UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23059

CLOUGH FUNDS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

303.623.2577

(Registrant’s telephone number, including area code)

Abigail J. Murray, Secretary

Clough Funds Trust

1290 Broadway, Suite 1100

Denver, CO 80203

(Name and address of agent for service)

Date of fiscal year end: October 31

Date of reporting period: November 1, 2015 – April 30, 2016

Item 1. Report to Stockholders.

| Clough Global Long/Short Fund | Table of Contents |

| Shareholder Letter | | 2 |

| Portfolio Allocation | | 6 |

| Disclosure of Fund Expenses | | 8 |

| Statement of Investments | | 9 |

| Statement of Assets and Liabilities | | 14 |

| Statement of Operations | | 15 |

| Statement of Changes in Net Assets | | 16 |

| Financial Highlights | | 17 |

| Notes to Financial Statements | | 20 |

| Additional Information | | 29 |

| Clough Global Long/Short Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

Dear Shareholders:

The six month period ending April 30th proved to be a difficult period for the Clough Global Long/Short Fund (the “Fund”). Several important long holdings declined at the same time some of our short positions rallied against us. On a sector basis energy was the most profitable theme. These gains were offset by declines in bank stocks, which fell in response to flattening yield curves and the negative interest rate regimes established by central banks in Japan and Europe. At the same time a rally in so-called risk assets carried several of our emerging market bank shorts higher. We think all of these trends are unsustainable and the portfolio is well positioned as these trends unwind and stock prices respond to fundamental reality.

Among individual stocks our most profitable holdings were made up of crude oil producers with strong low cost reserve assets, including WPX Energy, Sanchez Energy Corp and Continental Resources. Many of these investments were established in the first quarter as it became obvious to us that crude oil was entering an up cycle which could last several years. Stocks that moved against us included Restoration Hardware, an upscale furniture retailer, two financial companies, MGIC Investment Corp., Citigroup; and as noted above, short positions in two Brazilian banks, Banco Bradesco SA and Itau Unibanco Holding.

It has been widely noted that the beginning of 2016 was very challenging for active managers and particularly for long/short strategies. The purpose of this letter is to describe our strategies going forward.

The portfolio today is invested across a wide number of strategies. These include investments in companies generating high levels of free cash flow, deep value stocks such as U.S. financials, healthcare and Asian consumer companies. In recent months we increased exposure in both the energy sector and in companies we see as beneficiaries of a global semiconductor capital investment cycle. Our investment case for each follows.

Cash Flow: Cable Broadband

A key component of our investment search process sifts for durable businesses with recurring revenues and strong defenses against price competition. We also demand they generate high free cash flow yields and be able to reinvest that free cash at high reinvestment rates, creating so-called “compounders.” Compounding free cash flow invested at high rates of return indicates growing value in the business. Today over 6% of the Fund’s long portfolio is invested either directly or indirectly in broadband connectivity through both cable and satellite providers.

Cable broadband is becoming for all intents and purposes an oligopoly and company economics have improved dramatically now that the industry has consolidated into fewer players. Consolidation not only supports pricing power, but also provides leverage in negotiations with content suppliers. For example, we believe the merger of Charter Communications and Time Warner Cable will not only offer tremendous cost synergies, but will also likely allow Charter to benefit from Time Warner’s more favorable deals with content suppliers. The Fund’s three largest current holdings in the cable broadband space are Comcast Corp., ViaSat Inc., and Liberty Broadband, which is essentially Charter at a discount as Liberty holds a large investment in Charter.

We think the stocks will sell at higher valuations than they do today. They have been held back by fears that direct to consumer video services and “cord cutting” will erode revenues as subscribers try to reduce spending by paying only for what they want to watch. Millennials in particular are heavy users of both mobile and internet services and they are most likely to live in broadband-only homes. For companies like Comcast and Charter, this is an important positive. Streaming services require Internet service, which is where the cable companies dominate. Cable companies also offer a pricing advantage by offering triple-play services (video-cable-voice) at a discount to a combination of products sourced from standalone competitors. Comcast currently generates a 6–7% free cash flow yield, and we think that cash flow yield will increase, particularly as their major capital spending cycle peaks.

Energy

In an industry which has a cyclical component, we try to assess when investment capacity has collapsed to an extent its ability to maintain supplies has fallen behind demand levels. In the energy industry that happened in a remarkably short time, and for those companies with sustainable balance sheets and low cost reserves, returns are bottoming. The oil rig count is down 78% from its peak. Shale oil production is finally declining and we think it is unlikely it can be stabilized at current levels; the rig count is simply too low. U.S. crude production is down 6% since peaking in June of 2015, and that downturn is accelerating.

It was thought earlier that recovery in crude prices would quickly result in shale oil production startups, but that is no longer possible for two reasons. Banks and other providers of funding for speculative drilling ventures are nursing too many non-performing loans to continue lending. Loan defaults force lenders to refuse funding unprofitable drillers. The net debt of publicly listed oil and gas companies has tripled over the past decade to $549 billion and that excludes state-owned companies, according to a Wall Street Journal report.

In addition, many operators have laid down the majority of their rigs and let crews migrate away from the major oil producing areas. U.S. oil production is falling at an annual rate of 100 million barrels per day. According to a recent Merrill Lynch study, oil would have to sell $10 per barrel higher (over $60) to allow new drilling ventures and rebuild crews. Even $40–50 oil leaves producers cash-constrained unless they are sitting on the most productive fields.

Our investments in this area are focused on a select group of producers with low cost reserves that provide lifting costs of $10–20 per barrel and strong balance sheets, which we believe allows them to be profitable at the current price of oil. These investments are currently offset by short positions in offshore drillers where the outlook is not as attractive.

| Clough Global Long/Short Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

Healthcare

We have invested a tremendous amount of research to make sure we understand the underlying trends in healthcare spending and profitability, and we believe the selloff in the sector during the first quarter—though difficult in the short term—offers tremendous opportunities today. As is often the case when a sector falls out of favor, good companies are thrown out with the bad. A number of strong biotech franchises are selling at low-teens multiples of growing earnings streams and at a significant discount to the market multiple. With the end of the practice of so-called “foreign tax inversions,” we suspect U.S. pharmaceutical companies will once again turn to domestic biotech and specialty pharmaceutical franchises to build product depth. Not only do we see valuable franchises selling at their lowest valuations in years, but we also expect merger and acquisition activity in health care to be robust in the coming months.

North American Capital Market Banks

JP Morgan, Citigroup, and Bank of America have been long-term Fund holdings. From time to time they have been pair traded with short positions in European banks which lack capital strength and have been forced to shrink their market exposure. As credit concerns rose in January–February, the stocks, which were already selling at a 40% discount to the market and discounts to tangible book, sold off indiscriminately. However, we think the industry’s dynamics have secularly changed for the better and profitability is becoming more stable. The major banks have reported first quarter results which suffered from weak capital market activities and a flat yield curve. In other words, the operating environment could not be worse and we saw what bedrock earnings look like in the quarter.

Their earnings reports were impressive. Major U.S. banks gained market share, added further to excess capital, further cut costs, and most importantly from our perspective, grew their consumer and mortgage books. In some instances, earnings from those sectors grew at double digit rates. We think the existence of many community and regional banks will come into question. Their branch networks are very costly and we do not believe they have the resources to invest in the technologies necessary to achieve scale. The large banks have important competitive strength, particularly in the mortgage origination and credit card businesses.

The credit card portfolio is the top asset for a U.S. bank today and the issuer has the greatest chance to grow revenues in an internet banking world. Bank of America and JP Morgan Chase dominate this business and enjoy mid to high single digit revenue growth in their credit card businesses. Bank of America issued 1.2 million new cards in the first quarter alone. That bank in particular has a unique opportunity to reduce costs: its efficiency ratio of 73% is higher than the high 50s sported by Citigroup and JP Morgan making reducing it a key management objective.

In international banking, Citi is the last man standing. Virtually every major foreign competitive institution is being forced to shrink its market exposure due to capital shortfalls. Its valuable assets include Banamex, Mexico’s second largest bank and a major consumer lender. Only 44% of Mexicans have a bank account and the Mexican government is promoting efforts to bring more of its citizens into the formal financial network.

So far the market refuses to recognize how rapidly excess capital (over Basel requirements) has been growing for the major banks. For example, in a recent analyst presentation Bank of America noted that it had written off or paid in fines and fees in excess of $180 billion since 2011, an amount greater than its total market capitalization today. Yet at year end 2014, the company reported $22 billion in excess capital, a testament to how profitable the underlying bank has become. We suspect it is substantially higher today.

We have stepped up our long U.S./short European bank trade now that both legs seem to be working. Non-performing loans in Europe’s banks have risen from 2.6% in 2008 to 6.3% in 2015, according to the European Central Bank (ECB). Doubtful loans in Italian banks at 400 billion Euros are 15% of total loans and credits. We think there is zero equity in many of these institutions and the fact that bondholders have been tagged for losses makes new capital hesitant. We think the market may come to the same conclusion as we have.

A New Semiconductor Capital Investment Cycle Centered on China

We believe China builds too much capacity everywhere. In steel, coal, aluminum, retailing, any number of sectors, particularly if state-owned enterprises (SOEs) get involved, capital is destroyed. However, these investment cycles can be very profitable for global suppliers. For example, the commodities boom that continued for over a decade proved immensely profitable not only for iron ore producers, but also for the industry’s equipment suppliers. Now investment will move to semiconductors.

Sixty percent of the world’s semiconductors are used in China, yet China manufactures only 10–15% of them. China now imports more semiconductor chips than crude oil and semiconductor logic and memory chips are considered a strategic asset.

3D NAND flash is a type of flash memory that stacks memory cells on top of each other. This is a secular driver of growth in semiconductors. We fell this capability in NAND is critical and China is about to try to build it. This appears to be a multi-year cycle. We believe that Lam Research is particularly well-positioned to receive a significant market share of the orders.

| Semi-Annual Report | April 30, 2016 | 3 |

| Clough Global Long/Short Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

China has tried to buy technology through acquisition but was often thwarted by the target’s government. Tsinghua’s bid for Micron Technologies was the most prominent example of that, but now China has broken ground on a new fabrication plant and projects to spend $25 billion over four years to manufacture NAND. These are difficult technologies. Taiwanese manufacturers invested $11 billion in 2007 for a similar facility but failed. Samsung is currently the world leader in the technology.

The Fund currently has an investment in Lam Research, an equipment manufacturer with leadership in the manufacturing of equipment for 3D NAND. The company has been growing by gaining share in a flat market, but we believe that China’s entry will accelerate the company’s growth substantially. Valuation is very attractive with its stock selling for 11x earnings, possessing a highly liquid balance sheet, and 15% top line growth.

The Fund’s Non-U.S. Exposure is Still Concentrated in Asia

Given the performance of emerging market investing in recent years, one might question what the opportunity is. Most emerging markets have provided nothing but headwinds for well-known and often reported reasons. On the other hand, markets in both Europe and Japan have attracted substantial interest from investors who believe that active central banks would support those markets. But even those markets have disappointed; in Europe because the banks were never cleared of bad debt and in Japan because of the lack of structural reform. The profit cycle is weakening in Japan and we have reduced those positions but we like the rest of Asia.

We live in a debt-leveraged, low-growth world. Despite years and over $11 trillion of central bank liquidity pumping, developed economies struggle to sustain 1–2% growth rates. The only geography on the planet that we believe offers the promise of growing economies is Asia, primarily China. That is the reason we have chosen to invest heavily in bottom-up fundamental company research, with teams of analysts in both Boston and Hong Kong.

In spite of negative headlines, institutional investors are moving to China. Warburg Pincus reportedly is seeking to raise $2 billion for a new private equity fund which will invest alongside its $12 billion global fund, according to the Wall Street Journal. Hong Kong-based alternative investment management firm PAG raised $3.6 billion in December to do the same thing. In total, $41 billion was raised in 2015 in private equity compared with $2.9 billion for Japan and $12.1 billion for India.

China’s economy will likely not decline for the foreseeable future, but overall profits could. We believe government-announced growth targets are useless but domestic household savings are high and are being spent. What remains unresolved, and it is a big deal, is whether China will continue to reform the financial sector and will slow capital destruction by refusing to prop up deteriorating state enterprises. Recent reports that Chinese banks plan to package and sell loans packaged as securities means the banks will likely be forced to take sharp losses on those loans and is strong evidence to us that financial sector reform is real. Our strategy through this process is to hold long strong emerging consumer franchises in China and, on occasion, short the banks.

China has successfully restructured in the past when times were tough. A similar restructuring occurred in 2000 when non-performing loans in state-owned companies were simply transferred to non-bank asset managers. Subsequently only 20% of the face value of those loans was recovered. This is not as negative as it reads. The vast bulk of loans in China are to local governments and state-owned companies, so in one sense the government owes money to itself. Loans to households and private companies are rather modest in the aggregate. State banks were never established to service those markets.

Finally, devaluing the currency will not help the economy as we feel there is no demand at any price for all the excess industrial capacity China has built, so it will become difficult to keep exporting it. We suspect the downside for the currency is limited to 10–12% simply because the terms of trade are so favorable to China that a lower currency would be very stimulative and stock market positive.

If China successfully reforms its financial sector—and we understand it is very difficult to do politically with so many entrenched interests in the old economy—we think a significant new bull market could begin. If China does not make the right choices, then we could be charged with wasting our time following it.

What we know from history is that failure on the part of either China or India to continue with financial market reform will make it hard to find a bull market anywhere. We do believe that progress on reform, even if frustratingly slow, is likely to bring about the next bull market and it will be in Asia.

A Number of Current Themes in Our Short Book

| 1) | European banks will soon embark on waves of capital rebuilding. Bad loans continue to build and the failure of European stocks to respond to aggressive ECB reflation points to a weak profit cycle and further deterioration in bank loan quality. |

| 2) | Deep water drillers are well into a deteriorating profit cycle which we think won’t bottom for several years. The price of crude oil would have to be sustained at levels above $80 per barrel to reverse the collapse in rig usage which is underway. Some drillers will face severe financial stress. |

| 3) | Commercial aerospace managements and global airlines will likely face excess capacity and deteriorating pricing for an extended period. Huge backlogs for both narrow and wide body aircraft built in more optimistic times will prove troublesome not only for the original equipment manufacturers and their suppliers, but also for the airlines, which will face increasing competition from both Middle Eastern and Asian airlines. |

| Clough Global Long/Short Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

| 4) | We think investment in global liquefied natural gas (LNG) facilities will provide far more LNG than the world can use. |

In a world in which large growth stocks have been bid up to valuations which often leave limited upside, we try to find value in sectors which have been left behind for reasons we think are invalid or irrelevant. For the past several years, investors have benefitted from a persistent rise in the broad equity market powered by earnings growth and P/E expansion across virtually all sectors. Exchange Traded Funds (ETFs), particularly of the index variety, were very efficient at capturing that rise. Today, we see far more divergences in earnings trends among industries, some up and some down. This is much more difficult environment for index investing. A passive holder of the S&P 500 may be looking at flat returns in the years ahead. We think underlying sector performance in a slow growth world will be more volatile and varied, creating a much greater opportunity set for active fundamental investing, particularly of the long/short variety.

If you have any questions about your investment, please call 1-877-256-8445.

Sincerely,

Charles I. Clough, Jr.

| Semi-Annual Report | April 30, 2016 | 5 |

| Clough Global Long/Short Fund | Portfolio Allocation |

| | April 30, 2016 (Unaudited) |

Performance (as of April 30, 2016)

| | 1 Month | Quarter | YTD | Since Inception† |

| Class A - NAV* | 0.98% | -1.06% | -7.46% | -6.10% |

| Class A - MOP* | -4.62% | -6.53% | -12.51% | -10.02% |

| Class C - NAV* | 0.87% | -1.27% | -7.74% | -6.45% |

| Class C - CDSC* | -0.13% | -2.26% | -8.66% | -6.45% |

| Class I - NAV^ | 0.98% | -1.06% | -7.46% | -5.84% |

S&P 500 Total Return Index(a) | 0.39% | 7.05% | 1.74% | 2.36% |

HFRI Equity Hedge (Total) Index(b) | 1.12% | 4.18% | -0.60% | -1.18% |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (855) 425-6844 or by visiting www.cloughglobal.com.

