united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23066

Northern Lights Fund Trust IV

(Exact name of registrant as specified in charter)

17605 Wright Street, Omaha, Nebraska 68130

(Address of principal executive offices) (Zip code)

Jen Farrell, Gemini Fund Services, LLC.

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 11/30

Date of reporting period:11/30/18

Item 1. Reports to Stockholders.

| ||

| Moerus Worldwide Value Fund | ||

| Class N Shares (MOWNX) | ||

| Institutional ClassShares (MOWIX) | ||

| Annual Report | ||

| November 30, 2018 | ||

| 1-844-663-7871 | ||

| www.moerusfunds.com | ||

| This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Moerus Worldwide Value Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information. | ||

| Distributed by Foreside Fund Services, LLC | ||

| Member FINRA | ||

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.moerusfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

1

| Moerus Worldwide Value Fund (Unaudited) |

| Annual Shareholder Letter: Twelve Months Ended November 30, 2018 |

Dear Fellow Investors:

It is our pleasure to update you on recent developments regarding the Moerus Worldwide Value Fund (“the Fund”). In this Shareholder Letter, we will touch on Fund performance, how we currently view the world, portfolio activity since we last wrote to you, and some thoughts on asset-based investing in periods when earnings expectations and intrinsic value diverge.

We thank you very much for your support, and as always, we welcome any feedback that you might have.

Fund Performance (as of November 30, 2018)*

| Since Inception** | ||||

| Fund/Index | 6-Months | 1-year | Cumulative | Annualized |

| Moerus Worldwide Value Fund - Class N | -9.31% | -13.79% | 11.32% | 4.38% |

| Moerus Worldwide Value Fund - Institutional Class | -9.17% | -13.55% | 12.05% | 4.66% |

| MSCI AC World Index Net (USD) *** | -2.66% | -0.98% | 27.95% | 10.35% |

| * | Performance data quoted is historical, and is net of fees and expenses. |

| ** | Inception date is May 31, 2016. |

| *** | The MSCI AC World Index Net (USD) captures large and mid cap representation across 23 Developed Market and 24 Emerging Market countries. With 2,758 constituents, the index covers approximately 85% of the global investable equity opportunity set. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Returns are shown net of fees and expenses and assume reinvestment of dividends and other income. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Please call 1 (844) MOERUS1 or visit www.moerusfunds.com for most recent month end performance.

| Investment performance reflects expense limitations in effect. In the absence of such expense limitations, total return would be reduced. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2020, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any taxes, brokerage fees and commissions, borrowing costs, acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments, or extraordinary expenses such as litigation) will not exceed 1.65% and 1.40% for Class N and Institutional Class Shares, respectively. |

With regard to the table above, as always, please note that the Fund’s performance data is noted simply for informational purposes for our fellow investors. The Fund seeks to invest with a long-term time horizon, of five years or more, and it is not managed with any short-term performance objectives or benchmark considerations in mind. The investment objective of the Fund is long-term capital appreciation, and we manage the Fund with the goal of achieving attractive risk-adjusted performance over the long term.

Maintaining a long-term investment approach does not, unfortunately, make periods of poor performance any less painful. Indeed, for long-term, fundamental bottom-up investors like us, 20181 proved to be a frustrating year. It was a year in which macroeconomic and geopolitical headlines, in our view, played a much greater role in stock price performance than fundamental

| 1 | Please note that this letter covers the Fund’s 2018 Fiscal Year, or the twelve months ended November 30, 2018. |

2

developments at the level of the underlying businesses. Attractive long-term investment theses seemed to go underappreciated or unnoticed entirely, drowned out by the noise emanating from a wide range of sources, including trade negotiations with China, the Fed increasing interest rates, macroeconomic and political uncertainty across much of Latin America, a most unlikely coalition of populists coming to power in Italy, and intensifying political brinkmanship and threats of a prolonged government shutdown here in the U.S.

Many of the topics above contributed to one of the main themes unfolding in 2018 which negatively impacted the Fund’s portfolio: namely, the significant underperformance of markets outside of the U.S., especially emerging markets, in U.S. dollar terms. For a simple illustration of this, the MSCI All-Country World Index (ACWI) Net, in which the U.S. has by far the single largest country weighting (roughly 54%), declined by only 1% over the twelve months ended November 30, 2018. By comparison, The MSCI ACWI Ex-USA Index Net – which as the name suggests, excludes the U.S. declined over 8%, and the MSCI Emerging Markets Index Net declined over 9% during the same period. In many markets outside the U.S., weak performance in local currency terms was, in most cases, compounded by weakening currencies relative to the U.S. dollar. Notably, the Fund currently has muchless exposure to the U.S. (14.5% of assets, excluding cash at year-end) and muchmore exposure to emerging markets (over 25% of assets) than many global indices. As such, in 2018 the Fund’s performance suffered partly due to the “underperformance” of international markets, which many investors fled (particularly from emerging markets) for the perceived “safety” of the U.S. market and more specifically its high-flying tech sector, which until recently attracted many investors drawn to its real or perceived growth prospects.

It is important to emphasize that wherever the Fund’s assets are invested is simply a result of where we believe we are finding the most attractively valued, long-term opportunities at any point in time, period. It is not due to any benchmark considerations or top-down views on asset allocation. It is simply a result of where we believe we are seeing the best risk-adjusted values. Pursuing deeply discounted bargains wherever they may exist requires a contrarian bent, and therefore it is not surprising that we have been finding opportunities in unpopular areas that many others fled in 2018 (Latin America, which we discussed in detail in our Semi-Annual Shareholder Letter, comes to mind). On the other hand, the U.S. – in particular, its technology and other “growth” sectors – seemed to be one of the more “crowded rooms” in 2018, at least judging by the relative paucity of compellingly priced investment opportunities (in our view, anyway). But our longer-term views notwithstanding, the U.S. market held up well on a relative basis in 2018, which weighed on the Fund’s performance in a relative sense.

However, the non-U.S. geographic composition of the Fund’s investments was not the only factor impacting performance in 2018. Indeed, given what we have said thus far, you might then find it surprising that the U.S. was, in fact, the single largest detractor, by country, from the Fund’s performance during 2018. The primary reason for this, in our view, is driven by the types of U.S. investments that the Fund owns. Namely, as we have discussed at length in past letters, we have avoided the broadly loved stocks whose valuations – excessively inflated, in our view – were fueled by growth prospects and momentum in earnings, revenue, subscribers, unique users, eyeballs, or whatever the case may be. Instead, the opportunities found in the Fund are generally more asset-based in nature, trading at what we believe are unusually attractive discounts to intrinsic value, and have been executing concrete actions that we believe are building intrinsic

3

value over the long-term. These opportunities became available at attractive prices because they fell out of favor with most investors, primarily due to clouded immediate-term outlooks and a lack of reported current earnings, revenue or other metrics to please what we believe was a largely momentum-driven market in 2018. Holdings such as Spectrum Brands Holdings Inc., Tidewater Inc. and Jefferies Financial Group Inc. were punished excessively, in our view, due to disappointing short-term earnings and/or near-term outlooks, ironically despite longer-term, fundamental developments which we believe will increase intrinsic value over the long run.

Despite a painful 2018, longer-term we continue to be very encouraged by positive fundamental developments across many of the Fund’s holdings, most notably among some of the most significant negative drivers of performance during the year. In many cases, we’d argue that intrinsic values grew even as the stock prices suffered, widening discounts and, in our view, making the long-term investment cases even more attractive. In the short run, stock prices are often driven more by popularity contests and investors’ (sometimes irrational) hopes, fears, optimism and anxiety, than by underlying intrinsic value. The Fund seemed to suffer from this phenomenon in 2018.

Asset-based value investing of the type that we do at Moerus often requires enduring periods in which the lack of earnings-related momentum can cause stock prices and intrinsic value to diverge (we will return to this topic in greater detail later). In our view, 2018 was one of those periods. But in our experience, these large gaps between stock price and intrinsic value typically don’t persist indefinitely. The discount might eventually narrow in the market as short-term adversity wanes and investor sentiment improves. Or failing recognition in the securities markets, value might ultimately be crystallized in the private markets through a takeover offer, asset sales, or other actions. Either way, provided that the company in question has the wherewithal, financial and otherwise, to weather short-term periods of uncertainty (an important caveat), we believe that more times than not, underlying value is recognized over the long run. In fact, two profitable exits from the Fund in 2018 resulted from value-realizing events (more on that shortly).

Of course, the timing of such value-realizations is highly uncertain, and as we have cautioned in the past, given our contrarian approach the Fund can and will endure unpleasant periods of underperformance. While 2018 was an example of one of these periods and was a painful and frustrating year, we will maintain our long-term focus. We remain confident and encouraged that the Fund is well-positioned to ultimately benefit from sound fundamentals and valuations that we believe have gotten even more attractive from a long-term perspective as a result of stock price declines. In many cases, provided that our investment thesis holds and continues to develop in a sensible way, these declines have enabled us to add to existing positions.

Investment Activity in the Fund

In fact, in Fiscal Year 2018 (twelve months ended November 30, 2018), we added to 28 existing positions, in addition to initiating three new positions in the Fund that we discussed at length in the Fund’s Semi-Annual Shareholder Letter: Aspen Insurance Holdings Limited, Shinsei Bank, Ltd., and Tidewater Inc. As of November 30, 2018, the Fund’s portfolio included 38 holdings. The Fund also held roughly 11.1% of its assets in cash as of the end of November, which we believe provides us with flexibility and the ability to quickly respond if further market volatility provides us with opportunities to add to new or existing investments.

4

Portfolio Exits

The Fund’s investment in Aspen Insurance, however, proved to be short-lived, as it was one of two notable exits made from the Fund in 2018. As we had noted in our last letter, Aspen Insurance had a sound long-term underwriting track record. However, the company (and its stock) had fallen on hard times in 2017 due to hurricanes Irma, Harvey and Maria, wildfires in California, and growing pains associated with the primary insurance business it had been expanding. We began building the Fund’s position in Aspen stock in March 2018, at prices around book value, which represented a significant discount to recent industry transaction multiples.

In our prior Shareholder Letter, we also noted that Aspen management had recently acknowledged that the Board of Directors was considering all options to create shareholder value. On August 28, in what appears to have been the culmination of those efforts, the company announced that it had agreed to be acquired by Apollo Global Management LLC for $42.75 per share in cash. We would have liked to have owned Aspen for a much longer period our holding period turned out to be only about eight months but the deal’s completion seemed to be afait accompli, albeit at a price representing an over 5% premium to the Fund’s cost basis. As Aspen stock began to approach Apollo’s proposed purchase price (thereby limiting further upside potential, in our view), in consideration of the fact that the transaction is not expected to close until sometime in the first half of 2019, and until then is subject to break clauses that could potentially be triggered by major natural catastrophes, we decided to sell the Fund’s position in order to redeploy the capital into other opportunities.

The other notable exit from the Fund in 2018 was its position in Guoco Group Limited (“Guoco”), a Hong Kong-listed holding company with interests in various areas, including real estate, financial services, gaming, and hospitality. Guoco is a company with which our team is very familiar, as we have followed the company for many years. Back in 2001, Guoco sold its controlling stake in Dao Heng Bank Group Ltd. to DBS Group Holdings Ltd. in 2001 at what we deemed to be a rich price. Over the ensuing years, the company reinvested the proceeds from the sale – shrewdly, in our opinion – in various areas, including property development and investment, banking services, and gaming. Our investment thesis, in a nutshell, was that Guoco boasted an extremely strong, net cash balance sheet, a controlling shareholder (Quek Leng Chan) with a track record of value-accretive purchases and sales of assets, and an attractive valuation at a roughly 40% discount to our estimate of intrinsic value, the majority of which consisted of publicly traded assets.

We began acquiring shares of Guoco at the Fund’s inception in June 2016 and continued to build a position throughout 2016 and much of 2017, at an average cost of around HK$91.50. Guoco stock gradually rose until July 2018, when an entity affiliated with the controlling shareholder offered to take Guoco private for HK$135 per share, at a greater than 14% premium to the previous close and a roughly 47% premium to the Fund’s cost basis. In the weeks that followed the offer, Guoco stock approached the offer price, thereby limiting further upside potential in the event the transaction were completed. Further, we judged it possible that minority shareholders might reject the going-private plan given the fact that the offer, while at a nice premium, was nonetheless priced at a discount to the company’s disclosed intrinsic value (which again was based primarily on ownership stakes in other publicly listed securities). With the controlling shareholder, in our estimation, unlikely to increase the offer price, and in light of the possibility of the offer being rejected, we decided to exit the Fund’s position in Guoco at an average price of

5

roughly HK$130, electing to realize a meaningful profit. After the Fund’s exit, the controlling shareholder’s offer to take Guoco private was indeed subsequently rejected by shareholders, and Guoco’s share price has since declined by over 20%. If the share price were to once again decline to levels that offer, in our estimation, attractive risk-adjusted return potential with an adequate margin of safety, it is not inconceivable that we could potentially revisit an investment in Guoco at some point in the future.

As we noted earlier, large discounts to intrinsic value often exist from time to time for various reasons, but in our experience they often do not last indefinitely, instead eventually being recognized by either the public securities markets or failing that, in the private markets. Aspen and Guoco are two examples of the latter scenario playing out. While the positive impacts of these two events on the Fund’s performance were overshadowed in 2018 by the mostly market sentiment-driven negative impacts on stock prices that we previously discussed, we believe that these types of value-surfacing events are likely to contribute meaningfully to the Fund’s performance over the long run, as they have in our past experience. Despite a disappointing 2018, we believe that the Fund is well-positioned to benefit from these kinds of events going forward.

The Bumpy Road of Asset-Based Investing: When Momentum and Intrinsic Value Diverge

A defining characteristic of most investment approaches, particularly those of value investors, is their approach toward valuation. Namely, what constitutes a valuation attractive enough to result in the inclusion of a security in an investment portfolio? Different approaches employ a variety of data – backward-looking as well as forward – or a combination of past, present and future data to divine what the security in question might be worth. At Moerus, however, our methodology for assessing the valuation of a security tends to draw upon the actual data at that specific point in time, reflecting the past and present, but with very limited conjectures or predictions about the future. For a longer discussion of this approach to investing, please refer to our January 2016 Investor MemoAsset-Based Investing in an Earnings-Focused World. Our preference for evaluating an opportunity on an “as is” basis is predicated upon our belief that the future is inherently unknown, and that the likelihood of repeatedly, correctly estimating the future variables that influence an individual company’s operating performance (and by implication its valuation) is low.

