UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23059

CLOUGH FUNDS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Sareena Khwaja-Dixon, Secretary

Clough Funds Trust

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 855-425-6844

| Date of fiscal year end: | October 31 |

| | |

| Date of reporting period: | November 1, 2019 - October 31, 2020 |

| Item 1. | Report to Stockholders. |

| Clough Global Long/Short Fund | Table of Contents |

| Shareholder Letter | 2 |

| Portfolio Performance | 5 |

| Disclosure of Fund Expenses | 8 |

| Statement of Investments | 9 |

| Statement of Assets and Liabilities | 13 |

| Statement of Operations | 14 |

| Statements of Changes in Net Assets | 15 |

| Financial Highlights | 16 |

| Notes to Financial Statements | 20 |

| Report of Independent Registered Public Accounting Firm | 31 |

| Liquidity Risk Management Program | 32 |

| Additional Information | 33 |

| Trustees & Officers | 34 |

| Privacy Policy | 37 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission (the “Commission”), paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.cloughglobal.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Beginning on January 1, 2019, you may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-855-425-6844 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at http://www.cloughglobal.com/open-end-funds/overview/cloax.

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2020 (Unaudited)

Dear Shareholders:

For the fiscal year ending October 31, 2020, the Clough Global Long/Short Fund (the “Fund”) had a total net return of 8.79% for Class I, compared to 5.42% for the MSCI All Country World Index and 7.81% for the HFRI Equity Hedge (Total) Index for the same period. See total returns chart for the performance of all other share classes.

Top Five Positive and Negative Contributors for the Year

CRISPR Therapeutics, the leading company in the gene editing space, was the Fund’s largest contributor for the year, as the company made progress in its oncology, beta thalassemia and sickle cell therapies.

The Fund’s investment in Eurodollar futures as a hedge against a slowing global economy due to the emerging pandemic proved to be one of the largest contributors to performance for the year. Eurodollar futures, which are a proxy for future central bank policy, allowed the Fund to maintain its long equity book in the turbulent months of February and March while participating in the recovery rally that started in April. The Fund continues to hold this position as an intended hedge against any additional slowdown in economic activity from the spread of COVID-19.

PennyMac Financial Services Inc., a market dominant originator and servicer of residential and commercial mortgages, was a top contributor that benefited from increased refinance and new buyer activity as mortgage rates reached all time lows. Amazon.com Inc. and Teladoc Health Inc., a leading online healthcare provider, made significant gains from the COVID-19 driven shift to a stay at home economy.

Financial stocks were the top detractors for the year. Citigroup Inc., along with mortgage real estate investment trust (“REIT”) PennyMac Mortgage Investment Trust and Two Harbors Investment Corp., all declined as the markets priced in meaningful losses to the companies’ portfolios due to the sudden collapse in economy from COVID-19 related shutdowns. Finally, as the markets recovered in the spring, a hedge position in a S&P 500 Index exchange traded fund (“ETF”) and options on the S&P 500 Index were also top detractors from performance.

On The Markets: Liquidity Support for Equities is Positive

We are not political experts, but it appears equities have embraced a Biden presidency along with the possibility of a small Republican majority in the Senate and we can understand why. It is widely believed that there will be better coordination between a Biden administration and the Federal Reserve (the “Fed”) in combining monetary and fiscal policies. A Biden administration is expected to push for additional stimulus packages, and we assume will appoint dovish Federal Reserve governors.

The coronavirus was more of an exogenous shock to the market than would be a natural recession. There was no credit crisis or banking collapse, nor was there a profit hit from an excessive capacity build which destroys profitability in a key economic sector, like technology in 2000 or housing in 2008. The threat of more infections would likely prolong the policies of monetary ease.

The Fed is currently pumping liquidity into a growing economy and if it lives up to its promises of sustaining zero nominal interest rates into 2022 or 2023, the likelihood of higher returns on investment in the economy in 2021 and beyond looks pretty good.

In the meantime, investors are positioned defensively, holding $4.5 trillion in money market funds and another $15.7 trillion in short-term deposits. The amount of money sitting at the 90-day rate is close to the nominal gross domestic product (“GDP”). The Fed would like to see that money invested in the economy and is making holding that cash very costly.

The Fed is the most critical factor to the markets. Financial conditions are incredibly favorable, earnings expectations are rising, and the Fed continues to add reserves to the banking system. All of that is positive for equities.

Finally, businesses continue to generate large amounts of cash flow according to Bloomberg. Because business investment has been well below that spent in previous business expansions, businesses did not over invest, and excess capacity was never built, so pricing and profitability have held up. With the Pfizer vaccine likely to begin distribution over the next few months, we believe 2021 could be a very strong year for equities.

Positioning for 2021

The majority of the Fund’s current long exposure is focused in the high free cash flow generating sectors of technology and healthcare in the United States as well as in China. The Fund is also set up to potentially benefit from what we believe will be a long-lasting housing cycle in the U.S.

Technology

Looking ahead through the 2020s, we believe that the global buildout of 5G telecommunications networks will be a significant investment opportunity. All of the imaginative projects of the 2020s such as autonomous driving, machine learning and the “Internet of Things” require 5G technology. The 5G rollout accelerated with Apple’s announcement of a suite of its 5G equipped iPhones, which promise faster download and upload speeds, higher latency, and quality video gaming and streaming as enticements to buy the phones. Consumer spending is being diverted from travel and leisure to consumer electronics and evidence is mounting that affluent consumers will buy high-end phones. So far, 5G is widely available only in the Asia Pacific region, but where it is available selling prices are 15-20% higher than those of 4G equipped phones. Even in areas where 5G is not available, new phones are selling at a 7% premium to earlier generations.

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2020 (Unaudited)

Hundreds of billions of dollars will be spent building out 5G, and competition will be intense, particularly among service providers and companies which build the commodity portions of the infrastructure. To be competitive, service providers will be forced to overbuild their networks ahead of demand and to discount their products to fill capacity. Handset manufacturers without the strong applications businesses which lock in customers, unlike Apple which does, will also have to price aggressively to sell their products. A move to a new standard could add $50-100 per phone to the materials bill, especially for radio frequency (“RF”) chips, processing power and added memory. High-end phone modems must be able to work with any phone in any market and that is expensive. For example, the cost of the modem alone in 5G can increase by more than 50%. So, it is necessary to answer the question: who will capture the profits?

Higher materials costs mean more 5G dollars will go to the supply chain companies which solve the bottlenecks, the parts of the networks where proprietary technology breakthroughs are critical to making 5G work. The semiconductor companies with the technologies that solve those problems will not only capture a larger percentage of the phone’s value, but also lock in the highest profit margins.

A major barrier to entry in semiconductor manufacturing is a sharp rise in the capital intensity of component manufacturing. Taiwan Semiconductor Manufacturing Co Ltd. (“TSMC”), a current holding in the Fund, is expected to invest $130 billion through 2030 for high-end foundries for processor chips, an area where the company is already dominant. As capital intensity in the semiconductor industry rises, TSMC gains scale from share gains, and assumes pricing power and market share. Its foundry capacity is ten times that of Samsung’s and Chinese foundries barely compete in the space. TSMC has leading edge semiconductor design and production to the point that the company has already captured the leadership in processors from Intel Corp., and it already produces 20% of Intel’s sales. TSMC, with the industry’s first five nanometer A14 bionic chip, will provide the processors for all of Apple’s models offering speeds of up to 50% faster. Yet the stock has underperformed, and we believe it is relatively inexpensive.

We have particularly focused on companies that make up the Apple supply chain. For example, Skyworks Solutions Inc. is a manufacturer of RF chips whose products may capture a larger percentage of the iPhone’s revenues. Prior to 4G, radio frequency content per phone was about $10 for each smartphone. That rose to $20-30 per phone for 4G and will likely reach $35-40 for each 5G phone. Approximately 50% of the company’s revenues are from Apple.

Samsung Electronics Co Ltd. is also a current holding in the Fund. In memory and non-memory chips, the company has unexcelled research and development (“R&D”) and only trails Huawei Technologies Co Ltd. in announced patents. Now the company is making inroads into the manufacturing of 5G infrastructure, including high-end image sensors and foundry capacity. Its share of the telecom market, once a modest 4% or so for 4G, has risen to 10-15% for 5G. Not only is the company picking up on Huawei’s decline, but it has a secure supply chain located in Vietnam and South Korea. It has little China exposure and has far stronger R&D than either LM Ericsson or Nokia Oyj. The company successfully picked up a key Verizon 5G contract to supply 5G radio access equipment through 2025. Yet the stock sells at roughly book value, 11x 2021 earnings per share, offers a 3.5% yield, and its roughly $300 billion market capitalization includes $94 billion in cash.

Healthcare

In our view, health sciences will be one of the fastest growing areas of spending in the 2020s. Investors have been jittery since Hillary Clinton, as a presidential candidate in 2015, pushed price controls for big pharma and biotech. Since then, tens of billions of R&D dollars have been spent developing new therapies and huge strides have been made in medical discoveries and genomics. Many of those therapies are now entering human trials and that is the point at which value can be created for many companies. The industry offers the cheapest source of R&D in the securities markets. There are three ways to monetize this as we currently see it:

| | 1. | We anticipate a pickup in mergers and acquisitions (“M&A”). Only three deals were announced in the first half of 2020. In the third quarter, Gilead Sciences Inc. offered $21 billion for Immunomedics Inc. and Johnson and Johnson offered $6.5 billion for Momenta Pharmaceuticals Inc. We believe there exists significant pent-up demand at large pharma companies for attractive pipeline assets. The Fund is invested in potential biotechnology M&A targets that we believe generally have strong management teams, that have sold companies in the past, possess solid intellectual property, and disruptive technologies and attractive therapeutic focuses (e.g., oncology and rare diseases). |

| | | |

| | 2. | COVID has created significant business opportunities for innovative healthcare companies, but a successful vaccine may not be the only positive advancement. In our view, telemedicine and pharmaceutical testing may actually present some of the best long-term profit opportunities. COVID accelerated the shift to telemedicine from in-office visits and Teladoc Health Inc., the largest company in the telemedicine space, is a current holding in the Fund. Meanwhile, testing is becoming one of the fastest growing sectors in healthcare. We think the market underappreciates the critical role testing companies will continue to play, even with a vaccine approval. The Fund’s testing-related holdings include Hologic Inc., Thermo Fisher Scientific Inc., and Quest Diagnostics Inc. It should also be noted that Thermo Fisher is a leading producer of the refrigeration required for newly announced COVID-19 vaccines. |

| Annual Report | October 31, 2020 | 3 |

| Clough Global Long/Short Fund | Shareholder Letter |

October 31, 2020 (Unaudited)

| | 3. | Additional core holdings include CRISPR Therapeutics, which made further progress demonstrating clinical progress in sickle cell disease, beta thalassemia and solid tumor trials and has partnered with Vertex Pharmaceuticals Inc. in a series of oncology trials. CRISPR has resumed dosing hemophilia patients for phase 1/2 trials and patients have remained blood transfusion free for 15, 9 and 5 months which are highly encouraging outcomes. On the oncology front, where the company fully owns its intellectual property, the company presented initial data for its phase 1-2 allogeneic CAR-T trial showing excellent activity and outcomes in this tough to treat population. |

Housing and Mortgage Cycle

Financials are currently selling at low price to earnings ratios and a steeper yield curve would provide a strong tailwind for banks, mortgage REITs, and mortgage servicing companies, many of which sell below book value. Low money rates out to 2023 set up a good backdrop for strong profit margins in the business of agency holdings and credit, the fuel for profit growth among REITs. The Fed’s constant purchasing of mortgage-backed assets sustains the value of REIT holdings and the Fed’s low money rate policies set up a profit margin sweet spot for REITs which own mostly agency paper and mortgages.

U.S. housing and the mortgage markets which finance it are booming, yet the stocks of companies that originate and service mortgages and the title insurers sell at a depressed 5-7 times earnings. That would be a reasonable valuation if the housing cycle was peaking but at the beginning of a cycle that could last years, we think both earnings and the multiples on those earnings can rise in the years ahead. Current demand is strong, and land purchased by builders is being immediately developed, not stockpiled for speculative purposes. Millennials, after years of hesitancy, are migrating from parents’ basements and beehive apartments to single-family residences. Supply will struggle to meet that demand. New building has been depressed for a decade and the baby boomers, who own 60% of the housing stock, are not moving. Since 90% of supply comes from existing homes, new construction will have to provide most of the new supply.

Fixed Income

We continue to believe that a low interest rate world will continue to persist for the foreseeable future. We find duration an attractive hedge for the long equity book as well as a potential opportunity to produce positive returns. The Fund continues to hold long duration U.S. Treasuries as well as 10- to 30-year highly rated corporate bonds in sectors that are not adversely impacted by the pandemic.

Corporate Update

By way of a team update, we are very pleased to announce that Dr. Noelle Tune, M.D. has joined Clough Capital Partners L.P. ("Clough Capital") as a Director. Noelle earned her B.A. from Harvard College where she was captain of the women’s crew team. She graduated from medical school at University of North Carolina Chapel Hill before completing her residency at Indiana University, where she was a Chief Resident. Importantly, Mike Hearle worked directly with Dr. Tune in equity research at what is now SVB Leerink from 2000-2004 and has seen the quality of her analysis firsthand. She is an accomplished equity analyst in her own right with a unique combination of talents and is a timely addition to our research efforts. Most recently, Noelle has been on the frontline of the fight against COVID-19 in her capacity as an emergency medicine physician at a high-volume urban health center where she has treated countless patients infected with the virus. Dr. Tune will focus on covering public and private investments in the therapeutics and services areas.

As always, please don’t hesitate to reach out to us with any questions or comments.

| Sincerely, | |

| | |

|  |

| Charles I. Clough, Jr. | Robert M. Zdunczyk |

| Clough Global Long/Short Fund | Portfolio Performance |

October 31, 2020 (Unaudited)

Performance (as of October 31, 2020)

| | 1 Month | Quarter | 6 Month | 1 Year | Since Inception(a) |

| Class I - NAV | -2.83% | -1.67% | 14.00% | 8.79% | 3.58% |

| Investor Class - NAV(e) | -2.79% | -1.77% | 13.81% | 8.54% | 3.27% |

| Class A - NAV(f) | -2.79% | -1.69% | 13.81% | 8.54% | 3.27% |

| Class A - MOP(f) | -8.13% | -7.08% | 7.58% | 2.61% | 2.27% |

| Class C - NAV | -2.88% | -1.91% | 13.44% | 7.75% | 2.63% |

| Class C - CDSC | -3.85% | -2.89% | 12.44% | 6.75% | 2.63% |

| MSCI All Country World Index(b) | -2.41% | 0.30% | 13.88% | 5.42% | 7.54% |

| HFRI Equity Hedge Index(c) | 0.90% | 2.95% | 13.21% | 7.81% | 4.50% |

The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold, may be worth more or less than the original cost. Performance reflects the deduction of management fees and other applicable expenses and includes reinvested distributions and capital gains. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. Performance shown does not reflect the redemption fee, which, if reflected, would reduce the performance quoted. For the most current month-end performance data please call 1-855-425-6844.

Maximum Offering Price (MOP) for Class A shares includes the Fund's maximum sales charge of 5.50%. Contingent Deferred Sales Charge (CDSC) performance for Class C shares includes a 1.00% CDSC on Class C shares redeemed within 12 months of purchase. Performance shown at Net Asset Value (NAV) does not include these sales charges.

| (a) | The performance data quoted for periods prior to October 1, 2015 is that of an unregistered investment fund (the "Predecessor Fund") that was managed by the Adviser and was reorganized into the Fund as of the date the Fund commenced investment operations. The Predecessor Fund was not a registered mutual fund and therefore was not subject to the same investment and tax restrictions as the Fund. Performance information reflects all fees and expenses incurred by the Predecessor Fund and has not been adjusted to reflect Fund expenses. If it had been so adjusted, the Predecessor Fund's performance might have been higher or lower for a given period depending on the amount of such expenses incurred for any given period. Performance information for Investor Class and Class C have been adjusted to reflect 12b-1 fees and shareholder services fees, as applicable. The Predecessor Fund commenced operations on January 2, 2015. |

| | |

| (b) | The MSCI All Country World Index is a float-adjusted, capitalization weighted index that is designed to measure the equity market performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets. Both indices referenced herein reflect the reinvestment of dividends. The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaim all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com). |

| | |

| (c) | An index designed by Hedge Fund Research, Inc. to represent the performance of investment managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed by such managers to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. The HFRI family of indices reserves the right to revise historical performance data for a period of up to four months following the as of date. The performance shown was calculated using current, available data at the time of publication, but is subject to change outside of the control of the Fund and its affiliates |

Total returns for periods greater than one year are annualized.

The performance of the indices referenced herein is used for informational purposes only. One cannot invest directly in an index. Indices are not subject to any of the fees, allocations or expenses to which the Fund is subject, and there are significant differences between the Fund's investments and the components of the indices referenced herein.

| Annual Report | October 31, 2020 | 5 |

| Clough Global Long/Short Fund | Portfolio Allocation |

October 31, 2020 (Unaudited)

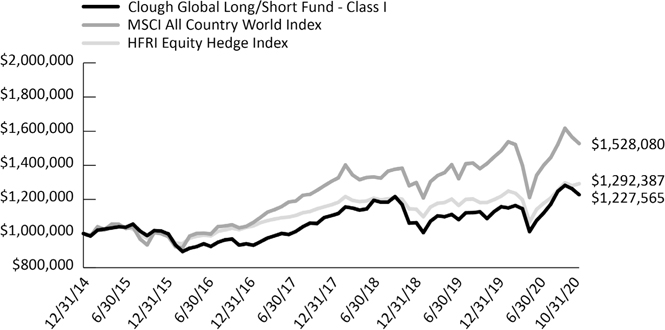

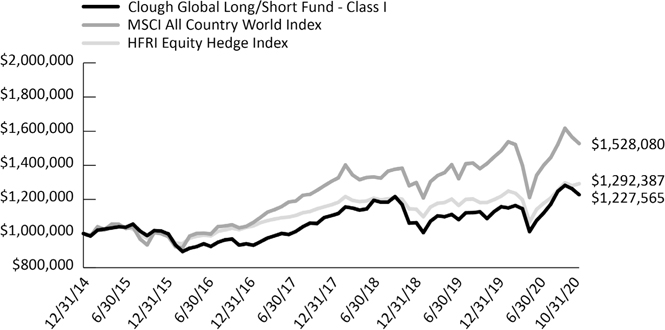

Performance of $1,000,000 Initial Investment (as of October 31, 2020)

The graph shown above represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. The historical performance prior to September 30, 2015 is that of the Predecessor Fund. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Long Holdings (as a % of Net Assets)(a) | |

| PennyMac Financial Services, Inc. | 3.37% |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 2.37% |

| Apple, Inc. | 2.34% |

| First American Financial Corp. | 2.18% |

| Annaly Capital Management, Inc. | 2.13% |

| Quest Diagnostics, Inc. | 2.09% |

| Microsoft Corp. | 2.01% |

| CRISPR Therapeutics AG | 2.00% |

| AGNC Investment Corp. | 1.87% |

| Hologic, Inc. | 1.83% |

| Top Ten Holdings | 22.19% |

| (a) | Holdings are subject to change without notice. Top Ten Long Holdings includes equity and equity-related securities only. The exposure figures include notional value of swaps. |

| Clough Global Long/Short Fund | Portfolio Allocation |

October 31, 2020 (Unaudited)

| Sector Allocation (as a % of Net Assets)(a) | Long | Short | Gross | Net |

| Health Care | 27.07% | -0.72% | 27.79% | 26.35% |

| Fixed Income | 15.35% | 0.00% | 15.35% | 15.35% |

| Financials | 17.13% | -3.04% | 20.17% | 14.09% |

| Information Technology | 16.38% | -3.46% | 19.84% | 12.92% |

| Consumer Discretionary | 10.20% | -0.37% | 10.57% | 9.83% |

| Communication Services | 3.62% | 0.00% | 3.62% | 3.62% |

| Industrials | 2.11% | 0.00% | 2.11% | 2.11% |

| Real Estate | 1.73% | 0.00% | 1.73% | 1.73% |

| Hedges | 1.47% | 0.00% | 1.47% | 1.47% |

| Consumer Staples | 1.04% | 0.00% | 1.04% | 1.04% |

| Total Investments | 96.10% | -7.59% | 103.69% | 88.51% |

| Region Allocation (as a % of Net Assets)(a) | Long | Short | Gross | Net |

| United States | 60.03% | -1.33% | 61.36% | 58.70% |

| Multinational(b) | 15.43% | -3.11% | 18.54% | 12.32% |

| China | 11.70% | 0.00% | 11.70% | 11.70% |

| Other - Emerging Markets | 2.86% | 0.00% | 2.86% | 2.86% |

| Europe | 4.76% | -3.15% | 7.91% | 1.61% |

| Other - Developed Markets | 0.82% | 0.00% | 0.82% | 0.82% |

| Japan | 0.50% | 0.00% | 0.50% | 0.50% |

| Total Investments | 96.10% | -7.59% | 103.69% | 88.51% |

| (a) | Holdings are subject to change without notice. The exposure figures reported include the market value of futures, notional value of swaps and do not include cash holdings. |

| | |

| (b) | Multinational companies include those organized or located in the United States that have more than 50% of revenues derived outside of the United States. |

| Annual Report | October 31, 2020 | 7 |

| Clough Global Long/Short Fund | Disclosure of Fund Expenses |

October 31, 2020 (Unaudited)

Examples. As a shareholder of the Clough Global Long/Short Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including applicable redemption fees and sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 01, 2020 and held through October 31, 2020.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period May 1, 2020 – October 31, 2020” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing Fund costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table below is useful in comparing ongoing costs only and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 05/01/20 | Ending Account Value 10/31/20 | Expense Ratio(a)(b) | Expenses Paid During period 05/01/20 - 10/31/20(c) |

| | | | | |

| Clough Global Long/Short Fund | | | | |

| Class I | | | | |

| Actual | $ 1,000.00 | $ 1,140.00 | 1.36% | $ 7.32 |

| Hypothetical (5% return before expenses) | $ 1,000.00 | $ 1,018.30 | 1.36% | $ 6.90 |

| Investor Class | | | | |

| Actual | $ 1,000.00 | $ 1,138.10 | 1.60% | $ 8.60 |

| Hypothetical (5% return before expenses) | $ 1,000.00 | $ 1,017.09 | 1.60% | $ 8.11 |

| Class A | | | | |

| Actual | $ 1,000.00 | $ 1,138.10 | 1.60% | $ 8.60 |

| Hypothetical (5% return before expenses) | $ 1,000.00 | $ 1,017.09 | 1.60% | $ 8.11 |

| Class C | | | | |

| Actual | $ 1,000.00 | $ 1,134.40 | 2.37% | $12.72 |

| Hypothetical (5% return before expenses) | $ 1,000.00 | $ 1,013.22 | 2.37% | $11.99 |

| (a) | Expense ratio excluding interest expense and dividends paid on borrowed securities for the Clough Global Long/Short Fund is 1.25%, 1.51%, 1.52%, and 2.25% for Class I, Investor Class, Class A, and Class C, respectively. |

| (b) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (c) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year 184/366 (to reflect the half-year period). |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2020

| | | Shares | | | Value | |

| COMMON STOCKS 74.58% | | | | | | | | |

| Communication Services 3.62% | | | | | | | | |

| Alphabet, Inc. - Class C(a) | | | 538 | | | $ | 872,103 | |

| Facebook, Inc. - Class A(a) | | | 2,810 | | | | 739,339 | |

| Tencent Holdings, Ltd. | | | 6,000 | | | | 457,401 | |

| | | | | | | | 2,068,843 | |

| | | | | | | | | |

| Consumer Discretionary 10.20% | | | | | | | | |

| Alibaba Group Holding, Ltd.(a) | | | 16,370 | | | | 619,114 | |

| Amazon.com, Inc.(a) | | | 332 | | | | 1,008,002 | |

| Carnival Corp. | | | 27,600 | | | | 378,396 | |

| Carvana Co.(a) | | | 3,513 | | | | 651,135 | |

| DR Horton, Inc. | | | 12,500 | | | | 835,125 | |

| Lennar Corp. - Class A | | | 11,300 | | | | 793,599 | |

| Meituan - Class B(a) | | | 13,200 | | | | 490,711 | |

| Royal Caribbean Cruises Ltd. | | | 12,160 | | | | 686,067 | |

| Samsonite International S.A.(a) | | | 367,200 | | | | 369,450 | |

| | | | | | | | 5,831,599 | |

| | | | | | | | | |

| Financials 17.13% | | | | | | | | |

| AGNC Investment Corp.(b) | | | 76,600 | | | | 1,070,102 | |

| Annaly Capital Management, Inc.(b) | | | 171,600 | | | | 1,216,644 | |

| Ares Capital Corp. | | | 11,100 | | | | 153,513 | |

| Bank of America Corp. | | | 33,260 | | | | 788,262 | |

| Barings BDC, Inc. | | | 43,900 | | | | 329,689 | |

| Citigroup, Inc. | | | 12,552 | | | | 519,904 | |

| First American Financial Corp. | | | 28,000 | | | | 1,248,520 | |

| Golub Capital BDC, Inc. | | | 27,735 | | | | 352,512 | |

| Hong Kong Exchanges and Clearing, Ltd. | | | 17,700 | | | | 845,216 | |

| JPMorgan Chase & Co. | | | 4,450 | | | | 436,278 | |

| PennyMac Financial Services, Inc.(b) | | | 37,900 | | | | 1,926,078 | |

| Sixth Street Specialty Lending, Inc. | | | 34,700 | | | | 571,162 | |

| Stewart Information Services Corp. | | | 7,900 | | | | 334,881 | |

| | | | | | | | 9,792,761 | |

| Health Care 26.48%(c) | | | | | | | | |

| 1Life Healthcare, Inc.(a) | | | 22,900 | | | | 646,011 | |

| AbbVie, Inc. | | | 4,600 | | | | 391,460 | |

| Amgen, Inc. | | | 2,827 | | | | 613,289 | |

| Apellis Pharmaceuticals, Inc.(a) | | | 13,500 | | | | 430,650 | |

| Baxter International, Inc. | | | 4,000 | | | | 310,280 | |

| Checkmate Pharmaceuticals, Inc.(a) | | | 47,742 | | | | 548,556 | |

| Covetrus, Inc.(a) | | | 22,100 | | | | 545,649 | |

| CRISPR Therapeutics AG(a) | | | 12,481 | | | | 1,146,005 | |

| Flexion Therapeutics, Inc.(a) | | | 46,300 | | | | 555,137 | |

| Fusion Pharmaceuticals, Inc.(a) | | | 13,800 | | | | 171,120 | |

| Gossamer Bio, Inc.(a) | | | 31,300 | | | | 259,790 | |

| GW Pharmaceuticals PLC - ADR(a) | | | 6,103 | | | | 549,331 | |

| Hologic, Inc.(a) | | | 15,200 | | | | 1,046,064 | |

| IDEXX Laboratories, Inc.(a) | | | 195 | | | | 82,840 | |

| Idorsia, Ltd.(a) | | | 10,000 | | | | 262,174 | |

| Laboratory Corp. of America Holdings(a) | | | 3,525 | | | | 704,189 | |

| | | Shares | | | Value | |

| Health Care (continued) | | | | | | | | |

| McKesson Corp. | | | 3,240 | | | $ | 477,868 | |

| Mirati Therapeutics, Inc.(a) | | | 1,205 | | | | 261,654 | |

| Moderna, Inc.(a) | | | 11,020 | | | | 743,519 | |

| Quest Diagnostics, Inc. | | | 9,770 | | | | 1,193,308 | |

| Regeneron Pharmaceuticals, Inc.(a) | | | 662 | | | | 359,837 | |

| Repare Therapeutics, Inc.(a) | | | 11,000 | | | | 297,330 | |

| SmileDirectClub, Inc.(a) | | | 27,000 | | | | 240,300 | |

| Teladoc Health, Inc.(a) | | | 2,593 | | | | 509,421 | |

| Thermo Fisher Scientific, Inc. | | | 1,708 | | | | 808,089 | |

| Veracyte, Inc.(a) | | | 13,770 | | | | 477,268 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 3,073 | | | | 640,290 | |

| Vir Biotechnology, Inc.(a) | | | 2,470 | | | | 77,657 | |

| Zai Lab, Ltd. - ADR(a) | | | 6,020 | | | | 493,941 | |

| Zimmer Biomet Holdings, Inc. | | | 445 | | | | 58,784 | |

| Zoetis, Inc. | | | 1,464 | | | | 232,117 | |

| | | | | | | | 15,133,928 | |

| | | | | | | | | |

| Information Technology 15.42% | | | | | | | | |

| Advanced Energy Industries, Inc.(a) | | | 5,500 | | | | 371,085 | |

| Apple, Inc. | | | 12,265 | | | | 1,335,168 | |

| Crowdstrike Holdings, Inc. - Class A(a) | | | 2,090 | | | | 258,826 | |

| Five9, Inc.(a) | | | 2,230 | | | | 338,336 | |

| Infineon Technologies AG | | | 9,063 | | | | 252,269 | |

| Intuit, Inc. | | | 825 | | | | 259,611 | |

| Lam Research Corp. | | | 920 | | | | 314,714 | |

| Lumentum Holdings, Inc.(a) | | | 3,800 | | | | 314,222 | |

| Mastercard, Inc. - Class A | | | 859 | | | | 247,942 | |

| Microsoft Corp.(b) | | | 5,661 | | | | 1,146,183 | |

| Qorvo, Inc.(a) | | | 3,170 | | | | 403,731 | |

| Renesas Electronics Corp.(a) | | | 35,100 | | | | 288,658 | |

| RingCentral, Inc. - Class A(a) | | | 975 | | | | 251,881 | |

| salesforce.com, Inc.(a) | | | 1,056 | | | | 245,277 | |

| Samsung Electronics Co., Ltd. | | | 5,593 | | | | 278,984 | |

| Skyworks Solutions, Inc. | | | 2,060 | | | | 291,057 | |

| Splunk, Inc.(a) | | | 1,250 | | | | 247,550 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 21,000 | | | | 317,164 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. - Sponsored ADR | | | 12,400 | | | | 1,039,988 | |

| Twilio, Inc. - Class A(a) | | | 1,070 | | | | 298,498 | |

| Workday, Inc. - Class A(a) | | | 1,480 | | | | 310,978 | |

| | | | | | | | 8,812,122 | |

| | | | | | | | | |

| Real Estate 1.73% | | | | | | | | |

| Community Healthcare Trust, Inc. | | | 16,550 | | | | 766,265 | |

| Physicians Realty Trust | | | 13,300 | | | | 224,238 | |

| | | | | | | | 990,503 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $36,291,617) | | | | | | | 42,629,756 | |

| Annual Report | October 31, 2020 | 9 |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2020

| Underlying Security/Expiration Date/ Exercise Price/Notional Amount | | Contracts | | | Value | |

| PURCHASED OPTIONS 0.76% | | | | | | | | |

| Call Options Purchased 0.76% | | | | | | | | |

| CRISPR Therapeutics AG | | | | | | | | |

| 01/15/21, $90, $826,380 | | | 90 | | | $ | 139,050 | |

| Eurodollar Future Option | | | | | | | | |

| 12/14/21, $100, $115,994,250 | | | 465 | | | | 31,969 | |

| Eurodollar Future Option | | | | | | | | |

| 12/14/21, $99.875, | | | | | | | | |

| $174,615,000 | | | 700 | | | | 65,625 | |

| Hologic, Inc. | | | | | | | | |

| 12/18/20, $70, $1,548,450 | | | 225 | | | | 97,875 | |

| Vertex Pharmaceuticals, Inc. | | | | | | | | |

| 01/15/21, $210, $1,458,520 | | | 70 | | | | 102,550 | |

| | | | | | | | | |

| Total Call Options Purchased | | | | | | | | |

| (Cost $637,982) | | | | | | | 437,069 | |

| | | | | | | | | |

| TOTAL PURCHASED OPTIONS | | | | | | | | |

| (Cost $637,982) | | | | | | | 437,069 | |

| Description/Maturity Date/Rate | | Principal Amount | | | Value | |

| CORPORATE BONDS 8.08% | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 10/01/2042, 4.625%(d) | | $ | 185,000 | | | | 220,394 | |

| Agile Group Holdings, Ltd. | | | | | | | | |

| 03/07/2022, 6.700%(e) | | | 250,000 | | | | 258,730 | |

| Anthem, Inc. | | | | | | | | |

| 05/15/2050, 3.125% | | | 200,000 | | | | 205,626 | |

| Apple, Inc. | | | | | | | | |

| 08/20/2050, 2.400% | | | 800,000 | | | | 782,191 | |

| Arrow Electronics, Inc. | | | | | | | | |

| 01/12/2028, 3.875% | | | 200,000 | | | | 222,362 | |

| Duke University | | | | | | | | |

| Series 2020, 10/01/2044, 2.682% | | | 200,000 | | | | 204,294 | |

| Fidelity National Financial, Inc. | | | | | | | | |

| 03/15/2031, 2.450% | | | 350,000 | | | | 342,931 | |

| Melco Resorts Finance, Ltd. | | | | | | | | |

| 07/21/2028, 5.750%(d) | | | 250,000 | | | | 249,442 | |

| Nestle Holdings, Inc. | | | | | | | | |

| 09/24/2038, 3.900%(d) | | | 300,000 | | | | 373,203 | |

| Prudential Financial, Inc. | | | | | | | | |

| 12/07/2049, 3.935% | | | 200,000 | | | | 226,706 | |

| Regeneron Pharmaceuticals, Inc. | | | | | | | | |

| 09/15/2050, 2.800% | | | 200,000 | | | | 187,790 | |

| Stanford Health Care | | | | | | | | |

| Series 2020, 08/15/2030, 3.310% | | | 200,000 | | | | 224,086 | |

| Sunac China Holdings, Ltd. | | | | | | | | |

| 04/19/2023, 8.350%(e) | | | 250,000 | | | | 256,698 | |

| Tencent Holdings, Ltd. | | | | | | | | |

| 01/26/2026, 1.810%(d) | | | 400,000 | | | | 406,127 | |

| Times China Holdings, Ltd. | | | | | | | | |

| 07/16/2023, 6.750%(e) | | | 250,000 | | | | 258,124 | |

| Description/Maturity Date/Rate | | Principal Amount | | | Value | |

| CORPORATE BONDS (continued) | | | | | | | | |

| University of Notre Dame du Lac | | | | | | | | |

| Series 2020, 02/15/2030, 1.637% | | $ | 200,000 | | | $ | 201,152 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $4,712,428) | | | | | | | 4,619,856 | |

| | | | | | | | | |

| CONVERTIBLE CORPORATE BONDS 0.67% | | | | | | | | |

| Ares Capital Corp. | | | | | | | | |

| 02/01/2022, 3.750% | | | 380,000 | | | | 383,040 | |

| | | | | | | | | |

| TOTAL CONVERTIBLE CORPORATE BONDS | | | | | | | | |

| (Cost $372,052) | | | | | | | 383,040 | |

| | | | | | | | | |

| GOVERNMENT & AGENCY OBLIGATIONS 6.27% | | | | | | | | |

| U.S. Treasury Bond | | | | | | | | |

| 02/15/2050, 2.000% | | | 1,600,000 | | | | 1,732,500 | |

| 05/15/2050, 1.250% | | | 550,000 | | | | 496,719 | |

| 08/15/2050, 1.375% | | | 1,450,000 | | | | 1,351,898 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | | | | | | |

| (Cost $3,789,018) | | | | | | | 3,581,117 | |

| | | | | | | | | |

| MUNICIPAL BONDS 0.33% | | | | | | | | |

| University of Virginia, Higher Education | | | | | | | | |

| Revenue Bonds | | | | | | | | |

| 09/01/2050, 2.256% | | | 200,000 | | | | 188,244 | |

| | | | | | | | | |

| TOTAL MUNICIPAL BONDS | | | | | | | | |

| (Cost $202,483) | | | | | | | 188,244 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS 3.73% | | | | | | | | |

| Money Market Funds 3.73% | | | | | | | | |

| BlackRock Liquidity Funds, T-Fund Portfolio - Institutional Class (0.040% 7-day yield) | | | 2,133,367 | | | | 2,133,367 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $2,133,367) | | | | | | | 2,133,367 | |

| | | | | | | | | |

| Total Investments - 94.42% | | | | | | | | |

| (Cost $48,138,947) | | | | | | | 53,972,449 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities - 5.58%(f) | | | | | | | 3,189,304 | |

| | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | $ | 57,161,753 | |

| SCHEDULE OF SECURITIES SOLD SHORT(a) | | Shares | | | Value | |

| COMMON STOCKS (7.29%) | | | | | | | | |

| Consumer Discretionary (0.37%) | | | | | | | | |

| Vroom, Inc. | | | (5,100 | ) | | | (209,610 | ) |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2020

| SCHEDULE OF SECURITIES SOLD SHORT(a)(continued) | | Shares | | | Value | |

| Financials (2.74%) | | | | | | | | |

| Deutsche Bank AG | | | (82,500 | ) | | $ | (763,125 | ) |

| Invesco, Ltd. | | | (10,800 | ) | | | (141,588 | ) |

| Mediobanca Banca di Credito Finanziario SpA | | | (33,533 | ) | | | (237,761 | ) |

| Societe Generale S.A. | | | (12,863 | ) | | | (174,377 | ) |

| UniCredit SpA | | | (33,659 | ) | | | (250,925 | ) |

| | | | | | | | (1,567,776 | ) |

| | | | | | | | | |

| Health Care (0.73%) | | | | | | | | |

| Bruker Corp. | | | (4,140 | ) | | | (176,115 | ) |

| PRA Health Sciences, Inc. | | | (2,445 | ) | | | (238,241 | ) |

| | | | | | | | (414,356 | ) |

| | | | | | | | | |

| Information Technology (3.45%) | | | | | | | | |

| Cree, Inc. | | | (6,300 | ) | | | (400,680 | ) |

| International Business Machines Corp. | | | (10,765 | ) | | | (1,202,020 | ) |

| Qualys, Inc. | | | (1,920 | ) | | | (168,672 | ) |

| Temenos AG | | | (1,892 | ) | | | (203,117 | ) |

| | | | | | | | (1,974,489 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Proceeds $4,827,355) | | | | | | | (4,166,231 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT | | | | | | | | |

| (Proceeds $4,827,355) | | | | | | $ | (4,166,231 | ) |

| (a) | Non-income producing security. |

| (b) | Pledged security; a portion or all of the security is pledged as collateral for securities sold short, total return swap contracts or futures contracts. As of October 31, 2020, the aggregate market value of those securities was $2,280,617, representing 3.99% of net assets. (See Note 1) |

| (c) | When sector categorization is categorized by industry, no industry exceeds the 25% maximum specified in the Statement of Additional Information. |

| (d) | Security exempt from registration of the Securities Act of 1933. These securities may be resold in transactions exempt from registration under Rule 144A, normally to qualified institutional buyers. As of October 31, 2020, the aggregate value of those securities was $1,249,166 or 2.19% of net assets. |

| (e) | Security was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As of October 31, 2020, the aggregate value of those securities was $773,552 or 1.35% of net assets. |

| (f) | Includes cash which is being held as collateral for total return swap contracts, securities sold short and/or futures contracts. |

| Annual Report | October 31, 2020 | 11 |

| Clough Global Long/Short Fund | Statement of Investments |

October 31, 2020

FUTURES CONTRACTS

| Description | | Counterparty | | Position | | Contracts | | Expiration Date | | Notional Value | | | Unrealized Appreciation (Depreciation) | |

| EURODOLLAR 90 DAY | | Morgan Stanley | | Long | | 289 | | June 2021 | | $ | 72,105,500 | | | $ | 783,230 | |

| EURODOLLAR 90 DAY | | Morgan Stanley | | Long | | 132 | | March 2022 | | | 32,909,250 | | | | (41,825 | ) |

| | | | | | | | | | | $ | 105,014,750 | | | $ | 741,405 | |

TOTAL RETURN SWAP CONTRACTS

| Counter Party | | Reference Obligation | | Notional Amount | | | Floating Rate Paid by the Fund | | Floating Rate Index | | Termination Date | | Value | | | Net Unrealized Appreciation | |

| Morgan Stanley | | Banco Santander SA | | $ | (181,851 | ) | | 1D FEDEF - 50 bps | | 1D FEDEF | | 5/20/2022 | | $ | (170,429 | ) | | $ | 11,422 | |

| Morgan Stanley | | Kweichow Moutai Co., Ltd. | | | 232,972 | | | 1D FEDEF - 250 bps | | 1D FEDEF | | 1/6/2022 | | | 294,114 | | | | 61,142 | |

| Morgan Stanley | | Luxshare Precision Industry Co., Ltd. | | | 464,355 | | | 1D FEDEF - 250 bps | | 1D FEDEF | | 1/6/2022 | | | 545,710 | | | | 81,355 | |

| Morgan Stanley | | Sany Heavy Industry Co., Ltd. | | | 587,570 | | | 1D FEDEF - 250 bps | | 1D FEDEF | | 1/6/2022 | | | 804,039 | | | | 216,469 | |

| Morgan Stanley | | Wuliangye Yibin Co., Ltd. | | | 181,196 | | | 1D FEDEF - 255 bps | | 1D FEDEF | | 5/4/2022 | | | 302,693 | | | | 121,497 | |

| Morgan Stanley | | Zoomlion Heavy Industry Science | | | 373,667 | | | 1D FEDEF - 250 bps | | 1D FEDEF | | 1/6/2022 | | | 400,030 | | | | 26,363 | |

| TOTAL | | | | $ | 1,657,909 | | | | | | | | | $ | 2,176,157 | | | $ | 518,248 | |

Investment Abbreviations:

1D FEDEF - Federal Funds Effective Rate (Daily)

FEDEF Rates:

1D FEDEF - 1 Day FEDEF as of October 31, 2020 was 0.09%

For Fund compliance purposes, the Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by the Fund's management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to the Financial Statements.

| Clough Global Long/Short Fund | Statement of Assets and Liabilities |

October 31, 2020

| ASSETS: | | | |

| | | | |

| Investments, at value (Cost - see below) | | $ | 53,972,449 | |

| Cash | | | 1,251,180 | |

| Deposit with broker for futures contracts | | | 137,565 | |

| Deposit with broker for securities sold short | | | 3,496,952 | |

| Deposit with broker for total return swap contracts | | | 981,692 | |

| Unrealized appreciation on total return swap contracts | | | 518,248 | |

| Dividends receivable | | | 23,765 | |

| Interest receivable | | | 49,960 | |

| Receivable for investments sold | | | 1,720,167 | |

| Receivable for shares sold | | | 24,979 | |

| Other assets | | | 30,019 | |

| Total Assets | | | 62,206,976 | |

| | | | | |

| LIABILITIES: | | | | |

| | | | | |

| Variation margin payable | | | 5,263 | |

| Securities sold short (Proceeds $4,827,355) | | | 4,166,231 | |

| Payable for investments purchased | | | 712,785 | |

| Payable for shares redeemed | | | 10,894 | |

| Payable for total return swap contracts payments | | | 20,011 | |

| Accrued investment advisory fee | | | 21,222 | |

| Accrued distribution and service fees | | | 4,191 | |

| Accrued legal expense | | | 18,779 | |

| Accrued administration fee | | | 10,114 | |

| Other payables and accrued expenses | | | 75,733 | |

| Total Liabilities | | | 5,045,223 | |

| Net Assets | | $ | 57,161,753 | |

| Cost of Investments | | $ | 48,138,947 | |

| | | | | |

| COMPOSITION OF NET ASSETS: | | | | |

| | | | | |

| Paid-in capital | | $ | 51,924,584 | |

| Distributable Earnings | | | 5,237,169 | |

| Net Assets | | $ | 57,161,753 | |

| PRICING OF CLASS I SHARES: | | | | |

| Net Assets | | $ | 48,931,799 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 3,952,651 | |

| Net Asset Value, offering and redemption price per share | | $ | 12.38 | |

| PRICING OF INVESTOR CLASS SHARES: | | | | |

| Net Assets | | $ | 2,602,048 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 213,246 | |

| Net Asset Value, offering and redemption price per share | | $ | 12.20 | |

| PRICING OF CLASS A SHARES: | | | | |

| Net Assets | | $ | 4,566,676 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 374,366 | |

| Net Asset Value, offering and redemption price per share | | $ | 12.20 | |

| Maximum offering price per share (NAV/0.945), based on maximum sales charge of 5.50% of the offering price | | $ | 12.91 | |

| PRICING OF CLASS C SHARES: | | | | |

| Net Assets | | $ | 1,061,230 | |

| Shares outstanding of no par value, unlimited shares authorized | | | 89,793 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.82 | |

See Notes to the Financial Statements.

| Annual Report | October 31, 2020 | 13 |

| Clough Global Long/Short Fund | Statement of Operations |

For the year ended October 31, 2020

| INVESTMENT INCOME: | | | | |

| | | | | |

| Dividends (net of foreign withholding taxes of $6,751) | | $ | 705,738 | |

| Interest Income | | | 181,718 | |

| Total Income | | | 887,456 | |

| | | | | |

| EXPENSES: | | | | |

| | | | | |

| Investment advisory fees | | | 564,675 | |

| Distribution and shareholder service fees: | | | | |

| Investor Class | | | 8,497 | |

| Class A | | | 11,680 | |

| Class C | | | 12,701 | |

| Administration fees | | | 88,955 | |

| Trustees fees | | | 78,053 | |

| Registration fees | | | 69,009 | |

| Dividend expense - short sales | | | 101,224 | |

| Custodian fees | | | 55,515 | |

| Audit & Tax Services fees | | | 43,000 | |

| Legal fees | | | 123,664 | |

| Printing fees | | | 10,271 | |

| Insurance fees | | | 24,746 | |

| Transfer agent fees | | | 40,587 | |

| Delegated transfer agent fees: | | | | |

| Class I | | | 5,934 | |

| Investor Class | | | 14 | |

| Class C | | | 139 | |

| Other expenses | | | 16,908 | |

| Total Expenses Before Waivers and/or Reimbursements | | | 1,255,572 | |

| Less fees waived and/or reimbursed by Adviser: | | | | |

| Class I | | | (419,823 | ) |

| Investor Class | | | (22,663 | ) |

| Class A | | | (30,639 | ) |

| Class C | | | (12,166 | ) |

| Net Expenses | | | 770,281 | |

| Net Investment Income | | | 117,175 | |

| | | | | |

| NET REALIZED GAIN/(LOSS) ON: | | | | |

| Investment securities | | | 4,102,880 | |

| Futures contracts | | | 487,849 | |

| Securities sold short | | | (2,237,915 | ) |

| Written options | | | (583,628 | ) |

| Total return swap contracts | | | 673,524 | |

| Foreign currency transactions | | | (2,277 | ) |

| Net realized gain distributions from other investment companies | | | 2,216 | |

