Exhibit (c)(4)

Preliminary Draft Analysis Strictly Confidential

Presentation to the Conflicts Committee of the Board of Directors of CPP

GP LLC

October 21, 2016 / Confidential

Jefferies LLC

Member SIPC

Disclaimer

Strictly Confidential

The following pages contain materials provided to the Conflicts Committee of the Board of Directors (the “Committee”) of CPP GP LLC, the general partner of Columbia Pipeline Partners, LP (“CPPL”), by Jefferies LLC (“Jefferies”) in connection with a potential transaction involving CPPL and Columbia Pipeline Group (“CPGX”).

These materials were prepared on a confidential basis in connection with an oral presentation to the Committee and not with a view toward complying with the disclosure standards under state or federal securities laws. These materials are for use of the Committee and may not be used for any other purpose or disclosed to any party without Jefferies’ prior written consent.

The information contained in this presentation is based solely on publicly available information or information furnished to Jefferies by CPGX management. Jefferies has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. These materials are necessarily based on economic, market and other conditions as they exist on, and information made available as of, the date hereof. None of Jefferies, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained herein.

Neither Jefferies nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. These materials are not and should not be construed as a fairness opinion.

Jefferies consents to the use of this presentation by CPPL for purposes of public disclosure in the Schedule13E-3.

Jefferies LLC / October 2016

i

Jefferies

Process Summary Strictly Confidential

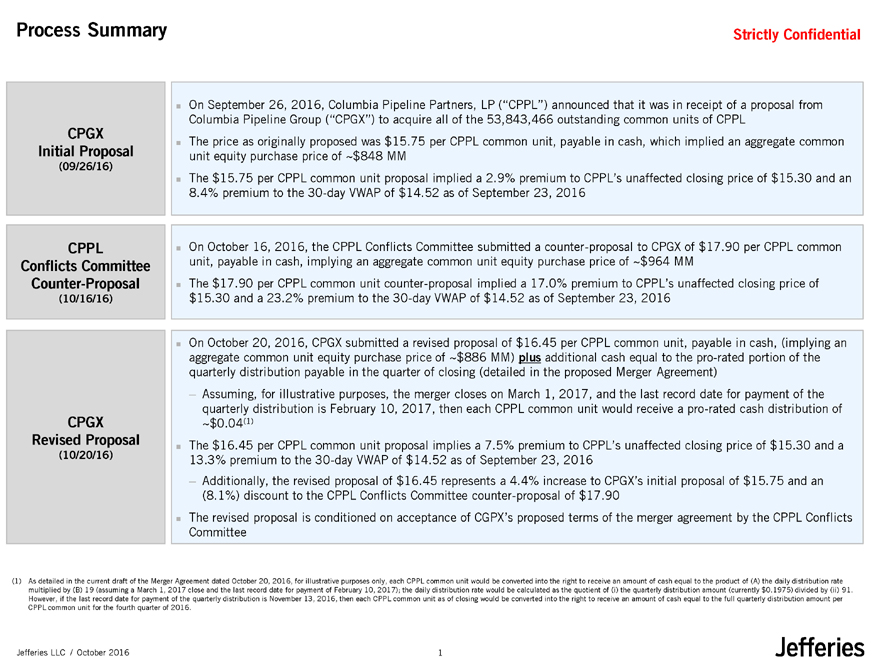

CPGX

Initial Proposal (09/26/16)

CPPL Conflicts Committee Counter-Proposal (10/16/16)

CPGX Revised Proposal (10/20/16)

On September 26, 2016, Columbia Pipeline Partners, LP (“CPPL”) announced that it was in receipt of a proposal from Columbia Pipeline Group (“CPGX”) to acquire all of the 53,843,466 outstanding common units of CPPL

The price as originally proposed was $15.75 per CPPL common unit, payable in cash, which implied an aggregate common

unit equity purchase price of

$848 MM The $15.75 per CPPL common unit proposal implied a 2.9% premium to CPPL’s unaffected closing price of $15.30 and an 8.4% premium to the 30-day VWAP of $14.52 as of September 23, 2016

On October 16, 2016, the CPPL Conflicts Committee submitted a counter-proposal to CPGX of $17.90 per CPPL common unit, payable in cash, implying an aggregate common unit equity purchase price of

$964 MM The $17.90 per CPPL common unit counter-proposal implied a 17.0% premium to CPPL’s unaffected closing price of $15.30 and a 23.2% premium to the 30-day VWAP of $14.52 as of September 23, 2016

On October 20, 2016, CPGX submitted a revised proposal of $16.45 per CPPL common unit, payable in cash, (implying an aggregate common unit equity purchase price of

$886 MM) plus additional cash equal to the pro-rated portion of the quarterly distribution payable in the quarter of closing (detailed in the proposed Merger Agreement) — Assuming, for illustrative purposes, the merger closes on March 1, 2017, and the last record date for payment of the quarterly distribution is February 10, 2017, then each CPPL common unit would receive a pro-rated cash distribution of

$0.04(1) The $16.45 per CPPL common unit proposal implies a 7.5% premium to CPPL’s unaffected closing price of $15.30 and a 13.3% premium to the 30-day VWAP of $14.52 as of September 23, 2016 — Additionally, the revised proposal of $16.45 represents a 4.4% increase to CPGX’s initial proposal of $15.75 and an (8.1%) discount to the CPPL Conflicts Committee counter-proposal of $17.90 The revised proposal is conditioned on acceptance of CGPX’s proposed terms of the merger agreement by the CPPL Conflicts Committee

(1) As detailed in the current draft of the Merger Agreement dated October 20, 2016, for illustrative purposes only, each CPPL common unit would be converted into the right to receive an amount of cash equal to the product of (A) the daily distribution rate multiplied by (B) 19 (assuming a March 1, 2017 close and the last record date for payment of February 10, 2017); the daily distribution rate would be calculated as the quotient of (i) the quarterly distribution amount (currently $0.1975) divided by (ii) 91.

However, if the last record date for payment of the quarterly distribution is November 13, 2016, then each CPPL common unit as of closing would be converted into the right to receive an amount of cash equal to the full quarterly distribution amount per CPPL common unit for the fourth quarter of 2016.

Jefferies LLC / October 2016 1

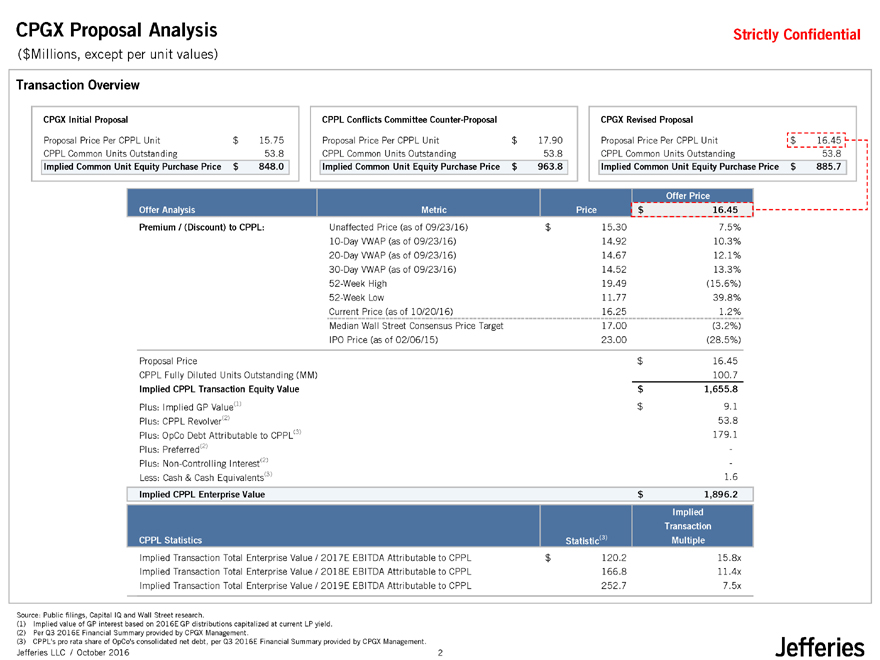

CPGX Proposal Analysis

($Millions, except per unit values)

Strictly Confidential

Transaction Overview

CPGX Initial Proposal

Proposal Price Per CPPL Unit $15.75

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $848.0

CPPL Conflicts Committee Counter-Proposal

Proposal Price Per CPPL Unit $17.90

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $963.8

CPGX Revised Proposal

Proposal Price Per CPPL Unit $16.45

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $885.7

Offer Price

Offer Analysis Metric Price$16.45

Premium / (Discount) to CPPL: Unaffected Price (as of 09/23/16) $15.307.5%

10-Day VWAP (as of 09/23/16) 14.9210.3%

20-Day VWAP (as of 09/23/16) 14.6712.1%

30-Day VWAP (as of 09/23/16) 14.5213.3%

52-Week High 19.49(15.6%)

52-Week Low 11.7739.8%

Current Price (as of 10/20/16) 16.251.2%

Median Wall Street Consensus Price Target 17.00(3.2%)

IPO Price (as of 02/06/15) 23.00(28.5%)

Proposal Price $16.45

CPPL Fully Diluted Units Outstanding (MM) 100.7

Implied CPPL Transaction Equity Value $1,655.8

Plus: Implied GP Value(1) $9.1

Plus: CPPL Revolver(2) 53.8

Plus: OpCo Debt Attributable to CPPL(3) 179.1

Plus: Preferred(2) -

Plus: Non-Controlling Interest(2) -

Less: Cash & Cash Equivalents(3) 1.6

Implied CPPL Enterprise Value $1,896.2

Implied

Transaction

CPPL Statistics Statistic(3) Multiple

Implied Transaction Total Enterprise Value / 2017E EBITDA Attributable to CPPL $120.215.8x

Implied Transaction Total Enterprise Value / 2018E EBITDA Attributable to CPPL 166.811.4x

Implied Transaction Total Enterprise Value / 2019E EBITDA Attributable to CPPL 252.77.5x

Source: Public filings, Capital IQ and Wall Street research.

(1) Implied value of GP interest based on 2016E GP distributions capitalized at current LP yield. (2) Per Q3 2016E Financial Summary provided by CPGX Management.

(3) CPPL’s pro rata share of OpCo’s consolidated net debt, per Q3 2016E Financial Summary provided by CPGX Management.

Jefferies LLC / October 2016 2

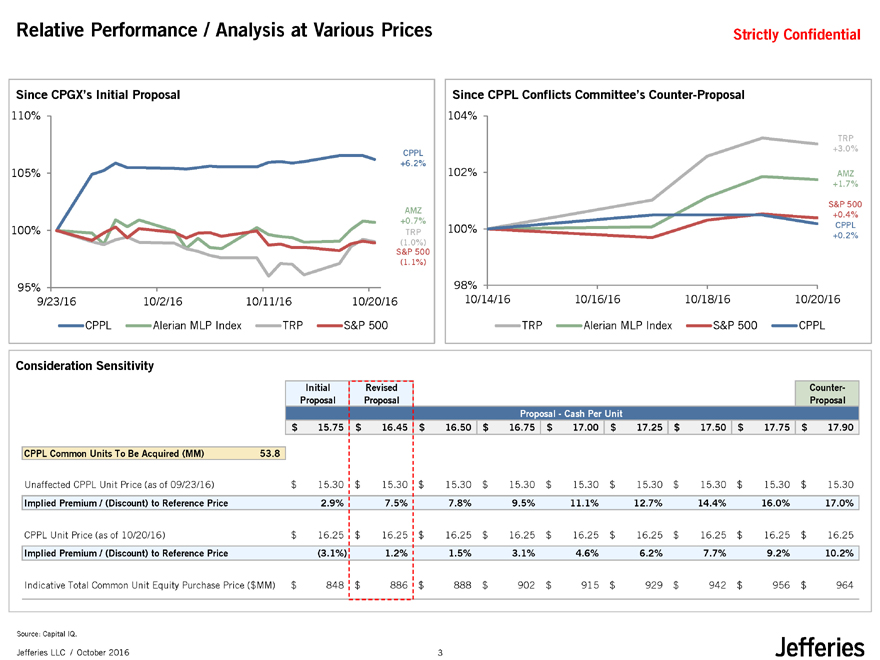

Relative Performance / Analysis at Various Prices

Strictly Confidential

Since CPGX’s Initial Proposal

110%

CPPL

+6.2%

105%

AMZ

+0.7%

100% TRP

(1.0%)

S&P 500

(1.1%)

95%

9/23/16 10/2/16 10/11/1610/20/16

CPPL Alerian MLP Index TRPS&P 500

Since CPPL Conflicts Committee’s Counter-Proposal

104%

TRP

+3.0%

102% AMZ

+1.7%

S&P 500

+0.4%

100% CPPL

+0.2%

98%

10/14/16 10/16/16 10/18/1610/20/16

TRP Alerian MLP Index S&P 500CPPL

Consideration Sensitivity

InitialRevisedCounter-

ProposalProposalProposal

Proposal—Cash Per Unit

$15.75$16.45$16.50$16.75$17.00$17.25$17.50$17.75$17.90

CPPL Common Units To Be Acquired (MM) 53.8

Unaffected CPPL Unit Price (as of 09/23/16) $15.30$15.30$15.30$15.30$15.30$15.30$15.30$15.30$15.30

Implied Premium / (Discount) to Reference Price 2.9%7.5%7.8%9.5%11.1%12.7%14.4%16.0%17.0%

CPPL Unit Price (as of 10/20/16) $16.25$16.25$16.25$16.25$16.25$16.25$16.25$16.25$16.25

Implied Premium / (Discount) to Reference Price (3.1%)1.2%1.5%3.1%4.6%6.2%7.7%9.2%10.2%

Indicative Total Common Unit Equity Purchase Price ($ MM) $848$886$888$902$915$929$942$956$964

Source: Capital IQ.

Jefferies LLC / October 2016 3

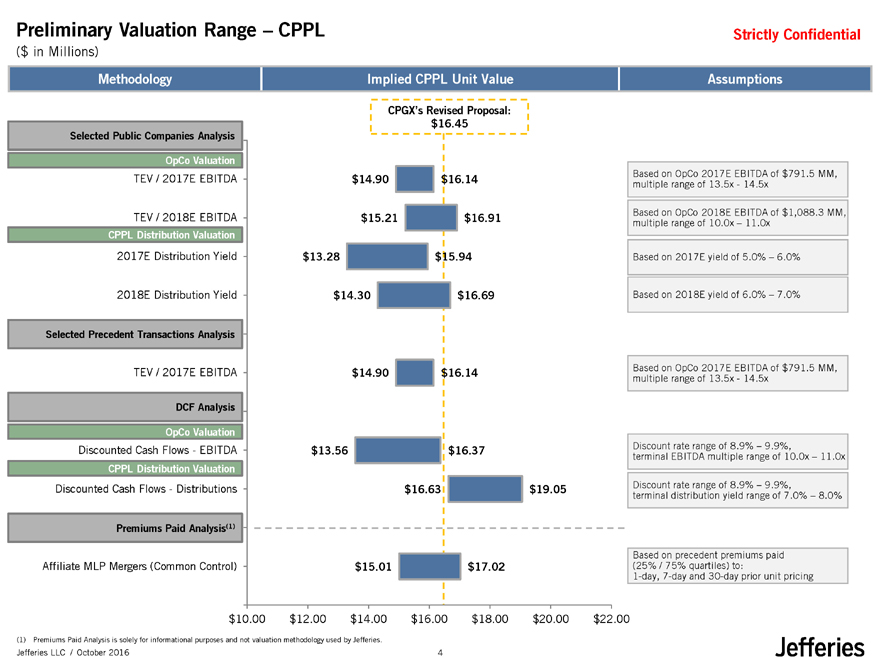

Preliminary Valuation Range – CPPL

($ in Millions)

Strictly Confidential

Methodology

Selected Public Companies Analysis

OpCo Valuation

TEV / 2017E EBITDA

TEV / 2018E EBITDA

CPPL Distribution Valuation

2017E Distribution Yield

2018E Distribution Yield

Selected Precedent Transactions Analysis

TEV / 2017E EBITDA

DCF Analysis

OpCo Valuation

Discounted Cash Flows—EBITDA

CPPL Distribution Valuation

Discounted Cash Flows—Distributions

Premiums Paid Analysis(1)

Affiliate MLP Mergers (Common Control)

Implied CPPL Unit Value

CPGX’s Revised Proposal:

$16.45

$14.90 $16.14

$15.21 $16.91

$13.28 $15.94

$14.30 $16.69

$14.90 $16.14

$13.56 $16.37

$16.63 $19.05

$15.01 $17.02

$10.00 $12.00 $14.00 $16.00 $18.00 $20.00 $22.00

Assumptions

Based on OpCo 2017E EBITDA of $791.5 MM, multiple range of 13.5x—14.5x

Based on OpCo 2018E EBITDA of $1,088.3 MM, multiple range of 10.0x – 11.0x

Based on 2017E yield of 5.0% – 6.0%

Based on 2018E yield of 6.0% – 7.0%

Based on OpCo 2017E EBITDA of $791.5 MM, multiple range of 13.5x—14.5x

Discount rate range of 8.9% – 9.9%, terminal EBITDA multiple range of 10.0x – 11.0x

Discount rate range of 8.9% – 9.9%, terminal distribution yield range of 7.0% – 8.0%

Based on precedent premiums paid (25% / 75% quartiles) to: 1-day, 7-day and 30-day prior unit pricing

(1) Premiums Paid Analysis is solely for informational purposes and not valuation methodology used by Jefferies.

Jefferies LLC / October 2016 4