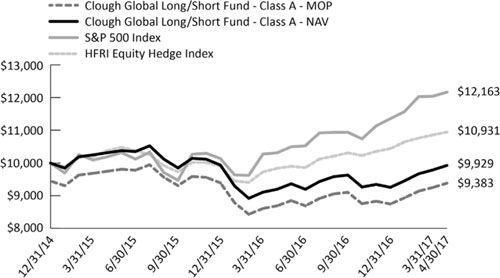

For the six month period ending April 30th, the Clough Global Long/Short Fund (the “Fund”) was up 7.3% for Class I. For the same period, the S&P 500 Index was up 13.3% and the HFRI Equity Hedge Index was up 6.8%. At a high level, the return profile of the Fund during the period could be characterized as benefitting from long exposure across sectors and regions, with the corresponding observation that the Fund’s short exposures detracted from performance across sectors and regions. Specifically, the long book contributed 13.0% to the Fund’s performance, while short positions detracted a total of 4.8% from returns. The rally in equities which was precipitated by the surprising outcome of the U.S. Presidential election extended across geographic borders and sector classifications. As a result, the Fund’s average net exposure for the period of 66% (long exposure minus short exposure) created a difficult relative comparison to its long-only benchmarks. The Fund was able to outperform the HFRI Equity Hedge Index, which is an index of other long/short funds, in the period.

From a sector perspective, the Fund benefitted from its overweight to the information technology, consumer discretionary, and financial sectors. The leading contributor to performance at a sector level was information technology, which contributed 3.0% to performance, which can be largely attributed to our thematic investing around smartphone innovation and pent-up demand for Apple’s next iPhone. We think the next version of the ubiquitous phone will deliver material functionality and form-factor improvements when compared to the current generation. While the phone is not expected to be released until the end of calendar 2017, the enthusiasm and build data-points are already influencing sentiment. As a result, the portfolio benefitted from direct exposure to Apple (AAPL), but also benefitted from the broader work we have done into the supply chain and various component manufacturers. Included among these holdings were positions in Broadcom (AVGO), ON Semiconductor (ON), Dialog Semiconductor (DLG), Samsung (005930 KS) and Ulvac (6728 JP). We maintain our view that the suppliers into this smartphone cycle are likely to offer proprietary, high margin components, making them highly leveraged to unit production.

The consumer discretionary sector contributed 2.5% to performance during the period, with the largest benefit to performance coming from our positions amongst the cable companies, e-commerce disruptors as well as several homebuilder stocks. Financials contributed 2.1% to performance as the prospects for elevated global growth, higher interest rates and reduced regulation on the heels of the recent U.S. presidential election caused several of our positions to re-rate higher. While we see potential for these entities to expand their book values, we are managing overall exposure to financials carefully as the abrupt stock price moves seem to reflect an optimism that, while not unfounded, may take a little more time to manifest into income statements.

The sectors that detracted from performance in the period were industrials, energy, and a slight loss incurred by exposure to the materials sector. Our perspective to hold short positions amongst industrial and aerospace companies at a time when much of the global economy is shifting from a commodity and construction driven cycle into a technology, consumption and services growth orientation has worked against us. We are managing this portion of the book with a perspective that fundamentals appear to be peaking, if not deteriorating, but we are simultaneously aware of our downside protection bias in a market that has been difficult for shorting, so exposures have been monitored. The largest detractors among these short positions have been positions in Lufthansa (LHA GY), Caterpillar (CAT), Boeing (BA), United Rentals (URI), and National-Oilwell Varco (NOV).

Geographically, the Fund derived 5.3% of its performance from holdings within the United States. The next largest contributor to performance on a regional basis was a 1.8% contribution from emerging markets. Within emerging markets, the Fund continues to hold positions in India and China that are exposed to an evolving consumption profile and higher growth rates.

While equity prices were broadly lifted during the six month period ending April 30th, we think opportunities to generate returns with the short portion of our portfolio are approaching. Central banks are now signaling that liquidity has peaked. The U.S. monetary base (the combination of cash and bank reserves) has been declining for months and the Federal Reserve is talking about actually shrinking its balance sheet. Our view is that the buoyancy of the major indexes has led to significant mispricing of many stocks and that will force markets to be more discriminating in future months. Once volatility and a wider dispersion of returns across sectors and geographies is re-introduced into the capital markets, it should provide a favorable backdrop for our investing style which is fundamentally-driven, global in scope, and seeks to generate returns from both the long and short side of the equity markets.

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (855) 425-6844 or by visiting www.cloughglobal.com.

Returns of less than 1 year are cumulative.

An investor cannot invest directly in an index.

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. The historical performance prior to September 30, 2015 is that of the Predecessor Fund. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table below is useful in comparing ongoing costs only and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

See Notes to the Financial Statements.

See Notes to the Financial Statements.

See Notes to the Financial Statements.

See Notes to the Financial Statements.

See Notes to the Financial Statements.

See Notes to the Financial Statements.

See Notes to the Financial Statements.

