Exhibit (c)(2)

Preliminary Draft – Confidential

The Conflicts Committee of the Board of Directors of VTTI Energy Partners GP LLC

Discussion Materials Regarding Project Terminal Velocity March 27, 2017

EVERCORE vtti energy partners

Preliminary Draft – Confidential

These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Conflicts Committee of the Board of Directors of VTTI Energy Partners GP LLC (“VTGP”) to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Evercore. These materials are based on information provided by or on behalf of the Board and/or other potential transaction participants, from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the management of the Board and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Board. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Board.

These materials were compiled on a confidential basis for use by the Board in evaluating the potential transaction described herein and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore.

These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore (or any affiliate) to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates.

Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein.

EVERCORE vtti energy partners

Preliminary Draft – Confidential

Table of Contents

Section

Executive Summary

I

VTTI Situation Analysis

II

VTTI Operating Asset Overview and Projections

III

VTTI Financial Projections

IV

Preliminary VTTI Valuation Analysis

V

Appendix

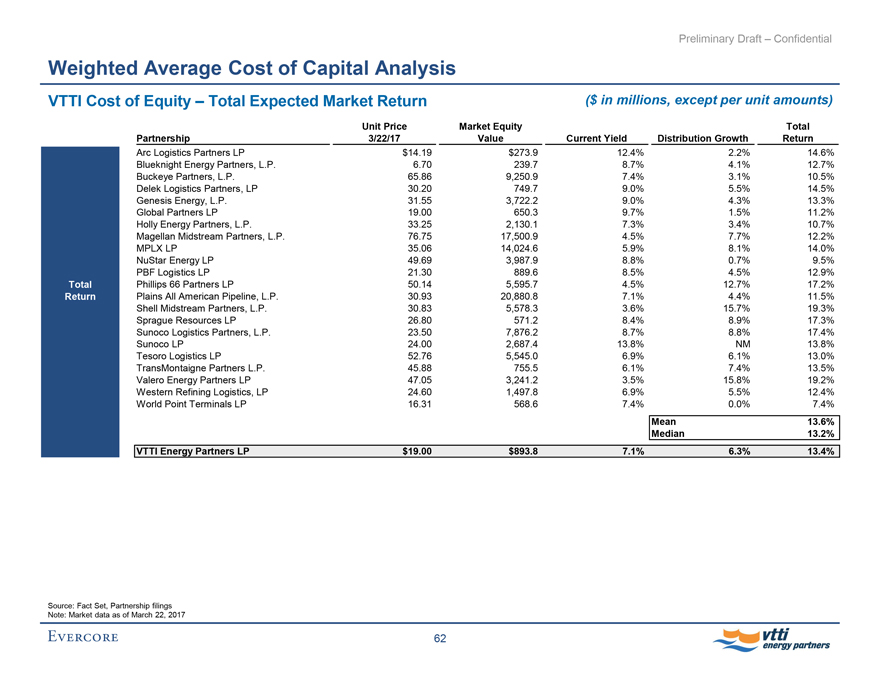

A. Weighted Average Cost of Capital Analysis

B. Selected Historical Market Data

EVERCORE vtti energy partners

Preliminary Draft – Confidential

I. Executive Summary

EVERCORE

Preliminary Draft – Confidential

Executive Summary

Introduction

Evercore Group L.L.C. (“Evercore”) is pleased to provide the materials herein to the Conflicts Committee of the Board of Directors of VTTI Energy Partners GP LLC (“VTGP”) (the “Conflicts Committee”), the general partner of VTTI Energy Partners LP (“VTTI” or the “Partnership”), regarding the proposed acquisition of all publicly-held common units representing limited partner interests in VTTI from the current holders of such units (the “Unaffiliated Unitholders”) by VTTI MLP Partners B.V. (the “Sponsor”) (the “Proposed Transaction”)

As part of the Proposed Transaction, the Sponsor has proposed to acquire each publicly-owned VTTI common unit for cash consideration of $18.75 per unit (the “Proposed Consideration”)

The Proposed Consideration represents a 1.9% premium to VTTI’s closing unit price of 18.40 as of March 2, 20171

The Proposed Consideration represents a 2.7% premium to VTTI’s30-day (trading) volume-weighted average unit price

(“VWAP”) of $18.26 as of March 2, 2017

Pro forma for the Proposed Transaction, VTTI will cease to be a publicly-traded partnership and will be a wholly-owned subsidiary of the Sponsor

The Proposed Transaction is subject to the negotiation and execution of a definitive agreement (the “Purchase Agreement”) and approval of the Purchase Agreement and the transactions contemplated thereunder by the Sponsor’s Board of Directors, VTGP’s Board of Directors, VTTI’s Board of Directors, the Conflicts Committee, and a majority vote of the

Unaffiliated Unitholders

Source: FactSet

1. Announcement date of the Proposed Transaction

1

EVERCORE vtti energy partners

Preliminary Draft – Confidential

Executive Summary

Overview of Materials

The materials herein include the following:

An executive summary including: (i) an overview of the current VTTI organizational structure, (ii) a review of certain trading statistics for VTTI and (iii) an overview of the historical trading performance of VTTI relative to the Proposed Consideration

A current situation analysis for VTTI, including an overview of VTTI’s business

An overview of the operating assets of VTTI MLP B.V. (“VTTI Operating”), in which VTTI owns a 51.0% interest, including an overview of the operating projections for VTTI Operating as provided by VTTI management (the “VTTI Operating Projections – Management Case”)

In addition to the Management Case, during its due diligence review, Evercore analyzed two additional scenarios: (i) an increase innon-contracted rates of 10.0% (the “VTTI Operating Projections – Sensitivity Case I”) and (ii) a decrease innon-contracted rates of 10.0% (the “VTTI Operating Projections – Sensitivity Case II”)

A review of the financial projections for VTTI as provided by VTTI management (the “VTTI Financial Projections – Management Case”)

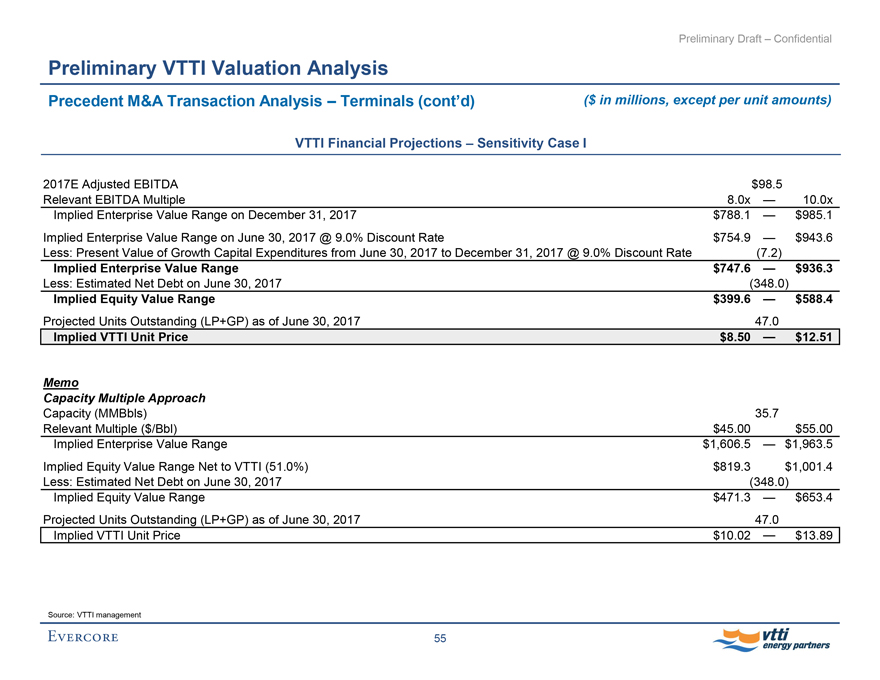

In addition to the Management Case, Evercore analyzed two additional scenarios during its due diligence review: (i) a scenario that assumes the VTTI Operating Projections – Sensitivity Case I (the “VTTI Financial Projections – Sensitivity Case I”) and (ii) a scenario that assumes the VTTI Operating Projections – Sensitivity Case II (the “VTTI Financial

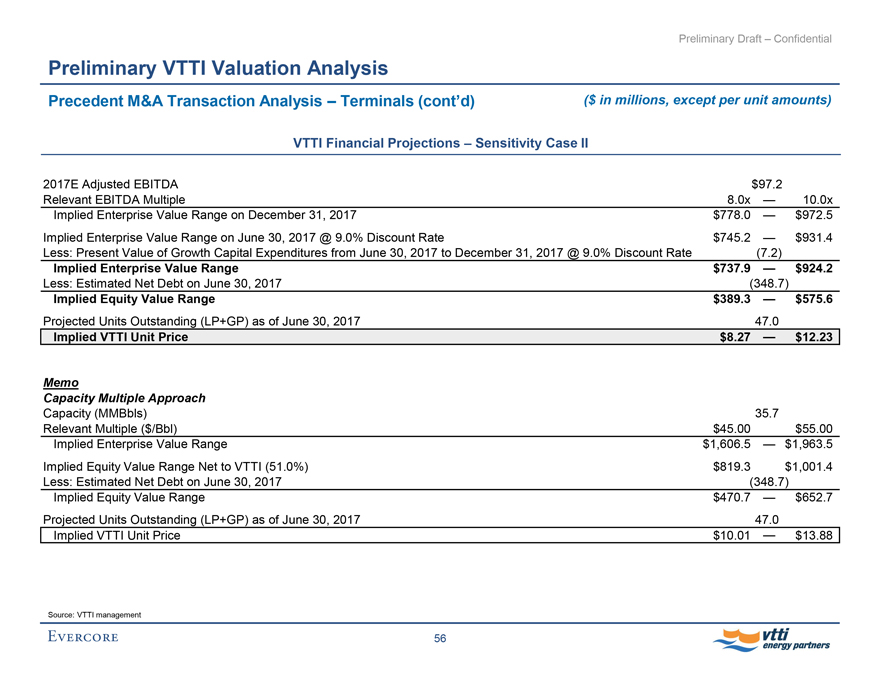

Projections – Sensitivity Case II”)

A preliminary valuation of VTTI based on (i) the VTTI Financial Projections – Management Case, (ii) the VTTI Financial Projections – Sensitivity Case I and (iii) the VTTI Financial Projections – Sensitivity Case III

2

EVERCORE vtti energy partners

Preliminary Draft – Confidential

Executive Summary

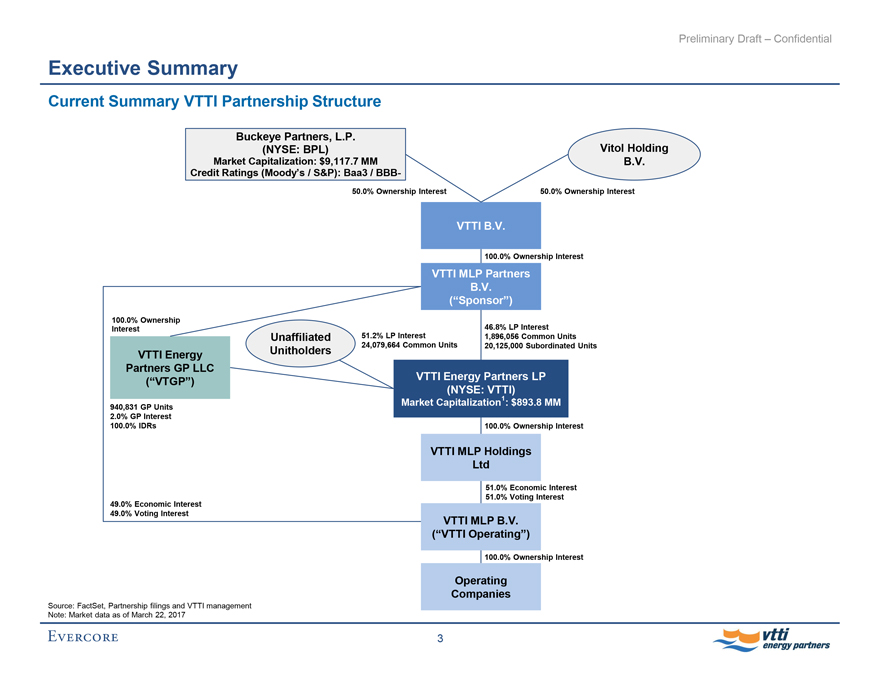

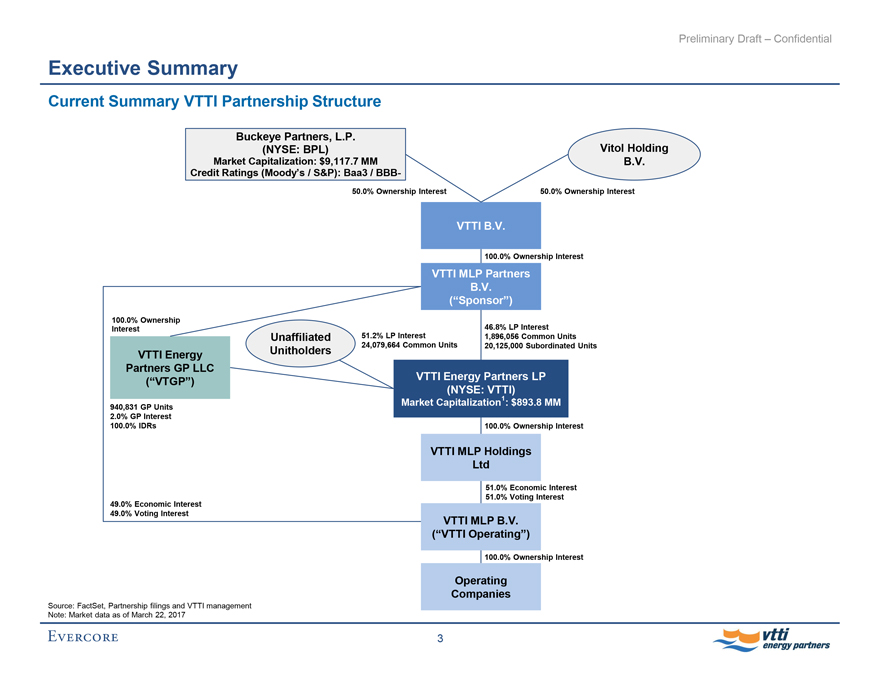

Current Summary VTTI Partnership Structure

Buckeye Partners, L.P.

(NYSE: BPL)

Market Capitalization: $9,117.7 MM

Credit Ratings (Moody’s / S&P): Baa3 /BBB-

50.0% Ownership Interest

Vitol Holding B.V.

50.0% Ownership Interest

VTTI B.V.

100.0% Ownership Interest

VTTI MLP Partners B.V.

(“Sponsor”)

100.0% Ownership Interest

VTTI Energy Partners GP LLC

(“VTGP”)

940,831 GP Units

2.0% GP Interest

100.0% IDRs

49.0% Economic Interest

49.0% Voting Interest

Unaffiliated

Unitholders

51.2% LP Interest

24,079,664 Common Units

46.8% LP Interest

1,896,056 Common Units

20,125,000 Subordinated Units

VTTI Energy Partners LP

(NYSE: VTTI)

Market Capitalization1: $893.8 MM

100.0% Ownership Interest

VTTI MLP Holdings Ltd

51.0% Economic Interest 51.0% Voting Interest

VTTI MLP B.V.

(“VTTI Operating”)

100.0% Ownership Interest

Operating Companies

Source: FactSet, Partnership filings and VTTI management

Note: Market data as of March 22, 2017

3

EVERCORE vtti energy partners

Preliminary Draft – Confidential

Executive Summary

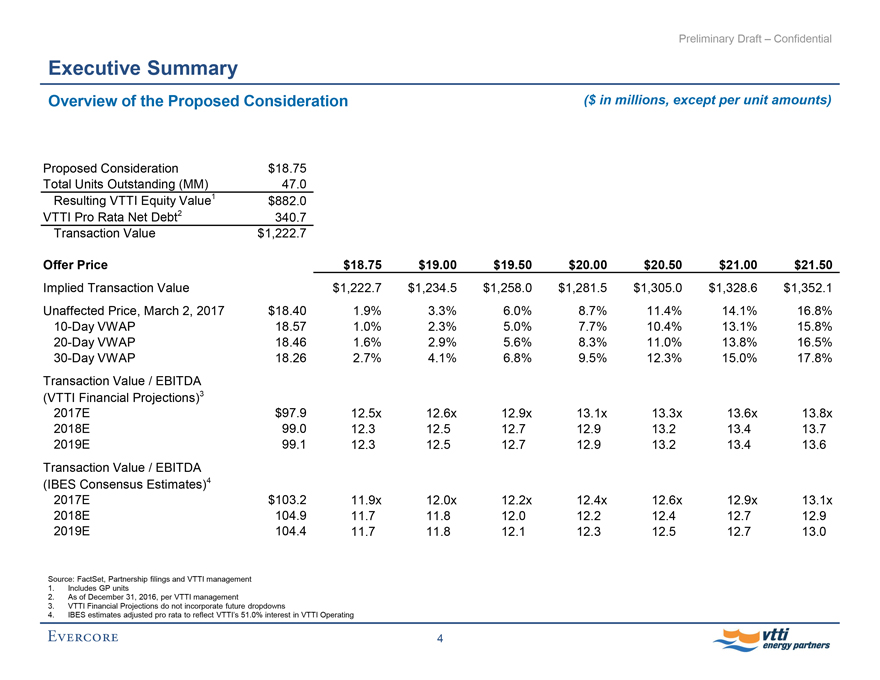

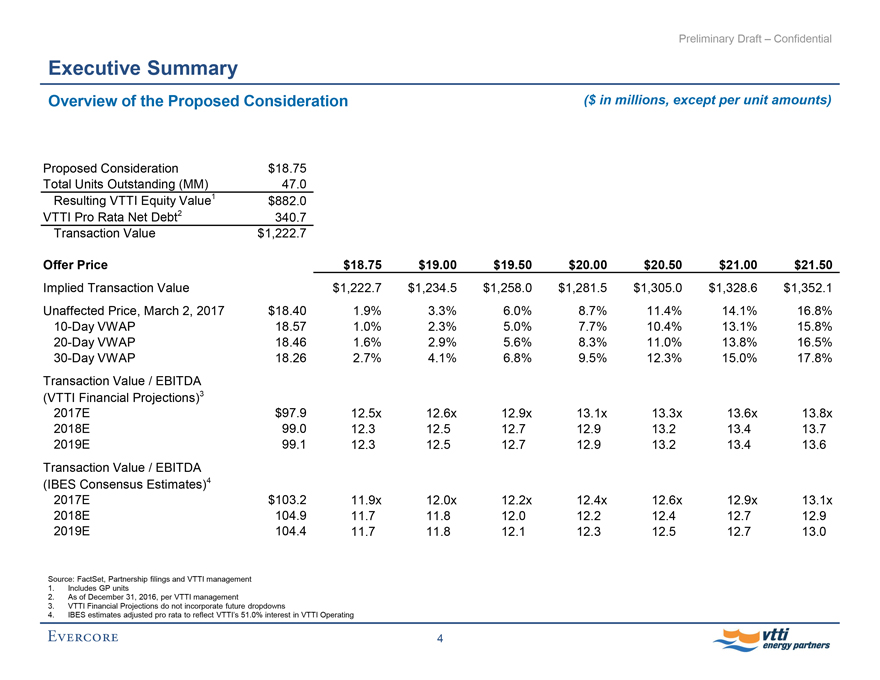

Overview of the Proposed Consideration

($ in millions, except per unit amounts)

Proposed Consideration $18.75

Total Units Outstanding (MM) 47.0

Resulting VTTI Equity Value1 $882.0

VTTI Pro Rata Net Debt2 340.7

Transaction Value $1,222.7

Offer Price $18.75 $19.00 $19.50 $20.00 $20.50 $21.00 $21.50

Implied Transaction Value $1,222.7 $1,234.5 $1,258.0 $1,281.5 $1,305.0 $1,328.6 $1,352.1

Unaffected Price, March 2, 2017 $18.40 1.9% 3.3% 6.0% 8.7% 11.4% 14.1% 16.8%

10-Day VWAP 18.57 1.0% 2.3% 5.0% 7.7% 10.4% 13.1% 15.8%

20-Day VWAP 18.46 1.6% 2.9% 5.6% 8.3% 11.0% 13.8% 16.5%

30-Day VWAP 18.26 2.7% 4.1% 6.8% 9.5% 12.3% 15.0% 17.8%

Transaction Value / EBITDA

(VTTI Financial Projections)3

2017E $97.9 12.5x 12.6x 12.9x 13.1x 13.3x 13.6x 13.8x

2018E 99.0 12.3 12.5 12.7 12.9 13.2 13.4 13.7

2019E 99.1 12.3 12.5 12.7 12.9 13.2 13.4 13.6

Transaction Value / EBITDA

(IBES Consensus Estimates)4

2017E $103.2 11.9x 12.0x 12.2x 12.4x 12.6x 12.9x 13.1x

2018E 104.9 11.7 11.8 12.0 12.2 12.4 12.7 12.9

2019E 104.4 11.7 11.8 12.1 12.3 12.5 12.7 13.0

Source: FactSet, Partnership filings and VTTI management

1. Includes GP units

2. As of December 31, 2016, per VTTI management

3. VTTI Financial Projections do not incorporate future dropdowns

4. IBES estimates adjusted pro rata to reflect VTTI’s 51.0% interest in VTTI Operating

4

EVERCORE vtti energy partners

Preliminary Draft – Confidential

Executive Summary

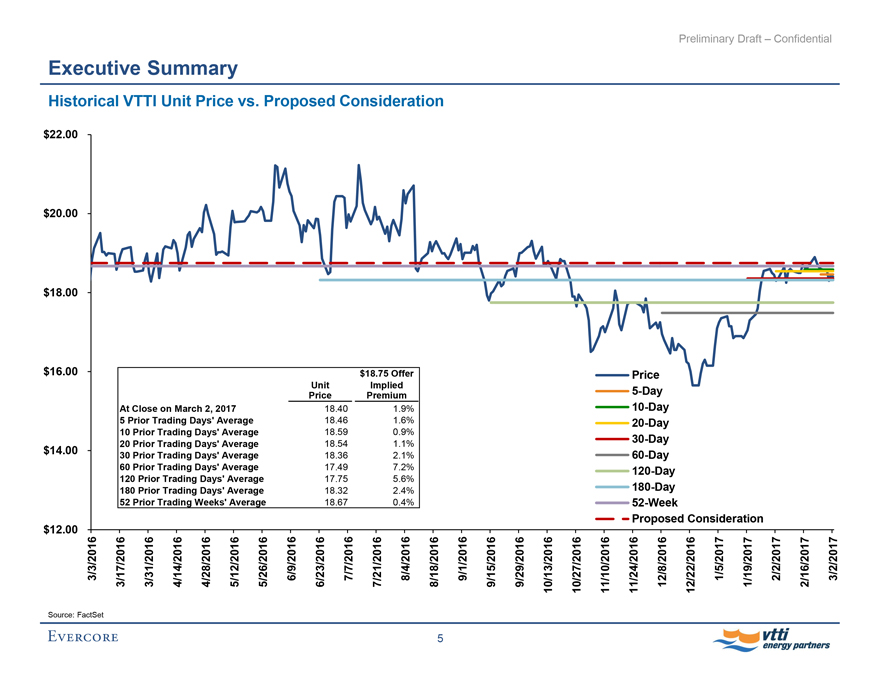

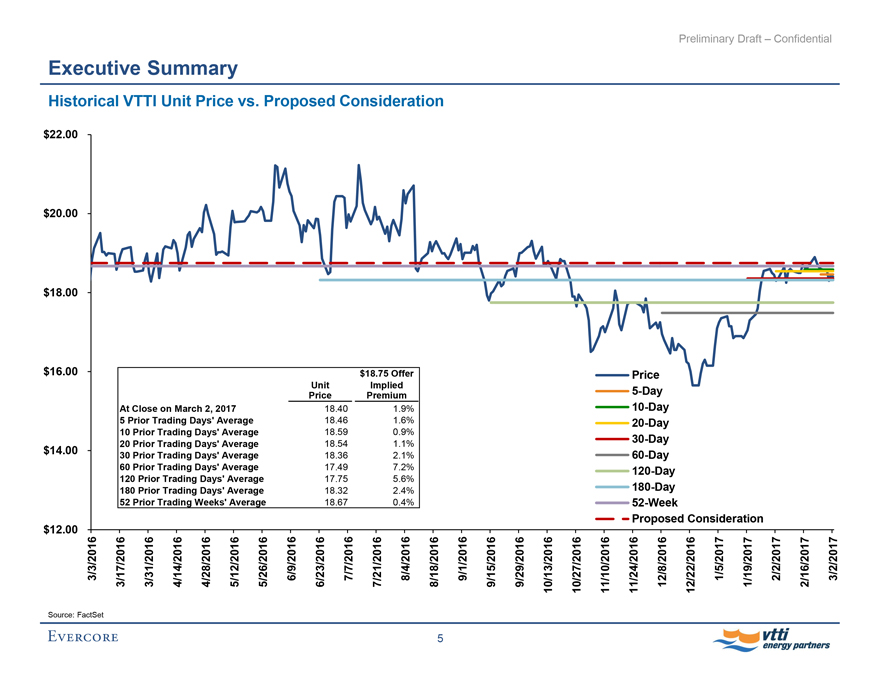

Historical VTTI Unit Price vs. Proposed Consideration

$22.00

$20.00

$18.00

$16.00

$14.00

$12.00

Unit Price

$18.75 Offer Implied Premium

At Close on March 2, 2017 18.40 1.9%

5 Prior Trading Days’ Average 18.46 1.6%

10 Prior Trading Days’ Average 18.59 0.9%

20 Prior Trading Days’ Average 18.54 1.1%

30 Prior Trading Days’ Average 18.36 2.1%

60 Prior Trading Days’ Average 17.49 7.2%

120 Prior Trading Days’ Average 17.75 5.6%

180 Prior Trading Days’ Average 18.32 2.4%

52 Prior Trading Weeks’ Average 18.67 0.4%

Price

5-Day

10-Day

20-Day

30-Day

60-Day

120-Day

180-Day

52-Week

Proposed Consideration

3/3/2016

3/17/2016

3/31/2016

4/14/2016

4/28/2016

5/12/2016

5/26/2016

6/9/2016

6/23/2016

7/7/2016

7/21/2016

8/4/2016

8/18/2016

9/1/2016

9/15/2016

9/29/2016

10/13/2016

10/27/2016

11/10/2016

11/24/2016

12/8/2016

12/22/2016

1/5/2017

1/19/2017

2/2/2017

2/16/2017

3/2/2017

Source: FactSet

5

EVERCORE vtti energy partners

Preliminary Draft – Confidential

II. VTTI Situation Analysis

EVERCORE

Preliminary Draft – Confidential

VTTI Situation Analysis

Company Overview

($ in millions)

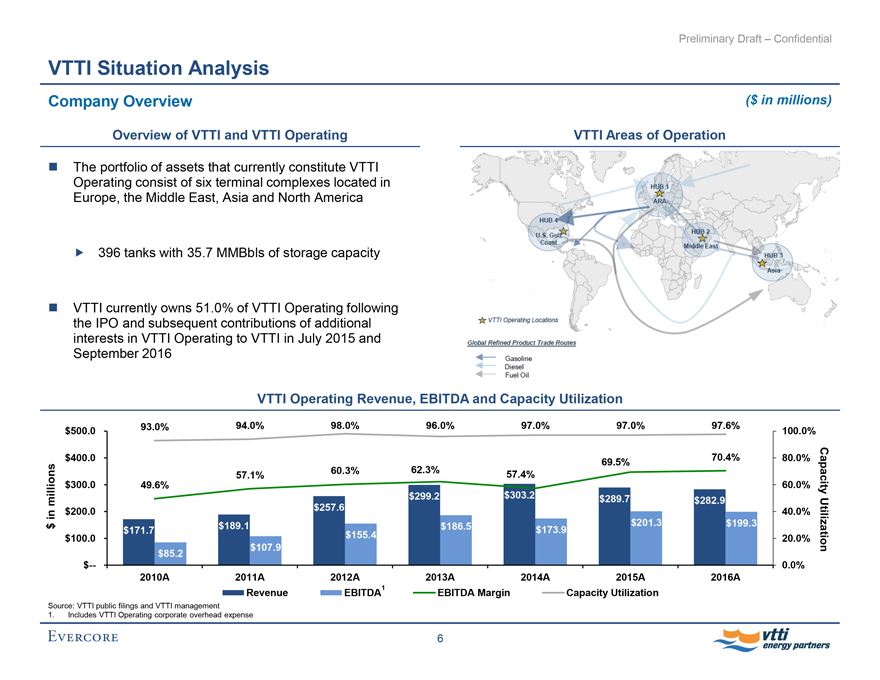

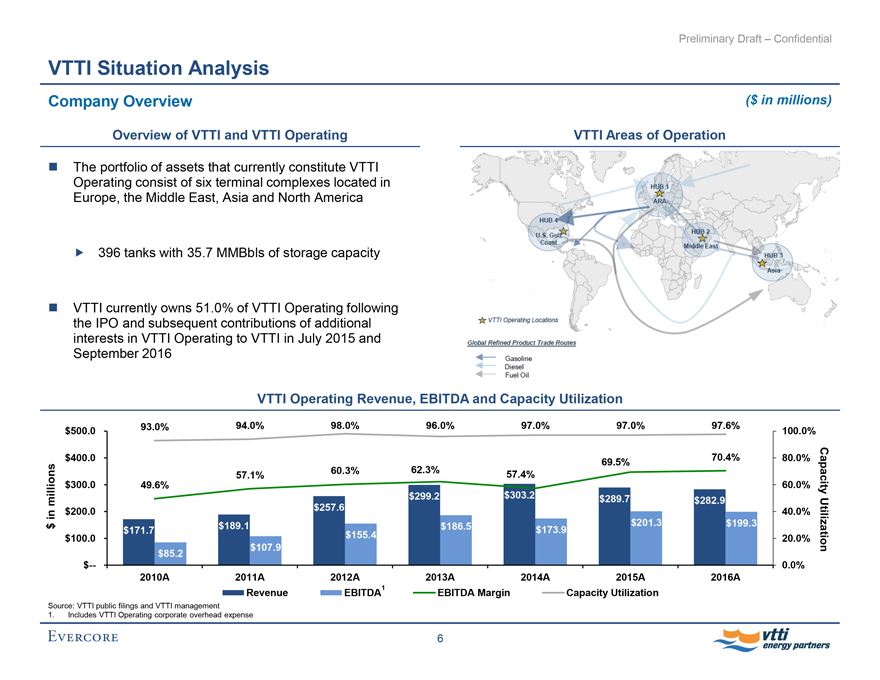

Overview of VTTI and VTTI Operating

The portfolio of assets that currently constitute VTTI Operating consist of six terminal complexes located in Europe, the Middle East, Asia and North America

396 tanks with 35.7 MMBbls of storage capacity

VTTI currently owns 51.0% of VTTI Operating following the IPO and subsequent contributions of additional interests in VTTI Operating to VTTI in July 2015 and September 2016

VTTI Areas of Operation

VTTI Operating Revenue, EBITDA and Capacity Utilization

$500.0 93.0% 94.0% 98.0% 96.0% 97.0% 97.0% 97.6% 100.0%

$400.0 69.5% 70.4% 80.0% 57.1% 60.3% 62.3% 57.4%

$300.0 49.6% 60.0% $299.2 $303.2 $289.7 $282.9

$200.0 $257.6 40.0% $189.1 $186.5 $201.3 $199.3 $171.7 $155.4 $173.9

$ in millions

$100.0

20.0% $107.9

Capacity Utilization

$85.2

$--

0.0%

2010A 2011A 2012A 2013A 2014A 2015A 2016A

Revenue

EBITDA1

EBITDA Margin

Capacity Utilization

Source: VTTI public filings and VTTI management

1. Includes VTTI Operating corporate overhead expense

6

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Situation Analysis

Buckeye Energy Partners, L.P. Acquisition of 50.0% Interest in VTTI B.V.

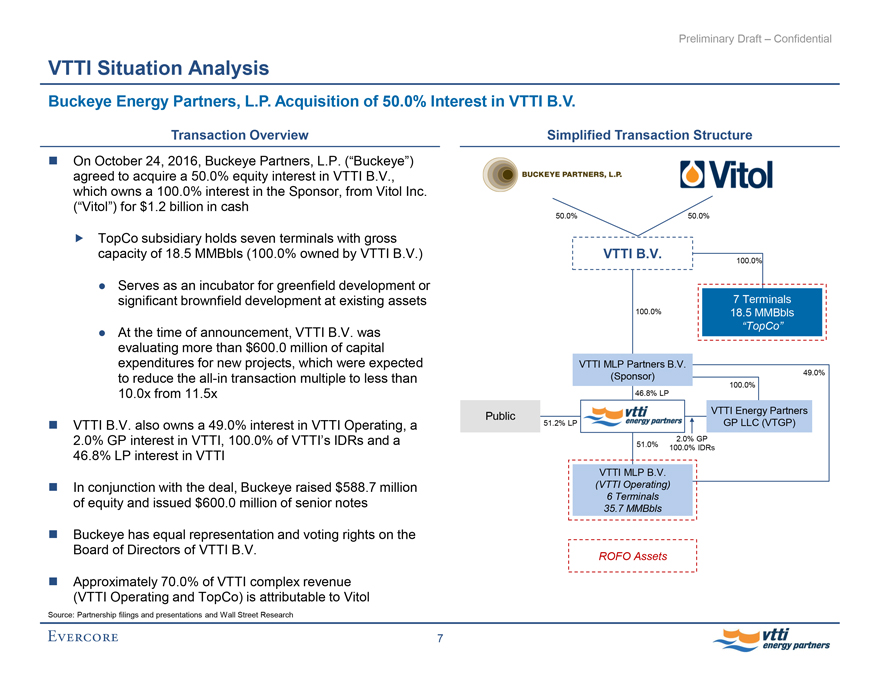

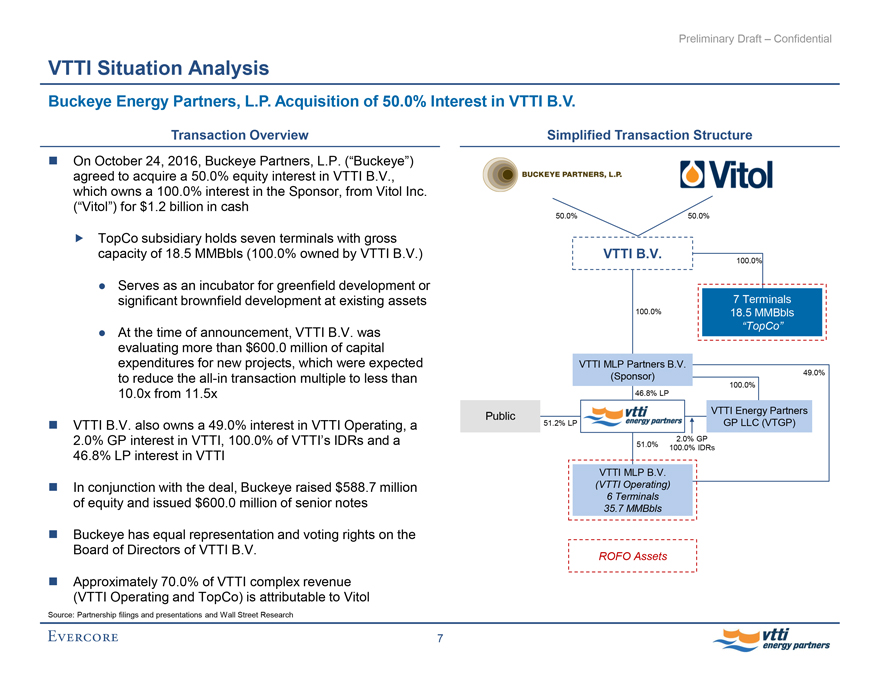

Transaction Overview

On October 24, 2016, Buckeye Partners, L.P. (“Buckeye”) agreed to acquire a 50.0% equity interest in VTTI B.V., which owns a 100.0% interest in the Sponsor, from Vitol Inc. (“Vitol”) for $1.2 billion in cash

TopCo subsidiary holds seven terminals with gross capacity of 18.5 MMBbls (100.0% owned by VTTI B.V.)

Serves as an incubator for greenfield development or significant brownfield development at existing assets

At the time of announcement, VTTI B.V. was evaluating more than $600.0 million of capital expenditures for new projects, which were expected to reduce theall-in transaction multiple to less than 10.0x from 11.5x

VTTI B.V. also owns a 49.0% interest in VTTI Operating, a 2.0% GP interest in VTTI, 100.0% of VTTI’s IDRs and a 46.8% LP interest in VTTI

In conjunction with the deal, Buckeye raised $588.7 million of equity and issued $600.0 million of senior notes

Buckeye has equal representation and voting rights on the Board of Directors of VTTI B.V.

