EXHIBIT (c)(5) Project Delphes Financial Analysis Report CONFIDENTIAL | Sã+7o Paulo, August 5th 2016 This document is a free translation of the “Relatório de Análises Financeiras” (in Portuguese) furnished by Banco Santander (Brasil) S.A. on August 5, 2016. The document in Portuguese should always prevail over this version.

Important Note p.1 1. Banco Santander (Brasil) S.A. (“Santander”) has been engaged by Via Varejo S.A. (“Via Varejo” or “Company”), as requested by Via Varejo’s special committee (“Via Varejo Special Committee”), a committee established to comply with the guidelines of CVM Practice Bulletin (Parecer de Orientação da Comissão de Valores Mobiliários) n 35, dated as of September 1st, 2008 (“POCVM35”), exclusively in relation to the integration of the electronic commerce activities developed by Cnova Comércio Eletrônico S.A. (“Cnova Brasil”), a wholly-owned subsidiary of Cnova N.V. (“Cnova”), with Via Varejo’s business, pursuant to the Material Fact published by Via Varejo on May 11, 2016 (“Reorganization”). 2. Santander has been engaged by the Company with the sole purpose of assisting the Via Varejo Special Committee in its work and preparing a financial analysis report ("Financial Analysis Report") consolidating the analysis prepared within the scope of the services and, based on such analysis, indicating a valuation range of the Cnova’s shares and a valuation range for the capital stock of Cnova Brazil. 3. This Financial Analysis Report is an intellectual property of Santander and was prepared by Santander, exclusively to aid the Special Committee of Via Varejo in the context of the analysis of the Reorganization. The present Financial Analysis Report is provided on a confidential basis and shall not be used by the Company, by the Via Varejo Special Committee or any authorized third parties, for other purposes and shall not be disclosed, distributed, reproduced, summarized or made available to any third parties or applied for any other purposes without prior written authorization of Santander. This Financial Analysis Report may be disclosed to Via Varejo, its board of directors and shareholders, and/or, in order to fulfill legal and regulatory obligations related to the Reorganization, to CVM and the stock exchanges (bolsa de valores) in which securities issued by the Company are listed, pursuant to the respective applicable normative laws. 4. In case it is necessary to disclose the Financial Analysis Report in accordance with the law and/or the applicable regulation, this material shall only be disclosed in case its content is reproduced in its entirety, and any description or reference to Santander shall be made in a reasonable form and expressly approved by Santander and its consultants. Except by prior and express authorization, in writing, by Santander, no other person beyond the members of the Via Varejo Special Committee and the Company’s Board of Directors is authorized to use any representations, advices, opinions or conducts to third parties, except in the form required by the applicable law and the applicable regulation. 5. In case versions of the Financial Analysis Report are prepared in any language other than Portuguese, the Portuguese version of the Financial Analysis Report shall always prevail. 6. The Financial Analysis Report shall be read and interpreted in light of the assumptions, restrictions, qualifications and other conditions herein mentioned. Any person that uses this Financial Analysis Report, as long as duly authorized to do so, shall consider in its analyses the restrictions and characteristics of the sources of information used herein.

Important Note (cont’d) p.2 7. This Financial Analysis Report does not constitute judgment, opinion, proposal, request, suggestion or recommendation, express or implied, to the Via Varejo Special Committee, the Board of Directors or shareholders of the Company, or any third party regarding the convenience and opportunity, or regarding the terms and conditions of the Reorganization, included, but not limited to, its contractual terms, the definition of value or the exchange of shares issued by Cnova with shares issued by Cnova Brasil, regarding the Reorganization, or any other related values or the structure of the Reorganization. 8. This Financial Analysis Report does not intend to be the only base for the Via Varejo Special Committee, the Board of Directors and shareholders of the Company’s analysis of the Reorganization, as it does not include all necessary information for such analysis. Any decision undertaken by the Via Varejo Special Committee, by the Board of Directors of the Company and its shareholders will be at their exclusive and sole responsibility. The analysis of risk and benefits related to the implementation and approval of the Reorganization shall be exclusively and independently conducted by the Via Varejo Special Committee, the Board of Directors of the Company and its shareholders, as the case may be. 9. Cnova and Cnova Brasil, including their respective controlled and affiliated entities, have been evaluated independently (standalone) and the possible success or failure of any transaction regarding the Reorganization was not considered in the results of the valuation range of both companies. 10. Notwithstanding the above, Santander was requested by the Via Varejo Special Committee to analyze, strictly from an economic and financial perspective, the potential synergies that the Company could capture as a result of the Reorganization. The studies and analysis of the potential synergies, their financial impact and ramp-up curves ("Synergies’ Studies") were prepared by external consultants and reviewed and/or discussed with the teams of Via Varejo and Cnova Brasil. Additionally, it was prepared by Via Varejo a study on the financial impact of the potential reduction of the inventories of Via Varejo and Cnova Brasil after the Reorganization. The Synergies’ Studies were considered as a base for the analysis conducted by Santander. Santander has not conducted any investigation, independent verification or due diligence regarding the Synergies’ Studies and its viability. Therefore, Santander assumes that the Synergies’ Studies are complete and accurate and reflect the current best estimates of the companies. Santander does not express any opinion on potential effects that the Company might incur and assumes no liability with respect to the result of the Reorganization. 11. The results presented in this Financial Analysis Report, except regarding the potential synergies, refer exclusively to the companies (standalone) and do not apply to any other matter or transaction, present or future, related to the Company, Cnova Brasil, Cnova or to the economic groups of which they are part or to the sector in which they operate. Additionally, this Financial Analysis Report does not cover the strategic and commercial merits of the Reorganization, neither covers the possible strategic and commercial decision of the Company or its shareholders in participating, analyzing or executing the Reorganization, or any other strategies or other transactions that may be available to the Company. The use of values informed in the Financial Analysis Report for any other valuation related to Cnova and Cnova Brasil, or to any other purpose not covered by this Financial Analysis Report, is of the exclusive responsibility of the Board of Directors, the Company and /or its shareholders.

Important Note (cont’d) p.312. Santander does not express any opinion about the effects that eventually may be generated to the Company from the execution of the Reorganization or by any transaction involving the Company, or any of its controlled or affiliated entities. This Financial Analysis Report did not take into consideration any previous valuations of the Company, its subsidiaries, controlled or affiliated entities directly or indirectly or any securities issued by those companies, done by Santander or by any other institution, in the context of any transaction, offers or past negotiations involving the Company. In preparing this Financial Analysis Report, Santander prepared exclusively a financial-economic valuation of the companies. 13. Among the methodologies presented in the Financial Analysis Report for informative and reference purposes, Santander understands that the discounted cash flow (DCF) is the most appropriate methodology to evaluate the Company, since it considers the Cnova and Cnova Brasil’s operational cash flow discounted by its respective cost of capital, based in their respective operational aspects and specificities. In this sense, the risk profile and the cash generation potential of these companies are projected in more detail. Additionally, Santander prepared a valuation analysis based on trading and transaction implied multiples of comparable companies. In order to determine the economic-financial value per share of Cnova and Cnova Brasil, Santander considered the number of shares issued and outstanding as of June 30th, 2016. 14. The base date of the valuation contained in this Financial Analysis Report is June 30th, 2016. 15. The Financial Analysis Report was prepared by Santander based on the information prepared or supplied by the companies and/or discussed with the companies’ representatives, their external advisors and with the Company’s representatives appointed to Santander, as well as other publicly available information, in addition to the projections, estimates and analysis based on Santander’s expertise and experience. 16. The Financial Analysis Report prepared by Santander was based on, among others, the following information or documents that were made available by the Company to Santander until July 29th, 2016, which, jointly with the public information, estimates, projections, business plans, budgets, discussions and other information referred to in the items set forth herein below and utilized in the Financial Analysis Report, are hereinafter jointly referred to as “Information”: (i) audited and consolidated financial statements, republished on July 22nd, 2016, of the companies’ fiscal years ending on December 31st, 2013, December 31st, 2014 and December 31st, 2015 and the financial statements reviewed by an auditor related to the period ended on June 30th, 2016 (the “Reported Financial Statements”); (ii) public information regarding the business sectors in which the companies operate; (iii) Company’s business plan for the fiscal years of 2016 to 2018 prepared and reviewed by the management of the companies and approved by Cnova’s Board of Directors (“Business Plan”); (iv) discussions with the companies’ representatives and external advisors appointed to Santander regarding past performances and expectations for the future of the companies’ business; and (v) Synergies’ Studies, and mentioned above. 17. When preparing the Financial Analysis Report, Santander contemplated other financial and market studies and analyses and considered other aspects it deemed necessary, including the judgment of economic, monetary and market conditions; however, without making any independent verification.

Important Note (cont’d) p.418. The demographic, macroeconomic and regulatory Information of the stock markets and markets in which the companies, their controlled and affiliated entities mentioned in the Financial Analysis Report have activities, when not supplied by the companies, were based, among others, in publicly renowned sources, considered trustworthy (sector entities, governmental authorities and specialized publications), and, if applicable, such as the Brazilian Institute of Geography and Statistics (IBGE), Brazilian Central Bank, Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários – CVM), Bloomberg, Thomson Reuters, Economática, Ibbotson and Santander’s Economic Department. 19. Except when otherwise stated, the Financial Analysis Report takes into consideration the financial and accounting conditions of the companies, its controlled and affiliated entities, as reflected on the information received until July 29th, 2016, and therefore any modification in these conditions or in any Information after the present date may impact the results presented herein. Santander is not obliged to, at any time, update, review, correct or restate any information contained in the Financial Analysis Report, or to supply any additional information regarding the Financial Analysis Report. 20. Santander assumes and relies on the correctness, truthfulness, integrity, consistence, sufficiency and precision of all Information, whether disclosed in written form, or by means of discussions with the companies’ representatives and external advisors appointed to Santander, or publicly available, and does not undertake any liability for the correctness, truthfulness, integrity, consistence, sufficiency and precision of the Information, nor regarding the manner in which they were prepared. Santander assumes that all Information supplied to Santander or, in any form, made available by the companies or discussed with the companies’ representatives appointed to Santander are complete, correct and sufficient for the purposes of the Financial Analysis Report, and that, between the date the Information was supplied until the present date, to the best of Santander’s knowledge, there were no material modification in the business, corporate purpose, financial situation, assets, liabilities, business perspectives, commercial transactions or in the number of shares of the companies’ capital stock, as well as there were no other significant events that could potentially impact the Information, or caused the Information to become incorrect or imprecise in any material aspects or that could potentially have a material effect on the results of the Financial Analysis Report. 21. Santander does not assume and did not assume, with the Company’s authorization, responsibility for any independent investigation and did not independently verify, or was solicited to verify, any information that is publicly available or in any form disclosed to Santander, related to the companies, or in any form used in this Financial Analysis Report, including, without limitation, any operational or financial information, provisions, estimates or projections, considered in the companies’ financial valuation, including the Synergies’ Studies. Thus, when preparing this Financial Analysis Report, Santander, with the Company’s authorization, assumed and considered such information, true, precise and complete. Santander did not conduct (i) any valuation of the assets and liabilities (including any contingency, responsibility or off-balance sheet debt) of the companies, their controlled and affiliated entities; (ii) review or due diligence of the companies’ financial statements, their controlled and affiliated entities; (iii) technical due diligence of the companies’ operations, their controlled and affiliated entities; (iv) valuation of the companies, their controlled and affiliated entities’ solvency, according to any legislation related to bankruptcy, insolvency, judicial or extra-judicial recovery or similar issues; or (v) any physical inspection of the real estate properties, installations or assets of the Company, its controlled and affiliated entities.

Important Note (cont’d) p.522. Based on the Company’s and its representatives’ statement, Santander adopts the following assumptions: (i) the Company’s financial projections as per the Business Plan that were delivered to Santander by the Company reflects the best existing estimates on the date hereof, and reflects the best judgment of the companies’ management regarding the expectations of the companies’ future performance; and (ii) the estimates and projections that were delivered by the companies to Santander or discussed between Santander and companies’ representatives appointed to Santander, especially those of which the occurrence depend on future and uncertain events (including revenues, expenses, investments, operational profit or net profit projections) were based on the best judgment of the companies’ management. 23. Santander assumed, with your permission, that all governmental or regulatory authorizations, or any necessary and relevant consents regarding the execution of the business plan proposed in this Financial Analysis Report shall be obtained and, that regarding the obtainment of such authorizations and consents, or any alterations, modifications or waiver to any agreements, instruments or order in which the Company or Cnova is part or is subject to or is bound to, no limitation, restriction, term or condition, that would be relevant to our analysis, shall be imposed. 24. Neither Santander, nor any officers, members of the board of directors, employees, consultants, agents, representatives or any other person related to Santander makes nor shall make, expressly or implicitly, any representation, declaration or warranty regarding the completeness, accuracy, veracity, integrity, consistency, sufficiency, reasonableness and precision of the supplied information, including studies, projections or provisions of the companies, or assumptions and estimates in which such projections and predicaments are based on, used for the drafting of the Financial Analysis Report, nor assume any responsibility or obligation to indemnify regarding the content, accuracy, truthfulness, integrality, consistency, sufficiency and precision of such Information, which are of the Company’s full and exclusive responsibility. In this sense, regarding the liabilities and contingencies of Cnova, it is worth mentioning that Santander considered only the amounts duly provisioned for in the Reported Financial Statements as well as the informed balance based on the results of the diligences, provided that it did not consider the possibility of its eventual inaccuracy or insufficiency neither the effects of any judicial claims and/or administrative proceedings (civil, environmental, fiscal, labor, social security or of any other nature) in course involving such Company. 25. To the extent that, as publicly known, Cnova went through an investigation conducted by legal advisors and external accountants hired to ascertain possible irregularities potentially committed in inventory management in its distribution centers in Brazil, Santander made no verification about the potential contingencies arising from such facts and the Financial Analysis Report does not include any analysis in this regard. 26. Santander does not provide nor render services related to due diligence, accounting or legal (including tax, competition or regulatory) and the preparation of the Financial Analysis Report by Santander does not include any service or advice of such nature. 27. Santander is not and shall not be held liable for any direct or indirect losses or losses of profits eventually resulting from the use of the Financial Analysis Report.

Important Note (cont’d) p.628. The preparation of financial-economic valuation is a complex process that involves subjective judgments, and is not subject to partial analysis or summarized description. Santander does not attribute specific importance to certain factors contemplated in the Financial Analysis Report, on the contrary, it performed a qualitative analysis of the importance and relevance of the totality of the factors considered herein. Santander reached a final conclusion based on the results of all the analyses made, considered as a whole, and did not come to conclusions based on, or related to, any of the factors or methods individually taken into consideration in the analysis. In this sense, the Financial Analysis Report must be analyzed as a whole and the analysis of selected parts, summaries or specific aspects of the Financial Analysis Report, without the knowledge and analysis of the Financial Analysis Report in its entirety, may result in an incomplete and incorrect understanding of the analysis performed by Santander and the conclusions contained in the Financial Analysis Report. 29. The estimates and projections contemplated in the Financial Analysis Report are intrinsically subject to uncertainties and various events or factors that are beyond control of the Company, as well as of Santander, especially regarding those estimates and projections that depend on future and uncertain events. There is no assurance that the estimates and projections used in the Financial Analysis Report will be effectively achieved. The actual future results may differ significantly from those of the Financial Analysis Report. In this sense, Santander does not undertake any responsibility or obligation to indemnify in any case that the future results are different from the estimates and projections presented in the Financial Analysis Report and does not represent or warrant, in any manner, the above referred estimates and projections. Santander does not undertake any responsibility regarding the referred estimates and projections, including the manner in which these were prepared. 30. Nothing contained herein is, or can be considered as a promise, warranty or representation in relation to the past or future. 31. The role of Santander in preparing this Financial Analysis Report is of an independent advisor, and no statement contained in this document shall create or may be interpreted as establishing a fiduciary relationship between Santander, the Company, Cnova and any of their shareholders, interested third parties or holders of securities issued by the companies. 32. Other valuations of companies and sectors prepared by Santander may treat market assumptions differently from this Financial Analysis Report, and the research department and other departments of Santander and affiliated entities can use in their analyses, reports and publications, different estimates, projections and methodologies than the ones used in the Financial Analysis Report, and such analyses, reports and publications may contain different conclusions than the ones described in the Financial Analysis Report. 33. Santander has provided, directly or through affiliated entities, certain financial services and investment banking services to the Company, its controlled and affiliated entities, as well as to its controlling companies, for which it has received remuneration, continues to provide the aforementioned services and may, at any moment, provide them again. Santander, directly or through affiliated entities, is or may become a creditor of the Company, its controlled or affiliated entities, as well as of its controlling companies, in certain financial transactions, as well as may increase or reduce the volume of the financial transactions with these entities.

Important Note (cont’d) p.734. In the ordinary course of business, Santander may provide investment banking services and other financial services to the companies and their affiliates, as well as trade, directly or through affiliated entities, securities issued by the Company, its controlled and affiliate entities, as well as its controlling companies, on its behalf or on behalf of its clients and, consequently, may, at any time, hold equity positions, long or short, of the above mentioned securities. Furthermore, the professionals of its equity research department and other divisions may use in their analysis and publications different operational and market assumptions and different methodologies than then ones used in the preparation of this Financial Analysis Report, in such a way that the research reports and other publications prepared by them may contain different results and conclusions than the ones presented herein. Santander has policies and procedures to preserve the independency of its research analysts, who may have views different than the ones from the investment banking department. Santander also has policies and procedures to preserve the independency between the investment banking and other departments and areas of Santander, including, but not limited to, asset management, proprietary trading desk of securities, debt instruments, and other financial instruments. Other companies related to Santander may also hold, directly or indirectly, through vehicles managed by them, shares or other securities issued by the Company. 35. Santander is not aware of any conflicts of interest that may affect the preparation of the Financial Analysis Report. For the preparation of the Financial Analysis Report, Santander will be remunerated by the Company, regardless the completion of the Reorganization, considering that such remuneration is not based and it does not have any, direct or indirect relation, with the valuation contained herein. 36. Santander declares that the Via Varejo Special Committee, the Board of Directors of the Company, its shareholders and its managers did not lead, interfered, limit, difficult or performed any acts which compromised the access, use or knowledge of information, assets, documents or methodologies relevant for the quality of conclusions contained in this document, nor did it determine or restricted the ability of Santander to determine the methods used to reach the conclusions presented in the Financial Analysis Report or restrict the ability of Santander to determine the conclusions presented in the Financial Analysis Report. 37. Santander will be remunerated by the Company for the services rendered related to the preparation of this Financial Analysis Report. The Company has agreed to indemnify Santander for certain obligations and liabilities that may arise from the preparation of this Financial Analysis Report. 38. Santander declares that it is not a related party, as defined by CVM Resolution n° 642 of October 7th, 2010, to the Company or to its shareholders and managers. 39. Some calculations presented in this Financial Analysis Report may not result in an exact value, due to the rounding of figures.

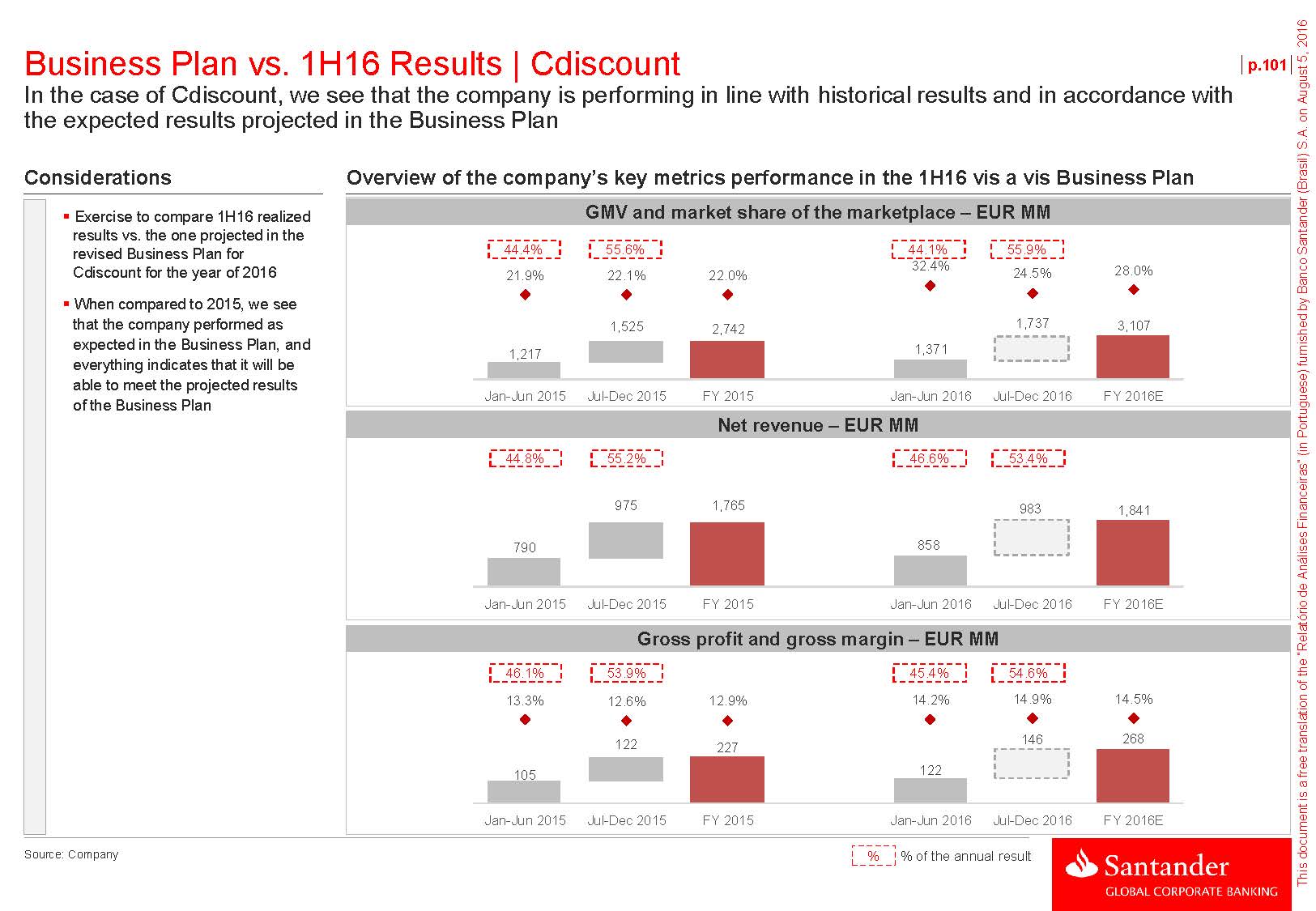

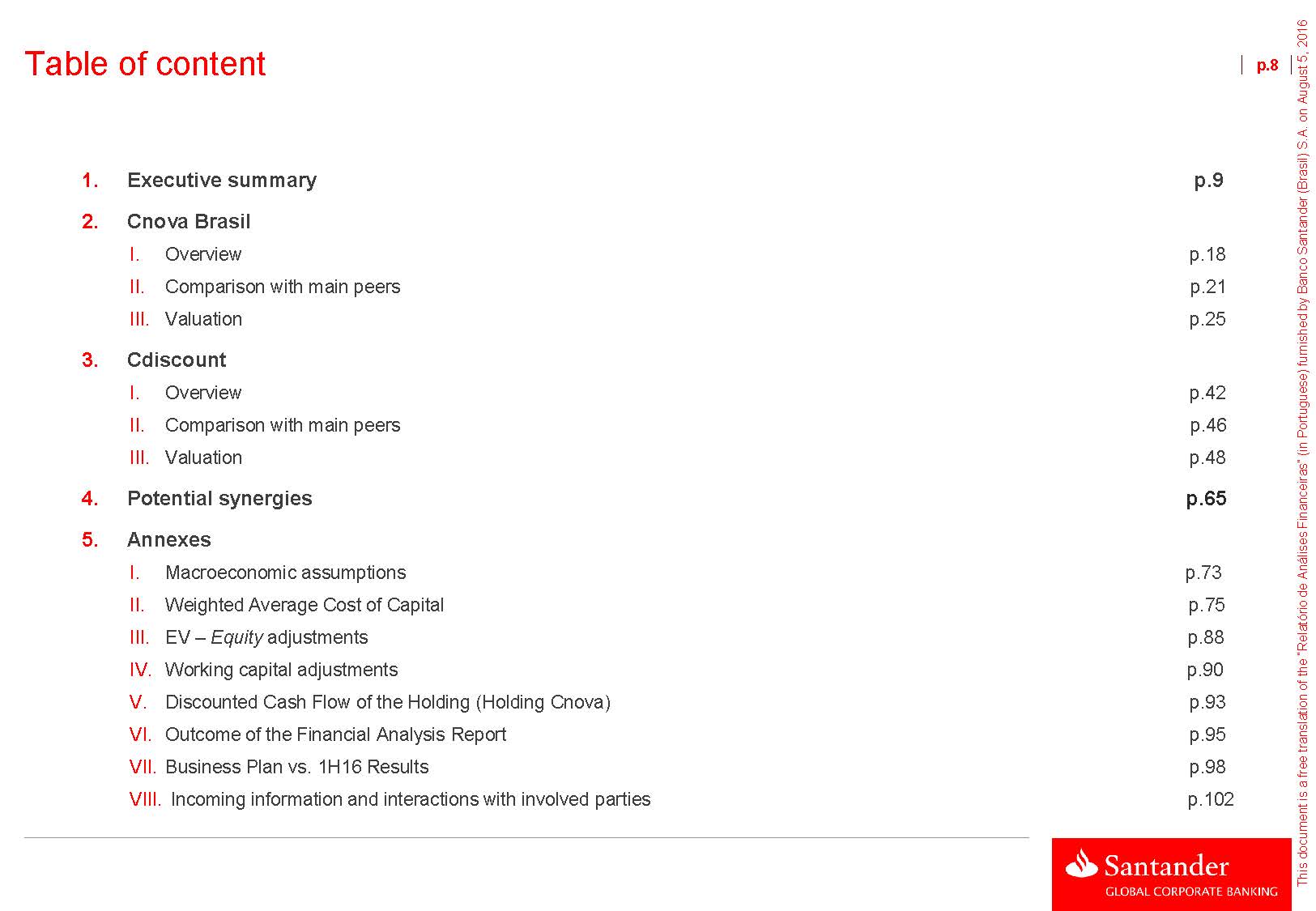

Table of content 1. Executive summary p.92. Cnova Brasilp.83.4. Potential synergies p.655. AnnexesI. Macroeconomic assumptions p.73 II. Weighted Average Cost of Capital p.75 III. EV –Equityadjustments p.88 IV. Working capital adjustments p.90 V. Discounted Cash Flow of the Holding (Holding Cnova) p.93 VI. Outcome of the Financial Analysis Report p.95 VII. Business Plan vs. 1H16 Results p.98 VIII. Incoming information and interactions with involved parties p.102 This document is a free translation of the “Relatório de Análises Financeiras” (in Portuguese) furnished by Banco Santander (Brasil) S.A. on August 5, 2016

Section 1 Executive summary P 9

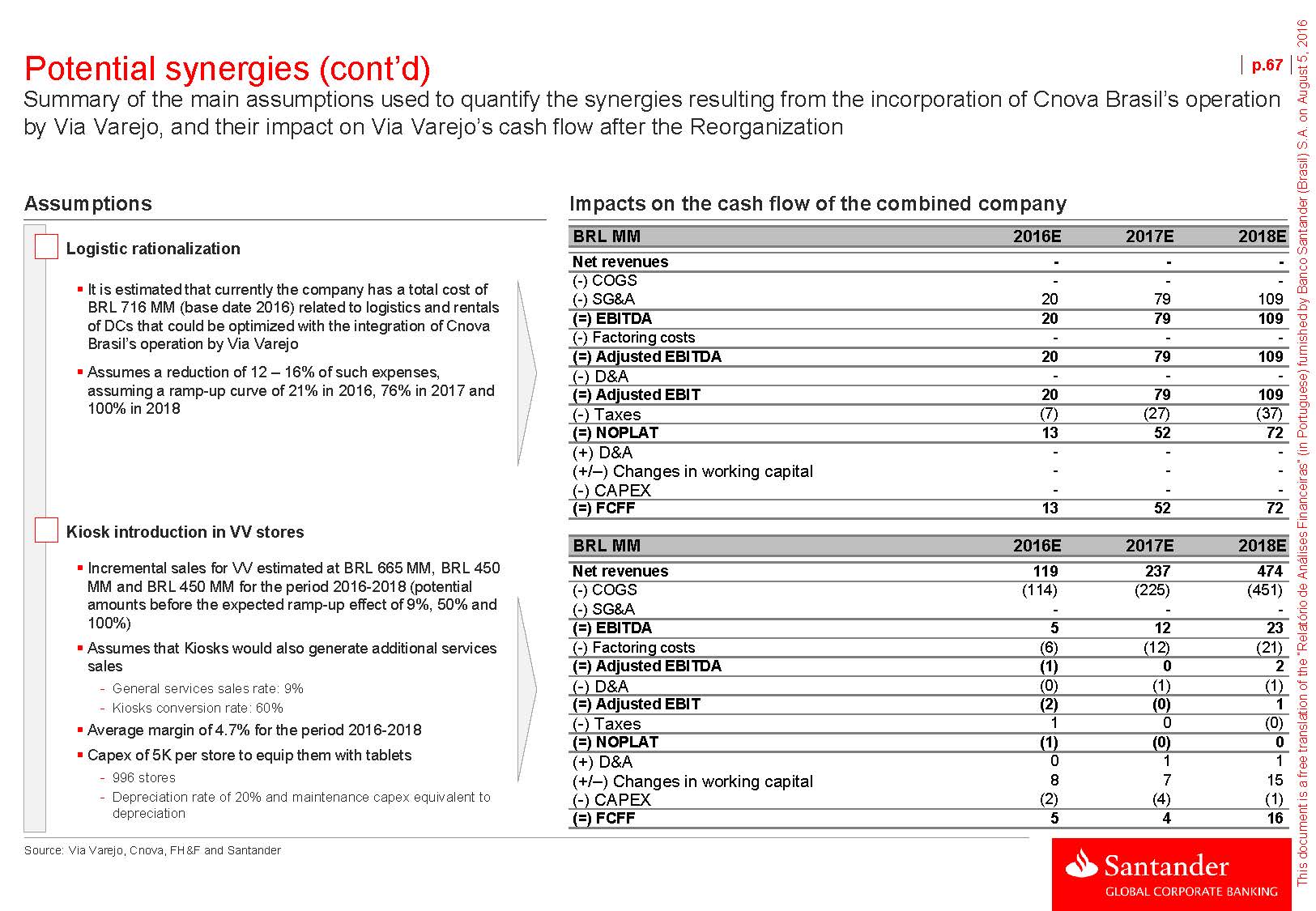

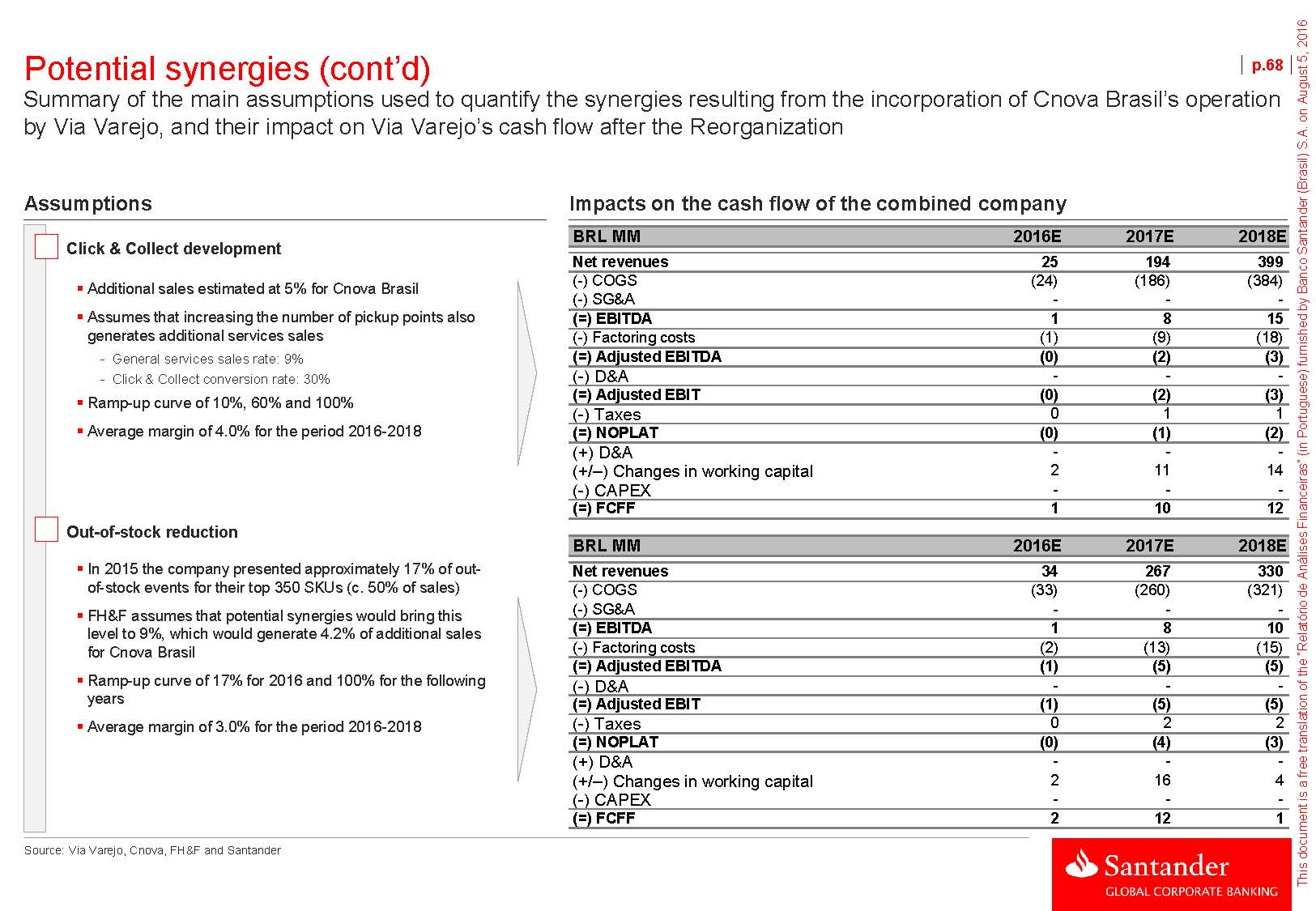

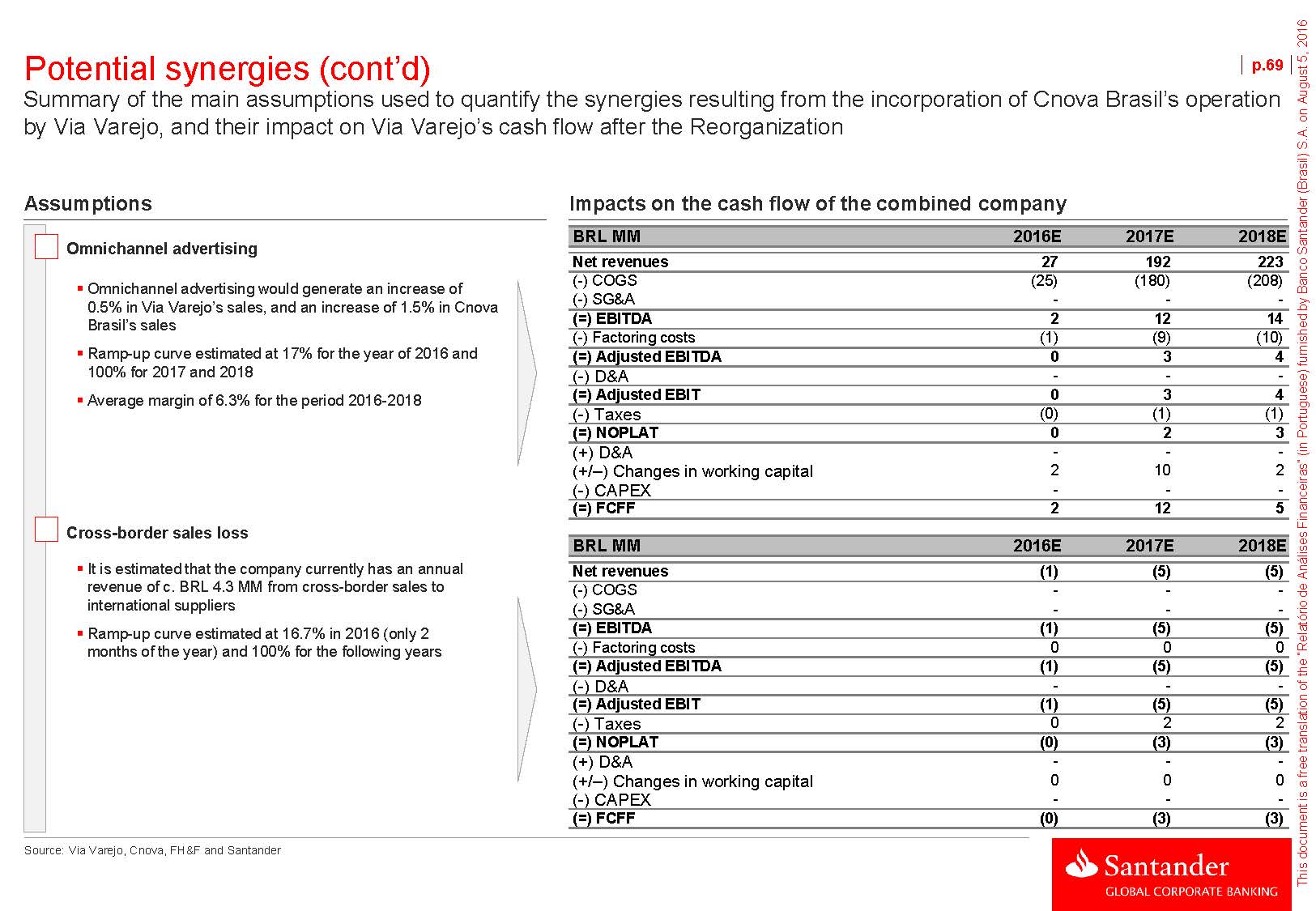

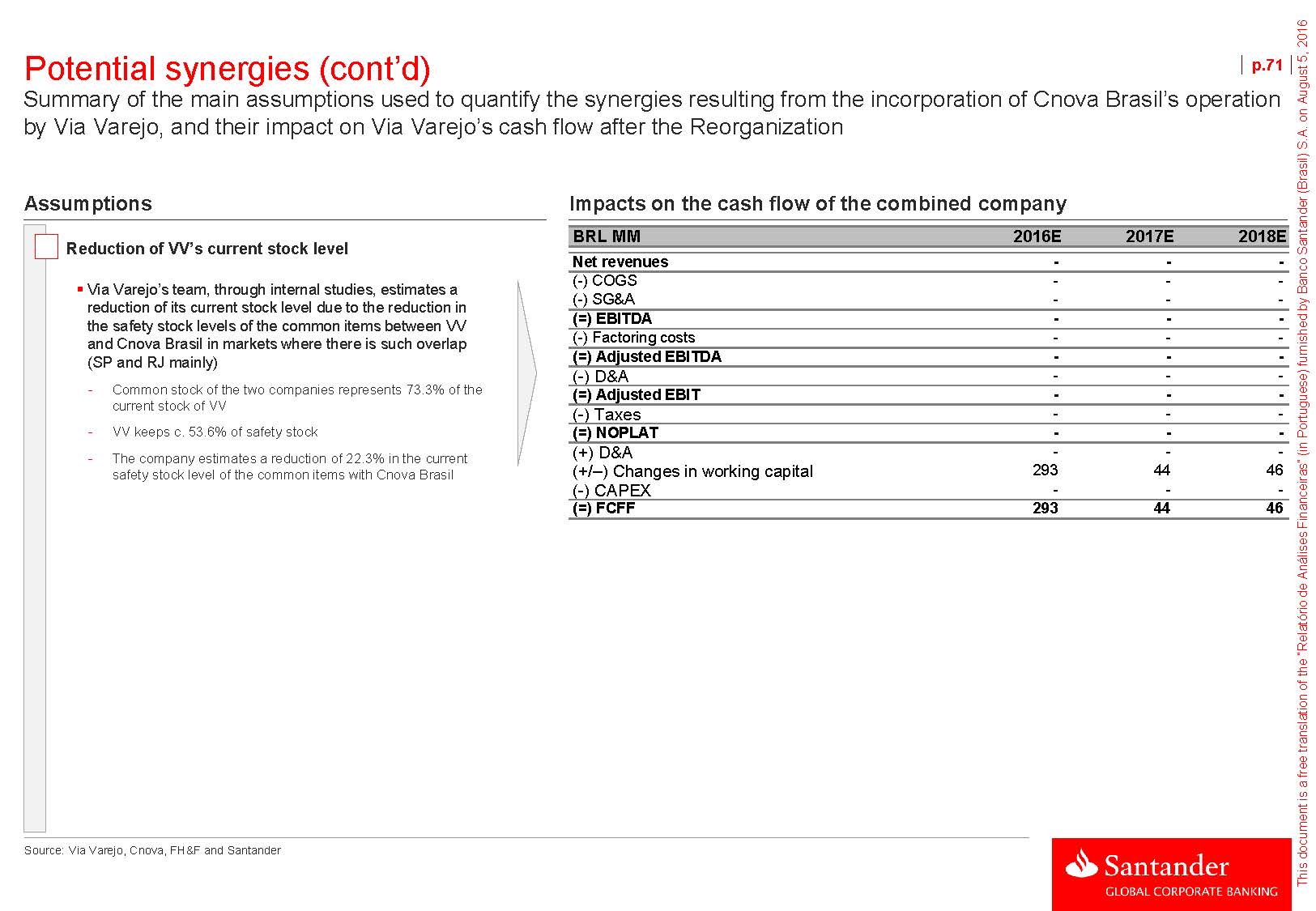

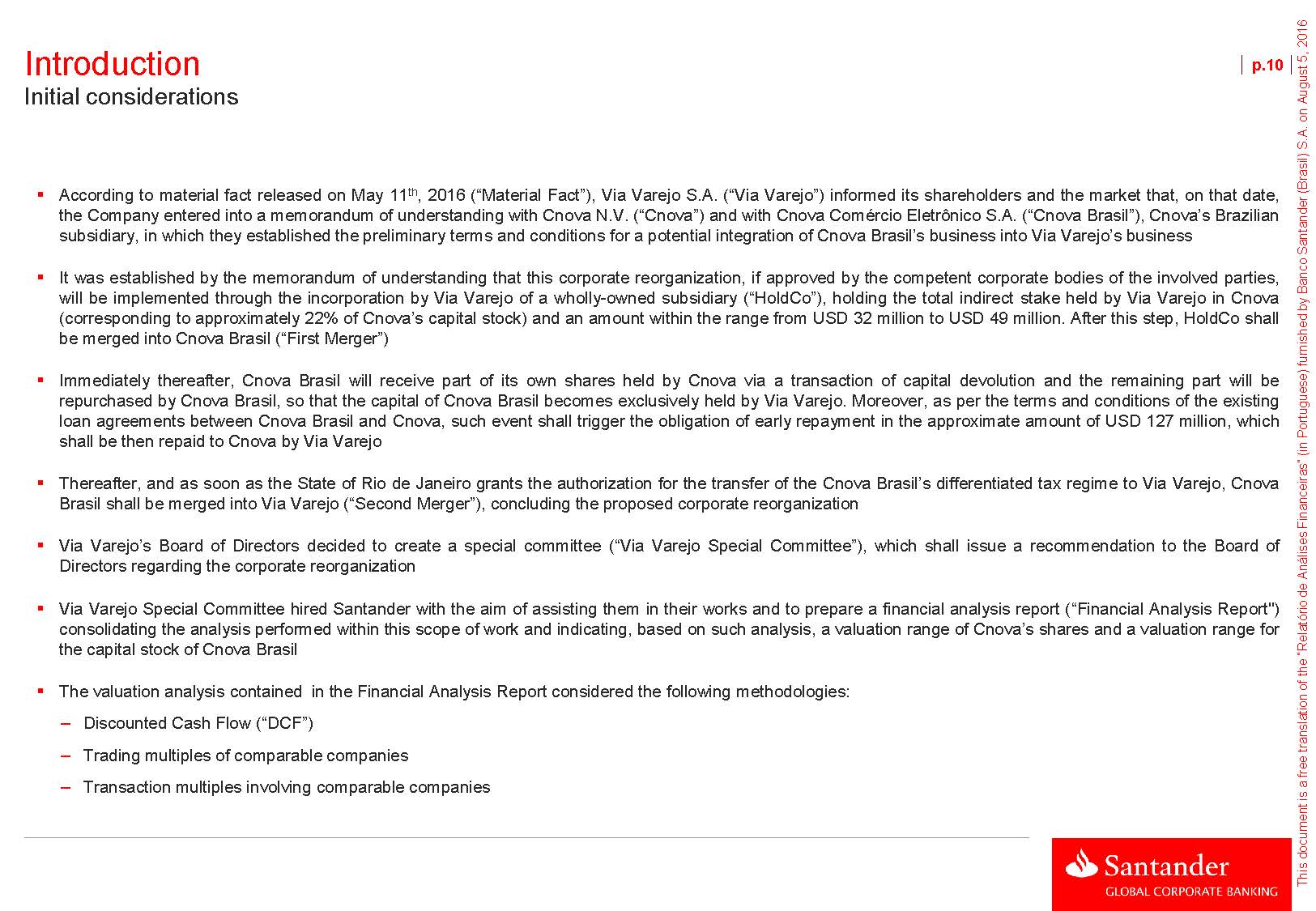

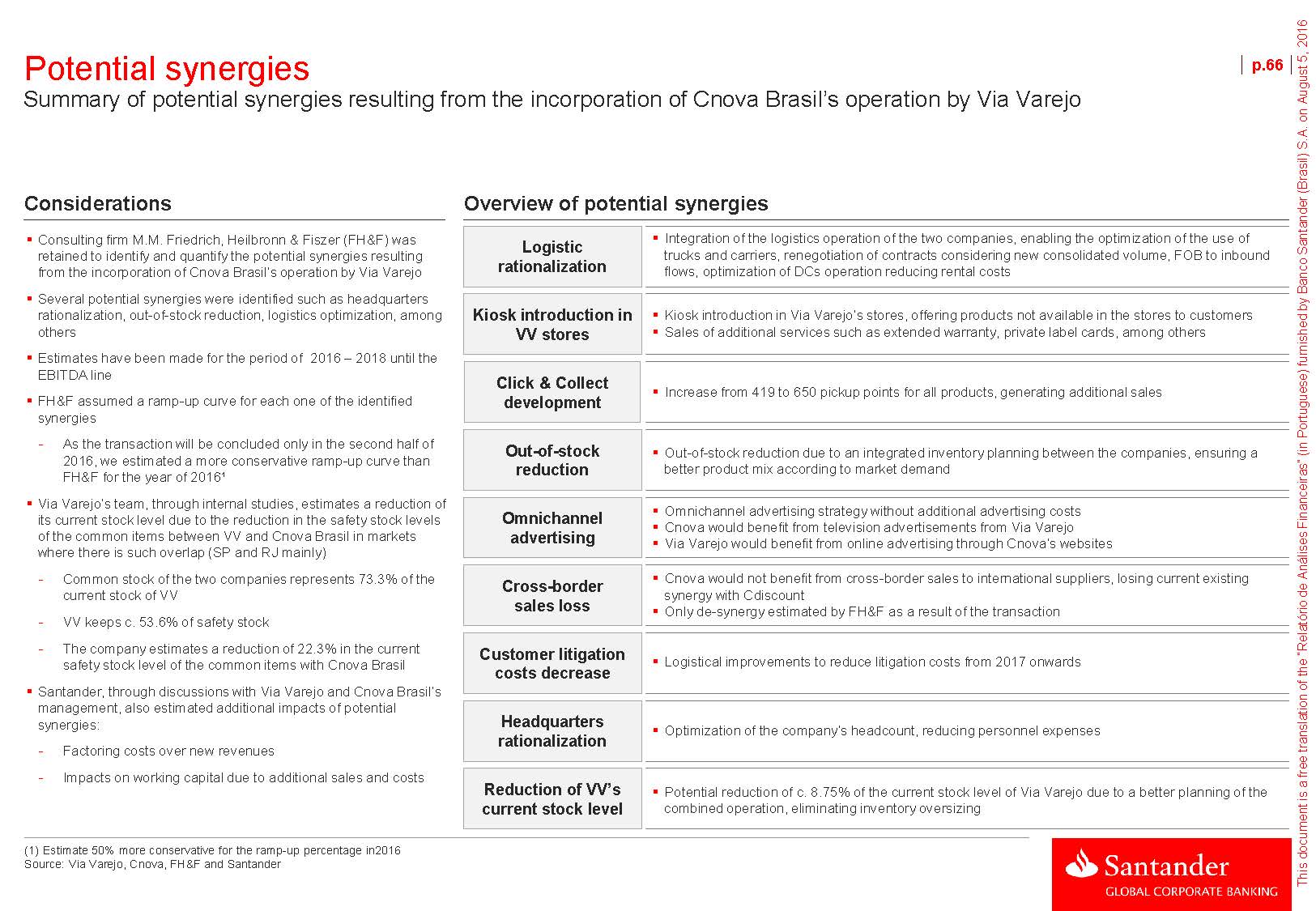

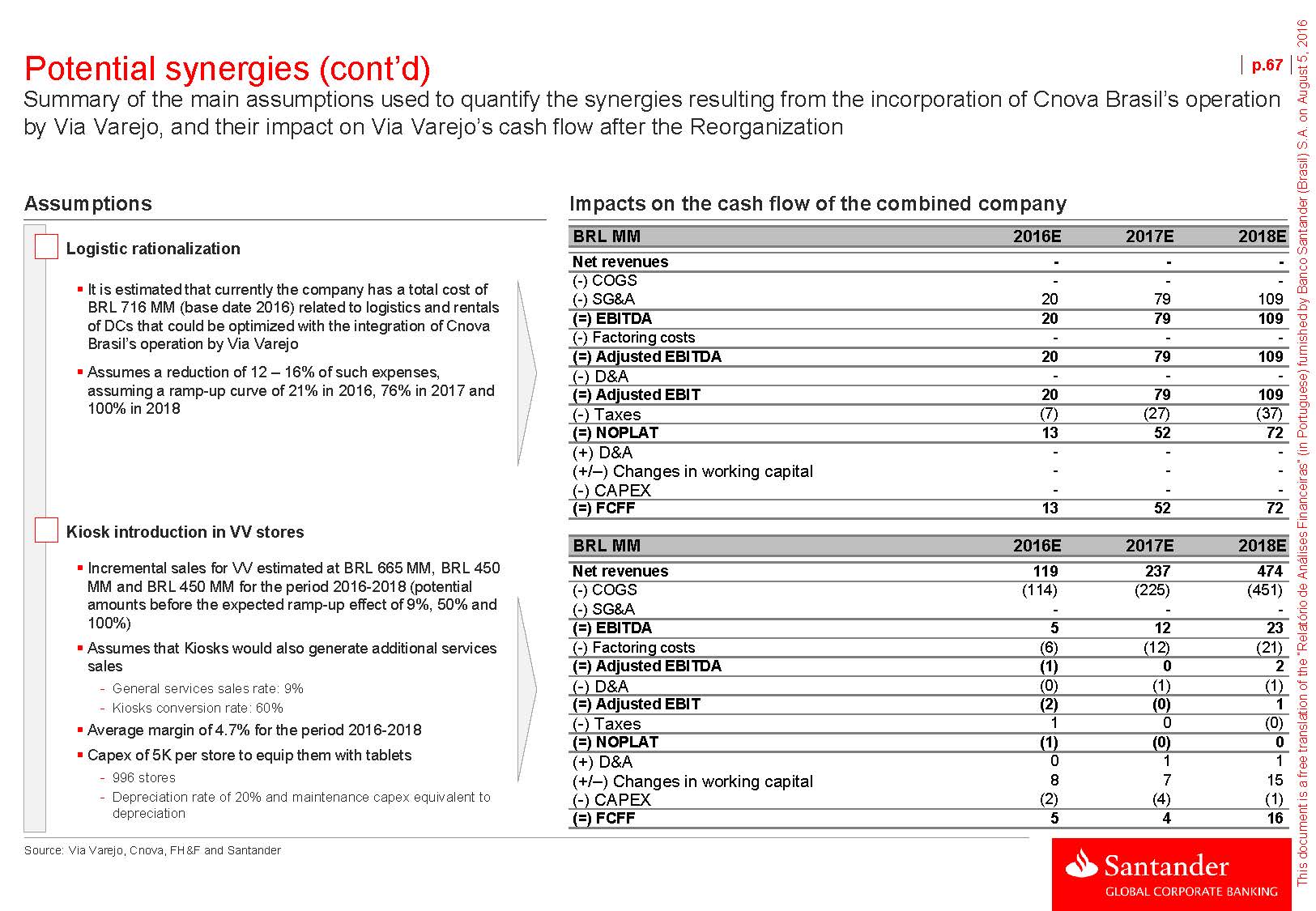

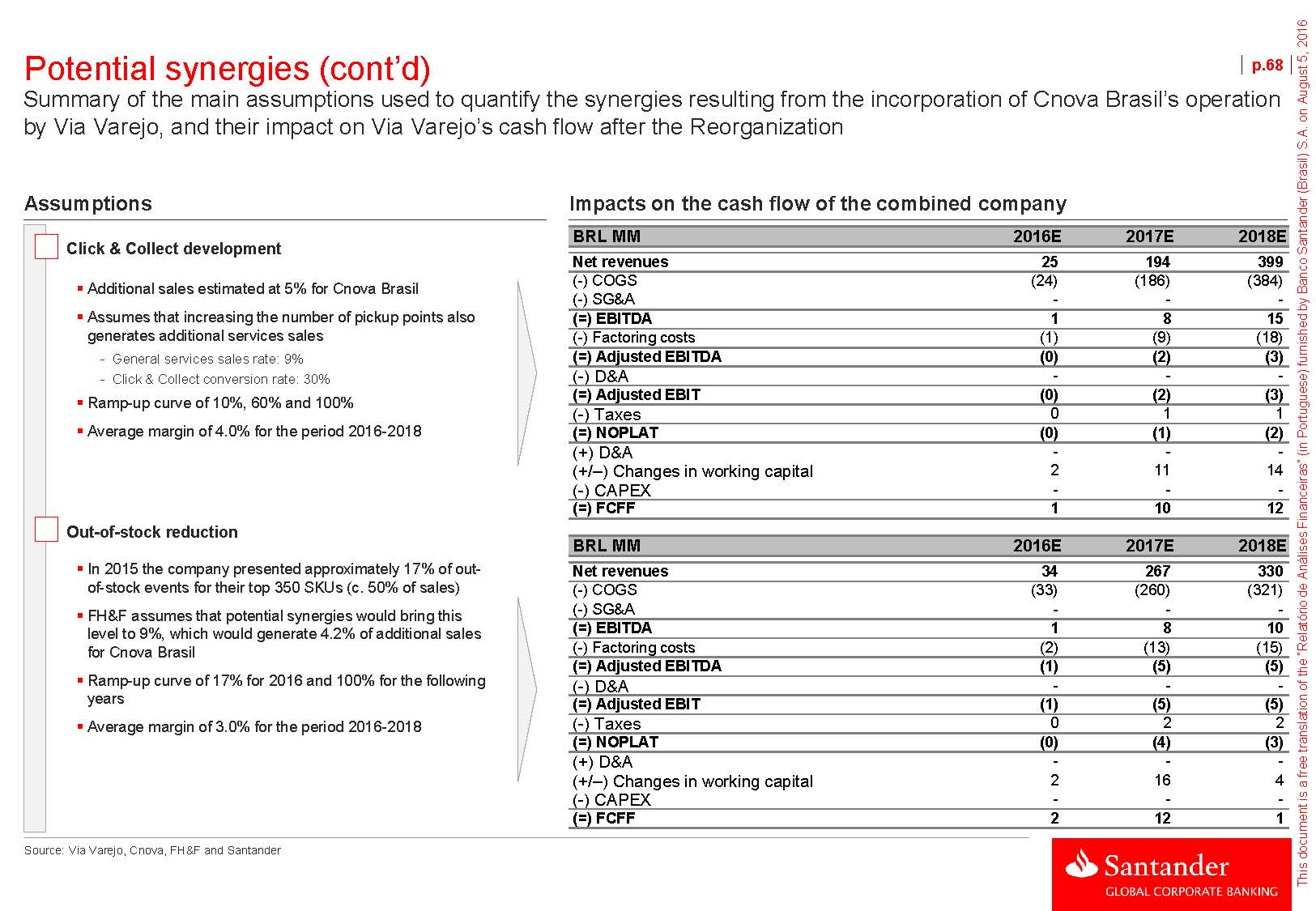

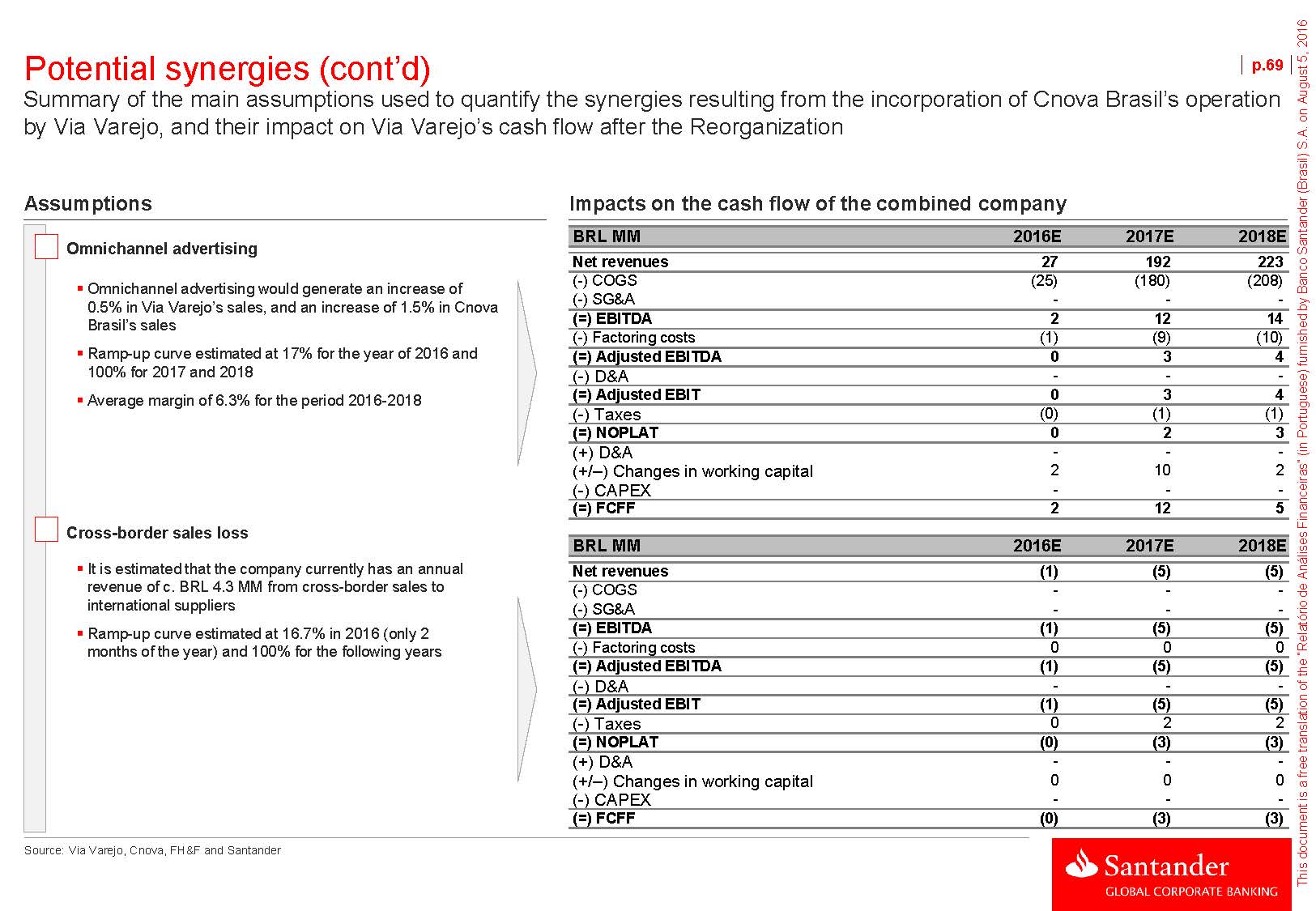

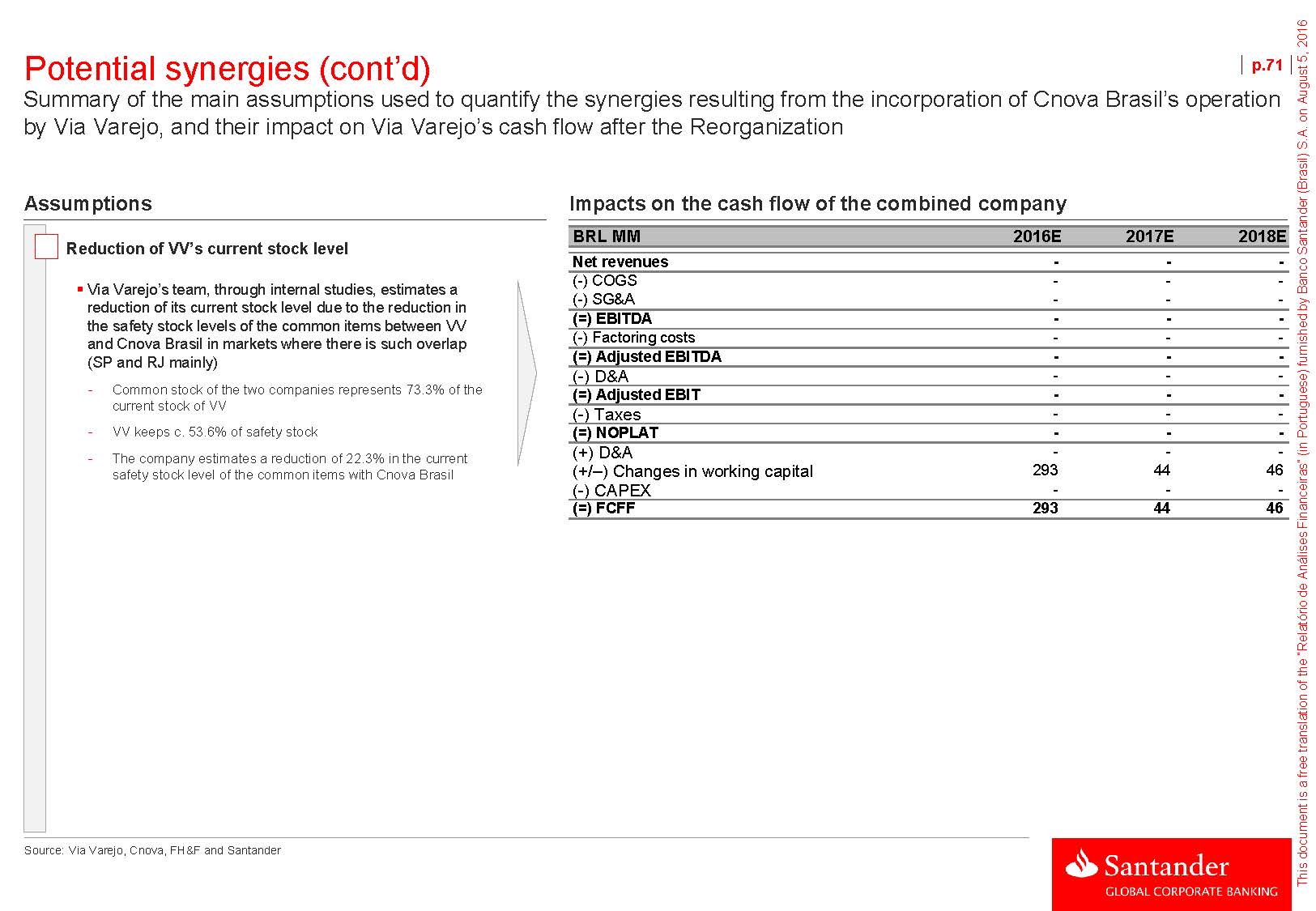

Introduction Initial considerations p.10According to material fact released on May 11th, 2016 (“Material Fact”), Via Varejo S.A. (“Via Varejo”) informed its shareholders and the market that, on that date, the Company entered into a memorandum of understanding with Cnova N.V. (“Cnova”) and with Cnova Comércio Eletrônico S.A. (“Cnova Brasil”), Cnova’s Brazilian subsidiary, in which they established the preliminary terms and conditions for a potential integration of Cnova Brasil’s business into Via Varejo’s businessIt was established by the memorandum of understanding that this corporate reorganization, if approved by the competent corporate bodies of the involved parties, will be implemented through the incorporation by Via Varejo of a wholly-owned subsidiary (“HoldCo”), holding the total indirect stake held by Via Varejo in Cnova (corresponding to approximately 22% of Cnova’s capital stock) and an amount within the range from USD 32 million to USD 49 million. After this step, HoldCo shall be merged into Cnova Brasil (“First Merger”)Immediately thereafter, Cnova Brasil will receive part of its own shares held by Cnova via a transaction of capital devolution and the remaining part will be repurchased by Cnova Brasil, so that the capital of Cnova Brasil becomes exclusively held by Via Varejo. Moreover, as per the terms and conditions of the existing loan agreements between Cnova Brasil and Cnova, such event shall trigger the obligation of early repayment in the approximate amount of USD 127 million, which shall be then repaid to Cnova by Via VarejoThereafter, and as soon as the State of Rio de Janeiro grants the authorization for the transfer of the Cnova Brasil’s differentiated tax regime to Via Varejo, Cnova Brasil shall be merged into Via Varejo (“Second Merger”), concluding the proposed corporate reorganizationVia Varejo’s Board of Directors decided to create a special committee (“Via Varejo Special Committee”), which shall issue a recommendation to the Board of Directors regarding the corporate reorganizationVia Varejo Special Committee hired Santander with the aim of assisting them in their works and to prepare a financial analysis report (“Financial Analysis Report") consolidating the analysis performed within this scope of work and indicating, based on such analysis, a valuation range of Cnova’s shares and a valuation range for the capital stock of Cnova BrasilThe valuation analysis contained in the Financial Analysis Report considered the following methodologies: Discounted Cash Flow (“DCF”) Trading multiples of comparable companies Transaction multiples involving comparable companies

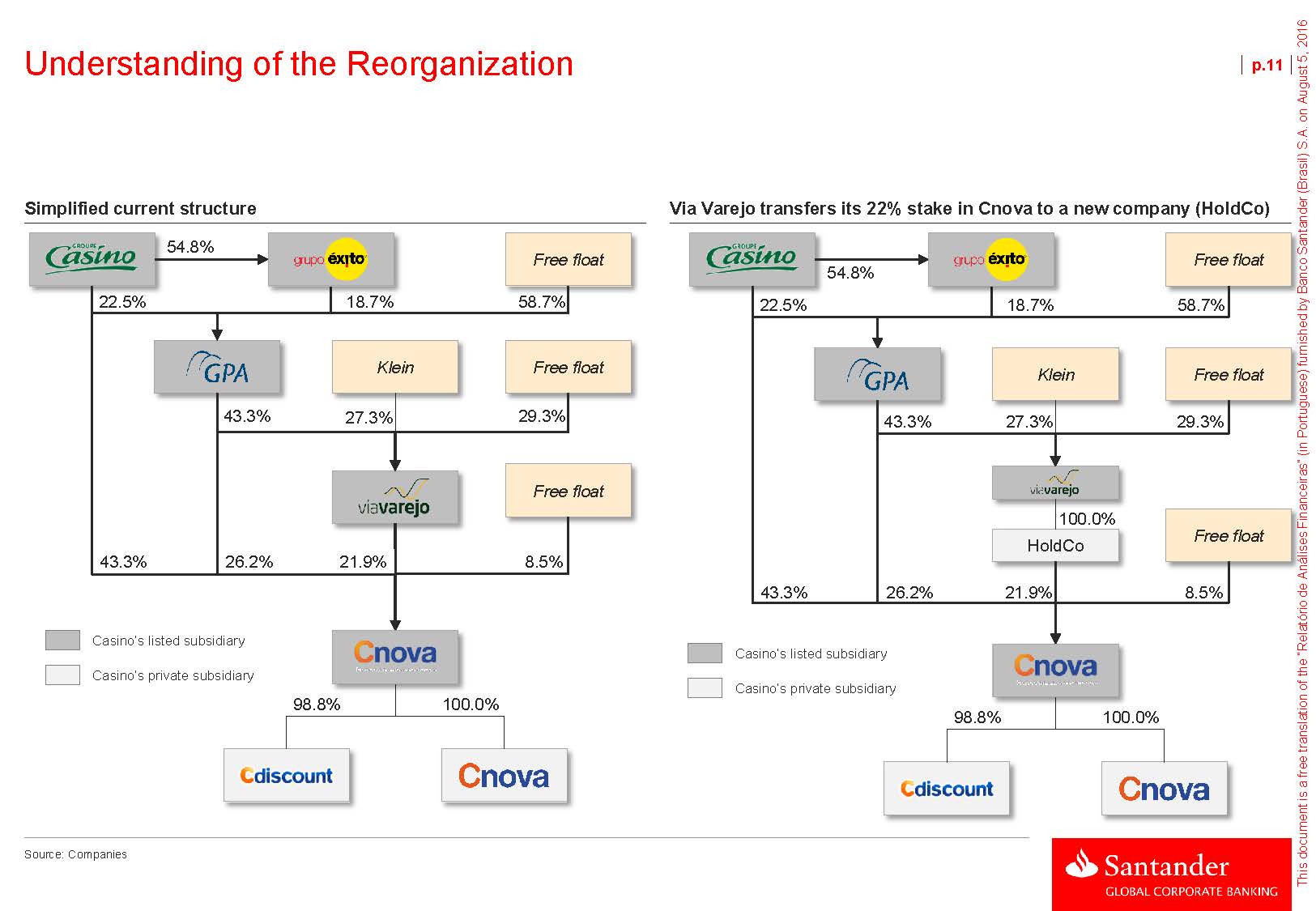

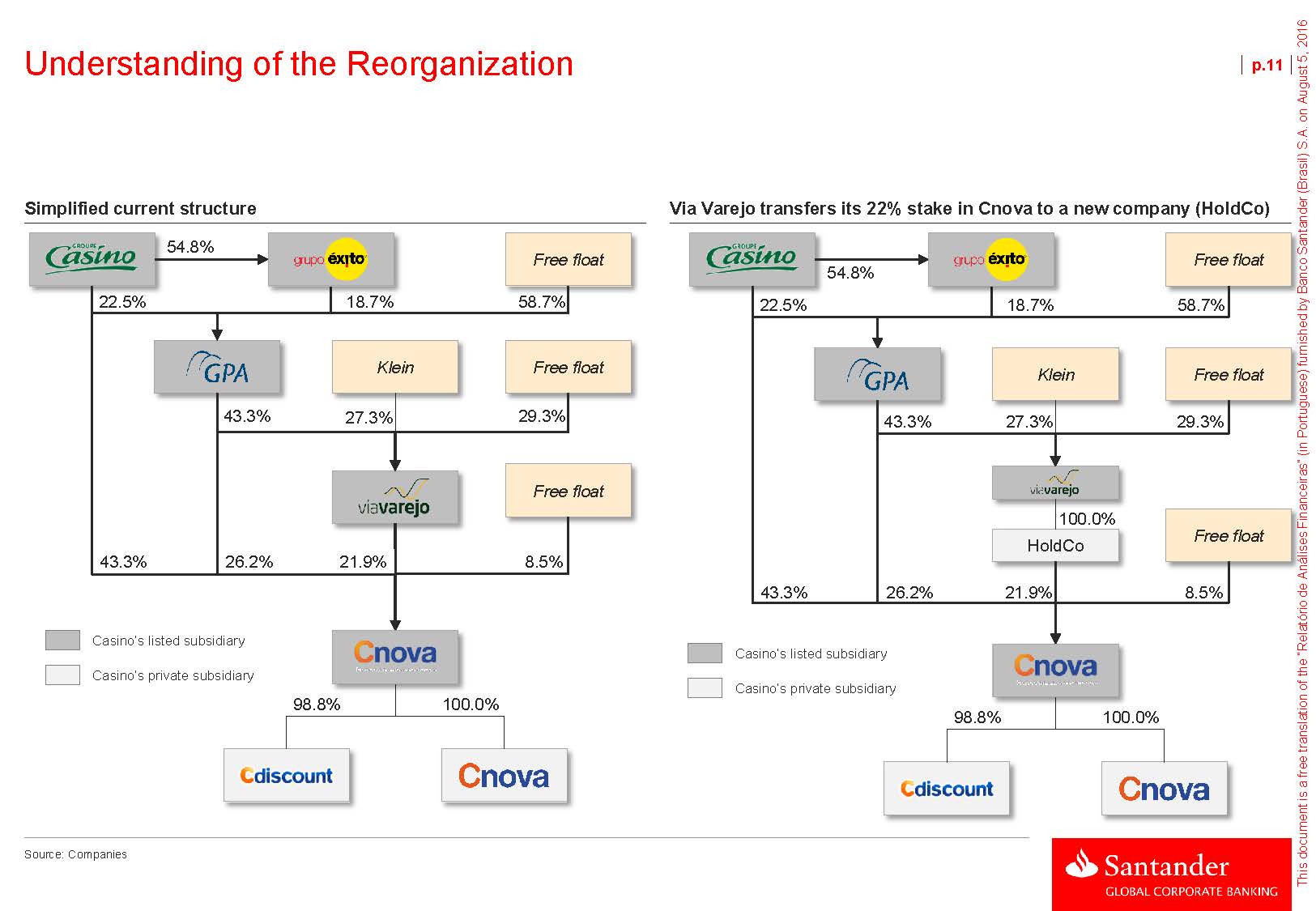

Understanding of the Reorganization p.11Simplified current structure Via Varejo transfers its 22% stake in Cnova to a new company (HoldCo) 22.5% 54.8% 18.7% Free float 58.7% 22.5% 54.8% 18.7% Free float 58.7% Klein Free float Klein Free float 43.3% 27.3% 29.3% 43.3% 27.3% 29.3% 43.3% 26.2% 21.9% Free float 8.5% 43.3% 26.2% 100.0% HoldCo 21.9% Free float 8.5% Casino’s listed subsidiary Casino’s private subsidiary 98.8% 100.0% Casino’s listed subsidiary Casino’s private subsidiary 98.8% 100.0% Source: Companies

Understanding of the Reorganization (cont’d) p.12HoldCo is incorporated by Cnova BrasilCnova NV’s capital devolution + repurchase of Cnova Brasil’s shares +prepayment of debt between related parties22.5% 54.8% 18.7% Free float 58.7% 22.5% 54.8% 18.7% Free float 58.7% Klein Free float Klein Free float 43.3% 27.3% 29.3% 43.3% 27.3% 29.3% HoldCo + Nova Free float + Cnova BrasilFree float 43.3% 26.2% 21.9% 8.5% 55.5% 33.6% 10.9% Casino’s listed subsidiary Casino’s private subsidiary 98.8% Casino’s listed subsidiary Casino’s private subsidiary 98.8% Source: Companies

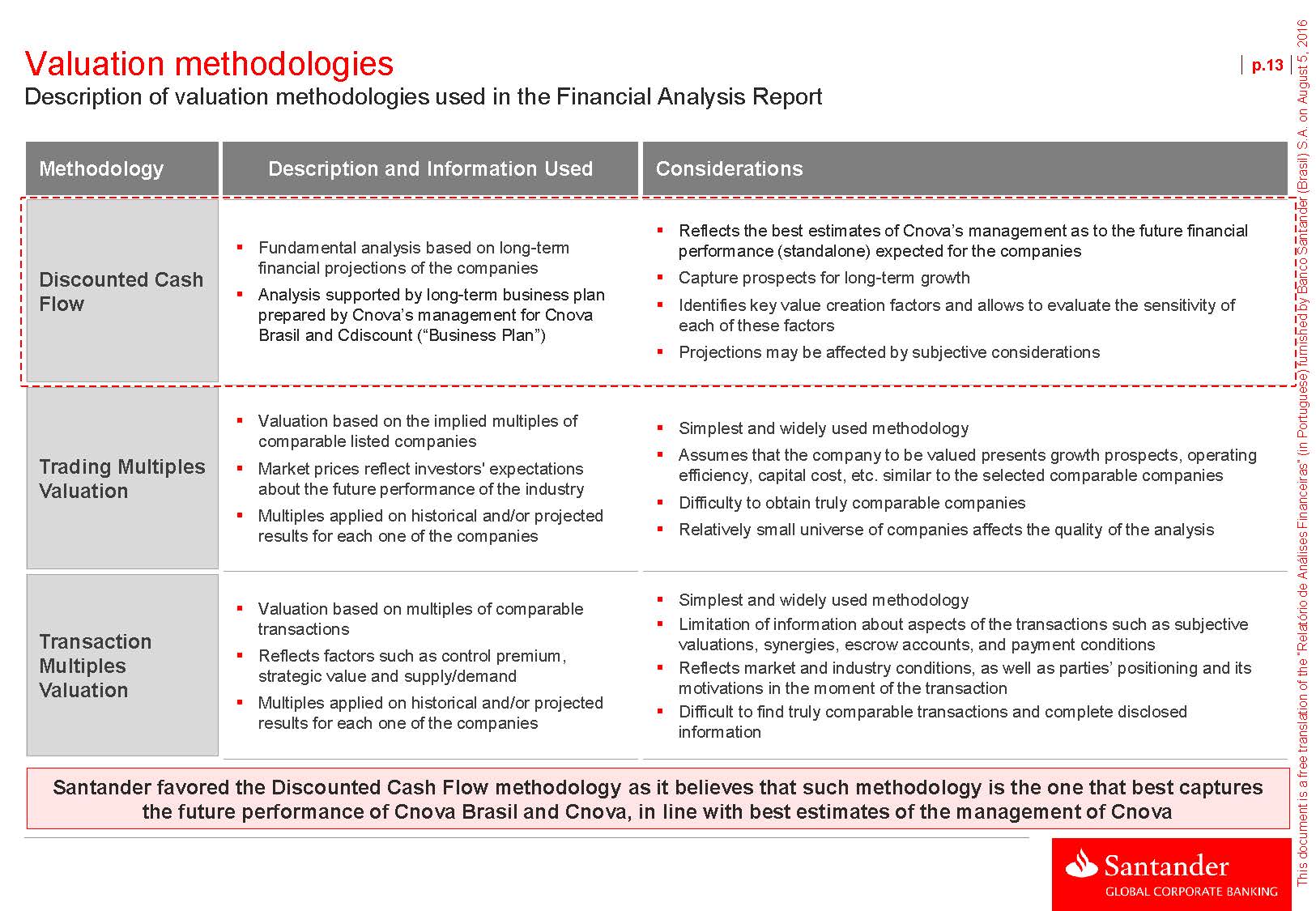

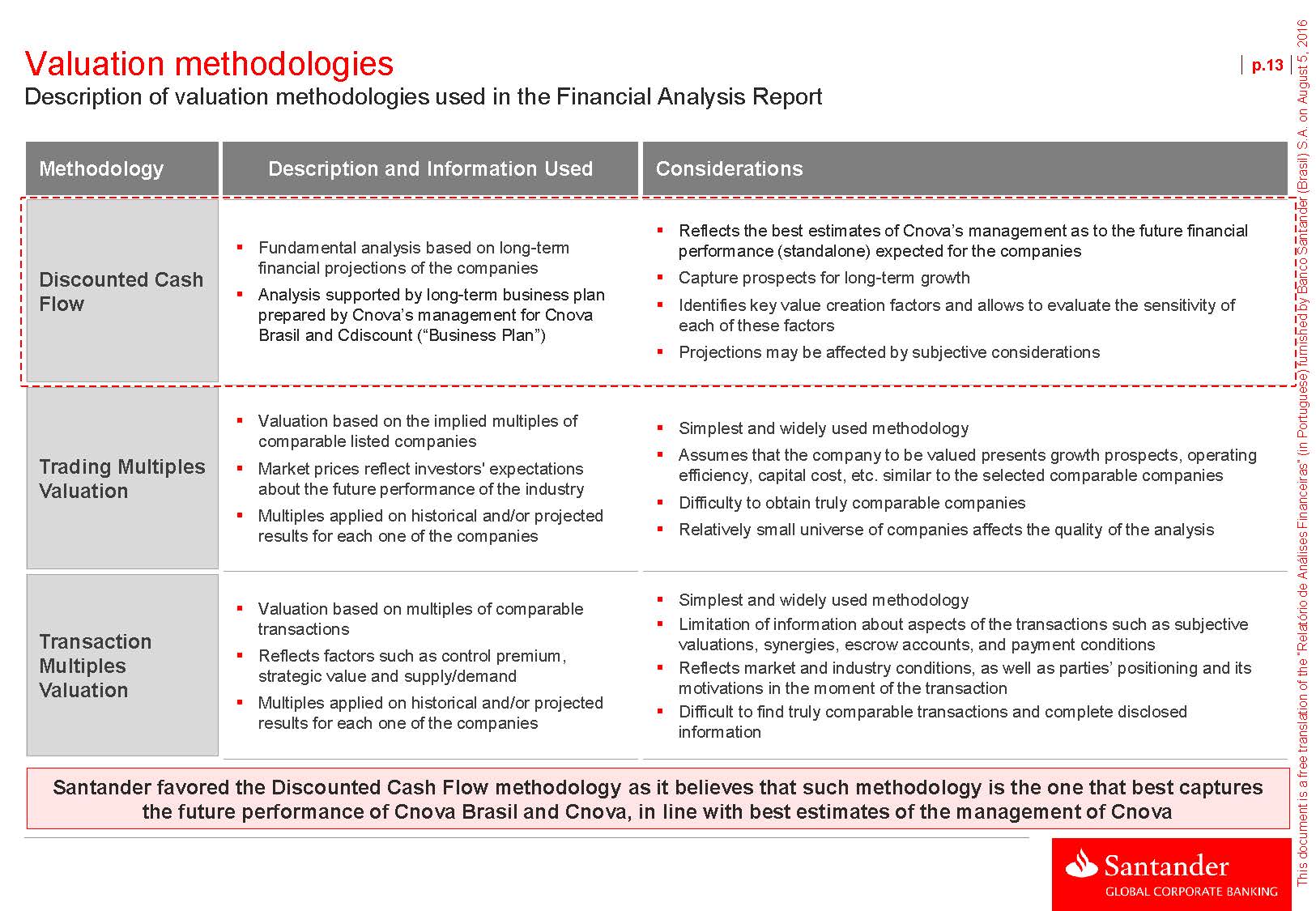

Valuation methodologies Description of valuation methodologies used in the Financial Analysis Report p.13Valuation based on the implied multiples of comparable listed companiesMarket prices reflect investors' expectations about the future performance of the industryMultiples applied on historical and/or projected results for each one of the companiesSimplest and widely used methodology Assumes that the company to be valued presents growth prospects, operating efficiency, capital cost, etc. similar to the selected comparable companiesDifficulty to obtain truly comparable companiesRelatively small universe of companies affects the quality of the analysisValuation based on multiples of comparable transactionsReflects factors such as control premium, strategic value and supply/demandMultiples applied on historical and/or projected results for each one of the companiesSimplest and widely used methodologyLimitation of information about aspects of the transactions such as subjective valuations, synergies, escrow accounts, and payment conditions Reflects market and industry conditions, as well as parties’ positioning and its motivations in the moment of the transactionDifficult to find truly comparable transactions and complete disclosed information Santander favored the Discounted Cash Flow methodology as it believes that such methodology is the one that best captures the future performance of Cnova Brasil and Cnova, in line with best estimates of the management of Cnova

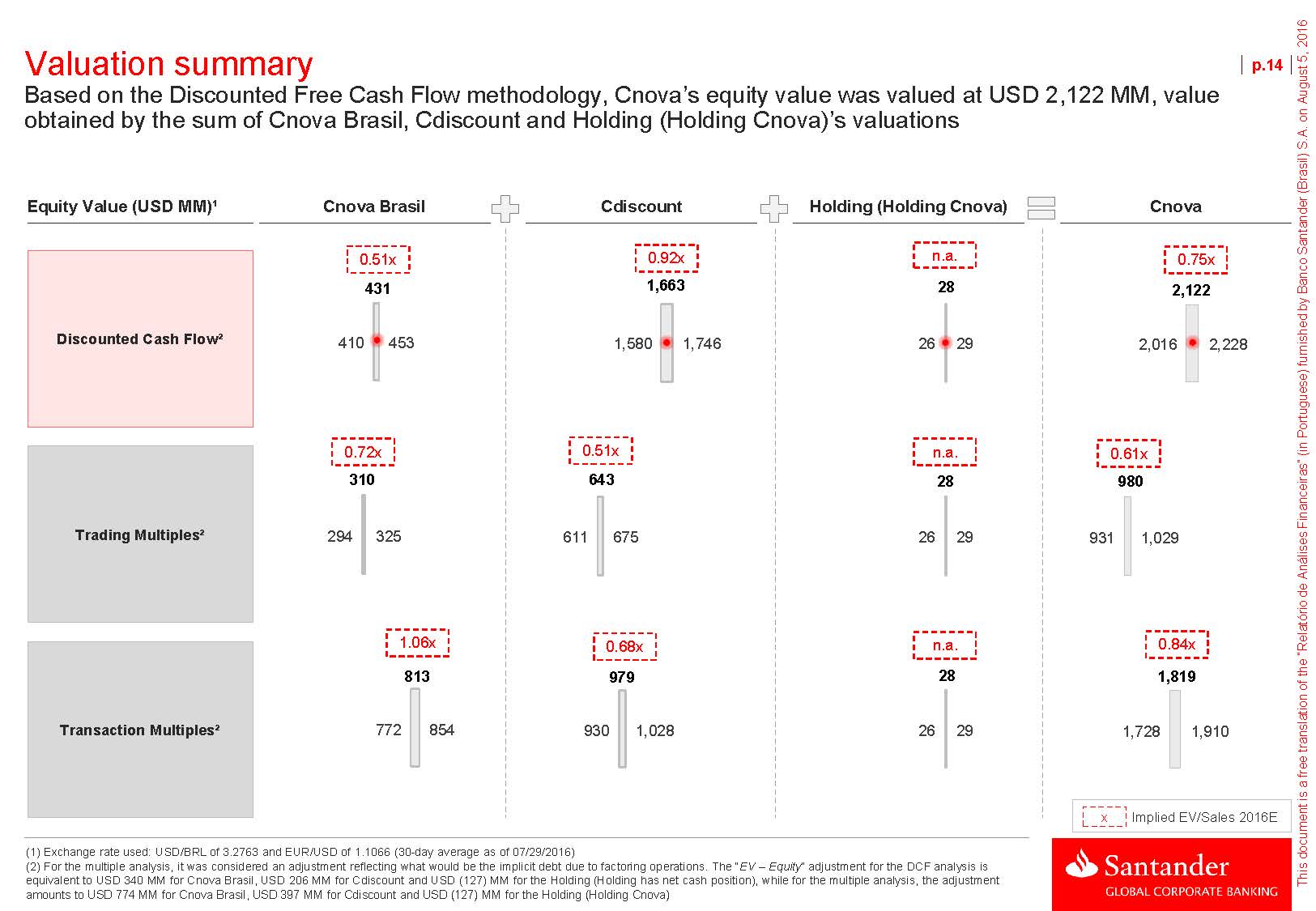

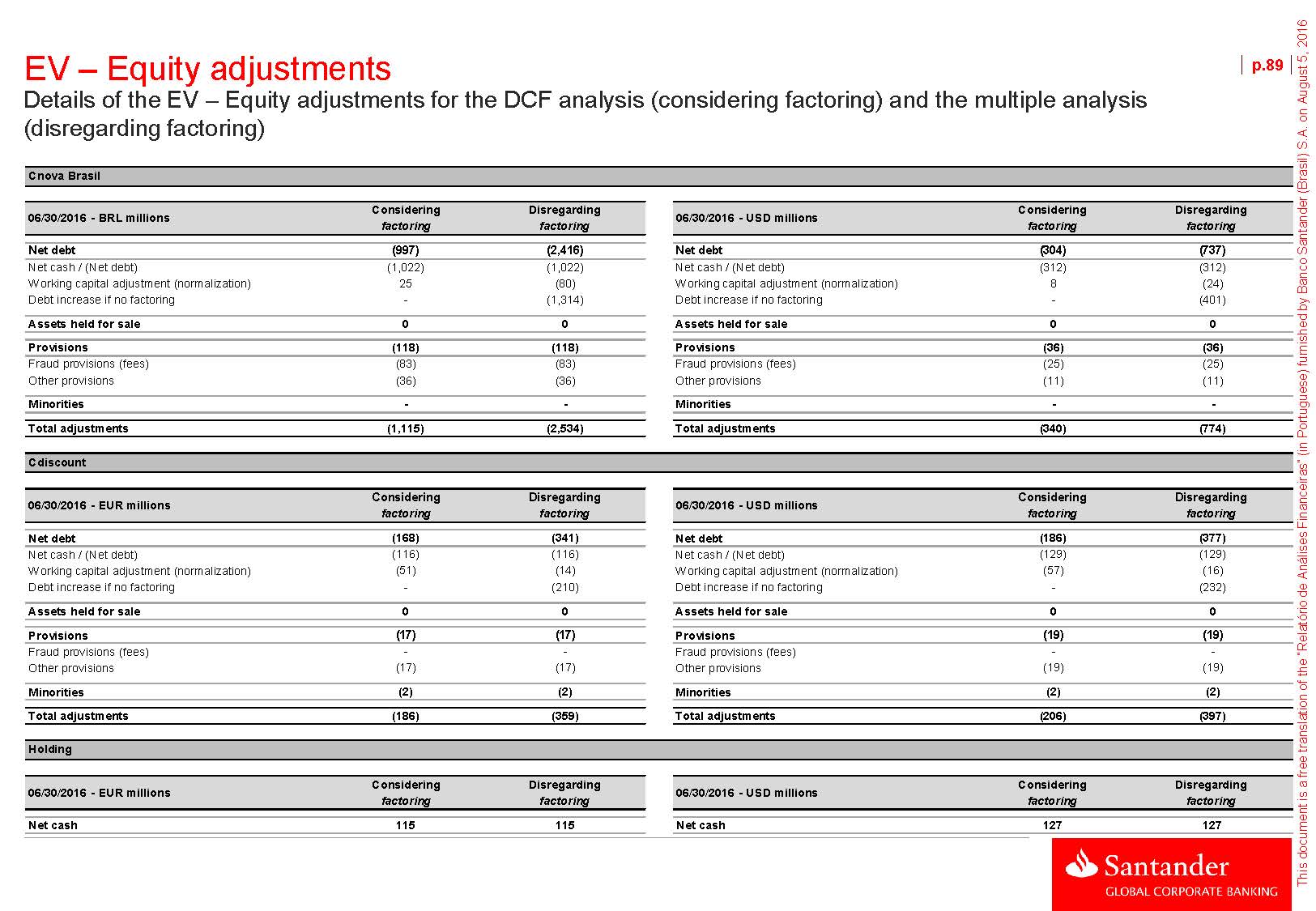

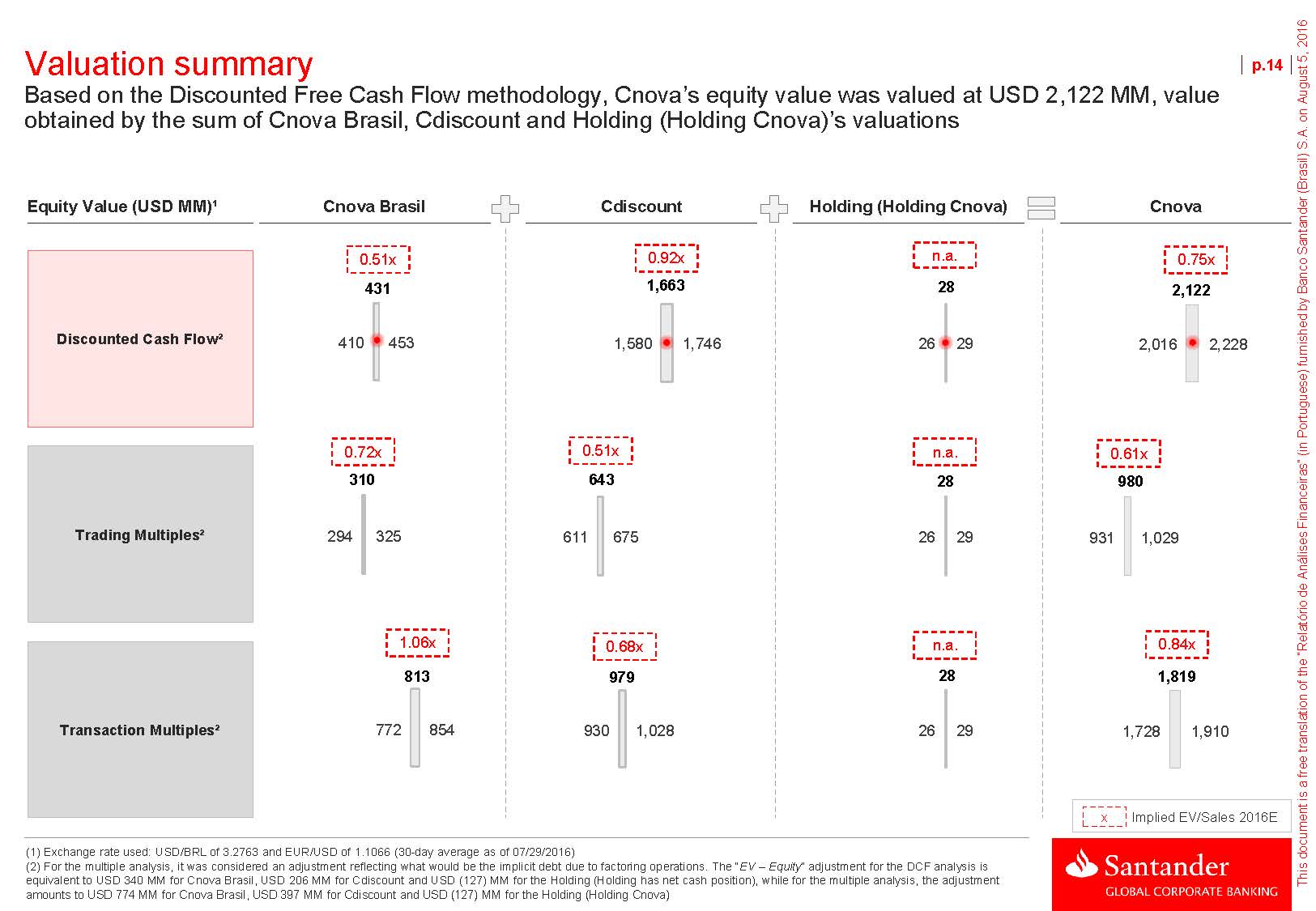

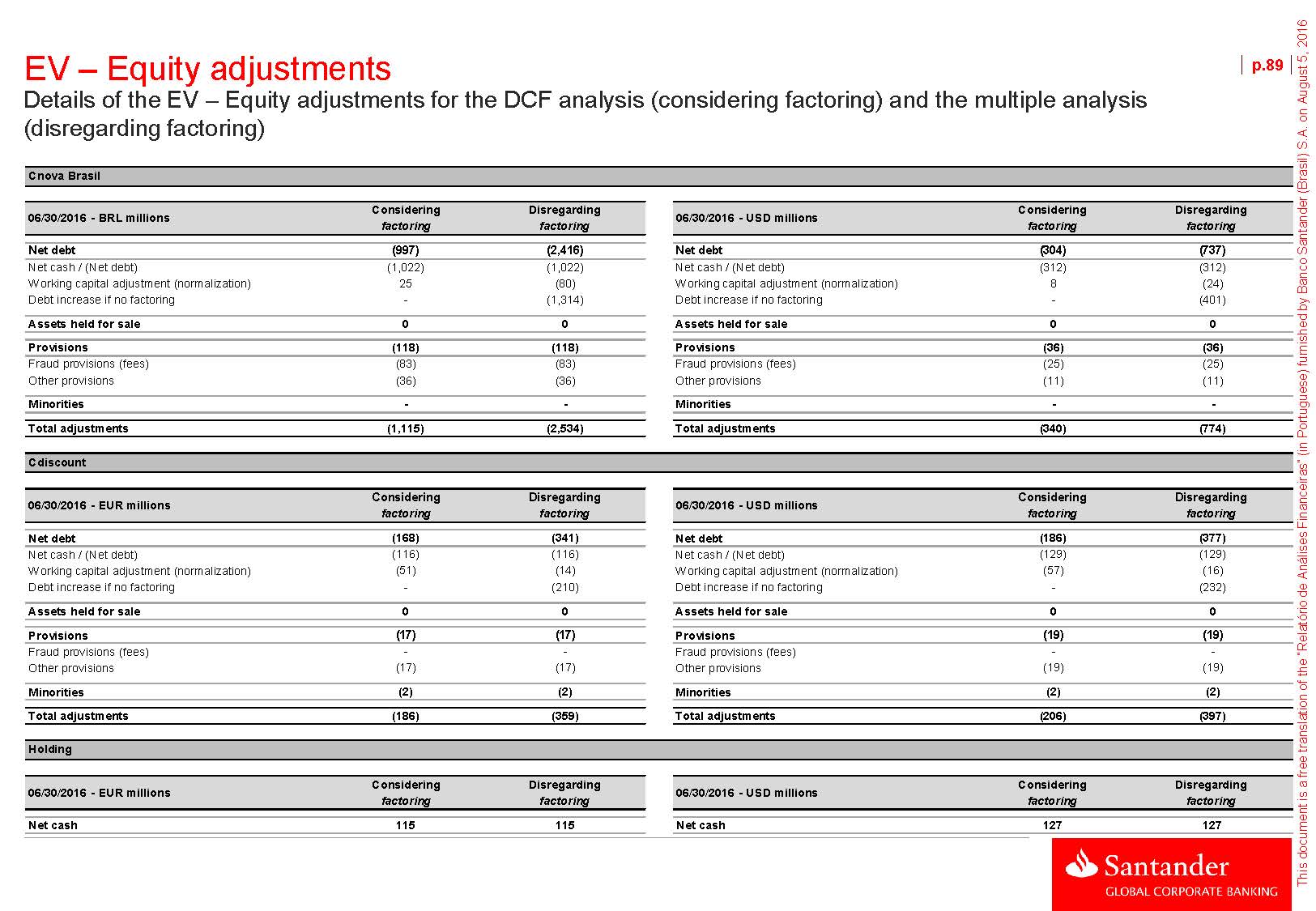

Valuation summary Based on the Discounted Free Cash Flow methodology, Cnova’s equity value was valued at USD 2,122 MM, value obtained by the sum of Cnova Brasil, Cdiscount and Holding (Holding Cnova)’s valuations p.14Equity Value (USD MM)¹Cnova BrasilCdiscount Holding (Holding Cnova) Cnova0.51x 4310.92x 1,663n.a. 280.75x 2,122Discounted Cash Flow²410 453 1,580 1,746 26 29 2,016 2,228 0.72x 3100.51x 643n.a. 280.61x 980Trading Multiples²294 325 611 675 26 29 931 1,029 1.06x 8130.68x 979n.a. 280.84x 1,819Transaction Multiples²772 854 930 1,028 26 29 1,728 1,910 (1) Exchange rate used: USD/BRL of 3.2763 and EUR/USD of 1.1066 (30-day average as of 07/29/2016) (2) For the multiple analysis, it was considered an adjustment reflecting what would be the implicit debt due to factoring operations. The “EV – Equity” adjustment for the DCF analysis is equivalent to USD 340 MM for Cnova Brasil, USD 206 MM for Cdiscount and USD (127) MM for the Holding (Holding has net cash position), while for the multiple analysis, the adjustment amounts to USD 774 MM for Cnova Brasil, USD 397 MM for Cdiscount and USD (127) MM for the Holding (Holding Cnova) x Implied EV/Sales 2016E

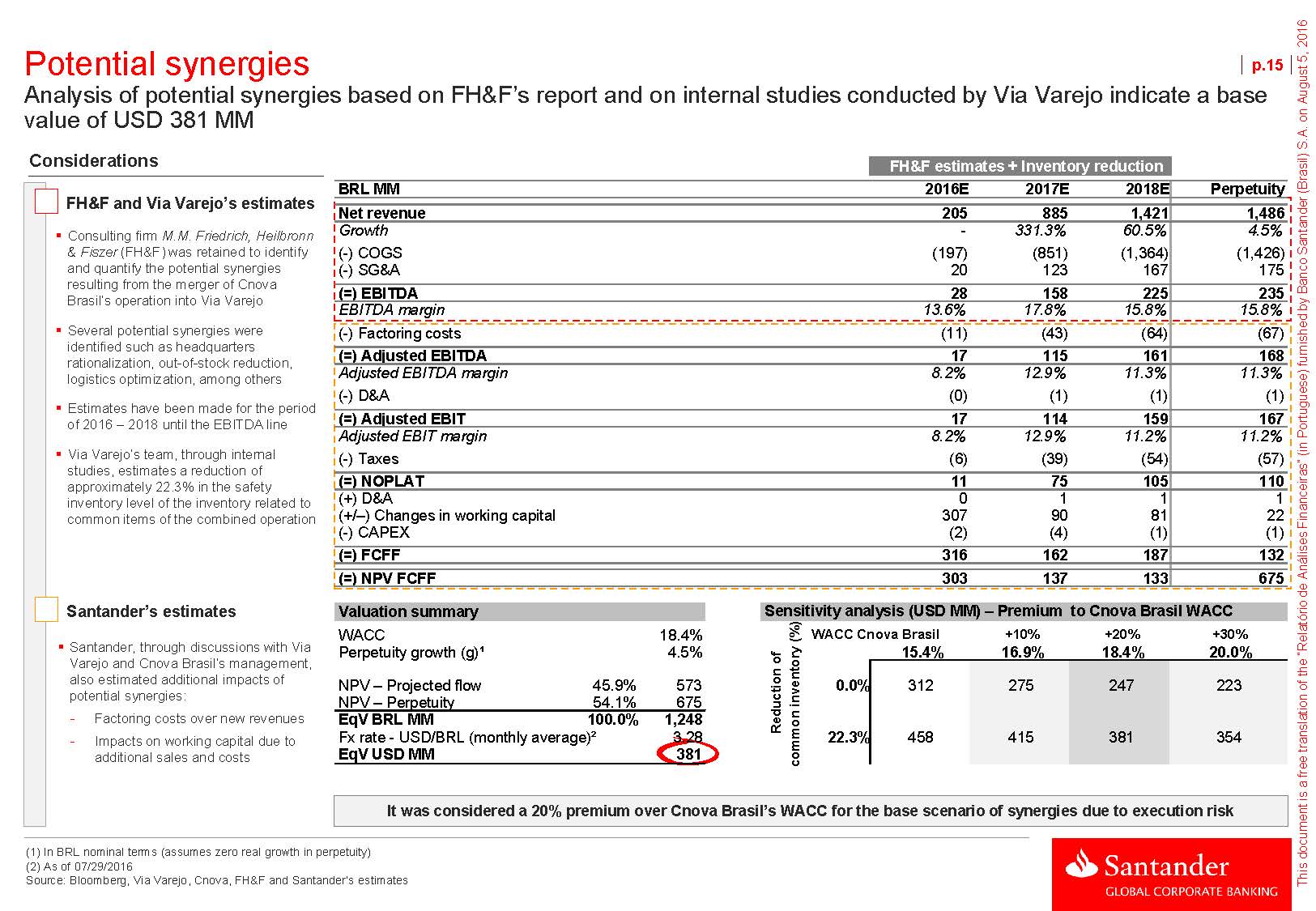

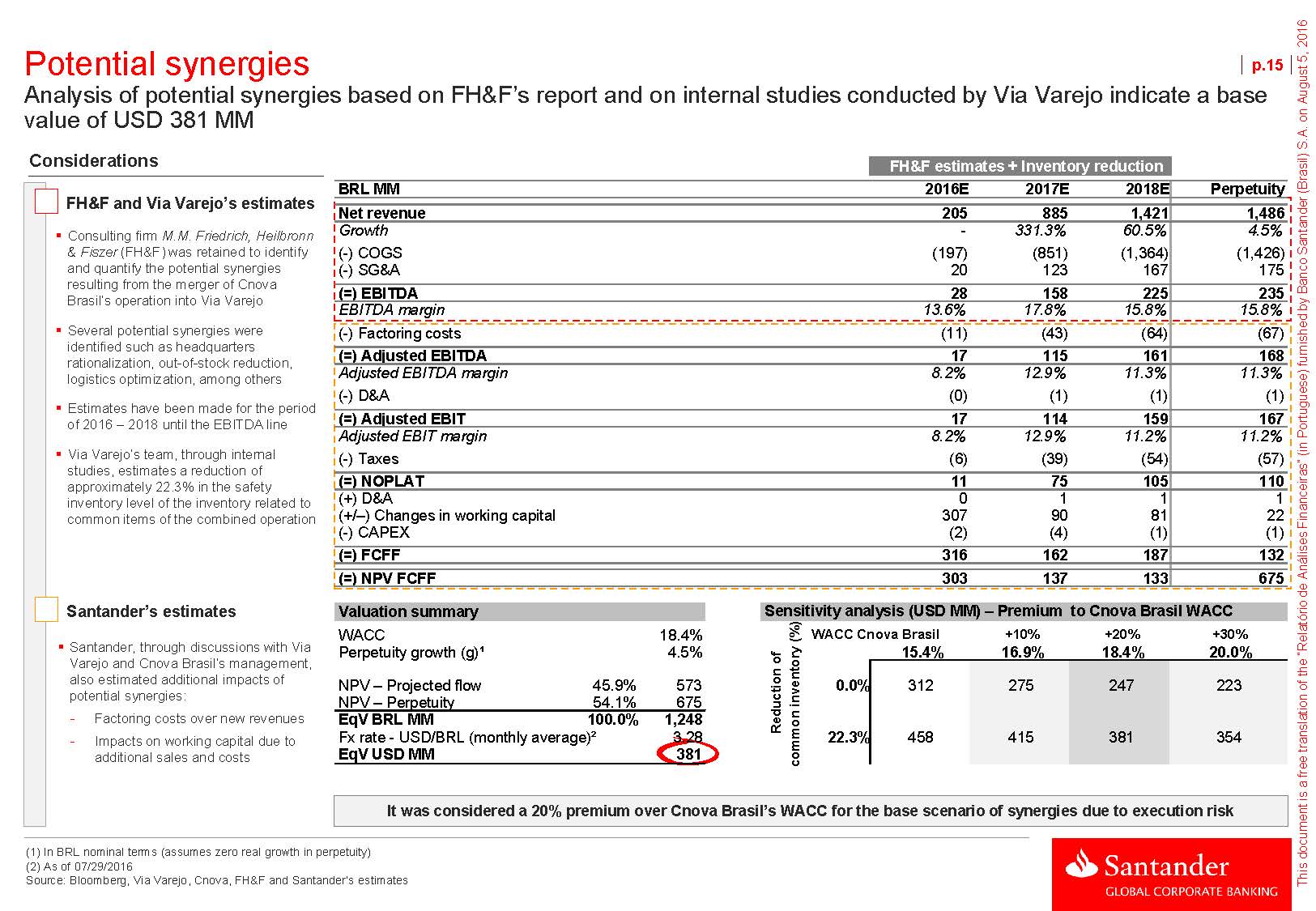

Potential synergies p.15Analysis of potential synergies based on FH&F’s report and on internal studies conducted by Via Varejo indicate a base value of USD 381 MM ConsiderationsFH&F and Via Varejo’s estimatesConsulting firmM.M. Friedrich, Heilbronn & Fiszer(FH&F) was retained to identify and quantify the potential synergies resulting from the merger of Cnova Brasil’s operation into Via VarejoSeveral potential synergies were identified such as headquarters rationalization, out-of-stock reduction, logistics optimization, among othersEstimates have been made for the period of 2016 – 2018 until the EBITDA lineVia Varejo’s team, through internal studies, estimates a reduction of approximately 22.3% in the safety inventory level of the inventory related to common items of the combined operation Santander’s estimatesSantander, through discussions with Via Varejo and Cnova Brasil’s management, also estimated additional impacts of potential synergies: Factoring costs over new revenues Impacts on working capital due to additional sales and costs FH&F estimates + Inventory reduction BRL MM 2016E 2017E 2018E Perpetuity Net revenue 205 885 1,421 1,486 Growth - 331.3% 60.5% (-) COGS (197) (851) (1,364) (-) SG&A 20 123 167 4.5% (1,426) 175 (=) EBITDA 28 158 225 235 EBITDA margin 13.6% 17.8% 15.8% 15.8% (-) Factoring costs (11) (43) (64) (67) (=) Adjusted EBITDA 17 115 161 168 Adjusted EBITDA margin 8.2% 12.9% 11.3% (-) D&A (0) (1) (1) 11.3% (1) (=) Adjusted EBIT 17 114 159 167 Adjusted EBIT margin 8.2% 12.9% 11.2% (-) Taxes (6) (39) (54) 11.2% (57) (=) NOPLAT 11 75 105 110 (+) D&A 0 1 1 (+/–) Changes in working capital 307 90 81 (-) CAPEX (2) (4) (1) 1 22 (1) (=) FCFF 316 162 187 132 (=) NPV FCFF 303 137 133 675 Valuation summary Sensitivity analysis (USD MM) – Premium to Cnova Brasil WACC WACC 18.4% WACC Cnova Brasil +10% +20% +30% Perpetuity growth (g)¹ 4.5% 15.4% 16.9% 18.4% 20.0% NPV – Projected flow 45.9% 573 0.0% 312 275 247 223 NPV – Perpetuity 54.1% 675 EqV BRL MM 100.0% 1,248 Fx rate - USD/BRL (monthly average)² 3.28 22.3% 458 415 381 354 EqV USD MM 381 It was considered a 20% premium over Cnova Brasil’s WACC for the base scenario of synergies due to execution risk (1) In BRL nominal terms (assumes zero real growth in perpetuity) (2) As of 07/29/2016 Source: Bloomberg, Via Varejo, Cnova, FH&F and Santander’s estimates

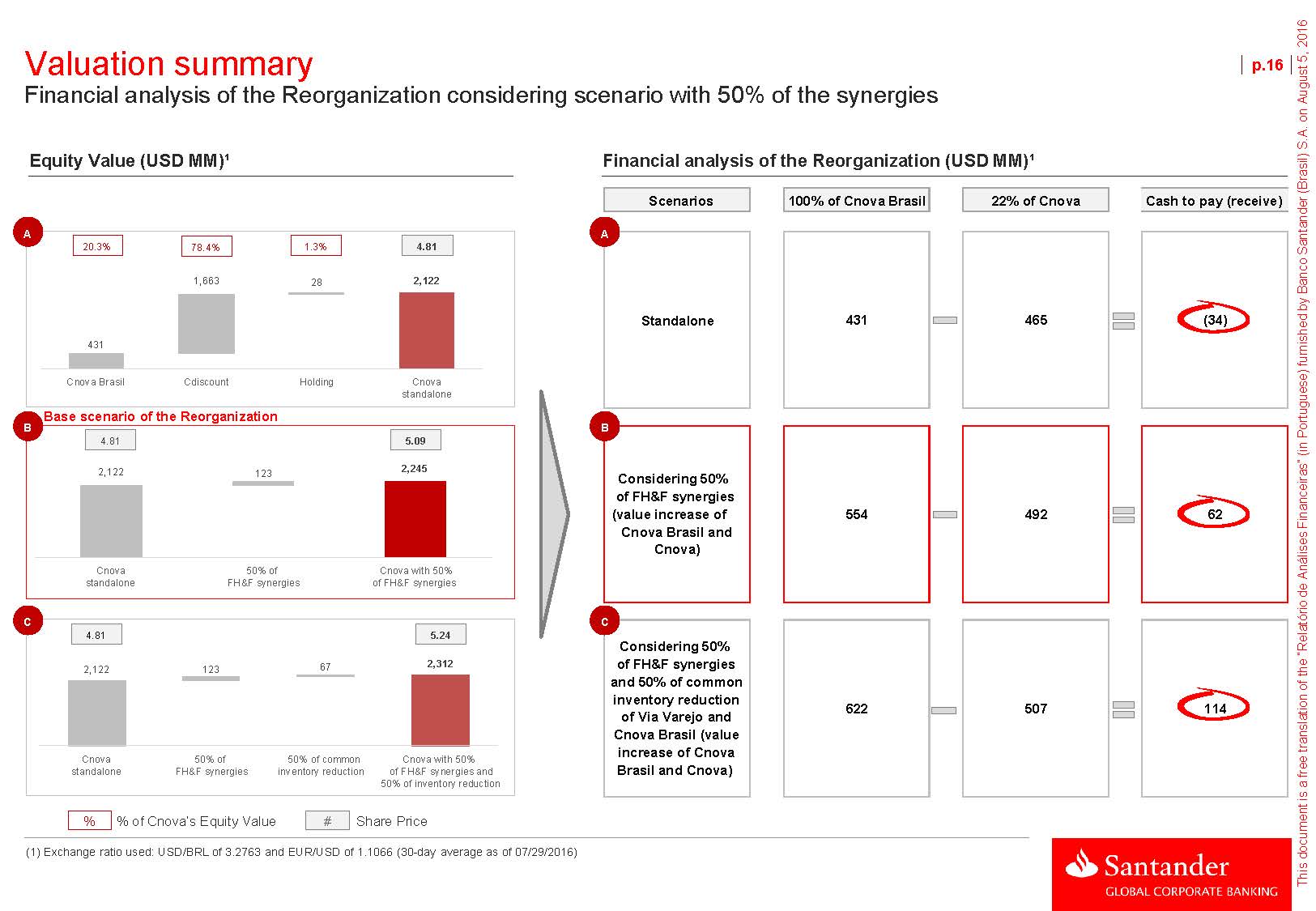

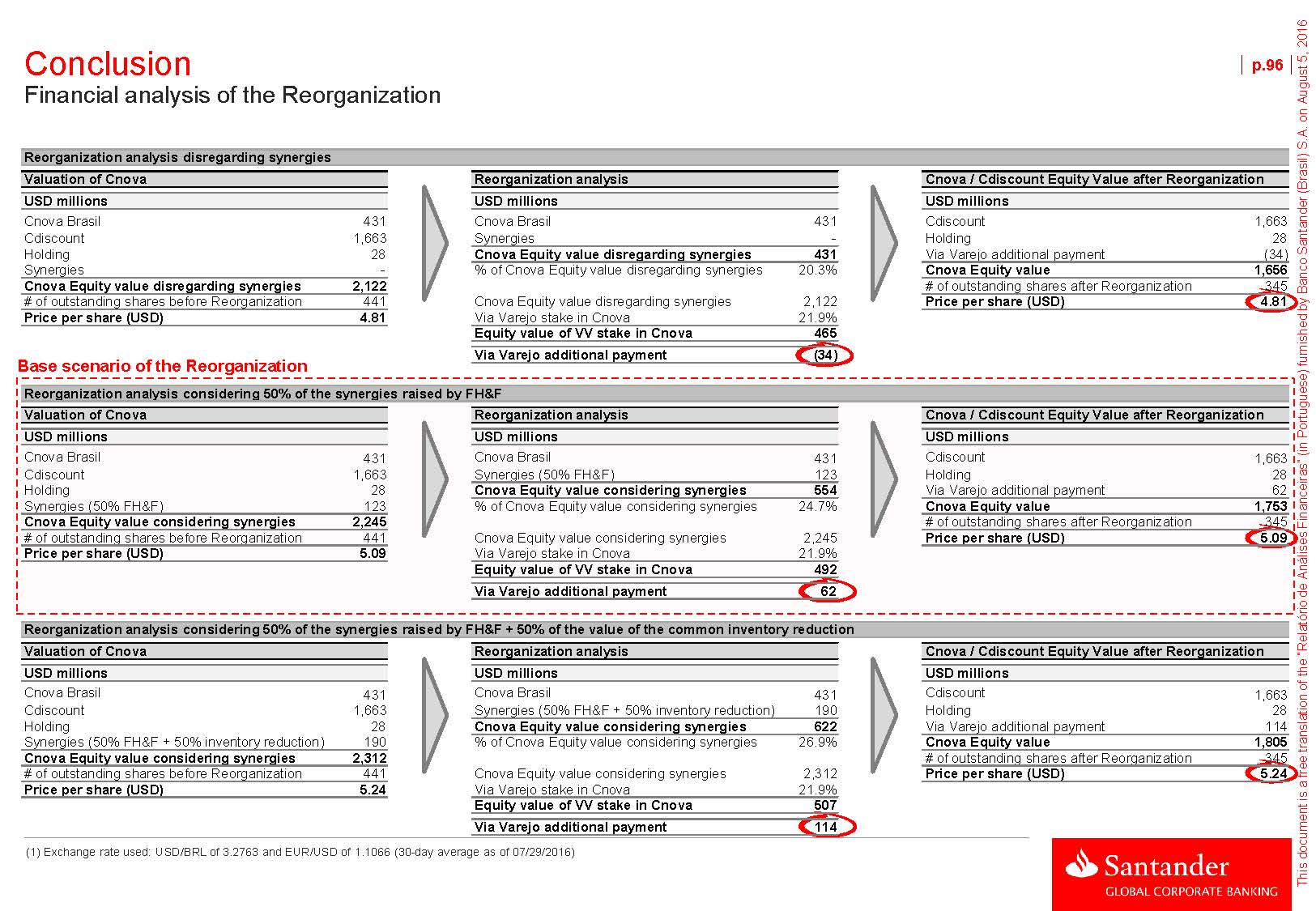

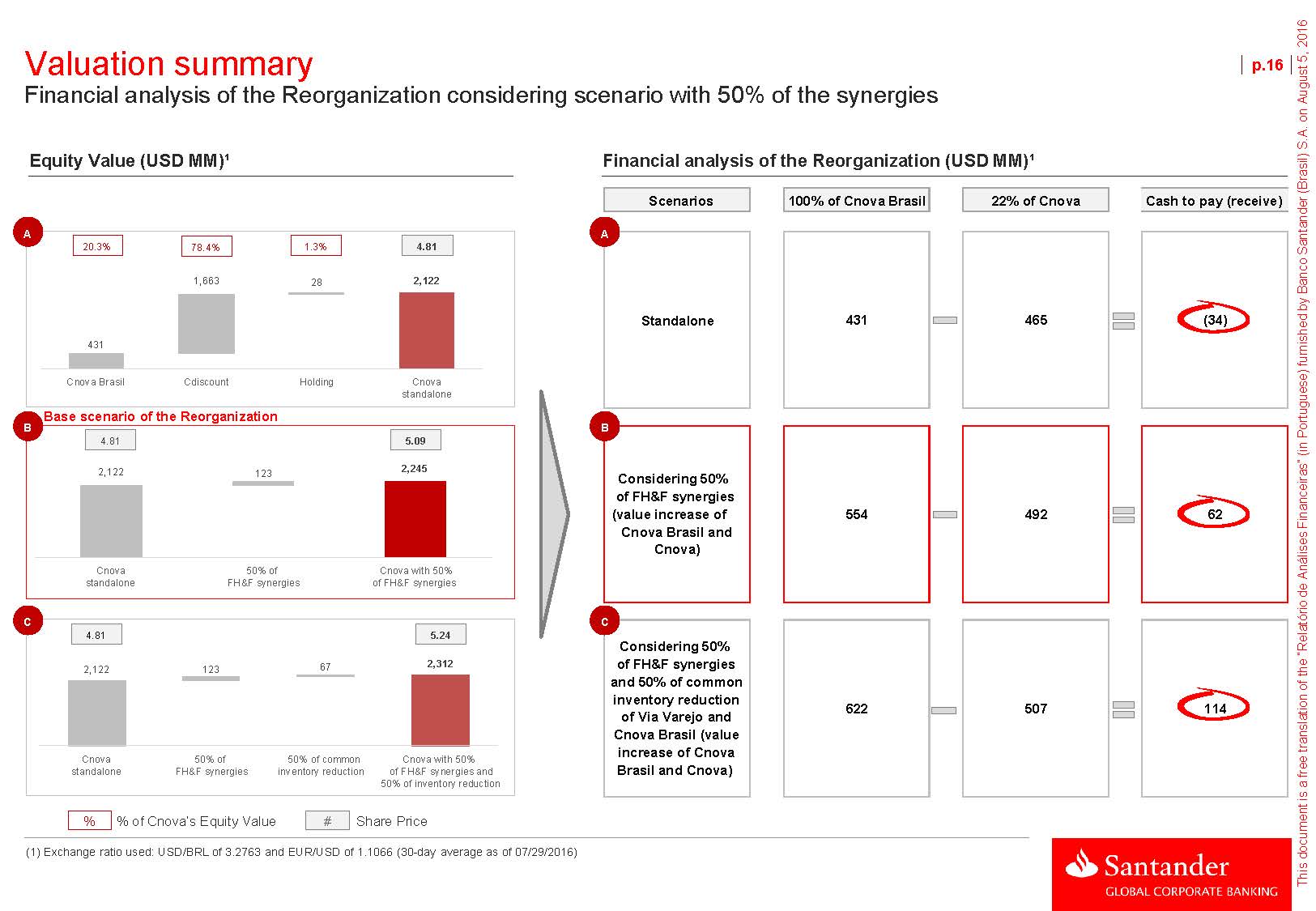

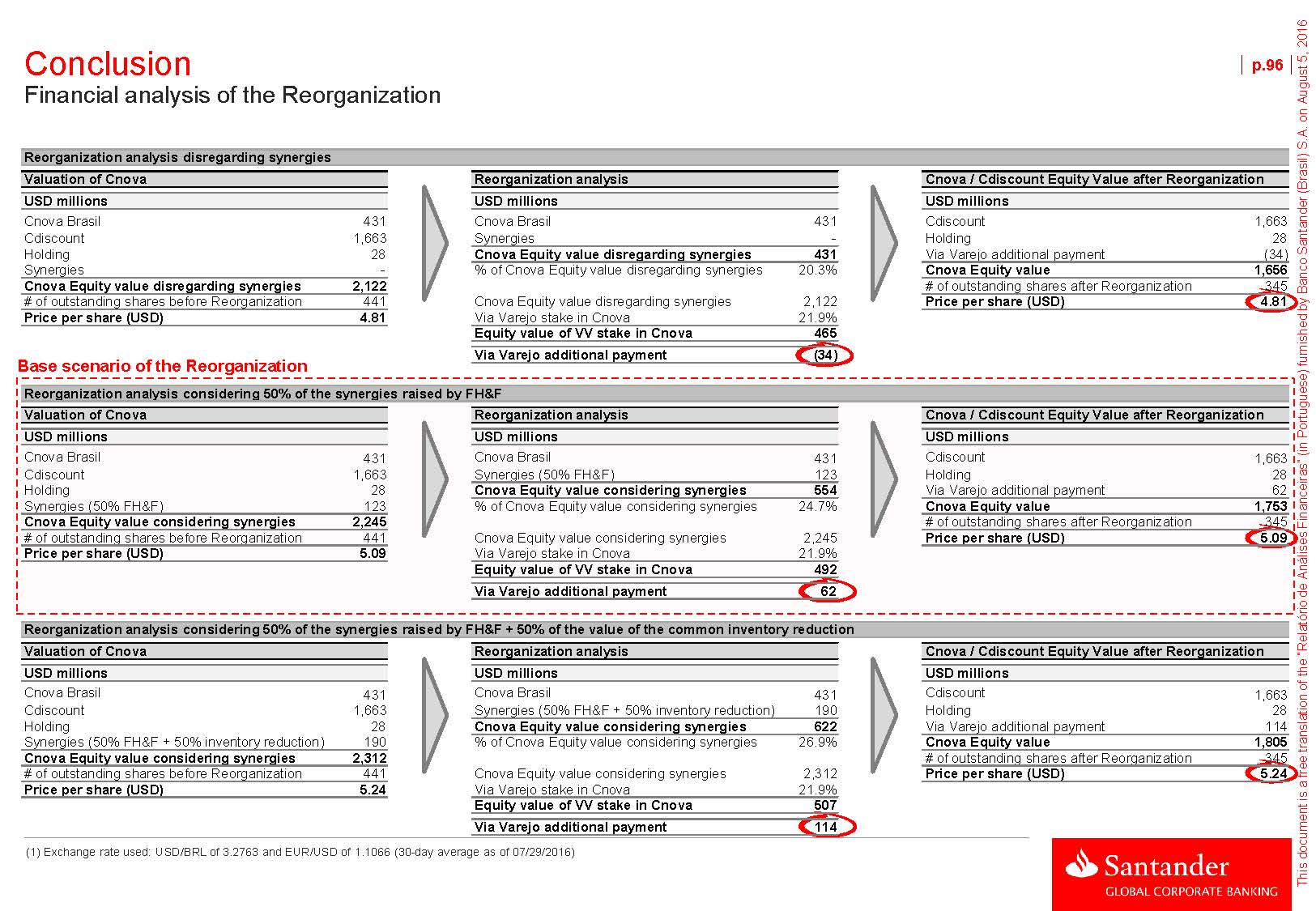

Valuation summary Financial analysis of the Reorganization considering scenario with 50% of the synergies p.16 Equity Value (USD MM)¹ Financial analysis of the Reorganization (USD MM)¹ Scenarios 100% of Cnova Brasil 22% of Cnova Cash to pay (receive) A A 20.3% 78.4% 1.3% 4.81 1,663 28 2,122 Standalone 431 465 (34) Cnova Brasil Cdiscount Holding Cnova standalone Base scenario of the Reorganization B 4.81 2,122 123 5.09 2,245 B Considering 50% of FH&F synergies (value increase of Cnova Brasil and Cnova) 554 492 62 Cnova standalone 50% of FH&F synergies Cnova with 50% of FH&F synergies C 4.81 2,122 123 67 5.24 2,312 C Considering 50% of FH&F synergies and 50% of common inventory reduction of Via Varejo and Cnova Brasil (value 622 507 114 Cnova standalone 50% of FH&F synergies 50% of common inventory reduction Cnova with 50% of FH&F synergies and 50% of inventory reduction increase of Cnova Brasil and Cnova) % % of Cnova’s Equity Value # Share Price (1) Exchange ratio used: USD/BRL of 3.2763 and EUR/USD of 1.1066 (30-day average as of 07/29/2016)

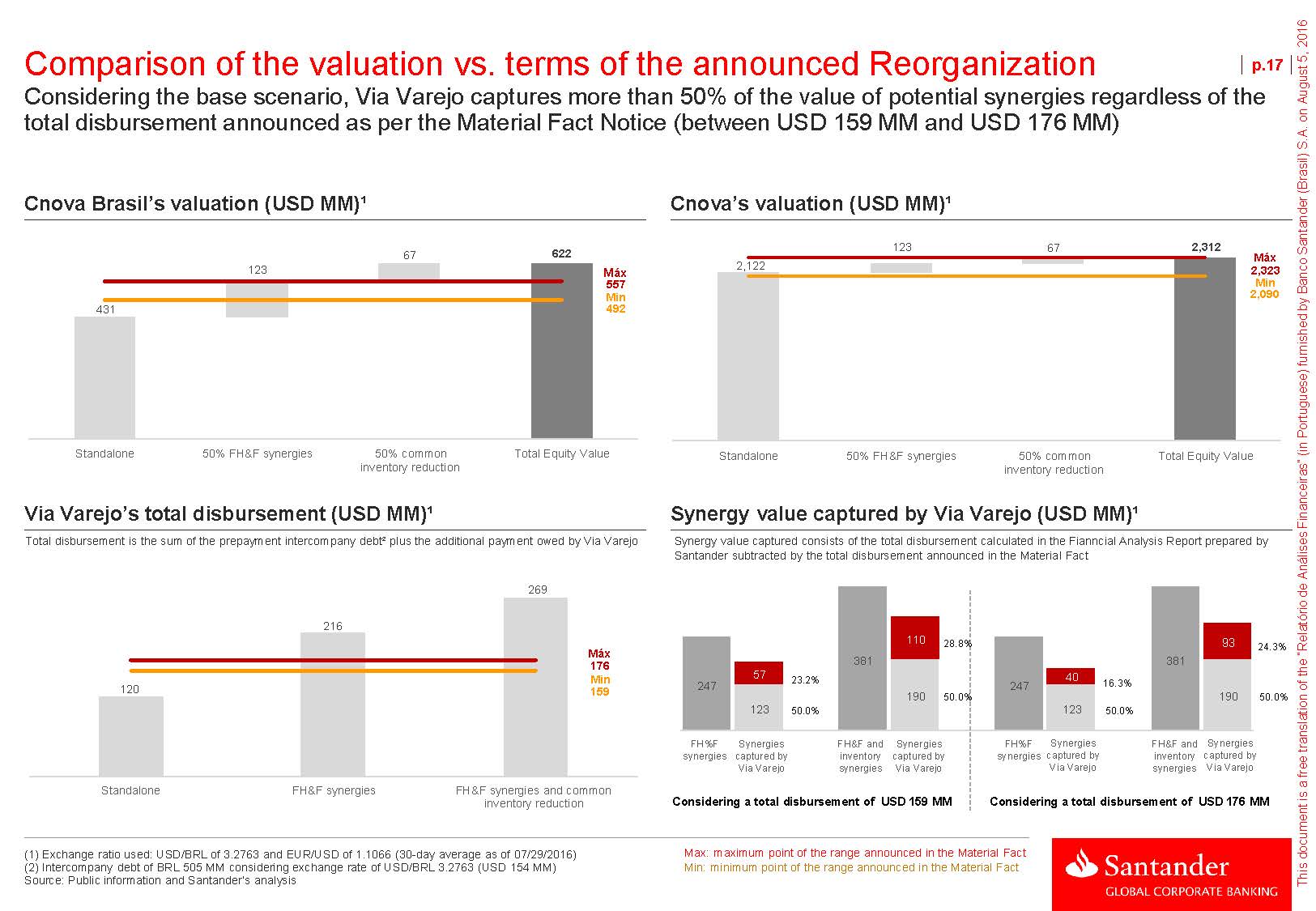

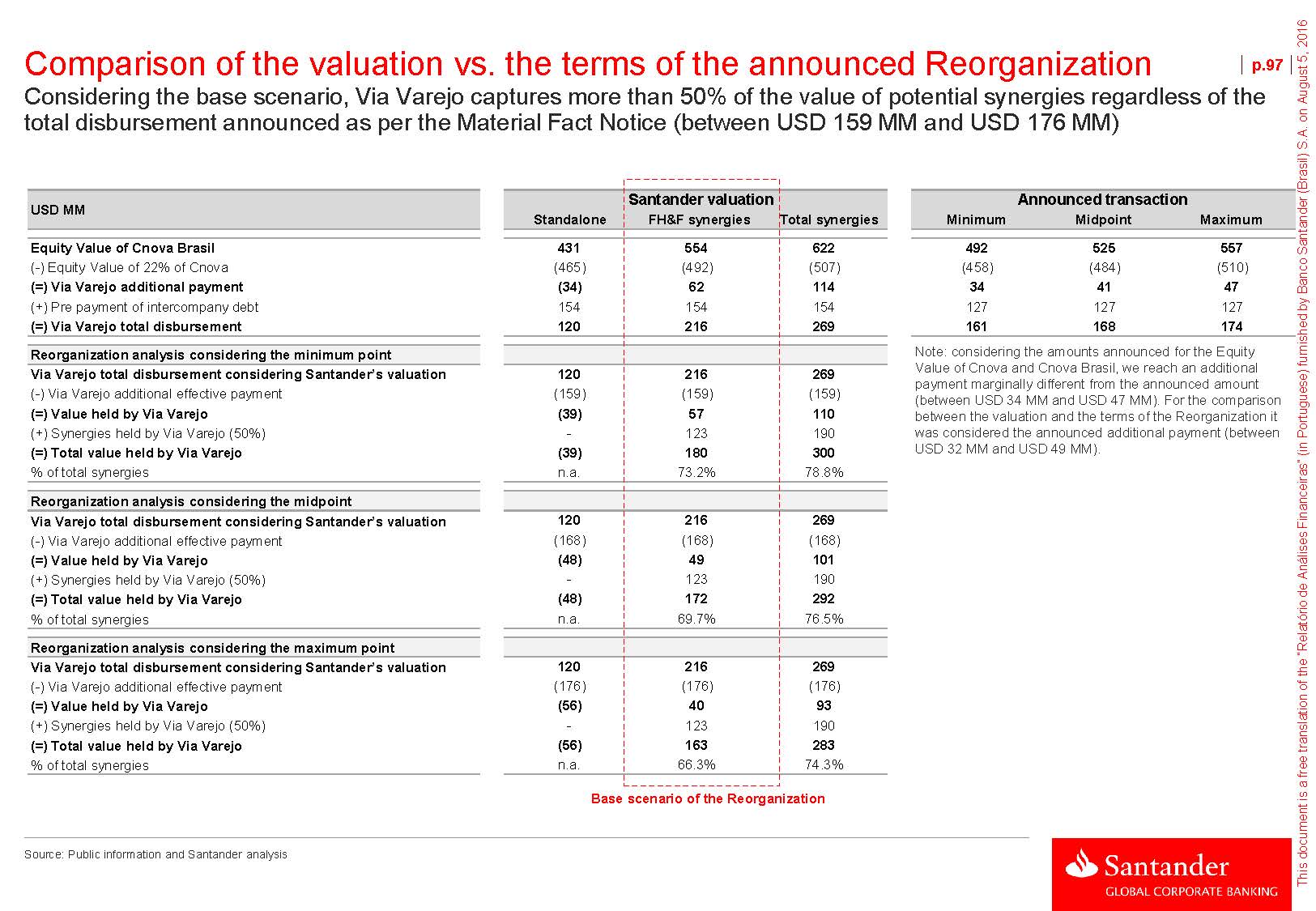

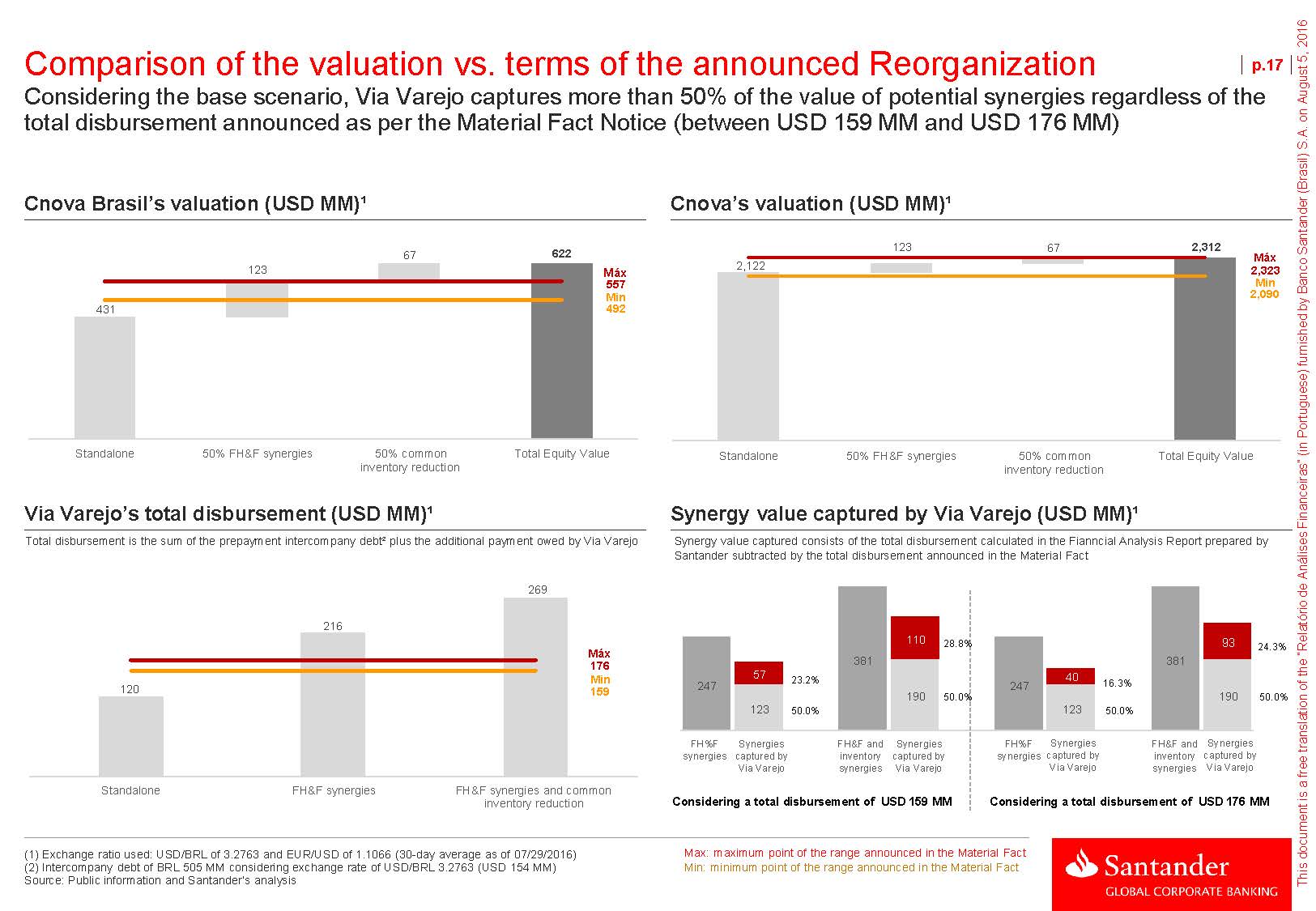

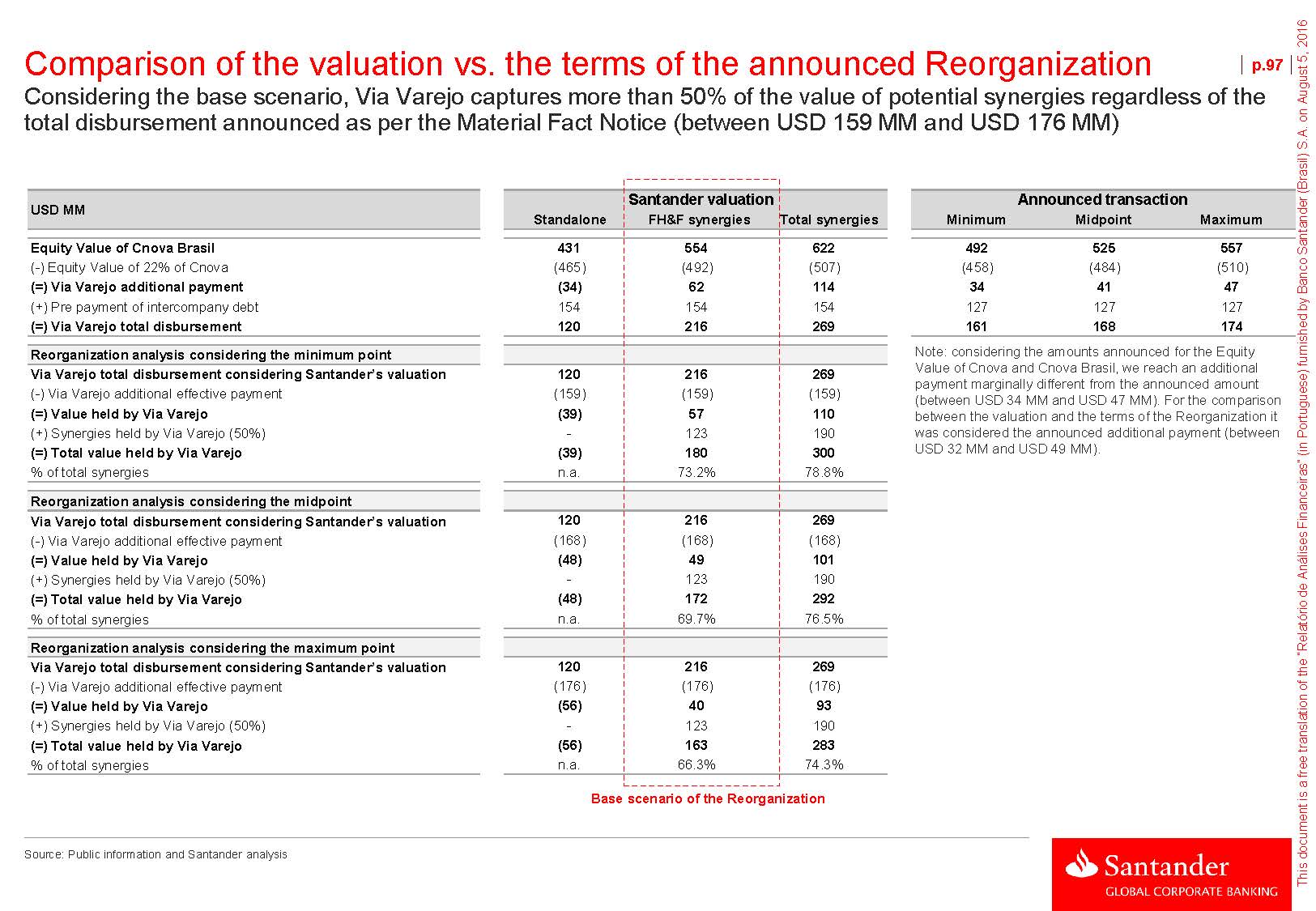

Comparison of the valuation vs. terms of the announced Reorganization p.17 Considering the base scenario, Via Varejo captures more than 50% of the value of potential synergies regardless of the total disbursement announced as per the Material Fact Notice (between USD 159 MM and USD 176 MM) Cnova Brasil’s valuation (USD MM)¹ Cnova’s valuation (USD MM)¹ 431 123 67 622 Máx 557 Min 492 2,122 123 67 2,312 Máx 2,323 Min 2,090 Standalone 50% FH&F synergies 50% common Total Equity Value Standalone 50% FH&F synergies 50% common Total Equity Value inventory reduction inventory reduction Via Varejo’s total disbursement (USD MM)¹ Synergy value captured by Via Varejo (USD MM)¹ Total disbursement is the sum of the prepayment intercompany debt² plus the additional payment owed by Via Varejo Synergy value captured consists of the total disbursement calculated in the Fianncial Analysis Report prepared by Santander subtracted by the total disbursement announced in the Material Fact 269 120 216 Máx 176 Min 159 247 57 123 23.2% 50.0% 381 110 190 28.8% 50.0% 247 40 123 16.3% 50.0% 381 93 190 24.3% 50.0% FH%F Synergies FH&F and Synergies FH%F Synergies FH&F and Synergies synergies captured by inventory captured by synergies captured by inventory captured by Standalone FH&F synergies FH&F synergies and common Via Varejo synergies Via Varejo Via Varejo synergies Via Varejo inventory reduction Considering a total disbursement of USD 159 MM Considering a total disbursement of USD 176 MM (1) Exchange ratio used: USD/BRL of 3.2763 and EUR/USD of 1.1066 (30-day average as of 07/29/2016) (2) Intercompany debt of BRL 505 MM considering exchange rate of USD/BRL 3.2763 (USD 154 MM) Source: Public information and Santander’s analysis Max: maximum point of the range announced in the Material Fact Min: minimum point of the range announced in the Material Fact

Section 2 Cnova Brasil I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.18

Overview p.19 With retail operations and marketplace, Cnova Brazil stands out as one of the largest e-commerce companies in Brazil with 904 million hits in 2015 Overview Founded in 2008, Cnova Brasil started its operations with Pontofrio.com, online electronics retailer and the eHub, providing solutions in e-commerce to third parties Currently has 7 sites in its portfolio – out of which 4 operate as marketplace platform – totaling 904 million hits in 2015, representing a growth of 22.8% when compared to 2014 Shareholding structure Free float Click-&-Collect: 1,300 pickup points, with more than 4,000 employees Marketplace has 2,300 registered vendors, representing 10.8% of GMV¹ in 2015 43.3% 26.2% 21.9% 8.5% Accelerated growth 2008 2010 2012 2015 Beginning of Expansion of Extra.com.br Expansion of operations in the business inaugurates the Click-&- Brazil with the e-commerce Pontofrio.com and eHub with the introduction of 3 new brands Brazilian marketplace Beginning of Barateiro.com’s operation Collect services in Brazil, reaching more than 1,000 pickup points 99.8% 100.0% (1) GMV – Gross Merchandise Value Source:Company

Online stores in operation The company has a portfolio of websites operating in all online market segments. It provides first and second line items, and also operates in the B2B segment, via wholesale and solutions for e-commerce Cnova Brasil’s websites p.20 Traditional brand in the Brazilian market due to physical stores operated Focused on discounted sales of repackaged or minimal damaged Traditional brand in Brazil, launched its marketplace in 2012 Created as an extension of Pontofrio, operated by Via Varejo by Via Varejo Offers more than 30 categories of products online products All products are reviewed and guaranteed by the Also participates in the loyalty program Clube Extra Recognized for its electronic goods and the commercialization of newly launched products Incudes marketplace operations manufacturer Incudes marketplace operations It operates providing services to the online platforms of industries and Brazilian stores (fullcommerce) It offers logistics services, marketing, customer service, etc. Launched in 2014, it offers a line with discount quality products, as well as a marketplace platform It has more than 50,000 products on offer Operates in the online wholesale segment, offering products for small and medium enterprises in the electronics and mobile segments Source:Company

Section 2 Cnova Brasil I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.21

Cnova Brasil vs. B2W B2W is the most comparable Brazilian company to Cnova Brasil in terms of geographic presence, business segments and marketplace exposure as a % of GMV p.22 2015 Figures Brasil E-commerce with 4 marketplaces and services for online sales platforms E-commerce with 3 marketplaces, services for online sales platforms and financial services BRL 7.7 bi BRL 11.2 bi 18% 26% 57% Cnova¹ BRL 837 mm B2W Others¹ 3.6% + 7.2 p.p. 10.8% 2014 2015 2,300 31% 69% Desktop Mobile device (1) Implicit values calculated from B2W’s market share Source:Companies and public information

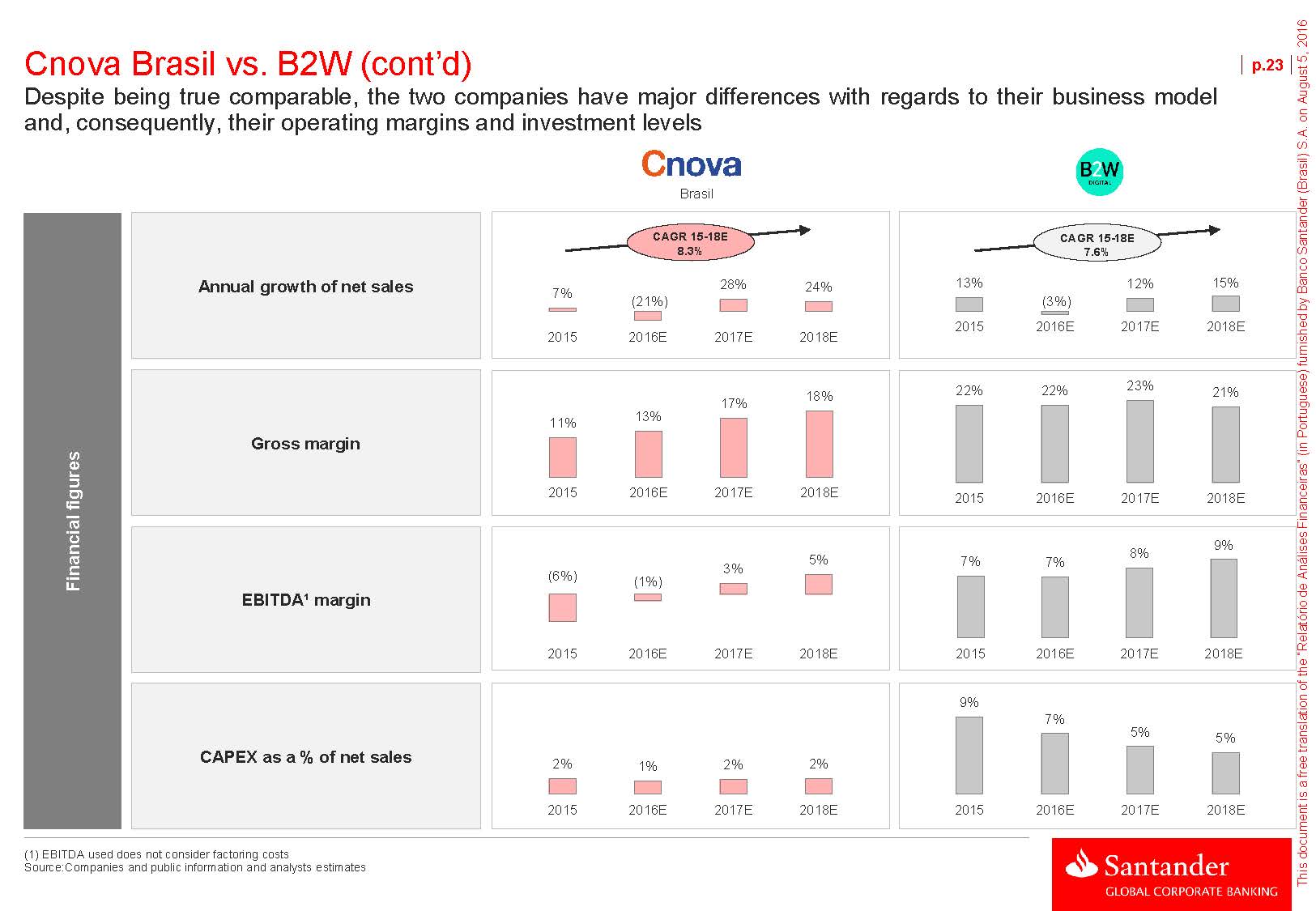

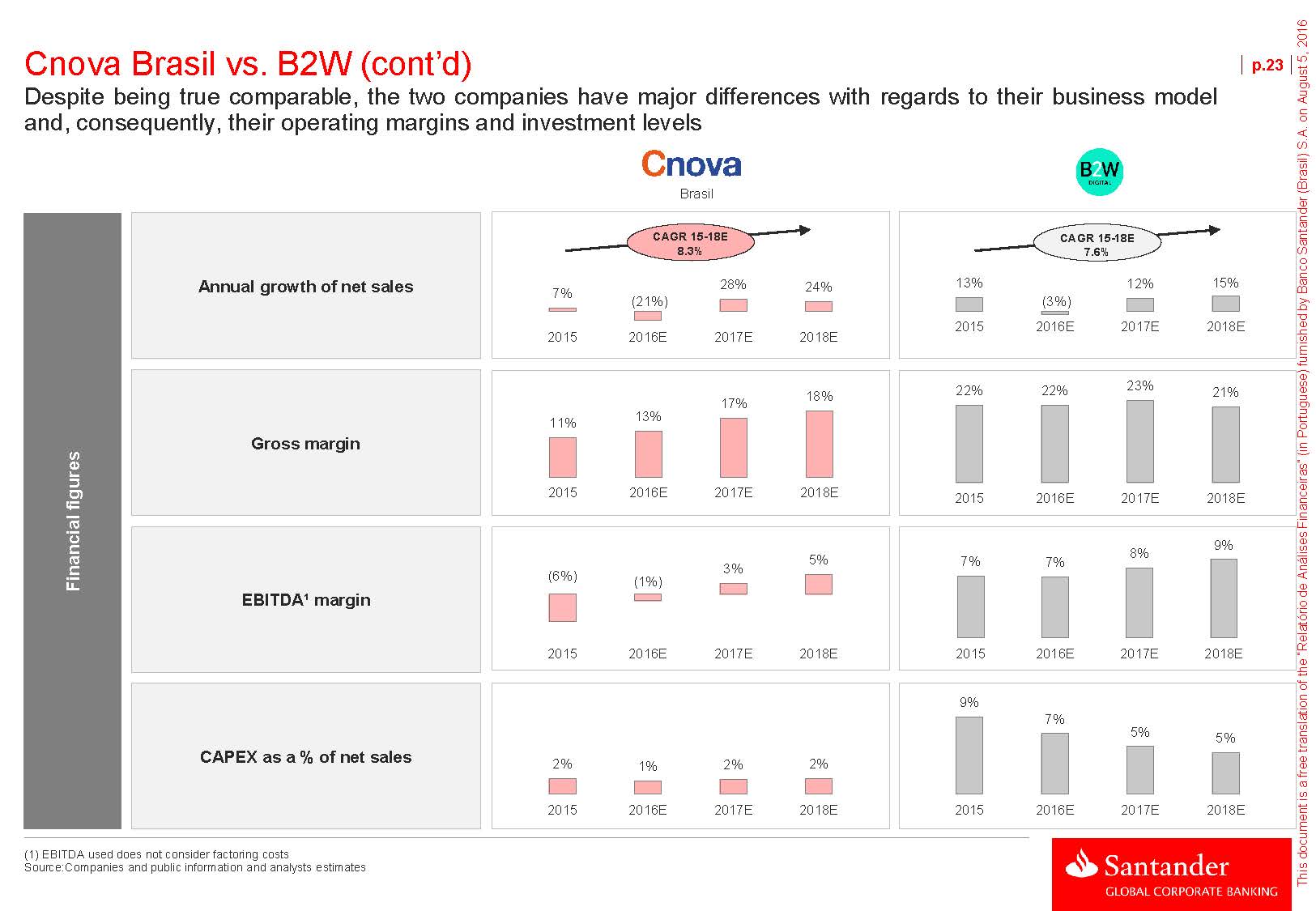

Cnova Brasil vs. B2W (cont’d) Despite being true comparable, the two companies have major differences with regards to their business model and, consequently, their operating margins and investment levels Brasil p.23 Annual growth of net sales CAGR 15-18E 8.3% 7% 28% 24% (21%) 13% CAGR 15-18E 7.6% 12% 15% (3%) 2015 2016E 2017E 2018E 2015 2016E 2017E 2018E Gross margin 11% 13% 17% 18% 22% 22% 23% 21% 2015 2016E 2017E 2018E 2015 2016E 2017E 2018E EBITDA¹ margin (6%) (1%) 3% 5% 7% 7% 8% 9% 2015 2016E 2017E 2018E 2015 2016E 2017E 2018E CAPEX as a % of net sales 2% 1% 2% 2% 9% 7% 5% 5% 2015 2016E 2017E 2018E 2015 2016E 2017E 2018E (1) EBITDA used does not consider factoring costs Source:Companies and public information and analysts estimates

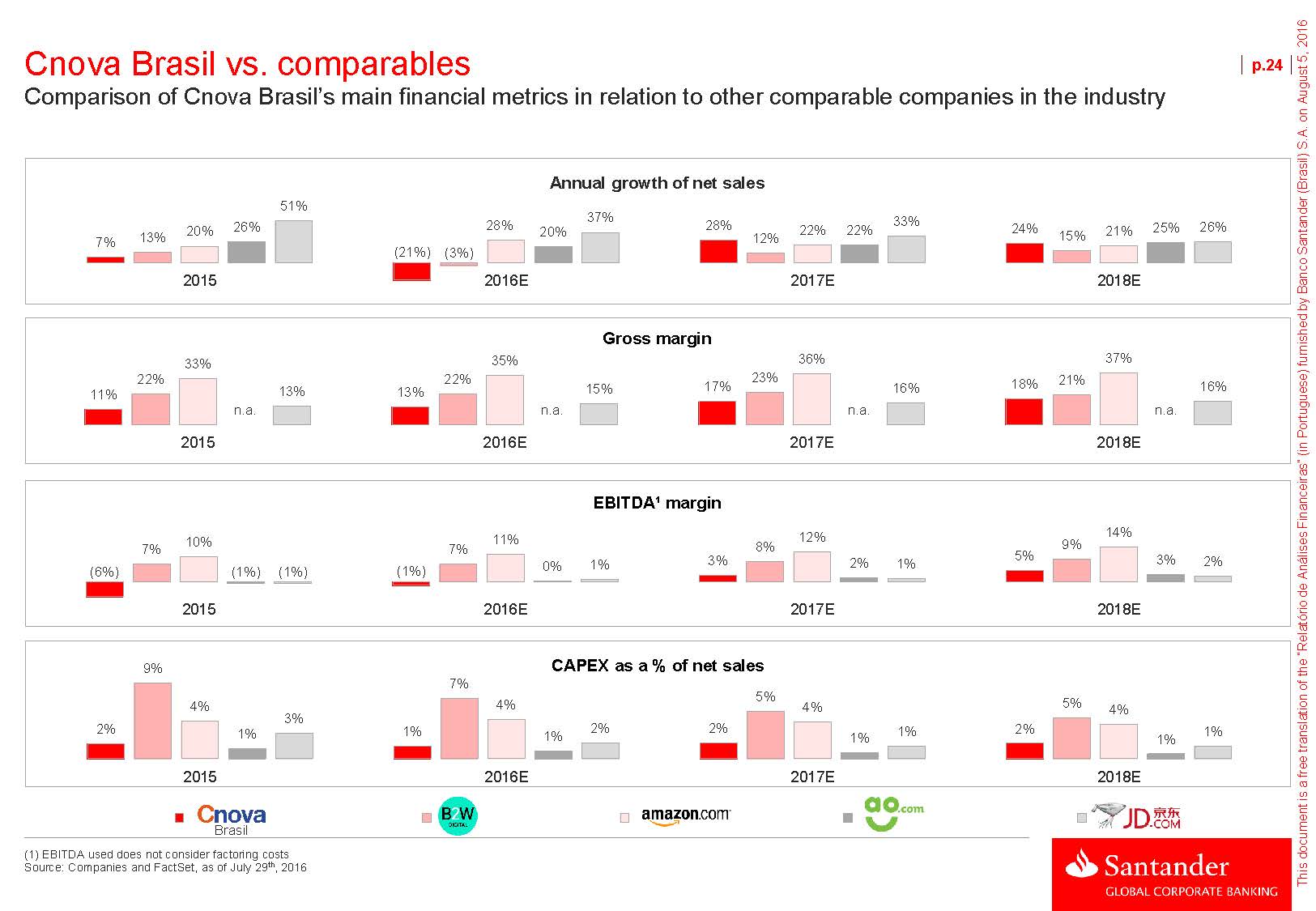

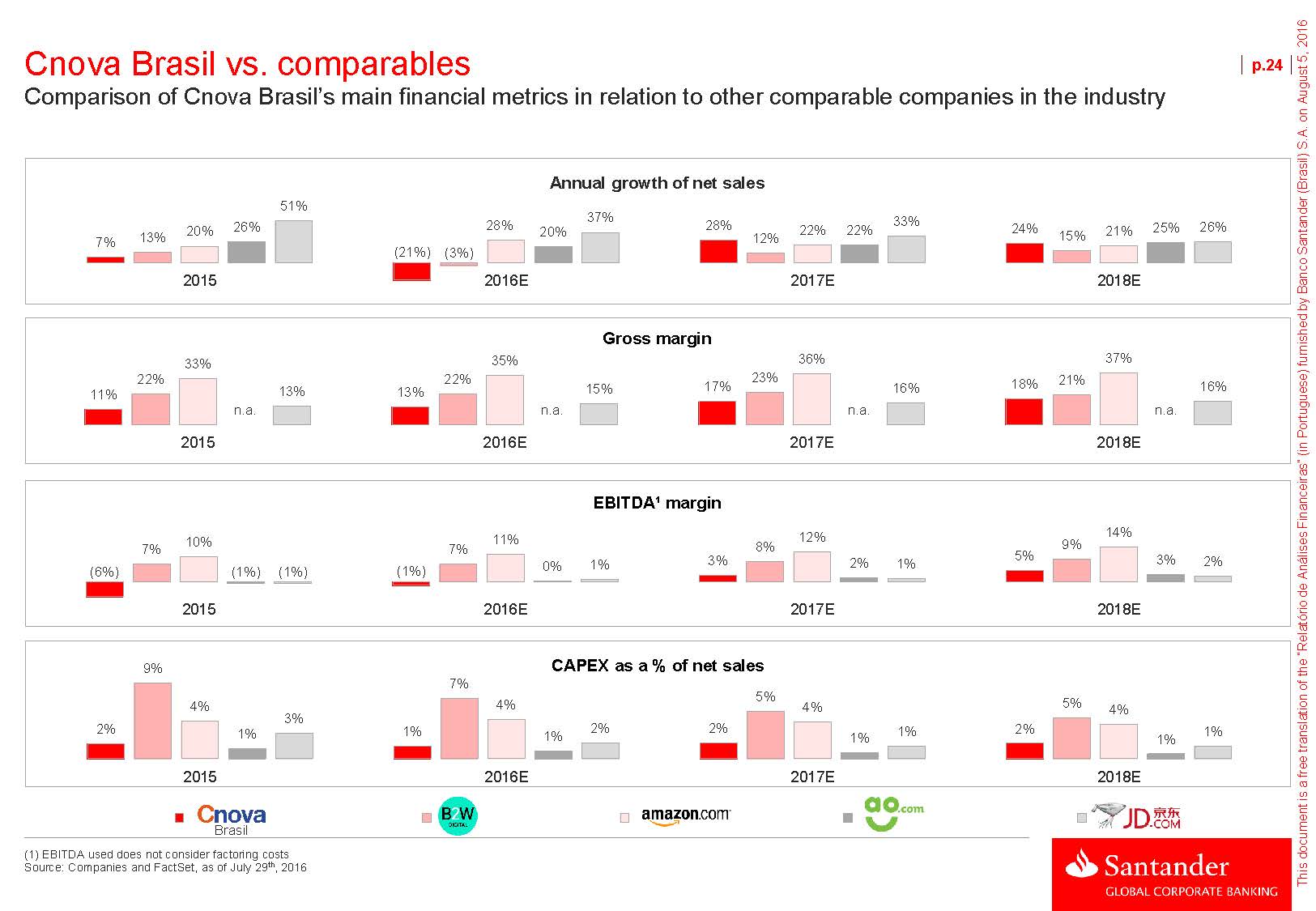

Cnova Brasil vs. comparables Comparison of Cnova Brasil’s main financial metrics in relation to other comparable companies in the industry p.24 51% Annual growth of net sales 7% 13% 20% 26% (21%) (3%) 28% 20% 37% 28% 12% 22% 22% 33% 24% 15% 21% 25% 26% 2015 2016E 2017E 2018E Gross margin 33% 35% 36% 37% 22% 22% 23% 21% 11% 13% 13% 15% 17% 16% 18% 16% n.a. n.a. n.a. n.a. 2015 2016E 2017E 2018E EBITDA¹ margin 10% 11% 12% 8% 14% 9% 7% 7% 3% 5% (6%) (1%) (1%) (1%) 0% 1% 2% 1% 3% 2% 2015 2016E 2017E 2018E 9% 7% 4% 4% 3% CAPEX as a % of net sales 5% 4% 5% 4% 2% 1% 1% 1% 2% 2% 1% 1% 2% 1% 1% 2015 2016E 2017E 2018E Brasil (1) EBITDA used does not consider factoring costs Source: Companies and FactSet, as of July 29th, 2016

Section 2 Cnova Brasil I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.25

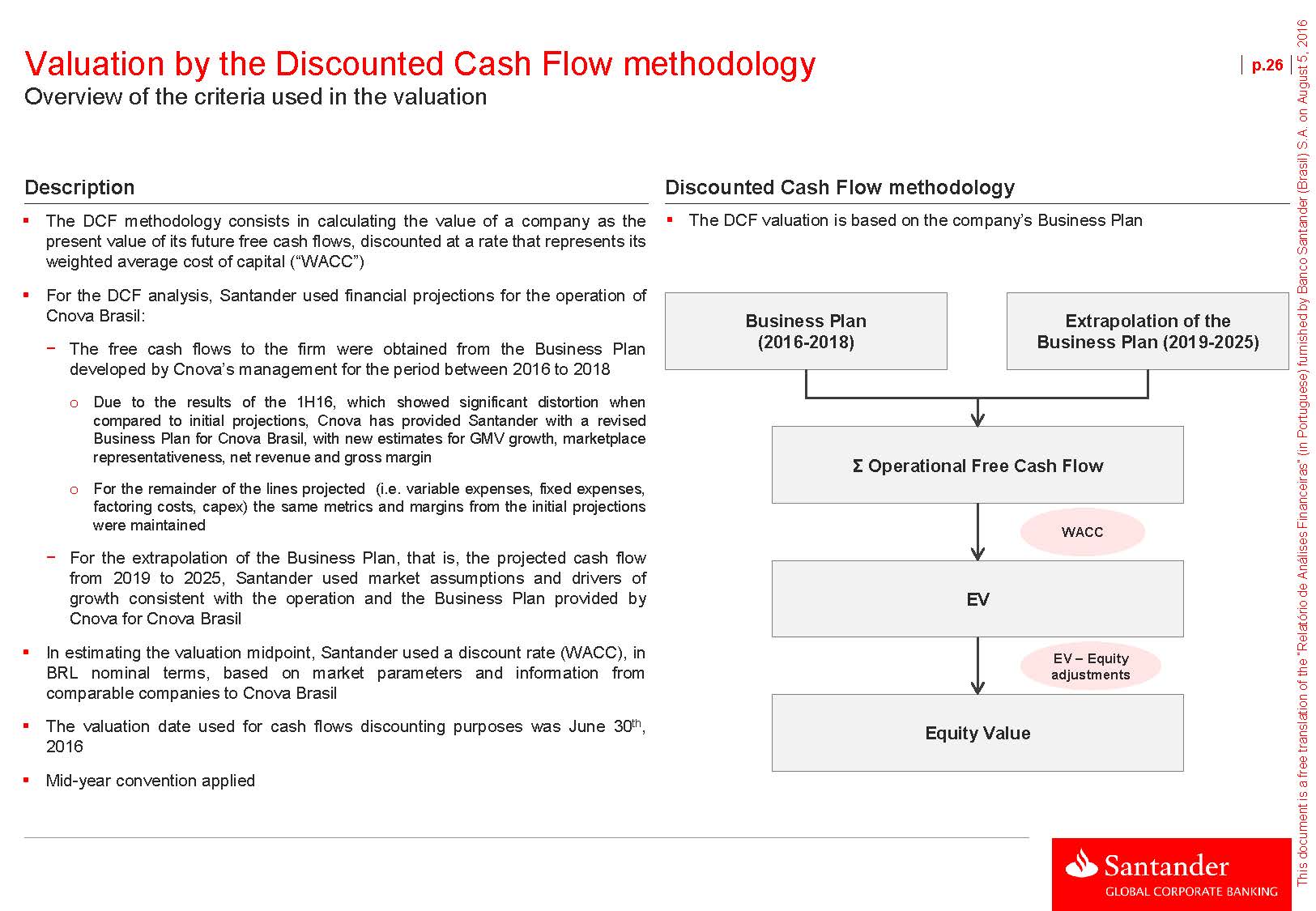

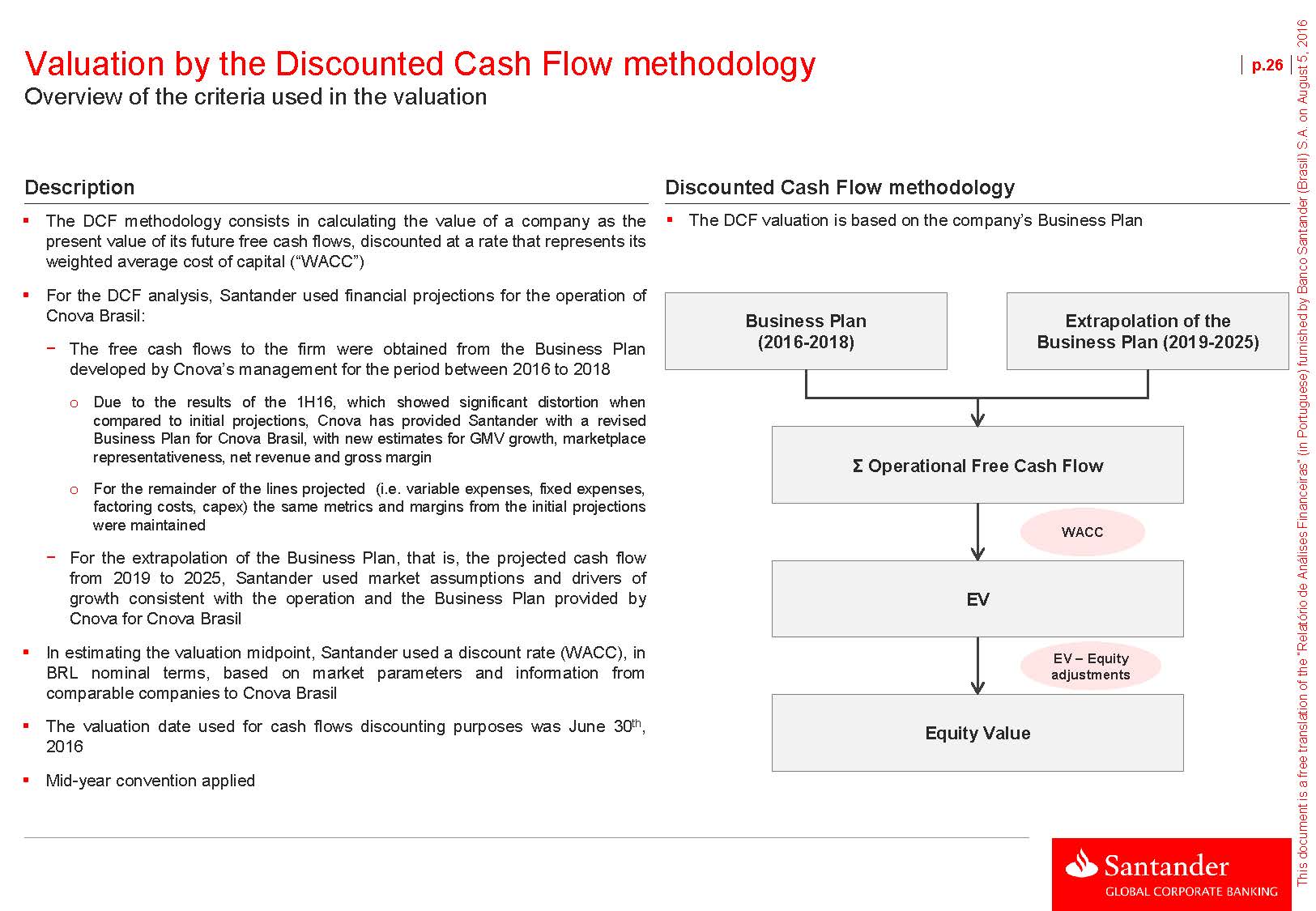

Valuation by the Discounted Cash Flow methodology Overview of the criteria used in the valuation p.26DescriptionThe DCF methodology consists in calculating the value of a company as the present value of its future free cash flows, discounted at a rate that represents its weighted average cost of capital (“WACC”) Discounted Cash Flow methodologyThe DCF valuation is based on the company’s Business PlanFor the DCF analysis, Santander used financial projections for the operation of Cnova Brasil: − The free cash flows to the firm were obtained from the Business Plan developed by Cnova’s management for the period between 2016 to 2018 Business Plan(2016-2018)Extrapolation of theBusiness Plan (2019-2025)oDue to the results of the 1H16, which showed significant distortion when compared to initial projections, Cnova has provided Santander with a revised Business Plan for Cnova Brasil, with new estimates for GMV growth, marketplace representativeness, net revenue and gross margin oFor the remainder of the lines projected (i.e. variable expenses, fixed expenses, factoring costs, capex) the same metrics and margins from the initial projections were maintained − For the extrapolation of the Business Plan, that is, the projected cash flow from 2019 to 2025, Santander used market assumptions and drivers of growth consistent with the operation and the Business Plan provided by Cnova for Cnova BrasilIn estimating the valuation midpoint, Santander used a discount rate (WACC), in BRL nominal terms, based on market parameters and information from comparable companies to Cnova Brasil The valuation date used for cash flows discounting purposes was June 30th, 2016Mid-year convention applied Σ Operational Free Cash FlowWACCEVEV – Equity adjustmentsEquity Value

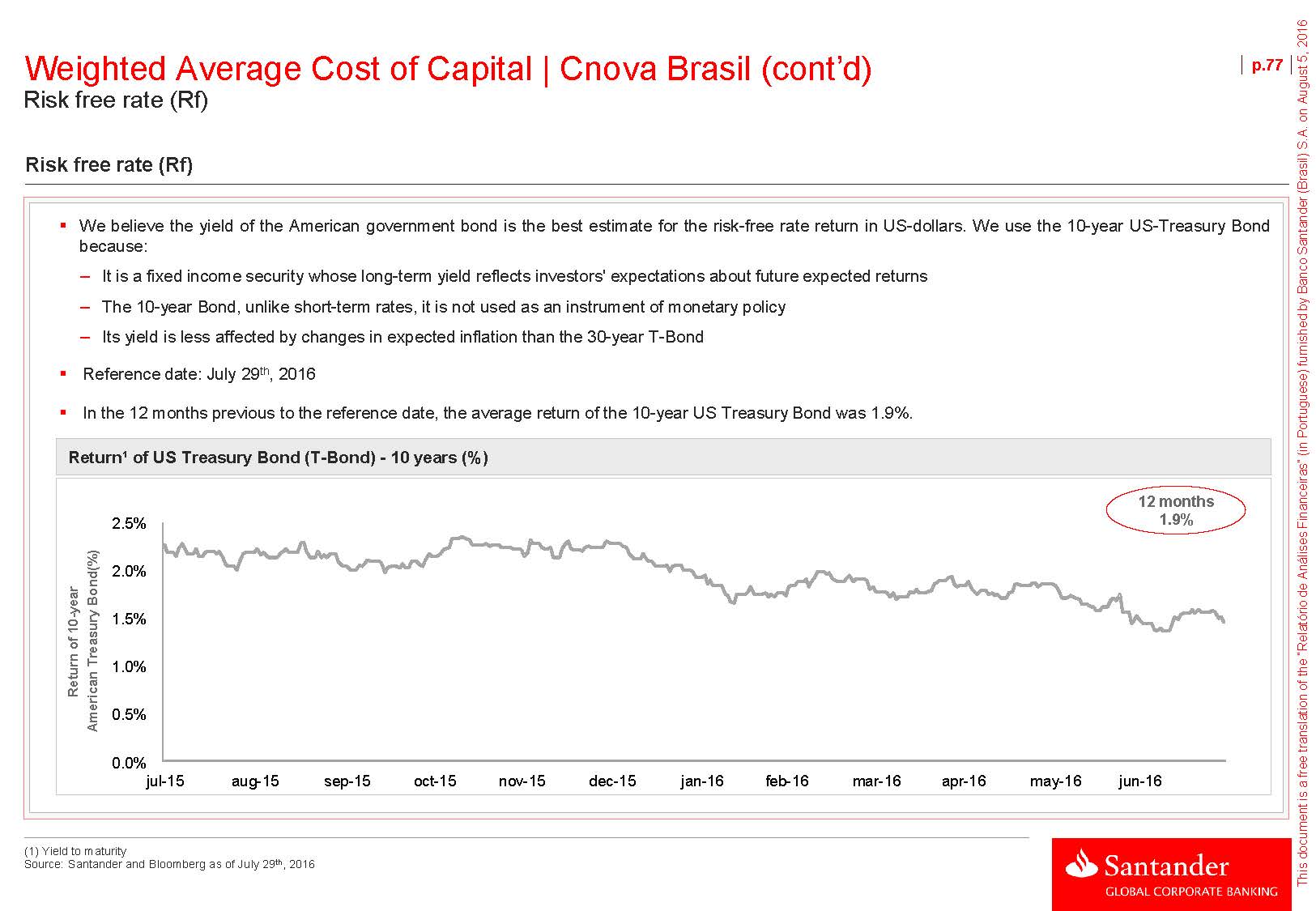

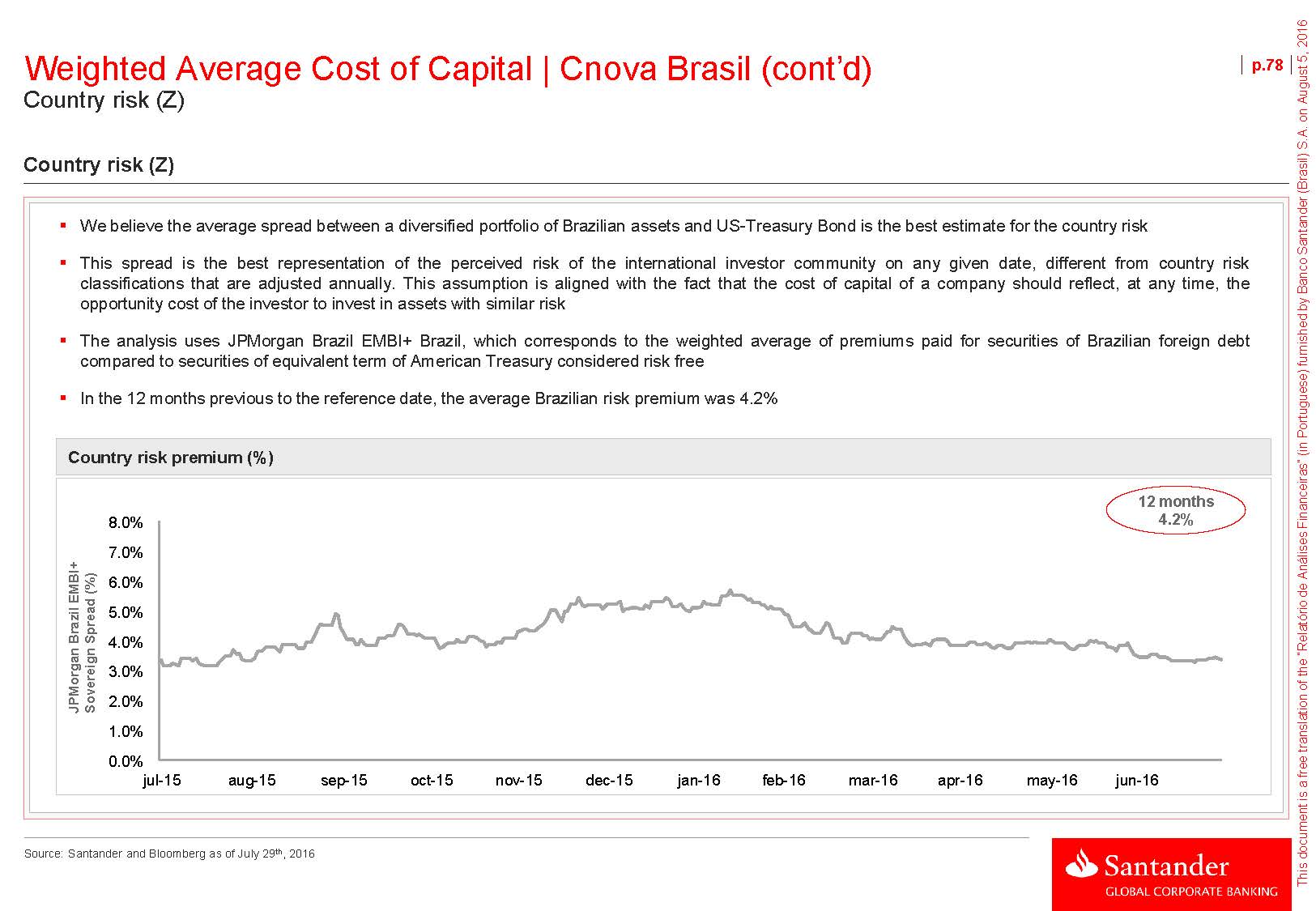

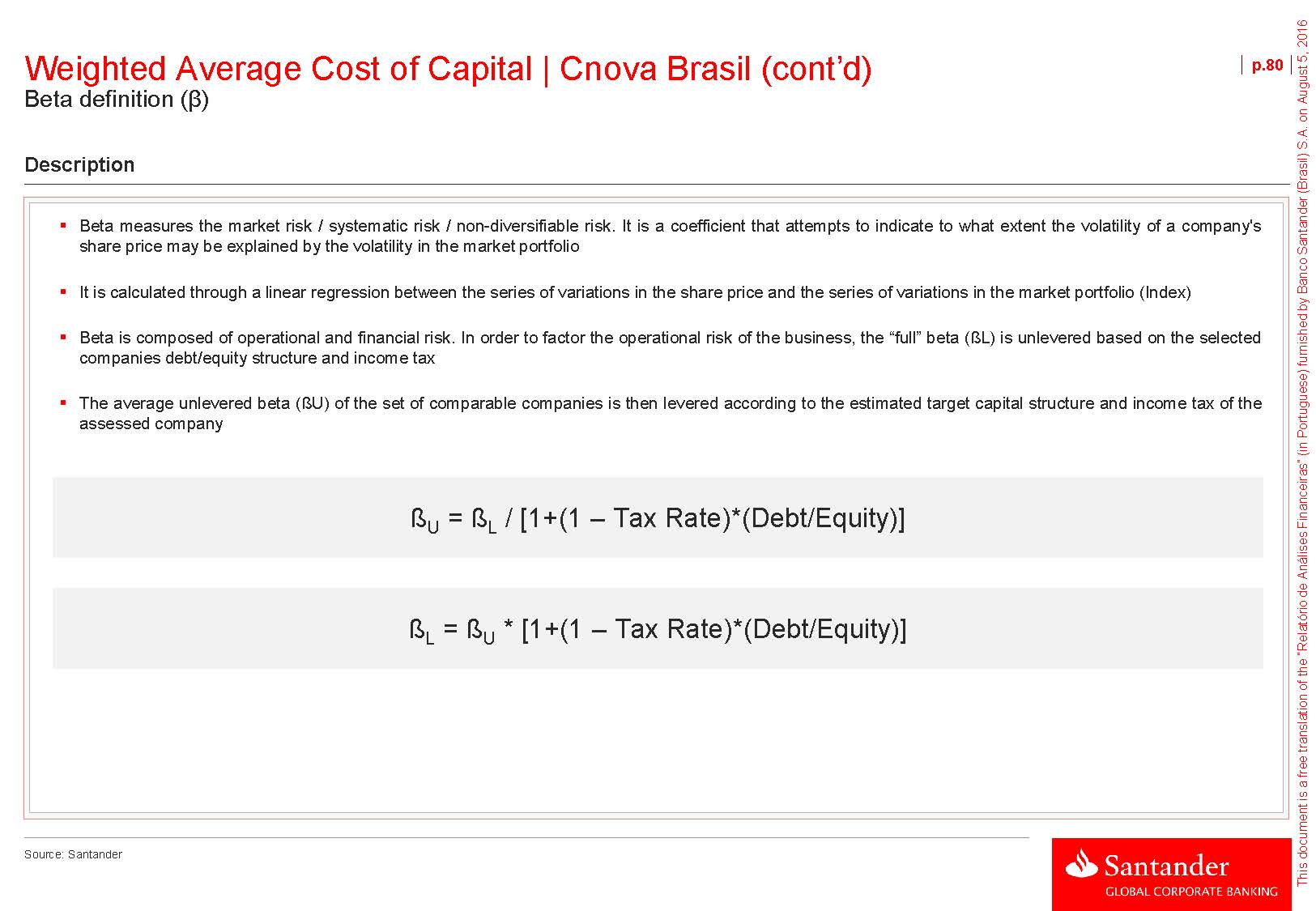

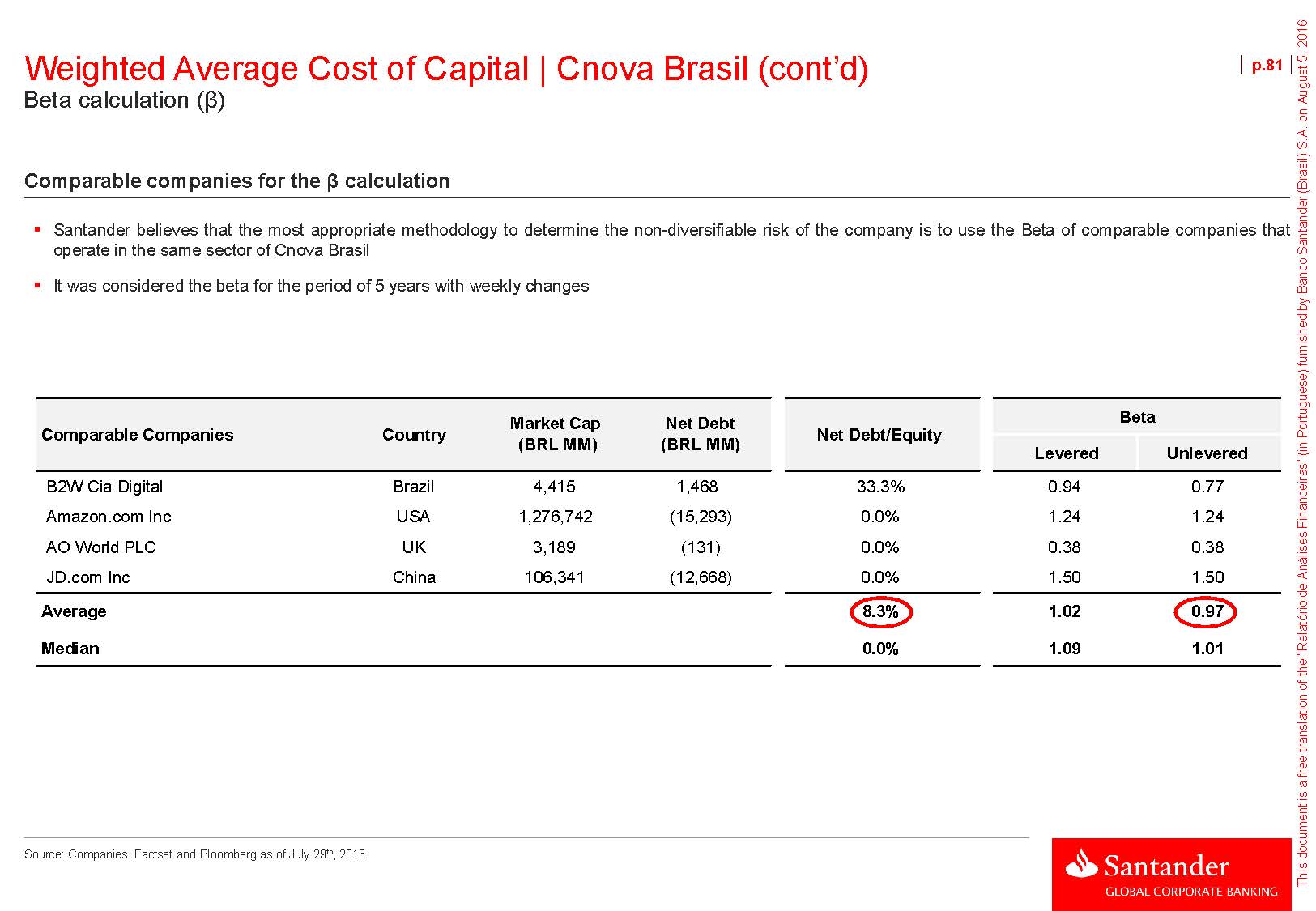

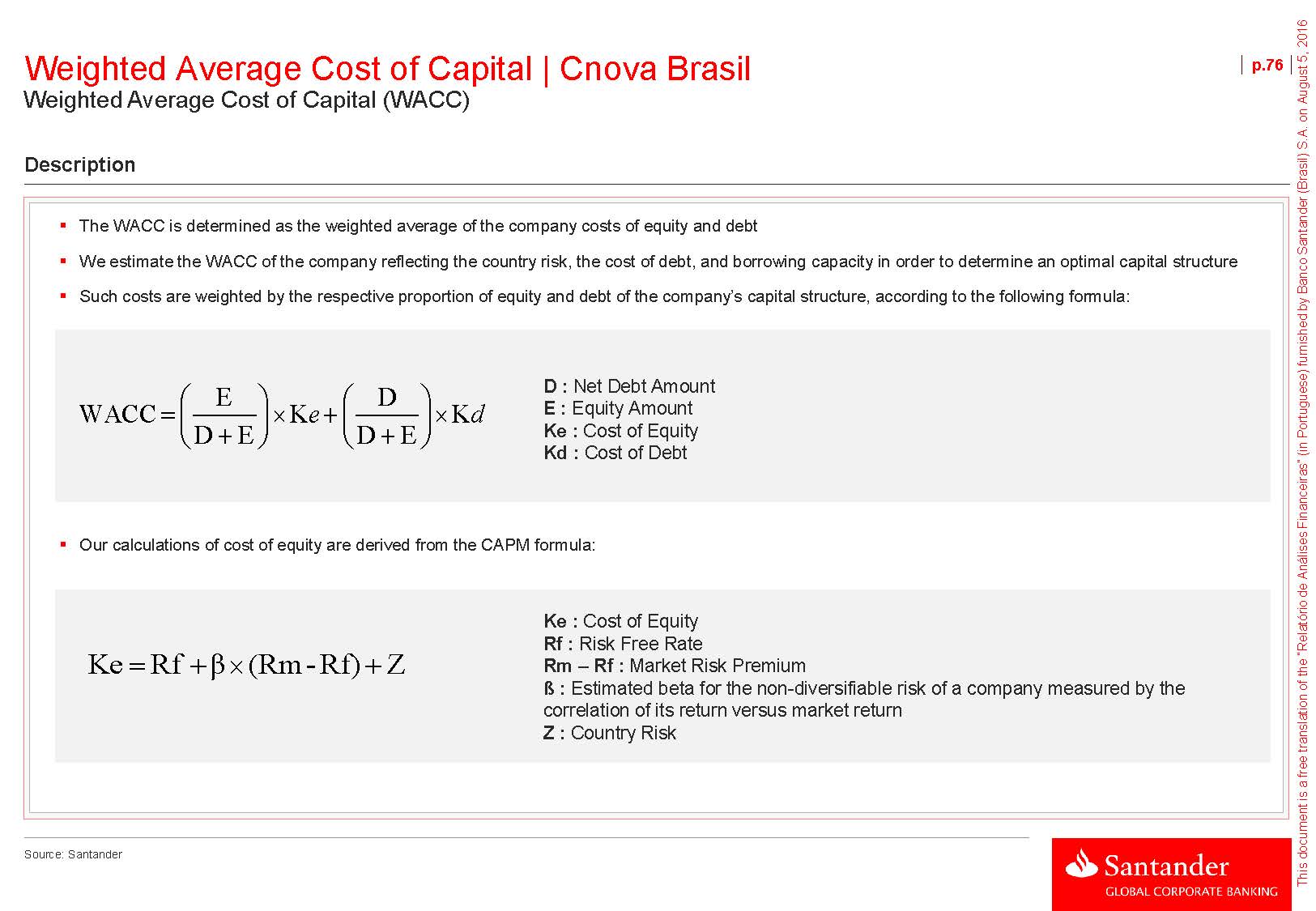

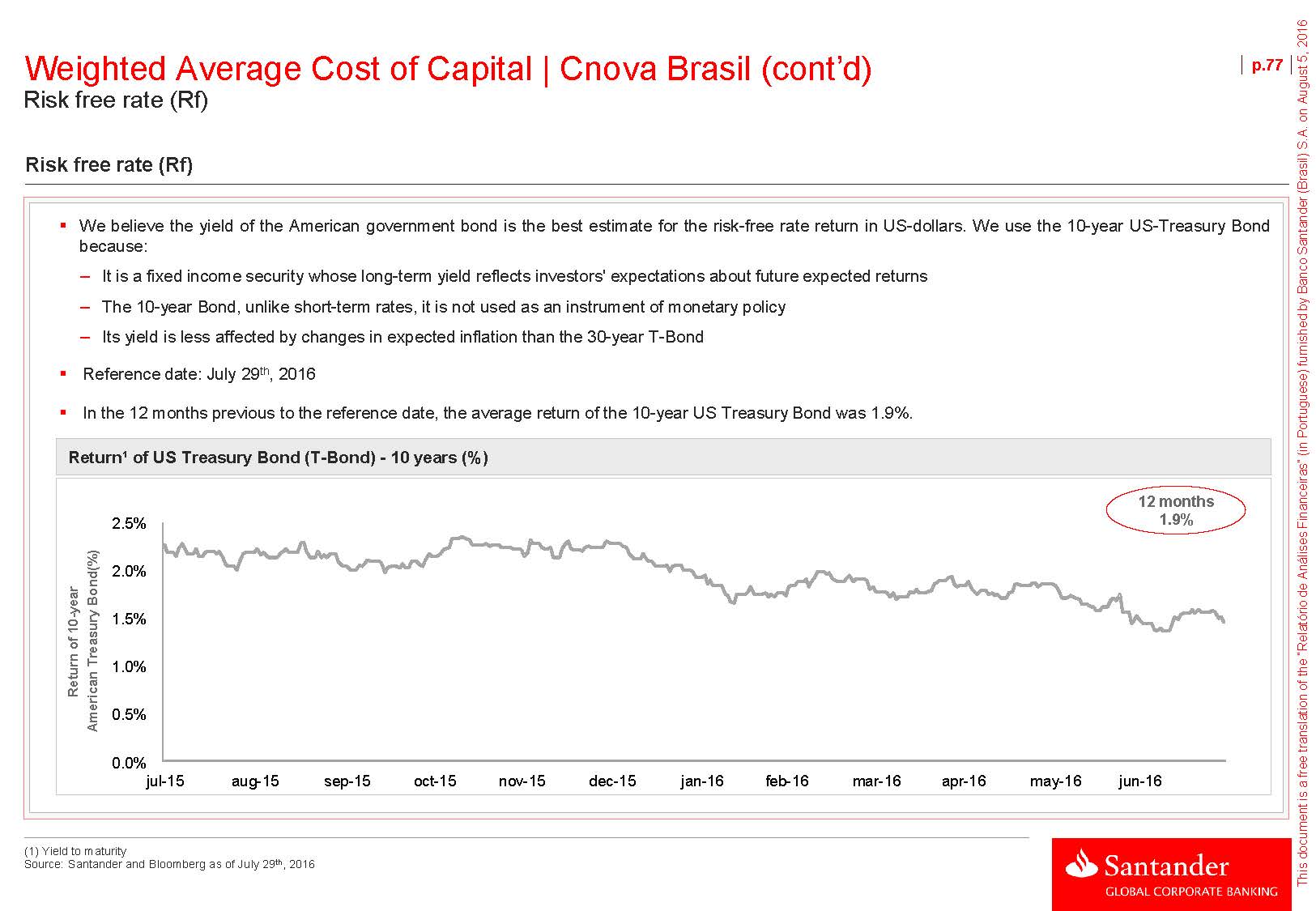

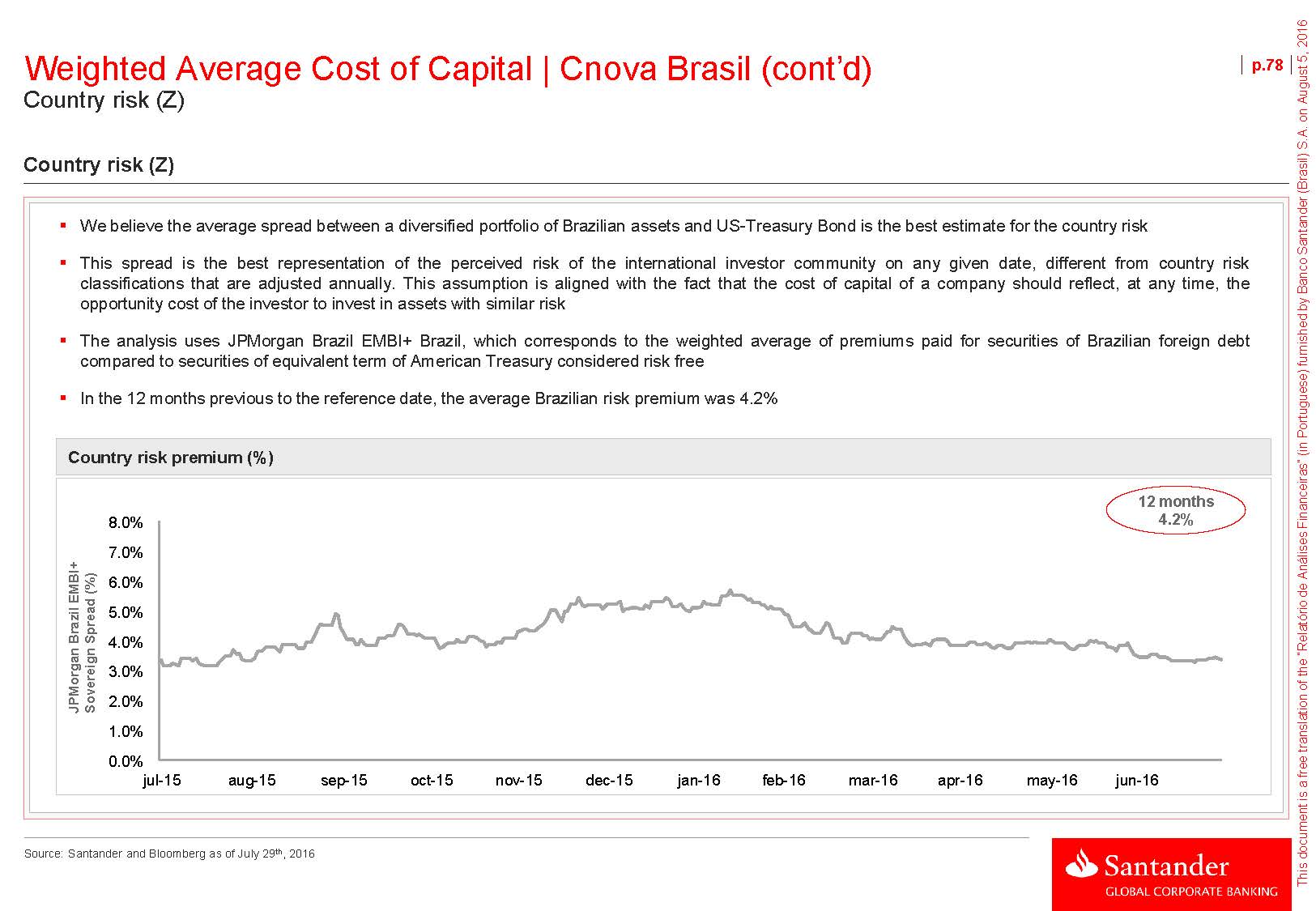

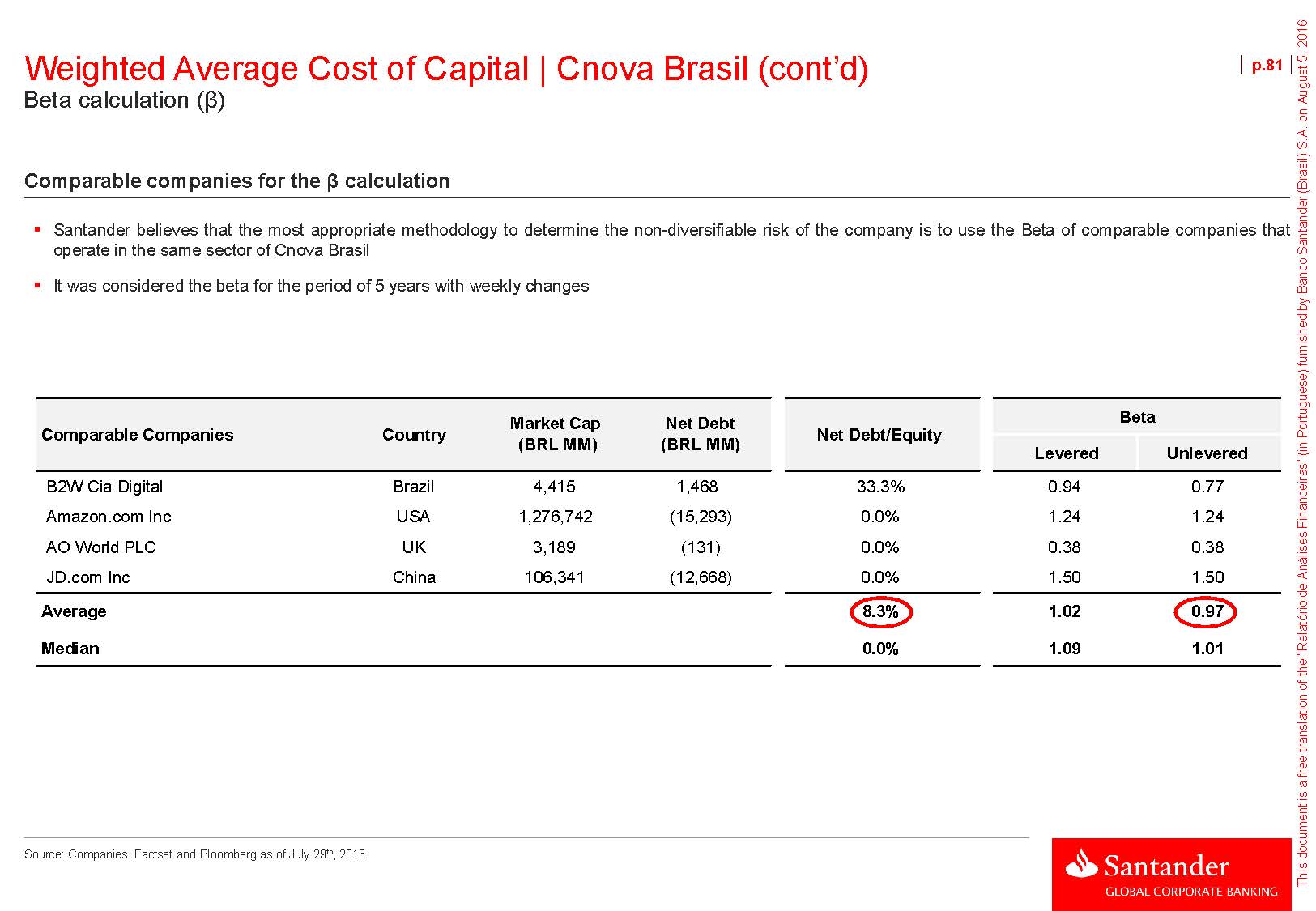

Discount rate - WACC WACC in BRL nominal terms p.27Cost of equity (Ke)Risk free rate 1.9% - Average return of the 10-year U.S. Treasury Bond (last 12 months) Market risk premium 7.0% - Spread between the return of S&P-500 and the return of long-term US Treasury Bond from 1926 to 2014 (Ibbotson 2015) Unlevered Beta 0.97 - Average of the unlevered betas of comparable companies (5 years weekly) Income tax rate 34.0% - Applicable income tax rate in Brazil Target leverage - D/E 8.3% - Average leverage of comparable companies Levered Beta 1.03 - Average of the unlevered betas of comparable companies adjusted by target leverage Ke, USD Nominal 9.1%Country risk premium 4.2% - Brazilian country risk premium considering JPMorgan Brazil EMBI+ (last 12 months) Ke, USD Nominal Adjusted to Brazil 13.3%Long term inflation - Brazil 4.5% - Long-term inflation forecast for Brazil (IMF) Long term inflation - USA 2.1% - Long-term inflation forecast for USA (IIMF) Inflation differential 2.3% - Differential between long-term inflation forecasts for Brazil and USA Ke, BRL Nominal 15.9%Cost of debt (Kd)Kd, USD pre-tax 8.4% Kd, USD post-tax 5.5% Inflation differential (%) 2.3% Kd, BRL pre-tax 10.8% - Average anticipation cost projected for the period between 2016 and 2025 (108% of the average CDI of the period) Kd, BRL post-tax 7.1%WACCTarget leverage - E/(D+E) 93.8% Target leverage - D/(D+E) 6.2% WACC USD Nominal Adjusted Brazil 12.9% WACC BRL Nominal 15.4%Source: Bloomberg, Ibbotson 2015, IMF and Santander (macroeconomic projections as of 07/29/2016)

