Exhibit (c)(2)

Preliminary Draft Analysis

Strictly Confidential

Presentation to the Conflicts Committee of the Board of Directors of CPP GP LLC

October 13, 2016 / Confidential

Jefferies LLC

Member SIPC

Disclaimer

Strictly Confidential

The following pages contain materials provided to the Conflicts Committee of the Board of Directors (the “Committee”) of CPP GP LLC, the general partner of Columbia Pipeline Partners, LP (“CPPL”), by Jefferies LLC (“Jefferies”) in connection with a potential transaction involving CPPL and Columbia Pipeline Group (“CPGX”).

These materials were prepared on a confidential basis in connection with an oral presentation to the Committee and not with a view toward complying with the disclosure standards under state or federal securities laws. These materials are for use of the Committee and may not be used for any other purpose or disclosed to any party without Jefferies’ prior written consent.

The information contained in this presentation is based solely on publicly available information or information furnished to Jefferies by CPGX management. Jefferies has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. These materials are necessarily based on economic, market and other conditions as they exist on, and information made available as of, the date hereof. None of Jefferies, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained herein.

Neither Jefferies nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. These materials are not and should not be construed as a fairness opinion.

Jefferies consents to the use of this presentation by CPPL for purposes of public disclosure in the Schedule13E-3.

Jefferies LLC / October 2016

i

Jefferies

Table of Contents Strictly Confidential

Situation Overview 1

Market Update 6

Preliminary Valuation Analysis 13

Appendix

Weighted Average Cost of Capital Analyses 28

Jefferies LLC / October 2016 ii

Strictly Confidential

Situation Overview

Jefferies LLC / October 2016 1

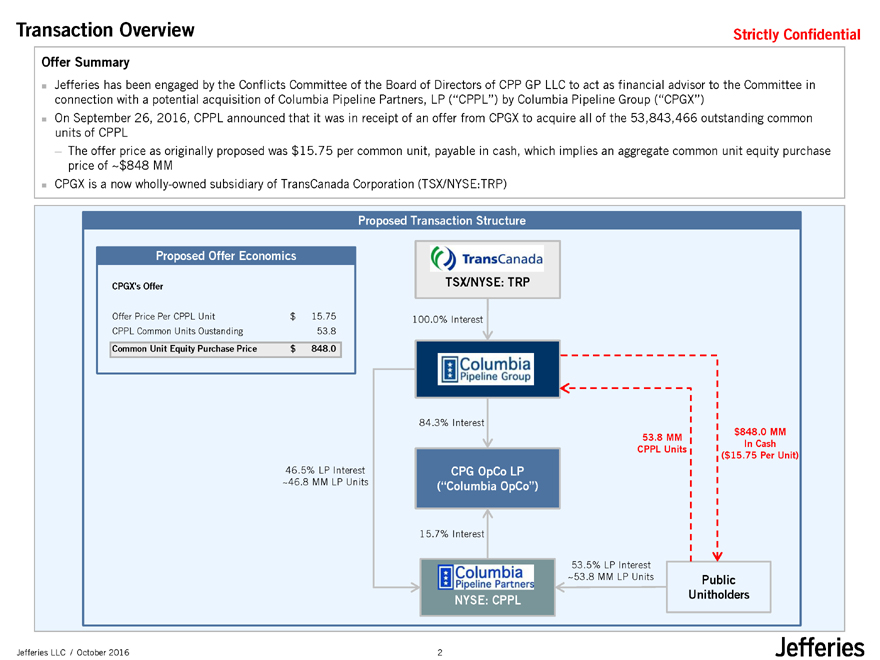

Transaction Overview Strictly Confidential

Offer Summary

Jefferies has been engaged by the Conflicts Committee of the Board of Directors of CPP GP LLC to act as financial advisor to the Committee in connection with a potential acquisition of Columbia Pipeline Partners, LP (“CPPL”) by Columbia Pipeline Group (“CPGX”)

On September 26, 2016, CPPL announced that it was in receipt of an offer from CPGX to acquire all of the 53,843,466 outstanding common units of CPPL

— The offer price as originally proposed was $15.75 per common unit, payable in cash, which implies an aggregate common unit equity purchase price of ~$848 MM

CPGX is a now wholly-owned subsidiary of TransCanada Corporation (TSX/NYSE:TRP)

Proposed Transaction Structure

Proposed Offer Economics

CPGX’s Offer TSX/NYSE: TRP

Offer Price Per CPPL Unit $ 15.75 100.0% Interest

CPPL Common Units Oustanding 53.8

Common Unit Equity Purchase Price $ 848.0

84.3% Interest

53.8 MM$848.0 MM

CPPL UnitsIn Cash

($15.75 Per Unit)

46.5% LP Interest CPG OpCo LP

~46.8 MM LP Units (“Columbia OpCo”)

15.7% Interest

53.5% LP Interest

~53.8 MM LP UnitsPublic

NYSE: CPPLUnitholders

Jefferies LLC / October 2016 2

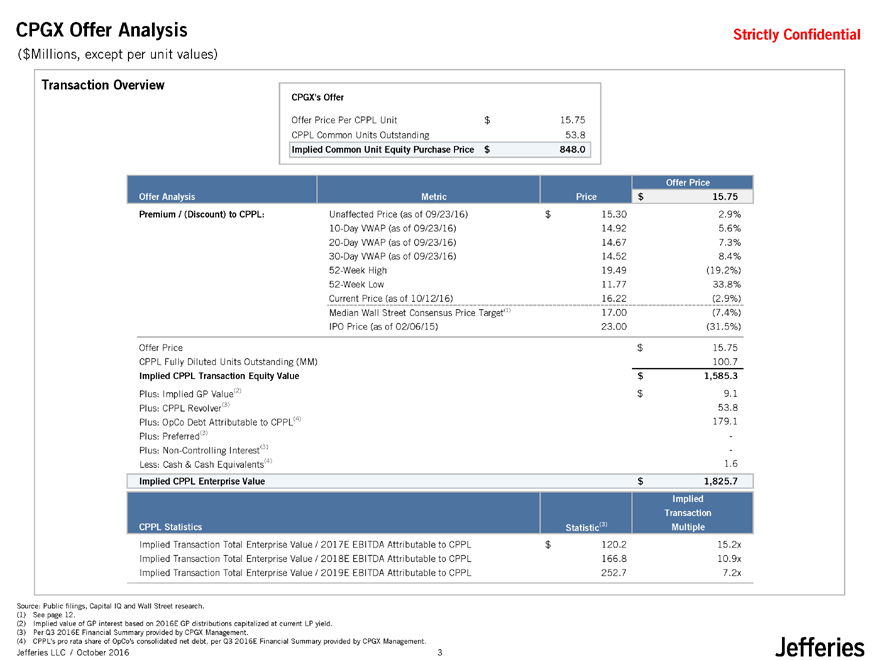

CPGX Offer Analysis Strictly Confidential

($Millions, except per unit values)

Transaction Overview

CPGX’s Offer

Offer Price Per CPPL Unit $ 15.75

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $ 848.0

Offer Price

Offer Analysis Metric Price$ 15.75

Premium / (Discount) to CPPL: Unaffected Price (as of 09/23/16) $ 15.302.9%

10-Day VWAP (as of 09/23/16) 14.925.6%

20-Day VWAP (as of 09/23/16) 14.677.3%

30-Day VWAP (as of 09/23/16) 14.528.4%

52-Week High 19.49(19.2%)

52-Week Low 11.7733.8%

Current Price (as of 10/12/16) 16.22(2.9%)

Median Wall Street Consensus Price Target(1) 17.00(7.4%)

IPO Price (as of 02/06/15) 23.00(31.5%)

Offer Price $ 15.75

CPPL Fully Diluted Units Outstanding (MM) 100.7

Implied CPPL Transaction Equity Value $ 1,585.3

Plus: Implied GP Value(2) $ 9.1

Plus: CPPL Revolver(3) 53.8

Plus: OpCo Debt Attributable to CPPL(4) 179.1

Plus: Preferred(3) -

Plus: Non-Controlling Interest(3) -

Less: Cash & Cash Equivalents(4) 1.6

Implied CPPL Enterprise Value $ 1,825.7

Implied

Transaction

CPPL Statistics Statistic(3)Multiple

Implied Transaction Total Enterprise Value / 2017E EBITDA Attributable to CPPL $ 120.2 15.2x

Implied Transaction Total Enterprise Value / 2018E EBITDA Attributable to CPPL 166.8 10.9x

Implied Transaction Total Enterprise Value / 2019E EBITDA Attributable to CPPL 252.7 7.2x

Source: Public filings, Capital IQ and Wall Street research. (1) See page 12.

(2) Implied value of GP interest based on 2016E GP distributions capitalized at current LP yield. (3) Per Q3 2016E Financial Summary provided by CPGX Management.

(4) CPPL’s pro rata share of OpCo’s consolidated net debt, per Q3 2016E Financial Summary provided by CPGX Management.

Jefferies LLC / October 2016 3

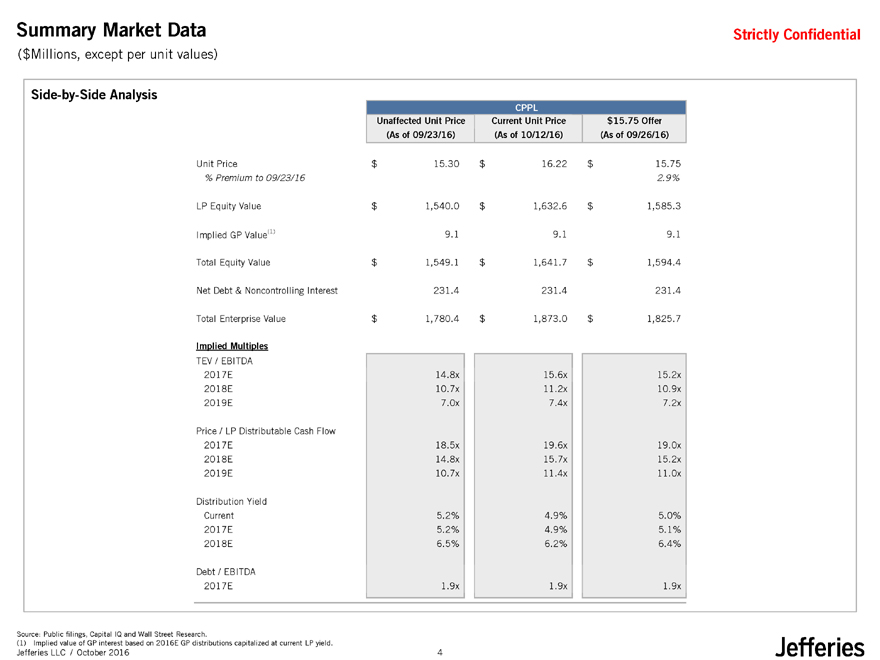

Summary Market Data Strictly Confidential

($Millions, except per unit values)

Side-by-Side Analysis

CPPL(2)

Unaffected Unit Price Current Unit Price$15.75 Offer

(As of 09/23/16) (As of 10/12/16)(As of 09/26/16)

Unit Price $ 15.30 $ 16.22$ 15.75

% Premium to 09/23/16 2.9%

LP Equity Value $ 1,540.0 $ 1,632.6$ 1,585.3

Implied GP Value(1) 9.1 9.19.1

Total Equity Value $ 1,549.1 $ 1,641.7$ 1,594.4

Net Debt & Noncontrolling Interest 231.4 231.4231.4

Total Enterprise Value $ 1,780.4 $ 1,873.0$ 1,825.7

Implied Multiples

TEV / EBITDA

2017E 14.8x 15.6x15.2x

2018E 10.7x 11.2x10.9x

2019E 7.0x 7.4x7.2x

Price / LP Distributable Cash Flow

2017E 18.5x 19.6x19.0x

2018E 14.8x 15.7x15.2x

2019E 10.7x 11.4x11.0x

Distribution Yield

Current 5.2% 4.9%5.0%

2017E 5.2% 4.9%5.1%

2018E 6.5% 6.2%6.4%

Debt / EBITDA

2017E 1.9x 1.9x1.9x

Source: Public filings, Capital IQ and Wall Street Research.

(1) Implied value of GP interest based on 2016E GP distributions capitalized at current LP yield.

Jefferies LLC / October 2016 4

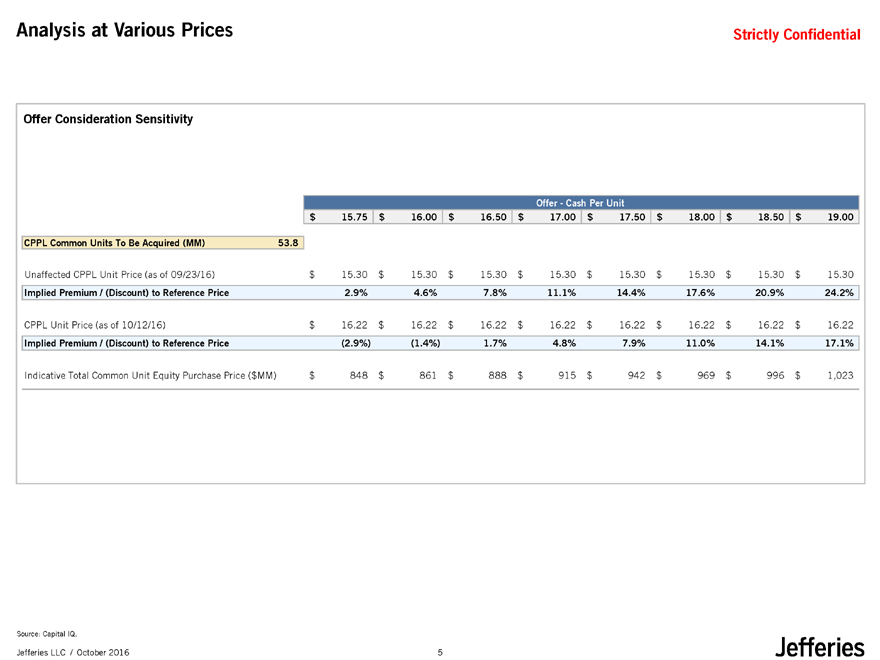

Analysis at Various Prices Strictly Confidential

Offer Consideration Sensitivity

Offer—Cash Per Unit

$ 15.75$ 16.00$ 16.50$ 17.00$ 17.50$ 18.00$ 18.50$ 19.00

CPPL Common Units To Be Acquired (MM) 53.8

Unaffected CPPL Unit Price (as of 09/23/16) $ 15.30$ 15.30$ 15.30$ 15.30$ 15.30$ 15.30$ 15.30$ 15.30

Implied Premium / (Discount) to Reference Price 2.9%4.6%7.8%11.1%14.4%17.6%20.9%24.2%

CPPL Unit Price (as of 10/12/16) $ 16.22$ 16.22$ 16.22$ 16.22$ 16.22$ 16.22$ 16.22$ 16.22

Implied Premium / (Discount) to Reference Price (2.9%)(1.4%)1.7%4.8%7.9%11.0%14.1%17.1%

Indicative Total Common Unit Equity Purchase Price ($ MM) $ 848$ 861$ 888$ 915$ 942$ 969$ 996$ 1,023

Source: Capital IQ.

Jefferies LLC / October 2016 5

Strictly Confidential

Market Update

Jefferies LLC / October 2016 6

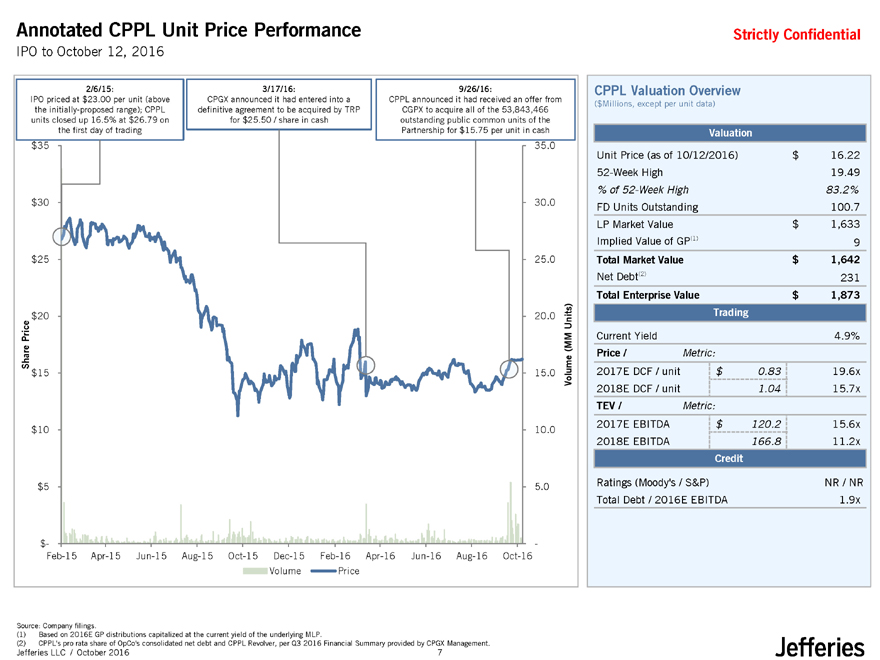

Annotated CPPL Unit Price PerformanceStrictly Confidential

IPO to October 12, 2016

2/6/15: 3/17/16: 9/26/16:

IPO priced at $23.00 per unit (above CPGX announced it had entered into a CPPL announced it had received an offer from

the initially-proposed range); CPPL definitive agreement to be acquired by TRP CGPX to acquire all of the 53,843,466

units closed up 16.5% at $26.79 on for $25.50 / share in cash outstanding public common units of the

the first day of trading Partnership for $15.75 per unit in cash

$35 35.0

$30 30.0

$25 25.0

$20 20.0 Units)

Price (MM

Share $15 15.0 Volume

$10 10.0

$5 5.0

$- -

Feb-15 Apr-15 Jun-15 Aug-15 Oct-15 Dec-15 Feb-16 Apr-16 Jun-16 Aug-16 Oct-16

Volume Price

CPPL Valuation Overview

($Millions, except per unit data)

Valuation

Unit Price (as of 10/12/2016) $ 16.22

52-Week High 19.49

% of 52-Week High 83.2%

FD Units Outstanding 100.7

LP Market Value $ 1,633

Implied Value of GP(1) 9

Total Market Value $ 1,642

Net Debt(2) 231

Total Enterprise Value $ 1,873

Trading

Current Yield 4.9%

Price / Metric:

2017E DCF / unit $ 0.83 19.6x

2018E DCF / unit 1.04 15.7x

TEV / Metric:

2017E EBITDA $ 120.2 15.6x

2018E EBITDA 166.8 11.2x

Credit

Ratings (Moody’s / S&P) NR / NR

Total Debt / 2016E EBITDA 1.9x

Source: Company filings.

(1) Based on 2016E GP distributions capitalized at the current yield of the underlying MLP.

(2) CPPL’s pro rata share of OpCo’s consolidated net debt and CPPL Revolver, per Q3 2016 Financial Summary provided by CPGX Management.

Jefferies LLC / October 2016 7

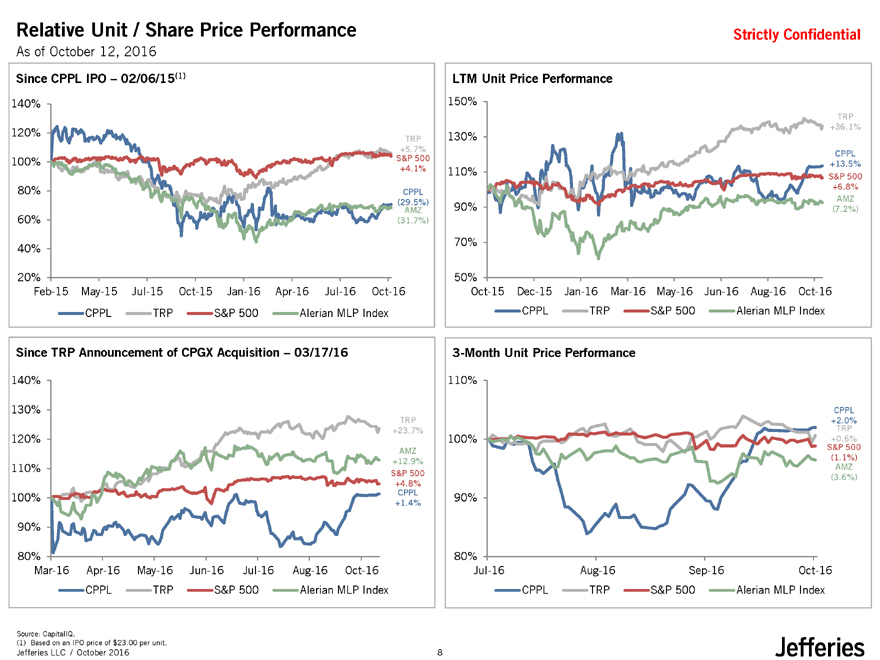

Relative Unit / Share Price PerformanceStrictly Confidential

As of October 12, 2016

Since CPPL IPO – 02/06/15(1)

140%

120% TRP

+5.7%

100% S&P 500

+4.1%

80% CPPL

(29.5%)

AMZ

60% (31.7%)

40%

20%

Feb-15 May-15 Jul-15 Oct-15 Jan-16Apr-16Jul-16Oct-16

CPPL TRP S&P 500Alerian MLP Index

LTM Unit Price Performance

150%

TRP

+36.1%

130%

CPPL

+13.5%

110% S&P 500

+6.8%

AMZ

90% (7.2%)

70%

50%

Oct-15 Dec-15 Jan-16 Mar-16 May-16Jun-16 Aug-16 Oct-16

CPPL TRP S&P 500Alerian MLP Index

Since TRP Announcement of CPGX Acquisition – 03/17/16

140%

130%

TRP

+23.7%

120%

AMZ

+12.9%

110% S&P 500

+4.8%

100% CPPL

+1.4%

90%

80%

Mar-16 Apr-16 May-16Jun-16Jul-16Aug-16Oct-16

CPPL TRPS&P 500Alerian MLP Index

3-Month Unit Price Performance

110%

CPPL

+2.0%

TRP

100% +0.6%

S&P 500

(1.1%)

AMZ

(3.6%)

90%

80%

Jul-16 Aug-16 Sep-16Oct-16

CPPL TRP S&P 500Alerian MLP Index

Source: CapitalIQ.

(1) Based on an IPO price of $23.00 per unit.