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING AND OPERATING POLICIES

Clough Funds Trust (the “Trust”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust was organized under the laws of the state of Delaware on March 17, 2015. The Trust currently offers shares of beneficial interest (“shares”) of the Clough Global Long/Short Fund (the “Fund”). The Fund’s commencement date is September 30, 2015. The Fund is a diversified investment company with an investment objective to seek to provide long-term capital appreciation. The Fund currently offers three Classes of shares: Classes A, C and I. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structure. As of April 30, 2017, over 50% of the Fund is owned by affiliated parties. The Board of Trustees (the “Board”) may establish additional funds and classes of shares at any time in the future without shareholder approval.

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company for financial reporting purposes under GAAP and follows the accounting and reporting guidance applicable to investment companies as codified in Accounting Standard Codification (“ASC”) 946 – Investment Companies.

The net asset value per share of the Fund is determined no less frequently than daily, on each day that the New York Stock Exchange (“NYSE” or the “Exchange”) is open for trading, as of the close of regular trading on the Exchange (normally 4:00 p.m. New York time). Trading may take place in foreign issues held by the Fund at times when the Fund is not open for business. As a result, the Fund’s net asset value may change at times when it is not possible to purchase or sell shares of the Fund.

Investment Valuation: Securities held by the Fund for which exchange quotations are readily available are valued at the last sale price, or if no sale price or if traded on the over-the-counter market, at the mean of the bid and asked prices on such day. Most securities listed on a foreign exchange are valued at the last sale price at the close of the exchange on which the security is primarily traded. In certain countries market maker prices are used since they are the most representative of the daily trading activity. Market maker prices are usually the mean between the bid and ask prices. Certain markets are not closed at the time that the Fund prices its portfolio securities. In these situations, snapshot prices are provided by the individual pricing services or other alternate sources at the close of the NYSE as appropriate. Securities not traded on a particular day are valued at the mean between the last reported bid and the asked quotes, or the last sale price when appropriate; otherwise fair value will be determined by the board-appointed fair valuation committee. Debt securities for which the over-the-counter market is the primary market are normally valued on the basis of prices furnished by one or more pricing services or dealers at the mean between the latest available bid and asked prices. As authorized by the Board, debt securities (including short-term obligations that will mature in 60 days or less) may be valued on the basis of valuations furnished by a pricing service which determines valuations based upon market transactions for normal, institutional-size trading units of securities or a matrix method which considers yield or price of comparable bonds provided by a pricing service. Total return swaps are priced based on valuations provided by a Board approved independent third party pricing agent. If a total return swap price cannot be obtained from an independent third party pricing agent the Fund shall seek to obtain a bid price from at least one independent and/or executing broker.

If the price of a security is unavailable in accordance with the aforementioned pricing procedures, or the price of a security is unreliable, e.g., due to the occurrence of a significant event, the security may be valued at its fair value determined by management pursuant to procedures adopted by the Board. For this purpose, fair value is the price that the Fund reasonably expects to receive on a current sale of the security. Due to the number of variables affecting the price of a security, however; it is possible that the fair value of a security may not accurately reflect the price that the Fund could actually receive on a sale of the security.

In accordance with ASC 820, a three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used as of April 30, 2017, in valuing the Fund’s investments carried at value. The Fund recognizes transfers between the levels as of the end of the period in which the transfer occurred. There were no transfers between Levels during the six months ended April 30, 2017.

Clough Global Long/Short Fund

| Investments in Securities at Value* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 18,368,004 | | | $ | – | | | $ | – | | | $ | 18,368,004 | |

| Participation Notes | | | – | | | | 241,288 | | | | – | | | | 241,288 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Money Market Fund | | | 4,072,013 | | | | – | | | | – | | | | 4,072,013 | |

| TOTAL | | $ | 22,440,017 | | | $ | 241,288 | | | $ | – | | | $ | 22,681,305 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

Total Return Swap Contracts** | | $ | – | | | $ | 457,918 | | | $ | – | | | $ | 457,918 | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stocks | | | (3,736,976 | ) | | | – | | | | – | | | | (3,736,976 | ) |

| TOTAL | | $ | (3,736,976 | ) | | $ | 457,918 | | | $ | – | | | $ | (3,279,058 | ) |

| * | For detailed sector descriptions, see the accompanying Statement of Investments. |

| ** | Swap contracts are reported at their unrealized appreciation/(depreciation) at measurement date, which represents the change in the contract's value from trade date. |

In the event a Board approved independent pricing service is unable to provide an evaluated price for a security or Clough Capital Partners L.P. (the “Adviser” or “Clough Capital”) believes the price provided is not reliable, securities of the Fund will be valued at fair value as described above. In these instances the Adviser may seek to find an alternative independent source, such as a broker/dealer to provide a price quote, or by using evaluated pricing models similar to the techniques and models used by the independent pricing service. These fair value measurement techniques may utilize unobservable inputs (Level 3).

On a monthly basis, the Fair Value Committee of the Fund meets and discusses securities that have been fair valued during the preceding month in accordance with the Fund’s Fair Value Procedures and reports quarterly to the Board on the results of those meetings.

For the six months ended April 30, 2017, the Fund did not have significant unobservable inputs (Level 3) used in determining fair value. Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

Class Expenses: Expenses that are specific to a class of shares are charged directly to that share class. Fees provided under the distribution (Rule 12b-1) and/or shareholder service plans for a particular class of the Fund are charged to the operations of such class.

Income Taxes: The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required. As of and during the six months ended April 30, 2017, the Fund did not have a liability for any unrecognized tax benefits. The Fund plans to file U.S. Federal and various state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

| Semi-Annual Report | April 30, 2017 | 17 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

The Fund normally pays dividends on an annual basis. Any net capital gains earned by the Fund are distributed annually. Distributions to shareholders are recorded by the Fund on the ex-dividend date.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income and dividend expense-short sales are recorded on the ex-dividend date. Certain dividend income from foreign securities will be recorded, in the exercise of reasonable diligence, as soon as a Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date and may be subject to withholding taxes in these jurisdictions. Interest income, which includes amortization of premium and accretion of discount, is recorded on the accrual basis. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis for both financial reporting and income tax purposes. All of the realized and unrealized gains and losses and net investment income, other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets.

Foreign Securities: The Fund may invest a portion of its assets in foreign securities. In the event that the Fund executes a foreign security transaction, the Fund will generally enter into a foreign currency spot contract to settle the foreign security transaction. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks.

The accounting records of the Fund are maintained in U.S. dollars. Prices of securities denominated in foreign currencies are translated into U.S. dollars at the closing rates of exchange at period end. Amounts related to the purchase and sale of foreign securities and investment income are translated at the rates of exchange prevailing on the respective dates of such transactions.

The effect of changes in foreign currency exchange rates on investments is reported with investment securities realized and unrealized gains and losses in the Fund’s Statement of Operations.

A foreign currency spot contract is a commitment to purchase or sell a foreign currency at a future date, at a negotiated rate. The Fund may enter into foreign currency spot contracts to settle specific purchases or sales of securities denominated in a foreign currency and for protection from adverse exchange rate fluctuation. Risks to the Fund include the potential inability of the counterparty to meet the terms of the contract.

The net U.S. dollar value of foreign currency underlying all contractual commitments held by the Fund and the resulting unrealized appreciation or depreciation are determined using prevailing forward foreign currency exchange rates. Unrealized appreciation and depreciation on foreign currency spot contracts are reported in the Fund’s Statements of Assets and Liabilities as a receivable or a payable and in the Fund’s Statement of Operations with the change in unrealized appreciation or depreciation on translation of assets and liabilities denominated in foreign currencies. These spot contracts are used by the broker to settle investments denominated in foreign currencies.

The Fund may realize a gain or loss upon the closing or settlement of the foreign transaction, excluding investment securities. Such realized gains and losses are reported with all other foreign currency gains and losses in the Statement of Operations.

Exchange Traded Funds: The Fund may invest in exchange traded funds (“ETFs”), which are funds whose shares are traded on a national exchange. ETFs may be based on underlying equity or fixed income securities, as well as commodities or currencies. ETFs do not sell individual shares directly to investors and only issue their shares in large blocks known as “creation units.” The investor purchasing a creation unit then sells the individual shares on a secondary market. Although similar diversification benefits may be achieved through an investment in another investment company, ETFs generally offer greater liquidity and lower expenses. Because an ETF incurs its own fees and expenses, shareholders of a Fund investing in an ETF will indirectly bear those costs. Such Funds will also incur brokerage commissions and related charges when purchasing or selling shares of an ETF. Unlike typical investment company shares, which are valued once daily, shares in an ETF may be purchased or sold on a securities exchange throughout the trading day at market prices that are generally close to the NAV of the ETF.

Short Sales: The Fund may sell a security it does not own in anticipation of a decline in the fair value of that security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker-dealer through which it made the short sale. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of the short sale.

The Fund's obligation to replace the borrowed security will be secured by collateral deposited with the broker-dealer, usually cash, U.S. government securities or other liquid securities. The Fund will also be required to designate on its books and records similar collateral with its custodian to the extent, if any, necessary so that the aggregate collateral value is at all times at least equal to the current value of the security sold short. The cash amount is reported on the Statement of Assets and Liabilities as Deposit with broker for securities sold short which is held with one counterparty. The Fund is obligated to pay interest to the broker for any debit balance of the margin account relating to short sales. The interest incurred by the Fund is reported on the Statement of Operations as Interest expense – margin account. Interest amounts payable are reported on the Statement of Assets and Liabilities as Interest payable – margin account.

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

The Fund may also sell a security short if it owns at least an equal amount of the security sold short or another security convertible or exchangeable for an equal amount of the security sold short without payment of further compensation (a short sale against-the-box). In a short sale against-the-box, the short seller is exposed to the risk of being forced to deliver stock that it holds to close the position if the borrowed stock is called in by the lender, which would cause gain or loss to be recognized on the delivered stock. The Fund expects normally to close its short sales against-the-box by delivering newly acquired stock. Since the Fund intends to hold securities sold short for the short term, these securities are excluded from the purchases and sales of investment securities in Note 4 and the Fund’s Portfolio Turnover in the Financial Highlights.

Derivative Instruments and Hedging Activities: The following discloses the Fund’s use of derivative instruments and hedging activities.

The Fund’s investment objective not only permits the Fund to purchase investment securities, it also allows the Fund to enter into various types of derivative contracts, including, but not limited to, forward foreign currency contracts, futures, options and swaps. The Fund may use derivatives, among other reasons, as part of the Fund’s investment strategy, to attempt to employ its currency strategies, to seek to hedge against foreign exchange risk, and to gain access to foreign markets.

