UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 23373

NORTH SQUARE INVESTMENTS TRUST

(Exact name of Registrant as specified in charter)

10 South LaSalle Street, Suite 1925

Chicago IL 60603

(Address of principal executive offices) (Zip code)

Alan E. Molotsky, Esq.

North Square Investments Trust

10 South LaSalle Street, Suite 1925

Chicago IL 60603

(Name and address of agent for service)

(312) 857-2160

Registrant's telephone number, including area code

Date of fiscal year end: May 31, 2022

Date of reporting period: June 1, 2021 – May 31, 2022

Item 1. Reports to Stockholders.

| | |

| ANNUAL REPORT | |

| | |

| NORTH SQUARE SPECTRUM ALPHA FUND | |

| (FORMERLY, NORTH SQUARE OAK RIDGE SMALL CAP GROWTH FUND) | |

| | |

| NORTH SQUARE DYNAMIC SMALL CAP FUND | |

| | |

| NORTH SQUARE ADVISORY RESEARCH SMALL CAP GROWTH FUND | |

| (FORMERLY, NORTH SQUARE OAK RIDGE ALL CAP GROWTH FUND) | |

| | |

| NORTH SQUARE MULTI STRATEGY FUND | |

| | |

| NORTH SQUARE PREFERRED AND INCOME SECURITIES FUND | |

| (FORMERLY, NORTH SQUARE OAK RIDGE DIVIDEND GROWTH FUND) | |

| | |

| NORTH SQUARE TACTICAL GROWTH FUND | |

| | |

| NORTH SQUARE TACTICAL DEFENSIVE FUND | |

| | |

| NORTH SQUARE TRILOGY ALTERNATIVE RETURN FUND | |

| | |

| MAY 31, 2022 | |

| | |

North Square Investments | www.northsquareinvest.com

North Square Funds

Table of Contents

| Shareholder Letters | | | 1 |

| | | | |

| Fund Performance | | | 17 |

| | | | |

| Schedules of Investments | | | 30 |

| | | | |

| Statements of Assets and Liabilities | | | 64 |

| | | | |

| Statements of Operations | | | 68 |

| | | | |

| Statements of Changes in Net Assets | | | 70 |

| | | | |

| Financial Highlights | | | 78 |

| | | | |

| Notes to Financial Statements | | | 94 |

| | | | |

| Report of Independent Registered Public Accounting Firm | | | 110 |

| | | | |

| Supplemental Information | | | 111 |

| | | | |

| Expense Examples | | | 115 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the North Square Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.northsquareinvest.com

|  |

| Discussion of Fund Performance |

|

A letter from David Appleby, Vice President - Risk, Quantitative Analysis and Portfolio Construction of NSI Retail Advisors, LLC and Portfolio Manager of the North Square Spectrum Alpha Fund.

Dear Shareholder,

Since the beginning of 2022 financial markets have been challenging across asset classes. Inflation has become more entrenched than originally anticipated and encouraged stronger language from the Federal Reserve on mitigation strategies. Impending tightening policy ignited volatility amidst fixed income markets while cautioning the equity marketplace that they should not anticipate monetary policy support in the near term. Bonds, which have often been a safe haven in other market corrections, offered only mild relative protection from the fall in asset prices. The Russell 3000 has declined 13.89% calendar year to date through May 31, 2022 and the Bloomberg Aggregate Bond Index has fallen 8.92%. In this changing environment, financial markets have begun a process of reevaluating risk and return. Those areas of the equity markets that had the most accelerated returns during the market fervor have experienced the greatest drawdowns as markets seek to internalize the disruptions to the economy. We believe, however, that as the tumultuous environment evolves, the more robust investment opportunities will become increasingly evident.

The small cap universe is populated with a diverse set of opportunities for investors. While the segment is more volatile than large cap indexes, it offers the potential to differentiate as the market shifts away from a regime of low interest rates and accommodative policy. Within an evolving investment landscape, compelling valuation and growth opportunities exist for the discerning investor. The North Square Spectrum Alpha Fund is an allocation strategy designed to bring together experienced active managers that can provide distinctive insights within the smaller capitalization equity marketplace. The strategy combines differentiated funds across style and smaller capitalizations seeking to improve alpha generating potential in an allocation with a similar risk profile to the Russell 2000.

On January 11, 2022, the North Square Spectrum Alpha Fund (formerly known as the North Square Oak Ridge Small Cap Growth Fund) changed subadvisers from Oak Ridge Investments to NSI Retail Advisors and expanded its focus from small cap growth to small cap funds in various styles. For the year ending May 31, 2022, the North Square Spectrum Alpha Fund (formerly known as the North Square Oak Ridge Small Cap Growth Fund) returned -18.90% for Class I shares. By comparison, the Russell 2000 index returned -16.92% and the Russell 2000 Growth index returned -25.71%*. The small cap growth index has had the most severe losses over the past year, skewed towards unprofitable and the most highly valued companies. At the beginning of the year, the Fund has more broadly diversified the small cap growth exposure to include a set of managers within the initial allocation that offer a more balanced solution to a small cap allocation: the North Square Dynamic Small Cap Fund, North Square Advisory Research Small Cap Value Fund and North Square Advisory Research Small Cap Growth Fund. Each of the managers has a demonstrated track record of investing in small capitalization companies throughout a variety of market environments. The Spectrum Alpha Fund currently has a larger allocation towards small cap core and small cap value compared to small cap growth.

Asset prices have had a material adjustment in the beginning months of 2022; however, we do not know how far along we are in rationalizing the multitude of economic challenges into prices. Though the investment climate may continue to be difficult, the current selection of managers inspires confidence in our ability to navigate its impact on the small cap universe. North Square and NSI Retail Advisors continue to seek additional managers and strategies that would further enhance the portfolio’s opportunity set. We appreciate your confidence in North Square Investments.

Sincerely,

David Appleby

Vice President – Risk, Quantitative Analysis and Portfolio Construction & Portfolio Manager

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing, including an in-vestment in the Fund. An investment in the Fund involves risk, including the following principal risks, among others: Market Risk, Micro-Cap, Small, and Mid-Sized Company Risk, Foreign and Emerging Market Company Risk, Affiliated Underlying Funds Risk, Blend Style Risk, Derivatives Risk, and ETF and Mutual Funds Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth in the Fund’s prospectus. Before you decide whether to invest in the Fund, carefully consider these risk factors and special considerations associated

with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The Russell 3000® Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S stock market.

The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The index is frequently used by investors as a “stand-in” for measuring the performance of the US bond market.

Effective January 11, 2022, the Russell 2000® Index has replaced the Russell 2000 Total Return Index as the Fund’s primary benchmark as the Russell 2000 Index is more closely aligned with the Fund’s principal investment strategies and portfolio holdings.

The Russell 2000 Index, the Fund’s benchmark, is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The volatility (beta) of an account may be greater or less than its respective benchmark. It is not possible to invest directly in an index.

The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The volatility (beta) of an account may be greater or less than its respective benchmark.

All indexes are shown for comparative purposes only. One cannot invest directly in an index.

A market “drawdown” measures the percentage decline from a peak to a trough.

The views in this letter are those of the Fund’s direct advisor and were as of May 31, 2022 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. International investments are subject to unique risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In addition, changes in exchange rates and interest rates may adversely affect the value of the fund’s foreign investments. Please see the prospectus for a more complete discussion of the fund’s risks.

|  |

| Discussion of Fund Performance |

|

A letter from Peter Algert, Chief Investment Officer of Algert Global LLC and Portfolio Manager of the North Square Dynamic Small Cap Fund.

Dear Shareholder,

U.S. small-cap stocks experienced a volatile period over the 12-months ending May 31, 2022, primarily driven by increasing inflationary and geopolitical concerns given ongoing dislocations in the aftermath of the COVID-19 pandemic and the Russian invasion of Ukraine. After rallying strongly in 2020 and the early part of 2021, the Russell 2000 Index fell, ending the trailing 12-month period at -16.92%. The Fund however notably outperformed the index over this period, delivering an absolute return of -10.43% for Class I shares at NAV.*

Stock Selection Designed to be the Primary Source of Benchmark Outperformance

During the trailing 12-month period, stock selection contributed positively to Fund performance. The Fund also benefitted from positive performance contribution from incidental active exposures to various risk factors (e.g. a company’s industry, leverage, liquidity and beta characteristics). Active industry-related positioning modestly detracted during the period.

Catalyst

The Catalyst model was the primary positive contributor to the performance of the Fund. Given the uncertain economic backdrop over the past 12 months, Catalyst-related exposures, which seek to assess investor sentiment and activities by other market participants, were able to capture the preference for stocks with attractive growth characteristics, supportive investor positioning, and strong underlying business model momentum.

Quality

The Quality model also contributed positively to the performance of the Fund. With an worsening economic outlook, investors appeared to favor companies with more robust and sustainable business models relative to peers. The performance of the Fund’s Quality exposures was strong across various types of insights, particularly those that seek to differentiate firms across cash flow and revenue generation.

Relative Value

The Relative Value model detracted modestly from the Fund’s performance during the measurement period. Value-related positioning underperformed as investors have favored stocks with stronger growth characteristics, despite generally unattractive valuations. However, as the inflationary concerns grew in early 2022 and the Federal Reserve began to raise interest rates, value-related stocks outperformed the broader market. The Fund continues to view value-oriented exposures less favorably relative to other opportunities.

Risk Factors

Incidental active exposures to industries and risk factors such as leverage, volatility and liquidity generally contributed positively to performance over the measurement period. While these exposures generated gains, we expect these exposures will have minimal impact on the Fund’s active performance over a full market cycle.

Fund Positioning for the Future

The Fund aims to be diversified across its three main investment themes, Relative Value, Quality and Catalyst. Given the uncertain economic backdrop given increasing inflationary and recessionary concerns, we expect the Fund’s Quality-driven positioning will be beneficial for the portfolio and should be the dominant theme going forward in the near term. We continue to favor Catalyst-driven positions relative to Value driven, in part, by the expectation of outperformance of firms with attractive trends in underlying business fundamentals.

Sincerely,

Peter Algert,

Chief Investment Officer

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing, including an investment in the Fund. An investment in the Fund involves risk, including the following principal risks, among others: Equity Risk, ETF Risk, Foreign Investment Risk, IPO Risk, Liquidity Risk, Management and Strategy Risk, Market Risk, Portfolio Turnover Risk, Preferred Stock Risk, Real Estate Investment Trust (“REIT”) Risk, Reliance on Technology Risk, Small Cap Company Risk, and Value-Oriented Investment Strategies Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth in the prospectus. Before you decide whether to invest in the Fund, carefully consider these risk factors and special considerations associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The Russell 2000 Index, the Fund’s benchmark, is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The index is shown for comparative purposes only. One cannot invest directly in an index.

Cash flow is the amount of cash that comes in and goes out of a business. Companies take in money from sales as revenues and spend money on expenses.

|  |

| Discussion of Fund Performance |

|

A letter from Andrew Cupps, Managing Director of Advisory Research, Inc. and Portfolio Manager of the North Square Advisory Research Small Cap Growth Fund.

Dear Shareholder,

The investment environment for 2022 through May was defined by several powerful negative forces. COVID-19’s impact persisted, in this period through the rapidly spreading omicron variant that wreaked human and economic havoc across the globe. Inflation, which had been essentially non-existent for over 20 years, emerged after the COVID lockdowns and began to accelerate through the economy in the form of home prices, energy prices, food prices and almost every other good and service. In response to the growing threat of inflation, the Federal Reserve, which had focused almost without exception on stimulating the economy all the way back to the 9/11 attacks, began to recognize the opposite approach was required and made clear in November that it would begin raising interest rates. The labor market and supply chains were in turmoil as a function of the government’s hard stop of the economy for COVID, followed by trillions of dollars in payments that created too much demand and too little supply across numerous sectors. The fragile global economy was further assaulted in February when Russia began an unprovoked hot war against Ukraine and at the same time effectively launched a cold war with Western powers that caused oil and energy prices to skyrocket.

For the period January through May, the benchmark Russell 2000 Growth index1 was down 24.8% and the Class I shares of the Fund declined 29.5%, though corporate earnings remained fairly robust and unemployment remained near historic lows. Investors sold stocks aggressively on rising rates and expectations of even higher rates as inflation pressures continued to mount. Higher growth sectors such as technology, healthcare and consumer discretionary were the hardest hit, with more mature, slower growth sectors like consumer staples and basic materials faring better. Energy was the sole sector with a positive return as oil prices climbed over $100. The Fund capitalized on the opportunity in energy by making a large relative allocation late last year. It also benefitted from good stock selections in healthcare. The most important holding in healthcare was Evolent Health, which has expertise in lowering the cost of patient care for health systems and insurance companies. Another selection that outperformed significantly in the period was Titan International, a manufacturer of large tires and wheels for agricultural tractors and mining trucks. Those industries were beneficiaries of the rising commodity prices. Two stocks that were notable decliners in the period were InMode, which makes devices for non-invasive cosmetic surgery and Kornit Digital, which makes digital printers that print directly on to fabric and garments. Both stocks were very strong performers throughout 2021 but were vulnerable to post-COVID changes in consumer behavior and the higher interest rates of 2022.

The defining variable for stocks in the year ahead is likely to be how long inflation remains elevated. Stubbornly high inflation data may lead to continuing difficult market conditions, whereas a downward inflection in inflation data could allow the Fed to limit additional interest rate hikes and give investors confidence that a recession can be avoided or that it will be brief. Steady or declining rates would also tend to be constructive for growth stock valuations. Though risks abound, we are generally optimistic, believing that with time the economy will overcome its COVID-related turbulence to better match supply and demand in the form of more stable prices, and appreciating the compelling opportunities created by significant reductions in stock valuations.

On behalf of all the dedicated members of the Advisory Research team, I thank you for investing in the North Square Advisory Research Small Cap Growth Fund.

Sincerely,

Andrew Cupps

Managing Director

______________

1 | The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the US equity universe. It includes those Russell 2000 companies with relatively higher price-to-book rations, higher I/B/E/S (Institutional Brokers’ Estimate System) forecast medium term (2 year) growth and higher sales per share historical growth (5 years). |

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing, including an investment in the Fund. An investment in the Fund involves risk, including the following principal risks, among others: Equity Risk, Sector Focus Risk, Portfolio Turnover Risk, Market Risk, Small-Cap Company Risk, Cybersecurity Risk, Preferred Securities Risk, Convertible Securities Risk, ETF Risk, Currency Risk, Emerging Market Risk, Growth-Style Investing Risk, Foreign Investment Risk, and Management and Strategy Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth in the Fund’s prospectus. Before you decide whether to invest in the Fund, carefully consider these risk factors and special considerations associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The Russell 2000 Growth Index is unmanaged, its return assumes reinvestment of dividends and, unlike mutual funds returns, does not reflect any fees or expenses associated with a mutual fund. It is not possible to invest directly in an index.

|  |

| Discussion of Fund Performance |

|

A letter from David Appleby, Vice President - Risk, Quantitative Analysis and Portfolio Construction of NSI Retail Advisors, LLC and Portfolio Manager of the North Square Multi Strategy Fund.

Dear Shareholder,

At the start of 2022, the S&P 500 was over 40% higher than its close on February 19, 2020 (the high prior to the COVID-19 shock to markets). This is primarily a symbol of the resilience of the US economy and the swift actions by the Federal Reserve to alleviate strain on the financial system at a critical point. Inflation, however, has become more entrenched than originally anticipated and encouraged stronger language from the Federal Reserve on mitigation strategies. Impending tightening policy and the lingering uncertainties related to the COVID crisis did not fully reconcile with the lofty expectations embedded in the US equity markets. In the first few weeks of 2022, the ramifications of a less spendthrift Federal Reserve began factoring into markets. Rates were rising along the curve, and the most ebullient portions of the equity indices (growth equities in particular) led to broad market declines.

Russian hostilities towards Ukraine further encouraged weakness across equity markets in the weeks leading into the events of February 24, 2022. As it became more apparent that the Ukrainian crisis was more than an isolated skirmish, energy and other commodity prices received further support at elevated levels, and ongoing inflation concerns only increased. The Federal Reserve is committed to containing inflation. They ended the pandemic quantitative easing purchase program in early 2022 and began implementing Fed Funds rate increases in March. The Ukrainian crisis, nevertheless, created an additional level of volatility in an already challenging rising rate environment. The 10-year Treasury yield rose from 1.63% on January 1, 2022, to a peak of 2.05% in mid-February, the highest since summer of 2019. Afterward, it declined to 1.71% on March 1, 2022, and ultimately ending at 2.84% on May 31, 2022. Meanwhile, yields for the two-year treasury note and shorter-dated Treasuries have risen more precipitously than longer-dated treasuries, effectively flattening the yield curve. Long-term economic growth expectations continue to decline and will likely weigh on equity markets as monetary policy’s efforts to control inflation limit further stimulative policy. The path to an improving outlook will depend on the whether the factors influencing price increases begin to subside to prevent the need for excessive policy rate adjustments.

The North Square Multi-Strategy Fund (Class I Shares) returned -4.79% for the fiscal year ending May 31, 2022.* Comparatively, the Russell 3000 Index returned -3.68%, and the Bloomberg US Aggregate Bond Index declined by -8.22%. As the market began to turn in January 2022, the Fund adjusted its allocation to meet the structural changes in markets. The Fund reduced its exposure to large-cap growth in favor of a more core-value exposure through a mixture of low-cost ETFs. Furthermore, a large portion of the allocation to dividend equities converted to the North Square Preferred and Income Securities Fund, a fund focused primarily on investing in preferred and debt securities as well as other income-producing securities. These updates to the allocation provided helpful risk mitigation during the most acute phases of the 2022 market drawdown.

The Fund diversified small-cap exposure early in 2022 to include the North Square Advisory Research Small Cap Growth Fund and North Square Advisory Research Small Cap Value Fund alongside the North Square Dynamic Small Cap Fund. While our overall allocation to small-cap detracted from performance for the fiscal year, we believe our adjustments early in 2022 helped to offset our continued emphasis on small-cap. We view the relative opportunity within smaller capitalization stocks in the US versus large-cap stocks as positive over the long run. Additionally, the more domestic market focus of small cap companies could prove beneficial should European and global tensions escalate. Leading into the new year our view was to gradually increase international exposure through the Altrinsic International Equity Fund, a value-focused strategy investing in developed and key emerging markets. After years of under-allocation to international equities, there appeared to be more promising economic growth prospects as countries recovered from the coronavirus. Following the events in Ukraine, we remain under-allocated to international equities and will be cautious of adding any more exposure until geopolitical events become clearer.

In October of 2021, the subadviser to the Fund changed from Oak Ridge Investments to NSI Retail Advisors. The investment objectives of the Multi Strategy Fund following the change of subadviser remain consistent with investment objectives as a multi strategy offering under Oak Ridge Investments. In general, we continue to believe this environment to be most conducive to flexible active managers with a focus on evaluating the relative merits of fundamental opportunities. The current holdings within the Multi Strategy Fund provide a diverse cross-section of investment strategies, and we believe the Multi Strategy Fund is well-equipped to meet a variety of market environments; nevertheless, North Square and NSI Retail Advisors continue to seek new managers and strategies that further enhance the portfolio’s opportunity set. We appreciate your continued confidence in North Square Investments.

Sincerely,

David Appleby

Vice President – Risk, Quantitative Analysis and Portfolio Construction & Portfolio Manager

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing, including an investment in the Fund. An investment in the Fund involves risk, including the following principal risks, among others: Bank Loan Risk, Convertible Securities Risk, Credit Risk, Currency Risk, Emerging Market Risk, Equity Risk, ETF and Mutual Funds Risk, Fixed Income Securities Risk, Foreign Investment Risk, Government-Sponsored Entities Risk, Growth-Oriented Investment Strategies Risk, High Yield (“Junk”) Bond Risk, Inflation-Linked Securities Risk, Interest Rate Risk, IPO Risk, Large Cap Company Risk, Liquidity Risk, Management and Strategy Risk, Market Risk, Mortgage-Backed and Asset-Backed Securities Risk, Municipal Securities Risk, Preferred Stock Risk, Small and Mid Cap Company Risk, Value-Oriented Investment Strategies Risk, and Warrants and Rights Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth below. Before you decide whether to invest in the Fund, carefully consider these risk factors and special considerations associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices.

The 10-year Treasury yield is the yield that the U.S. government pays investors that purchase the Treasury’s 10-year note. Purchase of the 10-year note is essentially a loan made to the U.S. government.

The Russell 3000® Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S stock market.

The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The index is frequently used by investors as a “stand-in” for measuring the performance of the US bond market.

All indexes are shown for comparative purposes only. One cannot invest directly in an index.

The views in this letter are those of the Fund’s direct advisor and were as of May 31, 2022 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. International investments are subject to unique risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In addition, changes in exchange rates and interest rates may adversely affect the value of the fund’s foreign investments. Please see the prospectus for a more complete discussion of the fund’s risks.

|  |

| Discussion of Fund Performance |

|

A letter from John L. Cassady III, CFA, Chief Investment Officer, and Brandon Bajema CFA, CPA, Sr. Portfolio Manager, Portfolio Managers of the North Square Preferred and Income Securities Fund.

Dear Shareholder,

The past several months has seen the world recovering from a pandemic only to be faced with a military conflict that has threatened the European theater in a way not seen in decades. This new crisis has significant humanitarian consequences for the people of Ukraine and, potentially, globally as energy and agricultural supply lines have been deeply curtailed. One bright spot has been the unifying impact this terror has brought among Ukraine, Western Europe, and the United States. Our thoughts continue to be with those most impacted by this war and we hope for a swift resolution.

The economy had already begun to heat up due to fiscal stimulus and accommodative FOMC (Federal Open Market Committee) policy in response to COVID challenges. Inflation as measured by CPI rose from 5.0% year-over-year in May of 2021 to 8.6% year-over-year in May of this year. Since the Russian invasion of Ukraine on February 24, energy prices in particular have surged due to sanctions. Lingering supply chain shortages along with additional shortages caused by the invasion do not appear to be abating any time soon.

It was only in March of this year that the Federal Reserve (“Fed”) embarked on its rate hike cycle by increasing the Fed Funds target rate by just 25 basis points. Realizing that it might be behind the curve on fighting inflation, the Fed began to move in earnest by increasing rates 50 basis points at the May 4 meeting, bringing the upper band of the Fed Funds target rate to 1.0%. The FOMC also continued its hawkish rhetoric as inflation remained stubbornly high.

The Fund provided investors with a total return of 9.38% for Class I Shares from the beginning of the fiscal year through January 10, 2022, when it was re-purposed to a preferred and income securities fund.* Since that date and against a backdrop of stubborn inflation, higher interest rates, and a slowing global economy, most risky assets have had a negative return during the second half of the Fund’s fiscal year. Preferred securities were no exception to the market sell-off and the fund returned -9.95% since inception of the new fund mandate through May 31, 2022. For the fiscal year the fund returned -1.49%.

While there is still uncertainty surrounding the war in Ukraine, inflation, the economy, and the path of the Fed, this sell-off has created some compelling opportunities in preferred securities. We continue to position the portfolio in anticipation of higher interest rates. Accordingly, the fund is underweight the longer duration fixed for life preferreds, and overweight the variable rate and shorter duration structures. Bank balance sheets remain in robust shape; hence we prefer credit risk to interest rate risk and have positioned the fund accordingly. The fund also continues to overweight European AT1’s, as many yield more than similarly rated U.S. Bank preferreds. Additionally, most AT1’s now trade at a meaningful discount to par.

Markets move quickly and respond rapidly to changing conditions in a world where news and opinions are broadcast almost instantaneously. We believe it is important to sort through the noise and focus on the issues which most directly impact the fund. With this focus and dedication, we strive to bring our investors the performance they have come to expect.

Regards,

John L. Cassady III, CFA

CIO

Brandon Bajema CFA, CPA

Senior Portfolio Manager

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing, including an in-vestment in the Fund. An investment in the Fund involves risk, including the following principal risks, among others: Credit and Subordination Risk, Preferred Securities Risk, Hybrid

Security Risk, Additional Tier 1 Securities Risk, Optionality Risk, Foreign Investments Risk, Rule 144A and Regulation S Securities Risk, Currency Risk, Emerging Markets Risk, Derivatives and Hedging Transactions Risk, and LIBOR Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth in the Fund’s prospectus. Before you decide whether to invest in the Fund, carefully consider these risk factors and special considerations associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

A basis point (bp) is a standard measure for interest rates and other percentages in finance, representing one-one hundredth of one percent. 100 basis points = 1.0 percent.

AT1s, also known as contingent convertible securities, are debt or preferred securities with loss absorption characteristics that provide for an automatic write-down of the principal amount or value of securities or the mandatory conversion into common shares of the issuer under certain circumstances. A mandatory conversion might be automatically triggered, for instance, if a company fails to meet the capital minimum described in the security, the company’s regulator makes a determination that the security should convert, or the company receives specified levels of extraordinary public support. Since the common stock of the issuer may not pay a dividend, investors in these instruments could experience a reduced income rate, potentially to zero, and conversion would deepen the subordination of the investor (worsening the Fund’s standing in a bankruptcy). In addition, some AT1s provide for an automatic write-down of capital under such circumstances.

|  |

| Discussion of Fund Performance |

|

A letter from Paul Frank of NSI Retail Advisors, LLC and Portfolio Manager of the North Square Tactical Growth Fund.

Dear Shareholder,

The North Square Tactical Growth Fund follows a rules-based, disciplined, proprietary model that quantitatively ranks—according to risk-adjusted return—all actively traded Exchange Traded Funds (“ETFs”) that pass our initial fundamental review. The Tactical Growth Fund will purchase and hold ETFs showing strength, and it will sell or not consider for purchase ETFs showing weakness. The Tactical Growth Fund’s objective is to produce long-term equity-like returns with less volatility than passive equity investments.

For the year ending May 31, 2022, the Tactical Growth Fund – Class I returned -5.71%.* The Fund’s benchmark, the Morningstar Moderately Aggressive Target Risk Index, returned -7.44%. The widely watched and referenced S&P 500 Index returned -0.30%, while the NASDAQ Composite Index led the way down with -11.53%.

On the fixed-income side, the Bloomberg U.S. Agg Total Return Index lost -8.22%.

The Fund’s portfolio started the fiscal year with four distinct asset classes. The first asset class was domestic equity which comprised approximately 70% of the portfolio. The second asset class was international equity, which was 5% of the portfolio. Overall, the combined equity allocation was 75%, which neared the Fund’s long-term average of 77%. The third asset class of the portfolio was fixed income which totaled 12%. Finally, the fourth asset class in the Fund was an 8% position in two energy-based commodities ETFs.

During the summer of 2021, the Fund sold its commodities holdings. During the autumn of 2021, our total equity weight increased to 83% of the portfolio. Our proprietary rankings did not find investable alternatives to equities, and our cash position rose to over 10%.

In January 2022, many of our holdings showed weakness in our proprietary internal rankings. We followed the Fund’s process and started to de-risk the portfolio. We sold core holdings in large-cap growth and some sector holdings in financials and small-cap. In February 2022, we further lightened our equity exposure and brought it down to 40%.

Our allocation to value-oriented holdings in 2020 and early 2021 worked well during this period by offsetting declines in our growth holdings.

In March 2022, our internal rankings showed strength and we added domestic equity exposure. We also added an international position in Brazil. We ended the first quarter of 2022 with 76% invested in equities, 7% in fixed-income, and 17% in cash. In April and May, our rankings showed weakness in our equity holdings, so we followed the process by de-risking the portfolio and selling a portion of our equity positioning. The portfolio ended the period covered in this letter in a moderately defensive posture. Our equity holdings totaled 60%. Fixed income constituted 8% of the Fund, and the remaining 32% was in cash.

Tactical Growth Fund followed its process during these 12 months, and our holdings and allocation changes helped limit the portfolio’s volatility.

The North Square Tactical Growth Fund started in 2004, and its process and goal have not changed over those 18 years. We strive to build a well-diversified multi-asset portfolio that compensates its investors for market risk.

Sincerely,

Paul Frank

Portfolio Manager

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing including an investment in the Fund. An investment in the Fund involves risk, including, the following principal risks, among others: Management and Strategy Risk, ETF and Mutual Funds Risk,

|  |

| Discussion of Fund Performance |

|

Derivatives Risk, Market Risk, Equity Risk, Fixed Income Securities Risk and Growth-Oriented Investment Strategies Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth below. Before you decide whether to invest in the Fund, carefully consider these risks associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The Morningstar Target Risk Index family is designed to meet the needs of investors who would like to maintain a target level of equity exposure through a portfolio diversified across equities, bonds and inflation-hedged instruments. The Morningstar Moderately Aggressive Target Risk Index seeks approximately 77.5% global equity exposure.

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices.

The NASDAQ Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange.

The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The index is frequently used by investors as a “stand-in” for measuring the performance of the US bond market.

All indexes are shown for comparative purposes only. One cannot invest directly in an index.

|  |

| Discussion of Fund Performance |

|

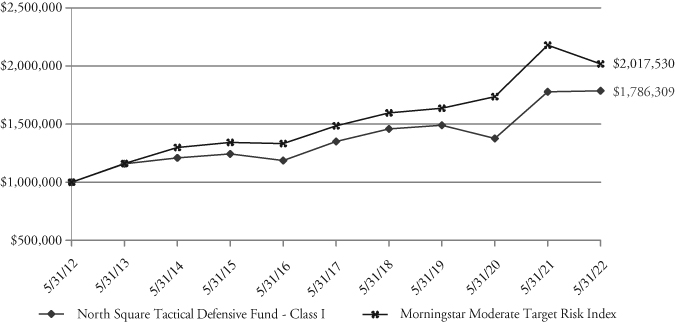

A letter from Brad Thompson, Director - Multi Asset Class Solutions of NSI Retail Advisors, LLC and Portfolio Manager of the North Square Tactical Defensive Fund.

Dear Shareholder,

Over the past twelve months ending in May 2022, we experienced two distinctly different investment environments. From May 2021 to December 2021, the Federal Reserve (Fed) provided quantitative easing to fuel the economy despite signs of inflation that the Fed initially deemed "transitory." Markets experienced subdued volatility and reached a new all-time high. The Fed remained dovish through the calendar year of 2021, global economies reopened, and Global Central Banks supported global growth. The mood changed at the beginning of 2022, and it became apparent that inflation was never transitory and had suddenly become a key concern. The S&P 500 Index sold off by -5.17% in January as investors’ outlooks dimmed when the Fed reversed its position to a decidedly hawkish stance. Investors feared rapid rate increases as the Fed tried to control inflation before it was too late. In February, Russia invaded Ukraine, which exacerbated the threat of rising inflation. The Russian-Ukraine war intensified an already stressed global supply chain shortage. By May, gasoline prices at the pumps rose to record highs, oil prices surged above $100-per-barrel as the world placed sanctions on Russia, the cost of wheat nearly doubled as Ukraine’s wheat production halted overnight, and China reestablished COVID-19 lockdowns. This uncertainty and volatility caused the S&P 500 Index to decline by -12.76% from 12/31/2021 to 5/31/2022. Rising rates combined with the high likelihood of a recession caused the NASDAQ Composite Index to fall by -22.53% during that same period. Equities were not the only asset class to struggle as bonds took a big hit with rising rates, evidenced by The Bloomberg US Aggregate Bond Total Return Index losing -8.92% and leaving few options for investors.

For the fiscal year ending 5/31/2022, the North Square Tactical Defensive Fund returned 0.46% for Class I shares compared to the Fund’s benchmark, the Morningstar Moderate Target Risk Index, which was down -7.42%. The S&P 500 Total Return Index declined by -0.30%, and the Nasdaq Composite Index lost -11.53%.

The Tactical Defensive Fund focuses on long and short-term market trends to balance safety and return. The longer-term Cyclical Trend (CT) measure governs one-half of the portfolio (core) and the other (satellite) by the shorter (more safety conscious) intermediate term, Dynamic Trend (DT) measure.

The Fund’s long-term measure remained fully invested from May 2021 through December 2021 as markets soared to all-time highs. The Fund’s faster reacting Dynamic Trend measure signaled higher risk levels at times, which triggered the Fund to reduce its equity allocation. The Fund closed the calendar year with a portfolio of 75% equities and 25% defensive positions. From May 31, 2021, through December 31, 2021, the Fund returned 7.31% compared to the Fund’s benchmark of 3.41%.

After the S&P 500 Index reached an all-time high on January 3, 2022, the investment climate rapidly changed. There was no place to hide as stocks and bonds both experienced significant price pressures. From December 31, 2021, to May 31, 2022, the S&P 500 Index fell by -12.76%, the NASDAQ Composite Index dropped by -22.53%, and the Bloomberg US Aggregate Bond Index lost -8.92%. Throughout most of that period, the Dynamic Trend measure signaled defensive to moderate allocations. The Cyclical Trend measure went to cash on two separate occasions (mid-February to mid-March and from April 8, 2022, through May). The defensive positioning helped decrease volatility in the Fund and reduced the overall drawdown. The Tactical Defensive Fund was down -6.38% and the Morningstar Moderate Target Risk Index benchmark was down -10.47% over the same period.

We are currently amid an unprecedented market environment with high inflation, a hawkish FED, global slowdowns, an ongoing war, and both Fixed Income and U.S. Equity markets suffering declines. The economic outlook over the next 6-months is pessimistic as the risk of global recession weighs on investors. That is why active management is a vital component of your overall portfolio. We follow a systematic approach to help us make allocation decisions during periods of uncertainty. The goal of the Tactical Defensive Fund is for long-term equity-like returns with lower drawdowns and less volatility than a typical long-only passive strategy, which can help provide the diversification needed to weather the storm.

Sincerely,

Brad Thompson

Director – Multi Asset Class Solutions & Portfolio Manager

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing including an investment in the Fund. An investment in the Fund involves risk, including, the following principal risks, among others: Management and Strategy Risk, ETF and Mutual Funds Risk, Derivatives Risk, Fixed Income Securities Risk, Equity Risk, Market Risk, Currency Risk, Foreign Investment Risk, and Portfolio Turnover Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth below. Before you decide whether to invest in the Fund, carefully consider these risks associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The Morningstar Target Risk Index family is designed to meet the needs of investors who would like to maintain a target level of equity exposure through a portfolio diversified across equities, bonds and inflation-hedged instruments. The Morningstar Moderate Target Risk Index, the Fund’s benchmark, seeks approximately 60% global equity exposure.

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices.

The NASDAQ Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange.

The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The index is frequently used by investors as a “stand-in” for measuring the performance of the US bond market.

All indexes are shown for comparative purposes only. One cannot invest directly in an index.

|  |

| Discussion of Fund Performance |

|

A letter from Clayton Wilkin of NSI Retail Advisors, LLC and portfolio manager of the North Square Trilogy Alternative Return Fund.

Dear Shareholder,

From May 2021 to December 2021, during a period of subdued volatility, the equity markets soared to new all-time highs. A number of factors contributed to the markets’ move higher, including more accommodative Federal Reserve monetary policy, the reopening of global economies and the underlying support provided to foster growth by global central banks.

Not long after the beginning of 2022, market sentiment changed markedly, however. The Federal Reserve shifted monetary policy to a more “hawkish,” or restrictive stance, signaling their intention to raise interest rates to subdue inflation and engineer a “soft landing” for an economy that appeared to be overheating. As a result, the S&P 500 Index sold off by -5.17% in January as investors and market observers began to readjust their outlooks and forecasts.

In February, Russia invaded Ukraine, which exacerbated the threat of rising inflation. The Russian-Ukraine war intensified a global supply chain shortage that was beginning to recover from the COVID-19 crisis. As the world placed sanctions on Russia, one of the world’s largest oil and natural gas providers, by May, retail gasoline prices at the pumps rose to record highs, and oil prices surged above $100-per-barrel. Additionally, the cost of wheat nearly doubled as Ukraine’s wheat production halted overnight, and China went through another round of COVID-19 lockdowns. All this uncertainty and volatility caused the S&P 500 Total Return Index to decline by -12.76% from 12/31/2021 to 5/31/2022.

For the fiscal year ending 5/31/2022, the North Square Trilogy Alternative Return Fund returned -5.45% for Class I shares, the Bloomberg US Agg Total Return Index lost -8.22%, the S&P 500 Index declined by -0.30%, and the HFRX Absolute Return Index returned 0.22%.

The North Square Trilogy Alternative Return Fund is a total return mutual fund managed with the aim of maintaining lower risk and volatility than the U.S. equity markets. However, it was a challenging market environment for the Trilogy Fund’s portfolio management team as the fixed income markets experienced one of its worst years in recent memory. For example, from December 31, 2021, to May 31, 2022, the Bloomberg US Agg Total Return Index was down -8.92%. As noted, the S&P Total Return Index was also down by -12.76%. During that same period, the Fund was only down -6.54%.* When there is a strong positive correlation between the fixed income and equity markets, fixed income securities cannot always be relied upon to supply the typical flight to safety during periods of market decline. The negative returns in both fixed income and equities hurt the Fund’s Income Position, which consists of fixed income ETFs, and the Equity Position, which consists of U.S. stocks and ETFs. Although it was a difficult 12 months, not all of the Trilogy Alternative Return Fund’s stocks were down as the Fund had robust performers in the healthcare sector. Merck, Pfizer, and Eli Lilly all contributed solid gains of over 30% from May 2021 to May 2022.

Fortunately, the Fund has option strategies that may help alleviate the pain of market drawdowns with downside protection. For example, the Equity Position has an option collar surrounding the notional value of the equity holdings. The Fund also has a Market Movement Position that employs various option strategies. In particular, the Market Movement Position holds long-put spreads that help protect your portfolio during periods of massive declines.

We have experienced a market environment unlike any other in recent years: high inflation, restrictive Federal Reserve monetary policy, global economic slowdowns, global war. Consequently, both fixed income and U.S. equity markets have suffered declines. We do not have another historical comparison we can look to for guidance, and the economic outlook over the next six months is pessimistic. That is why we believe active management is a necessity for your portfolio. We follow a systematic approach to help us make decisions during periods of uncertainty. We are confident the mix between equities, fixed income, and options will provide the Trilogy Alternative Return Fund and your portfolio the diversification that is required to weather the ongoing storm.

Sincerely,

Clayton Wilkin

Portfolio Manager

*Call 855-551-5521 or visit northsquareinvest.com for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Principal Risks of Investing: Risk is inherent in all investing including an investment in the Fund. An investment in the Fund involves risk, including, the following principal risks, among others: Management and Strategy Risk, ETF and Mutual Funds Risk, Derivatives Risk, Fixed Income Securities Risk, Equity Risk, Market Risk, Currency Risk, Foreign Investment Risk and High Yield (“Junk”) Bond Risk. Summary descriptions of these and other principal risks of investing in the Fund are set forth below. Before you decide whether to invest in the Fund, carefully consider these risks associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund is not a deposit of the bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please see the Fund’s prospectus for additional risk disclosures.

The S&P 500 Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. One cannot invest directly in an index.

The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The index is frequently used by investors as a “stand-in” for measuring the performance of the US bond market. This index is shown for comparative purposes only.

A market “drawdown” measures the percentage decline from a peak to a trough.

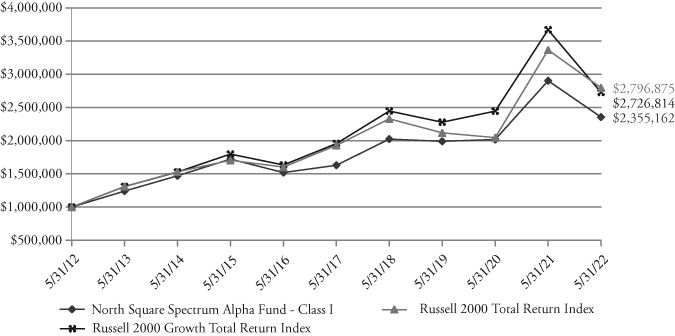

North Square Spectrum Alpha Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made on May 31, 2012, with a similar investment in the Russell 2000 Growth Total Return Index and the Russell 2000 Total Return Index. The performance graph above is shown for the Fund’s Class I shares; Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Growth Total Return Index measures the performance of U.S. small cap growth stocks. The Russell 2000 Total Return Index measures the performance of the small cap segment of the U.S. equity universe. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

| | | Average Annual | |

| | | | | | Since | Inception |

Total Returns as of May 31, 2022 | 6 Month | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | | |

Class A1 | -22.44% | -19.05% | 7.37% | 8.61% | 9.28% | 01/03/94 |

Class I2 | -22.34% | -18.90% | 7.65% | 8.94% | 9.49% | 12/29/09 |

| After deducting maximum sales charge | | | | | | |

Class A1 | -26.90% | -23.71% | 6.11% | 7.97% | 9.06% | 01/03/94 |

| Russell 2000 Growth Total Return Index | -24.46% | -25.71% | 6.87% | 10.55% | 7.22% | 01/03/94 |

| Russell 2000 Total Return Index | -14.70% | -16.92% | 7.72% | 10.83% | 8.68% | 01/03/94 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |

2 | Class I shares do not have any initial or contingent deferred sales charge. |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Small Cap Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund. Effective January 11, 2022, the Fund changed names to the North Square Spectrum Alpha Fund (formerly, North Square Oak Ridge Small Cap Growth Fund), changed investment strategy (Note 1), and changed Sub-Advisors to NSI Retail Advisors, LLC (formerly, Oak Ridge Investments, LLC).

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

North Square Spectrum Alpha Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited) – Continued

Gross and net expense ratios for Class A shares were 1.83% and 2.03%, for Class I shares were 1.59% and 1.78%, which were the amounts stated in the current prospectus dated January 11, 2022. The net expense ratio is higher than the gross as a result of fee recoupment. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.30% and 1.05% of the average daily net assets of the Fund’s Class A, and Class I shares, respectively. This agreement is in effect until September 30, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

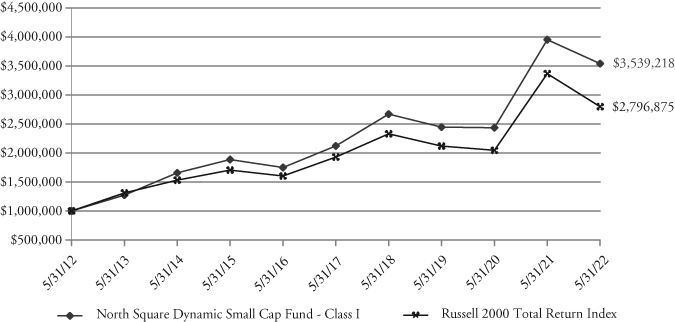

North Square Dynamic Small Cap Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made on May 31, 2012, with a similar investment in the Russell 2000 Total Return Index. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Total Return Index measures the performance of the small cap segment of the U.S. equity universe. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | Average Annual | |

| | | | | | Since | Inception |

Total Returns as of May 31, 2022 | 6 Month | 1 Year | 5 Year | 10 Year | Inception | Date |

Class I | -12.93% | -10.43% | 10.78% | 13.47% | 13.16% | 11/01/08 |

| Russell 2000 Total Return Index | -14.70% | -16.92% | 7.72% | 10.83% | 11.09% | 11/01/08 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Dynamic Small Cap Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. The Predecessor Fund commenced operations on September 30, 2015 after the conversion of the Algert Global U.S. Small Cap account (the “Predecessor Account”). As a result of each reorganization, the Fund is the accounting successor of each the Predecessor Fund and Predecessor Account. Performance results shown in the performance table above between May 10, 2019 and September 30, 2015 represent the performance of the Predecessor Fund, and performance results shown prior to September 30, 2015 represent the performance of the Predecessor Account. The Predecessor Account was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Account had been registered under the 1940 Act, the Predecessor Account’s performance may have been adversely affected.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for the Class I shares were 1.67% and 0.99%, respectively, which were stated in the current prospectus dated September 27, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses does not exceed 0.99% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

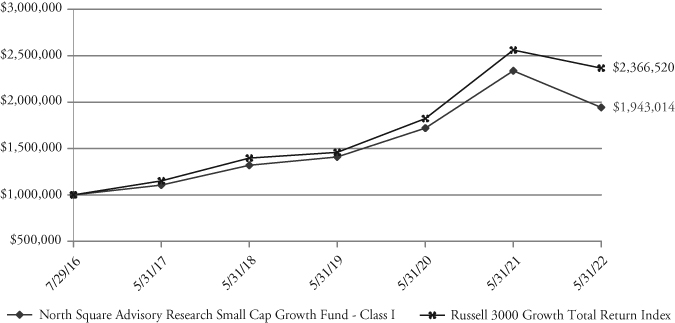

North Square Advisory Research Small Cap Growth Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at May 31, 2012, with a similar investment in the Russell 3000 Growth Total Return Index. Results include the reinvestment of all dividends and capital gains.

The Russell 3000 Growth Total Return Index is a market capitalization weighted index and includes companies that display signs of above average growth. The index is used to provide a gauge of the performance of growth stocks in the U.S. This index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | Average Annual | |

| | | | | | Since | Inception |

Total Returns as of May 31, 2022 | 6 Month | 1 Year | 3 Year | 5 Year | Inception | Date |

| Class I | -27.22% | -16.88% | 11.31% | 11.93% | 12.05% | 07/29/16 |

| Russell 3000 Growth Total Return Index | -20.48% | -7.60% | 17.51% | 15.50% | 15.90% | 07/29/16 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Disciplined Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund. Effective January 11, 2022, the Fund changed names to the North Square Advisory Research Small Cap Growth Fund (formerly, North Square Oak Ridge All Cap Growth Fund), changed investment strategy (Note 1), and changed Sub-Advisors to Advisory Research, Inc. (formerly, Oak Ridge Investments, LLC).

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for the Class I shares were 1.45% and 0.94%, respectively, which were stated in the current prospectus dated September 27, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses does not exceed 0.94% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

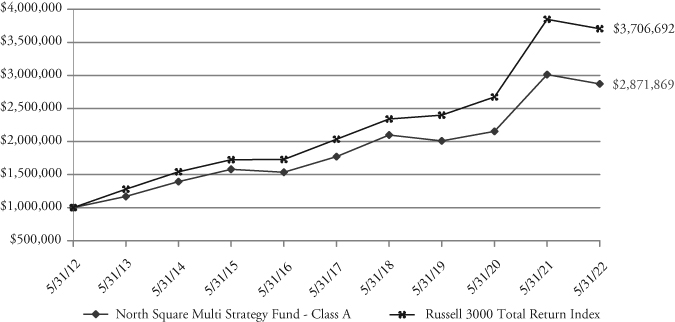

North Square Multi Strategy Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited)

Performance of a $10,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made on May 31, 2012, with a similar investment in the Russell 3000 Total Return Index. The performance graph above is shown for the Fund’s Class I shares; Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged, and it is not available for investment.

| | | Average Annual | |

| | | | | | Since | Inception |

Total Returns as of May 31, 2022 | 6 Month | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | | |

Class A1 | -9.48% | -4.94% | 9.66% | 10.86% | 5.66% | 03/01/99 |

Class I2 | -9.38% | -4.79% | 10.15% | 11.13% | 7.71% | 08/10/04 |

| After deducting maximum sales charge | | | | | | |

Class A1 | -14.69% | -10.41% | 8.37% | 10.21% | 5.39% | 03/01/99 |

| Russell 3000 Total Return Index | -10.50% | -3.68% | 12.75% | 14.00% | 7.58% | 03/01/99 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |

2 | Class I shares do not have any initial or contingent deferred sales charge. |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Multi Strategy Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund. Effective September 30, 2021, the Fund changed Sub-Advisors to NSI Retail Advisors, LLC (formerly, Oak Ridge Investments, LLC).

North Square Multi Strategy Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited) – Continued

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

The gross expense ratio for Class A shares was 1.93% and for Class I shares was 1.68%, which were the amounts stated in the current prospectus dated September 30, 2021. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (exclusive of any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, any acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 1.20% and 1.17% of the average daily net assets of the Fund’s Class A and Class I shares, respectively. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

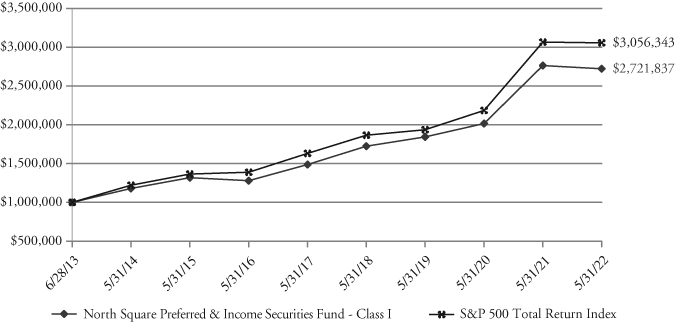

North Square Preferred and Income Securities Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the S&P 500 Total Return Index. Results include the reinvestment of all dividends and capital gains.

The S&P 500 Total Return Index measures the performance of primarily large cap U.S. stocks. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | Average Annual | |

| | | | | | Since | Inception |

Total Returns as of May 31, 2022 | 6 Month | 1 Year | 3 Year | 5 Year | Inception | Date |

Class I | -7.70% | -1.49% | 13.86% | 12.85% | 11.88% | 06/28/13 |

| S&P 500 Total Return Index | -8.85% | -0.30% | 16.44% | 13.38% | 13.34% | 06/28/13 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Dividend Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund. Effective January 11, 2022, the Fund changed names to the North Square Preferred and Income Securities Fund (formerly, North Square Oak Ridge Dividend Growth Fund), changed investment strategy (Note 1), and changed Sub-Advisors to Red Cedar Investment Management, LLC (formerly, Oak Ridge Investments, LLC).

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for the Class I shares were 1.43% and 0.97%, respectively, which were stated in the current prospectus dated September 27, 2019. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses does not exceed 0.97% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

North Square Tactical Growth Fund

FUND PERFORMANCE at May 31, 2022 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the Morningstar Moderately Aggressive Target Risk Total Return Index. Results include the reinvestment of all dividends and capital gains.

The Morningstar Moderately Aggressive Target Risk Total Return Index seeks approximately 80% exposure to global equity markets. The index does not incorporate Environmental, Social, or Governance (ESG) criteria. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged, and it is not available for investment.

| | | Average Annual | |

| | | | | | Since | Inception |

Total Returns as of May 31, 2022 | 6 Month | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | | |

Class A1 | -8.05% | -5.93% | 6.82% | NA | 6.88% | 04/01/13 |

Class C2 | -8.40% | -6.61% | 6.02% | NA | 6.08% | 04/01/13 |

Class I3 | -7.94% | -5.71% | 7.08% | 7.91% | 6.75% | 05/03/04 |

| After deducting maximum sales charge | | | | | | |

Class A1 | -13.34% | -11.34% | 5.56% | NA | 6.20% | 04/01/13 |

Class C2 | -9.27% | -7.50% | 6.02% | NA | 6.08% | 04/01/13 |

| Morningstar Moderately | | | | | | |

| Aggressive Target Risk Total Return Index | -7.87% | -7.44% | 7.72% | 9.03% | 7.57% | 05/03/04 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |