UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Report to Stockholders.

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

Kennedy Capital ESG SMID Cap Fund

(Institutional Class: KESGX)

Kennedy Capital Small Cap Growth Fund

(Institutional Class: KGROX)

Kennedy Capital Small Cap Value Fund

(Institutional Class: KVALX)

ANNUAL REPORT

DECEMBER 31, 2022

Kennedy Capital Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letter | 1 |

| Fund Performance | 9 |

| Schedule of Investments | 15 |

| Statements of Assets and Liabilities | 29 |

| Statements of Operations | 30 |

| Statements of Changes in Net Assets | 31 |

| Financial Highlights | 34 |

| Notes to Financial Statements | 37 |

| Report of Independent Registered Public Accounting Firm | 47 |

| Supplemental Information | 49 |

| Expense Example | 57 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Kennedy Capital Funds. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.kennedycapital.com

Executive Summary

The Kennedy Capital ESG SMID Cap Fund declined 17.82% (net of fees) in 2022, outperforming the benchmark, the Russell 2500™ Index, by 55 basis points1 while delivering on our stated Environmental, Social, and Governance priorities in the stock selection and portfolio construction process. The portfolio is fossil fuel free, has significantly lower greenhouse gas emissions in comparison to the benchmark, and has no exposure to the producers of tobacco, civil firearms, or controversial weapons. The portfolio has broad exposure across the growth-to-value style spectrum, with modest under- and over-weight positioning across sectors. The outperformance in 2022 was driven by favorable stock selection in the Industrials, Health Care, and Information Technology sectors, partially offset by unfavorable relative performance in Energy, Financials, and Materials.

Strategy Overview

We seek to outperform the Russell 2500™ Index, while optimizing the portfolio for ESG considerations. Our approach to stock selection and portfolio construction is both inclusionary and exclusionary in nature. The inclusionary component of our process is based on identifying small and mid-cap companies that leverage an environmental advantage or offer a solution to a societal problem as part of the company’s product or service offerings. We also consider each investment candidate’s governance framework and greenhouse gas emissions as part of our analysis. The exclusionary component of our process results in a portfolio that is fossil fuel free (defined as having no carbon reserves on the balance sheet), and has no exposure to producers of tobacco, civil firearms, or controversial weapons. The end result is a portfolio with exposure to many compelling societal and environmental trends, a significantly lower carbon footprint, and favorable governance characteristics. We believe thoughtful integration of these ESG considerations has the potential to manage long-term risk and enhance alpha* generation.

Performance Review

2022 was a challenging year for equity markets, as steadily increasing interest rates from the US Federal Reserve and a decline in the level of government stimulus payments resulted in investor pessimism. Fears of recession began to build throughout the year, and public equity valuations suffered. On a fundamental basis, many companies experienced strong financial performance in 2022, but the building uncertainty regarding the longevity of the economic cycle drove stocks lower. Relative outperformance in the portfolio was driven by stock selection, while sector allocation was a notable headwind.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call (833) 737-7788.

Portfolio Characteristics and Positioning

| ** | As of 12/31/22, the portfolio had weighted average carbon emissions (Scope 1, reported and estimated) of 83,273 metric tons, an 88% reduction from the weighted average emissions of the benchmark. The portfolio had zero carbon reserves, while the benchmark had reserves that equate to over 686 million metric tons of potential future emissions. The weighted average governance score of the portfolio (based on Institutional Shareholder Services’ Quality Score metric) was 3.38 compared with 4.19 for the Russell 2500TM Index or 19% more attractive (lower score is better). |

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Sector weightings in the portfolio are determined based on where we see the most compelling stock ideas and are not driven by a top-down forecast or macroeconomic model. As of 12/31/22, the portfolio was modestly overweight the Industrials, Health Care, and Information Technology sectors, and underweight Energy, Materials, and Financials. Given similar end market drivers, we view the weightings in Industrials and Materials/Energy as partially offsetting one another.

Outlook

We see the potential for a broad range of economic and financial scenarios in the year ahead. While interest rates are notably higher, home values have remained resilient as consumers adjust to this new reality. While the fear of a potential recession looms, corporate fundamentals have generally remained solid across many sectors and industries. Government spending in areas such as infrastructure and renewable energy is expected to serve as a buffer if a downturn in other construction-oriented parts of the economy weaken. Overall, we enter the year cautiously optimistic regarding the equity market outlook.

We continue to prioritize balance in the portfolio construction and stock selection process, striving to create a portfolio not wedded to a particular economic backdrop. We seek to have appropriate representation across sector weightings, growth vs. value style characteristics, and market capitalization. Our process remains “bottom-up” in nature, favoring stock ideas and sector weightings driven by company level fundamental analysis vs. a top down, macroeconomic forecast-based approach. We continue to see ESG integration providing opportunities for risk mitigation and alpha generation.

We remain confident in our ability to construct a portfolio with attractive ESG characteristics that strives to deliver relative investment outperformance over the long term. As always, we appreciate the confidence you place in our team.

| Sincerely, | |

| |

| Christian McDonald | |

| Portfolio Manager | |

| 1 | A basis point is a standard measure for interest rates and other percentages in finance. One basis point equals 1/100th of 1%, or 0.01% (and .0001 in decimal form). |

| * | Alpha is the excess return of an investment relative to the return of a benchmark index is the investment’s alpha. Alpha may be positive or negative and is the result of active investing. |

| ** | Source: Factset Research Systems Inc. |

| ** | Based on Global Industry Classification Standard (GICS), which was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc.(S&P). Excludes cash. |

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Carbon Emissions (Scope 1 Wtd. Avg., mt.) is a weighted average of companies’ reported or estimated Scope 1 greenhouse gas emissions measured in metric tons. Scope 1 emissions are those from sources owned or controlled by the company, typically direct combustion of fuel as in a furnace or vehicle. Exposure to Fossil Fuels is a measurement of how much of a company’s business model is invested in or tied to fossil fuels. The Governance Score is the ISS Governance QualityScore, which is derived from publicly disclosed data on a company’s governance practices and for which a lower score is preferable and a score 10 is considered high risk.

The views in this letter were as of December 31, 2022 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Important Information: There can be no guarantee that any strategy (risk management or otherwise) will be successful. All investing involves risk, including potential loss of principal. Equity securities (stocks) are generally more volatile and carry more risk than fixed income securities (bonds) and money market investments. The net asset value per share of the ESG SMID Cap fund (the Fund) will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater returns over long time periods than fixed income securities. The Fund is comprised primarily of equity securities and is subject to market risk. Stocks may decline due to general market and economic conditions or due to company specific circumstances. The Fund is comprised of small-mid capitalization (“SMID cap”) stocks. SMID cap stocks typically carry additional risk, since smaller companies generally have a higher risk of failure, and historically have experienced a greater degree of volatility. ESG criteria may affect the Fund’s exposure to risks associated with certain issuers, industries and sectors, which may impact the Fund’s investment performance. The Fund may forgo some market opportunities available to funds that do not use these criteria. Small-mid capitalization companies generally have a greater risk of failure, and their stocks generally have greater volatility than large companies. Must be preceded or accompanied by a prospectus.

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Executive Summary

The Kennedy Capital Small Cap Growth Fund returned -4.89% (net of fees) from inception 4/27/2022 through 12/31/2022. This compares to a decline of -5.05% for the benchmark, the Russell 2000® Growth Index.

2022 was a difficult year for investors, particularly those investing in growth-oriented strategies. In response to excessive inflation, the Federal Reserve implemented a series of sharp interest rate increases, which directly caused a reset of equity discount rates (lessening the value of future cash flows) and is expected to have a negative drag on demand (and thus estimates for near term earnings potential). The result was declining equity markets and underperformance, even within the Russell 2000® Growth Index, of companies with “growthier” characteristics (i.e., higher sales & earnings growth rates and higher valuations). Despite this general factor headwind and our lack of ownership in the Energy sector (which outperformed), the Fund was able to slightly outperform overall due to strong stock selection in the Consumer Staples sector.

Performance Review and Positioning

From Fund inception (4/27/22) through 12/31/22, the Kennedy Small Cap Growth Fund returned -4.89% (net of fees), outperforming the Russell 2000® Growth Index by 16 basis points*. Relative outperformance in the fund was driven primarily by strong stock selection in Consumer Staples, Industrials, and Consumer Discretionary. This was partially offset by weaker relative returns from holdings in the Health Care and Real Estate sectors, as well as the negative relative impact of not owning any companies in the Energy sector, which outperformed with a positive return in this time period.

Sector weightings in the portfolio are determined based on where we see the most compelling stock ideas and are not driven by a top-down forecast or macroeconomic model. Our investment process seeks to identify companies with high current and/or future returns on investment with opportunities to invest in higher-than-average growth. As of 12/31/22, this resulted in our largest overweight sectors in the portfolio (relative to the Russell 2000® Growth Index) being Industrials, Consumer Discretionary, and Consumer Staples. The largest underweight sectors relative to the benchmark were Energy, Materials, and Information Technology.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call (833) 737-7788.

