UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-02753 |

SBL FUND

|

| (Exact name of registrant as specified in charter) |

| | |

| ONE SECURITY BENEFIT PLACE, TOPEKA, KANSAS | | 66636-0001 |

| (Address of principal executive offices) | | (Zip code) |

THOMAS A. SWANK, PRESIDENT

SBL FUND

ONE SECURITY BENEFIT PLACE

TOPEKA, KANSAS 66636-0001

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (785) 438-3000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

SBL Fund

December 31, 2007

Annual Report

Table of Contents

Security Global Investors refers to the asset management arm of Security Benefit Corporation (“Security Benefit”) that consists of Security Investors, LLC, and for global investing, Security Global Investors, LLC. Security Distributors, Inc., Security Investors, LLC and Security Global Investors, LLC are subsidiaries of Security Benefit.

1

| | |

| | |

| Manager’s Commentary | | Series A |

| February 15, 2008 | | (Equity Series) |

| | |

| |

Adviser, Security Global Investors |

| |

To Our Shareholders:

For the year ended December 31, 2007, Series A of the SBL Fund – Equity Series returned -4.88% during the year, lagging the benchmark S&P 500 Index’s return of 5.49% and the Series’ peer group median return of 5.13%. Our performance has been disappointing and we feel not indicative of our potential.

The Series’ strategy uses a blended approach, investing in growth and value stocks. Growth oriented stocks are securities of established companies that typically have a record of consistent earnings growth greater than the overall market. Value oriented stocks are securities of companies that are believed to be trading well below their intrinsic value.

Our strategy is to buy companies that are trading at a significant discount to their intrinsic value. Our investment approach is a defined and disciplined process of three clear philosophical tenets that drive our investment decisions: a valuation focus, a long-term perspective and an opportunistic approach.

This investment process is fundamentally driven and quantitatively aided. We use proprietary screens to identify potential companies for investment and then perform rigorous fundamental analysis to identify the best ideas. Through this fundamental research, we determine an estimate of intrinsic value and thus a valuation target for each idea. We construct the portfolios based on the level of conviction generated by this bottom-up analysis and the upside/downside profile associated with each company.

Top Performers

The Series’ health care holdings were up more than 18% compared to 7% for the Index. Medco Health Solutions was up 89%, benefiting from increasing mail order business and higher generic prescription penetration rates. Also contributing to the sector’s performance was Hospira, Inc., up 22% on strong execution of their business plan.

The consumer staples sector was up over 20% versus the comparable sector Index return of 14%. The largest contributors were Costco Wholesale Corporation and CVS Caremark Corporation with returns of 33% and 29%, respectively.

Disappointing Performers

The largest detractor for the Series was the financials sector, down -26% versus down -18% for the sector in the Index. Our holdings were negatively impacted as concern increased over the potential impact of a debt crisis resulting from poor lending practices in the U.S. mortgage market. A majority of these holdings have nothing to do with the mortgage market, but were viewed in the same light. For example, First Marblehead Corporation a higher education student loan provider, was down -71% and Capital One Financial Corporation, a credit card lender, was down -38%. We believe both of these companies are trading well below their intrinsic value and that they have excellent business models with sustainable competitive advantages.

Energy sector holdings in the portfolio detracted even with an overweight in an outperforming sector due to stock selection. The sector returned 3% for the portfolio versus 34% for the sector within the S&P 500 Index. Evergreen Energy, Inc., down -77% (previously known as KFx) and BJ Services Company, down -16%, both contributed negatively to the Series performance. Evergreen Energy was hurt by concerns over the viability of the initial production results of its proprietary clean coal technology. BJ Services was impacted more generally by industry challenges in their core North American pressure pumping business.

2008 Market Outlook

Our bottom-up approach looks at market uncertainty in the context of the potential long-term impact on individual companies. Often times, volatility provides opportunity. We are maintaining flexibility in the portfolios to take advantage of these opportunities as they arise. Our focus is on

| | |

| | |

| Manager’s Commentary | | Series A |

| February 15, 2008 | | (Equity Series) |

identifying companies with the ability to be substantially better over the next three to five years or have the potential to maintain their return on capital at current levels in a difficult economic environment. We are confident in our ability to find these companies and we are pleased with the positions we own today.

We believe that investing is a long-term pursuit that requires patience and a consistent approach. Dollar cost averaging is a sound way to build long-term value. We recognize there are many investment fund alternatives available today and thank you for your business and the confidence you place in us.

Sincerely,

Mark A. Mitchell, Portfolio Manager

| | |

| | Series A |

| Performance Summary | | (Equity Series) |

| December 31, 2007 | | (unaudited) |

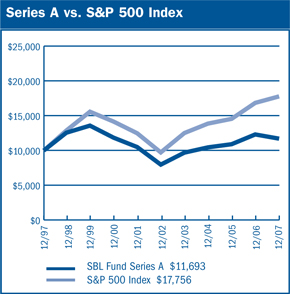

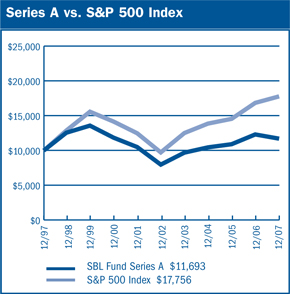

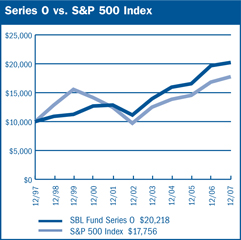

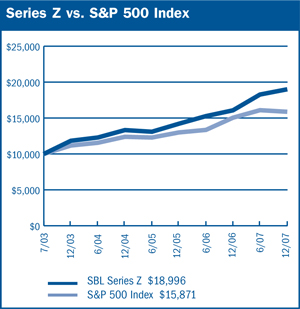

$10,000 Over 10 Years

The chart above assumes a hypothetical $10,000 investment in Series A (Equity Series) on December 31, 1997 and reflects the fees and expenses of Series A. The S&P 500 Index is a capitalization-weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

| | | | | | | | | |

Average Annual Returns | |

| Periods Ended 12-31-071 | | 1 Year | | | 5 Years | | | 10 Years | |

Series A | | (4.88 | %) | | 8.01 | % | | 1.58 | % |

1 Performance figures do not reflect fees and expenses associated with an investment in variable insurance products offered by Security Benefit Life Insurance Company. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a Series of SBL Fund are available only through the purchase of such products. | |

| |

The performance data quoted above represents past performance. Past performance is not predictive of future performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. | |

| | | |

Portfolio Composition by Sector | |

Consumer Discretionary | | 10.11 | % |

Consumer Staples | | 8.71 | |

Energy | | 10.34 | |

Financials | | 23.32 | |

Health Care | | 10.35 | |

Industrials | | 17.68 | |

Information Technology | | 12.27 | |

Telecommunication Services | | 2.03 | |

Commercial Paper | | 3.73 | |

U.S. Government Sponsored Agencies | | 1.22 | |

Repurchase Agreement | | 0.30 | |

Liabilities in Excess of Other Assets | | (0.06 | ) |

Total Net Assets | | 100.00 | % |

| | | | |

| | | | |

| | |

| 4 | | The accompanying notes are an integral part of the financial statements |

| | |

| | Series A |

| Performance Summary | | (Equity Series) |

| December 31, 2007 | | (unaudited) |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur ongoing costs, including management fees and other series expenses. Performance figures and expense ratios do not reflect fees and expenses associated with an investment in variable insurance products. Shares of a Series of SBL Fund are available only through the purchase of such products. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2007 through December 31, 2007.

Actual Expenses

The first line in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses associated with an investment in variable insurance products. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these fees and expenses associated with an investment in variable insurance products were included, your costs would have been higher.

| | | | | | |

Series Expenses |

| | | Beginning

Account

Value

7/1/2007 | | Ending

Account Value

12/31/20071 | | Expenses

Paid

During

Period2 |

Series A (Equity Series) |

Actual | | $1,000.00 | | $921.61 | | $4.36 |

Hypothetical | | 1,000.00 | | 1,020.67 | | 4.58 |

1 The actual ending account value is based on the actual total return of the Series for the period July 1, 2007 to December 31, 2007 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period July 1, 2007 to December 31, 2007 was (7.84%).

