UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23059

CLOUGH FUNDS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

303.623.2577

(Registrant’s telephone number, including area code)

Sareena Khwaja-Dixon, Secretary

Clough Funds Trust

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and address of agent for service)

Date of fiscal year end:October 31

Date of reporting period:November 1, 2018 - October 31, 2019

Item 1. Report to Stockholders.

| Clough Global Long/Short Fund | Table of Contents |

| Shareholder Letter | 2 |

| Portfolio Performance | 8 |

| Disclosure of Fund Expenses | 11 |

| Statement of Investments | 12 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 17 |

| Statement of Changes in Net Assets | 18 |

| Financial Highlights | 19 |

| Notes to Financial Statements | 23 |

| Report of Independent Registered Public Accounting Firm | 34 |

| Additional Information | 35 |

| Trustees & Officers | 36 |

| Privacy Policy | 40 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission (the “Commission”), paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.cloughglobal.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Beginning on January 1, 2019, you may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-855-425-6844 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at http://www.cloughglobal.com/open-end-funds/overview/cloax.

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

Dear Shareholders:

For the fiscal year ended in 2019, the Fund had a total return of 6.36% for Class I, compared to 13.22% for the MSCI ACWI and 4.85% for the HFRI Equity Hedge Index. The long book had an average delta-adjusted exposure of 86.4% exposure (adding 10.36% to returns), while the short book had an average delta-adjusted exposure of -22.7% exposure (detracting 2.89% from returns).

The Fund outperformed its long/short benchmark, the HFRI Equity Hedge Index, for the year by 1.51%, and trailed its long-only benchmark, the MSCI ACWI Index, by 6.86%.

By country, the portfolio had its most meaningful gains from the U.S. (559 basis points) and China (121 basis points). The countries which negatively impacted performance in the period were Italy (-59 basis points) and Canada (-48 basis points). By sector, the greatest contributions to returns were from Healthcare (182 basis points), Information Technology (180 basis points) and Financials (131 basis points). The sectors that detracted most from the Fund’s returns were Communication Services (-29 basis points) and Utilities (-6 basis points). Portfolio hedges helped reduce volatility, but also detracted 10 basis points from performance.

Top Five Performers

Carvana (CVNA), the online distributer of used cars, was a top performer. Earlier this year, the company secured asset backed financing in the public markets, dramatically reducing financial costs, a testimony to its market presence and dominant business model. The company is expected to soon reach desired markets throughout the United States, and its investment needs will slow. Revenues have continued to grow more than 100% annually. Free cash flow (“FCF”) could potentially reach $1 billion annually by 2022, according to some estimates. We think the company has the potential to grow several times its current size.

Apellis Pharmaceuticals (APLS), a rare disease company, gained due to positive efficacy data for its trial in paroxysmal nocturnal hemoglobinuria (PNH), a rare disease of the blood. Apellis is expected to report phase 3 data for this program in early 2020. Apellis also provided a positive update on its trial in geographic atrophy, a disease that causes vision loss. Apellis expects to complete enrollment for its phase 3 trial in early 2020.

Anta Sports Products (2020 HK) was one of the leading contributors to performance during the fiscal year. We think Anta, a leading designer, manufacturer and retailer of athletic apparel across China, is well-positioned to capitalize on the overall increase in discretionary spending towards the category. Anta has expanded its brand portfolio, increased retail and digital distribution capabilities, and has invested in a more efficient supply chain. A strong acquisition strategy combined with operational excellence led to strong results for Anta during the fiscal year.

CRISPR Therapeutics (CRSP) is a leading gene editing company and was a top performer over the last year. Our interest in the company began several years ago and today the company has by far the broadest gene editing pipeline and the strongest clinical momentum in the industry.

Owens & Minor (OMI), a medical supplies distributor and a long position in the Funds, gained after the company generated better than expected earnings during the most recent quarter. The company is in the midst of a broad turnaround and we believe there continues to be upside potential under the new management team.

Bottom Five Performers

A short position in Mediobanca (MB IM) was a bottom performer. The Italian bank, like other European banks, rallied off of very depressed levels during the year. We continue to believe there is little value in the equity of Mediobanca and other banks as they have yet to clear their balance sheets of crisis era bad loans. Their damaged balance sheets, along with the Euro Zone’s slumping economy and negative interest rates, makes it very difficult to expand credit and start to grow profits.

Qualcomm (QCOM) was a short idea which went against us. Our view was that their core modem technology was getting commoditized and their royalty business model was unsustainable. At the same time, consensus was modelling an aggressive roll out of 5G technology handset, which was different from our view.

A short position in a medical waste management company detracted from performance. While the company reported results below expectations during the period, the stock gained as the market was receptive to the new CEO’s turnaround plans.

Apple (AAPL), another bottom performer, is a company we like for multiple reasons. First, the services business is high margins and is growing at a healthy teens rate and in wearables (e.g., AirPods) it has found another successful product in addition to the iPhones. Furthermore, we believe CY 2019 will mark a trough in iPhone volumes as it is greatly under shipping what we believe to steady state demand driven by replacement cycles. The 5G phone to be introduced next year should drive a strong replacement cycle as well. While we believe we have been right on our broader thesis, it has been a very hard stock to own given its China exposure and sensitivity to China risk offs driven by presidential tweets. We will look to re-establish a position when the appropriate risk reward emerges.

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

Biomarin Pharmaceuticals (BMRN), a biotechnology company, also detracted from performance. The company reported mixed results for its key hemophilia pipeline product. This led Wall Street analysts to reassess their commercial estimates for the product, and the stock declined over the period.

The following is a summary of the key themes expressed in the Fund during the Fiscal Year

The Fund has been focused on four key themes: A) earnings power and product cycles in the technology space, B) mergers & acquisitions (“M&A”) targets and innovation in the healthcare space, C) the evolving business models in U.S. money center banks, and D) the emerging consumer in China and India.

Facing low interest rates, we think investors looking for yield will turn to equities, and companies that generate FCF that can support growing dividends, will perform well. FCF can essentially be a proxy for yield. Citigroup (C), a current holding that has also been amongst the Fund’s largest holdings for the fiscal year, sports a 3.3% dividend yield and is building excess capital that may support even higher dividends in the future. Microsoft (MSFT), another of the Fund’s current holdings, carries a dividend yield around 1.4%, but its 7% FCF yield may help to support strong dividend growth over the years ahead.

Technology: Earnings power and product cycles

The combination of high tech and low interest rates can create massive transformations such as the Internet, the smartphone, social media and the cloud. Or it can create equally massive profit disappointments such as shale and the venture capital boom in loss-making unicorns. Out of this, long and short opportunities will emerge.

The transformative technologies of the future largely rest on the advances going on in telecommunications. Enormous sums will be spent on the development of 5G telecom networks, artificial intelligence and autonomous driving. 5G has already launched in South Korea and some cities in the U.S. But it is not clear that these investments will be all that profitable. In fact, 5G and its offshoots could be problematic for many of the companies involved.

Many companies with a lot of capital will be chasing the same opportunities, and we think many players will be overwhelmed by competition and much of that spent capital will generate disappointing returns or even be destroyed. Fear of being left behind is energizing governments to invest vast sums in 5G networks and few companies involved in building or providing 5G telecom services will gain a competitive advantage. We are seeing early signs of this. For example, Nokia recently announced weak earnings and eliminated its dividend as a result of higher than expected costs in rolling out its 5G product line and intense price competition from Huawei.

The ground underneath the tech profit cycle is shifting and investing in technology requires being on the right block. Our strategy has been to move up and down various tech supply chains, looking for the technologies that are both critical and proprietary. In other words, we try to identify which companies have protected pieces of key technology that are likely to drive the emerging 5G, autonomous driving and artificial intelligence networks.

We think most of the intellectual capital and profitability will reside in companies that design and manufacture the chips that underlie the networks. As use of the cloud to process and store data grows, so do the processor and memory chips that power it. We think that profits may be most likely to accrue to these manufacturers.

Even more importantly, we believe most of these new technologies will be designed and launched in Asia for one key reason. Asian markets offer unrivaled scale. More investment dollars will likely flow into companies which serve Asian markets than Western markets. There will be far more competitors, designers, and coders. Governments in Asia will be more focused on supporting developments in these markets. And because of the vast scale, consumer costs should be lower, further spurring rapid growth in usage.

Cell sites in the U.S. will number 5,000 by year end, but over 250,000 cell sites will be operative in China and another 130,000 cell sites will be up and running in Korea (80x). And that gap will widen. Estimates are China will have 600,000 to 800,000 cell sites in operation by year end 2020. The U.S. and Europe will have several tens of thousands (Source: Credit Suisse).

The Fund has disclosed positions in Taiwan Semiconductor Manufacturing (TSM) and Mediatek (2454 TT). Both are Taiwanese companies with market leading chip technologies. Both also are ways to invest in China’s implementation of 5G as well as elsewhere across Asia. Huawei is China’s giant 5G company and most of the infrastructure chips it uses are manufactured by TSM.

| Annual Report | October 31, 2019 | 3 |

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

Today, TSM is the dominant foundry supplier of the most advanced processing chips for everything from wireless communications to advanced aircraft. It is the dominant producer of wireless broadband processor chips which are critical to 5G. In past decades, Intel chips offered the leading-edge technology and TSM was a secondary provider but now, outside of those made by Intel and Samsung, every leading-edge processor chip is made by TSM, including those in Apple phones, and those sold by Nvidia, Qualcomm, Advanced Micro Devices, Xilinx and most others.

We believe that demand for these components should likely rise exponentially as 5G is deployed. Several of TSM’s most advanced chips are already on allocation and the company announced it will spend as much as $15 billion on technology and capacity in 2019, 50% higher than originally planned.

Mediatek is a key manufacturer of merchant modem chips which allow a phone to connect to the network. No U.S. company (except Qualcomm and Apple) can make the radio chip that accomplishes that. In a 5G world, each phone will need a specially designed modem to connect to a 5G network, and currently the industry is a duopoly between Qualcomm and Mediatek. Given its long history of royalty disputes, Qualcomm is losing share as many companies would like to have an alternative source. Mediatek had a strong position in 3G but fell behind in the tech move to 4G. Its position in 5G seems to be equivalent to Qualcomm’s technically, but Mediatek has the added advantage of selling into Asia.

An important reason for the duopoly is the support and services organizations fielded by the two companies. It is necessary to work closely with the engineering teams of user companies. Outside of Mediatek and Qualcomm, no one qualifies.

Samsung (005930 KS), the Korean tech conglomerate, is the third leg of the Asian tech portfolio. The company is the largest manufacturer of memory chips, smartphones and organic light-emitting diode (“OLED”) screens. It is the one company with huge scale since it sells its chips into Apple as well as its own products. At the moment, the industry is sitting on what is likely the bottom of its profit cycle and as 5G ramps up, we expect surplus to move to shortage for dynamic random-access memory (“DRAM”) and OLED screens. The stock sells in the vicinity of book value, essentially the value of its depreciated plant, and that totally discounts the company’s vast intellectual property. We think it is currently one of the world’s most overlooked value stocks.

Healthcare: M&A and innovation

Recent activity in biotechnology follows four years in which the stocks suffered weak price performance and poor sentiment following the famous Hillary Clinton tweet that began the drug price controversy. Over that period, tens of billions of dollars have been spent developing important new therapies and many are only now entering human trials. We are at the point value can accrue to the companies that have both good science and good management.

During the year we increased our holdings in several biotechnology and medical device companies. These include CRISPR Therapeutics, the leading gene editing company and our largest biotech holding. CRISPR has by far the broadest gene editing pipeline and the strongest clinical momentum in the industry. Vertex, which already has several existing collaborations with CRISPR, recently expanded its partnership with two more indications when it paid $175 million up front for exclusive rights for CRISPR’s gene therapies for Duchenne Muscular Dystrophy (“DMD”) and DM1, which is another form of muscular dystrophy. The total value payment stream for these two indications alone has the potential to reach $1 billion over time for a company whose entire market capitalization is only ~$3.0 billion. In our view, this provides further validation of CRISPR’s gene editing platform. It is an even more positive development because DMD and DM1 are non-core products for CRISPR and the company retains full rights for many of its hematology and oncology assets. This technology has emerged from a Petri dish to human trials in a little less than 15 years and there are many more indications in the pipeline.

Apart from CRISPR, the Fund holds a portfolio of companies also developing new bio-therapies, at least half of which we believe are potential takeout candidates. A recent example is Gilead Sciences, decision to pay $5.1 billion to increase its position in Fund holding Galapagos NV (GLPG), a Belgian biotechnology company, from 12% to 20% with the option of taking it to 29%. Galapagos has six compounds in testing for conditions such as osteoarthritis and pulmonary fibrosis, each of which is a multibillion-dollar market. Gilead is under pressure to make up for declining sales of its hepatitis C and HIV offerings, including Solvaldi and Harvoni. Such co-development deals are proliferating and, to us, make sense. It allows a company with a promising drug in development to partially monetize it and while it takes the immediate take-out option off the table, it removes pressure for a premature sale. Gilead’s strong operating model helps the acquired companies grow and build shareholder value more rapidly than they would on their own. Gilead has a reputation for good management and good science in treating intractable diseases, but the stock has traded sideways since sales of its hepatitis C drug peaked several years ago.

U.S. Money Center Banks & Payments: Evolving business models

Lower costs and rising fees are the keys to higher returns on equity and valuations for money center banks. Their fee businesses have generated most of the revenue growth, particularly in credit cards and investment banking. Meanwhile, the money center banks have begun to aggressively adopt technology to reduce costs and offer better service than smaller local or regional banks. Revenues from credit cards rose 11% at Citigroup and 10% at J.P. Morgan in the third quarter.

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

The money centers have a different model, and this is showing up in earnings releases. Citi’s expenses declined in the quarter while share count fell 10%. An activist fund, ValueAct Capital Management, which successfully pushed for management change at Microsoft, is involved. Because of this technological leadership, large banks are likely to gain a disproportionate share of digital banking. We expect Citi’s book value has the potential to grow over the next few years.

Most regional and smaller banks are more interested in holding securities than making loans. We are seeing loan growth slow and securities holdings picking up at these institutions. The ratio of securities to loans among smaller banks is the highest in 25 years.

We think the best way to invest in the revolution around the payments system is through the money center banks. Consumers have more ways than ever to pay for things. ApplePay, PayPal, Starbucks and increasingly others have all devised ways to make purchases. The common belief is that these methods will displace the control the major card-issuing banks have over the payments business, but the reality is they offer just another way to connect the card to the payment transaction. Card issuers and the payments processors like Visa (V) and Mastercard (MA) are only digging in today. The average American has a credit card balance of $6,194, 6% higher year over year. U.S. credit card debt stands at $830 billion. We believe this business has substantial potential to grow over time.

Emerging consumer in India and Asia

To the investor, Asia’s markets are always suspect. For one, Asia’s growth is non-linear. Its financial markets are not fully developed, and sentiment is volatile and, at the moment, negative. We think the positives outweigh the negatives by a wide margin.

There are three reasons we believe Asian markets are likely to display the strongest profit cycles in coming years.

| 1) | Consumption in Asia is the only macro growth story on the planet. |

| 2) | Among emerging markets, only China and India offer scale, and scale is critical to profitability. If an economy is to invest in new technologies, it must have scale. Both countries have continental size markets and a combined middle class that is the largest in the world and growing at double digit rates. |

| 3) | Interest rates are coming down across Asia, including China, India, and South Korea. |

China

Chinese stocks are cheap at a time when an array of quality consumer focused companies are emerging. While China’s total population is stagnating, the number of entrants into the middle class continues to rise. More than half of China’s population still generates a per capita gross domestic product (“GDP”) below the national average of about $10,000, but accelerating urbanization and large gains in consumption can continue.

China is the only Asian economy which can replace exports with domestic demand. China grew 6% in its recent quarter; in the context of a $13 trillion economy this is still impressive. The slowdown is due to a fall in exports and to government policies to slow lending in the shadow economy to reform its financial sector. These are headwinds which could turn into tailwinds.

We believe China’s profit cycle is still strong, but it is focused within the consumer sector which grew 7-8%. China is now the second biggest pool of household wealth and could pass the U.S. as the largest consumer market by 2021.

China has huge talent and savings pools. It is increasingly at the vanguard of global growth in technology and life sciences. Technology is becoming more ubiquitous in China. For example, technology in financial services (so-called “fintech”) has reached the lowest income level—even the poorest villager may now have a scanner.

We see evidence that Chinese brands are getting stronger and U.S. goods are losing their once cool image. Demand for Nike and Adidas are giving way to Anta Sports Products (2020 HK), a producer of popular athletic shoes and apparel, and Li Ning (2331 HK), a fashion-based sports gear manufacturer in Beijing. Anta and Li Ning have been disclosed as investments in the Fund. Anta is moving globally by building a family of brands capable of reaching beyond China. It owns brands like Salomon, an outdoor sports equipment manufacturer, and Wilson, a sporting goods company. Market share losses to Chinese made brands used to be limited to passenger cars and electronic goods such as video games and smartphones, but now are occurring across a wide swath of luxury and sports apparel.

Trade issues will continue to be a fact of life but should be faded in our opinion. Provisions in the preliminary deal agreed to by the United States and China on October 11 seem credible to us. The China delegation did not agree to anything they had not already been willing to implement, or what was in their best interest anyway (purchase of agricultural goods). While subsidies for state-owned companies will persist, protections in place for intellectual property were already strengthened by the People’s Congress this past Spring and restrictions on foreign investments by U.S. companies were already being rolled back, especially in the financial sphere. If China is to be an important player on the global stage, it must integrate its now closed financial sector into the world’s payments system, and that effort will require American firms for it to succeed. Citi is establishing wholly-owned brokerage and investment banking operations in China. Visa and Mastercard are already operating there and Standard and Poor’s has a ratings licensing agreement. China’s currency exchange rate has been less “pegged” and more market-driven than the market perceives and has been for some time.

| Annual Report | October 31, 2019 | 5 |

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

India

India is the world’s third largest economy and has the world’s largest work force. It also possesses immense and undeveloped natural resources. The economy has slowed because of credit issues in non-bank financial institutions, but new stimulus is being provided by an aggressive corporate tax cut, a refined goods and services tax, and a stimulus package for affordable housing. Housing is desperately needed, and the industry has a powerful multiplier effect on jobs and materials suppliers.

Like China, India also offers scale and growth and has the potential to be the fastest growing economy in the world. This is all bullish. But India’s growth has slowed and that surprised many. As in China, growth in India slipped to a six year low for similar reasons. India is coming off a credit boom as non-bank entities and publicly owned banks subsidized a credit boom which has now burst. Its financial sector is populated by too many sub-scale competitors with bad loans and low profit margins. Over the years, a state-controlled banking system has existed as an ATM for bad government policies. As a result, 70% of deposits still sit in unlicensed banks which in turn sit on a pile of bad, unserviceable loans.

Last year’s collapse of Infrastructure Leasing & Financial Services, a large shadow bank, triggered a funding squeeze from which consumer demand has yet to recover. Passenger vehicle sales are down 25% year on year. India is working through a policy of financial sector reform like China did at the turn of the century, and that policy is, in the short-run, slowing credit formation and demand. Key to the effort is the restructuring of non-bank lenders and state-owned banks, upon which car buyers and small dealerships rely.

Prime Minister Modi’s government is trying to restart the economy, and we think the market is close to a turning point. Corporate taxes have been cut and business reenergized, and the government is now contemplating household tax cuts. Modi has inserted capital into banks and liberalized foreign investment rules and reduced corporate tax rates from 30% to 22% (15% for greenfield plants), making it competitive with Asian rivals like Vietnam and Bangladesh. This all is business-friendly. The Reserve Bank of India has reduced its policy repo rate by 25 basis points to 5.15%.

Investment is flowing back into India. Southeast Asia, including India have drawn more foreign investment than China in recent years. Samsung has moved its last plant from China to India and will build the largest smartphone factory in the world there. Ford is transferring ownership in its local assembly factories to a joint venture that Mahindra and Mahindra (MM IN) will run. Suzuki sells half of its cars in India and is profitable. India is trying to take advantage of China’s trade issues which force multinationals to rearrange their supply lines away from China.

Privatization is taking hold. The Financial Times reported that five companies, including Bharat Petroleum and Container Corporation of India, a major logistics firm, were recently scheduled to be sold. Pension funds and sovereign wealth investors across Asia are investing in technology, real estate and infrastructure. Blackstone and a local partner reportedly bought a technology park in Bangalore for $390 million and Canada’s Brookfield Asset Management bought a pipeline from a private entity and a $3 billion in telecom tower assets from Reliance Industries (Source: Wall St. Journal). Modi seems to be putting down anti-privatization sentiment in his own party. He has auctioned off six major airports and several toll roads.

Personal savings are high in India and interest rates are finally falling. India has a low 67% debt to GDP ratio. The central bank is overcapitalized, and inflation is receding. But Indians are only now opening bank accounts, leaving the fintech industry with a huge opportunity for quality private banks like Fund holding HDFC Bank (HDFCB IN & HDB), which reported 20% deposit growth and 25-30% asset growth in the recent quarter. The demise of many smaller, less solvent, institutions and the restructuring of public banks could become a big story.

To summarize our current Asia strategy, we are looking to find the emerging mega brands in Asia. We are finding strength in the emerging consumer brands in China, the financial leaders in India, and emerging tech leadership in Taiwan and South Korea.

Downside Protection Tools

While much of our portfolio commentary is dedicated to the Fund’s current long-book positioning across our highest conviction themes, investors in the Fund should also note some of the steps we take in the portfolio to protect against market drawdowns.

A short book of individual equity positions is one of the primary tools utilized in the portfolio to attempt to generate positive returns for investors amidst declining equity prices. Other positions include the use of put-spreads at the index level with a goal of protecting a portion of the portfolio against broad-based market declines, as well as exposure to U.S. Treasury positions, which have the potential to generate positive returns or reduce portfolio volatility during equity market declines.

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

The Fund’s long book, combined with these downside protection tools, can offer investors an opportunity to participate in rising equity prices with some potential for downside protection. For the fiscal year, the Fund captured 101.49% of the upside and 82.46% of the downside of its Morningstar Category average, with approximately 63.76% average, delta-adjusted exposure over the same period.

ON THE MARKETS

The U.S. is growing modestly but China and Europe are slowing. The Fed is once again growing its balance sheet, and the global easing cycle is regaining dominance. This should support bonds and stocks. Global short rates will reach new lows and bonds should benefit because the Treasury will issue more bills and fewer bonds to satisfy the Fed’s needs. We believe a shortage of long-term yield will re-emerge sooner rather than later. Consumers are OK but investment is weak and eventually that is likely to flow back to slow the economy.

Monetary easing is less powerful than it once was, and capital investment is systemically weaker in an asset light ecosystem. A slower housing cycle leaves the economy even further cash rich because the households are saving as they age. Eleven years after the Global Financial Crisis, the European and Japanese banking systems remain so burdened with bad debt they cannot create credit. Formerly fast-growing services industries such as hotels and cruise ships are facing a glut of new capacity.

In the long run, the absence of inflation is far more important to the financial markets than the trade wars. The market is giving us some opportunity to take advantage when prices of good stocks are down because unprecedented amounts of liquidity remain uninvested.

CORPORATE UPDATE FROM CHUCK CLOUGH

We would like to close with some exciting news as Clough Capital Partners, L.P. (“Clough Capital” or the “Firm”) celebrates its 20th year. Please join us in congratulating Michael J. Hearle, a Partner of the Firm and a Portfolio Manager on several of the Firm’s products, on his promotion to Chief Executive Officer and Co-Chief Investment Officer of the Firm. This will allow me to devote even more of my time to the markets. Vince Lorusso and I will continue to manage the Fund.

Together, our talented Partners, Portfolio Managers, and investment staff, share a long-term commitment to rigorous investment analysis, careful discipline in portfolio construction and above all, careful stewardship of our investors’ capital and trust. We are excited about this news and believe advancements in our leadership are critical to best position our Firm for success for years to come.

| Sincerely, | |

| | |

|  |

| | |

| Charles I. Clough, Jr. | Vincent M. Lorusso, Jr. |

| Annual Report | October 31, 2019 | 7 |

| Clough Global Long/Short Fund | Portfolio Performance |

October 31, 2019 (Unaudited)

| Performance(as of October 31, 2019) |

| | 1 Month | Quarter | 6 Month | 1 Year | Since

Inception(a) |

| Class I - NAV(b) | 3.74% | 0.53% | 1.52% | 6.36% | 2.53% |

| Investor Class - NAV(b)(f) | 3.69% | 0.45% | 1.35% | 6.04% | 2.21% |

| Class A - NAV(b)(g) | 3.69% | 0.36% | 1.35% | 6.04% | 2.21% |

| Class A - MOP(b)(g) | -2.01% | -5.15% | -4.26% | 0.18% | 1.02% |

| Class C - NAV(b) | 3.59% | 0.27% | 1.01% | 5.28% | 1.60% |

| Class C - CDSC(b) | 2.59% | -0.73% | 0.01% | 4.28% | 1.60% |

| MSCI All Country World Index(c) | 2.76% | 2.53% | 3.24% | 13.22% | 7.98% |

| HFRI Equity Hedge Index(d) | 1.31% | -0.19% | -0.11% | 4.85% | 3.85% |

| S&P 500 Index(e) | 2.17% | 2.43% | 4.16% | 14.33% | 10.62% |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling (855) 425-6844 or by visiting www.cloughglobal.com.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include sales charges and would have been lower had it been taken into account. A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days.

| (a) | Fund’s commencement date is September 30, 2015. The performance data quoted for the period prior to September 30, 2015 is that of an unregistered investment fund (the “Predecessor Fund”) that was managed by the Adviser since its inception and was reorganized into the Fund as of the date the Fund commenced investment operations. The Predecessor Fund was not a registered mutual fund and therefore was not subject to the same investment and tax restrictions as the Fund. Performance information reflects all fees and expenses incurred by the Predecessor Fund, and has not been adjusted to reflect Fund expenses. If it had been so adjusted, the Predecessor Fund’s performance would have been higher for that period. The Predecessor Fund commenced operations on January 2, 2015. |

| (b) | Returns shown prior to 9/30/2015 are based on the returns of the Predecessor Fund adjusted to reflect 12b-1 fees and shareholder services fees, as applicable. |

| (c) | The MSCI All Country World Index is a float-adjusted, capitalization weighted index that is designed to measure the equity market performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. Both indices referenced herein reflect the reinvestment of dividends. The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaim all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com). |

| (d) | An index designed by Hedge Fund Research, Inc. to represent the performance of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed by such managers to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. The HFRI family of indices reserves the right to revise historical performance data for a period of up to four months following the as of date. The performance shown was calculated using current, available data at the time of publication, but is subject to change outside of the control of the Fund and its affiliates |

| (e) | The Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. Index performance does not reflect fund performance. |

| (f) | On December 1, 2017, Class A was renamed Investor Class. |

| (g) | A new Class A commenced operations on June 29, 2018. |

Returns of less than 1 year are cumulative.

An investor cannot invest directly in an index.

| Clough Global Long/Short Fund | Portfolio Performance & Allocation |

October 31, 2019 (Unaudited)

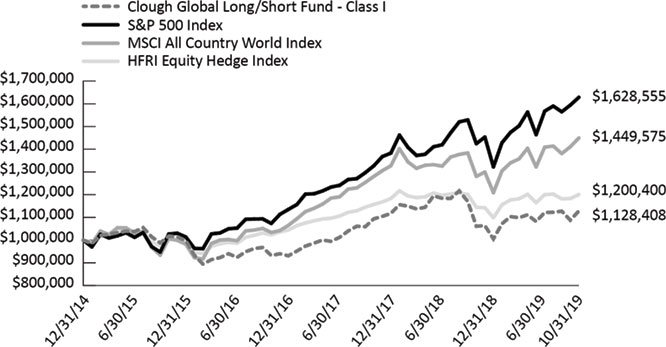

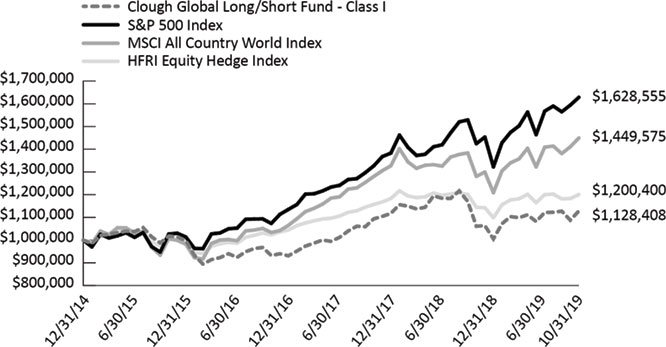

Performance of $1,000,000 Initial Investment(as of October 31, 2019)

The graph shown above represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Previous reports presented the performance of Investor Class. The historical performance prior to September 30, 2015 is that of the Predecessor Fund. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Long Holdings(as a % of Net Assets)* | |

| Citigroup, Inc. | 3.18% |

| U.S. Treasury Bond | 3.07% |

| Samsung Electronics Co., Ltd. | 3.05% |

| U.S. Treasury Bond | 2.62% |

| Micron Technology, Inc. | 2.57% |

| CRISPR Therapeutics AG | 2.55% |

| Broadcom, Ltd. | 2.24% |

| salesforce.com, Inc. | 2.17% |

| TransDigm Group, Inc. | 2.02% |

| JPMorgan Chase & Co. | 1.99% |

| Top Ten Holdings | 25.46% |

| * | Holdings are subject to change |

| Sector Allocation** | Long Exposure % TNA | Short Exposure % TNA | Gross Exposure % TNA | Net Exposure % TNA |

| Information Technology | 23.0% | -5.1% | 28.1% | 17.9% |

| Health Care | 19.3% | -5.1% | 24.4% | 14.2% |

| Consumer Discretionary | 15.6% | -2.5% | 18.1% | 13.1% |

| Financials | 20.5% | -6.7% | 27.2% | 13.8% |

| Fixed Income | 5.7% | 0.0% | 5.7% | 5.7% |

| Communication Services | 2.9% | -0.5% | 3.4% | 2.4% |

| Industrials | 3.3% | -1.0% | 4.3% | 2.3% |

| Energy | 1.0% | 0.0% | 1.0% | 1.0% |

| Materials | 0.4% | 0.0% | 0.4% | 0.4% |

| Hedge Portfolio | 0.4% | -0.2% | 0.6% | 0.2% |

| Consumer Staples | 3.0% | -3.0% | 6.0% | 0.0% |

| Total Investments | 95.1% | -24.1% | 119.2% | 71.0% |

| Annual Report | October 31, 2019 | 9 |

| Clough Global Long/Short Fund | Portfolio Allocation |

October 31, 2019 (Unaudited)

| Country Allocation ** | Long Exposure % TNA | Short Exposure % TNA | Gross Exposure % TNA | Net Exposure % TNA |

| United States | 50.3% | -12.0% | 62.3% | 38.3% |

| U.S. Multinationals† | 16.4% | -4.3% | 20.7% | 12.1% |

| China | 8.8% | 0.0% | 8.8% | 8.8% |

| India | 6.9% | 0.0% | 6.9% | 6.9% |

| Other - Emerging Markets | 6.5% | 0.0% | 6.5% | 6.5% |

| Other - Developed Markets | 0.5% | 0.0% | 0.5% | 0.5% |

| Europe | 5.7% | -7.8% | 13.5% | -2.1% |

| Total Investments | 95.1% | -24.1% | 119.2% | 71.0% |

| ** | Allocation summaries and top ten long holdings calculated as percent of total net assets using market value of cash traded securities, notional value of derivative contracts and excluding short-term investments. |

| † | US Multinational Corporations – has more than 50% of revenues derived outside of the U.S. |

| Clough Global Long/Short Fund | Disclosure of Fund Expenses |

October 31, 2019 (Unaudited)

Examples.As a shareholder of the Clough Global Long/Short Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including applicable redemption fees and sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2019 and held through October 31, 2019.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period May 1, 2019 – October 31, 2019” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table below is useful in comparing ongoing costs only and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

