| ANNUAL REPORT | |

| | |

| | |

| NORTH SQUARE ADVISORY RESEARCH ALL CAP VALUE FUND | |

| NORTH SQUARE ALTRINSIC INTERNATIONAL EQUITY FUND | |

| NORTH SQUARE MCKEE BOND FUND | |

| NORTH SQUARE STRATEGIC INCOME FUND | |

| | |

| | |

| OCTOBER 31, 2021 | |

As of January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, www.northsquareinvest.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, such as a broker-dealer or bank, or, if you are a direct investor, by calling the Funds toll-free at 1-855-551-5521.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call the Funds toll-free at 1-855-551-5521 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary.

North Square Investments | www.northsquareinvest.com

North Square Funds

Table of Contents

| Shareholder Letters | | | 1 |

| Fund Performance | | | 9 |

| Schedules of Investments | | | 14 |

| Statements of Assets and Liabilities | | | 50 |

| Statements of Operations | | | 51 |

| Statements of Changes in Net Assets | | | 52 |

| Financial Highlights | | | 54 |

| Notes to Financial Statements | | | 59 |

| Report of Independent Registered Public Accounting Firm | | | 69 |

| Supplemental Information | | | 70 |

| Expense Examples | | | 76 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the North Square Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.northsquareinvest.com

| Discussion of North Square Advisory Research All Cap Value Fund Performance | |  |

Dear Shareholder,

The past twelve months saw a continued rally in the U.S. stock market, as the economy continued its strong recovery from the 2020 economic shutdowns caused by the coronavirus pandemic. The S&P 500 Index rallied to a new all-time high over 4,600 in late October 2021. Demand for products and services continued to be strong, so much so that supply chains were not able to keep up. Transportation snarls (such as delays at West Coast ports) and parts shortages (semiconductors, for example) have impeded suppliers’ ability to meet demand. But that should lead to continued economic growth into 2022 as supply-side issues work themselves out.

Supply-side issues also contributed to an uptick in inflation. The Federal Reserve’s preferred gauge, the Personal Consumption Expenditures Index,1 breached 4% during the year, a level it had not reached since mid-2008. Still, the Fed believes this higher inflation is transitory and will subside. The markets appear to agree, as the breakeven spread between a nominal 10-year Treasury note and a Treasury Inflation-Protected Security of the same maturity was around 2.60% at the end of October – not far from the Fed’s long-term target goal of 2% inflation.

In early November 2021, the Fed announced that it will formally wind down the bond-buying program it started in early 2020 to counter the economic effects of the pandemic. If all goes according to plan, the program will terminate in mid-2022. While the Fed has not announced when it will start raising the target for the Federal Funds rate from the zero bound, market expectations are for at least one 25 basis point raise in the back half of 2022.2

All of this suggests that the economy should be supportive of business activity and ultimately create a constructive backdrop for the equity markets in the new year.

As of October 31, 2021, the North Square Advisory Research All Cap Value Fund (the Fund) returned 46.09% for the trailing twelve months (its fiscal year), versus 44.97% for its primary benchmark, the Russell 3000 Value Index.3 According to attribution analysis, smaller cap names made a material contribution to our performance during the year. We have typically run with an overweight to small caps relative to the benchmark, as we believe our research process allows us to uncover high quality, underfollowed, and misunderstood companies at the lower end of the market cap spectrum. We are pleased that our strategy has outperformed its benchmark over the past year, as well as longer term over the past five years.4

At the company level, Element Solutions (ESI), was one of our strongest performers. ESI is a specialty chemical manufacturer, and it specializes in chemicals and products used in semiconductor manufacturing. The company has been a beneficiary of the increased demand for semiconductors in the “connected” global economy for things such as 5G phones, automobile electrification, the “Internet of Things,” and cloud computing. It should continue to see strong top and bottom line growth as these macro trends continue to evolve. On the downside, one of our weaker performers was Cannae Holdings (CNNE), a diversified holding company with a mix of majority and minority owned investments in a variety of industries, including technology-enabled healthcare services, financials services, real estate, and more. CNNE fell during the year as the market prices for some of its publicly-traded portfolio investments came in. However, we believe the discount between CNNE’s stock price and the sum of its parts is too wide. We also believe our position is bolstered in CNNE through its management team, led by legendary investor Bill Foley.

__________________

1 | The Personal Consumption Expenditure Index, published by the Bureau of Economic Analysis, reflects changes in the prices of goods and services purchased by consumers in the United States. It is the Federal Reserve’s preferred gauge of inflation. |

2 | A basis point (bp) is equal to 1/100th of 1% or 0.01%. |

3 | The Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. |

4 | Please see page 9 for the fund’s complete standardized returns. |

Outlook

We are pleased with the performance of the portfolio over the past year and longer term. We believe that keeping a sharp eye on fundamentals, as well as the price paid for them, will continue to work. Return on equity (ROE) is a telling indicator of business quality, and our portfolio’s 16.9% ROE is materially above the Russell 3000 Value Index’s 10.5% level.5 We also want our businesses to exhibit good earnings growth going forward, and the weighted average estimated EPS growth for the portfolio is 12.1% over the next three to five years, compared to 9.8% for the index.6 At the same time, we want our companies to have sound balance sheets. Our portfolio’s debt to equity ratio is 1.38x, whereas the benchmark is at 1.48x.7 Overall, we think our forward P/E ratio of 18.8x, a little higher than the Russell 3000 Value’s 16.2x, is warranted.8

We remain confident in our process and current positioning. By focusing on both downside protection and upside potential over a multi-year investment horizon, we believe the Fund is well-positioned for a positively skewed risk/reward payoff. Relative to our benchmark, we own businesses that generate higher returns and are growing earnings faster, with responsible financial positions.

We thank you for investing in the North Square Advisory Research All Cap Value Fund and look forward to updating you again in 2022.

Advisory Research, Inc.

The views in this letter are those of the Fund’s direct advisor as of December 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

Fund holdings and sector allocations are subject to change at any time. Please see the Schedule of Investments in this report for a complete list of Fund holdings.

__________________

5 | Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity. |

6 | Earnings per share (EPS) growth measures the increase in EPS over a period of time. |

7 | The debt to equity calculation excludes companies with negative common equity. |

8 | P/E ratio is stock price dividend by EPS. |

| Discussion of North Square Altrinsic International Equity Fund Performance | |  |

Dear Shareholder,

The global economy rebounded sharply over the last year, aided by positive COVID-19 vaccine developments, incredibly supportive monetary and fiscal stimulus, and pent-up consumer demand. However, the growth in corporate earnings and liquidity supporting equity markets for most of this year appears to have peaked, just as uncertainties stemming from central bank policies, shifting regulatory regimes, and inflationary pressures have contributed to increased market volatility.

Developments involving inflationary pressures and interest rates, China, and cyber risks are among the topics capturing headlines and likely to have a significant influence on markets in both the near and long terms. Interest rates, which were tethered to inflation for decades, are increasingly fixed at low levels as central bankers seek to buoy the global economy and governments work to manage their war-time debt levels. Simultaneously, rising inflationary pressures, which began with the prices of goods, are now appearing in the service industries in many countries. Meanwhile, China is embarking on the delicate act of slowing its considerable and highly leveraged “old” economy and managing continued geopolitical tensions at home and abroad while increasingly relying on its internet giants to forge its future. Atop these other macro forces, cyber risks transcend all boundaries. They are underappreciated, intensifying, and will significantly impact individuals, companies, and nations. These issues, independently and in the aggregate, present both risks and nuanced opportunities for companies and investors alike.

A long-overdue broadening out of stock market leadership has begun. Near the end of 2020, the virtually uninterrupted leadership by highly-valued growth stocks initially gave way to lower quality and leveraged deep cyclical stocks. Market leadership has subsequently ebbed and flowed between these two segments of equity markets. We see vulnerability at both extremes, with growth stocks often priced for unfettered growth and permanently low interest rates, while many cyclical stocks are priced for a “new normal” in profitability.

As of October 31, 2021 calendar year to date, the North Square Altrinsic International Equity Fund gained 7.36%, underperforming the MSCI EAFE Index’s 11.01% gain1. While performance was strong on an absolute basis, underperformance can largely be attributed to our minimal exposure to growth stocks and low-quality deep cyclicals as well as the portfolio’s below-market risk. From a sector perspective, strong performance in non-bank financials (Aon and Chubb) and real estate (Daito Trust) were more than offset by consumer discretionary (Alibaba and Sands China) and information technology investments (Check Point and Cognizant).

We believe the Fund is attractively positioned, focusing on companies with underappreciated business models in which fundamentals are improving and where disciplined leaders are allocating capital in our long-term interest. Our insurance investments (including Chubb and Zurich) are expected to benefit from the combination of the strongest competitive environment in decades, increased demand for risk-reduction products, considerable cost control, and any increase in economic activity. Our exchange holdings (including Euronext and Singapore Exchange) are shifting their business mix to proprietary high-margin products like data and clearing services. Our health care holdings (including GSK and Astellas) are moving away from their declining pipelines, investing heavily in innovative sciences, and shifting business models to more recurring revenues but still trade at very attractive valuations. Our positions in consumer staples (including Diageo and Heineken) are often seen as boring and defensive but, in our view, offer several avenues for growth, including improving category mix, better capital allocation, and significant tailwinds from the world reopening to consumers. Our enterprise technology investments (including Check Point and SAP) are transitioning to stickier, recurring revenues, and we expect an uptake in demand as companies seek to reduce risks, lower costs, and become more digital.

__________________

1 | The MSCI EAFE Index is an equity index which captures large and mid cap representations across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 841 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. It is not possible to invest directly in an index. |

Looking ahead, we believe that most highly cyclical and highly leveraged stocks are likely to be tested given current valuation levels, margin expectations, and accelerating threats from new technologies. At the other end of the spectrum, many “new economy” companies may produce considerable revenue growth but fail to meet the lofty hurdles set by investors – or see their stocks prices swing considerably due to small changes in interest rates. We continue to see the greatest opportunities between these two extremes, primarily among companies that are not overly dependent on strong economic growth and have the ability to improve shareholder value through their independent initiatives.

We thank you for investing in the North Square Altrinsic International Equity Fund.

Sincerely,

John Hock

John DeVita

Rich McCormick

The securities identified in this letter are not necessarily held by the Fund at the time of publication or thereafter, and should not be considered a recommendation or solicitation to purchase or sell these securities. It should not be assumed that any investment in these securities was, or will be, profitable. The outlook and opportunities noted in this letter are prospective and based upon the opinions of Altrinsic as of the date of this letter. There is no guarantee that we will be successful in our efforts to implement investment strategies that take advantage of such perceived opportunities.

Risk is inherent in all investing including an investment in the Fund. An investment in the Fund involves certain principal risks, including, among others: Equity Risk, Large-Cap Company Risk, Market Risk, Foreign Investment Risk, Emerging Market Risk, Currency Risk, and Management and Strategy Risk. The Fund may invest in foreign securities which will involve political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for investments in emerging markets. Before you decide whether to invest in the Fund, carefully consider these risks associated with investing in the Fund, which may cause investors to lose money. There can be no assurance that the Fund will achieve its investment objective.

| Discussion of North Square McKee Bond Fund Performance | |  |

Dear Shareholders:

While it thankfully paled in comparison to 2020, the first ten months of 2021 (the funds’ tenure1) saw its share of volatility in the fixed income markets. The first chapter of this saga began with the 10-year Treasury yielding just 0.91%, double the 2020 low but significantly below all broad measures of inflation. Yields on intermediate and long-term Treasuries proceeded to rise in the first quarter as economic growth and inflation readings began to increase. Continued fiscal and monetary policy stimulus and increasing COVID-19 vaccine distribution boosted consumer financial conditions and unleashed pent up demand for goods and services. The surge in demand ran head long into reduced inventories, supply shortages, and staffing problems, prompting rising materials pricing and significant wage increases to fill open positions.

After stabilizing for much of the second and third calendar quarters of this year, market yields resumed their climb in late September as doubts concerning the “transitory” nature of inflation raised investors’ concern for the future of monetary policy. The Fed confirmed the market’s predictions at its November meeting, announcing a planned reduction in the pace of Treasury and mortgage buying.

While Treasury yields moved higher over the course the year through October, the favorable outlook for economy boosted investor demand for credit-sensitive bonds including corporate, asset-backed and commercial mortgage securities. These securities uniformly outperformed Treasuries with similar maturity dates, rewarding the Fund’s overweighting to each of these sectors. We expect the relative returns of these bonds versus Treasuries to continue over the next twelve months.

As of October 31, 2021, the calendar year to date return for the North Square McKee Bond Fund – Class I2 was -1.06%, versus -1.22% for Bloomberg Intermediate Aggregate Index3, the fund’s performance benchmark. Contributing to the Fund’s performance were the aforementioned allocation overweightings as well as significant contribution from government agency security selection and reduced holdings in residential agency mortgage holdings.

Fund performance also benefitted from an increasing allocation to floating-rate securities, bonds with coupon income rates that adjust higher in response to increases in certain market interest rates. Though these securities typically pay less than longer maturity, fixed-rate securities, they generally suffer very little price loss due to increasing interest rates relative to fixed-rate bonds. Of particular interest in floating rate securities are those tied to commercial mortgage loans, specifically those secured by distribution centers, data storage and other “new economy” assets.

Outlook

Though the Federal Open Market Committee has announced its intention to increase the Funds rate by a total 2% by 2024 (8 increases of 0.25%), we believe fewer rate hikes will be required to stabilize inflation and continue to promote economic growth. Nevertheless, we remain cautious and defensive with respect to portfolio structure while markets interest rates remain well below the current and expected levels of inflation. The bond market historically high degree of price sensitivity to changes in interest rates reinforces our focus on our own “dual mandate”, providing diversification within portfolios containing equities and other risk assets and principal preservation in a rising rate environment. Portfolio liquidity and active management allow us to achieve both goals.

On behalf of all the dedicated members of the CS McKee team, we thank you for the opportunity to serve your investment needs and wish you a safe and enjoyable holiday season!

Regards,

Brian S. Allen, CFA

Director – Fixed Income

CS McKee Asset Management

__________________

1 | The North Square McKee Bond Fund launched on December 28, 2020. |

2 | Effective on December 1, 2021, the outstanding Class Y shares of the McKee Bond Fund were renamed as Class I shares, and the previously outstanding Class I shares of the Fund were renamed as Class R6 shares. The ticker symbols of the renamed classes did not change. All references to Class Y shares in this report represent the new Class I shares, and all references to Class I shares in this report represent the new Class R6 shares. There were no charges imposed in connection with this renaming of share classes. |

3 | The Bloomberg Intermediate Aggregate index measures the performance of investment grade bonds with maturities (or average lives) of between one-year and ten years. |

The views in this letter are those of the Fund’s direct advisor as of December 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

The Fund invests in foreign securities which carry the associated risks of economic and political instability, market liquidity, currency volatility and differences in accounting standards. The Fund invests in debt securities which can lose their value as interest rates rise and are subject to credit risk which is the risk of deterioration in the financial condition of an issuer and/or general economic conditions that can cause the issuer to not make timely payments of principal and interest also causing the securities to decline in value and an investor can lose principal. When interest rates rise, the price of debt securities generally falls. Longer term securities are generally more volatile. The Fund invests in investment grade debt securities which may be downgraded by a Nationally Recognized Statistical Rating Organization (NRSRO) to below investment grade status. The Fund invests in non-investment grade debt securities which are considered speculative with respect to the issuers' ability to make timely payments of interest and principal, may lack liquidity and have had more frequent and larger price changes than other debt securities. The Fund invests in U.S. government and agency securities which are neither issued nor guaranteed by the U.S. Treasury and are not guaranteed against price movements due to changing interest rates. The Fund invests in mortgage-backed securities and asset-backed securities which are subject to the risks of prepayment, defaults, changing interest rates and, at times, the financial condition of the issuer. The advisor engages the sub-advisor to manage the Fund's portfolio; the sub-advisor's judgment may impact the Fund's performance.

| Discussion of North Square Strategic Income Fund Performance | |  |

Dear Shareholders,

As we near the end of 2021 with nearly 2 years of battling the COVID-19 pandemic under our belts, much of the world is still awash in lockdowns and illness with seemingly no end in sight. It turns out that the vaccines are not the panacea that everyone had hoped for and perhaps herd immunity is but a pipe dream. The silver lining in all this is that the world is now learning to live with the virus. That is to say, perhaps COVID-19 is moving from pandemic to endemic. As evidence of this I would submit that for the first time in nearly 2 years, I did not mention COVID-19 (this letter to shareholders notwithstanding) in many of my third quarter investment update meetings.

In the beginning of the North Square Strategic Income Fund’s (the Fund) fiscal year, the world was only a few months away from the first vaccine rollouts. Red Cedar had already moved the fund aggressively to take advantage of the ensuing pro-cyclical economic re-opening trade by owning preferred securities, European Alternative Tier 1 (AT1) securities, and corporate bonds. We also added some higher yielding Sovereign Debt, denominated in local currency. The capital markets had plenty of reasons to be optimistic: central bankers were providing unprecedented liquidity, the economic re-opening was finally upon us, and asset prices were still at reasonable, if not cheap levels.

The economic re-opening, supply chain disruptions, fiscal largesse of governments, labor shortages and incredibly easy financial conditions courtesy of the world’s central banks are all conditions contributing to inflationary pressures globally. As sub-advisor to the Fund, Red Cedar Investment Management was not an advocate of the Federal Reserve’s (the Fed) transitory narrative on the topic of inflation and positioned the Fund accordingly with a more defensive posture with respect duration. Put another way, we did not believe and still do not believe investors are being compensated appropriately to take unnecessary interest rate risk.

As 2021 unfolded, the reflationary trade was in overdrive, allowing credit spreads to tighten dramatically and boosting returns to the fund. During those first 3 months of the year, the relative safety of U.S. Treasuries (UST) began to lose its allure as the yield on 10-year USTs rose from 0.92% to 1.74%. The Fund’s positioning of low interest rate risk and overweighting of credit risk enabled it to achieve a slightly positive total return for the quarter, while the Bloomberg U.S. Aggregate Bond Index* (the Fund’s benchmark) posted a -3.4% return – its worst start to a year ever.

As we approached mid-year, the Federal Reserve seemed to be wavering on its ultra-dovish stance. Indeed, after the June 16 Federal Open Market Committee (FOMC) meeting, Fed Chairman Jerome Powell indicated that the Fed was now much closer to meeting their employment and inflation goals. Furthermore, the infamous “Dot Plot” now indicated that 13 of 18 FOMC members thought rate hikes would begin no later than 2023. With this new messaging from the Fed, U.S. Treasuries rallied, sending the 10-year UST yield down to 1.47%. Despite the Fund’s shorter duration stance than the broader fixed income market, it was able to outperform its benchmark during the quarter on the strength of its credit positioning.

The Fed has now telegraphed its intentions for Quantitative Easing and future rate hikes – they will begin tapering by year end and will not begin raising rates until after bond buying ceases. It did not take long for the markets to get comfortable with the Fed’s plans and interest rates traded in a relatively tight range until the Fund’s fiscal year end. While Red Cedar still sees plenty of runway before financial conditions truly begin to tighten, the clock is now ticking as to when the Fed begins to hike rates. As we also consider that inflation continues to run hot - prints of this magnitude have not been reported since the early 1990’s in the U.S. – the possibility of the Fed taking away the punch bowl early and/or a policy error does exist. Against this backdrop, Red Cedar increased the active tail-risk hedging within the Fund during the summer months. The hedging strategy is designed to help mitigate potential underperformance of risky assets held in the Fund if the aforementioned scenarios play out and cause a spike in volatility or a market spasm. While this is not our base case, it should be emphasized that tail-risk hedging is an important element of the Fund’s strategy.

Against the backdrop of exceptionally low interest rates globally, traditional fixed income investors experienced a total return of -0.48% as represented by the Bloomberg U.S. Aggregate Bond Index for the fiscal year ended October 31, 2021. The North Square Strategic Income Fund provided value to its shareholders with a return of 8.63% during that same time period. Red Cedar believes it has provided that return without undertaking undue levels of risk for the shareholders.

We at Red Cedar Investment Management would like to wish everyone a safe and peaceful holiday season and send our best wishes for a Happy New Year.

Regards,

John L. Cassady III, CFA

Chief Investment Officer

Red Cedar Investment Management

* The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The views in this letter are those of the Fund’s direct advisor as of December 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

The value of a convertible security is influenced by changes in interest rates, the credit standing of the issuer and other factors. Debt securities have interest rate, inflation and credit risks and are subject to prepayment and default risk. High yield and junk securities involve greater risk and tend to be more sensitive to economic conditions and credit risk. Foreign and US currencies may unfavorably fluctuate in value relative to each other. Distressed securities are typically unrated, lower-rated, in default or close to default and the prices may be extremely volatile, more likely to become worthless and the Fund may lose all of its investment.

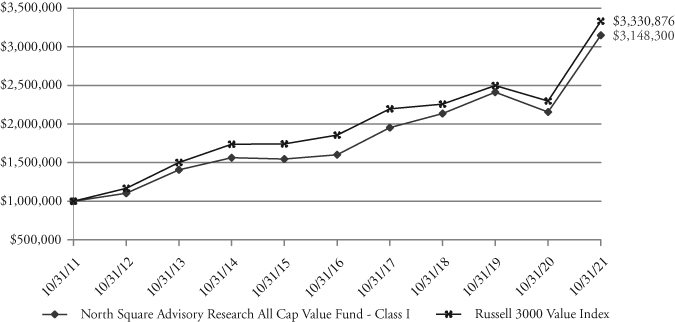

North Square Advisory Research All Cap Value Fund

FUND PERFORMANCE at October 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund, made on October 31, 2011, with a similar investment in the Russell 3000 Value Index. Results include the reinvestment of all dividends and capital gains.

The Russell 3000 Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. This index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and is not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of October 31, 2021 | 1 Year | 5 Year | 10 Year | Inception | Date |

Class I | 46.09% | 14.47% | 12.15% | 11.75% | 11/16/09 |

Russell 3000 Value Index | 44.97% | 12.41% | 12.79% | 11.90% | 11/16/09 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

The Fund acquired all assets and assumed the liabilities of the Advisory Research All Cap Value Fund (the “Predecessor Fund”) effective the close of business on February 21, 2020. The Predecessor Fund commenced investment operations on November 16, 2009. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the performance table above prior to February 21, 2020 reflect the performance of the Predecessor Fund.

Gross and net expense ratios for Class I shares were 1.96% and 0.96%, respectively, which were the amounts stated in the current prospectus dated February 28, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.95% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until February 28, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

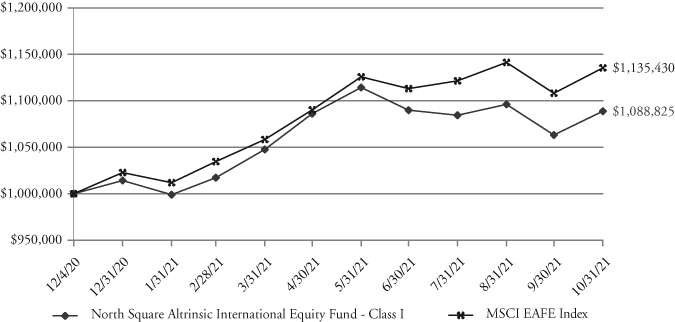

North Square Altrinsic International Equity Fund

FUND PERFORMANCE at October 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund, made at the Fund’s inception, with a similar investment in the MSCI EAFE Index. Results include the reinvestment of all dividends and capital gains.

The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 developed markets countries around the world, excluding the US and Canada. With 841 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

| | | Calendar | Since | Inception |

Total Returns as of October 31, 2021 | 6 Month | Year to Date | Inception | Date |

Class I | 0.24% | 7.36% | 8.88% | 12/04/20 |

MSCI EAFE Index | 4.14% | 11.01% | 13.54% | 12/04/20 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class I shares were 1.52% and 0.98%, respectively, which were the amounts stated in the current prospectus dated November 2, 2020. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.97% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until November 2, 2022, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

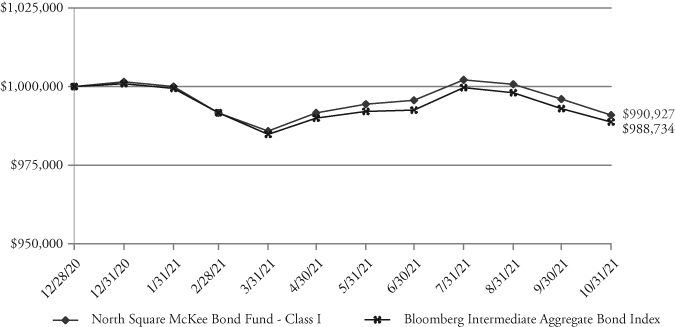

North Square McKee Bond Fund

FUND PERFORMANCE at October 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares (the class with the largest net assets), made at the Fund’s inception, with a similar investment in the Blomberg Intermediate Aggregate Bond Index. Results include the reinvestment of all dividends and capital gains.

The Bloomberg Intermediate Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

| | | | Calendar | Since | Inception |

Total Returns as of October 31, 2021 | 3 Month | 6 Month | Year to Date | Inception | Date |

Class I | (1.12)% | (0.07)% | (1.06)% | (0.91)% | 12/28/20 |

Class Y | (1.17)% | N/A | N/A | (0.12)% | 05/19/21 |

Bloomberg Intermediate Aggregate Bond Index | (1.09)% | (0.12)% | (1.22)% | (1.13)% | 12/28/20 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class I shares were 0.82% and 0.28%, and for Class Y shares were 0.82% and 0.47%, which were the amounts stated in the current prospectus dated November 2, 2020. For the Fund’s current expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.28% and 0.47% of the average daily net assets of the Fund’s Class I and Class Y shares, respectively. This agreement is in effect until November 2, 2022, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

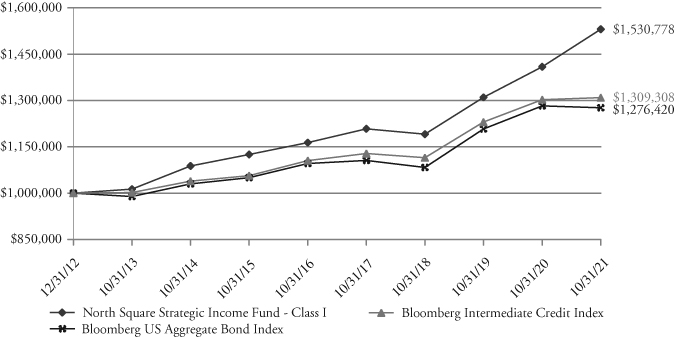

North Square Strategic Income Fund

FUND PERFORMANCE at October 31, 2021 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund, made on October 31, 2010, with a similar investment in the Bloomberg US Aggregate Bond Index and the Bloomberg Intermediate Credit Index. Results include the reinvestment of all dividends and capital gains.

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market. The Bloomberg Intermediate Credit Index is a board-based flagship benchmark that measures the non-securitized component of the US Aggregate Index with less than 10 years to maturity. The indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and are not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of October 31, 2021 | 1 Year | 5 Year | 10 Year | Inception | Date |

Class I | 8.63% | 5.64% | 5.33% | 4.58% | 12/31/12 |

Bloomberg US Aggregate Bond Index | (0.48)% | 3.10% | 3.00% | 2.80% | 12/31/12 |

Bloomberg Intermediate Credit Index | 0.51% | 3.44% | 3.53% | 3.10% | 12/31/12 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

The Fund acquired all assets and assumed the liabilities of the Advisory Research Strategic Income Fund (the “Predecessor Fund”) effective the close of business on February 21, 2020. The Predecessor Fund commenced investment operations on December 31, 2012 after the conversion of a limited partnership account, the Advisory Research Value Income Fund, L.P. (the “Predecessor Account”), which commenced operations on June 30, 2003. As a result of each reorganization, the Fund is the accounting successor of each the Predecessor Fund and Predecessor Account. Performance results shown in the performance table above between February 21, 2020 and December 31, 2012 reflect the performance of the Predecessor Fund, and performance results shown prior to December 31, 2012 reflect the performance of the Predecessor Account. The Predecessor Account was not registered under the 1940 Act and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Account had been registered under the 1940 Act, the Predecessor Account’s performance may have been adversely affected.

North Square Strategic Income Fund

FUND PERFORMANCE at October 31, 2021 (Unaudited)

Gross and net expense ratios for Class I shares were 1.50% and 0.92%, respectively, which were the amounts stated in the current prospectus dated February 28, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.90% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until February 28, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

North Square Advisory Research All Cap Value Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 96.7% | | | |

| | | | | | |

| | | BASIC MATERIALS – 4.5% | | | |

| | | Specialty Chemicals – 4.5% | | | |

| | 20,034 | | Element Solutions Inc. | | $ | 454,972 | |

| | | | TOTAL BASIC MATERIALS | | | 454,972 | |

| | | | | | | | |

| | | | | | | | |

| | | | CONSUMER DISCRETIONARY – 21.0% | | | | |

| | | | Apparel Retailers – 3.5% | | | | |

| | 5,412 | | The TJX Co., Inc. | | | 354,432 | |

| | | | Home Improvement Retailers – 3.0% | | | | |

| | 823 | | The Home Depot, Inc. | | | 305,942 | |

| | | | Household Furnishings – 3.1% | | | | |

| | 3,103 | | Fortune Brands Home & Security, Inc. | | | 314,644 | |

| | | | Restaurants and Bars – 4.9% | | | | |

| | 1,067 | | McDonald’s Corp. | | | 262,002 | |

| | 2,214 | | Starbucks Corp. | | | 234,839 | |

| | | | | | | 496,841 | |

| | | | Specialty Retailers – 6.5% | | | | |

| | 1,576 | | Asbury Automotive Group, Inc.* | | | 308,439 | |

| | 193 | | AutoZone, Inc.* | | | 344,474 | |

| | | | | | | 652,913 | |

| | | | TOTAL CONSUMER DISCRETIONARY | | | 2,124,772 | |

| | | | | | | | |

| | | | CONSUMER STAPLES – 3.0% | | | | |

| | | | Food Retailers and Wholesalers – 3.0% | | | | |

| | 6,665 | | Performance Food Group Co.* | | | 301,458 | |

| | | | TOTAL CONSUMER STAPLES | | | 301,458 | |

| | | | | | | | |

| | | | ENERGY – 7.2% | | | | |

| | | | Integrated Oil and Gas – 3.5% | | | | |

| | 3,103 | | Chevron Corp. | | | 355,262 | |

| | | | Oil: Crude Producers – 3.7% | | | | |

| | 4,389 | | Denbury Inc.* | | | 371,573 | |

| | | | TOTAL ENERGY | | | 726,835 | |

| | | | | | | | |

| | | | FINANCIALS – 17.5% | | | | |

| | | | Banks – 6.0% | | | | |

| | 8,327 | | First Interstate BancSystem, Inc. – Class A | | | 346,154 | |

| | 3,552 | | Nicolet Bankshares, Inc.* | | | 255,353 | |

| | | | | | | 601,507 | |

| | | | Diversified Financial Services – 7.0% | | | | |

| | 9,044 | | Cannae Holdings, Inc.* | | | 308,400 | |

| | 2,364 | | JPMorgan Chase & Co. | | | 401,620 | |

| | | | | | | 710,020 | |

| | | | Reinsurance – 4.5% | | | | |

| | 1,577 | | Berkshire Hathaway Inc. – Class B* | | | 452,615 | |

| | | | TOTAL FINANCIALS | | | 1,764,142 | |

See accompanying Notes to Financial Statements.

North Square Advisory Research All Cap Value Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | HEALTH CARE – 10.7% | | | |

| | | Health Care Management Services – 3.7% | | | |

| | 805 | | UnitedHealth Group Inc. | | $ | 370,678 | |

| | | | Medical Equipment – 3.4% | | | | |

| | 2,872 | | Medtronic, PLC1 | | | 344,238 | |

| | | | Pharmaceuticals – 3.6% | | | | |

| | 2,800 | | Abbott Laboratories | | | 360,892 | |

| | | | TOTAL HEALTH CARE | | | 1,075,808 | |

| | | | | | | | |

| | | | INDUSTRIALS – 17.0% | | | | |

| | | | Commercial Vehicles and Parts – 2.5% | | | | |

| | 5,961 | | Federal Signal Corp. | | | 255,190 | |

| | | | Electrical Components – 2.0% | | | | |

| | 1,346 | | Regal Rexnord Corp. | | | 205,030 | |

| | | | Industrial Suppliers – 3.6% | | | | |

| | 22,117 | | Gates Industrial Corp. plc*1 | | | 363,603 | |

| | | | Machinery: Industrial – 2.0% | | | | |

| | 5,503 | | Zurn Water Solutions Corp. | | | 199,649 | |

| | | | Railroads – 3.6% | | | | |

| | 1,512 | | Union Pacific Corp. | | | 364,997 | |

| | | | Transaction Processing Services – 3.3% | | | | |

| | 1,925 | | American Express Co. | | | 334,527 | |

| | | | TOTAL INDUSTRIALS | | | 1,722,996 | |

| | | | | | | | |

| | | | TECHNOLOGY – 10.4% | | | | |

| | | | Computer Hardware – 3.4% | | | | |

| | 1,841 | | CDW Corp. of Delaware | | | 343,623 | |

| | | | Consumer Digital Services – 4.3% | | | | |

| | 148 | | Alphabet Inc. – Class A* | | | 438,216 | |

| | | | Software – 2.7% | | | | |

| | 822 | | Microsoft Corp. | | | 272,592 | |

| | | | TOTAL TECHNOLOGY | | | 1,054,431 | |

| | | | | | | | |

| | | | TELECOMMUNICATIONS – 3.3% | | | | |

| | | | Telecommunications Equipment – 3.3% | | | | |

| | 1,445 | | L3Harris Technologies, Inc. | | | 333,130 | |

| | | | TOTAL TELECOMMUNICATIONS | | | 333,130 | |

| | | | | | | | |

| | | | UTILITIES – 2.1% | | | | |

| | | | Gas Distribution – 2.1% | | | | |

| | 1,624 | | Chesapeake Utilities Corp. | | | 212,858 | |

| | | | TOTAL UTILITIES | | | 212,858 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $7,647,942) | | | 9,771,402 | |

See accompanying Notes to Financial Statements.

North Square Advisory Research All Cap Value Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | SHORT-TERM INVESTMENT – 3.2% | | | |

| | 326,810 | | First American Treasury Obligations Fund – Class X, 0.01%2 | | $ | 326,810 | |

| | | | TOTAL SHORT-TERM INVESTMENT | | | | |

| | | | (Cost $326,810) | | | 326,810 | |

| | | | TOTAL INVESTMENTS – 99.9% | | | | |

| | | | (Cost $7,974,752) | | | 10,098,212 | |

| | | | Other Assets in Excess of Liabilities – 0.1% | | | 13,210 | |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 10,111,422 | |

PLC – Public Limited Company

| * | Non-Income producing security. |

1 | Foreign security denominated in U.S. Dollars. |

2 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

North Square Advisory Research All Cap Value Fund

SUMMARY OF INVESTMENTS

As of October 31, 2021

| | | Percent of Total |

Security Type/Sector | | Net Assets |

Common Stocks | | | |

Consumer Discretionary | | | 21.0 | % |

Financials | | | 17.5 | % |

Industrials | | | 17.0 | % |

Health Care | | | 10.7 | % |

Technology | | | 10.4 | % |

Energy | | | 7.2 | % |

Basic Materials | | | 4.5 | % |

Telecommunications | | | 3.3 | % |

Consumer Staples | | | 3.0 | % |

Utilities | | | 2.1 | % |

| Total Common Stocks | | | 96.7 | % |

Short-Term Investment | | | 3.2 | % |

| Total Investments | | | 99.9 | % |

Other Assets in Excess of Liabilities | | | 0.1 | % |

| Total Net Assets | | | 100.0 | % |

See accompanying Notes to Financial Statements.

North Square Altrinsic International Equity Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 93.8% | | | |

| | | | | | |

| | | BERMUDA – 2.4% | | | |

| | 2,094 | | Credicorp Ltd. | | $ | 271,508 | |

| | 3,086 | | Everest Re Group, Ltd. | | | 806,989 | |

| | | | | | | 1,078,497 | |

| | | | CANADA – 1.6% | | | | |

| | 5,245 | | Agnico Eagle Mines Ltd. | | | 278,247 | |

| | 71,759 | | Kinross Gold Corp. | | | 431,389 | |

| | | | | | | 709,636 | |

| | | | CHINA – 4.3% | | | | |

| | 2,883 | | Alibaba Group Holding Ltd. – ADR* | | | 475,522 | |

| | 2,827 | | Baidu, Inc. – ADR* | | | 458,653 | |

| | 129,200 | | Sands China Ltd.* | | | 295,248 | |

| | 27,297 | | Tencent Music Entertainment – ADR* | | | 214,555 | |

| | 17,060 | | Trip.com Group Ltd. – ADR* | | | 487,233 | |

| | | | | | | 1,931,211 | |

| | | | FRANCE – 12.0% | | | | |

| | 11,324 | | Accor SA* | | | 404,630 | |

| | 43,274 | | AXA SA | | | 1,258,625 | |

| | 27,607 | | Bureau Veritas SA | | | 876,352 | |

| | 9,429 | | Danone | | | 614,212 | |

| | 10,035 | | Sanofi | | | 1,002,630 | |

| | 6,386 | | SCOR SE | | | 214,823 | |

| | 19,704 | | TotalEnergies SE | | | 987,876 | |

| | | | | | | 5,359,148 | |

| | | | GERMANY – 7.4% | | | | |

| | 708 | | adidas AG | | | 231,867 | |

| | 2,953 | | Continental AG* | | | 346,556 | |

| | 9,815 | | Fresenius Medical Care AG & Co. KGaA | | | 651,951 | |

| | 6,765 | | SAP SE | | | 980,047 | |

| | 5,203 | | Siemens AG | | | 843,740 | |

| | 9,525 | | Siemens Energy AG* | | | 273,291 | |

| | | | | | | 3,327,452 | |

| | | | IRELAND – 4.3% | | | | |

| | 671 | | Linde Public Limited Co. | | | 216,026 | |

| | 5,665 | | Medtronic, PLC | | | 679,007 | |

| | 4,161 | | Willis Towers Watson Public Limited Co. | | | 1,008,127 | |

| | | | | | | 1,903,160 | |

| | | | ISRAEL – 2.4% | | | | |

| | 8,761 | | Check Point Software Technologies Ltd.* | | | 1,047,816 | |

| | | | | | | | |

| | | | JAPAN – 13.8% | | | | |

| | 70,346 | | Astellas Pharma Inc. | | | 1,183,183 | |

| | 9,687 | | Daito Trust Construction Co., Ltd. | | | 1,200,092 | |

| | 20,537 | | Japan Exchange Group Inc. | | | 485,338 | |

| | 10,740 | | KUBOTA CORP. | | | 228,275 | |

| | 14,623 | | Makita Corp. | | | 675,243 | |

| | 865 | | Nintendo Co., Ltd. | | | 380,987 | |

See accompanying Notes to Financial Statements.

North Square Altrinsic International Equity Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | JAPAN (Continued) | | | |

| | 25,201 | | Sumitomo Mitsui Trust Holdings, Inc. | | $ | 830,046 | |

| | 22,572 | | Tokio Marine Holdings, Inc. | | | 1,187,865 | |

| | | | | | | 6,171,029 | |

| | | | MEXICO – 0.1% | | | | |

| | 8,660 | | Grupo Financiero Banorte S.A.B. de C.V. | | | 54,741 | |

| | | | | | | | |

| | | | NETHERLANDS – 7.6% | | | | |

| | 7,126 | | Akzo Nobel N.V. | | | 818,990 | |

| | 10,730 | | Euronext NV | | | 1,208,141 | |

| | 12,509 | | Heineken N.V. | | | 1,385,599 | |

| | | | | | | 3,412,730 | |

| | | | REPUBLIC OF KOREA – 2.8% | | | | |

| | 20,098 | | KB Financial Group Inc. – ADR* | | | 966,111 | |

| | 199 | | Samsung Electronics Co., Ltd. – GDR | | | 297,107 | |

| | | | | | | 1,263,218 | |

| | | | SINGAPORE – 1.7% | | | | |

| | 106,431 | | Singapore Exchange Ltd. | | | 763,999 | |

| | | | | | | | |

| | | | SPAIN – 1.0% | | | | |

| | 2,736 | | Aena SME, S.A.* | | | 448,014 | |

| | | | | | | | |

| | | | SWEDEN – 1.5% | | | | |

| | 14,991 | | ASSA ABLOY AB – Class B | | | 439,012 | |

| | 22,112 | | Telefonaktiebolaget LM Ericsson – Class B | | | 242,027 | |

| | | | | | | 681,039 | |

| | | | SWITZERLAND – 15.0% | | | | |

| | 9,759 | | Chubb Ltd. | | | 1,906,713 | |

| | 10,027 | | Julius Baer Group Ltd. | | | 724,756 | |

| | 11,598 | | Nestle S.A. | | | 1,530,439 | |

| | 9,717 | | Novartis AG | | | 802,745 | |

| | 1,116 | | Roche Holding AG | | | 431,542 | |

| | 2,947 | | Zurich Insurance Group AG | | | 1,306,452 | |

| | | | | | | 6,702,647 | |

| | | | UNITED KINGDOM – 14.6% | | | | |

| | 2,166 | | Aon PLC – Class A | | | 692,947 | |

| | 12,615 | | BP p.l.c – ADR | | | 363,186 | |

| | 241,567 | | BT Group PLC* | | | 459,199 | |

| | 26,387 | | Diageo plc | | | 1,311,586 | |

| | 61,634 | | GlaxoSmithKline PLC | | | 1,272,493 | |

| | 29,544 | | Liberty Global plc – Class A* | | | 849,094 | |

| | 760,658 | | Lloyds Banking Group plc | | | 522,790 | |

| | 17,362 | | Smiths Group PLC | | | 322,077 | |

| | 49,314 | | Vodafone Group PLC – ADR | | | 737,244 | |

| | | | | | | 6,530,616 | |

See accompanying Notes to Financial Statements.

North Square Altrinsic International Equity Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | UNITED STATES – 1.3% | | | |

| | 105 | | Booking Holdings Inc.* | | $ | 254,182 | |

| | 4,430 | | Cognizant Technology Solutions Corp. – Class A | | | 345,938 | |

| | | | | | | 600,120 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $40,292,631) | | | 41,985,073 | |

| | | | | | | | |

| | | | PREFERRED STOCK – 1.6% | | | | |

| | | | GERMANY – 1.6% | | | | |

| | 7,807 | | Henkel AG & Co. KGaA | | | 698,348 | |

| | | | TOTAL PREFERRED STOCK | | | | |

| | | | (Cost $795,117) | | | 698,348 | |

| | | | | | | | |

| | | | SHORT-TERM INVESTMENT – 3.5% | | | | |

| | 1,550,715 | | First American Treasury Obligations Fund – Class X, 0.01%1 | | | 1,550,715 | |

| | | | TOTAL SHORT-TERM INVESTMENT | | | | |

| | | | (Cost $1,550,715) | | | 1,550,715 | |

| | | | TOTAL INVESTMENTS – 98.9% | | | | |

| | | | (Cost $42,638,463) | | | 44,234,136 | |

| | | | Other Assets in Excess of Liabilities – 1.1% | | | 498,790 | |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 44,732,926 | |

ADR – American Depositary Receipt

GDR – Global Depositary Receipt

PLC – Public Limited Company

| * | Non-Income producing security. |

1 | The rate is the annualized seven-day yield at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying Notes to Financial Statements.

North Square Altrinsic International Equity Fund

SUMMARY OF INVESTMENTS

As of October 31, 2021

| | | Percent of Total |

Security Type/Sector | | Net Assets |

Common Stocks | | | |

Financials | | | 31.8 | % |

Health Care | | | 13.4 | % |

Consumer Staples | | | 10.8 | % |

Industrials | | | 9.2 | % |

Communication Services | | | 6.9 | % |

Information Technology | | | 6.5 | % |

Consumer Discretionary | | | 5.6 | % |

Materials | | | 3.9 | % |

Energy | | | 3.0 | % |

Real Estate | | | 2.7 | % |

| Total Common Stocks | | | 93.8 | % |

Preferred Stock | | | 1.6 | % |

Short-Term Investment | | | 3.5 | % |

| Total Investments | | | 98.9 | % |

Other Assets in Excess of Liabilities | | | 1.1 | % |

| Total Net Assets | | | 100.0 | % |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | ASSET BACKED SECURITIES – 8.1% | | | |

| | | Aligned Data Centers Issuer LLC | | | |

$ | 400,000 | | 1.937%, 08/15/20461 | | $ | 398,526 | |

| | | | AmeriCredit Automobile Receivables Trust 2019-1 | | | | |

| | 28,371 | | 2.970%, 11/20/2023 | | | 28,429 | |

| | | | AmeriCredit Automobile Receivables Trust 2019-2 | | | | |

| | 161,000 | | 2.540%, 07/18/2024 | | | 163,126 | |

| | | | AmeriCredit Automobile Receivables Trust 2020-2 | | | | |

| | 245,544 | | 0.600%, 12/18/2023 | | | 245,720 | |

| | | | AMSR 2019-SFR1 Trust | | | | |

| | 500,000 | | 2.774%, 01/20/20391 | | | 515,532 | |

| | | | AMSR 2021-SFR2 Trust | | | | |

| | 200,000 | | 1.527%, 08/19/20381 | | | 197,814 | |

| | | | Amur Equipment Finance Receivables IX LLC | | | | |

| | 97,336 | | 0.750%, 11/20/20261 | | | 97,197 | |

| | | | Avis Budget Rental Car Funding AESOP LLC | | | | |

| | 208,333 | | 3.450%, 03/20/20231 | | | 209,810 | |

| | | | BNSF Railway Co 2015-1 Pass Through Trust | | | | |

| | 199,775 | | 3.442%, 06/16/20281 | | | 217,712 | |

| | | | Burlington Northern and Santa Fe Railway Co 2006-1 Pass Through Trust | | | | |

| | 91,261 | | 5.720%, 01/15/2024 | | | 95,627 | |

| | | | CNH Equipment Trust 2019-A | | | | |

| | 39,787 | | 3.010%, 04/15/2024 | | | 40,190 | |

| | | | CNH Equipment Trust 2020-A | | | | |

| | 6,532 | | 1.080%, 07/15/2023 | | | 6,535 | |

| | | | DT Auto Owner Trust 2020-1 | | | | |

| | 220,000 | | 2.160%, 05/15/20241 | | | 221,073 | |

| | | | Enterprise Fleet Funding 2021-1 LLC | | | | |

| | 475,000 | | 0.440%, 12/20/20261 | | | 473,823 | |

| | | | Exeter Automobile Receivables Trust 2021-2 | | | | |

| | 540,000 | | 0.340%, 03/15/2024 | | | 540,171 | |

| | | | Exeter Automobile Receivables Trust 2021-3 | | | | |

| | 306,000 | | 0.690%, 01/15/2026 | | | 305,067 | |

| | | | Federal Express Corp 1998 Pass Through Trust | | | | |

| | 33,212 | | 6.720%, 07/15/2023 | | | 33,560 | |

| | | | Federal Express Corp 1999 Pass Through Trust | | | | |

| | 39,201 | | 7.650%, 07/15/2024 | | | 40,221 | |

| | | | FedEx Corp 2020-1 Class AA Pass Through Trust | | | | |

| | 460,959 | | 1.875%, 08/20/2035 | | | 456,696 | |

| | | | Flagship Credit Auto Trust 2021-3 | | | | |

| | 131,407 | | 0.360%, 07/15/20271 | | | 131,131 | |

| | | | GLS Auto Receivables Issuer Trust 2021-3 | | | | |

| | 574,000 | | 0.780%, 11/17/20251 | | | 570,861 | |

| | | | GM Financial Automobile Leasing Trust 2020-1 | | | | |

| | 410,000 | | 1.700%, 12/20/2023 | | | 413,173 | |

| | | | GM Financial Automobile Leasing Trust 2020-2 | | | | |

| | 290,000 | | 2.560%, 07/20/2024 | | | 297,010 | |

| | | | GM Financial Automobile Leasing Trust 2021-3 | | | | |

| | 5,000 | | 0.240%, 12/20/2023 | | | 4,995 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | ASSET BACKED SECURITIES (Continued) | | | |

| | | GreatAmerica Leasing Receivables Funding LLC Series 2018-1 | | | |

$ | 22,304 | | 2.830%, 06/17/20241 | | $ | 22,328 | |

| | | | MMAF Equipment Finance LLC 2018-A | | | | |

| | 380,000 | | 3.390%, 01/10/20251 | | | 386,443 | |

| | | | Oportun Funding XIV LLC | | | | |

| | 100,000 | | 1.210%, 03/08/20281 | | | 100,060 | |

| | | | Oscar US Funding X LLC | | | | |

| | 340,000 | | 3.270%, 05/11/20261,2 | | | 351,376 | |

| | | | Oscar US Funding XII LLC | | | | |

| | 110,000 | | 0.700%, 04/10/20251,2 | | | 109,739 | |

| | | | Santander Drive Auto Receivables Trust 2020-4 | | | | |

| | 204,000 | | 0.730%, 03/17/2025 | | | 204,437 | |

| | | | Santander Drive Auto Receivables Trust 2021-1 | | | | |

| | 164,347 | | 0.290%, 11/15/2023 | | | 164,364 | |

| | | | Santander Retail Auto Lease Trust 2021-C | | | | |

| | 227,000 | | 0.500%, 03/20/20251 | | | 225,952 | |

| | | | Union Pacific Railroad Co 2005 Pass Through Trust | | | | |

| | 38,841 | | 5.082%, 01/02/2029 | | | 42,714 | |

| | | | Union Pacific Railroad Co 2014-1 Pass Through Trust | | | | |

| | 151,081 | | 3.227%, 05/14/2026 | | | 160,947 | |

| | | | Verizon Master Trust | | | | |

| | 274,000 | | 0.690%, 05/20/2027 | | | 271,659 | |

| | | | Verizon Owner Trust 2019-C | | | | |

| | 123,000 | | 1.940%, 04/20/2024 | | | 124,016 | |

| | | | Verizon Owner Trust 2020-C | | | | |

| | 340,000 | | 0.670%, 04/21/2025 | | | 338,721 | |

| | | | VMC Finance 2021-FL4 LLC | | | | |

| | 465,997 | | 1.180% (1 Month LIBOR USD + 1.100%), 06/18/20361 | | | 466,159 | |

| | | | Volvo Financial Equipment LLC Series 2019-2 | | | | |

| | 252,264 | | 2.040%, 11/15/20231 | | | 254,382 | |

| | | | Westlake Automobile Receivables Trust 2020-2 | | | | |

| | 300,000 | | 1.320%, 07/15/20251 | | | 301,870 | |

| | | | Westlake Automobile Receivables Trust 2020-3 | | | | |

| | 128,568 | | 0.560%, 05/15/20241 | | | 128,694 | |

| | | | Westlake Automobile Receivables Trust 2021-1 | | | | |

| | 166,706 | | 0.390%, 10/15/20241 | | | 166,720 | |

| | 295,000 | | 0.640%, 03/16/20261 | | | 294,972 | |

| | | | Westlake Automobile Receivables Trust 2021-2 | | | | |

| | 320,000 | | 0.620%, 07/15/20261 | | | 319,075 | |

| | | | World Financial Network Credit Card Master Trust | | | | |

| | 602,000 | | 2.490%, 04/15/2026 | | | 610,445 | |

| | 250,000 | | 2.210%, 07/15/2026 | | | 254,078 | |

| | | | World Omni Auto Receivables Trust 2018-A | | | | |

| | 23,845 | | 2.500%, 04/17/2023 | | | 23,899 | |

| | | | World Omni Auto Receivables Trust 2019-C | | | | |

| | 284,642 | | 1.960%, 12/15/2024 | | | 287,203 | |

| | | | TOTAL ASSET BACKED SECURITIES | | | | |

| | | | (Cost $11,354,221) | | | 11,314,252 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | CORPORATE BONDS – 28.1% | | | |

| | | | | | |

| | | COMMUNICATION SERVICES – 2.3% | | | |

| | | Diversified Telecommunication Services – 1.6% | | | |

| | | AT&T Inc. | | | |

$ | 292,000 | | 1.700%, 03/25/2026 | | $ | 293,334 | |

| | 545,000 | | 4.350%, 03/01/2029 | | | 619,091 | |

| | | | Verizon Communications Inc. | | | | |

| | 905,000 | | 2.100%, 03/22/2028 | | | 907,926 | |

| | 243,000 | | 4.329%, 09/21/2028 | | | 277,510 | |

| | 229,000 | | 4.016%, 12/03/2029 | | | 256,789 | |

| | | | | | | 2,354,650 | |

| | | | Entertainment – 0.4% | | | | |

| | | | The Walt Disney Co. | | | | |

| | 301,000 | | 1.750%, 01/13/2026 | | | 305,514 | |

| | 180,000 | | 2.000%, 09/01/2029 | | | 180,251 | |

| | | | | | | 485,765 | |

| | | | Media – 0.3% | | | | |

| | | | Fox Corp. | | | | |

| | 389,000 | | 3.050%, 04/07/2025 | | | 410,875 | |

| | | | TOTAL COMMUNICATION SERVICES | | | 3,251,290 | |

| | | | | | | | |

| | | | CONSUMER DISCRETIONARY – 2.6% | | | | |

| | | | Automobiles – 2.2% | | | | |

| | | | American Honda Finance Corp. | | | | |

| | 218,000 | | 2.000%, 03/24/2028 | | | 220,267 | |

| | | | Daimler Finance North America LLC | | | | |

| | 150,000 | | 1.450%, 03/02/20261 | | | 149,371 | |

| | | | General Motors Financial Co, Inc. | | | | |

| | 1,207,000 | | 1.250%, 01/08/2026 | | | 1,184,570 | |

| | 129,000 | | 2.400%, 04/10/2028 | | | 128,538 | |

| | | | Hyundai Capital America | | | | |

| | 250,000 | | 5.875%, 04/07/20251 | | | 284,029 | |

| | 122,000 | | 3.500%, 11/02/20261 | | | 129,747 | |

| | | | Toyota Motor Credit Corp. | | | | |

| | 894,000 | | 3.000%, 04/01/2025 | | | 946,781 | |

| | | | | | | 3,043,303 | |

| | | | Hotels, Restaurants & Leisure – 0.4% | | | | |

| | | | Booking Holdings Inc. | | | | |

| | 112,000 | | 3.650%, 03/15/2025 | | | 120,522 | |

| | 67,000 | | 3.600%, 06/01/2026 | | | 72,924 | |

| | | | McDonald’s Corp. | | | | |

| | 82,000 | | 3.300%, 07/01/2025 | | | 87,609 | |

| | | | Starbucks Corp. | | | | |

| | 287,000 | | 3.550%, 08/15/2029 | | | 316,658 | |

| | | | | | | 597,713 | |

| | | | TOTAL CONSUMER DISCRETIONARY | | | 2,456,446 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | CORPORATE BONDS (Continued) | | | |

| | | | | | |

| | | CONSUMER STAPLES – 1.2% | | | |

| | | Beverages – 0.3% | | | |

| | | The Coca-Cola Co. | | | |

$ | 152,000 | | 1.000%, 03/15/2028 | | $ | 145,570 | |

| | | | PepsiCo, Inc. | | | | |

| | 243,000 | | 2.625%, 03/19/2027 | | | 256,701 | |

| | | | | | | 402,271 | |

| | | | Tobacco – 0.9% | | | | |

| | | | Altria Group, Inc. | | | | |

| | 360,000 | | 4.800%, 02/14/2029 | | | 410,396 | |

| | | | B.A.T. Capital Corp. | | | | |

| | 254,000 | | 2.259%, 03/25/2028 | | | 249,536 | |

| | 257,000 | | 4.906%, 04/02/2030 | | | 291,400 | |

| | | | Philip Morris International Inc. | | | | |

| | 354,000 | | 2.750%, 02/25/2026 | | | 372,328 | |

| | | | | | | 1,323,660 | |

| | | | TOTAL CONSUMER STAPLES | | | 1,725,931 | |

| | | | | | | | |

| | | | ENERGY – 3.1% | | | | |

| | | | Oil, Gas & Consumable Fuels – 3.1% | | | | |

| | | | BP Capital Markets America Inc. | | | | |

| | 115,000 | | 2.750%, 05/10/2023 | | | 118,686 | |

| | 175,000 | | 3.017%, 01/16/2027 | | | 185,889 | |

| | 191,000 | | 3.543%, 04/06/2027 | | | 208,054 | |

| | 244,000 | | 3.937%, 09/21/2028 | | | 273,413 | |

| | | | Chevron Corp. | | | | |

| | 583,000 | | 2.954%, 05/16/2026 | | | 621,635 | |

| | | | Equinor ASA | | | | |

| | 515,000 | | 3.125%, 04/06/20302 | | | 556,400 | |

| | | | Exxon Mobil Corp. | | | | |

| | 619,000 | | 2.992%, 03/19/2025 | | | 654,603 | |

| | | | Saudi Arabian Oil Co. | | | | |

| | 200,000 | | 3.500%, 04/16/20291,2 | | | 213,866 | |

| | | | Shell International Finance B.V. | | | | |

| | 888,000 | | 2.375%, 11/07/20292 | | | 912,072 | |

| | | | TransCanada PipeLines Ltd. | | | | |

| | 590,000 | | 1.000%, 10/12/20242 | | | 587,805 | |

| | | | TOTAL ENERGY | | | 4,332,423 | |

| | | | | | | | |

| | | | FINANCIALS – 11.2% | | | | |

| | | | Banks – 8.2% | | | | |

| | | | Bank of America Corp. | | | | |

| | 557,000 | | 1.658% (SOFR + 0.910%), 03/11/20273 | | | 554,680 | |

| | 865,000 | | 1.734% (SOFR + 0.960%), 07/22/20273 | | | 859,718 | |

| | | | Bank of Montreal | | | | |

| | 170,000 | | 1.850%, 05/01/20252 | | | 173,667 | |

| | | | The Bank of Nova Scotia | | | | |

| | 717,000 | | 1.300%, 06/11/20252 | | | 717,016 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | CORPORATE BONDS (Continued) | | | |

| | | | | | |

| | | FINANCIALS (Continued) | | | |

| | | Banks (Continued) | | | |

| | | Canadian Imperial Bank of Commerce | | | |

$ | 415,000 | | 2.250%, 01/28/20252 | | $ | 427,810 | |

| | | | Citigroup Inc. | | | | |

| | 628,000 | | 0.981% (SOFR + 0.669%), 05/01/20253 | | | 625,399 | |

| | | | Comerica Inc. | | | | |

| | 128,000 | | 3.700%, 07/31/2023 | | | 134,279 | |

| | | | F.N.B. Corp. of Pennsylvania | | | | |

| | 249,000 | | 2.200%, 02/24/2023 | | | 251,932 | |

| | | | Federation des caisses Desjardins du Quebec | | | | |

| | 220,000 | | 2.050%, 02/10/20251,2 | | | 224,659 | |

| | | | Fifth Third Bancorp | | | | |

| | 536,000 | | 3.650%, 01/25/2024 | | | 567,302 | |

| | | | JPMorgan Chase & Co. | | | | |

| | 783,000 | | 0.969% (SOFR + 0.580%), 06/23/20253 | | | 778,769 | |

| | 1,688,000 | | 2.005% (SOFR + 1.585%), 03/13/20263 | | | 1,720,894 | |

| | 525,000 | | 1.578% (SOFR + 0.885%), 04/22/20273 | | | 520,170 | |

| | 286,000 | | 1.953% (SOFR + 1.065%), 02/04/20323 | | | 273,849 | |

| | | | KeyCorp | | | | |

| | 190,000 | | 2.250%, 04/06/2027 | | | 194,569 | |

| | | | PNC Financial Services Group, Inc. | | | | |

| | 301,000 | | 1.150%, 08/13/2026 | | | 298,349 | |

| | 513,000 | | 2.550%, 01/22/2030 | | | 530,174 | |

| | | | Royal Bank of Canada | | | | |

| | 431,000 | | 1.200%, 04/27/20262 | | | 425,027 | |

| | | | The Toronto-Dominion Bank | | | | |

| | 941,000 | | 1.150%, 06/12/20252 | | | 937,986 | |

| | 282,000 | | 1.250%, 09/10/20262 | | | 276,919 | |

| | | | Truist Financial Corp. | | | | |

| | 379,000 | | 1.200%, 08/05/2025 | | | 378,867 | |

| | | | U.S. Bancorp | | | | |

| | 404,000 | | 2.400%, 07/30/2024 | | | 419,975 | |

| | 135,000 | | 1.450%, 05/12/2025 | | | 136,355 | |

| | | | | | | 11,428,365 | |

| | | | Capital Markets – 2.5% | | | | |

| | | | The Charles Schwab Corp. | | | | |

| | 87,000 | | 2.000%, 03/20/2028 | | | 87,826 | |

| | | | The Goldman Sachs Group, Inc. | | | | |

| | 881,000 | | 3.272% (3 Month LIBOR USD + 1.201%), 09/29/20253 | | | 930,100 | |

| | 477,000 | | 1.431% (SOFR + 0.798%), 03/09/20273 | | | 469,887 | |

| | 692,000 | | 1.992% (SOFR + 1.090%), 01/27/20323 | | | 663,510 | |

| | | | Morgan Stanley | | | | |

| | 349,000 | | 0.790% (SOFR + 0.525%), 05/30/20253 | | | 345,347 | |

| | 1,036,000 | | 1.593% (SOFR + 0.879%), 05/04/20273 | | | 1,026,657 | |

| | | | | | | 3,523,327 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | CORPORATE BONDS (Continued) | | | |

| | | | | | |

| | | FINANCIALS (Continued) | | | |

| | | Consumer Finance – 0.4% | | | |

| | | Capital One Financial Corp. | | | |

$ | 206,000 | | 2.600%, 05/11/2023 | | $ | 211,810 | |

| | 279,000 | | 1.878%, 11/02/2027 | | | 278,528 | |

| | | | | | | 490,338 | |

| | | | Insurance – 0.1% | | | | |

| | | | American International Group, Inc. | | | | |

| | 100,000 | | 2.500%, 06/30/2025 | | | 103,914 | |

| | | | TOTAL FINANCIALS | | | 15,545,944 | |

| | | | | | | | |

| | | | HEALTH CARE – 1.4% | | | | |

| | | | Biotechnology – 0.3% | | | | |

| | | | AbbVie Inc. | | | | |

| | 195,000 | | 3.600%, 05/14/2025 | | | 209,137 | |

| | | | Amgen Inc. | | | | |

| | 197,000 | | 2.450%, 02/21/2030 | | | 200,315 | |

| | | | | | | 409,452 | |

| | | | Health Care Providers & Services – 0.8% | | | | |

| | | | CVS Health Corp. | | | | |

| | 70,000 | | 4.300%, 03/25/2028 | | | 79,286 | |

| | | | UnitedHealth Group Inc. | | | | |

| | 914,000 | | 3.750%, 07/15/2025 | | | 997,566 | |

| | 79,000 | | 2.300%, 05/15/2031 | | | 79,909 | |

| | | | | | | 1,156,761 | |

| | | | Pharmaceuticals – 0.3% | | | | |

| | | | AstraZeneca PLC | | | | |

| | 268,000 | | 0.700%, 04/08/20262 | | | 260,439 | |

| | | | Merck & Co., Inc. | | | | |

| | 130,000 | | 2.750%, 02/10/2025 | | | 136,495 | |

| | | | | | | 396,934 | |

| | | | TOTAL HEALTH CARE | | | 1,963,147 | |

| | | | | | | | |

| | | | INDUSTRIALS – 1.3% | | | | |

| | | | Aerospace & Defense – 0.8% | | | | |

| | | | The Boeing Co. | | | | |

| | 192,000 | | 1.167%, 02/04/2023 | | | 192,229 | |

| | 830,000 | | 4.875%, 05/01/2025 | | | 917,233 | |

| | | | | | | 1,109,462 | |

| | | | Air Freight & Logistics – 0.1% | | | | |

| | | | United Parcel Service, Inc. | | | | |

| | 152,000 | | 3.900%, 04/01/2025 | | | 165,307 | |

| | | | Machinery – 0.0% | | | | |

| | | | Caterpillar Financial Services Corp. | | | | |

| | 12,000 | | 2.150%, 11/08/2024 | | | 12,437 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | CORPORATE BONDS (Continued) | | | |

| | | | | | |

| | | INDUSTRIALS (Continued) | | | |

| | | Road & Rail – 0.4% | | | |

| | | CSX Corp. | | | |

$ | 150,000 | | 3.800%, 03/01/2028 | | $ | 166,531 | |

| | | | CSX Transportation, Inc. | | | | |

| | 323,183 | | 6.251%, 01/15/2023 | | | 342,321 | |

| | | | | | | 508,852 | |

| | | | TOTAL INDUSTRIALS | | | 1,796,058 | |

| | | | | | | | |

| | | | INFORMATION TECHNOLOGY – 2.9% | | | | |

| | | | Semiconductors & Semiconductor Equipment – 0.6% | | | | |

| | | | Broadcom Inc. | | | | |

| | 504,000 | | 3.459%, 09/15/2026 | | | 538,248 | |

| | | | Intel Corp. | | | | |

| | 296,000 | | 3.700%, 07/29/2025 | | | 321,615 | |

| | | | | | | 859,863 | |

| | | | Software – 0.8% | | | | |

| | | | Microsoft Corp. | | | | |

| | 671,000 | | 2.400%, 08/08/2026 | | | 704,363 | |

| | | | Oracle Corp. | | | | |

| | 390,000 | | 2.650%, 07/15/2026 | | | 405,542 | |

| | | | | | | 1,109,905 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals – 1.5% | | | | |

| | | | Apple Inc. | | | | |

| | 590,000 | | 2.050%, 09/11/2026 | | | 607,611 | |

| | 657,000 | | 1.400%, 08/05/2028 | | | 640,889 | |

| | | | Hewlett Packard Enterprise Co. | | | | |

| | 837,000 | | 1.450%, 04/01/2024 | | | 846,042 | |

| | | | | | | 2,094,542 | |

| | | | TOTAL INFORMATION TECHNOLOGY | | | 4,064,310 | |

| | | | | | | | |

| | | | MATERIALS – 0.4% | | | | |

| | | | Chemicals – 0.4% | | | | |

| | | | DuPont de Nemours, Inc. | | | | |

| | 306,000 | | 4.493%, 11/15/2025 | | | 340,568 | |

| | 155,000 | | 4.725%, 11/15/2028 | | | 181,356 | |

| | | | TOTAL MATERIALS | | | 521,924 | |

| | | | | | | | |

| | | | REAL ESTATE – 0.4% | | | | |

| | | | Equity Real Estate Investment Trusts (REITs) – 0.4% | | | | |

| | | | Crown Castle International Corp. | | | | |

| | 504,000 | | 1.050%, 07/15/2026 | | | 488,214 | |

| | | | TOTAL REAL ESTATE | | | 488,214 | |

See accompanying Notes to Financial Statements.

North Square McKee Bond Fund

SCHEDULE OF INVESTMENTS – Continued

As of October 31, 2021

| Principal | | | | | |

| Amount | | | | Value | |

| | | CORPORATE BONDS (Continued) | | | |

| | | UTILITIES – 1.3% | | | |

| | | | | | |

| | | Electric Utilities – 1.1% | | | |

| | | Duke Energy Corp. | | | |

$ | 151,000 | | 2.450%, 06/01/2030 | | $ | 151,059 | |

| | | | Florida Power & Light Co. | | | | |

| | 99,000 | | 2.850%, 04/01/2025 | | | 104,226 | |

| | | | NextEra Energy Capital Holdings, Inc.. | | | | |

| | 576,000 | | 1.900%, 06/15/2028 | | | 569,663 | |

| | | | Pacific Gas and Electric Co. | | | | |

| | 349,000 | | 1.367%, 03/10/2023 | | | 347,944 | |

| | | | Virginia Electric and Power Co. | | | | |

| | 324,000 | | 3.150%, 01/15/2026 | | | 346,071 | |

| | | | | | | 1,518,963 | |

| | | | Multi-Utilities – 0.2% | | | | |

| | | | Consolidated Edison Co. of New York, Inc. | | | | |

| | 327,000 | | 3.350%, 04/01/2030 | | | 355,672 | |

| | | | TOTAL UTILITIES | | | 1,874,635 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $39,630,094) | | | 39,204,892 | |

| | | | | | | | |

| | | | MORTGAGE BACKED SECURITIES – 33.7% | | | | |

| | | | COMM 2012-CCRE4 Mortgage Trust | | | | |

| | 268,361 | | 2.853%, 10/17/2045 | | | 272,479 | |

| | | | DBUBS 2017-BRBK Mortgage Trust | | | | |

| | 300,000 | | 3.452%, 10/12/20341 | | | 315,028 | |

| | | | EQUS 2021-EQAZ Mortgage Trust | | | | |

| | 600,000 | | 0.846% (1 Month LIBOR USD + 0.755%), 10/15/20361,4 | | | 597,433 | |

| | | | Fannie Mae Pool | | | | |

| | 18,357 | | 4.500%, 07/01/2026 | | | 19,256 | |

| | 60,684 | | 2.500%, 08/01/2028 | | | 63,148 | |

| | 46,125 | | 5.000%, 11/01/2029 | | | 51,229 | |

| | 186,209 | | 3.000%, 07/01/2030 | | | 196,243 | |

| | 310,633 | | 3.000%, 09/01/2030 | | | 328,390 | |

| | 13,842 | | 4.000%, 10/01/2030 | | | 14,921 | |

| | 106,747 | | 4.500%, 05/01/2031 | | | 116,463 | |

| | 98,883 | | 4.000%, 09/01/2031 | | | 107,347 | |

| | 42,058 | | 4.500%, 01/01/2032 | | | 45,857 | |

| | 28,086 | | 3.500%, 04/01/2032 | | | 30,423 | |

| | 556,784 | | 2.500%, 06/01/2032 | | | 579,819 | |

| | 249,810 | | 3.000%, 11/01/2032 | | | 264,969 | |

| | 185,871 | | 3.500%, 02/01/2033 | | | 198,275 | |

| | 1,246,855 | | 3.500%, 05/01/2033 | | | 1,347,904 | |

| | 367,890 | | 3.000%, 05/01/2033 | | | 390,521 | |

| | 157,863 | | 3.500%, 12/01/2033 | | | 167,444 | |

| | 108,597 | | 4.500%, 05/01/2034 | | | 119,216 | |

| | 127,468 | | 4.000%, 06/01/2034 | | | 139,626 | |

| | 179,248 | | 3.500%, 08/01/2034 | | | 190,655 | |

| | 148,378 | | 3.500%, 12/01/2034 | | | 159,348 | |

See accompanying Notes to Financial Statements.