Prior to and at the March 27-28, 2024 meeting of the Board, the Board requested, and Perpetual Americas Funds Services1 (the “Adviser”) and Barrow Hanley provided, both written and oral reports containing information and data relating to the consideration of: (i) the nature, extent, and quality of the services to be provided by each of the Adviser and Barrow Hanley to the Barrow Hanley Concentrated Emerging Markets ESG Fund, Barrow Hanley Total Return Bond Fund, Barrow Hanley Credit Opportunities Fund, Barrow Hanley Floating Rate Fund, Barrow Hanley US Value Opportunities Fund, Barrow Hanley Emerging Markets Value Fund, and Barrow Hanley International Value Fund (collectively, the “Funds”); (ii) the investment performance of the Funds’ predecessor funds; (iii) the costs of the services to be provided and the profits to be realized by the Adviser and Barrow Hanley from each of their relationships with the Funds; (iv) the extent to which economies of scale are expected to be realized as the Funds grow; (v) whether the proposed fee levels would reflect such economies of scale to the benefit of the Funds’ potential shareholders and (vi) any ancillary or other benefits to the Adviser or Barrow Hanley or their affiliates that may be derived from their sponsorship and investment management of the Funds. The Trustees were assisted in their evaluation of the Investment Advisory Agreement and Investment Subadvisory Agreement (together, the “Advisory Agreements”) by independent legal counsel, from whom they received assistance and advice, including a review of the legal standards applicable to the consideration of advisory arrangements, and with whom they met separately from management. In reviewing the Advisory Agreements, the Trustees, including all the Independent Trustees, considered the following and other factors with respect to the Funds.

Nature, Extent and Quality of the Services

The Board examined the nature, extent, and quality of services to be provided to each Fund by the Adviser and Barrow Hanley. The Board noted that the Adviser is an indirect wholly owned subsidiary of Perpetual Limited. The Board considered the terms of the Advisory Agreements, information and reports provided by each of the Adviser and Barrow Hanley on its respective personnel and operations, and the Adviser’s and Barrow Hanley’s experiences with the investment strategy and risks of each Fund. The Board reviewed, among other things, each of the Adviser’s and Barrow Hanley’s investment philosophies and portfolio construction processes, compliance program, insurance coverage, business continuity programs, and information security practices. Taking into account the personnel anticipated to be involved in servicing the Funds as well as the anticipated services to be provided by the Adviser and Barrow Hanley, the Board expressed satisfaction with the quality, extent, and nature of the services expected from the Adviser and Barrow Hanley.

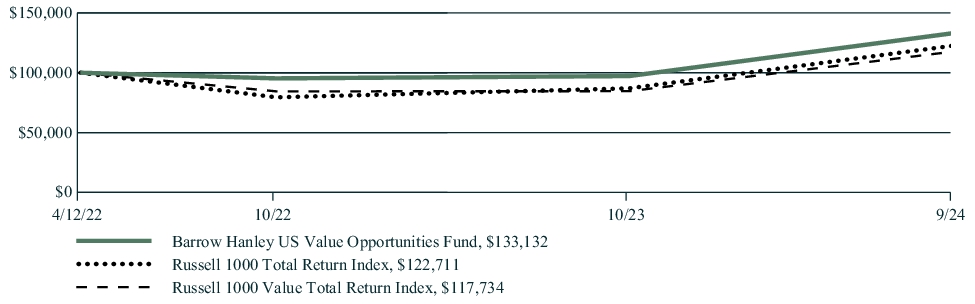

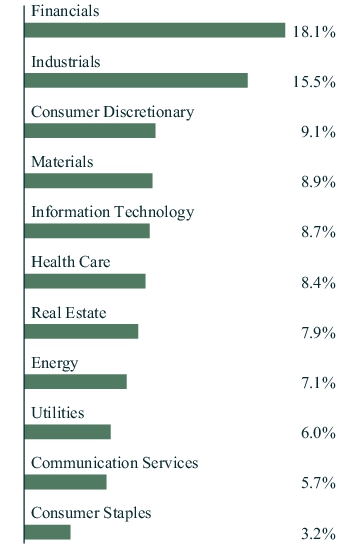

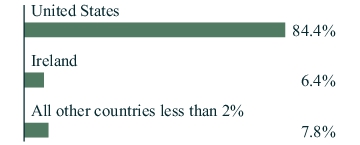

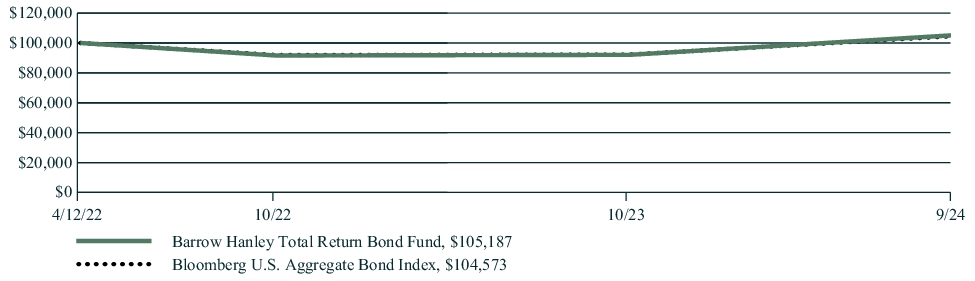

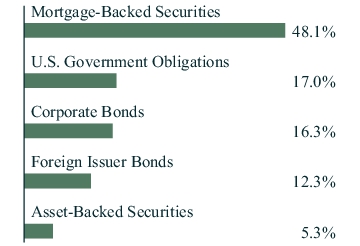

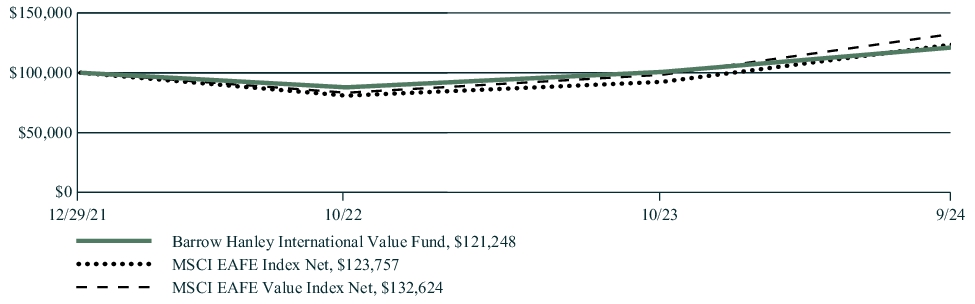

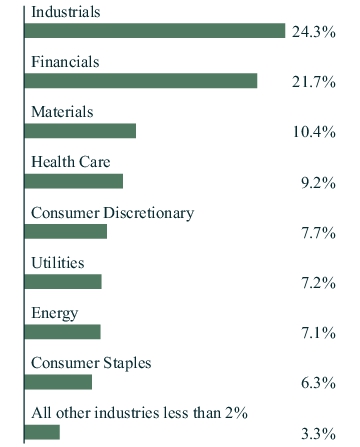

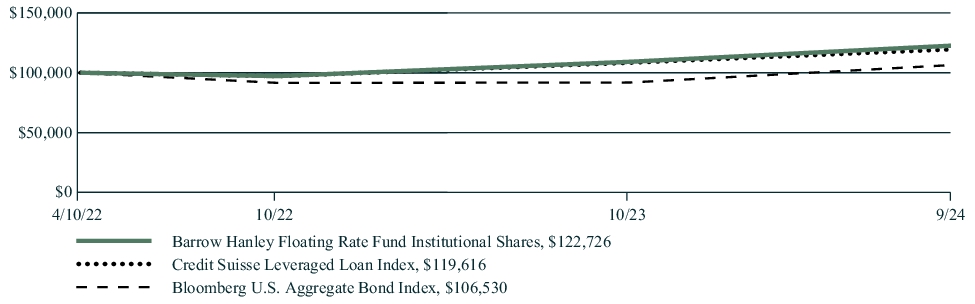

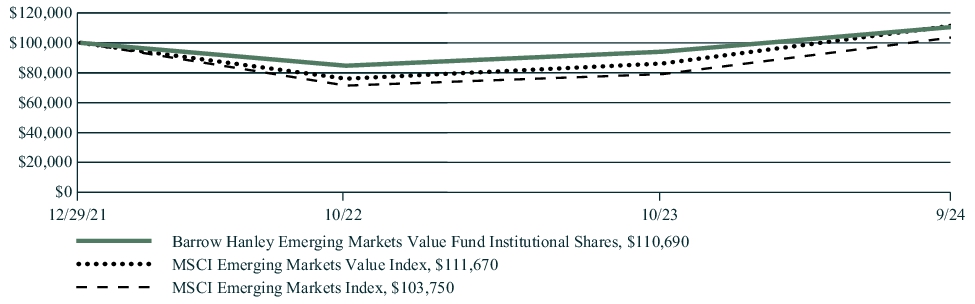

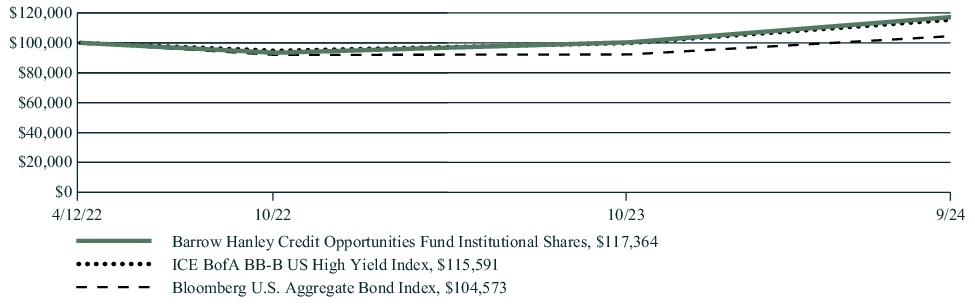

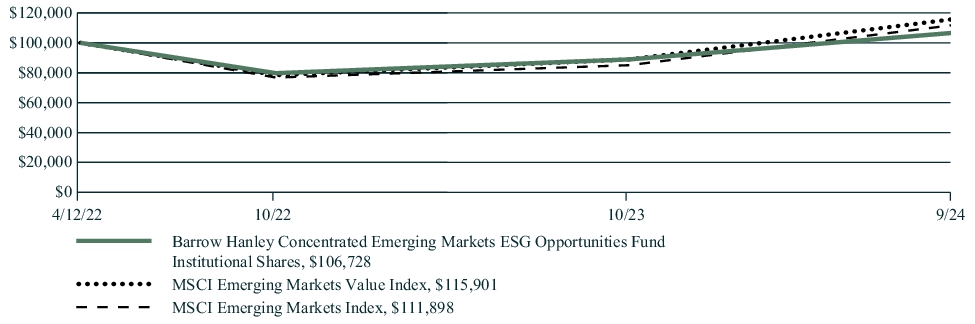

The Board then turned to performance and considered the investment performance of the Barrow Hanley Concentrated Emerging Markets ESG Fund, Barrow Hanley Total Return Bond Fund, Barrow Hanley Credit Opportunities Fund, Barrow Hanley Floating Rate Fund, Barrow Hanley US Value Opportunities Fund, Barrow Hanley Emerging Markets Value Fund and Barrow Hanley International Value Fund, each a series of The Advisors’ Inner Circle Fund III (the “AIC BH Funds”), as the proposed predecessor funds to the Funds following the anticipated reorganization of the AIC BH Funds with and into the Barrow Hanley Funds (the “Reorganizations”), and the overall performance of its portfolio managers. The Board considered a report prepared by an industry standard independent service provider, Broadridge Financial Solutions, which presented comparisons of investment performance, expenses and fees of the Funds relative to their investment categories, competitor fund groups and broader benchmarks, as applicable.

The Board also reviewed comparative data from the Adviser and Barrow Hanley on the advisory fees for the AIC BH Funds, as the proposed predecessor funds to the Funds. The Trustees noted that the advisory fees proposed for the Funds were the same as each AIC BH Fund’s current advisory fee. After considering the comparative data provided by the Adviser and Barrow Hanley, the Board concluded that the proposed investment advisory fees, subadvisory fees, and expense ratios after waiver or reimbursement were reasonable.

With respect to the Barrow Hanley Concentrated Emerging Markets ESG Opportunities Fund, the Board noted that the Fund’s Contractual Management Fee2 ranked seven out of 18 among the Fund’s Expense Group. The Board further noted that the Fund’s Contractual Management Fee was 0.930% compared to a median Contractual Management Fee of 0.962% for the Expense Group. The Board next considered the Fund’s total expenses, after fee waivers and expense reimbursements, and noted that the Fund ranked 10 out of 18 amongst

1 The business name under which JOHCM (USA) Inc subcontracts portfolio management services to affiliated investment advisers.

2 Broadridge combines the advisory fee and administrator fee into a management fee that Broadridge recommends boards focus on.