Outlook

While the macro backdrop remains volatile, valuations and earnings expectations have declined significantly from their peaks in 2021, increasingly presenting us with more attractive long-term opportunities to consider. As a result, we have started the process of slowly deploying our excess cash into new and existing investments where we have conviction in the medium-term earnings potential vs. market expectations. That said, we believe there is still significant risk as to exactly where things land in 2023/2024 – both to the upside and the downside – and expect that near term the equity markets will continue to be dominated by any news on the same key macro factors: inflation, interest rates, and demand destruction. For this reason, we are taking a deliberately slow and methodical approach to any changes in the portfolio holdings. But we still believe that at some point in 2023, visibility on these key macro inputs should settle out and investors will again focus on individual company earnings execution and longer-term opportunities. We spend the majority of our time preparing the portfolio for that day, understanding how the new environment impacts our companies’ returns but making sure to keep our focus on the 3–5-year growth opportunities. In aggregate, the portfolio is invested in companies with higher CFROIs (cash flow return on investment) and higher asset growth (i.e., re-investment opportunities), trading at a roughly similar valuation as the benchmark (based on current and next year’s price/earnings ratio). Assuming our companies can execute against these growth opportunities, we believe this should be a recipe for potential longer-term outperformance.

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Thank you for your continued confidence in the Kennedy Capital team.

| Sincerely, | |

| | |

| |

| Jean Barnard, CFA® | |

| Portfolio Manager | |

| |

| Ryan Dunnegan, CPA | |

| Portfolio Manager | |

| * | A basis point is a standard measure for interest rates and other percentages in finance. One basis point equals 1/100th of 1%, or 0.01% (and .0001 in decimal form). |

The views in this letter were as of December 31, 2022 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Important Information: There can be no guarantee that any strategy (risk management or otherwise) will be successful. All investing involves risk, including potential loss of principal. Equity securities (stocks) are generally more volatile and carry more risk than fixed income securities (bonds) and money market investments. The net asset value per share of the ESG SMID Cap fund (the Fund) will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater returns over long time periods than fixed income securities. The Fund is comprised primarily of equity securities and is subject to market risk. Stocks may decline due to general market and economic conditions or due to company specific circumstances. The Fund is comprised of small-mid capitalization (“SMID cap”) stocks. SMID cap stocks typically carry additional risk, since smaller companies generally have a higher risk of failure, and historically have experienced a greater degree of volatility. ESG criteria may affect the Fund’s exposure to risks associated with certain issuers, industries and sectors, which may impact the Fund’s investment performance. The Fund may forgo some market opportunities available to funds that do not use these criteria. Small-mid capitalization companies generally have a greater risk of failure, and their stocks generally have greater volatility than large companies. Must be preceded or accompanied by a prospectus.

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Executive Summary

The Kennedy Capital Small Cap Value Fund returned -0.34% (net of fees) from 4/27/2022 through 12/31/2022. This compares to a decline of 5.91% for the benchmark, Russell 2000® Value Index.

2022 experienced a number of significant shifts in the macro environment, which created a difficult backdrop for equity market performance. To summarize:

| - | The Russian invasion of Ukraine, which caused oil prices to spike over 60% from year end 2021 levels. |

| - | Inflation, as measured by the Consumer Price Index* “CPI”, increased at a high single digit percentage rate. This is the highest inflation reading we’ve seen since the early 1980s. |

| - | In response to the higher inflation readings, the Federal Reserve shifted quickly to monetary tightening, raising the Federal Funds Target Rate by over 400 basis points. The Fed has signaled that further rate increases will be needed to quell inflationary pressures, which will have a slowing effect on economic growth. |

| - | Longer term interest rate measures – such as the 10-year treasury yield and the 30-year mortgage rate – rose sharply to multi-year highs in response to the higher inflation readings. |

One of the consequences of higher interest rates is an increase in the discount rate that’s used to value financial assets. The arithmetic is straight forward: Rising discount rates means the value of future cash flows generated by an asset are worth less in today’s dollars. We believe this sharp rise in discount rates was the predominate factor driving negative equity market returns in 2022. While no sectors were immune from the compression in equity valuations, the impact was most acutely felt in historically expensive areas of the market, such as biotech and software. These industry groups dramatically underperformed the broader market in 2022, posting declines of 38%, and 51%, respectively, within the benchmark.

Performance Review and Positioning

From fund inception (4/27/22) through 12/31/2022, the Kennedy Capital Small Cap Value Fund returned -0.34% (net of fees), outperforming the Russell 2000® Value Index which declined 5.91% over the same period. Relative outperformance in the portfolio was driven primarily by strong stock selection in the Industrials, Energy, and Communication Services sectors. This was partially offset by weaker relative returns from holdings in the Financials, Real Estate, and Consumer Discretionary sectors.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call (833) 737-7788.

Sector weightings in the portfolio are determined based on where we see the most compelling stock ideas and are not driven by a top-down forecast or macroeconomic model. As of 12/31/22, the largest overweight sectors in the portfolio (relative to the Russell 2000® Value Index) were Industrials, Information Technology and Consumer Discretionary. The largest underweight sectors relative to the benchmark were Utilities, Communication Services and Financials.

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Outlook

The intermediate macroeconomic picture is decidedly cloudy. Financial conditions are tightening, economic growth is slowing, and markets have responded with increased volatility. Experience tells us the most attractive long term investment opportunities present themselves during such times of heightened uncertainty and bearish market sentiment. Capturing these opportunities requires a deep focus on company and industry fundamentals, and the ability to recognize situations where market prices inadequately reflect the long-term value creation potential of the underlying business. By staying disciplined to our process, we can construct a portfolio of companies that in aggregate have attractive fundamental attributes relative to the overall market, but at valuation levels that give us a sufficient margin of safety**. We believe this is a winning recipe for potential portfolio returns over the long term.

We welcome the opportunity to discuss any questions or concerns you may have, and we thank you for the opportunity you have given us to manage your investment.

| Sincerely, | |

| |

| Frank Latuda, Jr., CFA® | |

| Chief Investment Officer & Portfolio Manager | |

| |

| McAfee Burke, CFA® | |

| Portfolio Manager, Research Analyst | |

| * | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. |

| ** | Margin of safety is when a security is purchased for less than its estimated value. This helps protect against permanent capital loss in the case of an unexpected event or analytical mistake. A purchase made with a margin of safety does not guarantee the security will not decline in price. |

The views in this letter were as of December 31, 2022 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

Important Information: There can be no guarantee that any strategy (risk management or otherwise) will be successful. All investing involves risk, including potential loss of principal. Equity securities (stocks) are generally more volatile and carry more risk than fixed income securities (bonds) and money market investments. The net asset value per share of the ESG SMID Cap fund (the Fund) will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater returns over long time periods than fixed income securities. The Fund is comprised primarily of equity securities and is subject to market risk. Stocks may decline due to general market and economic conditions or due to company specific circumstances. The Fund is comprised of small-mid capitalization (“SMID cap”) stocks. SMID cap stocks typically carry additional risk, since smaller companies generally have a higher risk of failure, and historically have experienced a greater degree of volatility. ESG criteria may affect the Fund’s exposure to risks associated with certain issuers, industries and sectors, which may impact the Fund’s investment performance. The Fund may forgo some market opportunities available to funds that do not use these criteria. Small-mid capitalization companies generally have a greater risk of failure, and their stocks generally have greater volatility than large companies. Must be preceded or accompanied by a prospectus.

| 10829 Olive Boulevard, Suite 100, St. Louis, MO 63141 | www.kennedycapital.com | (314) 432 – 0400 |

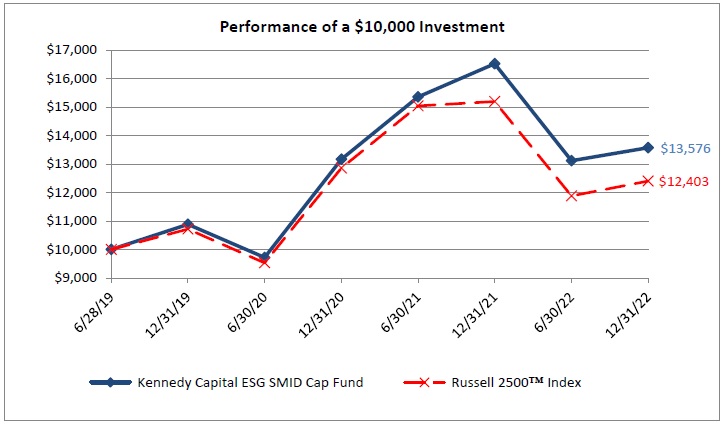

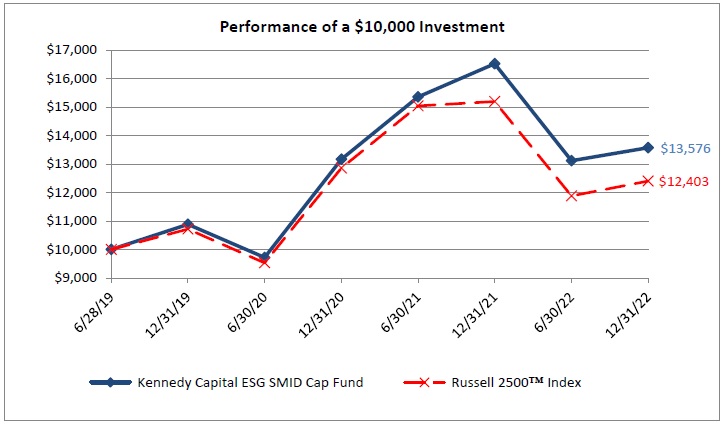

Kennedy Capital ESG SMID Cap Fund

FUND PERFORMANCE at December 31, 2022 (Unaudited)

This graph compares a hypothetical $10,000 investment in the Fund’s Institutional Class shares, made at its inception, with a similar investment in the Russell 2500™ Index. Results include the reinvestment of all dividends and capital gains.