Risk of Investing in Derivatives: The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. In instances where the Fund is using derivatives to decrease or hedge exposures to market risk factors for securities held by the Fund, there are also risks that those derivatives may not perform as expected, resulting in losses for the combined or hedged positions.

Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows the Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivative and the Fund. Typically, the associated risks are not the risks that the Fund is attempting to increase or decrease exposure to its investment objective, but the additional risks from investing in derivatives. Associated risks can be different for each type of derivative and are discussed by each derivative type in the notes that follow.

Examples of these associated risks are liquidity risk, which is the risk that the Fund will not be able to sell the derivative in the open market in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund.

Market Risk Factors: In addition, in pursuit of its investment objectives, the Fund may seek to use derivatives, which may increase or decrease exposure to the following market risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk: Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the value of the foreign currency denominated security will increase as the dollar depreciates against the currency.

Futures Contracts: The Fund may enter into futures contracts. A futures contract is an agreement to buy or sell a security or currency (or to deliver a final cash settlement price in the case of a contract relating to an index or otherwise not calling for physical delivery at the end of trading in the contract) for a set price at a future date. If the Fund buys a security futures contract, the Fund enters into a contract to purchase the underlying security and is said to be "long" under the contract. If the Fund sells a security futures contact, the Fund enters into a contract to sell the underlying security and is said to be "short" under the contract. The price at which the contract trades (the "contract price") is determined by relative buying and selling interest on a regulated exchange. Futures contracts are marked to market daily and an appropriate payable or receivable for the change in value (“variation margin”) is recorded by the Fund. Such payables or receivables are recorded for financial statement purposes as variation margin payable or variation margin receivable by the Fund. The Fund pledges cash or liquid assets as collateral to satisfy the current obligations with respect to futures contracts. The cash amount is reported on the Statement of Assets and Liabilities as Deposit with broker for futures contracts.

| Semi-Annual Report | April 30, 2017 | 19 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

The Fund enters into such transactions for hedging and other appropriate risk-management purposes or to increase return. While the Fund may enter into futures contracts for hedging purposes, the use of futures contracts might result in a poorer overall performance for the Fund than if it had not engaged in any such transactions. If, for example, the Fund had insufficient cash, it might have to sell a portion of its underlying portfolio of securities in order to meet daily variation margin requirements on its futures contracts or options on futures contracts at a time when it might be disadvantageous to do so. There may be an imperfect correlation between the Fund’s portfolio holdings and futures contracts entered into by the Fund, which may prevent the Fund from achieving the intended hedge or expose the Fund to risk of loss.

Futures contract transactions may result in losses substantially in excess of the variation margin. There can be no guarantee that there will be a correlation between price movements in the hedging vehicle and in the portfolio securities being hedged. An incorrect correlation could result in a loss on both the hedged securities in the Fund and the hedging vehicle so that the portfolio return might have been greater had hedging not been attempted. There can be no assurance that a liquid market will exist at a time when the Fund seeks to close out a futures contract. Lack of a liquid market for any reason may prevent the Fund from liquidating an unfavorable position, and the Fund would remain obligated to meet margin requirements until the position is closed. In addition, the Fund could be exposed to risk if the counterparties to the contracts are unable to meet the terms of their contracts. With exchange-traded futures contracts, there is minimal counterparty credit risk to the Fund since futures contracts are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures contracts, guarantees the futures contracts against default.

Swaps: During the period, the Fund engaged in total return swaps. A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. The Fund may utilize swap agreements as a means to gain exposure to certain assets and/or to “hedge” or protect the Fund from adverse movements in securities prices or interest rates. The Fund is subject to equity risk and interest rate risk in the normal course of pursuing its investment objective through investments in swap contracts. Swap agreements entail the risk that a party will default on its payment obligation to the Fund. If the other party to a swap defaults, the Fund would risk the loss of the net amount of the payments that it contractually is entitled to receive. If the Fund utilizes a swap at the wrong time or judges market conditions incorrectly, the swap may result in a loss to the Fund and reduce the Fund’s total return.

Total return swaps involve an exchange by two parties in which one party makes payments based on a set rate, either fixed or variable, while the other party makes payments based on the return of an underlying asset, which includes both the income it generates and any capital gains over the payment period. A Fund’s maximum risk of loss from counterparty risk or credit risk is the discounted value of the payments to be received from/paid to the counterparty over the contract’s remaining life, to the extent that the amount is positive. The risk is mitigated by having a netting arrangement between a Fund and the counterparty and by the posting of collateral to a Fund to cover the Fund’s exposure to the counterparty. The Fund pledges cash or liquid assets as collateral to satisfy the current obligations with respect to swap contracts. The cash amount is reported on the Statement of Assets and Liabilities as Deposit with broker for total return swap contracts which is held with one counterparty.

During the six months ended April 30, 2017, the Fund invested in swap agreements consistent with the Fund’s investment strategies to seek to hedge against foreign exchange risk or to gain exposure to certain markets or indices.

The effect of derivatives instruments on the Fund’s Statement of Assets and Liabilities as of April 30, 2017:

| | Asset Derivatives | | | |

| Risk Exposure | Statements of Assets and Liabilities Location | | Fair Value | |

| Equity Contracts (Total Return Swap Contracts) | Unrealized appreciation on total return swap contracts | | $ | 457,918 | |

| | | | $ | 457,918 | |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

The effect of derivatives instruments on the Fund’s Statement of Operations for the six months ended April 30, 2017:

| Risk Exposure | Statements of Operations Location | | Realized Gain/(Loss) on Derivatives Recognized in Income | | | Change in Unrealized Appreciation/ (Depreciation) on Derivatives Recognized in Income | |

Foreign Currency Contracts (Futures Contracts) | Net realized gain/(loss) on futures contracts/Net change in unrealized appreciation/(depreciation) on futures contracts | | $ | 108,870 | | | $ | (15,429 | ) |

Equity Contracts (Total Return Swap Contracts) | Net realized gain/(loss) on total return swap contracts/Net change in unrealized appreciation/(depreciation) on total return swap contracts | | | (39,518 | ) | | | 473,004 | |

| Total | | | $ | 69,352 | | | $ | 457,575 | |

The average futures contracts notional amount during the six months ended April 30, 2017 is $(783,212).

The average total return swap contracts notional amount during the six months ended April 30, 2017 is $2,082,795.

Certain derivative contracts are executed under either standardized netting agreements or, for exchange-traded derivatives, the relevant contracts for a particular exchange which contain enforceable netting provisions. A derivative netting arrangement creates an enforceable right of set-off that becomes effective, and affects the realization of settlement on individual assets, liabilities and collateral amounts, only following a specified event of default or early termination. Default events may include the failure to make payments or deliver securities timely, material adverse changes in financial condition or insolvency, the breach of minimum regulatory capital requirements, or loss of license, charter or other legal authorization necessary to perform under the contract.

The following table presents derivative financial instruments that are subject to enforceable netting arrangements as of April 30, 2017.

Offsetting of Derivatives Assets

| | | | | | | | | | | | Gross Amounts Not Offset in the

Statements of Assets and Liabilities | |

| | | Gross Amounts of Recognized Assets | | | Gross Amounts Offset in the Statements of Assets and Liabilities | | | Net Amounts Presented in the Statements of Assets and Liabilities | | | Financial Instruments(a) | | | Cash Collateral Pledged | | | Net Amount | |

| Total Return Swap Contracts | | $ | 457,918 | | | $ | – | | | $ | 457,918 | | | $ | (457,918 | ) | | $ | – | | | $ | – | |

| Total | | $ | 457,918 | | | $ | – | | | $ | 457,918 | | | $ | (457,918 | ) | | $ | – | | | $ | – | |

| (a) | These amounts are limited to the derivative asset/liability balance and, accordingly, do not include excess collateral received/pledged which is disclosed in the Statement of Investments. |

| Semi-Annual Report | April 30, 2017 | 21 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

Counterparty Risk: The Fund runs the risk that the issuer or guarantor of a fixed income security, the counterparty to an over-the-counter derivatives contract or the obligor of an obligation underlying an asset-backed security will be unable or unwilling to make timely principal, interest, or settlement payments or otherwise honor its obligations. In addition, to the extent that the Fund uses over-the-counter derivatives, and/or has significant exposure to a single counterparty, this risk will be particularly pronounced for the Fund.

Other Risk Factors: Investing in the Fund may involve certain risks including, but not limited to, the following:

Unforeseen developments in market conditions may result in the decline of prices of, and the income generated by, the securities held by the Fund. These events may have adverse effects on the Fund such as a decline in the value and liquidity of many securities held by the Fund, and a decrease in net asset value. Such unforeseen developments may limit or preclude the Funds’ ability to achieve their investment objective.

Investing in stocks may involve larger price fluctuation and greater potential for loss than other types of investments. This may cause the securities held by the Fund to be subject to larger short-term declines in value.

The Fund may have elements of risk due to concentrated investments in foreign issuers located in a specific country. Such concentrations may subject the Fund to additional risks resulting from future political or economic conditions and/or possible impositions of adverse foreign governmental laws or currency exchange restrictions. Investments in securities of non-U.S. issuers have unique risks not present in securities of U.S. issuers, such as greater price volatility and less liquidity.

2. TAXES

Classification of Distributions: Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of the distributions paid by the Fund during the year ended October 31, 2016, were as follows:

| | | Ordinary Income | | | Long-Term

Capital Gains | | | Total | |

| October 31, 2016 | | $ | 146,946 | | | $ | 6,033 | | | $ | 152,979 | |

Tax Basis of Investments: Net unrealized appreciation/(depreciation) of investments based on federal tax costs as of April 30, 2017, was as follows:

| Gross appreciation (excess of value over tax cost) | | $ | 2,045,306 | |

| Gross depreciation (excess of tax cost over value) | | | (242,282 | ) |

| Net unrealized appreciation | | $ | 1,803,024 | |

| Cost of investments for income tax purposes | | $ | 20,878,281 | |

The difference between book and tax basis unrealized appreciation is attributable primarily to wash sales and passive foreign investment companies.

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

3. CAPITAL TRANSACTIONS

Common Shares: There is an unlimited number of shares of beneficial interest with no par value per share. Shares redeemed within 30 days of purchase may incur a 2.00% redemption fee deducted from the redemption amount.

| | | For the Six

Months Ended

April 30, 2017

(Unaudited) | | | For the

Year Ended

October 31,

2016 | |

| Class A: | | | | | | |

| Beginning of period | | | 8,059 | | | | 2,600 | |

| Shares sold | | | 1,678 | | | | 5,454 | |

| Distributions reinvested | | | – | | | | 10 | |

| Shares redeemed | | | (99 | ) | | | (5 | ) |

| Net increase in shares outstanding | | | 1,579 | | | | 5,459 | |

| Shares outstanding, end of period | | | 9,638 | | | | 8,059 | |

| Class C: | | | | | | | | |

| Beginning of period | | | 7,843 | | | | 2,500 | |

| Shares sold | | | – | | | | 5,333 | |

| Distributions reinvested | | | – | | | | 10 | |

| Shares redeemed | | | (938 | ) | | | – | |

| Net increase (decrease) in shares outstanding | | | (938 | ) | | | 5,343 | |

| Shares outstanding, end of period | | | 6,905 | | | | 7,843 | |

| Class I: | | | | | | | | |

| Beginning of period | | | 4,681,053 | | | | 3,472,903 | |

| Shares sold | | | 172,795 | | | | 1,899,988 | |

| Distributions reinvested | | | – | | | | 15,233 | |

| Shares redeemed | | | (2,495,483 | ) | | | (707,071 | ) |

| Net increase (decrease) in shares outstanding | | | (2,322,688 | ) | | | 1,208,150 | |

| Shares outstanding, end of period | | | 2,358,365 | | | | 4,681,053 | |

4. PORTFOLIO SECURITIES

Purchases and sales of investment securities, excluding securities sold short intended to be held for less than one year, short-term securities, and Long Term U.S. Government obligations, for the six months ended April 30, 2017, are listed in the table below.

| Cost of Investments Purchased | | | Proceeds From Investments Sold | |

| $ | 44,009,925 | | | $ | 62,157,276 | |

| Semi-Annual Report | April 30, 2017 | 23 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

5. INVESTMENT ADVISORY AND OTHER AGREEMENTS

Investment Advisory Agreement: Clough Capital will serve as the Fund’s investment adviser pursuant to an Investment Advisory Agreement with the Fund. As compensation for its services to the Fund, the Adviser receives an annual investment advisory fee of 1.35% based on the Fund’s average daily net assets, paid monthly. The Adviser has agreed contractually to limit the operating expenses of each class of the Fund (excluding Rule 12b-1 Distribution and Service Fees, Shareholder Services Fees, acquired fund fees and expenses, interest, taxes, brokerage costs and commissions, dividend and interest expense on short sales, and litigation, indemnification and extraordinary expenses as determined under generally accepted accounting principles) to an annual rate of 1.60% through February 28, 2018. The Adviser is permitted to recover, on a class-by-class basis, any fees waived and/or expenses reimbursed pursuant to the waiver agreement described above to the extent that such recovery does not cause total annual operating expenses to exceed the expense limitation in effect (i) at the time the fees and/or expenses to be recovered were waived and/or reimbursed and (ii) at the time of such recovery. The Adviser will not be entitled to recover any such waived or reimbursed fees and expenses more than three years after the end of the fiscal year in which the fees were waived or expenses were reimbursed. The Adviser may not terminate this waiver arrangement without the approval of the Fund’s Board.

As of October 31, 2016, the balances of future recoupable expenses were as follows:

| | | Expires in 2018 | | | Expires in 2019 | | | Total | |

| Class A | | $ | (85 | ) | | $ | (470 | ) | | $ | (555 | ) |

| Class C | | $ | (82 | ) | | $ | (734 | ) | | $ | (816 | ) |

| Class I | | $ | (83,042 | ) | | $ | (537,227 | ) | | $ | (620,269 | ) |

Administration Agreement: The Fund currently employs ALPS Fund Services, Inc. (“ALPS”) under an administration agreement to provide certain administrative services to the Fund. As compensation for its services to the Fund, ALPS receives an annual administration fee based on the Fund’s average daily net assets, paid monthly.

Transfer Agency and Service Agreement: ALPS, pursuant to a Transfer Agency and Service Agreement, serves as transfer agent for the Fund.

Distribution and Shareholder Services Plan: The Fund has adopted a separate plan of distribution for Class A and Class C shares, pursuant to Rule 12b-1 under the 1940 Act (each, a “Plan” and collectively, the “Plans”). ALPS Portfolio Solutions Distributor, Inc. (the “Distributor”) serves as the Fund’s distributor.

The Plans allow the Fund, as applicable, to use Class A and Class C assets to pay fees in connection with the distribution and marketing of Class A and Class C shares and/or the provision of ongoing servicing for the benefit of shareholders. Each Plan permits payment for services in connection with the administration of plans or programs that use Class A and/or Class C shares of the Fund as their funding medium and for related expenses.

The Plans permit the Fund to make total payments at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to its Class A shares, and 1.00% of the Fund’s average daily net assets attributable to its Class C shares. Because these fees are paid out of the Fund’s Class A and Class C shares, respectively, on an ongoing basis, over time they will increase the cost of an investment in Class A and Class C shares. For example, the Class C Plan fees may cost an investor more than the Class A Plan sales charges over time.

Under the terms of the Plans, the Trust is authorized to make payments to the Distributor for remittance to financial intermediaries, as compensation for distribution and/or the provision of on-going servicing for the benefit of shareholders performed by such financial intermediaries for their customers who are investors in the Fund. Financial intermediaries may from time to time be required to meet certain additional criteria in order to continue to receive 12b-1 fees. For Class C shares, the Distributor is entitled to retain all fees paid under the Plan for the first 12 months on any investment in Class C Shares to recoup the expenses with respect to the payment of commissions on sales of Class C Shares. Financial intermediaries will become eligible for Class C Plan compensation beginning in the 13th month following the purchase of Class C Shares, although the Distributor may, pursuant to a written agreement between the Distributor and a particular financial intermediary, pay such financial intermediary 12b-1 fees prior to the 13th month following the purchase of Class C Shares. The Distributor may retain some or all compensation payable pursuant to the Plans under certain circumstances, such as when a financial intermediary is removed as the broker of record or a financial intermediary fails to meet certain qualification standards to be eligible to continue to be the broker of record.

Shareholder Services Plan for Class A Shares: The Fund has adopted a non-12b-1 shareholder services plan (the “Services Plan”) with respect to the Fund’s Class A shares. Under the Services Plan, the Fund is authorized to pay financial intermediaries an aggregate fee in an amount not to exceed on an annual basis 0.10% of the average daily net asset value of the Class A shares of the Fund attributable to or held in the name of the financial intermediary for its clients as compensation for maintaining customer accounts that hold Fund shares. These activities may include, but are not limited to, establishing and maintaining Fund shareholder accounts on a transaction processing and record keeping system, providing Fund shareholders with the ability to access current Fund information, including without limitation, share balances, dividend information and transaction history, and permitting the Fund’s transfer agent to receive order instructions from or on behalf of Fund shareholders for the purchase or redemption of Shares. None of these activities include distribution services. Any amount of the Services Plan fees not paid during the Fund’s fiscal year for such servicing shall be reimbursed to the Fund.

| Clough Global Long/Short Fund | Notes to Financial Statements |

April 30, 2017 (Unaudited)

6. INDEMNIFICATION

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust believes the risk of loss to be remote.

7. OTHER

The Independent Trustees of the Fund receive a quarterly retainer of $4,000, plus $2,250 for each regular Board meeting attended, $1,000 for each special telephonic Board or Committee meeting attended and $2,250 for each special in-person Board meeting attended. The Independent Trustees are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings.

8. RECENT ACCOUNTING PRONOUNCEMENT

In December 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update (“ASU”) 2016-19, “Technical Corrections and Improvements.” It includes an update to Accounting Standards Codification Topic 820 (“Topic 820”), Fair Value Measurement. The update to Topic 820 clarifies the difference between a valuation approach and a valuation technique. It also requires disclosure when there has been a change in either or both a valuation approach and/or a valuation technique. The changes related to Topic 820 are effective for annual reporting periods, including interim periods within those annual periods, beginning after December 15, 2016. Management is currently evaluating the impact of the ASU to the financial statements.

9. SEC REGULATIONS

On October 13, 2016, the SEC amended Regulation S-X, which will require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management is currently evaluating the impact to the financial statements and disclosures.

| Semi-Annual Report | April 30, 2017 | 25 |

| Clough Global Long/Short Fund | Additional Information |

April 30, 2017 (Unaudited)

FUND PROXY VOTING POLICIES & PROCEDURES

The Fund’s policies and procedures used in determining how to vote proxies relating to portfolio securities are available on the Fund’s website at http://www.cloughglobal.com. Information regarding how the Fund voted proxies relating to portfolio securities held by the Fund for the period ended June 30, are available without charge, upon request, by contacting the Funds at 1-877-256-8445 and on the Commission’s website at http://www.sec.gov.

PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N–Q within 60 days after the end of the period. Copies of the Fund’s Form N–Q are available without a charge, upon request, by contacting the Fund at 1–877–256–8445 and on the Commission’s website at http://www.sec.gov. You may also review and copy Form N–Q at the Commission’s Public Reference Room in Washington, D.C. For more information about the operation of the Public Reference Room, please call the Commission at 1–800–SEC–0330.

| Clough Global Long/Short Fund | Investment Advisory Agreement Approval |

April 30, 2017 (Unaudited)

At an in-person meeting of the Board held on April 13, 2017, the Trustees of Clough Funds Trust (the “Trust”), including a majority of the Trustees who are not “interested persons” of the Trust (the “Independent Trustees”), voted to approve the continuation of the current Management Agreement (the “Management Agreement”) with Clough Capital Partners L.P. (the “Adviser”) with respect to the Clough Global Long/Short Fund (the “Fund”). In voting such approval, the Board took into account various sources of information, considerations and conclusions, as summarized below.

Management Agreement Approval Process

Section 15(c) of the 1940 Act, requires that each mutual fund’s board of directors or trustees, including a majority of those directors or trustees who are not “interested persons” of the mutual fund, as defined in the 1940 Act, initially approve, and after an initial term not exceeding two years, annually review and consider the continuation of, the mutual fund’s investment advisory agreement. The Board reviewed information relating to the Fund and the Adviser that was prepared in response to specific inquiries made on behalf of the Independent Trustees to assist them in their consideration of the continuation of the Management Agreement. This information included, among other things, information about: the Adviser’s organization, operations and personnel; the services provided to the Fund by the Adviser; the Adviser’s portfolio management, trading and compliance practices; and the level of the advisory fee and the total expense ratio of the Fund relative to a peer group of comparable alternative long-short equity funds, as detailed in a comparative analysis prepared by an independent data provider. As part of its consideration process, the Board received presentations from representatives of the Adviser regarding the Fund and its investment strategy, and reviewed the Fund’s investment performance in comparison to the performance of other similarly managed funds. The Independent Trustees of the Board also met in executive session separately from Fund management and the interested Trustees to consider the information provided and to confer with independent legal counsel regarding their responsibilities under relevant laws and regulations.

Nature, Quality and Extent of Services

In evaluating the nature, quality and extent of services provided by the Adviser to the Fund, the Board reviewed information relating to the Adviser’s operations and personnel, including: its organizational and management structure; the qualifications, education and experience of the individual investment professionals whose responsibilities include portfolio management and investment research for the Fund; the portfolio management and trading practices to be employed in managing the Fund; the Adviser’s financial condition and its ability to devote the resources necessary to provide the services required under the Management Agreement; and the Adviser’s dedication to maintaining appropriate compliance programs with respect to the Fund. In particular, the Board noted that the Adviser is a well-regarded organization with an appropriate level of financial and human resources, including personnel with experience managing global long-short portfolios. The Board also compared the Fund’s investment performance to benchmark indices and a peer group of comparable long-short equity funds selected by an independent data provider, noting that for the one-year period ended February 28, 2017, the average annual net total return performance of the peer group was 9.14% and the Fund’s performance was 8.87%, which was in the 52nd percentile.

Based upon these and other relevant factors, the Board concluded that the Adviser possesses the capability to effectively perform the duties required of it under the Management Agreement and that the Adviser’s personnel are qualified to manage the Fund’s assets in accordance with its stated investment objectives and policies.

Fees and Expenses

In considering the fee payable to the Adviser under the Management Agreement, the Board reviewed comparative information presented in the report of an independent data provider relating to the actual and contractual fee level and total expense ratio of the Fund relative to a peer group of comparable long-short equity funds. In this regard, the Board considered that the advisory fee payable by funds in the expense group ranged from 1.250% to 1.990%, with a median of 1.450%, and that the Fund’s advisory fee was 1.350%. The Board also considered that the net total expense ratio for the expense group, excluding investment related expenses, ranged from 0.831% to 2.990%, with a median of 1.720%, and the Fund’s net total expense ratio, excluding investment related expenses, was 1.600%.

The Board also requested and reviewed information regarding the fees charged by the Adviser to the other registered funds and institutional separate accounts it manages. In addition, the Board noted that the Adviser had proposed to maintain a limit on total operating expenses, including waiving advisory fees, if necessary, for each share class of the Fund for a period of at least one year from the date of the Fund’s prospectus.

On the basis of the information provided, the Board concluded that the advisory fee was reasonable in light of the nature, quality and extent of services provided by the Adviser.

Profitability

In considering the fees payable under the Management Agreement, the Board reviewed information regarding the Adviser’s costs to provide investment management and related services to the Fund and the estimated profitability to the Adviser from all services provided to the Fund. In its evaluation, the Board considered the Adviser’s representation that the level of its estimated profitability was reasonable based on the nature and quality of the services provided and the Adviser’s costs in delivering such services. The Board also considered that the actual profitability of the Fund to the Adviser would depend on the growth of assets under management, after giving effect to the Adviser’s agreement to maintain a limit on total expenses for a period of at least one year from the date of the Fund’s prospectus. Based on these considerations, the Board concluded that the profits expected to be realized by the Adviser as a result of the continuation of the Management Agreement would not be excessive.

| Semi-Annual Report | April 30, 2017 | 27 |

| Clough Global Long/Short Fund | Investment Advisory Agreement Approval |

April 30, 2017 (Unaudited)

Economies of Scale

In reviewing the Fund’s advisory fee, the Board considered the extent to which the Adviser, on the one hand, and the Fund, on the other hand, can expect to benefit from economies of scale in the event the assets of the Fund increase over time. In considering the potential to realize benefits from economies of scale, the Board reviewed the Fund’s advisory fee in comparison to comparable peer funds as well as the Fund’s current and expected expense ratio after giving effect to the Adviser’s agreement to limit total expenses for a period of one year from the date of the Fund’s prospectus. On the basis of the foregoing, and in light of the Fund’s current and expected asset levels, the Board concluded that the structure of the advisory fee is appropriate and that fee breakpoints are not required at this time. The Board noted, however, that it would review future growth in Fund assets and the appropriateness of breakpoints as part of future annual reviews of the Management Agreement.

Other Benefits

The Board considered other potential benefits to be derived by the Adviser from its relationship with the Fund, as well as any additional benefits which may be derived by the Fund as a result of its association with the Adviser.

Conclusion

Based on its review of the information provided, and such other factors and conclusions as the Board deemed relevant, the Board, including a majority of the Independent Trustees, concluded that the approval of the Management Agreement is in the best interests of the Fund and voted to approve its continuation. In reaching this determination, the Board did not assign relative weights to any factors or conclusions taken into account nor did it deem any one or group of such factors or conclusions to be determinative in isolation.

Must be accompanied or preceded by a prospectus.

ALPS Portfolio Solutions Distributor, Inc. is the distributor for the Clough Global Long/Short Fund.