05/01/19 | Ending

Account Value

10/31/19 | Expense Ratio(a)(b) | Expenses Paid

During period

05/01/19 - 10/31/19(c) |

| Clough Global Long/Short Fund | | | | |

| Class I | | | | |

| Actual | $1,000.00 | $1,015.20 | 2.21% | $11.23 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.06 | 2.21% | $11.22 |

| Investor Class | | | | |

| Actual | $1,000.00 | $1,013.50 | 2.47% | $12.54 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,012.75 | 2.47% | $12.53 |

| Class A | | | | |

| Actual | $1,000.00 | $1,013.50 | 2.30% | $11.67 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.61 | 2.30% | $11.67 |

| Class C | | | | |

| Actual | $1,000.00 | $1,010.10 | 3.29% | $16.67 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,008.62 | 3.29% | $16.66 |

| (a) | Expense ratio excluding interest expense and dividends paid on borrowed securities for the Clough Global Long/Short Fund is 1.54%, 1.89%, 1.89%, and 2.54% for Class I, Investor Class, Class A, and Class C respectively. |

| (b) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (c) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year 184/365 (to reflect the half-year period). |

| Annual Report | October 31, 2019 | 11 |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2019

| | | Shares | | Value |

| COMMON STOCKS 86.81% | | | | | | | | |

| Communication Services 2.86% | | | | | | | | |

| GCI Liberty, Inc. - Class A(a)(b) | | | 9,481 | | | $ | 663,480 | |

| IMAX Corp.(a) | | | 26,500 | | | | 565,775 | |

| Netflix, Inc.(a) | | | 816 | | | | 234,527 | |

| | | | | | | | 1,463,782 | |

| | | | | | | | | |

| Consumer Discretionary 15.57% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 470 | | | | 835,030 | |

| ANTA Sports Products, Ltd. | | | 82,400 | | | | 807,601 | |

| Carvana Co.(a)(b) | | | 12,100 | | | | 981,068 | |

| Floor & Decor Holdings, Inc. - Class A(a) | | | 10,586 | | | | 485,156 | |

| Home Depot, Inc. | | | 4,090 | | | | 959,432 | |

| Li Ning Co., Ltd. | | | 139,000 | | | | 472,738 | |

| Meituan Dianping - Class B(a) | | | 10,200 | | | | 121,904 | |

| Pool Corp. | | | 2,733 | | | | 566,824 | |

| RH(a) | | | 1,553 | | | | 282,180 | |

| Service Corp. International | | | 13,936 | | | | 633,809 | |

| Titan Co., Ltd. | | | 36,727 | | | | 689,297 | |

| Vail Resorts, Inc. | | | 3,250 | | | | 755,202 | |

| Wayfair, Inc. - Class A(a) | | | 1,750 | | | | 143,903 | |

| XTEP International Holdings, Ltd. | | | 427,000 | | | | 248,486 | |

| | | | | | | | 7,982,630 | |

| | | | | | | | | |

| Consumer Staples 1.37% | | | | | | | | |

| Boston Beer Co., Inc. - Class A(a) | | | 310 | | | | 116,083 | |

| Estee Lauder Cos., Inc. - Class A | | | 882 | | | | 164,290 | |

| L'Oreal SA | | | 1,449 | | | | 423,087 | |

| | | | | | | | 703,460 | |

| | | | | | | | | |

| Energy 0.99% | | | | | | | | |

| Reliance Industries, Ltd. | | | 24,650 | | | | 508,908 | |

| | | | | | | | | |

| Financials 20.49% | | | | | | | | |

| AGNC Investment Corp. | | | 3,000 | | | | 51,150 | |

| AIA Group, Ltd. | | | 51,600 | | | | 516,596 | |

| American International Group, Inc. | | | 6,000 | | | | 317,760 | |

| Ares Capital Corp. | | | 22,000 | | | | 402,600 | |

| Bank of America Corp.(b) | | | 31,050 | | | | 970,934 | |

| Barings BDC, Inc. | | | 51,100 | | | | 524,797 | |

| Citigroup, Inc.(b) | | | 22,649 | | | | 1,627,557 | |

| Golub Capital BDC, Inc. | | | 33,300 | | | | 593,073 | |

| HDFC Bank, Ltd. | | | 13,600 | | | | 830,824 | |

| HDFC Bank, Ltd. - ADR | | | 32,612 | | | | 565,697 | |

| JPMorgan Chase & Co.(b) | | | 8,150 | | | | 1,018,098 | |

| Ladder Capital Corp. | | | 15,400 | | | | 265,958 | |

| Morgan Stanley(b) | | | 17,800 | | | | 819,690 | |

| PennyMac Mortgage Investment Trust | | | 22,500 | | | | 515,025 | |

| Ping An Insurance Group Co. of China, Ltd. - Class H | | | 41,400 | | | | 479,463 | |

| Starwood Property Trust, Inc.(b) | | | 15,800 | | | | 388,680 | |

| | | Shares | | Value |

| Financials (continued) | | | | | | | | |

| Two Harbors Investment Corp. | | | 44,300 | | | $ | 614,441 | |

| | | | | | | | 10,502,343 | |

| Health Care 19.26% | | | | | | | | |

| Align Technology, Inc.(a) | | | 1,220 | | | | 307,794 | |

| Amgen, Inc. | | | 1,852 | | | | 394,939 | |

| Apellis Pharmaceuticals, Inc.(a)(b) | | | 33,300 | | | | 978,687 | |

| Baxter International, Inc. | | | 5,250 | | | | 402,675 | |

| BeiGene, Ltd. - ADR(a) | | | 3,650 | | | | 504,941 | |

| Boston Scientific Corp.(a) | | | 8,191 | | | | 341,565 | |

| Correvio Pharma Corp.(a) | | | 137,570 | | | | 275,140 | |

| CRISPR Therapeutics AG(a) | | | 25,981 | | | | 1,308,663 | |

| Elanco Animal Health, Inc.(a) | | | 11,400 | | | | 308,028 | |

| Galapagos NV - Sponsored ADR(a) | | | 1,820 | | | | 334,825 | |

| Gossamer Bio, Inc.(a)(b) | | | 28,400 | | | | 584,330 | |

| GW Pharmaceuticals PLC - ADR(a) | | | 1,511 | | | | 202,202 | |

| IDEXX Laboratories, Inc.(a) | | | 665 | | | | 189,532 | |

| Idorsia, Ltd.(a) | | | 27,929 | | | | 634,737 | |

| Masimo Corp.(a) | | | 1,100 | | | | 160,369 | |

| Owens & Minor, Inc. | | | 63,100 | | | | 424,663 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 820 | | | | 251,150 | |

| SmileDirectClub, Inc.(a) | | | 10,800 | | | | 126,306 | |

| Tandem Diabetes Care, Inc.(a) | | | 2,800 | | | | 172,424 | |

| Teladoc Health, Inc.(a) | | | 4,600 | | | | 352,360 | |

| Thermo Fisher Scientific, Inc. | | | 1,378 | | | | 416,128 | |

| Veracyte, Inc.(a) | | | 12,750 | | | | 292,357 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 1,572 | | | | 307,295 | |

| WAVE Life Sciences, Ltd.(a) | | | 9,200 | | | | 232,668 | |

| Zoetis, Inc. | | | 2,864 | | | | 366,363 | |

| | | | | | | | 9,870,141 | |

| | | | | | | | | |

| Industrials 3.35% | | | | | | | | |

| Larsen & Toubro, Ltd. | | | 32,877 | | | | 682,791 | |

| TransDigm Group, Inc.(b) | | | 1,965 | | | | 1,034,140 | |

| | | | | | | | 1,716,931 | |

| | | | | | | | | |

| Information Technology 22.48% | | | | | | | | |

| Advanced Energy Industries, Inc.(a) | | | 4,700 | | | | 277,770 | |

| Broadcom, Ltd.(b) | | | 3,917 | | | | 1,147,093 | |

| Genpact, Ltd. | | | 6,500 | | | | 254,605 | |

| HubSpot, Inc.(a) | | | 1,614 | | | | 250,331 | |

| Lam Research Corp. | | | 1,920 | | | | 520,397 | |

| Mastercard, Inc. - Class A | | | 960 | | | | 265,738 | |

| MediaTek, Inc. | | | 65,200 | | | | 873,888 | |

| Micron Technology, Inc.(a)(b) | | | 27,649 | | | | 1,314,710 | |

| Microsoft Corp. | | | 3,643 | | | | 522,297 | |

| MongoDB, Inc.(a) | | | 990 | | | | 126,492 | |

| Okta, Inc.(a) | | | 2,120 | | | | 231,228 | |

| RingCentral, Inc. - Class A(a) | | | 1,590 | | | | 256,817 | |

| salesforce.com, Inc.(a) | | | 7,102 | | | | 1,111,392 | |

| Samsung Electronics Co., Ltd. | | | 36,089 | | | | 1,563,355 | |

| ServiceNow, Inc.(a) | | | 1,042 | | | | 257,645 | |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2019

| | | Shares | | Value |

| Information Technology (continued) | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR | | | 17,500 | | | $ | 903,525 | |

| Twilio, Inc. - Class A(a) | | | 2,267 | | | | 218,902 | |

| Visa, Inc. - Class A(b) | | | 5,132 | | | | 917,910 | |

| WNS Holdings, Ltd. - ADR(a) | | | 4,300 | | | | 265,912 | |

| Zendesk, Inc.(a) | | | 3,411 | | | | 240,987 | |

| | | | | | | | 11,520,994 | |

| | | | | | | | | |

| Materials 0.44% | | | | | | | | |

| Zhaojin Mining Industry Co., Ltd. - Class H | | | 201,000 | | | | 223,420 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $38,285,465) | | | | | | | 44,492,609 | |

| Underlying Security/Expiration Date/Exercise Price/Notional Amount | | Contracts | | Value |

| PURCHASED OPTIONS 0.35% | | | | | | | | |

| Put Options Purchased 0.35% | | | | | | | | |

| S&P 500 Index | | | | | | | | |

| 01/17/20, 2,950, $12,150,240 | | | 40 | | | | 181,400 | |

| | | | | | | | | |

| Total Put Options Purchased | | | | | | | | |

| (Cost $198,694) | | | | | | | 181,400 | |

| | | | | | | | | |

| TOTAL PURCHASED OPTIONS | | | | | | | | |

| (Cost $198,694) | | | | | | | 181,400 | |

Description and Maturity Date | | Principal

Amount | | Value |

| GOVERNMENT & AGENCY OBLIGATIONS 5.69% | |

| U.S. Treasury Bond | | | | | | | | |

| 11/15/2048, 3.375% | | | 1,250,000 | | | | 1,573,266 | |

| 05/15/2049, 2.875% | | | 1,165,000 | | | | 1,341,252 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | |

| (Cost $2,894,570) | | | | | | | 2,914,518 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS 0.89% | | | | | | | | |

| Money Market Funds 0.89% | | | | | | | | |

| BlackRock Liquidity Funds, T-Fund Portfolio - Institutional Class (1.713% 7-day yield) | | | 456,592 | | | | 456,592 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | |

| (Cost $456,592) | | | | | | | 456,592 | |

| | | Value |

| Total Investments - 93.74% | | | | |

| (Cost $41,835,321) | | $ | 48,045,119 | |

| | | | | |

| Other Assets in Excess of Liabilities - 6.26%(c) | | | 3,209,677 | |

| | | | | |

| NET ASSETS - 100.00% | | $ | 51,254,796 | |

| SCHEDULE OF SECURITIES SOLD SHORT(a) | | Shares | | Value |

| COMMON STOCKS (20.05%) | | | | | | | | |

| Communication Services (0.52%) | | | | | | | | |

| AT&T, Inc. | | | (6,984 | ) | | | (268,820 | ) |

| | | | | | | | | |

| Consumer Discretionary (2.46%) | | | | | | | | |

| Dick's Sporting Goods, Inc. | | | (12,580 | ) | | | (489,740 | ) |

| Ford Motor Co. | | | (56,000 | ) | | | (481,040 | ) |

| Williams-Sonoma, Inc. | | | (4,360 | ) | | | (291,204 | ) |

| | | | | | | | (1,261,984 | ) |

| | | | | | | | | |

| Consumer Staples (3.01%) | | | | | | | | |

| Tesco PLC | | | (169,962 | ) | | | (517,818 | ) |

| Walgreens Boots Alliance, Inc. | | | (11,000 | ) | | | (602,580 | ) |

| WM Morrison Supermarkets PLC | | | (163,405 | ) | | | (420,900 | ) |

| | | | | | | | (1,541,298 | ) |

| | | | | | | | | |

| Financials (5.94%) | | | | | | | | |

| Apollo Investment Corp. | | | (15,800 | ) | | | (250,430 | ) |

| Deutsche Bank AG | | | (81,100 | ) | | | (587,975 | ) |

| Mediobanca Banca di Credito Finanziario SpA | | | (59,304 | ) | | | (704,410 | ) |

| Santander Consumer USA Holdings, Inc. | | | (12,300 | ) | | | (308,484 | ) |

| Societe Generale S.A. | | | (17,049 | ) | | | (483,925 | ) |

| TCG BDC, Inc. | | | (9,100 | ) | | | (130,039 | ) |

| UniCredit SpA | | | (45,618 | ) | | | (578,378 | ) |

| | | | | | | | (3,043,641 | ) |

| | | | | | | | | |

| Health Care (3.09%) | | | | | | | | |

| Bruker Corp. | | | (2,300 | ) | | | (102,350 | ) |

| Catalent, Inc. | | | (2,100 | ) | | | (102,165 | ) |

| Charles River Laboratories International, Inc. | | | (790 | ) | | | (102,684 | ) |

| Editas Medicine, Inc. | | | (6,200 | ) | | | (129,208 | ) |

| Guardant Health, Inc. | | | (1,400 | ) | | | (97,300 | ) |

| Illumina, Inc. | | | (330 | ) | | | (97,522 | ) |

| Intellia Therapeutics Inc. | | | (11,600 | ) | | | (144,826 | ) |

| IQVIA Holdings, Inc. | | | (700 | ) | | | (101,094 | ) |

| McKesson Corp. | | | (3,821 | ) | | | (508,193 | ) |

| PerkinElmer Inc. | | | (1,200 | ) | | | (103,152 | ) |

| Annual Report | October 31, 2019 | 13 |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2019

| SCHEDULE OF SECURITIES SOLD SHORT(a)(continued) | | Shares | | Value |

| Health Care (continued) | | | | | | | | |

| PRA Health Sciences, Inc. | | | (1,000 | ) | | $ | (97,710 | ) |

| | | | | | | | (1,586,204 | ) |

| | | | | | | | | |

| Industrials (1.04%) | | | | | | | | |

| Stericycle, Inc. | | | (9,250 | ) | | | (532,800 | ) |

| | | | | | | | | |

| Information Technology (3.99%) | | | | | | | | |

| Advanced Micro Devices, Inc. | | | (8,400 | ) | | | (285,012 | ) |

| Amkor Technology, Inc. | | | (8,700 | ) | | | (108,141 | ) |

| Cisco Systems, Inc. | | | (10,500 | ) | | | (498,855 | ) |

| Diebold Nixdorf, Inc. | | | (38,700 | ) | | | (270,900 | ) |

| Everbridge, Inc. | | | (4,200 | ) | | | (291,942 | ) |

| NCR Corp. | | | (10,000 | ) | | | (292,100 | ) |

| Telefonaktiebolaget LM Ericsson - Sponsored ADR | | | (34,100 | ) | | | (297,352 | ) |

| | | | | | | | (2,044,302 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Proceeds $10,536,275) | | | | | | | (10,279,049 | ) |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS (3.02%) | | | | | | | | |

| Health Care Select Sector SPDR® Fund | | | (2,100 | ) | | | (198,975 | ) |

| iShares®Nasdaq Biotechnology ETF | | | (2,600 | ) | | | (279,084 | ) |

| SPDR®S&P® Biotech ETF | | | (6,700 | ) | | | (546,921 | ) |

| VanEck Vectors® Semiconductor ETF | | | (4,100 | ) | | | (522,709 | ) |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Proceeds $1,479,339) | | | | | | | (1,547,689 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT | | | | | | | | |

| (Proceeds $12,015,614) | | | | | | $ | (11,826,738 | ) |

| (a) | Non-income producing security. |

| (b) | Pledged security; a portion or all of the security is pledged as collateral for securities sold short, total return swap contracts, or written options. As of October 31, 2019, the aggregate market value of those securities was $4,531,603, representing 8.84% of net assets. (See Note 1) |

| (c) | Includes cash which is being held as collateral for total return swap contracts, securities sold short, and written options. |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2019

TOTAL RETURN SWAP CONTRACTS

| Counter Party | | Reference

Entity/Obligation | | Notional Amount | | Floating Rate

Paid by the Fund | | Floating

Rate Index | | Termination

Date | | Value | | Net Unrealized Appreciation |

| Morgan Stanley | | Banco Santander SA | | $ | (465,987 | ) | | 1D FEDEF - 50 bps | | 1D FEDEF | | 5/20/2020 | | $ | (409,922 | ) | | $ | 56,065 | |

| Morgan Stanley | | Kweichow Moutai Co., Ltd. | | | 758,923 | | | 1D FEDEF + 250 bps | | 1D FEDEF | | 1/8/2020 | | | 855,396 | | | | 96,473 | |

| Morgan Stanley | | Luxshare Precision Industry Co., Ltd. | | | 256,250 | | | 1D FEDEF + 250 bps | | 1D FEDEF | | 9/12/2020 | | | 292,988 | | | | 36,738 | |

| | | | | $ | 549,186 | | | | | | | | | $ | 738,462 | | | $ | 189,276 | |

PUT OPTIONS WRITTEN

| Underlying Security | | Expiration

Date | | Exercise

Price | | Contracts | | Notional

Amount | | Value |

| S&P 500 Index | | 01/17/2020 | | $ | 2,800 | | | | (40) | | | $ | (12,150,240 | ) | | $ | (90,600 | ) |

| | | | | | | | | | | | | $ | (12,150,240 | ) | | $ | (90,600 | ) |

Investment Abbreviations:

1D FEDEF - Federal Funds Effective Rate (Daily)

FEDEF Rates:

1D FEDEF - 1 Day FEDEF as of October 31, 2019 1.58%

For Fund compliance purposes, the Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by the Fund's management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to the Financial Statements.

| Annual Report | October 31, 2019 | 15 |

| Clough Global Long/Short Fund | Statement of Assets and Liabilities |

October 31, 2019

| ASSETS: | | |

| | | |

| Investments, at value (Cost - see below) | | $ | 48,045,119 | |

| Cash | | | 1,175,295 | |

| Foreign currency, at value (Cost $249,784) | | | 249,784 | |

| Deposit with broker for securities sold short | | | 10,843,170 | |

| Deposit with broker for total return swap contracts | | | 560,733 | |

| Deposit with broker for written options | | | 94,984 | |

| Unrealized appreciation on total return swap contracts | | | 189,276 | |

| Interest receivable - margin account | | | 13,088 | |

| Dividends receivable | | | 16,577 | |

| Interest receivable | | | 40,846 | |

| Receivable for investments sold | | | 3,024,897 | |

| Receivable for shares sold | | | 10,932 | |

| Prepaid expenses and other assets | | | 11,312 | |

| Due from Adviser | | | 39,741 | |

| Total Assets | | | 64,315,754 | |

| | | | | |

| LIABILITIES: | | | | |

| | | | | |

| Securities sold short (Proceeds $12,015,614) | | | 11,826,738 | |

| Written options, at value (Premiums received $98,798) | | | 90,600 | |

| Payable for investments purchased | | | 863,586 | |

| Payable for shares redeemed | | | 97,219 | |

| Payable for total return swap contracts payments | | | 16,088 | |

| Dividends payable - short sales | | | 28,292 | |

| Accrued distribution and service fees | | | 4,453 | |

| Accrued legal expense | | | 38,956 | |

| Accrued administration fee | | | 11,377 | |

| Other payables and accrued expenses | | | 83,649 | |

| Total Liabilities | | | 13,060,958 | |

| Net Assets | | $ | 51,254,796 | |

| Cost of Investments | | $ | 41,835,321 | |

| | | | | |

| COMPOSITION OF NET ASSETS: | | | | |

| | | | | |

| Paid-in capital | | $ | 49,758,356 | |

| Distributable Earnings | | | 1,496,440 | |

| Net Assets | | $ | 51,254,796 | |

| PRICING OF CLASS I SHARES: | | | | |

| Net Assets | | $ | 44,213,178 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 3,886,012 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.38 | |

| PRICING OF INVESTOR CLASS SHARES: | | | | |

| Net Assets | | $ | 2,406,781 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 214,073 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.24 | |

| PRICING OF CLASS A SHARES: | | | | |

| Net Assets | | $ | 2,822,255 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 251,058 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.24 | |

| Maximum offering price per share (NAV/0.945), based on maximum sales charge of 5.50% of the offering price | | $ | 11.89 | |

| PRICING OF CLASS C SHARES: | | | | |

| Net Assets | | $ | 1,812,582 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 165,212 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.97 | |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund | Statement of Operations |

For the year ended October 31, 2019

| INVESTMENT INCOME: | | | | |

| | | | | |

| Dividends (net of foreign withholding taxes of $9,234) | | $ | 760,046 | |

| Interest income - margin account | | | 161,799 | |

| Total Income | | | 921,845 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 695,089 | |

| Distribution and shareholder service fees: | | | | |

| Investor Class | | | 9,113 | |

| Class A | | | 3,955 | |

| Class C | | | 29,625 | |

| Administration fees | | | 94,910 | |

| Trustees fees | | | 84,088 | |

| Registration fees | | | 73,057 | |

| Dividend expense - short sales | | | 298,314 | |

| Custodian fees | | | 54,362 | |

| Audit & Tax Services fees | | | 46,750 | |

| Legal fees | | | 121,870 | |

| Printing fees | | | 38,290 | |

| Insurance fees | | | 22,624 | |

| Transfer agent fees | | | 41,361 | |

| Delegated transfer agent fees: | | | | |

| Class I | | | 6,475 | |

| Investor Class | | | 56 | |

| Class C | | | 150 | |

| Other expenses | | | 36,157 | |

| Total Expenses Before Waivers and/or Reimbursements | | | 1,656,246 | |

| Less fees waived and/or reimbursed by Adviser: | | | | |

| Class I | | | (432,912 | ) |

| Investor Class | | | (24,344 | ) |

| Class A | | | (12,710 | ) |

| Class C | | | (26,750 | ) |

| Net Expenses | | | 1,159,530 | |

| Net Investment Loss | | | (237,685 | ) |

| | | | | |

| NET REALIZED GAIN/(LOSS) ON: | | | | |

| Investment securities | | | (2,802,944 | ) |

| Securities sold short | | | (21,515 | ) |

| Written options | | | 159,498 | |

| Total return swap contracts | | | 203,673 | |

| Foreign currency transactions | | | (64,819 | ) |

| Net realized gain distributions from other investment companies | | | 2,287 | |

| Net realized loss | | | (2,523,820 | ) |

| | | | | |

| NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) ON: | | | | |

| Investment securities | | | 6,537,182 | |

| Securities sold short | | | (881,905 | ) |

| Written options | | | 8,198 | |

| Total return swap contracts | | | 100,785 | |

| Translation of assets and liabilities denominated in foreign currencies | | | (23,787 | ) |

| Net change in unrealized appreciation | | | 5,740,473 | |

| Net realized and unrealized gain | | | 3,216,653 | |

| Net Increase in Net Assets from Operations | | $ | 2,978,968 | |

See Notes to the Financial Statements.

| Annual Report | October 31, 2019 | 17 |

| Clough Global Long/Short Fund | Statement of Changes in Net Assets |

| | | For the Year Ended October 31, 2019 | | | For the Year Ended October 31, 2018 | |

| OPERATIONS: | | | | |

| | | | | |

| Net investment loss | | $ | (237,685 | ) | | $ | (369,740 | ) |

| Net realized loss | | | (2,523,820 | ) | | | (1,325,090 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 5,740,473 | | | | (3,159,490 | ) |

| Net Increase/(Decrease) in Net Assets From Operations | | | 2,978,968 | | | | (4,854,320 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from shares sold | | | 6,165,858 | | | | 40,880,632 | |

| Payments for shares redeemed | | | (17,250,650 | ) | | | (13,523,671 | ) |

| Net Increase/(Decrease) in Net Assets From Class I Capital Share Transactions | | | (11,084,792 | ) | | | 27,356,961 | |

| | | | | | | | | |

| Investor Class(a) | | | | | | | | |

| Proceeds from shares sold | | | 194,186 | | | | 3,164,441 | |

| Payments for shares redeemed | | | (705,866 | ) | | | (424,647 | ) |

| Net Increase/(Decrease) in Net Assets From Investor Class Capital Share Transactions | | | (511,680 | ) | | | 2,739,794 | |

| | | | | | | | | |

| Class A(b) | | | | | | | | |

| Proceeds from shares sold | | | 2,629,347 | | | | 268,606 | |

| Payments for shares redeemed, net of redemption fees | | | (91,853 | ) | | | (39,847 | ) |

| Net Increase in Net Assets From Class A Capital Share Transactions | | | 2,537,494 | | | | 228,759 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from shares sold | | | 109,956 | | | | 3,909,708 | |

| Payments for shares redeemed | | | (2,006,516 | ) | | | (83,154 | ) |

| Net Increase/(Decrease) in Net Assets From Class C Capital Share Transactions | | | (1,896,560 | ) | | | 3,826,554 | |

| | | | | | | | | |

| Total Increase/(Decrease) in Net Assets | | $ | (7,976,570 | ) | | $ | 29,297,748 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 59,231,366 | | | | 29,933,618 | |

| End of period | | $ | 51,254,796 | | | $ | 59,231,366 | |

| (a) | On December 1, 2017, Class A was renamed Investor Class. |

| (b) | A new Class A commenced operations on June 29, 2018. |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund – Class I | Financial Highlights |

For a share outstanding throughout the period indicated

| | | For the Year Ended October 31, 2019 | | | For the Year Ended October 31, 2018 | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | | | For the Period September 30, 2015

(commencement)

to October 31, 2015 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.70 | | | $ | 11.03 | | | $ | 9.40 | | | $ | 10.30 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.04 | ) | | | (0.07 | ) | | | (0.10 | ) | | | (0.12 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.72 | | | | (0.26 | ) | | | 1.73 | | | | (0.74 | ) | | | 0.31 | |

| Total from Investment Operations | | | 0.68 | | | | (0.33 | ) | | | 1.63 | | | | (0.86 | ) | | | 0.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | – | | | | – | | | | – | | | | (0.04 | ) | | | – | |

| Total Distributions to Common Shareholders | | | – | | | | – | | | | – | | | | (0.04 | ) | | | – | |

| Net asset value - end of period | | $ | 11.38 | | | $ | 10.70 | | | $ | 11.03 | | | $ | 9.40 | | | $ | 10.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(b) | | | 6.36 | % | | | (2.99 | )% | | | 17.34 | % | | | (8.39 | )% | | | 3.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 44,213 | | | $ | 52,684 | | | $ | 29,629 | | | $ | 44,003 | | | $ | 35,760 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 3.09 | % | | | 2.85 | % | | | 3.21 | % | | | 3.76 | %(c) | | | 5.62 | %(c)(d) |

| Operating expenses including fee waivers/reimbursements | | | 2.14 | % | | | 2.03 | % | | | 1.96 | % | | | 2.50 | %(c) | | | 2.32 | %(c)(d) |

| Net investment loss including fee waivers/reimbursements | | | (0.38 | )% | | | (0.64 | )% | | | (0.96 | )% | | | (1.30 | )%(c) | | | (1.66 | )%(c)(d) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.52 | % | | | 2.42 | % | | | 2.85 | % | | | 2.86 | %(c) | | | 4.90 | %(c)(d) |

| Operating expenses including fee waivers/reimbursements | | | 1.57 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | %(c) | | | 1.60 | %(c)(d) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.19 | % | | | (0.21 | )% | | | (0.60 | )% | | | (0.40 | )%(c) | | | (0.94 | )%(c)(d) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE(e) | | | 269 | % | | | 156 | % | | | 237 | % | | | 261 | % | | | 22 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total investment return is for the period indicated and has not been annualized. The total investment return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the Fund level. |

See Notes to the Financial Statements.

| Annual Report | October 31, 2019 | 19 |

| Clough Global Long/Short Fund – Investor Class | Financial Highlights |

For a share outstanding throughout the period indicated

| | | For the Year Ended October 31, 2019 | | | For the Year Ended October 31, 2018(a) | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | | | For the Period September 30, 2015

(commencement)

to October 31, 2015 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.60 | | | $ | 10.96 | | | $ | 9.37 | | | $ | 10.30 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(b) | | | (0.07 | ) | | | (0.11 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.02 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.71 | | | | (0.25 | ) | | | 1.73 | | | | (0.74 | ) | | | 0.32 | |

| Total from Investment Operations | | | 0.64 | | | | (0.36 | ) | | | 1.59 | | | | (0.89 | ) | | | 0.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | – | | | | – | | | | – | | | | (0.04 | ) | | | – | |

| Total Distributions to Common Shareholders | | | – | | | | – | | | | – | | | | (0.04 | ) | | | – | |

| Net asset value - end of period | | $ | 11.24 | | | $ | 10.60 | | | $ | 10.96 | | | $ | 9.37 | | | $ | 10.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(c) | | | 6.04 | % | | | (3.28 | )% | | | 16.97 | %(d) | | | (8.68 | )%(d) | | | 3.00 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 2,407 | | | $ | 2,776 | | | $ | 210 | | | $ | 76 | | | $ | 27 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 3.34 | % | | | 3.14 | % | | | 3.78 | % | | | 4.23 | %(e) | | | 6.44 | %(e)(f) |

| Operating expenses including fee waivers/reimbursements | | | 2.40 | % | | | 2.33 | %(g) | | | 2.29 | %(g) | | | 2.85 | %(e) | | | 2.67 | %(e)(f) |

| Net investment loss including fee waivers/reimbursements | | | (0.64 | )% | | | (0.93 | )% | | | (1.36 | )% | | | (1.57 | )%(e) | | | (2.00 | )%(e)(f) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.77 | % | | | 2.71 | % | | | 3.38 | % | | | 3.33 | %(e) | | | 5.72 | %(e)(f) |

| Operating expenses including fee waivers/reimbursements | | | 1.83 | % | | | 1.90 | %(g) | | | 1.89 | %(g) | | | 1.95 | %(e) | | | 1.95 | %(e)(f) |

| Net investment loss including fee waivers/reimbursements | | | (0.07 | )% | | | (0.50 | )% | | | (0.96 | )% | | | (0.67 | )%(e) | | | (1.28 | )%(e)(f) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE(h) | | | 269 | % | | | 156 | % | | | 237 | % | | | 261 | % | | | 22 | % |

| (a) | On December 1, 2017, Class A was renamed Investor Class. |

| (b) | Per share amounts are based upon average shares outstanding. |

| (c) | Total investment return is for the period indicated and has not been annualized. The total investment return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total investment return does not reflect the effect of sales charge. |

| (d) | Total investment return does not reflect the effect of sales charge. |

| (e) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (g) | According to the Fund's shareholder services plan, any amount of such payment not paid during the Fund's fiscal year for such services activities shall be reimbursed to the Fund as soon as practical after the end of the fiscal year. Fees were reimbursed to the Fund during the year ended October 31, 2018 and the year ended October 31, 2017, in the amounts of 0.05% and 0.06%, respectively of average net assets of the share class. |

| (h) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the Fund level. |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund – Class A | Financial Highlights |

| For a share outstanding throughout the period indicated |

| | | For the Year Ended October 31, 2019 | | | For the Period June 29, 2018

(commencement)

to October 31, 2018 | |

| PER SHARE OPERATING PERFORMANCE: | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.60 | | | $ | 11.84 | |