Exhibit (c)(4)

Market Update November 2023 Strictly confidential | © Macquarie Group Limited

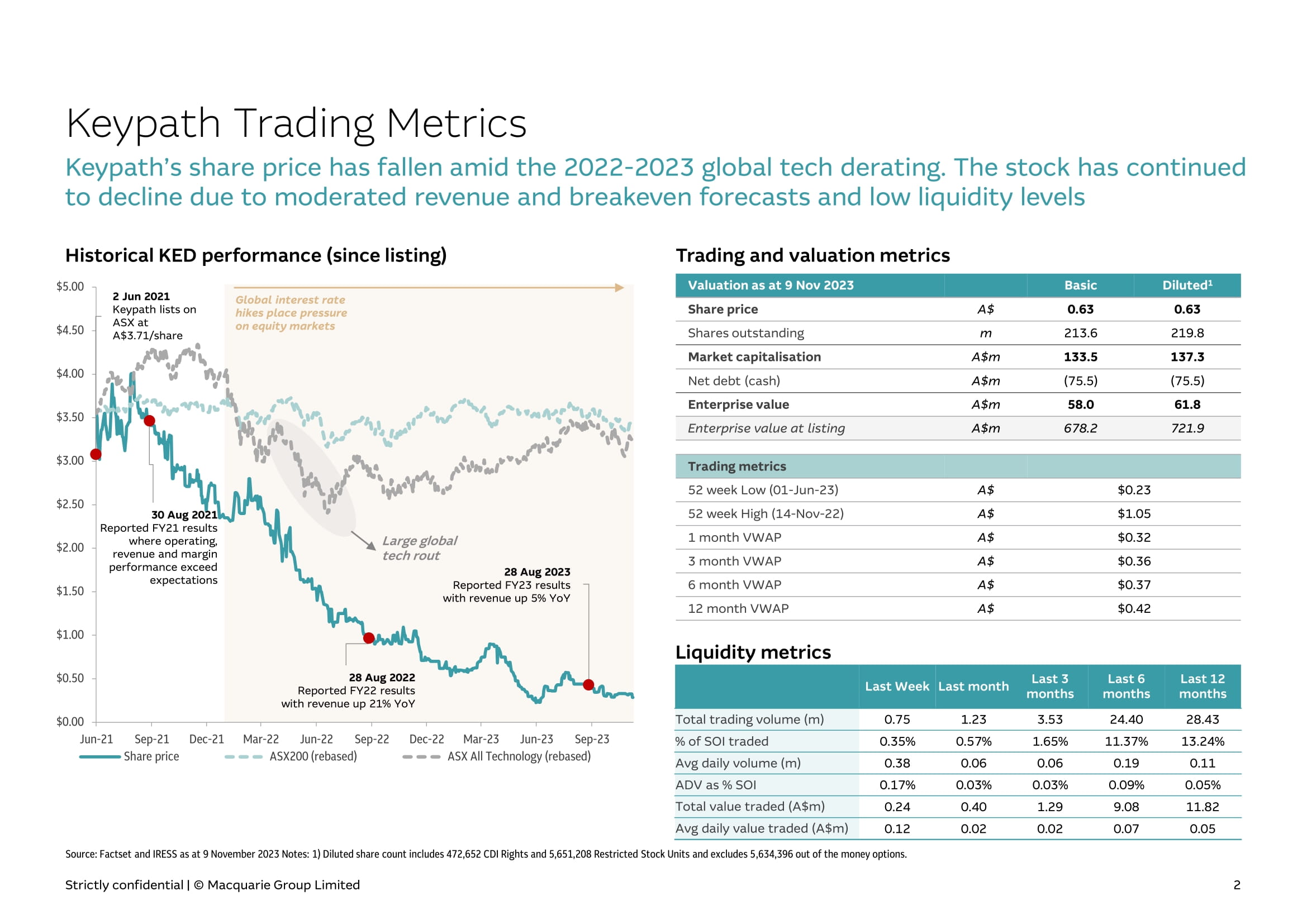

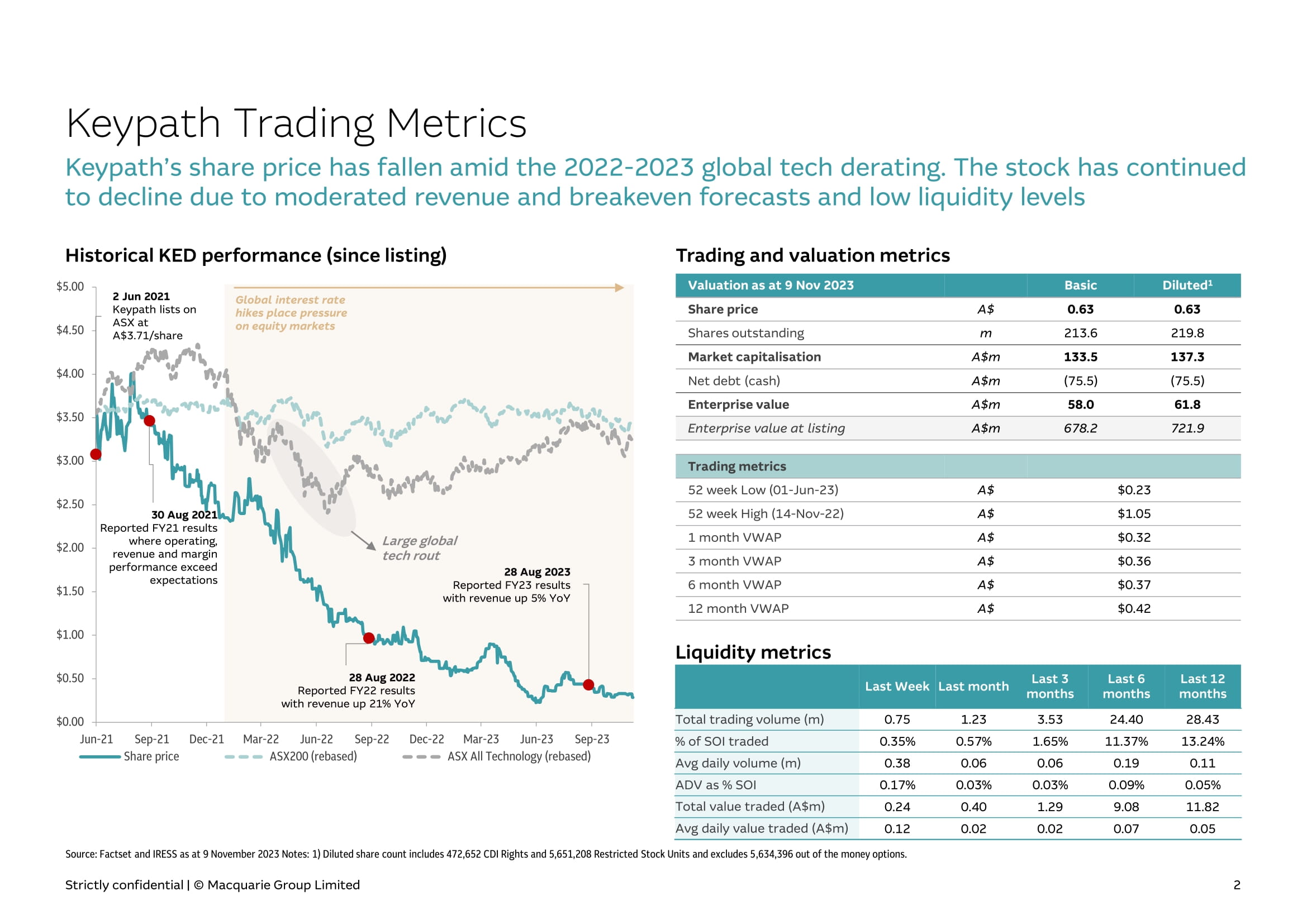

$0.00 $0.50 $1.00 $1.50 $2.00 $4.00 $3.50 $3.00 $2.50 $4.50 $5.00 Jun - 21 Sep - 21 Dec - 21 Share price Mar - 23 Jun - 23 Sep - 23 ASX All Technology (rebased) Mar - 22 Jun - 22 Sep - 22 Dec - 22 ASX200 (rebased) Large global tech rout Keypath Trading Metrics Keypath’s share price has fallen amid the 2022 - 2023 global tech derating. The stock has continued to decline due to moderated revenue and breakeven forecasts and low liquidity levels Diluted 1 Basic Valuation as at 9 Nov 2023 0.63 0.63 A$ Share price 219.8 213.6 m Shares outstanding 137.3 133.5 A$m Market capitalisation (75.5) (75.5) A$m Net debt (cash) 61.8 58.0 A$m Enterprise value 721.9 678.2 A$m Enterprise value at listing Trading metrics $0.23 A$ 52 week Low (01 - Jun - 23) $1.05 A$ 52 week High (14 - Nov - 22) $0.32 A$ 1 month VWAP $0.36 A$ 3 month VWAP $0.37 A$ 6 month VWAP $0.42 A$ 12 month VWAP Source: Factset and IRESS as at 9 November 2023 Notes: 1) Diluted share count includes 472,652 CDI Rights and 5,651,208 Restricted Stock Units and excludes 5,634,396 out of the money options. Historical KED performance (since listing) Trading and valuation metrics Liquidity metrics Last 12 months Last 6 months Last 3 months Last month Last Week 28.43 24.40 3.53 1.23 0.75 Total trading volume (m) 13.24% 11.37% 1.65% 0.57% 0.35% % of SOI traded 0.11 0.19 0.06 0.06 0.38 Avg daily volume (m) 0.05% 0.09% 0.03% 0.03% 0.17% ADV as % SOI 11.82 9.08 1.29 0.40 0.24 Total value traded (A$m) 0.05 0.07 0.02 0.02 0.12 Avg daily value traded (A$m) 2 Jun 2021 Keypath lists on ASX at A$3.71/share Global interest rate hikes place pressure on equity markets 30 Aug 2021 Reported FY21 results where operating, revenue and margin performance exceed expectations 28 Aug 2022 Reported FY22 results with revenue up 21% YoY 28 Aug 2023 Strictly confidential | © Macquarie Group Limited 2 Reported FY23 results with revenue up 5% YoY

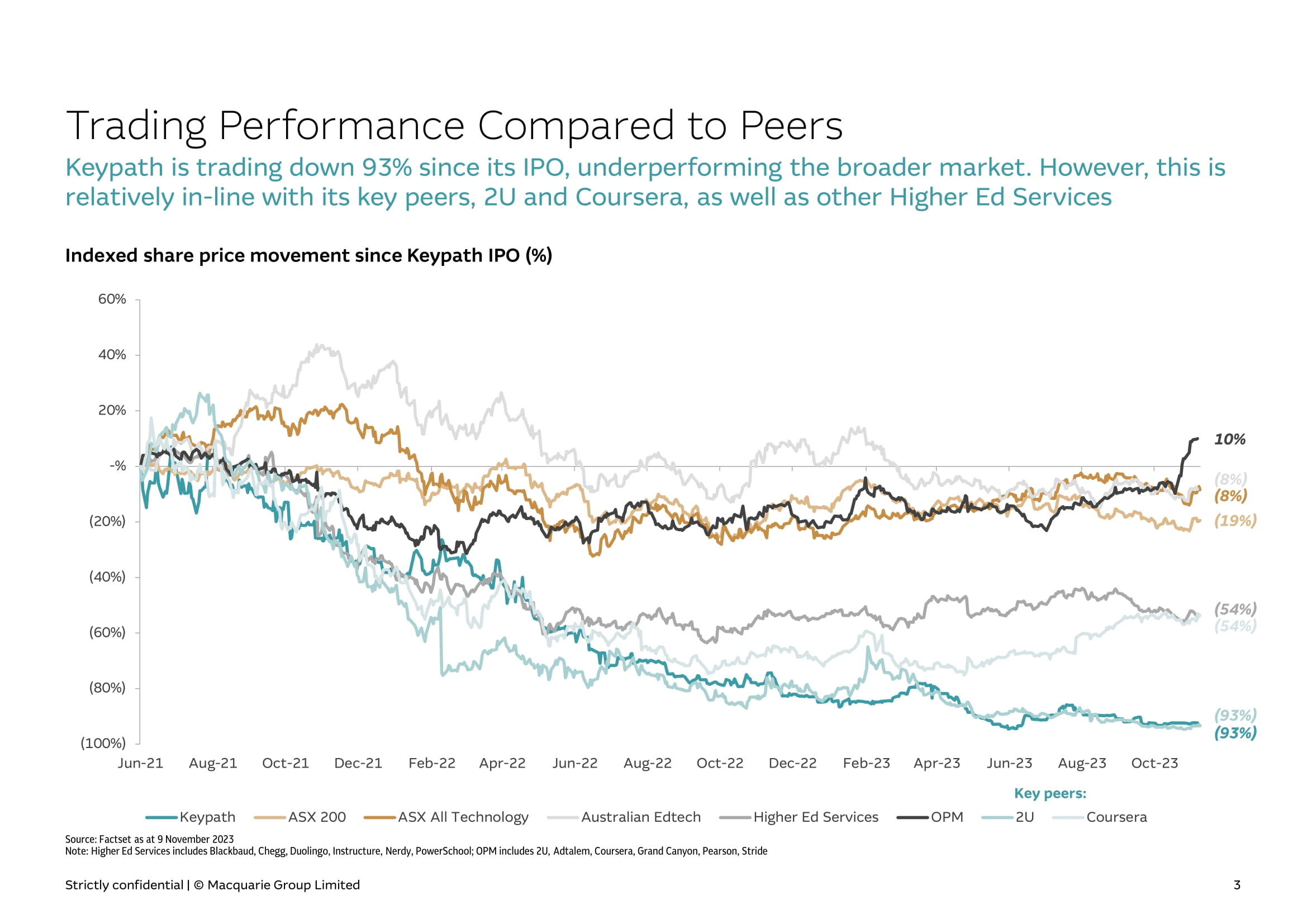

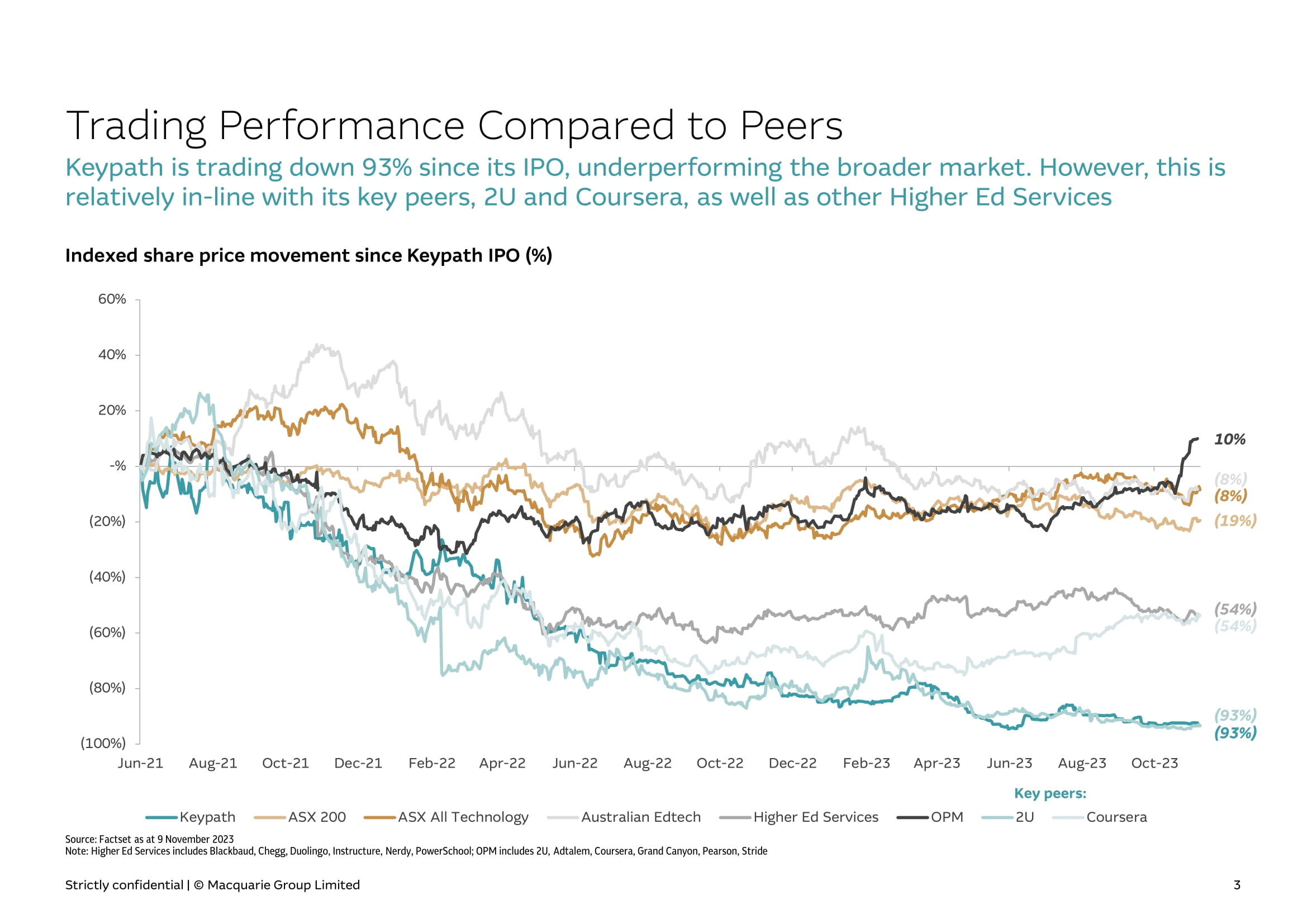

(100%) (80%) (60%) (40%) (20%) - % Indexed share price movement since Keypath IPO (%) 60% 40% 20% Jun - 21 Aug - 21 Oct - 21 Dec - 21 Feb - 22 Apr - 22 Jun - 22 Aug - 22 Oct - 22 Dec - 22 Feb - 23 Apr - 23 Jun - 23 Aug - 23 Oct - 23 Key peers: Keypath ASX 200 ASX All Technology Australian Edtech Higher Ed Services Source: Factset as at 9 November 2023 Note: Higher Ed Services includes Blackbaud, Chegg, Duolingo, Instructure, Nerdy, PowerSchool; OPM includes 2U, Adtalem, Coursera, Grand Canyon, Pearson, Stride OPM 2U Coursera Strictly confidential | © Macquarie Group Limited 3 Trading Performance Compared to Peers Keypath is trading down 93% since its IPO, underperforming the broader market. However, this is relatively in - line with its key peers, 2U and Coursera, as well as other Higher Ed Services (93%) (93%) (8%) (8%) (19%) (54%) (54%) 10%

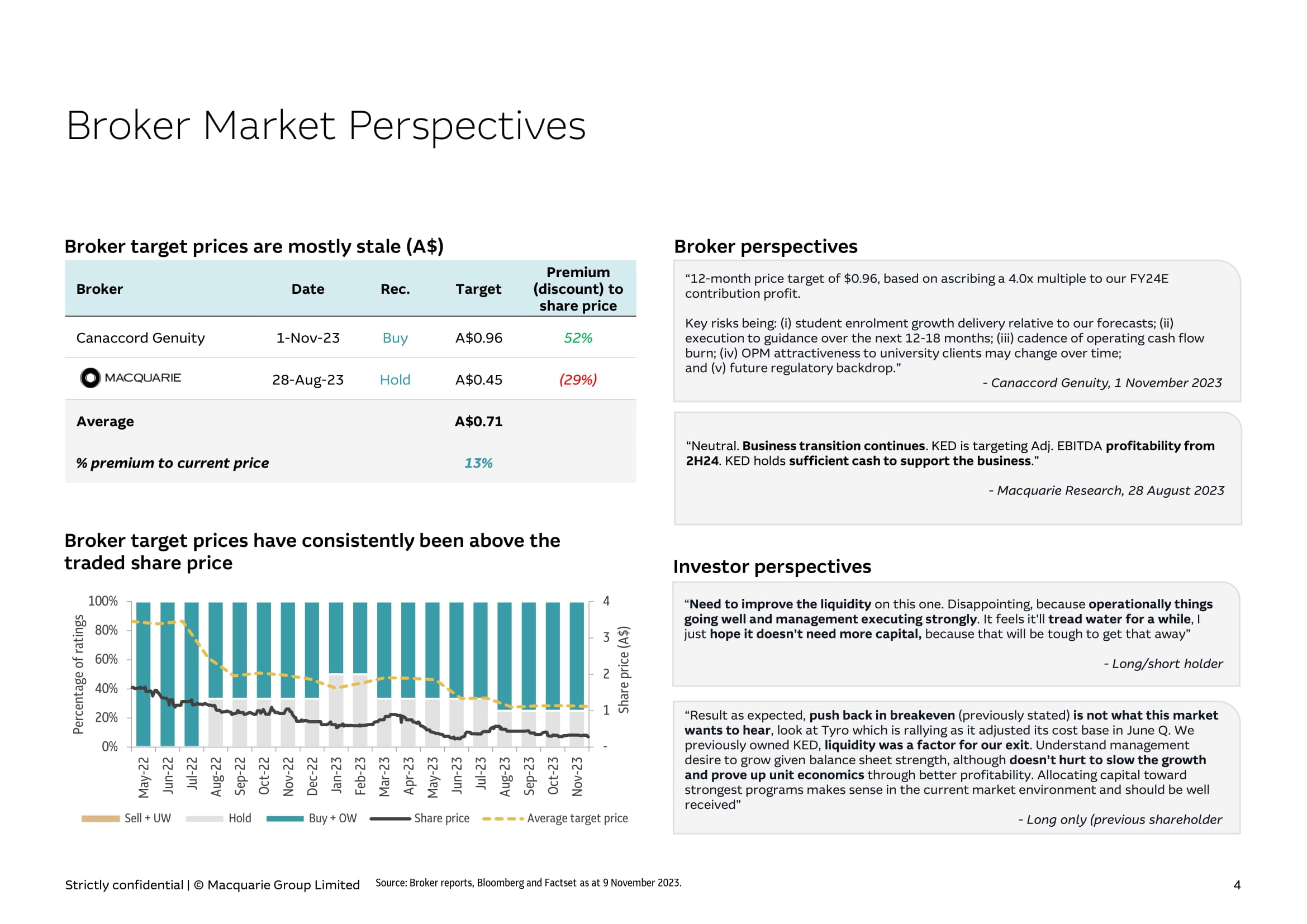

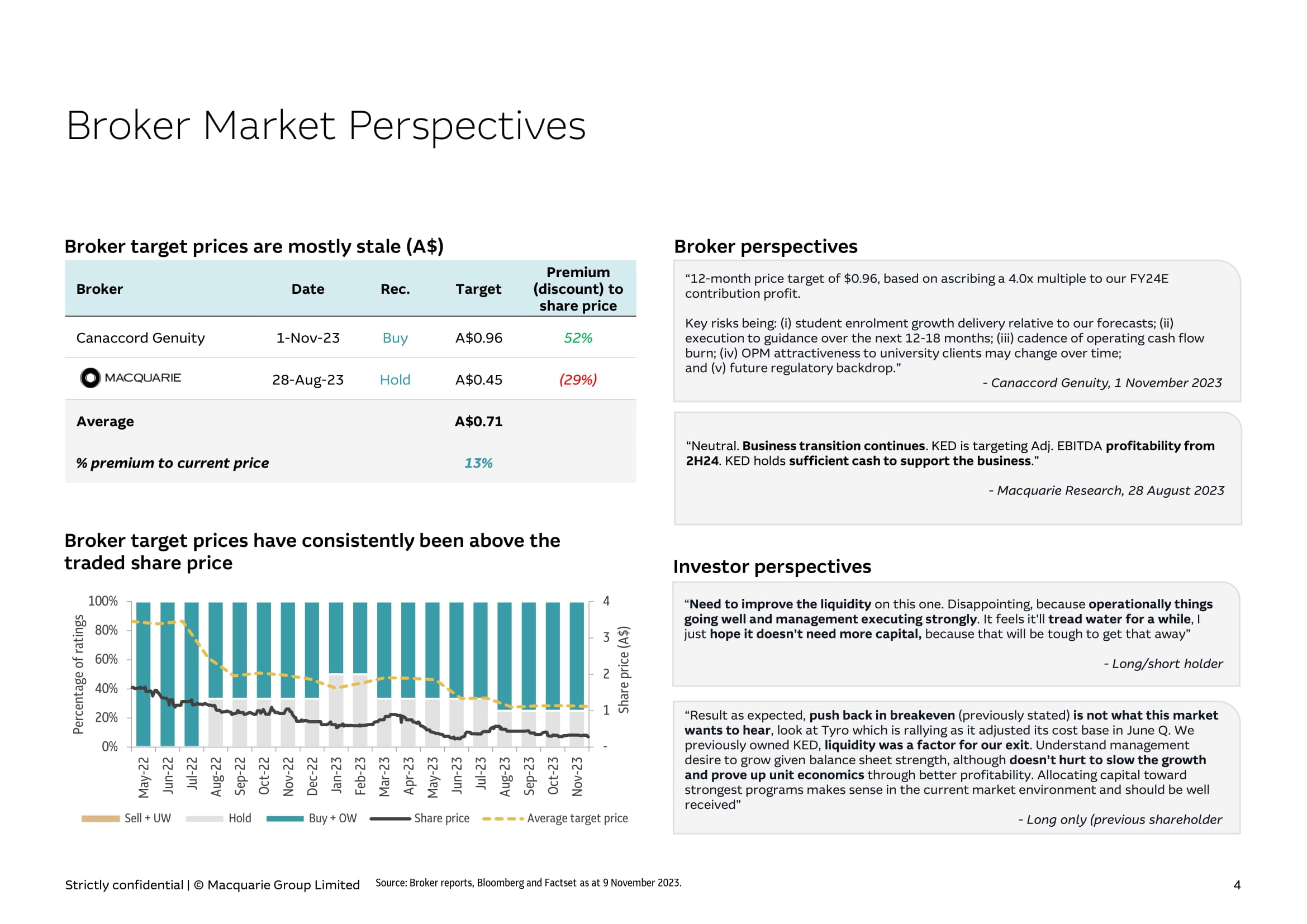

Broker Market Perspectives Premium (discount) to share price Target Rec. Date Broker 52% A$0.96 Buy 1 - Nov - 23 Canaccord Genuity (29%) A$0.45 Hold 28 - Aug - 23 A$0.71 Average 13% % premium to current price Broker target prices are mostly stale (A$) Broker target prices have consistently been above the traded share price Investor perspectives “ Need to improve the liquidity on this one. Disappointing, because operationally things going well and management executing strongly . It feels it'll tread water for a while , I just hope it doesn't need more capital, because that will be tough to get that away” - Long/short holder Broker perspectives “12 - month price target of $0.96, based on ascribing a 4.0x multiple to our FY24E contribution profit. Key risks being: (i) student enrolment growth delivery relative to our forecasts; (ii) execution to guidance over the next 12 - 18 months; (iii) cadence of operating cash flow burn; (iv) OPM attractiveness to university clients may change over time; and (v) future regulatory backdrop.” - Canaccord Genuity, 1 November 2023 “Result as expected, push back in breakeven (previously stated) is not what this market wants to hear , look at Tyro which is rallying as it adjusted its cost base in June Q. We previously owned KED, liquidity was a factor for our exit . Understand management desire to grow given balance sheet strength, although doesn't hurt to slow the growth and prove up unit economics through better profitability. Allocating capital toward strongest programs makes sense in the current market environment and should be well received” - Long only (previous shareholder “Neutral. Business transition continues . KED is targeting Adj. EBITDA profitability from 2H24 . KED holds sufficient cash to support the business .” - Macquarie Research, 28 August 2023 - 1 2 3 4 100% 80% 60% 40% 20% 0% May - 22 Jun - 22 Jul - 22 Aug - 22 Sep - 22 Oct - 22 Nov - 22 Dec - 22 Jan - 23 Feb - 23 Mar - 23 Apr - 23 May - 23 Jun - 23 Jul - 23 Aug - 23 Sep - 23 Oct - 23 Nov - 23 Share price (A$) Percentage of ratings Sell + UW Hold Buy + OW Share price Average target price Source: Broker reports, Bloomberg and Factset as at 9 November 2023. Strictly confidential | © Macquarie Group Limited 4

(10) (20) - 40 30 20 10 Jul - 21 Oct - 21 Jan - 22 Jul - 22 Oct - 22 FY24E Jan - 23 FY25E Apr - 23 Jul - 23 Oct - 23 Adjusted EBITDA (US$m) Apr - 22 FY23E 280 260 240 220 200 180 160 140 120 100 Jul - 21 Jul - 22 Oct - 22 Apr - 23 Jul - 23 Oct - 23 Revnue (US$m) FY24E Jan - 23 FY25E Keypath consistently outperformed its prospectus forecasts over FY21 to FY23, which was positively received by brokers As the macroeconomic environment declined and became more uncertain, brokers have lowered their growth expectations to account for enrolment and retention risk Peers 2U and Coursera also reported lower revenue and lower than expected student enrolments, particularly in mature degree programs Brokers have since: — Decreased revenue growth forecasts following Keypath’s FY24 guidance to ~US$130m in FY24 and known roll - off of some mature vintage programs — Improved EBITDA forecasts following stronger than expected FY24 guidance to ~(US$4m) EBITDA. Breakeven still expected on an Adj. EBITDA basis in 2H24 Key focuses and risks for Keypath remain as performance on mature programs and non - Healthcare verticals and execution on growth in programs in the Healthcare vertical needs to be proved up Keypath Analyst Estimates Over Time Analysts have reduced revenue expectations following the roll - off of mature vintages in FY23, however are expecting slightly stronger Adj. EBITDA performance in FY24 Average Revenue broker forecasts have fallen over time while Adj. EBITDA Overview breakeven forecasts have been pushed out from FY23E to FY25E Source: Broker reports, Factset, Company announcements. Note: 1) In FY21 results, Keypath introduced the metric of Adjusted EBITDA, which represents EBITDA adjusted for non - recurring expenses associated with Keypath’s initial public offering and non - cash stock - based compensation. Apr - 22: Keypath guides to Adj EBITDA breakeven from 2H24. Macquarie FY24 Adj. EBITDA estimate cut from US$16.4m to US($3.4)m 28 - Apr - 22: Macq r evenue forecasts moderated by - 6.2% (FY23) and - 12.3% (FY24) Oct - 21 Jan - 22 Apr - 22 FY23E 28 - Jul - 22: Macquarie revenue forecasts moderated by - 15% (FY23) and - 9% (FY24) and updated expense assumptions 28 - Aug - 22: Macquarie cut FY27 - 30 growth rates to 6 - 7.5% given lower FY23E guidance from Keypath and to reflect the weaker performance in mature programs 28 - Aug - 23: Brokers cut revenue growth expectations to 5 - 6.5% in FY24 following guidance in FY23 results Strictly confidential | © Macquarie Group Limited 5 Actual Actual 28 - Aug - 23: FY24 EBITDA expectations improved to ~($4m) in FY24 following guidance in FY23 results. Full - year Breakeven still expected in FY25

Strictly confidential | © Macquarie Group Limited 6 DRAFT Keypath Register Composition Keypath’s share register has a large number of minority holders with small positions in the company. Institutional shareholder position sizes have also reduced since IPO - - - Source: Miraqle and ASX announcements as at 9 November 2023 with the share price as $0.285. Note: 1)Excluding CDI Rights and Options. 2) Diluted share count includes and 5,436,045 Restricted Stock Units and excludes 5.361.556 out of the money options. Top shareholders (publicly available) 92% of shareholders own less than A$6.5k of Keypath CDIs 1 Average entry price (A$) % of fully diluted SOI % of basic SOI Shares (m) Investors $3.71 64.6% 66.2% 141.7 Sterling Partners 1 ⯆ $3.30 7.7% 7.8% 16.8 NovaPort 2 ⯆ $1.29 5.4% 5.5% 11.8 Lennox Capital Partners 3 ⯆ $1.29 4.9% 5.0% 10.7 Regal Funds 4 ⯅ $3.65 4.3% 4.4% 9.5 Steve Fireng 5 n/a 0.6% 0.6% 1.3 Peter Vlerick 6 n/a 0.3% 0.3% 0.6 Ryan O'Hare 7 n/a 0.1% 0.1% 0.2 Annette Hone 8 n/a 0.1% 0.1% 0.2 Antony Hill 9 n/a 0.1% 0.1% 0.2 Gordon Ballantyne 10 - 87.9% 90.1% 192.8 Total Top 8 anagement members or m Board 214.0 Total SOI (basic) A$1 - 5 - m ld be size - to ~ tions wou decl - ined in . These posi s h a 2 v 1 e 9 . n 8 ow hare price n T o s t t i a t l u S t i O o I n ( a f u l l s l y h a d r i l e u h t o e d l d ) 2 in g due to the decrease in s I % of securities Number of securities % of holders Number of holders Max. value of holding (A$) CDI distribution schedule (FY22) 0.1% 167,234 52.5% 330 $285 1 to 1,000 0.2% 418,992 28.7% 180 $1,425 1,001 to 5,000 0.1% 320,457 7.2% 45 $2,850 5,001 to 10,000 0.8% 1,784,418 8.9% 56 $28,500 10,001 to 100,000 98.7% 211,280,027 2.7% 17 n/a 100,001 and over 100.0% 213,971,128 100.0% 628 Total ~92% of shareholders own <A$2.9k of Keypath CDIs 52.5% 28.7% 7.2% 8.9% 2.7% At 28 Aug 2023, 330 CDI holders were holding less than A$450 worth of ~1,000 CDIs, based on a CDI price of A$0.45 As the share price has fallen, this group of shareholder has likely grown larger marked to market in their books with any successful takeovers at a premium providing a profit for the period ⯅ ⯆ Movements of >1k shares

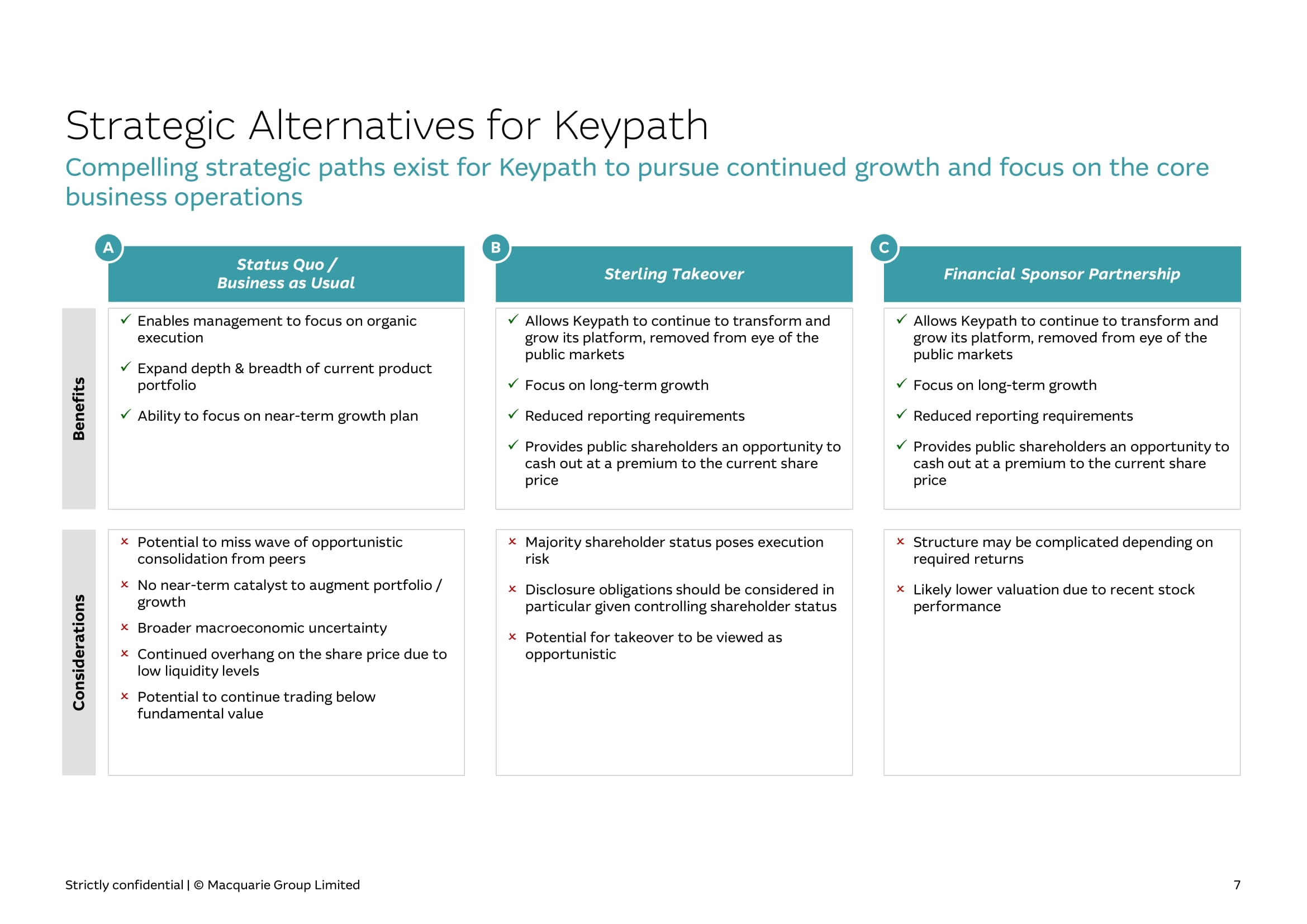

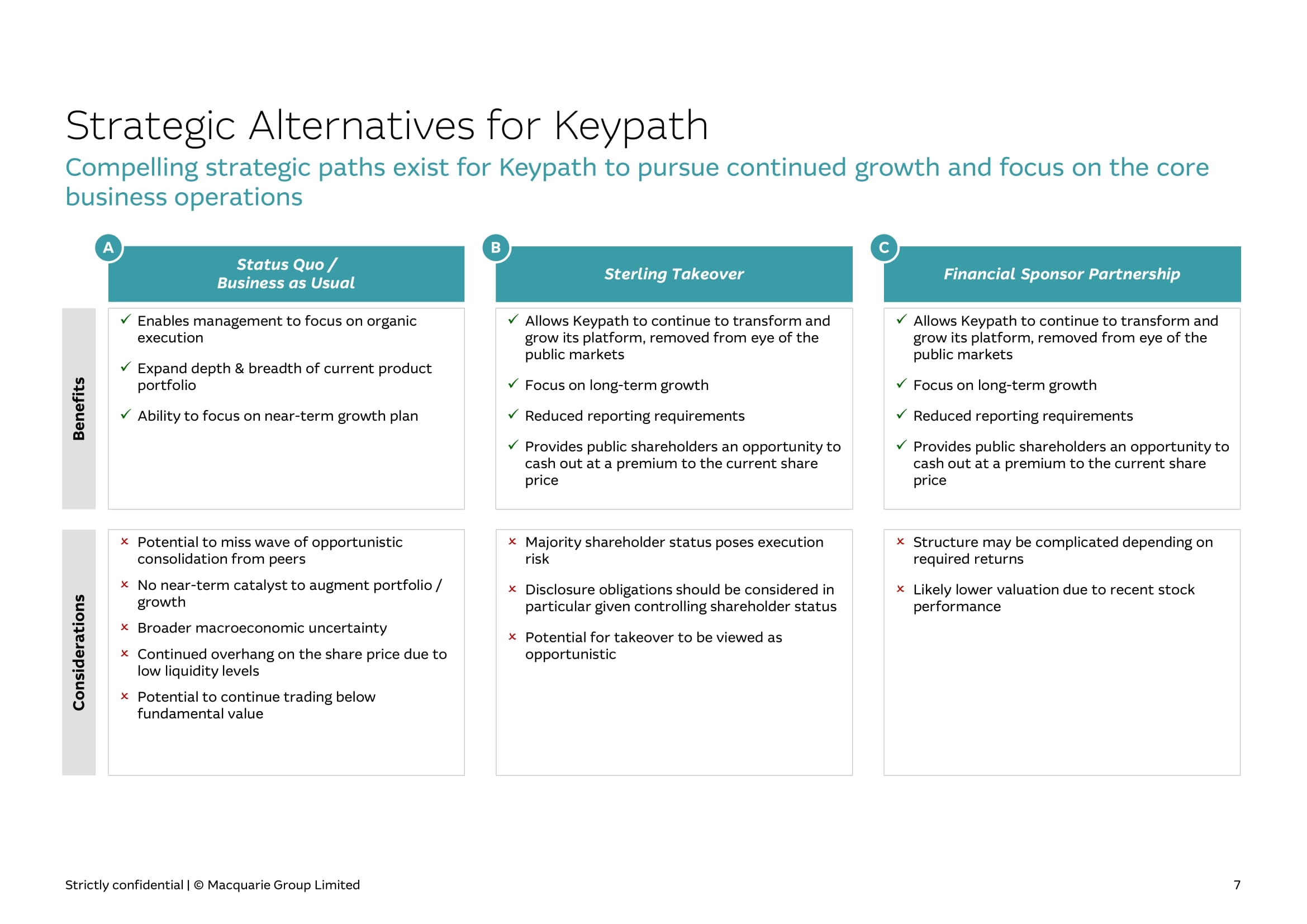

DRAFT Strategic Alternatives for Keypath Compelling strategic paths exist for Keypath to pursue continued growth and focus on the core business operations Benefits Considerations x Enables management to focus on organic execution x Expand depth & breadth of current product portfolio x Ability to focus on near - term growth plan ᴟ Potential to miss wave of opportunistic consolidation from peers ᴟ No near - term catalyst to augment portfolio / growth ᴟ Broader macroeconomic uncertainty ᴟ Continued overhang on the share price due to low liquidity levels ᴟ Potential to continue trading below fundamental value Status Quo / Business as Usual x Allows Keypath to continue to transform and grow its platform, removed from eye of the public markets x Focus on long - term growth x Reduced reporting requirements x Provides public shareholders an opportunity to cash out at a premium to the current share price ᴟ Structure may be complicated depending on required returns ᴟ Likely lower valuation due to recent stock performance Financial Sponsor Partnership x Allows Keypath to continue to transform and grow its platform, removed from eye of the public markets x Focus on long - term growth x Reduced reporting requirements x Provides public shareholders an opportunity to cash out at a premium to the current share price ᴟ Majority shareholder status poses execution risk ᴟ Disclosure obligations should be considered in particular given controlling shareholder status ᴟ Potential for takeover to be viewed as opportunistic Sterling Takeover A B C Strictly confidential | © Macquarie Group Limited 7

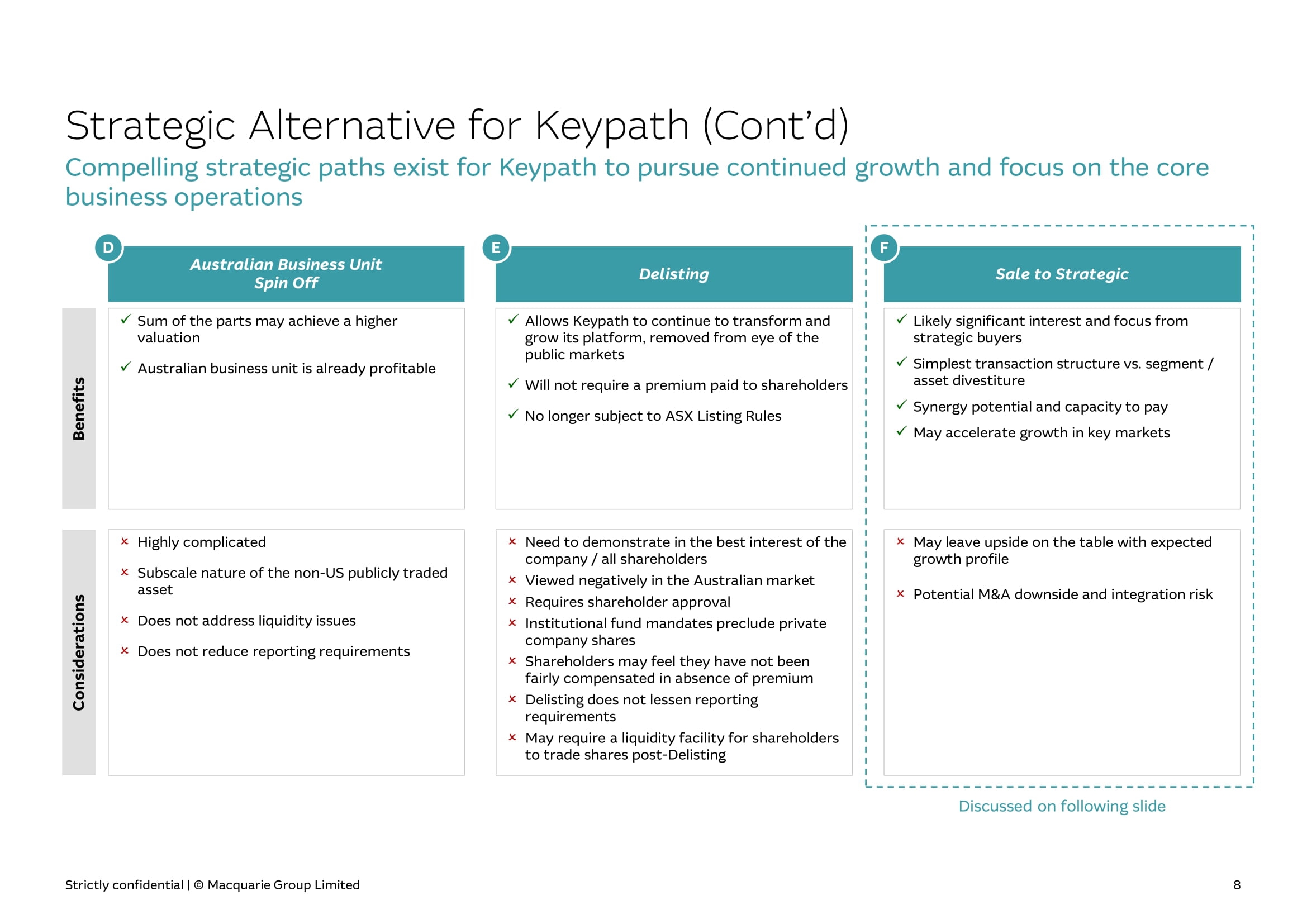

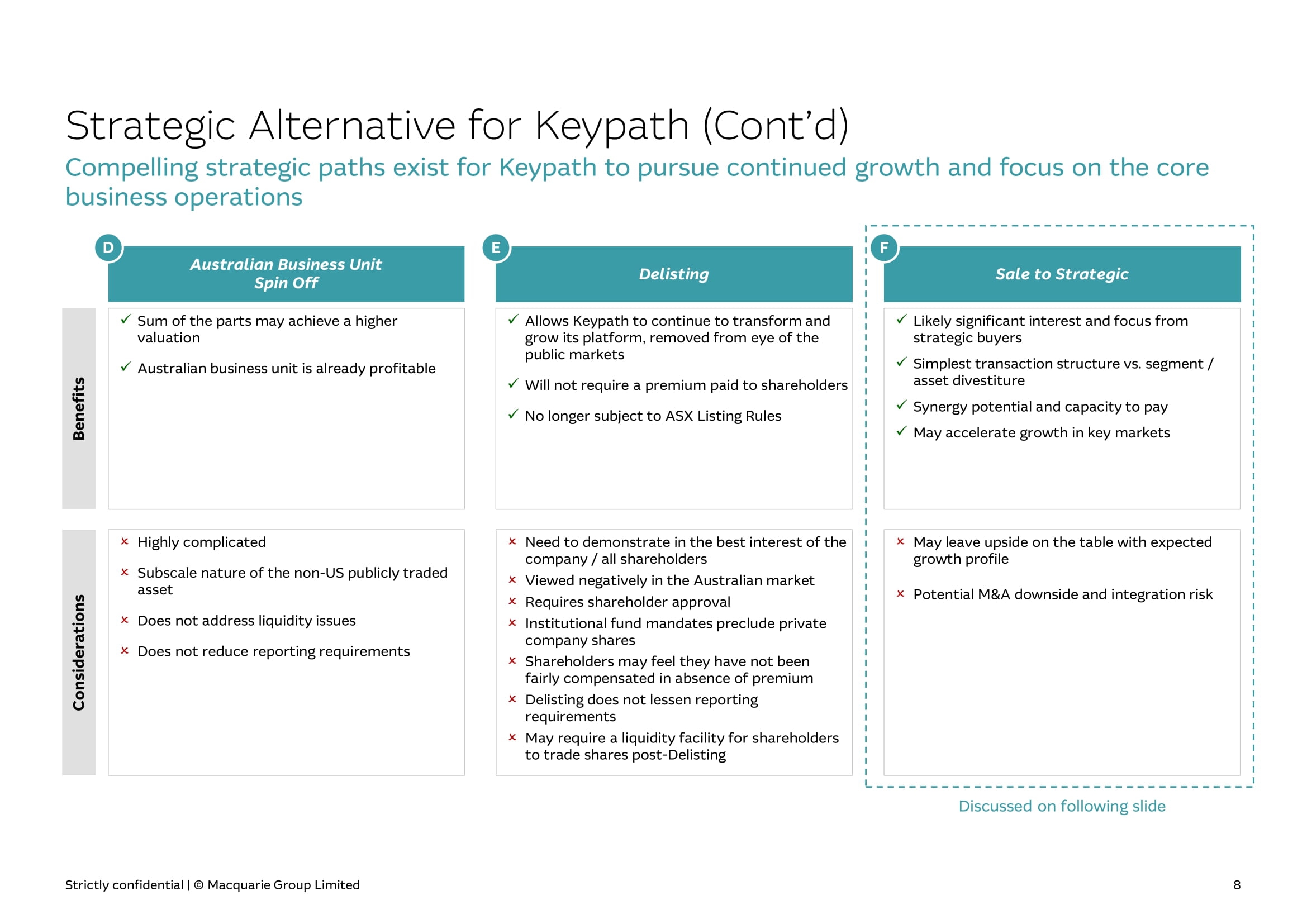

DRAFT Strategic Alternative for Keypath (Cont’d) Compelling strategic paths exist for Keypath to pursue continued growth and focus on the core business operations Benefits Considerations Discussed on following slide x Sum of the parts may achieve a higher valuation x Australian business unit is already profitable ᴟ Highly complicated ᴟ Subscale nature of the non - US publicly traded asset ᴟ Does not address liquidity issues ᴟ Does not reduce reporting requirements Australian Business Unit Spin Off x Likely significant interest and focus from strategic buyers x Simplest transaction structure vs. segment / asset divestiture x Synergy potential and capacity to pay x May accelerate growth in key markets ᴟ May leave upside on the table with expected growth profile ᴟ Potential M&A downside and integration risk F Sale to Strategic x Allows Keypath to continue to transform and grow its platform, removed from eye of the public markets x Will not require a premium paid to shareholders x No longer subject to ASX Listing Rules ᴟ Need to demonstrate in the best interest of the company / all shareholders ᴟ Viewed negatively in the Australian market ᴟ Requires shareholder approval ᴟ Institutional fund mandates preclude private company shares ᴟ Shareholders may feel they have not been fairly compensated in absence of premium ᴟ Delisting does not lessen reporting requirements ᴟ May require a liquidity facility for shareholders to trade shares post - Delisting Delisting D E Strictly confidential | © Macquarie Group Limited 8

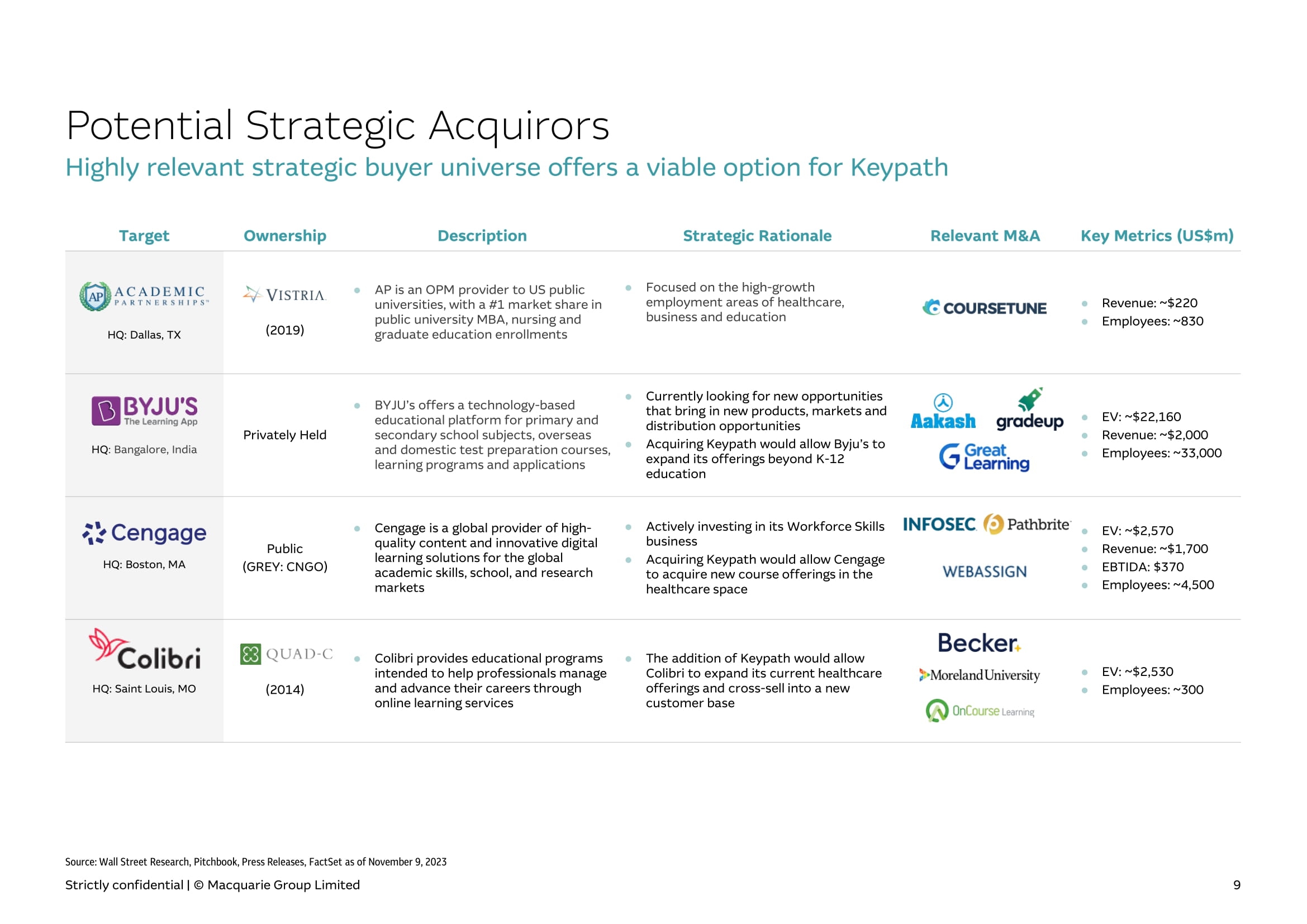

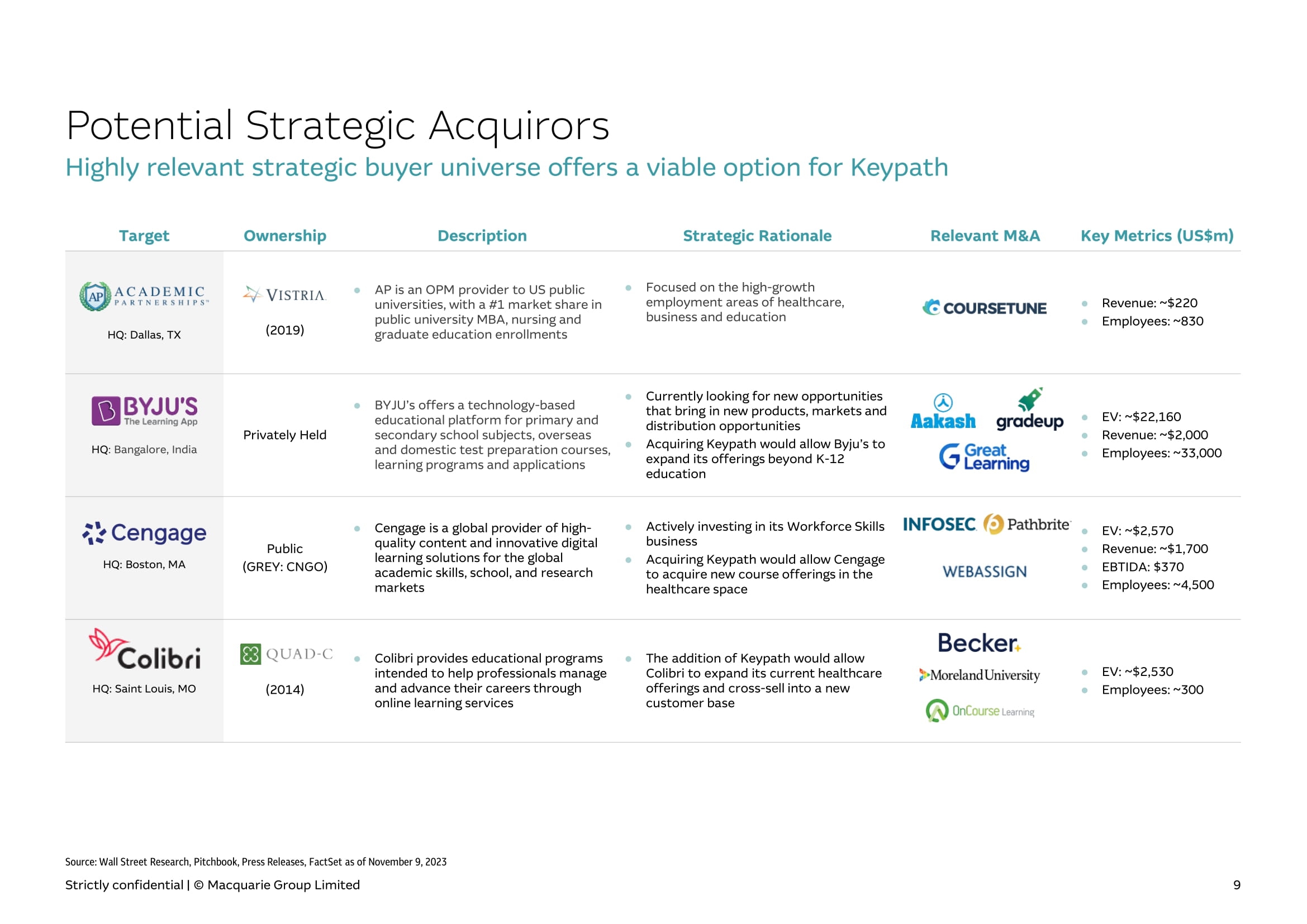

DRAFT Source: Wall Street Research, Pitchbook, Press Releases, FactSet as of November 9, 2023 Key Metrics (US$m) Relevant M&A Strategic Rationale Description Ownership Target Revenue: ~$220 Employees: ~830 Focused on the high - growth employment areas of healthcare, business and education AP is an OPM provider to US public universities, with a #1 market share in public university MBA, nursing and graduate education enrollments HQ: Dallas, TX (2019) EV: ~$22,160 Revenue: ~$2,000 Employees: ~33,000 Currently looking for new opportunities that bring in new products, markets and distribution opportunities Acquiring Keypath would allow Byju’s to expand its offerings beyond K - 12 education BYJU’s offers a technology - based educational platform for primary and secondary school subjects, overseas and domestic test preparation courses, learning programs and applications Privately Held HQ : Bangalore, India EV: ~$2,570 Revenue: ~$1,700 EBTIDA: $370 Employees: ~4,500 Actively investing in its Workforce Skills business Acquiring Keypath would allow Cengage to acquire new course offerings in the healthcare space Cengage is a global provider of high - quality content and innovative digital learning solutions for the global academic skills, school, and research markets Public (GREY: CNGO) HQ: Boston, MA EV: ~$2,530 Employees: ~300 The addition of Keypath would allow Colibri to expand its current healthcare offerings and cross - sell into a new customer base Colibri provides educational programs intended to help professionals manage and advance their careers through online learning services (2014) HQ: Saint Louis, MO Potential Strategic Acquirors Highly relevant strategic buyer universe offers a viable option for Keypath Strictly confidential | © Macquarie Group Limited 9

Strictly confidential | © Macquarie Group Limited 10 DRAFT "Macquarie Capital" refers to Macquarie Corporate Holdings Pty Limited, its worldwide subsidiaries and the funds or other investment vehicles that they manage. Macquarie Corporate Holdings Pty Limited is an indirect, wholly - owned subsidiary of Macquarie Group Limited. This document and its contents are confidential to the person(s) to whom it is delivered and should not be copied or distributed, in whole or in part, or its contents disclosed by such person(s) to any other person. Notwithstanding the foregoing, the recipient (which includes each employee, representative, or other agent of the recipient) is hereby expressly authorized to disclose to any and all persons, without limitation of any kind, the tax structure and US federal income tax treatment of the proposed transaction and all materials of any kind (including opinions and other tax analysis) if any, that are provided to the recipient related to the tax structure and US federal income tax treatment. This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. It is an outline of matters for discussion only. You may not rely upon this document in evaluating the merits of investing in any securities referred to herein. This document does not constitute and should not be interpreted as either an investment recommendation or advice, including legal, tax or accounting advice. Future results are impossible to predict. Opinions and estimates offered in this presentation constitute our judgment and are subject to change without notice, as are statements about market trends, which are based on current market conditions. This presentation may include forward - looking statements that represent opinions, estimates and forecasts, which may not be realized. We believe the information provided herein is reliable, as of the date hereof, but do not warrant its accuracy or completeness. In preparing these materials, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Nothing in this document contains a commitment from any member of Macquarie Capital to subscribe for securities, to provide debt, to arrange any facility, to invest in any way in any transaction described herein or otherwise imposes any obligation on Macquarie Capital. Macquarie Capital does not guarantee the performance or return of capital from investments. Any participation by Macquarie Capital in any transaction would be subject to its internal approval process. None of the entities noted in this document are authorized deposit - taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL). MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities. © 2023 Macquarie Capital (USA) Inc. Important Notice and Disclaimer