UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 02753

Guggenheim Variable Funds Trust

(Exact name of registrant as specified in charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Guggenheim Variable Funds Trust

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e‑1 under the Investment Company Act of 1940 (17 CFR 270.30e‑1). The Commission may use the information provided on Form N‑CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N‑CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N‑CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549‑0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

12.31.2014

Guggenheim Variable Funds Trust Annual Report

| Series | |

| Series A | (StylePlus—Large Core Series) |

| Series B | (Large Cap Value Series) |

| Series C | (Money Market Series) |

| Series D | (World Equity Income Series) |

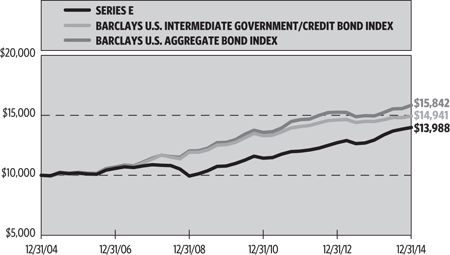

| Series E | (Total Return Bond Series) |

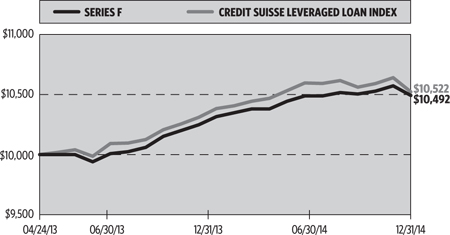

| Series F | (Floating Rate Strategies Series) |

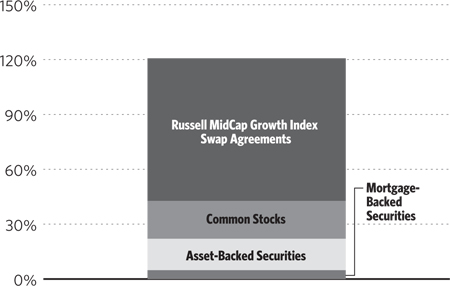

| Series J | (StylePlus—Mid Growth Series) |

| Series M | (Macro Opportunities Series) |

| Series N | (Managed Asset Allocation Series) |

| Series O | (All Cap Value Series) |

| Series P | (High Yield Series) |

| Series Q | (Small Cap Value Series) |

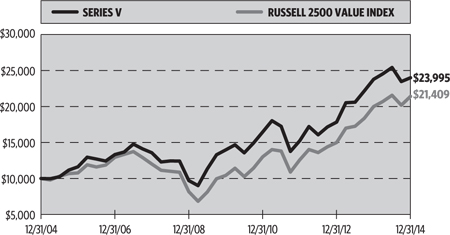

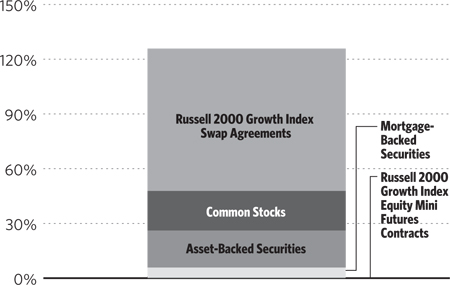

| Series V | (Mid Cap Value Series) |

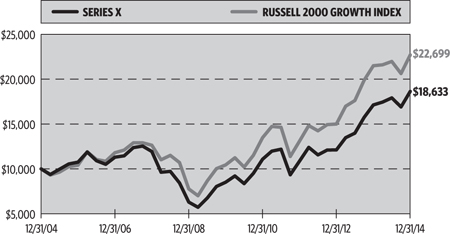

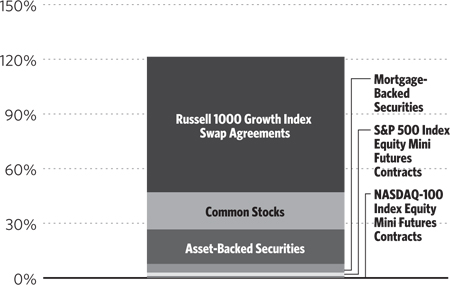

| Series X | (StylePlus—Small Growth Series) |

| Series Y | (StylePlus—Large Growth Series) |

| Series Z | (Alpha Opportunity Series) |

| GVFT-ANN-2-1214x1215 | guggenheiminvestments.com |

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Guggenheim Funds Distributors, LLC.

| DEAR SHAREHOLDER | 2 |

| ECONOMIC AND MARKET OVERVIEW | 5 |

| ABOUT SHAREHOLDERS’ FUND EXPENSES | 7 |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | 9 |

