EXHIBIT (c)(3)PROJECT DELPHES VALUATION BOOK 09/05/2016

Table of content Sections 1. Considerations on structure p.4 2. Valuation summary p.9 3. Focus on intrinsic valuations p.14 Appendices Additional material on valuation p.24 2 09/05/2016 Project Delphes – Valuation book Confidential

Introduction< Casino Guichard Perrachon (“CGP”), together with certain of its affiliates (GPA, Via Varejo and Cnova), is contemplating a two-step transaction to reorganize its e-commerce activities with the objective of simplifying cross-shareholding structures while unlocking full potential value of its French and Brazilian activitiesSTEP 1:Via Varejo would merge with Nova Brazil in order to create the leading Brazilian omni-channel non-food retailer Cnova would “swap” the shares it holds into Nova Brazil against (i) the shares held by Via Varejo into Cnova and (ii) a cash payment cancellation of cross- shareholdings Cdiscount France will hence refocus on its core market (France) where it is the leader STEP 2:Casino may consider to launch a voluntary cash tender offer on remaining Cnova shares held by free float< This valuation report has been prepared with the purpose of assessing the value of the different counterparties involved in the transaction. Notwithstanding, it does not constitute a fairness opinion as defined by the AMF (Autorité des Marchés Financiers) neither a valuation assessment to be provided to Casino’s Boards of Directors3 09/05/2016 Project Delphes – Valuation book Confidential

Section 1: Considerations on structure 4 09/05/2016 Project Delphes – Valuation book Confidential

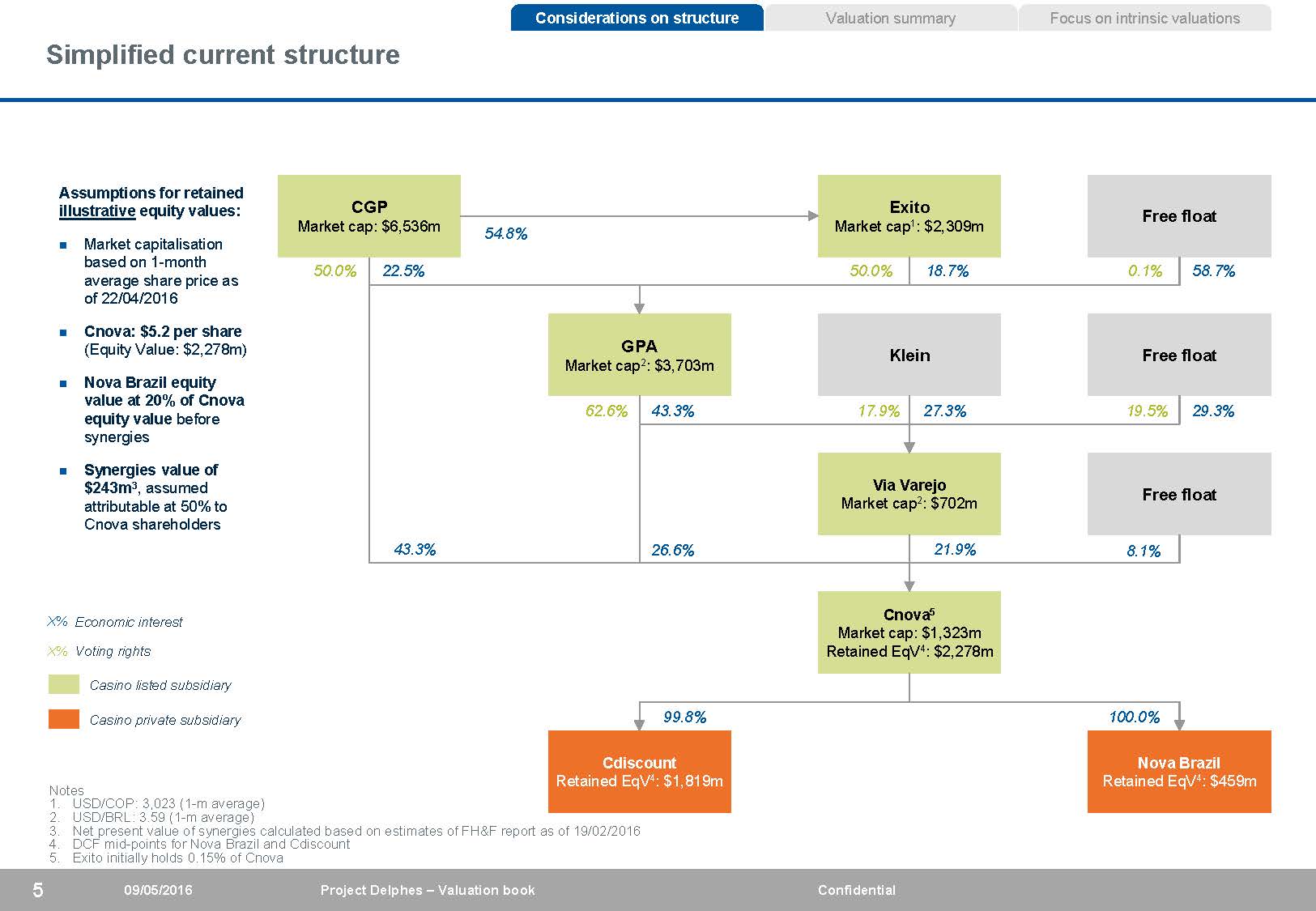

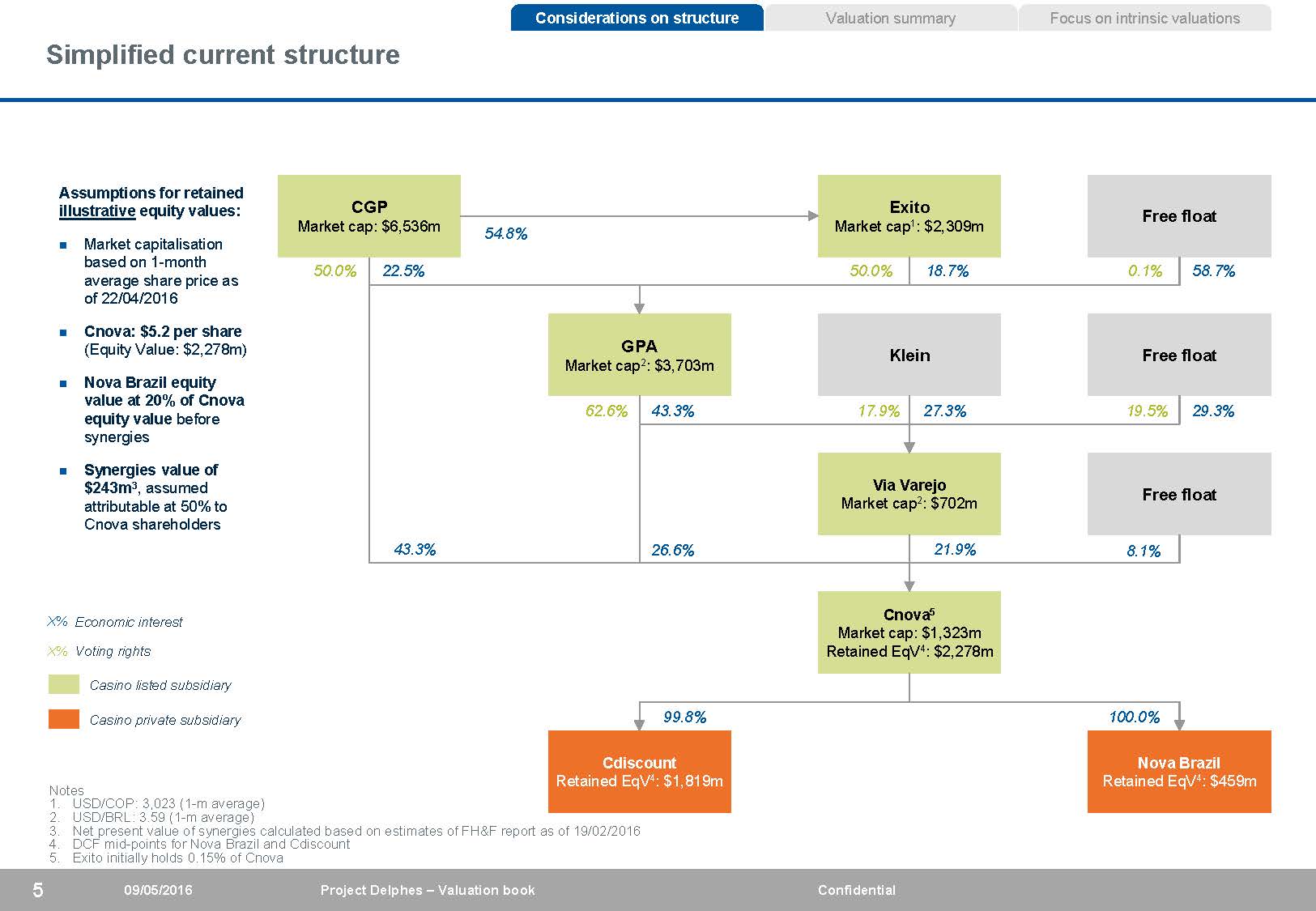

Simplified current structure Considerations on structure Valuation summary Focus on intrinsic valuations Assumptions for retained illustrative equity values:n Market capitalisation CGP Market cap: $6,536m54.8%Exito Market cap1: $2,309m Free float based on 1-month average share price as of 22/04/2016 50.0% 22.5% 50.0% 18.7% 0.1% 58.7%n Cnova: $5.2 per share (Equity Value: $2,278m)n Nova Brazil equity value at 20% of Cnova GPA Market cap2: $3,703m Klein Free float equity value before synergies 62.6% 43.3% 17.9% 27.3% 19.5% 29.3%n Synergies value of $243m3, assumed attributable at 50% to Cnova shareholders Via Varejo Market cap2: $702m Free float 43.3% 26.6% 21.9% 8.1% X% Economic interest X% Voting rightsCasino listed subsidiaryCasino private subsidiary Cnova5 Market cap: $1,323m Retained EqV4: $2,278m 99.8% 100.0% Notes 1. USD/COP: 3,023 (1-m average) 2. USD/BRL: 3.59 (1-m average) Cdiscount Retained EqV4: $1,819m Nova Brazil Retained EqV4: $459m 3. Net present value of synergies calculated based on estimates of FH&F report as of 19/02/2016 4. DCF mid-points for Nova Brazil and Cdiscount 5. Exito initially holds 0.15% of Cnova 5 09/05/2016 Project Delphes – Valuation book Confidential

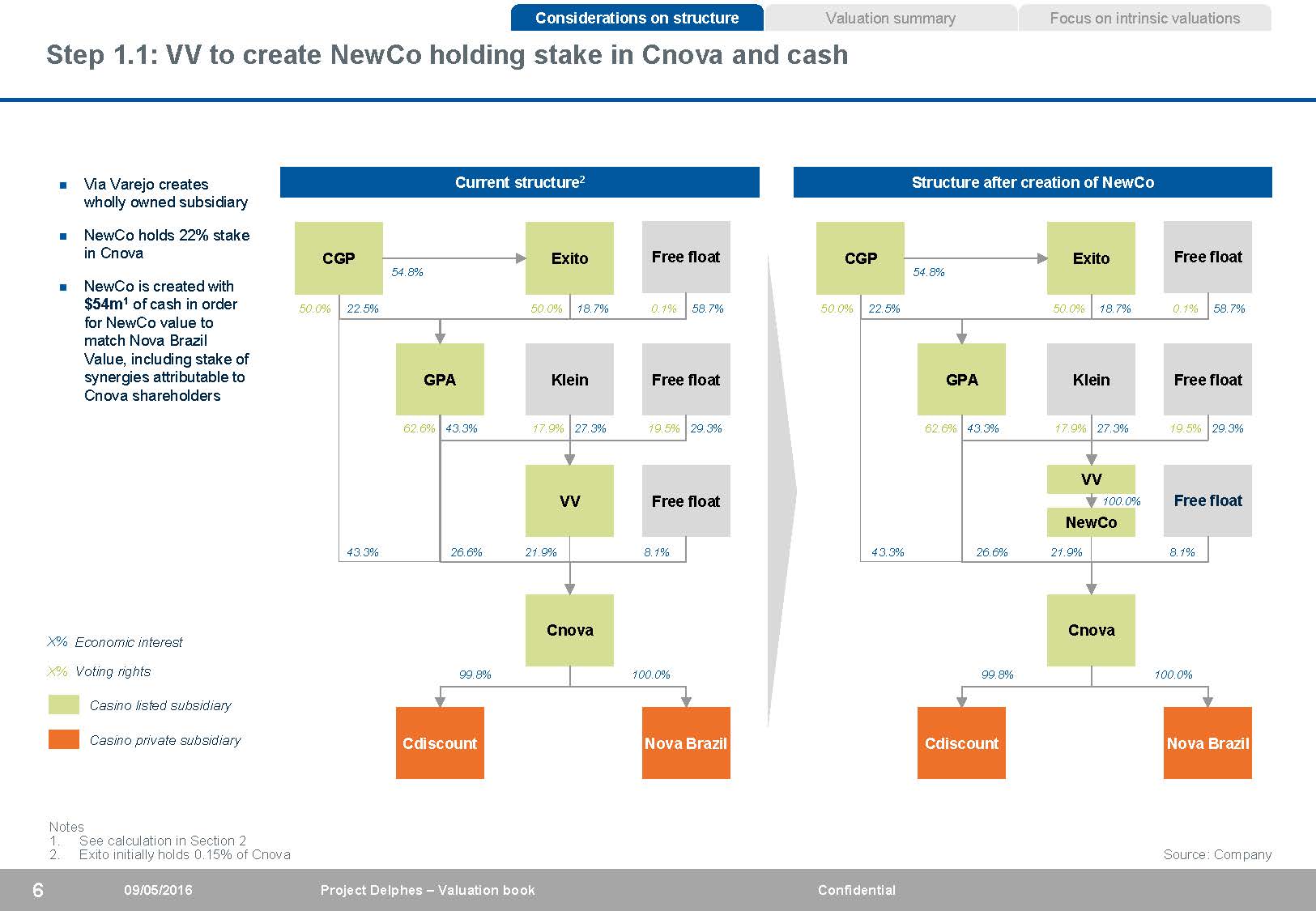

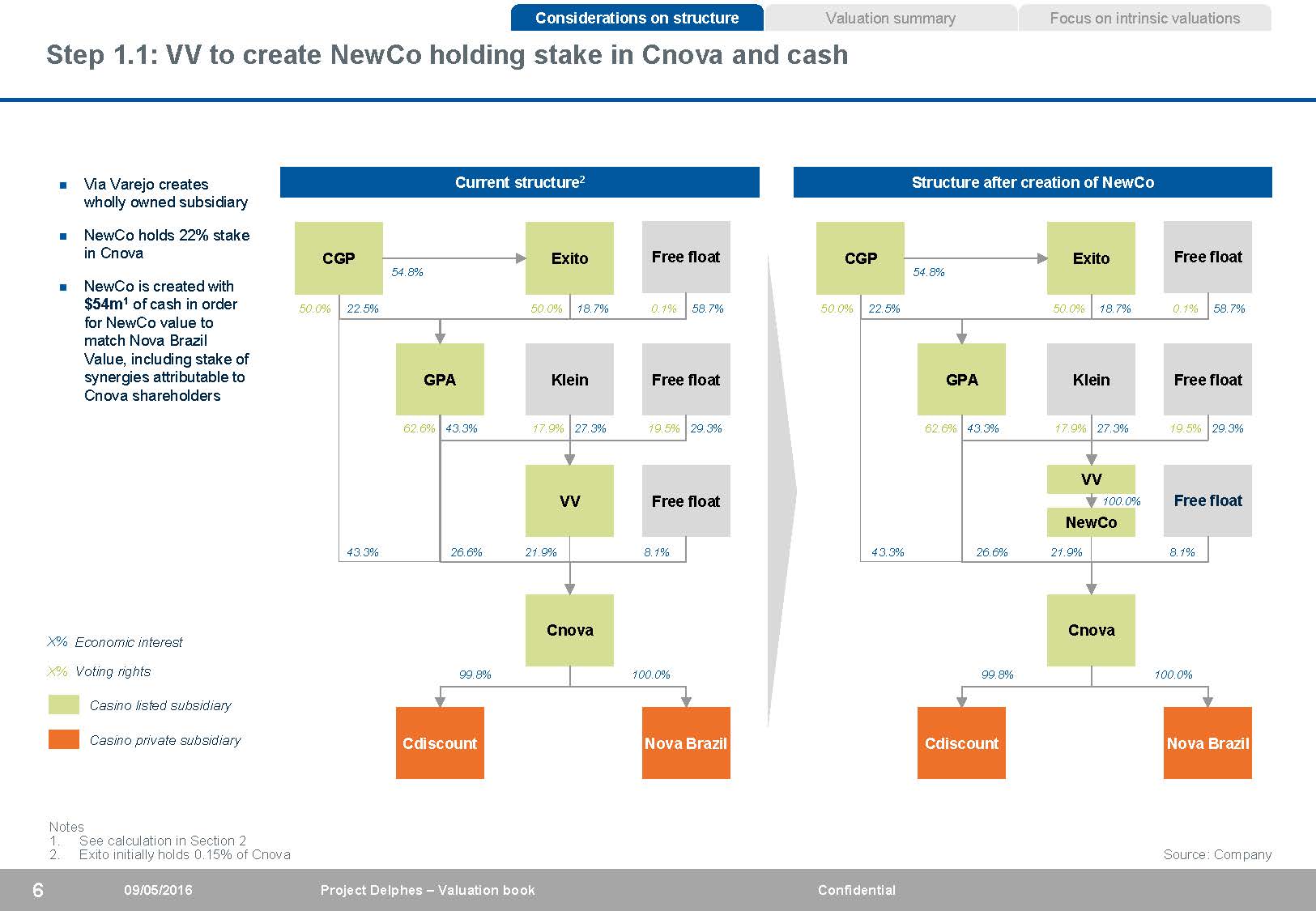

Considerations on structure Valuation summary Focus on intrinsic valuations Step 1.1: VV to create NewCo holding stake in Cnova and cashnVia Varejo creates wholly owned subsidiary Current structure2 Structure after creation of NewCon NewCo holds 22% stake in Cnovan NewCo is created with CGP 54.8% Exito Free float CGP 54.8% Exito Free float $54m1 of cash in order for NewCo value to match Nova Brazil Value, including stake of 50.0% 22.5% 50.0% 18.7% 0.1% 58.7% 50.0% 22.5% 50.0% 18.7% 0.1% 58.7% synergies attributable to Cnova shareholders GPA Klein Free float GPA Klein Free float 62.6% 43.3% 17.9% 27.3% 19.5% 29.3% 62.6% 43.3% 17.9% 27.3% 19.5% 29.3% VV Free float VV 100.0% Free float NewCo X% Economic interest 43.3% 26.6% 21.9% Cnova 8.1% 43.3% 26.6% 21.9% 8.1% Cnova X% Voting rightsCasino listed subsidiaryCasino private subsidiary 99.8% 100.0% Cdiscount Nova Brazil 99.8% 100.0% Cdiscount Nova Brazil Notes 1. See calculation in Section 2 2. Exito initially holds 0.15% of Cnova Source: Company 6 09/05/2016 Project Delphes – Valuation book Confidential