| Net realized gain | | | 2,442,649 | |

| NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) ON: | | | | |

| Investment securities | | | (376,296 | ) |

| Futures contracts | | | 741,405 | |

| Securities sold short | | | 472,248 | |

| Written options | | | (8,198 | ) |

| Total return swap contracts | | | 328,972 | |

| Translation of assets and liabilities denominated in foreign currencies | | | 22,774 | |

| Net change in unrealized appreciation | | | 1,180,905 | |

| Net realized and unrealized gain | | | 3,623,554 | |

| Net Increase in Net Assets from Operations | | $ | 3,740,729 | |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund | Statements of Changes in Net Assets |

| | | For the Year Ended October 31, 2020 | | | For the Year Ended October 31, 2019 | |

| | | | | | | |

| OPERATIONS: | | | | | | | | |

| | | | | | | | | |

| Net investment income/(loss) | | $ | 117,175 | | | $ | (237,685 | ) |

| Net realized gain/(loss) | | | 2,442,649 | | | | (2,523,820 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 1,180,905 | | | | 5,740,473 | |

| Net Increase in Net Assets From Operations | | | 3,740,729 | | | | 2,978,968 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from shares sold | | | 10,824,361 | | | | 6,165,858 | |

| Payments for shares redeemed | | | (9,378,901 | ) | | | (17,250,650 | ) |

| Net Increase/(Decrease) in Net Assets From Class I Capital Share Transactions | | | 1,445,460 | | | | (11,084,792 | ) |

| | | | | | | | | |

| Investor Class | | | | | | | | |

| Proceeds from shares sold | | | 233,084 | | | | 194,186 | |

| Payments for shares redeemed | | | (238,615 | ) | | | (705,866 | ) |

| Net Decrease in Net Assets From Investor Class Capital Share Transactions | | | (5,531 | ) | | | (511,680 | ) |

| | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from shares sold | | | 1,530,240 | | | | 2,629,347 | |

| Payments for shares redeemed, net of redemption fees | | | – | | | | (91,853 | ) |

| Net Increase in Net Assets From Class A Capital Share Transactions | | | 1,530,240 | | | | 2,537,494 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from shares sold | | | 60,594 | | | | 109,956 | |

| Payments for shares redeemed | | | (864,535 | ) | | | (2,006,516 | ) |

| Net Decrease in Net Assets From Class C Capital Share Transactions | | | (803,941 | ) | | | (1,896,560 | ) |

| | | | | | | | | |

| Total Increase/(Decrease) in Net Assets | | $ | 5,906,957 | | | $ | (7,976,570 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 51,254,796 | | | | 59,231,366 | |

| End of period | | $ | 57,161,753 | | | $ | 51,254,796 | |

See Notes to the Financial Statements.

| Annual Report | October 31, 2020 | 15 |

| Clough Global Long/Short Fund – Class I | Financial Highlights |

For a share outstanding throughout the period indicated

| | | For the Year Ended October 31, 2020 | | | For the Year Ended October 31, 2019 | | | For the Year Ended October 31, 2018 | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.38 | | | $ | 10.70 | | | $ | 11.03 | | | $ | 9.40 | | | $ | 10.30 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | 0.03 | | | | (0.04 | ) | | | (0.07 | ) | | | (0.10 | ) | | | (0.12 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.97 | | | | 0.72 | | | | (0.26 | ) | | | 1.73 | | | | (0.74 | ) |

| Total from Investment Operations | | | 1.00 | | | | 0.68 | | | | (0.33 | ) | | | 1.63 | | | | (0.86 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| Total Distributions to Common Shareholders | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| Net asset value - end of period | | $ | 12.38 | | | $ | 11.38 | | | $ | 10.70 | | | $ | 11.03 | | | $ | 9.40 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(b) | | | 8.79 | % | | | 6.36 | % | | | (2.99 | )% | | | 17.34 | % | | | (8.39 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 48,932 | | | $ | 44,213 | | | $ | 52,684 | | | $ | 29,629 | | | $ | 44,003 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.39 | % | | | 3.09 | % | | | 2.85 | % | | | 3.21 | % | | | 3.76 | %(c) |

| Operating expenses including fee waivers/reimbursements | | | 1.45 | % | | | 2.14 | % | | | 2.03 | % | | | 1.96 | % | | | 2.50 | %(c) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.28 | % | | | (0.38 | )% | | | (0.64 | )% | | | (0.96 | )% | | | (1.30 | )%(c) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.19 | % | | | 2.52 | % | | | 2.42 | % | | | 2.85 | % | | | 2.86 | %(c) |

| Operating expenses including fee waivers/reimbursements | | | 1.25 | % | | | 1.57 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | %(c) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.48 | % | | | 0.19 | % | | | (0.21 | )% | | | (0.60 | )% | | | (0.40 | )%(c) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE(d) | | | 253 | % | | | 269 | % | | | 156 | % | | | 237 | % | | | 261 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total investment return is for the period indicated and has not been annualized. The total investment return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay |

| | on Fund distributions or the redemption of Fund shares. |

| (c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the Fund level. |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund – Investor Class | Financial Highlights |

For a share outstanding throughout the period indicated

| | | For the Year Ended October 31, 2020 | | | For the Year Ended October 31, 2019 | | | For the Year Ended October 31, 2018(a) | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.24 | | | $ | 10.60 | | | $ | 10.96 | | | $ | 9.37 | | | $ | 10.30 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(b) | | | 0.00 | (c) | | | (0.07 | ) | | | (0.11 | ) | | | (0.14 | ) | | | (0.15 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.96 | | | | 0.71 | | | | (0.25 | ) | | | 1.73 | | | | (0.74 | ) |

| Total from Investment Operations | | | 0.96 | | | | 0.64 | | | | (0.36 | ) | | | 1.59 | | | | (0.89 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| Total Distributions to Common Shareholders | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| Net asset value - end of period | | $ | 12.20 | | | $ | 11.24 | | | $ | 10.60 | | | $ | 10.96 | | | $ | 9.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(d) | | | 8.54 | % | | | 6.04 | % | | | (3.28 | )% | | | 16.97 | %(e) | | | (8.68 | )%(e) |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 2,602 | | | $ | 2,407 | | | $ | 2,776 | | | $ | 210 | | | $ | 76 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.63 | % | | | 3.34 | % | | | 3.14 | % | | | 3.78 | % | | | 4.23 | %(f) |

| Operating expenses including fee waivers/reimbursements | | | 1.70 | % | | | 2.40 | % | | | 2.33 | %(g) | | | 2.29 | %(g) | | | 2.85 | %(f) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.04 | % | | | (0.64 | )% | | | (0.93 | )% | | | (1.36 | )% | | | (1.57 | )%(f) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.43 | % | | | 2.77 | % | | | 2.71 | % | | | 3.38 | % | | | 3.33 | %(f) |

| Operating expenses including fee waivers/reimbursements | | | 1.50 | % | | | 1.83 | % | | | 1.90 | %(g) | | | 1.89 | %(g) | | | 1.95 | %(f) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.24 | % | | | (0.07 | )% | | | (0.50 | )% | | | (0.96 | )% | | | (0.67 | )%(f) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE(h) | | | 253 | % | | | 269 | % | | | 156 | % | | | 237 | % | | | 261 | % |

| (a) | On December 1, 2017, Class A was renamed Investor Class. |

| (b) | Per share amounts are based upon average shares outstanding. |

| (c) | Less than $0.005 per share. |

| (d) | Total investment return is for the period indicated and has not been annualized. The total investment return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total investment return does not reflect the effect of sales charge. |

| (e) | Total investment return does not reflect the effect of sales charge. |

| (f) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (g) | According to the Fund's shareholder services plan, any amount of such payment not paid during the Fund's fiscal year for such services activities shall be reimbursed to the Fund as soon as practical after the end of the fiscal year. Fees were reimbursed to the Fund during the year ended October 31, 2018 and the year ended October 31, 2017, in the amounts of 0.05% and 0.06%, respectively of average net assets of the share class. |

| (h) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the Fund level. |

See Notes to the Financial Statements.

| Annual Report | October 31, 2020 | 17 |

| Clough Global Long/Short Fund – Class A | Financial Highlights |

For a share outstanding throughout the period indicated

| | | For the Year Ended October 31, 2020 | | | For the Year Ended October 31, 2019 | | | For the Period June 29, 2018 (commencement) to October 31, 2018 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.24 | | | $ | 10.60 | | | $ | 11.84 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | 0.01 | | | | (0.04 | ) | | | (0.02 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.95 | | | | 0.68 | | | | (1.22 | )(b) |

| Total from Investment Operations | | | 0.96 | | | | 0.64 | | | | (1.24 | ) |

| | | | | | | | | | | | | |

| Net asset value - end of period | | $ | 12.20 | | | $ | 11.24 | | | $ | 10.60 | |

| | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(c) | | | 8.54 | % | | | 6.04 | % | | | (10.47 | )% |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 4,567 | | | $ | 2,822 | | | $ | 209 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.60 | % | | | 3.42 | % | | | 2.91 | %(d)(e) |

| Operating expenses including fee waivers/reimbursements | | | 1.68 | % | | | 2.30 | % | | | 2.32 | %(d)(e) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.04 | % | | | (0.32 | )% | | | (0.61 | )%(d)(e) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 2.42 | % | | | 2.97 | % | | | 2.44 | %(d)(e) |

| Operating expenses including fee waivers/reimbursements | | | 1.50 | % | | | 1.85 | % | | | 1.85 | %(d)(e)(f) |

| Net investment income/(loss) including fee waivers/reimbursements | | | 0.22 | % | | | 0.13 | % | | | (0.14 | )%(d)(e) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE(g) | | | 253 | % | | | 269 | % | | | 156 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | The per share amount varies from the net realized and unrealized gain/loss for the whole period because of the timing of sales of fund shares and per share amount of realized and unrealized gains and losses at such time. |

| (c) | Total investment return is for the period indicated and has not been annualized. The total investment return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total investment return does not reflect the effect of sales charge. |

| (d) | Annualized. |

| (e) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (f) | According to the Fund's shareholder services plan, any amount of such payment not paid during the Fund's fiscal year for such services activities shall be reimbursed to the Fund as soon as practical after the end of the fiscal year. Fees were reimbursed to the Fund during the year ended October 31, 2018 in the amount of 0.10% of average net assets of the share class. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the Fund level. |

See Notes to the Financial Statements.

| Clough Global Long/Short Fund – Class C | Financial Highlights |

For a share outstanding throughout the period indicated

| | | For the Year Ended October 31, 2020 | | | For the Year Ended October 31, 2019 | | | For the Year Ended October 31, 2018 | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.97 | | | $ | 10.42 | | | $ | 10.84 | | | $ | 9.34 | | | $ | 10.30 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.08 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.20 | ) | | | (0.21 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.93 | | | | 0.70 | | | | (0.24 | ) | | | 1.70 | | | | (0.71 | ) |

| Total from Investment Operations | | | 0.85 | | | | 0.55 | | | | (0.42 | ) | | | 1.50 | | | | (0.92 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| Total Distributions to Common Shareholders | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| Net asset value - end of period | | $ | 11.82 | | | $ | 10.97 | | | $ | 10.42 | | | $ | 10.84 | | | $ | 9.34 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Investment Return - Net Asset Value(b) | | | 7.75 | % | | | 5.28 | % | | | (3.87 | )% | | | 16.06 | % | | | (8.97 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (in 000s) | | $ | 1,061 | | | $ | 1,813 | | | $ | 3,562 | | | $ | 95 | | | $ | 73 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS (including interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 3.42 | % | | | 4.07 | % | | | 3.79 | % | | | 4.33 | % | | | 4.78 | %(c) |

| Operating expenses including fee waivers/reimbursements | | | 2.46 | % | | | 3.17 | % | | | 3.06 | % | | | 2.97 | % | | | 3.50 | %(c) |

| Net investment loss including fee waivers/reimbursements | | | (0.74 | )% | | | (1.44 | )% | | | (1.58 | )% | | | (2.03 | )% | | | (2.19 | )%(c) |

| RATIOS TO AVERAGE NET ASSETS (excluding interest expense and dividend expense on securities sold short) | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 3.21 | % | | | 3.48 | % | | | 3.32 | % | | | 3.96 | % | | | 3.88 | %(c) |

| Operating expenses including fee waivers/reimbursements | | | 2.25 | % | | | 2.58 | % | | | 2.59 | % | | | 2.60 | % | | | 2.60 | %(c) |

| Net investment loss including fee waivers/reimbursements | | | (0.53 | )% | | | (0.85 | )% | | | (1.11 | )% | | | (1.66 | )% | | | (1.29 | )%(c) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE(d) | | | 253 | % | | | 269 | % | | | 156 | % | | | 237 | % | | | 261 | % |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total investment return is for the period indicated and has not been annualized. The total investment return would have been lower had certain expenses not been waived / reimbursed during the period. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total investment return does not reflect the effect of sales charge. |

| (c) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized and is calculated at the Fund level. |

See Notes to the Financial Statements.

| Annual Report | October 31, 2020 | 19 |

| Clough Global Long/Short Fund | Notes to Financial Statements |

October 31, 2020

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING AND OPERATING POLICIES

Clough Funds Trust (the “Trust”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust was organized under the laws of the state of Delaware on March 17, 2015. The Trust currently offers shares of beneficial interest (“shares”) of the Clough Global Long/Short Fund (the “Fund”). The Fund’s commencement date is September 30, 2015. The Fund is a diversified investment company with an investment objective to seek to provide long-term capital appreciation. The Fund currently offers four Classes of shares: Class I, Investor Class, Class A and Class C. Prior to December 1, 2017, Investor Class shares were named Class A shares. On June 29, 2018, a new Class A commenced operations. Each share class of the Fund represents an investment in the same portfolio of securities, but each share class has its own expense structure. As of October 31, 2020, approximately 45% of the Fund is owned by affiliated parties. The Board of Trustees (the “Board”) may establish additional funds and classes of shares at any time in the future without shareholder approval.

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company for financial reporting purposes under GAAP and follows the accounting and reporting guidance applicable to investment companies as codified in Accounting Standards Codification (“ASC”) Topic 946 – Investment Companies.

The net asset value (“NAV”) per share of the Fund is determined no less frequently than daily, on each day that the New York Stock Exchange (“NYSE” or the “Exchange”) is open for trading, as of the close of regular trading on the Exchange (normally 4:00 p.m. New York time). Trading may take place in foreign issues held by the Fund at times when the Fund is not open for business. As a result, the Fund’s NAV may change at times when it is not possible to purchase or sell shares of the Fund.

Investment Valuation: Securities held by the Fund for which exchange quotations are readily available are valued at the last sale price, or if no sale price or if traded on the over-the-counter market, at the mean of the bid and asked prices on such day. Most securities listed on a foreign exchange are valued at the last sale price at the close of the exchange on which the security is primarily traded. In certain countries market maker prices are used since they are the most representative of the daily trading activity. Market maker prices are usually the mean between the bid and ask prices. Certain markets are not closed at the time that the Fund prices its portfolio securities. In these situations, snapshot prices are provided by the individual pricing services or other alternate sources at the close of the NYSE as appropriate. Securities not traded on a particular day are valued at the mean between the last reported bid and the asked quotes, or the last sale price when appropriate; otherwise fair value will be determined by the Board-appointed fair valuation committee. Debt securities for which the over-the-counter market is the primary market are normally valued on the basis of prices furnished by one or more pricing services or dealers at the mean between the latest available bid and asked prices. As authorized by the Board, debt securities (including short-term obligations that will mature in 60 days or less) may be valued on the basis of valuations furnished by a pricing service which determines valuations based upon market transactions for normal, institutional-size trading units of securities or a matrix method which considers yield or price of comparable bonds provided by a pricing service. Total return swaps are priced based on valuations provided by a Board approved independent third party pricing agent. If a total return swap price cannot be obtained from an independent third party pricing agent the Fund shall seek to obtain a bid price from at least one independent and/or executing broker.