| SERIES B (LARGE CAP VALUE SERIES) | 18 |

| SERIES C (MONEY MARKET SERIES) | 26 |

| SERIES D (WORLD EQUITY INCOME SERIES) | 32 |

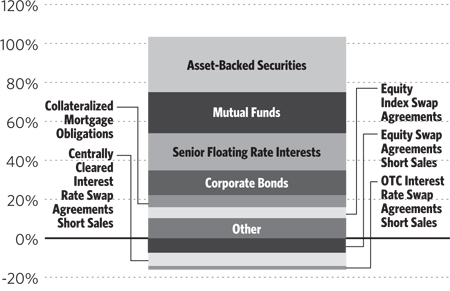

| SERIES E (TOTAL RETURN BOND SERIES) | 41 |

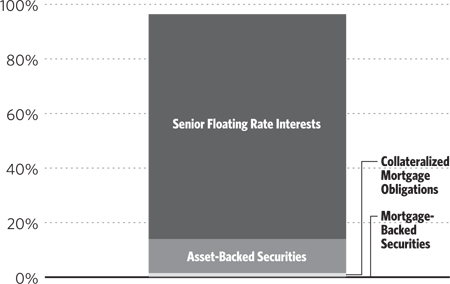

| SERIES F (FLOATING RATE STRATEGIES SERIES) | 54 |

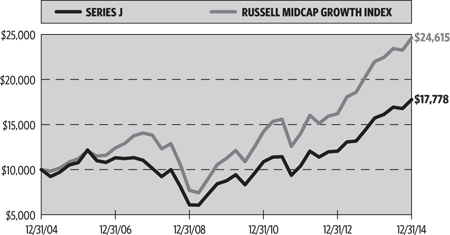

| SERIES J (STYLEPLUS—MID GROWTH SERIES) | 64 |

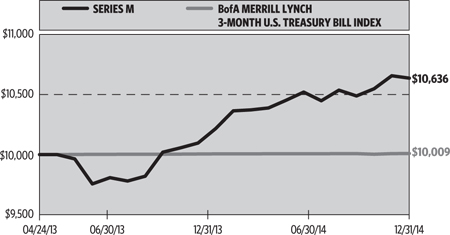

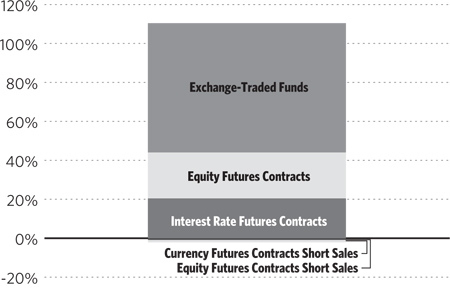

| SERIES M (MACRO OPPORTUNITIES SERIES) | 74 |

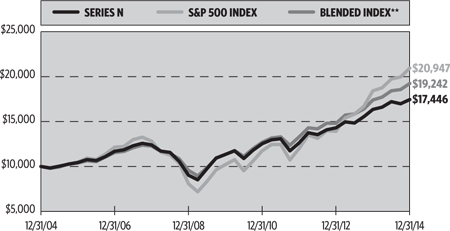

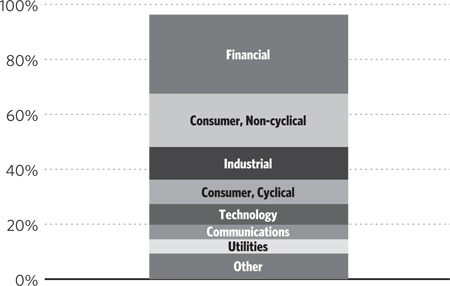

| SERIES N (MANAGED ASSET ALLOCATION SERIES) | 87 |

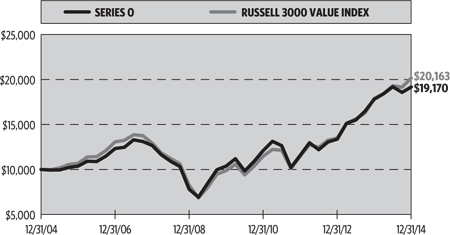

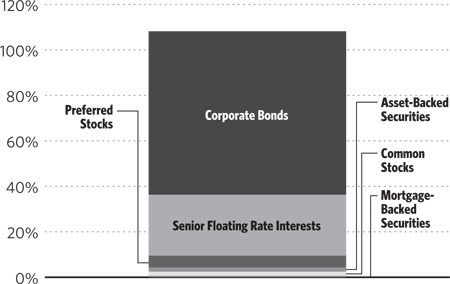

| SERIES O (ALL CAP VALUE SERIES) | 94 |

| SERIES P (HIGH YIELD SERIES) | 102 |

| SERIES Q (SMALL CAP VALUE SERIES) | 114 |

| SERIES V (MID CAP VALUE SERIES) | 122 |

| SERIES X (STYLEPLUS—SMALL GROWTH SERIES) | 130 |

| SERIES Y (STYLEPLUS—LARGE GROWTH SERIES) | 140 |

| SERIES Z (ALPHA OPPORTUNITY SERIES) | 149 |

| NOTES TO FINANCIAL STATEMENTS | 155 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 180 |

| OTHER INFORMATION | 181 |

| INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 182 |

| GUGGENHEIM INVESTMENTS PRIVACY POLICIES | 186 |

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC and Guggenheim Partners Investment Management (the “Investment Advisers”) are pleased to present the annual shareholder report for 16 of our funds that are part of the Guggenheim Variable Funds Trust (the “Funds”). This report covers performance of the Funds for the annual period ended December 31, 2014.

The Investment Advisers are part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim Partners, LLC and the Investment Advisers.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter, and then the Manager’s Commentary for each Fund.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

January 31, 2015

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

The Series StylePlus Funds may not be suitable for all investors. Investments in large capitalization stocks may underperform other segments of the equity market or the equity market as a whole. • Investments in small-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. • Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. • The Funds may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • The Funds’ use of leverage, through borrowings or instruments such as derivatives, may cause the Funds to be more volatile than if it had not been leveraged. • The Funds’ investments in other investment vehicles subject the Funds to those risks and expenses affecting the investment vehicle. • The Funds may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question

| 2 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

(investments in emerging markets securities are generally subject to an even greater level of risks). • The Funds may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The Funds may invest in bank loans and asset-backed securities, including mortgage-backed, which involve special types of risks. • The Funds may invest in restricted securities which may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Funds are not guaranteed by the U.S. government. • Please read the prospectus for more detailed information regarding these and other risks.

The Series Value Funds may not be suitable for all investors. • An investment in the Funds will fluctuate and is subject to investment risks, which means investors could lose money. The intrinsic value of the underlying stocks may never be realized or the stocks may decline in value. Investments in small- and/or mid-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. • Please read the prospectus for more detailed information regarding these and other risks.

The Series C (Money Market Series) may not be suitable for all investors. • An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. • It is possible to lose money by investing in the Fund. The principal risks of investing in the Fund are listed below. • The Fund could lose money if the issuer of a bond is unable to repay interest and principal on time or defaults. • The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility and liquidity of the bond. • Investments in fixed-income securities are subject to the possibility that interest rates could rise sharply, causing the value of the Fund’s securities and share price to decline. • Fixed income securities with longer durations are subject to more volatility than those with shorter durations. • Regulations of money market funds are evolving. • New regulations may affect negatively the Fund’s performance, yield and cost. • Please read the prospectus for more detailed information regarding these and other risks.

The Series D (World Equity Income Series) may not be suitable for all investors. • Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. •The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets are generally subject to an even greater level of risks). Additionally, the Fund’s exposure to foreign currencies subjects the fund to the risk that those currencies will decline in value relative to the U.S. Dollar. • The Fund’s investments in derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. •The Fund’s use of leverage, through instruments such as derivatives, may cause the fund to be more volatile than if it had not been leveraged. •The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. •The Fund may have significant exposure to securities in a particular capitalization range e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the pre-denominate capitalization range may underperform other segments of the equity market or the equity market as a whole. • Please read the prospectus for more detailed information regarding these and other risks.

The Series E (Total Return Bond Series) may not be suitable for all investors. • The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. • Investments in reverse repurchase agreements expose the Fund to the many of the same risks as investments in derivatives. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. • The Fund’s investments in municipal securities can be affected by events that affect the municipal bond market. • The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. • The Fund’s investments in restricted securities may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government. • Please read the prospectus for more detailed information regarding these and other risks.

The Series F (Floating Rate Strategies Series) may not be suitable for all investors. • Investments in floating rate senior secured syndicated bank loans and other floating rate securities involve special types of risks, including credit rate risk, interest rate risk, liquidity risk and prepayment risk. • The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. • Investments in reverse repurchase agreements and synthetic instruments (such as synthetic collateralized debt obligations) expose the Fund to the many of the same risks as investments in derivatives. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. • The Fund’s investments in restricted securities may involve financial and liquidity risk. • The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government. • Please read the prospectus for more detailed information regarding these and other risks.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 3 |

The Series M (Macro Opportunities Series) may not be suitable for all investors. • The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The intrinsic value of the underlying stocks in which the Fund invests may never be realized or the stock may decline in value. • When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. • The use of short selling involves increased risks and costs. You risk paying more for a security than you received from its sale. Theoretically, stocks sold short have the risk of unlimited losses. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. • Investments in reverse repurchase agreements expose the Fund to the many of the same risks as investments in derivatives. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. • A highly liquid secondary market may not exist for the commodity-linked structured notes the Fund invests in, and there can be no assurance that a highly liquid secondary market will develop. • The Fund’s exposure to the commodity markets may subject the Fund to greater volatility as commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity such as droughts, floods, weather, embargos, tariffs and international economic, political and regulatory developments. • The Fund’s investments in municipal securities can be affected by events that affect the municipal bond market. • The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. • The Fund’s investments in restricted securities may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government. • This Fund is considered nondiversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single security could cause greater fluctuations in the value of fund shares than would occur in a more diversified fund. • Please read the prospectus for more detailed information regarding these and other risks.

The Series N (Managed Asset Allocation Series) may not be suitable for all investors. • The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The Fund could lose money if the issuer of a bond or a counterparty to a derivatives transaction or other transaction is unable to repay interest and principal on time or defaults. The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility and liquidity of the bond. Derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including the risk that the Fund will be unable to sell, unwind or value the derivative because of an illiquid market, the risk that the derivative is not well correlated with underlying investments or the Fund’s other portfolio holdings, and the risk that the counterparty is unwilling or unable to meet its obligation. The use of derivatives by the Fund to hedge risk may reduce the opportunity for gain by offsetting the positive effect of favorable price movements. Furthermore, if the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could result in a loss, which in some cases may be unlimited. Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs. The Investment Manager may not be able to cause certain of the underlying funds’ performance to match or correlate to that of the underlying funds’ respective underlying index or benchmark, either on a daily or aggregate basis. Factors such as underlying fund expenses, imperfect correlation between an underlying fund’s investments and those of its underlying index or underlying benchmark, rounding of share prices, changes to the composition of the underlying index or underlying benchmark, regulatory policies, high portfolio turnover rate, and the use of leverage all contribute to tracking error. Tracking error may cause an underlying fund’s and, thus the Fund’s, performance to be less than you expect. • Please read the prospectus for more detailed information regarding these and other risks.

The Series P (High Yield Series) may not be suitable for all investors. • The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. •The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. • Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. • The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund’s investments in restricted securities may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government. • Please read the prospectus for more detailed information regarding these and other risks.

The Series Z (Alpha Opportunity Series) may not be suitable for all investors. • The Alpha Opportunity Fund is subject to a number of risks and is not suitable for all investors. • Investments in securities and derivatives, in general, are subject to market risks that may cause their prices to fluctuate over time. An investment in the Fund may lose money. There can be no guarantee the Fund will achieve it investment objective. •The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. • Certain of the derivative instruments, such as swaps and structured notes, are also subject to the risks of counterparty default and adverse tax treatment. •The more the fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. • The Fund’s use of short selling involves increased risk and costs, including paying more for a security than it received from its sale and the risk of unlimited losses. •In certain circumstances the Fund may be subject to liquidity risk and it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. •In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. •The Fund’s fixed income investments will change in value in response to interest rate changes and other factors. •See the prospectus for more information on these and additional risks.

| 4 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | December 31, 2014 |

The U.S. economy continued to grow throughout the 12 months ended December 31, 2014, despite some seasonal volatility in September and October that caused spreads in leveraged credit to widen and upward momentum in U.S. stocks to deteriorate. By the end of October, the spread widening had reversed and equities regained their footing, with some key indices shooting to new highs. Markets similarly overcame a weather-related winter soft patch in the first quarter of 2014. The benchmark U.S. 10-year Treasury rate declined from 3.03% to 2.17% over the period, a positive stimulant to continued economic expansion.

U.S. growth appears to have decoupled from the rest of the world. The third quarter’s 5% U.S. gross domestic product (GDP) growth—the fastest pace in 11 years—signals that the U.S. economy is doing very well. Deeming growth sustainable, the U.S. Federal Reserve (the “Fed”) formally ended its quantitative easing (QE) program in October, and all eyes are now on economic data—primarily inflation and employment figures—that would prompt the Fed to raise rates in 2015. Slowing global growth has translated into expectations of weaker demand for oil in an already oversupplied market, which contributed to oil’s 49% decline in the second half of the year, with West Texas Intermediate ending the year at a five-year low of $53 a barrel.

The bright side to declining energy prices is that it leaves more money for consumers to spend on other goods. Data are already confirming this, as American consumer confidence reached new post-recession highs, and fourth quarter retail spending posted solid gains. Overall, this should be positive for consumer-related companies with primarily domestic operations.

The U.S. added 246,000 jobs per month on average in 2014. Employment levels are transitioning from the recovery phase to the expansion phase, which typically coincides with accelerating economic activity. The downward trend in labor force participation has begun to flatten and, as fewer people leave the workforce, the rapid decline in the nation’s unemployment rate could begin to slow. Until unemployment falls below the natural rate of unemployment, it’s unlikely that the U.S. economy will experience the kind of meaningful wage pressure that would spur action by the Fed. An improving labor market, subdued mortgage rates, and tight housing inventory all point to a rebound in the housing market.

The battle against deflation in Europe forced the European Central Bank (ECB) to announce its own form of QE via purchases of asset-backed securities (ABS) and covered bonds. The consensus appears to be that in its current form, the program is insufficient to avert a slowdown. The next step for the ECB may be to buy sovereign bonds, which the ECB will decide on in the coming months. The only notable positive for Europe over the past year has been the devaluation of the euro, which fell by 13% against the U.S. dollar between May and December. A weaker euro makes exports more competitive, but still will not be enough to boost inflation in the region.

While markets were already anxious over Europe’s struggles and the potential impact of a stronger dollar on U.S. company earnings, Japan relapsed into recession. This drove the Bank of Japan to announce it would expand its asset purchase program in 2015. China also faces slowing growth as financing costs remain high for smaller companies, forcing the People’s Bank of China (PBOC) to cut benchmark interest rates for the first time since July 2012.

From an investment standpoint, U.S. assets continue to look attractive. With global central banks easing or engaging in their form of QE, global yields remain anchored and are driving investors into U.S. markets. But we are wary of the potential for a setback in U.S. equities as certain factors, such as oil prices and currency fluctuations, drive markets to aggressively discount valuations for some sectors more than others.

For the year ended December 31, 2014, the Standard & Poor’s 500® (“S&P 500”) Index* returned 13.69%. The Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index* returned -4.90%. The return of the MSCI Emerging Markets Index* was -2.19%.

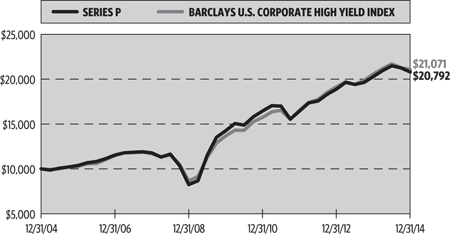

In the bond market, the Barclays U.S. Aggregate Bond Index* posted a 5.97% return for the period, while the Barclays U.S. Corporate High Yield Index* returned 2.45%. The return of the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.04% for the 12-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 5 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | December 31, 2014 |

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

Barclays U.S. Corporate High Yield Index measures the market of U.S. dollar denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Barclays U.S. Intermediate Government/Credit Bond Index measures the performance of U.S. dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2500® Value Index measures the performance of the small- to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

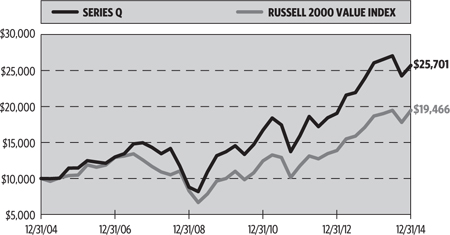

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth value.

Russell 1000® Value Index measures the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

| 6 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning June 30, 2014 and ending December 31, 2014.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| | Expense Ratio1 | Fund Return | Beginning Account Value June 30, 2014 | Ending Account Value December 31, 2014 | Expenses Paid During Period2 |

Table 1. Based on actual Fund return3 | | | | | |

| Series A (StylePlus—Large Core Series) | 0.96% | 6.29% | $1,000.00 | $1,062.90 | $4.99 |

| Series B (Large Cap Value Series) | 0.84% | 1.22% | 1,000.00 | 1,012.20 | 4.26 |

| Series C (Money Market Series) | 0.50% | (0.15%) | 1,000.00 | 998.50 | 2.52 |

| Series D (World Equity Income Series) | 0.98% | (5.12%) | 1,000.00 | 948.80 | 4.81 |

| Series E (Total Return Bond Series) | 0.81% | 2.19% | 1,000.00 | 1,021.90 | 4.13 |

| Series F (Floating Rate Strategies Series) | 1.16% | 0.04% | 1,000.00 | 1,000.40 | 5.85 |

| Series J (StylePlus—Mid Growth Series) | 0.98% | 5.02% | 1,000.00 | 1,050.20 | 5.06 |

| Series M (Macro Opportunities Series) | 1.42% | 1.10% | 1,000.00 | 1,011.00 | 7.20 |

| Series N (Managed Asset Allocation Series) | 0.93% | 1.36% | 1,000.00 | 1,013.60 | 4.72 |

| Series O (All Cap Value Series) | 0.90% | (0.11%) | 1,000.00 | 998.90 | 4.53 |

| Series P (High Yield Series) | 1.13% | (3.23%) | 1,000.00 | 967.70 | 5.60 |

| Series Q (Small Cap Value Series) | 1.17% | (4.95%) | 1,000.00 | 950.50 | 5.75 |

| Series V (Mid Cap Value Series) | 0.95% | (5.61%) | 1,000.00 | 943.90 | 4.65 |

| Series X (StylePlus—Small Growth Series) | 1.29% | 4.03% | 1,000.00 | 1,040.30 | 6.63 |

| Series Y (StylePlus—Large Growth Series) | 1.20% | 6.79% | 1,000.00 | 1,067.90 | 6.25 |

| Series Z (Alpha Opportunity Series) | 2.56% | 3.37% | 1,000.00 | 1,033.70 | 13.12 |

| |

| Table 2. Based on hypothetical 5% return (before expenses) | | | | |

| Series A (StylePlus—Large Core Series) | 0.96% | 5.00% | $1,000.00 | $1,020.37 | $4.89 |

| Series B (Large Cap Value Series) | 0.84% | 5.00% | 1,000.00 | 1,020.97 | 4.28 |

| Series C (Money Market Series) | 0.50% | 5.00% | 1,000.00 | 1,022.68 | 2.55 |

| Series D (World Equity Income Series) | 0.98% | 5.00% | 1,000.00 | 1,020.27 | 4.99 |

| Series E (Total Return Bond Series) | 0.81% | 5.00% | 1,000.00 | 1,021.12 | 4.13 |

| Series F (Floating Rate Strategies Series) | 1.16% | 5.00% | 1,000.00 | 1,019.36 | 5.90 |

| Series J (StylePlus—Mid Growth Series) | 0.98% | 5.00% | 1,000.00 | 1,020.27 | 4.99 |

| Series M (Macro Opportunities Series) | 1.42% | 5.00% | 1,000.00 | 1,018.05 | 7.22 |

| Series N (Managed Asset Allocation Series) | 0.93% | 5.00% | 1,000.00 | 1,020.52 | 4.74 |

| Series O (All Cap Value Series) | 0.90% | 5.00% | 1,000.00 | 1,020.67 | 4.58 |

| Series P (High Yield Series) | 1.13% | 5.00% | 1,000.00 | 1,019.51 | 5.75 |

| Series Q (Small Cap Value Series) | 1.17% | 5.00% | 1,000.00 | 1,019.31 | 5.96 |

| Series V (Mid Cap Value Series) | 0.95% | 5.00% | 1,000.00 | 1,020.42 | 4.84 |

| Series X (StylePlus—Small Growth Series) | 1.29% | 5.00% | 1,000.00 | 1,018.70 | 6.56 |

| Series Y (StylePlus—Large Growth Series) | 1.20% | 5.00% | 1,000.00 | 1,019.16 | 6.11 |

| Series Z (Alpha Opportunity Series) | 2.56% | 5.00% | 1,000.00 | 1,012.30 | 12.98 |

1 | Annualized and excludes expenses of the underlying funds in which the Funds invest. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses shown do not include fees charged by insurance companies. |

3 | Actual cumulative return at net asset value for the period June 30, 2014 to December 31, 2014. |

| 8 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

MANAGER'S COMMENTARY (Unaudited) | December 31, 2014 |

To Our Shareholders:

The Series A (StylePlus—Large Core Series) is managed by a team of seasoned professionals, including B. Scott Minerd, Global Chairman of Investments and Chief Investment Officer; Farhan Sharaff, Senior Managing Director and Assistant Chief Investment Officer, Equities; Jayson Flowers, Senior Managing Director and Head of Equity and Derivative Strategies; and Scott Hammond, Managing Director and Portfolio Manager. In the following paragraphs, the investment team discusses performance for the fiscal year ended December 31, 2014.

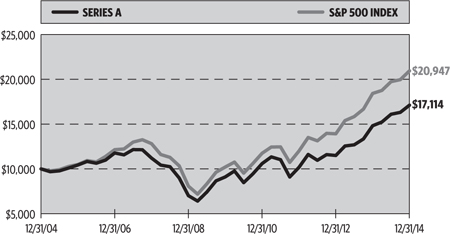

For the year ended December 31, 2014, the Series A (StylePlus—Large Core Series) returned 15.48%, compared with the 13.69% return of its benchmark, the S&P 500 Index.

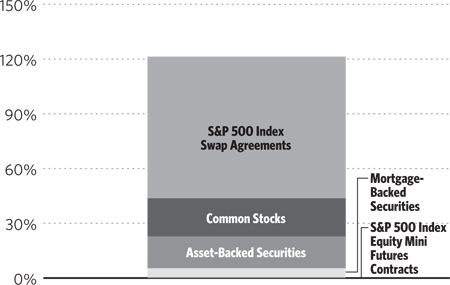

The Fund seeks to outperform the S&P 500 Index by combining actively managed and passive equity exposure, along with an actively managed fixed income portfolio. The passive equity position is maintained with swap agreements and futures contracts. The Fund’s fixed income component invests in a variety of fixed income sectors, including asset-backed securities (ABS), mortgage-backed securities (MBS), high yield corporate bonds and bank loans.

The allocation between active and passive equity is tactically managed based on the environment for stock-picking opportunities. When stock selection opportunities are less attractive, the Fund invests in derivatives based on the target index, backed by a diversified portfolio of fixed income instruments. In this way, the Fund believes it will deliver the target index return plus an alpha component commensurate with the yield achieved on the active fixed income portfolio.

For the period, the Fund maintained an average allocation of a little more than 20% to the actively managed equity allocation and slightly less than 80% to the passive equity position. The actively managed equity sleeve was scaled down from 25% to 20% mid-year, as U.S. equity and credit markets became more volatile beginning in the third quarter. While the sell-off was initially sparked by market unease over the Fed winding down its purchases of U.S. Treasuries and mortgage-backed securities, it continued through the fourth quarter as markets grew anxious over the weakening global outlook. The actively managed sleeve was maintained at about 20% for the rest of the period.

The Fund’s active equity and active fixed income exposures both contributed to performance for the period. The passive equity position was neutral to performance, and the swap agreements contributed to performance.

The actively managed equity portfolio was underweight the more expensive smaller and momentum names (based on various measures, such as price-to-earnings), and overweight the less expensive and larger holdings. Sectors that contributed most to performance for the year were Consumer Staples and Industrials. Sectors that detracted most from performance for the year were Financials and Utilities.

Uncorrelated with the Fund’s active equity component, the fixed-income component was largely invested in ABS and MBS. These positions constituted the majority of the fixed income sleeve’s total return.

Performance displayed represents past performance, which is no guarantee of future results.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 9 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | December 31, 2014 |

SERIES A (STYLEPLUS—LARGE CORE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

Holdings Diversification

(Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments or investments in Guggenheim Strategy Funds Trust mutual funds.

| Portfolio Composition by Quality Rating** |

| Rating | |

| Fixed Income Instruments | |

| AAA | 6.3% |

| AA | 3.0% |

| A | 4.7% |

| BBB | 5.3% |

| BB | 0.5% |

| B | 2.3% |

| CCC | 0.4% |

| Other Instruments | |

| Mutual Funds | 53.5% |

| Common Stocks | 21.0% |

| Short Term Investments | 3.0% |

| Total Investments | 100.0% |

| | |

| The chart above reflects percentages of the value of total investments. |

Inception Date: May 1, 1979 |

| Ten Largest Holdings (% of Total Net Assets) |

| Guggenheim Variable Insurance Strategy Fund III | 23.2% |

| Guggenheim Strategy Fund I | 17.4% |

| Guggenheim Strategy Fund II | 7.5% |

| Guggenheim Strategy Fund III | 5.0% |

| HSI Asset Securitization Corporation Trust — Class 2A3 | 1.0% |

| Duane Street CLO IV Ltd. — Class A1T | 0.9% |

| Apple, Inc. | 0.8% |

| Resource Capital Corporation CRE Notes 2013 Ltd. — Class B | 0.8% |

| Boca Hotel Portfolio Trust — Class D | 0.8% |

| Argent Securities Incorporated Asset-Backed Pass-Through Certificates Series — Class A2D | 0.8% |

| Top Ten Total | 58.2% |

| | |

| “Ten Largest Holdings” exclude any temporary cash or derivative instruments. |

| 10 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | December 31, 2014 |

Cumulative Fund Performance*,†

Average Annual Returns*

Periods Ended December 31, 2014†

| | 1 Year | 5 Year | 10 Year |

| Series A (StylePlus— Large Core Series) | 15.48% | 13.45% | 5.52% |

| S&P 500 Index | 13.69% | 15.45% | 7.67% |

| * | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

| ** | Source: Factset. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All rated securities have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, which are all a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Unrated securities do not necessarily indicate low credit quality. Security ratings are determined at the time of purchase and may change thereafter. |

† | Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 11 |

| SCHEDULE OF INVESTMENTS | December 31, 2014 |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| | | Shares | | | Value | |

| | | | | | | | | |

COMMON STOCKS† - 20.9% | |

| | | | | | | | | |

| CONSUMER, NON-CYCLICAL - 7.3% | |

| Johnson & Johnson | | | 12,643 | | | $ | 1,322,078 | |

| Pfizer, Inc. | | | 34,965 | | | | 1,089,160 | |

| Merck & Company, Inc. | | | 16,891 | | | | 959,240 | |

| Gilead Sciences, Inc.* | | | 9,100 | | | | 857,766 | |

| Philip Morris International, Inc. | | | 10,385 | | | | 845,858 | |

| UnitedHealth Group, Inc. | | | 7,822 | | | | 790,727 | |

| Coca-Cola Co. | | | 17,673 | | | | 746,154 | |

| Express Scripts Holding Co.* | | | 8,625 | | | | 730,279 | |

| Medtronic, Inc. | | | 9,607 | | | | 693,625 | |

| Archer-Daniels-Midland Co. | | | 12,949 | | | | 673,348 | |

| PepsiCo, Inc. | | | 7,109 | | | | 672,227 | |

| Mondelez International, Inc. — Class A | | | 18,008 | | | | 654,140 | |

| Procter & Gamble Co. | | | 6,900 | | | | 628,521 | |

| Kimberly-Clark Corp. | | | 5,406 | | | | 624,609 | |

| Baxter International, Inc. | | | 8,445 | | | | 618,934 | |

| Cardinal Health, Inc. | | | 7,534 | | | | 608,220 | |

| Aetna, Inc. | | | 6,715 | | | | 596,493 | |

| Kroger Co. | | | 9,249 | | | | 593,878 | |

| Cigna Corp. | | | 5,641 | | | | 580,515 | |

| Kellogg Co. | | | 8,198 | | | | 536,477 | |

| Kraft Foods Group, Inc. | | | 7,307 | | | | 457,857 | |

| General Mills, Inc. | | | 8,126 | | | | 433,360 | |

| Eli Lilly & Co. | | | 4,517 | | | | 311,628 | |

| Anthem, Inc. | | | 2,299 | | | | 288,915 | |

| Altria Group, Inc. | | | 4,496 | | | | 221,518 | |

| Stryker Corp. | | | 2,152 | | | | 202,998 | |

| Amgen, Inc. | | | 1,238 | | | | 197,201 | |

| Abbott Laboratories | | | 4,126 | | | | 185,753 | |

| Actavis plc* | | | 626 | | | | 161,139 | |

| Becton Dickinson and Co. | | | 1,092 | | | | 151,963 | |

| Total Consumer, Non-cyclical | | | | | | | 17,434,581 | |

| | | | | | | | | |

| INDUSTRIAL - 4.1% | |

| General Electric Co. | | | 31,079 | | | | 785,366 | |

| United Technologies Corp. | | | 6,731 | | | | 774,065 | |

| Boeing Co. | | | 5,817 | | | | 756,095 | |

| Lockheed Martin Corp. | | | 3,534 | | | | 680,542 | |

| Caterpillar, Inc. | | | 7,241 | | | | 662,769 | |

| Emerson Electric Co. | | | 10,229 | | | | 631,436 | |

| FedEx Corp. | | | 3,623 | | | | 629,170 | |

| Norfolk Southern Corp. | | | 5,655 | | | | 619,844 | |

| General Dynamics Corp. | | | 4,481 | | | | 616,675 | |

| Corning, Inc. | | | 26,172 | | | | 600,124 | |

| Waste Management, Inc. | | | 11,615 | | | | 596,082 | |

| Raytheon Co. | | | 5,491 | | | | 593,961 | |

| Northrop Grumman Corp. | | | 3,990 | | | | 588,086 | |

| Cummins, Inc. | | | 4,018 | | | | 579,275 | |

| Honeywell International, Inc. | | | 4,254 | | | | 425,060 | |

| CSX Corp. | | | 6,856 | | | | 248,393 | |

| Total Industrial | | | | | | | 9,786,943 | |

| | | | | | | | | |

| TECHNOLOGY - 3.6% | |

| Apple, Inc. | | | 17,419 | | | | 1,922,709 | |

| Microsoft Corp. | | | 25,863 | | | | 1,201,336 | |

| International Business Machines Corp. | | | 5,828 | | | | 935,044 | |

| Intel Corp. | | | 25,469 | | | | 924,269 | |

| Hewlett-Packard Co. | | | 18,758 | | | | 752,759 | |

| EMC Corp. | | | 21,823 | | | | 649,016 | |

| Western Digital Corp. | | | 5,307 | | | | 587,485 | |

| Micron Technology, Inc.* | | | 16,355 | | | | 572,589 | |

| Oracle Corp. | | | 11,082 | | | | 498,358 | |

| QUALCOMM, Inc. | | | 4,097 | | | | 304,530 | |

| Texas Instruments, Inc. | | | 3,034 | | | | 162,213 | |

| Total Technology | | | | | | | 8,510,308 | |

| | | | | | | | | |

| FINANCIAL - 1.8% | |

| MetLife, Inc. | | | 12,246 | | | | 662,387 | |

| Prudential Financial, Inc. | | | 6,979 | | | | 631,320 | |

| American International Group, Inc. | | | 10,548 | | | | 590,794 | |

| Allstate Corp. | | | 6,793 | | | | 477,208 | |

| Wells Fargo & Co. | | | 7,664 | | | | 420,140 | |

| JPMorgan Chase & Co. | | | 6,280 | | | | 393,002 | |

| Aflac, Inc. | | | 5,331 | | | | 325,671 | |

| Berkshire Hathaway, Inc. — Class B* | | | 1,568 | | | | 235,435 | |

| Bank of America Corp. | | | 11,675 | | | | 208,866 | |

| Charles Schwab Corp. | | | 5,206 | | | | 157,169 | |

| Travelers Companies, Inc. | | | 1,472 | | | | 155,811 | |

| State Street Corp. | | | 1,955 | | | | 153,468 | |

| Total Financial | | | | | | | 4,411,271 | |

| | | | | | | | | |

| ENERGY - 1.8% | |

| Exxon Mobil Corp. | | | 9,858 | | | | 911,372 | |

| Chevron Corp. | | | 8,019 | | | | 899,571 | |

| ConocoPhillips | | | 11,188 | | | | 772,643 | |

| Valero Energy Corp. | | | 11,901 | | | | 589,100 | |

| Occidental Petroleum Corp. | | | 5,244 | | | | 422,719 | |

| Anadarko Petroleum Corp. | | | 5,014 | | | | 413,655 | |

| Kinder Morgan, Inc. | | | 4,069 | | | | 172,159 | |

| Halliburton Co. | | | 3,841 | | | | 151,067 | |

| Total Energy | | | | | | | 4,332,286 | |

| | | | | | | | | |

| COMMUNICATIONS - 1.2% | |

| Cisco Systems, Inc. | | | 33,729 | | | | 938,172 | |

| Verizon Communications, Inc. | | | 9,965 | | | | 466,163 | |

| Viacom, Inc. — Class B | | | 5,909 | | | | 444,653 | |

| Comcast Corp. — Class A | | | 6,142 | | | | 356,297 | |

| Google, Inc. — Class C* | | | 657 | | | | 345,845 | |

| Time Warner, Inc. | | | 2,639 | | | | 225,423 | |

| Total Communications | | | | | | | 2,776,553 | |

| | | | | | | | | |

| CONSUMER, CYCLICAL - 1.1% | |

| Wal-Mart Stores, Inc. | | | 9,636 | | | | 827,540 | |

| Walgreens Boots Alliance, Inc. | | | 8,292 | | | | 631,850 | |

| CVS Health Corp. | | | 6,501 | | | | 626,111 | |

| Southwest Airlines Co. | | | 6,832 | | | | 289,130 | |

| 12 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (continued) | December 31, 2014 |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Delta Air Lines, Inc. | | | 5,629 | | | $ | 276,891 | |

| Total Consumer, Cyclical | | | | | | | 2,651,522 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $44,541,253) | | | | | | | 49,903,464 | |

| | | | | | | | | |

MUTUAL FUNDS†,1 - 53.2% | |

| Guggenheim Variable Insurance Strategy Fund III | | | 2,234,897 | | | | 55,514,847 | |

| Guggenheim Strategy Fund I | | | 1,672,774 | | | | 41,551,695 | |

| Guggenheim Strategy Fund II | | | 726,187 | | | | 18,045,743 | |

| Guggenheim Strategy Fund III | | | 483,567 | | | | 12,011,805 | |

| Total Mutual Funds | | | | | | | | |

| (Cost $127,673,685) | | | | | | | 127,124,090 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS† - 2.9% | |

| Dreyfus Treasury Prime Cash Management Fund | | | 7,065,861 | | | | 7,065,861 | |

| Total Short Term Investments | | | | | | | | |

| (Cost $7,065,861) | | | | | | | 7,065,861 | |

| | | | | | | | | |

| | | Face

Amount | | | | |

| | | | | | | | | |

ASSET-BACKED SECURITIES†† - 17.4% | |

| Duane Street CLO IV Ltd. | | | | | | | | |

2007-4A, 0.46% due 11/14/212,3 | | $ | 2,199,736 | | | | 2,181,037 | |

| Argent Securities Incorporated Asset-Backed Pass-Through Certificates Series | | | | | | | | |

2005-W3, 0.51% due 11/25/352 | | | 1,893,179 | | | | 1,818,696 | |

| Goldman Sachs Asset Management CLO plc | | | | | | | | |

2007-1A, 2.98% due 08/01/222,3 | | | 1,800,000 | | | | 1,787,760 | |

| Brentwood CLO Corp. | | | | | | | | |

2006-1A, 0.50% due 02/01/222,3 | | | 1,241,197 | | | | 1,222,455 | |

2006-1A, 1.05% due 02/01/222,3 | | | 600,000 | | | | 541,620 | |

| Garrison Funding 2013-2 Ltd. | | | | | | | | |

2013-2A, 2.03% due 09/25/232,3 | | | 1,770,000 | | | | 1,763,805 | |

| Salus CLO 2012-1 Ltd. | | | | | | | | |

2013-1AN, 2.48% due 03/05/212,3 | | | 1,700,000 | | | | 1,695,240 | |

| ALM VII R-2 Ltd. | | | | | | | | |

2013-7R2A, 2.83% due 04/24/242,3 | | | 1,700,000 | | | | 1,636,930 | |

| JP Morgan Mortgage Acquisition Trust | | | | | | | | |

2007-CH3, 0.32% due 03/25/372 | | | 1,602,083 | | | | 1,579,681 | |

| Cerberus Onshore II CLO LLC | | | | | | | | |

2014-1A, 2.93% due 10/15/232,3 | | | 1,350,000 | | | | 1,329,885 | |

2014-1A, 2.23% due 10/15/232,3 | | | 250,000 | | | | 249,450 | |

| Central Park CLO Ltd. | | | | | | | | |

2011-1A, 3.43% due 07/23/222,3 | | | 1,580,000 | | | | 1,560,092 | |

| Cornerstone CLO Ltd. | | | | | | | | |

2007-1A, 0.45% due 07/15/212,3 | | | 1,557,913 | | | | 1,544,204 | |

| KKR Financial CLO 2007-1 Ltd. | | | | | | | | |

2007-1A, 2.48% due 05/15/212,3 | | | 1,400,000 | | | | 1,387,680 | |

| Black Diamond CLO 2005-1 Delaware Corp. | | | | | | | | |

2005-1A, 2.15% due 06/20/172,3 | | | 1,350,000 | | | | 1,310,715 | |

| GreenPoint Mortgage Funding Trust | | | | | | | | |

2005-HE4, 0.87% due 07/25/302 | | | 1,344,649 | | | | 1,268,462 | |

| Symphony CLO VII Ltd. | | | | | | | | |

2011-7A, 3.43% due 07/28/212,3 | | | 1,250,000 | | | | 1,248,250 | |

| GSC Group CDO Fund VIII Ltd. | | | | | | | | |

2007-8A, 0.61% due 04/17/212,3 | | | 1,250,000 | | | | 1,226,750 | |

| Aegis Asset Backed Securities Trust | | | | | | | | |

2005-3, 0.64% due 08/25/352 | | | 1,205,222 | | | | 1,188,264 | |

| Wells Fargo Home Equity Asset-Backed Securities 2006-2 Trust | | | | | | | | |

2006-3, 0.32% due 01/25/372 | | | 1,234,227 | | | | 1,181,730 | |

| N-Star REL CDO VIII Ltd. | | | | | | | | |

2006-8A, 0.46% due 02/01/412,3 | | | 1,171,724 | | | | 1,128,371 | |

| Race Point V CLO Ltd. | | | | | | | | |

2014-5AR, 3.09% due 12/15/222,3 | | | 1,050,000 | | | | 1,045,695 | |

| Foothill CLO Ltd. | | | | | | | | |

2007-1A, 0.48% due 02/22/212,3 | | | 1,005,499 | | | | 997,556 | |

| Popular ABS Mortgage Pass-Through Trust | | | | | | | | |

2005-A, 0.60% due 06/25/352 | | | 1,005,922 | | | | 968,852 | |

| OFSI Fund V Ltd. | | | | | | | | |

2013-5A, 3.43% due 04/17/252,3 | | | 1,000,000 | | | | 965,200 | |

| Northwoods Capital VII Ltd. | | | | | | | | |

2006-7A, 1.78% due 10/22/212,3 | | | 960,000 | | | | 949,632 | |

| Black Diamond CLO 2006-1 Luxembourg S.A. | | | | | | | | |

2007-1A, 0.62% due 04/29/192,3 | | | 1,000,000 | | | | 940,700 | |

| Golub Capital Partners CLO 18 Ltd. | | | | | | | | |

2014-18A, 2.73% due 04/25/262,3 | | | 880,000 | | | | 877,800 | |

| H2 Asset Funding Ltd. | | | | | | | | |

| 2.06% due 03/19/37 | | | 850,000 | | | | 851,785 | |

| Symphony CLO IX, LP | | | | | | | | |

2012-9A, 2.73% due 04/16/222,3 | | | 800,000 | | | | 799,040 | |

| Hewett’s Island CDO Ltd. | | | | | | | | |

2007-6A, 2.49% due 06/09/192,3 | | | 750,000 | | | | 744,900 | |

| Soundview Home Loan Trust | | | | | | | | |

2003-1, 2.42% due 08/25/312 | | | 545,296 | | | | 540,661 | |

| Tricadia CDO 2006-6 Ltd. | | | | | | | | |

2006-6A, 0.78% due 11/05/412,3 | | | 522,320 | | | | 518,977 | |

| Race Point IV CLO Ltd. | | | | | | | | |

2007-4A, 0.98% due 08/01/212,3 | | | 500,000 | | | | 485,700 | |

| Halcyon Loan Advisors Funding 2012-1 Ltd. | | | | | | | | |

2012-1A, 3.23% due 08/15/232,3 | | | 500,000 | | | | 485,550 | |

| NewStar Commercial Loan Trust | | | | | | | | |

2007-1A, 1.53% due 09/30/222,3 | | | 500,000 | | | | 474,500 | |

| DIVCORE CLO Ltd. | | | | | | | | |

| 2013-1A B, 4.06% due 11/15/32 | | | 400,000 | | | | 400,120 | |

| West Coast Funding Ltd. | | | | | | | | |

2006-1A, 0.39% due 11/02/412,3 | | | 308,544 | | | | 304,255 | |

| Global Leveraged Capital Credit Opportunity Fund | | | | | | | | |

2006-1A, 0.53% due 12/20/182,3 | | | 279,136 | | | | 278,773 | |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 13 |

SCHEDULE OF INVESTMENTS (concluded) | December 31, 2014 |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| | | Face

Amount | | | Value | |

| | | | | | | | | |

| Golub Capital Partners Fundings Ltd. | | | | | | | | |

2007-1A, 0.49% due 03/15/222,3 | | $ | 160,758 | | | $ | 159,826 | |

| Total Asset-Backed Securities | | | | | | | | |

| (Cost $41,130,999) | | | | | | | 41,640,599 | |

| | | | | | | | | |

MORTGAGE-BACKED SECURITIES†† - 5.0% | |

| HSI Asset Securitization Corporation Trust | | | | | | | | |

2007-WF1, 0.34% due 05/25/372 | | | 2,539,781 | | | | 2,456,360 | |

| Resource Capital Corporation CRE Notes 2013 Ltd. | | | | | | | | |

2013-CRE1, 3.01% due 12/15/282,3 | | | 1,900,000 | | | | 1,908,568 | |

| Boca Hotel Portfolio Trust | | | | | | | | |

2013-BOCA, 3.21% due 08/15/262,3 | | | 1,900,000 | | | | 1,898,848 | |

| Hilton USA Trust | | | | | | | | |

2013-HLF, 2.92% due 11/05/302,3 | | | 1,675,291 | | | | 1,675,378 | |

| SRERS Funding Ltd. | | | | | | | | |

2011-RS, 0.41% due 05/09/462,3 | | | 1,377,704 | | | | 1,312,263 | |

| Bank of America Merrill Lynch Commercial Mortgage, Inc. | | | | | | | | |

2005-6, 6.13% due 09/10/472,3 | | | 1,053,600 | | | | 1,069,402 | |

| HarborView Mortgage Loan Trust | | | | | | | | |

2006-12, 0.35% due 01/19/382 | | | 1,231,062 | | | | 1,043,008 | |

| Wachovia Bank Commercial Mortgage Trust Series | | | | | | | | |

2007-WHL8, 0.24% due 06/15/202,3 | | | 534,289 | | | | 533,050 | |

| Total Mortgage-Backed Securities | | | | | | | | |

| (Cost $11,695,432) | | | | | | | 11,896,877 | |

| | | | | | | | | |

| Total Investments - 99.4% | | | | | | | | |

| (Cost $232,107,230) | | | | | | $ | 237,630,891 | |

| Other Assets & Liabilities, net - 0.6% | | | | | | | 1,444,541 | |

| Total Net Assets - 100.0% | | | | | | $ | 239,075,432 | |

| | | | | | | | | |

| | | Contracts | | | Unrealized

Gain (Loss) | |

| | | | | | | | | |

EQUITY FUTURES CONTRACTS PURCHASED† | |

March 2015 S&P 500 Index Equity

Mini Futures Contracts

(Aggregate Value of

Contracts $1,026,000) | | | 10 | | | $ | (8,532 | ) |

| | | | | | | | | |

| | | Units | | | | |

| | | | | | | | | |

OTC EQUITY INDEX SWAP AGREEMENTS†† | |

Bank of America

January 2015 S&P 500 Index Swap,

Terminating 01/02/154

(Notional Value $185,488,360) | | | 90,091 | | | $ | 654,255 | |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | Affiliated issuer — See Note 10. |

| 2 | Variable rate security. Rate indicated is rate effective at December 31, 2014. |

| 3 | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $40,239,857 (cost $39,916,768), or 16.8% of total net assets. These securities have been determined to be liquid under guidelines established by the Board of Trustees. |

| 4 | Total Return based on S&P 500 Index +/- financing at a variable rate. |

| | plc — Public Limited Company |

| 14 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| STATEMENT OF ASSETS AND LIABILITIES | | |

| December 31, 2014 | |

| | | | |

| Assets: | |

| Investments in unaffiliated issuers, at value (cost $104,433,545) | | $ | 110,506,801 | |

| Investments in affiliated issuers, at value (cost $127,673,685) | | | 127,124,090 | |

| Total investments (cost $232,107,230) | | | 237,630,891 | |

| Unrealized appreciation on swap agreements | | | 654,255 | |

| Segregated cash with broker | | | 46,000 | |

| Prepaid expenses | | | 10,180 | |

| Receivables: | |

| Securities sold | | | 734,748 | |

| Dividends | | | 263,130 | |

| Fund shares sold | | | 237,028 | |

| Interest | | | 116,054 | |

| Foreign taxes reclaim | | | 575 | |

| Total assets | | | 239,692,861 | |

| | | | | |

| Liabilities: | |

| Overdraft due to custodian bank | | | 12,331 | |

| Payable for: | |

| Securities purchased | | | 201,938 | |

| Fund shares redeemed | | | 173,211 | |

| Management fees | | | 152,220 | |

| Fund accounting/administration fees | | | 19,288 | |

| Variation margin | | | 12,350 | |

| Transfer agent/maintenance fees | | | 3,453 | |

| Trustees’ fees* | | | 717 | |

| Miscellaneous | | | 41,921 | |

| Total liabilities | | | 617,429 | |

| Net assets | | $ | 239,075,432 | |

| | | | | |

| Net assets consist of: | |

| Paid in capital | | $ | 236,181,406 | |

| Undistributed net investment income | | | 3,137,523 | |

| Accumulated net realized loss on investments | | | (6,412,881 | ) |

| Net unrealized appreciation on investments | | | 6,169,384 | |

| Net assets | | $ | 239,075,432 | |

| Capital shares outstanding | | | 6,370,923 | |

| Net asset value per share | | $ | 37.53 | |

| Year Ended December 31, 2014 | |

| | | | |

| Investment Income: | |

| Interest | | $ | 2,445,520 | |

| Dividends from securities of affiliated issuers | | | 1,503,227 | |

| Dividends from securities of unaffiliated issuers | | | 1,238,985 | |

| Total investment income | | | 5,187,732 | |

| | | | | |

| Expenses: | |

| Management fees | | | 1,746,485 | |

| Transfer agent/maintenance fees | | | 25,005 | |

| Fund accounting/administration fees | | | 221,225 | |

| Trustees’ fees* | | | 22,810 | |

| Line of credit fees | | | 21,200 | |

| Custodian fees | | | 10,156 | |

| Tax expense | | | 7 | |

| Miscellaneous | | | 205,611 | |

| Total expenses | | | 2,252,499 | |

| Less: | |

| Expenses waived by Adviser | | | (46,924 | ) |

| Net expenses | | | 2,205,575 | |

| Net investment income | | | 2,982,157 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | |

| Net realized gain (loss) on: | |

| Investments in unaffiliated issuers | | | 7,750,273 | |

| Investments in affiliated issuers | | | (149,822 | ) |

| Swap agreements | | | 21,219,870 | |

| Futures contracts | | | 236,171 | |

| Net realized gain | | | 29,056,492 | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments in unaffiliated issuers | | | 1,205,517 | |

| Investments in affiliated issuers | | | (353,199 | ) |

| Swap agreements | | | 654,255 | |

| Futures contracts | | | (8,532 | ) |

| Net change in unrealized appreciation (depreciation) | | | 1,498,041 | |

| Net realized and unrealized gain | | | 30,554,533 | |

| Net increase in net assets resulting from operations | | $ | 33,536,690 | |

| * | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 15 |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended December 31, 2014 | | | Year Ended December 31, 2013 | |

| Increase (Decrease) in Net Assets from Operations: | | | | | | |

| Net investment income | | $ | 2,982,157 | | | $ | 1,223,101 | |

| Net realized gain on investments | | | 29,056,492 | | | | 69,445,264 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,498,041 | | | | (15,861,052 | ) |

| Net increase in net assets resulting from operations | | | 33,536,690 | | | | 54,807,313 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 15,968,926 | | | | 13,501,310 | |

| Cost of shares redeemed | | | (41,624,282 | ) | | | (35,729,632 | ) |

| Net decrease from capital share transactions | | | (25,655,356 | ) | | | (22,228,322 | ) |

| Net increase in net assets | | | 7,881,334 | | | | 32,578,991 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 231,194,098 | | | | 198,615,107 | |

| End of year | | $ | 239,075,432 | | | $ | 231,194,098 | |

| Undistributed net investment income at end of year | | $ | 3,137,523 | | | $ | 1,196,673 | |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Shares sold | | | 467,403 | | | | 476,713 | |

| Shares redeemed | | | (1,210,200 | ) | | | (1,236,898 | ) |

| Net decrease in shares | | | (742,797 | ) | | | (760,185 | ) |

| 16 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| SERIES A (STYLEPLUS—LARGE CORE SERIES) | |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Year Ended December 31, 2014 | | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | | | Year Ended December 31, 2010 | |

| Per Share Data | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 32.50 | | | $ | 25.22 | | | $ | 22.31 | | | $ | 23.24 | | | $ | 19.97 | |

| Income (loss) from investment operations: | |

Net investment income (loss)a | | | .44 | | | | .16 | | | | .23 | | | | .13 | | | | .18 | |

| Net gain (loss) on investments (realized and unrealized) | | | 4.59 | | | | 7.12 | | | | 2.68 | | | | (1.06 | ) | | | 3.09 | |

| Total from investment operations | | | 5.03 | | | | 7.28 | | | | 2.91 | | | | (.93 | ) | | | 3.27 | |

| Net asset value, end of period | | $ | 37.53 | | | $ | 32.50 | | | $ | 25.22 | | | $ | 22.31 | | | $ | 23.24 | |

| | |

Total Returnb | | | 15.48 | % | | | 28.87 | % | | | 13.04 | % | | | (4.00 | %) | | | 16.37 | % |

| Ratios/Supplemental Data | |

| Net assets, end of period (in thousands) | | $ | 239,075 | | | $ | 231,194 | | | $ | 198,615 | | | $ | 206,995 | | | $ | 243,820 | |

| Ratios to average net assets: | |

| Net investment income (loss) | | | 1.28 | % | | | 0.56 | % | | | 0.92 | % | | | 0.57 | % | | | 0.89 | % |

Total expensesd | | | 0.97 | % | | | 0.96 | % | | | 0.94 | % | | | 0.90 | % | | | 0.92 | % |

Net expensesc,d | | | 0.95 | % | | | 0.96 | % | | | 0.94 | % | | | 0.90 | % | | | 0.92 | % |

| Portfolio turnover rate | | | 88 | % | | | 267 | % | | | 103 | % | | | 87 | % | | | 111 | % |

a | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

b | Total return does not take into account any of the expenses associated with an investment in variable insurance products. If total return had taken into account these expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

c | Net expense information reflects the expense ratios after expense waivers. |

d | Does not include expenses of the underlying funds in which the Fund invests. |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 17 |

MANAGER'S COMMENTARY (Unaudited) | December 31, 2014 |

To Our Shareholders:

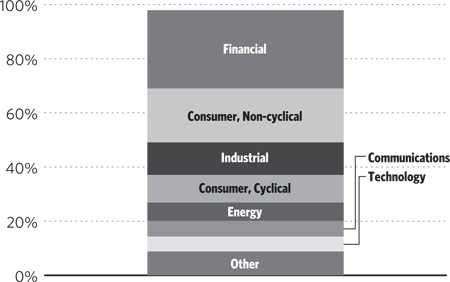

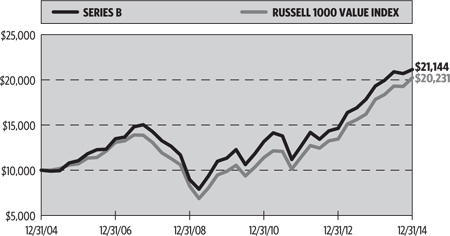

The Series B (Large Cap Value Series) is managed by a team of seasoned professionals led by Mark A. Mitchell, CFA, Portfolio Manager. In the following paragraphs, he discusses performance of the Fund for the fiscal year ended December 31, 2014.

For the fiscal year ended December 31, 2014, the Series B (Large Cap Value Series) returned 9.47%, compared with the Russell 1000® Value Index, which returned 13.45%.

Strategy and Market Overview

Our investment approach focuses on understanding how companies make money and how easily companies can either improve returns, or maintain existing high levels of profitability or benefit from change that occurs in the industries in which they operate.

In today’s rapid-fire environment marked by very sharp, quick but constrained volatility, our long term orientation and discipline are a competitive advantage. This should become especially critical when the environment of indiscriminant valuation expansion subsides and when fundamentals once again become a more dominant factor in the market.

Performance Review

The largest contributors to the Fund’s performance for the period were stock selection within the Health Care, Industrials and Utilities sectors.

Health Care proved somewhat defensive in the period as global growth concerns impacted industries with higher non-U.S. exposure. We believe many health care names are fairly valued and thus maintain the Fund’s underweight position—which offset the benefit from stock selection for the period. Teva Pharmaceuticals was a big contributor to the sector’s performance, based on success of its drugs for multiple sclerosis.

CVS Health, which is part of the Consumer Staples sector, was one of the top individual contributors for the year and a large position in the portfolio—the company has been reporting solid earnings and continues to benefit from its acquisition of pharmacy benefit manager PBM. In addition, store chains like CVS saw less drop-off in traffic compared with more traditional retailers in the discretionary space.

While the Fund’s stock selection within the Industrials sector helped performance, it was offset by an overweight in the sector. This is a large and eclectic sector in which we have diverse holdings. We believe the portfolio is well positioned to benefit from the growing cap-ex and construction environment tied to infrastructure renewal and reindustrialization in the U.S.

Utilities benefited from stock selection from the Fund’s main holding in the sector, Edison International, which was the largest individual contributor to performance for the year. The sector is one the largest underweights relative to the index, as we do not view Utilities as attractive from either a fundamental or valuation standpoint. Edison was up partly due to a settlement in which it will recoup some expenses related to a nuclear plant shutdown, but we like the holding due to its diversity of business.

The Energy sector provided the only negative return in the benchmark and the Fund amid a general commodities selloff and falling crude oil prices. Both its performance and the Fund’s overweight to the sector detracted from performance for the year. Our belief is that longer-term energy prices will be higher than current levels as the cost to pull oil out of the ground isn’t declining and the demand trends ultimately are positive.

Poor stock selection in Information Technology was another detractor from return for the Fund. Our overall sector position weight is in-line with the benchmark, but we own more stable, services-related companies and non-personal computer related hardware providers. The Fund also does not own large benchmark companies that were up significantly for the year, Apple and Intel. Both are good companies, but we view their future prospects as already fully valued in the current share price.

| 18 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

MANAGER'S COMMENTARY (Unaudited)(concluded) | December 31, 2014 |

Financials was a modest detractor for the year, but included one of the leading individual detractors, Ocwen Financial Corp. The company has been under pressure due to inquiries about its mortgage servicing practices in California and New York.

Fund performance was also impacted slightly by poor stock selection in Materials. Underperformance in this sector was driven mostly by Coeur Mining, Inc., which is not in the index and fell as part of a wider commodities selloff over the past year. Coeur was the largest single stock detractor for the year.

Portfolio Positioning

The largest relative sector exposures for the year were an underweight in Health Care and overweights in Energy and Consumer Staples. Only the Consumer Staples positioning benefited Fund performance for the year.

The Health Care sector underweight was predominantly driven by our view that the large pharmaceutical companies look fairly valued, thus are less attractive than companies in other sectors.

The overweights in both Energy and Consumer Staples were driven by our bottom-up fundamental research having identified several companies with favorable risk-return profiles.

Portfolio and Market Outlook