Russell 2500™ Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500™ index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2500™ index is constructed to provide a comprehensive and unbiased barometer for the small to mid-cap segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance characteristics of the true small to mid-cap opportunity set. The index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| Average Annual Total Returns as of December 31, 2022 | 1 Year | Since Inception | Inception Date |

| Institutional Class | -17.82% | 9.10% | 06/28/19 |

| Russell 2500™ Index | -18.37% | 6.33% | 06/28/19 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 882-8825.

Gross and net expense ratios for the Institutional Class shares were 2.49% and 0.82%, respectively, which were the amounts stated in the current prospectus dated May 01, 2022. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.82% of the average daily net assets of the Institutional Class shares of the Fund. This agreement is in effect until April 30, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Kennedy Capital ESG SMID Cap Fund

FUND PERFORMANCE at December 31, 2022 (Unaudited) - Continued

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

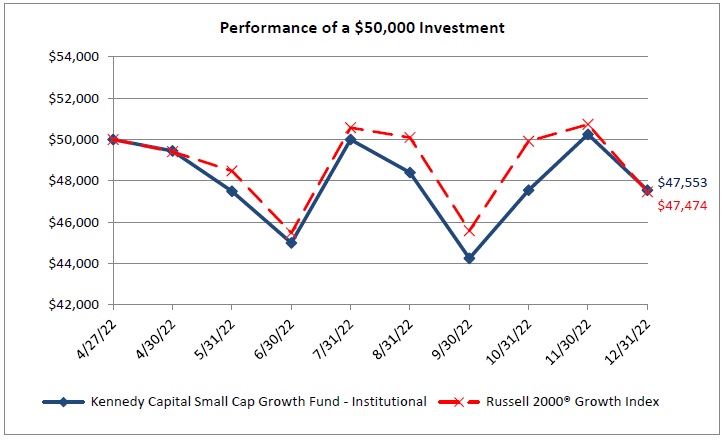

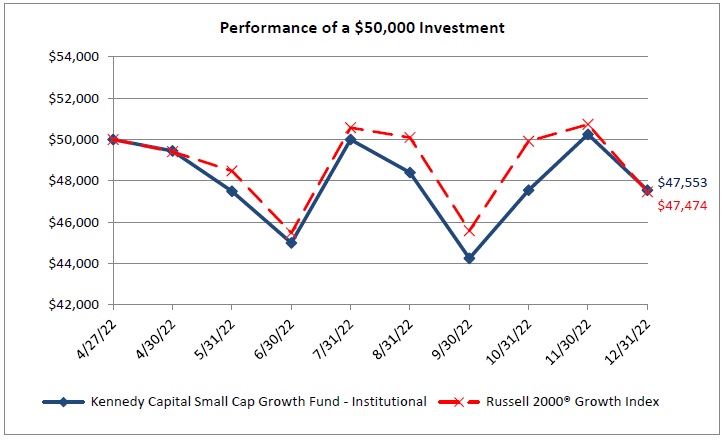

Kennedy Capital Small Cap Growth Fund

FUND PERFORMANCE at December 31, 2022 (Unaudited)

This graph compares a hypothetical $50,000 investment in the Fund’s Institutional Class shares, made at its inception, with a similar investment in the Russell 2000® Growth Index. Results include the reinvestment of all dividends and capital gains.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The Russell 2000® Growth Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect growth characteristics. The index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| Total Returns as of December 31, 2022 | 3 Months (Actual) | 6 Months (Actual) | Since Inception (Cumulative) | Inception Date |

| Institutional Class | 7.46% | 5.67% | -4.89% | 04/27/22 |

| Russell 2000® Growth Index | 4.13% | 4.38% | -5.05% | 04/27/22 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 882-8825. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund returns will fluctuate over long and short-term period. Periods over one year are annualized.

Kennedy Capital Small-Cap Growth Fund

FUND PERFORMANCE at December 31, 2022 (Unaudited) - Continued

Gross and net expense ratio for the Institutional Class shares were 1.44% and 0.89%, respectively, which were the amounts stated in the current prospectus dated April 27, 2022. For the Fund’s current period ended December 31, 2022 expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.89% of the average daily net assets of the Institutional Class shares of the Fund. This agreement is in effect until April 30, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

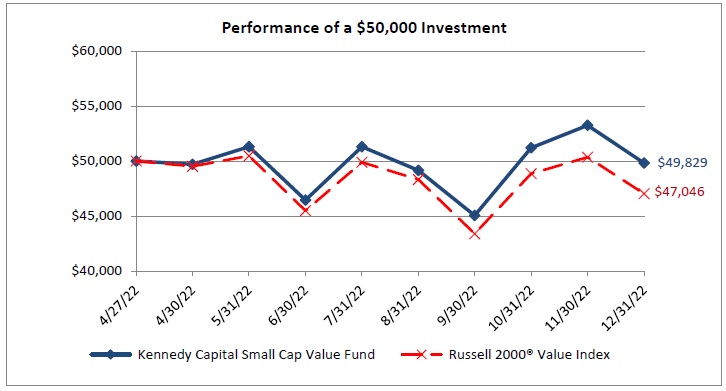

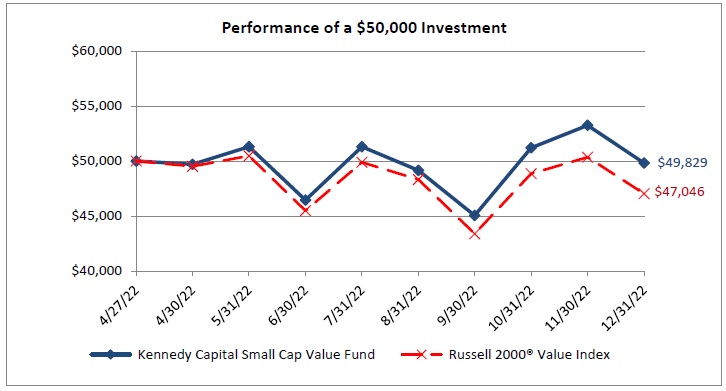

Kennedy Capital Small Cap Value Fund

FUND PERFORMANCE at December 31, 2022 (Unaudited)

This graph compares a hypothetical $50,000 investment in the Fund’s Institutional Class shares, made at its inception, with a similar investment in the Russell 2000® Value Index. Results include the reinvestment of all dividends and capital gains.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Value Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The Russell 2000® Value Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect value characteristics. The index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| Total Returns as of December 31, 2022 | 3 Months (Actual) | 6 Months (Actual) | Since Inception (Cumulative) | Inception Date |

| Institutional Class | 10.61% | 7.28% | -0.34% | 04/27/22 |

| Russell 2000® Value Index | 8.42% | 3.42% | -5.91% | 04/27/22 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 882-8825. The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund returns will fluctuate over long and short-term period. Periods over one year are annualized.

Gross and net expense ratio for the Institutional Class shares were 1.45% and 0.89%, respectively, which were the amounts stated in the current prospectus dated April 27, 2022. For the Fund’s current period ended December 31, 2022 expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.89% of the average daily net assets Institutional Class shares of the Fund. This agreement is in effect until April 30, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Kennedy Capital Small-Cap Value Fund

FUND PERFORMANCE at December 31, 2022 (Unaudited) - Continued

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Kennedy Capital ESG SMID Cap Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 96.9% | | | | |

| | | | | COMMUNICATION SERVICES — 0.5% | | | | |

| | 17,761 | | | Magnite, Inc.* | | $ | 188,089 | |

| | | | | | | | | |

| | | | | CONSUMER DISCRETIONARY — 11.8% | | | | |

| | 11,292 | | | American Eagle Outfitters, Inc. | | | 157,636 | |

| | 4,879 | | | Brunswick Corp. | | | 351,678 | |

| | 4,893 | | | Columbia Sportswear Co. | | | 428,529 | |

| | 11,298 | | | Gentex Corp. | | | 308,096 | |

| | 2,946 | | | Hasbro, Inc. | | | 179,735 | |

| | 2,982 | | | Helen of Troy, Ltd.*,1 | | | 330,734 | |

| | 1,509 | | | Lithia Motors, Inc. - Class A | | | 308,953 | |

| | 9,217 | | | LKQ Corp. | | | 492,280 | |

| | 2,836 | | | Papa John's International, Inc. | | | 233,431 | |

| | 1,222 | | | Pool Corp. | | | 369,447 | |

| | 6,390 | | | Steven Madden Ltd. | | | 204,224 | |

| | 2,853 | | | TopBuild Corp.* | | | 446,466 | |

| | 24,682 | | | Topgolf Callaway Brands Corp.* | | | 487,470 | |

| | 1,210 | | | Vail Resorts, Inc. | | | 288,404 | |

| | | | | | | | 4,587,083 | |

| | | | | | | | | |

| | | | | CONSUMER STAPLES — 2.7% | | | | |

| | 2,387 | | | Bunge, Ltd.1 | | | 238,151 | |

| | 3,302 | | | elf Beauty, Inc.* | | | 182,601 | |

| | 30,903 | | | SunOpta, Inc.*,1 | | | 260,821 | |

| | 9,997 | | | United Natural Foods, Inc.* | | | 386,984 | |

| | | | | | | | 1,068,557 | |

| | | | | | | | | |

| | | | | ENERGY — 2.4% | | | | |

| | 14,822 | | | ChampionX Corp. | | | 429,690 | |

| | 25,161 | | | DMC Global, Inc.* | | | 489,130 | |

| | | | | | | | 918,820 | |

| | | | | | | | | |

| | | | | FINANCIALS — 14.8% | | | | |

| | 2,326 | | | Assurant, Inc. | | | 290,890 | |

| | 9,517 | | | BankUnited, Inc. | | | 323,292 | |

| | 5,212 | | | Banner Corp. | | | 329,398 | |

| | 6,510 | | | Brown & Brown, Inc. | | | 370,875 | |

| | 7,395 | | | Commerce Bancshares, Inc. | | | 503,378 | |

| | 5,999 | | | East West Bancorp, Inc. | | | 395,334 | |

| | 486 | | | FactSet Research Systems, Inc. | | | 194,988 | |

| | 14,597 | | | First Foundation, Inc. | | | 209,175 | |

| | 3,920 | | | Globe Life, Inc. | | | 472,556 | |

| | 10,154 | | | Hannon Armstrong Sustainable Infrastructure Capital, Inc. - REIT | | | 294,263 | |

| | 6,258 | | | HomeStreet, Inc. | | | 172,596 | |

| | 1,096 | | | LPL Financial Holdings, Inc. | | | 236,922 | |

| | 5,657 | | | PacWest Bancorp | | | 129,828 | |

Kennedy Capital ESG SMID Cap Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | FINANCIALS (Continued) | | | | |

| | 6,714 | | | Stifel Financial Corp. | | $ | 391,896 | |

| | 8,075 | | | Voya Financial, Inc. | | | 496,532 | |

| | 3,715 | | | Walker & Dunlop, Inc. | | | 291,553 | |

| | 5,188 | | | Western Alliance Bancorp | | | 308,997 | |

| | 4,059 | | | Wintrust Financial Corp. | | | 343,067 | |

| | | | | | | | 5,755,540 | |

| | | | | | | | | |

| | | | | HEALTH CARE — 14.7% | | | | |

| | 3,743 | | | Axonics, Inc.* | | | 234,050 | |

| | 1,259 | | | Charles River Laboratories International, Inc.* | | | 274,336 | |

| | 792 | | | Chemed Corp. | | | 404,260 | |

| | 6,918 | | | Encompass Health Corp. | | | 413,766 | |

| | 21,148 | | | Enhabit, Inc.* | | | 278,308 | |

| | 21,968 | | | Evolent Health, Inc. - Class A* | | | 616,861 | |

| | 8,659 | | | Halozyme Therapeutics, Inc.* | | | 492,697 | |

| | 1,381 | | | ICON PLC*,1 | | | 268,259 | |

| | 3,835 | | | ICU Medical, Inc.* | | | 603,936 | |

| | 4,065 | | | Intra-Cellular Therapies, Inc.* | | | 215,120 | |

| | 4,059 | | | Ionis Pharmaceuticals, Inc.* | | | 153,308 | |

| | 13,964 | | | Iovance Biotherapeutics, Inc.* | | | 89,230 | |

| | 5,481 | | | LivaNova PLC*,1 | | | 304,415 | |

| | 1,903 | | | Neurocrine Biosciences, Inc.* | | | 227,294 | |

| | 10,749 | | | NextGen Healthcare, Inc.* | | | 201,866 | |

| | 6,569 | | | NuVasive, Inc.* | | | 270,906 | |

| | 4,329 | | | Omnicell, Inc.* | | | 218,268 | |

| | 12,462 | | | Premier, Inc. - Class A | | | 435,921 | |

| | | | | | | | 5,702,801 | |

| | | | | | | | | |

| | | | | INDUSTRIALS — 22.4% | | | | |

| | 4,437 | | | AAON, Inc. | | | 334,195 | |

| | 4,524 | | | Albany International Corp. - Class A | | | 446,021 | |

| | 2,316 | | | Axon Enterprise, Inc.* | | | 384,294 | |

| | 1,971 | | | Chart Industries, Inc.* | | | 227,118 | |

| | 4,383 | | | ESCO Technologies, Inc. | | | 383,688 | |

| | 3,190 | | | Hillenbrand, Inc. | | | 136,117 | |

| | 1,888 | | | IDEX Corp. | | | 431,087 | |

| | 2,184 | | | John Bean Technologies Corp. | | | 199,465 | |

| | 46,338 | | | Leonardo DRS, Inc.* | | | 592,200 | |

| | 8,569 | | | Mercury Systems, Inc.* | | | 383,377 | |

| | 2,097 | | | Middleby Corp.* | | | 280,788 | |

| | 3,518 | | | MSA Safety, Inc. | | | 507,260 | |

| | 1,626 | | | Nordson Corp. | | | 386,533 | |

| | 3,626 | | | Regal Rexnord Corp. | | | 435,047 | |

| | 7,158 | | | Spirit AeroSystems Holdings, Inc., Class A | | | 211,877 | |

| | 4,750 | | | Stanley Black & Decker, Inc. | | | 356,820 | |

Kennedy Capital ESG SMID Cap Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | INDUSTRIALS (Continued) | | | | |

| | 2,392 | | | Tetra Tech, Inc. | | $ | 347,294 | |

| | 27,182 | | | Thermon Group Holdings, Inc.* | | | 545,815 | |

| | 3,289 | | | Titan Machinery, Inc.* | | | 130,672 | |

| | 8,633 | | | Trex Co., Inc.* | | | 365,435 | |

| | 790 | | | United Rentals, Inc.* | | | 280,782 | |

| | 2,335 | | | Valmont Industries, Inc. | | | 772,114 | |

| | 6,004 | | | XPO, Inc.* | | | 199,873 | |

| | 17,065 | | | Zurn Elkay Water Solutions Corp. | | | 360,925 | |

| | | | | | | | 8,698,797 | |

| | | | | | | | | |

| | | | | INFORMATION TECHNOLOGY — 15.5% | | | | |

| | 3,493 | | | CyberArk Software Ltd.*,1 | | | 452,867 | |

| | 3,740 | | | Elastic N.V.*,1 | | | 192,610 | |

| | 4,545 | | | Euronet Worldwide, Inc.* | | | 428,957 | |

| | 7,655 | | | Everbridge, Inc.* | | | 226,435 | |

| | 1,305 | | | F5, Inc.* | | | 187,281 | |

| | 6,157 | | | Kulicke & Soffa Industries, Inc. | | | 272,509 | |

| | 8,079 | | | PagerDuty, Inc.* | | | 214,578 | |

| | 1,549 | | | Paylocity Holding Corp.* | | | 300,909 | |

| | 2,029 | | | Perficient, Inc.* | | | 141,685 | |

| | 1,821 | | | Rogers Corp.* | | | 217,318 | |

| | 2,304 | | | TD SYNNEX Corp. | | | 218,212 | |

| | 1,992 | | | Teledyne Technologies, Inc.* | | | 796,621 | |

| | 2,390 | | | Teradyne, Inc. | | | 208,767 | |

| | 11,912 | | | Trimble, Inc.* | | | 602,271 | |

| | 20,282 | | | Vishay Precision Group, Inc.* | | | 783,899 | |

| | 7,480 | | | WNS Holdings Ltd. ADR* | | | 598,325 | |

| | 2,683 | | | Wolfspeed, Inc.* | | | 185,234 | |

| | | | | | | | 6,028,478 | |

| | | | | | | | | |

| | | | | MATERIALS — 3.6% | | | | |

| | 7,003 | | | Avient Corp. | | | 236,421 | |

| | 4,560 | | | Crown Holdings, Inc. | | | 374,878 | |

| | 9,276 | | | Livent Corp.* | | | 184,314 | |

| | 2,919 | | | Reliance Steel & Aluminum Co. | | | 590,922 | |

| | | | | | | | 1,386,535 | |

| | | | | | | | | |

| | | | | REAL ESTATE — 6.4% | | | | |

| | 2,727 | | | EastGroup Properties, Inc. - REIT | | | 403,760 | |

| | 24,179 | | | Independence Realty Trust, Inc. - REIT | | | 407,658 | |

| | 2,000 | | | Jones Lang LaSalle, Inc.* | | | 318,740 | |

| | 20,683 | | | Kite Realty Group Trust - REIT | | | 435,377 | |

| | 31,669 | | | Macerich Co. - REIT | | | 356,593 | |

| | 7,267 | | | National Storage Affiliates Trust - REIT | | | 262,484 | |

Kennedy Capital ESG SMID Cap Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | REAL ESTATE (Continued) | | | | |

| | 2,281 | | | Sun Communities, Inc. - REIT | | $ | 326,183 | |

| | | | | | | | 2,510,795 | |

| | | | | UTILITIES — 2.1% | | | | |

| | 12,371 | | | Atlantica Sustainable Infrastructure PLC1 | | | 320,409 | |

| | 10,381 | | | Essential Utilities, Inc. | | | 495,485 | |

| | | | | | | | 815,894 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $40,493,122) | | | 37,661,389 | |

Principal

Amount | | | | | | |

| | | | SHORT-TERM INVESTMENTS — 3.6% | | | |

| $ | 1,409,482 | | | UMB Bank Demand Deposit, 0.01%2 | | | 1,409,482 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $1,409,482) | | | 1,409,482 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 100.5% | | | | |

| | | | | (Cost $41,902,604) | | | 39,070,871 | |

| | | | | Liabilities in Excess of Other Assets — (0.5)% | | | (180,353 | ) |

| | | | | NET ASSETS — 100.0% | | $ | 38,890,518 | |

REIT – Real Estate Investment Trusts

PLC – Public Limited Company

ADR – American Depository Receipt

| * | Non-income producing security. |

| 1 | Foreign security denominated in U.S. Dollars. |

| 2 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

Kennedy Capital ESG SMID Cap Fund

SUMMARY OF INVESTMENTS

As of December 31, 2022

| Security Type/Sector | Percent of Total

Net Assets |

| Common Stocks | |

| Industrials | 22.4% |

| Information Technology | 15.5% |

| Financials | 14.8% |

| Health Care | 14.7% |

| Consumer Discretionary | 11.8% |

| Real Estate | 6.4% |

| Materials | 3.6% |

| Consumer Staples | 2.7% |

| Energy | 2.4% |

| Utilities | 2.1% |

| Communication Services | 0.5% |

| Total Common Stocks | 96.9% |

| Short-Term Investments | 3.6% |

| Total Investments | 100.5% |

| Liabilities in Excess of Other Assets | (0.5)% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

Kennedy Capital Small Cap Growth Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 98.5% | | | | |

| | | | | COMMUNICATION SERVICES — 1.9% | | | | |

| | 875 | | | Magnite, Inc.* | | $ | 9,266 | |

| | | | | | | | | |

| | | | | CONSUMER DISCRETIONARY — 15.5% | | | | |

| | 58 | | | Installed Building Products, Inc. | | | 4,965 | |

| | 33 | | | Lithia Motors, Inc. - Class A | | | 6,757 | |

| | 78 | | | Marriott Vacations Worldwide Corp. | | | 10,498 | |

| | 138 | | | Monarch Casino & Resort, Inc.* | | | 10,611 | |

| | 93 | | | Ollie's Bargain Outlet Holdings, Inc.* | | | 4,356 | |

| | 128 | | | Planet Fitness, Inc. - Class A* | | | 10,086 | |

| | 214 | | | Skyline Champion Corp.* | | | 11,023 | |

| | 380 | | | Topgolf Callaway Brands Corp.* | | | 7,505 | |

| | 57 | | | Wingstop, Inc. | | | 7,844 | |

| | | | | | | | 73,645 | |

| | | | | | | | | |

| | | | | CONSUMER STAPLES — 6.5% | | | | |

| | 332 | | | elf Beauty, Inc.* | | | 18,360 | |

| | 214 | | | Performance Food Group Co* | | | 12,495 | |

| | | | | | | | 30,855 | |

| | | | | | | | | |

| | | | | FINANCIALS — 5.7% | | | | |

| | 204 | | | Axos Financial, Inc.* | | | 7,797 | |

| | 312 | | | BRP Group, Inc. - Class A* | | | 7,843 | |

| | 168 | | | National Bank Holdings Corp. - Class A | | | 7,068 | |

| | 87 | | | Triumph Financial, Inc.* | | | 4,252 | |

| | | | | | | | 26,960 | |

| | | | | | | | | |

| | | | | HEALTH CARE — 22.9% | | | | |

| | 353 | | | AdaptHealth Corp.* | | | 6,785 | |

| | 792 | | | ADMA Biologics, Inc.* | | | 3,073 | |

| | 117 | | | Apollo Medical Holdings, Inc.* | | | 3,462 | |

| | 317 | | | Artivion, Inc.* | | | 3,842 | |

| | 419 | | | Avid Bioservices, Inc.* | | | 5,770 | |

| | 135 | | | Axonics, Inc.* | | | 8,442 | |

| | 106 | | | Bruker Corp. | | | 7,245 | |

| | 1,146 | | | Cerus Corp.* | | | 4,183 | |

| | 170 | | | Cullinan Oncology, Inc.* | | | 1,794 | |

| | 205 | | | Halozyme Therapeutics, Inc.* | | | 11,664 | |

| | 123 | | | Intra-Cellular Therapies, Inc.* | | | 6,509 | |

| | 72 | | | Ionis Pharmaceuticals, Inc.* | | | 2,719 | |

| | 251 | | | Iovance Biotherapeutics, Inc.* | | | 1,604 | |

| | 62 | | | Keros Therapeutics, Inc.* | | | 2,977 | |

| | 219 | | | Kezar Life Sciences, Inc.* | | | 1,542 | |

| | 30 | | | Ligand Pharmaceuticals, Inc.* | | | 2,004 | |

| | 91 | | | LivaNova PLC*,1 | | | 5,054 | |

| | 150 | | | NuVasive, Inc.* | | | 6,186 | |

Kennedy Capital Small Cap Growth Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | HEALTH CARE (Continued) | | | | |

| | 02 | | | OmniAb, Inc.* | | $ | — | 3 |

| | 11 | | | OmniAb, Inc. Earnout Shares4 | | | — | |

| | 11 | | | OmniAb, Inc. Earnout Shares4 | | | — | |

| | 108 | | | Omnicell, Inc.* | | | 5,445 | |

| | 131 | | | Protagonist Therapeutics, Inc.* | | | 1,429 | |

| | 70 | | | Reata Pharmaceuticals, Inc. - Class A* | | | 2,659 | |

| | 173 | | | Surgery Partners, Inc.* | | | 4,820 | |

| | 130 | | | Tandem Diabetes Care, Inc.* | | | 5,844 | |

| | 100 | | | Travere Therapeutics, Inc.* | | | 2,103 | |

| | 80 | | | Zentalis Pharmaceuticals, Inc.* | | | 1,611 | |

| | | | | | | | 108,766 | |

| | | | | | | | | |

| | | | | INDUSTRIALS — 24.7% | | | | |

| | 418 | | | Array Technologies, Inc.* | | | 8,080 | |

| | 120 | | | ASGN, Inc.* | | | 9,778 | |

| | 88 | | | Axon Enterprise, Inc.* | | | 14,602 | |

| | 143 | | | Casella Waste Systems, Inc. - Class A* | | | 11,341 | |

| | 53 | | | Chart Industries, Inc.* | | | 6,107 | |

| | 61 | | | John Bean Technologies Corp. | | | 5,571 | |

| | 466 | | | Leonardo DRS, Inc.* | | | 5,955 | |

| | 55 | | | MasTec, Inc.* | | | 4,693 | |

| | 116 | | | Mercury Systems, Inc.* | | | 5,190 | |

| | 67 | | | NV5 Global, Inc.* | | | 8,865 | |

| | 69 | | | Tetra Tech, Inc. | | | 10,018 | |

| | 133 | | | Trex Co., Inc.* | | | 5,630 | |

| | 95 | | | UFP Industries, Inc. | | | 7,529 | |

| | 316 | | | WillScot Mobile Mini Holdings Corp.* | | | 14,274 | |

| | | | | | | | 117,633 | |

| | | | | | | | | |

| | | | | INFORMATION TECHNOLOGY — 17.7% | | | | |

| | 221 | | | CI&T, Inc. - Class A*,1 | | | 1,437 | |

| | 64 | | | Elastic N.V.*,1 | | | 3,296 | |

| | 86 | | | Euronet Worldwide, Inc.* | | | 8,117 | |

| | 111 | | | Five9, Inc.* | | | 7,533 | |

| | 1,188 | | | Infinera Corp.* | | | 8,007 | |

| | 183 | | | MACOM Technology Solutions Holdings, Inc.* | | | 11,525 | |

| | 194 | | | MaxLinear, Inc.* | | | 6,586 | |

| | 246 | | | PagerDuty, Inc.* | | | 6,534 | |

| | 44 | | | Paylocity Holding Corp.* | | | 8,547 | |

| | 40 | | | Perficient, Inc.* | | | 2,793 | |

| | 125 | | | Shift4 Payments, Inc. - Class A* | | | 6,991 | |

| | 26 | | | Synaptics, Inc.* | | | 2,474 | |

| | 127 | | | WNS Holdings Ltd. ADR* | | | 10,159 | |

| | | | | | | | 83,999 | |

Kennedy Capital Small Cap Growth Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | REAL ESTATE — 3.6% | | | | |

| | 527 | | | Independence Realty Trust, Inc. - REIT | | $ | 8,885 | |

| | 81 | | | Innovative Industrial Properties, Inc. - REIT | | | 8,210 | |

| | | | | | | | 17,095 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $491,541) | | | 468,219 | |

| | | | | EXCHANGE-TRADED FUNDS — 3.8% | | | | |

| | 85 | | | iShares Russell 2000 Growth ETF | | | 18,234 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Cost $18,115) | | | 18,234 | |

Principal

Amount | | | | | | |

| | | | SHORT-TERM INVESTMENTS — 6.3% | | | |

| $ | 29,985 | | | UMB Bank Demand Deposit, 0.01%5 | | | 29,985 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $29,985) | | | 29,985 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 108.6% | | | | |

| | | | | (Cost $539,641) | | | 516,438 | |

| | | | | Liabilities in Excess of Other Assets — (8.6)% | | | (40,951 | ) |

| | | | | NET ASSETS — 100.0% | | $ | 475,487 | |

PLC – Public Limited Company

ADR – American Depository Receipt

REIT – Real Estate Investment Trusts

ETF – Exchange-Traded Fund

| * | Non-income producing security. |

| 1 | Foreign security denominated in U.S. Dollars. |

| 2 | Amount represents less than 0.5 shares. |

| 3 | Amount represents less than $0.50. |

| 4 | Level 3 securities fair valued under procedures established by the Board of Trustees, represents 0.00% of Net Assets. The total value of these securities is $0. |

| 5 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

Kennedy Capital Small Cap Growth Fund

SUMMARY OF INVESTMENTS

As of December 31, 2022

| Security Type/Sector | Percent of Total

Net Assets |

| Common Stocks | |

| Industrials | 24.7% |

| Health Care | 22.9% |

| Information Technology | 17.7% |

| Consumer Discretionary | 15.5% |

| Consumer Staples | 6.5% |

| Financials | 5.7% |

| Real Estate | 3.6% |

| Communication Services | 1.9% |

| Total Common Stocks | 98.5% |

| Exchange-Traded Funds | |

| Unknown GICS Sector | 3.8% |

| Short-Term Investments | 6.3% |

| Total Investments | 108.6% |

| Liabilities in Excess of Other Assets | (8.6)% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

Kennedy Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 97.3% | | | | |

| | | | | COMMUNICATION SERVICES — 1.0% | | | | |

| | 715 | | | Ziff Davis, Inc.* | | $ | 56,557 | |

| | | | | | | | | |

| | | | | CONSUMER DISCRETIONARY — 10.3% | | | | |

| | 3,958 | | | American Eagle Outfitters, Inc. | | | 55,254 | |

| | 546 | | | America's Car-Mart, Inc.* | | | 39,454 | |

| | 3,202 | | | Bloomin' Brands, Inc. | | | 64,424 | |

| | 293 | | | Cavco Industries, Inc.* | | | 66,291 | |

| | 4,663 | | | Dana, Inc. | | | 70,551 | |

| | 1,009 | | | Green Brick Partners, Inc.* | | | 24,448 | |

| | 579 | | | Helen of Troy, Ltd.*,1 | | | 64,217 | |

| | 431 | | | Johnson Outdoors, Inc. - Class A | | | 28,498 | |

| | 239 | | | LCI Industries | | | 22,095 | |

| | 1,549 | | | Modine Manufacturing Co.* | | | 30,763 | |

| | 851 | | | Ollie's Bargain Outlet Holdings, Inc.* | | | 39,861 | |

| | 1,009 | | | Rent-A-Center, Inc. | | | 22,753 | |

| | 314 | | | TopBuild Corp.* | | | 49,138 | |

| | | | | | | | 577,747 | |

| | | | | | | | | |

| | | | | CONSUMER STAPLES — 1.7% | | | | |

| | 1,744 | | | BellRing Brands, Inc. - Class A* | | | 44,716 | |

| | 1,698 | | | Calavo Growers, Inc. | | | 49,921 | |

| | | | | | | | 94,637 | |

| | | | | | | | | |

| | | | | ENERGY — 4.6% | | | | |

| | 2,013 | | | ChampionX Corp. | | | 58,357 | |

| | 134 | | | Denbury, Inc.* | | | 11,661 | |

| | 704 | | | Helmerich & Payne, Inc. | | | 34,897 | |

| | 705 | | | HF Sinclair Corp. | | | 36,582 | |

| | 1,964 | | | Northern Oil and Gas, Inc. | | | 60,531 | |

| | 9,701 | | | Southwestern Energy Co.* | | | 56,751 | |

| | | | | | | | 258,779 | |

| | | | | | | | | |

| | | | | FINANCIALS — 26.9% | | | | |

| | 1,291 | | | 1st Source Corp. | | | 68,539 | |

| | 1,338 | | | American Equity Investment Life Holding Co. | | | 61,040 | |

| | 2,520 | | | Argo Group International Holdings Ltd.1 | | | 65,142 | |

| | 1,613 | | | Bank OZK | | | 64,617 | |

| | 1,463 | | | BankUnited, Inc. | | | 49,698 | |

| | 528 | | | Banner Corp. | | | 33,370 | |

| | 2,297 | | | Cadence Bank | | | 56,644 | |

| | 1,245 | | | Enterprise Financial Services Corp. | | | 60,955 | |

| | 667 | | | FB Financial Corp. | | | 24,105 | |

| | 2,043 | | | First Interstate BancSystem, Inc., Class A | | | 78,962 | |

| | 3,263 | | | Heritage Commerce Corp. | | | 42,419 | |

| | 4,173 | | | Home BancShares, Inc. | | | 95,103 | |

Kennedy Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | FINANCIALS (Continued) | | | | |

| | 1,111 | | | HomeStreet, Inc. | | $ | 30,641 | |

| | 534 | | | Horace Mann Educators Corp. | | | 19,956 | |

| | 2,089 | | | National Bank Holdings Corp. - Class A | | | 87,884 | |

| | 2,528 | | | New York Community Bancorp, Inc. | | | 21,741 | |

| | 1,734 | | | Origin Bancorp, Inc. | | | 63,638 | |

| | 1,147 | | | PacWest Bancorp | | | 26,324 | |

| | 1,365 | | | Peapack-Gladstone Financial Corp. | | | 50,805 | |

| | 650 | | | Pinnacle Financial Partners, Inc. | | | 47,710 | |

| | 580 | | | Piper Sandler Cos. | | | 75,510 | |

| | 1,210 | | | Sandy Spring Bancorp, Inc. | | | 42,628 | |

| | 185 | | | SouthState Corp. | | | 14,127 | |

| | 1,365 | | | Stifel Financial Corp. | | | 79,675 | |

| | 1,097 | | | Texas Capital Bancshares, Inc.* | | | 66,160 | |

| | 1,454 | | | United Community Banks, Inc. | | | 49,145 | |

| | 1,139 | | | Washington Federal, Inc. | | | 38,214 | |

| | 1,122 | | | Wintrust Financial Corp. | | | 94,831 | |

| | | | | | | | 1,509,583 | |

| | | | | | | | | |

| | | | | HEALTH CARE — 9.8% | | | | |

| | 1,371 | | | AdaptHealth Corp.* | | | 26,351 | |

| | 737 | | | Addus HomeCare Corp.* | | | 73,324 | |

| | 447 | | | AMN Healthcare Services Inc* | | | 45,960 | |

| | 1,760 | | | ANI Pharmaceuticals, Inc.* | | | 70,805 | |

| | 2,551 | | | Enhabit, Inc.* | | | 33,571 | |

| | 1,474 | | | Halozyme Therapeutics, Inc.* | | | 83,871 | |

| | 255 | | | ICU Medical, Inc.* | | | 40,157 | |

| | 991 | | | LeMaitre Vascular, Inc. | | | 45,606 | |

| | 171 | | | Mesa Laboratories, Inc. | | | 28,422 | |

| | 3,401 | | | NextGen Healthcare, Inc.* | | | 63,871 | |

| | 404 | | | Omnicell, Inc.* | | | 20,370 | |

| | 446 | | | Syneos Health, Inc.* | | | 16,359 | |

| | | | | | | | 548,667 | |

| | | | | | | | | |

| | | | | INDUSTRIALS — 16.9% | | | | |

| | 207 | | | Acuity Brands, Inc. | | | 34,281 | |

| | 660 | | | Alamo Group, Inc. | | | 93,456 | |

| | 1,528 | | | Altra Industrial Motion Corp. | | | 91,298 | |

| | 1,215 | | | Astec Industries, Inc. | | | 49,402 | |

| | 244 | | | Chart Industries, Inc.* | | | 28,116 | |

| | 1,159 | | | Gibraltar Industries, Inc.* | | | 53,175 | |

| | 959 | | | IES Holdings, Inc.* | | | 34,112 | |

| | 1,675 | | | Insteel Industries, Inc. | | | 46,096 | |

| | 897 | | | Kirby Corp.* | | | 57,722 | |

| | 540 | | | Regal Rexnord Corp. | | | 64,789 | |

| | 238 | | | Saia, Inc.* | | | 49,904 | |

Kennedy Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | INDUSTRIALS (Continued) | | | | |

| | 471 | | | Simpson Manufacturing Co., Inc. | | $ | 41,759 | |

| | 665 | | | UFP Industries, Inc. | | | 52,701 | |

| | 229 | | | UniFirst Corp. | | | 44,195 | |

| | 270 | | | Valmont Industries, Inc. | | | 89,281 | |

| | 3,433 | | | Wabash National Corp. | | | 77,586 | |

| | 351 | | | WESCO International, Inc.* | | | 43,945 | |

| | | | | | | | 951,818 | |

| | | | | | | | | |

| | | | | INFORMATION TECHNOLOGY — 6.4% | | | | |

| | 1,752 | | | Cambium Networks Corp.*,1 | | | 37,966 | |

| | 1,919 | | | Coherent, Corp.* | | | 67,357 | |

| | 411 | | | Diodes, Inc.* | | | 31,294 | |

| | 2,145 | | | Ichor Holdings Ltd.*,1 | | | 57,529 | |

| | 837 | | | MaxLinear, Inc.* | | | 28,416 | |

| | 653 | | | Perficient, Inc.* | | | 45,599 | |

| | 439 | | | Plexus Corp.* | | | 45,186 | |

| | 909 | | | Progress Software Corp. | | | 45,859 | |

| | | | | | | | 359,206 | |

| | | | | | | | | |

| | | | | MATERIALS — 5.6% | | | | |

| | 760 | | | Alcoa Corp. | | | 34,557 | |

| | 1,034 | | | Carpenter Technology Corp. | | | 38,196 | |

| | 345 | | | Eagle Materials, Inc. | | | 45,833 | |

| | 488 | | | H.B. Fuller Co. | | | 34,951 | |

| | 1,482 | | | Hawkins, Inc. | | | 57,205 | |

| | 384 | | | Materion Corp. | | | 33,604 | |

| | 256 | | | Quaker Chemical Corp. | | | 42,726 | |

| | 957 | | | Ryerson Holding Corp. | | | 28,959 | |

| | | | | | | | 316,031 | |

| | | | | | | | | |

| | | | | REAL ESTATE — 10.8% | | | | |

| | 2,464 | | | Alpine Income Property Trust, Inc. - REIT | | | 47,013 | |

| | 1,733 | | | American Assets Trust, Inc. - REIT | | | 45,924 | |

| | 815 | | | Community Healthcare Trust, Inc. - REIT | | | 29,177 | |

| | 1,520 | | | Corporate Office Properties Trust - REIT | | | 39,429 | |

| | 427 | | | EastGroup Properties, Inc. - REIT | | | 63,222 | |

| | 1,161 | | | Essential Properties Realty Trust, Inc. - REIT | | | 27,249 | |

| | 122 | | | Innovative Industrial Properties, Inc. - REIT | | | 12,365 | |

| | 3,562 | | | Kite Realty Group Trust - REIT | | | 74,980 | |

| | 4,633 | | | Macerich Co. - REIT | | | 52,167 | |

| | 1,161 | | | National Storage Affiliates Trust - REIT | | | 41,935 | |

| | 1,430 | | | NexPoint Residential Trust, Inc. - REIT | | | 62,234 | |

| | 1,283 | | | PotlatchDeltic Corp. - REIT | | | 56,439 | |

| | 5,370 | | | Sunstone Hotel Investors, Inc. - REIT | | | 51,874 | |

| | | | | | | | 604,008 | |

Kennedy Capital Small Cap Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of December 31, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | UTILITIES — 3.3% | | | | |

| | 450 | | | ALLETE, Inc. | | $ | 29,029 | |

| | 507 | | | American States Water Co. | | | 46,923 | |

| | 1,197 | | | Avista Corp. | | | 53,075 | |

| | 520 | | | IDACORP, Inc. | | | 56,082 | |

| | | | | | | | 185,109 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $5,543,866) | | | 5,462,142 | |

Principal

Amount | | | | | | |

| | | | SHORT-TERM INVESTMENTS — 3.9% | | | |

| $ | 222,018 | | | UMB Bank Demand Deposit, 0.01%2 | | | 222,018 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $222,018) | | | 222,018 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 101.2% | | | | |

| | | | | (Cost $5,765,884) | | | 5,684,160 | |

| | | | | Liabilities in Excess of Other Assets — (1.2)% | | | (69,547 | ) |

| | | | | NET ASSETS — 100.0% | | $ | 5,614,613 | |

REIT – Real Estate Investment Trusts

| * | Non-income producing security. |

| 1 | Foreign security denominated in U.S. Dollars. |

| 2 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

Kennedy Capital Small Cap Value Fund

SUMMARY OF INVESTMENTS

As of December 31, 2022

| Security Type/Sector | Percent of Total

Net Assets |

| Common Stocks | |

| Financials | 26.9% |

| Industrials | 16.9% |

| Real Estate | 10.8% |

| Consumer Discretionary | 10.3% |

| Health Care | 9.8% |

| Information Technology | 6.4% |

| Materials | 5.6% |

| Energy | 4.6% |

| Utilities | 3.3% |

| Consumer Staples | 1.7% |

| Communication Services | 1.0% |

| Total Common Stocks | 97.3% |

| Short-Term Investments | 3.9% |

| Total Investments | 101.2% |

| Liabilities in Excess of Other Assets | (1.2)% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

Kennedy Capital Funds

STATEMENTS OF ASSETS AND LIABILITIES

As of December 31, 2022

| | | Kennedy Capital ESG SMID Cap Fund | | | Kennedy Capital Small Cap Growth Fund | | | Kennedy Capital Small Cap Value Fund | |

| Assets: | | | | | | | | | |

Investments, at value (cost $41,902,604, $539,641 and $5,765,884, respectively) | | $ | 39,070,871 | | | $ | 516,438 | | | $ | 5,684,160 | |

| Receivables: | | | | | | | | | | | | |

| Investment securities sold | | | 157,387 | | | | - | | | | - | |

| Fund shares sold | | | 6,352 | | | | - | | | | - | |

| Dividends and interest | | | 23,322 | | | | 300 | | | | 4,147 | |

| Due from Advisor | | | - | | | | 15,274 | | | | 11,445 | |

| Prepaid expenses | | | 6,147 | | | | 3,891 | | | | 3,890 | |

| Total assets | | | 39,264,079 | | | | 535,903 | | | | 5,703,642 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Investment securities purchased | | | 294,752 | | | | - | | | | 26,423 | |

| Offering costs - Advisor | | | - | | | | 13,985 | | | | 13,985 | |

| Advisory fees | | | 6,965 | | | | - | | | | - | |

Fund administration and accounting fees | | | 15,713 | | | | 8,188 | | | | 8,219 | |

| Transfer agent fees and expenses | | | 4,757 | | | | 4,225 | | | | 3,997 | |

| Custody fees | | | 6,290 | | | | 3,967 | | | | 4,245 | |

| Auditing fees | | | 16,279 | | | | 14,999 | | | | 14,999 | |

| Trustees' deferred compensation (Note 3) | | | 11,251 | | | | 1,412 | | | | 1,416 | |

| Legal fees | | | 7,553 | | | | 3,541 | | | | 5,789 | |

| Chief Compliance Officer fees | | | 4,374 | | | | 632 | | | | 637 | |

| Trustees' fees and expenses | | | 614 | | | | 2,842 | | | | 2,833 | |

| Accrued other expenses | | | 5,013 | | | | 6,625 | | | | 6,486 | |

| Total liabilities | | | 373,561 | | | | 60,416 | | | | 89,029 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 38,890,518 | | | $ | 475,487 | | | $ | 5,614,613 | |

| | | | | | | | | | | | | |

| Components of Net Assets: | | | | | | | | | | | | |

Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 42,228,313 | | | $ | 504,198 | | | $ | 5,686,760 | |

Total distributable earnings (accumulated deficit) | | | (3,337,795 | ) | | | (28,711 | ) | | | (72,147 | ) |

| Net Assets | | $ | 38,890,518 | | | $ | 475,487 | | | $ | 5,614,613 | |

| | | | | | | | | | | | | |

| Maximum Offering Price per Share: | | | | | | | | | | | | |

| Institutional Class: | | | | | | | | | | | | |

Net assets applicable to shares outstanding | | $ | 38,890,518 | | | $ | 475,487 | | | $ | 5,614,613 | |

| Shares of beneficial interest issued and outstanding | | | 3,089,124 | | | | 50,480 | | | | 570,829 | |

Net asset value, offering and redemption price per share | | $ | 12.59 | | | $ | 9.42 | | | $ | 9.84 | |

See accompanying Notes to Financial Statements.

Kennedy Capital Funds

STATEMENTS OF OPERATIONS

For the Year/Period Ended December 31, 2022

| | | Kennedy Capital ESG SMID Cap Fund | | | Kennedy Capital Small Cap Growth Fund | | | Kennedy Capital Small Cap Value Fund | |

| Investment income: | | | | | | | | | |

| Dividends (net of foreign withholding taxes of $3, $0 and $0, respectively) | | $ | 252,592 | | | $ | 940 | | | $ | 26,517 | |

| Interest | | | 100 | | | | 2 | | | | 7 | |

| Total investment income | | | 252,692 | | | | 942 | | | | 26,524 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Advisory fees | | | 233,374 | | | | 2,663 | | | | 10,756 | |

| Fund administration and accounting fees | | | 87,936 | | | | 32,796 | | | | 33,588 | |

| Transfer agent fees and expenses | | | 30,007 | | | | 7,774 | | | | 7,774 | |

| Custody fees | | | 16,250 | | | | 7,366 | | | | 7,609 | |

| Registration fees | | | 28,199 | | | | 6,240 | | | | 6,240 | |

| Legal fees | | | 18,998 | | | | 12,765 | | | | 12,765 | |

| Auditing fees | | | 16,002 | | | | 14,999 | | | | 14,999 | |

| Chief Compliance Officer fees | | | 14,399 | | | | 5,865 | | | | 5,869 | |

| Trustees' fees and expenses | | | 11,478 | | | | 6,776 | | | | 6,776 | |

| Shareholder reporting fees | | | 7,501 | | | | 6,239 | | | | 6,239 | |

| Miscellaneous | | | 7,001 | | | | 3,716 | | | | 3,716 | |

| Insurance fees | | | 3,201 | | | | 2,039 | | | | 2,039 | |

| Offering costs | | | - | | | | 13,796 | | | | 13,796 | |

| Total expenses | | | 474,346 | | | | 123,034 | | | | 132,166 | |

| Advisory fees recovered (waived) | | | (216,728 | ) | | | (2,663 | ) | | | (10,756 | ) |

| Other expenses reimbursed | | | - | | | | (117,407 | ) | | | (109,663 | ) |

| Fees paid indirectly (Note 3) | | | (2,477 | ) | | | (74 | ) | | | (74 | ) |

| Net expenses | | | 255,141 | | | | 2,890 | | | | 11,673 | |

| Net investment income (loss) | | | (2,449 | ) | | | (1,948 | ) | | | 14,851 | |

| | | | | | | | | | | | | |

| Realized and Unrealized Gain (Loss): | | | | | | | | | | | | |

| Net realized gain (loss) on investments | | | (453,594 | ) | | | 638 | | | | 67,387 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (4,608,674 | ) | | | (23,203 | ) | | | (81,724 | ) |

Net realized and unrealized gain (loss) | | | (5,062,268 | ) | | | (22,565 | ) | | | (14,337 | ) |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets from Operations | | $ | (5,064,717 | ) | | $ | (24,513 | ) | | $ | 514 | |

See accompanying Notes to Financial Statements.

Kennedy Capital ESG SMID Cap Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Year Ended

December 31, 2022 | | | For the

Year Ended

December 31, 2021 | |

| Increase (Decrease) in Net Assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income (loss) | | $ | (2,449 | ) | | $ | (10,774 | ) |

| Net realized gain (loss) on investments | | | (453,594 | ) | | | 936,242 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (4,608,674 | ) | | | 1,306,088 | |

| Net increase (decrease) in net assets resulting from operations | | | (5,064,717 | ) | | | 2,231,556 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Institutional Class | | | (178,033 | ) | | | (814,389 | ) |

| Total distributions to shareholders | | | (178,033 | ) | | | (814,389 | ) |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Net proceeds from shares sold: | | | | | | | | |

| Institutional Class | | | 31,318,748 | | | | 10,241,312 | |

| Reinvestment of distributions: | | | | | | | | |

| Institutional Class | | | 173,506 | | | | 814,389 | |

| Cost of shares redeemed: | | | | | | | | |

| Institutional Class | | | (685,560 | ) | | | (5,514,555 | ) |

Net increase (decrease) in net assets from capital transactions | | | 30,806,694 | | | | 5,541,146 | |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 25,563,944 | | | | 6,958,313 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 13,326,574 | | | | 6,368,261 | |

| End of period | | $ | 38,890,518 | | | $ | 13,326,574 | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold: | | | | | | | | |

| Institutional Class | | | 2,260,237 | | | | 680,684 | |

| Shares reinvested: | | | | | | | | |

| Institutional Class | | | 13,461 | | | | 54,804 | |

| Shares redeemed: | | | | | | | | |

| Institutional Class | | | (50,411 | ) | | | (355,562 | ) |

| Net increase (decrease) in capital share transactions | | | 2,223,287 | | | | 379,926 | |

See accompanying Notes to Financial Statements.

Kennedy Capital Small Cap Growth Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Period

April 27, 2022*

through

December 31, 2022 | |

| Increase (Decrease) in Net Assets from: | | | | |

| Operations: | | | | |

| Net investment income (loss) | | $ | (1,948 | ) |

| Net realized gain (loss) on investments | | | 638 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (23,203 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (24,513 | ) |

| | | | | |

| Distributions to Shareholders: | | | | |

| Institutional Class | | | (4,670 | ) |

| Total distributions to shareholders | | | (4,670 | ) |

| | | | | |

| Capital Transactions: | | | | |

| Net proceeds from shares sold: | | | | |

| Institutional Class | | | 500,000 | |

| Reinvestment of distributions: | | | | |

| Institutional Class | | | 4,670 | |

| Net increase (decrease) in net assets from capital transactions | | | 504,670 | |

| | | | | |

| Total increase (decrease) in net assets | | | 475,487 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | - | |

| End of period | | $ | 475,487 | |

| Capital Share Transactions: | | | | |

| Shares sold: | | | | |

| Institutional Class | | | 50,000 | |

| Shares reinvested: | | | | |

| Institutional Class | | | 480 | |

| Net increase (decrease) in capital share transactions | | | 50,480 | |

| * | Commencement of operations. |

See accompanying Notes to Financial Statements.

Kennedy Capital Small Cap Value Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Period

April 27, 2022*

through

December 31, 2022 | |

| Increase (Decrease) in Net Assets from: | | | | |

| Operations: | | | | |

| Net investment income (loss) | | $ | 14,851 | |

| Net realized gain (loss) on investments | | | 67,387 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (81,724 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 514 | |

| | | | | |

| Distributions to Shareholders: | | | | |

| Institutional Class | | | (72,993 | ) |

| Total distributions to shareholders | | | (72,993 | ) |

| | | | | |

| Capital Transactions: | | | | |

| Net proceeds from shares sold: | | | | |

| Institutional Class | | | 5,618,769 | |

| Reinvestment of distributions: | | | | |

| Institutional Class | | | 71,045 | |

| Cost of shares redeemed: | | | | |

| Institutional Class | | | (2,722 | ) |

| Net increase (decrease) in net assets from capital transactions | | | 5,687,092 | |

| | | | | |

| Total increase (decrease) in net assets | | | 5,614,613 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | - | |

| End of period | | $ | 5,614,613 | |

| Capital Share Transactions: | | | | |

| Shares sold: | | | | |

| Institutional Class | | | 564,097 | |

| Shares reinvested: | | | | |

| Institutional Class | | | 7,000 | |

| Shares redeemed: | | | | |

| Institutional Class | | | (268 | ) |

| Net increase (decrease) in capital share transactions | | | 570,829 | |

| * | Commencement of operations. |

See accompanying Notes to Financial Statements.

FINANCIAL HIGHLIGHTS

Kennedy Capital ESG SMID Cap Fund

Institutional Class

Per share operating performance.

For a capital share outstanding throughout each period.

| | | For the

Year Ended

December 31, | | | For the Period

June 28, 2019*

through

December 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net asset value, beginning of period | | $ | 15.39 | | | $ | 13.11 | | | $ | 10.86 | | | $ | 10.00 | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | |

| Net investment income (loss)1 | | | - | 2 | | | (0.01 | ) | | | - | 2 | | | 0.01 | |

| Net realized and unrealized gain (loss) | | | (2.74 | ) | | | 3.31 | | | | 2.28 | | | | 0.87 | |

| Total from investment operations | | | (2.74 | ) | | | 3.30 | | | | 2.28 | | | | 0.88 | |

| | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.01 | ) | | | - | | | | (0.03 | ) | | | (0.02 | ) |

| From net realized gain | | | (0.05 | ) | | | (1.02 | ) | | | - | | | | - | |

| Total distributions | | | (0.06 | ) | | | (1.02 | ) | | | (0.03 | ) | | | (0.02 | ) |

| Net asset value, end of period | | $ | 12.59 | | | $ | 15.39 | | | $ | 13.11 | | | $ | 10.86 | |

| | | | | | | | | | | | | | | | | |

| Total return3 | | | (17.82 | )% | | | 25.47 | % | | | 20.98 | % | | | 8.83 | %4 |

| | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 38,891 | | | $ | 13,327 | | | $ | 6,368 | | | $ | 1,390 | |

| | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed/recovered | | | 1.52 | % | | | 2.49 | % | | | 15.92 | % | | | 19.45 | %5 |

| After fees waived and expenses absorbed/recovered | | | 0.82 | % | | | 0.82 | % | | | 0.82 | % | | | 0.82 | %5 |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed/recovered | | | (0.71 | )% | | | (1.75 | )% | | | (15.08 | )% | | | (18.53 | )%5 |

| After fees waived and expenses absorbed/recovered | | | (0.01 | )% | | | (0.08 | )% | | | 0.02 | % | | | 0.10 | %5 |

| Portfolio turnover rate | | | 50 | % | | | 87 | % | | | 63 | % | | | 27 | %4 |

| * | Commencement of operations. |

| 1 | Based on average shares outstanding for the period. |

| 2 | Amount represents less than $0.01 per share. |

| 3 | Total returns would have been lower/higher had certain expenses not been waived or absorbed/recovered by the Advisor. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| 4 | Not annualized. |

| 5 | Annualized. |

See accompanying Notes to Financial Statements.

FINANCIAL HIGHLIGHTS

Kennedy Capital Small Cap Growth Fund

Institutional Class

Per share operating performance.

For a capital share outstanding throughout each period.

| | | For the Period

April 27, 2022*

through

December 31,

2022 | |