ANNUAL REPORT

NORTH SQUARE OAK RIDGE SMALL CAP GROWTH FUND

NORTH SQUARE DYNAMIC SMALL CAP FUND

NORTH SQUARE OAK RIDGE ALL CAP GROWTH FUND

NORTH SQUARE MULTI STRATEGY FUND

NORTH SQUARE OAK RIDGE DIVIDEND GROWTH FUND

MAY 31, 2021

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, www.northsquareinvest.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, such as a broker-dealer or bank, or, if you are a direct investor, by calling the Funds toll-free at 1-855-551-5521.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call the Funds toll-free at 1-855-551-5521 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary.

| North Square Investments | www.northsquareinvest.com |

North Square Funds

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 11 |

| Schedules of Investments | 18 |

| Statements of Assets and Liabilities | 42 |

| Statements of Operations | 46 |

| Statements of Changes in Net Assets | 48 |

| Financial Highlights | 53 |

| Notes to Financial Statements | 60 |

| Report of Independent Registered Public Accounting Firm | 71 |

| Supplemental Information | 72 |

| Expense Examples | 75 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the North Square Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.northsquareinvest.com

| Discussion of Fund Performance |  |

A letter from David Klaskin, Chief Executive Officer and Chief Investment Officer of Oak Ridge Investments and lead portfolio manager of the North Square Oak Ridge Small Cap Growth Fund.

Fellow Shareholders,

All U.S. stock indices have had a strong ascent over the past year, and more recently, vaccine adoption has unlocked significant pent-up demand and expanded growth expectations. There is debate over the need for ongoing broad economic aid and its impact on available labor and the inflation uptick, but we are clearly in the midst of a very strong recovery, with forecasts for GDP growth in excess of 6% for 2021. This would likely be even higher if there were not inventory and supply issues for a number of key inputs, such as semiconductor components and certain commodities. The consumer is very healthy, with near record levels of savings and low debt, fueled by confidence from a booming stock market and escalating home prices. Spending should remain strong and eventually shift toward leisure travel and other discretionary activities. There is a consensus belief that 2022 will see U.S. GDP growth remain in excess of 4%, with a stronger catch-up throughout global markets, particularly those with good access to effective vaccines.

Expansion has been meager for twenty years, as 2000 was the last time the economy grew at the once average rate of 4%, until the COVID relief spike of this year. Demographic shifts, high debt, political uncertainties and the influx of technology driven efficiencies have created a sluggish economic backdrop and more than a generation of muted inflation. It has been three decades since the CPI advanced at a rate of 4%. The common belief is that the current spike in inflationary indicators will be transitory. This is far from certain. Job openings now exceed pre-Pandemic levels, yet employment subsidies will continue into the fall. Wage pressures will remain, given popular legislative movements and a workforce relatively untrained for many of the job openings. Heightened regulations encourage fair labor practices, promote competitive markets and support the environment, but they are also inflationary as they pressure supply channels and make products more expensive to produce. Striking a balance is key, but perhaps less realistic in these polarizing political times.

Housing has exploded to the upside, benefitting from extremely low interest rates, available credit, increased wealth and the need for more space as most of the country has been relegated to their homes. People have fled the big cities, which lost their appeal during the shutdown and have experienced increased violence. The most favorable tax states have seen a surge in relocations of businesses and wealthy individuals, which is not likely to abate and is expected to result in widening budget deficits in already troubled states. The Federal government is likely to take on more of the expenses of beleaguered states, which will be another contributing factor to the burgeoning national debt. This is less a partisan issue over the next couple of years, as the country regains its footing, but it will continue to pressure the U.S. dollar and, at some point down the road, stress our standard of living.

Accelerated economic growth encouraged the broadening of equity leadership in late 2020 and into the early part of 2021, as value stocks began to outperform growth and the early COVID beneficiaries. The longer-term strength of this trend, however, will be highly dependent on the trajectory of broad economic growth going forward. Aside from a limited area of excessive speculation, there are not material bubbles in the sense of unviable investment attractions garnering large inflows. There are, nevertheless, valuations above levels that have been historically sustainable, where we must model realistic, and in most cases, more subdued returns going forward. Whenever the proverbial music stops and the Fed becomes less accommodating, earnings growth will be at a premium and valuations will reflect individual companies’ ability to navigate effectively. Price/earnings ratios are also influenced by interest rates, as a lack of alternatives for competitive returns is a large contributing factor to the unprecedented returns since the 2008 financial crisis. While the Fed is in no hurry, they will be closely monitoring inflation to determine rate policy.

The North Square Oak Ridge Small Cap Growth Fund – Class I Shares returned 43.92% versus the Russell 2000 Growth return of 50.14% for the year ending May 31, 2021. The year began with investors heavily pivoted toward companies that were the most likely beneficiaries of unusual economic circumstances. In many ways, the emphasis on software and other services that did not require in-person contact accentuated the trends that had been driving the small cap growth marketplace over the prior few years. In the first two quarters of the market’s recovery, choice investments within Information Technology and Health Care Technology allowed the strategy to lead the index by 469 basis points. As we approached the end of 2020, however, market breadth expanded, with highly economically sensitive and the most deeply impacted companies beginning to outperform in anticipation of broad economic recovery. The small cap market began to outperform its larger capitalization brethren and those beneficiaries that benefitted in the first few months lagged. Given our low turnover and emphasis on earnings consistency and visibility, we by nature under-represent the most economically sensitive companies within our strategy. At the time, a robust recovery was not a given; furthermore, as we have progressed further into 2021 many of the long-tailed effects of the COVID crisis on the economy remain unclear. We continued to firmly hold positions that had clear opportunity to grow, rather than rely on a fickle market for recovery and turnaround stories.

Industrials and Consumer Discretionary were the primary detractors to relative performance for the year, where the shift mid-year away from the initial beneficiaries toward recovery stocks was most acute. Within Consumer Discretionary, Ollies’ Bargain Outlet (OLLI: -5.48%), one of America’s largest closeout retailers, did not keep pace with investors renewed interest in restaurants and other hard hit areas despite its continued success in growing their business, opening 20 new stores in the first 5 months of 2021. Within the Industrials sector, a combination of recovery in construction and other heavier industrial areas with speculation in green energy stocks drove the sector to outperform the broad index. High quality Mercury Systems Inc (MRCY: -26.75%) was a larger detractor as defense budgets contracted; however, growth going forward continues to look more visible and less contingent on economic growth or individual government programs. Our electrical component firm Vicor Corporation (VICR: 47.72%) is more functional in its application across various power systems and did not strike the same heightened interest as the pure-play alternative energy companies within the Electrical Equipment industry.

Continuity and the Importance of Active Management

The Fund has been managed by the same lead portfolio manager, employing the same discipline rooted in fundamentals with a valuation awareness, since the Fund’s inception. Our persistent focus on supportable valuations and quality has often not appeared as relevant, and has actually detracted from investment results, throughout this long bull market. This overlooked metric, however, is likely to be a key factor in determining success over the next several years.

Thank you for your continued confidence in Oak Ridge Investments.

Sincerely,

David Klaskin

CIO & Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor and were as of May 31, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 2000 Growth Index measures the performance of small cap U.S. growth stocks.

| Discussion of Fund Performance |  |

A letter from Peter Algert, Chief Investment Officer of Algert Global LLC and portfolio manager of the North Square Dynamic Small Cap Fund.

Fellow Shareholders,

U.S. small-cap stocks experienced a significant rally over the 12-month period ending May 31, 2021, primarily driven by an ongoing economic recovery from the unprecedented public health and economic crises related to the COVID-19 pandemic. After falling precipitously in February-March 2020, the Russell 2000 Index rose significantly over the remainder of 2020 and thus far in 2021, ending the trailing 12-month period at +64.56%. The Fund however underperformed the index over this period, delivering an absolute return of +62.34% for Class I shares at NAV.

Stock Selection Designed to be the Primary Source of Benchmark Outperformance

During the trailing 12-month period, stock selection contributed negatively to Fund performance, however it was partially offset by positive contribution from incidental active exposures to various risk factors (e.g. a company’s industry, leverage, liquidity and beta characteristics). In addition to negative stock selection performance, the Fund also suffered from various unusual stock-specific events, such as the rise of meme stocks early in 2021.

Relative Value

The Relative Value model detracted from the Fund’s performance during the measurement period. Value-related positioning underperformed as investors have favored stocks with stronger growth characteristics and price levels which have made them unattractive on most valuation criteria. Value-related stocks subsequently rebounded in Q4 2020 – Q1 2021 amid favorable COVID-19 vaccination developments and falling infection rates. The Strategy continues to view value-oriented exposures less favorably relative to other opportunities.

Quality

The Quality model was the primary positive contributor to the performance of the Fund. With an uncertain economic backdrop, investors appeared to favor companies with more robust and sustainable business models relative to peers. The performance of our Quality insights was strong across various types of insights, particularly those constructed with natural language processing (NLP) techniques.

Catalyst

The Catalyst model was a modestly negative contributor to the Fund’s performance. The Catalyst theme, which assesses sentiment and activities by other market participants, was volatile at times during the measurement period but ultimately ended nearly flat relative to the benchmark as insights favoring various growth characteristics continued to be favored by investors amid the evolving and uneven economic recovery.

Risk Factors

Incidental active exposures to industries and risk factors such as leverage, volatility and liquidity contributed to gains over the measurement period. In particular, the Fund’s exposure to cyclically-exposures, high beta stocks helped as these stocks meaningfully outperformed over the trailing 12-months. While these exposures benefitted during the measurement period, we expect these exposures will have minimal impact on the Fund’s active performance over a full market cycle.

Fund Positioning for the Future

The Fund aims to be diversified across its three main investment themes, Relative Value, Quality and Catalyst. Given the uncertain economic backdrop relating to the COVID-19 pandemic, we expect our Quality-driven positioning will be beneficial for the portfolio and should be the dominant theme going forward in the near term. We continue to favor Catalyst-driven positions relative to Value driven, in part, by the expectation of ongoing access to cheap financing for growth-oriented firms.

Sincerely,

Peter Algert,

Chief Investment Officer

The views in this letter were as of May 31, 2021 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. International investments are subject to unique risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In addition, changes in exchange rates and interest rates may adversely affect the value of the fund’s foreign investments. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 2000 Index measures the performance of primarily small cap U.S. stocks.

| Discussion of Fund Performance |  |

A letter from Robert G. McVicker, lead portfolio manager of the North Square Oak Ridge All Cap Growth Fund.

Fellow Shareholders,

US equity markets continued their rampant rise over the past year from the initial impact of COVID-19. As 2020 progressed, the near-term likelihood of effective vaccines encouraged the market forward in anticipation of a robust economic recovery. As adoption of novel vaccines has continued to spread over a more meaningful share of the population the economic recovery is beginning to take shape. It would be naïve to think that the broad shutdown of large segments of the economy would not cause issues as the economy began to reopen in earnest. Challenges in key inputs, such as semiconductor components and certain commodities, will disrupt the pace of the recovery in certain segments but a largely inoculated population gives consumers an opportunity to shift spending towards travel and other discretionary services. Despite the startlingly high unemployment numbers in 2020, the consumer in aggregate has remained relatively healthy, increasing savings and reducing high interest revolving debt. A decline in utilization of services was one of the leading contributors to the decline in GDP in 2020 and consumer strength will be critical to both the recuperation of the service sector and reintegration of the unemployed back into the workforce this fall.

During the early phases of the market rebound, investors pivoted toward companies that were the most likely beneficiaries of unusual economic circumstances. In many ways, the emphasis on software and other services that did not require in-person contact accentuated the trends that had been driving the growth indices over the prior few years. As we approached the end of 2020, however, market breadth expanded, with highly economically sensitive and the most deeply impacted companies beginning to outperform in anticipation of broad economic recovery. The small cap market began to outperform its larger capitalization brethren and those beneficiaries that benefitted in the first few months lagged. As we have progressed further into 2021, growth equities have begun to show strength against value as concerns over peak growth rates question the long-term trajectory for more procyclical companies. The specter of inflation has become a more debated risk factor as Consumer Price Index (CPI) results exceed levels not seen for decades. The Federal Reserve believes the current spike in inflationary indicators will be transitory and, at least for the moment, the market seems more focused on the long run growth prospects of the economy.

The North Square Oak Ridge All Cap Growth Fund – Class I Shares returned 35.93% compared to the Russell 3000 Growth Index which returned 40.51% for the year ending May 31, 2021. Generally, our discipline towards more consistent growth companies with healthy balance sheets has served us well. As growth at the expense of profitability has become an increasingly common theme amongst segments of the growth investment universe, our attention to quality has lagged at times. As we approached the end of 2020, however, market breadth expanded, with highly economically sensitive and the most deeply impacted companies beginning to outperform in anticipation of broad economic recovery. This erratic behavior has been a challenge for our style of investing. We are not completely averse to companies that are more sensitive to broad economic growth, however, we prefer to find returns in these companies incrementally as the greater consistency and visibility of our companies prove themselves over multiple periods. Our perennial style of investing has on a relative basis seemingly become consistently out of season as the appetite for risk shifts dramatically, leaving our quiet and consistent companies operating in the background of a market that seeks the flair of either a sharp economic rally or the most rampant growth prospects.

The Fund’s cash position was the primary detractor to relative performance for the year. A combination of an underweight position and our generally more conservative mix of holdings within the Consumer Discretionary and Industrial sectors were further detractors, only partially offset by stronger relative returns from our Information Technology and Health Care holdings. After such a dramatic year of performance, not owning Tesla (TSLA: 274%) was the leading cause of underperformance within Consumer Discretionary. Our exposure within Industrials is skewed towards more consistent service businesses. Companies such as Waste Connections (WCN: 5% sold from the portfolio), a waste management company, and Verisk Analytics (VRSK: 0.7%) did not participate in the strong rally that caused the benchmark sector to outperform the broad index. Within Information Technology, Five9 (FIVN: 70%) and Fortinet (FTNT: 57%) presented strong returns during a period where the software segment underperformed the index. The Health Care sector, in general, underperformed the Russell 3000 Growth. Within the portfolio UnitedHealth Group (UNH: 37%), a health care insurance company, Eli Lilly and Company (LLY: 33%), a pharmaceutical company, led to stronger sector returns in the portfolio relative to the benchmark sector. The sector has many of the attractive qualities we seek in the strategy, but we have maintained a mild underweight relative to the index due to the ongoing headline risks that have led to broad underperformance for several years.

The characteristics that we look for within our process has led to stronger returns in more sustained down-market periods in the past. Overall outperformance in the first quarter of 2020 during the disruption caused by the coronavirus demonstrates the value of the process we have continued to develop over the past 27 years. We are confident that an adherence to our discipline can potentially be rewarded as the US continues to navigate from the ongoing public health and economic crisis.

Thank you for your continued confidence in Oak Ridge Investments.

Sincerely,

Robert G. McVicker

Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor and were as of May 31, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 3000 Growth Index measures the performance of growth stocks across almost all market caps.

| Discussion of Fund Performance |  |

A letter from David Klaskin, Chief Executive Officer and Chief Investment Officer of Oak Ridge Investments and lead portfolio manager of the North Square Multi Strategy Fund.

Fellow Shareholders:

US equity markets continued their rampant rise over the past year from the initial impact of COVID-19. The COVID-19 crisis indeed creates challenges across the economy, however the unprecedented support from the Federal Reserve effectively stymied what would likely have been a much more severe disruption to financial markets. In the initial phases, investors immediately pivoted to companies that were the most likely beneficiaries of unusual economic circumstances. As 2020 progressed, the near-term likelihood of effective vaccines encouraged the market forward in anticipation of a robust economic recovery and market breadth expanded, with highly economically sensitive and the most deeply impacted companies beginning to outperform. With adoption of novel vaccines continuing to spread over a more meaningful share of the population, the economic recovery is only beginning to take shape in the US. The recent increase in expanded leadership is encouraging, but the trajectory of broad economic growth going forward will determine the longer-term strength of this trend. The US is leading other global markets in the recovery, but the advent of new variants of the coronavirus adds uncertainty as governments handle the ongoing public health crisis and the broad reopening of their economies.

The specter of inflation has become a more debated risk factor as CPI results exceed levels not seen for decades. The 10-year yield rose from a low of 0.54% in early August of 2020 to 1.71% in April of 2021. The Federal Reserve believes the current spike in inflationary indicators will be transitory and has maintained cautious language about the potential for rate increases. In recent months, the 10-year has begun to slide lower despite the increasingly higher inflation figures. At least for the moment, the market seems more focused on the long run growth prospects of the economy and its subsequent impact on equity markets. There is growing concern that the second quarter of 2021 will be the peak for the US GDP growth rate. Expansion has been meager for twenty years, as 2000 was the last time the economy grew at the once average rate of 4%. Prior to the current crisis, a paucity of growth across the investment landscape encouraged more aggressive investment within select areas of the market that appear to offer rapid growth. This has left equity valuations in some segments above levels that have been historically sustainable, while the nascent recovery within the more cyclically oriented value companies is heavily path dependent. Furthermore, Treasury yields are relatively low and US corporate credit spreads have compressed significantly to below pre-pandemic levels. The investment landscape going forward could prove challenging and will likely require a more differentiated approach than in prior years.

The North Square Multi Fund – Class I Shares returned 40.07% versus the Russell 3000 return of 43.91% for the year ending May 31, 2021. Up until recently it had been a particularly difficult period to invest outside of traditional large cap strategies. Our allocation to the Dynamic Small Cap Fund had hurt relative returns despite exceptional alpha generation from the fund relative to its benchmark and favorable relative valuations to areas within larger capitalizations. As the market rotated towards value and small cap companies in late 2020, however, our patience with our position was rewarded as the fund returned 62.34% for the year ending May 31, 2021. Over the trailing 1 year, the Dynamic Small Cap Fund has been the largest contributor to returns as positions in the All Cap Growth Fund and Dividend Growth Fund have lagged the Russell 3000. We continue to maintain a strong position in the Dividend Growth Fund as the low-volatility nature of the strategy has proven effective in more tortuous market environments.

The Multi Strategy added three new funds into the strategy over the past year: the North Square Advisory Research All Cap Value Fund, the North Square Altrinsic International Equity Fund and the North Square McKee Bond Fund. The All Cap Value Fund sub-advised by Advisory Research was a timely addition to the Multi Strategy as years of underperformance of the value style relative to growth reversed in late 2020. We recently increased our allocation to the strategy after having reduced some of our excess growth exposure in March of 2021. Our initial weight within the Altrinsic International Equity Fund is modest, but the Fund provides a helpful means of diversifying our domestic equity exposure with an experienced manager should international markets continue to improve. CS McKee has a long history of managing core bond portfolios and the team is well seasoned in managing fixed income across a variety of rate environments. As the onset of 2021 has demonstrated, the comfort of consistently falling interest rates seen over the past few decades may be challenged. While the Multi Strategy competes within the 85%+ Equity category and thus has a limited allocation to fixed income, having an allocation to a strong core bond offering within the strategy is encouraging.

In general, we continue to believe this environment to be most conducive to flexible active managers with a focus on evaluating the relative merits of fundamentals rather than broad index exposures. The current holdings within the Multi Strategy provide a diverse cross section of investment strategies and we believe the Multi Strategy is well equipped to meet a variety of market environments; nevertheless, North Square and Oak Ridge continue to seek new managers and strategies to further enhance the portfolio’s allocation opportunities. We appreciate your continued confidence in North Square Investments.

Sincerely,

David Klaskin

CIO & Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor and were as of May 31, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. International investments are subject to unique risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In addition, changes in exchange rates and interest rates may adversely affect the value of the fund’s foreign investments. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 3000 Growth Index measures the performance of growth stocks across all market caps.

| Discussion of Fund Performance |  |

A letter from David Klaskin, Chief Executive Officer and Chief Investment Officer of Oak Ridge Investments and lead portfolio manager of the North Square Oak Ridge Dividend Growth Fund.

Fellow Shareholders,

All U.S. stock indices have had a strong ascent over the past year, and more recently, vaccine adoption has unlocked significant pent-up demand and expanded growth expectations. There is debate over the need for ongoing broad economic aid and its impact on available labor and the inflation uptick, but we are clearly in the midst of a very strong recovery, with forecasts for GDP growth in excess of 6% for 2021. This would likely be even higher if there were not inventory and supply issues for a number of key inputs, such as semiconductor components and certain commodities. The consumer is very healthy, with near record levels of savings and low debt, fueled by confidence from a booming stock market and escalating home prices. Spending should remain strong and eventually shift toward leisure travel and other discretionary activities. There is a consensus belief that 2022 will see U.S. GDP growth remain in excess of 4%, with a stronger catch-up throughout global markets, particularly those with good access to effective vaccines.

Expansion has been meager for twenty years, as 2000 was the last time the economy grew at the once average rate of 4%, until the COVID relief spike of this year. Demographic shifts, high debt, political uncertainties and the influx of technology driven efficiencies have created a sluggish economic backdrop and more than a generation of muted inflation. It has been three decades since the CPI advanced at a rate of 4%. The common belief is that the current spike in inflationary indicators will be transitory. This is far from certain. Job openings now exceed pre-Pandemic levels, yet employment subsidies will continue into the fall. Wage pressures will remain, given popular legislative movements and a workforce relatively untrained for many of the job openings. Heightened regulations encourage fair labor practices, promote competitive markets and support the environment, but they are also inflationary as they pressure supply channels and make products more expensive to produce. Striking a balance is key, but perhaps less realistic in these polarizing political times.

Accelerated economic growth encouraged the broadening of equity leadership in late 2020 and into the early part of 2021, as value stocks began to outperform growth and the early COVID beneficiaries. The longer-term strength of this trend, however, will be highly dependent on the trajectory of broad economic growth going forward. Aside from a limited area of excessive speculation, there are not material bubbles in the sense of unviable investment attractions garnering large inflows. There are, nevertheless, valuations above levels that have been sustainable, and in most cases, more subdued returns going forward. Whenever the proverbial music stops and the Fed becomes less accommodating, earnings growth will be at a premium and valuations will reflect individual companies’ ability to navigate effectively. Price/earnings ratios* are also influenced by interest rates, as a lack of alternatives for competitive returns is a large contributing factor to the unprecedented returns since the 2008 financial crisis. While the Fed is in no hurry, they will be closely monitoring inflation to determine rate policy.

The North Square Oak Ridge Dividend Growth Fund – Class I Shares returned 37.06% versus the S&P 500 return of 40.32% for the year ending May 31, 2021. The process focuses on companies that are able to consistently grow their dividend over time while maintaining a reasonable payout ratio. This approach can lead to stable-to-growing cash flow businesses that have historically performed well in difficult market environments. The COVID crisis disrupted businesses in different ways than a typical recessionary period. The traditional model of seeking stable cash flow businesses did not operate in the same way as some businesses fared better than others atypically during restrictions. The swift intervention from the Federal Reserve, while necessary to stabilize markets, further disavowed the merits of consistent dividend paying businesses. The S&P 500 index itself has been supported since the March 23rd lows, albeit by the two divergent groups of companies. In the leading quarters of the market recovery, previously leading technology-based companies printed impressive gains relative to the market, given their models were not only less impacted but were often enhanced by a homebound populace. As recovery prospects improved in late 2020, the market shifted towards the most damaged companies with the value-oriented segment supporting the index as growth stocks began to wane. More recently, investors have begun to scrutinize the risks of higher valuations within Growth stocks as well as the concerns for the speed of the recovery for Value stocks. This has favored the more stable dividend stocks that we hold within the portfolio relative to the broad market.

The portfolio’s cash position, an overweight in Real Estate and stock selection within Communication Services were the Fund’s primary detractors to relative returns. Verizon Wireless was sold from the portfolio after declining 1% during our holding period amidst a year of robust market returns. The Communication Services sector was largely driven by Facebook (FB: 46.04%) and Alphabet Inc. (GOOG: 64%; GOOGL: 69%), which are non-dividend paying companies and are thereby not something we would hold in the portfolio. Consumer Discretionary was a positive contributor to relative returns. Our combination of holdings was able to outperform the broad market despite not holding companies such as Amazon.com (AMZN: 32%). The Health Care sector, in general,

underperformed the S&P 500. Within the portfolio UnitedHealth Group (UNH: 37%), a health care insurance company, Eli Lilly and Company (LLY: 33%), a pharmaceutical company, led to stronger sector returns in the portfolio relative to the benchmark sector. The sector has many of the attractive qualities we seek in the strategy, but we have maintained a neutral weight relative to the index due to the ongoing headline risks that have led to broad underperformance for several years.

Without a sustained drawdown in the market, the attractiveness of dividend payors over the long run is less apparent. For long stretches, yield as a factor has become less important, such as during the rising rate environment and during the periods when the more dynamic growth companies led US equity markets. We are encouraged by how well our quality driven approach has competed against a broad based index. As longer horizons have shown, the virtue of the lower volatility component of the market is that gains are more likely retained when the market does experience duress. We are confident our disciplined approach and portfolio of strong cash flow generating companies remains an attractive option for investors as the US continues to navigate from the ongoing public health and economic crisis.

Thank you for your continued confidence in Oak Ridge Investments.

Sincerely,

David Klaskin

CIO & Senior Portfolio Manager

| * | The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS) |

The views in this letter are those of the Fund’s direct advisor and were as of May 31, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

The S&P 500 Index measures the performance of the largest 500 U.S. stocks.

North Square Oak Ridge Small Cap Growth Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares (the Class with the largest net assets), made on May 31, 2011, with a similar investment in the Russell 2000 Growth Index and the Russell 2000 Index. The performance graph above is shown for the Fund’s Class I shares; Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Growth Index measures the performance of U.S. small cap growth stocks. The Russell 2000 Index measures the performance of the small cap segment of the U.S. equity universe. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2021 | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | |

Class A1 | 43.47% | 13.49% | 9.96% | 10.49% | 01/03/94 |

Class I2 | 43.92% | 13.81% | 10.31% | 12.40% | 12/29/09 |

| After deducting maximum sales charge | | | | | |

Class A1 | 35.22% | 12.16% | 9.31% | 10.25% | 01/03/94 |

| Russell 2000 Growth Index | 50.14% | 17.57% | 12.76% | 8.66% | 01/03/94 |

| Russell 2000 Index | 64.56% | 16.01% | 11.86% | 9.75% | 01/03/94 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |

2 | Class I shares do not have any initial or contingent deferred sales charge. |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Small Cap Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

North Square Oak Ridge Small Cap Growth Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited) – Continued

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class A shares were 2.07% and 1.40%, and for Class I shares were 1.79% and 1.15%, which were the amounts stated in the current prospectus dated September 30, 2020. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.39%, and 1.14% of the average daily net assets of the Fund’s Class A and Class I shares, respectively. This agreement is in effect until September 30, 2021, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

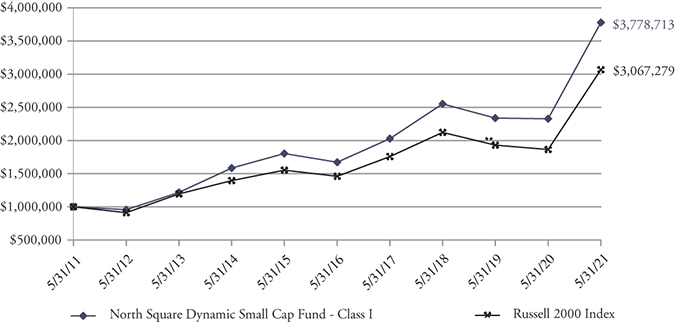

North Square Dynamic Small Cap Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made on May 31, 2011, with a similar investment in the Russell 2000 Index. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Index measures the performance of the small cap segment of the U.S. equity universe. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2021 | 1 Year | 5 Year | 10 Year | Inception | Date |

| Class I | 62.34% | 17.71% | 14.22% | 15.28% | 11/01/08 |

| Russell 2000 Index | 64.56% | 16.01% | 11.86% | 13.68% | 11/01/08 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Dynamic Small Cap Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. The Predecessor Fund commenced operations on September 30, 2015 after the conversion of the Algert Global U.S. Small Cap account (the “Predecessor Account”). As a result of each reorganization, the Fund is the accounting successor of each the Predecessor Fund and Predecessor Account. Performance results shown in the performance table above between May 10, 2019 and September 30, 2015 represent the performance of the Predecessor Fund, and performance results shown prior to September 30, 2015 represent the performance of the Predecessor Account. The Predecessor Account was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Account had been registered under the 1940 Act, the Predecessor Account’s performance may have been adversely affected.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class I shares were 2.23% and 1.15%, respectively, which were the amounts stated in the current prospectus dated September 30, 2020. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.15% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

North Square Oak Ridge All Cap Growth Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the Russell 3000 Growth Index. Results include the reinvestment of all dividends and capital gains.

The Russell 3000 Growth Index is a market capitalization weighted index and includes companies that display signs of above average growth. The index is used to provide a gauge of the performance of growth stocks in the U.S. This index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | | Since | Inception |

Average Annual Total Returns as of May 31, 2021 | 1 Year | 3 Year | Inception | Date |

| Class I | 35.93% | 21.01% | 19.18% | 07/29/16 |

| Russell 3000 Growth Index | 40.51% | 22.40% | 21.46% | 07/29/16 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Disciplined Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for the Class I shares were 1.89% and 0.96%, respectively, which were stated in the current prospectus dated September 30, 2020. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses does not exceed 0.95% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

North Square Multi Strategy Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited)

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund’s Class A shares (assumes the maximum sales load charged by the Fund), made on May 31, 2011, with a similar investment in the Russell 3000 Index and the Russell 3000 Growth Index. The performance graph above is shown for the Fund’s Class A shares; Class I shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Russell 3000 Index measures the performance of the largest 3,000 US companies. The Russell 3000 Growth Index is a market capitalization weighted index and includes companies that display signs of above average growth. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2021 | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | |

Class A1 | 39.20% | 13.98% | 11.53% | 6.16% | 03/01/99 |

Class I2 | 40.07% | 14.44% | 11.80% | 8.50% | 08/10/04 |

| After deducting maximum sales charge | | | | | |

Class A1 | 31.17% | 12.64% | 10.87% | 5.88% | 03/01/99 |

| Russell 3000 Index | 43.91% | 17.36% | 14.21% | 8.12% | 03/01/99 |

| Russell 3000 Growth Index | 40.51% | 21.75% | 16.66% | 7.87% | 03/01/99 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |

2 | Class I shares do not have any initial or contingent deferred sales charge. |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Multi Strategy Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

North Square Multi Strategy Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited) – Continued

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class A shares were 2.85% and 2.25%, respectively, and for Class I shares were 2.43% and 1.95%, respectively, which were the amounts stated in the current prospectus dated September 30, 2020. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.20% and 1.17% of the average daily net assets of the Fund’s Class A and Class I shares, respectively. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

North Square Oak Ridge Dividend Growth Fund

FUND PERFORMANCE at May 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the S&P 500 Index. Results include the reinvestment of all dividends and capital gains.

The S&P 500 Index measures the performance of primarily large cap U.S. stocks. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2021 | 1 Year | 3 Year | 5 Year | Inception | Date |

| Class I | 37.06% | 17.03% | 16.65% | 13.69% | 06/28/13 |

| S&P 500 Index | 40.32% | 18.00% | 17.16% | 15.19% | 06/28/13 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Dividend Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class I shares were 1.90% and 1.01%, respectively, which were the amounts stated in the current prospectus dated September 30, 2020. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.00% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 99.7% | | | |

| | | | | | |

| | | CONSUMER DISCRETIONARY – 16.1% | | | |

| | | | | | |

| | | Distributors – 1.5% | | | |

| | 5,000 | | Pool Corp. | | $ | 2,182,750 | |

| | | | | | | | |

| | | | Diversified Consumer Services – 1.5% | | | | |

| | 40,859 | | frontdoor, Inc.* | | | 2,194,128 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure – 1.7% | | | | |

| | 18,525 | | NeoGames S.A.*1 | | | 1,187,452 | |

| | 9,845 | | Wingstop, Inc. | | | 1,404,685 | |

| | | | | | | 2,592,137 | |

| | | | Internet & Direct Marketing Retail – 0.8% | | | | |

| | 64,777 | | The RealReal Inc.* | | | 1,131,654 | |

| | | | | | | | |

| | | | Leisure Products – 2.5% | | | | |

| | 43,392 | | YETI Holdings, Inc.* | | | 3,801,139 | |

| | | | | | | | |

| | | | Multiline Retail – 1.5% | | | | |

| | 25,549 | | Ollie’s Bargain Outlet Holdings, Inc.* | | | 2,208,456 | |

| | | | | | | | |

| | | | Specialty Retail – 6.6% | | | | |

| | 5,767 | | Burlington Stores, Inc.* | | | 1,864,875 | |

| | 10,320 | | Five Below, Inc.* | | | 1,900,118 | |

| | 102,230 | | Leslie’s, Inc.* | | | 2,981,027 | |

| | 60,909 | | National Vision Holdings, Inc.* | | | 3,025,350 | |

| | | | | | | 9,771,370 | |

| | | | TOTAL CONSUMER DISCRETIONARY | | | 23,881,634 | |

| | | | | | | | |

| | | | CONSUMER STAPLES – 5.8% | | | | |

| | | | | | | | |

| | | | Food & Staples Retailing – 3.0% | | | | |

| | 64,575 | | BJ’s Wholesale Club Holdings, Inc.* | | | 2,892,314 | |

| | 46,340 | | Grocery Outlet Holding Corp.* | | | 1,578,804 | |

| | | | | | | 4,471,118 | |

| | | | Food Products – 2.8% | | | | |

| | 137,054 | | Nomad Foods Ltd.*1 | | | 4,203,446 | |

| | | | TOTAL CONSUMER STAPLES | | | 8,674,564 | |

| | | | | | | | |

| | | | FINANCIALS – 1.7% | | | | |

| | | | | | | | |

| | | | Insurance – 1.7% | | | | |

| | 6,872 | | Kinsale Capital Group, Inc. | | | 1,143,913 | |

| | 19,397 | | Palomar Holdings, Inc.* | | | 1,415,981 | |

| | | | TOTAL FINANCIALS | | | 2,559,894 | |

| | | | | | | | |

| | | | HEALTH CARE – 31.4% | | | | |

| | | | | | | | |

| | | | Biotechnology – 11.6% | | | | |

| | 10,900 | | Acceleron Pharma, Inc.* | | | 1,426,701 | |

| | 5,167 | | argenx SE – ADR*1 | | | 1,441,541 | |

| | 27,542 | | Arrowhead Pharmaceuticals, Inc.* | | | 1,999,549 | |

| | 13,413 | | Biohaven Pharmaceutical Holding Co Ltd.*1 | | | 1,166,931 | |

| | 9,937 | | Blueprint Medicines Corp.* | | | 907,745 | |

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | HEALTH CARE (Continued) | | | |

| | | | | | |

| | | Biotechnology (Continued) | | | |

| | 21,999 | | Emergent BioSolutions, Inc.* | | $ | 1,334,239 | |

| | 59,101 | | Halozyme Therapeutics, Inc.* | | | 2,447,372 | |

| | 97,277 | | Heron Therapeutics, Inc.* | | | 1,290,866 | |

| | 16,686 | | Horizon Therapeutics PLC*1 | | | 1,529,439 | |

| | 32,486 | | Insmed, Inc.* | | | 799,156 | |

| | 21,924 | | Oyster Point Pharma, Inc.* | | | 392,878 | |

| | 54,134 | | Travere Therapeutics, Inc.* | | | 821,213 | |

| | 41,143 | | Veracyte, Inc.* | | | 1,606,634 | |

| | | | | | | 17,164,264 | |

| | | | Health Care Equipment & Supplies – 8.9% | | | | |

| | 37,317 | | AtriCure, Inc.* | | | 2,788,699 | |

| | 42,021 | | Axonics, Inc.* | | | 2,424,192 | |

| | 25,551 | | CONMED Corp. | | | 3,518,117 | |

| | 4,233 | | Insulet Corp.* | | | 1,141,513 | |

| | 20,092 | | OrthoPediatrics Corp.* | | | 1,134,997 | |

| | 4,632 | | Penumbra, Inc.* | | | 1,153,878 | |

| | 68,236 | | Zynex, Inc.* | | | 1,038,552 | |

| | | | | | | 13,199,948 | |

| | | | Health Care Providers & Services – 2.1% | | | | |

| | 15,903 | | LHC Group, Inc.* | | | 3,130,506 | |

| | | | | | | | |

| | | | Health Care Technology – 5.9% | | | | |

| | 60,852 | | Inovalon Holdings, Inc. – Class A* | | | 1,908,319 | |

| | 15,375 | | Inspire Medical Systems, Inc.* | | | 2,987,363 | |

| | 15,389 | | Omnicell, Inc.* | | | 2,139,071 | |

| | 25,263 | | Schrodinger, LLC* | | | 1,772,957 | |

| | | | | | | 8,807,710 | |

| | | | Life Sciences Tools & Services – 2.4% | | | | |

| | 86,611 | | NeoGenomics, Inc.* | | | 3,553,649 | |

| | | | | | | | |

| | | | Pharmaceuticals – 0.5% | | | | |

| | 11,865 | | Axsome Therapeutics, Inc.* | | | 720,324 | |

| | | | TOTAL HEALTH CARE | | | 46,576,401 | |

| | | | | | | | |

| | | | INDUSTRIALS – 15.7% | | | | |

| | | | | | | | |

| | | | Aerospace & Defense – 1.0% | | | | |

| | 21,928 | | Mercury Systems, Inc.* | | | 1,435,187 | |

| | | | | | | | |

| | | | Building Products – 1.3% | | | | |

| | 45,996 | | The AZEK Co. Inc.* | | | 2,002,206 | |

| | | | | | | | |

| | | | Commercial Services & Supplies – 1.7% | | | | |

| | 38,469 | | Casella Waste Systems, Inc. – Class A* | | | 2,593,965 | |

| | | | | | | | |

| | | | Construction & Engineering – 1.5% | | | | |

| | 67,174 | | Construction Partners, Inc. – Class A* | | | 2,163,674 | |

| | | | | | | | |

| | | | Electrical Equipment – 2.0% | | | | |

| | 32,584 | | Vicor Corp.* | | | 2,935,167 | |

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | INDUSTRIALS (Continued) | | | |

| | | | | | |

| | | Machinery – 4.0% | | | |

| | 75,859 | | Colfax Corp.* | | $ | 3,352,968 | |

| | 18,399 | | John Bean Technologies Corp. | | | 2,650,008 | |

| | | | | | | 6,002,976 | |

| | | | Road & Rail – 2.3% | | | | |

| | 14,858 | | Saia, Inc.* | | | 3,419,717 | |

| | | | | | | | |

| | | | Trading Companies & Distributors – 1.9% | | | | |

| | 16,300 | | SiteOne Landscape Supply, Inc.* | | | 2,804,252 | |

| | | | TOTAL INDUSTRIALS | | | 23,357,144 | |

| | | | | | | | |

| | | | INFORMATION TECHNOLOGY – 28.2% | | | | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components – 1.8% | | | | |

| | 10,026 | | Littelfuse, Inc. | | | 2,619,192 | |

| | | | | | | | |

| | | | IT Services – 11.5% | | | | |

| | 34,193 | | Endava PLC – ADR*1 | | | 3,507,518 | |

| | 16,555 | | Euronet Worldwide, Inc.* | | | 2,477,290 | |

| | 37,397 | | Maximus, Inc. | | | 3,465,580 | |

| | 46,750 | | Perficient, Inc.* | | | 3,346,833 | |

| | 66,706 | | Repay Holdings Corp.* | | | 1,514,893 | |

| | 14,305 | | WEX, Inc.* | | | 2,802,493 | |

| | | | | | | 17,114,607 | |

| | | | Semiconductors & Semiconductor Equipment – 3.9% | | | | |

| | 30,908 | | Diodes, Inc.* | | | 2,338,808 | |

| | 64,058 | | Lattice Semiconductor Corp.* | | | 3,399,558 | |

| | | | | | | 5,738,366 | |

| | | | Software – 11.0% | | | | |

| | 36,733 | | Altair Engineering, Inc. – Class A* | | | 2,474,702 | |

| | 15,141 | | Cerence, Inc.* | | | 1,440,363 | |

| | 40,673 | | The Descartes Systems Group Inc.*1 | | | 2,376,930 | |

| | 31,754 | | Envestnet, Inc.* | | | 2,285,336 | |

| | 8,344 | | Everbridge, Inc.* | | | 980,420 | |

| | 25,313 | | Five9, Inc.* | | | 4,482,932 | |

| | 54,763 | | Upland Software, Inc.* | | | 2,244,736 | |

| | | | | | | 16,285,419 | |

| | | | TOTAL INFORMATION TECHNOLOGY | | | 41,757,584 | |

| | | | | | | | |

| | | | REAL ESTATE – 0.8% | | | | |

| | | | | | | | |

| | | | Real Estate Management & Development – 0.8% | | | | |

| | 20,605 | | Redfin Corp.* | | | 1,216,313 | |

| | | | TOTAL REAL ESTATE | | | 1,216,313 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $94,358,726) | | | 148,023,534 | |

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | SHORT-TERM INVESTMENT – 0.5% | | | |

| | 726,027 | | First American Treasury Obligations Fund – Class X, 0.02%2 | | $ | 726,027 | |

| | | | TOTAL SHORT-TERM INVESTMENT | | | | |

| | | | (Cost $726,027) | | | 726,027 | |

| | | | TOTAL INVESTMENTS – 100.2% | | | | |

| | | | (Cost $95,084,753) | | | 148,749,561 | |

| | | | Liabilities in Excess of Other Assets – (0.2)% | | | (337,563 | ) |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 148,411,998 | |

ADR – American Depositary Receipt

PLC – Public Limited Company

| * | Non-Income producing security. |

1 | Foreign security denominated in U.S. Dollars. |

2 | The rate is the annualized seven-day yield at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SUMMARY OF INVESTMENTS

As of May 31, 2021

| | Percent of Total |

| Security Type/Sector | Net Assets |

| Common Stocks | | | |

| Health Care | | 31.4% | |

| Information Technology | | 28.2% | |

| Consumer Discretionary | | 16.1% | |

| Industrials | | 15.7% | |

| Consumer Staples | | 5.8% | |

| Financials | | 1.7% | |

| Real Estate | | 0.8% | |

| Total Common Stocks | | 99.7% | |

| Short-Term Investment | | 0.5% | |

| Total Investments | | 100.2% | |

| Liabilities in Excess of Other Assets | | (0.2)% | |

| Total Net Assets | | 100.0% | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 95.3% | | | |

| | | | | | |

| | | COMMUNICATION SERVICES – 3.0% | | | |

| | | | | | |

| | | Diversified Telecommunication Services – 0.9% | | | |

| | 1,270 | | Cogent Communications Holdings, Inc. | | $ | 96,012 | |

| | 4,430 | | Ooma, Inc.* | | | 85,986 | |

| | | | | | | 181,998 | |

| | | | Entertainment – 0.4% | | | | |

| | 8,560 | | Zynga, Inc. – Class A* | | | 92,790 | |

| | | | | | | | |

| | | | Media – 1.1% | | | | |

| | 1,960 | | AMC Networks, Inc. – Class A* | | | 105,213 | |

| | 2,720 | | Gray Television, Inc. | | | 63,267 | |

| | 760 | | TechTarget, Inc.* | | | 53,436 | |

| | | | | | | 221,916 | |

| | | | Wireless Telecommunication Services – 0.6% | | | | |

| | 8,890 | | Gogo, Inc.* | | | 121,082 | |

| | | | TOTAL COMMUNICATION SERVICES | | | 617,786 | |

| | | | | | | | |

| | | | CONSUMER DISCRETIONARY – 21.1% | | | | |

| | | | | | | | |

| | | | Auto Components – 1.8% | | | | |

| | 200 | | Fox Factory Holding Corp.* | | | 31,096 | |

| | 3,158 | | Patrick Industries, Inc. | | | 270,640 | |

| | 860 | | XPEL, Inc.* | | | 70,520 | |

| | | | | | | 372,256 | |

| | | | Automobiles – 1.3% | | | | |

| | 3,700 | | Winnebago Industries, Inc. | | | 273,652 | |

| | | | | | | | |

| | | | Distributors – 0.3% | | | | |

| | 1,170 | | Core-Mark Holding Co., Inc. | | | 53,656 | |

| | | | | | | | |

| | | | Diversified Consumer Services – 1.0% | | | | |

| | 7,701 | | Stride, Inc.* | | | 207,003 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure – 5.3% | | | | |

| | 8,530 | | Bloomin’ Brands, Inc.* | | | 252,061 | |

| | 620 | | Dave & Buster’s Entertainment, Inc.* | | | 26,214 | |

| | 7,820 | | Everi Holdings, Inc.* | | | 162,109 | |

| | 4,490 | | International Game Technology PLC*2 | | | 108,927 | |

| | 240 | | Jack in the Box, Inc. | | | 27,264 | |

| | 1,272 | | Monarch Casino & Resort, Inc.* | | | 90,770 | |

| | 1,580 | | Papa John’s International, Inc. | | | 148,441 | |

| | 750 | | Penn National Gaming, Inc.* | | | 61,477 | |

| | 370 | | Scientific Games Corp.* | | | 26,840 | |

| | 850 | | Texas Roadhouse, Inc. | | | 85,604 | |

| | 563 | | Wingstop, Inc. | | | 80,329 | |

| | | | | | | 1,070,036 | |

| | | | Household Durables – 2.5% | | | | |

| | 1,460 | | Helen of Troy Ltd.*2 | | | 307,301 | |

| | 210 | | iRobot Corp.* | | | 20,517 | |

| | 2,090 | | Purple Innovation, Inc.* | | | 59,607 | |

| | 3,000 | | Sonos, Inc.* | | | 111,000 | |

| | | | | | | 498,425 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | CONSUMER DISCRETIONARY (Continued) | | | |

| | | | | | |

| | | Internet & Direct Marketing Retail – 1.2% | | | |

| | 3,140 | | CarParts.com, Inc.* | | $ | 51,307 | |

| | 1,634 | | Overstock.com, Inc.* | | | 139,593 | |

| | 2,180 | | PetMed Express, Inc. | | | 63,002 | |

| | | | | | | 253,902 | |

| | | | Leisure Products – 1.8% | | | | |

| | 4,600 | | Nautilus, Inc.* | | | 82,846 | |

| | 3,230 | | YETI Holdings, Inc.* | | | 282,948 | |

| | | | | | | 365,794 | |

| | | | Specialty Retail – 3.3% | | | | |

| | 690 | | RH* | | | 442,325 | |

| | 910 | | Sleep Number Corp.* | | | 101,456 | |

| | 2,740 | | Sonic Automotive, Inc. – Class A | | | 132,150 | |

| | | | | | | 675,931 | |

| | | | Textiles, Apparel & Luxury Goods – 2.6% | | | | |

| | 2,700 | | Carter’s, Inc. | | | 276,048 | |

| | 410 | | Deckers Outdoor Corp.* | | | 137,530 | |

| | 1,880 | | Kontoor Brands, Inc. | | | 120,358 | |

| | | | | | | 533,936 | |

| | | | TOTAL CONSUMER DISCRETIONARY | | | 4,304,591 | |

| | | | | | | | |

| | | | CONSUMER STAPLES – 7.2% | | | | |

| | | | | | | | |

| | | | Beverages – 0.9% | | | | |

| | 2,710 | | MGP Ingredients, Inc. | | | 188,860 | |

| | | | | | | | |

| | | | Food & Staples Retailing – 1.2% | | | | |

| | 4,639 | | The Andersons, Inc. | | | 144,180 | |

| | 4,990 | | SpartanNash Co. | | | 104,640 | |

| | | | | | | 248,820 | |

| | | | Food Products – 0.6% | | | | |

| | 3,630 | | B&G Foods, Inc. | | | 111,078 | |

| | | | | | | | |

| | | | Personal Products – 4.3% | | | | |

| | 8,190 | | e.l.f. Beauty, Inc.* | | | 229,320 | |

| | 4,250 | | Herbalife Nutrition Ltd.*2 | | | 223,422 | |

| | 720 | | Inter Parfums, Inc. | | | 55,066 | |

| | 500 | | Medifast, Inc. | | | 166,125 | |

| | 1,810 | | Nu Skin Enterprises, Inc. – Class A | | | 108,890 | |

| | 860 | | USANA Health Sciences, Inc.* | | | 90,936 | |

| | | | | | | 873,759 | |

| | | | Tobacco – 0.2% | | | | |

| | 800 | | Turning Point Brands, Inc. | | | 34,216 | |

| | | | TOTAL CONSUMER STAPLES | | | 1,456,733 | |

| | | | | | | | |

| | | | ENERGY – 3.1% | | | | |

| | | | | | | | |

| | | | Energy Equipment & Services – 0.7% | | | | |

| | 580 | | Dril-Quip, Inc.* | | | 19,447 | |

| | 2,710 | | Select Energy Services, Inc. – Class A* | | | 15,393 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | ENERGY (Continued) | | | |

| | | | | | |

| | | Energy Equipment & Services (Continued) | | | |

| | 8,130 | | Solaris Oilfield Infrastructure, Inc. – Class A | | $ | 81,219 | |

| | 2,880 | | US Silica Holdings, Inc.* | | | 29,549 | |

| | | | | | | 145,608 | |

| | | | Oil, Gas & Consumable Fuels – 2.4% | | | | |

| | 3,680 | | Brigham Minerals, Inc. – Class A | | | 66,755 | |

| | 10,040 | | Dorian LPG Ltd.*2 | | | 142,668 | |

| | 13,560 | | Magnolia Oil & Gas Corp. – Class A* | | | 175,195 | |

| | 1,240 | | Renewable Energy Group, Inc.* | | | 75,727 | |

| | 168 | | REX American Resources Corp.* | | | 16,133 | |

| | | | | | | 476,478 | |

| | | | TOTAL ENERGY | | | 622,086 | |

| | | | | | | | |

| | | | FINANCIALS – 10.1% | | | | |

| | | | | | | | |

| | | | Banks – 4.7% | | | | |

| | 1,295 | | Bank OZK | | | 55,309 | |

| | 3,390 | | First Commonwealth Financial Corp. | | | 51,359 | |

| | 2,220 | | First Foundation, Inc. | | | 55,722 | |

| | 1,251 | | Great Western Bancorp, Inc. | | | 41,858 | |

| | 2,730 | | National Bank Holdings Corp. – Class A | | | 108,108 | |

| | 2,130 | | OFG Bancorp2 | | | 51,333 | |

| | 3,650 | | TriState Capital Holdings, Inc.* | | | 83,914 | |

| | 4,180 | | United Community Banks, Inc. of Georgia | | | 144,544 | |

| | 1,360 | | Univest Financial Corp. | | | 39,658 | |

| | 1,194 | | Western Alliance Bancorp | | | 119,412 | |

| | 3,510 | | Zions Bancorp NA | | | 203,159 | |

| | | | | | | 954,376 | |

| | | | Capital Markets – 1.7% | | | | |

| | 4,000 | | Cowen, Inc. – Class A | | | 157,320 | |

| | 1,530 | | Piper Sandler Cos | | | 195,014 | |

| | | | | | | 352,334 | |

| | | | Consumer Finance – 1.1% | | | | |

| | 4,300 | | PROG Holdings, Inc. | | | 226,696 | |

| | | | | | | | |

| | | | Insurance – 1.8% | | | | |

| �� | 10,780 | | American Equity Investment Life Holding Co. | | | 328,790 | |

| | 430 | | First American Financial Corp. | | | 27,653 | |

| | 360 | | James River Group Holdings Ltd.2 | | | 12,571 | |

| | | | | | | 369,014 | |

| | | | Thrifts & Mortgage Finance – 0.8% | | | | |

| | 2,730 | | Flagstar Bancorp, Inc. | | | 125,034 | |

| | 291 | | Walker & Dunlop, Inc. | | | 29,548 | |

| | | | | | | 154,582 | |

| | | | TOTAL FINANCIALS | | | 2,057,002 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | HEALTH CARE – 16.0% | | | |

| | | | | | |

| | | Biotechnology – 5.1% | | | |

| | 7,013 | | Adverum Biotechnologies, Inc.* | | $ | 24,265 | |

| | 5,505 | | Aeglea BioTherapeutics, Inc.* | | | 36,388 | |

| | 1,850 | | Arena Pharmaceuticals, Inc.* | | | 113,053 | |

| | 680 | | Celldex Therapeutics, Inc.* | | | 19,006 | |

| | 5,401 | | Constellation Pharmaceuticals, Inc.* | | | 106,994 | |

| | 5,187 | | Eiger BioPharmaceuticals, Inc.* | | | 40,770 | |

| | 10,280 | | Immunovant, Inc.* | | | 155,845 | |

| | 1,120 | | Iovance Biotherapeutics, Inc.* | | | 20,798 | |

| | 4,458 | | IVERIC bio, Inc.* | | | 31,518 | |

| | 6,920 | | Kura Oncology, Inc.* | | | 153,970 | |

| | 1,230 | | Magenta Therapeutics, Inc.* | | | 15,191 | |

| | 1,240 | | Molecular Templates, Inc.* | | | 11,086 | |

| | 1,830 | | RAPT Therapeutics, Inc.* | | | 35,319 | |

| | 1,240 | | REVOLUTION Medicines, Inc.* | | | 37,088 | |

| | 4,720 | | Sutro Biopharma, Inc.* | | | 87,839 | |

| | 1,380 | | Twist Bioscience Corp.* | | | 148,088 | |

| | | | | | | 1,037,218 | |

| | | | Health Care Equipment & Supplies – 4.6% | | | | |

| | 1,650 | | Cardiovascular Systems, Inc.* | | | 64,663 | |

| | 3,520 | | Inmode Ltd.*2 | | | 300,467 | |

| | 7,607 | | Sientra, Inc.* | | | 52,945 | |

| | 440 | | STAAR Surgical Co.* | | | 64,253 | |

| | 800 | | Surmodics, Inc.* | | | 42,440 | |

| | 810 | | Tactile Systems Technology, Inc.* | | | 43,554 | |

| | 3,450 | | Tandem Diabetes Care, Inc.* | | | 294,596 | |

| | 4,863 | | Zynex, Inc.* | | | 74,015 | |

| | | | | | | 936,933 | |

| | | | Health Care Providers & Services – 1.7% | | | | |

| | 1,120 | | AMN Healthcare Services, Inc.* | | | 99,344 | |

| | 290 | | Fulgent Genetics, Inc.* | | | 21,480 | |

| | 759 | | The Joint Corp.* | | | 53,950 | |

| | 2,740 | | Progyny, Inc.* | | | 175,470 | |

| | | | | | | 350,244 | |

| | | | Health Care Technology – 0.8% | | | | |

| | 1,560 | | Evolent Health, Inc. – Class A* | | | 30,311 | |

| | 7,802 | | NextGen Healthcare, Inc.* | | | 128,109 | |

| | | | | | | 158,420 | |

| | | | Life Sciences Tools & Services – 2.2% | | | | |

| | 6,040 | | Bionano Genomics, Inc.* | | | 37,267 | |

| | 1,370 | | Bruker Corp. | | | 95,133 | |

| | 5,047 | | Codexis, Inc.* | | | 103,463 | |

| | 440 | | Medpace Holdings, Inc.* | | | 73,506 | |

| | 2,300 | | Personalis, Inc.* | | | 51,727 | |

| | 470 | | Quanterix Corp.* | | | 24,200 | |

| | 380 | | Repligen Corp.* | | | 69,392 | |

| | | | | | | 454,688 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | HEALTH CARE (Continued) | | | |

| | | | | | |

| | | Pharmaceuticals – 1.6% | | | |

| | 11,220 | | Amneal Pharmaceuticals, Inc.* | | $ | 63,505 | |

| | 7,850 | | Antares Pharma, Inc.* | | | 31,164 | |

| | 41,750 | | BioDelivery Sciences International, Inc.* | | | 147,378 | |

| | 2,710 | | Phibro Animal Health Corp. – Class A | | | 76,395 | |

| | | | | | | 318,442 | |

| | | | TOTAL HEALTH CARE | | | 3,255,945 | |

| | | | | | | | |

| | | | INDUSTRIALS – 17.7% | | | | |

| | | | | | | | |

| | | | Aerospace & Defense – 0.1% | | | | |

| | 220 | | HEICO Corp. | | | 30,901 | |

| | | | | | | | |

| | | | Building Products – 0.8% | | | | |

| | 930 | | Trex Co, Inc.* | | | 90,591 | |

| | 830 | | UFP Industries, Inc. | | | 66,002 | |

| | | | | | | 156,593 | |

| | | | Commercial Services & Supplies – 1.6% | | | | |

| | 5,760 | | HNI Corp. | | | 262,771 | |

| | 2,610 | | Knoll, Inc. | | | 67,860 | |

| | | | | | | 330,631 | |

| | | | Construction & Engineering – 1.4% | | | | |