Jefferies LLC / October 2016 8

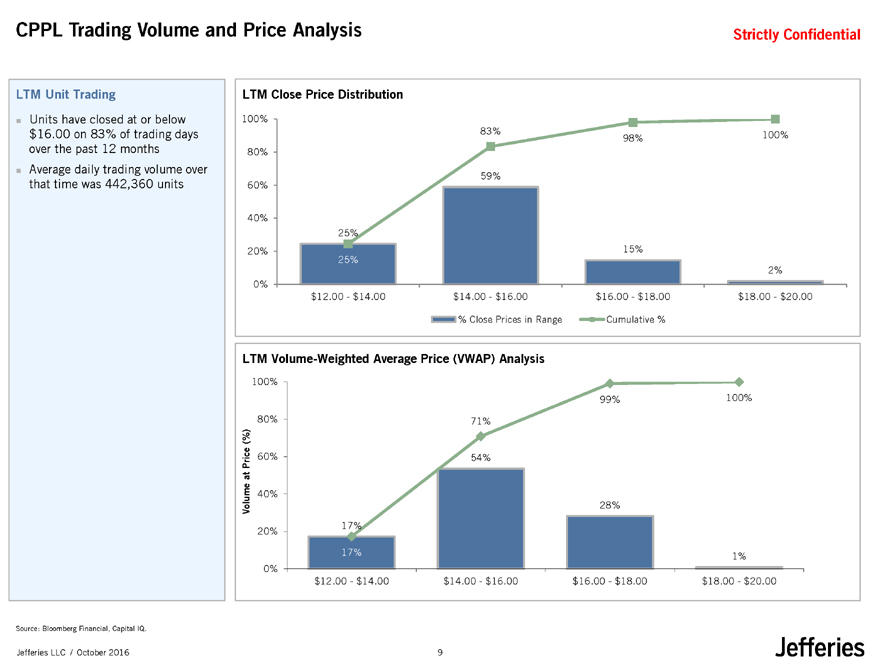

CPPL Trading Volume and Price Analysis Strictly Confidential

LTM Unit Trading

Units have closed at or below $16.00 on 83% of trading days over the past 12 months Average daily trading volume over that time was 442,360 units

LTM Close Price Distribution

100%

83% 98%100%

80%

59%

60%

40%

25%

20% 15%

25%

2%

0%

$12.00—$14.00 $14.00—$16.00 $16.00—$18.00$18.00—$20.00

% Close Prices in Range Cumulative %

LTM Volume-Weighted Average Price (VWAP) Analysis

100%

99%100%

80% 71%

(%)

Price 60% 54%

at

40%

Volume 28%

20% 17%

17%1%

0%

$12.00—$14.00$14.00—$16.00$16.00—$18.00$18.00—$20.00

Source: Bloomberg Financial, Capital IQ.

Jefferies LLC / October 2016 9

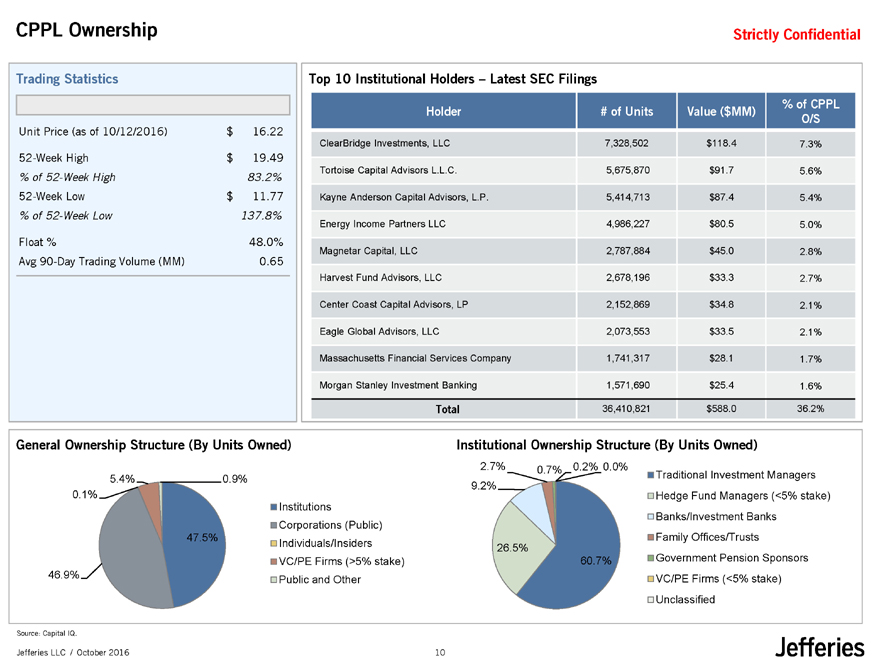

CPPL Ownership

Strictly Confidential

Trading Statistics

Unit Price (as of 10/12/2016) $16.22

52-Week High $19.49

% of 52-Week High 83.2%

52-Week Low $11.77

% of 52-Week Low 137.8%

Float % 48.0%

Avg 90-Day Trading Volume (MM) 0.65

Top 10 Institutional Holders – Latest SEC Filings

% of CPPL

Holder # of Units Value ($MM)O/S

ClearBridge Investments, LLC 7,328,502 $118.47.3%

Tortoise Capital Advisors L.L.C. 5,675,870 $91.75.6%

Kayne Anderson Capital Advisors, L.P. 5,414,713 $87.45.4%

Energy Income Partners LLC 4,986,227 $80.55.0%

Magnetar Capital, LLC 2,787,884 $45.02.8%

Harvest Fund Advisors, LLC 2,678,196 $33.32.7%

Center Coast Capital Advisors, LP 2,152,869 $34.82.1%

Eagle Global Advisors, LLC 2,073,553 $33.52.1%

Massachusetts Financial Services Company 1,741,317 $28.11.7%

Morgan Stanley Investment Banking 1,571,690 $25.41.6%

Total 36,410,821 $588.036.2%

General Ownership Structure (By Units Owned)

5.4% 0.9%

0.1%

Institutions

Corporations (Public)

47.5% Individuals/Insiders

VC/PE Firms (>5% stake)

46.9% Public and Other

Institutional Ownership Structure (By Units Owned)

2.7% 0.7% 0.2% 0.0%

Traditional Investment Managers

9.2%

Hedge Fund Managers (<5% stake)

Banks/Investment Banks

Family Offices/Trusts

26.5%

60.7% Government Pension Sponsors

VC/PE Firms (<5% stake)

Unclassified

Source: Capital IQ.

Jefferies LLC / October 2016 10

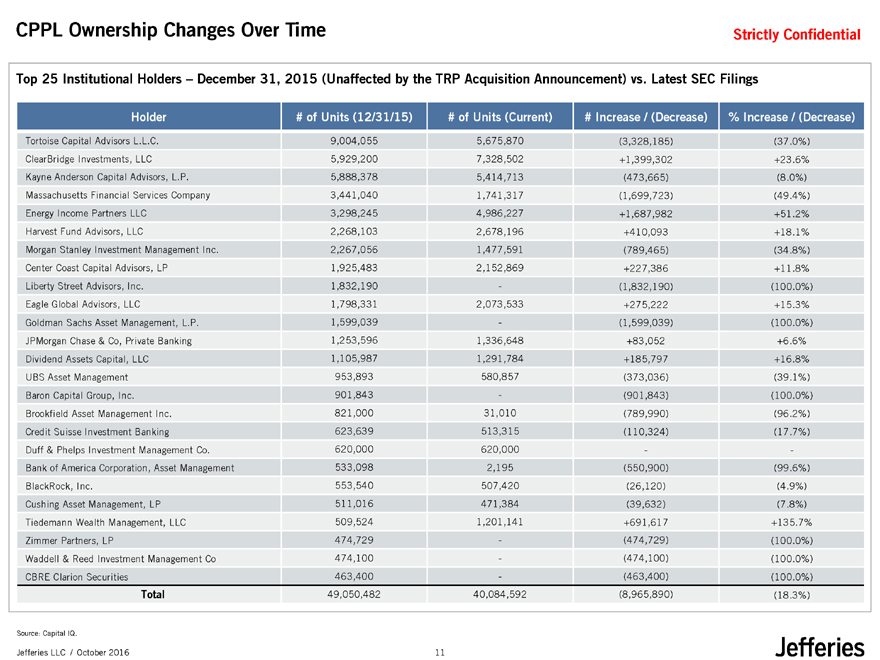

CPPL Ownership Changes Over Time Strictly Confidential

Top 25 Institutional Holders – December 31, 2015 (Unaffected by the TRP Acquisition Announcement) vs. Latest SEC Filings

Holder # of Units (12/31/15) # of Units (Current)# Increase / (Decrease)% Increase / (Decrease)

Tortoise Capital Advisors L.L.C. 9,004,055 5,675,870(3,328,185)(37.0%)

ClearBridge Investments, LLC 5,929,200 7,328,502+1,399,302+23.6%

Kayne Anderson Capital Advisors, L.P. 5,888,378 5,414,713(473,665)(8.0%)

Massachusetts Financial Services Company 3,441,040 1,741,317(1,699,723)(49.4%)

Energy Income Partners LLC 3,298,245 4,986,227+1,687,982+51.2%

Harvest Fund Advisors, LLC 2,268,103 2,678,196+410,093+18.1%

Morgan Stanley Investment Management Inc. 2,267,056 1,477,591(789,465)(34.8%)

Center Coast Capital Advisors, LP 1,925,483 2,152,869+227,386+11.8%

Liberty Street Advisors, Inc. 1,832,190 -(1,832,190)(100.0%)

Eagle Global Advisors, LLC 1,798,331 2,073,533+275,222+15.3%

Goldman Sachs Asset Management, L.P. 1,599,039 -(1,599,039)(100.0%)

JPMorgan Chase & Co, Private Banking 1,253,596 1,336,648+83,052+6.6%

Dividend Assets Capital, LLC 1,105,987 1,291,784+185,797+16.8%

UBS Asset Management 953,893 580,857(373,036)(39.1%)

Baron Capital Group, Inc. 901,843 -(901,843)(100.0%)

Brookfield Asset Management Inc. 821,000 31,010(789,990)(96.2%)

Credit Suisse Investment Banking 623,639 513,315(110,324)(17.7%)

Duff & Phelps Investment Management Co. 620,000 620,000--

Bank of America Corporation, Asset Management 533,098 2,195(550,900)(99.6%)

BlackRock, Inc. 553,540 507,420(26,120)(4.9%)

Cushing Asset Management, LP 511,016 471,384(39,632)(7.8%)

Tiedemann Wealth Management, LLC 509,524 1,201,141+691,617+135.7%

Zimmer Partners, LP 474,729 -(474,729)(100.0%)

Waddell & Reed Investment Management Co 474,100 -(474,100)(100.0%)

CBRE Clarion Securities 463,400 -(463,400)(100.0%)

Total 49,050,482 40,084,592(8,965,890)(18.3%)

Source: Capital IQ.

Jefferies LLC / October 2016 11

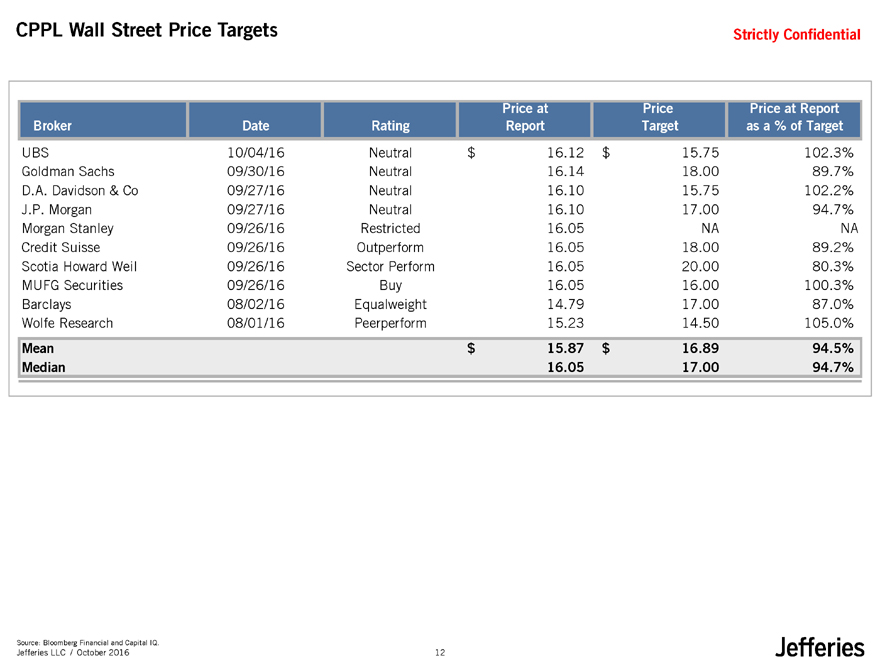

CPPL Wall Street Price Targets Strictly Confidential

Price atPricePrice at Report

Broker Date RatingReportTargetas a % of Target

UBS 10/04/16 Neutral$16.12$15.75102.3%

Goldman Sachs 09/30/16 Neutral16.1418.0089.7%

D.A. Davidson & Co 09/27/16 Neutral16.1015.75102.2%

J.P. Morgan 09/27/16 Neutral16.1017.0094.7%

Morgan Stanley 09/26/16 Restricted16.05NANA

Credit Suisse 09/26/16 Outperform16.0518.0089.2%

Scotia Howard Weil 09/26/16 Sector Perform16.0520.0080.3%

MUFG Securities 09/26/16 Buy16.0516.00100.3%

Barclays 08/02/16 Equalweight14.7917.0087.0%

Wolfe Research 08/01/16 Peerperform15.2314.50105.0%

Mean $15.87$16.8994.5%

Median 16.0517.0094.7%

Source: Bloomberg Financial and Capital IQ.

Jefferies LLC / October 2016 12

Strictly Confidential

Preliminary Valuation Analysis

Jefferies LLC / October 2016 13

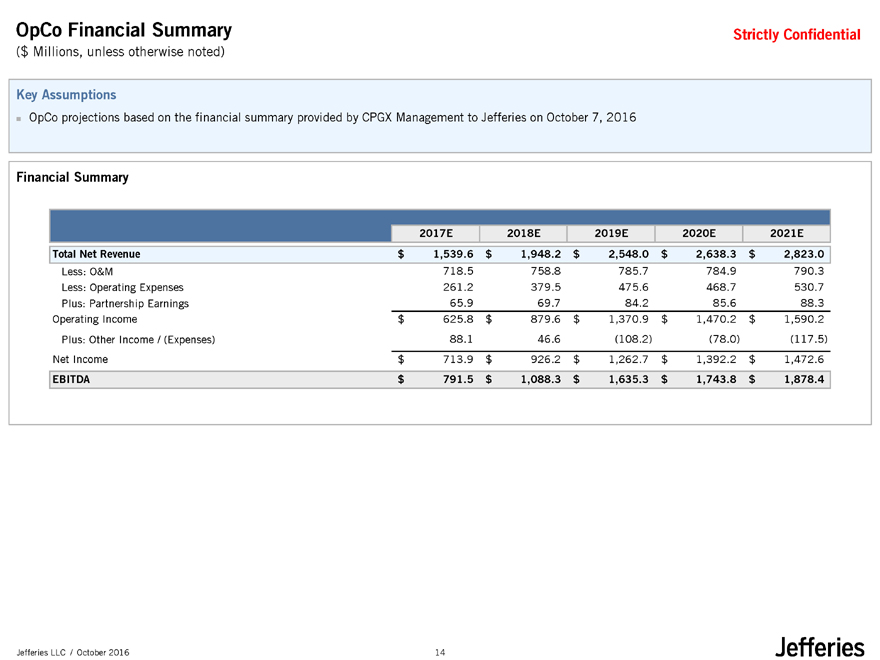

OpCo Financial Summary Strictly Confidential

($ Millions, unless otherwise noted)

Key Assumptions

OpCo projections based on the financial summary provided by CPGX Management to Jefferies on October 7, 2016

Financial Summary

2017E 2018E2019E2020E2021E

Total Net Revenue $ 1,539.6 $1,948.2$2,548.0$2,638.3$2,823.0

Less: O&M 718.5 758.8785.7784.9790.3

Less: Operating Expenses 261.2 379.5475.6468.7530.7

Plus: Partnership Earnings 65.9 69.784.285.688.3

Operating Income $ 625.8 $879.6$1,370.9$1,470.2$1,590.2

Plus: Other Income / (Expenses) 88.1 46.6(108.2)(78.0)(117.5)

Net Income $ 713.9 $926.2$1,262.7$1,392.2$1,472.6

EBITDA $ 791.5 $1,088.3$1,635.3$1,743.8$1,878.4

Jefferies LLC / October 2016 14

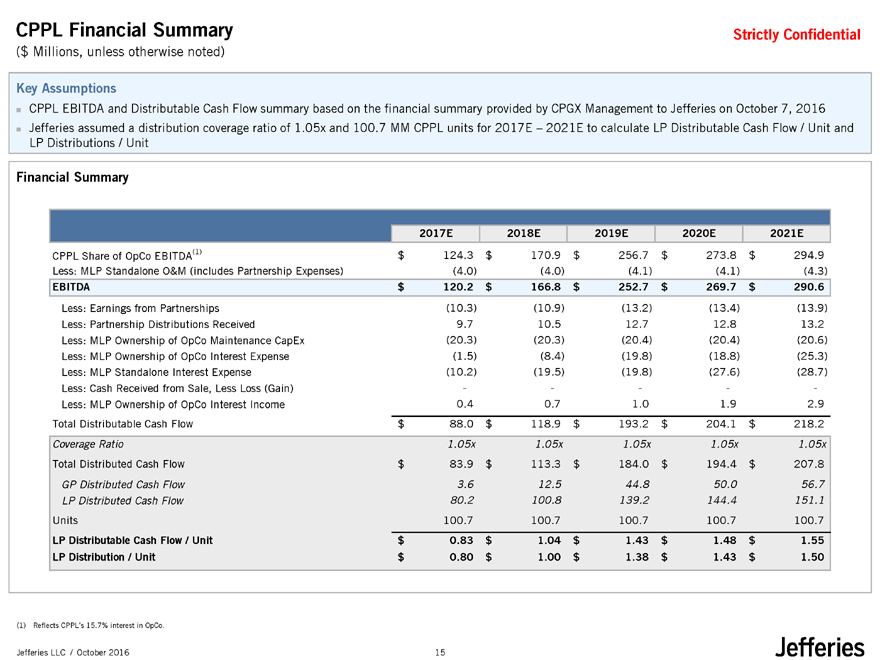

CPPL Financial Summary Strictly Confidential

($ Millions, unless otherwise noted)

Key Assumptions

CPPL EBITDA and Distributable Cash Flow summary based on the financial summary provided by CPGX Management to Jefferies on October 7, 2016 Jefferies assumed a distribution coverage ratio of 1.05x and 100.7 MM CPPL units for 2017E – 2021E to calculate LP Distributable Cash Flow / Unit and LP Distributions / Unit

Financial Summary

2017E 2018E2019E2020E2021E

CPPL Share of OpCo EBITDA(1) $ 124.3 $170.9$256.7$273.8$294.9

Less: MLP Standalone O&M (includes Partnership Expenses) (4.0) (4.0)(4.1)(4.1)(4.3)

EBITDA $ 120.2 $166.8$252.7$269.7$290.6

Less: Earnings from Partnerships (10.3) (10.9)(13.2)(13.4)(13.9)

Less: Partnership Distributions Received 9.7 10.512.712.813.2

Less: MLP Ownership of OpCo Maintenance CapEx (20.3) (20.3)(20.4)(20.4)(20.6)

Less: MLP Ownership of OpCo Interest Expense (1.5) (8.4)(19.8)(18.8)(25.3)

Less: MLP Standalone Interest Expense (10.2) (19.5)(19.8)(27.6)(28.7)

Less: Cash Received from Sale, Less Loss (Gain) - ----

Less: MLP Ownership of OpCo Interest Income 0.4 0.71.01.92.9

Total Distributable Cash Flow $ 88.0 $118.9$193.2$204.1$218.2

Coverage Ratio 1.05x 1.05x1.05x1.05x1.05x

Total Distributed Cash Flow $ 83.9 $113.3$184.0$194.4$207.8

GP Distributed Cash Flow 3.6 12.544.850.056.7

LP Distributed Cash Flow 80.2 100.8139.2144.4151.1

Units 100.7 100.7100.7100.7100.7

LP Distributable Cash Flow / Unit $ 0.83 $1.04$1.43$1.48$1.55

LP Distribution / Unit $ 0.80 $1.00$1.38$1.43$1.50

(1) Reflects CPPL’s 15.7% interest in OpCo.

Jefferies LLC / October 2016 15

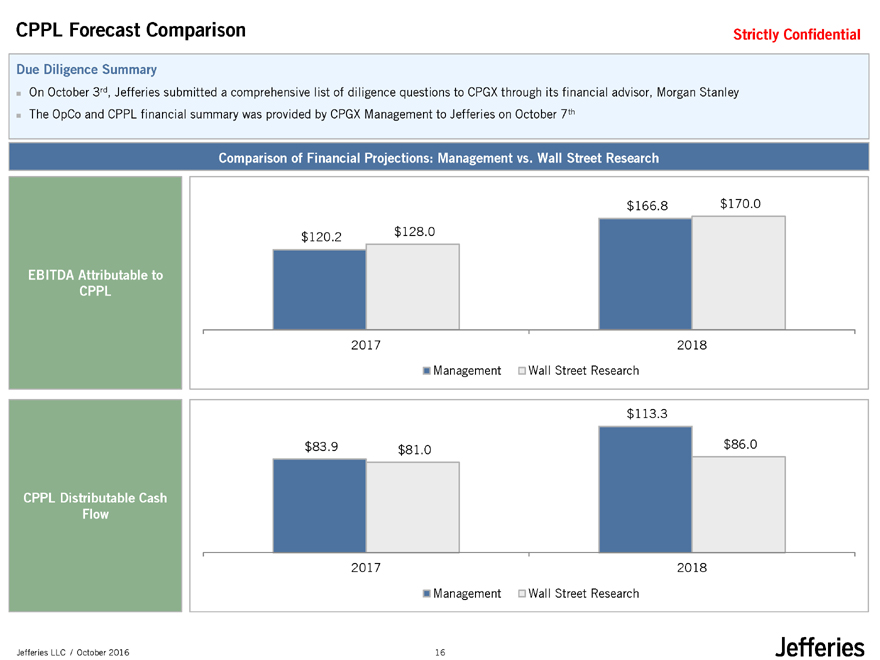

CPPL Forecast Comparison Strictly Confidential

Due Diligence Summary

October 3rd

On , Jefferies submitted a comprehensive list of diligence questions to CPGX through its financial advisor, Morgan Stanley The OpCo and CPPL financial summary was provided by CPGX Management to Jefferies on October 7th

Comparison of Financial Projections: Management vs. Wall Street Research

$166.8$170.0

$120.2 $128.0

EBITDA Attributable to

CPPL

20172018

ManagementWall Street Research

$113.3

$83.9 $81.0$86.0

CPPL Distributable Cash

Flow

20172018

ManagementWall Street Research

Jefferies LLC / October 2016 16

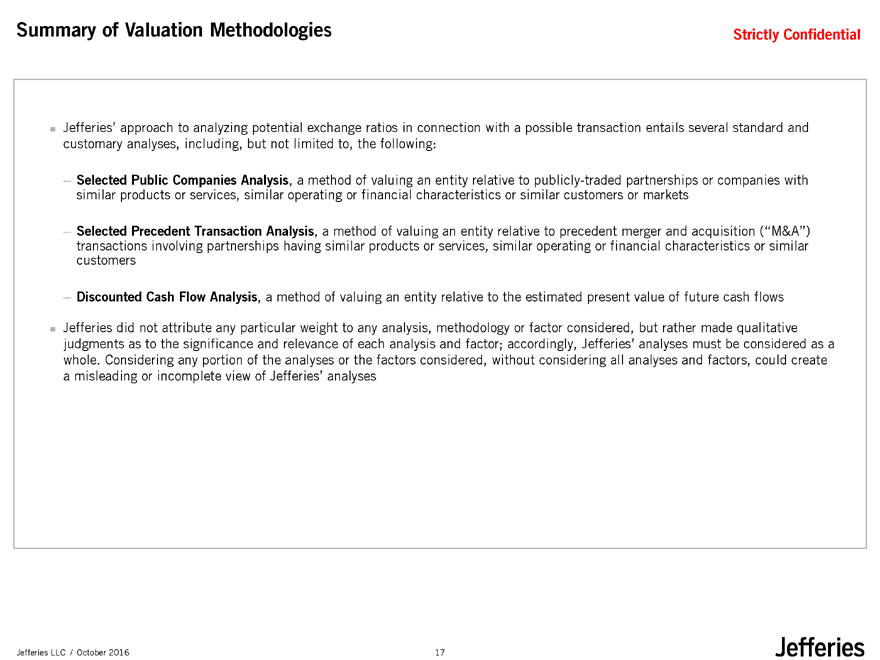

Summary of Valuation Methodologies Strictly Confidential

Jefferies’ approach to analyzing potential exchange ratios in connection with a possible transaction entails several standard and customary analyses, including, but not limited to, the following:

— Selected Public Companies Analysis, a method of valuing an entity relative to publicly-traded partnerships or companies with similar products or services, similar operating or financial characteristics or similar customers or markets

— Selected Precedent Transaction Analysis, a method of valuing an entity relative to precedent merger and acquisition (“M&A”) transactions involving partnerships having similar products or services, similar operating or financial characteristics or similar customers

— Discounted Cash Flow Analysis, a method of valuing an entity relative to the estimated present value of future cash flows

Jefferies did not attribute any particular weight to any analysis, methodology or factor considered, but rather made qualitative judgments as to the significance and relevance of each analysis and factor; accordingly, Jefferies’ analyses must be considered as a whole. Considering any portion of the analyses or the factors considered, without considering all analyses and factors, could create a misleading or incomplete view of Jefferies’ analyses

Jefferies LLC / October 2016 17

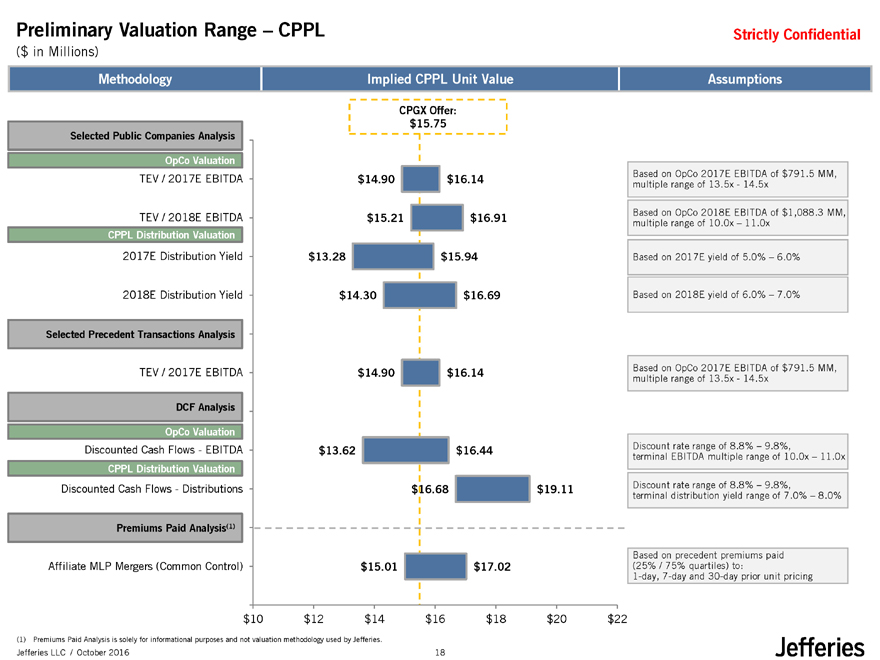

Preliminary Valuation Range – CPPL

($ in Millions)

Strictly Confidential

Methodology Implied CPPL Unit ValueAssumptions

CPGX Offer:

$15.75

Selected Public Companies Analysis

OpCo Valuation

TEV / 2017E EBITDA $14.90$16.14Based on OpCo 2017E EBITDA of $791.5 MM,

multiple range of 13.5x—14.5x

Based on OpCo 2018E EBITDA of $1,088.3 MM,

TEV / 2018E EBITDA $15.21$16.91multiple range of 10.0x – 11.0x

CPPL Distribution Valuation

2017E Distribution Yield $13.28$15.94Based on 2017E yield of 5.0% – 6.0%

2018E Distribution Yield $14.30$16.69Based on 2018E yield of 6.0% – 7.0%

Selected Precedent Transactions Analysis

TEV / 2017E EBITDA $14.90$16.14Based on OpCo 2017E EBITDA of $791.5 MM,

multiple range of 13.5x—14.5x

DCF Analysis

OpCo Valuation

Discounted Cash Flows—EBITDA $13.62$16.44Discount rate range of 8.8% – 9.8%,

terminal EBITDA multiple range of 10.0x – 11.0x

CPPL Distribution Valuation

Discounted Cash Flows—Distributions $16.68$19.11Discount rate range of 8.8% – 9.8%,

terminal distribution yield range of 7.0% – 8.0%

Premiums Paid Analysis(1)

Based on precedent premiums paid

Affiliate MLP Mergers (Common Control) $15.01$17.02(25% / 75% quartiles) to:

1-day, 7-day and 30-day prior unit pricing

$10 $12$14$16$18$20$22

(1) Premiums Paid Analysis is solely for informational purposes and not valuation methodology used by Jefferies.

Jefferies LLC / October 2016 18

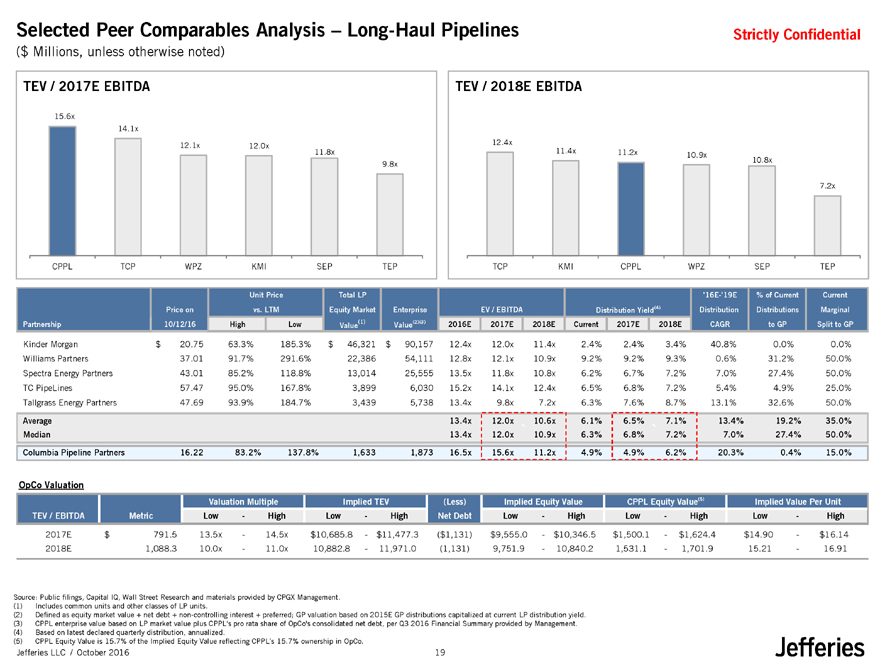

Selected Peer Comparables Analysis – Long-Haul Pipelines

($ Millions, unless otherwise noted)

Strictly Confidential

TEV / 2017E EBITDA

15.6x

14.1x

12.1x12.0x

11.8x

9.8x

CPPL TCP WPZKMISEPTEP

TEV / 2018E EBITDA

12.4x

11.4x 11.2x10.9x10.8x

7.2x

TCP KMI CPPLWPZSEPTEP

Unit PriceTotal LP’16E-‘19E% of CurrentCurrent

Price on vs. LTMEquity MarketEnterpriseEV / EBITDADistribution Yield(4)DistributionDistributionsMarginal

Partnership 10/12/16 HighLowValue(1)Value(2)(3)2016E2017E2018ECurrent2017E2018ECAGRto GPSplit to GP

Kinder Morgan $ 20.75 63.3%185.3%$ 46,321$90,15712.4x12.0x11.4x2.4%2.4%3.4%40.8%0.0%0.0%

Williams Partners 37.01 91.7%291.6%22,38654,11112.8x12.1x10.9x9.2%9.2%9.3%0.6%31.2%50.0%

Spectra Energy Partners 43.01 85.2%118.8%13,01425,55513.5x11.8x10.8x6.2%6.7%7.2%7.0%27.4%50.0%

TC PipeLines 57.47 95.0%167.8%3,8996,03015.2x14.1x12.4x6.5%6.8%7.2%5.4%4.9%25.0%

Tallgrass Energy Partners 47.69 93.9%184.7%3,4395,73813.4x9.8x7.2x6.3%7.6%8.7%13.1%32.6%50.0%

Average 13.4x12.0x10.6x6.1%6.5%7.1%13.4%19.2%35.0%

Median 13.4x12.0x`10.9x6.3%6.8%`7.2%7.0%27.4%50.0%

Columbia Pipeline Partners 16.22 83.2%137.8%1,6331,87316.5x15.6x11.2x4.9%4.9%6.2%20.3%0.4%15.0%

OpCo Valuation

Valuation MultipleImplied TEV(Less)Implied Equity ValueCPPL Equity Value(5)Implied Value Per Unit

TEV / EBITDA MetricLow- HighLow- HighNet DebtLow- HighLow-HighLow-High

2017E $791.513.5x- 14.5x$10,685.8- $11,477.3($1,131)$9,555.0- $10,346.5$1,500.1-$1,624.4$14.90-$16.14

2018E 1,088.310.0x- 11.0x10,882.8- 11,971.0(1,131)9,751.9- 10,840.21,531.1-1,701.915.21-16.91

Source: Public filings, Capital IQ, Wall Street Research and materials provided by CPGX Management. (1) Includes common units and other classes of LP units.

(2) Defined as equity market value + net debt + non-controlling interest + preferred; GP valuation based on 2015E GP distributions capitalized at current LP distribution yield. (3) CPPL enterprise value based on LP market value plus CPPL’s pro rata share of OpCo’s consolidated net debt, per Q3 2016 Financial Summary provided by Management. (4) Based on latest declared quarterly distribution, annualized.

(5) CPPL Equity Value is 15.7% of the Implied Equity Value reflecting CPPL’s 15.7% ownership in OpCo.

Jefferies LLC / October 2016 19

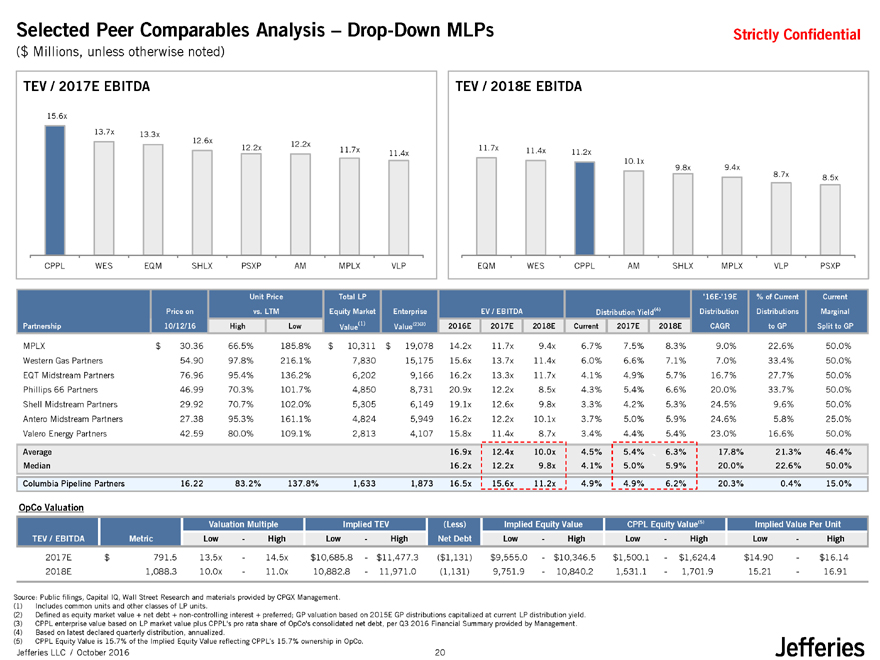

Selected Peer Comparables Analysis – Drop-Down MLPs

($ Millions, unless otherwise noted)

Strictly Confidential

TEV / 2017E EBITDA

15.6x

13.7x 13.3x

12.6x12.2x

12.2x11.7x11.4x

CPPL WES EQMSHLXPSXPAMMPLXVLP

TEV / 2018E EBITDA

11.7x 11.4x 11.2x

10.1x

9.8x9.4x

8.7x8.5x

EQM WES CPPLAMSHLXMPLXVLPPSXP

Unit PriceTotal LP’16E-‘19E% of CurrentCurrent

Price on vs. LTMEquity MarketEnterpriseEV / EBITDADistribution Yield(4)DistributionDistributionsMarginal

Partnership 10/12/16 HighLowValue(1)Value(2)(3)2016E2017E2018ECurrent2017E2018ECAGRto GPSplit to GP

MPLX $ 30.36 66.5%185.8%$ 10,311$19,07814.2x11.7x9.4x6.7%7.5%8.3%9.0%22.6%50.0%

Western Gas Partners 54.90 97.8%216.1%7,83015,17515.6x13.7x11.4x6.0%6.6%7.1%7.0%33.4%50.0%

EQT Midstream Partners 76.96 95.4%136.2%6,2029,16616.2x13.3x11.7x4.1%4.9%5.7%16.7%27.7%50.0%

Phillips 66 Partners 46.99 70.3%101.7%4,8508,73120.9x12.2x8.5x4.3%5.4%6.6%20.0%33.7%50.0%

Shell Midstream Partners 29.92 70.7%102.0%5,3056,14919.1x12.6x9.8x3.3%4.2%5.3%24.5%9.6%50.0%

Antero Midstream Partners 27.38 95.3%161.1%4,8245,94916.2x12.2x10.1x3.7%5.0%5.9%24.6%5.8%25.0%

Valero Energy Partners 42.59 80.0%109.1%2,8134,10715.8x11.4x8.7x3.4%4.4%5.4%23.0%16.6%50.0%

Average 16.9x12.4x10.0x4.5%5.4%6.3%17.8%21.3%46.4%

`

Median 16.2x12.2x9.8x4.1%5.0%5.9%20.0%22.6%50.0%

Columbia Pipeline Partners 16.22 83.2%137.8%1,6331,87316.5x15.6x11.2x4.9%4.9%6.2%20.3%0.4%15.0%

OpCo Valuation

Valuation MultipleImplied TEV(Less)Implied Equity ValueCPPL Equity Value(5)Implied Value Per Unit

TEV / EBITDA MetricLow- HighLow- HighNet DebtLow- HighLow-HighLow-High

2017E $791.513.5x- 14.5x$10,685.8- $11,477.3($1,131)$9,555.0- $10,346.5$1,500.1-$1,624.4$14.90-$16.14

2018E 1,088.310.0x- 11.0x10,882.8- 11,971.0(1,131)9,751.9- 10,840.21,531.1-1,701.915.21-16.91

Source: Public filings, Capital IQ, Wall Street Research and materials provided by CPGX Management. (1) Includes common units and other classes of LP units.

(2) Defined as equity market value + net debt + non-controlling interest + preferred; GP valuation based on 2015E GP distributions capitalized at current LP distribution yield. (3) CPPL enterprise value based on LP market value plus CPPL’s pro rata share of OpCo’s consolidated net debt, per Q3 2016 Financial Summary provided by Management. (4) Based on latest declared quarterly distribution, annualized.

(5) CPPL Equity Value is 15.7% of the Implied Equity Value reflecting CPPL’s 15.7% ownership in OpCo.

Jefferies LLC / October 2016 20

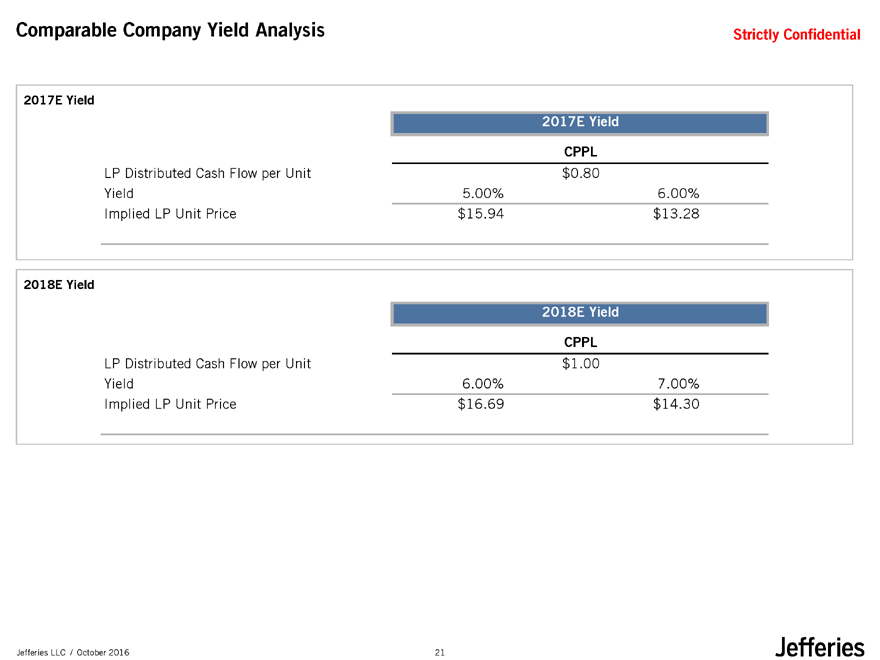

Comparable Company Yield Analysis Strictly Confidential

2017E Yield

2017E Yield

CPPL

LP Distributed Cash Flow per Unit $0.80

Yield 5.00%6.00%

Implied LP Unit Price $15.94$13.28

2018E Yield

2018E Yield

CPPL

LP Distributed Cash Flow per Unit $1.00

Yield 6.00%7.00%

Implied LP Unit Price $16.69$14.30

Jefferies LLC / October 2016 21

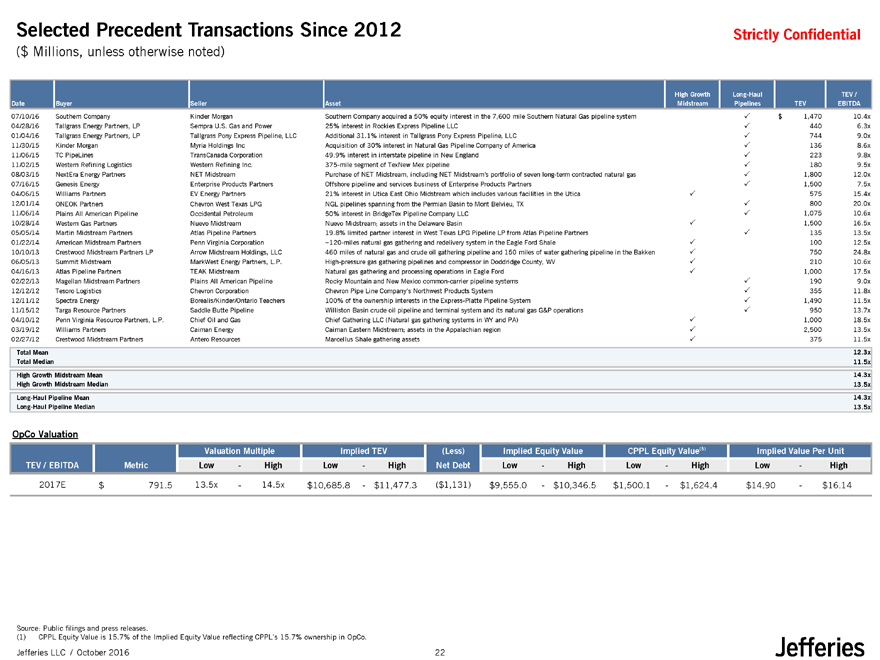

Selected Precedent Transactions Since 2012

($ Millions, unless otherwise noted)

Strictly Confidential

High GrowthLong-HaulTEV /

Date Buyer SellerAssetMidstreamPipelinesTEVEBITDA

07/10/16 Southern Company Kinder MorganSouthern Company acquired a 50% equity interest in the 7,600 mile Southern Natural Gas pipeline systemP$ 1,47010.4x

04/28/16 Tallgrass Energy Partners, LP Sempra U.S. Gas and Power25% interest in Rockies Express Pipeline LLCP4406.3x

01/04/16 Tallgrass Energy Partners, LP Tallgrass Pony Express Pipeline, LLCAdditional 31.1% interest in Tallgrass Pony Express Pipeline, LLCP7449.0x

11/30/15 Kinder Morgan Myria Holdings IncAcquisition of 30% interest in Natural Gas Pipeline Company of AmericaP1368.6x

11/06/15 TC PipeLines TransCanada Corporation49.9% interest in interstate pipeline in New EnglandP2239.8x

11/02/15 Western Refining Logistics Western Refining Inc.375-mile segment of TexNew Mex pipelineP1809.5x

08/03/15 NextEra Energy Partners NET MidstreamPurchase of NET Midstream, including NET Midstream’s portfolio of seven long-term contracted natural gasP1,80012.0x

07/16/15 Genesis Energy Enterprise Products PartnersOffshore pipeline and services business of Enterprise Products PartnersP1,5007.5x

04/06/15 Williams Partners EV Energy Partners21% interest in Utica East Ohio Midstream which includes various facilities in the UticaP57515.4x

12/01/14 ONEOK Partners Chevron West Texas LPGNGL pipelines spanning from the Permian Basin to Mont Belvieu, TXP80020.0x

11/06/14 Plains All American Pipeline Occidental Petroleum50% interest in BridgeTex Pipeline Company LLCP1,07510.6x

10/28/14 Western Gas Partners Nuevo MidstreamNuevo Midstream; assets in the Delaware BasinP1,50016.5x

05/05/14 Martin Midstream Partners Atlas Pipeline Partners19.8% limited partner interest in West Texas LPG Pipeline LP from Atlas Pipeline PartnersP13513.5x

01/22/14 American Midstream Partners Penn Virginia Corporation~120-miles natural gas gathering and redelivery system in the Eagle Ford ShaleP10012.5x

10/10/13 Crestwood Midstream Partners LP Arrow Midstream Holdings, LLC460 miles of natural gas and crude oil gathering pipeline and 150 miles of water gathering pipeline in the BakkenP75024.8x

06/05/13 Summit Midstream MarkWest Energy Partners, L.P.High-pressure gas gathering pipelines and compressor in Doddridge County, WVP21010.6x

04/16/13 Atlas Pipeline Partners TEAK MidstreamNatural gas gathering and processing operations in Eagle FordP1,00017.5x

02/22/13 Magellan Midstream Partners Plains All American PipelineRocky Mountain and New Mexico common-carrier pipeline systemsP1909.0x

12/12/12 Tesoro Logistics Chevron CorporationChevron Pipe Line Company’s Northwest Products SystemP35511.8x

12/11/12 Spectra Energy Borealis/Kinder/Ontario Teachers100% of the ownership interests in the Express-Platte Pipeline SystemP1,49011.5x

11/15/12 Targa Resource Partners Saddle Butte PipelineWilliston Basin crude oil pipeline and terminal system and its natural gas G&P operationsP95013.7x

04/10/12 Penn Virginia Resource Partners, L.P. Chief Oil and GasChief Gathering LLC (Natural gas gathering systems in WY and PA)P1,00018.5x

03/19/12 Williams Partners Caiman EnergyCaiman Eastern Midstream; assets in the Appalachian regionP2,50013.5x

02/27/12 Crestwood Midstream Partners Antero ResourcesMarcellus Shale gathering assetsP37511.5x

Total Mean 12.3x

Total Median 11.5x

High Growth Midstream Mean 14.3x

High Growth Midstream Median 13.5x

Long-Haul Pipeline Mean 14.3x

Long-Haul Pipeline Median 13.5x

OpCo Valuation

Valuation MultipleImplied TEV(Less)Implied Equity ValueCPPL Equity Value(5)Implied Value Per Unit

TEV / EBITDA MetricLow- HighLow- HighNet DebtLow- HighLow-HighLow-High

2017E $791.513.5x- 14.5x$10,685.8- $11,477.3($1,131)$9,555.0- $10,346.5$1,500.1-$1,624.4$14.90-$16.14

Source: Public filings and press releases.

(1) CPPL Equity Value is 15.7% of the Implied Equity Value reflecting CPPL’s 15.7% ownership in OpCo.

Jefferies LLC / October 2016 22

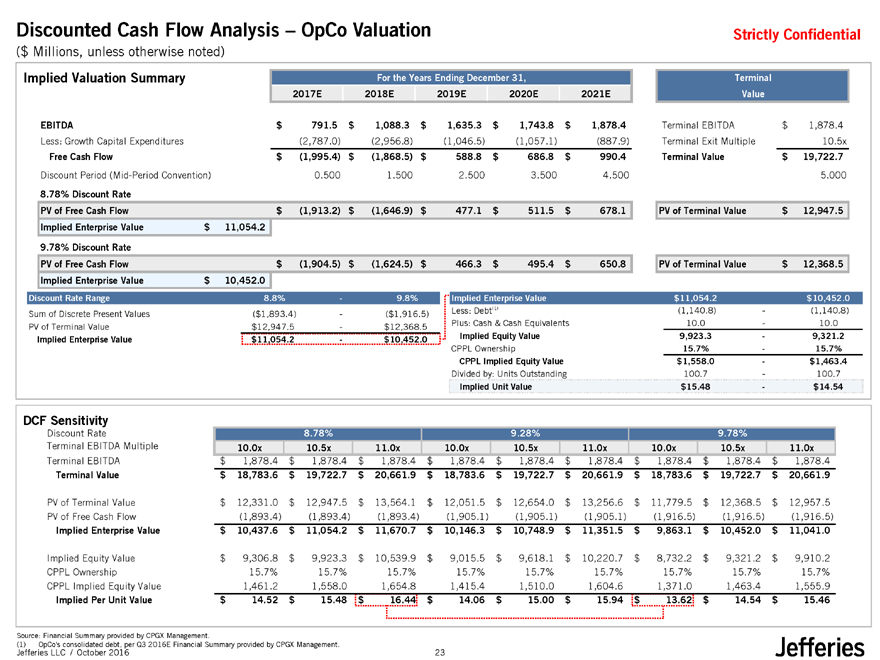

Discounted Cash Flow Analysis – OpCo Valuation

($ Millions, unless otherwise noted)

Strictly Confidential

Implied Valuation Summary For the Years Ending December 31,Terminal

2017E2018E2019E2020E2021EValue

EBITDA $791.5$1,088.3$1,635.3$1,743.8$1,878.4Terminal EBITDA$ 1,878.4

Less: Growth Capital Expenditures (2,787.0)(2,956.8)(1,046.5)(1,057.1)(887.9)Terminal Exit Multiple10.5x

Free Cash Flow $(1,995.4)$(1,868.5)$588.8$686.8$990.4Terminal Value$ 19,722.7

Discount Period (Mid-Period Convention) 0.5001.5002.5003.5004.5005.000

8.78% Discount Rate

PV of Free Cash Flow $(1,913.2)$(1,646.9)$477.1$511.5$678.1PV of Terminal Value$ 12,947.5

Implied Enterprise Value $11,054.2

9.78% Discount Rate

PV of Free Cash Flow $(1,904.5)$(1,624.5)$466.3$495.4$650.8PV of Terminal Value$ 12,368.5

Implied Enterprise Value $10,452.0

Discount Rate Range 8.8%-9.8%Implied Enterprise Value$11,054.2$10,452.0

Sum of Discrete Present Values ($1,893.4)-($1,916.5)Less: Debt(1)(1,140.8)-(1,140.8)

PV of Terminal Value $12,947.5-$12,368.5Plus: Cash & Cash Equivalents10.0-10.0

Implied Enterprise Value $11,054.2-$10,452.0Implied Equity Value9,923.3-9,321.2

CPPL Ownership15.7%-15.7%

CPPL Implied Equity Value$1,558.0-$1,463.4

Divided by: Units Outstanding100.7-100.7

Implied Unit Value$15.48-$14.54

DCF Sensitivity

Discount Rate 8.78%9.28%9.78%

Terminal EBITDA Multiple 10.0x 10.5x11.0x10.0x10.5x11.0x10.0x10.5x11.0x

Terminal EBITDA $ 1,878.4 $1,878.4$1,878.4$1,878.4$1,878.4$1,878.4$1,878.4$1,878.4$1,878.4

Terminal Value $ 18,783.6 $19,722.7$20,661.9$18,783.6$19,722.7$20,661.9$18,783.6$19,722.7$20,661.9

PV of Terminal Value $ 12,331.0 $12,947.5$13,564.1$12,051.5$12,654.0$13,256.6$11,779.5$12,368.5$12,957.5

PV of Free Cash Flow (1,893.4) (1,893.4)(1,893.4)(1,905.1)(1,905.1)(1,905.1)(1,916.5)(1,916.5)(1,916.5)

Implied Enterprise Value $ 10,437.6 $11,054.2$11,670.7$10,146.3$10,748.9$11,351.5$9,863.1$10,452.0$11,041.0

Implied Equity Value $ 9,306.8 $9,923.3$10,539.9$9,015.5$9,618.1$10,220.7$8,732.2$9,321.2$9,910.2

CPPL Ownership 15.7% 15.7%15.7%15.7%15.7%15.7%15.7%15.7%15.7%

CPPL Implied Equity Value 1,461.2 1,558.01,654.81,415.41,510.01,604.61,371.01,463.41,555.9

Implied Per Unit Value $ 14.52 $15.48$16.44$14.06$15.00$15.94$13.62$14.54$15.46

Source: Financial Summary provided by CPGX Management.

Jefferies (1) OpCo’s LLC consolidated / October debt, 2016 per Q3 2016E Financial Summary provided by CPGX Management. 23

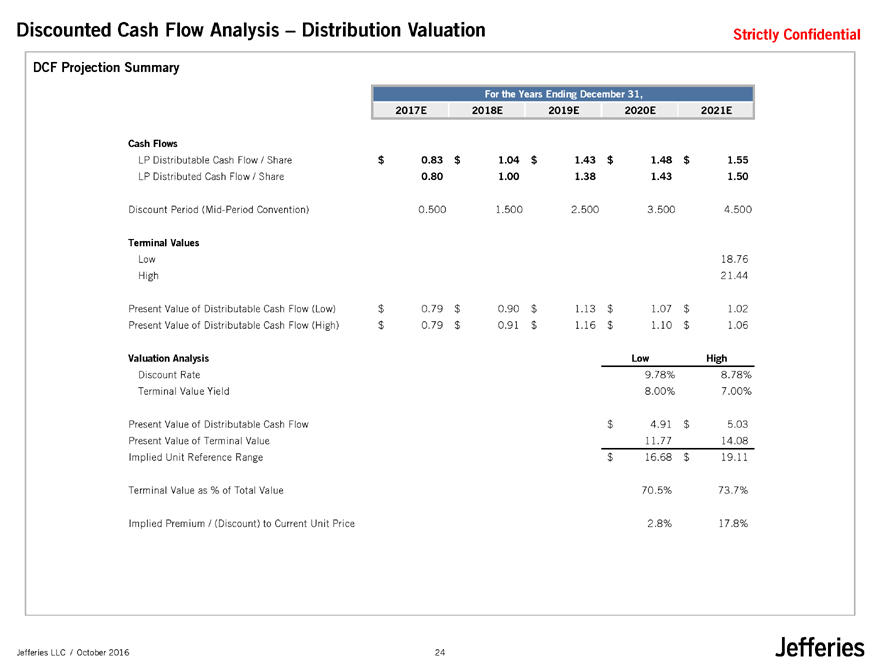

Discounted Cash Flow Analysis – Distribution Valuation

Strictly Confidential

DCF Projection Summary

For the Years Ending December 31,

2017E2018E2019E2020E2021E

Cash Flows

LP Distributable Cash Flow / Share $0.83$1.04$1.43$1.48$1.55

LP Distributed Cash Flow / Share 0.801.001.381.431.50

Discount Period (Mid-Period Convention) 0.5001.5002.5003.5004.500

Terminal Values

Low 18.76

High 21.44

Present Value of Distributable Cash Flow (Low) $0.79$0.90$1.13$1.07$1.02

Present Value of Distributable Cash Flow (High) $0.79$0.91$1.16$1.10$1.06

Valuation Analysis LowHigh

Discount Rate 9.78%8.78%

Terminal Value Yield 8.00%7.00%

Present Value of Distributable Cash Flow $4.91$5.03

Present Value of Terminal Value 11.7714.08

Implied Unit Reference Range $16.68$19.11

Terminal Value as % of Total Value 70.5%73.7%

Implied Premium / (Discount) to Current Unit Price 2.8%17.8%

Jefferies LLC / October 2016 24

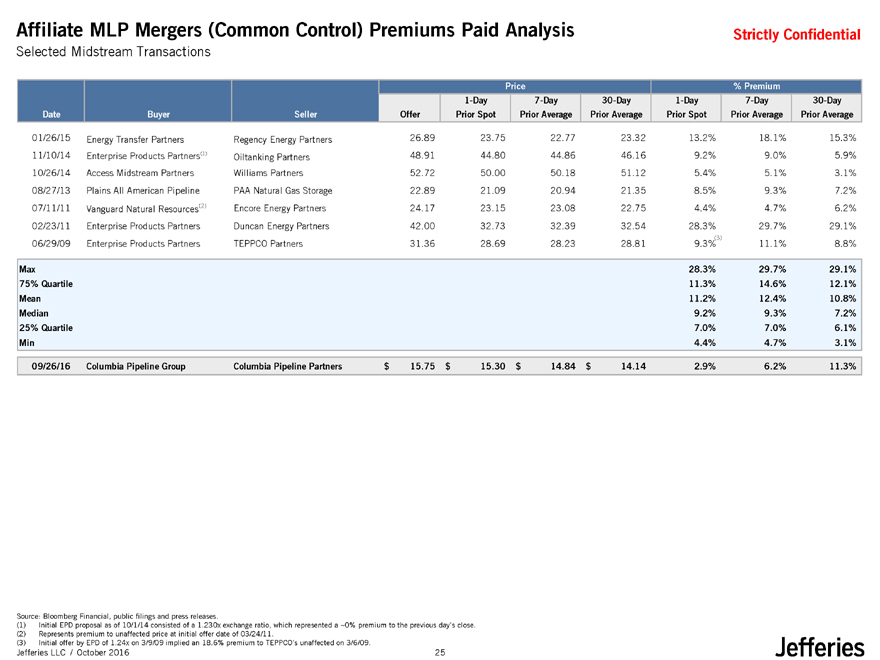

Affiliate MLP Mergers (Common Control) Premiums Paid Analysis

Selected Midstream Transactions

Strictly Confidential

Price% Premium

1-Day7-Day30-Day1-Day7-Day30-Day

Date Buyer SellerOfferPrior SpotPrior AveragePrior AveragePrior SpotPrior AveragePrior Average

01/26/15 Energy Transfer Partners Regency Energy Partners26.8923.7522.7723.3213.2%18.1%15.3%

11/10/14 Enterprise Products Partners(1) Oiltanking Partners48.9144.8044.8646.169.2%9.0%5.9%

10/26/14 Access Midstream Partners Williams Partners52.7250.0050.1851.125.4%5.1%3.1%

08/27/13 Plains All American Pipeline PAA Natural Gas Storage22.8921.0920.9421.358.5%9.3%7.2%

07/11/11 Vanguard Natural Resources(2) Encore Energy Partners24.1723.1523.0822.754.4%4.7%6.2%

02/23/11 Enterprise Products Partners Duncan Energy Partners42.0032.7332.3932.5428.3%29.7%29.1%

06/29/09 Enterprise Products Partners TEPPCO Partners31.3628.6928.2328.819.3%(3)11.1%8.8%

Max 28.3%29.7%29.1%

75% Quartile 11.3%14.6%12.1%

Mean 11.2%12.4%10.8%

Median 9.2%9.3%7.2%

25% Quartile 7.0%7.0%6.1%

Min 4.4%4.7%3.1%

09/26/16 Columbia Pipeline Group Columbia Pipeline Partners$ 15.75$15.30$14.84$ 14.142.9%6.2%11.3%

Source: Bloomberg Financial, public filings and press releases.

(1) Initial EPD proposal as of 10/1/14 consisted of a 1.230x exchange ratio, which represented a ~0% premium to the previous day’s close.

(2) Represents premium to unaffected price at initial offer date of 03/24/11.

(3) Initial offer by EPD of 1.24x on 3/9/09 implied an 18.6% premium to TEPPCO’s unaffected on 3/6/09.

Jefferies LLC / October 2016 25

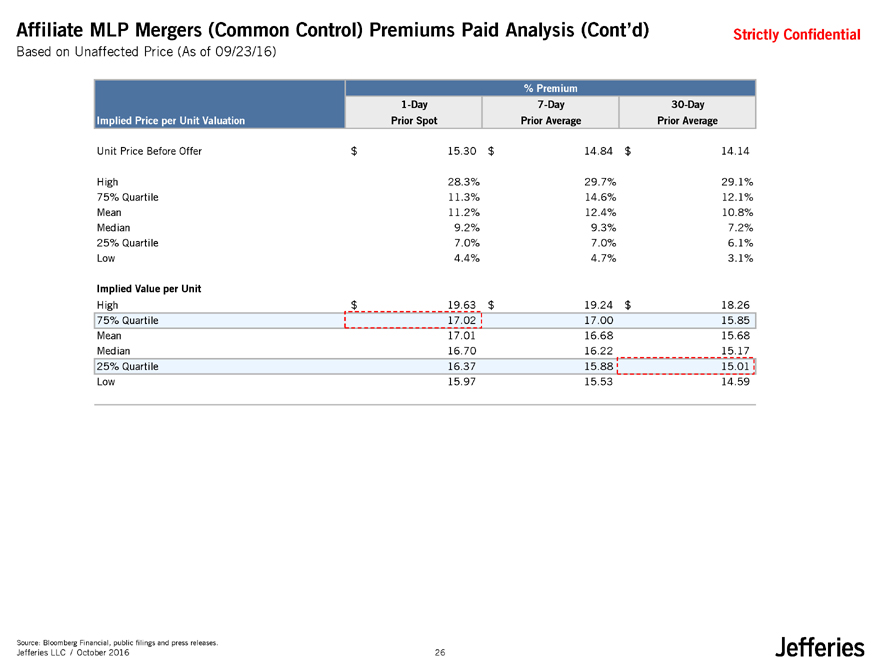

Affiliate MLP Mergers (Common Control) Premiums Paid Analysis (Cont’d)

Based on Unaffected Price (As of 09/23/16)

Strictly Confidential

% Premium

1-Day 7-Day30-Day

Implied Price per Unit Valuation Prior Spot Prior AveragePrior Average

Unit Price Before Offer $15.30$14.84$14.14

High 28.3%29.7%29.1%

75% Quartile 11.3%14.6%12.1%

Mean 11.2%12.4%10.8%

Median 9.2%9.3%7.2%

25% Quartile 7.0%7.0%6.1%

Low 4.4%4.7%3.1%

Implied Value per Unit

High $19.63$19.24$18.26

75% Quartile 17.0217.0015.85

Mean 17.0116.6815.68

Median 16.7016.2215.17

25% Quartile 16.3715.8815.01

Low 15.9715.5314.59

Source: Bloomberg Financial, public filings and press releases.

Jefferies LLC / October 2016 26

Strictly Confidential

Appendix

Jefferies LLC / October 2016 27

Strictly Confidential

Weighted Average Cost of Capital Analyses

Jefferies LLC / October 2016 28

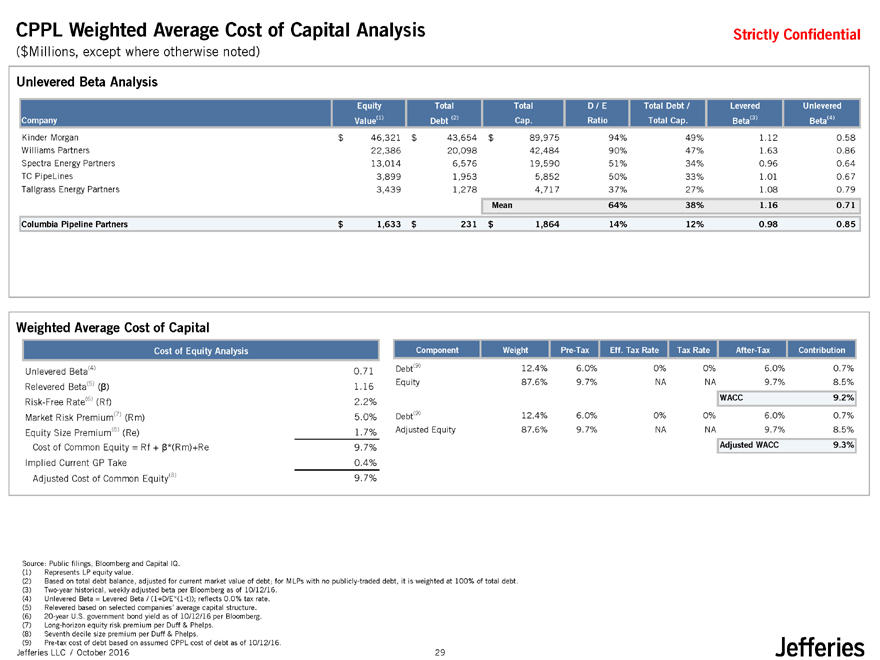

CPPL Weighted Average Cost of Capital Analysis

($Millions, except where otherwise noted)

Strictly Confidential

Unlevered Beta Analysis

Equity TotalTotalD / ETotal Debt /LeveredUnlevered

Company Value(1) Debt (2)Cap.RatioTotal Cap.Beta(3)Beta(4)

Kinder Morgan $ 46,321 $43,654$89,97594%49%1.120.58

Williams Partners 22,386 20,09842,48490%47%1.630.86

Spectra Energy Partners 13,014 6,57619,59051%34%0.960.64

TC PipeLines 3,8991,9535,85250%33%1.010.67

Tallgrass Energy Partners 3,4391,2784,71737%27%1.080.79

Mean64%38%1.160.71

Columbia Pipeline Partners $1,633$231$1,86414%12%0.980.85

Weighted Average Cost of Capital

Cost of Equity Analysis ComponentWeightPre-TaxEff. Tax RateTax RateAfter-TaxContribution

Unlevered Beta(4) 0.71 Debt(9)12.4%6.0%0%0%6.0%0.7%

Relevered Beta(5) (â) 1.16 Equity87.6%9.7%NANA9.7%8.5%

Risk-Free Rate(6) (Rf) 2.2% WACC9.2%

Market Risk Premium(7) (Rm) 5.0% Debt(9)12.4%6.0%0%0%6.0%0.7%

Equity Size Premium(8) (Re) 1.7% Adjusted Equity87.6%9.7%NANA9.7%8.5%

Cost of Common Equity = Rf + â*(Rm)+Re 9.7% Adjusted WACC9.3%

Implied Current GP Take 0.4%

Adjusted Cost of Common Equity(8) 9.7%

Source: Public filings, Bloomberg and Capital IQ. (1) Represents LP equity value.

(2) Based on total debt balance, adjusted for current market value of debt; for MLPs with no publicly-traded debt, it is weighted at 100% of total debt. (3) Two-year historical, weekly adjusted beta per Bloomberg as of 10/12/16.

(4) Unlevered Beta = Levered Beta / (1+D/E*(1-t)); reflects 0.0% tax rate. (5) Relevered based on selected companies’ average capital structure. (6) 20-year U.S. government bond yield as of 10/12/16 per Bloomberg. (7) Long-horizon equity risk premium per Duff & Phelps.

(8) Seventh decile size premium per Duff & Phelps.

(9) Pre-tax cost of debt based on assumed CPPL cost of debt as of 10/12/16.

Jefferies LLC / October 2016 29