Exhibit (c)(5)

Project Karpos Valuation Support Materials March 2024

Strictly confidential | © Macquarie Group Limited 2 Executive Summary At A$0.80/share, Sterling’s offer increases Keypath’s valuation to ~0.5x revenue multiple, double Keypath’s current revenue multiple in the market today, and comparable to recent transactions in the OPM space. Despite the volatility of the stock price in the last couple of weeks, the offer is comparable and competitive to median premiums of recent Australian take - privates. This offer provides the best opportunity for immediate and guaranteed liquidity to Keypath shareholders, who would otherwise require substantial time to realize liquidity when assuming customary investment protocol. Recent transactions involving OPMs indicate that Sterling’s offer for Keypath is a significant premium to its intrinsic value. Certain of those transactions involved profitable companies, and as Keypath is not yet profitable or cash flow positive, it should be valued substantially less. Additionally, recent transactions for profitable OPMs have required creative structuring and discounts due to industry headwinds and uncertain regulatory environment. Despite company performance, Keypath continues to trade at a significant discount to market comps, signalling a disconnect with public investors primarily driven by low trading volume, lack of liquidity and overall investor sentiment towards companies that are not meaningfully profitable. It is likely that investor sentiment will continue to persist for the foreseeable future. Although there has not been any direct OPM take - private comparables in recent years, Sterling’s offer price implies a premium comparable to recent transactions in the Australian technology sector, which typically trade at higher premiums than other industries.

Keypath proposed offer price At A$0.80 stock price offer, Sterling provides the best liquidity option for shareholders of Keypath, providing a significantly higher valuation than the current public market value and in - line with recent comparable transactions in the space LTM total trading volume (TDV) by share price range In the last 12 months, ~75% of the traded volume has been at or below today’s (3/20/24) closing stock price of A$0.52. At the A$0.80 offer from Sterling, these shareholders would receive a minimum of 54% premium with the majority receiving more than 100% premium to their purchase price. For comparison, on 3/19/2024, Avada Group, a micro cap stock on the ASX, announced a substantial sale of shares at a 19% premium to the 6 - month VWAP and ~30% premium to last close. The Company has a $42M market cap and $16M of Adj. EBITDA. Regal Funds Management, a current Keypath material holder, sold their ~15% stake in this transaction. The selling price is significantly lower than Sterling’s offer of 70%+ and 50%+ premium to the 6 - month VWAP and last close, respectively. Sterling’s offer presents the most attractive exit option for Keypath shareholders. Share Price 5M Strictly confidential | © Macquarie Group Limited 3 21M 5M 10M 1M 0M 5M 10M 20M 15M TDV 25M <A$0.30 A$0.30 - A$0.40 A$0.40 - A$0.52 A$0.52 - A$0.62 A$0.62 - A$0.90 Market sentiment has shifted considerably, penalizing companies that are not materially profitable. This has resulted in low valuation for Keypath that is likely to persist for some time to come ᴣ Significant public company costs continue to burden Keypath financials ᴣ Sentiment from a broad financing outreach was relatively weak and very expensive, indicating investors believe Keypath involves a high degree of risk ᴣ Keypath’s low level of liquidity is likely to dampen its stock price indefinitely ᴣ Realizing liquidity through normal daily trading would take substantial time well above customary public investment durations (e.g., greater than 5 years) ᴣ Considerations Into the Offer A$0.80 Offer price ~54% Offer premium to last close of A$0.52 Amount Top 4 Holdings Duration to Liquidity 1 59,128 Total Top 4 Holdings 156 LTM Average Daily Volume 30% % of ADV that can be sold (Est.) Time Needed for Top 4 Shareholders to Liquidate 1,264 Trading Days (Est. 250 / year) 5.1 Years Notes: (1) Top 4 consists of next 4 largest shareholders after Sterling Fund Management according to FactSet

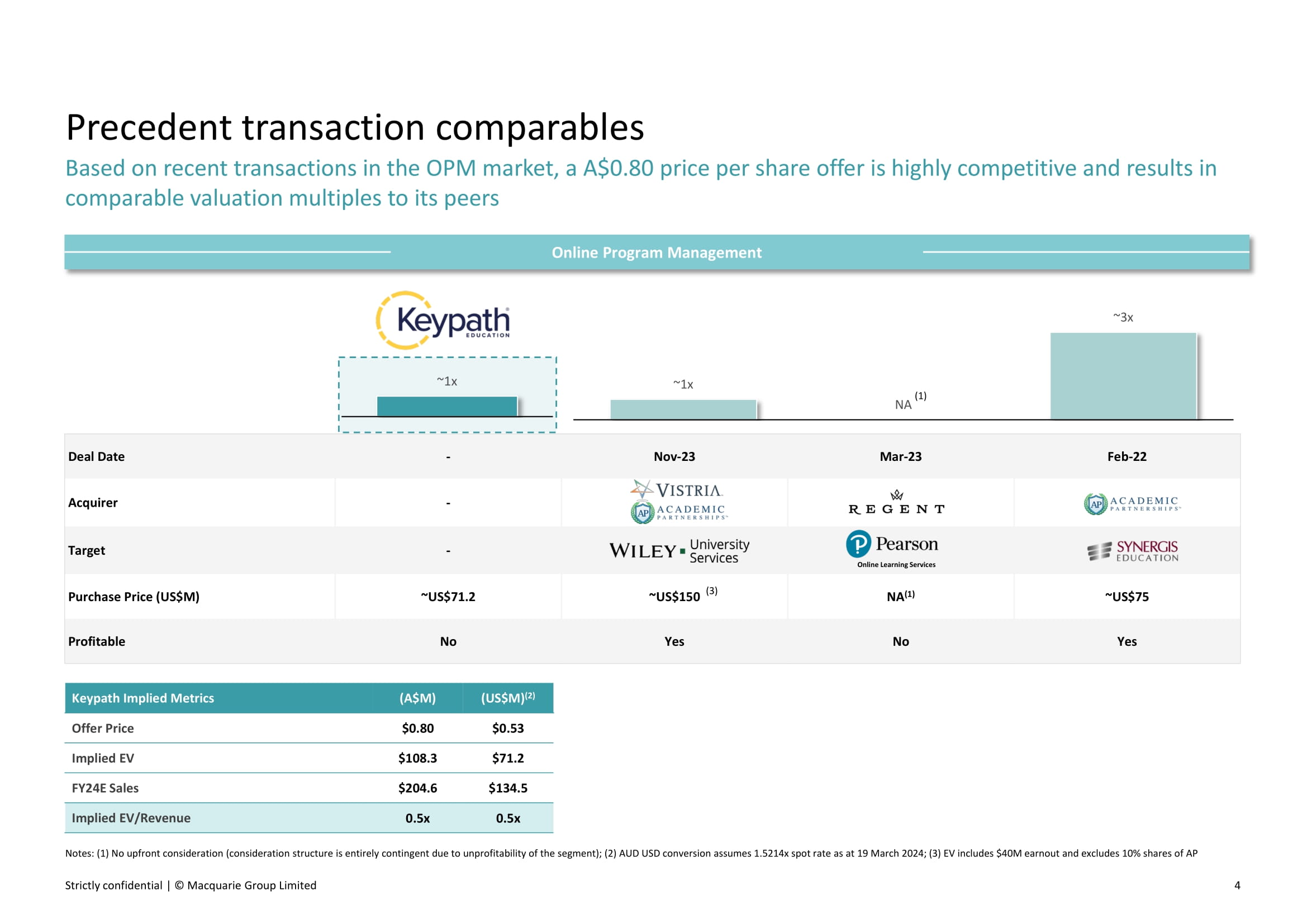

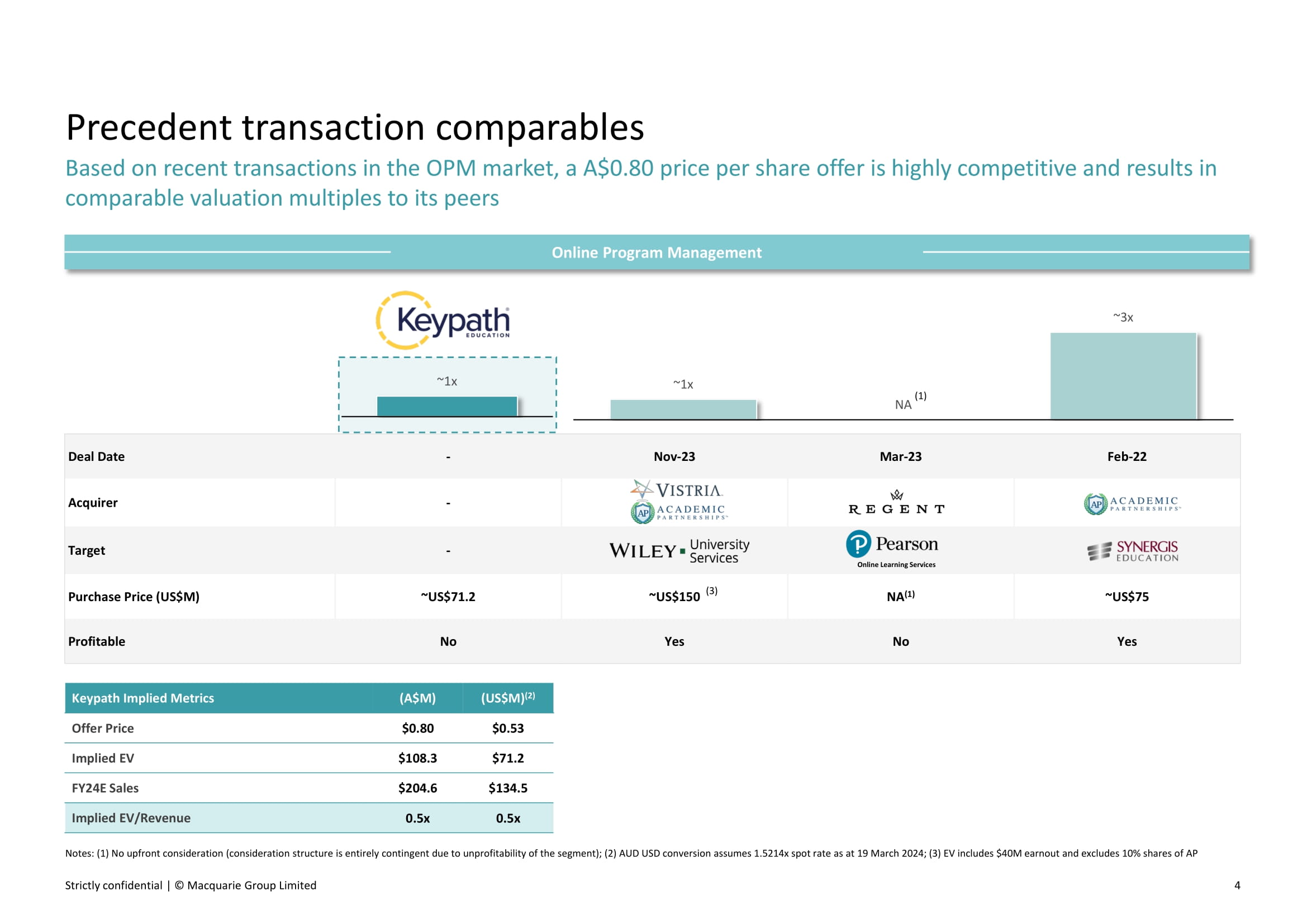

Deal Date - Nov - 23 Mar - 23 Feb - 22 Acquirer - Target - Purchase Price (US$M) ~US$71.2 NA (1) ~US$75 Profitable No Yes No Yes Precedent transaction comparables Based on recent transactions in the OPM market, a A$0.80 price per share offer is highly competitive and results in comparable valuation multiples to its peers (US$M) (2) (A$M) Keypath Implied Metrics $0.53 $0.80 Offer Price $71.2 $108.3 Implied EV $134.5 $204.6 FY24E Sales 0.5x 0.5x Implied EV/Revenue ~1x ~1x NA ~3x Online Program Management Online Learning Services Notes: (1) No upfront consideration (consideration structure is entirely contingent due to unprofitability of the segment); (2) AUD USD conversion assumes 1.5214x spot rate as at 19 March 2024; (3) EV includes $40M earnout and excludes 10% shares of AP Strictly confidential | © Macquarie Group Limited 4 (1) ~US$150 (3)

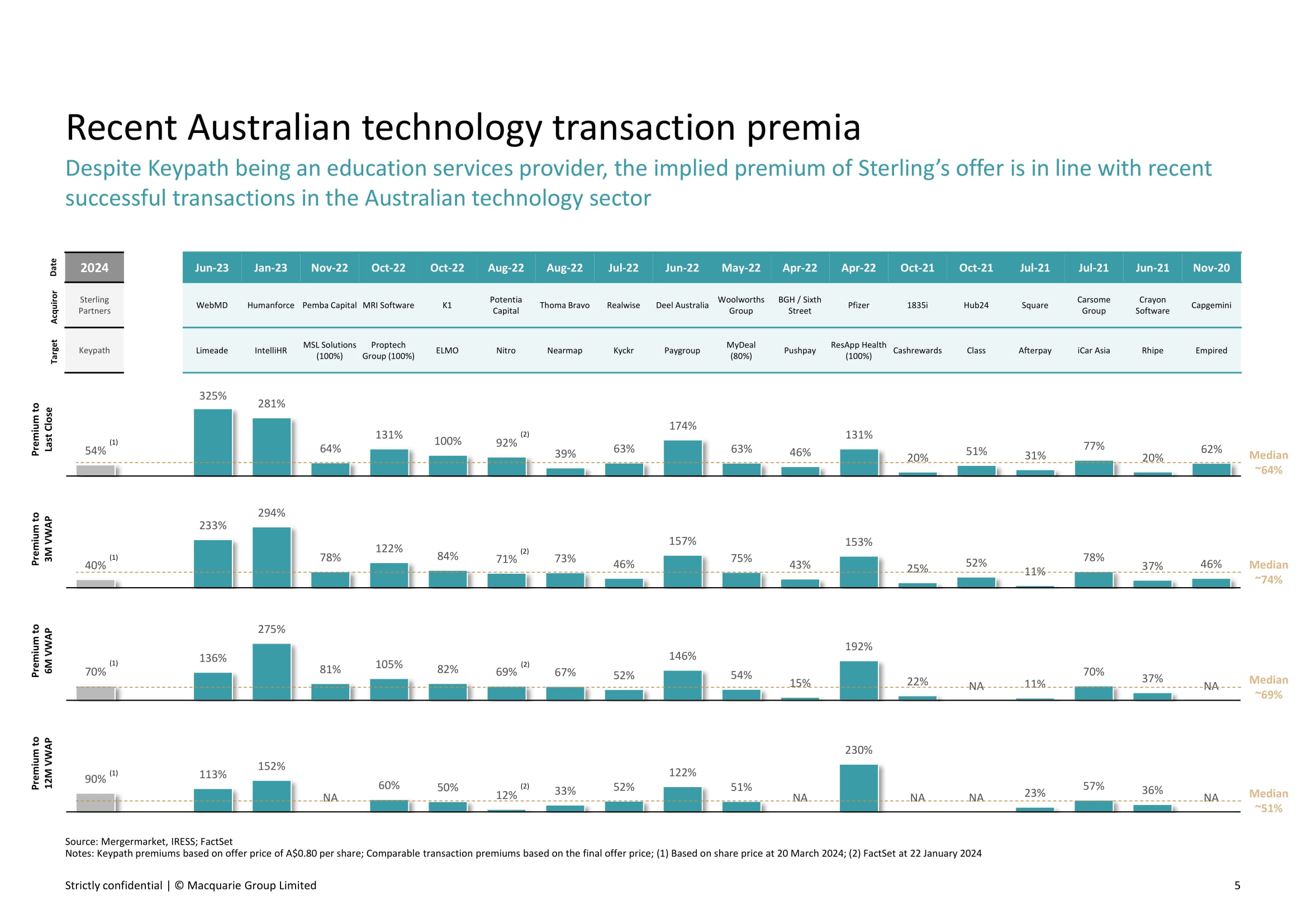

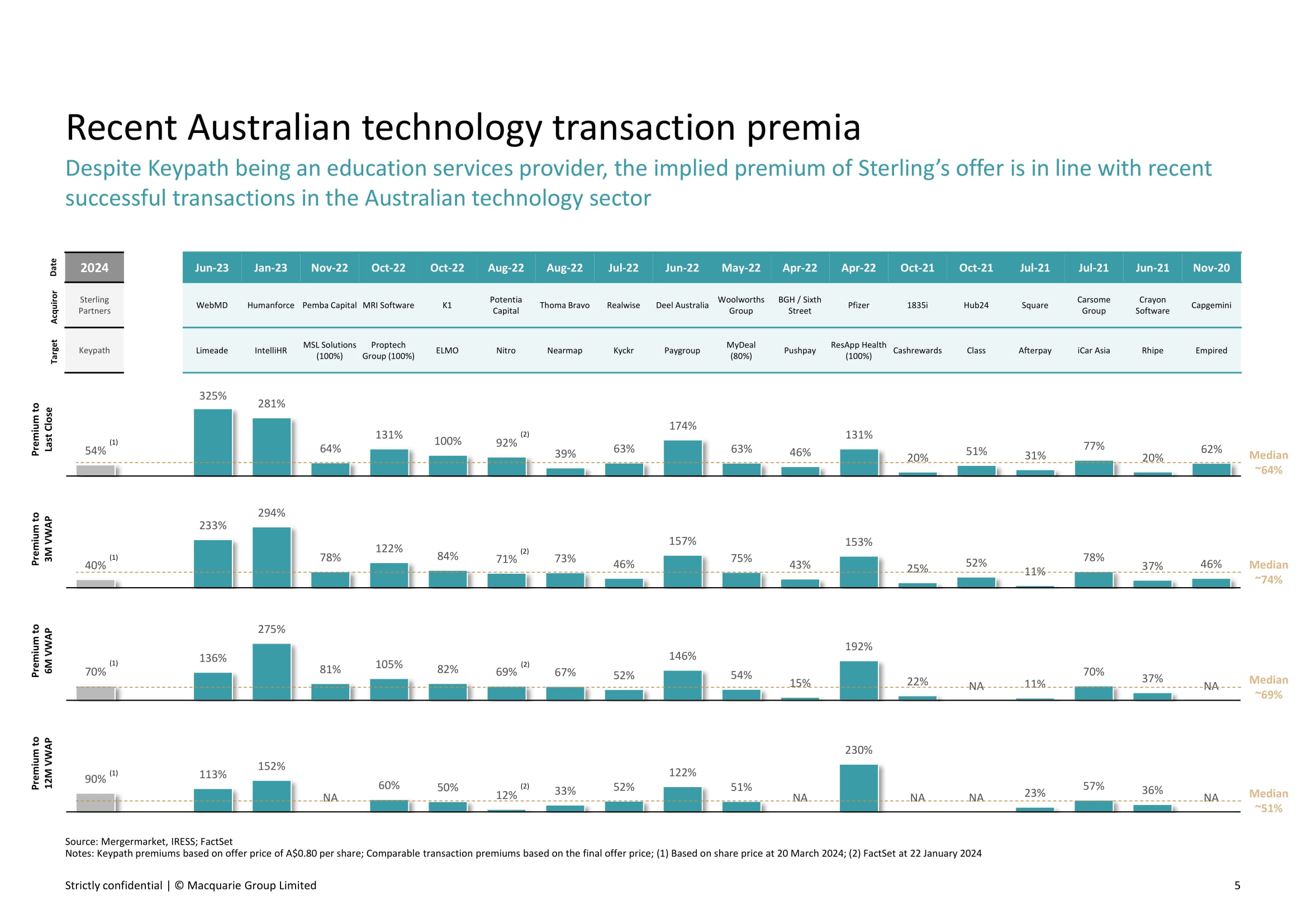

Recent Australian technology transaction premia Despite Keypath being an education services provider, the implied premium of Sterling’s offer is in line with recent successful transactions in the Australian technology sector Date Target Acquiror Nov - 20 Jun - 21 Jul - 21 Jul - 21 Oct - 21 Oct - 21 Apr - 22 Apr - 22 May - 22 Jun - 22 Jul - 22 Aug - 22 Aug - 22 Oct - 22 Oct - 22 Nov - 22 Jan - 23 Jun - 23 2024 Capgemini Crayon Software Carsome Group Square Hub24 1835i Pfizer BGH / Sixth Street Woolworths Group Deel Australia Realwise Thoma Bravo Potentia Capital K1 MRI Software Pemba Capital Humanforce WebMD Sterling Partners Empired Rhipe iCar Asia Afterpay Class Cashrewards ResApp Health (100%) Pushpay MyDeal (80%) Paygroup Kyckr Nearmap Nitro ELMO Proptech Group (100%) MSL Solutions (100%) IntelliHR Limeade Keypath Source: Mergermarket, IRESS; FactSet 325% 281% 64% 131% 100% 92% 39% 63% 174% 63% 46% 131% 20% 51% 31% 77% 20% 62% Premium to Last Close Median ~64% 294% 233% 78% 122% 84% 71% 73% 46% 157% 75% 43% 153% 25% 52% 11% 78% 37% 46% Premium to 3M VWAP Median ~74% 70% 136% 275% 81% 105% 82% 69% 67% 52% 146% 54% 15% 192% 22% NA 11% 70% 37% NA Premium to 6M VWAP Median ~69% 113% 152% NA 60% 50% 33% 52% 122% 51% NA 230% NA NA 23% 57% 36% NA Premium to 12M VWAP Median ~51% (2) 12% Notes: Keypath premiums based on offer price of A$0.80 per share; Comparable transaction premiums based on the final offer price; (1) Based on share price at 20 March 2024; (2) FactSet at 22 January 2024 Strictly confidential | © Macquarie Group Limited 5 (1) 90% (2) (1) 54% (2) (1) 40% (2) (1)

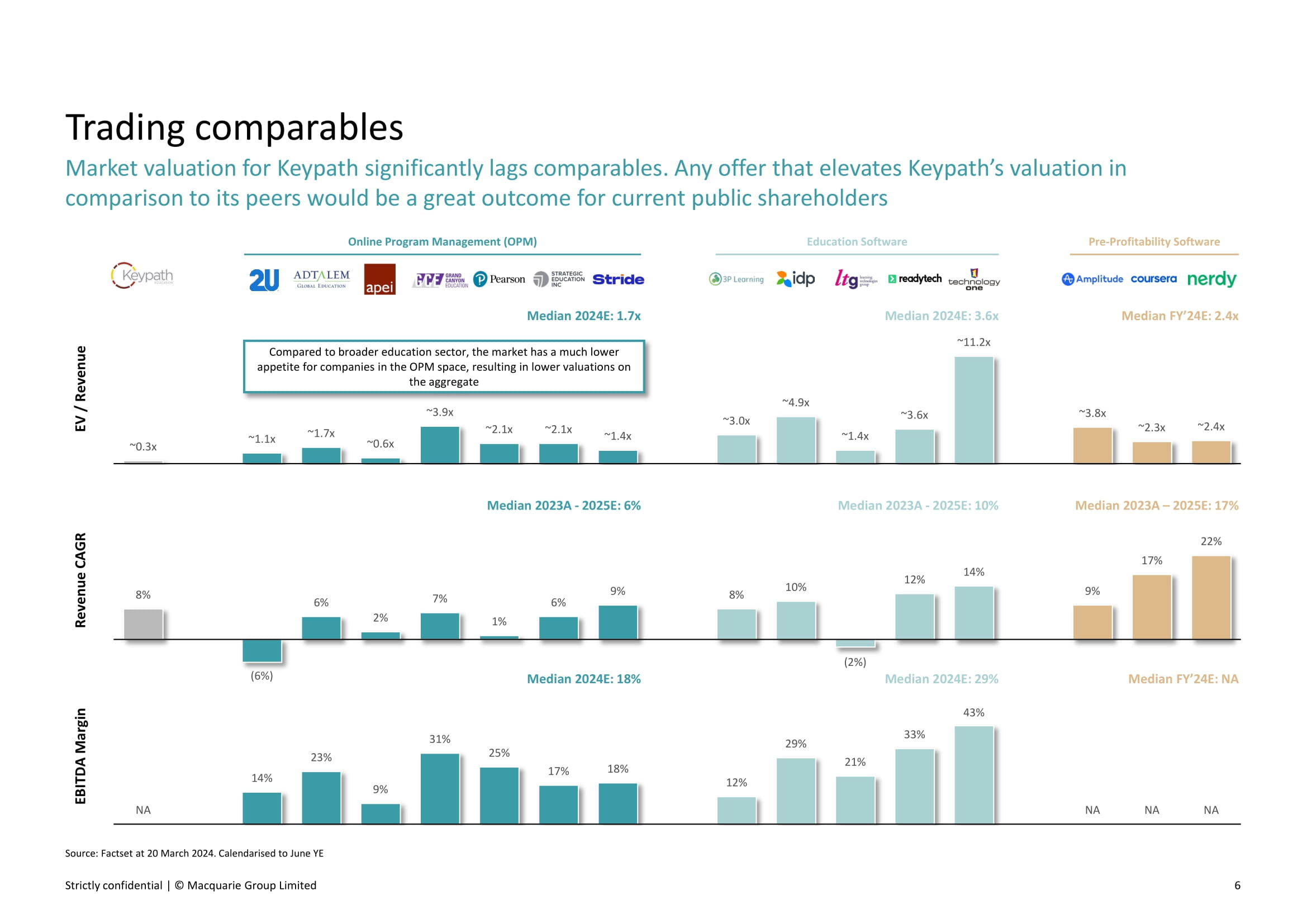

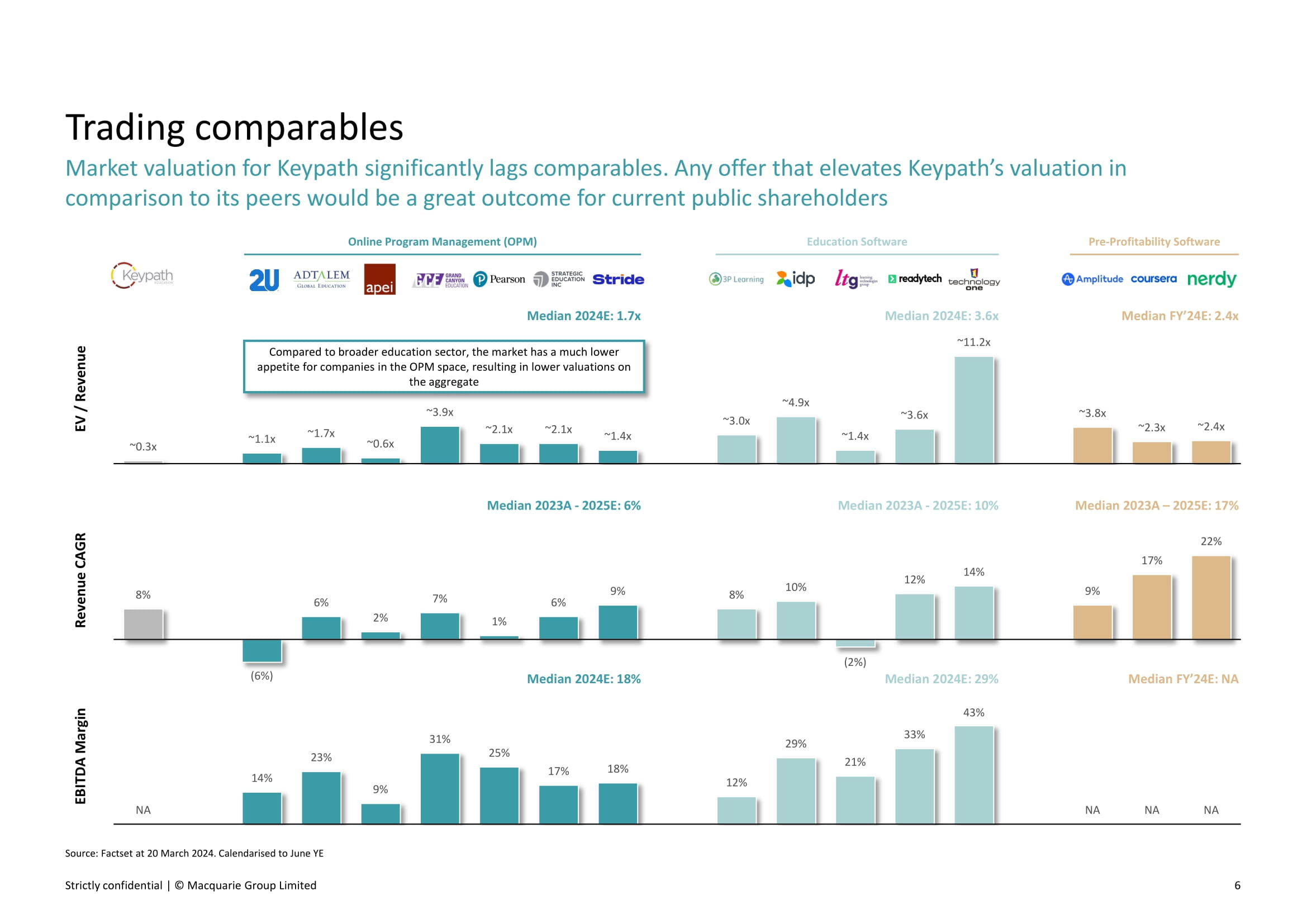

Trading comparables ~0.3x ~1.1x ~1.7x ~0.6x ~3.9x ~2.1x ~2.1x ~1.4x ~3.0x ~4.9x ~1.4x ~3.6x ~11.2x ~3.8x ~2.3x ~2.4x Market valuation for Keypath significantly lags comparables. Any offer that elevates Keypath’s valuation in comparison to its peers would be a great outcome for current public shareholders Online Program Management (OPM) Education Software Pre - Profitability Software 8% (6%) 6% 2% 7% 1% 6% 9% 8% 10% (2%) 12% 14% 9% 22% 17% NA 14% 23% 9% 31% 25% 17% 18% 12% 29% 21% 33% 43% NA NA NA Median 2024E: 1.7x Median 2024E: 3.6x Median FY’24E: 2.4x Median 2023A - 2025E: 6% Median 2023A - 2025E: 10% Median 2023A – 2025E: 17% Median 2024E: 18% Median 2024E: 29% Median FY’24E: NA EV / Revenue Revenue CAGR EBITDA Margin Compared to broader education sector, the market has a much lower appetite for companies in the OPM space, resulting in lower valuations on the aggregate Source: Factset at 20 March 2024. Calendarised to June YE Strictly confidential | © Macquarie Group Limited 6

“Macquarie Capital” refers to Macquarie Corporate Holdings Pty Limited and its worldwide direct and indirect subsidiaries . Macquarie Corporate Holdings Pty Limited is an indirect, wholly - owned subsidiary of Macquarie Group Limited . This confidential presentation has been prepared in connection with Project Karpos (the “Company”) solely for informational purposes . This presentation is being furnished to the recipient in connection with assessing its interest in a potential transaction involving the Company (the “Transaction”) . As a result, it is preliminary in nature and provided for discussion purposes only . The presentation does not purport to contain all of the information that a prospective investor may require in making an investment decision, and the recipient may not rely upon this presentation in evaluating the merits of any Transaction with the Company or its affiliates . This presentation contains confidential information . By accepting this presentation, the recipient agrees that all of the information contained herein will be kept confidential and the recipient will not use this information for any purpose other than considering the Transaction . The recipient agrees that it will not copy or reproduce the contents of this presentation, nor disclose or distribute the contents of this presentation to any third party, in whole or in part, other than to persons who are advising the recipient in connection with its evaluation of the Transaction and who agree to keep such information confidential . Macquarie Capital, its affiliates and any of its and their respective employees, directors, officers, contractors, consultants, advisors, members, successors, representatives and agents (collectively, its “Representatives”) are not responsible for the information in this presentation and do not make any representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this presentation, nor has Macquarie Capital or its Representatives acted on the recipient’s behalf to independently verify the information in this presentation . Macquarie Capital and its Representatives cannot assure the recipient that the information in this presentation is accurate or complete and shall have no liability for this presentation or for any representations (expressed or implied) contained in, or for any omissions from, this presentation or any other written or oral communications transmitted to the recipient in the course of its evaluation of the Transaction . The only representations upon which the recipient may rely will be those contained in the definitive agreement relating to the Transaction . This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities or to participate in any Transaction . It is an outline of matters for discussion only . Any person receiving this presentation and wishing to effect the Transaction contemplated hereby, must do so in accordance with applicable law . This presentation is not intended for distribution to, or use by, any person or entity in any location where such distribution or use would be contrary to law or regulation, or which would subject Macquarie Capital or its affiliates to any registration requirement or similar regulation or governmental requirement within such location . Any Transaction implementing any proposal discussed in this presentation shall be exclusively upon the terms and subject to the conditions set out in the definitive transaction agreements . Neither the U . S . Securities and Exchange Commission nor any U . S . or non - U . S . state securities commission has approved or disapproved of the Transaction contemplated hereby or determined if this presentation is truthful or complete . Any representation to the contrary is a criminal offense . By accepting this presentation, the recipient agrees that neither the recipient nor the recipient’s agents or representatives will directly contact the Company, its affiliates or any of its or its affiliates’ respective directors, officers, employees, shareholders, customers, vendors, consultants, advisors, representatives, agents or related parties at any time with respect to the Transaction or the information contained herein . Macquarie Capital is not an authorized deposit - taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) . The obligations of Macquarie Capital do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (“MBL”) . Any investments are subject to investment risk including possible delays in repayment and loss of income and principal invested . MBL does not guarantee or otherwise provide assurance in respect of the obligations of Macquarie Capital . © 2024 Macquarie Capital (USA) Inc . All inquiries with respect to the presentation should be directed to : Sam Shah Co - Head, Macquarie Capital, Americas and Global Head of Software & Services Phone: (216) 543 9797 sam.shah@macquarie.com Strictly confidential | © Macquarie Group Limited 7 Ha - Andza Young Vice President Phone: (346) 932 6729 ha - andza.young@macquarie.com Vincent Peterson Associate Phone: (415) 676 7243 vincent.peterson@macquarie.com Davis Franks Analyst Phone: (646) 510 4138 davis.franks@macquarie.com Important notice and disclaimer