It’s not always easy, but as investors we must accept that regardless of how confident we might be in a potential outcome, we simply do not possess a crystal ball that will tell us the future with an adequate degree of certainty. It is therefore critical, in our view, to acknowledge this and formulate an approach that adequately addresses this inconvenient truth about investing. At Moerus this involves a pursuit of conservatism, in which we undertake an evaluation of each investment with a reduced dependence upon assumptions of unknown future variables. This approach ascribes estimated realizable values for companies based on the here and now. Importantly, these are often periods of adversity for the company, industry, or geographic regions in which it operates, and thus our estimates may well understate the “ultimate” values which might be realized in a more normal (e.g.,a more benign) operating environment.

As we have often discussed, bargains in the investment world are not often easy to come by. Like a department store, in which the largest discounts are typically offered on merchandise that has not sold briskly, in the securities markets deeply discounted investment opportunities often are available because for whatever reason, they are not in fashion at that point in time. It may be a

6

poor current or near-term outlook for an industry or country, or perhaps a company-specific event (e.g., a misstep by management). Whatever the reason for it, valuations are often most attractive when the investment in question is out of favor. Following this investment approach therefore requires a long-term investment horizon. And given this longer-term holding period, it is of paramount importance that the investment in question have a strong financial and business position with an ability to survive, or preferably, thrive during the periods of adversity that will almost inevitably occur over the lifecycle of a typical investment.

Circumstances that could close the discount between price paid and intrinsic value could entail a more traditional path, such as the improved operating performance of assets stemming from management initiatives or an improving operating environment for the business,inter alia. Alternatively, value could also be surfaced by sales of assets, or the entire business, at attractive prices, as in the Aspen Insurance and Guoco Group cases highlighted earlier. In each case, to implement this approach successfully, the investor’s focus needs to be less on near-term earnings expectations, and more on the nature of the measures that could potentially be taken to create and realize value – which are necessarily longer-term in nature. Accordingly, this requires one to largely ignore earnings-related movements of securities prices, and focus instead on the evolution of the intrinsic value underlying the company in question. The overwhelming importance most investors attach to earnings (and to changes in earnings expectations), coupled with the ever-shortening investment horizons of most market participants, makes such patient investing, where most (non-fundamental) near-term stock price movements are treated as noise, a challenging endeavor for most investors. This is especially true in the current era of 24-hour news cycles and market-moving presidential tweets.

What Implications Does the Asset-Based Approach Have for the Fund’s Portfolio?

This asset-based approach functions well, we believe, as a means of assessing a conservative value of a business to a potential purchaser of the company – such as Apollo Global Management in its pending acquisition of Aspen Insurance, or Guoco’s controlling shareholder in its proposal to take the company private. It is also, in our opinion, of considerable importance in mitigating price risk (as a result of buying cheaply) in a longer-term context. However, we must emphasize that this approach is of limited utility as a timing tool for buying “at the bottom.” Looking back through our years of investing, we believe that buying securities based on this valuation methodology has historically tended to diminish price risk in a longer-term context, but it has generally proven unhelpful as a guide to side-stepping transitory price declines in the short-term. To wit, buying cheaply mitigates, but certainly does not eliminate, the likelihood of experiencing price declines and significant stock price volatility along the way.

Another implication is that, again, investment time horizons matter. An asset-based investor such as Moerus would typically view any operating development through a long-term investor’s lens, assessing any earnings-impacting operating development quite differently than a typical earnings-focused investor might. A long-term investor would typically assess the impact, if any, that the development had on the long-term intrinsic asset value of the underlying business. On the other hand, for the shorter-term, earnings-focused investor, the primacy of earnings and the information contained in the income statement or earnings release would dominate, prompting hair-trigger trading responses, which even small earnings changes (which may be immaterial in the long-term) can cause.

7

Example: Tidewater Inc.

An example of the potentially divergent interpretations of reported operating results is offered by the reaction to the most recent reported results of Tidewater Inc., a company we wrote about in our last Shareholder Letter. The company provides offshore service vessels and associated services to offshore oil exploration and production installations, which are currently experiencing significantly depressed levels of business activity. The weakness of the current level of business activity was evident in the company’s recently reported results (released in November), which nonetheless showed positive cash earnings, no small achievement in a fragmented industry in which many of its peers are at death’s door. Meanwhile, also in November, Tidewater merged with a peer (Gulfmark Offshore) that had complementary operations, continuing to broaden the geographic scope of its operations while acquiring Gulfmark’s fleet at what seems likely to be a significant discount to replacement cost. Our take on the merger and earnings results was generally positive in the context of the long-term building of the business value. But the majority of other investors, who are earnings-focused and probably shorter-term in nature, seemed to view these events far more negatively, with an ensuing impact on the company’s stock price. In our opinion, the currently depressed levels of offshore activity that drove Tidewater’s results are long-known, and the company’s results for the past quarter were therefore not surprising. Yes, the past quarter’s reported earnings were weak, but from our perspective as a long-term investor in a business that we believe is building intrinsic value and strengthening its position for an eventual normalization in business conditions, it merely reflects noise that is irrelevant to the long-term operation of the business.

Emerging Markets

Nowhere is this dichotomy more visible, in our opinion, than in emerging markets. Normally the domain of growth investors, emerging market stocks accordingly seem to be subject to heightened sensitivity to changes in earnings estimates in both directions. Additionally, the reaction in emerging markets’ securities prices to changes in earnings estimates/expectations is usually amplified by the relative illiquidity of the securities in such markets. The volatility resulting from a downward revision in earnings estimates, which in turn has often been amplified as a result of relative illiquidity, has historically proven to be a quite good source of attractively valued investment opportunities for us in developing markets, despite their reputation as a home primarily of growth investors. We have found this to be especially true in the area of asset-rich companies, where current earnings provide a poor yardstick for assessing value.

Example: BR Properties S.A.

An example of this would be the Fund’s investment in BR Properties S.A., a Brazilian company whosemodus operandi has been to acquire a portfolio of very high-quality office properties, primarily in São Paulo and Rio de Janeiro, at unusually attractive prices from stressed or motivated sellers. The acquisitions of properties at uniquely attractive prices have been made possible by a severe economic downturn that resulted in a sharp rise in vacancy rates and a plunge in office rental rates in Brazil. Buying high-quality buildings cheaply in such an environment with low occupancy rates and depressed rents is unlikely to result in meaningful earnings contribution to the reported results or demonstrate earnings momentum in the short run. The earnings momentum will only get going when occupancy and rental rates stabilize at

8

higher, more normalized levels (at which point in time a presumably ample or less-discounted valuation, mirroring a less depressed outlook, would make it a far less attractive investment opportunity in our view). In fact, acquiring high vacancy buildings in the midst of weak rental rates is likely to do just the opposite, making the company’s income statement look worse as costs pile up while revenues remain elusive and depressed. Accordingly, earnings-focused investors have steered clear of BR Properties, as its earnings were deemed to be low and disappointing (perversely endowing it with a stratospheric Price/Earnings multiple). From our perspective, however, the company’s management has done a credible job building a formidable portfolio of prime office properties in a cyclically depressed market, which we believe would, in more normal times, command far higher prices than those at which they are currently valued on the balance sheet. This, in our view, presents an opportunity which lay in plain sight for a long-term investor.