Approximately 70.0% of VTTI complex revenue (VTTI Operating and TopCo) is attributable to Vitol

Source: Partnership filings and presentations and Wall Street Research

Simplified Transaction Structure

BUCKEYE PARTNERS, L.P. Vitol

50.0% 50.0%

VTTI B.V. 100.0%

7 Terminals 18.5 MMBbls “TopCo”

100.0%

VTTI MLP Partners B.V. (Sponsor)

49.0%

100.0%

46.8% LP

Public

vtti energy partners

VTTI Energy Partners

51.2% LP

GP LLC (VTGP)

2.0% GP

51.0%

100.0% IDRs

VTTI MLP B.V.

(VTTI Operating)

6 Terminals

35.7 MMBbls

ROFO Assets

7

EVERCORE vtti energy partners

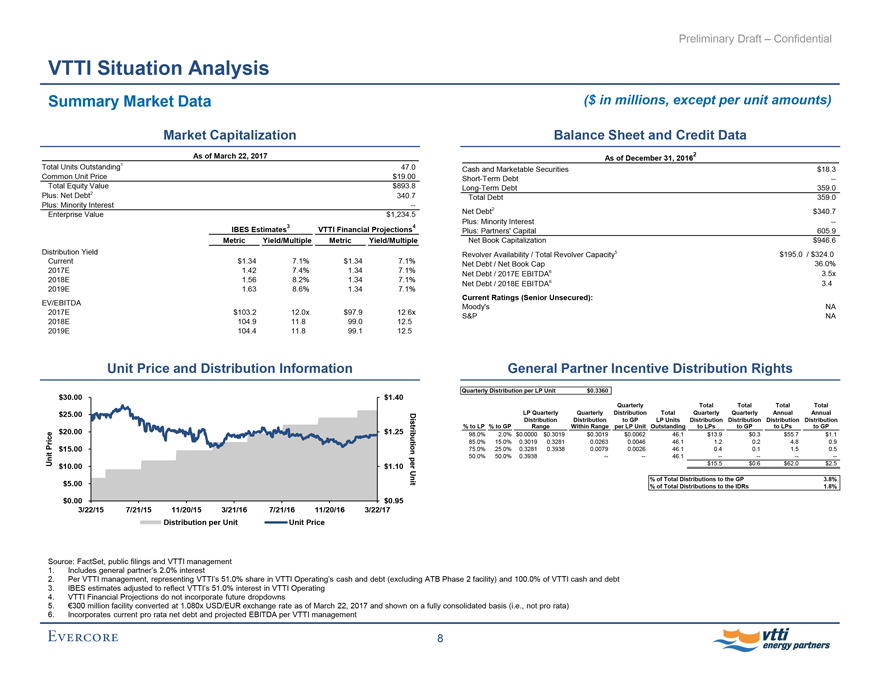

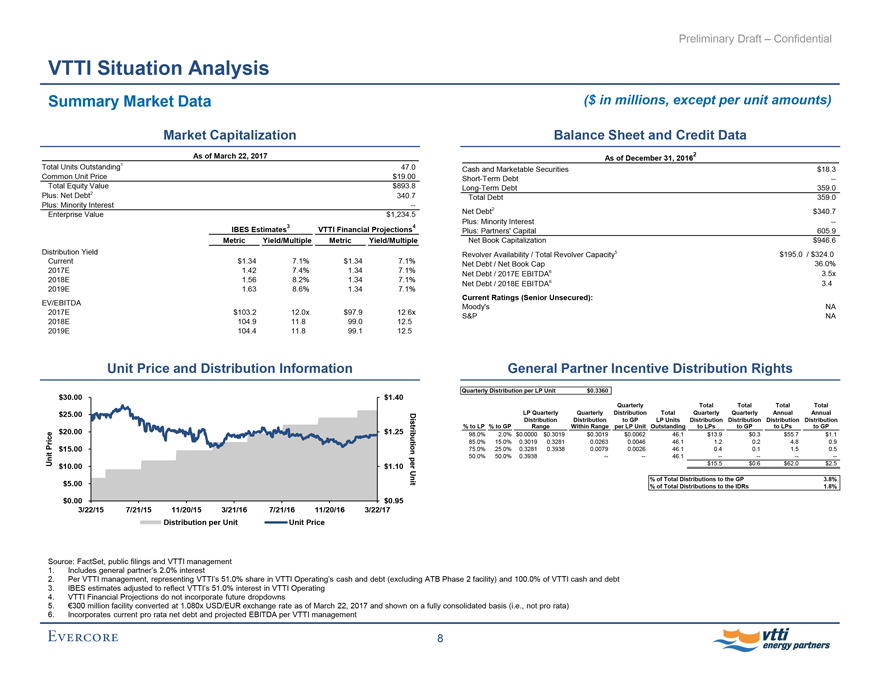

Preliminary Draft - Confidential VTTI Situation Analysis Summary Market Data ($ in millions, except per unit amounts) Market Capitalization As of March 22, 2017 Total Units Outstanding1 47.0 Common Unit Price $19.00 Total Equity Value $893.8 Plus: Net Debt2 340.7 Plus: Minority Interest -- Enterprise Value $1,234.5 IBES Estimates3 VTTI Financial Projections4 Metric Yield/Multiple Metric Yield/Multiple Distribution Yield Current $1.34 7.1% $1.34 7.1% 2017E 1.42 7.4% 1.34 7.1% 2018E 1.56 8.2% 1.34 7.1% 2019E 1.63 8.6% 1.34 7.1% EV/EBITDA 2017E $103.2 12.0x $97.9 12.6x 2018E 104.9 11.8 99.0 12.5 2019E 104.4 11.8 99.1 12.5

Unit Price and Distribution Information $30.00 $1.40 $25.00 $20.00 $1.25 $15.00 Unit Price $10.00 $1.10 Distribution per Unit

$5.00 $0.00 $0.95 3/22/15 7/21/15 11/20/15 3/21/16 7/21/16 11/20/16 3/22/17 Distribution per Unit Unit Price Source: FactSet, public filings and VTTI management 1. Includes general partner’s 2.0% interest 2. Per VTTI management, representing VTTI’s 51.0% share in VTTI Operating’s cash and debt (excluding ATB Phase 2 facility) and 100.0% of VTTI cash and debt 3. IBES estimates adjusted to reflect VTTI’s 51.0% interest in VTTI Operating 4. VTTI Financial Projections do not incorporate future dropdowns 5. €300 million facility converted at 1.080x USD/EUR exchange rate as of March 22, 2017 and shown on a fully consolidated basis (i.e., not pro rata)

6. Incorporates current pro rata net debt and projected EBITDA per VTTI management Balance Sheet and Credit Data As of December 31, 20162 Cash and Marketable Securities $18.3 Short-Term Debt -- Long-Term Debt 359.0 Total Debt 359.0 Net Debt2 $340.7 Plus: Minority Interest -- Plus: Partners’ Capital 605.9 Net Book Capitalization $946.6 Revolver Availability / Total Revolver Capacity5 $195.0 / $324.0 Net Debt / Net Book Cap 36.0% Net Debt / 2017E EBITDA6 3.5x Net Debt / 2018E EBITDA6 3.4 Current Ratings (Senior Unsecured): Moody’s NA S&P NA General Partner Incentive Distribution Rights Quarterly Distribution per LP Unit $0.3360 % to LP % to GP LP Quarterly Distribution Range Quarterly Distribution Within Range Quarterly Distribution to GP per LP Unit Total LP Units Outstanding Total Quarterly Distribution to LPs Total Quarterly Distribution to GP Total Annual Distribution to LPs Total Annual Distribution to GP 98.0% 2.0% $0.0000 $0.3019 $0.3019 $0.0062 46.1 $13.9 $0.3 $55.7 $1.1 85.0% 15.0% 0.3019 0.3281 0.0263 0.0046 46.1 1.2 0.2 4.8 0.9 75.0% 25.0% 0.3281 0.3938 0.0079 0.0026 46.1 0.4 0.1 1.5 0.5 50.0% 50.0% 0.3938 -- -- 46.1 -- -- -- -- $15.5 $0.6 $62.0 $2.5 % of Total Distributions to the GP 3.8% % of Total Distributions to the IDRs 1.8%

8 EVERCORE vtti energy partners

Preliminary Draft - Confidential

VTTI Situation Analysis

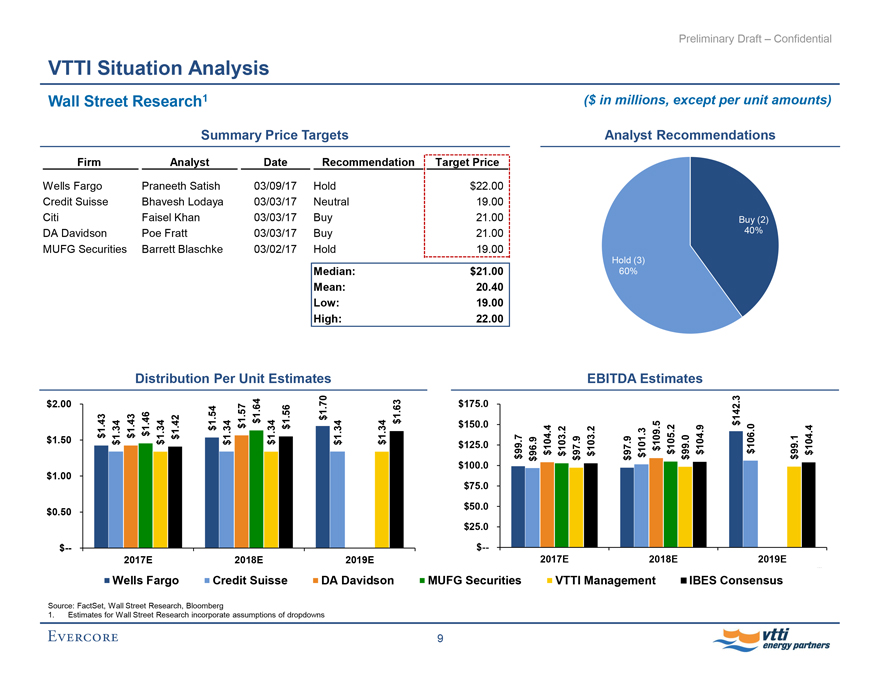

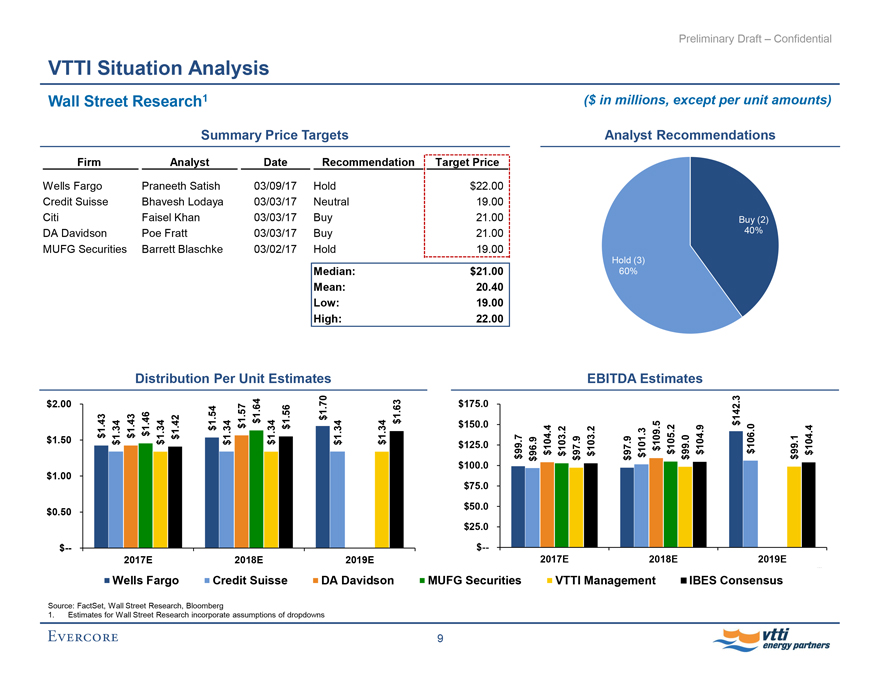

Wall Street Research1 ($ in millions, except per unit amounts)

Summary Price Targets

Firm Analyst Date Recommendation Target Price

Wells Fargo Praneeth Satish 03/09/17 Hold $22.00

Credit Suisse Bhavesh Lodaya 03/03/17 Neutral 19.00

Citi Faisel Khan 03/03/17 Buy 21.00

DA Davidson Poe Fratt 03/03/17 Buy 21.00

MUFG Securities Barrett Blaschke 03/02/17 Hold 19.00

Median: $21.00

Mean: 20.40

Low: 19.00

High: 22.00

Analyst Recommendations

Buy (2)

40%

Hold (3)

60%

Distribution Per Unit Estimates

$2.00

$1.50

$1.00

$0.50

$--

$1.43 $1.54 $1.70 $1.34 $1.34 $1.34 $1.43 $1.57 $1.46 $1.64 $1.34 $1.34 $1.34 $1.42 $1.56 $1.63

2017E 2018E 2019E

Wells Fargo Credit Suisse DA Davidson EBITDA Estimates

$175.0

$150.0

$125.0

$100.0

$75.0

$50.0

$25.0

$--

$99.7 $97.9 $142.3 $96.9 $101.3 $106.0 $104.4 $109.5 $103.2 $105.2 $97.9 $99.0 $99.1 $103.2 $104.9 $104.4

2017E 2018E 2019E

MUFG Securities VTTI Management IBES Consensus

Source: FactSet, Wall Street Research, Bloomberg

1. Estimates for Wall Street Research incorporate assumptions of dropdowns

9

EVERCORE vtti energy partners

Preliminary Draft - Confidential

VTTI Situation Analysis

Wall Street Research Commentary

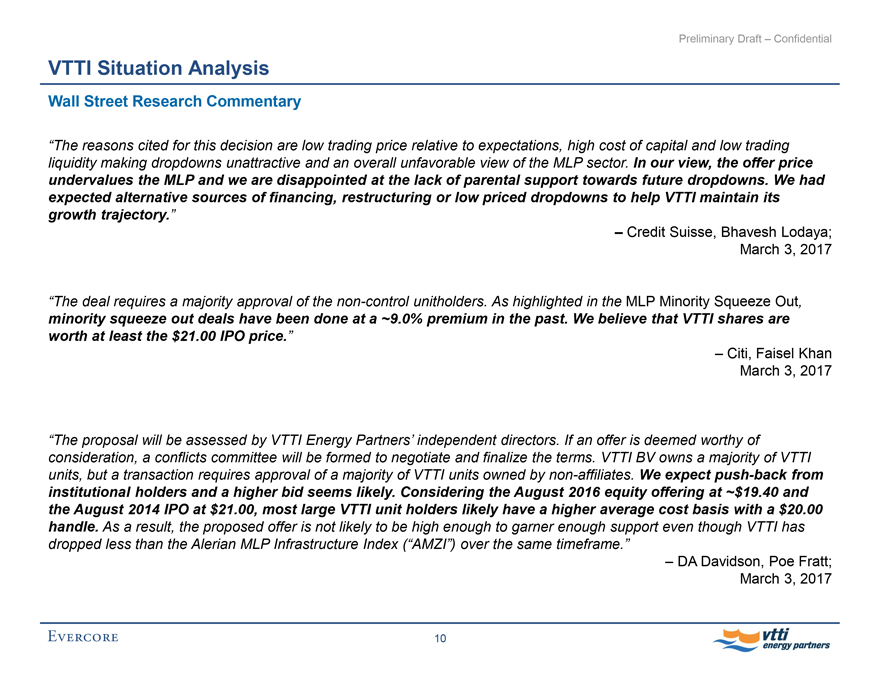

“The reasons cited for this decision are low trading price relative to expectations, high cost of capital and low trading liquidity making dropdowns unattractive and an overall unfavorable view of the MLP sector. In our view, the offer price undervalues the MLP and we are disappointed at the lack of parental support towards future dropdowns. We had expected alternative sources of financing, restructuring or low priced dropdowns to help VTTI maintain its growth trajectory.”

- Credit Suisse, Bhavesh Lodaya;

March 3, 2017

“The deal requires a majority approval of thenon-control unitholders. As highlighted in the MLP Minority Squeeze Out, minority squeeze out deals have been done at a ~9.0% premium in the past. We believe that VTTI shares are worth at least the $21.00 IPO price.”

- Citi, Faisel Khan

March 3, 2017

“The proposal will be assessed by VTTI Energy Partners’ independent directors. If an offer is deemed worthy of consideration, a conflicts committee will be formed to negotiate and finalize the terms. VTTI BV owns a majority of VTTI units, but a transaction requires approval of a majority of VTTI units owned bynon-affiliates. We expect push-back from institutional holders and a higher bid seems likely. Considering the August 2016 equity offering at ~$19.40 and the August 2014 IPO at $21.00, most large VTTI unit holders likely have a higher average cost basis with a $20.00 handle. As a result, the proposed offer is not likely to be high enough to garner enough support even though VTTI has dropped less than the Alerian MLP Infrastructure Index (“AMZI”) over the same timeframe.”

- DA Davidson, Poe Fratt;

March 3, 2017

10

EVERCORE vtti energy partners

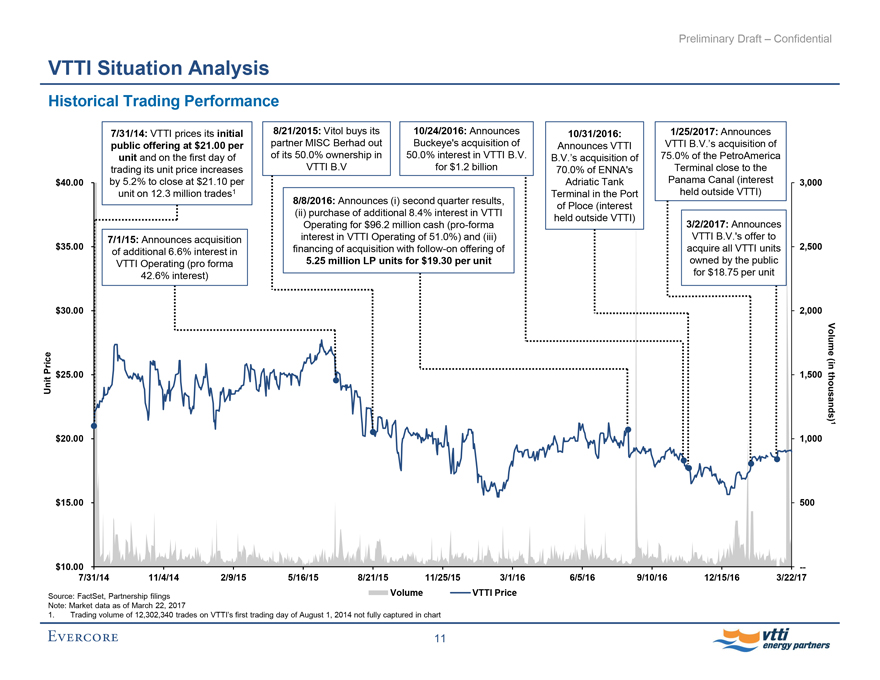

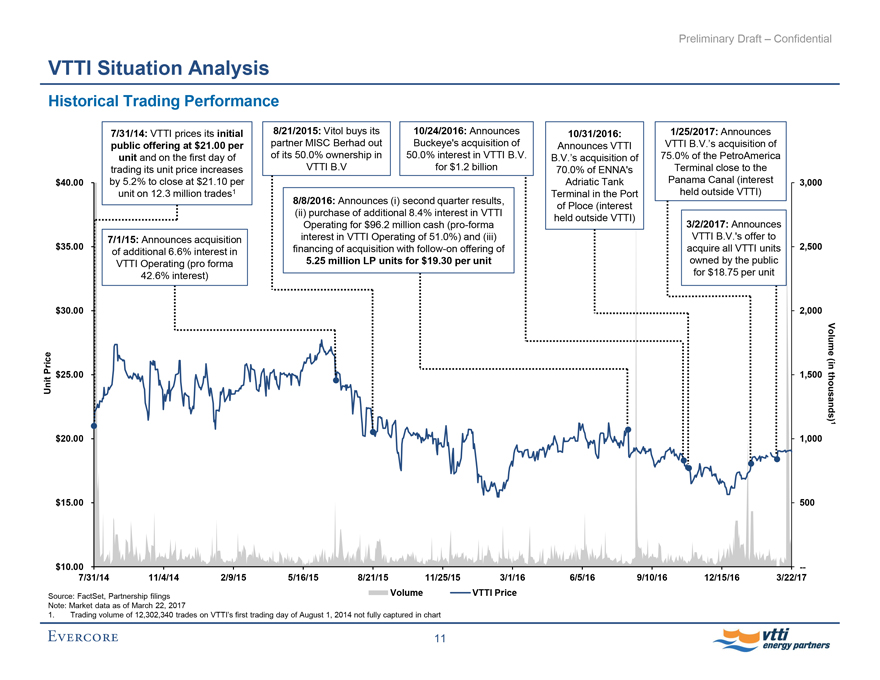

Preliminary Draft - Confidential VTTI Situation Analysis Historical Trading Performance Unit Price 7/31/14: VTTI prices its initial

public offering at $21.00 per unit and on the first day of trading its unit price increases by 5.2% to close at $21.10 per unit on 12.3 million trades1 8/21/2015: Vitol buys its partner MISC Berhad out of its 50.0% ownership in VTTI B.V 10/24/2016: Announces

Buckeye’s acquisition of 50.0% interest in VTTI B.V. for $1.2 billion 10/31/2016: Announces VTTI B.V.’s acquisition of 70.0% of ENNA’s Adriatic Tank Terminal in the Port of Ploce (interest held outside VTTI) 1/25/2017: Announces VTTI B.V.’s acquisition of

75.0% of the PetroAmerica Terminal close to the Panama Canal (interest held outside VTTI) 3/2/2017: Announces VTTI B.V.��s offer to acquire all VTTI units owned by the public for $18.75 per unit 7/1/15: Announces acquisition $35.00 of additional 6.6% interest in

VTTI Operating (pro forma 42.6% interest) 8/8/2016: Announces (i) second quarter results, (ii) purchase of additional 8.4% interest in VTTI Operating for $96.2 million cash(pro-forma interest in VTTI Operating of 51.0%) and (iii) financing of acquisition withfollow-on offering of 5.25 million LP units for $19.30 per unit $40.00 $30.00 $25.00 $20.00 $15.00 $10.00 7/31/14 11/4/14 2/9/15 5/16/15 8/21/15 11/25/15 3/1/16 6/5/16 9/10/16 12/15/16 3/22/17 3,000 2,500 2,000 1,500 1,000 500 -- Volume (in thousands)1 Volume VTTI Price Source: FactSet, Partnership filings Note: Market data as of March 22, 2017 1. Trading volume of 12,302,340 trades on VTTI’s first trading day of August 1, 2014 not fully captured in chart 11 EVERCORE vtti energy partners

Preliminary Draft - Confidential

VTTI Situation Analysis

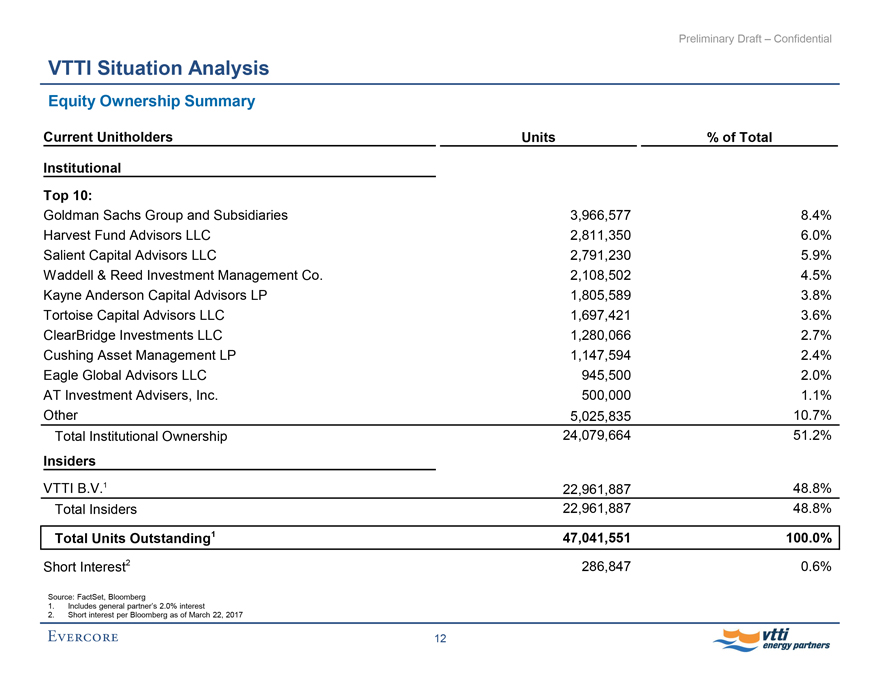

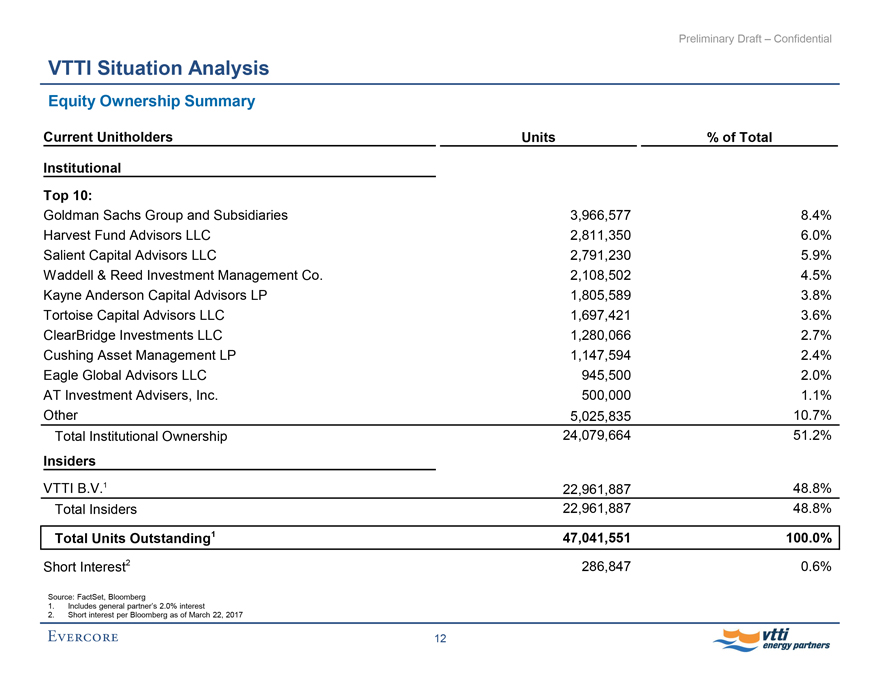

Equity Ownership Summary

Current Unitholders Units % of Total

Institutional

Top 10:

Goldman Sachs Group and Subsidiaries 3,966,577 8.4%

Harvest Fund Advisors LLC 2,811,350 6.0%

Salient Capital Advisors LLC 2,791,230 5.9%

Waddell & Reed Investment Management Co. 2,108,502 4.5%

Kayne Anderson Capital Advisors LP 1,805,589 3.8%

Tortoise Capital Advisors LLC 1,697,421 3.6%

ClearBridge Investments LLC 1,280,066 2.7%

Cushing Asset Management LP 1,147,594 2.4%

Eagle Global Advisors LLC 945,500 2.0%

AT Investment Advisers, Inc. 500,000 1.1%

Other 5,025,835 10.7%

Total Institutional Ownership 24,079,664 51.2%

Insiders

VTTI B.V.1 22,961,887 48.8%

Total Insiders 22,961,887 48.8%

Total Units Outstanding1 47,041,551 100.0%

Short Interest2 286,847 0.6%

Source: FactSet, Bloomberg

1. Includes general partner’s 2.0% interest

2. Short interest per Bloomberg as of March 22, 2017

12

EVERCORE vtti energy partners

Preliminary Draft - Confidential

III. VTTI Operating Asset Overview and Projections

EVERCORE

Preliminary Draft – Confidential

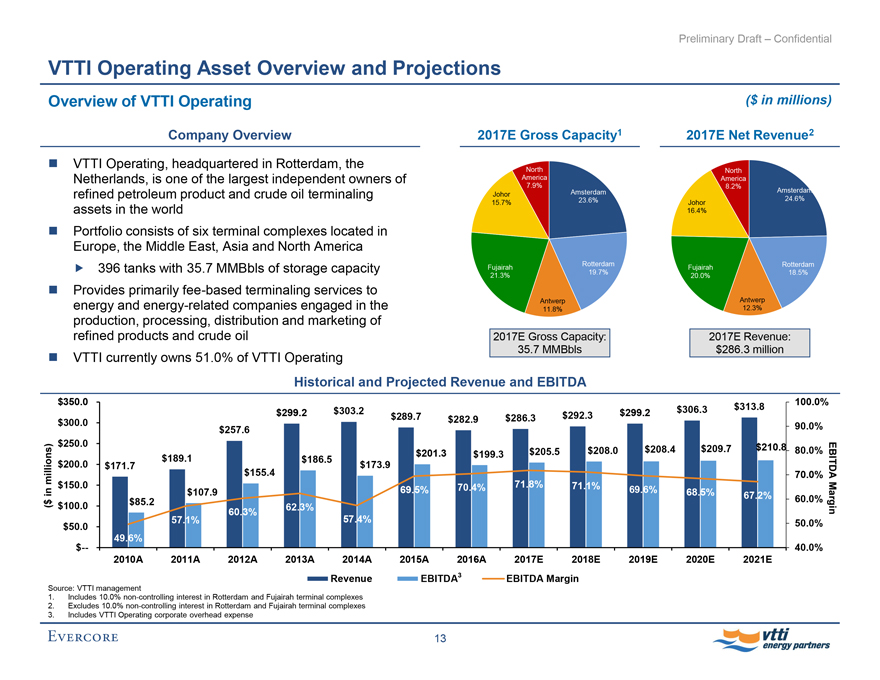

VTTI Operating Asset Overview and Projections

Overview of VTTI Operating

($ in millions)

Company Overview

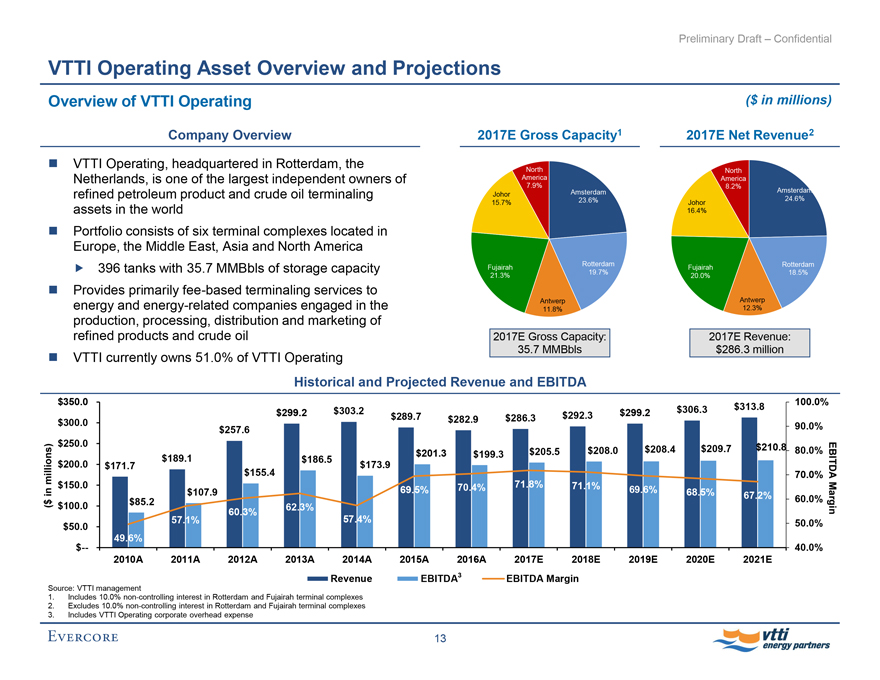

VTTI Operating, headquartered in Rotterdam, the

Netherlands, is one of the largest independent owners of refined petroleum product and crude oil terminaling assets in the world

Portfolio consists of six terminal complexes located in Europe, the Middle East, Asia and North America

396 tanks with 35.7 MMBbls of storage capacity

Provides primarilyfee-based terminaling services to energy and energy-related companies engaged in the production, processing, distribution and marketing of refined products and crude oil

VTTI currently owns 51.0% of VTTI Operating

2017E Gross Capacity1 North America 7.9% Johor 15.7% Amsterdam 23.6%

Fujairah 21.3% Rotterdam 19.7% Antwerp 11.8%

2017E Gross Capacity: 35.7 MMBbls

2017E Net Revenue2 North America 8.2%

Amsterdam 24.6% Johor 16.4% Fujairah 20.0% Rotterdam 18.5% Antwerp 12.3%

2017E Revenue: $286.3 million

Historical and Projected Revenue and EBITDA

$350.0 100.0%

$171.7 $189.1 $257.6 $299.2 $303.2 $289.7 $282.9 $286.3 $292.3 $299.2 $306.3 $313.8

$300 90.0%

$250.0 80.0%

$200.0 70.0%

$150.0 60.0%

$100.0 50.0%

$50.0 40.0%

$—

$85.2 $107.9 $155.4 $186.5 $173.9 $201.3 $199.3 $205.5 $208.0 $208.4 $209.7 $210.8

49.6% 57.1% 60.3% 62.3% 57.4% 69.5% 70.4% 71.8% 71.1% 69.6% 68.5% 67.2%

( $ in millions) EBITDA Margin

2010A 2011A 2012A 2013A 2014A 2015A 2016A 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA3 EBITDA Margin

Source: VTTI management

1. Includes 10.0%non-controlling interest in Rotterdam and Fujairah terminal complexes

2. Excludes 10.0%non-controlling interest in Rotterdam and Fujairah terminal complexes

3. Includes VTTI Operating corporate overhead expense

13

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

VTTI Operating Global Asset Footprint

VTTI Operating Assets

Gross Capacity No. of

Location Ownership (MMBbls) tanks

Amsterdam 100.0% 8.4 211

Rotterdam 90.0% 7.0 28

Antwerp 100.0% 4.2 45

Fujairah 90.0% 7.6 47

Johor 100.0% 5.6 41

Seaport Canaveral 100.0% 2.8 24

Total VTTI Operating 35.7 396

TopCo Assets

Gross Capacity No. of

Location Ownership (MMBbls) Tanks

Ventspils, Latvia 49.0% 7.5 105

Vasiliko, Cyprus 100.0% 3.4 28

Buenos Aires, Argentina 100.0% 1.4 24

Nairobi, Kenya 100.0% 0.7 10

Kaliningrad, Russia 100.0% 0.3 7

Lagos, Nigeria 50.0% 0.1 2

Johor, Malaysia Phase 2 100.0% 1.6 12

Fujairah, UAE Phase 3 90.0% 2.7 5

Cape Town, South Africa 100.0% 0.8 12

Total TopCo 18.5 205

Global VTTI Operating Asset Map

Amsterdam, Netherlands

Rotterdam, Netherlands Antwerp, Belgium Seaport Canaveral, Florida, USA Vasiliko, Cyprus Ventspils, Latvia Kaliningrad, Russia Fujairah, UAE Lagos, Nigeria Mombasa, Kenya Johor, Malaysia Buenos Aires, Argentina Cape Town, South Africa

Legend VTTI Operating

VTTI TopCo <5 20 MMBbls MMBbls

Source: Partnership filings and presentations and Wall Street Research

14

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

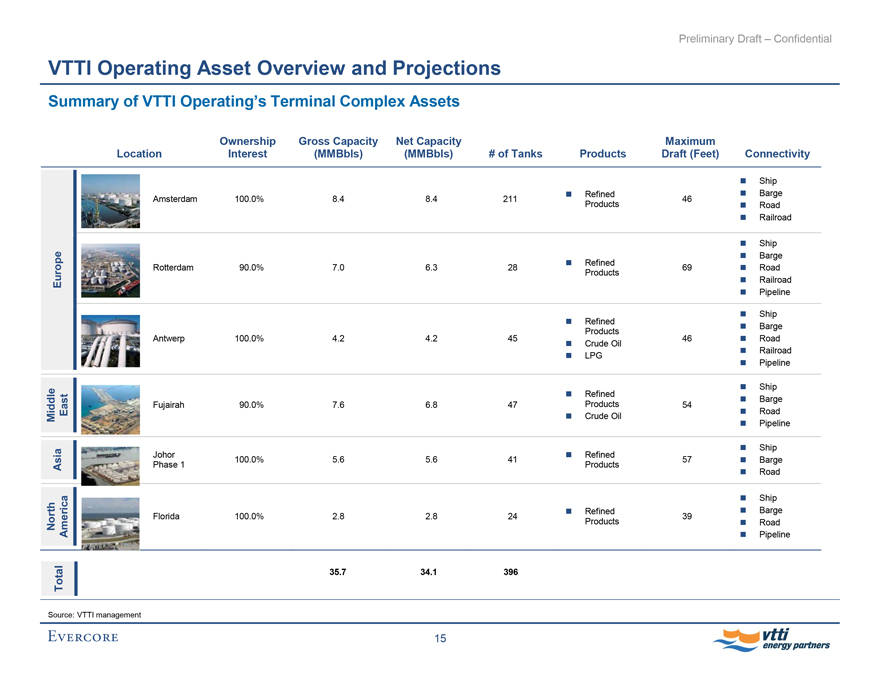

VTTI Operating Asset Overview and Projections

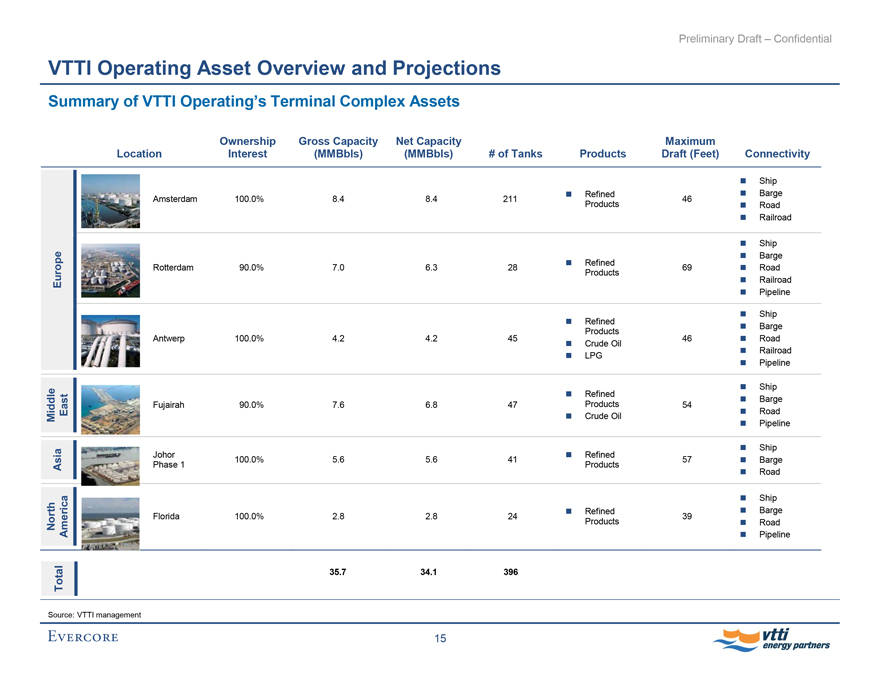

Summary of VTTI Operating’s Terminal Complex Assets

Ownership Gross Capacity Net Capacity Maximum

Location Interest (MMBbls) (MMBbls) # of Tanks Products Draft (Feet) Connectivity

Amsterdam 100.0% 8.4 8.4 211 Refined Products 46 Ship Barge Road Railroad

Europe Rotterdam 90.0% 7.0 6.3 28 Refined Products 69 Ship Barge Road Railroad Pipeline

Antwerp 100.0% 4.2 4.2 45 Refined Products Crude Oil LPG 46 Ship Barge Road Railroad Pipeline

Middle East Fujairah 90.0% 7.6 6.8 47 Refined Products Crude Oil 54 Ship Barge Road Pipeline

Asia Johor Phase 1 Florida 100.0% 100.0% 5.6 2.8 5.6 2.8 41 24 Refined Products Refined Products 57 39 Ship Barge Road Ship Barge Road

North America Total 35.7 34.1 396 Pipeline

Source: VTTI management

15

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

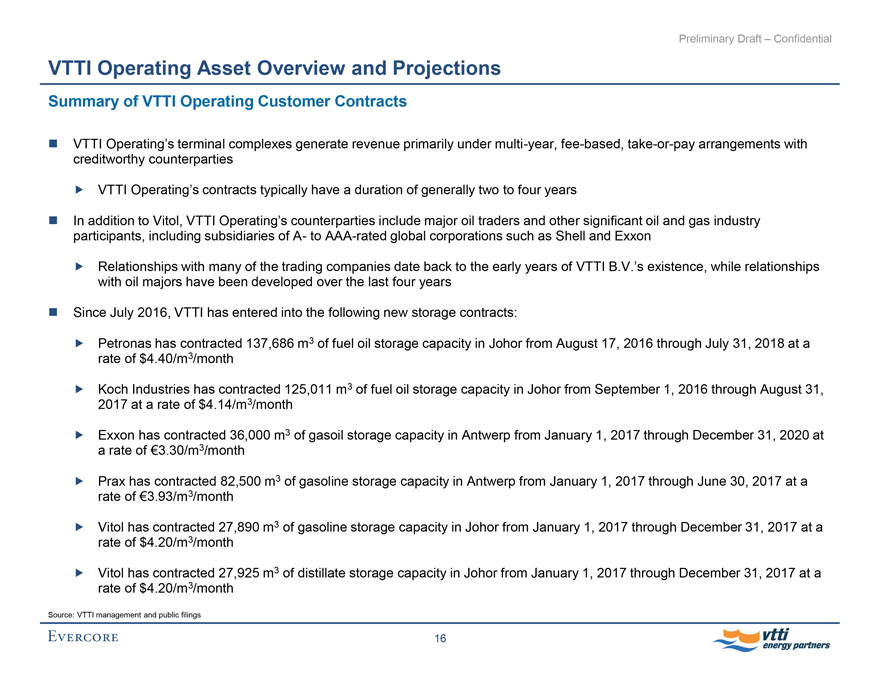

VTTI Operating Asset Overview and Projections

Summary of VTTI Operating Customer Contracts

VTTI Operating’s terminal complexes generate revenue primarily under multi-year,fee-based,take-or-pay arrangements with creditworthy counterparties

VTTI Operating’s contracts typically have a duration of generally two to four years

In addition to Vitol, VTTI Operating’s counterparties include major oil traders and other significant oil and gas industry participants, including subsidiaries ofA- toAAA-rated global corporations such as Shell and Exxon

Relationships with many of the trading companies date back to the early years of VTTI B.V.’s existence, while relationships with oil majors have been developed over the last four years

Since July 2016, VTTI has entered into the following new storage contracts:

Petronas has contracted 137,686 m3 of fuel oil storage capacity in Johor from August 17, 2016 through July 31, 2018 at a rate of $4.40/m3/month

Koch Industries has contracted 125,011 m3 of fuel oil storage capacity in Johor from September 1, 2016 through August 31, 2017 at a rate of $4.14/m3/month

Exxon has contracted 36,000 m3 of gasoil storage capacity in Antwerp from January 1, 2017 through December 31, 2020 at a rate of € 3.30/m 3/month

Prax has contracted 82,500 m3 of gasoline storage capacity in Antwerp from January 1, 2017 through June 30, 2017 at a rate of € 3.93/m3/month

Vitol has contracted 27,890 m3 of gasoline storage capacity in Johor from January 1, 2017 through December 31, 2017 at a rate of $4.20/m3/month

Vitol has contracted 27,925 m3 of distillate storage capacity in Johor from January 1, 2017 through December 31, 2017 at a rate of $4.20/m3/month

Source: VTTI management and public filings

16

EVERCORE Vtti energy partners

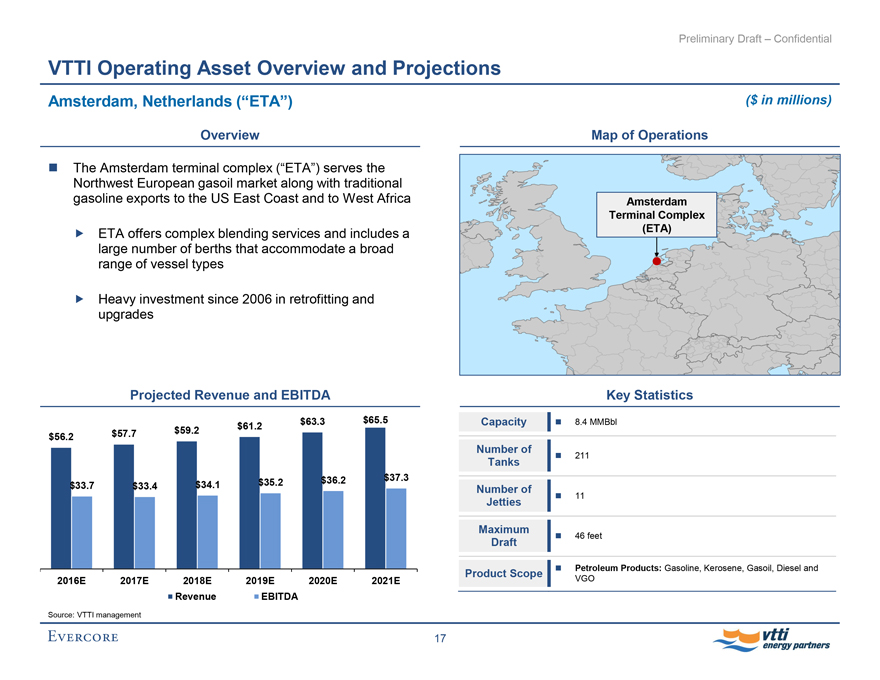

Preliminary Draft – Confidential VTTI Operating Asset Overview and Projections

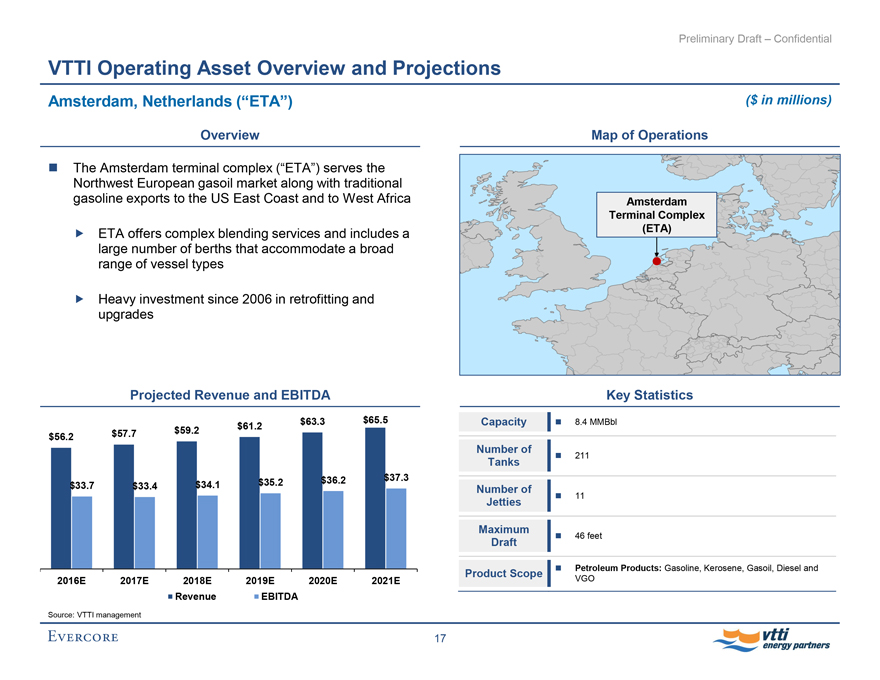

Amsterdam, Netherlands (“ETA”) ($ in millions) Overview

The Amsterdam terminal complex (“ETA”) serves the Northwest European gasoil market along with traditional gasoline exports to the US East Coast and to West Africa

ETA offers complex blending services and includes a large number of berths that accommodate a broad range of vessel types

Heavy investment since 2006 in retrofitting and upgrades

Projected Revenue and EBITDA $56.2 $57.7 $59.2 $61.2 $63.3 $65.5

$33.7 $33.4 $34.1 $35.2 $36.2 $37.3

2016E 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA Source: VTTI management

Map of Operations Amsterdam Terminal Complex (ETA)

Key Statistics

Capacity 8.4 MMBbl

Number of Tanks 211

Number of Jetties 11

Maximum Draft 46 feet

Product Scope Petroleum Products: Gasoline, Kerosene, Gasoil, Diesel and

VGO 17 EVERCORE vtti energy partners

Preliminary Draft – Confidential VTTI Operating Asset Overview and Projections

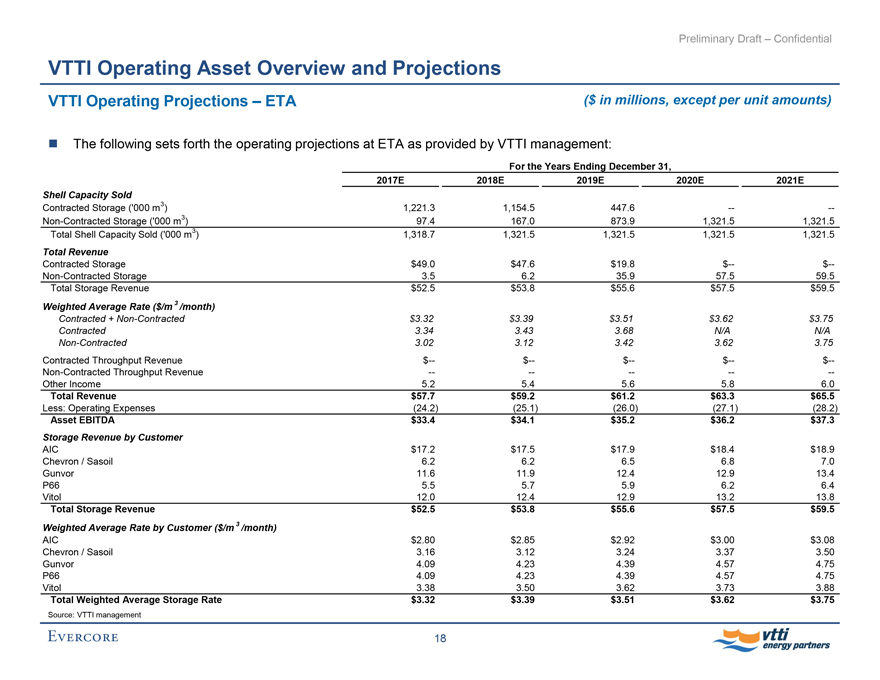

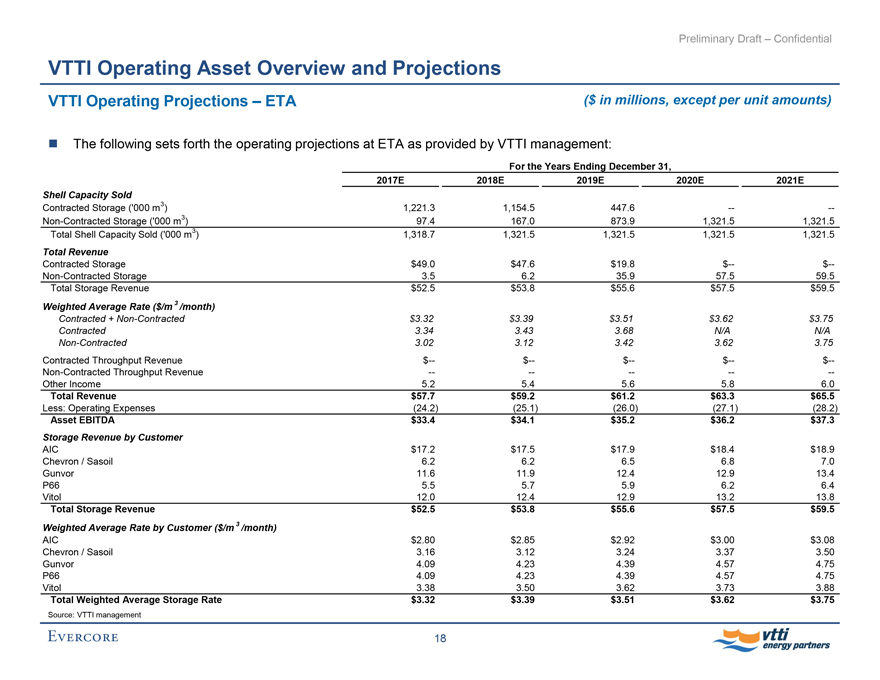

VTTI Operating Projections – ETA ($ in millions, except per unit amounts)

The following sets forth the operating projections at ETA as provided by VTTI management:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E

Shell Capacity Sold

Contracted Storage (‘000 m3) 1,221.3 1,154.5 447.6 — —

Non-Contracted Storage (‘000 m3) 97.4 167.0 873.9 1,321.5 1,321.5

Total Shell Capacity Sold (‘000 m3) 1,318.7 1,321.5 1,321.5 1,321.5 1,321.5

Total Revenue

Contracted Storage $49.0 $47.6 $19.8 $— $—

Non-Contracted Storage 3.5 6.2 35.9 57.5 59.5

Total Storage Revenue $52.5 $53.8 $55.6 $57.5 $59.5

Weighted Average Rate ($/m3 /month)

Contracted +Non-Contracted $3.32 $3.39 $3.51 $3.62 $3.75

Contracted 3.34 3.43 3.68 N/A N/A

Non-Contracted 3.02 3.12 3.42 3.62 3.75

Contracted Throughput Revenue $— $— $— $— $—

Non-Contracted Throughput Revenue — — — — —

Other Income 5.2 5.4 5.6 5.8 6.0

Total Revenue $57.7 $59.2 $61.2 $63.3 $65.5

Less: Operating Expenses (24.2) (25.1) (26.0) (27.1) (28.2)

Asset EBITDA $33.4 $34.1 $35.2 $36.2 $37.3

Storage Revenue by Customer

AIC $17.2 $17.5 $17.9 $18.4 $18.9

Chevron / Sasoil 6.2 6.2 6.5 6.8 7.0

Gunvor 11.6 11.9 12.4 12.9 13.4

P66 5.5 5.7 5.9 6.2 6.4

Vitol 12.0 12.4 12.9 13.2 13.8

Total Storage Revenue $52.5 $53.8 $55.6 $57.5 $59.5

Weighted Average Rate by Customer ($/m3 /month)

AIC $2.80 $2.85 $2.92 $3.00 $3.08

Chevron / Sasoil 3.16 3.12 3.24 3.37 3.50

Gunvor 4.09 4.23 4.39 4.57 4.75

P66 4.09 4.23 4.39 4.57 4.75

Vitol 3.38 3.50 3.62 3.73 3.88

Total Weighted Average Storage Rate $3.32 $3.39 $3.51 $3.62 $3.75

Source: VTTI management

18 EVERCORE vtti energy partners

Preliminary Draft – Confidential VTTI Operating Asset Overview and Projections

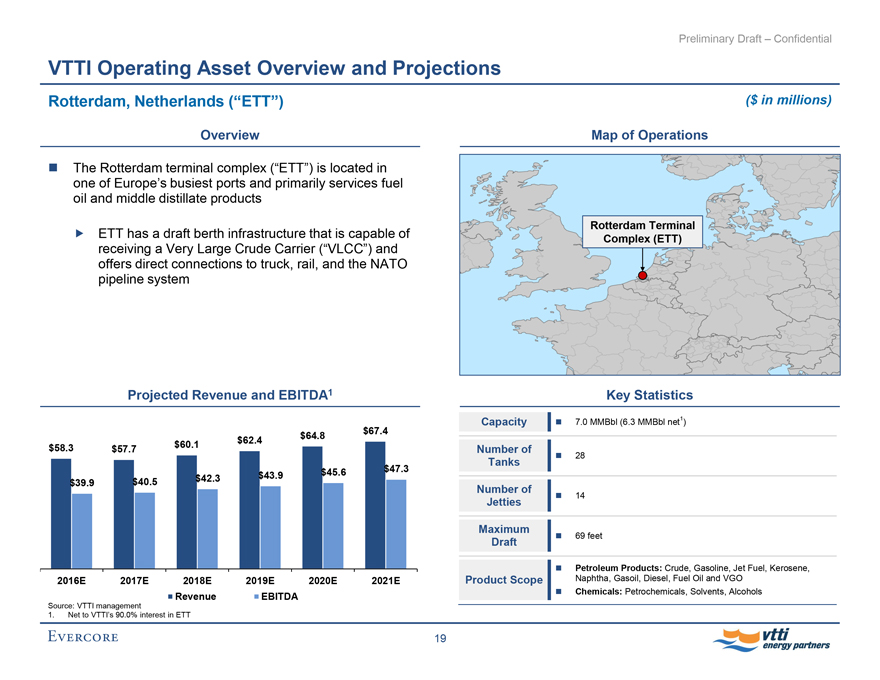

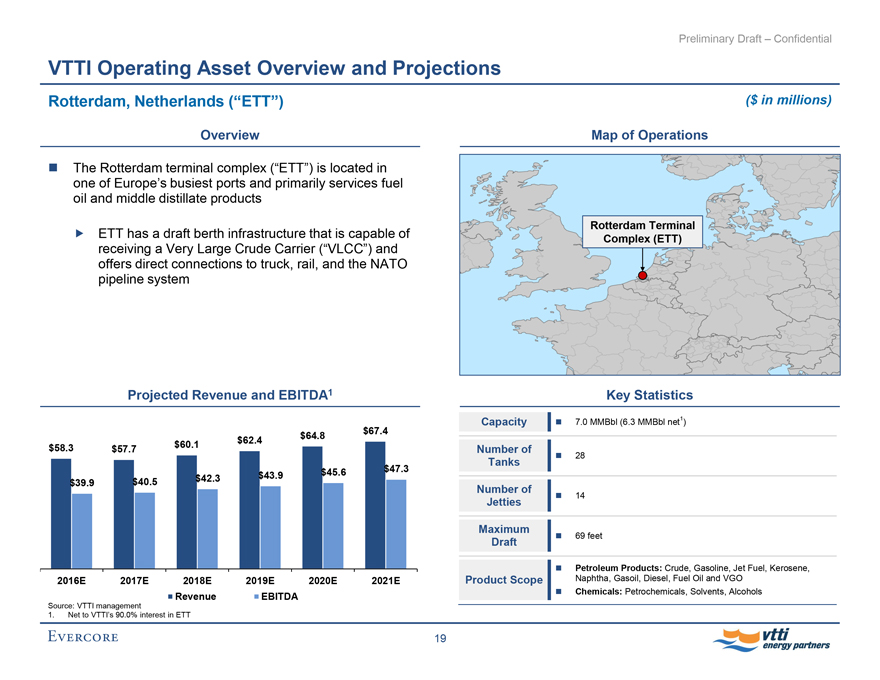

Rotterdam, Netherlands (“ETT”) ($ in millions)

Overview

The Rotterdam terminal complex (“ETT”) is located in one of Europe’s busiest ports and primarily services fuel oil and middle distillate products

ETT has a draft berth infrastructure that is capable of receiving a Very Large Crude Carrier (“VLCC”) and offers direct connections to truck, rail, and the NATO pipeline system

Projected Revenue and EBITDA1

$58.3 $57.7 $60.1 $62.4 $64.8 $67.4

$39.9 $40.5 $42.3 $43.9 $45.6 $47.3

2016E 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA

Source: VTTI management

1. Net to VTTI’s 90.0% interest in ETT

Map of Operations Rotterdam Terminal Complex (ETT) Key Statistics

Capacity 7.0 MMBbl (6.3 MMBbl net1 )

Number of Tanks 28

Number of Jetties 14

Maximum Draft 69 feet

Petroleum Products: Crude, Gasoline, Jet Fuel, Kerosene,

Product Scope

Naphtha, Gasoil, Diesel, Fuel Oil and VGO

Chemicals: Petrochemicals, Solvents, Alcohols

19 EVERCORE vtti energy partners

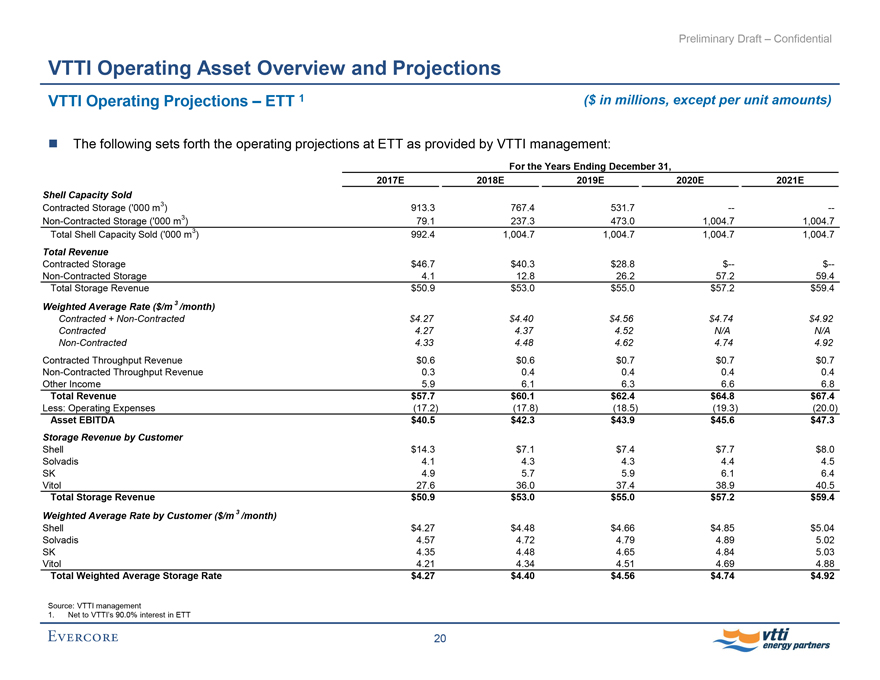

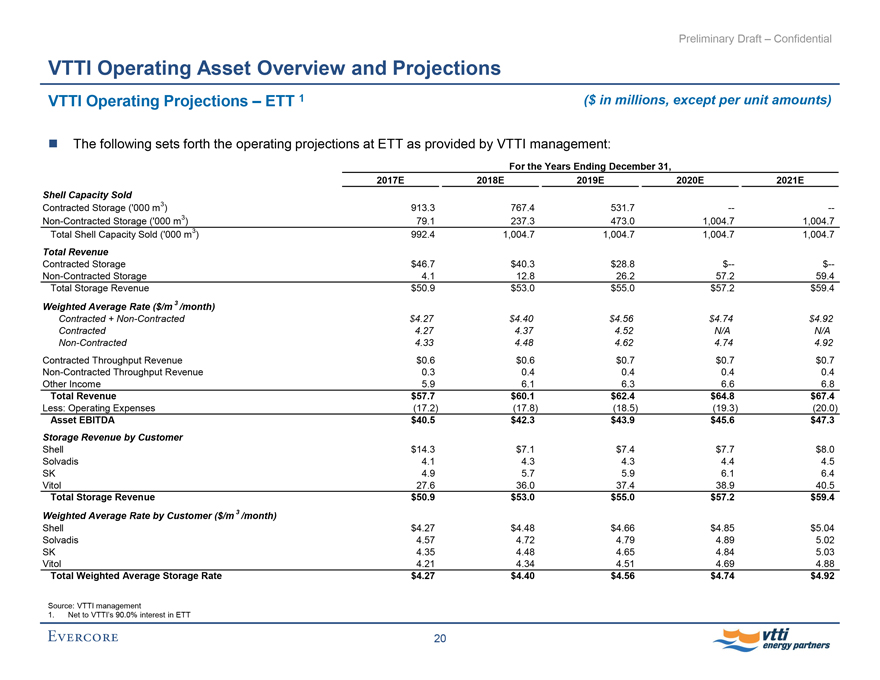

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

VTTI Operating Projections – ETT1

($ in millions, except per unit amounts)

The following sets forth the operating projections at ETT as provided by VTTI management:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E

Shell Capacity Sold

Contracted Storage (‘000 m3) 913.3 767.4 531.7 — —

Non-Contracted Storage (‘000 m3) 79.1 237.3 473.0 1,004.7 1,004.7

Total Shell Capacity Sold (‘000 m3) 992.4 1,004.7 1,004.7 1,004.7 1,004.7

Total Revenue

Contracted Storage $46.7 $40.3 $28.8 $— $—

Non-Contracted Storage 4.1 12.8 26.2 57.2 59.4

Total Storage Revenue $50.9 $53.0 $55.0 $57.2 $59.4

Weighted Average Rate ($/m3 /month)

Contracted +Non-Contracted $4.27 $4.40 $4.56 $4.74 $4.92

Contracted 4.27 4.37 4.52 N/A N/A

Non-Contracted 4.33 4.48 4.62 4.74 4.92

Contracted Throughput Revenue $0.6 $0.6 $0.7 $0.7 $0.7

Non-Contracted Throughput Revenue 0.3 0.4 0.4 0.4 0.4

Other Income 5.9 6.1 6.3 6.6 6.8

Total Revenue $57.7 $60.1 $62.4 $64.8 $67.4

Less: Operating Expenses (17.2) (17.8) (18.5) (19.3) (20.0)

Asset EBITDA $40.5 $42.3 $43.9 $45.6 $47.3

Storage Revenue by Customer

Shell $14.3 $7.1 $7.4 $7.7 $8.0

Solvadis 4.1 4.3 4.3 4.4 4.5

SK 4.9 5.7 5.9 6.1 6.4

Vitol 27.6 36.0 37.4 38.9 40.5

Total Storage Revenue $50.9 $53.0 $55.0 $57.2 $59.4

Weighted Average Rate by Customer ($/m 3 /month)

Shell $4.27 $4.48 $4.66 $4.85 $5.04

Solvadis 4.57 4.72 4.79 4.89 5.02

SK 4.35 4.48 4.65 4.84 5.03

Vitol 4.21 4.34 4.51 4.69 4.88

Total Weighted Average Storage Rate $4.27 $4.40 $4.56 $4.74 $4.92

Source: VTTI management

1. Net to VTTI’s 90.0% interest in ETT

20 EVERCORE vtti energy partners

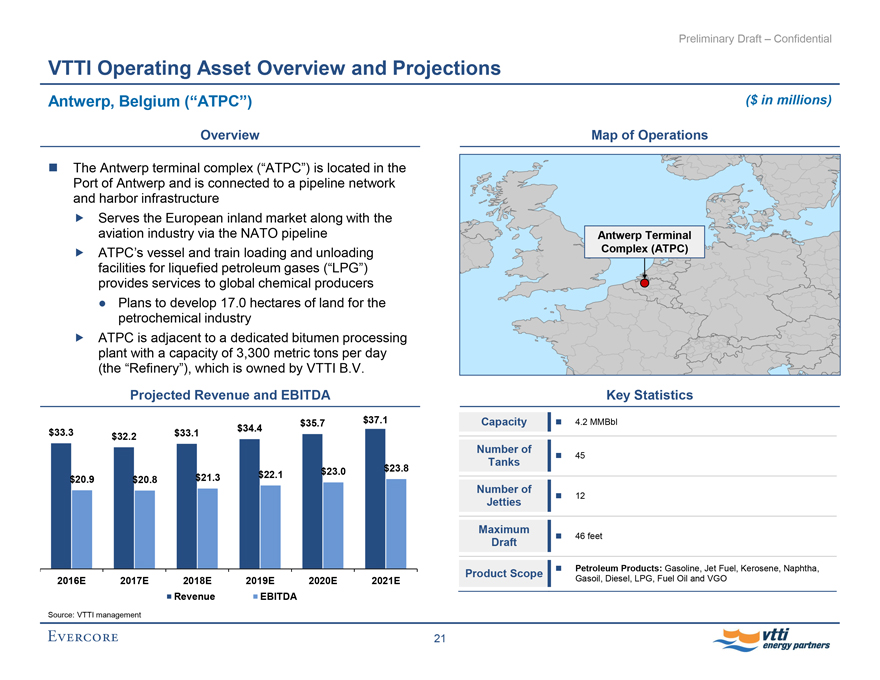

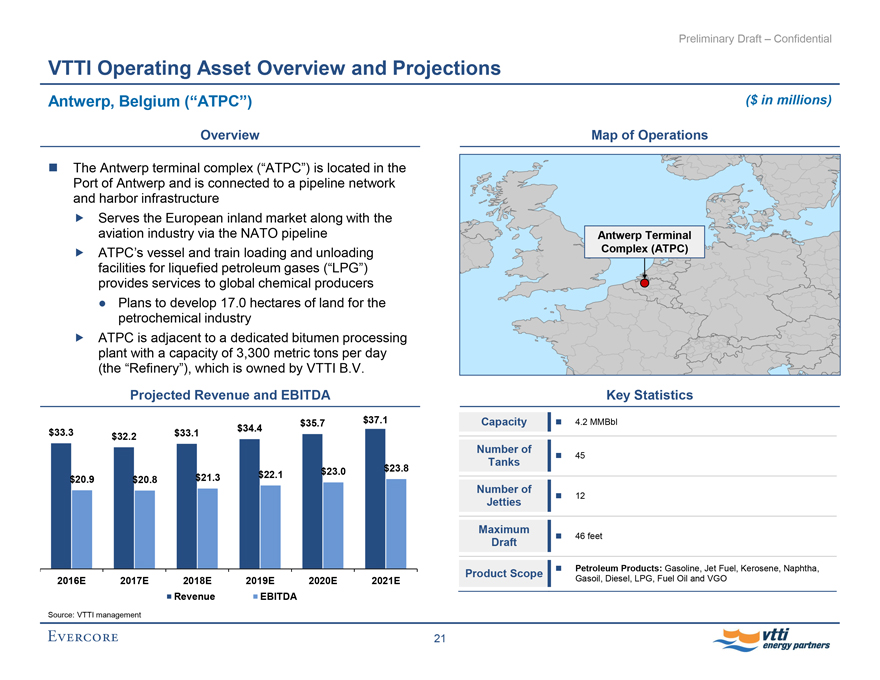

Preliminary Draft – Confidential VTTI Operating Asset Overview and Projections

Antwerp, Belgium (“ATPC”) ($ in millions)

Overview

The Antwerp terminal complex (“ATPC”) is located in the

Port of Antwerp and is connected to a pipeline network and harbor infrastructure

Serves the European inland market along with the aviation industry via the NATO pipeline

ATPC’s vessel and train loading and unloading facilities for liquefied petroleum gases (“LPG”) provides services to global chemical producers

Plans to develop 17.0 hectares of land for the petrochemical industry

ATPC is adjacent to a dedicated bitumen processing plant with a capacity of 3,300 metric tons per day (the “Refinery”), which is owned by VTTI B.V.