† | Fund’s commencement date is September 30, 2015. |

| * | Returns shown prior to 9/30/2015 are based on the returns of Clough Global Long/Short Fund LP Predecessor adjusted for fees and expenses. |

| ^ | Returns shown prior to 9/30/2015 are based on the returns of Clough Global Long/Short Fund LP Predecessor. |

(a) | The Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. Index performance does not reflect fund performance. An investor cannot invest directly in an index. |

(b) | An index designed by Hedge Fund Research, Inc. to represent the performance of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed by such managers to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. The HFRI family of indices reserves the right to revise historical performance data for a period of up to four months following the as of date. The performance shown was calculated using current, available data at the time of publication, but is subject to change outside of the control of the Fund and its affiliates. An investor cannot invest directly in an index. |

Returns of less than 1 year are cumulative.

An investor cannot invest directly in an index.

The Fund is new and has a limited operating history.

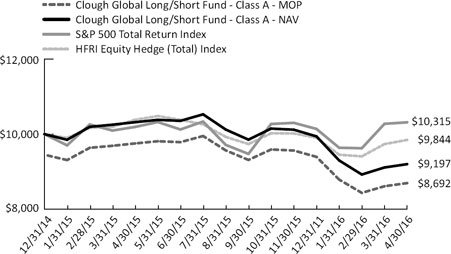

Performance of $10,000 Initial Investment (as of April 30, 2016)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception, including the Predecessor. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Clough Global Long/Short Fund | Portfolio Allocation |

| | April 30, 2016 (Unaudited) |

Top Ten Long Holdings (as a % of Net Assets)* | |

| Bank of America Corp. | 3.26% |

| Citigroup, Inc. | 2.92% |

| Liberty Ventures - Series A | 2.47% |

| Anadarko Petroleum Corp. | 2.28% |

| Apache Corp. | 2.22% |

| Hess Corp. | 2.20% |

| IMAX Corp. | 2.14% |

| Liberty Broadband Corp. - Class C | 2.12% |

| BP PLC - Sponsored ADR | 2.05% |

| Continental Resources, Inc. | 1.73% |

| Top Ten Holdings | 23.39% |

| * | Holdings are subject to change |

| Sector Allocation ** | Long Exposure % TNA | Short Exposure % TNA | Net Exposure % TNA |

| Consumer Discretionary | 25.50% | -4.32% | 21.18% |

| Consumer Staples | 2.92% | -4.81% | -1.89% |

| Energy | 22.63% | -2.33% | 20.30% |

| Exchange Traded Funds | 1.19% | -4.90% | -3.71% |

| Financials | 12.87% | -5.42% | 7.45% |

| Health Care | 8.03% | -0.75% | 7.28% |

| Industrials | 4.59% | -6.56% | -1.97% |

| Information Technology | 10.01% | -5.14% | 4.87% |

| Materials | 1.06% | -0.67% | 0.39% |

| Real Estate | 5.55% | 0.00% | 5.55% |

| Telecommunication Services | 1.10% | 0.00% | 1.10% |

| Total Investments | 95.45% | -34.90% | 60.55% |

| Country Allocation ** | Long Exposure % TNA | Short Exposure % TNA | Net Exposure % TNA |

| China | 7.89% | 0.00% | 7.89% |

| Europe | 5.07% | -5.01% | 0.06% |

| Japan | 1.38% | -0.62% | 0.76% |

| Other Developed Markets | 3.29% | -0.73% | 2.56% |

| Other Emerging Markets | 0.00% | -1.72% | -1.72% |

| United States | 77.82% | -26.83% | 50.99% |

| Total Investments | 95.45% | -34.91% | 60.54% |

| ** | Allocation summaries calculated as percent of total net assets using market value of cash traded securities, notional value of derivative contracts and excluding short-term investments and futures. |

| Semi-Annual Report | April 30, 2016 | 7 |

| Clough Global Long/Short Fund | Disclosure of Fund Expenses |

| | April 30, 2016 (Unaudited) |

Examples. As a shareholder of the Clough Global Long/Short Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including applicable redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2015 and held through April 30, 2016.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period November 1, 2015 – April 30, 2016” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table below is useful in comparing ongoing costs only and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 11/1/2015 | Ending Account Value 4/30/16 | Expense Ratio(a)(b) | Expenses Paid During period 11/1/2015 - 4/30/16(c) |

| | | | | |

| Clough Global Long/Short Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $906.40 | 2.93% | $13.89 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,010.29 | 2.93% | $14.64 |

| Class C | | | | |

| Actual | $1,000.00 | $906.40 | 3.58% | $16.97 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,007.06 | 3.58% | $17.87 |

| Class I | | | | |

| Actual | $1,000.00 | $907.40 | 2.58% | $12.24 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,012.03 | 2.58% | $12.91 |

(a) | Expense ratio excluding interest expense and dividends paid on borrowed securities for the Clough Global Long/Short Fund is 1.95%, 2.60% and 1.60% for Class A, Class C and Class I respectively. |

(b) | Annualized, based on the Fund's most recent fiscal half year expenses. |

(c) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182)/366 (to reflect the half-year period). |

| Clough Global Long/Short Fund | Statement of Investments |

April 30, 2016 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS 92.42% | | | | | | |

