| | OMB APPROVAL |

| | OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22960 | |

| Eubel Brady & Suttman Mutual Fund Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 | Cincinnati, Ohio 45246 |

| (Address of principal executive offices) | (Zip code) |

Carol J. Highsmith

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | July 31 | |

| | | |

| Date of reporting period: | July 31, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Eubel Brady & Suttman

Income and Appreciation Fund

Ticker Symbol: EBSZX

Eubel Brady & Suttman

Income Fund

Ticker Symbol: EBSFX

Each a series of the

Eubel Brady & Suttman Mutual Fund Trust

ANNUAL REPORT

July 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one may no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports may be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-800-391-1223 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-800-391-1223. If you own shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to both series of the Eubel Brady & Suttman Mutual Fund Trust.

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

LETTER TO OUR SHAREHOLDERS | July 31, 2020 |

Dear Shareholders:

The fiscal year ended July 31, 2020 was interesting, challenging and thought provoking. Saber-rattling between the U.S. and China contributed to slowing economic growth, the global value of negative yielding debt reached an estimated $17T in August 2019 and the Federal Reserve (the “Fed”) served as lender of last resort when the U.S. economy essentially shutdown in March due to COVID-19. This confluence of events led to significant volatility over the course of the fiscal year, bouts of illiquidity and ultimately lower yields and tighter credit spreads.

The large gains enjoyed by fixed-income investors in the declining yield environment of the last 39 years are likely nearing an end. Accordingly, we believe that fixed-income is poised to take on its more traditional role of preserving capital in the coming decade.

We discuss the year in more detail, review our investment philosophy and results, and share our perspective below. We welcome your questions, comments or both. Feel free to give us a call anytime (800-391-1223).

A Review of the 2020 Fiscal Year – The fiscal year can be summarized by Negative Yields and the Fed.

Negative Yields – The concept of negative yielding debt is bizarre and was rarely heard of before early 2015, yet the global balance grew swiftly from 2015 until peaking at an estimated $17T in August 2019. This phenomenon made the U.S.’s ultra-low yields very attractive to foreign buyers. Increased buying generally boosted prices and lowered yields further. Fortunately, negative nominal yields have not washed ashore in the U.S. to date.

The Fed – The Fed was extremely busy and influential during the fiscal year. After raising rates in 2018, it changed course and lowered rates by 0.25% in August, September and October of 2019. This was an attempt to extend the economic cycle in the midst of bitter trade negotiations between the U.S. and China which contributed to slowing economic growth and an inverted yield curve at different points during the year.

Furthermore, after short-term funding rates spiked to around 10% in September, it committed to purchasing $60B per month of Treasury Bills until at least the second quarter of 2020 – boosting liquidity in the banking system. These efforts quickly brought short-term rates back down around the 2% level.

Then, with the onset of COVID-19 – it reduced rates 1.5% in March 2020 to a range of 0% - 0.25%. With those rate reductions, it again achieved a normal sloping yield curve- where short-term rates are lower than longer term rates.

Lastly, when fixed-income and equity markets became dislocated in mid-March, the Fed stepped in as lender of last resort and provided a backstop. This caused rising yields to decline and widening credit spreads to narrow, quickly. With yields and credit spreads under control, corporations issued a gargantuan amount of debt to fortify their balance sheets in the face of

1

rapidly deteriorating economic conditions due to the COVID-19 induced shutdown of the U.S. economy.

Investment Philosophy – Managing risks so that investors are being adequately compensated for them is an important element of our bottom-up investment philosophy. Flexibility in portfolio management can support long-term success, in our view. As such, each Fund has latitude with respect to maturity, duration (price sensitivity to a change in interest rates) and credit quality (among other factors). Essentially, we can invest where we find the most value.

Importantly, since we are not managing to a specific maturity or duration target, we can and often do hold bonds to maturity. We believe this provides our Funds an advantage over those which are more constrained and are constantly repositioning their portfolio to remain within a mandate.

Furthermore, with the Funds’ investor base being comprised of EBS clients, fund flows are considerably more stable than those of funds open to the general public. This, too, can provide the Funds advantages relative to those which may have assets under management fluctuate wildly at the whims of unknown investors’ emotions. For example, when investors exit a fund en masse during a time of panic (like mid-March), it can result in forced selling at an inopportune time. However, this same event can provide investment opportunities for investors with capital available (e.g., the Funds).

Each Fund held around 50 securities at fiscal year-end but maintained good diversification in our view. We are inclined to generally hold fewer rather than more securities. We believe this allows us to be more selective and provide closer oversight.

The composition of the EBS Funds will often be materially different than their benchmarks. You should expect their returns to diverge from the benchmarks – at times significantly. Lastly, neither Fund uses leverage (borrows money) to make investments.

Results For Various Periods Ended July 31, 2020 – Since inception (September 30, 2014) through July 31, 2020, the EBS Income and Appreciation Fund (“EBSZX”) posted a total annualized return of 2.74%, while its primary benchmark, the ICE BofA U.S. Yield Alternatives Index, returned 3.92%. On a five-year basis, the Fund returned 3.12% and the benchmark 5.24%. On a three-year basis, the Fund returned 2.49% and the benchmark 5.57%. On a one-year basis, the Fund returned 3.04% and the benchmark returned 6.27%. Lastly, on a six-month basis, the Fund returned 1.64% and the benchmark returned 0.81%.

The primary factors contributing to EBSZX’s outperformance, relative to its benchmark, during the six-month period and underperformance in other periods are described below:

| | ● | EBSZX’s investment in non-convertible securities contributed to its relative outperformance on a six-month basis, as those securities held up better than the index during the March market meltdown. Those same securities contributed to EBSZX’s relative underperformance in all other periods, as those assets do not display the same equity sensitivity as ones comprising the benchmark. |

2

| | ● | Equities appreciated in each period boosting the more equity sensitive benchmark more than the Fund. |

We believe EBSZX is positioned well to capitalize on convertible investments in the future, as it did in March, should they become available at compelling prices.

Since inception (September 30, 2014) through July 31, 2020, the EBS Income Fund (“EBSFX”) logged a total annualized return of 2.52%, while its primary benchmark, the ICE BofA U.S. Corporate & Government Master Index was up 4.72%. On a five-year basis, the Fund returned 2.90% and the benchmark 5.01%. On a three-year basis, the Fund returned 2.73% and the benchmark 6.46%. On a one-year basis, the Fund returned 3.49% and the benchmark 11.96%. Lastly, on a six-month basis, the Fund returned 2.07% and the benchmark 6.67%.

The primary factors contributing to EBSFX’s underperformance, relative to its benchmark, are described below:

| | ● | EBSFX has a much shorter duration and less Government & Agency debt exposure than its benchmark. As such, the Fund did not benefit as much as the benchmark from declining yields. |

| | ● | Fixed-income prices generally move inversely to yields and instruments with longer maturities are more sensitive to movements in yield. Yields of securities with the largest impact on the benchmark declined on average, positively impacting prices and the benchmark’s performance more than the Fund. |

Our Perspective – With COVID-19 still present, unemployment elevated and the economy fragile, the Fed will likely keep short-term rates near zero for the foreseeable future and continue its asset purchases.

Furthermore, it will likely continue backstopping markets through various programs, as needed. On the one hand, its programs should help markets function in an orderly manner during times of stress. This is important. On the other hand, the Fed’s support has squeezed nearly all the compensation for default risk out of the equation as evidenced by tight credit spreads. The combination of low yields and tight credit spreads makes finding investments that adequately compensate investors for the risk taken more difficult than usual. We sift through numerous issues on a weekly basis, but only a few meet our criteria.

Given the current structure of the yield curve, we remain focused on shorter maturities and continue to be more comfortable selectively taking credit risk to enhance yield rather than extending maturities. We believe that shorter maturities provide navigational flexibility.

Convertible exposure within EBSZX remains lower than we prefer. The continued modest allocation is largely due to the low yield environment and stock prices that seem generally high relative to underlying values.

We continue to have a defensive bias and believe both Funds are well positioned to capitalize on opportunities as they arise.

We appreciate your trust and confidence in our firm.

Sincerely,

The EBS Research Group

3

Important Disclosures – Performance data quoted in this letter or the report itself represents past performance. Past performance does not guarantee future results. The value of an investor’s shares will fluctuate, and may be worth more or less than the original cost when redeemed. Current performance may be higher or lower than performance quoted herein. Performance data, current to the most recent month end, is available by calling 1-800-391-1223.

The information in this “Letter To Our Shareholders” represents the opinion of the author and is not intended to be a forecast or investment advice. This publication does not constitute an offer or solicitation of any transaction in any securities. Information contained in this publication has been obtained from sources believed to be reliable, but has not been independently verified by EBS. Please note that any discussion of fund holdings, fund performance and views expressed are as of July 31, 2020 (except if otherwise stated) and are subject to change without notice.

4

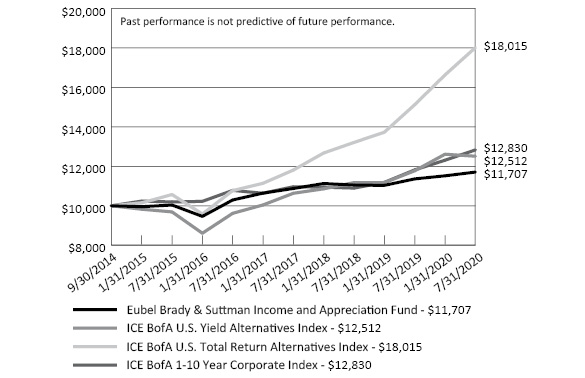

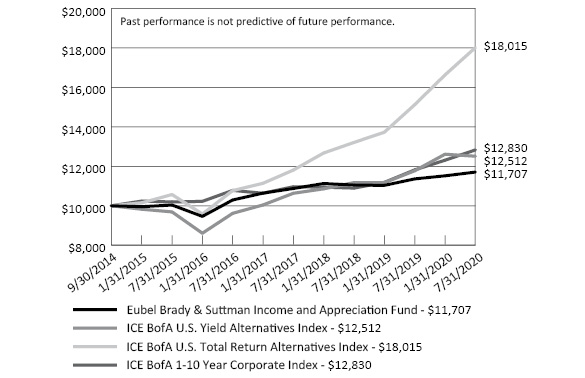

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

PERFORMANCE INFORMATION

July 31, 2020 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Eubel Brady & Suttman Income and Appreciation Fund versus the

ICE BofA U.S. Yield Alternatives Index, the ICE BofA U.S. Total Return Alternatives Index and the ICE BofA 1-10 Year Corporate Index

Average Annual Total Returns(a) For the periods ended July 31, 2020 | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Eubel Brady & Suttman Income and Appreciation Fund | 3.04% | 3.12% | 2.74% | |

ICE BofA U.S. Yield Alternatives Index* | 6.27% | 5.24% | 3.92% | |

ICE BofA U.S. Total Return Alternatives Index* | 19.13% | 11.25% | 10.62% | |

ICE BofA 1-10 Year Corporate Index* | 8.55% | 4.71% | 4.36% | |

(a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes dividends or distributions, if any, are reinvested in shares of the Fund. |

(b) | Represents the period from the commencement of operations (September 30, 2014) through July 31, 2020. |

* | The ICE BofA U.S. Yield Alternatives Index tracks the performance of U.S. dollar denominated convertible debt. The ICE BofA U.S. Total Return Alternatives Index tracks the performance of U.S. dollar denominated convertible debt with more equity sensitivity than typically found in the Yield Alternatives Index, on average. The ICE BofA 1-10 Year Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market with a remaining term to final maturity less than 10 years. The Fund does not invest solely in securities included in these indices and may invest in other types of securities. |

The performance in the chart represents past performance. Performance shown above does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of shares. Current performance may be higher or lower than the performance data presented above. Investment return and principal value will fluctuate; shares, when redeemed, may be worth more or less than their original cost. As presented in the Fund’s prospectus dated December 1, 2019, the Fund’s total operating expense ratio was 0.27% of the Fund’s average daily net assets. Each Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund. The Fund’s performance reflects the deduction of these fees. Investors cannot invest directly in an index.

5

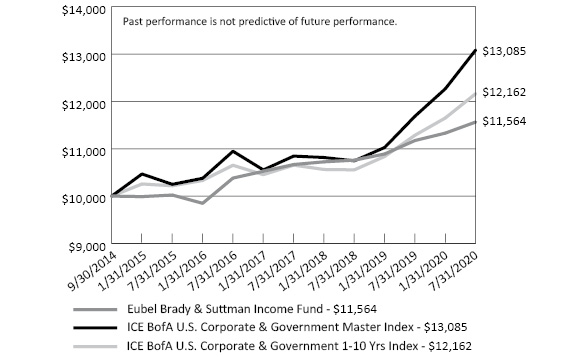

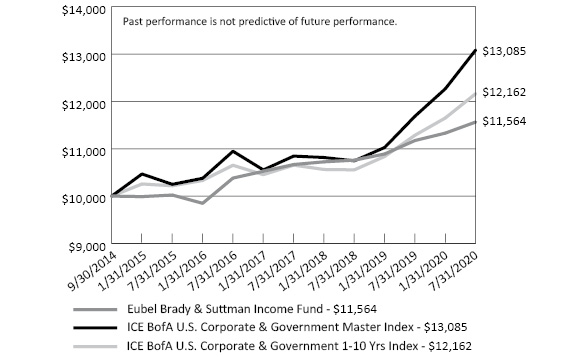

EUBEL BRADY & SUTTMAN INCOME FUND

PERFORMANCE INFORMATION

July 31, 2020 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Eubel Brady & Suttman Income Fund versus

the ICE BofA U.S. Corporate & Government Master Index and

the ICE BofA U.S. Corporate & Government 1-10 Yrs Index

Average Annual Total Returns(a) For the periods ended July 31, 2020 | |

| | 1 Year | 5 Years | Since

Inception(b) | |

Eubel Brady & Suttman Income Fund | 3.49% | 2.90% | 2.52% | |

ICE BofA U.S. Corporate & Government Master Index* | 11.96% | 5.01% | 4.72% | |

ICE BofA U.S. Corporate & Government 1-10 Yrs Index* | 7.77% | 3.54% | 3.41% | |

(a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes dividends or distributions, if any, are reinvested in shares of the Fund. |

(b) | Represents the period from the commencement of operations (September 30, 2014) through July 31, 2020. |

* | The ICE BofA U.S. Corporate & Government Master Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities. The ICE BofA U.S. Corporate & Government 1-10 Yrs Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities with a remaining term to final maturity less than 10 years. The Fund does not invest solely in securities included in these indices and may invest in other types of securities. |

The performance in the chart represents past performance. Performance shown above does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of shares. Current performance may be higher or lower than the performance data presented above. Investment return and principal value will fluctuate; shares, when redeemed, may be worth more or less than their original cost. As presented in the Fund’s prospectus dated December 1, 2019, the Fund’s total operating expense ratio was 0.20% of the Fund’s average daily net assets. Each Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund. The Fund’s performance reflects the deduction of these fees. Investors cannot invest directly in an index.

6

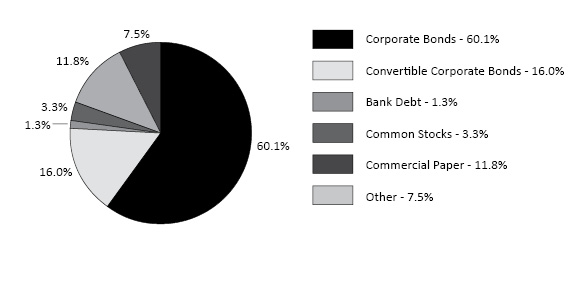

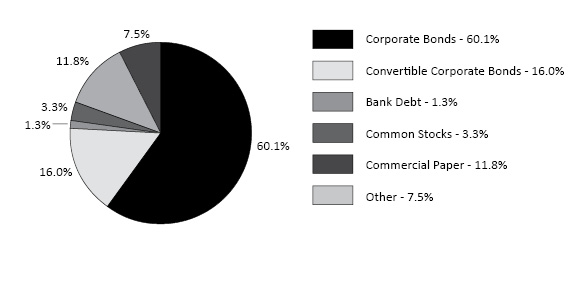

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

PORTFOLIO INFORMATION

July 31, 2020 (Unaudited)

Eubel Brady & Suttman Income and Appreciation Fund

Asset Allocation (% of Net Assets)

Eubel Brady & Suttman Income Fund

Asset Allocation (% of Net Assets)

7

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS

July 31, 2020 |

CORPORATE BONDS — 60.1% | | Coupon | | | Maturity | | | Par Value | | | Value | |

Communications — 5.3% | | | | | | | | | | | | | | | | |

Discovery Communications, LLC | | | 2.950 | % | | | 03/20/23 | | | $ | 900,000 | | | $ | 947,141 | |

Discovery Communications, LLC | | | 3.800 | % | | | 03/13/24 | | | | 2,085,000 | | | | 2,284,931 | |

Verizon Communications, Inc. (3MO LIBOR + 100) (a) | | | 1.321 | % | | | 03/16/22 | | | | 2,100,000 | | | | 2,130,554 | |

| | | | | | | | | | | | | | | | 5,362,626 | |

Consumer Discretionary — 6.4% | | | | | | | | | | | | | | | | |

AutoZone, Inc. | | | 3.700 | % | | | 04/15/22 | | | | 2,250,000 | | | | 2,350,274 | |

Lennar Corporation | | | 2.950 | % | | | 11/29/20 | | | | 2,600,000 | | | | 2,589,236 | |

Silversea Cruise Finance Ltd., 144A | | | 7.250 | % | | | 02/01/25 | | | | 1,600,000 | | | | 1,544,000 | |

| | | | | | | | | | | | | | | | 6,483,510 | |

Consumer Staples — 4.9% | | | | | | | | | | | | | | | | |

Kroger Company (The) | | | 3.850 | % | | | 08/01/23 | | | | 1,000,000 | | | | 1,089,054 | |

Mead Johnson Nutrition Company | | | 3.000 | % | | | 11/15/20 | | | | 1,596,000 | | | | 1,607,609 | |

Mondelēz International, Inc., 144A | | | 2.000 | % | | | 10/28/21 | | | | 2,290,000 | | | | 2,329,641 | |

| | | | | | | | | | | | | | | | 5,026,304 | |

Energy — 2.1% | | | | | | | | | | | | | | | | |

CNX Resources Corporation | | | 5.875 | % | | | 04/15/22 | | | | 1,318,000 | | | | 1,304,820 | |

CONSOL Energy, Inc., 144A | | | 11.000 | % | | | 11/15/25 | | | | 2,000,000 | | | | 830,000 | |

| | | | | | | | | | | | | | | | 2,134,820 | |

Financials — 16.4% | | | | | | | | | | | | | | | | |

American International Group, Inc. | | | 3.300 | % | | | 03/01/21 | | | | 1,700,000 | | | | 1,725,657 | |

CNG Holdings, Inc., 144A | | | 12.500 | % | | | 06/15/24 | | | | 2,700,000 | | | | 2,416,500 | |

Goldman Sachs Group, Inc. (The) (3MO LIBOR + 75) (a) | | | 1.109 | % | | | 02/23/23 | | | | 500,000 | | | | 500,896 | |

Goldman Sachs Group, Inc. (The) (3MO LIBOR + 100) (a) | | | 1.263 | % | | | 07/24/23 | | | | 2,500,000 | | | | 2,515,004 | |

JPMorgan Chase & Company | | | 2.400 | % | | | 06/07/21 | | | | 2,500,000 | | | | 2,539,447 | |

Pershing Square Holdings Ltd., 144A | | | 5.500 | % | | | 07/15/22 | | | | 2,500,000 | | | | 2,636,625 | |

Round Up Ventures, L.P. (b)(c)(d) | | | 15.000 | % | | | 03/06/25 | | | | 2,227,973 | | | | 2,311,310 | |

Wells Fargo & Company | | | 3.750 | % | | | 01/24/24 | | | | 1,895,000 | | | | 2,076,752 | |

| | | | | | | | | | | | | | | | 16,722,191 | |

See accompanying notes to financial statements.

8

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

CORPORATE BONDS — 60.1% (Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

Health Care — 4.0% | | | | | | | | | | | | | | | | |

Anthem, Inc. | | | 4.350 | % | | | 08/15/20 | | | $ | 605,000 | | | $ | 605,755 | |

Becton, Dickinson and Company (3MO LIBOR + 103) (a) | | | 1.348 | % | | | 06/06/22 | | | | 2,615,000 | | | | 2,625,884 | |

Becton, Dickinson and Company | | | 2.894 | % | | | 06/06/22 | | | | 775,000 | | | | 804,535 | |

| | | | | | | | | | | | | | | | 4,036,174 | |

Industrials — 4.9% | | | | | | | | | | | | | | | | |

General Electric Company (3MO LIBOR + 100) (a) | | | 1.313 | % | | | 03/15/23 | | | | 1,000,000 | | | | 991,608 | |

Penske Truck Leasing Company, L.P., 144A | | | 4.125 | % | | | 08/01/23 | | | | 1,130,000 | | | | 1,222,965 | |

Roper Technologies, Inc. | | | 2.800 | % | | | 12/15/21 | | | | 2,700,000 | | | | 2,781,172 | |

| | | | | | | | | | | | | | | | 4,995,745 | |

Materials — 10.5% | | | | | | | | | | | | | | | | |

Avnet, Inc. | | | 3.750 | % | | | 12/01/21 | | | | 2,600,000 | | | | 2,680,707 | |

Ball Corporation | | | 5.000 | % | | | 03/15/22 | | | | 1,672,000 | | | | 1,751,420 | |

DowDuPont, Inc. | | | 3.766 | % | | | 11/15/20 | | | | 945,000 | | | | 953,869 | |

DowDuPont, Inc. | | | 4.493 | % | | | 11/15/25 | | | | 1,345,000 | | | | 1,571,829 | |

Methanex Corporation | | | 5.250 | % | | | 03/01/22 | | | | 1,641,000 | | | | 1,641,000 | |

Steel Dynamics, Inc. | | | 2.800 | % | | | 12/15/24 | | | | 2,000,000 | | | | 2,126,849 | |

| | | | | | | | | | | | | | | | 10,725,674 | |

Technology — 3.1% | | | | | | | | | | | | | | | | |

FLIR Systems, Inc. | | | 3.125 | % | | | 06/15/21 | | | | 3,071,000 | | | | 3,128,138 | |

| | | | | | | | | | | | | | | | | |

Utilities — 2.5% | | | | | | | | | | | | | | | | |

Southern Company (The) | | | 2.350 | % | | | 07/01/21 | | | | 2,495,000 | | | | 2,534,897 | |

| | | | | | | | | | | | | | | | | |

Total Corporate Bonds (Cost $60,722,800) | | | | | | | | | | | | | | $ | 61,150,079 | |

|

CONVERTIBLE BONDS — 16.0% | | Coupon | | | Maturity | | | Par Value | | | Value | |

Communications — 2.9% | | | | | | | | | | | | | | | | |

Twitter, Inc. | | | 1.000 | % | | | 09/15/21 | | | $ | 3,000,000 | | | $ | 2,955,000 | |

| | | | | | | | | | | | | | | | | |

Consumer Discretionary — 2.0% | | | | | | | | | | | | | | | | |

Patrick Industries, Inc. | | | 1.000 | % | | | 02/01/23 | | | | 2,000,000 | | | | 2,009,539 | |

See accompanying notes to financial statements.

9

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

CONVERTIBLE BONDS — 16.0% (Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

Financials — 4.3% | | | | | | | | | | | | | | | | |

Ares Capital Corporation | | | 3.750 | % | | | 02/01/22 | | | $ | 2,000,000 | | | $ | 2,004,744 | |

Redwood Trust, Inc. | | | 4.750 | % | | | 08/15/23 | | | | 2,700,000 | | | | 2,393,897 | |

| | | | | | | | | | | | | | | | 4,398,641 | |

Technology — 6.8% | | | | | | | | | | | | | | | | |

Palo Alto Networks, Inc. | | | 0.750 | % | | | 07/01/23 | | | | 3,000,000 | | | | 3,460,805 | |

Zillow Group, Inc. | | | 1.500 | % | | | 07/01/23 | | | | 3,000,000 | | | | 3,435,619 | |

| | | | | | | | | | | | | | | | 6,896,424 | |

Total Convertible Bonds (Cost $14,798,662) | | | | | | | | | | | | | | $ | 16,259,604 | |

|

BANK DEBT — 1.3% | | Coupon | | | Maturity | | | Par Value | | | Value | |

Financials — 0.8% | | | | | | | | | | | | | | | | |

NCP Finance Ltd. Partnership Sr. Term Loan (1MO LIBOR + 400) (a)(b)(d) | | | 4.171 | % | | | 12/21/20 | | | $ | 830,769 | | | $ | 833,528 | |

| | | | | | | | | | | | | | | | | |

Materials — 0.5% | | | | | | | | | | | | | | | | |

Ball Metalpack, LLC (3MO LIBOR + 450) (a) | | | 4.863 | % | | | 07/26/25 | | | | 490,000 | | | | 459,375 | |

| | | | | | | | | | | | | | | | | |

Total Bank Debt (Cost $1,318,320) | | | | | | | | | | | | | | $ | 1,292,903 | |

|

COMMON STOCKS — 3.3% | | Shares | | | Value | |

Financials — 2.9% | | | | | | | | |

Capital One Financial Corporation | | | 9,904 | | | $ | 631,875 | |

Hartford Financial Services Group, Inc. (The) | | | 41,269 | | | | 1,746,504 | |

Lincoln National Corporation | | | 15,673 | | | | 584,133 | |

| | | | | | | | 2,962,512 | |

Industrials — 0.4% | | | | | | | | |

Air Industries Group (e) | | | 327,171 | | | | 386,062 | |

| | | | | | | | | |

Total Common Stocks (Cost $1,788,524) | | | | | | $ | 3,348,574 | |

See accompanying notes to financial statements.

10

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

WARRANTS — 0.0% (f) | | Shares | | | Value | |

Financials — 0.0% (f) | | | | | | | | |

American International Group, Inc., $42.4734, expires 01/19/21 (e) | | | 26,500 | | | $ | 27,560 | |

| | | | | | | | | |

Materials — 0.0% (f) | | | | | | | | |

American Zinc Recycling, LLC, $630.227, expires 09/30/22 (b)(d)(e) | | | 965 | | | | 10 | |

| | | | | | | | | |

Total Warrants (Cost $1,803,660) | | | | | | $ | 27,570 | |

|

COMMERCIAL PAPER — 11.8% (g) | | Par Value | | | Value | |

Consolidated Edison, Inc., 0.15%, due 08/03/20 | | $ | 3,000,000 | | | $ | 2,999,975 | |

Dow Chemical Company (The), 0.21%, due 08/19/20 | | | 3,000,000 | | | | 2,999,685 | |

L’Oreal USA, Inc., 0.12%, due 08/19/20 | | | 3,000,000 | | | | 2,999,820 | |

Prudential plc, 0.12%, due 08/20/20 | | | 3,000,000 | | | | 2,999,810 | |

Total Commercial Paper (Cost $11,999,290) | | | | | | $ | 11,999,290 | |

See accompanying notes to financial statements.

11

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 6.8% | | Shares | | | Value | |

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.07% (h) (Cost $6,866,431) | | | 6,866,431 | | | $ | 6,866,431 | |

| | | | | | | | | |

Total Investments at Value — 99.3% (Cost $99,297,687) | | | | | | $ | 100,944,451 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.7% | | | | | | | 689,955 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 101,634,406 | |

144A - | Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $10,979,731 as of July 31, 2020, representing 10.8% of net assets. |

LIBOR - | London Interbank Offered Rate. |

(a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of July 31, 2020. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. |

(b) | Illiquid security. The total fair value of these securities as of July 31, 2020 was $3,144,848, representing 3.1% of net assets. |

(c) | Payment-in-kind bond. The rate shown is the coupon rate of 11.0% and the payment in kind rate of 4.0%. |

(d) | Security has been fair valued using significant unobservable inputs in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees. The total value of such securities is $3,144,848 as of July 31, 2020, representing 3.1% of net assets. |

(e) | Non-income producing security. |

(f) | Percentage rounds to less than 0.1%. |

(g) | The rate shown is the annualized yield at the time of purchase, not a coupon rate. |

(h) | The rate shown is the 7-day effective yield as of July 31, 2020. |

See accompanying notes to financial statements.

12

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS

July 31,2020 |

CORPORATE BONDS — 72.4% | | Coupon | | | Maturity | | | Par Value | | | Value | |

Communications — 3.1% | | | | | | | | | | | | | | | | |

Discovery Communications, LLC | | | 3.300 | % | | | 05/15/22 | | | $ | 1,161,000 | | | $ | 1,200,262 | |

Verizon Communications, Inc. (3MO LIBOR + 100) (a) | | | 1.321 | % | | | 03/16/22 | | | | 5,000,000 | | | | 5,072,746 | |

| | | | | | | | | | | | | | | | 6,273,008 | |

Consumer Discretionary — 8.3% | | | | | | | | | | | | | | | | |

AutoZone, Inc. | | | 4.000 | % | | | 11/15/20 | | | | 3,000,000 | | | | 3,003,035 | |

AutoZone, Inc. | | | 2.500 | % | | | 04/15/21 | | | | 1,609,000 | | | | 1,629,013 | |

Lennar Corporation | | | 2.950 | % | | | 11/29/20 | | | | 6,000,000 | | | | 5,975,160 | |

Marriott International, Inc. | | | 2.300 | % | | | 01/15/22 | | | | 2,000,000 | | | | 2,009,197 | |

Silversea Cruise Finance Ltd., 144A | | | 7.250 | % | | | 02/01/25 | | | | 4,500,000 | | | | 4,342,500 | |

| | | | | | | | | | | | | | | | 16,958,905 | |

Consumer Staples — 8.2% | | | | | | | | | | | | | | | | |

Keurig Dr Pepper, Inc. | | | 3.551 | % | | | 05/25/21 | | | | 5,000,000 | | | | 5,125,252 | |

Kroger Company (The) | | | 2.950 | % | | | 11/01/21 | | | | 5,206,000 | | | | 5,357,198 | |

Mondelēz International, Inc., 144A | | | 2.000 | % | | | 10/28/21 | | | | 5,995,000 | | | | 6,098,778 | |

| | | | | | | | | | | | | | | | 16,581,228 | |

Energy — 2.1% | | | | | | | | | | | | | | | | |

CNX Resources Corporation | | | 5.875 | % | | | 04/15/22 | | | | 2,746,000 | | | | 2,718,540 | |

CONSOL Energy, Inc., 144A | | | 11.000 | % | | | 11/15/25 | | | | 3,700,000 | | | | 1,535,500 | |

| | | | | | | | | | | | | | | | 4,254,040 | |

Financials — 19.8% | | | | | | | | | | | | | | | | |

American International Group, Inc. | | | 6.400 | % | | | 12/15/20 | | | | 3,232,000 | | | | 3,303,402 | |

American International Group, Inc. | | | 3.300 | % | | | 03/01/21 | | | | 1,000,000 | | | | 1,015,092 | |

Bank of the Ozarks, Inc. (U.S. Treasury Note, 1.625%, 05/26 + 393.5) (a) | | | 5.500 | % | | | 07/01/26 | | | | 4,792,000 | | | | 4,795,833 | |

Barclays Bank plc (3MO LIBOR + 211) (a) | | | 2.558 | % | | | 08/10/21 | | | | 2,684,000 | | | | 2,729,840 | |

CNG Holdings, Inc., 144A | | | 12.500 | % | | | 06/15/24 | | | | 6,300,000 | | | | 5,638,500 | |

Goldman Sachs Group, Inc. (The) (3MO LIBOR + 75) (a) | | | 1.109 | % | | | 02/23/23 | | | | 500,000 | | | | 500,896 | |

Goldman Sachs Group, Inc. (The) (3MO LIBOR + 100) (a) | | | 1.263 | % | | | 07/24/23 | | | | 5,500,000 | | | | 5,533,010 | |

JPMorgan Chase & Company | | | 2.700 | % | | | 05/15/23 | | | | 3,000,000 | | | | 3,173,106 | |

Morgan Stanley | | | 4.875 | % | | | 11/01/22 | | | | 3,100,000 | | | | 3,374,123 | |

See accompanying notes to financial statements.

13

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

CORPORATE BONDS — 72.4% (Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

Financials — 19.8% (Continued) | | | | | | | | | | | | | | | | |

Pershing Square Holdings Ltd., 144A | | | 5.500 | % | | | 07/15/22 | | | $ | 5,000,000 | | | $ | 5,273,250 | |

Round Up Ventures, L.P. (b)(c)(d) | | | 15.000 | % | | | 03/06/25 | | | | 4,861,032 | | | | 5,042,859 | |

| | | | | | | | | | | | | | | | 40,379,911 | |

Health Care — 3.4% | | | | | | | | | | | | | | | | |

Anthem, Inc. | | | 4.350 | % | | | 08/15/20 | | | | 1,000,000 | | | | 1,001,248 | |

Becton, Dickinson and Company (3MO LIBOR + 103) (a) | | | 1.348 | % | | | 06/06/22 | | | | 5,825,000 | | | | 5,849,243 | |

| | | | | | | | | | | | | | | | 6,850,491 | |

Industrials — 9.4% | | | | | | | | | | | | | | | | |

Caterpillar, Inc. | | | 2.600 | % | | | 06/26/22 | | | | 2,691,000 | | | | 2,786,907 | |

General Electric Company (3MO LIBOR + 100) (a) | | | 1.313 | % | | | 03/15/23 | | | | 5,000,000 | | | | 4,958,042 | |

Penske Truck Leasing Company, L.P., 144A | | | 2.700 | % | | | 03/14/23 | | | | 5,000,000 | | | | 5,183,681 | |

Penske Truck Leasing Company, L.P., 144A | | | 4.125 | % | | | 08/01/23 | | | | 1,000,000 | | | | 1,082,270 | |

Roper Technologies, Inc. | | | 2.800 | % | | | 12/15/21 | | | | 4,903,000 | | | | 5,050,403 | |

| | | | | | | | | | | | | | | | 19,061,303 | |

Materials — 12.3% | | | | | | | | | | | | | | | | |

Ball Corporation | | | 5.000 | % | | | 03/15/22 | | | | 1,997,000 | | | | 2,091,857 | |

Cabot Corporation | | | 3.700 | % | | | 07/15/22 | | | | 3,980,000 | | | | 4,157,332 | |

DowDuPont, Inc. | | | 3.766 | % | | | 11/15/20 | | | | 6,000,000 | | | | 6,056,307 | |

Methanex Corporation | | | 5.250 | % | | | 03/01/22 | | | | 5,680,000 | | | | 5,680,000 | |

Sherwin-Williams Company (The) | | | 4.200 | % | | | 01/15/22 | | | | 5,250,000 | | | | 5,462,499 | |

Steel Dynamics, Inc. | | | 2.800 | % | | | 12/15/24 | | | | 1,575,000 | | | | 1,674,894 | |

| | | | | | | | | | | | | | | | 25,122,889 | |

Technology — 3.3% | | | | | | | | | | | | | | | | |

Dell, Inc., 144A | | | 4.420 | % | | | 06/15/21 | | | | 718,000 | | | | 737,804 | |

FLIR Systems, Inc. | | | 3.125 | % | | | 06/15/21 | | | | 5,900,000 | | | | 6,009,774 | |

| | | | | | | | | | | | | | | | 6,747,578 | |

Utilities — 2.5% | | | | | | | | | | | | | | | | |

Duke Energy Corporation (3MO LIBOR + 25) (a) | | | 0.610 | % | | | 11/26/21 | | | | 3,000,000 | | | | 3,001,108 | |

Southern Company (The) | | | 2.350 | % | | | 07/01/21 | | | | 2,000,000 | | | | 2,031,982 | |

| | | | | | | | | | | | | | | | 5,033,090 | |

Total Corporate Bonds (Cost $147,002,003) | | | | | | | | | | | | | | $ | 147,262,443 | |

See accompanying notes to financial statements.

14

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

BANK DEBT — 0.7% | | Coupon | | | Maturity | | | Par Value | | | Value | |

Financials — 0.7% | | | | | | | | | | | | | | | | |

NCP Finance Ltd. Partnership Sr. Term Loan (1MO LIBOR + 400) (Cost $1,384,615) (a)(b)(d) | | | 4.171 | % | | | 12/21/20 | | | $ | 1,384,615 | | | $ | 1,389,214 | |

|

COMMERCIAL PAPER — 17.2% (e) | | Par Value | | | Value | |

Chevron Corporation, 0.11%, due 08/17/20 | | $ | 6,000,000 | | | $ | 5,999,707 | |

Consolidated Edison, Inc., 0.15%, due 08/03/20 | | | 6,000,000 | | | | 5,999,950 | |

Dow Chemical Company (The), 0.21%, due 08/19/20 | | | 6,000,000 | | | | 5,999,370 | |

L’Oreal USA, Inc., 0.12%, due 08/19/20 | | | 6,000,000 | | | | 5,999,640 | |

Prudential plc, 0.12%, due 08/20/20 | | | 6,000,000 | | | | 5,999,620 | |

Unilever Capital Corporation, 0.11%, due 08/17/20 | | | 5,000,000 | | | | 4,999,765 | |

Total Commercial Paper (Cost $34,998,052) | | | | | | $ | 34,998,052 | |

See accompanying notes to financial statements.

15

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 9.1% | | Shares | | | Value | |

Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.08% (f) (Cost $18,568,098) | | | 18,568,098 | | | $ | 18,568,098 | |

| | | | | | | | | |

Total Investments at Value — 99.4% (Cost $201,952,768) | | | | | | $ | 202,217,807 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.6% | | | | | | | 1,277,684 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 203,495,491 | |

144A - | Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $29,892,283 as of July 31, 2020, representing 14.7% of net assets. |

LIBOR - | London Interbank Offered Rate. |

(a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of July 31, 2020. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. |

(b) | Illiquid security. The total fair value of these securities as of July 31, 2020 was $6,432,073, representing 3.2% of net assets. |

(c) | Payment-in-kind bond. The rate shown is the coupon rate of 11.0% and the payment in kind rate of 4.0%. |

(d) | Security has been fair valued using significant unobservable inputs in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees. The total value of such securities is $6,432,073 as of July 31, 2020, representing 3.2% of net assets. |

(e) | The rate shown is the annualized yield at the time of purchase, not a coupon rate. |

(f) | The rate shown is the 7-day effective yield as of July 31, 2020. |

See accompanying notes to financial statements. |

16

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

STATEMENTS OF ASSETS AND LIABILITIES

July 31, 2020 |

| | Eubel Brady

& Suttman

Income and

Appreciation

Fund | | | Eubel Brady

& Suttman

Income Fund | |

ASSETS | | | | | | | | |

Investments in securities: | | | | | | | | |

At cost | | $ | 99,297,687 | | | $ | 201,952,768 | |

At value (Note 2) | | $ | 100,944,451 | | | $ | 202,217,807 | |

Receivable for capital shares sold | | | 18,317 | | | | 94,288 | |

Dividends and interest receivable | | | 685,432 | | | | 1,215,587 | |

Other assets | | | 10,395 | | | | 19,694 | |

Total assets | | | 101,658,595 | | | | 203,547,376 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for capital shares redeemed | | | 1,396 | | | | 17,780 | |

Payable to administrator (Note 4) | | | 8,540 | | | | 16,900 | |

Other accrued expenses | | | 14,253 | | | | 17,205 | |

Total liabilities | | | 24,189 | | | | 51,885 | |

| | | | | | | | | |

CONTINGENCIES AND COMMITMENTS (Note 7) | | | — | | | | — | |

| | | | | | | | | |

NET ASSETS | | $ | 101,634,406 | | | $ | 203,495,491 | |

| | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid-in capital | | $ | 101,515,613 | | | $ | 206,463,741 | |

Accumulated earnings (deficit) | | | 118,793 | | | | (2,968,250 | ) |

NET ASSETS | | $ | 101,634,406 | | | $ | 203,495,491 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 10,408,603 | | | | 20,668,972 | |

| | | | | | | | | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 9.76 | | | $ | 9.85 | |

See accompanying notes to financial statements.

17

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

STATEMENTS OF OPERATIONS

For the Year Ended July 31, 2020 |

| | Eubel Brady

& Suttman

Income and

Appreciation

Fund | | | Eubel Brady

& Suttman

Income Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividends | | $ | 145,657 | | | $ | 108,930 | |

Interest | | | 3,391,334 | | | | 7,314,296 | |

Total investment income | | | 3,536,991 | | | | 7,423,226 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Administration fees (Note 4) | | | 91,081 | | | | 192,835 | |

Shareholder servicing fees (Note 6) | | | 37,744 | | | | 79,869 | |

Registration and filing fees | | | 27,778 | | | | 26,570 | |

Legal fees | | | 22,671 | | | | 22,671 | |

Custody and bank service fees | | | 15,891 | | | | 24,832 | |

Audit and tax services fees | | | 17,750 | | | | 17,750 | |

Trustees’ fees (Note 4) | | | 16,250 | | | | 16,250 | |

Insurance expense | | | 7,377 | | | | 14,670 | |

Postage and supplies | | | 5,351 | | | | 5,867 | |

Pricing fees | | | 5,185 | | | | 5,570 | |

Printing of shareholder reports | | | 2,117 | | | | 2,359 | |

Other expenses | | | 9,676 | | | | 9,942 | |

Total expenses | | | 258,871 | | | | 419,185 | |

| | | | | | | | | |

NET INVESTMENT INCOME | | | 3,278,120 | | | | 7,004,041 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

Net realized gains (losses) from investment transactions | | | 101,915 | | | | (2,507,765 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (303,607 | ) | | | 1,334,621 | |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (201,692 | ) | | | (1,173,144 | ) |

| | | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 3,076,428 | | | $ | 5,830,897 | |

See accompanying notes to financial statements.

18

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Year Ended

July 31, 2020 | | | Year Ended

July 31, 2019 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 3,278,120 | | | $ | 2,839,055 | |

Net realized gains (losses) from investment transactions | | | 101,915 | | | | (1,359,240 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (303,607 | ) | | | 861,516 | |

Net increase in net assets resulting from operations | | | 3,076,428 | | | | 2,341,331 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (3,315,245 | ) | | | (2,872,948 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 18,544,836 | | | | 8,785,208 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 3,313,598 | | | | 2,869,462 | |

Payments for shares redeemed | | | (8,781,072 | ) | | | (10,645,575 | ) |

Net increase in net assets from captial share transactions | | | 13,077,362 | | | | 1,009,095 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 12,838,545 | | | | 477,478 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 88,795,861 | | | | 88,318,383 | |

End of year | | $ | 101,634,406 | | | $ | 88,795,861 | |

| | | | | | | | | |

CAPITAL SHARES ACTIVITY | | | | | | | | |

Shares sold | | | 1,918,266 | | | | 902,768 | |

Shares reinvested | | | 343,372 | | | | 295,344 | |

Shares redeemed | | | (905,005 | ) | | | (1,100,004 | ) |

Net increase in shares outstanding | | | 1,356,633 | | | | 98,108 | |

Shares outstanding at beginning of year | | | 9,051,970 | | | | 8,953,862 | |

Shares outstanding at end of year | | | 10,408,603 | | | | 9,051,970 | |

See accompanying notes to financial statements.

19

EUBEL BRADY & SUTTMAN INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Year Ended

July 31, 2020 | | | Year Ended

July 31, 2019 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 7,004,041 | | | $ | 6,703,267 | |

Net realized losses from investment transactions | | | (2,507,765 | ) | | | (60,927 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 1,334,621 | | | | 800,875 | |

Net increase in net assets resulting from operations | | | 5,830,897 | | | | 7,443,215 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (7,003,977 | ) | | | (6,717,506 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 56,707,791 | | | | 33,771,307 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 6,994,245 | | | | 6,698,963 | |

Payments for shares redeemed | | | (59,749,154 | ) | | | (39,382,888 | ) |

Net increase in net assets from captial share transactions | | | 3,952,882 | | | | 1,087,382 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 2,779,802 | | | | 1,813,091 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 200,715,689 | | | | 198,902,598 | |

End of year | | $ | 203,495,491 | | | $ | 200,715,689 | |

| | | | | | | | | |

CAPITAL SHARES ACTIVITY | | | | | | | | |

Shares sold | | | 5,791,136 | | | | 3,449,122 | |

Shares reinvested | | | 715,082 | | | | 683,725 | |

Shares redeemed | | | (6,201,262 | ) | | | (4,032,376 | ) |

Net increase in shares outstanding | | | 304,956 | | | | 100,471 | |

Shares outstanding at beginning of year | | | 20,364,016 | | | | 20,263,545 | |

Shares outstanding at end of year | | | 20,668,972 | | | | 20,364,016 | |

See accompanying notes to financial statements.

20

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Year |

| | Year Ended

July 31,

2020 | | | Year Ended

July 31,

2019 | | | Year Ended

July 31,

2018 | | | Year Ended

July 31,

2017 | | | Year Ended

July 31,

2016 | |

Net asset value at beginning of year | | $ | 9.81 | | | $ | 9.86 | | | $ | 9.97 | | | $ | 9.71 | | | $ | 9.85 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.34 | | | | 0.32 | | | | 0.27 | | | | 0.27 | | | | 0.28 | |

Net realized and unrealized gains (losses) on investments | | | (0.05 | ) | | | (0.05 | ) | | | (0.11 | ) | | | 0.27 | | | | (0.05 | ) |

Total from investment operations | | | 0.29 | | | | 0.27 | | | | 0.16 | | | | 0.54 | | | | 0.23 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.34 | ) | | | (0.32 | ) | | | (0.27 | ) | | | (0.28 | ) | | | (0.28 | ) |

Net realized gains on investments | | | — | | | | — | | | | — | | | | — | | | | (0.09 | ) |

Total distributions | | | (0.34 | ) | | | (0.32 | ) | | | (0.27 | ) | | | (0.28 | ) | | | (0.37 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 9.76 | | | $ | 9.81 | | | $ | 9.86 | | | $ | 9.97 | | | $ | 9.71 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 3.04 | % | | | 2.82 | % | | | 1.61 | % | | | 5.65 | % | | | 2.55 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 101,634 | | | $ | 88,796 | | | $ | 88,318 | | | $ | 84,969 | | | $ | 79,253 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 0.27 | % | | | 0.27 | % | | | 0.25 | % | | | 0.26 | % | | | 0.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets | | | 3.48 | % | | | 3.24 | % | | | 2.71 | % | | | 2.72 | % | | | 2.94 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 45 | % | | | 16 | % | | | 60 | % | | | 42 | % | | | 33 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

See accompanying notes to financial statements. |

21

EUBEL BRADY & SUTTMAN INCOME FUND

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Year |

| | Year Ended

July 31,

2020 | | | Year Ended

July 31,

2019 | | | Year Ended

July 31,

2018 | | | Year Ended

July 31,

2017 | | | Year Ended

July 31,

2016 | |

Net asset value at beginning of year | | $ | 9.86 | | | $ | 9.82 | | | $ | 10.00 | | | $ | 9.97 | | | $ | 9.89 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.35 | | | | 0.33 | | | | 0.27 | | | | 0.24 | | | | 0.25 | |

Net realized and unrealized gains (losses) on investments | | | (0.01 | ) | | | 0.04 | | | | (0.19 | ) | | | 0.04 | | | | 0.10 | |

Total from investment operations | | | 0.34 | | | | 0.37 | | | | 0.08 | | | | 0.28 | | | | 0.35 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.35 | ) | | | (0.33 | ) | | | (0.26 | ) | | | (0.24 | ) | | | (0.25 | ) |

Net realized gains on investments | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.02 | ) |

Total distributions | | | (0.35 | ) | | | (0.33 | ) | | | (0.26 | ) | | | (0.25 | ) | | | (0.27 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 9.85 | | | $ | 9.86 | | | $ | 9.82 | | | $ | 10.00 | | | $ | 9.97 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 3.49 | % | | | 3.86 | % | | | 0.86 | % | | | 2.75 | % | | | 3.58 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 203,495 | | | $ | 200,716 | | | $ | 198,903 | | | $ | 185,957 | | | $ | 160,540 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 0.21 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets | | | 3.51 | % | | | 3.37 | % | | | 2.69 | % | | | 2.36 | % | | | 2.54 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 27 | % | | | 19 | % | | | 65 | % | | | 40 | % | | | 35 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

See accompanying notes to financial statements. |

22

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS

July 31, 2020

1. Organization

Eubel Brady & Suttman Income and Appreciation Fund (“EBS Income and Appreciation Fund”) and Eubel Brady & Suttman Income Fund (“EBS Income Fund”) (individually, a “Fund” and collectively, the “Funds”) are each a no-load diversified series of Eubel Brady & Suttman Mutual Fund Trust (the “Trust”), an open-end management investment company organized as an Ohio business trust on April 22, 2014.

The investment objective of EBS Income and Appreciation Fund is to provide total return through a combination of current income and capital appreciation.

The investment objective of EBS Income Fund is to preserve capital, produce income and maximize total return.

2. Significant Accounting Policies

The Funds follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies,” including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

New Accounting Pronouncement — In March 2017, FASB issued Accounting Standards Update No. 2017-08 (“ASU 2017-08”), “Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities.” ASU 2017-08 shortens the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. ASU 2017-08 does not require an accounting change for securities held at a discount, which continues to accrete to maturity. ASU 2017-08 is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. The Funds are complying with ASU 2017-08 and the impact is not deemed to be material to the Funds.

Securities Valuation — Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded on NASDAQ are generally valued at the NASDAQ Official Closing Price. Investments representing shares of other open-end investment companies, including money market funds, are valued at their net asset value (“NAV”) as reported by such companies. The Funds typically use an independent pricing service to determine the value of their fixed income securities. The pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics

23

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

to determine prices for normal institutional-size trading units of fixed income securities without regard to sale or bid prices. Commercial paper may be valued at amortized cost, which under normal circumstances approximates market value.

If Eubel Brady & Suttman Asset Management, Inc. (the “Adviser”), the investment adviser to the Funds, determines that a price provided by the pricing service does not accurately reflect the market value of the securities, when prices are not readily available from the pricing service or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees of the Trust (the “Board”).

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

● Level 1 – quoted prices in active markets for identical securities

● Level 2 – other significant observable inputs

● Level 3 – significant unobservable inputs

Certain fixed income securities held by the Funds are classified as Level 2 since the values are typically provided by an independent pricing service that utilizes various “other significant observable inputs” as discussed above. Other fixed income securities (including certain corporate bonds and bank debt) and warrants held by the Funds, are classified as Level 3 since the values for these securities are based on prices derived from one or more significant inputs that are unobservable. The inputs or methodology used are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is based on the lowest level input that is significant to the fair value measurement.

24

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

The following is a summary of the inputs used to value each Fund’s investments as of July 31, 2020 by security type:

EBS Income and Appreciation Fund: |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Corporate Bonds | | $ | — | | | $ | 58,838,769 | | | $ | 2,311,310 | | | $ | 61,150,079 | |

Convertible Corporate Bonds | | | — | | | | 16,259,604 | | | | — | | | | 16,259,604 | |

Bank Debt | | | — | | | | 459,375 | | | | 833,528 | | | | 1,292,903 | |

Common Stocks | | | 3,348,574 | | | | — | | | | — | | | | 3,348,574 | |

Warrants | | | 27,560 | | | | — | | | | 10 | | | | 27,570 | |

Commercial Paper | | | — | | | | 11,999,290 | | | | — | | | | 11,999,290 | |

Money Market Funds | | | 6,866,431 | | | | — | | | | — | | | | 6,866,431 | |

Total | | $ | 10,242,565 | | | $ | 87,557,038 | | | $ | 3,144,848 | | | $ | 100,944,451 | |

EBS Income Fund: |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Corporate Bonds | | $ | — | | | $ | 142,219,584 | | | $ | 5,042,859 | | | $ | 147,262,443 | |

Bank Debt | | | — | | | | — | | | | 1,389,214 | | | | 1,389,214 | |

Commercial Paper | | | — | | | | 34,998,052 | | | | — | | | | 34,998,052 | |

Money Market Funds | | | 18,568,098 | | | | — | | | | — | | | | 18,568,098 | |

Total | | $ | 18,568,098 | | | $ | 177,217,636 | | | $ | 6,432,073 | | | $ | 202,217,807 | |

The following is a reconciliation of Level 3 investments of the Funds for which significant unobservable inputs were used to determine fair value for the year ended July 31, 2020:

EBS Income and Appreciation Fund |

Investments

in Securities | | Value

as of

July 31,

2019 | | | Purchases | | | Sales/

maturities | | | Realized

gain (loss) | | | Net change

in unrealized

appreciation

(depreciation) | | | Value

as of

July 31,

2020 | |

Corporate Bonds | | $ | — | | | $ | 2,227,973 | | | $ | — | | | $ | — | | | $ | 83,337 | | | $ | 2,311,310 | |

Bank Debt | | | 2,366,378 | | | | 266,664 | | | | (1,751,416 | ) | | | — | | | | (48,098 | ) | | | 833,528 | |

Warrants | | | 10 | | | | — | | | | — | | | | — | | | | — | | | | 10 | |

Total | | $ | 2,366,388 | | | $ | 2,494,637 | | | $ | (1,751,416 | ) | | $ | — | | | $ | 35,239 | | | $ | 3,144,848 | |

25

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

EBS Income Fund |

Investments

in Securities | | Value

as of

July 31,

2019 | | | Purchases | | | Sales/

maturities | | | Realized

gain (loss) | | | Net change

in unrealized

appreciation

(depreciation) | | | Value

as of

July 31,

2020 | |

Corporate Bond | | $ | — | | | $ | 4,861,032 | | | $ | — | | | $ | — | | | $ | 181,827 | | | $ | 5,042,859 | |

Bank Debt | | | 3,943,963 | | | | 444,400 | | | | (2,919,027 | ) | | | — | | | | (80,122 | ) | | | 1,389,214 | |

Total | | $ | 3,943,963 | | | $ | 5,305,432 | | | $ | (2,919,027 | ) | | $ | — | | | $ | 101,705 | | | $ | 6,432,073 | |

The total change in unrealized appreciation (depreciation) included on the Statements of Operations attributable to Level 3 investments still held at July 31, 2020 is $35,239 and $101,705 for EBS Income and Appreciation Fund and EBS Income Fund, respectively.

The following table summarizes the valuation techniques used and unobservable inputs developed by the Adviser in conformity with guidelines adopted by and subject to review by the Board to determine the fair value of the Level 3 investments.

EBS Income and Appreciation Fund |

| | Fair Value at

July 31,

2020 | | | Valuation

Technique | | | Unobservable

Input1 | | Value/

Range | Weighted

Average of

Unobservable

Inputs |

Corporate Bond | | $ | 2,311,310 | | | | Management’s Estimate of Future Cash Flows | | | | Discount Rate2 | | 14.18% | N/A |

Bank Debt | | $ | 833,528 | | | | DCF Model | | | | Discount Rate2 | | 3.12% | N/A |

Warrants | | $ | 10 | | | | Management’s Estimate of Future Cash Flows | | | | N/A | | N/A | N/A |

EBS Income Fund |

| | Fair Value at

July 31,

2020 | | | Valuation

Technique | | | Unobservable

Input1 | | Value/

Range | Weighted

Average of

Unobservable

Inputs |

Corporate Bond | | $ | 5,042,859 | | | | Management’s Estimate of Future Cash Flows | | | | Discount Rate2 | | 14.18% | N/A |

Bank Debt | | $ | 1,389,214 | | | | DCF Model | | | | Discount Rate2 | | 3.12% | N/A |

26

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

DCF - Discounted Cash Flow |

1 | Significant increases and decreases in the unobservable inputs used to determine fair value of Level 3 assets could result in significantly higher or lower fair value measurements. An increase to the unobservable input would result in a decrease to the fair value. A decrease to the unobservable input would have the opposite effect. |

2 | The Discount Rate used is determined by the Adviser by employing a reference benchmark, adjusted by a credit spread. |

There were no derivative instruments held by the Funds as of or during the year ended July 31, 2020.

Share Valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to its NAV per share.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Income, Investment Transactions and Realized Capital Gains and Losses — Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income is recorded as earned. Discounts and premiums on fixed income securities are amortized using the effective interest method. Investment transactions are accounted for on trade date. Realized capital gains and losses on investments sold are determined on a specific identification basis.

Expenses — Expenses of the Trust that are directly identifiable to a specific Fund are charged to that Fund. Expenses which are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable.

Distributions to Shareholders — Distributions to shareholders of net investment income, if any, are paid monthly. Capital gain distributions, if any, are distributed to shareholders annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and realized capital gains on various investment securities held by the Funds, timing differences and differing characterizations of distributions made by the Funds. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid by each Fund during the year ended July 31, 2020 and 2019 was ordinary income.

27

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

Federal Income Tax — Each Fund has qualified and intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of July 31, 2020:

| | EBS Income and

Appreciation

Fund | | | EBS Income

Fund | |

Tax cost of portfolio investments | | $ | 99,424,129 | | | $ | 201,963,403 | |

Gross unrealized appreciation | | $ | 5,474,783 | | | $ | 3,568,755 | |

Gross unrealized depreciation | | | (3,954,461 | ) | | | (3,314,351 | ) |

Net unrealized appreciation on investments | | | 1,520,322 | | | | 254,404 | |

Undistributed ordinary income | | | 26,956 | | | | 14,382 | |

Accumulated capital and other losses | | | (1,428,485 | ) | | | (3,237,036 | ) |

Accumulated earnings (deficit) | | $ | 118,793 | | | $ | (2,968,250 | ) |

The difference between the federal income tax cost of portfolio investments and the Schedule of Investments cost for EBS Income and Appreciation Fund is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to basis adjustments related to the Fund’s holdings in convertible bonds.

During the year ended July 31, 2020, EBS Income and Appreciation Fund utilized capital loss carryforwards (“CLCFs”) of $51,532 to offset current year gains.

28

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

As of July 31, 2020, the Funds had the following CLCFs for federal income tax purposes:

| | EBS Income and

Appreciation

Fund | | | EBS Income

Fund | |

Short-term | | $ | 443,806 | | | $ | 395,444 | |

Long-term | | | 984,679 | | | | 2,841,592 | |

| | | $ | 1,428,485 | | | $ | 3,237,036 | |

These CLCFs, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. Each Fund identifies its major tax jurisdiction as U.S. federal.

3. Unfunded Loan Commitment

At July 31, 2020, unfunded loan commitments for the Funds were as follows:

Fund | Borrower | | Unfunded

Commitment | |

EBS Income and Appreciation Fund | NCP Finance Limited Partnership | | $ | 1,153,846 | |

EBS Income Fund | NCP Finance Limited Partnership | | $ | 1,923,077 | |

Pursuant to an Asset-Based Lending Credit Agreement between the Funds and NCP Finance Limited Partnership (the “Borrower”), the Borrower has agreed to pay the Funds a commitment fee equal to 0.25% of the average daily unfunded commitment balance, which is included within interest income on the Statements of Operations.

4. Transactions with Related Parties

Certain officers of the Trust are also officers of the Adviser, of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative services agent, shareholder servicing and transfer agent, and accounting services agent for the Funds, or of Ultimus Fund Distributors, LLC (the “Distributor”), the principal underwriter and exclusive agent for the distribution of shares of the Funds.

Investment Adviser — Under the terms of the Management Agreement between the Trust and the Adviser, the Adviser manages each Fund’s investments subject to oversight by the Board. The Funds do not pay the Adviser investment advisory

29

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

fees under the Management Agreement. However, prior to investing in a Fund, a prospective shareholder must enter into an investment advisory agreement with the Adviser that calls for the payment of an advisory fee based upon a percentage of all assets (including shares of the Funds) managed by the Adviser on behalf of the prospective shareholder. The fee schedule may be negotiable at the time the account is opened and is generally based upon the value of assets held in the client’s account and the style of management.

The Adviser has entered into an agreement with the Funds under which it has agreed to reimburse Fund expenses to the extent necessary to limit total annual operating expenses (excluding brokerage costs, taxes, interest, acquired fund fees and expenses, expenses incurred pursuant to the Funds’ Shareholder Servicing Plan and extraordinary expenses) to an amount not exceeding 0.35% of each Fund’s average daily net assets. Any payments by the Adviser of expenses which are a Fund’s obligation are subject to repayment by the Fund for a period of three years following the date on which such expenses were paid, provided that the repayment does not cause the Fund’s total annual operating expenses to exceed the lesser of: (i) the expense limitation in effect at the time such expenses were reimbursed; and (ii) the expense limitation in effect at the time the Adviser seeks reimbursement of such expenses. This agreement is currently in effect until December 1, 2021. No expense reimbursements were required during the year ended July 31, 2020.

Administrator — Ultimus provides administration, fund accounting and transfer agency services to each Fund. The Funds pay Ultimus fees in accordance with the agreements for such services. In addition, the Funds pay out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Funds’ portfolio securities.

Compensation of Trustees — Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Funds for their services. Each Trustee who is not an interested person of the Trust receives from the Funds a fee of $2,625 for attendance at each meeting of the Board, in addition to reimbursement of travel and other expenses incurred in attending the meetings. The Chairman of the Audit and Governance Committee receives an additional annual fee of $1,000, paid quarterly.

5. Securities Transactions

During the year ended July 31, 2020, cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments and U.S. government securities, were as follows:

30

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

| | EBS Income and

Appreciation

Fund | | | EBS Income

Fund | |

Purchases of investment securities | | $ | 35,297,902 | | | $ | 42,169,620 | |

Proceeds from sales and maturities of investment securities | | $ | 41,099,979 | | | $ | 83,598,270 | |

During the year ended July 31, 2020, there were no purchases or sales and maturities from U.S. government long-term securities for the Funds.

6. Shareholder Servicing Plan

The Funds have adopted a Shareholder Servicing Plan (the “Plan”) which allows each Fund to make payments to financial organizations (including payments directly to the Adviser and the Distributor) for providing account administration and account maintenance services to Fund shareholders. The annual fees paid under the Plan may not exceed an amount equal to 0.25% of each Fund’s average daily net assets. During the year ended July 31, 2020, EBS Income and Appreciation Fund and EBS Income Fund incurred $37,744 and $79,869, respectively, of shareholder servicing fees pursuant to the Plan. No payments were made to the Adviser or the Distributor during the year ended July 31, 2020.

7. Contingencies and Commitments

The Funds indemnify the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

8. Subsequent Events

The Funds are required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statements of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Funds are required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

31

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Eubel Brady & Suttman Mutual Fund Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Eubel Brady & Suttman Mutual Fund Trust, comprising Eubel Brady & Suttman Income and Appreciation Fund and Eubel Brady & Suttman Income Fund (the “Funds”), as of July 31, 2020, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Funds as of July 31, 2020, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of July 31, 2020, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2014.

COHEN & COMPANY, LTD.

Cleveland, Ohio

September 25, 2020

32

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

ABOUT YOUR FUNDS’ EXPENSES (Unaudited)