UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811- 02753 |

SBL Fund

(Exact name of registrant as specified in charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Donald C. Cacciapaglia

SBL Fund

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 1-301-296-5100 |

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Reports to Stockholders.

SERIES A (LARGE CAP CORE SERIES)

SERIES B (LARGE CAP VALUE SERIES)

SERIES C (MONEY MARKET SERIES)

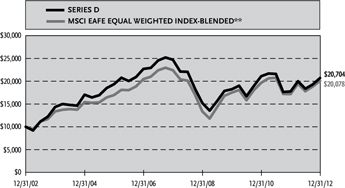

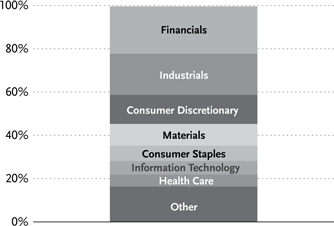

SERIES D (MSCI EAFE EQUAL WEIGHT SERIES)

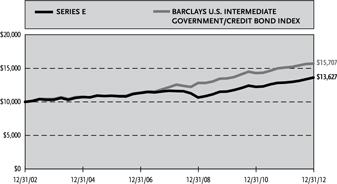

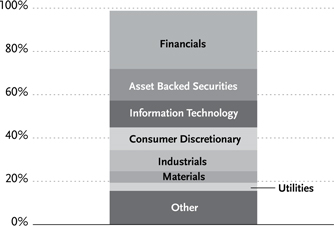

SERIES E (U.S. INTERMEDIATE BOND SERIES)

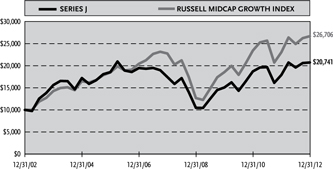

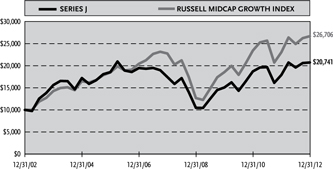

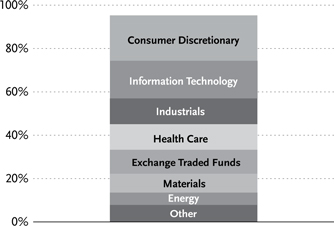

SERIES J (MID CAP GROWTH SERIES)

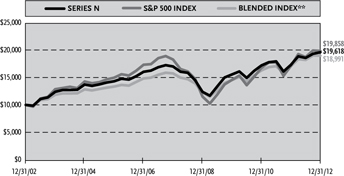

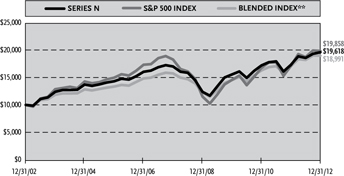

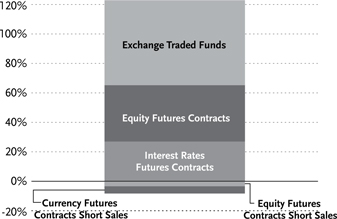

SERIES N (MANAGED ASSET ALLOCATION SERIES)

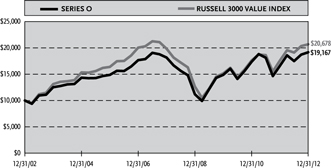

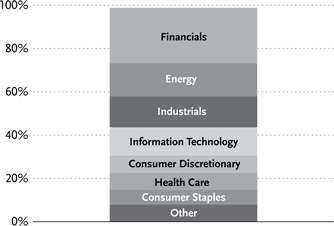

SERIES O (ALL CAP VALUE SERIES)

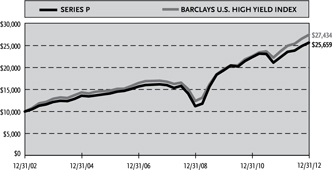

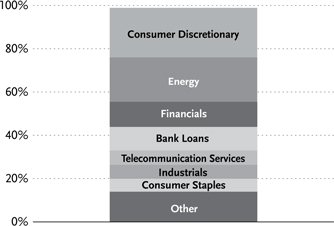

SERIES P (HIGH YIELD SERIES)

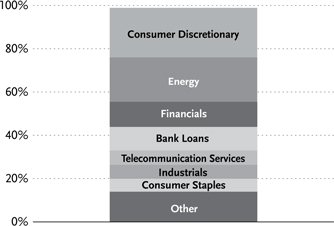

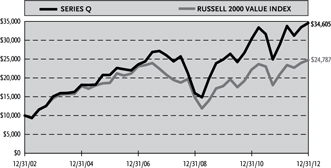

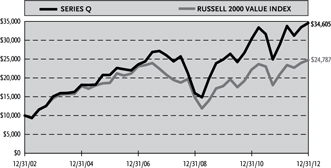

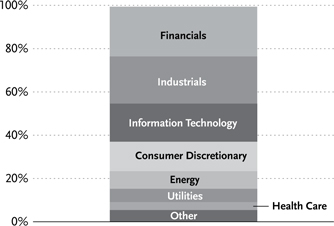

SERIES Q (SMALL CAP VALUE SERIES)

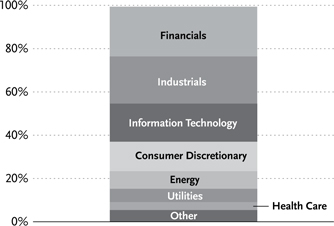

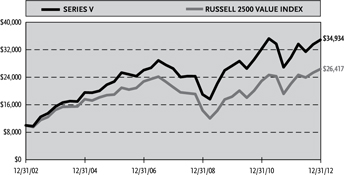

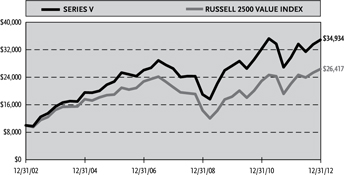

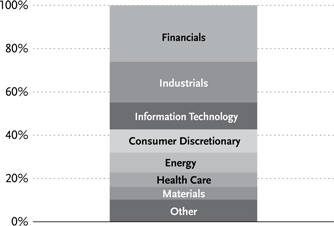

SERIES V (MID CAP VALUE SERIES)

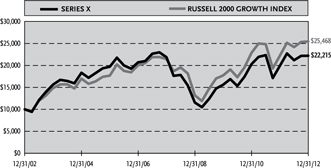

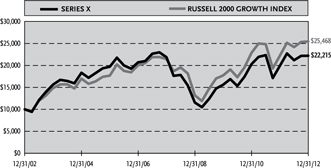

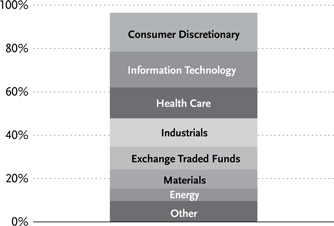

SERIES X (SMALL CAP GROWTH SERIES)

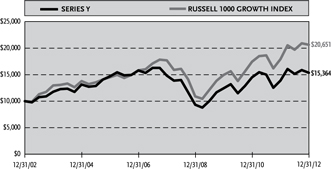

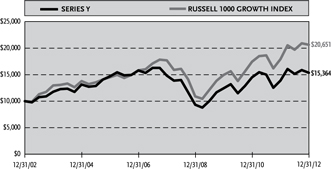

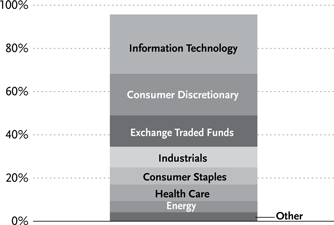

SERIES Y (LARGE CAP CONCENTRATED GROWTH SERIES)

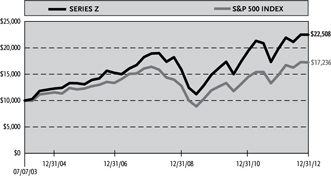

SERIES Z (ALPHA OPPORTUNITY SERIES)

460425800

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Guggenheim Distributors, LLC.

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the annual shareholder report for 14 of our variable insurance funds.

The Investment Adviser is a part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, a global, diversified financial services firm.

This report covers performance of the following Funds for the annual period ended December 31, 2012:

– Series A (Large Cap Core Series)

– Series B (Large Cap Value Series)

– Series C (Money Market Series)

– Series D (MSCI EAFE Equal Weight Series)

– Series E (U.S. Intermediate Bond Series)

– Series J (Mid Cap Growth Series)

– Series N (Managed Asset Allocation Series)

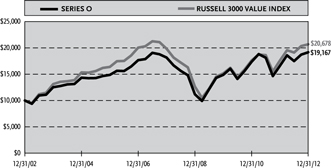

– Series O (All Cap Value Series)

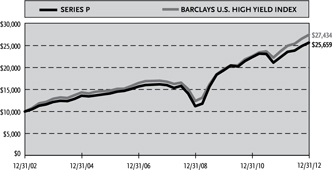

– Series P (High Yield Series)

– Series Q (Small Cap Value Series)

– Series V (Mid Cap Value Series)

– Series X (Small Cap Growth Series)

– Series Y (Large Cap Concentrated Growth Series)

– Series Z (Alpha Opportunity Series)

Guggenheim Distributors, LLC is the distributor of the Funds. Guggenheim Distributors, LLC is affiliated with Guggenheim Partners, LLC and Security Investors, LLC.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter, and then the Manager’s Commentary for each Fund.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

January 31, 2013

| 2 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

Read each fund’s prospectus and summary prospectus (if available) carefully before investing. It contains the fund’s investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

The Series Value and Growth Funds may not be suitable for all investors. • An investment in the Funds will fluctuate and is subject to investment risks, which means investors could lose money. • Value stocks are subject to the risk that the intrinsic value of the underlying stocks may never be realized by the market or that the stock’s price will decline in value. • Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing company. • Investments in small- and/or mid-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies.

The Series C (Money Market Series) may not be suitable for all investors. • An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. • It is possible to lose money by investing in the Fund. The principal risks of investing in the Fund are listed below. • The Fund could lose money if the issuer of a bond is unable to repay interest and principal on time or defaults. • The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility and liquidity of the bond. • Investments in fixed-income securities are subject to the possibility that interest rates could rise sharply, causing the value of the Fund’s securities and share price to decline. • Fixed income securities with longer durations are subject to more volatility than those with shorter durations. • Regulations of money market funds are evolving. • New regulations may affect negatively the Fund’s performance, yield and cost.

The Series D (MSCI EAFE Equal Weight Series) may not be suitable for all investors. • Investments in securities, in general, are subject to market risks that may cause their prices to fluctuate over time. An investment in the fund may lose money. • Unlike many investment companies, the Fund is not actively “managed.” This means that, based on market and economic conditions, the Fund’s performance could be lower than other types of mutual funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline. • Noncorrelation risk refers to the risk that the advisor may not be able to cause the Fund’s performance to match or correlate to that of the Fund’s underlying index, either on a daily or aggregate basis. Noncorrelation risk may cause the Fund’s performance to be less than you expect. • The Fund’s investment in foreign instruments may be volatile due to the impact of diplomatic, political or economic developments on the country in question. Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. dollar. • The Fund’s use of futures contracts may be more volatile than direct investments in underlying securities, involve additional expenses and may involve a small initial investment relative to the risk assumed. • The Fund’s underlying index may be composed primarily of, or have significant exposure to, securities in a particular capitalization range, e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the predominant capitalization range represented in the underlying index may underperform other segments of the equity market or the equity market as a whole. See the prospectus for more details.

The Series E (U.S. Intermediate Bond Series) may not be suitable for all investors. • The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • The Fund’s investments in restricted securities may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government.

The Series N (Managed Asset Allocation Series) may not be suitable for all investors. • The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The Fund could lose money if the issuer of a bond or a counterparty to a derivatives transaction or other transaction is unable to repay interest and principal on time or defaults. The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility and liquidity of the bond. Derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including the risk that the Fund will be unable to sell, unwind or value the derivative because of an illiquid market, the risk that the derivative is not well correlated with underlying investments or the Fund’s other portfolio holdings, and the risk that the counterparty is unwilling or unable to meet its obligation. The use of derivatives by the Fund to hedge risk may reduce the opportunity for gain by offsetting the positive effect of favorable price movements. Furthermore, if the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could result in a loss, which in some cases may be unlimited. Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs. The Investment Manager may not be able to cause certain of the underlying funds’ performance to match or correlate to that of the underlying funds’ respective underlying index or benchmark, either on a daily or aggregate basis. Factors such as underlying fund expenses, imperfect correlation between an underlying fund’s investments and those of its underlying index or underlying benchmark, rounding of share prices, changes to the composition of the underlying index or underlying benchmark, regulatory policies, high portfolio turnover rate, and the use of leverage all contribute to tracking error. Tracking error may cause an underlying fund’s and, thus the Fund’s, performance to be less than you expect.

The Series P (High Yield Series) may not be suitable for all investors. • The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. • The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund’s investments in restricted securities may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government.

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 3 |

| ECONOMIC AND MARKET OVERVIEW | December 31, 2012 |

The U.S. economy is reaching “escape velocity,” powered by the monetary rocket fuel from central banks around the world. Almost every domestic economic indicator is now positive and the economic backdrop is stronger than it has been in the last seven years.

Markets have now begun focusing on the U.S. debt ceiling debate, following Congress’ New Year’s reprieve on the Fiscal Cliff. Despite the uncertainty created by political partisanship in Washington, the strength of recent U.S. economic data demonstrates the resilience of the current U.S. economic expansion, including improvements in industrial production, initial jobless claims, third quarter GDP and continued recovery in the housing market. Investors can expect a continuation of the themes that have dominated the environment since the recovery began: tighter credit spreads, low interest rates, improving employment, modest inflation, and sustained economic growth.

Although Europe remains in a recession, more importantly, the political process towards fiscal unity appears to be underway with the initial steps taken towards the creation of a banking union. This has, for the time being, eliminated the worst-case scenario – an unwinding of the European Union. As the structural outlook in Europe improves, albeit at a glacial pace, tail risk, the possibility that an unlikely event will occur and cause a very large loss, is significantly mitigated. In China, along with the transition in political leadership, there are positive signs that the country may also have passed the bottom in the economic cycle, which could also be good news for emerging markets.

For the 12-month period ended December 31, 2012, the Standard & Poor’s 500 (“S&P 500”) Index*, which is generally regarded as an indicator of the broad U.S. stock market, returned 16.00%. Foreign markets were even stronger: the Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index*, which is composed of approximately 1,100 companies in 20 developed countries in Europe and the Pacific Basin, returned 17.32%. The return of the MSCI Emerging Markets Index*, which measures market performance in global emerging markets, was 21.93%.

In the bond market, higher quality issues underperformed lower-rated bonds, as investors embraced risk. The Barclays U.S. Aggregate Bond Index*, which is a proxy for the U.S. investment grade bond market, posted a 4.21% return for the period, while the Barclays U.S. High Yield Index* returned 15.81%. Reflecting the Fed’s continuing accommodative monetary policy, interest rates on short-term securities remained at their lowest levels in many years; the return of the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.11% for the 12-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| 4 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

| ECONOMIC AND MARKET OVERVIEW (concluded) | December 31, 2012 |

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

Barclays U.S. High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Barclays U.S. Intermediate Government/Credit Bond® Index measures the performance of U.S. Dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI EAFE Equal Weighted Index equally weights the issuers in the MSCI EAFE Index, which is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Equal Weighted Index is rebalanced quarterly so that each issuer has the same weight on each rebalancing date. The MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market.

Russell 2500® Value Index measures the performance of the small- to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth value.

Russell 1000® Value Index: A measure of the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 5 |

| ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) |

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning June 30, 2012 and ending December 31, 2012.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| 6 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

| ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded) |

| | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1,4 | | | Return | | | June 30, 2012 | | | December 31, 2012 | | | Period2 | |

| Table 1. Based on actual Fund return3 | | | | | | | | | | | | | | | | | | | | |

| Series A (Large Cap Core Series) | | | 0.96 | % | | | 4.91 | % | | | $1,000.00 | | | | $1,049.10 | | | | $4.94 | |

| Series B (Large Cap Value Series) | | | 0.84 | % | | | 9.01 | % | | | 1,000.00 | | | | 1,090.10 | | | | 4.41 | |

| Series C (Money Market Series) | | | 0.73 | % | | | (0.22 | %) | | | 1,000.00 | | | | 997.80 | | | | 3.67 | |

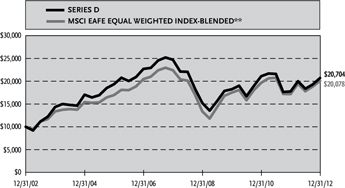

| Series D (MSCI EAFE Equal Weight Series) | | | 1.18 | % | | | 12.78 | % | | | 1,000.00 | | | | 1,127.80 | | | | 6.31 | |

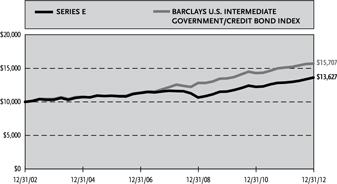

| Series E (U.S. Intermediate Bond Series) | | | 0.81 | % | | | 3.73 | % | | | 1,000.00 | | | | 1,037.30 | | | | 4.15 | |

| Series J (Mid Cap Growth Series) | | | 0.95 | % | | | 5.78 | % | | | 1,000.00 | | | | 1,057.80 | | | | 4.91 | |

| Series N (Managed Asset Allocation Series) | | | 1.22 | % | | | 5.59 | % | | | 1,000.00 | | | | 1,055.90 | | | | 6.30 | |

| Series O (All Cap Value Series) | | | 0.91 | % | | | 9.60 | % | | | 1,000.00 | | | | 1,096.00 | | | | 4.79 | |

| Series P (High Yield Series) | | | 0.98 | % | | | 7.56 | % | | | 1,000.00 | | | | 1,075.60 | | | | 5.11 | |

| Series Q (Small Cap Value Series) | | | 1.16 | % | | | 10.74 | % | | | 1,000.00 | | | | 1,107.40 | | | | 6.14 | |

| Series V (Mid Cap Value Series) | | | 0.93 | % | | | 10.99 | % | | | 1,000.00 | | | | 1,109.90 | | | | 4.93 | |

| Series X (Small Cap Growth Series) | | | 1.16 | % | | | 4.82 | % | | | 1,000.00 | | | | 1,048.20 | | | | 5.97 | |

| Series Y (Large Cap Concentrated Growth Series) | | | 1.04 | % | | | 1.44 | % | | | 1,000.00 | | | | 1,014.40 | | | | 5.27 | |

| Series Z (Alpha Opportunity Series) | | | 2.23 | % | | | 6.48 | % | | | 1,000.00 | | | | 1,064.80 | | | | 11.57 | |

| | | | | | | | | | | | | | | | | | | | | |

| Table 2. Based on hypothetical 5% return (before expenses) |

| Series A (Large Cap Core Series) | | | 0.96 | % | | | 5.00 | % | | | $1,000.00 | | | | $1,020.31 | | | | $4.88 | |

| Series B (Large Cap Value Series) | | | 0.84 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.91 | | | | 4.27 | |

| Series C (Money Market Series) | | | 0.73 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,021.47 | | | | 3.71 | |

| Series D (MSCI EAFE Equal Weight Series) | | | 1.18 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.20 | | | | 5.99 | |

| Series E (U.S. Intermediate Bond Series) | | | 0.81 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,021.06 | | | | 4.12 | |

| Series J (Mid Cap Growth Series) | | | 0.95 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.36 | | | | 4.82 | |

| Series N (Managed Asset Allocation Series) | | | 1.22 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.00 | | | | 6.19 | |

| Series O (All Cap Value Series) | | | 0.91 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.56 | | | | 4.62 | |

| Series P (High Yield Series) | | | 0.98 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.21 | | | | 4.98 | |

| Series Q (Small Cap Value Series) | | | 1.16 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.30 | | | | 5.89 | |

| Series V (Mid Cap Value Series) | | | 0.93 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.46 | | | | 4.72 | |

| Series X (Small Cap Growth Series) | | | 1.16 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.30 | | | | 5.89 | |

| Series Y (Large Cap Concentrated Growth Series) | | | 1.04 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.91 | | | | 5.28 | |

| Series Z (Alpha Opportunity Series) | | | 2.23 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,013.93 | | | | 11.29 | |

| 1 | Annualized and excludes expenses of the underlying funds in which the Funds invest. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses shown do not include fees charged by insurance companies. |

| 3 | Actual cumulative return at net asset value for the period June 30, 2012 to December 31, 2012. |

| 4 | This ratio represents annualized net expenses which includes dividends on short sales and prime broker interest expense. Excluding these expenses, the operating expense ratio would be 0.03% lower in Series Z (Alpha Opportunity Series). |

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 7 |

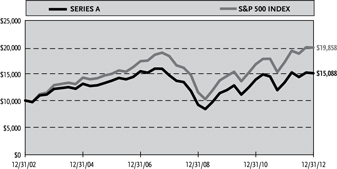

| MANAGERS’ COMMENTARY (Unaudited) | December 31, 2012 |

To Our Shareholders

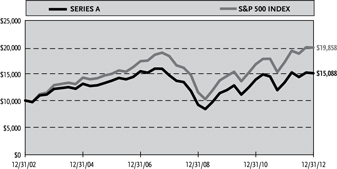

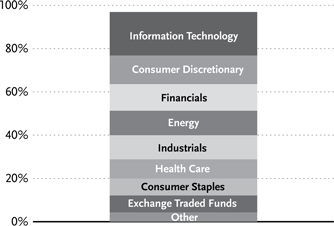

For the fiscal year ended December 31, 2012, the Series A (Large Cap Core Series) returned 13.04%, while the benchmark, the S&P 500® Index, gained 16.00%. The Fund pursues its objective by investing 50% of its total assets according to a large cap growth strategy and approximately 50% to a large cap value strategy. The managers rebalance if either strategy equals or exceeds 60% of total assets. The managers use a blended approach, investing in growth stocks and value stocks, and may invest in a limited number of industries and sectors.

The large cap growth manager chooses growth-oriented companies through a combination of a qualitative top-down approach in reviewing growth trends that are based on several fixed-income factors, along with a quantitative fundamental bottom-up approach. The large cap value manager chooses securities of companies that appear to be undervalued relative to assets, growth potential and cash flow. The managers sell a security when the reasons for buying it no longer apply or when the company begins to show deteriorating fundamentals or poor performance.

Poor stock selection, particularly in the Financials and Health Care sectors, was the main reason for the underperformance relative to the benchmark. These effects were partially offset by good stock selection in the Consumer Discretionary sector and by both stock selection and an underweight in the Utilities sector.

The holdings contributing most to return were Apple, Inc. and Wells Fargo & Co. Leading detractors from performance were Caterpillar, Inc. and Hewlett-Packard Co.

From the growth perspective, our fixed income indicators, including the slope of the yield curve and corporate bond spreads, continue to point to a modest economic environment but a decent risk environment. Strong corporate debt issuance, coupled with historically tight bond spreads, confirms a healthy risk appetite with fixed-income markets, which we believe is a leading indicator of the risk environment for equities. We will focus our attention on secular growth names in the year to come, with an eye towards more cyclical names if the global economy can find firmer footing.

In the value side of the portfolio, we remain focused on searching for companies we think have good long-term fundamental prospects and attractive valuations that are likely to generate strong performance relative to the broader market, regardless of macroeconomic events.

We appreciate your business and the trust you place in us.

Sincerely,

Mark Bronzo, CFA, Portfolio Manager

Mark A. Mitchell, CFA, Portfolio Manager

Performance displayed represents past performance, which is no guarantee of future results.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| 8 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

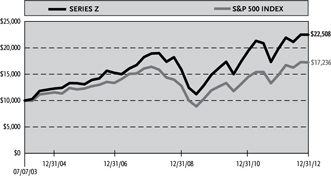

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | December 31, 2012 |

SERIES A (LARGE CAP CORE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

Cumulative Fund Performance*

Average Annual Returns*

Periods Ended 12/31/121

| | | 1 Year | | | 5 Year | | | 10 Year | |

| Series A (Large Cap Core Series) | | | 13.04 | % | | | 0.52 | % | | | 4.20 | % |

| S&P 500 Index | | | 16.00 | % | | | 1.66 | % | | | 7.10 | % |

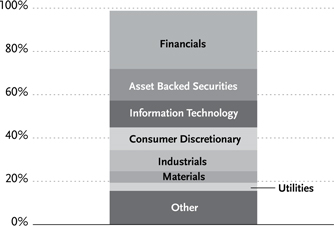

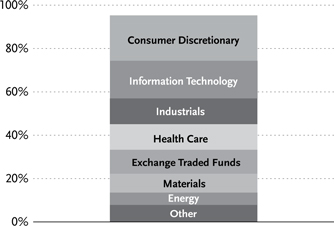

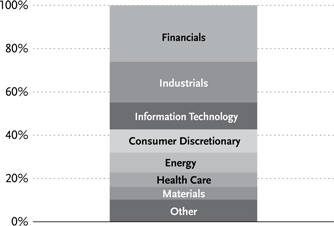

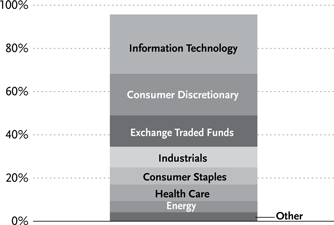

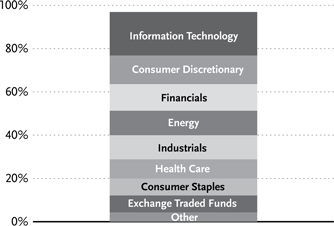

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Inception Date: May 1, 1979 | | | |

| | | | |

| Ten Largest Holdings (% of Total Net Assets) |

| Apple, Inc. | | | 4.1 | % |

| Financial Select Sector SPDR Fund | | | 2.3 | % |

| JPMorgan Chase & Co. | | | 2.3 | % |

| Mondelez International, Inc. — Class A | | | 2.2 | % |

| Health Care Select Sector SPDR Fund | | | 2.1 | % |

| Covidien plc | | | 2.1 | % |

| Wells Fargo & Co. | | | 1.9 | % |

| Aetna, Inc. | | | 1.9 | % |

| Google, Inc. — Class A | | | 1.9 | % |

| Chevron Corp. | | | 1.8 | % |

| Top Ten Total | | | 22.6 | % |

“Ten Largest Holdings” exclude any temporary cash or derivative investments.

| * | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

| 1 | Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products. |

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 9 |

| SCHEDULE OF INVESTMENTS | December 31, 2012 |

| SERIES A (LARGE CAP CORE SERIES) | |

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS† - 89.1% | | | | | | | | |

| | | | | | | | | |

| Information Technology - 20.1% | | | | | | | | |

| Apple, Inc. | | | 15,295 | | | $ | 8,152,693 | |

| Google, Inc. — Class A* | | | 5,235 | | | | 3,713,552 | |

| International Business Machines Corp. | | | 17,250 | | | | 3,304,238 | |

| Microsoft Corp. | | | 121,530 | | | | 3,248,497 | |

| eBay, Inc.* | | | 63,650 | | | | 3,247,423 | |

| Computer Sciences Corp. | | | 75,010 | | | | 3,004,151 | |

| Oracle Corp. | | | 89,550 | | | | 2,983,806 | |

| TE Connectivity Ltd. | | | 77,700 | | | | 2,884,224 | |

| EMC Corp.* | | | 107,650 | | | | 2,723,545 | |

| Broadcom Corp. — Class A | | | 63,080 | | | | 2,094,887 | |

| Cisco Systems, Inc. | | | 102,700 | | | | 2,018,055 | |

| Hewlett-Packard Co. | | | 74,214 | | | | 1,057,549 | |

| NetApp, Inc.* | | | 22,270 | | | | 747,159 | |

| Euronet Worldwide, Inc.* | | | 20,642 | | | | 487,151 | |

| Mercury Systems, Inc.* | | | 23,080 | | | | 212,336 | |

| Total Information Technology | | | | | | | 39,879,266 | |

| Consumer Discretionary - 13.2% | | | | | | | | |

| Time Warner, Inc. | | | 69,400 | | | | 3,319,401 | |

| Starbucks Corp. | | | 60,450 | | | | 3,241,329 | |

| TJX Companies, Inc. | | | 75,650 | | | | 3,211,343 | |

| Comcast Corp. — Class A | | | 84,800 | | | | 3,169,824 | |

| Home Depot, Inc. | | | 50,800 | | | | 3,141,980 | |

| Walt Disney Co. | | | 61,842 | | | | 3,079,113 | |

| BorgWarner, Inc.* | | | 33,350 | | | | 2,388,527 | |

| Wynn Resorts Ltd. | | | 19,750 | | | | 2,221,678 | |

| Lowe’s Companies, Inc. | | | 50,390 | | | | 1,789,853 | |

| DeVry, Inc. | | | 27,900 | | | | 662,067 | |

| Total Consumer Discretionary | | | | | | | 26,225,115 | |

| Financials - 12.3% | | | | | | | | |

| JPMorgan Chase & Co. | | | 101,836 | | | | 4,477,729 | |

| Wells Fargo & Co. | | | 109,404 | | | | 3,739,428 | |

| Aon plc | | | 51,190 | | | | 2,846,164 | |

| Berkshire Hathaway, Inc. — Class A* | | | 19 | | | | 2,547,140 | |

| American International Group, Inc.* | | | 67,730 | | | | 2,390,869 | |

| Allstate Corp. | | | 48,400 | | | | 1,944,228 | |

| State Street Corp. | | | 40,100 | | | | 1,885,101 | |

| U.S. Bancorp | | | 55,658 | | | | 1,777,717 | |

| BB&T Corp. | | | 49,017 | | | | 1,426,885 | |

| Reinsurance Group of America, Inc. — | | | | | | | | |

| Class A | | | 17,460 | | | | 934,459 | |

| Citigroup, Inc. | | | 12,280 | | | | 485,797 | |

| Total Financials | | | | | | | 24,455,517 | |

| Energy - 11.3% | | | | | | | | |

| Chevron Corp. | | | 33,800 | | | | 3,655,132 | |

| Ensco plc — Class A | | | 47,450 | | | | 2,812,836 | |

| Schlumberger Ltd. | | | 38,500 | | | | 2,667,665 | |

| Williams Companies, Inc. | | | 78,900 | | | | 2,583,186 | |

| McDermott International, Inc.* | | | 214,160 | | | | 2,360,043 | |

| Apache Corp. | | | 22,405 | | | | 1,758,792 | |

| Halliburton Co. | | | 46,300 | | | | 1,606,147 | |

| Exxon Mobil Corp. | | | 16,530 | | | | 1,430,672 | |

| ConocoPhillips | | | 19,000 | | | | 1,101,810 | |

| Whiting Petroleum Corp.* | | | 20,310 | | | | 880,845 | |

| Chesapeake Energy Corp. | | | 42,300 | | | | 703,026 | |

| Phillips 66 | | | 9,500 | | | | 504,450 | |

| WPX Energy, Inc.* | | | 29,566 | | | | 439,942 | |

| Total Energy | | | | | | | 22,504,546 | |

| Industrials - 11.2% | | | | | | | | |

| Honeywell International, Inc. | | | 44,000 | | | | 2,792,679 | |

| Deere & Co. | | | 31,450 | | | | 2,717,909 | |

| AMETEK, Inc. | | | 65,675 | | | | 2,467,410 | |

| URS Corp. | | | 62,160 | | | | 2,440,402 | |

| Boeing Co. | | | 29,780 | | | | 2,244,221 | |

| Republic Services, Inc. — Class A | | | 73,900 | | | | 2,167,487 | |

| United Technologies Corp. | | | 24,700 | | | | 2,025,647 | |

| Quanta Services, Inc.* | | | 67,890 | | | | 1,852,718 | |

| Equifax, Inc. | | | 34,180 | | | | 1,849,822 | |

| Parker Hannifin Corp. | | | 19,050 | | | | 1,620,393 | |

| Total Industrials | | | | | | | 22,178,688 | |

| Health Care - 8.9% | | | | | | | | |

| Covidien plc | | | 73,020 | | | | 4,216,174 | |

| Aetna, Inc. | | | 80,400 | | | | 3,722,520 | |

| Abbott Laboratories | | | 32,600 | | | | 2,135,300 | |

| Gilead Sciences, Inc.* | | | 29,038 | | | | 2,132,841 | |

| Biogen Idec, Inc.* | | | 11,550 | | | | 1,694,039 | |

| Forest Laboratories, Inc.* | | | 41,400 | | | | 1,462,248 | |

| UnitedHealth Group, Inc. | | | 24,200 | | | | 1,312,608 | |

| Teva Pharmaceutical Industries Ltd. ADR | | | 24,850 | | | | 927,899 | |

| Total Health Care | | | | | | | 17,603,629 | |

| Consumer Staples - 7.8% | | | | | | | | |

| Mondelez International, Inc. — Class A | | | 173,700 | | | | 4,424,139 | |

| Coca-Cola Co. | | | 87,700 | | | | 3,179,125 | |

| CVS Caremark Corp. | | | 53,050 | | | | 2,564,968 | |

| JM Smucker Co. | | | 24,300 | | | | 2,095,632 | |

| Wal-Mart Stores, Inc. | | | 29,780 | | | | 2,031,889 | |

| Kraft Foods Group, Inc. | | | 17,066 | | | | 775,991 | |

| Costco Wholesale Corp. | | | 4,770 | | | | 471,133 | |

| Total Consumer Staples | | | | | | | 15,542,877 | |

| 10 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (concluded) | December 31, 2012 |

| SERIES A (LARGE CAP CORE SERIES) | |

| | | Shares | | | Value | |

| | | | | | | |

| Materials - 2.3% | | | | | | | | |

| Dow Chemical Co. | | | 76,950 | | | $ | 2,487,024 | |

| CF Industries Holdings, Inc. | | | 10,350 | | | | 2,102,706 | |

| Total Materials | | | | | | | 4,589,730 | |

| Utilities - 1.6% | | | | | | | | |

| Edison International | | | 72,000 | | | | 3,253,680 | |

| Telecommunication Services - 0.4% | | | | | | | | |

| Windstream Corp. | | | 89,400 | | | | 740,232 | |

| Total Common Stocks | | | | | | | | |

| (Cost $156,659,980) | | | | | | | 176,973,280 | |

| EXCHANGE TRADED FUNDS† - 7.8% | | | | | | | | |

| Financial Select Sector SPDR Fund | | | 279,300 | | | | 4,580,520 | |

| Health Care Select Sector SPDR Fund | | | 106,600 | | | | 4,258,670 | |

| Materials Select Sector SPDR Fund | | | 62,050 | | | | 2,329,357 | |

| Industrial Select Sector SPDR Fund | | | 59,450 | | | | 2,253,155 | |

| Consumer Staples Select Sector | | | | | | | | |

| SPDR Fund | | | 59,400 | | | | 2,068,902 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $15,271,509) | | | | | | | 15,490,604 | |

| | | Face | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| REPURCHASE AGREEMENT††,1 - 2.1% | | | | | | | | |

| UMB Financial Corp. | | | | | | | | |

| issued 12/31/12 at 0.07% | | | | | | | | |

| due 01/02/13 | | $ | 4,142,000 | | | $ | 4,142,000 | |

| Total Repurchase Agreement | | | | | | | | |

| (Cost $4,142,000) | | | | | | | 4,142,000 | |

| Total Investments - 99.0% | | | | | | | | |

| (Cost $176,073,489) | | | | | | $ | 196,605,884 | |

| Other Assets & Liabilities, net - 1.0% | | | | | | | 2,009,223 | |

| Total Net Assets - 100.0% | | | | | | $ | 198,615,107 | |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | Repurchase Agreement — See Note 5. |

ADR — American Depositary Receipt

plc — Public Limited Company

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 11 |

| SERIES A (LARGE CAP CORE SERIES) |

| STATEMENT OF ASSETS |

| AND LIABILITIES |

| December 31, 2012 |

| Assets: | | | | |

| Investments, at value | | | | |

| (cost $171,931,489) | | $ | 192,463,884 | |

| Repurchase agreements, at value | | | | |

| (cost $4,142,000) | | | 4,142,000 | |

| Total investments | | | | |

| (cost $176,073,489) | | | 196,605,884 | |

| Cash | | | 1,603,724 | |

| Prepaid expenses | | | 4,756 | |

| Receivables: | | | | |

| Securities sold | | | 372,619 | |

| Dividends | | | 304,815 | |

| Fund shares sold | | | 4,585 | |

| Interest | | | 8 | |

| Total assets | | | 198,896,391 | |

| Liabilities: | | | | |

| Payable for: | | | | |

| Management fees | | | 126,300 | |

| Fund shares redeemed | | | 73,685 | |

| Fund accounting/administration fees | | | 15,998 | |

| Transfer agent/maintenance fees | | | 5,592 | |

| Directors’ fees* | | | 535 | |

| Miscellaneous | | | 59,174 | |

| Total liabilities | | | 281,284 | |

| Net assets | | $ | 198,615,107 | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 218,405,358 | |

| Undistributed net investment income | | | 1,952,226 | |

| Accumulated net realized loss on investments | | | (42,274,872 | ) |

| Net unrealized appreciation on investments | | | 20,532,395 | |

| Net assets | | $ | 198,615,107 | |

| Capital shares outstanding | | | 7,873,905 | |

| Net asset value per share | | $ | 25.22 | |

| STATEMENT OF |

| OPERATIONS |

| Year Ended December 31, 2012 |

| Investment Income: | | | | |

| Dividends | | $ | 3,933,710 | |

| Interest | | | 1,519 | |

| Total investment income | | | 3,935,229 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 1,583,420 | |

| Transfer agent/maintenance fees | | | 26,593 | |

| Fund accounting/administration fees | | | 200,564 | |

| Directors’ fees* | | | 23,885 | |

| Custodian fees | | | 11,060 | |

| Miscellaneous | | | 137,481 | |

| Total expenses | | | 1,983,003 | |

| Net investment income | | | 1,952,226 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 13,722,503 | |

| Net realized gain | | | 13,722,503 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 10,476,312 | |

| Net change in unrealized appreciation (depreciation) | | | 10,476,312 | |

| Net realized and unrealized gain | | | 24,198,815 | |

| Net increase in net assets resulting from operations | | $ | 26,151,041 | |

* Relates to Directors not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

| 12 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| SERIES A (LARGE CAP CORE SERIES) |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2012 | | | 2011 | |

| | | | | | | |

| Increase (Decrease) In Net Assets From Operations: | | | | | | | | |

| Net investment income | | $ | 1,952,226 | | | $ | 1,309,773 | |

| Net realized gain on investments | | | 13,722,503 | | | | 6,657,049 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 10,476,312 | | | | (16,841,599 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 26,151,041 | | | | (8,874,777 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 8,284,929 | | | | 13,965,682 | |

| Cost of shares redeemed | | | (42,815,935 | ) | | | (41,915,795 | ) |

| Net decrease from capital share transactions | | | (34,531,006 | ) | | | (27,950,113 | ) |

| Net decrease in net assets | | | (8,379,965 | ) | | | (36,824,890 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 206,995,072 | | | | 243,819,962 | |

| End of year | | $ | 198,615,107 | | | $ | 206,995,072 | |

| Undistributed net investment income at end of year | | $ | 1,952,226 | | | $ | 1,309,773 | |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Shares sold | | | 335,217 | | | | 602,805 | |

| Shares redeemed | | | (1,738,927 | ) | | | (1,815,320 | ) |

| Net decrease in shares | | | (1,403,710 | ) | | | (1,212,515 | ) |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 13 |

| SERIES A (LARGE CAP CORE SERIES) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 22.31 | | | $ | 23.24 | | | $ | 19.97 | | | $ | 15.38 | | | $ | 24.57 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment incomea | | | .23 | | | | .13 | | | | .18 | | | | .11 | | | | .14 | |

| Net gain (loss) on investments (realized and unrealized) | | | 2.68 | | | | (1.06 | ) | | | 3.09 | | | | 4.48 | | | | (9.33 | ) |

| Total from investment operations | | | 2.91 | | | | (.93 | ) | | | 3.27 | | | | 4.59 | | | | (9.19 | ) |

| Net asset value, end of period | | $ | 25.22 | | | $ | 22.31 | | | $ | 23.24 | | | $ | 19.97 | | | $ | 15.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Returnb | | | 13.04 | % | | | (4.00 | %) | | | 16.37 | % | | | 29.84 | % | | | (37.40 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 198,615 | | | $ | 206,995 | | | $ | 243,820 | | | $ | 186,007 | | | $ | 165,109 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.92 | % | | | 0.57 | % | | | 0.89 | % | | | 0.68 | % | | | 0.66 | % |

| Total expensesc | | | 0.94 | % | | | 0.90 | % | | | 0.92 | % | | | 0.92 | % | | | 0.90 | % |

| Portfolio turnover rate | | | 103 | % | | | 87 | % | | | 111 | % | | | 78 | % | | | 142 | % |

| a | Net investment income per share was computed using average shares outstanding throughout the period. |

| b | Total return does not take into account any of the expenses associated with an investment in variable insurance products. If total return had taken into account these expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products. |

| c | Does not include expenses of the underlying funds in which the Fund invests. |

| 14 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| MANAGER’S COMMENTARY (Unaudited) | December 31, 2012 |

To Our Shareholders:

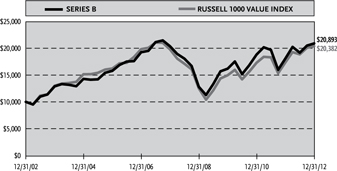

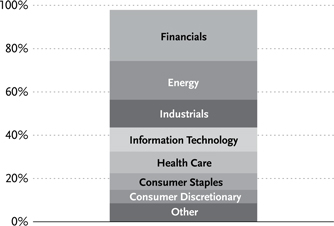

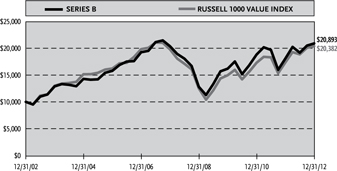

For the fiscal year ended December 31, 2012, the Series B (Large Cap Value Series) returned 15.61%, compared with the Russell 1000® Value Index, which returned 17.51%.

Our strategy is to select securities of companies that appear undervalued by the overall market relative to assets, earnings, growth potential or cash flows. Our investment approach is a defined and disciplined process with three key philosophical tenets that drive our investment decisions: a valuation focus, a long-term investment horizon and an opportunistic approach.

Our investment process is fundamentally driven and quantitatively aided. We use proprietary screens to identify potential companies for investment and then perform rigorous fundamental analysis to identify the best ideas. Through this fundamental research, we determine an estimate of intrinsic value and a corresponding valuation target for each company. We construct the portfolio based on the level of conviction generated by the bottom-up analysis and the upside/downside profile associated with each company.

The portfolio’s performance was helped by good stock selection and an underweight in the Utilities sector, as well as good stock selection in the Information Technology sector. However, these benefits were not enough to offset poor stock selection in the Financials sectors, and an underweight and poor stock selection in the Telecommunication Services sector.

The holdings contributing most to portfolio performance over the period were Computer Sciences Corp. and Equifax, Inc. The main detractors were Hewlett-Packard Co. and Western Union Co.

We remain focused on searching for companies we think have good long-term fundamental prospects and attractive valuations that are likely to generate strong performance relative to the broader market, regardless of macroeconomic events.

We appreciate your business and the trust you place in us.

Sincerely,

Mark A. Mitchell, CFA, Portfolio Manager

Performance displayed represents past performance, which is no guarantee of future results.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 15 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | December 31, 2012 |

SERIES B (LARGE CAP VALUE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

Cumulative Fund Performance*

| Average Annual Returns* |

| Periods Ended 12/31/121 |

| | | 1 Year | | | 5 Year | | | 10 Year | |

| Series B (Large Cap Value Series) | | | 15.61 | % | | | 0.51 | % | | | 7.65 | % |

| Russell 1000 Value Index | | | 17.51 | % | | | 0.59 | % | | | 7.38 | % |

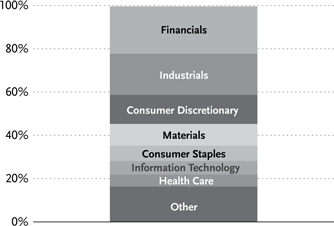

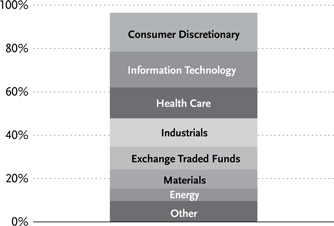

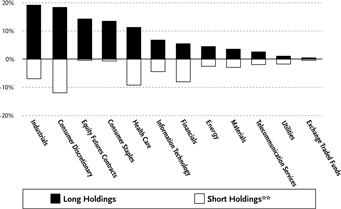

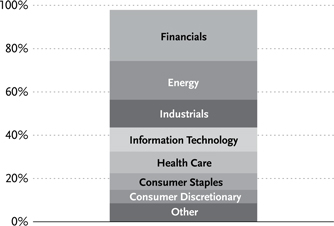

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Date: May 1, 1979

Ten Largest Holdings (% of Total Net Assets) | | | | |

| Aetna, Inc. | | | 4.0 | % |

| Chevron Corp. | | | 3.9 | % |

| Wells Fargo & Co. | | | 3.8 | % |

| Time Warner, Inc. | | | 3.5 | % |

| Edison International | | | 3.5 | % |

| Computer Sciences Corp. | | | 3.2 | % |

| TE Connectivity Ltd. | | | 3.1 | % |

| Aon plc | | | 3.1 | % |

| Williams Companies, Inc. | | | 2.8 | % |

| CVS Caremark Corp. | | | 2.7 | % |

| Top Ten Total | | | 33.6 | % |

“Ten Largest Holdings” exclude any temporary cash or derivative investments.

| * | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The Russell 1000 Value Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

| 1 | Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products. |

| 16 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

| SCHEDULE OF INVESTMENTS | December 31, 2012 |

| SERIES B (LARGE CAP VALUE SERIES) | |

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS† - 96.4% | | | | | | | | |

| | | | | | | | | |

| Financials - 23.6% | | | | | | | | |

| Wells Fargo & Co. | | | 272,825 | | | $ | 9,325,158 | |

| Aon plc | | | 136,310 | | | | 7,578,836 | |

| Berkshire Hathaway, Inc. — Class A* | | | 50 | | | | 6,702,999 | |

| American International Group, Inc.* | | | 179,839 | | | | 6,348,317 | |

| JPMorgan Chase & Co. | | | 135,369 | | | | 5,952,175 | |

| Allstate Corp. | | | 127,050 | | | | 5,103,599 | |

| State Street Corp. | | | 104,500 | | | | 4,912,545 | |

| U.S. Bancorp | | | 148,526 | | | | 4,743,920 | |

| BB&T Corp. | | | 128,263 | | | | 3,733,736 | |

| Reinsurance Group of America, Inc. — | | | | | | | | |

| Class A | | | 46,530 | | | | 2,490,286 | |

| Citigroup, Inc. | | | 32,730 | | | | 1,294,799 | |

| Total Financials | | | | | | | 58,186,370 | |

| Energy - 17.9% | | | | | | | | |

| Chevron Corp. | | | 88,400 | | | | 9,559,577 | |

| Williams Companies, Inc. | | | 208,910 | | | | 6,839,713 | |

| McDermott International, Inc.* | | | 570,019 | | | | 6,281,609 | |

| Apache Corp. | | | 58,612 | | | | 4,601,042 | |

| Halliburton Co. | | | 120,900 | | | | 4,194,021 | |

| Exxon Mobil Corp. | | | 43,470 | | | | 3,762,329 | |

| ConocoPhillips | | | 41,200 | | | | 2,389,188 | |

| Whiting Petroleum Corp.* | | | 54,090 | | | | 2,345,883 | |

| Chesapeake Energy Corp. | | | 111,800 | | | | 1,858,116 | |

| WPX Energy, Inc.* | | | 77,433 | | | | 1,152,203 | |

| Phillips 66 | | | 20,600 | | | | 1,093,860 | |

| Total Energy | | | | | | | 44,077,541 | |

| Industrials - 12.8% | | | | | | | | |

| URS Corp. | | | 163,270 | | | | 6,409,980 | |

| Republic Services, Inc. — Class A | | | 191,700 | | | | 5,622,561 | |

| United Technologies Corp. | | | 63,900 | | | | 5,240,439 | |

| Quanta Services, Inc.* | | | 180,890 | | | | 4,936,488 | |

| Equifax, Inc. | | | 91,020 | | | | 4,926,002 | |

| Parker Hannifin Corp. | | | 50,760 | | | | 4,317,646 | |

| Total Industrials | | | | | | | 31,453,116 | |

| Information Technology - 11.2% | | | | | | | | |

| Computer Sciences Corp. | | | 199,580 | | | | 7,993,178 | |

| TE Connectivity Ltd. | | | 204,550 | | | | 7,592,896 | |

| Cisco Systems, Inc. | | | 267,800 | | | | 5,262,270 | |

| Hewlett-Packard Co. | | | 196,051 | | | | 2,793,727 | |

| NetApp, Inc.* | | | 58,490 | | | | 1,962,340 | |

| Euronet Worldwide, Inc.* | | | 54,865 | | | | 1,294,814 | |

| Mercury Systems, Inc.* | | | 60,620 | | | | 557,704 | |

| Total Information Technology | | | | | | | 27,456,929 | |

| Health Care - 10.0% | | | | | | | | |

| Aetna, Inc. | | | 211,000 | | | | 9,769,300 | |

| Covidien plc | | | 89,100 | | | | 5,144,634 | |

| Forest Laboratories, Inc.* | | | 107,800 | | | | 3,807,496 | |

| UnitedHealth Group, Inc. | | | 63,300 | | | | 3,433,392 | |

| Teva Pharmaceutical Industries Ltd. ADR | | | 65,320 | | | | 2,439,049 | |

| Total Health Care | | | | | | | 24,593,871 | |

| Consumer Staples - 7.7% | | | | | | | | |

| CVS Caremark Corp. | | | 139,120 | | | | 6,726,452 | |

| Wal-Mart Stores, Inc. | | | 79,090 | | | | 5,396,310 | |

| Mondelez International, Inc. — Class A | | | 136,300 | | | | 3,471,561 | |

| Kraft Foods Group, Inc. | | | 45,433 | | | | 2,065,839 | |

| Costco Wholesale Corp. | | | 12,680 | | | | 1,252,404 | |

| Total Consumer Staples | | | | | | | 18,912,566 | |

| Consumer Discretionary - 6.2% | | | | | | | | |

| Time Warner, Inc. | | | 181,933 | | | | 8,701,855 | |

| Lowe’s Companies, Inc. | | | 134,480 | | | | 4,776,730 | |

| DeVry, Inc. | | | 73,500 | | | | 1,744,155 | |

| Total Consumer Discretionary | | | | | | | 15,222,740 | |

| Utilities - 3.5% | | | | | | | | |

| Edison International | | | 189,700 | | | | 8,572,543 | |

| Materials - 2.7% | | | | | | | | |

| Dow Chemical Co. | | | 205,350 | | | | 6,636,912 | |

| Telecommunication Services - 0.8% | | | | | | | | |

| Windstream Corp. | | | 232,532 | | | | 1,925,365 | |

| Total Common Stocks | | | | | | | | |

| (Cost $194,130,430) | | | | | | | 237,037,953 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS† - 1.5% | | | | | | | | |

| iShares Russell 1000 Value Index Fund | | | 51,780 | | | | 3,770,620 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $3,547,806) | | | | | | | 3,770,620 | |

| | | | Face | | | | | |

| | | | Amount | | | | | |

| REPURCHASE AGREEMENT††,1 - 2.1% | | | | | | | | |

| UMB Financial Corp. | | | | | | | | |

| issued 12/31/12 at 0.07% | | | | | | | | |

| due 01/02/13 | | $ | 5,245,000 | | | | 5,245,000 | |

| Total Repurchase Agreement | | | | | | | | |

| (Cost $5,245,000) | | | | | | | 5,245,000 | |

| Total Investments - 100.0% | | | | | | | | |

| (Cost $202,923,236) | | | | | | $ | 246,053,573 | |

| Other Assets & Liabilities, net - 0.0% | | | | | | | 53,122 | |

| Total Net Assets - 100.0% | | | | | | $ | 246,106,695 | |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | Repurchase Agreement — See Note 5. |

ADR — American Depositary Receipt

plc — Public Limited Company

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 17 |

| SERIES B (LARGE CAP VALUE SERIES) |

| STATEMENT OF ASSETS |

| AND LIABILITIES |

| December 31, 2012 |

| Assets: | | | | |

| Investments, at value | | | | |

| (cost $197,678,236) | | $ | 240,808,573 | |

| Repurchase agreements, at value | | | | |

| (cost $5,245,000) | | | 5,245,000 | |

| Total investments | | | | |

| (cost $202,923,236) | | | 246,053,573 | |

| Prepaid expenses | | | 5,644 | |

| Cash | | | 1,319 | |

| Receivables: | | | | |

| Dividends | | | 360,133 | |

| Fund shares sold | | | 23,414 | |

| Interest | | | 10 | |

| Total assets | | | 246,444,093 | |

| Liabilities: | | | | |

| Payable for: | | | | |

| Fund shares redeemed | | | 143,509 | |

| Management fees | | | 134,955 | |

| Fund accounting/administration fees | | | 19,724 | |

| Transfer agent/maintenance fees | | | 6,020 | |

| Directors’ fees* | | | 393 | |

| Miscellaneous | | | 32,797 | |

| Total liabilities | | | 337,398 | |

| Net assets | | $ | 246,106,695 | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 249,494,013 | |

| Undistributed net investment income | | | 3,229,551 | |

| Accumulated net realized loss on investments | | | (49,747,206 | ) |

| Net unrealized appreciation on investments | | | 43,130,337 | |

| Net assets | | $ | 246,106,695 | |

| Capital shares outstanding | | | 8,586,755 | |

| Net asset value per share | | $ | 28.66 | |

| STATEMENT OF |

| OPERATIONS |

| Year Ended December 31, 2012 |

| Investment Income: | | | | |

| Dividends | | $ | 5,312,153 | |

| Interest | | | 2,413 | |

| Total investment income | | | 5,314,566 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 1,639,125 | |

| Transfer agent/maintenance fees | | | 27,124 | |

| Fund accounting/administration fees | | | 239,561 | |

| Directors’ fees* | | | 28,311 | |

| Custodian fees | | | 8,163 | |

| Miscellaneous | | | 142,731 | |

| Total expenses | | | 2,085,015 | |

| Net investment income | | | 3,229,551 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 10,161,128 | |

| Net realized gain | | | 10,161,128 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 23,246,913 | |

| Net change in unrealized appreciation (depreciation) | | | 23,246,913 | |

| Net realized and unrealized gain | | | 33,408,041 | |

| Net increase in net assets resulting from operations | | $ | 36,637,592 | |

* Relates to Directors not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

| 18 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| SERIES B (LARGE CAP VALUE SERIES) |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2012 | | | 2011 | |

| | | | | | | |

| Increase (Decrease) In Net Assets From Operations: | | | | | | | | |

| Net investment income | | $ | 3,229,551 | | | $ | 2,783,403 | |

| Net realized gain on investments | | | 10,161,128 | | | | 8,846,208 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 23,246,913 | | | | (21,354,454 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 36,637,592 | | | | (9,724,843 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 14,915,262 | | | | 17,773,916 | |

| Cost of shares redeemed | | | (54,897,141 | ) | | | (56,778,889 | ) |

| Net decrease from capital share transactions | | | (39,981,879 | ) | | | (39,004,973 | ) |

| Net decrease in net assets | | | (3,344,287 | ) | | | (48,729,816 | ) |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 249,450,982 | | | | 298,180,798 | |

| End of year | | $ | 246,106,695 | | | $ | 249,450,982 | |

| Undistributed net investment income at end of year | | $ | 3,229,551 | | | $ | 2,783,403 | |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Shares sold | | | 550,498 | | | | 700,724 | |

| Shares redeemed | | | (2,025,731 | ) | | | (2,201,359 | ) |

| Net decrease in shares | | | (1,475,233 | ) | | | (1,500,635 | ) |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 19 |

| SERIES B (LARGE CAP VALUE SERIES) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 24.79 | | | $ | 25.79 | | | $ | 22.20 | | | $ | 17.55 | | | $ | 27.94 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment incomea | | | .35 | | | | .26 | | | | .19 | | | | .19 | | | | .29 | |

| Net gain (loss) on investments (realized and unrealized) | | | 3.52 | | | | (1.26 | ) | | | 3.40 | | | | 4.46 | | | | (10.68 | ) |

| Total from investment operations | | | 3.87 | | | | (1.00 | ) | | | 3.59 | | | | 4.65 | | | | (10.39 | ) |

| Net asset value, end of period | | $ | 28.66 | | | $ | 24.79 | | | $ | 25.79 | | | $ | 22.20 | | | $ | 17.55 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Returnb | | | 15.61 | % | | | (3.88 | %) | | | 16.17 | % | | | 26.50 | % | | | (37.19 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 246,107 | | | $ | 249,451 | | | $ | 298,181 | | | $ | 280,473 | | | $ | 250,972 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.28 | % | | | 1.00 | % | | | 0.81 | % | | | 1.03 | % | | | 1.21 | % |

| Total expensesc | | | 0.83 | % | | | 0.80 | % | | | 0.80 | % | | | 0.81 | % | | | 0.80 | % |

| Portfolio turnover rate | | | 17 | % | | | 19 | % | | | 17 | % | | | 16 | % | | | 32 | % |

| a | Net investment income per share was computed using average shares outstanding throughout the period. |

| b | Total return does not take into account any of the expenses associated with an investment in variable insurance products. If total return had taken into account these expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products. |

| c | Does not include expenses of the underlying funds in which the Fund invests. |

| 20 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| MANAGER’S COMMENTARY (Unaudited) | December 31, 2012 |

To Our Shareholders:

For the fiscal year ended December 31, 2012, the Series C (Money Market Series) returned -0.52%. The U.S. Federal Reserve continues to hold rates near 0%, making it a challenge to maintain a positive yield. The Fed has signaled that it will continue to keep rates low in the near future.

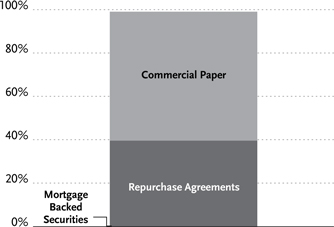

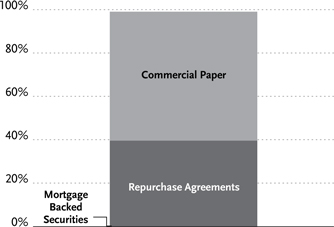

Composition of Portfolio Assets

At December 31, 2012, the average weighted maturity of the holdings in the Fund was 45 days. At year-end, approximately 40% of the Fund consisted of a mix of Treasury and Agency repurchase agreements and 60% in commercial paper.

Market Review

The Federal Reserve has repeatedly stated its intention to keep rates low for the foreseeable future, which will continue to be challenging for money market portfolios as there is very little yield available. Because of the historically low yields, returns in the Fund turned negative after the application of management fees. Newly instituted SEC regulations require at least 30% of portfolio assets to be invested in government issues or equivalent securities, such as repurchase agreements. Additionally, average weighted maturity is now limited to a maximum of 60 days. Both changes are on the side of safety but weigh on the yield of money market funds.

The Fund focused on the high quality issuers and short duration periods due to the relatively flat yield curve over 60 day maturities, which provided no incentive to increase the Funds’ duration. In addition, we invested in asset-backed commercial paper of large, well-diversified programs that offer multiple layers of protection.

Outlook

Our philosophy in managing the Fund is to take a conservative approach that doesn’t add risk to the portfolio by reaching for marginal gains in yield. With the yield environment likely to remain as is for the time being, we will continue to manage the Fund conservatively with expectations of low returns. As always, we will continue to monitor the economic and market conditions when deciding portfolio strategies and will adjust the asset mix and maturity structure in the portfolio accordingly.

Thank you for your investment in the Series C (Money Market Series).

Sincerely,

Steve McFeely, CFA, Portfolio Manager

Performance displayed represents past performance, which is no guarantee of future results.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| THE GUGGENHEIM FUNDS ANNUAL REPORT | 21 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | December 31, 2012 |

SERIES C (MONEY MARKET SERIES)

OBJECTIVE: Seeks as high a level of current income as is consistent with preservation of capital by investing in money market securities with varying maturities.

Holdings Diversification (Market Exposure as % of Net Assets)

Inception Date: May 1, 1979

The Fund invests principally in money market instruments such as commercial paper.

Average Annual Returns*

Periods Ended 12/31/121

| | | 1 Year | | | 5 Year | | | 10 Year | |

| Series C (Money Market Series) | | | -0.52 | % | | | 0.04 | % | | | 1.32 | % |

| * | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. |

| 1 | Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products. |

| 22 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

| SCHEDULE OF INVESTMENTS | December 31, 2012 |

| SERIES C (MONEY MARKET SERIES) | |

| | | Face | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| MORTGAGE BACKED SECURITIES†† - 0.2% | | | | | | | | |

| Small Business Administration Pools | | | | | | | | |

| #503303, 0.75% due 01/01/131,2 | | $ | 91,673 | | | $ | 91,971 | |

| #503295, 0.75% due 01/01/131,2 | | | 50,403 | | | | 50,567 | |

| #502353, 1.00% due 01/01/131,2 | | | 20,872 | | | | 20,872 | |

| Total Mortgage Backed Securities | | | | | | | | |

| (Cost $162,977) | | | | | | | 163,410 | |

| COMMERCIAL PAPER†† - 59.5% | | | | | | | | |

| Toyota Motor Credit Corp. | | | | | | | | |

| 0.24% due 03/06/13 | | | 3,500,000 | | | | 3,499,128 | |

| 0.23% due 08/14/13 | | | 205,000 | | | | 204,691 | |

| Total Toyota Motor Credit Corp. | | | | | | | 3,703,819 | |

| Archer-Daniels-Midland Co. | | | | | | | | |

| 0.20% due 01/31/13 | | | 3,000,000 | | | | 2,999,500 | |

| 0.25% due 02/06/13 | | | 600,000 | | | | 599,850 | |

| Total Archer-Daniels-Midland Co. | | | | | | | 3,599,350 | |

| Coca-Cola Co. | | | | | | | | |

| 0.16% due 03/04/13 | | | 2,000,000 | | | | 1,999,545 | |

| 0.20% due 02/06/13 | | | 1,000,000 | | | | 999,894 | |

| 0.14% due 03/01/13 | | | 600,000 | | | | 599,870 | |

| Total Coca-Cola Co. | | | | | | | 3,599,309 | |

| American Honda Finance Corp. | | | | | | | | |

| 0.16% due 02/22/13 | | | 2,500,000 | | | | 2,499,171 | |

| 0.16% due 03/21/13 | | | 1,100,000 | | | | 1,099,404 | |

| Total American Honda Finance Corp. | | | | | | | 3,598,575 | |

| Sheffield Receivables Corp. | | | | | | | | |

| 0.23% due 03/12/13 | | | 3,600,000 | | | | 3,598,531 | |

| Prudential plc | | | | | | | | |

| 0.38% due 01/04/13 | | | 2,000,000 | | | | 1,999,962 | |

| 0.35% due 05/02/13 | | | 1,100,000 | | | | 1,098,677 | |

| 0.80% due 05/02/13 | | | 500,000 | | | | 499,398 | |

| Total Prudential plc | | | | | | | 3,598,037 | |

| Barclays US Funding LLC | | | | | | | | |

| 0.50% due 01/03/13 | | | 3,000,000 | | | | 2,999,965 | |

| 0.25% due 02/01/13 | | | 500,000 | | | | 499,923 | |

| Total Barclays US Funding LLC | | | | | | | 3,499,888 | |

| General RE Corp. | | | | | | | | |

| 0.17% due 02/06/13 | | | 3,500,000 | | | | 3,499,338 | |

| Nestle Capital Corp. | | | | | | | | |

| 0.24% due 05/20/13 | | | 2,000,000 | | | | 1,998,810 | |

| 0.23% due 05/20/13 | | | 1,500,000 | | | | 1,499,108 | |

| Total Nestle Capital Corp. | | | | | | | 3,497,918 | |

| Societe Generale North America, Inc. | | | | | | | | |

| 0.30% due 02/01/13 | | | 2,900,000 | | | | 2,899,251 | |

| 0.38% due 02/07/13 | | | 500,000 | | | | 499,862 | |

| Total Societe Generale North America, Inc. | | | | | | | 3,399,113 | |

| Jupiter Securitization Company LLC | | | | | | | | |

| 0.21% due 03/06/13 | | | 2,000,000 | | | | 1,999,345 | |

| 0.21% due 03/05/13 | | | 1,250,000 | | | | 1,249,596 | |

| Total Jupiter Securitization Company LLC | | | | | | | 3,248,941 | |

| UBS Finance Delaware LLC | | | | | | | | |

| 0.38% due 09/10/13 | | | 3,000,000 | | | | 2,991,194 | |

| ING (U.S.) Funding LLC | | | | | | | | |

| 0.60% due 05/02/13 | | | 1,000,000 | | | | 998,797 | |

| 0.55% due 05/01/13 | | | 800,000 | | | | 799,053 | |

| Total ING U.S. Funding LLC | | | | | | | 1,797,850 | |

| Total Commercial Paper | | | | | | | | |

| (Cost $43,628,812) | | | | | | | 43,631,863 | |

| REPURCHASE AGREEMENT††,3 - 39.3% | | | | | | | | |

| UMB Financial Corp. | | | | | | | | |

| issued 12/31/12 at 0.07% | | | | | | | | |

| due 01/02/13 | | | 28,846,000 | | | | 28,846,000 | |

| Total Repurchase Agreement | | | | | | | | |

| (Cost $28,846,000) | | | | | | | 28,846,000 | |

| Total Investments - 99.0% | | | | | | | | |

| (Cost $72,637,789) | | | | | | $ | 72,641,273 | |

| Other Assets & Liabilities, net - 1.0% | | | | | | | 729,734 | |

| Total Net Assets - 100.0% | | | | | | $ | 73,371,007 | |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | Maturity date indicated is next interest reset date. |

| 2 | Variable rate security. Rate indicated is rate effective at December 31, 2012. |

| 3 | Repurchase Agreement — See Note 5. |

plc — Public Limited Company

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 23 |

| SERIES C (MONEY MARKET SERIES) |

| STATEMENT OF ASSETS |

| AND LIABILITIES |

| December 31, 2012 |

| Assets: | | | | |

| Investments, at value | | | | |

| (cost $43,791,789) | | $ | 43,795,273 | |

| Repurchase agreements, at value | | | | |

| (cost $28,846,000) | | | 28,846,000 | |

| Total investments | | | | |

| (cost $72,637,789) | | | 72,641,273 | |

| Prepaid expenses | | | 2,207 | |

| Cash | | | 349 | |

| Receivables: | | | | |

| Fund shares sold | | | 747,886 | |

| Securities sold | | | 71,618 | |

| Interest | | | 322 | |

| Total assets | | | 73,463,655 | |

| Liabilities: | | | | |

| Payable for: | | | | |

| Management fees | | | 31,280 | |

| Fund shares redeemed | | | 17,344 | |

| Professional fees | | | 12,990 | |

| Transfer agent/maintenance fees | | | 7,737 | |

| Fund accounting/administration fees | | | 5,943 | |

| Directors’ fees* | | | 2,612 | |

| Miscellaneous | | | 14,742 | |

| Total liabilities | | | 92,648 | |

| Net assets | | $ | 73,371,007 | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 73,367,523 | |

| Undistributed net investment income | | | — | |

| Accumulated net realized gain on investments | | | — | |

| Net unrealized appreciation on investments | | | 3,484 | |

| Net assets | | $ | 73,371,007 | |

| Capital shares outstanding | | | 5,492,548 | |

| Net asset value per share | | $ | 13.36 | |

| STATEMENT OF |

| OPERATIONS |

| Year Ended December 31, 2012 |

| Investment Income: | | | | |

| Interest | | $ | 157,305 | |

| Total investment income | | | 157,305 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 439,108 | |

| Transfer agent/maintenance fees | | | 28,630 | |

| Fund accounting/administration fees | | | 83,430 | |

| Directors’ fees* | | | 8,337 | |

| Custodian fees | | | 6,051 | |

| Miscellaneous | | | 57,618 | |

| Total expenses | | | 623,174 | |

| Net investment loss | | | (465,869 | ) |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | | | | |