UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23615

JOHCM Funds Trust

(Exact name of registrant as specified in charter)

53 State Street, 13th Floor

Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Mary Lomasney

53 State Street, 13th Floor

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 933-0712

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

ANNUAL REPORT

SEPTEMBER 30, 2022

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for the distribution to prospective investors unless preceded or accompanied by an effective prospectus.

JOHCM FUNDS TRUST

TABLE OF CONTENTS

September 30, 2022

DEAR SHAREHOLDER:

I am pleased to present the Annual Report for the 12-months ended September 30, 2022 for the series of JOHCM Funds Trust (the “Trust”).

On August 25th Pendal Group Limited (“Pendal”), the parent of JOHCM (USA) Inc and Thompson, Siegel & Walmsley LLC (“TSW”), entered into an agreement with Perpetual Limited (“Perpetual”), a diversified financial services firm that has been in existence since 1886, under which Perpetual will acquire Pendal (the “Transaction”) subject to Pendal shareholder approval. Perpetual’s multi-boutique model is complementary to Pendal’s and I believe our fund managers’ investment independence is assured. We have always been confident in our ability to grow Pendal’s business across our key markets organically; however, the combination of the two businesses is expected to deliver a significant increase in scale, an enlarged and enhanced global distribution team, greater product capability, expertise and diversity, and global ESG leadership. All of this should enable us to achieve our strategic goals sooner.

Pendal’s culture of investment autonomy and its well-regarded Pendal, J O Hambro, TSW and Regnan brands will be retained, and Pendal’s clients will continue to experience the same investment approach and teams across each brand. I believe the combined group will be well placed to:

| | • | | Deliver greater diversification of products and expanded distribution footprint; |

| | • | | Leverage capabilities of two recognized leaders in ESG and responsible investment that will be readily able to respond to clients’ growing interest in this area; |

| | • | | Achieve benefits of greater scale across distribution, technology and infrastructure globally; |

| | • | | Increase the impact from recent investments in new teams, data and analytics, marketing, client service, technology and infrastructure; and |

| | • | | Attract more top-ranking investment talent to support the combined group’s multi-brand growth strategy. |

The Transaction is expected to close in January 2023 and will result in a change in control of JOHCM (USA) Inc, the investment adviser to the Trust, and TSW, the subadviser to the TSW Funds of the Trust (collectively the “Advisers”). This change in control of the Advisers will result in the automatic termination of the related advisory arrangements. As a shareholder of the Trust, you will be asked to vote on new advisory arrangements with JOHCM (USA) Inc and TSW at a special meeting of shareholders to be held in December 2022.

i

Consistent with our efforts to expand the breadth of offerings in the Trust, we are continuing to develop new products within the Regnan branded strategies. We look forward to sharing more information with you about these new offerings as we bring them to market.

We thank you for the continued trust and confidence that you have placed in us.

Respectfully submitted,

Nicholas Good

Chairman of the Board of Trustees

ii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

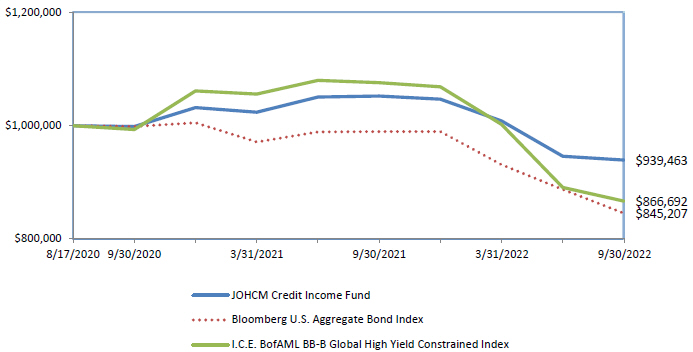

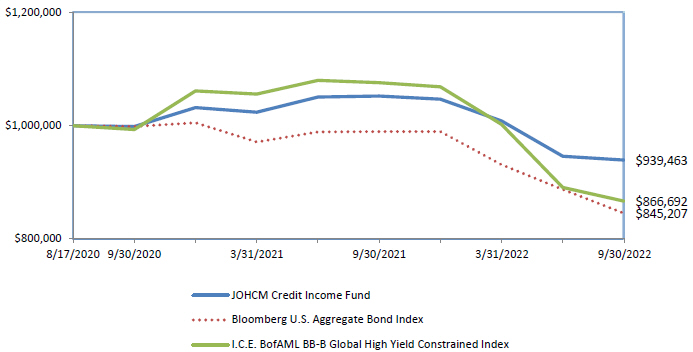

JOHCM Credit Income Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from August 17, 2020 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -10.76% | | -2.90% | | 1.60% | | 0.59% |

Advisor Shares | | -10.77% | | -3.30% | | 1.70% | | 0.69% |

Bloomberg U.S. Aggregate Bond Index | | -14.60% | | -7.62% | | — | | — |

I.C.E. BofAML BB-B Global High Yield Constrained Index | | -19.47% | | -6.52% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM Credit Income Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Advisor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Advisor Shares prior to their inception is based on performance of predecessor share classes of the JOHCM Credit Income Fund of the Advisers Investment Trust.

Historical performance for Advisor Shares prior to its July 19, 2021 inception is based on the performance of the Class I Shares predecessor share class. The performance of the Class I Shares predecessor share class, which commenced operations on December 18, 2020, is based on performance of the Institutional Shares predecessor share class, which commenced operations on August 17, 2020, for periods prior to the Class I Shares predecessor share class inception date. Performance of the Class I Shares predecessor share class was adjusted to reflect differences in expenses.

iii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmarks for performance comparison purposes are the: Bloomberg US Aggregate Bond Index and the I.C.E. BofAML BB-B Global High Yield Constrained Index. The Bloomberg US Aggregate Bond Index is a broad-based benchmark that measures the investment grade U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The I.C.E. BofAML BB-B Global High Yield Constrained Index contains all securities in The I.C.E. BofAML Global High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. The table reflects the theoretical reinvestment of dividends on securities in the indices. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the indices calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks to preserve capital and deliver returns through a combination of income and modest capital appreciation. The Fund invests, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities. The fixed income investments give exposure to a wide range of maturities and can include investment grade corporate debt, high yield securities (higher risk, lower rated fixed income securities rated below BBB- by S&P or below Baa3 by Moody’s, also known as “junk bonds”), convertible bonds (including contingent convertible bonds), preferred stock, floating-rate debt, collateralized debt, municipal debt, non-U.S. debt (including in emerging markets), commercial paper, loans and loan participations. The Fund may also gain exposure to up to 10% of equity securities in companies of any size.

Performance

The Fund’s Institutional share class lost -10.76% for the 12 months ended September 30, 2022. During the same time period, the ICE Bank of America (BofA) BB-B Global High Yield Constrained Index lost -19.47%.

The dominant themes of the year have been inflation and the central bankers’ subsequent response. As central banks the world over hiked interest rates aggressively, assets with duration suffered the derating consequences. Moreover, as markets began to fear that the rate cycle (and war in Ukraine) would lead to a recession, credit spreads moved wider, with US Investment grade spreads doubling to nearly 170 basis points over government bonds in the 12 months ending in September and Global High Yield spreads 200 basis points wider during the same period.

