Exhibit (c)(5)

Preliminary Draft Analysis Strictly Confidential

Presentation to the Conflicts Committee of the Board of Directors of CPP

GP LLC

October 26, 2016 / Confidential

Jefferies LLC

Member SIPC

Disclaimer

Strictly Confidential

The following pages contain materials provided to the Conflicts Committee of the Board of Directors (the “Committee”) of

CPP GP LLC, the general partner of Columbia Pipeline Partners, LP (“CPPL”), by Jefferies LLC (“Jefferies”) in

connection with a potential transaction involving CPPL and Columbia Pipeline Group (“CPGX”).

These materials were prepared on a confidential basis in connection with an oral presentation to the Committee and not with a view toward complying with the disclosure standards under state or federal securities laws. These materials are for use of the Committee and may not be used for any other purpose or disclosed to any party without Jefferies’ prior written consent.

The information contained in this presentation is based solely on publicly available information or information furnished to Jefferies by CPGX management. Jefferies has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. These materials are necessarily based on economic, market and other conditions as they exist on, and information made available as of, the date hereof. None of Jefferies, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained herein.

Neither Jefferies nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. These materials are not and should not be construed as a fairness opinion.

Jefferies consents to the use of this presentation by CPPL for purposes of public disclosure in the Schedule13E-3.

Jefferies LLC / October 2016

i

Jefferies

Process Summary

Strictly Confidential

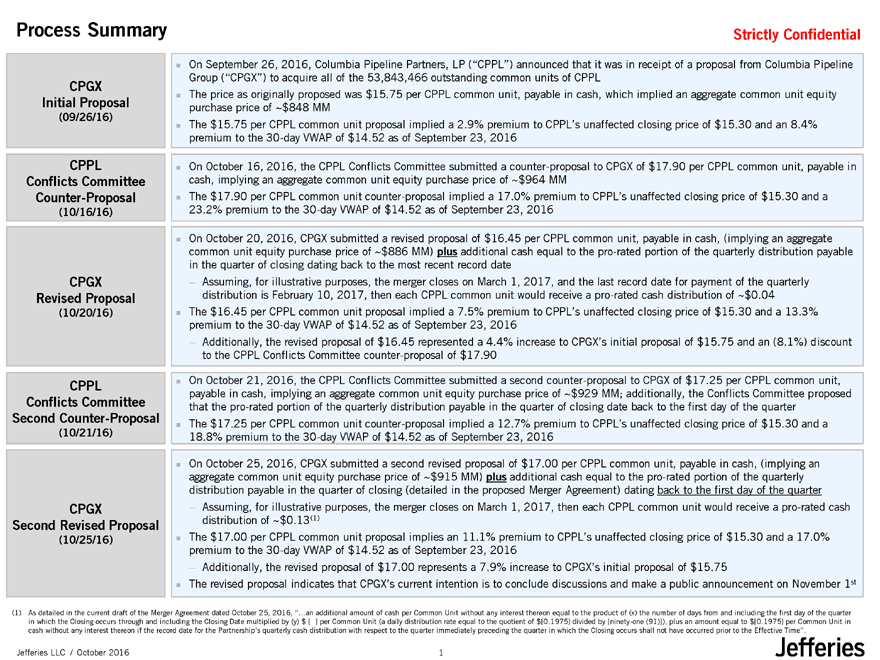

CPGX

Initial Proposal

(09/26/16)

CPPL

Conflicts Committee

Counter-Proposal

(10/16/16)

CPGX

Revised Proposal

(10/20/16)

CPPL

Conflicts Committee

Second Counter-Proposal

(10/21/16)

CPGX

Second Revised Proposal

(10/25/16)

On September 26, 2016, Columbia Pipeline Partners, LP (“CPPL”) announced that it was in receipt of a proposal from Columbia Pipeline

Group (“CPGX”) to acquire all of the 53,843,466 outstanding common units of CPPL

The price as originally proposed was $15.75 per CPPL common unit, payable in cash, which implied an aggregate common unit equity

purchase price of ~$848 MM

The $15.75 per CPPL common unit proposal implied a 2.9% premium to CPPL’s unaffected closing price of $15.30 and an 8.4%

premium to the 30-day VWAP of $14.52 as of September 23, 2016

On October 16, 2016, the CPPL Conflicts Committee submitted a counter-proposal to CPGX of $17.90 per CPPL common unit, payable in

cash, implying an aggregate common unit equity purchase price of ~$964 MM

The $17.90 per CPPL common unit counter-proposal implied a 17.0% premium to CPPL’s unaffected closing price of $15.30 and a

23.2% premium to the 30-day VWAP of $14.52 as of September 23, 2016

On October 20, 2016, CPGX submitted a revised proposal of $16.45 per CPPL common unit, payable in cash, (implying an aggregate

common unit equity purchase price of ~$886 MM) plus additional cash equal to the pro-rated portion of the quarterly distribution payable

in the quarter of closing dating back to the most recent record date

— Assuming, for illustrative purposes, the merger closes on March 1, 2017, and the last record date for payment of the quarterly

distribution is February 10, 2017, then each CPPL common unit would receive a pro-rated cash distribution of ~$0.04

The $16.45 per CPPL common unit proposal implied a 7.5% premium to CPPL’s unaffected closing price of $15.30 and a 13.3%

premium to the 30-day VWAP of $14.52 as of September 23, 2016

— Additionally, the revised proposal of $16.45 represented a 4.4% increase to CPGX’s initial proposal of $15.75 and an (8.1%) discount

to the CPPL Conflicts Committee counter-proposal of $17.90

On October 21, 2016, the CPPL Conflicts Committee submitted a second counter-proposal to CPGX of $17.25 per CPPL common unit,

payable in cash, implying an aggregate common unit equity purchase price of ~$929 MM; additionally, the Conflicts Committee proposed

that the pro-rated portion of the quarterly distribution payable in the quarter of closing date back to the first day of the quarter

The $17.25 per CPPL common unit counter-proposal implied a 12.7% premium to CPPL’s unaffected closing price of $15.30 and a

18.8% premium to the 30-day VWAP of $14.52 as of September 23, 2016

On October 25, 2016, CPGX submitted a second revised proposal of $17.00 per CPPL common unit, payable in cash, (implying an

aggregate common unit equity purchase price of ~$915 MM) plus additional cash equal to the pro-rated portion of the quarterly

distribution payable in the quarter of closing (detailed in the proposed Merger Agreement) dating back to the first day of the quarter

— Assuming, for illustrative purposes, the merger closes on March 1, 2017, then each CPPL common unit would receive a pro-rated cash

distribution of ~$0.13(1)

The $17.00 per CPPL common unit proposal implies an 11.1% premium to CPPL’s unaffected closing price of $15.30 and a 17.0%

premium to the 30-day VWAP of $14.52 as of September 23, 2016

— Additionally, the revised proposal of $17.00 represents a 7.9% increase to CPGX’s initial proposal of $15.75

The revised proposal indicates that CPGX’s current intention is to conclude discussions and make a public announcement on November 1st

(1) As detailed in the current draft of the Merger Agreement dated October 25, 2016, “…an additional amount of cash per Common Unit without any interest thereon equal to the product of (x) the number of days from and including the first day of the quarter in which the Closing occurs through and including the Closing Date multiplied by (y) $ [ ] per Common Unit (a daily distribution rate equal to the quotient of $[0.1975] divided by [ninety-one (91)]), plus an amount equal to $[0.1975] per Common Unit in cash without any interest thereon if the record date for the Partnership’s quarterly cash distribution with respect to the quarter immediately preceding the quarter in which the Closing occurs shall not have occurred prior to the Effective Time”.

Jefferies LLC / October 2016 1

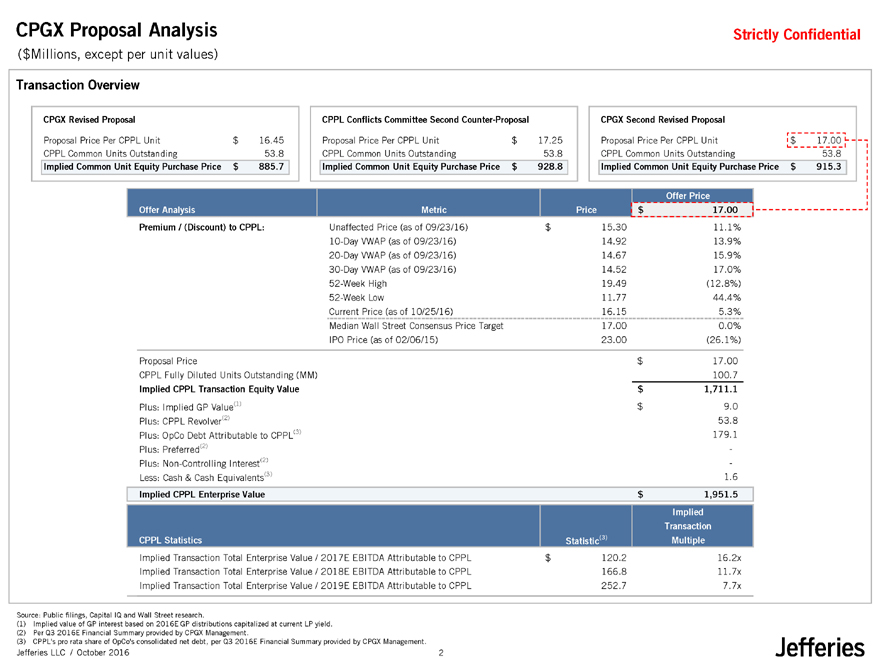

CPGX Proposal Analysis

($Millions, except per unit values)

Strictly Confidential

Transaction Overview

CPGX Revised Proposal

Proposal Price Per CPPL Unit $16.45

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $885.7

CPPL Conflicts Committee Second Counter-Proposal

Proposal Price Per CPPL Unit $17.25

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $928.8

CPGX Second Revised Proposal

Proposal Price Per CPPL Unit $17.00

CPPL Common Units Outstanding 53.8

Implied Common Unit Equity Purchase Price $915.3

Offer Price

Offer Analysis Metric Price$17.00

Premium / (Discount) to CPPL: Unaffected Price (as of 09/23/16) $15.3011.1%

10-Day VWAP (as of 09/23/16) 14.9213.9%

20-Day VWAP (as of 09/23/16) 14.6715.9%

30-Day VWAP (as of 09/23/16) 14.5217.0%

52-Week High 19.49(12.8%)

52-Week Low 11.7744.4%

Current Price (as of 10/25/16) 16.155.3%

Median Wall Street Consensus Price Target 17.000.0%

IPO Price (as of 02/06/15) 23.00(26.1%)

Proposal Price $17.00

CPPL Fully Diluted Units Outstanding (MM) 100.7

Implied CPPL Transaction Equity Value $1,711.1

Plus: Implied GP Value(1) $9.0

Plus: CPPL Revolver(2) 53.8

Plus: OpCo Debt Attributable to CPPL(3) 179.1

Plus: Preferred(2) -

Plus: Non-Controlling Interest(2) -

Less: Cash & Cash Equivalents(3) 1.6

Implied CPPL Enterprise Value $1,951.5

Implied

Transaction

CPPL Statistics Statistic(3)Multiple

Implied Transaction Total Enterprise Value / 2017E EBITDA Attributable to CPPL $120.216.2x

Implied Transaction Total Enterprise Value / 2018E EBITDA Attributable to CPPL 166.811.7x

Implied Transaction Total Enterprise Value / 2019E EBITDA Attributable to CPPL 252.77.7x

Source: Public filings, Capital IQ and Wall Street research.

(1) Implied value of GP interest based on 2016E GP distributions capitalized at current LP yield. (2) Per Q3 2016E Financial Summary provided by CPGX Management.

(3) CPPL’s pro rata share of OpCo’s consolidated net debt, per Q3 2016E Financial Summary provided by CPGX Management.

Jefferies LLC / October 2016 2

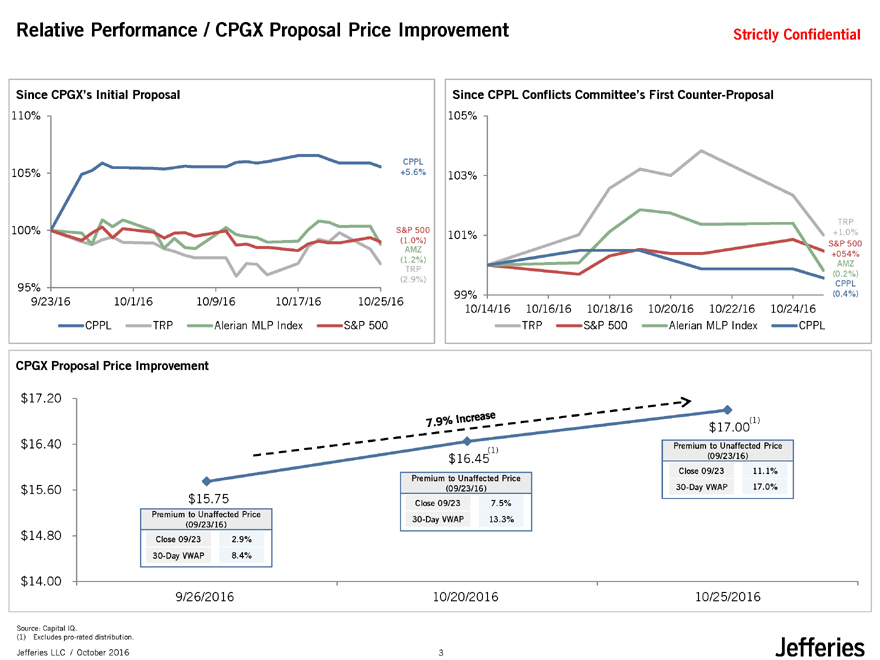

Relative Performance / CPGX Proposal Price Improvement

Strictly Confidential

Since CPGX’s Initial Proposal

110%

CPPL

105% +5.6%

100% S&P 500

(1.0%)

AMZ

(1.2%)

TRP

(2.9%)

95%

9/23/16 10/1/16 10/9/1610/17/1610/25/16

CPPL TRP Alerian MLP IndexS&P 500

Since CPPL Conflicts Committee’s First Counter-Proposal

105%

103%

TRP

101% +1.0%

S&P 500

+054%

AMZ

(0.2%)

CPPL

99% (0.4%)

10/14/16 10/16/16 10/18/1610/20/16 10/22/1610/24/16

TRP S&P 500Alerian MLP IndexCPPL

CPGX Proposal Price Improvement

$ 17.20

$17.00(1)

$ 16.40 Premium to Unaffected Price

$16.45(1)(09/23/16)

Close 09/2311.1%

Premium to Unaffected Price

$ 15.60 (09/23/16)30-Day VWAP17.0%

$15.75Close 09/237.5%

Premium to Unaffected Price30-Day VWAP13.3%

(09/23/16)

$ 14.80 Close 09/232.9%

30-Day VWAP8.4%

$ 14.00

9/26/201610/20/201610/25/2016

Source: Capital IQ.

(1) Excludes pro-rated distribution.

Jefferies LLC / October 2016 3

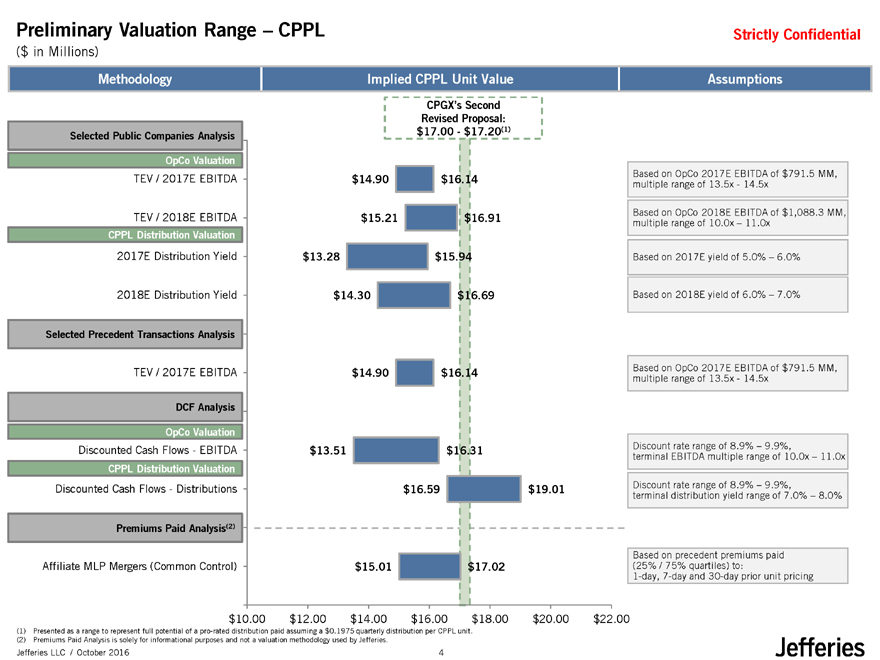

Preliminary Valuation Range – CPPL

($ in Millions)

Strictly Confidential

Methodology

Selected Public Companies Analysis

OpCo Valuation

TEV / 2017E EBITDA

TEV / 2018E EBITDA

CPPL Distribution Valuation

2017E Distribution Yield

2018E Distribution Yield

Selected Precedent Transactions Analysis

TEV / 2017E EBITDA

DCF Analysis

OpCo Valuation

Discounted Cash Flows—EBITDA

CPPL Distribution Valuation

Discounted Cash Flows—Distributions

Premiums Paid Analysis(2)

Affiliate MLP Mergers (Common Control)

Implied CPPL Unit Value

CPGX’s Second

Revised Proposal:

$17.00—$17.20(1)

$14.90 $16.14

$15.21 $16.91

$13.28 $15.94

$14.30 $16.69

$14.90 $16.14

$13.51 $16.31

$16.59 $19.01

$15.01 $17.02

Assumptions

Based on OpCo 2017E EBITDA of $791.5 MM, multiple range of 13.5x—14.5x

Based on OpCo 2018E EBITDA of $1,088.3 MM, multiple range of 10.0x – 11.0x

Based on 2017E yield of 5.0% – 6.0%

Based on 2018E yield of 6.0% – 7.0%

Based on OpCo 2017E EBITDA of $791.5 MM, multiple range of 13.5x—14.5x

Discount rate range of 8.9% – 9.9%, terminal EBITDA multiple range of 10.0x – 11.0x

Discount rate range of 8.9% – 9.9%, terminal distribution yield range of 7.0% – 8.0%

Based on precedent premiums paid (25% / 75% quartiles) to: 1-day, 7-day and 30-day prior unit pricing

$10.00 $12.00 $14.00 $16.00 $18.00 $20.00 $22.00

(1) Presented as a range to represent full potential of a pro-rated distribution paid assuming a $0.1975 quarterly distribution per CPPL unit. (2) Premiums Paid Analysis is solely for informational purposes and not a valuation methodology used by Jefferies.

Jefferies LLC / October 2016 4