Projected Revenue and EBITDA $33.3 $32.2 $33.1 $34.4 $35.7 $37.1

$20.9 $20.8 $21.3 $22.1 $23.0 $23.8

2016E 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA

Source: VTTI management

Map of Operations

Antwerp Terminal Complex (ATPC)

Key Statistics

Capacity 4.2 MMBbl

Number of Tanks 45

Number of Jetties 12

Maximum Draft 46 feet

Product Scope

Petroleum Products: Gasoline, Jet Fuel, Kerosene, Naphtha,

Gasoil, Diesel, LPG, Fuel Oil and VGO

21 EVERCORE vtti energy partners

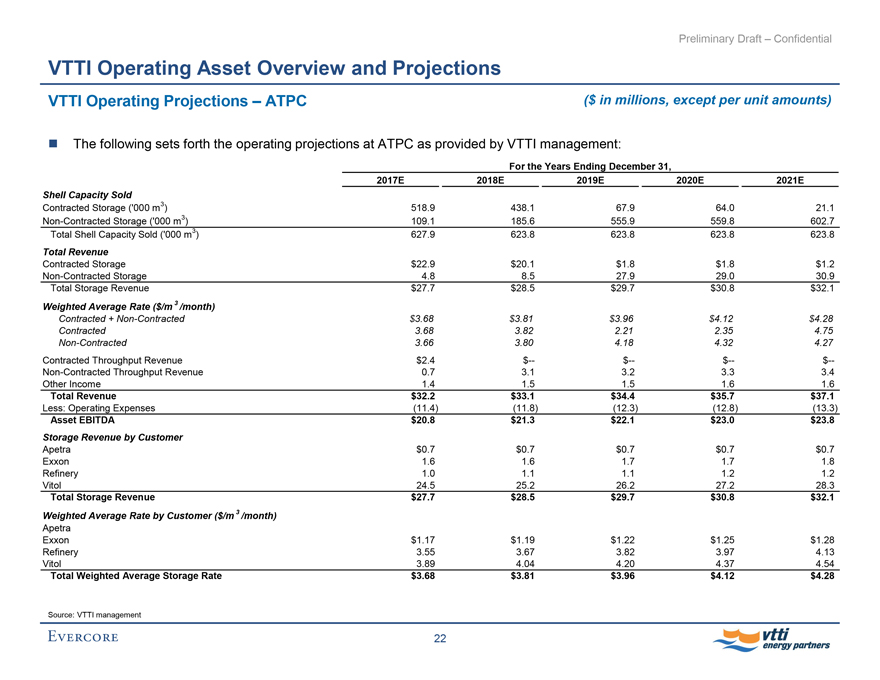

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

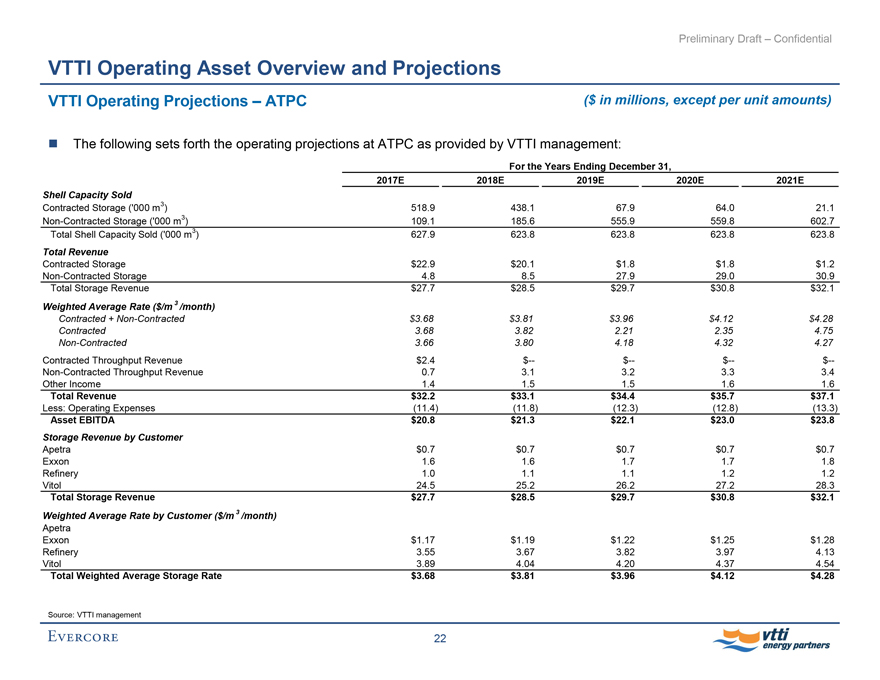

VTTI Operating Projections – ATPC ($ in millions, except per unit amounts)

The following sets forth the operating projections at ATPC as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Shell Capacity Sold

Contracted Storage (‘000 m3) 518.9 438.1 67.9 64.0 21.1

Non-Contracted Storage (‘000 m3) 109.1 185.6 555.9 559.8 602.7

Total Shell Capacity Sold (‘000 m3) 627.9 623.8 623.8 623.8 623.8

Total Revenue

Contracted Storage $22.9 $20.1 $1.8 $1.8 $1.2

Non-Contracted Storage 4.8 8.5 27.9 29.0 30.9

Total Storage Revenue $27.7 $28.5 $29.7 $30.8 $32.1

Weighted Average Rate ($/m 3 /month)

Contracted +Non-Contracted $3.68 $3.81 $3.96 $4.12 $4.28

Contracted 3.68 3.82 2.21 2.35 4.75

Non-Contracted 3.66 3.80 4.18 4.32 4.27

Contracted Throughput Revenue $2.4 $- $- $- $-

Non-Contracted Throughput Revenue 0.7 3.1 3.2 3.3 3.4

Other Income 1.4 1.5 1.5 1.6 1.6

Total Revenue $32.2 $33.1 $34.4 $35.7 $37.1

Less: Operating Expenses (11.4) (11.8) (12.3) (12.8) (13.3)

Asset EBITDA $20.8 $21.3 $22.1 $23.0 $23.8

Storage Revenue by Customer

Apetra $0.7 $0.7 $0.7 $0.7 $0.7

Exxon 1.6 1.6 1.7 1.7 1.8

Refinery 1.0 1.1 1.1 1.2 1.2

Vitol 24.5 25.2 26.2 27.2 28.3

Total Storage Revenue $27.7 $28.5 $29.7 $30.8 $32.1

Weighted Average Rate by Customer ($/m 3 /month)

Apetra

Exxon $1.17 $1.19 $1.22 $1.25 $1.28

Refinery 3.55 3.67 3.82 3.97 4.13

Vitol 3.89 4.04 4.20 4.37 4.54

Total Weighted Average Storage Rate $3.68 $3.81 $3.96 $4.12 $4.28

Source: VTTI management

22

EVERCORE vtti energy partners

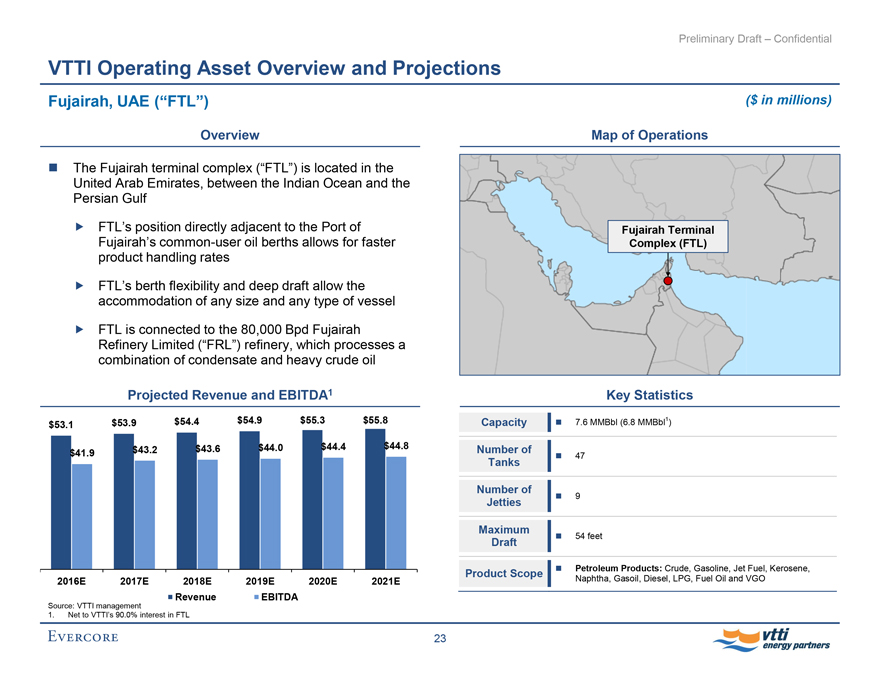

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

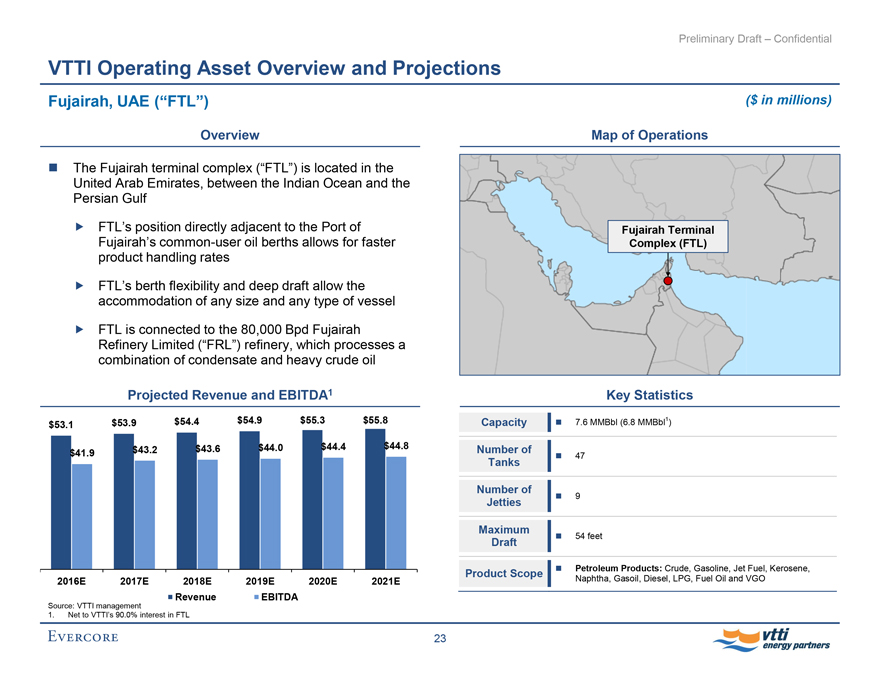

Fujairah, UAE (“FTL”) ($ in millions)

Overview

The Fujairah terminal complex (“FTL”) is located in the United Arab Emirates, between the Indian Ocean and the Persian Gulf

FTL’s position directly adjacent to the Port of Fujairah’s common-user oil berths allows for faster product handling rates

FTL’s berth flexibility and deep draft allow the accommodation of any size and any type of vessel

FTL is connected to the 80,000 Bpd Fujairah

Refinery Limited (“FRL”) refinery, which processes a combination of condensate and heavy crude oil

Projected Revenue and EBITDA1

$53.1 $53.9 $54.4 $54.9 $55.3 $55.8

$41.9 $43.2 $43.6 $44.0 $44.4 $44.8

2016E 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA

Source: VTTI management

1. Net to VTTI’s 90.0% interest in FTL

Map of Operations

Fujairah Terminal Complex (FTL)

Key Statistics

Capacity 7.6 MMBbl (6.8 MMBbl1 )

Number of

Tanks 47

Number of

Jetties 9

Maximum

Draft 54 feet

Product Scope Petroleum Products: Crude, Gasoline, Jet Fuel, Kerosene,

Naphtha, Gasoil, Diesel, LPG, Fuel Oil and VGO

23

EVERCORE vtti energy partners

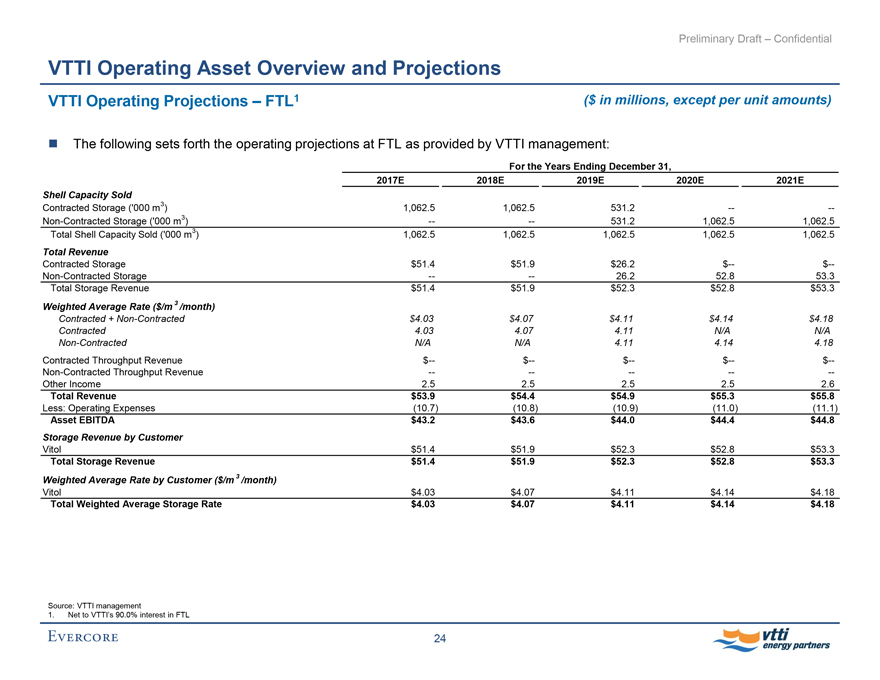

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

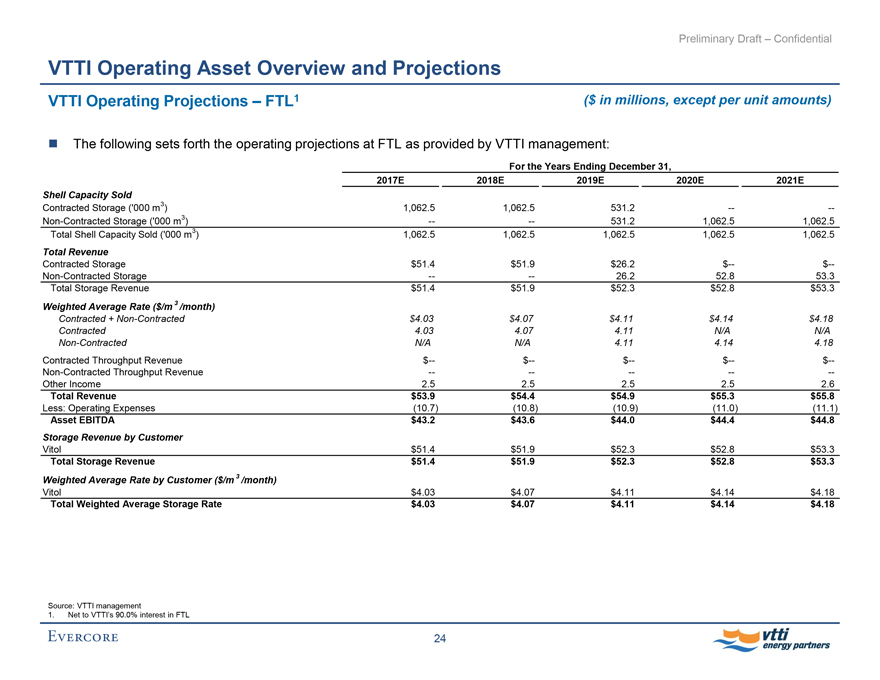

VTTI Operating Projections – FTL1 ($ in millions, except per unit amounts)

The following sets forth the operating projections at FTL as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Shell Capacity Sold

Contracted Storage (‘000 m3) 1,062.5 1,062.5 531.2 - -

Non-Contracted Storage (‘000 m3) - - 531.2 1,062.5 1,062.5

Total Shell Capacity Sold (‘000 m3) 1,062.5 1,062.5 1,062.5 1,062.5 1,062.5

Total Revenue

Contracted Storage $51.4 $51.9 $26.2 $- $-

Non-Contracted Storage - - 26.2 52.8 53.3

Total Storage Revenue $51.4 $51.9 $52.3 $52.8 $53.3

Weighted Average Rate ($/m 3 /month)

Contracted +Non-Contracted $4.03 $4.07 $4.11 $4.14 $4.18

Contracted 4.03 4.07 4.11 N/A N/A

Non-Contracted N/A N/A 4.11 4.14 4.18

Contracted Throughput Revenue $- $- $- $- $-

Non-Contracted Throughput Revenue - - - - -

Other Income 2.5 2.5 2.5 2.5 2.6

Total Revenue $53.9 $54.4 $54.9 $55.3 $55.8

Less: Operating Expenses (10.7) (10.8) (10.9) (11.0) (11.1)

Asset EBITDA $43.2 $43.6 $44.0 $44.4 $44.8

Storage Revenue by Customer

Vitol $51.4 $51.9 $52.3 $52.8 $53.3

Total Storage Revenue $51.4 $51.9 $52.3 $52.8 $53.3

Weighted Average Rate by Customer ($/m 3 /month)

Vitol $4.03 $4.07 $4.11 $4.14 $4.18

Total Weighted Average Storage Rate $4.03 $4.07 $4.11 $4.14 $4.18

Source: VTTI management

1. Net to VTTI’s 90.0% interest in FTL

24

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

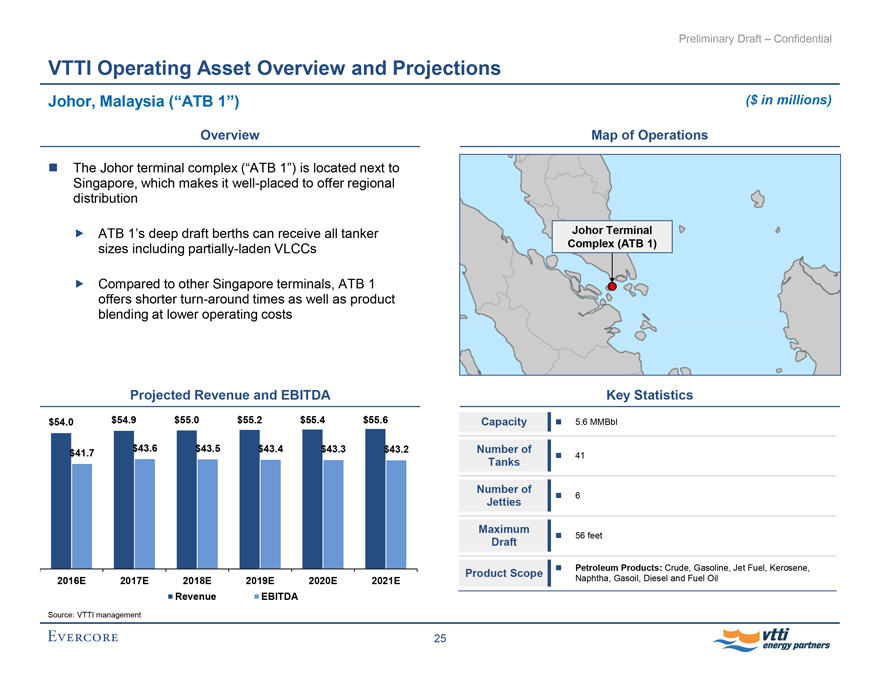

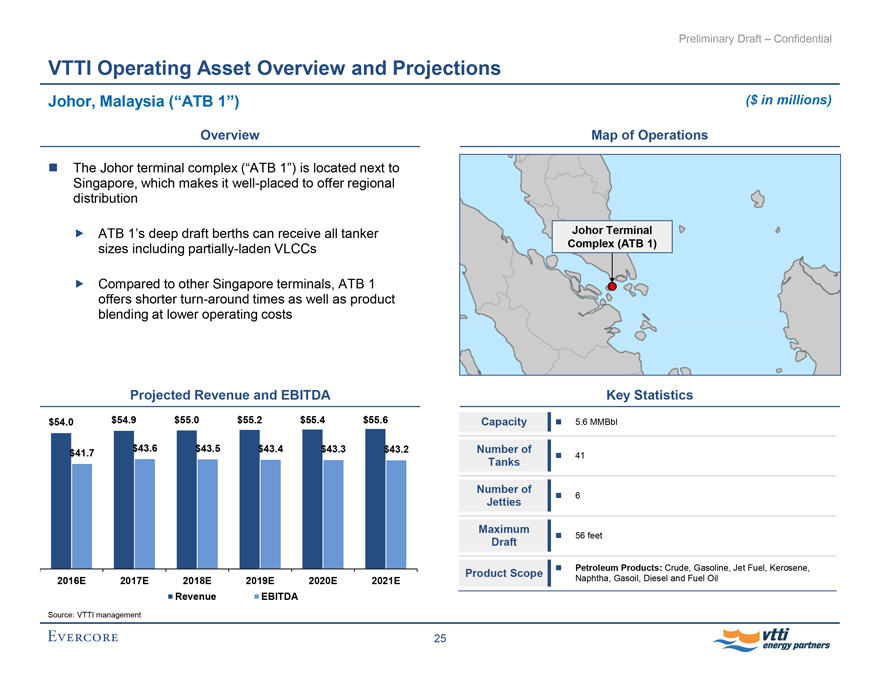

Johor, Malaysia (“ATB 1”) ($ in millions)

Overview

The Johor terminal complex (“ATB 1”) is located next to Singapore, which makes it well-placed to offer regional distribution

ATB 1’s deep draft berths can receive all tanker sizes including partially-laden VLCCs

Compared to other Singapore terminals, ATB 1 offers shorter turn-around times as well as product blending at lower operating costs

Projected Revenue and EBITDA

$54.0 $54.9 $55.0 $55.2 $55.4 $55.6

$41.7 $43.6 $43.5 $43.4 $43.3 $43.2

2016E 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA

Source: VTTI management

Map of Operations

Johor Terminal Complex (ATB 1)

Key Statistics

Capacity 5.6 MMBbl

Number of

Tanks 41

Number of

Jetties 6

Maximum

Draft 56 feet

Product Scope Petroleum Products: Crude, Gasoline, Jet Fuel, Kerosene,

Naphtha, Gasoil, Diesel and Fuel Oil

25

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

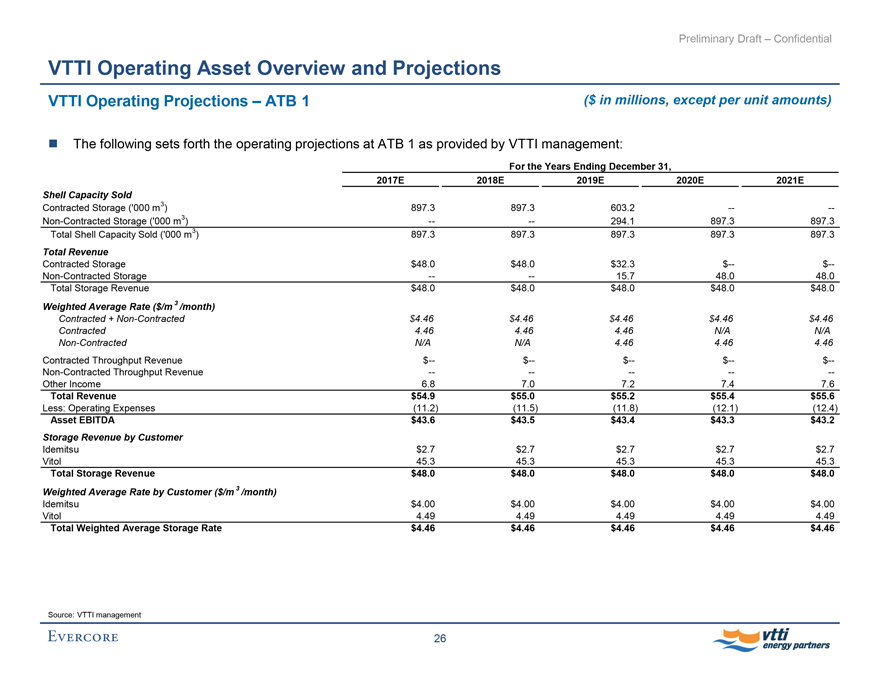

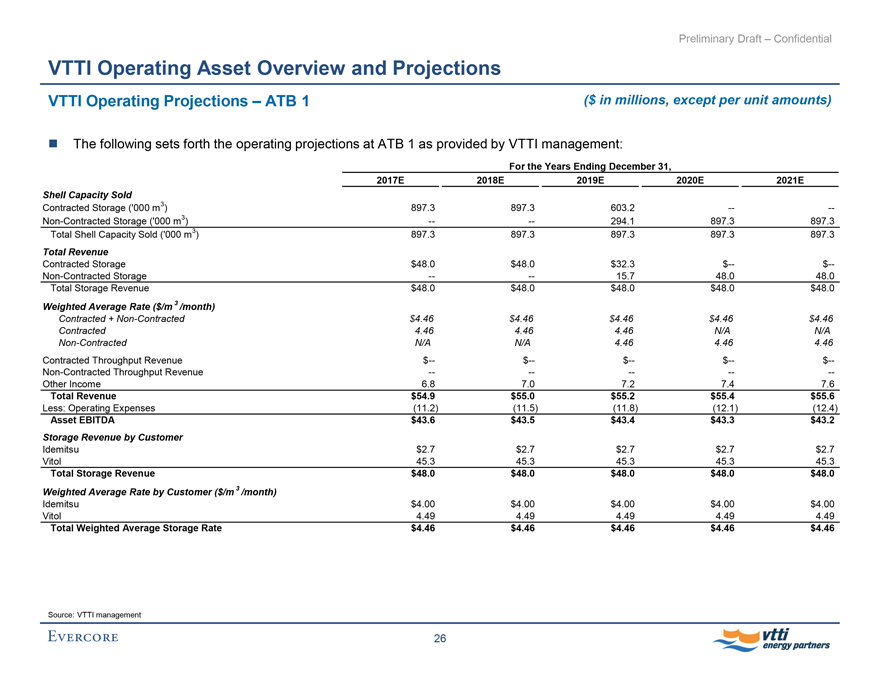

VTTI Operating Projections – ATB 1 ($ in millions, except per unit amounts)

The following sets forth the operating projections at ATB 1 as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Shell Capacity Sold

Contracted Storage (‘000 m3) 897.3 897.3 603.2 - -

Non-Contracted Storage (‘000 m3) - - 294.1 897.3 897.3

Total Shell Capacity Sold (‘000 m3) 897.3 897.3 897.3 897.3 897.3

Total Revenue

Contracted Storage $48.0 $48.0 $32.3 $- $-

Non-Contracted Storage - - 15.7 48.0 48.0

Total Storage Revenue $48.0 $48.0 $48.0 $48.0 $48.0

Weighted Average Rate ($/m 3 /month)

Contracted +Non-Contracted $4.46 $4.46 $4.46 $4.46 $4.46

Contracted 4.46 4.46 4.46 N/A N/A

Non-Contracted N/A N/A 4.46 4.46 4.46

Contracted Throughput Revenue $- $- $- $- $-

Non-Contracted Throughput Revenue - - - - -

Other Income 6.8 7.0 7.2 7.4 7.6

Total Revenue $54.9 $55.0 $55.2 $55.4 $55.6

Less: Operating Expenses (11.2) (11.5) (11.8) (12.1) (12.4)

Asset EBITDA $43.6 $43.5 $43.4 $43.3 $43.2

Storage Revenue by Customer

Idemitsu $2.7 $2.7 $2.7 $2.7 $2.7

Vitol 45.3 45.3 45.3 45.3 45.3

Total Storage Revenue $48.0 $48.0 $48.0 $48.0 $48.0

Weighted Average Rate by Customer ($/m 3 /month)

Idemitsu $4.00 $4.00 $4.00 $4.00 $4.00

Vitol 4.49 4.49 4.49 4.49 4.49

Total Weighted Average Storage Rate $4.46 $4.46 $4.46 $4.46 $4.46

Source: VTTI management

26

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

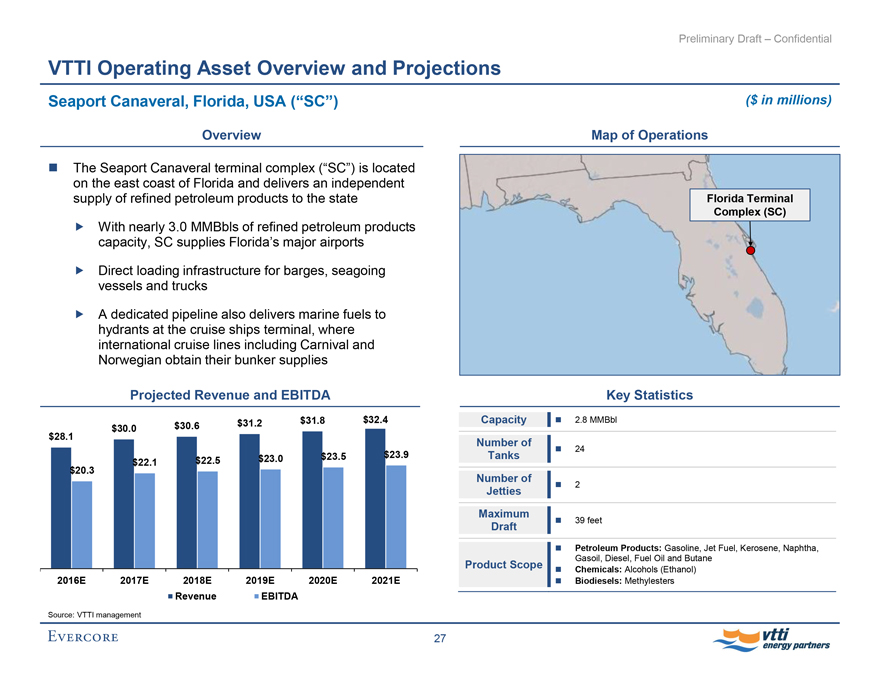

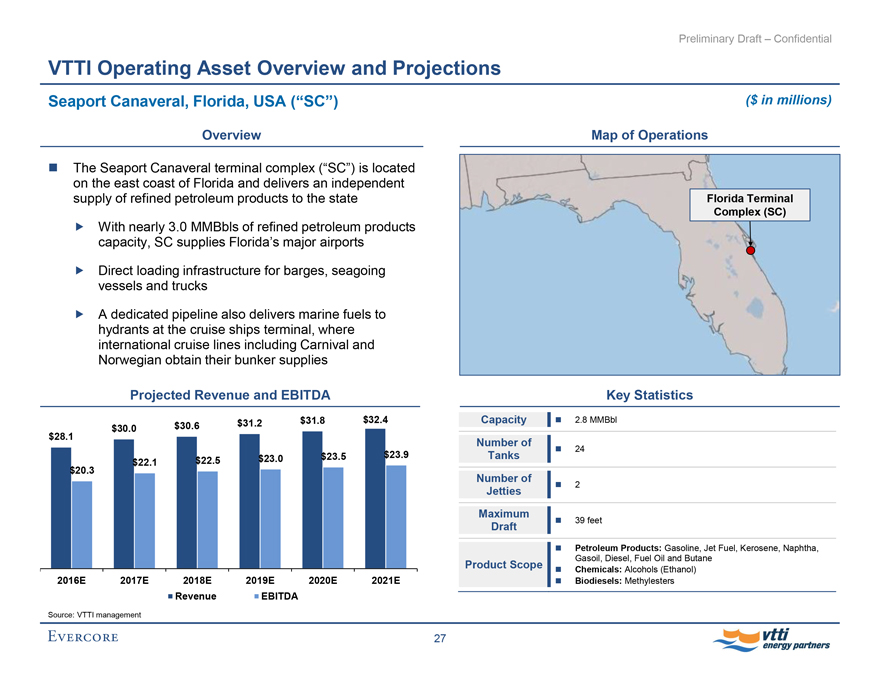

Seaport Canaveral, Florida, USA (“SC”) ($ in millions)

Overview

The Seaport Canaveral terminal complex (“SC”) is located on the east coast of Florida and delivers an independent supply of refined petroleum products to the state

With nearly 3.0 MMBbls of refined petroleum products capacity, SC supplies Florida’s major airports

Direct loading infrastructure for barges, seagoing vessels and trucks

A dedicated pipeline also delivers marine fuels to hydrants at the cruise ships terminal, where international cruise lines including Carnival and Norwegian obtain their bunker supplies

Projected Revenue and EBITDA

$30.0 $30.6 $31.2 $31.8 $32.4

$28.1

$22.1 $22.5 $23.0 $23.5 $23.9

$20.3

2016E 2017E 2018E 2019E 2020E 2021E

Revenue EBITDA

Source: VTTI management

Map of Operations

Florida Terminal Complex (SC)

Key Statistics

Capacity 2.8 MMBbl

Number of

Tanks 24

Number of

Jetties 2

Maximum

Draft 39 feet

Petroleum Products: Gasoline, Jet Fuel, Kerosene, Naphtha,

Gasoil, Diesel, Fuel Oil and Butane

Product Scope Chemicals: Alcohols (Ethanol)

Biodiesels: Methylesters

27

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

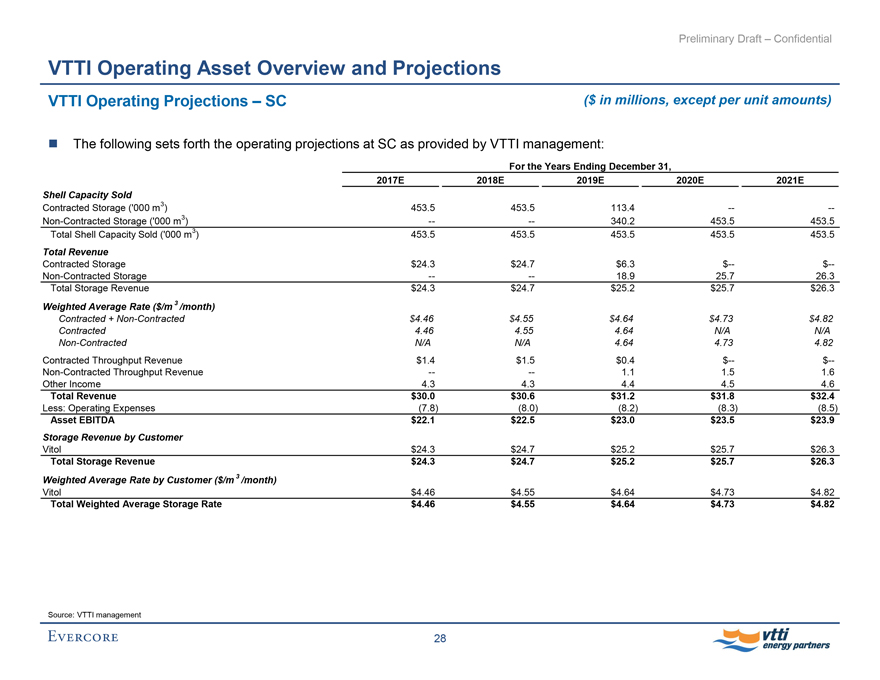

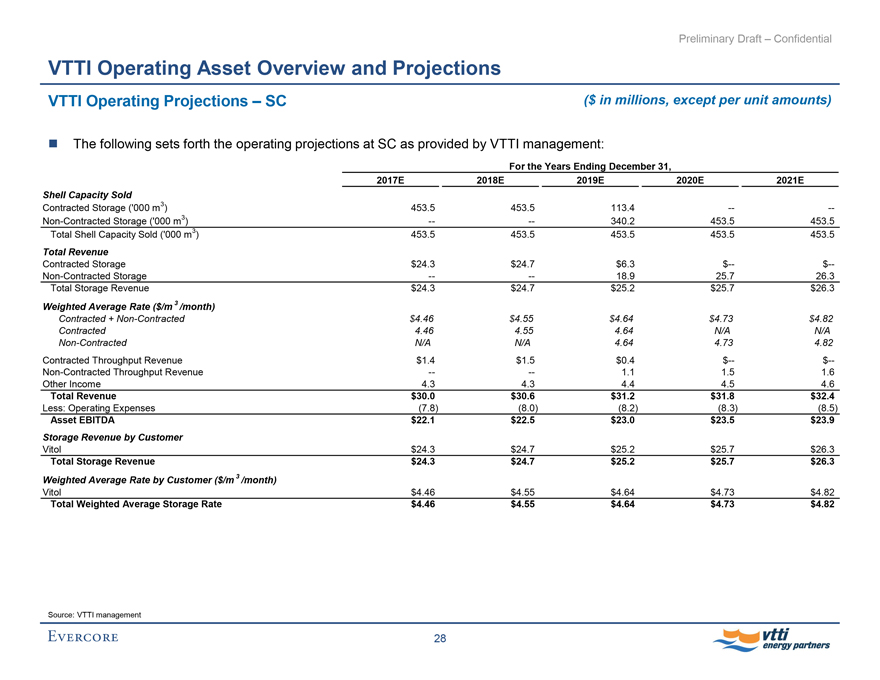

VTTI Operating Projections – SC ($ in millions, except per unit amounts)

The following sets forth the operating projections at SC as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Shell Capacity Sold

Contracted Storage (‘000 m3) 453.5 453.5 113.4 - -

Non-Contracted Storage (‘000 m3) - - 340.2 453.5 453.5

Total Shell Capacity Sold (‘000 m3) 453.5 453.5 453.5 453.5 453.5

Total Revenue

Contracted Storage $24.3 $24.7 $6.3 $- $-

Non-Contracted Storage - - 18.9 25.7 26.3

Total Storage Revenue $24.3 $24.7 $25.2 $25.7 $26.3

Weighted Average Rate ($/m 3 /month)

Contracted +Non-Contracted $4.46 $4.55 $4.64 $4.73 $4.82

Contracted 4.46 4.55 4.64 N/A N/A

Non-Contracted N/A N/A 4.64 4.73 4.82

Contracted Throughput Revenue $1.4 $1.5 $0.4 $- $-

Non-Contracted Throughput Revenue - - 1.1 1.5 1.6

Other Income 4.3 4.3 4.4 4.5 4.6

Total Revenue $30.0 $30.6 $31.2 $31.8 $32.4

Less: Operating Expenses (7.8) (8.0) (8.2) (8.3) (8.5)

Asset EBITDA $22.1 $22.5 $23.0 $23.5 $23.9

Storage Revenue by Customer

Vitol $24.3 $24.7 $25.2 $25.7 $26.3

Total Storage Revenue $24.3 $24.7 $25.2 $25.7 $26.3

Weighted Average Rate by Customer ($/m 3 /month)