Example: Spectrum Brands Holdings, Inc.

Another area of divergence between the asset-based approach and the traditional earnings-based approach relates to corporate events that crystallize value (e.g., by asset sales), but which might have an adverse (or ambiguous) earnings impact over the shorter-term. These are often viewed by the traditional earnings-centric investor as a loss in earnings power for the business and therefore usually are viewed negatively. In contrast, we would view such an event positively if it were to realize value at an attractive price. An example of this is our investment in Spectrum Brands Holdings Inc., which sold two of its (previously six) businesses for what we’d argue were very attractive prices. The sale proceeds, which are significant in the context of a company of this size, will now afford it the opportunity to significantly strengthen its balance sheet, reinvest in its remaining business, and potentially return excess capital to shareholders. These are significant positives in our interpretation of these asset sales, but the benign neglect (disdain?) with which the consummation of the sales was greeted by the market has left the shares at multi-year lows, which seems to us to be a reaction (overreaction?) to the market’s resulting forecast of diminished earnings.

Not for Everybody

Of course, the long-term, asset-based investment approach that we implement at Moerus is not for everybody, or even for most. Quarterly earnings reports, momentum, and near-term outlooks are much more important for those who practice different approaches to investing/trading. For example, for very short-term oriented investors with very high turnover, who actively churn their portfolios, a quarterly earnings report, or management’s guidance for the next six months might indeed be very important. At Moerus, however, this is much less relevant to us other than as a frequent source of opportunity to find longer-term bargains that have found themselves in temporary disfavor.

Short-term outlooks, reported earnings and momentum take on much greater importance for another subset of investors: those who employ margin debt (financial leverage) in their portfolios. While margin debt can enhance returns when things work out, it also makes getting short-term variables “right” much more critical, because even temporary price declines, if sharp enough, could trigger margin calls and forced selling (often at the worst of times, when a security is depressed). The Fund, however, does not invest on margin. Not doing so suits the Moerus investment approach quite well; when businesses become available at depressed prices due to temporary adversity, we’d much rather be the opportunistic buyer than the forced seller.

9

These are just two examples of the many market participants who focus mainly on the short run and particularly on earnings-related momentum. Because this perspective tends to predominate across much of the securities markets, our asset-based approach to valuation and our long-term investment horizon often cause us to view corporate and market events quite differently than much of, if not most of the market. The upshot: as in the Tidewater, BR Properties and Spectrum Brands examples above, our approach to valuation and our long-term investment horizon might, and often does, lead to selection of securities that, while potentially rewarding over the long term, might experience considerable bumps in the road along the way, in the form of price volatility over the holding period. This volatility will often mirror what is, in our opinion, shorter-term earnings-related noise that, in the longer-term, might well amount to little true impact in economic terms, given the financial strength of the underlying businesses in which we strive to invest. Volatility can certainly be unsettling at times. But as we have often said, at Moerus we view volatility as “friend” rather than “foe,” as in our experience it has provided us with very attractive opportunities from a long-term perspective.

As always, many thanks for your continued support, interest, and curiosity. We look forward to writing you again later in the year. Best wishes for a happy, healthy, safe, and prosperous 2019!

Sincerely,

Amit Wadhwaney

Portfolio Manager

© 2019 Moerus Capital Management, LLC (“Moerus”) is a registered investment adviser. The information set forth herein is informational in nature and is not intended to be investment advice. This information reflects the opinion of Moerus on the date written and is subject to change at any time without notice. Due to various factors including, but not limited to, changing market conditions, the content may no longer reflect our current opinions or positions. Performance figure reflected herein are presented net of fees. Past performance is not an indicator or guarantee of future results.

Investing in Mutual Funds involves risks including the possible loss of principal and there can be no assurance that any investment will achieve its objectives. International investing involves increased risk and volatility due to currency fluctuations, economics and political conditions, and differences in financial reporting standards.

The preceding information is not being provided in a fiduciary capacity, and it is not intended to be, and should not be considered as, impartial investment advice.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling 1-844-MOERUS1 or by visiting www.moerusfunds.com. The prospectus should be read carefully before investing. The Moerus Worldwide Value Fund is distributed by Foreside Fund Services, LLC, Member FINRA.

10

| Fund Performance - (Unaudited) |

| November 30, 2018 |

| Moerus Worldwide Value Fund |

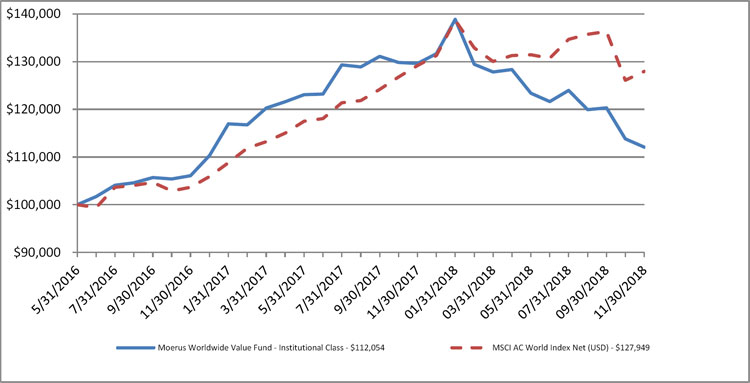

The Fund’s performance figures* for the periods ended November 30, 2018, compared to its benchmark:

| Average Annual | ||

| Since Inception** - | ||

| Fund/Index | One Year | November 30, 2018 |

| Moerus Worldwide Value Fund - Class N | (13.79)% | 4.38% |

| Moerus Worldwide Value Fund - Institutional Class | (13.55)% | 4.66% |

| MSCI AC World Index Net (USD) *** | (0.98)% | 10.35% |

Moerus Worldwide Value Fund vs. MSCI AC World Index Net (USD)

Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The total operating expense ratio, as stated in the fee table in the Fund’s Prospectus dated March 30, 2018, is 2.55% for Class N shares and 2.05% for Institutional Class shares. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2020, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any taxes, brokerage fees and commissions, borrowing costs, acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments, or extraordinary expenses such as litigation) will not exceed 1.65% and 1.40% for Class N and Institutional Class Shares, respectively. The fee waiver and expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three year basis, if such recoupment can be achieved within the lesser of the foregoing expense limits or those in place at the time of recapture. This agreement may be terminated only by the Trust’s Board of Trustees on 60 days written notice to the advisor. Absent this agreement, the performance would have been lower. Redemptions within 90 days of purchase may be assessed a 2.00% fee of the amount redeemed. For performance information current to the most recent month-end table, please call 1-844-MOERUS1. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

| * | Performance data quoted is historical. |

| ** | Inception date is May 31, 2016. |

| *** | The MSCI AC World Index Net (USD) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 2,758 constituents, the index covers approximately 85% of the global investable equity opportunity set. |

Please refer to the Portfolio of Investments in this annual report for a detailed listing of the Fund’s holdings.

11

| Fund Review - (Unaudited) |

| November 30, 2018 |

| Moerus Worldwide Value Fund |

| TOP 10 HOLDINGS BY ASSET CLASS OR INDUSTRY AS OF NOVEMBER 30, 2018 | % OF NET ASSETS | |||

| Investment Companies | 10.3 | % | ||

| Real Estate | 9.2 | % | ||

| Oil & Gas Services | 8.5 | % | ||

| Base Metals | 5.1 | % | ||

| Restaurants | 4.3 | % | ||

| Precious Metal Mining | 4.2 | % | ||

| Banks | 3.9 | % | ||

| Telecom Carriers | 3.8 | % | ||

| Life Insurance | 3.7 | % | ||

| Security and Commodity Exchanges | 3.5 | % | ||

| Other, Cash and Cash Equivalents | 43.5 | % | ||

| TOTAL | 100.0 | % | ||

| COUNTRIES DIVERSIFICATION OF ASSETS | % OF NET ASSETS | |||

| Canada | 23.9 | % | ||

| United States | 14.5 | % | ||

| Brazil | 7.5 | % | ||

| Colombia | 6.9 | % | ||

| United Kingdom | 5.3 | % | ||

| Uruguay | 4.3 | % | ||

| Greece | 3.7 | % | ||

| Netherlands | 3.7 | % | ||

| Singapore | 3.2 | % | ||

| Panama | 2.9 | % | ||

| Hong Kong | 2.8 | % | ||

| British Virgin Islands | 2.3 | % | ||

| Norway | 2.3 | % | ||

| Japan | 2.2 | % | ||

| Italy | 1.7 | % | ||

| Bermuda | 1.4 | % | ||

| TOTAL | 88.6 | % | ||

| Other Assets Less Liabilities - Net | 11.4 | % | ||

| GRAND TOTAL | 100.0 | % | ||

12

MOERUS WORLDWIDE VALUE FUND (UNAUDITED)

Management Discussion of Fund Performance

The Moerus Worldwide Value Fund (the “Fund”) generated returns of -13.79% and -13.55% (net of fees) for the Class N and Institutional Class Shares, respectively, during the twelve months ended November 30, 2018. For comparison purposes only, the MSCI AC World Index Net (USD) returned -0.98% (net) over the same period. It is important to note that the investment objective of the Fund is long-term capital appreciation, and that the Fund typically invests with a time horizon of roughly five years (or more in some cases). For these reasons the Fund is not managed according to any short-term performance objectives or benchmark considerations. Therefore, although we will provide a brief discussion of the Fund’s performance below, we are much more focused on the longer-term merits and attractiveness of the Fund’s individual investments, and by extension the Fund’s aggregate portfolio. As we have detailed in the Annual Shareholder Letter that precedes this discussion, we remain encouraged by what we view as solid long-term, fundamental developments across much of the Fund’s portfolio.

With that said, the Fund performed poorly in 2018. In our view, positive developments regarding underlying, long-term business fundamentals across many of the Fund’s investments were overshadowed by numerous sources of macroeconomic and geopolitical uncertainty, including trade negotiations with China, the Federal Reserve tightening monetary policy, a strengthening U.S. dollar and conversely, depreciating local currencies across multiple emerging markets, and political uncertainty in various areas, such as Brazil, Italy, and the United States. Against this backdrop, given the Fund’s current exposure mostly to markets outside of the U.S., including emerging markets, the Fund’s 2018 performance was negatively impacted by the significant underperformance of these markets in U.S. dollar terms. In general, the strong performance of many large U.S. technology stocks, a theme in recent years, continued until late 2018, and capital seemed to flow away from international markets (especially emerging markets) and into the perceived “safety” of the U.S. market and more specifically its high-flying, richly-valued tech sector. Our continued focus on attempting to limit price risk by not investing in businesses whose valuations seem excessive contributed to the Fund’s 2018 performance lagging that of global benchmark indexes, which have significant allocations to the U.S. in general and the Information Technology sector in particular.

The Fund’s weak absolute performance during the year ended November 30, 2018, was driven by fairly broad-based share price depreciation among many of its holdings, with the three single largest detractors from performance being the Fund’s investments in Spectrum Brands Holdings, Inc., BR Properties S.A., and Tidewater, Inc. Listed in the United States, Spectrum Brands Holdings, Inc. (“Spectrum Brands”) is a global consumer products company focused on non-discretionary consumer products, in areas such as hardware and home improvement, home and garden, global pet supplies, and global auto care. In 2018, Spectrum Brands stock was negatively impacted by earnings results which disappointed analysts and were driven, in part, by disruptions related to the company’s consolidation of manufacturing and distribution activities into new green-field facilities.

However, unlike the broader market, which generally is much more short-term oriented, we believe the 2018 developments at Spectrum Brands seem likely to contribute to the long-term development of the business and its intrinsic value. Specifically, more important to us than the quarterly earnings reports that disappointed investors, was our view that in 2018 Spectrum Brands completed a number of concrete steps that have transformed what had been a grab-bag of disparate assets and businesses into a slimmed down, simplified company that is focused on faster growing, cash generative businesses. These steps have included a merger between the listed holding company and listed

13

MOERUS WORLDWIDE VALUE FUND (UNAUDITED) (CONTINUED)

primary subsidiary company – resulting in a more widely distributed shareholder base, improved trading liquidity, a simplified corporate and governance structure, and significant tax attributes – in addition to the completed sale of its Rayovac battery business and the pending sale of its Global Auto Care businesses at what we think are attractive prices. We continue to believe that Spectrum Brands offers an attractive long-term investment for the Fund, and its valuation has gotten more attractive as a result of the stock declining.

BR Properties S.A., the second largest detractor from the Fund’s performance during 2018, is a leading Brazilian owner of high-quality commercial real estate, the large majority of which consists of prime office buildings in Brazil’s two largest cities, Sao Paulo and Rio de Janeiro. In the Fund’s Fiscal 2018, BR Properties’ stock price suffered in local currency, which in turn depreciated by over 15% relative to the U.S. dollar, resulting in a double-negative impact on the Fund’s performance. In recent years, Brazil has suffered from a severe economic downturn that resulted in a sharp rise in vacancy rates and a plunge in office rental rates in Brazil. In response, BR Properties management, quite reasonably in our opinion, has striven to take advantage of this downturn by acquiring some high-quality office properties at unusually attractive prices from distressed or otherwise motivated sellers. While from our perspective, such actions seem likely to provide the potential for meaningful growth in intrinsic value over time if economic conditions in Brazil normalize, in the short run earnings are likely to be subdued given high vacancy rates and low rental rates, which in turn has likely discouraged shorter-term investors. This phenomenon has allowed the Fund to accumulate a position in BR Properties at what we believe is an increasingly attractive valuation. We continue to be encouraged by its long-term investment case.

Tidewater, Inc., the third largest detractor from Fund performance in Fiscal 2018, is a United States-based provider of offshore service vessels (“OSVs”) and associated services to offshore oil exploration and production installations, which are currently experiencing significantly depressed levels of business activity. Tidewater stock was negatively impacted by a sharp decline in oil prices late in 2018, which in turn reignited fears of continued near-term weakness in offshore energy activity (the primary source of demand for Tidewater’s services). However, while conditions in its business remain quite weak, given our long-term perspective, we believe the investment thesis remains strong, and in fact may even be strengthened given some advantages that Tidewater possesses relative to the rest of the industry. Specifically, its best-in-class balance sheet allowed the company to acquire Gulfmark Offshore’s high-quality vessel fleet at what seems to be a deep discount to replacement cost. We believe the company remains uniquely well-positioned to lead consolidation in the OSV space and emerge stronger when industry conditions normalize. In our view, Tidewater’s valuation is increasingly compelling, at a deep discount to tangible book value, which in turn has been dramatically written down in recent years.

On the positive side, notable contributions to the Fund’s performance were made by Aker ASA, a Norwegian investment holding company, Cameco Corp., a Canadian uranium producer, Guoco Group Limited, a Hong Kong-listed holding company, and Gran Tierra Energy, Inc., a Canada-listed oil and gas exploration and production company whose assets are primarily located in Colombia. However, these positive contributions were more than offset by generally broad-based declines across much of the Fund’s holdings during the year. Going forward, we remain encouraged by the portfolio’s fundamentals and valuation.

14

MOERUS WORLDWIDE VALUE FUND (UNAUDITED) (CONTINUED)

Expense Ratio: Class N: 1.65% / Class Inst.: 1.40%

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Returns are shown net of fees and expenses and assume reinvestment of dividends and other income. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Investment performance reflects expense limitations in effect. In the absence of such expense limitations, total return would be reduced.

The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least March 31, 2020, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any taxes, brokerage fees and commissions, borrowing costs, acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments, or extraordinary expenses such as litigation) will not exceed 1.65% and 1.40% for Class N and Institutional Class Shares, respectively.

The inception date of the Moerus Worldwide Value Fund is May 31, 2016.

The MSCI AC World Index Net (USD) is an unmanaged index consisting of 47 country indices comprised of 23 developed and 24 emerging market country indices and is calculated with dividends reinvested after deduction of withholding tax. The Index is a trademark of MSCI Inc. and is not available for direct investment.

Investing in Mutual Funds involves risks including the possible loss of principal and there can be no assurance that any investment will achieve its objectives. International investing involves increased risk and volatility due to currency fluctuations, economics and political conditions, and differences in financial reporting standards.

15

| Moerus Worldwide Value Fund |

| PORTFOLIO OF INVESTMENTS |

| November 30, 2018 |

| Shares | Value | |||||||

| COMMON STOCK - 88.6% | ||||||||

| AGRICULTURAL CHEMICALS - 3.0% | ||||||||

| 30,868 | Nutrien Ltd. * | $ | 1,591,554 | |||||

| AIRLINES - 2.9% | ||||||||

| 18,440 | Copa Holdings SA | 1,567,953 | ||||||

| BANKS - 3.9% | ||||||||

| 101,038 | Mediobanca SpA | 893,009 | ||||||

| 87,000 | Shinsei Bank Ltd. | 1,193,712 | ||||||

| 2,086,721 | ||||||||

| BASE METALS - 5.1% | ||||||||

| 177,401 | Cameco Corp. | 2,104,893 | ||||||

| 150,841 | Lundin Mining Corp. | 657,113 | ||||||

| 2,762,006 | ||||||||

| DIVERSIFIED BANKS - 3.3% | ||||||||

| 228,895 | Standard Chartered PLC | 1,779,736 | ||||||

| EXPLORATION & PRODUCTION - 2.6% | ||||||||

| 530,715 | Gran Tierra Energy, Inc. * | 1,413,536 | ||||||

| FLOW CONTROL EQUIPMENT - 2.1% | ||||||||

| 45,798 | Colfax Corp. * | 1,142,202 | ||||||

| FOOD & DRUG STORES - 3.3% | ||||||||

| 439,183 | Almacenes Exito SA | 1,760,614 | ||||||

| HOMEBUILDERS - 0.3% | ||||||||

| 17,624 | Melcor Developments Ltd. | 165,751 | ||||||

| HOUSEHOLD PRODUCTS - 2.2% | ||||||||

| 24,192 | Spectrum Brands Holdings, Inc. | 1,194,601 | ||||||

| INVESTMENT COMPANIES - 10.3% | ||||||||

| 21,404 | Aker ASA * | 1,219,070 | ||||||

| 617,164 | Atlas Mara Ltd. * | 1,234,328 | ||||||

| 75,988 | Jefferies Financial Group, Inc. | 1,660,338 | ||||||

| 757,552 | The Westaim Corp. * | 1,419,235 | ||||||

| 5,532,971 | ||||||||

| INVESTMENT MANAGEMENT - 2.4% | ||||||||

| 37,343 | Franklin Resources, Inc. | 1,265,554 | ||||||

| LIFE INSURANCE - 3.7% | ||||||||

| 46,075 | NN Group NV | 1,959,968 | ||||||

| MINING SERVICES - 2.1% | ||||||||

| 310,038 | Major Drilling Group International, Inc. * | 1,110,361 | ||||||

| OIL & GAS SERVICES - 8.5% | ||||||||

| 140,417 | Enerflex Ltd. | 1,723,122 | ||||||

| 67,052 | Pason Systems, Inc. | 1,005,452 | ||||||

| 77,285 | Tidewater, Inc. * | 1,837,837 | ||||||

| 4,566,411 | ||||||||

See accompanying notes to financial statements.

16

| Moerus Worldwide Value Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| November 30, 2018 |

| Shares | Value | |||||||

| PRECIOUS METAL MINING - 4.2% | ||||||||

| 120,248 | Lundin Gold, Inc. * | $ | 429,748 | |||||

| 205,332 | Osisko Mining, Inc. * | 389,314 | ||||||

| 8,807 | Royal Gold, Inc. | 644,232 | ||||||

| 50,639 | Wheaton Precious Metals Corp. * | 791,994 | ||||||

| 2,255,288 | ||||||||

| PRIVATE EQUITY - 1.4% | ||||||||

| 563,600 | GP Investments Ltd. - BDR * | 730,173 | ||||||

| REAL ESTATE - 9.2% | ||||||||

| 1,022,400 | BR Properties SA | 2,029,074 | ||||||

| 861,266 | Sino Land Co. Ltd. | 1,481,346 | ||||||

| 921,300 | Straits Trading Co. Ltd. * | 1,396,723 | ||||||

| 4,907,143 | ||||||||

| REFINING & MARKETING - 1.8% | ||||||||

| 331,385 | Organizacion Terpel SA | 938,526 | ||||||

| REIT - 2.1% | ||||||||

| 109,844 | Grivalia Properties REIC AE * | 1,109,388 | ||||||

| RESTAURANTS - 4.3% | ||||||||

| 278,888 | Arcos Dorados Holdings, Inc. | 2,300,826 | ||||||

| SECURITY & COMMODITY EXCHANGES - 3.5% | ||||||||

| 249,237 | Bolsa de Valores de Colombia | 986,835 | ||||||

| 204,381 | Hellenic Exchanges - Athens Stock Exchange SA | 893,244 | ||||||

| 1,880,079 | ||||||||

| TELECOM CARRIERS - 3.8% | ||||||||

| 169,997 | Telefonica Brasil SA - ADR | 2,014,465 | ||||||

| TEXTILE & TEXTILE PRODUCTS - 2.0% | ||||||||

| 1,027,792 | Coats Group PLC * | 1,066,136 | ||||||

| TRANSPORT SUPPORT SERVICES - 0.6% | ||||||||

| 1,161,500 | Hutchison Port Holdings Trust | 301,990 | ||||||

| TOTAL COMMON STOCK (Cost - $53,151,231) | 47,403,953 | |||||||

| SHORT-TERM INVESTMENT - 11.0% | ||||||||

| MONEY MARKET FUND - 11.0% | ||||||||

| 5,859,154 | Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio, Institutional Class, 2.04% ** | 5,859,154 | ||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $5,859,154) | ||||||||

| TOTAL INVESTMENTS - 99.6% (Cost - $59,010,385) | $ | 53,263,107 | ||||||

| OTHER ASSETS LESS LIABILITIES - NET - 0.4% | 212,591 | |||||||

| NET ASSETS - 100.0% | $ | 53,475,698 | ||||||

| ADR | American Depositary Receipt |

| BDR | Brazilian Depositary Receipt |

| PLC | Public Limited Company |

| REIC | Real Estate Investment Company |

| REIT | Real Estate Investment Trust |

| * | Non-income producing securities. |

| ** | Money Market Fund; rate reflects seven-day effective yield on November 30, 2018. |

See accompanying notes to financial statements.

17

| Moerus Worldwide Value Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| November 30, 2018 |

| ASSETS | ||||

| Investment securities: | ||||

| Securities at Cost | $ | 59,010,385 | ||

| Securities at Value | $ | 53,263,107 | ||

| Foreign cash (cost $45,258) | 44,975 | |||

| Receivable for Fund shares sold | 7,500 | |||

| Dividends and interest receivable | 209,940 | |||

| Prepaid expenses and other assets | 19,900 | |||

| TOTAL ASSETS | 53,545,422 | |||

| LIABILITIES | ||||

| Investment advisory fees payable | 26,149 | |||

| Payable to related parties | 12,700 | |||

| Distribution (12b-1) fees payable | 216 | |||

| Trustee’s fees payable | 2,449 | |||

| Accrued expenses and other liabilities | 28,210 | |||

| TOTAL LIABILITIES | 69,724 | |||

| NET ASSETS | $ | 53,475,698 | ||

| Net Assets Consist Of: | ||||

| Paid in capital | $ | 58,485,148 | ||

| Accumulated loss | (5,009,450 | ) | ||

| NET ASSETS | $ | 53,475,698 | ||

| Net Asset Value Per Share: | ||||

| Class N Shares: | ||||

| Net Assets | $ | 1,032,278 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 93,743 | |||

| Net asset value, offering price and redemption price per share (Net assets/Shares of Beneficial Interest) (a) | $ | 11.01 | ||

| Institutional Class Shares: | ||||

| Net Assets | $ | 52,443,420 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 4,747,237 | |||

| Net asset value, offering price and redemption price per share (Net assets/Shares of Beneficial Interest) (a) | $ | 11.05 |

| (a) | Redemptions made within 90 days of purchase may be assessed a redemption fee of 2.00%. |

See accompanying notes to financial statements.

18

| Moerus Worldwide Value Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended November 30, 2018 |

| INVESTMENT INCOME | ||||

| Dividends (net of $52,947 foreign withholding taxes) | $ | 1,198,631 | ||

| Interest | 86,664 | |||

| Other income | 445 | |||

| TOTAL INVESTMENT INCOME | 1,285,740 | |||

| EXPENSES | ||||

| Investment advisory fees | 509,717 | |||

| Administrative services fees | 85,568 | |||

| Custodian fees | 73,583 | |||

| Transfer agent fees | 40,437 | |||

| Accounting services fees | 35,872 | |||

| Registration fees | 31,964 | |||

| Compliance officer fees | 22,204 | |||

| Shareholder reporting expenses | 17,314 | |||

| Audit and tax fees | 16,767 | |||

| Legal fees | 15,046 | |||

| Trustees’ fees and expenses | 10,495 | |||

| Distribution (12b-1) fees: | ||||

| Class N | 2,812 | |||

| Insurance expense | 1,832 | |||

| Other expenses | 9,719 | |||

| TOTAL EXPENSES | 873,330 | |||

| Fees waived and expenses reimbursed by Adviser | (119,091 | ) | ||

| NET EXPENSES | 754,239 | |||

| NET INVESTMENT INCOME | 531,501 | |||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized gain from investments and foreign currency translation | 351,442 | |||

| Net change in unrealized appreciation (depreciation) on investments and foreign currency translation | (8,892,839 | ) | ||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (8,541,397 | ) | ||

| NET DECREASE IN NET ASSETS FROM OPERATIONS | $ | (8,009,896 | ) |

See accompanying notes to financial statements.

19

| Moerus Worldwide Value Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| November 30, 2018 | November 30, 2017 | |||||||

| FROM OPERATIONS: | ||||||||

| Net investment income | $ | 531,501 | $ | 126,690 | ||||

| Net realized gain from investments | 351,442 | 210,902 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (8,892,839 | ) | 3,005,400 | |||||

| Net increase (decrease) in net assets resulting from operations | (8,009,896 | ) | 3,342,992 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | ||||||||

| Net investment income | ||||||||

| Class N | — | (838 | ) | |||||

| Institutional Class | — | (22,764 | ) | |||||

| Total distributions paid * | ||||||||

| Class N | (420,081 | ) | — | |||||

| Institutional Class | (6,496 | ) | — | |||||

| Net decrease in net assets from distributions to shareholders | (426,577 | ) | (23,602 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST: | ||||||||

| Proceeds from shares sold: | ||||||||

| Class N | 724,608 | 1,097,746 | ||||||

| Institutional Class | 19,789,812 | 41,038,017 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders: | ||||||||

| Class N | 6,496 | 838 | ||||||

| Institutional Class | 417,612 | 22,263 | ||||||

| Redemption fee proceeds: | ||||||||

| Class N | 65 | 7,935 | ||||||

| Institutional Class | 2,188 | 155 | ||||||

| Payments for shares redeemed: | ||||||||

| Class N | (491,777 | ) | (375,220 | ) | ||||

| Institutional Class | (5,352,682 | ) | (3,037,561 | ) | ||||

| Net increase in net assets from shares of beneficial interest | 15,096,322 | 38,754,173 | ||||||

| TOTAL INCREASE IN NET ASSETS | 6,659,849 | 42,073,563 | ||||||

| NET ASSETS: | ||||||||

| Beginning of Year | 46,815,849 | 4,742,286 | ||||||

| End of Year ** | $ | 53,475,698 | $ | 46,815,849 | ||||

| SHARE ACTIVITY | ||||||||

| Class N: | ||||||||

| Shares Sold | 57,737 | 89,601 | ||||||

| Shares Reinvested | 513 | 77 | ||||||

| Shares Redeemed | (40,288 | ) | (29,895 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 17,962 | 59,783 | ||||||

| Institutional Class: | ||||||||

| Shares Sold | 1,591,893 | 3,357,832 | ||||||

| Shares Reinvested | 33,188 | 2,046 | ||||||

| Shares Redeemed | (432,459 | ) | (236,319 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 1,192,622 | 3,123,559 | ||||||

| * | Distributions from net investment income and net realized capital gains are combined for the year ended November 30, 2018. See “New Accounting pronouncements” in the Notes to Financial Statements for more information. The dividends and distributions to shareholders for the year ended November 30, 2017 have not been reclassified to conform to the current year presentation. |

| ** | Net Assets - End of Year includes undistributed net investment income of $70,149 as of November 30, 2017. |

See accompanying notes to financial statements.

20

| Moerus Worldwide Value Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period Presented |

| Class N | ||||||||||||

| For the | For the | For the | ||||||||||

| Year Ended | Year Ended | Period Ended | ||||||||||

| November 30, | November 30, | November 30, | ||||||||||

| 2018 | 2017 | 2016* | ||||||||||

| Net asset value, beginning of period | $ | 12.86 | $ | 10.60 | $ | 10.00 | ||||||

| Activity from investment operations: | ||||||||||||

| Net investment income (1) | 0.09 | 0.02 | 0.00 | (2) | ||||||||

| Net realized and unrealized gain (loss) on investments | (1.85 | ) | 2.29 | 0.60 | ||||||||

| Total from investment operations | (1.76 | ) | 2.31 | 0.60 | ||||||||

| Paid-in-capital from redemption fees (2) | 0.00 | 0.00 | 0.00 | |||||||||

| Less distributions from: | ||||||||||||

| Net investment income | (0.03 | ) | (0.05 | ) | — | |||||||

| Net realized gain | (0.06 | ) | — | — | ||||||||

| Total distributions | (0.09 | ) | (0.05 | ) | — | |||||||

| Net asset value, end of period | $ | 11.01 | $ | 12.86 | $ | 10.60 | ||||||

| Total return (3) | (13.79 | )% (4) | 21.82 | % | 6.00 | % (5) | ||||||

| Net assets, end of period (000s) | $ | 1,032 | $ | 974 | $ | 170 | ||||||

| Ratio of gross expenses to average net assets (6) | 1.87 | % | 2.53 | % | 9.21 | % (7) | ||||||

| Ratio of net expenses to average net assets | 1.65 | % | 1.65 | % | 1.65 | % (7) | ||||||

| Ratio of net investment income to average net assets | 0.73 | % | 0.17 | % | 0.05 | % (7) | ||||||

| Portfolio Turnover Rate | 14 | % | 8 | % | 6 | % (5) | ||||||

| * | Moerus Worldwide Value Fund commenced operations on May 31, 2016. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Less than $0.005 per share. |

| (3) | Total returns shown exclude the effect of applicable sales loads/redemption fees. Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributions, if any. Had the Adviser not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (4) | As a result of a trade error, the Fund’s Class N experienced a loss totaling $21 for the year ended November 30, 2018, all of which was reimburs by the Adviser; there was no effect on total return due to trade error. (Note 7) |

| (5) | Not annualized. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Adviser. |

| (7) | Annualized. |

See accompanying notes to financial statements.

21

| Moerus Worldwide Value Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period Presented |

| Institutional Class | ||||||||||||

| For the | For the | For the | ||||||||||

| Year Ended | Year Ended | Period Ended | ||||||||||

| November 30, | November 30, | November 30, | ||||||||||

| 2018 | 2017 | 2016* | ||||||||||

| Net asset value, beginning of period | $ | 12.90 | $ | 10.61 | $ | 10.00 | ||||||

| Activity from investment operations: | ||||||||||||

| Net investment income (loss) (1) | 0.12 | 0.06 | (0.00 | ) (2) | ||||||||

| Net realized and unrealized gain (loss) on investments | (1.86 | ) | 2.28 | 0.61 | ||||||||

| Total from investment operations | (1.74 | ) | 2.34 | 0.61 | ||||||||

| Paid-in-capital from redemption fees | 0.00 | (2) | 0.00 | (2) | — | |||||||

| Less distributions from: | ||||||||||||

| Net investment income | (0.05 | ) | (0.05 | ) | — | |||||||

| Net realized gain | (0.06 | ) | — | — | ||||||||

| Total distributions | (0.11 | ) | (0.05 | ) | — | |||||||

| Net asset value, end of period | $ | 11.05 | $ | 12.90 | $ | 10.61 | ||||||

| Total return (3) | (13.55 | )% (4) | 22.16 | % | 6.10 | % (5) | ||||||

| Net assets, end of period (000s) | $ | 52,443 | $ | 45,842 | $ | 4,573 | ||||||

| Ratio of gross expenses to average net assets (6) | 1.62 | % | 2.03 | % | 10.22 | % (7) | ||||||

| Ratio of net expenses to average net assets | 1.40 | % | 1.40 | % | 1.40 | % (7) | ||||||

| Ratio of net investment income (loss) to average net assets | 1.00 | % | 0.47 | % | (0.08 | )% (7) | ||||||

| Portfolio Turnover Rate | 14 | % | 8 | % | 6 | % (5) | ||||||

| * | Moerus Worldwide Value Fund commenced operations on May 31, 2016. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. the period. |

| (2) | Less than $0.005 per share. |

| (3) | Total returns shown exclude the effect of applicable sales loads/redemption fees. Total returns are historical in nature and assumes changes in share price, reinvestment of dividends and capital gain distributions, if any. Had the Adviser not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (4) | As a result of a trade error, the Fund’s Institutional Class experienced a loss totaling $900 for the year ended November 30, 2018, all of which was reimbursed by the Adviser; there was no effect on total return due to trade error. (Note 7) |

| (5) | Not annualized. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Adviser. |

| (7) | Annualized. |

See accompanying notes to financial statements

22

| MOERUS WORLDWIDE VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2018 |

| 1. | ORGANIZATION |

The Moerus Worldwide Value Fund (the “Fund”) is a non-diversified series of Northern Lights Fund Trust IV (the “Trust”), a trust organized under the laws of the State of Delaware on June 2, 2015, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund’s investment objective is long-term capital appreciation. The Fund commenced operations on May 31, 2016.

The Fund currently offers Class N and Institutional Class shares, which are offered at net asset value. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies”. Fund level income and expenses, and realized and unrealized capital gains and losses are allocated to each class of shares based on their relative net assets within the Fund. Class specific expenses are allocated to that share class.

Security Valuation– Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price. In the absence of a sale such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase may be valued at amortized cost which approximates fair value. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Board of Trustees (the “Board”) based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions or market quotations from a major market maker in the securities.

Valuation of Underlying Funds– The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). Mutual funds are valued at their respective net asset value per share (“NAV”) as reported by such investment companies. Exchange-traded funds (“ETFs”) are valued at the last reported sale price or official closing price. Open-end investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the open-end funds. The shares of many closed-end investment companies and ETFs, after their initial public offering, frequently trade at a price per share, which is different than the NAV. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company or ETF purchased by the Fund will not change.

23

| MOERUS WORLDWIDE VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be value d using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) adviser. The committee may also enlist third party consultants such as a valuation specialist from a public accounting firm, valuation consultant, or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value.

Fair Valuation Process.As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) adviser. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the adviser, the prices or values available do not represent the fair value of the instrument. Factors which may cause the adviser to make such a judgment include, but are not limited to, the following: only a bid price or an ask price is available; the spread between bid and ask prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the adviser based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the adviser is unable to obtain a current bid from such independent dealers or other independent parties, the fair value team shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1– Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2– Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3– Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on

24

| MOERUS WORLDWIDE VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| November 30, 2018 |

models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of November 30, 2018 for the Fund’s investments measured at fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock | $ | 47,403,953 | $ | — | $ | — | $ | 47,403,953 | ||||||||

| Money Market Fund | 5,859,154 | — | — | 5,859,154 | ||||||||||||

| Total | $ | 53,263,107 | $ | — | $ | — | $ | 53,263,107 | ||||||||