| Consumer Discretionary 25.50% | | | | | | |

Amazon.com, Inc.(a) | | | 520 | | | $ | 342,987 | |

| Anta Sports Products, Ltd. | | | 165,000 | | | | 422,024 | |

| Blue Nile, Inc. | | | 18,461 | | | | 475,924 | |

Cable One, Inc.(b) | | | 1,000 | | | | 458,960 | |

CarMax, Inc.(a) | | | 6,700 | | | | 354,765 | |

Charter Communications, Inc. ‐ Class A(a)(b) | 700 | | | | 148,568 | |

China ZhengTong Auto Services Holdings, Ltd. | | | 303,500 | | | | 124,422 | |

| Comcast Corp. ‐ Class A | | | 9,695 | | | | 589,068 | |

DR Horton, Inc.(b) | | | 9,408 | | | | 282,804 | |

IMAX Corp.(a) | | | 28,660 | | | | 917,120 | |

JD.com, Inc. ‐ ADR(a) | | | 4,300 | | | | 109,908 | |

Lennar Corp. ‐ Class A(b) | | | 9,601 | | | | 435,021 | |

Liberty Braves Group ‐ Class C(a) | | | 1,577 | | | | 23,530 | |

Liberty Broadband Corp. ‐ Class C(a) | | | 15,859 | | | | 907,928 | |

Liberty Global PLC ‐ Class A(a) | | | 2,700 | | | | 101,871 | |

Liberty Media Group ‐ Class C(a) | | | 3,943 | | | | 70,970 | |

Liberty SiriusXM Group ‐ Class C(a) | | | 15,771 | | | | 504,987 | |

Liberty Ventures ‐ Series A(a) | | | 26,452 | | | | 1,058,080 | |

| Man Wah Holdings, Ltd. | | | 158,000 | | | | 184,543 | |

| Manchester United PLC ‐ Class A | | | 15,200 | | | | 259,768 | |

| Monro Muffler Brake, Inc. | | | 5,900 | | | | 408,398 | |

| Pacific Textiles Holdings, Ltd. | | | 118,000 | | | | 152,123 | |

Papa Murphy's Holdings, Inc.(a)(b) | | | 13,500 | | | | 169,560 | |

| Pool Corp. | | | 3,400 | | | | 297,194 | |

| PulteGroup, Inc. | | | 16,400 | | | | 301,596 | |

| Service Corp. International | | | 11,300 | | | | 301,371 | |

| Signet Jewelers, Ltd. | | | 4,635 | | | | 503,176 | |

| Sony Corp. | | | 5,500 | | | | 143,600 | |

TRI Pointe Group, Inc.(a) | | | 26,800 | | | | 310,880 | |

Wayfair, Inc. ‐ Class A(a)(b) | | | 10,600 | | | | 400,150 | |

William Lyon Homes ‐ Class A(a) | | | 12,400 | | | | 174,840 | |

| | | | | | | | 10,936,136 | |

| | | | | | | | | |

| Consumer Staples 2.14% | | | | | | | | |

| China Resources Beer Holdings Company, Ltd. | | | 66,000 | | | | 145,326 | |

| CVS Health Corp. | | | 2,800 | | | | 281,400 | |

Prestige Brands Holdings, Inc.(a) | | | 4,600 | | | | 261,188 | |

WH Group, Ltd.(a) | | | 286,000 | | | | 231,546 | |

| | | | | | | | 919,460 | |

| | | | | | | | | |

| Energy 22.63% | | | | | | | | |

| Anadarko Petroleum Corp. | | | 18,500 | | | | 976,060 | |

Antero Resources Corp.(a) | | | 7,700 | | | | 217,910 | |

Apache Corp.(b) | | | 17,500 | | | | 952,000 | |

| BP PLC ‐ Sponsored ADR | | | 26,200 | | | | 879,796 | |

Concho Resources, Inc.(a) | | | 5,150 | | | | 598,275 | |

| | | Shares | | | Value | |

| Energy (continued) | | | | | | |

Continental Resources, Inc.(a) | | | 19,900 | | | $ | 741,474 | |

| Devon Energy Corp. | | | 11,800 | | | | 409,224 | |

| Energen Corp. | | | 4,900 | | | | 208,201 | |

Helix Energy Solutions Group, Inc.(a)(b) | | | 22,700 | | | | 195,901 | |

| Hess Corp. | | | 15,800 | | | | 941,996 | |

| Marathon Oil Corp. | | | 20,900 | | | | 294,481 | |

Newfield Exploration Co.(a) | | | 11,800 | | | | 427,750 | |

| Noble Energy, Inc. | | | 8,500 | | | | 306,935 | |

| Occidental Petroleum Corp. | | | 7,900 | | | | 605,535 | |

Parsley Energy, Inc. ‐ Class A(a) | | | 11,100 | | | | 259,962 | |

| Pioneer Natural Resources Co. | | | 2,700 | | | | 448,470 | |

Sanchez Energy Corp.(a) | | | 41,700 | | | | 374,883 | |

WPX Energy, Inc.(a)(b) | | | 67,100 | | | | 648,186 | |

| YPF S.A. ‐ Sponsored ADR | | | 10,800 | | | | 217,620 | |

| | | | | | | | 9,704,659 | |

| | | | | | | | | |

| Financials 12.87% | | | | | | | | |

| American International Group, Inc. | | | 13,138 | | | | 733,363 | |

| Ares Capital Corp. | | | 33,800 | | | | 513,422 | |

Bank of America Corp.(b) | | | 96,150 | | | | 1,399,944 | |

| China Everbright, Ltd. | | | 60,000 | | | | 119,120 | |

| CITIC Securities Co., Ltd. ‐ Class H | | | 184,500 | | | | 407,679 | |

Citigroup, Inc.(b) | | | 27,049 | | | | 1,251,828 | |

Essent Group, Ltd.(a) | | | 3,200 | | | | 65,344 | |

| JPMorgan Chase & Co. | | | 3,900 | | | | 246,480 | |

MGIC Investment Corp.(a) | | | 41,677 | | | | 301,325 | |

| Radian Group, Inc. | | | 8,800 | | | | 112,552 | |

| Solar Capital, Ltd. | | | 20,800 | | | | 366,704 | |

| | | | | | | | 5,517,761 | |

| | | | | | | | | |

| Health Care 8.03% | | | | | | | | |

| Actelion, Ltd. | | | 864 | | | | 139,602 | |

Aduro Biotech, Inc.(a) | | | 7,000 | | | | 90,650 | |

Akorn, Inc.(a) | | | 13,500 | | | | 343,575 | |

Alexion Pharmaceuticals, Inc.(a) | | | 500 | | | | 69,640 | |

Allergan PLC(a) | | | 1,800 | | | | 389,808 | |

| Becton Dickinson and Co. | | | 300 | | | | 48,378 | |

Boston Scientific Corp.(a) | | | 2,300 | | | | 50,416 | |

| Bristol‐Meyers Squibb Co. | | | 4,726 | | | | 341,122 | |

Cerner Corp.(a)(b) | | | 3,985 | | | | 223,718 | |

Corindus Vascular Robotics, Inc.(a) | | | 77,500 | | | | 81,375 | |

Dynavax Technologies Corp.(a) | | | 11,775 | | | | 193,228 | |

Edwards Lifesciences Corp.(a)(b) | | | 500 | | | | 53,105 | |

HCA Holdings, Inc.(a) | | | 940 | | | | 75,783 | |

Healthways, Inc.(a) | | | 11,940 | | | | 139,101 | |

Jazz Pharmaceuticals PLC(a) | | | 700 | | | | 105,490 | |

| Medtronic PLC | | | 500 | | | | 39,575 | |

Otonomy, Inc.(a) | | | 12,200 | | | | 173,972 | |

| Shire PLC ‐ ADR | | | 1,000 | | | | 187,420 | |

Team Health Holdings, Inc.(a) | | | 1,700 | | | | 71,111 | |

TherapeuticsMD, Inc.(a) | | | 16,700 | | | | 137,775 | |

| Semi-Annual Report | April 30, 2016 | 9 |

| Clough Global Long/Short Fund | Statement of Investments |

April 30, 2016 (Unaudited)

| | | Shares | | | Value | |

| Health Care (continued) | | | | | | |

Valeant Pharmaceuticals International, Inc.(a) | | | 6,600 | | | $ | 220,176 | |

Veracyte, Inc.(a) | | | 8,500 | | | | 49,300 | |

Vertex Pharmaceuticals, Inc.(a) | | | 2,600 | | | | 219,284 | |

| | | | | | | | 3,443,604 | |

| | | | | | | | | |

| Industrials 3.54% | | | | | | | | |

Allison Transmission Holdings, Inc.(b) | | | 18,100 | | | | 521,461 | |

Armstrong World Industries, Inc.(a)(b) | | | 7,994 | | | | 326,235 | |

| Kansas City Southern | | | 3,970 | | | | 376,158 | |

| Rollins, Inc. | | | 10,900 | | | | 292,883 | |

| | | | | | | | 1,516,737 | |

| | | | | | | | | |

| Information Technology 10.00% | | | | | | | | |

Alibaba Group Holding, Ltd. ‐ Sponsored ADR(a) | | | 3,000 | | | | 230,820 | |

Alphabet, Inc. ‐ Class C(a) | | | 742 | | | | 514,213 | |

| Broadcom, Ltd. | | | 1,900 | | | | 276,925 | |

| Crown Castle International Corp. | | | 4,900 | | | | 425,712 | |

Electronics For Imaging, Inc.(a)(b) | | | 3,600 | | | | 143,424 | |

Facebook, Inc. ‐ Class A(a)(b) | | | 5,049 | | | | 593,661 | |

| Lam Research Corp. | | | 7,864 | | | | 600,810 | |

| Microsoft Corp. | | | 6,900 | | | | 344,103 | |

Monolithic Power Systems, Inc.(b) | | | 3,700 | | | | 230,954 | |

| Nintendo Co., Ltd. | | | 1,529 | | | | 217,782 | |

Palo Alto Networks, Inc.(a) | | | 800 | | | | 120,696 | |

salesforce.com, Inc.(a) | | | 4,400 | | | | 333,520 | |

| SCREEN Holdings Co., Ltd. | | | 13,000 | | | | 106,053 | |

Western Digital Corp.(b) | | | 3,728 | | | | 152,345 | |

| | | | | | | | 4,291,018 | |

| | | | | | | | | |

| Materials 1.06% | | | | | | | | |

Axalta Coating Systems, Ltd.(a) | | | 12,300 | | | | 350,181 | |

| Chr Hansen Holding A/S | | | 1,662 | | | | 103,432 | |

| | | | | | | | 453,613 | |

| | | | | | | | | |

| Real Estate 5.55% | | | | | | | | |

American Capital Agency Corp.(b) | | | 23,600 | | | | 433,532 | |

| American Capital Mortgage Investment Corp. | | | 17,100 | | | | 253,593 | |

Annaly Capital Management, Inc.(b) | | | 16,800 | | | | 175,056 | |

| Colony Capital, Inc. ‐ Class A | | | 6,300 | | | | 111,384 | |

| Community Healthcare Trust, Inc. | | | 15,300 | | | | 278,460 | |

| Ladder Capital Corp. | | | 10,700 | | | | 127,437 | |

| Starwood Property Trust, Inc. | | | 23,100 | | | | 447,216 | |

| Takara Leben Co., Ltd. | | | 18,100 | | | | 121,120 | |

| | | Shares | | | Value | |

| Real Estate (continued) | | | | | | |

Two Harbors Investment Corp.(b) | | | 55,200 | | | $ | 432,216 | |

| | | | | | | | 2,380,014 | |

| | | | | | | | | |

| Telecommunication Services 1.10% | | | | | | | | |

| China Mobile, Ltd. | | | 41,000 | | | | 470,156 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $37,825,254) | | | | | | | 39,633,158 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS 1.20% | | | | | | | | |

Market Vectors® Gold Miners ETF | | | 11,200 | | | | 289,296 | |

SPDR® Gold Shares(a) | | | 1,800 | | | | 222,570 | |

| | | | | | | | 511,866 | |

| | | | | | | | | |

TOTAL EXCHANGE TRADED FUNDS (Cost $507,141) | | | | | | | 511,866 | |

| | | | | | | | | |

| PARTICIPATION NOTES 1.83% | | | | | | | | |

| Consumer Staples 0.78% | | | | | | | | |

| Kweichow Moutai Co., Ltd. ‐ Class A (Loan Participation Notes issued by Morgan Stanley Asia Products), expiring 11/09/2017 | | | 8,625 | | | | 334,120 | |

| | | | | | | | | |

| Industrials 1.05% | | | | | | | | |

| Shanghai International Airport Co., Ltd. ‐ Class A (Loan Participation issued by Morgan Stanley Asia Products), expiring 08/11/2017 | | | 41,600 | | | | 174,560 | |

| Zhengzhou Yutong Bus Co., Ltd. ‐ Class A (Loan Participation Notes issued by Morgan Stanley Asia Products), expiring 10/27/2017 | | | 87,750 | | | | 277,547 | |

| | | | | | | | 452,107 | |

TOTAL PARTICIPATION NOTES (Cost $779,215) | | | | | | | 786,227 | |

| Clough Global Long/Short Fund | Statement of Investments |

April 30, 2016 (Unaudited)

| | | Shares | | | Value | |

| SHORT‐TERM INVESTMENTS 3.95% | | | | | | |

| Money Market Fund 3.95% | | | | | | |

| BlackRock Liquidity Funds, T‐Fund Portfolio ‐ Institutional Class (0.199% 7‐day yield) | | | 1,695,197 | | | $ | 1,695,197 | |

| | | | | | | | | |

TOTAL SHORT‐TERM INVESTMENTS (Cost $1,695,197) | | | | | | | 1,695,197 | |

| | | | | | | | | |

Total Investments ‐ 99.40% (Cost $40,806,807) | | | | | | | 42,626,448 | |

| | | | | | | | | |

| Assets in Excess of Other Liabilities ‐ 0.60% | | | | 257,995 | |

| | | | | | | | | |

| NET ASSETS ‐ 100.00% | | | | | | $ | 42,884,443 | |

| | | | | | | | | |

SCHEDULE OF SECURITIES SOLD SHORT (a) | | Shares | | | Value | |

| COMMON STOCKS (29.06%) | | | | | | | | |

| Consumer Discretionary (4.32%) | | | | | | | | |

| Beazer Homes USA, Inc. | | | (19,900 | ) | | | (163,578 | ) |

| Bridgestone Corp. | | | (3,300 | ) | | | (127,658 | ) |

| CBS Corp. ‐ Class B | | | (1,900 | ) | | | (106,229 | ) |

| Chipotle Mexican Grill, Inc. | | | (345 | ) | | | (145,234 | ) |

| Garmin, Ltd. | | | (2,600 | ) | | | (110,838 | ) |

| Lowe's Cos., Inc. | | | (1,400 | ) | | | (106,428 | ) |

| Macy's, Inc. | | | (2,400 | ) | | | (95,016 | ) |

| McDonald's Corp. | | | (800 | ) | | | (101,192 | ) |

| NIKE, Inc. ‐ Class B | | | (1,700 | ) | | | (100,198 | ) |

| Staples, Inc. | | | (9,600 | ) | | | (97,920 | ) |

| Target Corp. | | | (1,300 | ) | | | (103,350 | ) |

| Tiffany & Co. | | | (3,000 | ) | | | (214,050 | ) |

| Under Armour, Inc. ‐ Class A | | | (1,200 | ) | | | (52,728 | ) |

| Under Armour, Inc. ‐ Class C | | | (1,200 | ) | | | (48,960 | ) |

| Urban Outfitters, Inc. | | | (3,196 | ) | | | (96,903 | ) |

| Williams‐Sonoma, Inc. | | | (3,100 | ) | | | (182,218 | ) |

| | | | | | | | (1,852,500 | ) |

| | | | | | | | | |

| Consumer Staples (4.81%) | | | | | | | | |

| Campbell Soup Co. | | | (2,800 | ) | | | (172,788 | ) |

| ConAgra Foods, Inc. | | | (3,800 | ) | | | (169,328 | ) |

| General Mills, Inc. | | | (2,800 | ) | | | (171,752 | ) |

| Hormel Foods Corp. | | | (2,700 | ) | | | (104,085 | ) |

| Kellogg Co. | | | (2,200 | ) | | | (168,982 | ) |

| Kimberly‐Clark Corp. | | | (1,000 | ) | | | (125,190 | ) |

| Monster Beverage Corp. | | | (2,200 | ) | | | (317,284 | ) |

| PepsiCo, Inc. | | | (1,700 | ) | | | (175,032 | ) |

| Philip Morris International, Inc. | | | (1,700 | ) | | | (166,804 | ) |

| The Procter & Gamble Co. | | | (2,500 | ) | | | (200,300 | ) |

| Tyson Foods, Inc. ‐ Class A | | | (2,600 | ) | | | (171,132 | ) |

| Wal‐Mart Stores, Inc. | | | (1,800 | ) | | | (120,366 | ) |

| | | | | | | | (2,063,043 | ) |

SCHEDULE OF SECURITIES SOLD SHORT (a) (continued) | | Shares | | | Value | |

| Energy (2.33%) | | | | | | |

| Atwood Oceanics, Inc. | | | (22,100 | ) | | $ | (213,486 | ) |

| Noble Corp., PLC | | | (25,800 | ) | | | (289,734 | ) |

| Rowan Cos., PLC ‐ Class A | | | (11,900 | ) | | | (223,839 | ) |

| Transocean, Ltd. | | | (24,600 | ) | | | (272,568 | ) |

| | | | | | | | (999,627 | ) |

| | | | | | | | | |

| Financials (4.77%) | | | | | | | | |

| ABN AMRO Group NV | | | (4,927 | ) | | | (105,330 | ) |

| American Express Co. | | | (4,000 | ) | | | (261,720 | ) |

| BNP Paribas S.A. | | | (1,680 | ) | | | (88,951 | ) |

| Credit Suisse Group AG ‐ Sponsored ADR | | | (8,600 | ) | | | (130,806 | ) |

| Deutsche Bank AG | | | (14,100 | ) | | | (267,336 | ) |

| Greenhill & Co., Inc. | | | (10,358 | ) | | | (228,083 | ) |

| Intesa Sanpaolo SpA | | | (61,715 | ) | | | (171,014 | ) |

| Itau Unibanco Holding S.A. ‐ Preference Shares, Sponsored ADR | | | (35,030 | ) | | | (333,836 | ) |

| Societe Generale S.A. | | | (1,706 | ) | | | (66,906 | ) |

| Synchrony Financial | | | (9,600 | ) | | | (293,472 | ) |

| United Overseas Bank, Ltd. | | | (6,974 | ) | | | (96,454 | ) |

| | | | | | | | (2,043,908 | ) |

| | | | | | | | | |

| Health Care (0.75%) | | | | | | | | |

| Eli Lilly & Co. | | | (3,400 | ) | | | (256,802 | ) |

| Varian Medical Systems, Inc. | | | (810 | ) | | | (65,756 | ) |

| | | | | | | | (322,558 | ) |

| | | | | | | | | |

| Industrials (6.55%) | | | | | | | | |

| Air France‐KLM | | | (18,669 | ) | | | (167,424 | ) |

| The Boeing Co. | | | (3,300 | ) | | | (444,840 | ) |

| Carillion PLC | | | (29,000 | ) | | | (124,578 | ) |

| Caterpillar, Inc. | | | (4,020 | ) | | | (312,434 | ) |

| Deutsche Lufthansa AG | | | (14,518 | ) | | | (225,419 | ) |

| Flowserve Corp. | | | (2,500 | ) | | | (122,025 | ) |

| International Consolidated Airlines Group S.A. | | | (33,729 | ) | | | (258,737 | ) |

| Metso OYJ | | | (8,893 | ) | | | (213,740 | ) |

| Petrofac, Ltd. | | | (4,900 | ) | | | (60,499 | ) |

| Sandvik AB | | | (26,177 | ) | | | (268,601 | ) |

| Sembcorp Industries, Ltd. | | | (39,000 | ) | | | (83,809 | ) |

| Spirit AeroSystems Holdings, Inc. ‐ Class A | | | (3,600 | ) | | | (169,740 | ) |

| WSP Global, Inc. | | | (2,200 | ) | | | (74,011 | ) |

| WW Grainger, Inc. | | | (1,218 | ) | | | (285,645 | ) |

| | | | | | | | (2,811,502 | ) |

| | | | | | | | | |

| Information Technology (4.86%) | | | | | | | | |

| Analog Devices, Inc. | | | (4,900 | ) | | | (275,968 | ) |

| First Data Corp. ‐ Class A | | | (12,800 | ) | | | (145,792 | ) |

| International Business Machines Corp. | | | (7,215 | ) | | | (1,052,957 | ) |

| Semi-Annual Report | April 30, 2016 | 11 |

| Clough Global Long/Short Fund | Statement of Investments |

April 30, 2016 (Unaudited)

SCHEDULE OF SECURITIES SOLD SHORT (a) (continued) | | Shares | | | Value | |

| Information Technology (continued) | | | | | | |

| Knowles Corp. | | | (14,400 | ) | | $ | (192,528 | ) |

| Mobileye NV | | | (3,400 | ) | | | (129,710 | ) |

| NETGEAR, Inc. | | | (3,500 | ) | | | (148,400 | ) |

| Nippon Electric Glass Co., Ltd. | | | (25,000 | ) | | | (137,453 | ) |

| | | | | | | | (2,082,808 | ) |

| | | | | | | | | |

| Materials (0.67%) | | | | | | | | |

| Cliffs Natural Resources, Inc. | | | (43,500 | ) | | | (229,245 | ) |

| Potash Corp. of Saskatchewan, Inc. | | | (3,400 | ) | | | (60,248 | ) |

| | | | | | | | (289,493 | ) |

| | | | | | | | | |

TOTAL COMMON STOCKS (Proceeds $12,134,221) | | | | | | | (12,465,439 | ) |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS (4.90%) | | | | | | | | |

iShares® Russell 2000® ETF | | | (3,100 | ) | | | (348,316 | ) |

Market Vectors® Semiconductor ETF | | | (13,000 | ) | | | (681,980 | ) |

SPDR® S&P Retail ETF | | | (12,300 | ) | | | (543,660 | ) |

Technology Select Sector SPDR® Fund | | | (12,500 | ) | | | (526,625 | ) |

| | | | | | | | | |

TOTAL EXCHANGE TRADED FUNDS (Proceeds $2,111,812) | | | | | | | (2,100,581 | ) |

| | | | | | | | | |

| PREFERRED STOCKS (0.65%) | | | | | | | | |

| Financials (0.65%) | | | | | | | | |

| Banco Bradesco S.A. ‐ ADR | | | (37,272 | ) | | | (278,422 | ) |

| | | | | | | | | |

TOTAL PREFERRED STOCKS (Proceeds $230,956) | | | | | | | (278,422 | ) |

| | | | | | | | | |

TOTAL SECURITIES SOLD SHORT (Proceeds $14,476,989) | | | | | | $ | (14,844,442 | ) |

(a) | Non-income producing security. |

(b) | Pledged security; a portion or all of the security is pledged as collateral for total return swap contracts and securities sold short. As of April 30, 2016, the aggregate market value of those securities was $4,967,002 representing 11.58% of net assets. (See Note 1) |

| Clough Global Long/Short Fund | Statement of Investments |

April 30, 2016 (Unaudited)

TOTAL RETURN SWAP CONTRACTS

| Counter Party | Reference Entity/Obligation | | Notional Amount | | Floating Rate Paid by the Fund | Floating Rate Index | Termination Date | | Net Unrealized Depreciation | |

| Morgan Stanley | Hermes Microvision, Inc. | | $ | (92,318 | ) | 750 bps ‐ 1D FEDEF | 1 D FEDEF | 10/27/2017 | | $ | (31,081 | ) |

| | | | $ | (92,318 | ) | | | | | $ | (31,081 | ) |

Abbreviations:

1D FEDEF - Federal Funds Effective Rate (Daily)

AB - Aktiebolag is the Swedish equivalent of the term corporation

ADR - American Depositary Receipt

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders

A/S - Aktieselskab, Joint Stock Company in Denmark

bps - Basis Points

ETF - Exchange Traded Fund

Ltd. - Limited

NV - Naamloze Vennootschap (Dutch: Limited Liability Company)

OYJ - Osakeyhtio is the Finnish equivalent of a public limited company.

PLC - Public Limited Company

S.A. - Generally designates corporations in various countries, mostly those employing the civil law.

SpA - Societa` Per Azioni is an Italian shared company

S&P - Standard & Poor's

SPDR - Standard & Poor's Depositary Receipt

For Fund compliance purposes, the Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by the Fund's management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to the Financial Statements.

| Semi-Annual Report | April 30, 2016 | 13 |

| Clough Global Long/Short Fund | Statement of Assets and Liabilities |

April 30, 2016 (Unaudited)

| ASSETS: | | | |

| | | | |

| Investments, at value (Cost - see below) | | $ | 42,626,448 | |

| Cash | | | 52,281 | |

| Foreign currency, at value (Cost $57,084) | | | 55,608 | |

| Deposit with broker for securities sold short and total return swap contracts | | | 14,018,553 | |

| Dividends receivable | | | 20,007 | |

| Receivable for investments sold | | | 4,260,349 | |

| Prepaid expenses and other assets | | | 83,011 | |

| Total Assets | | | 61,116,257 | |

| | | | | |

| LIABILITIES: | | | | |

| | | | | |

| Securities sold short (Proceeds $14,476,989) | | | 14,844,442 | |

| Payable for investments purchased | | | 3,215,423 | |

| Unrealized depreciation on total return swap contracts | | | 31,081 | |

| Dividends payable - short sales | | | 37,888 | |

| Interest payable - margin account | | | 9,892 | |

| Accrued investment advisory fee | | | 9,116 | |

| Distribution and service fees | | | 80 | |

| Accrued legal expense | | | 41,421 | |

| Accrued administration fee | | | 8,990 | |

| Accrued trustees fee | | | 2,885 | |

| Other payables and accrued expenses | | | 30,596 | |

| Total Liabilities | | | 18,231,814 | |

| Net Assets | | $ | 42,884,443 | |

| Cost of Investments | | $ | 40,806,807 | |

| | | | | |

| COMPOSITION OF NET ASSETS: | | | | |

| | | | | |

| Paid-in capital | | $ | 46,454,442 | |

| Accumulated net investment loss | | | (320,544 | ) |

| Accumulated net realized loss on investment securities, futures contracts, securities sold short, total return swap contracts and foreign currency transactions | | | (4,668,316 | ) |

| Net unrealized appreciation in value of investment securities, securities sold short, total return swap contracts and translation of assets and liabilities denominated in foreign currency | | | 1,418,861 | |

| Net Assets | | $ | 42,884,443 | |

| PRICING OF CLASS A SHARES: | | | | |

| Net Assets | | $ | 27,317 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 2,938 | |

| Net Asset Value, offering and redemption price per share | | $ | 9.30 | |

| Maximum offering price per share (NAV/0.945), based on maximum sales charge of 5.50% of the offering price | | $ | 9.84 | |

| PRICING OF CLASS C SHARES: | | | | |

| Net Assets | | $ | 72,942 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 7,843 | |

| Net Asset Value, offering and redemption price per share | | $ | 9.30 | |

| PRICING OF CLASS I SHARES: | | | | |

| Net Assets | | $ | 42,784,184 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 4,594,473 | |

| Net Asset Value, offering and redemption price per share | | $ | 9.31 | |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund | Statement of Operations |

For the six months ended April 30, 2016 (Unaudited)

| INVESTMENT INCOME: | | | |

| | | | |

| Dividends (net of foreign withholding taxes of $258) | | $ | 216,709 | |

| Total Income | | | 216,709 | |

| | | | | |

| EXPENSES: | | | | |

| | | | | |

| Investment advisory fee | | | 279,148 | |

| Distribution and shareholder service fees: | | | | |

| Class A | | | 44 | |

| Class C | | | 198 | |

| Administration fee | | | 34,798 | |

| Interest expense - margin account | | | 47,791 | |

| Trustees fee | | | 53,861 | |

| Dividend expense - short sales | | | 155,730 | |

| Custody | | | 22,507 | |

| Audit & Tax Services | | | 21,383 | |

| Legal | | | 53,896 | |

| Offering costs | | | 63,793 | |

| Printing | | | 2,695 | |

| Insurance | | | 12,854 | |

| Transfer agent | | | 9,092 | |

| Other expenses | | | 13,608 | |

| Total Expenses Before Waivers and/or Reimbursements | | | 771,398 | |

| Less fees waived and/or reimbursed by Adviser: | | | | |

| Class A | | | (145 | ) |

| Class C | | | (227 | ) |

| Class I | | | (236,417 | ) |

| Net Expenses | | | 534,609 | |

| Net Investment Loss | | | (317,900 | ) |

| | | | | |

| NET REALIZED GAIN/(LOSS) ON: | | | | |

| Investment securities | | | (3,674,676 | ) |

| Futures contracts | | | (30,806 | ) |

| Securities sold short | | | (700,915 | ) |

| Total return swap contracts | | | (61,415 | ) |

| Foreign currency transactions | | | (10,445 | ) |

| NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) ON: | | | | |

| Investment securities | | | 762,780 | |

| Futures contracts | | | (8,524 | ) |

| Securities sold short | | | (12,326 | ) |

| Total return swap contracts | | | (33,538 | ) |

| Translation of assets and liabilities denominated in foreign currencies | | | (2,224 | ) |

| Net realized and unrealized loss | | | (3,772,089 | ) |

| Net Decrease in Net Assets from Operations | | $ | (4,089,989 | ) |

See Notes to the Financial Statements.

| Semi-Annual Report | April 30, 2016 | 15 |

| Clough Global Long/Short Fund | Statement of Changes in Net Assets |

| | | For the Six Months Ended April 30, 2016 (Unaudited) | | | For the Period Ended October 31, 2015(a) | |

| OPERATIONS: | | | | | | |

| | | | | | | |

| Net investment loss | | $ | (317,900 | ) | | $ | (41,745 | ) |

| Net realized gain/(loss) from: | | | | | | | | |

| Investment securities | | | (3,674,676 | ) | | | 174,140 | |

| Futures contracts | | | (30,806 | ) | | | – | |

| Securities sold short | | | (700,915 | ) | | | (153,665 | ) |

| Total return swap contracts | | | (61,415 | ) | | | (3 | ) |

| Foreign currency transactions | | | (10,445 | ) | | | (169 | ) |

| Net change in unrealized appreciation/(depreciation) on: | | | | | | | | |

| Investment securities | | | 762,780 | | | | 1,056,861 | |

| Futures contracts | | | (8,524 | ) | | | 8,524 | |

| Securities sold short | | | (12,326 | ) | | | (355,127 | ) |

| Total return swap contracts | | | (33,538 | ) | | | 2,457 | |

| Translation of assets and liabilities denominated in foreign currencies | | | (2,224 | ) | | | (22 | ) |

| Net Increase/(Decrease) in Net Assets From Operations | | | (4,089,989 | ) | | | 691,251 | |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | |

| Class A | | | | | | | | |

| Net realized gains | | | (100 | ) | | | – | |

| Net Decrease in Net Assets from Distributions | | | (100 | ) | | | – | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Net realized gains | | | (97 | ) | | | – | |

| Net Decrease in Net Assets from Distributions | | | (97 | ) | | | – | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Net realized gains | | | (152,783 | ) | | | – | |

| Net Decrease in Net Assets from Distributions | | | (152,783 | ) | | | – | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from shares sold/proceeds from subscription in-kind | | | 3,100 | | | | 25,994 | |

| Net Increase in Net Assets From Class A Capital Share Transactions | | | 3,100 | | | | 25,994 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from shares sold | | | 49,397 | | | | 25,000 | |

| Net Increase in Net Assets From Class C Capital Share Transactions | | | 49,397 | | | | 25,000 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from shares sold/proceeds from subscription in-kind | | | 18,262,783 | | | | 35,069,887 | |

| Payments for shares redeemed | | | (7,000,000 | ) | | | – | |

| Net Increase in Net Assets From Class I Capital Share Transactions | | | 11,262,783 | | | | 35,069,887 | |

| | | | | | | | | |

| Total Increase in Net Assets | | $ | 7,072,311 | | | $ | 35,812,132 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 35,812,132 | | | | – | |

| End of period* | | $ | 42,884,443 | | | $ | 35,812,132 | |

| *Includes accumulated net investment loss of: | | $ | (320,544 | ) | | $ | (2,644 | ) |

(a) | Commencement of Operations September 30, 2015. |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund – Class A | Financial Highlights |

For a share outstanding throughout the periods indicated

| | | For the Six Months Ended April 30, 2016 (Unaudited) | | | For the Period September 30, 2015 (commencement) to October 31, 2015 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.30 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | |

Net investment loss(a) | | | (0.09 | ) | | | (0.02 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.87 | ) | | | 0.32 | |

| Total from Investment Operations | | | (0.96 | ) | | | 0.30 | |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | |

| Net realized gains | | | (0.04 | ) | | | – | |

| Total Distributions to Common Shareholders | | | (0.04 | ) | | | – | |

| Net asset value - end of period | | $ | 9.30 | | | $ | 10.30 | |

Total Investment Return - Net Asset Value(b) | | | (9.36 | )% | | | 3.00 | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 27 | | | $ | 27 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | 4.08 | %(d) | | | 6.44 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | 2.93 | %(d) | | | 2.67 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | (1.90 | )%(d) | | | (2.00 | )%(d) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | 3.10 | %(d) | | | 5.72 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | 1.95 | %(d) | | | 1.95 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | (0.92 | )%(d) | | | (1.28 | )%(d) |

| | | | | | | | | |

PORTFOLIO TURNOVER RATE(e) | | | 120 | % | | | 22 | % |

(a) | Per share amounts are based upon average shares outstanding. |

(b) | Total return is for the period indicated and has not been annualized. The total return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

(e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the fund level. |

See Notes to the Financial Statements.

| Semi-Annual Report | April 30, 2016 | 17 |

| Clough Global Long/Short Fund – Class C | Financial Highlights |

For a share outstanding throughout the periods indicated

| | | For the Six Months Ended April 30, 2016 (Unaudited) | | | For the Period September 30, 2015 (commencement) to October 31, 2015 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.30 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | |

Net investment loss(a) | | | (0.12 | ) | | | (0.02 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.84 | ) | | | 0.32 | |

| Total from Investment Operations | | | (0.96 | ) | | | 0.30 | |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | |

| Net realized gains | | | (0.04 | ) | | | – | |

| Total Distributions to Common Shareholders | | | (0.04 | ) | | | – | |

| Net asset value - end of period | | $ | 9.30 | | | $ | 10.30 | |

Total Investment Return - Net Asset Value(b) | | | (9.36 | )% | | | 3.00 | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 73 | | | $ | 26 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | 4.73 | %(d) | | | 7.09 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | 3.58 | %(d) | | | 3.32 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | (2.50 | )%(d) | | | (2.66 | )%(d) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | 3.75 | %(d) | | | 6.37 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | 2.60 | %(d) | | | 2.60 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | (1.52 | )%(d) | | | (1.94 | )%(d) |

| | | | | | | | | |

PORTFOLIO TURNOVER RATE(e) | | | 120 | % | | | 22 | % |

(a) | Per share amounts are based upon average shares outstanding. |

(b) | Total return is for the period indicated and has not been annualized. The total return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

(e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the fund level. |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund – Class I | Financial Highlights |

For a share outstanding throughout the periods indicated

| | | For the Six Months Ended April 30, 2016 (Unaudited) | | | For the Period September 30, 2015 (commencement) to October 31, 2015 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.30 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | |

Net investment loss(a) | | | (0.07 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.88 | ) | | | 0.31 | |

| Total from Investment Operations | | | (0.95 | ) | | | 0.30 | |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | |

| Net realized gains | | | (0.04 | ) | | | – | |

| Total Distributions to Common Shareholders | | | (0.04 | ) | | | – | |

| Net asset value - end of period | | $ | 9.31 | | | $ | 10.30 | |

Total Investment Return - Net Asset Value(b) | | | (9.26 | )% | | | 3.00 | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 42,784 | | | $ | 35,760 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | 3.73 | %(d) | | | 5.62 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | 2.58 | %(d) | | | 2.32 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | (1.54 | )%(d) | | | (1.66 | )%(d) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements(c) | | | 2.75 | %(d) | | | 4.90 | %(d) |

Operating expenses including fee waivers/reimbursements(c) | | | 1.60 | %(d) | | | 1.60 | %(d) |

Net investment loss including fee waivers/reimbursements(c) | | | (0.56 | )%(d) | | | (0.94 | )%(d) |

| | | | | | | | | |

PORTFOLIO TURNOVER RATE(e) | | | 120 | % | | | 22 | % |

(a) | Per share amounts are based upon average shares outstanding. |

(b) | Total return is for the period indicated and has not been annualized. The total return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

(e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the fund level. |

See Notes to the Financial Statements.

| Semi-Annual Report | April 30, 2016 | 19 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING AND OPERATING POLICIES

The Clough Funds Trust (the “Trust”) is an open‐end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust was organized under the laws of the state of Delaware on March 17, 2015. The Trust currently offers shares of beneficial interest (“shares”) of the Fund. The Fund’s commencement date is September 30, 2015. The Fund is a diversified investment company with an investment objective to seek to provide long‐term capital appreciation. The Fund currently offers three Classes of shares: Classes A, C and I. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structure. As of April 30, 2016, 45.23% of the Fund is owned by affiliated parties. The Board of Trustees (the “Board”) may establish additional funds and classes of shares at any time in the future without shareholder approval.

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company for financial reporting purposes under GAAP.

The net asset value per share of the Fund is determined no less frequently than daily, on each day that the New York Stock Exchange (“NYSE” or the “Exchange”) is open for trading, as of the close of regular trading on the Exchange (normally 4:00 p.m. New York time). Trading may take place in foreign issues held by the Fund at times when a Fund is not open for business. As a result, each Fund’s net asset value may change at times when it is not possible to purchase or sell shares of the Fund.

Investment Valuation: Securities held by the Fund for which exchange quotations are readily available are valued at the last sale price, or if no sale price or if traded on the over‐the‐counter market, at the mean of the bid and asked prices on such day. Most securities listed on a foreign exchange are valued at the last sale price at the close of the exchange on which the security is primarily traded. In certain countries market maker prices are used since they are the most representative of the daily trading activity. Market maker prices are usually the mean between the bid and ask prices. Certain markets are not closed at the time that the Fund prices its portfolio securities. In these situations, snapshot prices are provided by the individual pricing services or other alternate sources at the close of the NYSE as appropriate. Securities not traded on a particular day are valued at the mean between the last reported bid and the asked quotes, or the last sale price when appropriate; otherwise fair value will be determined by the board‐appointed fair valuation committee. Debt securities for which the over‐the‐counter market is the primary market are normally valued on the basis of prices furnished by one or more pricing services or dealers at the mean between the latest available bid and asked prices. As authorized by the Board of Trustees, debt securities (including short‐term obligations that will mature in 60 days or less) may be valued on the basis of valuations furnished by a pricing service which determines valuations based upon market transactions for normal, institutional‐size trading units of securities or a matrix method which considers yield or price of comparable bonds provided by a pricing service. Total return swaps are priced based on valuations provided by a Board approved independent third party pricing agent. If a total return swap price cannot be obtained from an independent third party pricing agent the Fund shall seek to obtain a bid price from at least one independent and/or executing broker.

If the price of a security is unavailable in accordance with the aforementioned pricing procedures, or the price of a security is unreliable, e.g., due to the occurrence of a significant event, the security may be valued at its fair value determined by management pursuant to procedures adopted by the Board of Trustees. For this purpose, fair value is the price that the Fund reasonably expects to receive on a current sale of the security. Due to the number of variables affecting the price of a security, however; it is possible that the fair value of a security may not accurately reflect the price that the Fund could actually receive on a sale of the security.

A three‐tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used as of April 30, 2016, in valuing the Fund’s investments carried at value. The Fund recognizes transfers between the levels as of the end of the period in which the transfer occurred. There were no transfers between Levels 1 and 2 during the period ended April 30, 2016.

Clough Global Long/Short Fund

| Investments in Securities at Value* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 39,633,158 | | | $ | – | | | $ | – | | | $ | 39,633,158 | |

| Exchange Traded Funds | | | 511,866 | | | | – | | | | – | | | | 511,866 | |

| Participation Notes | | | – | | | | 786,227 | | | | – | | | | 786,227 | |

| Short‐Term Investments | | | 1,695,197 | | | | – | | | | – | | | | 1,695,197 | |

| TOTAL | | $ | 41,840,221 | | | $ | 786,227 | | | $ | – | | | $ | 42,626,448 | |

| Other Financial Instruments | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | |

| Common Stocks | | | (12,465,439 | ) | | | – | | | | – | | | | (12,465,439 | ) |

| Exchange Traded Funds | | | (2,100,581 | ) | | | – | | | | – | | | | (2,100,581 | ) |

| Preferred Stocks | | | (278,422 | ) | | | – | | | | – | | | | (278,422 | ) |

| Total Return Swap Contracts** | | | – | | | | (31,081 | ) | | | – | | | | (31,081 | ) |

| TOTAL | | $ | (14,844,442 | ) | | $ | (31,081 | ) | | $ | – | | | $ | (14,875,523 | ) |

| * | For detailed industry descriptions, see the accompanying Statement of Investments. |

| ** | Swap contracts are reported at their unrealized appreciation/(depreciation) at measurement date, which represents the change in the contract's value from trade date. |

In the event a Board approved independent pricing service is unable to provide an evaluated price for a security or Clough Capital believes the price provided is not reliable, securities of the Fund may be valued at fair value as described above. In these instances the Adviser may seek to find an alternative independent source, such as a broker/dealer to provide a price quote, or by using evaluated pricing models similar to the techniques and models used by the independent pricing service. These fair value measurement techniques may utilize unobservable inputs (Level 3).

On a monthly basis, the Fair Value Committee of the Fund meets and discusses securities that have been fair valued during the preceding month in accordance with the Fund’s Fair Value Procedures and reports quarterly to the Board of Trustees on the results of those meetings.

For the period ended April 30, 2016, the Fund did not have significant unobservable inputs (Level 3) used in determining fair value. Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

Offering Costs: The Fund incurred offering costs during the period ended April 30, 2016. These offering costs, including fees for printing initial prospectuses, legal and registration fees, were amortized over the first twelve months from the inception date of the Fund. Amount amortized during the period ended April 30, 2016 is shown on the Fund’s Statement of Operations. The remaining amount to be amortized, $58,762, is included in Prepaid expenses and other assets on the Fund's Statement of Assets and Liabilities.

Class Expenses: Expenses that are specific to a class of shares are charged directly to that share class. Fees provided under the distribution (Rule 12b‐1) and/or shareholder service plans for a particular class of the Fund are charged to the operations of such class.

| Semi-Annual Report | April 30, 2016 | 21 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)