ANNUAL REPORT

NORTH SQUARE OAK RIDGE SMALL CAP GROWTH FUND

NORTH SQUARE DYNAMIC SMALL CAP FUND

NORTH SQUARE OAK RIDGE DISCIPLINED GROWTH FUND

NORTH SQUARE MULTI STRATEGY FUND

NORTH SQUARE OAK RIDGE DIVIDEND GROWTH FUND

MAY 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, www.northsquareinvest.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, such as a broker-dealer or bank, or, if you are a direct investor, by calling the Funds toll-free at 1-855-551-5521.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call the Funds toll-free at 1-855-551-5521 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary.

| North Square Investments | www.northsquareinvest.com |

North Square Funds

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 11 |

| Schedules of Investments | 18 |

| Statements of Assets and Liabilities | 36 |

| Statements of Operations | 40 |

| Statements of Changes in Net Assets | 42 |

| Financial Highlights | 47 |

| Notes to Financial Statements | 57 |

| Report of Independent Registered Public Accounting Firm | 67 |

| Supplemental Information | 68 |

| Expense Examples | 71 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the North Square Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.northsquareinvest.com

| Discussion of Fund Performance |  |

A letter from David Klaskin, Chief Executive Officer and Chief Investment Officer of Oak Ridge Investments and lead portfolio manager of the North Square Oak Ridge Small Cap Growth Fund.

Fellow Shareholders,

There have been many unprecedented occurrences as the result of COVID-19. This included the fastest decline of over 30% in history during a 33-day period in February and March, as the economy ground to a halt with the first ever shutdown of societies across the globe. The U.S. economy declined at a rate of 5% during the first quarter due to the closures in March and despite the partial reopening of businesses, GDP is expected to decline an unimaginable 40% in the second quarter. Even knowing a 20% rebound was forecasted for GDP over the next three months due to pent-up demand, very few investors anticipated the ensuing rally that included the largest 50-day advance in history, which nearly erased all of the broad market declines for the year.

The gains were much greater in growth stocks. The Nasdaq Composite, which is heavily comprised of leading companies with strong earnings visibility in the technology and healthcare sectors is shockingly 11% ahead of the Standard & Poor’s 500 Index for the year through May 31. Despite a strong recovery from doomsday levels, cyclical stocks remain significantly lower for the year and face uncertain futures dependent on a more significant economic recovery and in many cases, further government aid. The primary credit for the rapid turnaround is owed to the swift and aggressive response around the globe in providing broad stimulus and targeted aid. There was no alternative to the unparalleled level of debt incurred to maintain order and it is impossible to determine how severe unemployment might have been without extraordinary incentives for employee retention, or how rapidly companies will rehire. The damage to people and businesses has been uneven, as those deemed essential, or able to thrive remotely and online, are mostly financially whole through this ordeal, while others are on the brink of despair. Forecasts for a ‘V’-shaped recovery seem to ignore the need for businesses to recover what they lost during the shutdown by remaining cautious on expenditures, particularly given the uncertainty of the economic impact of the virus going forward.

The stock market is forward looking and there will clearly be easy comparisons and significant pent-up demand for everything from travel to elective medical procedures. While debt is high, significant government spending is earmarked for infrastructure improvements and interest rates should remain extremely low for a number of years, providing technology and innovation continue to keep inflation in check. There are few alternatives to the equity markets for retirees and pension plans in need of returns to meet their objectives, which should support stock prices. The largest stocks continue to lead the market, but over time, the averages are likely to level off and new leaders and surviving long-standing businesses will attract investor interest and reward active management.

The North Square Oak Ridge Small Cap Growth Fund – Class I Shares returned 1.41% versus the Russell 2000 Growth Index return of 7.32% for the year ending May 31, 2020. Our investment style favors more consistent growth opportunities, taking a tempered approach to less visible areas. This not only manifests itself within the sector allocations we emphasize but within the particular industries underlying those sectors. The recovery across healthcare and information technology stocks drove positive returns for the index for the year. While the Fund produced healthy gains for the year in these two sectors, they were also the largest detractors to relative returns. Within healthcare, the biopharma industry group was the strongest contributor to index returns. The broad opportunity set amidst this group in small caps, however, has grown increasingly aggressive as the vast majority of companies did not produce positive earnings for the year. While the growth potential for many burgeoning biopharma companies can be attractive, the visibility is low when most are developmental stage companies. We have maintained a cautious underweight to the industries while focusing more on equipment and life sciences where we believe there has been great visibility over time. As many healthcare services have been postponed due to concerns over the spread of coronavirus, many stable companies have seen uncharacteristic disruption in their businesses.

The dramatic and unexpected need for large segments of the workforce to begin working from home supported cloud-based computing and infrastructure stocks during the treacherous market of the first quarter of 2020. These companies went onto lead the recovery in the Russell 2000 Growth Index from the March 18th trough. The secular trend towards utilization of services provided through the cloud has only strengthened during this crisis, further driving what has been extraordinary outperformance of the group over the past few years. The strength in semiconductors, much like within the unprofitable biotechnology stocks, was surprising given it is a departure from experiences during previous market downturns. Returns within the semiconductor industry have proven themselves over time to be transient and we have favored the more service-oriented businesses within information technology. Two IT Services companies in particular proved less resilient than expected, WEX (-21.7%) and Euronet Worldwide (-38.9%). As a card service provider for the trucking industry and a portfolio holding since 2008, WEX was hurt by a material decline in the use of credit cards and severe weakness in key verticals tied to fuel prices and the travel industry. This consistent grower is a prototype Oak Ridge

holding that lost 80% of its value in 2008 despite never being in danger of losing money, before rising nearly 30 fold over the following 11 years. We remain highly confident in this holding over the next several years. Euronet Worldwide is a provider of ATM machines within large segments of Europe, as people have stayed home cash withdrawal has declined in an otherwise healthy cash usage region.

Avoiding weaker segments within the index such as communication services, utilities and materials benefited the portfolio. We adjusted our thesis throughout the year on consumer discretionary companies. The strength of the consumer seemed a positive driver for stocks; however, as the length of the lockdown measures became more clear we have reduced our weight across the sector. Unfortunately, positive stock selection did not make up for the overweight we have held within the sector. Within industrials, the machinery segment was a large detractor of performance. The industry has a history of being a place where we have been able to find unique end market companies with long-term opportunities. This has not changed but the near term has been difficult for otherwise healthy companies, particularly in Welbilt Inc. (-63.6%, sold from the portfolio in 2020) a provider of restaurant equipment. The strongest contribution to relative returns came from the real estate sector, where our two companies Terreno Realty (+14.6%) and recently added CoreSite Realty (-2.2%) proved to be the healthier markets within an otherwise abysmal sector.

We remain constructive on our portfolio and acknowledge that the unfolding public health and resulting economic crisis has not been resolved. We are confident that our patient, fundamentally-driven process is well suited for the uncertain times ahead.

Continuity and the Importance of Active Management

The Fund has been managed by the same lead portfolio manager, employing the same discipline rooted in fundamentals with a valuation awareness, since the Fund’s inception. Our persistent focus on supportable valuations and quality has often not appeared as relevant, and has actually detracted from investment results, throughout this long bull market. This overlooked metric, however, is likely to be a key factor in determining success over the next several years.

Thank you for your continued confidence in Oak Ridge Investments.

Sincerely,

David Klaskin

CIO & Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor were as of July 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 2000 Growth Index measures the performance of small cap U.S. growth stocks.

| Discussion of Fund Performance |  |

A letter from Peter Algert, Chief Investment Officer of Algert Global LLC and portfolio manager of the North Square Dynamic Small Cap Fund.

Fellow Shareholders,

U.S. small-cap stocks experienced a significant amount of volatility over the 12-month period ending May 31, 2020, primarily driven by the unprecedented public health and economic crises related to the COVID-19 pandemic. After a significant rally spanning the fourth quarter of 2019 and the beginning of 2020, the Russell 2000 Index fell precipitously in February-March 2020 and subsequently partially rebounded, ending the 12-month period at -3.44%. The Fund however outperformed the index over this period, delivering an absolute return of -0.44% for Class I shares at NAV.

Stock Selection Designed to be the Primary Source of Benchmark Outperformance

During the trailing 12-month period, stock selection contributed positively to Fund performance, however it was partially offset by negative contribution from incidental active exposures to various risk factors (e.g. a company’s industry, leverage, liquidity and beta characteristics). In addition to positive stock selection, the Fund also benefitted from various stock-specific events.

Relative Value

The Relative Value model detracted from the Fund’s performance during the measurement period. Value-related positioning underperformed as investors have favored stocks with stronger growth characteristics and price levels which have made them unattractive on most valuation criteria. The poor performance of our Relative Value model has been particularly acute in the more fundamental insights, while some of our non-traditional valuation factors have performed modestly better.

Quality

The Quality model was the primary positive contributor to the performance of the Fund. With an uncertain economic backdrop, investors appeared to favor companies with more robust and sustainable business models relative to peers. The performance of our Quality insights was strong across various types of insights, particularly those constructed with natural language processing (NLP) techniques.

Catalyst

The Catalyst model was a positive contributor to the Fund’s performance. The Catalyst theme, which assesses sentiment and activities by other market participants, was volatile at times during the measurement period but ultimately profited as insights favoring various growth characteristics continued their longer term trend of strong performance.

Risk Factors

Incidental active exposures to industries and risk factors such as leverage, volatility and liquidity detracted from performance over the measurement period. In particular, the Fund’s industry weights relative to the index detracted as dispersion in industry returns over the trailing 12-months was meaningful, for example within the materials and energy sectors. While these exposures detracted during the measurement period, we expect these exposures will have minimal impact on the Fund’s active performance over a full market cycle.

Fund Positioning for the Future

The Fund aims to be diversified across its three main investment themes, Relative Value, Quality and Catalyst. Given the uncertain economic backdrop relating to the COVID-19 pandemic, we expect our Quality-driven positioning will be beneficial for the portfolio. We continue to favor Catalyst-driven positions relative to Value driven, in part, by the expectation of ongoing access to cheap financing for growth-oriented firms.

Sincerely,

Peter Algert,

Chief Investment Officer

The views in this letter were as of July 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. International investments are subject to unique risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In addition, changes in exchange rates and interest rates may adversely affect the value of the fund’s foreign investments. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 2000 Index measures the performance of primarily small cap U.S. stocks.

| Discussion of Fund Performance |  |

A letter from Robert G. McVicker, Director of Research of Oak Ridge Investments and portfolio manager of the North Square Oak Ridge Disciplined Growth Fund.

Fellow Shareholders,

Despite the significant economic disruption as a result of COVID-19, U.S. large cap growth indexes remarkably returned over 20% for the year ending May 31. The primary credit for the rapid turnaround from doomsday levels is owed to the swift and aggressive response around the globe in providing broad stimulus and targeted aid. There was no alternative to the unparalleled level of debt incurred to maintain order. It is impossible to determine how severe unemployment might have been without extraordinary incentives for employee retention. The damage to people and businesses has been uneven, as those deemed essential or able to thrive remotely and online, are mostly financially whole through this ordeal, while others are facing great uncertainty. Cyclical stocks remain significantly lower for the year as their uncertain futures are more dependent on significant economic recovery, and in many cases, further government aid. Forecasts for a ‘V’-shaped recovery seem to ignore the need for businesses to recover what they lost during the shutdown by remaining cautious on expenditures, particularly given the uncertainty of the economic impact of the virus going forward.

The stock market is forward looking and there will clearly be easy comparisons and some pent-up demand for everything from travel to elective medical procedures. While debt is high, significant government spending is earmarked for infrastructure improvements and interest rates should remain extremely low for a number of years, providing technology and innovation continue to keep inflation in check. Current valuations are a consideration and long term expected returns should be evaluated conservatively. The largest stocks continue to lead the market, but over time, the averages are likely to level off and new leaders and surviving long standing businesses should attract investor interest and reward active management.

The North Square Oak Ridge Disciplined Growth Fund - Class I Shares returned 22.05% compared to the Russell 3000 Growth Index which returned 24.99% for the year ending May 31, 2020. Returns for the year were most notably driven by the large cap technology-based companies Facebook (+26.8%) Apple (+83.8%), Amazon(+37.6%), Microsoft (+50.0%) and Google (+29.6%) which accounted for 27.8% of the index weight during the year while contributing 50% of the total returns for the year. The crisis surrounding COVID-19 has accelerated many of the trends that were benefiting these companies over the past few years. As we look across the opportunities for growth and profitability, these companies, even following healthy increases in share price, have had superior fundamental growth in the current environment and present the more visible and consistent growth trajectories going forward. This is not to suggest that these five stocks represented the extent of the market opportunity for the past year. Excluding the above FAAMG stocks, the index returned 16.9% for the year, which is still stronger than the 12.8% return of the S&P 500 Index.

The growth style has significantly outperformed value in 2020 through May 31, with the Russell 3000 Growth Index outperforming the Russell 3000 Value Index by over 20%. Economic growth in the foreseeable future will likely impact future consumer spending priorities due to concerns of public safety, whether through a broad understanding of herd immunity or a heavily vaccinated population. As such many of drivers of the long-term underperformance of value to growth persist. Surely there will be a recovery, but the longer the disruption to the economy the more trying the rebound will be for many cyclical stocks. Many of the dynamic elements of the market that have been drivers within the market for the past few years, such as ecommerce, cloud computing, big data analytics and medical genetics, continue to have traction into the future. An exposure to these types of secular and organic growth themes within the market is an important consideration for investors, particularly should the long-term growth environment of the economy remain tepid.

Holdings in healthcare, consumer discretionary and the portfolio’s cash position were the primary detractors to performance for the year, but partially offset by strong stock selection in information technology, real estate and industrials. Healthcare underperformance was driven largely by stock selection in biotechnology company Sage Therapeutics (-57.8%, sold from the portfolio), which had mixed results on a trial to treat major depressive disorders, and healthcare equipment maker ABIOMED (-31.7%, sold from the portfolio), which had seen diminishing growth in utilization of their Impella technology. Both these companies had been long-term positive contributors to portfolio returns. Consumer discretionary was inhibited by retail-oriented companies VF Corp (-29.8%) and Ulta Beauty (-28.8%, sold from the portfolio). Software and IT services, two areas we tend to favor for their recurring revenue potential, were the largest contributors within information technology. The purchase of data center real estate firm Equinix (+33.1%) proved a timely purchase in an otherwise poor performing Real Estate sector. Within industrials, avoiding deep cyclical type companies in favor of more recurring businesses such as Verisk Analytics (+24.2%) and Transdigm Group (+7.8%) benefited relative returns.

We remain constructive on our portfolio and acknowledge that the unfolding public health and resulting economic crisis has not been resolved. We are confident that our patient, fundamentally-driven process is well suited for the uncertain times ahead.

Thank you for your continued confidence in Oak Ridge Investments.

Sincerely,

Robert G. McVicker

Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor were as of July 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 3000 Growth Index measures the performance of growth stocks across almost all market caps.

| Discussion of Fund Performance |  |

A letter from David Klaskin, Chief Executive Officer and Chief Investment Officer of Oak Ridge Investments and lead portfolio manager of the North Square Multi Strategy Fund.

Fellow Shareholders:

The pace and scale of the recovery within the U.S. financial markets past couple of months has been remarkable. Swift intervention from the Federal Reserve Board proved highly effective in alleviating liquidity concerns and restoring investor confidence in financial markets. The scope of the Federal Reserve’s response combined actions used during the Financial Crisis with new tools, but over a much more accelerated timeline. In addition to standard quantitative easing and liquidity support for critical markets such as commercial paper, the Federal Reserve announced it would also purchase corporate bonds. Rapidly increasing spreads across the corporate bond markets, including within high yield, began to narrow and select portions of the US equity markets quickly recovered toward pre-COVID-19 levels. With the promise of Fed support of corporate bonds companies opportunistically raised capital with new bond issuances, a critical cash infusion for many companies facing the brunt of revenue losses from shutdown measures. Within US equities, large cap technology companies that had previously been leading pre-virus experienced muted drawdowns relative to more economically sensitive sectors as economic shutdowns proved less impactful to their business models and in many cases amplified existing secular trends. At the same time the ability to acquire capital through bond issuance and secondary offerings to meet their current cash needs helped the more disrupted businesses to survive and to rebound off the March trough. The recovery across equities in the second quarter, nevertheless, was heavily imbalanced, reflecting continued economic uncertainty.

The most troubling part of the current economic narrative is the rampant rise in unemployment. The unemployment rate in the US rose to 14.7% in April. While the rate of unemployment shows signs of decline and initial claims have tapered in recent weeks, employment metrics are still dangerously above anything experienced in recent memory. Government support for small businesses and the unemployed has temporarily ameliorated a difficult situation for the most immediately affected portions of the population, though it will be an elongated challenge to restore a more normalized employment environment with perhaps the more pervasive legacy of the COVID-19 crisis being underemployment. As we look at the employment situation combined with sizable increases in public and private debt, we must consider how much of the pain has been postponed. Government actions undoubtably avoided liquidity issues from immediately turning into a more cataclysmic solvency crisis, but the degree to which financial markets have disconnected from the real economy gives us pause. This is not meant to convey a draconian outlook for the US economy and markets but more to suggest current valuations are a consideration and long-term expected returns should be evaluated conservatively.

Following significant cuts in the Federal Funds rate in March we are once again in an ultra-low interest rate environment. It is not surprising that growth has outperformed value given the growing cyclical nature of the value indexes. In order to resume manufacturing, travel and consumption in earnest going forward we need some assurance of public safety, whether through a broad understanding of herd immunity or a heavily vaccinated population. Surely there will be a recovery, but the longer the disruption to the economy the more trying the rebound will be for many cyclical stocks. On the other hand, many of the dynamic elements that have been drivers of the market for the past few years, such as ecommerce, cloud computing, big data analytics and medical genetics, continue to have traction into the future. An exposure to these types of secular and organic growth themes within the market is an important consideration for investors, particularly should the long-term growth environment of the economy remain tepid.

The North Square Multi Strategy Fund - Class I returned 7.17% for the year ending May 31, 2020 relative to 11.46% within the Russell 3000 Index and 24.99% for the Russell 3000 Growth Index. Growth equities remain an important element within the Multi Strategy. The North Square Oak Ridge Disciplined Growth Fund – Class I (+22.1%) has been a strong contributor to returns for the year. The strategy allocates opportunistically across growth companies and more recently heavily in the larger cap range. The FAAMG stocks (Facebook, Apple, Amazon, Microsoft and Google) have disproportionately contributed to returns. Even following healthy increases in share prices, the companies have had superior fundamental growth in the current environment and present visible and consistent growth trajectories. As growth stocks have continued to rampage higher; however, the strategy has more recently taken a more conservative view within the portfolio. The strategy’s overall quality-minded approach to growth investing resonates with the Multi Strategy’s cautious enthusiasm for growth equities looking forward. Our allocation to the North Square Oak Ridge Dividend Growth Fund – Class I (9.4%) was a detractor to returns in the year. The strategy has remained consistent in its discipline towards stable to growing businesses that continue to increase dividends to shareholders overtime. As a strategy that focuses on stable to growing companies with an ability to increase shareholder income over time, companies such as Amazon, Google and Facebook do not meet the yield requirement for inclusion within the strategy and are not owned by the Fund. Despite mild underperformance in the difficult first quarter of 2020, we are not dissuaded from the merit of holding stable companies at the core of the strategy and are encouraged at how well the quality driven approach has competed against a highly growth centric environment. Monetary and fiscal

measures punctuated what would likely have been a more disastrous drawdown in the market. Had the Federal Reserve not intervened we believe in the case of the Dividend Growth Fund that quality would have proven to be even more effective in preserving capital.

The largest detractor for the year was the North Square Dynamic Small Cap Fund – Class I (-0.4%). Recovery within small caps has been strong but has not made up for losses in the first quarter. In fact, the Russell 2000 has still not reached the former highs from September of 2018. We believe that over the next three to five years that Small Caps present one of the best return opportunities in US equity markets. In the near term there are higher tail risks in a few segments of the small cap universe, namely the growing share of unprofitable companies. The Dynamic Small Cap Fund, with its systematic approach across three main investment themes: Relative Value, Quality and Catalyst, has successfully generated alpha throughout the more challenging past few years for small cap managers. We remain confident that their flexible, diversified strategy will continue to successfully navigate what will likely continue to be a dynamic environment.

The Fund has sold out of the North Square Global Resources and Infrastructure Fund and North Square International Small Cap Fund. The Global Resources Fund was a detractor to returns over the preceding years. As most of our equity managers have had meaningful underweight positions to resource and infrastructure sectors such as energy, materials and utilities the Global Resources Fund provided specialized exposure to these under-represented areas. The strategy, however, maintained a heavy exposure to energy, particularly in exploration and production companies, throughout the volatile past few years. Following the sale of the International Small Cap Fund we have limited exposure to international equities. International equities (MSCI EAFE: -2.4%) and emerging market equities (MSCI EM: -4.0%) underperformed the US for the first half of the year. The US equity market environment has clearly become more volatile, but still appears to be a better near-term opportunity than most international markets.

Perhaps the boldest action of the Federal Reserve in the past few months was their announcement that they would provide directed support to the corporate bond market. The ensuing deluge of new issuances; however, has altered the allocation across the US aggregate bond universe with an influx of lower quality rated bonds. With the 10-year Treasury yield declining to 0.65% as of May 29, the fixed income investment environment will be more challenging going forward and given ongoing economic uncertainty it is questionable whether investors are being broadly compensated for potential risks in bonds below the highest quality investment ratings. As interest rates have compressed and spreads tightened our focus within the fixed income allocation has been towards non-traditional fixed income managers where managers can adjust across multiple bond categories to capitalize on relative opportunities in the dynamic fixed income environment. The portfolio management team for the recently added North Square Strategic Income Fund specializes in investing in preferred securities where they feel they can achieve higher yields without investing in lower quality companies. Results have been strong since the strategy was added to the Fund in late March as the team has been opportunistic during the recovery in fixed income markets.

In general, we continue to believe this environment to be most conducive to flexible active managers with a focus on evaluating the relative merits of fundamentals rather than broad index exposures. We believe we have a set of holdings that are well suited to navigate a more differentiating market environment within each of the funds’ areas of expertise. We appreciate your continued confidence in North Square Investments.

Sincerely,

David Klaskin

CIO & Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor were as of July 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. International investments are subject to unique risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. In addition, changes in exchange rates and interest rates may adversely affect the value of the fund’s foreign investments. Please see the prospectus for a more complete discussion of the fund’s risks.

The Russell 3000 Growth Index measures the performance of growth stocks across all market caps.

| Discussion of Fund Performance |  |

A letter from David Klaskin, Chief Executive Officer and Chief Investment Officer of Oak Ridge Investments and lead portfolio manager of the North Square Oak Ridge Dividend Growth Fund.

Fellow Shareholders,

There have been many unprecedented occurrences as the result of COVID-19. This included the fastest decline of over 30% in history during a 33-day period in February and March, as the economy ground to a halt with the first ever shutdown of societies across the globe. The U.S. economy declined at a rate of 5% during the first quarter due to the closures in March and, despite the partial reopening of businesses, GDP is expected to decline an unimaginable 40% in the second quarter. Even knowing a 20% rebound was forecasted for GDP over the next three months due to pent-up demand, very few investors anticipated the ensuing rally that included the largest 50-day advance in history, which nearly erased all of the broad market declines for the year.

The gains were much greater in growth stocks. The Nasdaq Composite, which is heavily comprised of leading companies with strong earnings visibility in the technology and healthcare sectors, is shockingly 11% ahead of the S&P 500 Index for the year through May 31. Despite the significant economic disruption as a result of COVID-19, U.S. large cap growth indexes remarkably returned over 20% for the year ending May 31. The primary credit for the rapid turnaround from doomsday levels is owed to the swift and aggressive response around the globe in providing broad stimulus and targeted aid. There was no alternative to the unparalleled level of debt incurred to maintain order. It is impossible to determine how severe unemployment might have been without extraordinary incentives for employee retention. The damage to people and businesses has been uneven, as those deemed essential or able to thrive remotely and online, are mostly financially whole through this ordeal, while others are on the brink of despair. Cyclical stocks remain significantly lower for the year as their uncertain futures are more dependent on significant economic recovery, and in many cases, further government aid. Forecasts for a ‘V’-shaped recovery seem to ignore the need for businesses to recover what they lost during the shutdown by remaining cautious on expenditures, particularly given the uncertainty of the economic impact of the virus going forward.

The stock market is forward looking and there will clearly be easy comparisons and significant pent-up demand for everything from travel to elective medical procedures. While debt is high, significant government spending is earmarked for infrastructure improvements and interest rates should remain extremely low for a number of years, providing technology and innovation continue to keep inflation in check. There are few alternatives to the equity markets for retirees and pension plans in need of returns to meet their objectives, which should support stock prices. The largest stocks continue to lead the market, but over time, the averages are likely to level off and new leaders and surviving long standing businesses will attract investor interest and reward active management.

The North Square Oak Ridge Dividend Growth Fund - Class I Shares returned 9.35% compared to the S&P 500 Index, which returned 12.84% for the year ending May 31, 2020. The crisis surrounding COVID-19 has accelerated many of the trends that were benefiting the largest growth companies over past few years. As a strategy that focuses on stable to growing companies with an ability to increase shareholder income over time, companies such as Amazon (+37.6%), Google (+29.6%) and Facebook (+26.8%) do not meet the yield requirement for inclusion within the strategy and are not owned by the Fund. These three companies collectively detracted 1.4% from relative returns for the year. Our approach leads to cash flow-oriented businesses that have historically performed well in difficult market environments, which we believe results in superior compounded returns in the long run. Over the trailing three years, which includes periods such as the fourth quarter of 2018 (S&P 500: -13.5%) and the first quarter of 2020 (S&P 500: -19.6%), the North Square Oak Ridge Dividend Growth Fund - Class I Shares returned 10.67% compared to the S&P 500, which returned 10.23%.

The financials sector was the strongest contributor to relative returns for the year. Capital markets firms, Blackstone Group (+55.7%) and BlackRock (+31.4%), were resilient amidst a fractious environment for financial companies. Similarly, recent additions within the real estate sector Prologis (-1.6%) and American Tower Corporation (+7.1%), were brighter areas of an otherwise negative performing sector over the past year. Information technology, communication services and the Fund’s cash and equivalents position were the primary detractors for the quarter. As mentioned previously, many high growth companies are outside of the investment guidelines due to their lack of a dividend. In addition to Google and Facebook, within communication services, companies such as NVIDIA (+162.7%; semiconductors) and PayPal (+41.3%; IT services) within information technology performed remarkably over the past year but were not owned. We believe that Qualcomm (+25.0%) and recently added Broadcom (+4.7%) within semiconductors, which both contributed positively to relative returns, have a stable outlook for their businesses and the potential for yield makes them attractive companies to own.

We remain constructive on our portfolio and acknowledge that the unfolding public health and resulting economic crisis have not been resolved. Dividends were less of a focus for the markets over the past year; nevertheless, we believe the Dividend Growth Fund can add value to the long-term investor’s overall allocation. Stable cash flows and an opportunity for shareholder income should appeal to investors as the rapidly shifting market environment continues.

Thank you for your continued confidence in Oak Ridge Investments.

Sincerely,

David Klaskin

CIO & Senior Portfolio Manager

The views in this letter are those of the Fund’s direct advisor were as of July 30, 2020 and may not necessarily reflect the same views on the date this letter is first published or any date thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

Investment in equity securities involves substantial risks and may be subject to wide and sudden fluctuations in market value. Investing in small and mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger companies. Please see the prospectus for a more complete discussion of the fund’s risks.

The S&P 500 Index measures the performance of the largest 500 U.S. stocks.

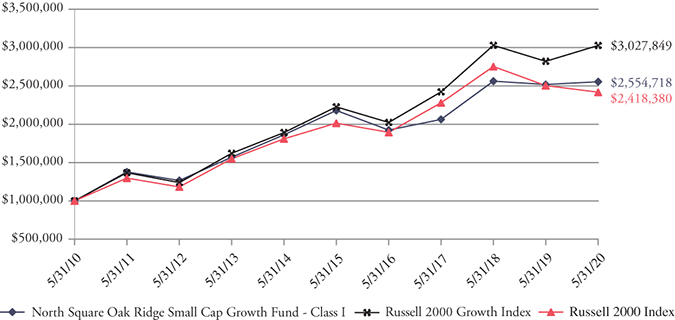

North Square Oak Ridge Small Cap Growth Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares (the Class with the largest net assets), made on May 31, 2010, with a similar investment in the Russell 2000 Growth Index and the Russell 2000 Index. The performance graph above is shown for the Fund’s Class I shares; Class A, Class C, and Class K shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Growth Index measures the performance of U.S. small cap growth stocks. The Russell 2000 Index measures the performance of the small cap segment of the U.S. equity universe. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2020 | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | |

Class A1 | 1.16% | 2.92% | 9.48% | 9.40% | 01/03/94 |

Class C2 | 0.39% | 2.16% | 8.66% | 7.12% | 03/01/97 |

Class I3 | 1.41% | 3.22% | 9.83% | 9.77% | 12/29/09 |

Class K3 | 1.56% | 3.37% | N/A | 8.64% | 12/20/12 |

| After deducting maximum sales charge | | | | | |

Class A1 | -4.66%

| 1.71% | 8.84% | 9.16% | 01/03/94 |

Class C2 | -0.17%

| 2.16% | 8.66% | 7.12% | 03/01/97 |

| Russell 2000 Growth Index | 7.32% | 6.34% | 11.72%

| 7.34% | 01/03/94 |

| Russell 2000 Index | -3.44%

| 3.72% | 9.23% | 8.08% | 01/03/94 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |

2 | A CDSC of 1.00% will be charged on Class C Shares purchases that are redeemed in whole or in part within 12 months of the date of purchase. |

3 | Class I and Class K shares do not have any initial or contingent deferred sales charge. |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Small Cap Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

North Square Oak Ridge Small Cap Growth Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited) – Continued

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class A shares were 1.46% and 1.38%, for Class C shares were 2.19% and 2.11%, for Class I shares were 1.22% and 1.14%, and for Class K shares were 1.08% and 1.00%, which were the amounts stated in the current prospectus dated September 27, 2019. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.39%, 2.14%, 1.14%, and 0.99% of the average daily net assets of the Fund’s Class A, Class C, Class I, and Class K shares, respectively. This agreement is in effect until September 30, 2021, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

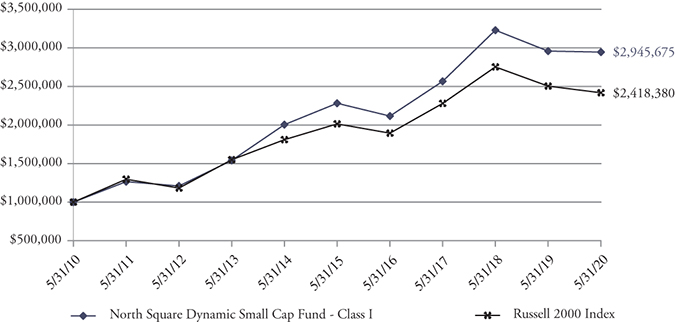

North Square Dynamic Small Cap Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made on May 31, 2010, with a similar investment in the Russell 2000 Index. Results include the reinvestment of all dividends and capital gains.

The Russell 2000 Index measures the performance of the small cap segment of the U.S. equity universe. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2020 | 1 Year | 5 Year | 10 Year | Inception | Date |

| Class I | -0.44% | 5.24% | 11.41% | 11.92% | 11/01/08 |

| Russell 2000 Index | -3.44% | 3.72% | 9.23% | 10.11% | 11/01/08 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Dynamic Small Cap Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. The Predecessor Fund commenced operations on September 30, 2015 after the conversion of the Algert Global U.S. Small Cap account (the “Predecessor Account”). As a result of each reorganization, the Fund is the accounting successor of each the Predecessor Fund and Predecessor Account. Performance results shown in the performance table above between May 10, 2019 and September 30, 2015 represent the performance of the Predecessor Fund, and performance results shown prior to September 30, 2015 represent the performance of the Predecessor Account. The Predecessor Account was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Account had been registered under the 1940 Act, the Predecessor Account’s performance may have been adversely affected.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class I shares were 2.02% and 1.15%, respectively, which were the amounts stated in the current prospectus dated September 27, 2019. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.15% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

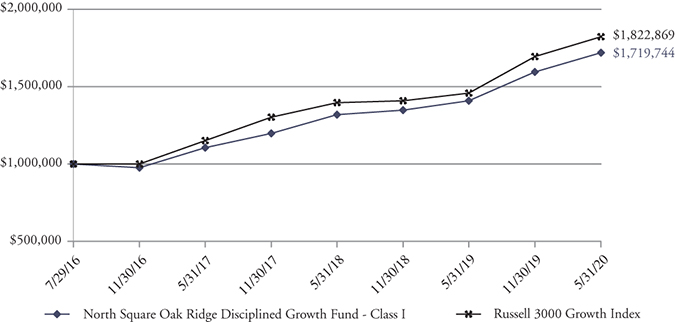

North Square Oak Ridge Disciplined Growth Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the Russell 3000 Growth Index. Results include the reinvestment of all dividends and capital gains.

The Russell 3000 Growth Index is a market capitalization weighted index and includes companies that display signs of above average growth. The index is used to provide a gauge of the performance of growth stocks in the U.S. This index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | | Since | Inception |

Average Annual Total Returns as of May 31, 2020 | 1 Year | 3 Year | Inception | Date |

| Class I | 22.05% | 15.86% | 15.17% | 07/29/16 |

| Russell 3000 Growth Index | 24.99% | 16.55% | 16.93% | 07/29/16 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Disciplined Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for the Class I shares were 2.04% and 0.95%, respectively, which were stated in the current prospectus dated September 27, 2019. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses does not exceed 0.95% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

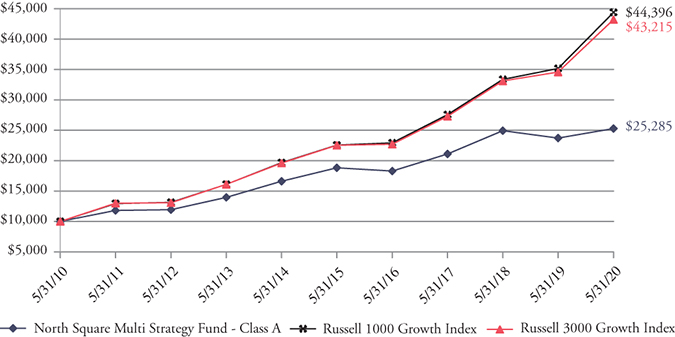

North Square Multi Strategy Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited)

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund’s Class A shares (assumes the maximum sales load charged by the Fund), made on May 31, 2010, with a similar investment in the Russell 1000 Growth Index and the Russell 3000 Growth Index. The performance graph above is shown for the Fund’s Class A shares; Class I and Class C shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The Russell 1000 Growth Index measures the performance of U.S. large cap growth stocks. The Russell 3000 Growth Index is a market capitalization weighted index and includes companies that display signs of above average growth. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2020 | 1 Year | 5 Year | 10 Year | Inception | Date |

| Before deducting maximum sales charge | | | | | |

Class A1 | 6.63% | 6.08% | 9.72% | 4.82% | 03/01/99 |

Class C2 | 5.75% | 5.22% | 8.78% | 5.12% | 02/13/04 |

Class I3 | 7.17% | 6.40% | 9.94% | 6.77% | 08/10/04 |

| After deducting maximum sales charge | | | | | |

Class A1 | 0.50% | 4.83% | 9.07% | 4.52% | 03/01/99 |

Class C2 | 4.76% | 5.22% | 8.78% | 5.12% | 02/13/04 |

| Russell 1000 Growth Index | 26.25% | 14.50% | 16.07% | 6.49% | 03/01/99 |

| Russell 3000 Growth Index | 24.99% | 13.91% | 15.76% | 6.53% | 03/01/99 |

1 | Maximum sales charge for Class A shares is 5.75%. No initial sales charge applies on investments of $500,000 or more, but a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed on certain redemptions of such shares within 12 months of the date of purchase. |

2 | A CDSC of 1.00% will be charged on Class C Shares purchases that are redeemed in whole or in part within 12 months of the date of purchase. |

3 | Class I and Class K shares do not have any initial or contingent deferred sales charge. |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Multi Strategy Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

North Square Multi Strategy Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited) – Continued

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class A shares were 1.32% and 1.50%, respectively, for Class C shares were 2.09% and 2.28%, respectively, and for Class I shares were 0.94% and 1.12%, respectively, which were the amounts stated in the current prospectus dated September 27, 2019. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.20%, 2.10%, and 1.17% of the average daily net assets of the Fund’s Class A, Class C, and Class I shares, respectively. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

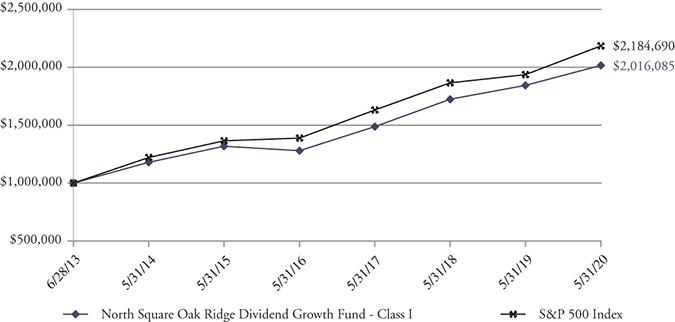

North Square Oak Ridge Dividend Growth Fund

FUND PERFORMANCE at May 31, 2020 (Unaudited)

Performance of a $1,000,000 Investment

This graph compares a hypothetical $1,000,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the S&P 500 Index. Results include the reinvestment of all dividends and capital gains.

The S&P 500 Index measures the performance of primarily large cap U.S. stocks. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| | | | | Since | Inception |

Average Annual Total Returns as of May 31, 2020 | 1 Year | 3 Year | 5 Year | Inception | Date |

| Class I | 9.35% | 10.67% | 8.87% | 10.66% | 06/28/13 |

| S&P 500 Index | 12.84% | 10.23% | 9.86% | 11.95% | 06/28/13 |

The Fund acquired all assets and assumed the liabilities of the Oak Ridge Dividend Growth Fund (the “Predecessor Fund”) effective the close of business on May 10, 2019. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the table above for periods prior to the close of business on May 10, 2019 reflect the performance of the Predecessor Fund.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling 1-855-551-5521.

Gross and net expense ratios for Class I shares were 2.38% and 1.00%, respectively, which were the amounts stated in the current prospectus dated September 27, 2019. Expense ratios reported for other periods in the Financial Highlights section of this report may differ. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.00% of the average daily net assets of the Fund’s Class I shares. This agreement is in effect until September 30, 2029, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would have been lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 91.4% | | | |

| | | | | | |

| | | CONSUMER DISCRETIONARY – 13.5% | | | |

| | 7,981 | | Burlington Stores, Inc.* | | $ | 1,673,376 | |

| | 12,328 | | Five Below, Inc.* | | | 1,290,125 | |

| | 47,469 | | frontdoor, inc.* | | | 2,166,960 | |

| | 76,166 | | National Vision Holdings, Inc.* | | | 2,039,725 | |

| | 46,450 | | Ollie’s Bargain Outlet Holdings, Inc.* | | | 4,247,853 | |

| | 15,858 | | Pool Corp. | | | 4,266,119 | |

| | 56,789 | | YETI Holdings, Inc.* | | | 1,822,927 | |

| | | | | | | 17,507,085 | |

| | | | CONSUMER STAPLES – 6.8% | | | | |

| | 82,586 | | BJ’s Wholesale Club Holdings, Inc.* | | | 2,973,096 | |

| | 59,321 | | Grocery Outlet Holding Corp.* | | | 2,183,606 | |

| | 172,659 | | Nomad Foods Ltd.*1 | | | 3,656,918 | |

| | | | | | | 8,813,620 | |

| | | | FINANCIALS – 1.8% | | | | |

| | 7,950 | | Kinsale Capital Group, Inc. | | | 1,187,094 | |

| | 15,740 | | Palomar Holdings, Inc.* | | | 1,171,371 | |

| | | | | | | 2,358,465 | |

| | | | HEALTH CARE – 30.3% | | | | |

| | 13,845 | | Acceleron Pharma, Inc.* | | | 1,368,301 | |

| | 6,063 | | argenx SE – ADR*1 | | | 1,329,616 | |

| | 34,017 | | Arrowhead Pharmaceuticals, Inc.* | | | 1,096,708 | |

| | 10,874 | | Axsome Therapeutics, Inc.* | | | 837,081 | |

| | 12,298 | | Blueprint Medicines Corp.* | | | 801,092 | |

| | 32,055 | | CONMED Corp. | | | 2,353,158 | |

| | 108,190 | | Heron Therapeutics, Inc.* | | | 1,971,222 | |

| | 93,309 | | Horizon Therapeutics PLC*1 | | | 4,733,566 | |

| | 20,383 | | Inspire Medical Systems, Inc.* | | | 1,662,030 | |

| | 6,069 | | Insulet Corp.* | | | 1,144,431 | |

| | 8,612 | | Intercept Pharmaceuticals, Inc.* | | | 622,303 | |

| | 19,801 | | LHC Group, Inc.* | | | 3,217,860 | |

| | 17,144 | | Ligand Pharmaceuticals Inc.* | | | 1,741,316 | |

| | 58,127 | | Livongo Health, Inc.* | | | 3,483,551 | |

| | 5,104 | | Mesa Laboratories, Inc. | | | 1,348,732 | |

| | 108,473 | | NeoGenomics, Inc.* | | | 2,895,144 | |

| | 34,889 | | Omnicell, Inc.* | | | 2,334,423 | |

| | 22,577 | | OrthoPediatrics Corp.* | | | 1,041,477 | |

| | 28,550 | | Oyster Point Pharma, Inc.* | | | 812,533 | |

| | 10,948 | | Penumbra, Inc.* | | | 1,887,654 | |

| | 48,446 | | Retrophin, Inc.* | | | 759,876 | |

| | 7,398 | | Sarepta Therapeutics, Inc.* | | | 1,126,493 | |

| | 20,900 | | Zogenix, Inc.* | | | 608,817 | |

| | | | | | | 39,177,384 | |

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | INDUSTRIALS – 17.4% | | | |

| | 91,950 | | Advanced Disposal Services, Inc.* | | $ | 2,867,001 | |

| | 78,097 | | Casella Waste Systems, Inc. – Class A* | | | 3,979,042 | |

| | 59,588 | | Colfax Corp.* | | | 1,672,039 | |

| | 48,058 | | Construction Partners, Inc. – Class A* | | | 850,627 | |

| | 41,938 | | Cubic Corp. | | | 1,728,265 | |

| | 21,821 | | John Bean Technologies Corp. | | | 1,792,595 | |

| | 26,299 | | Mercury Systems, Inc.* | | | 2,349,816 | |

| | 13,443 | | RBC Bearings, Inc.* | | | 1,890,758 | |

| | 19,078 | | Saia, Inc.* | | | 2,068,818 | |

| | 21,632 | | SiteOne Landscape Supply, Inc.* | | | 2,299,698 | |

| | 17,900 | | Vicor Corp.* | | | 1,091,542 | |

| | | | | | | 22,590,201 | |

| | | | INFORMATION TECHNOLOGY – 21.6% | | | | |

| | 52,943 | | The Descartes Systems Group Inc.*1 | | | 2,519,557 | |

| | 47,264 | | Envestnet, Inc.* | | | 3,431,839 | |

| | 9,721 | | EPAM Systems, Inc.* | | | 2,242,051 | |

| | 26,448 | | Euronet Worldwide, Inc.* | | | 2,505,419 | |

| | 19,385 | | Everbridge, Inc.* | | | 2,835,250 | |

| | 32,144 | | Five9, Inc.* | | | 3,349,405 | |

| | 77,783 | | Lattice Semiconductor Corp.* | | | 1,934,463 | |

| | 12,486 | | Littelfuse, Inc. | | | 2,028,850 | |

| | 58,326 | | Perficient, Inc.* | | | 1,985,417 | |

| | 32,702 | | ShotSpotter, Inc.* | | | 760,322 | |

| | 59,152 | | Upland Software Inc.* | | | 2,043,702 | |

| | 15,306 | | WEX Inc.* | | | 2,266,513 | |

| | | | | | | 27,902,788 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $85,945,077) | | | 118,349,543 | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS (REITS) – 3.8% | | | | |

| | 18,775 | | CoreSite Realty Corp. | | | 2,343,495 | |

| | 50,978 | | Terreno Realty Corp. | | | 2,609,564 | |

| | | | TOTAL REITS | | | | |

| | | | (Cost $4,194,819) | | | 4,953,059 | |

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | SHORT-TERM INVESTMENT – 7.1% | | | |

| | 9,123,003 | | First American Treasury Obligations Fund – Class X, 0.10%2 | | $ | 9,123,003 | |

| | | | TOTAL SHORT-TERM INVESTMENT | | | | |

| | | | (Cost $9,123,003) | | | 9,123,003 | |

| | | | TOTAL INVESTMENTS – 102.3% | | | | |

| | | | (Cost $99,262,899) | | | 132,425,605 | |

| | | | Liabilities in Excess of Other Assets – (2.3)% | | | (2,998,228 | ) |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 129,427,377 | |

ADR – American Depositary Receipt

PLC – Public Limited Company

| * | Non-Income producing security. |

1 | Foreign security denominated in U.S. Dollars. |

2 | The rate is the annualized seven-day yield at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying Notes to Financial Statements.

North Square Oak Ridge Small Cap Growth Fund

SUMMARY OF INVESTMENTS

As of May 31, 2020

| | Percent of Total |

| Security Type/Sector | Net Assets |

| Common Stocks | | | | |

| Health Care | | | 30.3 | % | |

| Information Technology | | | 21.6 | % | |

| Industrials | | | 17.4 | % | |

| Consumer Discretionary | | | 13.5 | % | |

| Consumer Staples | | | 6.8 | % | |

| Financials | | | 1.8 | % | |

| Total Common Stocks | | | 91.4 | % | |

| REITs | | | 3.8 | % | |

| Short-Term Investment | | | 7.1 | % | |

| Total Investments | | | 102.3 | % | |

| Liabilities in Excess of Other Assets | | | (2.3 | )% | |

| Total Net Assets | | | 100.0 | % | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 95.4% | | | |

| | | | | | |

| | | COMMUNICATION SERVICES – 4.5% | | | |

| | 170 | | ATN International, Inc. | | $ | 10,098 | |

| | 560 | | Bandwidth, Inc. – Class A* | | | 62,076 | |

| | 2,980 | | Boingo Wireless, Inc.* | | | 40,826 | |

| | 3,160 | | Cogent Communications Holdings, Inc. | | | 241,803 | |

| | 2,090 | | EverQuote, Inc. – Class A* | | | 112,693 | |

| | 5,000 | | Ooma, Inc.* | | | 62,700 | |

| | 2,230 | | Scholastic Corp. | | | 65,562 | |

| | 7,850 | | TrueCar, Inc.* | | | 21,195 | |

| | 2,150 | | United States Cellular Corp.* | | | 67,746 | |

| | 310 | | World Wrestling Entertainment, Inc. – Class A | | | 14,344 | |

| | | | | | | 699,043 | |

| | | | CONSUMER DISCRETIONARY – 13.3% | | | | |

| | 3,634 | | American Outdoor Brands Corp.* | | | 42,954 | |

| | 1,640 | | Boot Barn Holdings, Inc.* | | | 35,227 | |

| | 3,680 | | Callaway Golf Co. | | | 56,378 | |

| | 8,660 | | Core-Mark Holding Co., Inc. | | | 242,307 | |

| | 560 | | Five Below, Inc.* | | | 58,604 | |

| | 810 | | Floor & Decor Holdings, Inc. – Class A* | | | 42,120 | |

| | 1,240 | | Fox Factory Holding Corp.* | | | 89,416 | |

| | 6,450 | | Hilton Grand Vacations Inc.* | | | 138,933 | |

| | 1,230 | | LCI Industries | | | 121,684 | |

| | 630 | | LGI Homes, Inc.* | | | 52,555 | |

| | 2,600 | | MarineMax, Inc.* | | | 49,478 | |

| | 2,830 | | M.D.C. Holdings, Inc. | | | 96,192 | |

| | 1,420 | | Ollie’s Bargain Outlet Holdings, Inc.* | | | 129,859 | |

| | 4,329 | | Perdoceo Education Corp.* | | | 70,476 | |

| | 2,590 | | PetMed Express, Inc. | | | 93,499 | |

| | 6,076 | | PlayAGS, Inc.* | | | 31,656 | |

| | 12,340 | | Red Rock Resorts, Inc. – Class A | | | 170,292 | |

| | 1,570 | | Scientific Games Corp.* | | | 24,696 | |

| | 230 | | Stamps.com, Inc.* | | | 45,574 | |

| | 2,370 | | Stitch Fix, Inc. – Class A* | | | 54,794 | |

| | 500 | | Sturm Ruger & Co, Inc. | | | 31,170 | |

| | 730 | | TopBuild Corp.* | | | 83,724 | |

| | 1,693 | | Wingstop, Inc. | | | 206,461 | |

| | 730 | | YETI Holdings, Inc.* | | | 23,433 | |

| | 2,972 | | Zumiez Inc.* | | | 72,428 | |

| | | | | | | 2,063,910 | |

| | | | CONSUMER STAPLES – 4.4% | | | | |

| | 290 | | Beyond Meat, Inc.* | | | 37,204 | |

| | 2,420 | | The Chefs’ Warehouse, Inc. | | | 35,816 | |

| | 1,940 | | Freshpet, Inc.* | | | 149,729 | |

| | 1,800 | | Inter Parfums, Inc. | | | 83,538 | |

| | 1,050 | | J&J Snack Foods Corp. | | | 135,062 | |

| | 1,130 | | Lancaster Colony Corp. | | | 173,410 | |

| | 2,180 | | The Simply Good Foods Co. | | | 37,125 | |

| | 1,154 | | Turning Point Brands, Inc. | | | 27,684 | |

| | | | | | | 679,568 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | ENERGY – 1.6% | | | |

| | 4,314 | | Cactus, Inc. – Class A | | $ | 82,311 | |

| | 5,380 | | GasLog Ltd.2 | | | 18,454 | |

| | 4,780 | | International Seaways, Inc.2 | | | 108,410 | |

| | 1,403 | | Matrix Service Co.* | | | 15,461 | |

| | 1,170 | | Scorpio Tankers Inc.2 | | | 20,756 | |

| | | | | | | 245,392 | |

| | | | FINANCIALS – 9.1% | | | | |

| | 7,335 | | Bank OZK | | | 164,964 | |

| | 3,437 | | Brightsphere Investment Group Inc. | | | 28,699 | |

| | 9,588 | | First BanCorp.2 | | | 52,446 | |

| | 930 | | Great Western Bancorp, Inc. | | | 13,243 | |

| | 2,950 | | IBERIABANK Corp. | | | 125,109 | |

| | 6,675 | | International Bancshares Corp. | | | 205,456 | |

| | 12,849 | | National General Holdings Corp. | | | 260,835 | |

| | 2,557 | | NMI Holdings, Inc. – Class A* | | | 39,288 | |

| | 2,220 | | Peapack-Gladstone Financial Corp. | | | 41,803 | |

| | 780 | | Primerica, Inc. | | | 88,639 | |

| | 3,540 | | Univest Financial Corp. | | | 58,198 | |

| | 3,291 | | Walker & Dunlop, Inc. | | | 133,286 | |

| | 5,244 | | Western Alliance Bancorp | | | 200,059 | |

| | | | | | | 1,412,025 | |

| | | | HEALTH CARE – 20.8% | | | | |

| | 830 | | ACADIA Pharmaceuticals Inc.* | | | 41,234 | |

| | 210 | | Acceleron Pharma, Inc.* | | | 20,754 | |

| | 1,835 | | Addus HomeCare Corp.* | | | 181,592 | |

| | 2,063 | | Adverum Biotechnologies, Inc.* | | | 42,560 | |

| | 1,950 | | Aerie Pharmaceuticals, Inc.* | | | 27,359 | |

| | 230 | | Amedisys, Inc.* | | | 44,172 | |

| | 7,100 | | Amicus Therapeutics, Inc.* | | | 88,573 | |

| | 990 | | AMN Healthcare Services, Inc.* | | | 43,916 | |

| | 5,660 | | AnaptysBio, Inc.* | | | 107,993 | |

| | 2,980 | | Apellis Pharmaceuticals, Inc.* | | | 100,396 | |

| | 828 | | Arcus Biosciences, Inc.* | | | 25,958 | |

| | 7,324 | | Ardelyx, Inc.* | | | 53,685 | |

| | 2,360 | | Arvinas, Inc.* | | | 78,517 | |

| | 260 | | Ascendis Pharma A/S – ADR*2 | | | 37,827 | |

| | 11,180 | | BioDelivery Sciences International, Inc.* | | | 53,440 | |

| | 1,890 | | BioTelemetry, Inc.* | | | 89,170 | |

| | 810 | | Blueprint Medicines Corp.* | | | 52,763 | |

| | 1,010 | | ChemoCentryx, Inc.* | | | 63,014 | |

| | 640 | | China Biologic Products Holdings, Inc.*2 | | | 70,893 | |

| | 2,461 | | Constellation Pharmaceuticals, Inc.* | | | 87,439 | |

| | 380 | | Deciphera Pharmaceuticals, Inc.* | | | 22,257 | |

| | 10,417 | | Eiger BioPharmaceuticals, Inc.* | | | 125,733 | |

| | 2,655 | | Epizyme, Inc.* | | | 46,595 | |

| | 1,460 | | Globus Medical, Inc. – Class A* | | | 79,789 | |

| | 3,660 | | Iovance Biotherapeutics, Inc.* | | | 117,449 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | HEALTH CARE (Continued) | | | |

| | 230 | | iRhythm Technologies, Inc.* | | $ | 28,591 | |

| | 1,630 | | Kiniksa Pharmaceuticals, Ltd. – Class A*2 | | | 34,018 | |

| | 5,450 | | Kura Oncology, Inc.* | | | 93,141 | |

| | 1,820 | | Luminex Corp. | | | 56,711 | |

| | 2,450 | | Mersana Therapeutics, Inc.* | | | 55,468 | |

| | 1,050 | | Mirati Therapeutics, Inc.* | | | 104,150 | |

| | 1,510 | | Molecular Templates, Inc.* | | | 23,435 | |

| | 910 | | Momenta Pharmaceuticals, Inc.* | | | 28,647 | |

| | 3,630 | | Natera, Inc.* | | | 159,176 | |

| | 800 | | National Research Corp. | | | 45,376 | |

| | 2,210 | | NextGen Healthcare, Inc.* | | | 22,807 | |

| | 200 | | Omnicell, Inc.* | | | 13,382 | |

| | 471 | | Quidel Corp.* | | | 82,425 | |

| | 1,160 | | Rocket Pharmaceuticals, Inc.* | | | 21,820 | |

| | 3,420 | | Sage Therapeutics, Inc.* | | | 122,162 | |

| | 3,642 | | Simulations Plus, Inc. | | | 184,540 | |

| | 2,230 | | STAAR Surgical Co.* | | | 86,524 | |

| | 1,740 | | Tactile Systems Technology, Inc.* | | | 84,303 | |

| | 1,900 | | Tandem Diabetes Care, Inc.* | | | 157,985 | |

| | 592 | | Twist Bioscience Corp.* | | | 22,466 | |

| | 400 | | uniQure NV*2 | | | 26,864 | |

| | 350 | | United Therapeutics Corp.* | | | 41,283 | |

| | 2,526 | | Voyager Therapeutics, Inc.* | | | 30,565 | |

| | | | | | | 3,228,917 | |

| | | | INDUSTRIALS – 15.7% | | | | |

| | 707 | | AAR Corp. | | | 14,260 | |

| | 6,210 | | BMC Stock Holdings Inc.* | | | 162,516 | |

| | 3,750 | | Comfort Systems USA, Inc. | | | 138,750 | |

| | 445 | | CSW Industrials, Inc. | | | 31,844 | |

| | 1,236 | | DXP Enterprises, Inc. of Texas* | | | 21,791 | |

| | 2,400 | | Encore Wire Corp. | | | 115,896 | |

| | 560 | | Exponent, Inc. | | | 41,574 | |

| | 9,185 | | Federal Signal Corp. | | | 267,651 | |

| | 1,080 | | Forward Air Corp. | | | 53,654 | |

| | 8,150 | | H&E Equipment Services, Inc. | | | 139,691 | |

| | 2,890 | | Healthcare Services Group, Inc. | | | 69,129 | |

| | 970 | | Insperity, Inc. | | | 50,285 | |

| | 1,802 | | Korn Ferry | | | 54,529 | |

| | 9,140 | | Marten Transport Ltd. | | | 233,893 | |

| | 3,973 | | McGrath RentCorp | | | 221,534 | |

| | 1,140 | | RBC Bearings, Inc.* | | | 160,341 | |

| | 860 | | Robert Half International, Inc. | | | 43,636 | |

| | 1,100 | | Rush Enterprises, Inc. – Class A | | | 45,782 | |

| | 4,470 | | Sunrun Inc.* | | | 74,649 | |

| | 2,020 | | Trex Co, Inc.* | | | 242,642 | |

| | 530 | | TriNet Group, Inc.* | | | 28,477 | |

| | 1,090 | | UFP Industries, Inc. | | | 49,846 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | INDUSTRIALS (Continued) | | | |

| | 1,270 | | Vicor Corp.* | | $ | 77,445 | |

| | 1,050 | | Watts Water Technologies, Inc. – Class A | | | 87,318 | |

| | | | | | | 2,427,133 | |

| | | | INFORMATION TECHNOLOGY – 18.6% | | | | |

| | 13,880 | | A10 Networks Inc.* | | | 94,384 | |

| | 660 | | Alarm.com Holdings, Inc.* | | | 31,211 | |

| | 1,930 | | Altair Engineering, Inc. – Class A* | | | 75,444 | |

| | 3,710 | | Amkor Technology, Inc.* | | | 39,252 | |

| | 1,240 | | Appfolio, Inc. – Class A* | | | 196,552 | |

| | 2,190 | | Axcelis Technologies, Inc.* | | | 58,801 | |

| | 19,740 | | Box, Inc. – Class A* | | | 394,405 | |

| | 2,910 | | Dolby Laboratories, Inc. – Class A | | | 176,724 | |

| | 720 | | DSP Group, Inc.* | | | 12,974 | |

| | 3,889 | | ePlus, Inc.* | | | 286,658 | |

| | 2,380 | | Fabrinet*2 | | | 152,177 | |

| | 474 | | Globant S.A.*2 | | | 66,460 | |

| | 29,411 | | Harmonic Inc.* | | | 158,525 | |

| | 1,410 | | Impinj, Inc.* | | | 36,448 | |

| | 8,580 | | Limelight Networks, Inc.* | | | 42,385 | |

| | 4,950 | | LivePerson, Inc.* | | | 185,378 | |

| | 5,402 | | MagnaChip Semiconductor Corp.* | | | 59,746 | |

| | 1,070 | | Manhattan Associates, Inc.* | | | 94,588 | |

| | 1,613 | | ManTech International Corp. – Class A | | | 125,395 | |

| | 3,140 | | National Instruments Corp. | | | 121,581 | |

| | 4,150 | | NeoPhotonics Corp.* | | | 35,981 | |

| | 7,833 | | OneSpan Inc.* | | | 159,167 | |

| | 1,010 | | PC Connection, Inc. | | | 43,713 | |

| | 4,770 | | Perficient, Inc.* | | | 162,371 | |

| | 1,620 | | Switch, Inc. – Class A | | | 30,958 | |

| | 1,139 | | TTEC Holdings, Inc. | | | 48,248 | |

| | | | | | | 2,889,526 | |

| | | | MATERIALS – 3.9% | | | | |

| | 10,580 | | Amyris, Inc.* | | | 39,464 | |

| | 4,300 | | Boise Cascade Co. | | | 146,329 | |

| | 2,558 | | Innospec Inc. | | | 197,196 | |

| | 7,310 | | Louisiana-Pacific Corp. | | | 172,589 | |

| | 513 | | Stepan Co. | | | 49,843 | |

| | | | | | | 605,421 | |

| | | | REAL ESTATE – 0.4% | | | | |

| | 2,030 | | Redfin Corp.* | | | 60,880 | |

| | | | | | | | |

| | | | UTILITIES – 3.1% | | | | |

| | 1,090 | | American States Water Co. | | | 89,391 | |

| | 870 | | Black Hills Corp. | | | 53,688 | |

| | 470 | | Otter Tail Corp. | | | 20,168 | |

| | 1,690 | | Portland General Electric Co. | | | 79,616 | |

| | 2,230 | | Southwest Gas Holdings, Inc. | | | 169,368 | |

See accompanying Notes to Financial Statements.

North Square Dynamic Small Cap Fund

SCHEDULE OF INVESTMENTS – Continued

As of May 31, 2020

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | | | | |

| | | UTILITIES (Continued) | | | |

| | 1,250 | | Unitil Corp. | | $ | 60,212 | |

| | | | | | | 472,443 | |

| | | | TOTAL COMMON STOCKS | | | | |