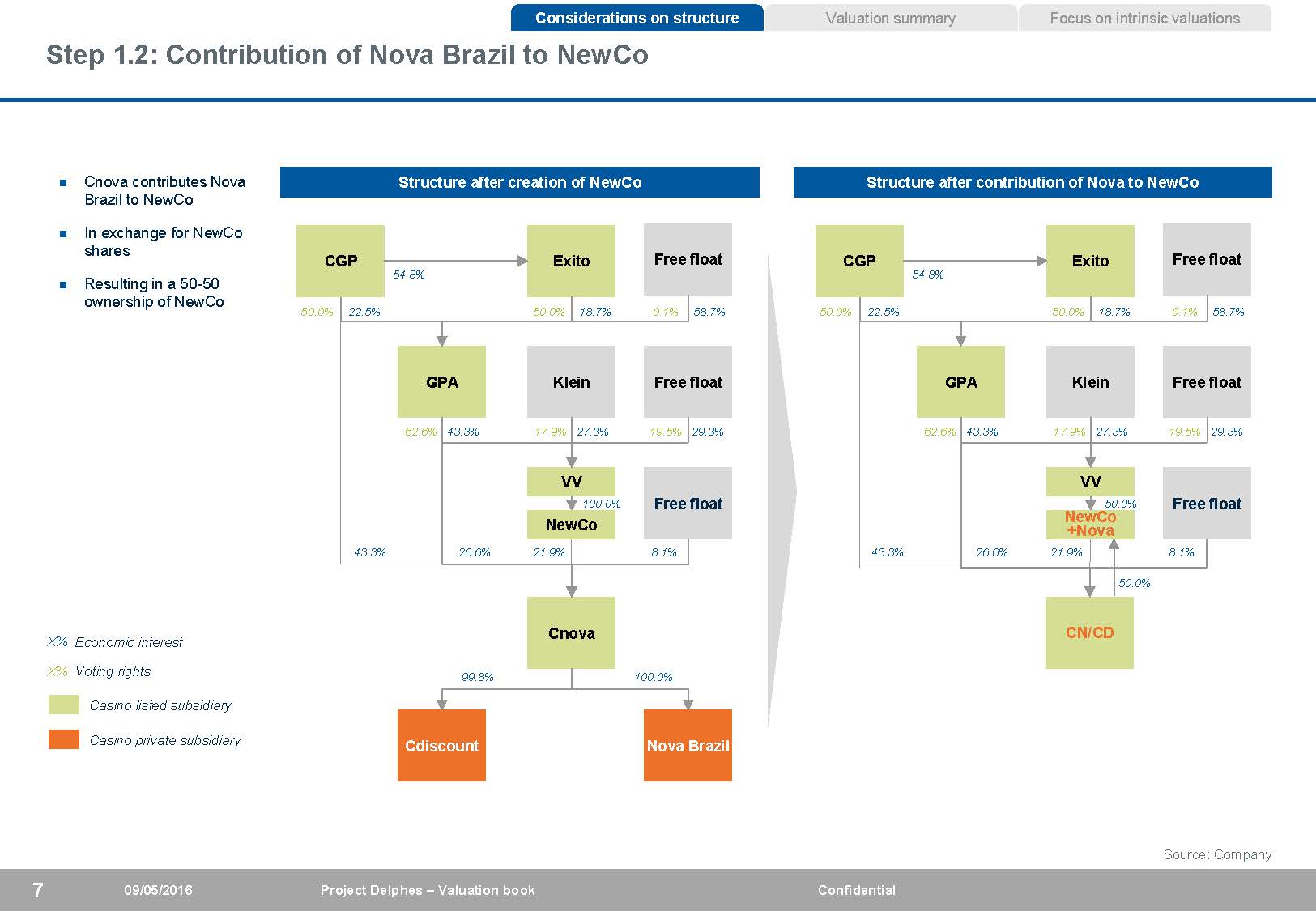

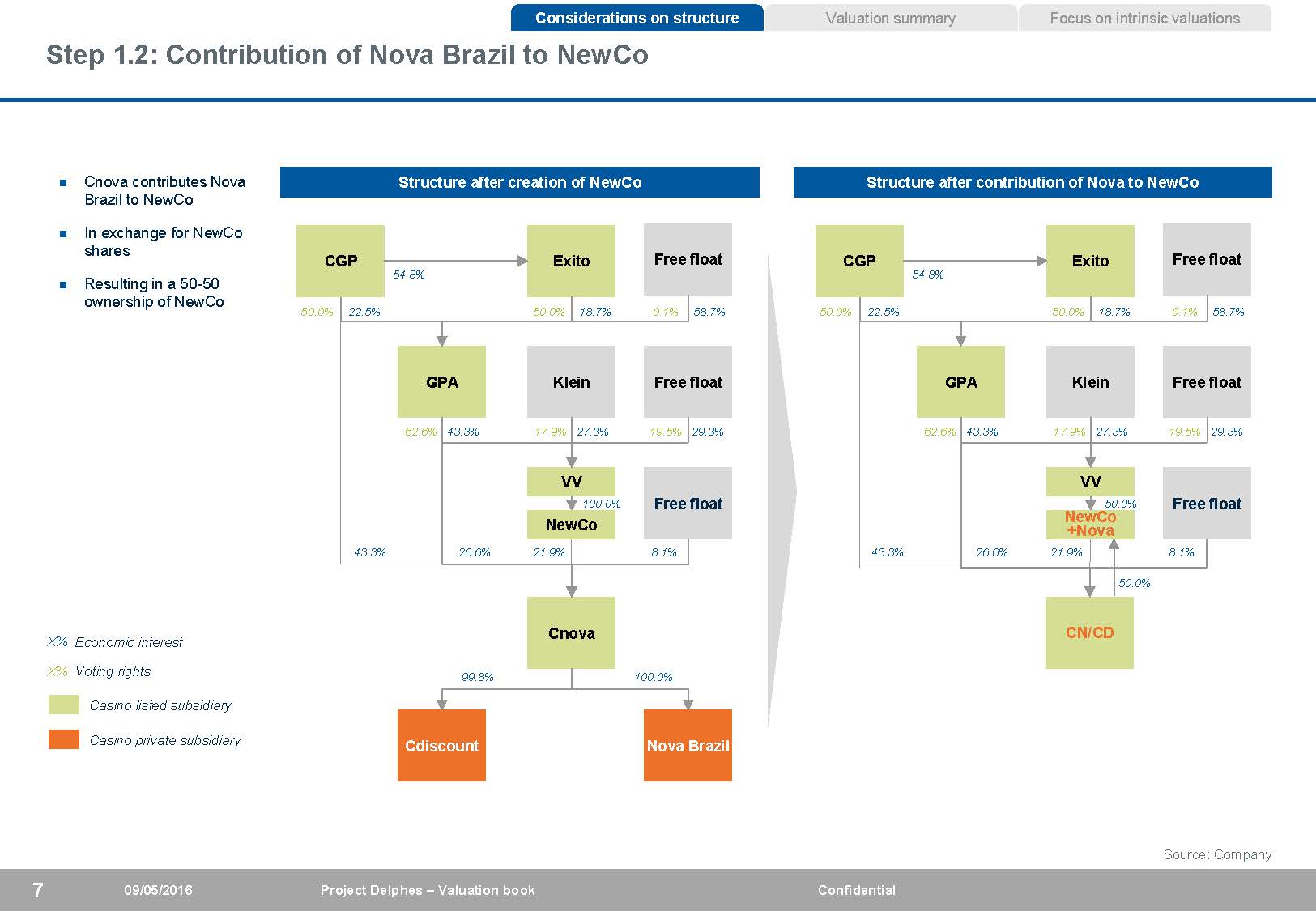

Considerations on structure Step 1.2: Contribution of Nova Brazil to NewCo Valuation summary Focus on intrinsic valuationsnCnova contributes Nova Brazil to NewCo Structure after creation of NewCo Structure after contribution of Nova to NewConIn exchange for NewCo sharesnResulting in a 50-50 ownership of NewCo CGP 54.8% Exito Free float CGP 54.8% Exito Free float 50.0% 22.5% 50.0% 18.7% 0.1% 58.7% 50.0% 22.5% 50.0% 18.7% 0.1% 58.7% GPA Klein Free float GPA Klein Free float 62.6% 43.3% 17.9% 27.3% 19.5% 29.3% 62.6% 43.3% 17.9% 27.3% 19.5% 29.3% VV 100.0% Free float VV 50.0% Free float NewCo NewCo +Nova 43.3% 26.6% 21.9% 8.1% 43.3% 26.6% 21.9% 8.1% 50.0% X% Economic interest X% Voting rightsCasino listed subsidiaryCasino private subsidiary Cnova 99.8% 100.0% Cdiscount Nova Brazil CN/CD 7 09/05/2016 Project Delphes – Valuation book Confidential Source: Company

Considerations on structure Valuation summary Focus on intrinsic valuations Step 1.3: Swap of cross shareholding with cash balancing paymentn CN/CD swaps its 50% stake in NewCo in exchange for NewCo 22% stake in CN/CD Structure after contribution of Nova Brazil to NewCo Structure post swap1 and a cash balancing payment of $54m CGP 54.8% Exito Free float CGP 54.8% Exito Free floatnTreasury shares cancellation at Cnova level 50.0% 22.5% 50.0% 18.7% 0.1% 58.7% 50.0% 22.5% 50.0% 18.7% 0.1% 58.7%nTreasury shares cancellation at NewCo level GPA Klein Free float GPA Klein Free floatnPost operation, VV+N would have a remaining 62.6% 43.3% 17.9% 27.3% 19.5% 29.3% 62.6% 43.3% 17.9% 27.3% 19.5% 29.3% debt of c.$130m towards CN/CD (former VV 50.0% Free float VV + Nova Free float shareholder loan) X% Economic interest X% Voting rightsCasino listed subsidiaryCasino private subsidiary NewCo +Nova 43.3% 26.6% 21.9% 8.1% 50.0% CN/CD 55.4% 34.0% CN/CD 10.3% Source: CompanynFollowing the completion of Step 1, Casino may launch a voluntary cash tender offer on Cnova shares held by minority shareholders Note 1. 0.15% of Cnova initially held by Exito would be 0.19% post shares cancellation 8 09/05/2016 Project Delphes – Valuation book Confidential

Section 2: Valuation summary 9 09/05/2016 Project Delphes – Valuation book Confidential

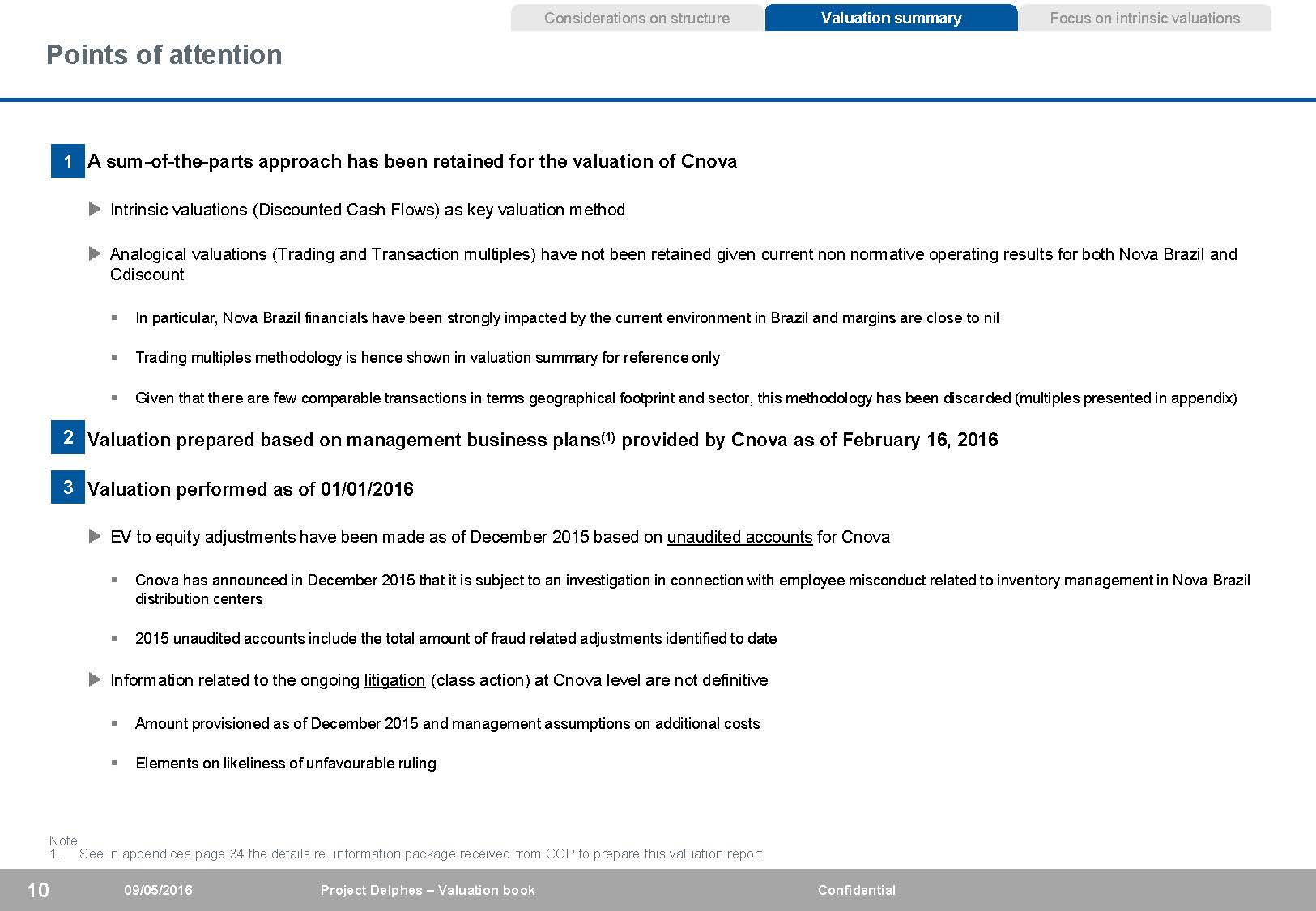

Points of attention Considerations on structure Valuation summary Focus on intrinsic valuations 1 A sum-of-the-parts approach has been retained for the valuation of Cnovau Intrinsic valuations (Discounted Cash Flows) as key valuation methodu Analogical valuations (Trading and Transaction multiples) have not been retained given current non normative operating results for both Nova Brazil andCdiscount§ In particular, Nova Brazil financials have been strongly impacted by the current environment in Brazil and margins are close to nil§ Trading multiples methodology is hence shown in valuation summary for reference only§Given that there are few comparable transactions in terms geographical footprint and sector, this methodology has been discar ded (multiples presented in appendix) 2 Valuation prepared based on management business plans(1) provided by Cnova as of February 16, 2016 3 Valuation performed as of 01/01/2016uEV to equity adjustments have been made as of December 2015 based on unaudited accounts for Cnova§Cnova has announced in December 2015 that it is subject to an investigation in connection with employee misconduct related to inven tory management in Nova Brazil distribution centers§2015 unaudited accounts include the total amount of fraud related adjustments identified to dateuInformation related to the ongoing litigation (class action) at Cnova level are not definitive§Amount provisioned as of December 2015 and management assumptions on additional costs§Elements on likeliness of unfavourable ruling Note 1. See in appendices page 34 the details re. information package received from CGP to prepare this valuation report 10 09/05/2016 Project Delphes – Valuation book Confidential