Vitol $4.46 $4.55 $4.64 $4.73 $4.82

Total Weighted Average Storage Rate $4.46 $4.55 $4.64 $4.73 $4.82

Source: VTTI management

28

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

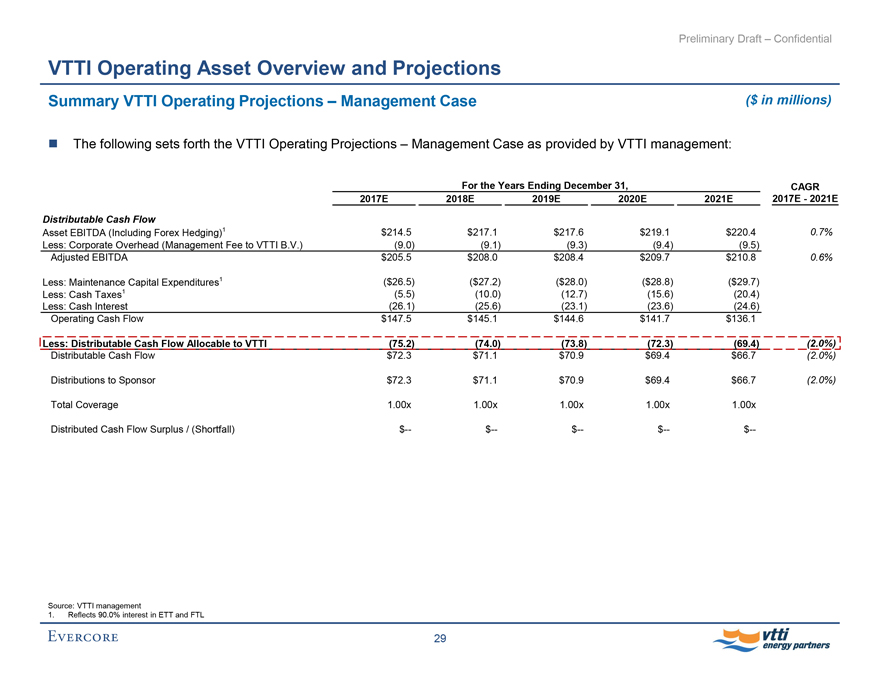

Summary VTTI Operating Projections – Management Case

($ in millions)

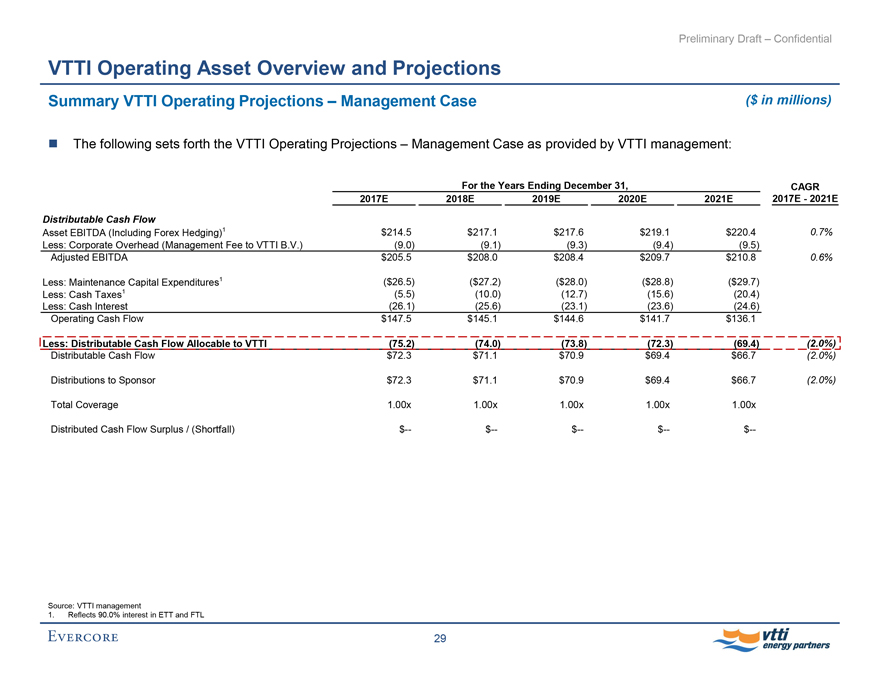

The following sets forth the VTTI Operating Projections – Management Case as provided by VTTI management:

For the Years Ending December 31, CAGR

2017E 2018E 2019E 2020E 2021E 2017E - 2021E

Distributable Cash Flow

Asset EBITDA (Including Forex Hedging)1 $214.5 $217.1 $217.6 $219.1 $220.4 0.7%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (9.0) (9.1) (9.3) (9.4) (9.5)

Adjusted EBITDA $205.5 $208.0 $208.4 $209.7 $210.8 0.6%

Less: Maintenance Capital Expenditures1 ($26.5) ($27.2) ($28.0) ($28.8) ($29.7)

Less: Cash Taxes1 (5.5) (10.0) (12.7) (15.6) (20.4)

Less: Cash Interest (26.1) (25.6) (23.1) (23.6) (24.6)

Operating Cash Flow $147.5 $145.1 $144.6 $141.7 $136.1

Less: Distributable Cash Flow Allocable to VTTI (75.2) (74.0) (73.8) (72.3) (69.4) (2.0%)

Distributable Cash Flow $72.3 $71.1 $70.9 $69.4 $66.7 (2.0%)

Distributions to Sponsor $72.3 $71.1 $70.9 $69.4 $66.7 (2.0%)

Total Coverage 1.00x 1.00x 1.00x 1.00x 1.00x

Distributed Cash Flow Surplus / (Shortfall) $- $- $- $- $-

Source: VTTI management

1. Reflects 90.0% interest in ETT and FTL

29

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

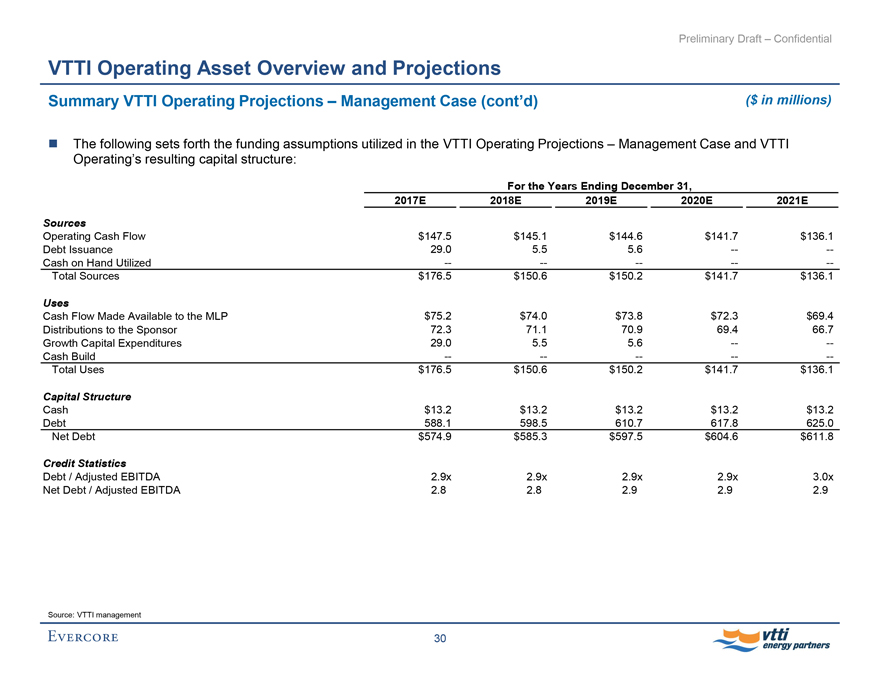

Summary VTTI Operating Projections – Management Case (cont’d)

($ in millions)

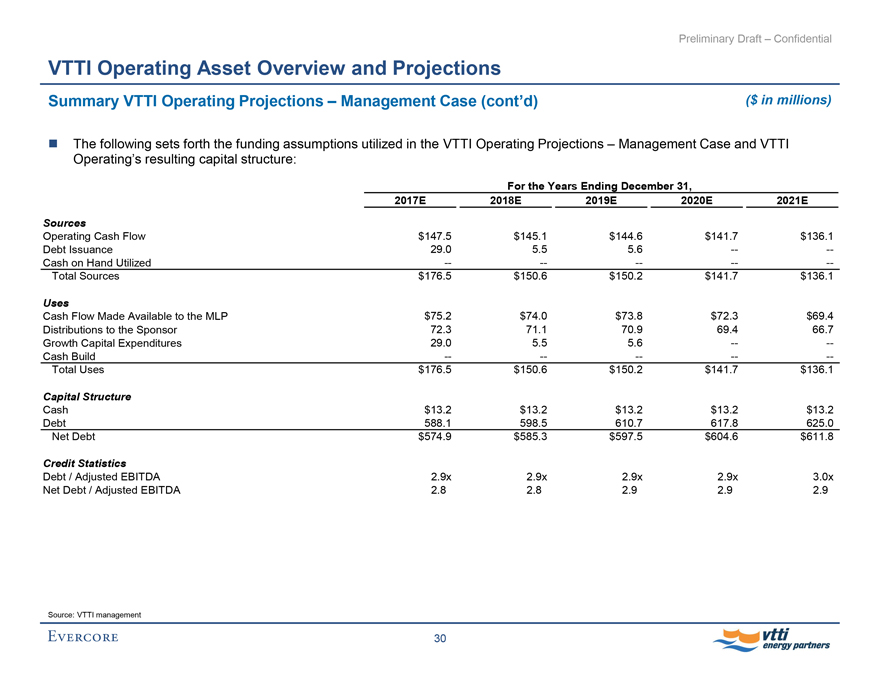

The following sets forth the funding assumptions utilized in the VTTI Operating Projections – Management Case and VTTI Operating’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

Operating Cash Flow $147.5 $145.1 $144.6 $141.7 $136.1

Debt Issuance 29.0 5.5 5.6 - -

Cash on Hand Utilized - - - - -

Total Sources $176.5 $150.6 $150.2 $141.7 $136.1

Uses

Cash Flow Made Available to the MLP $75.2 $74.0 $73.8 $72.3 $69.4

Distributions to the Sponsor 72.3 71.1 70.9 69.4 66.7

Growth Capital Expenditures 29.0 5.5 5.6 - -

Cash Build - - - - -

Total Uses $176.5 $150.6 $150.2 $141.7 $136.1

Capital Structure

Cash $13.2 $13.2 $13.2 $13.2 $13.2

Debt 588.1 598.5 610.7 617.8 625.0

Net Debt $574.9 $585.3 $597.5 $604.6 $611.8

Credit Statistics

Debt / Adjusted EBITDA 2.9x 2.9x 2.9x 2.9x 3.0x

Net Debt / Adjusted EBITDA 2.8 2.8 2.9 2.9 2.9

Source: VTTI management

30

EVERCORE vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

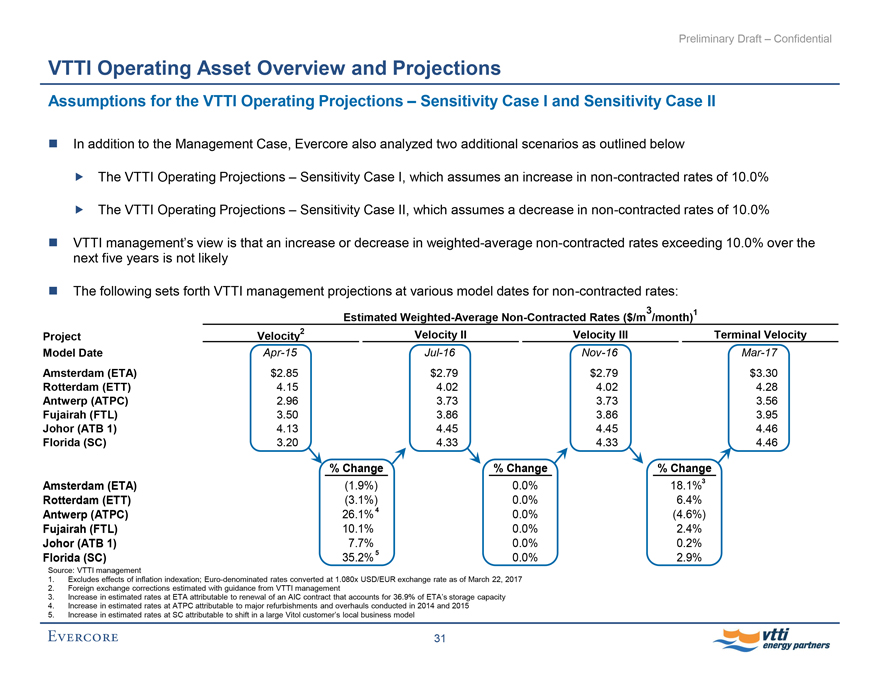

Assumptions for the VTTI Operating Projections – Sensitivity Case I and Sensitivity Case II

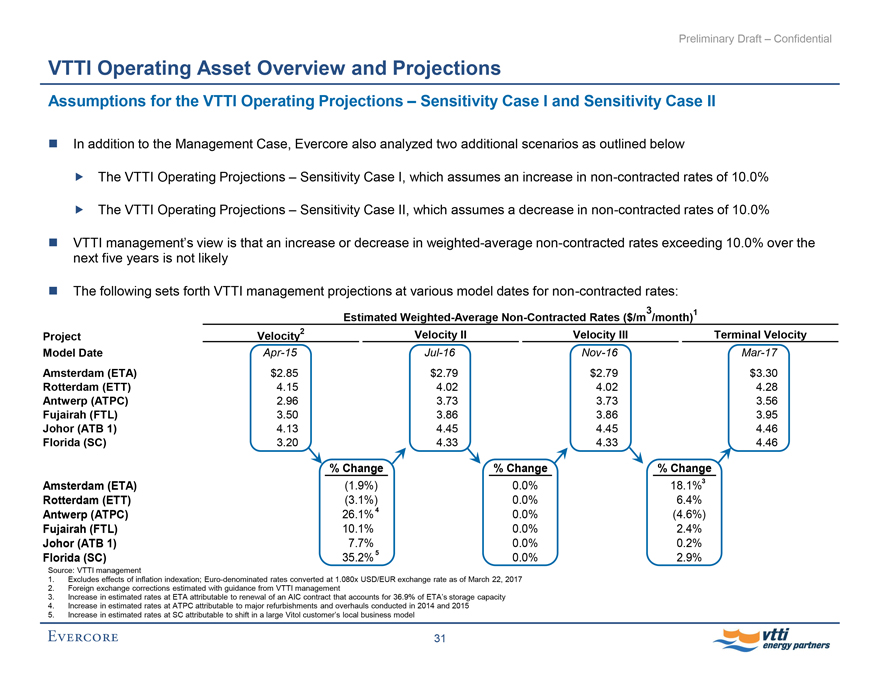

In addition to the Management Case, Evercore also analyzed two additional scenarios as outlined below

The VTTI Operating Projections – Sensitivity Case I, which assumes an increase innon-contracted rates of 10.0%

The VTTI Operating Projections – Sensitivity Case II, which assumes a decrease innon-contracted rates of 10.0%

VTTI management’s view is that an increase or decrease in weighted-averagenon-contracted rates exceeding 10.0% over the next five years is not likely

The following sets forth VTTI management projections at various model dates fornon-contracted rates:

Estimated Weighted-AverageNon-Contracted Rates ($/m3 /month)1

Project Velocity2 Velocity II Velocity III Terminal Velocity Model DateApr-15Jul-16Nov-16Mar-17 Amsterdam (ETA)

$2.85 $2.79 $2.79 $3.30 Rotterdam (ETT) 4.15 4.02 4.02 4.28 Antwerp (ATPC) 2.96 3.73 3.73 3.56 Fujairah (FTL) 3.50 3.86 3.86 3.95 Johor (ATB 1) 4.13 4.45 4.45 4.46 Florida (SC) 3.20 4.33 4.33 4.46 % Change % Change % Change Amsterdam (ETA) (1.9%) 0.0% 18.1%3 Rotterdam (ETT) (3.1%) 0.0% 6.4% Antwerp (ATPC) 26.1% 4 0.0% (4.6%) Fujairah (FTL) 10.1% 0.0% 2.4%

Johor (ATB 1) 7.7% 0.0% 0.2% Florida (SC) 35.2% 5 0.0% 2.9%

Source: VTTI management

1. Excludes effects of inflation indexation; Euro-denominated rates converted at 1.080x USD/EUR exchange rate as of March 22, 2017

2. Foreign exchange corrections estimated with guidance from VTTI management

3. Increase in estimated rates at ETA attributable to renewal of an AIC contract that accounts for 36.9% of ETA’s storage capacity

4. Increase in estimated rates at ATPC attributable to major refurbishments and overhauls conducted in 2014 and 2015

5. Increase in estimated rates at SC attributable to shift in a large Vitol customer’s local business model

31

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

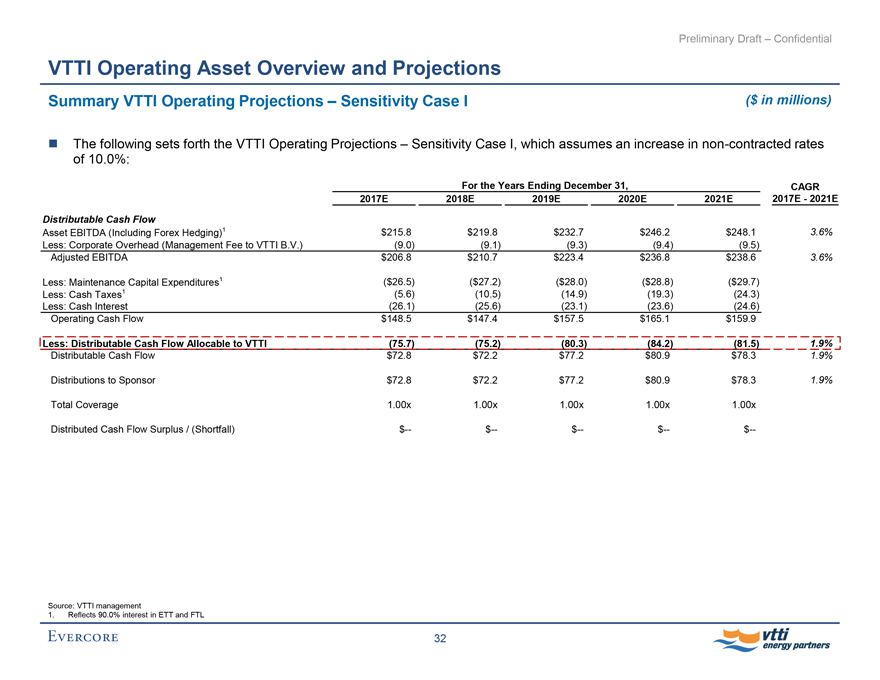

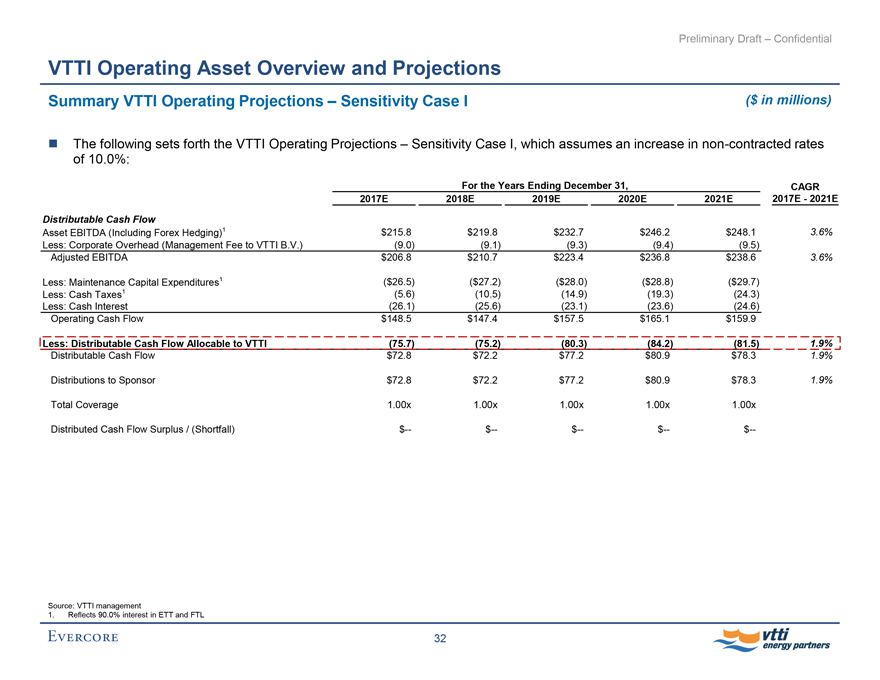

Summary VTTI Operating Projections – Sensitivity Case I ($ in millions)

The following sets forth the VTTI Operating Projections – Sensitivity Case I, which assumes an increase innon-contracted rates of 10.0%: For the Years Ending December 31, CAGR 2017E 2018E 2019E 2020E 2021E 2017E—2021E Distributable Cash Flow

Asset EBITDA (Including Forex Hedging)1 $215.8 $219.8 $232.7 $246.2 $248.1 3.6%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (9.0) (9.1) (9.3) (9.4) (9.5)

Adjusted EBITDA $206.8 $210.7 $223.4 $236.8 $238.6 3.6%

Less: Maintenance Capital Expenditures1 ($26.5) ($27.2) ($28.0) ($28.8) ($29.7)

Less: Cash Taxes1 (5.6) (10.5) (14.9) (19.3) (24.3)

Less: Cash Interest (26.1) (25.6) (23.1) (23.6) (24.6)

Operating Cash Flow $148.5 $147.4 $157.5 $165.1 $159.9

Less: Distributable Cash Flow Allocable to VTTI (75.7) (75.2) (80.3) (84.2) (81.5) 1.9%

Distributable Cash Flow $72.8 $72.2 $77.2 $80.9 $78.3 1.9%

Distributions to Sponsor $72.8 $72.2 $77.2 $80.9 $78.3 1.9%

Total Coverage 1.00x 1.00x 1.00x 1.00x 1.00x

Distributed Cash Flow Surplus / (Shortfall)

$— $— $— $— $—

Source: VTTI management

1. Reflects 90.0% interest in ETT and FTL

32

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

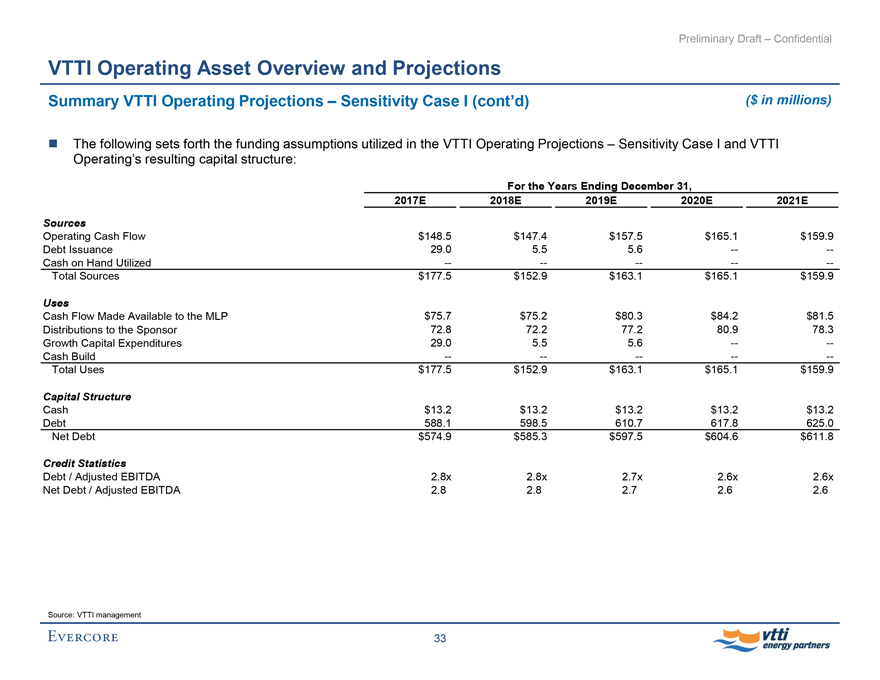

VTTI Operating Asset Overview and Projections

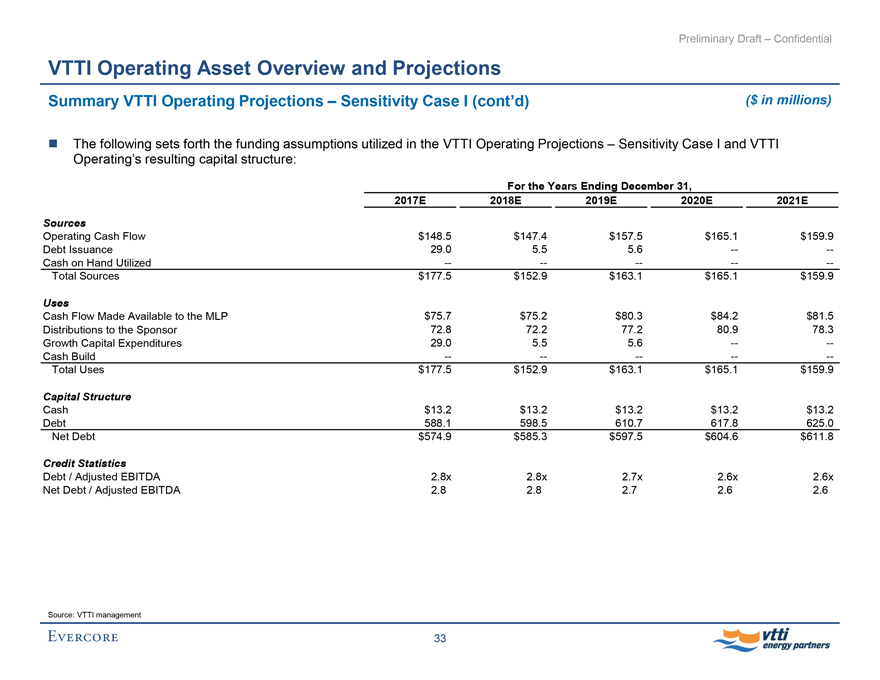

Summary VTTI Operating Projections – Sensitivity Case I (cont’d)

($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Operating Projections – Sensitivity Case I and VTTI Operating’s resulting capital structure:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Sources

Operating Cash Flow $148.5 $147.4 $157.5 $165.1 $159.9

Debt Issuance 29.0 5.5 5.6 — —

Cash on Hand Utilized — — — — —

Total Sources $177.5 $152.9 $163.1 $165.1 $159.9

Uses Cash Flow Made Available to the MLP $75.7 $75.2 $80.3 $84.2 $81.5

Distributions to the Sponsor 72.8 72.2 77.2 80.9 78.3

Growth Capital Expenditures 29.0 5.5 5.6 — —

Cash Build — — — — —

Total Uses $177.5 $152.9 $163.1 $165.1 $159.9

Capital Structure

Cash $13.2 $13.2 $13.2 $13.2 $13.2

Debt 588.1 598.5 610.7 617.8 625.0

Net Debt $574.9 $585.3 $597.5 $604.6 $611.8

Credit Statistics

Debt / Adjusted EBITDA 2.8x 2.8x 2.7x 2.6x 2.6x

Net Debt / Adjusted EBITDA 2.8 2.8 2.7 2.6 2.6

Source: VTTI management

33

EVERCORE Vtti energy partners

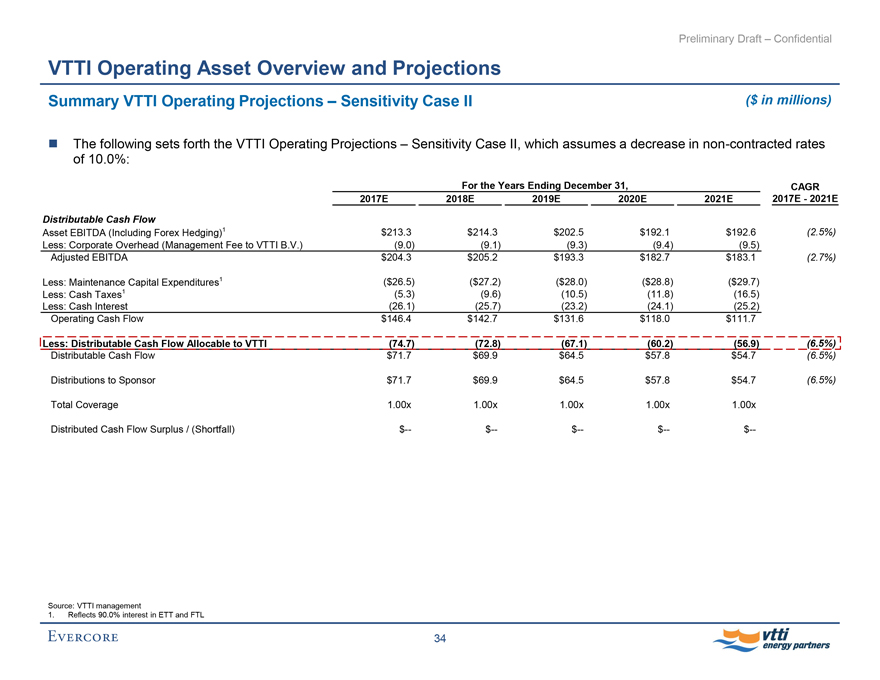

Preliminary Draft – Confidential

VTTI Operating Asset Overview and Projections

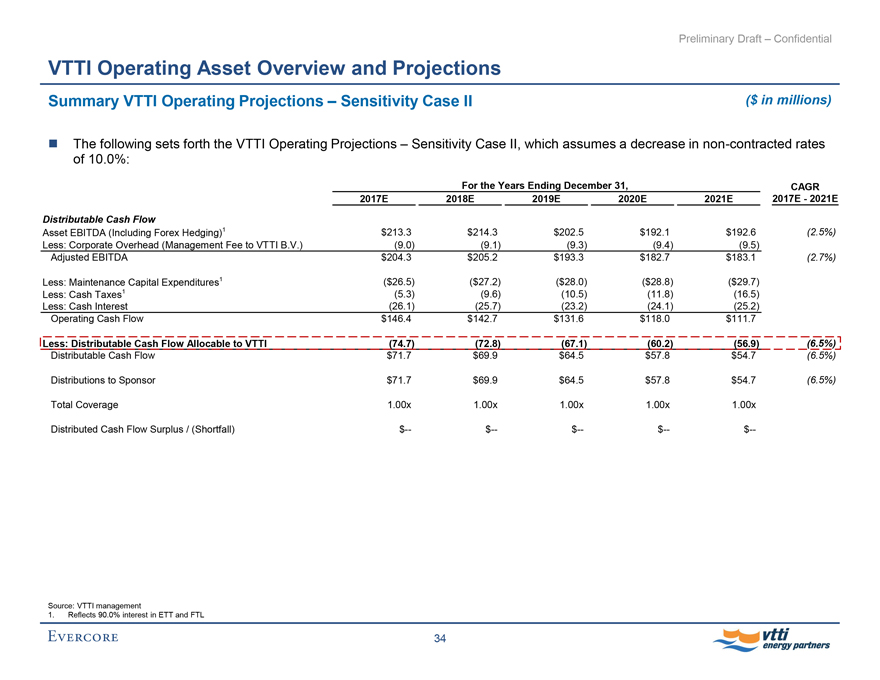

Summary VTTI Operating Projections – Sensitivity Case II

($ in millions)

The following sets forth the VTTI Operating Projections – Sensitivity Case II, which assumes a decrease innon-contracted rates of 10.0%: For the Years Ending December 31,

CAGR 2017E 2018E 2019E 2020E 2021E 2017E - 2021E

Distributable Cash Flow

Asset EBITDA (Including Forex Hedging)1 $213.3 $214.3 $202.5 $192.1 $192.6 (2.5%)

Less: Corporate Overhead (Management Fee to VTTI B.V.) (9.0) (9.1) (9.3) (9.4) (9.5)

Adjusted EBITDA $204.3 $205.2 $193.3 $182.7 $183.1 (2.7%)

Less: Maintenance Capital Expenditures1 ($26.5) ($27.2) ($28.0) ($28.8) ($29.7)

Less: Cash Taxes1 (5.3) (9.6) (10.5) (11.8) (16.5)

Less: Cash Interest (26.1) (25.7) (23.2) (24.1) (25.2)

Operating Cash Flow $146.4 $142.7 $131.6 $118.0 $111.7

Less: Distributable Cash Flow Allocable to VTTI (74.7) (72.8) (67.1) (60.2) (56.9) (6.5%)

Distributable Cash Flow $71.7 $69.9 $64.5 $57.8 $54.7 (6.5%)

Distributions to Sponsor $71.7 $69.9 $64.5 $57.8 $54.7 (6.5%)

Total Coverage 1.00x 1.00x 1.00x 1.00x 1.00x

Distributed Cash Flow Surplus / (Shortfall) $— $— $— $— $—

Source: VTTI management

1. Reflects 90.0% interest in ETT and FTL

34

EVERCORE Vtti energy partners

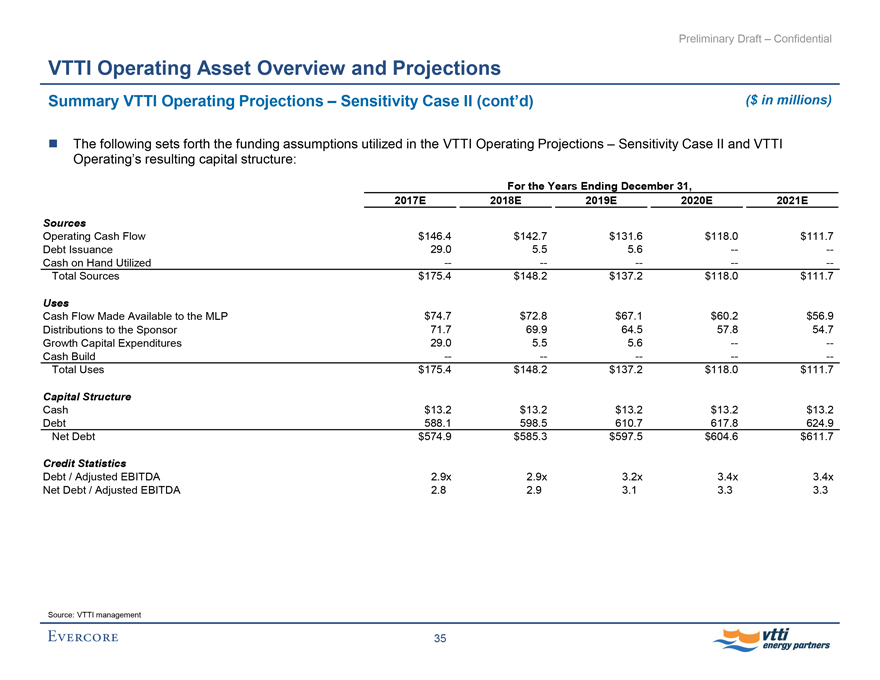

Preliminary Draft – Confidential

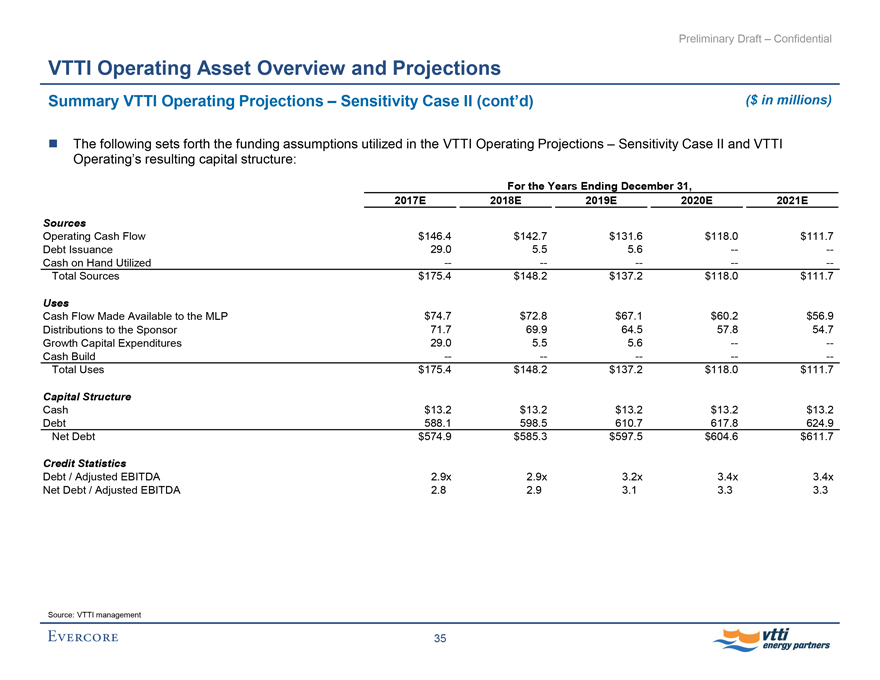

VTTI Operating Asset Overview and Projections

Summary VTTI Operating Projections – Sensitivity Case II (cont’d)

($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Operating Projections – Sensitivity Case II and VTTI Operating’s resulting capital structure:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E

Sources Operating Cash Flow $146.4 $142.7 $131.6 $118.0 $111.7

Debt Issuance 29.0 5.5 5.6 — —

Cash on Hand Utilized — — — — —

Total Sources $175.4 $148.2 $137.2 $118.0 $111.7

Uses Cash Flow Made Available to the MLP $74.7 $72.8 $67.1 $60.2 $56.9

Distributions to the Sponsor 71.7 69.9 64.5 57.8 54.7

Growth Capital Expenditures 29.0 5.5 5.6 — —

Cash Build — — — — —

Total Uses $175.4 $148.2 $137.2 $118.0 $111.7

Capital Structure Cash $13.2 $13.2 $13.2 $13.2 $13.2

Debt 588.1 598.5 610.7 617.8 624.9

Net Debt $574.9 $585.3 $597.5 $604.6 $611.7

Credit Statistics

Debt / Adjusted EBITDA 2.9x 2.9x 3.2x 3.4x 3.4x

Net Debt / Adjusted EBITDA 2.8 2.9 3.1 3.3 3.3

Source: VTTI management

35

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

IV. VTTI Financial Projections

EVERCORE

Preliminary Draft – Confidential

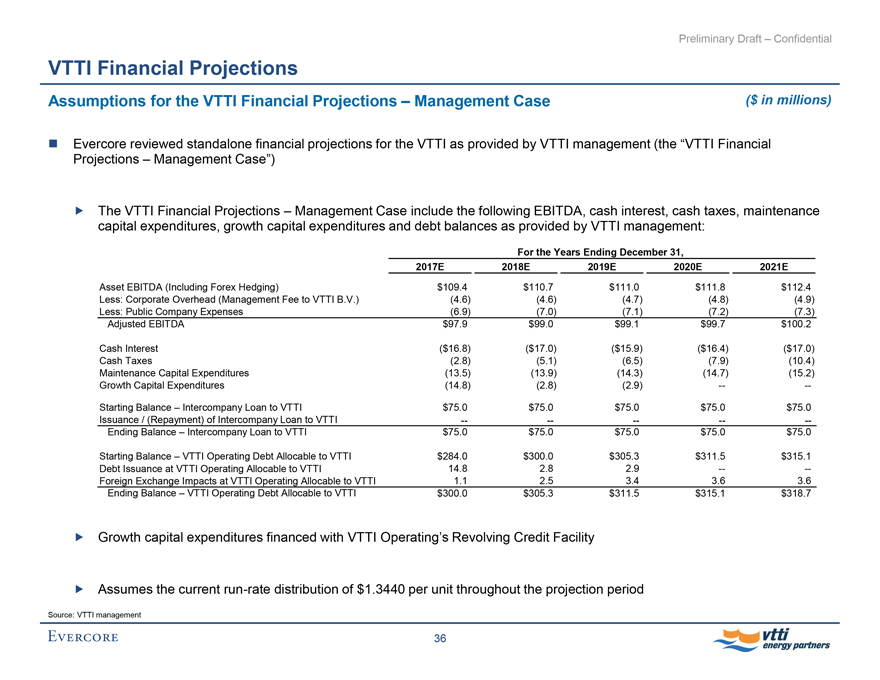

VTTI Financial Projections

Assumptions for the VTTI Financial Projections – Management Case ($ in millions)

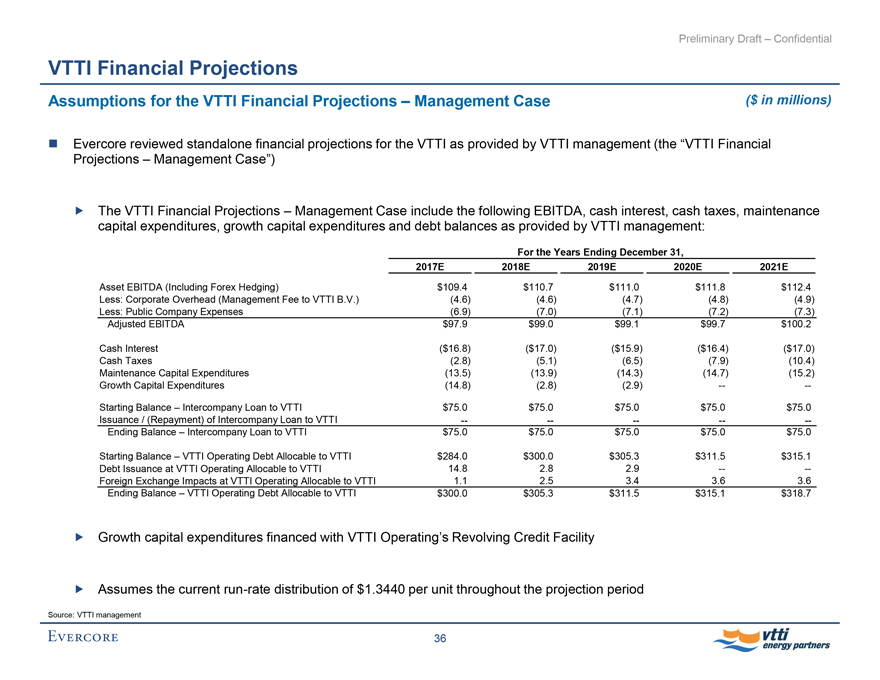

Evercore reviewed standalone financial projections for the VTTI as provided by VTTI management (the “VTTI Financial Projections – Management Case”)

The VTTI Financial Projections – Management Case include the following EBITDA, cash interest, cash taxes, maintenance capital expenditures, growth capital expenditures and debt balances as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Asset EBITDA (Including Forex Hedging) $109.4 $110.7 $111.0 $111.8 $112.4

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Company Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $97.9 $99.0 $99.1 $99.7 $100.2

Cash Interest ($16.8) ($17.0) ($15.9) ($16.4) ($17.0)

Cash Taxes (2.8) (5.1) (6.5) (7.9) (10.4)

Maintenance Capital Expenditures (13.5) (13.9) (14.3) (14.7) (15.2)

Growth Capital Expenditures (14.8) (2.8) (2.9) — —

Starting Balance – Intercompany Loan to VTTI $75.0 $75.0 $75.0 $75.0 $75.0

Issuance / (Repayment) of Intercompany Loan to VTTI — — — — —

Ending Balance – Intercompany Loan to VTTI $75.0 $75.0 $75.0 $75.0 $75.0

Starting Balance – VTTI Operating Debt Allocable to VTTI $284.0 $300.0 $305.3 $311.5 $315.1

Debt Issuance at VTTI Operating Allocable to VTTI 14.8 2.8 2.9 — —

Foreign Exchange Impacts at VTTI Operating Allocable to VTTI 1.1 2.5 3.4 3.6 3.6

Ending Balance – VTTI Operating Debt Allocable to VTTI $300.0 $305.3 $311.5 $315.1 $318.7

Growth capital expenditures financed with VTTI Operating’s Revolving Credit Facility

Assumes the currentrun-rate distribution of $1.3440 per unit throughout the projection period

Source: VTTI management

36

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

VTTI Financial Projections

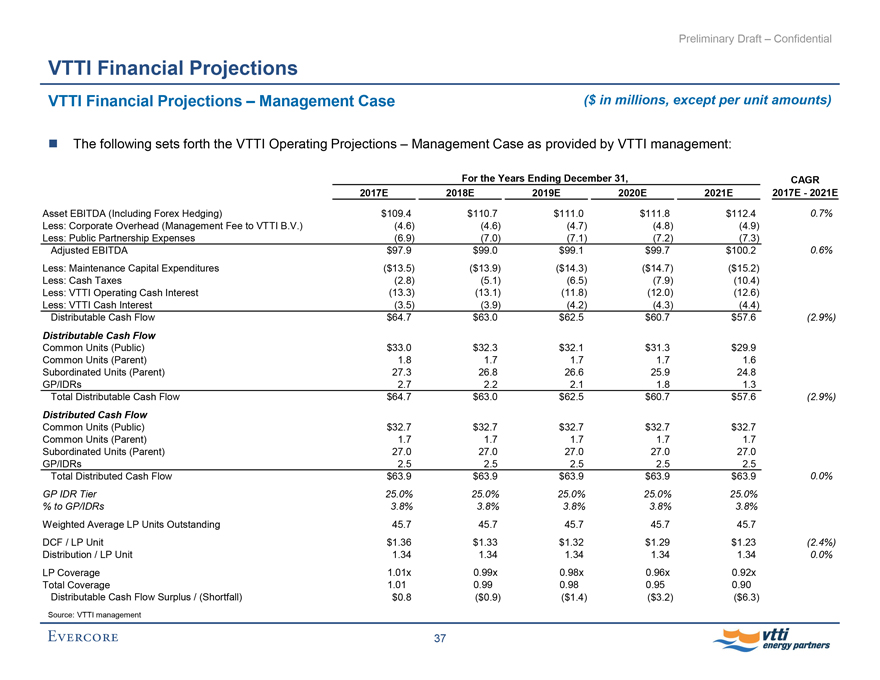

VTTI Financial Projections – Management Case ($ in millions, except per unit amounts)

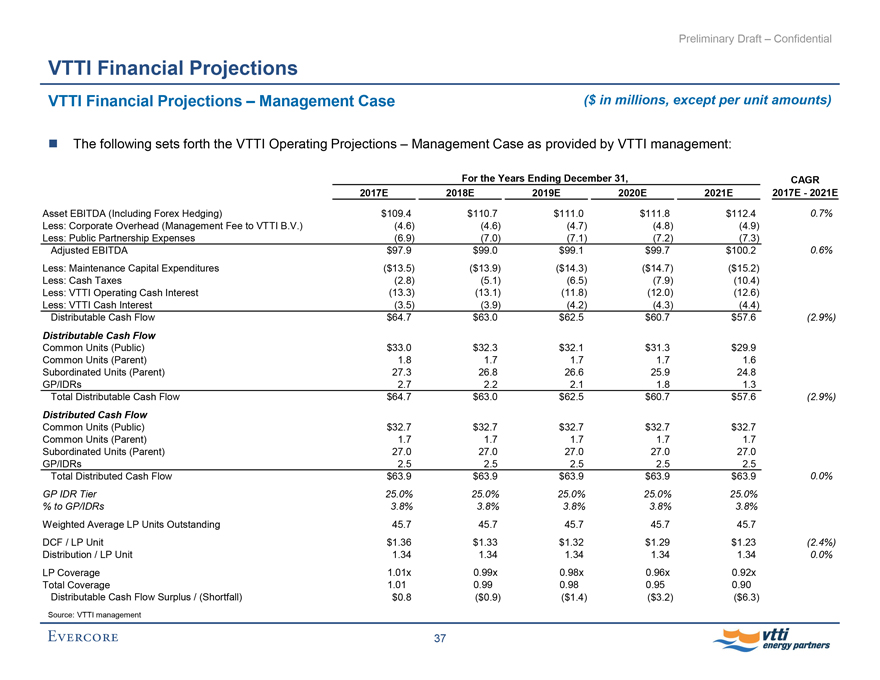

The following sets forth the VTTI Operating Projections – Management Case as provided by VTTI management:

For the Years Ending December 31, CAGR

2017E 2018E 2019E 2020E 2021E 2017E - 2021E

Asset EBITDA (Including Forex Hedging) $109.4 $110.7 $111.0 $111.8 $112.4 0.7%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $97.9 $99.0 $99.1 $99.7 $100.2 0.6%

Less: Maintenance Capital Expenditures ($13.5) ($13.9) ($14.3) ($14.7) ($15.2)

Less: Cash Taxes (2.8) (5.1) (6.5) (7.9) (10.4)

Less: VTTI Operating Cash Interest (13.3) (13.1) (11.8) (12.0) (12.6)

Less: VTTI Cash Interest (3.5) (3.9) (4.2) (4.3) (4.4)

Distributable Cash Flow $64.7 $63.0 $62.5 $60.7 $57.6 (2.9%)

Distributable Cash Flow

Common Units (Public) $33.0 $32.3 $32.1 $31.3 $29.9

Common Units (Parent) 1.8 1.7 1.7 1.7 1.6

Subordinated Units (Parent) 27.3 26.8 26.6 25.9 24.8

GP/IDRs 2.7 2.2 2.1 1.8 1.3

Total Distributable Cash Flow $64.7 $63.0 $62.5 $60.7 $57.6 (2.9%)

Distributed Cash Flow

Common Units (Public) $32.7 $32.7 $32.7 $32.7 $32.7

Common Units (Parent) 1.7 1.7 1.7 1.7 1.7

Subordinated Units (Parent) 27.0 27.0 27.0 27.0 27.0

GP/IDRs 2.5 2.5 2.5 2.5 2.5

Total Distributed Cash Flow $63.9 $63.9 $63.9 $63.9 $63.9 0.0%

GP IDR Tier 25.0% 25.0% 25.0% 25.0% 25.0%

% to GP/IDRs 3.8% 3.8% 3.8% 3.8% 3.8%

Weighted Average LP Units Outstanding 45.7 45.7 45.7 45.7 45.7

DCF / LP Unit $1.36 $1.33 $1.32 $1.29 $1.23 (2.4%)

Distribution / LP Unit 1.34 1.34 1.34 1.34 1.34 0.0%

LP Coverage 1.01x 0.99x 0.98x 0.96x 0.92x

Total Coverage 1.01 0.99 0.98 0.95 0.90

Distributable Cash Flow Surplus / (Shortfall) $0.8 ($0.9) ($1.4) ($3.2) ($6.3)

Source: VTTI management

37

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

VTTI Financial Projections

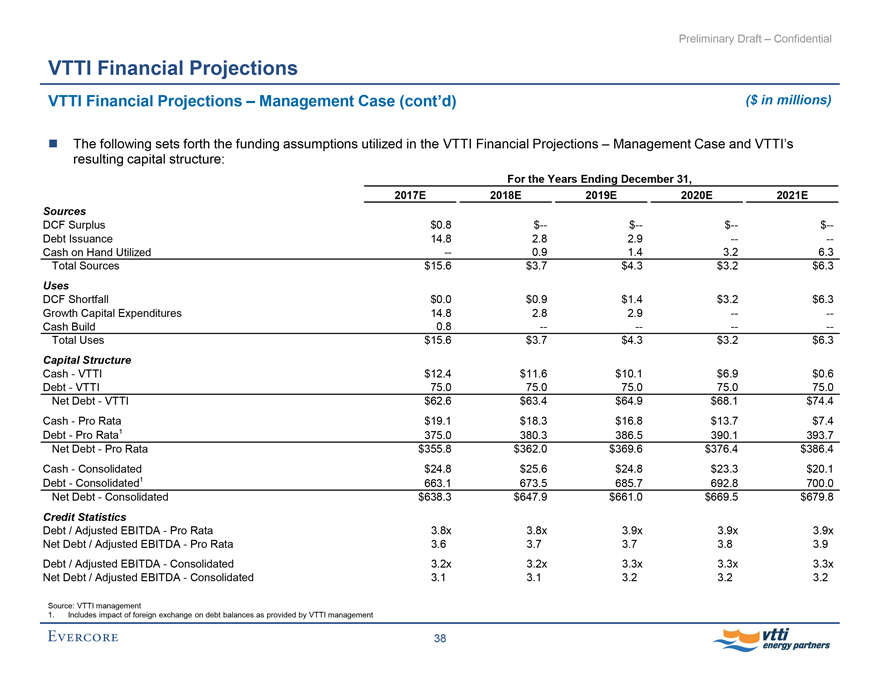

VTTI Financial Projections – Management Case (cont’d) ($ in millions)

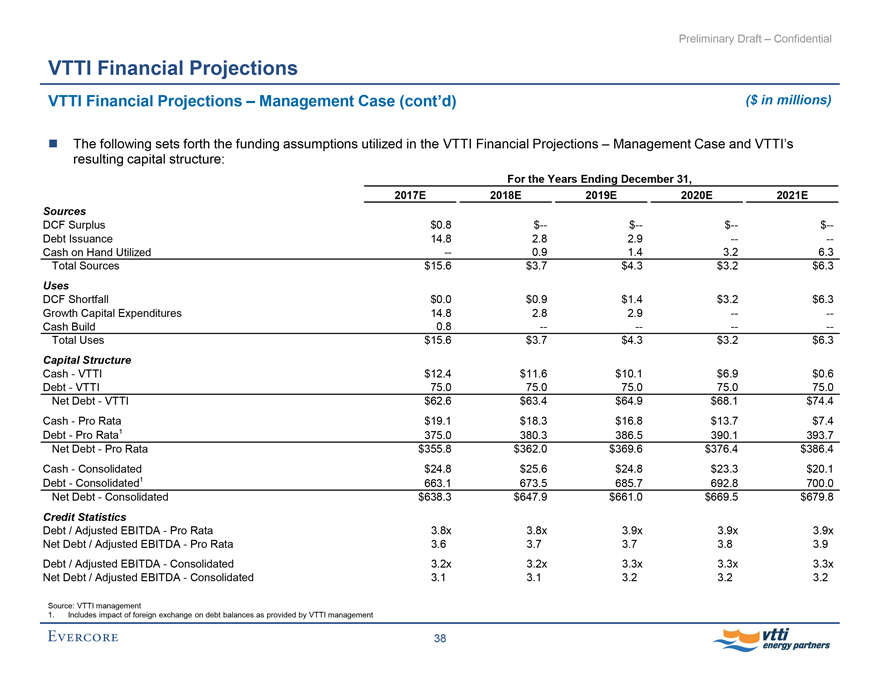

The following sets forth the funding assumptions utilized in the VTTI Financial Projections – Management Case and VTTI’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

DCF Surplus $0.8 $— $— $— $—

Debt Issuance 14.8 2.8 2.9 — —

Cash on Hand Utilized — 0.9 1.4 3.2 6.3

Total Sources $15.6 $3.7 $4.3 $3.2 $6.3

Uses

DCF Shortfall $0.0 $0.9 $1.4 $3.2 $6.3

Growth Capital Expenditures 14.8 2.8 2.9 — —

Cash Build 0.8 — — — —

Total Uses $15.6 $3.7 $4.3 $3.2 $6.3

Capital Structure

Cash - VTTI $12.4 $11.6 $10.1 $6.9 $0.6

Debt - VTTI 75.0 75.0 75.0 75.0 75.0

Net Debt - VTTI $62.6 $63.4 $64.9 $68.1 $74.4

Cash - Pro Rata $19.1 $18.3 $16.8 $13.7 $7.4

Debt - Pro Rata1 375.0 380.3 386.5 390.1 393.7

Net Debt - Pro Rata $355.8 $362.0 $369.6 $376.4 $386.4

Cash - Consolidated $24.8 $25.6 $24.8 $23.3 $20.1

Debt - Consolidated1 663.1 673.5 685.7 692.8 700.0

Net Debt - Consolidated $638.3 $647.9 $661.0 $669.5 $679.8

Credit Statistics

Debt / Adjusted EBITDA - Pro Rata 3.8x 3.8x 3.9x 3.9x 3.9x

Net Debt / Adjusted EBITDA - Pro Rata 3.6 3.7 3.7 3.8 3.9

Debt / Adjusted EBITDA - Consolidated 3.2x 3.2x 3.3x 3.3x 3.3x

Net Debt / Adjusted EBITDA - Consolidated 3.1 3.1 3.2 3.2 3.2

Source: VTTI management

1. Includes impact of foreign exchange on debt balances as provided by VTTI management

38

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

VTTI Financial Projections

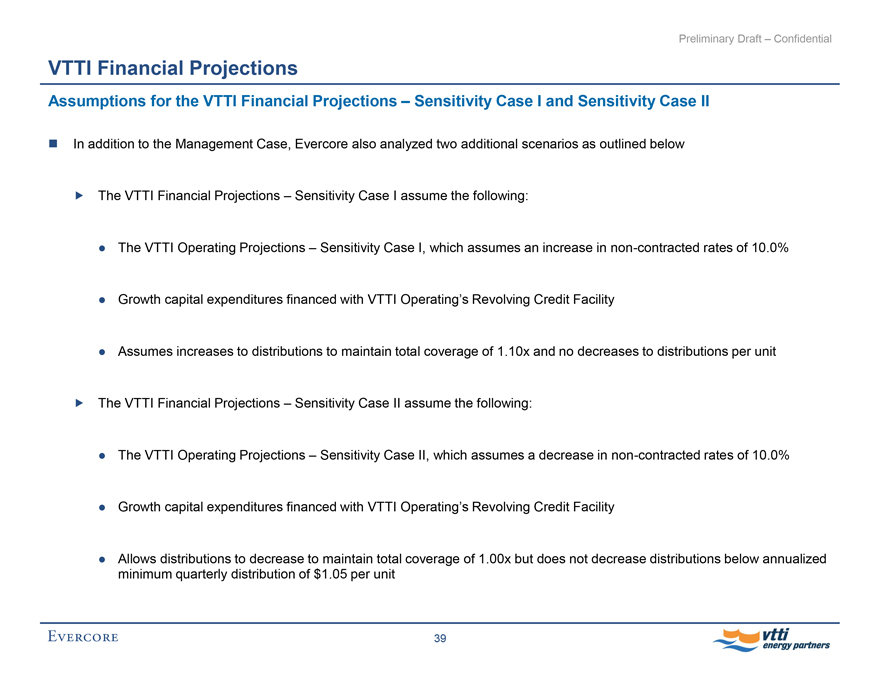

Assumptions for the VTTI Financial Projections – Sensitivity Case I and Sensitivity Case II

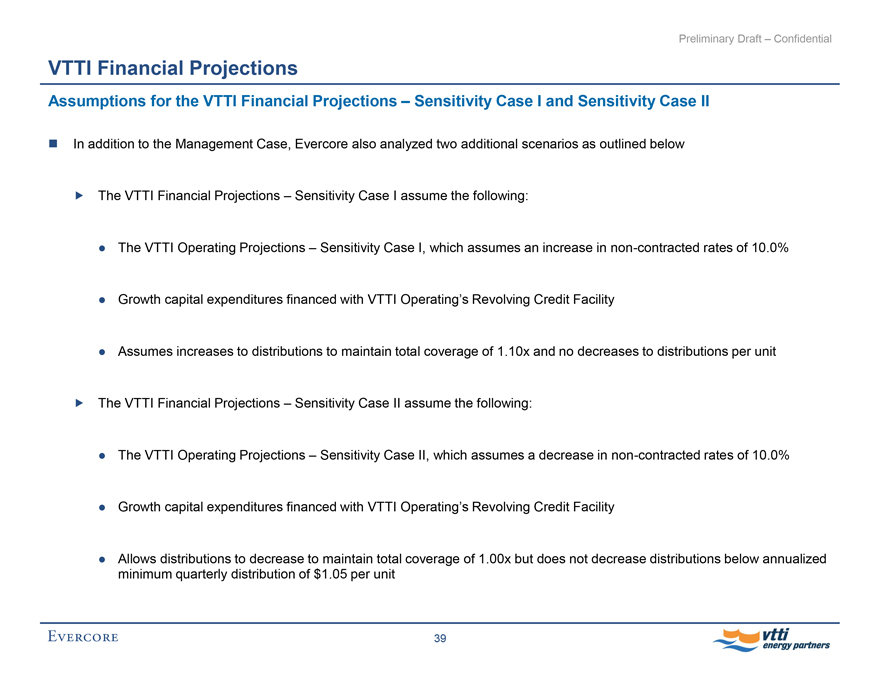

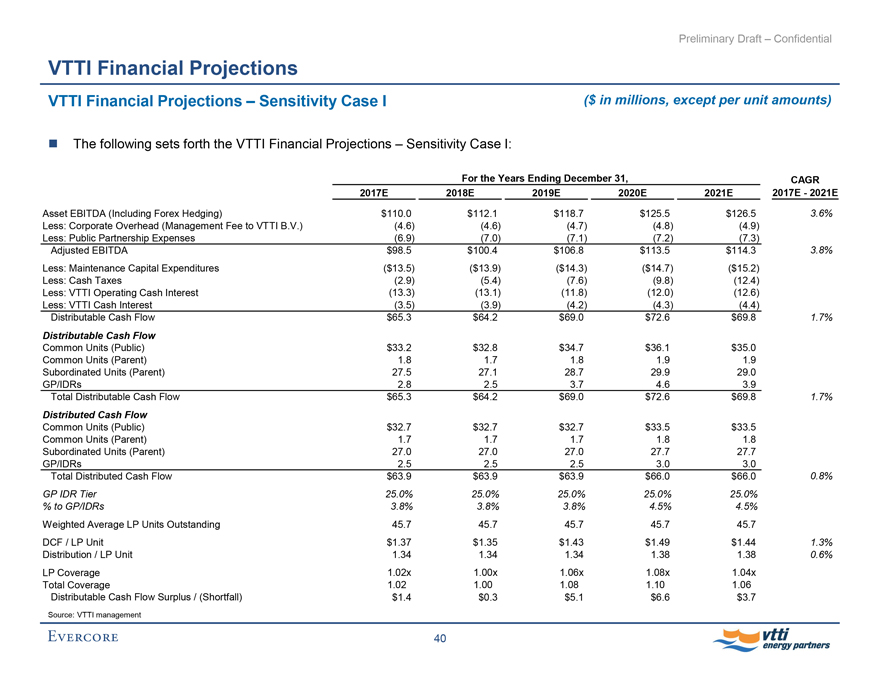

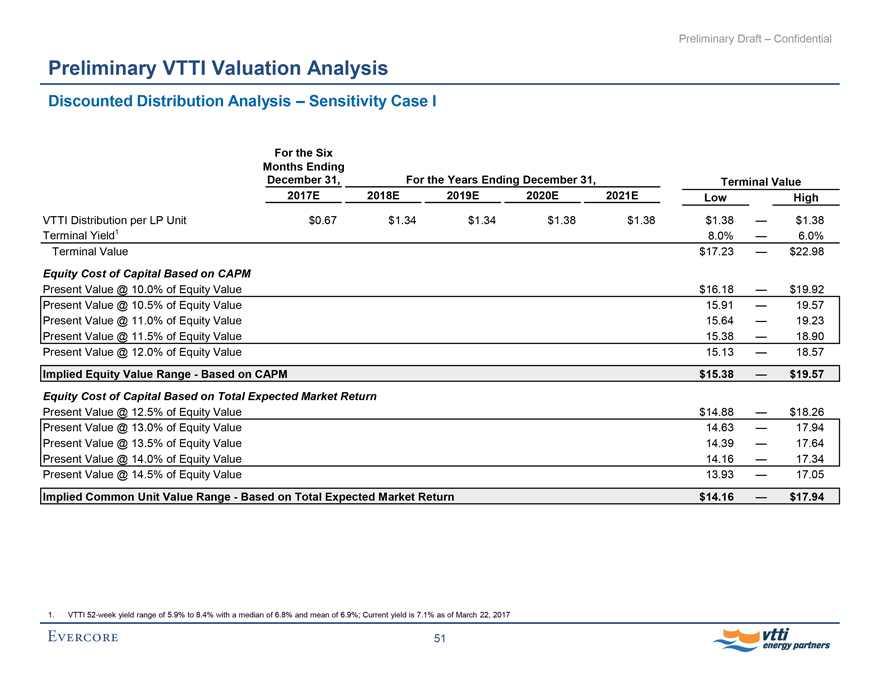

In addition to the Management Case, Evercore also analyzed two additional scenarios as outlined below

The VTTI Financial Projections – Sensitivity Case I assume the following:

The VTTI Operating Projections – Sensitivity Case I, which assumes an increase innon-contracted rates of 10.0%

Growth capital expenditures financed with VTTI Operating’s Revolving Credit Facility

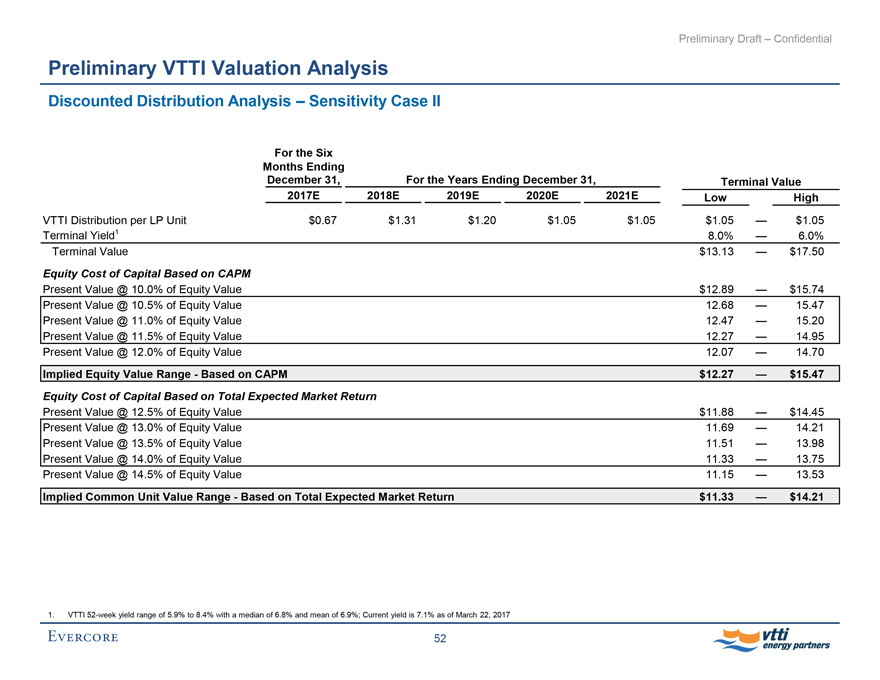

Assumes increases to distributions to maintain total coverage of 1.10x and no decreases to distributions per unit

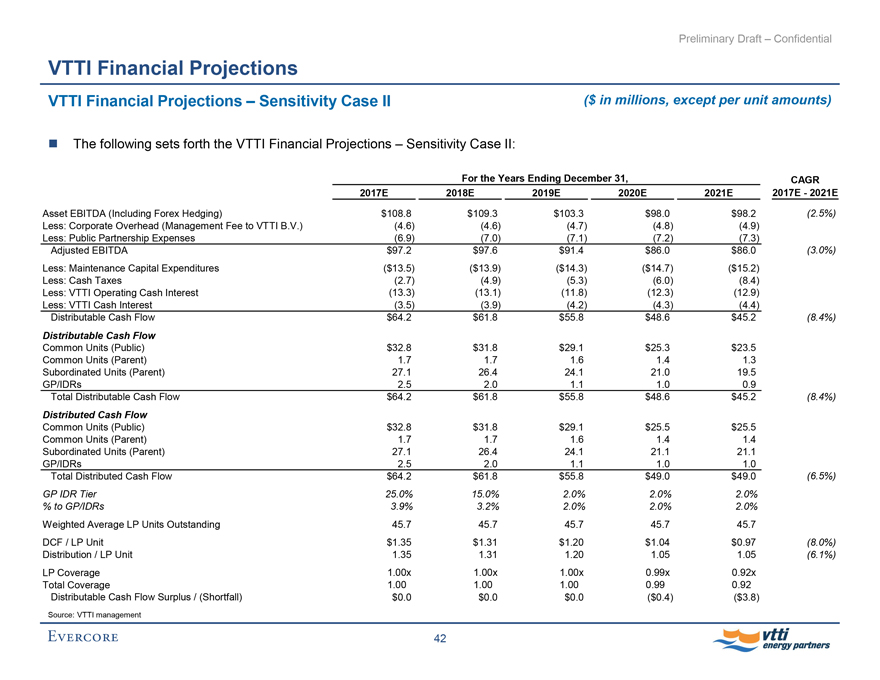

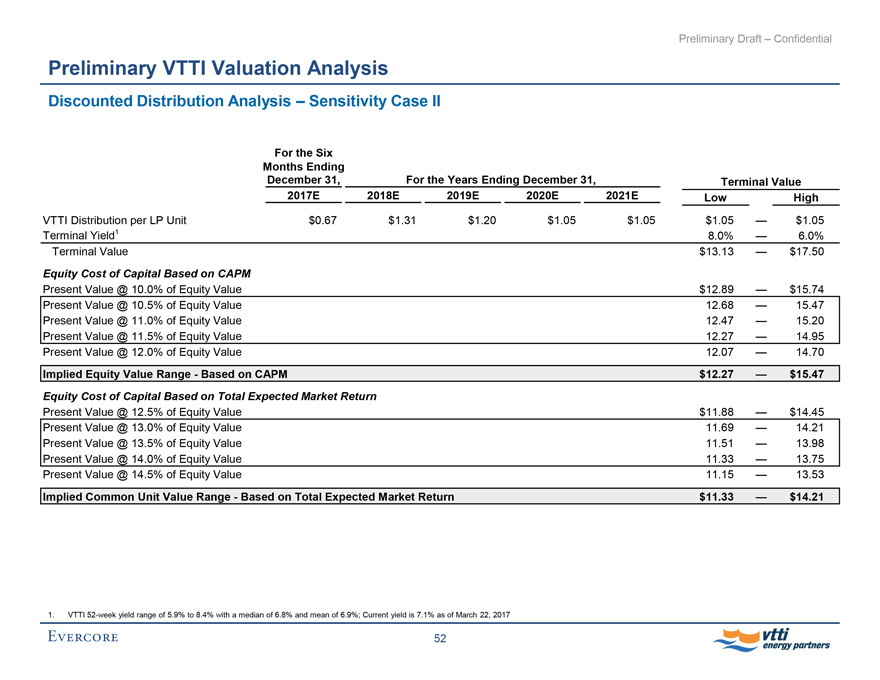

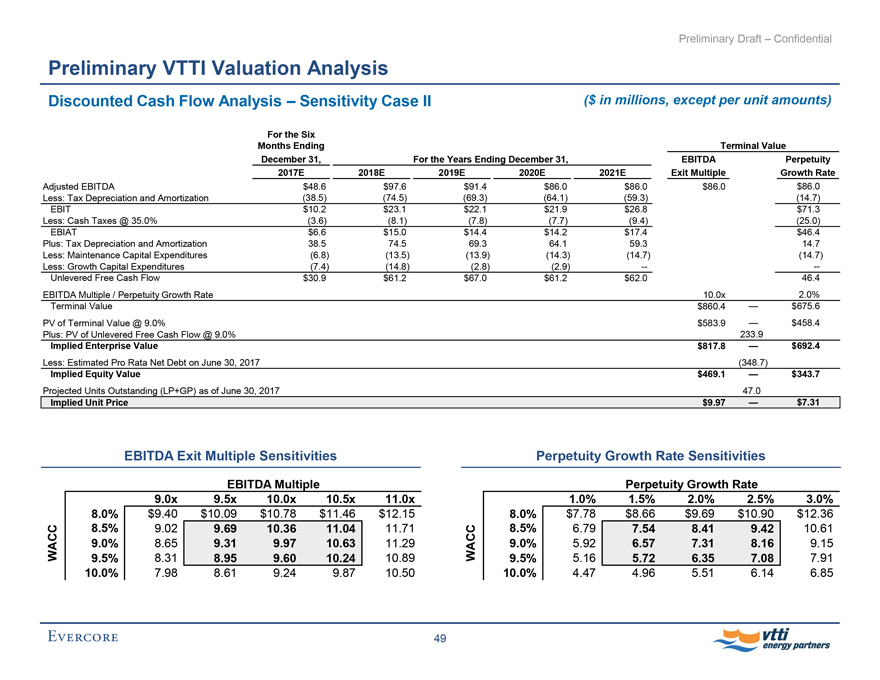

The VTTI Financial Projections – Sensitivity Case II assume the following:

The VTTI Operating Projections – Sensitivity Case II, which assumes a decrease innon-contracted rates of 10.0%

Growth capital expenditures financed with VTTI Operating’s Revolving Credit Facility

Allows distributions to decrease to maintain total coverage of 1.00x but does not decrease distributions below annualized minimum quarterly distribution of $1.05 per unit

39 EVERCORE vtti energy partners

Preliminary Draft – Confidential

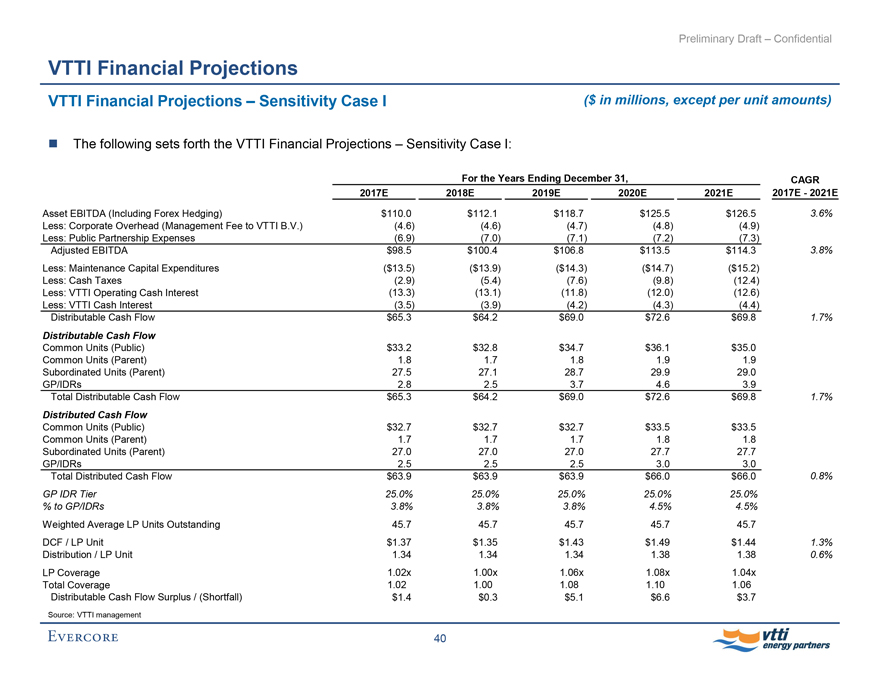

VTTI Financial Projections

VTTI Financial Projections – Sensitivity Case I

($ in millions, except per unit amounts)

The following sets forth the VTTI Financial Projections – Sensitivity Case I:

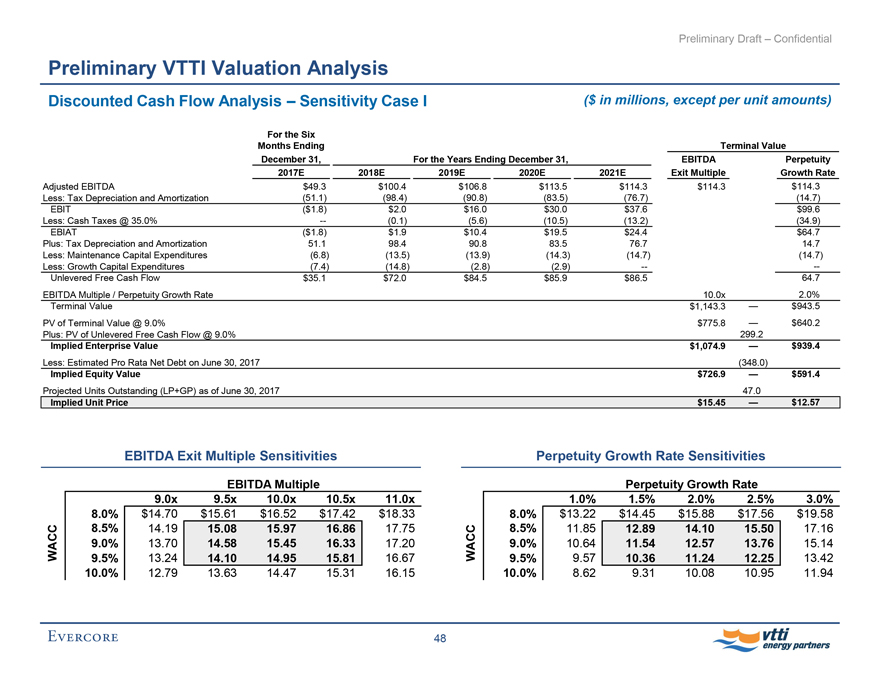

For the Years Ending December 31, CAGR 2017E 2018E 2019E 2020E 2021E 2017E - 2021E

Asset EBITDA (Including Forex Hedging) $110.0 $112.1 $118.7 $125.5 $126.5 3.6%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $98.5 $100.4 $106.8 $113.5 $114.3 3.8%

Less: Maintenance Capital Expenditures ($13.5) ($13.9) ($14.3) ($14.7) ($15.2)

Less: Cash Taxes (2.9) (5.4) (7.6) (9.8) (12.4)

Less: VTTI Operating Cash Interest (13.3) (13.1) (11.8) (12.0) (12.6)

Less: VTTI Cash Interest (3.5) (3.9) (4.2) (4.3) (4.4)

Distributable Cash Flow $65.3 $64.2 $69.0 $72.6 $69.8 1.7%

Distributable Cash Flow

Common Units (Public)

$33.2 $32.8 $34.7 $36.1 $35.0

Common Units (Parent) 1.8 1.7 1.8 1.9 1.9

Subordinated Units (Parent) 27.5 27.1 28.7 29.9 29.0

GP/IDRs 2.8 2.5 3.7 4.6 3.9

Total Distributable Cash Flow $65.3 $64.2 $69.0 $72.6 $69.8 1.7%

Distributed Cash Flow

Common Units (Public) $32.7 $32.7 $32.7 $33.5 $33.5

Common Units (Parent) 1.7 1.7 1.7 1.8 1.8

Subordinated Units (Parent) 27.0 27.0 27.0 27.7 27.7

GP/IDRs 2.5 2.5 2.5 3.0 3.0

Total Distributed Cash Flow $63.9 $63.9 $63.9 $66.0 $66.0 0.8%

GP IDR Tier 25.0% 25.0% 25.0% 25.0% 25.0%

% to GP/IDRs 3.8% 3.8% 3.8% 4.5% 4.5%

Weighted Average LP Units Outstanding 45.7 45.7 45.7 45.7 45.7

DCF / LP Unit $1.37 $1.35 $1.43 $1.49 $1.44 1.3%

Distribution / LP Unit 1.34 1.34 1.34 1.38 1.38 0.6%

LP Coverage 1.02x 1.00x 1.06x 1.08x 1.04x

Total Coverage 1.02 1.00 1.08 1.10 1.06

Distributable Cash Flow Surplus / (Shortfall) $1.4 $0.3 $5.1 $6.6 $3.7

Source: VTTI management 40 EVERCORE vtti energy partners

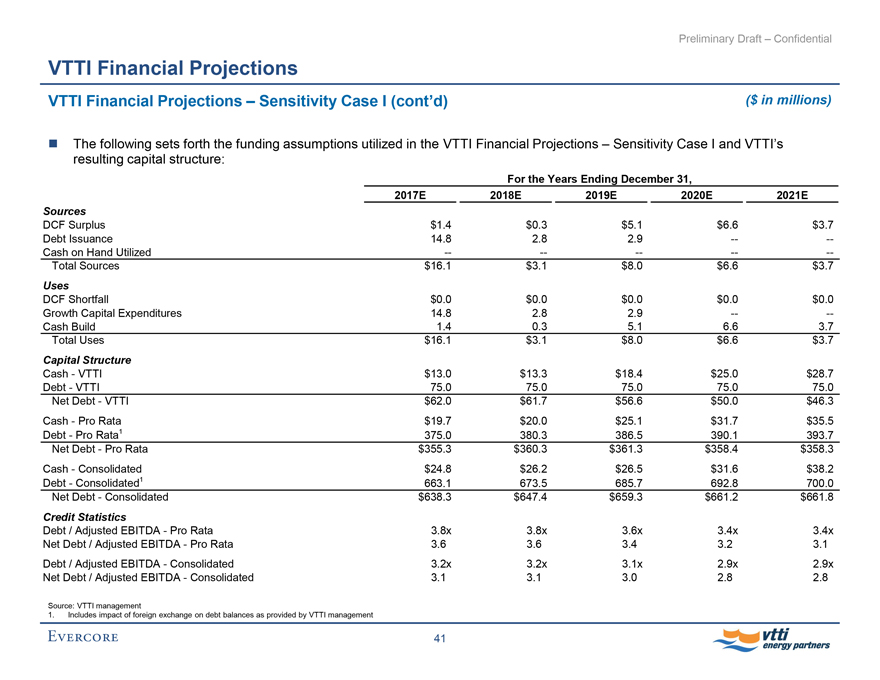

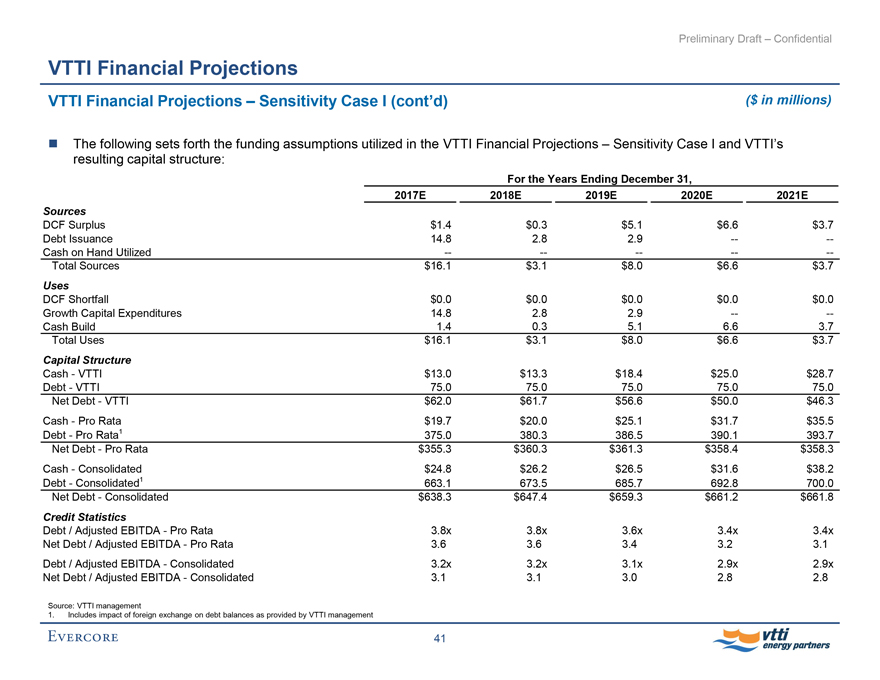

Preliminary Draft – Confidential VTTI Financial Projections VTTI Financial Projections – Sensitivity Case I (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Financial Projections – Sensitivity Case I and VTTI’s resulting capital structure:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Sources

DCF Surplus $1.4 $0.3 $5.1 $6.6 $3.7

Debt Issuance 14.8 2.8 2.9 — —

Cash on Hand Utilized — — — — —

Total Sources $16.1 $3.1 $8.0 $6.6 $3.7

Uses DCF Shortfall $0.0 $0.0 $0.0 $0.0 $0.0

Growth Capital Expenditures 14.8 2.8 2.9 — —

Cash Build 1.4 0.3 5.1 6.6 3.7

Total Uses $16.1 $3.1 $8.0 $6.6 $3.7

Capital Structure Cash - VTTI $13.0 $13.3 $18.4 $25.0 $28.7

Debt - VTTI 75.0 75.0 75.0 75.0 75.0

Net Debt - VTTI $62.0 $61.7 $56.6 $50.0 $46.3

Cash - Pro Rata $19.7 $20.0 $25.1 $31.7 $35.5

Debt - Pro Rata1 375.0 380.3 386.5 390.1 393.7

Net Debt - Pro Rata $355.3 $360.3 $361.3 $358.4 $358.3

Cash - Consolidated $24.8 $26.2 $26.5 $31.6 $38.2

Debt - Consolidated1 663.1 673.5 685.7 692.8 700.0

Net Debt - Consolidated $638.3 $647.4 $659.3 $661.2 $661.8

Credit Statistics Debt / Adjusted EBITDA - Pro Rata 3.8x 3.8x 3.6x 3.4x 3.4x

Net Debt / Adjusted EBITDA - Pro Rata 3.6 3.6 3.4 3.2 3.1

Debt / Adjusted EBITDA - Consolidated 3.2x 3.2x 3.1x 2.9x 2.9x

Net Debt / Adjusted EBITDA - Consolidated 3.1 3.1 3.0 2.8 2.8

Source: VTTI management

1. Includes impact of foreign exchange on debt balances as provided by VTTI management

41 EVERCORE vtti energy partners

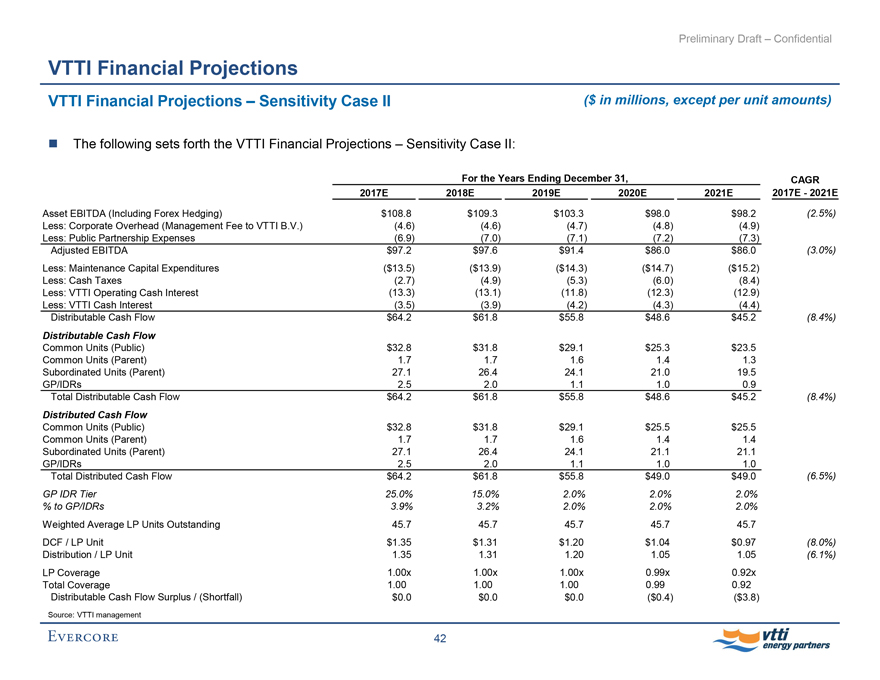

Preliminary Draft – Confidential VTTI Financial Projections

VTTI Financial Projections – Sensitivity Case II

($ in millions, except per unit amounts)

The following sets forth the VTTI Financial Projections – Sensitivity Case II:

For the Years Ending December 31, CAGR 2017E 2018E 2019E 2020E 2021E 2017E - 2021E

Asset EBITDA (Including Forex Hedging) $108.8 $109.3 $103.3 $98.0 $98.2 (2.5%)

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $97.2 $97.6 $91.4 $86.0 $86.0 (3.0%)

Less: Maintenance Capital Expenditures ($13.5) ($13.9) ($14.3) ($14.7) ($15.2)

Less: Cash Taxes (2.7) (4.9) (5.3) (6.0) (8.4)

Less: VTTI Operating Cash Interest (13.3) (13.1) (11.8) (12.3) (12.9)

Less: VTTI Cash Interest (3.5) (3.9) (4.2) (4.3) (4.4)

Distributable Cash Flow $64.2 $61.8 $55.8 $48.6 $45.2 (8.4%)

Distributable Cash Flow

Common Units (Public) $32.8 $31.8$29.1 $25.3 $23.5

Common Units (Parent) 1.7 1.7 1.6 1.4 1.3

Subordinated Units (Parent) 27.1 26.4 24.1 21.0 19.5

GP/IDRs 2.5 2.0 1.1 1.0 0.9

Total Distributable Cash Flow $64.2 $61.8 $55.8 $48.6 $45.2 (8.4%)

Distributed Cash Flow

Common Units (Public) $32.8 $31.8 $29.1 $25.5 $25.5

Common Units (Parent) 1.7 1.7 1.6 1.4 1.4

Subordinated Units (Parent) 27.1 26.4 24.1 21.1 21.1

GP/IDRs 2.5 2.0 1.1 1.0 1.0

Total Distributed Cash Flow $64.2 $61.8 $55.8 $49.0 $49.0 (6.5%)

GP IDR Tier 25.0% 15.0% 2.0% 2.0% 2.0%

% to GP/IDRs 3.9% 3.2% 2.0% 2.0% 2.0%

Weighted Average LP Units Outstanding 45.7 45.7 45.7 45.7 45.7

DCF / LP Unit $1.35 $1.31 $1.20 $1.04 $0.97 (8.0%)

Distribution / LP Unit 1.35 1.31 1.20 1.05 1.05 (6.1%)

LP Coverage 1.00x 1.00x 1.00x 0.99x 0.92x

Total Coverage 1.00 1.00 1.00 0.99 0.92

Distributable Cash Flow Surplus / (Shortfall) $0.0 $0.0 $0.0 ($0.4) ($3.8)

Source: VTTI management

42 EVERCORE vtti energy partners

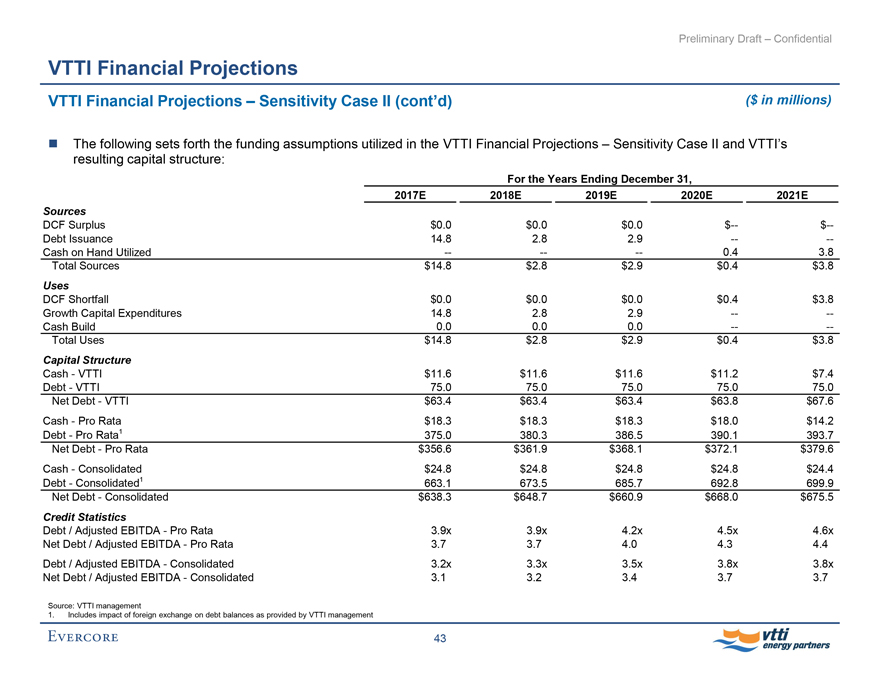

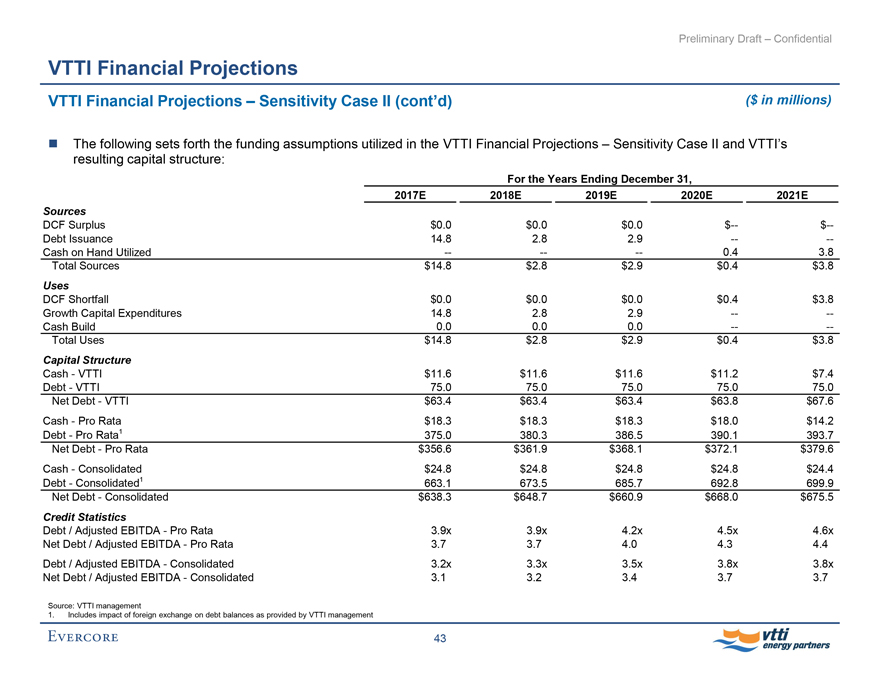

Preliminary Draft – Confidential VTTI Financial Projections

VTTI Financial Projections – Sensitivity Case II (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Financial Projections – Sensitivity Case II and VTTI’s resulting capital structure:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E

Sources

DCF Surplus $0.0 $0.0 $0.0 $— $—

Debt Issuance 14.8 2.8 2.9 — —

Cash on Hand Utilized — — — 0.4 3.8

Total Sources $14.8 $2.8 $2.9 $0.4 $3.8

Uses

DCF Shortfall $0.0 $0.0 $0.0 $0.4 $3.8

Growth Capital Expenditures 14.8 2.8 2.9 — —

Cash Build 0.0 0.0 0.0 — —

Total Uses $14.8 $2.8 $2.9 $0.4 $3.8

Capital Structure

Cash - VTTI $11.6 $11.6 $11.6 $11.2 $7.4

Debt - VTTI 75.0 75.0 75.0 75.0 75.0

Net Debt - VTTI $63.4 $63.4 $63.4 $63.8 $67.6

Cash - Pro Rata $18.3 $18.3 $18.3 $18.0 $14.2

Debt - Pro Rata1 375.0 380.3 386.5 390.1 393.7

Net Debt - Pro Rata $356.6 $361.9 $368.1 $372.1 $379.6

Cash - Consolidated $24.8 $24.8 $24.8 $24.8 $24.4

Debt - Consolidated1 663.1 673.5 685.7 692.8 699.9

Net Debt - Consolidated $638.3 $648.7 $660.9 $668.0 $675.5

Credit Statistics

Debt / Adjusted EBITDA - Pro Rata 3.9x 3.9x 4.2x 4.5x 4.6x

Net Debt / Adjusted EBITDA - Pro Rata 3.7 3.7 4.0 4.3 4.4

Debt / Adjusted EBITDA - Consolidated 3.2x 3.3x 3.5x 3.8x 3.8x

Net Debt / Adjusted EBITDA - Consolidated 3.1 3.2 3.4 3.7 3.7

Source: VTTI management

1. Includes impact of foreign exchange on debt balances as provided by VTTI management

43 EVERCORE vtti energy partners

Preliminary Draft – Confidential

V. Preliminary VTTI Valuation Analysis

EVERCORE

Preliminary Draft – Confidential

Preliminary VTTI Valuation Analysis

Valuation Methodologies

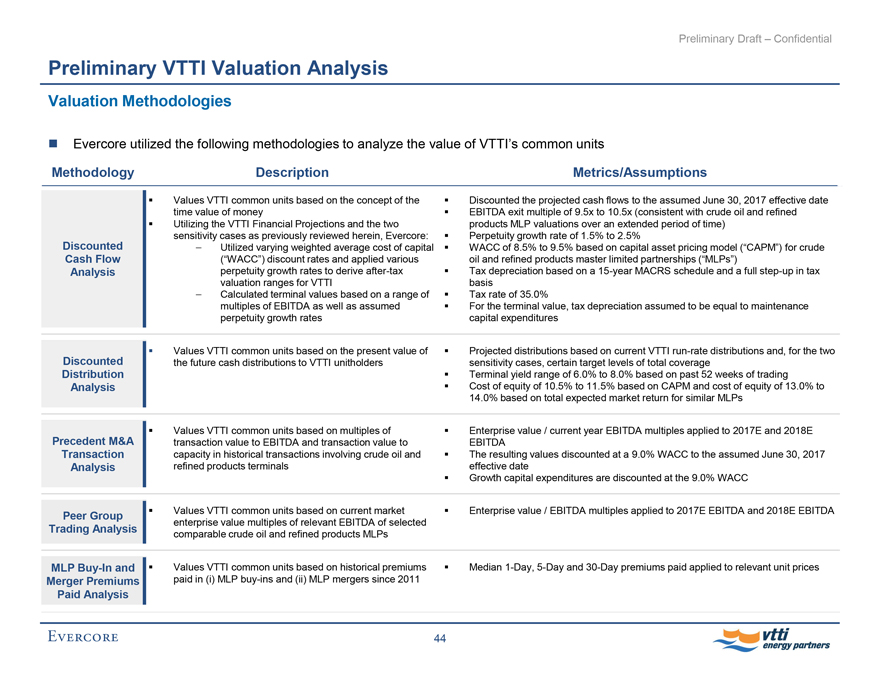

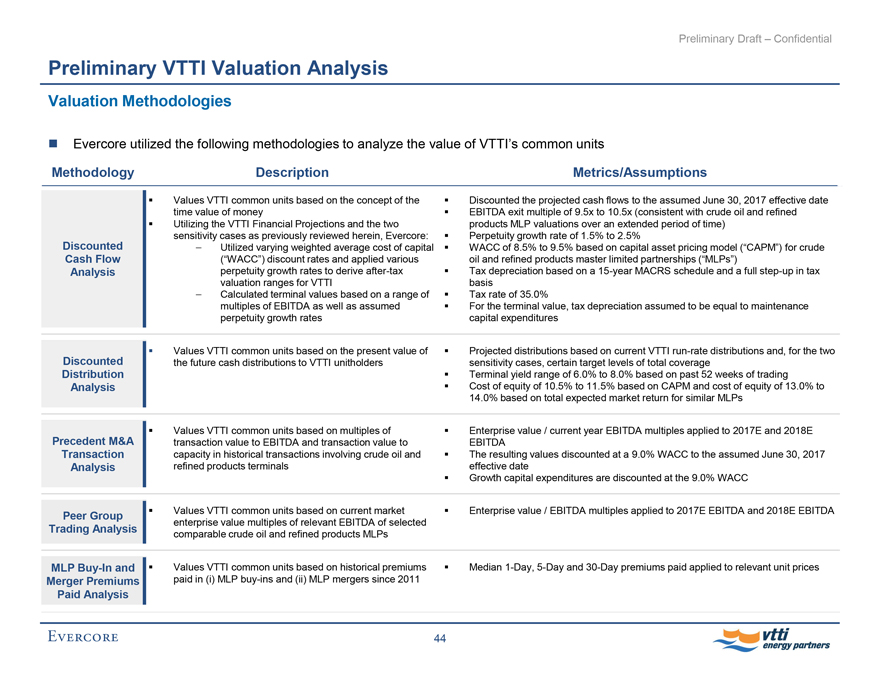

Evercore utilized the following methodologies to analyze the value of VTTI’s common units

Methodology Description Metrics/Assumptions

Values VTTI common units based on the concept of the Discounted the projected cash flows to the assumed June 30, 2017 effective date

time value of money EBITDA exit multiple of 9.5x to 10.5x (consistent with crude oil and refined

Utilizing the VTTI Financial Projections and the two products MLP valuations over an extended period of time)

sensitivity cases as previously reviewed herein, Evercore: Perpetuity growth rate of 1.5% to 2.5%

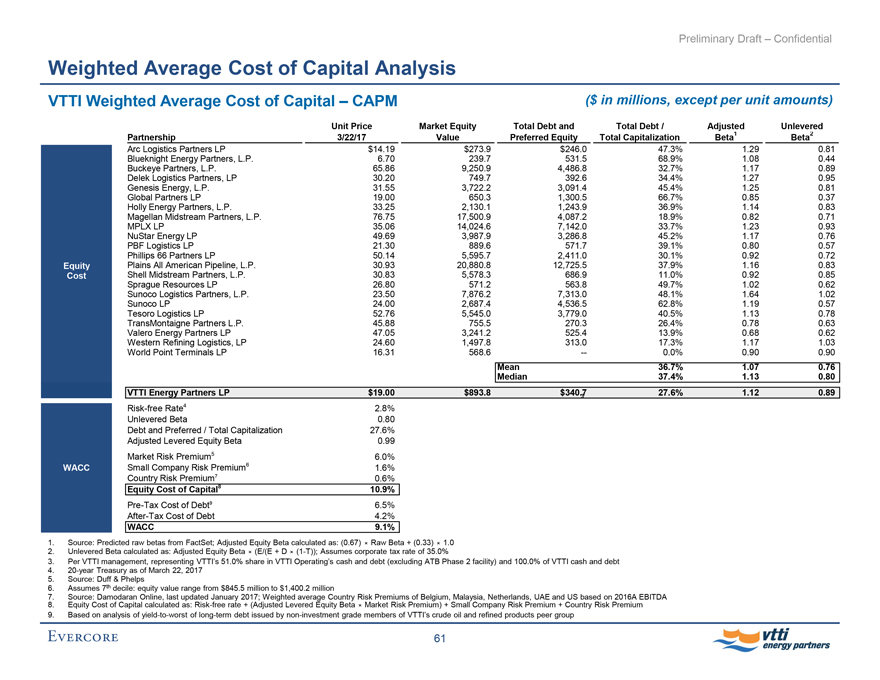

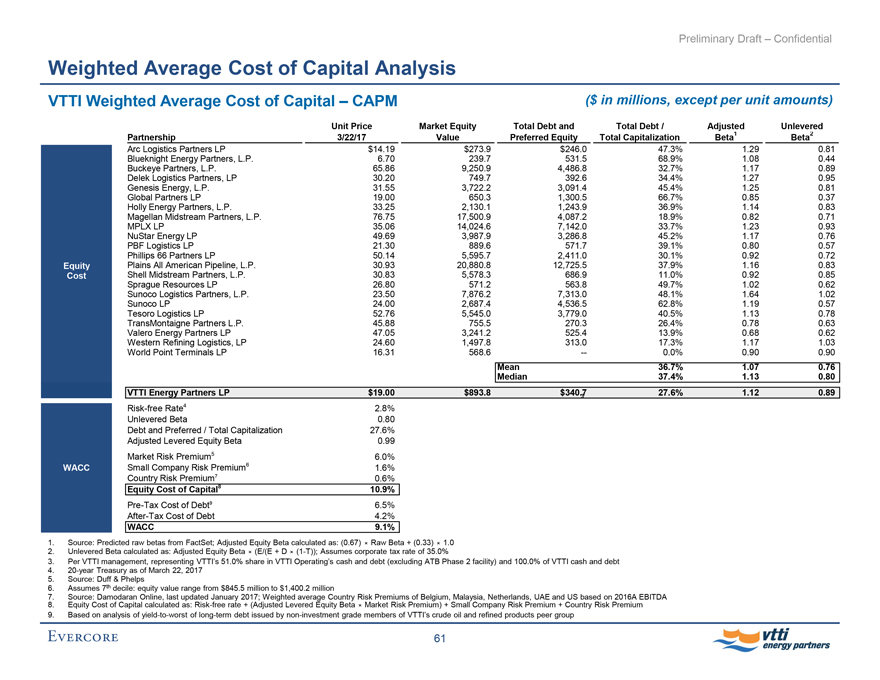

Discounted Utilized varying weighted average cost of capital WACC of 8.5% to 9.5% based on capital asset pricing model (“CAPM”) for crude

Cash Flow (“WACC”) discount rates and applied various oil and refined products master limited partnerships (“MLPs”)

Analysis perpetuity growth rates to deriveafter-tax Tax depreciation based on a15-year MACRS schedule and a fullstep-up in tax

valuation ranges for VTTI basis

Calculated terminal values based on a range of Tax rate of 35.0%

multiples of EBITDA as well as assumed For the terminal value, tax depreciation assumed to be equal to maintenance

perpetuity growth rates capital expenditures

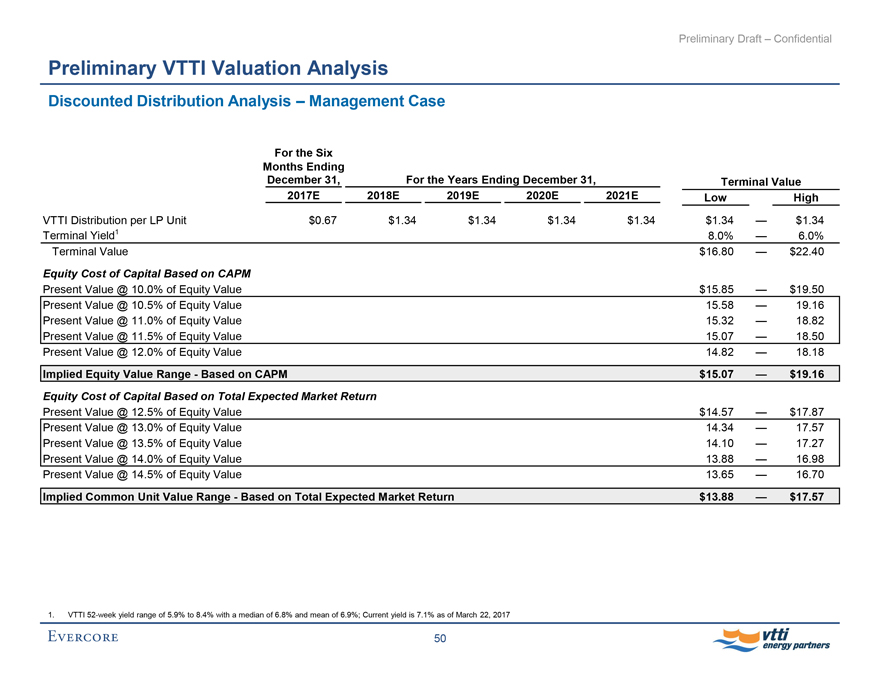

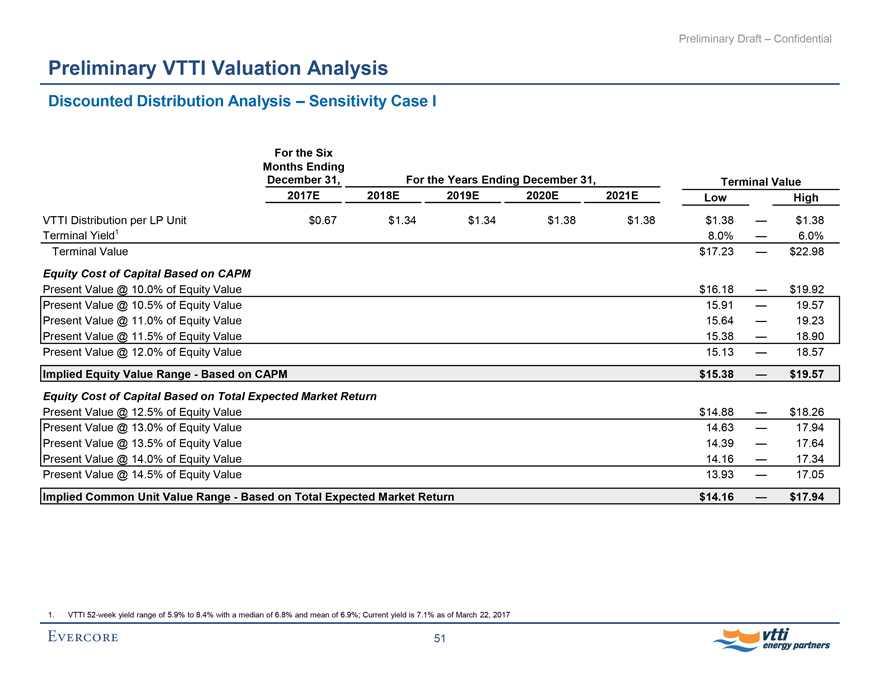

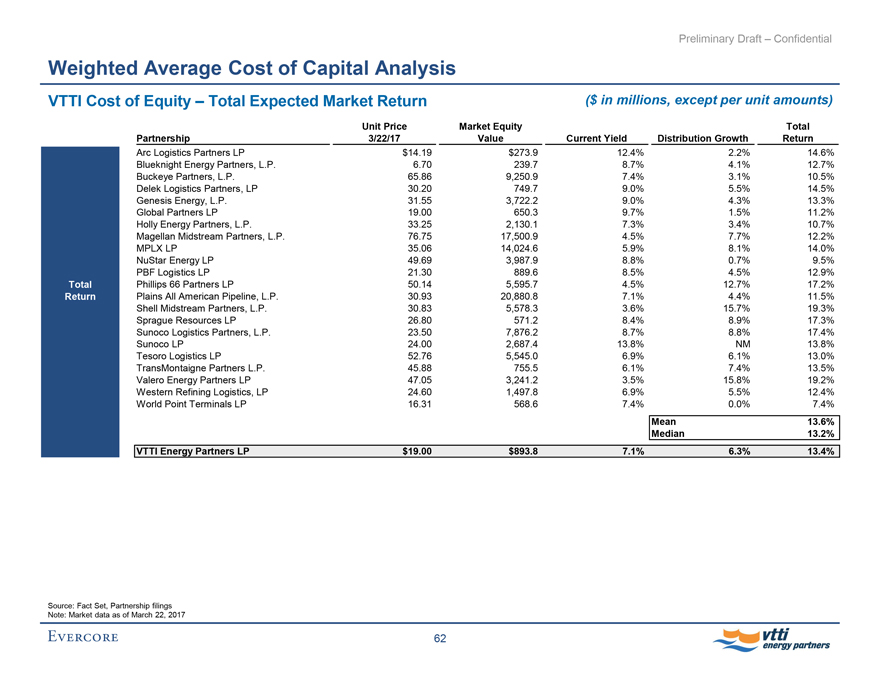

Values VTTI common units based on the present value of Projected distributions based on current VTTIrun-rate distributions and, for the two

Discounted the future cash distributions to VTTI unitholders sensitivity cases, certain target levels of total coverage

Distribution Terminal yield range of 6.0% to 8.0% based on past 52 weeks of trading

Analysis Cost of equity of 10.5% to 11.5% based on CAPM and cost of equity of 13.0% to

14.0% based on total expected market return for similar MLPs

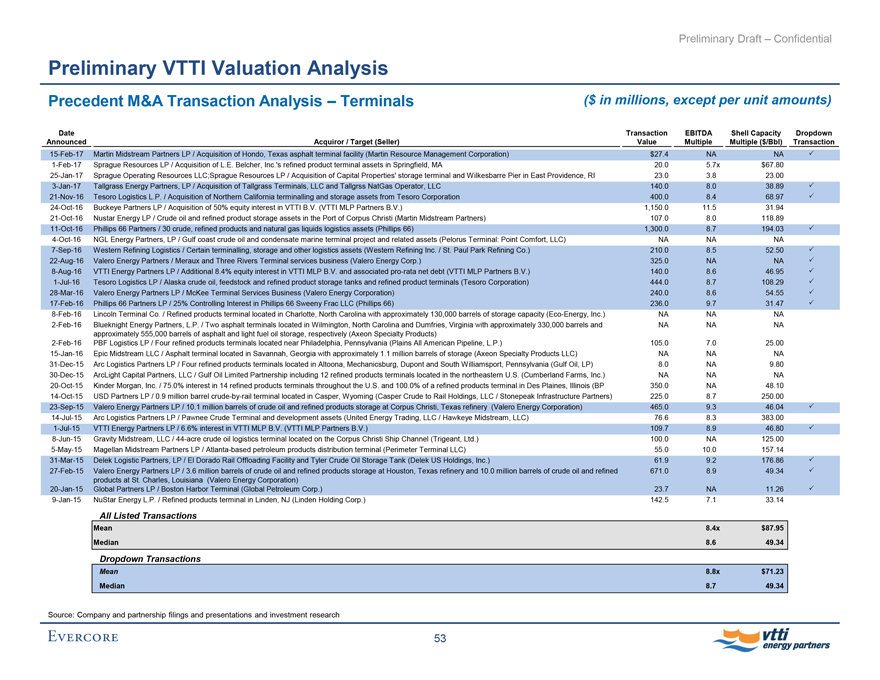

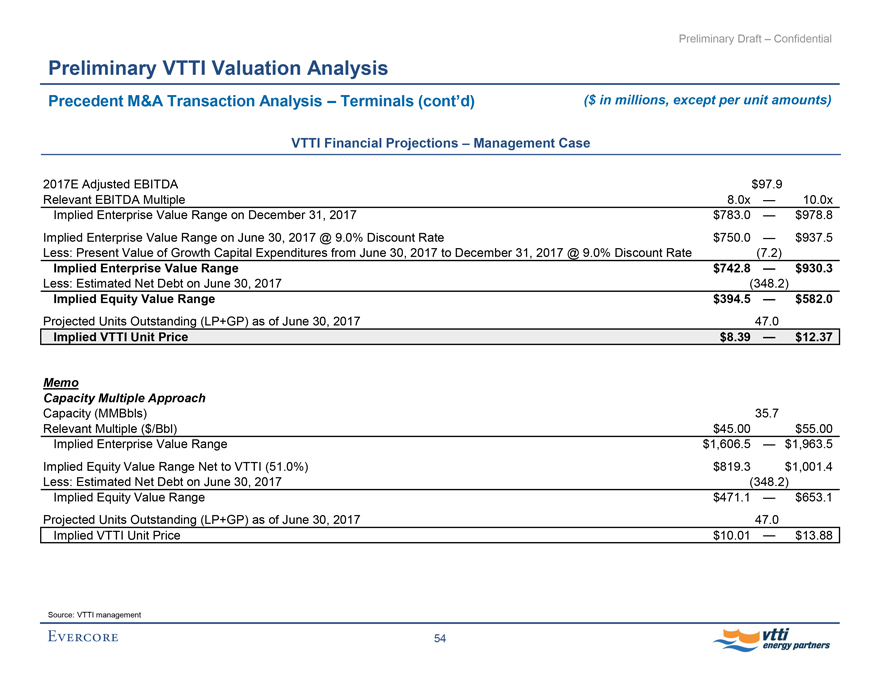

Values VTTI common units based on multiples of Enterprise value / current year EBITDA multiples applied to 2017E and 2018E

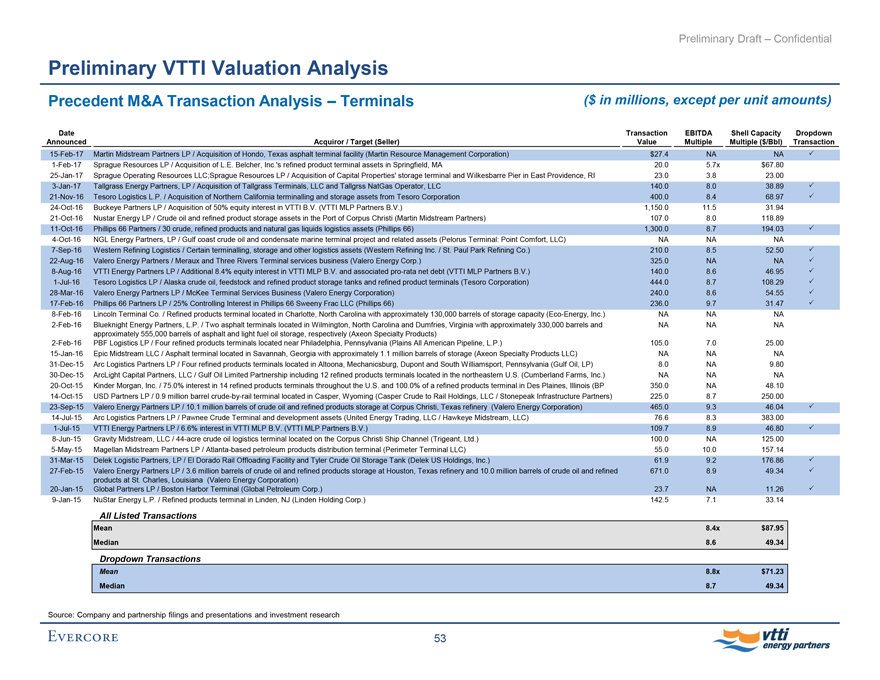

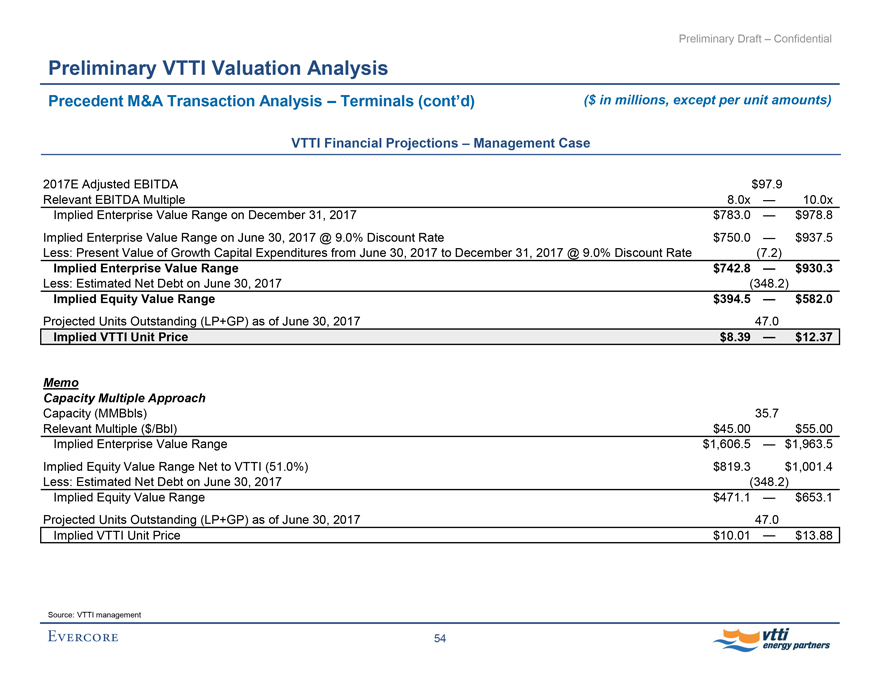

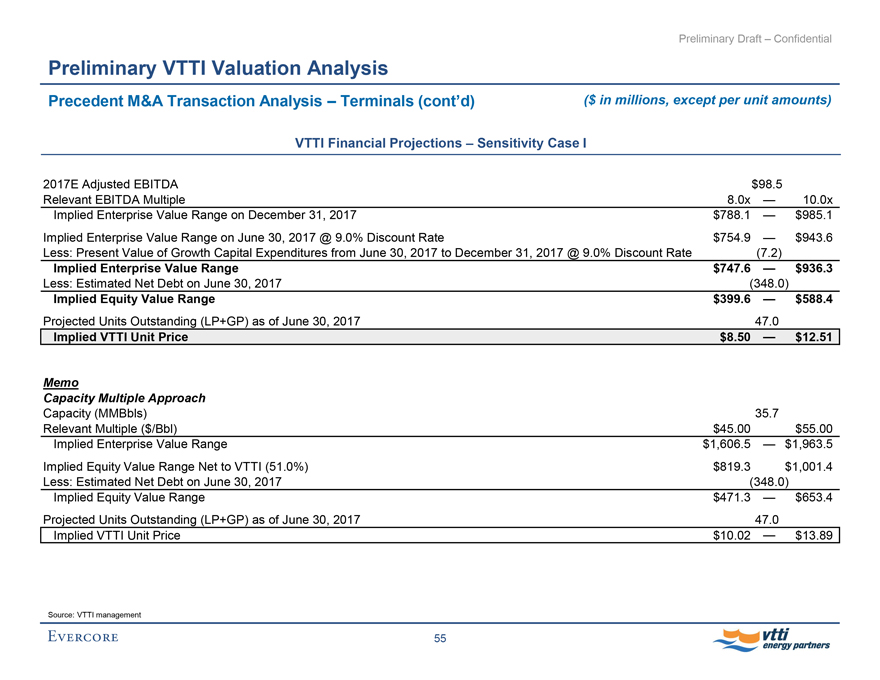

Precedent M&A transaction value to EBITDA and transaction value to EBITDA

Transaction capacity in historical transactions involving crude oil and The resulting values discounted at a 9.0% WACC to the assumed June 30, 2017

Analysis refined products terminals effective date

Growth capital expenditures are discounted at the 9.0% WACC

Peer Group Values VTTI common units based on current market Enterprise value / EBITDA multiples applied to 2017E EBITDA and 2018E EBITDA

enterprise value multiples of relevant EBITDA of selected

Trading Analysis comparable crude oil and refined products MLPs

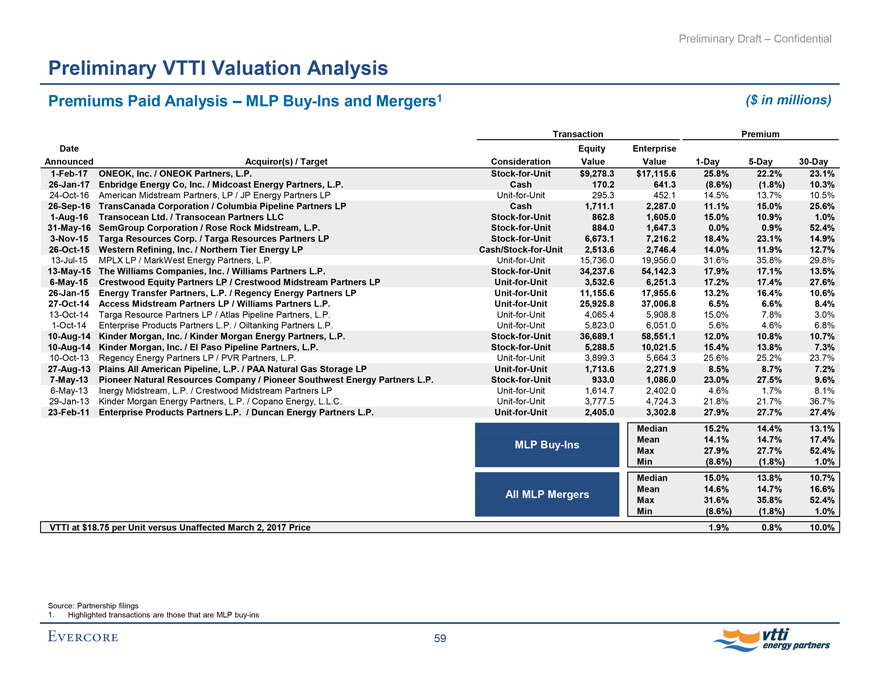

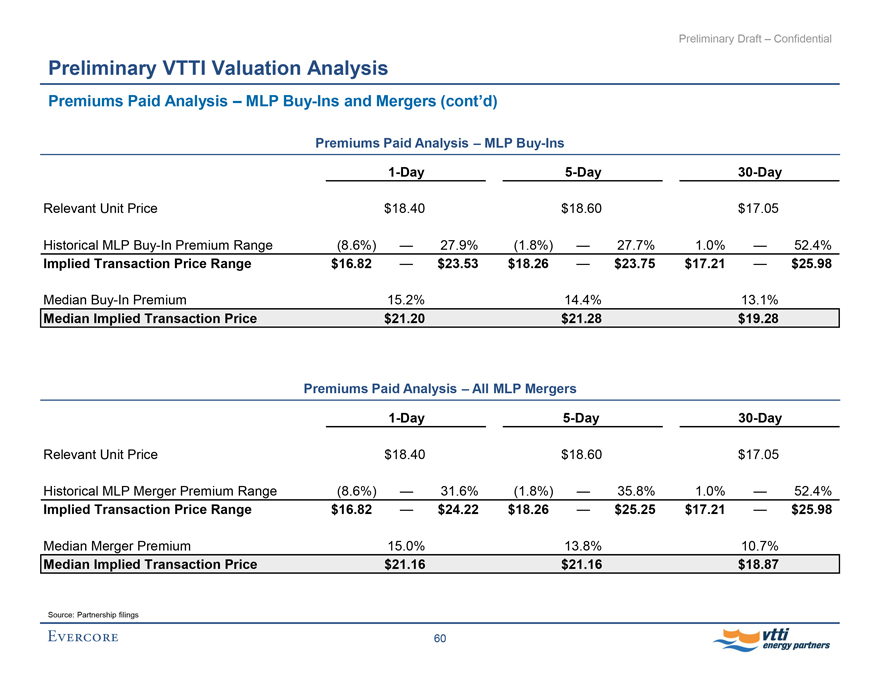

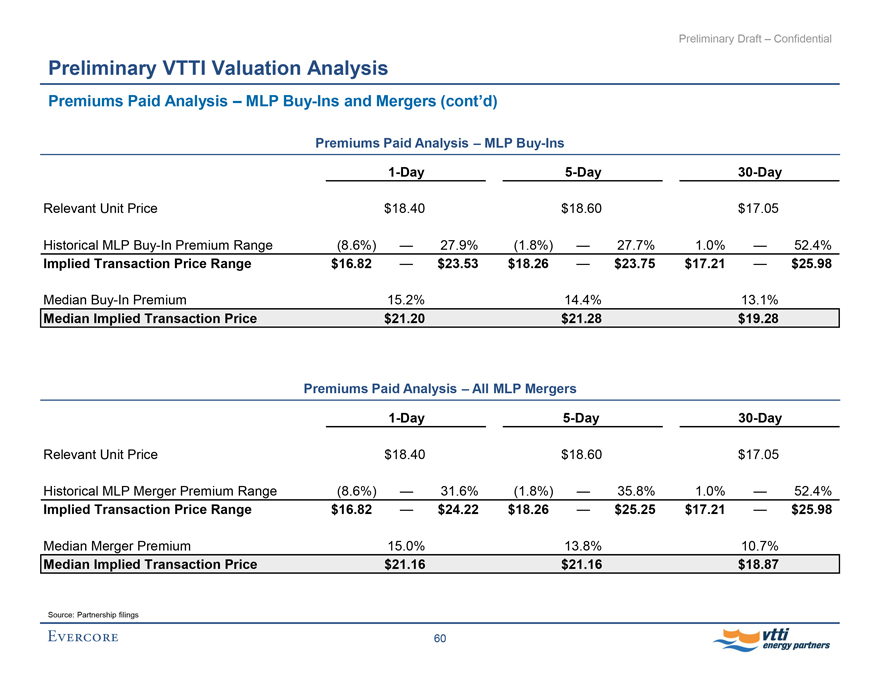

MLPBuy-In and Values VTTI common units based on historical premiums Median1-Day,5-Day and30-Day premiums paid applied to relevant unit prices

Merger Premiums paid in (i) MLPbuy-ins and (ii) MLP mergers since 2011

Paid Analysis

44

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

Preliminary VTTI Valuation Analysis

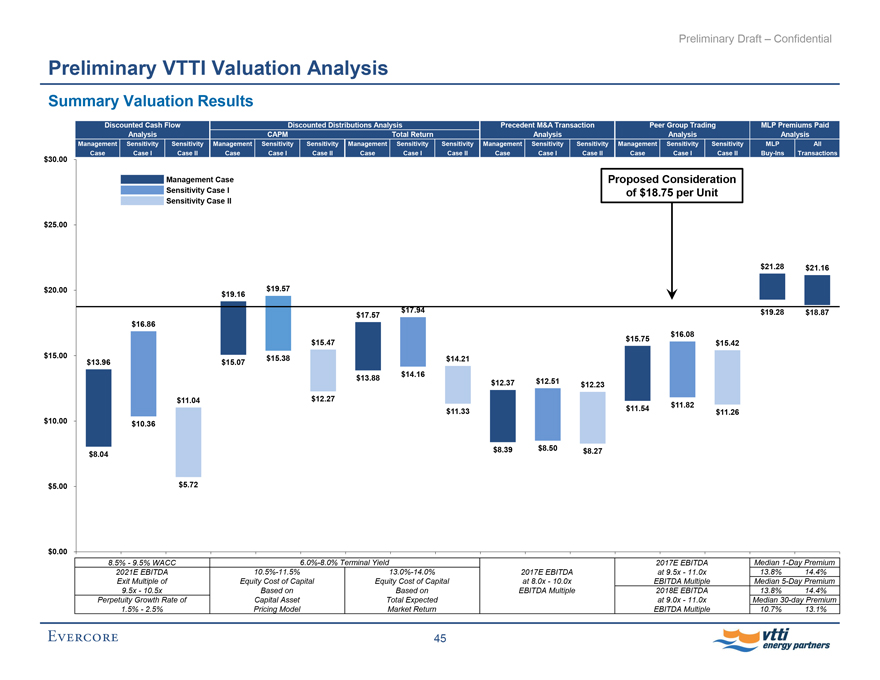

Summary Valuation Results

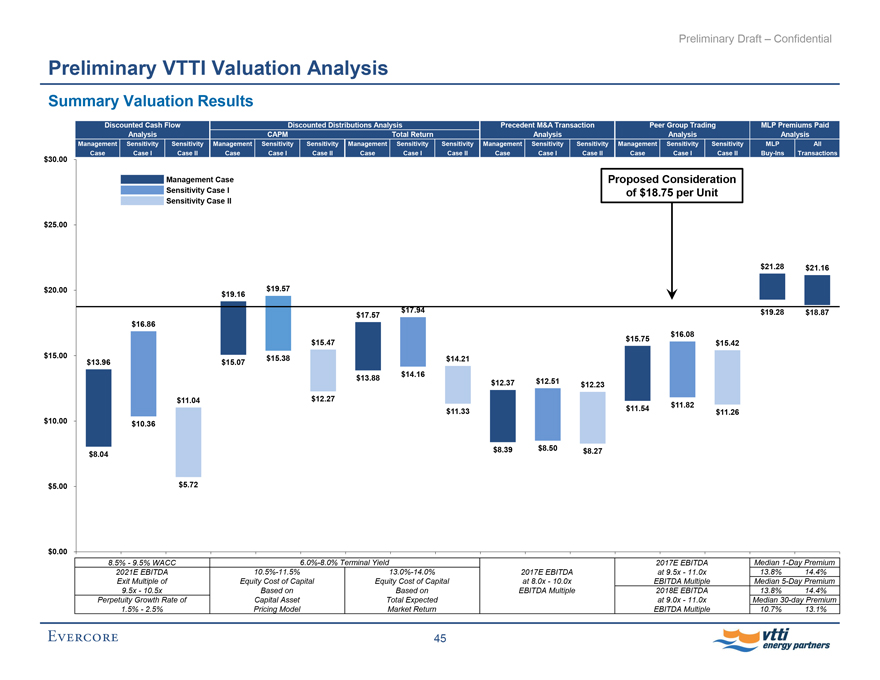

Discounted Cash Flow Analysis Discounted Distributions Analysis Precedent M&A Transaction Analysis Peer Group Trading Analysis MLP Premiums Paid Analysis

CAPM Total Return

Management Case Sensitivity Case I Sensitivity Case II Management Case Sensitivity Case I Sensitivity Case II Management Case Sensitivity Case I Sensitivity Case II Management Case Sensitivity Case I Sensitivity Case II Management Case Sensitivity Case I Sensitivity Case II MLPBuy-Ins All Transactions

$30.00

Management Case Proposed Consideration

Sensitivity Case I of $18.75 per Unit

Sensitivity Case II

$25.00

$21.28 $21.16

$20.00 $19.57

$19.16

$17.57 $17.94 $19.28 $18.87

$16.86

$15.75 $16.08

$15.47 $15.42

$15.00 $15.38 $14.21

$13.96 $15.07

$14.16

$13.88 $12.37 $12.51 $12.23

$11.04 $12.27

$11.33 $11.54 $11.82 $11.26

$10.00 $10.36

$8.04 $8.39 $8.50 $8.27

$5.00 $5.72

$0.00

8.5% - 9.5% WACC6.0%-8.0% Terminal Yield 2017E EBITDA at 9.5x - 11.0x EBITDA Multiple Median1-Day Premium 13.8% 14.4% Median5-Day Premium

2021E EBITDA Exit Multiple of 9.5x - 10.5x10.5%-11.5% Equity Cost of Capital Based on Capital Asset Pricing Model13.0%-14.0% Equity Cost of Capital Based on Total Expected Market Return 2017E EBITDA at 8.0x - 10.0x EBITDA Multiple 2018E EBITDA at 9.0x - 11.0x EBITDA Multiple 13.8% 14.4% Median30-day Premium 10.7% 13.1%

Perpetuity Growth Rate of 1.5% - 2.5%

45

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

Preliminary VTTI Valuation Analysis

Discounted Cash Flow Analysis – Assumptions

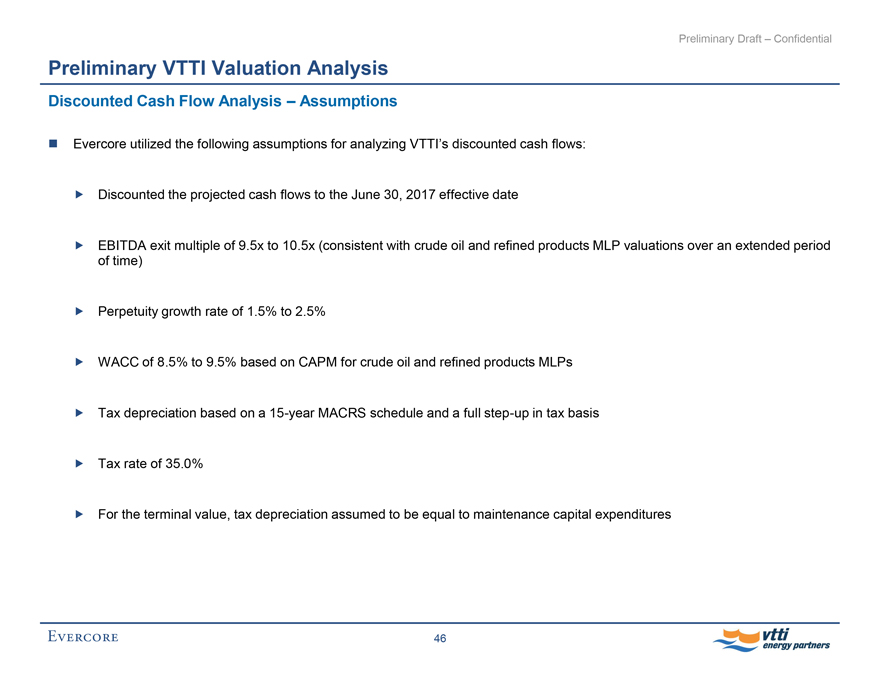

Evercore utilized the following assumptions for analyzing VTTI’s discounted cash flows:

Discounted the projected cash flows to the June 30, 2017 effective date

EBITDA exit multiple of 9.5x to 10.5x (consistent with crude oil and refined products MLP valuations over an extended period of time)

Perpetuity growth rate of 1.5% to 2.5%

WACC of 8.5% to 9.5% based on CAPM for crude oil and refined products MLPs

Tax depreciation based on a15-year MACRS schedule and a fullstep-up in tax basis

Tax rate of 35.0%

For the terminal value, tax depreciation assumed to be equal to maintenance capital expenditures

46

EVERCORE Vtti energy partners

Preliminary Draft – Confidential

Preliminary VTTI Valuation Analysis

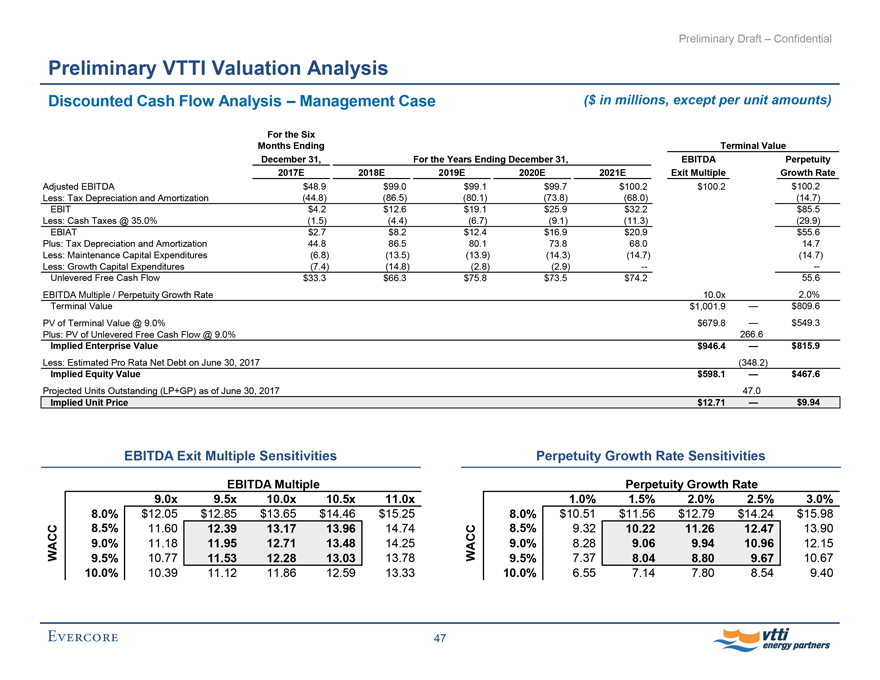

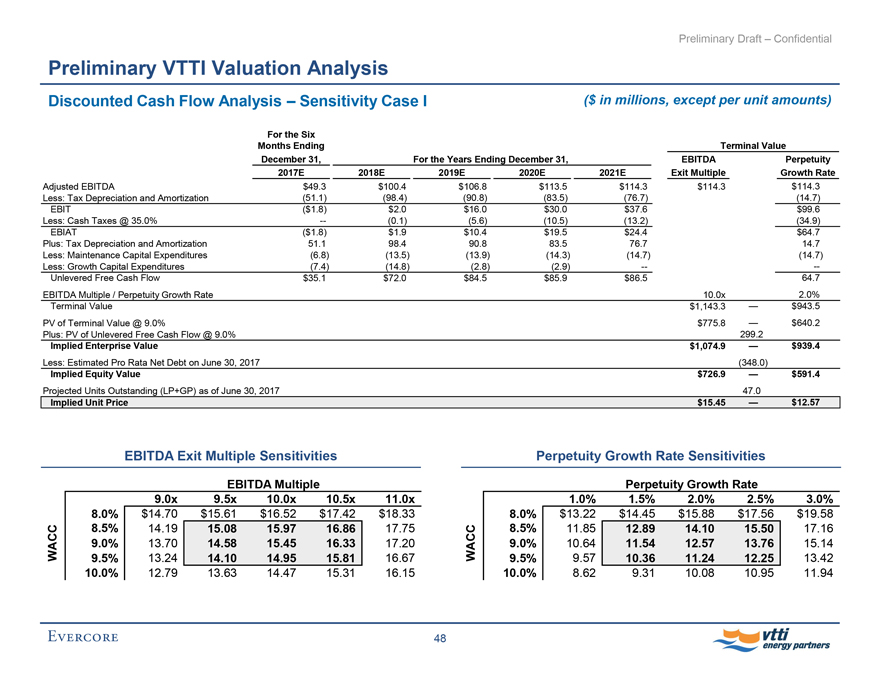

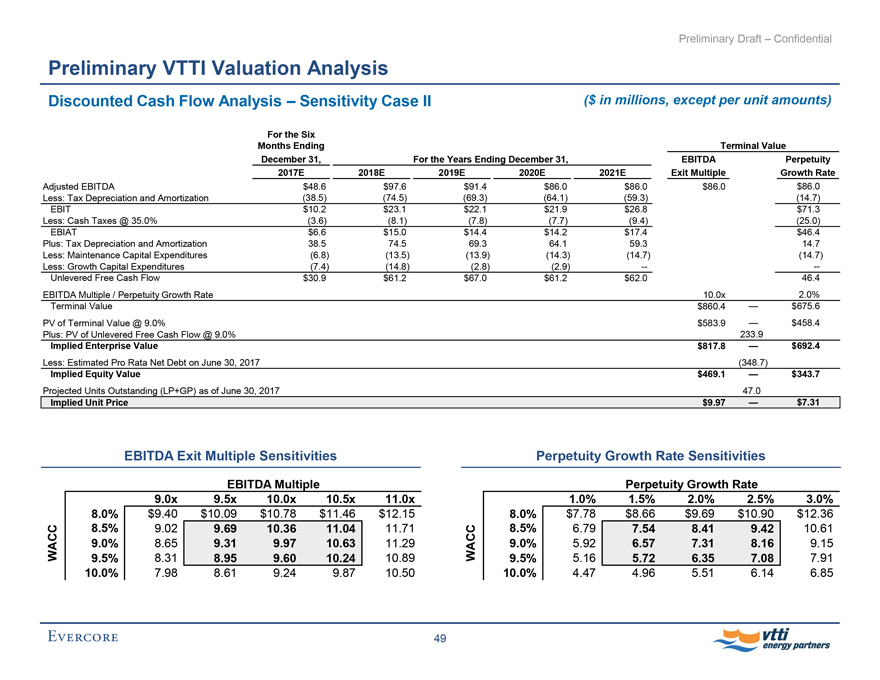

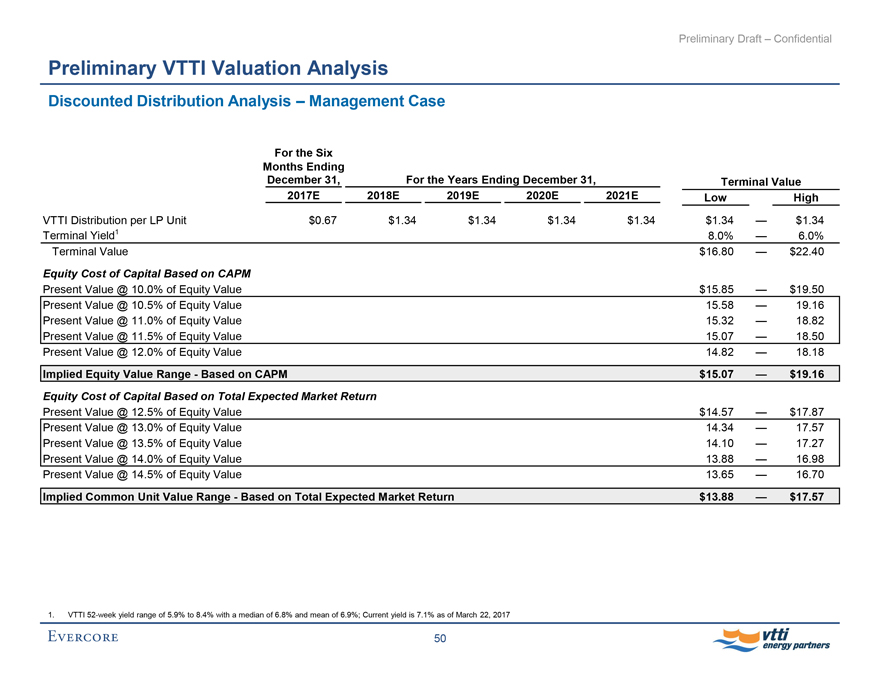

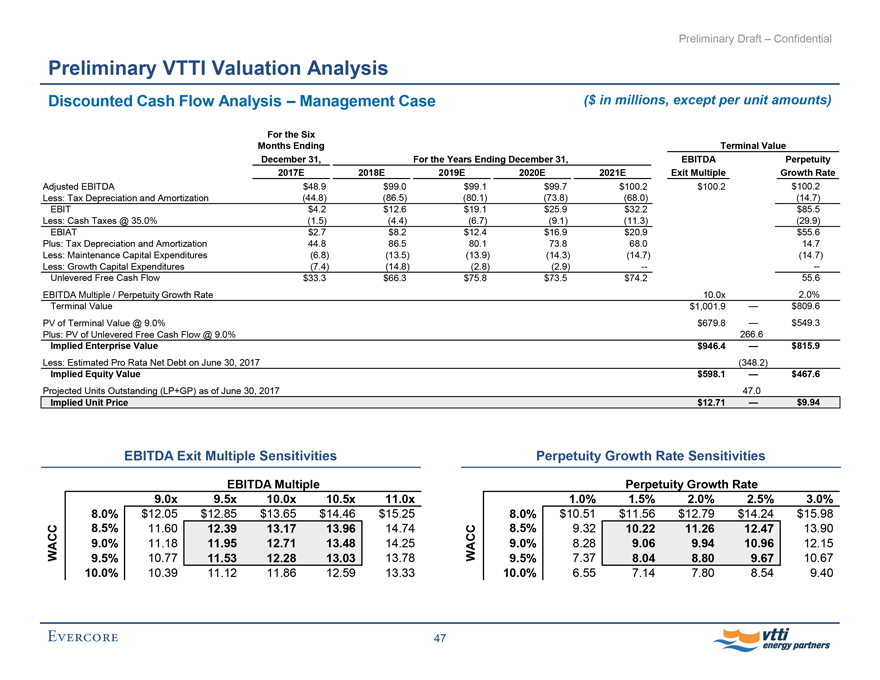

Discounted Cash Flow Analysis – Management Case ($ in millions, except per unit amounts)

For the Six

Months Ending

December 31, Terminal Value

For the Years Ending December 31,

EBITDA

Exit Multiple

Perpetuity

Growth Rate

2017E 2018E 2019E 2020E 2021E

Adjusted EBITDA $48.9 $99.0 $99.1 $99.7 $100.2 $100.2 $100.2

Less: Tax Depreciation and Amortization (44.8) (86.5) (80.1) (73.8) (68.0) (14.7)

EBIT $4.2 $12.6 $19.1 $25.9 $32.2 $85.5

Less: Cash Taxes @ 35.0% (1.5) (4.4) (6.7) (9.1) (11.3) (29.9)

EBIAT $2.7 $8.2 $12.4 $16.9 $20.9 $55.6

Plus: Tax Depreciation and Amortization 44.8 86.5 80.1 73.8 68.0 14.7

Less: Maintenance Capital Expenditures (6.8) (13.5) (13.9) (14.3) (14.7) (14.7)

Less: Growth Capital Expenditures (7.4) (14.8) (2.8) (2.9) — —

Unlevered Free Cash Flow $33.3 $66.3 $75.8 $73.5 $74.2 55.6

EBITDA Multiple / Perpetuity Growth Rate 10.0x 2.0%

Terminal Value $1,001.9 — $809.6