2 Expenses are equal to the Series annualized expense ratio of 0.90%, net of any applicable fee waivers or earnings credits, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period)

| | |

| | |

| Schedule of Investments | | Series A (Equity Series) |

| December 31, 2007 | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK - 94.8% |

Aerospace & Defense - 4.4% | | | | | |

General Dynamics Corporation | | 162,100 | | $ | 14,425,279 |

| | | | | |

| | |

Air Freight & Logistics - 2.9% | | | | | |

FedEx Corporation | | 106,000 | | | 9,452,020 |

| | | | | |

| | |

Broadcasting & Cable TV -1.3% | | | | | |

CBS Corporation (CI.B) | | 152,950 | | | 4,167,887 |

| | | | | |

| | |

Building Products - 2.0% | | | | | |

USG Corporation * | | 180,900 | | | 6,474,411 |

| | | | | |

| | |

Coal & Consumable Fuels - 0.3% | | | | | |

Evergreen Energy, Inc. * | | 488,700 | | | 1,089,801 |

| | | | | |

| | |

Communications Equipment - 2.1% | | | | | |

ADC Telecommunications, Inc. * | | 452,100 | | | 7,030,155 |

| | | | | |

| | |

Consumer Finance - 8.3% | | | | | |

American Express Company | | 222,700 | | | 11,584,854 |

Capital One Financial Corporation | | 181,700 | | | 8,587,142 |

Discover Financial Services | | 217,000 | | | 3,272,360 |

First Marblehead Corporation | | 248,900 | | | 3,808,170 |

| | | | | |

| | | | | 27,252,526 |

| | | | | |

Data Processing & Outsourced | | | | | |

Services - 3.5% | | | | | |

Western Union Company | | 477,600 | | | 11,596,128 |

| | | | | |

| | |

Drug Retail - 2.8% | | | | | |

CVS Caremark Corporation | | 228,500 | | | 9,082,875 |

| | | | | |

| | |

Electronic Manufacturing Services - 1.1% | | | | | |

Tyco Electronics, Ltd. | | 96,900 | | | 3,597,897 |

| | | | | |

Health Care Equipment - 3.7% | | | | | |

Covidien, Ltd. | | 96,900 | | | 4,291,701 |

Hospira, Inc. * | | 185,300 | | | 7,901,192 |

| | | | | |

| | | | | 12,192,893 |

| | | | | |

Health Care Services - 2.6% | | | | | |

Medco Health Solutions, Inc. * | | 82,900 | | | 8,406,060 |

| | | | | |

| | |

Home Improvement Retail - 3.8% | | | | | |

Home Depot, Inc. | | 467,300 | | | 12,589,062 |

| | | | | |

| | |

Hotels, Resorts & Cruise Lines - 2.3% | | | | | |

Carnival Corporation | | 172,200 | | | 7,661,178 |

| | | | | |

| | |

Hypermarkets & Super Centers - 5.9% | | | | | |

Costco Wholesale Corporation | | 92,500 | | | 6,452,800 |

Wal-Mart Stores, Inc. | | 275,800 | | | 13,108,774 |

| | | | | |

| | | | | 19,561,574 |

| | | | | |

Industrial Conglomerates - 8.5% | | | | | |

General Electric Company | | 492,700 | | | 18,264,389 |

McDermott International, Inc. * | | 97,000 | | | 5,725,910 |

Tyco International, Ltd. | | 96,900 | | | 3,842,085 |

| | | | | |

| | | | | 27,832,384 |

| | | | | |

| | | | | | |

| | | Shares | | Value |

COMMON STOCK (continued) |

Integrated Oil & Gas - 7.3% | | | | | | |

Chevron Corporation | | | 120,000 | | $ | 11,199,600 |

Exxon Mobil Corporation | | | 137,900 | | | 12,919,851 |

| | | | | | |

| | | | | | 24,119,451 |

| | | | | | |

Movies & Entertainment - 2.7% | | | | | | |

Time Warner, Inc. | | | 535,000 | | | 8,832,850 |

| | | | | | |

| | |

Multi-Line Insurance - 5.3% | | | | | | |

American International Group, Inc. | | | 300,700 | | | 17,530,810 |

| | | | | | |

| | |

Oil & Gas Equipment & Services - 2.7% | | | | | | |

Baker Hughes, Inc. | | | 32,300 | | | 2,619,530 |

BJ Services Company | | | 70,900 | | | 1,720,034 |

Halliburton Company | | | 117,700 | | | 4,462,007 |

| | | | | | |

| | | | | | 8,801,571 |

| | | | | | |

Other Diversified Financial | | | | | | |

Services - 3.5% | | | | | | |

Citigroup, Inc. | | | 95,500 | | | 2,811,520 |

JPMorgan Chase & Company | | | 197,200 | | | 8,607,780 |

| | | | | | |

| | | | | | 11,419,300 |

| | | | | | |

Pharmaceuticals - 4.1% | | | | | | |

Johnson & Johnson | | | 201,400 | | | 13,433,380 |

| | | | | | |

| | |

Property & Casualty Insurance - 6.2% | | | | | | |

Berkshire Hathaway, Inc. * | | | 145 | | | 20,532,000 |

| | | | | | |

| | |

Systems Software - 5.5% | | | | | | |

Microsoft Corporation | | | 510,200 | | | 18,163,120 |

| | | | | | |

| | |

Wireless Telecommunication | | | | | | |

Services - 2.0% | | | | | | |

Sprint Nextel Corporation | | | 508,300 | | | 6,673,979 |

| TOTAL COMMON STOCK (Cost $285,675,496) | | $ | 311,918,591 |

| | | Principal

Amount | | Value |

| U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES 1.2% |

Federal Home Loan Bank | | | | | | |

4.24% - 2008 | | $ | 3,000,000 | | | 2,999,325 |

4.26% - 2008 | | | 1,000,000 | | | 999,078 |

| TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES | | | | | $ | 3,998,403 |

(Cost $3,998,403) | | | | | | |

COMMERCIAL PAPER - 3.8% |

Banking -0.8% | | | | | | |

UBS Finance (DE) LLC | | | | | | |

5.04%, 1/14/2008 | | | 1,400,000 | | | 1,397,725 |

Wells Fargo & Company, Inc. | | | | | | |

4.25%, 1/2/2008 | | | 1,100,000 | | | 1,099,870 |

| | | | | | |

| | | | | | 2,497,595 |

| | | | | | |

| | |

| 6 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Schedule of Investments | | Series A (Equity Series) |

| December 31, 2007 - continued | | |

| | | | | | | |

| | | Principal

Amount | | Value | |

COMMERCIAL PAPER (continued) | |

Brokerage - 0.3% | | | | | | | |

Goldman Sachs Group, Inc. | | | | | | | |

5.25%, 1/8/2008 | | | 1,000,000 | | $ | 998,979 | |

| | | | | | | |

| | |

Consumer Products - 0.7% | | | | | | | |

Unilever Capital Corporation | | | | | | | |

4.25%, 1/11/2008 | | | 1,200,000 | | | 1,198,583 | |

4.22%, 1/15/2008 | | | 1,100,000 | | | 1,098,182 | |

| | | | | | | |

| | | | | | 2,296,765 | |

| | | | | | | |

| | |

Electric - 0.6% | | | | | | | |

Florida Power & Light Company | | | | | | | |

4.25%, 1/10/2008 | | | 1,800,000 | | | 1,798,088 | |

| | | | | | | |

| | |

Financial Companies - Captive - 0.9% | | | | | | | |

Caterpillar Financial Services Corporation | | | | | | | |

4.25%, 1/7/2008 | | | 1,500,000 | | | 1,498,937 | |

International Lease Finance Company | | | | | | | |

4.38%, 1/4/2008 | | | 1,500,000 | | | 1,499,453 | |

| | | | | | | |

| | | | | | 2,998,390 | |

| | | | | | | |

| | |

Pharmaceuticals - 0.5% | | | | | | | |

Johnson & Johnson | | | | | | | |

4.08%, 1/3/2008 | | | 1,700,000 | | | 1,699,615 | |

| TOTAL COMMERCIAL PAPER (Cost $12,289,432) | | $ | 12,289,432 | |

REPURCHASE AGREEMENT - 0.3% | |

United Missouri Bank, 3.61%, dated 12/31/07, matures 1/02/08; repurchase amount $971,195 (Collateralized by FHLB Discount Note, 5/30/08 with a value of $991,338) | | $ | 971,000 | | $ | 971,000 | |

| TOTAL REPURCHASE AGREEMENT (Cost $971,000) | | $ | 971,000 | |

Total Investments (SBL A Fund) | | | | | $ | 329,177,426 | |

(Cost $302,934,331) - 100.1% | | | | | | | |

Liabilities in Excess of Other Assets - (0.1)% | | | | | | (182.004 | ) |

| | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | $ | 328,995,422 | |

| | | | | | | |

Footnotes

Percentages are stated as a percent of net assets.

For federal income tax purposes the identified cost of investments owned at 12/31/2007 was $303,072,667.

| | |

* | | - Non-income producing security |

|

| Glossary: |

FHLB | | - Federal Home Loan Bank |

|

| See notes to financial statements. |

| | |

| 7 | | The accompanying notes are an integral part of the financial statements |

Statement of Assets and Liabilities

December 31, 2007

| | | |

Assets: | | | |

Investments, at value* | | $ | 329,177,426 |

Cash | | | 483 |

Receivables: | | | |

Fund shares sold | | | 153,135 |

Securities sold | | | 245,591 |

Dividends | | | 293,350 |

Prepaid expenses | | | 7,418 |

| | | |

Total assets | | | 329,877,403 |

| | | |

Liabilities: | | | |

| |

Payable for: | | | |

Fund shares redeemed | | | 549,462 |

Management fees | | | 213,872 |

Administration fees | | | 27,240 |

Transfer agent/maintenance fees | | | 2,083 |

Custodian fees | | | 8,000 |

Directors’ fees | | | 7,525 |

Professional fees | | | 36,150 |

Other fees | | | 37,649 |

| | | |

Total liabilities | | | 881,981 |

| | | |

Net assets | | $ | 328,995,422 |

| | | |

Net assets consist of: | | | |

Paid in capital | | $ | 261,396,080 |

Undistributed net investment income | | | 2,057,542 |

Undistributed net realized gain on sale of investments | | | 39,298,705 |

Net unrealized appreciation in value of investments | | | 26,243,095 |

| | | |

Net assets | | $ | 328,995,422 |

| | | |

| |

Capital shares authorized | | | unlimited |

Capital shares outstanding | | | 13,392,748 |

Net asset value per share | | | |

(net assets divided by shares outstanding) | | $ | 24.57 |

| | | |

| |

*Investments, at cost | | $ | 302,934,331 |

Statement of Operations

For Year Ended December 31, 2007

| | | | |

Investment Income: | | | | |

Dividends | | $ | 5,107,798 | |

Interest | | | 452,331 | |

| | | | |

Total investment income | | | 5,560,129 | |

| | | | |

| |

Expenses: | | | | |

Management fees | | | 2,954,771 | |

Administration fees | | | 374,988 | |

Transfer agent/maintenance fees | | | 25,253 | |

Custodian fees | | | 25,316 | |

Directors’ fees | | | 23,512 | |

Professional fees | | | 38,964 | |

Reports to shareholders | | | 40,090 | |

Other | | | 19,693 | |

| | | | |

Total expenses | | | 3,502,587 | |

| | | | |

Net investment income | | | 2,057,542 | |

| | | | |

| |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) during the year on: | | | | |

Investments | | | 39,328,102 | |

Options written | | | 108,939 | |

| | | | |

Net realized gain | | | 39,437,041 | |

| | | | |

| |

Net unrealized appreciation (depreciation) during the year on: | | | | |

Investments | | | (57,218,273 | ) |

Options written | | | 56,904 | |

| | | | |

Net unrealized depreciation | | | (57,161,369 | ) |

| | | | |

Net realized and unrealized loss | | | (17,724,328 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (15,666,786 | ) |

| | | | |

| | |

| 8 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| | Series A |

| Statement of Changes in Net Assets | | (Equity Series) |

| | | | | | | | |

| | | Year Ended

December 31, 2007 | | | Year Ended

December 31, 2006 | |

| | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment income | | $ | 2,057,542 | | | $ | 1,466,765 | |

Net realized gain during the year on investments | | | 39,437,041 | | | | 47,236,718 | |

Net unrealized appreciation (depreciation) during the year on investments | | | (57,161,369 | ) | | | 4,445,082 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (15,666,786 | ) | | | 53,148,565 | |

| | | | | | | | |

| | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | 34,320,140 | | | | 37,464,659 | |

Cost of shares redeemed | | | (131,446,012 | ) | | | (115,755,780 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (97,125,872 | ) | | | (78,291,121 | ) |

| | | | | | | | |

Net decrease in net assets | | | (112,792,658 | ) | | | (25,142,556 | ) |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of year | | | 441,788,080 | | | | 466,930,636 | |

| | | | | | | | |

End of year | | $ | 328,995,422 | | | $ | 441,788,080 | |

| | | | | | | | |

| | |

Undistributed net investment income at end of year | | $ | 2,057,542 | | | $ | 1,466,765 | |

| | | | | | | | |

| | |

Capital share activity: | | | | | | | | |

Shares sold | | | 1,322,125 | | | | 1,582,979 | |

Shares redeemed | | | (5,035,865 | ) | | | (4,888,558 | ) |

| | | | | | | | |

Total capital share activity | | | (3,713,740 | ) | | | (3,305,579 | ) |

| | | | | | | | |

| | |

| 9 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Financial Highlights | | Series A |

| Selected data for each share of capital stock outstanding throughout each year | | (Equity Series) |

| | | | | | | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | Year Ended

December 31,

2003 |

Per Share Data | | | | | | | | | | |

Net asset value, beginning of period | | $25.83 | | $22.88 | | $21.93 | | $20.37 | | $16.83 |

| |

Income (loss) from investment operations: | | | | | | | | | | |

Net investment incomea | | 0.14 | | 0.11 | | 0.16 | | 0.18 | | 0.13 |

Net gain (loss) on securities (realized and unrealized) | | (1.40) | | 2.84 | | 0.79 | | 1.40 | | 3.53 |

| | |

Total from investment operations | | (1.26) | | 2.95 | | 0.95 | | 1.58 | | 3.66 |

| |

Less distributions: | | | | | | | | | | |

Dividends from net investment income | | - | | - | | - | | (0.02) | | (0.12) |

| | |

Total distributions | | - | | - | | - | | (0.02) | | (0.12) |

| |

Net asset value, end of period | | $24.57 | | $25.83 | | $22.88 | | $21.93 | | $20.37 |

| | |

| | | | | | | | | | |

| |

Total Returnb | | (4.88%) | | 12.89% | | 4.33% | | 7.77% | | 21.74% |

| |

Ratios/Supplemental Data | | | | | | | | | | |

Net assets, end of period (in thousands) | | $328,995 | | $441,788 | | $466,931 | | $530,096 | | $559,290 |

| |

Ratios to average net assets: | | | | | | | | | | |

Net investment income | | 0.52% | | 0.33% | | 0.55% | | 0.81% | | 0.66% |

Total expensesc | | 0.89% | | 0.90% | | 0.89% | | 0.87% | | 0.82% |

Net expensesd | | 0.89% | | 0.90% | | 0.89% | | 0.87% | | 0.82% |

| |

Portfolio turnover rate | | 14% | | 26% | | 37% | | 27% | | 53% |

a Net investment income (loss) was computed using average shares outstanding throughout the period.

b Total return does not take into account any of the expenses associated with an investment in variable insurance products offered by Security Benefit Life Insurance Company. If total return had taken into account these expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products.

c Total expense information reflects the expense ratios absent expense reductions by the Investment Manager, and earnings credits, as applicable.

d Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable.

| | |

| 10 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Manager’s Commentary | | Series B |

| February 15, 2008 | | (Large Cap Value Series) |

Adviser, Security Global Investors

| | |

| | To Our Shareholders: For the year ended December 31, 2007, Series B of the SBL Fund -Large Cap Value series returned 5.83%, beating the benchmark Russell 1000 Value Index’s return of -0.17% by 600 basis points. The Series’ peer group median return of 2.19% was less than half of the return of the Series. Good individual stock selection and sector weightings contribution drove performance in 2007. |

Our strategy is to buy companies that are trading at a significant discount to their intrinsic value. Our investment approach is a defined and disciplined process with three clear philosophical tenets that drive our investment decisions: a valuation focus, a long-term perspective and an opportunistic approach.

This investment process is fundamentally driven and quantitatively aided. We use proprietary screens to identify potential companies for investment and then perform rigorous fundamental analysis to identify the best ideas. Through this fundamental research, we determine an estimate of intrinsic value and thus a valuation target for each idea. We construct the portfolios based on the level of conviction generated by this bottom-up analysis and the upside/downside profile associated with each company. For Series B, we apply this philosophy to a broad range of value names.

Top Performers

The Series’ Industrial holdings were up 29% compared to 12% for the Index. In addition to superior stock selection, the Series was overweight in the sector, 19% relative to 9% for the Index. McDermott International, Inc., returned 132% during the period while Union Pacific Corporation, Inc., was up 38%. McDermott benefited from strong demand in the global infrastructure market and Union Pacific experienced solid demand coupled with operational improvements.

In the health care sector, our second best performing, Medco Health Solutions, Inc., rose 90% and Hospira, Inc. gained 27%. The Consumer Staples sector was able to add value to the Series as Costco Wholesale Corporation increased 33%, Archer-Daniels-Midland 47%, and CVS Caremark Corporation by 29%.

Disappointing Performers

The largest sector detractor from the portfolio was telecommunications due mostly to stock selection although an underweight position also contributed to the relative under-performance. The portfolio’s telecommunications sector holdings declined 14%, while the Index holdings returned greater than 13%. More traditional companies like AT&T and Verizon performed better than our holdings in Sprint Nextel Corporation and Windstream Corporation.

The consumer discretionary sector in general experienced a difficult environment in 2007. The sector within the Series was down -20% versus -13% for the sector in the Russell 1000 Value Index. Home Depot, Inc. was the largest detractor, sliding over 31% in the period. This was caused by the impact of a slowing housing market. We feel confident that Home Depot still enjoys a solid competitive position and will benefit once the housing market improves.

2008 Market Outlook

Our bottom-up approach looks at market uncertainty in the context of the potential long-term impact on individual companies. Often times, volatility provides opportunity. We are maintaining flexibility in the portfolios to take advantage of these opportunities as they arise. Our focus is on identifying companies with the ability to be substantially better over the next three to five years or have the potential to maintain their return on capital at current levels in a difficult economic environment. We are confident in our ability to find these companies and we are pleased with the positions we own today.

We believe that investing is a long-term pursuit that requires patience and a consistent approach. Dollar cost averaging is a sound way to build long-term value. We recognize there are many investment fund alternatives available today and thank you for your business and the confidence you place in us.

Sincerely,

Mark A. Mitchell, Portfolio Manager

| | |

| | Series B |

| Performance Summary | | (Large Cap Value Series) |

| December 31, 2007 | | (unaudited) |

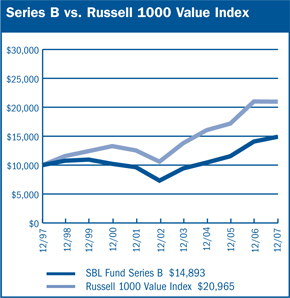

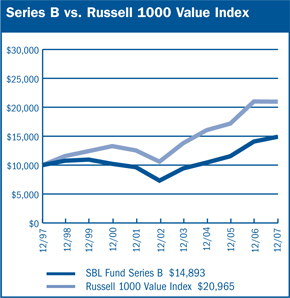

$10,000 Over 10 Years

The chart above assumes a hypothetical $10,000 investment in Series B (Large Cap Value Series) on December 31, 1997 and reflects the fees and expenses of Series B. The Russell 1000 Value Index is an unmanaged index representing the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

| | | | | | | | | |

Average Annual Returns | |

| Periods Ended 12-31-071 | | 1 Year | | | 5 Years | | | 10 Years | |

Series B | | 5.83 | % | | 15.29 | % | | 4.06 | % |

1 Performance figures do not reflect fees and expenses associated with an investment in variable insurance products offered by Security Benefit Life Insurance Company. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a Series of SBL Fund are available only through the purchase of such products. The performance data quoted above represents past performance. Past performance is not predictive of future performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. | |

| | |

Portfolio Composition by Sector | | |

Consumer Discretionary | | 8.88% |

Consumer Staples | | 9.86 |

Energy | | 13.02 |

Financials | | 21.16 |

Health Care | | 4.73 |

Industrials | | 17.98 |

Information Technology | | 4.57 |

Materials | | 3.35 |

Telecommunication Services | | 2.39 |

Utilities | | 2.18 |

Exchange Traded Funds | | 4.35 |

Commercial Paper | | 2.66 |

U.S. Government Sponsored Agencies | | 3.56 |

Repurchase Agreement | | 0.12 |

Other Assets in Excess of Liabilities | | 1.19 |

Total Net Assets | | 100.00% |

| | | |

| | |

| 12 | | The accompanying notes are an integral part of the financial statements |

| | |

| | Series B |

| Performance Summary | | (Large Cap Value Series) |

| December 31, 2007 | | (unaudited) |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur ongoing costs, including management fees and other series expenses. Performance figures and expense ratios do not reflect fees and expenses associated with an investment in variable insurance products. Shares of a Series of SBL Fund are available only through the purchase of such products. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2007 through December 31, 2007.

Actual Expenses

The first line in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses associated with an investment in variable insurance products. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these fees and expenses associated with an investment in variable insurance products were included, your costs would have been higher.

| | | | | | |

Series Expenses |

| | | Beginning

Account

Value

7/1/2007 | | Ending

Account Value

12/31/20071 | | Expenses

Paid

During

Period2 |

Series B (Large Cap Value Series) |

Actual | | $1,000.00 | | $963.78 | | $3.91 |

Hypothetical | | 1,000.00 | | 1,021.22 | | 4.02 |

1 The actual ending account value is based on the actual total return of the Series for the period July 1, 2007 to December 31, 2007 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period July 1, 2007 to December 31, 2007 was (3.62%).

2 Expenses are equal to the Series annualized expense ratio of 0.79%, net of any applicable fee waivers or earnings credits, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period)

| | |

| | |

| Schedule of Investments | | Series B (Large Cap Value Series) |

| December 31, 2007 | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK - 92.5% | | | | | |

Aerospace & Defense - 3.6% | | | | | |

United Technologies Corporation | | 228,400 | | $ | 17,481,736 |

| | | | | |

| | |

Agricultural Products - 1.0% | | | | | |

Archer-Daniels-Midland Company | | 107,600 | | | 4,995,868 |

| | | | | |

| | |

Air Freight & Logistics - 1.5% | | | | | |

FedEx Corporation | | 80,800 | | | 7,204,936 |

| | | | | |

| | |

Broadcasting & Cable TV -2.3% | | | | | |

CBS Corporation (CI.B) | | 402,100 | | | 10,957,225 |

| | | | | |

| | |

Building Products -3.2% | | | | | |

USG Corporation * | | 431,100 | | | 15,429,069 |

| | | | | |

| | |

Computer Hardware -2.5% | | | | | |

Hewlett-Packard Company | | 239,200 | | | 12,074,816 |

| | | | | |

| | |

Consumer Finance -5.9% | | | | | |

Capital One Financial Corporation | | 298,700 | | | 14,116,562 |

Discover Financial Services | | 280,000 | | | 4,222,400 |

First Marblehead Corporation | | 640,950 | | | 9,806,535 |

| | | | | |

| | | | | 28,145,497 |

| | | | | |

Data Processing & Outsourced | | | | | |

Services - 1.3% | | | | | |

Western Union Company | | 250,000 | | | 6,070,000 |

| | | | | |

| | |

Diversified Banks - 1.0% | | | | | |

Wells Fargo & Company | | 162,600 | | | 4,908,894 |

| | | | | |

| | |

Diversified Chemicals - 1.5% | | | | | |

Dow Chemical Company | | 176,400 | | | 6,953,688 |

| | | | | |

| | |

Drug Retail -2.3% | | | | | |

CVS Caremark Corporation | | 280,800 | | | 11,161,800 |

| | | | | |

| | |

Electric Utilities -2.2% | | | | | |

Edison International | | 196,300 | | | 10,476,531 |

| | | | | |

| | |

Electronic Manufacturing | | | | | |

Services -0.8% | | | | | |

Tyco Electronics, Ltd. | | 101,650 | | | 3,774,265 |

| | | | | |

Exchange Traded Funds -4.4% iShares Russell 1000 Value Index Fund | | 170,600 | | | 13,707,710 |

iShares S&P 500 Value Index Fund | | 93,600 | | | 7,155,720 |

| | | | | |

| | | | | 20,863,430 |

| | | | | |

Health Care Equipment - 2.7% | | | | | |

Covidien, Ltd. | | 101,650 | | | 4,502,078 |

Hospira, Inc. * | | 200,700 | | | 8,557,848 |

| | | | | |

| | | | | 13,059,926 |

| | | | | |

Health Care Services - 2.0% | | | | | |

Medco Health Solutions, Inc. * | | 95,300 | | | 9,663,420 |

| | | | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK (continued) |

Home Improvement Retail - 3.0% | | | | | |

Home Depot, Inc. | | 540,600 | | $ | 14,563,764 |

| | | | | |

| | |

Hypermarkets & Super Centers -5.1% | | | | | |

Costco Wholesale Corporation | | 169,700 | | | 11,838,272 |

Wal-Mart Stores, Inc. | | 260,800 | | | 12,395,824 |

| | | | | |

| | | | | 24,234,096 |

| | | | | |

Industrial Conglomerates - 6.4% | | | | | |

General Electric Company | | 411,900 | | | 15,269,133 |

McDermott International, Inc. * | | 193,900 | | | 11,445,917 |

Tyco International, Ltd. | | 101,650 | | | 4,030,422 |

| | | | | |

| | | | | 30,745,472 |

| | | | | |

Integrated Oil & Gas -8.6% | | | | | |

Chevron Corporation | | 98,600 | | | 9,202,338 |

ConocoPhillips | | 41,200 | | | 3,637,960 |

Exxon Mobil Corporation | | 168,700 | | | 15,805,503 |

Sasol, Ltd. ADR | | 251,600 | | | 12,446,652 |

| | | | | |

| | | | | 41,092,453 |

| | | | | |

Integrated Telecommunication | | | | | |

Services -0.9% | | | | | |

Windstream Corporation | | 331,932 | | | 4,321,755 |

| | | | | |

| | |

Movies & Entertainment - 3.6% | | | | | |

News Corporation | | 260,800 | | | 5,343,792 |

Time Warner, Inc. | | 712,600 | | | 11,765,026 |

| | | | | |

| | | | | 17,108,818 |

| | | | | |

Multi-Line Insurance - 4.6% | | | | | |

American International Group, Inc. | | 374,400 | | | 21,827,520 |

| | | | | |

| | |

Oil & Gas Equipment & Services - 1.8% | | | | | |

Halliburton Company | | 232,600 | | | 8,817,866 |

| | | | | |

| | |

Oil & Gas Storage & Transportation -2.6% | | | | | |

Williams Companies, Inc. | | 350,800 | | | 12,551,624 |

| | | | | |

| | |

Other Diversified Financial Services -4.1% | | | | | |

Citigroup, Inc. | | 101,600 | | | 2,991,104 |

JPMorgan Chase & Company | | 384,700 | | | 16,792,155 |

| | | | | |

| | | | | 19,783,259 |

| | | | | |

Property & Casualty Insurance - 5.6% | | | | | |

Berkshire Hathaway, Inc. * | | 190 | | | 26,904,000 |

| | | | | |

| | |

Railroads -3.2% | | | | | |

Union Pacific Corporation | | 122,800 | | | 15,426,136 |

| | | | | |

| | |

Specialty Chemicals -1.9% | | | | | |

Rohm & Haas Company | | 172,200 | | | 9,138,654 |

| | | | | |

| | |

Tobacco - 1.4% | | | | | |

Altria Group, Inc. | | 91,800 | | | 6,938,244 |

| | | | | |

| | |

| 14 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Schedule of Investments | | Series B (Large Cap Value Series) |

| December 31, 2007 - continued | | |

| | | | | | |

| | | Shares | | | Value |

COMMON STOCK (continued) | | | | | | |

Wireless Telecommunication Services - 1.5% | | | | | | |

Sprint Nextel Corporation | | | 544,700 | | $ | 7,151,911 |

TOTAL COMMON STOCK (Cost $382,777,101) | | $ | 443,826,673 |

| | | Principal

Amount | | Value |

U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES - 3.5% |

Federal Home Loan Bank | | | | | | |

4.24% - 2008 | | $ | 5,300,000 | | | 5,298,899 |

4.235% - 2008 | | | 1,100,000 | | | 1,099,619 |

4.26% - 2008 | | | 1,400,000 | | | 1,398,709 |

4.30% - 2008 | | | 2,000,000 | | | 1,996,417 |

Federal National Mortgage Association | | | | | | |

4.10% - 2008 | | | 1,900,000 | | | 1,898,485 |

4.15% - 2008 | | | 1,600,000 | | | 1,596,949 |

4.18% - 2008 | | | 1,800,000 | | | 1,798,119 |

4.60% - 2008 | | | 2,000,000 | | | 1,999,767 |

TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES (Cost $17,086,964) | | $ | 17,086,964 |

COMMERCIAL PAPER - 2.7% | | | | | | |

Banking - 1.1% | | | | | | |

Credit Suisse First Boston USA | | | | | | |

4.71%, 1/28/2008 | | | 1,900,000 | | | 1,893,288 |

UBS Finance (DE) LLC | | | | | | |

4.55%, 1/25/2008 | | | 2,000,000 | | | 1,993,934 |

Wells Fargo & Company, Inc. | | | | | | |

4.25%, 1/14/2008 | | | 1,500,000 | | | 1,497,698 |

| | | | | | |

| | | | | | 5,384,920 |

| | | | | | |

Brokerage - 0.3% | | | | | | |

Goldman Sachs Group, Inc. | | | | | | |

5.05%, 1/11/2008 | | | 1,200,000 | | | 1,198,300 |

| | | | | | |

Consumer Products - 0.7% | | | | | | |

Unilever Capital Corporation | | | | | | |

4.21%, 1/7/2008 | | | 1,800,000 | | | 1,798,737 |

4.22%, 1/15/2008 | | | 1,400,000 | | | 1,397,686 |

| | | | | | |

| | | | | | 3,196,423 |

| | | | | | |

Non U.S. Banking - 0.6% | | | | | | |

Danske Corporation | | | | | | |

4.57%, 1/22/2008 | | | 1,000,000 | | | 997,404 |

Royal Bank of Canada | | | | | | |

4.20%, 1/22/2008 | | | 2,000,000 | | | 1,995,100 |

| | | | | | |

| | | | | | 2,992,504 |

| TOTAL COMMERCIAL PAPER (Cost $12,772,147) | | $ | 12,772,147 |

| | | | | | |

| | | Principal

Amount | | Value |

REPURCHASE AGREEMENT - 0.1% | | | | | | |

United Missouri Bank, 3.61%, dated 12/31/07, matures 1/02/08; repurchase amount $581,117 (Collateralized by FHLMC, 1/12/08 & FHLB, 1/19/08 with a combined value of $592,620) | | $ | 581,000 | | $ | 581,000 |

TOTAL REPURCHASE AGREEMENT (Cost $581,000) | | $ | 581,000 |

Total Investments (SBL B Fund) | | | | | $ | 474,266,784 |

(Cost $413,217,212) - 98.8% | | | | | | |

Other Assets in Excess of Liabilities - 1.2% | | | | | | 5,705.584 |

| | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | $ | 479,972,368 |

| | | | | | |

Footnotes

Percentages are stated as a percent of net assets.

For federal income tax purposes the identified cost of investments owned at 12/31/2007 was $416,158,353.

| | |

* | | - Non-income producing security |

|

| Glossary: |

ADR | | - American Depositary Receipt |

|

See notes to financial statements. |

| | |

| 15 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| | Series B |

| | (Large Cap Value Series) |

Statement of Assets and Liabilities

December 31, 2007

| | |

Assets: | | |

Investments, at value* | | $474,266,784 |

Cash | | 1,446,478 |

Receivables: | | |

Fund shares sold | | 8,548,307 |

Dividends | | 679,178 |

Prepaid expenses | | 9,679 |

| | |

| | |

Total assets | | 484,950,426 |

| | |

| |

Liabilities: | | |

Payable for: | | |

Fund shares redeemed | | 1,699,748 |

Securities purchased | | 2,877,654 |

Management fees | | 265,960 |

Administration fees | | 39,051 |

Transfer agent/maintenance fees | | 2,083 |

Custodian fees | | 8,000 |

Directors’ fees | | 3,668 |

Professional fees | | 38,950 |

Other fees | | 42,944 |

| | |

Total liabilities | | 4,978,058 |

| | |

| | |

Net assets | | $479,972,368 |

| | |

| | |

Net assets consist of: | | |

Paid in capital | | $578,184,229 |

Undistributed net investment income | | 4,458,590 |

Accumulated net realized loss on sale of investments | | (163,720,023) |

Net unrealized appreciation in value of investments | | 61,049,572 |

| | |

Net assets | | $479,972,368 |

| | |

| | |

Capital shares authorized | | unlimited |

Capital shares outstanding | | 17,178,073 |

Net asset value per share | | |

(net assets divided by shares outstanding) | | $27.94 |

| | |

*Investments, at cost | | $413,217,212 |

Statement of Operations

For Year Ended December 31, 2007

| | |

Investment Income: | | |

Dividends | | $7,598,768 |

Interest | | 742,495 |

| | |

Total investment income | | 8,341,263 |

| | |

| |

Expenses: | | |

Management fees | | 3,213,945 |

Administration fees | | 470,657 |

Transfer agent/maintenance fees | | 25,258 |

Custodian fees | | 27,551 |

Directors’ fees | | 25,263 |

Professional fees | | 46,492 |

Reports to shareholders | | 52,849 |

Other | | 20,658 |

| | |

Total expenses | | 3,882,673 |

| | |

Net investment income | | 4,458,590 |

| | |

| |

Net Realized and Unrealized Gain (Loss): | | |

Net realized gain (loss) during the year on: | | |

Investments | | 63,209,892 |

Options written | | 178,938 |

| | |

Net realized gain | | 63,388,830 |

| | |

| |

Net unrealized appreciation (depreciation) during the year on: | | |

Investments | | (40,728,888) |

Options written | | 20,791 |

| | |

Net unrealized depreciation | | (40,708,097) |

| | |

Net realized and unrealized gain | | 22,680,733 |

| | |

Net increase in net assets resulting from operations | | $27,139,323 |

| | |

| | |

| 16 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| | Series B |

| |

| Statement of Changes in Net Assets | | (Large Cap Value Series) |

| | | | | | | | |

| | | Year Ended

December 31, 2007 | | | Year Ended

December 31, 2006 | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment income | | $ | 4,458,590 | | | $ | 3,504,848 | |

Net realized gain during the year on investments | | | 63,388,830 | | | | 27,019,837 | |

Net unrealized appreciation (depreciation) during the year on investments | | | (40,708,097 | ) | | | 57,084,019 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 27,139,323 | | | | 87,608,704 | |

| | | | | | | | |

| | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | 117,350,624 | | | | 88,964,012 | |

Cost of shares redeemed | | | (145,200,986 | ) | | | (106,581,077 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (27,850,362 | ) | | | (17,617,065 | ) |

| | | | | | | | |

Net increase (decrease) in net assets | | | (711,039 | ) | | | 69,991,639 | |

| | | | | | | | |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 480,683,407 | | | | 410,691,768 | |

| | | | | | | | |

End of year | | $ | 479,972,368 | | | $ | 480,683,407 | |

| | | | | | | | |

| | |

Undistributed net investment income at end of year | | $ | 4,458,590 | | | $ | 3,504,848 | |

| | | | | | | | |

| | |

Capital share activity: | | | | | | | | |

Shares sold | | | 4,134,610 | | | | 3,705,999 | |

Shares redeemed | | | (5,162,697 | ) | | | (4,475,464 | ) |

| | | | | | | | |

Total capital share activity | | | (1,028,087 | ) | | | (769,465 | ) |

| | | | | | | | |

| | |

| 17 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Financial Highlights | | Series B |

| Selected data for each share of capital stock outstanding throughout each year | | (Large Cap Value Series) |

| | | | | | | | | | | | | | | | | |

| | | 2007 | | 2006 | | 2005a | | 2004 | | | Year Ended

December 31,

2003 | |

Per Share Data | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 26.40 | | $ | 21.64 | | $ | 19.58 | | $ | 17.68 | | | $ | 13.84 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.25 | | | 0.20 | | | 0.24 | | | 0.21 | | | | 0.14 | |

Net gain on securities (realized and unrealized) | | | 1.29 | | | 4.56 | | | 1.82 | | | 1.70 | | | | 3.84 | |

| | | | |

Total from investment operations | | | 1.54 | | | 4.76 | | | 2.06 | | | 1.91 | | | | 3.98 | |

| | |

Less distributions: | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | — | | | — | | | (0.01 | ) | | | (0.14 | ) |

| | | | |

Total distributions | | | — | | | — | | | — | | | (0.01 | ) | | | (0.14 | ) |

| | |

Net asset value, end of period | | $ | 27.94 | | $ | 26.40 | | $ | 21.64 | | $ | 19.58 | | | $ | 17.68 | |

| | | | |

| | | | | | | | | | | | | | | | | |

| | |

Total Returnc | | | 5.83% | | | 22.00% | | | 10.52% | | | 10.82% | | | | 28.81% | |

| | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 479,972 | | $ | 480,683 | | $ | 410,692 | | $ | 429,493 | | | $ | 434,575 | |

| | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.90% | | | 0.80% | | | 0.98% | | | 1.09% | | | | 0.93% | |

Total expensesd | | | 0.79% | | | 0.79% | | | 0.84% | | | 0.92% | | | | 0.89% | |

Net expensese | | | 0.79% | | | 0.79% | | | 0.84% | | | 0.87% | | | | 0.83% | |

| | |

Portfolio turnover rate | | | 29% | | | 20% | | | 99% | | | 73% | | | | 60% | |

a | Security Global Investors (SGI), formerly Security Management Company, LLC, became the advisor of Series B effective June 30, 2005. Prior to June 30, 2005, SGI paid Dreyfus Corporation for sub-advisory services. |

b | Net investment income (loss) was computed using average shares outstanding throughout the period. |

c | Total return does not take into account any of the expenses associated with an investment in variable insurance products offered by Security Benefit Life Insurance Company. If total return had taken into account these expenses, performance would have been lower. Shares of a series of SBL Fund are available only through the purchase of such products. |

d | Total expense information reflects the expense ratios absent expense reductions by the Investment Manager, and earnings credits, as applicable. |

e | Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable. |

| | |

| 18 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Manager’s Commentary | | Series C |

| February 15, 2008 | | (Money Market Series) |

Adviser, Security Global Investors

| | |

| | To Our Shareholders: |

| | Series C of the SBL Fund - Money Market Series returned 4.71% for the year ended December 31, 2007, which exceeded the benchmark I-Money Net Retail Tier 1 of 4.58% and the 4.68% performance of its peer group for the same period. |

| | The last four months of 2007 ended with the Federal Reserve Board decreasing interest rates on three separate occasions from 5.25% at the beginning of the year to 4.25% at the close. |

Composition of Portfolio Assets

At December 31, 2007, the average maturity of the holdings in the Series was 53 days.

The majority of the Series’ assets lie in the corporate debt sector of commercial paper. At year-end, approximately 70% of the Series consisted of Commercial Paper, 12% in Floating Rate securities (which includes corporate and U.S. government-backed), 7% in U.S. Government/Agency obligations, 7% in CD’s/Yankee CD’s, and a fraction of 1% in mortgage related products.

2007 Performance

The turning point in the year was an abrupt deterioration in credit markets in June as the sub-prime mortgage concerns began to unfold. The credit crunch worsened in August as the extent of the crisis became more apparent.

The year was far from uneventful and presented many challenges for Money Market managers. During the first half of 2007, sub-prime mortgage loans became the topic of interest as defaults continued to rise, which triggered downgrades of securities backed by pools of these loans. Many money market funds had invested in investment-pooled securities or SIVs, (Structured Investment Vehicles), which boosted yields but created a liquidity problem as the rating agencies downgraded many of these programs.

The Money Market Series does not invest in these types of securities. The manager remained focused on liquidity

and credit quality, and the sub-prime mortgage securities never passed these tests. While a small portion of the portfolio was invested in asset-backed commercial paper, which posed no risk to the portfolio, we chose to take the conservative approach and further reduce the exposure to this type investment.

2008 Market Outlook

The upcoming year provides a challenging economic environment for the Federal Reserve Board and Chairman Bernanke as they attempt to balance the fear of recession with an up-tick in inflation. As we continue to see broader contagion from the sub-prime defaults, our expectation is that we will see an increase in inflation, as companies have the pricing power to pass costs onto the consumer rather than absorbing the costs themselves.

We expect the Federal Reserve will continue its current rate cycle of reducing Federal Funds in hopes of providing liquidity to the markets while attempting to balance inflation. The goal is to eliminate the probability of recession and maintain a level of growth in the US economy.

We expect the sub-prime contagion to continue to be an ongoing concern through the first half of the year until visibility becomes clearer as to where the bottom will be, at which point the second half of the year will be a period of correction and adjustment. The effects of the Federal Reserve rate reductions and a fiscal stimulus injection by Congress should aid the growth of the economy during the second half of the year.

As always, we will continue to monitor the economic and market conditions when deciding portfolio strategies and will adjust the asset mix and maturity structure in the portfolio accordingly.

Thank you for your investment in the Money Market Series.

We appreciate the confidence that you have placed in us and continue to focus on achieving the Series’ investment goals.

Sincerely,

Christina Fletcher

Portfolio Manager

| | |

| | Series C |

| Performance Summary | | (Money Market Series) |

| December 31, 2007 | | (unaudited) |

| | |

Portfolio Composition by Quality Ratings |

| | |

Tier 1 investments | | 99.06% |

Repurchase Agreement | | 0.24 |

Other Assets in Excess of Liabilities | | 0.70 |

Total Net Assets | | 100.00% |

| | | |

| | | | | | | | | |

Average Annual Returns | |

| | | | |

| Periods Ended 12-31-071 | | 1 Year | | | 5 Years | | | 10 Years | |

Series C | | 4.71 | % | | 2.61 | % | | 3.37 | % |

1 Performance figures do not reflect fees and expenses associated with an investment in variable insurance products offered by Security Benefit Life Insurance Company. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a Series of SBL Fund are available only through the purchase of such products. | |

The performance data quoted above represents past performance. Past performance is not predictive of future performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. | |

| | |

| 20 | | The accompanying notes are an integral part of the financial statements |

| | |

| | Series C |

| |

| Performance Summary | | (Money Market Series) |

| December 31, 2007 | | (unaudited) |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur ongoing costs, including management fees and other series expenses. Performance figures and expense ratios do not reflect fees and expenses associated with an investment in variable insurance products. Shares of a Series of SBL Fund are available only through the purchase of such products. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2007 through December 31, 2007.

Actual Expenses

The first line in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses associated with an investment in variable insurance products. Therefore, the second line is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these fees and expenses associated with an investment in variable insurance products were included, your costs would have been higher.

| | | | | | |

Series Expenses |

| | | Beginning

Account

Value

7/1/2007 | | Ending

Account Value

12/31/20071 | | Expenses

Paid

During

Period2 |

Series C (Money Market Series) | | |

Actual | | $1,000.00 | | $1,023.02 | | $3.31 |

Hypothetical | | 1,000.00 | | 1,021.93 | | 3.31 |

1 | The actual ending account value is based on the actual total return of the Series for the period July 1, 2007 to December 31, 2007 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period July 1, 2007 to December 31, 2007 was 2.30%. |

2 | Expenses are equal to the Series annualized expense ratio of 0.65%, net of any applicable fee waivers or earnings credits, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period) |

| | |

| | |

| Schedule of Investments | | Series C (Money Market Series) |

| December 31, 2007 | | |

| | | | | | |

| | | Principal

Amount | | Value |

CERTIFICATE OF DEPOSIT - 6.6% |

Bank of America | | | | | | |

5.28%, 1/10/2008 | | | 1,500,000 | | $ | 1,500,166 |

BNP Paribas NY | | | | | | |

5.40%, 3/17/2008 | | | 1,000,000 | | | 1,001,185 |

Credit Suisse New York | | | | | | |

5.30%, 5/22/2008 | | | 3,500,000 | | | 3,506,083 |

Societe Generale NY | | | | | | |

5.17%, 1/09/2008 to | | | | | | |

1/17/2008 | | | 2,600,000 | | | 2,600,346 |

UBS AG Stamford CT | | | | | | |

5.05%, 3/20/2008 | | | 2,500,000 | | | 2,501,531 |

TOTAL CERTIFICATE OF DEPOSIT (Cost $11,098,385) | | $ | 11,109,311 |

CORPORATE BOND - 11.7% |

Automotive - 2.4% | | | | | | |

Toyota Motor Credit Corporation | | | | | | |

4.065%, 1/02/2008 (1)(2) | | $ | 2,500,000 | | | 2,496,675 |

4.961%, 3/17/2008 (1)(2) | | | 1,500,000 | | | 1,499,655 |

| | | | | | |

| | | | | | 3,996,330 |

| | | | | | |

Brokerage - 5.7% | | | | | | |

Lehman Brothers Holdings, Inc. | | | | | | |

5.092%, 2/29/2008 (1)(2) | | | 3,000,000 | | | 2,986,434 |

Merrill Lynch & Company, Inc. | | | | | | |

4.90%, 2/14/2008 (2) | | | 1,950,000 | | | 1,949,195 |

Morgan Stanley | | | | | | |

5.114%, 1/25/2008 (1)(2) | | | 1,500,000 | | | 1,497,820 |

5.201%, 3/07/2008 (2) | | | 1,000,000 | | | 999,618 |

5.334%, 1/18/2008 (2) | | | 2,200,000 | | | 2,199,540 |

| | | | | | |

| | | | | | 9,632,607 |

| | | | | | |

| | | | | | |

Financial Companies - Captive - 3.6% | | | | | | |

General Electric Capital Corporation | | | | | | |

4.955%, 2/19/2008 (1)(2) | | | 1,500,000 | | | 1,499,927 |

5.171%, 3/04/2008 (2) | | | 2,000,000 | | | 2,001,182 |

5.29%, 1/03/2008 (2) | | | 2,600,000 | | | 2,600,000 |

| | | | | | |

| | | | | | 6,101,109 |

| TOTAL CORPORATE BOND (Cost $19,752,092) | | $ | 19,730,046 |

MORTGAGE BACKED SECURITIES - 0.6% |

Other Non-Agency - 0.6% | | | | | | |

Pass-Thru’s -0.6% | | | | | | |

Small Business Administration Pools | | | | | | |

#503308, 5.00% - | | | | | | |

1/01/2008 (1)(2) | | | 141,781 | | | 141,781 |

#503176, 5.125% - | | | | | | |

1/01/2008 (1)(2) | | | 24,091 | | | 24,211 |

#503343, 5.125% - | | | | | | |

1/01/2008 (1)(2) | | | 226,982 | | | 226,982 |

#503347, 5.125% - | | | | | | |

1/01/2008 (1)(2) | | | 84,076 | | | 84,076 |

#502353, 5.25% - | | | | | | |

1/01/2008 (1)(2) | | | 37,926 | | | 37,926 |

#503295, 5.25% - | | | | | | |

1/01/2008 (1)(2) | | | 112,430 | | | 112,186 |

| | | | | | |

| | | Principal

Amount | | Value |

MORTGAGE BACKED SECURITIES (continued) |

Other Non-Agency (continued) | | | | | | |

Pass-Thru’s (continued) Small Business Administration Pools | | | | | | |

(continued) | | | | | | |

#503303, 5.25% - | | | | | | |

1/01/2008 (1)(2) | | $ | 197,557 | | $ | 197,128 |

#502163, 5.50% - | | | | | | |

1/01/2008 (1)(2) | | | 176,194 | | | 176,194 |

| | | | | | |

| | | | | | 1,000,484 |

TOTAL MORTGAGE BACKED SECURITIES

(Cost $1,001,351) | | | | | $ | 1,000,484 |

U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES -10.1% |

Federal Home Loan Bank | | | | | | |

3.563% -1/02/2008 (1)(2) | | | 2,000,000 | | | 1,997,778 |

3.583% - 1/02/2008 (1)(2) | | | 1,500,000 | | | 1,499,552 |

4.30% - 12/18/2008 | | | 1,000,000 | | | 1,000,760 |

4.35% - 12/11/2008 | | | 3,000,000 | | | 3,002,934 |

4.47% - 12/15/2008 | | | 2,000,000 | | | 2,002,936 |

4.50% - 11/28/2008 | | | 1,500,000 | | | 1,500,925 |

4.625% - 12/04/2008 | | | 2,000,000 | | | 2,002,030 |

4.701% - 2/04/2008 (1)(2) | | | 2,000,000 | | | 1,999,856 |

4.841% - 3/17/2008 (1)(2) | | | 2,000,000 | | | 2,001,264 |

TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES

(Cost $16,999,040) | | $ | 17,008,035 |

COMMERCIAL PAPER - 70.1% |

Automotive -6.9% | | | | | | |

American Honda Finance | | | | | | |

4.48%, 1/4/2008 | | | 2,500,000 | | | 2,499,067 |

4.52%, 1/9/2008 | | | 1,000,000 | | | 998,996 |

4.48%, 1/25/2008 | | | 1,200,000 | | | 1,196,416 |

4.50%, 1/30/2008 | | | 1,500,000 | | | 1,494,287 |

4.51%, 2/13/2008 | | | 2,000,000 | | | 1,988,875 |

Toyota Motor Credit Corporation | | | | | | |

4.65%, 2/25/2008 | | | 1,000,000 | | | 992,900 |

4.82%, 3/31/2008 | | | 1,000,000 | | | 988,011 |

4.55%, 4/10/2008 | | | 1,600,000 | | | 1,578,575 |

| | | | | | |

| | | | | | 11,737,127 |

| | | | | | |

Banking -2.8% | | | | | | |

Bank of America | | | | | | |

5.065%, 1/22/2008 | | | 1,300,000 | | | 1,296,159 |

UBS Finance (DE) LLC | | | | | | |

5.04%, 1/14/2008 | | | 1,500,000 | | | 1,497,579 |

4.70%, 2/14/2008 | | | 2,000,000 | | | 1,988,700 |

| | | | | | |

| | | | | | 4,782,438 |

| | | | | | |

Brokerage - 11.7% | | | | | | |

Goldman Sachs Group, Inc. | | | | | | |

4.80%, 1/2/2008 | | | 1,000,000 | | | 999,867 |

5.05%, 1/11/2008 | | | 1,200,000 | | | 1,198,317 |

4.50%, 1/14/2008 | | | 1,000,000 | | | 998,375 |

| | |

| 22 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Schedule of Investments | | Series C (Money Market Series) |

December 31, 2007 - continued | | |

| | | | | |

| | | Principal

Amount | | Value |

COMMERCIAL PAPER (continued) |

Brokerage (continued) |

Goldman Sachs Group, Inc. (continued) | | | | | |

4.50%, 1/17/2008 | | 1,000,000 | | $ | 998,000 |

4.80%, 1/28/2008 | | 1,500,000 | | | 1,494,600 |

4.78%, 1/29/2008 | | 1,100,000 | | | 1,095,935 |

4.80%, 1/30/2008 | | 1,200,000 | | | 1,195,430 |

ING (US) Funding LLC | | | | | |

4.50%, 1/3/2008 | | 1,000,000 | | | 999,750 |

5.12%, 1/9/2008 | | 1,000,000 | | | 998,862 |

4.85%, 1/15/2008 | | 1,700,000 | | | 1,696,794 |

4.82%, 1/23/2008 | | 1,500,000 | | | 1,495,582 |

4.50%, 2/5/2008 | | 1,600,000 | | | 1,593,000 |

4.46%, 2/6/2008 | | 1,500,000 | | | 1,493,310 |

JP Morgan Chase & Company | | | | | |

5.07%, 1/3/2008 | | 1,500,000 | | | 1,499,410 |

4.80%, 1/4/2008 | | 1,000,000 | | | 999,600 |

4.67%, 1/24/2008 | | 1,000,000 | | | 996,886 |

| | | | | |

| | | | | 19,753,718 |

| | | | | |

Consumer Products - 3.6% | | | | | |

Procter & Gamble International Funding | | | | | |

4.42%, 1/4/2008 | | 1,075,000 | | | 1,074,604 |

4.20%, 1/23/2008 | | 2,000,000 | | | 1,994,867 |

4.22%, 1/25/2008 | | 1,500,000 | | | 1,495,780 |

4.50%, 2/8/2008 | | 1,500,000 | | | 1,492,642 |

| | | | | |

| | | | | 6,057,893 |

| | | | | |

Diversified Financial Services - 1.5% | | | | | |

Irish Life & Permanent | | | | | |

4.38%, 2/29/2008 | | 2,500,000 | | | 2,482,054 |

| | | | | |

| | |

Electric -0.8% | | | | | |

Florida Power & Light Company | | | | | |

4.27%, 1/7/2008 | | 1,300,000 | | | 1,299,075 |

| | | | | |

| | |

Financial Companies - Captive - 5.3% | | | | | |

General Electric Capital Corporation | | | | | |

4.62%, 2/22/2008 | | 1,000,000 | | | 993,298 |

International Lease Finance Company | | | | | |

4.67%, 1/8/2008 | | 3,900,000 | | | 3,896,532 |

4.555%, 1/10/2008 | | 2,000,000 | | | 1,997,723 |

4.76%, 1/11/2008 | | 2,000,000 | | | 1,997,356 |

| | | | | |

| | | | | 8,884,909 |

| | | | | |

Financial Companies - Noncaptive | | | | | |

Consumer -0.9% | | | | | |

American Express Credit Corporation | | | | | |

4.60%, 1/16/2008 | | 1,500,000 | | | 1,496,853 |

| | | | | |

| | |

Food & Beverage - 4.4% | | | | | |

Archer Daniels Midland Company | | | | | |

4.51%, 1/8/2008 | | 2,300,000 | | | 2,297,983 |

4.47%, 1/29/2008 | | 2,090,000 | | | 2,082,734 |

4.316%, 2/26/2008 | | 3,000,000 | | | 2,978,159 |

| | | | | |

| | | | | 7,358,876 |

| | | | | |

| | | | | |

| | | Principal

Amount | | Value |

COMMERCIAL PAPER (continued) |

Insurance -3.7% | | | | | |

Swiss Re Financial Products | | | | | |

4.95%, 1/2/2008 | | 1,700,000 | | $ | 1,699,557 |

4.95%, 1/7/2008 | | 2,000,000 | | | 1,998,176 |

5.31%, 1/28/2008 | | 1,000,000 | | | 996,444 |

4.85%, 2/27/2008 | | 1,500,000 | | | 1,488,951 |

| | | | | |

| | | | | 6,183,128 |

| | | | | |

Life Insurance - 2.9% | | | | | |

Prudential plc | | | | | |

4.77%, 1/18/2008 | | 1,500,000 | | | 1,496,482 |

4.95%, 1/23/2008 | | 1,500,000 | | | 1,495,537 |

4.82%, 2/4/2008 | | 2,000,000 | | | 1,991,186 |

| | | | | |

| | | | | 4,983,205 |

| | | | | |

Non U.S. Banking - 18.5% | | | | | |

Bank of Ireland | | | | | |

5.09%, 1/15/2008 | | 1,700,000 | | | 1,696,656 |

4.92%, 1/22/2008 | | 2,000,000 | | | 1,994,252 |

Barclays US Funding LLC | | | | | |

4.65%, 1/15/2008 | | 1,000,000 | | | 998,192 |

Danske Corporation | | | | | |

4.57%, 1/22/2008 | | 1,000,000 | | | 997,334 |

4.65%, 1/31/2008 | | 1,200,000 | | | 1,195,000 |

4.65%, 1/31/2008 | | 1,000,000 | | | 996,091 |

4.66%, 2/1/2008 | | 2,700,000 | | | 2,688,883 |

5.00%, 2/8/2008 | | 1,850,000 | | | 1,840,724 |

Royal Bank of Canada | | | | | |

4.30%, 1/28/2008 | | 1,000,000 | | | 996,475 |

4.49%, 2/12/2008 | | 1,700,000 | | | 1,691,095 |

4.30%, 2/29/2008 | | 2,500,000 | | | 2,482,382 |

4.50%, 3/6/2008 | | 1,500,000 | | | 1,487,317 |

Societe Generale | | | | | |

5.08%, 1/4/2008 | | 1,000,000 | | | 999,479 |

4.83%, 2/20/2008 | | 2,000,000 | | | 1,986,583 |

4.81%, 2/21/2008 | | 1,500,000 | | | 1,490,146 |

4.45%, 3/6/2008 | | 1,000,000 | | | 991,965 |

Westpac Banking Corporation | | | | | |

5.12%, 1/7/2008 | | 1,000,000 | | | 999,147 |

4.90%, 2/1/2008 | | 1,000,000 | | | 995,781 |

4.90%, 2/1/2008 | | 1,500,000 | | | 1,493,951 |

4.65%, 2/5/2008 | | 2,000,000 | | | 1,990,936 |

4.96%, 2/26/2008 | | 1,200,000 | | | 1,191,321 |

| | | | | |

| | | | | 31,203,710 |

| | | | | |

Oil Field Services - 2.4% | | | | | |

BP Capital Markets plc | | | | | |

4.46%, 2/6/2008 | | 2,000,000 | | | 1,990,686 |

4.45%, 2/11/2008 | | 2,000,000 | | | 1,989,444 |

| | | | | |

| | | | | 3,980,130 |

| | | | | |

Pharmaceuticals -4.7% | | | | | |

AstraZeneca plc | | | | | |

4.95%, 1/14/2008 | | 1,500,000 | | | 1,497,264 |

4.55%, 1/16/2008 | | 1,500,000 | | | 1,496,873 |

| | |

| 23 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| Schedule of Investments | | Series C (Money Market Series) |

| December 31, 2007 - continued | | |

| | | | | | |

| | | Principal

Amount | | Value |

| COMMERCIAL PAPER (continued) |

Pharmaceuticals (continued) |

GlaxoSmithKline Finance plc | | | | | | |

4.55%, 1/22/2008 | | | 1,500,000 | | $ | 1,495,717 |

4.65%, 2/4/2008 | | | 1,500,000 | | | 1,493,389 |

4.63%, 3/3/2008 | | | 2,000,000 | | | 1,983,914 |

| | | | | | |

| | | | | | 7,967,157 |

TOTAL COMMERCIAL PAPER (Cost $118,174,759) | | $ | 118,170,273 |

REPURCHASE AGREEMENT - 0.2% | | | |

United Missouri Bank, 3.61%, dated 12/31/07, matures 1/02/08; repurchase amount $412,083 (Collateralized by FHLB Discount Note, 1/19/08 with a value of $420,240) | | $ | 412,000 | | $ | 412,000 |

| |

TOTAL REPURCHASE AGREEMENT (Cost $412,000) | | $ | 412,000 |

| |

Total Investments (SBL C Fund) | | $ | 167,430,149 |

(Cost $167,437,627) - 99.3% | | | |

Other Assets in Excess of Liabilities - 0.7% | | | 1,231,340 |

| | | | | | |

TOTAL NET ASSETS - 100.0% | | $ | 168,661,489 |

| | | | | | |

Footnotes

Percentages are stated as a percent of net assets.

For federal income tax purposes the identified cost of investments owned at 12/31/2007 was $167,437,627.

| | |

| 1 | | - Maturity date indicated is next interest reset date. |

| 2 | | - Variable rate security. Rate indicated is rate effective at December 31, 2007. |

|

| Glossary: |

FHLB | | - Federal Home Loan Bank |

plc | | - Public Limited Company |

|

| See notes to financial statements. |

| | |

| 24 | | The accompanying notes are an integral part of the financial statements |

| | |

| | |

| | Series C |

| | (Money Market Series) |

Statement of Assets and Liabilities

December 31, 2007

| | |

Assets: | | |

Investments, at value* | | $167,430,149 |

Cash | | 351 |

Receivables: | | |

Fund shares sold | | 3,144,904 |

Securities sold | | 6,256 |

Interest | | 567,140 |

Prepaid expenses | | 2,546 |

| | |

Total assets | | 171,151,346 |

| | |

| |

Liabilities: | | |

| |

Payable for: | | |

Fund shares redeemed | | 2,382,110 |

Management fees | | 69,623 |

Administration fees | | 15,403 |

Transfer agent/maintenance fees | | 2,083 |

Custodian fees | | 4,800 |

Directors’ fees | | 1,500 |

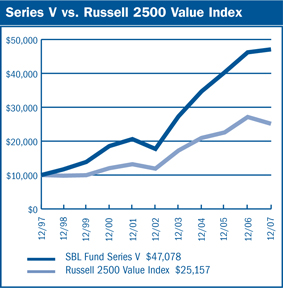

Professional fees | | 9,000 |