| OMB APPROVAL |

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22960 | |

| Eubel Brady & Suttman Mutual Fund Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 | Cincinnati, Ohio 45246 |

| (Address of principal executive offices) | (Zip code) |

Carol J. Highsmith

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | July 31 | |

| | | |

| Date of reporting period: | July 31, 2021 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| INVESTMENT + WEALTH MANAGEMENT |

| |

| |

| |

| Eubel Brady & Suttman |

| Income and Appreciation Fund |

| Ticker Symbol: EBSZX |

| |

| |

| |

| Eubel Brady & Suttman |

| Income Fund |

| Ticker Symbol: EBSFX |

| |

| |

| |

| Each a series of the |

| Eubel Brady & Suttman Mutual Fund Trust |

| |

| |

| |

| |

| |

| ANNUAL REPORT |

| |

| July 31, 2021 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| LETTER TO OUR SHAREHOLDERS | July 31, 2021 |

| | |

Dear Shareholders:

The fiscal year ended July 31, 2021 was dominated by monetary policy, public health policy and inflation. We cannot recall the interconnectedness of these elements and their impact on America ever being greater. Accommodating monetary policy kept America’s economic engine lubricated during a time of stress. Public health policy stood at the intersection of saving lives and economic growth, and unfortunately, politics.

We discuss the year in more detail, review our investment philosophy and results, and share our perspective below. We welcome your questions, comments or both. Feel free to give us a call anytime (800-391-1223).

A Review of the 2021 Fiscal Year –

Monetary Policy – The Federal Reserve (the “Fed”) maintained its accommodative stance throughout the period by keeping the Fed Funds Rate target range at 0.00% - 0.25% and continuing its purchase of Treasury and Agency debt totaling $120 billion per month – supporting bond prices and helping keep yields suppressed.

However, toward the end of the funds’ fiscal year (July 31, 2021) Chairman Powell and some Fed Governors began to hint at the possibility of reducing its monthly purchases by calendar year-end 2021. If this happens, it will be the initial move toward a less accommodating monetary policy but does not mean higher Fed Funds rates are in the offing. Ultra-low yields continued penalizing savers and subsidizing debtors at period end, promoting increased risk taking and the use of leverage. When the cost of capital is almost free, the prospects of borrowers making unintelligent decisions is increased.

Public Health Policy – COVID-19 placed policy at the ambiguous intersection of concurrently saving human life, not doing

irreparable harm to America’s economic engine and navigating a political minefield. A challenging position for policymakers.

Vaccination rates plateaued around fiscal year-end just as the Delta variant gained momentum, causing many employers to re-think their back-to-the-office plans. The longer employees are separated from one another physically, the greater the likelihood of thoughtfully crafted corporate cultures deteriorating and individualistic tendencies supplanting efforts supporting the greater good. On the other hand, efficiencies learned during the pandemic will benefit corporations for many years.

Inflation – Strong demand for products and labor during the fiscal year contributed to higher prices. Although improving, supply chain bottlenecks are making it difficult to satisfy pent-up demand. Bottlenecks are in part due to varying global and domestic health policies and the unwillingness of employees to work in a challenging environment for a wage that sometimes is only slightly more than their unemployment benefits. Additionally, some workers retired early at the onset of COVID, compounding the effects of the labor shortage during the recovery.

Of course, the current debate is whether recent elevated rates of inflation are permanent or transitory. We do not know (nor does anyone else) and invest accordingly.

Investment Philosophy – Managing risks so that investors are being adequately compensated for them is an important element of our bottom-up investment philosophy. Flexibility in portfolio management can support long -term success, in our view. As such, each Fund has latitude with respect to maturity, duration (price sensitivity to a change in interest rates) and credit quality (among other factors). Essentially, we can invest where we find the most value.

Importantly, since we are not managing to a specific maturity or duration target, we can and often do hold bonds to maturity. We believe this provides our Funds an advantage over those which are more constrained and are constantly repositioning their portfolio to remain within a mandate.

Furthermore, with the Funds’ investor base being comprised of EBS clients, fund flows are considerably more stable than those of funds open to the general public. This, too, can provide the Funds advantages relative to those which may have assets under management fluctuate wildly at the whims of unknown investors’ emotions. For example, when investors exit a fund en masse during a time of panic, it can result in forced selling at an inopportune time. However, this same event can provide investment opportunities for investors with capital available (e.g., the Funds).

Each Fund held around 50 securities at fiscal year-end but maintained good diversification, in our view. We are inclined to generally hold fewer rather than more

securities. We believe this allows us to be more selective and provide closer oversight.

The composition of the EBS Funds will often be materially different than their benchmarks. You should expect their returns to diverge from the benchmarks – at times significantly. Lastly, neither Fund uses leverage (borrows money) to make investments.

Results For Various Periods Ended July 31, 2021 – Since inception (September 30, 2014) through July 31, 2021, the EBS Income and Appreciation Fund (“EBSZX”) posted a total annualized return of 3.66%, while its primary benchmark, the ICE BofA U.S. Yield Alternatives Index, returned 5.74%. On a five-year basis, the Fund returned 4.43% and the benchmark 8.76%. On a three-year basis, the Fund returned 4.98% and the benchmark 9.41%. On a one-year basis, the Fund returned 9.20% and the benchmark returned 17.00%. Lastly, on a six-month basis, the Fund returned 3.61% and the benchmark returned 2.92%.

The primary factors contributing to EBSZX’s outperformance, relative to its benchmark, during the six-month period and underperformance in other periods are described below:

| ● | EBSZX’s convertible securities’ premiums and common stock increased at a faster rate than those of the benchmark, on average, and companies called non-convertible bonds for redemptions above par as they refinanced into lower yielding debt, generally, during the six-month period. |

| ● | During other periods, the Fund’s less equity sensitive convertible securities and non-convertible instruments contributed to its |

underperformance relative to its more equity sensitive benchmark which benefited to a greater degree from rising equity prices.

We believe EBSZX is positioned well to capitalize on convertible investments in the future, should they become available at compelling prices.

Since inception (September 30, 2014) through July 31, 2021, the EBS Income Fund (“EBSFX”) logged a total annualized return of 2.65%, while its primary benchmark, the ICE BofA U.S. Corporate & Government Master Index was up 3.83%. On a five-year basis, the Fund returned 2.87% and the benchmark 3.38%. On a three-year basis, the Fund returned 3.59% and the benchmark 6.35%. On a one-year basis, the Fund returned 3.43% and the benchmark -1.22%. Lastly, on a six-month basis, the Fund returned 1.12% and the benchmark 0.36%.

The primary factors contributing to EBSFX’s outperformance, relative to its benchmark, in the six-month and one-year periods, and underperformance in other periods are described below:

| ● | EBSFX outpaced its benchmark during the six-month period due to a number of instruments being called at or above par and others appreciating as credit spreads contracted in concert with rising equities. On a one-year basis, EBSFX bested its benchmark due to its shorter duration and less government exposure, which made it less susceptible to the increase in longer dated Treasury yields. |

| ● | In other periods, due to its shorter duration, the Fund did not benefit from declining yields as much as |

the benchmark which has longer average maturities and is more sensitive to interest rate changes.

Our Perspective – We believe the fixed-income landscape will remain challenging as it relates to adequate yield for a given maturity and credit quality. If the Fed reduces its monthly Treasury and Agency purchases in the second half of calendar year 2021, that would be a small step toward normalization. However, there is a chance Delta or some other variant of COVID-19 could delay this step. Absent a change in narrative from the Fed, the Fed Funds rate should be stuck in a range of 0.00% - 0.25% for the foreseeable future.

Given the current structure of the yield curve, we continue focusing on short to intermediate term maturities and selectively taking credit risk to enhance yield. This is in lieu of extending maturities and accepting meaningful interest rate risk for only a nominal pick up in yield.

Convertible exposure within EBSZX remains lower than we prefer. The continued modest allocation is largely due to the low yield environment and stock prices that seem generally high relative to underlying values.

We continue to have a defensive bias and believe both Funds are well positioned to capitalize on opportunities as they arise.

We appreciate your trust and confidence in our firm.

Sincerely,

The EBS Research Group

Important Disclosures – Performance data quoted in this letter or the report itself represents past performance. Past performance does not guarantee future results. The value of an investor’s shares will fluctuate, and may be worth more or less than the original cost when redeemed. Current performance may be higher or lower than performance quoted herein. Performance data, current to the most recent month end, is available by calling 1-800-391-1223.

The information in this “Letter To Our Shareholders” represents the opinion of the author and is not intended to be a forecast or investment advice. This publication does not constitute an offer or solicitation of any transaction in any securities. Information contained in this publication has been obtained from sources believed to be reliable, but has not been independently verified by EBS. Please note that any discussion of fund holdings, fund performance and views expressed are as of July 31, 2021 (except if otherwise stated) and are subject to change without notice.

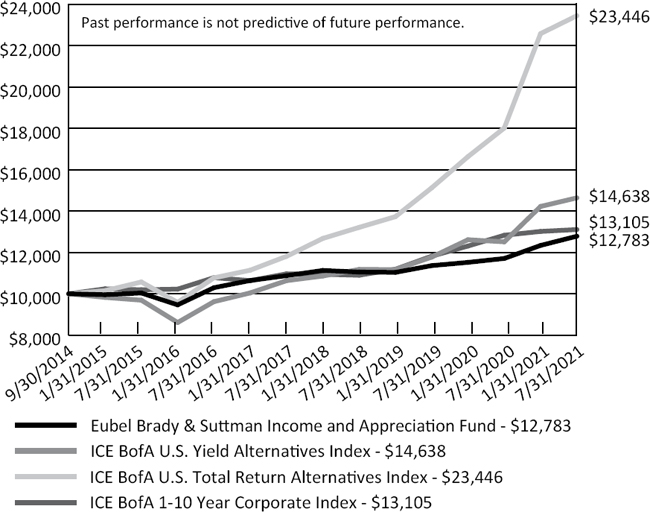

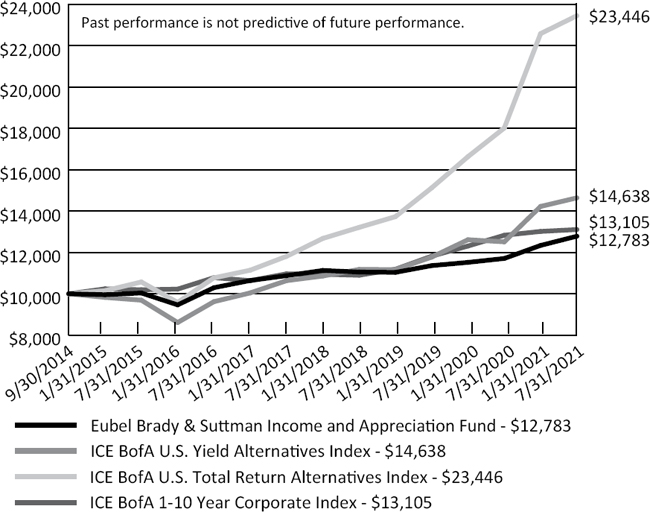

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| PERFORMANCE INFORMATION |

| July 31, 2021 (Unaudited) |

| |

Comparison of the Change in Value of a $10,000 Investment in

Eubel Brady & Suttman Income and Appreciation Fund versus the

ICE BofA U.S. Yield Alternatives Index, the ICE BofA U.S. Total Return Alternatives Index

and the ICE BofA 1-10 Year Corporate Index

| Average Annual Total Returns(a) |

| For the periods ended July 31, 2021 |

| |

| | | | | | Since | |

| | 1 Year | | 5 Years | | Inception(b) | |

| Eubel Brady & Suttman Income and Appreciation Fund | 9.20% | | 4.43% | | 3.66% | |

| ICE BofA U.S. Yield Alternatives Index* | 17.00% | | 8.76% | | 5.74% | |

| ICE BofA U.S. Total Return Alternatives Index* | 30.14% | | 16.83% | | 13.28% | |

| ICE BofA 1-10 Year Corporate Index* | 2.14% | | 3.99% | | 4.04% | |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes dividends or distributions, if any, are reinvested in shares of the Fund. |

| (b) | Represents the period from the commencement of operations (September 30, 2014) through July 31, 2021. |

| * | The ICE BofA U.S. Yield Alternatives Index tracks the performance of U.S. dollar denominated convertible debt. The ICE BofA U.S. Total Return Alternatives Index tracks the performance of U.S. dollar denominated convertible debt with more equity sensitivity than typically found in the Yield Alternatives Index, on average. The ICE BofA 1-10 Year Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market with a remaining term to final maturity less than 10 years. The Fund does not invest solely in securities included in these indices and may invest in other types of securities. |

The performance in the chart represents past performance. Performance shown above does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of shares. Current performance may be higher or lower than the performance data presented above. Investment return and principal value will fluctuate; shares, when redeemed, may be worth more or less than their original cost. As presented in the Fund’s prospectus dated December 1, 2020, the Fund’s total operating expense ratio was 0.28% of the Fund’s average daily net assets. Each Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund. The Fund’s performance reflects the deduction of these fees. Investors cannot invest directly in an index.

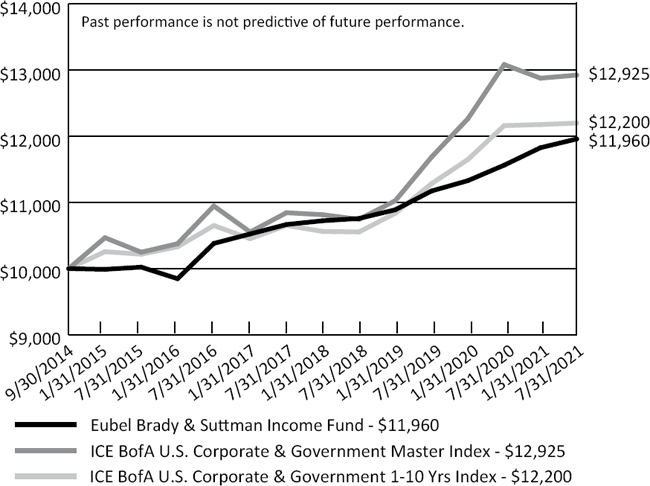

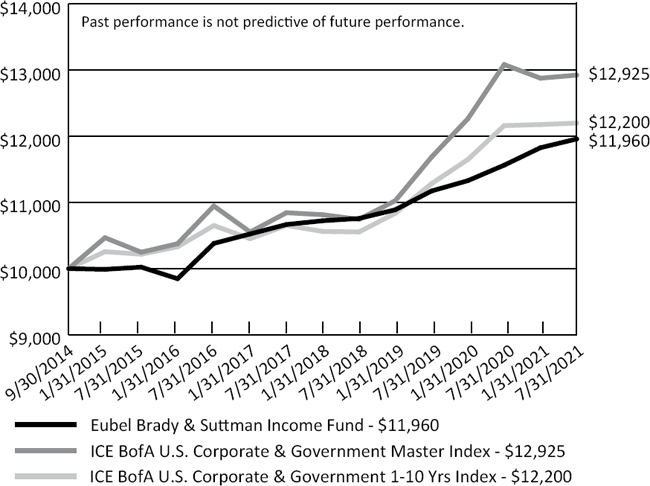

| EUBEL BRADY & SUTTMAN INCOME FUND |

| PERFORMANCE INFORMATION |

| July 31, 2021 (Unaudited) |

| |

Comparison of the Change in Value of a $10,000 Investment in

Eubel Brady & Suttman Income Fund versus

the ICE BofA U.S. Corporate & Government Master Index and

the ICE BofA U.S. Corporate & Government 1-10 Yrs Index

| Average Annual Total Returns(a) |

| For the periods ended July 31, 2021 |

| |

| | | | | | Since | |

| | 1 Year | | 5 Years | | Inception(b) | |

| Eubel Brady & Suttman Income Fund | 3.43% | | 2.87% | | 2.65% | |

| ICE BofA U.S. Corporate & Government Master Index* | (1.22%) | | 3.38% | | 3.83% | |

| ICE BofA U.S. Corporate & Government 1-10 Yrs Index* | 0.31% | | 2.75% | | 2.95% | |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes dividends or distributions, if any, are reinvested in shares of the Fund. |

| (b) | Represents the period from the commencement of operations (September 30, 2014) through July 31, 2021. |

| * | The ICE BofA U.S. Corporate & Government Master Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities. The ICE BofA U.S. Corporate & Government 1-10 Yrs Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the U.S. domestic market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities with a remaining term to final maturity less than 10 years. The Fund does not invest solely in securities included in these indices and may invest in other types of securities. |

The performance in the chart represents past performance. Performance shown above does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of shares. Current performance may be higher or lower than the performance data presented above. Investment return and principal value will fluctuate; shares, when redeemed, may be worth more or less than their original cost. As presented in the Fund’s prospectus dated December 1, 2020, the Fund’s total operating expense ratio was 0.22% of the Fund’s average daily net assets. Each Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund. The Fund’s performance reflects the deduction of these fees. Investors cannot invest directly in an index.

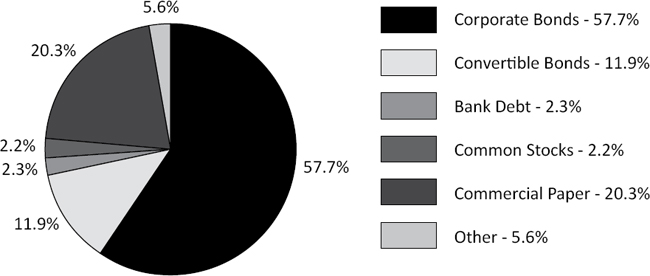

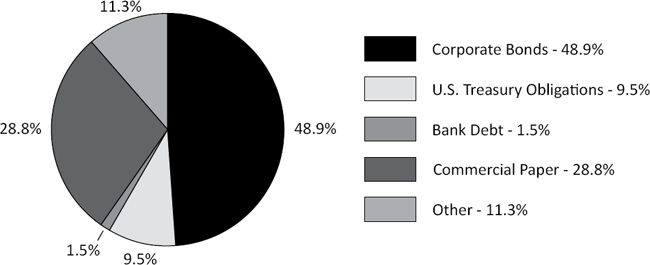

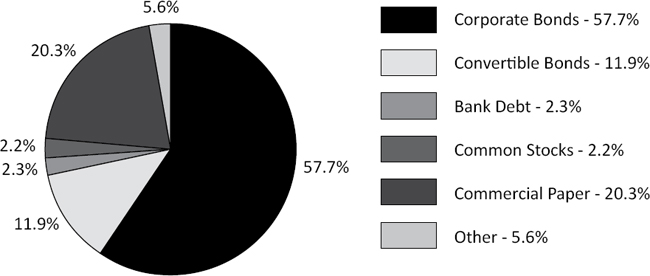

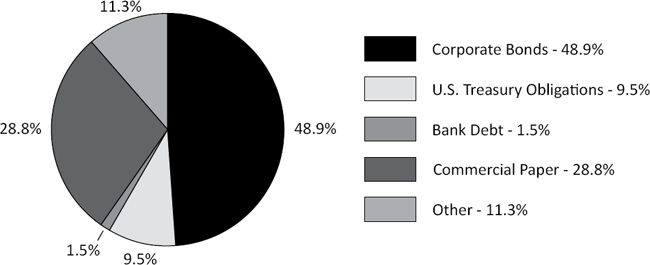

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| PORTFOLIO INFORMATION |

| July 31, 2021 (Unaudited) |

Eubel Brady & Suttman Income and Appreciation Fund

Asset Allocation (% of Net Assets)

Eubel Brady & Suttman Income Fund

Asset Allocation (% of Net Assets)

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| SCHEDULE OF INVESTMENTS |

| July 31, 2021 |

| CORPORATE BONDS — 57.7% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Communications — 4.5% | | | | | | | | | | | | | | |

| Discovery Communications, LLC | | 2.950% | | | 03/20/23 | | | $ | 900,000 | | | $ | 933,972 | |

| Discovery Communications, LLC | | 3.800% | | | 03/13/24 | | | | 2,085,000 | | | | 2,239,091 | |

| Verizon Communications, Inc. (3MO LIBOR + 100) (a) | | 1.118% | | | 03/16/22 | | | | 2,100,000 | | | | 2,112,432 | |

| | | | | | | | | | | | | | 5,285,495 | |

| Consumer Discretionary — 1.9% | | | | | | | | | | | | | | |

| AutoZone, Inc. | | 3.700% | | | 04/15/22 | | | | 2,250,000 | | | | 2,283,915 | |

| | | | | | | | | | | | | | | |

| Consumer Staples — 3.8% | | | | | | | | | | | | | | |

| Honeywell International, Inc. | | 0.483% | | | 08/19/22 | | | | 1,125,000 | | | �� | 1,125,158 | |

| Kroger Company (The) | | 3.850% | | | 08/01/23 | | | | 1,000,000 | | | | 1,059,672 | |

| Mondelēz International, Inc., 144A | | 2.000% | | | 10/28/21 | | | | 2,290,000 | | | | 2,296,161 | |

| | | | | | | | | | | | | | 4,480,991 | |

| Energy — 3.5% | | | | | | | | | | | | | | |

| CONSOL Energy, Inc., 144A | | 11.000% | | | 11/15/25 | | | | 3,000,000 | | | | 3,009,000 | |

| Exxon Mobil Corporation | | 3.043% | | | 03/01/26 | | | | 1,000,000 | | | | 1,089,964 | |

| | | | | | | | | | | | | | 4,098,964 | |

| Financials — 22.0% | | | | | | | | | | | | | | |

| Bank of America Corporation (3MO LIBOR + 370.5, effective 09/05/24) (a)(b) | | 6.250% | | | 03/05/65 | | | | 2,000,000 | | | | 2,210,000 | |

| Charles Schwab Corporation (The) | | 0.900% | | | 03/11/26 | | | | 3,000,000 | | | | 2,998,127 | |

| CNG Holdings, Inc., 144A | | 12.500% | | | 06/15/24 | | | | 2,700,000 | | | | 2,578,500 | |

| First Maryland Capital I (3MO LIBOR + 100) (a) | | 1.126% | | | 01/15/27 | | | | 2,000,000 | | | | 1,934,900 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 75) (a) | | 0.900% | | | 02/23/23 | | | | 500,000 | | | | 504,286 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 100) (a) | | 1.125% | | | 07/24/23 | | | | 2,500,000 | | | | 2,518,017 | |

| JPMorgan Chase & Company (3MO LIBOR + 123) (a) | | 1.355% | | | 10/24/23 | | | | 2,000,000 | | | | 2,026,679 | |

| Pershing Square Holdings Ltd., 144A | | 5.500% | | | 07/15/22 | | | | 2,500,000 | | | | 2,593,216 | |

| Round Up Ventures, L.P. (c)(d)(e) | | 15.000% | | | 03/06/25 | | | | 2,318,438 | | | | 2,438,016 | |

| Southern Bancshares (N.C.), Inc. (3MO SOFR + 2.41, effective 06/30/26) (a) | | 3.125% | | | 06/30/31 | | | | 2,200,000 | | | | 2,224,372 | |

| Truist Bank (3MO LIBOR + 67) (a) | | 0.830% | | | 05/15/27 | | | | 2,000,000 | | | | 1,951,442 | |

| Wells Fargo & Company | | 3.750% | | | 01/24/24 | | | | 1,895,000 | | | | 2,037,157 | |

| | | | | | | | | | | | | | 26,014,712 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| CORPORATE BONDS — 57.7% (Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Health Care — 12.1% | | | | | | | | | | | | | | |

| AbbVie, Inc. | | 2.900% | | | 11/06/22 | | | $ | 3,000,000 | | | $ | 3,093,792 | |

| AmerisourceBergen Corporation | | 0.737% | | | 05/15/23 | | | | 3,380,000 | | | | 3,386,342 | |

| Becton, Dickinson and Company (3MO LIBOR + 103) (a) | | 1.161% | | | 06/06/22 | | | | 2,615,000 | | | | 2,635,078 | |

| Becton, Dickinson and Company | | 2.894% | | | 06/06/22 | | | | 661,000 | | | | 674,150 | |

| Danaher Corporation | | 2.200% | | | 11/15/24 | | | | 1,492,000 | | | | 1,560,424 | |

| McKesson Corporation | | 0.900% | | | 12/03/25 | | | | 3,000,000 | | | | 2,985,933 | |

| | | | | | | | | | | | | | 14,335,719 | |

| Industrials — 4.9% | | | | | | | | | | | | | | |

| General Electric Company (3MO LIBOR + 100) (a) | | 1.119% | | | 03/15/23 | | | | 1,000,000 | | | | 1,012,284 | |

| Penske Truck Leasing Company, L.P., 144A | | 4.125% | | | 08/01/23 | | | | 1,130,000 | | | | 1,200,440 | |

| Republic Services, Inc. | | 2.500% | | | 08/15/24 | | | | 849,000 | | | | 892,372 | |

| Roper Technologies, Inc. | | 2.800% | | | 12/15/21 | | | | 2,700,000 | | | | 2,720,120 | |

| | | | | | | | | | | | | | 5,825,216 | |

| Materials — 5.0% | | | | | | | | | | | | | | |

| Ball Corporation | | 5.000% | | | 03/15/22 | | | | 2,172,000 | | | | 2,222,521 | |

| DowDuPont, Inc. | | 4.493% | | | 11/15/25 | | | | 1,345,000 | | | | 1,530,059 | |

| Steel Dynamics, Inc. | | 2.800% | | | 12/15/24 | | | | 2,000,000 | | | | 2,111,551 | |

| | | | | | | | | | | | | | 5,864,131 | |

| Total Corporate Bonds (Cost $66,878,383) | | | | | | | | | | | | $ | 68,189,143 | |

| CONVERTIBLE BONDS — 11.9% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Communications — 3.3% | | | | | | | | | | | | | | |

| Twitter, Inc., 144A | | 0.000% | | | 03/15/26 | | | $ | 4,000,000 | | | $ | 3,842,500 | |

| | | | | | | | | | | | | | | |

| Consumer Discretionary — 1.9% | | | | | | | | | | | | | | |

| Patrick Industries, Inc. | | 1.000% | | | 02/01/23 | | | | 2,000,000 | | | | 2,270,000 | |

| | | | | | | | | | | | | | | |

| Financials — 4.1% | | | | | | | | | | | | | | |

| Ares Capital Corporation | | 4.625% | | | 03/01/24 | | | | 2,000,000 | | | | 2,163,800 | |

| Redwood Trust, Inc. | | 4.750% | | | 08/15/23 | | | | 2,700,000 | | | | 2,706,750 | |

| | | | | | | | | | | | | | 4,870,550 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| CONVERTIBLE BONDS — 11.9% (Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Technology — 2.6% | | | | | | | | | | | | | | |

| Palo Alto Networks, Inc. | | 0.750% | | | 07/01/23 | | | $ | 2,000,000 | | | $ | 3,090,000 | |

| | | | | | | | | | | | | | | |

| Total Convertible Bonds (Cost $12,274,645) | | | | | | | | | | | | $ | 14,073,050 | |

| | | | | | | | | | | | | | | |

| BANK DEBT — 2.3% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Financials — 1.9% | | | | | | | | | | | | | | |

| NCP SPV Texas, L.P. Revolving Loan (Prime + 275) (a)(c)(e) | | 6.000% | | | 11/30/22 | | | $ | 2,268,973 | | | $ | 2,289,137 | |

| | | | | | | | | | | | | | | |

| Materials — 0.4% | | | | | | | | | | | | | | |

| Ball Metalpack, LLC (3MO LIBOR + 450) (a) | | 4.635% | | | 07/26/25 | | | | 485,000 | | | | 481,363 | |

| | | | | | | | | | | | | | | |

| Total Bank Debt (Cost $2,751,548) | | | | | | | | | | | | $ | 2,770,500 | |

| | | | | | | | | | | | | | | |

| COMMON STOCKS — 2.2% | | | | | | | | Shares | | | Value | |

| Financials — 2.2% | | | | | | | | | | | | | | |

| Capital One Financial Corporation | | | | | | | | | 9,904 | | | $ | 1,601,477 | |

| Lincoln National Corporation | | | | | | | | | 15,673 | | | | 965,770 | |

| Total Common Stocks (Cost $934,971) | | | | | | | | | | | | $ | 2,567,247 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMERCIAL PAPER — 20.3% (f) | | Par Value | | | Value | |

| Cigna Corporation, 0.13%, due 08/04/21 | | $ | 3,000,000 | | | $ | 2,999,968 | |

| Cintas Corporation, 0.12%, due 08/02/21 | | | 3,000,000 | | | | 2,999,990 | |

| Consolidated Edison, Inc., 0.10%, due 08/02/21 | | | 3,000,000 | | | | 2,999,992 | |

| Duke Energy Corporation, 0.11%, due 08/18/21 | | | 3,000,000 | | | | 2,999,844 | |

| Eaton Capital Unlimited Company, 0.17%, due 08/06/21 | | | 3,000,000 | | | | 2,999,929 | |

| Fiserv, Inc., 0.13%, due 08/05/21 | | | 3,000,000 | | | | 2,999,957 | |

| McCormick & Company, Inc., 0.12%, due 08/06/21 | | | 3,000,000 | | | | 2,999,950 | |

| Metlife, Inc., 0.05%, due 08/04/21 | | | 3,000,000 | | | | 2,999,987 | |

| Total Commercial Paper (Cost $23,999,617) | | | | | | $ | 23,999,617 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 5.0% | | Shares | | | Value | |

| Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.01% (g) (Cost $5,894,698) | | | 5,894,698 | | | $ | 5,894,698 | |

| | | | | | | | | |

| Total Investments at Value — 99.4% (Cost $112,733,862) | | | | | | $ | 117,494,255 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.6% | | | | | | | 690,503 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 118,184,758 | |

| 144A - | Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $15,519,817 as of July 31, 2021, representing 13.1% of net assets. |

| LIBOR - | London Interbank Offered Rate. |

| SOFR - | Secured Overnight Financing Rate. |

| (a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of July 31, 2021. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. |

| (b) | Security has a perpetual maturity date. |

| (c) | Illiquid security. The total fair value of these securities as of July 31, 2021 was $4,727,153, representing 4.0% of net assets. |

| (d) | Payment-in-kind bond. The rate shown is the coupon rate of 11.0% and the payment-in-kind rate of 4.0%. |

| (e) | Security has been fair valued using significant unobservable inputs in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees. The total value of these securities as of July 31, 2021 was $4,727,153, representing 4.0% of net assets. |

| (f) | The rate shown is the annualized yield at the time of purchase, not a coupon rate. |

| (g) | The rate shown is the 7-day effective yield as of July 31, 2021. |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

SCHEDULE OF INVESTMENTS

July 31, 2021 |

| CORPORATE BONDS — 48.9% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Communications — 2.4% | | | | | | | | | | | | | | |

| Discovery Communications, LLC | | 3.300% | | | 05/15/22 | | | $ | 1,161,000 | | | $ | 1,186,104 | |

| Discovery Communications, LLC | | 4.900% | | | 03/11/26 | | | | 1,000,000 | | | | 1,146,430 | |

| Verizon Communications, Inc. (3MO LIBOR + 100) (a) | | 1.118% | | | 03/16/22 | | | | 5,000,000 | | | | 5,029,599 | |

| | | | | | | | | | | | | | 7,362,133 | |

| Consumer Discretionary — 0.6% | | | | | | | | | | | | | | |

| Marriott International, Inc. | | 2.300% | | | 01/15/22 | | | | 2,000,000 | | | | 2,012,595 | |

| | | | | | | | | | | | | | | |

| Consumer Staples — 3.6% | | | | | | | | | | | | | | |

| Kroger Company (The) | | 2.950% | | | 11/01/21 | | | | 5,206,000 | | | | 5,230,098 | |

| Mondel z International, Inc.,144A | | 2.000% | | | 10/28/21 | | | | 5,995,000 | | | | 6,011,128 | |

| | | | | | | | | | | | | | 11,241,226 | |

| Energy — 1.8% | | | | | | | | | | | | | | |

| CONSOL Energy, Inc., 144A | | 11.000% | | | 11/15/25 | | | | 5,700,000 | | | | 5,717,100 | |

| | | | | | | | | | | | | | | |

| Financials — 20.5% | | | | | | | | | | | | | | |

| Bank of America Corporation (3MO LIBOR + 370.5, effective 09/05/24) (a)(b) | | 6.250% | | | 03/05/65 | | | | 4,000,000 | | | | 4,420,000 | |

| Barclays Bank plc (3MO LIBOR + 211) (a) | | 2.272% | | | 08/10/21 | | | | 2,684,000 | | | | 2,685,162 | |

| Charles Schwab Corporation (The) | | 0.900% | | | 03/11/26 | | | | 7,000,000 | | | | 6,995,631 | |

| Citigroup, Inc. | | 2.900% | | | 12/08/21 | | | | 2,220,000 | | | | 2,235,785 | |

| CNG Holdings, Inc., 144A | | 12.500% | | | 06/15/24 | | | | 6,300,000 | | | | 6,016,500 | |

| First Maryland Capital I (3MO LIBOR + 100) (a) | | 1.126% | | | 01/15/27 | | | | 5,000,000 | | | | 4,837,251 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 75) (a) | | 0.900% | | | 02/23/23 | | | | 500,000 | | | | 504,286 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 100) (a) | | 1.125% | | | 07/24/23 | | | | 5,500,000 | | | | 5,539,639 | |

| JPMorgan Chase & Company | | 2.700% | | | 05/18/23 | | | | 3,000,000 | | | | 3,112,753 | |

| JPMorgan Chase & Company (3MO LIBOR + 123) (a) | | 1.355% | | | 10/24/23 | | | | 2,115,000 | | | | 2,143,213 | |

| Morgan Stanley | | 4.875% | | | 11/01/22 | | | | 3,100,000 | | | | 3,266,617 | |

| Pershing Square Holdings Ltd., 144A | | 5.500% | | | 07/15/22 | | | | 5,000,000 | | | | 5,186,432 | |

| Round Up Ventures, L.P. (c)(d)(e) | | 15.000% | | | 03/06/25 | | | | 5,058,410 | | | | 5,319,307 | |

| Southern Bancshares (N.C.), Inc. (3MO SOFR + 2.41, effective 06/30/26) (a) | | 3.125% | | | 06/30/31 | | | | 5,800,000 | | | | 5,864,254 | |

| Truist Bank (3MO LIBOR + 67) (a) | | 0.830% | | | 05/15/27 | | | | 5,788,000 | | | | 5,647,472 | |

| | | | | | | | | | | | | | 63,774,302 | |

| | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| CORPORATE BONDS — 48.9% (Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Health Care — 7.0% | | | | | | | | | | | | | | |

| AbbVie, Inc. | | 2.900% | | | 11/06/22 | | | $ | 7,275,000 | | | $ | 7,502,447 | |

| Becton, Dickinson and Company (3MO LIBOR + 103) (a) | | 1.161% | | | 06/06/22 | | | | 5,825,000 | | | | 5,869,724 | |

| McKesson Corporation | | 0.900% | | | 12/03/25 | | | | 8,665,000 | | | | 8,624,370 | |

| | | | | | | | | | | | | | 21,996,541 | |

| Industrials — 5.5% | | | | | | | | | | | | | | |

| General Electric Company (3MO LIBOR + 100) (a) | | 1.119% | | | 03/15/23 | | | | 5,000,000 | | | | 5,061,423 | |

| Penske Truck Leasing Company, L.P., 144A | | 2.700% | | | 03/14/23 | | | | 5,000,000 | | | | 5,162,868 | |

| Penske Truck Leasing Company, L.P., 144A | | 4.125% | | | 08/01/23 | | | | 1,000,000 | | | | 1,062,336 | |

| Roper Technologies, Inc. | | 2.800% | | | 12/15/21 | | | | 5,703,000 | | | | 5,745,498 | |

| | | | | | | | | | | | | | 17,032,125 | |

| Materials — 6.5% | | | | | | | | | | | | | | |

| Ball Corporation | | 5.000% | | | 03/15/22 | | | | 7,912,000 | | | | 8,096,033 | |

| Cabot Corporation | | 3.700% | | | 07/15/22 | | | | 3,980,000 | | | | 4,099,035 | |

| Sherwin-Williams Company (The) | | 4.200% | | | 01/15/22 | | | | 5,250,000 | | | | 5,290,183 | |

| Steel Dynamics, Inc. | | 2.800% | | | 12/15/24 | | | | 2,696,000 | | | | 2,846,371 | |

| | | | | | | | | | | | | | 20,331,622 | |

| Utilities — 1.0% | | | | | | | | | | | | | | |

| Duke Energy Corporation | | | | | | | | | | | | | | |

| (3MO LIBOR + 25) (a) | | 0.391% | | | 11/26/21 | | | | 3,000,000 | | | | 3,001,719 | |

| | | | | | | | | | | | | | | |

| Total Corporate Bonds (Cost $150,488,989) | | | | | | | | | | | | $ | 152,469,363 | |

| | | | | | | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS — 9.5% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| U.S. Treasury Notes | | 0.250% | | | 06/30/25 | | | $ | 10,000,000 | | | $ | 9,888,281 | |

| U.S. Treasury Notes | | 0.750% | | | 03/31/26 | | | | 10,000,000 | | | | 10,042,969 | |

| U.S. Treasury Notes | | 0.375% | | | 07/31/27 | | | | 10,000,000 | | | | 9,717,968 | |

| Total U.S. Treasury Obligations (Cost $29,317,056) | | | | | | | | | | | | $ | 29,649,218 | |

| | | | | | | | | �� | | | | | | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| BANK DEBT — 1.5% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Financials — 1.5% | | | | | | | | | | | | | | |

| NCP SPV Texas, L.P. Revolving Loan (Prime + 275) (a)(c)(e) (Cost $4,606,703) | | 6.000% | | | 11/30/22 | | | $ | 4,606,703 | | | $ | 4,647,643 | |

| | | | | | | | | | | | | | | |

| COMMERCIAL PAPER — 28.8% (f) | | | | | | | | Par Value | | | Value | |

| Cintas Corporation, 0.12%, due 08/02/21 | | | | | | | | $ | 9,000,000 | | | $ | 8,999,970 | |

| Consolidated Edison, Inc., 0.10%, due 08/02/21 | | | | | | | | | 9,000,000 | | | | 8,999,975 | |

| Duke Energy Corporation, 0.11%, due 08/18/21 | | | | | | | | | 9,000,000 | | | | 8,999,532 | |

| Eaton Capital Unlimited Company, 0.17%, due 08/06/21 | | | | | | | | | 9,000,000 | | | | 8,999,788 | |

| Fiserv, Inc., 0.13%, due 08/05/21 | | | | | | | | | 9,000,000 | | | | 8,999,870 | |

| General Mills, Inc., 0.07%, due 08/12/21 | | | | | | | | | 9,000,000 | | | | 8,999,808 | |

| Hyundai Capital America, Inc., 0.13%, due 08/10/21 | | | | | | | | | 9,000,000 | | | | 8,999,708 | |

| McCormick & Company, Inc., 0.12%, due 08/06/21 | | | | | | | | | 9,000,000 | | | | 8,999,850 | |

| Metlife, Inc., 0.05%, due 08/04/21 | | | | | | | | | 9,000,000 | | | | 8,999,962 | |

| Montana-Dakota Utilities Company, 0.15%, due 08/03/21 | | | | | | | | | 8,825,000 | | | | 8,824,926 | |

| Total Commercial Paper (Cost $89,823,389) | | | | | | | | | | | | $ | 89,823,389 | |

| | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 13.5% | | Shares | | | Value | |

| Invesco Short-Term Investments Trust - Treasury Portfolio - Institutional Class, 0.01% (g) (Cost $41,948,121) | | | 41,948,121 | | | $ | 41,948,121 | |

| | | | | | | | | |

| Total Investments at Value — 102.2% (Cost $316,184,258) . | | | | | | $ | 318,537,734 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (2.2%) | | | | | | | (6,998,634 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 311,539,100 | |

| 144A - | Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $29,156,364 as of July 31, 2021, representing 9.4% of net assets. |

| LIBOR - | London Interbank Offered Rate. |

| SOFR - | Secured Overnight Financing Rate. |

| (a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of July 31, 2021. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. |

| (b) | Security has a perpetual maturity date. |

| (c) | Illiquid security. The total fair value of these securities as of July 31, 2021 was $9,966,950, representing 3.2% of net assets. |

| (d) | Payment-in-kind bond. The rate shown is the coupon rate of 11.0% and the payment-in-kind rate of 4.0%. |

| (e) | Security has been fair valued using significant unobservable inputs in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees. The total value of these securities as of July 31, 2021 was $9,966,950, representing 3.2% of net assets. |

| (f) | The rate shown is the annualized yield at the time of purchase, not a coupon rate. |

| (g) | The rate shown is the 7-day effective yield as of July 31, 2021. |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| STATEMENTS OF ASSETS AND LIABILITIES |

| July 31, 2021 |

| | | Eubel Brady | | | | |

| | | & Suttman | | | | |

| | | Income and | | | Eubel Brady | |

| | | Appreciation | | | & Suttman | |

| | | Fund | | | Income Fund | |

| ASSETS | | | | | | | | |

| Investments in securities: | | | | | | | | |

| At cost | | $ | 112,733,862 | | | $ | 316,184,258 | |

| At value (Note 2) | | $ | 117,494,255 | | | $ | 318,537,734 | |

| Receivable for capital shares sold | | | 90,272 | | | | 1,428,714 | |

| Dividends and interest receivable | | | 614,531 | | | | 1,058,708 | |

| Other assets | | | 8,645 | | | | 13,870 | |

| Total assets | | | 118,207,703 | | | | 321,039,026 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Distributions payable | | | 116 | | | | 491 | |

| Payable for capital shares redeemed | | | 633 | | | | 446,361 | |

| Payable to custodian | | | — | | | | 8,999,773 | |

| Payable to administrator (Note 4) | | | 9,820 | | | | 21,940 | |

| Other accrued expenses | | | 12,376 | | | | 31,361 | |

| Total liabilities | | | 22,945 | | | | 9,499,926 | |

| | | | | | | | | |

| CONTINGENCIES AND COMMITMENTS (Note 7) | | | — | | | | — | |

| | | | | | | | | |

| NET ASSETS | | $ | 118,184,758 | | | $ | 311,539,100 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | $ | 112,167,057 | | | $ | 311,684,672 | |

| Accumulated earnings (deficit) | | | 6,017,701 | | | | (145,572 | ) |

| NET ASSETS | | $ | 118,184,758 | | | $ | 311,539,100 | |

| | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 11,449,016 | | | | 31,252,726 | |

| | | | | | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 10.32 | | | $ | 9.97 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| STATEMENTS OF OPERATIONS |

| For the Year Ended July 31, 2021 |

| | | Eubel Brady | | | | |

| | | & Suttman | | | | |

| | | Income and | | | Eubel Brady | |

| | | Appreciation | | | & Suttman | |

| | | Fund | | | Income Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Dividends | | $ | 78,547 | | | $ | 5,655 | |

| Interest | | | 2,996,594 | | | | 5,964,200 | |

| Total investment income | | | 3,075,141 | | | | 5,969,855 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Administration fees (Note 4) | | | 100,053 | | | | 233,663 | |

| Shareholder servicing fees (Note 6) | | | 43,001 | | | | 102,197 | |

| Registration and filing fees | | | 31,872 | | | | 47,863 | |

| Legal fees | | | 31,487 | | | | 31,487 | |

| Custody and bank service fees | | | 16,406 | | | | 27,917 | |

| Audit and tax services fees | | | 18,910 | | | | 18,910 | |

| Trustees’ fees and expenses (Note 4) | | | 15,472 | | | | 15,472 | |

| Insurance expense | | | 7,437 | | | | 15,326 | |

| Printing of shareholder reports | | | 3,867 | | | | 3,867 | |

| Postage and supplies | | | 3,899 | | | | 3,821 | |

| Pricing fees | | | 3,467 | | | | 3,576 | |

| Other expenses | | | 4,979 | | | | 4,961 | |

| Total expenses | | | 280,850 | | | | 509,060 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 2,794,291 | | | | 5,460,795 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | | | | | |

| Net realized gains from investment transactions | | | 3,435,119 | | | | 755,400 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 3,113,629 | | | | 2,088,437 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 6,548,748 | | | | 2,843,837 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 9,343,039 | | | $ | 8,304,632 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | July 31, | | | July 31, | |

| | | 2021 | | | 2020 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 2,794,291 | | | $ | 3,278,120 | |

| Net realized gains from investment transactions | | | 3,435,119 | | | | 101,915 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 3,113,629 | | | | (303,607 | ) |

| Net increase in net assets resulting from operations | | | 9,343,039 | | | | 3,076,428 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (3,444,131 | ) | | | (3,315,245 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 16,849,213 | | | | 18,544,836 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 3,442,296 | | | | 3,313,598 | |

| Payments for shares redeemed | | | (9,640,065 | ) | | | (8,781,072 | ) |

| Net increase in net assets from capital share transactions | | | 10,651,444 | | | | 13,077,362 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 16,550,352 | | | | 12,838,545 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 101,634,406 | | | | 88,795,861 | |

| End of year | | $ | 118,184,758 | | | $ | 101,634,406 | |

| | | | | | | | | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Shares sold | | | 1,655,391 | | | | 1,918,266 | |

| Shares reinvested | | | 341,630 | | | | 343,372 | |

| Shares redeemed | | | (956,608 | ) | | | (905,005 | ) |

| Net increase in shares outstanding | | | 1,040,413 | | | | 1,356,633 | |

| Shares outstanding at beginning of year | | | 10,408,603 | | | | 9,051,970 | |

| Shares outstanding at end of year | | | 11,449,016 | | | | 10,408,603 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | July 31, | | | July 31, | |

| | | 2021 | | | 2020 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 5,460,795 | | | $ | 7,004,041 | |

| Net realized gains (losses) from investment transactions | | | 755,400 | | | | (2,507,765 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 2,088,437 | | | | 1,334,621 | |

| Net increase in net assets resulting from operations | | | 8,304,632 | | | | 5,830,897 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (5,481,954 | ) | | | (7,003,977 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 135,505,778 | | | | 56,707,791 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 5,474,966 | | | | 6,994,245 | |

| Payments for shares redeemed | | | (35,759,813 | ) | | | (59,749,154 | ) |

| Net increase in net assets from capital share transactions | | | 105,220,931 | | | | 3,952,882 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 108,043,609 | | | | 2,779,802 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 203,495,491 | | | | 200,715,689 | |

| End of year | | $ | 311,539,100 | | | $ | 203,495,491 | |

| | | | | | | | | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Shares sold | | | 13,631,168 | | | | 5,791,136 | |

| Shares reinvested | | | 551,547 | | | | 715,082 | |

| Shares redeemed | | | (3,598,961 | ) | | | (6,201,262 | ) |

| Net increase in shares outstanding | | | 10,583,754 | | | | 304,956 | |

| Shares outstanding at beginning of year | | | 20,668,972 | | | | 20,364,016 | |

| Shares outstanding at end of year | | | 31,252,726 | | | | 20,668,972 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | July 31, | | | July 31, | | | July 31, | | | July 31, | | | July 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Net asset value at beginning of year | | $ | 9.76 | | | $ | 9.81 | | | $ | 9.86 | | | $ | 9.97 | | | $ | 9.71 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.26 | | | | 0.34 | | | | 0.32 | | | | 0.27 | | | | 0.27 | |

| Net realized and unrealized gains (losses) on investments | | | 0.63 | | | | (0.05 | ) | | | (0.05 | ) | | | (0.11 | ) | | | 0.27 | |

| Total from investment operations | | | 0.89 | | | | 0.29 | | | | 0.27 | | | | 0.16 | | | | 0.54 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.27 | ) | | | (0.34 | ) | | | (0.32 | ) | | | (0.27 | ) | | | (0.28 | ) |

| Net realized gains on investments | | | (0.06 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.33 | ) | | | (0.34 | ) | | | (0.32 | ) | | | (0.27 | ) | | | (0.28 | ) |

| Net asset value at end of year | | $ | 10.32 | | | $ | 9.76 | | | $ | 9.81 | | | $ | 9.86 | | | $ | 9.97 | |

| Total return (a) | | | 9.20 | % | | | 3.04 | % | | | 2.82 | % | | | 1.61 | % | | | 5.65 | % |

| Net assets at end of year (000’s) | | $ | 118,185 | | | $ | 101,634 | | | $ | 88,796 | | | $ | 88,318 | | | $ | 84,969 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.26 | % | | | 0.27 | % | | | 0.27 | % | | | 0.25 | % | | | 0.26 | % |

| Ratio of net investment income to average net assets | | | 2.59 | % | | | 3.48 | % | | | 3.24 | % | | | 2.71 | % | | | 2.72 | % |

| Portfolio turnover rate | | | 50 | % | | | 45 | % | | | 16 | % | | | 60 | % | | | 42 | % |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | July 31, | | | July 31, | | | July 31, | | | July 31, | | | July 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Net asset value at beginning of year | | $ | 9.85 | | | $ | 9.86 | | | $ | 9.82 | | | $ | 10.00 | | | $ | 9.97 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.21 | | | | 0.35 | | | | 0.33 | | | | 0.27 | | | | 0.24 | |

| Net realized and unrealized gains (losses) on investments | | | 0.12 | | | | (0.01 | ) | | | 0.04 | | | | (0.19 | ) | | | 0.04 | |

| Total from investment operations | | | 0.33 | | | | 0.34 | | | | 0.37 | | | | 0.08 | | | | 0.28 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.21 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.26 | ) | | | (0.24 | ) |

| Net realized gains on investments | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) |

| Total distributions | | | (0.21 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.26 | ) | | | (0.25 | ) |

| Net asset value at end of year | | $ | 9.97 | | | $ | 9.85 | | | $ | 9.86 | | | $ | 9.82 | | | $ | 10.00 | |

| Total return (a) | | | 3.43 | % | | | 3.49 | % | | | 3.86 | % | | | 0.86 | % | | | 2.75 | % |

| Net assets at end of year (000’s) | | $ | 311,539 | | | $ | 203,495 | | | $ | 200,716 | | | $ | 198,903 | | | $ | 185,957 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.20 | % | | | 0.21 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

| Ratio of net investment income to average net assets | | | 2.13 | % | | | 3.51 | % | | | 3.37 | % | | | 2.69 | % | | | 2.36 | % |

| Portfolio turnover rate | | | 33 | % | | | 27 | % | | | 19 | % | | | 65 | % | | | 40 | % |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS July 31, 2021 |

Eubel Brady & Suttman Income and Appreciation Fund (“EBS Income and Appreciation Fund”) and Eubel Brady & Suttman Income Fund (“EBS Income Fund”) (individually, a “Fund” and collectively, the “Funds”) are each a no-load diversified series of Eubel Brady & Suttman Mutual Fund Trust (the “Trust”), an open-end management investment company organized as an Ohio business trust on April 22, 2014.

The investment objective of EBS Income and Appreciation Fund is to provide total return through a combination of current income and capital appreciation.

The investment objective of EBS Income Fund is to preserve capital, produce income and maximize total return.

| 2. | Significant Accounting Policies |

The Funds follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies,” including Accounting Standards Update 2013-8. The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

New Accounting Pronouncement — In March 2020, the FASB issued Accounting Standards Update No. 2020-04 (“ASU 2020-04”), “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” ASU 2020-04 provides optional temporary financial reporting relief from the effect of certain types of contract modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other interbank-offered based reference rates at the end of 2021. ASU 2020-04 is effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. The Funds will consider this optional guidance prospectively, if applicable.

Securities Valuation — Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded on NASDAQ are generally valued at the NASDAQ Official Closing Price. Investments representing shares of other open-end investment companies, including money market funds, are valued at their net asset value (“NAV”) as reported by such companies. The Funds typically use an independent pricing service to determine the value of their fixed income securities. The pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of fixed income securities without regard to sale or bid prices. Commercial paper may be valued at amortized cost, which under normal circumstances approximates market value.

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

If Eubel Brady & Suttman Asset Management, Inc. (the “Adviser”), the investment adviser to the Funds, determines that a price provided by the pricing service does not accurately reflect the market value of the securities or, when prices are not readily available from the pricing service, securities are valued at fair value as determined in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees of the Trust (the “Board”).

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

Certain fixed income securities held by the Funds are classified as Level 2 since the values are typically provided by an independent pricing service that utilizes various “other significant observable inputs” as discussed above. Other fixed income securities (including certain corporate bonds and bank debt) and warrants held by the Funds, are classified as Level 3 since the values for these securities are based on prices derived from one or more significant inputs that are unobservable. The inputs or methodology used are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is based on the lowest level input that is significant to the fair value measurement.

The following is a summary of each Fund’s investments and the inputs used to value the investments as of July 31, 2021 by security type:

| EBS Income and Appreciation Fund: |

| | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | — | | | $ | 65,751,127 | | | $ | 2,438,016 | | | $ | 68,189,143 | |

| Convertible Bonds | | | — | | | | 14,073,050 | | | | — | | | | 14,073,050 | |

| Bank Debt | | | — | | | | 481,363 | | | | 2,289,137 | | | | 2,770,500 | |

| Common Stocks | | | 2,567,247 | | | | — | | | | — | | | | 2,567,247 | |

| Commercial Paper | | | — | | | | 23,999,617 | | | | — | | | | 23,999,617 | |

| Money Market Funds | | | 5,894,698 | | | | — | | | | — | | | | 5,894,698 | |

| Total | | $ | 8,461,945 | | | $ | 104,305,157 | | | $ | 4,727,153 | | | $ | 117,494,255 | |

| | | | | | | | | | | | | | | | | |

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

| EBS Income Fund: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | — | | | $ | 147,150,056 | | | $ | 5,319,307 | | | $ | 152,469,363 | |

| U.S. Treasury Obligations | | | — | | | | 29,649,218 | | | | — | | | | 29,649,218 | |

| Bank Debt | | | — | | | | — | | | | 4,647,643 | | | | 4,647,643 | |

| Commercial Paper | | | — | | | | 89,823,389 | | | | — | | | | 89,823,389 | |

| Money Market Funds | | | 41,948,121 | | | | — | | | | — | | | | 41,948,121 | |

| Total | | $ | 41,948,121 | | | $ | 266,622,663 | | | $ | 9,966,950 | | | $ | 318,537,734 | |

| | | | | | | | | | | | | | | | | |

The following is a reconciliation of Level 3 investments of the Funds for which significant unobservable inputs were used to determine fair value for the year ended July 31, 2021:

| EBS Income and Appreciation Fund |

| | | | | | | | | | | | | | | | | | | |

| | | Value | | | | | | | | | | | | Net change | | | Value | |

| | | as of | | | | | | | | | | | | in unrealized | | | as of | |

| Investments | | July 31, | | | | | | Sales/ | | | Realized | | | appreciation | | | July 31, | |

| in Securities | | 2020 | | | Purchases | | | maturities | | | losses | | | (depreciation) | | | 2021 | |

| Corporate Bonds | | $ | 2,311,310 | | | $ | 90,465 | | | $ | — | | | $ | — | | | $ | 36,241 | | | $ | 2,438,016 | |

| Bank Debt | | | 833,528 | | | | 3,280,865 | | | | (1,842,661 | ) | | | — | | | | 17,405 | | | | 2,289,137 | |

| Warrants | | | 10 | | | | — | | | | (10 | ) | | | (1,211,709 | ) | | | 1,211,709 | | | | — | |

| Total | | $ | 3,144,848 | | | $ | 3,371,330 | | | $ | (1,842,671 | ) | | $ | (1,211,709 | ) | | $ | 1,265,355 | | | $ | 4,727,153 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBS Income Fund |

| | | | | | | | | | | | | | | | | | | |

| | | Value | | | | | | | | | | | | Net change | | | Value | |

| | | as of | | | | | | | | | | | | in unrealized | | | as of | |

| Investments | | July 31, | | | | | | Sales/ | | | Realized | | | appreciation | | | July 31, | |

| in Securities | | 2020 | | | Purchases | | | maturities | | | gain (loss) | | | (depreciation) | | | 2021 | |

| Corporate Bonds | | $ | 5,042,859 | | | $ | 197,377 | | | $ | — | | | $ | — | | | $ | 79,071 | | | $ | 5,319,307 | |

| Bank Debt | | | 1,389,214 | | | | 6,293,189 | | | | (3,071,102 | ) | | | — | | | | 36,342 | | | | 4,647,643 | |

| Total | | $ | 6,432,073 | | | $ | 6,490,566 | | | $ | (3,071,102 | ) | | $ | — | | | $ | 115,413 | | | $ | 9,966,950 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The total change in unrealized appreciation (depreciation) included on the Statements of Operations attributable to Level 3 investments still held at July 31, 2021 is $53,646 and $115,413 for EBS Income and Appreciation Fund and EBS Income Fund, respectively.

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

The following table summarizes the valuation techniques used and unobservable inputs developed by the Adviser in conformity with guidelines adopted by and subject to review by the Board to determine the fair value of the Level 3 investments.

| EBS Income and Appreciation Fund | |

| | |

| | | | | | | | | | | | | Weighted | |

| | | Fair Value at | | | | | | | | | | Average of | |

| | | July 31, | | | Valuation | | Unobservable | | | Value/ | | Unobservable | |

| | | 2021 | | | Technique | | Input1 | | | Range | | Inputs | |

| | | | | | | Management’s | | | | | | | | | | |

| | | | | | | Estimate of Future | | | | | | | | | | |

| Corporate Bonds | | $ | 2,438,016 | | | Cash Flows | | | Discount Rate2 | | | 13.51% | | | N/A | |

| Bank Debt | | $ | 2,289,137 | | | DCF Model | | | Discount Rate2 | | | 5.31% | | | N/A | |

| EBS Income Fund |

| |

| | | | | | | | | | | | | Weighted | |

| | | Fair Value at | | | | | | | | | | Average of | |

| | | July 31, | | | Valuation | | Unobservable | | | Value/ | | Unobservable | |

| | | 2021 | | | Technique | | Input1 | | | Range | | Inputs | |

| | | | | | | Management’s | | | | | | | | | | |

| | | | | | | Estimate of Future | | | | | | | | | | |

| Corporate Bonds | | $ | 5,319,307 | | | Cash Flows | | | Discount Rate2 | | | 13.51% | | | N/A | |

| Bank Debt | | $ | 4,647,643 | | | DCF Model | | | Discount Rate2 | | | 5.31% | | | N/A | |

DCF - Discounted Cash Flow

| 1 | Significant increases and decreases in the unobservable inputs used to determine fair value of Level 3 assets could result in significantly higher or lower fair value measurements. An increase to the unobservable input would result in a decrease to the fair value. A decrease to the unobservable input would have the opposite effect. |

| 2 | The Discount Rate used is determined by the Adviser by employing a reference benchmark, adjusted by a credit spread. |

There were no derivative instruments held by the Funds as of or during the year ended July 31, 2021.

Share Valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to its NAV per share.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Income, Investment Transactions and Realized Capital Gains and Losses — Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income is recorded as earned. Discounts and premiums on fixed income securities are amortized using the effective interest method. Investment transactions are accounted for on trade date. Realized capital gains and losses on investments sold are determined on a specific identification basis.

Expenses — Expenses of the Trust that are directly identifiable to a specific Fund are charged to that Fund. Expenses which are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable.

Distributions to Shareholders — Distributions to shareholders of net investment income, if any, are paid monthly. Capital gain distributions, if any, are distributed to shareholders annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and realized capital gains on various investment securities held by the Funds, timing differences and differing characterizations of distributions made by the Funds. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid by each Fund during the years ended July 31, 2021 and July 31, 2020 was ordinary income.

Federal Income Tax — Each Fund has qualified and intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

The following information is computed on a tax basis for each item as of July 31, 2021:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Tax cost of portfolio investments | | $ | 112,808,810 | | | $ | 316,184,258 | |

| Gross unrealized appreciation | | $ | 4,833,465 | | | $ | 2,601,434 | |

| Gross unrealized depreciation | | | (148,020 | ) | | | (247,958 | ) |

| Net unrealized appreciation on investments | | | 4,685,445 | | | | 2,353,476 | |

| Undistributed ordinary income | | | 1,252,064 | | | | 15,800 | |

| Undistributed long-term gains | | | 80,192 | | | | — | |

| Capital loss carryforwards | | | — | | | | (2,514,848 | ) |

| Accumulated earnings (deficit) | | $ | 6,017,701 | | | $ | (145,572 | ) |

| | | | | | | | | |

The difference between the federal income tax cost of portfolio investments and the Schedule of Investments cost for the Funds is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to basis adjustments related to each Fund’s holdings in convertible bonds and the differing methods in the amortization of premiums on fixed income securities.

During the year ended July 31, 2021, EBS Income and Appreciation Fund and EBS Income Fund utilized capital loss carryforwards (“CLCFs”) of $1,428,485 and $722,188, respectively, to offset current year gains.

As of July 31, 2021, the Funds had the following CLCFs for federal income tax purposes:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Short-term | | $ | — | | | $ | 352,523 | |

| Long-term | | | — | | | | 2,162,325 | |

| | | $ | — | | | $ | 2,514,848 | |

| | | | | | | | | |

These CLCFs, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for all

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. Each Fund identifies its major tax jurisdiction as U.S. Federal.

| 3. | Unfunded Loan Commitment |

At July 31, 2021, unfunded loan commitments for the Funds were as follows:

| | | | | Unfunded | |

| Fund | | Borrower | | Commitment | |

| EBS Income and Appreciation Fund | | NCP SVP Texas, L.P. | | $ | 1,031,027 | |

| EBS Income Fund | | NCP SVP Texas, L.P. | | $ | 2,093,297 | |

Pursuant to an Asset-Based Lending Credit Agreement between the Funds and NCP SVP Texas, L.P. (the “Borrower”), the Borrower has agreed to pay the Funds a commitment fee equal to 0.25% of the average daily unfunded commitment balance, which is included within interest income on the Statements of Operations.

| 4. | Transactions with Related Parties |

Certain officers of the Trust are also officers of the Adviser, of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative services agent, shareholder servicing and transfer agent, and accounting services agent for the Funds, or of Ultimus Fund Distributors, LLC (the “Distributor”), the principal underwriter and exclusive agent for the distribution of shares of the Funds.

Investment Adviser — Under the terms of the Management Agreement between the Trust and the Adviser, the Adviser manages each Fund’s investments subject to oversight by the Board. The Funds do not pay the Adviser investment advisory fees under the Management Agreement. However, prior to investing in a Fund, a prospective shareholder must enter into an investment advisory agreement with the Adviser that calls for the payment of an advisory fee based upon a percentage of all assets (including shares of the Funds) managed by the Adviser on behalf of the prospective shareholder. The fee schedule may be negotiable at the time the account is opened and is generally based upon the value of assets held in the client’s account and the style of management.

The Adviser has entered into an agreement with the Funds under which it has agreed to reimburse Fund expenses to the extent necessary to limit total annual operating expenses (excluding brokerage costs, taxes, interest, acquired fund fees and expenses, expenses incurred pursuant to the Funds’ Shareholder Servicing Plan and extraordinary expenses) to an amount not exceeding 0.35% of each Fund’s average daily net assets. Any payments by the Adviser of expenses which are a Fund’s obligation are subject to repayment by the Fund for a period of three years following the date on which such expenses were paid, provided that the repayment

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

does not cause the Fund’s total annual operating expenses to exceed the lesser of: (i) the expense limitation in effect at the time such expenses were reimbursed; and (ii) the expense limitation in effect at the time the Adviser seeks reimbursement of such expenses. This agreement is currently in effect until December 1, 2021. No expense reimbursements were required during the year ended July 31, 2021.

Administrator — Ultimus provides administration, fund accounting and transfer agency services to each Fund. The Funds pay Ultimus fees in accordance with the agreements for such services. In addition, the Funds pay out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Funds’ portfolio securities.

Compensation of Trustees — Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Funds for their services. Each Trustee who is not an interested person of the Trust receives from the Funds a fee of $2,625 for attendance at each meeting of the Board, in addition to reimbursement of travel and other expenses incurred in attending the meetings. The Chairperson of the Audit and Governance Committee receives an additional annual fee of $1,000, paid quarterly.

| 5. | Securities Transactions |

During the year ended July 31, 2021, cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments and U.S. government securities, were as follows:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Purchases of investment securities | | $ | 38,080,807 | | | $ | 62,918,761 | |

| | | | | | | | | |

| Proceeds from sales and maturities of investment securities | | $ | 38,177,949 | | | $ | 49,925,399 | |

| | | | | | | | | |

During the year ended July 31, 2021, cost of purchases and proceeds from sales and maturities of long-term U.S. government securities were as follows:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Purchases of investment securities | | $ | — | | | $ | 29,270,835 | |

| | | | | | | | | |

| Proceeds from sales and maturities of investment securities | | $ | — | | | $ | — | |

| | | | | | | | | |

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

NOTES TO FINANCIAL STATEMENTS (Continued) |

| 6. | Shareholder Servicing Plan |

The Funds have adopted a Shareholder Servicing Plan (the “Plan”) which allows each Fund to make payments to financial organizations (including payments directly to the Adviser and the Distributor) for providing account administration and account maintenance services to Fund shareholders. The annual fees paid under the Plan may not exceed an amount equal to 0.25% of each Fund’s average daily net assets. During the year ended July 31, 2021, EBS Income and Appreciation Fund and EBS Income Fund incurred $43,001 and $102,197, respectively, of shareholder servicing fees pursuant to the Plan. No payments were made to the Adviser or the Distributor during the year ended July 31, 2021.

| 7. | Contingencies and Commitments |

The Funds indemnify the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

The Funds are required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statements of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Funds are required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

| EUBEL BRADY & SUTTMAN MUTUAL FUND |

| TRUST REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

To the Shareholders and Board of Trustees of

Eubel Brady & Suttman Mutual Fund Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Eubel Brady & Suttman Mutual Fund Trust, comprising Eubel Brady & Suttman Income and Appreciation Fund and Eubel Brady & Suttman Income Fund (the “Funds”) as of July 31, 2021, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of July 31, 2021, the results of their operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.