We came into the year wary of the path of rates and with less duration than our benchmarks as a result. Beginning in January, we treated every rally as an opportunity to sell our lowest credit quality instruments and redeploy most of the capital into shorter dated and higher quality bonds as our rate fears turned into economic concern. Credit investing requires a keen and constant awareness that return distributions in credit are negatively skewed – the downside is usually much farther down than the upside is up. That is especially true when transitioning from a low/no rate regime into a positive real rate one. As such, our conservative positioning this year reflected our view that things could not get much better but they could get much worse.

More recently, while we have generally not been buyers of rallies, we have also stopped selling into strength. Probabilistically, spreads are more likely to get worse before they get better, and we are well positioned for that outcome. We have begun to extend our duration modestly as rates have moved wider, but we have absolutely not budged on our stance toward the best credit quality. However, we remain vigilant in our hunt for signs that the worst economic paths will fail to come to fruition and instead credit will enjoy a benign default cycle in which both spreads and duration are very attractive. Over the next 12 months, we expect that time will come, and we will look to take advantage of the high return environment in credit that ensues.

iv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

JOHCM Emerging Markets Opportunities Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from November 20, 2012 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Five Year

Return | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -21.11% | | -0.91% | | 2.61% | | 1.03% | | 1.03% |

Advisor Shares | | -21.18% | | -1.01% | | 2.53% | | 1.08% | | 1.08% |

Investor Shares | | -21.33% | | -1.15% | | 2.38% | | 1.23% | | 1.23% |

MSCI Emerging Markets Index | | -28.11% | | -1.81% | | 1.28% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM Emerging Markets Opportunities Fund of the Advisers Investment Trust and the predecessor JOHCM Emerging Markets Opportunities Fund of the Scotia Institutional Funds for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares, Advisor Shares, and Investor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares, Advisor Shares, and Investor Shares prior to their inception is based on performance of predecessor share classes of the predecessor JOHCM Emerging Markets Opportunities Fund of the Advisers Investment Trust and the predecessor JOHCM Emerging Markets Opportunities Fund of the Scotia Institutional Funds.

Historical performance for Investor Shares prior to its July 19, 2021 inception is based on the performance of the Class II Shares predecessor share class. The performance of the Class II Shares predecessor share class, which commenced operations on December 18, 2013, is based on the performance of the Class I Shares predecessor share class, which commenced operations on November 21, 2012, for periods prior to the Class II Shares predecessor share class inception date. . Performance of the Class II Shares predecessor share class was adjusted to reflect differences in expenses.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

v

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index. The Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of companies located in emerging market countries. Emerging market countries are those countries included in the MSCI Emerging Markets Index and MSCI Frontier Markets Index, countries with low to middle-income economies according to the International Bank for Reconstruction and Development (more commonly referred to as the World Bank) and other countries with similar emerging market characteristics. The Fund may invest in companies of any size, including small- and mid-capitalization companies. The Fund may also invest up to 5% of its assets in frontier markets, which are generally smaller, less liquid, and less developed than emerging markets.

Performance

The 12 months ended September 2022 was a difficult one for global markets, including emerging markets. With inflationary pressures already a concern in many countries, the war in Ukraine drove food, fertilizer, and energy prices sharply higher, exacerbating inflation and creating a more challenging outlook for interest rates and economic growth. As a result, MSCI Emerging Markets Index returned - 28.11%.

The Chinese economy remained weak, despite credit and monetary data suggesting efforts to stimulate. The key causes of the weakness remain the sharp policy-driven slowdown in the real estate sector as well as ongoing Covid lockdowns. The period also saw economic slowdowns in China, Korea and Taiwan. Collectively, these were the weakest markets in the period, with MSCI China returning -35.4%, MSCI Korea -40.7%, MSCI Taiwan -30.5% and MSCI indices in Hungary and Poland each down more than 50%. The portfolio was generally underweight these areas in the period, which was a positive contributor to performance.

Despite higher global interest rates, domestic demand continued to recover in traditionally high-beta, current account economies where trade balances currently support growth. We held overweight positions in Brazil, India and Mexico in the period, and added a position in Indonesia. The equity markets in these countries were among the best-performing in the period, with MSCI Indonesia the strongest emerging market, returning +14.3%, MSCI Brazil up +4.3%, MSCI India down -9.9% and MSCI Mexico down -7.4%, all of these were positive contributors to performance.

Other strongly performing emerging markets were those with significant economic exposure to commodities. MSCI Qatar was up 12.7%, MSCI Kuwait up 6.4% and MSCI UAE was up 5.1%. We chose to be exposed to this area through an overweight position in UAE, which contributed positively to performance. Finally, the effect of sanctions on Russia meant that MSCI Russia returned -100% and was removed from the EM Index in the first quarter of 2022.

vi

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

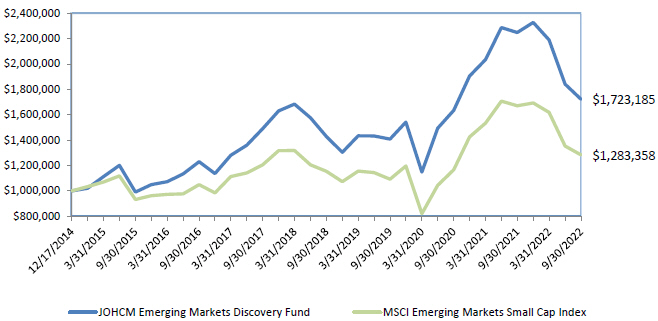

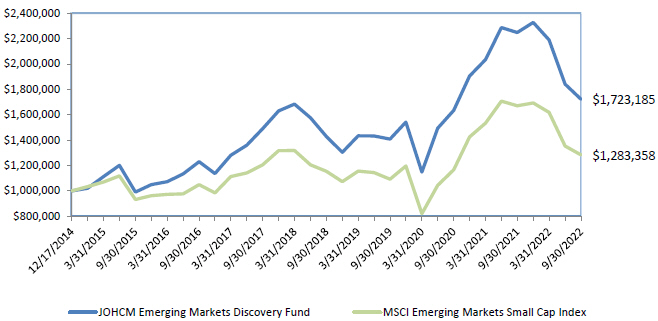

JOHCM Emerging Markets Discovery Fund

(formerly the JOHCM Emerging Markets Small Mid Cap Equity Fund)

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from December 17, 2014 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Five Year

Return | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -23.44% | | 2.93% | | 7.24% | | 1.65% | | 1.49% |

Advisor Shares | | -23.44% | | 2.84% | | 7.15% | | 1.75% | | 1.59% |

MSCI Emerging Markets Small Cap Index | | -23.23% | | 1.25% | | 3.26% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM Emerging Markets Small Mid Cap Equity Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Advisor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Advisor Shares prior to their inception is based on performance of predecessor share classes of the JOHCM Emerging Markets Small Mid Cap Equity Fund of the Advisers Investment Trust.

Historical performance for Advisor Shares prior to its July 19, 2021 inception is based on the performance of the Class I Shares predecessor share class. The performance of the Class I Shares predecessor share class, which commenced operations on January 28, 2016, is based on performance of the Institutional Shares predecessor share class, which commenced operations on December 17, 2014, for periods prior to the Class I Shares predecessor share class inception date. Performance of the Class I Shares predecessor share class was adjusted to reflect differences in expenses.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

vii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Emerging Markets Small Cap Index. The Index includes small cap representation across 24 Emerging Markets countries and covers approximately 14% of the free float-adjusted market capitalization in each country. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities issued by companies located in emerging markets, including frontier markets. Equity securities include direct and indirect investments in common and preferred stocks, and include rights and warrants to subscribe to common stock or other equity securities. The Fund may also obtain exposure to equity securities indirectly through depositary receipts, exchange-traded funds and participatory notes. Emerging market countries are those countries included in the MSCI Emerging Markets Index and MSCI Frontier Markets Index, countries with low to middle-income economies according to the International Bank for Reconstruction and Development (more commonly referred to as the World Bank), and other countries with similar emerging market characteristics. Frontier markets are generally smaller, less liquid, and less developed than emerging markets.

Performance

In a challenging and volatile year for most asset classes, emerging markets corrected in line with the NASDAQ and some other developed markets. We anticipated more than 18 months ago that central banks would miss the reappearance of inflation, and the divergent performance among countries was primarily due to the different speeds with which they officially recognized the problem and tried to address it to one degree or another. The tragic war in Ukraine exacerbated issues with higher commodity prices and disruption in supply chains, thus further intensifying and aggravating the magnitude of market moves.

We underperformed in South Africa and India. However, the two best performing stocks in the portfolio were Indian companies — Varun Beverages and KPIT. Varun Beverages’ somewhat defensive consumer side helped it benefit from the reopening and expansion of India. KPIT Technologies, an Indian software company, outperformed on the increase in demand for higher technical sophistication in the autonomous driving car market. On the other hand, Hansol Chemical, based in Korea, suffered in the technology sector crash.

Importantly, we continue to benefit from our underweight call in China, where the harsh zero-Covid policies dampened several sectors. In addition, we are overweight in Brazil, which has provided us with additional alpha during a tough global economic environment.

We want to especially emphasise the orthodox economic, monetary and fiscal policies run by many of the emerging market economies. It is a striking difference, and a positive one, in comparison with Western Europe, the UK or even the US which were not as proactive with their interest rate increases. Brazil was a remarkable example, as the local central bank did not hesitate to raise interest rates above inflation. This orthodoxy has helped emerging market countries manage the crisis better than their Western counterparts.

viii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

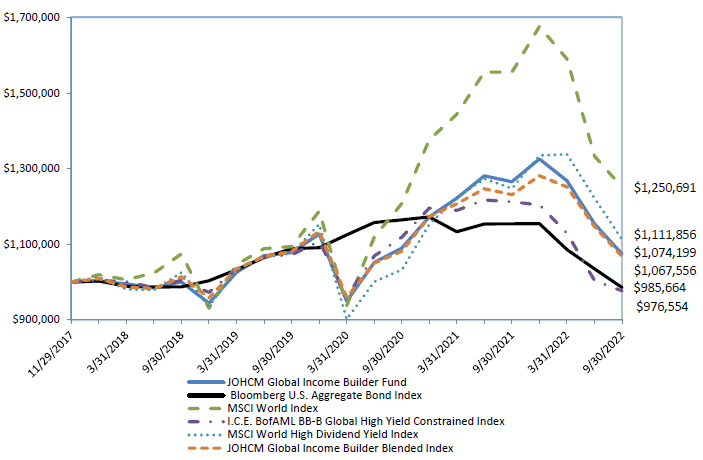

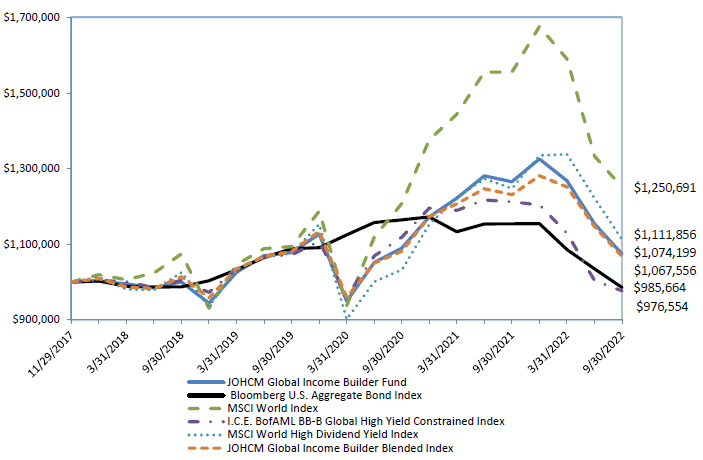

JOHCM Global Income Builder

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from November 29, 2017 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -15.11% | | 1.49% | | 0.80% | | 0.73% |

Advisor Shares | | -15.19% | | 1.39% | | 0.90% | | 0.83% |

Investor Shares | | -15.38% | | 1.24% | | 1.05% | | 0.98% |

Bloomberg U.S. Aggregate Bond Index | | -14.60% | | -0.30% | | — | | — |

MSCI World Index | | -19.63% | | 4.73% | | — | | — |

I.C.E. BofAML BB-B Global High Yield Constrained Index | | -19.47% | | -0.49% | | — | | — |

MSCI World High Dividend Yield Index | | -10.90% | | 2.22% | | — | | — |

JOHCM Global Income Builder Blended Index (60% MSCI World High Dividend Yield Index/ 20% Bloomberg U.S. Aggregate Bond Index/ 20% ICE BofAML BB-B Global High Yield Constrained Index) | | -13.29% | | 1.38% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM Global Income Builder Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The

ix

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares, Advisor Shares, and Investor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares, Advisor Shares, and Investor Shares prior to their inception is based on performance of predecessor share classes of the JOHCM Global Income Builder Fund of the Advisers Investment Trust.

Historical performance for Investor Shares prior to its July 19, 2021 inception is based on the performance of the Class II Shares predecessor share class. The performance of the Class II Shares predecessor share class, which commenced operations on June 28, 2019, is based on performance of the Institutional Shares predecessor share class, which commenced operations on November 29, 2017, for periods prior to the Class II Shares predecessor share class inception date. Performance of the Class II Shares predecessor share class was adjusted to reflect differences in expense.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

Effective January 28, 2022, the JOHCM Global Income Builder Blended Index, a custom benchmark comprised of 60% MSCI World High Dividend Yield Index / 20% Bloomberg U.S. Aggregate Bond Index / 20% ICE BofAML BB-B Global High Yield Constrained Index, is the Fund’s primary benchmark and replaces all four of the Fund’s prior benchmark indices. JOHCM (USA) Inc believes that the custom benchmark is more representative of the Fund’s investment strategies and provides investors with a more useful point of comparison than the Fund’s current benchmarks.

The Fund’s prior benchmarks for performance comparison purposes were the: Bloomberg US Aggregate Bond Index, I.C.E. BofAML BB-B Global High Yield Constrained Index, Morgan Stanley Capital International (“MSCI”) World Index and MSCI World High Dividend Yield Index. The Bloomberg US Aggregate Bond Index is a broad-based benchmark that measures the investment grade U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The I.C.E. BofAML BB-B Global High Yield Constrained Index contains all securities in The I.C.E. BofAML Global High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed market countries. The MSCI World High Dividend Yield Index is based on the MSCI World Index, its parent index, and includes large and mid-cap stocks across 23 developed markets countries. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The table reflects the theoretical reinvestment of dividends on securities in the Indices. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Indices calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks a level of current income that is consistent with the preservation and long-term growth of capital in inflation-adjusted terms. The Fund seeks this objective by applying a bottom-up, long-term global value investing philosophy across a broad range of asset classes. In a bottom-up approach, companies and securities are researched and chosen individually.

The Fund normally will invest in a wide range of income-producing equity securities of U.S. and non-U.S. companies, including common stocks that offer attractive dividend yields. The Fund’s equity securities include direct and indirect investments in common and preferred stocks, and include rights and warrants to subscribe to common stock or other equity securities. The Fund may obtain its exposure to equity securities indirectly through participatory notes and depositary receipts. The Fund also normally will invest in a wide range of fixed income instruments from markets in the United States and multiple countries around the world such as high-yield instruments (commonly referred to as ‘‘junk bonds’’), investment grade instruments, sovereign debt, loans and loan participations. The Fund maintains flexibility to have significant exposure to high-yield instruments in response to current market conditions. The Fund may invest in securities of any maturity or investment rating, as well as unrated securities, and will normally invest in hybrid securities that embody elements of both equity and fixed income securities such as preferred shares and convertible bonds. The Fund

x

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

may invest in initial public offerings and real estate investment trusts. While the Fund may hold investments in non-income producing securities, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) will be comprised of income producing securities.

Performance

The Fund returned -15.11% for the 12-month period ending September 30, 2022. The Fund’s top contributors were ON Semiconductor, Williams Companies and Cheniere Energy. Despite headwinds facing the semiconductor group, which as a whole delivered substantially negative performance over this time frame, ON performed well thanks to a series of strong earnings results. Williams and Cheniere, both of which are important players in US natural gas infrastructure, benefited from higher natural gas prices and the prospect of greater US gas production, as Russia’s future as a supplier of energy to Europe looks bleak.

The Fund’s top detractors were Meta Platforms, Julius Baer Group and Alphabet. Meta (formerly Facebook) and Alphabet (which operates Google) reached all-time highs in late 2021 but then performed poorly as the outlook for online advertising deteriorated and higher interest rates brought down valuations for growth equities. Julius Baer suffered along with other European financials in the aftermath of the Ukraine-Russia conflict.

Global equity markets posted a strong finish to 2021 but almost immediately began to slide with Russia’s invasion of Ukraine, which among other things exacerbated inflationary pressures that contributed to a hawkish pivot by the Fed and surging interest rates. With rising rates and higher credit spreads, bond markets are experiencing one of the worst years in recent history. Elevated inflation readings in 2022 have taken investors by surprise. High inflation has led to aggressive central bank tightening, which hurts risks assets by raising the cost of capital, pulling liquidity out of the financial system and creating the risk of a recession. A silver lining is that prospective potential returns appear high and many high-quality businesses are available at low prices relative to recent history. We are cautiously taking advantage of opportunities created by negative sentiment, while being mindful of the potential for further deterioration given the uncertain macro environment.

xi

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

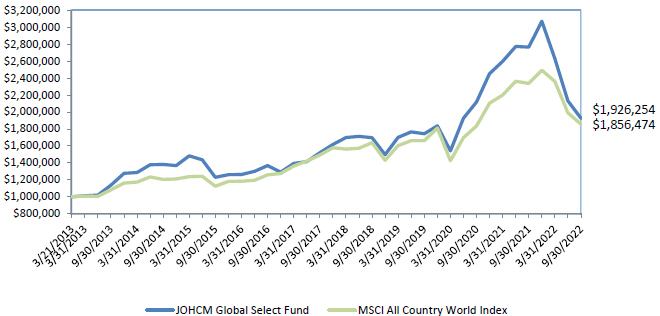

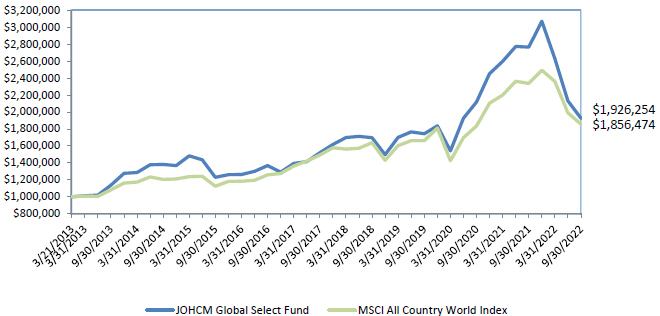

JOHCM Global Select Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from March 21, 2013 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Five Year

Return | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -30.43% | | 4.85% | | 7.12% | | 0.98% | | 0.98% |

Advisor Shares | | -30.52% | | 4.74% | | 7.03% | | 1.05% | | 1.05% |

MSCI All Country World Index | | -20.66% | | 4.44% | | 6.71% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM Global Equity Fund of the Advisers Investment Trust and the predecessor JOHCM Global Equity Fund of the Scotia Institutional Funds for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Advisor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Advisor Shares prior to their inception is based on performance of predecessor share classes of the predecessor JOHCM Global Equity Fund of the Advisers Investment Trust and the predecessor JOHCM Global Equity Fund of the Scotia Institutional Funds.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

xii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) All Country World Index (ACWI). The Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks long-term capital appreciation by investing primarily in common stocks and other equity securities of U.S. and non-U.S. companies, including direct and indirect investments in common and preferred stock, rights, and warrants. The Fund may obtain its exposure to equity securities indirectly through participatory notes, depositary receipts and exchange-traded funds. The Fund can invest without limit in non-U.S. securities and can invest in any country, including emerging market countries. The Fund normally invests at least 40% of its assets in companies located in countries other than the U.S., provided that the Fund reserves the flexibility to invest as little as 30% of its assets in companies located outside the U.S. when market conditions are unfavorable. Notwithstanding the previous sentence, the Fund may invest a percentage lower than 40% in such non-U.S. securities if the weighting of non-U.S. securities in the Fund’s performance benchmark (currently, the MSCI ACWI) drops below 45%, in which case the minimum level for investments in non-U.S. securities must remain within 5% of the benchmark’s weighting (e.g. if the weighting of non-U.S. securities in the Fund’s performance benchmark is 38%, the minimum level for investing in non-U.S. securities for the Fund would be 33%). Typically, the Fund invests in a number of different countries. The Fund is not required to allocate its investments in any set percentages in any particular countries. The Fund may invest in companies of any size, including small- and mid-capitalization companies, in order to achieve its objective.

Performance

The portfolio underperformed its benchmark, the MSCI ACWI for the 12 months ended September 30, 2022. The current market crisis is very different to anything we have seen recently as ‘safe haven’ government bonds have fallen along with equities. So much so, that this is the worst year for combined equity and bond losses in living memory. Inflation reached 40-year highs in many parts of the world, prompting central banks to hike interest rates much more than expected, leading to fears of a global recession and financial crisis.

During the year the Fund struggled to perform for three main reasons:

1. We got interest rates wrong, expecting moderate rather than near-record rises;

2. Which meant we got the Net Present Value (NPV) wrong for our ‘offense’ growth stocks (in other words, too much duration in most sectors/regions);

3. Which also meant we picked the wrong type of ‘defensive’ stocks (such as traditionally low beta healthcare) as the classic 60/40 asset allocation model that our portfolio construction is based upon stopped working when bonds and equities crashed together. As a result, we did not deliver our usual ‘relative downside protection’.

In response, we sold economically cyclical stocks with earnings risk due to increasing recession risk (for example, stocks such as Nvidia, Micron, Ono, Lam and ASML each in the semiconductor industry and Avantor and DSM in the healthcare and materials sectors, respectively). We purchased more economically resilient stocks such as Danaher, Envista and Perkin Elmer. Within healthcare, we purchased ANSYS, Epam Globant and Repligen. Within emerging markets, we purchased Bank Mandiri and Banco Bradesco (Indonesia and Brazil, respectively).

xiii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

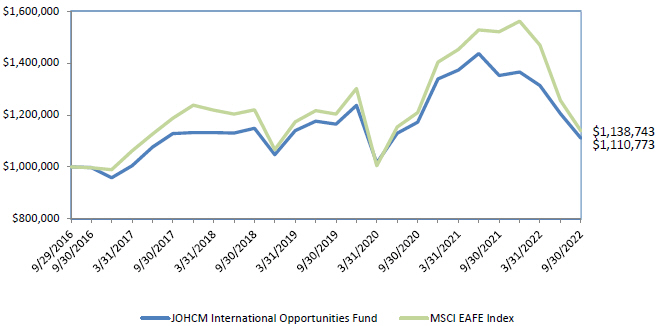

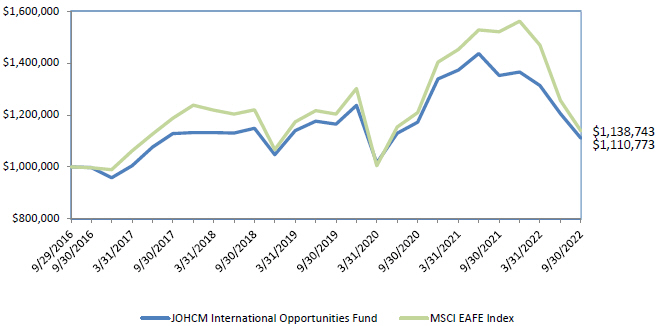

JOHCM International Opportunities Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from September 29, 2016 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Five Year

Return | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -17.89% | | -0.32% | | 1.77% | | 1.93% | | 0.88% |

MSCI EAFE Index | | -25.13% | | -0.84% | | 2.19% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM International Opportunities Fund of the Advisers Investment Trust for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares prior to their inception is based on performance of the predecessor share class of the JOHCM International Opportunities Fund of the Advisers Investment Trust.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

xiv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index. The Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks to achieve long-term total return by investing, under normal market conditions, primarily in equity securities of companies located outside the United States, including those located in emerging market countries. The Fund may invest in non-U.S. companies of any size, including small- and mid-capitalization companies, in order to achieve its objective. Equity securities include direct and indirect investments in common and preferred stocks, and include rights and warrants to subscribe to common stock or other equity securities. The Fund may also invest in equity related instruments, such as equity linked notes and participatory notes, all of which derive their value from equities. The equity linked notes and participatory notes in which the Fund invests are securitized and freely transferable. The Fund does not intend to use its investments in equity linked notes as a means of achieving leverage.

Performance

The defining features of the 12 months ended September 30, 2022 have been: further rises in inflation; rising energy prices, partly as a consequence of the Russian invasion of Ukraine in February 2022; rising interest rates; and a very strong U.S. dollar.

The Fund outperformed as conditions which had been headwinds in recent years turned aggressively. Equity market volatility was most pronounced at the extremes: rising interest rates caused a derating of highly-valued ‘growth’ stocks; and cost inflation, refinancing risk and recessionary fears weighed on geared, cyclical and lower quality ‘value’ companies. The Fund outperformed as a result of having little exposure to either of these extremes. We saw positive sector allocation contributions from our underweights in Technology and Industrials, for example. At the same time we benefitted from a re-evaluation of some companies which had suffered unfairly during the first wave of ESG adoption – such as defense company Thales or integrated energy company Shell. Our best performers included names in the ‘forgotten middle’ of what we believe are underappreciated high-quality growing companies outside the technology sector – e.g., Compass, Deutsche Boerse and Alimentation Couche-Tard. Worst performers generally had exposure to Europe or China, given disruption in those economies, including Continental, ENEL and LGH&H. We have continued adding names in the ‘forgotten middle’, such as CRH, Publicis and Merck, funded by selling names with less attractive combinations of growth, resilience in the current challenging environment, and valuation support.

In our opinion, volatility is likely to remain high given tightening liquidity and macro and geopolitical uncertainty. Longer term we expect the 2020s to see higher inflation, interest rates and capital investment than the 2010s. We believe this would likely benefit ‘real world’ companies as opposed to the ‘virtual world’ winners of recent years.

xv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

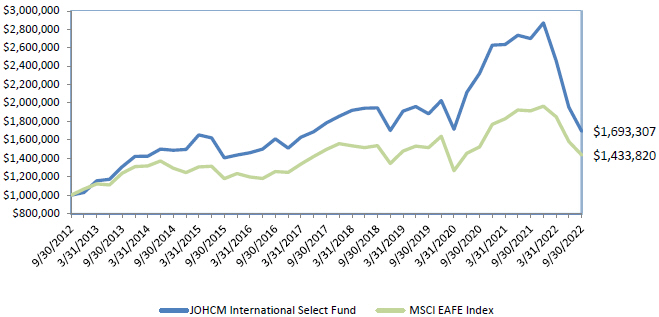

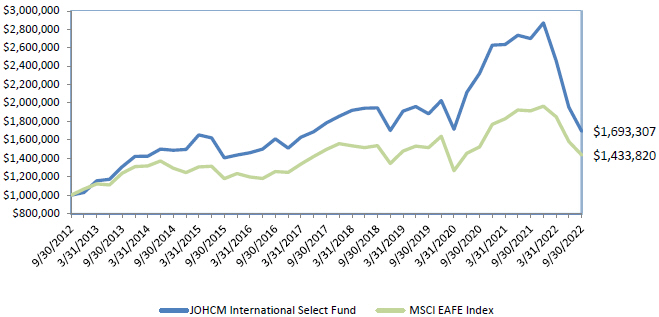

JOHCM International Select Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from September 30, 2012 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Five Year

Return | | Ten Year

Return | | Gross

Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -37.27% | | -1.03% | | 5.41% | | 0.98% | | 0.98% |

Investor Shares | | -37.43% | | -1.28% | | 5.15% | | 1.19% | | 1.19% |

MSCI EAFE Index | | -25.13% | | -0.84% | | 3.67% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor JOHCM International Select Fund of the Advisers Investment Trust and the predecessor JOHCM International Select Fund of the Scotia Institutional Funds for periods prior to the reorganization into the JOHCM Funds Trust on July 19, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares and Investor Shares of the Fund commenced operations on July 19, 2021. Historical performance for Institutional Shares and Investor Shares prior to their inception is based on performance of predecessor share classes of the predecessor JOHCM International Select Fund of the Advisers Investment Trust and the predecessor JOHCM International Select Fund of the Scotia Institutional Funds.

Historical performance for Investor Shares prior to its July 19, 2021 inception is based on the performance of the Class II Shares predecessor share class. The performance of the Class II Shares predecessor share class, which commenced operations on March 31, 2010, is based on performance of the Class I Shares predecessor share class, which commenced operations on July 29, 2009, for periods prior to the Class II Shares predecessor share class inception date. Performance of the Class II Shares predecessor share class was adjusted to reflect differences in expenses.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

xvi

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index. The Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks long-term capital appreciation by investing primarily in common stocks and other equity securities of companies located outside the United States, including those located in emerging market countries. The Fund’s equity securities include direct and indirect investments in common and preferred stocks, and rights and warrants to subscribe for common stock or other equity securities. The Fund may obtain its exposure to equity securities indirectly through participatory notes, depositary receipts and exchange-traded funds. The Fund may invest in companies of any size, including small- and mid-capitalization companies, in order to achieve its objective.

Performance

The portfolio underperformed its benchmark, the MSCI EAFE NR Index, for the 12 months ended September 30, 2022. The current market crisis is very different to anything we have seen recently as ‘safe haven’ government bonds have fallen along with equities. So much so, that this is the worst year for combined equity and bond losses in living memory. Inflation reached 40-year highs in many parts of the world, prompting central banks to hike interest rates much more than expected, leading to fears of a global recession and financial crisis.

During the year the Fund struggled to perform for three main reasons:

1. We got interest rates wrong, expecting moderate rather than near-record rises;

2. Which meant we got the Net Present Value (NPV) wrong for our ‘offense’ growth stocks (in other words, too much duration in most sectors/regions);

3. Which also meant we picked the wrong type of ‘defensive’ stocks (such as traditionally low beta healthcare) as the classic 60/40 asset allocation model that our portfolio construction is based upon stopped working when bonds and equities crashed together. As a result, we did not deliver our usual ‘relative downside protection’.

In reesponse, we sold economically cyclical stocks with earnings risk due to increasing recession risk (for example, stocks such as ASML in the semiconductor industry and DSM in the materials sector). We purchased what we believe are more economically resilient stocks such as Danaher, Envista and Perkin Elmer. Within healthcare, we purchased ANSYS, Epam Globant and Repligen. Within emerging markets, we purchased Bank Mandiri and Banco Bradesco (Indonesia and Brazil, respectively).

xvii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

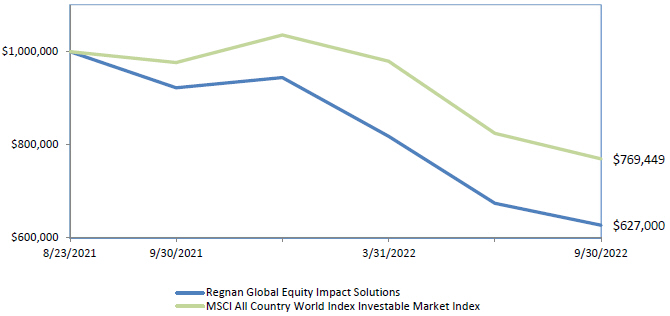

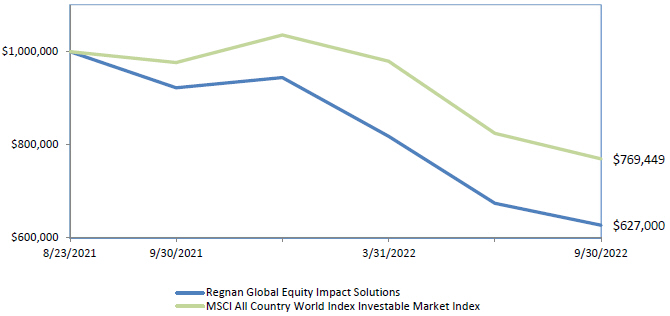

Regnan Global Equity Impact Solutions

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from August 23, 2021 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Since Inception

Return | | Gross

Expense

Ratio* | | Net

Expense

Ratio* |

Institutional Shares | | -32.00% | | -34.48% | | 7.10% | | 0.89% |

MSCI All Country World Index Investable Market Index | | -21.16% | | -21.13% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) All Country World Index (“ACWI”) Investable Markets Index (“IMI”). The Index captures large, mid and small cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 9,248 constituents, the Index is comprehensive, covering approximately 99% of the global equity investment opportunity set. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

xviii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

Investment Philosophy and Process

The Fund seeks to achieve long-term capital appreciation by investing in companies that contribute solutions to addressing the world’s major social and environmental challenges. The Fund seeks to achieve this objective by investing primarily in a high-conviction global equity portfolio of companies the portfolio managers believe have the potential to contribute solutions to the world’s major social and environmental challenges. The Fund invests, under normal circumstances, at least 80% of its assets (net assets plus the amount of borrowings for investment purposes) in equity securities of companies that the portfolio managers believe satisfy their criteria for positive social or environmental impact. The portfolio managers currently measure this impact by applying the Regnan Taxonomy and a proprietary impact assessment based upon objective criteria, including the measurement of the activities that currently constitute, or that the portfolio managers expect over the long term will constitute, a significant portion (i.e., at least 30%) of a company’s business (using metrics that may include, without limitation, any of the following: revenues, earnings, capital expenditures, research and development investment, or book value). The Fund gains exposure to equity securities either directly or indirectly, including through equity-linked instruments such as participatory notes or index exchange-traded funds, and may invest in preferred stocks.

Performance

The last quarter of 2021 marked the start of a break-out in the trade-weighted exchange rate of the U.S. dollar, a run that has continued well into 2022. While this has been a headwind to the portfolio given its overweight in Europe and relative underweight to the U.S., the negative effects have been reduced as it has been translated into company earnings through the first half of 2022. Cyclicals continued to outperform through the last quarter of 2021 and into the opening weeks of 2022, at least until investors were roiled by Russia’s invasion of Ukraine on February 24th.

The Fund delivered a positive return of 2.37% but trailed a benchmark return of 6.10% in the first quarter of 2022. The quarter initially favoured a broad range of cyclical sectors. However, in the wake of the invasion, market dynamics supported only the resource complex and more defensively positioned sectors for the remainder of the quarter. The defensive characteristics of the portfolio’s exposure to healthcare and industrials provided the strongest contribution to performance.

In Q2, the Fund underperformed, down -13.34% against a benchmark decline of -5.47%. The environment remained challenging as nominal and real yields in developed markets accelerated upwards fuelled by higher inflation expectations. As a result, industrials, consumer discretionary, materials, utilities, healthcare, real estate and financials all declined. Befesa, a heavy user of energy and zinc, was a key detractor over Q2. We continued to see pressure on the Brazilian education names YDUQS and Afya, driven more by macro sentiment rather than company-specific fundamentals.

After a brief bear-market rally at the start of the summer, the August Federal Reserve meeting saw this quickly unfold; volatility remained the order of the day in Q3, with index measures such as VIX ending the quarter marginally higher than at the start. While the portfolio has been negatively impacted by rising real yields, as central bank policy rates have been revised higher over the course of this year, continued strong fundamental and earnings momentum for many of the names in the portfolio has made our holdings even more attractive.

xix

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

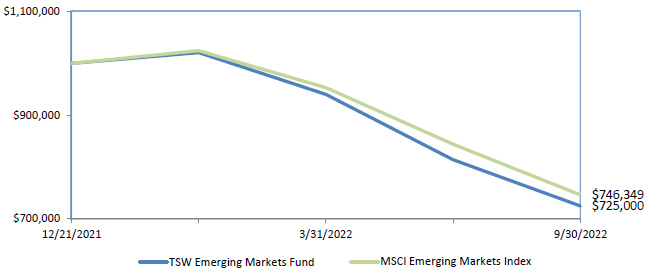

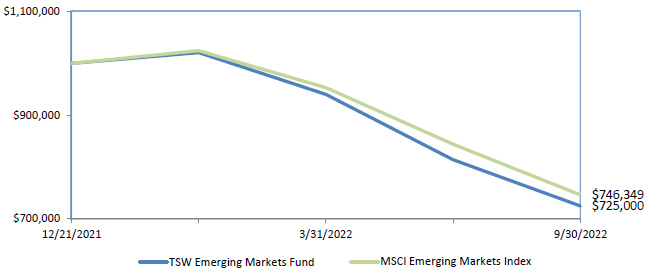

TSW Emerging Markets Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from December 21, 2021 to September 30, 2022

Cumulative Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | |

| | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -27.50% | | 6.18% | | 0.99% |

MSCI Emerging Markets Index | | -25.37% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

The Fund’s benchmark for performance comparison purposes is the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index. The Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks to maximize long-term capital appreciation by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of companies that are located in emerging market countries, including frontier markets. The Fund’s equity securities include direct and indirect investments in common and preferred stocks, and rights and warrants to subscribe to common stock or other equity securities. The Fund obtains its exposure to equity

xx

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

securities either directly or indirectly, including through Depositary Receipts, and may invest in rights and warrants. Emerging market countries are those countries included in the MSCI Emerging Markets Index and MSCI Frontier Markets Index and other countries with similar emerging or frontier market characteristics, (for example, relatively low gross national product per capita compared to the world’s major economies). The portfolio manager considers an investment tied economically to emerging market countries if it trades primarily on an emerging market exchange or if the issuer derives at least 50% of its revenue from emerging market countries. Frontier markets are generally smaller, less liquid, and less developed than other emerging markets.

Performance

Since inception, the TSW Emerging Markets Fund has returned -27.50% through September 30, 2022 (Total Return-Net). Emerging markets have been adversely affected by war in Ukraine and policy tightening by central banks, whose balance sheets are shallow in comparison to developed economies. China and Taiwan, which together comprise one-third of the fund’s holdings, have been especially affected by political tensions and uncertainty concerning their future place in the global supply chain.

The top contributors to return over the period were ICICI Bank (India), Banco BTG Pactual (Brazil) and Turkiye Sise ve Cam Fabrikalari A.S. (Turkey). These companies represent resilient business models and regions that have largely been shielded from the broader concerns regarding stability in some emerging markets. TSMC (Taiwan), Tencent (China) and Samsung Electronics (Korea) were the largest detractors from performance. Investor sentiment toward these tech-focused “national champion” businesses has turned pessimistic amidst slowing global GDP growth. However, rising interest rates are not a new challenge for these businesses, and we believe they have the resources to navigate near-term headwinds and emerge stronger relative to younger, smaller competitors.

xxi

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

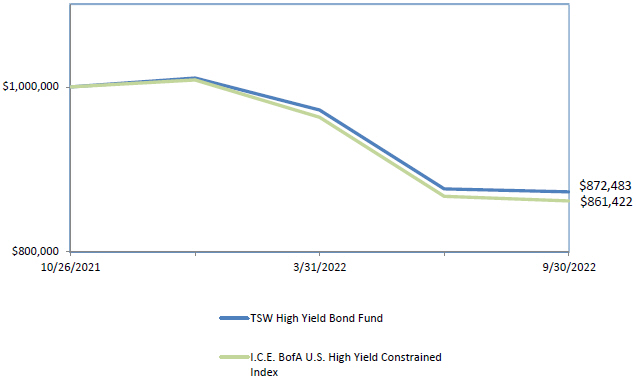

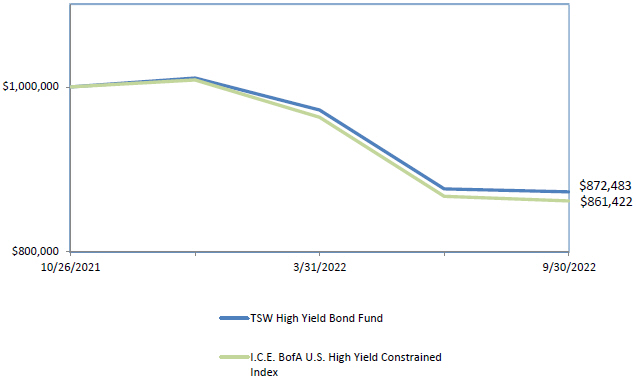

TSW High Yield Bond Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from October 26, 2021 to September 30, 2022

Cumulative Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | |

| | | Since Inception

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -12.75% | | 1.16% | | 0.65% |

ICE BofA U.S. High Yield Constrained Index | | -13.86% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

xxii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The Fund’s benchmark for performance comparison purposes is the I.C.E. BofA U.S. High Yield Constrained Index. The Index tracks the performance of US dollar denominated below investment grade rated corporate debt publicly issued in the US domestic market. The table reflects the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and administration fees, are not reflected in the Index calculations. It is not possible to invest directly in an index.

Investment Philosophy and Process

The Fund seeks high current income with a secondary focus on capital appreciation by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in high yield fixed income securities, also known as “junk bonds” (higher risk, lower rated fixed income securities rated BB or below by at least one nationally recognized statistical rating organization or determined to be of a similar quality by TSW). The Fund’s fixed income securities include primarily corporate debt, but may also include convertible bonds, preferred securities, loans (senior floating rate loans as well as other secured and unsecured loans) and loan participations. The Fund may also seek to obtain exposure to fixed income investments through investments in affiliated or unaffiliated investment companies, including exchange-traded funds. The Fund expects to invest primarily in securities denominated in U.S. dollars and may invest in companies of any size, including small- and mid-capitalization companies.

Performance

Since inception (October 26, 2021) and through the period ended September 30, 2022, the Fund outperformed its benchmark. Strong inflationary pressures, geopolitical instability and emerging recession fears all weighed heavily on the high yield bond market. During the period ended September 30, 2022, the 5-year treasury yield jumped from, 1.17% to 4.09% and high yield credit spreads widened 277 bps. The Fund’s outperformance was largely attributable to its shorter duration and underweight positioning in CCC credits which underperformed the single B and BB rating buckets. We will continue to monitor the macroeconomic environment and individual valuation at the company level to make adjustments to the portfolio as needed.

xxiii

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

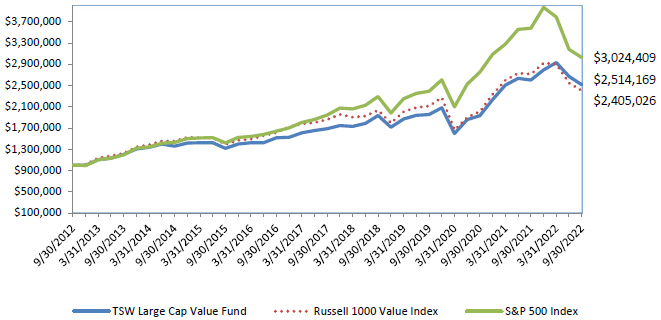

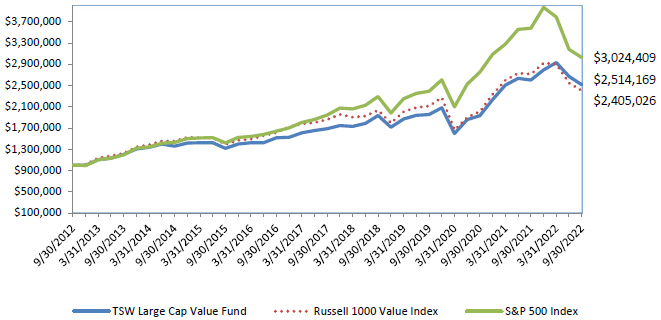

TSW Large Cap Value Fund

Change in value of a hypothetical $1,000,000 investment in the Fund’s Institutional Shares

from September 30, 2012 to September 30, 2022

Average Annual Total Returns as of September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | Five Year

Return | | Ten Year

Return | | Gross Expense

Ratio* | | Net Expense

Ratio* |

Institutional Shares | | -3.46% | | 8.33% | | 9.66% | | 0.91% | | 0.74% |

Russell 1000 Value Index | | -11.36% | | 5.29% | | 9.17% | | — | | — |

Data as of September 30, 2022. The Fund’s performance reflects the performance of the predecessor TS&W Equity Portfolio of the Advisors’ Inner Circle Fund for periods prior to the reorganization into the JOHCM Funds Trust on December 6, 2021. The performance also reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. The performance does not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Institutional Shares of the Fund commenced operations on December 6, 2021. Historical performance for Institutional Shares prior to their inception is based on the performance of predecessor share class of the predecessor TS&W Equity Portfolio of the Advisors’ Inner Circle Fund.

* Expense ratios are per the most recent Fund Prospectus dated January 28, 2022, as revised March 11, 2022 and July 11, 2022. The Adviser has entered into a contractual expense limitation agreement with respect to the Fund until January 28, 2023.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data quoted. Investors may obtain performance information current to the most recent month-end, within 7 business days, by calling 866-260-9549 or 312-557-5913.

xxiv

JOHCM FUNDS TRUST

PORTFOLIO COMMENTARY

September 30, 2022 (Unaudited)

The Fund’s benchmark for performance comparison purposes is the Russell 1000 Value Index. The Russell 1000 Value Index measures the performance of the large-cap value segment of the US equity universe.

Investment Philosophy and Process

The Fund seeks maximum long-term total return, consistent with reasonable risk to principal by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of companies with large market capitalizations. The Fund considers a company’s market capitalization to be large if it equals or exceeds that of the smallest company in the Russell 1000 Index. The Fund will invest primarily in a diversified portfolio of common stocks. Although the Fund will primarily draw its holdings from larger, more seasoned or established companies, it may also invest in companies of varying size as measured by assets, sales or market capitalization. The Fund may invest up to 20% of its total assets in American Depositary Receipts, which are certificates evidencing ownership of shares of a non-U.S. issuer that are issued by depositary banks and traded on U.S. exchanges.

Performance

The TSW Large Cap Value composite outperformed the -11.36% return of the Russell 1000 Value Index by 790 basis points (Total Return – Net). Outperformance for the Fund is generally in-line with our expectations given the shift in favor of valuation and moderation/reversal of the prior few years that rewarded speculative growth stocks with little to no fundamental bearing. It is worth noting that while 2021 forward has generally shown favoritism for value and has presented what we believe to be the potential beginning of a more sustained rotation for value, it certainly has not been a straight line, nor would we expect it to be so as history has shown. Ultimately, we are pleased with the long-awaited market rotation in favor of value over the last year, which has coincided with positive stock selection and overall outperformance, while also protecting capital on a relative basis in a down-market.

The leading industries in terms of contribution to Large Cap Value portfolio’s relative return were Financials, Consumer Staples and Consumer Discretionary. Within Financials, positions across insurance providers, Progressive and Arch Capital, were the primary contributors driven by rate increases across both companies, and overall sound underwriting execution and profitability. Within Consumer Staples, the portfolio benefited from both an overweight allocation to the industry, and positive stock selection across McKesson, a drug distributor, and Post Holdings, a diversified consumer packaged goods company. Both benefited from resilient business models during a period of market stress. Lastly, with Consumer Discretionary, Dollar Tree, a discount retailer, was the standout driven by their announcement of a multi-dollar price point for items, share buy-backs, and activist involvement.

The primary detractors from relative performance were Telecommunications, Technology, and Utilities. Within Telecommunications, our position in Dish Network Corp. was the primary laggard driven by lack of visibility provided by management at a recent analyst day. Within Technology, our positions in Meta Platforms, a social media technology company, and Intel Corp., were the primary laggards driven by advertising spend headwinds and social media competition in the former, and recessionary concerns on semiconductor spend in the latter. Lastly, within Utilities, our underweight allocation was the sole detractor.

xxv

JOHCM FUNDS TRUST

JOHCM CREDIT INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2022

| | | | | | | | | | | | |

| | | Percentage

of Net

Assets | | | Shares | | | Value | |

COMMON STOCKS | | | 0.1 | % | | | | | | | | |

Asset Management | | | 0.1 | % | | | | | | | | |

Austerlitz Acquisition Corp. II(a) | | | | | | | 634 | | | $ | 6,220 | |

CC Neuberger Principal Holdings III(a) | | | | | | | 104 | | | | 1,034 | |

Northern Star Investment Corp. III(a) | | | | | | | 211 | | | | 2,076 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,330 | |

| | | | | | | | | | | | |

TOTAL COMMON STOCKS (Cost $9,505) | | | | | | | | | | | 9,330 | |

| | | | | | | | | | | | |

| | | |

| | | Percentage

of Net

Assets | | | Principal Amount | | | Value | |

CONVERTIBLE BONDS | | | 19.7 | % | | | | | | | | |

Biotechnology & Pharmaceuticals | | | 2.0 | % | | | | | | | | |

Bridgebio Pharma, Inc.

2.25%, 02/01/29 | | | | | | $ | 50,000 | | | | 21,685 | |

Innoviva, Inc.

2.50%, 08/15/25 | | | | | | | 100,000 | | | | 96,125 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 117,810 | |

| | | | | | | | | | | | |

Cable & Satellite | | | 7.2 | % | | | | | | | | |

Liberty Broadband Corp.,

1.25%, 09/30/50(b) | | | | | | | 100,000 | | | | 94,500 | |

2.75%, 09/30/50(b) | | | | | | | 150,000 | | | | 143,808 | |

Liberty Latin America Ltd.

2.00%, 07/15/24 | | | | | | | 220,000 | | | | 192,371 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 430,679 | |

| | | | | | | | | | | | |

Internet Media & Services | | | 2.4 | % | | | | | | | | |

Spotify U.S.A., Inc.

0.00%, 03/15/26 | | | | | | | 180,000 | | | | 141,300 | |

| | | | | | | | | | | | |

Software | | | 8.1 | % | | | | | | | | |

1Life Healthcare, Inc.

3.00%, 06/15/25 | | | | | | | 100,000 | | | | 96,750 | |

Avalara, Inc.

0.25%, 08/01/26 | | | | | | | 130,000 | | | | 125,710 | |

Bill.com Holdings, Inc.

0.00%, 04/01/27 | | | | | | | 100,000 | | | | 78,050 | |

Envestnet, Inc.

0.75%, 08/15/25 | | | | | | | 100,000 | | | | 83,625 | |

Splunk, Inc.

1.13%, 06/15/27 | | | | | | | 130,000 | | | | 102,281 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 486,416 | |

| | | | | | | | | | | | |