Exhibit (c)(8)

Confidential

The Conflicts Committee of the Board of Directors of VTTI Energy Partners GP LLC

Discussion Materials Regarding Project Terminal Velocity May 5, 2017

Evercore vtti energy partners

Confidential

These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Conflicts Committee of the Board of Directors of VTTI Energy Partners GP LLC (“VTGP”) to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Evercore. These materials are based on information provided by or on behalf of the Board and/or other potential transaction participants, from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the management of the Board and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Board. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Board.

These materials were compiled on a confidential basis for use by the Board in evaluating the potential transaction described herein and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore.

These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore (or any affiliate) to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates.

Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein.

Evercore vtti energy partners

Confidential

Table of Contents

Section

Executive Summary

I

VTTI Situation Analysis

II

VTTI Operating Asset Overview and Projections

III

VTTI Financial Projections

IV

Preliminary VTTI Valuation Analysis

V

Appendix

A. Weighted Average Cost of Capital Analysis

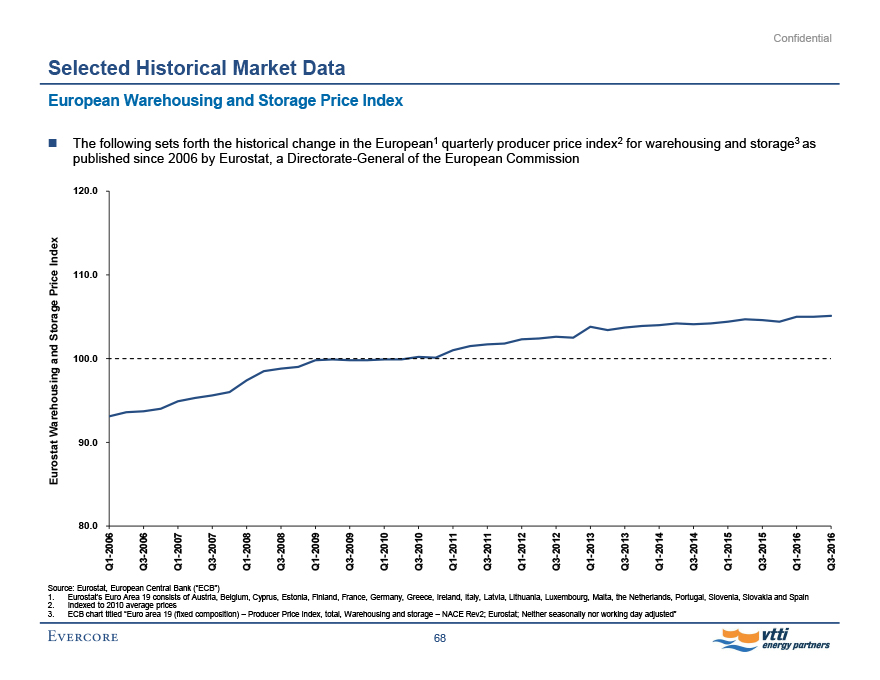

B. Selected Historical Market Data

Evercore vtti energy partners

Confidential

I. Executive Summary

Evercore

Confidential

Executive Summary

Introduction

Evercore Group L.L.C. (“Evercore”) is pleased to provide the materials herein to the Conflicts Committee of the Board of Directors of VTTI Energy Partners GP LLC (“VTGP”) (the “Conflicts Committee”), the general partner of VTTI Energy Partners LP (“VTTI” or the “Partnership”), regarding the proposed acquisition of all publicly-held common units representing limited partner interests in VTTI from the current holders of such units (the “Unaffiliated Common Unitholders”) by VTTI MLP Partners B.V. (the “Sponsor”) (the “Proposed Transaction” or the “Merger”)

On March 2, 2017, the Sponsor proposed to acquire each publicly-owned VTTI common unit for cash consideration of

$18.75 per unit as part of the Proposed Transaction (the “Initial Offer”)

On March 30, 2017, the Conflicts Committee made a counterproposal to the Sponsor for cash consideration of $21.00 per unit (the “First Counterproposal”)

On April 13, 2017, the Sponsor responded to the Conflicts Committee with a revised offer of $19.10 per unit (the “First Sponsor Counterproposal”)

On April 14, 2017, the Conflicts Committee made a second counterproposal to the Sponsor for cash consideration of $20.30 per unit and requested that quarterly distributions continue to be paid up to the closing date of the Proposed Transaction, including a pro rata distribution for a partial quarter (the “Second Counterproposal”)

On April 20, 2017, the Sponsor responded to the Conflicts Committee with an offer of $19.30 per unit and agreed to pay quarterly distributions up to the closing date of the Proposed Transaction, including a pro rata distribution for a partial quarter

(the “Second Sponsor Counterproposal”)

On April 27, 2017, the Conflicts Committee made a third counterproposal to the Sponsor for cash consideration of $19.50 per unit as well as quarterly distributions up to the closing date of the Proposed Transaction, including a pro rata distribution for a partial quarter (the “Third Counterproposal”)

On May 2, 2017, the Sponsor responded to the Conflicts Committee with an offer of $19.50 per unit, but excluding any partial or full quarterly distributions past the second quarter of 2017 (the “Third Sponsor Counterproposal”)

1

Evercore vtti energy partners

Confidential

Executive Summary

Introduction (cont’d)

On May 2, 2017, the Conflicts Committee made a fourth counterproposal to the Sponsor providing two alternatives: (i) cash consideration of $19.50 per unit plus quarterly distributions up to the closing date of the Proposed Transaction for any fully completed quarters, but excluding a pro rata distribution for a partial quarter or (ii) cash consideration of $19.40 per unit plus quarterly distributions up to the closing date of the Proposed Transaction including a pro rata distribution for a partial quarter

(the “Fourth Counterproposal”)

On May 3, 2017, the Sponsor accepted the first option under the Conflicts Committee’s Fourth Counterproposal, agreeing to pay a cash consideration of $19.50 per unit plus quarterly distributions up to the closing date of the Proposed Transaction for any fully completed quarter, but excluding a pro rata distribution for a partial quarter (the “Proposed Consideration”)

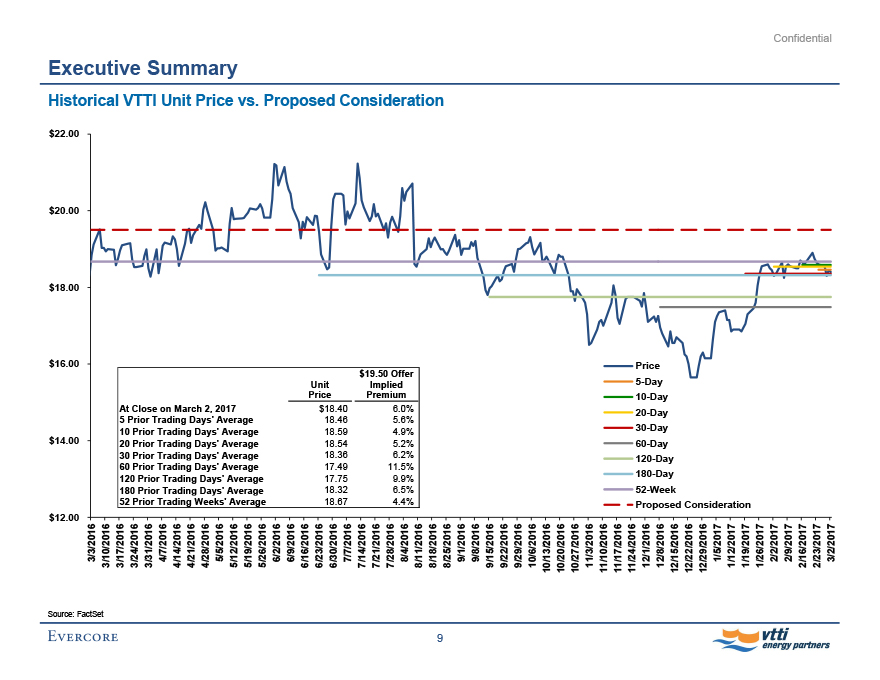

The Proposed Consideration represents a 6.0% premium to VTTI’s closing unit price of $18.40 as of March 2, 20171

The Proposed Consideration represents a 6.8% premium to VTTI’s 30-day (trading) volume-weighted average unit price

(“VWAP”) of $18.26 as of March 2, 20171

Pro forma for the Proposed Transaction, VTTI will cease to be a publicly-traded partnership and will be a wholly-owned subsidiary of the Sponsor

The Proposed Transaction is subject to the negotiation and execution of an agreement and plan of merger among VTTI B.V.,

VTTI MLP Partners B.V., VTTI Merger Sub LLC, VTTI Energy Partners LP, and VTTI Energy Partners GP LLC (the “Merger Agreement”), including approval of the Merger Agreement and the transactions contemplated thereunder by the Sponsor’s Board of Directors, VTGP’s Board of Directors, VTTI’s Board of Directors, the Conflicts Committee, and a majority vote of the Unafilliated Common Unitholders

Source: FactSet

1. Announcement date of the Proposed Transaction

2

Evercore vtti energy partners

Confidential

Executive Summary

Overview of Materials

The materials herein include the following:

An executive summary including: (i) a review of Evercore’s evaluation process to-date, (ii) a review of summary terms to the Merger, (iii) an overview of the current VTTI organizational structure, (iv) a review of certain financial metrics for VTTI implied by the Proposed Transaction, (v) an analysis of projected distribution growth rates for MLPs and implications with respect to distribution yield and (vi) an overview of the historical trading performance of VTTI relative to the Proposed Consideration

A current situation analysis for VTTI, including an overview of VTTI’s business

An overview of the operating assets of VTTI MLP B.V. (“VTTI Operating”), in which VTTI owns a 51.0% interest, including an overview of the operating projections for VTTI Operating as provided by VTTI management (the “VTTI Operating Projections

– Management Case”)

• In addition to the Management Case, during its due diligence review, Evercore analyzed two additional scenarios (the “Sensitivity Cases”): (i) an increase in non-contracted rates of 10.0% (the “VTTI Operating Projections – Sensitivity Case I”) and (ii) a decrease in non-contracted rates of 10.0% (the “VTTI Operating Projections – Sensitivity Case II”)

A review of the financial projections for VTTI as provided by VTTI management (the “VTTI Financial Projections – Management Case”)

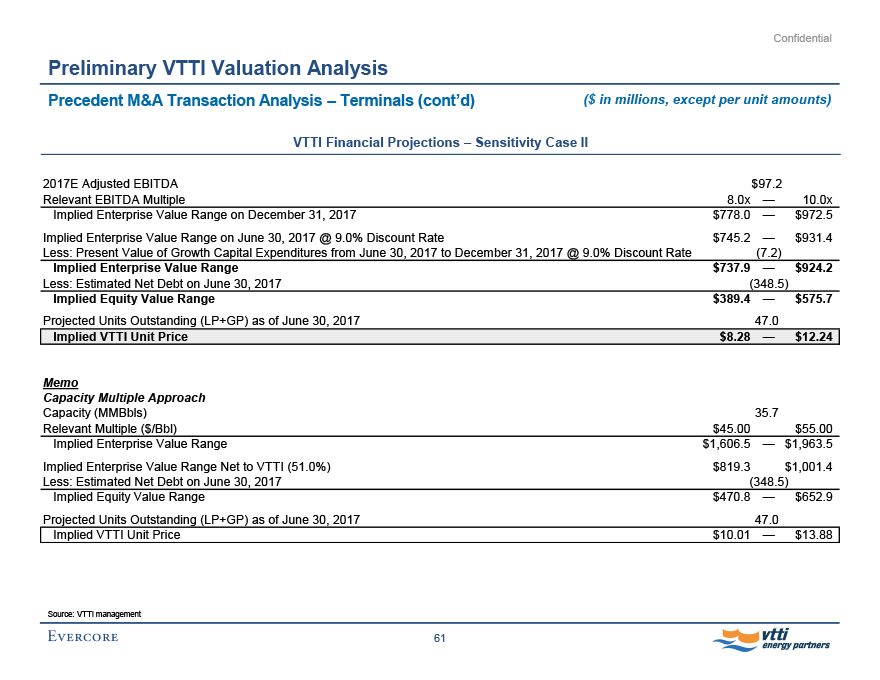

In addition to the Management Case, Evercore analyzed two additional scenarios: (i) a scenario that assumes the VTTI Operating Projections – Sensitivity Case I (the “VTTI Financial Projections – Sensitivity Case I”) and (ii) a scenario that assumes the VTTI Operating Projections – Sensitivity Case II (the “VTTI Financial Projections – Sensitivity Case II”)

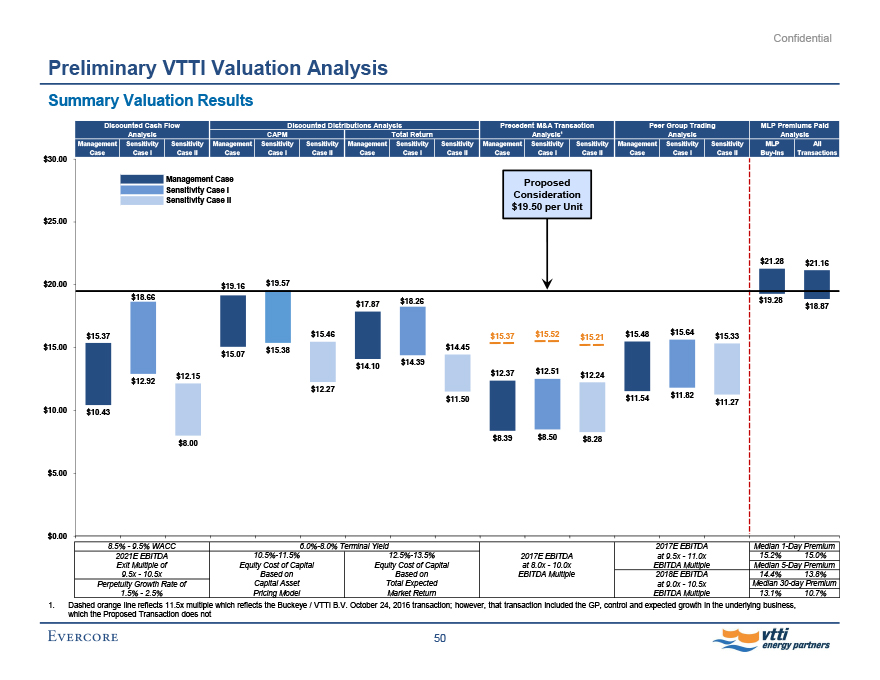

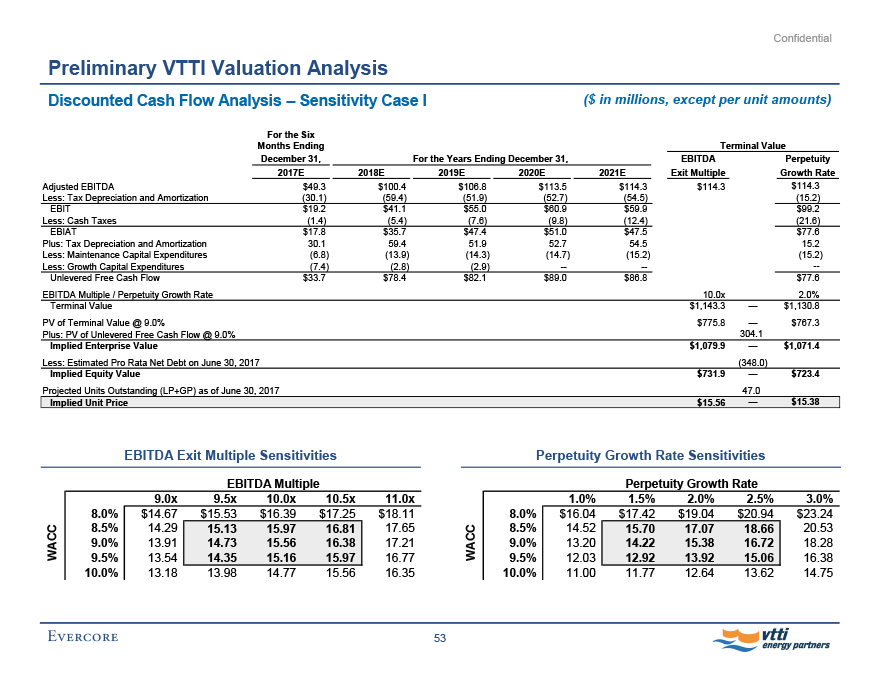

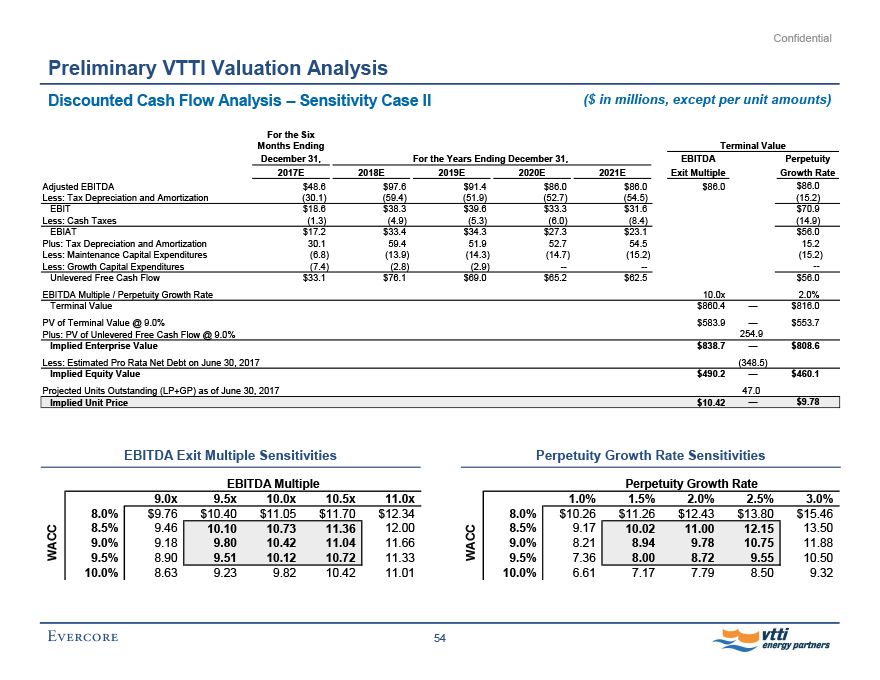

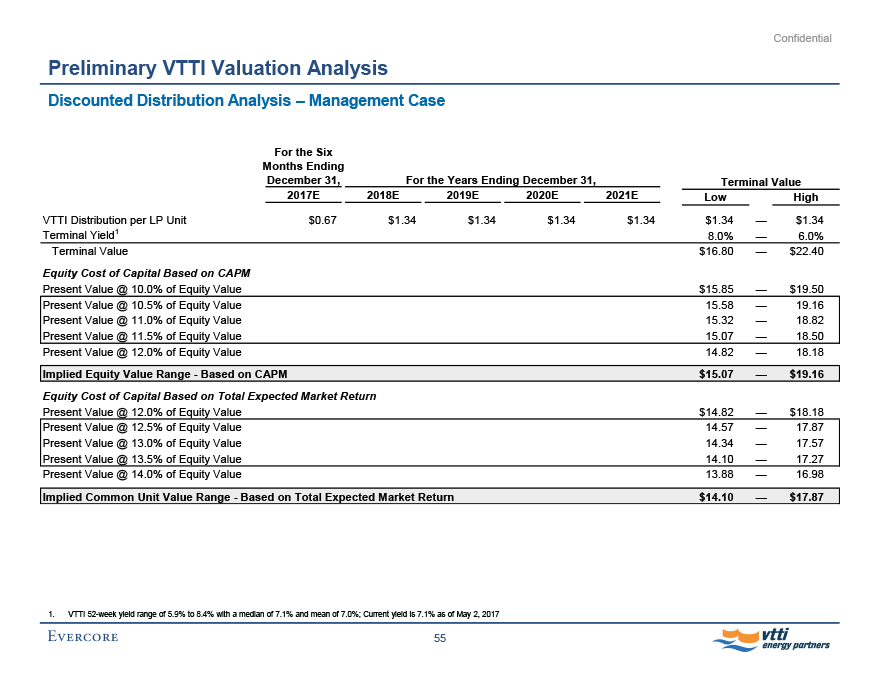

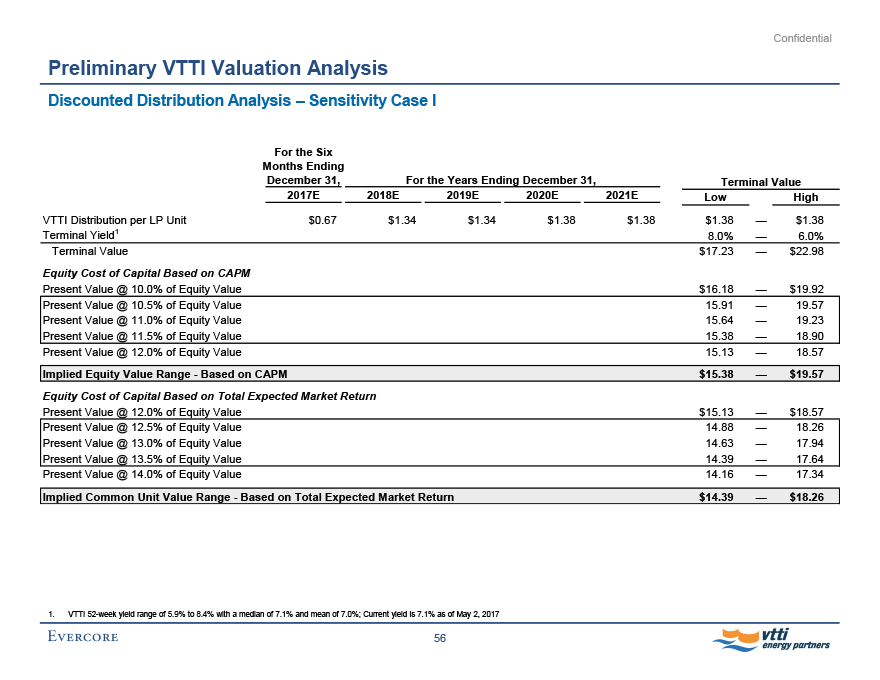

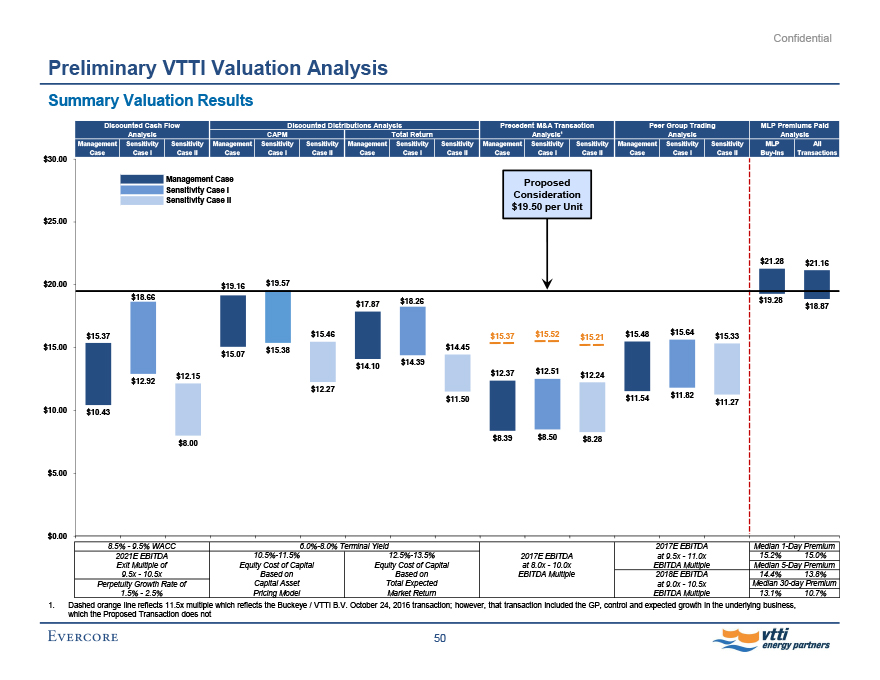

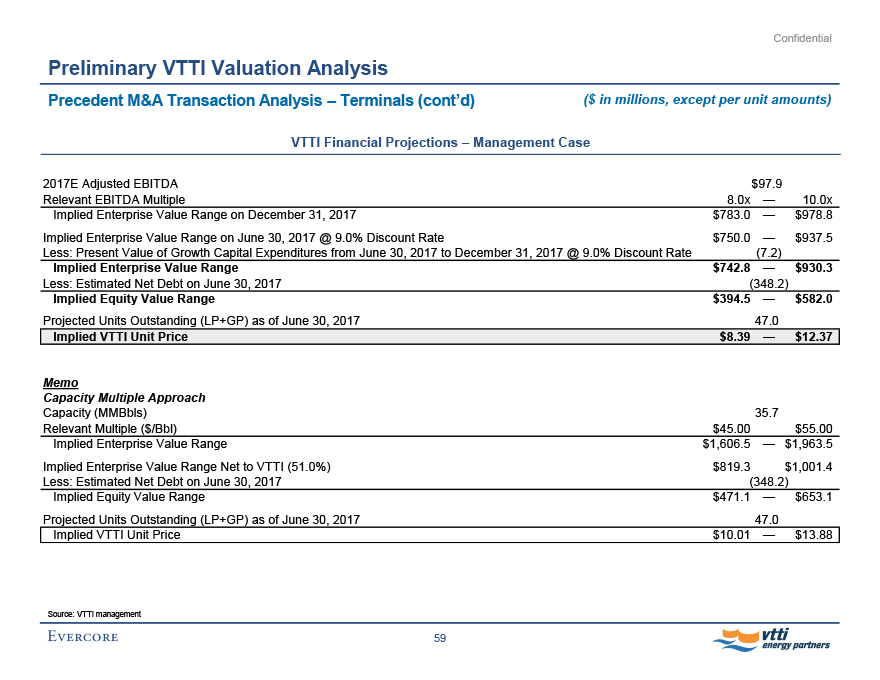

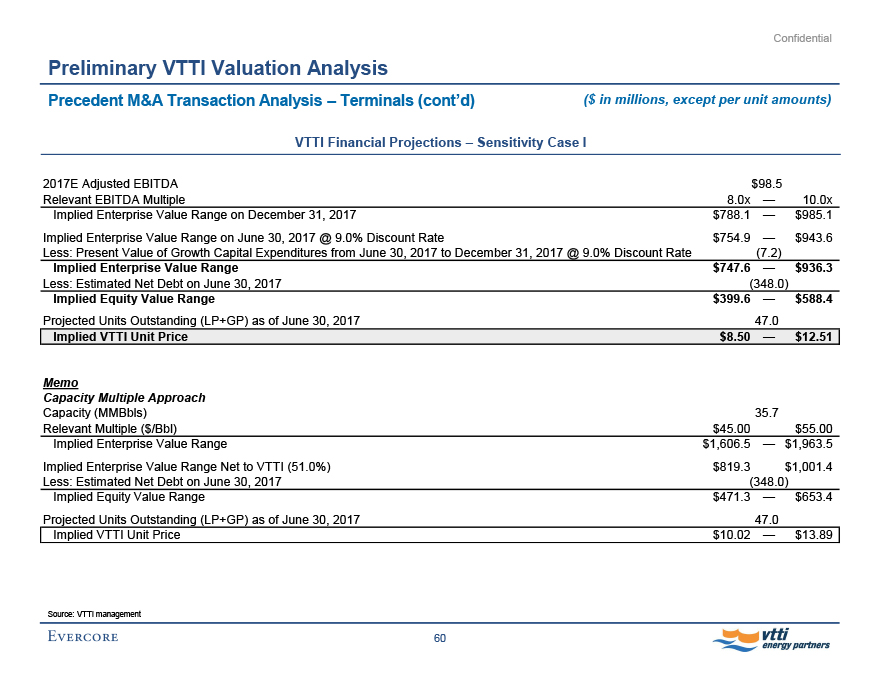

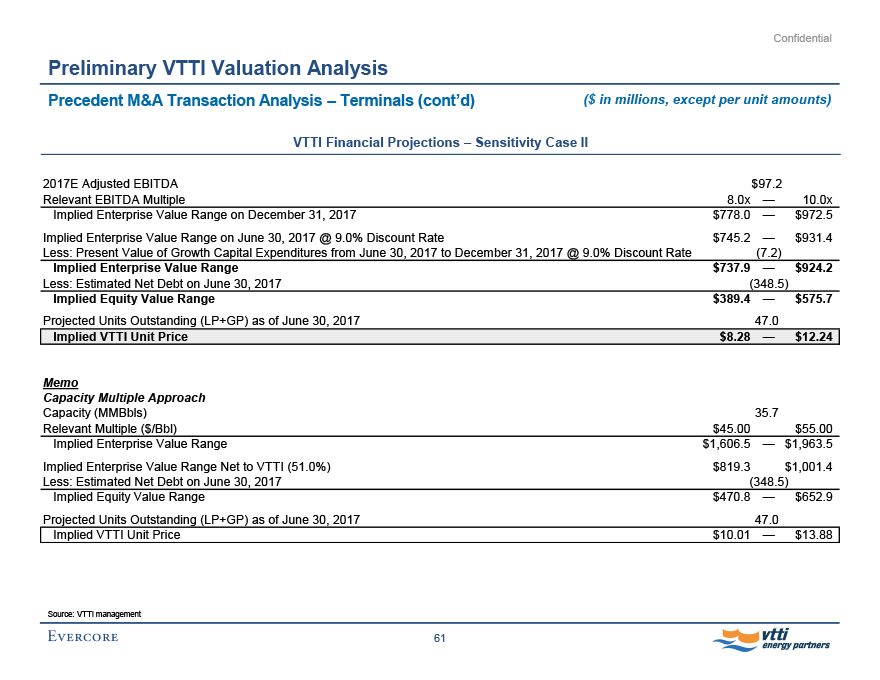

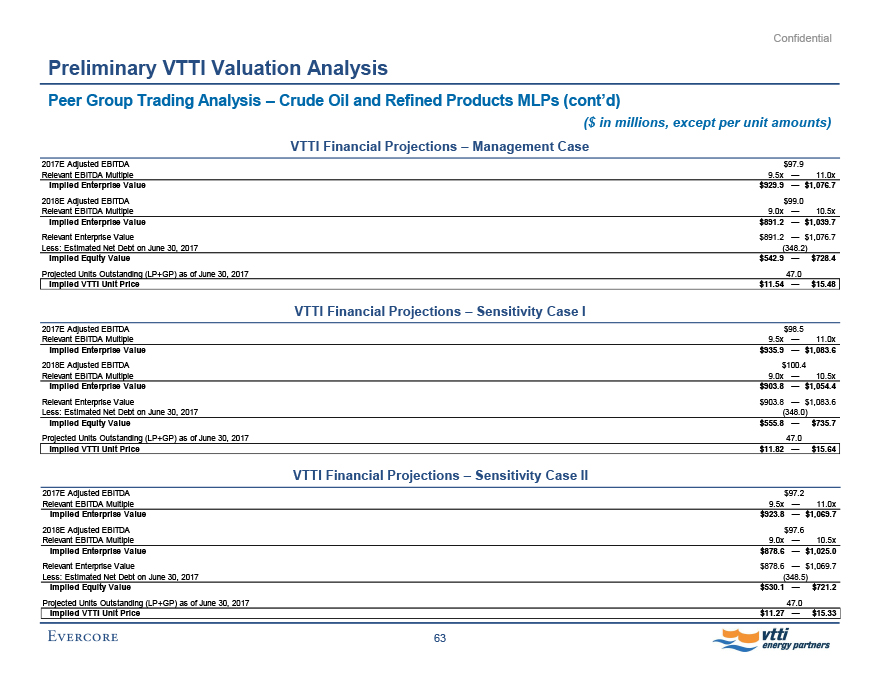

A preliminary valuation of VTTI based on (i) the VTTI Financial Projections – Management Case, (ii) the VTTI Financial Projections – Sensitivity Case I and (iii) the VTTI Financial Projections – Sensitivity Case II

3

Evercore vtti energy partners

Confidential

Executive Summary

Evercore Evaluation Process

In connection with its review of the Proposed Transaction, Evercore has, among other things:

Reviewed certain publicly-available historical operating and financial information relating to the Partnership that we deemed relevant, including the Annual Report on Form 20-F for the year ended December 31, 2016, preliminary financial results as filed on Form 6-K for the quarters ended December 31, 2016, September 30, 2016, June 30, 2016, and March 31, 2016, the Prospectus Supplement dated August 8, 2016 and certain reports on Form 6-K, in each case as filed with or furnished to the U.S. Securities and Exchange Commission by the Partnership since January 1, 2016;

Reviewed certain non-public historical and projected financial and operating data and assumptions relating to the Partnership prepared and furnished to us by management of the Partnership;

Prepared and reviewed the Sensitivity Cases with respect to the projected financial and operating data and assumptions relating to the Partnership which we deemed relevant, including sensitivities related to the rates utilized to project uncontracted revenues;

Discussed the Sensitivity Cases and their underlying assumptions with management of the Partnership;

Discussed the current operations of the Partnership and the historical and projected financial and operating data and assumptions relating to the Partnership with management of the Partnership (including management’s views on the risks and uncertainties of achieving such projections);

Reviewed publicly-available research analyst estimates for the Partnership’s future financial performance;

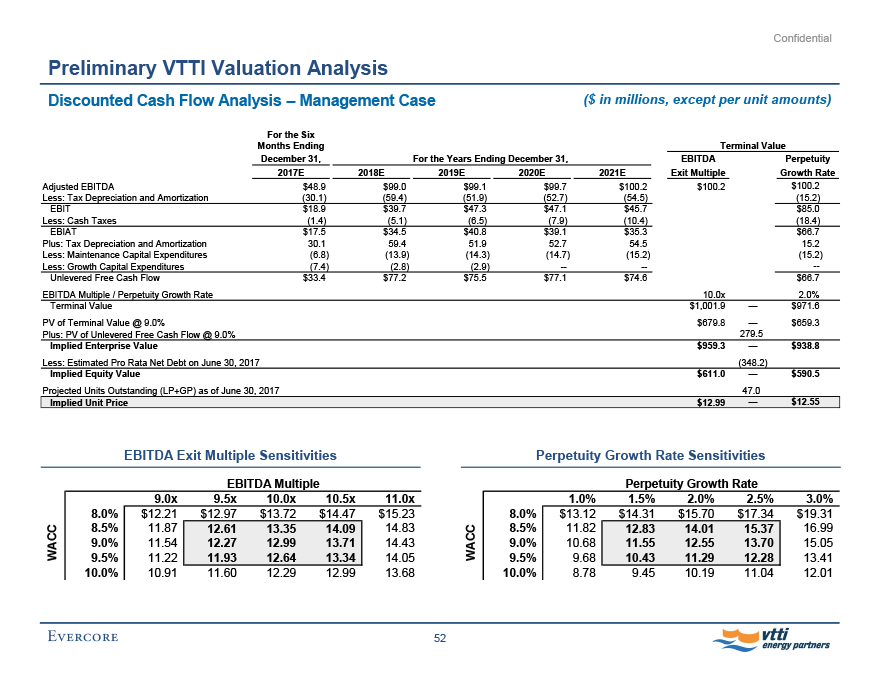

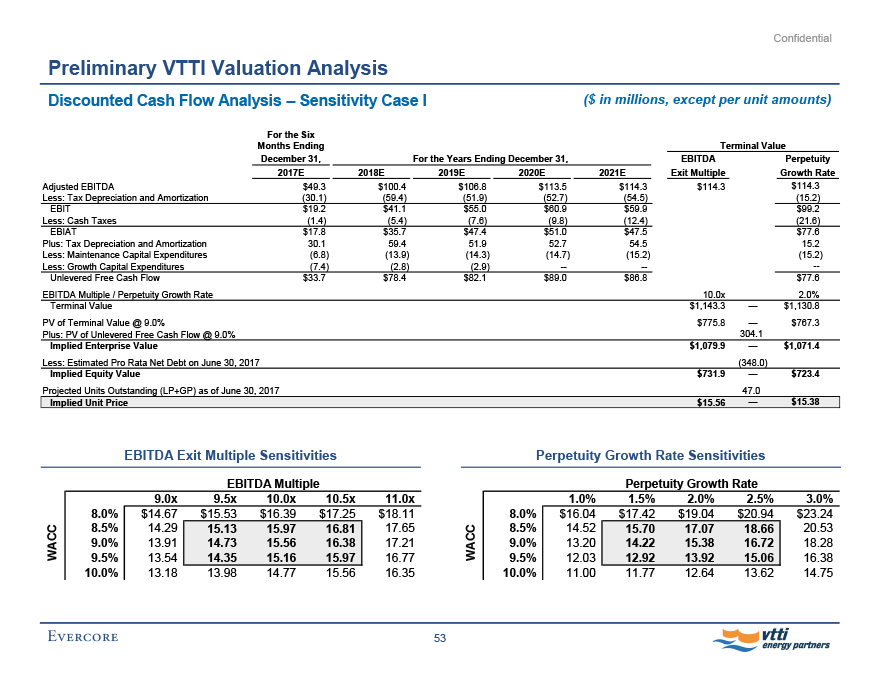

Performed discounted cash flow analyses on the Partnership based on forecasts and other data provided by management of the Partnership and the Sensitivity Cases based thereon;

4

Evercore vtti energy partners

Confidential

Executive Summary

Evercore Evaluation Process (cont’d)

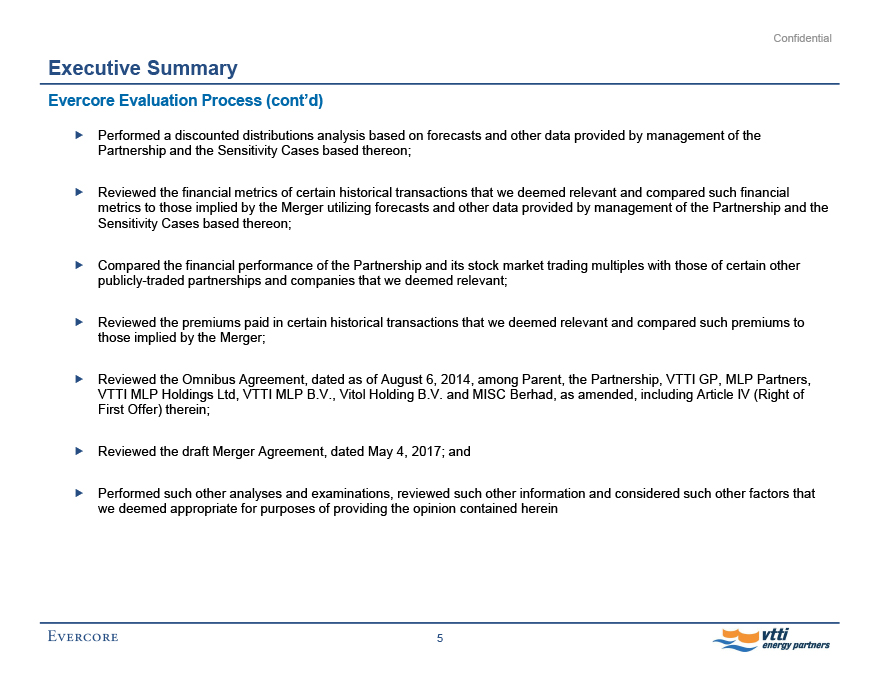

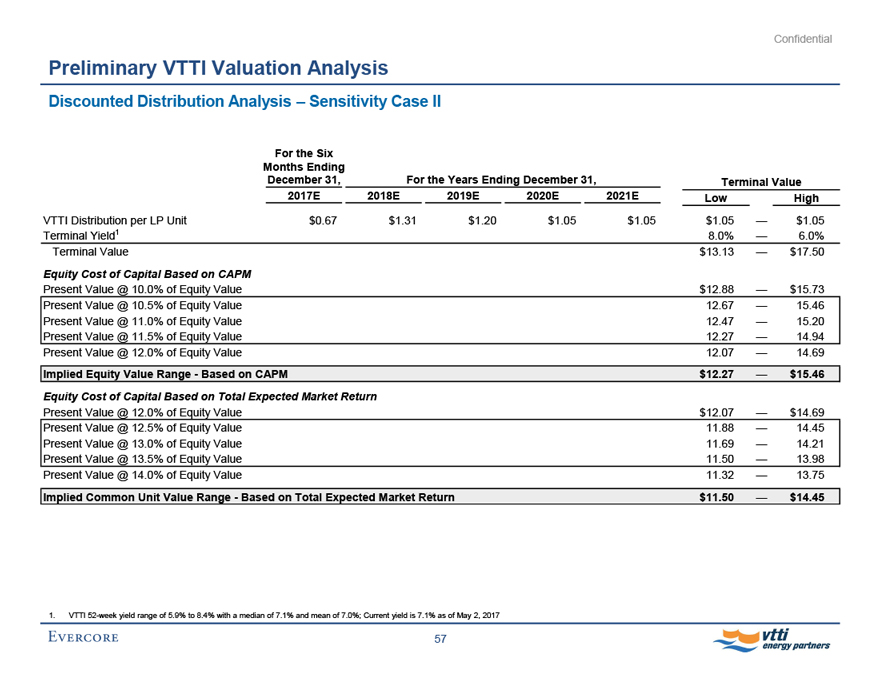

Performed a discounted distributions analysis based on forecasts and other data provided by management of the Partnership and the Sensitivity Cases based thereon;

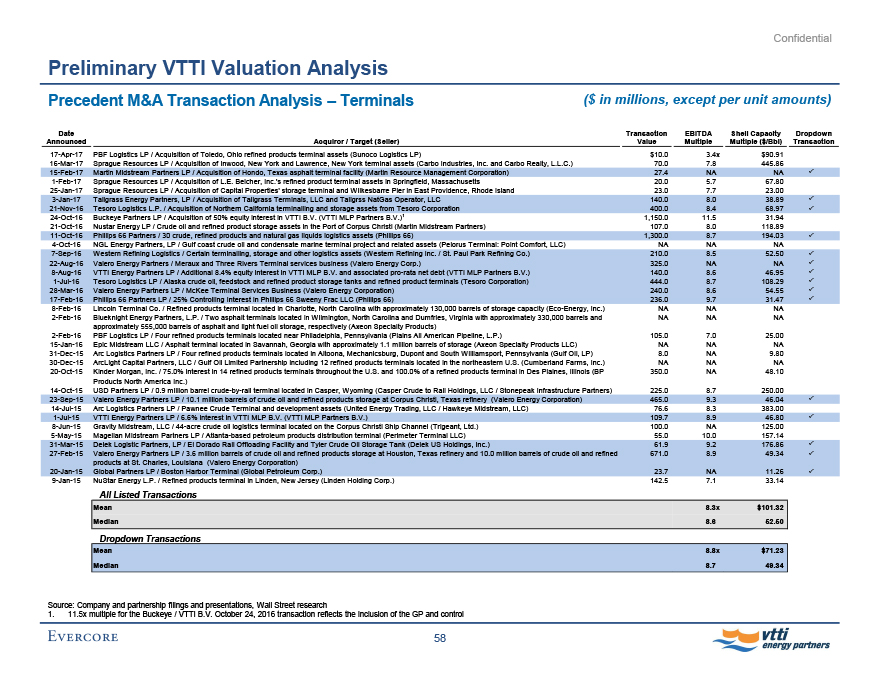

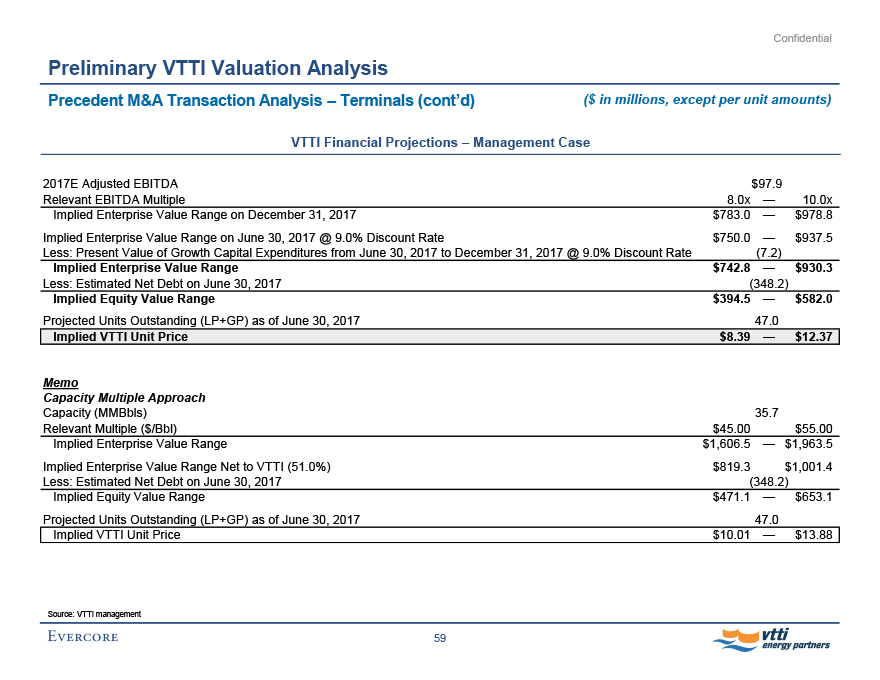

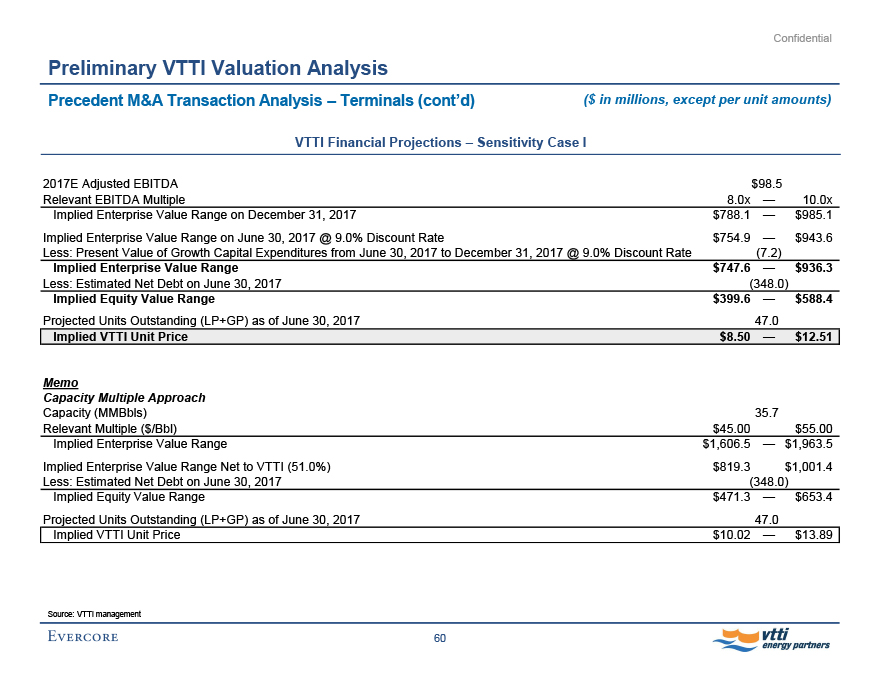

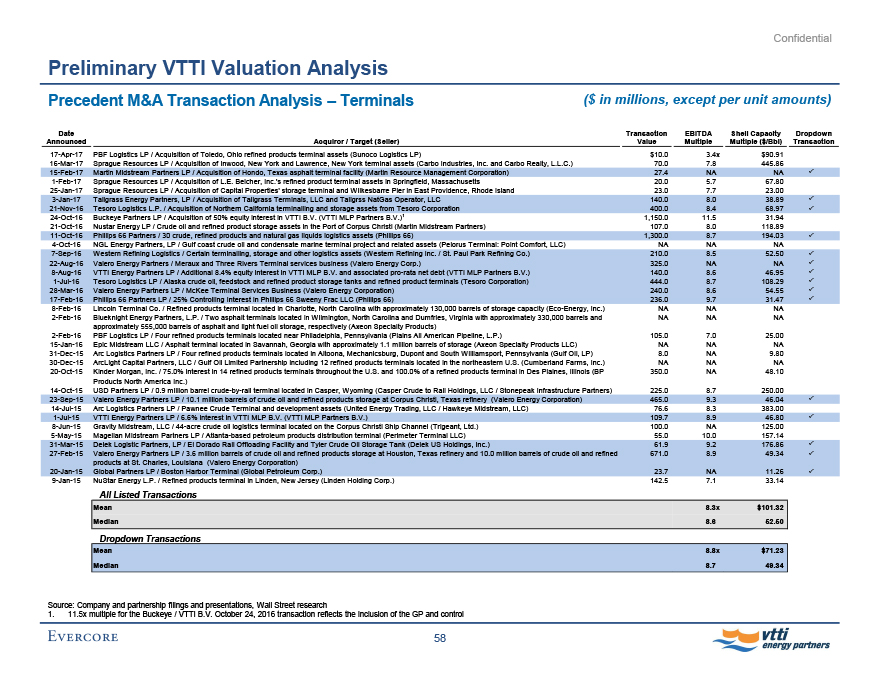

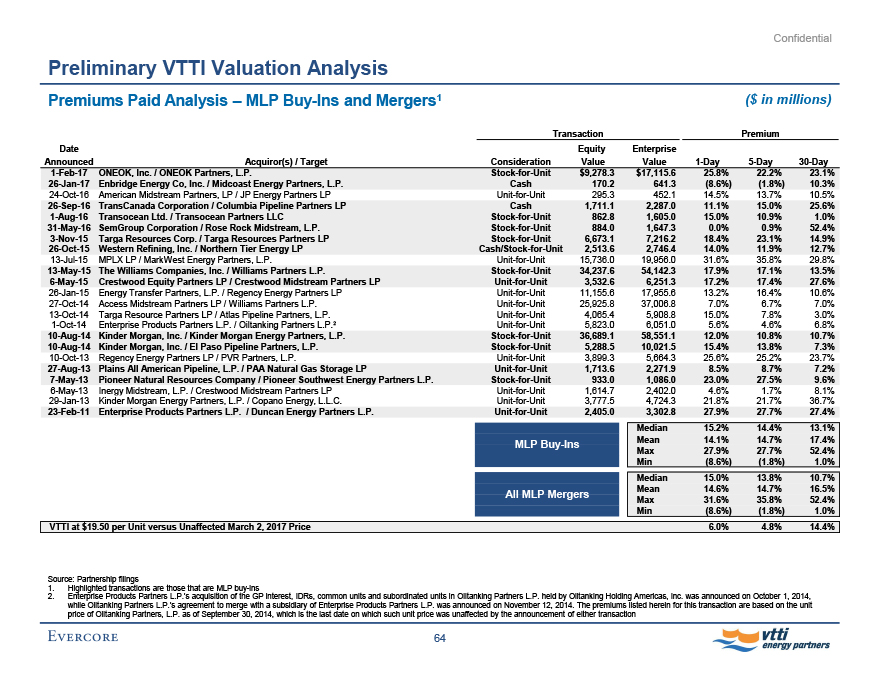

Reviewed the financial metrics of certain historical transactions that we deemed relevant and compared such financial metrics to those implied by the Merger utilizing forecasts and other data provided by management of the Partnership and the Sensitivity Cases based thereon;

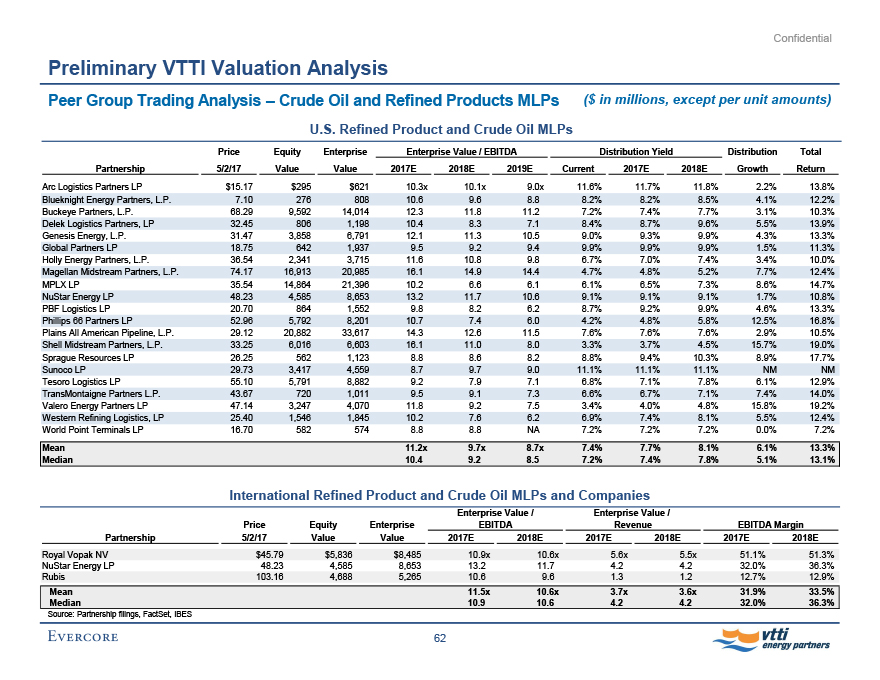

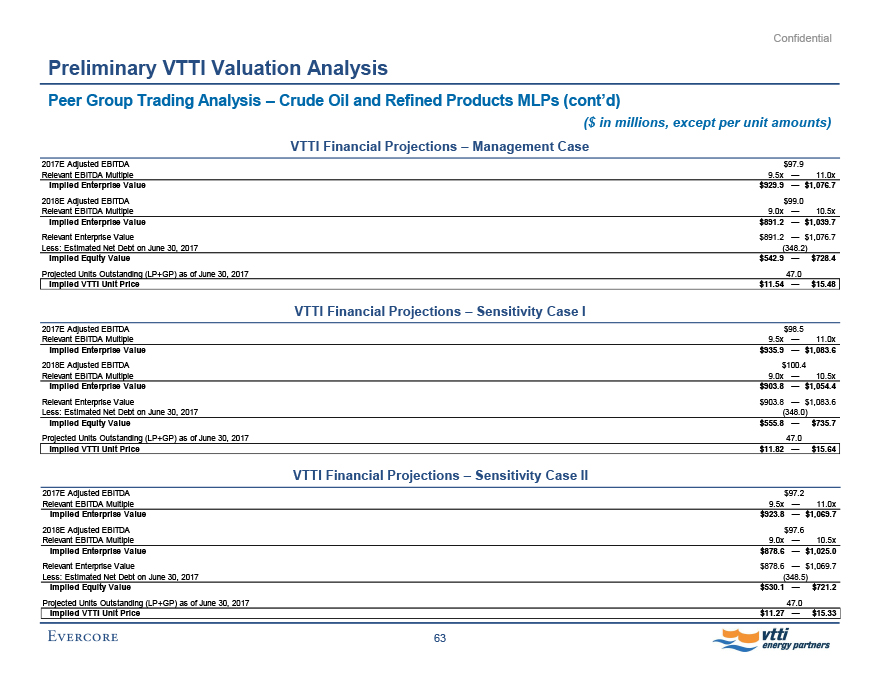

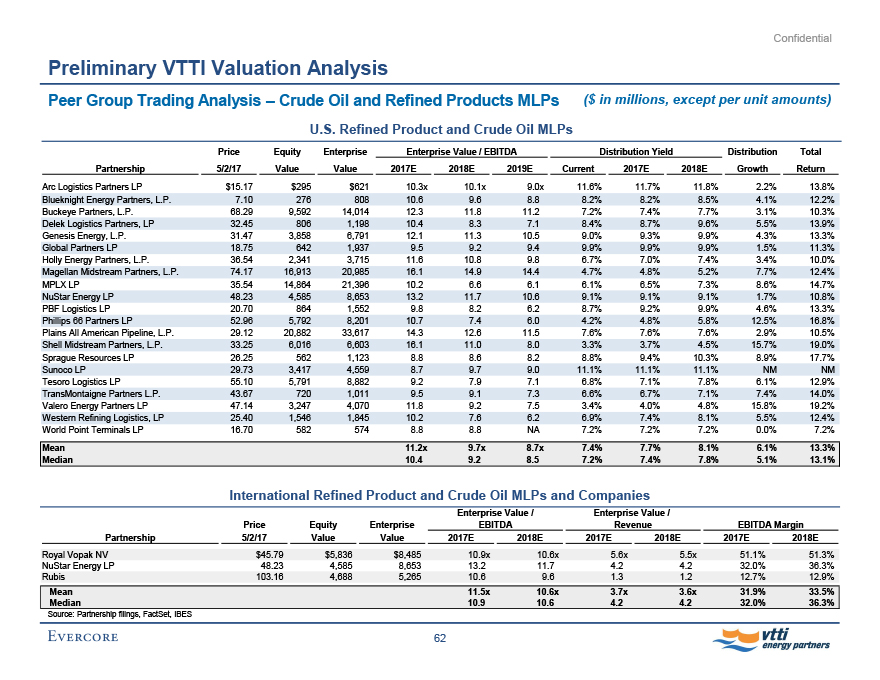

Compared the financial performance of the Partnership and its stock market trading multiples with those of certain other publicly-traded partnerships and companies that we deemed relevant;

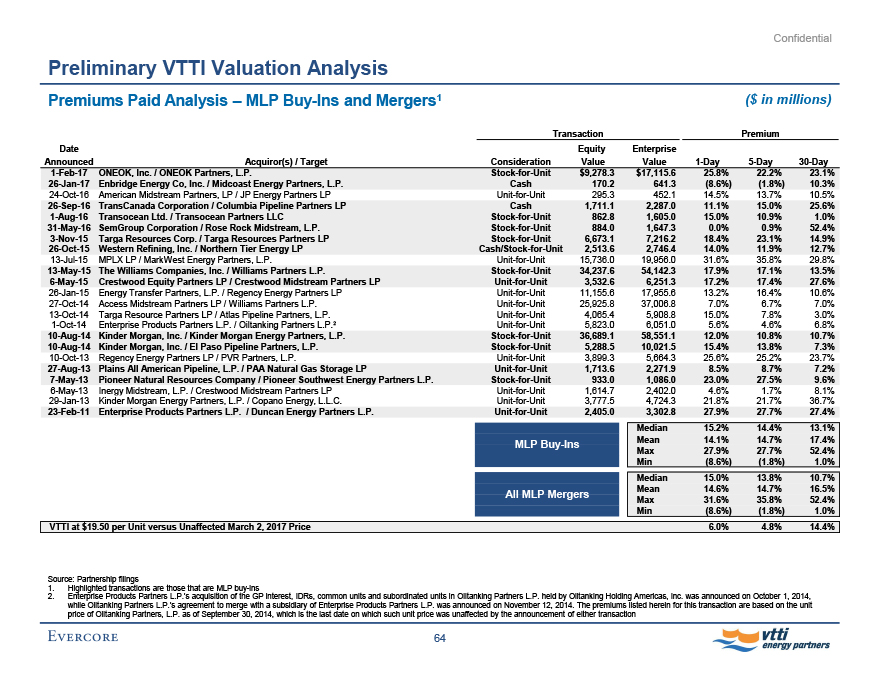

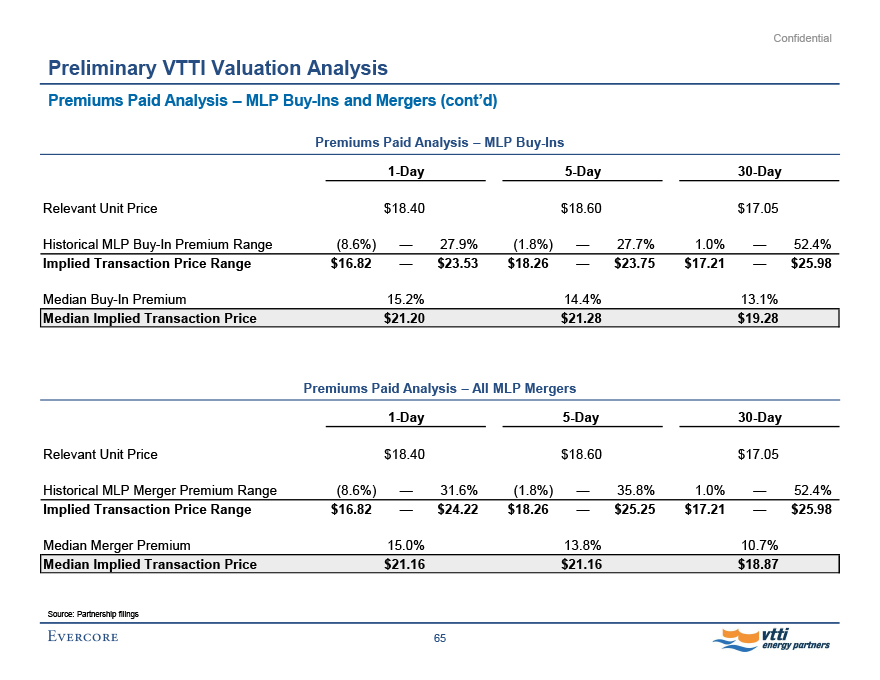

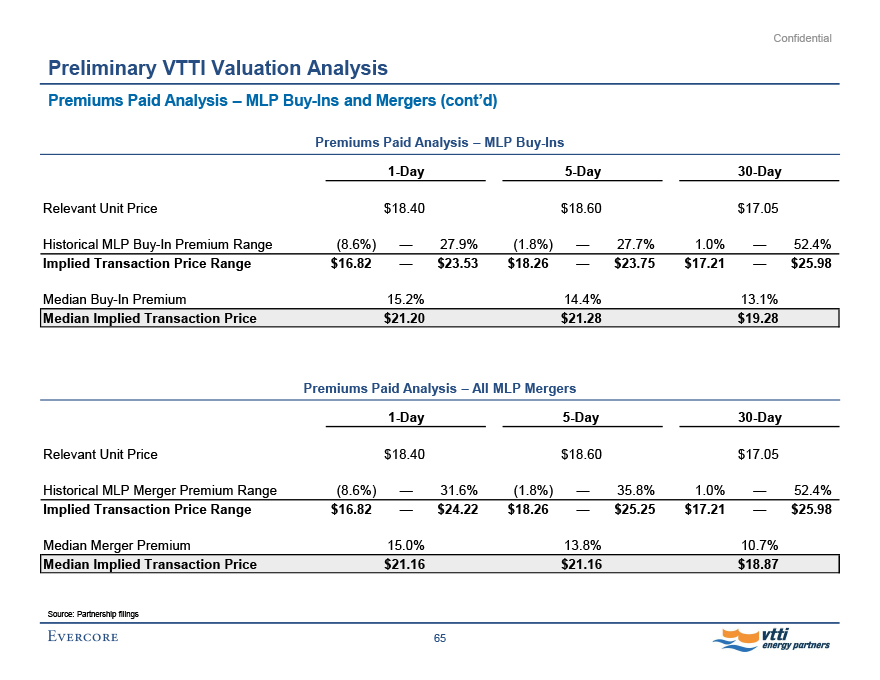

Reviewed the premiums paid in certain historical transactions that we deemed relevant and compared such premiums to those implied by the Merger;

Reviewed the Omnibus Agreement, dated as of August 6, 2014, among Parent, the Partnership, VTTI GP, MLP Partners, VTTI MLP Holdings Ltd, VTTI MLP B.V., Vitol Holding B.V. and MISC Berhad, as amended, including Article IV (Right of First Offer) therein;

Reviewed the draft Merger Agreement, dated May 4, 2017; and

Performed such other analyses and examinations, reviewed such other information and considered such other factors that we deemed appropriate for purposes of providing the opinion contained herein

5

Evercore vtti energy partners

Confidential

Executive Summary

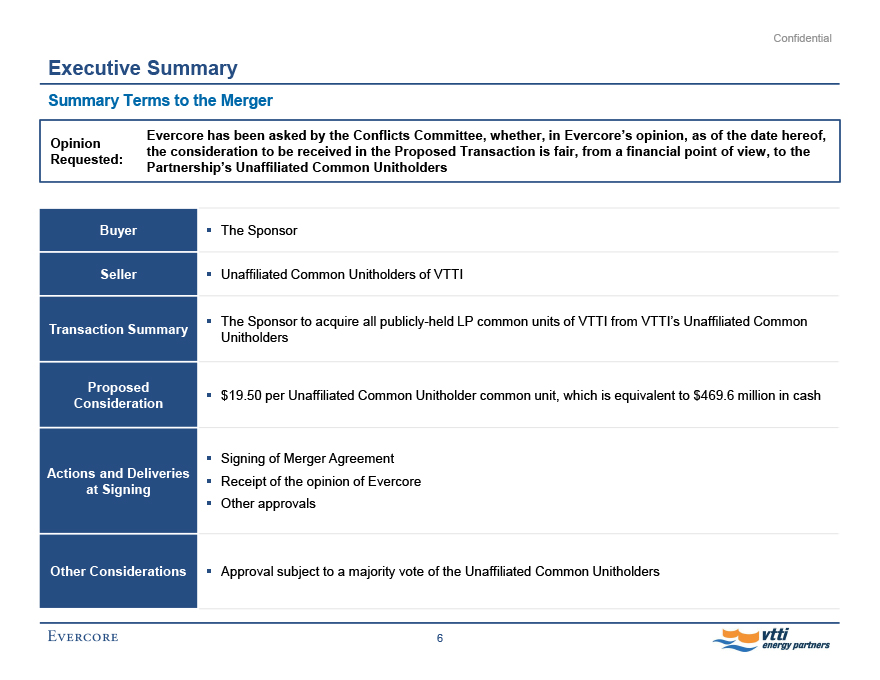

Summary Terms to the Merger

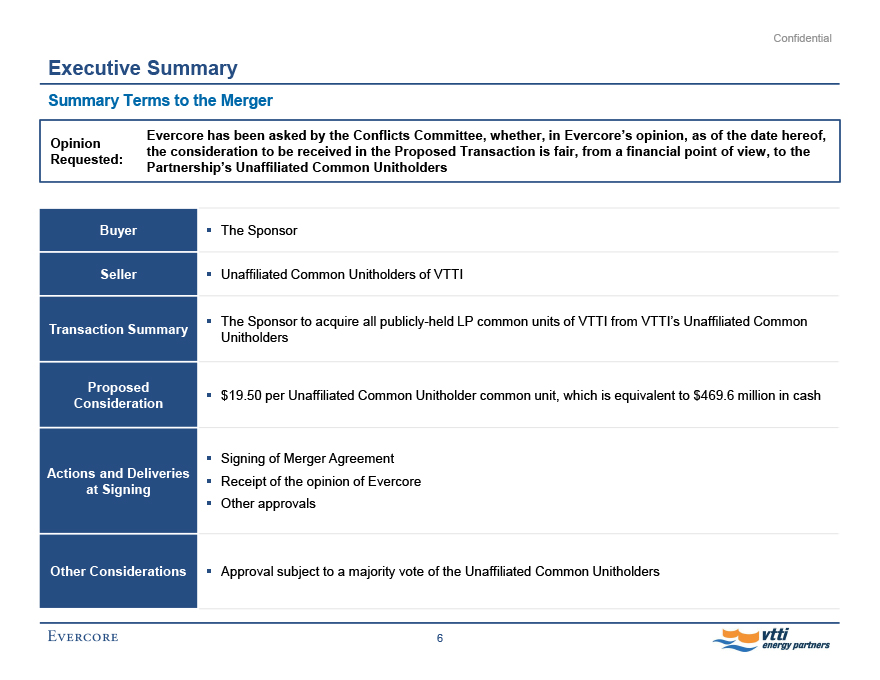

Opinion Requested:

Evercore has been asked by the Conflicts Committee, whether, in Evercore’s opinion, as of the date hereof, the consideration to be received in the Proposed Transaction is fair, from a financial point of view, to the Partnership’s Unaffiliated Common Unitholders

Buyer

The Sponsor

Seller

Unaffiliated Common Unitholders of VTTI

Transaction Summary

The Sponsor to acquire all publicly-held LP common units of VTTI from VTTI’s Unaffiliated Common

Unitholders

Proposed

$19.50 per Unaffiliated Common Unitholder common unit, which is equivalent to $469.6 million in cash

Consideration

Signing of Merger Agreement

Actions and Deliveries

Receipt of the opinion of Evercore

at Signing

Other approvals

Other Considerations

Approval subject to a majority vote of the Unaffiliated Common Unitholders

6

Evercore vtti energy partners

Confidential

Executive Summary

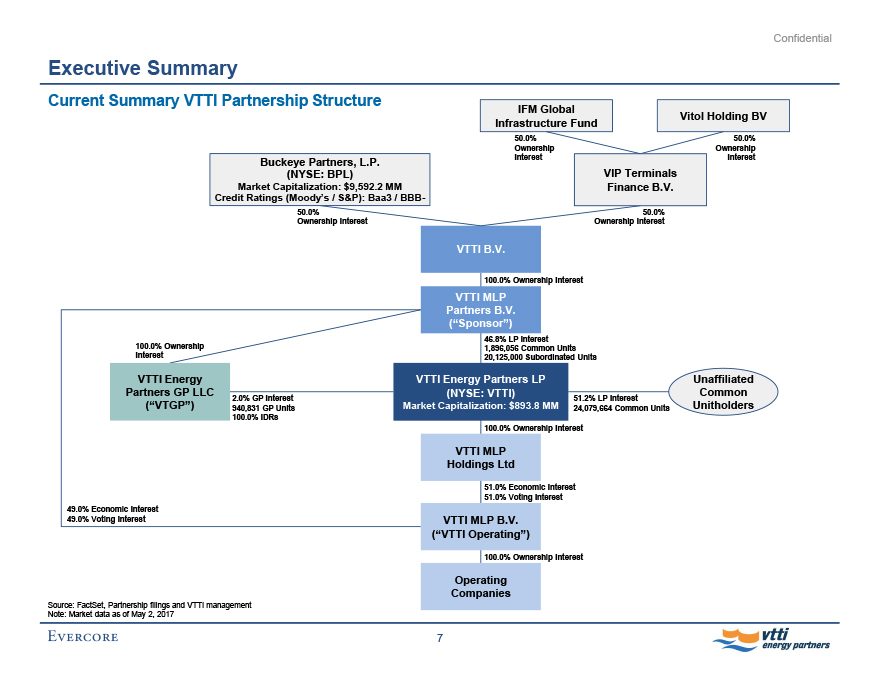

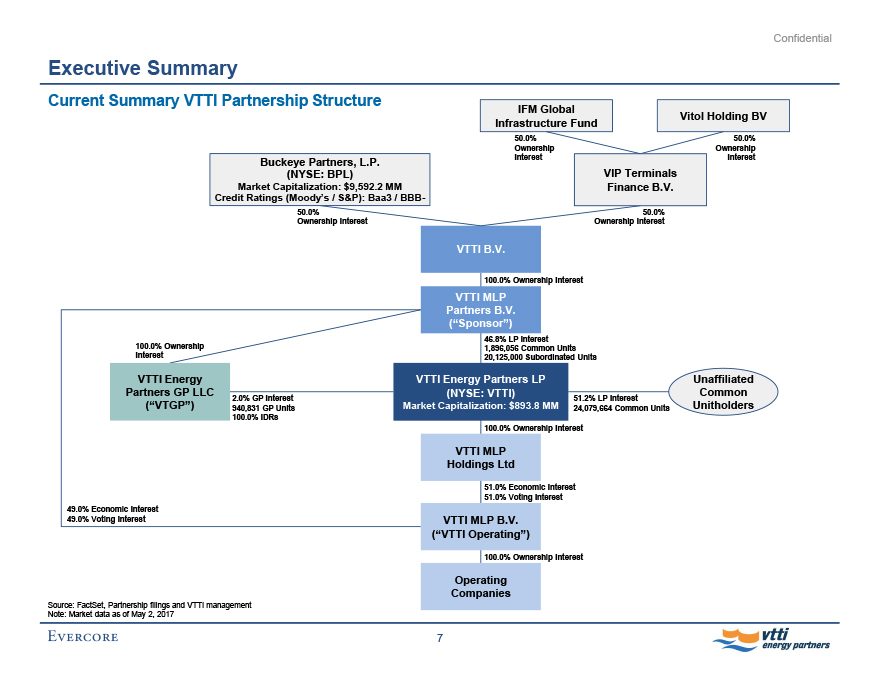

Current Summary VTTI Partnership Structure

Buckeye Partners, L.P.

(NYSE: BPL)

Market Capitalization: $9,592.2 MM

Credit Ratings (Moody’s / S&P): Baa3 / BBB-

50.0%

Ownership Interest

IFM Global

Infrastructure Fund

50.0%

Ownership

Interest

Vitol Holding BV

50.0%

Ownership

Interest

VIP Terminals

Finance B.V.

50.0%

Ownership Interest

100.0% Ownership Interest

VTTI Energy Partners GP LLC

(“VTGP”)

2.0% GP Interest

940,831 GP Units

100.0% IDRs

49.0% Economic Interest

49.0% Voting Interest

VTTI B.V.

100.0% Ownership Interest

VTTI MLP

Partners B.V.

(“Sponsor”)

46.8% LP Interest

1,896,056 Common Units

20,125,000 Subordinated Units

VTTI Energy Partners LP (NYSE: VTTI)

Market Capitalization: $893.8 MM

51.2% LP Interest

24,079,664 Common Units

Unaffiliated Common Unitholders

100.0% Ownership Interest

VTTI MLP

Holdings Ltd

51.0% Economic Interest

51.0% Voting Interest

VTTI MLP B.V.

(“VTTI Operating”)

100.0% Ownership Interest

Operating

Companies

Source: FactSet, Partnership filings and VTTI management Note: Market data as of May 2, 2017

7

Evercore vtti energy partners

Confidential

Executive Summary

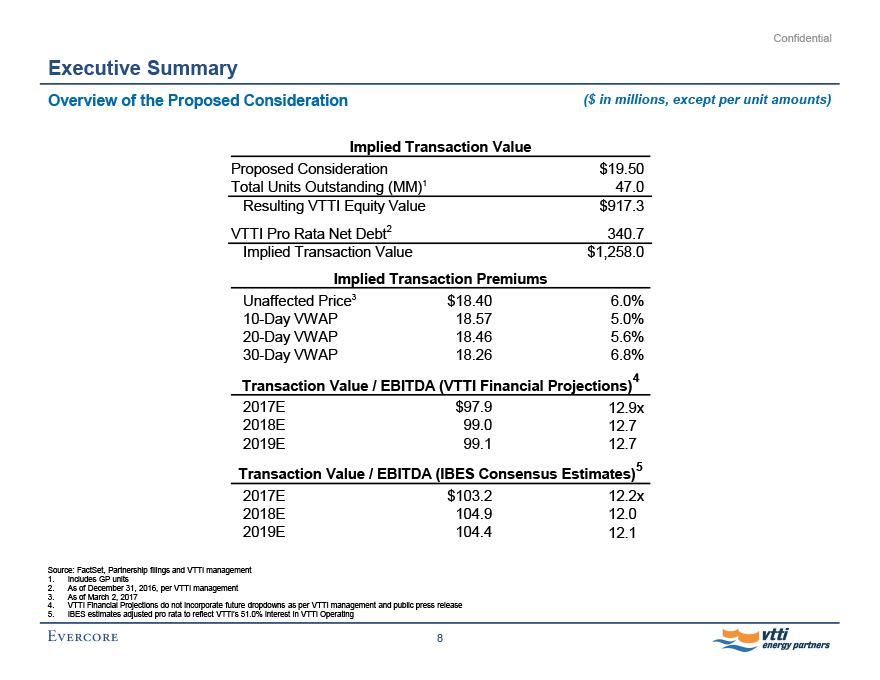

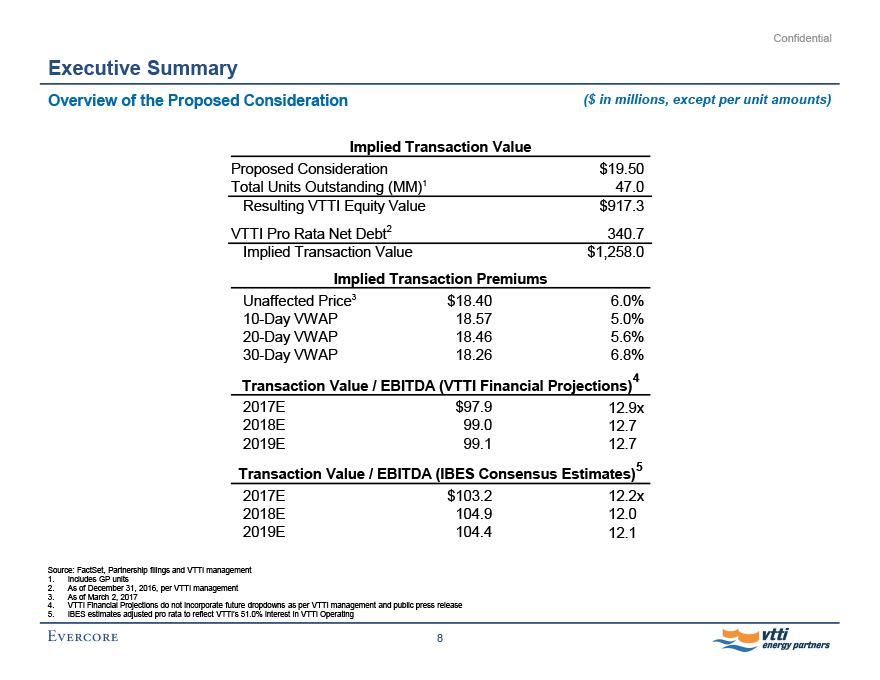

Overview of the Proposed Consideration ($ in millions, except per unit amounts)

Implied Transaction Value

Proposed Consideration

$19.50

Total Units Outstanding (MM)1

47.0

Resulting VTTI Equity Value

$917.3

VTTI Pro Rata Net Debt2

340.7

Implied Transaction Value

$1,258.0

Implied Transaction Premiums

Unaffected Price3

$18.40

6.0%

10-Day VWAP

18.57

5.0%

20-Day VWAP

18.46

5.6%

30-Day VWAP

18.26

6.8%

Transaction Value / EBITDA (VTTI Financial Projections)4

2017E

$97.9

12.9x

2018E

99.0

12.7

2019E

99.1

12.7

Transaction Value / EBITDA (IBES Consensus Estimates)5

2017E

$103.2

12.2x

2018E

104.9

12.0

2019E

104.4

12.1

Source: FactSet, Partnership filings and VTTI management

1. Includes GP units

2. As of December 31, 2016, per VTTI management

3. As of March 2, 2017

4. VTTI Financial Projections do not incorporate future dropdowns as per VTTI management and public press release

5. IBES estimates adjusted pro rata to reflect VTTI’s 51.0% interest in VTTI Operating

8

Evercore vtti energy partners

Confidential

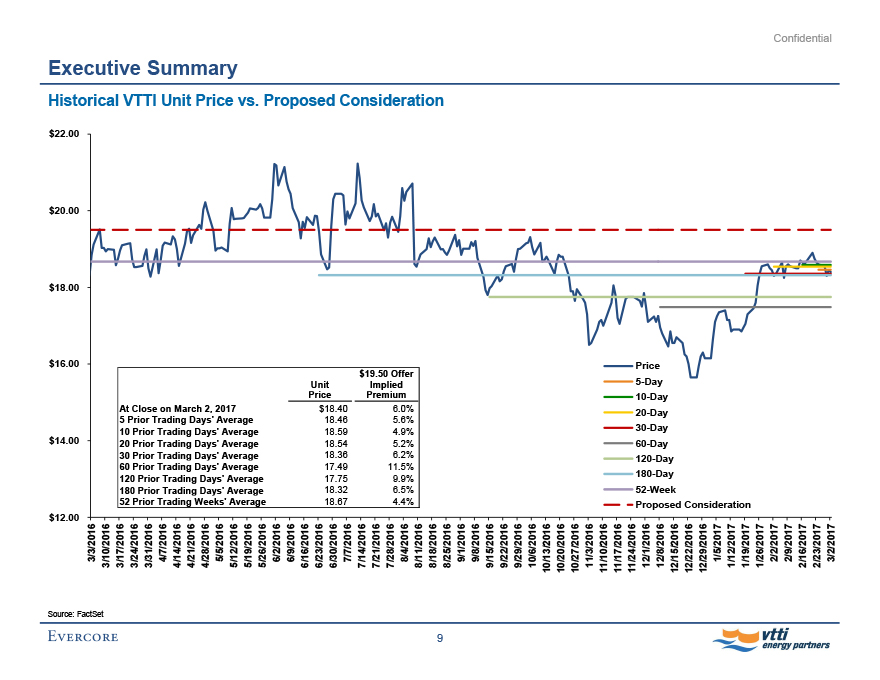

Executive Summary Historical VTTI Unit Price vs. Proposed Consideration $22.00 $20.00 $18.00 $16.00 $14.00 $12.00 $19.50 Offer Unit Implied Price Premium At Close on March 2, 2017 $18.40 6.0% 5 Prior Trading Days’ Average 18.46 5.6% 10 Prior Trading Days’ Average 18.59 4.9% 20 Prior Trading Days’ Average 18.54 5.2% 30 Prior Trading Days’ Average 18.36 6.2% 60 Prior Trading Days’ Average 17.49 11.5% 120 Prior Trading Days’ Average 17.75 9.9% 180 Prior Trading Days’ Average 18.32 6.5% 52 Prior Trading Weeks’ Average 18.67 4.4% Price 5-Day 10-Day 20-Day 30-Day 60-Day 120-Day 180-Day 52-Week Proposed Consideration 3/3/2016 3/10/2016 3/17/2016 3/24/2016 3/31/2016 4/7/2016 4/14/2016 4/21/2016 4/28/2016 5/5/2016 5/12/2016 5/19/2016 5/26/2016 6/2/2016 6/9/2016 6/16/2016 6/23/2016 6/30/2016 7/7/2016 7/14/2016 7/21/2016 7/28/2016 8/4/2016 8/11/2016 8/18/2016 8/25/2016 9/1/2016 9/8/2016 9/15/2016 9/22/2016 9/29/2016 10/6/2016 10/13/2016 10/20/2016 10/27/2016 11/3/2016 11/10/2016 11/17/2016 11/24/2016 12/1/2016 12/8/2016 12/15/2016 12/22/2016 12/29/2016 1/5/2017 1/12/2017 1/19/2017 1/26/2017 2/2/2017 2/9/2017 2/16/2017 2/23/2017 3/2/2017 Source: FactSet 9

Evercore vtti energy partners

Confidential

Executive Summary

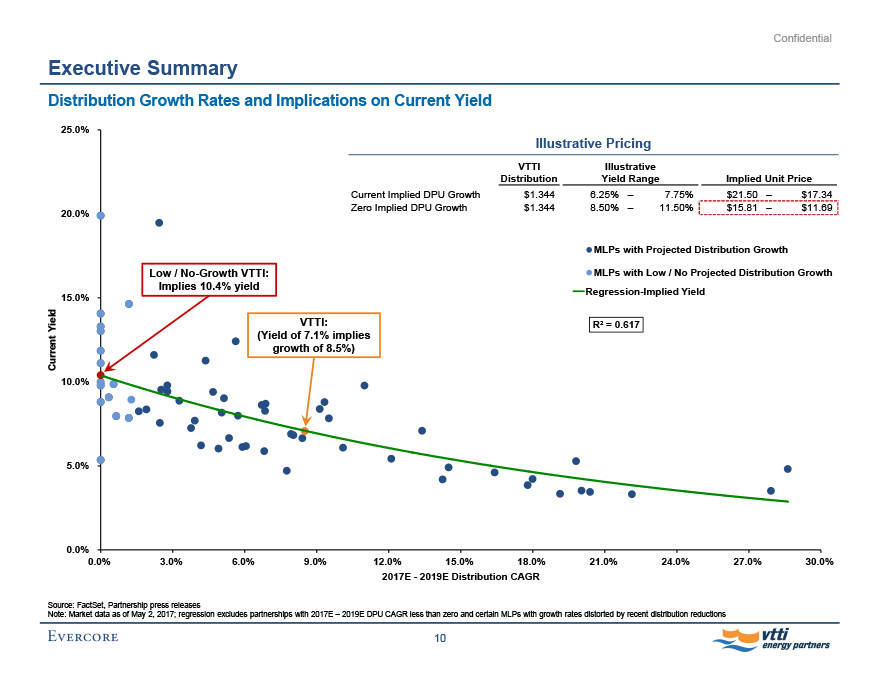

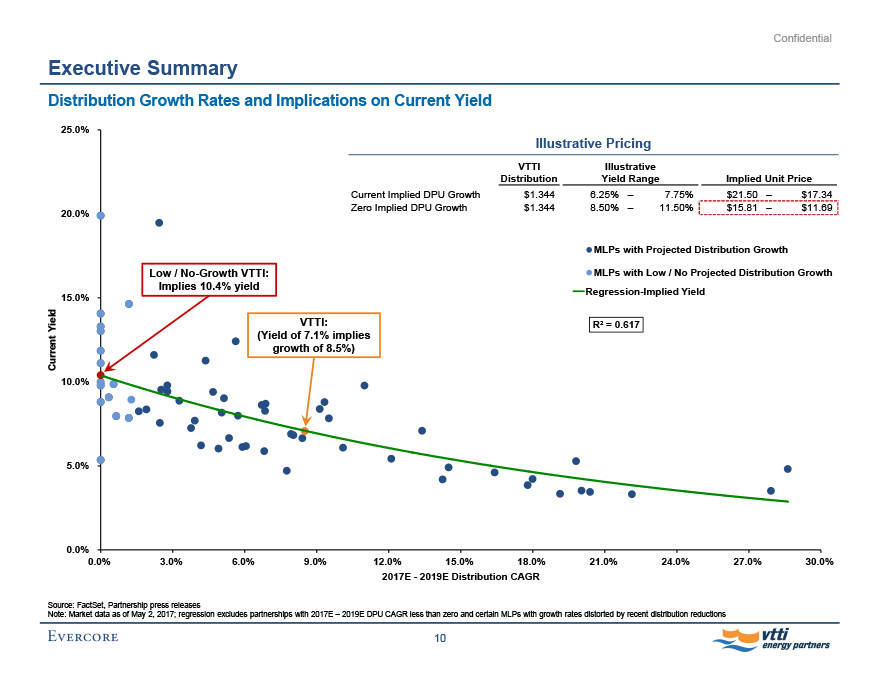

Distribution Growth Rates and Implications on Current Yield

Current Yield

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

Illustrative Pricing

VTTI

Illustrative

Distribution

Yield Range

Implied Unit Price

Current Implied DPU Growth

$1.344

6.25%

–

7.75%

$21.50

–

$17.34

Zero Implied DPU Growth

$1.344

8.50%

–

11.50%

$15.81

–

$11.69

Low / No-Growth VTTI: Implies 10.4% yield

VTTI:

(Yield of 7.1% implies growth of 8.5%)

MLPs with Projected Distribution Growth

MLPs with Low / No Projected Distribution Growth Regression-Implied Yield

R² = 0.617

0.0%

3.0%

6.0%

9.0%

12.0%

15.0%

18.0%

21.0%

24.0%

27.0%

30.0%

2017E - 2019E Distribution CAGR

Source: FactSet, Partnership press releases

Note: Market data as of May 2, 2017; regression excludes partnerships with 2017E – 2019E DPU CAGR less than zero and certain MLPs with growth rates distorted by recent distribution reductions

10

Evercore vtti energy partners

Confidential

II. VTTI Situation Analysis

Evercore vtti energy partners

Confidential

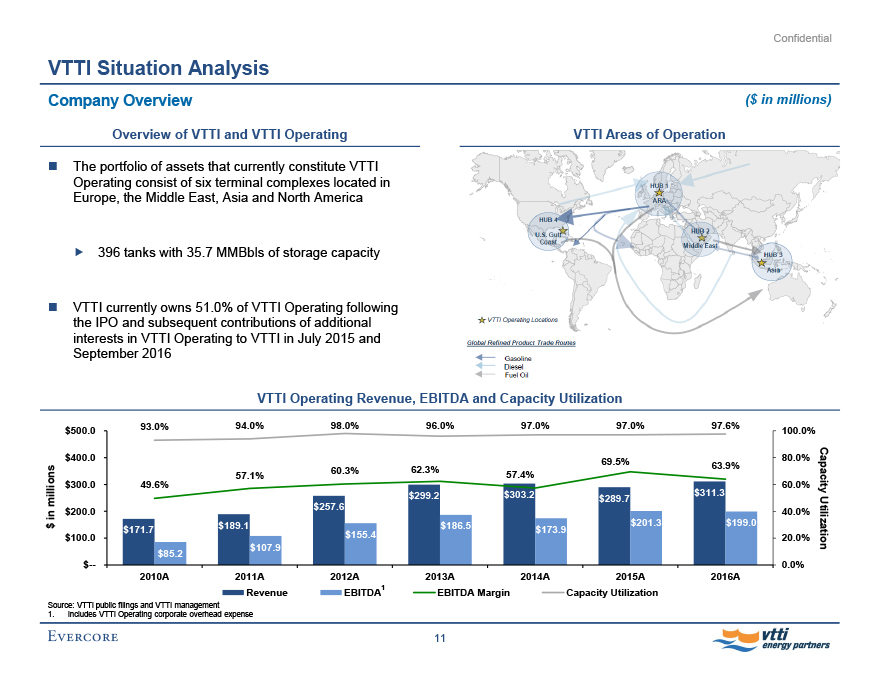

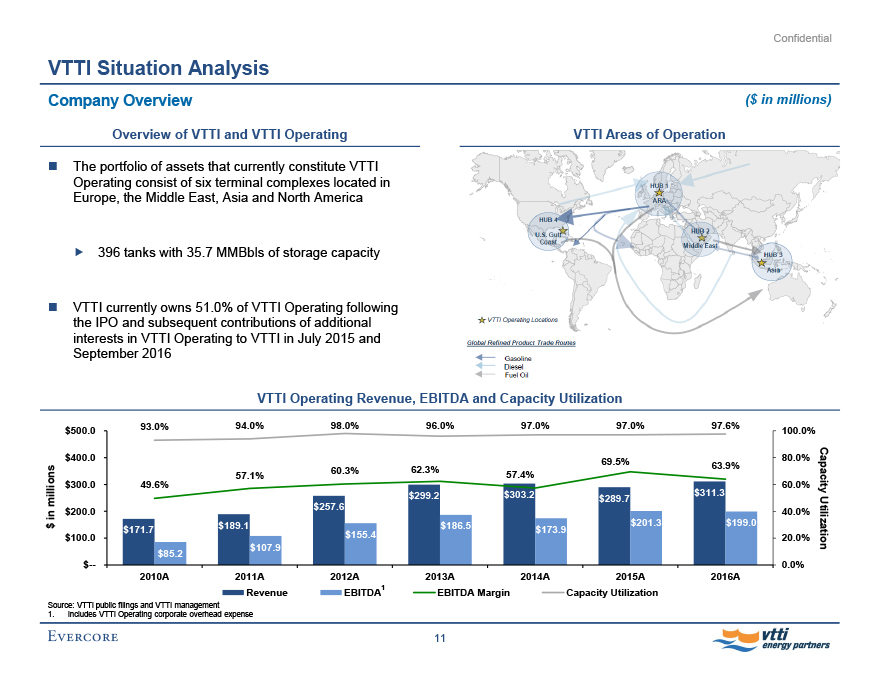

HUB 4 U.S. Gulf Coast HUB 1 ARA HUB 2 Middle East HUB 3 Asia VTTI Operating Locations Global Refined Product Trade Routes Gasoline Diesel Fuel Oil VTTI Situation Analysis Company Overview ($ in millions) Overview of VTTI and VTTI Operating The portfolio of assets that currently constitute VTTI Operating consist of six terminal complexes located in Europe, the Middle East, Asia and North America 396 tanks with 35.7 MMBbls of storage capacity VTTI currently owns 51.0% of VTTI Operating following the IPO and subsequent contributions of additional interests in VTTI Operating to VTTI in July 2015 and September 2016 VTTI Areas of Operation VTTI Operating Revenue, EBITDA and Capacity Utilization $ in millions $500.0 $400.0 $300.0 $200.0 $100.0 $-- 93.0% 94.0% 98.0% 96.0% 97.0% 97.0% 97.6% 69.5% 57.1% 60.3% 62.3% 57.4% 63.9% 49.6% $299.2 $303.2 $289.7 $311.3 $257.6 $189.1 $186.5 $201.3 $199.0 $171.7 $155.4 $173.9 $85.2 $107.9 2010A 2011A 2012A 2013A 2014A 2015A 2016A 100.0% 80.0% 60.0% 40.0% 20.0% 0.0% Capacity Utilization 1 Revenue EBITDA EBITDA Margin Capacity Utilization Source: VTTI public filings and VTTI management 1. Includes VTTI Operating corporate overhead expense 11

Evercore vtti energy partners

Confidential

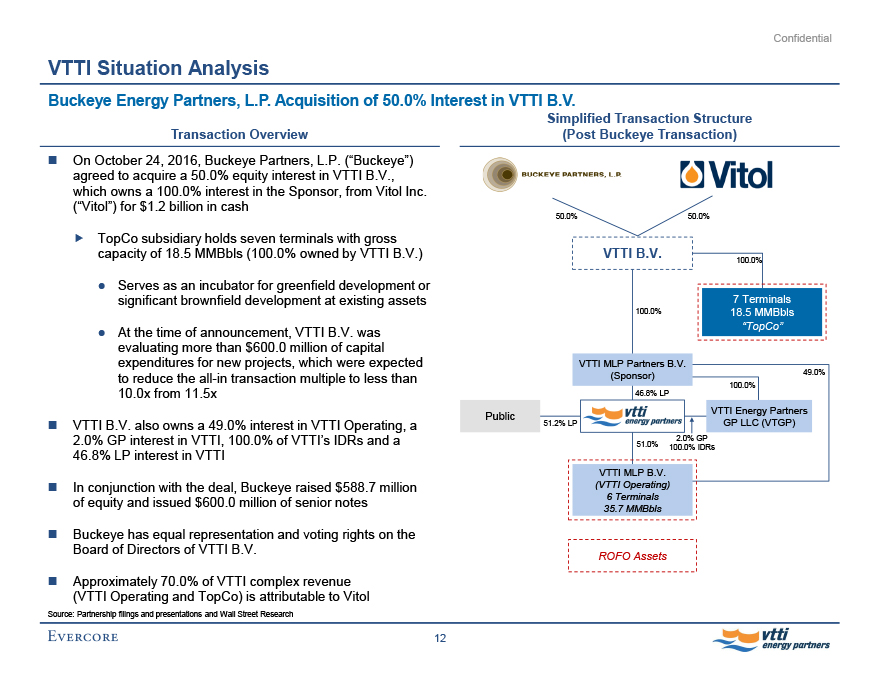

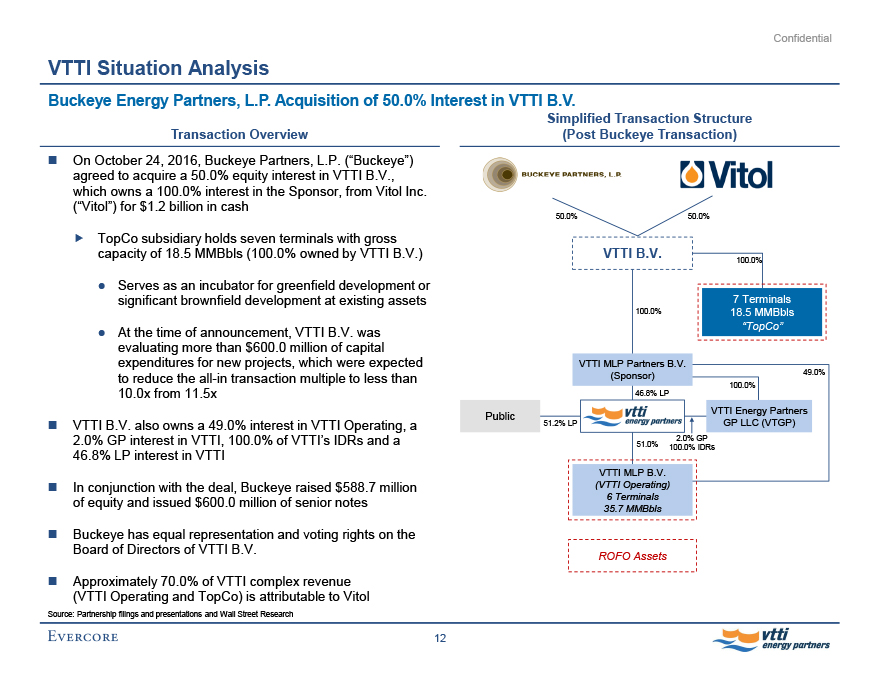

VTTI Situation Analysis

Buckeye Energy Partners, L.P. Acquisition of 50.0% Interest in VTTI B.V.

Transaction Overview

On October 24, 2016, Buckeye Partners, L.P. (“Buckeye”) agreed to acquire a 50.0% equity interest in VTTI B.V., which owns a 100.0% interest in the Sponsor, from Vitol Inc.

(“Vitol”) for $1.2 billion in cash

TopCo subsidiary holds seven terminals with gross capacity of 18.5 MMBbls (100.0% owned by VTTI B.V.)

Serves as an incubator for greenfield development or significant brownfield development at existing assets

At the time of announcement, VTTI B.V. was evaluating more than $600.0 million of capital expenditures for new projects, which were expected to reduce the all-in transaction multiple to less than

10.0x from 11.5x

VTTI B.V. also owns a 49.0% interest in VTTI Operating, a

2.0% GP interest in VTTI, 100.0% of VTTI���s IDRs and a

46.8% LP interest in VTTI

In conjunction with the deal, Buckeye raised $588.7 million of equity and issued $600.0 million of senior notes

Buckeye has equal representation and voting rights on the Board of Directors of VTTI B.V.

Approximately 70.0% of VTTI complex revenue (VTTI Operating and TopCo) is attributable to Vitol

Simplified Transaction Structure (Post Buckeye Transaction)

BUCKEYE PARTNERS, L.P.

Vitol

50.0% 50.0%

VTTI B.V.

100.0%

100.0%

7 Terminals

18.5 MMBbls

“TopCo”

VTTI MLP Partners B.V. (Sponsor)

46.8% LP

100.0%

49.0%

Public

51.2% LP

vtti energy partners

VTTI Energy Partners

GP LLC (VTGP)

51.0%

2.0% GP

100.0% IDRs

VTTI MLP B.V.

(VTTI Operating)

6 Terminals

35.7 MMBbls

ROFO Assets

Source: Partnership filings and presentations and Wall Street Research

12

Evercore vtti energy partners

Confidential

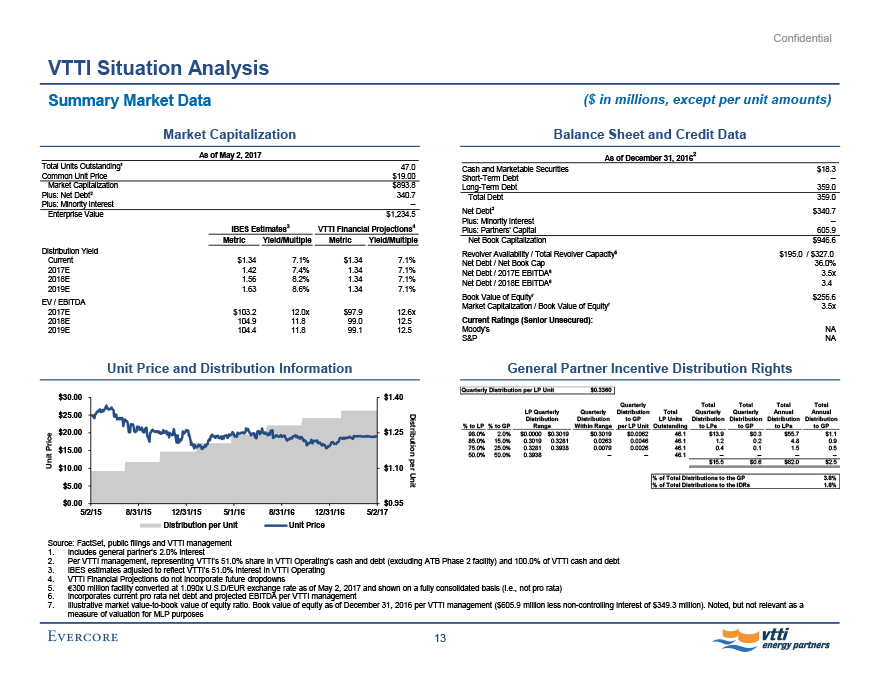

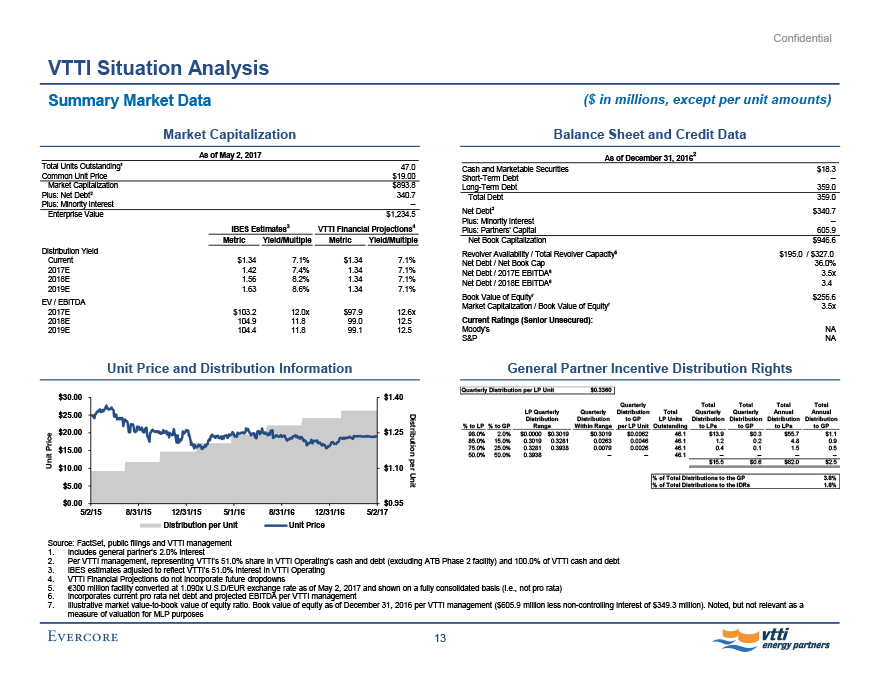

VTTI Situation Analysis Summary Market Data ($ in millions, except per unit amounts) Market Capitalization As of May 2, 2017 Total Units Outstanding1 47.0 Common Unit Price $19.00 Market Capitalization $893.8 Plus: Net Debt2 340.7 Plus: Minority Interest -- Enterprise Value $1,234.5 IBES Estimates3 VTTI Financial Projections4 Metric Yield/Multiple Metric Yield/Multiple Distribution Yield Current $1.34 7.1% $1.34 7.1% 2017E 1.42 7.4% 1.34 7.1% 2018E 1.56 8.2% 1.34 7.1% 2019E 1.63 8.6% 1.34 7.1% EV / EBITDA 2017E $103.2 12.0x $97.9 12.6x 2018E 104.9 11.8 99.0 12.5 2019E 104.4 11.8 99.1 12.5 Balance Sheet and Credit Data 2 As of December 31, 2016 Cash and Marketable Securities $18.3 Short-Term Debt -- Long-Term Debt 359.0 Total Debt 359.0 Net Debt2 $340.7 Plus: Minority Interest -- Plus: Partners’ Capital 605.9 Net Book Capitalization $946.6 Revolver Availability / Total Revolver Capacity5 $195.0 / $327.0 Net Debt / Net Book Cap 36.0% Net Debt / 2017E EBITDA6 3.5x Net Debt / 2018E EBITDA6 3.4 Book Value of Equity7 $256.6 Market Capitalization / Book Value of Equity7 3.5x Current Ratings (Senior Unsecured): Moody’s NA S&P NA Unit Price and Distribution Information Unit Price $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 $1.40 $1.25 $1.10 $0.95 Distribution per Unit 5/2/15 8/31/15 12/31/15 5/1/16 8/31/16 12/31/16 5/2/17 Distribution per Unit Unit Price General Partner Incentive Distribution Rights Quarterly Distribution per LP Unit $0.3360 Quarterly Total Total Total Total LP Quarterly Quarterly Distribution Total Quarterly Quarterly Annual Annual Distribution Distribution to GP LP Units Distribution Distribution Distribution Distribution % to LP % to GP Range Within Range per LP Unit Outstanding to LPs to GP to LPs to GP 98.0% 2.0% $0.0000 $0.3019 $0.3019 $0.0062 46.1 $13.9 $0.3 $55.7 $1.1 85.0% 15.0% 0.3019 0.3281 0.0263 0.0046 46.1 1.2 0.2 4.8 0.9 75.0% 25.0% 0.3281 0.3938 0.0079 0.0026 46.1 0.4 0.1 1.5 0.5 50.0% 50.0% 0.3938 -- -- 46.1 -- -- -- -- $15.5 $0.6 $62.0 $2.5 % of Total Distributions to the GP 3.8% % of Total Distributions to the IDRs

1.8% Source: FactSet, public filings and VTTI management

1. Includes general partner’s 2.0% interest 2. Per VTTI management, representing VTTI’s 51.0% share in VTTI Operating’s cash and debt (excluding ATB Phase 2 facility) and 100.0% of VTTI cash and debt

3. IBES estimates adjusted to reflect VTTI’s 51.0% interest in VTTI Operating 4. VTTI Financial Projections do not incorporate future dropdowns 5. €300 million facility converted at 1.090x U.S.D/EUR exchange rate as of May 2, 2017 and shown on a fully consolidated basis (i.e., not pro rata) 6. Incorporates current pro rata net debt and projected EBITDA per VTTI management 7. Illustrative market value-to-book value of equity ratio. Book value of equity as of December 31, 2016 per VTTI management ($605.9 million less non-controlling interest of $349.3 million). Noted, but not relevant as a measure of valuation for MLP purposes 13

Evercore vtti energy partners

Confidential

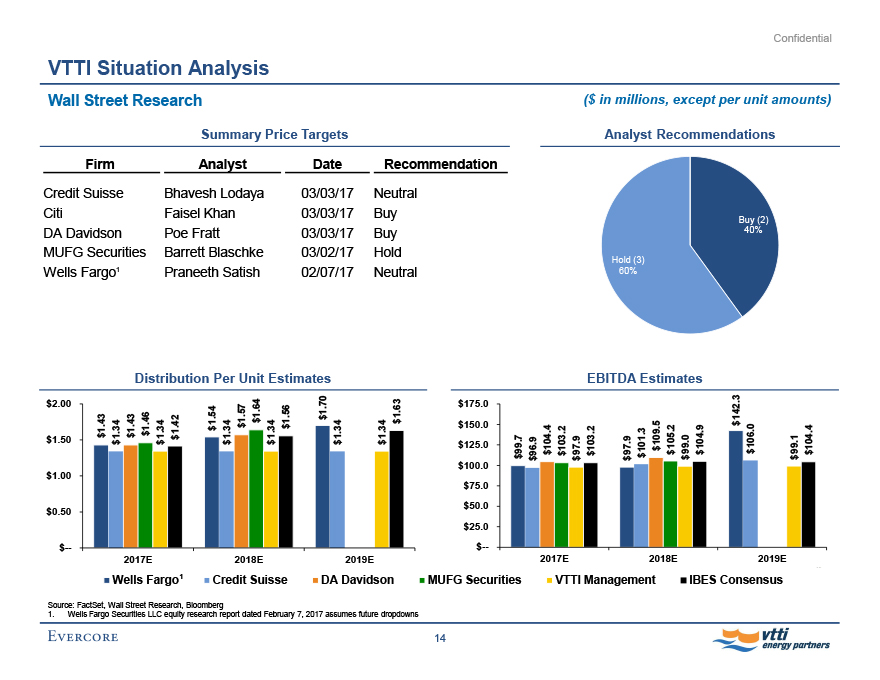

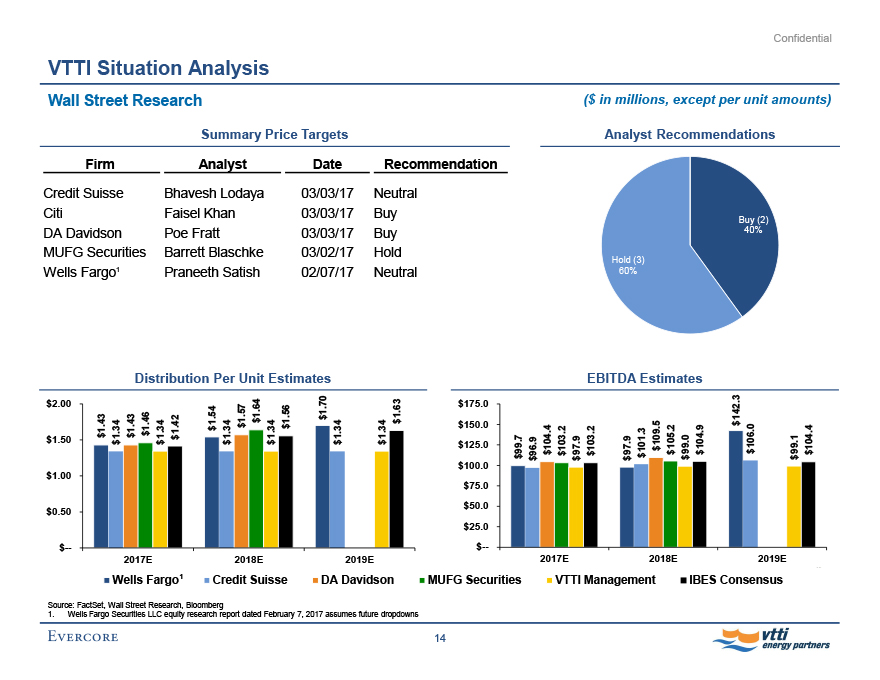

VTTI Situation Analysis Wall Street Research ($ in millions, except per unit amounts) Summary Price Targets Firm Analyst Date Recommendation Credit Suisse Bhavesh Lodaya 03/03/17 Neutral Citi Faisel Khan 03/03/17 Buy DA Davidson Poe Fratt 03/03/17 Buy MUFG Securities Barrett Blaschke 03/02/17 Hold Wells Fargo1 Praneeth Satish 02/07/17 Neutral Analyst Recommendations Hold (3) 60% Buy (2) 40% Distribution Per Unit Estimates $2.00 $1.50 $1.00 $0.50 $-- $1.43 $1.34 $1.43 $1.46 $1.34 $1.42 $1.54 $1.34 $1.57 $1.64 $1.34 $1.56 $1.70 $1.34 $1.34 $1.63 2017E 2018E 2019E EBITDA Estimates $175.0 $150.0 $125.0 $100.0 $75.0 $50.0 $25.0 $-- $99.7 $96.9 $104.4 $103.2 $97.9 $103.2 $97.9 $101.3 $109.5 $105.2 $99.0 $104.9 $142.3 $106.0 $99.1 $104.4 2017E 2018E 2019E Wells Fargo1 Credit Suisse DA Davidson MUFG Securities VTTI Management IBES Consensus Source: FactSet, Wall Street Research, Bloomberg 1. Wells Fargo Securities LLC equity research report dated February 7, 2017 assumes future dropdowns 14

Evercore vtti energy partners

Confidential

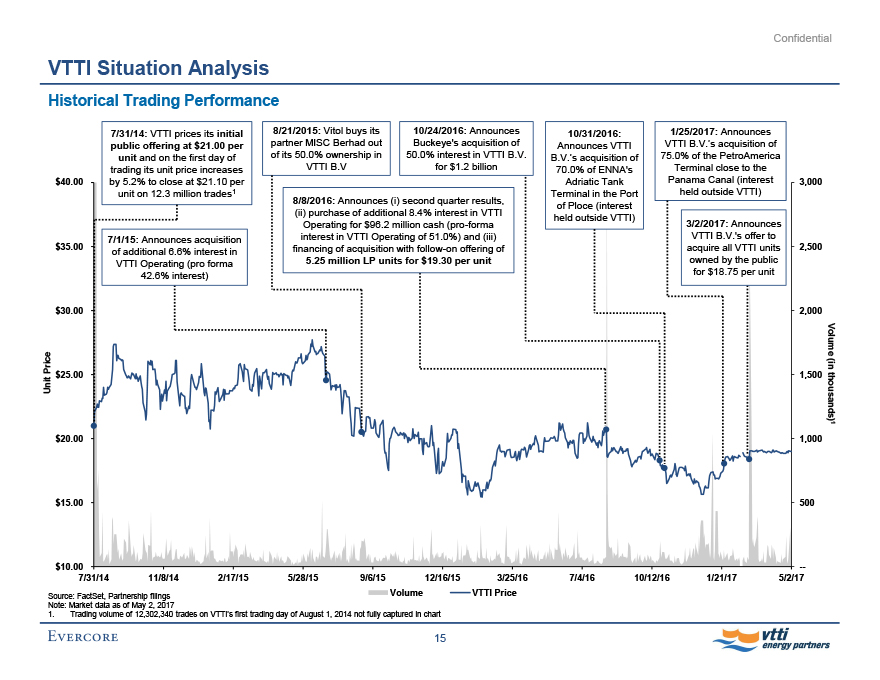

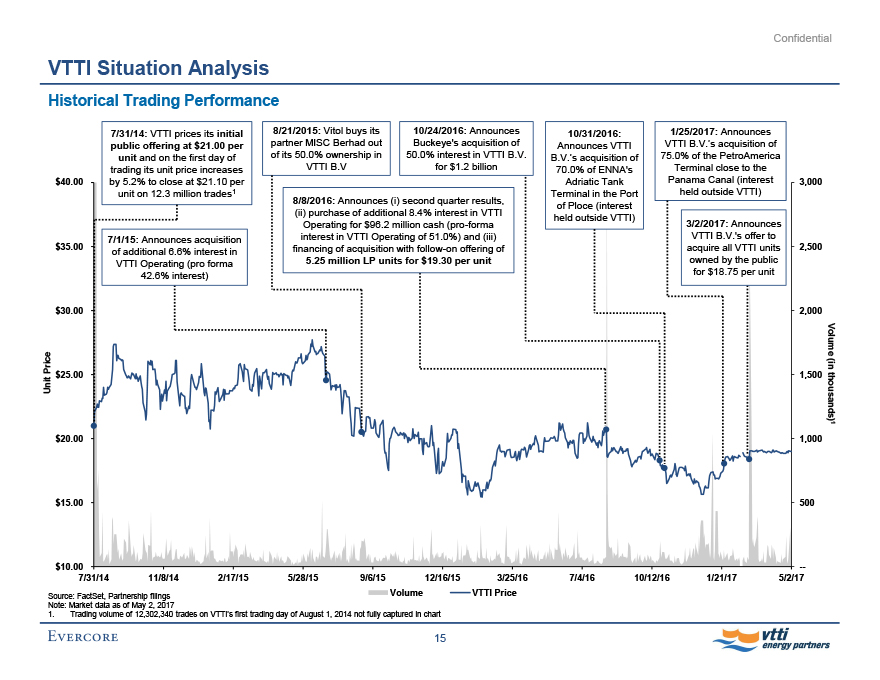

VTTI Situation Analysis

Historical Trading Performance

Unit Price

$40.00

$35.00

$30.00

$25.00

$20.00

$15.00

$10.00

7/31/14: VTTI prices its initial public offering at $21.00 per unit and on the first day of trading its unit price increases by 5.2% to close at $21.10 per unit on 12.3 million trades1

7/1/15: Announces acquisition of additional 6.6% interest in VTTI Operating (pro forma 42.6% interest)

8/21/2015: Vitol buys its partner MISC Berhad out of its 50.0% ownership in VTTI B.V

10/24/2016: Announces

Buckeye’s acquisition of

50.0% interest in VTTI B.V. for $1.2 billion

8/8/2016: Announces (i) second quarter results, (ii) purchase of additional 8.4% interest in VTTI

Operating for $96.2 million cash (pro-forma interest in VTTI Operating of 51.0%) and (iii) financing of acquisition with follow-on offering of 5.25 million LP units for $19.30 per unit

10/31/2016:

Announces VTTI

B.V.’s acquisition of

70.0% of ENNA’s Adriatic Tank Terminal in the Port of Ploce (interest held outside VTTI)

1/25/2017: Announces

VTTI B.V.’s acquisition of

75.0% of the PetroAmerica Terminal close to the Panama Canal (interest held outside VTTI)

3/2/2017: Announces

VTTI B.V.‘s offer to acquire all VTTI units owned by the public for $18.75 per unit

3,000

2,500

2,000

1,500

1,000

500

Volume (in thousands)1

7/31/14 11/8/14 2/17/15 5/28/15 9/6/15 12/16/15 3/25/16 7/4/16 10/12/16 1/21/17 5/2/17

Volume VTTI Price

Source: FactSet, Partnership filings Note: Market data as of May 2, 2017

1. Trading volume of 12,302,340 trades on VTTI’s first trading day of August 1, 2014 not fully captured in chart

15

Evercore vtti energy partners

Confidential

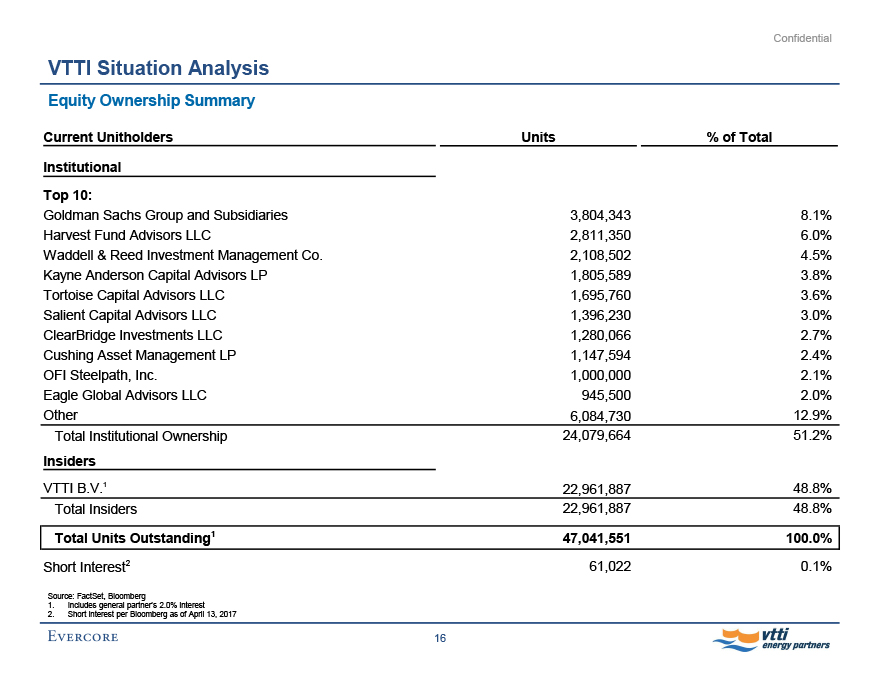

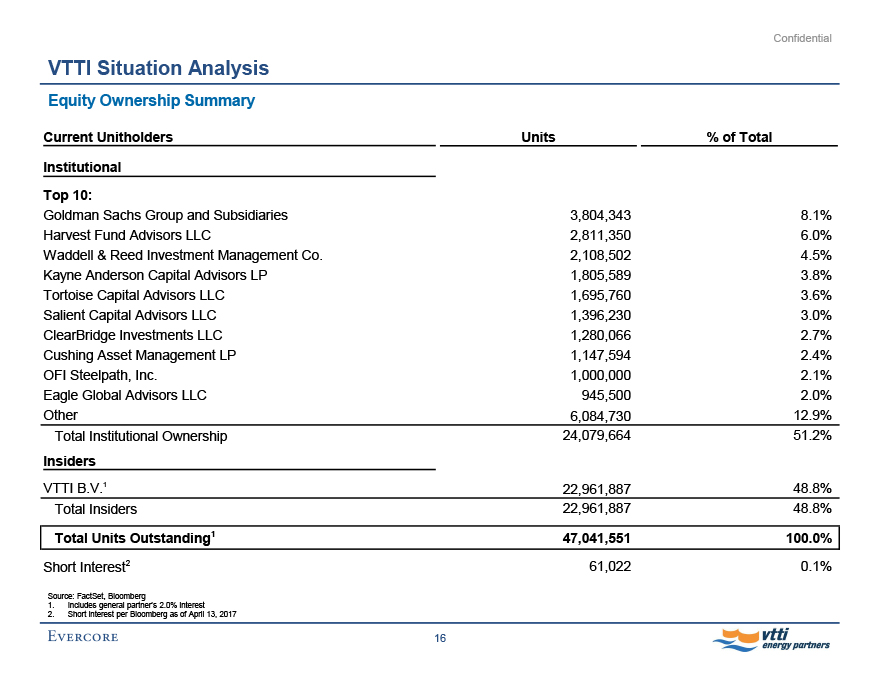

VTTI Situation Analysis Equity Ownership Summary Current Unitholders Units % of Total Institutional Top 10: Goldman Sachs Group and Subsidiaries 3,804,343 8.1% Harvest Fund Advisors LLC 2,811,350 6.0% Waddell & Reed Investment Management Co. 2,108,502 4.5% Kayne Anderson Capital Advisors LP 1,805,589 3.8% Tortoise Capital Advisors LLC 1,695,760 3.6% Salient Capital Advisors LLC 1,396,230 3.0% ClearBridge Investments LLC 1,280,066 2.7% Cushing Asset Management LP 1,147,594 2.4% OFI Steelpath, Inc. 1,000,000 2.1% Eagle Global Advisors LLC 945,500 2.0% Other 6,084,730 12.9% Total Institutional Ownership 24,079,664 51.2% Insiders VTTI B.V.1 22,961,887 48.8% Total Insiders 22,961,887 48.8% Total Units Outstanding1 47,041,551 100.0% Short Interest2 61,022 0.1% Source: FactSet, Bloomberg 1. Includes general partner’s 2.0% interest 2. Short interest per Bloomberg as of April 13, 2017 16

Evercore vtti energy partners

Confidential

VTTI Situation Analysis

Right of First Offer

Pursuant to the Omnibus Agreement between VTTI B.V. and the Partnership entered into upon completion of the Partnership’s initial public offering, VTTI B.V. granted the Partnership a right of first offer (“ROFO”) on any proposed Transfer of any Sale Asset (other than Sale Assets Transferred to an Affiliate of VTTI B.V. who agrees in writing that such Sale Asset remains subject to the provisions of the ROFO and assumes the obligations under the ROFO with respect to such Sale Asset)

“Sale Assets” means any right, title or interests in the VTTI Entities’ existing assets and any terminaling and other energy infrastructure assets that any of them may acquire or construct in the future, which assets shall include the terminal facilities, pipelines, storage tanks, equipment, machinery, docks and the real property appurtenant thereto

“VTTI Entities” means VTTI B.V. and each of its Affiliates, other than the Partnership and its Subsidiaries

“Affiliate” means, with respect to any Person, any other Person that directly or indirectly through one or more intermediaries controls, is controlled by or is under common control with, the Person in question

The term “control” means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise

Source: Partnership filings

17

Evercore vtti energy partners

Confidential

III. VTTI Operating Asset Overview and Projections

Evercore

Confidential

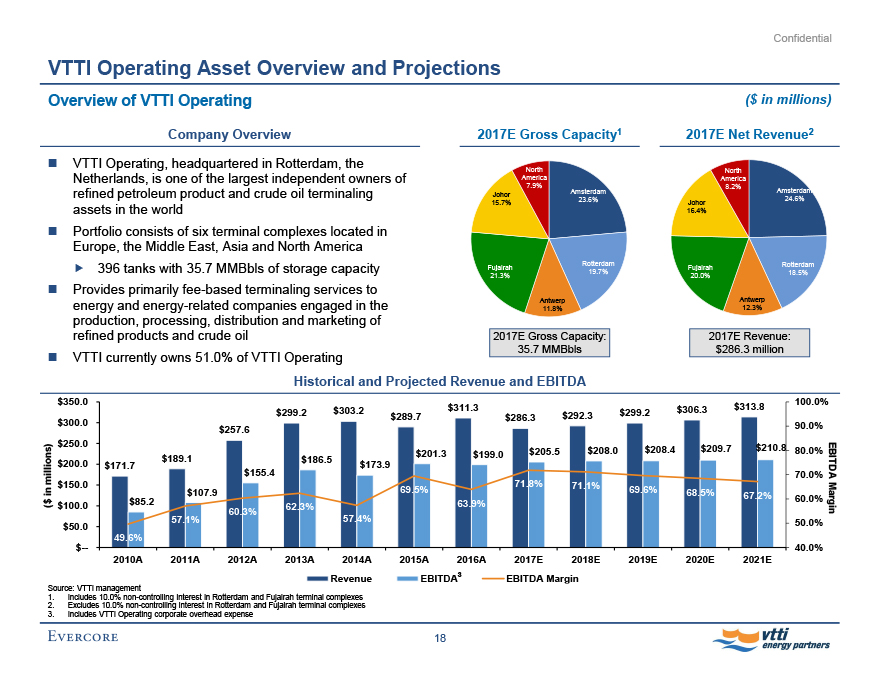

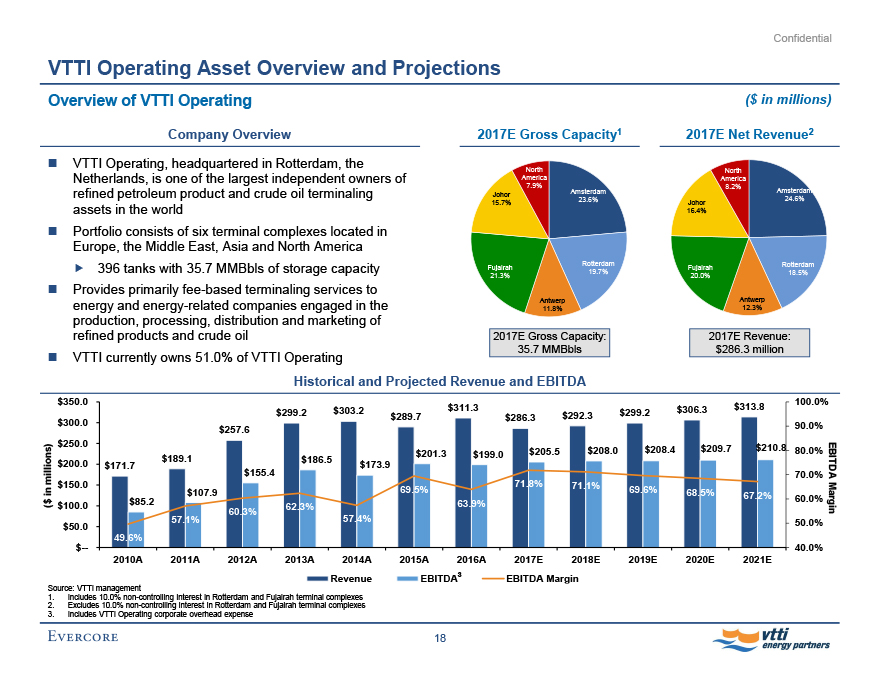

VTTI Operating Asset Overview and Projections Overview of VTTI Operating ($ in millions) Company Overview VTTI Operating, headquartered in Rotterdam, the Netherlands, is one of the largest independent owners of refined petroleum product and crude oil terminaling assets in the world Portfolio consists of six terminal complexes located in Europe, the Middle East, Asia and North America 396 tanks with 35.7 MMBbls of storage capacity Provides primarily fee-based terminaling services to energy and energy-related companies engaged in the production, processing, distribution and marketing of refined products and crude oil VTTI currently owns 51.0% of VTTI Operating 2017E Gross Capacity1 Johor 15.7% North America 7.9% Amsterdam 23.6% Fujairah 21.3% Antwerp 11.8% Rotterdam 19.7% 2017E Net Revenue2 North America 8.2% Johor 16.4% Amsterdam 24.6% Fujairah 20.0% Rotterdam 18.5% Antwerp 12.3% 2017E Gross Capacity: 35.7 MMBbls 2017E Revenue: $286.3 million Historical and Projected Revenue and EBITDA ($ in millions) $350.0 $300.0 $250.0 $200.0 $150.0 $100.0 $50.0 $-- $299.2 $303.2 $311.3 $292.3 $299.2 $306.3 $313.8 $289.7 $286.3 $257.6 $189.1 $186.5 $201.3 $199.0 $205.5 $208.0 $208.4 $209.7 $210.8 $171.7 $173.9 $155.4 71.8% 71.1% $107.9 69.5% 69.6% 68.5% 67.2% $85.2 62.3% 63.9% 60.3% 57.1% 57.4% 49.6% 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% EBITDA Margin 2010A 2011A 2012A 2013A 2014A 2015A 2016A 2017E 2018E 2019E 2020E 2021E Revenue EBITDA3 EBITDA Margin Source: VTTI management 1. Includes 10.0% non-controlling interest in Rotterdam and Fujairah terminal complexes 2. Excludes 10.0% non-controlling interest in Rotterdam and Fujairah terminal complexes 3. Includes VTTI Operating corporate overhead expense 18

Evercore vtti energy partners

Confidential

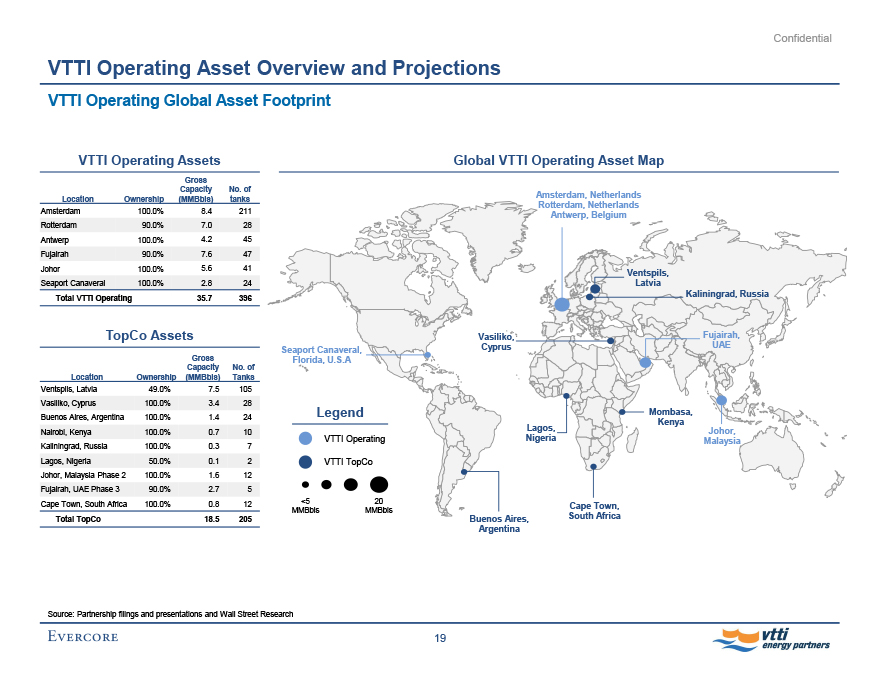

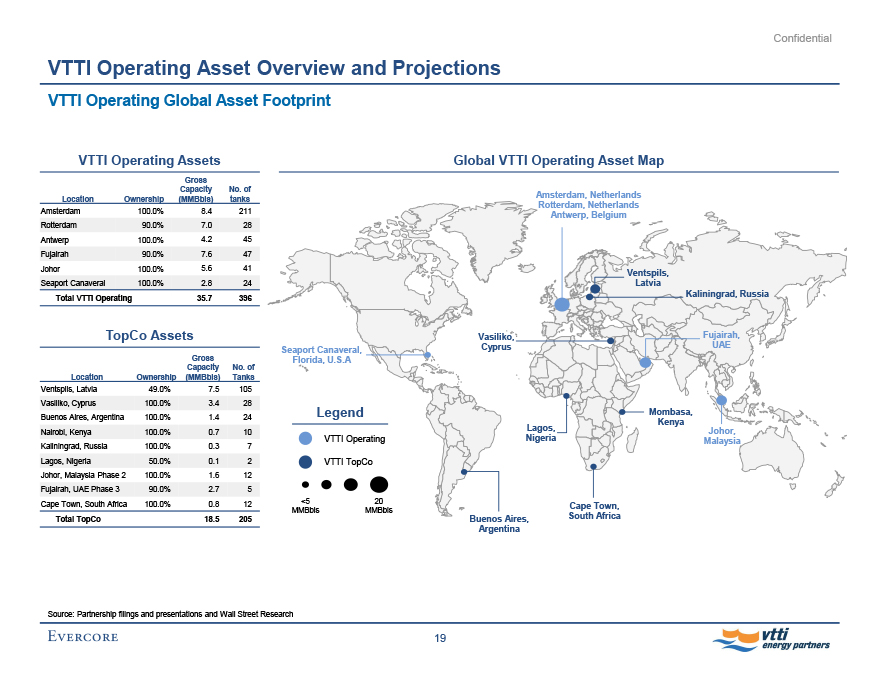

VTTI Operating Asset Overview and Projections VTTI Operating Global Asset Footprint VTTI Operating Assets Gross Capacity No. of Location Ownership (MMBbls) tanks Amsterdam 100.0% 8.4 211 Rotterdam 90.0% 7.0 28 Antwerp 100.0% 4.2 45 Fujairah 90.0% 7.6 47 Johor 100.0% 5.6 41 Seaport Canaveral 100.0% 2.8 24 Total VTTI Operating 35.7 396 TopCo Assets Gross Capacity No. of Location Ownership (MMBbls) Tanks Ventspils, Latvia 49.0% 7.5 105 Vasiliko, Cyprus 100.0% 3.4 28 Buenos Aires, Argentina 100.0% 1.4 24 Nairobi, Kenya 100.0% 0.7 10 Kaliningrad, Russia 100.0% 0.3 7 Lagos, Nigeria 50.0% 0.1 2 Johor, Malaysia Phase 2 100.0% 1.6 12 Fujairah, UAE Phase 3 90.0% 2.7 5 Cape Town, South Africa 100.0% 0.8 12 Total TopCo 18.5 205 Global VTTI Operating Asset Map Seaport Canaveral, Florida, U.S.A Legend VTTI Operating VTTI TopCo <5 20 MMBbls MMBbls Amsterdam, Netherlands Rotterdam, Netherlands Antwerp, Belgium Ventspils, Latvia Kaliningrad, Russia Vasiliko, Fujairah, Cyprus UAE Mombasa, Kenya Lagos, Johor, Nigeria Malaysia Cape Town, Buenos Aires, South Africa Argentina Source: Partnership filings and presentations and Wall Street Research 19

Evercore vtti energy partners

Confidential

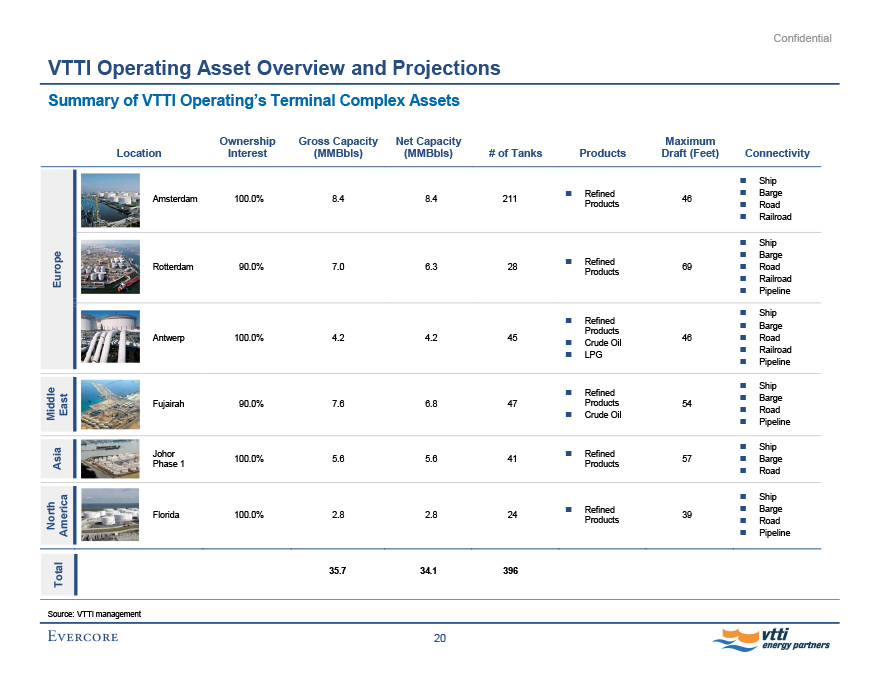

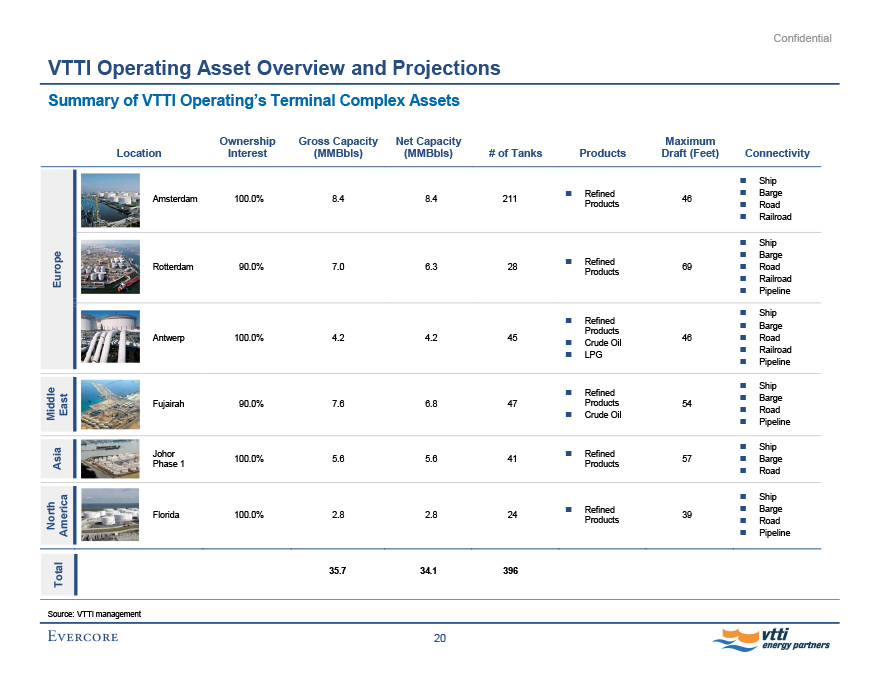

VTTI Operating Asset Overview and Projections Summary of VTTI Operating’s Terminal Complex Assets Europe Middle East Asia North America Total Ownership Gross Capacity Net Capacity Maximum Location Interest (MMBbls) (MMBbls) # of Tanks Products Draft (Feet) Connectivity Ship Refined Barge Amsterdam 100.0% 8.4 8.4 211 46 Products Road Railroad Ship Barge Refined Rotterdam 90.0% 7.0 6.3 28 69 Road Products Railroad Pipeline Ship Refined Barge Products Antwerp 100.0% 4.2 4.2 45 46 Road Crude Oil LPG Railroad Pipeline Ship Refined Barge Fujairah 90.0% 7.6 6.8 47 Products 54 Crude Oil Road Pipeline Ship Johor Refined 100.0% 5.6 5.6 41 57 Barge Phase 1 Products Road Ship Refined Barge Florida 100.0% 2.8 2.8 24 39 Products Road Pipeline 35.7 34.1 396 Source: VTTI management 20

Evercore vtti energy partners

Confidential

VTTI Operating Asset Overview and Projections

Summary of VTTI Operating Customer Contracts

VTTI Operating’s terminal complexes generate revenue primarily under multi-year, fee-based, take-or-pay arrangements with creditworthy counterparties VTTI Operating’s contracts typically have a duration of generally two to four years In addition to Vitol, VTTI Operating’s counterparties include major oil traders and other significant oil and gas industry participants, including subsidiaries of A- to AAA-rated global corporations such as Shell and Exxon Relationships with many of the trading companies date back to the early years of VTTI B.V.’s existence, while relationships with oil majors have been developed over the last four years Since July 2016, VTTI has entered into the following new storage contracts: Petronas has contracted 137,686 m3 of fuel oil storage capacity in Johor from August 17, 2016 through July 31, 2018 at a rate of $4.40/m3/month Koch Industries has contracted 125,011 m3 of fuel oil storage capacity in Johor from September 1, 2016 through August 31, 2017 at a rate of $4.14/m3/month Exxon has contracted 36,000 m3 of gasoil storage capacity in Antwerp from January 1, 2017 through December 31, 2020 at a rate of 3.30/m3/month Prax has contracted 82,500 m3 of gasoline storage capacity in Antwerp from January 1, 2017 through June 30, 2017 at a rate of 3.93/m3/month Vitol has contracted 27,890 m3 of gasoline storage capacity in Johor from January 1, 2017 through December 31, 2017 at a rate of $4.20/m3/month Vitol has contracted 27,925 m3 of distillate storage capacity in Johor from January 1, 2017 through December 31, 2017 at a rate of $4.20/m3/month Gunvor has contracted 55,816 m3 of gasoline storage capacity in Johor from January 4, 2017 through July 3, 2017 at a rate of $4.35/m3/month Source: VTTI management and public filings 21 Evercore vtti energy partners

Confidential

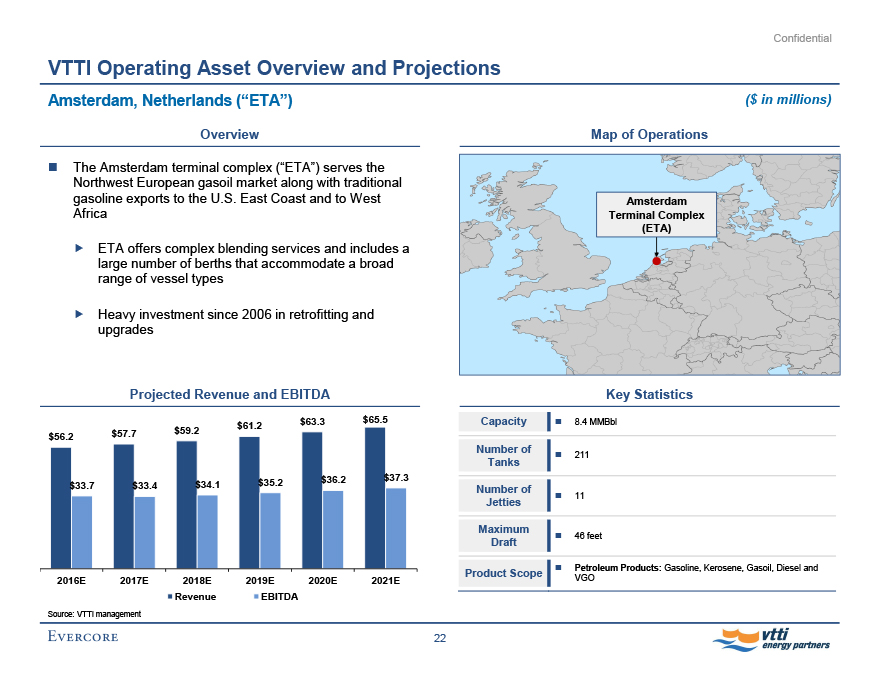

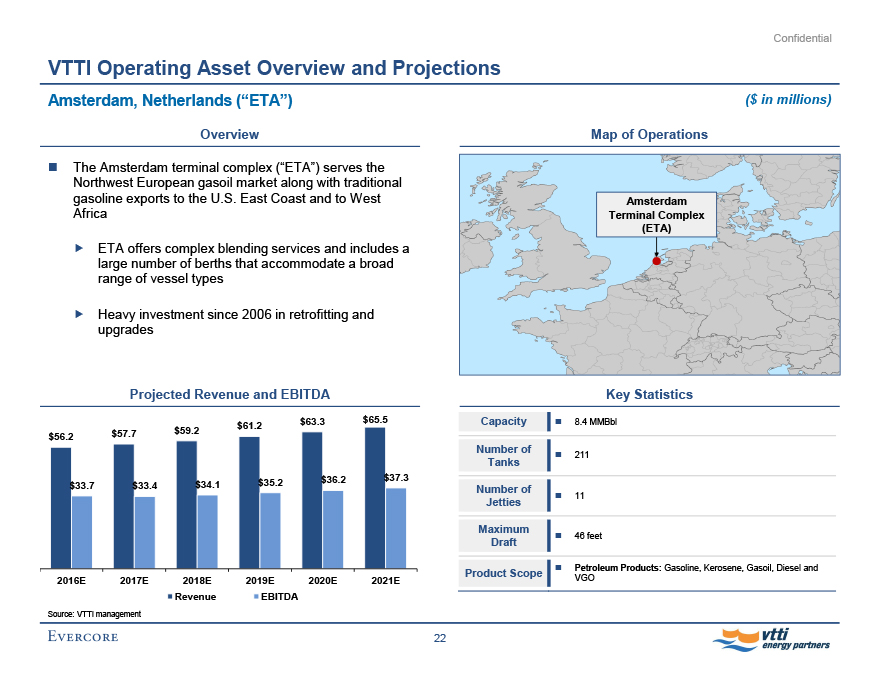

VTTI Operating Asset Overview and Projections Amsterdam, Netherlands (“ETA”) ($ in millions) Overview The Amsterdam terminal complex (“ETA”) serves the Northwest European gasoil market along with traditional gasoline exports to the U.S. East Coast and to West Africa ETA offers complex blending services and includes a large number of berths that accommodate a broad range of vessel types Heavy investment since 2006 in retrofitting and upgrades Projected Revenue and EBITDA Map of Operations

$63.3 $65.5 $56.2 $57.7 $59.2 $61.2 $33.7 $33.4 $34.1 $35.2 $36.2 $37.3 2016E 2017E 2018E 2019E 2020E 2021E Revenue EBITDA Source: VTTI management Amsterdam Terminal Complex (ETA) Key Statistics Capacity 8.4 MMBbl Number of Tanks 211 Number of Jetties 11 Maximum Draft 46 feet Product Scope Petroleum Products: Gasoline, Kerosene, Gasoil, Diesel and VGO 22 Evercore vtti energy partners

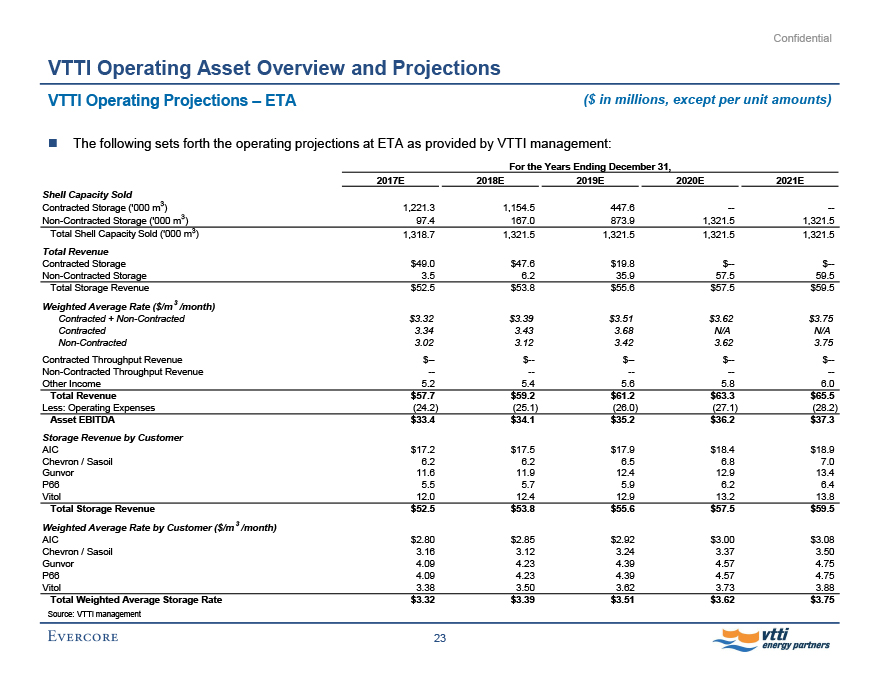

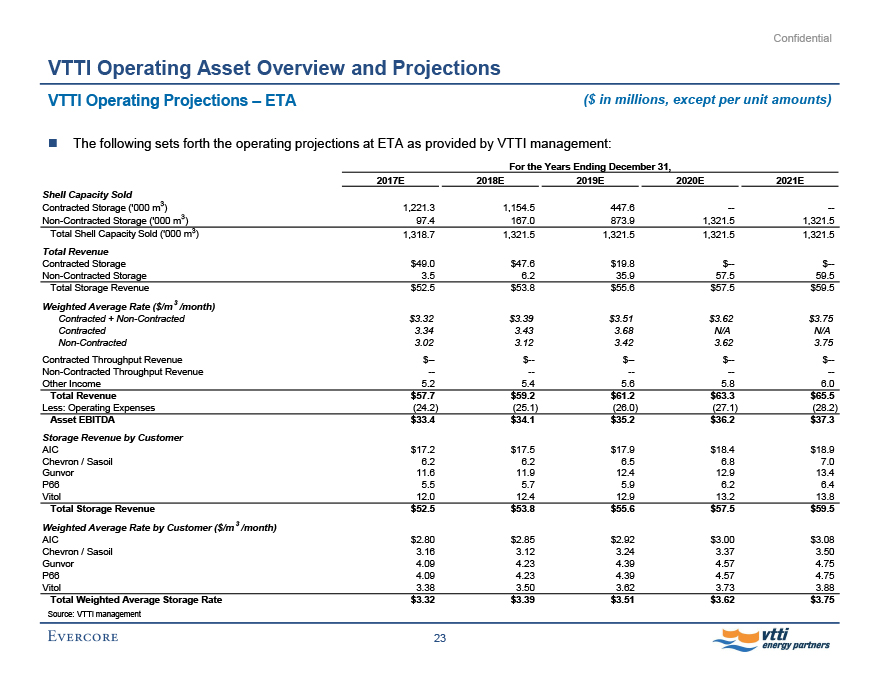

Confidential VTTI Operating Asset Overview and Projections VTTI Operating Projections – ETA ($ in millions, except per unit amounts) The following sets forth the operating projections at ETA as provided by VTTI management: For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Shell Capacity Sold Contracted Storage (‘000 m3 ) 1,221.3 1,154.5 447.6 -- -- Non-Contracted Storage (‘000 m3 ) 97.4 167.0 873.9 1,321.5 1,321.5 Total Shell Capacity Sold (‘000 m3 ) 1,318.7 1,321.5 1,321.5 1,321.5 1,321.5 Total Revenue Contracted Storage $49.0 $47.6 $19.8 $-- $-- Non-Contracted Storage 3.5 6.2 35.9 57.5 59.5 Total Storage Revenue $52.5 $53.8 $55.6 $57.5 $59.5 Weighted Average Rate ($/m 3 /month) Contracted + Non-Contracted $3.32 $3.39 $3.51 $3.62 $3.75 Contracted 3.34 3.43 3.68 N/A N/A Non-Contracted 3.02 3.12 3.42 3.62 3.75 Contracted Throughput Revenue $-- $-- $-- $-- $-- Non-Contracted Throughput Revenue -- -- -- -- -- Other Income 5.2 5.4 5.6 5.8 6.0 Total Revenue $57.7 $59.2 $61.2 $63.3 $65.5 Less: Operating Expenses (24.2) (25.1) (26.0) (27.1) (28.2) Asset EBITDA $33.4 $34.1 $35.2 $36.2 $37.3 Storage Revenue by Customer AIC $17.2 $17.5 $17.9 $18.4 $18.9 Chevron / Sasoil 6.2 6.2 6.5 6.8 7.0 Gunvor 11.6 11.9 12.4 12.9 13.4 P66 5.5 5.7 5.9 6.2 6.4 Vitol 12.0 12.4 12.9 13.2 13.8 Total Storage Revenue $52.5 $53.8 $55.6 $57.5 $59.5 Weighted Average Rate by Customer ($/m 3 /month) AIC $2.80 $2.85 $2.92 $3.00 $3.08 Chevron / Sasoil 3.16 3.12 3.24 3.37 3.50 Gunvor 4.09 4.23 4.39 4.57 4.75 P66 4.09 4.23 4.39 4.57 4.75 Vitol 3.38 3.50 3.62 3.73 3.88 Total Weighted Average Storage Rate $3.32 $3.39 $3.51 $3.62 $3.75 Source: VTTI management 23 Evercore vtti energy partners

Confidential

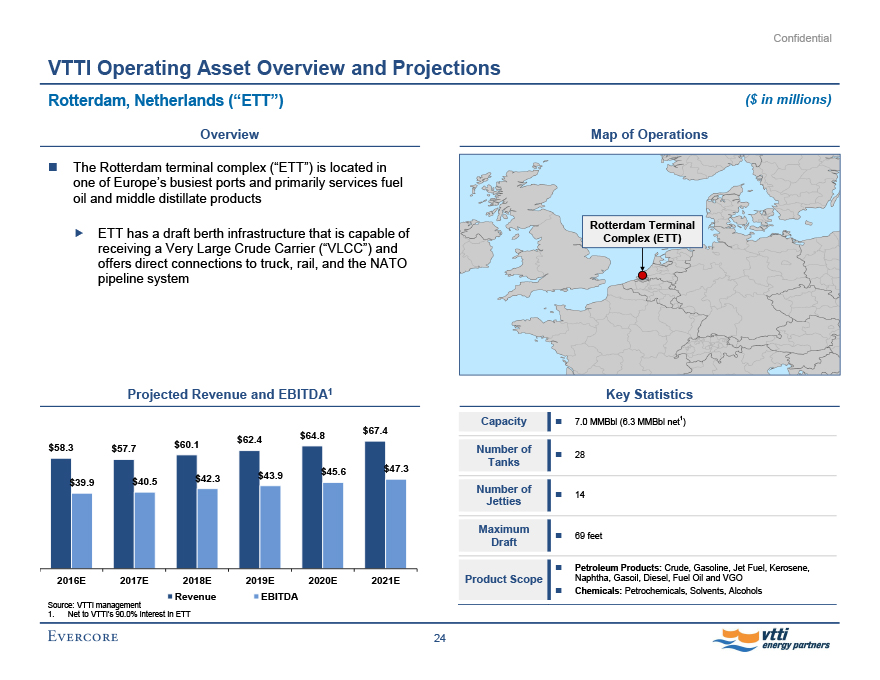

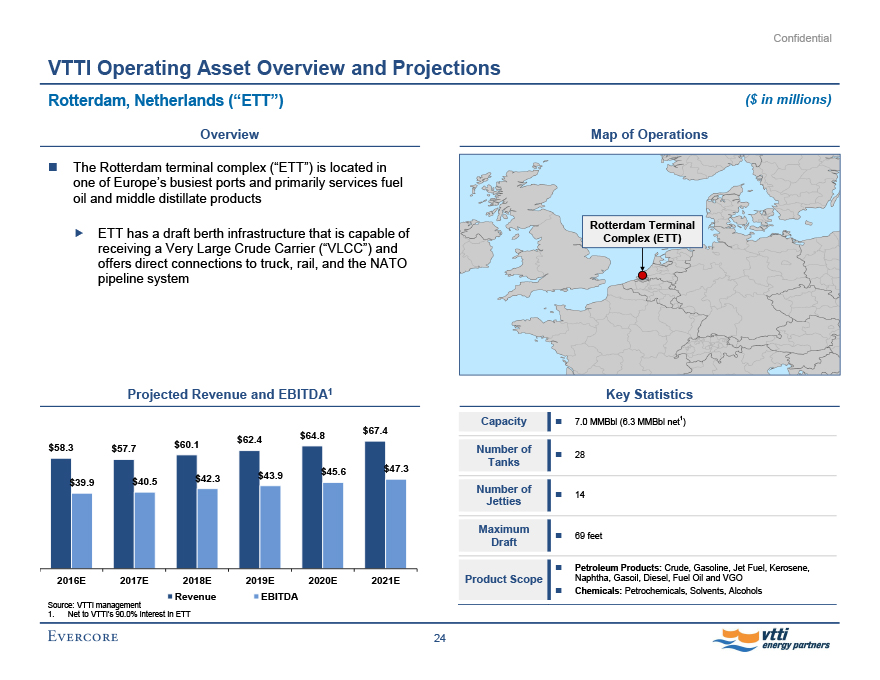

VTTI Operating Asset Overview and Projections Rotterdam, Netherlands (“ETT”)

($ in millions) Overview The Rotterdam terminal complex (“ETT”) is located in one of Europe’s busiest ports and primarily services fuel oil and middle distillate products ETT has a draft berth infrastructure that is capable of receiving a Very Large Crude Carrier (“VLCC”) and offers direct connections to truck, rail, and the NATO pipeline system Projected Revenue and EBITDA1 $67.4

$62.4 $64.8 $58.3 $57.7 $60.1 $47.3 $39.9 $40.5 $42.3 $43.9 $45.6 2016E 2017E 2018E 2019E 2020E 2021E Revenue EBITDA Source: VTTI management 1. Net to VTTI’s 90.0% interest in ETT Map of Operations Rotterdam Terminal Complex (ETT) Key Statistics Capacity 7.0 MMBbl (6.3 MMBbl net1 ) Number of Tanks 28 Number of Jetties 14 Maximum Draft 69 feet Petroleum Products: Crude, Gasoline, Jet Fuel, Kerosene, Product Scope Naphtha, Gasoil, Diesel, Fuel Oil and VGO Chemicals: Petrochemicals, Solvents, Alcohols 24 Evercore vtti energy partners

Confidential

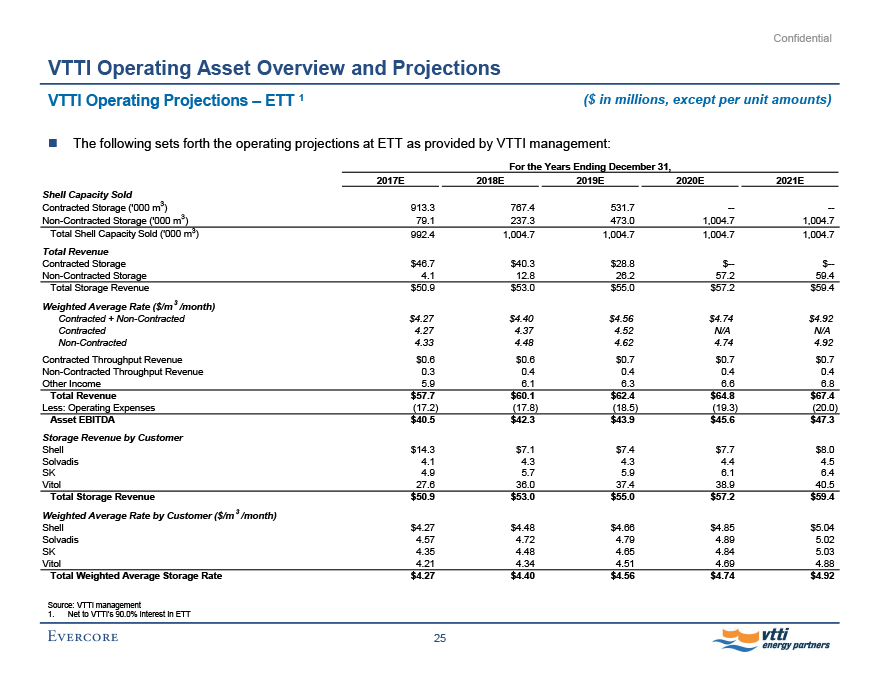

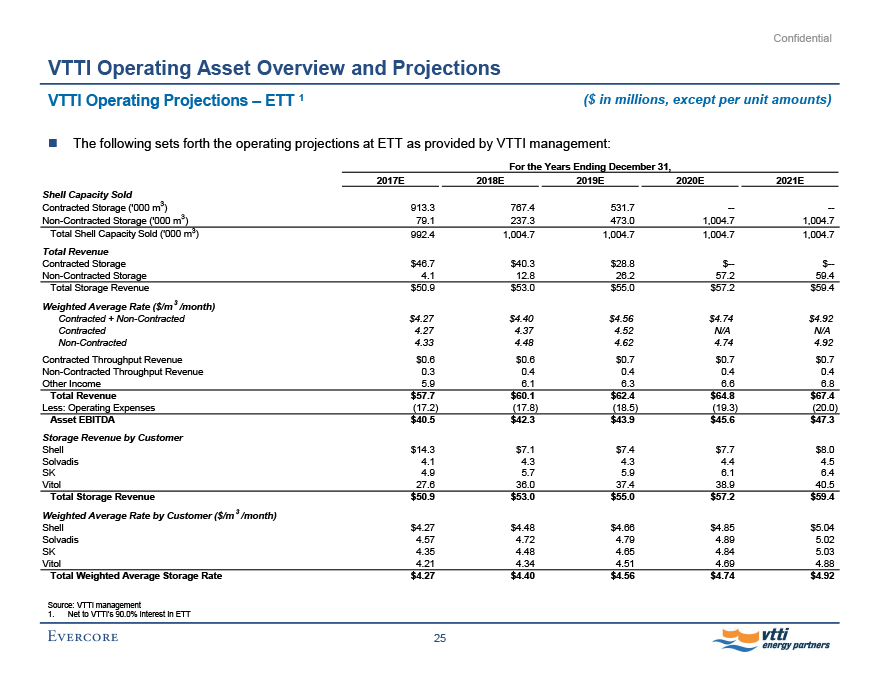

VTTI Operating Asset Overview and Projections

VTTI Operating Projections – ETT 1 ($ in millions, except per unit amounts) The following sets forth the operating projections at ETT as provided by VTTI management: For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Shell Capacity Sold Contracted Storage (‘000 m3 ) 913.3 767.4 531.7 -- -- Non-Contracted Storage (‘000 m3 ) 79.1 237.3 473.0 1,004.7 1,004.7 Total Shell Capacity Sold (‘000 m3 ) 992.4 1,004.7 1,004.7 1,004.7 1,004.7 Total Revenue Contracted Storage $46.7 $40.3 $28.8 $-- $-- Non-Contracted Storage 4.1 12.8 26.2 57.2 59.4 Total Storage Revenue $50.9 $53.0 $55.0 $57.2 $59.4 Weighted Average Rate ($/m 3 /month) Contracted + Non-Contracted $4.27 $4.40 $4.56 $4.74 $4.92 Contracted 4.27 4.37 4.52 N/A N/A Non-Contracted 4.33 4.48 4.62 4.74 4.92 Contracted Throughput Revenue $0.6 $0.6 $0.7 $0.7 $0.7 Non-Contracted Throughput Revenue 0.3 0.4 0.4 0.4 0.4 Other Income 5.9 6.1 6.3 6.6 6.8 Total Revenue $57.7 $60.1 $62.4 $64.8 $67.4 Less: Operating Expenses (17.2) (17.8) (18.5) (19.3) (20.0) Asset EBITDA $40.5 $42.3 $43.9 $45.6 $47.3 Storage Revenue by Customer Shell $14.3 $7.1 $7.4 $7.7 $8.0 Solvadis 4.1 4.3 4.3 4.4 4.5 SK 4.9 5.7 5.9 6.1 6.4 Vitol 27.6 36.0 37.4 38.9 40.5 Total Storage Revenue $50.9 $53.0 $55.0 $57.2 $59.4 Weighted Average Rate by Customer ($/m 3 /month) Shell $4.27 $4.48 $4.66 $4.85 $5.04 Solvadis 4.57 4.72 4.79 4.89 5.02 SK 4.35 4.48 4.65 4.84 5.03 Vitol 4.21 4.34 4.51 4.69 4.88 Total Weighted Average Storage Rate $4.27 $4.40 $4.56 $4.74 $4.92 Source: VTTI management 1. Net to VTTI’s 90.0% interest in ETT 25 Evercore vtti energy partners

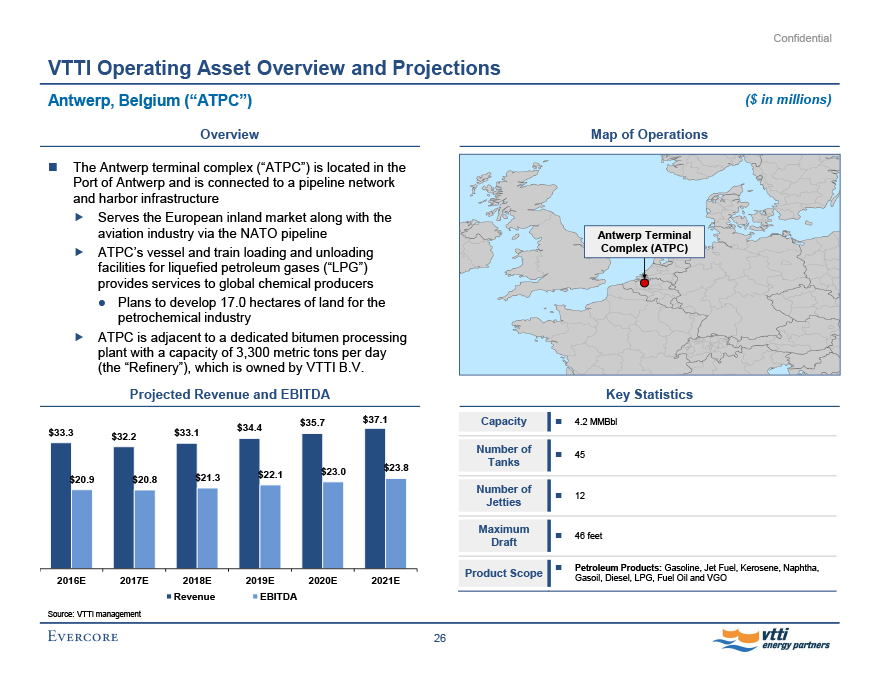

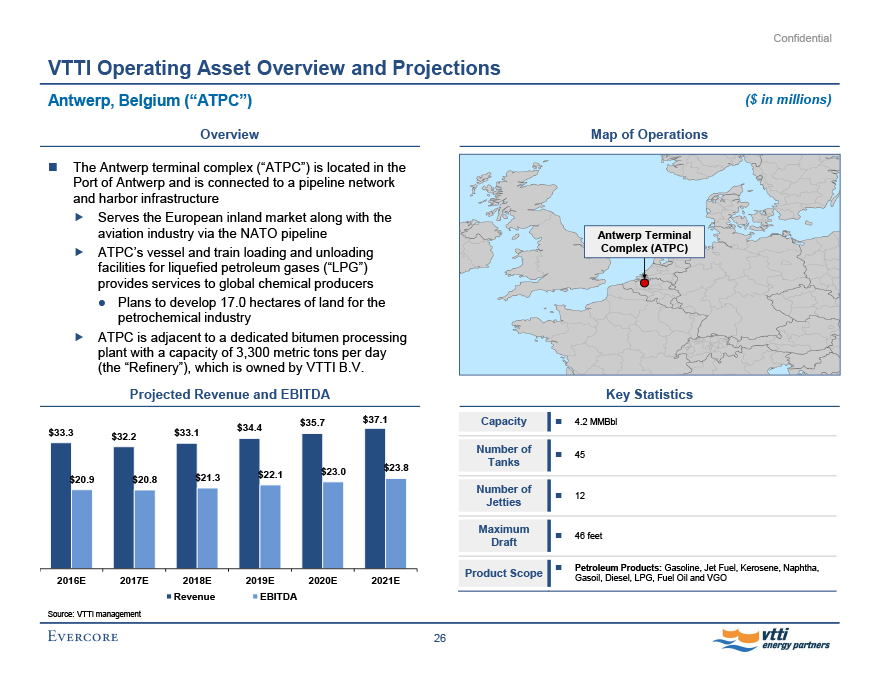

Confidential VTTI Operating Asset Overview and Projections Antwerp, Belgium (“ATPC”) ($ in millions) Overview The Antwerp terminal complex (“ATPC”) is located in the Port of Antwerp and is connected to a pipeline network and harbor infrastructure Serves the European inland market along with the aviation industry via the NATO pipeline ATPC’s vessel and train loading and unloading facilities for liquefied petroleum gases (“LPG”) provides services to global chemical producers Plans to develop 17.0 hectares of land for the petrochemical industry ATPC is adjacent to a dedicated bitumen processing plant with a capacity of 3,300 metric tons per day (the “Refinery”), which is owned by VTTI B.V. Projected Revenue and EBITDA $35.7 $37.1 $33.3 $33.1 $34.4 $32.2 $23.8 $20.9 $20.8 $21.3 $22.1 $23.0 2016E 2017E 2018E 2019E 2020E 2021E Revenue EBITDA Source: VTTI management Map of Operations Antwerp Terminal Complex (ATPC) Key Statistics Capacity 4.2 MMBbl Number of Tanks 45 Number of Jetties 12 Maximum Draft 46 feet Product Scope Petroleum Products: Gasoline, Jet Fuel, Kerosene, Naphtha, Gasoil, Diesel, LPG, Fuel Oil and VGO 26 Evercore vtti energy partners

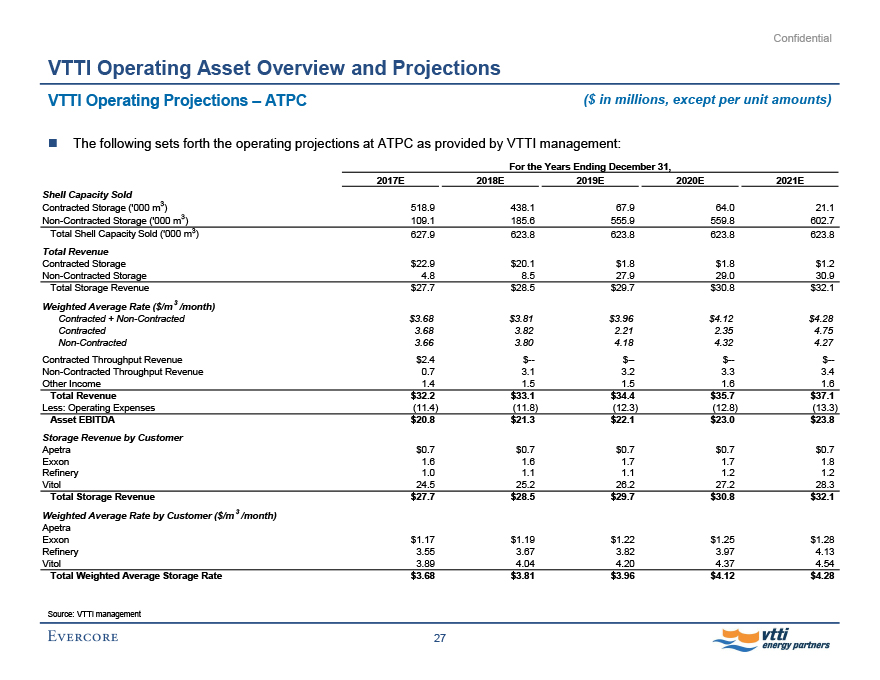

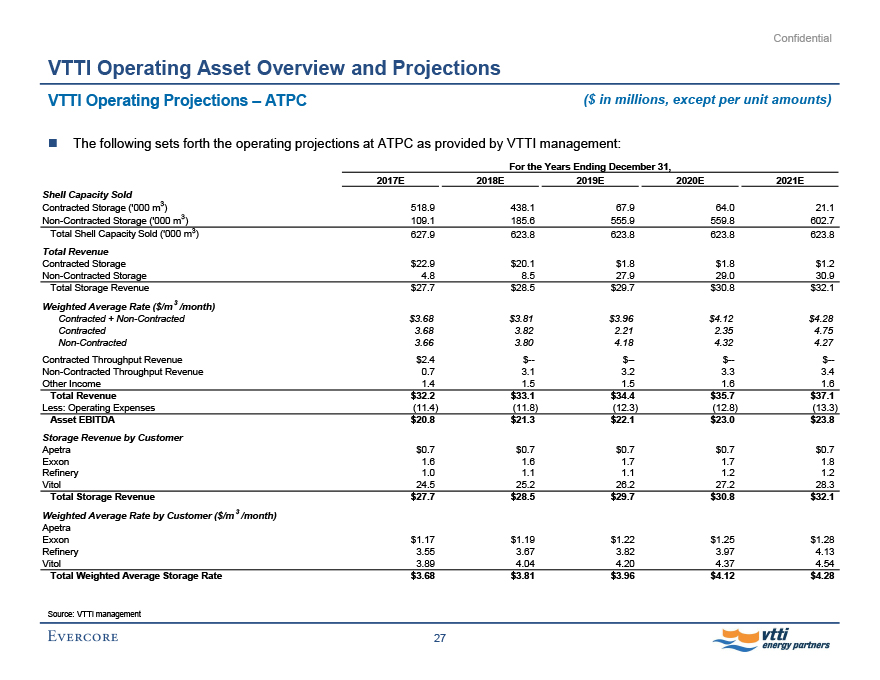

Confidential VTTI Operating Asset Overview and Projections VTTI Operating Projections – ATPC ($ in millions, except per unit amounts) The following sets forth the operating projections at ATPC as provided by VTTI management: For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Shell Capacity Sold Contracted Storage (‘000 m3) 518.9 438.1 67.9 64.0 21.1

Non-Contracted Storage (‘000 m3) 109.1 185.6 555.9 559.8 602.7 Total Shell Capacity Sold (‘000 m3) 627.9 623.8 623.8 623.8 623.8 Total Revenue Contracted Storage $22.9 $20.1 $1.8 $1.8 $1.2 Non-Contracted Storage 4.8 8.5 27.9 29.0 30.9 Total Storage Revenue $27.7 $28.5 $29.7 $30.8 $32.1 Weighted Average Rate ($/m 3 /month) Contracted + Non-Contracted $3.68 $3.81 $3.96 $4.12 $4.28 Contracted 3.68 3.82 2.21 2.35 4.75 Non-Contracted 3.66 3.80 4.18 4.32 4.27 Contracted Throughput Revenue $2.4 $-- $-- $-- $-- Non-Contracted Throughput Revenue 0.7 3.1 3.2 3.3 3.4 Other Income 1.4 1.5 1.5 1.6 1.6 Total Revenue $32.2 $33.1 $34.4 $35.7 $37.1 Less: Operating Expenses (11.4) (11.8) (12.3) (12.8) (13.3) Asset EBITDA $20.8 $21.3 $22.1 $23.0 $23.8 Storage Revenue by Customer Apetra $0.7 $0.7 $0.7 $0.7 $0.7 Exxon 1.6 1.6 1.7 1.7 1.8 Refinery 1.0 1.1 1.1 1.2 1.2 Vitol 24.5 25.2 26.2 27.2 28.3 Total Storage Revenue $27.7 $28.5 $29.7 $30.8 $32.1 Weighted Average Rate by Customer ($/m 3 /month) Apetra Exxon $1.17 $1.19 $1.22 $1.25 $1.28 Refinery 3.55 3.67 3.82 3.97 4.13 Vitol 3.89 4.04 4.20 4.37 4.54 Total Weighted Average Storage Rate $3.68 $3.81 $3.96 $4.12 $4.28 Source: VTTI management 27 Evercore vtti energy partners

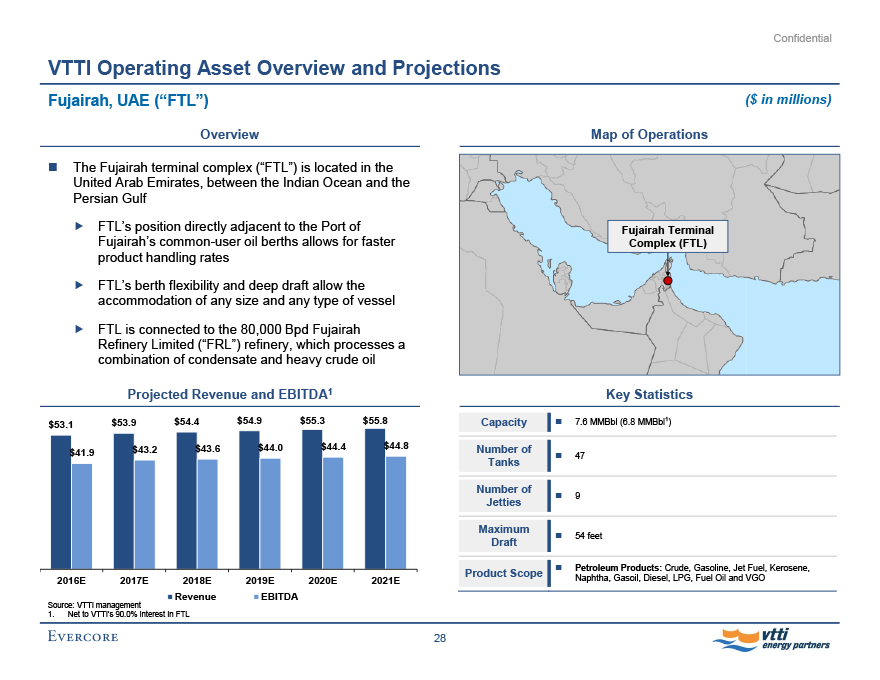

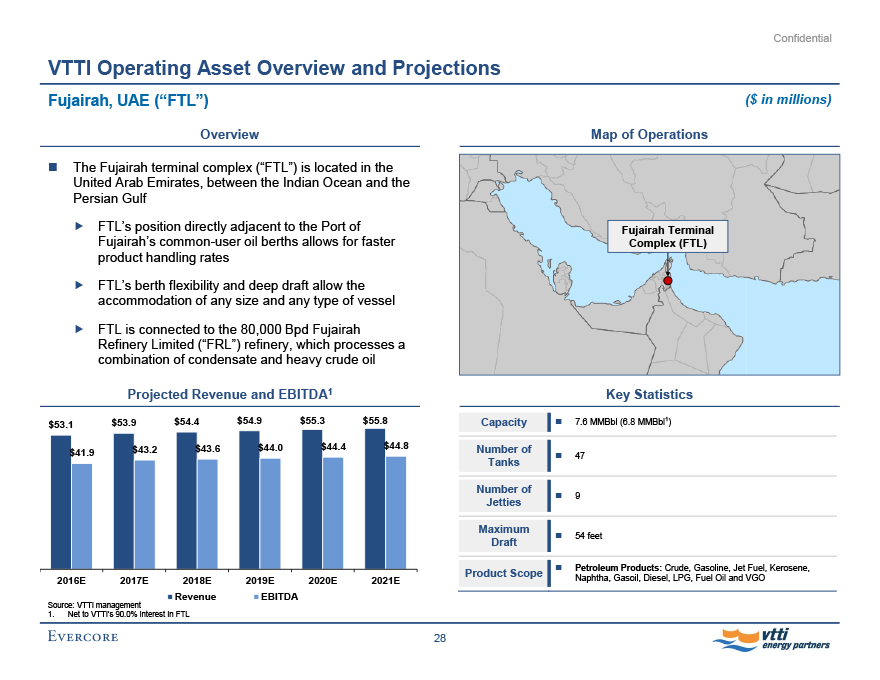

Confidential VTTI Operating Asset Overview and Projections Fujairah, UAE (“FTL”) ($ in millions) Overview The Fujairah terminal complex (“FTL”) is located in the United Arab Emirates, between the Indian Ocean and the Persian Gulf FTL’s position directly adjacent to the Port of Fujairah’s common-user oil berths allows for faster product handling rates FTL’s berth flexibility and deep draft allow the accommodation of any size and any type of vessel FTL is connected to the 80,000 Bpd Fujairah Refinery Limited (“FRL”) refinery, which processes a combination of condensate and heavy crude oil Projected Revenue and EBITDA1 $53.1 $53.9 $54.4 $54.9 $55.3 $55.8 $41.9 $43.2 $43.6 $44.0 $44.4 $44.8 2016E 2017E 2018E 2019E 2020E 2021E Revenue EBITDA Source: VTTI management 1. Net to VTTI’s 90.0% interest in FTL Map of Operations Fujairah Terminal Complex (FTL) Key Statistics Capacity 7.6 MMBbl (6.8 MMBbl1 ) Number of Tanks 47 Number of Jetties 9 Maximum Draft 54 feet Product Scope Petroleum Products: Crude, Gasoline, Jet Fuel, Kerosene, Naphtha, Gasoil, Diesel, LPG, Fuel Oil and VGO 28 Evercore vtti energy partners

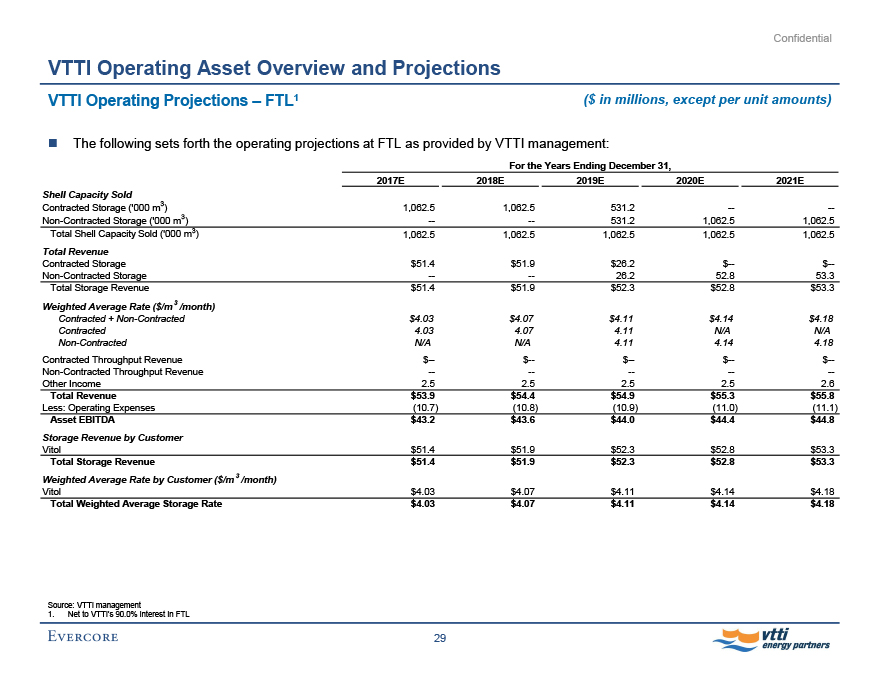

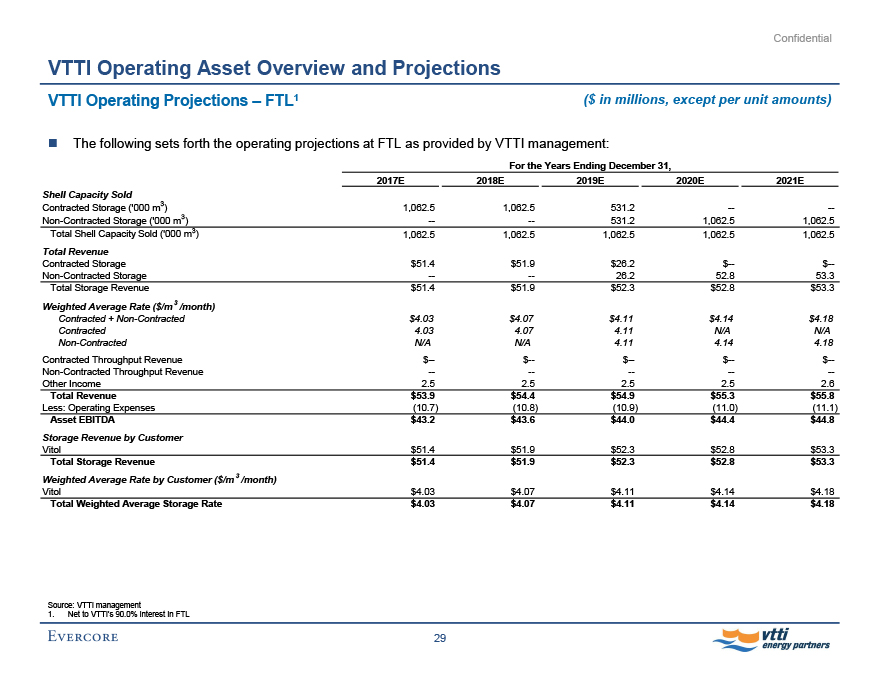

Confidential VTTI Operating Asset Overview and Projections VTTI Operating Projections – FTL1 ($ in millions, except per unit amounts) The following sets forth the operating projections at FTL as provided by VTTI management: For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Shell Capacity Sold Contracted Storage (‘000 m3) 1,062.5 1,062.5 531.2 -- -- Non-Contracted Storage (‘000 m3) -- -- 531.2 1,062.5 1,062.5 Total Shell Capacity Sold (‘000 m3) 1,062.5 1,062.5 1,062.5 1,062.5 1,062.5 Total Revenue Contracted Storage $51.4 $51.9 $26.2 $-- $-- Non-Contracted Storage -- -- 26.2 52.8 53.3 Total Storage Revenue $51.4 $51.9 $52.3 $52.8 $53.3 Weighted Average Rate ($/m 3 /month) Contracted + Non-Contracted $4.03 $4.07 $4.11 $4.14 $4.18 Contracted 4.03 4.07 4.11 N/A N/A Non-Contracted N/A N/A 4.11 4.14 4.18 Contracted Throughput Revenue $-- $-- $-- $-- $-- Non-Contracted Throughput Revenue -- -- -- -- -- Other Income 2.5 2.5 2.5 2.5 2.6 Total Revenue $53.9 $54.4 $54.9 $55.3 $55.8 Less: Operating Expenses (10.7) (10.8) (10.9) (11.0) (11.1) Asset EBITDA $43.2 $43.6 $44.0 $44.4 $44.8 Storage Revenue by Customer Vitol $51.4 $51.9 $52.3 $52.8 $53.3 Total Storage Revenue $51.4 $51.9 $52.3 $52.8 $53.3 Weighted Average Rate by Customer ($/m 3 /month) Vitol $4.03 $4.07 $4.11 $4.14 $4.18 Total Weighted Average Storage Rate $4.03 $4.07 $4.11 $4.14 $4.18 Source: VTTI management 1. Net to VTTI’s 90.0% interest in FTL 29 Evercore vtti energy partners

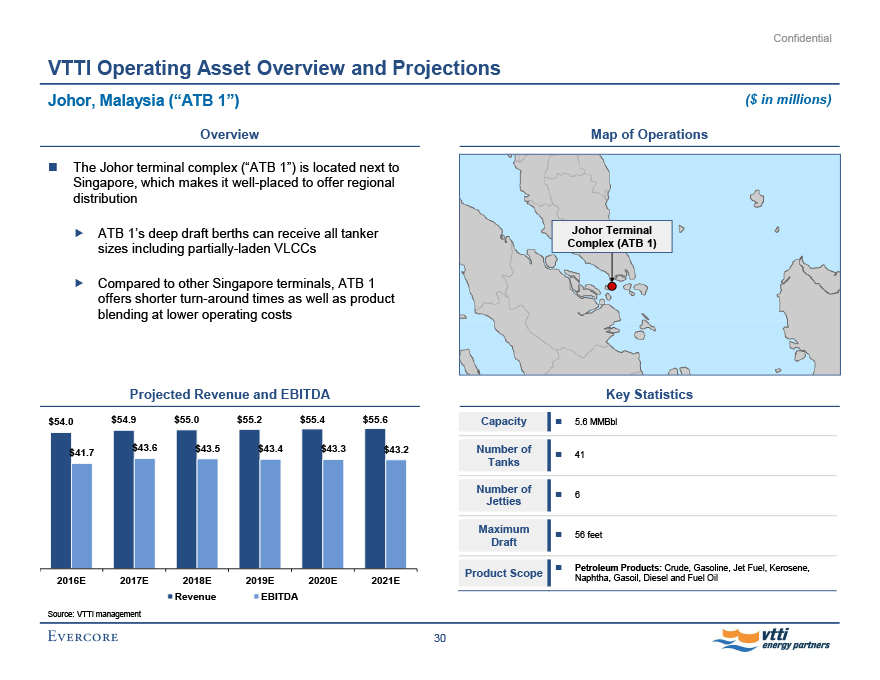

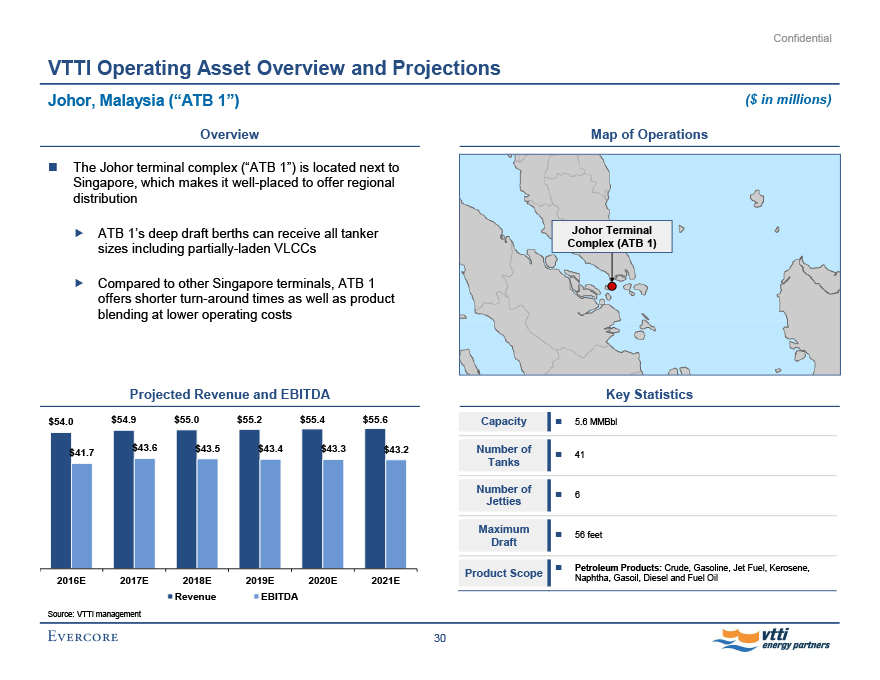

Confidential VTTI Operating Asset Overview and Projections Johor, Malaysia (“ATB 1”) ($ in millions) Overview The Johor terminal complex (“ATB 1”) is located next to Singapore, which makes it well-placed to offer regional distribution ATB 1’s deep draft berths can receive all tanker sizes including partially-laden VLCCs Compared to other Singapore terminals, ATB 1 offers shorter turn-around times as well as product blending at lower operating costs Projected Revenue and EBITDA $54.0 $54.9 $55.0 $55.2 $55.4 $55.6 $41.7 $43.6 $43.5 $43.4 $43.3 $43.2 2016E 2017E 2018E 2019E 2020E 2021E Revenue EBITDA Source: VTTI management Map of Operations Johor Terminal Complex (ATB 1) Key Statistics Capacity 5.6 MMBbl Number of Tanks 41 Number of Jetties 6 Maximum Draft 56 feet Product Scope Petroleum Products: Crude, Gasoline, Jet Fuel, Kerosene, Naphtha, Gasoil, Diesel and Fuel Oil 30 Evercore vtti energy partners

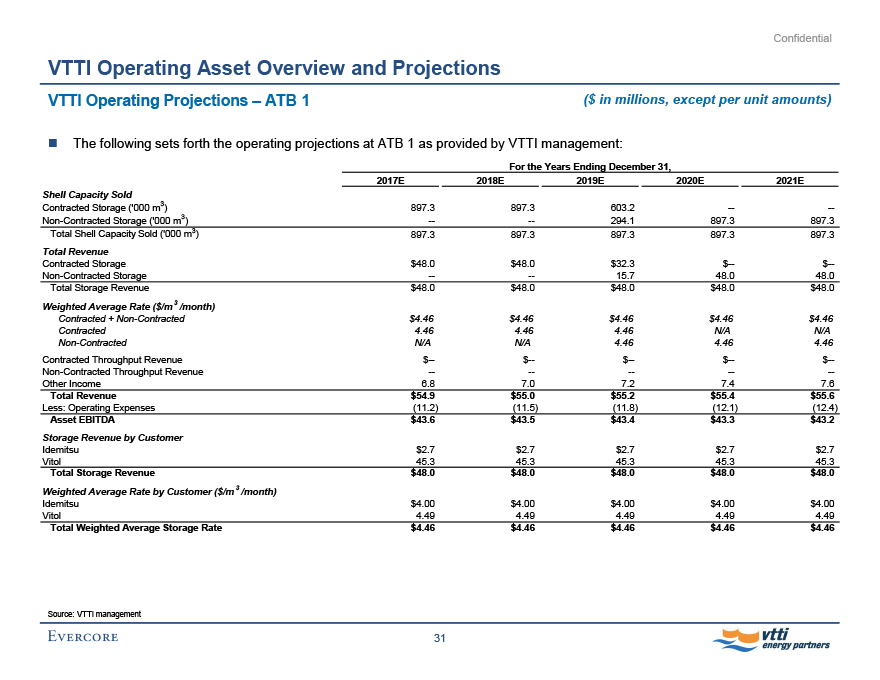

Confidential

VTTI Operating Asset Overview and Projections

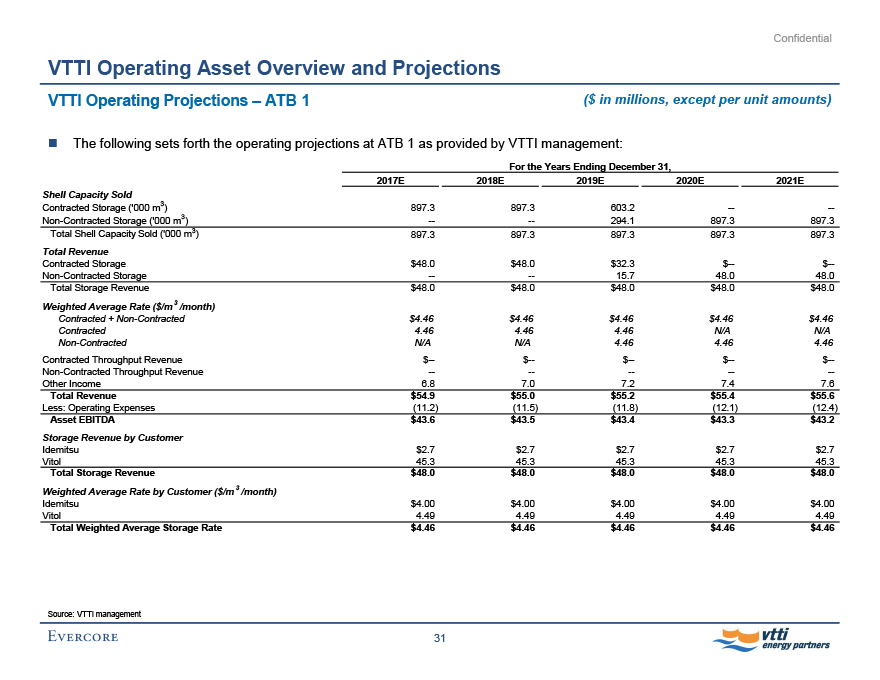

VTTI Operating Projections – ATB 1 ($ in millions, except per unit amounts)

The following sets forth the operating projections at ATB 1 as provided by VTTI management:

For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Shell Capacity Sold Contracted Storage (‘000 m3) 897.3 897.3 603.2 -- -- Non-Contracted Storage (‘000 m3) -- -- 294.1 897.3 897.3 Total Shell Capacity Sold (‘000 m3) 897.3 897.3 897.3 897.3 897.3 Total Revenue Contracted Storage $48.0 $48.0 $32.3 $-- $-- Non-Contracted Storage -- -- 15.7 48.0 48.0 Total Storage Revenue $48.0 $48.0 $48.0 $48.0 $48.0 Weighted Average Rate ($/m 3 /month) Contracted + Non-Contracted $4.46 $4.46 $4.46 $4.46 $4.46 Contracted 4.46 4.46 4.46 N/A N/A Non-Contracted N/A N/A 4.46 4.46 4.46 Contracted Throughput Revenue $-- $-- $-- $-- $-- Non-Contracted Throughput Revenue -- -- -- -- -- Other Income 6.8 7.0 7.2 7.4 7.6 Total Revenue $54.9 $55.0 $55.2 $55.4 $55.6 Less: Operating Expenses (11.2) (11.5) (11.8) (12.1) (12.4) Asset EBITDA $43.6 $43.5 $43.4 $43.3 $43.2 Storage Revenue by Customer Idemitsu $2.7 $2.7 $2.7 $2.7 $2.7 Vitol 45.3 45.3 45.3 45.3 45.3 Total Storage Revenue $48.0 $48.0 $48.0 $48.0 $48.0 Weighted Average Rate by Customer ($/m 3 /month) Idemitsu $4.00 $4.00 $4.00 $4.00 $4.00 Vitol 4.49 4.49 4.49 4.49 4.49 Total Weighted Average Storage Rate $4.46 $4.46 $4.46 $4.46 $4.46 Source: VTTI management 31 Evercore vtti energy partners

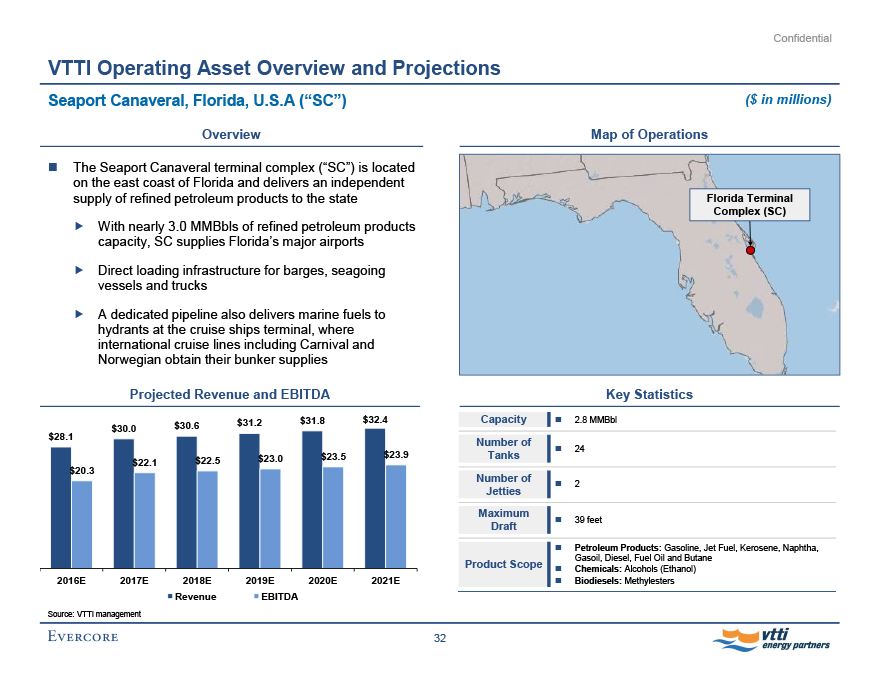

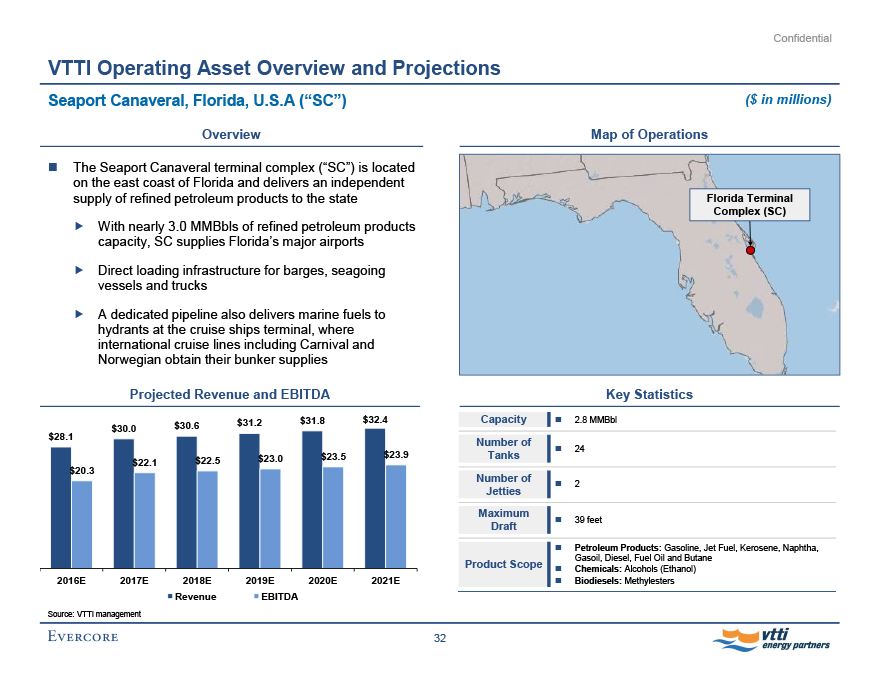

Confidential VTTI Operating Asset Overview and Projections Seaport Canaveral, Florida, U.S.A (“SC”) ($ in millions) Overview The Seaport Canaveral terminal complex (“SC”) is located on the east coast of Florida and delivers an independent supply of refined petroleum products to the state With nearly 3.0 MMBbls of refined petroleum products capacity, SC supplies Florida’s major airports Direct loading infrastructure for barges, seagoing vessels and trucks A dedicated pipeline also delivers marine fuels to hydrants at the cruise ships terminal, where international cruise lines including Carnival and Norwegian obtain their bunker supplies Projected Revenue and EBITDA $30.0 $30.6 $31.2 $31.8 $32.4 $28.1 $22.1 $22.5 $23.0 $23.5 $23.9 $20.3 2016E 2017E 2018E 2019E 2020E 2021E Revenue EBITDA Source: VTTI management Map of Operations Florida Terminal Complex (SC) Key Statistics Capacity 2.8 MMBbl Number of Tanks 24 Number of Jetties 2 Maximum Draft 39 feet Petroleum Products: Gasoline, Jet Fuel, Kerosene, Naphtha, Gasoil, Diesel, Fuel Oil and Butane Product Scope Chemicals: Alcohols (Ethanol) Biodiesels: Methylesters 32 Evercore vtti energy partners

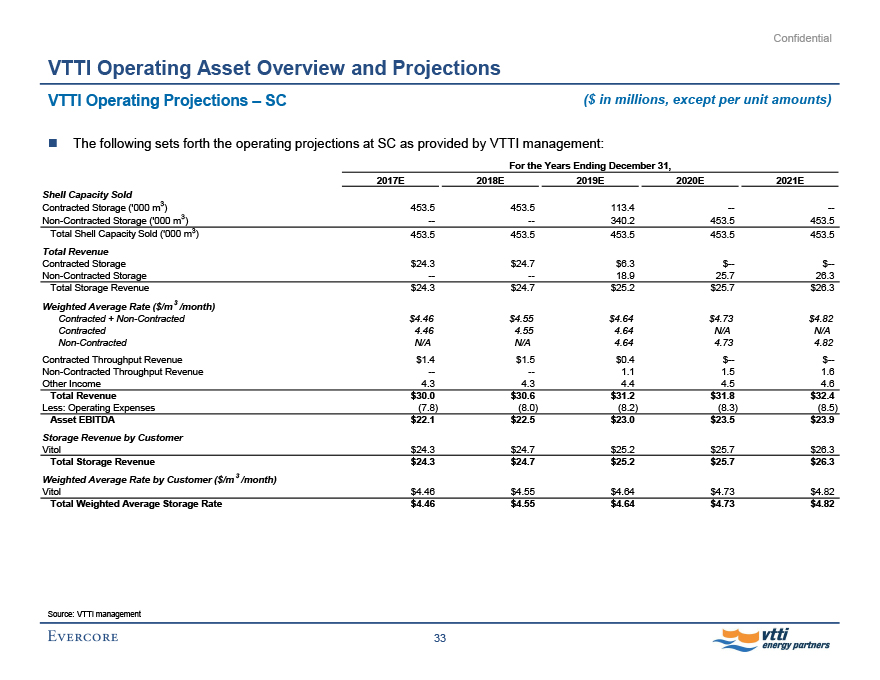

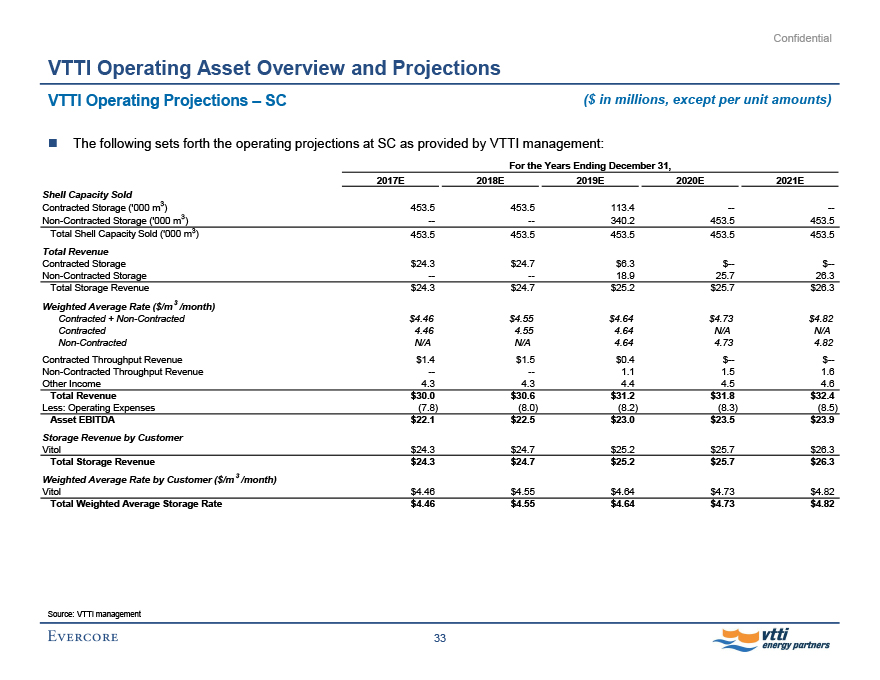

Confidential VTTI Operating Asset Overview and Projections VTTI Operating Projections – SC ($ in millions, except per unit amounts) The following sets forth the operating projections at SC as provided by VTTI management: For the Years Ending December 31, 2017E 2018E 2019E 2020E 2021E Shell Capacity Sold Contracted Storage (‘000 m3) 453.5 453.5 113.4 -- -- Non-Contracted Storage (‘000 m3) -- -- 340.2 453.5 453.5 Total Shell Capacity Sold (‘000 m3) 453.5 453.5 453.5 453.5 453.5 Total Revenue Contracted Storage $24.3 $24.7 $6.3 $-- $-- Non-Contracted Storage -- -- 18.9 25.7 26.3 Total Storage Revenue $24.3 $24.7 $25.2 $25.7 $26.3 Weighted Average Rate ($/m 3 /month) Contracted + Non-Contracted $4.46 $4.55 $4.64 $4.73 $4.82 Contracted 4.46 4.55 4.64 N/A N/A Non-Contracted N/A N/A 4.64 4.73 4.82 Contracted Throughput Revenue $1.4 $1.5 $0.4 $-- $-- Non-Contracted Throughput Revenue -- -- 1.1 1.5 1.6 Other Income 4.3 4.3 4.4 4.5 4.6 Total Revenue $30.0 $30.6 $31.2 $31.8 $32.4 Less: Operating Expenses (7.8) (8.0) (8.2) (8.3) (8.5) Asset EBITDA $22.1 $22.5 $23.0 $23.5 $23.9 Storage Revenue by Customer Vitol $24.3 $24.7 $25.2 $25.7 $26.3 Total Storage Revenue $24.3 $24.7 $25.2 $25.7 $26.3 Weighted Average Rate by Customer ($/m 3 /month) Vitol $4.46 $4.55 $4.64 $4.73 $4.82 Total Weighted Average Storage Rate $4.46 $4.55 $4.64 $4.73 $4.82 Source: VTTI management 33 Evercore vtti energy partners

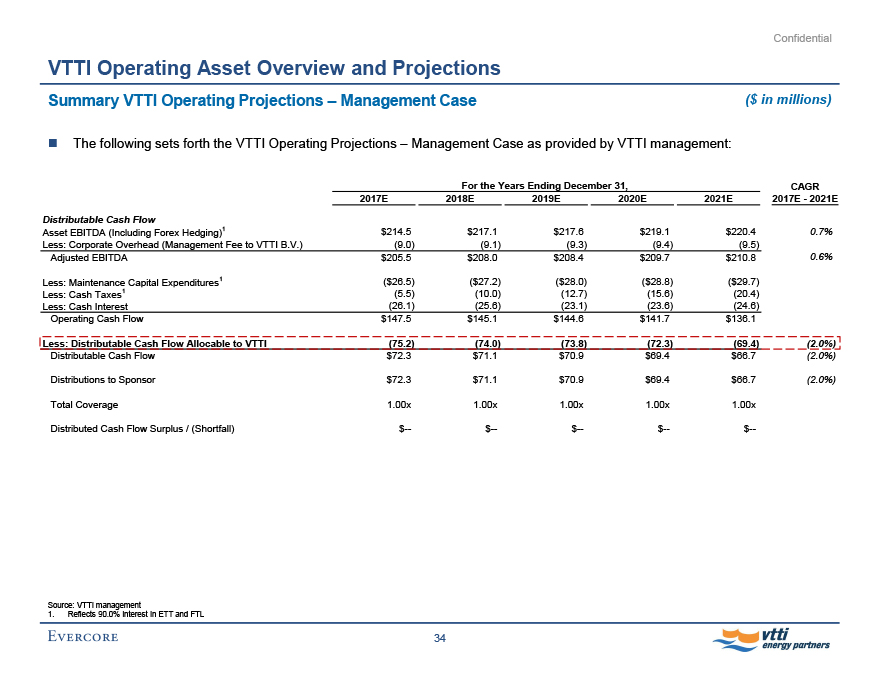

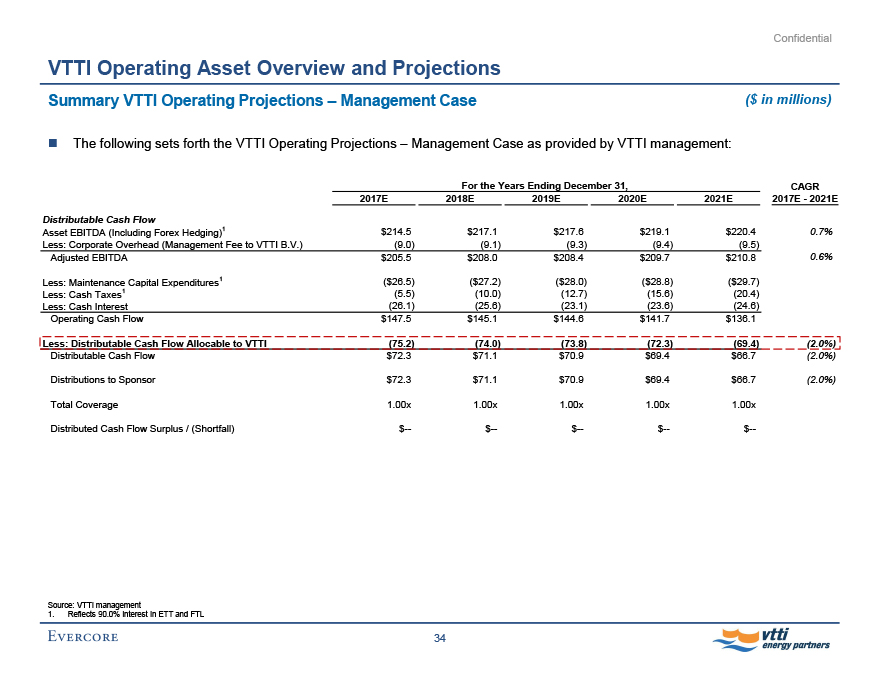

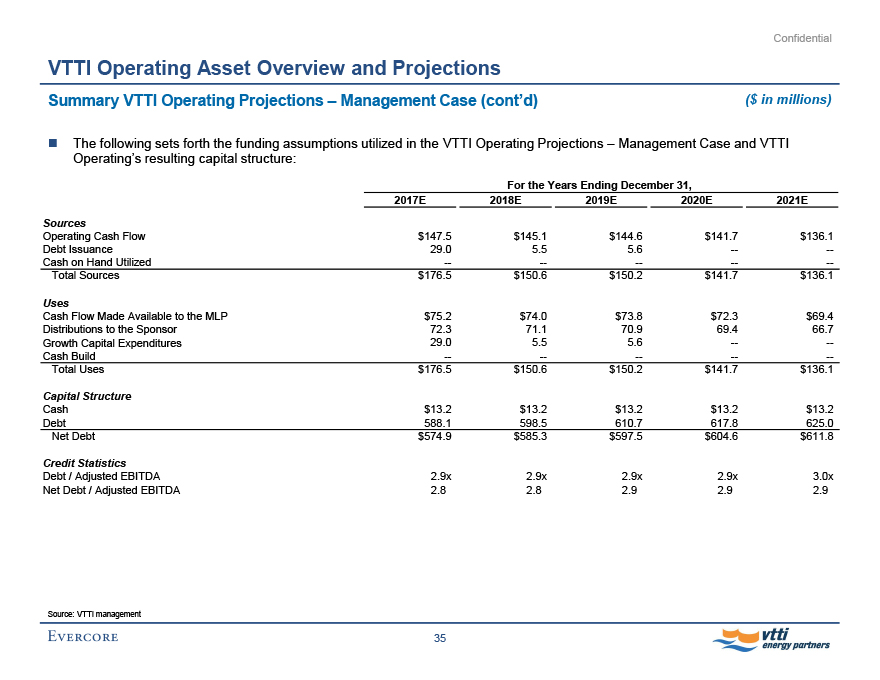

Confidential VTTI Operating Asset Overview and Projections Summary VTTI Operating Projections - Management Case ($ in millions) The following sets forth the VTTI Operating Projections - Management Case as provided by VTTI management: For the Years Ending December 31, CAGR 2017E 2018E 2019E 2020E 2021E 2017E - 2021E Distributable Cash Flow Asset EBITDA (Including Forex Hedging)1 $214.5 $217.1 $217.6 $219.1 $220.4 0.7% Less: Corporate Overhead (Management Fee to VTTI B.V.) (9.0) (9.1) (9.3) (9.4) (9.5) Adjusted EBITDA $205.5 $208.0 $208.4 $209.7 $210.8 0.6% Less: Maintenance Capital Expenditures1 ($26.5) ($27.2) ($28.0) ($28.8) ($29.7) Less: Cash Taxes1 (5.5) (10.0) (12.7) (15.6) (20.4) Less: Cash Interest (26.1) (25.6) (23.1) (23.6) (24.6) Operating Cash Flow $147.5 $145.1 $144.6 $141.7 $136.1 Less: Distributable Cash Flow Allocable to VTTI (75.2) (74.0) (73.8) (72.3) (69.4) (2.0%) Distributable Cash Flow $72.3 $71.1 $70.9 $69.4 $66.7 (2.0%) Distributions to Sponsor $72.3 $71.1 $70.9 $69.4 $66.7 (2.0%) Total Coverage 1.00x 1.00x 1.00x 1.00x 1.00x Distributed Cash Flow Surplus / (Shortfall) $-- $-- $-- $-- $-- Source: VTTI management 1. Reflects 90.0% interest in ETT and FTL 34 Evercore vtti energy partners

Confidential

VTTI Operating Asset Overview and Projections

Summary VTTI Operating Projections - Management Case (cont’d) ($ in millions)

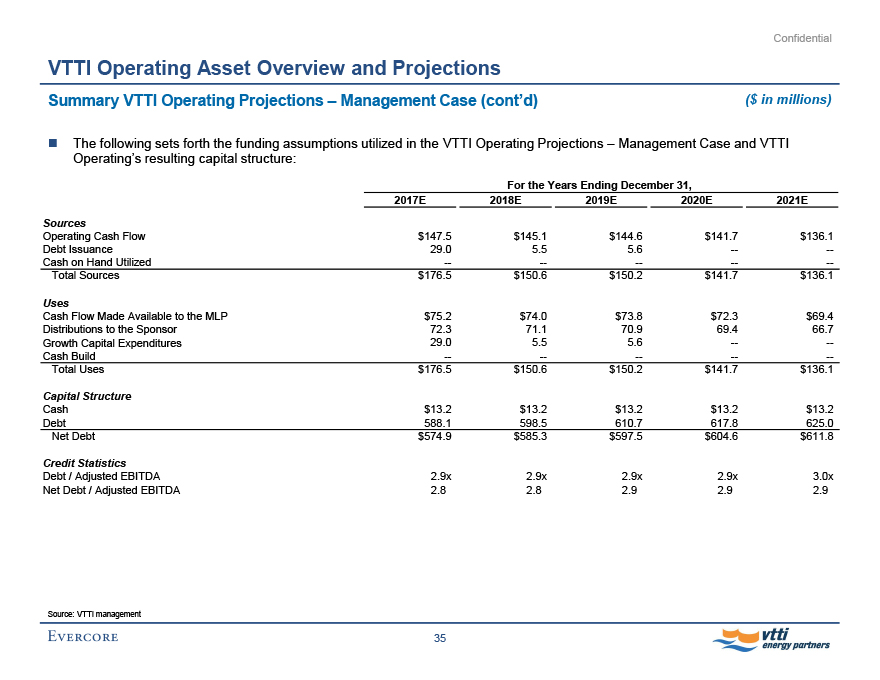

The following sets forth the funding assumptions utilized in the VTTI Operating Projections - Management Case and VTTI Operating’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

Operating Cash Flow $147.5 $145.1 $144.6 $141.7 $136.1

Debt Issuance 29.0 5.5 5.6 -- --

Cash on Hand Utilized -- -- -- -- --

Total Sources $176.5 $150.6 $150.2 $141.7 $136.1

Uses

Cash Flow Made Available to the MLP $75.2 $74.0 $73.8 $72.3 $69.4

Distributions to the Sponsor 72.3 71.1 70.9 69.4 66.7

Growth Capital Expenditures 29.0 5.5 5.6 -- --

Cash Build -- -- -- -- --

Total Uses $176.5 $150.6 $150.2 $141.7 $136.1

Capital Structure

Cash $13.2 $13.2 $13.2 $13.2 $13.2

Debt 588.1 598.5 610.7 617.8 625.0

Net Debt $574.9 $585.3 $597.5 $604.6 $611.8

Credit Statistics

Debt / Adjusted EBITDA 2.9x 2.9x 2.9x 2.9x 3.0x

Net Debt / Adjusted EBITDA 2.8 2.8 2.9 2.9 2.9

Source: VTTI management

35

Evercore vtti energy partners

Confidential

VTTI Operating Asset Overview and Projections

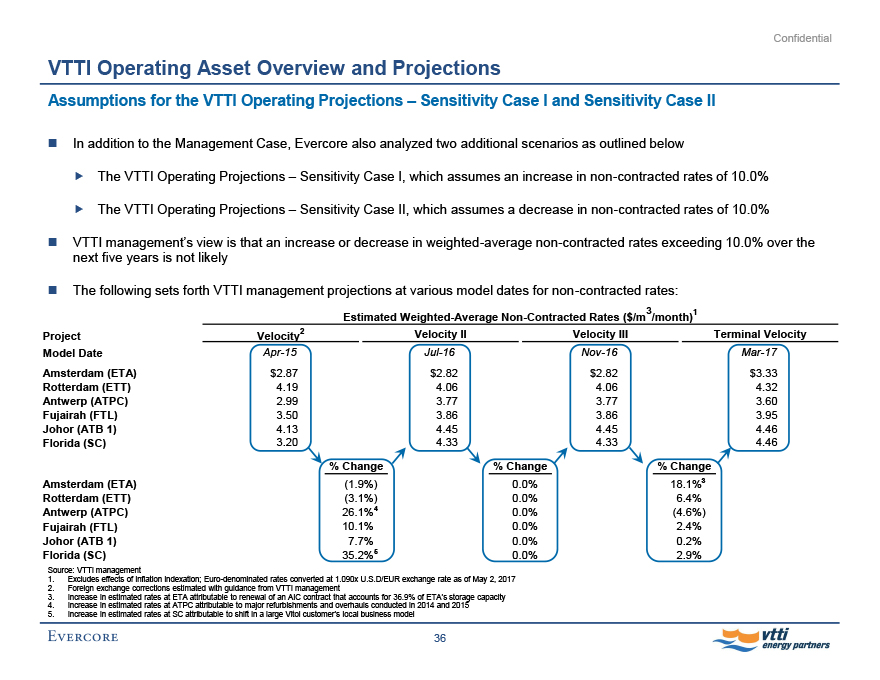

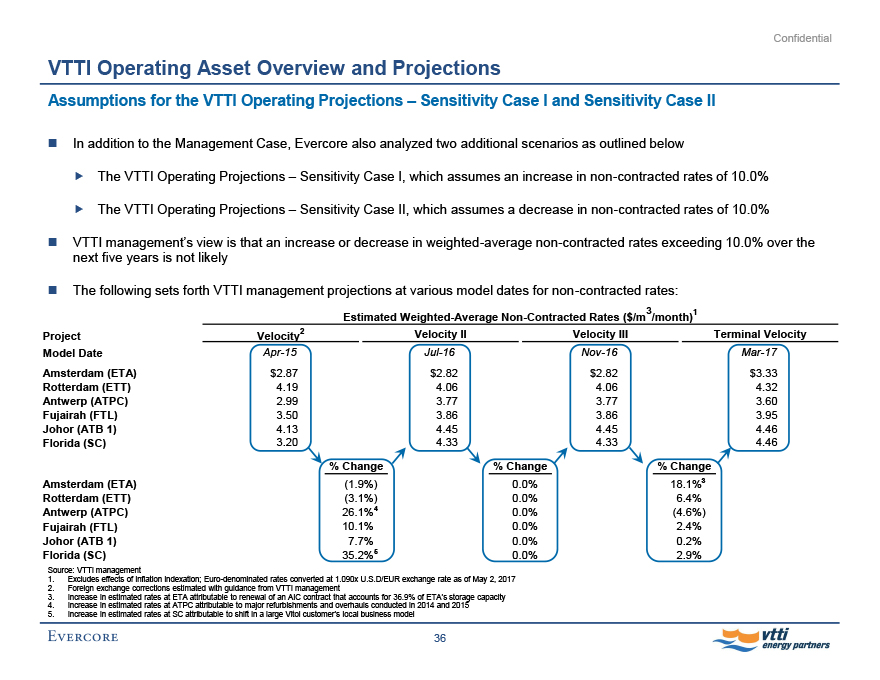

Assumptions for the VTTI Operating Projections - Sensitivity Case I and Sensitivity Case II

In addition to the Management Case, Evercore also analyzed two additional scenarios as outlined below

The VTTI Operating Projections - Sensitivity Case I, which assumes an increase in non-contracted rates of 10.0%

The VTTI Operating Projections - Sensitivity Case II, which assumes a decrease in non-contracted rates of 10.0%

VTTI management’s view is that an increase or decrease in weighted-average non-contracted rates exceeding 10.0% over the next five years is not likely

The following sets forth VTTI management projections at various model dates for non-contracted rates:

Estimated Weighted-Average Non-Contracted Rates ($/m3 /month)1

Project Velocity2 Velocity II Velocity III Terminal Velocity

Model Date Apr-15 Jul-16 Nov-16 Mar-17

Amsterdam (ETA) $2.87 $2.82 $2.82 $3.33

Rotterdam (ETT) 4.19 4.06 4.06 4.32

Antwerp (ATPC) 2.99 3.77 3.77 3.60

Fujairah (FTL) 3.50 3.86 3.86 3.95

Johor (ATB 1) 4.13 4.45 4.45 4.46

Florida (SC) 3.20 4.33 4.33 4.46

% Change % Change % Change

Amsterdam (ETA) (1.9%) 0.0% 18.1%3

Rotterdam (ETT) (3.1%) 0.0% 6.4%

Antwerp (ATPC) 26.1%4 0.0% (4.6%)

Fujairah (FTL) 10.1% 0.0% 2.4%

Johor (ATB 1) 7.7% 0.0% 0.2%

Florida (SC) 35.2%5 0.0% 2.9%

Source: VTTI management

1. Excludes effects of inflation indexation; Euro-denominated rates converted at 1.090x U.S.D/EUR exchange rate as of May 2, 2017

2. Foreign exchange corrections estimated with guidance from VTTI management

3. Increase in estimated rates at ETA attributable to renewal of an AIC contract that accounts for 36.9% of ETA’s storage capacity

4. Increase in estimated rates at ATPC attributable to major refurbishments and overhauls conducted in 2014 and 2015

5. Increase in estimated rates at SC attributable to shift in a large Vitol customer’s local business model

36

Evercore vtti energy partners

Confidential

VTTI Operating Asset Overview and Projections

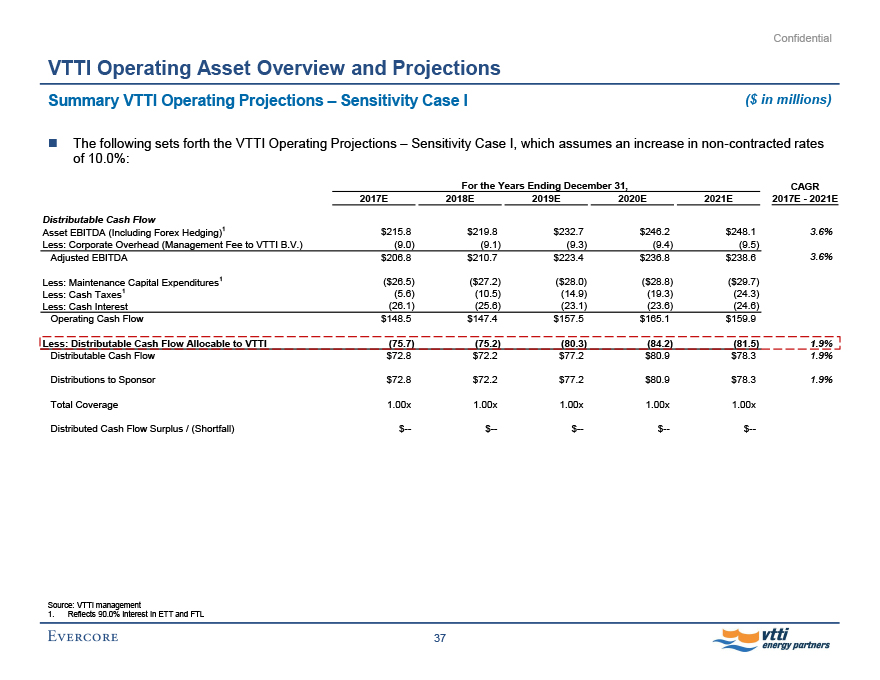

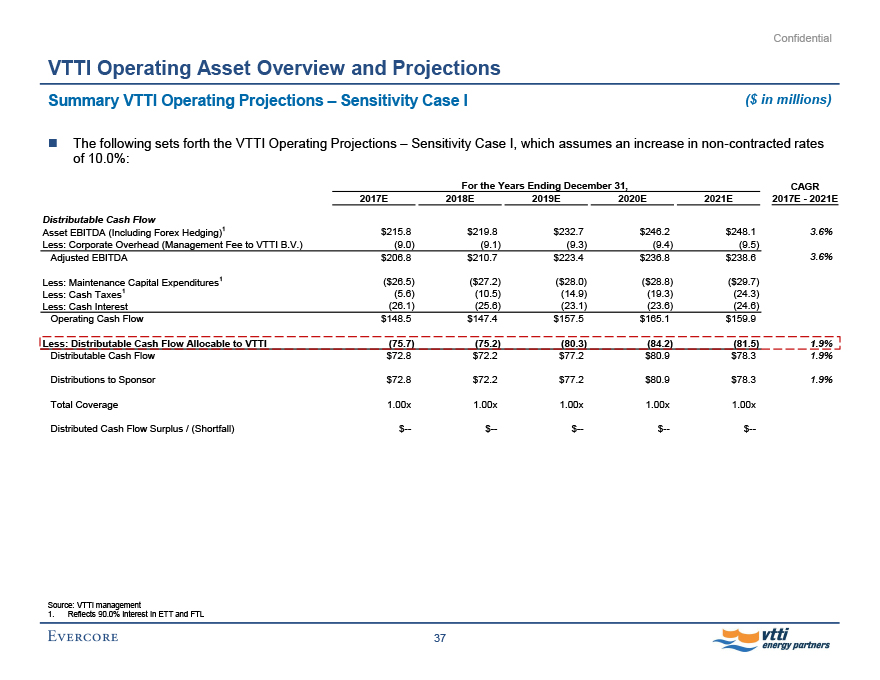

Summary VTTI Operating Projections - Sensitivity Case I ($ in millions)

The following sets forth the VTTI Operating Projections - Sensitivity Case I, which assumes an increase in non-contracted rates of 10.0%:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E CAGR 2017E - 2021E

Distributable Cash Flow

Asset EBITDA (Including Forex Hedging)1 $215.8 $219.8 $232.7 $246.2 $248.1 3.6%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (9.0) (9.1) (9.3) (9.4) (9.5)

Adjusted EBITDA $206.8 $210.7 $223.4 $236.8 $238.6 3.6%

Less: Maintenance Capital Expenditures1 ($26.5) ($27.2) ($28.0) ($28.8) ($29.7)

Less: Cash Taxes1 (5.6) (10.5) (14.9) (19.3) (24.3)

Less: Cash Interest (26.1) (25.6) (23.1) (23.6) (24.6)

Operating Cash Flow $148.5 $147.4 $157.5 $165.1 $159.9

Less: Distributable Cash Flow Allocable to VTTI (75.7) (75.2) (80.3) (84.2) (81.5) 1.9%

Distributable Cash Flow $72.8 $72.2 $77.2 $80.9 $78.3 1.9%

Distributions to Sponsor $72.8 $72.2 $77.2 $80.9 $78.3 1.9%

Total Coverage 1.00x 1.00x 1.00x 1.00x 1.00x

Distributed Cash Flow Surplus / (Shortfall) $-- $-- $-- $-- $--

Source: VTTI management

1. Reflects 90.0% interest in ETT and FTL

37

Evercore vtti energy partners

Confidential

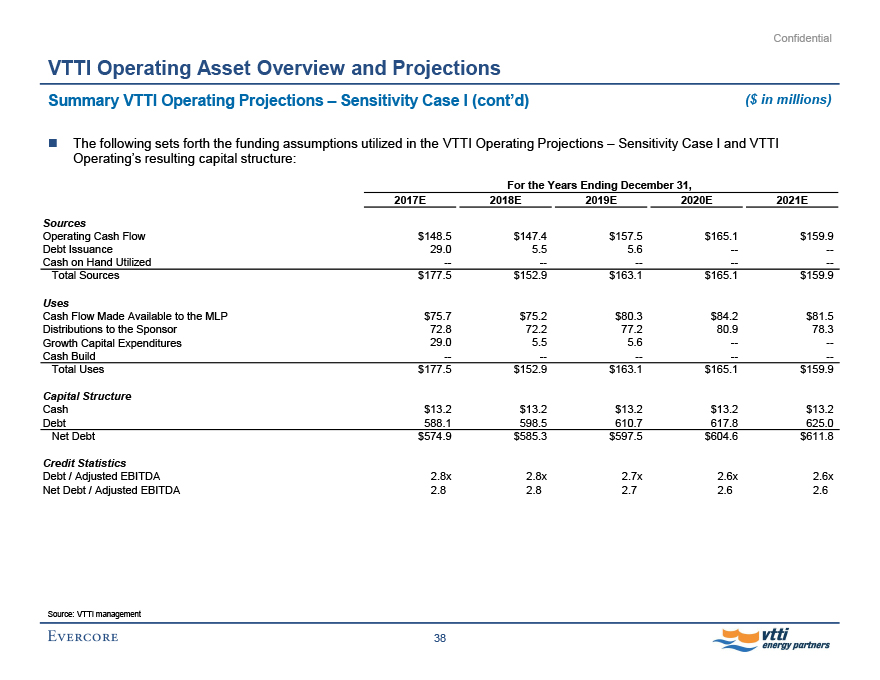

VTTI Operating Asset Overview and Projections

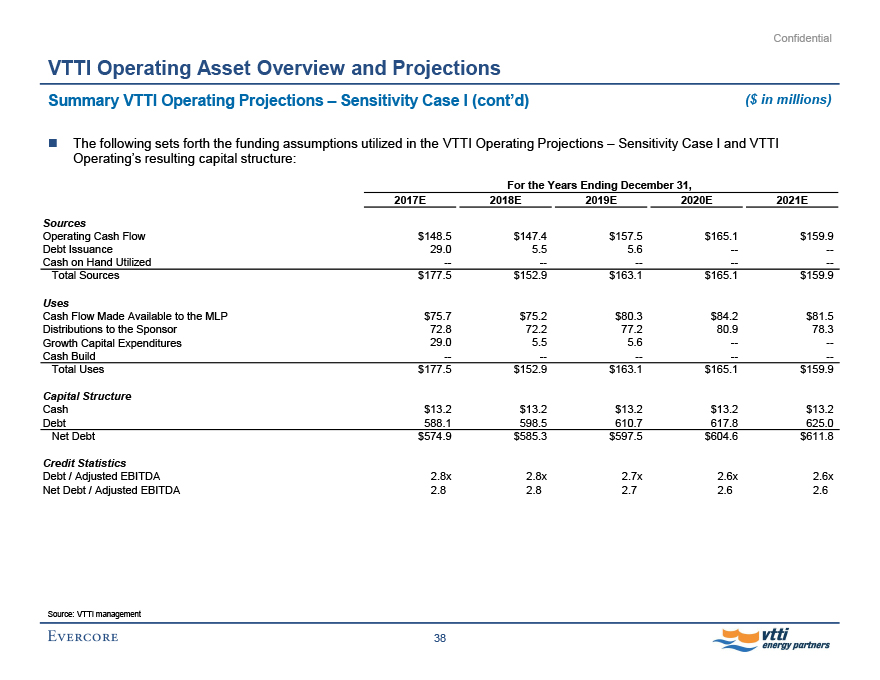

Summary VTTI Operating Projections - Sensitivity Case I (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Operating Projections - Sensitivity Case I and VTTI Operating’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

Operating Cash Flow $148.5 $147.4 $157.5 $165.1 $159.9

Debt Issuance 29.0 5.5 5.6 -- --

Cash on Hand Utilized -- -- -- -- --

Total Sources $177.5 $152.9 $163.1 $165.1 $159.9

Uses

Cash Flow Made Available to the MLP $75.7 $75.2 $80.3 $84.2 $81.5

Distributions to the Sponsor 72.8 72.2 77.2 80.9 78.3

Growth Capital Expenditures 29.0 5.5 5.6 -- --

Cash Build -- -- -- -- --

Total Uses $177.5 $152.9 $163.1 $165.1 $159.9

Capital Structure

Cash $13.2 $13.2 $13.2 $13.2 $13.2

Debt 588.1 598.5 610.7 617.8 625.0

Net Debt $574.9 $585.3 $597.5 $604.6 $611.8

Credit Statistics

Debt / Adjusted EBITDA 2.8x 2.8x 2.7x 2.6x 2.6x

Net Debt / Adjusted EBITDA 2.8 2.8 2.7 2.6 2.6

Source: VTTI management

38

Evercore vtti energy partners

Confidential

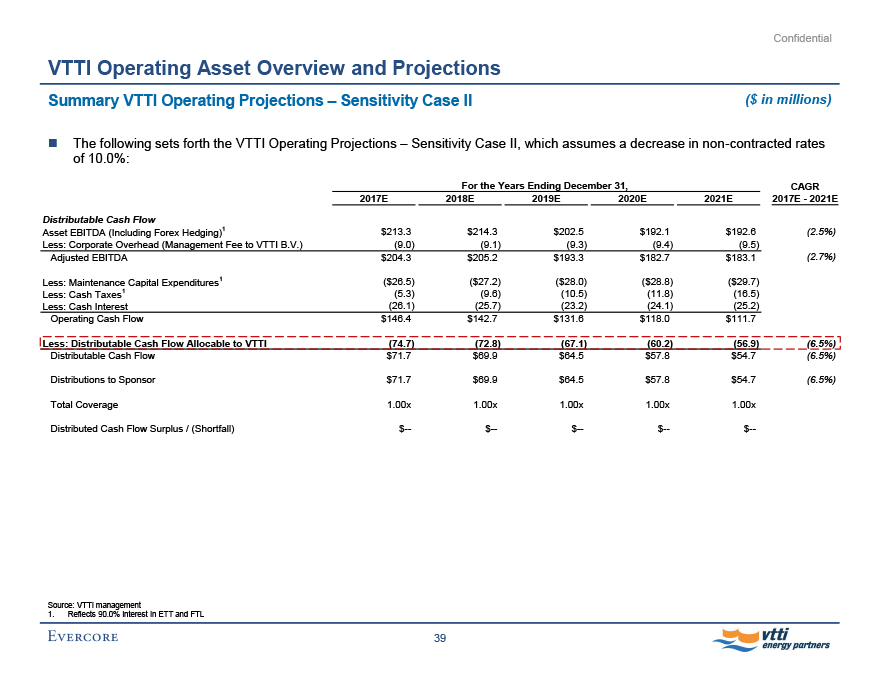

VTTI Operating Asset Overview and Projections

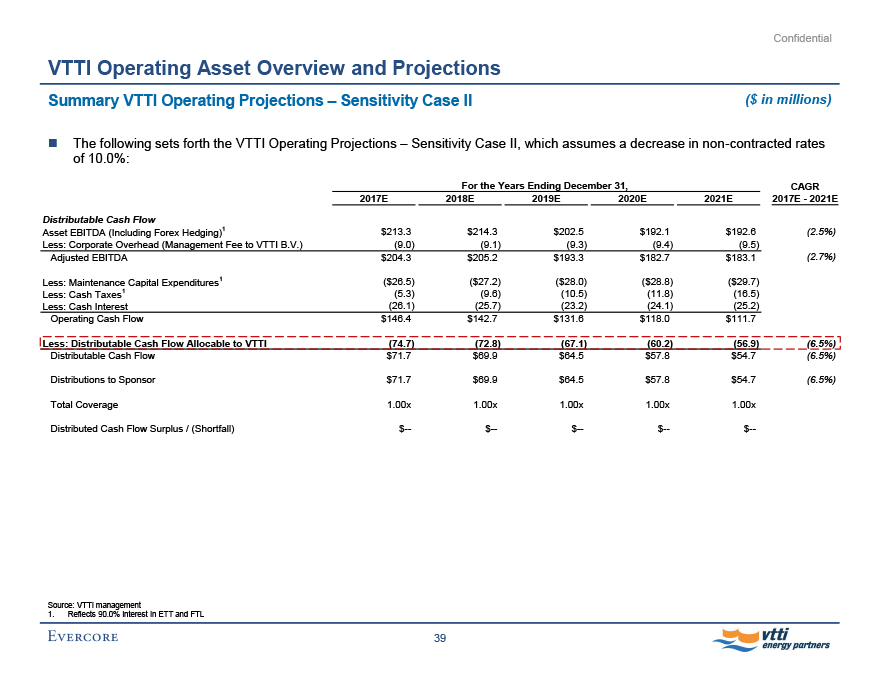

Summary VTTI Operating Projections - Sensitivity Case II ($ in millions)

The following sets forth the VTTI Operating Projections - Sensitivity Case II, which assumes a decrease in non-contracted rates of 10.0%:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E CAGR 2017E - 2021E

Distributable Cash Flow

Asset EBITDA (Including Forex Hedging)1 $213.3 $214.3 $202.5 $192.1 $192.6 (2.5%)

Less: Corporate Overhead (Management Fee to VTTI B.V.) (9.0) (9.1) (9.3) (9.4) (9.5)

Adjusted EBITDA $204.3 $205.2 $193.3 $182.7 $183.1 (2.7%)

Less: Maintenance Capital Expenditures1 ($26.5) ($27.2) ($28.0) ($28.8) ($29.7)

Less: Cash Taxes1 (5.3) (9.6) (10.5) (11.8) (16.5)

Less: Cash Interest (26.1) (25.7) (23.2) (24.1) (25.2)

Operating Cash Flow $146.4 $142.7 $131.6 $118.0 $111.7

Less: Distributable Cash Flow Allocable to VTTI (74.7) (72.8) (67.1) (60.2) (56.9) (6.5%)

Distributable Cash Flow $71.7 $69.9 $64.5 $57.8 $54.7 (6.5%)

Distributions to Sponsor $71.7 $69.9 $64.5 $57.8 $54.7 (6.5%)

Total Coverage 1.00x 1.00x 1.00x 1.00x 1.00x

Distributed Cash Flow Surplus / (Shortfall) $-- $-- $-- $-- $--

Source: VTTI management

1. Reflects 90.0% interest in ETT and FTL

39

Evercore vtti energy partners

Confidential

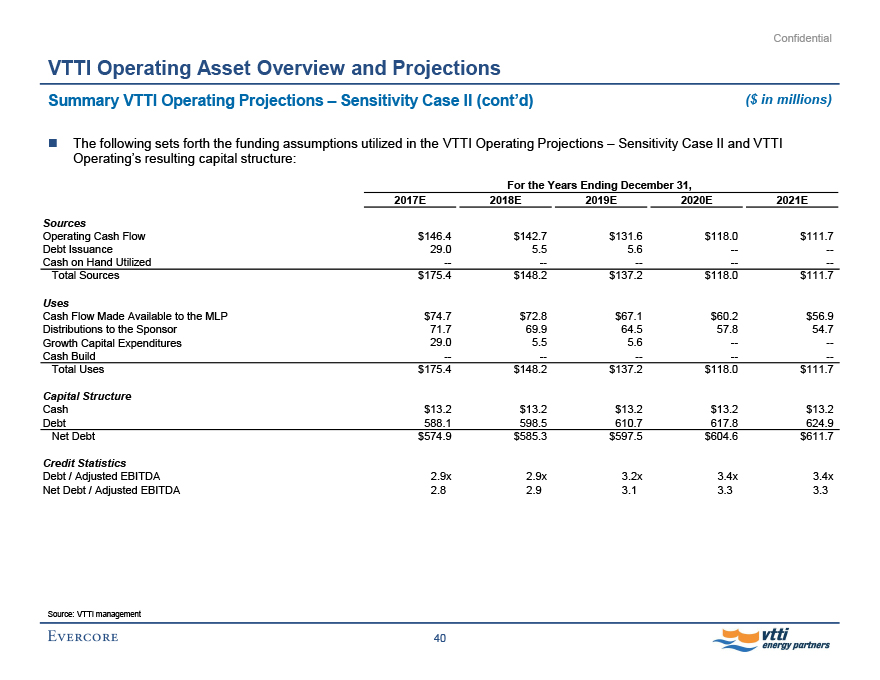

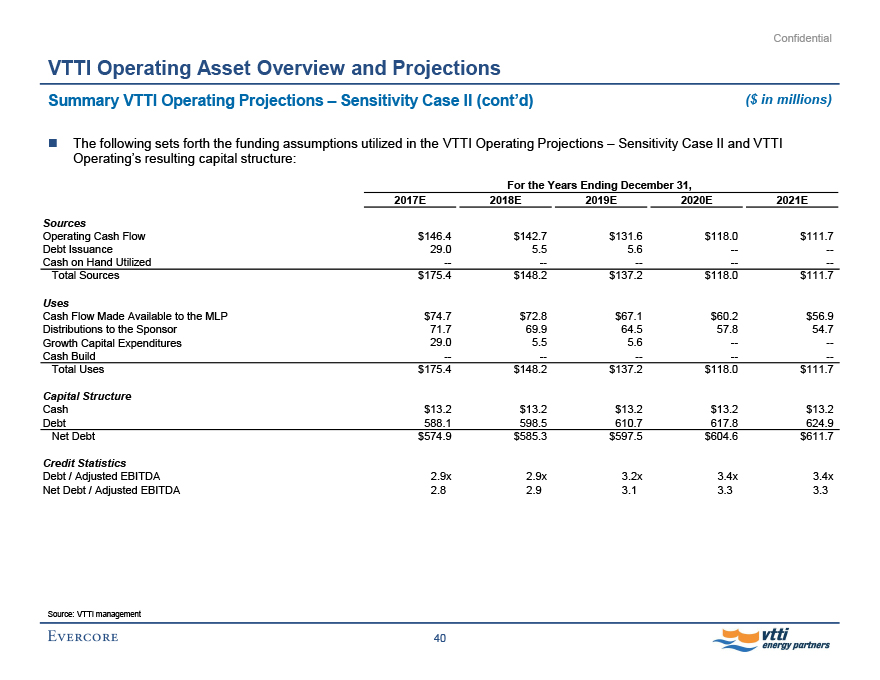

VTTI Operating Asset Overview and Projections

Summary VTTI Operating Projections - Sensitivity Case II (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Operating Projections - Sensitivity Case II and VTTI Operating’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

Operating Cash Flow $146.4 $142.7 $131.6 $118.0 $111.7

Debt Issuance 29.0 5.5 5.6 -- --

Cash on Hand Utilized -- -- -- -- --

Total Sources $175.4 $148.2 $137.2 $118.0 $111.7

Uses

Cash Flow Made Available to the MLP $74.7 $72.8 $67.1 $60.2 $56.9

Distributions to the Sponsor 71.7 69.9 64.5 57.8 54.7

Growth Capital Expenditures 29.0 5.5 5.6 -- --

Cash Build -- -- -- -- --

Total Uses $175.4 $148.2 $137.2 $118.0 $111.7

Capital Structure

Cash $13.2 $13.2 $13.2 $13.2 $13.2

Debt 588.1 598.5 610.7 617.8 624.9

Net Debt $574.9 $585.3 $597.5 $604.6 $611.7

Credit Statistics

Debt / Adjusted EBITDA 2.9x 2.9x 3.2x 3.4x 3.4x

Net Debt / Adjusted EBITDA 2.8 2.9 3.1 3.3 3.3

Source: VTTI management

40

Evercore vtti energy partners

Confidential

IV. VTTI Financial Projections

Evercore

Confidential

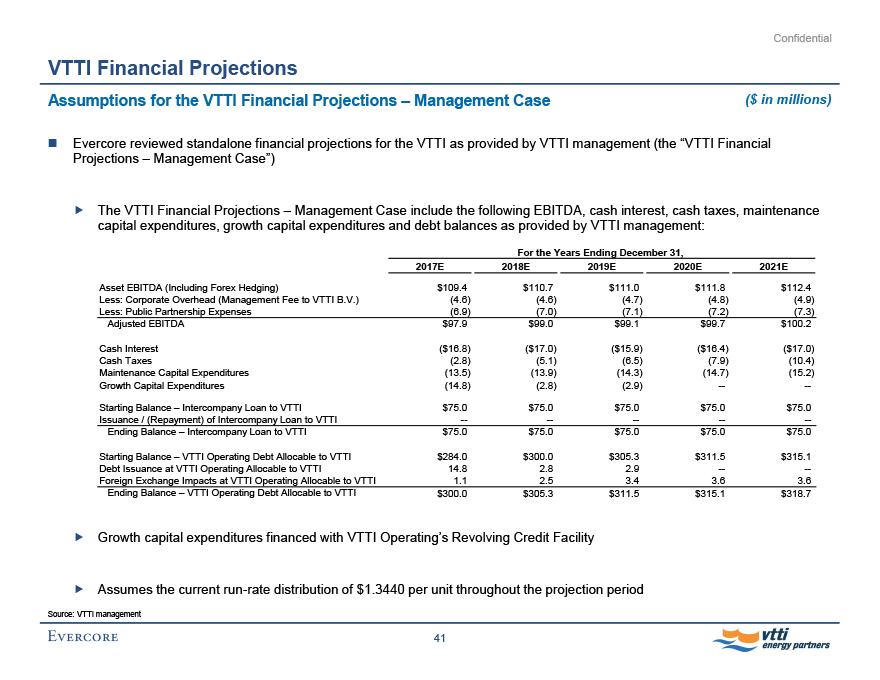

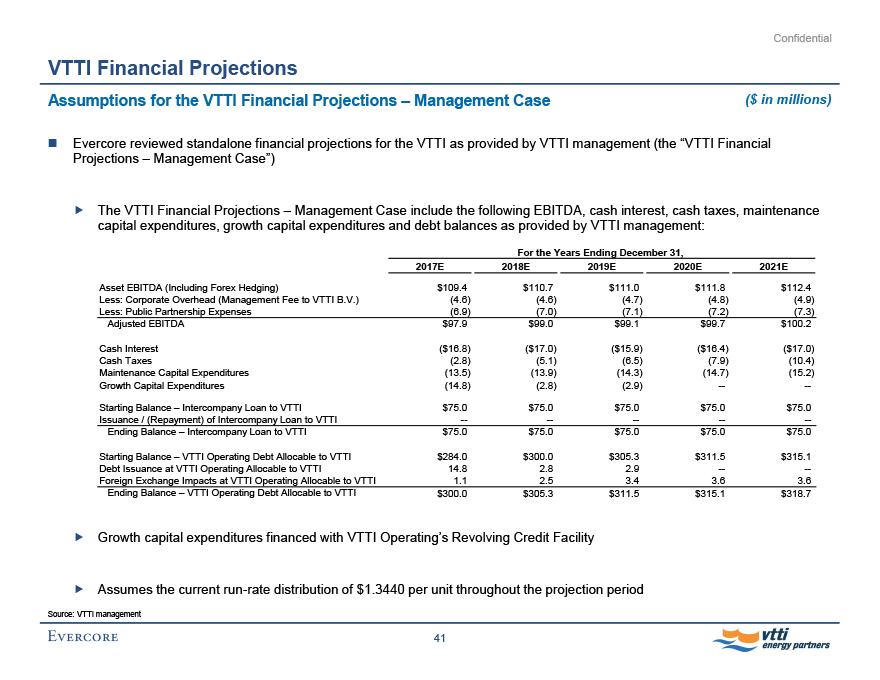

VTTI Financial Projections

Assumptions for the VTTI Financial Projections - Management Case ($ in millions)

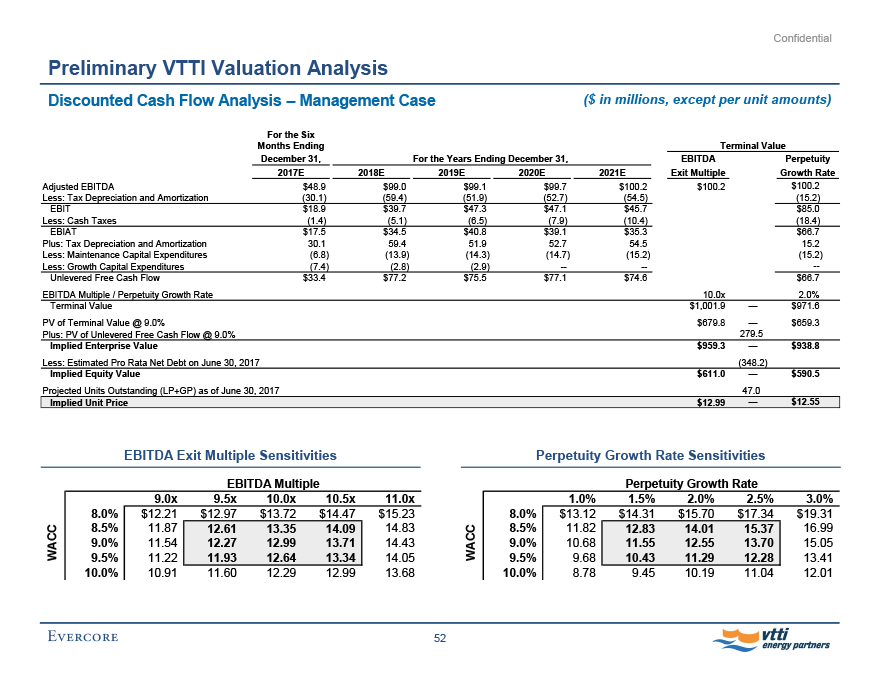

Evercore reviewed standalone financial projections for the VTTI as provided by VTTI management (the “VTTI Financial Projections - Management Case”)

The VTTI Financial Projections - Management Case include the following EBITDA, cash interest, cash taxes, maintenance capital expenditures, growth capital expenditures and debt balances as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Asset EBITDA (Including Forex Hedging) $109.4 $110.7 $111.0 $111.8 $112.4

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $97.9 $99.0 $99.1 $99.7 $100.2

Cash Interest ($16.8) ($17.0) ($15.9) ($16.4) ($17.0)

Cash Taxes (2.8) (5.1) (6.5) (7.9) (10.4)

Maintenance Capital Expenditures (13.5) (13.9) (14.3) (14.7) (15.2)

Growth Capital Expenditures (14.8) (2.8) (2.9) -- --

Starting Balance - Intercompany Loan to VTTI $75.0 $75.0 $75.0 $75.0 $75.0

Issuance / (Repayment) of Intercompany Loan to VTTI -- -- -- -- --

Ending Balance - Intercompany Loan to VTTI $75.0 $75.0 $75.0 $75.0 $75.0

Starting Balance - VTTI Operating Debt Allocable to VTTI $284.0 $300.0 $305.3 $311.5 $315.1

Debt Issuance at VTTI Operating Allocable to VTTI 14.8 2.8 2.9 -- --

Foreign Exchange Impacts at VTTI Operating Allocable to VTTI 1.1 2.5 3.4 3.6 3.6

Ending Balance - VTTI Operating Debt Allocable to VTTI $300.0 $305.3 $311.5 $315.1 $318.7

Growth capital expenditures financed with VTTI Operating’s Revolving Credit Facility

Assumes the current run-rate distribution of $1.3440 per unit throughout the projection period

Source: VTTI management

41

Evercore vtti energy partners

Confidential

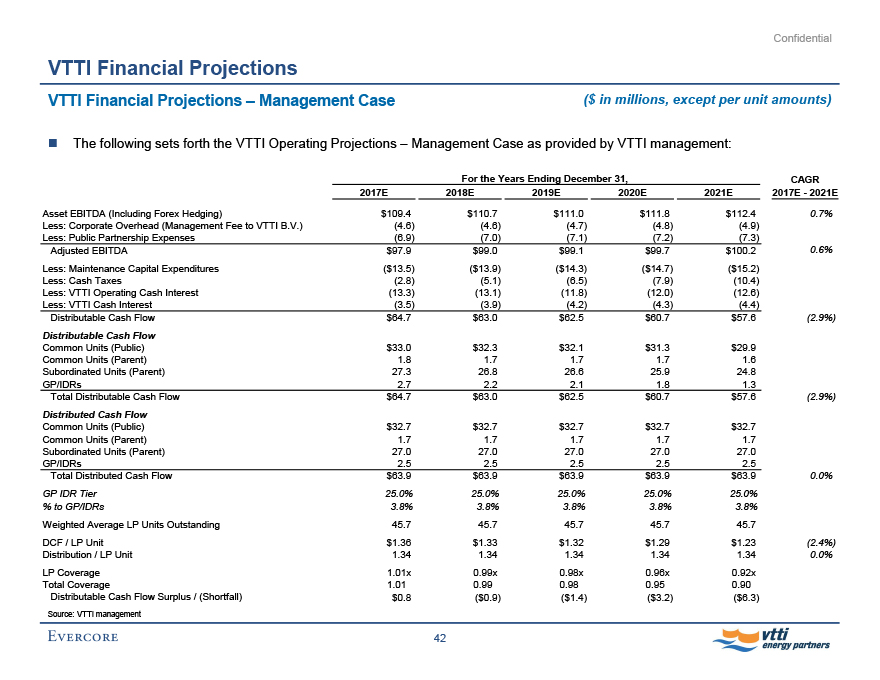

VTTI Financial Projections

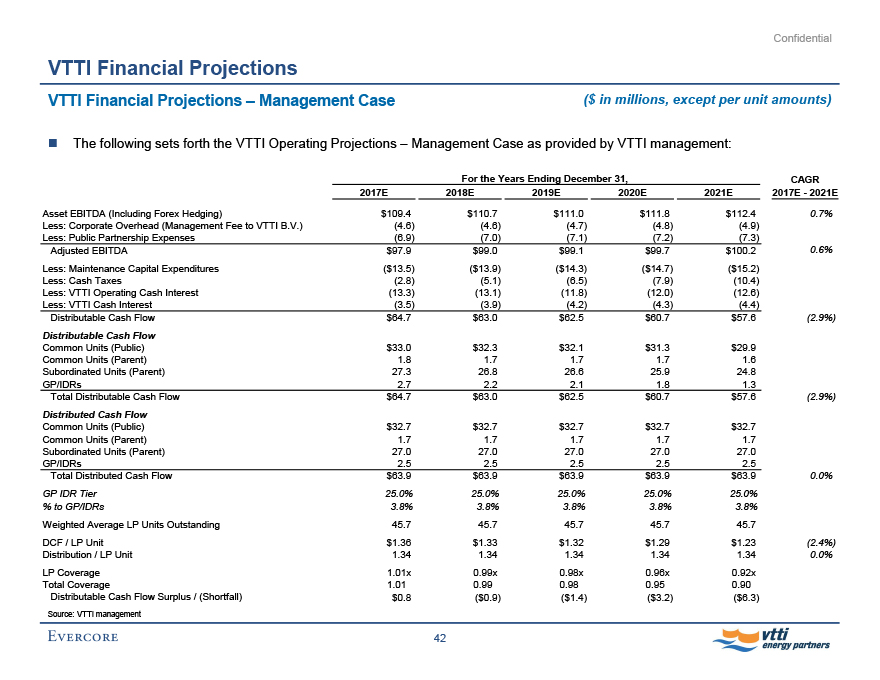

VTTI Financial Projections - Management Case ($ in millions, except per unit amounts)

The following sets forth the VTTI Operating Projections - Management Case as provided by VTTI management:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E CAGR 2017E - 2021E

Asset EBITDA (Including Forex Hedging) $109.4 $110.7 $111.0 $111.8 $112.4 0.7%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $97.9 $99.0 $99.1 $99.7 $100.2 0.6%

Less: Maintenance Capital Expenditures ($13.5) ($13.9) ($14.3) ($14.7) ($15.2)

Less: Cash Taxes (2.8) (5.1) (6.5) (7.9) (10.4)

Less: VTTI Operating Cash Interest (13.3) (13.1) (11.8) (12.0) (12.6)

Less: VTTI Cash Interest (3.5) (3.9) (4.2) (4.3) (4.4)

Distributable Cash Flow $64.7 $63.0 $62.5 $60.7 $57.6 (2.9%)

Distributable Cash Flow

Common Units (Public) $33.0 $32.3 $32.1 $31.3 $29.9

Common Units (Parent) 1.8 1.7 1.7 1.7 1.6

Subordinated Units (Parent) 27.3 26.8 26.6 25.9 24.8

GP/IDRs 2.7 2.2 2.1 1.8 1.3

Total Distributable Cash Flow $64.7 $63.0 $62.5 $60.7 $57.6 (2.9%)

Distributed Cash Flow

Common Units (Public) $32.7 $32.7 $32.7 $32.7 $32.7

Common Units (Parent) 1.7 1.7 1.7 1.7 1.7

Subordinated Units (Parent) 27.0 27.0 27.0 27.0 27.0

GP/IDRs 2.5 2.5 2.5 2.5 2.5

Total Distributed Cash Flow $63.9 $63.9 $63.9 $63.9 $63.9 0.0%

GP IDR Tier 25.0% 25.0% 25.0% 25.0% 25.0%

% to GP/IDRs 3.8% 3.8% 3.8% 3.8% 3.8%

Weighted Average LP Units Outstanding 45.7 45.7 45.7 45.7 45.7

DCF / LP Unit $1.36 $1.33 $1.32 $1.29 $1.23 (2.4%)

Distribution / LP Unit 1.34 1.34 1.34 1.34 1.34 0.0%

LP Coverage 1.01x 0.99x 0.98x 0.96x 0.92x

Total Coverage 1.01 0.99 0.98 0.95 0.90

Distributable Cash Flow Surplus / (Shortfall) $0.8 ($0.9) ($1.4) ($3.2) ($6.3)

Source: VTTI management

42

Evercore vtti energy partners

Confidential

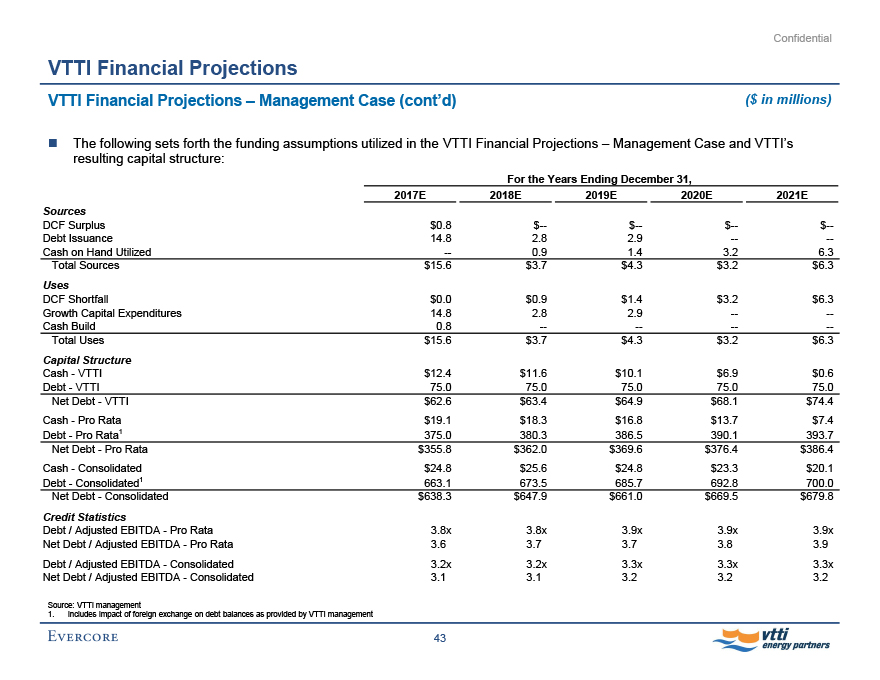

VTTI Financial Projections

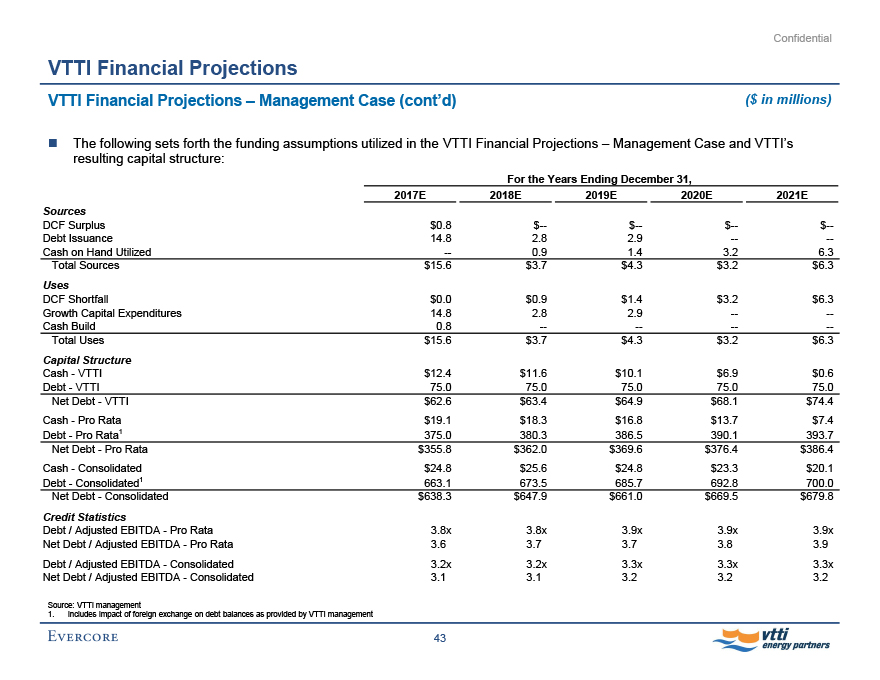

VTTI Financial Projections - Management Case (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Financial Projections - Management Case and VTTI’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

DCF Surplus $0.8 $-- $-- $-- $--

Debt Issuance 14.8 2.8 2.9 -- --

Cash on Hand Utilized -- 0.9 1.4 3.2 6.3

Total Sources $15.6 $3.7 $4.3 $3.2 $6.3

Uses

DCF Shortfall $0.0 $0.9 $1.4 $3.2 $6.3

Growth Capital Expenditures 14.8 2.8 2.9 -- --

Cash Build 0.8 -- -- -- --

Total Uses $15.6 $3.7 $4.3 $3.2 $6.3

Capital Structure

Cash - VTTI $12.4 $11.6 $10.1 $6.9 $0.6

Debt - VTTI 75.0 75.0 75.0 75.0 75.0

Net Debt - VTTI $62.6 $63.4 $64.9 $68.1 $74.4

Cash - Pro Rata $19.1 $18.3 $16.8 $13.7 $7.4

Debt - Pro Rata1 375.0 380.3 386.5 390.1 393.7

Net Debt - Pro Rata $355.8 $362.0 $369.6 $376.4 $386.4

Cash - Consolidated $24.8 $25.6 $24.8 $23.3 $20.1

Debt - Consolidated1 663.1 673.5 685.7 692.8 700.0

Net Debt - Consolidated $638.3 $647.9 $661.0 $669.5 $679.8

Credit Statistics

Debt / Adjusted EBITDA - Pro Rata 3.8x 3.8x 3.9x 3.9x 3.9x

Net Debt / Adjusted EBITDA - Pro Rata 3.6 3.7 3.7 3.8 3.9

Debt / Adjusted EBITDA - Consolidated 3.2x 3.2x 3.3x 3.3x 3.3x

Net Debt / Adjusted EBITDA - Consolidated 3.1 3.1 3.2 3.2 3.2

Source: VTTI management

1. Includes impact of foreign exchange on debt balances as provided by VTTI management

43

Evercore vtti energy partners

Confidential

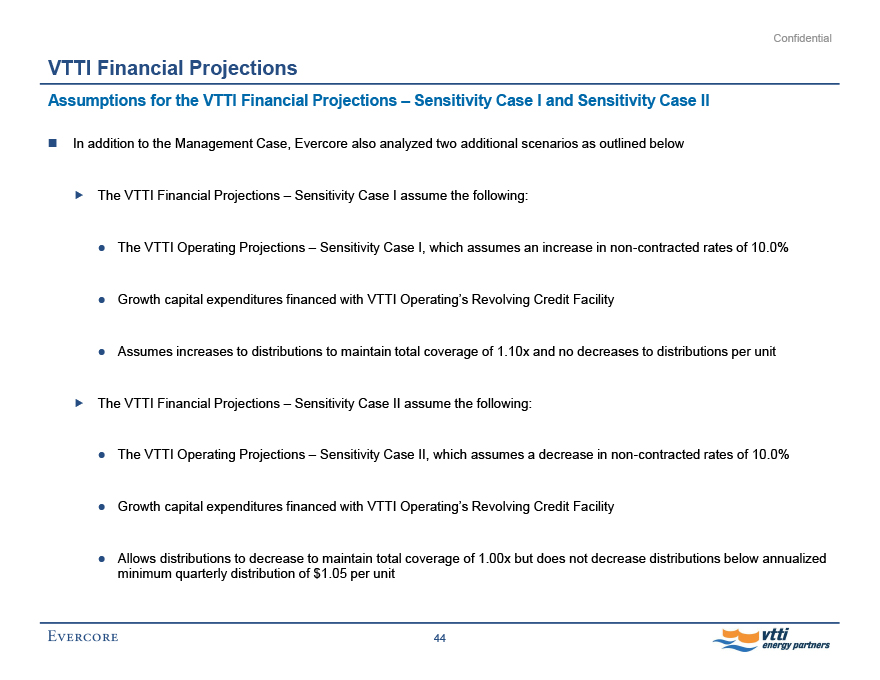

VTTI Financial Projections

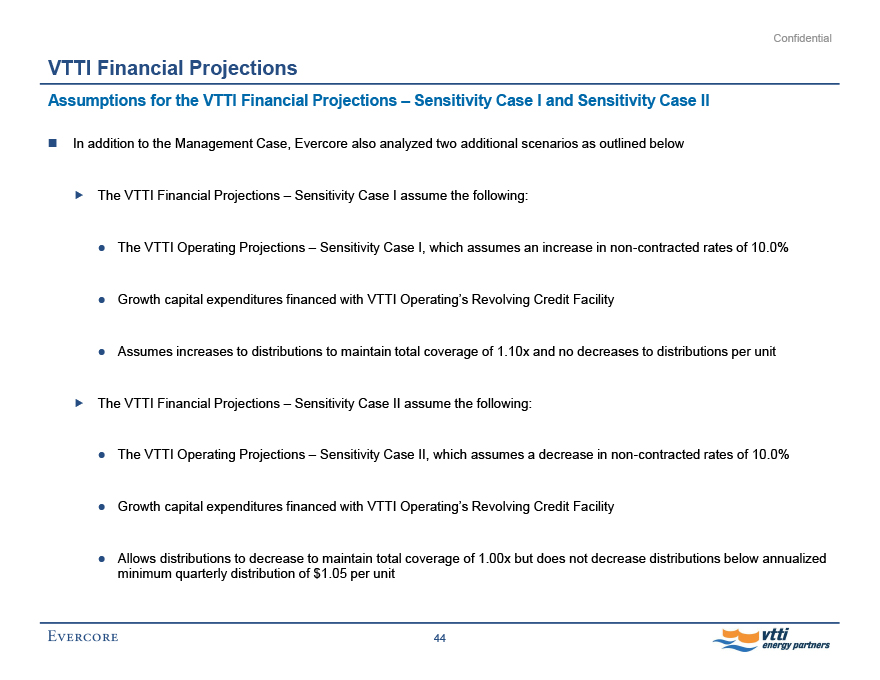

Assumptions for the VTTI Financial Projections - Sensitivity Case I and Sensitivity Case II

In addition to the Management Case, Evercore also analyzed two additional scenarios as outlined below

The VTTI Financial Projections - Sensitivity Case I assume the following:

The VTTI Operating Projections - Sensitivity Case I, which assumes an increase in non-contracted rates of 10.0%

Growth capital expenditures financed with VTTI Operating’s Revolving Credit Facility

Assumes increases to distributions to maintain total coverage of 1.10x and no decreases to distributions per unit

The VTTI Financial Projections - Sensitivity Case II assume the following:

The VTTI Operating Projections - Sensitivity Case II, which assumes a decrease in non-contracted rates of 10.0%

Growth capital expenditures financed with VTTI Operating’s Revolving Credit Facility

Allows distributions to decrease to maintain total coverage of 1.00x but does not decrease distributions below annualized minimum quarterly distribution of $1.05 per unit

44

Evercore vtti energy partners

Confidential

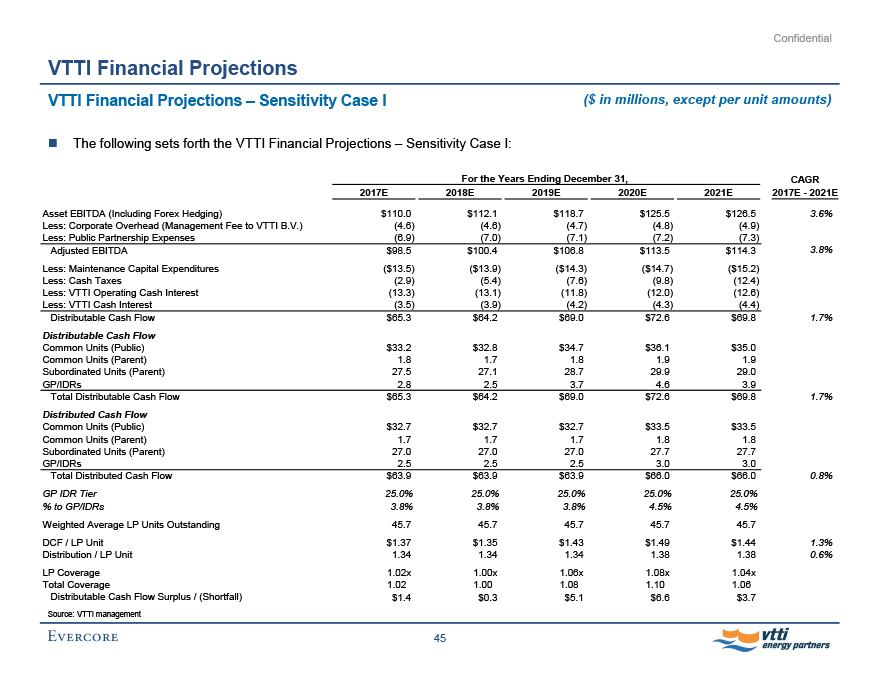

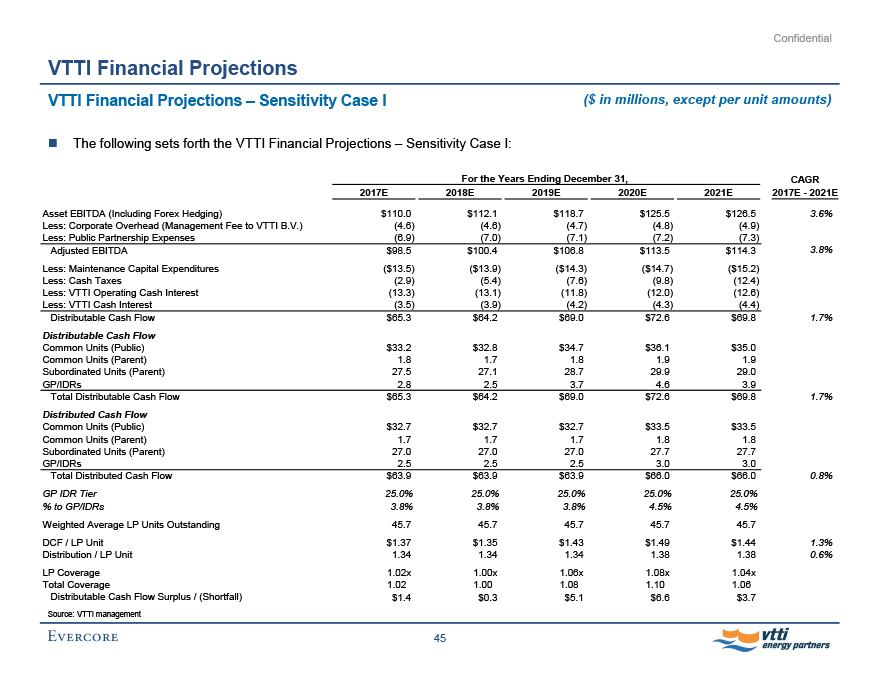

VTTI Financial Projections

VTTI Financial Projections - Sensitivity Case I ($ in millions, except per unit amounts)

The following sets forth the VTTI Financial Projections - Sensitivity Case I:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E CAGR 2017E - 2021E

Asset EBITDA (Including Forex Hedging) $110.0 $112.1 $118.7 $125.5 $126.5 3.6%

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $98.5 $100.4 $106.8 $113.5 $114.3 3.8%

Less: Maintenance Capital Expenditures ($13.5) ($13.9) ($14.3) ($14.7) ($15.2)

Less: Cash Taxes (2.9) (5.4) (7.6) (9.8) (12.4)

Less: VTTI Operating Cash Interest (13.3) (13.1) (11.8) (12.0) (12.6)

Less: VTTI Cash Interest (3.5) (3.9) (4.2) (4.3) (4.4)

Distributable Cash Flow $65.3 $64.2 $69.0 $72.6 $69.8 1.7%

Distributable Cash Flow

Common Units (Public) $33.2 $32.8 $34.7 $36.1 $35.0

Common Units (Parent) 1.8 1.7 1.8 1.9 1.9

Subordinated Units (Parent) 27.5 27.1 28.7 29.9 29.0

GP/IDRs 2.8 2.5 3.7 4.6 3.9

Total Distributable Cash Flow $65.3 $64.2 $69.0 $72.6 $69.8 1.7%

Distributed Cash Flow

Common Units (Public) $32.7 $32.7 $32.7 $33.5 $33.5

Common Units (Parent) 1.7 1.7 1.7 1.8 1.8

Subordinated Units (Parent) 27.0 27.0 27.0 27.7 27.7

GP/IDRs 2.5 2.5 2.5 3.0 3.0

Total Distributed Cash Flow $63.9 $63.9 $63.9 $66.0 $66.0 0.8%

GP IDR Tier 25.0% 25.0% 25.0% 25.0% 25.0%

% to GP/IDRs 3.8% 3.8% 3.8% 4.5% 4.5%

Weighted Average LP Units Outstanding 45.7 45.7 45.7 45.7 45.7

DCF / LP Unit $1.37 $1.35 $1.43 $1.49 $1.44 1.3%

Distribution / LP Unit 1.34 1.34 1.34 1.38 1.38 0.6%

LP Coverage 1.02x 1.00x 1.06x 1.08x 1.04x

Total Coverage 1.02 1.00 1.08 1.10 1.06

Distributable Cash Flow Surplus / (Shortfall) $1.4 $0.3 $5.1 $6.6 $3.7

Source: VTTI management

45

Evercore vtti energy partners

Confidential

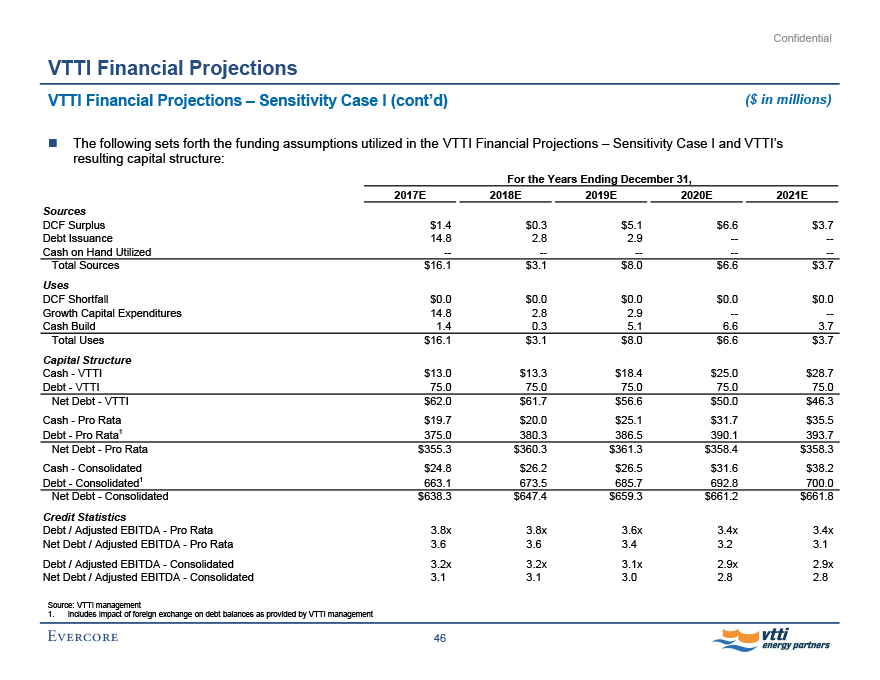

VTTI Financial Projections

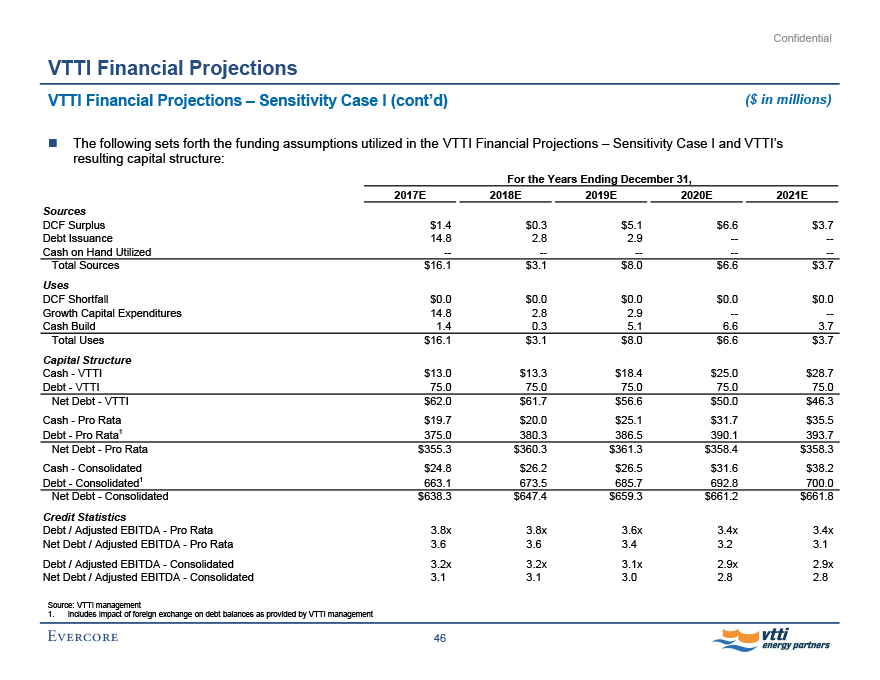

VTTI Financial Projections - Sensitivity Case I (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Financial Projections - Sensitivity Case I and VTTI’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

DCF Surplus $1.4 $0.3 $5.1 $6.6 $3.7

Debt Issuance 14.8 2.8 2.9 -- --

Cash on Hand Utilized -- -- -- -- --

Total Sources $16.1 $3.1 $8.0 $6.6 $3.7

Uses

DCF Shortfall $0.0 $0.0 $0.0 $0.0 $0.0

Growth Capital Expenditures 14.8 2.8 2.9 -- --

Cash Build 1.4 0.3 5.1 6.6 3.7

Total Uses $16.1 $3.1 $8.0 $6.6 $3.7

Capital Structure

Cash - VTTI $13.0 $13.3 $18.4 $25.0 $28.7

Debt - VTTI 75.0 75.0 75.0 75.0 75.0

Net Debt - VTTI $62.0 $61.7 $56.6 $50.0 $46.3

Cash - Pro Rata $19.7 $20.0 $25.1 $31.7 $35.5

Debt - Pro Rata1 375.0 380.3 386.5 390.1 393.7

Net Debt - Pro Rata $355.3 $360.3 $361.3 $358.4 $358.3

Cash - Consolidated $24.8 $26.2 $26.5 $31.6 $38.2

Debt - Consolidated1 663.1 673.5 685.7 692.8 700.0

Net Debt - Consolidated $638.3 $647.4 $659.3 $661.2 $661.8

Credit Statistics

Debt / Adjusted EBITDA - Pro Rata 3.8x 3.8x 3.6x 3.4x 3.4x

Net Debt / Adjusted EBITDA - Pro Rata 3.6 3.6 3.4 3.2 3.1

Debt / Adjusted EBITDA - Consolidated 3.2x 3.2x 3.1x 2.9x 2.9x

Net Debt / Adjusted EBITDA - Consolidated 3.1 3.1 3.0 2.8 2.8

Source: VTTI management

1. Includes impact of foreign exchange on debt balances as provided by VTTI management

46

Evercore vtti energy partners

Confidential

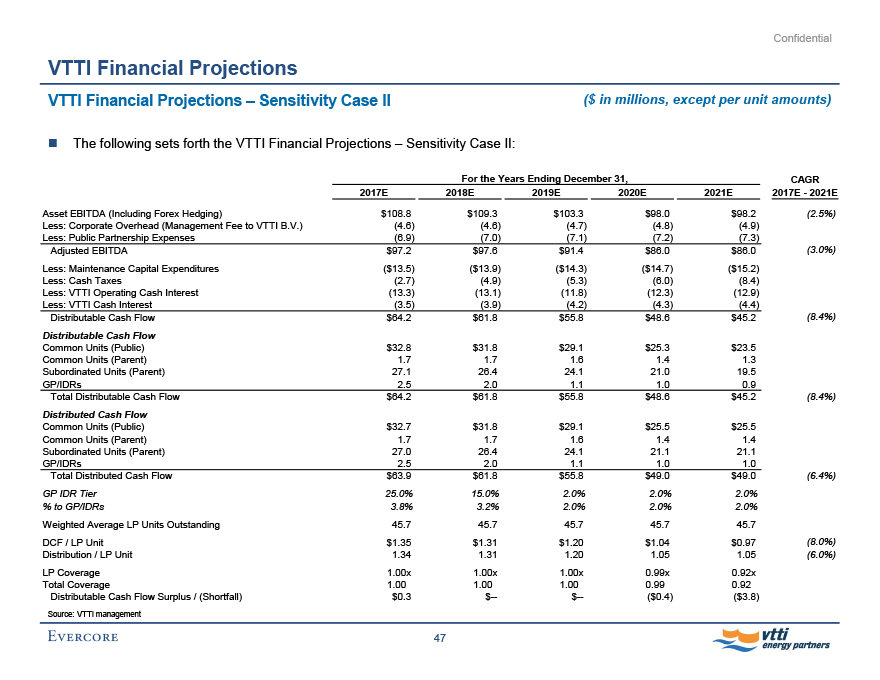

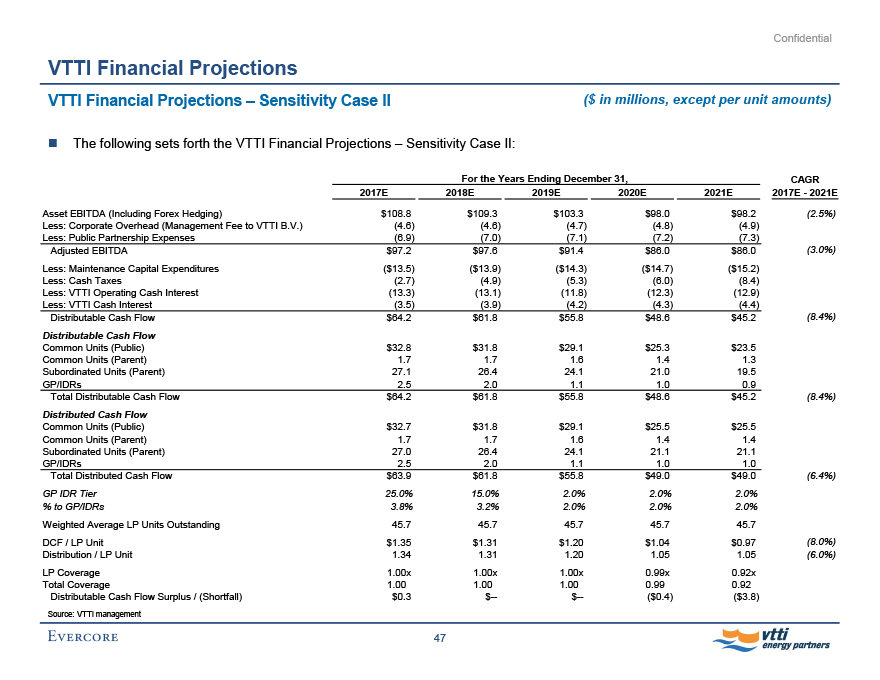

VTTI Financial Projections

VTTI Financial Projections - Sensitivity Case II ($ in millions, except per unit amounts)

The following sets forth the VTTI Financial Projections - Sensitivity Case II:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E CAGR 2017E - 2021E

Asset EBITDA (Including Forex Hedging) $108.8 $109.3 $103.3 $98.0 $98.2 (2.5%)

Less: Corporate Overhead (Management Fee to VTTI B.V.) (4.6) (4.6) (4.7) (4.8) (4.9)

Less: Public Partnership Expenses (6.9) (7.0) (7.1) (7.2) (7.3)

Adjusted EBITDA $97.2 $97.6 $91.4 $86.0 $86.0 (3.0%)

Less: Maintenance Capital Expenditures ($13.5) ($13.9) ($14.3) ($14.7) ($15.2)

Less: Cash Taxes (2.7) (4.9) (5.3) (6.0) (8.4)

Less: VTTI Operating Cash Interest (13.3) (13.1) (11.8) (12.3) (12.9)

Less: VTTI Cash Interest (3.5) (3.9) (4.2) (4.3) (4.4)

Distributable Cash Flow $64.2 $61.8 $55.8 $48.6 $45.2 (8.4%)

Distributable Cash Flow

Common Units (Public) $32.8 $31.8 $29.1 $25.3 $23.5

Common Units (Parent) 1.7 1.7 1.6 1.4 1.3

Subordinated Units (Parent) 27.1 26.4 24.1 21.0 19.5

GP/IDRs 2.5 2.0 1.1 1.0 0.9

Total Distributable Cash Flow $64.2 $61.8 $55.8 $48.6 $45.2 (8.4%)

Distributed Cash Flow

Common Units (Public) $32.7 $31.8 $29.1 $25.5 $25.5

Common Units (Parent) 1.7 1.7 1.6 1.4 1.4

Subordinated Units (Parent) 27.0 26.4 24.1 21.1 21.1

GP/IDRs 2.5 2.0 1.1 1.0 1.0

Total Distributed Cash Flow $63.9 $61.8 $55.8 $49.0 $49.0 (6.4%)

GP IDR Tier 25.0% 15.0% 2.0% 2.0% 2.0%

% to GP/IDRs 3.8% 3.2% 2.0% 2.0% 2.0%

Weighted Average LP Units Outstanding 45.7 45.7 45.7 45.7 45.7

DCF / LP Unit $1.35 $1.31 $1.20 $1.04 $0.97 (8.0%)

Distribution / LP Unit 1.34 1.31 1.20 1.05 1.05 (6.0%)

LP Coverage 1.00x 1.00x 1.00x 0.99x 0.92x

Total Coverage 1.00 1.00 1.00 0.99 0.92

Distributable Cash Flow Surplus / (Shortfall) $0.3 $-- $-- ($0.4) ($3.8)

Source: VTTI management

47

Evercore vtti energy partners

Confidential

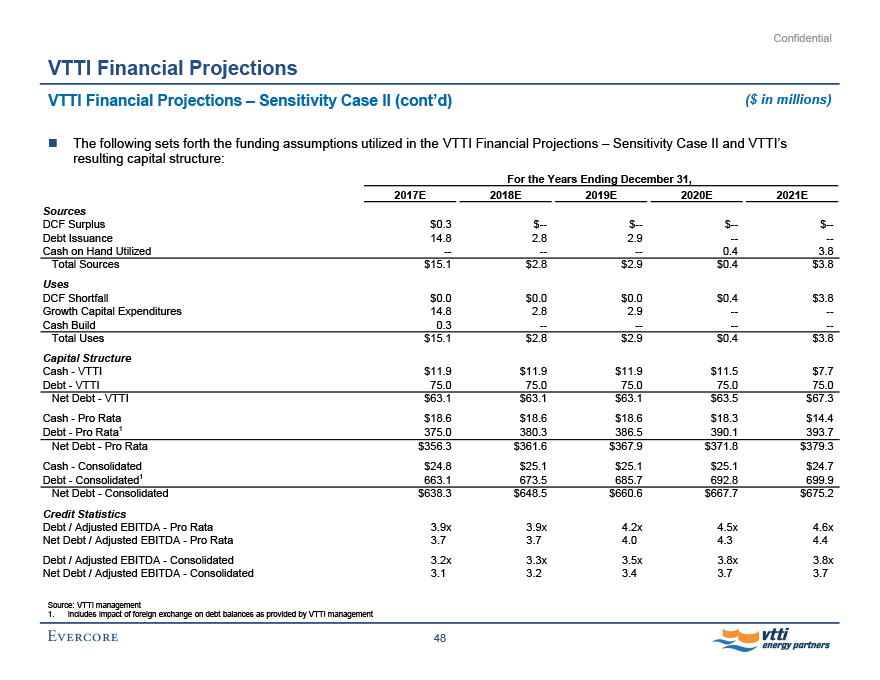

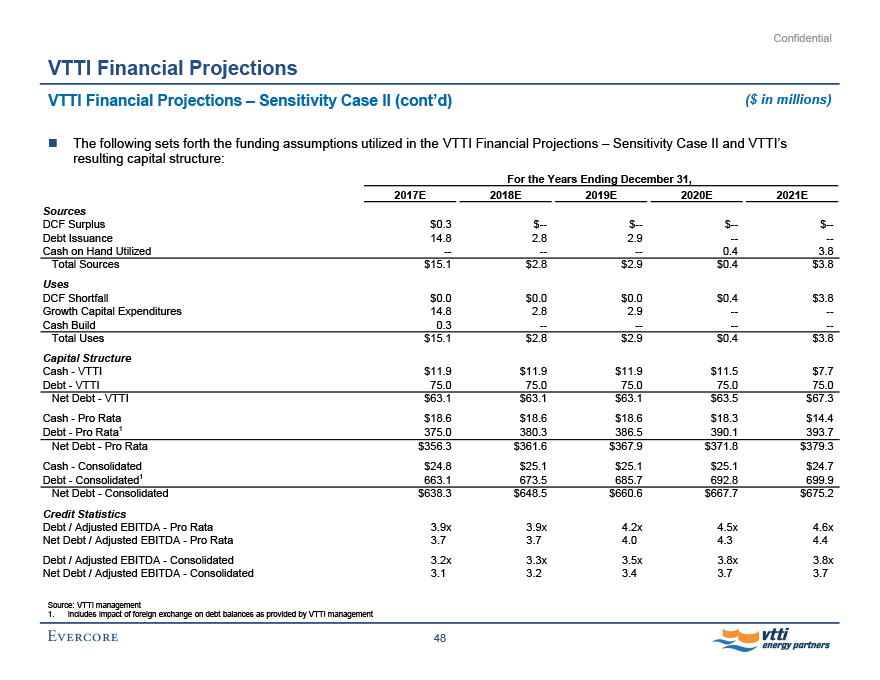

VTTI Financial Projections

VTTI Financial Projections - Sensitivity Case II (cont’d) ($ in millions)

The following sets forth the funding assumptions utilized in the VTTI Financial Projections - Sensitivity Case II and VTTI’s resulting capital structure:

For the Years Ending December 31,

2017E 2018E 2019E 2020E 2021E

Sources

DCF Surplus $0.3 $-- $-- $-- $--

Debt Issuance 14.8 2.8 2.9 -- --

Cash on Hand Utilized -- -- -- 0.4 3.8

Total Sources $15.1 $2.8 $2.9 $0.4 $3.8

Uses

DCF Shortfall $0.0 $0.0 $0.0 $0.4 $3.8

Growth Capital Expenditures 14.8 2.8 2.9 -- --

Cash Build 0.3 -- -- -- --

Total Uses $15.1 $2.8 $2.9 $0.4 $3.8

Capital Structure

Cash - VTTI $11.9 $11.9 $11.9 $11.5 $7.7

Debt - VTTI 75.0 75.0 75.0 75.0 75.0

Net Debt - VTTI $63.1 $63.1 $63.1 $63.5 $67.3

Cash - Pro Rata $18.6 $18.6 $18.6 $18.3 $14.4

Debt - Pro Rata1 375.0 380.3 386.5 390.1 393.7

Net Debt - Pro Rata $356.3 $361.6 $367.9 $371.8 $379.3

Cash - Consolidated $24.8 $25.1 $25.1 $25.1 $24.7

Debt - Consolidated1 663.1 673.5 685.7 692.8 699.9

Net Debt - Consolidated $638.3 $648.5 $660.6 $667.7 $675.2

Credit Statistics

Debt / Adjusted EBITDA - Pro Rata 3.9x 3.9x 4.2x 4.5x 4.6x

Net Debt / Adjusted EBITDA - Pro Rata 3.7 3.7 4.0 4.3 4.4

Debt / Adjusted EBITDA - Consolidated 3.2x 3.3x 3.5x 3.8x 3.8x

Net Debt / Adjusted EBITDA - Consolidated 3.1 3.2 3.4 3.7 3.7

Source: VTTI management

1. Includes impact of foreign exchange on debt balances as provided by VTTI management

48

Evercore vtti energy partners

Confidential

V. Preliminary VTTI Valuation Analysis

Evercore

Confidential

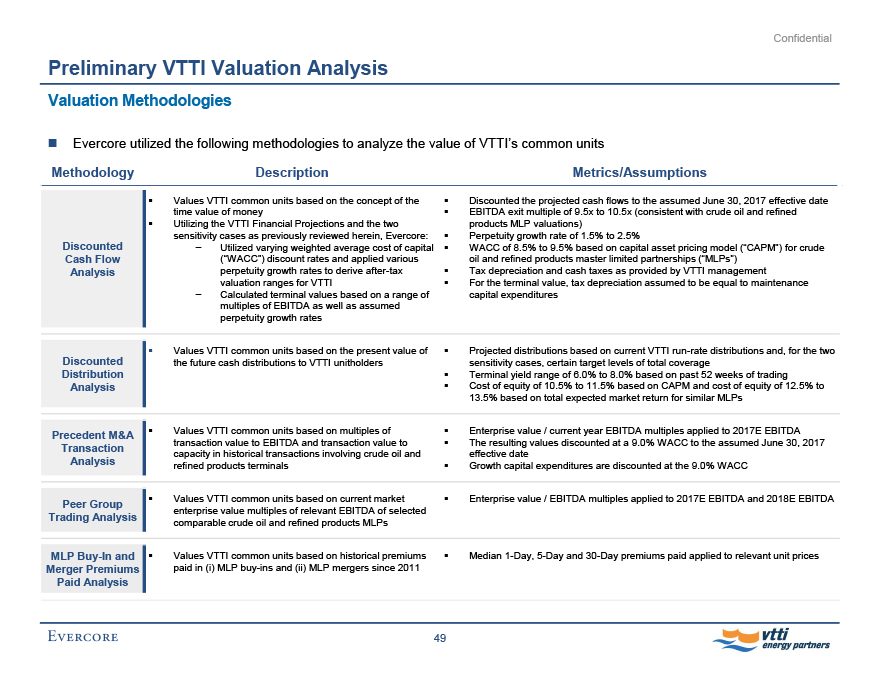

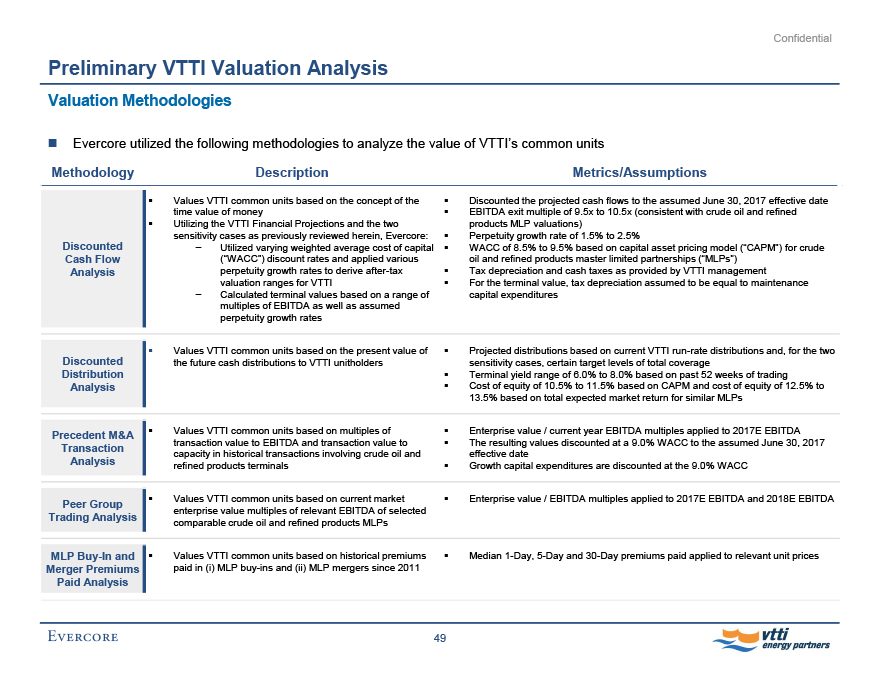

Preliminary VTTI Valuation Analysis

Valuation Methodologies

Evercore utilized the following methodologies to analyze the value of VTTI’s common units

Methodology Description Metrics/Assumptions

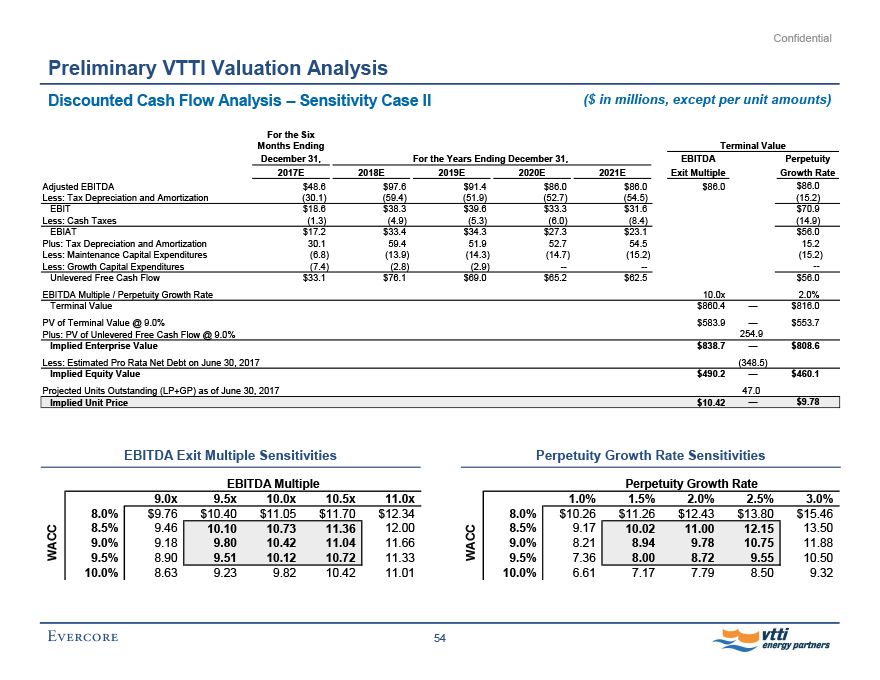

Discounted Cash Flow Analysis

Values VTTI common units based on the concept of the time value of money

Utilizing the VTTI Financial Projections and the two sensitivity cases as previously reviewed herein, Evercore:

- Utilized varying weighted average cost of capital (“WACC”) discount rates and applied various perpetuity growth rates to derive after-tax valuation ranges for VTTI

- Calculated terminal values based on a range of multiples of EBITDA as well as assumed perpetuity growth rates

Discounted the projected cash flows to the assumed June 30, 2017 effective date

EBITDA exit multiple of 9.5x to 10.5x (consistent with crude oil and refined products MLP valuations)

Perpetuity growth rate of 1.5% to 2.5%

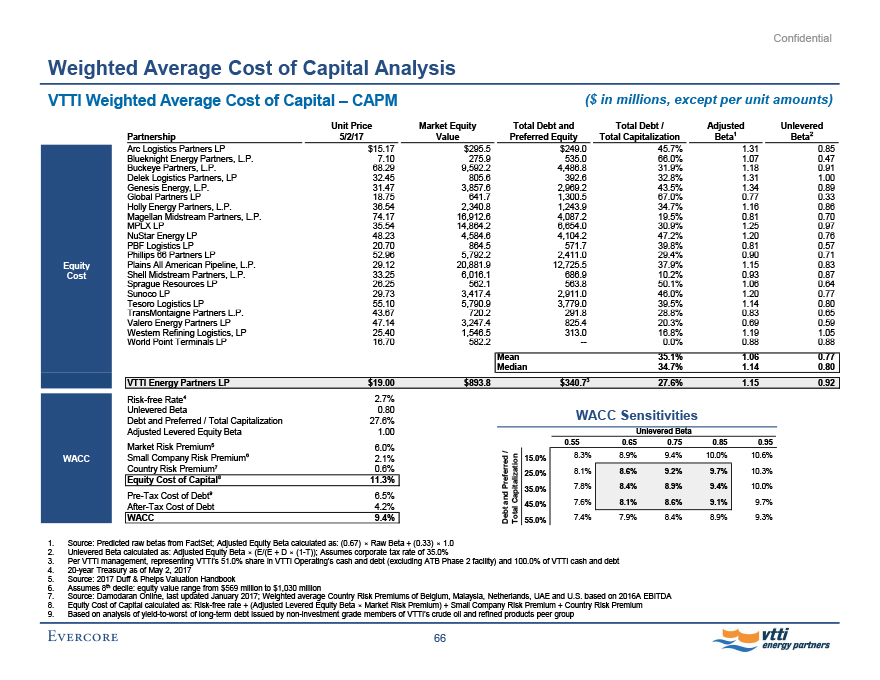

WACC of 8.5% to 9.5% based on capital asset pricing model (“CAPM”) for crude oil and refined products master limited partnerships (“MLPs”)

Tax depreciation and cash taxes as provided by VTTI management

For the terminal value, tax depreciation assumed to be equal to maintenance capital expenditures

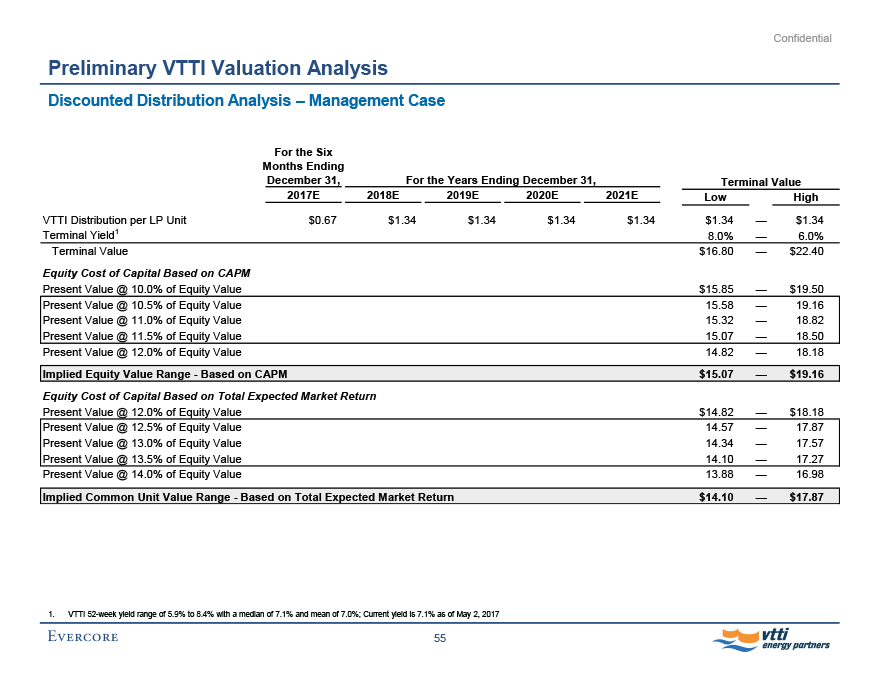

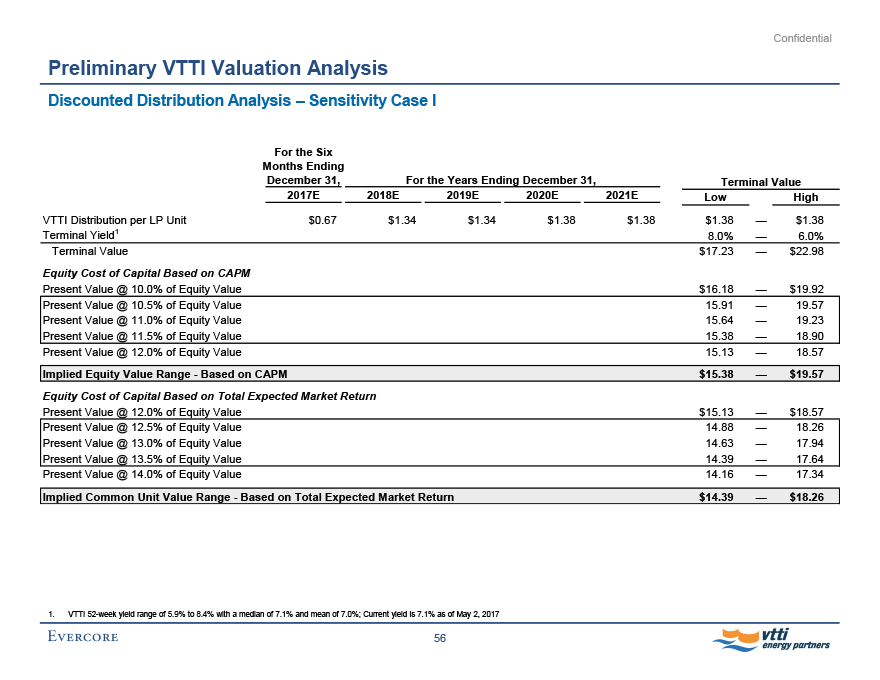

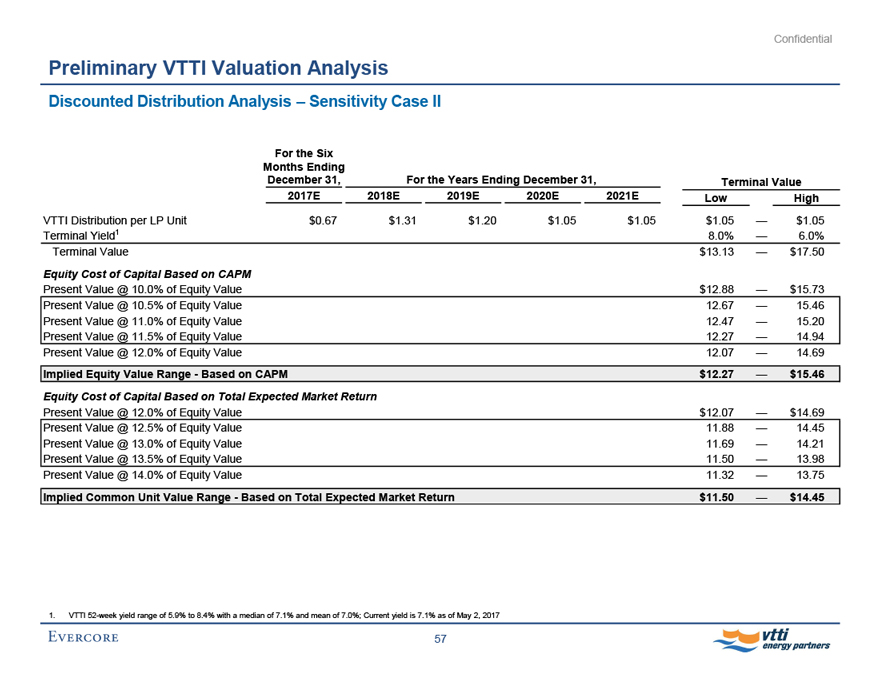

Discounted Distribution Analysis

Values VTTI common units based on the present value of the future cash distributions to VTTI unitholders

Projected distributions based on current VTTI run-rate distributions and, for the two sensitivity cases, certain target levels of total coverage

Terminal yield range of 6.0% to 8.0% based on past 52 weeks of trading