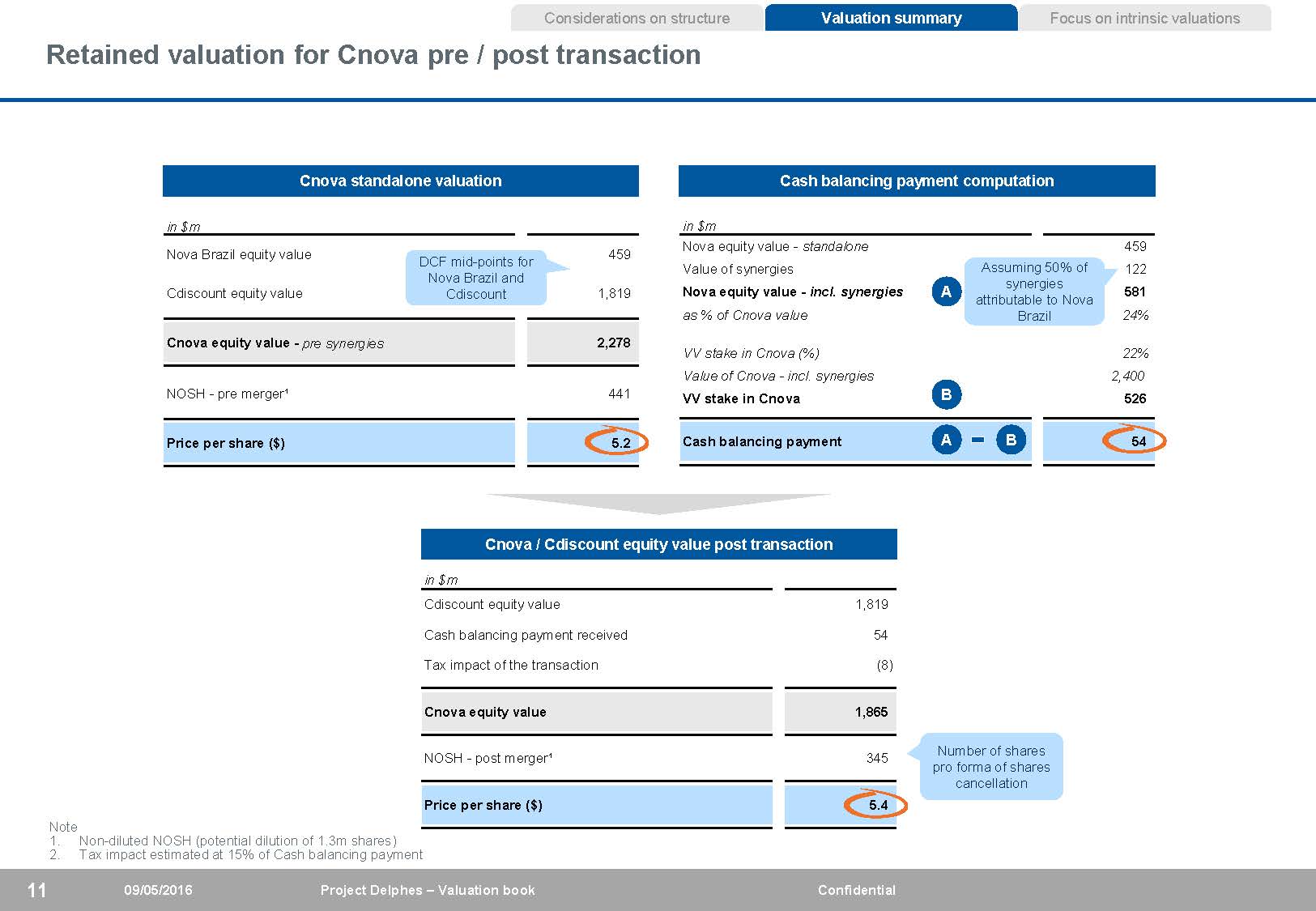

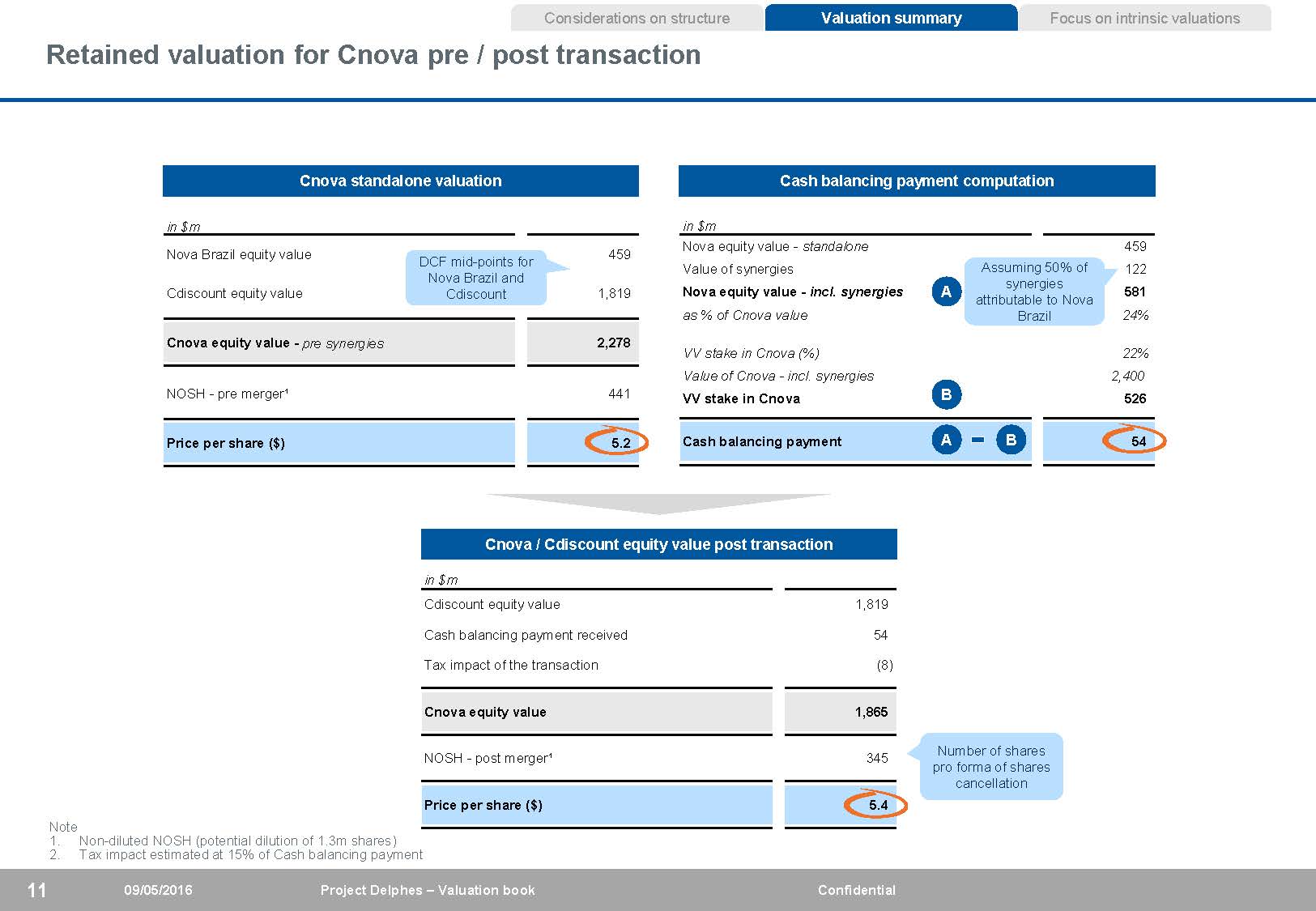

Considerations on structure Retained valuation for Cnova pre / post transaction Valuation summary Focus on intrinsic valuations Cnova standalone valuation Cash balancing payment computation in $m Nova Brazil equity value 459 in $m Nova equity value -standalone459 Cdiscount equity value DCF mid-points for Nova Brazil and Cdiscount 1,819 Value of synergies Nova equity value -incl. synergiesas % of Cnova value Assuming 50% of synergies A attributable to Nova Brazil 122 581 24% Cnova equity value -pre synergies2,278 VV stake in Cnova (%) 22% Value of Cnova - incl. synergies 2,400 NOSH - pre merger¹ 441 Price per share ($) 5.2 VV stake in Cnova B Cash balancing payment A B 526 54 Cnova / Cdiscount equity value post transaction in $m Cdiscount equity value 1,819 Cash balancing payment received 54 Tax impact of the transaction (8) Cnova equity value 1,865 Note 1. Non-diluted NOSH (potential dilution of 1.3m shares) 2. Tax impact estimated at 15% of Cash balancing payment NOSH - post merger¹ 345 Price per share ($) 5.4 Number of shares pro forma of shares cancellation 11 09/05/2016 Project Delphes – Valuation book Confidential

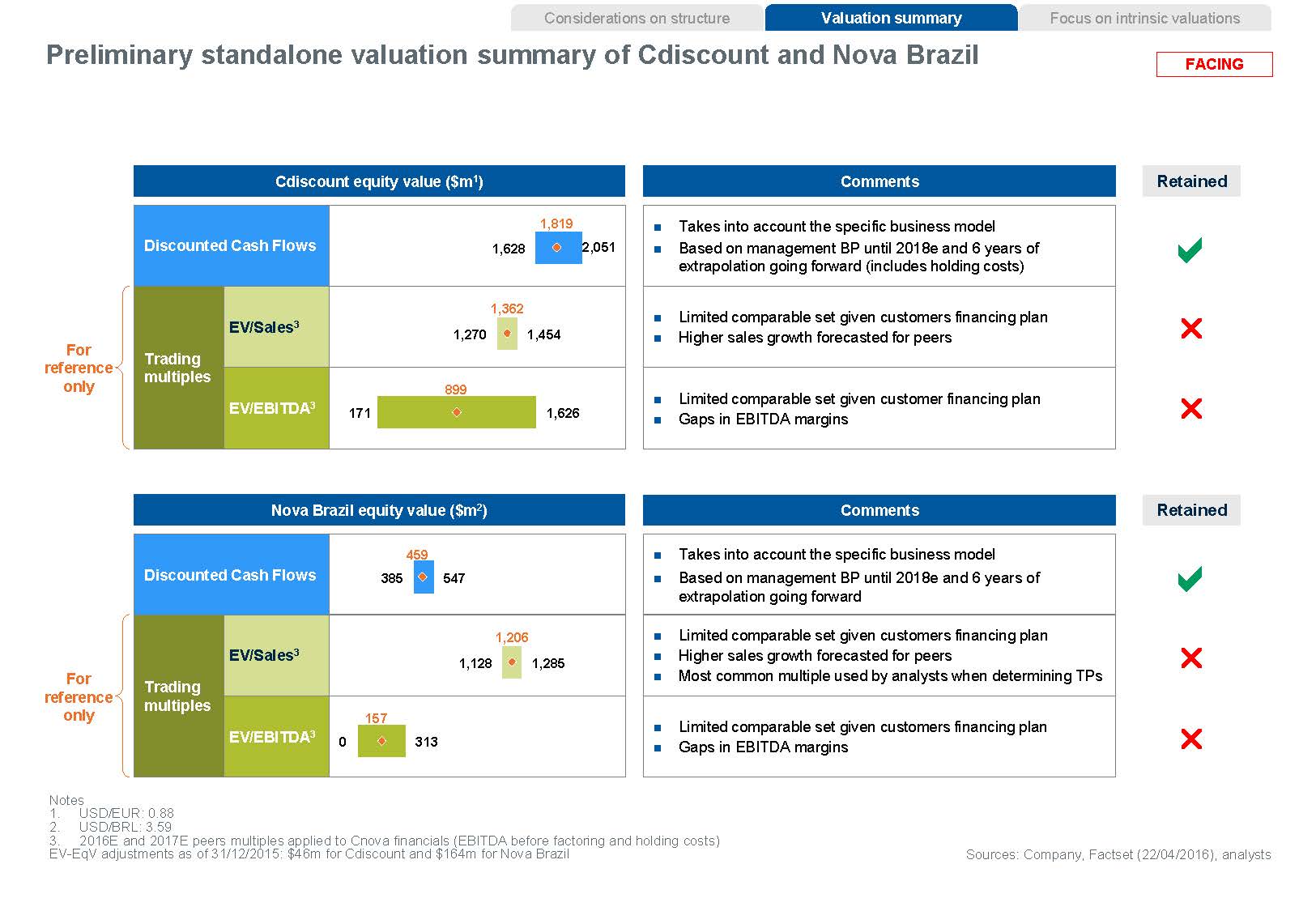

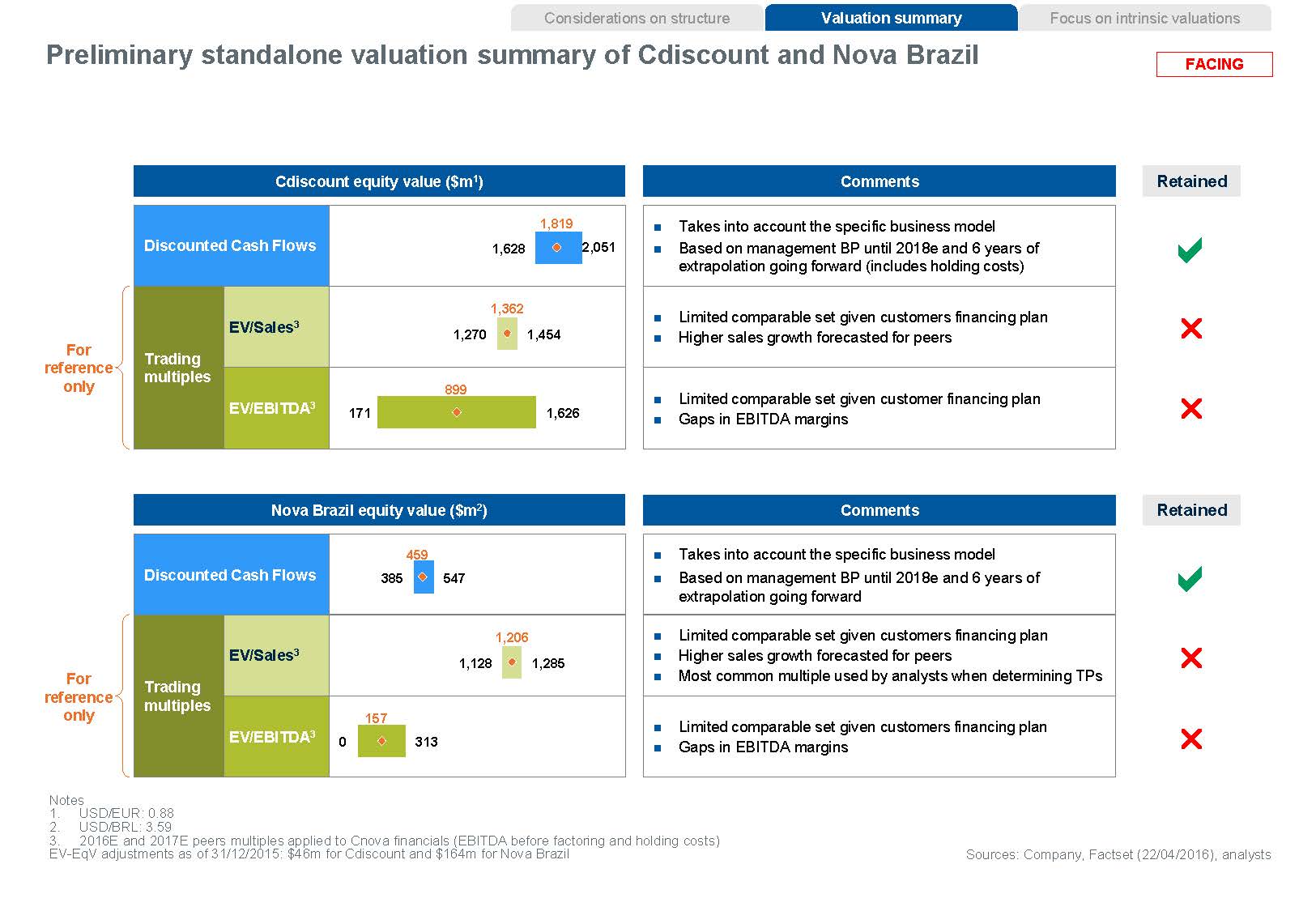

Considerations on structure Valuation summary Focus on intrinsic valuations Preliminary standalone valuation summary of Cdiscount and Nova Brazil FACING Cdiscount equity value ($m1) Comments Retained For reference onlynTakes into account the specific business modelnBased on management BP until 2018e and 6 years of extrapolation going forward (includes holding costs)nLimited comparable set given customers financing plannHigher sales growth forecasted for peersnLimited comparable set given customer financing plannGaps in EBITDA margins Nova Brazil equity value ($m2) Comments Retained For reference onlynTakes into account the specific business modelnBased on management BP until 2018e and 6 years of extrapolation going forwardnLimited comparable set given customers financing plannHigher sales growth forecasted for peers rn Most common multiple used by analysts when determining TPsn Limited comparable set given customers financing plannGaps in EBITDA margins Notes 1. USD/EUR: 0.88 2. USD/BRL: 3.59 3. 2016E and 2017E peers multiples applied to Cnova financials (EBITDA before factoring and holding costs) EV-EqV adjustments as of 31/12/2015: $46m for Cdiscount and $164m for Nova Brazil Sources: Company, Factset (22/04/2016), analysts

Considerations on structure Preliminary standalone valuation summary of Cnova Valuation summary Focus on intrinsic valuations Majority approach methods Minority approach methods Cnova equity value ($m1) Comments Retained as key valuation method aFor reference only Not retained rNotes 1. USD/EUR: 0.88 2. 2016E and 2017E peers multiples applied to Cnova financials (EBITDA before factoring and holding costs) EV-EqV adjustments as of 31/12/2015: $210m for Cnova Sources: Company, Factset (22/04/2016), analysts 13 09/05/2016 Project Delphes – Valuation bookConfidential

Section 3: Focus on intrinsic valuations 14 09/05/2016 Project Delphes – Valuation book Confidential

