united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23611

James Alpha Funds Trust

(Exact name of registrant as specified in charter)

515 Madison Avenue, 24th Floor, New York, NY 10022

(Address of principal executive offices) (Zip code)

Emile R. Molineaux

80 Arkay Drive, Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 623-266-4567

Date of fiscal year end: 11/30

Date of reporting period: 11/30/23

Amended to update trust name.

Item 1. Reports to Stockholders.

JAMES ALPHA FUNDS TRUST d/b/a EASTERLY FUNDS TRUST

CLASS A, C, I AND R6 SHARES

ANNUAL REPORT

November 30, 2023

THIS REPORT IS AUTHORIZED FOR DISTRIBUTION ONLY TO SHAREHOLDERS AND TO OTHERS WHO HAVE RECEIVED A COPY OF THE PROSPECTUS.

James Alpha Funds Trust d/b/a Easterly Funds Trust

ANNUAL REPORT TO SHAREHOLDERS

January 29, 2024

Dear Shareholder:

Easterly Income Opportunities Fund (JSVIX) posted 4.42% for the period from November 30, 2022, to November 30, 2023, outperforming the Bloomberg Aggregate Index by 3.24%. The main contributors were overweight allocations to RMBS and CMBS as well as a shorter duration compared to the Index. The main detractors were an overweight to Corporate Structured Notes (CMS spread floaters) and a High Yield hedge in the form of a CDX HY contract where we bought protection on a benchmark CDX index.

Based on all available statistics at the end of November 2023, the Federal Reserve can pat itself on the back as it was able to produce a near perfect script following a tumultuous 2022. After 150bp of interest rate hikes, the Fed has been able to bring down core CPI to 4.0% YoY in Q4 2023 from a high of 6.6% YoY in Q3 2022. The reduction in inflation didn’t come at the cost of a much-anticipated recession or even any meaningful rise in unemployment. Amazingly, the real GDP is set to increase to 2.6% YoY in 2023 after reaching 2.1% in 2022 while the unemployment rate only inched higher by 0.1% relative to Q4 2022 at 3.7%. In an even more stunning twist, the Fed and US economy were able to successfully navigate the regional banking crisis that produced 2 out of the 3 largest banking failures in US history while US equity markets, led by the Big Tech Magnificent 71 soared to new all-time highs. Jerome Powell did draw down $1.7 trillion from RRP (Reverse Repo Program) balances to offset $1.3 trillion of the Quantitative Tightening (QT) related reduction of the Fed’s balance sheet.

At the end of Q4 2023 the Federal reserve began to signal a likely end of interest rate hikes as the inflation rate was on the right trajectory to the Fed’s target of 2.0%. Interest rates exhibited an elevated volatility throughout 2023 with 10-year Treasury rising by 72bp while 2-year was up 37bp from November 2022 to November 2023. Higher rates were primarily driven by high US budget deficits that averaged 8% of GDP in 2023.

US credit markets had strong returns over the past 12 months with US Investment-grade Corporates up 4.01% while the Bloomberg Corporate High Yield index managed an impressive 9.37% return from 11/2022 to 11/2023 with around 100bp of spread tightening versus Treasuries. Structured credit sectors had mixed returns relative to corporate credit. New issue on-the-run sectors like GSE Credit Risk Transfer (CRTs) and BBB/BB Non-Qualified Mortgage (Non-QM) tranches saw 200-450bp of spread tightening relative to Treasuries as the credit curve flattened for the new issue RMBS. However, Legacy RMBS spreads were roughly flat in 2023 while CMBS on-the-run and legacy spreads widened over the last 12 months as a toxic mixture of higher interest rates, lower collateral values, declining credit availability and structural headwinds affecting office and retail collateral pushed many CMBS investors away amidst thin liquidity.

| 1 | The Magnificent 7 stocks include: Amazon.com (AMZN), Apple (AAPL), Google parent Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA). Not to be construed as an offer or solicitation of an offer to buy or sell specific securities. Past performance is not an indication of future results. |

The Fund benefited from its opportunistic investment approach in RMBS and sections of the CMBS market. In RMBS our Prime 2.0 and Non-QM subordinate positions made the most contribution to the portfolio’s price return while Legacy RMBS contributed to the portfolio’s carry. In CMBS space, 12% allocation to Small Balance Commercial (SBC) and Agency CMBS sectors made the biggest contribution within the CMBS allocation. The portfolio’s hedges included a short interest rate hedge using an interest rate swap and a short exposure to US HY market via CDX HY protection hedge some of the credit exposure. Portfolio hedges subtracted 0.03% from the overall return as credit spreads tightened into Fiscal year end. The Fund does not have a policy or practice of maintaining a specified level of distribution or yield payout to shareholders.

20240130-3358128

Easterly Income Opportunities Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2023

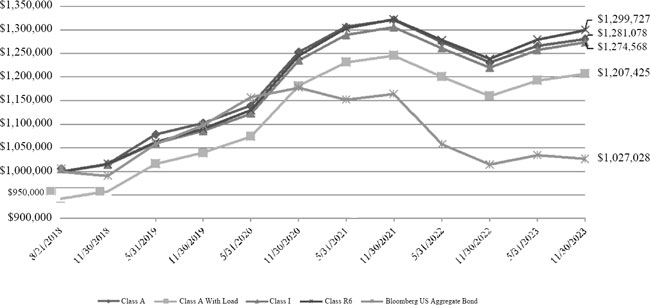

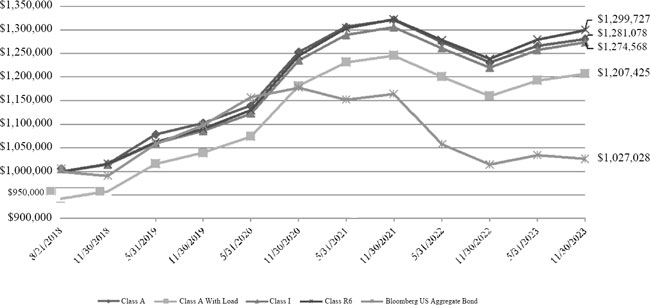

The Fund’s performance figures* for each of the periods ended November 30, 2023, compared to its benchmarks:

| | | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | Since Inception** |

| Class A | 4.04% | 4.75% | 4.81% |

| Class A With Load | 2.00% | 3.51% | 3.64% |

| Class C | 3.37% | 3.69% | 3.80% |

| Class I | 4.42% | 4.66% | 4.70% |

| Class R6 | 4.86% | 5.05% | 5.09% |

| Bloomberg US Aggregate Bond Index(a) | 1.18% | 0.71% | 0.51% |

| * | Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (833) 999-2636. The total operating expense ratio as stated in the fee table to the Portfolio’s prospectus dated April 1, 2023 and supplement dated November 6, 2023, is 1.86%, 2.61%, 1.61%, and 1.61% for the A, C, I and R6 Classes, respectively. |

| (a) | The Bloomberg U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investmen-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark. |

| ** | Inception date is August 21, 2018. |

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $1,000,000 INVESTED IN THE

EASTERLY INCOME OPPORTUNITIES FUND VS. BENCHMARK

| Top 10 Holdings by Industry * | | % of Net Assets | |

| Collateralized Mortgage Obligations | | | 32.5 | % |

| Non Agency CMBS | | | 25.7 | % |

| U.S. Treasury Notes | | | 5.5 | % |

| Institutional Financial Services | | | 4.2 | % |

| Home Equity | | | 3.7 | % |

| Banking | | | 3.7 | % |

| Specialty Finance | | | 3.7 | % |

| Residential Mortgage | | | 3.0 | % |

| CDO | | | 2.3 | % |

| Agency CMBS | | | 1.9 | % |

| Other/Cash & Equivalents | | | 13.8 | % |

| | | | 100.0 | % |

| | | | | |

| * | Does not include derivative holdings |

| | | |

| Please refer to the Schedule of Investments for a more detailed breakdown of the Fund’s assets. |

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% | | | | | | | | | | |

| | | | | AGENCY CMBS — 1.9% | | | | | | | | | | |

| | 847,054 | | | Freddie Mac Multifamily Structured Pass Through Series K092 X3(a),(b) | | | | 2.2490 | | 05/25/47 | | $ | 84,304 | |

| | 2,848,068 | | | FREMF Mortgage Trust Series 2017-KF37 B(c),(d) | | SOFR30A + 2.864% | | 8.1840 | | 06/25/27 | | | 2,721,295 | |

| | 2,678,719 | | | FREMF Mortgage Trust Series 2019-KF63(c),(d) | | SOFR30A + 2.464% | | 7.7840 | | 05/25/29 | | | 2,350,981 | |

| | 55,821 | | | Government National Mortgage Association Series 2012-27 IO(a),(b) | | | | 0.2300 | | 04/16/53 | | | 127 | |

| | 96,616 | | | Government National Mortgage Association Series 3 IO(a),(b) | | | | 0.6400 | | 02/16/61 | | | 4,452 | |

| | 692,796 | | | Government National Mortgage Association Series 210 IO(a),(b) | | | | 0.6960 | | 07/16/64 | | | 42,340 | |

| | 40,000 | | | Government National Mortgage Association Series 196 BE(b) | | | | 3.0000 | | 10/16/64 | | | 27,207 | |

| | 40,000 | | | Government National Mortgage Association Series 220 E(b) | | | | 3.0000 | | 10/16/64 | | | 25,110 | |

| | 695,273 | | | Government National Mortgage Association Series 216 IO(a),(b) | | | | 0.7500 | | 07/16/65 | | | 40,946 | |

| | 923,183 | | | Multifamily Connecticut Avenue Securities Trust Series 2019-01 M10(c),(d) | | SOFR30A + 3.364% | | 8.6930 | | 10/25/49 | | | 885,103 | |

| | | | | | | | | | | | | | 6,181,865 | |

| | | | | AUTO LOAN — 0.9% | | | | | | | | | | |

| | 519,062 | | | ACM Auto Trust Series 2023-2A A(c) | | | | 7.9700 | | 06/20/30 | | | 520,384 | |

| | 334,000 | | | Flagship Credit Auto Trust Series 2020-3 E(c) | | | | 4.9800 | | 12/15/27 | | | 311,181 | |

| | 100,000 | | | SFS Auto Receivables Securitization Trust Series 2023-1A C(c) | | | | 5.9700 | | 02/20/31 | | | 98,755 | |

| | 3,500,000 | | | US Auto Funding Series 2021-1A D(c) | | | | 4.3600 | | 03/15/27 | | | 2,026,892 | |

| | | | | | | | | | | | | | 2,957,212 | |

| | | | | CDO — 2.3% | | | | | | | | | | |

| | 109,353 | | | Aspen Funding I Ltd. Series 2002-1x | | | | 9.0600 | | 07/10/37 | | | 110,433 | |

| | 4,612,046 | | | Galleria CDO V Ltd. Series 5A B(c),(d) | | US0003M + 2.400% | | 8.0630 | | 09/19/37 | | | 4,461,172 | |

| | 3,417,418 | | | Mid Ocean CBO Ltd. Series 2001-1X A1L(d) | | US0003M + 0.500% | | 2.3910 | | 11/05/36 | | | 290,665 | |

| | 3,000,000 | | | Tropic CDO IV Ltd. Series 2004-4A A3L(c),(d) | | US0003M + 1.000% | | 6.6550 | | 04/15/35 | | | 2,422,860 | |

| | | | | | | | | | | | | | 7,285,130 | |

| | | | | CLO — 1.7% | | | | | | | | | | |

| | 500,000 | | | Ellington Clo III Ltd. Series 2018-3A D(c),(d) | | TSFR3M + 4.002% | | 9.4170 | | 07/20/30 | | | 510,590 | |

| | 200,000 | | | GC FTPYME Pastor FTA Series 4(d) | | EUR003M + 2.400% | | 6.4020 | | 07/15/45 | | | 73,554 | |

| | 142,544 | | | Halcyon Loan Advisors Funding Ltd. Series 2014-2A C(c),(d) | | TSFR3M + 3.762% | | 9.1520 | | 04/28/25 | | | 142,547 | |

| | 957,044 | | | Halcyon Loan Advisors Funding Ltd. Series 2013-2A D(c),(d) | | TSFR3M + 4.062% | | 9.4390 | | 08/01/25 | | | 647,562 | |

| | 250,000 | | | Nassau Ltd. Series 2018-IA E(c),(d) | | TSFR3M + 6.112% | | 11.5050 | | 07/15/31 | | | 173,265 | |

| | 500,000 | | | Peaks CLO 2 Ltd. Series 2017-2A CR(c),(d) | | TSFR3M + 3.862% | | 9.2770 | | 07/20/31 | | | 483,964 | |

| | 2,750,000 | | | Peaks CLO 2 Ltd. Series 2017-2A DR(c),(d) | | TSFR3M + 5.262% | | 10.6770 | | 07/20/31 | | | 2,435,270 | |

| | 500,000 | | | Steele Creek Clo Ltd. Series 2018-2A D(c),(d) | | TSFR3M + 3.662% | | 9.0290 | | 08/18/31 | | | 448,467 | |

| | | | | | | | | | | | | | | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | CLO — 1.7% (Continued) | | | | | | | | | | |

| | 500,000 | | | Zais Clo Ltd. Series 2019-13A D1(c),(d) | | TSFR3M + 4.782% | | 10.1750 | | 07/15/32 | | $ | 458,750 | |

| | | | | | | | | | | | | | 5,373,969 | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% | | | | | | | | | | |

| | 80,146 | | | ABN Amro Mortgage Corporation Series 2003-11 A4 | | | | 5.5000 | | 10/25/33 | | | 75,964 | |

| | 253,525 | | | Adjustable Rate Mortgage Trust Series 2005-3 7A1(b) | | | | 5.3760 | | 07/25/35 | | | 221,056 | |

| | 475,639 | | | Adjustable Rate Mortgage Trust Series 2005-6A 2A2(d) | | TSFR1M + 0.954% | | 6.2970 | | 11/25/35 | | | 154,593 | |

| | 33,505 | | | Alternative Loan Trust Series 1998-4 IIA3(e) | | | | 5.8320 | | 08/25/28 | | | 32,178 | |

| | 89,123 | | | Alternative Loan Trust Series 2005-J1 3A1 | | | | 6.5000 | | 08/25/32 | | | 86,039 | |

| | 26,623 | | | Alternative Loan Trust Series 2004-J11 3A1 | | | | 7.2500 | | 08/25/32 | | | 26,699 | |

| | 108,968 | | | Alternative Loan Trust Series 2003-J2 A1 | | | | 6.0000 | | 10/25/33 | | | 105,979 | |

| | 102,694 | | | Alternative Loan Trust Series 2003-J3 1A3 | | | | 5.2500 | | 11/25/33 | | | 88,861 | |

| | 17,495 | | | Alternative Loan Trust Series 2003-22CB 1A1 | | | | 5.7500 | | 12/25/33 | | | 17,037 | |

| | 33,670 | | | Alternative Loan Trust Series 2003-J3 2A1(g) | | | | 6.2500 | | 12/25/33 | | | 32,795 | |

| | 8,997 | | | Alternative Loan Trust Series 2004-16CB 1A1 | | | | 5.5000 | | 07/25/34 | | | 8,669 | |

| | 136,090 | | | Alternative Loan Trust Series 2004-J8 2A1 | | | | 7.0000 | | 08/25/34 | | | 120,023 | |

| | 54,247 | | | Alternative Loan Trust Series 2004-J10 2CB1 | | | | 6.0000 | | 09/25/34 | | | 52,851 | |

| | 45,282 | | | Alternative Loan Trust Series 2004-15 1A2(b) | | | | 6.2410 | | 09/25/34 | | | 42,462 | |

| | 565,823 | | | Alternative Loan Trust Series 2004-J10 5CB1 | | | | 5.5000 | | 11/25/34 | | | 534,960 | |

| | 427,471 | | | Alternative Loan Trust Series 2004-28CB 2A4 | | | | 5.7500 | | 01/25/35 | | | 383,794 | |

| | 80,024 | | | Alternative Loan Trust Series 2004-28CB 3A1 | | | | 6.0000 | | 01/25/35 | | | 69,536 | |

| | 38,709 | | | Alternative Loan Trust Series 2004-28CB 6A1 | | | | 6.0000 | | 01/25/35 | | | 35,038 | |

| | 31,966 | | | Alternative Loan Trust Series 2005-3CB 1A9 | | | | 5.0000 | | 03/25/35 | | | 25,663 | |

| | 132,574 | | | Alternative Loan Trust Series 2005-6CB 1A6 | | | | 5.5000 | | 04/25/35 | | | 111,393 | |

| | 76,516 | | | Alternative Loan Trust Series 2005-14 2A1(d) | | TSFR1M + 0.534% | | 5.8770 | | 05/25/35 | | | 63,854 | |

| | 136,479 | | | Alternative Loan Trust Series 2005-J8 1A5 | | | | 5.5000 | | 07/25/35 | | | 95,134 | |

| | 182,461 | | | Alternative Loan Trust Series 2005-27 2A1(d) | | 12MTA + 1.350% | | 6.1500 | | 08/25/35 | | | 144,054 | |

| | 40,736 | | | Alternative Loan Trust Series 2005-J11 2A1 | | | | 6.0000 | | 10/25/35 | | | 20,509 | |

| | 52,601 | | | Alternative Loan Trust Series 2005-J11 1A3 | | | | 5.5000 | | 11/25/35 | | | 29,696 | |

| | 32,385 | | | Alternative Loan Trust Series 2005-54CB 1A11 | | | | 5.5000 | | 11/25/35 | | | 24,612 | |

| | 96,551 | | | Alternative Loan Trust Series 2005-61 2A1(d) | | TSFR1M + 0.674% | | 6.0170 | | 12/25/35 | | | 84,164 | |

| | 125,942 | | | Alternative Loan Trust Series 2005-72 A3(d) | | TSFR1M + 0.714% | | 6.0570 | | 01/25/36 | | | 113,101 | |

| | 105,859 | | | Alternative Loan Trust Series 2006-40T1 2A1 | | | | 6.0000 | | 12/25/36 | | | 31,770 | |

| | 43,355 | | | Alternative Loan Trust Resecuritization Series 2005-12R A3 | | | | 6.0000 | | 11/25/34 | | | 40,396 | |

| | 1,068,047 | | | Alternative Loan Trust Resecuritization Series 2005-12R A4 | | | | 6.0000 | | 11/25/34 | | | 995,145 | |

| | | | | | | | | | | | | | | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 369,552 | | | Alternative Loan Trust Resecuritization Series 2008-2R 2A1(b) | | | | 4.0150 | | 08/25/37 | | $ | 156,681 | |

| | 93,783 | | | American Home Mortgage Investment Trust Series 2004-1 2M1(d) | | TSFR6M + 2.428% | | 7.8630 | | 04/25/44 | | | 83,730 | |

| | 1,879,000 | | | Angel Oak Mortgage Trust Series 2021-6 M1(b),(c) | | | | 2.7720 | | 09/25/66 | | | 1,058,469 | |

| | 127,371 | | | APS Resecuritization Trust Series 2016-3 3A(c),(d) | | TSFR1M + 2.964% | | 8.3070 | | 09/27/46 | | | 127,243 | |

| | 188,063 | | | Banc of America Alternative Loan Trust Series 2003-8 1CB1 | | | | 5.5000 | | 10/25/33 | | | 180,257 | |

| | 102,933 | | | Banc of America Alternative Loan Trust Series 2004-6 3A1 | | | | 6.0000 | | 07/25/34 | | | 97,570 | |

| | 58,838 | | | Banc of America Alternative Loan Trust Series 2007-1 1A1(b) | | | | 3.9860 | | 02/25/57 | | | 48,260 | |

| | 216,710 | | | Banc of America Funding Trust Series 2005-1 1A1 | | | | 5.5000 | | 02/25/35 | | | 194,578 | |

| | 42,326 | | | Banc of America Funding Trust Series 2005-E 8A1(d) | | 12MTA + 1.430% | | 6.3590 | | 06/20/35 | | | 29,919 | |

| | 30,526 | | | Banc of America Funding Trust Series 2015-R4 5A1(c),(d) | | TSFR1M + 0.264% | | 5.5890 | | 10/25/36 | | | 30,288 | |

| | 88,269 | | | Banc of America Funding Trust Series 2007-2 1A8(a) | | | | 6.0000 | | 03/25/37 | | | 16,949 | |

| | 704,330 | | | Banc of America Funding Trust Series 2006-I 4A1(b) | | | | 4.0840 | | 10/20/46 | | | 575,923 | |

| | 16,582 | | | Banc of America Mortgage Trust Series 2002-L 1A1(b) | | | | 3.5500 | | 12/25/32 | | | 12,376 | |

| | 50,675 | | | Banc of America Mortgage Trust Series 2005-E 2A1(b) | | | | 4.5840 | | 06/25/35 | | | 42,109 | |

| | 43,789 | | | Banc of America Mortgage Trust Series 2005-F 3A1(b) | | | | 5.2540 | | 07/25/35 | | | 35,110 | |

| | 69,393 | | | Banc of America Mortgage Trust Series 2005-G 2A1(b) | | | | 5.1300 | | 08/25/35 | | | 58,672 | |

| | 25,414 | | | Banc of America Mortgage Trust Series 2005-H 2A1(b) | | | | 5.1240 | | 09/25/35 | | | 20,804 | |

| | 127,961 | | | Banc of America Mortgage Trust Series 2005-L 2A4(b) | | | | 3.9890 | | 01/25/36 | | | 102,191 | |

| | 841,585 | | | BCAP, LLC Series 2014-RR2 7A2(c),(d) | | TSFR1M + 0.314% | | 4.7810 | | 01/26/38 | | | 803,594 | |

| | 1,595,920 | | | BCAP, LLC Trust Series 2011-RR5 12A1(c),(e) | | | | 4.5260 | | 03/26/37 | | | 1,547,251 | |

| | 838,498 | | | BCAP, LLC Trust Series 2011-RR10 1A2(b),(c) | | | | 5.0000 | | 03/26/37 | | | 655,139 | |

| | 3,598 | | | Bear Stearns ALT-A Trust Series 2004-11 2A1(b) | | | | 3.0710 | | 11/25/34 | | | 3,294 | |

| | 31,839 | | | Bear Stearns ARM Trust Series 2003-5 1A1(b) | | | | 5.8670 | | 08/25/33 | | | 29,518 | |

| | 4,211 | | | Bear Stearns ARM Trust Series 2003-7 6A(b) | | | | 5.6140 | | 10/25/33 | | | 3,932 | |

| | 43,250 | | | Bear Stearns ARM Trust Series 2003-8 2A1(b) | | | | 3.8970 | | 01/25/34 | | | 39,353 | |

| | 105,998 | | | Bear Stearns ARM Trust Series 2004-1 124M(b) | | | | 4.1790 | | 04/25/34 | | | 89,784 | |

| | 11,476 | | | Bear Stearns ARM Trust Series 2004-1 21A1(b) | | | | 4.9230 | | 04/25/34 | | | 10,281 | |

| | 111,760 | | | Bear Stearns ARM Trust Series 2004-5(b) | | | | 3.6770 | | 07/25/34 | | | 89,112 | |

| | 95,797 | | | Bear Stearns ARM Trust Series 2004-6 3A(b) | | | | 5.8900 | | 09/25/34 | | | 67,314 | |

| | 878,603 | | | Bear Stearns ARM Trust Series 2004-8 13A1(b) | | | | 4.0640 | | 11/25/34 | | | 785,497 | |

| | 47,095 | | | Bear Stearns ARM Trust Series 2004-8 2A1(b) | | | | 4.7030 | | 11/25/34 | | | 42,714 | |

| | 41,852 | | | Bear Stearns ARM Trust Series 2004-10 12A5(b) | | | | 4.2950 | | 01/25/35 | | | 39,297 | |

| | 916,814 | | | Bear Stearns ARM Trust Series 2007-3 2A1(b) | | | | 3.7320 | | 05/25/47 | | | 729,436 | |

| | 582,668 | | | Bear Stearns Asset Backed Securities I Trust Series 2006-AC2 21A6 | | | | 6.0000 | | 03/25/36 | | | 235,459 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 588,796 | | | Bear Stearns Asset Backed Securities Trust Series 2003-AC7 A1(e) | | | | 5.5000 | | 01/25/34 | | $ | 508,905 | |

| | 148,094 | | | Bear Stearns Structured Products Inc Trust Series 2007-R6 1A1(b) | | | | 4.7580 | | 01/26/36 | | | 118,577 | |

| | 35,215 | | | Bella Vista Mortgage Trust Series 2004-1 1A(d) | | TSFR1M + 0.814% | | 6.1460 | | 11/20/34 | | | 32,834 | |

| | 65,119 | | | BlackRock Capital Finance, L.P. Series 1997-R2 1B1(b),(c) | | | | 3.5020 | | 12/25/35 | | | 48,839 | |

| | 240,421 | | | Brean Asset Backed Securities Trust Series 2021-RM2 A(b),(c) | | | | 1.7500 | | 10/25/61 | | | 197,374 | |

| | 169,288 | | | Brean Asset Backed Securities Trust Series 2022-RM5 A(b),(c) | | | | 4.5000 | | 09/25/62 | | | 147,247 | |

| | 2,133,511 | | | Brean Asset Backed Securities Trust Series 2023-RM6 A2(c),(e) | | | | 5.2500 | | 01/25/63 | | | 1,814,638 | |

| | 3,241,666 | | | Brean Asset Backed Securities Trust Series 2021-RM1 M1(c) | | | | 1.6000 | | 10/25/63 | | | 1,888,228 | |

| | 606,924 | | | Cascade Funding Mortgage Trust Series 2018-RM2 D(b),(c) | | | | 4.0000 | | 10/25/68 | | | 576,356 | |

| | 2,854,813 | | | Cascade Funding Mortgage Trust Series 2019-RM3 D(b),(c) | | | | 4.0000 | | 06/25/69 | | | 2,330,603 | |

| | 72,306 | | | CDMC Mortgage Pass-Through Certificates Series 2004-4 A8(b) | | | | 5.4370 | | 09/25/34 | | | 67,728 | |

| | 82,333 | | | CDMC Mortgage Pass-Through Certificates Series 2005-1 A4(b) | | | | 5.1050 | | 02/18/35 | | | 76,491 | |

| | 1,003,415 | | | Cendant Mortgage Capital, LLC CDMC Mort Pas Thr Ce Series 2004-1 A7 | | | | 5.5000 | | 02/25/34 | | | 959,085 | |

| | 230,000 | | | CFMT, LLC Series 2022-HB9 M3(b),(c) | | | | 3.2500 | | 09/25/37 | | | 182,862 | |

| | 92,462 | | | Chase Home Lending Mortgage Trust Series 2019-1 B4(b),(c) | | | | 3.8900 | | 03/25/50 | | | 70,539 | |

| | 153,698 | | | Chase Mortgage Finance Trust Series 2004-S2 2A4 | | | | 5.5000 | | 02/25/34 | | | 144,925 | |

| | 300,076 | | | Chase Mortgage Finance Trust Series 2006-A1 2A3(b) | | | | 5.2130 | | 09/25/36 | | | 244,796 | |

| | 483,864 | | | Chase Mortgage Finance Trust Series 2007-S3 AP(f) | | | | 0.0000 | | 05/25/37 | | | 7,285 | |

| | 267,879 | | | Chase Mortgage Finance Trust Series 2007-S3 1A17(a) | | | | 4.0000 | | 05/25/37 | | | 65,114 | |

| | 189,112 | | | Chevy Chase Funding, LLC Mortgage-Backed Series 2005-4A A2(c),(d) | | TSFR1M + 0.364% | | 5.7070 | | 10/25/36 | | | 127,715 | |

| | 99,714 | | | CHL Mortgage Pass-Through Trust Series 2002-19 1A1 | | | | 6.2500 | | 11/25/32 | | | 82,164 | |

| | 113,802 | | | CHL Mortgage Pass-Through Trust Series 2002-39 A37 | | | | 5.7500 | | 02/25/33 | | | 104,802 | |

| | 112,883 | | | CHL Mortgage Pass-Through Trust Series 2003-60 2A1(b) | | | | 4.1160 | | 02/25/34 | | | 95,581 | |

| | 27,175 | | | CHL Mortgage Pass-Through Trust Series 2004-3 A4 | | | | 5.7500 | | 04/25/34 | | | 25,752 | |

| | 49,733 | | | CHL Mortgage Pass-Through Trust Series 2004-6 2A1(b) | | | | 4.7370 | | 05/25/34 | | | 45,269 | |

| | 64,932 | | | CHL Mortgage Pass-Through Trust Series 2004-5 2A9 | | | | 5.2500 | | 05/25/34 | | | 62,967 | |

| | 73,003 | | | CHL Mortgage Pass-Through Trust Series 2004-5 2A2 | | | | 5.5000 | | 05/25/34 | | | 71,387 | |

| | 39,145 | | | CHL Mortgage Pass-Through Trust Series 2004-HYB2 2A(b) | | | | 4.7410 | | 07/20/34 | | | 36,324 | |

| | 112,697 | | | CHL Mortgage Pass-Through Trust Series 2004-J5 A4 | | | | 5.5000 | | 07/25/34 | | | 105,286 | |

| | 39,424 | | | CHL Mortgage Pass-Through Trust Series 2004-14 4A1(b) | | | | 5.3660 | | 08/25/34 | | | 34,885 | |

| | 57,665 | | | CHL Mortgage Pass-Through Trust Series 2004-J9 2A6 | | | | 5.5000 | | 01/25/35 | | | 55,479 | |

| | 53,750 | | | CHL Mortgage Pass-Through Trust Series 2004-HYB5 6A2(b) | | | | 5.0120 | | 04/20/35 | | | 47,653 | |

| | 2,971,198 | | | CHL Mortgage Pass-Through Trust Series 2005-14 A1 | | | | 6.0000 | | 07/25/35 | | | 1,209,702 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 537,547 | | | CHL Mortgage Pass-Through Trust Series 2005-J2 3A12 | | | | 5.0000 | | 08/25/35 | | $ | 320,273 | |

| | 99,632 | | | CHL Mortgage Pass-Through Trust Series 2006-J1 3A1 | | | | 6.0000 | | 02/25/36 | | | 40,413 | |

| | 81,098 | | | CHL Mortgage Pass-Through Trust Series 2007-HY1 2A1(b) | | | | 3.7650 | | 03/25/37 | | | 70,988 | |

| | 292,314 | | | CHL Mortgage Pass-Through Trust Series 2007-15 2A2 | | | | 6.5000 | | 09/25/37 | | | 106,860 | |

| | 250,000 | | | CHNGE Mortgage Trust Series 2023-1 M1(b),(c) | | | | 8.3630 | | 03/25/58 | | | 243,816 | |

| | 225,000 | | | CHNGE Mortgage Trust Series 2022-2 B2(b),(c) | | | | 4.6220 | | 03/25/67 | | | 131,430 | |

| | 855,206 | | | CIM Trust Series 2019-J1 B3(b),(c) | | | | 3.9440 | | 08/25/49 | | | 682,617 | |

| | 123,458 | | | Citicorp Mortgage Securities REMIC Pass-Through Series 2005-4 1A5 | | | | 5.5000 | | 07/25/35 | | | 115,431 | |

| | 36,708 | | | Citicorp Mortgage Securities Trust Series Series 2006-6 A4 | | | | 6.0000 | | 11/25/36 | | | 35,069 | |

| | 74,496 | | | Citicorp Mortgage Securities Trust Series Series 2007-2 APO(f) | | | | 0.0000 | | 02/25/37 | | | 38,255 | |

| | 181,497 | | | Citicorp Mortgage Securities Trust Series Series 2007-4 1A5 | | | | 6.0000 | | 05/25/37 | | | 155,899 | |

| | 1,469 | | | Citicorp Mortgage Securities Trust Series Series 2005-7 2A1 | | | | 5.0000 | | 10/25/55 | | | 1,441 | |

| | 102,726 | | | Citigroup Global Markets Mortgage Securities VII, Series 1997- HUD2 B2(b) | | | | 7.0000 | | 07/25/24 | | | 2,527 | |

| | 3,789 | | | Citigroup Global Markets Mortgage Securities VII, Series 2002- HYB1 B2(b) | | | | 6.2320 | | 09/25/32 | | | 3,337 | |

| | 159,336 | | | Citigroup Mortgage Loan Trust Series 2009-10 6A2(b),(c) | | | | 5.8900 | | 09/25/34 | | | 136,895 | |

| | 176,996 | | | Citigroup Mortgage Loan Trust Series 2009-4 7A5(b),(c) | | | | 5.4840 | | 05/25/35 | | | 161,473 | |

| | 55,948 | | | Citigroup Mortgage Loan Trust Series 2014-10 4A1(c),(b) | | | | 5.6080 | | 02/25/37 | | | 55,203 | |

| | 561 | | | Citigroup Mortgage Loan Trust Series 2010-9 5A3(c),(e) | | | | 5.7020 | | 03/25/37 | | | 554 | |

| | 42,973 | | | Citigroup Mortgage Loan Trust Series 2015-RP2 A(c) | | | | 4.2500 | | 01/25/53 | | | 38,936 | |

| | 300,000 | | | Citigroup Mortgage Loan Trust Series 2020-EXP1 B1(b),(c) | | | | 4.4670 | | 05/25/60 | | | 230,432 | |

| | 258,543 | | | CITIGROUP MORTGAGE LOAN TRUST Series 2021-J1 A4A(b),(c) | | | | 2.5000 | | 04/25/51 | | | 196,565 | |

| | 11,432 | | | Citigroup Mortgage Loan Trust, Inc. Series 2003-1 3A4 | | | | 5.2500 | | 09/25/33 | | | 10,139 | |

| | 101,878 | | | Citigroup Mortgage Loan Trust, Inc. Series 2004-UST1 A4(b) | | | | 5.7890 | | 08/25/34 | | | 88,992 | |

| | 24,318 | | | Citigroup Mortgage Loan Trust, Inc. Series 2004-UST1 A6(b) | | | | 5.9110 | | 08/25/34 | | | 20,874 | |

| | 43,963 | | | Citigroup Mortgage Loan Trust, Inc. Series 2004-NCM2 1CB2 | | | | 6.7500 | | 08/25/34 | | | 38,445 | |

| | 43,996 | | | Citigroup Mortgage Loan Trust, Inc. Series 2005-2 2A11 | | | | 5.5000 | | 05/25/35 | | | 42,332 | |

| | 38,221 | | | COLT Funding, LLC Series 2021-3R A2(b),(c) | | | | 1.2570 | | 12/25/64 | | | 31,458 | |

| | 422,000 | | | COLT Mortgage Loan Trust Series 2020-2 M1(b),(c) | | | | 5.2500 | | 03/25/65 | | | 400,318 | |

| | 130,754 | | | Credit Suisse First Boston Mortgage Securities Series 2001-26 5A1(b) | | | | 4.2590 | | 11/25/31 | | | 130,315 | |

| | 238,030 | | | Credit Suisse First Boston Mortgage Securities Series 2002-NP14 M1(c),(d) | | TSFR1M + 2.302% | | 4.2990 | | 11/25/31 | | | 142,298 | |

| | 139,173 | | | Credit Suisse First Boston Mortgage Securities Series 2001-33 3B1(b) | | | | 7.2020 | | 01/25/32 | | | 123,987 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 74,357 | | | Credit Suisse First Boston Mortgage Securities Series 2003-11 1A31 | | | | 5.5000 | | 06/25/33 | | $ | 71,076 | |

| | 522,049 | | | Credit Suisse First Boston Mortgage Securities Series 2003-19 1A19 | | | | 5.2500 | | 07/25/33 | | | 505,176 | |

| | 21,884 | | | Credit Suisse First Boston Mortgage Securities Series 2003-21 1A4 | | | | 5.2500 | | 09/25/33 | | | 20,000 | |

| | 72,553 | | | Credit Suisse First Boston Mortgage Securities Series 2003-25 1A8(d) | | 8*(USISDA30-USISDA02) | | 5.5000 | | 10/25/33 | | | 66,857 | |

| | 217,658 | | | Credit Suisse First Boston Mortgage Securities Series 2003-25 1A11 | | | | 5.5000 | | 10/25/33 | | | 200,920 | |

| | 160,488 | | | Credit Suisse First Boston Mortgage Securities Series 2004-6 1A3 | | | | 5.5000 | | 10/25/34 | | | 145,781 | |

| | 104,670 | | | Credit Suisse First Boston Mortgage Securities Series 2005-8 9A9(d) | | TSFR1M + 0.764% | | 6.1070 | | 09/25/35 | | | 69,835 | |

| | 5,680 | | | CSFB Mortgage-Backed Pass-Through Certificates Series 2005-10 2A1(g) | | | | 5.2500 | | 01/01/24 | | | — | |

| | 418,201 | | | CSFB Mortgage-Backed Pass-Through Certificates Series 2002-9 1A2 | | | | 7.5000 | | 03/25/32 | | | 381,251 | |

| | 87,021 | | | CSFB Mortgage-Backed Pass-Through Certificates Series 2003- AR24 3A1(b) | | | | 4.7370 | | 10/25/33 | | | 79,506 | |

| | 67,613 | | | CSFB Mortgage-Backed Pass-Through Certificates Series 2003-27 4A4 | | | | 5.7500 | | 11/25/33 | | | 62,815 | |

| | 416,713 | | | CSFB Mortgage-Backed Pass-Through Certificates Series 2004-4 1A5 | | | | 6.0000 | | 08/25/34 | | | 376,434 | |

| | 26,594 | | | CSFB Mortgage-Backed Pass-Through Certificates Series 2005-3 7A5 | | | | 5.7500 | | 07/25/35 | | | 25,534 | |

| | 33,335 | | | CSMC Series Series 2010-18R 4A4(b),(c) | | | | 3.5000 | | 04/26/38 | | | 31,382 | |

| | 308,570 | | | CSMC Trust Series 2007-5R A5 | | | | 6.5000 | | 07/26/36 | | | 77,628 | |

| | 279,423 | | | CSMC Trust Series 2021-RPL2 M3(b),(c) | | | | 3.6040 | | 01/25/60 | | | 175,486 | |

| | 506,774 | | | Deutsche Alt-B Securities Mortgage Loan Trust Series AB1 PO(f) | | | | 0.0000 | | 04/25/37 | | | 230,949 | |

| | 31,989 | | | Deutsche Mortgage Sec Inc Mort Loan Tr Series 2004-1 1A1 | | | | 5.5000 | | 09/25/33 | | | 30,864 | |

| | 37,908 | | | DSLA Mortgage Loan Trust Series 2004-AR4 2A1A(d) | | TSFR1M + 0.834% | | 6.1660 | | 01/19/45 | | | 28,392 | |

| | 400,000 | | | Ellington Financial Mortgage Trust Series 2022-1 B2(b),(c) | | | | 3.8800 | | 01/25/67 | | | 224,521 | |

| | 196,153 | | | Fannie Mae Trust Series 2005-W3 3A(b) | | | | 4.0550 | | 04/25/45 | | | 186,307 | |

| | 473,000 | | | Finance of America HECM Buyout Series 2022-HB1 M3(b),(c) | | | | 5.0840 | | 02/25/32 | | | 410,115 | |

| | 41,117 | | | Financial Asset Securities Corp AAA Trust Series 2005-2 A3(c),(d) | | TSFR1M + 0.414% | | 5.7620 | | 11/26/35 | | | 34,709 | |

| | 151,536 | | | First Horizon Alternative Mortgage Securities Series 2004-AA1 A1(b) | | | | 6.8450 | | 06/25/34 | | | 139,854 | |

| | 9,071 | | | First Horizon Alternative Mortgage Securities Series 2004-AA3 A1(b) | | | | 5.9430 | | 09/25/34 | | | 8,574 | |

| | 59,789 | | | First Horizon Alternative Mortgage Securities Series AA7 2A2(b) | | | | 6.4900 | | 02/25/35 | | | 52,920 | |

| | 72,259 | | | First Horizon Alternative Mortgage Securities Series 2007-FA4 1A8 | | | | 6.2500 | | 08/25/37 | | | 29,694 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

Principal

Amount ($) | | | | | Spread | | Coupon Rate

(%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 521,327 | | | First Horizon Mortgage Pass-Through Trust Series 2005-AR3 2A1(b) | | | | 5.4650 | | 08/25/35 | | $ | 361,517 | |

| | 29,935 | | | First Horizon Mortgage Pass-Through Trust Series 2005-AR5 3A1(b) | | | | 0.0000 | | 10/25/35 | | | 16,476 | |

| | 501 | | | First Horizon Mortgage Pass-Through Trust Series 2005-AR5 1A1(b) | | | | 0.0000 | | 11/25/35 | | | 446 | |

| | 100,341 | | | First Horizon Mortgage Pass-Through Trust Series 2006-AR3 1A1(b) | | | | 4.0270 | | 11/25/36 | | | 55,245 | |

| | 237,346 | | | First Horizon Mortgage Pass-Through Trust Series 2007-AR3 1A1(b) | | | | 4.8230 | | 11/25/37 | | | 102,794 | |

| | 1,109,000 | | | Flagstar Mortgage Trust Series 2017-1 B5(b),(c) | | | | 3.6190 | | 03/25/47 | | | 623,518 | |

| | 355,470 | | | Flagstar Mortgage Trust Series 2018-3INV B4(b),(c) | | | | 4.4610 | | 05/25/48 | | | 282,529 | |

| | 274,399 | | | Flagstar Mortgage Trust Series 2019-2 B3(b),(c) | | | | 4.0130 | | 12/25/49 | | | 211,769 | |

| | 96,003 | | | Flagstar Mortgage Trust Series 2021-13IN B5(b),(c) | | | | 3.3630 | | 12/30/51 | | | 52,350 | |

| | 1,000,000 | | | Freddie Mac STACR REMIC Trust Series 2022-HQA1 M2(c),(d) | | SOFR30A + 5.250% | | 10.5780 | | 03/25/42 | | | 1,063,258 | |

| | 420,000 | | | Freddie Mac STACR REMIC Trust Series 2020-DNA6 B1(c),(d) | | SOFR30A + 3.000% | | 8.3280 | | 12/25/50 | | | 411,438 | |

| | 1,000,000 | | | Freddie Mac STACR Trust Series 2019-DNA3 B2(c),(d) | | SOFR30A + 8.264% | | 13.5930 | | 07/25/49 | | | 1,111,255 | |

| | 89,994 | | | Freddie Mac Structured Pass-Through Certificates Series T-61 1A1(d) | | 12MTA + 1.400% | | 6.2000 | | 07/25/44 | | | 81,120 | |

| | 140,567 | | | Freddie Mac Structured Pass-Through Certificates Series T-62 1A1(d) | | 12MTA + 1.200% | | 6.2100 | | 10/25/44 | | | 125,068 | |

| | 1,031,051 | | | Global Mortgage Securitization Ltd. Series 2004-A A3(c),(b) | | | | 7.6030 | | 11/25/32 | | | 1,015,243 | |

| | 84,995 | | | GMACM Mortgage Loan Trust Series 2004-J2 A8 | | | | 5.7500 | | 06/25/34 | | | 81,783 | |

| | 65,839 | | | GMACM Mortgage Loan Trust Series 2005-AR3 5A2(b) | | | | 3.8730 | | 06/19/35 | | | 53,934 | |

| | 1,891,760 | | | GMACM Mortgage Loan Trust Series 2005-AR5 4A1(b) | | | | 4.0100 | | 09/19/35 | | | 1,581,284 | |

| | 114,849 | | | GMACM Mortgage Loan Trust Series 2006-AR1 1A1(b) | | | | 3.3570 | | 04/19/36 | | | 83,578 | |

| | 303,180 | | | Government National Mortgage Association Series 2012-H27 AI(a),(b) | | | | 1.7240 | | 10/20/62 | | | 6,813 | |

| | 1,213,077 | | | Government National Mortgage Association Series 2016-H24 AI(a),(b) | | | | 0.1010 | | 11/20/66 | | | 48,933 | |

| | 102,318 | | | GS Mortgage Securities Corporation II Series 2000-1A A(c),(d) | | TSFR1M + 0.464% | | 5.7960 | | 06/20/24 | | | 96,446 | |

| | 401,423 | | | GS Mortgage-Backed Securities Corp Trust Series 2019-PJ1 B3(b),(c) | | | | 4.0470 | | 08/25/49 | | | 299,432 | |

| | 1,213,111 | | | GSMPS Mortgage Loan Trust Series 2000-1 A(b),(c) | | | | 8.5000 | | 06/19/29 | | | 1,095,906 | |

| | 1,049,579 | | | GSMPS Mortgage Loan Trust Series 2004-4 1AF(c),(d) | | TSFR1M + 0.514% | | 5.8570 | | 06/25/34 | | | 924,213 | |

| | 1,824,819 | | | GSMPS Mortgage Loan Trust Series 2004-4 1A2(c) | | | | 7.5000 | | 06/25/34 | | | 1,761,989 | |

| | 296,772 | | | GSMPS Mortgage Loan Trust Series 2004-4 1A3(c) | | | | 8.0000 | | 06/25/34 | | | 285,477 | |

| | 31,531 | | | GSMPS Mortgage Loan Trust Series 2005-RP2 1AF(c),(d) | | TSFR1M + 0.464% | | 5.8070 | | 03/25/35 | | | 27,614 | |

| | 164,841 | | | GSMPS Mortgage Loan Trust Series 2005-RP3 1AF(c),(d) | | TSFR1M + 0.464% | | 5.8070 | | 09/25/35 | | | 132,206 | |

| | 114,384 | | | GSMPS Mortgage Loan Trust Series 2006-RP1 1A2(c) | | | | 7.5000 | | 01/25/36 | | | 98,539 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) |

| | 785,500 | | | GSMSC Pass-Through Trust Series 2008-2R 2A1(b),(c) | | | | 7.5000 | | 10/25/36 | | $ | 112,390 | |

| | 119,323 | | | GSR Mortgage Loan Trust Series 2004-7 1A1(b) | | | | 4.2420 | | 06/25/34 | | | 104,914 | |

| | 561,387 | | | GSR Mortgage Loan Trust Series 2004-12 1B1(d) | | TSFR1M + 0.714% | | 6.0570 | | 12/25/34 | | | 244,552 | |

| | 42,833 | | | GSR Mortgage Loan Trust Series 2005-4F 6A1 | | | | 6.5000 | | 02/25/35 | | | 39,849 | |

| | 29,482 | | | GSR Mortgage Loan Trust Series 2005-AR3 1A1(d) | | TSFR1M + 0.554% | | 5.8970 | | 05/25/35 | | | 24,731 | |

| | 14,263 | | | GSR Mortgage Loan Trust Series 2005-AR3 2A1(d) | | TSFR1M + 0.554% | | 5.8970 | | 05/25/35 | | | 10,506 | |

| | 527,985 | | | GSR Mortgage Loan Trust Series 2005-AR4 2A1(b) | | | | 5.0980 | | 07/25/35 | | | 280,011 | |

| | 5,027 | | | GSR Mortgage Loan Trust Series 2005-6F 1A7 | | | | 5.2500 | | 07/25/35 | | | 4,721 | |

| | 27,593 | | | GSR Mortgage Loan Trust Series 2005-8F 3A4 | | | | 6.0000 | | 11/25/35 | | | 10,627 | |

| | 112,415 | | | GSR Mortgage Loan Trust Series 2006-1F 2A16 | | | | 6.0000 | | 02/25/36 | | | 54,128 | |

| | 71,370 | | | GSR Mortgage Loan Trust Series 2007-AR2 2A1(b) | | | | 4.3050 | | 05/25/37 | | | 41,108 | |

| | 222,274 | | | HarborView Mortgage Loan Trust Series 2003-1 A(b) | | | | 5.2850 | | 05/19/33 | | | 181,552 | |

| | 1,519,121 | | | HarborView Mortgage Loan Trust Series 2004-7 4A(b) | | | | 5.0380 | | 11/19/34 | | | 1,349,104 | |

| | 43,445 | | | HarborView Mortgage Loan Trust Series 2005-14 2A1A(b) | | | | 5.8410 | | 12/19/35 | | | 27,413 | |

| | 85,000 | | | HomeBanc Mortgage Trust Series 2005-3 M3(d) | | TSFR1M + 0.879% | | 6.2220 | | 07/25/35 | | | 83,369 | |

| | 189,555 | | | HSI Asset Loan Obligation Trust Series 2007-AR1 4A1(b) | | | | 4.4910 | | 01/25/37 | | | 144,888 | |

| | 201,663 | | | HSI Asset Loan Obligation Trust Series 2007-1 2A12 | | | | 6.5000 | | 06/25/37 | | | 77,036 | |

| | 160,964 | | | HSI Asset Loan Obligation Trust Series 2007-AR2 4A1(b) | | | | 4.5320 | | 09/25/37 | | | 116,630 | |

| | 267,372 | | | Hundred Acre Wood Trust Series 2021-INV1 B1(b),(c) | | | | 3.2260 | | 07/25/51 | | | 212,912 | |

| | 168,621 | | | Hundred Acre Wood Trust Series 2021-INV1 B2(b),(c) | | | | 3.2260 | | 07/25/51 | | | 126,976 | |

| | 272,957 | | | Hundred Acre Wood Trust Series 2021-INV2 B3(b),(c) | | | | 3.2970 | | 10/25/51 | | | 177,746 | |

| | 447,600 | | | Hundred Acre Wood Trust Series 2021-INV2 B1(b),(c) | | | | 3.2970 | | 10/25/51 | | | 319,173 | |

| | 294,904 | | | Hundred Acre Wood Trust Series 2021-INV2 B2(b),(c) | | | | 3.2970 | | 10/25/51 | | | 205,629 | |

| | 769,064 | | | Hundred Acre Wood Trust Series 2021-INV3 B1(b),(c) | | | | 3.3230 | | 10/25/51 | | | 608,616 | |

| | 216,526 | | | Hundred Acre Wood Trust Series 2021-INV3 B2(b),(c) | | | | 3.3230 | | 12/25/51 | | | 151,265 | |

| | 140,278 | | | Hundred Acre Wood Trust Series 2021-INV3 B3(b),(c) | | | | 3.3230 | | 12/25/51 | | | 93,312 | |

| | 53,575 | | | Impac CMB Trust Series 2003-2F M2(e) | | | | 6.5700 | | 01/25/33 | | | 51,825 | |

| | 62,150 | | | Impac CMB Trust Series 2003-4 3M2(e) | | | | 5.7290 | | 07/25/33 | | | 59,035 | |

| | 28,752 | | | Impac CMB Trust Series 2004-7 M4(d) | | TSFR1M + 1.914% | | 7.2570 | | 11/25/34 | | | 28,069 | |

| | 36,261 | | | Impac CMB Trust Series 2004-10 3M2(d) | | TSFR1M + 0.999% | | 6.3420 | | 03/25/35 | | | 31,944 | |

| | 282,162 | | | Impac CMB Trust Series 2005-4 2M1(d) | | TSFR1M + 0.614% | | 6.2070 | | 05/25/35 | | | 258,764 | |

| | 717,685 | | | Impac CMB Trust Series 2005-4 2M2(d) | | TSFR1M + 0.864% | | 6.5820 | | 05/25/35 | | | 665,479 | |

| | 590,118 | | | Impac CMB Trust Series 2005-8 2M1(d) | | TSFR1M + 0.864% | | 6.2070 | | 02/25/36 | | | 530,068 | |

| | 36,773 | | | Impac CMB Trust Series Series 2004-10 3M3(d) | | TSFR1M + 1.089% | | 6.4320 | | 03/25/35 | | | 32,948 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 37,881 | | | Impac CMB Trust Series Series 2005-2 2B(d) | | TSFR1M + 2.589% | | 7.9320 | | 04/25/35 | | $ | 35,758 | |

| | 128,019 | | | Impac CMB Trust Series Series 2005-8 2M3(d) | | TSFR1M + 2.364% | | 7.7070 | | 02/25/36 | | | 120,186 | |

| | 115,601 | | | Impac CMB Trust Series Series 2005-8 2B(d) | | TSFR1M + 2.364% | | 7.7070 | | 02/25/36 | | | 106,517 | |

| | 191,668 | | | Impac Secured Assets CMN Owner Trust Series 2003-2 A2 | | | | 6.0000 | | 08/25/33 | | | 152,865 | |

| | 86,577 | | | Impac Secured Assets Trust Series 2006-1 2A1(d) | | TSFR1M + 0.814% | | 6.1570 | | 05/25/36 | | | 80,889 | |

| | 18,306 | | | IndyMac INDX Mortgage Loan Trust Series 2004-AR11 2A(b) | | | | 3.9920 | | 12/25/34 | | | 16,182 | |

| | 252,065 | | | IndyMac INDX Mortgage Loan Trust Series 2004-AR15 3A1(b) | | | | 4.0620 | | 02/25/35 | | | 223,332 | |

| | 248,608 | | | IndyMac INDX Mortgage Loan Trust Series 2005-AR8 2A1A(d) | | TSFR1M + 0.574% | | 5.9170 | | 04/25/35 | | | 200,762 | |

| | 197,557 | | | IndyMac INDX Mortgage Loan Trust Series 2005-AR13 1A1(b) | | | | 3.9650 | | 08/25/35 | | | 90,550 | |

| | 2,028 | | | Interstar Millennium Series Trust Series 2003-3G A2(d) | | US0003M + 0.500% | | 6.1530 | | 09/27/35 | | | 1,849 | |

| | 23,963 | | | Interstar Millennium Series Trust Series 2005-1G A(d) | | US0003M + 0.400% | | 6.0590 | | 12/08/36 | | | 20,962 | |

| | 245,916 | | | JP Morgan Alternative Loan Trust Series 2005-S1 1A8(a),(d) | | TSFR1M + 7.036% | | 1.6930 | | 12/25/35 | | | 21,624 | |

| | 889,777 | | | JP Morgan Alternative Loan Trust Series A1 1A2(d) | | TSFR1M + 0.714% | | 6.0570 | | 03/25/36 | | | 789,232 | |

| | 948,467 | | | JP Morgan Alternative Loan Trust Series 2008-R4 1A1(c) | | | | 6.0000 | | 12/27/36 | | | 497,683 | |

| | 376,562 | | | JP Morgan MBS Series Series 2006-R1 6A1(b),(c) | | | | 5.2560 | | 09/28/44 | | | 302,007 | |

| | 33,238 | | | JP Morgan Mortgage Trust Series 2006-A2 5A4(b) | | | | 5.7410 | | 11/25/33 | | | 29,926 | |

| | 5,250 | | | JP Morgan Mortgage Trust Series 2004-A3 3A3(b) | | | | 4.8830 | | 07/25/34 | | | 4,830 | |

| | 23,849 | | | JP Morgan Mortgage Trust Series 2004-S2 4A5 | | | | 6.0000 | | 11/25/34 | | | 20,988 | |

| | 30,458 | | | JP Morgan Mortgage Trust Series 2005-A7 1A4(b) | | | | 5.3500 | | 10/25/35 | | | 29,049 | |

| | 829,281 | | | JP Morgan Mortgage Trust Series 2005-S3 1A22 | | | | 5.5000 | | 01/25/36 | | | 352,979 | |

| | 15,906 | | | JP Morgan Mortgage Trust Series 2006-A4 3A1(b) | | | | 4.0490 | | 06/25/36 | | | 10,751 | |

| | 180,976 | | | JP Morgan Mortgage Trust Series 2006-A7 2A4R(b) | | | | 3.9840 | | 01/25/37 | | | 139,189 | |

| | 148,606 | | | JP Morgan Mortgage Trust Series 2006-A7 2A1R(b) | | | | 3.9840 | | 01/25/37 | | | 111,915 | |

| | 350,202 | | | JP Morgan Mortgage Trust Series 2007-A2 2A3(b) | | | | 4.4990 | | 04/25/37 | | | 229,098 | |

| | 19,655 | | | JP Morgan Mortgage Trust Series 2018-8 A3(b),(c) | | | | 4.0000 | | 01/25/49 | | | 17,023 | |

| | 183,370 | | | JP Morgan Mortgage Trust Series 2019-8 B4(b),(c) | | | | 4.1700 | | 03/25/50 | | | 143,647 | |

| | 225,262 | | | JP Morgan Mortgage Trust Series Series 2008-R2 2A(b),(c) | | | | 5.5000 | | 12/27/35 | | | 171,970 | |

| | 121,464 | | | JP Morgan Tax-Emept Pass-Through Trust Series Series 2012-3 A(b),(c) | | | | 3.0000 | | 10/27/42 | | | 106,944 | |

| | 163,768 | | | JPMorgan Chase Bank NA - CHASE Series 2020-CL1 M3(d) | | TSFR1M + 3.464% | | 8.8070 | | 10/25/57 | | | 162,747 | |

| | 2,614,872 | | | La Hipotecaria Panamanian Mortgage Trust Series 2021-1 GA(c) | | | | 4.3500 | | 07/13/52 | | | 2,423,011 | |

| | 139,302 | | | Lehman Mortgage Trust Series 2006-2 2A3 | | | | 5.7500 | | 04/25/36 | | | 133,047 | |

| | 97,663 | | | LSTAR Securities Investment Ltd. Series 2020-1 A(c),(d) | | TSFR1M + 2.914% | | 8.2350 | | 02/01/26 | | | 93,750 | |

| | 39,884 | | | MASTR Adjustable Rate Mortgages Trust Series 2003-1 2A1(b) | | | | 4.3720 | | 12/25/32 | �� | | 35,655 | |

| | 16,539 | | | MASTR Adjustable Rate Mortgages Trust Series 2003-2 4A1(b) | | | | 5.4870 | | 07/25/33 | | | 14,787 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 39,335 | | | MASTR Adjustable Rate Mortgages Trust Series 2003-6 2A1(b) | | | | 4.0570 | | 12/25/33 | | $ | 35,079 | |

| | 20,658 | | | MASTR Adjustable Rate Mortgages Trust Series 2003-6 7A1(b) | | | | 5.1250 | | 12/25/33 | | | 20,149 | |

| | 45,878 | | | MASTR Adjustable Rate Mortgages Trust Series 2003-7 B1(b) | | | | 5.5190 | | 01/25/34 | | | 40,153 | |

| | 50,399 | | | MASTR Adjustable Rate Mortgages Trust Series 2004-4 1A1(b) | | | | 6.2880 | | 04/25/34 | | | 44,044 | |

| | 175,335 | | | MASTR Adjustable Rate Mortgages Trust Series 2004-15 4A1(b) | | | | 3.3840 | | 12/25/34 | | | 163,954 | |

| | 222,804 | | | MASTR Adjustable Rate Mortgages Trust Series 2005-7 3A1(b) | | | | 3.8190 | | 09/25/35 | | | 134,754 | |

| | 108,864 | | | MASTR Adjustable Rate Mortgages Trust Series 2006-2 5A1(b) | | | | 4.4280 | | 05/25/36 | | | 40,376 | |

| | 154,596 | | | MASTR Alternative Loan Trust Series 2003-3 B2(b) | | | | 6.1730 | | 05/25/33 | | | 137,200 | |

| | 41,928 | | | MASTR Alternative Loan Trust Series 2003-5 8A1 | | | | 5.5000 | | 06/25/33 | | | 37,993 | |

| | 54,003 | | | MASTR Alternative Loan Trust Series 2003-7 6A1 | | | | 6.5000 | | 12/25/33 | | | 54,013 | |

| | 100,067 | | | MASTR Alternative Loan Trust Series 2004-1 2A1 | | | | 7.0000 | | 01/25/34 | | | 92,512 | |

| | 184,065 | | | MASTR Alternative Loan Trust Series 2004-1 4A1 | | | | 5.5000 | | 02/25/34 | | | 170,794 | |

| | 56,125 | | | MASTR Alternative Loan Trust Series 2004-3 2A1 | | | | 6.2500 | | 04/25/34 | | | 55,168 | |

| | 208,190 | | | MASTR Alternative Loan Trust Series 2004-3 6A1 | | | | 6.5000 | | 04/25/34 | | | 196,013 | |

| | 24,664 | | | MASTR Alternative Loan Trust Series 2004-4 1A1 | | | | 5.5000 | | 05/25/34 | | | 23,466 | |

| | 52,763 | | | MASTR Alternative Loan Trust Series 2004-7 10A1 | | | | 6.0000 | | 06/25/34 | | | 47,190 | |

| | 41,386 | | | MASTR Alternative Loan Trust Series 2004-6 10A1 | | | | 6.0000 | | 07/25/34 | | | 38,722 | |

| | 164,779 | | | MASTR Alternative Loan Trust Series 2004-6 7A1 | | | | 6.0000 | | 07/25/34 | | | 152,361 | |

| | 690,905 | | | MASTR Alternative Loan Trust Series 2004-6 6A1 | | | | 6.5000 | | 07/25/34 | | | 664,364 | |

| | 870,220 | | | MASTR Alternative Loan Trust Series 2004-7 9A1 | | | | 6.0000 | | 08/25/34 | | | 849,875 | |

| | 25,400 | | | MASTR Alternative Loan Trust Series 2007-1 30PO(f) | | | | 0.0000 | | 10/25/36 | | | 13,984 | |

| | 2,179 | | | MASTR Alternative Loan Trust Series 2005-1 5A1 | | | | 5.5000 | | 12/25/41 | | | 1,855 | |

| | 300,341 | | | MASTR Alternative Loan Trust Series 2005-2 6A1 | | | | 5.0000 | | 03/25/43 | | | 221,769 | |

| | 866,092 | | | MASTR Alternative Loan Trust Series 2007-HF1 4PO(f) | | | | 0.0000 | | 10/25/47 | | | 9 | |

| | 19,914 | | | MASTR Asset Securitization Trust Series 2003-12 6A1 | | | | 5.0000 | | 12/25/33 | | | 18,603 | |

| | 47,857 | | | MASTR Asset Securitization Trust Series 2003-12 6A2 | | | | 5.0000 | | 12/25/33 | | | 40,011 | |

| | 48,875 | | | MASTR Asset Securitization Trust Series 2003-11 9A6 | | | | 5.2500 | | 12/25/33 | | | 46,689 | |

| | 63,181 | | | MASTR Asset Securitization Trust Series 2003-11 7A5 | | | | 5.2500 | | 12/25/33 | | | 59,057 | |

| | 8,411 | | | MASTR Asset Securitization Trust Series 2003-11 2A10 | | | | 5.5000 | | 12/25/33 | | | 7,854 | |

| | 185,009 | | | MASTR Asset Securitization Trust Series 2003-11 8A1 | | | | 5.5000 | | 12/25/33 | | | 155,790 | |

| | 8,941 | | | MASTR Asset Securitization Trust Series 2004-1 1A12 | | | | 5.5000 | | 02/25/34 | | | 8,374 | |

| | 2,874,522 | | | MASTR Asset Securitization Trust Series 2004-9 4A1 | | | | 6.0000 | | 09/25/34 | | | 2,154,448 | |

| | 69,855 | | | MASTR Asset Securitization Trust Series 2005-1 2A9 | | | | 5.5000 | | 05/25/35 | | | 54,175 | |

| | 4,115,554 | | | MASTR Asset Securitization Trust Series 2006-2 2A2(d) | | TSFR1M + 0.614% | | 5.9570 | | 06/25/36 | | | 887,587 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 1,004,759 | | | MASTR Asset Securitization Trust Series 2006-3 2A1(d) | | TSFR1M + 0.564% | | 5.9070 | | 10/25/36 | | $ | 154,779 | |

| | 18,388 | | | MASTR Reperforming Loan Trust Series 2005-2 1A4(c) | | | | 8.0000 | | 05/25/35 | | | 13,769 | |

| | 138,809 | | | MASTR Reperforming Loan Trust Series 2006-2 2A1(b),(c) | | | | 3.6090 | | 05/25/36 | | | 124,686 | |

| | 16,786 | | | MASTR Seasoned Securitization Trust Series 2005-1 3A1(b) | | | | 4.4330 | | 10/25/32 | | | 13,701 | |

| | 57,266 | | | MASTR Seasoned Securitization Trust Series 2004-1 4A1(b) | | | | 6.2190 | | 10/25/32 | | | 51,351 | |

| | 362,849 | | | MASTR Seasoned Securitization Trust Series 2003-1 2A1 | | | | 6.0000 | | 02/25/33 | | | 340,323 | |

| | 880,000 | | | Mello Mortgage Capital Acceptance Series 2018-MTG2 B5(b),(c) | | | | 4.2740 | | 10/25/48 | | | 587,379 | |

| | 560,849 | | | Mello Mortgage Capital Acceptance Series 2021-MTG1 B1(b),(c) | | | | 2.6430 | | 04/25/51 | | | 420,389 | |

| | 35,232 | | | Merrill Lynch Mortgage Investors Trust MLMI Series Series 2003- A4 3A(b) | | | | 4.9700 | | 05/25/33 | | | 31,447 | |

| | 159,601 | | | Merrill Lynch Mortgage Investors Trust MLMI Series Series 2005- A4 1A(b) | | | | 4.3990 | | 07/25/35 | | | 66,185 | |

| | 32,184 | | | Merrill Lynch Mortgage Investors Trust Series Series 2003-A6 1A(b) | | | | 5.6190 | | 09/25/33 | | | 29,569 | |

| | 148,323 | | | Merrill Lynch Mortgage Investors Trust Series MLCC Series 2004- HB1(b) | | | | 5.1950 | | 04/25/29 | | | 131,003 | |

| | 44,695 | | | Merrill Lynch Mortgage Investors Trust Series MLCC Series 2007-3 2A2(b) | | | | 3.3710 | | 09/25/37 | | | 32,586 | |

| | 1,000,000 | | | MFA Trust Series 2022-RPL1 M1(b),(c) | | | | 4.1210 | | 08/25/61 | | | 792,813 | |

| | 60,154 | | | Morgan Stanley Dean Witter Capital I Inc Trust Series 2003-HYB1 A3(b) | | | | 5.8140 | | 03/25/33 | | | 52,099 | |

| | 18,127 | | | Morgan Stanley Mortgage Loan Trust Series 2004-2AR 2A(b) | | | | 6.4770 | | 02/25/34 | | | 16,746 | |

| | 23,985 | | | Morgan Stanley Mortgage Loan Trust Series 2004-8AR 2A(b) | | | | 3.3780 | | 10/25/34 | | | 21,219 | |

| | 19,971 | | | Morgan Stanley Mortgage Loan Trust Series 2004-8AR 4A1(b) | | | | 5.2880 | | 10/25/34 | | | 17,366 | |

| | 15,965 | | | Morgan Stanley Mortgage Loan Trust Series 2004-10AR 2A2(b) | | | | 5.9470 | | 11/25/34 | | | 14,359 | |

| | 73,890 | | | Morgan Stanley Mortgage Loan Trust Series 2005-10 5A1 | | | | 6.0000 | | 12/25/35 | | | 29,051 | |

| | 47,096 | | | Morgan Stanley Mortgage Loan Trust Series 2006-8AR 4A2(b) | | | | 7.1250 | | 06/25/36 | | | 42,931 | |

| | 2,899,257 | | | Mortgage Equity Conversion Asset Trust Series 2007-FF2 A(c),(d) | | H15T1Y + 0.470% | | 5.7400 | | 02/25/42 | | | 2,840,181 | |

| | 139,107 | | | MortgageIT Trust Series 2004-2 B2(d) | | TSFR1M + 3.339% | | 8.6820 | | 12/25/34 | | | 133,552 | |

| | 241,094 | | | MortgageIT Trust Series 2005-3 M2(d) | | TSFR1M + 0.909% | | 6.2520 | | 08/25/35 | | | 225,223 | |

| | 144,303 | | | MRFC Mortgage Pass-Through Trust Series Series 2000-TBC3 B4(b),(c) | | | | 5.8110 | | 12/15/30 | | | 128,894 | |

| | 545,621 | | | National City Mortgage Capital Trust Series 2008-1 2A1 | | | | 6.0000 | | 03/25/38 | | | 524,936 | |

| | 26,609 | | | National City Mortgage Capital Trust Series 2008-1 2A2 | | | | 6.0000 | | 03/25/38 | | | 25,598 | |

| | 337,374 | | | New Residential Mortgage Loan Trust Series 2017-2A B2(b),(c) | | | | 4.7500 | | 03/25/57 | | | 282,239 | |

| | 720,000 | | | New ResidentialMortgage Loan Trust Series 2020-RPL1 B3(b),(c) | | | | 3.8810 | | 11/25/59 | | | 456,055 | |

| | 151,455 | | | Nomura Asset Acceptance Corp Alternative Loan Series 2004-R1 A2(c) | | | | 7.5000 | | 03/25/34 | | | 133,183 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 540,101 | | | Nomura Asset Acceptance Corp Alternative Loan Series 2005-AR3 1A1(d) | | TSFR1M + 0.634% | | 5.9770 | | 07/25/35 | | $ | 373,343 | |

| | 81,410 | | | Nomura Asset Acceptance Corp Alternative Loan Series 2007-1 1A3(e) | | | | 5.9570 | | 03/25/47 | | | 76,112 | |

| | 3,646,578 | | | Ocwen Residential MBS Corporation Series 1998-R3 AWAC(b),(c) | | | | 0.0000 | | 09/25/38 | | | 246,144 | |

| | 384,998 | | | PHHMC Series Trust Series 2005-4 A8(b) | | | | 5.9010 | | 07/18/35 | | | 364,540 | |

| | 361,299 | | | Prime Mortgage Trust Series 2003-3 A9 | | | | 5.5000 | | 01/25/34 | | | 339,205 | |

| | 456,760 | | | Provident Funding Mortgage Trust Series 2020-1 B3(b),(c) | | | | 3.2480 | | 02/25/50 | | | 347,638 | |

| | 17,712 | | | RAAC Series Trust Series 2005-SP1 4A1 | | | | 7.0000 | | 09/25/34 | | | 16,751 | |

| | 4,168 | | | RALI Series Trust Series 2005-QA4 A41(b) | | | | 4.1630 | | 04/25/35 | | | 3,997 | |

| | 107,445 | | | RALI Series Trust Series 2005-QA12 CB1(b) | | | | 5.3050 | | 12/25/35 | | | 48,166 | |

| | 382,342 | | | RAMP Series Trust Series 2002-SL1 AII4(b) | | | | 4.3030 | | 06/25/32 | | | 347,672 | |

| | 10,367 | | | RBSGC Mortgage Loan Trust Series 2007-B 3B1(b) | | | | 5.6220 | | 01/25/37 | | | 9,603 | |

| | 328,957 | | | RBSGC Structured Trust Series 2008-A A1(b),(c) | | | | 5.5000 | | 11/25/35 | | | 268,996 | |

| | 8,438,392 | | | RBSSP Resecuritization Trust Series 2009-12 19A2(b),(c) | | | | 4.0430 | | 12/25/35 | | | 5,626,776 | |

| | 105,134 | | | Reperforming Loan REMIC Trust Series 2003-R4 2A(b),(c) | | | | 4.4410 | | 01/25/34 | | | 82,175 | |

| | 17,693 | | | Reperforming Loan REMIC Trust Series 2004-R1 2A(c) | | | | 6.5000 | | 11/25/34 | | | 16,281 | |

| | 13,603 | | | Reperforming Loan REMIC Trust Series 2005-R2 2A4(c) | | | | 8.5000 | | 06/25/35 | | | 13,137 | |

| | 84,156 | | | Reperforming Loan REMIC Trust Series 2006-R2 AF1(c),(d) | | TSFR1M + 0.534% | | 5.8770 | | 07/25/36 | | | 74,066 | |

| | 135,886 | | | Resecuritization Pass-Through Trust Series 2005-8R A5 | | | | 6.0000 | | 10/25/34 | | | 128,490 | |

| | 1,412,122 | | | Residential Asset Securitization Trust Series 2003-A9 A3(d) | | TSFR1M + 0.664% | | 6.0070 | | 08/25/33 | | | 1,231,498 | |

| | 513,469 | | | Residential Asset Securitization Trust Series 2003-A10 A5 | | | | 5.2500 | | 09/25/33 | | | 464,050 | |

| | 26,052 | | | RESIMAC Bastille Trust Series Series 2019-1NCA A1(c),(d) | | TSFR1M + 1.044% | | 6.3740 | | 09/05/57 | | | 26,250 | |

| | 5,210,000 | | | RMF Buyout Issuance Trust Series 2022-HB1 M3(b),(c) | | | | 4.5000 | | 04/25/32 | | | 4,260,578 | |

| | 280,087 | | | RMF Proprietary Issuance Trust Series 2021-2 A(b),(c) | | | | 2.1250 | | 09/25/61 | | | 223,078 | |

| | 1,045,030 | | | RMF Proprietary Issuance Trust Series 2021-2 M1(b),(c) | | | | 2.1250 | | 09/25/61 | | | 735,932 | |

| | 1,000,000 | | | RMF Proprietary Issuance Trust Series 2022-1 M1(b),(c) | | | | 3.0000 | | 01/25/62 | | | 699,395 | |

| | 232,741 | | | RMF Proprietary Issuance Trust Series 2022-1 A1(b),(c) | | | | 3.0000 | | 01/25/62 | | | 185,954 | |

| | 1,000,000 | | | RMF Proprietary Issuance Trust Series 2022-2 M3(b),(c) | | | | 3.7500 | | 06/25/62 | | | 562,539 | |

| | 225,000 | | | RMF Proprietary Issuance Trust Series 2022-3 A(b),(c) | | | | 4.0000 | | 08/25/62 | | | 172,743 | |

| | 1,414 | | | Ryland Mortgage Securities Corporation Series 1994-1 B(b) | | | | 0.0000 | | 04/29/30 | | | — | |

| | 650,000 | | | SBALR Commercial Mortgage Trust Series 2020-RR1 C(b),(c) | | | | 3.9790 | | 02/13/53 | | | 441,738 | |

| | 46,607 | | | Seasoned Credit Risk Transfer Trust Series Series 2017-3 B(f) | | | | 0.0000 | | 07/25/56 | | | 4,998 | |

| | 860,000 | | | Seasoned Credit Risk Transfer Trust Series Series 2019-1 M(b) | | | | 4.7500 | | 07/25/58 | | | 764,882 | |

| | 3,140,000 | | | Seasoned Credit Risk Transfer Trust Series Series 2020-1 M(b) | | | | 4.2500 | | 08/25/59 | | | 2,689,686 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 3,400,000 | | | Seasoned Credit Risk Transfer Trust Series Series 2020-2 M(b) | | | | 4.2500 | | 11/25/59 | | $ | 3,007,881 | |

| | 382,811 | | | Sequoia Mortgage Trust Series 2003-4 1A1(d) | | TSFR1M + 0.734% | | 6.0660 | | 07/20/33 | | | 333,773 | |

| | 32,243 | | | Sequoia Mortgage Trust Series 2004-10 A1A(d) | | TSFR1M + 0.734% | | 6.0660 | | 11/20/34 | | | 29,102 | |

| | 43,273 | | | Sequoia Mortgage Trust Series 2004-10 A3B(d) | | TSFR6M + 1.208% | | 6.6970 | | 11/20/34 | | | 35,032 | |

| | 64,557 | | | Sequoia Mortgage Trust Series 2005-2 A1(d) | | TSFR1M + 0.554% | | 5.8860 | | 03/20/35 | | | 56,409 | |

| | 357,690 | | | Sequoia Mortgage Trust Series 2005-3 B1(d) | | TSFR1M + 0.669% | | 6.0010 | | 05/20/35 | | | 252,040 | |

| | 349,192 | | | Sequoia Mortgage Trust Series 2007-4 1A1(d) | | TSFR1M + 0.894% | | 6.2260 | | 01/20/36 | | | 244,030 | |

| | 273,509 | | | Sequoia Mortgage Trust Series 2007-2 1B1(d) | | TSFR1M + 0.714% | | 6.0460 | | 06/20/36 | | | 208,748 | |

| | 152,644 | | | Sequoia Mortgage Trust Series 2013-6 B1(b),(c) | | | | 3.5130 | | 05/25/43 | | | 142,585 | |

| | 267,880 | | | Sequoia Mortgage Trust Series 2014-4 A6(b),(c) | | | | 3.5000 | | 11/25/44 | | | 233,973 | |

| | 77,265 | | | Sequoia Mortgage Trust Series 2017-1 B3(b),(c) | | | | 3.6070 | | 02/25/47 | | | 52,201 | |

| | 78,158 | | | Shellpoint Co-Originator Trust Series 2017-1 B4(b),(c) | | | | 3.6020 | | 04/25/47 | | | 50,552 | |

| | 434,926 | | | Sofi Mortgage Trust Series 2016-1A B3(b),(c) | | | | 3.0990 | | 11/25/46 | | | 263,218 | |

| | 100,000 | | | Spruce Hill Mortgage Loan Trust Series 2020-SH1 B2(b),(c) | | | | 4.6760 | | 01/28/50 | | | 79,919 | |

| | 548,521 | | | STARM Mortgage Loan Trust Series 2007-4 3A1(b) | | | | 4.4290 | | 10/25/37 | | | 432,480 | |

| | 48,502 | | | Structured Adjustable Rate Mortgage Loan Trust Series 2004-2 4A1(b) | | | | 5.8120 | | 03/25/34 | | | 43,541 | |

| | 63,645 | | | Structured Adjustable Rate Mortgage Loan Trust Series 2004-18 1A3(b) | | | | 4.9080 | | 12/25/34 | | | 53,958 | |

| | 206,830 | | | Structured Adjustable Rate Mortgage Loan Trust Series 2005-4 1A1(b) | | | | 4.8170 | | 03/25/35 | | | 170,279 | |

| | 337,645 | | | Structured Adjustable Rate Mortgage Loan Trust Series 2005-15 1A1(b) | | | | 4.6170 | | 07/25/35 | | | 179,568 | |

| | 783,236 | | | Structured Adjustable Rate Mortgage Loan Trust Series 2006-1 2A2(b) | | | | 4.9580 | | 02/25/36 | | | 674,869 | |

| | 7,611 | | | Structured Adjustable Rate Mortgage Loan Trust Series 2006-8 3AF(d) | | TSFR1M + 0.494% | | 5.8370 | | 09/25/36 | | | 6,583 | |

| | 307,993 | | | Structured Adjustable Rate Mortgage Loan Trust Series 9 2A1(b) | | | | 4.4180 | | 10/25/47 | | | 176,359 | |

| | 163,521 | | | Structured Asset Sec Corp Mort Passthr Certs Ser Series 2003-40A 3A1(b) | | | | 5.6660 | | 01/25/34 | | | 142,221 | |

| | 28,857 | | | Structured Asset Sec Corp Mort Passthr Certs Ser Series 2003-40A 3A2(b) | | | | 5.6660 | | 01/25/34 | | | 27,597 | |

| | 57,114 | | | Structured Asset Securities Corp Mortgage Series 2000-5 B3(b) | | | | 0.0000 | | 11/25/30 | | | 35,220 | |

| | 2,309 | | | Structured Asset Securities Corporation Series 2003-37A B1I(d) | | TSFR1M + 0.894% | | 6.2090 | | 12/25/33 | | | 2,106 | |

| | 13,381 | | | Structured Asset Securities Corporation Series 2004-4XS A3A(e),(g) | | | | 4.9190 | | 02/25/34 | | | 12,599 | |

| | 104,121 | | | Structured Asset Securities Corporation Series 2004-4XS 1A5(e),(g) | | | | 4.9190 | | 02/25/34 | | | 98,009 | |

| | 391,934 | | | Structured Asset Securities Corporation Series 2004-4XS 1M1(e) | | | | 4.9190 | | 02/25/34 | | | 323,031 | |

| | 78,630 | | | Structured Asset Securities Corporation Series 2005-RF2 A(c),(d) | | TSFR1M + 0.464% | | 5.8070 | | 04/25/35 | | | 67,872 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| | 106,691 | | | Structured Asset Securities Corporation Series 2005-RF3 2A(b),(c) | | | | 3.9680 | | 06/25/35 | | $ | 89,948 | |

| | 59,228 | | | Suntrust Alternative Loan Trust Series Series 2005-1F 1A1(d) | | TSFR1M + 0.764% | | 5.7500 | | 12/25/35 | | | 44,221 | |

| | 212,710 | | | TIAA Bank Mortgage Loan Trust Series 2018-2 B3(b),(c) | | | | 3.6760 | | 07/25/48 | | | 170,106 | |

| | 233,635 | | | TIAA Bank Mortgage Loan Trust Series 2018-3 B4(b),(c) | | | | 4.1490 | | 11/25/48 | | | 158,664 | |

| | 230,000 | | | Towd Point Mortgage Trust Series 2015-1 B1(b),(c) | | | | 4.3540 | | 10/25/53 | | | 199,481 | |

| | 100,000 | | | Verus Securitization Trust Series 2020-INV1 B2(b),(c) | | | | 6.0000 | | 03/25/60 | | | 88,385 | |

| | 538,000 | | | Vista Point Securitization Trust Series 2020-1 M1(b),(c) | | | | 4.1510 | | 03/25/65 | | | 496,218 | |

| | 48,738 | | | Wachovia Mortgage Loan Trust, LLC Series Series 2006-A 4A1(b) | | | | 6.2380 | | 05/20/36 | | | 46,856 | |

| | 41,710 | | | WaMu Mortgage Pass-Through Certificates Series Series 2002- AR14 B1(b) | | | | 4.4120 | | 11/25/32 | | | 35,612 | |

| | 38,142 | | | WaMu Mortgage Pass-Through Certificates Series Series 2002- AR18 A(b) | | | | 4.4690 | | 01/25/33 | | | 36,893 | |

| | 35,946 | | | WaMu Mortgage Pass-Through Certificates Series Series 2003-S3 1A4 | | | | 5.5000 | | 06/25/33 | | | 32,925 | |

| | 39,267 | | | WaMu Mortgage Pass-Through Certificates Series Series 2003-S5 1A13 | | | | 5.5000 | | 06/25/33 | | | 37,571 | |

| | 240,824 | | | WaMu Mortgage Pass-Through Certificates Series Series 2003- AR9 1A7(b) | | | | 5.6810 | | 09/25/33 | | | 211,469 | |

| | 22,053 | | | WaMu Mortgage Pass-Through Certificates Series Series 2002- AR2 A(d) | | ECOFC + 1.250% | | 4.2640 | | 02/27/34 | | | 19,006 | |

| | 42,995 | | | WaMu Mortgage Pass-Through Certificates Series Series 2006- AR2 1A1(b) | | | | 3.8370 | | 03/25/36 | | | 38,153 | |

| | 9,769 | | | WaMu Mortgage Pass-Through Certificates Series Series 2002- AR17 1A(d) | | 12MTA + 1.200% | | 6.0000 | | 11/25/42 | | | 8,283 | |

| | 41,627 | | | WaMu Mortgage Pass-Through Certificates Series Series 2005- AR1 A1A(d) | | TSFR1M + 0.754% | | 6.0970 | | 01/25/45 | | | 38,501 | |

| | 122,180 | | | WaMu Mortgage Pass-Through Certificates Series Series 2006- AR8 1A1(b) | | | | 4.4100 | | 08/25/46 | | | 107,808 | |

| | 154,499 | | | Washington Mutual MSC Mortgage Pass-Through Series 2003- MS7 A12 | | | | 5.5000 | | 03/25/33 | | | 147,463 | |

| | 51,815 | | | Washington Mutual MSC Mortgage Pass-Through Series 2003- MS9 2A | | | | 7.5000 | | 04/25/33 | | | 51,324 | |

| | 182,899 | | | Washington Mutual MSC Mortgage Pass-Through Series 2003- AR3 B1(b) | | | | 4.3320 | | 06/25/33 | | | 149,711 | |

| | 12,999 | | | Washington Mutual MSC Mortgage Pass-Through Series 2005- RA1 3B4(b),(c) | | | | 4.1880 | | 01/25/35 | | | 10,483 | |

| | 608,506 | | | Wells Fargo Alternative Loan Trust Series 2005-1 2A1 | | | | 5.5000 | | 02/25/35 | | | 542,095 | |

| | 1,014,463 | | | Wells Fargo Alternative Loan Trust Series 2005-1 2A3 | | | | 5.5000 | | 02/25/35 | | | 977,329 | |

| | 72,505 | | | Wells Fargo Mortgage Backed Securities Series 2007-7 A6 | | | | 6.0000 | | 06/25/37 | | | 61,060 | |

| | 234,000 | | | Wells Fargo Mortgage Backed Securities Series 2018-1 B4(b),(c) | | | | 3.6600 | | 07/25/47 | | | 129,609 | |

| | 65,317 | | | Wells Fargo Mortgage Backed Securities Series 2019-4 A2(b),(c) | | | | 3.0000 | | 09/25/49 | | | 51,868 | |

| | 210,206 | | | WinWater Mortgage Loan Trust Series 2015-1 B2(b),(c) | | | | 3.8700 | | 01/20/45 | | | 188,207 | |

| | | | | | | | | | | | | | | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

Principal

Amount ($) | | | | | Spread | | Coupon Rate

(%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | COLLATERALIZED MORTGAGE OBLIGATIONS — 32.5% (Continued) | | | | | | |

| |

| | | | | CREDIT CARD — 0.3% | | | | | | | | $ | 103,260,254 | |

| | 1,000,000 | | | Continental Finance Credit Card A.B.S Master Trust Series 2022-A A(c) | | | | 6.1900 | | 10/15/30 | | | 983,255 | |

| | | | | | | | | | | | | | | |

| | | | | HOME EQUITY — 3.7% | | | | | | | | | | |

| | 68,106 | | | ABFC Trust Series 2004-OPT2 A2(d) | | TSFR1M + 0.674% | | 6.0170 | | 10/25/33 | | | 64,108 | |

| | 160,395 | | | AFC Trust Series Series 1999-3 1A(d) | | TSFR1M + 1.094% | | 6.4190 | | 09/28/29 | | | 104,108 | |

| | 44,059 | | | American Residential Home Equity Loan Trust Series 1998-1 B(d) | | TSFR1M + 2.289% | | 7.6320 | | 05/25/29 | | | 54,600 | |

| | 498,785 | | | Bayview Financial Asset Trust Series 2007-SR1A A(c),(d) | | TSFR1M + 0.564% | | 5.9070 | | 03/25/37 | | | 489,875 | |

| | 2,989,822 | | | Bayview Financial Mortgage Pass-Through Trust Series 2004-B A1(c),(d) | | TSFR1M + 1.114% | �� | 6.4620 | | 05/28/39 | | | 2,472,846 | |

| | 1,349,759 | | | Bayview Financial Mortgage Pass-Through Trust Series 2005-A M1(c),(d) | | TSFR1M + 1.614% | | 6.9620 | | 02/28/40 | | | 1,286,335 | |

| | 29,194 | | | Bear Stearns Asset Backed Securities I Trust Series 2004-FR2 M4(d) | | TSFR1M + 2.214% | | 4.6260 | | 06/25/34 | | | 26,236 | |

| | 330,763 | | | Bear Stearns Home Loan Owner Trust Series 2001-A B(e) | | | | 10.5000 | | 02/15/31 | | | 327,908 | |

| | 769,000 | | | BRAVO Residential Funding Trust Series 2021-HE2 B2(c),(d) | | SOFR30A + 3.400% | | 7.8930 | | 11/25/69 | | | 684,903 | |

| | 236,253 | | | CHEC Loan Trust Series 2004-1 M2(c),(d) | | TSFR1M + 1.089% | | 6.4320 | | 07/25/34 | | | 229,938 | |

| | 12,367 | | | Citigroup Global Markets Mortgage Securities VII, Series 2002- WMC1 M1(d) | | TSFR1M + 1.464% | | 6.8070 | | 01/25/32 | | | 12,468 | |

| | 124,435 | | | Delta Funding Home Equity Loan Trust Series 1999-3 A2F(e) | | | | 8.0610 | | 09/15/29 | | | 118,002 | |

| | 296,744 | | | Delta Funding Home Equity Loan Trust Series 2000-1 M2(e) | | | | 8.0900 | | 05/15/30 | | | 275,554 | |

| | 109,370 | | | Delta Funding Home Equity Loan Trust Series 1999-2 A1A(d) | | TSFR1M + 0.434% | | 6.0770 | | 08/15/30 | | | 107,742 | |

| | 174,738 | | | EMC Mortgage Loan Trust Series 2001-A M1(c),(d) | | TSFR1M + 1.164% | | 6.5070 | | 05/25/40 | | | 172,391 | |

| | 168,757 | | | Financial Asset Securities Corp AAA Trust Series 2005-1A 1A3B(c),(d) | | TSFR1M + 0.524% | | 5.8760 | | 02/27/35 | | | 149,197 | |

| | 65,241 | | | GE Capital Mortgage Services Inc Trust Series 1999-HE1 A6(b) | | | | 6.7000 | | 04/25/29 | | | 64,566 | |

| | 236,013 | | | Home Equity Asset Trust Series 2002-2 A2(d) | | TSFR1M + 0.714% | | 6.0390 | | 06/25/32 | | | 226,735 | |

| | 1,018,165 | | | Mastr Asset Backed Securities Trust Series 2004-FRE1 M7(d) | | TSFR1M + 2.814% | | 8.1570 | | 07/25/34 | | | 917,756 | |

| | 232,470 | | | Mastr Asset Backed Securities Trust Series 2005-NC1 M2(d) | | TSFR1M + 0.864% | | 6.2070 | | 12/25/34 | | | 224,658 | |

| | 242,044 | | | Mastr Asset Backed Securities Trust Series 2007-NCW A2(c),(d) | | TSFR1M + 0.714% | | 6.0570 | | 05/25/37 | | | 186,155 | |

| | 295,776 | | | Morgan Stanley A.B.S Capital I Inc Trust Series Series 2003-SD1 M2(d) | | TSFR1M + 4.014% | | 9.3570 | | 03/25/33 | | | 270,618 | |

| | 100,449 | | | Nomura Home Equity Loan Inc Home Equity Loan Trust Series 2006-HE2 Series 2006-HE2 M1(d) | | TSFR1M + 0.609% | | 5.9520 | | 03/25/36 | | | 84,731 | |

| | 257,423 | | | NovaStar Mortgage Funding Trust Series Series 2003-4 A1(d) | | TSFR1M + 0.854% | | 6.1970 | | 02/25/34 | | | 250,075 | |

| | 29,061 | | | RAAC Series Trust Series 2004-SP1 AII(d) | | TSFR1M + 0.814% | | 6.1570 | | 03/25/34 | | | 27,164 | |

| | 262,136 | | | RBSSP Resecuritization Trust Series 2010-4 6A2(c),(e) | | | | 5.8250 | | 02/26/36 | | | 250,154 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | HOME EQUITY — 3.7% (Continued) | | | | | | | | | | |

| | 468,635 | | | Renaissance Home Equity Loan Trust Series 2002-3 M1(d) | | TSFR1M + 1.614% | | 6.9570 | | 12/25/32 | | $ | 424,667 | |

| | 93,979 | | | Renaissance Home Equity Loan Trust Series 2002-3 M2(d) | | TSFR1M + 2.664% | | 8.0070 | | 12/25/32 | | | 75,386 | |

| | 26,304 | | | Saxon Asset Securities Trust Series 2001-2 AF5(e) | | | | 7.1700 | | 03/25/29 | | | 26,288 | |

| | 30,005 | | | Saxon Asset Securities Trust Series 2003-3 M2(d) | | TSFR1M + 2.514% | | 3.6930 | | 12/25/33 | | | 25,942 | |

| | 211,327 | | | Saxon Asset Securities Trust Series 2003-3 AF5(e) | | | | 4.2140 | | 12/25/33 | | | 195,894 | |

| | 150,232 | | | Saxon Asset Securities Trust Series 2004-1 A(d) | | TSFR1M + 0.654% | | 2.0020 | | 03/25/35 | | | 124,732 | |

| | 1,500,000 | | | Security National Mortgage Loan Trust Series 2005-2A A4(b),(c) | | | | 6.8960 | | 02/25/35 | | | 1,463,872 | |

| | 309,947 | | | Security National Mortgage Loan Trust Series 2005-2A A3(b),(c) | | | | 6.2130 | | 02/25/36 | | | 304,433 | |

| | 40,728 | | | Soundview Home Loan Trust Series 2006-OPT4 1A1(d) | | TSFR1M + 0.414% | | 5.7570 | | 06/25/36 | | | 39,858 | |

| | 186,070 | | | Southern Pacific Secured Asset Corporation Series 1997-2 M1F | | | | 7.3200 | | 05/25/27 | | | 201,021 | |

| | | | | | | | | | | | | | 11,960,916 | |

| | | | | MANUFACTURED HOUSING — 0.3% | | | | | | | | | | |

| | 1,000,000 | | | Cascade MH Asset Trust Series 2019-MH1 M(b),(c) | | | | 5.9850 | | 11/25/44 | | | 851,208 | |

| | | | | | | | | | | | | | | |

| | | | | NON AGENCY CMBS — 25.7% | | | | | | | | | | |

| | 3,204,350 | | | Angel Oak SB Commercial Mortgage Trust Series 2020-SBC1 B1(b),(c) | | | | 3.6530 | | 05/25/50 | | | 2,281,571 | |

| | 2,124,264 | | | Angel Oak SB Commercial Mortgage Trust Series 2020-SBC1 B2(b),(c) | | | | 5.3780 | | 05/25/50 | | | 1,479,520 | |

| | 723,000 | | | Arbor Multifamily Mortgage Securities Trust Series 2020-MF1 D(c) | | | | 1.7500 | | 05/15/53 | | | 411,083 | |

| | 1,000,000 | | | Arbor Multifamily Mortgage Securities Trust Series 2020-MF1 E(c) | | | | 1.7500 | | 05/15/53 | | | 530,055 | |

| | 300,000 | | | BAMLL Commercial Mortgage Securities Trust Series 2014-520M C(b),(c) | | | | 4.3540 | | 08/15/46 | | | 169,826 | |

| | 800,000 | | | BANK Series 2019-BN17 E(c) | | | | 3.0000 | | 04/15/52 | | | 401,123 | |

| | 1,735,000 | | | BANK Series 2023-BNK45 E(c) | | | | 4.0000 | | 02/15/56 | | | 898,256 | |

| | 868,000 | | | BANK Series 2019-BN19 D(c) | | | | 3.0000 | | 08/15/61 | | | 318,017 | |

| | 1,460,000 | | | BANK Series 2019-BN19 B | | | | 3.6470 | | 08/15/61 | | | 1,019,000 | |

| | 474,000 | | | BANK Series 2020-BNK27 B(b) | | | | 2.9060 | | 04/15/63 | | | 318,500 | |

| | 30,046 | | | Bayview Commercial Asset Trust Series 2005-2A M1(c),(d) | | TSFR1M + 0.759% | | 6.1020 | | 08/25/35 | | | 26,086 | |

| | 46,492 | | | Bayview Commercial Asset Trust Series 2005-2A B1(c),(d) | | TSFR1M + 1.839% | | 7.1820 | | 08/25/35 | | | 44,390 | |

| | 183,515 | | | Bayview Commercial Asset Trust Series 2005-3A A1(c),(d) | | TSFR1M + 0.594% | | 5.7770 | | 11/25/35 | | | 162,149 | |

| | 24,419 | | | Bayview Commercial Asset Trust Series 2005-4A M1(c),(d) | | TSFR1M + 0.789% | | 6.1320 | | 01/25/36 | | | 21,369 | |

| | 84,448 | | | Bayview Commercial Asset Trust Series 2007-1 M2(c),(d) | | TSFR1M + 0.549% | | 5.8920 | | 03/25/37 | | | 70,074 | |

| | 1,598,553 | | | Bayview Commercial Asset Trust Series 2007-3 M1(c),(d) | | TSFR1M + 0.579% | | 5.9220 | | 07/25/37 | | | 1,440,240 | |

| | 385,029 | | | Bayview Commercial Asset Trust Series 2007-3 M2(c),(d) | | TSFR1M + 0.624% | | 5.9670 | | 07/25/37 | | | 326,607 | |

| | 504,740 | | | Bayview Commercial Asset Trust Series 2007-3 M3(c),(d) | | TSFR1M + 0.669% | | 6.0120 | | 07/25/37 | | | 429,130 | |

See accompanying notes to financial statements

| EASTERLY INCOME OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2023 |

| Principal | | | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | Spread | | (%) | | Maturity | | Fair Value | |

| | | | | ASSET BACKED SECURITIES — 75.8% (Continued) | | | | | | | | | | |

| | | | | NON AGENCY CMBS — 25.7% (Continued) | | | | | | | | | | |

| | 951,781 | | | Bayview Commercial Asset Trust Series 2007-3 M4(c),(d) | | TSFR1M + 0.864% | | 6.2070 | | 07/25/37 | | $ | 821,429 | |

| | 324,000 | | | BBCMS Mortgage Trust Series 2019-BWAY A(c),(d) | | TSFR1M + 1.070% | | 6.3930 | | 11/15/34 | | | 230,099 | |

| | 1,040,000 | | | Benchmark Mortgage Trust Series 2020-IG2 B(b),(c) | | | | 3.4030 | | 09/15/48 | | | 572,782 | |

| | 88,283 | | | Benchmark Mortgage Trust Series 2018-B5 A2 | | | | 4.0770 | | 07/15/51 | | | 82,498 | |

| | 130,000 | | | Benchmark Mortgage Trust Series 2019-B9 B | | | | 4.4680 | | 03/15/52 | | | 99,565 | |

| | 900,000 | | | Benchmark Mortgage Trust Series 2020-B17 E(c) | | | | 2.2500 | | 03/15/53 | | | 371,451 | |