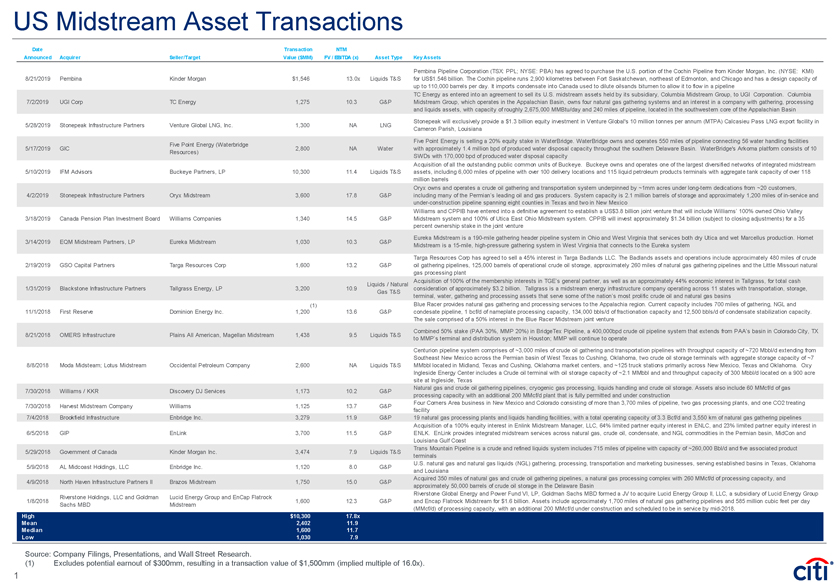

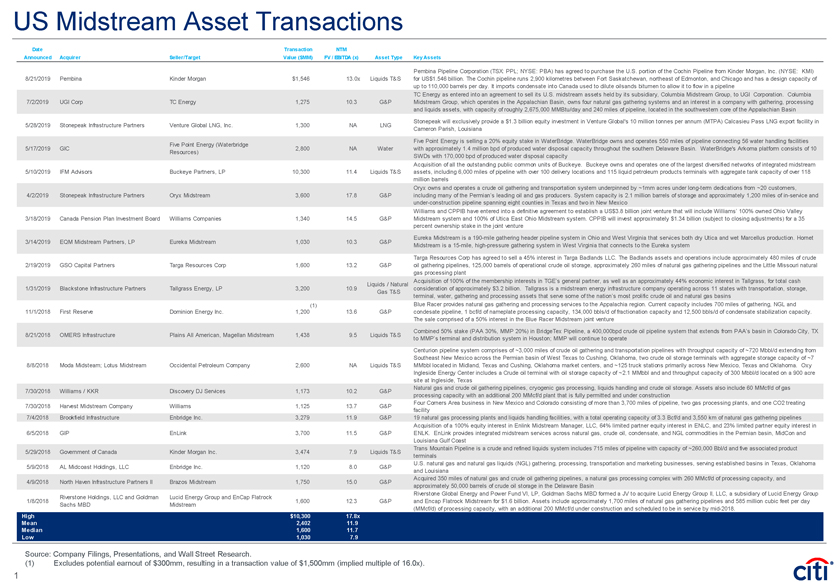

US Midstream Asset Transactions Date Transaction NTM Announced Acquirer Seller/Target Value ($MM) FV / EBITDA (x) Asset Type Key Assets Pembina Pipeline Corporation (TSX: PPL; NYSE: PBA) has agreed to purchase the U.S. portion of the Cochin Pipeline from Kinder Morgan, Inc. (NYSE: KMI) 8/21/2019 Pembina Kinder Morgan $1,546 13.0x Liquids T&S for US$1.546 billion. The Cochin pipeline runs 2,900 kilometres between Fort Saskatchewan, northeast of Edmonton, and Chicago and has a design capacity of up to 110,000 barrels per day. It imports condensate into Canada used to dilute oilsands bitumen to allow it to flow in a pipeline TC Energy as entered into an agreement to sell its U.S. midstream assets held by its subsidiary, Columbia Midstream Group, to UGI Corporation. Columbia 7/2/2019 UGI Corp TC Energy 1,275 10.3 G&P Midstream Group, which operates in the Appalachian Basin, owns four natural gas gathering systems and an interest in a company with gathering, processing and liquids assets, with capacity of roughly 2,675,000 MMBtu/day and 240 miles of pipeline, located in the southwestern core of the Appalachian Basin Stonepeak will exclusively provide a $1.3 billion equity investment in Venture Global’s 10 million tonnes per annum (MTPA) Calcasieu Pass LNG export facility in 5/28/2019 Stonepeak Infrastructure Partners Venture Global LNG, Inc. 1,300 NA LNG Cameron Parish, Louisiana Five Point Energy is selling a 20% equity stake in WaterBridge. WaterBridge owns and operates 550 miles of pipeline connecting 56 water handling facilities Five Point Energy (Waterbridge 5/17/2019 GIC 2,800 NA Water with approximately 1.4 million bpd of produced water disposal capacity throughout the southern Delaware Basin. WaterBridge’s Arkoma platform consists of 10 Resources) SWDs with 170,000 bpd of produced water disposal capacity Acquisition of all the outstanding public common units of Buckeye. Buckeye owns and operates one of the largest diversified networks of integrated midstream 5/10/2019 IFM Advisors Buckeye Partners, LP 10,300 11.4 Liquids T&S assets, including 6,000 miles of pipeline with over 100 delivery locations and 115 liquid petroleum products terminals with aggregate tank capacity of over 118 million barrels Oryx owns and operates a crude oil gathering and transportation system underpinned by ~1mm acres under long-term dedications from ~20 customers, 4/2/2019 Stonepeak Infrastructure Partners Oryx Midstream 3,600 17.8 G&P including many of the Permian’s leading oil and gas producers. System capacity is 2.1 million barrels of storage and approximately 1,200 miles ofin-service and under-construction pipeline spanning eight counties in Texas and two in New Mexico Williams and CPPIB have entered into a definitive agreement to establish a US$3.8 billion joint venture that will include Williams’ 100% owned Ohio Valley 3/18/2019 Canada Pension Plan Investment Board Williams Companies 1,340 14.5 G&P Midstream system and 100% of Utica East Ohio Midstream system. CPPIB will invest approximately $1.34 billion (subject to closing adjustments) for a 35 percent ownership stake in the joint venture Eureka Midstream is a190-mile gathering header pipeline system in Ohio and West Virginia that services both dry Utica and wet Marcellus production. Hornet 3/14/2019 EQM Midstream Partners, LP Eureka Midstream 1,030 10.3 G&P Midstream is a15-mile, high-pressure gathering system in West Virginia that connects to the Eureka system Targa Resources Corp has agreed to sell a 45% interest in Targa Badlands LLC. The Badlands assets and operations include approximately 480 miles of crude 2/19/2019 GSO Capital Partners Targa Resources Corp 1,600 13.2 G&P oil gathering pipelines, 125,000 barrels of operational crude oil storage, approximately 260 miles of natural gas gathering pipelines and the Little Missouri natural gas processing plant Acquisition of 100% of the membership interests in TGE’s general partner, as well as an approximately 44% economic interest in Tallgrass, for total cash Liquids / Natural 1/31/2019 Blackstone Infrastructure Partners Tallgrass Energy, LP 3,200 10.9 consideration of approximately $3.2 billion. Tallgrass is a midstream energy infrastructure company operating across 11 states with transportation, storage, Gas T&S terminal, water, gathering and processing assets that serve some of the nation’s most prolific crude oil and natural gas basins (1) Blue Racer provides natural gas gathering and processing services to the Appalachia region. Current capacity includes 700 miles of gathering, NGL and 11/1/2018 First Reserve Dominion Energy Inc. 1,200 13.6 G&P condesate pipeline, 1 bcf/d of nameplate processing capacity, 134,000 bbls/d of fractionation capacity and 12,500 bbls/d of condensate stabilization capacity. The sale comprised of a 50% interest in the Blue Racer Midstream joint venture Combined 50% stake (PAA 30%, MMP 20%) in BridgeTex Pipeline, a 400,000bpd crude oil pipeline system that extends from PAA’s basin in Colorado City, TX 8/21/2018 OMERS Infrastructure Plains All American, Magellan Midstream 1,438 9.5 Liquids T&S to MMP’s terminal and distribution system in Houston; MMP will continue to operate Centurion pipeline system comprises of ~3,000 miles of crude oil gathering and transportation pipelines with throughput capacity of ~720 Mbbl/d extending from Southeast New Mexico across the Permian basin of West Texas to Cushing, Oklahoma, two crude oil storage terminals with aggregate storage capacity of ~7 8/8/2018 Moda Midsteam; Lotus Midstream Occidental Petroleum Company 2,600 NA Liquids T&S MMbbl located in Midland, Texas and Cushing, Oklahoma market centers, and ~125 truck stations primarily across New Mexico, Texas and Oklahoma. Oxy Ingleside Energy Center includes a Crude oil terminal with oil storage capacity of ~2.1 MMbbl and and throughput capacity of 300 Mbbl/d located on a 900 acre site at Ingleside, Texas Natural gas and crude oil gathering pipelines, cryogenic gas processing, liquids handling and crude oil storage. Assets also include 60 MMcf/d of gas 7/30/2018 Williams / KKR Discovery DJ Services 1,173 10.2 G&P processing capacity with an additional 200 MMcf/d plant that is fully permitted and under construction Four Corners Area business in New Mexico and Colorado consisting of more than 3,700 miles of pipeline, two gas processing plants, and one CO2 treating 7/30/2018 Harvest Midstream Company Williams 1,125 13.7 G&P facility 7/4/2018 Brookfield Infrastructure Enbridge Inc. 3,279 11.9 G&P 19 natural gas processing plants and liquids handling facilities, with a total operating capacity of 3.3 Bcf/d and 3,550 km of natural gas gathering pipelines Acquisition of a 100% equity interest in Enlink Midstream Manager, LLC, 64% limited partner equity interest in ENLC, and 23% limited partner equity interest in 6/5/2018 GIP EnLink 3,700 11.5 G&P ENLK. EnLink provides integrated midstream services across natural gas, crude oil, condensate, and NGL commodities in the Permian basin, MidCon and Louisiana Gulf Coast Trans Mountain Pipeline is a crude and refined liquids system includes 715 miles of pipeline with capacity of ~260,000 Bbl/d and five associated product 5/29/2018 Government of Canada Kinder Morgan Inc. 3,474 7.9 Liquids T&S terminals U.S. natural gas and natural gas liquids (NGL) gathering, processing, transportation and marketing businesses, serving established basins in Texas, Oklahoma 5/9/2018 AL Midcoast Holdings, LLC Enbridge Inc. 1,120 8.0 G&P and Louisiana Acquired 350 miles of natural gas and crude oil gathering pipelines, a natural gas processing complex with 260 MMcf/d of processing capacity, and 4/9/2018 North Haven Infrastructure Partners II Brazos Midstream 1,750 15.0 G&P approximately 50,000 barrels of crude oil storage in the Delaware Basin Riverstone Global Energy and Power Fund VI, LP, Goldman Sachs MBD formed a JV to acquire Lucid Energy Group II, LLC, a subsidiary of Lucid Energy Group Riverstone Holdings, LLC and Goldman Lucid Energy Group and EnCap Flatrock 1/8/2018 1,600 12.3 G&P and Encap Flatrock Midstream for $1.6 billion. Assets include approximately 1,700 miles of natural gas gathering pipelines and 585 million cubic feet per day Sachs MBD Midstream (MMcf/d) of processing capacity, with an additional 200 MMcf/d under construction and scheduled to be in service bymid-2018. High $10,300 17.8x Mean 2,402 11.9 Median 1,600 11.7 Low 1,030 7.9 Source: Company Filings, Presentations, and Wall Street Research. (1) Excludes potential earnout of $300mm, resulting in a transaction value of $1,500mm (implied multiple of 16.0x). 1