Discounted Cash Flow Main operating assumptions based on the Business Plan p.28AssumptionsFinancials – BRL MMBrazilian e-commerce marketProjection of the Brazilian e-commerce market for the Business Plan period was based on estimates from E-bit / Buscapé and CnovaFor the extrapolation period, by the nature and history of high growth rates in the internet segment in Brazil, projections assume a real growth curve starting in 2019 with a premium over the Brazilian GDP, until converging to the same in 2025 Business Plan Extrapolation8% 11% 10% 10% 9% 9% 8% 8% 7% 7% 83,541 89,796 96,079 59,811 65,463 71,328 77,369 41,300 44,600 49,506 54,457 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Brazilian e-commerce market Growth CAGR 15 -25E 8.8% Cnova Brasil’s GMVGMV growth estimated by Cnova itself in the Business PlanFor the extrapolation period, GMV was projected based on the assumptions of maintenance of market share for Cnova Brasil’s own operations, and an Business Plan Extrapolation30% 32% 32% 32% 32% 19% 16% 20% 26,778 29,016 31,046 21,407 24,388 CAGR 15 -25E 14.7% 34.5% accelerated growth for the marketplace, 12,827 15,322 18,209 11,136 12,469 13,636 14,590 which explains the gain in market share presented in the projections 7,869 7,343 10,064 754 1,221 2,400 3,500 5,077 6,996 9,190 14,309 15,380 16,456 8.7% 7,115 6,122 7,664 9,327 10,244 11,212 12,217 13,252 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, E-bit / Buscapé and Santander estimates Own operation GMV Marketplace GMV Market share

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.29AssumptionsFinancials – BRL MMNet revenueNet revenue projection assumes Business Plan Extrapolation28% 24% maintenance of discounts in relation to the GMV for all segments, in accordance with the Business Plan -21% 12% 12% 11% 10% 8% 8% 7% 11,875 12,883 13,879 CAGR 15 -25E 9.1%Marketplace fees in line with the Business Plan of Cnova Brasil 6,231 4,920 6,287 7,773 8,704 9,721 473 685 945 10,803 1,241 1,503 1,683 1,841 1,970 37.4% 82 324 6,149 4,755 5,963 7,301 8,018 8,776 9,562 10,372 11,200 12,038 12,880 7.7% 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Own operation revenue Marketplace revenue Growth Gross profitProjections assume the same margins contained in the Business Plan for all Business Plan Extrapolation20% 22% 23% 24% 25% 25% 25% CAGR 15 -25E lines of operating costsMargin improvement is explained by an accelerated growth of the marketplace, which presents a gross margin of 100% 11% 13% 17% 18% 1,438 1,746 2,105 2,505 2,875 3,164 3,433 3,673 18.3% 684 629 1,037 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, E-bit / Buscapé and Santander estimates Gross profit Gross margin

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.30AssumptionsFinancials – BRL MMOpexMost of the operating expenses, such as Payments, Marketing and IT, were projected as a percentage of GMVGeneral and administrative expenses indexed to inflation (IPCA) Business Plan Extrapolation25% 23% 14% 14% 14% 11% 9% 8% 7% -22% 1,949 2,102 2,246 CAGR 15 -25E 9.6% 1,082 1,239 1,415 1,607 1,790 107 111 122 127 393 426 456For fulfillment expenses, projectionsassume the same percentage of net 901 702 878 358 179 214 255 299 341 374 406 434 421 456 488 revenues of the segments B2C, 217159 286 336 383 344 420 461 505 550 597 644 692 741 wholesales and B2B, as per the Business Plan 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Fulfillment Payment Marketing Technology G&A Growth Factoring costsFactoring costs projected considering a spread of 108% of CDIBusiness Plan assumes 100% discount of GMV from direct sales (B2C) and marketplace, 33% of GMV from wholesales and only 8.3% of GMV from sales B2BBusiness Plan assumes an average term of 6 installments – a reduction to 4 installments from 2019 onwards was considered in the projectionsBusiness Plan Extrapolation3.0% 3.6% 3.1% 2.7% 2.3% 1.9% 1.8% 1.7% 1.7% 1.7% 1.7% 487 521 408 449 350 359 354 239 265 308 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E CAGR 15 -25E 8.1% Source: Via Varejo, Cnova, FH&F, E-bit / Buscapé and Santander estimates Factoring costs % of GMV

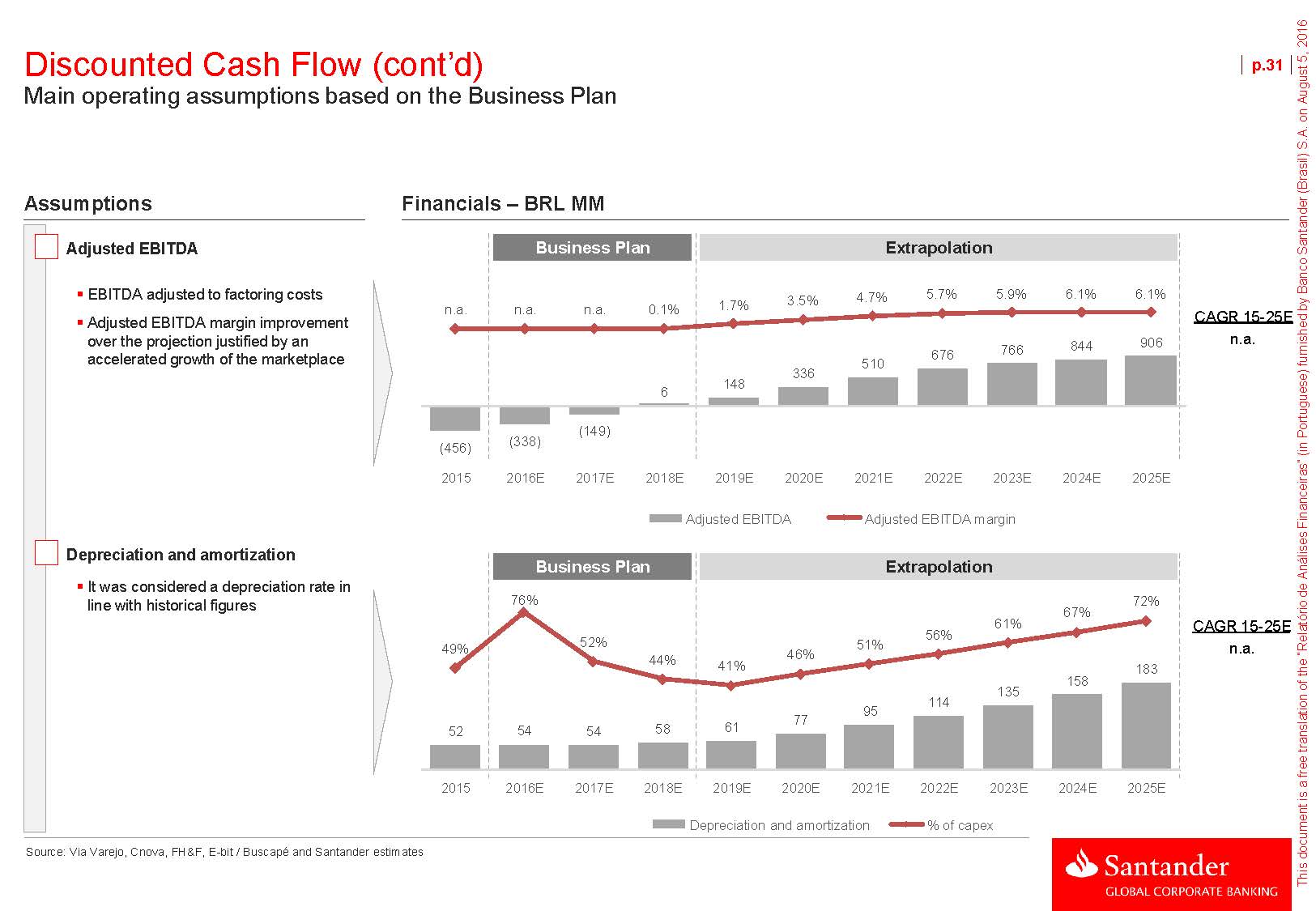

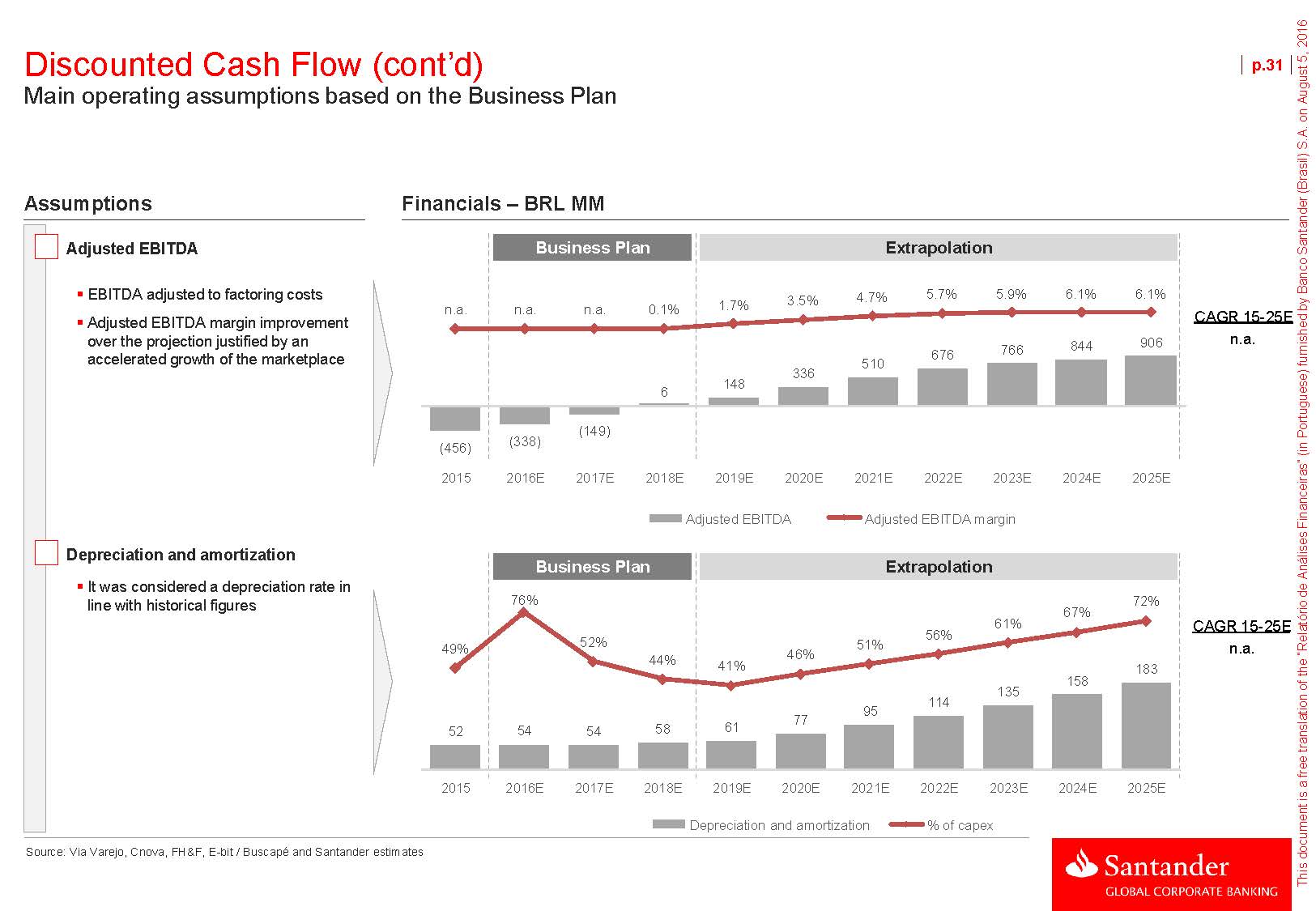

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.31AssumptionsFinancials – BRL MMAdjusted EBITDABusiness Plan ExtrapolationEBITDA adjusted to factoring costsAdjusted EBITDA margin improvement over the projection justified by an n.a. n.a. n.a. 0.1% 1.7% 3.5% 4.7% 5.7% 5.9% 6.1% 6.1% 766 844 906 CAGR 15-25E n.a. accelerated growth of the marketplace 6 148 336 676 510 (456) (338) (149) 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Adjusted EBITDA Adjusted EBITDA margin Depreciation and amortizationIt was considered a depreciation rate in line with historical figures Business Plan Extrapolation76% 56% 61% 72% 67% CAGR 15 -25E 49% 52% 44% 41% 51% 46% 77 95 114 135 158 183 n.a. 52 54 54 58 61 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, E-bit / Buscapé and Santander estimates Depreciation and amortization % of capex

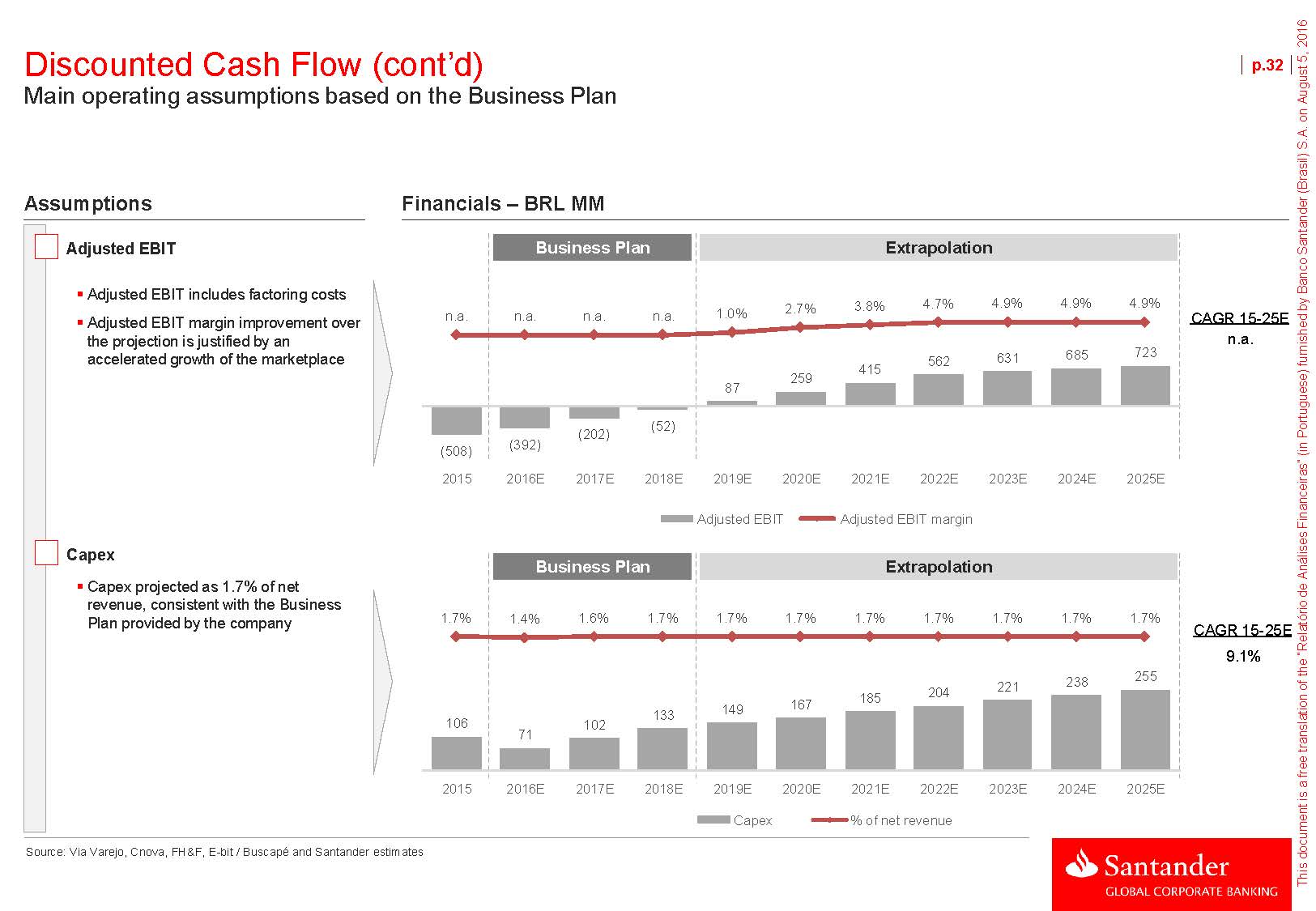

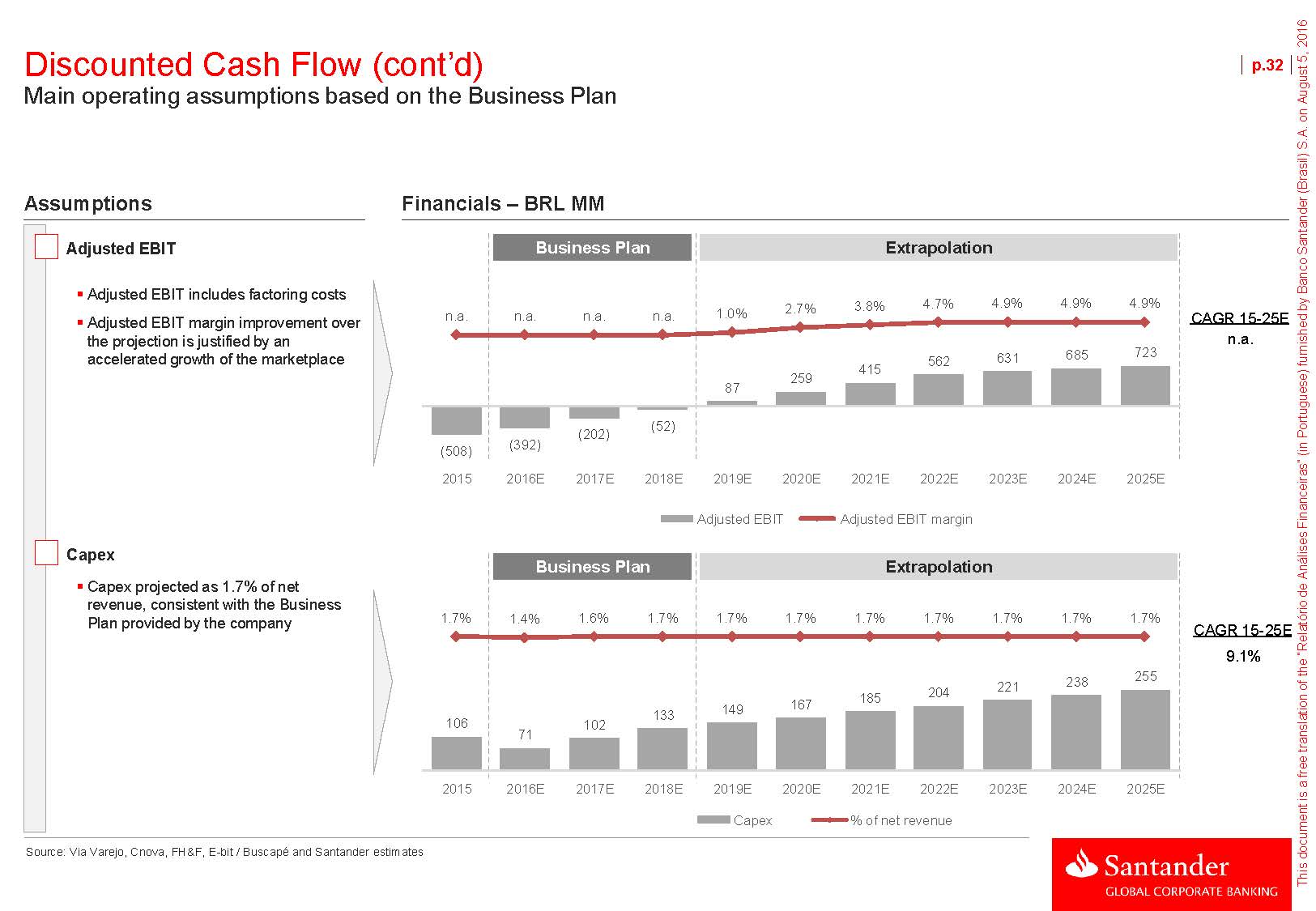

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.32AssumptionsFinancials – BRL MMAdjusted EBITBusiness Plan ExtrapolationAdjusted EBIT includes factoring costsAdjusted EBIT margin improvement over the projection is justified by an accelerated growth of the marketplace n.a. n.a. n.a. n.a. 1.0% 2.7% 3.8% 4.7% 4.9% 4.9% 4.9% 562 631 685 723 CAGR 15 -25E n.a. 259 415 87 (508) (392) (202) (52) 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Adjusted EBIT Adjusted EBIT margin CapexCapex projected as 1.7% of net revenue, consistent with the Business Plan provided by the company Business Plan Extrapolation 1.7% 1.4% 1.6% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 255 CAGR 15 -25E 9.1% 106 71 133 102 149 167 185 204 221 238 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, E-bit / Buscapé and Santander estimates Capex % of net revenue

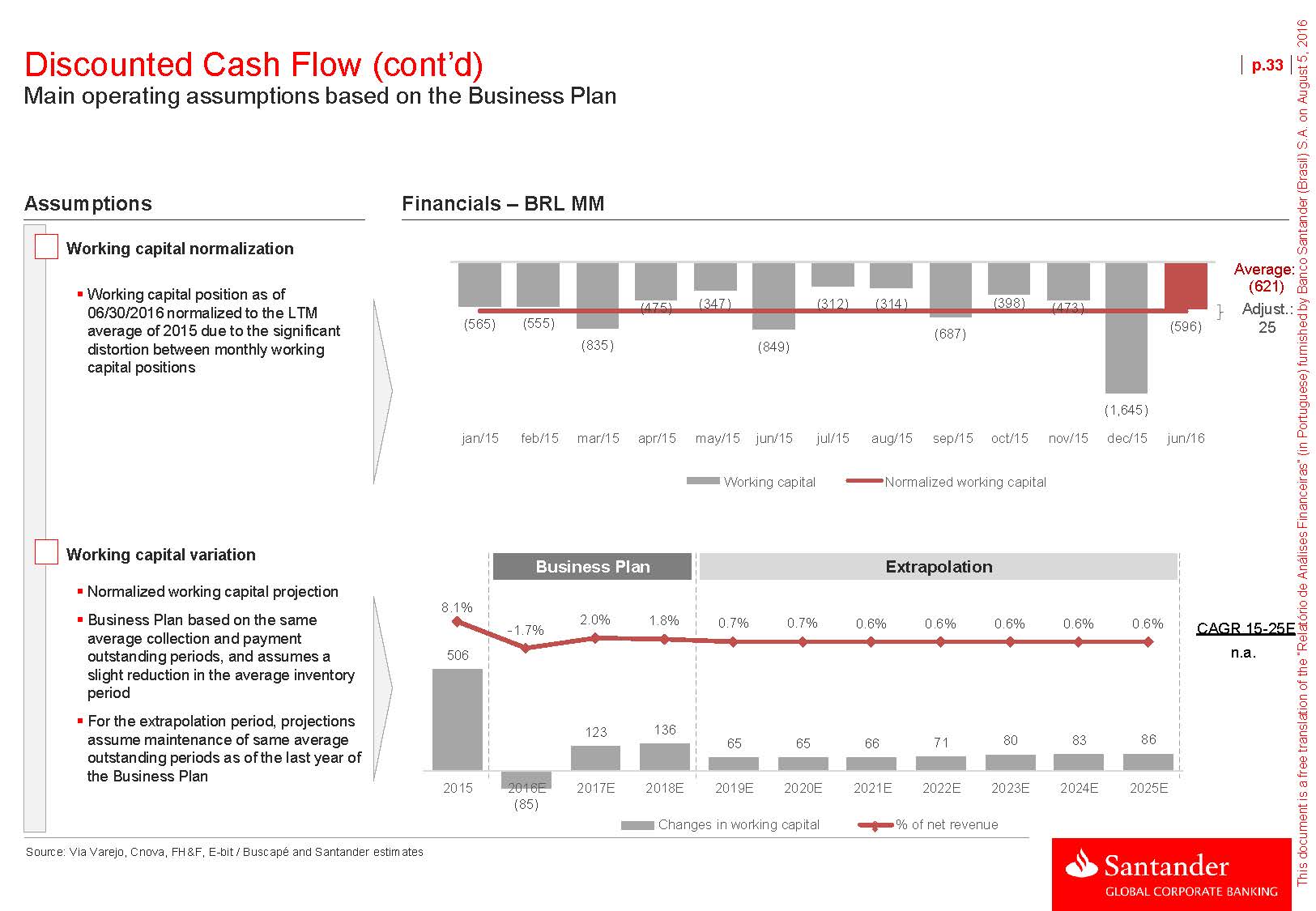

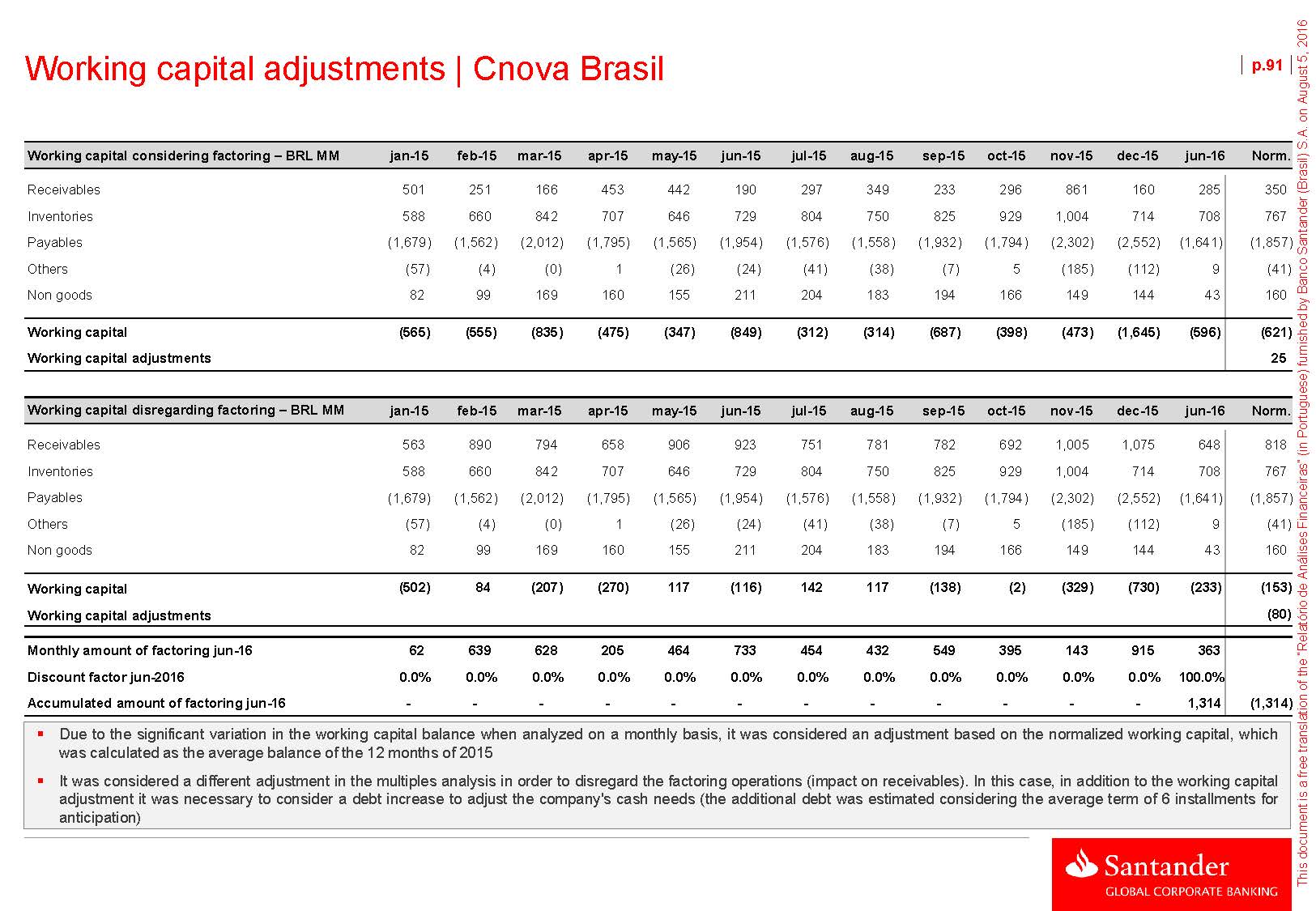

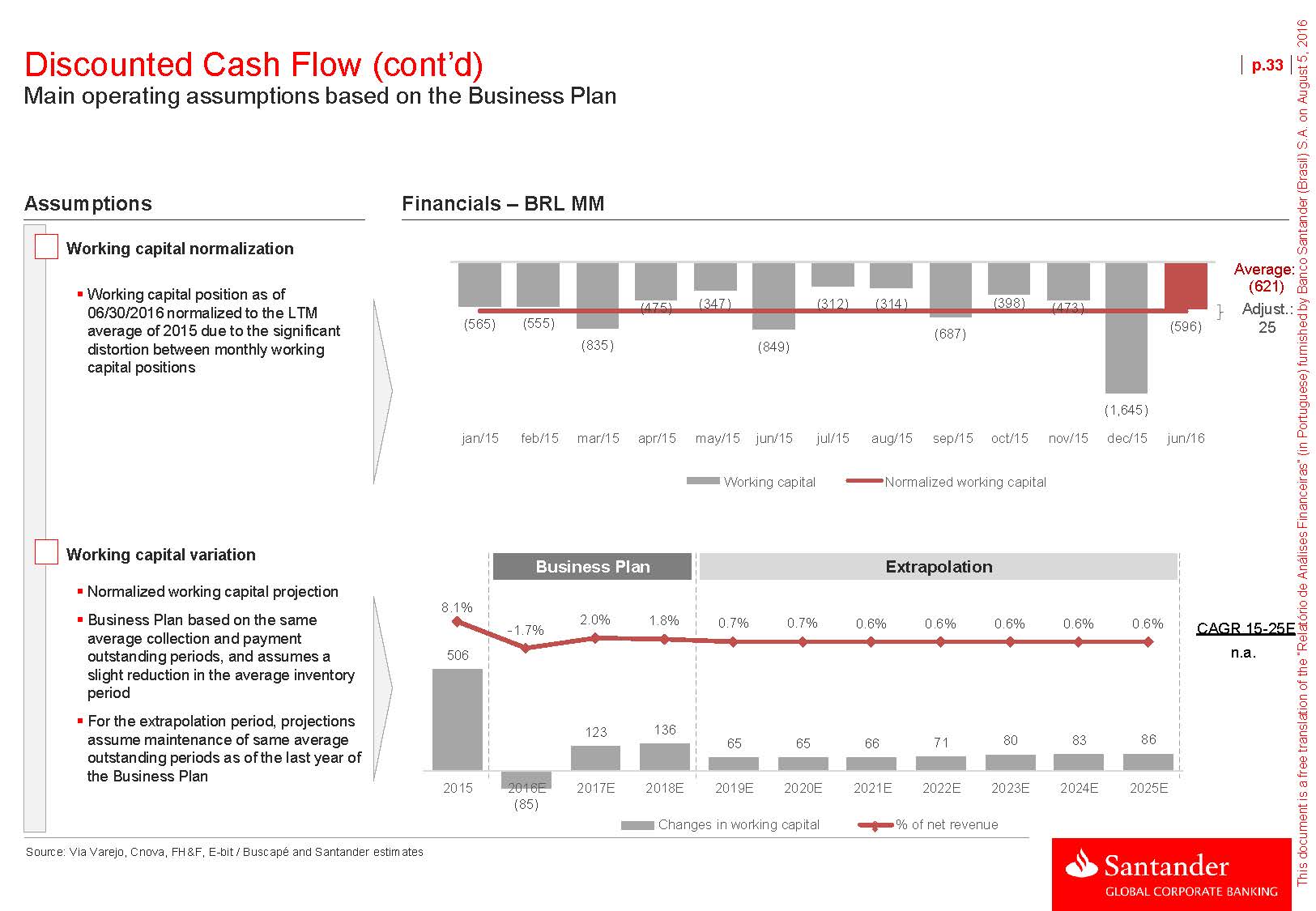

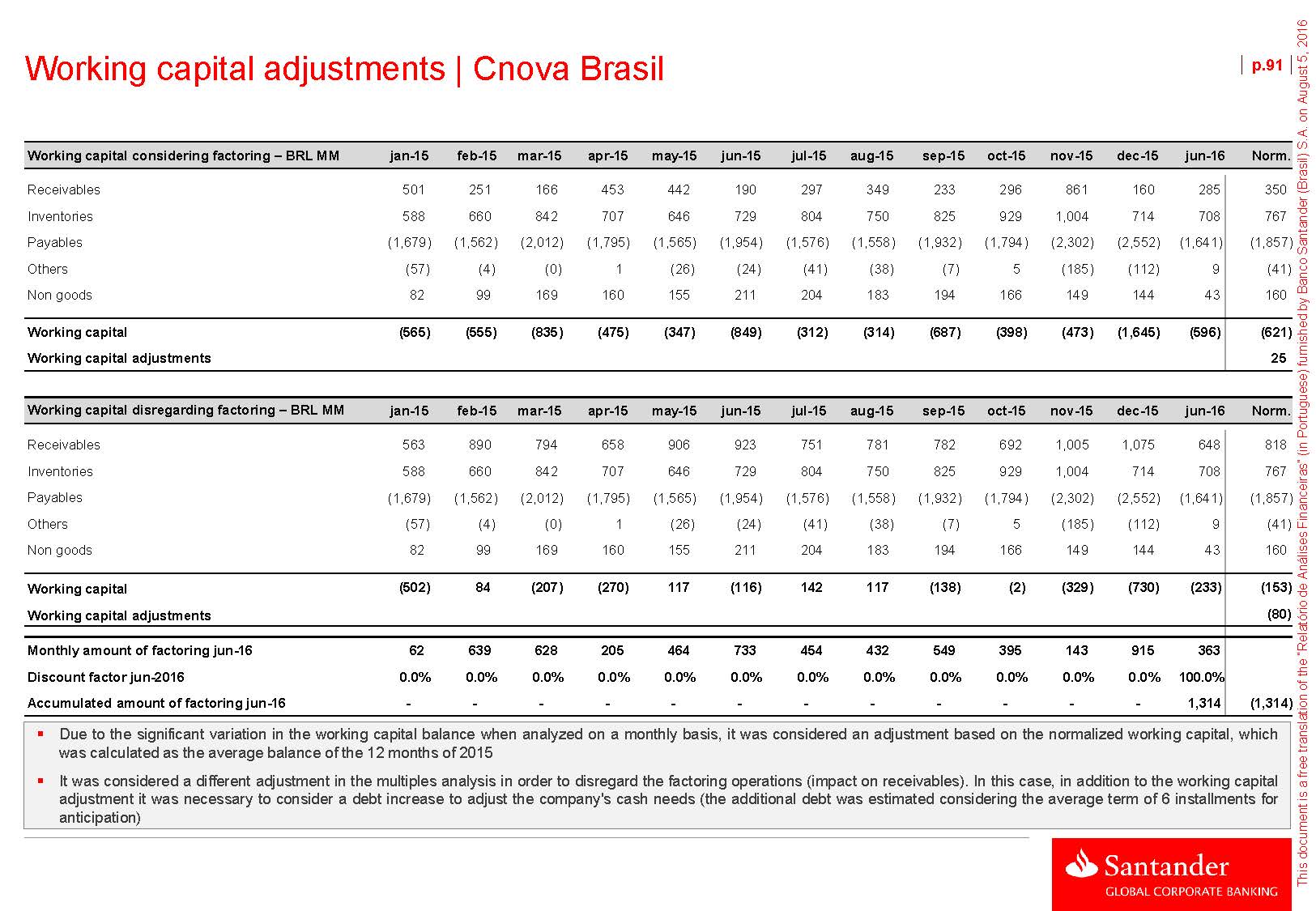

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.33AssumptionsFinancials – BRL MMWorking capital normalizationWorking capital position as of 06/30/2016 normalized to the LTM average of 2015 due to the significant distortion between monthly working capital positions (565) (555) (835) (475) (347) (849) (312) (314) (687) (398) (473) (596) Average: (621) Adjust.: 25 (1,645) jan/15 feb/15 mar/15 apr/15 may/15 jun/15 jul/15 aug/15 sep/15 oct/15 nov/15 dec/15 jun/16 Working capital Normalized working capital Working capital variationNormalized working capital projectionBusiness Plan based on the same average collection and payment outstanding periods, and assumes a slight reduction in the average inventory periodFor the extrapolation period, projections 8.1% 506 Business Plan Extrapolation -1.7% 2.0% 1.8% 0.7% 0.7% 0.6% 0.6% 0.6% 0.6% 0.6% CAGR 15-25E n.a. assume maintenance of same average outstanding periods as of the last year of the Business Plan 123 136 65 65 66 71 80 83 86 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E (85) Source: Via Varejo, Cnova, FH&F, E-bit / Buscapé and Santander estimates Changes in working capital % of net revenue

Discounted Cash Flow (cont’d) DCF valuation summary p.34RealizedBusiness PlanBusiness Plan extrapolationBRL MM Jan-Jun 16 Jul-Dec 16 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Perpetuity Net revenue 2,256 2,664 6,287 7,773 8,704 9,721 10,803 11,875 12,883 13,879 14,850 15,821 Growth (21.0%) 27.8% 23.6% 12.0% 11.7% 11.1% 9.9% 8.5% 7.7% 7.0% (-) COGS and SG&A (2,507) (2,486) (6,128) (7,417) (8,197) (9,030) (9,904) (10,791) (11,668) (12,548) (13,423)6.5% (14,301) (=) EBITDA (252) 178 159 356 507 690 899 1,085 1,215 1,331 1,427 1,520 EBITDA margin (11.2%) 6.7% 2.5% 4.6% 5.8% 7.1% 8.3% 9.1% 9.4% 9.6% 9.6% (-) Factoring costs (101) (163) (308) (350) (359) (354) (388) (408) (449) (487) (521)9.6% (555) (=) Adjusted EBITDA (353) 15 (149) 6 148 336 510 676 766 844 906 965 Adjusted EBITDA margin (15.6%) 0.6% (2.4%) 0.1% 1.7% 3.5% 4.7% 5.7% 5.9% 6.1% 6.1% (-) D&A (29) (25) (54) (58) (61) (77) (95) (114) (135) (158) (183)6.1% (195) (=) Adjusted EBIT (382) (10) (202) (52) 87 259 415 562 631 685 723 770 Adjusted EBIT margin (16.9%) (0.4%) (3.2%) (0.7%) 1.0% 2.7% 3.8% 4.7% 4.9% 4.9% 4.9% (-) Taxes - - - (29) (88) (141) (191) (214) (233) (246)4.9% (262) (=) NOPLAT (10) (202) (52) 57 171 274 371 416 452 477 508 (+) D&A 25 54 58 61 77 95 114 135 158 183 (+/–) Changes in working capital (85) 123 136 65 65 66 71 80 83 86 (-) CAPEX (25) (102) (133) (149) (167) (185) (204) (221) (238) (255) 195 86 (208) (=) FCFF (95) (128) 8 34 147 249 353 411 456 491 581 (=) NPV FCFF (92) (111) 6 22 83 122 150 151 145 136 1,816 (=) FCFF Fiscal credit - - - 9 26 42 57 64 36 - - (=) NPV FCFF Fiscal credit - - - 6 15 21 24 24 11 - - Valuation summary Implied multiples EV sensitivity analysis (USD MM) WACC 15.4% EV / Sales 16E 0.51x WACC Perpetuity growth (g)¹ 6.5% EV / Sales 17E 0.40x 14.4% 14.9% 15.4% 15.9% 16.4% 5.5% 816 756 702 653 609NPV – Projected flow 24.2% 611 6.0% 860 635 NPV – Fiscal credit 4.0% 101 g 6.5% 909663 NPV – Perpetuity 71.8% 1,816 Exit multiple (Perpetuity) 7.0% 965 694 EV BRL MM 100.0% 2,528 EV / Sales 0.44x 7.5% 1,029 938 859 790 729Fx rate - USD/BRL (monthly average)² 3.28 EV USD MM 772(1) In BRL nominal terms (considers 2.0% real growth in perpetuity) (2) As of 07/29/2016 Source: Bloomberg and Santander estimates

Discounted Cash Flow (cont’d) EV to Equity adjustments p.35EV – Equity adjustmentsTo arrive at Cnova Brasil’s equity value, the - Fraud provisions (fee of advisors) estimated by Brasil’s equity value was valued at BRL 1,413 MM (USD 431 MM) (1) Exchange rate used: USD/BRL of 3.2763 (30-day average as of 07/29/2016)

Section 2Cnova Brasil I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.36

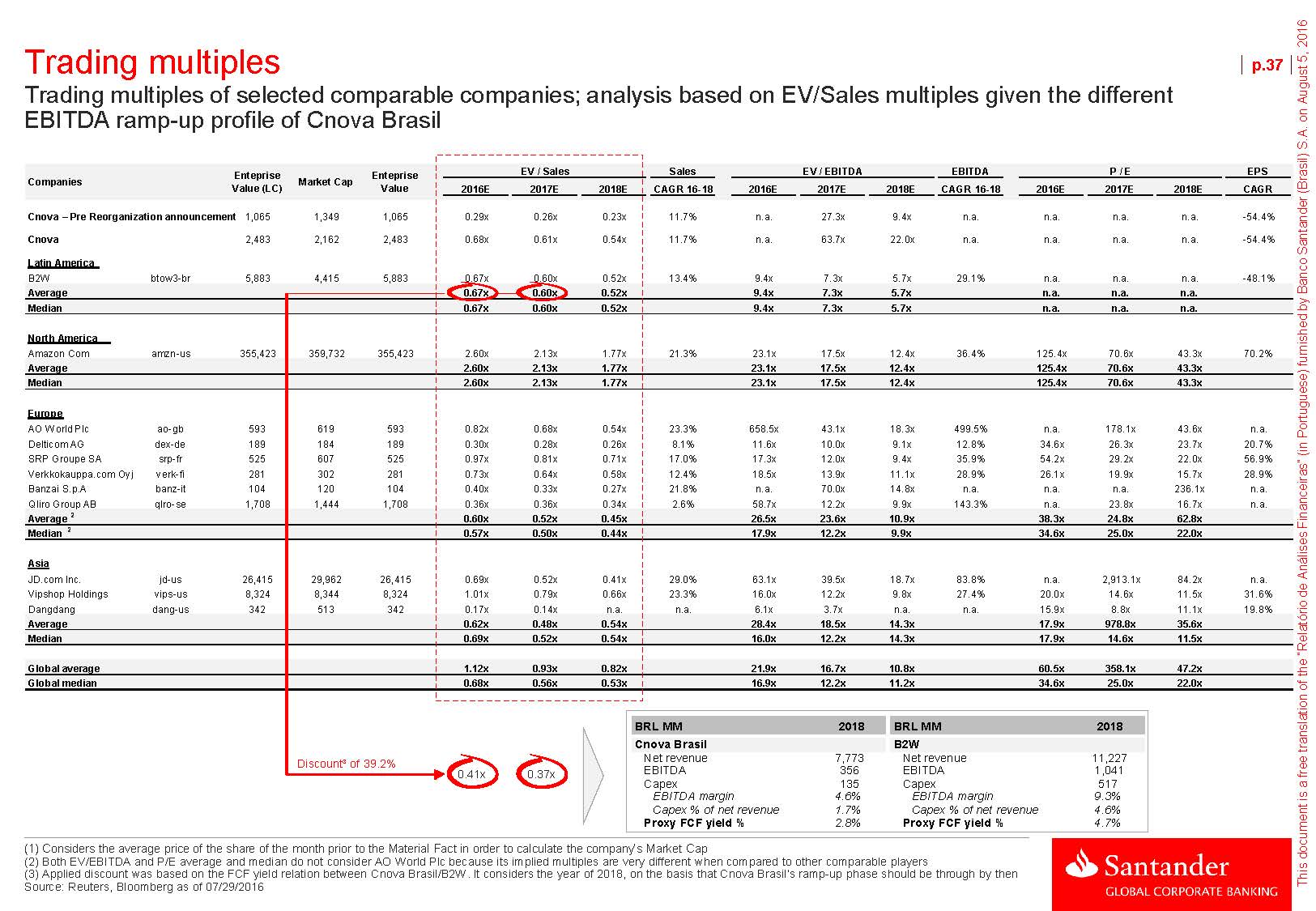

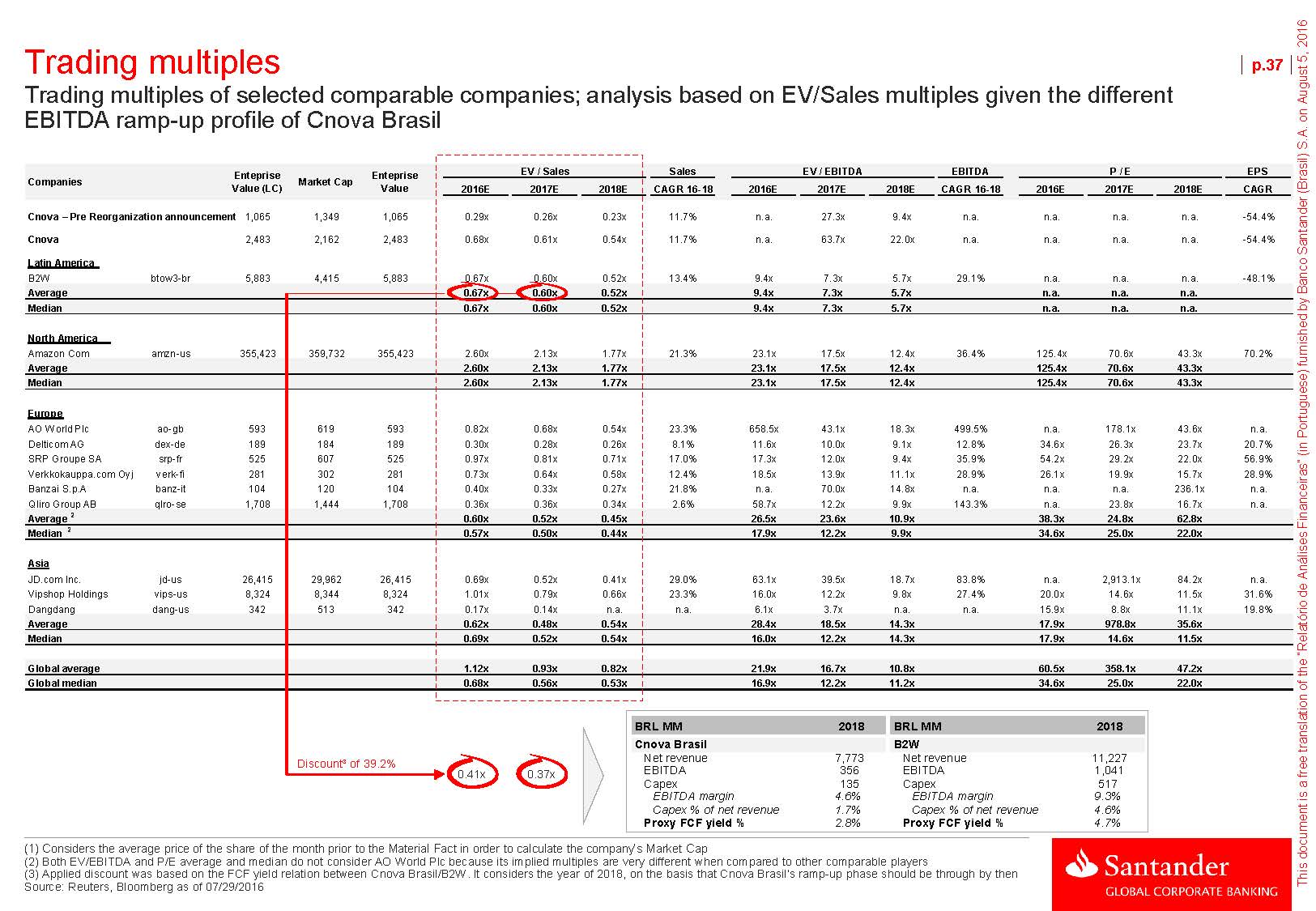

Trading multiples Trading multiples of selected comparable companies; analysis based on EV/Sales multiples given the different EBITDA ramp-up profile of Cnova Brasil p.37CompaniesEntepriseValue (LC)Market Cap EntepriseValue EV / Sales Sales EV / EBITDA EBITDA P / E EPS 2016E 2017E2018ECAGR 16-182016E 2017E 2018E CAGR 16-182016E 2017E 2018E CAGR Cnova – Pre Reorganization announcement1,065 1,349 1,065 0.29x 0.26x 0.23x 11.7% n.a. 27.3x 9.4x n.a. n.a. n.a. n.a. -54.4%CnovaLatin America 2,483 2,162 2,483 0.68x 0.61x 0.54x 11.7% n.a. 63.7x 22.0x n.a. n.a. n.a. n.a. -54.4% B2W btow3-br 5,883 4,415 5,883 0.67x 0.60x 0.52x 13.4% 9.4x 7.3x 5.7x 29.1% n.a. n.a. n.a. -48.1% Average 0.67x 0.60x 0.52x 9.4x 7.3x 5.7x n.a. n.a. n.a. Median 0.67x 0.60x 0.52x 9.4x 7.3x 5.7x n.a. n.a. n.a. North America Amazon Com amzn-us 355,423 359,732 355,423 2.60x 2.13x 1.77x 21.3% 23.1x 17.5x 12.4x 36.4% 125.4x 70.6x 43.3x 70.2% Average 2.60x 2.13x 1.77x 23.1x 17.5x 12.4x 125.4x 70.6x 43.3x Median 2.60x 2.13x 1.77x 23.1x 17.5x 12.4x 125.4x 70.6x 43.3x Europe AO World Plc ao-gb 593 619 593 0.82x 0.68x 0.54x 23.3% 658.5x 43.1x 18.3x 499.5% n.a. 178.1x 43.6x n.a. Delticom AG dex-de 189 184 189 0.30x 0.28x 0.26x 8.1% 11.6x 10.0x 9.1x 12.8% 34.6x 26.3x 23.7x 20.7% SRP Groupe SA srp-fr 525 607 525 0.97x 0.81x 0.71x 17.0% 17.3x 12.0x 9.4x 35.9% 54.2x 29.2x 22.0x 56.9% Verkkokauppa.com Oyj verk-fi 281 302 281 0.73x 0.64x 0.58x 12.4% 18.5x 13.9x 11.1x 28.9% 26.1x 19.9x 15.7x 28.9% Banzai S.p.A banz-it 104 120 104 0.40x 0.33x 0.27x 21.8% n.a. 70.0x 14.8x n.a. n.a. n.a. 236.1x n.a. Qliro Group AB qlro-se 1,708 1,444 1,708 0.36x 0.36x 0.34x 2.6% 58.7x 12.2x 9.9x 143.3% n.a. 23.8x 16.7x n.a. Average2 0.60x 0.52x 0.45x 26.5x 23.6x 10.9x 38.3x 24.8x 62.8x Median20.57x 0.50x 0.44x 17.9x 12.2x 9.9x 34.6x 25.0x 22.0x Asia JD.com Inc. jd-us 26,415 29,962 26,415 0.69x 0.52x 0.41x 29.0% 63.1x 39.5x 18.7x 83.8% n.a. 2,913.1x 84.2x n.a. Vipshop Holdings vips-us 8,324 8,344 8,324 1.01x 0.79x 0.66x 23.3% 16.0x 12.2x 9.8x 27.4% 20.0x 14.6x 11.5x 31.6% Dangdang dang-us 342 513 342 0.17x 0.14x n.a. n.a. 6.1x 3.7x n.a. n.a. 15.9x 8.8x 11.1x 19.8% Average 0.62x 0.48x 0.54x 28.4x 18.5x 14.3x 17.9x 978.8x 35.6x Median 0.69x 0.52x 0.54x 16.0x 12.2x 14.3x 17.9x 14.6x 11.5x Global average 1.12x 0.93x 0.82x 21.9x 16.7x 10.8x 60.5x 358.1x 47.2x Global median 0.68x 0.56x 0.53x 16.9x 12.2x 11.2x 34.6x 25.0x 22.0x Discount³ of 39.2% 0.41x 0.37x (1) Considers the average price of the share of the month prior to the Material Fact in order to calculate the company’s Market Cap (2) Both EV/EBITDA and P/E average and median do not consider AO World Plc because its implied multiples are very different when compared to other comparable players (3) Applied discount was based on the FCF yield relation between Cnova Brasil/B2W. It considers the year of 2018, on the basis that Cnova Brasil’s ramp-up phase should be through by then Source: Reuters, Bloomberg as of 07/29/2016

Trading multiples valuation p.38 Based on the trading multiples methodology, the Equity Value of Cnova Brasil was valued at c. BRL 1.0 bi (USD 0.3 bi) Enterprise Value (BRL MM) Equity Value (BRL MM)11Implied multiples at mid-point EV / Sales20162017CommentsMethodology based on comparable listed companies EV / SalesMultiples2016E2017E3,277 3,719 3,356 3,843 0.67x 0.77x 0.53x 0.60xEnterprise Value is calculated by applying the multiple EV/Sales from selected peers to Cnova Brasil’s projected net revenue in the Business Plan 2EV / SalesAdjusted² Multiples2016E2017E1,989 2,286 2,041 2,309 0.41x 0.47x 0.32x 0.37xEV/EBITDA multiples valuation was disregarded in this exercise given that Cnova Brasil has a negative EBITDA in 2016 and only reaches stable margins consistent with its operation from 2022 onwardsAverage range calculated from the average of the EV midpoints of the valuations using non- Average Range (BRL MM)Average Range (USD MM)³ 1,068 1,099 3,498 3,599 0.72x 0.56x adjusted EV/Sales multiplesAssumes a total adjustment from Enterprise Value to Equity Value for Cnova Brasil of BRL 2,534 million4 (1) Valuation range by applying a +/- 5% variation to the Equity Value (2) A 39.2% discount over B2W ‘s EV/Sales multiple was considered (3) Exchange rate used: USD/BRL of 3.2763 (30-day average as of 07/29/2016) (4) EV to Equity adjustment details in the Annex III Source: Santander, Reuters, Bloomberg

Section 2Cnova Brasil I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading Multiples c) Transaction Multiples p.39

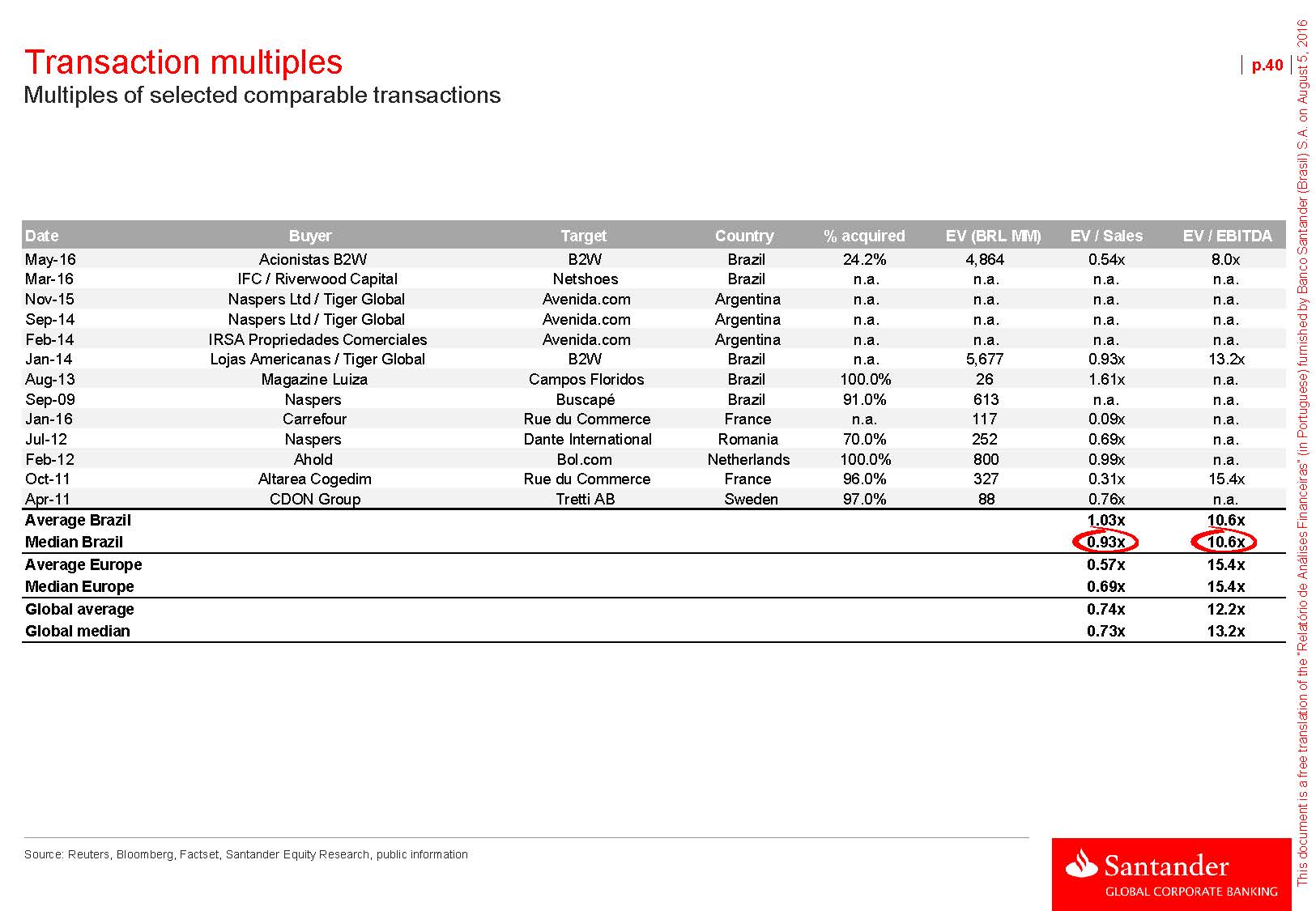

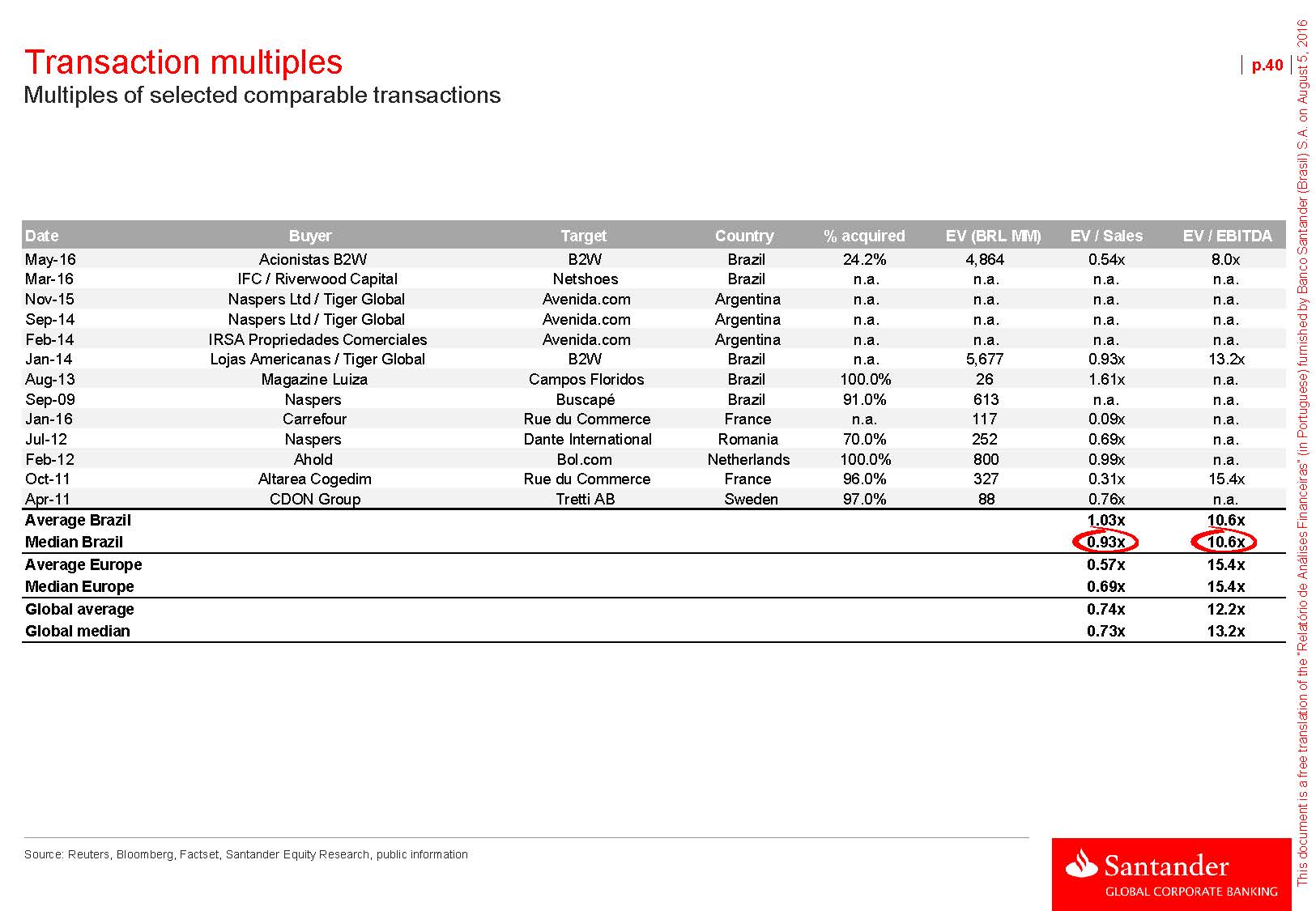

Transaction multiples Multiples of selected comparable transactions p.40Date Buyer Target Country % acquired EV (BRL MM) EV / Sales EV / EBITDA May-16 Acionistas B2W B2W Brazil 24.2% 4,864 0.54x 8.0x Mar-16 IFC / Riverwood Capital Netshoes Brazil n.a. n.a. n.a. n.a. Nov-15 Naspers Ltd / Tiger Global Avenida.com Argentina n.a. n.a. n.a. n.a. Sep-14 Naspers Ltd / Tiger Global Avenida.com Argentina n.a. n.a. n.a. n.a. Feb-14 IRSA Propriedades Comerciales Avenida.com Argentina n.a. n.a. n.a. n.a. Jan-14 Lojas Americanas / Tiger Global B2W Brazil n.a. 5,677 0.93x 13.2x Aug-13 Magazine Luiza Campos Floridos Brazil 100.0% 26 1.61x n.a. Sep-09 Naspers Buscapé Brazil 91.0% 613 n.a. n.a. Jan-16 Carrefour Rue du Commerce France n.a. 117 0.09x n.a. Jul-12 Naspers Dante International Romania 70.0% 252 0.69x n.a. Feb-12 Ahold Bol.com Netherlands 100.0% 800 0.99x n.a. Oct-11 Altarea Cogedim Rue du Commerce France 96.0% 327 0.31x 15.4x Apr-11 CDON Group Tretti AB Sweden 97.0% 88 0.76x n.a. Average Brazil 1.03x 10.6x Median Brazil 0.93x 10.6x Average Europe 0.57x 15.4x Median Europe 0.69x 15.4x Global average 0.74x 12.2xGlobal median 0.73x 13.2xSource: Reuters, Bloomberg, Factset, Santander Equity Research, public information

Transaction multiples valuation Based on the transaction multiples methodology, the Equity Value of Cnova Brasil was valued at c. BRL 2.7 bi (USD 0.8 bi) p.41 Enterprise Value (BRL MM) Equity Value (BRL MM)1Implied multiples at mid-point over ’16EV / SalesCommentsMethodology based on comparable transactionsEV / SalesMultiples20155,646 5,973 1.18xEnterprise Value is calculated by applying the multiple EV/Sales from selected comparable transactions to Cnova Brasil’s projected net revenue EV/EBITDA multiples valuation was disregarded 2016EAverage Range (BRL MM)Average Range (USD MM)²1,546 4,485 5,065 1,627 4,690 5,332 0.93x 1.06x in this exercise given that Cnova Brasil has a negative EBITDA in 2016 and only reaches stable margins consistent with its operation from 2022 onwardsAverage range calculated as the average of the EV midpointsAssumes a total adjustment from Enterprise Value to Equity Value for Cnova Brasil of BRL 2.534 milhões3 (1) Values range built by applying a +/- 5% variation to the Equity Value (2) Exchange rate used: USD/BRL of 3.2763 (30-day average as of 07/29/2016) (3) EV to Equity adjustment details in the Annex III Source: Santander, Reuters, Bloomberg, Factset, public information

Section 3Cdiscount I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.42

Overview Cdiscount is the second largest e-commerce in France, with more than 760 hits in 2015 and over 16 million registered customers p.43Overview Shareholding structureFounded in 1999 and currently under Casino, Cdiscount has registered more than 16 million customers since its creationIt holds operations in France, Senegal, Cameroon, Ivory Coast and ColombiaThe company offers more than 100,000 products in about 40 different categories, in addition to its marketplace, which counts with another 10 million items offered by selected partners Cdiscount gives its customers the option of collecting purchased products directly at one of its 18,000 pickup points, which are distributed between its registered partners and hypermarkets from Casino’s chainThe company has a daily average of 900,000 visitors, reaching a peak of 2.5 million visitors in the first day of winter promotion It has 2 distribution centers in France, with 100,000 m² available and more than 1,200 employees 43.3% 26.2% 21.9% Free float 8.5% Geographic footprint99.8% 100.0% Source:Company

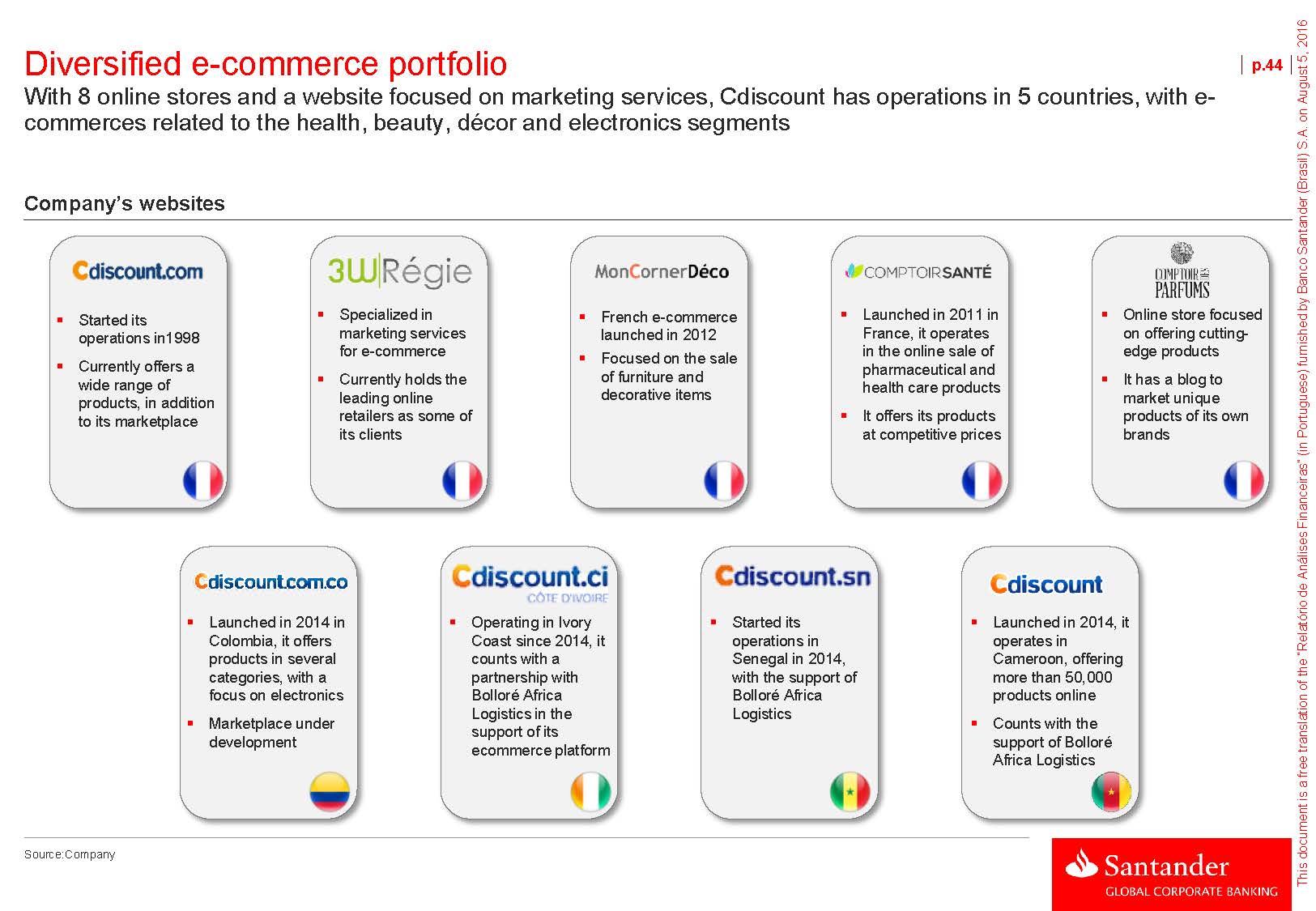

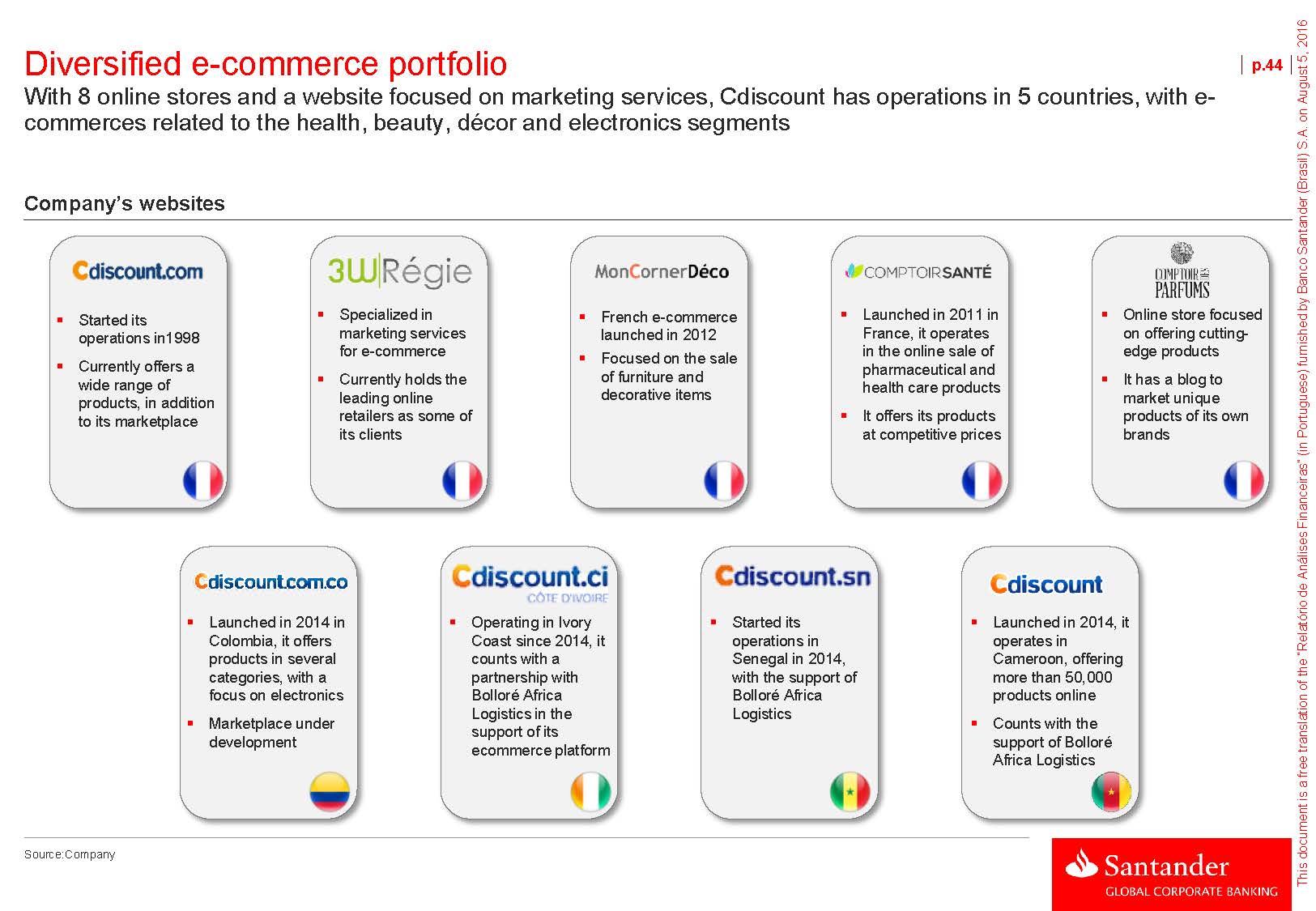

Diversified e-commerce portfolio With 8 online stores and a website focused on marketing services, Cdiscount has operations in 5 countries, with e- commerces related to the health, beauty, décor and electronics segments Company’s websitesp.44Started its operations in1998Currently offers a wide range of products, in addition to its marketplace Specialized in marketing services for e-commerceCurrently holds the leading online retailers as some of its clientsFrench e-commerce launched in 2012Focused on the sale of furniture and decorative itemsLaunched in 2011 in France, it operates in the online sale of pharmaceutical and health care productsIt offers its products at competitive pricesOnline store focused on offering cutting- edge productsIt has a blog to market unique products of its own brandsLaunched in 2014 in Colombia, it offers products in several categories, with a focus on electronicsMarketplace under developmentOperating in Ivory Coast since 2014, it counts with a partnership with Bolloré Africa Logistics in the support of its ecommerce platformStarted its operations in Senegal in 2014, with the support of Bolloré Africa LogisticsLaunched in 2014, it operates in Cameroon, offering more than 50,000 products onlineCounts with the support of Bolloré Africa Logistics Source:Company

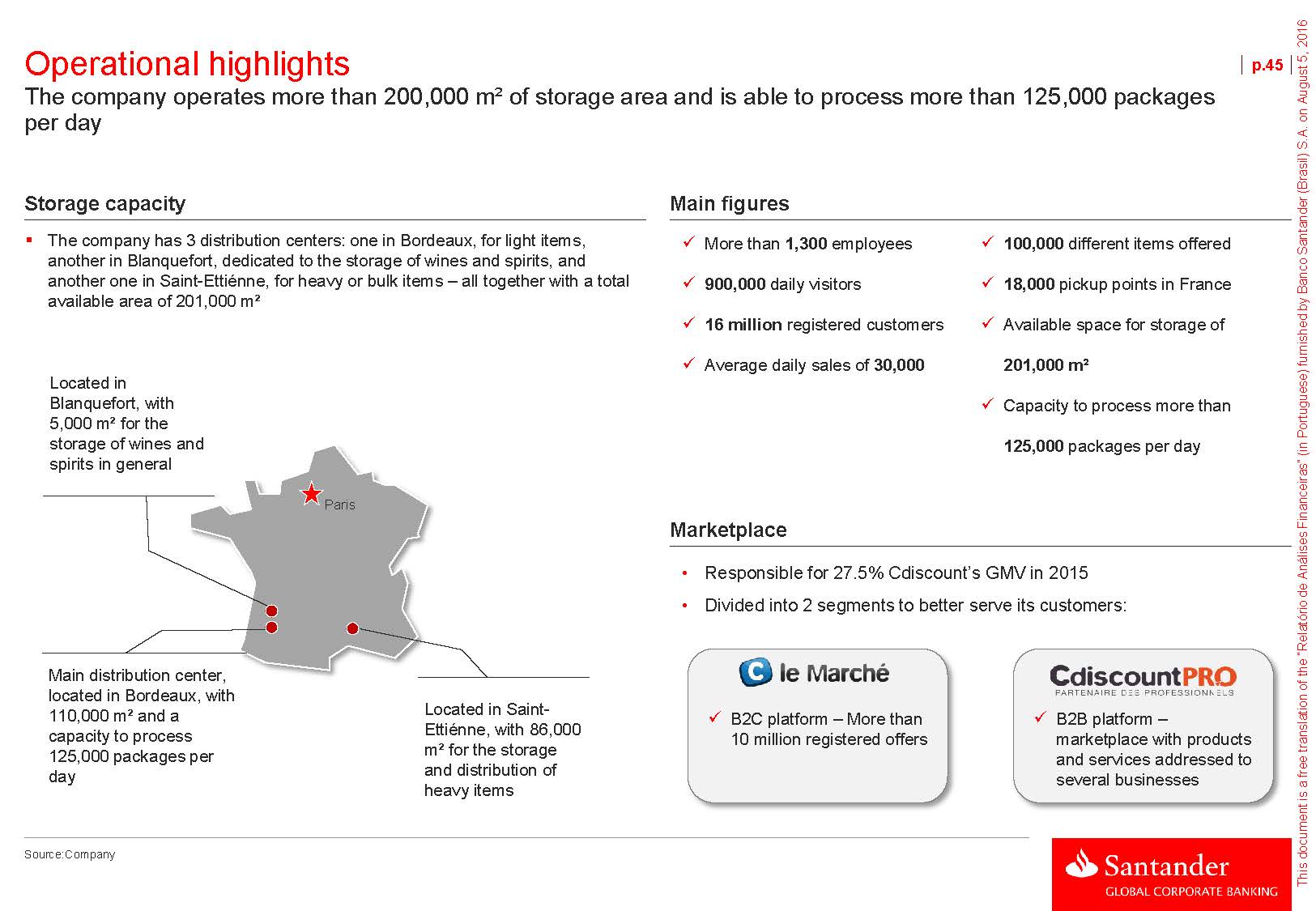

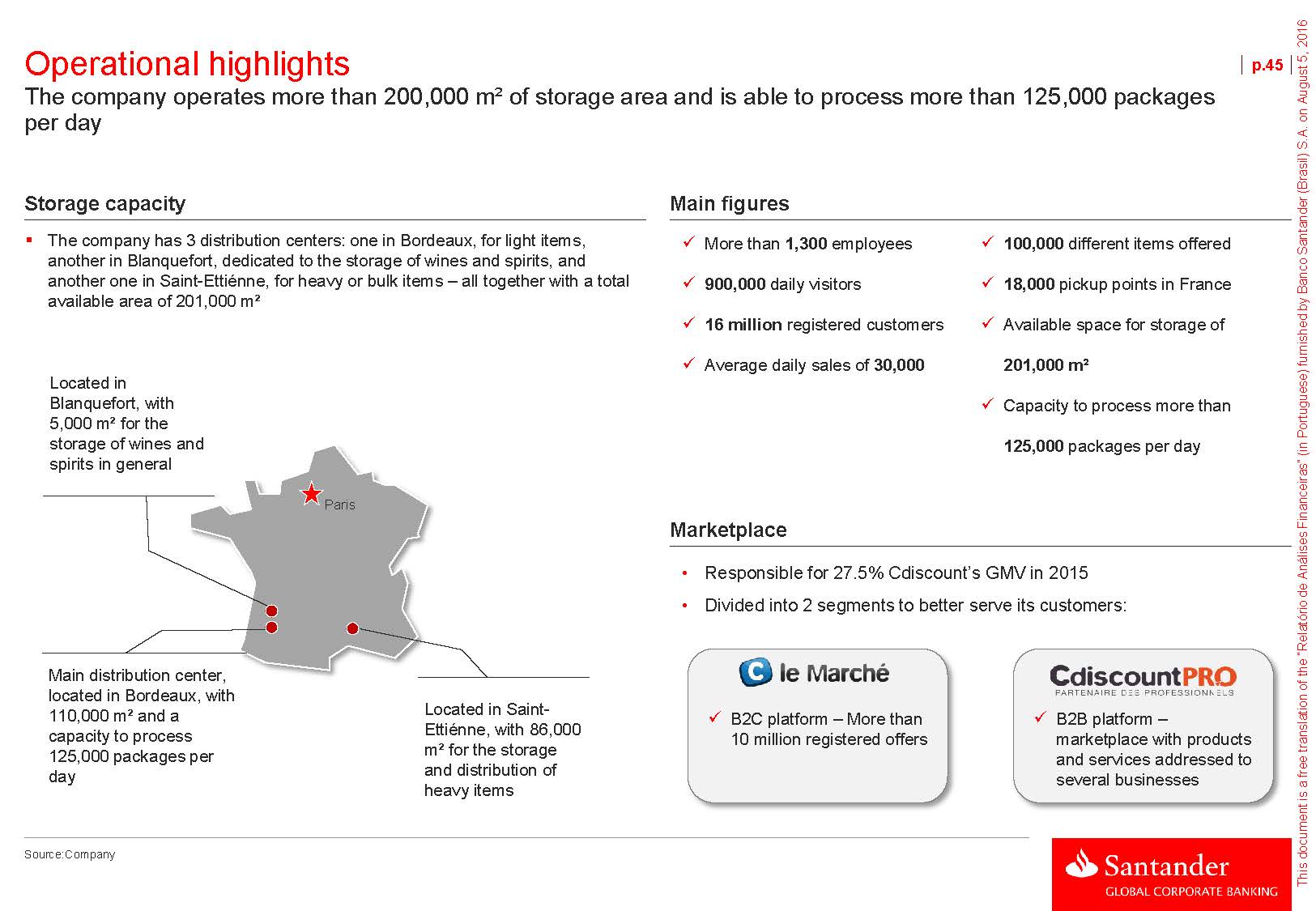

Operational highlights The company operates more than 200,000 m² of storage area and is able to process more than 125,000 packages per day p.45Storage capacityThe company has 3 distribution centers: one in Bordeaux, for light items, another in Blanquefort, dedicated to the storage of wines and spirits, and another one in Saint-Ettiénne, for heavy or bulk items – all together with a total available area of 201,000 m² Located in Blanquefort, with 5,000 m² for the storage of wines and spirits in general Main figuresüMore than 1,300 employeesü900,000 daily visitorsü 16 million registered customersüAverage daily sales of 30,000ü100,000 different items offeredü18,000 pickup points in Franceü Available space for storage of 201,000 m²üCapacity to process more than 125,000packages per dayParis Marketplace• Responsible for 27.5% Cdiscount’s GMV in 2015 • Divided into 2 segments to better serve its customers: Main distribution center, located in Bordeaux, with 110,000 m² and a capacity to process 125,000 packages per day Located in Saint- Ettiénne, with 86,000 m² for the storage and distribution of heavy itemsü B2C platform – More than 10 million registered offersüB2B platform – marketplace with products and services addressed to several businesses Source:Company

Section 3Cdiscount I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.46

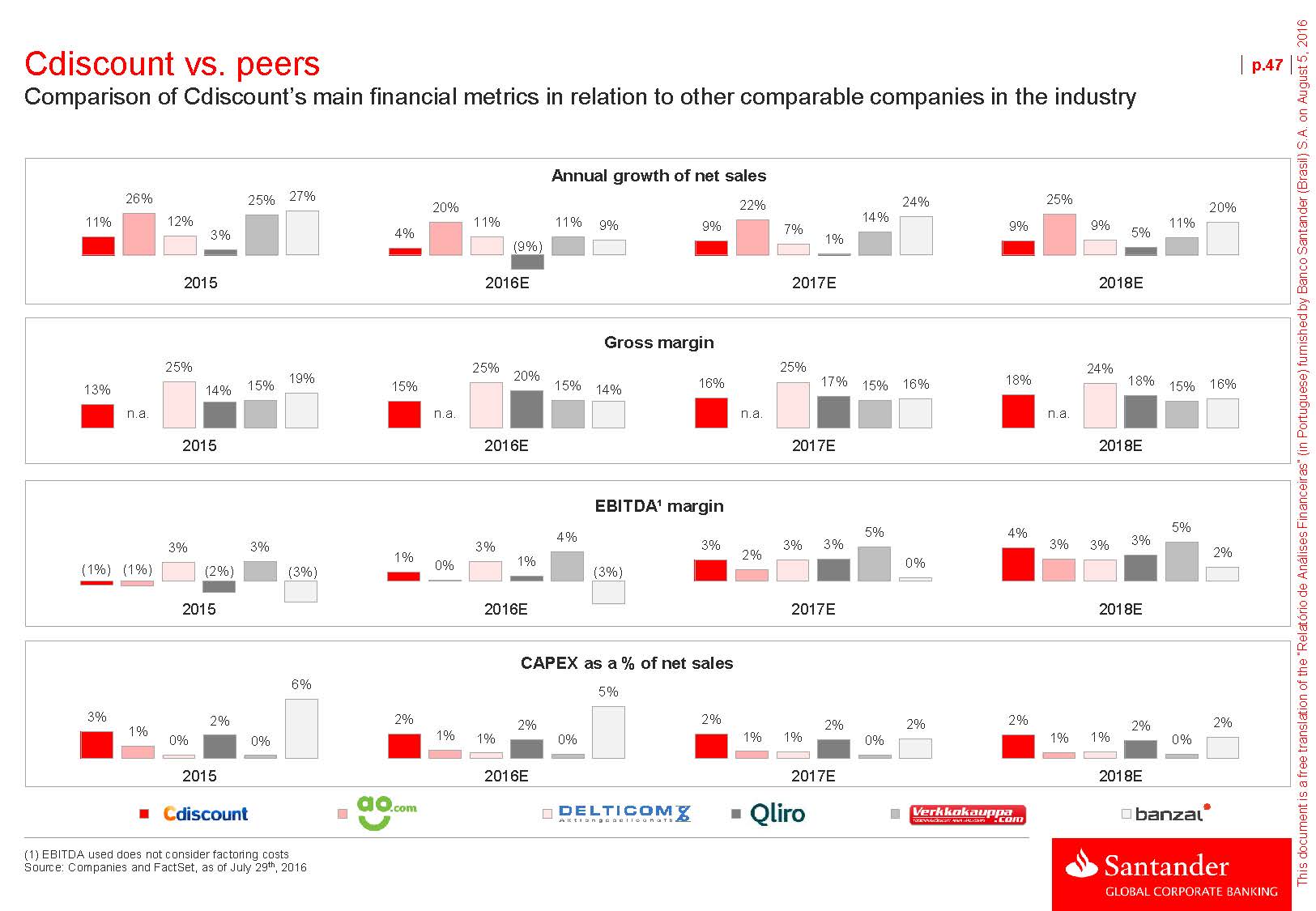

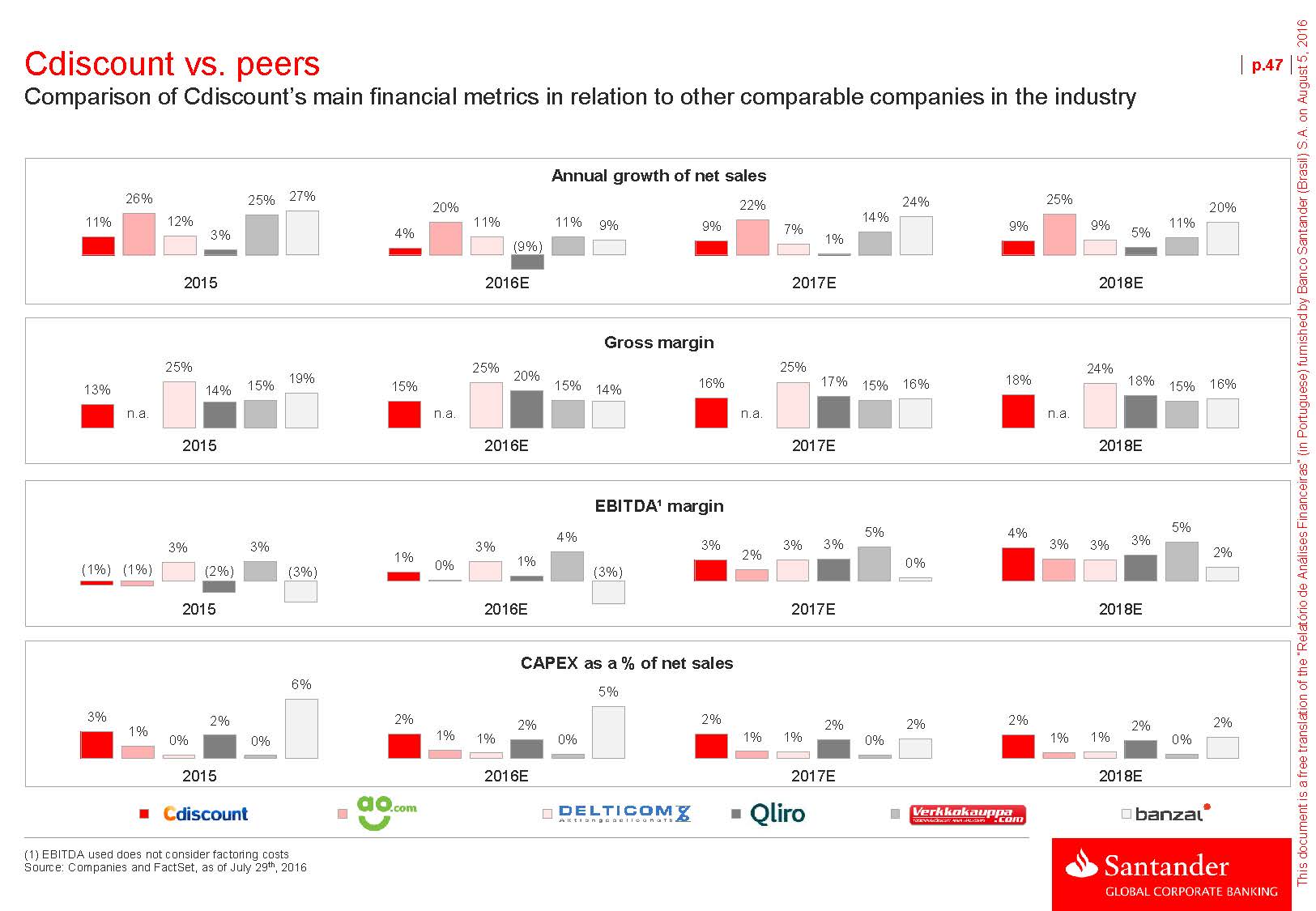

Cdiscount vs. peers Comparison of Cdiscount’s main financial metrics in relation to other comparable companies in the industry p.4726% 25% 27% Annual growth of net sales20% 22% 24% 25% 20% 11% 12% 11% 11% 7% 14% 11% 3% 4% 9% 9% 9% 9% (9%) 1% 5% 2015 2016E 2017E 2018E 25% 25% 20% Gross margin25% 24% 13% 14% 15% 19% 15% 15% 14% 16% 17% 15% 16% 18% 18% 15% 16% n.a. n.a. n.a. n.a. 2015 2016E 2017E 2018E 3% 3% EBITDA¹ margin3% 4% 3% 1% 2% 5% 3% 3% 4% 5% 3% 3% 3% 2% (1%) (1%) (2%) (3%) 0% 1% 0% (3%) 2015 2016E 2017E 2018E CAPEX as a % of net sales6% 5% 3% 2% 1% 0% 0% 2% 2% 1% 1% 0% 2% 1% 1% 2% 2% 0% 2% 1% 1% 2% 2% 0% 2015 2016E 2017E 2018E (1) EBITDA used does not consider factoring costs Source: Companies and FactSet, as of July 29th, 2016

Section 3Cdiscount I. Overview II. Comparison with main peers III. Valuation a) Discounted Cash Flow b) Trading multiples c) Transaction multiples p.48

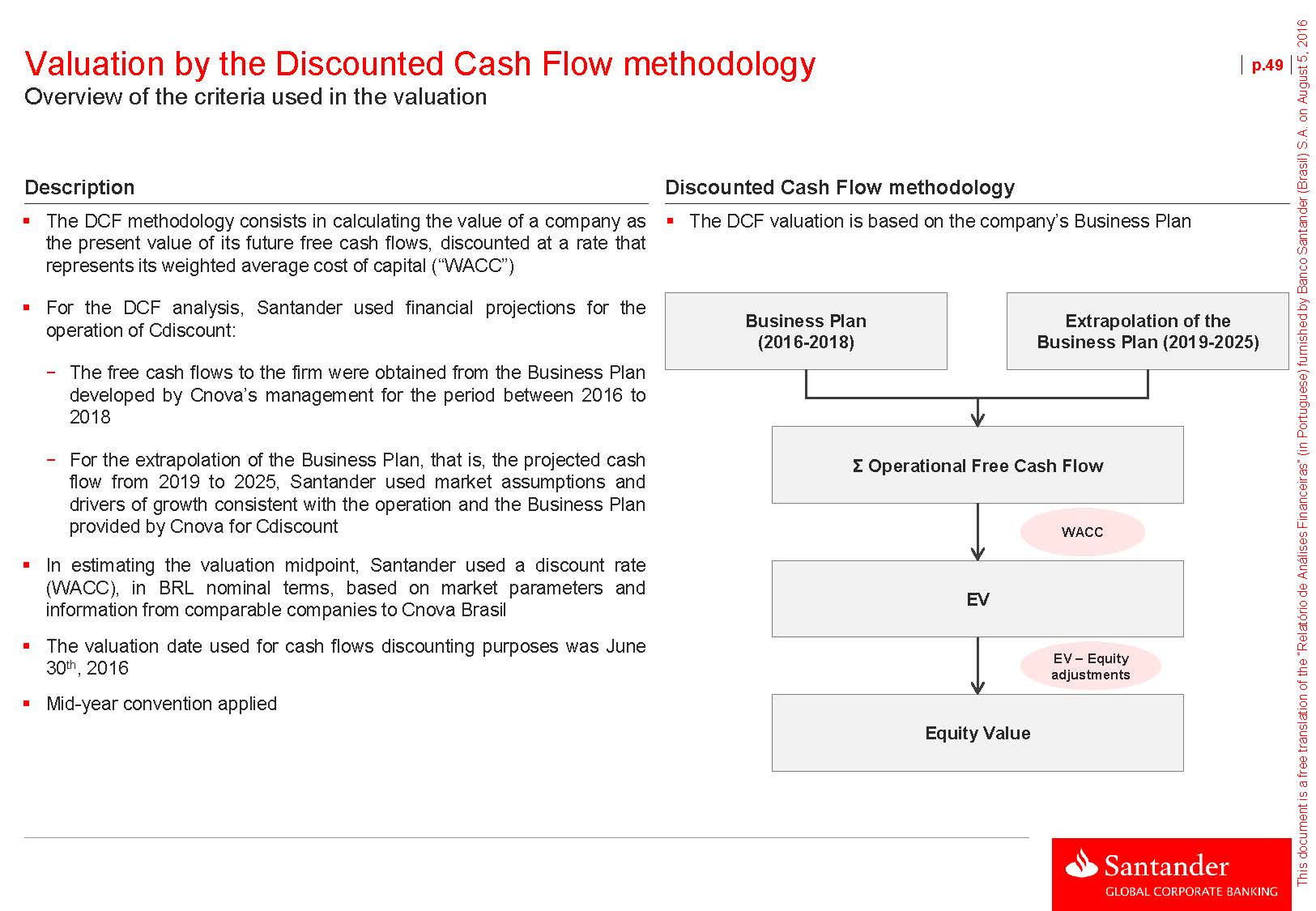

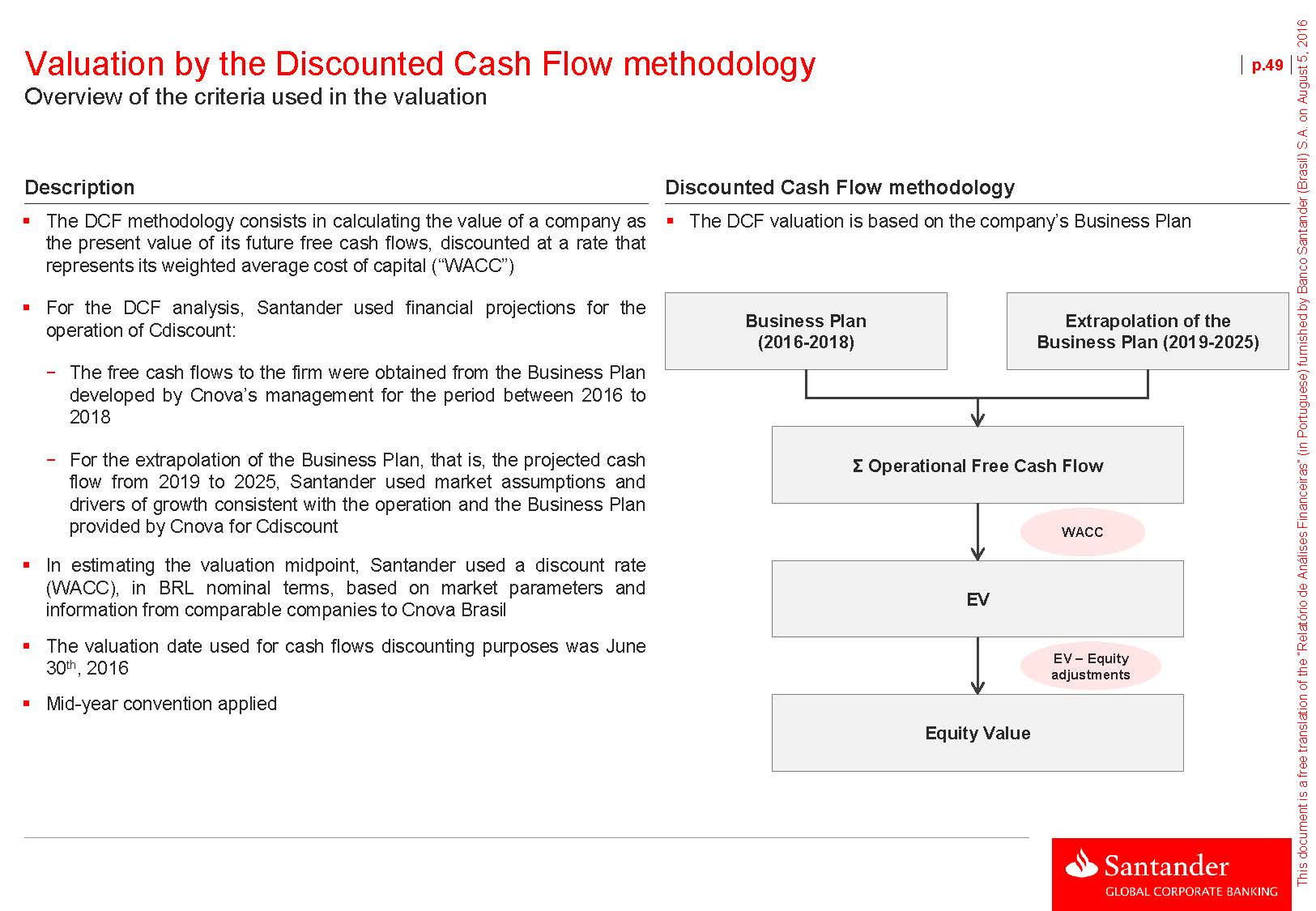

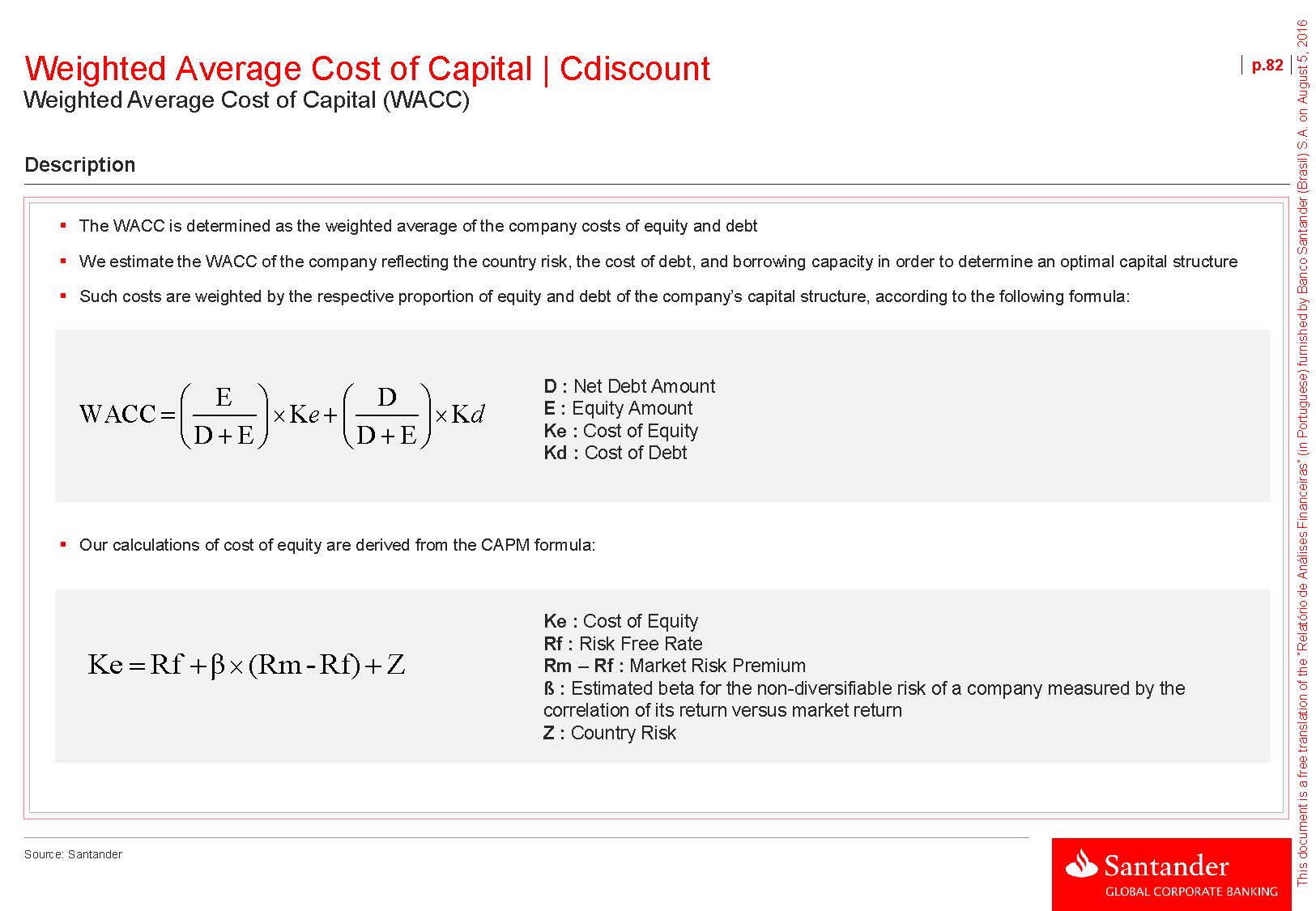

Valuation by the Discounted Cash Flow methodology Overview of the criteria used in the valuation p.49DescriptionThe DCF methodology consists in calculating the value of a company as the present value of its future free cash flows, discounted at a rate that represents its weighted average cost of capital (“WACC”) Discounted Cash Flow methodologyThe DCF valuation is based on the company’s Business PlanFor the DCF analysis, Santander used financial projections for the operation of Cdiscount: − The free cash flows to the firm were obtained from the Business Plan developed by Cnova’s management for the period between 2016 to 2018 Business Plan (2016-2018)Extrapolation of theBusiness Plan (2019-2025)− For the extrapolation of the Business Plan, that is, the projected cash flow from 2019 to 2025, Santander used market assumptions and drivers of growth consistent with the operation and the Business Plan provided by Cnova for CdiscountIn estimating the valuation midpoint, Santander used a discount rate (WACC), in BRL nominal terms, based on market parameters and information from comparable companies to Cnova BrasilThe valuation date used for cash flows discounting purposes was June 30th, 2016Mid-year convention appliedΣ Operational Free Cash FlowWACCEVEV – Equity adjustmentsEquity Value

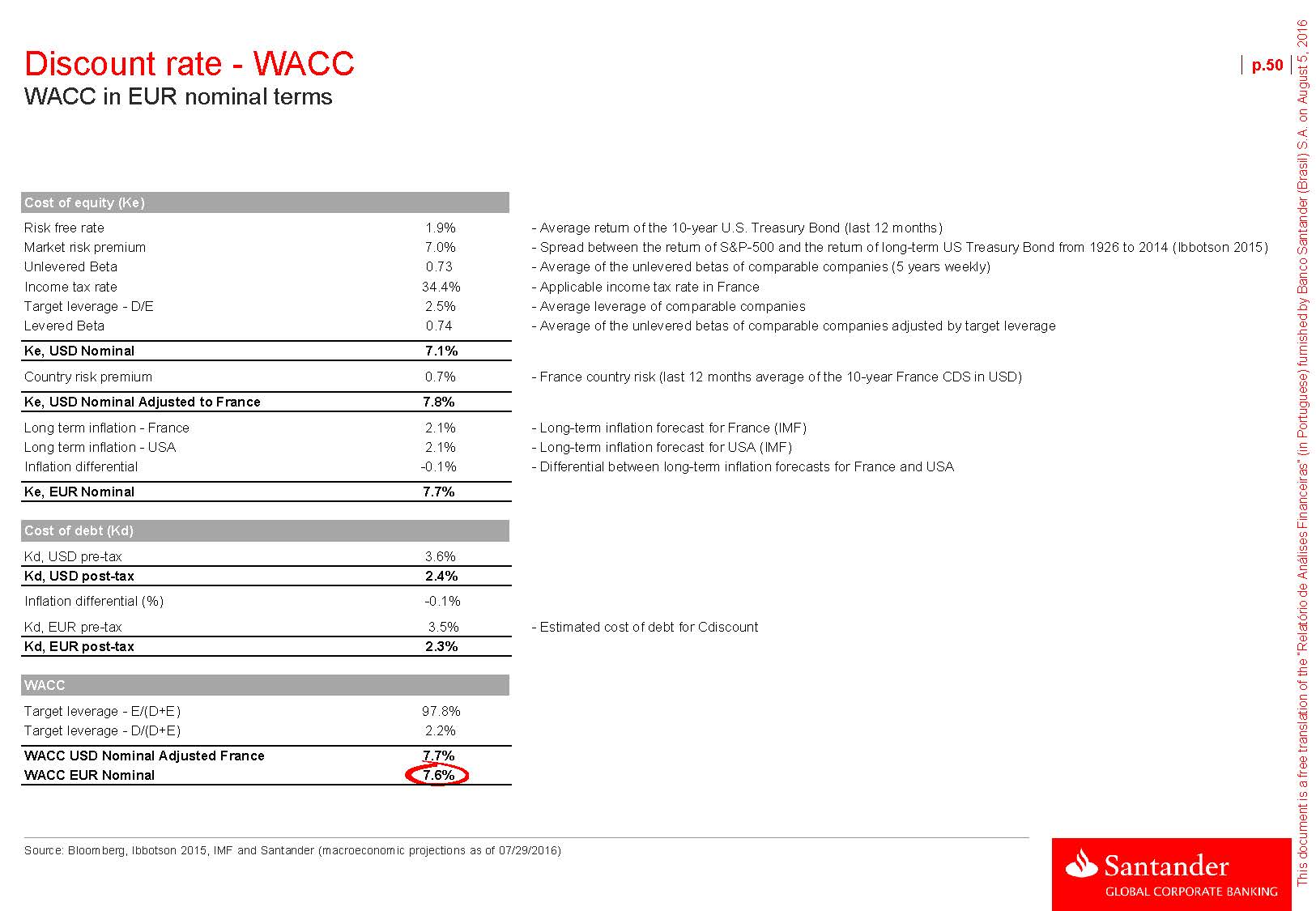

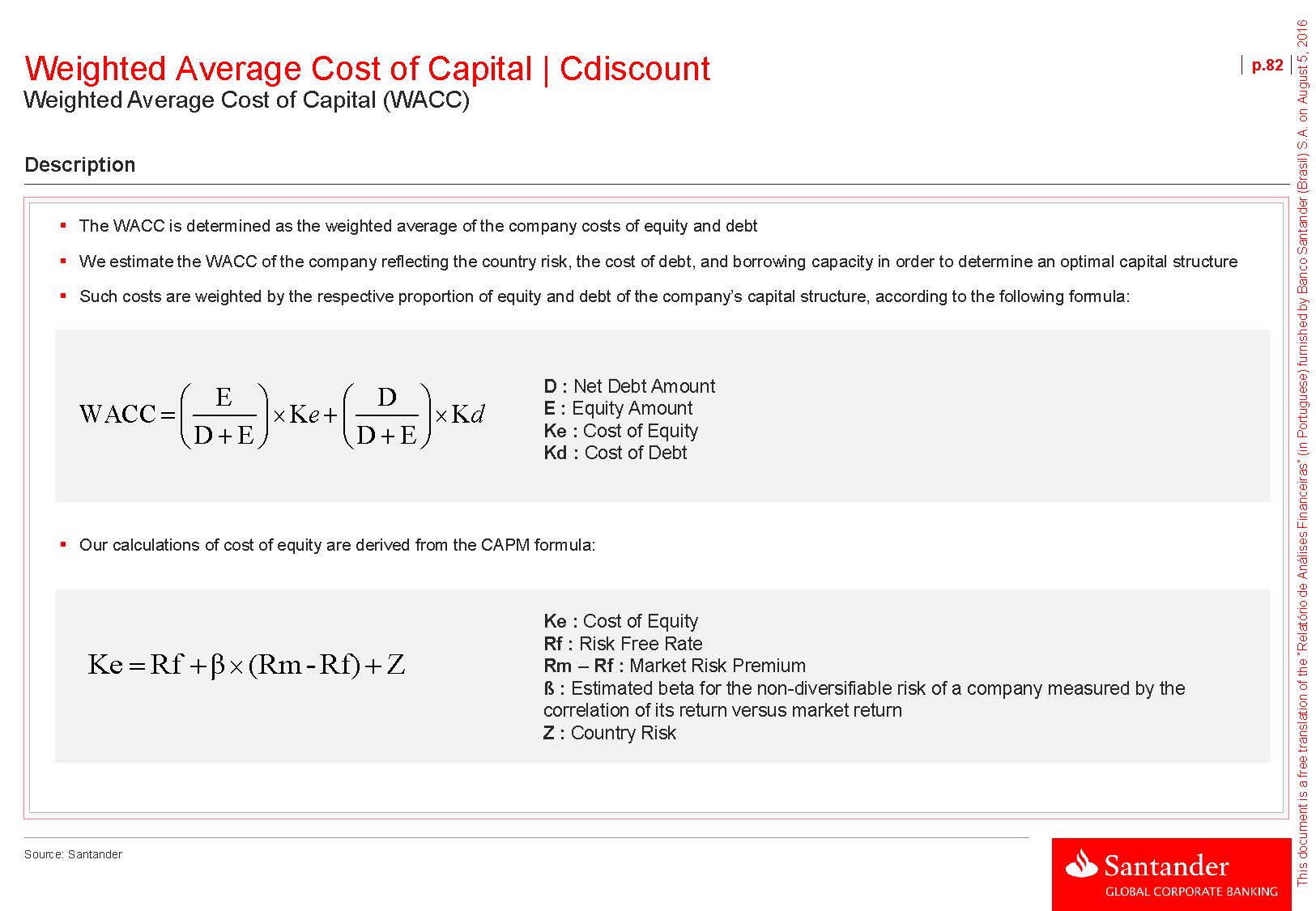

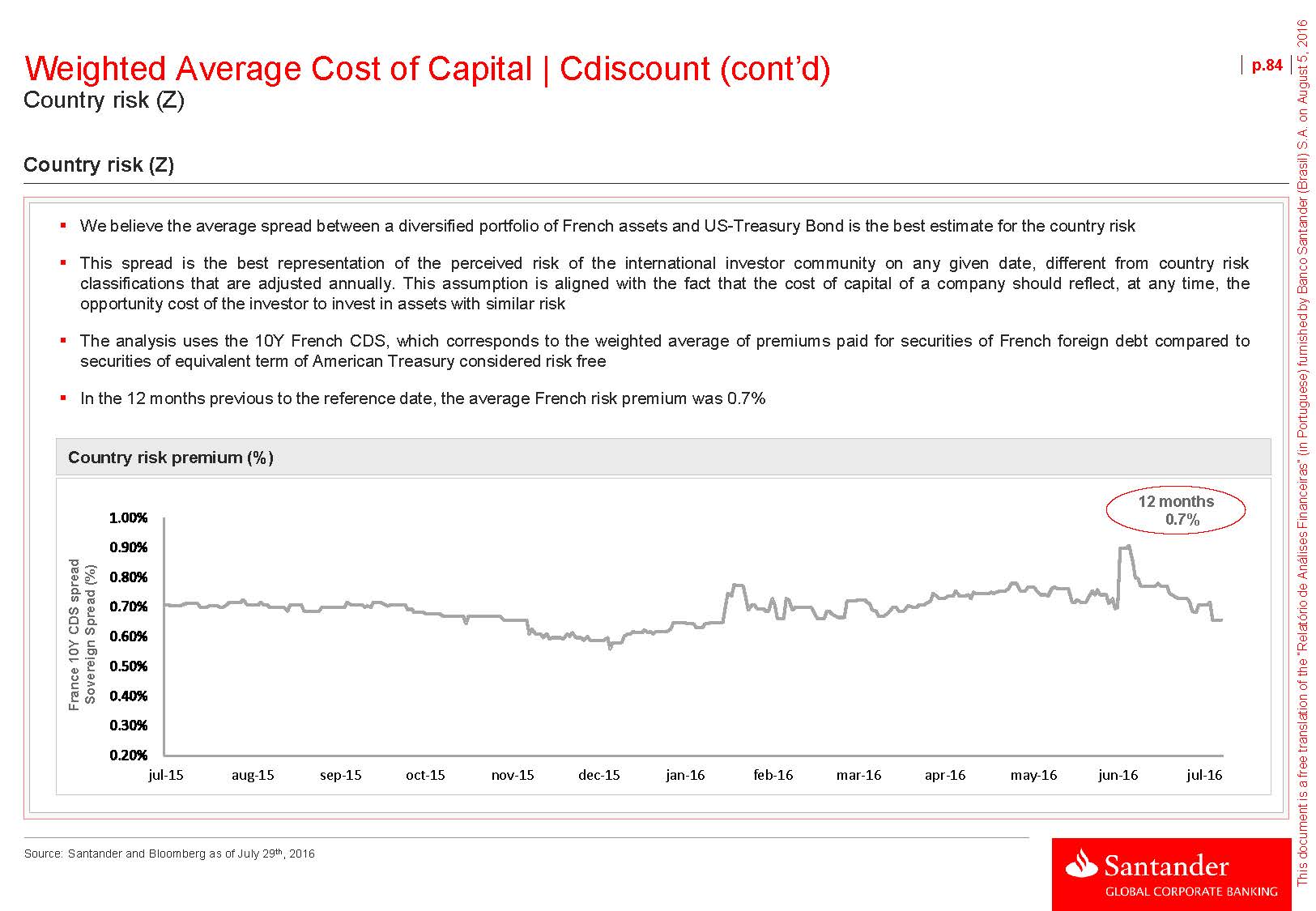

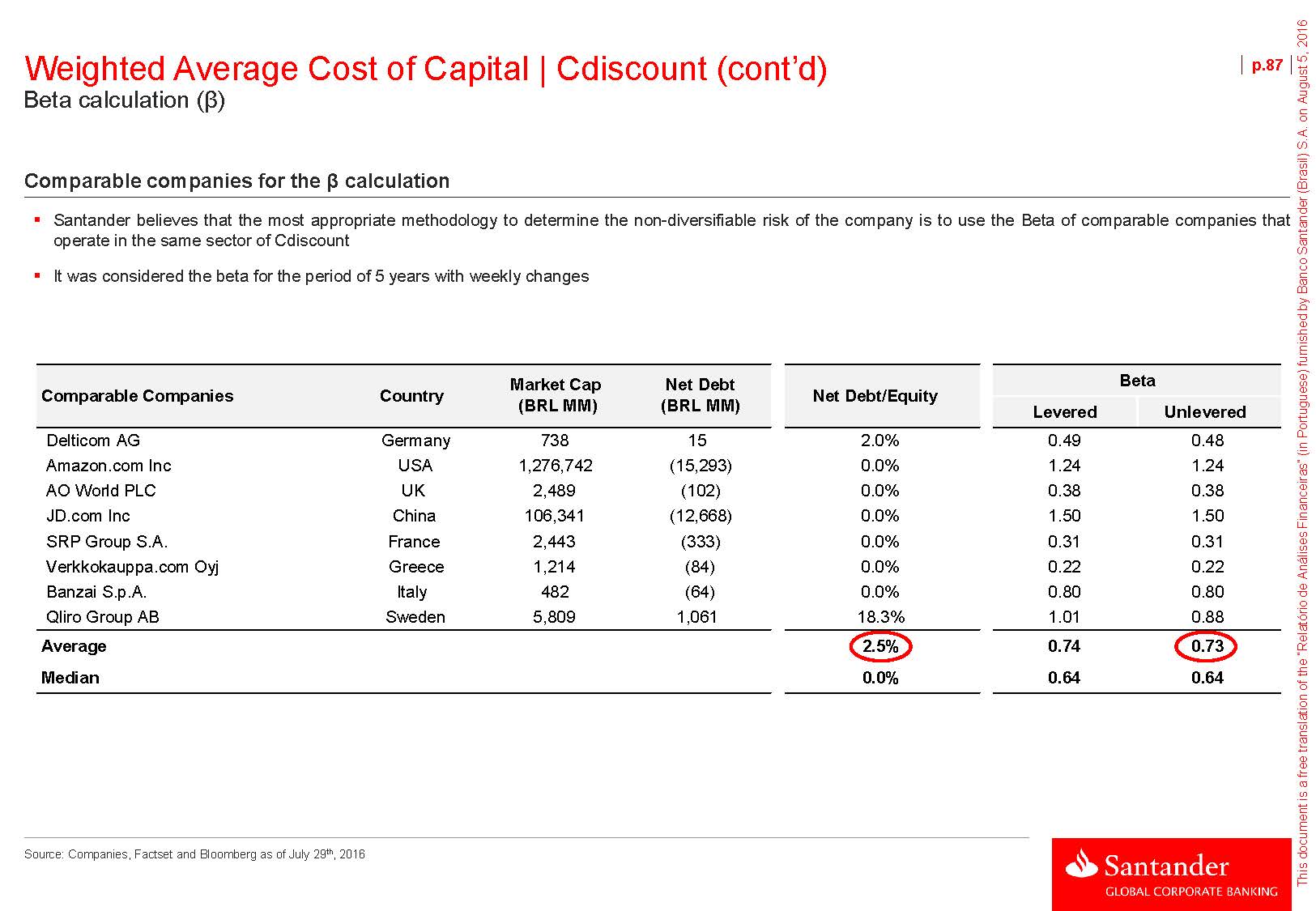

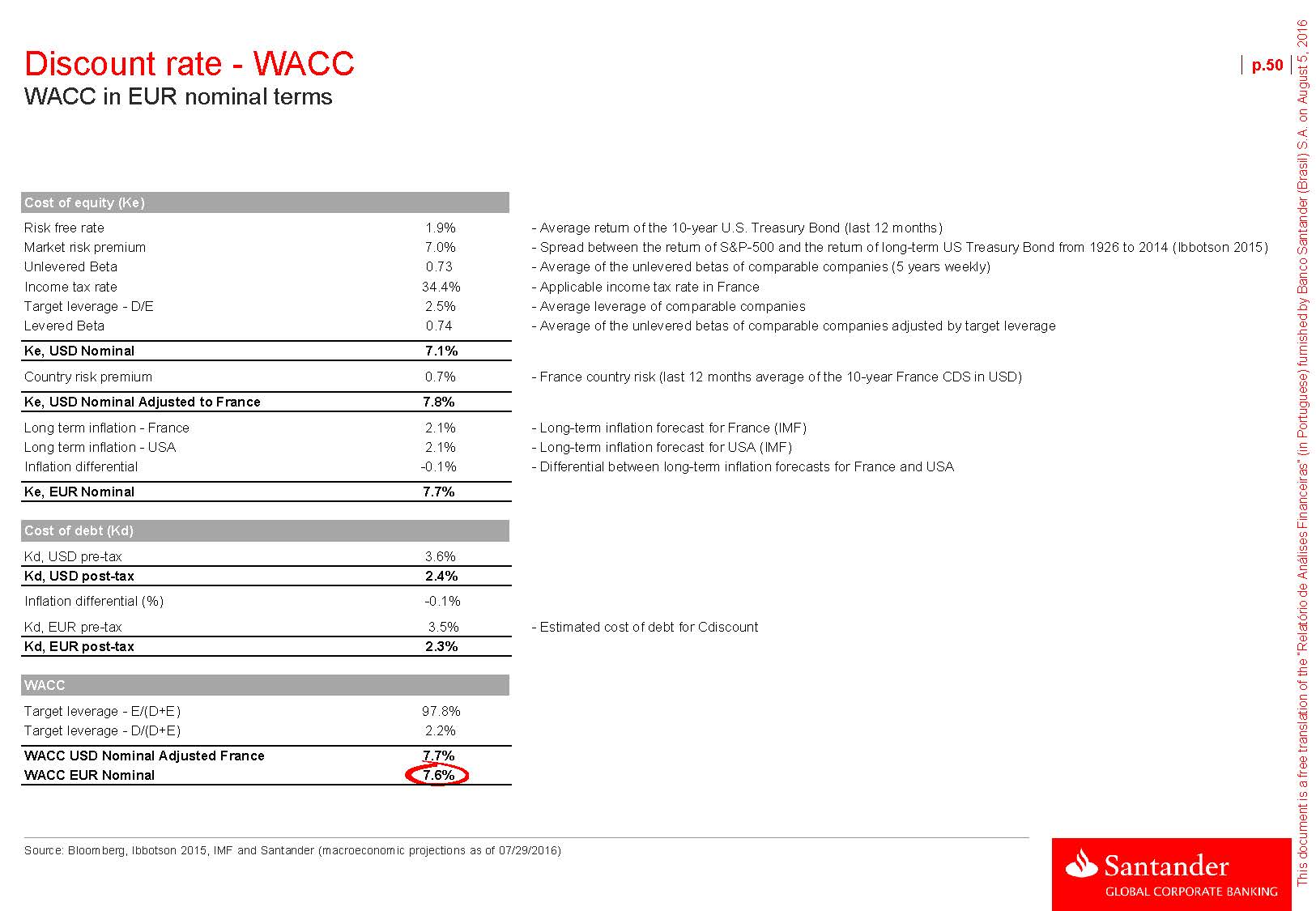

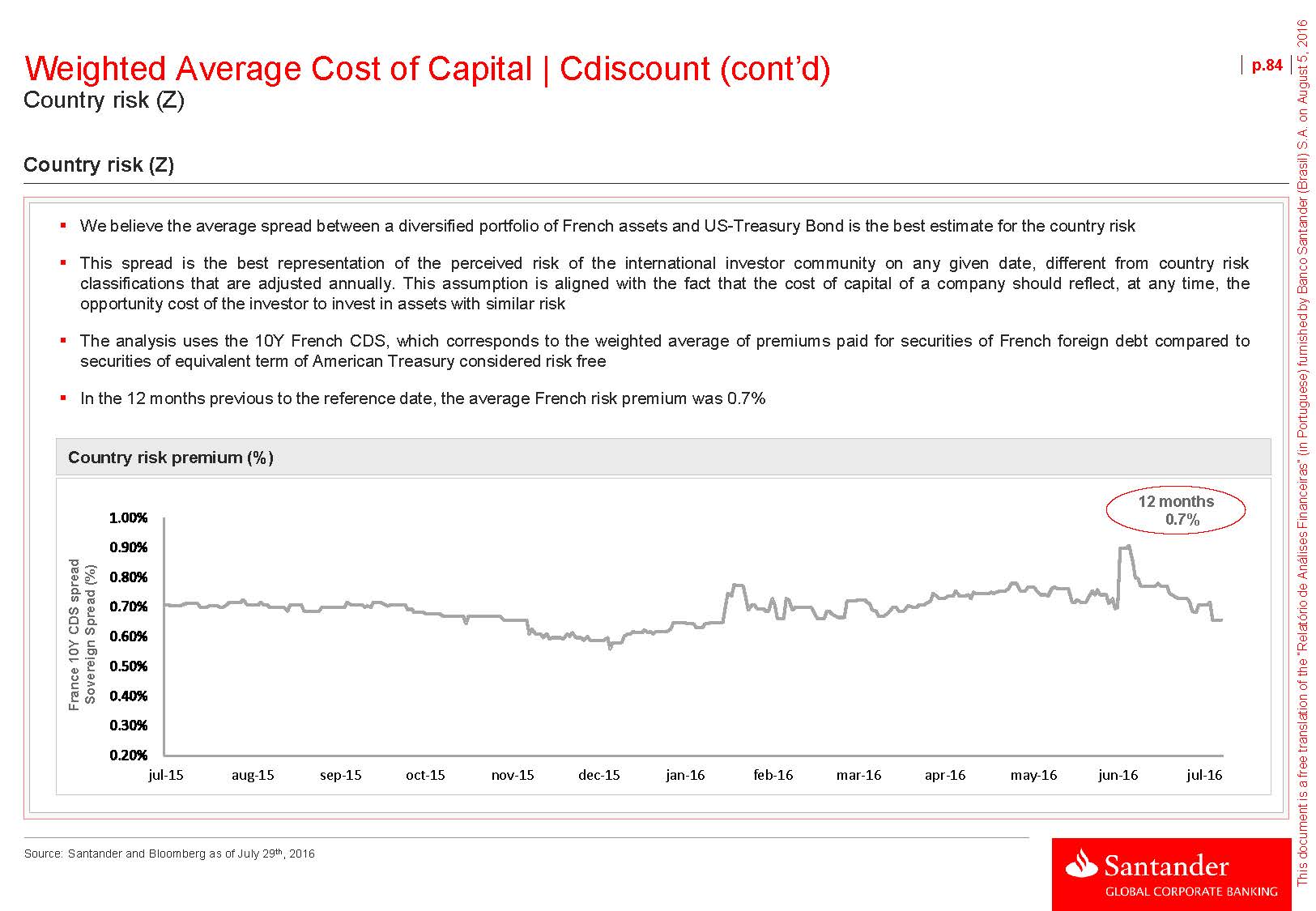

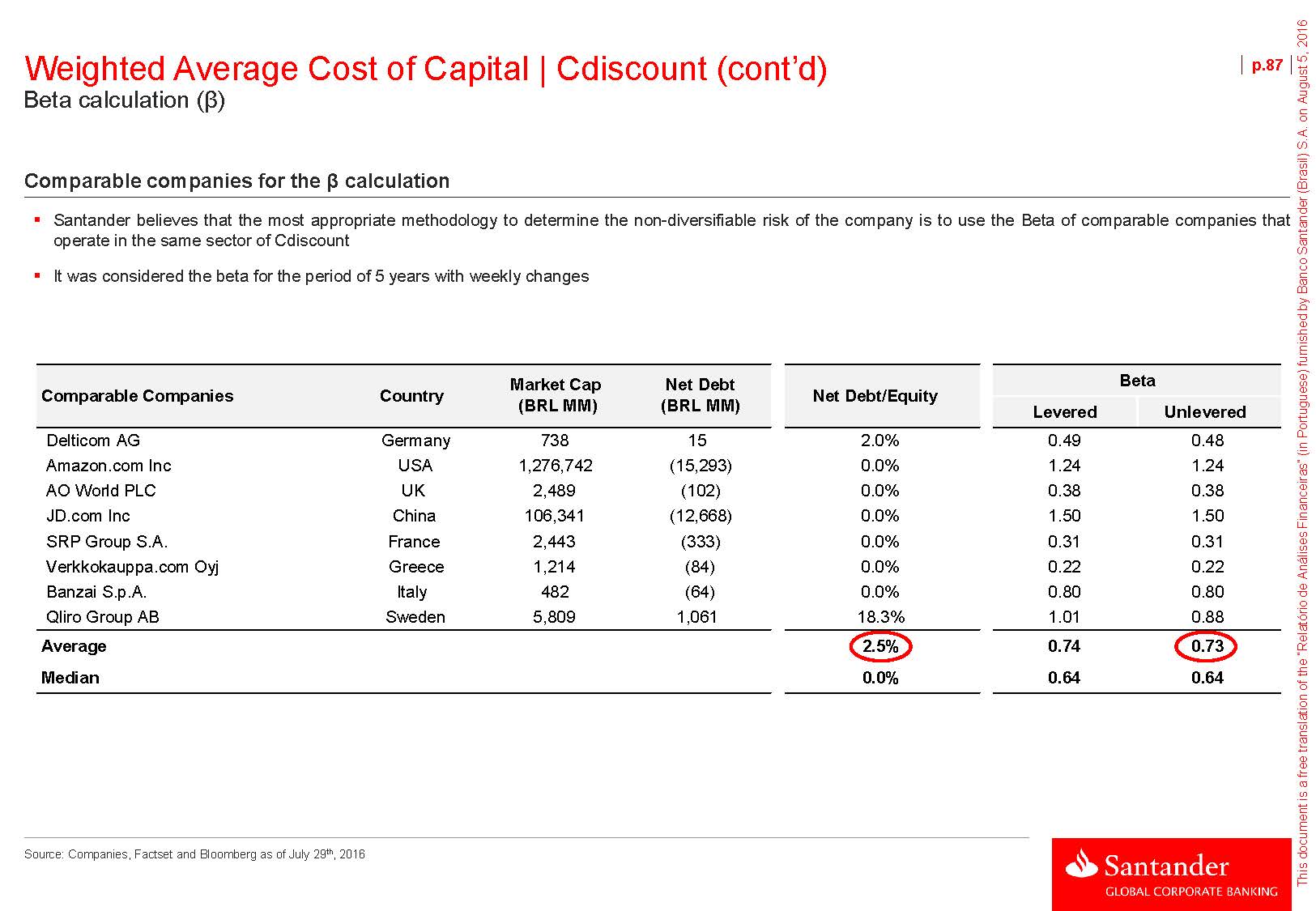

Discount rate - WACC WACC in EUR nominal terms p.50Cost of equity (Ke)Risk free rate 1.9% - Average return of the 10-year U.S. Treasury Bond (last 12 months) Market risk premium 7.0% - Spread between the return of S&P-500 and the return of long-term US Treasury Bond from 1926 to 2014 (Ibbotson 2015) Unlevered Beta 0.73 - Average of the unlevered betas of comparable companies (5 years weekly) Income tax rate 34.4% - Applicable income tax rate in France Target leverage - D/E 2.5% - Average leverage of comparable companies Levered Beta 0.74 - Average of the unlevered betas of comparable companies adjusted by target leverage Ke, USD Nominal 7.1%Country risk premium 0.7% - France country risk (last 12 months average of the 10-year France CDS in USD) Ke, USD Nominal Adjusted to France 7.8%Long term inflation - France 2.1% - Long-term inflation forecast for France (IMF) Long term inflation - USA 2.1% - Long-term inflation forecast for USA (IMF) Inflation differential -0.1% - Differential between long-term inflation forecasts for France and USA Ke, EUR Nominal 7.7%Cost of debt (Kd)Kd, USD pre-tax 3.6% Kd, USD post-tax 2.4%Inflation differential (%) -0.1% Kd, EUR pre-tax 3.5% - Estimated cost of debt for Cdiscount Kd, EUR post-tax 2.3%WACCTarget leverage - E/(D+E) 97.8% Target leverage - D/(D+E) 2.2% WACC USD Nominal Adjusted France 7.7% WACC EUR Nominal 7.6%Source: Bloomberg, Ibbotson 2015, IMF and Santander (macroeconomic projections as of 07/29/2016)

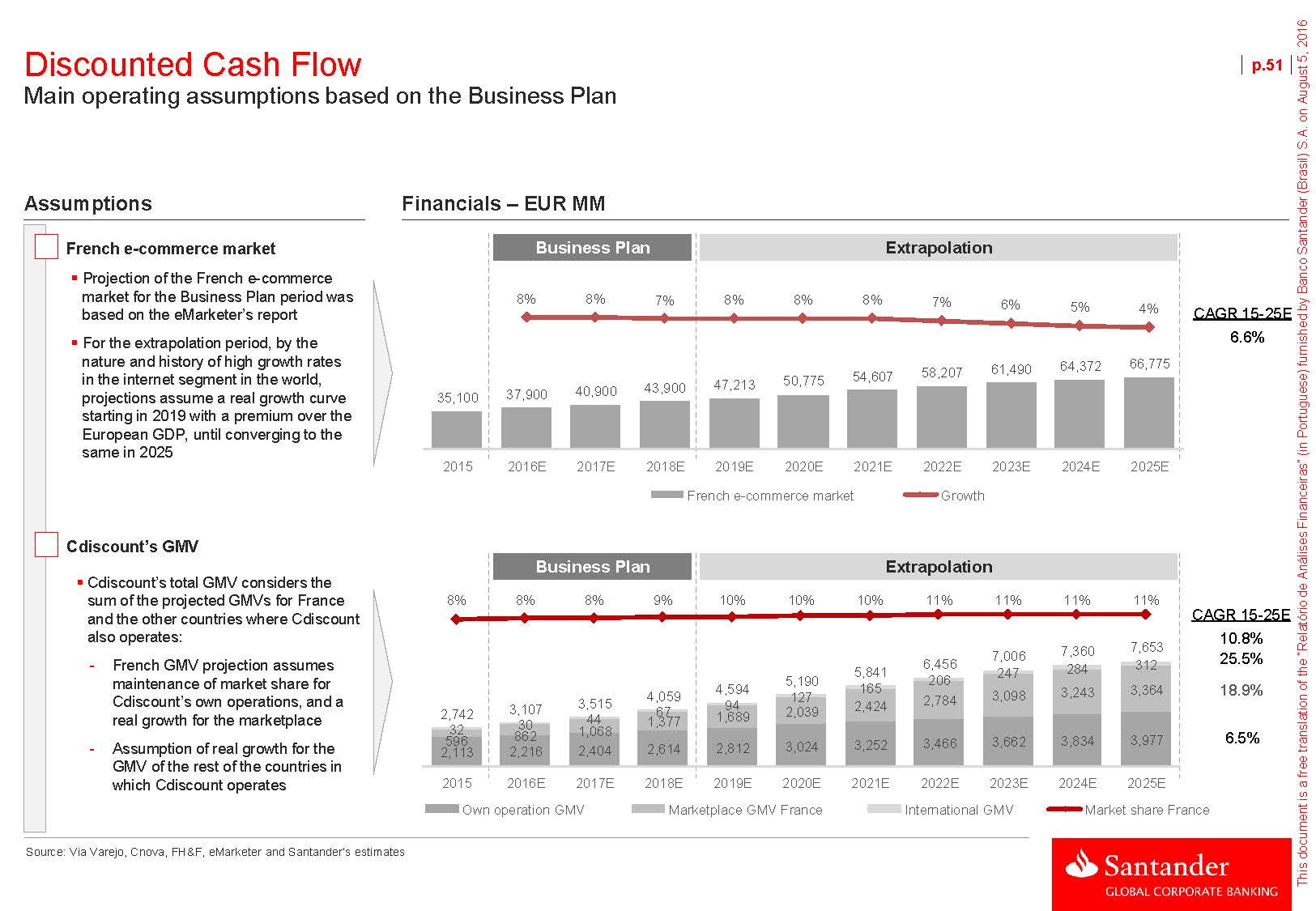

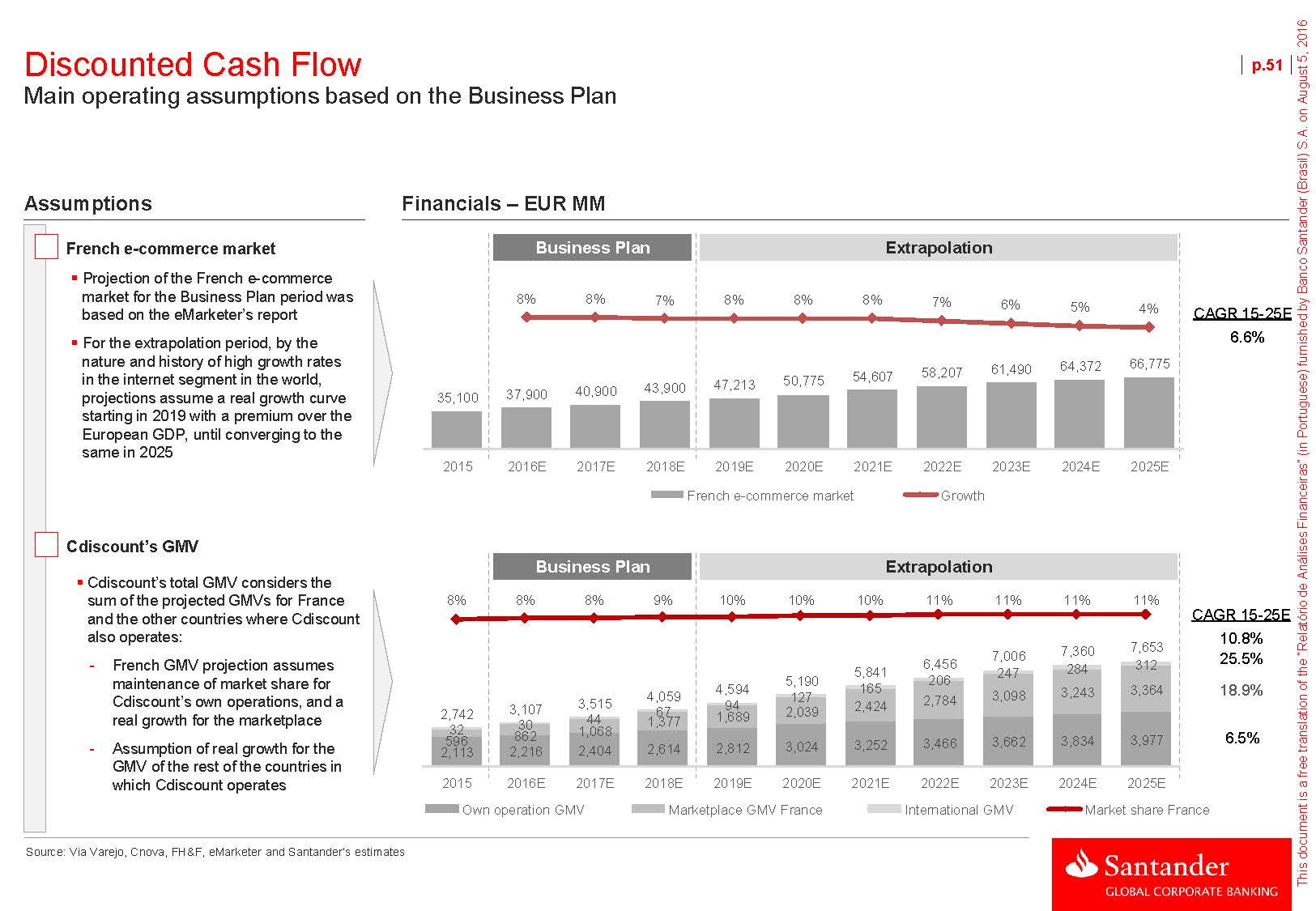

Discounted Cash Flow Main operating assumptions based on the Business Plan p.51AssumptionsFinancials – EUR MMFrench e-commerce marketProjection of the French e-commerce market for the Business Plan period was based on the eMarketer’s reportFor the extrapolation period, by the nature and history of high growth rates in the internet segment in the world, projections assume a real growth curve starting in 2019 with a premium over the European GDP, until converging to the same in 2025 Business Plan Extrapolation8% 8% 7% 8% 8% 8% 7% 6% 5% 4% 50,775 54,607 58,207 61,490 35,100 37,900 40,900 43,900 47,213 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E CAGR 15 -25E 6.6% French e-commerce market Growth Cdiscount’s GMVCdiscount’s total GMV considers the sum of the projected GMVs for France and the other countries where Cdiscount also operates: Business Plan Extrapolation 8% 8% 8% 9% 10% 10% 10% 11% 11% 11% 11% 7,006 7,360 7,653 CAGR 15 -25E 10.8% 25.5% - French GMV projection assumes maintenance of market share for 4,594 5,190 5,841 6,456 165 206 247 284 312 3,364 18.9% Cdiscount’s own operations, and a 3,515 4,059 67 94 127 2,424 2,784 3,098 3,243 real growth for the marketplace 2,742 3,107 596 862 1,068 1,377 1,689 2,039 6.5% - Assumption of real growth for the GMV of the rest of the countries in which Cdiscount operates Source: Via Varejo, Cnova, FH&F, eMarketer and Santander‘s estimates 2,113 2,216 2,404 2,614 2,812 3,024 3,252 3,466 3,662 3,834 3,977 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Own operation GMV Marketplace GMV France International GMV Market share France

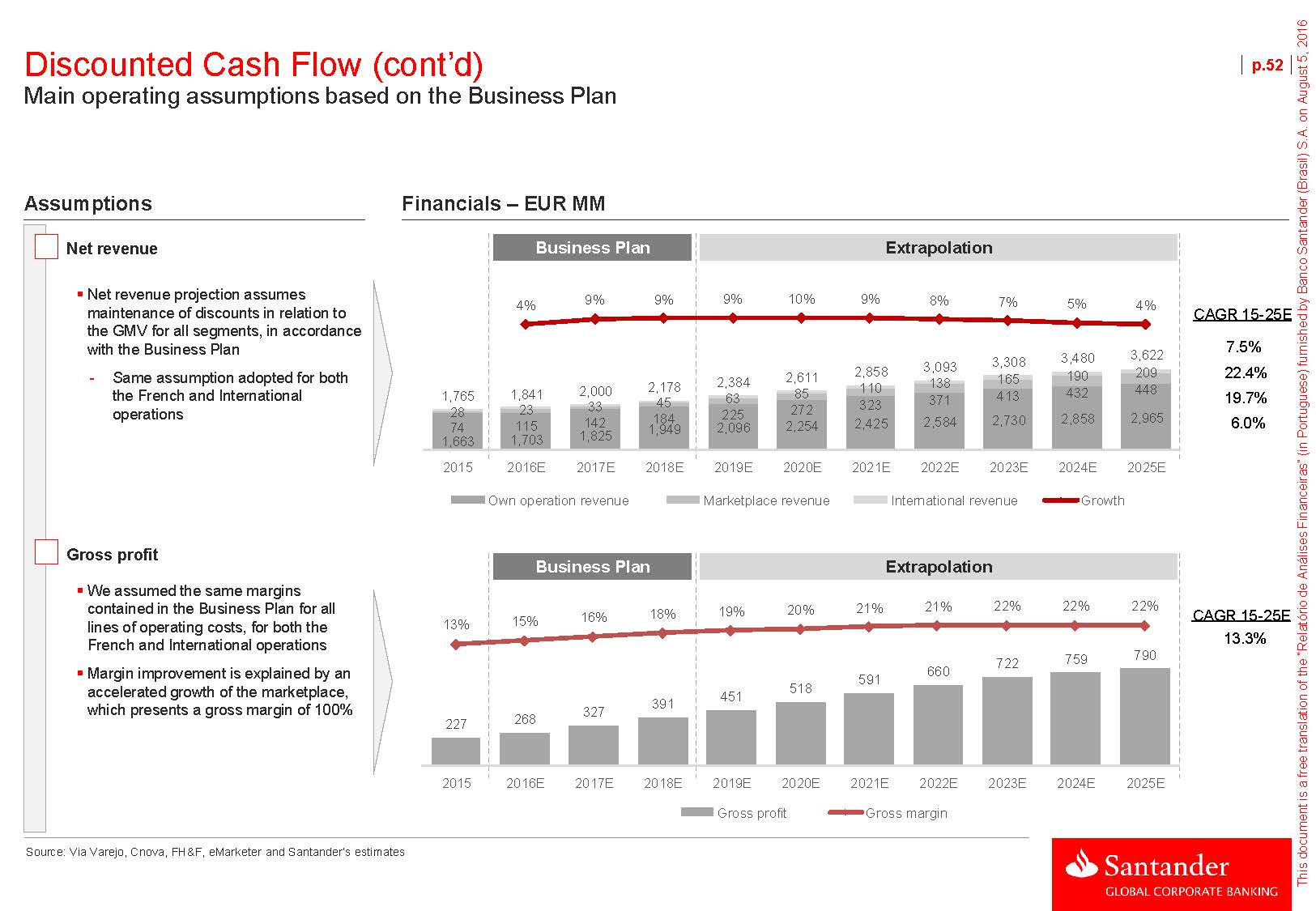

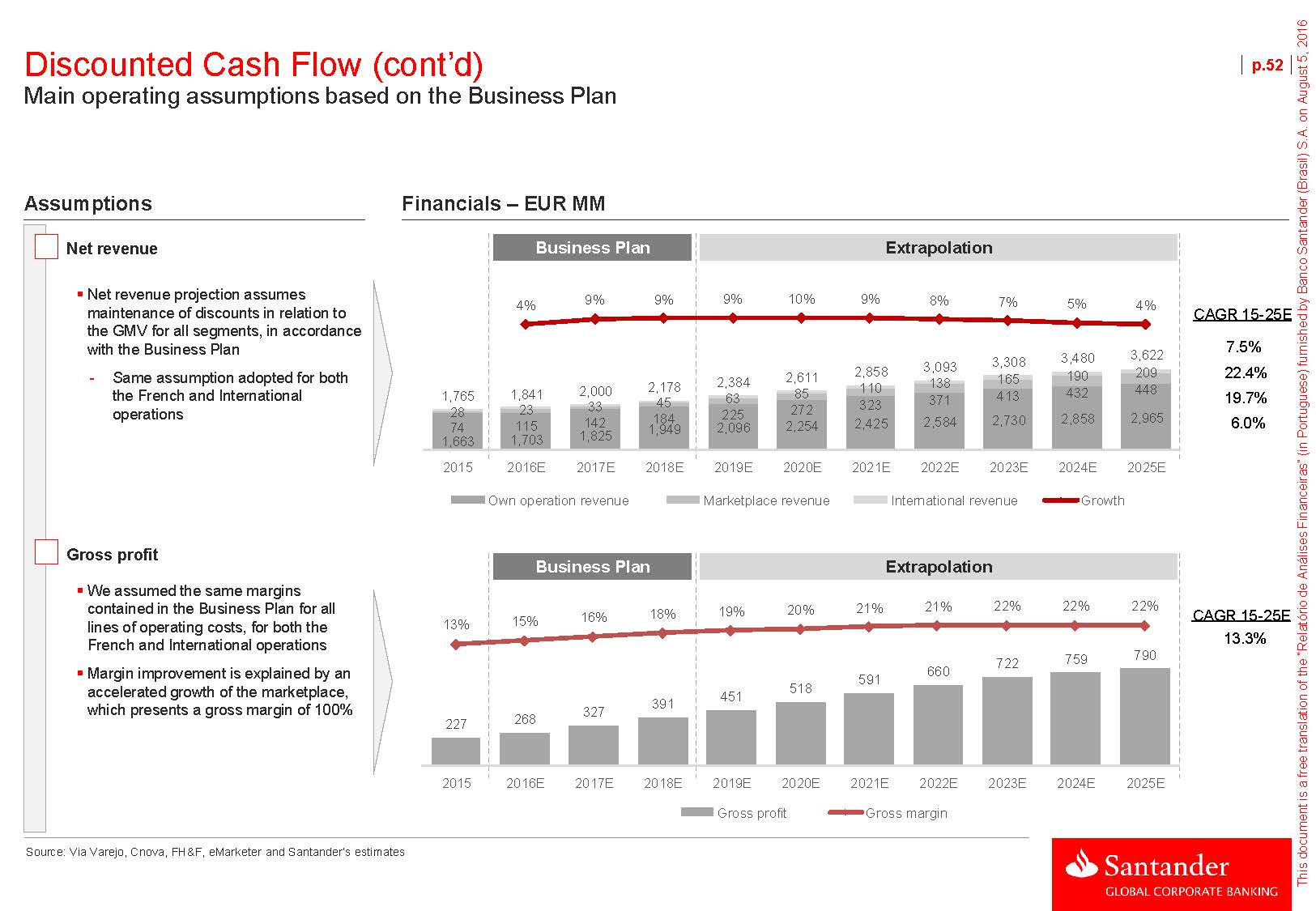

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.52AssumptionsFinancials – EUR MMNet revenue Business Plan ExtrapolationNet revenue projection assumes maintenance of discounts in relation to the GMV for all segments, in accordance with the Business Plan 4% 9% 9% 9% 10% 9% 8% 7% 5% 4% 3,093 3,308 3,480 3,622 CAGR 15-25E 7.5% - Same assumption adopted for both the French and International operations 1,765 1,841 2,000 2,178 28 23 33 45 2,384 2,611 2,858 63 85 110 225 272 323 138 165 190 209 371 413 432 448 22.4% 19.7% 142 184 1,663 1,703 1,825 1,949 2,096 2,254 2,425 2,584 2,730 2,858 2,965 6.0% 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Own operation revenue Marketplace revenue International revenue Growth Gross profitWe assumed the same margins contained in the Business Plan for all lines of operating costs, for both the French and International operationsBusiness Plan Extrapolation19% 20% 21% 21% 22% 22% 22% 13% 15% 722 759 790 CAGR 15 -25E 13.3%Margin improvement is explained by an accelerated growth of the marketplace, which presents a gross margin of 100% 227 268 327 391 451 518 591 660 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, eMarketer and Santander‘s estimates Gross profit Gross margin

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.53AssumptionsFinancials – EUR MMOpexBusiness Plan ExtrapolationMost of the operating expenses, such as Payments, Marketing and IT, were projected as a percentage of GMVGeneral and administrative expenses 6% 10% 9% 10% 10% 10% 9% 7% 5% 4% 422 453 477 496 CAGR 15 -25E 7.9% indexed to inflation (CPI) 294 322 354 388 38 39 40 41 41 42 92 99 104For fulfillment expenses we assumed 231 245 270 56 65 74 84 64 68 71 the same percentage of net revenues of 52 58 20 23 26 30 34 38 41 45 47 49 direct sales 117 133 147 159 172 186 199 211 222 231 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Fulfillment Payment Marketing Technology G&A Growth Factoring costsFor the Business Plan period we considered the factoring costs estimated by the companyFor the extrapolation period, factoring costs were projected as a percentage of the GMV of Cdiscount’s own operations in FranceInternational operation does not anticipate receivables Business Plan Extrapolation0.6% 1.0% 1.0% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 30 32 34 35 23 23 23 25 27 29 13 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E CAGR 15 -25E 10.5% Source: Via Varejo, Cnova, FH&F, eMarketer and Santander‘s estimates Factoring costs % of own operation GMV

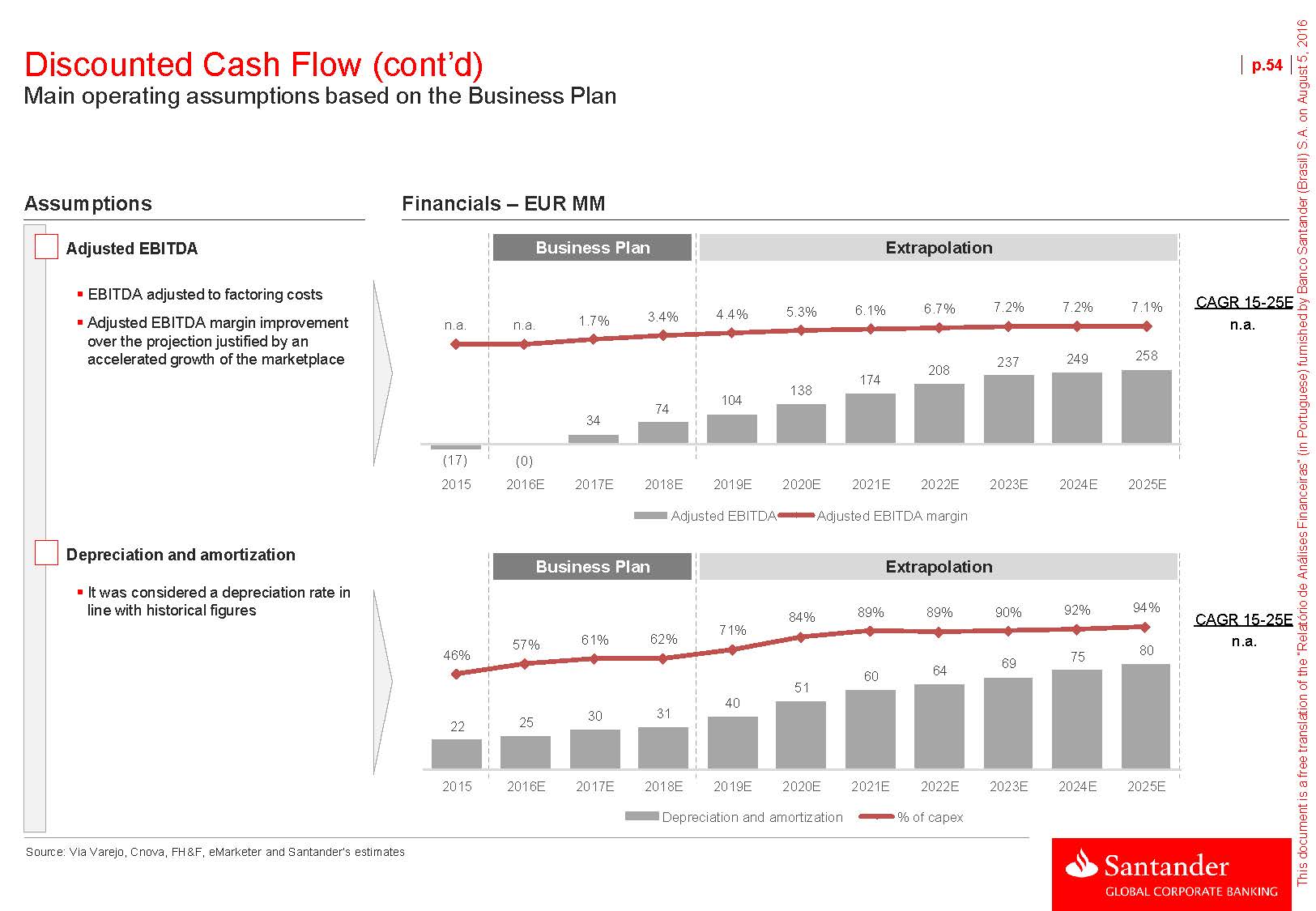

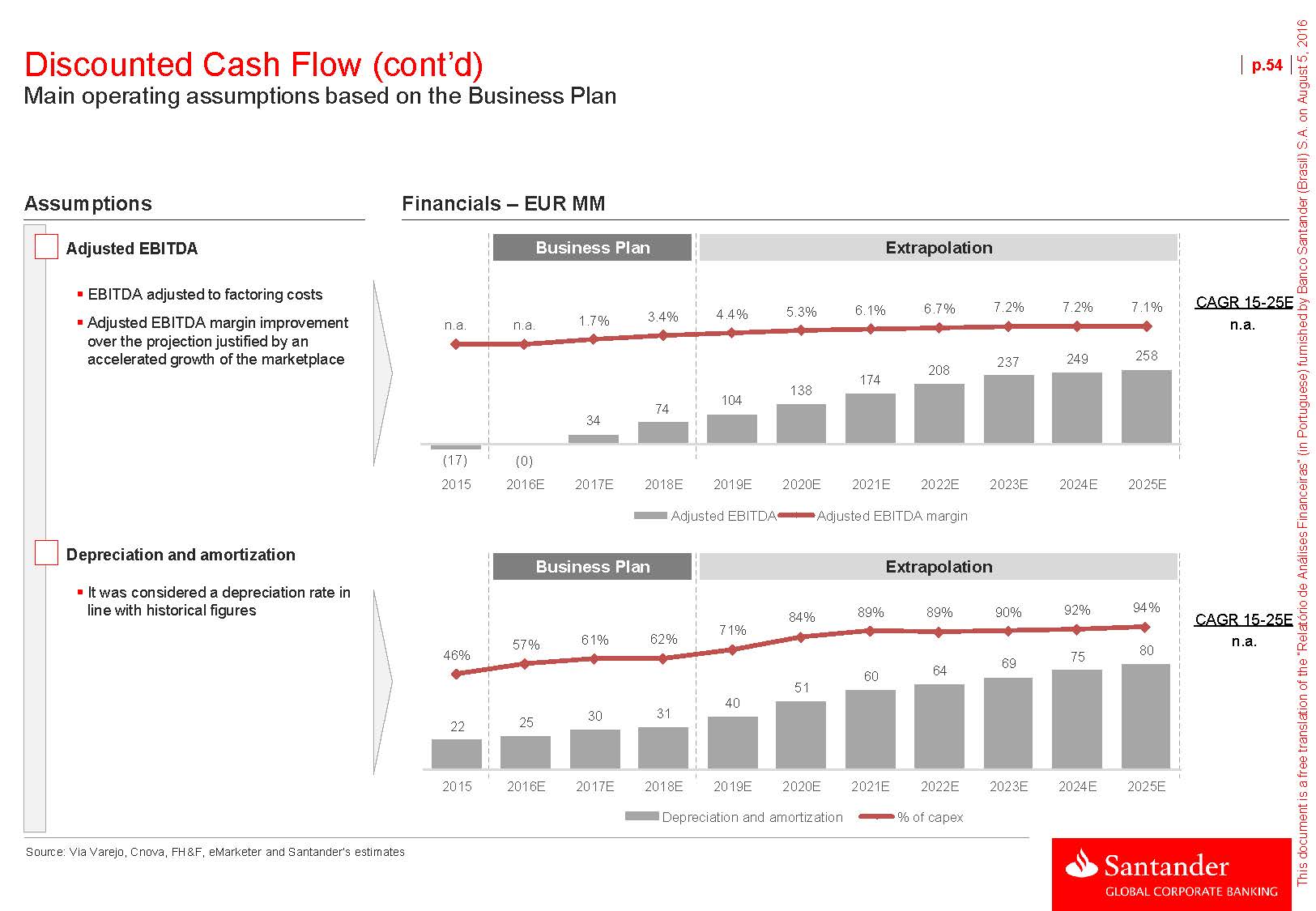

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.54AssumptionsFinancials – EUR MMAdjusted EBITDABusiness Plan ExtrapolationEBITDA adjusted to factoring costsAdjusted EBITDA margin improvement over the projection justified by an accelerated growth of the marketplace n.a. n.a. 1.7% 3.4% 4.4% 5.3% 6.1% 6.7% 7.2% 7.2% 7.1% 208 237 249 CAGR 15 -25E n.a. 74 104 34 138 174 (17) (0) 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Adjusted EBITDA Adjusted EBITDA margin Depreciation and amortizationIt was considered a depreciation rate in line with historical figuresBusiness Plan Extrapolation84% 89% 89% 90% 92% 94% 71% 61% 62% CAGR 15 -25E n.a. 57% 46% 51 40 22 25 30 31 60 64 69 75 80 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, eMarketer and Santander‘s estimates Depreciation and amortization % of capex

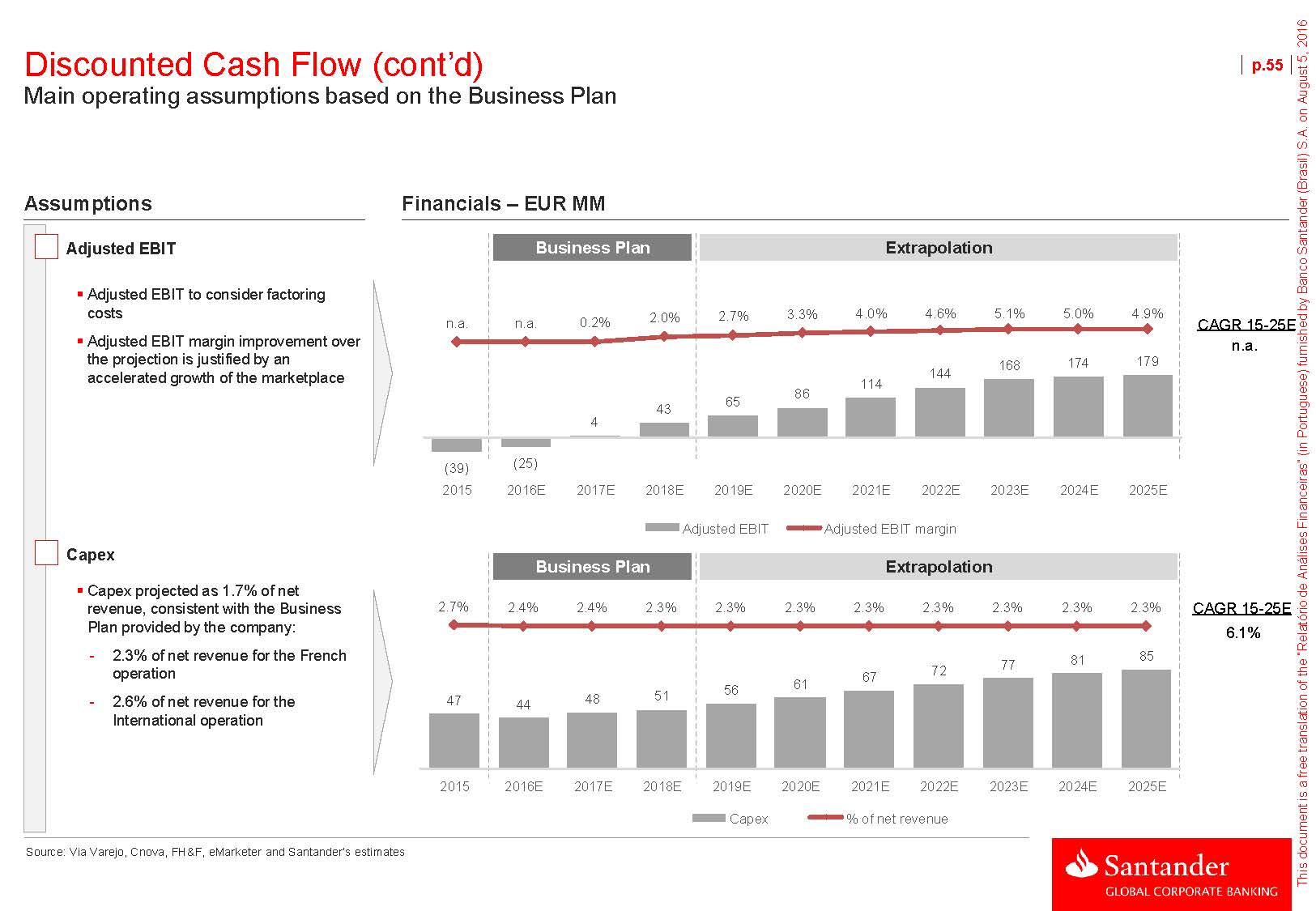

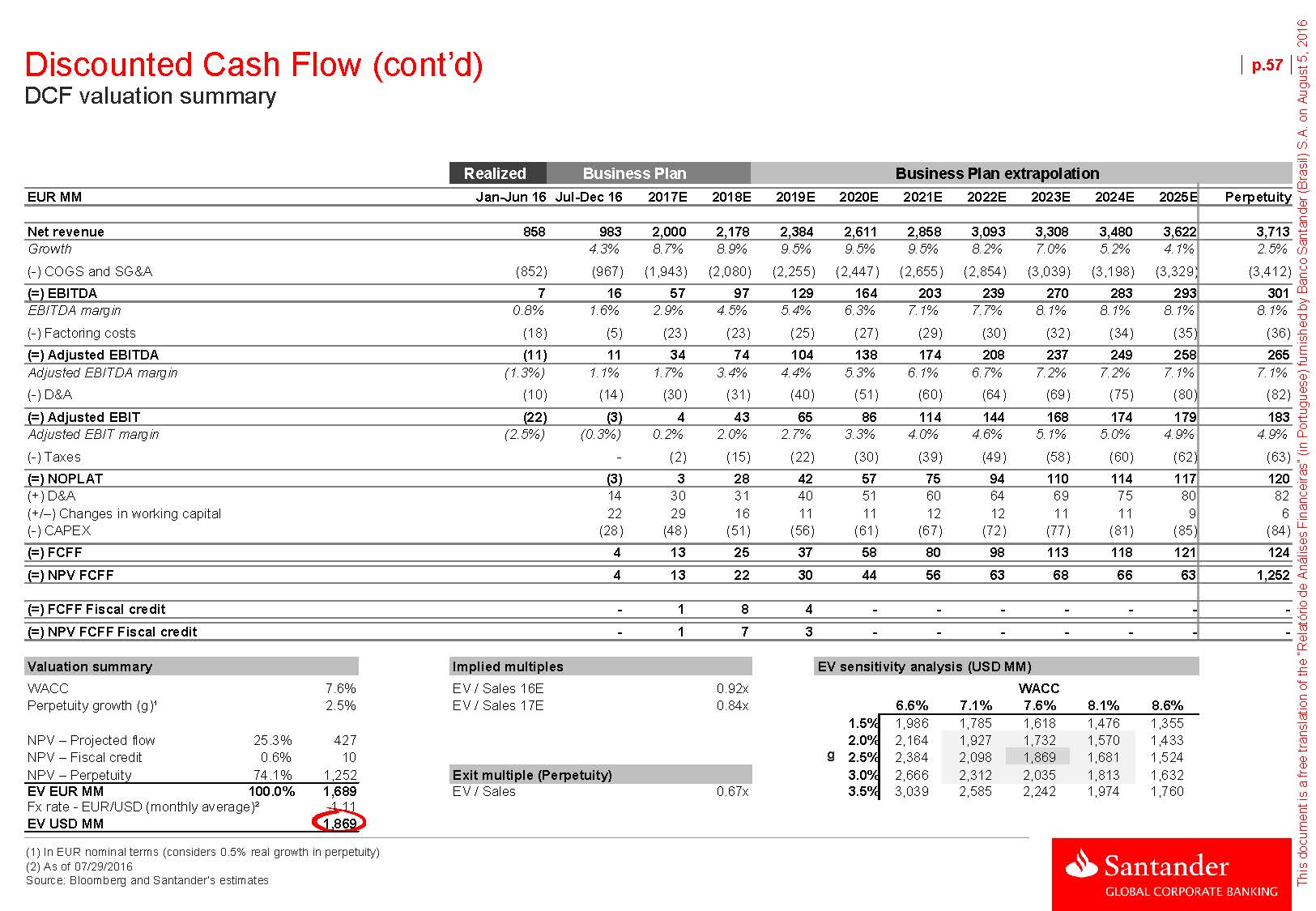

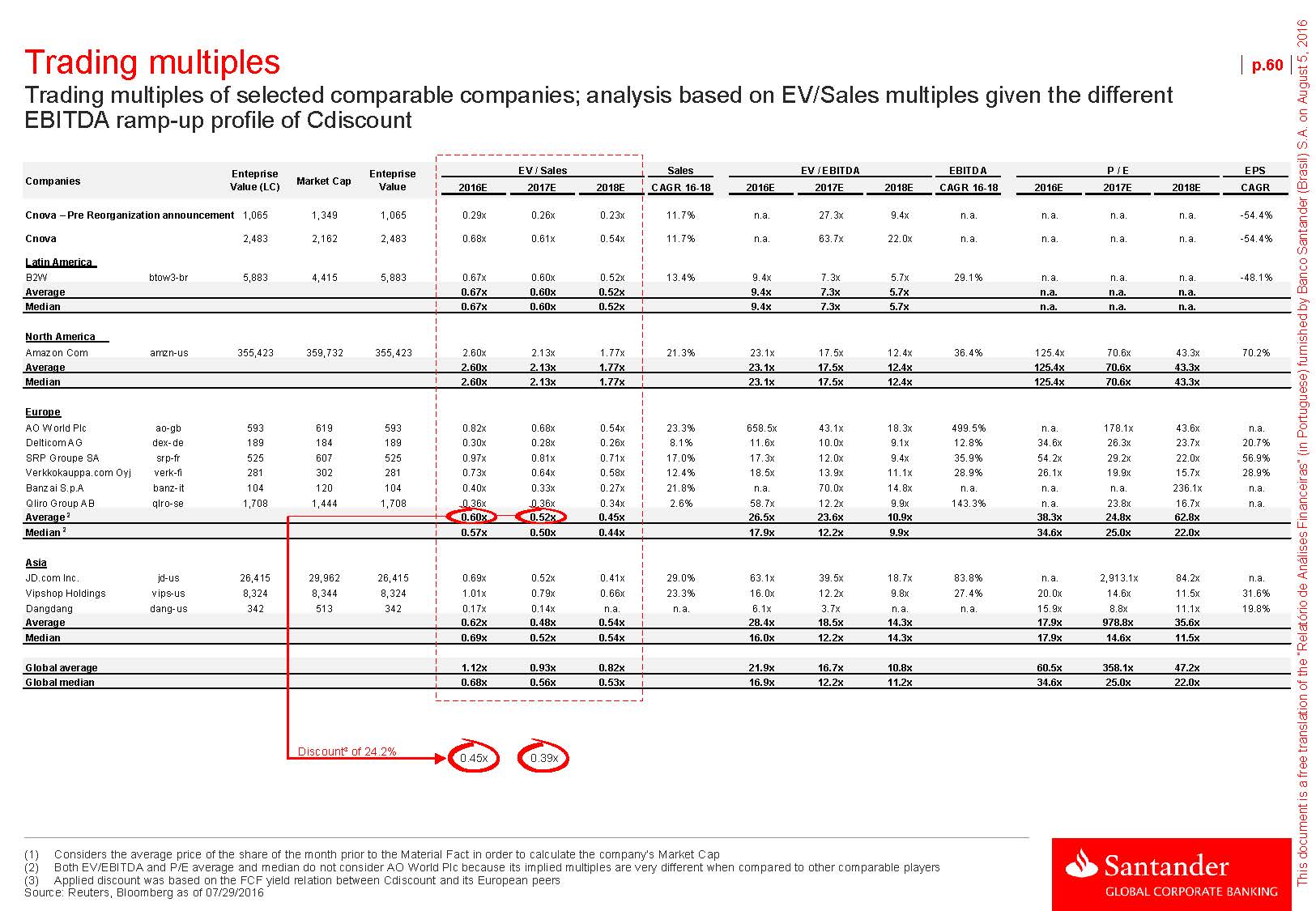

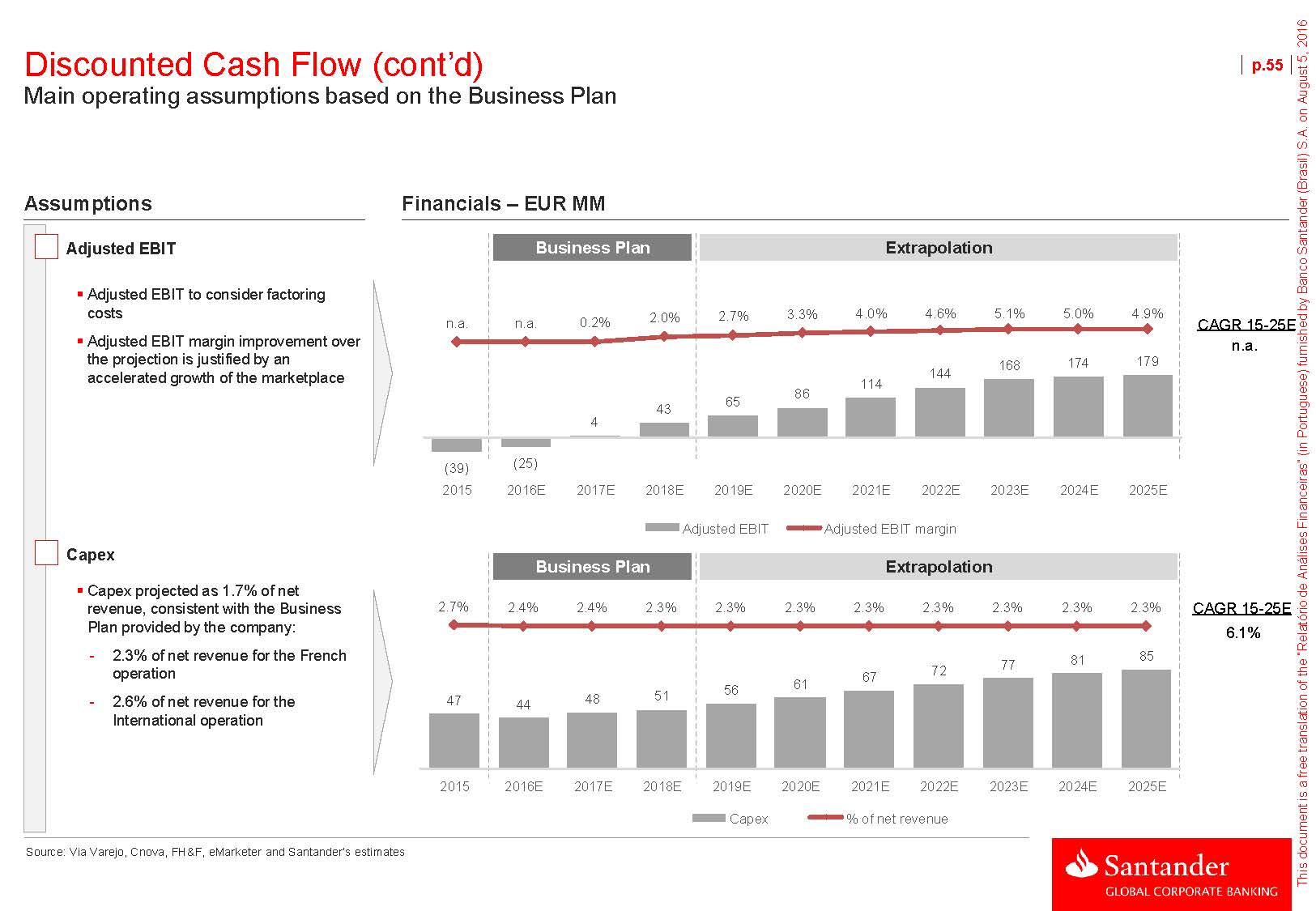

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.55AssumptionsFinancials – EUR MMAdjusted EBITBusiness Plan ExtrapolationAdjusted EBIT to consider factoring costsAdjusted EBIT margin improvement over the projection is justified by an accelerated growth of the marketplace n.a. n.a. 0.2% 2.0% 2.7% 43 65 3.3% 4.0% 4.6% 5.1% 5.0% 4.9% 168 174 179 144 114 86 CAGR 15 -25E n.a. 4 (39) (25) 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E CapexCapex projected as 1.7% of net revenue, consistent with the Business Plan provided by the company: - 2.3% of net revenue for the French operation Adjusted EBIT Adjusted EBIT margin Business Plan Extrapolation2.7% 2.4% 2.4% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 72 77 81 56 61 67 CAGR 15 -25E 6.1% - 2.6% of net revenue for the International operation 47 44 48 51 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Source: Via Varejo, Cnova, FH&F, eMarketer and Santander‘s estimates Capex % of net revenue

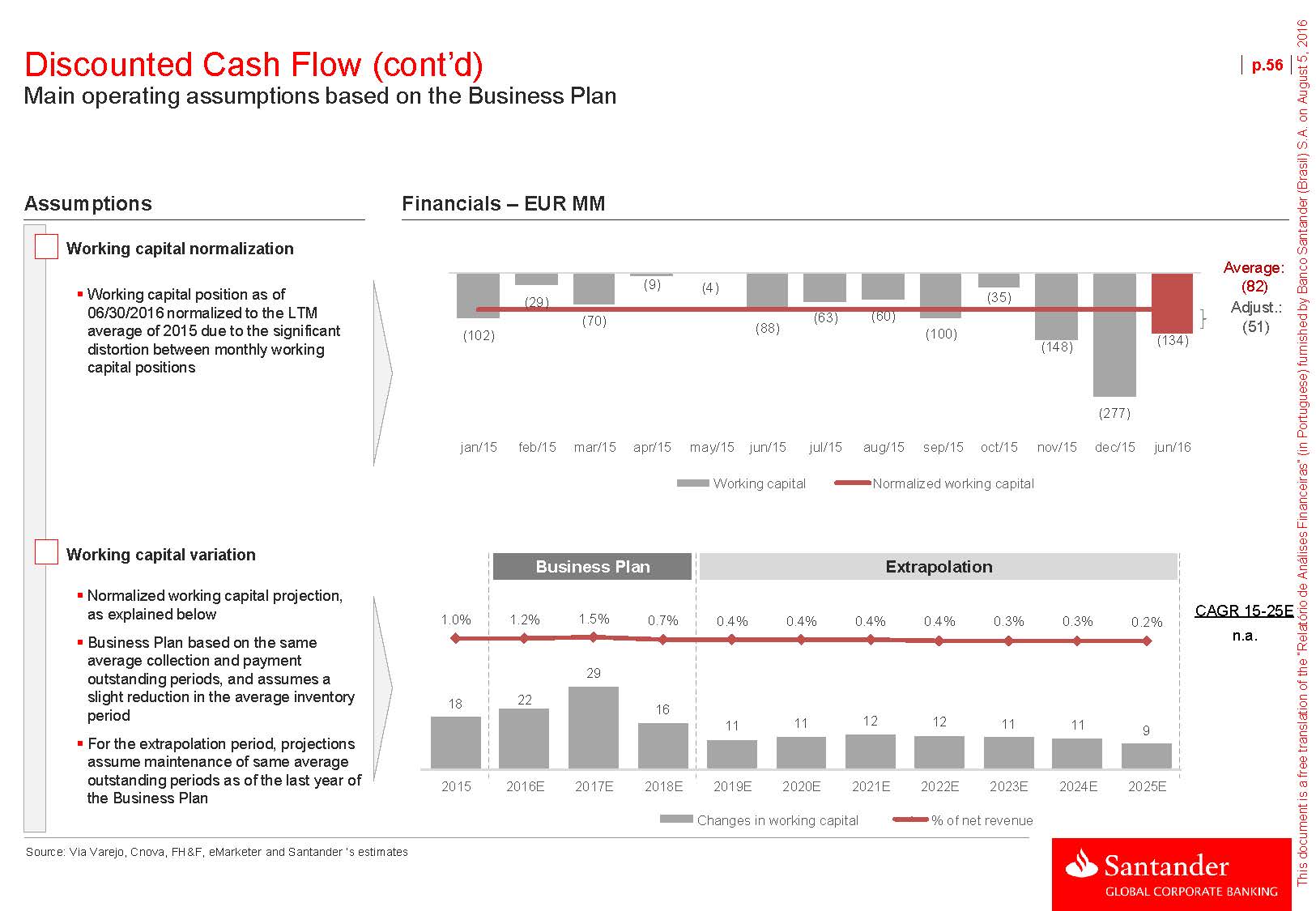

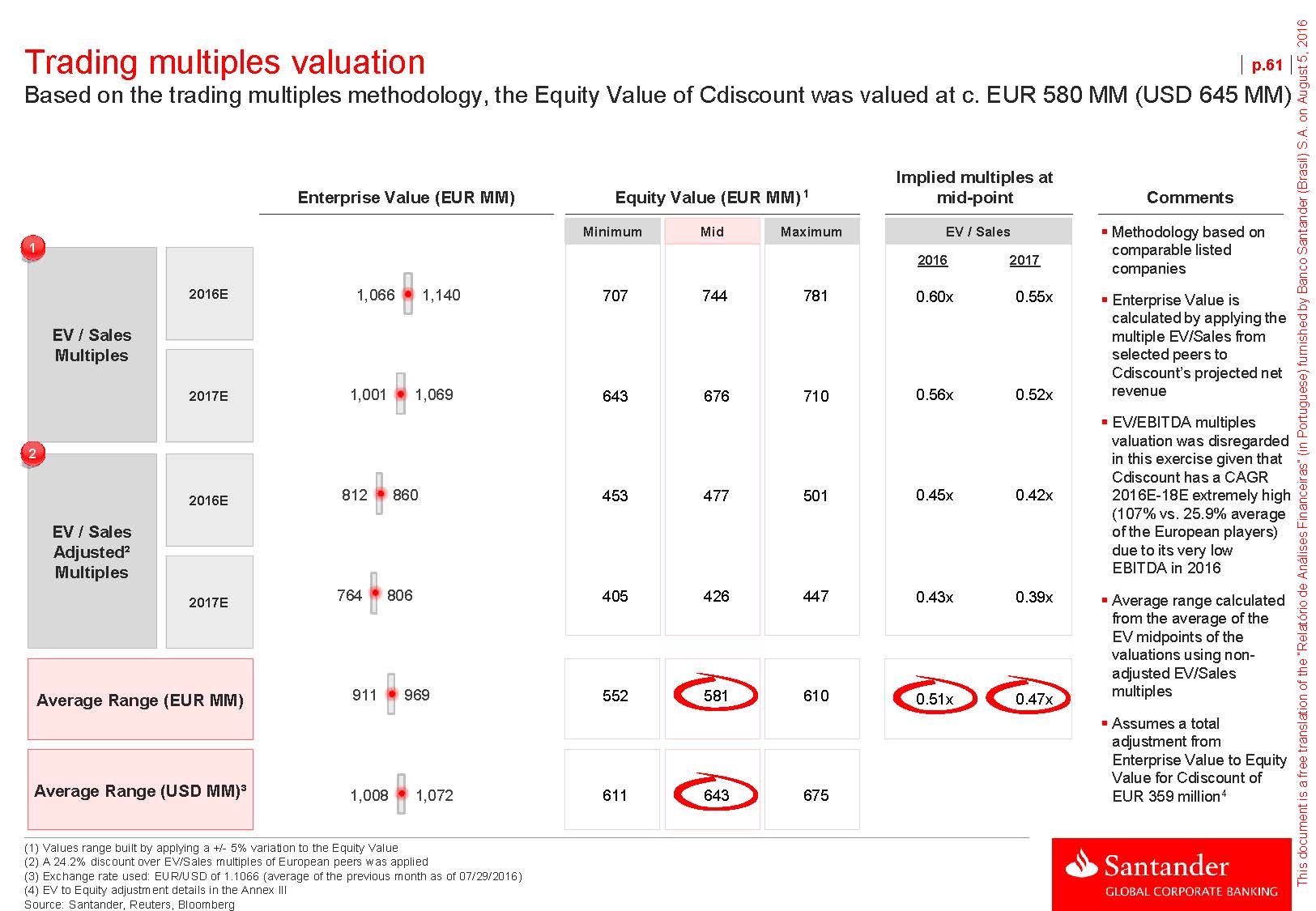

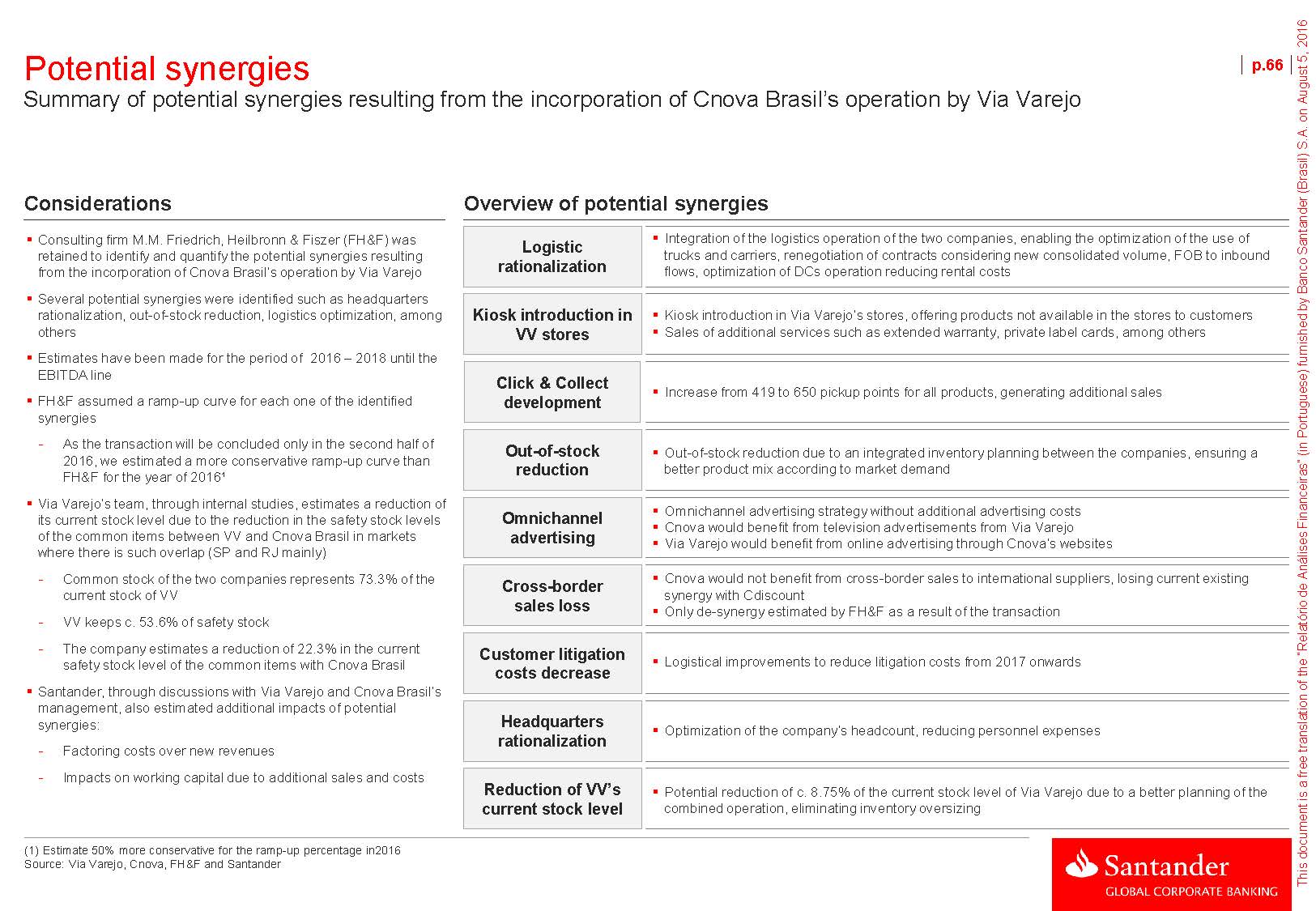

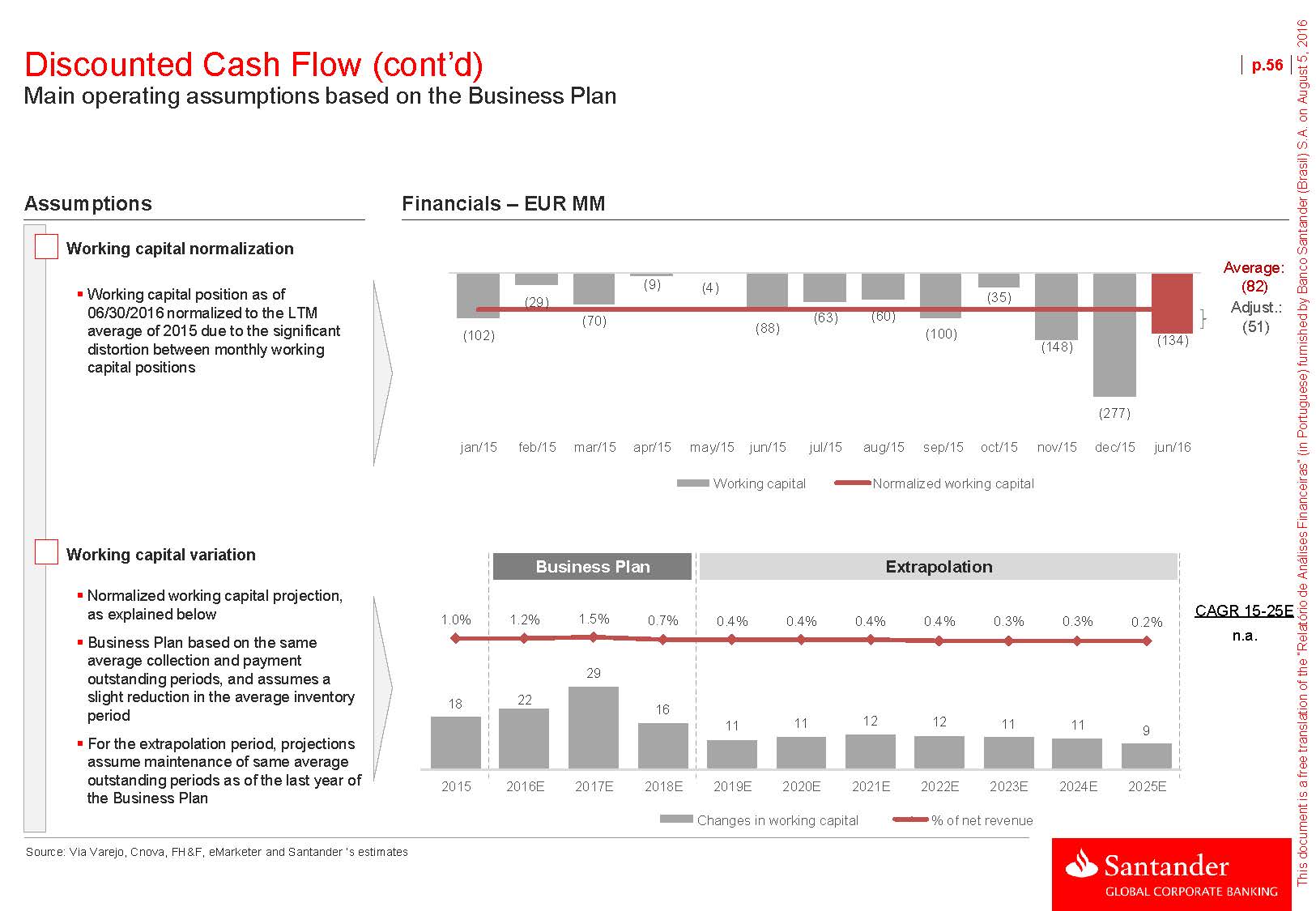

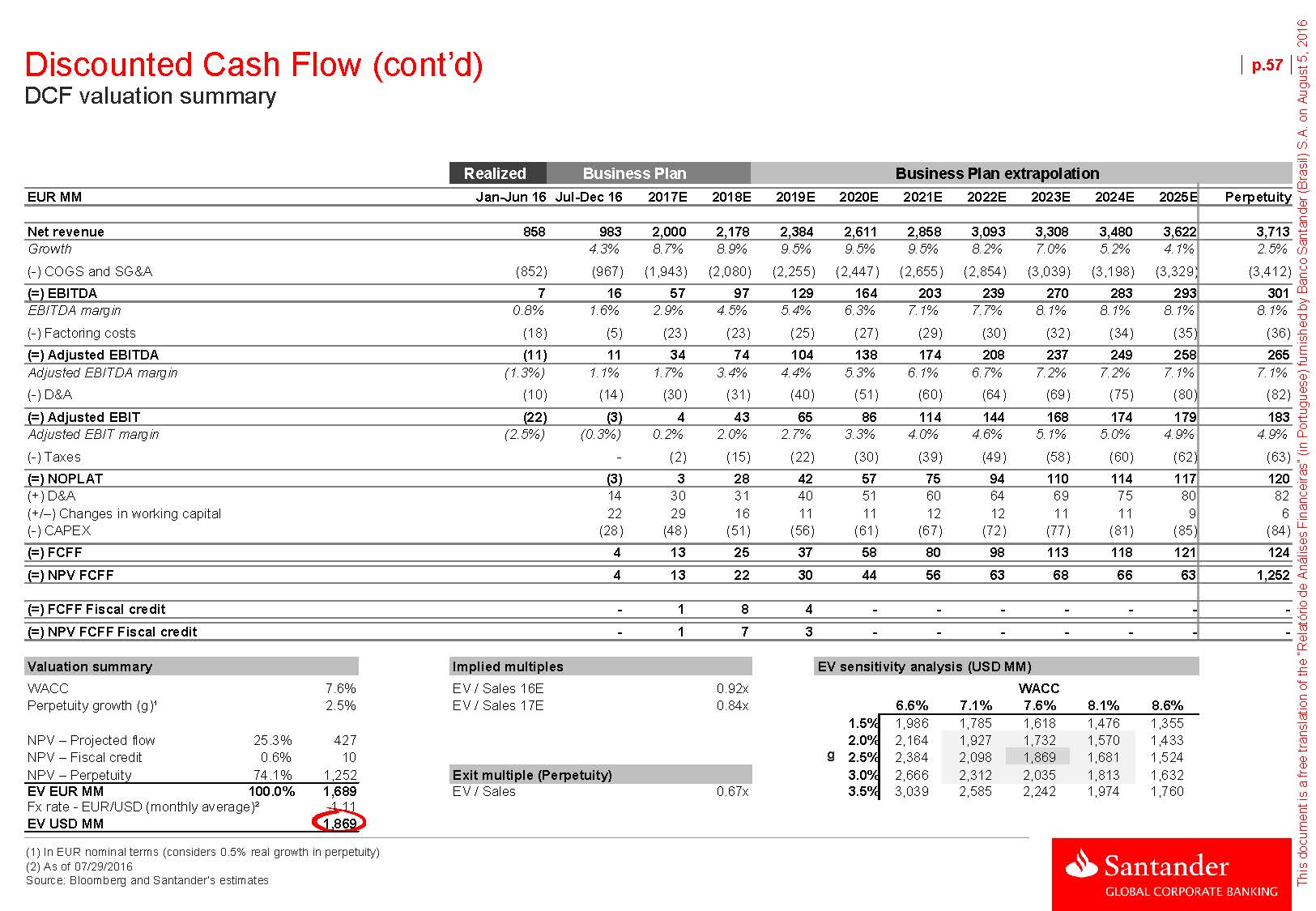

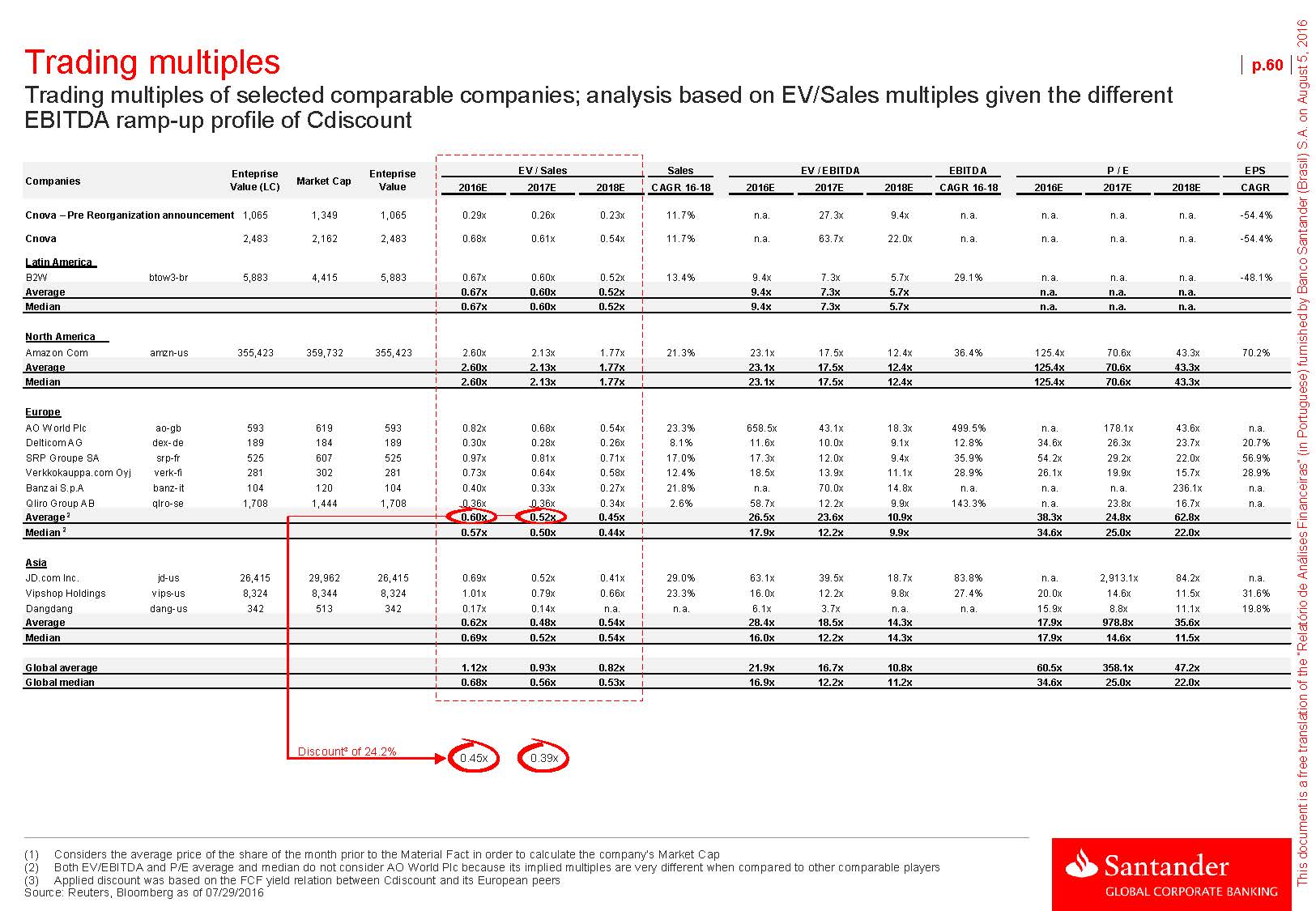

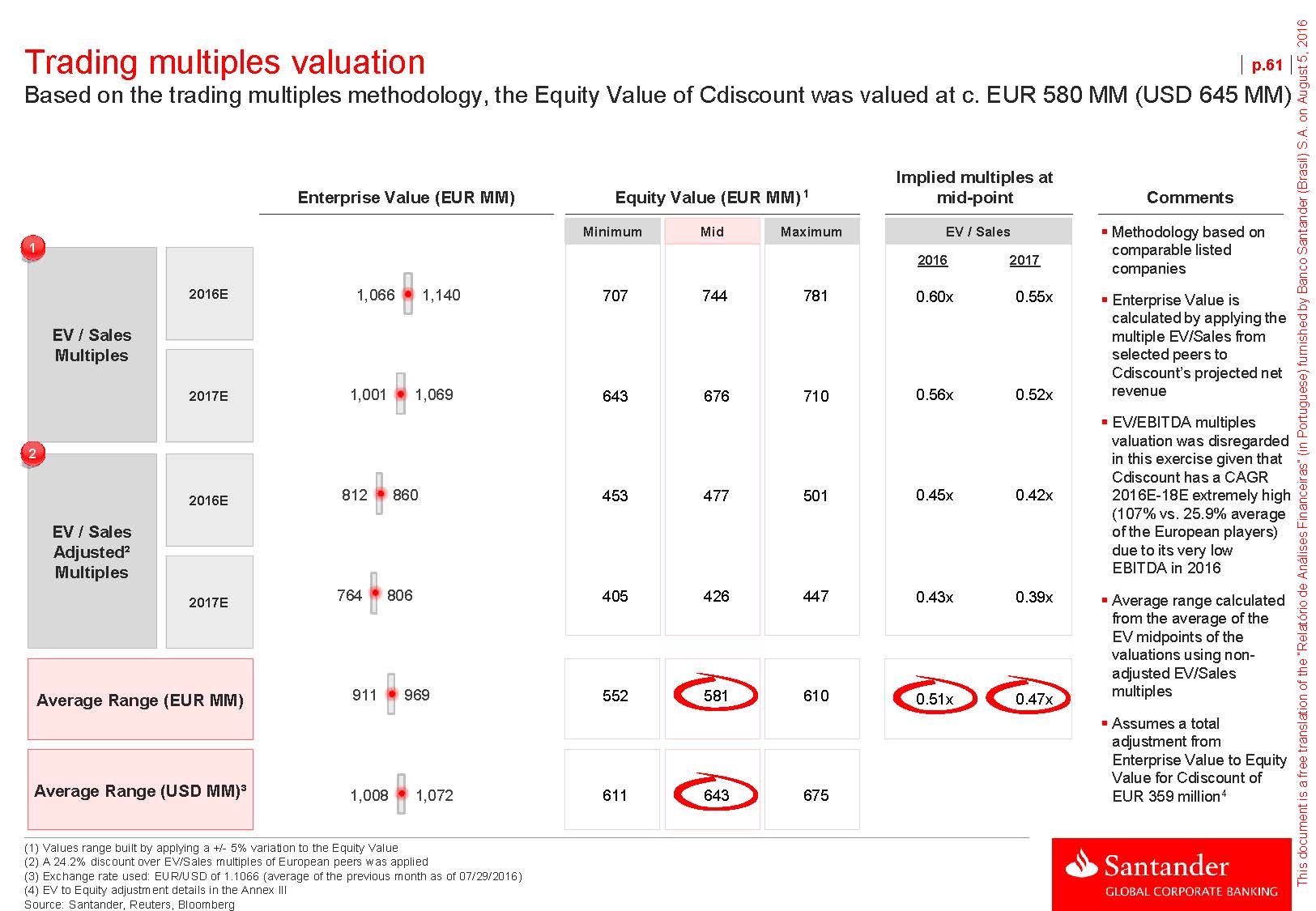

Discounted Cash Flow (cont’d) Main operating assumptions based on the Business Plan p.56AssumptionsFinancials – EUR MMWorking capital normalizationWorking capital position as of 06/30/2016 normalized to the LTM average of 2015 due to the significant distortion between monthly working capital positions (102) (29) (70) (9) (4) (88) (63) (60) (100) (35) (148) (134) Average: (82) Adjust.: (51) (277) jan/15 feb/15 mar/15 apr/15 may/15 jun/15 jul/15 aug/15 sep/15 oct/15 nov/15 dec/15 jun/16 Working capital Normalized working capital Working capital variationNormalized working capital projection, as explained belowBusiness Plan based on the same average collection and payment outstanding periods, and assumes a slight reduction in the average inventory period Business Plan Extrapolation1.0% 1.2% 1.5% 0.7% 0.4% 0.4% 0.4% 0.4% 0.3% 0.3% 0.2% 29 18 22 16 CAGR 15 -25E n.a.For the extrapolation period, projections assume maintenance of same average outstanding periods as of the last year of the Business Plan Source: Via Varejo, Cnova, FH&F, eMarketer and Santander ‘s estimates 11 11 12 12 11 11 9 2015 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E Changes in working capital % of net revenue