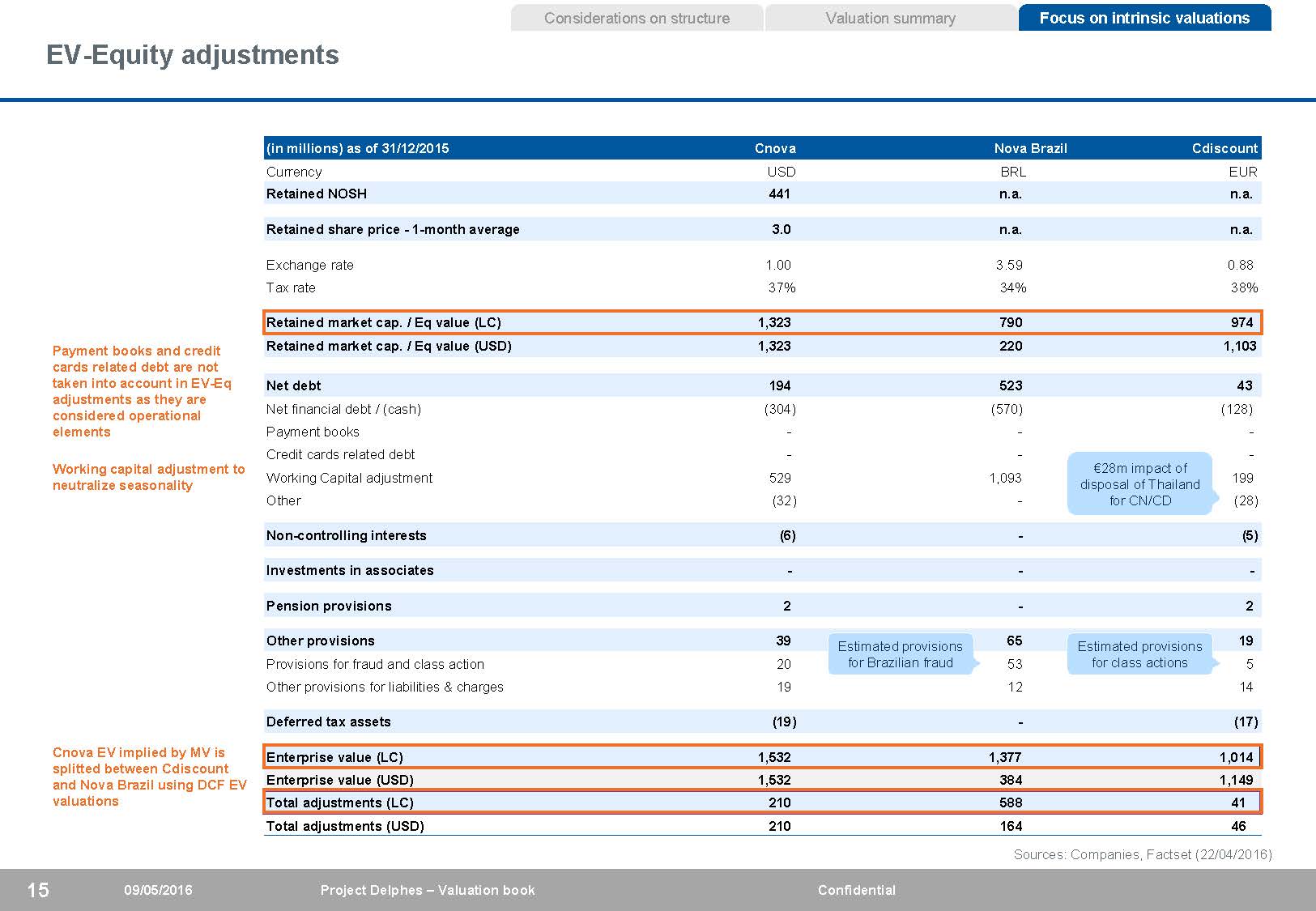

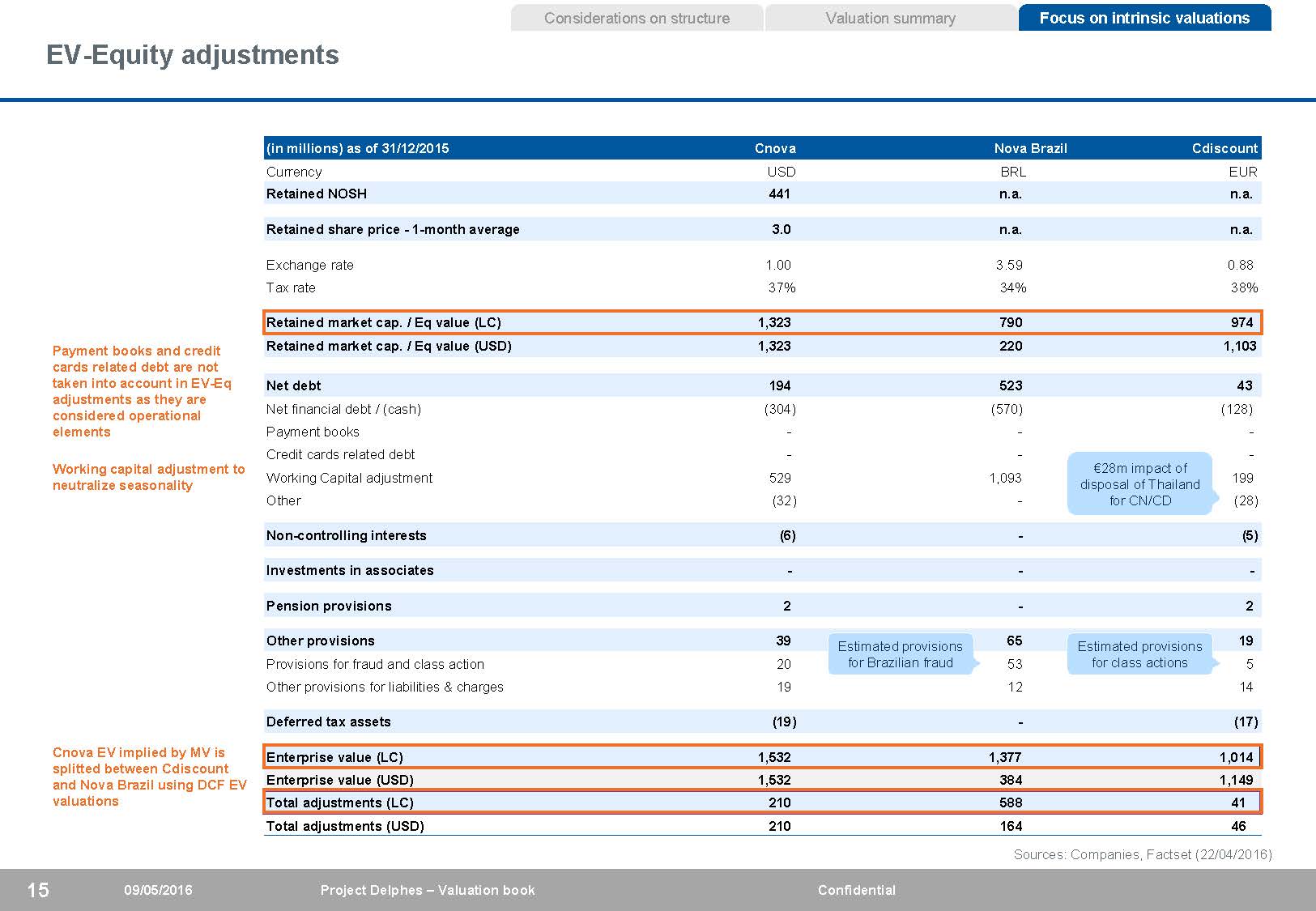

EV-Equity adjustments Considerations on structure Valuation summary Focus on intrinsic valuations (in millions) as of 31/12/2015 Cnova Nova Brazil Cdiscount Currency USD BRL EUR Retained NOSH 441 n.a. n.a. Retained share price - 1-month average 3.0 n.a. n.a. Exchange rate 1.00 3.59 0.88 Tax rate 37% 34% 38% Payment books and credit cards related debt are not taken into account in EV-Eq adjustments as they are considered operational elements Working capital adjustment to Retained market cap. / Eq value (LC) 1,323 790 974 Retained market cap. / Eq value (USD) 1,323 220 1,103 Net debt 194 523 43 Net financial debt / (cash) (304) (570) (128) Payment books - - - Credit cards related debt - - - €28m impact of neutralize seasonality Working Capital adjustment 529 1,093 Other (32) - disposal of Thailand for CN/CD 199 (28) Non-controlling interests (6) - (5) Investments in associates - - - Pension provisions 2 - 2 Other provisions 39 Provisions for fraud and class action 20 Estimated provisions 65 for Brazilian fraud 53 Estimated provisions 19 for class actions 5 Other provisions for liabilities & charges 19 12 14 Cnova EV implied by MV is splitted between Cdiscount and Nova Brazil using DCF EV valuations Deferred tax assets (19) - (17) Enterprise value (LC) 1,532 1,377 1,014 Enterprise value (USD) 1,532 384 1,149 Total adjustments (LC) 210 588 41 Total adjustments (USD) 210 164 46 15 09/05/2016 Project Delphes – Valuation book Confidential Sources: Companies, Factset (22/04/2016)

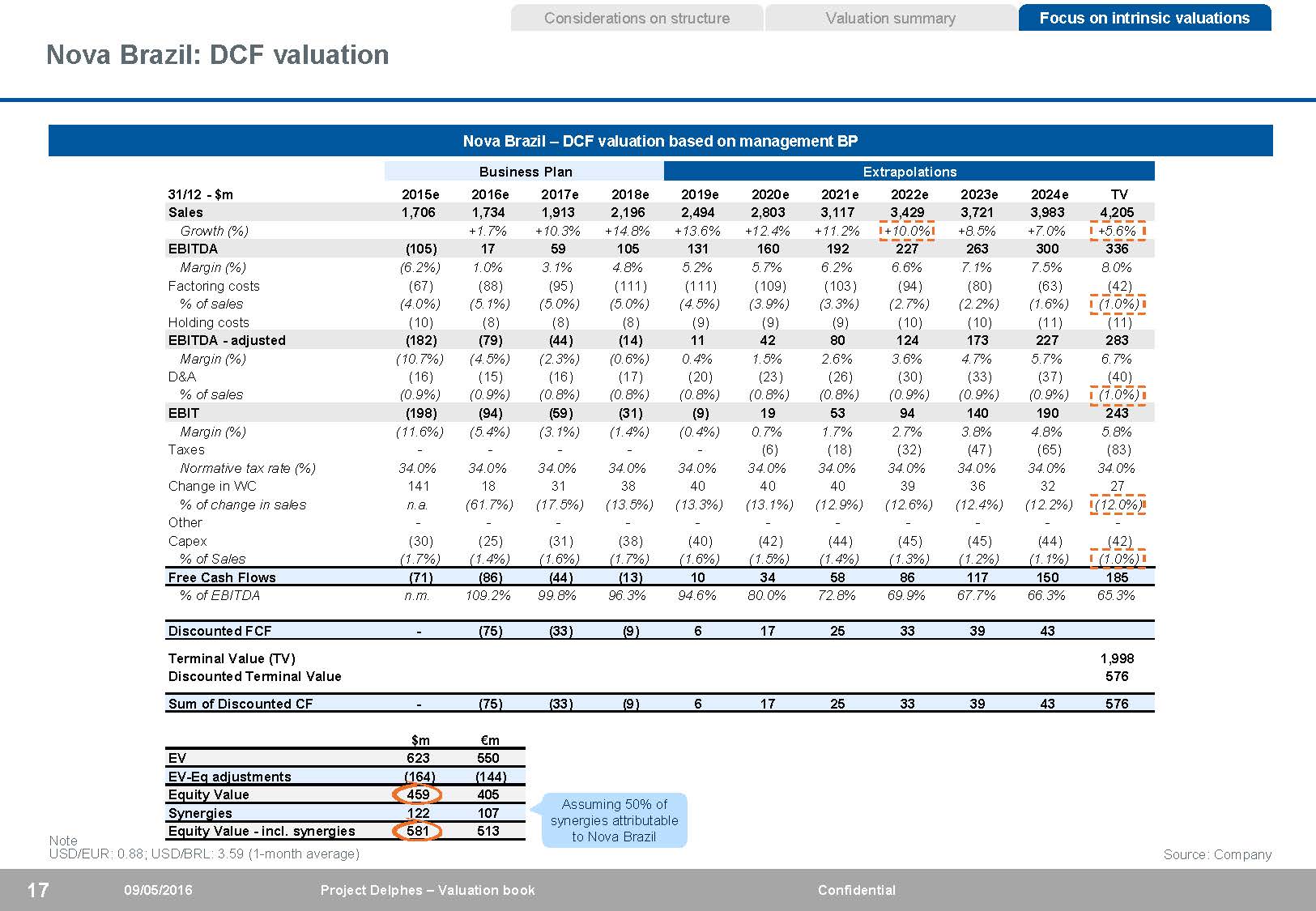

Considerations on structure DCF valuation – assumptions / sensitivity analysis Valuation summary Focus on intrinsic valuations FACING Assumptions Equity Value ($m)n Valuation as of 01/01/2016nEnd-year convention given that most cash flow are generated in H2n 2015e-2018e forecasts based on management BPnHolding costs as per management guidance and affected at sales split between Nova Brazil and Cdiscount + InternationalnExtrapolations beyond 2018enWACC1: 14.8%nTerminal value assumptions • PGR2: 5.6% (Brazil LT inflation rate + 1.0%) • Normative operational EBITDA margin3: 8.0% • Normative factoring cost4 / sales: (1.0%) • D&A at 95% of Capex in terminal year • Normative change in WC as change in sales: (12.0%) • Normative Capex / sales: (1.0%) • Tax rate: 34.0% PGR WACC 13.8% 14.3% 14.8% 15.3% 15.8% 5.1% 536 473 417 367 322 5.3% 563 496 437 385 338 5.6% 591 521 459 404 355 5.8% 621 547 482 424 373 6.1% 654 575 506 446 392 Notes 1. WACC calculation details on Page 18 2. PGR in line with peer benchmark (B2W), details on Page 30 3. TY EBITDA margin at 8.0%, higher than E-commerce peers average level to factor in the increasing weight of Market places activity benefiting from higher margins 4. Factoring activity is part of Cnova business itself and the cost of discounting receivables needs to be taken into account to measure genuine profitability. Thus , factoring costs which are taken into account in net financial expenses in Cnova financial statements have been taken into account at EBITDA level in the DCF analysis

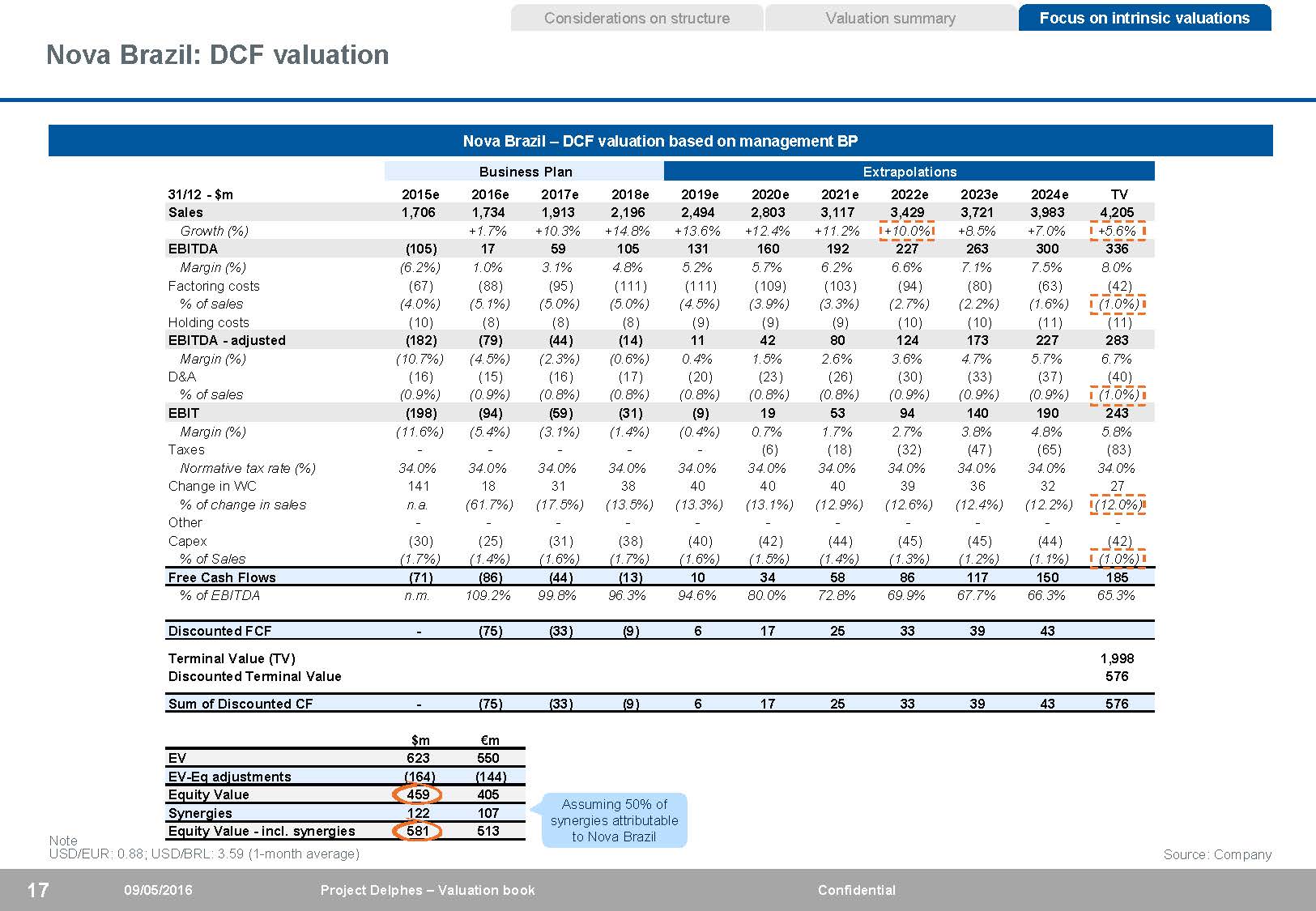

Nova Brazil: DCF valuation Considerations on structure Valuation summary Focus on intrinsic valuations Nova Brazil – DCF valuation based on management BP 31/12 - $m Business Plan Extrapolations Sales 1,706 1,734 1,913 2,196 2,494 2,803 3,117 3,429 3,721 3,983 4,205 Growth (%) +1.7% +10.3% +14.8% +13.6% +12.4% +11.2%+10.0% +8.5% +7.0%+5.6%EBITDA (105) 17 59 105 131 160 192 227 263 300 336Margin (%) (6.2%) 1.0% 3.1% 4.8% 5.2% 5.7% 6.2% 6.6% 7.1% 7.5% 8.0% Factoring costs (67) (88) (95) (111) (111) (109) (103) (94) (80) (63) (42) % of sales (4.0%) (5.1%) (5.0%) (5.0%) (4.5%) (3.9%) (3.3%) (2.7%) (2.2%) (1.6%) (1.0%) Holding costs (10) (8) (8) (8) (9) (9) (9) (10) (10) (11) (11) EBITDA - adjusted (182) (79) (44) (14) 11 42 80 124 173 227 283 Margin (%) (10.7%) (4.5%) (2.3%) (0.6%) 0.4% 1.5% 2.6% 3.6% 4.7% 5.7% 6.7% D&A (16) (15) (16) (17) (20) (23) (26) (30) (33) (37) (40) % of sales (0.9%) (0.9%) (0.8%) (0.8%) (0.8%) (0.8%) (0.8%) (0.9%) (0.9%) (0.9%) (1.0%) EBIT (198) (94) (59) (31) (9) 19 53 94 140 190 243 Margin (%) (11.6%) (5.4%) (3.1%) (1.4%) (0.4%) 0.7% 1.7% 2.7% 3.8% 4.8% 5.8% Taxes - - - - - (6) (18) (32) (47) (65) (83) Normative tax rate (%) 34.0% 34.0% 34.0% 34.0% 34.0% 34.0% 34.0% 34.0% 34.0% 34.0% 34.0% Change in WC 141 18 31 38 40 40 40 39 36 32 27 % of change in sales n.a. (61.7%) (17.5%) (13.5%) (13.3%) (13.1%) (12.9%) (12.6%) (12.4%) (12.2%) (12.0%) Other - - - - - - - - - - - Capex (30) (25) (31) (38) (40) (42) (44) (45) (45) (44) (42) % of Sales (1.7%) (1.4%) (1.6%) (1.7%) (1.6%) (1.5%) (1.4%) (1.3%) (1.2%) (1.1%) (1.0%) Free Cash Flows (71) (86) (44) (13) 10 34 58 86 117 150 185 % of EBITDA n.m. 109.2% 99.8% 96.3% 94.6% 80.0% 72.8% 69.9% 67.7% 66.3% 65.3% Discounted FCF - (75) (33) (9) 6 17 25 33 39 43 Terminal Value (TV) 1,998 Discounted Terminal Value 576 Sum of Discounted CF - (75) (33) (9) 6 17 25 33 39 43 576 Note $m €m EV 623 550 EV-Eq adjustments (164) (144) Equity Value 459 405 Synergies 122 107 Equity Value - incl. synergies 581 513 Assuming 50% of synergies attributable to Nova Brazil USD/EUR: 0.88; USD/BRL: 3.59 (1-month average) Source: Company 17 09/05/2016 Project Delphes – Valuation book Confidential

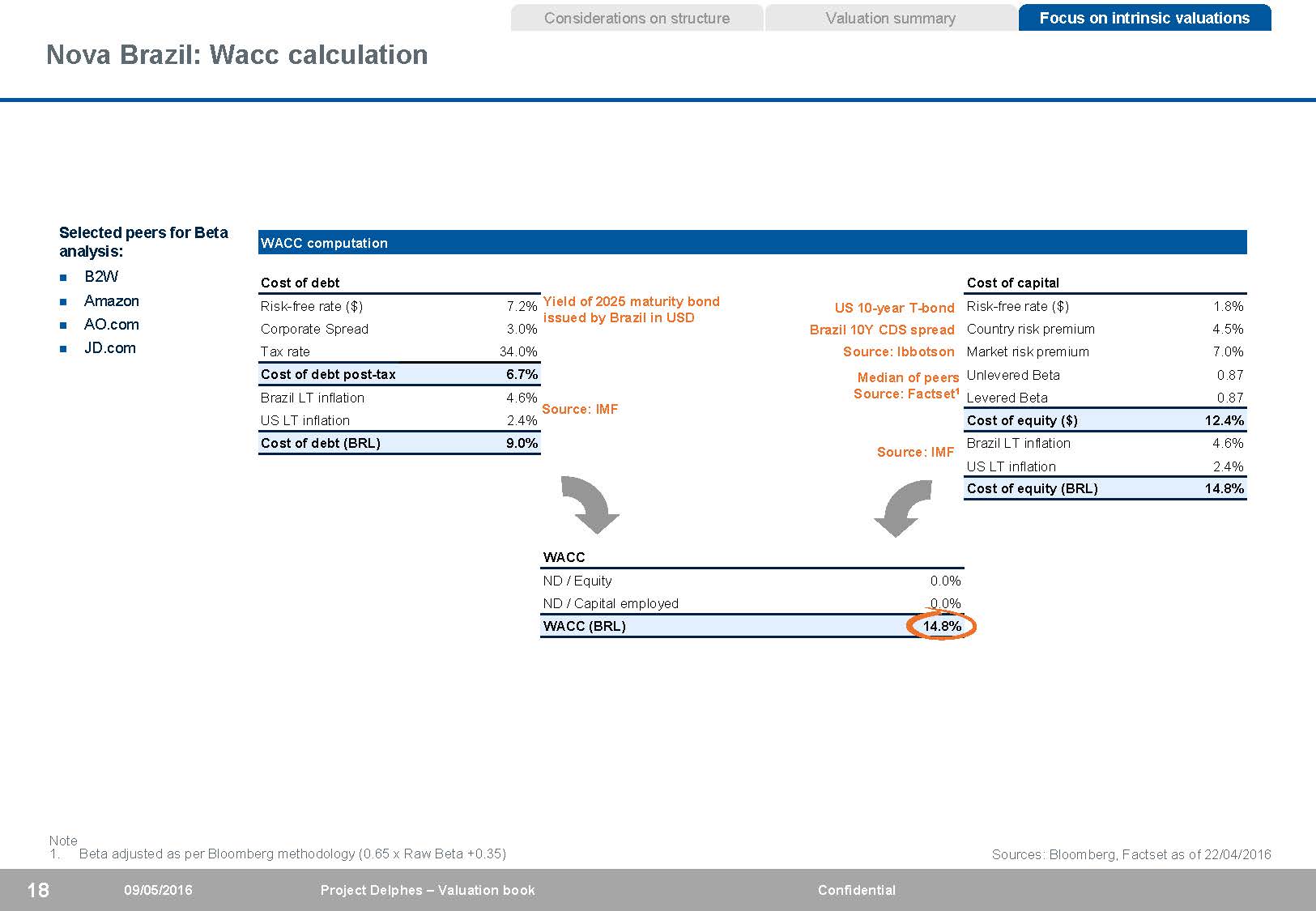

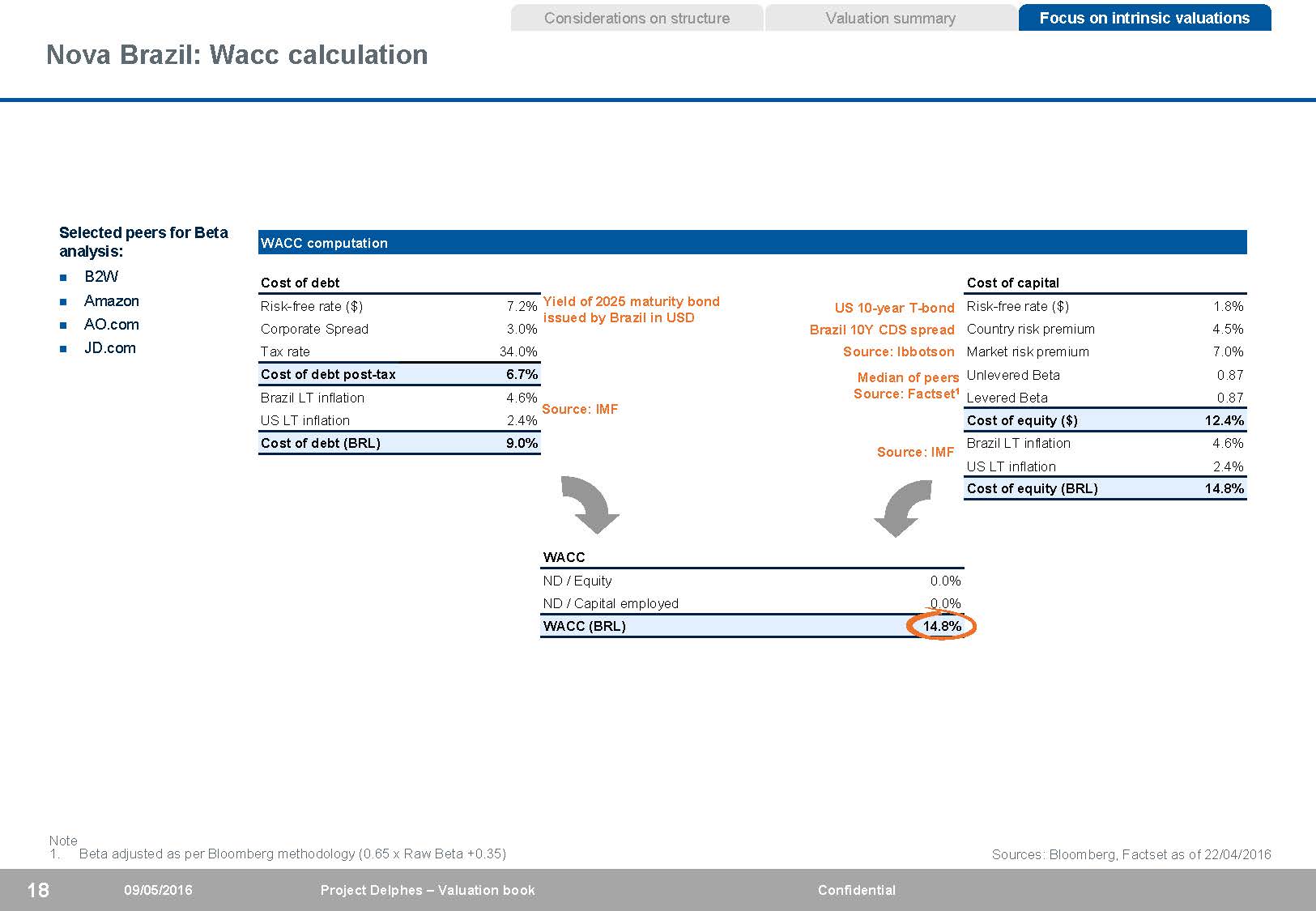

Nova Brazil: Wacc calculation Considerations on structure Valuation summary Focus on intrinsic valuations Selected peers for Beta analysis:n B2W WACC computation Cost of debt Cost of capitaln Amazonn AO.comn JD.com Risk-free rate ($) 7.2% Yield of 2025 maturity bond issued by Brazil in USD Corporate Spread 3.0% Tax rate 34.0% US 10-year T-bond Brazil 10Y CDS spread Source: Ibbotson Risk-free rate ($) 1.8% Country risk premium 4.5% Market risk premium 7.0% Cost of debt post-tax 6.7% Brazil LT inflation 4.6% Source: IMF Median of peers Unlevered Beta 0.87 Source: Factset1 Levered Beta 0.87 US LT inflation 2.4% Cost of equity ($) 12.4% Cost of debt (BRL) 9.0% Source: IMF Brazil LT inflation 4.6% US LT inflation 2.4% Cost of equity (BRL) 14.8% WACC ND / Equity 0.0% ND / Capital employed 0.0% WACC (BRL) 14.8% Note 1. Beta adjusted as per Bloomberg methodology (0.65 x Raw Beta +0.35) Sources: Bloomberg, Factset as of 22/04/2016 18 09/05/2016 Project Delphes – Valuation book Confidential

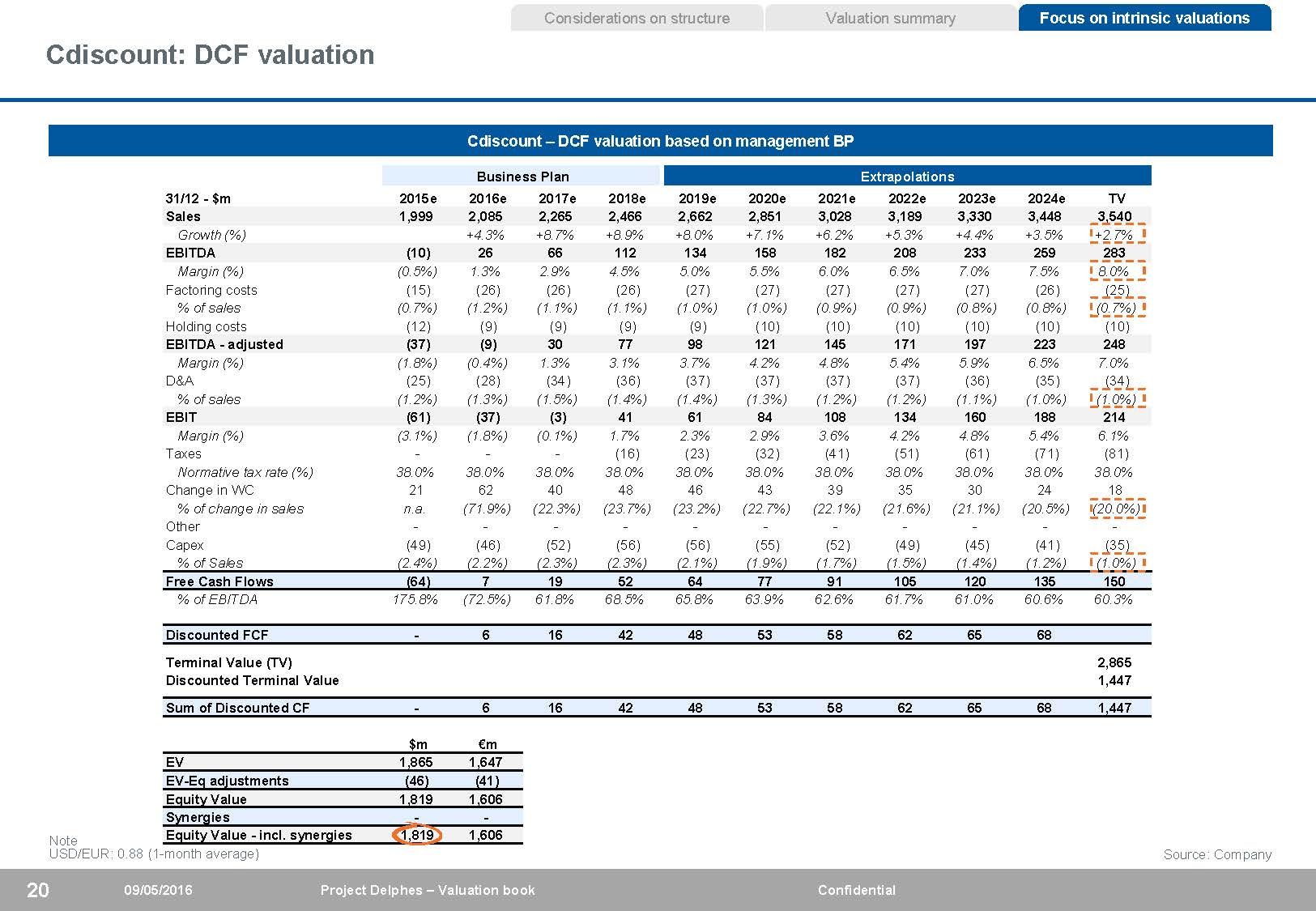

Considerations on structure DCF valuation – assumptions / sensitivity analysis Valuation summary Focus on intrinsic valuations FACING Assumptions Equity Value ($m)n Valuation as of 01/01/2016nEnd-year convention given that most cash flow are generated in H2n 2015e-2018e forecasts based on management BP for France WACC 7.4% 7.6% 7.9% 8.1% 8.4% 2.2% 1,821 1,721 1,629 1,546 1,469 and international operationsnHolding costs as per management guidance and affected at sales split between Nova Brazil and Cdiscount + InternationalnExtrapolations beyond 2018e PGR 2.4% 1,931 2.7% 2,053 2.9% 2,188 1,545 1,627 1,717n WACC1: 7.9%nTerminal value assumptions • PGR2: 2.7% (France LT inflation rate + 1.0%) • Normative operational EBITDA margin3: 8.0% • Normative factoring cost4 / sales: (0.7%) • D&A at 95% of Capex in terminal year • Normative change in WC as change in sales: (20.0%) • Normative Capex / sales: (1.0%) • Tax rate: 38.0% 3.2% 2,339 2,186 2,049 1,926 1,816 Notes 1. WACC calculation details on Page 21 2. PGR slightly higher than peer benchmark (Delticom), details on Page 30 3. TY EBITDA margin at 8.0%, higher than E-commerce peers average level to factor in the increasing weight of Market places activity benefiting from higher margins 4. Factoring activity is part of Cnova business itself and the cost of discounting receivables needs to be taken into account to measure genuine profitability. Thus , factoring costs which are taken into account in net financial expenses in Cnova financial statements have been taken into account at EBITDA level in the DCF analysis

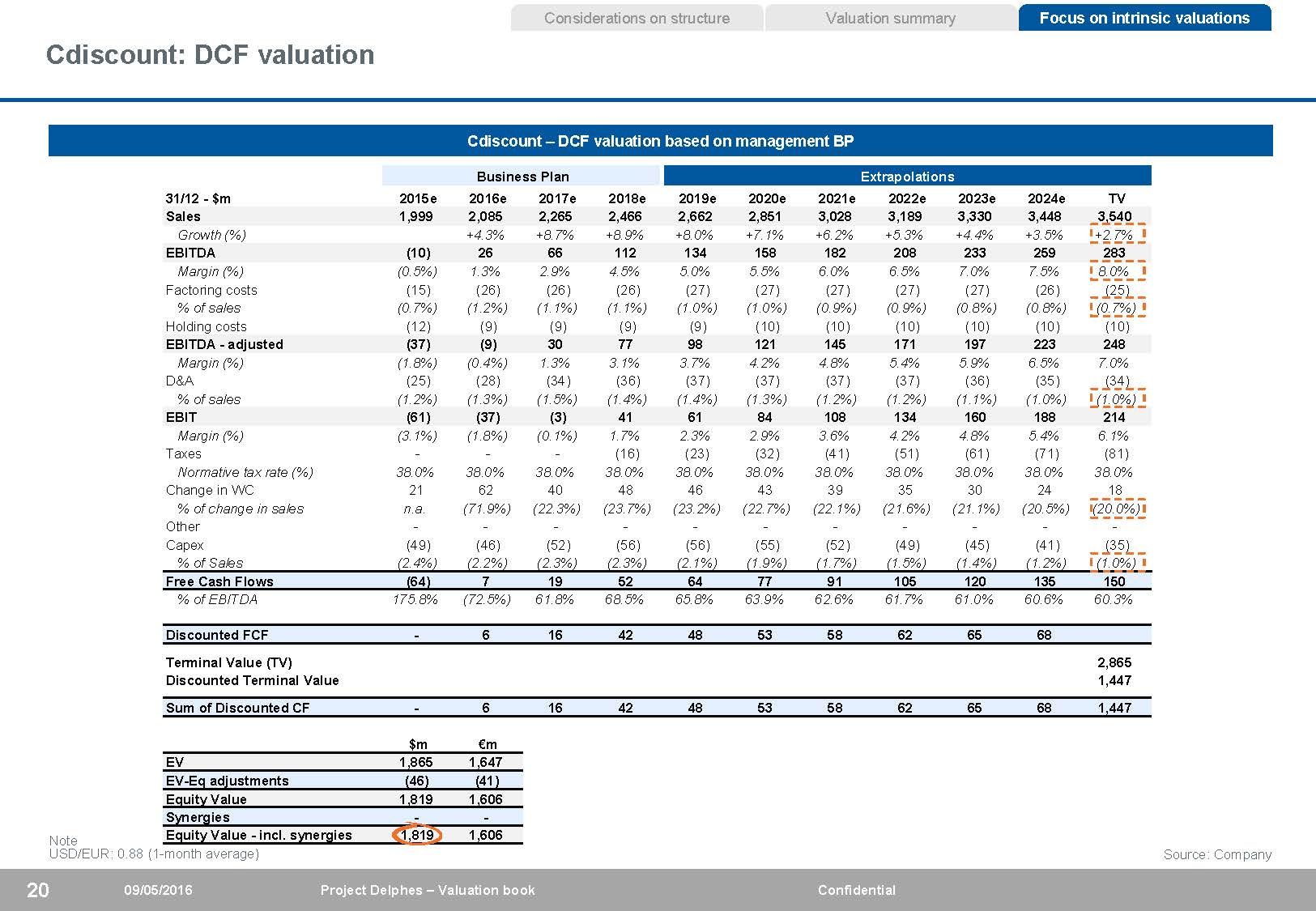

Cdiscount: DCF valuation Considerations on structure Valuation summary Focus on intrinsic valuations Cdiscount – DCF valuation based on management BP 31/12 - $m Business Plan Extrapolations Margin (%) (0.5%) 1.3% 2.9% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% Factoring costs (15) (26) (26) (26) (27) (27) (27) (27) (27) (26) (25) % of sales (0.7%) (1.2%) (1.1%) (1.1%) (1.0%) (1.0%) (0.9%) (0.9%) (0.8%) (0.8%) (0.7%) Holding costs (12) (9) (9) (9) (9) (10) (10) (10) (10) (10) (10) EBITDA - adjusted (37) (9) 30 77 98 121 145 171 197 223 248 Margin (%) (1.8%) (0.4%) 1.3% 3.1% 3.7% 4.2% 4.8% 5.4% 5.9% 6.5% 7.0% D&A (25) (28) (34) (36) (37) (37) (37) (37) (36) (35) (34) % of sales (1.2%) (1.3%) (1.5%) (1.4%) (1.4%) (1.3%) (1.2%) (1.2%) (1.1%) (1.0%) (1.0%) EBIT (61) (37) (3) 41 61 84 108 134 160 188 214 Margin (%) (3.1%) (1.8%) (0.1%) 1.7% 2.3% 2.9% 3.6% 4.2% 4.8% 5.4% 6.1% Taxes - - - (16) (23) (32) (41) (51) (61) (71) (81) Normative tax rate (%) 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% Change in WC 21 62 40 48 46 43 39 35 30 24 18 % of change in sales n.a. (71.9%) (22.3%) (23.7%) (23.2%) (22.7%) (22.1%) (21.6%) (21.1%) (20.5%) (20.0%) Other - - - - - - - - - - - Capex (49) (46) (52) (56) (56) (55) (52) (49) (45) (41) (35) % of Sales (2.4%) (2.2%) (2.3%) (2.3%) (2.1%) (1.9%) (1.7%) (1.5%) (1.4%) (1.2%) (1.0%) Free Cash Flows (64) 7 19 52 64 77 91 105 120 135 150 % of EBITDA 175.8% (72.5%) 61.8% 68.5% 65.8% 63.9% 62.6% 61.7% 61.0% 60.6% 60.3% Discounted FCF - 6 16 42 48 53 58 62 65 68 Terminal Value (TV) 2,865 Discounted Terminal Value 1,447 Sum of Discounted CF - 6 16 42 48 53 58 62 65 68 1,447 Note $m €m EV 1,865 1,647 EV-Eq adjustments (46) (41) Equity Value 1,819 1,606 Synergies - - Equity Value - incl. synergies 1,819 1,606 USD/EUR: 0.88 (1-month average) Source: Company 20 09/05/2016 Project Delphes – Valuation book Confidential

Cdiscount: Wacc calculation Considerations on structure Valuation summary Focus on intrinsic valuations Selected peers for Beta analysis:n Delticom WACC computation Cost of debt Cost of capitaln Amazonn AO.comn JD.com Risk-free rate 0.5% Corporate Spread 3.0% Tax rate 38.0% Cost of debt post-tax 2.2% French risk-free rate US 10-year T-bond Risk-free rate ($) 1.8% France 10Y CDS spread Country risk premium 0.7% Source: Ibbotson Market risk premium 7.0% Median of peers Unlevered Beta 0.88 Source: Factset1 Levered Beta 0.88 Cost of equity ($) 8.6% Source: IMF France LT inflation 1.7% US LT inflation 2.4% Cost of equity (EUR) 7.9% WACC ND / Equity 0.0% ND / Capital employed 0.0% WACC (EUR) 7.9% Note 1. Beta adjusted as per Bloomberg methodology (0.65 x Raw Beta +0.35) Sources: Bloomberg, Factset as of 22/04/2016 21 09/05/2016 Project Delphes – Valuation book Confidential

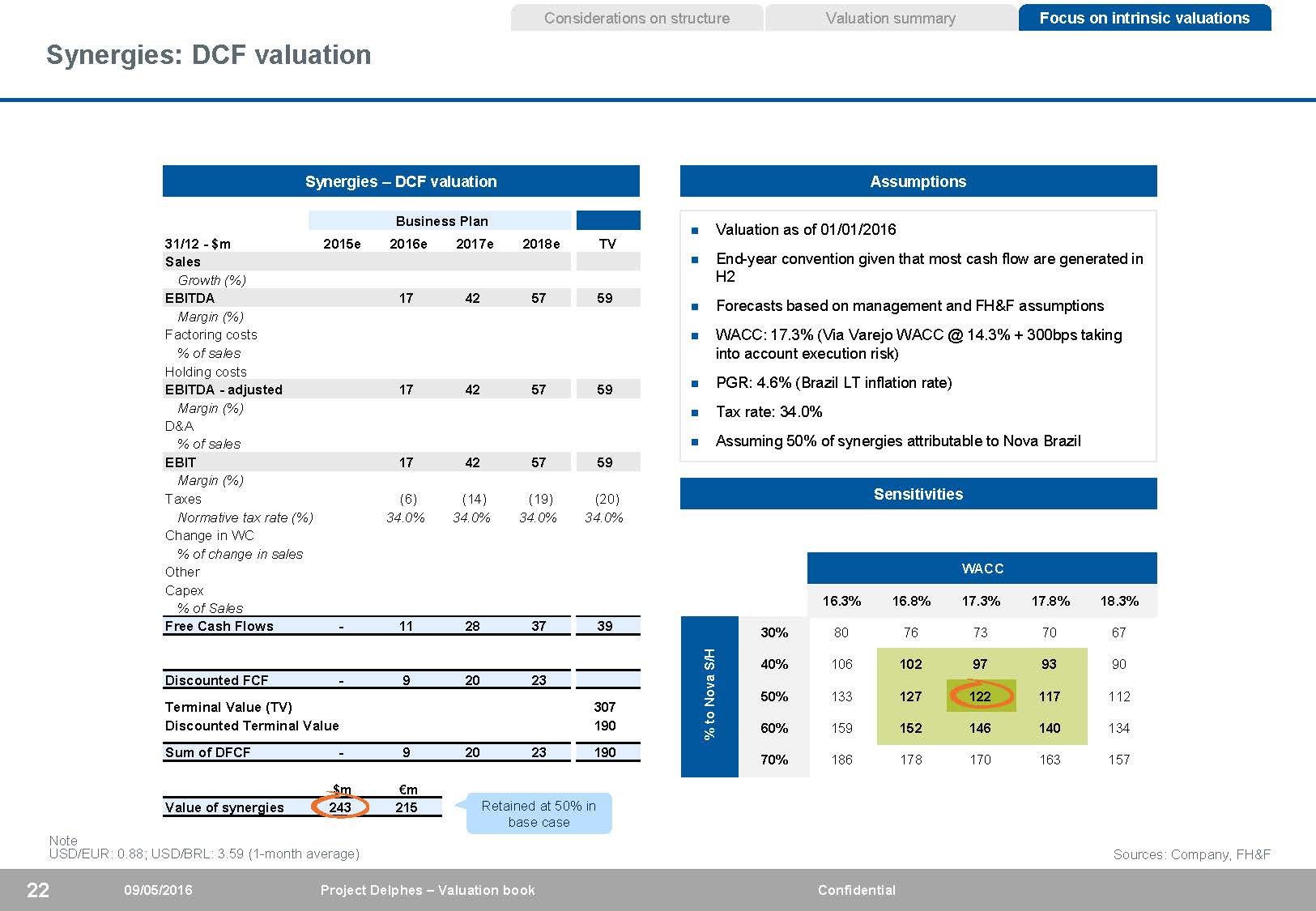

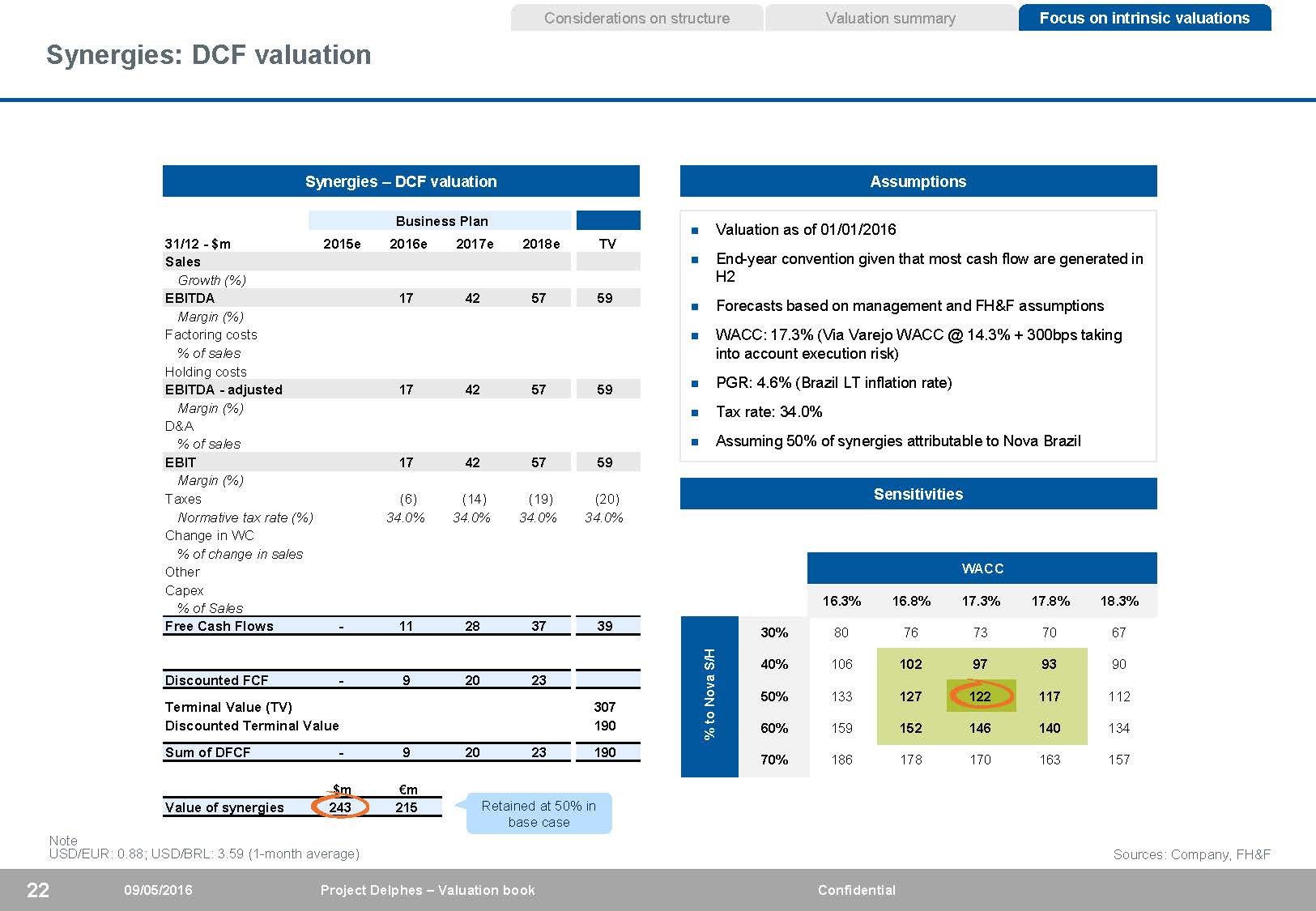

Synergies: DCF valuation Considerations on structure Valuation summary Focus on intrinsic valuations Synergies – DCF valuation Assumptions Business Plan 31/12 - $m 2015e 2016e 2017e 2018e TV Sales Growth (%) EBITDA 17 42 57 59 Margin (%) Factoring costs % of sales Holding costs EBITDA - adjusted 17 42 57 59 Margin (%) D&A % of sales EBIT 17 42 57 59 Margin (%) Taxes (6) (14) (19) (20) Normative tax rate (%) 34.0% 34.0% 34.0% 34.0% Change in WC % of change in sales Other Capex % of Sales Free Cash Flows - 11 28 37 39 Discounted FCF - 9 20 23 Terminal Value (TV) 307 Discounted Terminal Value 190 Sum of DFCF - 9 20 23 190nValuation as of 01/01/2016nEnd-year convention given that most cash flow are generated in H2n Forecasts based on management and FH&F assumptionsnWACC: 17.3% (Via Varejo WACC @ 14.3% + 300bps taking into account execution risk)nPGR: 4.6% (Brazil LT inflation rate)nTax rate: 34.0%nAssuming 50% of synergies attributable to Nova Brazil Sensitivities WACC 16.3% 16.8% 17.3% 17.8% 18.3% 30% 80 76 73 70 67 40% 106 102 97 93 90 50% 133 127 122 117 112 60% 159 152 146 140 134 70% 186 178 170 163 157 Note $m €m Value of synergies 243 215 Retained at 50% in base case USD/EUR: 0.88; USD/BRL: 3.59 (1-month average) Sources: Company, FH&F 22 09/05/2016 Project Delphes – Valuation book Confidential

Via Varejo: Wacc calculation Considerations on structure Valuation summary Focus on intrinsic valuations Selected peers for Beta analysis:n BestBuyn Dixons WACC computation Cost of debt Cost of capital Yield of 2025 maturity bondnLojasnFnacnDartynM. Luiza Risk-free rate ($) 7.2% Corporate Spread 3.0% Tax rate 34.0% Cost of debt post-tax ($) 6.7% Brazil LT inflation 4.6% issued by Brazil in USD US 10-year T-bond Risk-free rate ($) 1.8% Brazil 10Y CDS spread Country risk premium 4.5% Source: Ibbotson Market risk premium 7.0% Median of peers Unlevered Beta 0.80 Source: Factset1 Levered Beta 0.80nSteinhoffn LojasRn Heringn GuaranLiverpooln Falan Metro US LT inflation 2.4% Cost of equity ($) 11.9% Cost of debt (BRL) 9.0% Brazil LT inflation 4.6% US LT inflation 2.4% Cost of equity (BRL) 14.3% WACC ND / Equity 0.0% ND / Capital employed 0.0% WACC (BRL) 14.3% Note 1. Beta adjusted as per Bloomberg methodology (0.65 x Raw Beta +0.35) Sources: Bloomberg, Factset as of 22/04/2016 23 09/05/2016 Project Delphes – Valuation book Confidential

Appendices: Additional material on valuation 24 09/05/2016 Project Delphes – Valuation book Confidential

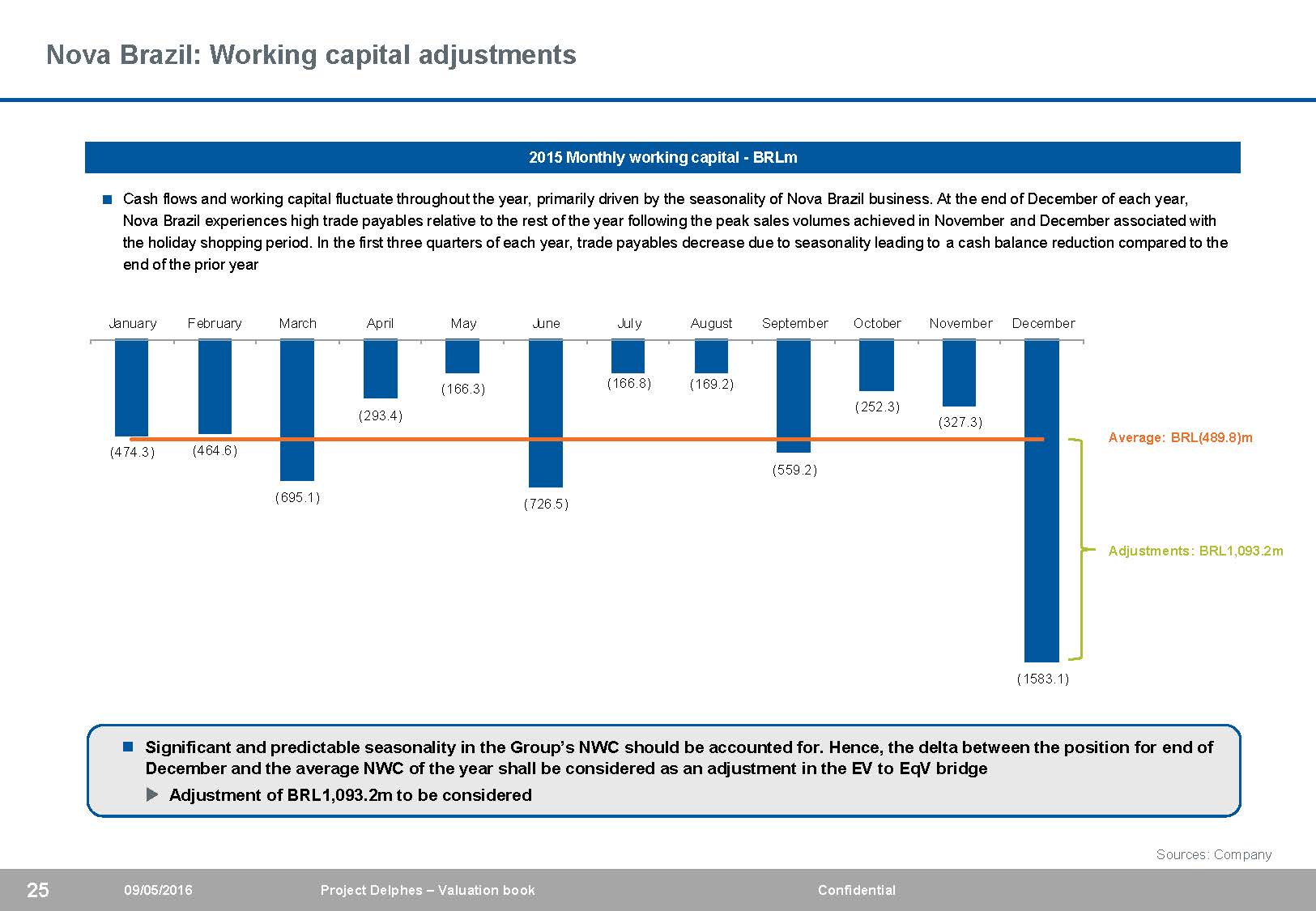

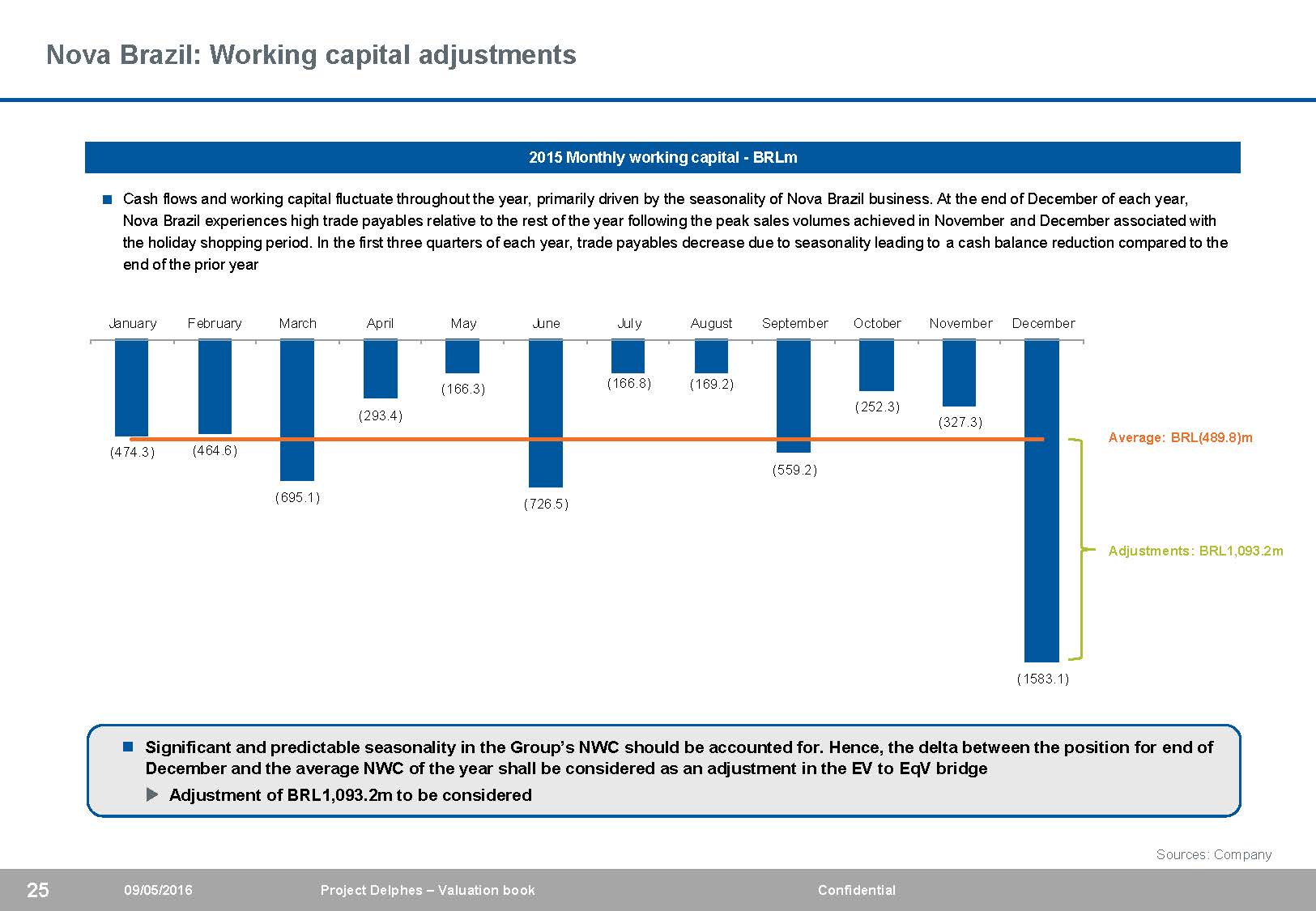

Nova Brazil: Working capital adjustments 2015 Monthly working capital - BRLm<Cash flows and working capital fluctuate throughout the year, primarily driven by the seasonality of Nova Brazil business. At the end of December of each year, Nova Brazil experiences high trade payables relative to the rest of the year following the peak sales volumes achieved in November and December associated with the holiday shopping period. In the first three quarters of each year, trade payables decrease due to seasonality leading to a cash balance reduction compared to theend of the prior year January February March April May June July August September October November December (474.3) (464.6) (695.1) (293.4) (166.3) (726.5) (166.8) (169.2) (559.2) (252.3) (327.3) Average: BRL(489.8)m Adjustments: BRL1,093.2m (1583.1)nSignificant and predictable seasonality in the Group’s NWC should be accounted for. Hence, the delta between the position for end of December and the average NWC of the year shall be considered as an adjustment in the EV to EqV bridgeuAdjustment of BRL1,093.2m to be considered25 09/05/2016 Project Delphes – Valuation book Confidential Sources: Company

Cdiscount: Working capital adjustments 2015 Monthly working capital - EURm<Cash flows and working capital fluctuate throughout the year, primarily driven by the seasonality of Cdiscount business. At the end of December of each year, Cdiscount experiences high trade payables relative to the rest of the year following the peak sales volumes achieved in November and December assoc iated withthe holiday shopping period. In the first three quarters of each year, trade payables decrease due to seasonality leading to a cash balance reduction compared to the end of the prior year January February March April May June July August September October November December 1.0 (98.4) (25.1) (65.5) (4.8) (82.9) (58.4) (55.4) (95.4) (29.9) Average: EUR(77.9)m (143.3) Adjustments: EUR198.8m (276.7)nSignificant and predictable seasonality in the Group’s NWC should be accounted for. Hence, the delta between the position for end of December and the average NWC of the year shall be considered as an adjustment in the EV to EqV bridgeuAdjustment of EUR198.8m to be considered26 09/05/2016 Project Delphes – Valuation book Confidential Sources: Company

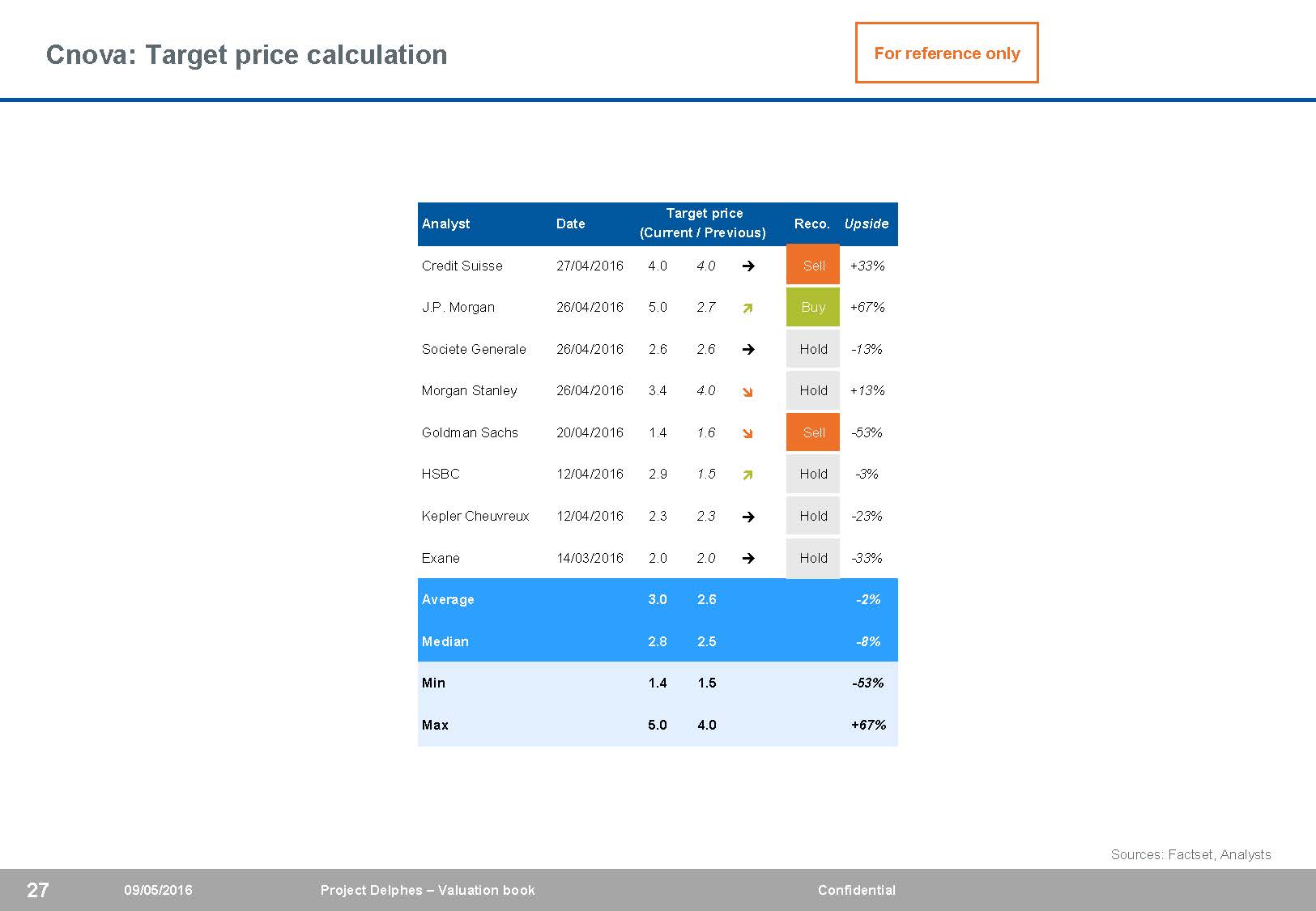

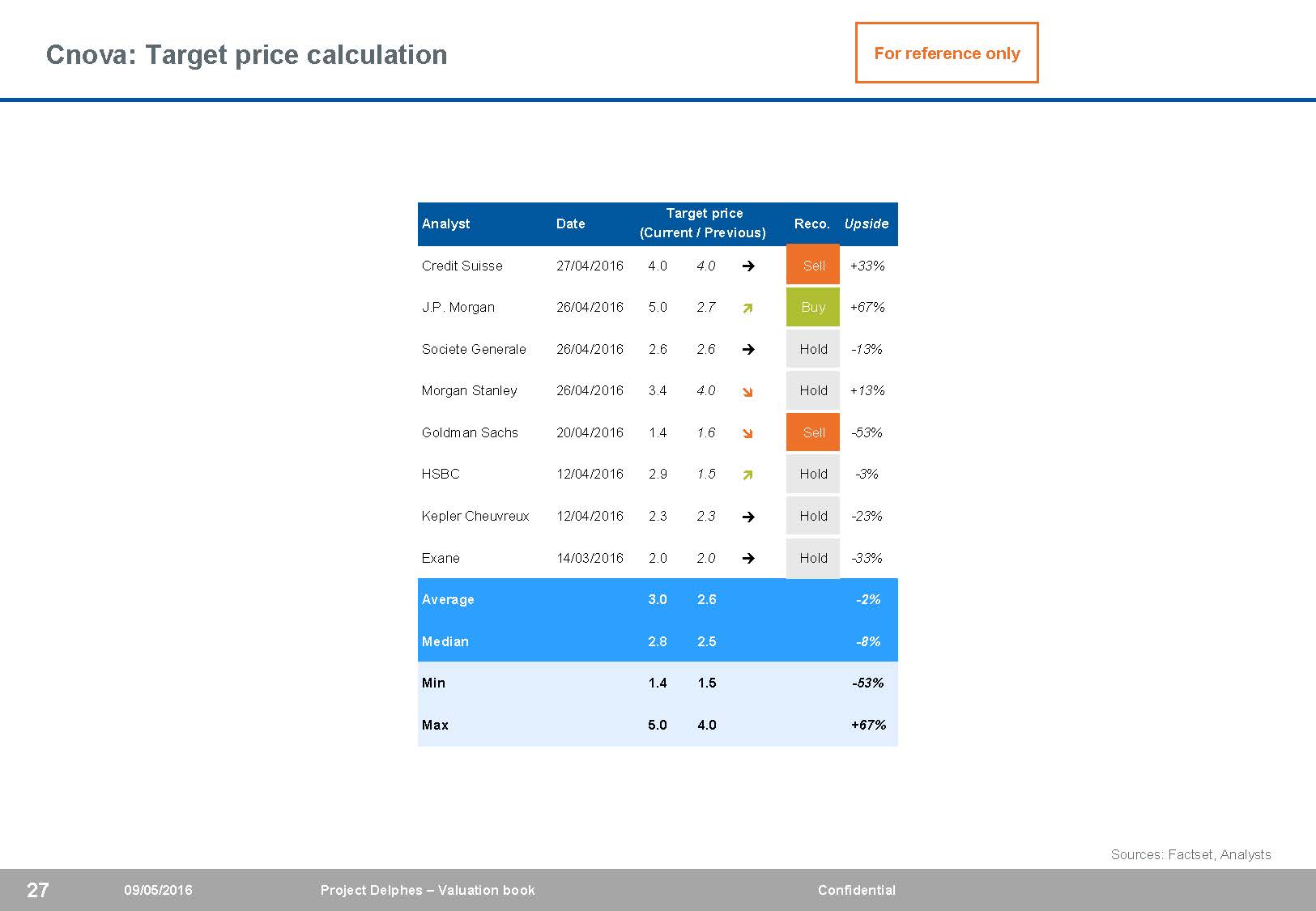

Cnova: Target price calculation For reference only Target price Analyst Date (Current / Previous) Reco.UpsideCredit Suisse 27/04/2016 4.04.0èSell+33% J.P. Morgan 26/04/2016 5.02.7ìBuy+67% Societe Generale 26/04/2016 2.62.6èHold-13% Morgan Stanley 26/04/2016 3.44.0îHold+13% Goldman Sachs 20/04/2016 1.41.6îSell-53% HSBC 12/04/2016 2.91.5ìHold-3% Kepler Cheuvreux 12/04/2016 2.32.3èHold-23% Exane 14/03/2016 2.02.0èHold-33% Average 3.0 2.6-2%Median 2.8 2.5-8%Min 1.4 1.5-53% Max 5.0 4.0+67%27 09/05/2016 Project Delphes – Valuation book Confidential Sources: Factset, Analysts

Cnova historical share price and target price evolution For reference only In $ Volumes (m) 11.0 8.0 10.0 7.0 9.0 6.0 8.0 7.0 6.0 5.0 IPO price of $7.0; Volumes of 14.1m 5.0 4.0 3.0 IPO price: $7.0 VWAP since IPO: $5.7 4.0 3.0 2.0 2.0 1.0 0.0 1-year VWAP: $3.6 Spot: $3.2 1-month VWAP: $3.2 Last Average TP: $3.0 6-month VWAP: $2.6 3-month VWAP: $2.5 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 Daily volumes Closing price Average TP 1-month VWAP 3-month VWAP 6-month VWAP 1-year VWAP VWAP since IPO IPO price Free float of 6.6% representing 29.2m shares of Cnova NV 28 09/05/2016 Project Delphes – Valuation book Confidential Sources: Factset as of 22/04/2016

WACC and PGR benchmark– Via Varejo & Cnova Broker Date WACC PGR Credit Suisse 20/04/2016 17.1% n.a. BBInvestimentos 24/02/2016 14.8% 3.0% Citi 24/02/2016 17.7% 5.0% Votorantim 22/02/2016 14.6% 5.0% Santander 09/12/2015 n.a. 4.0% HSBC 04/11/2015 16.2% 3.0% JP Morgan 13/10/2015 n.a. 5.5% Average 16.1% 4.3% Broker Date WACC PGR Credit Suisse 27/04/2016 14.0% 3.0% Société Générale 12/04/2016 12.0% 3.0% Morgan Stanley 08/04/2016 12.0% 4.0% JP Morgan 01/03/2016 12.3% 3.0% Kepler Cheuvreux 08/05/2015 13.2% 4.0% BAML 12/04/2015 13.1% 2.0% Average 12.8% 3.2% 29 09/05/2016 Project Delphes – Valuation book Confidential Source: Analysts

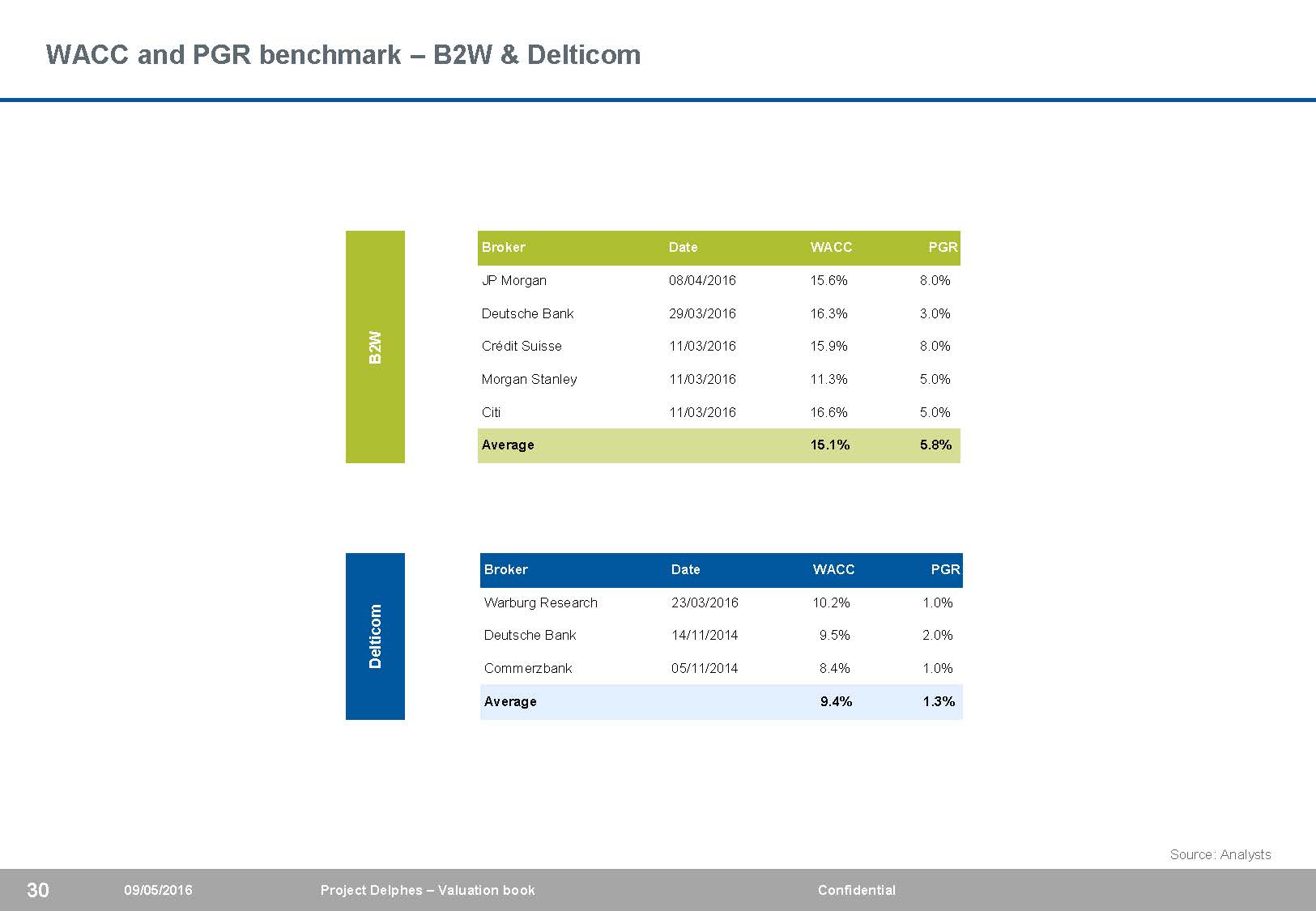

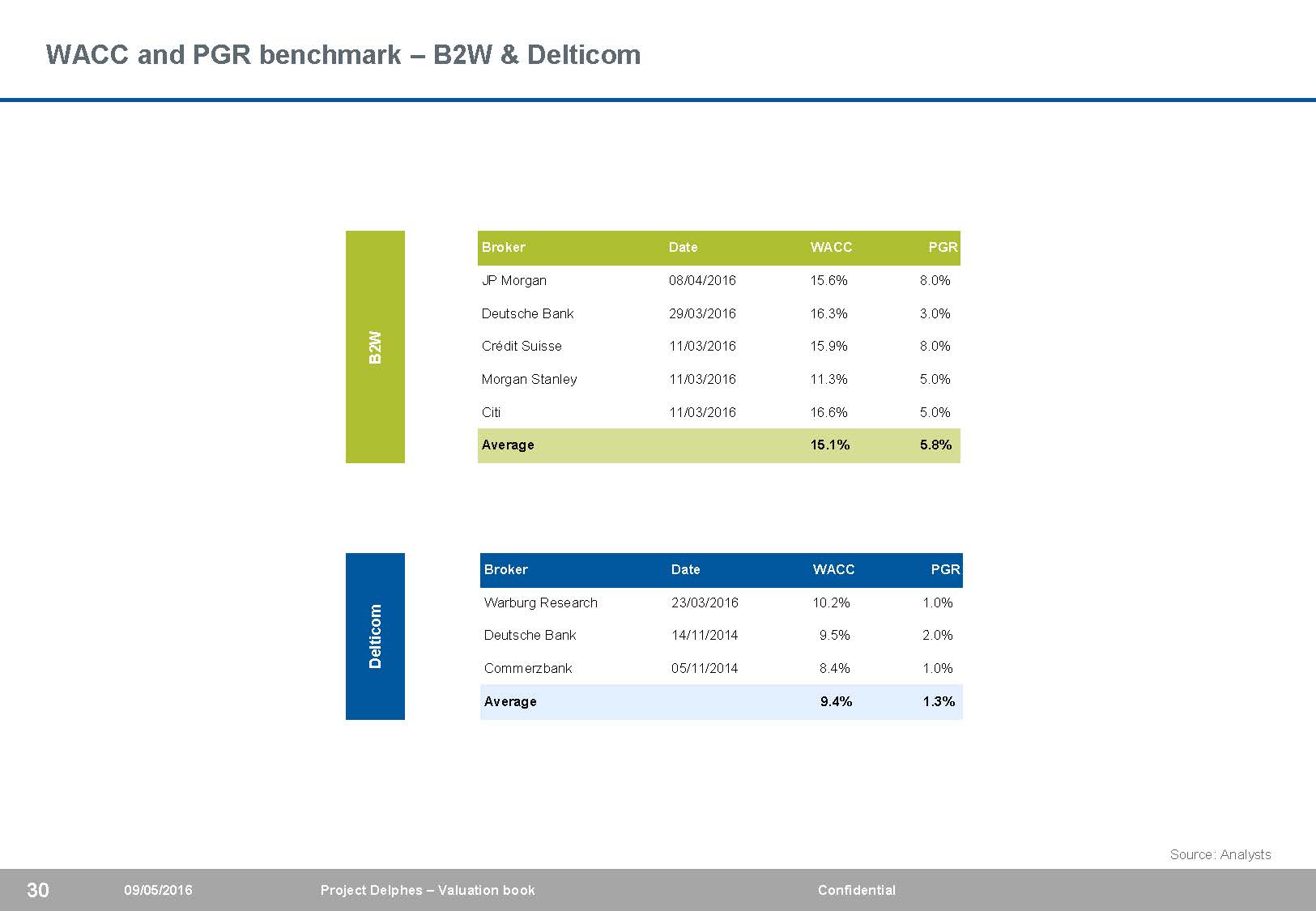

WACC and PGR benchmark – B2W & Delticom Broker Date WACC PGR JP Morgan 08/04/2016 15.6% 8.0% Deutsche Bank 29/03/2016 16.3% 3.0% Crédit Suisse 11/03/2016 15.9% 8.0% Morgan Stanley 11/03/2016 11.3% 5.0% Citi 11/03/2016 16.6% 5.0% Average 15.1% 5.8% Broker Date WACC PGR Warburg Research 23/03/2016 10.2% 1.0% Deutsche Bank 14/11/2014 9.5% 2.0% Commerzbank 05/11/2014 8.4% 1.0% Average 9.4% 1.3% 30 09/05/2016 Project Delphes – Valuation book Confidential Source: Analysts

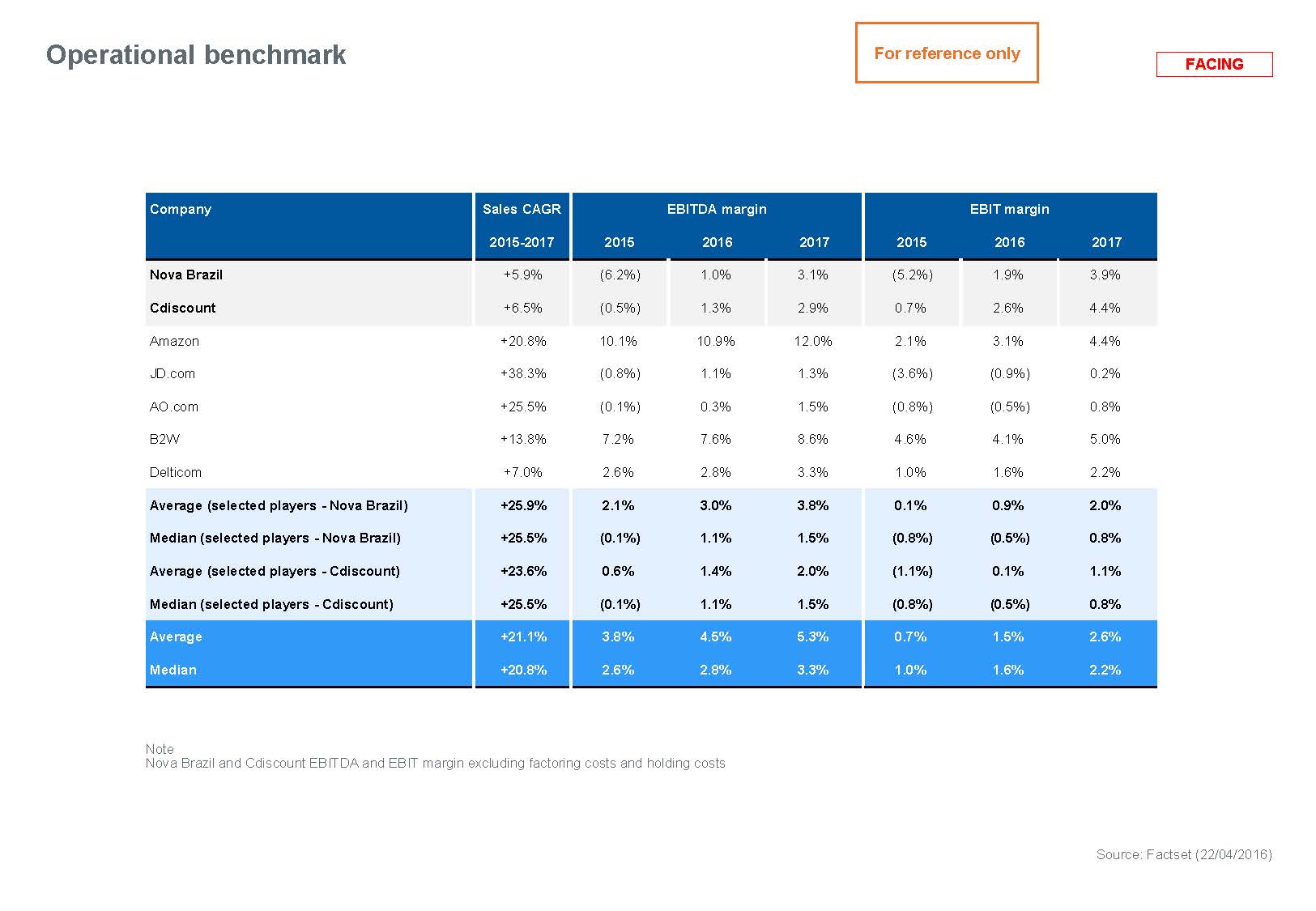

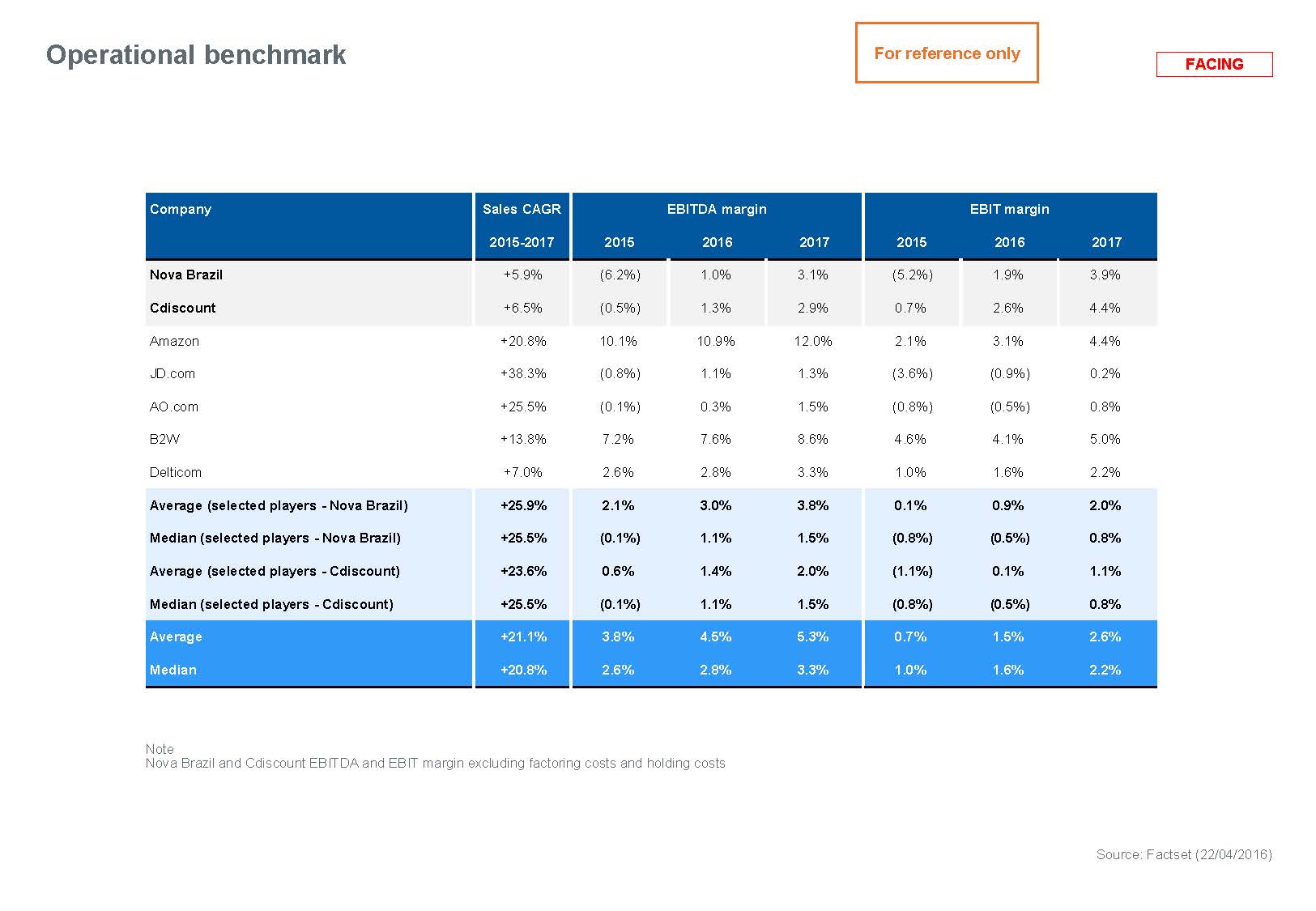

Operational benchmark For reference only FACING Company Sales CAGR 2015-2017 EBITDA margin 2015 2016 2017 EBIT margin 2015 2016 2017 Nova Brazil Cdiscount +5.9% +6.5% (6.2%) (0.5%) 1.0% 1.3% 3.1% 2.9% (5.2%) 0.7% 1.9% 2.6% 3.9% 4.4% Amazon JD.com AO.com B2W Delticom +20.8% +38.3% +25.5% +13.8% +7.0% 10.1% 10.9% 12.0% (0.8%) 1.1% 1.3% (0.1%) 0.3% 1.5% 7.2% 7.6% 8.6% 2.6% 2.8% 3.3% 2.1% 3.1% 4.4% (3.6%) (0.9%) 0.2% (0.8%) (0.5%) 0.8% 4.6% 4.1% 5.0% 1.0% 1.6% 2.2% Average (selected players - Nova Brazil) Median (selected players - Nova Brazil) Average (selected players - Cdiscount) Median (selected players - Cdiscount) +25.9% +25.5% +23.6% +25.5% 2.1% 3.0% 3.8% (0.1%) 1.1% 1.5% 0.6% 1.4% 2.0% (0.1%) 1.1% 1.5% 0.1% 0.9% 2.0% (0.8%) (0.5%) 0.8% (1.1%) 0.1% 1.1% (0.8%) (0.5%) 0.8%Average Median +21.1% +20.8% 3.8% 4.5% 5.3% 2.6% 2.8% 3.3% 0.7% 1.5% 2.6% 1.0% 1.6% 2.2%Note Nova Brazil and Cdiscount EBITDA and EBIT margin excluding factoring costs and holding costs Source: Factset (22/04/2016)

Trading multiples E-commerce peers For reference only Methodology: no EBITDA adjustment for factoring costs, Payment Book added to EV-Eq adjustments Selected peers for Nova Brazil:n AO.comn JD.comn B2W Selected peers for Cdiscount:n AO.comn JD.comn Delticom Company Country MC EV EV/Sales EV/EBITDA EV/EBIT 32 09/05/2016 Project Delphes – Valuation book Confidential Source: Factset (22/04/2016)

Transaction multiples E-commerce peers For reference only EV EV / EV / Date Acquiror Target Country Sector (€m) Sales EBITDA Apr-16 Carrefour Rue du Commerce France e-retailing 25 0.08x n.a. Apr-15 Innov8 Group Ascendeo SAS France Electronic appliances 50 0.67x n.a. Dec-14 Weinberg Capital Bruneau Group France Furniture 100 0.33x 4.0x Jan-14 Tiger / Lojas Americanas B2W Companhia Digital (37%) Brazil e-retailing 2,529 1.46x 26.0x Feb-12 Royal Ahold Bol.com Netherlands Electronic appliances 350 0.99x n.a. Oct-11 Altarea Rue du Commerce France Internet / e-commerce 86 0.28x 14.2x Average 0.63x 14.7x Median 0.50x 14.2x 33 09/05/2016 Project Delphes – Valuation book Confidential Sources: Companies, Mergermarket

Information package details< The financial information contained in this document is based on the information package received from CGP including, inter alia :u“160208_ Tableaux Board FY2015 à 2018 mis à jour_hors Thailand et Vietnam...”: for 2015 figures and Business Plan (basis for extrapolation)u“Retrieve_Bilan CONTRIB Decembre 2015 CT ccv24022016”for adjusted net financial debtu“Frais de holdings V Draft 2”for Holding P&L assumptionsu “BFR Nova et Cdiscount” for working capital adjustmentsu“20160219 - Delphes - Synergies FHF”for synergiesu“TSO Cnova NV”for Cnova capitalisation table34 09/05/2016 Project Delphes – Valuation book Confidential

Disclaimer< This document (the “Document”) is being provided by Crédit Agricole CIB (“CA-CIB”) and Rothschild & Cie (“Rothschild”) acting as financial advisors of Casino Guichard-Perrachon SA (“Casino” or the “Recipient”) for the sole benefit of the Recipient. The Document was drafted for the sole purpose of presenting the valuation of Cnova NV and its subsidiaries (Nova Brazil and Cdiscount) in the context of combination of the e-commerce business currently operated by Nova Brazil with the brick and mortar activities currently developed by Via Varejo (the “Project”). This Document and its content are confidential and should not be quoted, referred, distributed or otherwise disclosed, in whole or in part to any third party, without the prior written consent of CA-CIB and Rothschild and only for the sole purpose of the achievement of the Project. It is understood that, in such a case, by receiving the Document from the Recipient, all of the provisions of the present disclaimer shall apply in the same terms and conditions to any of such third party. To that extent, the Recipient undertakes to notify any of such third party of this disclaimer in providing it with the Document.<This Document has been prepared on the basis of information provided by Casino and also from publicly available information. This information has not been independently verified by CA-CIB and Rothschild. This Document does not constitute an audit or a due diligence review and should not be construed as such. No representation or warranty, express or implied, is or will be made and no responsibility or liability is or will be accepted by CA-CIB and Rothschild or by any of their partners, officers, employees or affiliates as to or in relation to the accuracy of completeness of the information forming the basis of this Document or for any errors, inaccuracies or omissions in this Document resulting from inaccurate or incomplete information used in preparing this Document.<Nothing contained in the Document is a promise or a representation of the future or should be relied upon as being so. In particular, no representation or warranty is given by CA-CIB and Rothschild as to the achievement or reasonableness of any future projections, estimates, management targets or prospects, if any. It is therefore advisable for the Recipient to make its own judgement and assessment of the information contained in the Document.<In providing the Document, CA-CIB and Rothschild do not undertake to provide the Recipient with access to any additional information or to update theinformation contained in the Document or to correct any inaccuracies therein which may become apparent.<Nothing in this Document shall be taken as constituting the giving of investment advice and this Document is not intended to provide, and must not be taken as, the basis of any decision and should not be considered as a recommendation by CA-CIB and Rothschild. Casino must make its own independent assessment and such investigations as it deems necessary.<Furthermore, the Recipient agrees that although this Document might contain legal, tax, or accounting references as a way to clarify its contents, it does not constitute any legal, tax, or accounting advising.35 09/05/2016 Project Delphes – Valuation book Confidential