cycles and competitive dynamics in our estimates of future corporate performance. Lastly, we make another allowance for uncertainty by only investing in companies when our estimate of value exceeds the available purchase price by a considerable margin.

During the 2020-2021 period, we made minor adjustments to our estimates of company values as the Covid-induced corporate downside was already incorporated into our expectations. We didn’t foresee Covid, but we had made downside allowances to future corporate performance as we realized that eventually a downturn would occur. Due to the realization of a downside event in 2020-2021 that negatively impacted the corporate performance of many Fund companies (e.g., lower demand, supply-chain disruption, higher cost), we expected stable-to-improving corporate performance coming out of this period for the Fund’s portfolio companies before another downcycle would hit in the medium to longer term. We did not foresee Russia’s invasion of Ukraine, and the subsequent impacts it would have. Supply-chain efficiency worsened, input costs increased, and interest rates rose. These items are expected to negatively impact the near-term corporate performance of many Fund companies, and therefore we recalibrated our valuation assumptions to reflect this new environment.

The Fund’s second largest detractor for fiscal 2022 was Countryside Partnerships Plc (“Countryside”), our third largest was Eurocell Plc (“Eurocell”), and our fourth largest was Greencore Plc (“Greencore”). Each company has its specific circumstances, but Countryside and Eurocell are related.

Countryside is a U.K.-based home builder, and Eurocell is a U.K.-based manufacturer and retailer of PVC (plastic) window frames and other products for the repair, maintenance, and improvement (RMI) market. Both companies are expected to be negatively impacted by inflationary cost increases at a time of deteriorating consumer confidence related to rising inflation and higher interest rates. Each company’s share price dropped to reflect the deteriorating near-term corporate performance outlook. We also expect a more difficult near-term operating environment for both companies but believe the market’s focus on near-term first-order effects has caused a large overreaction in the companies’ share-price declines. Business value is determined by the cash returned to shareholders over the corporation’s life, and therefore we should focus on the long term versus the short term. Long-term questions to answer relate to whether the current environment will negatively impact the durability of the company and whether the longer-term end market demand has been impaired.

Both Countryside and Eurocell have strong balance sheets, and near-term corporate headwinds should pose no durability risks. Both companies are also very favorably positioned within their market, and we expect both to take market share during difficult industry periods. Both companies are leaders in their industry, have the scale to withstand industry stress, and each has specific assets that differentiate it from competition (recycling and retail capability for Eurocell and relationships and offsite manufacturing for Countryside). Instead of the current events deteriorating each company’s durability, we think it might enhance it. We also see little risk of deteriorating long-term end-market demand, perhaps the opposite. This inflationary crisis is partially driven by high energy prices, and one of the easiest and most affordable ways to improve a home’s energy efficiency is by replacing old drafty windows. Eurocell is the U.K.’s market-leading manufacturer of energy-efficient window frames to cater to this demand. Countryside’s specific focus on homebuilding is for affordable housing in partnership with quasi-government authorities. The U.K. has a significant shortage of affordable housing, and the solution to rising home prices and the associated lack of affordability is to increase the supply of housing. Further, the energy efficiency of new-build homes is significantly greater than the old current stock, and this might accelerate the demolition of old stock in favor of new homes. We believe the longer-term demand drivers for both companies remain in place. We have made small negative value adjustments to both companies to recalibrate to their likely worse near-term corporate performance, but the longer-term outlook remains very positive, and has perhaps improved.

Greencore, an Ireland-based assembler and distributor of food to-go items (mostly sandwiches, salads, and sushi), is a business-to-business company and sells mostly into U.K. grocery and convenience stores. The company was negatively impacted by the Covid pandemic as fewer people went to the office and had fewer occasions to grab a Greencore item for lunch or for dinner on the way back home. Greencore has illustrated its durability and adaptability over the past two years by thriving when competitors languished. The company’s revenue is 20% greater than pre-Covid levels, while industry revenue barely returned to pre-Covid levels. Greencore has had to invest in new capacity to satisfy the new business wins, and these start-up costs have reduced margins in the near term. The recent inflationary cost increases should put further strain on the company’s margins, and the market appears myopically focused on this and any potential demand drop from higher prices. We believe the market is again missing the forest for the trees. Greencore has a demonstrated track record of gaining market share during industry downturns. Its margins are held back currently due to various non-repeating items and should expand into the future as facility efficiency improves. Further, the company’s products should hold up well during an industry downturn. First-order thinking is that higher food costs will increase Greencore’s sandwich prices, and this, in turn, will lower consumer demand. However, it is not just Greencore’s costs that are increasing—all alternatives to food to-go items are also increasing in cost and price. It is likely that certain Greencore customers will trade down to buying grocery items and making their own sandwiches. Offsetting this is the potential that restaurant or fast-food customers trade down to Greencore products, which are approximately 20% cheaper than the equivalent fast-food option. We expect the market to eventually realize the favorable competitive position and earnings power of the business.

We made mistakes:

Naked Wines was the Fund’s largest detractor in 2022, with the share price down approximately 85% this fiscal year. This is bad enough by itself, but Naked Wines was also the Fund’s third-largest holding (6.0% fund position) coming into fiscal 2022. We got the investment wrong, and we got the weighting wrong. This requires explanation.

Naked Wines is based in the U.K. but is considered the largest winery in the U.S., selling wine online only, direct to consumer (DTC). The U.S. alcohol market has a three-tier distribution system where the normal wine supply chain goes from winery to distributor to retail store (the three tiers). Wineries need to make a margin, distributors need to make a margin, and retail stores need to make a large margin due to high levels of inventory and low levels of product turnover. Naked Wines’ model disrupts this status quo wine supply chain. Naked Wines funds wine makers, who make the wine, and distributes the wine DTC. This supply chain removes a layer of cost and increases inventory turnover, further saving cost, and allows Naked Wines to offer similar-quality wine at retail stores for prices that are 20-50% lower. Further benefits of the company’s model are that wine is shipped directly to your house, and the trouble of finding the wine you want has been reduced by online algorithms that match wines to your preferences. The downside of this proposition is that consumers need to buy in larger quantities (usually 12 bottles), as shipping fewer bottles is expensive and would reduce or remove Naked Wines’ price advantage versus the retail channel. A further downside is that it takes around two to three days to receive a shipment of wine, and impulse buys are therefore best satisfied in the retail channel.

We validated the company’s unit economics and validated the company’s differentiated business model and proposition. We were/are confident that it would be nearly impossible for a competitor to replicate Naked Wines’ model as the company’s size has created a virtuous circle of network effects. Naked Wines is the industry’s largest DTC company, and this attracts more talented wine makers to join the company. More talented wine makers provide a selection of quality wines, which attracts more consumers. More consumers attract more talented wine makers, etc. The main uncertainty for us in evaluating this business was the eventual end-market demand. Our research indicated the consumer surplus was real (lower prices at equivalent quality), but we were uncertain about the number of U.S. households willing to buy wine online in 12-bottle increments. Further, we were uncertain about Naked Wines’ ability to increase customer awareness to attract new customers. Absent looking for a good business to invest in, we never would have been aware of Naked Wines and its products. Uncertainty about eventual end-market penetration kept us from initially making the investment a larger position in the Fund.

Enter the Covid pandemic. Suddenly people were locked in their houses and were forced to find alternative sources for many household goods and consumer products outside of normal retail channels. In 2020, many people learned that wine can be shipped directly from a winery to a consumer’s house. Naked Wines’ customer base had grown from 474,000 to 580,000 in the two years prior to Covid, but then jumped to 886,000 (+53%) during the Covid year. Revenue went up an even more impressive 67%, and profit went up an even more impressive 86%! More consumers buying more wine led to more efficiency in Naked Wines’ supply chain and much higher profits. Naked Wines’ share price appreciated significantly in fiscal 2020, but we did not sell. We believed that Covid was a step change for the business and that its prospects had structurally improved. More awareness should increase customers, which should incentivize more talented wine makers to join, which should improve product assortment, which should lead to more sales, which should allow for more supply-chain efficiency, which in turn should allow Naked Wines to improve its customer proposition (either higher quality or lower prices). We liked the business model before, the business model appeared to be improving, and now we believed our concerns about consumer adoption were alleviated. We re-evaluated the business based on the new information and increased our estimate of value for the company and maintained a sizable position in the company after it had appreciated significantly (approximately 6% of Fund assets coming into fiscal 2022).

Things have not worked out as we expected. The management team believed, like us, that the customer base would continue to grow due to increased brand awareness and a strong and improving customer proposition. During 2020, the company’s inventory level was short of customer demand, and the company wanted to make sure this would not reoccur. Wine has a long supply chain (grapes planting to harvesting to crushing to wine aging), and the company made large upfront wine purchase commitments during 2021 to allow for sufficient inventory and consumer choice over the subsequent years. Unfortunately, the management team, and we, misread the Covid cycle. When Covid became more endemic and retail locations and restaurants opened again, consumer expenditure shifted away from online purchases. In 2022, the volume of DTC wine shipments was down approximately 9%. The company quickly went from a well-capitalized company with a thriving business to one overcommitted on inventory that needed a credit facility to pay for wine production in progress and the committed inventory that was sitting idle in its warehouses. Further, Apple made changes to its privacy policies for iOS devices, and this made digital advertising much less effective and, hence, more expensive. Lastly, inflation increased Naked Wines’ distribution costs, and the company had to raise prices while industry volumes were declining. The confluence of these events led to the company’s 85% share-price decline.

We acknowledge two mistakes in our Naked Wines investment. We overestimated the company’s potential market share. We had many debates internally about artificially inflated demand during Covid and the normalized economics for the business. After our research, we sided with the view that penetration in the U.S. was still low (Naked Wines has ~1% market share of the addressable U.S. market versus closer to 4% and 7% in the company’s more mature markets of Australia and the U.K., respectively) and that Covid was the awareness event the company needed to unlock future market penetration. We were wrong. It has now become apparent that many of the consumers that joined the company during the Covid period have a lower propensity to remain customers. These customers are not as loyal nor as profitable as prior customers. This is evidence that contradicts our view of an improving customer proposition and growing future market penetration off the Covid customer level. Our second mistake was position sizing. We believed the positive events during 2020 would unlock a virtuous circle for the company and would allow the company to go from strength to strength. This outcome was increasingly built into the company’s share price and, while our research indicated that the share price could/should be higher, this was only the case if the “strength to strength” scenario played out. It didn’t, and we should have allowed more room for uncertainty in the Naked Wines investment by sizing it smaller.

We remain shareholders of Naked Wines, but now at a reduced position size. We are again less certain about the eventual penetration rate in the U.S., but now the company’s share price doesn’t require us to believe the penetration rate will go up. We remain confident that the company’s business model is differentiated (not replicable), that it provides a large consumer surplus, that its unit economics work, and that online sales of wine is not a dying business. The company is profitable, and once it runs down its excess inventory over the next one to two years, the company should have a significant net cash balance. We believe the company’s current profitability combined with the future excess cash approximate the company’s market cap at the end of November 2022. Any growth should be upside. We are frustrated with our mistakes, but we always try to make the next best decision. In this case, we believe it is continued ownership of Naked Wines.

Intra-year portfolio decisions have not borne fruit:

The Fund also had several large contributors in the year. The French defense company, Thales, appreciated by greater than 70%, and our investments in a Canadian insurance company, Fairfax Financial (“Fairfax”), and in a Norwegian insurance company, Protector Forsikring (“Protector”), both appreciated by greater than 30%.

We were on the negative side of short-term market moves on Countryside, Eurocell and Greencore (and others), but we got the benefit of short-term trading flows on Thales, Fairfax, and Protector. Russia’s invasion of Ukraine put E.U. defense spending front and center, and with Thales as one of the best-positioned European defense contractors, the market quickly revalued the company’s share price. In October 2021, we invested in Thales, as our research indicated that E.U. defense budgets were too low and should grow while the company’s share price reflected zero future growth. Thales is well-capitalized and well-managed, and we envisioned a satisfactory return in the company if it managed to grow in the future. Further, the company’s exposure would diversify the Fund’s risk exposures as defense expenditures often do not align with the business cycle. We did not envision Russia’s invasion of Ukraine and the subsequent announcement of E.U. governments to raise their defense budget expenditures. The share price appreciated notably in 2022. Both insurance companies, Fairfax and Protector, benefited from rising global interest rates as higher interest rates should improve the forward-going investment return on both companies’ investment books.

All three companies’ share prices appreciated rapidly in 2022, and our changes in estimates of value did not keep up (our estimates of value increased, just not by as much as their share-price appreciation), so we decided to trim all three positions. If we take the group of three companies as a basket, the trim decision was a negative one. We trimmed as prices increased, but prices continued to go up after we trimmed. Worse, we reinvested the trim proceeds into a group of companies whose risk/reward was much more favorable, but whose share prices continued to go down after we purchased them. These portfolio decisions contributed negatively during the year, but we believe the Fund will be rewarded for these decisions over the longer term.

Fiscal 2022 year in review conclusion:

We are disappointed in the Fund’s 2022 performance. We had to recalibrate the through-the-cycle expectations for many Fund companies due to the sooner-than-expected deteriorating end markets. This was a small negative impact. Further, we made a mistake in estimating the longer-term corporate performance for one investment, and this mistake was compounded by its overweight in the Fund. We will certainly make mistakes in the future but hope to not repeat this compound mistake. Lastly, fiscal 2022 performance was negatively impacted by portfolio decisions where we sold securities that went up more and invested in companies that continued to go down. In the short run, this price momentum hurt our performance. However, we believe the market is misappraising the Fund’s investments, as articulated above, and expect a significant amount of the negative performance to be unwound in future periods. The next sections attempt to quantify the Fund’s potential prospects.

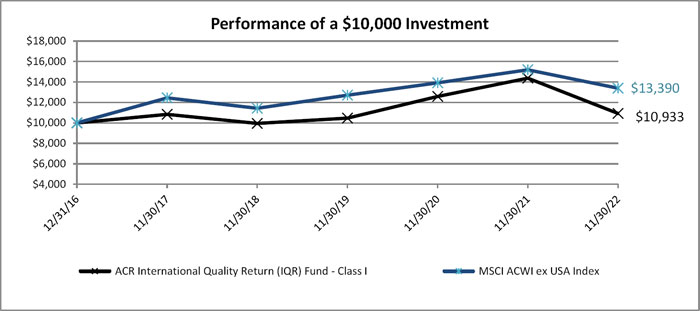

Below is the Fund’s annual performance, the Fund benchmark’s annual performance, and the Fund’s cash balance. Fiscal 2022 is the worst absolute and relative performance in the Fund’s history (considering the nearly fully invested level versus the relative underperformance with 50% average cash in 2017).

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data may be obtained by calling toll-free, 1-855-955-9552. Per the most recent prospectus, gross and net expense ratios were 1.56% and 1.12%, respectively.

The IQR Fund got off to a slow start with capital deployment (average cash balance of 50%) and, hence, got left behind when the market rallied strongly in 2017. After the start-up phase, we believe the IQR Fund performance versus its benchmark is more illustrative.* After a disappointing 2022, the Fund is now behind the benchmark and behind the longer-term absolute-return expectation we have for the Fund. We have already articulated that we believe the negative 2022 performance is mostly transitory, and the next section will highlight why we remain confident in meeting the Fund’s absolute- and relative-return objectives over the longer term.

| * | Please reference the appendix for the full IQR Fund performance disclosures. |

| | Fiscal Year Ended

11/30/2022 | 3 Yr | 5 Yr | Since

Inception |

| IQR Fund | -23.95% | 1.46% | 0.17% | 1.52% |

MSCI ACWI ex USA Index | -11.87% | 1.75% | 1.48% | 5.06% |

Inception date of the Fund is December 30, 2016, and returns are annualized for the period ended November 30, 2022.

| IV. | IQR Fund’s Positioning and Potential Prospects |

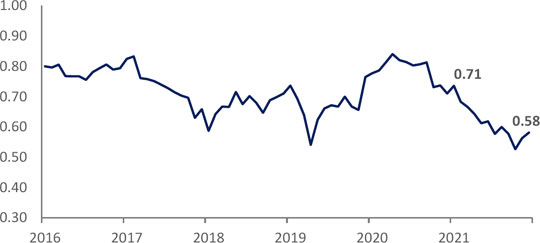

There were many positive aspects to fiscal 2022. We were able to reduce the Fund’s cash balance from 15.7% to 2.6% (a historical low), and the Fund’s price to value was reduced from 0.71 to 0.58.

% Invested vs. Liquid Reserve

Source: ACR

As of November 30, 2022

Past Performance is no guarantee of future results.

IQR Price to Value

Our estimate of potential future returns goes up with a higher percentage invested (i.e., lower cash balance) at a lower price to value (i.e., higher discount to estimate of value). The Fund’s value gap to our estimate of fair value at the start of the year was approximately 34% ((84.3% / 0.71 + 15.7%) - 1), but this value gap has increased to 70% at the end of 2022 ((97.4% / 0.58 + 2.6%) - 1). The significant increase in the value gap during fiscal 2022 highlights that the underlying Fund performance (the one we measure based on the change in estimated Fund value during the year) was much better than the Fund’s actual price performance during the year.

We hope we have provided Fund shareholders with sufficient information to make a sound judgment on the historical performance of the Fund and its prospects. We made mistakes in the year, but we also believe our capital allocation decisions that hurt fiscal 2022 performance have added value and should drive future performance. Further, we believe the market prices for many Fund investments are not representative of the value of those investments and expect the Fund shareholders to be rewarded for their patience in these investments in the future. Below is a graphical representation of our historical view of the Fund’s estimate of value and the actual Fund trading price. The graph clearly shows that the Fund has added value over time (assuming our valuation estimates are approximately correct) but that the Fund’s price has dipped back to starting levels in fiscal 2022. Our historically low cash balance at near-historical low price to value (0.58 P/V), underpins the potential for strong expected future returns. This is illustrated by our estimate of $17.10 value versus the fiscal year-end 2022 IQR Fund trading price of $10.05.

IQR Fund Estimated Value vs. Fund Price

Thank you for your continued trust, and please reach out to us if you have any questions.

The ACR Investment Team

Willem Schilpzand, CFA®

Portfolio Manager

Appendix: Notes on the IQR Fund Investment Objectives

IQR Fund Investment Objective

“The investment objective of the ACR International Quality Return (IQR) Fund (the “Fund” or “IQR Fund”) is to protect capital from permanent impairment while providing a return above both the Fund’s cost of capital and the Fund’s benchmark over a full market cycle.”

It is important to note that “providing a return above the Fund’s cost of capital and the Fund’s benchmark” are performance objectives the Fund expects to meet. We consider the “cost of capital” of the Fund to be approximately 6% real + inflation (the opportunity cost for our Fund shareholders). The Fund’s benchmark is the MSCI All Country World Index Ex-U.S. The timeframe of “over a full market cycle” remains purposefully undefined as market prices can vary widely from fundamental value over the short to medium term. The IQR Fund has no control over when prices start to converge towards underlying fundamental value (as determined by actual cash flows of companies), but history and corporate financial theory give us significant confidence that prices will eventually converge with value. This is the Fund’s advantage. We make the trade-off for short- to medium-term uncertainty for the opportunity to outperform over the longer term (i.e., “a full market cycle”). “Protect capital from permanent impairment” is a philosophical objective that signals to Fund shareholders that the IQR Fund is resolutely focused on risk and will not allocate capital (i.e., will build a cash balance) in the absence of satisfactory risk/reward investment opportunities. This is a similar methodology to what private equity firms deploy, but IQR executes this strategy in the public markets. “Risk” does not mean volatility, as the IQR Fund portfolio is expected to move around similarly to markets, but “risk” means taking equity risk and not getting an equity-like return over a sufficiently long investment period.

Appendix: IQR Fund’s Performance Disclosures

| | Fiscal Year Ended

11/30/2021 | Fiscal Year Ended

11/30/2022 | Since

Inception |

| IQR Fund | 14.24% | -23.95% | 1.52% |

| MSCI ACWI ex USA Index | 9.14% | -11.87% | 5.06% |

Inception date of the Fund is December 30, 2016.

Per the most recent prospectus, gross and net expense ratios were 1.56% and 1.12%, respectively.

The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses as determined in accordance with SEC Form N-1A), professional fees related to services for the collection of foreign tax reclaims, expenses incurred in connection with any merger or reorganization, and extraordinary expenses (such as litigation expenses) do not exceed 1.10% of the average daily net assets of Class I shares of the Fund. This agreement is in effect until March 31, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees.