Exhibit (c)(2)

PRELIMINARY AND SUBJECT TO CHANGE Presentation to the Special Committee March 14 th , 2024

PR O JECT CHEL I O S This presentation, and any supplemental information (written or oral) or other documents provided in connection therewith (co llectively, the “materials”), are provided solely for the information of the Special Committee (the “Special Committee”) of the Board of Directors (the “Board”) of Chelios (the “Company”) by BMO Capital Markets Corp. (“BMO”) in connection with the Board’s consideration of a potential transaction (the “Transaction”) involving the Company. This presentation is incomplete without reference to, and should be considered in conjunction with, any supplemental informat ion provided by and discussions with BMO in connection therewith. Any defined terms used herein shall have the meanings set forth herein, even if such defined terms have been given different meanings elsewhere in the materials. The materials are for discussion purposes only. BMO expressly disclaims any and all liability which may be based on the materials and any errors therein or omissions therefrom. The materials were prepared for specific persons famili ar with the business and affairs of the Company for use in a specific context and were not prepared with a view to public disclosure or to conform with any disclosure standards under any state, federal or international securities la ws or other laws, rules or regulations, and none of the Special Committee, Board, the Company or BMO takes any responsibility for the use of the materials by persons other than the Special Committee. The materials are provided on a confidential basis for the information of the Special Committee and may not be disclosed, summarized, reproduced, disseminated or quoted or otherwise referred to, in whole or in part, without BMO’s express prior written consent except to the extent required by applicable laws or the rules of the ASX. Notwithstanding any other provision herein, the Company (and each employee, representative or other agent of the Company) may disclose to any and all persons without limitation of any kind, the tax treatment and tax structure of any transaction and all materials of any kind (including opinions or other tax analyses, if any) that are provided to the Company relating to such tax treatment and structure. However, any information relating to the tax treatment and tax structure shall remain confidential (and the foregoing sentence shall not apply) to the extent necessary to enable any person to comply with securities laws. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. income or franchise tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. income or franchise tax treatment of the transaction. If the Company plans to disclose information pursuant to the first sentence of this paragraph, the Company shall inform those to whom it discloses any such information that they may not rely upon such information for any purpose without BMO’s prior written consent. BMO is not an expert on, and nothing contained in the materials should be construed as advice with regard to, legal, accounting, regulatory, insurance, tax or other specialist matters. BMO’s role in reviewing any information is limited solely to performing such a review as it shall deem necessary to support i ts own advice and analysis and shall not be on behalf of the Special Committee or the Board. The materials necessarily are based on financial, economic, market and other conditions as in effect on, and the information available to B MO as of, the date of the materials. Although subsequent developments may affect the contents of the materials, BMO has not undertaken, and is under no obligation, to update, revise or reaffirm the materials, except as may be expressly contemplated by BMO’s engagement letter. The materials are not intended to provide the sole basis for evaluation of the Transaction and do not purport to contain all information that may be required. The materials do not address the underlying business decision of the Company or any other party to proceed with or effect the Transaction, or the relative merits of the Transaction as compared to any alternative business strategies or transactions that might be available for the Company or any other party. The materials do not constitute any opinion, nor do the materials constitute a recommendation to the Special Committee, the Board, the Company, any security holder of the Company or any other party as to how to vote or act with respect to any matter relating to the Transaction or otherwise or whether to buy or sell any assets or securities of any company. BMO’s only opinion is the opinion, if any, that is actually delivered to the Special Committee. The materials may not reflect information known to other professionals in other business areas of BMO and its affiliates. The preparation of the materials was a complex process involving quantitative and qualitative judgments and determinations with respect to the financial, comparative and other analytic methods employed and the adaption and applicatio n of these methods to the unique facts and circumstances presented and, therefore, is not readily susceptible to partial analysis or summary description. Furthermore, BMO did not attribute any particular weight to any analy sis or factor considered by it, but rather made qualitative judgments as to the significance and relevance of each analysis and factor. Each analytical technique has inherent strengths and weaknesses, and the nature of the available in formation may further affect the value of particular techniques. Accordingly, the analyses contained in the materials must be considered as a whole. Selecting portions of the analyses, analytic methods and factors without considering all analyses and factors could create a misleading or incomplete view. The materials reflect judgments and assumptions with regard to industry performance, general business, economic, regulatory, market and financial conditions and other matters, many of which are beyond the control of the participants in the Transaction. Any estimates of value contained in the materials are not necessarily indicative of actual value or predictive of future results or values, which may be significantly more or less favorable. Any analyses relating to the value of assets, businesses or securities do not purport to be appraisals or to reflect the prices at which any assets, businesses or securities may actually be sold. The materials do not constitute a valuation opinion or credit rating. In preparing the materials, BMO has not conducted any physical inspection or independent appraisal or evaluation of any of the assets, properties or liabilit ies (contingent or otherwise) of the Company or any other party and has no obligation to evaluate the solvency of the Company or any other party under any law. All budgets, projections, estimates, financial analyses, reports and other information with respect to operations (including estimates of potential cost savings and expenses) reflected in the materials have been prepared by management of the relevant party or are derived from such budgets, projections, estimates , financial analyses, reports and other information or from other sources, which involve numerous and significant subjective determinations made by management of the relevant party and/or which such management has reviewed and found reasonable. The budgets, projections and estimates (including, without limitation, estimates of potential cost savings and synergies) contained in the materials may or may not be achieved and differences between projected results and those actually achieved may be material. BMO has relied upon representations made by management of the Company that such budgets, projections and estimates have been reasonably prepared in good faith on bases r eflecting the best currently available estimates and judgments of such management (or, with respect to information obtained from public sources, represent reasonable estimates), and BMO expresses no opinion with respect to such budgets, projections or estimates or the assumptions on which they are based. The scope of the financial analysis contained herein is based on discussions with the Special Committee (including, without limitation, regard ing the methodologies to be utilized), and BMO does not make any representation, express or implied, as to the sufficiency or adequacy of such financial analysis or the scope thereof for any particular purpose. BMO has assumed and relied upon the accuracy and completeness of the financial and other information provided to, discussed w ith or reviewed by it without (and without assuming responsibility for) independent verification of such information, makes no representation or warranty (express or implied) in respect of the accuracy or completeness of such info rmation and has further relied upon the assurances of the Company that it is not aware of any facts or circumstances that would make such information inaccurate or misleading. In addition, BMO has relied upon and assumed, withou t independent verification, that there has been no change in the business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Company or any other participant in the Transaction since the respective dates of the most recent financial statements and other information, financial or otherwise, provided to BMO that would be material to its analyses, and that the final forms of any draft documents reviewed by BMO will not differ in any material respect from such draft documents. The materials are not an offer to sell or a solicitation of an indication of interest to purchase any security, option, commodity, future, loan or currency. The materials do not constitute a commitment by BMO or any of its affiliates to underwrite, subscribe for or place any securities, to extend or arrange credit, or to provide any other services. In the ordinary course of business, certain of BMO’s affiliates and employees, as well as investment funds in which they may have financial interests or with which they may co - invest, may acquire, hold or sell, long or short positions, or trade or otherwise effect transactions, in debt, equity, and other securities and financial instruments (including loans and other obligations) of, or investments in, one or more parties that may be involved in the Transaction and their respective affiliates or any currency or commodity that may be involved in the Transaction. BMO provides mergers and acquisitions, restructuring and other advisory and consulting services to clients. BMO’s personnel may make statements or provide advice that is contrary to information contained in the materials. BMO’s or its affiliates’ proprietary interests may conflict with the Company’s interests. BMO may have advised, may seek to advise and may in the future advise one or more participants in the Transaction and/or other companies mentioned in the materials. 1 PRELIMINARY AND SUBJECT TO CHANGE Di s claimer

2 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Section 1: Situation Overview SIT U ATION OVE R VI E W Situation Overview Section 1 Preli m inary F inancial Anal y sis Section 2 Appendix

3 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Sterling Funds Proposal Letter 23 - Feb - 2024, FactSet 1. To the extent there is any management or other rollover, such affiliated stockholder would also be excluded from the scope of opinion. SIT U ATION OVE R VI E W Chelios received a non - binding proposal on February 23, 2024 for a gross cash consideration of A$0.65 per share from Sterling Ca pital Partners IV, L.P. and SCP IV Parallel, L.P. (“Sterling” or the “Purchaser”) to acquire all of the outstanding equity of the Company not currently owned by the Purchaser (the “Transaction”), less the per share dollar amount of the aggregate fees/expenses incurred by Special Committee of the Board of Directors (the “Special Committee”) in connection with this Transaction in excess of a mutually agreed reasonable expense amount As of the date the proposal was received, the offer represented: – 38% premium to the then prevailing price – 41% premium to 30 - day VWAP – 76% premium to 90 - day VWAP The offer was submitted one business day before the Company had an investor call to discuss FY24 H1 results, which was followed by an 11% increase in the Company’s stock price; as of March 13, 2024, the offer represents: – 10% premium to the current share price – 9% premium to 30 - day VWAP – 10% premium to 90 - day VWAP The Purchaser owns approximately 66% of the Company as of February 23, 2024 Prior to the offer expiration (March 8, 2024), the Special Committee responded to the Purchaser's offer BMO Capital Markets Corp. (“BMO”, “we”, or “our”) has been engaged by the Special Committee of the Company to render an opinion to the Special Committee, as to the fairness, from a financial point of view, to the Company’s common stockholders (other than the Purchaser (1) ) of the consideration to be received by such stockholders in the Transaction Chelios is headquartered in Chicago, IL and is listed on the Australian Securities Exchange (ASX) The Transaction will be structured as a take - private acquisition whereby the Purchaser will acquire the outstanding equity owned by minority shareholders and de - list the stock from the Australian Securities Exchange BMO has relied, with the consent of the Special Committee, on Chelios management with respect to adjusted historical and projected financial data Executive Summary

4 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Sterling Capital Partners IV, L.P. and SCP IV Parallel, L.P. (“Sterling”) Current ownership of ~66% of the outstanding common stock Purchaser AUD$0.65 per share (USD$0.43) (1) for all of the outstanding shares of common stock not already owned by Sterling, less the per share dollar amount of the aggregate fees/expenses incurred by the Special Committee in connection with this transaction in excess of a mutually agreed reasonable expense amount As of the date the proposal was received, the offer represented: – 38% premium to the then prevailing price – 41% premium to 30 - day VWAP – 76% premium to 90 - day VWAP The offer was submitted one business day before the Company had an investor call to discuss FY24 H1 results, which was followed by an 11% increase in the Company’s stock price; as of March 13, 2024, the offer represents: – 10% premium to the current share price – 9% premium to 30 - day VWAP – 10% premium to 90 - day VWAP Implied enterprise value to estimated FY24 revenue multiple of 0.40x (2) Valuation Finalization and execution of financing commitments Rollover of 100% of the existing shares of stock owned by management Approval of the holders of a majority of the shares not owned by Sterling Material Conditions Senior secured term loan from Morgan Stanley Private Credit (term sheet provided as an exhibit to the offer letter) Financing Subject to the completion of limited due diligence Due Diligence Written response required by March 8, 2024 or the proposal shall expire and be deemed withdrawn Timing to closing will ultimately depend on effectiveness of the registration statement on Form 10 filed with the SEC; however, illustrative timeline to completion was shared by Sterling: Estimated timing to signing definitive documentation: 1 - 4 weeks Estimated timing from signing to closing (key potential filings / workstreams include HSR, 13E - 3, Proxy, Schedule TO, 14D - 9): ~15 weeks Timing Sterling intends to terminate the existing incentive equity plan and adopt a new plan for directors, management, and certain other employees of Chelios Management / Incenti v e Equity Plan Sterling intends to invite non - management accredited holders of common stock that have holdings above a certain level to participate in rollover, if that can be achieved under both U.S. and Australian law in a manner that does not jeopardize the goal of de - registering under U.S. law and delisting under ASX rules and regulations Sterling intends to remain shareholders of the Company regardless of outcome of this potential Transaction and is not interes ted in pursuing an alternative transaction, such as a sale to a potential third - party buyer Other SIT U ATION OVE R VI E W Summary of Sterling’s Non - Binding Proposal Source: Sterling Funds Proposal Letter 23 - Feb - 2024, FactSet 1. Share price converted using exchange rate of A$1 / US$0.656 as of 22 - Feb - 24. 2. Based on financial projections from management.

5 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Research (4) Number of Brokers M ed ian Ta r ge t P r ic e Premium to Current 5 $1.21 104 . 2 % (A $ ) (%) 100% B uy Ho l d S e l l Unknown Capitalization $0.59 A$ S har e P r i c e $0.39 (US$) S har e P r i c e 225.27 (mm) F. D . S hare s (2) 88 ( US$ mm) F. D . M a r ke t Ca p 42 Le ss: Ca sh 46 ( US$ mm) En te rpri s e V a lue T r ad i n g Mu l t i p l e s ( 3) EV / FY' 2 4 Revenu e EV / FY' 2 5 Revenu e EV / FY' 2 4 EBIT D A EV / FY' 2 5 EBIT D A P / FY' 2 4 EP P / F Ma r k e t D a ta $0.93 (A$) 52 - W ee k H i g h $0.22 (A$) 52 - W ee k Lo w $0.60 (A$) 30 - D a y V W AP 148 (k) 1 - Ye a r A vg . D a ily Vol $54 ( A$ k ) 1 - Ye a r A vg . D a ily Val Source: Company filings, FactSet, Street research Note: Market data as of 13 - Mar - 24. Note: Enterprise Value includes equity market capitalization, net of cash. Note : Online Program Management includes 2 U, Inc . and Grand Canyon Education, Inc .. Online Courses & Platforms includes IDP Education LTD .; Stride, Inc .; Coursera Inc .; Udemy, Inc .; Skillsoft Corp .; Nerdy, Inc .; Thinkific Labs, Inc .. 1. 2. Converted using exchange rate of A $ 1 / US $ 0 . 65967 as of 13 - Mar - 24 . Fully diluted share count includes 214 , 694 , 686 basic CDIs and 10 , 578 , 569 RSUs . Company has 4 , 894 , 462 options outstanding at an average strike price of A $ 3 . 71 , which are not exercisable at current trading levels . Trading multiples based on available consensus estimates . Buy includes Buy, Speculative Buy, and Outperform from equity research analysts . Evans & Partners ratings and estimates are from 29 - Aug - 23 . Share price and trading volume based on activity for the next trading day . 3. 4. 5. Chelios: Share Price Performance and Capitalization INDEXED SHARE PRICE PERFORMANCE SINCE CHELIOS IPO TRADING INFO (1) SIT U ATION OVE R VI E W Ch e li o s Online Program Management Online Courses & Platforms (FYE June 30) Broader market sentiment shift away from high - growth, cash - burning businesses combined with perceived Chelios liquidity concerns due to upfront investment required for recently signed programs 02 - Jun - 21: Completes IPO on the ASX, raising A$212mm of new capital through issuance of 57mm Chess Depository Interests ("CDI") at A$3.71 per share 28 - Nov - 23: DoE noted that matters relating to TPS could be addressed in future negotiated rulemaking sessions, and that it intended to issue guidance in 2024 26 - Feb - 24: Announced H1 FY24 results with revenue growing 14% Y/Y and contribution margin expanding significantly. Raised FY24 revenue and Adj. EBITDA guidance. Share price increased 10.6% with ~62K trading volume (5) Chelios Share Price 84.4 % 3 Month Return 68.6 % 6 Month Return 73.5 % YTD (30.2)% 1 Year Return (83.4)% Since IPO 15 - Feb - 23: The Department of Education ("DoE") announced revisions to Third - Party Servicer ("TPS") guidance through a Dear Colleague Letter (“DCL”) to expand the definition of covered activities and exclude foreign companies from providing services 11 - Mar - 24: Announced that its CFO, Peter Vlerick, has tendered his resignation and will remain in his role until 03 - May - 24

6 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Company filings, FactSet, Street research Note: Market data as of 13 - Mar - 24 Note: Enterprise Value includes equity market capitalization and market value of debt, net of cash 1 . Fully diluted share count includes 83 , 644 , 026 common shares, 4 , 595 , 630 RSUs, 1 , 404 , 125 performance RSUs . Company has 3 , 229 , 631 options outstanding at an average strike price of $ 31 . 66 , which are not exercisable at current trading levels 2U, Inc. (“2U”): Relative Performance Analysis and Trading Metrics INDEXED 2YR SHARE PRICE PERFORMANCE TRADING INFO 09 - Jan - 23: Announces agreement to refinance its term loan, extending maturity from Dec - 24 to Dec - 26, along with 1L RCF of $40mm 15 - Apr - 22: Chief Accounting Officer John Ellis resigns; Morgan Stanley cuts price target 28 - Jul - 22: Reported Q2’22 results and cut guidance for FY22; net losses widened 09 - Feb - 22: Announces Q4’21 results; net loss widened while enrollment growth slowed down; brokerages downgrade and cut down price targets following earnings results 09 - Nov - 23: USC partnership terminated, agreed on transitioning 2 U - managed programs SIT U ATION OVE R VI E W Research Number of Brokers 6 $1.25 (US$) Median Target Price 246.0% (%) Premium to Current 67 % 33% Buy Hold 2. Trading multiples based on available consensus estimates. 3. Market capitalization and trading levels of debt as of 13 - Mar - 24 from Bloomberg. S e l l Unknown 17 - Nov - 23: Co - founder and CEO, Chip Paucek, resigns after high profile USC partnership ends. CFO Paul Lalljie takes over the CEO position 02 - Feb - 23: Included in Q4 and FY23 results the following statement about company liquidity: “The company expects that if it does not amend or refinance its term loan, or raise capital to reduce its debt in the short term, and in the event the obligations under its term loan accelerate Trading Multiples (2) EV / CY24 Revenue EV / CY25 Revenue EV / CY24 EBITDA EV / CY25 EBITDA P / CY24 EP P / C 15 - Feb - 23: The Department of Education ("DoE") announced revisions to Third - Party Servicer ("TPS") guidance through a Dear Colleague Letter (“DCL”) to expand the definition of covered activities and exclude foreign companies from providing services 28 - Nov - 23: DoE noted that matters relating to TPS could be addressed in future negotiated rulemaking sessions, and that it intended to issue guidance in 2024 C ap i t ali z a t i o n Share Price ( US $) $0 . 3 6 Less: Cash 61 Enterprise Value (US$ mm) 606 (U S $ mm ) Total Debt ( 3 ) De bt T y pe Princip a l Sr. Sec. Term Loan $376 Pricing Trading Due 95 . 125 % $35 8 J un - 2 6 May - 25 $176 46.404% $380 Bond 1 or come due within twelve months from the to USC over the Feb - 30 $55 37.125% $147 Bond 2 date of its financial statement issuance in following 15 months Revo l v ing Cred it Facility $4 0 n . a . $4 0 - Ot he r B orro w in g s $ 5 n . a . $ 5 - accordance with its current terms, there is substantial doubt about its ability to continue as a going concern.” Total Deb t $948 $634 TWOU Share Price 3 Month Return (67.7)% 89.64 (mm) F.D. Shares (1) (87.9)% 6 Month Return 32 (US$ mm) F.D. Market Cap (70.6)% YTD 634 Add: Debt (Market Value) (96.1)% 1 Year Return Since IPO (99.0)%

7 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Section 2: Preliminary Financial Analysis PRELIMINARY FINANCIAL ANALYSIS Situation Overview Section 1 Preli m inary F inancial Anal y sis Section 2 Appendix

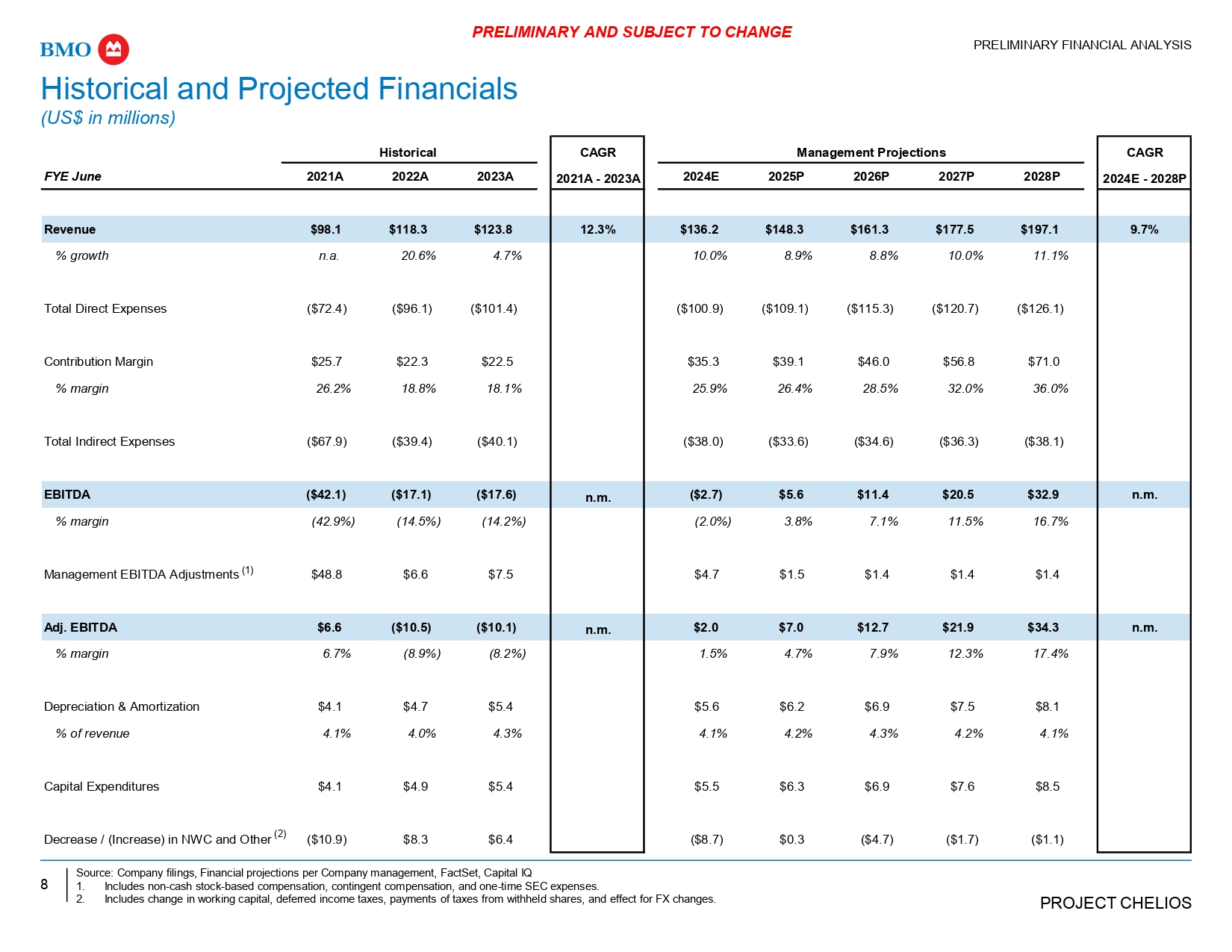

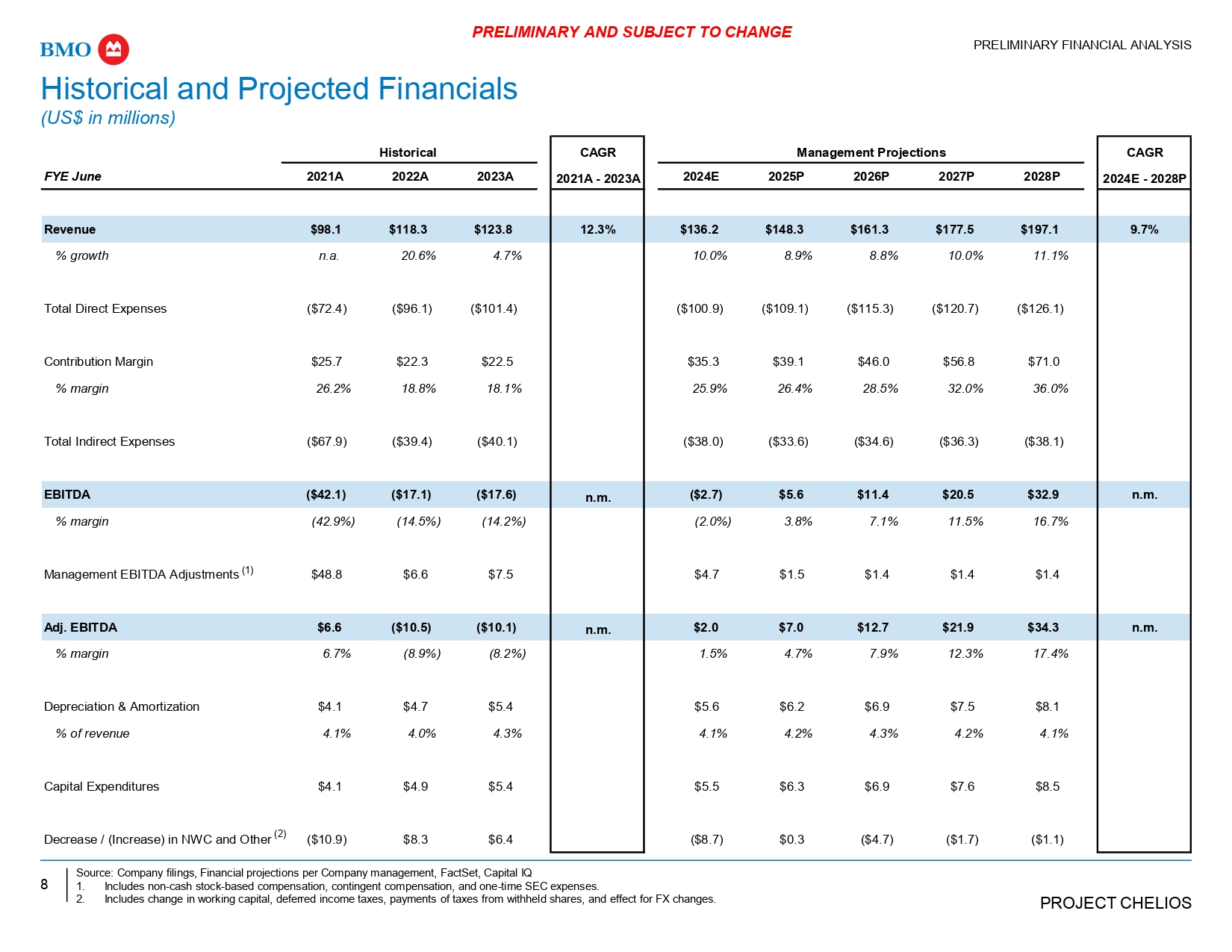

CAGR Management Projections CAGR Historical 2024E - 2028P 2028P 2027P 2026P 2025P 2024E 2021 A - 2023 A 2023A 2022A 2021A FYE June 9.7% $197.1 $177.5 $161.3 $148.3 $136.2 12.3% $123.8 $118.3 $98.1 Revenue 11.1% 10.0% 8.8% 8.9% 10.0% 4.7% 20.6% n.a. % growth ($126.1) ($120.7) ($115.3) ($109.1) ($100.9) ($101.4) ($96.1) ($72.4) Total Direct Expenses $71.0 $56.8 $46.0 $39.1 $35.3 $22.5 $22.3 $25.7 Contribution Margin 36.0% 32.0% 28.5% 26.4% 25.9% 18.1% 18.8% 26.2% % margin ($38.1) ($36.3) ($34.6) ($33.6) ($38.0) ($40.1) ($39.4) ($67.9) Total Indirect Expenses n.m. $32.9 $20.5 $11.4 $5.6 ($2.7) n.m. ($17.6) ($17.1) ($42.1) EBITDA 16.7% 11.5% 7.1% 3.8% (2.0%) (14.2%) (14.5%) (42.9%) % margin $1.4 $1.4 $1.4 $1.5 $4.7 $7.5 $6.6 $48.8 M anage m en t EBIT D A A d just m en ts (1) n.m. $34.3 $21.9 $12.7 $7.0 $2.0 n.m. ($10.1) ($10.5) $6.6 Adj. EBITDA 17.4% 12.3% 7.9% 4.7% 1.5% (8.2%) (8.9%) 6.7% % margin $8.1 $7.5 $6.9 $6.2 $5.6 $5.4 $4.7 $4.1 Depreciation & Amortization 4.1% 4.2% 4.3% 4.2% 4.1% 4.3% 4.0% 4.1% % of revenue $8.5 $7.6 $6.9 $6.3 $5.5 $5.4 $4.9 $4.1 Capital Expenditures ($1.1) ($1.7) ($4.7) $0.3 ($8.7) $6.4 $8.3 ($10.9) Decrease / (Increase) in NWC and Other (2) 8 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE PRELIMINARY FINANCIAL ANALYSIS Historical and Projected Financials (US$ in millions) Source: Company filings, Financial projections per Company management, FactSet, Capital IQ 1. Includes non - cash stock - based compensation, contingent compensation, and one - time SEC expenses. 2. Includes change in working capital, deferred income taxes, payments of taxes from withheld shares, and effect for FX changes.

9 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Public filings, FactSet, Department of Education, BMO research, and Street research Note: Market capitalization and trading levels of debt as of 13 - Mar - 24. PRELIMINARY FINANCIAL ANALYSIS Preliminary Advisor Valuation Perspectives Selected Public Companies: Online Program Management (“OPM”) 2U, Inc. (“2U”): has experienced a 96% decrease in share price over the last year, as 2U recently announced a termination of a significant partnership, replaced its CEO with its CFO, and is facing concerns that its liquidity may not be sufficient to pay off its debt balance – 2U’s debt is currently trading below par value: $376mm term loan (trading at 95.125), $380mm bond (trading at 46.404), and $147mm bond (trading at 37.125) – 2U noted in its Q4 and FY23 results that if it does not amend or refinance its term loan, or raise capital to reduce its debt in the short term, and in the event the obligations under its term loan accelerate, there is substantial doubt about its ability to continue as a going concern Grand Canyon Education, Inc. (“GCE”): benefits from the stability of being deeply intertwined with its most significant university partner, Grand Canyon University (“GCU”), which comprises ~97% of GCE’s enrollment and was consummated through an asset purchase agreement with GCE – In conjunction with purchase, GCU signed a 15 - year agreement with GCE (expires 30 - Jun - 2033) in which GCE receives ~60% of GCU’s tuition and fee revenue – With ~79% of GCU’s students being online, there is long - term alignment with the institution’s strategic importance of online offerings – GCE has a ~32% EBITDA margin and its market capitalization is ~$4bn – Brian Mueller, GCE’s CEO, also serves as the President of GCU Online Courses & Platforms While these selected public companies enable online education for learners, there are significant differences to Chelios, including but not limited to: servicing end - segments in addition to or other than higher education (i.e., K - 12, corporate enterprises), services provided (i.e., tutoring, learning marketplaces, etc.), sources of revenue (public pay vs. private pay), payment models (i.e., subscription or transactional vs. revenue - share agreements), and exposure to recently contemplated changes to regulation from the Department of Education (“DoE”)

10 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Public filings, FactSet, Department of Education, BMO research, and Street research Note: Market capitalization and trading levels of debt as of 13 - Mar - 24. PRELIMINARY FINANCIAL ANALYSIS Preliminary Advisor Valuation Perspectives (Cont’d) Selected Precedent Transactions: BMO has chosen to exclude precedent transactions from the core valuation analyses given the lack of recent OPM transactions with publicly disclosed multiples The most recent OPM transaction with publicly disclosed multiples closed in 2018; since then, the OPM market landscape and investor sentiment towards the OPM industry has changed, which have been partially impacted by the DoE announcing potential regulatory actions aimed at the OPM sector in 2024 Since the DoE issued its Dear Colleague Letter on February 15, 2023, two OPM transactions have closed: Academic Partnerships acquired Wiley University Services (Jan - 24) and Regent acquired Pearson Online Learning Services (“POLS”; Mar - 23) Neither of these transactions included cash at closing, as 100% of the consideration was deferred, despite the fact that: Wiley paid $465 million to acquire three of the businesses (Deltak, Learning House and XYZ Media) that comprised Wiley University Systems in 2012 - 2021 Pearson paid $650 million to acquire the business that comprised POLS (EmbanetCompass) in 2012 Discounted Cash Flow (“DCF”) Analysis: The DCF and its implied valuation range can be sensitive to changes in key inputs, such as the weighted average cost of capital used to calculate the net present value of free cash flows and the perpetuity growth rate used to calculate the DCF’s terminal value Given Chelios is forecasting limited free cash flow in the projection period, the terminal value is contributing a large portion of the implied value from the DCF The DCF assumes that Chelios is able to generate U.S. EBT in order to utilize outstanding NOLs

11 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE For Informational Purposes ONLY For Valuation Purposes Equity Research Analyst Price Targets 52 - Week Range Premiums Paid Analysis Selected Public C o mpanies (FY 25 Adj. EBITDA) Selected Public C o mpanies (FY 25 Revenue) Selected Public C o mpanies (FY 24 Revenue) Discounted Cash Flow Analysis Share Price Range Share Price Range Premium to Current: 40.0% - 60.0% FY 25 Adj. EBITDA (Jun - 25) Multiple Range: 5.4x - 13.4x FY 25 Revenue (Jun - 25) Multiple Range: 0.7x - 1.9x FY 24 Revenue (Jun - 24) Multiple Range: 0.7x - 2.4x W A C C R a n g e : 16.8% - 20.8% Value Drivers Low - High Low - High Current Share Price: A$0.59 FY 25 Adj. EBITDA (Jun - 25): $7.0 FY 25 Revenue (Jun - 25): $148.3 FY 24 Revenue (Jun - 24): $136.2 Perpetuity Growth Range: 2.5% - 4.5% 0.4x - 1.7x (0.1x) - 0.7x 0.6x - 0.7x 0.3x - 0.7x 0.8x - 2.1x 0.7x - 2.4x 0.3x - 0.6x EV / FY 24 Revenue (Jun - 24) ($136.2) 0.4x - 1.5x (0.1x) - 0.6x 0.5x - 0.7x 0.3x - 0.6x 0.7x - 1.9x 0.6x - 2.2x 0.3x - 0.6x EV / FY 25 Revenue (Jun - 25) ($148.3) 8.2x - 32.2x (1.3x) - 13.6x 11.5x - 14.0x 5.4x - 13.4x 14.8x - 40.1x 13.6x - 46.6x 6.3x - 11.7x EV / FY 25 Adj. EBITDA (Jun - 25) ($7.0) 14% - 205% (63%) - 57% 40% - 60% (9%) - 55% 66% - 269% 56% - 320% (2%) - 41% Implied Premium / (Discount) to Current Stock Price A $0 .9 2 A $0 .9 8 A$0.54 A $0 .8 3 A $0 .2 2 A$0.67 A$0.83 A $2 .4 8 A $2 .1 8 A $0 .9 1 A $0 .9 4 A $0 .9 3 A $1 .8 0 -- A $ 0 . 2 5 A $ 0 . 5 0 A $ 0. 7 5 A $ 1 . 0 0 A $ 1 . 2 5 A $ 1 . 5 0 A $ 1 . 7 5 A $ 2 . 0 0 A $ 2 . 2 5 A $ 2 . 5 0 A $ 2 . 7 5 A $ 3 . 0 0 PRELIMINARY FINANCIAL ANALYSIS Preliminary Financial Perspectives (US$ in millions, except share prices in A$) ASSESSMENT METHODOLOGIES Source: Company filings, Financial projections per Company management, FactSet Note: Fiscal year ends June 30 th . Share prices converted using exchange rate of A$1 / US$0.65967 as of 13 - Mar - 24. Fully diluted shares outstanding adjusted for vesting of restricted stock units and in - the - money stock options. 1. Present value of equity research analyst price targets calculated using an assumed cost of equity range of 16.8% - 20.8% and discount period of one year. 2. Illustratively assumed U.S. Federal NOL savings range of A$0.03 - A$0.04 per share. Sterling Funds Non - Binding Propos a l: $0 . 4 3 / A$0.65 Present Value of Equity Research Analyst Price Targets (1) A$1.54 A$0.55 A$0.87 A$0.58 A$0.61 DCF Including NPV of Future Tax Savings from U.S. Fed e r a l N OL s (2)

12 PRELIMINARY AND SUBJECT TO CHANGE EV/EBITDA EV/Revenue Price E nt e rprise Value E q u i ty Value Ticker (US$ in millions, except per share data) Company LTM Jun - 25E LTM LTM Jun - 24E LTM Jun - 24E LTM Jun - 25E LTM 13 - Mar - 24 Online Program Management 11.1x 12.4x 12.3x 3.8x 3.5x 3.9x $132.97 $3,747 $3,992 LOPE Grand Canyon Education, Inc. 8.2x 5.4x 6.1x 1.0x 1.1x 1.0x 0.36 920 32 TWOU 2U, Inc. (Book Value of Debt) 5.4x 3.5x 4.0x 0.7x 0.7x 0.6x 0.36 606 32 TWOU 2U, Inc. (Market Value of Debt) (1) 8.2x 8.0x 8.1x 2.2x 2.1x 2.3x Mean (2) 8.2x 8.0x 8.1x 2.2x 2.1x 2.3x Median (2) 15.9x 21.5x 17.7x 5.1x 4.7x 5.3x $13.13 $3,758 $3,664 IEL Online Courses & Platforms IDP Education Limited (3) 6.9x 8.1x 8.7x 1.4x 1.3x 1.5x 61.92 2,837 2,733 LRN St r id e , I n c . ( Ma r k e t V a lue o f Deb t) (4) 44.5x nmf nmf 2.9x 2.5x 3.1x 14.74 1,947 2,670 COUR Coursera, Inc. 48.0x nmf nmf 2.0x 1.8x 2.1x 11.24 1,501 1,978 UDMY Udemy, Inc. 4.9x 6.7x 5.6x 1.2x 1.1x 1.2x 11.52 664 186 SKIL Skillsoft Corp. (Market Value of Debt) (5) 30.8x nmf nmf 2.4x 1.9x 2.5x 2.68 492 534 NRDY Nerdy, Inc. nmf nmf nmf 2.4x 2.1x 2.5x 2.80 150 236 THNC Thinkific Labs Inc. (6) 25.2x 12.1x 10.7x 2.5x 2.2x 2.6x Mean 23.3x 8.1x 8.7x 2.4x 1.9x 2.5x Median 20.9x 10.4x 9.7x 2.4x 2.2x 2.5x Overall Mean (2) 13.5x 8.1x 8.7x 2.4x 1.9x 2.5x Overall Median (2) 6.5x nmf 35.3x 0.3x 0.3x 0.3x $0.39 $46 $88 Chelios (3) Bloomberg. Trading debt includes $376mm Term Loan (trading at 95.125); $380mm 2025 Bond (trading at 46.404); $147mm 2030 Bond (trading at 37.125). Mean and median calculations exclude trading multiples based on 2U’s book value of debt. Converted using exchange rate of A$1 / US$0.65967 as of 13 - Mar - 24. Market capitalization and trading levels of debt as of 13 - Mar - 24 from 2. Source: Company filings, Company materials, FactSet, Capital IQ, Street research Note: Enterprise Value includes equity market capitalization and book value of total debt, minority interest and preferred or convertible securities, capital leases, net of cash. Book value of debt includes unamortized issuance costs and d i scoun t s. 3. 1. M arke t cap i t a li za t i on and t rad i ng l e v e l s o f deb t as o f 1 3 - M a r - 24 f ro m 4. Bloomberg. Trading debt includes $420mm Convertible Senior Notes (trading at 129.92, with conversion price of $52.88 per share). 5. Market capitalization and trading levels of debt as of 13 - Mar - 24 from B l oomberg . T rad i ng deb t i nc l udes $596 mm T L B ( t rad i ng a t 95 . 000 ). PR O JECT CHEL I O S Converted using exchange rate of C$1 / US$0.740660 as of 13 - Mar - 24. 6. Selected Public Companies – Trading Metrics PRELIMINARY FINANCIAL ANALYSIS

13 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Net Total LTM Jun - 25 LTM Jun - 24E LTM LTM Jun - 25 LTM Jun - 24E LTM EBIT EBITDA Gross Online Program Management (0.8x) 0.0x $338 $305 $302 $1,067 $990 $961 25.9% 31.5% 52.4% LOPE Grand Canyon Education, Inc. 5.2x 5.6x 113 151 171 821 897 946 (23.9%) 18.1% 54.0% TWOU 2U, Inc. (Book Value of Debt) 2.2x 2.8x $226 $228 $237 $944 $944 $953 1.0% 24.8% 53.2% Mean 2.2x 2.8x $226 $228 $237 $944 $944 $953 1.0% 24.8% 53.2% Median 0.5x 1.1x $237 $212 $175 $798 $741 $707 23.9% 24.7% 35.1% IEL Online Courses & Platforms IDP Education Limited (1,2) (0.1x) 1.4x 410 327 351 2,160 1,982 1,939 11.0% 18.1% 37.2% LRN Stride, Inc. (Book Value of Debt) nmf nmf 44 (4) (10) 795 672 636 (22.9%) (1.6%) 51.9% COUR Coursera, Inc. nmf -- 31 5 8 856 755 729 (16.7%) 1.1% 57.5% UDMY Udemy, Inc. 5.1x 6.4x 135 118 99 595 571 556 (21.6%) 17.8% 71.8% SKIL Skillsoft Corp. (Book Value of Debt) nmf nmf 16 (7) (2) 265 203 193 (29.8%) (1.3%) 70.6% NRDY Nerdy, Inc. nmf nmf 2 0 (3) 73 62 59 (22.9%) (5.1%) 75.5% THNC Thinkific Labs Inc. 1.9x 2.2x $125 $93 $88 $792 $712 $688 (11.3%) 7.7% 57.1% Mean 0.5x 1.2x $44 $5 $8 $795 $672 $636 (21.6%) 1.1% 57.5% Median 1.9x 2.9x $216 $175 $170 $1,054 $964 $936 (3.0%) 15.6% 56.2% Overall Mean 0.5x 1.2x $113 $118 $99 $798 $741 $707 (21.6%) 17.8% 54.0% Overall Median nmf nmf $7 $1 ($5) $172 $152 $132 (2.1%) (3.6%) 24.2% Chelios (US$ in millions) Operating Performance Financial Data Co m p a ny T i c k er LTM Operating Margins Re v e n ue EBI T DA Leverage (3) Source: Company filings, Company materials, FactSet, Capital IQ, Street research. 1. Given filing currency is A$, LTM financials were converted based on average exchange rate of A$1 / US$0.681663. 2. Forward multiples converted using exchange rate of A$1 / US$0.65967 as of 13 - Mar - 24. 3. Book value of debt includes unamortized issuance costs and discounts. Selected Public Companies – Operating Metrics PRELIMINARY FINANCIAL ANALYSIS

14 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE 5 . 0 x Selected Precedent Transactions ($ millions) 2. 9 x ( 2 ) (3) 7.2x Sou r ce: P r ess R e l ease s , C o m pany F ili ngs Note: No precedent transaction is identical or directly comparable to the Transaction. 1. 2. 3. 5.8x Revenue multiple based on CY18A Revenue. Total consideration was all cash. 2.9x R even u e m u l t i p l e based on C Y 18E R even ue . T otal cons i de r a t i o n w as a l l cash. 5. 7.2x Revenue multiple based on CY16A Revenue. Total consideration includes $103mm in cash and $20mm in 6. ea r no ut s sub j ect to ach i ev e m e n t of ce r ta i n f i n an c i al mil estones i n C Y 17 and C Y 18. 7. 8. 4. 5.4x Revenue multiple based on FY16A (ending Dec 31 st ) Revenue. Total consideration was all cash. In this transaction, SEEK Ltd acquired an additional 30% majority stake from its existing 50% in Online Education Services Pty Ltd from Swinburne University of Technology for AUD119.6 million (US$92 million) in cash. 5.0x Revenue multiple based on FY12E Revenue. Total consideration was all cash. 4.1x Revenue multiple based on FY12A ending (Sep 30 th ) Revenue. Total consideration was all cash. 28.6x EBITDA multiple based on CY18E Adj. EBITDA. 12.1x EBITDA multiple based on FY16A Adj. EBITDA. PRELIMINARY FINANCIAL ANALYSIS Oct - 12 Oct - 12 Mar - 17 May - 17 Oct - 18 Dec - 18 Date Target Acquiror Online program manager Online program manager Online program manager Online short courses in partnership with universities Online program manager and skills training Healthcare - focused online program manager Overview $220 $650 $305 $123 $200 $366 TEV ($mm) n.a. n.a. 12.1x (8) n.a. 28.6x (7) nmf EV / E BI T DA ( 5 ) 4.1x (6) (1) 5.9x Median: 4.6x 4.1x (4) The most recent OPM transaction with publicly disclosed multiples closed in 2018 In February 2023, the Department of Education issued a Dear Colleague Letter indicating it was considering regulatory actions aimed at the OPM sector Since that time, two OPM transactions have closed: Academic Partnerships acquired Wiley University Services Regent acquired Pearson Online Learning Services (“POLS”) Neither of these transactions included cash at closing, as 100% of the consideration was deferred, despite the fact that: Wiley paid $465 million to acquire three of the businesses (Deltak, Learning House and XYZ Media) that comprised Wiley University Systems in 2012 - 2021 Pearson paid $650 million to acquire the business that comprised POLS (EmbanetCompass) in 2012 EV / R e v e n u e :

15 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE M a r k e t C a pit a li z a t i on C a s h & C a s h E M a r k e t V Ent Source: Company filings and Company website Note: Enterprise Value includes equity market capitalization and book value of total debt, minority interest and preferred or convertible securities, capital leases, net of cash. Total debt includes book value of debt plus unamortized issuance costs and discounts. 1. Market capitalization and trading levels of debt as of 13 - Mar - 24 from Bloomberg. Trading debt includes $376mm Term Loan (trading at 95.125); $380mm 2025 Bond (trading at 46.404); $147mm 2030 Bond (trading at 37.125). PRELIMINARY FINANCIAL ANALYSIS Select Precedent Transactions – OPM Industry Valuation Trends 4 . 1x 5.0 x 4. 1 x 7 . 2x 2012 2014 2016 2018 2020 2022 2024 2. 9 x 5 . 8x The Department of Education released and subsequently rescinded new third - party servicer guidance through a Dear Colleague Letter, which was directly aimed at the OPM industry. The DoE has since announced that it will issue updated guidance in 2024 Regent & Pearson Online Learning Services (“POLS”) Transaction (Mar - 23) Academic Partnerships & Wiley University Services Transaction (Jan - 24) Pearson paid $650mm to acquire the business that comprised POLS (EmbanetCompass) in 2012 In March 2023, POLS was sold to Regent in a highly structured transaction with no cash at closing for potential future earn - out equal to 27.5% of positive Adj. EBITDA over the next six years plus 27.5% of the proceeds from a potential future sale of POLS Wiley paid $465mm to acquire three of the businesses (Deltak, Learning House and XYZ Media) that comprised Wiley University Services in structured transaction with no cash at closing, with consideration comprising a seller note, earn - out, and 10% common equity interest in AP (privately held business) 2012 - 2021 $877 $807 $970 In January 2024, Wiley University Services was 9% (17%) - sold to Academic Partnerships in a highly $142 $122 $168 Apr - 19 Nov - 21 Purchase Price $ 7 5 0 mm $ 8 0 0 mm EV / Revenue 5.6x 7.7x The most recent OPM transaction with publicly disclosed multiples closed in 2018 In February 2023, the Department of Education issued a Dear Colleague Letter indicating it was considering regulatory actions aimed at the OPM sector Since that time, two OPM transactions have closed: Academic Partnerships acquired Wiley University Services Regent acquired Pearson Online Learning Services Neither of these transactions included cash at closing, as 100% of the consideration was deferred VALUATION AS OF 13 - MAR - 24 ( U S$ i n m illi on s , e xc ep t pe r s ha r e da t a ) St o c k Pri c e a s of 13 - M a r - 2 4 % o f 52 - W ee k H i g h 2U Valuation & Trading Metrics Over Time VALUATION AS OF 31 - DEC - 18 ( U S$ i n m illi on s , e xc ep t pe r s ha r e da t a ) St o c k Pri c e a s of 31 - D ec - 1 8 M a r k e t C a pit a li z a t i on C a s h & C a s h E Total De Ent C Y E CY2020 CY2019 CY2018 $762 $573 $412 Revenue 33% 39% - % Growth $11 n.a. $18 EBITDA % Margin 4% - 1% EV / Revenu e EV/EBITDA 5 . 9 x n m f 4 . 3 x n m f 3 . 2 x n m f Recent Acquisitions O n lin e L ea r ni n g Services Univ e r s it y Services ( 1 ) CY E CY 202 3 CY 202 4 CY 202 5 Revenue % G r o w t h EBITDA % Ma r g in 17% 15% 16% EV / Re v enu e EV/EBITDA 0 . 6 x 3 . 6 x 0 . 8 x 5 . 0 x 0 . 7 x 4 . 3 x

16 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Public filings, press releases, investor presentations, earnings call transcripts, and other public sources Note: Key stats represent at time of transaction. 1. Based on FY12A revenue of $54mm, per Wiley’s press release on the acquisition. 2. Based on FY18E revenue of $70mm, per Wiley’s investor presentation on the acquisition. 3. Based on FY21A revenue of $15mm, per Wiley’s Q3 FY22 earnings call transcript. PRELIMINARY FINANCIAL ANALYSIS Case Study: Wiley University Services Carve - out Deltak.edu Target Designs and develops online learning programs Business Description 100+ Programs Key Stats October 2012 Closed Date $220mm Purchase Price 100% upfront cash consideration Consideration 4.1x (1) Implied Revenue Multiple Learning Hou s e Target Online program management services Business Description 800+ Programs | 60+ Partners Key Stats November 2018 Closed Date $200mm Purchase Price 100% upfront cash consideration Consideration 2.9x (2) Implied Revenue Multiple Wiley University Services Target Academic Partnerships (“AP”) Acquiror January 2024 Closed Date $110mm seller note $40mm potential earn - out 10% equity in Academic Partnerships common equity (privately owned business) Purchase Price FORMATION OF WILEY UNIVERSITY SERVICES WILEY UNIVERSITY SERVICES CARVE - OUT Wiley University Services was formed through acquisitions of Deltak, Learning House, and XYZ Media XYZ Media Target Lead generation and marketing for universities Business Description 140K+ student leads annually Key Stats December 2021 Closed Date $45mm Purchase Price $38mm in cash; $7mm in Wiley Class A shares Consideration 3.0x (3) Implied Revenue Multiple Transaction Overview As part of its value creation plan for FY24, Wiley divested its University Services business in a broader effort to carve - out non - core assets and refocus its strategy on its strongest and most profitable businesses For the divestiture, Wiley issued a $110mm seller note, received 10% of Academic Partnerships common equity, and agreed on $40mm of potential, ratable earn - out based on achieving 2025 and 2026 revenue targets: 2025: $10mm of earn - out based on achieving a revenue threshold of $168mm – $179mm 2026: $30mm of earn - out based on achieving a revenue threshold of $166mm – $184mm Terms of the $110mm seller note include: 10% interest rate for the first two years following the transaction close, stepping up to 12% thereafter; may be paid in cash or PIK Between 2012 and 2021, Wiley acquired Deltak.edu, Learning House, and XYZ Media for $465mm In 2024, these businesses were sold in a highly structured transaction with no cash at closing, with consideration comprising a seller note, earn - out, and 10% common equity interest in AP (privately held business)

17 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Public filings, press releases, investor presentations, earnings call transcripts, and other public sources Note: Key stats represent at time of transaction. 1. Based on FY12E revenue of $130mm, per Pearson’s press release for the acquisition. PRELIMINARY FINANCIAL ANALYSIS Case Study: Pearson Online Learning Services Carve - Out Pearson’s Online Learning Services Division Target Regent Acquiror March 2023 Announced Date 100% Contingent Payment Purchase Price FORMATION OF PEARSON ONLINE LEARNING SERVICES PEARSON ONLINE LEARNING SERVICES CARVE - OUT Pearson Online Learning Services was formed through its acquisition of EmbanetCompass EmbanetCompass Target Online learning for non - profit universities Target Overview 100+ Programs Key Stats October 2012 Closed Date $650mm Purchase Price 100% upfront cash consideration Consideration 5.0x (1) Implied Revenue Multiple Transaction Overview Pearson conducted and announced a strategic review in August 2022, resulting in the sale of its POLS business to Regent in March 2023 The divesture is part of Pearson’s efforts to reshape its portfolio towards future growth opportunities centered around lifelong learning The sale did not include Pearson’s entire OPM segment; most notably, it did not include its ASU contract which accounted for approximately one - third of its total OPM revenue and expired in June 2023 During FY22, the POLS business generated £155mm in revenue and £26mm in adjusted operating loss No cash was paid at closing, with all consideration deferred and set to be paid out based on two variables: Each year, for six years following completion of the transaction, Pearson will receive 27.5% of positive POLS Adj. EBITDA in each calendar year Payment equal to 27.5% of the proceeds received by Regent in the event of a future sale of POLS Pearson acquired EmbanetCompass for $650mm in 2012 POLS was sold to Regent in a highly structured transaction in 2023 for potential future earn - out equal to 27.5% of positive Adj. EBITDA over the next six years plus 27.5% of the proceeds from a potential future sale of POLS

18 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE T e rmina l ( 2 ) 2028P 2027P 2026P 2025P H2 24E (1) 2023A $197 $197 $177 $161 $148 $69 $124 Revenue -- 11% 10% 9% 9% n.a. -- Annual Growth (%) $33 $33 $20 $11 $6 ($2) -- EBITDA (3) 17% 17% 12% 7% 4% (3%) -- Margin (%) $26 $25 $13 $4 ($1) ($5) -- EBIT (5) (5) (5) (4) (3) (1) -- Less: Unlevered Cash Taxes $20 $20 $8 $0 ($4) ($6) -- Tax - Affected EBIT 7 8 7 7 6 3 -- Plus: D&A (8) (8) (8) (7) (6) (3) -- Less: Capex -- (1) (2) (5) 0 (7) -- Less: Increase in Net Working Capital & Other (4) $19 $18 $6 ($4) ($4) ($13) -- Unlevered Free Cash Flow Fiscal Year Ending June 30, PRELIMINARY FINANCIAL ANALYSIS Discounted Cash Flow Summary (US$ in millions, except share prices in A$) PROJECTED FREE CASH FLOWS IMPLIED VALUE PER SHARE SENSITIVITY ANALYSIS Source: Company filings, Financial projections per Company management Note: Valuation as of 31 - Dec - 23. Share prices converted using exchange rate of A$1 / US$0.65967 as of 13 - Mar - 24. 1. Only H2 FY24 cash flows attributed to valuation due to assumed valuation date of 31 - Dec - 23. 2. Normalized depreciation equal to 83.6% of capital expenditures based on 2.5% inflation and 15 - year depreciation period. 3. EBITDA figures burdened by stock - based compensation. 4. Includes change in working capital, deferred income taxes, payments of taxes from withheld shares, and effect for FX changes. 5. Supporting WACC calculation included in the appendix. 6. Roughly in - line with long - term GDP and inflationary growth expectations. 7. PV of Cash Flows assumes mid - year discounting convention. 8. PV of Terminal Value discounted from 30 - Dec - 27. 9. Balance sheet per Q2 FY24 Activity Report; assumes cash of ~$42mm. 10. Represents fully diluted shares outstanding adjusted for vesting of restricted stock units. $82 $75 $69 $65 $59 $55 $52 $48 $44 A$0.83 A$0.78 A$0.74 A$0.72 A$0.68 A$0.65 A$0.63 A$0.60 A$0.58 5.3x 4.9x 4.5x 4.6x 4.3x 4.0x 4.1x 3.8x 3.6x Enterprise Value Equity Value per Share (A$) Implied Terminal Multiple P erp et ui t y Gro w t h P erp et ui t y Gro w t h P erp et ui t y Gro w t h 2.5 % 3.5 % 4.5 % 2.5 % 3.5 % 4.5 % 2.5 % 3.5 % 4.5 % 16.8 % 16.8 % 16.8 % 18.8 % 18.8 % 18.8 % 20.8 % 20.8 % 20.8 % WAC C WAC C WAC C Low Hi gh Cost of Capital (5) 20.8 % 16.8 % Perpetuity Growth (6) 2.5 % 4.5 % Terminal Value PV of Cash Flows (7) PV of Terminal Value (8) $107 (6) 50 $161 (5) 87 En t e rpri s e V al ue $44 $82 Less: Net Debt (9) 42 42 I m pl ie d Equi t y V al ue $86 $124 F.D. Shares Outstanding (10) 225.273 225.273 Implied Value per Share (US$) Implied Value per Share (A$) $0.38 A $0.5 8 $0.55 A $0.8 3 Implied Terminal EBITDA Multiple TV % of Total 3.6x 113% 5.3x 106%

19 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Illustrative Present Value of Future U.S. Federal Net Operating Loss Carryforward ("NOL") Savings (US$ in millions, except share prices in A$) MANAGEMENT PROJECTED U.S. FEDERAL NOL SAVINGS PRELIMINARY FINANCIAL ANALYSIS Year Ending June 30, Fi sca l 2036P 2035P 2034P 2033P 2032P 2031P 2030P 2029P 2028P $33 $32 $31 $29 $28 $28 $27 $26 $25 Total Pre - Tax Income 3.5% 3.5% 3.5% 3.5% 3.5% 3.5% 3.5% 3.5% % A nnua l G r o w th (1) 55% 55% 55% 55% 55% 55% 55% 55% % Allocated to U.S. (2) $18 $17 $17 $16 $16 $15 $15 $14 U.S. Pre - Tax Income $14 $14 $13 $13 $13 $12 $12 $11 80.0% M a x N OL U s ag e ( 2 ) NOL Schedule $2 $16 $30 $43 $55 $67 $79 $90 $90 Beginning (2) (2) (14) (13) (13) (13) (12) (12) (11) Less: Usage -- $2 $16 $30 $43 $55 $67 $79 $90 Ending $2 $14 $13 $13 $13 $12 $12 $11 NOL Utilized 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% Federal Tax Rate $0 $3 $3 $3 $3 $3 $2 $2 Tax Savings from NOL Usage $5 Net Present Value of Tax Savings (3) 225.3 F.D. Shares Outstanding (4) $0.02 Implied Value per Share (US$) A$0.03 Implied Value per Share (A$) SENSITIVITY ANALYSIS Source: Company filings, Illustrative BMO Extrapolation Note: Valuation as of 31 - Dec - 23. Share prices converted using exchange rate of A$1 / US$0.65967 as of 13 - Mar - 24. 1. Based on the middle portion of the perpetuity growth range. 2. Per management guidance. 3. NPV of Tax Savings is discounted at ~18.8% WACC and assumes mid - year discounting convention. 4. Represents fully diluted shares outstanding adjusted for vesting of restricted stock units. A$0.04 A$0.03 A$0.03 A$0.04 A$0.03 A$0.03 A$0.04 A$0.03 A$0.03 Equity Value per Share (A$) WACC 20 . 8 % 18 . 8 % 16 . 8 % 2 . 5 % 3 . 5 % 4 . 5 % A nnual Pr e - Tax Income Gro wt h

20 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Appendix APPE ND IX Situation Overview Section 1 Preli m inary F inancial Anal y sis Section 2 Appendix

21 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE 3 8% 5 0% 5 6% 34% 4 9% 5 3% 4 3% 50% 58% A l l Stoc k s Micro Cap Stocks Low Liquidity Micro Cap Stocks U n af f e c t e d 1 Day 30 Day APPE ND IX Take - Private Premiums Paid Analysis All Stocks Premiums paid statistics since Mar - 2019 for U.S. and Australian targets across all industries 536 transactions included in data set Micro Cap Stocks P re m i u m s p ai d statistics since Mar - 19 for U.S. and Australian targets across all industries for transaction values between US$1 million and US$500 million 278 transactions included in data set Low Liquidity Micro Cap Stocks A subset of the Micro Cap stocks with less than US$100k per day trading volume for the 6 months leading up to announcement 93 transactions included in data set LAST 5 YEARS MEDIAN PREMIUM RELATIVE TO PRE - ANNOUNCEMENT SHARE PRICE Source: FactSet Note: Data set includes completed and pending take - private transactions in the U.S. and Australia.

22 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE βu = 1.66 βu = 1.38 βu = 1.10 Selected Betas Cost of Equity 4.19% 4.19% 4.19% No m in a l R i s k F re e Ra te (4) 7.17% 7.17% 7.17% Equity Risk Premium (5) 4.70% 4.70% 4.70% Size Premium (5) 1.66 1.38 1.10 Selected Unlevered Beta -- -- -- Optimal Debt in Capital Structure 1.66 1.38 1.10 Levered Beta (3) 20.8% 18.8% 16.8% Cost of Equity (6) Implied WACC (7) 16.8% 18.8% 20.8% Source: Public filings, FactSet, Bloomberg, BMO CM estimates Note: Levered Betas are Bloomberg 5 - year monthly raw Betas, unless otherwise noted. 1. Total Debt is based on market value where applicable, otherwise included as book value. 2. Equity value as of 13 - Mar - 24. 3. β U = β L / ( 1 + ( 1 - t a x ra t e ) x De b t / E qu it y ) . 4. Yield on 10 - year US Government bond. APPE ND IX Illustrative Cost of Capital Analysis – All Comps (US$ in millions) CO M P ARAB L E BE T A A NA L Y SIS Implied WACC of ~16.8% to ~20.8% ILLUSTRATIVE COST OF CAPITAL 5. Kroll Valuation Handbook - Guide to Cost of Capital. 6. Cost of equity = risk free rate + β x market risk premium + size premium + country risk premium. 7. WACC = debt / (debt + equity) x ((1 - tax rate) x cost of debt) + equity / (debt + equity) x cost of equity. WACC Equal to CoE due to Optimal Debt of 0% 1.10 1.66 Selected Beta - Low Selected Beta - High Company Beta Le v ere d R 2 Total Debt ( 1 ) Equity Va l ue ( 2 ) Debt Rat i o Tax Rate Beta (3) Unlevered 0.59 21.0% -- $3,992 -- 0.10 0.59 Grand Canyon Education, Inc. 1.62 30.0% 4.9% 3,625 188 0.30 1.68 IDP Education Limited 0.22 21.0% 18.2% 2,733 609 0.01 0.26 Stride, Inc. 1.52 21.0% -- 2,670 -- 0.31 1.52 Coursera, Inc. 2.16 21.0% -- 1,978 -- 0.30 2.16 Udemy, Inc. 1.93 21.0% -- 534 -- 0.18 1.93 Nerdy, Inc. 1.52 21.0% -- 236 -- 0.12 1.52 Thinkific Labs, Inc. 0.33 21.0% 76.5% 186 607 0.15 1.17 Skillsoft Corp 0.05 21.0% 95.1% 32 634 0.04 0.84 2U, Inc. 1.38 11.6% $1,889 $114 1.51 Mean (R 2 > 0.1) Chelios 1.0 3 0.0 5 -- $88 – 21.0 % 1.0 3

23 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE S our c e : P ub lic f ilin g s, P ub lic m a t er ials, F a ctS e t, Ca p it a l I Q, St r ee t re s ear ch 1 . Note : Enterprise Value includes equity market capitalization and market value of total 2 . debt, minority interest and preferred or convertible securities, capital leases, net of 3 . cash . US$ in millions; market data as of 13 - Mar - 24. Based on market value of debt as of 13 - Mar - 24. Represents average total enrollment for Q2 FY24. APPE ND IX Business Description Key Stats TEV (1) HQ Company Provides technology, academic, counseling and support, marketing, communication, and back - office services to universities across the U.S. 25 University Partners ~ 1 21,000 Students $3,747 Phoenix, AZ NASDAQ: LOPE Program gement Operates an online learning platform that connects users with affordable, career - relevant learning opportunities, from free courses to full degrees, through partnerships with universities, institutions, and industry experts 260 Institutional Partners ~68,000 Students $606 (2) Lanha m , M D NASDAQ: TWOU Online Mana Provides a comprehensive range of services across international education, including student placement, English language teaching and testing, and digital marketing and data insights ~800 Institutional Partners ~2,100 IELTS test locations $3,720 M elbourne, Australia ASX: IEL Offers technology - based products and services, ranging from curriculum systems to instruction services, to help attract, enroll, educate, track progress, and support learners from PreK through career development ~ 1 93,000 Enroll m en t (3) $2,837 (2) Re s ton, VA NYSE: LRN Offers courses and certificates to consumer learners, provides enterprise clients access to a catalog of learning products, and develops and delivers degree programs for university partners ~142mm registered learners 325 Educator Partners $1,947 M ountain Vie w , CA NYSE: COUR latform s Operates a learning marketplace platform that enables thousands of subject matter experts to develop, distribute, and enhance content that reaches Udemy’s broad base of learners 210,000+ Cour s es ~34mm Monthly Visitors $1,501 San Fr a n c i sc o, CA NASDAQ: UDMY ourses & P Delivers leadership, business, technology and developer, and compliance learning experiences to enterprise organizations and a global community of learners through various modalities 150,000+ C ourses 86mm+ learners $664 (2) Nashua, NH NYSE: SKIL Onlin e C Operates a live online learning platform that provides learning experiences across various subjects and formats, including one - on - one instruction, small group tutoring, group classes, and adaptive self - study ~3,400 Subjects $492 St. Louis, MO NYSE: NRDY Cloud - based, multi - tenant platform that enables customers to create and sell learning products comprised of customized courses, communities, membership sites, and digital products ~34,000 Paying Customers $150 Vancouver, Canada TSX: THNC Select Public Companies Overview

24 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Public filings, Public materials, FactSet, Capital IQ, Street research 1. Statistics included in the target business description are as of when the transaction was completed. APPE ND IX Online program manager that supports healthcare education programs for universities Provides all program management services necessary to produce workforce - ready, clinically skilled healthcare practitioners Indianapolis, IN Provides online program management services for colleges and universities, including graduate and undergraduate programs, short courses, bootcamps, pathway services for international students, and professional development for teachers Louisville, KY Offers 70+ premium online short courses to working professionals through partnerships with higher education institutions in South America and the United States Cape Town, South Africa Provides a variety of solutions to universities, including learning analytics, marketing and student recruitment, student advisory support, technology optimization, success coaching, learning delivery, and market analysis Cre m orne, Au s tralia Provides online program management services targeted towards online graduate programs, including program design and development, marketing, student recruitment, faculty training and support, student retention and support services, and technology support Elk Grove Village, IL Partners with colleges and universities to develop fully online degree and certificate programs Provides a variety of services, including marketing, instructional design, market research validating program demand, student recruitment, and student retention Oak Brook, IL Target Business Description (1) Target HQ Acquiror Target Select Precedent Transactions – Target Company Overview

25 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Department of Education, BMO research, and Street research APPE ND IX OPM Industry Government Regulation Recent U.S. Higher Education & Third - Party Servicer Regulatory Updates: On February 15, 2023, the Department of Education issued a Dear Colleague Letter (“DCL”) indicating it was considering regulatory actions aimed at the OPM sector: New third - party servicer (“TPS”) guidance that was subsequently rescinded and planned for re - release in 2024 A review of whether to keep or amend tuition revenue - sharing agreements In the Feb. 15, 2023 DCL, the DoE announced plans to hold “virtual listening sessions” to gain insight into how the incentive compensation rule and its bundling exemption for OPMs has affected the growth of online education and student debt The incentive compensation rule prohibits institutions that accept Title IV financial aid from providing any form of commission or bonus based on recruiting activities or the awarding of financial aid – In March 2011, the DoE issued guidance exempting tuition revenue sharing arrangements with third parties, such as OPMs, if they provide a bundled set of services, including student recruitment The DoE’s DCL aimed to expand the definition of covered activities and to exclude foreign companies from contracting with U.S. higher education institutions to provide such services; most notably, including OPMs in the definition of TPS On February 28, 2023, following concerns expressed by both service providers and universities, the DoE announced that it was delaying the effective date of this implementation from May 1, 2023 until September 1, 2023 In a blog posted on April 11, 2023, Undersecretary of Education James Kvaal announced that the DoE would revise its initial letter, with the effective date at least six months after the final guidance letter is published On November 28, 2023, the DoE announced that it intends to issue updated guidance on TPS in early 2024

26 PR O JECT CHEL I O S PRELIMINARY AND SUBJECT TO CHANGE Source: Financial projections per Company management, Street research APPE ND IX Management Forecast Compared to Equity Research Estimates (US$ in millions) FYE 6/30 FY26E FY25E FY24E Management Forecast vs. Consensus Estimates $161.3 $148.3 $136.2 Management Forecast Revenue $171.7 $151.4 $134.7 Consensus Research Revenue ($10.3) ($3.1) $1.5 $ Favorable / (Unfavorable) to Consensus (6.4%) (2.1%) 1.1% % Favorable / (Unfavorable) to Consensus $12.7 $7.0 $2.0 Management Forecast Adj. EBITDA $12.4 $7.1 $1.3 Consensus Research Adj. EBITDA $0.4 ($0.1) $0.7 $ Favorable / (Unfavorable) to Consensus 3.0% (1.6%) 34.6% % Favorable / (Unfavorable) to Consensus